The local currency weakened by 7 paise to 83.57 against the US dollar.

It closed at 83.50 on Monday.

Source: Cogencis

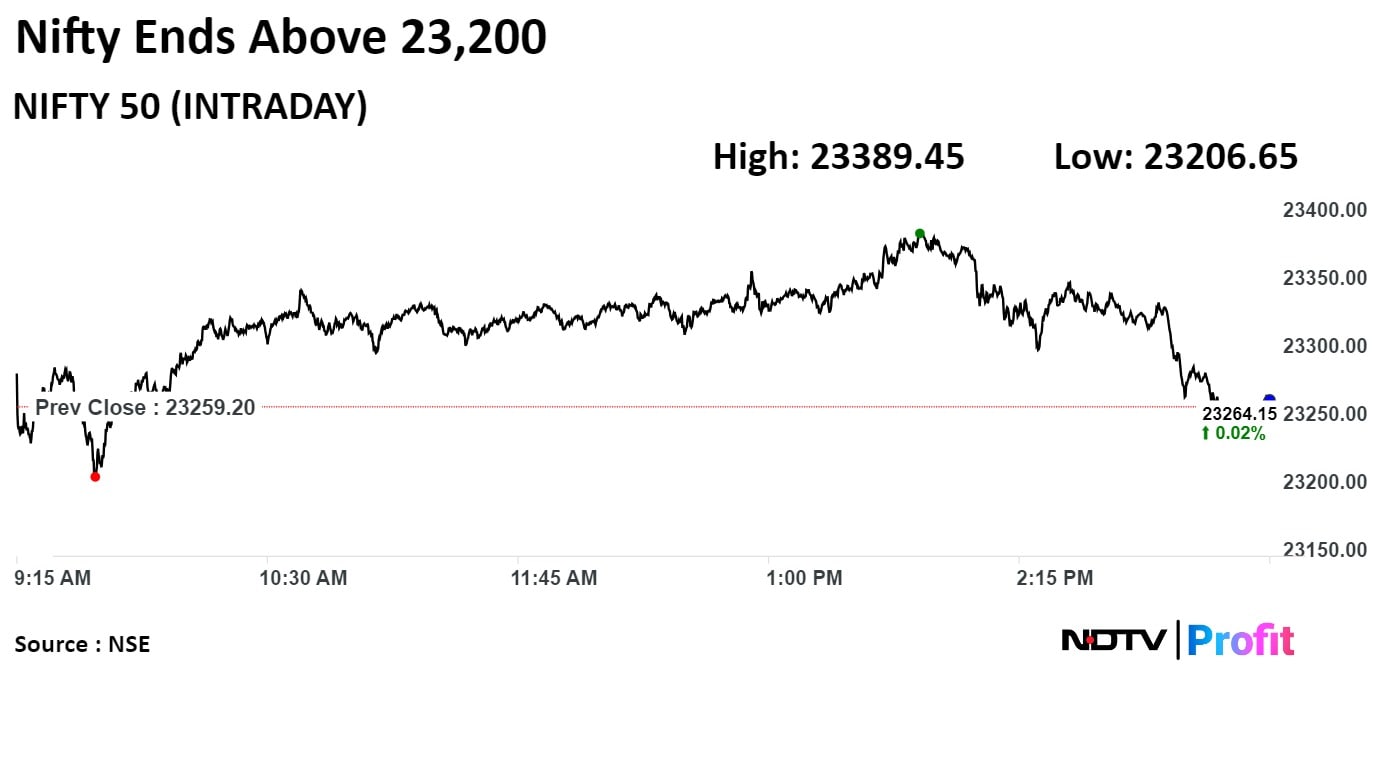

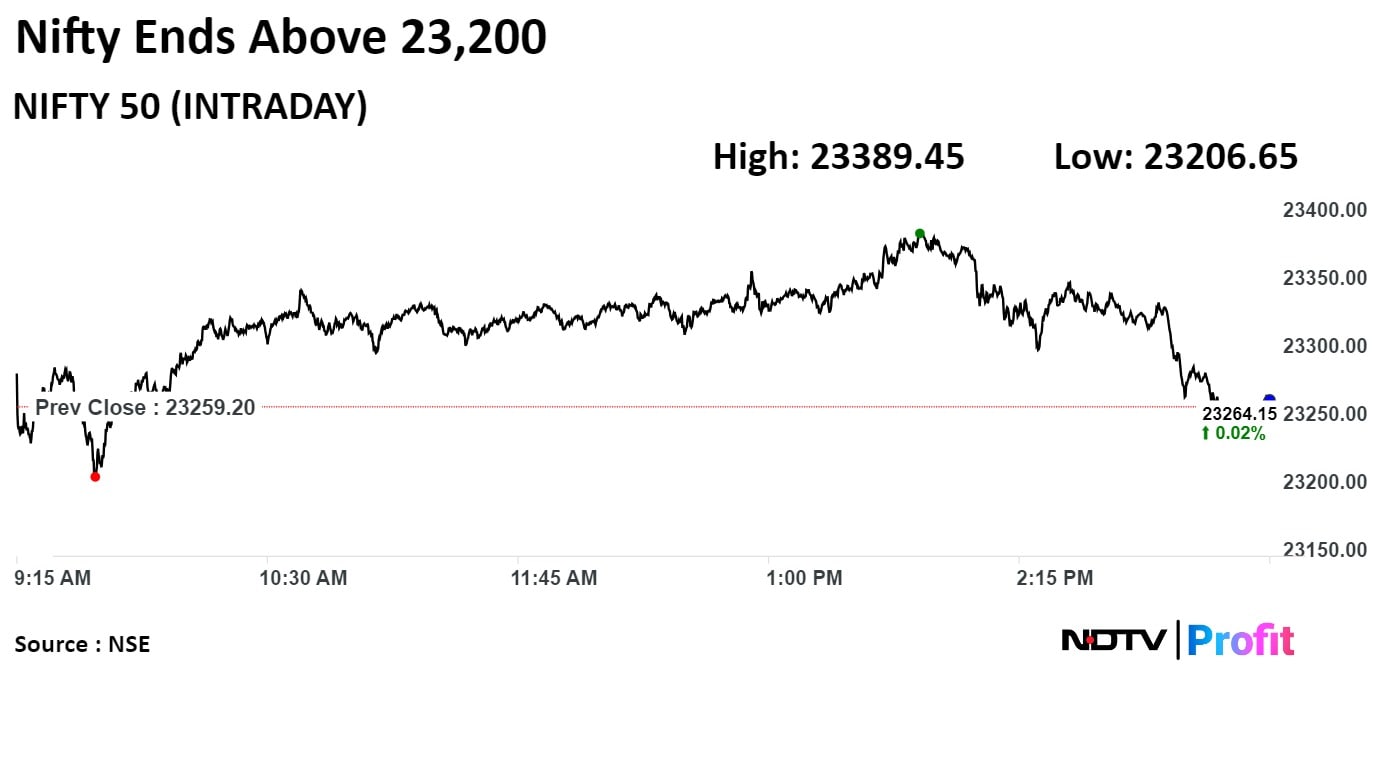

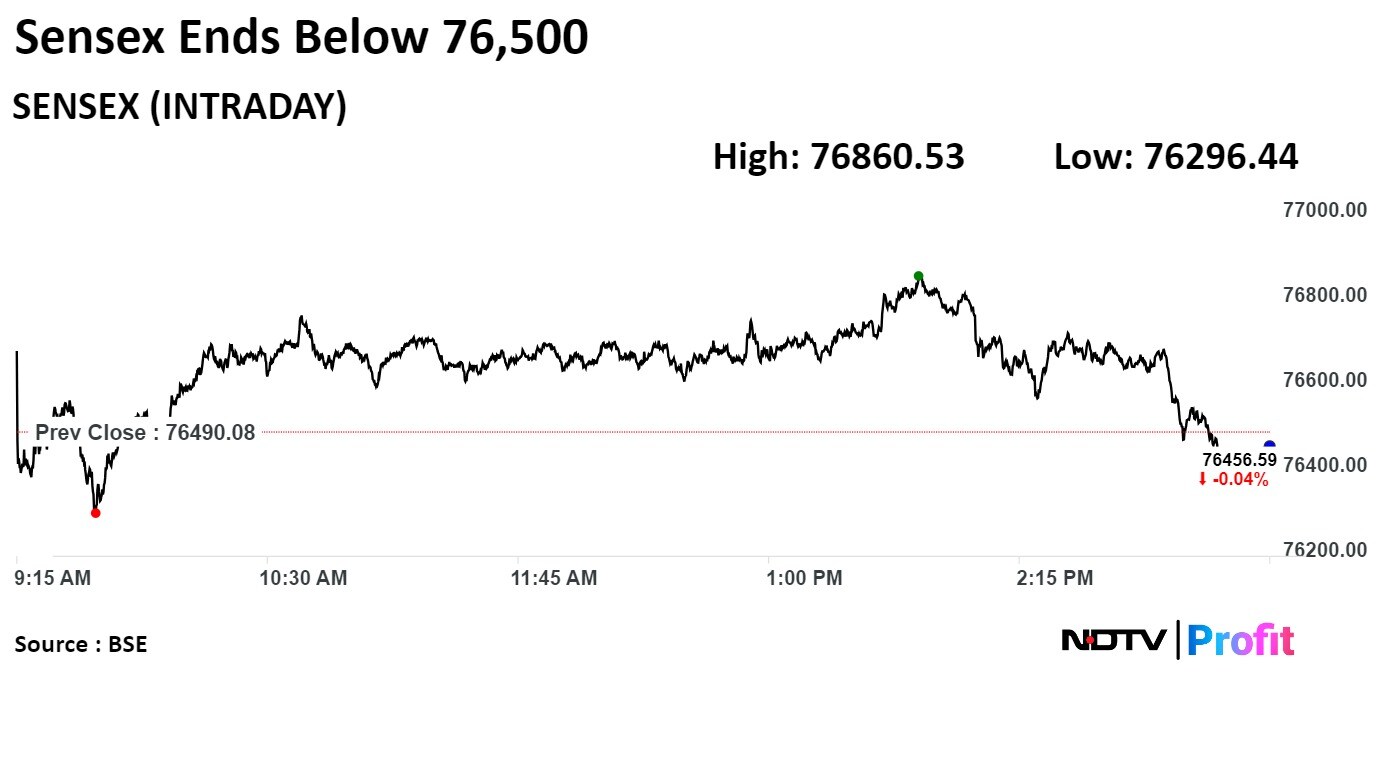

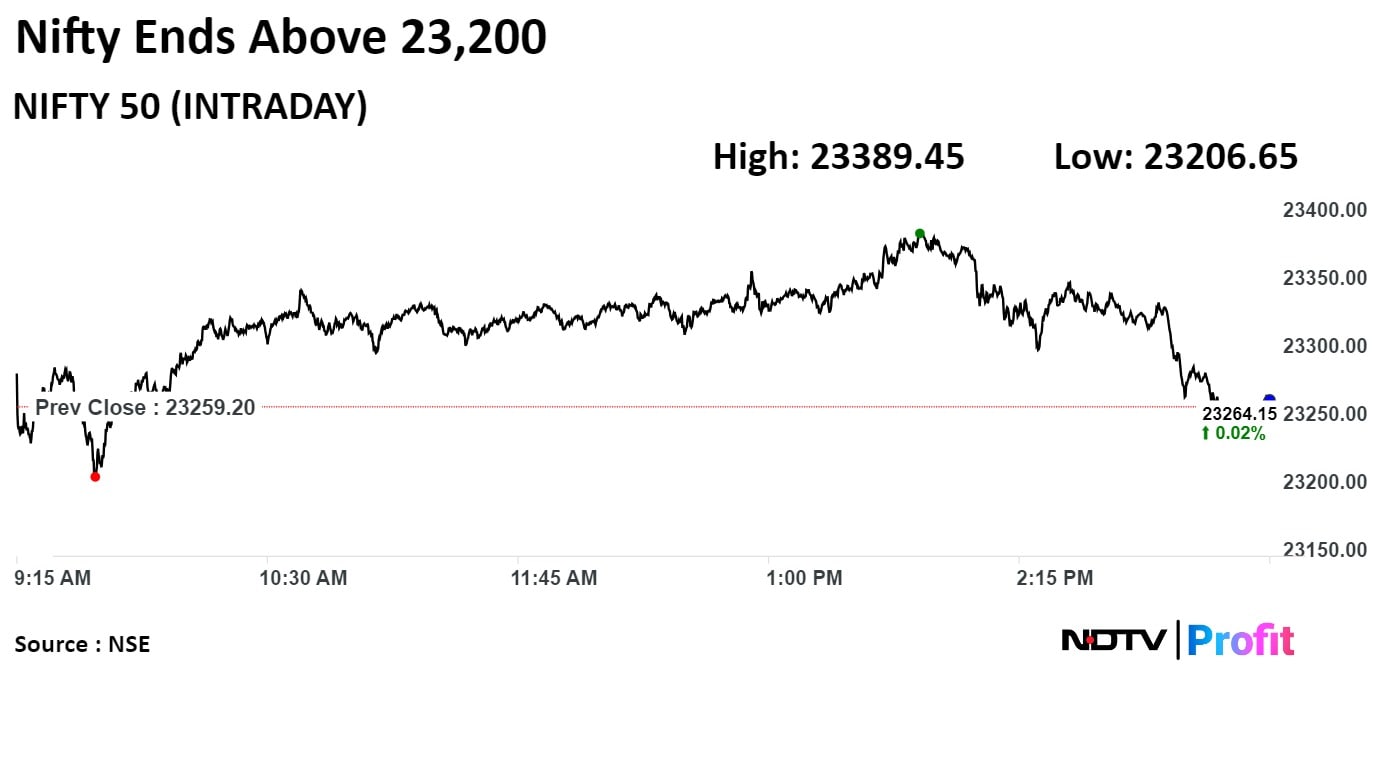

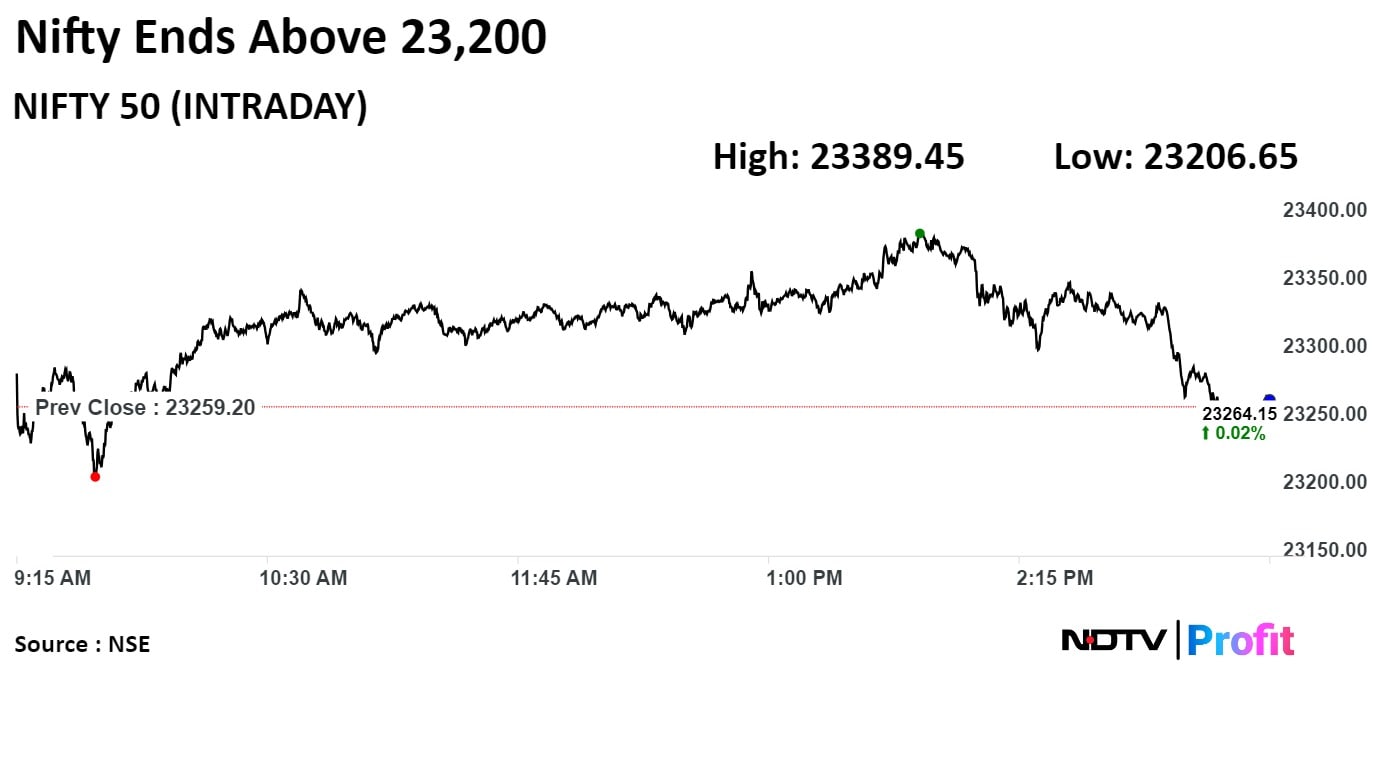

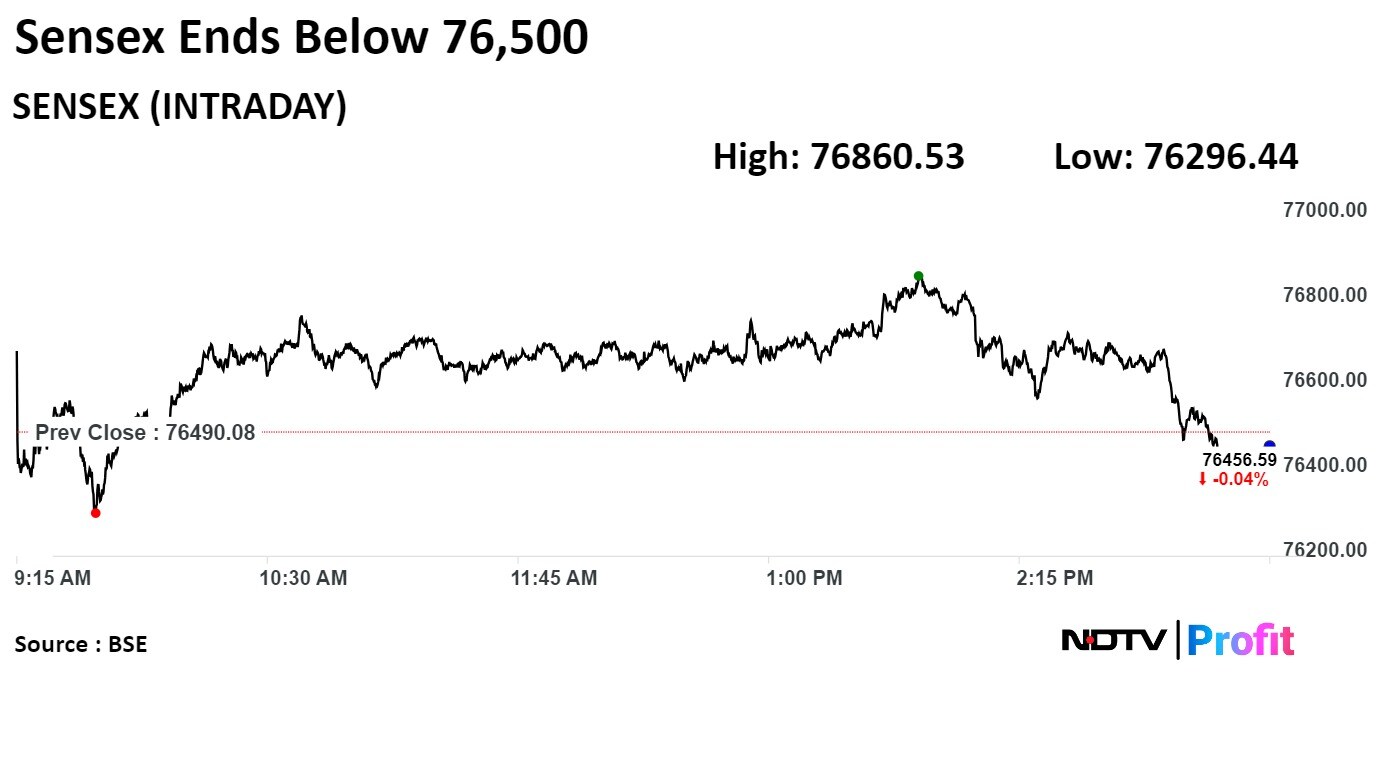

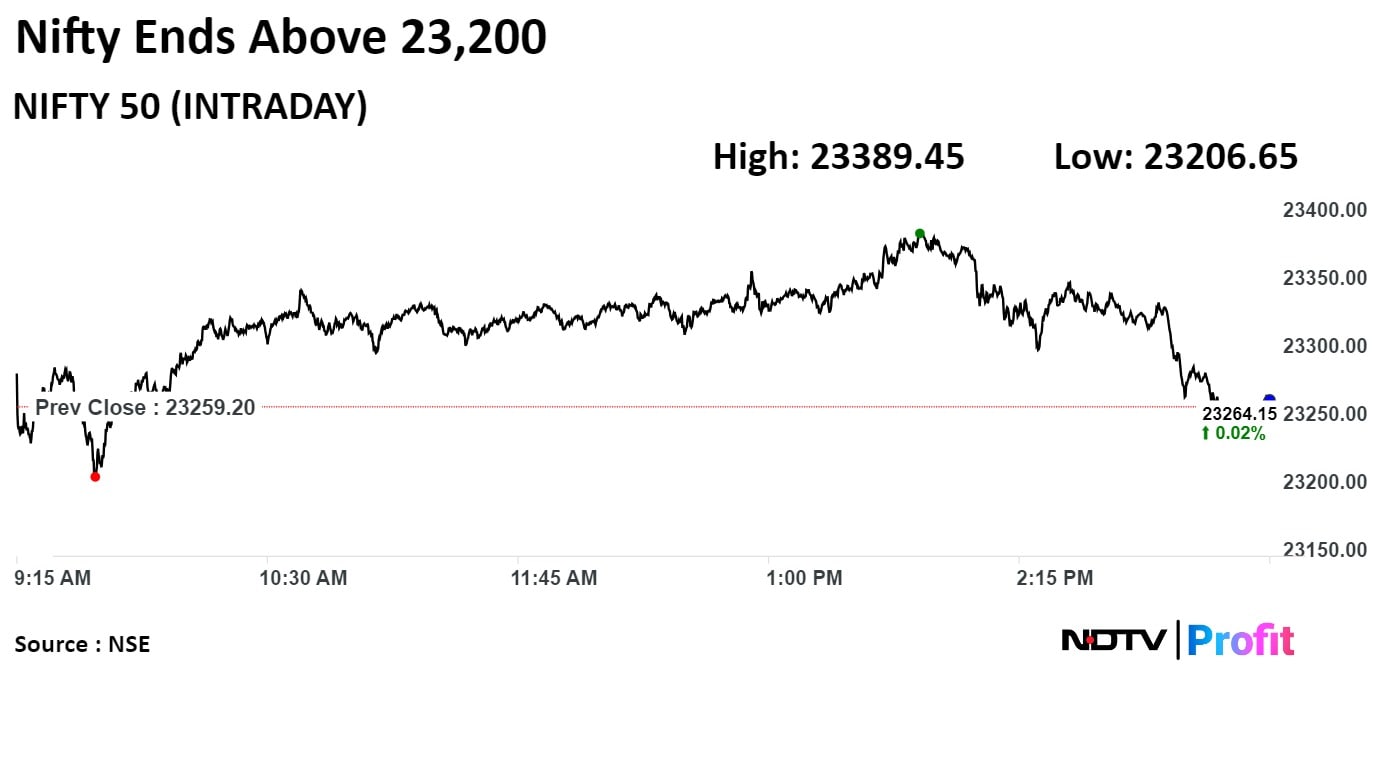

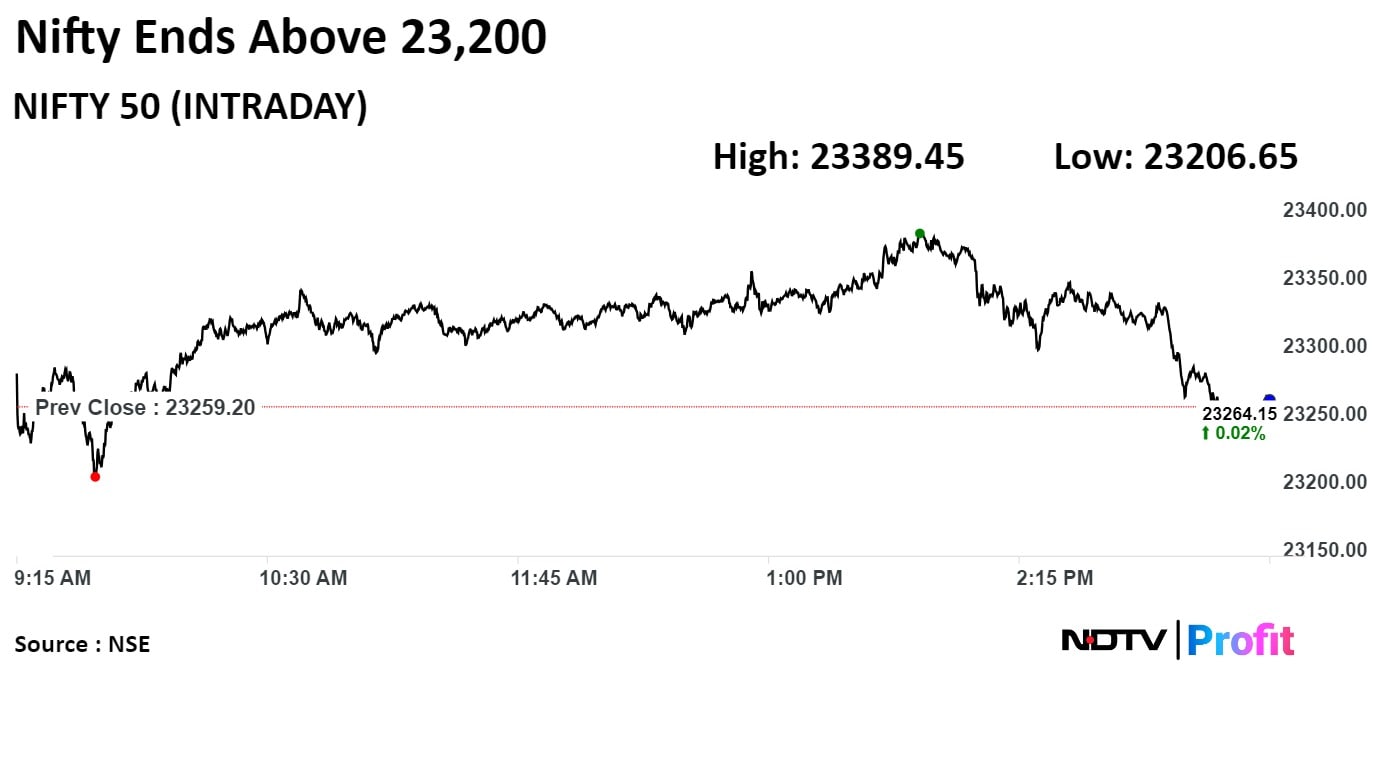

