-The local currency weakened 20 paise to close at an all-time low of 83.65 against the US dollar.

-It closed at 83.45 on Wednesday.

Source: Bloomberg

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

.jpeg)

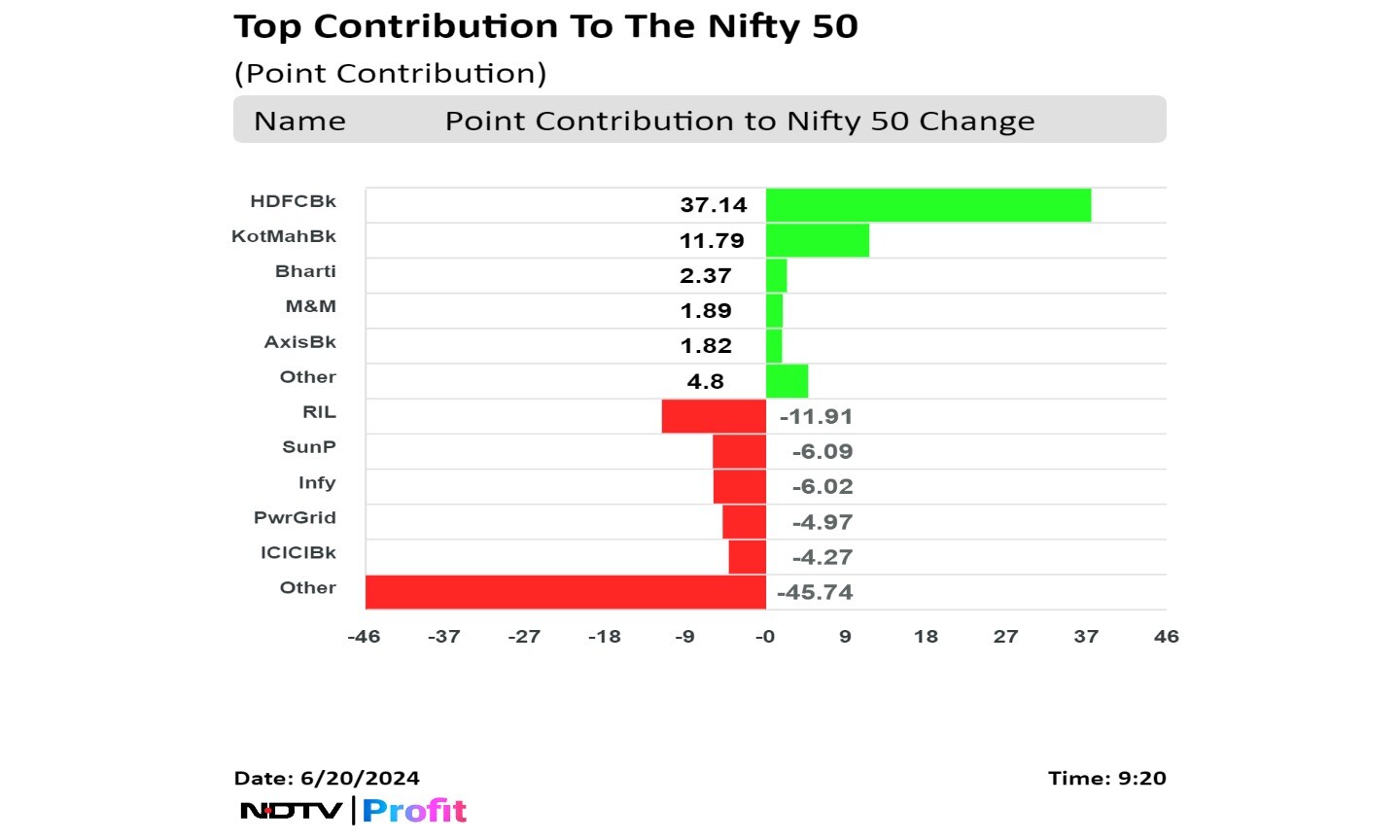

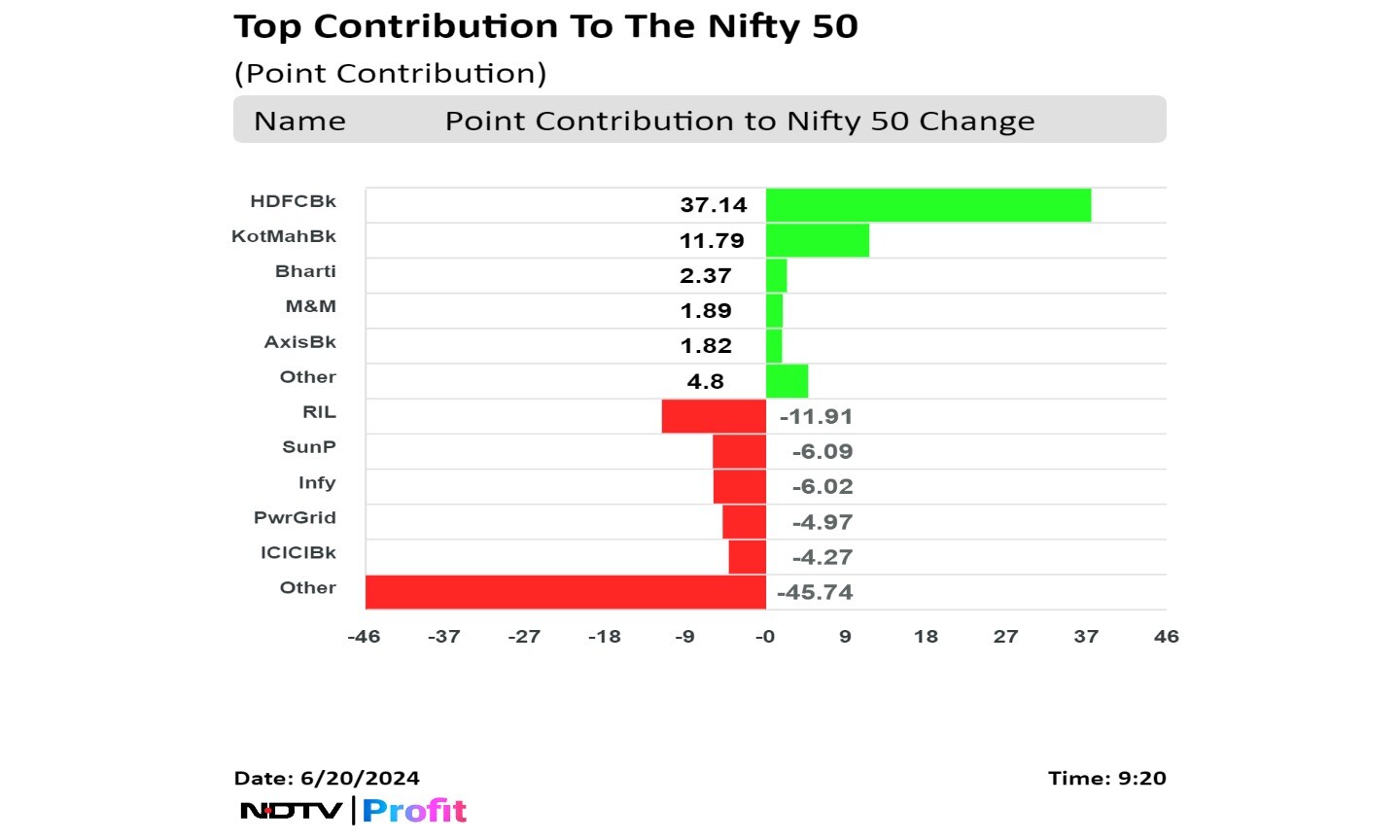

Shares of Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains.

While those of Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., State Bank Of India, and NTPC Ltd weighed.

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

.jpeg)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains.

While those of Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., State Bank Of India, and NTPC Ltd weighed.

.jpeg)

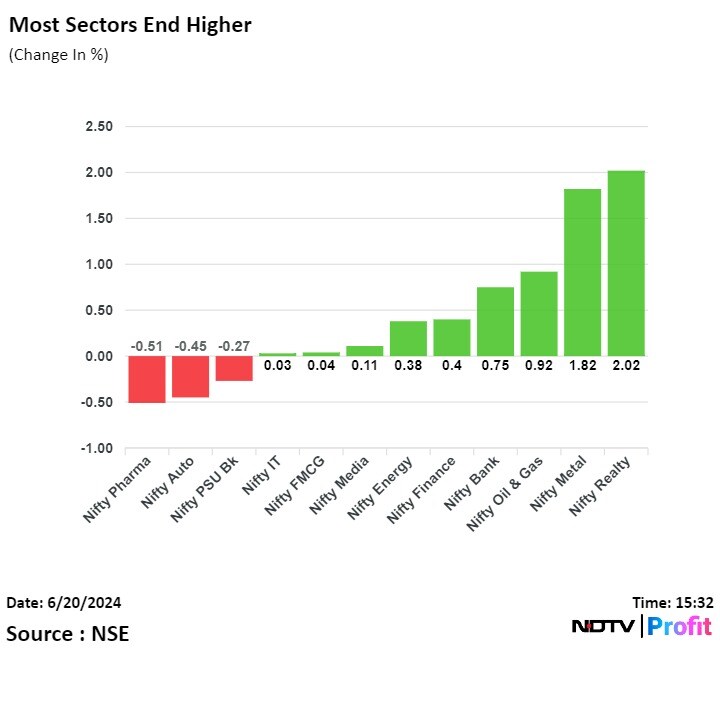

Most sectoral indices were higher at close. Nifty Realty and Nifty Metal rose around 2%, the most.

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

.jpeg)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains.

While those of Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., State Bank Of India, and NTPC Ltd weighed.

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

The Nifty recovered from Wednesday's fall and the Sensex logged its best winning streak in four months to close at their highest levels as Reliance Industries and private banks led the gains.

The Nifty recorded its highest close of 23,567, up 51 points or 0.22% from previous close and the Sensex closed at its highest level of 77,478.93, up by 141.34 points or 0.18% .Intraday, both the indices gained over 0.4%.

"With a Spinning Top candlestick pattern, nothing has changed for Nifty50 i.e. lower side is protected at 23,340 while 23,660 will be considered as resistance," said Aditya Gaggar, director of Progressive Shares. "For the past couple of days, the Index has been oscillating in a range, breakout on either sides will provide a clear direction."

