(Bloomberg) -- Equities had a dour start to the year as traders clung to wagers that a March interest rate cut was still on the table after a slew of mixed jobs and US service sector data.

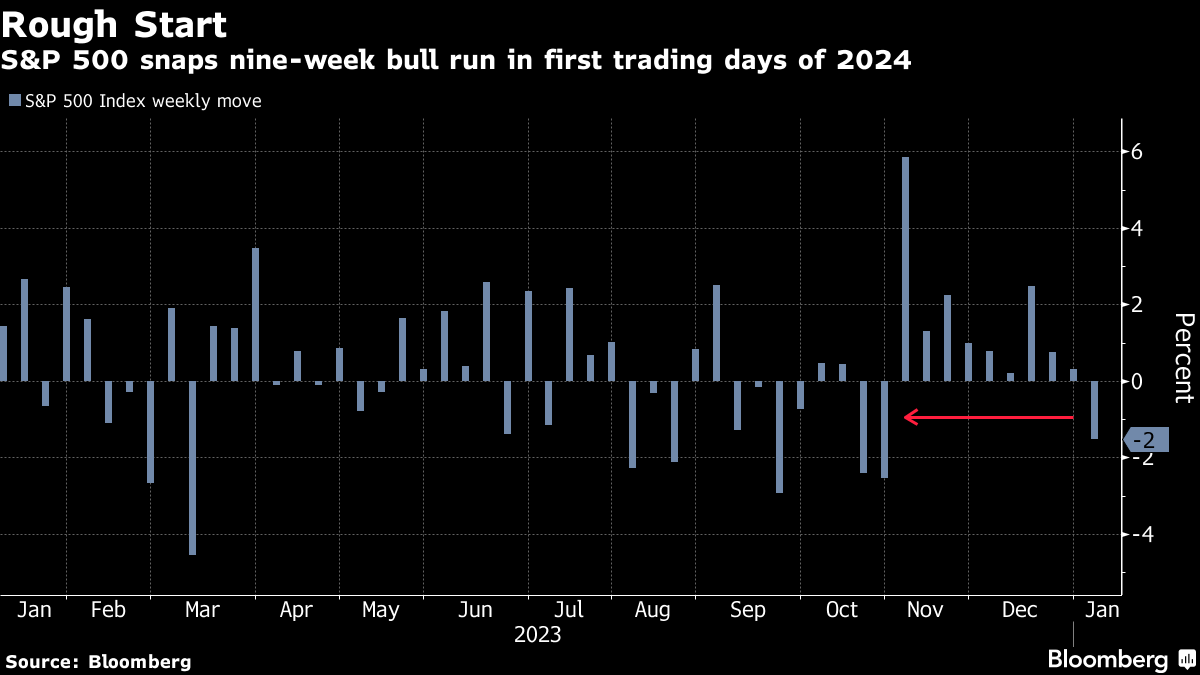

The S&P 500 eked out a gain as Friday closed the stock market's worst week since late October. The equities benchmark kicked off the new year by snapping its nine-week bull run. The Nasdaq 100 also squeezed out a small advance after five days of losses.

The first few days of the year started off with a selloff in 2023's big tech winners, including Apple Inc. and Nvidia Corp.

The downbeat tone of the shortened holiday week signals rough waters ahead for equities in the first half, according to Fundstrat Global Advisors LLC's Tom Lee. The jobs data “adds to misery of early 2024,” he said.

“The first four trading days of 2024 have been a terrible start for equities,” Lee wrote in a note to clients. “The year tends to play out in January. Meaning, this turmoil in the first week of trading is telling us to brace for a challenging year.”

The strategist, who was one of the few to forecast last year's bull run, still expects a rally in the latter half of the year.

Richmond Fed President Thomas Barkin said Friday the labor market was moving in a steady, softening pattern and the Federal Reserve can lower rates as the economy normalizes and confidence grows about the downward path of inflation.

Friday's strong jobs report initially battered stocks and bonds but a brief rebound was staged after data showing the US service sector slowed in December but remained above a key level that indicates expansion.

