(Bloomberg) -- Asian markets are poised for losses on Monday as fears of a deeper US economic slowdown roil traders around the globe worried that the Federal Reserve may be behind the curve on rate cuts. Oil climbed on rising tensions in the Middle East.

US futures dropped in early trading, amid the fallout from heavy losses on Wall Street on Friday and Berkshire Hathaway Inc.'s weekend disclosure that it slashed its stake in Apple Inc. by almost half during the second quarter. Contracts indicate that Australian, Japanese and Hong Kong shares are set to drop on Monday.

Berkshire's selling is “going to be immediately seen as a negative,” said Mark Lehmann, chief executive officer at Citizens JMP Securities. “Apple is the number one player in the global consumer space and that's the statement about the global consumer.”

Oil rose in early Monday trading after Saudi Arabia lifted the price of crude it sells to Asia and amid reports Iran may strike Israel to avenge assassinations of Hezbollah and Hamas officials. Saudi Arabian and Israeli stocks slumped more than 2% on Sunday, outpacing Friday's losses on Wall Street.

Japanese shares have plunged in the last two sessions on expectations for more domestic interest rate hikes. The broader Topix index sank more than 6% on Friday, marking its worst day since 2016. The yen has continued its gains, hitting 145.78 against the dollar on Monday, its strongest since January.

Data on Friday showed that US nonfarm payrolls rose by 114,000 in July — one of the weakest prints since the pandemic — and job growth was revised lower in the prior two months. The jobless rate unexpectedly climbed for a fourth month to 4.3%, above the Federal Reserve's year-end forecast, triggering a closely watched recession indicator.

The S&P 500 saw its worst reaction to jobs data in almost two years, dropping 1.8%. Intel Corp. plunged 26% on a grim growth forecast, adding to a string of poor tech earnings that have sent the Nasdaq 100 down over 10% from its peak to enter a correction.

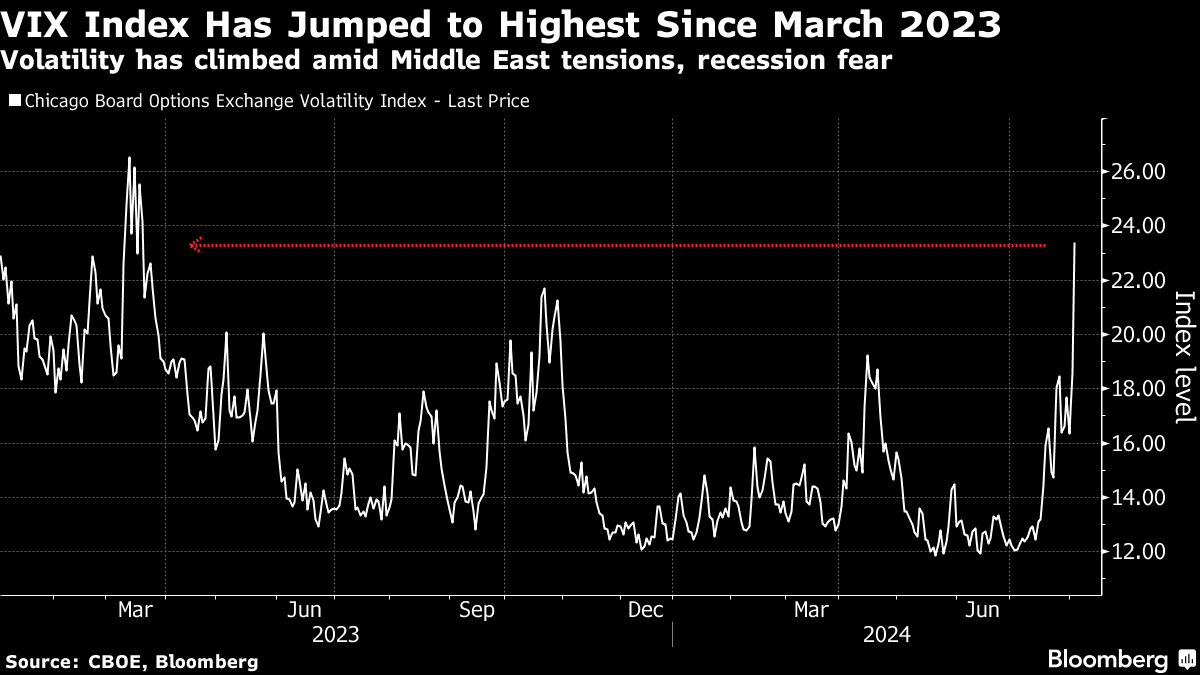

A worsening conflict in the Middle East risks adding more tumult to markets as investors brace for a turbulent second half of the year. A gauge of bond market volatility has climbed, while the VIX Index - Wall Street's fear gauge - jumped to the highest in almost 18 months after a weak US jobs report ratcheted fears of a recession, as focus increases on an already chaotic US election race.

