(Bloomberg) -- US equity indexed slumped as traders fully priced in quarter-point interest rate increases at the Federal Reserve's next two meeting, suggesting investors heeded warnings Thursday that 50 basis-point hikes were not out of the question.

Both the S&P 500 Index and Nasdaq 100 fell at the open one day after each dropped more than 1%. The Bloomberg dollar gauge erased its losses for the year, while benchmark Treasury yields climbed for a fourth day.

On Thursday, Federal Reserve Bank of Cleveland President Loretta Mester said she had seen a “compelling economic case” for rolling out another 50 basis-point hike, and St. Louis President James Bullard said he would not rule out supporting a half-percentage-point increase at the March meeting.

“If investors are really finally starting to believe the Fed about their claim that rates will stay ‘higher for longer,'” Matt Maley, chief market strategist at Miller Tabak + Co., wrote, “we could be looking at a significant decline in the weeks ahead. With the stock market as expensive as it is, a shift in thinking by investors about the issues of interest rates and liquidity is a dangerous combination.”

Investors have been upping their bets on how far the Fed will raise rates this tightening cycle. They now see the federal funds rate climbing past 5.3% in July, according to trading in the US money markets. That compares with a perceived peak rate of 4.9% just two weeks ago.

“With the 6 month and 1 year T-bills yielding more than 5% this morning, I would expect to see short duration cash go into those assets before much of it goes into stocks,” Kenny Polcari, senior market strategist at Slatestone Wealth, wrote.

European stocks fell and rates-sensitive technology stocks were among the biggest decliners as money market traders priced in 3.75% for the ECB's deposit rate by October, up from 3.4% following the bank's last meeting this month.

On the outlook for US equities, Bank of America Corp. strategists wrote that the delayed arrival of a recession will weigh on stocks in the second half of the year, noting that a resilient economy thus far means interest rates will stay higher for longer.

A BofA team led by Michael Hartnett is among those predicting a scenario known as “no landing” in the first half of the year, where economic growth will stay robust and central banks will likely remain hawkish for longer. That will probably be followed by a “hard landing” in the latter part of 2023, they wrote.

Bitcoin retreated after three days of gains after the US Securities & Exchange Commission accused Do Kwon and Terraform Labs Pte of fraud over the wipeout of digital currencies he created.

In commodities, oil headed for a weekly drop as rising US inventories and the prospect of further tightening by the Federal Reserve eclipsed the lift from more signs that Chinese energy demand is improving.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% to the lowest since Jan. 30 as of 9:30 a.m. New York time

- The Nasdaq 100 fell 0.8% to the lowest since Feb. 10

- The Dow Jones Industrial Average fell 0.4% to the lowest since Jan. 20

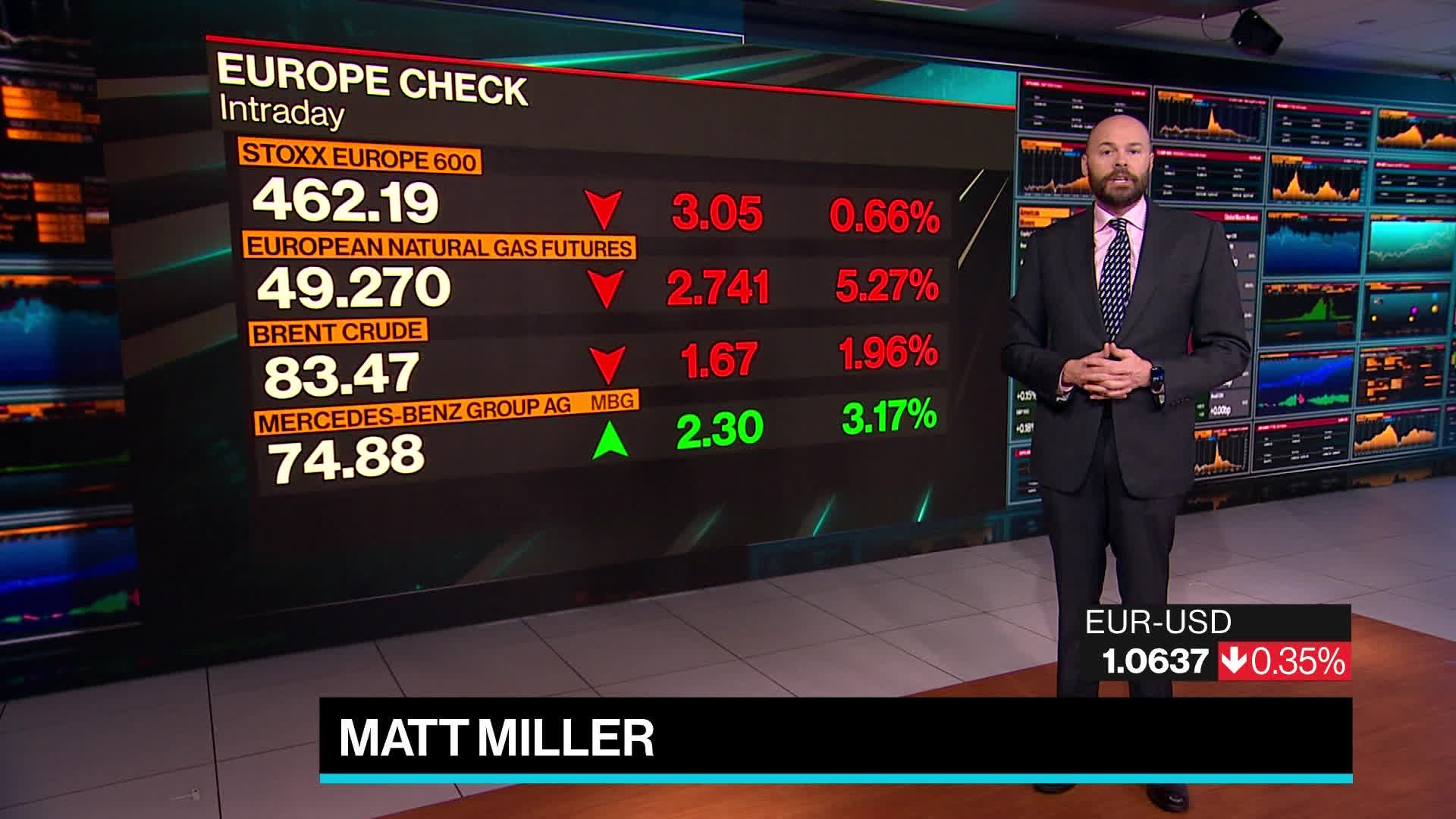

- The Stoxx Europe 600 fell 0.3%, ending a four-day winning streak

- The MSCI World index fell 0.7%, more than any closing loss since Feb. 6

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%, climbing for the third straight day, the longest winning streak since Feb. 6

- The euro fell 0.3% to $1.0646

- The British pound was little changed at $1.1984

- The Japanese yen fell 0.4% to 134.51 per dollar

Cryptocurrencies

- Bitcoin slipped 2.6%, more than any closing loss since Feb. 9

- Ether fell 1% to $1,666.04

Bonds

- The yield on 10-year Treasuries advanced three basis points, climbing for the fourth straight day, the longest winning streak since Nov. 7

- Germany's 10-year yield was little changed at 2.49%

- Britain's 10-year yield advanced four basis points to 3.54%

Commodities

- West Texas Intermediate crude fell 3.7%, the most since Jan. 4

- Gold futures fell 0.8% to $1,837.20 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from and .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.