Shilpa Medicare Ltd.'s contract development and manufacturing organisation customer, Unicycive Therapeutics Inc., reported positive results from a pivotal clinical trial and placed a binding purchase order with the company.

The clinical trial was for Oxylanthanum Carbonate, a new chemical entity molecule with potential treatment for hyperphosphatemia in chronic kidney disease patients, according to an exchange filing on Thursday.

Unicycive is expected to file the New Drug Application for the molecule by mid-2024, with potential approval by mid-2025, it said.

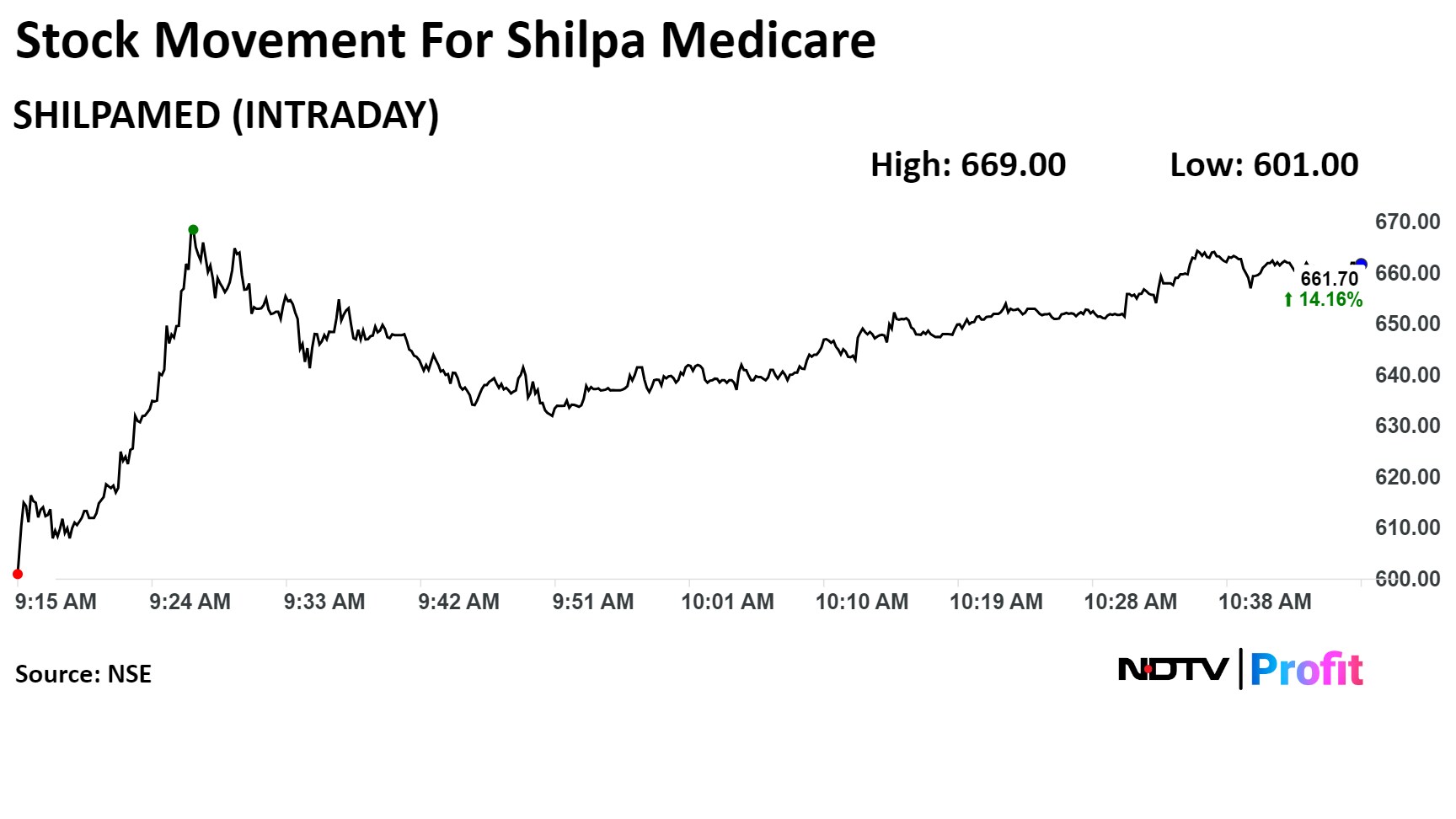

Shares of the company surged as much as 15.41% before paring some gains to trade 15.33% at Rs 668.50 per share at 11:01 a.m. This compares to a 0.2% fall in the NSE Nifty 50. The stock has risen 100.2% year-to-date.

Key Levels

Resistance level: Rs 787 per share.

Support level: Rs 417 apiece (two-day low).

How Will Shilpa Medicare Benefit?

Shilpa Medicare partnered with Unicycive to provide end-to-end CDMO services, covering everything from the development and supply of the active pharmaceutical ingredients to the finished dosage form.

Based on the outcome of the pivotal clinical studies, Unicycive has entered into a long-term manufacturing and supply agreement with SML and has agreed to place a binding purchase order for the supply of OLC tablets by June 30, 2025.

Unicycive has committed to placing additional orders for tablets to be delivered between Dec. 31, 2025, and June 30, 2026.

In addition to the supply arrangement, SML is expected to receive $10 million in milestone payments spanning the filing, approval, and launch of the product. Anticipating increased product demand, Unicycive will also fund the establishment of a new manufacturing block at Shilpa's site.

Future Outlook

Shilpa Medicare Ltd. is focusing on several key initiatives to drive future growth and strengthen its market position:

De-leveraging balance sheet: The company aims to de-leverage its balance sheet using the recently raised qualified institutional placement funding of Rs 500 crore. This strategic move is expected to enhance financial stability and support long-term growth.

Expanding CDMO projects: Shilpa Medicare is actively working on CDMO projects and plans to expand into Europe and rest of the world markets, with a particular focus on strengthening its presence in India. This expansion is aimed at tapping into new opportunities and broadening the company's global footprint.

Diversifying API portfolio: The company is adding three new molecules to its API portfolio: Methotrexate, Liraglutide, and Teriparatide. This diversification is intended to enhance the product offering and cater to a broader range of therapeutic areas.

Capex Plans

Shilpa Medicare Ltd. is making significant capital investments to enhance its production capabilities and expand its portfolio:

Enhancing Tranexamic acid capacity: The company is investing approximately Rs 25 crore to increase the production capacity of Tranexamic acid from 15 metric tons to 25 metric tons per month. This investment aims to meet growing market demand and improve operational efficiency.

Biocare facility investment: Shilpa Medicare is also planning to invest in its Biocare facility to support the fermentation of albumin. This strategic investment is expected to bolster the company's capabilities in biopharmaceutical production and expand its product offerings.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.