Sunteck Realty Ltd. share price jumped on Tuesday after the company reported strong growth in business in the second quarter. Pre-sales saw an uptick of 32.7% in the July–September quarter. Total pre-sales stood at Rs 524 crore year-on-year for the quarter ended September, as compared to Rs 502 crore in the quarter ended June.

In the first half of the current fiscal, pre-sales registered a growth to Rs 1,026.7 crore, a notable 21.3% increase from Rs 782 crore that was witnessed in the previous financial year's similar period.

Sunteck Realty also registered collections of Rs 267 crore in the second quarter of fiscal 2025, up 24.8% on a year-on-year basis. For the first half of the financial year, collections stood at Rs 609 crore, a growth of 21.3% from the corresponding half of the preceding fiscal at Rs 502 crore.

The company is expected to announce its earnings for the second quarter on Oct. 18.

Nuvama said it anticipates higher sales trajectory on sustained expansion of portfolio, as it maintained a 'buy' rating on the Sunteck Realty stock with a target of Rs 702, an upside of 27% over Monday's close.

It noted that focus on cash flows and low gearing should hold the company in good stead.

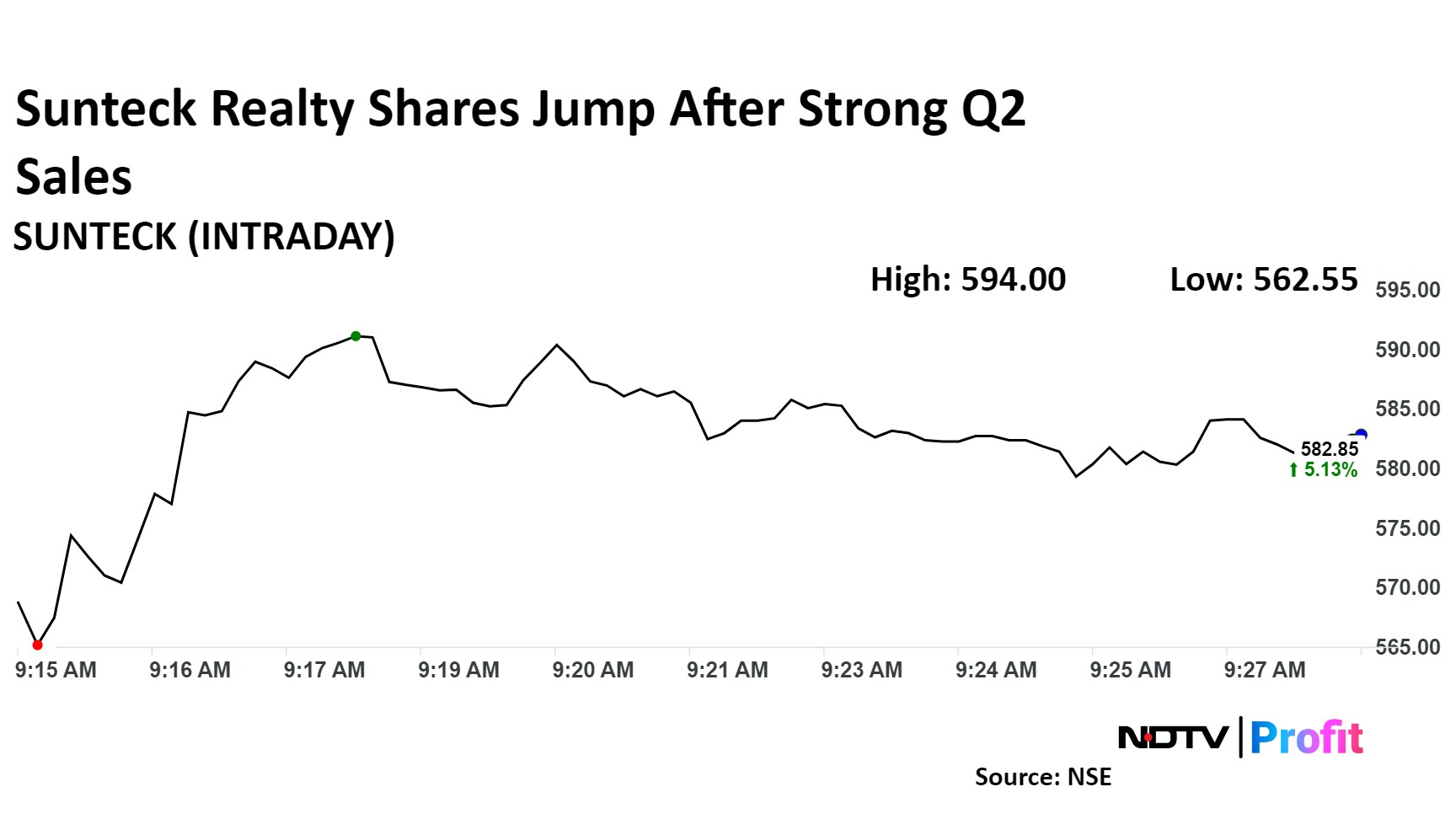

Share Price Movement

Sunteck Realty share price advanced over 7% intraday to Rs 602.75 apiece, highest since end of August. The scrip was trading 5% higher at Rs 582.85 by 9:28 a.m. The benchmark NSE Nifty 50 was up 0.15%.

The stock has risen 26% in the last 12 months and 34% year-to-date. The relative strength index was at 52.

All thirteen analysts tracking the company maintain a "buy" rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 27%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.