.jpeg)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains.

While those of Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., State Bank Of India, and NTPC Ltd weighed.

.jpeg)

Most sectoral indices were higher at close. Nifty Realty and Nifty Metal rose around 2%, the most.

Market breadth was skewed in favour of buyers. Around 2,291 stocks advanced, 1,546 stocks declined, and 138 stocks remained unchanged on BSE.

Broader markets outperformed benchmark indices. The S&P BSE Midcap and Smallcap settled 0.55% and 1.00% higher, respectively.

On BSE, 13 sectors advanced, and seven declined out of 20. The S&P BSE Realty rose the most, and the S&P BSE Auto declined the most among other sectors.

Supplies 100 freight wagons to Mozambique's Port of Nacala

Source: Exchange Filing

Talks of yuan falling to 7.50/$ may put pressure on rupee

Dollar/yuan rate currently at 7.26 yuan per dollar

Traders expect rupee's fall limited to 83.75/$

Oil importers' month-end dollar demand may also weigh

Provisional payroll data shows 8.87 lakh new members enrolled with EPFO during April 2024

Increase of 31.29% seen in net member addition in April v/s March 2024.

New member data shows dominance of the 18-25 age group.

55.5% of the total new members in April 2024 are in the 18-25 age bracket

Among new members 2.49 lakh are new female members.

Net- member addition is highest in Maharashtra, Karnataka, Tamil Nadu, Gujarat and Haryana.

14.53 lakh members exited and subsequently rejoined EPFO

Source: PIB

-The local currency weakened 17 paise to an all-time low of 83.62 against the US dollar.

-It closed at 83.45 on Wednesday.