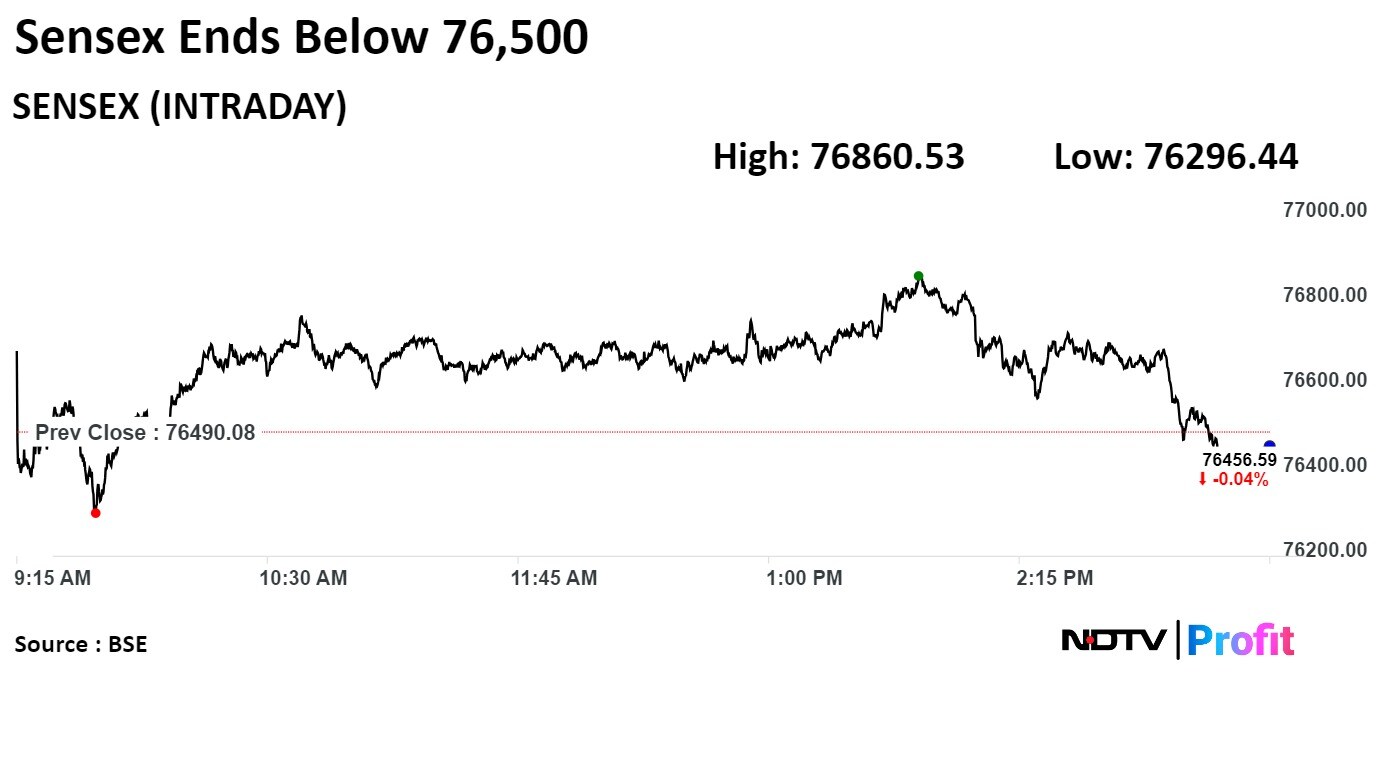

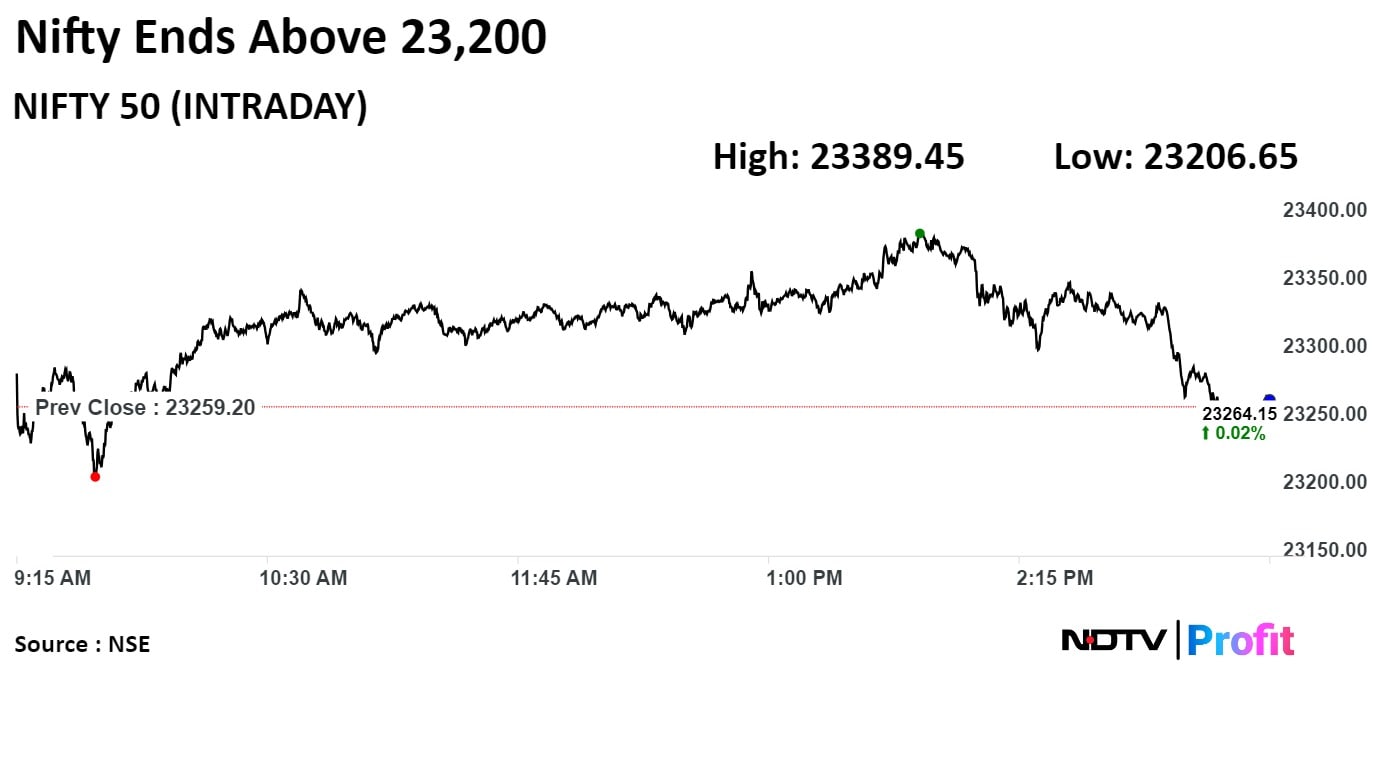

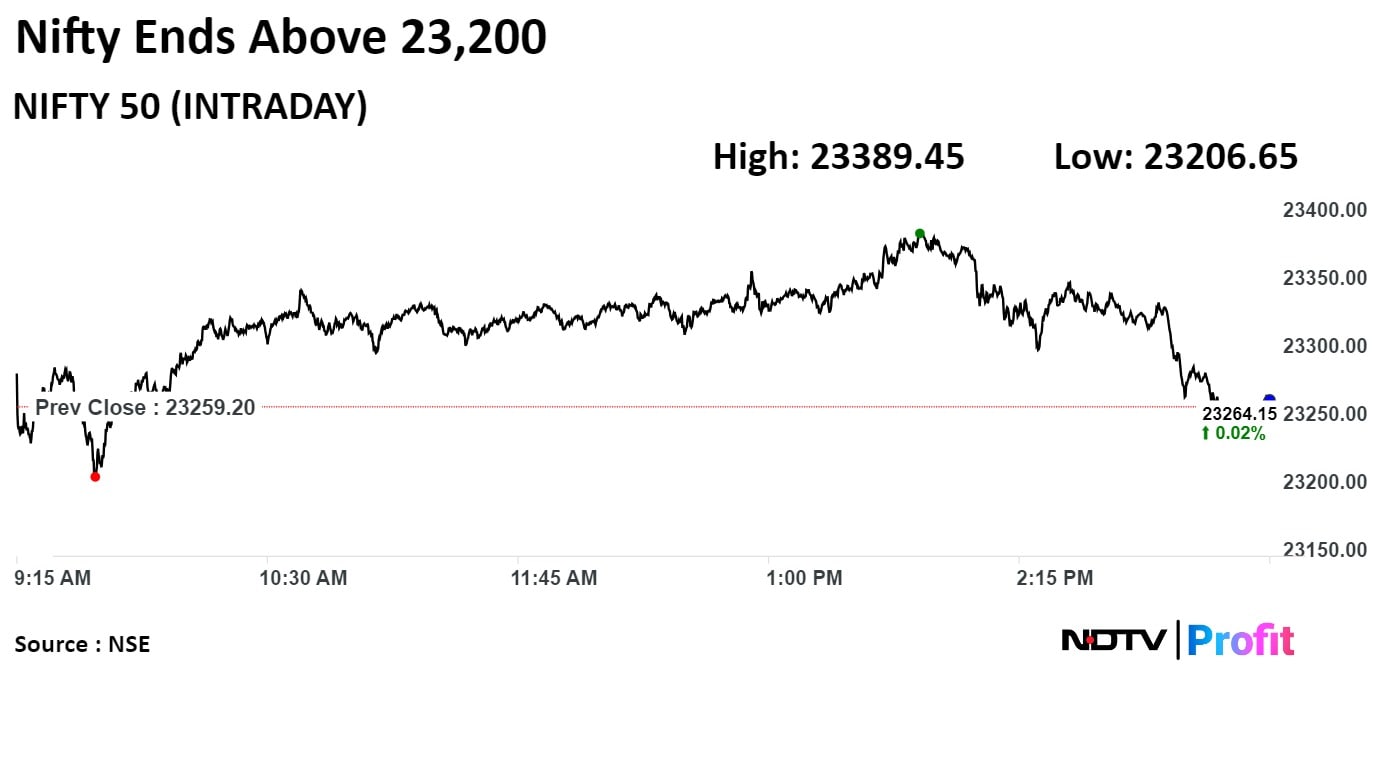

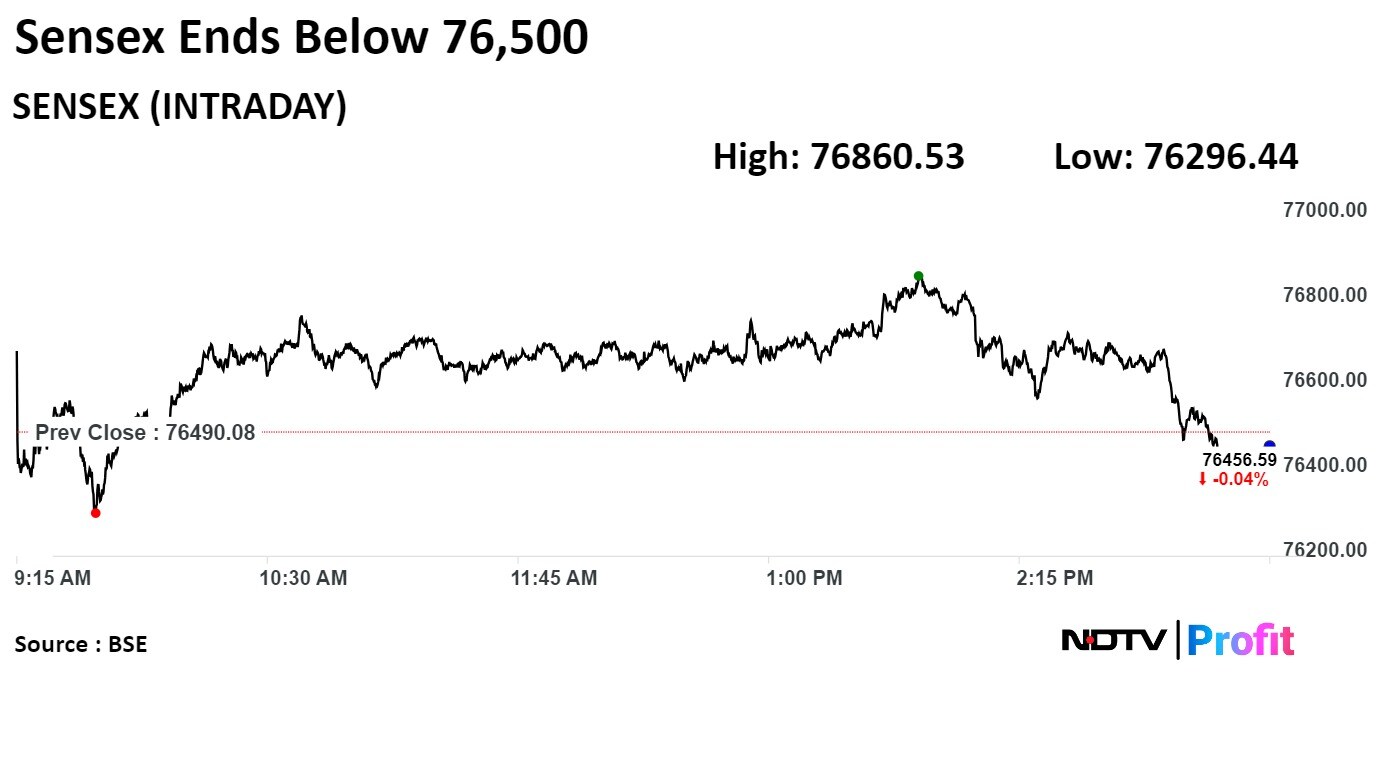

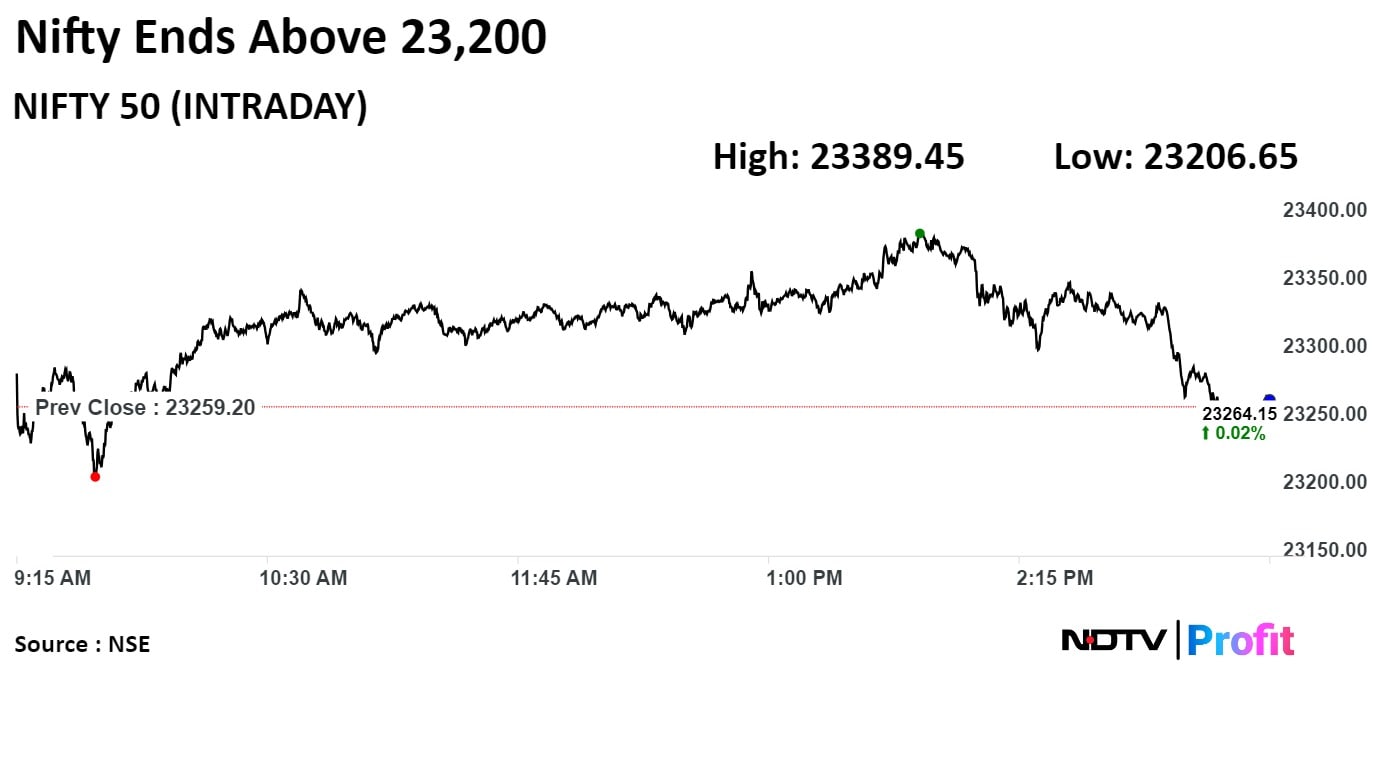

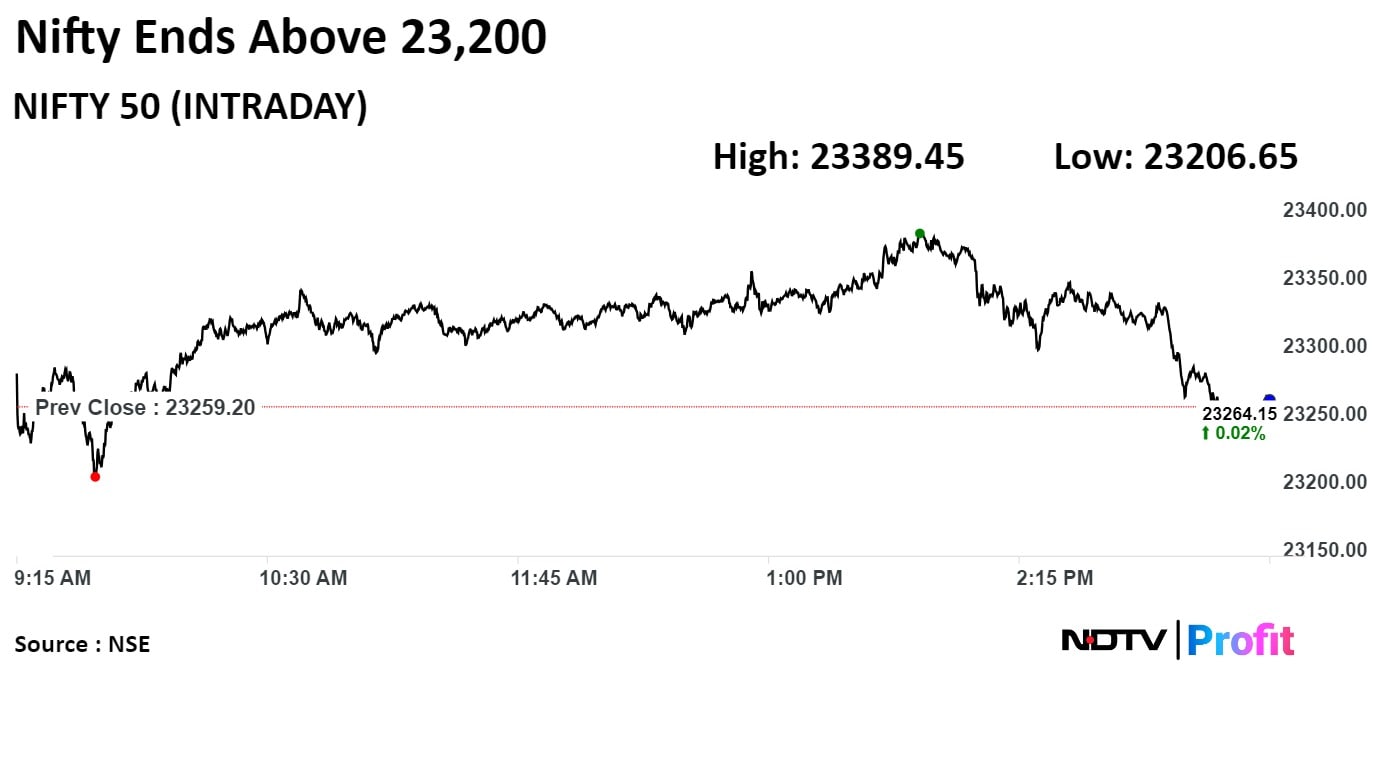

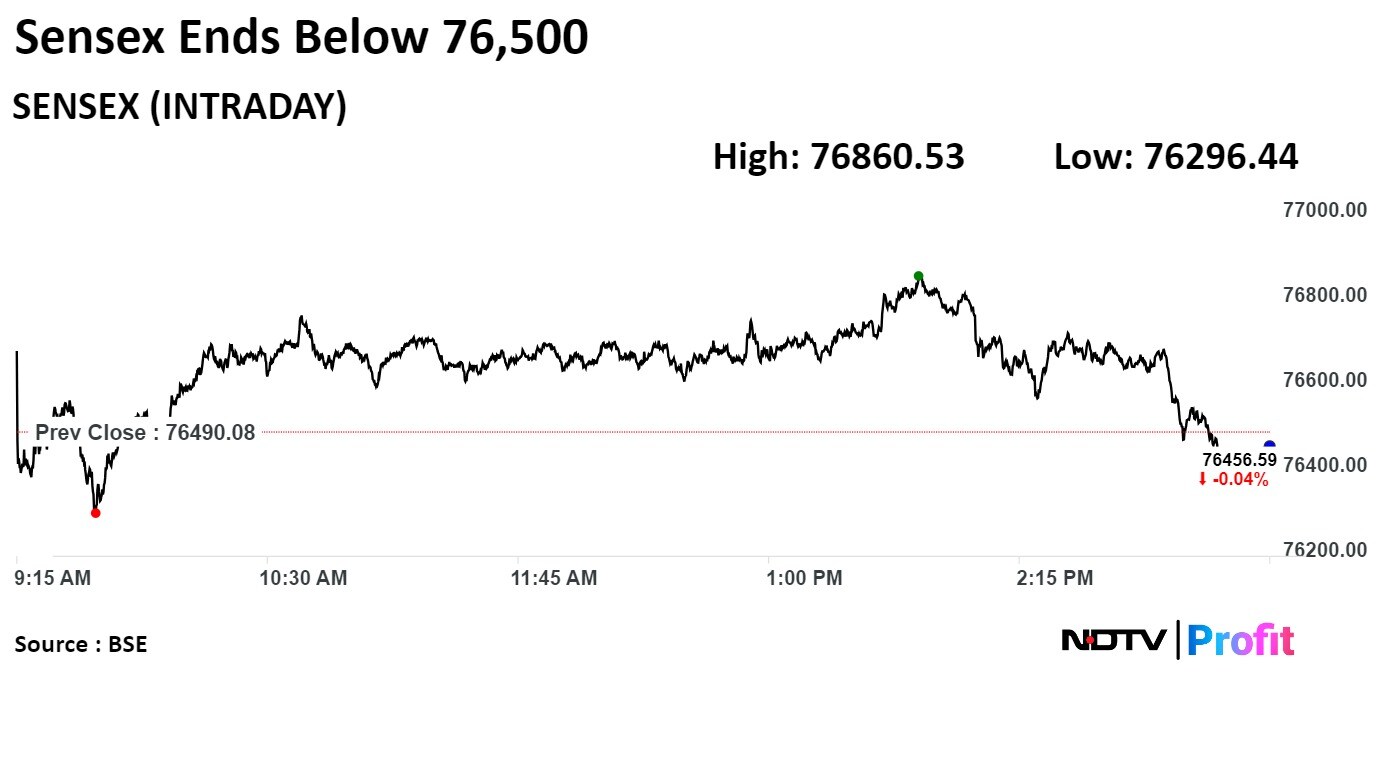

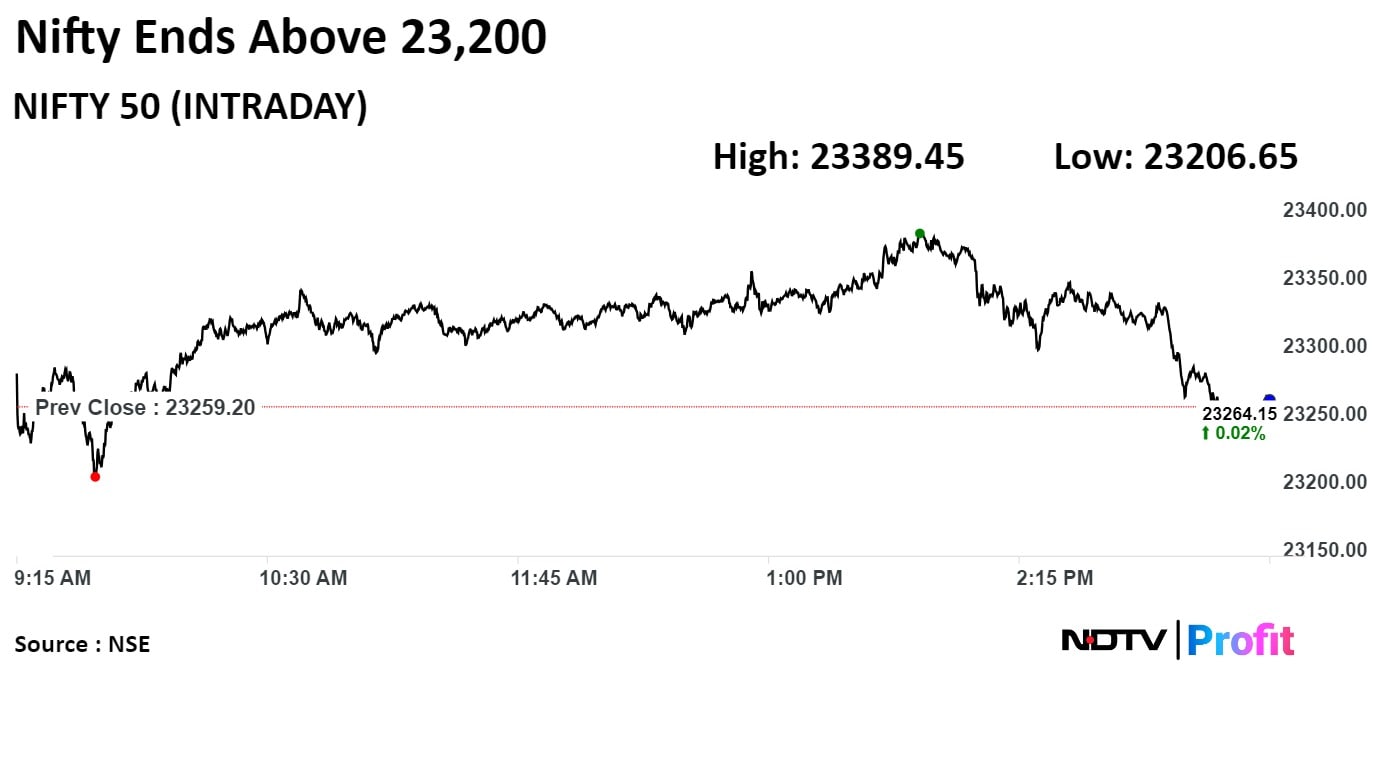

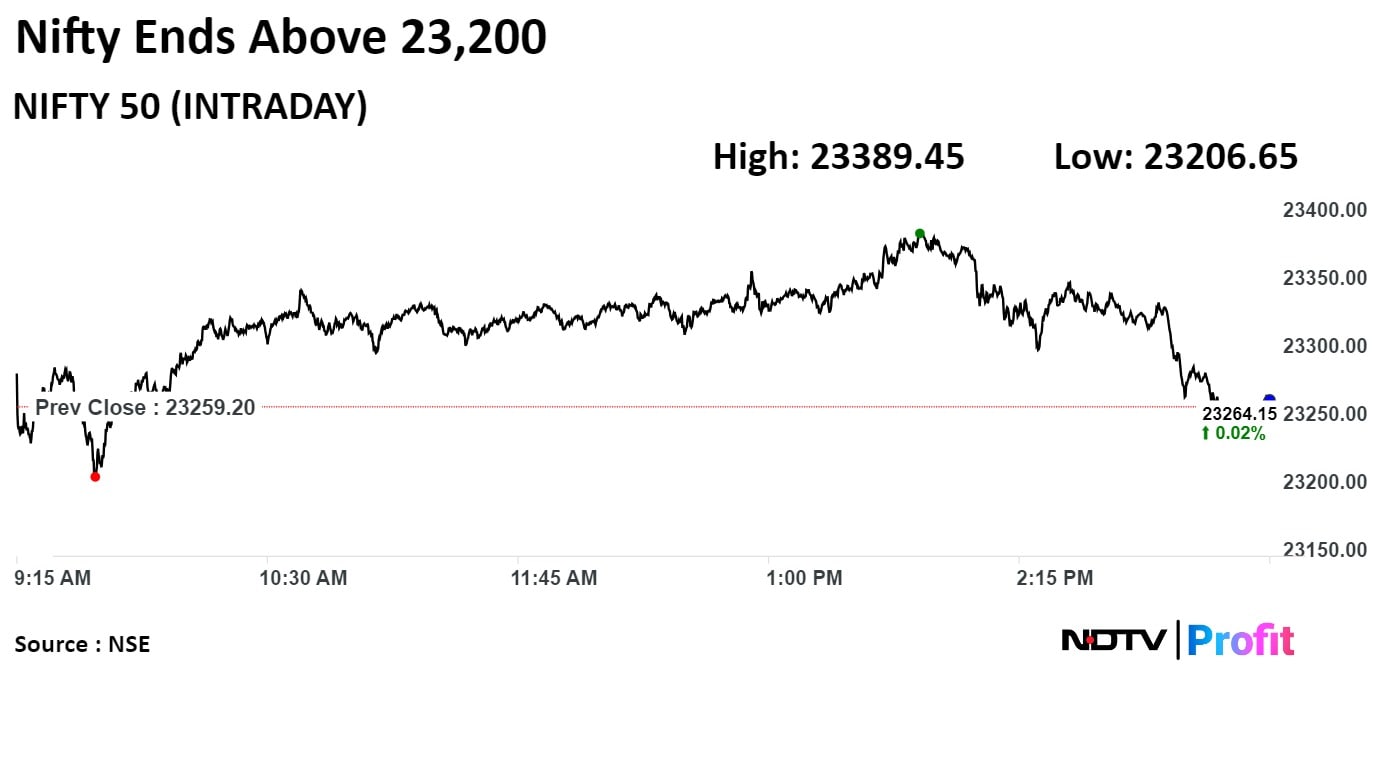

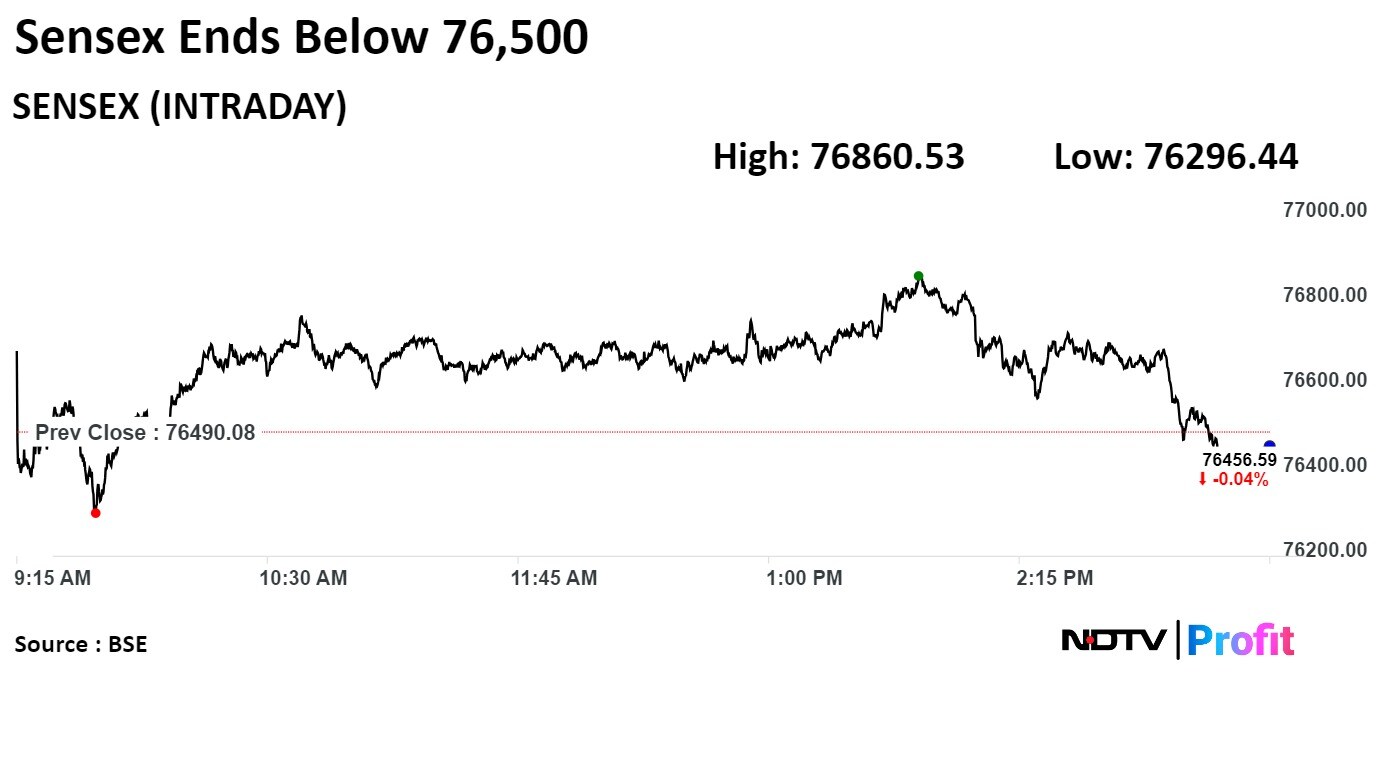

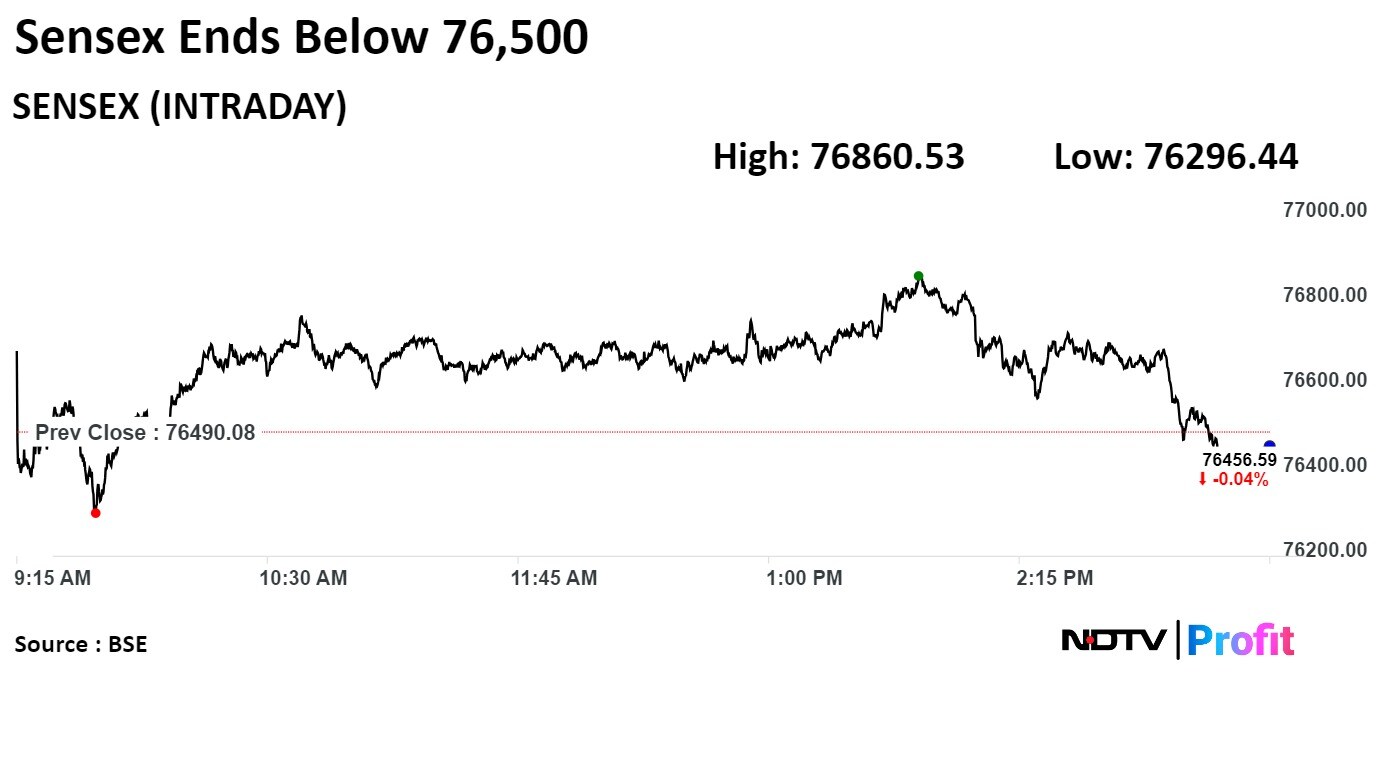

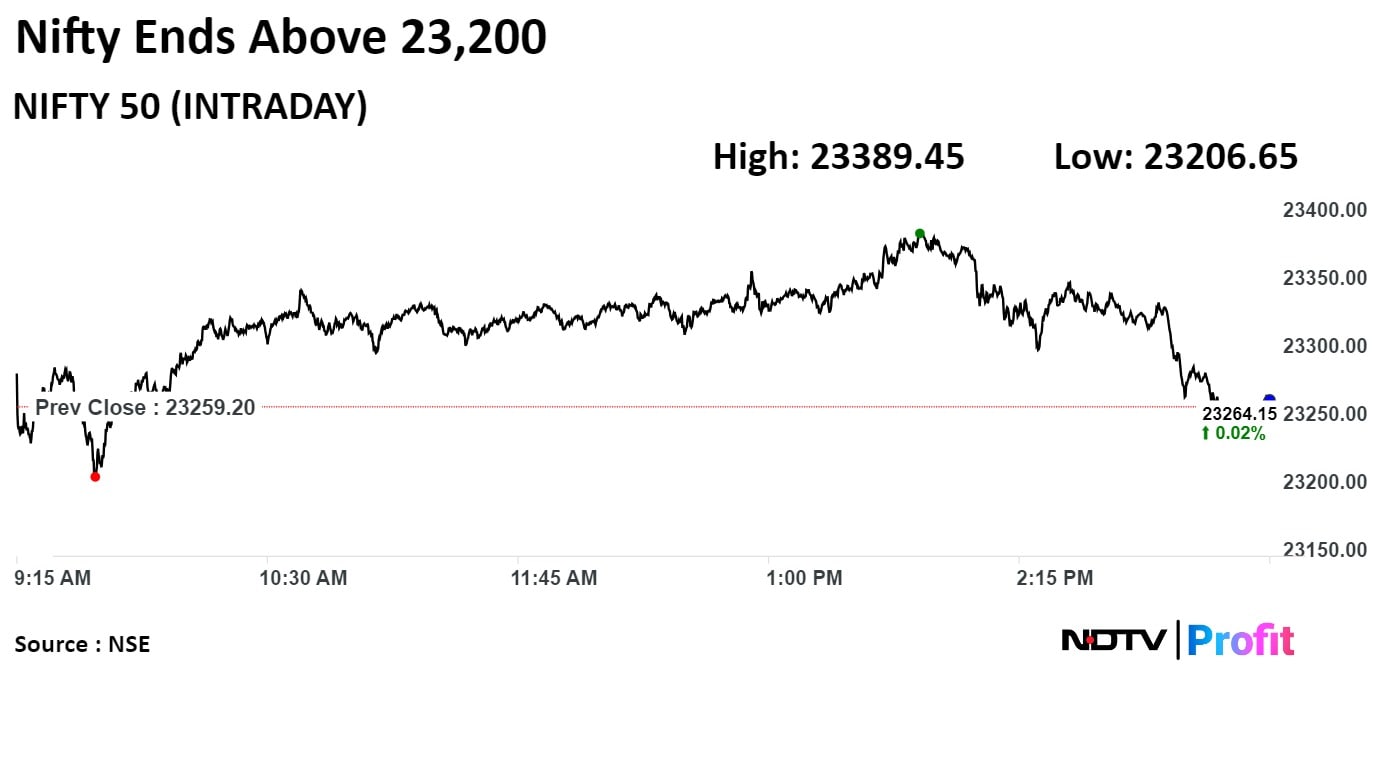

