The local currency closed flat at 83.51 against the US dollar.

It closed at 83.51 on Wednesday.

Source: Bloomberg

The local currency closed flat at 83.51 against the US dollar.

It closed at 83.51 on Wednesday.

Source: Bloomberg

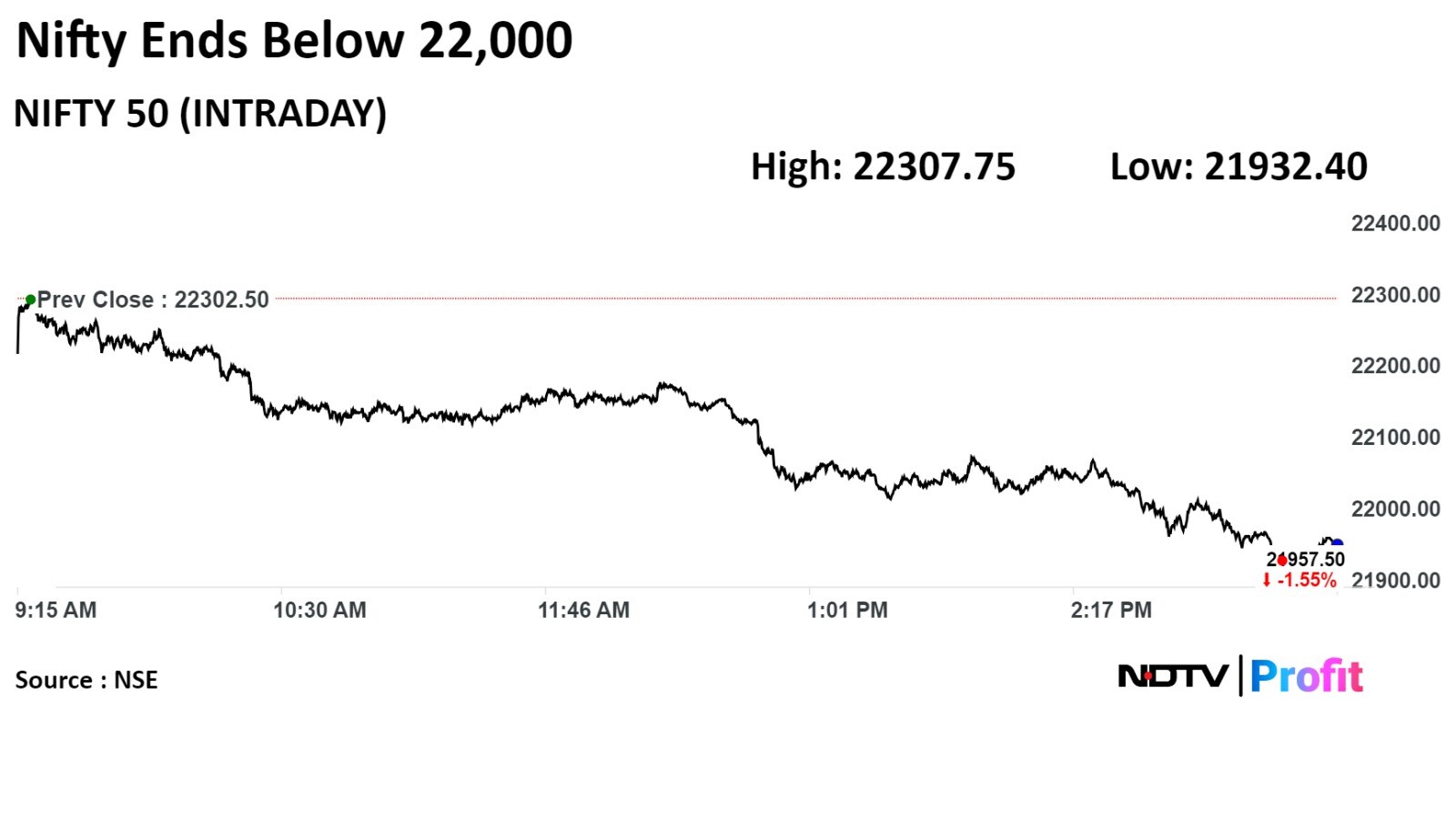

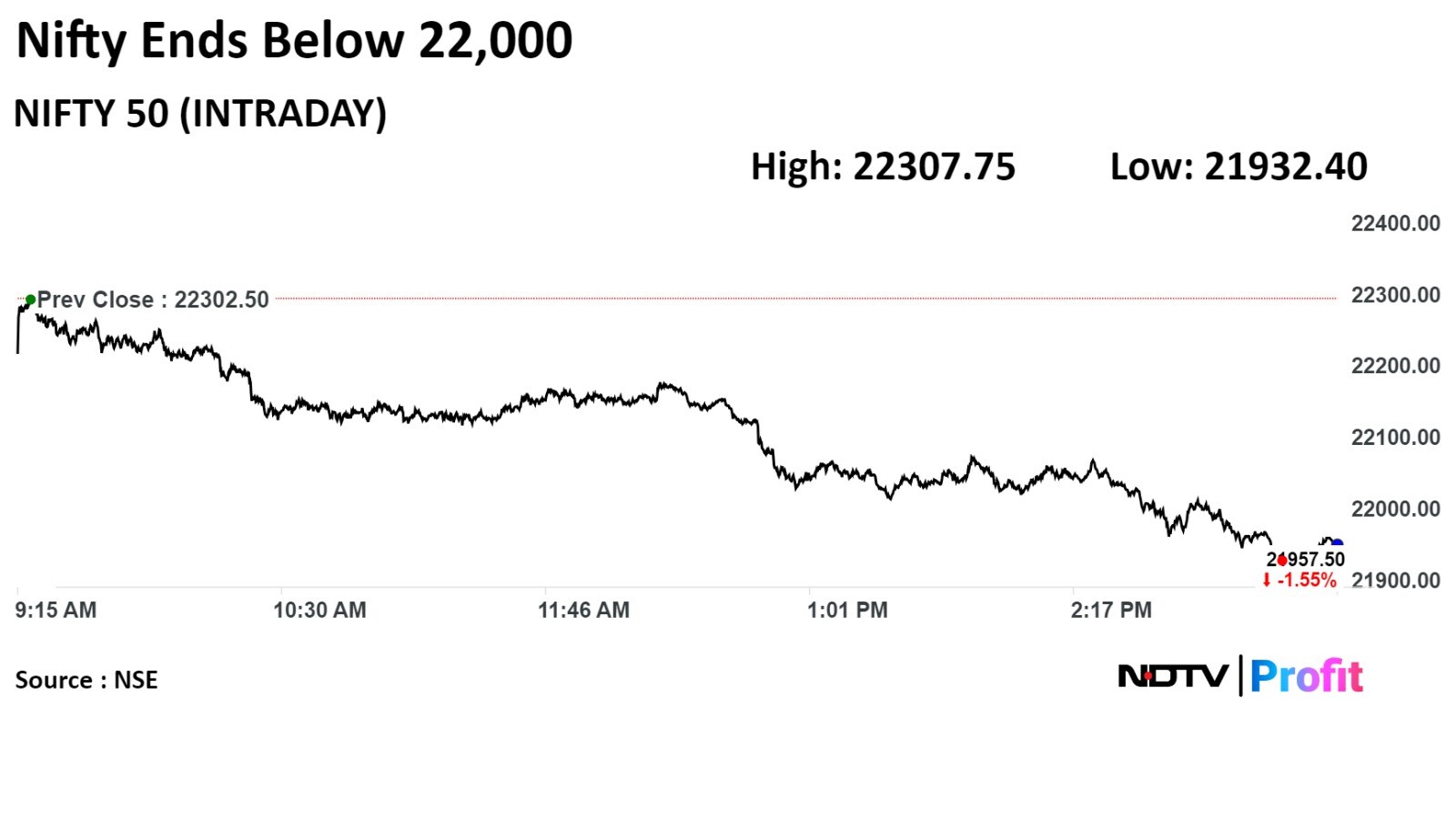

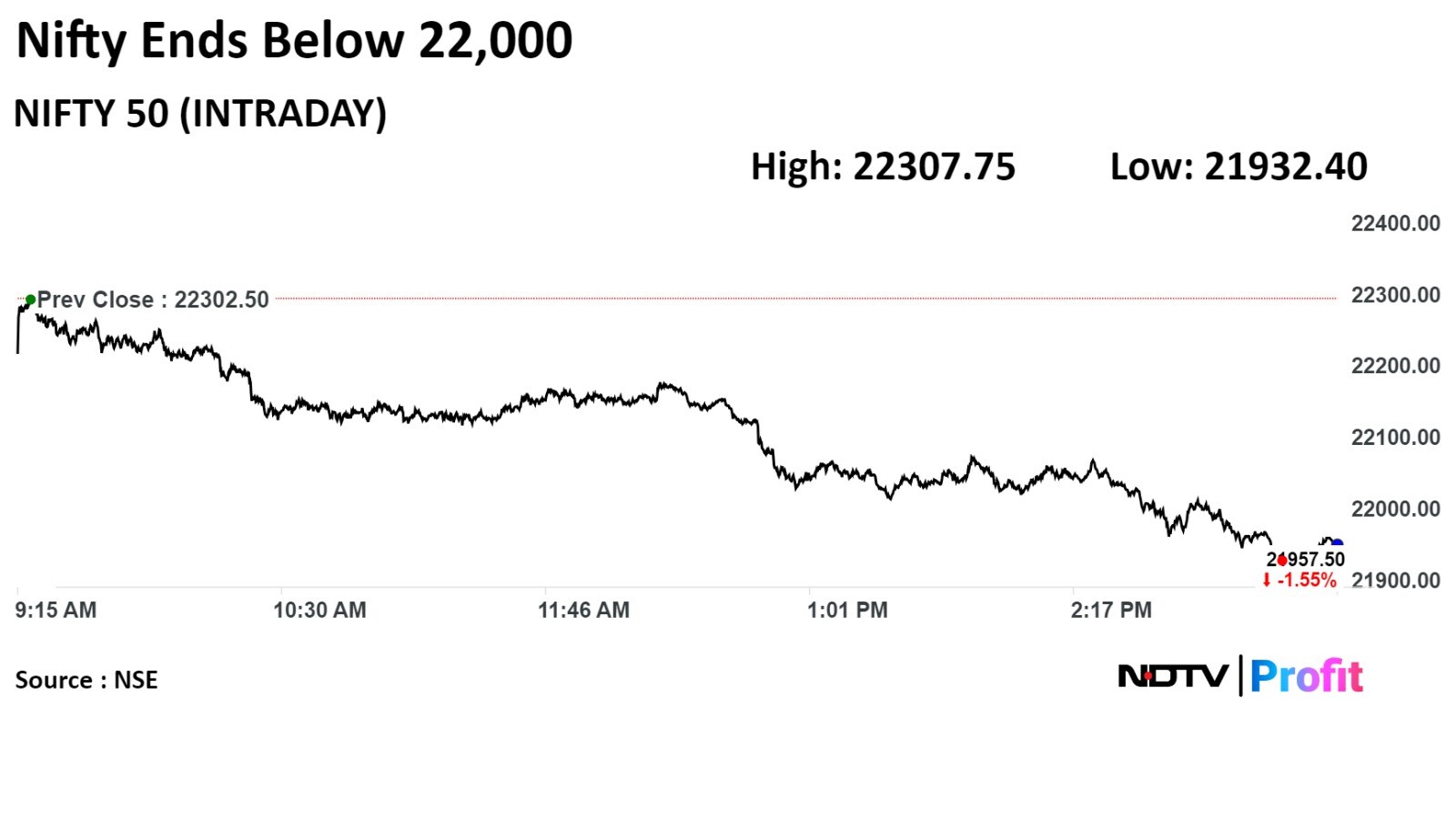

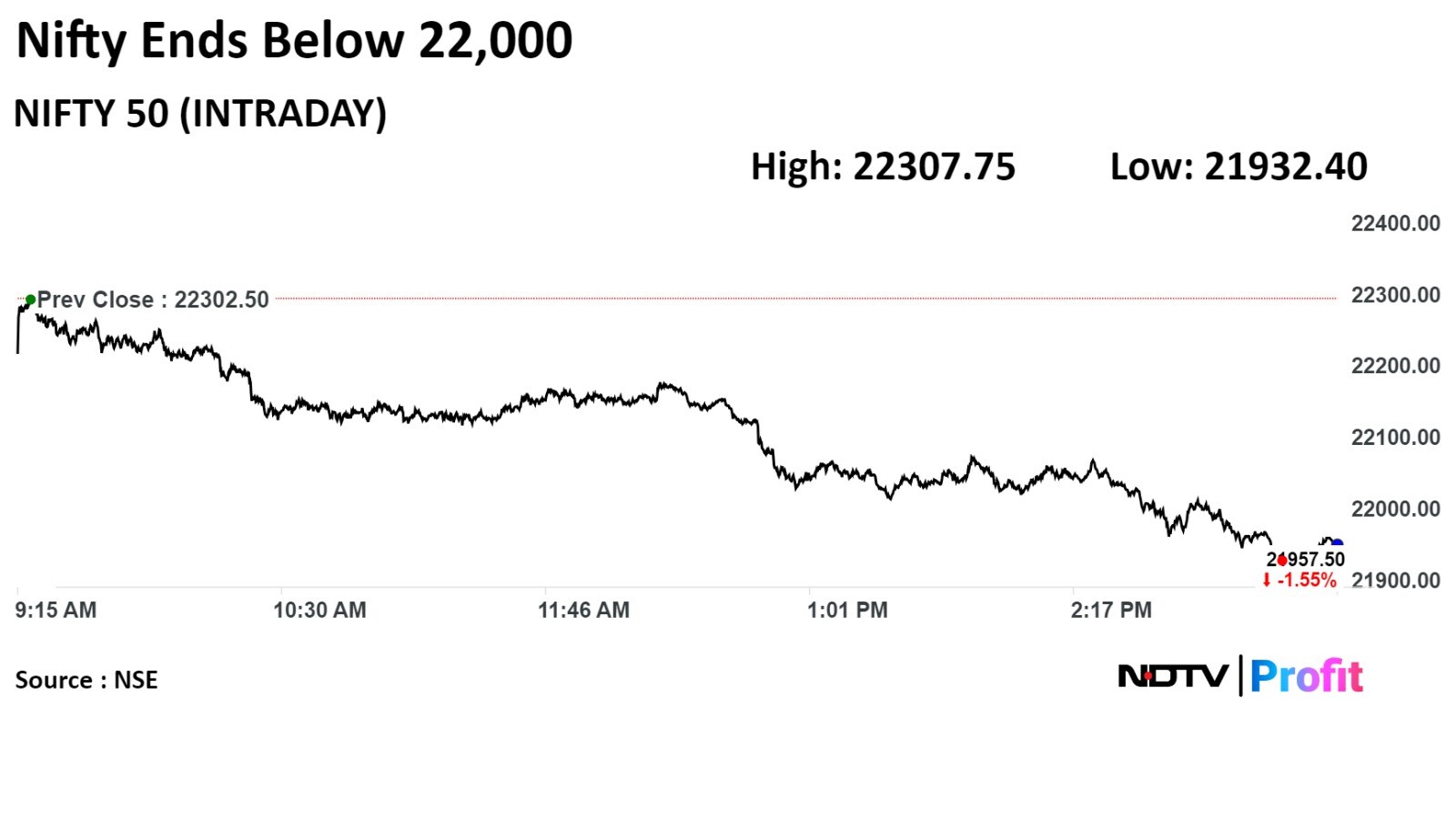

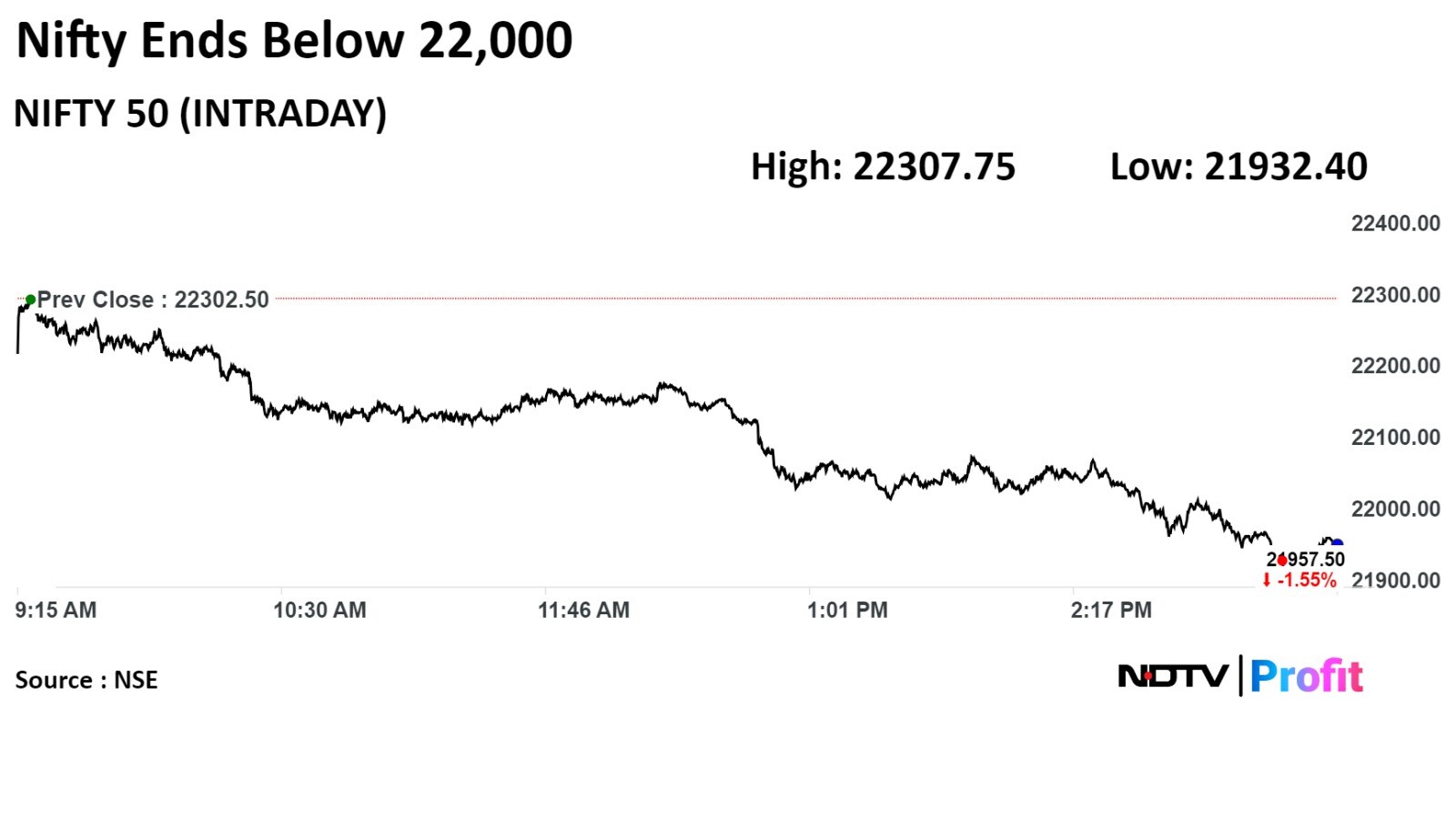

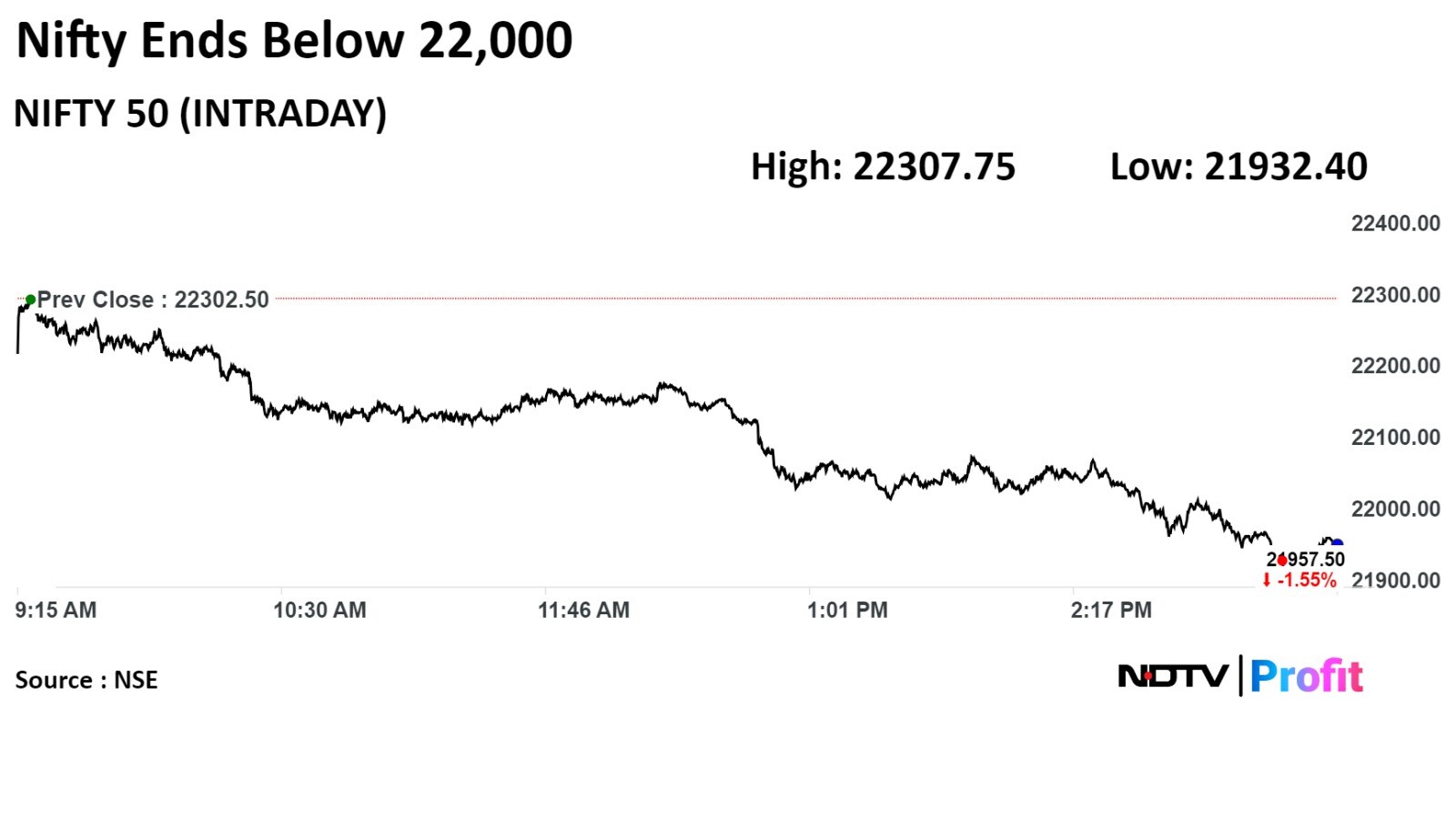

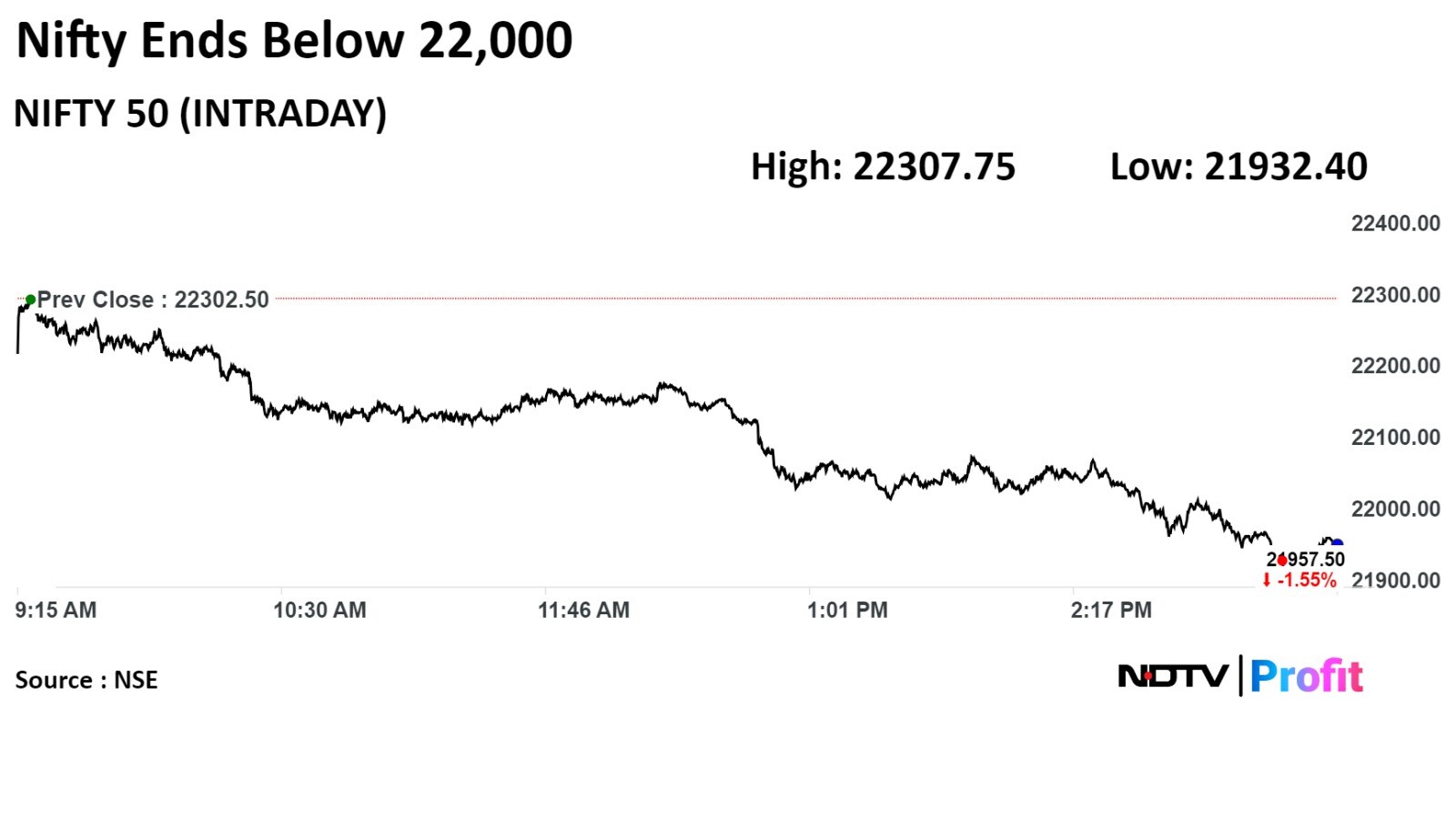

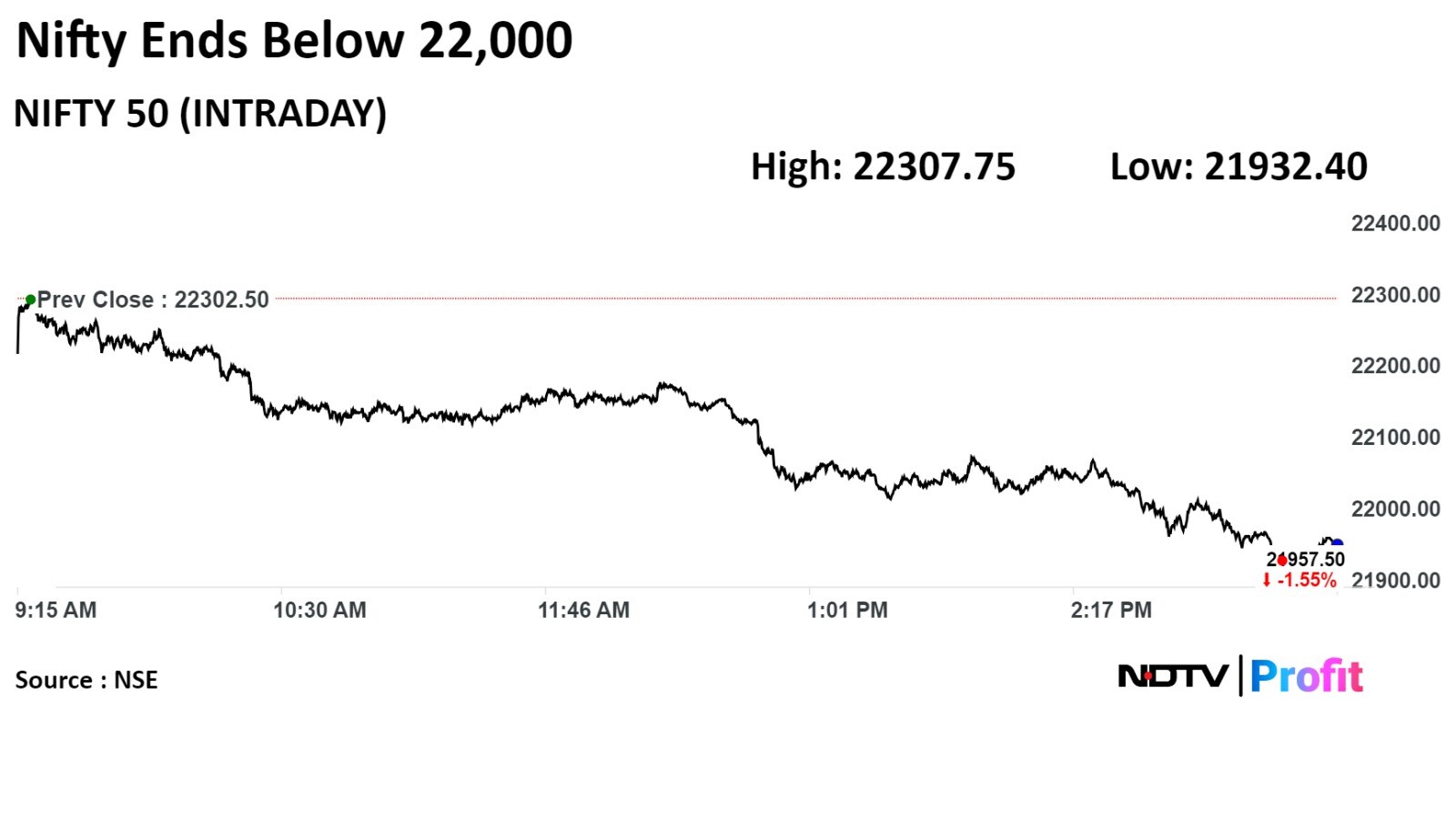

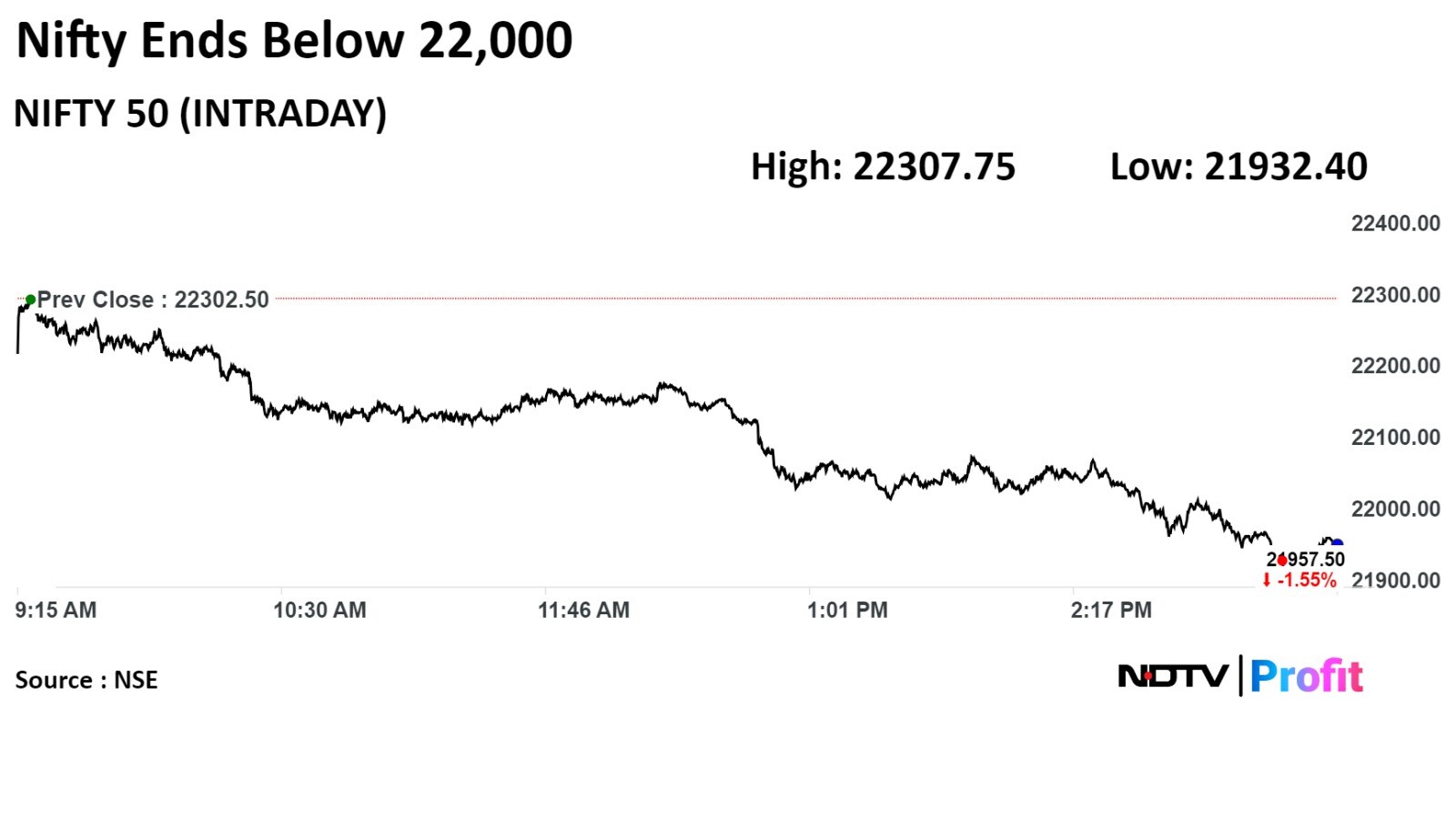

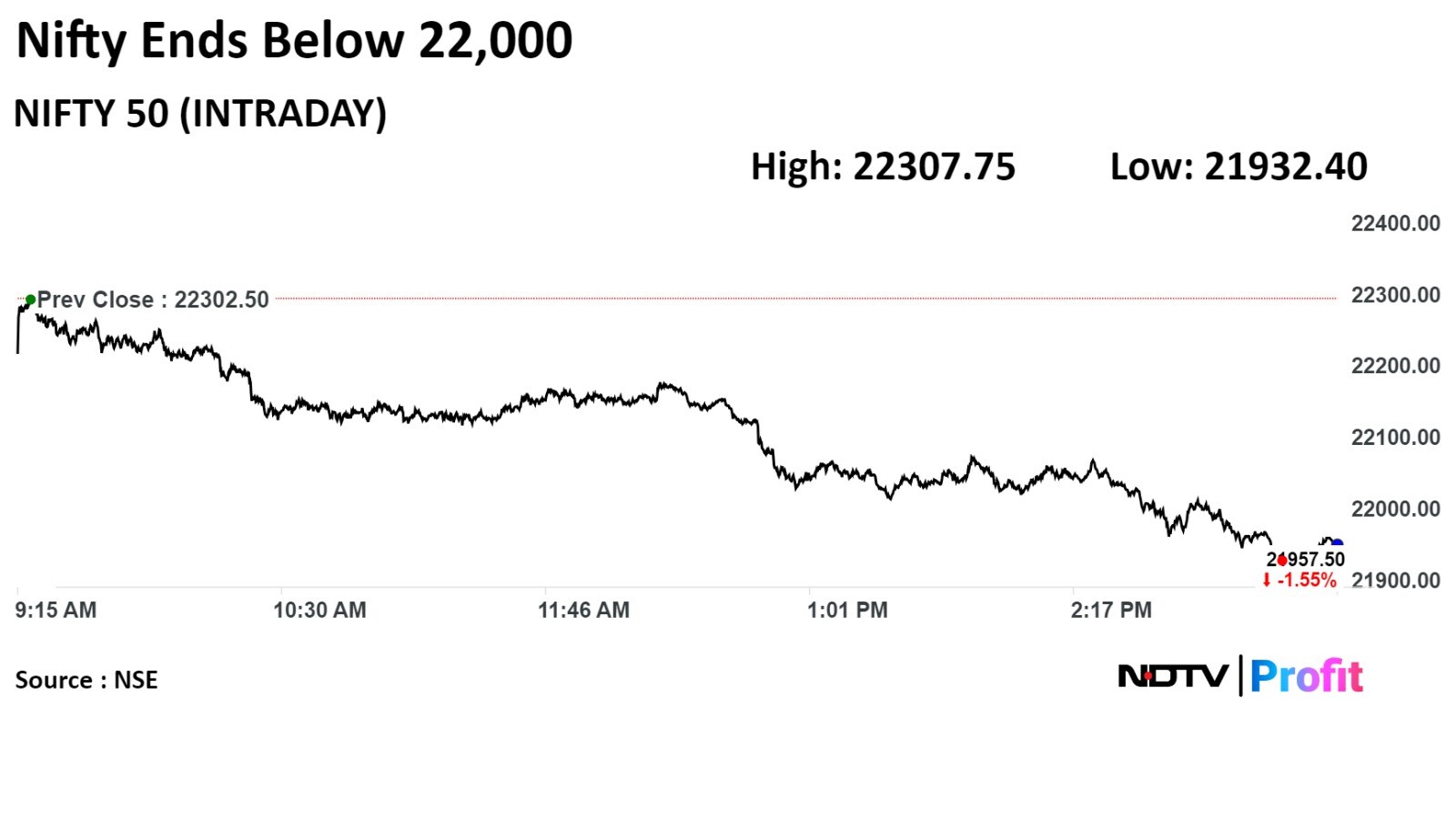

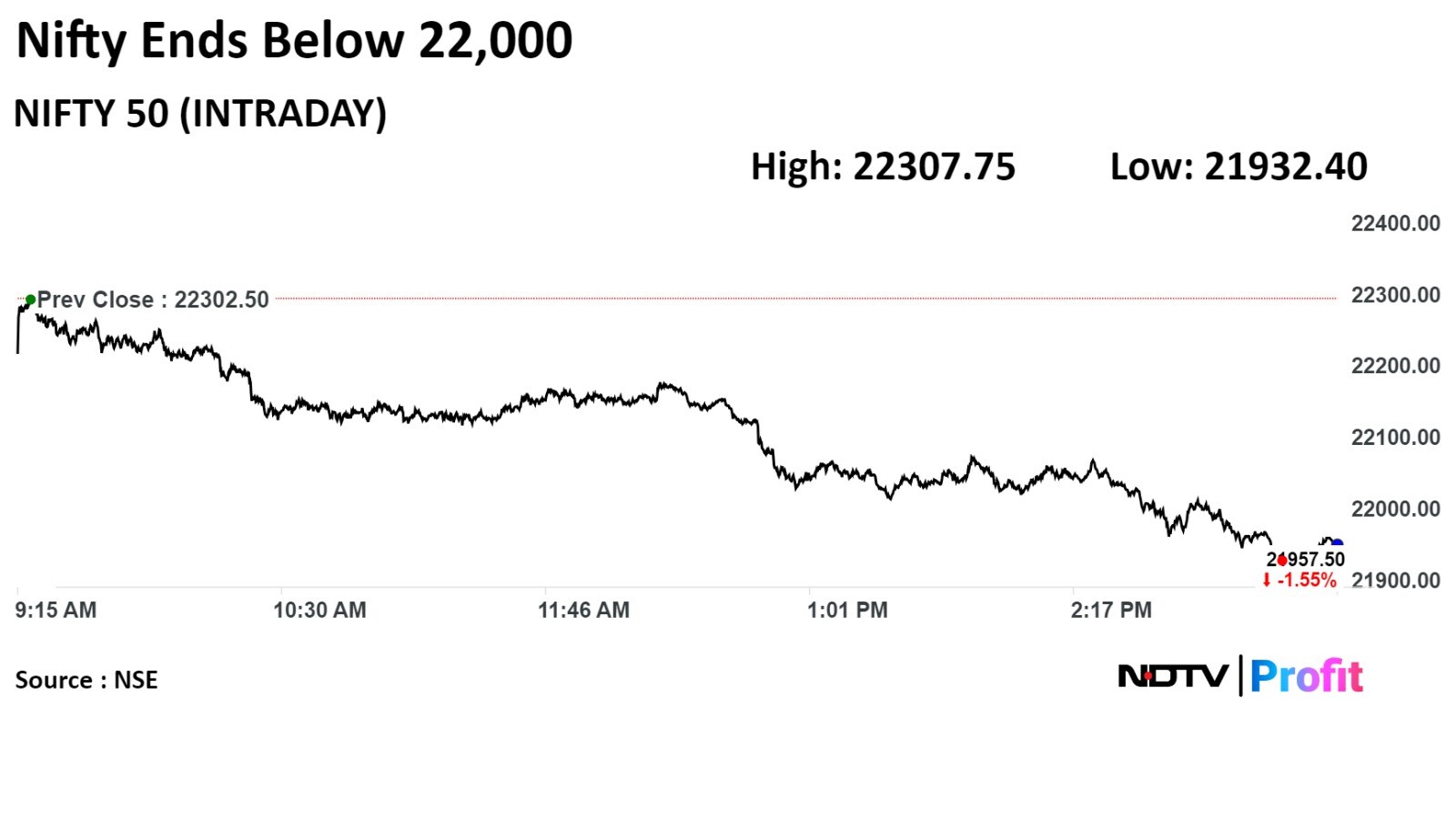

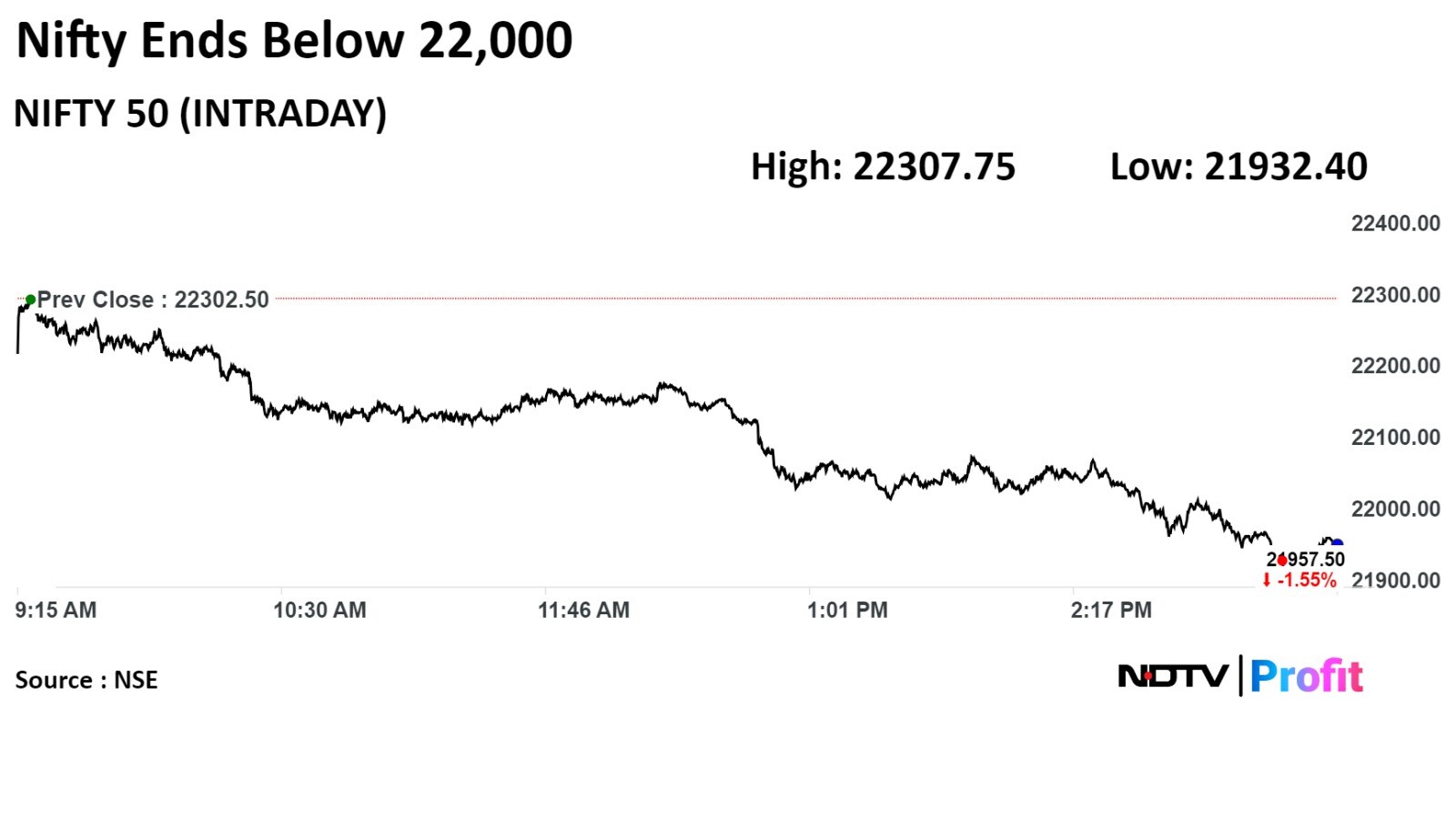

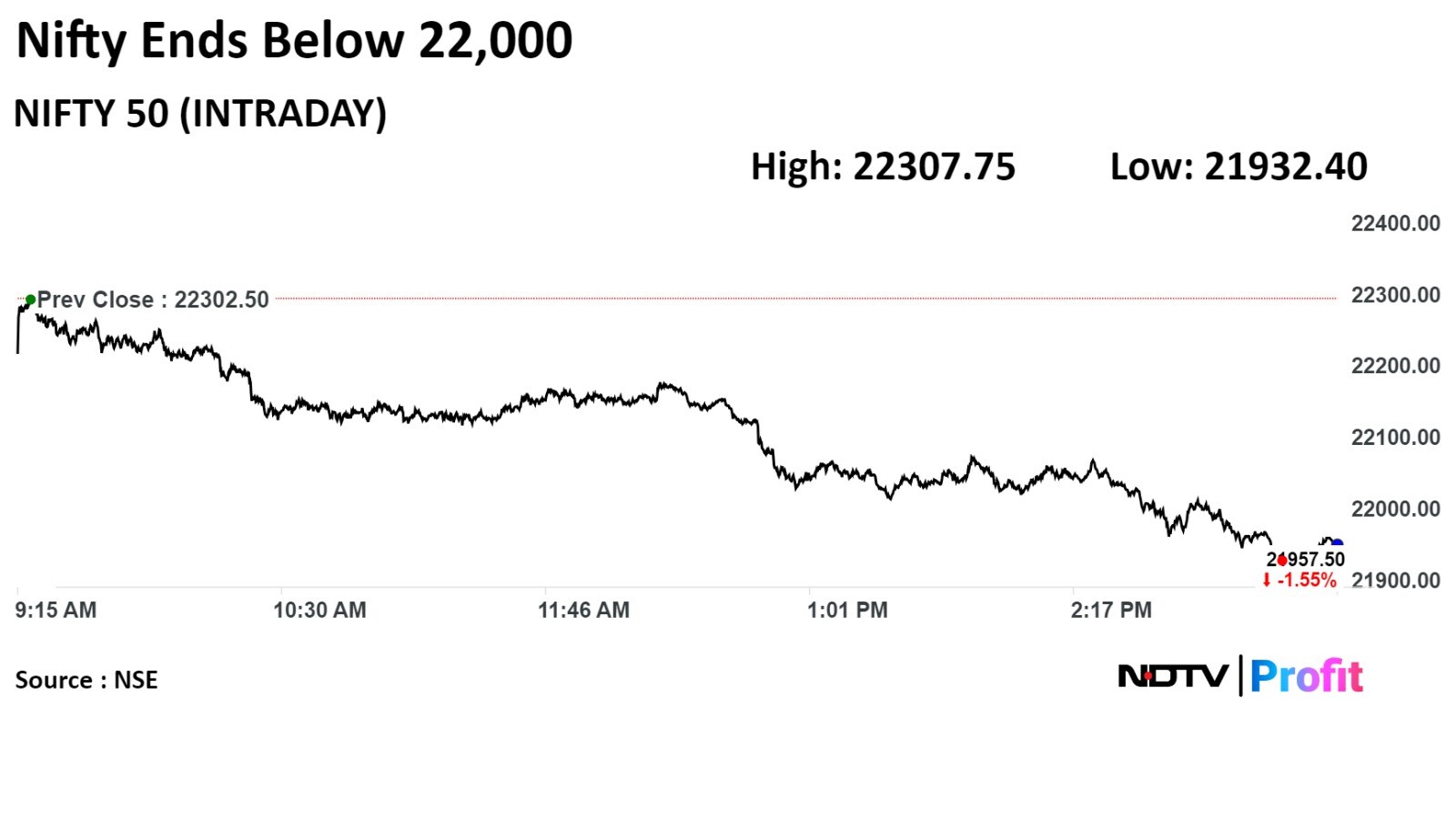

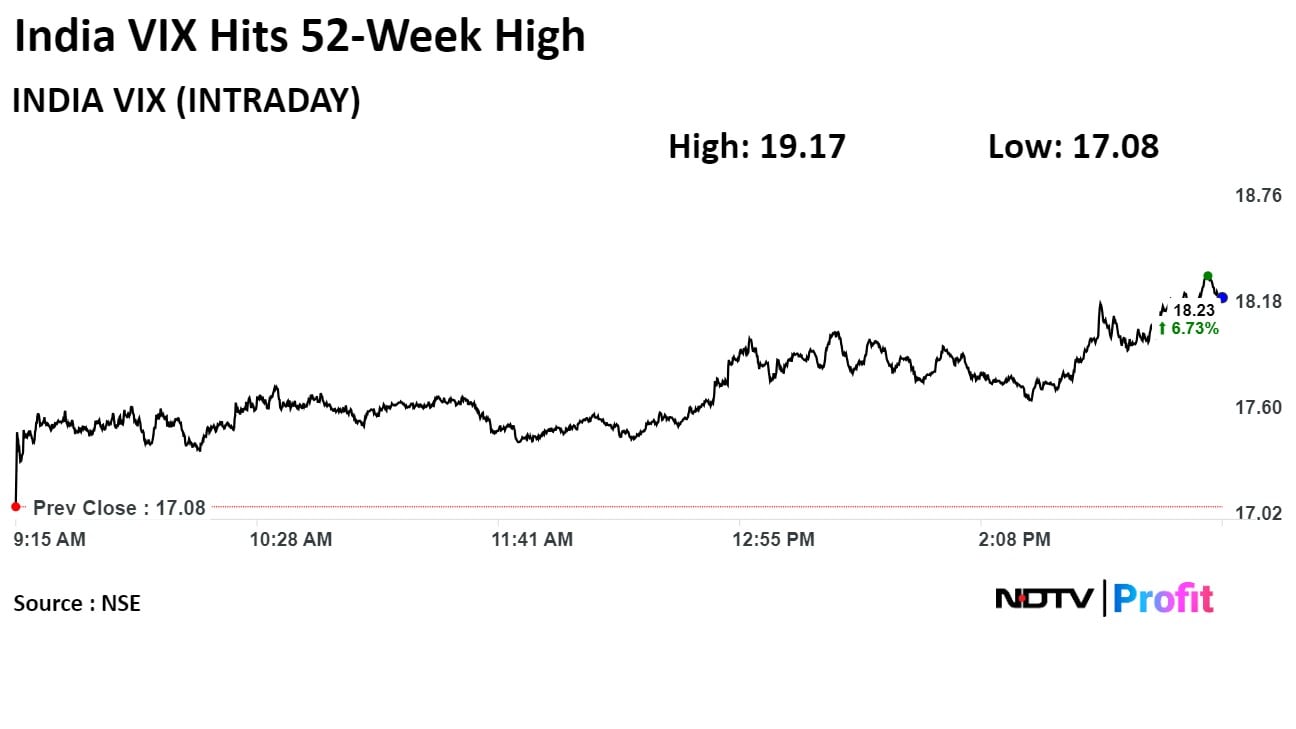

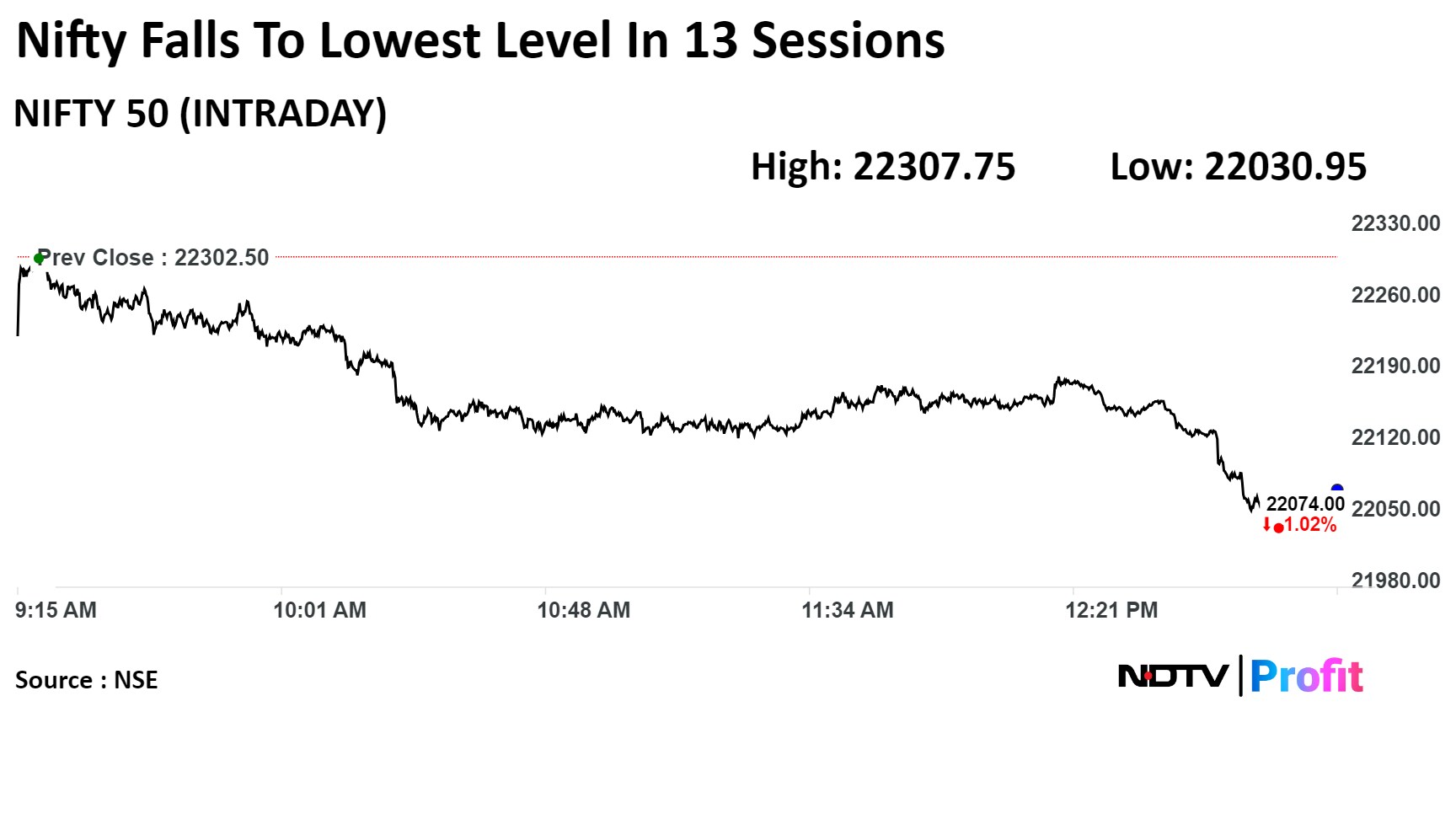

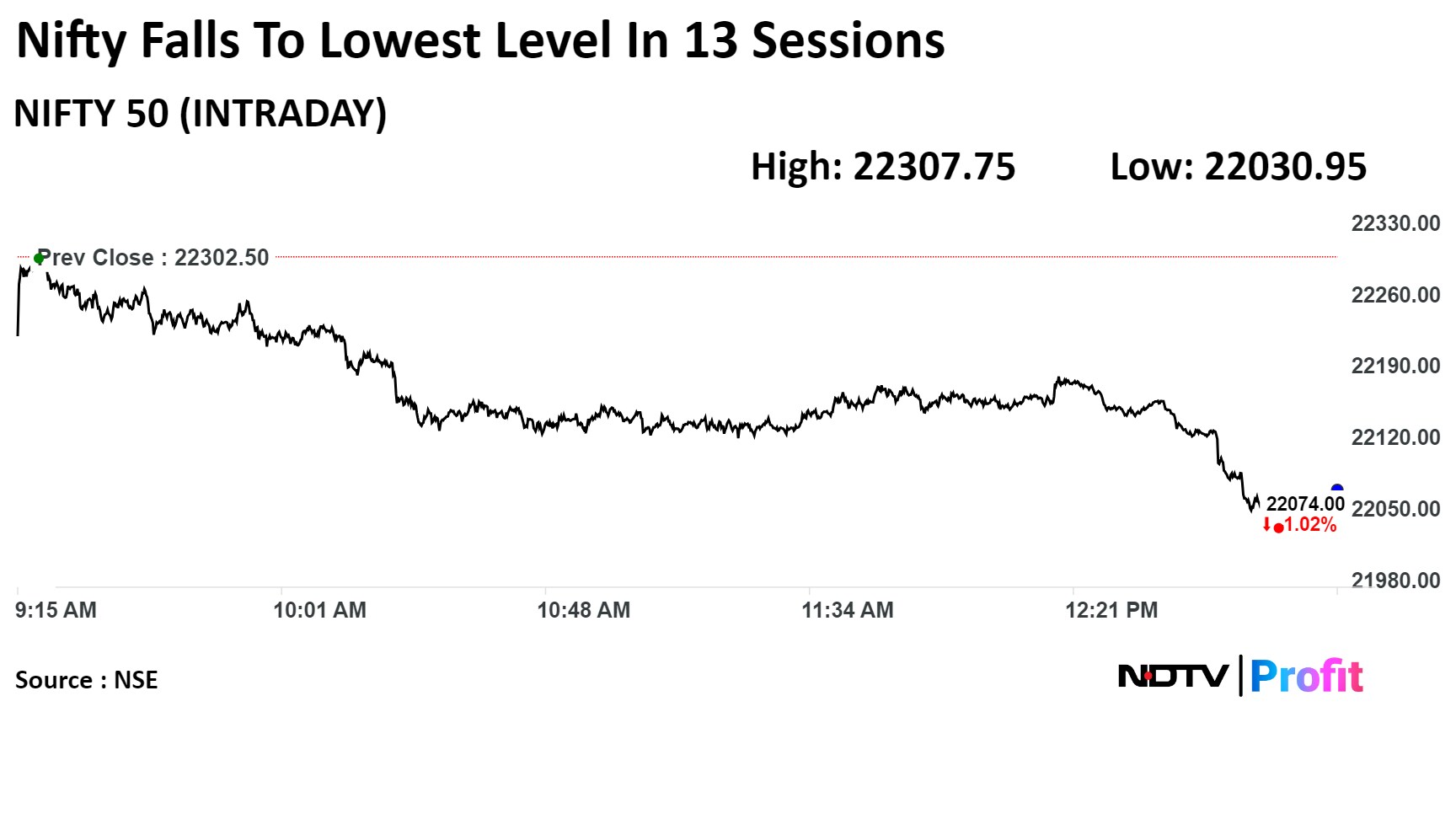

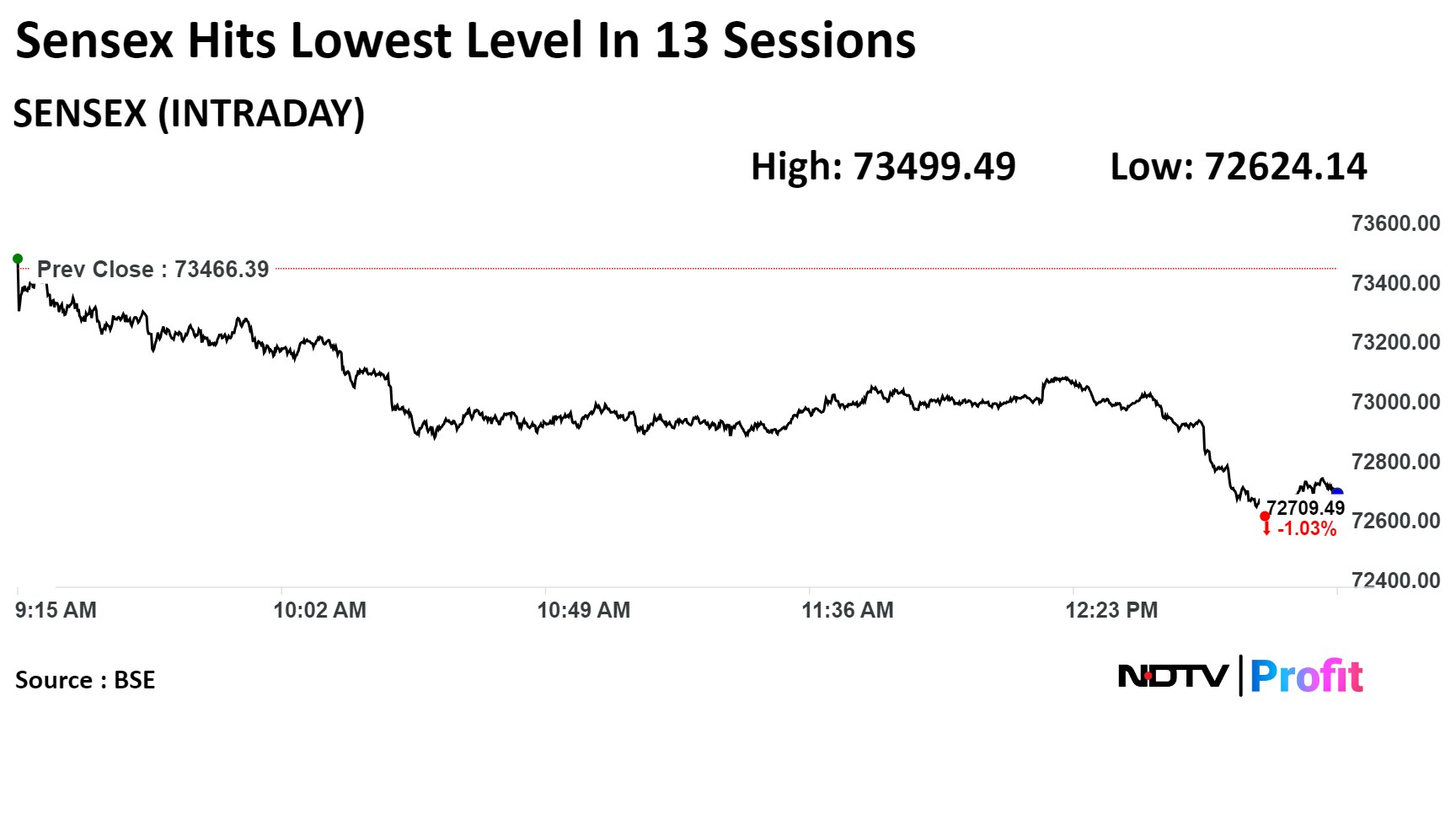

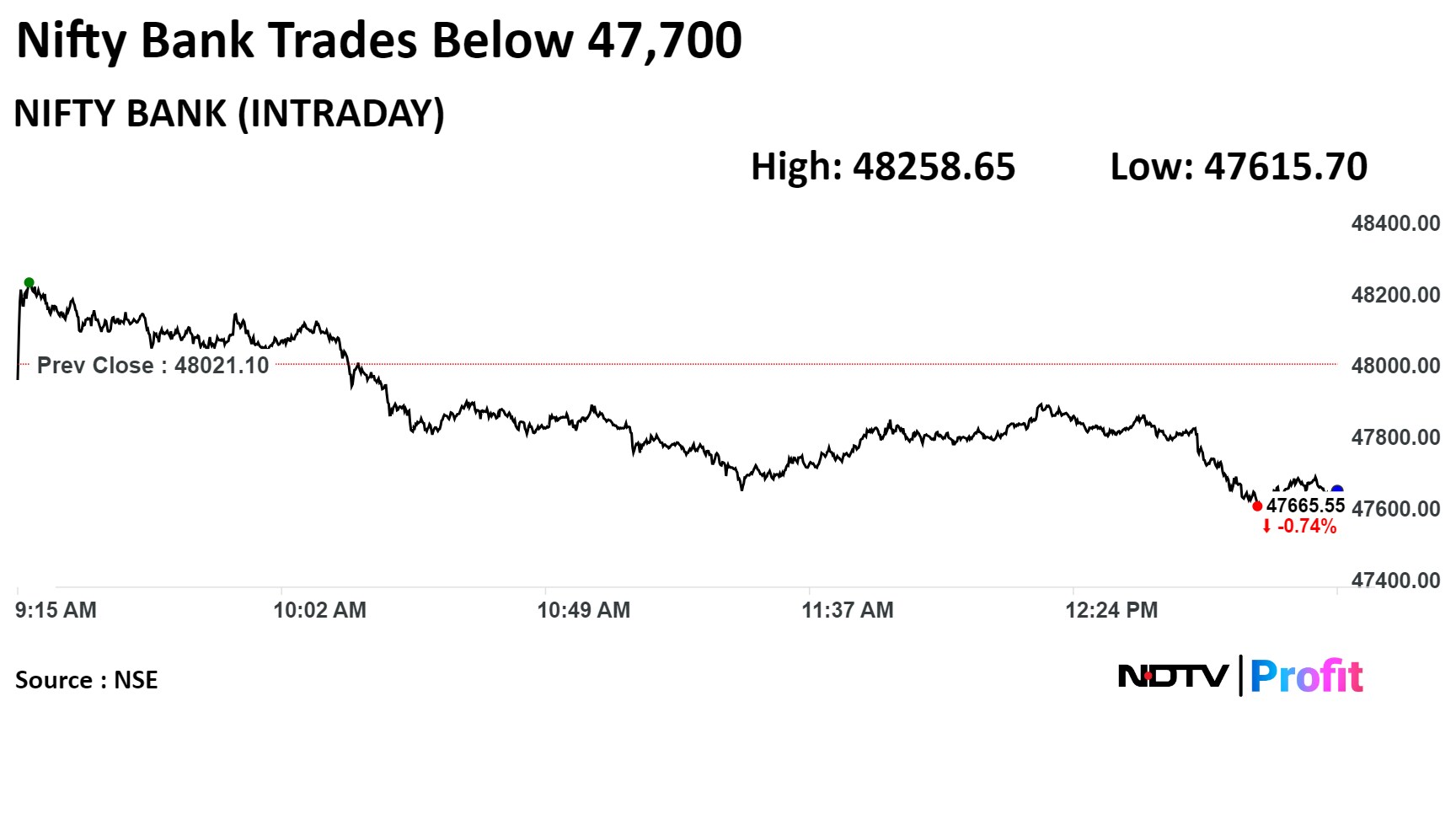

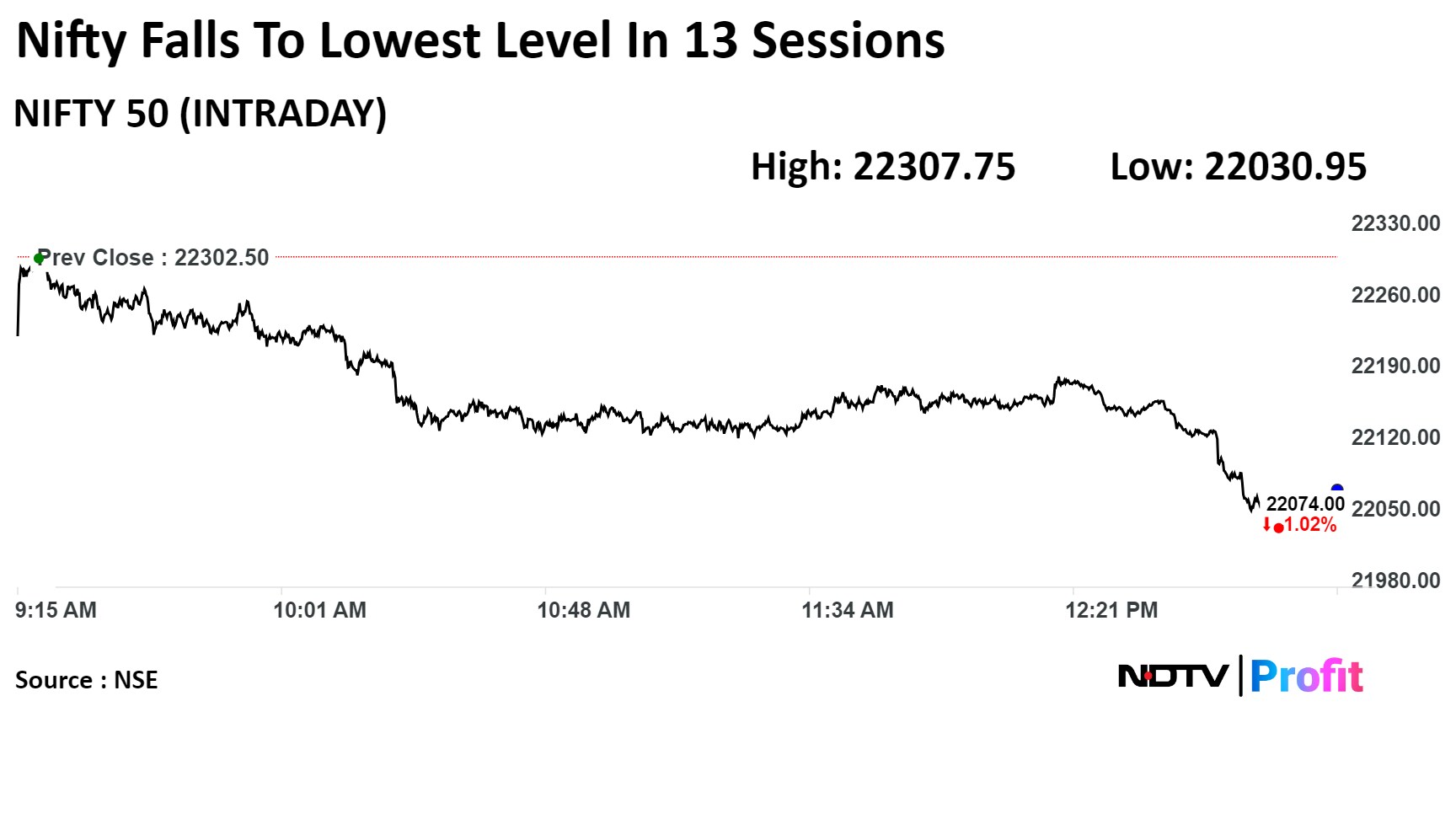

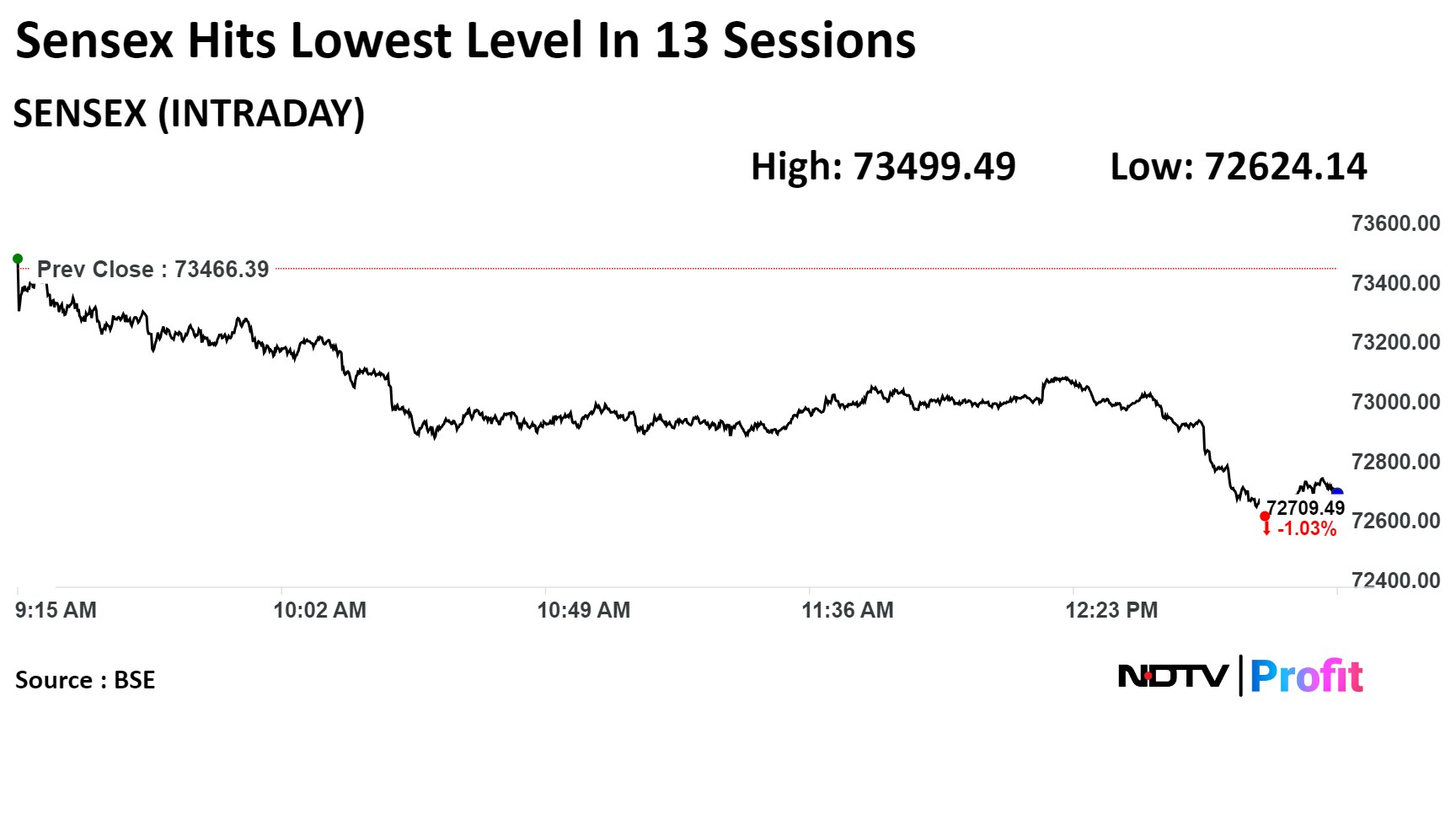

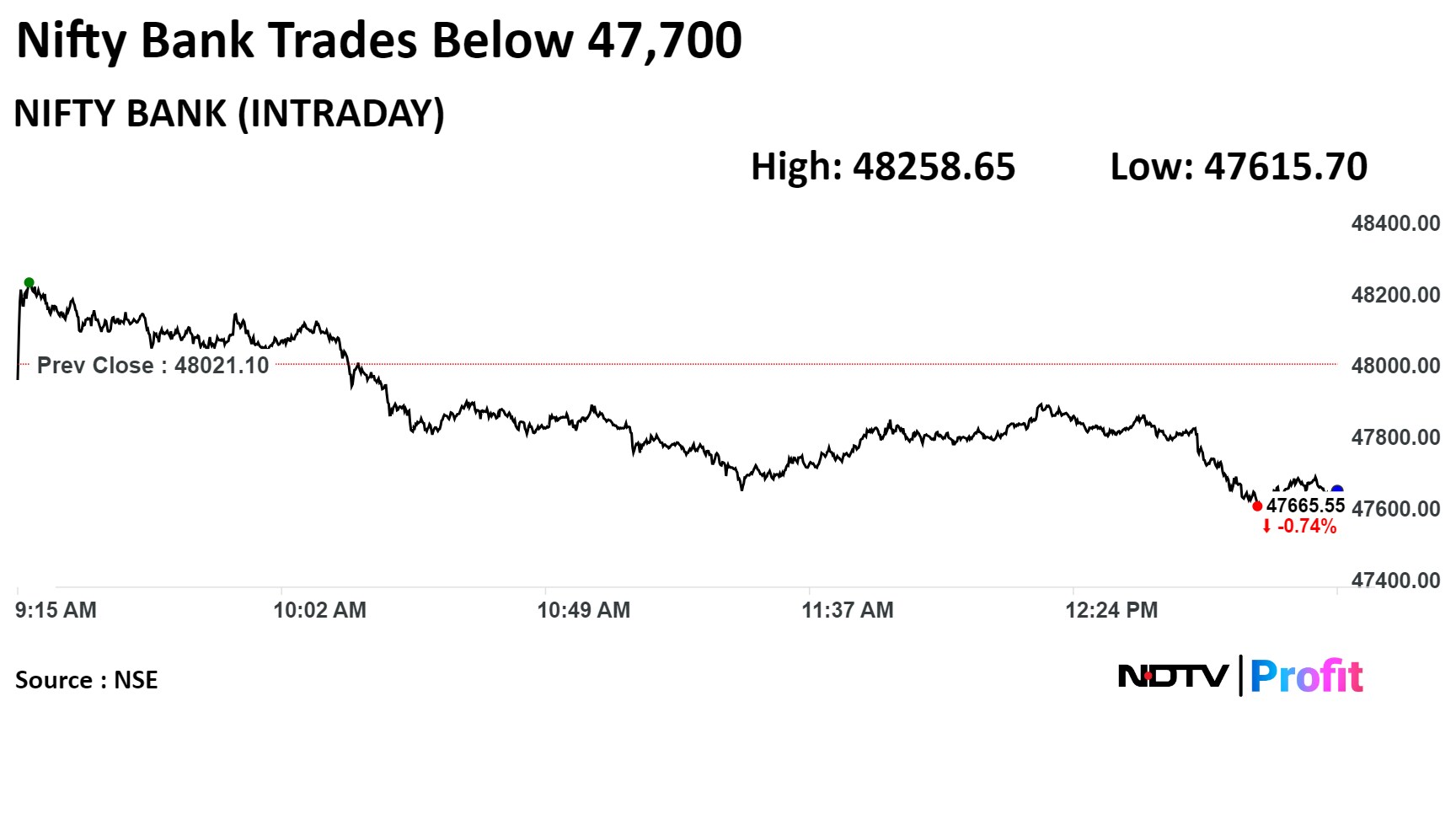

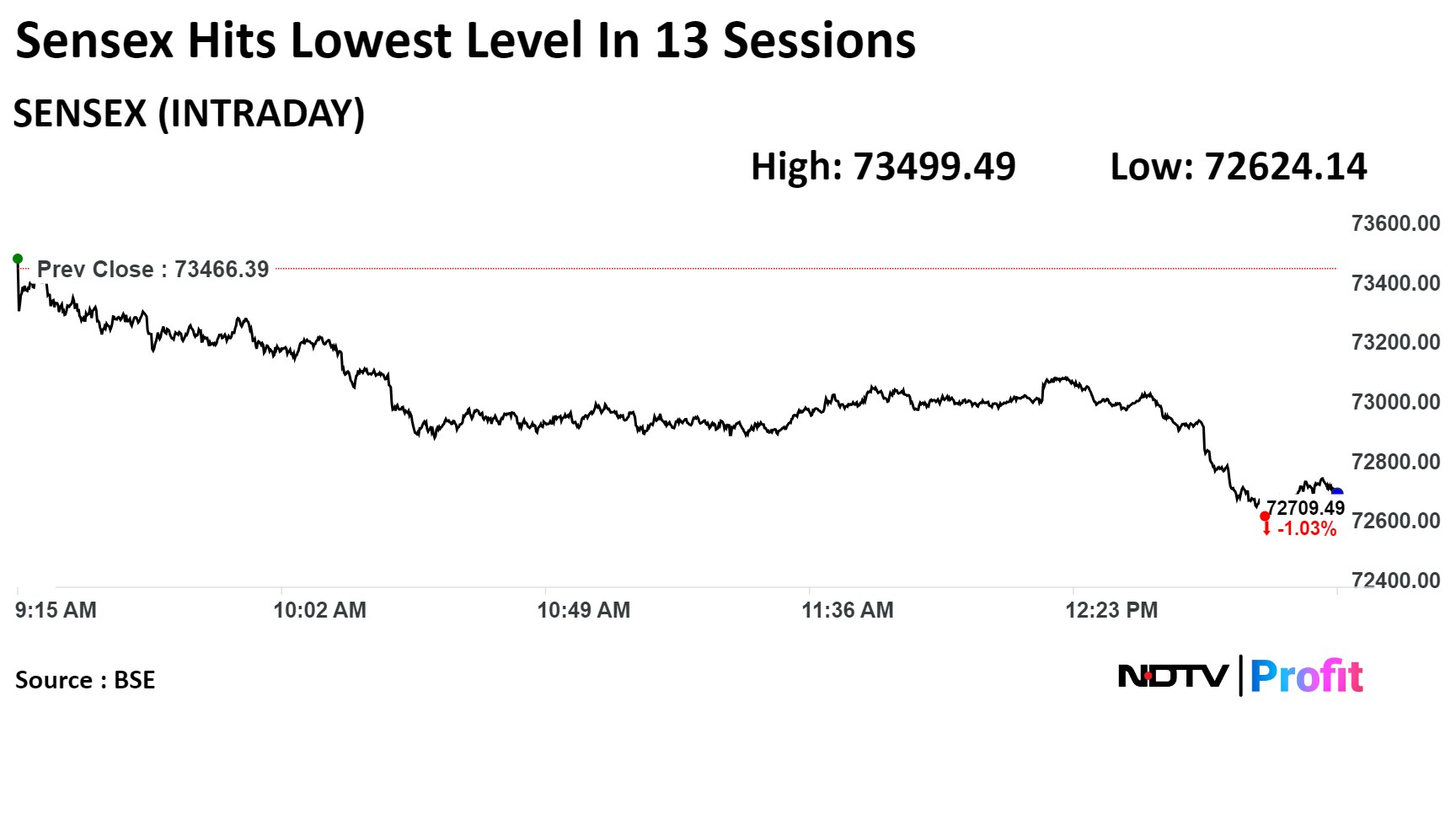

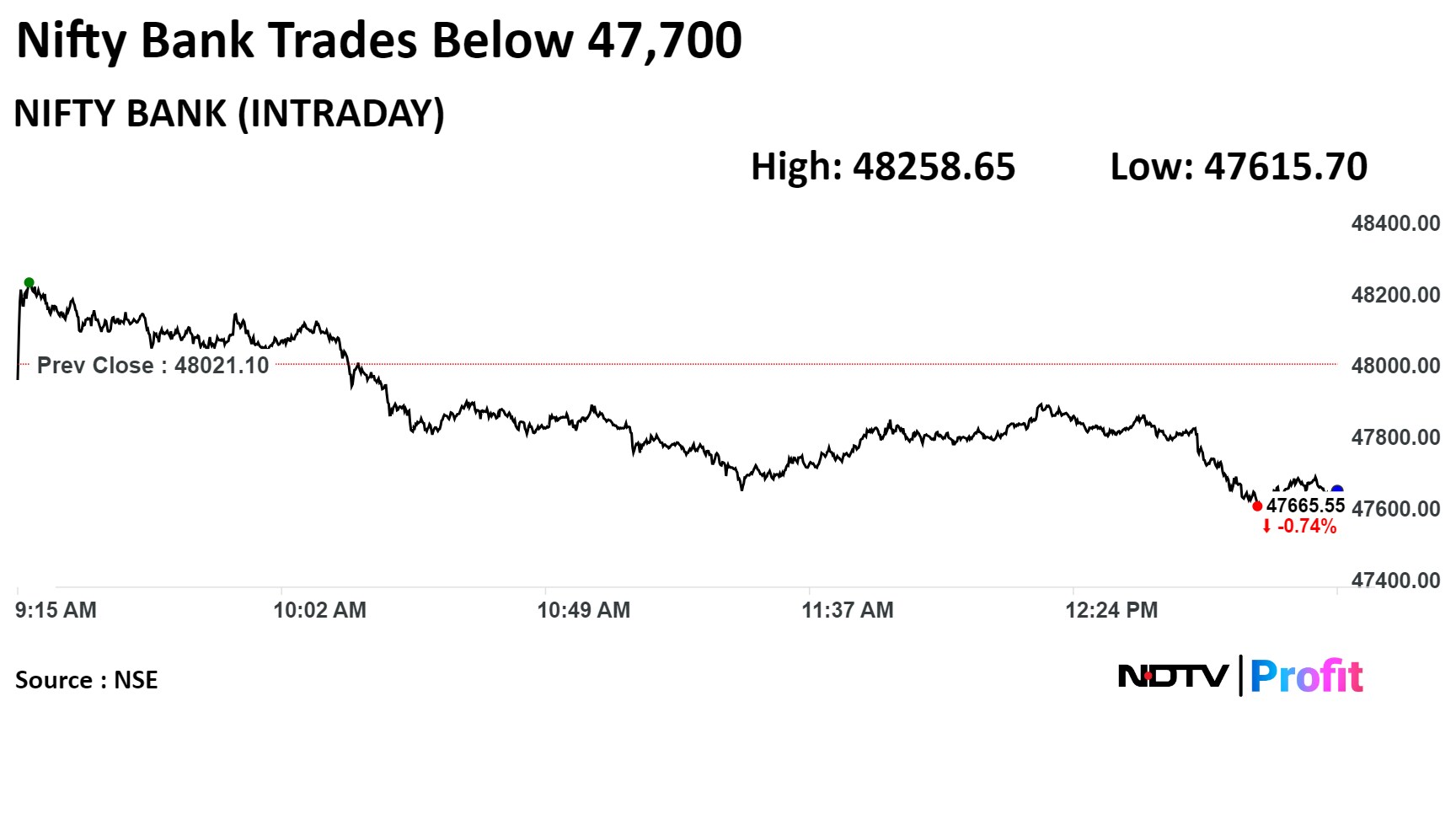

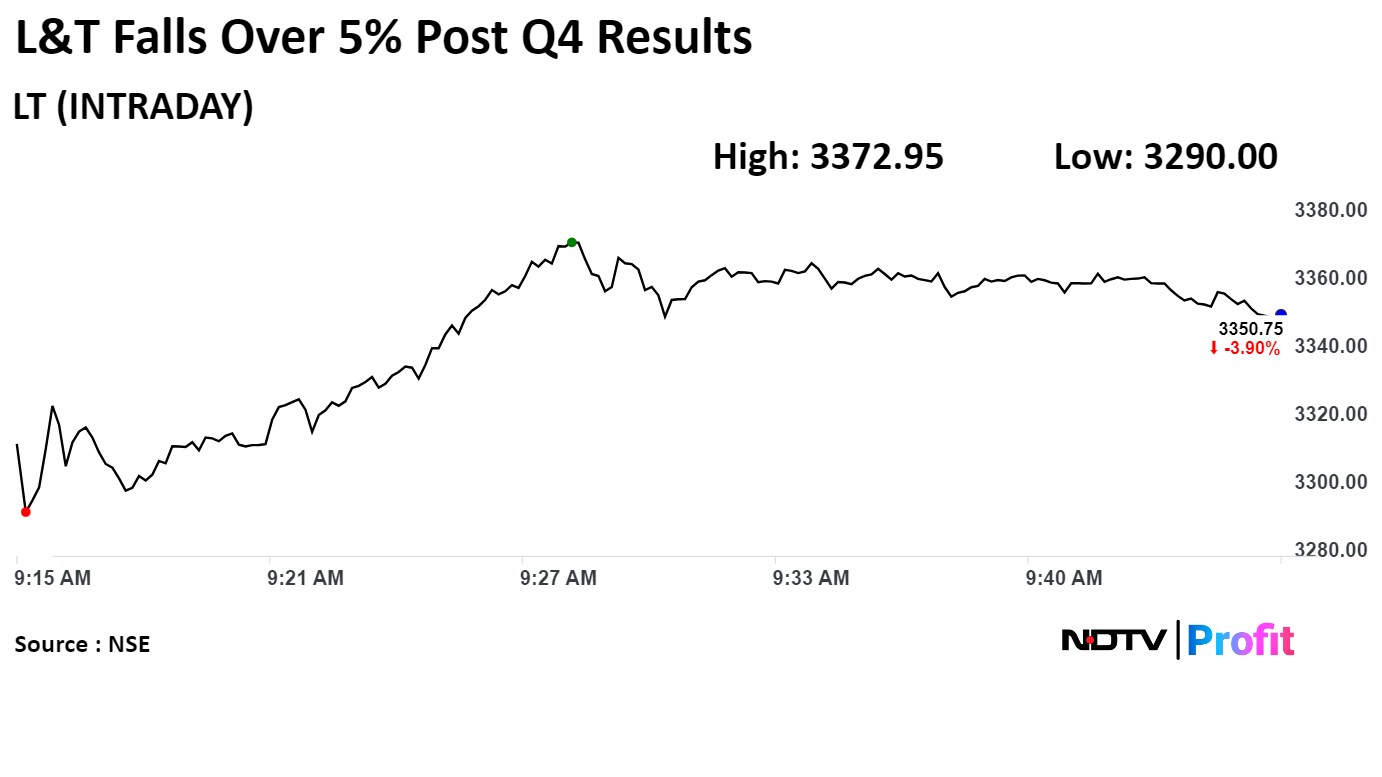

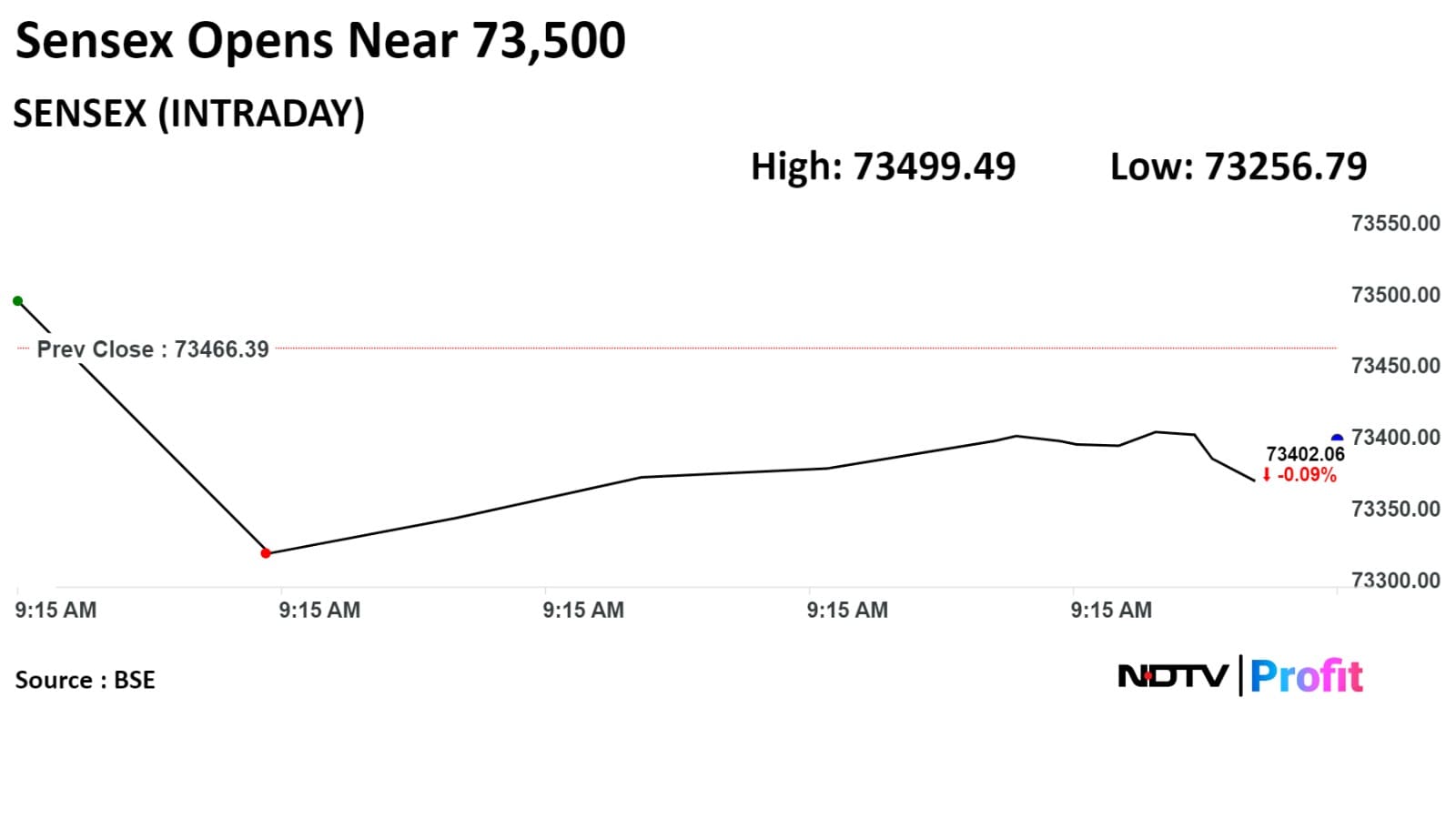

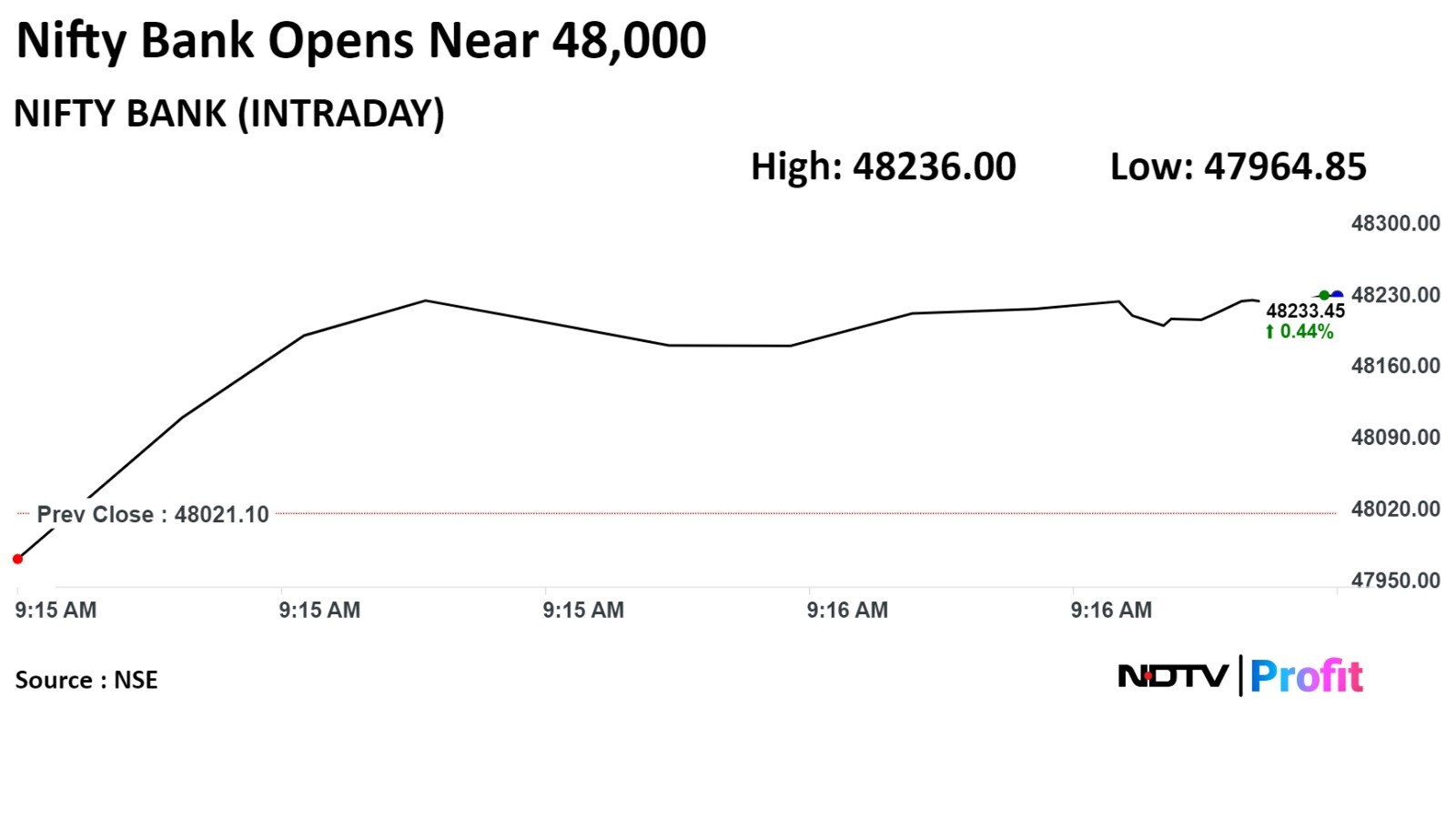

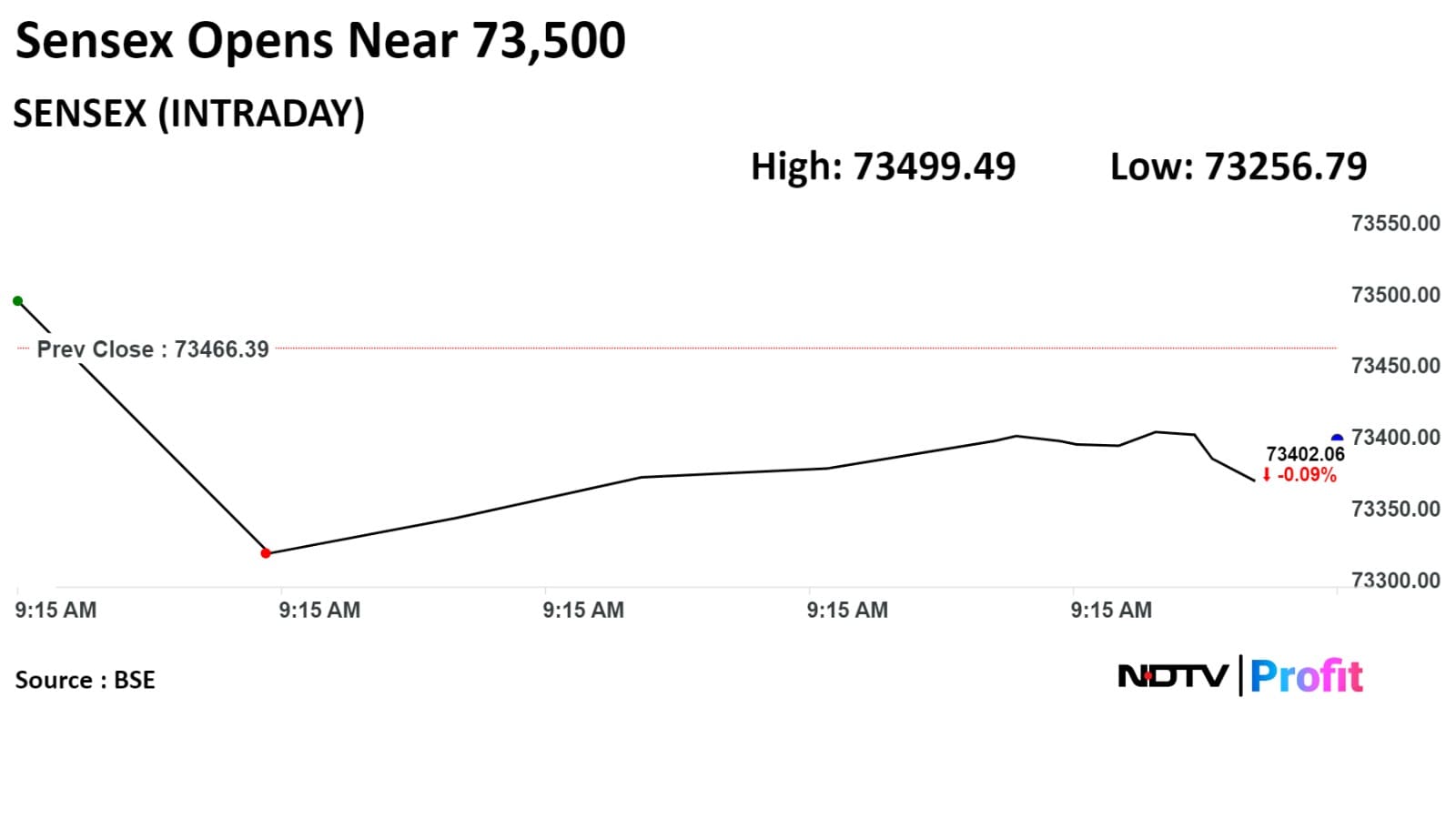

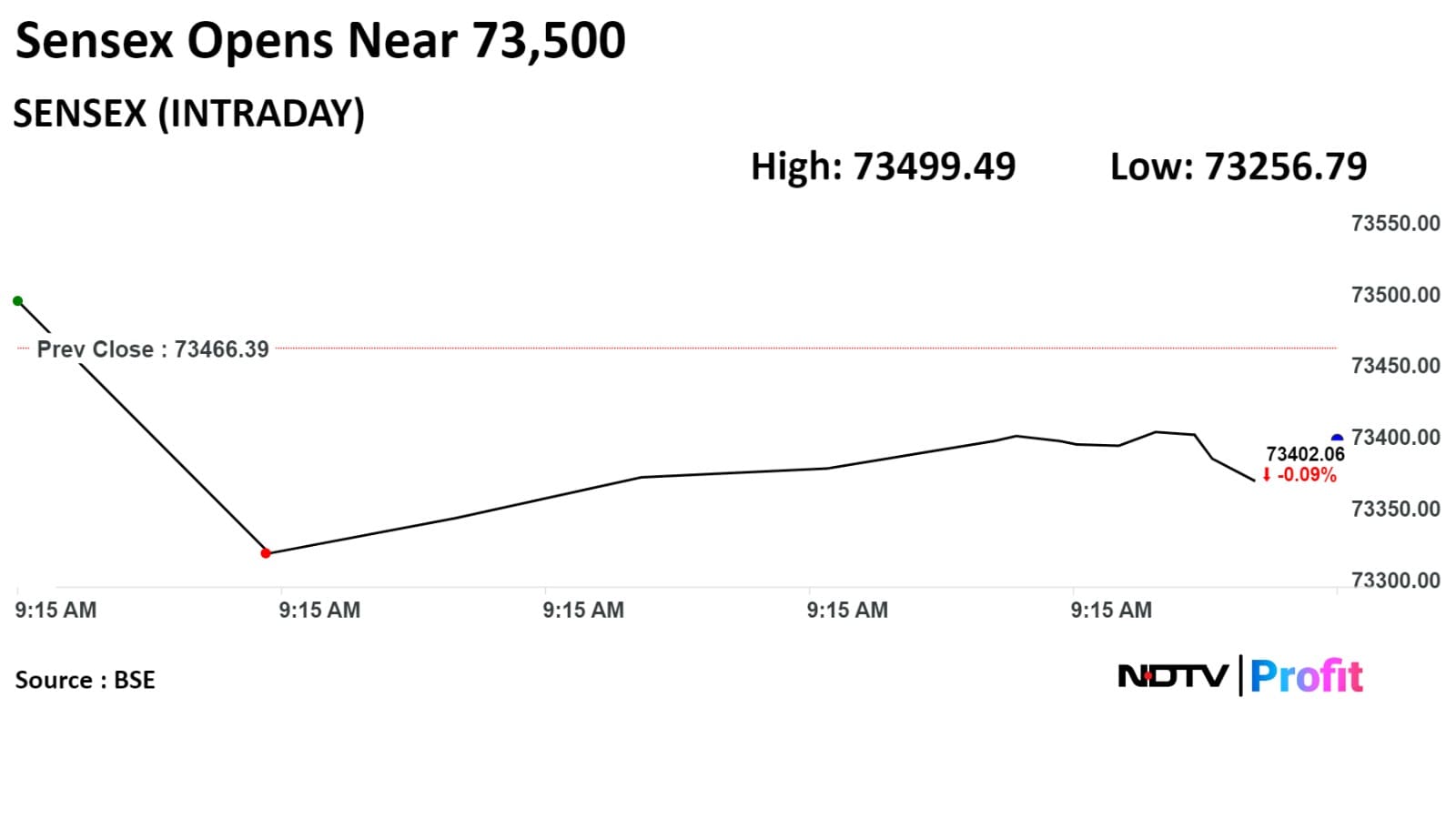

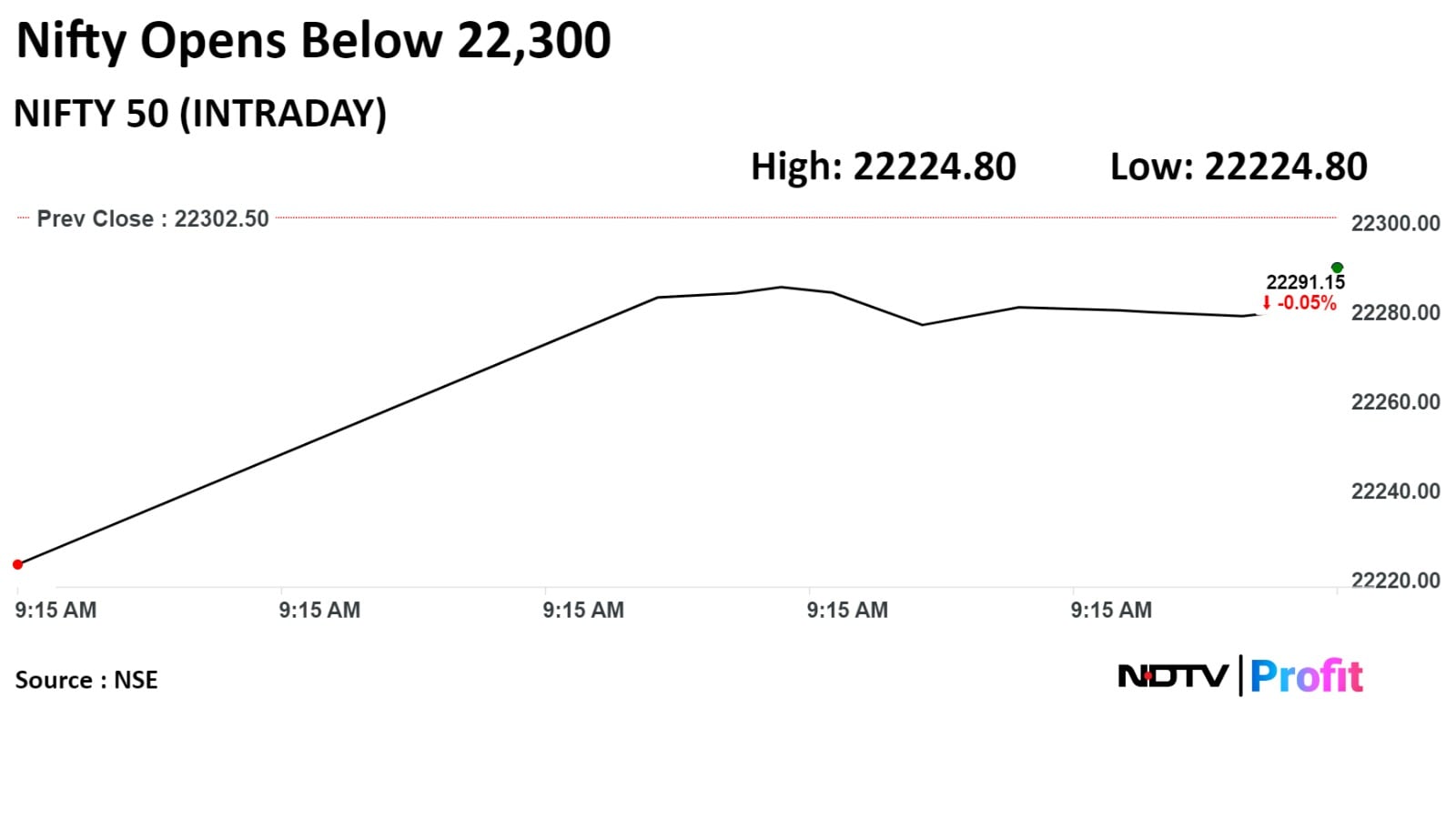

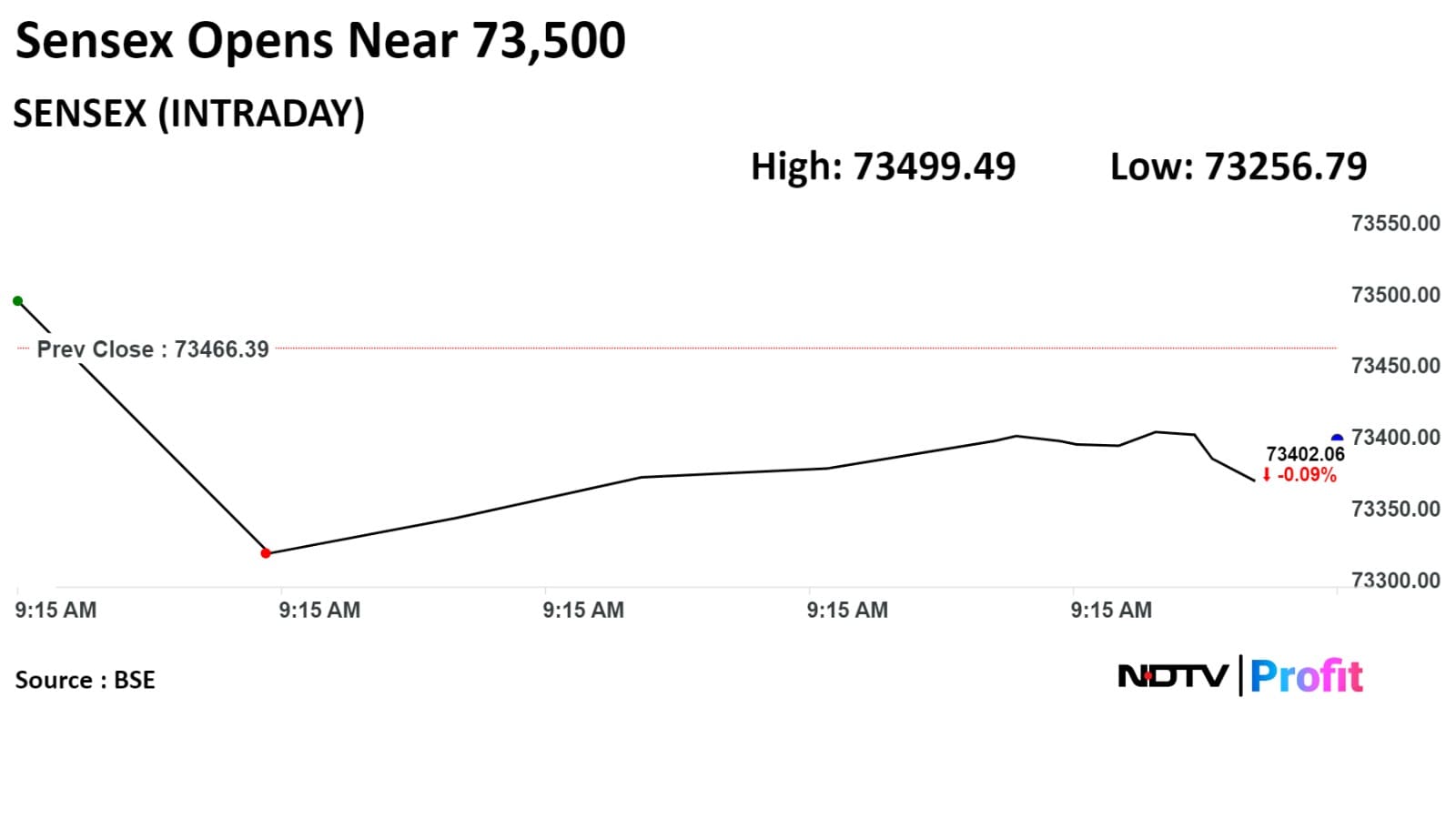

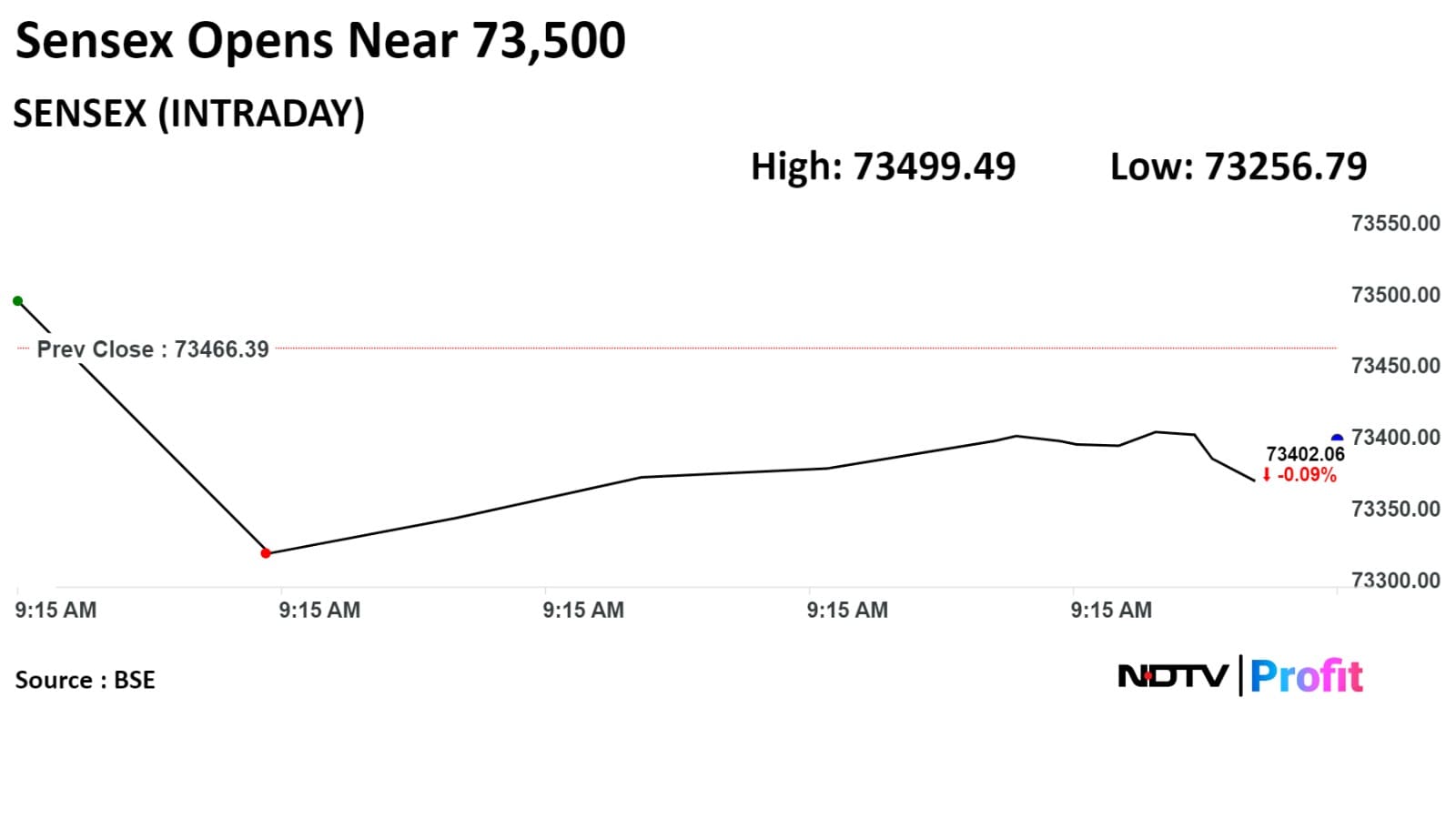

