Share indices in Asia–Pacific rose on Thursday, tracking overnight gains on Wall Street ahead of the release of US CPI for September, which will provide clues about the Federal Reserve's policy going forward.

The Nikkei 225 was 187.68 points or 0.48% higher at 39,465.64, and the S&P ASX 200 was 42.60 points or 0.52% higher at 8,230.00 as of 06:28 a.m.

Wall Street traders, preparing for important inflation data, pushed stocks to their record highs, with major tech companies once again driving the gains, reported Bloomberg.

On Wednesday, the S&P 500 and Nasdaq Composite ended 0.71% and 0.60% higher, respectively. The Dow Jones Industrial Average settled 1.08% higher.

Brent crude was trading 0.56% higher at $77.01 a barrel as of 06:31 a.m. The Bloomberg Spot Gold was 0.07% higher at $2,609.68 an ounce.

The GIFT Nifty was trading 0.08% or 19 points higher at 25,207.50 as of 06:32 a.m.

India's benchmark equity indices were back in the red after one session of ending higher as they erased gains in the last hour to close near Wednesday's lowest levels.

Intraday, the indices had risen as much as around 1.2% after the RBI's monetary policy meeting changed the liquidity stance to 'neutral' from 'withdrawal of accommodation earlier, signalling a potential rate cut. The weekly futures contract of Nifty Bank closed flat on expiry day.

The Nifty ended 0.12% or 31.20 points lower at 24981.95 and Sensex lost 0.21% or 167.7 points down at 81467.10.

Overseas investors, commonly known as Foreign Portfolio Investors, or FPIs, remained net sellers of Indian equities for eight consecutive sessions on Wednesday, while domestic institutional investors bought stocks worth Rs 3,508.61 crore.

According to provisional data from the National Stock Exchange, FPIs offloaded stocks worth Rs 4,562.71 crore.

The Indian rupee closed flat at 83.96 against the US dollar.

Stocks To Watch

Tata Group: Ratan Tata, the former chairman and chairman emeritus of Tata Sons, passed away on Wednesday at the age of 86. He was a highly respected Indian industrialist.

Bharat Petroleum Corp.: Andhra Pradesh Chief Minister N. Chandrababu Naidu announced that BPCL plans to establish a refinery in the state with an investment of Rs 85,000 crore. The company is currently conducting a feasibility study to determine the location.

Adani Enterprises: The company aims to raise $500 million through a share sale, offering approximately 14.2 million shares at an indicative price of Rs 2,962 each. This represents an implied discount of 6.08% to the last closing price.

Star Health and Allied Insurance Co.: The company has filed a statement regarding a data breach issue, acknowledging that it was the victim of a targeted cyberattack. They confirmed that operations remain unaffected and all services continue without interruption.

Note: An official statement from the company has also been provided to NDTV Profit.

Britannia Industries: The company has opened a cheese factory in Ranjangaon, Maharashtra, dedicated to producing The Laughing Cow products. This factory has an annual capacity of 10,000 tonnes for processed cheese. Additionally, it has also invested Rs. 87.50 lakh to acquire 875,000 equity shares at Rs. 10 each, which represents a 6.04% stake in the equity share capital of Suryaurja One Pvt. Ltd.

Patanjali Foods: The company has received approval from the CCI to acquire Patanjali Ayurveda's home and personal care business.

Additionally, the arbitration tribunal has ruled in favour of Ashav Advisory in its case against the company, requiring it to deliver 1.86 crore shares to Ashav Advisory within 90 days. It is currently contesting this decision.

Fortis Healthcare: The company has approved the issuance of Rs 15.5 billion in bonds, which will be offered through a private placement with a face value of 100,000.

PNC Infratech: It has been declared the L1 bidder for an EPC project, with the item rate percentage awarded to PNC Infratech and AAKSHYA Infra Projects Pvt. Ltd. for Rs 2,090.59 crore.