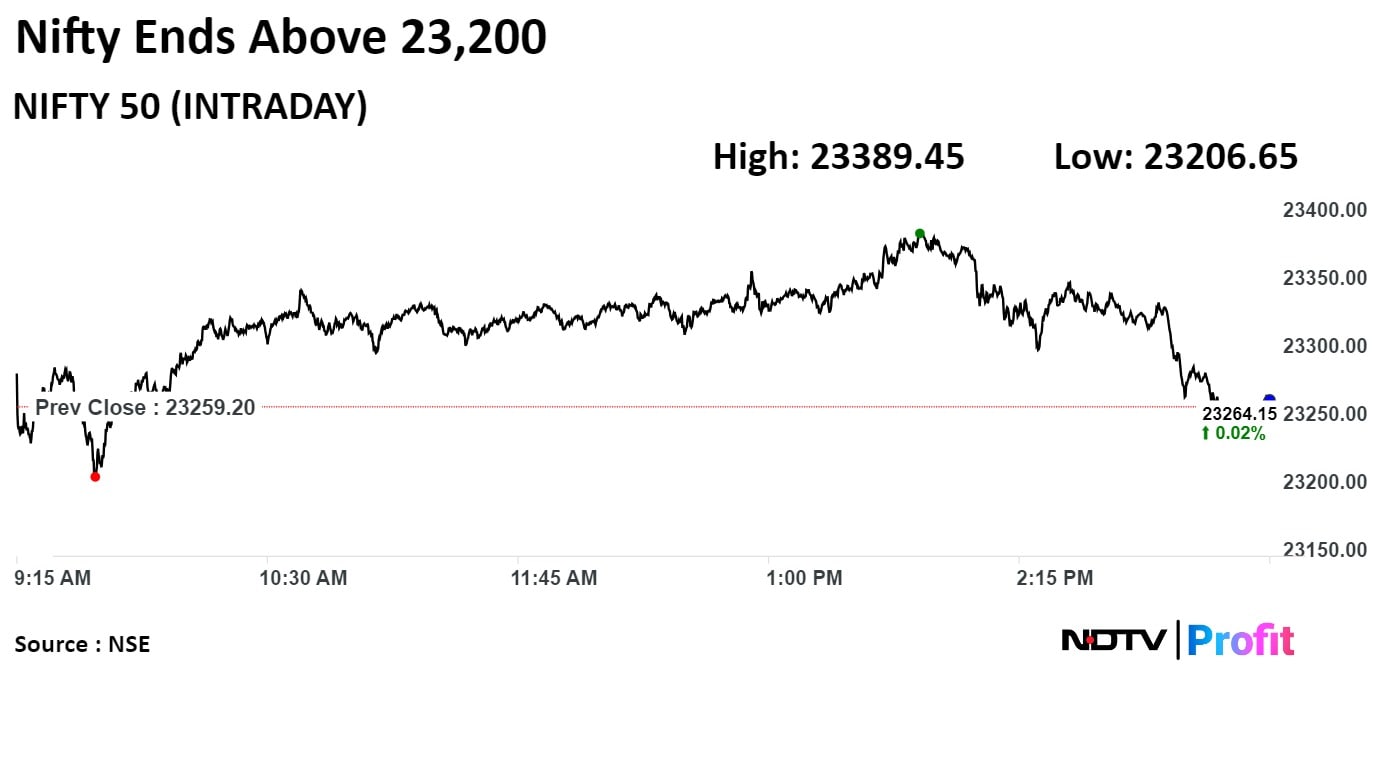

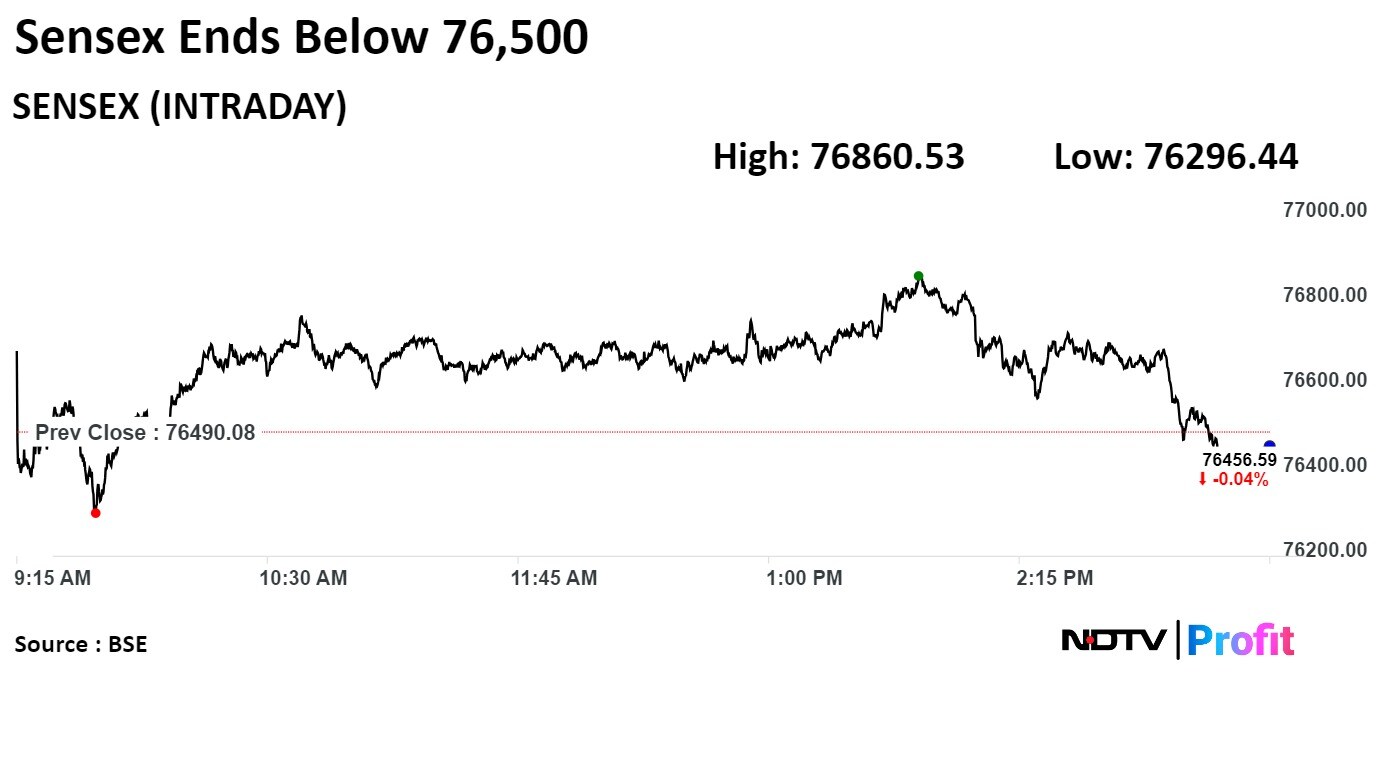

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

Shares of Reliance Industries Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., ITC Ltd., and Axis Bank Ltd. weighed on the Nifty.

While those of Larsen & Toubro Ltd., Oil & Natural Gas Corp. Ltd., Tata Motors Ltd., Maruti Suzuki India Ltd, and Mahindra & Mahindra Ltd. minimised the losses

