Stocks took a breather after notching their longest weekly rally this year, with traders gearing up for key earnings reports from Tesla Inc. to Boeing Co. and United Parcel Service Inc.

Following a relentless advance to all-time highs, equities dropped from nearly overbought levels. In another sign of how greed has trumped fear, the S&P 500 hasn't suffered back-to-back losses in about 30 sessions. While a month with no consecutive down days may not sound like much, the current streak ranks among the very best since 1928, according to data compiled by SentimenTrader.

“The index remains overbought across multiple time frames and is still vulnerable to profit-taking over the short run,” said Dan Wantrobski, director of research at Janney Montgomery Scott.

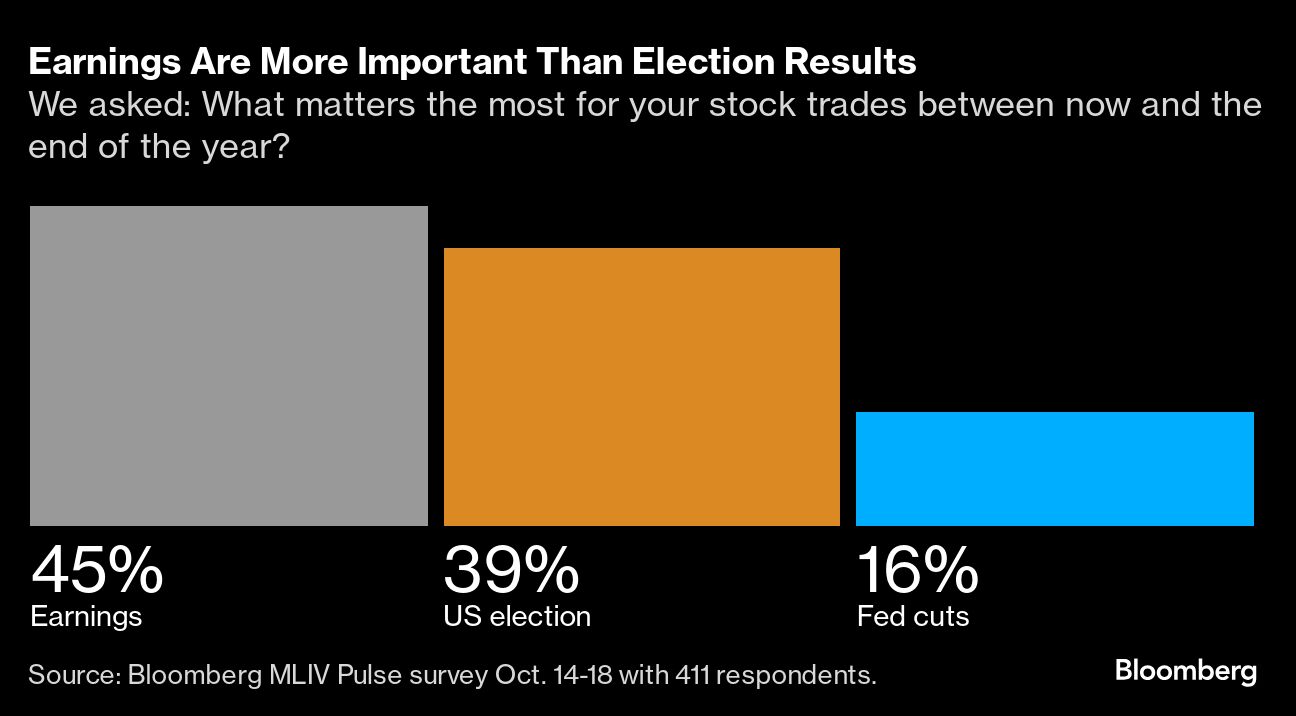

Wall Street faces a big earnings hurdle this week, with roughly 20% of the S&P 500 companies scheduled to report. The latest Bloomberg Markets Live Pulse survey shows respondents see Corporate America's results as more crucial for the equity market's performance than who wins the November election or even the Federal Reserve's policy path.

The S&P 500 fell 0.2%, with all of its major groups but technology pushing lower. The Dow Jones Industrial Average slid 0.8%. Nvidia Corp. hit a record high, with the Nasdaq 100 up 0.2%. The Russell 2000 retreated 1.6%. Homebuilders tumbled. United Parcel Service Inc. sank on a sell recommendation at Barclays Plc. Boeing Co. rallied after a tentative agreement with its workers' union.

US 10-year yields jumped 10 basis points to 4.19%. They will test the 5% threshold in the next six months amid rising inflation expectations and concerns over fiscal spending, said T. Rowe Price's Arif Husain. Meantime, Torsten Slok at Apollo Global Management sees higher chances the Fed will leave rates unchanged in November as the economy powers ahead.

Oil climbed as China moved again to bolster its economy and traders tracked the risk to supplies from tensions in the Middle East.

Volatility is elevated for options on stocks, bonds and currencies alike as investors pay up for protection. The risks are clear: a hotly contested US election, interest-rate decisions in the US and Europe, the threat of a wider Middle East conflict and quarterly earnings. In the stock market, implied volatility is outpacing actual swings, and puts protecting against a selloff are favored over bullish calls.

To Matt Maley at Miller Tabak, no matter the reason, “we certainly cannot blame investors for buying some protection in the options market and/or gold.”

“With the stock market as expensive as it is (especially on a price/sales basis), it is much more vulnerable than usual when these kinds of political and geopolitical issues became significant concerns in the past,” he said.