Source: Bloomberg

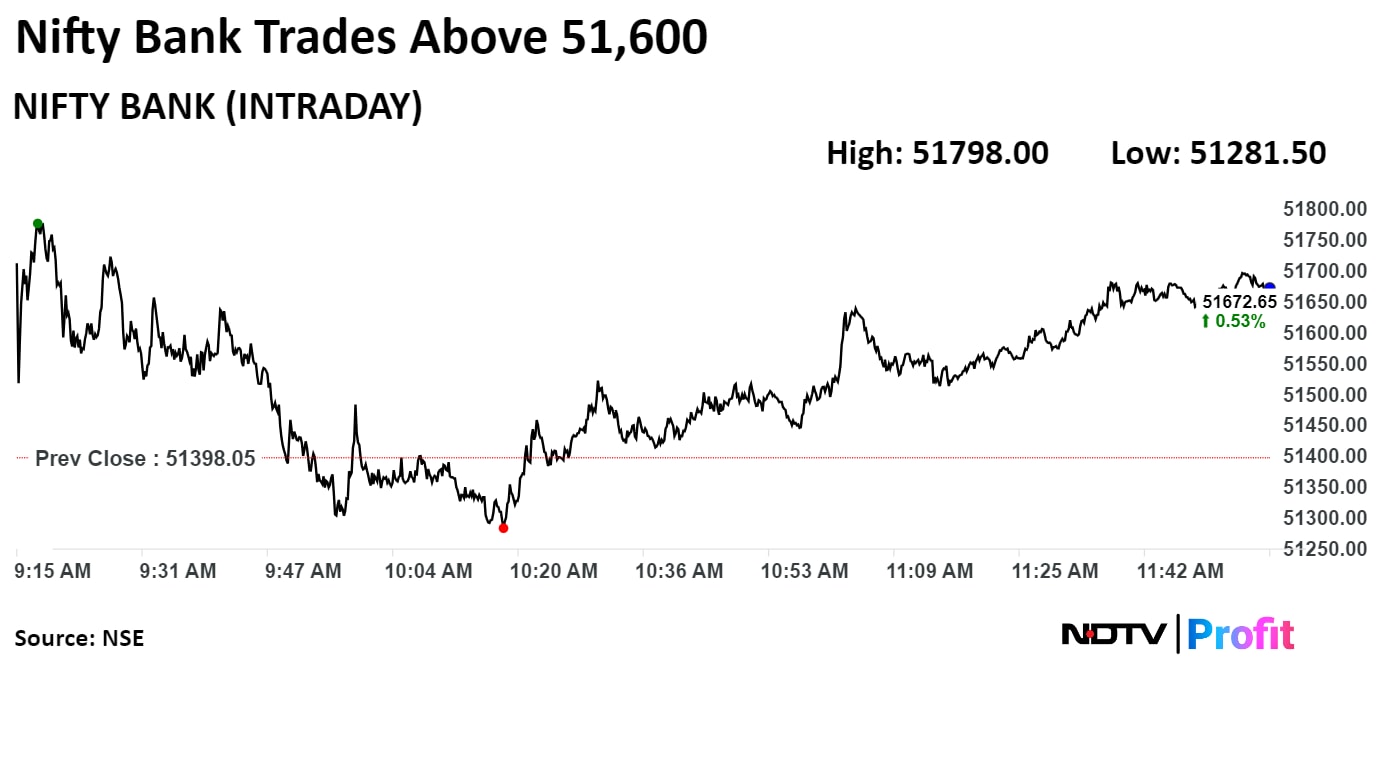