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

Shares of Reliance Industries Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., ITC Ltd., and Axis Bank Ltd. weighed on the Nifty.

While those of Larsen & Toubro Ltd., Oil & Natural Gas Corp. Ltd., Tata Motors Ltd., Maruti Suzuki India Ltd, and Mahindra & Mahindra Ltd. minimised the losses

.jpeg)

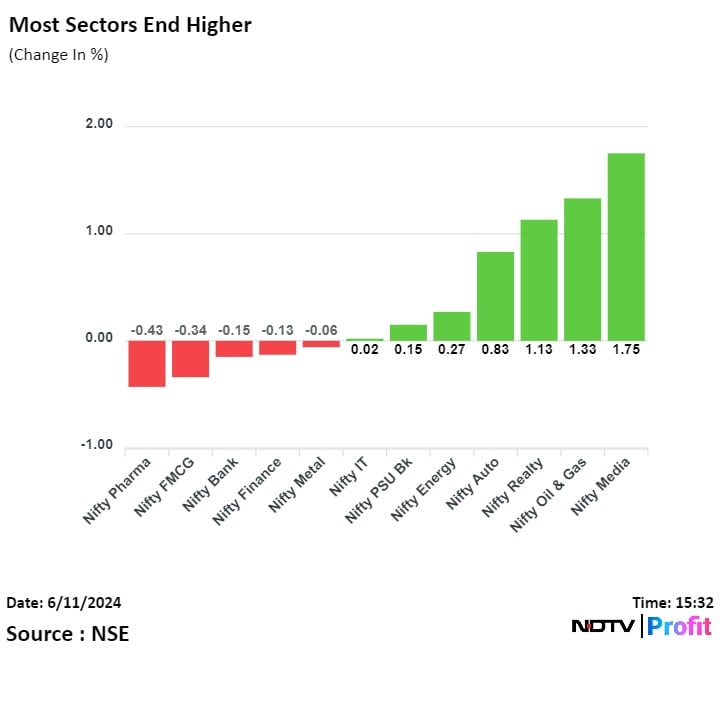

Nifty Media and Nifty Oil & Gas were the top gainers whereas Nifty Pharma lost the most.