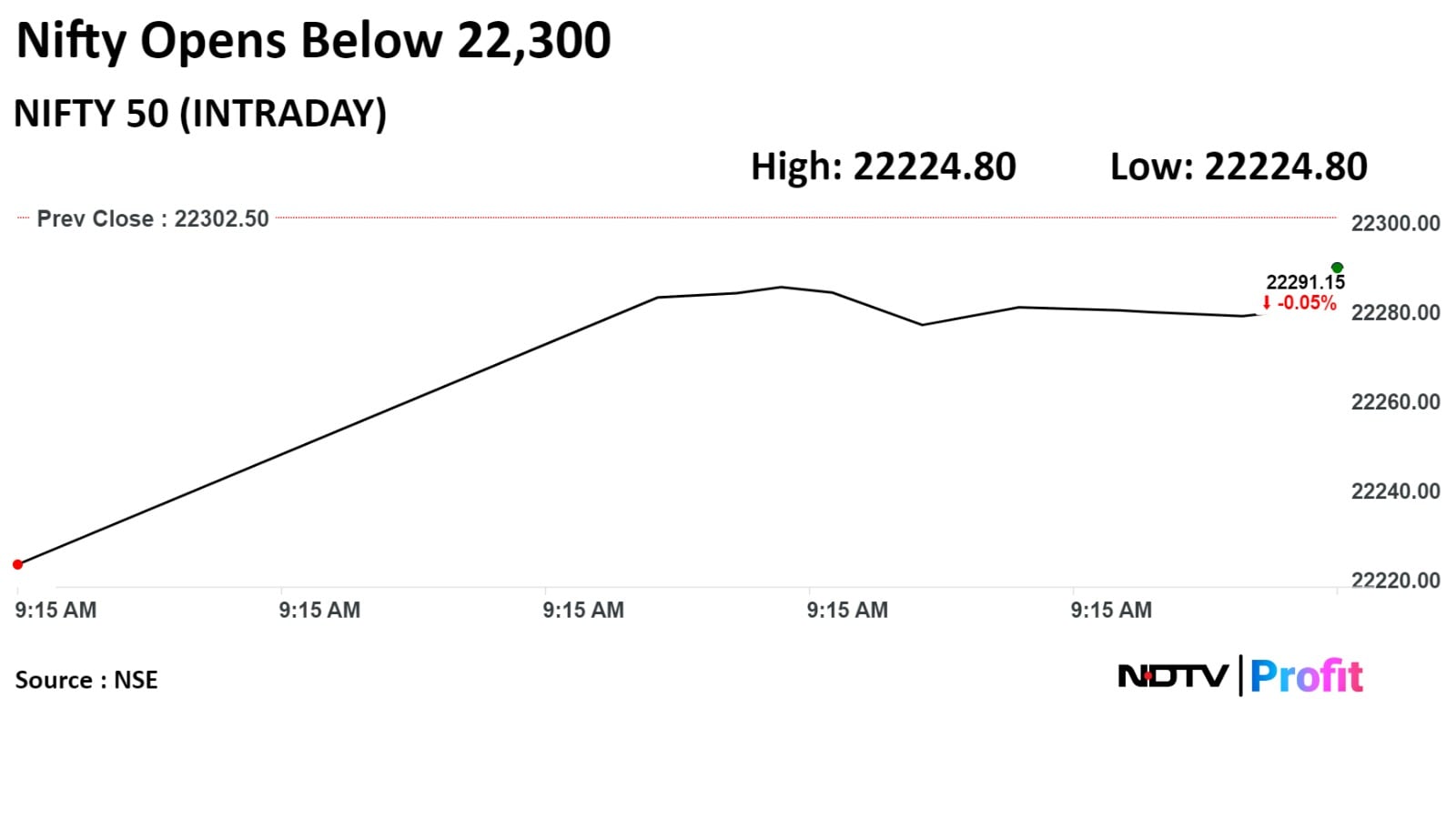

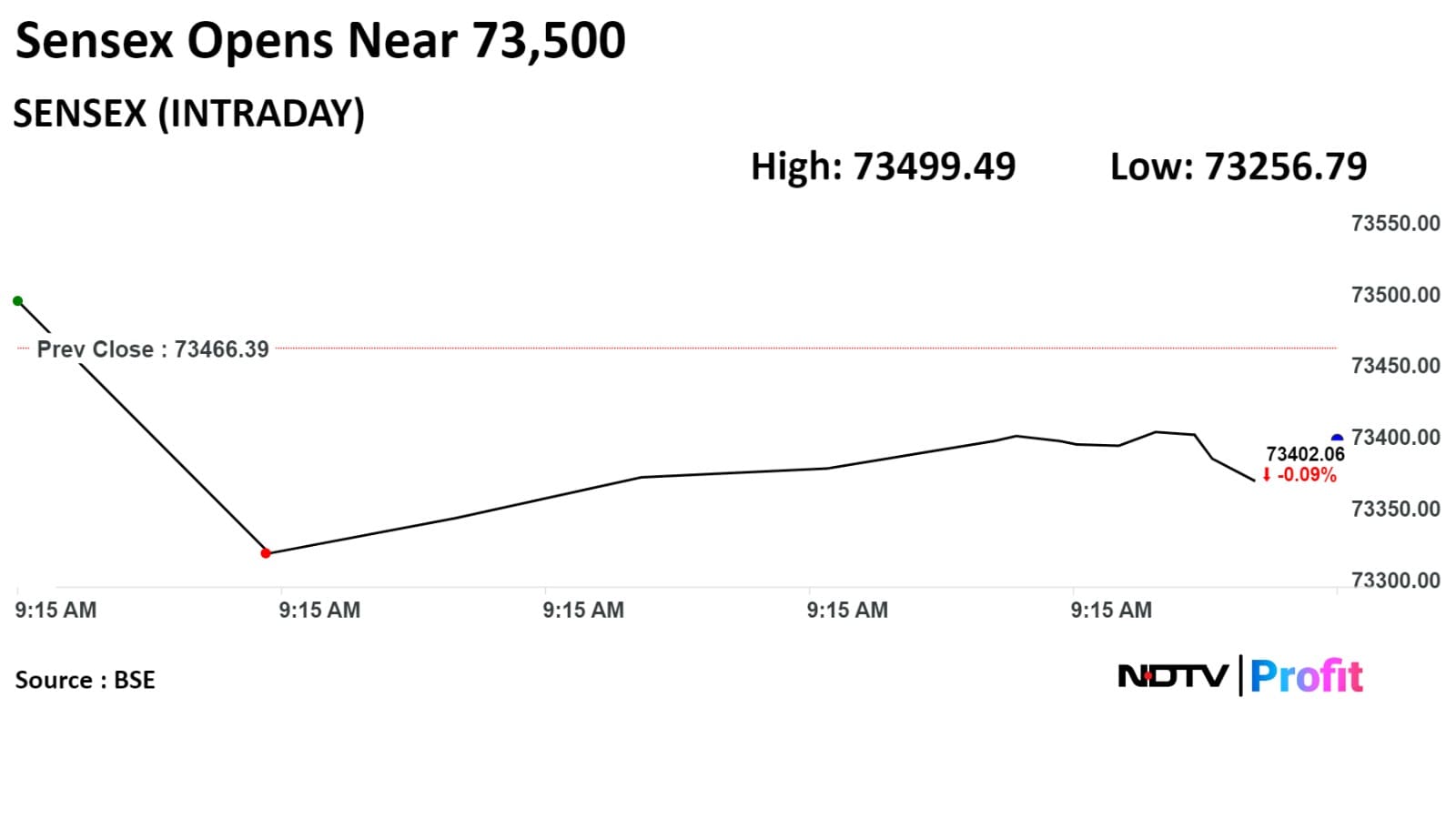

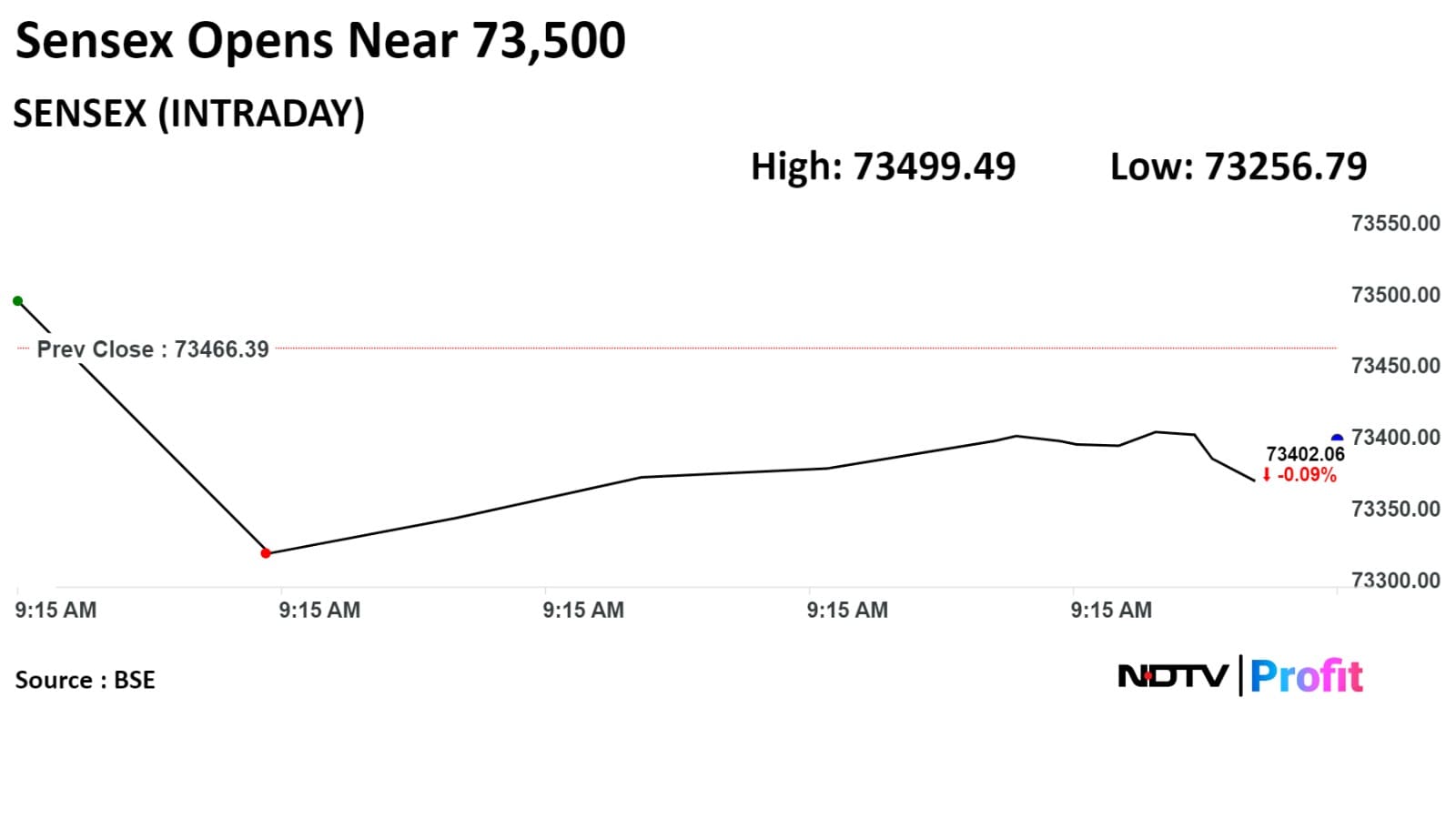

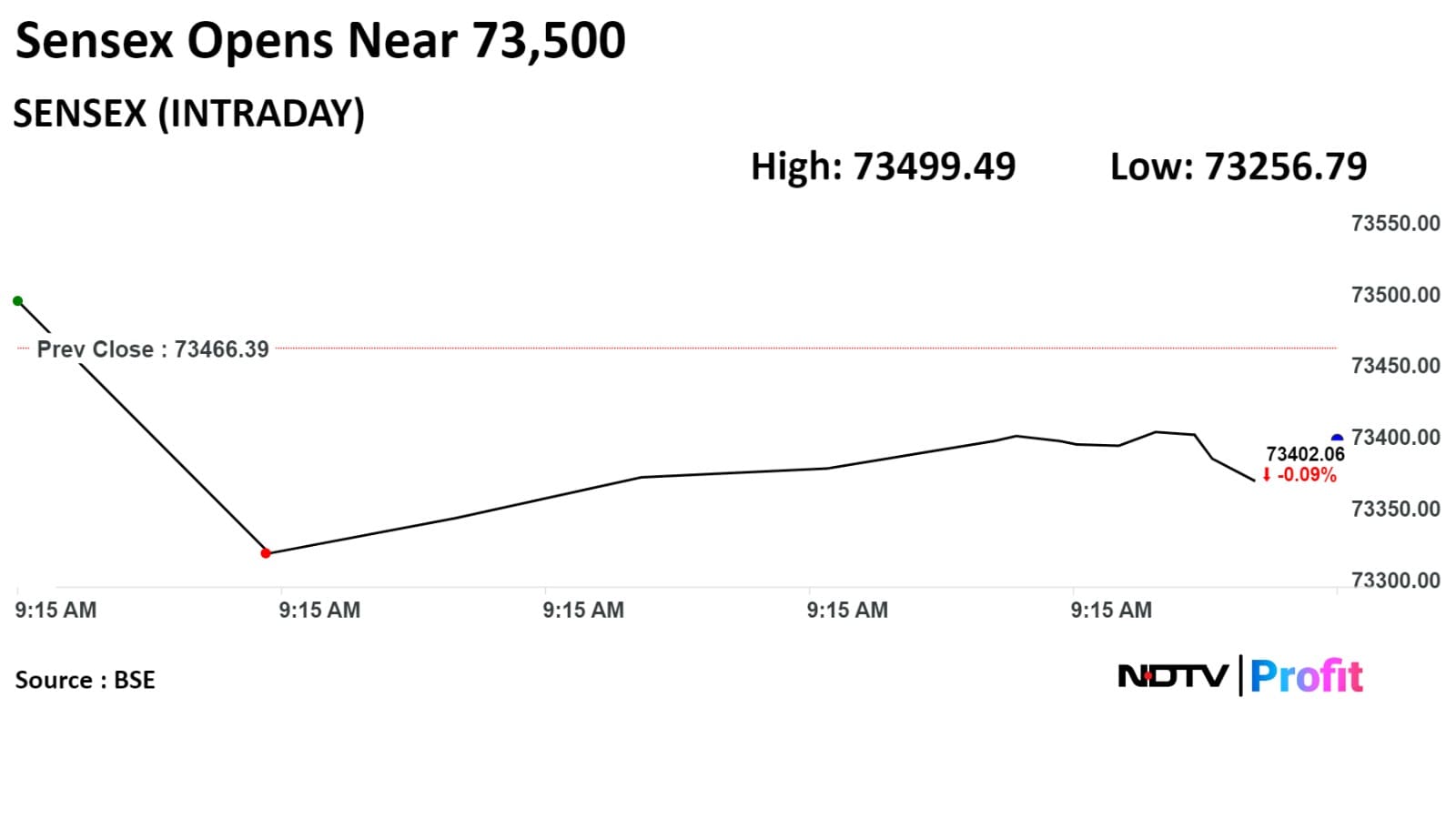

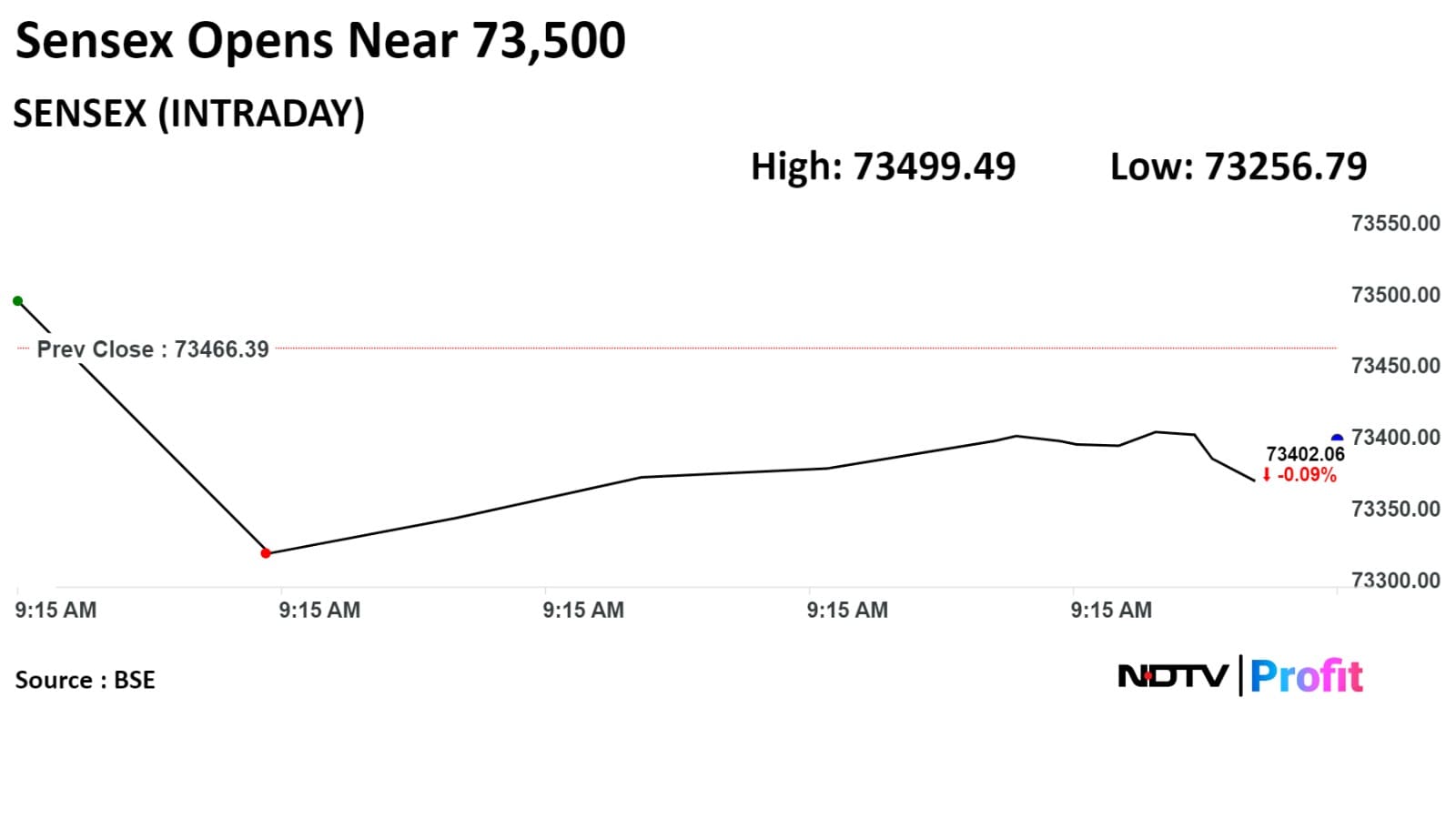

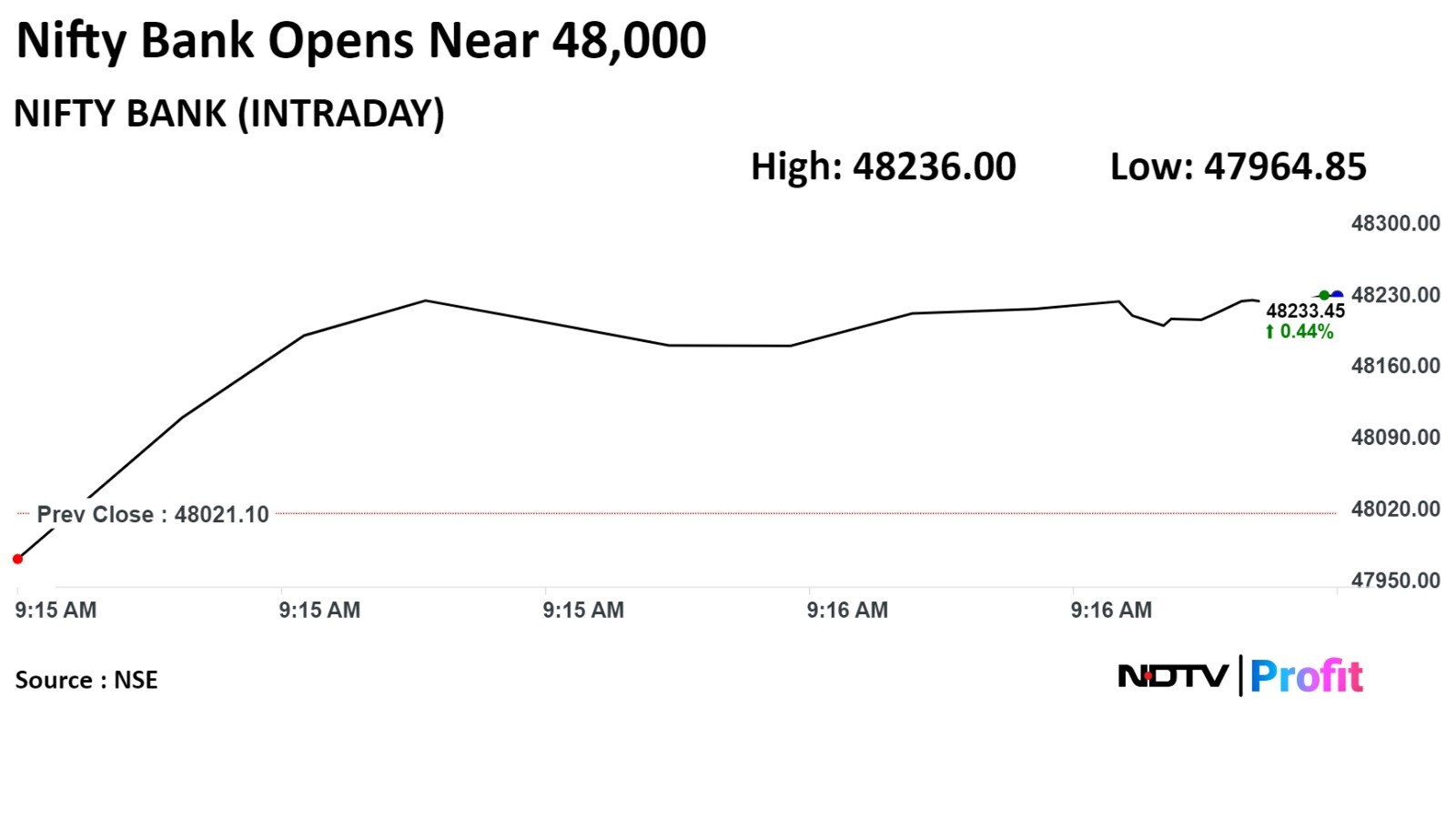

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

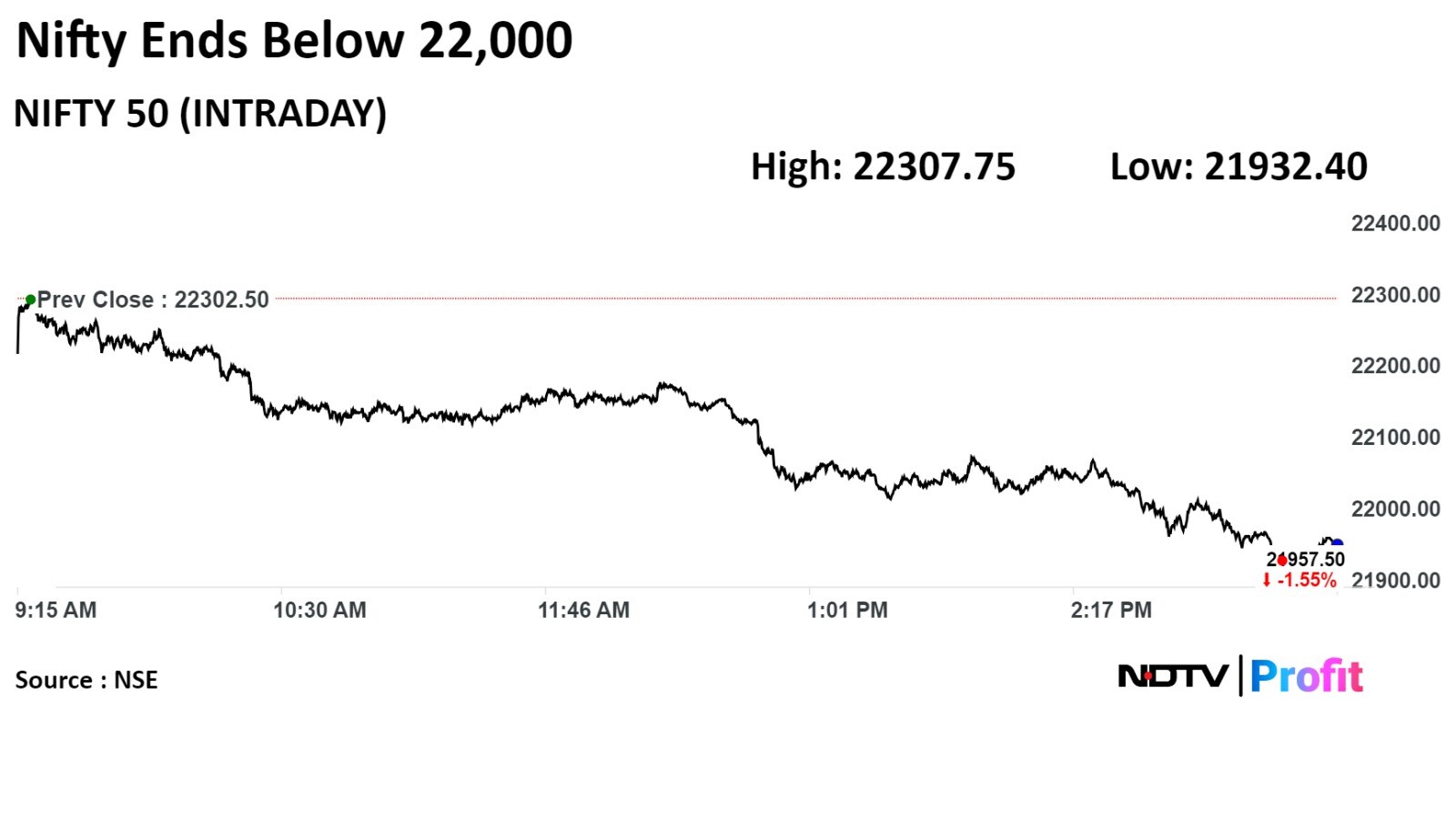

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

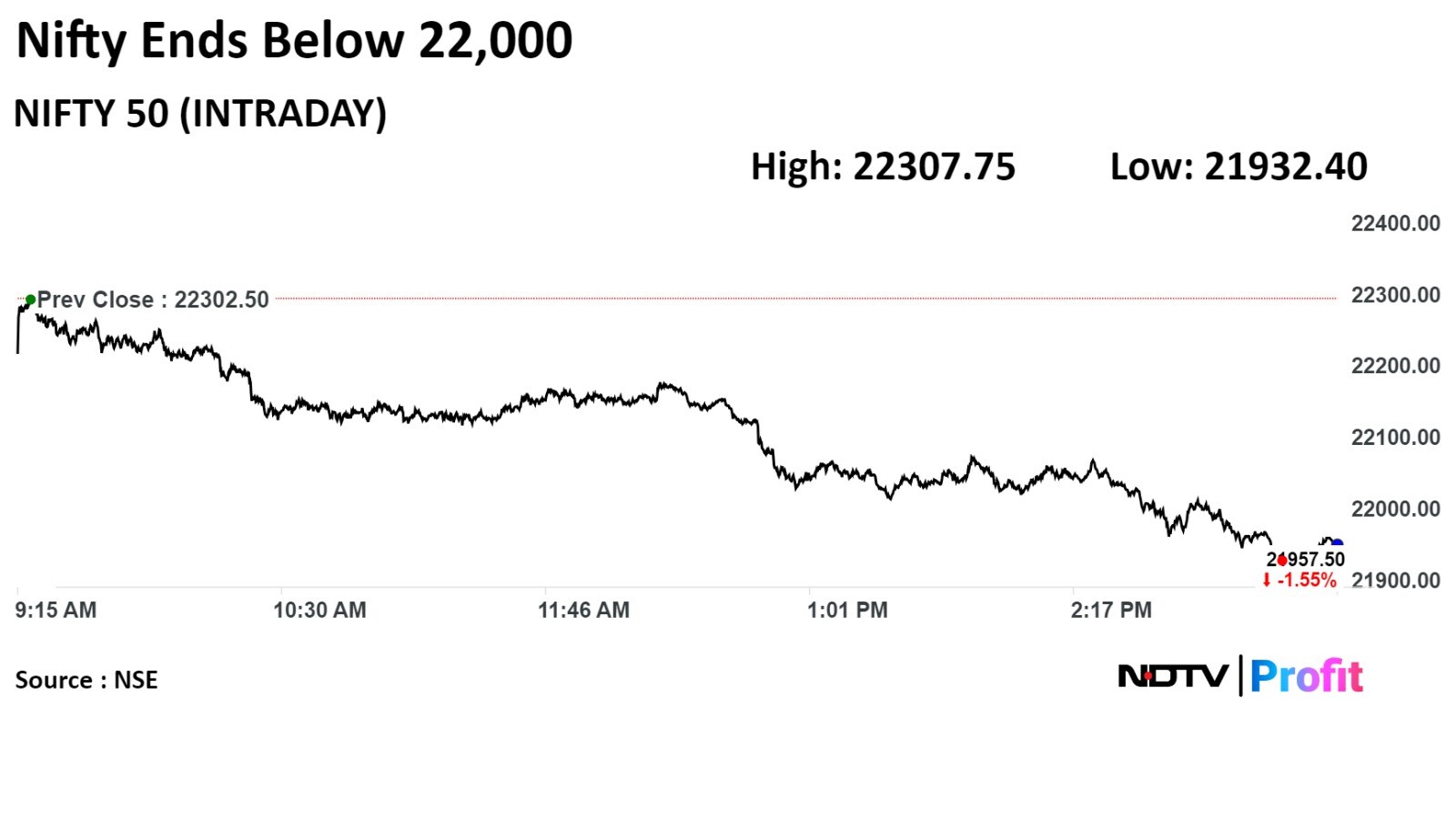

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

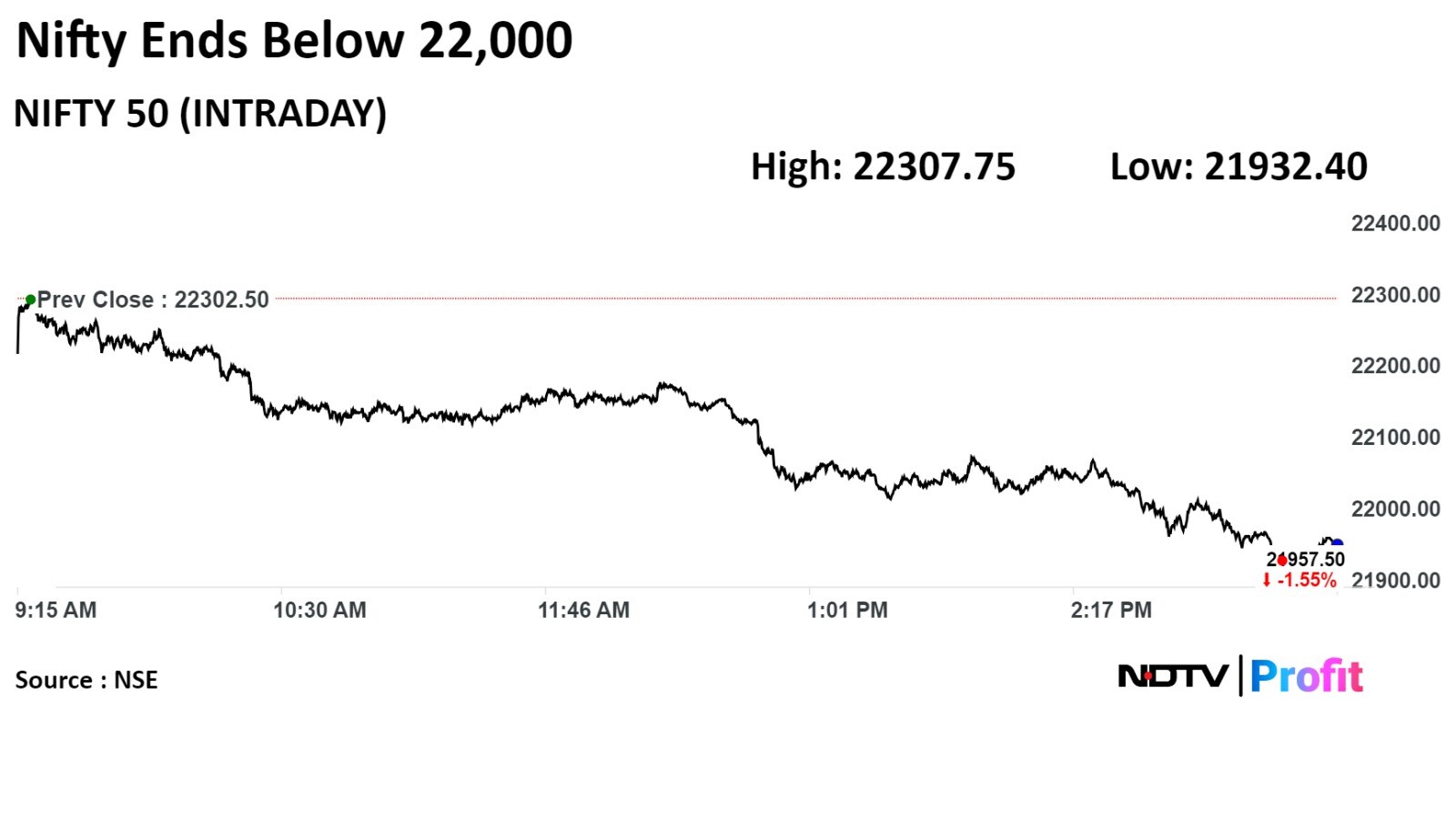

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

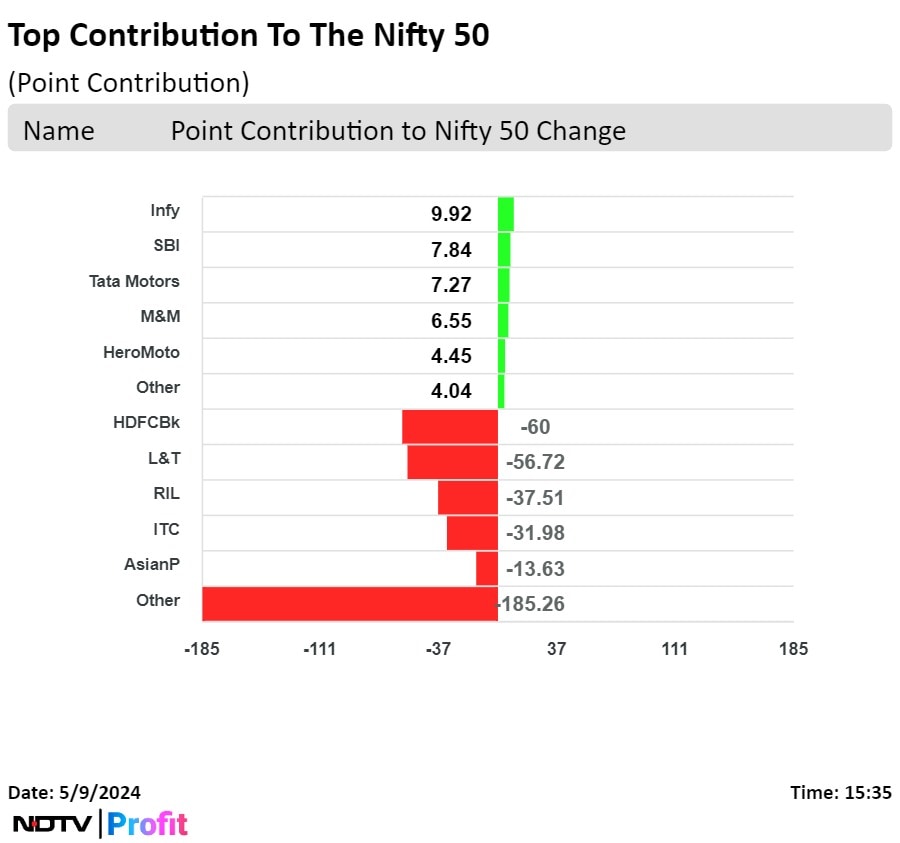

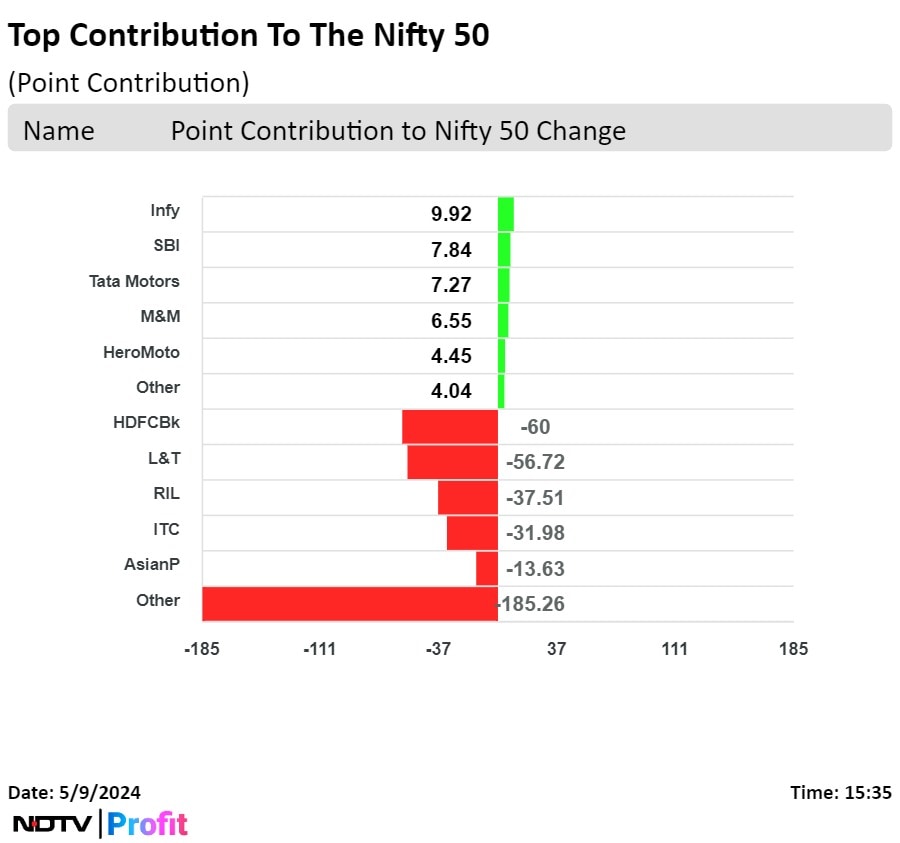

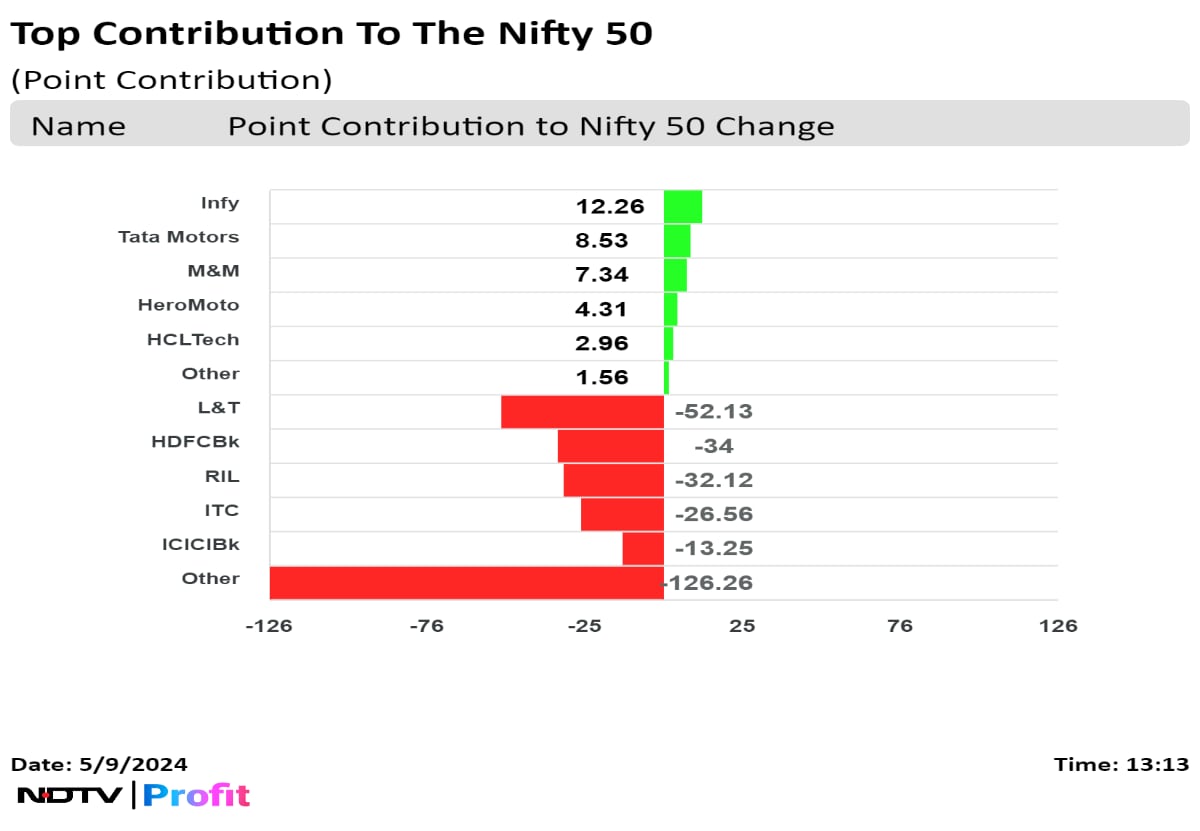

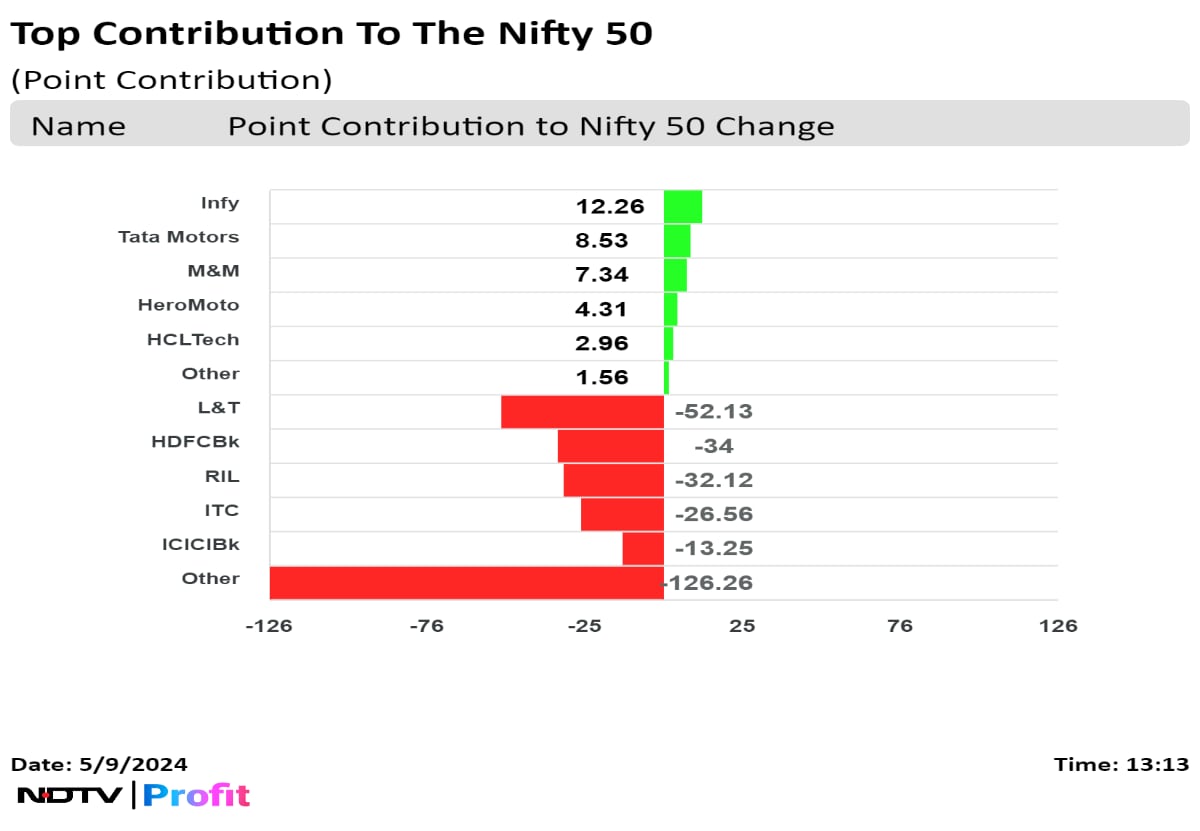

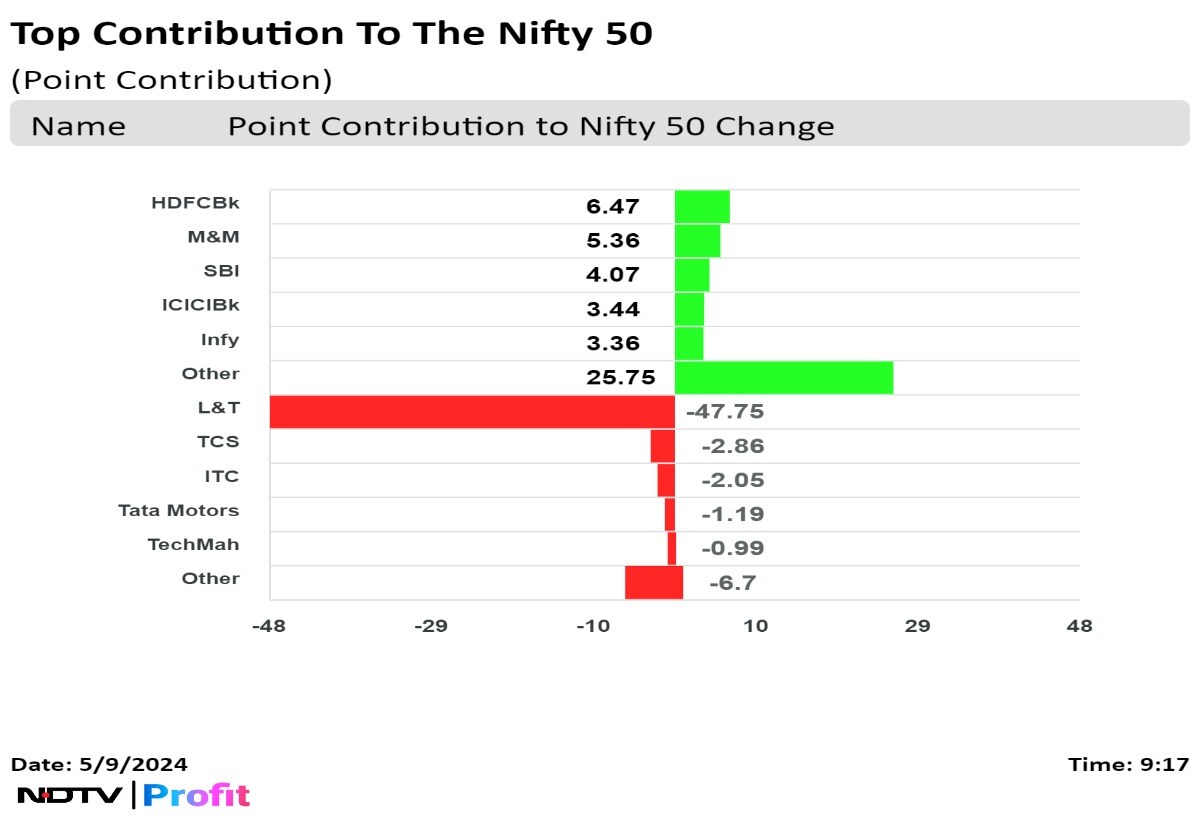

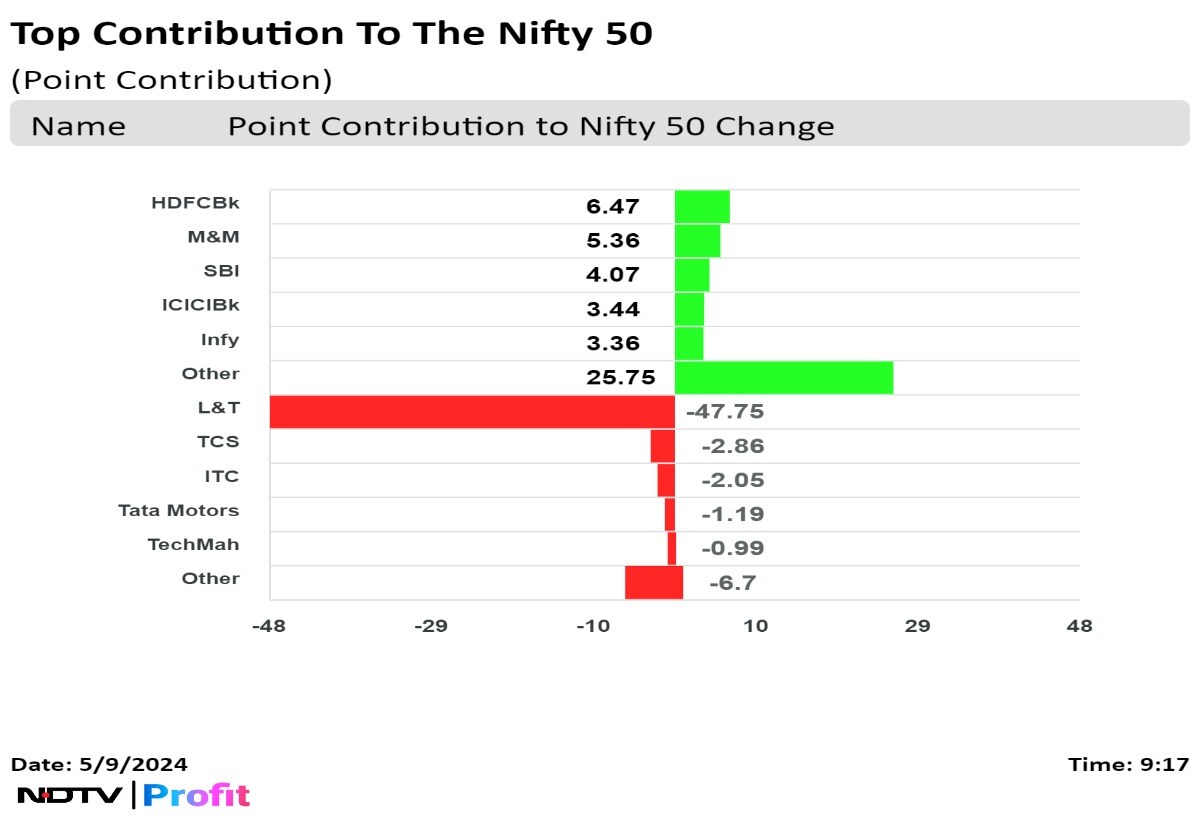

HDFC Bank Ltd., Larsen & Toubro Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd. dragged on the benchmark index.

Infosys Ltd., State Bank of India, Tata Motors Ltd., Mahindra & Mahindra Ltd., and Hero MotoCorp Ltd. limited the fall in the index.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

HDFC Bank Ltd., Larsen & Toubro Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd. dragged on the benchmark index.

Infosys Ltd., State Bank of India, Tata Motors Ltd., Mahindra & Mahindra Ltd., and Hero MotoCorp Ltd. limited the fall in the index.

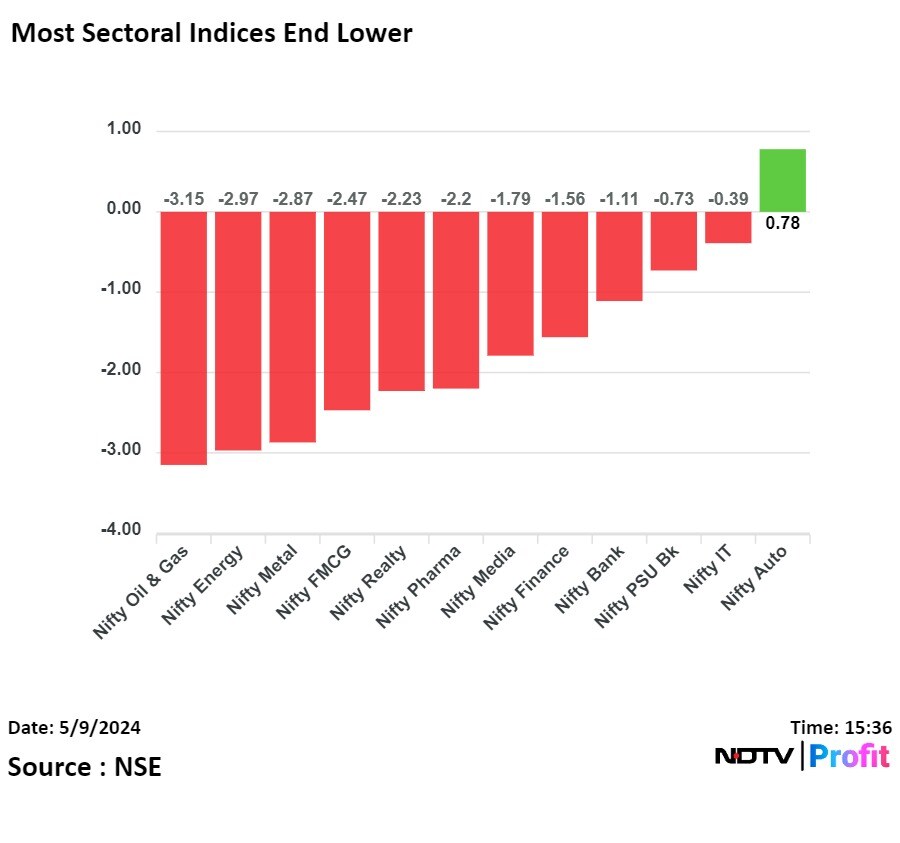

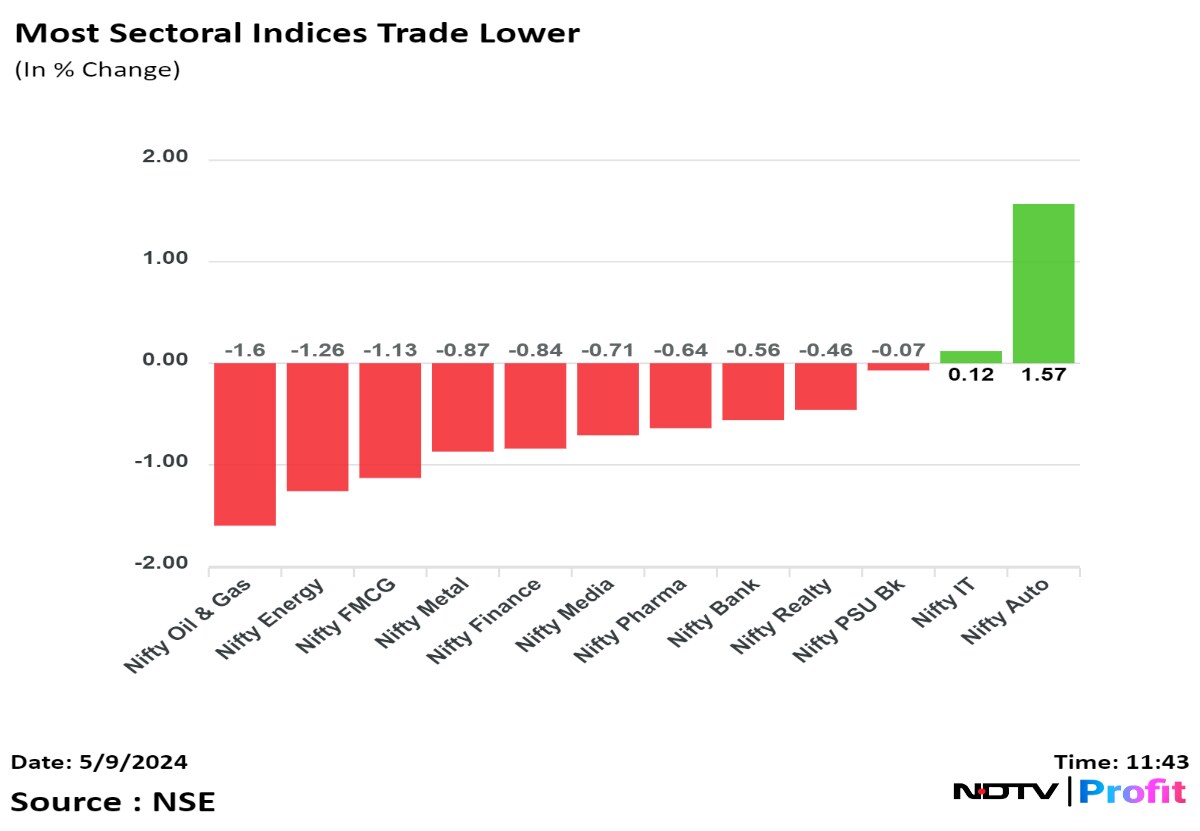

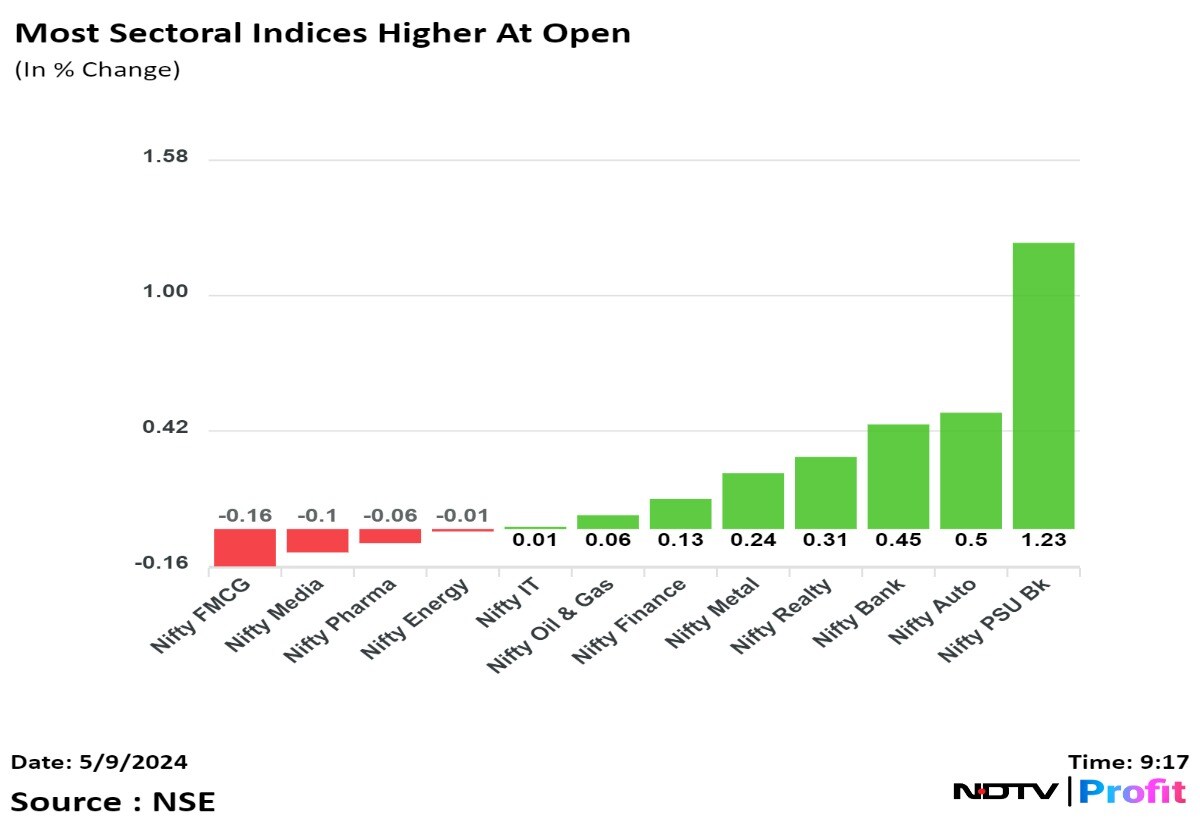