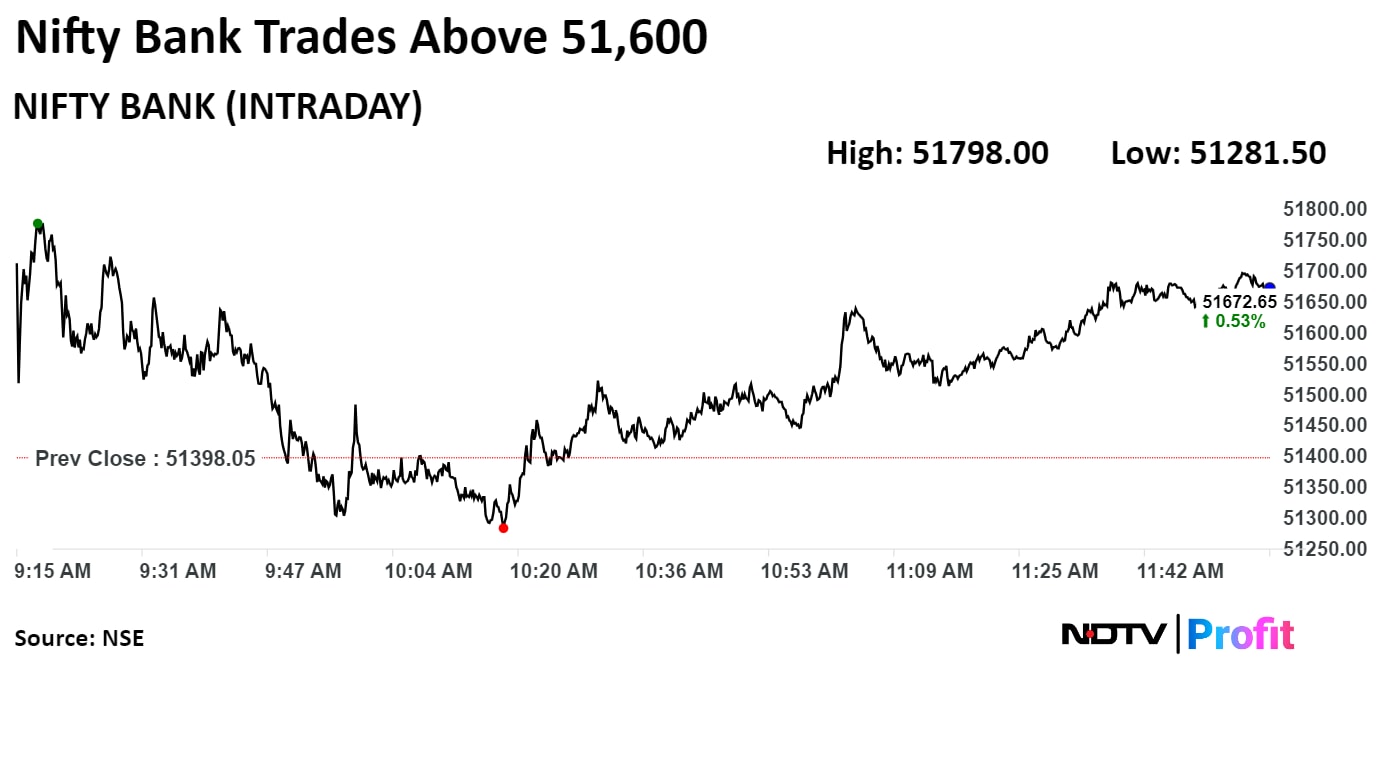

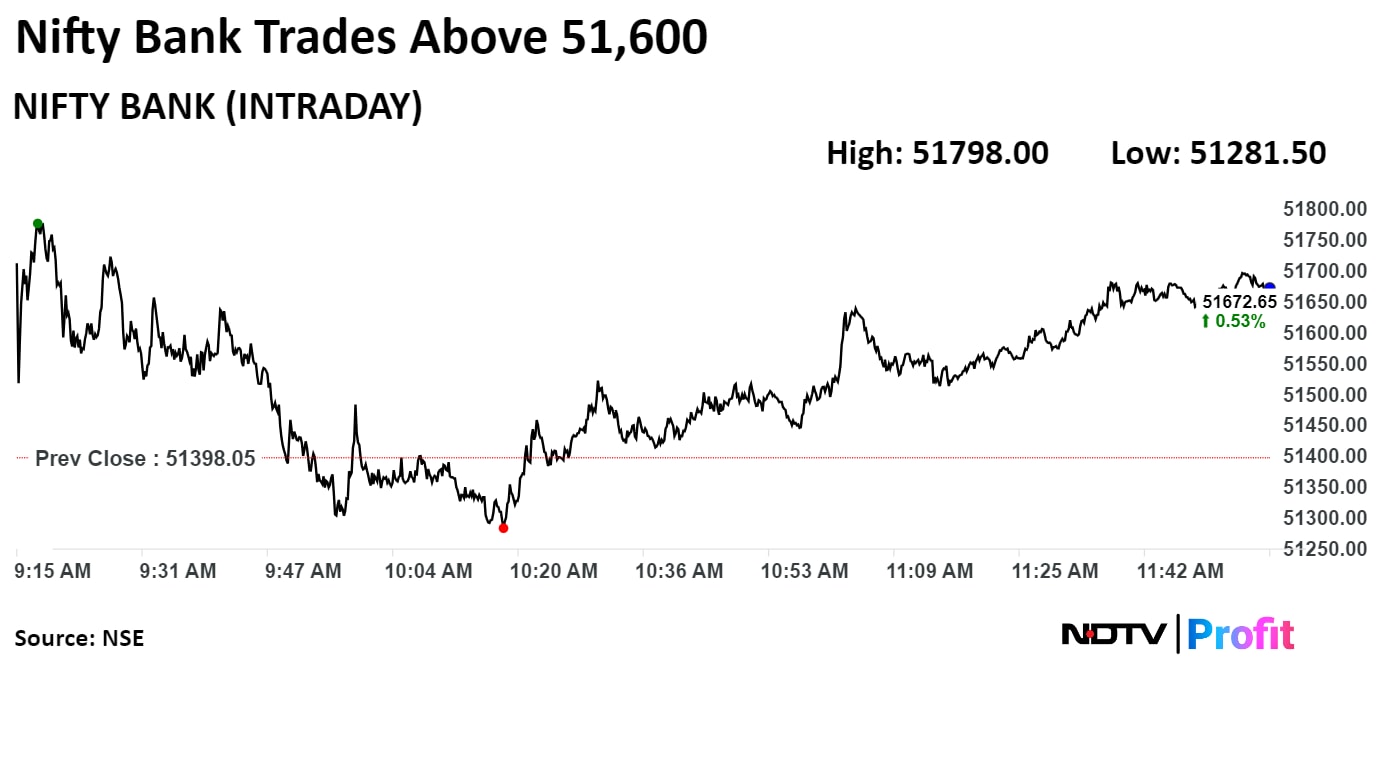