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

Shares of Reliance Industries Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., ITC Ltd., and Axis Bank Ltd. weighed on the Nifty.

While those of Larsen & Toubro Ltd., Oil & Natural Gas Corp. Ltd., Tata Motors Ltd., Maruti Suzuki India Ltd, and Mahindra & Mahindra Ltd. minimised the losses

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

India's benchmark equity gauges ended erased all their gains in the last hour of the session and ended little changed from Monday's close as losses in the shares of Reliance Industries and ICICI Bank weighed.

The Nifty ended at 23,264.85, up by 5.65 points or 0.02% and the Sensex closed lower by 33.48 points or 0.04% at 76,456.59. Intraday, the Nifty gained as much as 0.56% and the Sensex gained 0.48%.

"The short-term texture suggesting 23400/77000 would be the key resistance zone for the short-term traders, while 23200/76300 would act as a crucial support zone," said Shrikant Chouhan, head of equity research at Kotak Securities. "We are of the view that, post 23400/77000 breakout the market could rally up to 23500-23525/77300-77400."

Shares of Reliance Industries Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., ITC Ltd., and Axis Bank Ltd. weighed on the Nifty.

While those of Larsen & Toubro Ltd., Oil & Natural Gas Corp. Ltd., Tata Motors Ltd., Maruti Suzuki India Ltd, and Mahindra & Mahindra Ltd. minimised the losses

.jpeg)

Nifty Media and Nifty Oil & Gas were the top gainers whereas Nifty Pharma lost the most.

Broader markets outperformed benchmark indices. The S&P BSE Midcap ended 0.74% higher, and the S&P BSE Smallcap settled 0.95% higher.

Out 20 sectors compiled by BSE, 17 sectors advanced and three decline. The S&P BSE Oil & Gas ended nearly 2% higher to become the top performing sector in Tuesday's session. The S&P BSE Metal is the worst performing sector.

Market breadth was skewed in favour of buyers. On BSE, 2,468 stocks advanced, 1,390 stocks declined, and 111 stocks remained unchanged.

Approves raising up to Rs 10,000 crore

Approves raising up to Rs 6,000 crore via FPO &/or rights issue

Approves raising up to Rs 4,000 crore via bonds

Source: Exchange Filing

Sells 7.63 acres land to Snowman Logistics for Rs 20 crore

Source: Exchange Filing

The stock jumped as much as 0.80% to hit a lifetime high of Rs 1,546.45.

The stock jumped as much as 0.80% to hit a lifetime high of Rs 1,546.45.

.png)

Gets multiple construction orders worth Rs 878 crore

Source: Exchange filing

Capacite Infraprojects Ltd.' board approved raising up to Rs 100 crore via NCDs

Source: Exchange Filing

.png)

.png)

.png)

Shares of railway companies advanced on Tuesday on optimism that the government's infrastructure push will continue as key ministries had no personnel changes in National Democratic Alliance's third government.

Jupiter Wagon Ltd. gained the most among its peers, which was followed by Railtel Corp of India, and Texmaco Rail and Engineering Ltd.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

.png)

Larsen & Toubro Ltd., Oil and Natural Gas Corp, Mahindra & Mahindra Ltd., Tata Motors Ltd., and Tata Steel Ltd. added to the Nifty.

Kotak Mahindra Bank Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd., and Bharti Airtel Ltd. weighed on the index.

On NSE, 10 sectors advanced and two remained flat. The NSE Nifty Realty rose the most among peers, and the NSE Nifty Bank was the top loser on Tuesday.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

.png)

Larsen & Toubro Ltd., Oil and Natural Gas Corp, Mahindra & Mahindra Ltd., Tata Motors Ltd., and Tata Steel Ltd. added to the Nifty.

Kotak Mahindra Bank Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd., and Bharti Airtel Ltd. weighed on the index.

On NSE, 10 sectors advanced and two remained flat. The NSE Nifty Realty rose the most among peers, and the NSE Nifty Bank was the top loser on Tuesday.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

.png)

Larsen & Toubro Ltd., Oil and Natural Gas Corp, Mahindra & Mahindra Ltd., Tata Motors Ltd., and Tata Steel Ltd. added to the Nifty.

Kotak Mahindra Bank Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd., and Bharti Airtel Ltd. weighed on the index.

On NSE, 10 sectors advanced and two remained flat. The NSE Nifty Realty rose the most among peers, and the NSE Nifty Bank was the top loser on Tuesday.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

Indian benchmark stock indices rebounded after seesawing between positive and negative territory during morning trade on Tuesday, led by gains in Larsen & Toubro Ltd., Oil and Natural Gas Corp., and Mahindra & Mahindra Ltd.

As of 12:19 p.m., the NSE Nifty 50 was 75.50 points or 0.32% higher at 23,334.70, and the S&P BSE Sensex gained 178.78 points or 0.23% to trade at 76,668.86.

The Nifty 50 declined 0.23% to touch an intraday low of 23,206.65, and the Sensex fell 0.25% to hit a low of 76,296.44.

"After the roller coaster ride last week, markets are taking a breather near record highs. The good part is that there's no price-wise correction. Yesterday, it was a muted session, and today the trend continued," said Ajit Mishra, senior vice president of research at Religare Broking.

Markets not only reclaimed short-term averages but also closed around record highs. It's a healthy consolidation. Religare is expecting markets to maintain this trend and gradually move towards the 23,800–24,000 zone, he told NDTV Profit.

.png)

.png)

.png)

Larsen & Toubro Ltd., Oil and Natural Gas Corp, Mahindra & Mahindra Ltd., Tata Motors Ltd., and Tata Steel Ltd. added to the Nifty.

Kotak Mahindra Bank Ltd., Reliance Industries Ltd., ITC Ltd., Asian Paints Ltd., and Bharti Airtel Ltd. weighed on the index.

On NSE, 10 sectors advanced and two remained flat. The NSE Nifty Realty rose the most among peers, and the NSE Nifty Bank was the top loser on Tuesday.

.png)

.png)

The NSE Nifty Midcap 150 and the NSE Nifty Smallcap 250 surged to record high for a second day on Tuesday. The indices were trading 0.93% and 0.75% higher, respectively.

Broader markets outperformed the benchmarks on BSE. The S&P BSE Midcap rose 0.98% and the S&P BSE Smallcap rose 1.01%.

On BSE, all 20 sectors advanced with the S&P BSE Capital Goods emerging as the top performing sector.

Market breadth was skewed in favour of buyers. Around 2,489 stocks advanced, 1,195 stocks declined, and 144 stocks remained unchanged on BSE.

State Bank of India launched 'SME Digital Business Loans' for loans to micro, small and medium enterprises.

The product offered an end-to-end sanction with turnaround time of up to 45 minutes.

Source: SBI release

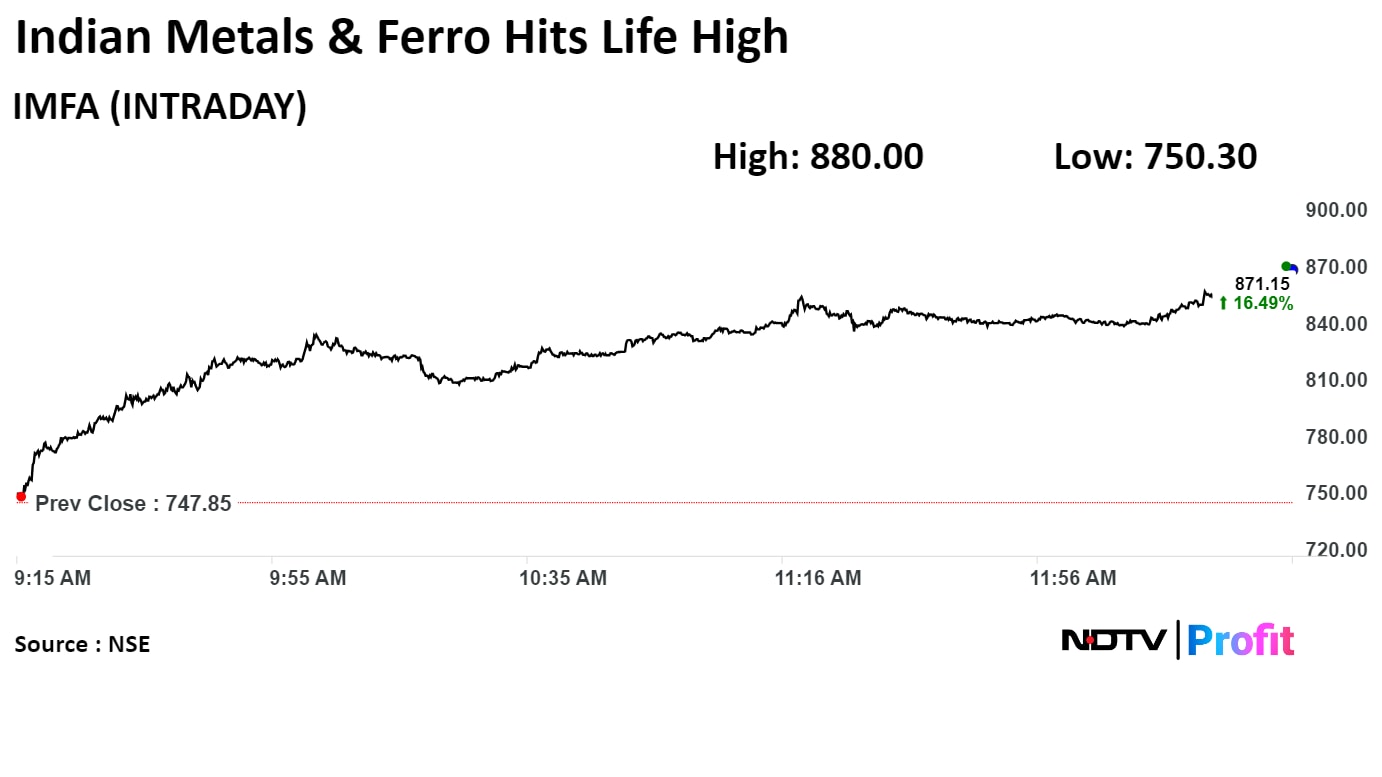

Shares of Indian Metals & Ferro Alloys Ltd. jumped 17.67% to Rs 880.00, the highest level since its listing on Jul 23, 2010. It was trading 16.28% higher at Rs 869.60 as compared to 0.29% advance.

The scrip gained 203.00% in 12 months, and on year to date basis, it has gained 77.26%. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 69.25.

Shares of Indian Metals & Ferro Alloys Ltd. jumped 17.67% to Rs 880.00, the highest level since its listing on Jul 23, 2010. It was trading 16.28% higher at Rs 869.60 as compared to 0.29% advance.

The scrip gained 203.00% in 12 months, and on year to date basis, it has gained 77.26%. Total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 69.25.

Shares of Hindustan Construction Co jumped the most in nearly three months to hit an all-time high after the company get's its first ever analysts coverage.

Homegrown brokerage firm Elara Capital initiated coverage on the stock with a 'buy' rating, brokerage set a target price of Rs 63 apiece, implying an upside of 58% from Monday's close.

.png)

Adani Defence and EDGE Group sign cooperation agreement in defence & security

Agreement explores setting up R&D facilities in India, the UAE, and other global markets

Source: Exchange filing

.png)

In long-term pact with Google Cloud for expanded reach in US, India, UK and Australia

Source: Exchange filing

In long-term pact with Google Cloud for expanded reach in US, India, UK and Australia

Source: Exchange filing

.png)

Shares of Tata Steel, Vedanta, and Hindustan Zinc contributed the most to the gains in the index.

Shares of Tata Steel, Vedanta, and Hindustan Zinc contributed the most to the gains in the index.

.png)

Shares of Rail Vikas Nigam Ltd. rose over 4% on Monday after bagging two contracts.

The latest was a contract from the Bangalore Metro Rail Corporation Ltd. of over 300 Crore for the third rail track electrification of phase-2A and phase-2B. The time period for the completion of the project is 130 weeks.

RVNL was also the lowest bidder for a contract of Rs 138 Crore from Central Railway for upgrading the electric traction system in the Amla-Nagpur Section of the Nagpur railway division.

Shares of Rail Vikas Nigam Ltd. rose over 4% on Monday after bagging two contracts.

The latest was a contract from the Bangalore Metro Rail Corporation Ltd. of over 300 Crore for the third rail track electrification of phase-2A and phase-2B. The time period for the completion of the project is 130 weeks.

RVNL was also the lowest bidder for a contract of Rs 138 Crore from Central Railway for upgrading the electric traction system in the Amla-Nagpur Section of the Nagpur railway division.

.jpeg)

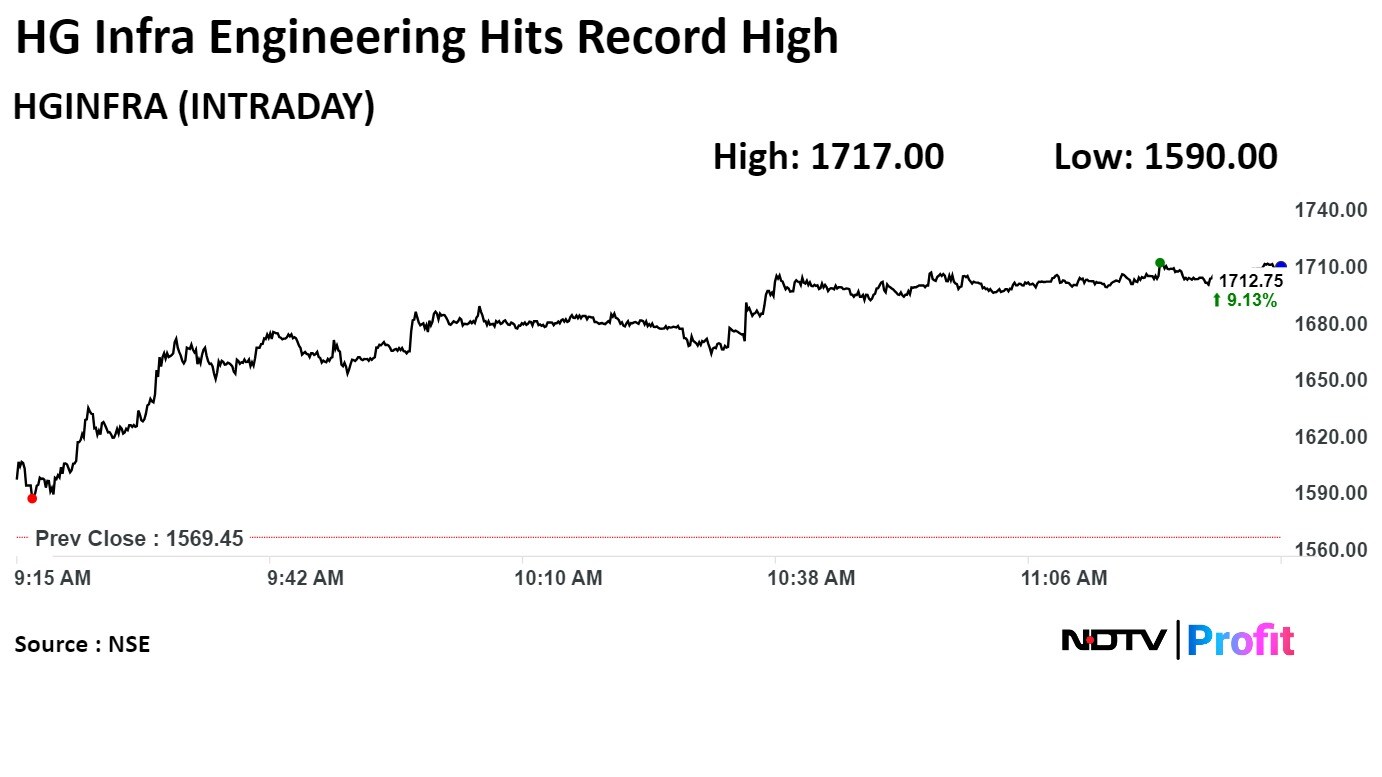

Shares of H.G. Infra Engineering Ltd. jumped to fresh highs after its unit has set up a new subsidiary on June 4 to deal in solar power sector.

Shares of H.G. Infra Engineering Ltd. jumped to fresh highs after its unit has set up a new subsidiary on June 4 to deal in solar power sector.

Shares of H.G. Infra Engineering Ltd. surged 9.40% to Rs 1,717.00, the highest level since listing on March 9, 2018.

The scrip gained 95.05% in 12 months and on year to date basis, it has gained 102.22%. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 68.77.

Out of 14 analysts tracking the company, 13 maintain a 'buy' rating, one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 20.1%.

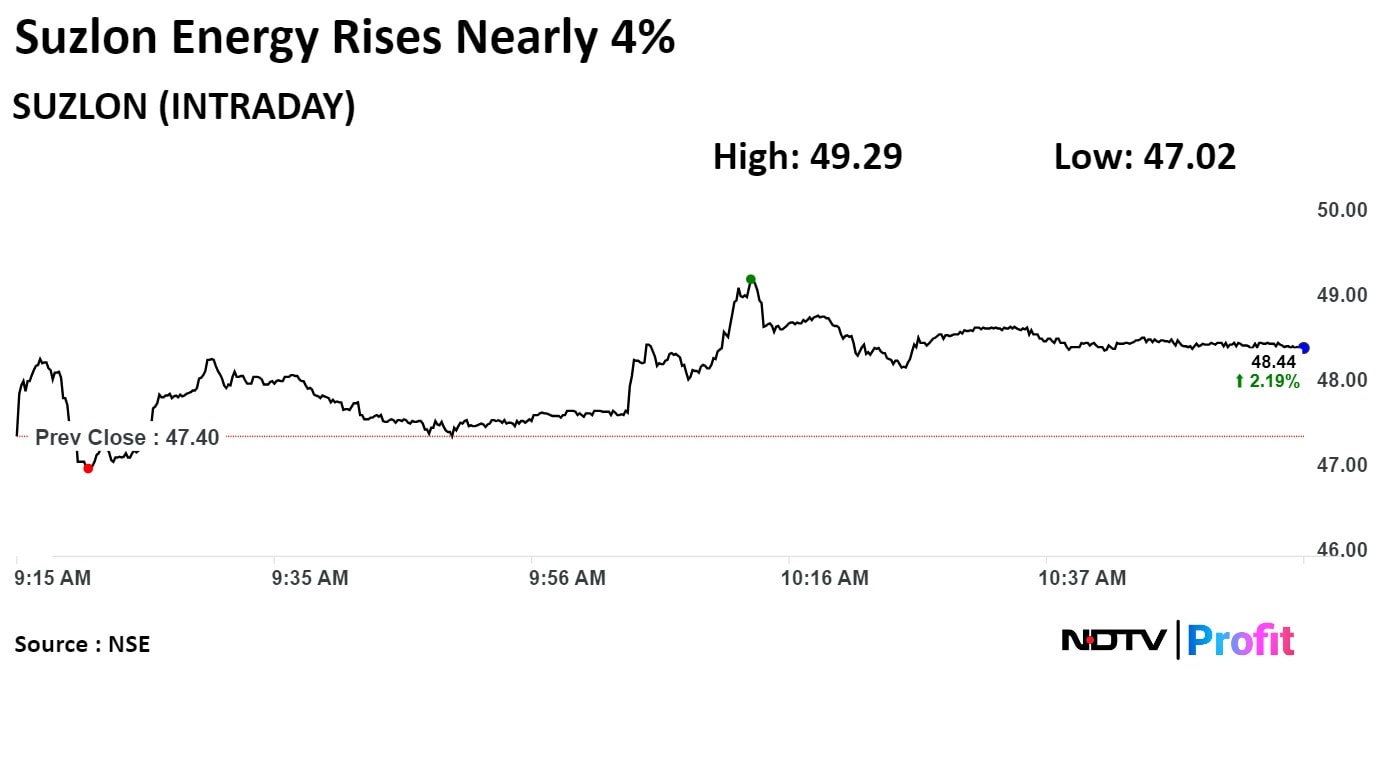

Suzlon Energy Ltd. rose to nearly one-week high on Tuesday after the company informed the exchanges about securing 103.95 MW from AMPIN Energy Transition Pvt. Ltd.