On NSE, 11 sectors out of the 12 ended lower, and one sector ended higher. The NSE Nifty Oil & Gas was the worst performing sector, and the NSE Nifty Auto was the best performing sector.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

HDFC Bank Ltd., Larsen & Toubro Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd. dragged on the benchmark index.

Infosys Ltd., State Bank of India, Tata Motors Ltd., Mahindra & Mahindra Ltd., and Hero MotoCorp Ltd. limited the fall in the index.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

India benchmark indices recorded their worst fall since January, tracking declines in shares of heavyweight HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industry Ltd.

The NSE Nifty 50 ended 345.00 points or 1.55% lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points or 1.45% lower at 72,404.17.

The NSE Nifty 50 index fell 1.66% to 21,932.40, and the S&P BSE Sensex fell 1.54% to 72,334.74 during the day.

The benchmark NSE Nifty 50 also slipped below 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed long bearish candle, which supports further weakness from the current levels. We are of the view that, the short-term market texture is weak but due to temporary oversold conditions, we could see a one technical pullback rally from the current levels. For the traders now, 22,000/72,550 would act as key level to watch out. Above 22,000/72,550, the market could bounce back till 22,100-22,150/72,300-72,500. On the flip side, below 22,000/72,550 the weak sentiment is likely to continue. Below which the market could slip till 21,850-21,800/72,100-72,000," said Shrikant Chouhan, head equity research, Kotak Securities.