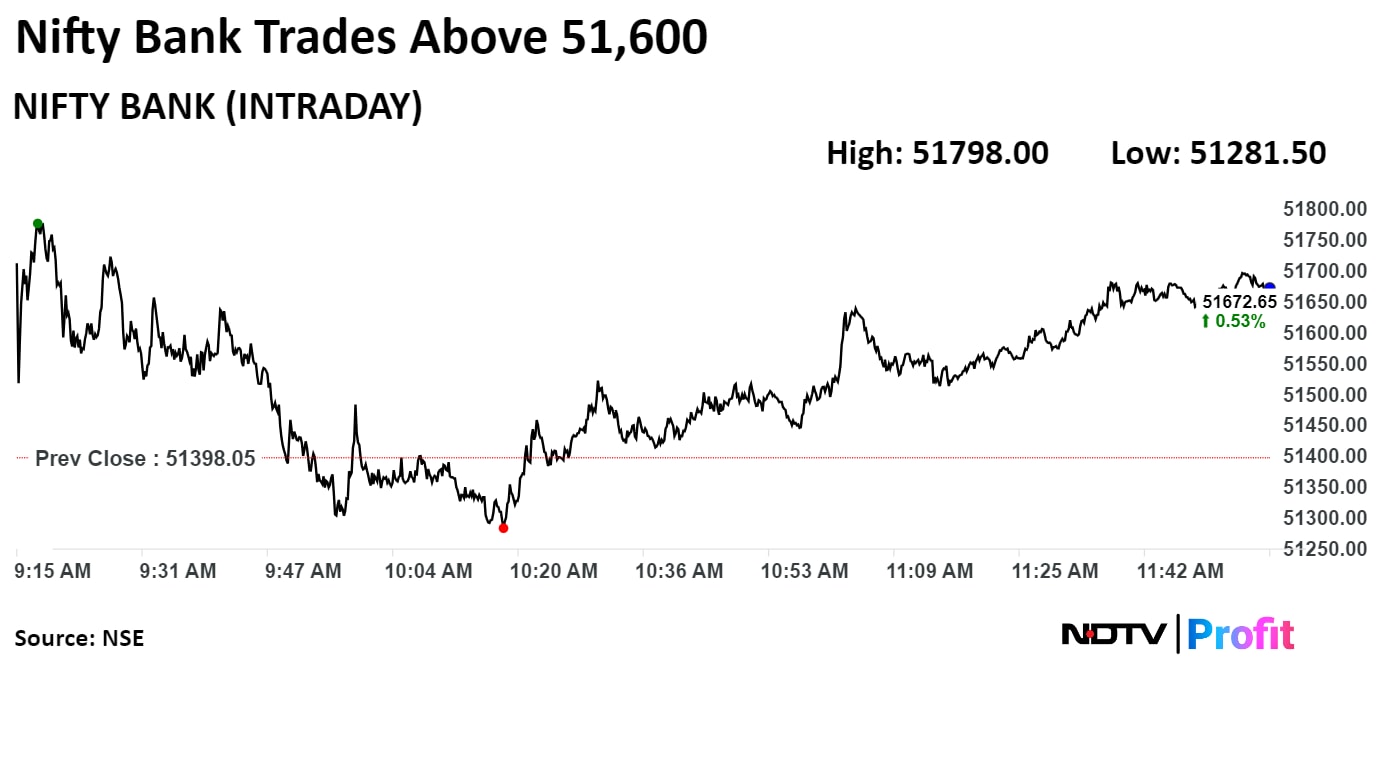

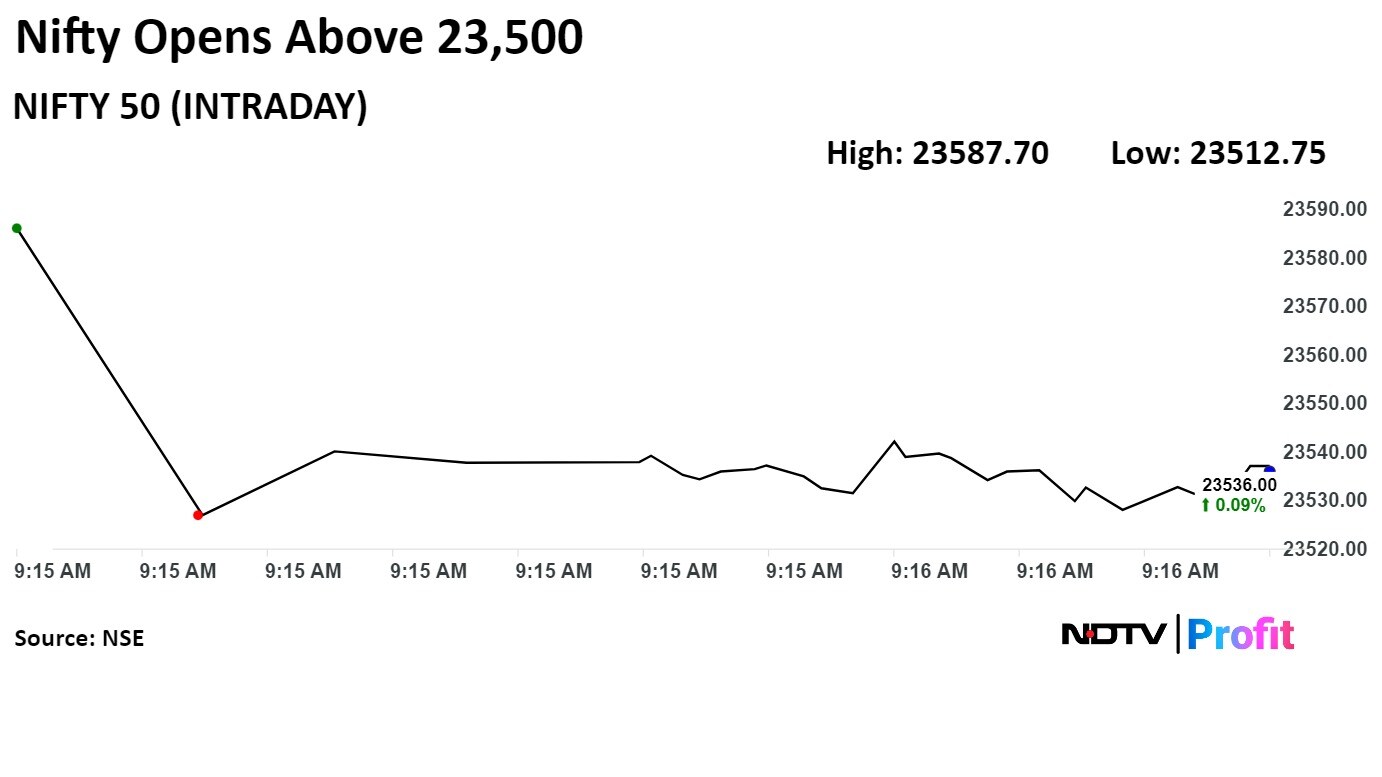