Suzlon Energy Ltd. rose to nearly one-week high on Tuesday after the company informed the exchanges about securing 103.95 MW from AMPIN Energy Transition Pvt. Ltd.

Shares of Suzlon Energy rose 3.99% to Rs 49.29, the highest level since June 5. It was trading 2.24% higher at Rs 48.46 as of 10:56 a.m., as compared to 0.29% advance in the NSE Nifty 50 index.

On Monday, the stock had fallen as much as 5% after the independent director's resignation raised concern about corporate governance issue.

The scrip gained 216.99% in 12 months, and 26.94% on year to date basis. Total traded volume on NSE so far in the day stood at 0.53 times its 30-day average. The relative strength index was at 58.48.

Five analysts tracking the company have a 'buy' rating for the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 18.3%.

May production at 69,886 units vs 59,490 units YoY

May sales at 69,011 units vs 58,799 units YoY

May exports at 2,671 units vs 2,616 units YoY

Source: Exchange Filing

“With expectations of above-normal monsoon and continued emphasis on economic development by the new government, the auto industry is optimistic of steady growth in 2024-25 as well.”

— Vinod Aggarwal, SIAM President

Car sales in India clocked a modest growth in May 2024, amid surge in two-wheeler dispatches.

- Car sales up 3.9% YoY at 3,47,492 units.

- 2W sales up 10.1% YoY at 16,20,084 units.

- 3W sales up 14.7% YoY at 55,763 units.

Source: SIAM statement

Confirms to continue with announced closure of heavy end assets and restructuring program

Expresses concern at UK media reports on policy differences between UK Govt & opposition

Source : Exchange filing

Indian equities are poised for significant growth, presenting lucrative opportunities for investors.

That's the word coming in from Morgan Stanley India's MD Riddham Desai, who added that domestic investors surged ahead, displaying robust confidence in India's market prospects.

"There's a palpable enthusiasm among local investors, signalling a strong belief in the Indian economy." However, he acknowledged foreign investors' cautious stance, stating, "While international interest persists, there's a measured approach reflecting global uncertainties."

Shares of IRB Infrastructure Developers Ltd slumped after multiple large trades happened on the NSE and a total of 6.64% stake or 40.15 crore shares were exchanged.

The buyers and sellers of the trade were not known immediately. A total of 23 large trades happened on the NSE at a price ranging from Rs 64.1 to Rs 66.49.

Shares of IRB Infrastructure Developers Ltd slumped after multiple large trades happened on the NSE and a total of 6.64% stake or 40.15 crore shares were exchanged.

The buyers and sellers of the trade were not known immediately. A total of 23 large trades happened on the NSE at a price ranging from Rs 64.1 to Rs 66.49.

.png)

The scrip fell as much as 10.21% to Rs 63 apiece, the lowest level since June 5. It pared losses to trade 6.94% lower at Rs 65.33 apiece, as of 11:08 a.m. This compares to a 0.28% advance in the NSE Nifty 50 Index.

It has risen 57.28% on a year-to-date basis and 143.09% in the last 12 months. Total traded volume on the NSE so far in the day stood at 8.80 times its 30-day average. The relative strength index was at 45.53.

Out of the nine analysts tracking the company, six maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.7%.

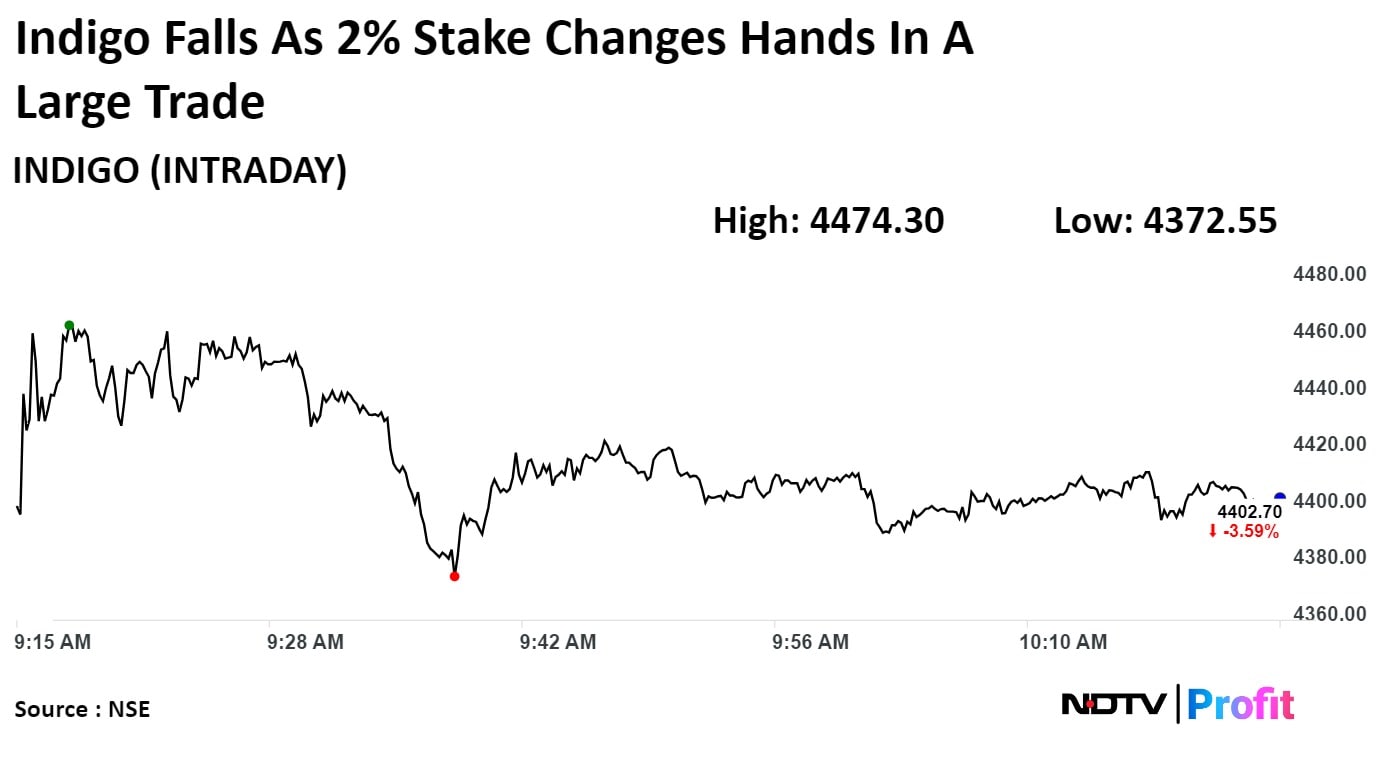

Shares of Interglobe Aviation Ltd fell after 7.73 million shares changed hands on the BSE.

Shares of Interglobe Aviation Ltd fell after 7.73 million shares changed hands on the BSE.

The Nifty Smallcap 250 rose as much as 0.67% to hit its record high of 16422.20 points. The Nifty Midcap 100 was 0.67% higher.

The Nifty Smallcap 250 rose as much as 0.67% to hit its record high of 16422.20 points. The Nifty Midcap 100 was 0.67% higher.

.png)

Gets 103.95 MW order from AMPIN Energy Transition

To supply 33 wind turbines with a rated capacity of 3.15 MW each

Source: Exchange filing

HDFC Bank raises fixed deposit rates by 20 bps

Rates on deposits between 18-21 months raised to 7.25%

Rates effective June 10

Source: Bank Website

India business net debt free in FY24

JLR on track to become net debt free in FY25

All businesses are self sustaining, investment spends are well funded

Strong Infrastructure push by the Govt augurs well for the long term industry growth

Aim to deliver over 25% market share across addressable market

Aim EV EBITDA breakeven in FY26

Source: Investor presentation

Cognizant announced acquisition of Belcan for $1.29 billion

Target company is a North American ER&D company

Acquisition implies target multiple of 1.6x EV/Sales

Cognizant expects synergies of over $100 million within 3 years

Target company has a revenue run rate of $800 million and grew at over 8% over the past 2 years

This acquisition follows moves by large Indian IT peers to acquireER&D services companies

Believes competition is intensifying with the entry of large peers

Shares of Transformers & Rectifiers (India) Ltd. were locked in an upper circuit of up to 5% after its Qualified Institutions Placement opened.

The filing stated that the company would be issuing shares at a floor price of Rs 699.95 per share, with a face value of Rs 1.

Shares of Transformers & Rectifiers (India) Ltd. were locked in an upper circuit of up to 5% after its Qualified Institutions Placement opened.

The filing stated that the company would be issuing shares at a floor price of Rs 699.95 per share, with a face value of Rs 1.

.jpeg)

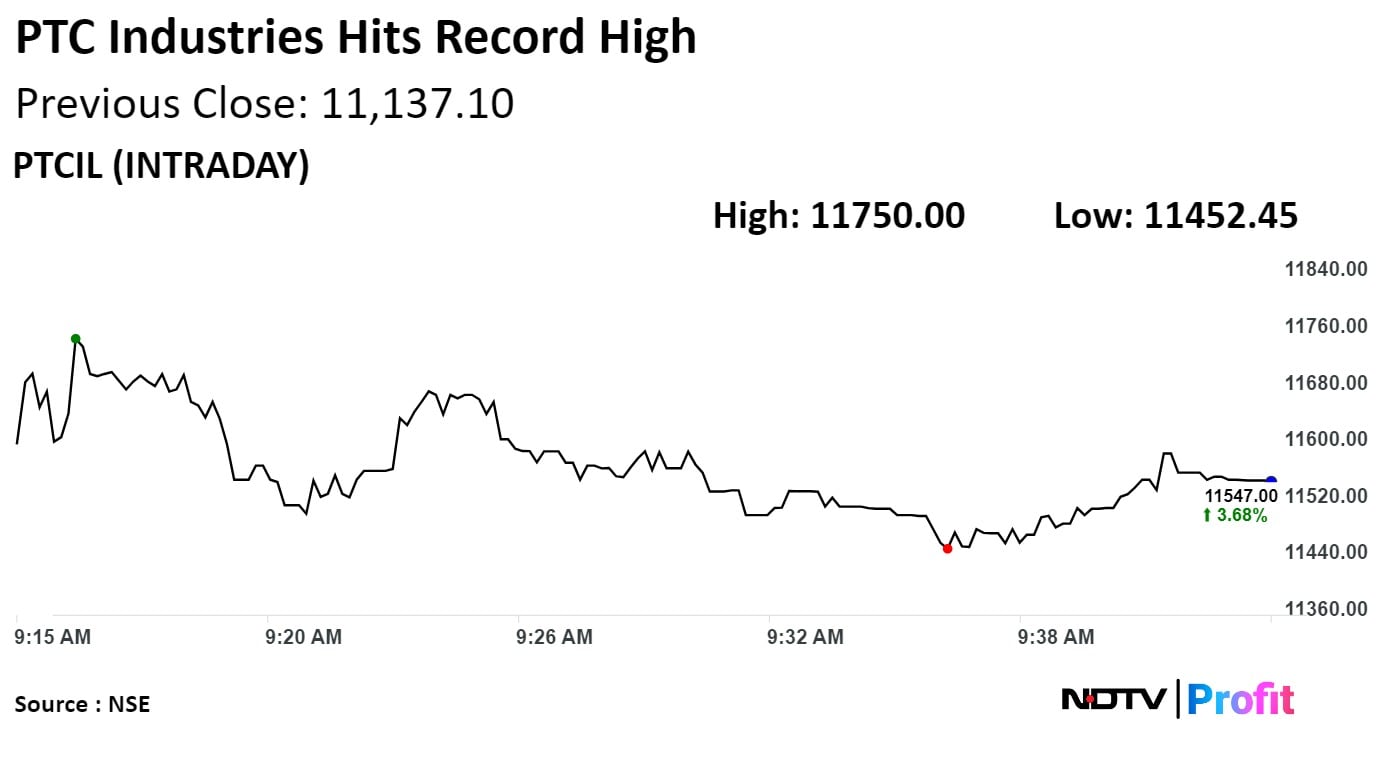

Shares of PTC Industries Ltd. has surged to the highest level since its listing on the bourses after it said it has partnered with leading entities under the Defense Testing Infrastructure scheme.

PTC Industries Ltd. has risen 5.50% to Rs 11,750.00, the highest level since June 9, 2023, when it was listed. It was trading 3.71% higher at Rs 11,550.00 as of 09:47 a.m. as compared to 0.05% decline in the NSE Nifty 50 index.

Shares of PTC Industries Ltd. has surged to the highest level since its listing on the bourses after it said it has partnered with leading entities under the Defense Testing Infrastructure scheme.

PTC Industries Ltd. has risen 5.50% to Rs 11,750.00, the highest level since June 9, 2023, when it was listed. It was trading 3.71% higher at Rs 11,550.00 as of 09:47 a.m. as compared to 0.05% decline in the NSE Nifty 50 index.

The scrip has gained 212.8% in 12 months, and 92.49% on year to date basis. Total traded volume on NSE so far in the day stood at 0.14 times its 30-day average. The relative strength index was at 74.07, which implied the stock is overbought.

One analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.8%.

.jpeg)

.jpeg)