JM Financial: The company has received approval from the CCI to acquire a 42.99% stake in JM Financial Credit Solutions. Additionally, the CCI has approved JM Financial Credit's acquisition of a 71.79% stake in JM Financial Asset Reconstruction Company.

Vedanta: The company cancels its board meeting scheduled for Wednesday.

Sonata Software: The company has partnered with iNube to provide a digital insurance platform.

Rashtriya Chemicals and Fertilizers: The company has approved a Rs 1,000 crore order to L&T for the establishment of a 1,200 MTPD fertilizer plant.

Shriram Finance: An allotment of 19,774 equity shares has been made following the exercise of fresh stock options under the Shriram Finance Limited Employee Stock Option Scheme 2023.

Zee Entertainments Enterprises: The Independent Investigation Committee submitted its report to the board, concluding that no material irregularities were found.

IRB Infrastructure Developers: Moody's has reaffirmed IRB Infrastructure's Ba1 rating.

Akums Drugs and Pharmaceuticals: The company has announced the launch of its new product, which includes famotidine, calcium carbonate, and magnesium hydroxide, in the Indian market. This product is classified as an antacid, antiflatulent, and anti-ulcerant, aimed at serving the domestic market in India.

Avenue Supermarts: The company has opened two new stores today in Thergaon and Nawanshahr. The total number of stores now stands at 381.

Indian Railway Finance Corp.: The company has appointed Shri Manoj Kumar Dubey as chairman, managing director, and chief executive officer for a term of five years.

Rain Industries: Northern Graphite and Rain Carbon have announced an agreement to jointly develop natural graphite battery anode material.

G R Infraprojects: The company received a letter of acceptance for a project valued at Rs 904 crore from Maharashtra Metro Rail Corp.

KCP Sugar & Industries Corp. and The Ramco Cements:

Andhra Pradesh Chief Minister N. Chandrababu Naidu announced on Tuesday that the World Bank has agreed to provide a Rs 15,000 crore loan to the state government for the construction of the capital, Amaravati, with work set to begin in December. Naidu also stated that the Centre has agreed to release Rs 12,500 crore for the construction of the Polavaram project.

Earnings In Focus

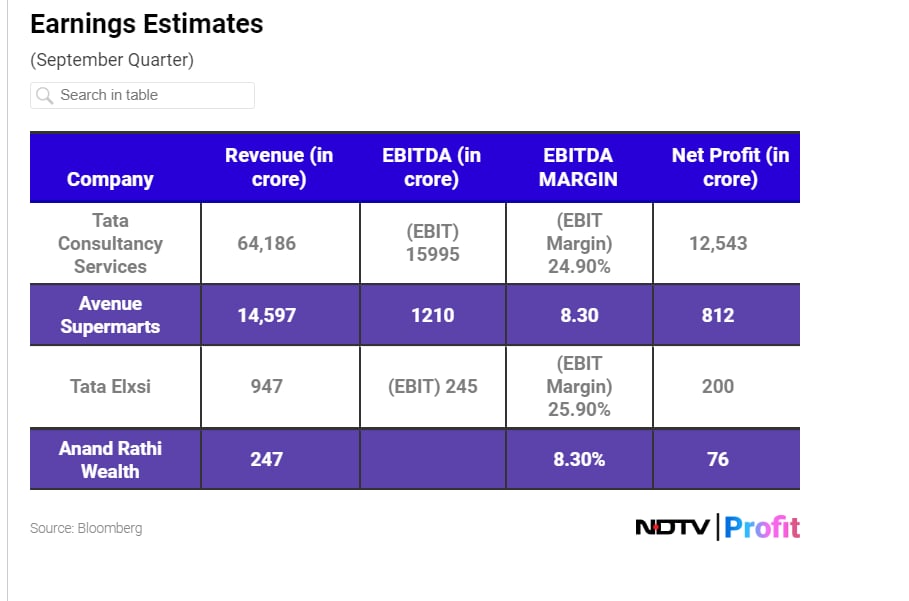

Tata Consultancy Services Ltd., DMart-parent Avenue Supermarts Ltd., Tata Elxsi Ltd. and Anand Rathi Wealth will kick-start the earnings season for the second quarter.