"Pessimism persisted in the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points. Barring Auto, all other sectors ended the day in red with Energy and Metal being the major laggards. Relentless selling continued in the Mid and Smallcap stocks which resulted in the underperformance of the broader markets. On a technical front, the Index has formed a big bearish candle which indicates dominance of the Bears. Now, the immediate support is placed at 21,830 which is the lower end of an Ascending Triangle Formation while on the higher side, 22,230 will be a crucial hurdle," said Aditya Gaggar, Director, Progressive Shares.

HDFC Bank Ltd., Larsen & Toubro Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd. dragged on the benchmark index.

Infosys Ltd., State Bank of India, Tata Motors Ltd., Mahindra & Mahindra Ltd., and Hero MotoCorp Ltd. limited the fall in the index.

On NSE, 11 sectors out of the 12 ended lower, and one sector ended higher. The NSE Nifty Oil & Gas was the worst performing sector, and the NSE Nifty Auto was the best performing sector.

The broader markets underperformed; the S&P BSE MidCap Index closed down 2.01%, whereas S&P BSE SmallCap Index was 2.41% lower.

Nineteen out of 20 sectors compiled by BSE declined. Only S&P BSE Auto ended higher.

The market breadth was skewed in the favour of the sellers. About 2,902 stocks fell, 929 rose, while 112 remained unchanged on the BSE.