“In the next few months global and Australian shares look vulnerable to further falls, suggesting that it's too early to buy the dip,” said Shane Oliver, chief economist and head of investment strategy at AMP Ltd. in Sydney. “A correction is underway.”

Meantime, US Treasuries climbed Friday, with policy sensitive two-year yields falling to the lowest since May 2023 as worries mount the Fed's decision to hold rates at a two-decade high is risking a deeper economic slowdown. Traders are projecting the Fed will cut rates by more than a full percentage point in 2024, with an increased chance of an outsized 50-basis point cut in September, according to data compiled by Bloomberg.

“With the unemployment rate above and core PCE inflation now below the Fed's year-end forecasts, we believe that the balance of risks favors more aggressive action by the Fed,” said Brian Rose, a senior US economist at UBS Group AG's wealth management unit. “We are changing our base case to rate cuts of 50 basis points in September and 25 basis points each in November and December” after previously just seeing half that amount by year-end, he wrote in a note to clients.

In Asia, traders will soon focus on the private Caixin China services and composite activity data for a further gauge on the health of the world's second largest economy after manufacturing PMI contracted unexpectedly for the first time in nine months. The data comes as Chinese officials made clear in July that there would be limited aid to spur domestic consumption.

Elsewhere this week, inflation data in Thailand and Chile are due while Mexico and Peru will hold policy decisions as debate rages on the outlook for emerging market dollar and local currency bonds. The Reserve Bank of Australia's policy meeting will be parsed to confirm bets of easing by year-end, while US economic activity and credit data and speeches from regional Fed bank presidents will be closely watched.

“Better data this week could provide some confidence to a bond market that is grossly overbought and offer reassurances to equity and credit,” Chris Weston, head of research at Pepperstone Group wrote in a note to clients.

“Conversely, if the data continues to weaken and central banks don't meet the market pricing in their narrative, one thing seems clear: buying the dip in risk may not be as effective this time around, while short sellers will have a far more prosperous hunting ground,” he said.

Key events this week:

- Bank of Japan issues minutes of June meeting, Monday

- China Caixin services PMI, Monday

- Indonesia GDP, Monday

- Singapore retail sales, Monday

- Thailand CPI, Monday

- Eurozone PPI, HCOB Services PMI, Monday

- US ISM Services index, Monday

- Chicago Fed President Austan Goolsbee speaks, Monday

- San Francisco Fed President Mary Daly speaks, Monday

- Australia rate decision, Tuesday

- Japan cash earnings, Tuesday

- Philippines CPI, trade, Tuesday

- Eurozone retail sales, Tuesday

- US trade, Tuesday

- New Zealand unemployment, Wednesday

- China trade, Wednesday

- Chile copper exports, trade, Wednesday

- US consumer credit, Wednesday

- ECB Supervisory Board member Elizabeth McCaul speaks, Wednesday

- RBA Governor Michele Bullock speaks, Thursday

- Philippines GDP, Thursday

- India rate decision, Thursday

- US initial jobless claims, Thursday

- Richmond Fed President Thomas Barkin speaks, Thursday

- Chile CPI, Thursday

- Colombia CPI, Thursday

- Mexico CPI, rate decision Thursday

- Peru rate decision, Thursday

- China PPI, CPI, Friday

- Germany CPI, Friday

- Canada unemployment, Friday

- Brazil CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 1% as of 8:45 a.m. Tokyo time

- Hang Seng futures fell 0.4%

- S&P/ASX 200 futures fell 1.5%

- Nikkei 225 futures fell 3.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0906

- The Japanese yen rose 0.5% to 145.78 per dollar

- The offshore yuan rose 0.2% to 7.1494 per dollar

- The Australian dollar fell 0.1% to $0.6502

Cryptocurrencies

- Bitcoin fell 1.4% to $58,304.18

- Ether fell 1.8% to $2,700.26

Commodities

- West Texas Intermediate crude rose 0.4% to $73.83 a barrel

- Spot gold was little changed

Bonds

- The yield on 10-year Treasuries declined 19 basis points to 3.79% on Friday

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Richard Henderson.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.