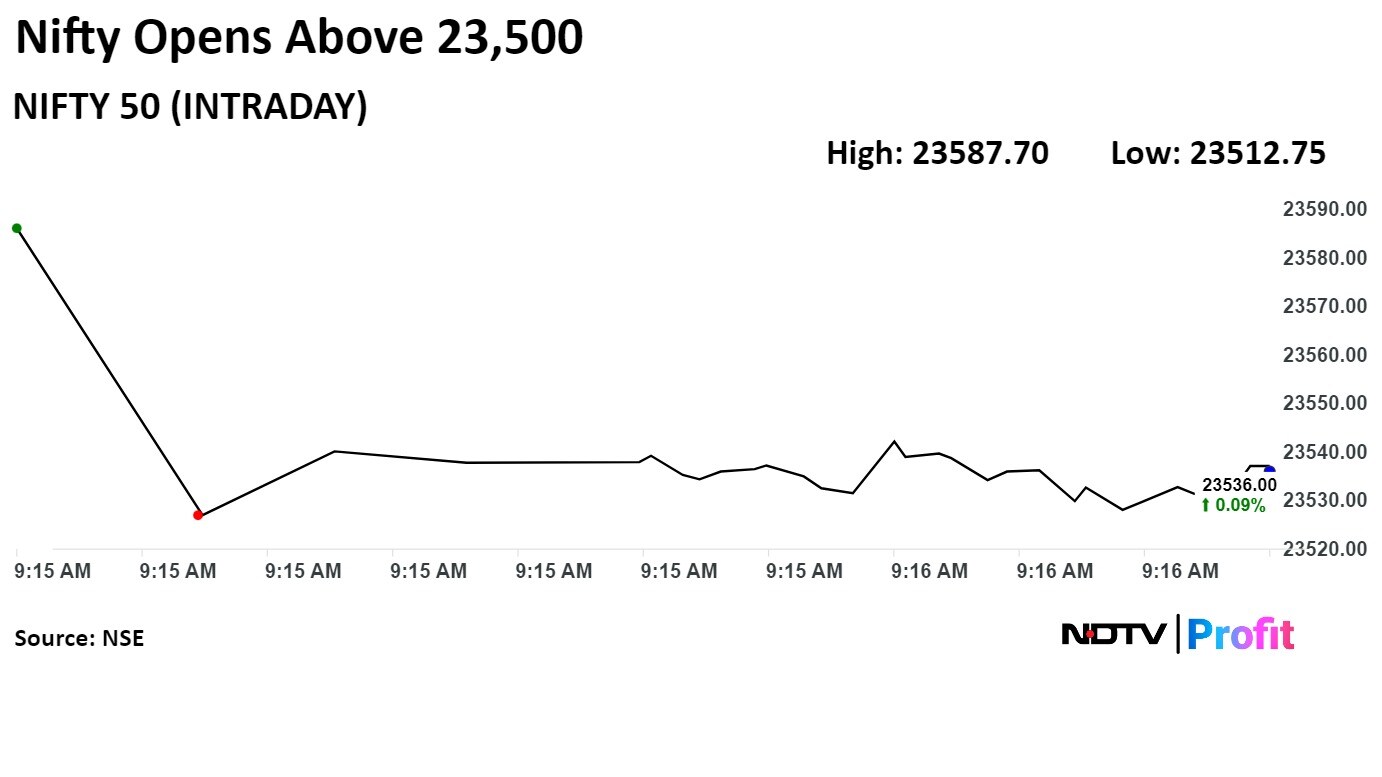

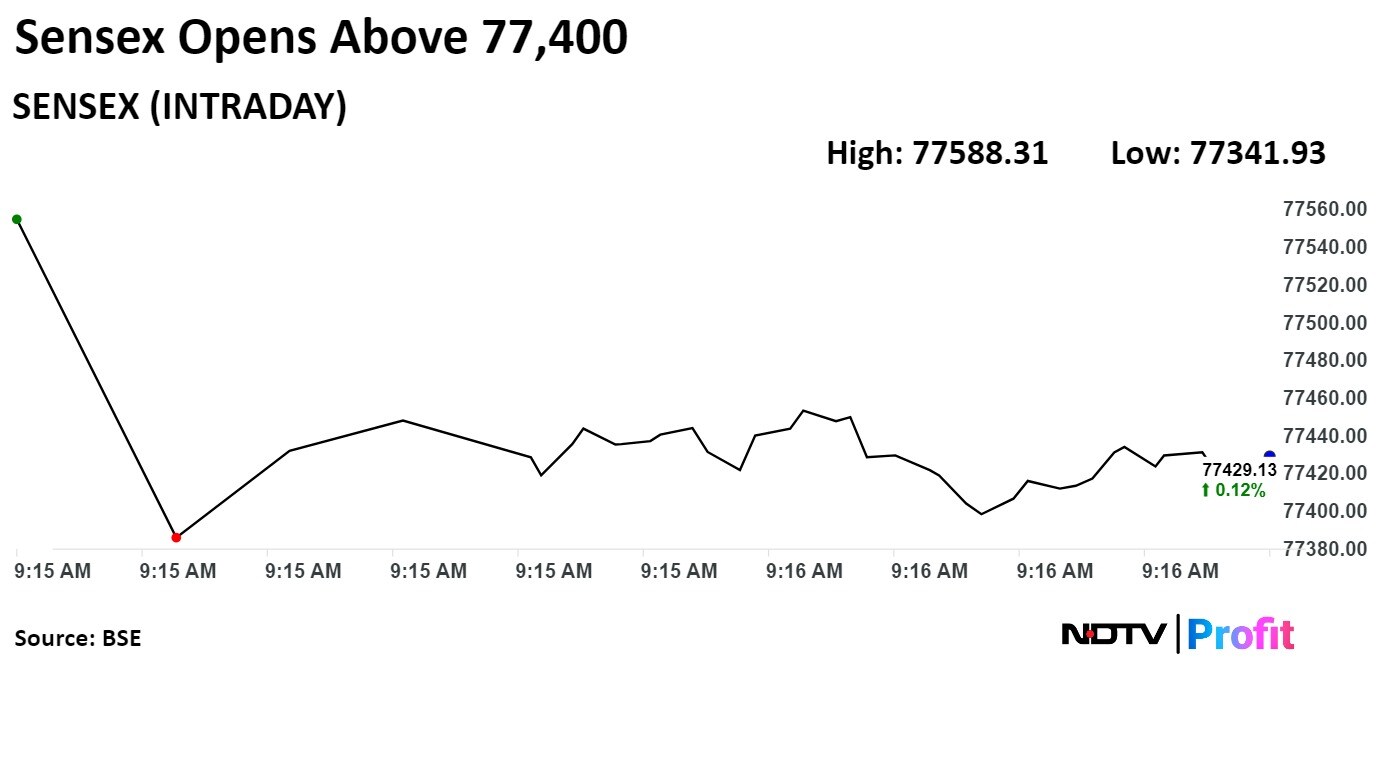