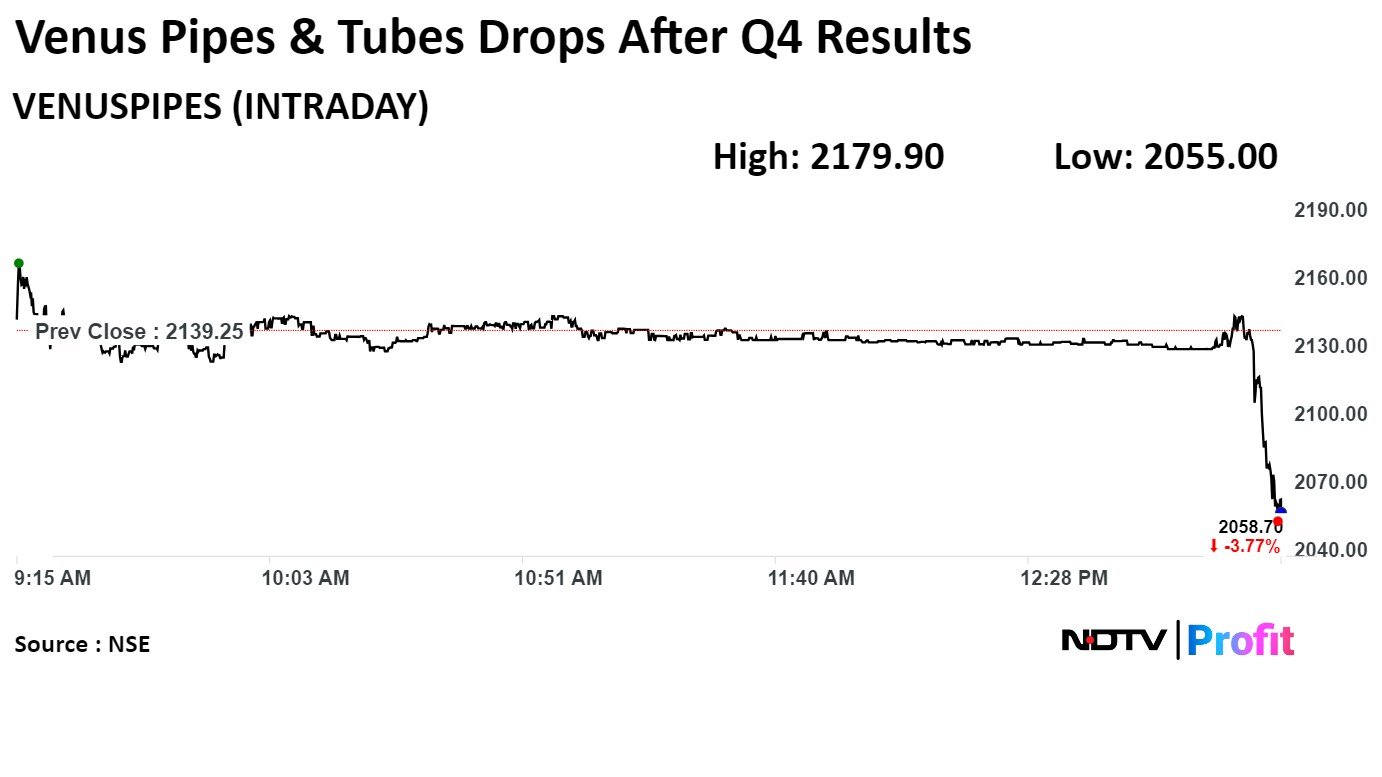

Revenue fell 5.47% to Rs 2,093.53 crore from Rs 2,214.48 crore

Ebitda rose 11.75% to Rs 260.56 crore from Rs 233.16 crore

Margin rose 191 basis points to 12.44% from 10.52%

Net profit rose 16.36% to Rs 251.89 crore from Rs 216.46 crore

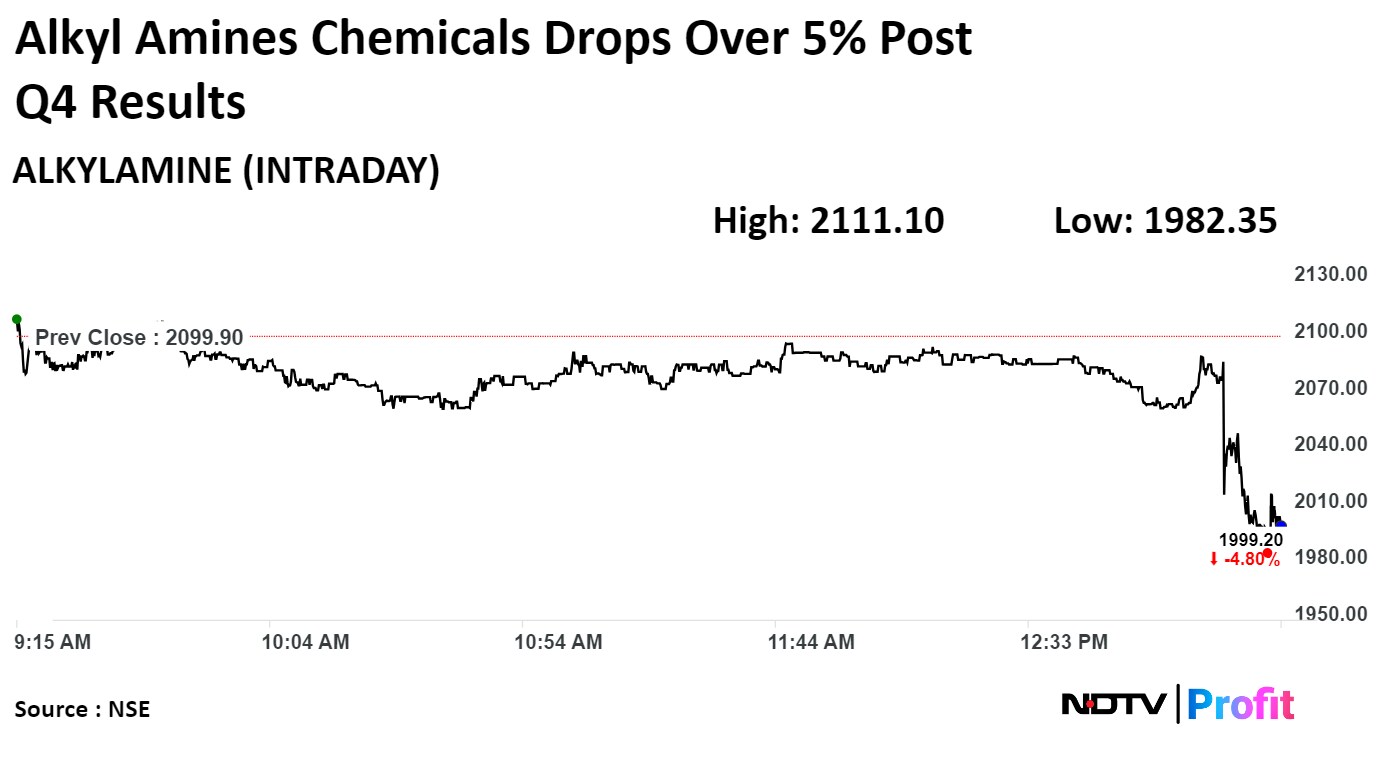

Revenue rose19.72% to Rs 787.66 crore from Rs 657.91 crore

Ebitda fell 33.18% to Rs 30.73 crore from Rs 45.99 crore

Margin fell 308 basis points to 3.9% from 6.99%

Net profit fell 47.96% Rs 12.8 crore from Rs 24.6 crore

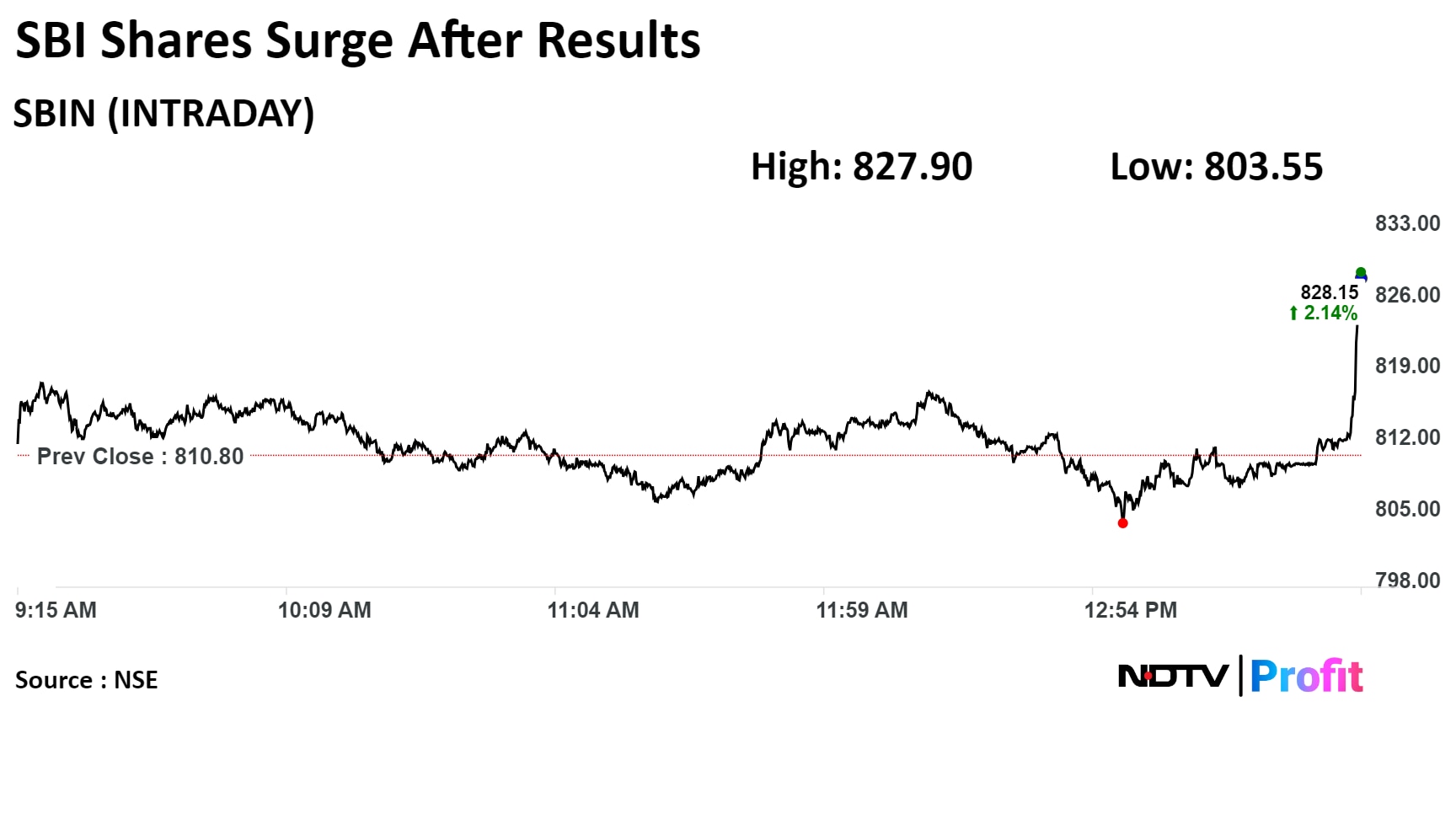

Revenue grew 2.6% to Rs 1,14,556.87 crore from Rs 1,11,306.32 crore

Ebitda grew 122.03% to Rs 4,803.75 crore from Rs 2,163.54 crore

Margin rose 224 bps to 4.19% from 1.94%

Net profit rose 437.36% to Rs 2,842.75 crore from Rs 529.02 crore

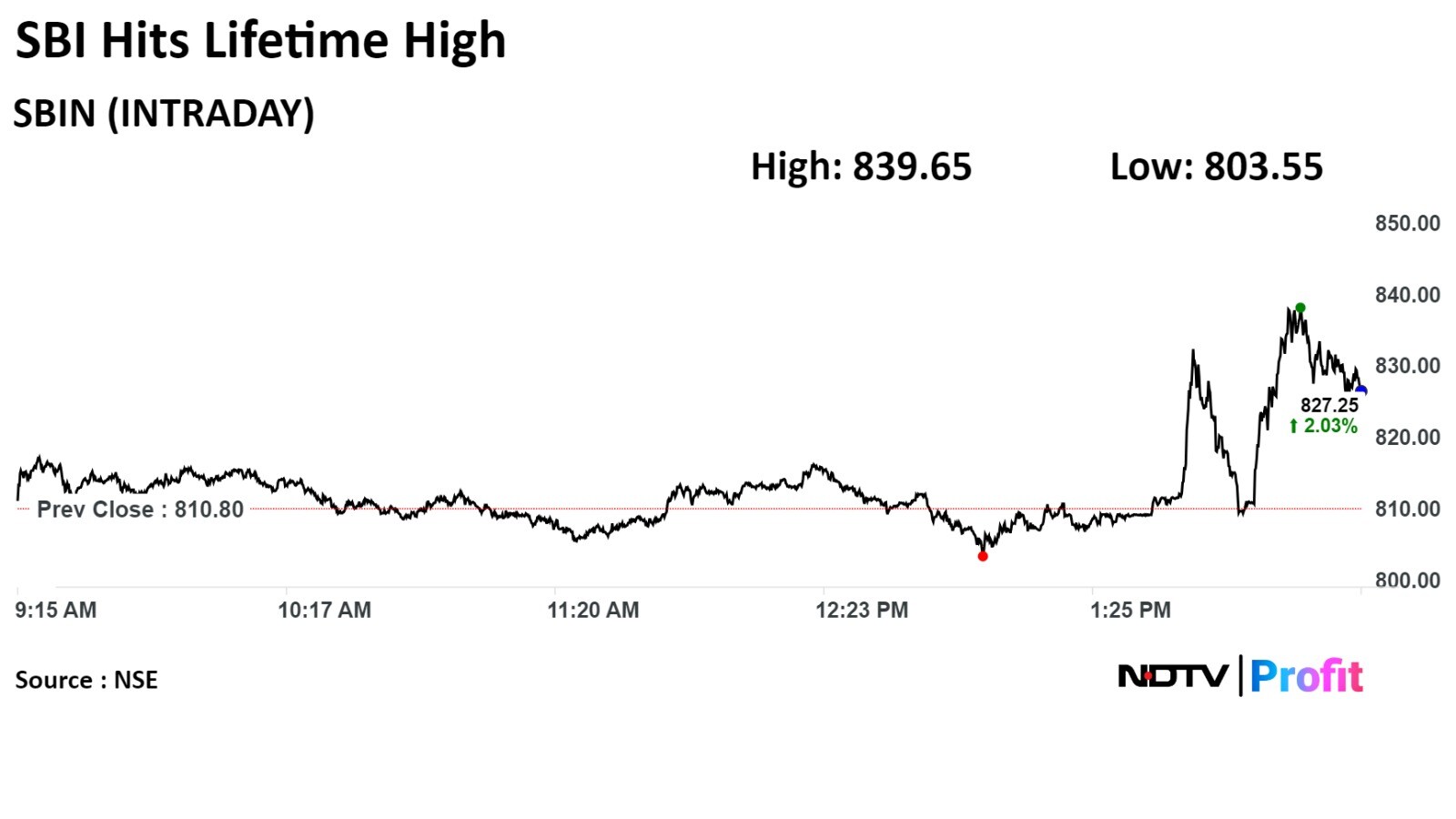

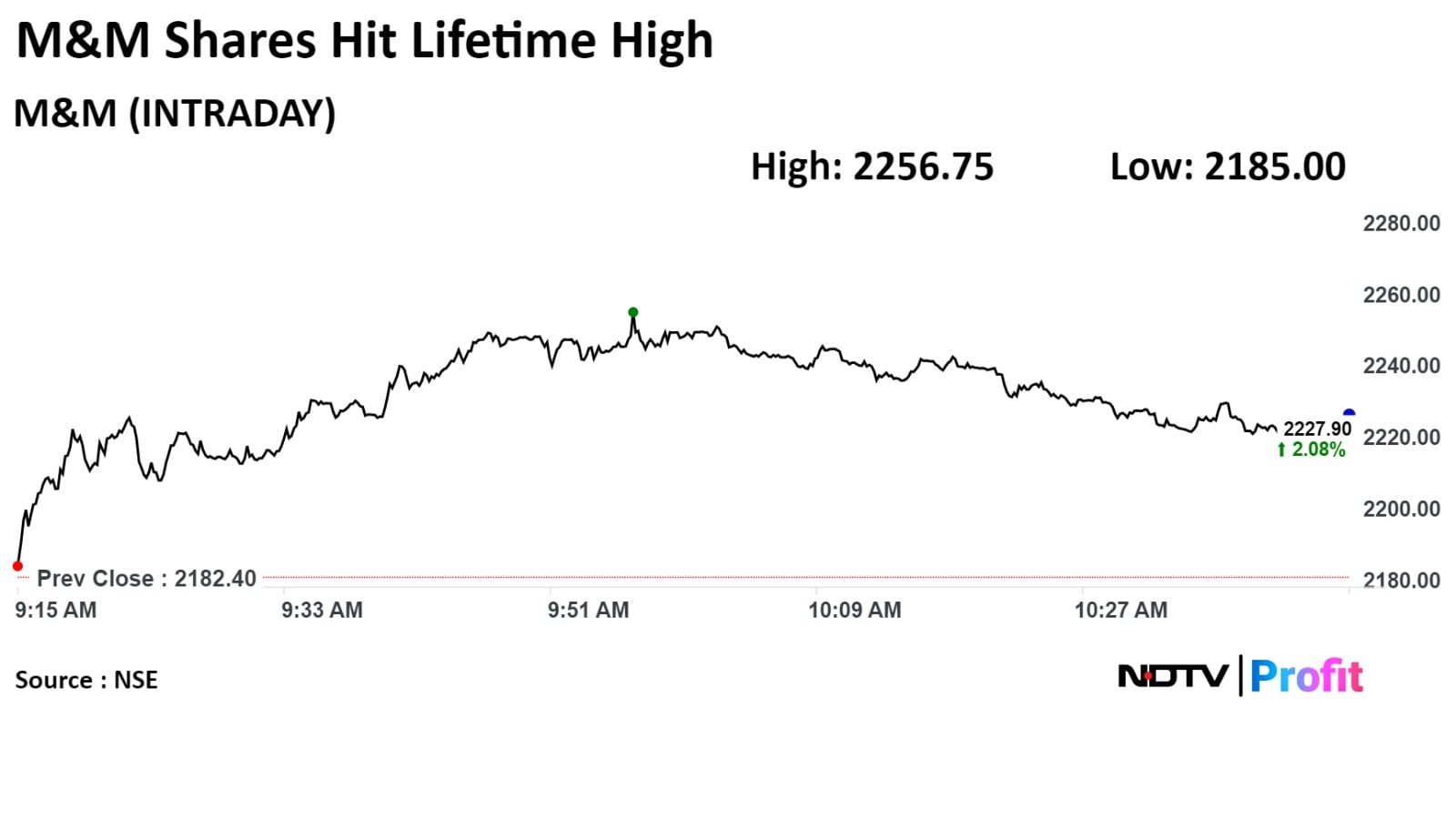

The stock rose 3.56% higher at Rs 839.65, the highest level since its listing on March 1, 1995. It was trading 2.08% higher at 827.70 as of 2:33 p.m., as compared to 1.22% decline in the NSE Nifty 50 index.

The stock rose 3.56% higher at Rs 839.65, the highest level since its listing on March 1, 1995. It was trading 2.08% higher at 827.70 as of 2:33 p.m., as compared to 1.22% decline in the NSE Nifty 50 index.

