Stocks struggled in late hours after downbeat news from some key American companies, with traders also mulling prospects for a slower pace of Federal Reserve rate cuts.

A $600 billion exchange-traded fund tracking the S&P 500 (SPY) wavered after the close of regular trading. Texas Instruments Inc., the biggest maker of analog chips, gave a weak outlook even after topping estimates.

Starbucks Corp. pulled guidance for 2025 after sales plunged for a third consecutive quarter. McDonald's Corp. plunged as its Quarter Pounders were linked to an E. coli outbreak in the US.

Equities finished mildly lower, with the S&P 500 seeing its first back-to-back drop in six weeks. Exposure to the gauge has reached levels that were followed by a 10% slump in the past, according to Citigroup Inc. strategists led by Chris Montagu. Long positions on futures linked to the benchmark are looking “particularly extended,” they said.

“We're not suggesting investors should start to reduce exposure, but the positioning risks do rise when markets get extended like this,” they said.

The S&P 500 was little changed. The Nasdaq 100 rose 0.1%. The Dow Jones Industrial Average was little changed.

Treasury 10-year yields hovered near 4.20%. The euro hit the lowest since early August amid bets the European Central Bank will keep lowering rates. Oil advanced as traders tracked tensions between Israel and Iran. Gold climbed to a fresh record.

Wall Street is paring back bets on aggressive policy easing as the US economy remains robust while Fed officials sound a cautious tone over the pace of future rate decreases. Rising oil prices and the prospect of bigger fiscal deficits after the upcoming presidential election are only compounding the market's concerns. Since the end of last week, traders have trimmed the extent of expected Fed cuts through September 2025 by more than 10 basis points.

“Of course, higher yields do not have to be negative for stocks. Let's face it, the stock market has been advancing as these bond yields have been rising for a full month now,” said Matt Maley at Miller Tabak + Co. “However, given how expensive the market is today, these higher yields could cause some problems for the equity market before too long.”

A string of stronger-than-estimated data points sent the US version of Citigroup's Economic Surprise Index to the highest since April. The gauge measures the difference between actual releases and analyst expectations.

“On the back of September's strong economic data, markets have already priced a slower pace of cuts,” said Lauren Goodwin at New York Life Investments. “If the Fed is able to move towards a 4% policy rate — still above the levels most believe represent the ‘neutral' rate — then the equity market rally can continue. Disruptions to that view make equity market volatility more likely.”