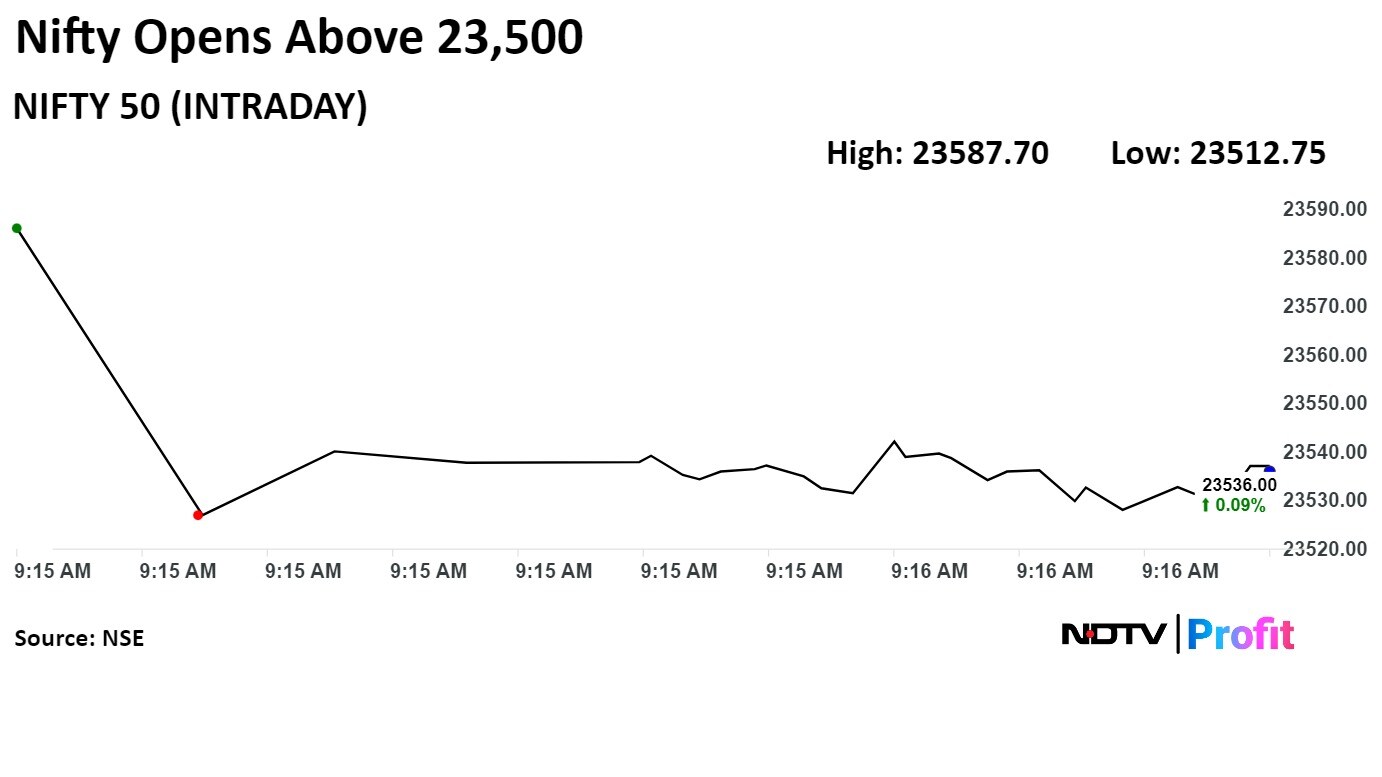

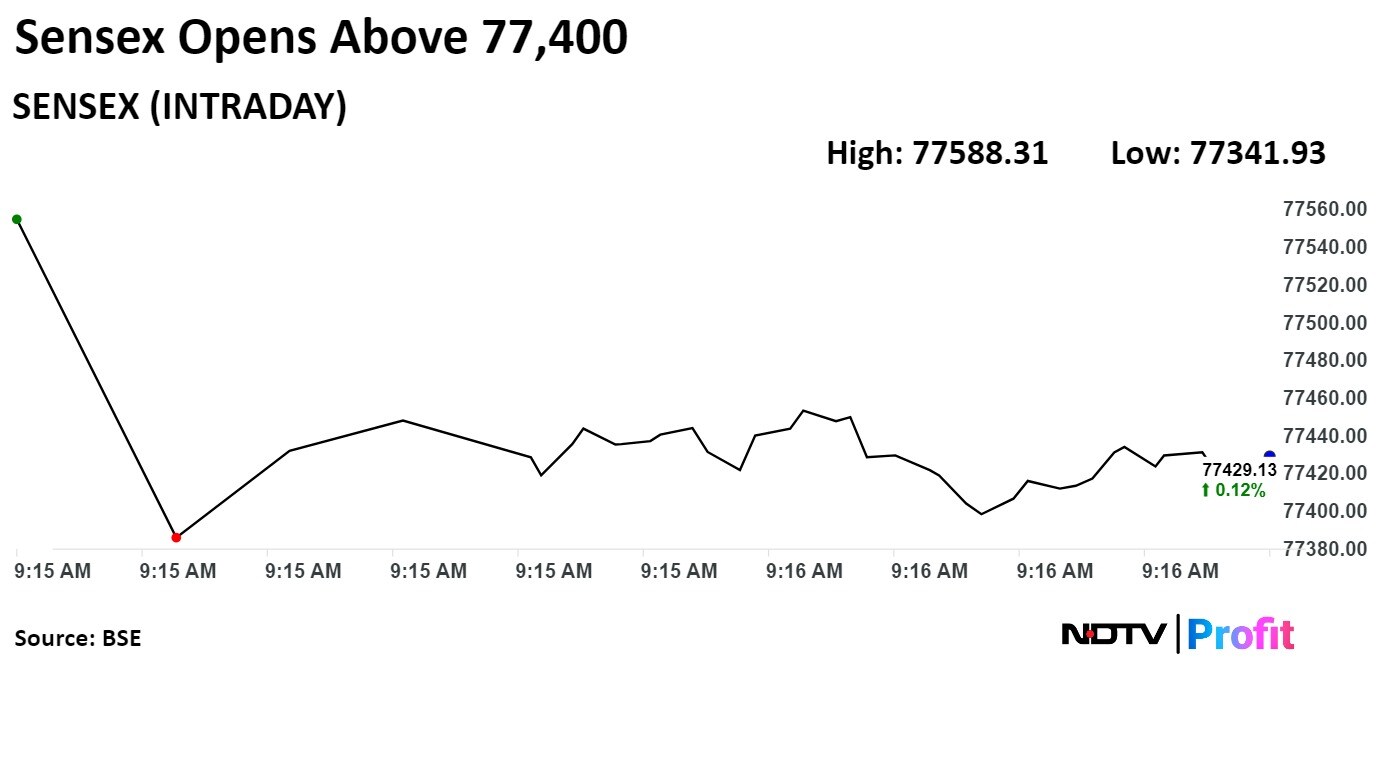