Earnings Post Market Hours

GTPL Hathway- Q2FY25 (Consolidated, YoY)

Revenue at up 9.8% Rs 855.56 crore vs Rs 779.20 crore

Ebitda down 13.64% at Rs 107.37 crore vs Rs 124.32 crore

Margin at 12.55% vs 15.95% down 340 bps

Net profit down 61.69% at Rs 13.74 crore vs Rs 35.87 crore

Western Carriers Q1FY25 (Consolidated, YoY)

Revenue up 5.26% at Rs 422.71 crore vs Rs 401.57 crore

Ebitda up 13.22% at Rs 35.46 crore vs Rs 31.32 crore

Margin at 8.38% vs 7.79% up 58 bps

Net profit up 8.24% at Rs 18.9 crore vs Rs 17.46 crore

IPO Offerings:

Garuda Construction and Engineering: The public issue was subscribed to 4.1 times on day 2. There bids were led retail investors (6.73 times), non-institutional investors (2.58 times), and qualified institutional investors (0.91 times).

Shiv Texchem: The public issue was subscribed to 6.44 times on day 2. There bids were led retail investors (8.51 times), non-institutional investors (6.05 times), and qualified institutional investors (3.11 times).

Bulk Deals

IDFC Ltd.: Ubs Principal Capital Asia Limited bought 81.48 lakh shares (0.5%) at Rs 107.92 apiece.

Vertoz Ltd.: Sajm Global Impex Private Limited sold 47.63 lakh shares (11.17%) at Rs 23.7 apiece.

Jyoti Structures: Aion Jyoti Llc sold 91.87 lakh shares (1.08%) at Rs 32.15 apiece.

Trading Tweaks

Jindal Saw Ltd. - Stock Split from Rs 2 to Rs 1

Insider Trades

Avantel: Promoter Lakshmee Foundation sold 9 lakh shares on Oct. 8

F&O Cues

Nifty October futures fell by 0.05% to 25,083.9 at a premium of 101.95 points.

Nifty October futures open interest fell by 1.32%.

Nifty Bank October futures rose by 0.01% to 51,373.7 at a premium of 366.7 points.

Nifty Bank October futures open interest grew by 7.89%.

Nifty Options Oct. 10 Expiry: Maximum call open interest at 25,500 and maximum put open interest at 24,000.

Bank Nifty Options Oct. 16 Expiry: Maximum call open interest at 62,000 and maximum put open interest at 43,000.

Securities in ban period: Bandhan Bank, Birlasoft, Gujarat Narmada Valley Fertilizers & Chemicals, Granules India, Hindustan Copper, IDFC First Bank, Manappuram Finance, Punjab National Bank, RBL Bank, Steel Authority of India, Tata Chemicals

Money Market Update

The Indian rupee closed flat against the US dollar on Wednesday after the Monetary Policy Committee held the Reserve Bank of India's repo rate unchanged at 6.5%, while changing the policy stance to 'neutral'.

The currency closed at Rs 83.96, unchanged from Rs 83.96 at close on Tuesday, according to Bloomberg data.

Research Reports

IT Services Q2 Result Preview – Slowly Shaping Up; Recovery Expected: Axis Securities

Telecom Q2 Results Preview - Higher Monetisation In Near-Term; Recovery Expected: Axis Securities

Banks, Insurers, Asset Managers, Brokers, Fintech Q2 FY25 Earnings Preview: Yes Securities

Building Material Q2 Results Preview - Expect Insipid Quarter Across Segments: ICICI Securities

Inox Wind Q2 Results Preview - Stable Execution But Realisations Likely To Improve: Systematix

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.