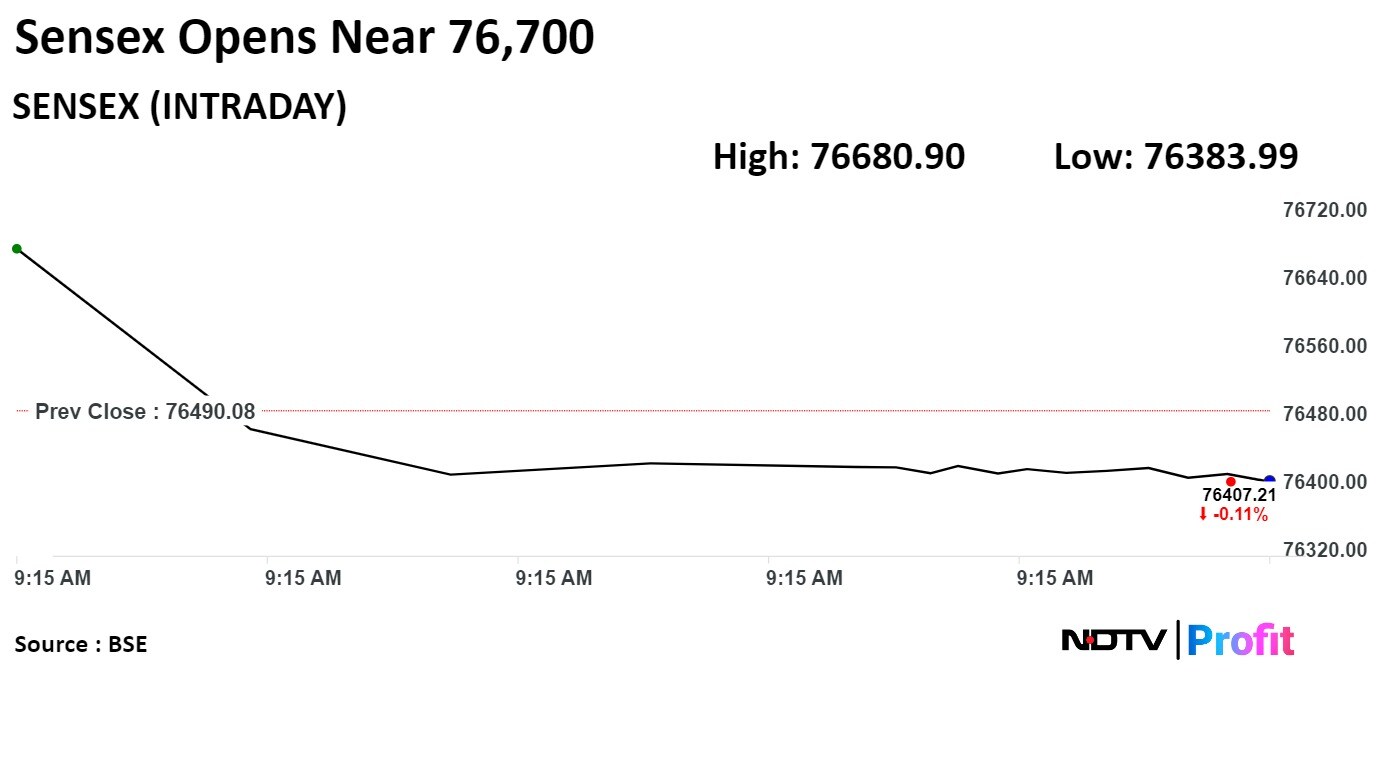

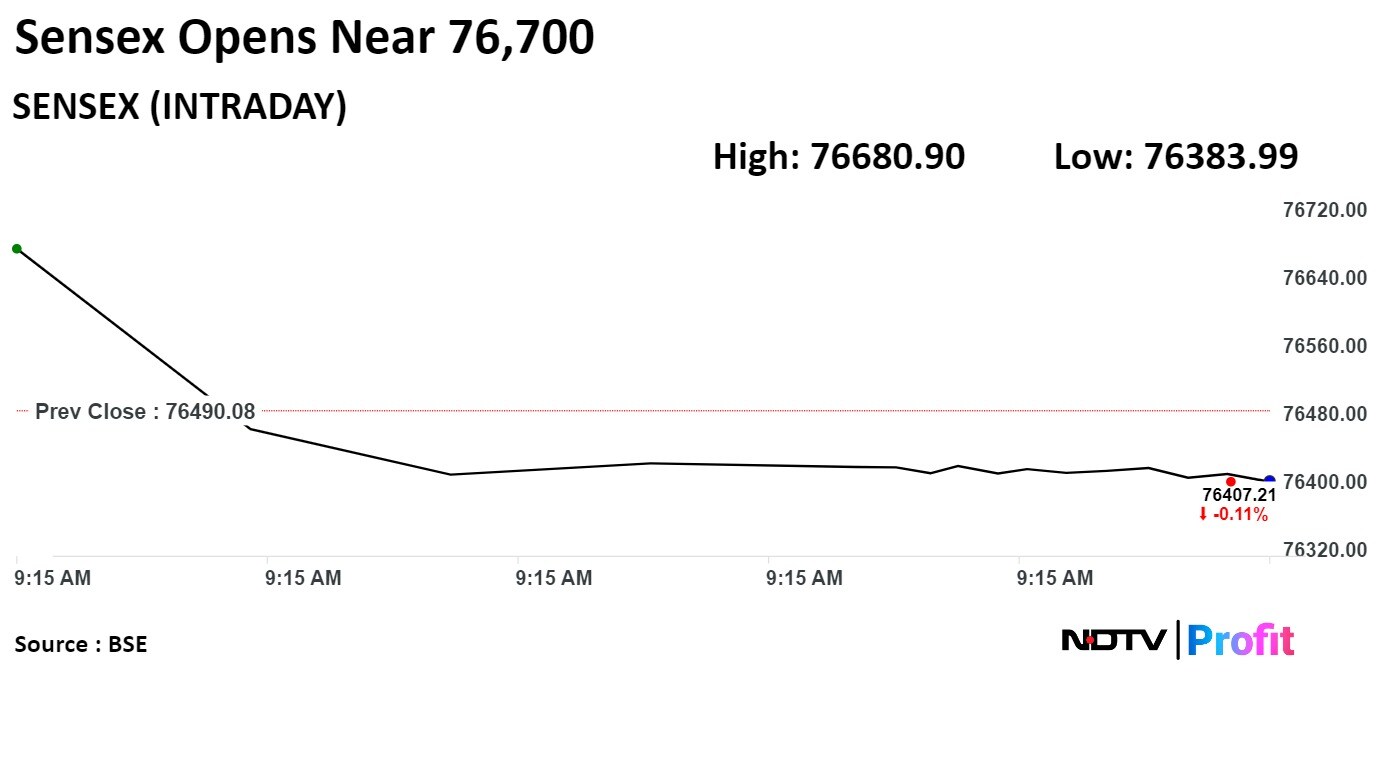

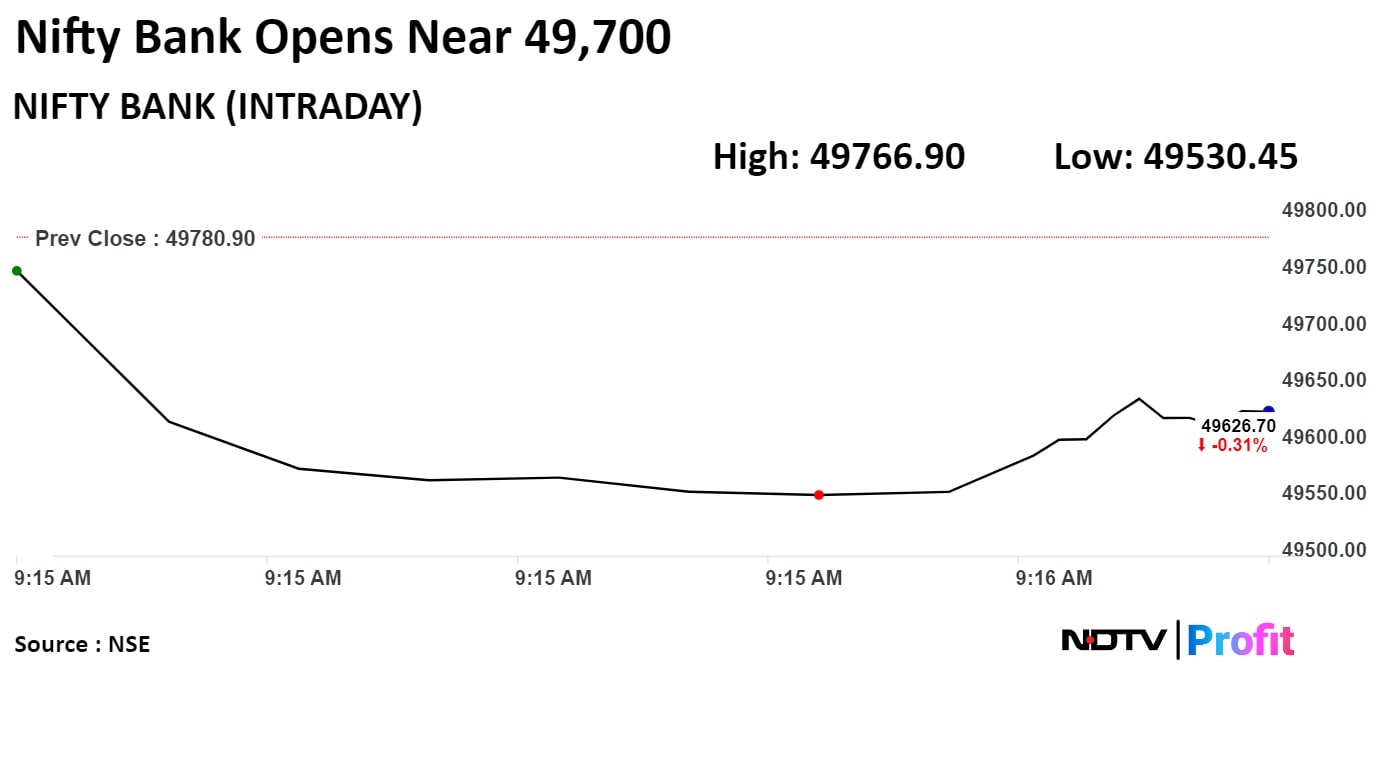

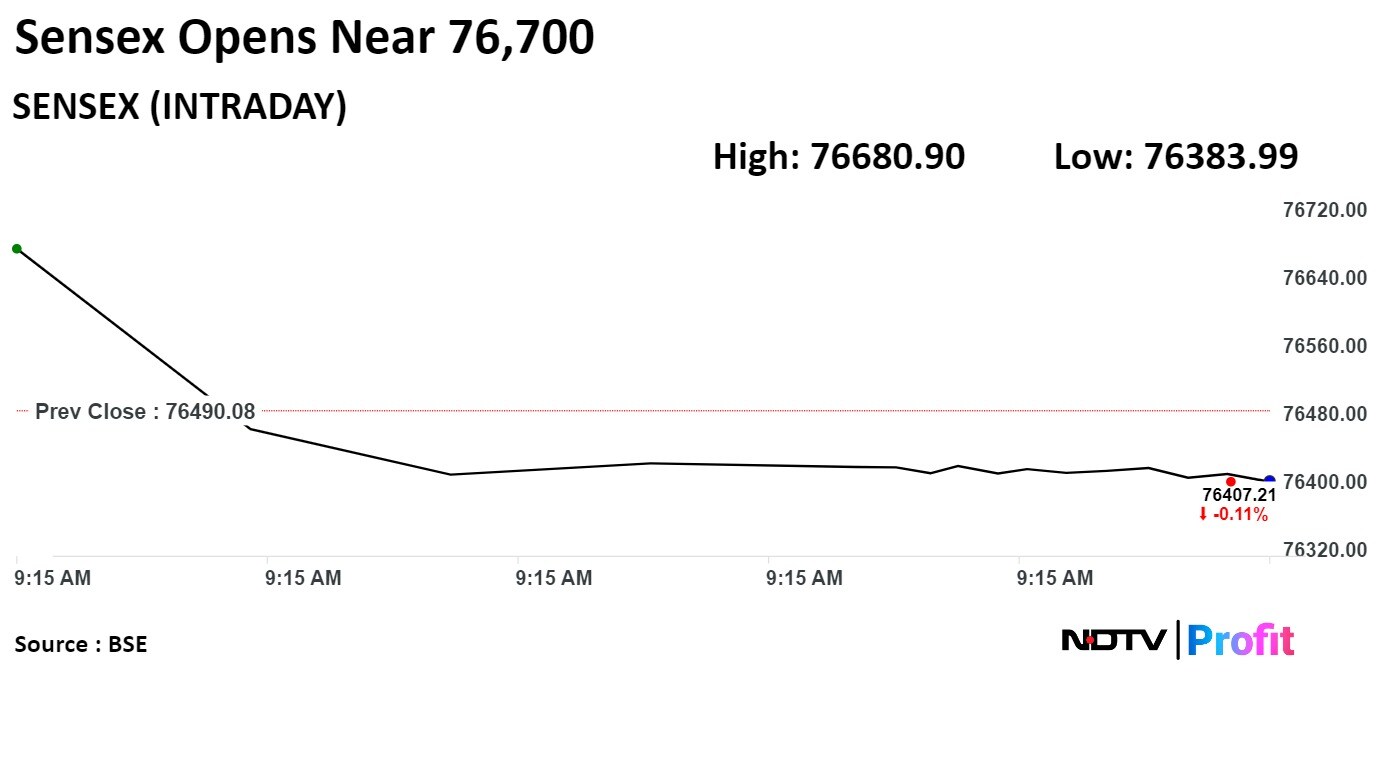

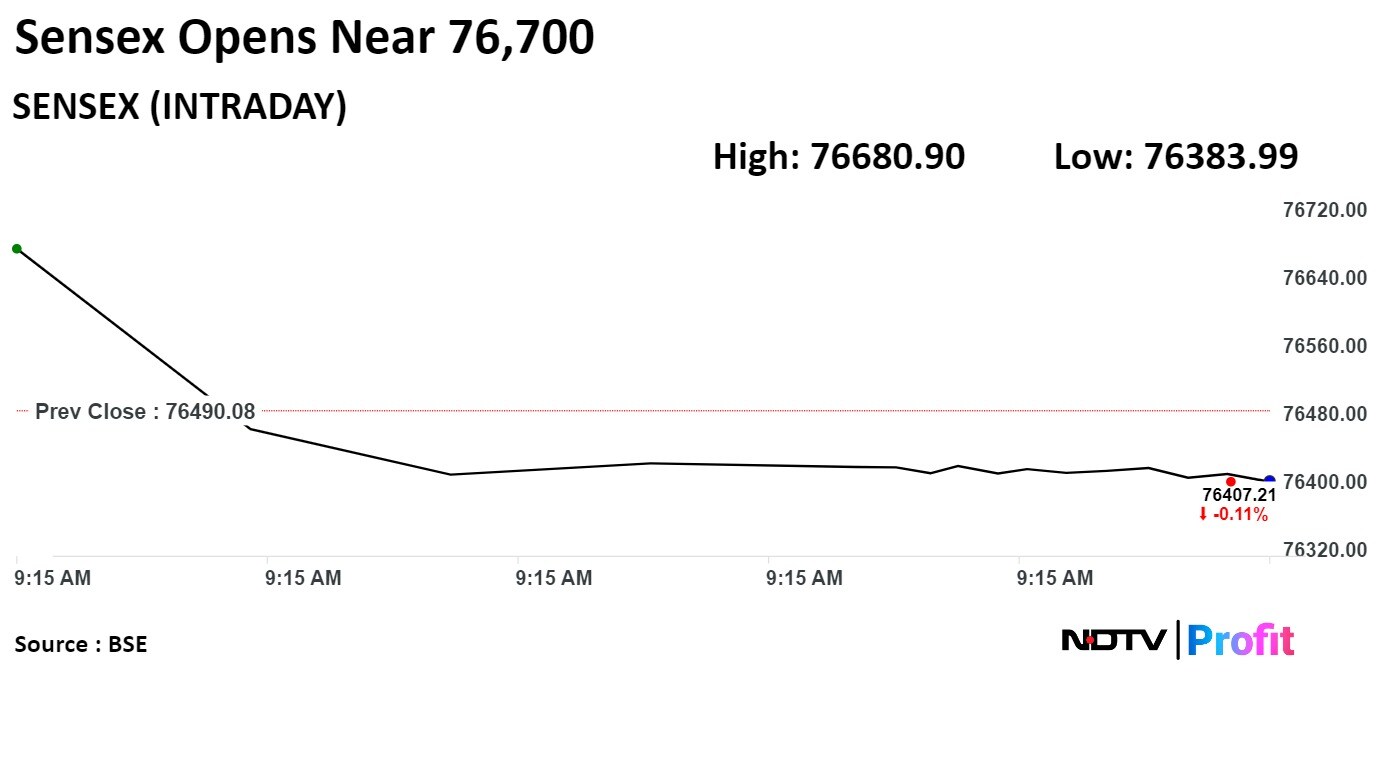

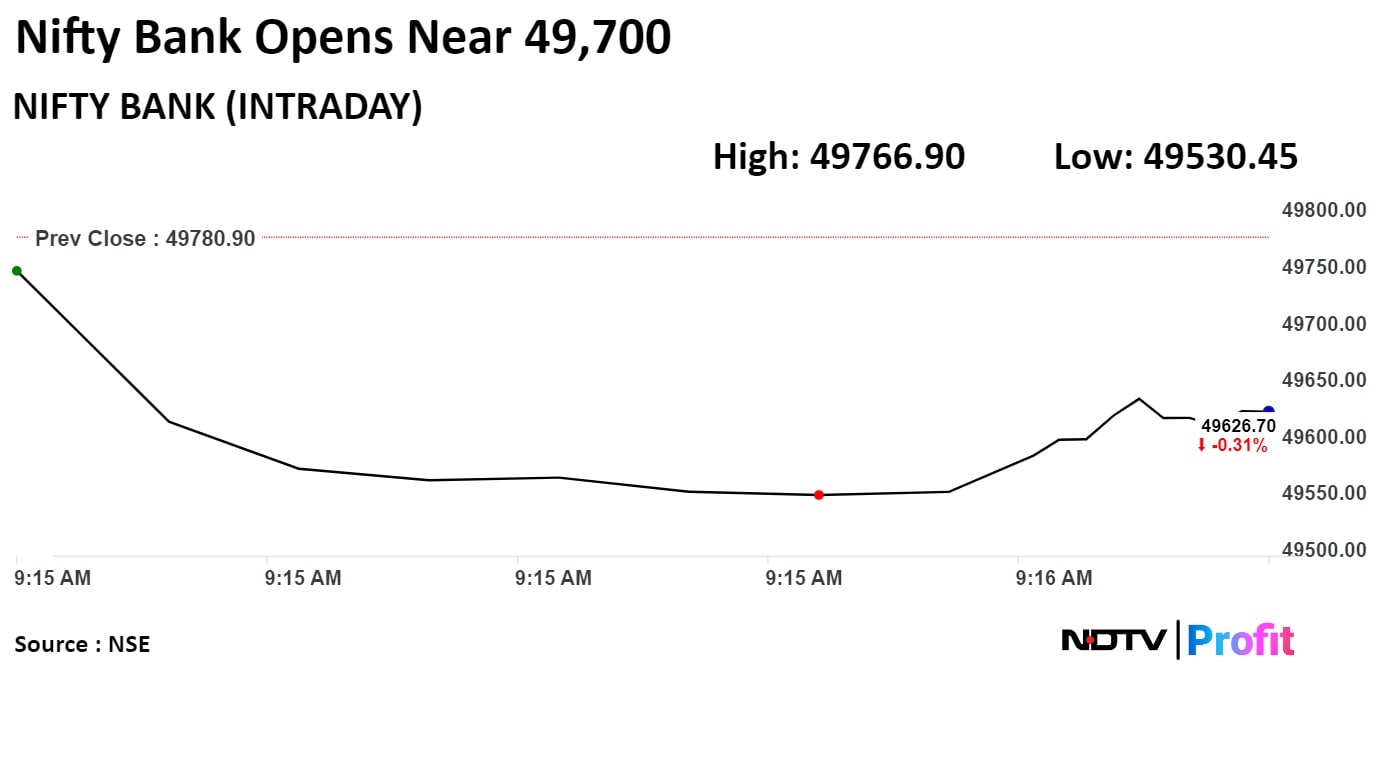

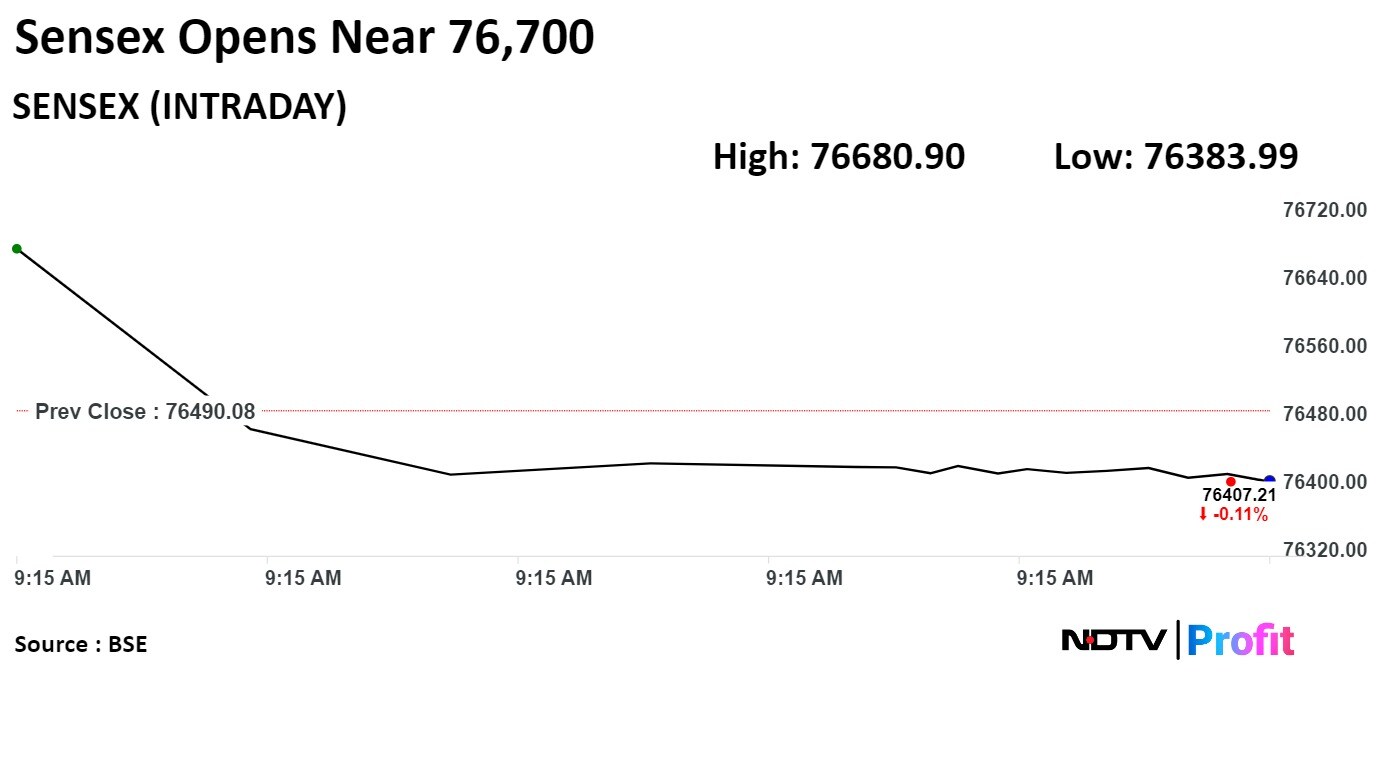

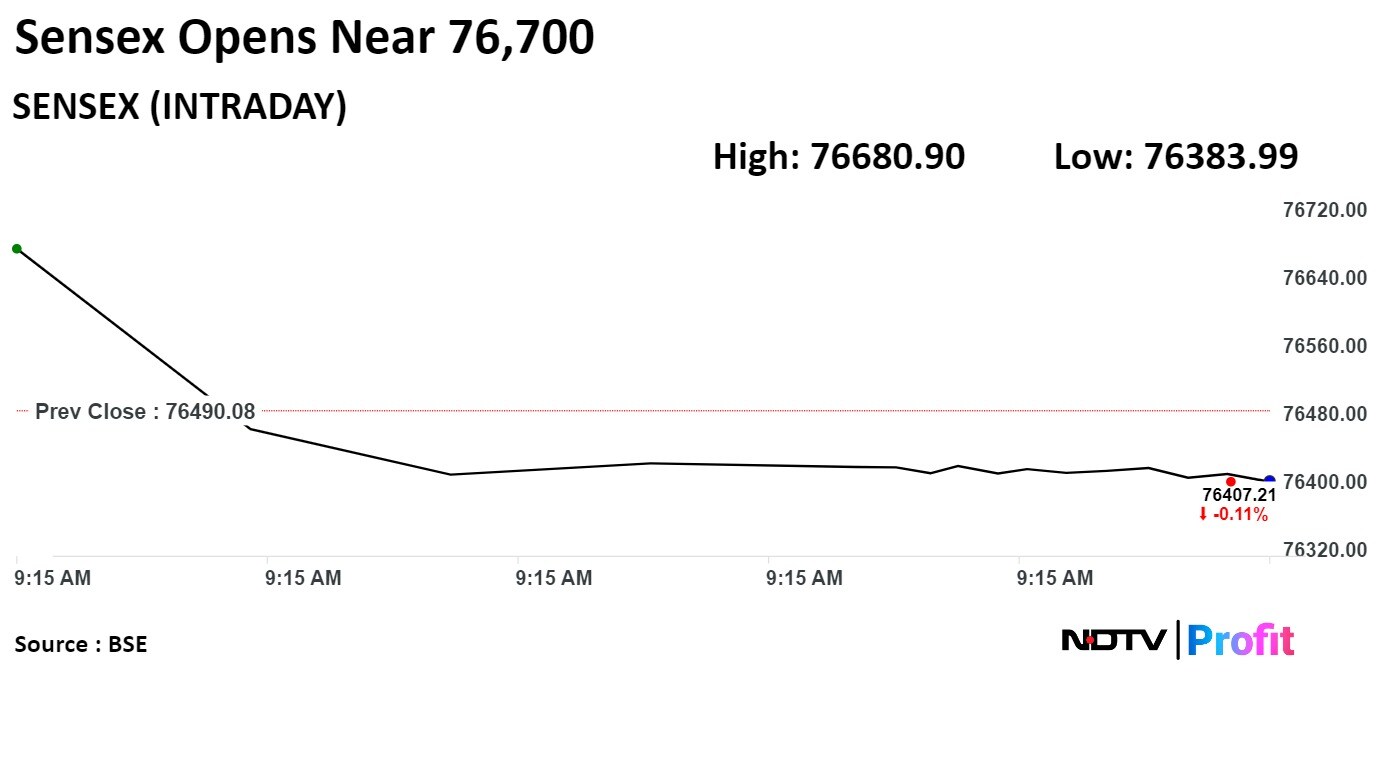

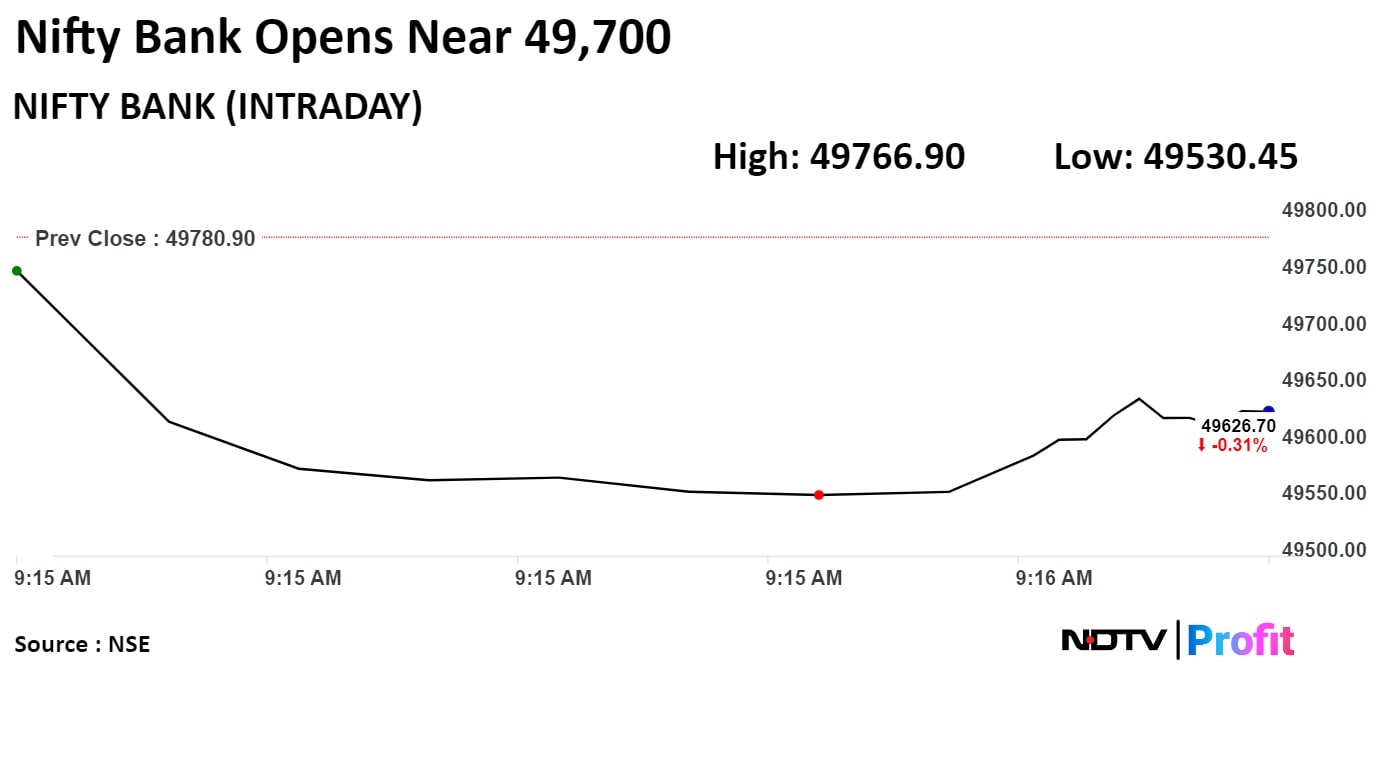

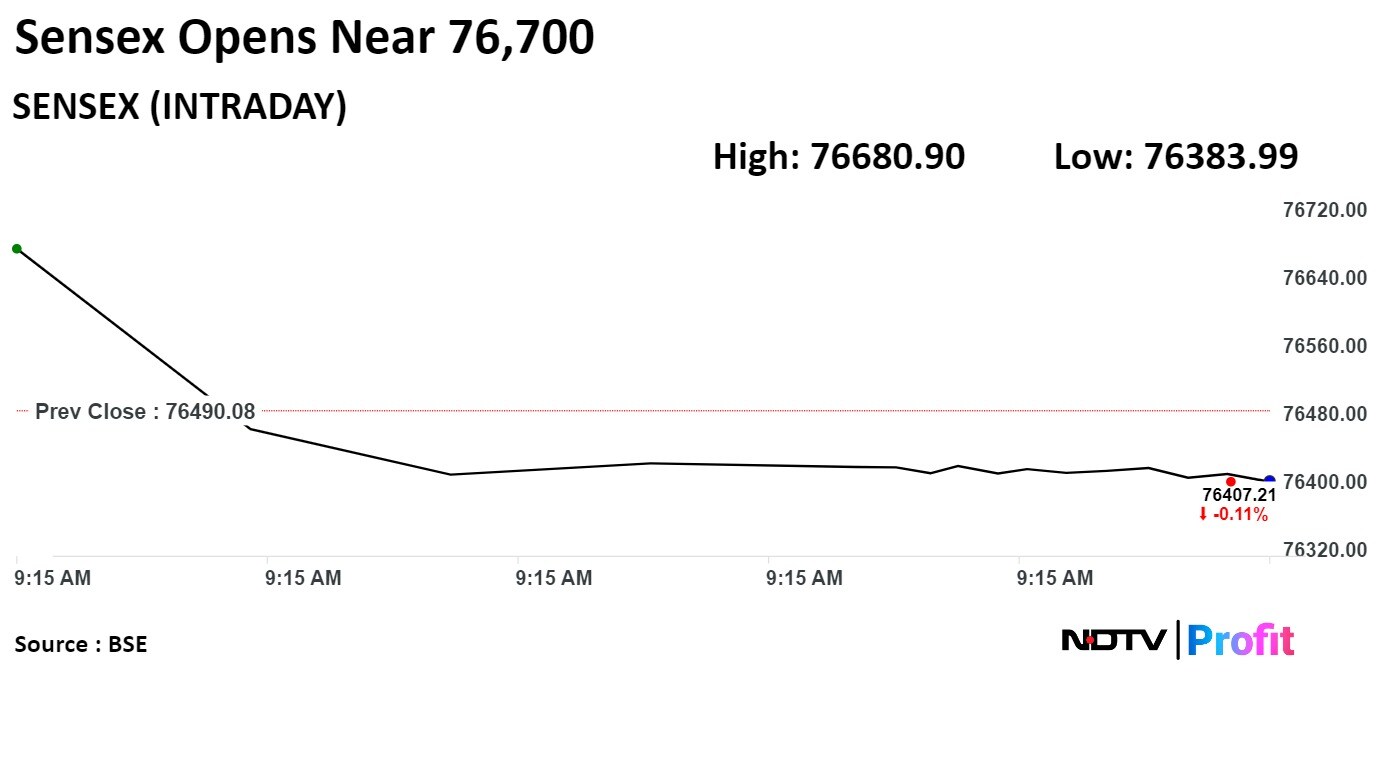

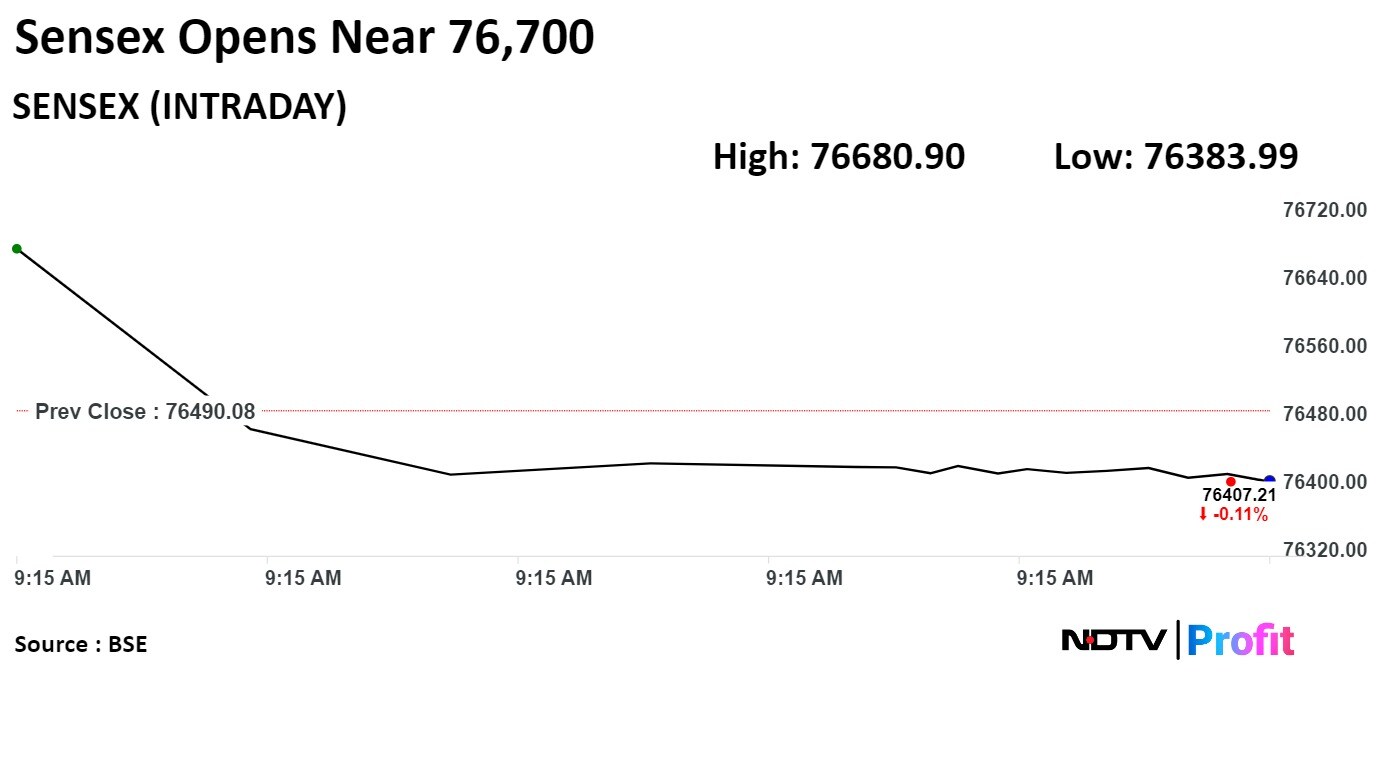

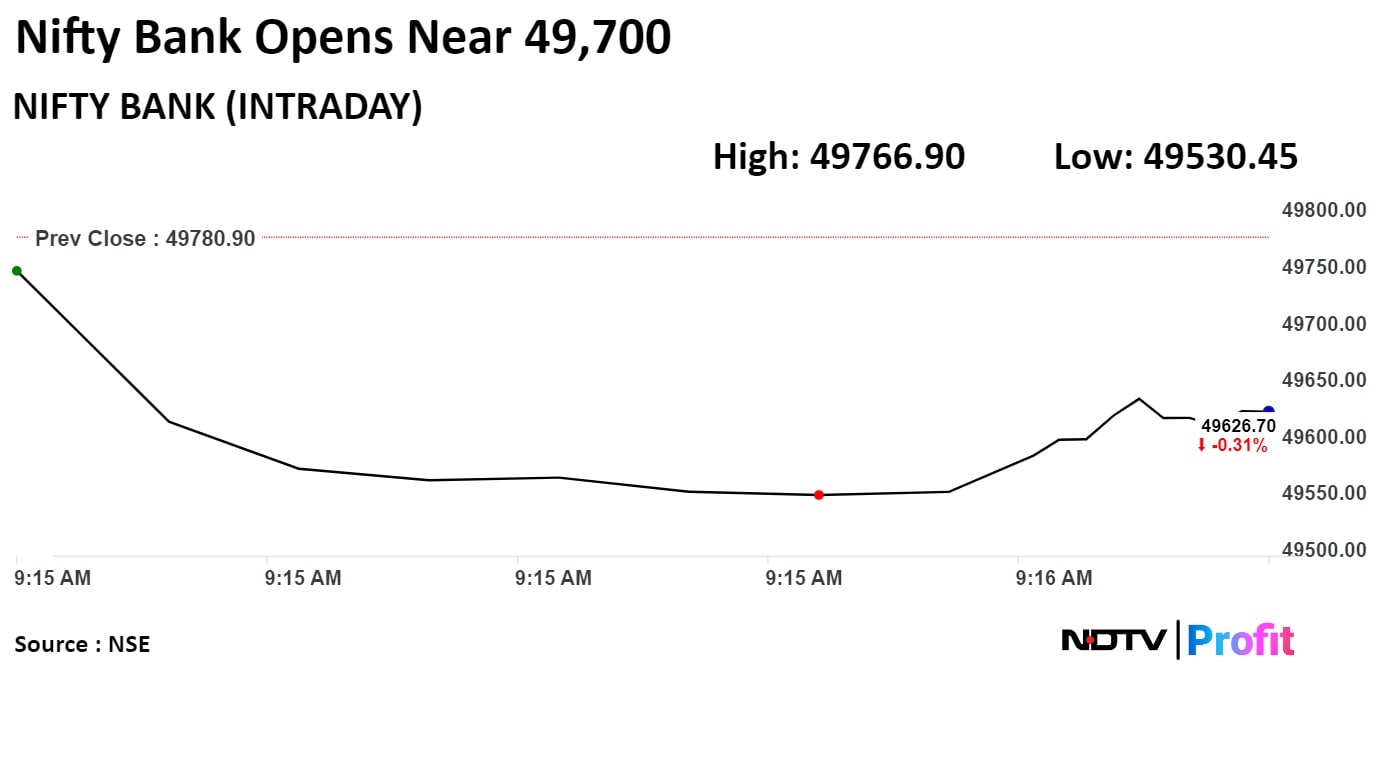

Benchmark equity indices saw a muted start on Tuesday as shares of ICICI Bank weighed on them but gains in Oil & Natural Gas Corp. and Larsen & Toubro kept them from falling.

At pre-open, the Nifty was at 23,283.75, up by 24.55 points or 0.11% and the Sensex rose 190.82 points or 0.25% at 76,680.90.

For day traders, 23400/77000 will be the immediate resistance level," according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For day traders, 23400/77000 will be the immediate resistance level," he said adding that as long as the market is trading below the same, the correction trend is likely to continue.

"Below the same, the market may slip towards 23100-23025/76100-76000," he said.

Benchmark equity indices saw a muted start on Tuesday as shares of ICICI Bank weighed on them but gains in Oil & Natural Gas Corp. and Larsen & Toubro kept them from falling.

At pre-open, the Nifty was at 23,283.75, up by 24.55 points or 0.11% and the Sensex rose 190.82 points or 0.25% at 76,680.90.

For day traders, 23400/77000 will be the immediate resistance level," according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For day traders, 23400/77000 will be the immediate resistance level," he said adding that as long as the market is trading below the same, the correction trend is likely to continue.

"Below the same, the market may slip towards 23100-23025/76100-76000," he said.

.jpeg)

Benchmark equity indices saw a muted start on Tuesday as shares of ICICI Bank weighed on them but gains in Oil & Natural Gas Corp. and Larsen & Toubro kept them from falling.

At pre-open, the Nifty was at 23,283.75, up by 24.55 points or 0.11% and the Sensex rose 190.82 points or 0.25% at 76,680.90.

