Stocks closed at all-time highs as investors looked past Donald Trump's tariff plan, with geopolitical risks abating after Israel and Hezbollah reached a cease-fire agreement.

Equities extended gains into a seventh straight session, with the S&P 500 notching its 52nd record this year. Shortly after oil futures settled, the US said Israel and the Lebanese militant group had reached a deal. In late hours, Dell Technologies Inc. reported worse-than-expected sales, while HP Inc. and CrowdStrike Holdings Inc. gave lackluster outlooks.

Wall Street shrugged off Trump's plan to impose additional tariffs on the US's top trading partners. Microsoft Corp. drove software companies higher amid the group's lower susceptibility to tariff risks. While automakers like General Motors Corp. and Ford Motor Co. were hit due to their exposure to Mexico and China, a slide in equity volatility showed calm prevailed.

“We still see tariffs as more strategizing and think the bark will be worse than the bite,” said Andrew Brenner at NatAlliance Securities.

The S&P 500 rose 0.6%. The Nasdaq 100 climbed 0.6%. The Dow Jones Industrial Average added 0.3%.

US 10-year yields advanced two basis points to 4.30%. A dollar gauge gained 0.2%. The Mexican peso and Canadian dollar slid.

To Dennis DeBusschere at 22V Research, Trump linking tariffs to drugs and immigration, rather than trade policy and economics signaled to investors that this announcement is a negotiating tactic, not a policy tool.

“It was Trump ‘following through' on his campaign promises – nothing more, nothing less – and my sense is that investors welcomed the move,” said Kenny Polcari at SlateStone Wealth.

While stocks gained, the bond market response was mild following its second-biggest advance this year.

At BMO Capital Markets, Ian Lyngen says that perhaps the muted response in Treasuries is because not only had the market already priced in a renewed emphasis on “tariffs as trade policy,” but it's also an acknowledgment that increases in levies have a one-time impact on realized inflation.