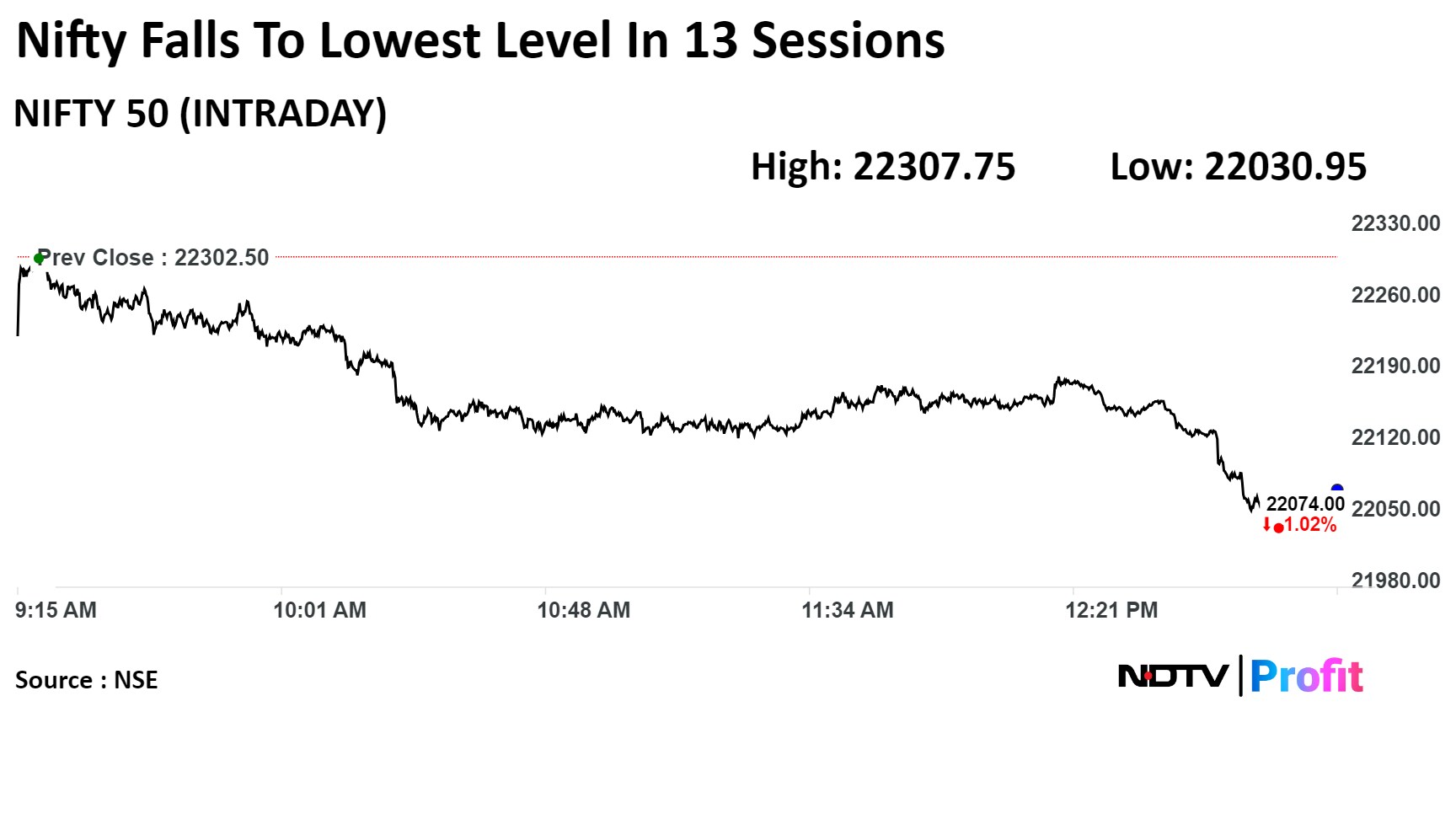

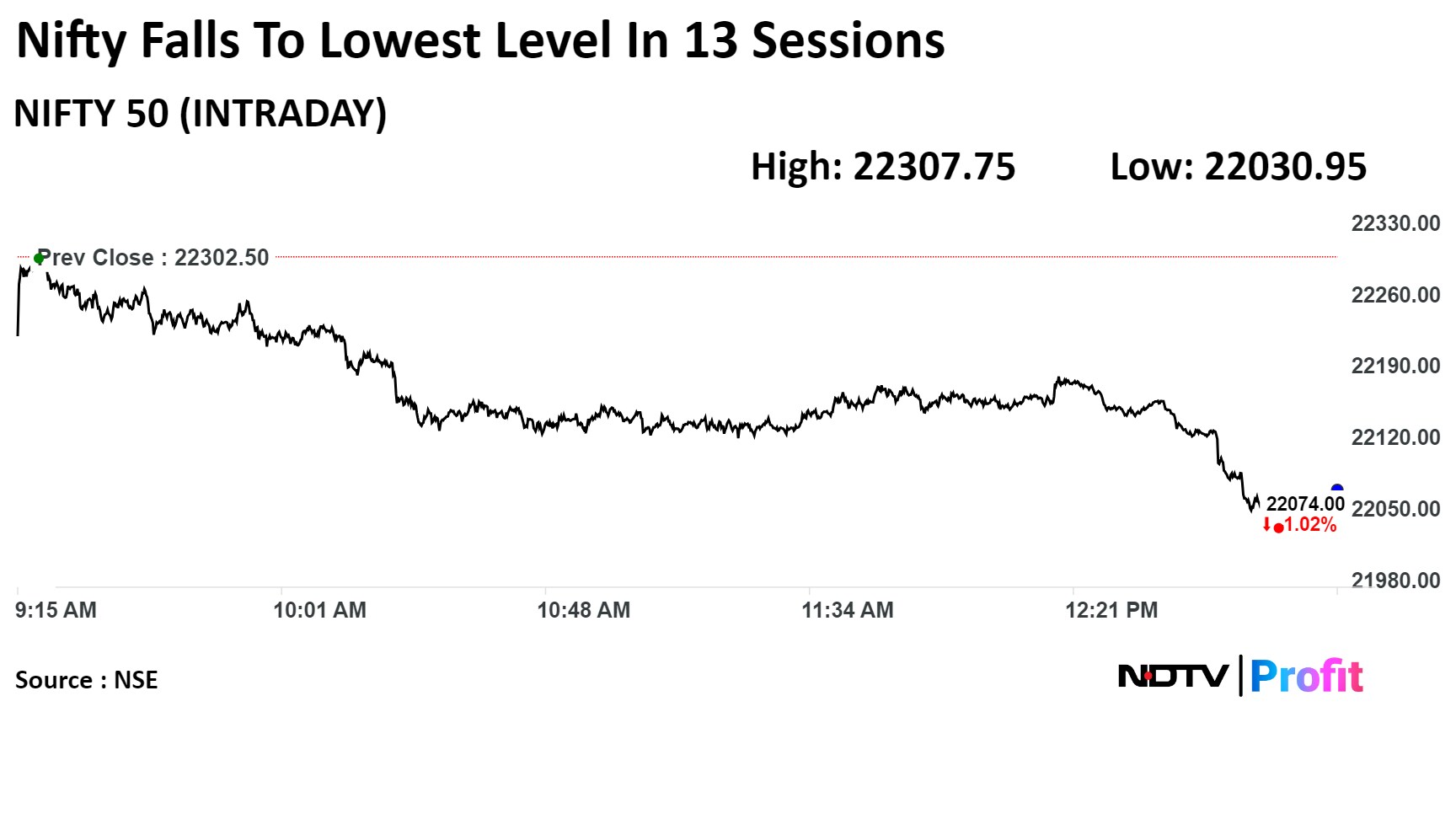

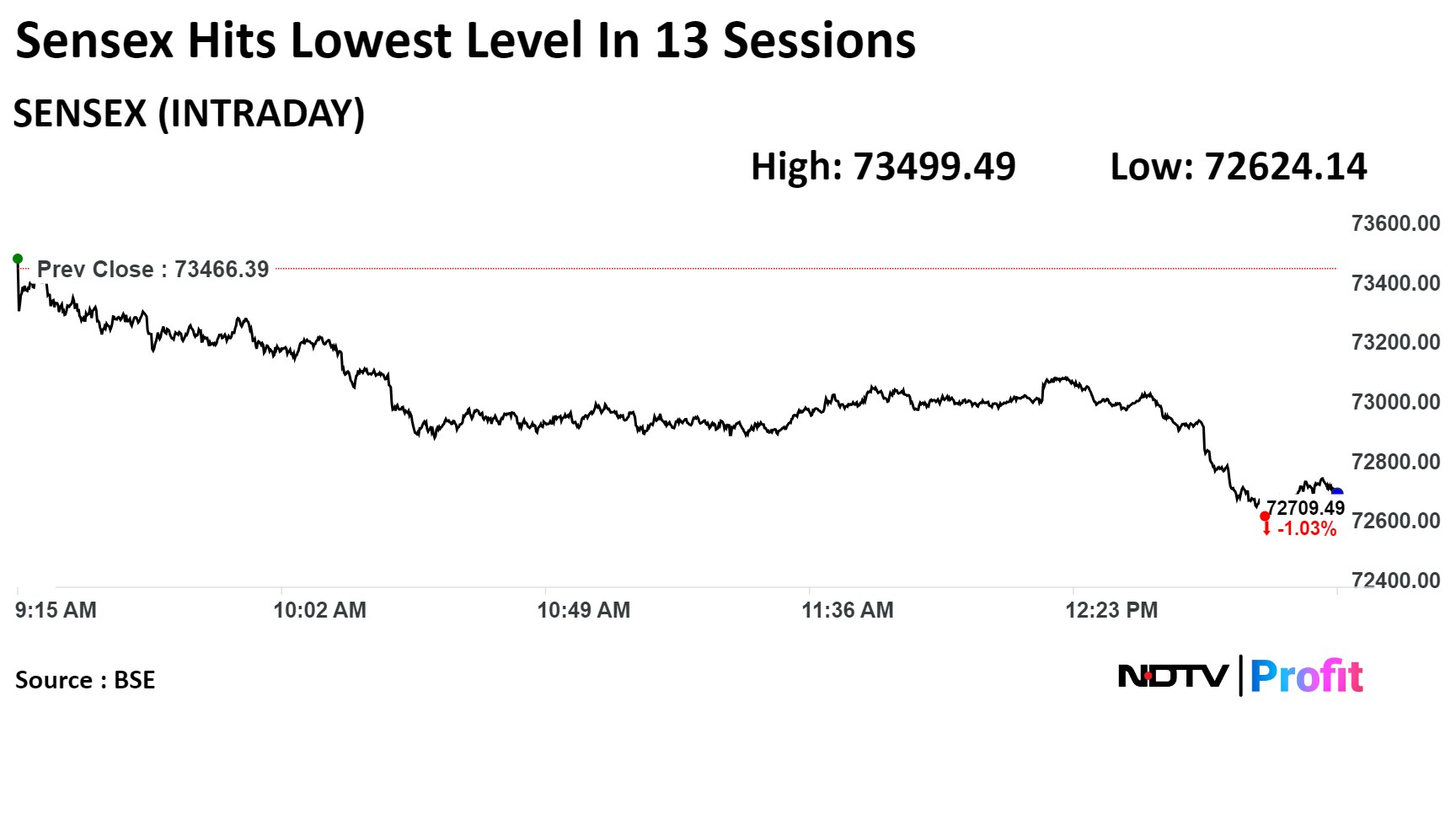

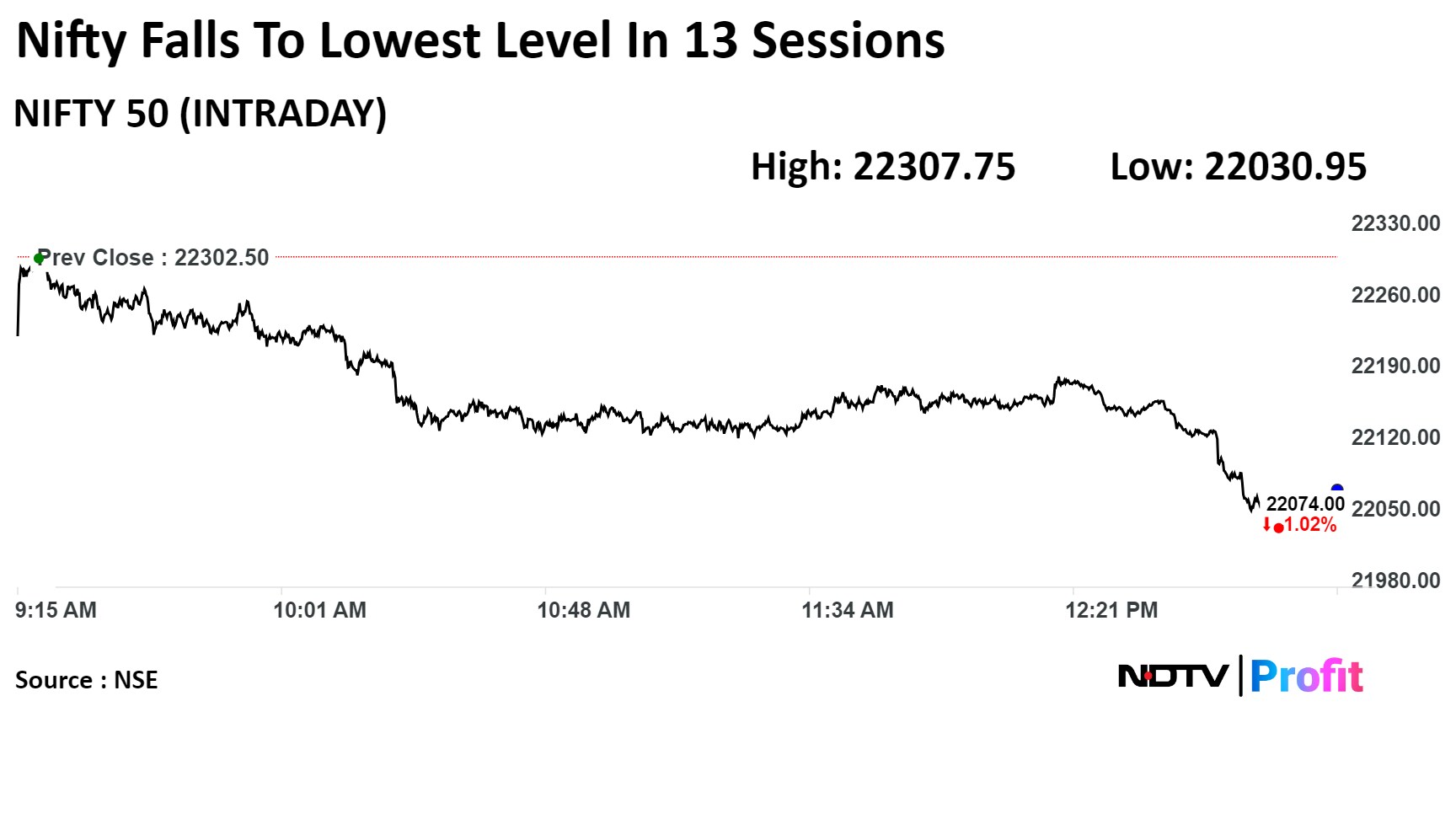

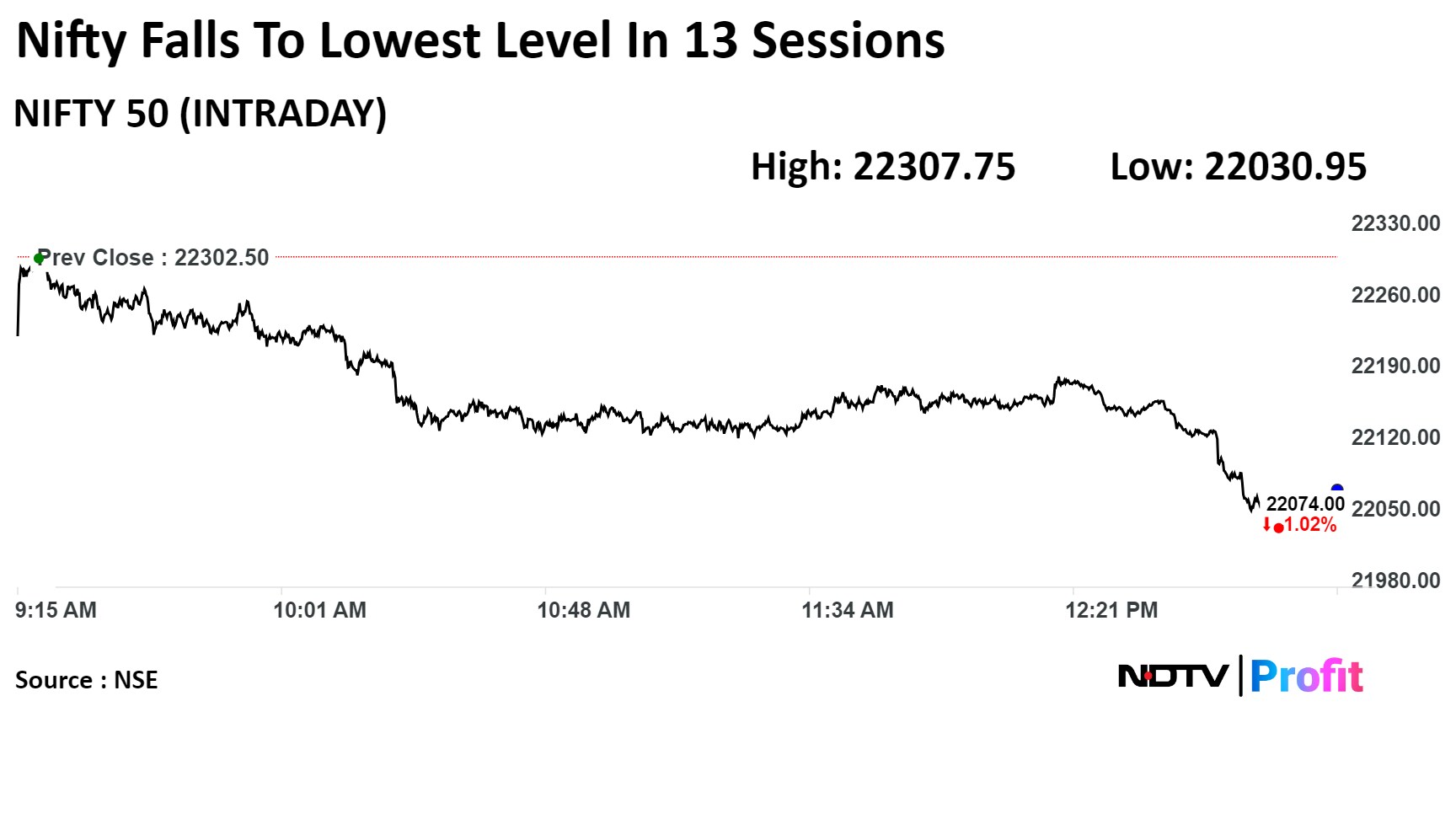

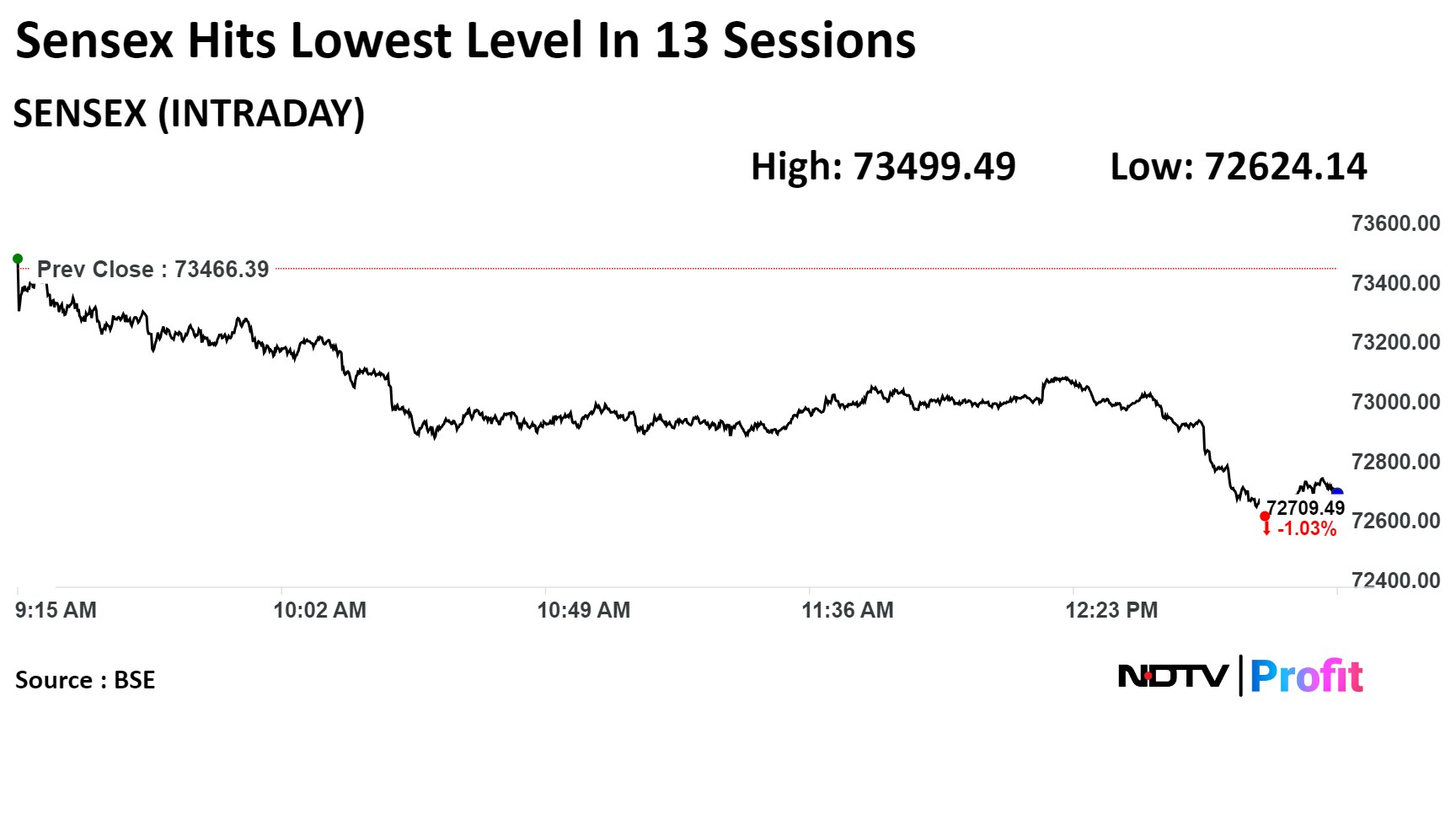

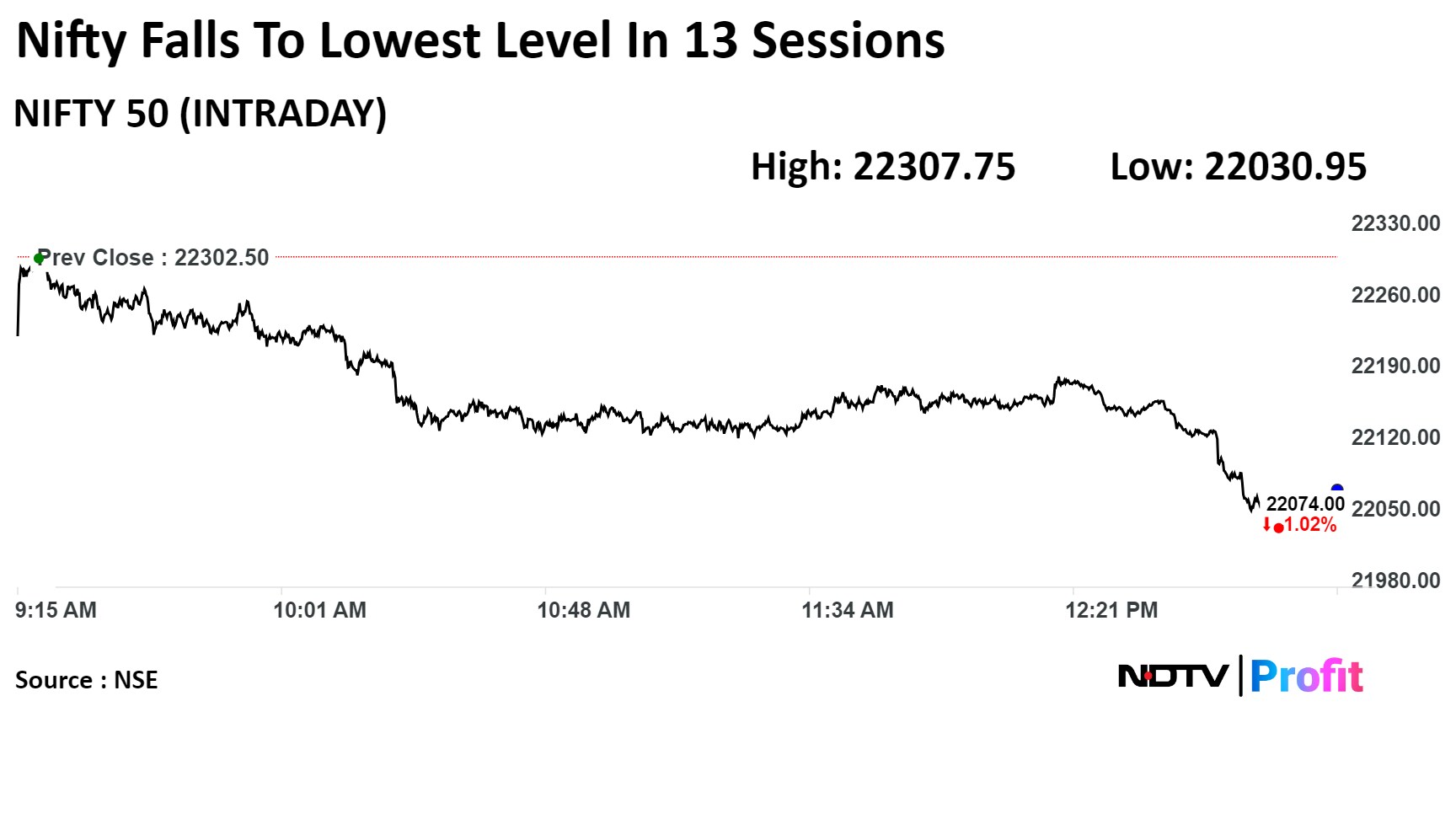

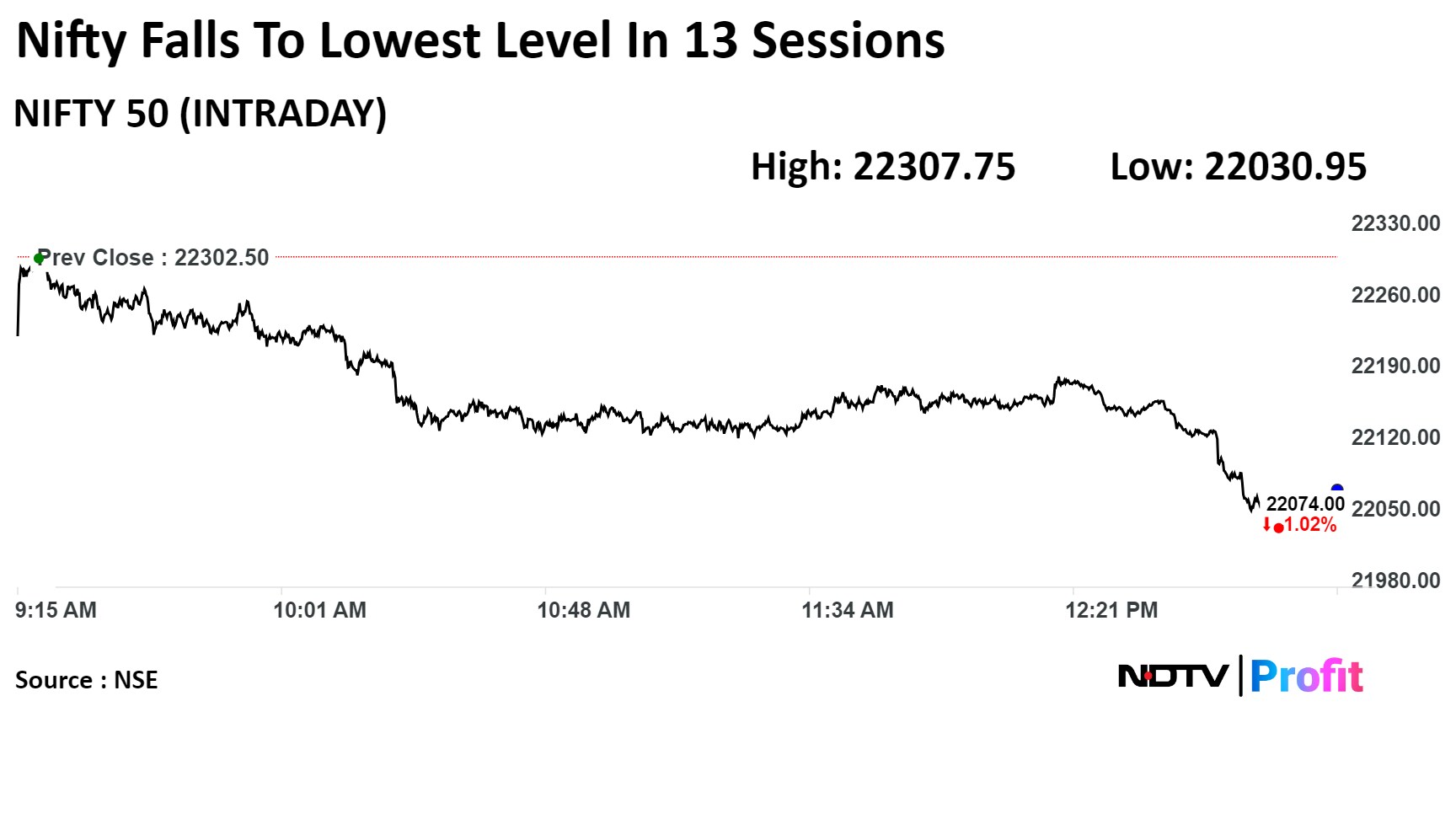

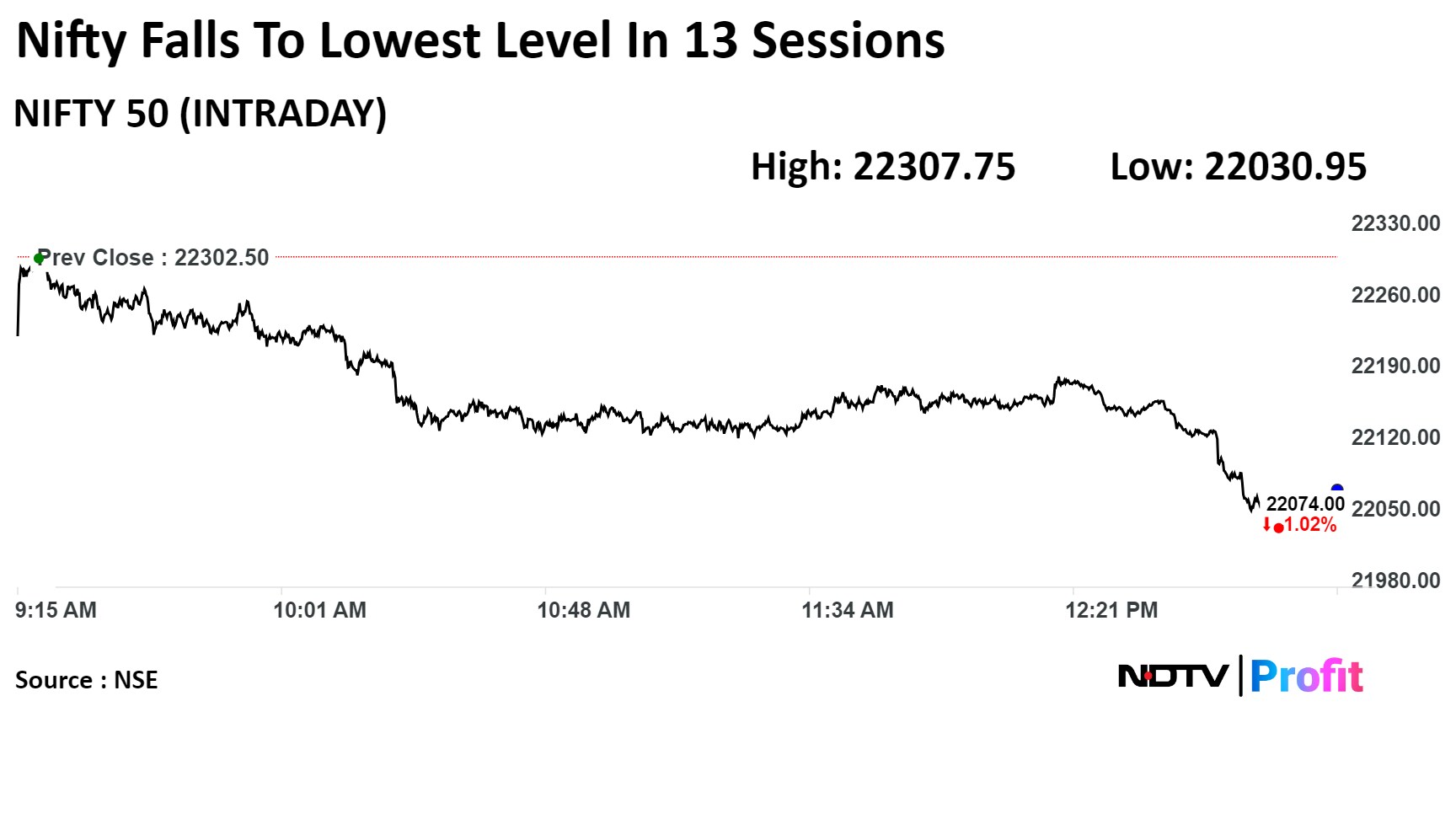

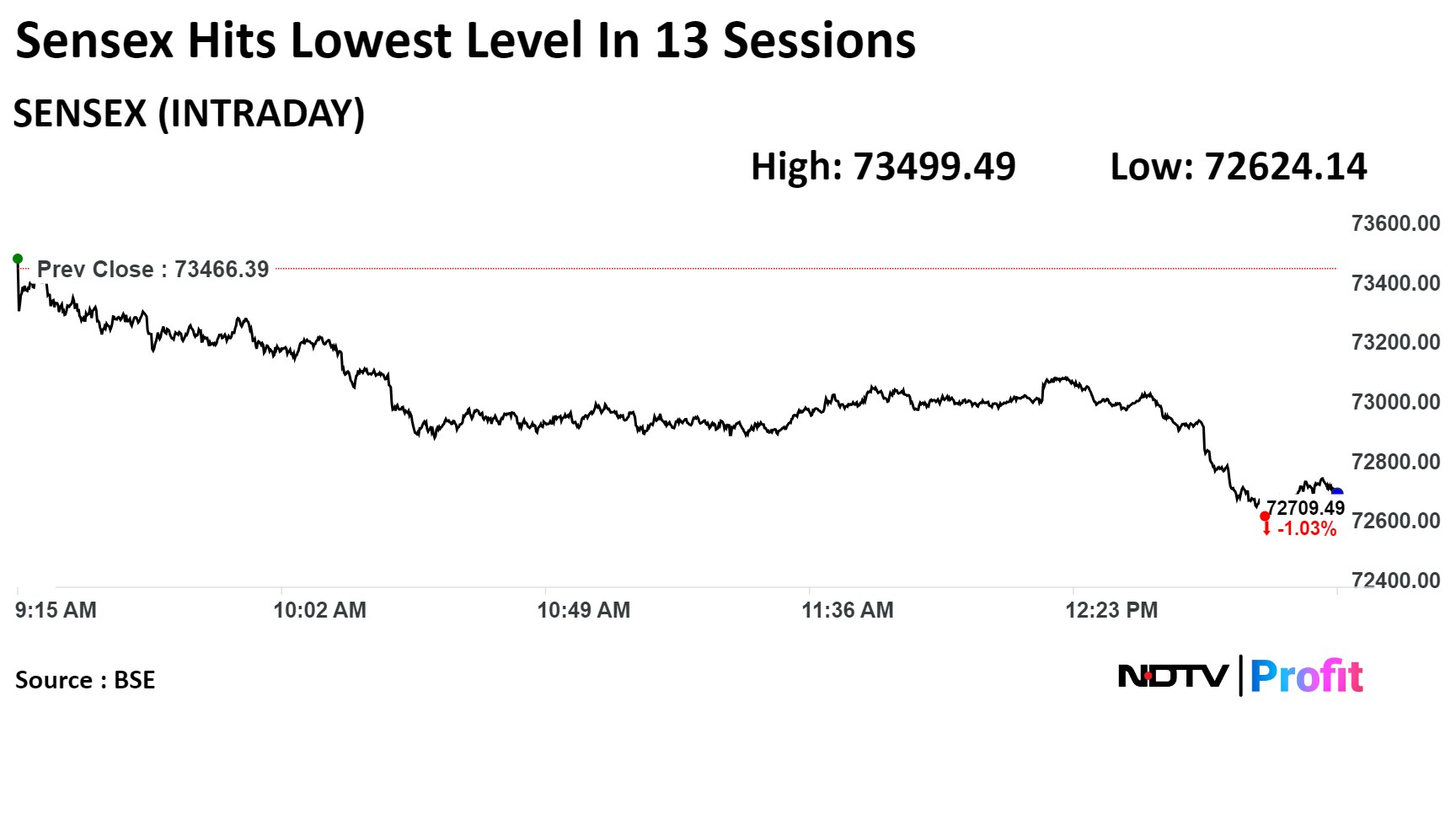

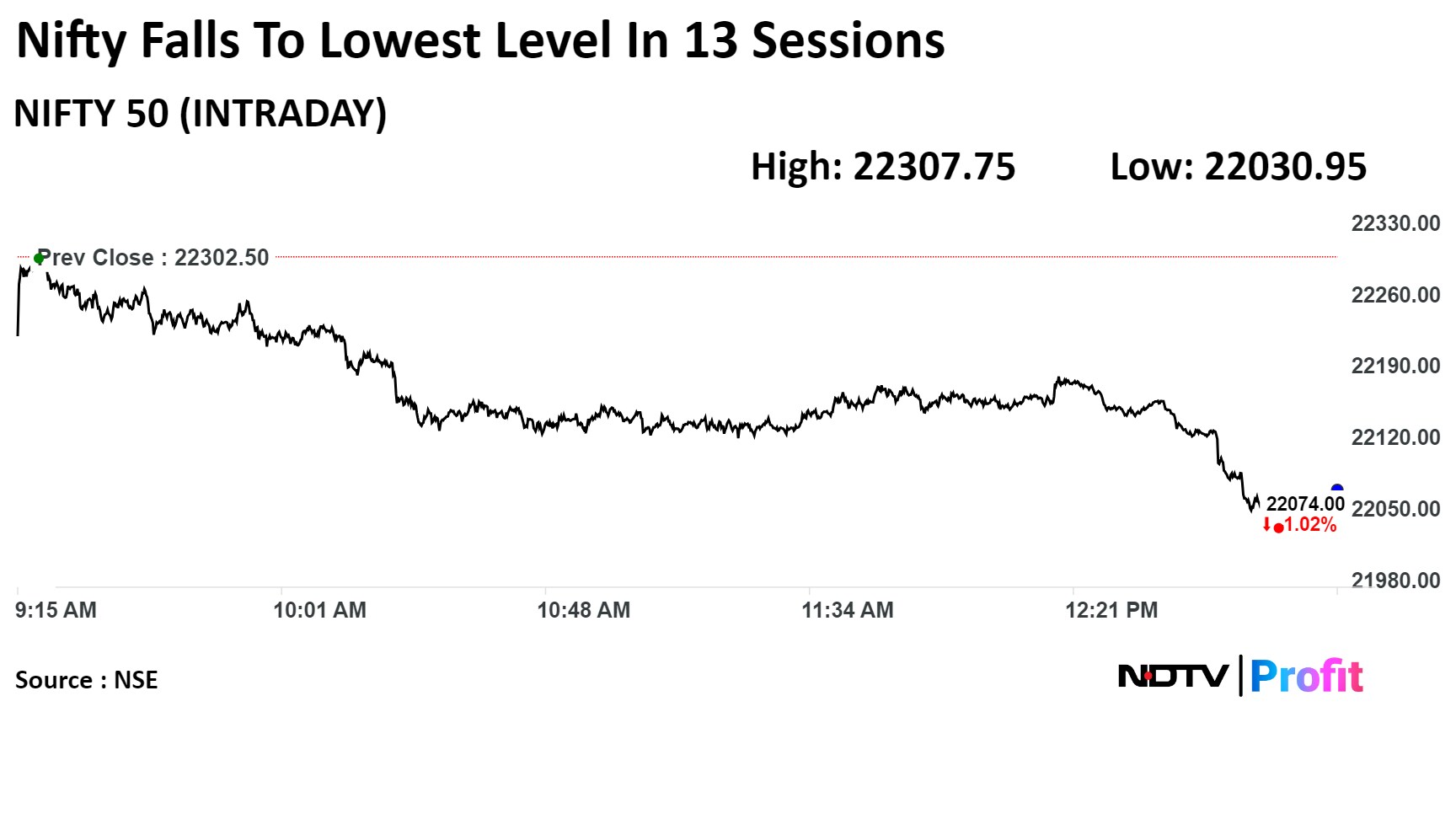

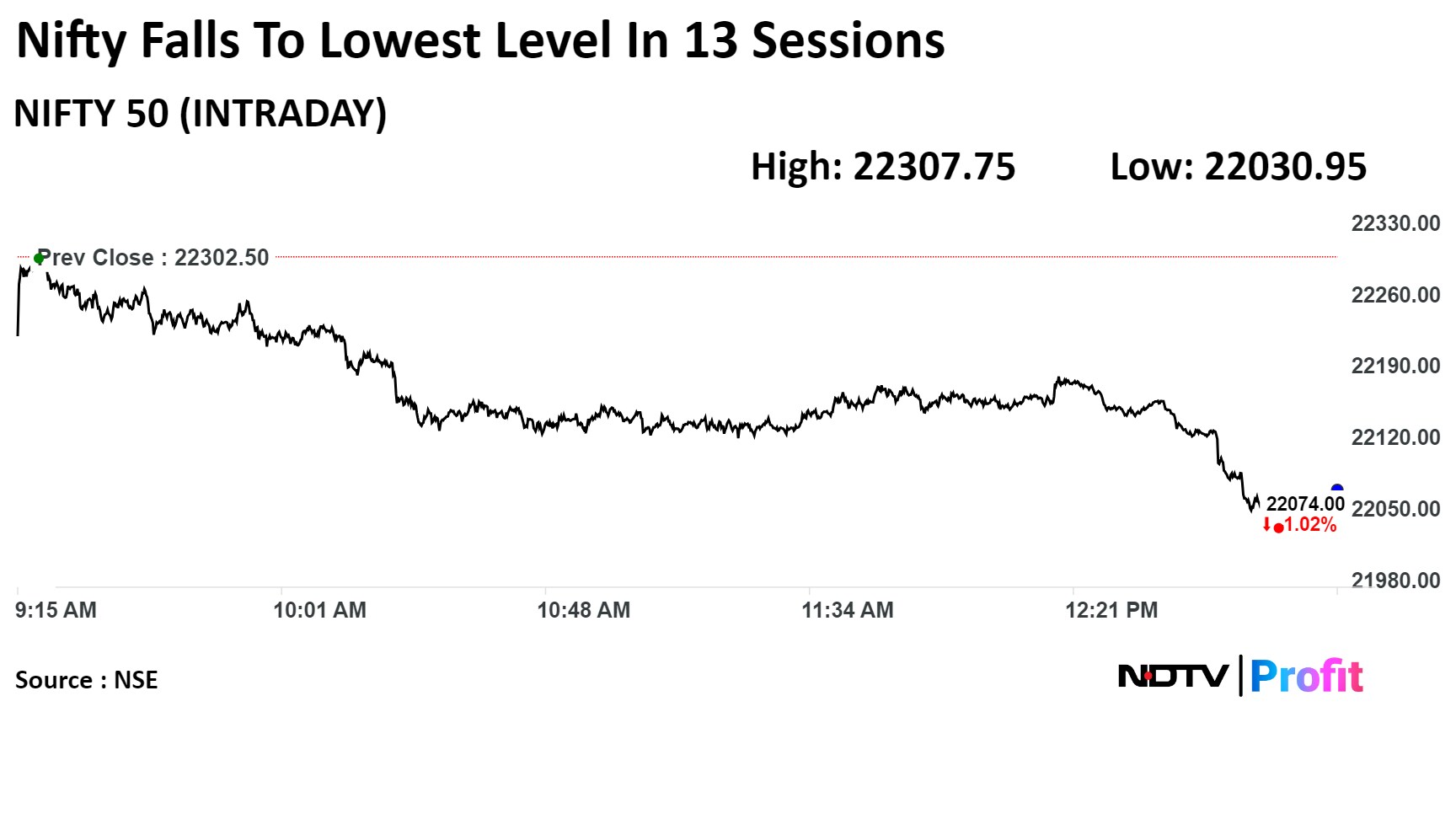

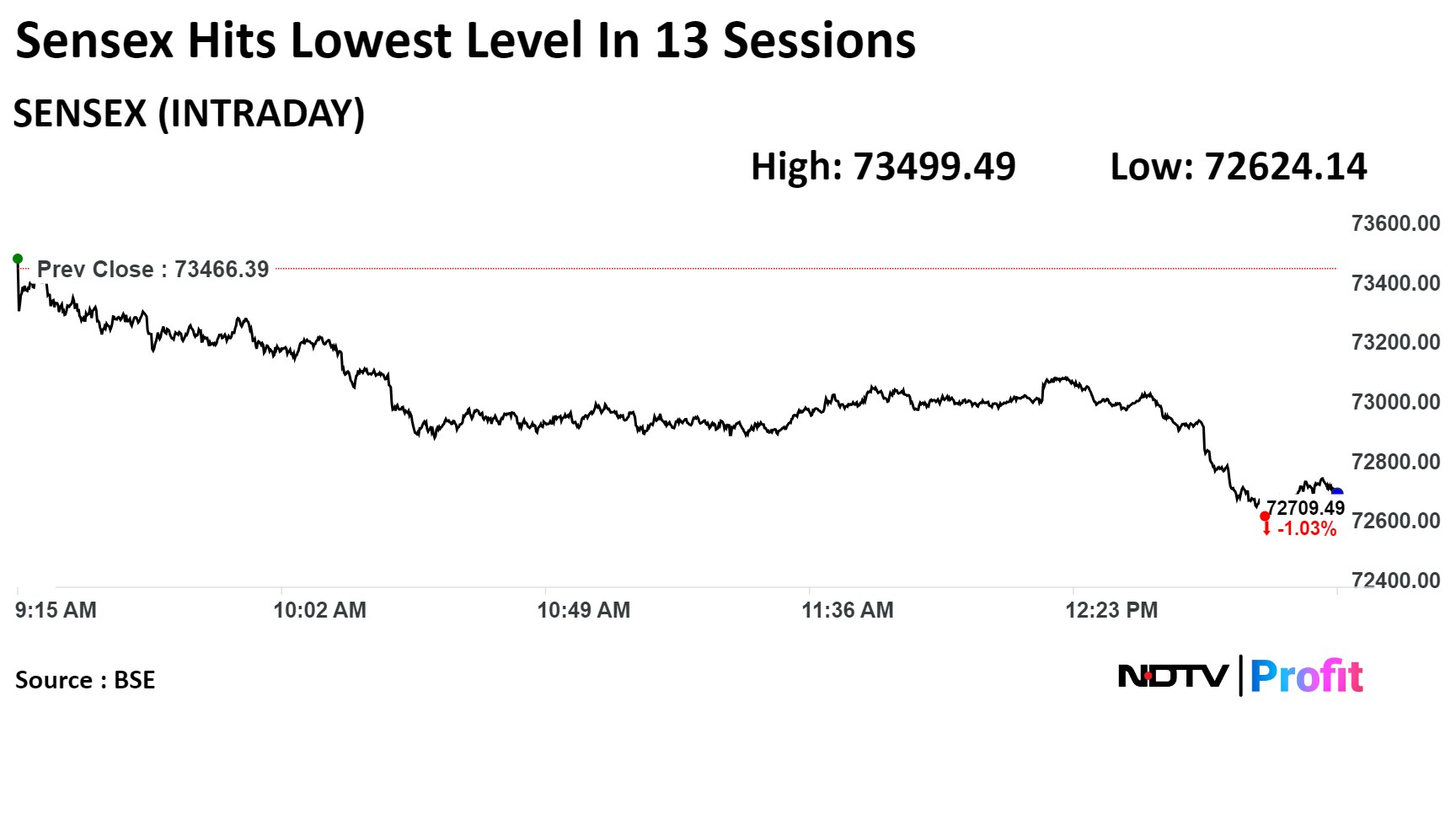

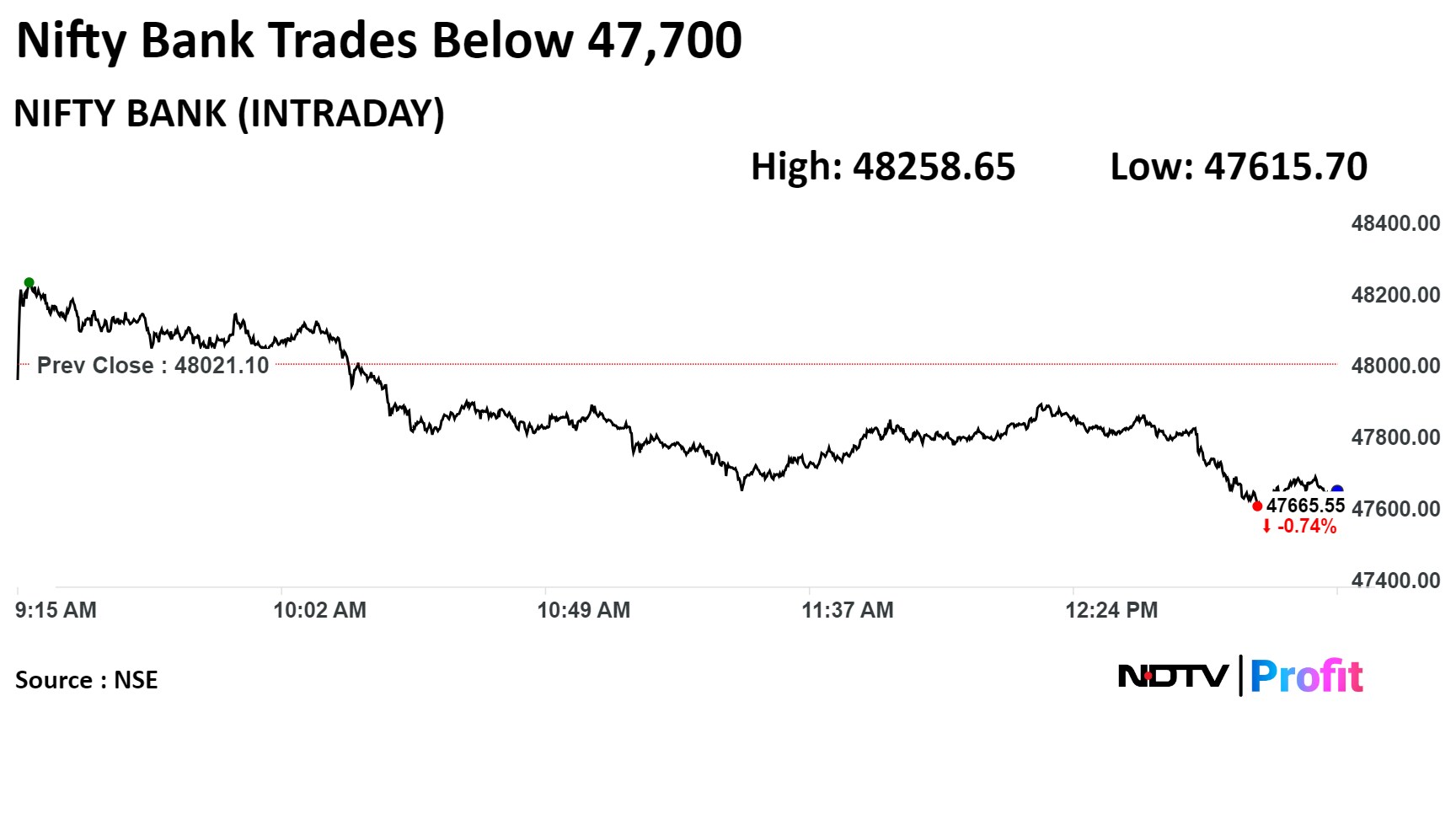

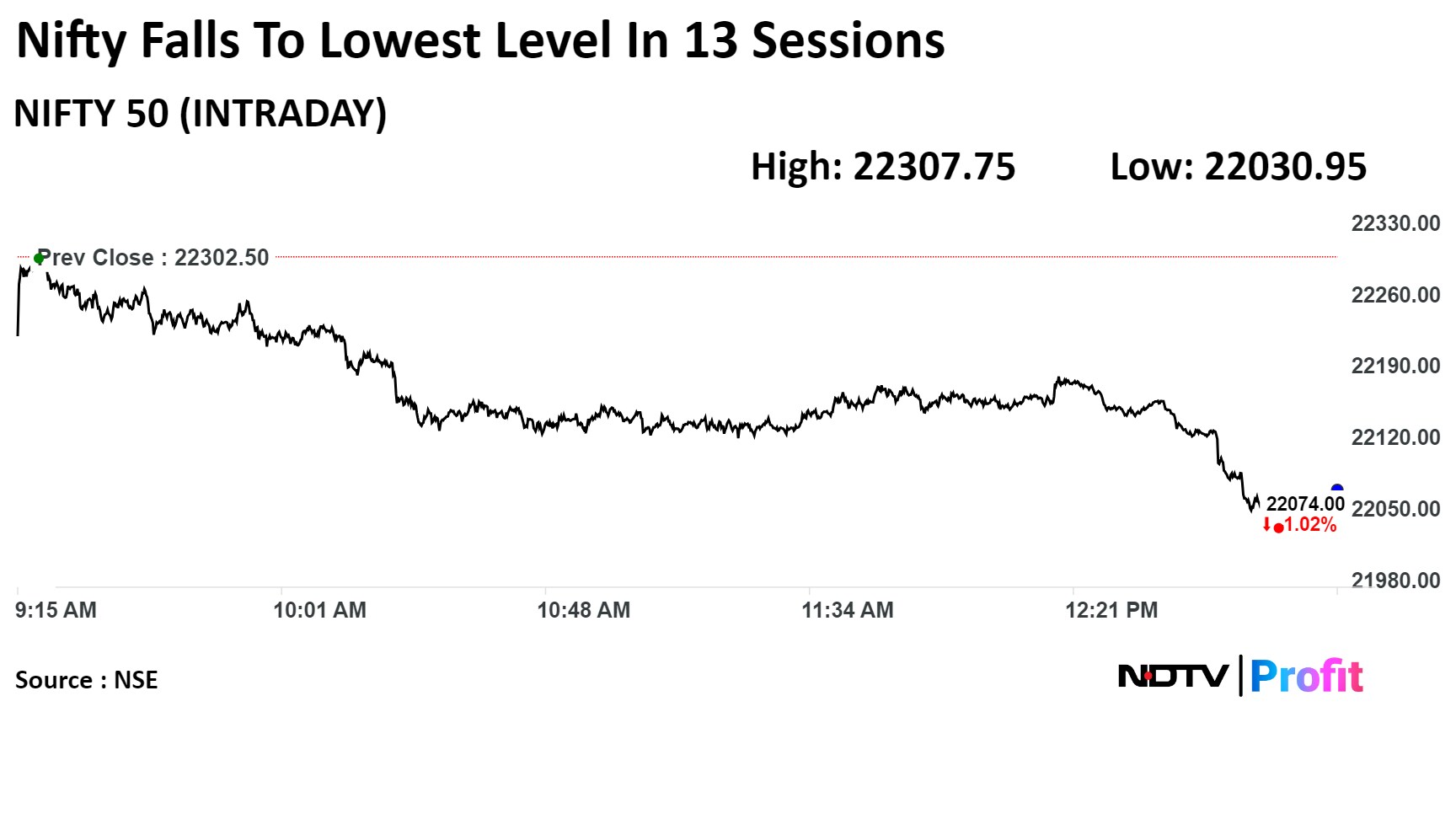

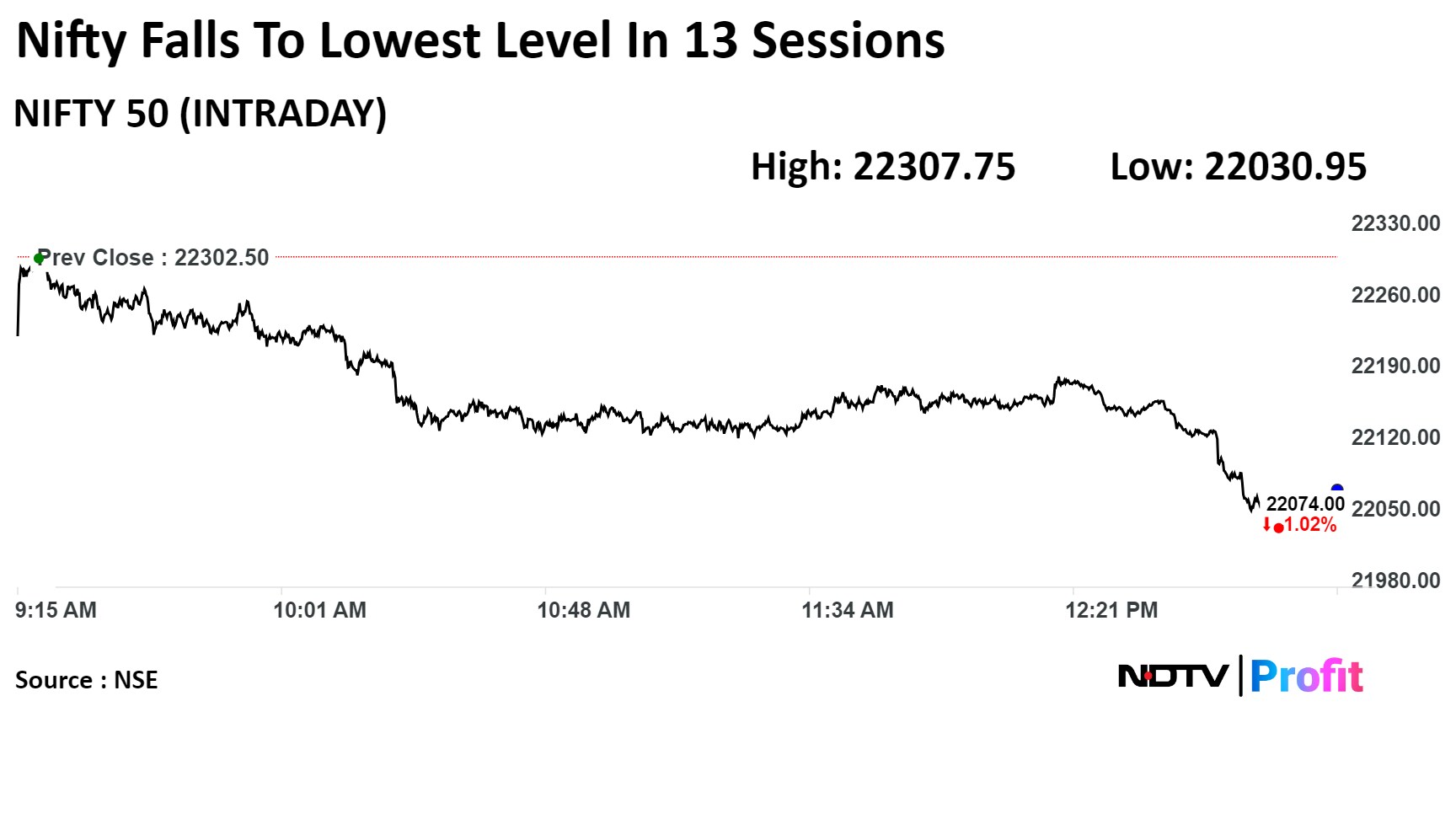

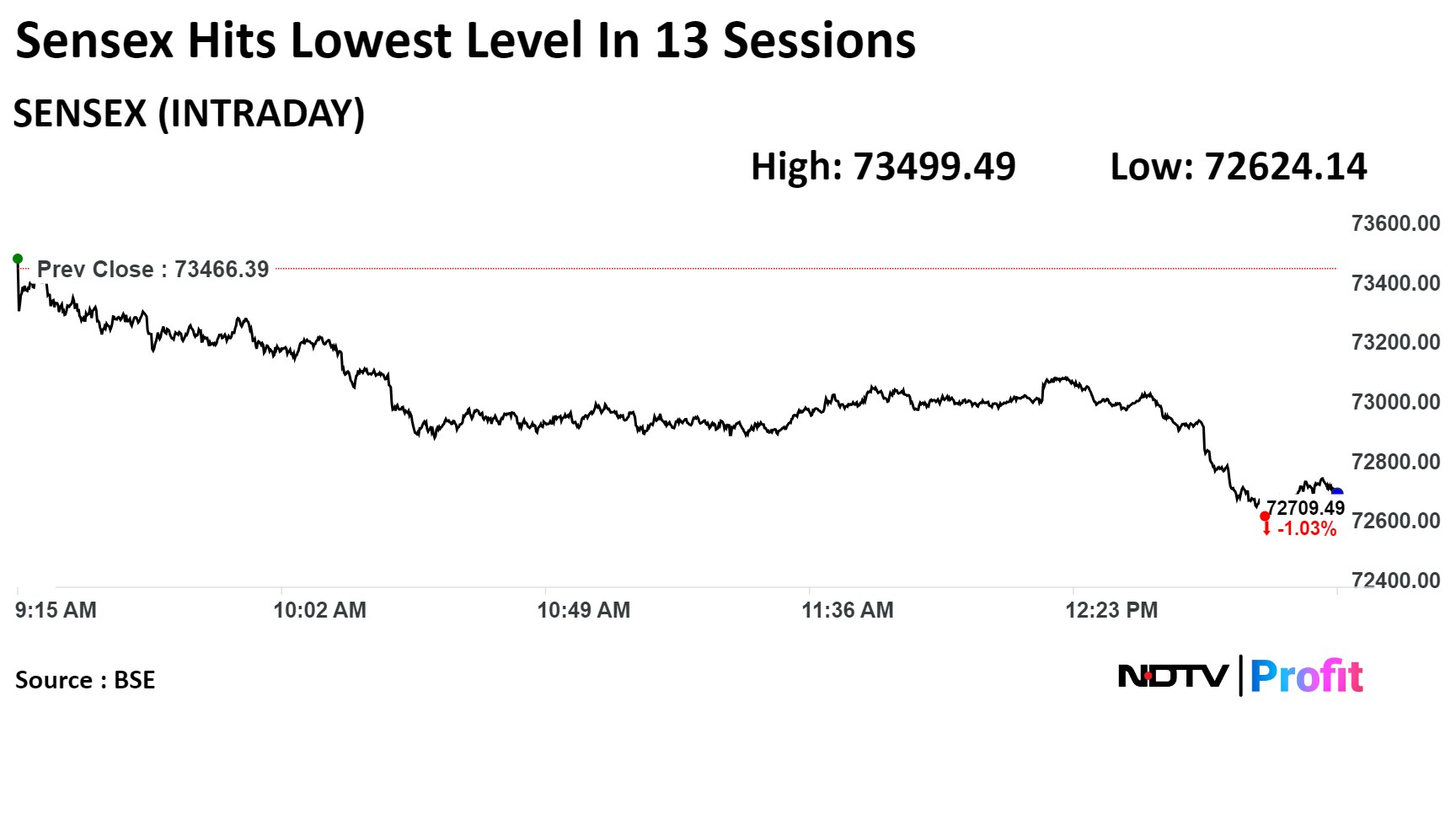

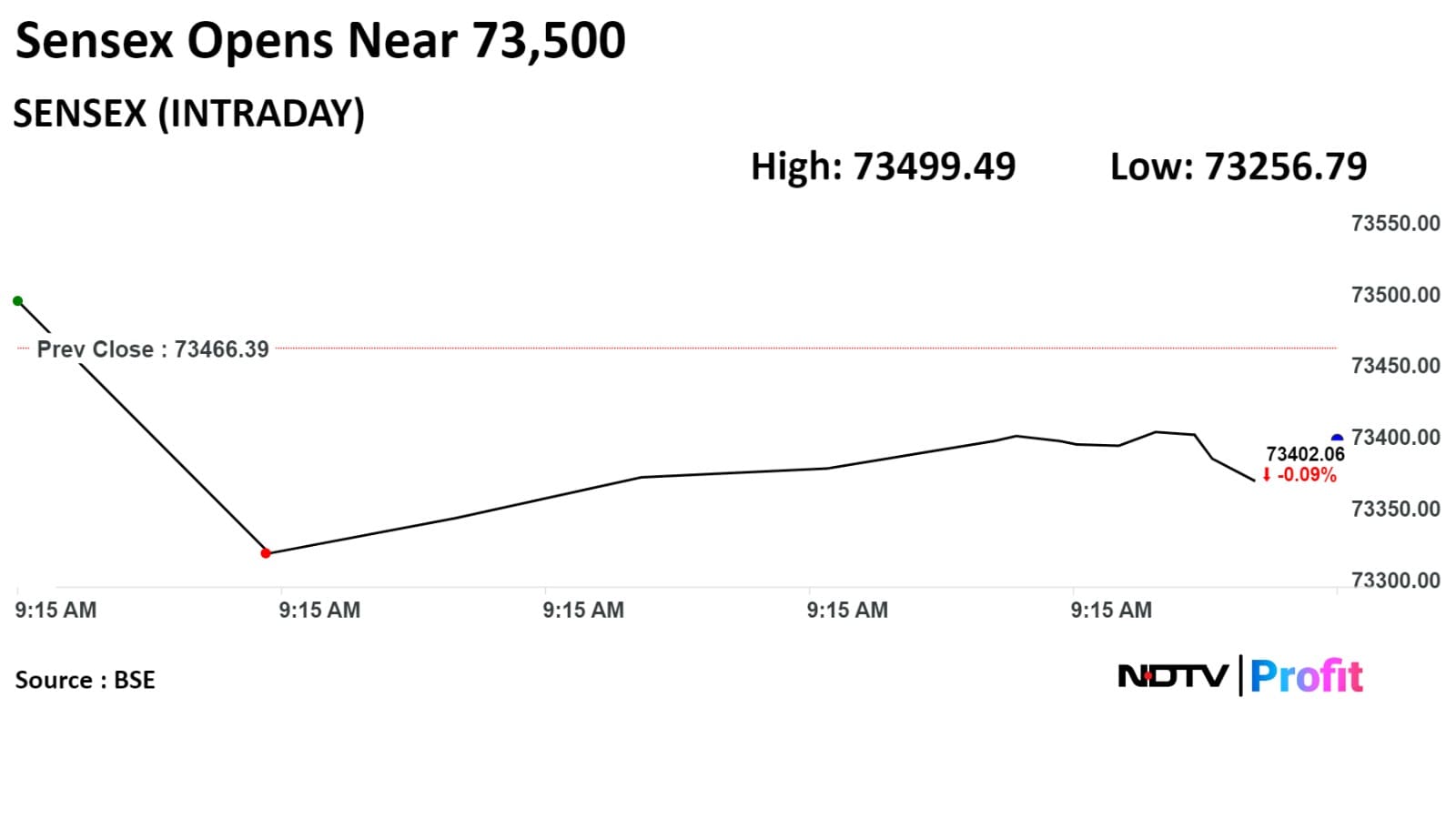

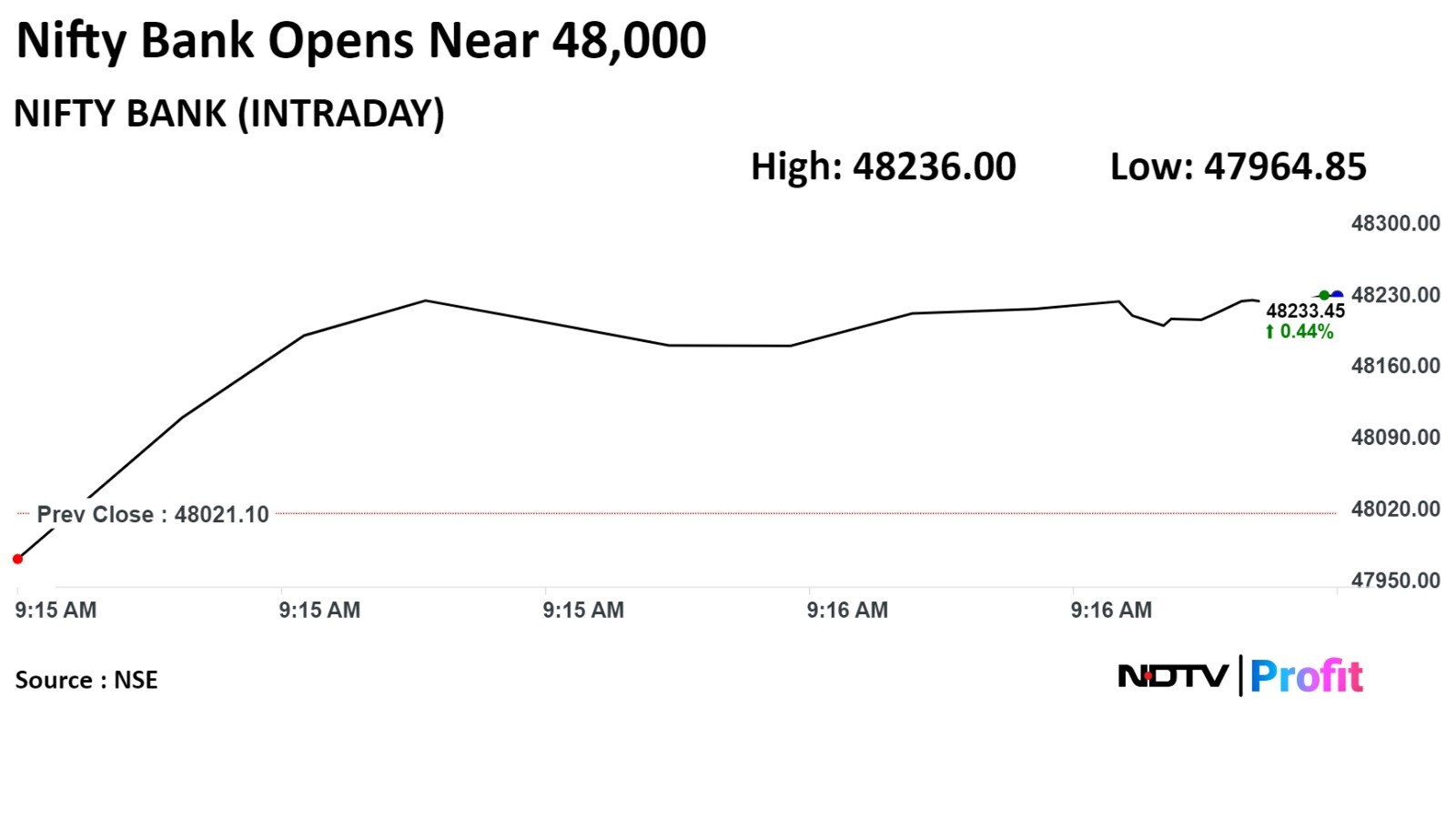

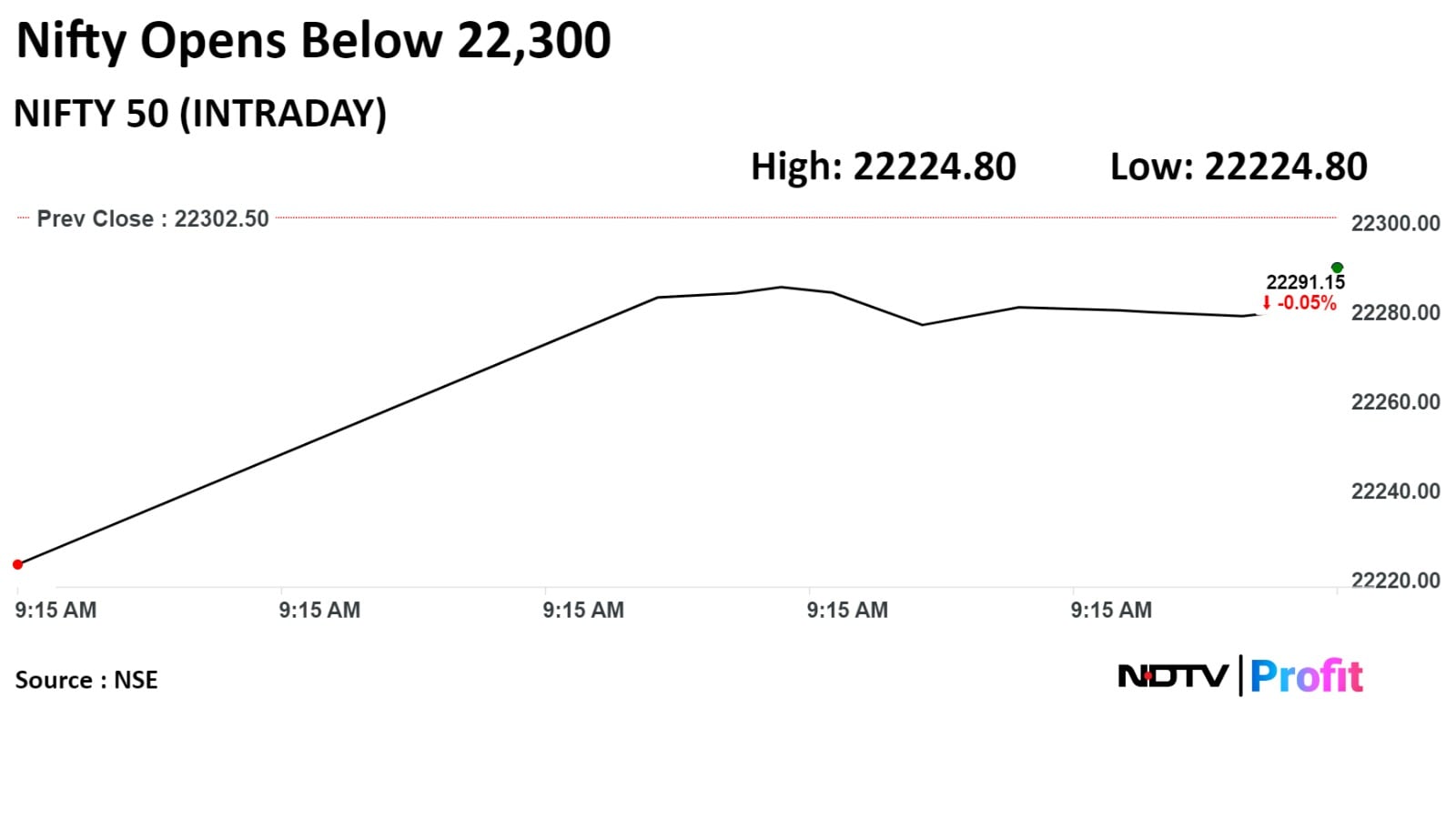

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

Shares of Larsen & Toubro Ltd., Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., and ITC Ltd. dragged the indices.

While those of Infosys Ltd., Mahindra & Mahindra Ltd., Tata Motors Ltd., Hero MotoCorp Ltd., HCLTech Ltd. minimised the losses.

Most sectoral indices on the NSE fell with Nifty Oil & Gas and Nifty Energy falling the most while Nifty Auto jumped to hit its lifetime high.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

Shares of Larsen & Toubro Ltd., Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., and ITC Ltd. dragged the indices.

While those of Infosys Ltd., Mahindra & Mahindra Ltd., Tata Motors Ltd., Hero MotoCorp Ltd., HCLTech Ltd. minimised the losses.

Most sectoral indices on the NSE fell with Nifty Oil & Gas and Nifty Energy falling the most while Nifty Auto jumped to hit its lifetime high.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

Shares of Larsen & Toubro Ltd., Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., and ITC Ltd. dragged the indices.

While those of Infosys Ltd., Mahindra & Mahindra Ltd., Tata Motors Ltd., Hero MotoCorp Ltd., HCLTech Ltd. minimised the losses.

Most sectoral indices on the NSE fell with Nifty Oil & Gas and Nifty Energy falling the most while Nifty Auto jumped to hit its lifetime high.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

India's benchmark stock indices extended their losses and lost nearly Rs 2 lakh crore in market capitalisation so far on Thursday as investors remained cautious amid the ongoing results season and union elections.

Traders anticipate that this trend will persist in the upcoming weeks until the declaration of election results.

At 1:16 p.m., the Nifty fell 249.85 points, or 1.12%, to trade at 22,052.65, and the Sensex declined 777.58 points or 1.06% to 72,688.8.

The support for the Nifty is between 22,000 and 22,200 points, and the resistance is at 22,500, above which Ghose said there's room for upside, according to Rahul Ghose, chief executive at hedged.in.

Shares of Larsen & Toubro Ltd., Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., and ITC Ltd. dragged the indices.

While those of Infosys Ltd., Mahindra & Mahindra Ltd., Tata Motors Ltd., Hero MotoCorp Ltd., HCLTech Ltd. minimised the losses.

Most sectoral indices on the NSE fell with Nifty Oil & Gas and Nifty Energy falling the most while Nifty Auto jumped to hit its lifetime high.

Broader markets underperformed their larger peers, with the S&P BSE Smallcap falling 1.48% and the S&P BSE Midcap lossing 1.28% through midday on Thursday.

Seventeen out of 20 sectoral indices fell and four rose. S&P BSE Capital Goods fell the most.