For day traders, 23400/77000 will be the immediate resistance level," according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For day traders, 23400/77000 will be the immediate resistance level," he said adding that as long as the market is trading below the same, the correction trend is likely to continue.

"Below the same, the market may slip towards 23100-23025/76100-76000," he said.

Benchmark equity indices saw a muted start on Tuesday as shares of ICICI Bank weighed on them but gains in Oil & Natural Gas Corp. and Larsen & Toubro kept them from falling.

At pre-open, the Nifty was at 23,283.75, up by 24.55 points or 0.11% and the Sensex rose 190.82 points or 0.25% at 76,680.90.

For day traders, 23400/77000 will be the immediate resistance level," according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For day traders, 23400/77000 will be the immediate resistance level," he said adding that as long as the market is trading below the same, the correction trend is likely to continue.

"Below the same, the market may slip towards 23100-23025/76100-76000," he said.

.jpeg)

Benchmark equity indices saw a muted start on Tuesday as shares of ICICI Bank weighed on them but gains in Oil & Natural Gas Corp. and Larsen & Toubro kept them from falling.

At pre-open, the Nifty was at 23,283.75, up by 24.55 points or 0.11% and the Sensex rose 190.82 points or 0.25% at 76,680.90.

For day traders, 23400/77000 will be the immediate resistance level," according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For day traders, 23400/77000 will be the immediate resistance level," he said adding that as long as the market is trading below the same, the correction trend is likely to continue.

"Below the same, the market may slip towards 23100-23025/76100-76000," he said.

Benchmark equity indices saw a muted start on Tuesday as shares of ICICI Bank weighed on them but gains in Oil & Natural Gas Corp. and Larsen & Toubro kept them from falling.

At pre-open, the Nifty was at 23,283.75, up by 24.55 points or 0.11% and the Sensex rose 190.82 points or 0.25% at 76,680.90.

For day traders, 23400/77000 will be the immediate resistance level," according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For day traders, 23400/77000 will be the immediate resistance level," he said adding that as long as the market is trading below the same, the correction trend is likely to continue.

"Below the same, the market may slip towards 23100-23025/76100-76000," he said.

.jpeg)