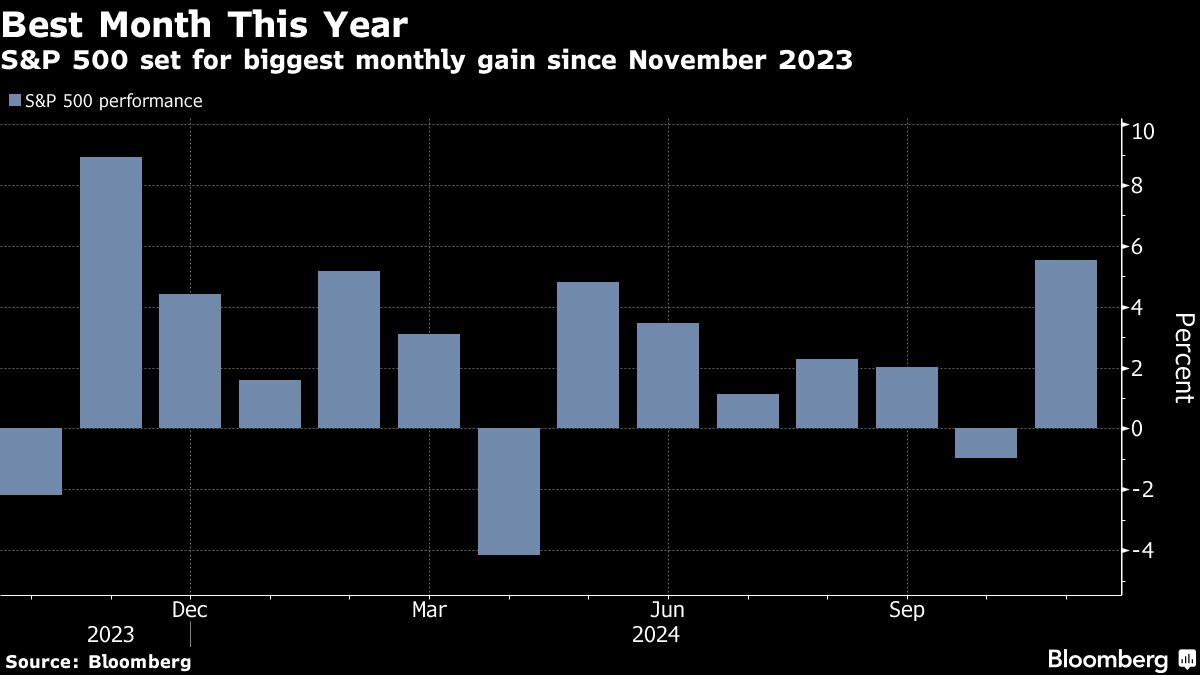

Stocks resumed their post-election upward trajectory last week and the S&P 500 has since posted moderate gains. Overall, turnover however has been relatively muted in both cash and futures trading ahead of the Thanksgiving holiday on Thursday.

The S&P 500 has surged more than 25% in 2024, on track for a second year of returns above 20% — a run that's occurred just four times in the past 100 years.

Deutsche Bank AG's Bankim Chadha says the benchmark will hit 7,000 points by the end of next year, making him the most optimistic among Wall Street strategists predicting further gains for US stocks.

“We see steady robust momentum continuing into 2025, with earnings-per-share growth in the low double digits,” Chadha and his team wrote in a note dated Monday.

Meantime, Bank of America Corp.'s Savita Subramanian is counting on another year of double-digit gains for the S&P 500 in 2025 — but says even better opportunities are present in individual stocks outside the benchmark.

Her 2025 year-end target for the gauge is 6,666, and she recommends companies with healthy cash return prospects and tied to US economy. The strategist is overweight financials, consumer discretionary, materials, real estate and utilities.

At Goldman Sachs Group Inc., strategists are advising investors to keep their money in US equities, but to adjust their holdings to mitigate the fact that close to half of the S&P 500's rise in 2024 was due to the so-called “Magnificent Seven” big-tech stocks.

The high concentration and valuation of the US stock market is a reason to implement diversification across strategies and regions, says Goldman's Peter Oppenheimer. He adds that a overweight on US stocks still makes sense, however, given solid economic and earnings expectations for 2025.

Corporate Highlights:

Urban Outfitters Inc. reported stronger-than-expected sales growth in the third quarter, led by its Anthropologie brand.

Nordstrom Inc. raised the lower end of its annual sales guidance after its off-price and flagship chains reported quarterly growth that was better than expected — results that could encourage the company's board to push the founding family for a better offer to take Nordstrom private.

Amgen Inc.'s experimental obesity shot failed to significantly outperform rivals and showed a high rate of gastrointestinal side effects.

Kohl's Corp. cut its full-year sales outlook, signaling that its turnaround efforts are fizzling in an increasingly difficult retail environment.

Dick's Sporting Goods Inc. raised its full-year sales outlook after posting strong results in the back-to-school season ahead of the holidays, spurred by high demand for sports gear.

Best Buy Co. cut its full-year guidance on sluggish demand for electronics and appliances, a sign of trouble for the retailer looking to pull off a turnaround.

JM Smucker Co. raised its earnings guidance as its popular Uncrustables frozen sandwiches outperformed expectations, offsetting softness at the recently acquired Hostess brand.

Key events this week:

US PCE, initial jobless claims, GDP, Wednesday

Eurozone consumer confidence, Thursday

US Thanksgiving holiday. Markets closed, Thursday

Eurozone CPI, Friday

ECB releases consumer expectations survey for October, Friday

“Black Friday,” the traditional start of the US holiday shopping rush

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.6% as of 4 p.m. New York time

The Nasdaq 100 rose 0.6%

The Dow Jones Industrial Average rose 0.3%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.1% to $1.0482

The British pound was little changed at $1.2559

The Japanese yen rose 0.8% to 153.06 per dollar

Cryptocurrencies

Bitcoin fell 2.9% to $91,004.89

Ether fell 3.4% to $3,321.02

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.30%

Germany's 10-year yield declined two basis points to 2.19%

Britain's 10-year yield advanced one basis point to 4.35%

Commodities

West Texas Intermediate crude fell 0.4% to $68.66 a barrel

Spot gold rose 0.3% to $2,631.80 an ounce

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.