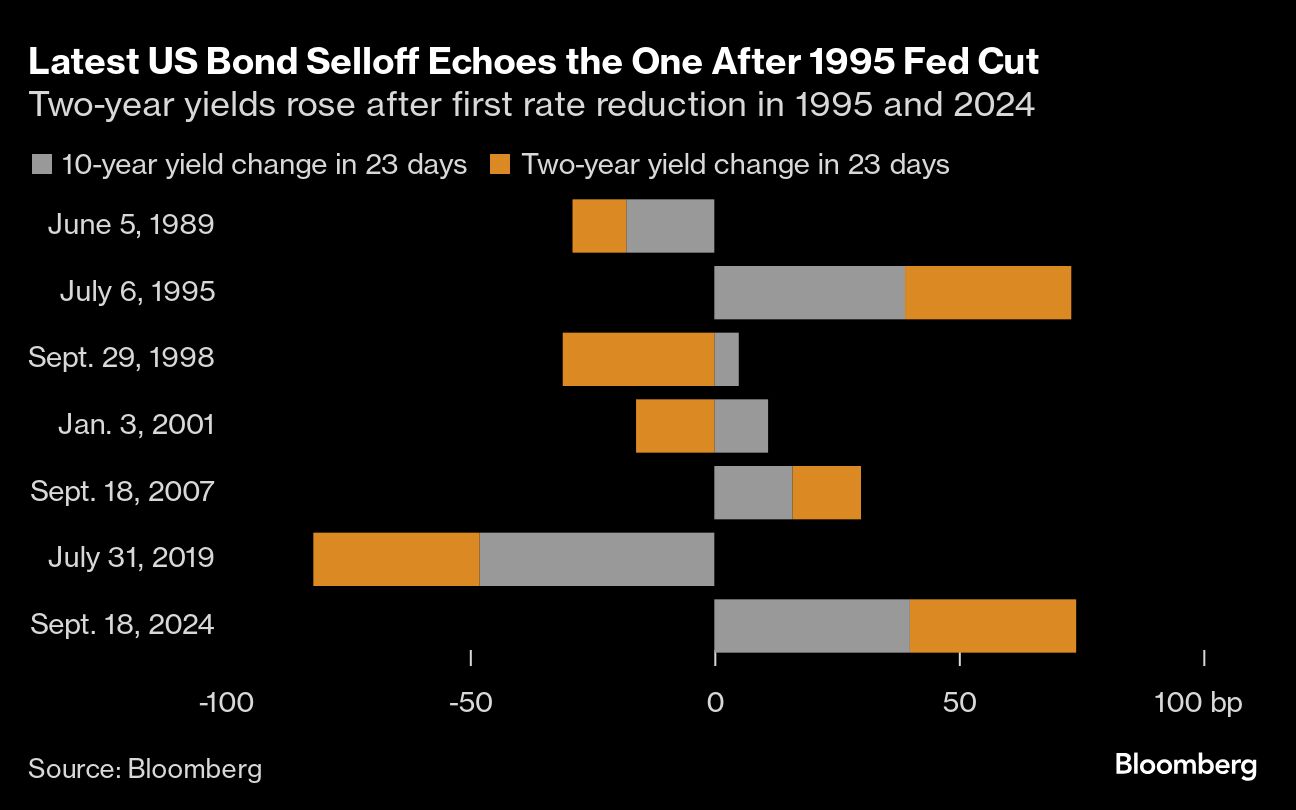

The last time US government bonds sold off this much as the Fed started cutting interest rates, Alan Greenspan was orchestrating a rare soft landing.

Two-year yields have climbed 34 basis points since the Fed reduced interest rates on Sept. 18 for the first time since 2020. Yields rose similarly in 1995, when the Fed — led by Greenspan — managed to cool the economy without causing a recession.

In prior rate cutting cycles going back to 1989, two-year yields on average fell 15 basis points one month after the Fed started slashing rates.

Meantime, the International Monetary Fund said the US election is creating “high uncertainty” for markets and policymakers, given the sharply divergent trade priorities of the candidates. That gap creates the risk of another potential round of volatility on global markets similar to the rattling August selloff.

“Presidents don't control markets,” said Callie Cox at Ritholtz Wealth Management. “Over time, the stock market's common thread has been the economy and earnings, not who's in the Oval Office. Be prepared for mood swings in markets as we get closer to Election Day. But remember that election-fueled storms often dissipate quickly.”