Market breadth was skewed in favour of sellers. Around 2,610 stock declined, 1,063 stocks rose, and 136 stocks remained unchanged on BSE.

Revenue down 1.06% to Rs 2,459.41 crore from Rs 2,485.61 crore

Ebitda up 17.69% at Rs 308.2 crore from Rs 261.87 crore

Margin up 199 bps at 12.53% from 10.53%

Net profit up 26.43% at Rs 202.13 crore from Rs 159.87 crore

Net profit rose 24.3 Rs 808.1 crore from Rs 650.07 crore YoY

NII rose 21% to Rs 2,763.08 crore from 2,276.11 crore YoY

Gross NPA at 3.10% vs 3.90% (QoQ)

Net NPA at 0.57% vs 0.62% (QoQ)

Revenue up 7.85% to Rs 1,516.98 crore from Rs 1,406.45 crore

Ebitda up 22.54% at Rs 260.06 crore from Rs 212.22 crore

Margin up 205 bps at 17.14% from 15.08%

Net profit up 16.78% at Rs 178.21 crore from Rs 152.6 crore

Net interest income up 9% to Rs 10,363 crore. (YoY)

Net profit up 159.8% to Rs 3,010 crore. (Bloomberg estimate: Rs 2,276.99 crore). (YoY)

Gross NPA at 5.73% vs 6.24% (QoQ)

NNPA at 0.73% vs 0.96% (QoQ)

Revenue up 7.17% to Rs 310.45 crore from Rs 289.67 crore

Ebitda up 12.91% at Rs 125.23 crore from Rs 110.91 crore

Margin up 204 bps at 40.33% from 38.28%

Net profit up 16.32% at Rs 102.98 crore from Rs 88.53 crore

Revenue at Rs 8730.8 crore vs Rs 8787.3 crore, down 0.65%

EBITDA at Rs 1691.4 crore vs Rs 1864.7 crore, down 9.29%

Margin at 19.37% vs 21.22%, down 184 bps

Net profit at Rs 1275.3 crore vs Rs 1258.4 crore, up 1.34%

Net profit at Rs 20,698 crore Vs Bloomberg estimate of Rs 13,440 crore

Gross NPA at 2.24% vs 2.42% QoQ

Net NPA at 0.57% vs 0.64% QoQ

NII rose 3% on year to Rs 41,655 crore vs Rs 40,393 crore

Net profit at Rs 20,698 crore Vs Bloomberg estimate of Rs 13,440 crore

Gross NPA at 2.24% vs 2.42% QoQ

Net NPA at 0.57% vs 0.64% QoQ

NII rose 3% on year to Rs 41,655 crore vs Rs 40,393 crore

Domestic deposits up 11.07% YoY at Rs 47.24 lakh crore

CASA Deposits up 4.25% YoY at Rs 19.41 lakh crore

Credit cost FY24 at 0.29%, up 3 bps YoY

PVR Inox Ltd. opened a four screen multiplex at Ambience Mall, Gurugram.

Source: Exchange filing

Revenue down 13.54% to Rs 356.6 crore from Rs 412.4 crore

Ebitda down 11.23% at Rs 68.94 crore from Rs 77.67 crore

Margin up 49 bps at 19.33% from 18.83%

Net profit down 20.94% at Rs 38.45 crore from Rs 48.64 crore

Revenue down 13.54% to Rs 356.6 crore from Rs 412.4 crore

Ebitda down 11.23% at Rs 68.94 crore from Rs 77.67 crore

Margin up 49 bps at 19.33% from 18.83%

Net profit down 20.94% at Rs 38.45 crore from Rs 48.64 crore

Revenue up 27.18% to Rs 224.1 crore from Rs 176.2 crore

Ebitda up 109.1% at Rs 45 crore from Rs 21.52 crore

Margin up 786 bps at 20.08% from 12.21%

Net profit up 86.44% at Rs 25.04 crore from Rs 13.43 crore

Revenue up 27.18% to Rs 224.1 crore from Rs 176.2 crore

Ebitda up 109.1% at Rs 45 crore from Rs 21.52 crore

Margin up 786 bps at 20.08% from 12.21%

Net profit up 86.44% at Rs 25.04 crore from Rs 13.43 crore

Revenue up 11.87% to Rs 897.8 crore from Rs 802.5 crore

Ebitda up 30.01% at Rs 198.8 crore from Rs 152.9 crore

Margin up 309 basis points at 22.14% from 19.05%

Net profit up 35.31% at Rs 141.4 crore from Rs 104.5 crore

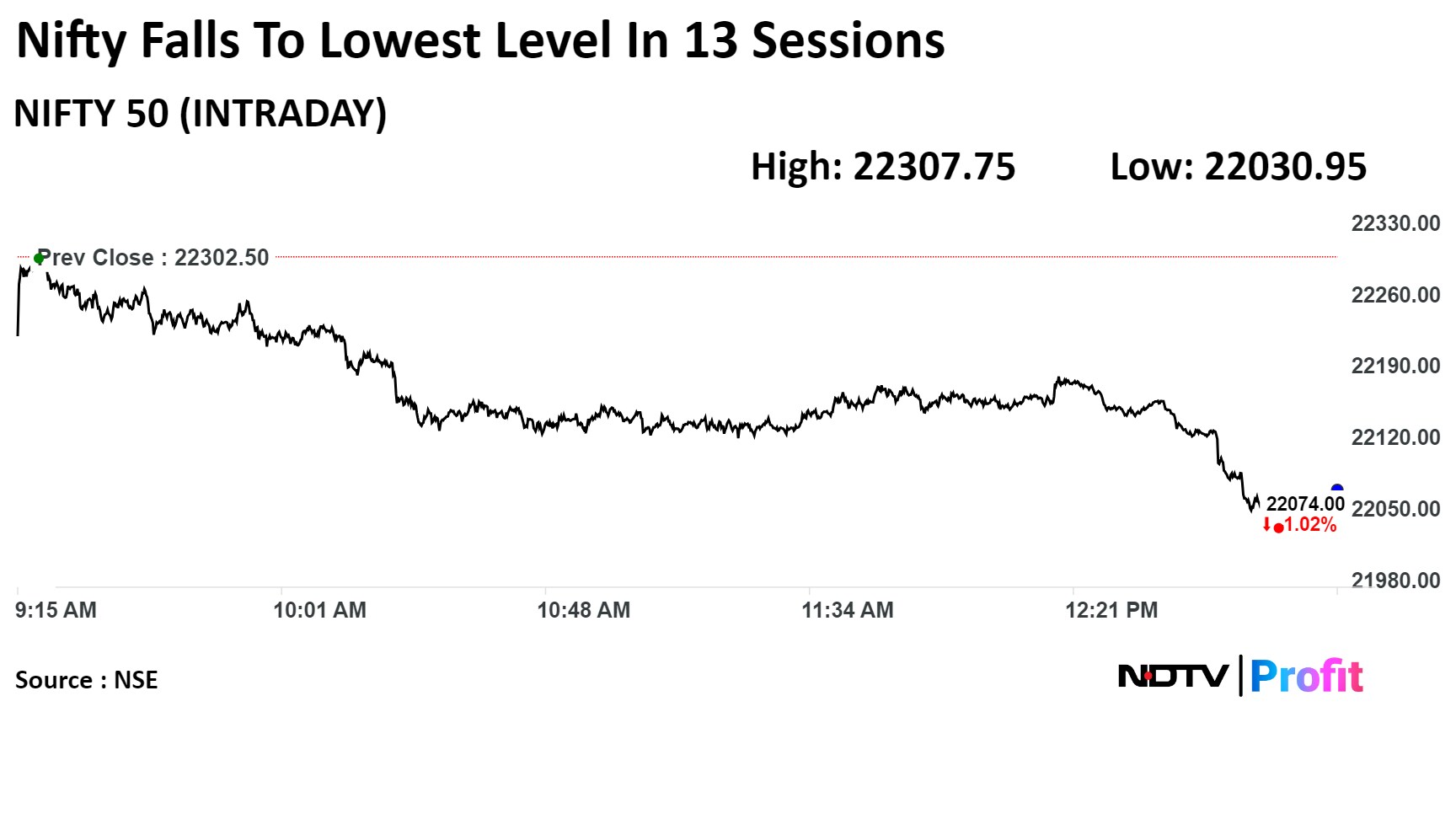

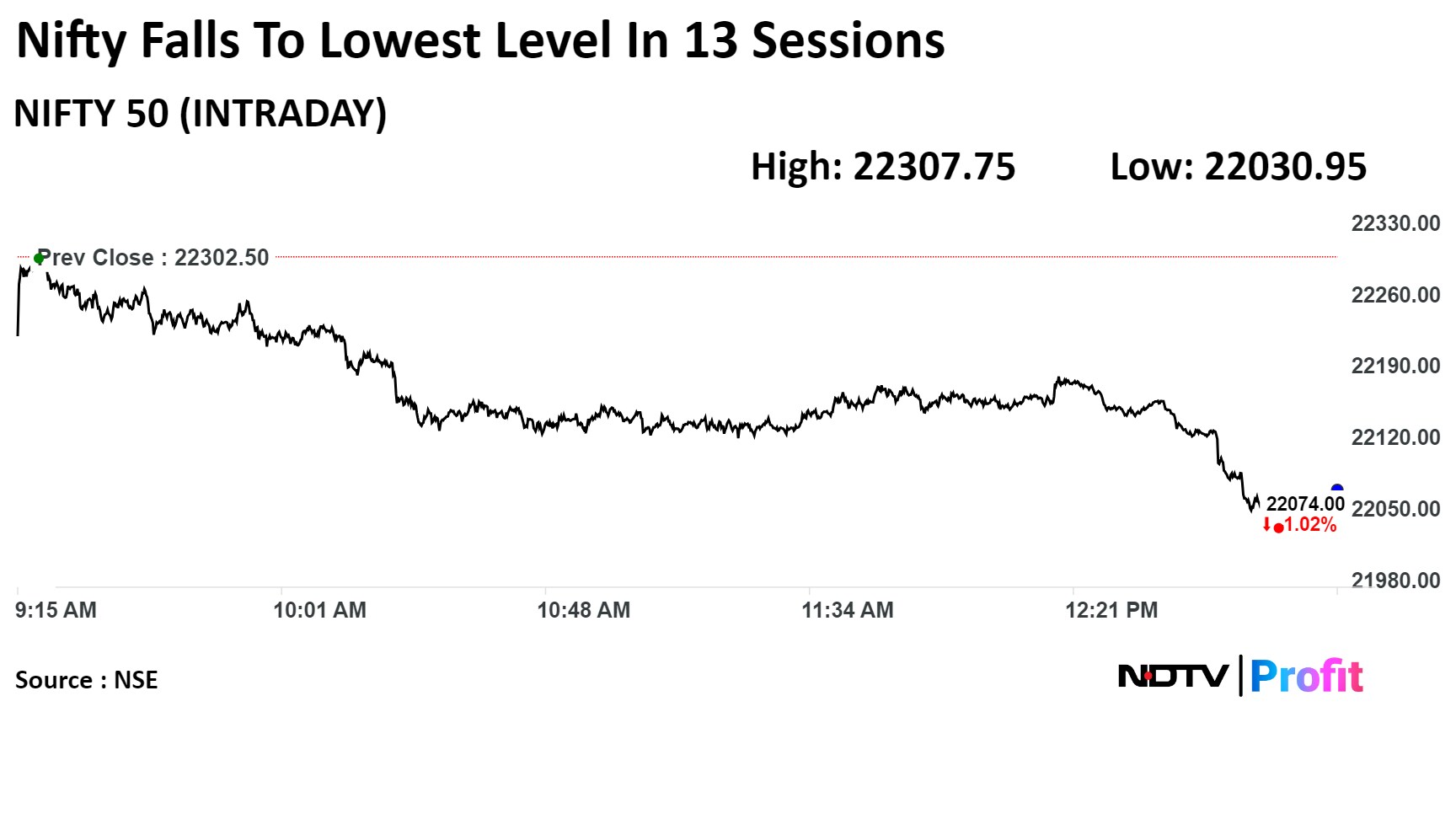

The NSE Nifty 50 erased 260 points from day's high, while erasing over Rs 2 lakh crore market cap.

The NSE Nifty 50 erased 260 points from day's high, while erasing over Rs 2 lakh crore market cap.

The S&P BSE Sensex shed 785.53 points from day's high, while the benchmark lost 1.3 lakh crore market crore.

The NSE Nifty 50 erased 260 points from day's high, while erasing over Rs 2 lakh crore market cap.

The NSE Nifty 50 erased 260 points from day's high, while erasing over Rs 2 lakh crore market cap.

