Asian shares slipped after China's new economic support disappointed some investors and data showed persistent deflationary pressures. Bitcoin surged past $81,000 to a record.

A gauge of the region's equities dropped 0.4% early Monday, with losses in Australia and South Korea. Futures pointed to a weak open in Hong Kong. Japanese benchmarks were steady. US contracts edged higher after the S&P 500 rose 0.4% on Friday.

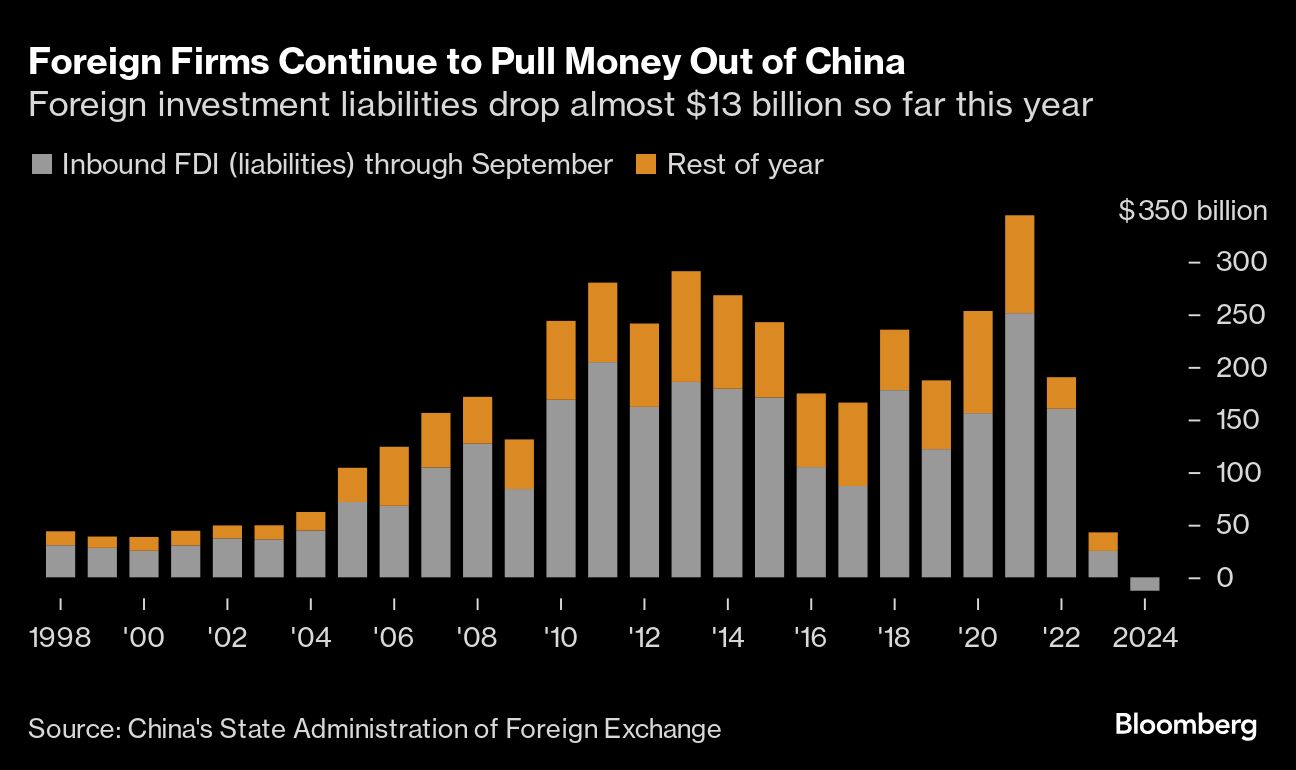

The focus will likely be on Chinese markets after Beijing unveiled a 10 trillion yuan ($1.4 trillion) program to defuse local governments' debt risk but stopped short of unleashing new fiscal stimulus, preserving room to respond to a potential trade war when Donald Trump takes office next year. In addition to anemic inflation, sentiment toward the world's No. 2 economy is also faltering as foreign direct investment continues to slump.

“Many feel that China is keeping its tactical powder in play for such time as the Trump-China tariff negotiations build, and they can respond in a more targeted fashion to stem the likely economic fallout,” Chris Weston, head of research at Pepperstone Group in Melbourne wrote in a note. “In the short-term, however, it does suggest downside risk to China/Hong Kong equity and the yuan.”

Elsewhere, Bitcoin surged past $81,000 for the first time in early Asia hours, after hitting a record $80,000 on Sunday, driven by the incoming president's support for digital assets and the election of pro-crypto lawmakers.

Oil slid further after the biggest one-day drop in almost two weeks as a soft outlook in top importer China continued to plague the market.

The dollar was little changed in early Asian trading.

Federal Reserve Bank of Minneapolis President Neel Kashkari indicated at the weekend the central bank could ease rates less than previously expected amid a strong US economy. Kashkari emphasized, however, that it's too early to determine the impact of Trump's policies.

“The market's next move will hinge on whether Trump prioritizes cutting taxes or raising tariffs, each having vastly different impact,” Tony Sycamore, an analyst at IG Markets in Sydney, wrote in a note. “This clarification may still be months away and it's worth remembering that back in 2016, Trump's first move was to cut taxes which sent stock markets surging before tariffs on China caused headwinds.”

This week, traders will be parsing data from Australian jobs to Chinese retail sales and industrial production, inflation from the US and Eurozone as well as growth readings in the UK and Japan. A swath of Federal Reserve officials are scheduled to speak which may help indicate the central bank's thinking following the election result.

Key events this week:

Japan current account, Monday

Denmark CPI, Monday

Norway CPI, Monday

United Nations climate change conference, COP29 begins, Monday

Germany CPI, Tuesday

UK jobless claims, unemployment, Tuesday

Fed speakers including Christopher Waller, Tuesday

Japan PPI, Wednesday

Eurozone industrial production, Wednesday

US CPI, Wednesday

Australia unemployment, Thursday

Eurozone GDP, Thursday

US PPI, jobless claims, Thursday

Reserve Bank of Australia Governor Michele Bullock speaks, Thursday

Fed Chair Jerome Powell speaks, Thursday

ECB President Christine Lagarde speaks, Thursday

BOE Governor Andrew Bailey speaks, Thursday

Japan GDP, industrial production, Friday

China retail sales, industrial production, fixed-asset investment, Friday

UK GDP, industrial production, trade balance, Friday

US retail sales, Friday

Alibaba earnings, Friday

Some of the major moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 9:10 a.m. Tokyo time

Hang Seng futures fell 1.6%

Japan's Topix rose 0.3%

Australia's S&P/ASX 200 fell 0.3%

Euro Stoxx 50 futures fell 1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0711

The Japanese yen fell 0.3% to 153.05 per dollar

The offshore yuan was little changed at 7.2003 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $80,526.62

Ether rose 0.5% to $3,187.07

Bonds

The yield on 10-year Treasuries was little changed at 4.30%

Australia's 10-year yield declined two basis points to 4.55%

Commodities

West Texas Intermediate crude fell 0.2% to $70.24 a barrel

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.