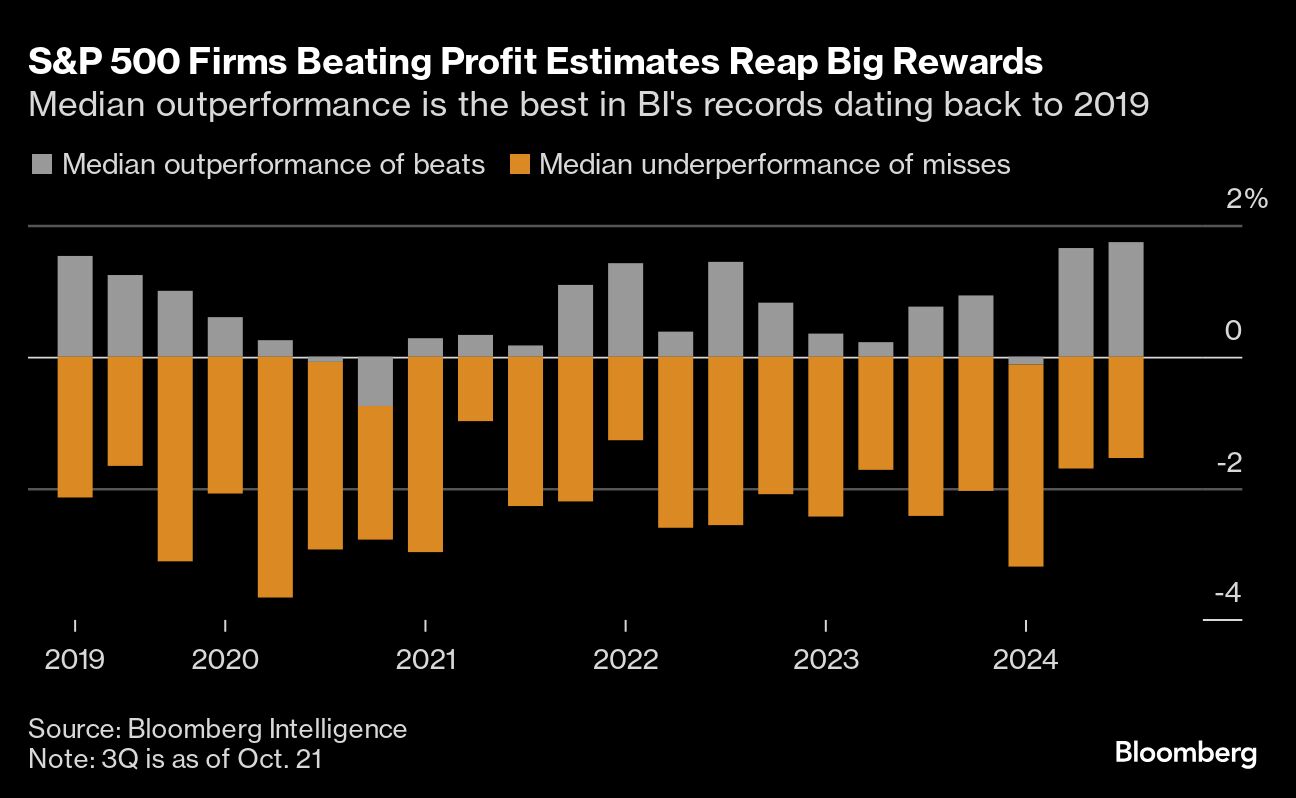

As the earnings season rolls in, US companies are reaping the best stock-market reward in five years for beating profit expectations that were lowered in the run-up to the reporting season.

S&P 500 firms that posted better-than-estimated third-quarter earnings have outperformed the benchmark by a median of 1.74% on the day of reporting results, according to data compiled by Bloomberg Intelligence. That's the strongest rate in BI's records going back to 2019.

At the same time, companies missing estimates trailed the S&P 500 by a median of 1.5%, a less severe underperformance than the 1.7% experienced in the second quarter, the data showed.

“This earnings season we are watching what companies are saying about inflation and the economy,” said Megan Horneman at Verdence Capital Advisors. “In addition, their view on interest rates, especially if the Fed cannot be as aggressive as the market is pricing in at this point. It is good to see analysts getting realistic about 2025 earnings growth. However, at 15% earnings growth, we believe it is still too optimistic given the expectation for slower economic growth in 2025.”

Corporate Highlights:

Verizon Communications Inc. reported revenue that missed analysts' expectations, weighed down by lackluster sales of hardware such as mobile phones.

3M Co. increased the low end of its 2024 profit forecast and reported earnings that topped analyst estimates as a push to boost productivity gained traction.

General Motors Co. signaled solid US demand for its highest-margin vehicles even as the broader market softens, posting better-than-expected results for the latest quarter and raising the low end of its full-year profit forecast.

General Electric Co.'s sales fell short of Wall Street's expectations last quarter, tempering enthusiasm for its improved profit outlook as the jet engine maker grapples with supply-chain limitations that are weighing on deliveries.

Kimberly-Clark Corp., owner of the Scott toilet paper brand, lowered its full-year organic sales forecast after reporting weaker-than-expected results.

Philip Morris International Inc. shares soared Tuesday after the company forecast higher-than-expected profit this year thanks to soaring demand for its Zyn nicotine pouches in the US.

Lockheed Martin Corp.'s third-quarter revenue missed expectations, pulled down by weaker aeronautical sales and ongoing issues with its F-35 fighter jet program.

L'Oreal SA posted disappointing sales last quarter as the beauty company suffers from worsening consumer demand in China.

Key events this week:

Canada rate decision, Wednesday

Eurozone consumer confidence, Wednesday

US existing home sales, Wednesday

Boeing, Tesla, Deutsche Bank earnings, Wednesday

Fed's Beige Book, Wednesday

US new home sales, jobless claims, S&P Global Manufacturing and Services PMI, Thursday

UPS, Barclays earnings, Thursday

Fed's Beth Hammack speaks, Thursday

US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The S&P 500 was little changed as of 4 p.m. New York time

The Nasdaq 100 rose 0.1%

The Dow Jones Industrial Average was little changed

The MSCI World Index fell 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0794

The British pound was little changed at $1.2980

The Japanese yen fell 0.2% to 151.13 per dollar

Cryptocurrencies

Bitcoin fell 0.4% to $67,428.76

Ether fell 1.8% to $2,625.8

Bonds

The yield on 10-year Treasuries was little changed at 4.20%

Germany's 10-year yield advanced four basis points to 2.32%

Britain's 10-year yield advanced three basis points to 4.17%

Commodities

West Texas Intermediate crude rose 2.2% to $72.09 a barrel

Spot gold rose 1.1% to $2,748.60 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.