The S&P BSE Sensex shed 785.53 points from day's high, while the benchmark lost 1.3 lakh crore market crore.

MF industry net inflows at Rs 2.39 lakh crore vs outflow of Rs 1.59 lakh crore MoM

Net AUM of MF industry at Rs 57.25 lakh crore vs Rs 53.4 lakh crore MoM

Active equity funds see net inflow of Rs 18,917 crore vs Rs 22,633 crore MoM

Net AUM for active schemes at Rs 24.74 crore as of April vs Rs 23.48 lakh crore as of March

Small cap funds see net inflow of Rs 2,208 crore vs outflow of Rs 94.17 crore MoM

Midcap funds see net inflow of Rs 1,793 crore vs Rs 1,017 crore MoM

Large cap funds see net inflow of Rs 357 crore vs Rs 2,127 crore MoM

Flexi cap funds see net inflow of Rs 2172 crore vs Rs 2,738 crore MoM

India accounts for nearly half of all Swift cars sold globally, Maruti Suzuki says.

Suzuki has sold 6.5 million Swift units globally.

About 3 million Swift cars have been sold in India.

Source: Press conference

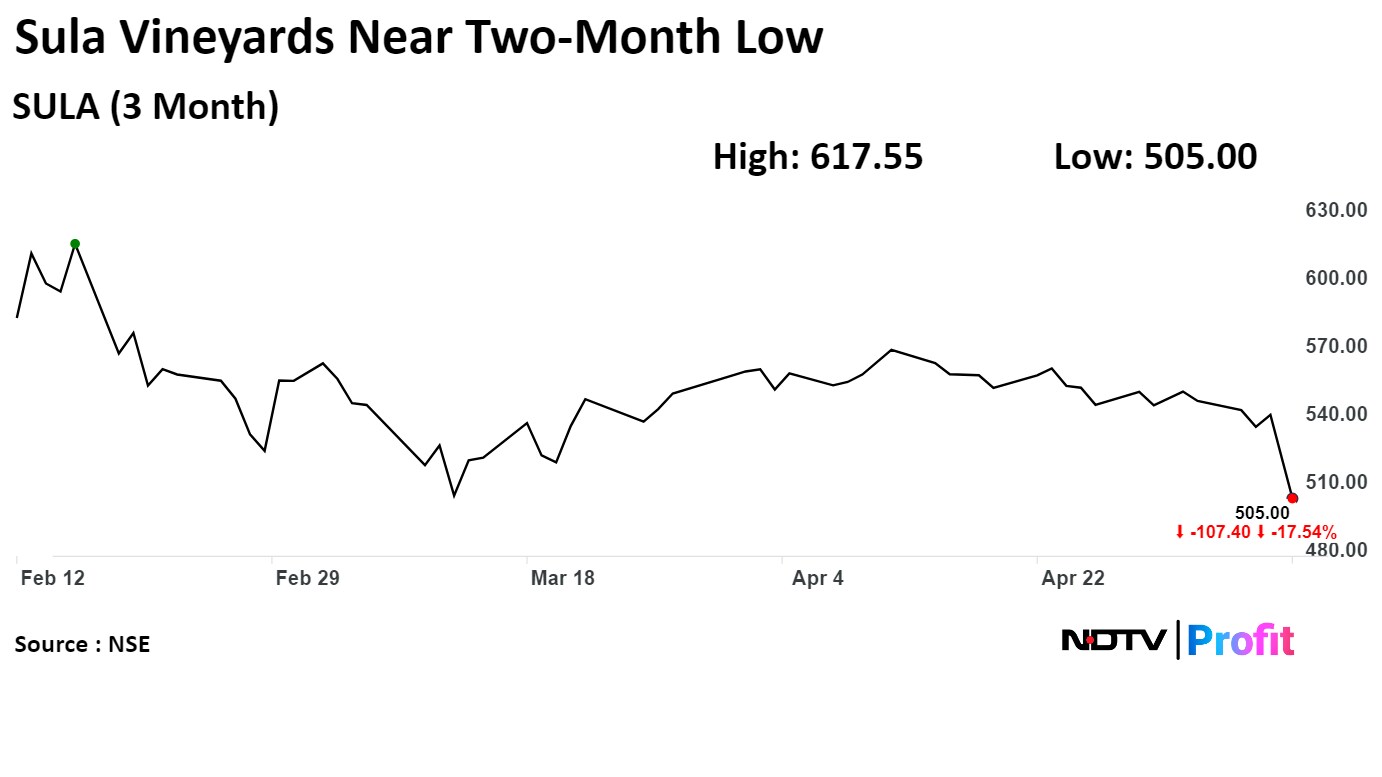

Sula Vineyards Ltd. fell 6.95% to Rs 504.30, the lowest level since March 14. It was trading 6.46% down at Rs 506.95 as of 12:02 p.m., as compared to 0.62% decline in the NSE Nifty 50 index.

The scrip rose 1.36% on year-to-date basis, and in 12 months it has risen 19.32%. Total traded volume so far in the day stood at 1.93 times its 30-day average. The relative strength index was at 30.11.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 27.3%.

Sula Vineyards Ltd. fell 6.95% to Rs 504.30, the lowest level since March 14. It was trading 6.46% down at Rs 506.95 as of 12:02 p.m., as compared to 0.62% decline in the NSE Nifty 50 index.

The scrip rose 1.36% on year-to-date basis, and in 12 months it has risen 19.32%. Total traded volume so far in the day stood at 1.93 times its 30-day average. The relative strength index was at 30.11.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 27.3%.

EMS Ltd. emerged as the lowest bidder for infrastructure project worth Rs 148 crore.

Source: Exchange filing

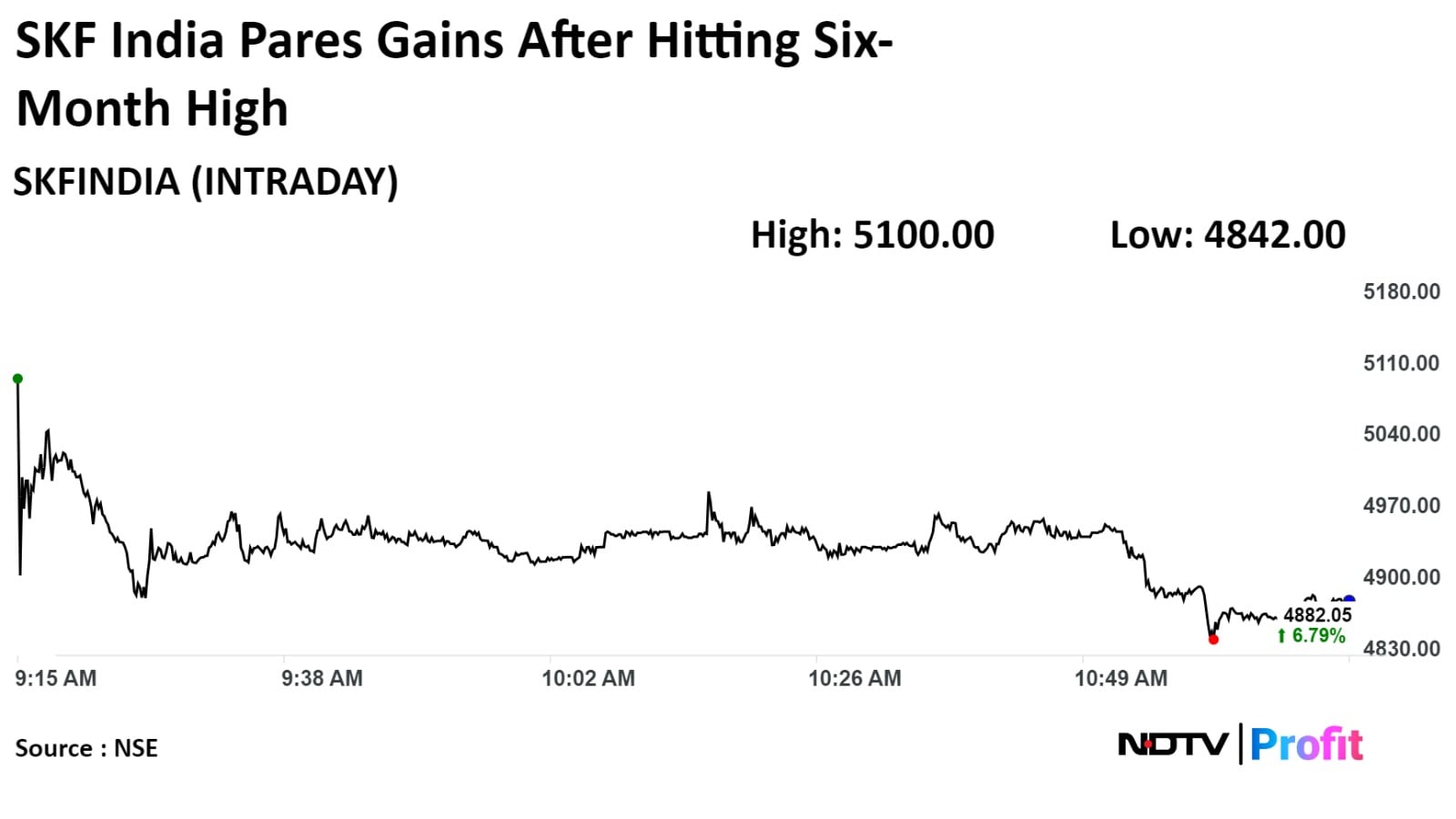

Shares of SKF India Ltd. surged 11.56% to Rs 5,100.00, a six-month high on Thursday after it reported over 42% rise in its net profit during January-March. It was pared gains to trade 6.97% higher at 4,890.00 as of 11:27 a.m., as compared to 0.73% decline in the NSE Nifty 50 index.

Shares of SKF India Ltd. surged 11.56% to Rs 5,100.00, a six-month high on Thursday after it reported over 42% rise in its net profit during January-March. It was pared gains to trade 6.97% higher at 4,890.00 as of 11:27 a.m., as compared to 0.73% decline in the NSE Nifty 50 index.

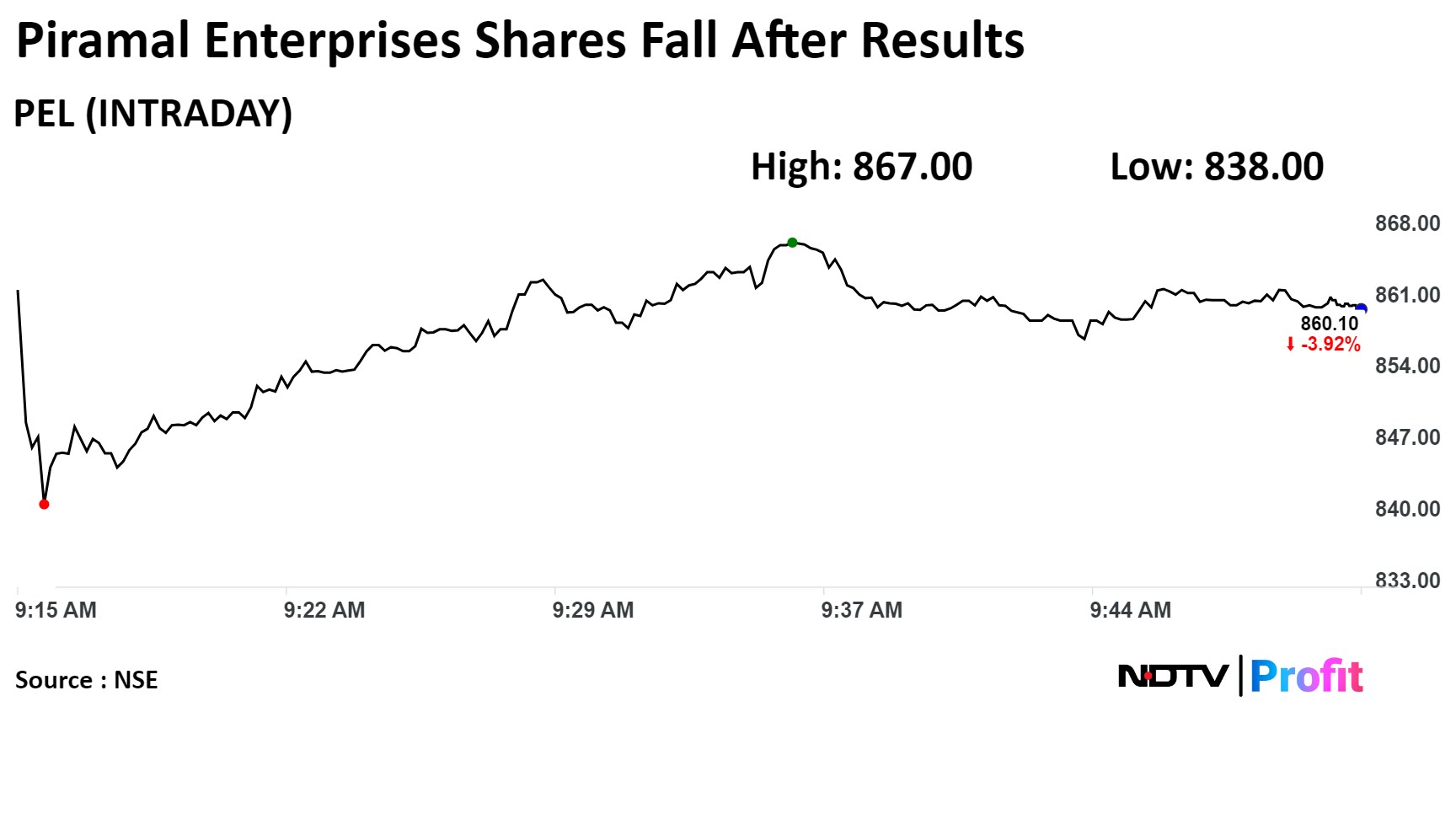

Shares of Piramal Enterprises Ltd. fell on Thursday after its fourth-quarter profit missed analysts' estimates by a wide margin, prompting most brokerages to cut both ratings and target price on the stock.

Shares of the company fell as much as 6.38% to Rs 838 apiece, the lowest level since April 22. It pared gains to trade 4.49% lower at Rs 855 apiece as of 10:25 a.m. This compares to a 0.63% decline in the NSE Nifty 50 Index.

The stock has fallen 4.44% on a year-to-date basis and 8.20% in the last 12 months. Total traded volume so far in the day stood at 1.64 times its 30-day average. The relative strength index was at 41.75.

Out of the seven analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.4%.

Shares of Piramal Enterprises Ltd. fell on Thursday after its fourth-quarter profit missed analysts' estimates by a wide margin, prompting most brokerages to cut both ratings and target price on the stock.