Equities lost steam after the S&P 500 notched six straight weeks of gains. Winning streaks of that length are relatively rare, occurring only 53 times since 1950 (roughly 8% of all six-week periods), according to Adam Turnquist at LPL Financial.

Looking ahead, the index has historically posted an average return of 0.2% the following week, with 58% extending to seven-week win streaks, he noted. Forward six- and 12-month returns averaged 5.1% and 11.4%, respectively, with both periods generating above-average positivity rates.

“While the market is entering a potentially volatile period ahead of the election and facing overhead resistance near the upper end of its rising price channel, history suggests investors should buy dips as momentum tends to continue after a six-week winning streak,” he noted.

“We believe there is continued upside ahead for stocks, especially now that we are entering a seasonally strong period of the year for markets,” said David Laut at Abound Financial. “Earnings season is heating up and we will soon hear from big tech companies and the latest on their artificial intelligence spend. For big tech, this is the show-me-the-money quarter.”

This week, Tesla will likely face questions during its earnings call on production targets and regulatory challenges after the unveiling of its much-hyped Cybercab failed to enthuse investors and quell concerns over its recent vehicle sales. Boeing will also have to mollify investors increasingly concerned over production delays, labor strife and depleted financial resources.

Reports from UPS, Norfolk Southern Corp. and Southwest Airlines Co. should reveal the combined impact of Hurricane Helene and the three-day East Coast dockworker strike on the recent quarter.

Jeffrey Buchbinder at LPL Financial says the bar for third-quarter results is low, with analysts currently expecting only about a 3% increase in S&P 500 earnings per share.

“That low bar and a supportive economic environment points to potential upside,” he said. “However, stocks may already be pricing in solid results.”

Companies in the US benchmark gauge that have beaten profit estimates so far this season are being rewarded “more significantly” compared with the previous four quarters, according to Morgan Stanley strategists led by Michael Wilson. They also noted that the revisions breadth for 2025 is “significantly outperforming” seasonality.

“As is typical, the early days of earnings season are sparking relatively strong price reactions,” said Bloomberg Intelligence strategists Gina Martin Adams and Wendy Soong. “Both beats and misses are resulting in bigger-than-usual price moves.”

Stocks that surpassed third-quarter earnings or revenue estimates — or both — recorded an average one-day excess return to the index of 2.1%, 2.3% and 2.6%, more than double the longer-term average (for whole earnings seasons), they said. Misses are likewise resulting in steeper selloffs of 3.8%, 2% and 3.7%, BI said.

Although the market has shown incredible resilience this year, with nine out of 10 positive months, we're beginning to see parallels with the 2001–2006 period where tech valuations were high, according to Mark Hackett at Nationwide.

“Unlike the dot-com bubble, today's leading tech firms have solid fundamentals, but the market is far from ‘normal',” he noted. “High expectations are warning signs for potential instability in the next few years. Investors should prepare for moderating returns and volatility, especially as cracks begin to appear beyond 2024.”

US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, according to Goldman Sachs Group Inc. strategists including David Kostin.

The S&P 500 is expected to post an annualized nominal total return of just 3% over the next 10 years, they said. That compares with 13% in the last decade, and a long-term average of 11%.

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the team wrote in a note dated Oct. 18.

Corporate Highlights:

SAP SE said its cloud revenue grew by 25% in the third quarter, as Europe's biggest software company pushed customers to transition away from locally-installed legacy systems.

Qualcomm Inc. unveiled a more powerful processor that's designed to bring laptop-level capabilities to smartphones, helping the devices take advantage of new artificial intelligence tools.

Microsoft Corp. is launching a set of artificial intelligence tools designed to send emails, manage records and take other actions on behalf of business workers, expanding an AI push that intensifies competition with rivals like Salesforce Inc.

Spirit Airlines Inc. soared after the carrier secured more time to address a troublesome debt load that has raised the prospect of bankruptcy.

Kenvue Inc. rallied after activist investor Starboard Value took a stake in the Tylenol maker with an eye toward making changes to boost the company's stock price.

Take the MLIV Pulse surveyWhat does the US election mean for your wallet? Share your views

Key events this week:

ECB's Christine Lagarde is interviewed by Bloomberg Television, Tuesday

BOE's Andrew Bailey as well as ECB's Klaas Knot and Robert Holzmann to speak at Bloomberg Global Regulatory Forum in New York, Tuesday

Philadelphia Fed President Patrick Harker speaks, Tuesday

Canada rate decision, Wednesday

Eurozone consumer confidence, Wednesday

US existing home sales, Wednesday

Boeing, Tesla, Deutsche Bank earnings, Wednesday

Fed's Beige Book, Wednesday

US new home sales, jobless claims, S&P Global Manufacturing and Services PMI, Thursday

UPS, Barclays earnings, Thursday

Fed's Beth Hammack speaks, Thursday

US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.2% as of 4 p.m. New York time

The Nasdaq 100 rose 0.2%

The Dow Jones Industrial Average fell 0.8%

The MSCI World Index fell 0.4%

The Russell 2000 Index fell 1.6%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.5% to $1.0815

The British pound fell 0.5% to $1.2983

The Japanese yen fell 0.8% to 150.79 per dollar

Cryptocurrencies

Bitcoin fell 1.5% to $67,746.88

Ether fell 1.2% to $2,679.24

Bonds

The yield on 10-year Treasuries advanced 10 basis points to 4.19%

Germany's 10-year yield advanced 10 basis points to 2.28%

Britain's 10-year yield advanced eight basis points to 4.14%

Commodities

West Texas Intermediate crude rose 1.6% to $70.35 a barrel

Spot gold was little changed

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.