Treasuries ended Friday lower after a choppy session, notching a weekly slide. The yield on the 10-year rose to %. US bonds were whipsawed after data showing nonfarm payrolls rose by 216,000, a larger than expected gain and the unemployment rate held steady at 3.7% in December.

Read more: Bond Traders Are Resolute on 2024 Fed Cuts as Data Whips Yields

The jobs report initially cooled wagers on faster and deeper rate cuts from the Fed. But swaps traders eventually reformed bets on roughly 140 basis points of easing this year, with about a 70% chance of a decrease in March. Some on Wall Street kept faith in the central bank's ability to cool the economy while side-stepping a downturn.

“Clearly, the economy is strong enough as of now to withstand the Fed's currently elevated interest rates,” according to Jeremy Straub, chief executive officer of Coastal Wealth.

Treasury Secretary Janet Yellen was also optimistic the world's largest economy was on the right path after declaring the US had achieved a much-anticipated soft landing.

Read more: Yellen Declares US Economy Has Achieved Soft Landing

But many were skeptical about the prospect of deeper rate cuts after the payrolls report — noting the devil was in the details. The data did little to change the views of economists at Goldman Sachs Group Inc. and JPMorgan as the banks reiterated their forecasts on rate cuts.

“This number does question the confidence of the market around the March cut,” said Lindsay Rosner a portfolio manager at Goldman Sachs Asset Management. “We've got three inflation prints between now and the March meeting. Every number counts.”

Investors will get a taste next Thursday. Consumer inflation for the year is projected to come in at 3.2%, according to economists surveyed by Bloomberg. Investors will also be watching the financial sector next Friday as JPMorgan Chase & Co. and other big banks kick off earnings.

BMO Capital's Ian Lyngen said Friday's better-than-expected jobs report “affords the Fed plenty of flexibility to delay cutting rates early in 2024.”

Vital Knowledge's Adam Crisafulli was even more circumspect: “Hourly wage growth ran hot and the participation rate sank, all of which suggests markets are far off the mark in terms of what they're pricing in for 2024 Fed easing.”

What Bloomberg Economics Says:

Any thoughtful examination of the December jobs report and ISM Services survey shows the labor market is sending concerning signs, if not outright recessionary signals. If the sharp plunge in the ISM Services employment index is correct, the labor market is weaker than at the worst point of the 2001 recession. Jobless claims data (Thurs.) in coming weeks will be particularly signaling – as this is about the time of year when firms lay off temporary workers.

— Economists led by Anna Wong

Earlier, Citigroup Inc. strategists recommended buying global stocks at times of weakness and said don't chase rallies as this year offers less upside than 2023.

In corporate news, Tesla Inc. is recalling more than 1.6 million cars in China over issues with the driver-assistance system.

Deal speculation swirled Friday afternoon. Synopsys Inc. is in advanced talks to acquire engineering software provider Ansys Inc. for about $35 billion while Southwestern Energy Co. and Chesapeake Energy Corp. are near a $17 billion merger, according to reports.

In China, shadow banking giant Zhongzhi Enterprise Group Co. filed for bankruptcy. The downfall marks one of China's biggest-ever corporate collapses, putting more stress on already fragile consumer and investor sentiment.

The dollar edged lower after being whipsawed by the data. Oil climbed, cementing a weekly gain, as simmering tensions in the Middle East and North Africa eclipsed signs of weakening US demand.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.2% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.1%

- The Dow Jones Industrial Average was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0939

- The British pound rose 0.3% to $1.2720

- The Japanese yen was little changed at 144.76 per dollar

Cryptocurrencies

- Bitcoin fell 1.2% to $43,960.51

- Ether fell 1.2% to $2,248.57

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.05%

- Germany's 10-year yield advanced three basis points to 2.16%

- Britain's 10-year yield advanced six basis points to 3.79%

Commodities

- West Texas Intermediate crude rose 2.4% to $73.91 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Alex Nicholson, Edward Bolingbroke, Allegra Catelli, Cecile Gutscher and Sujata Rao.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.