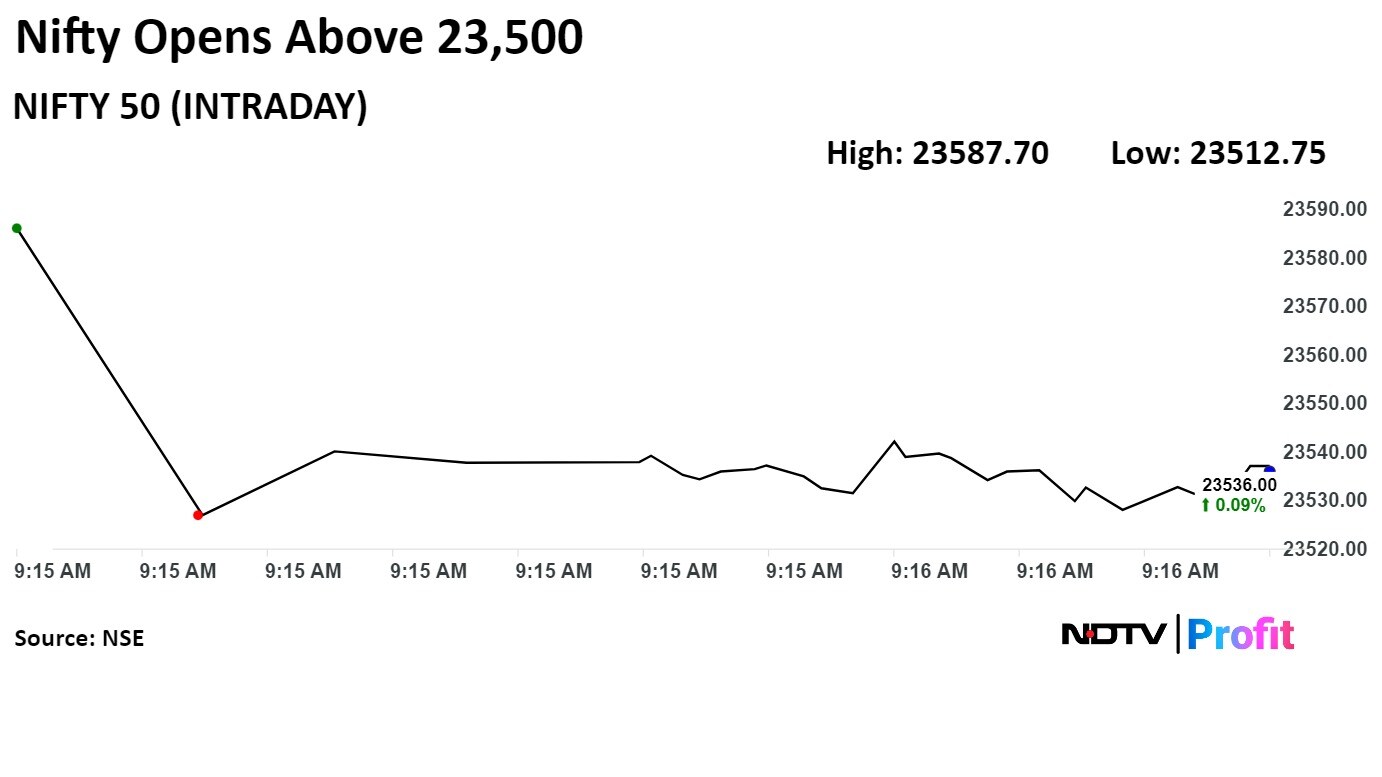

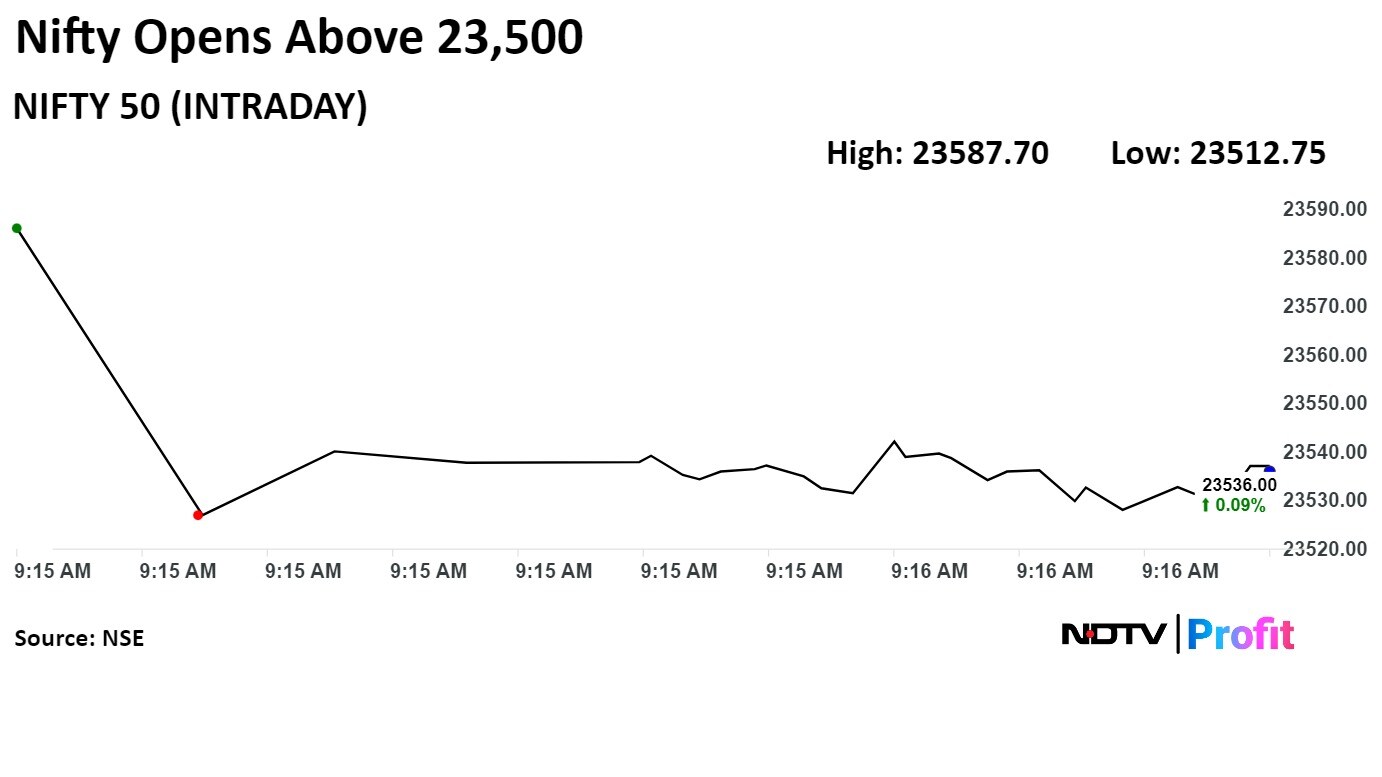

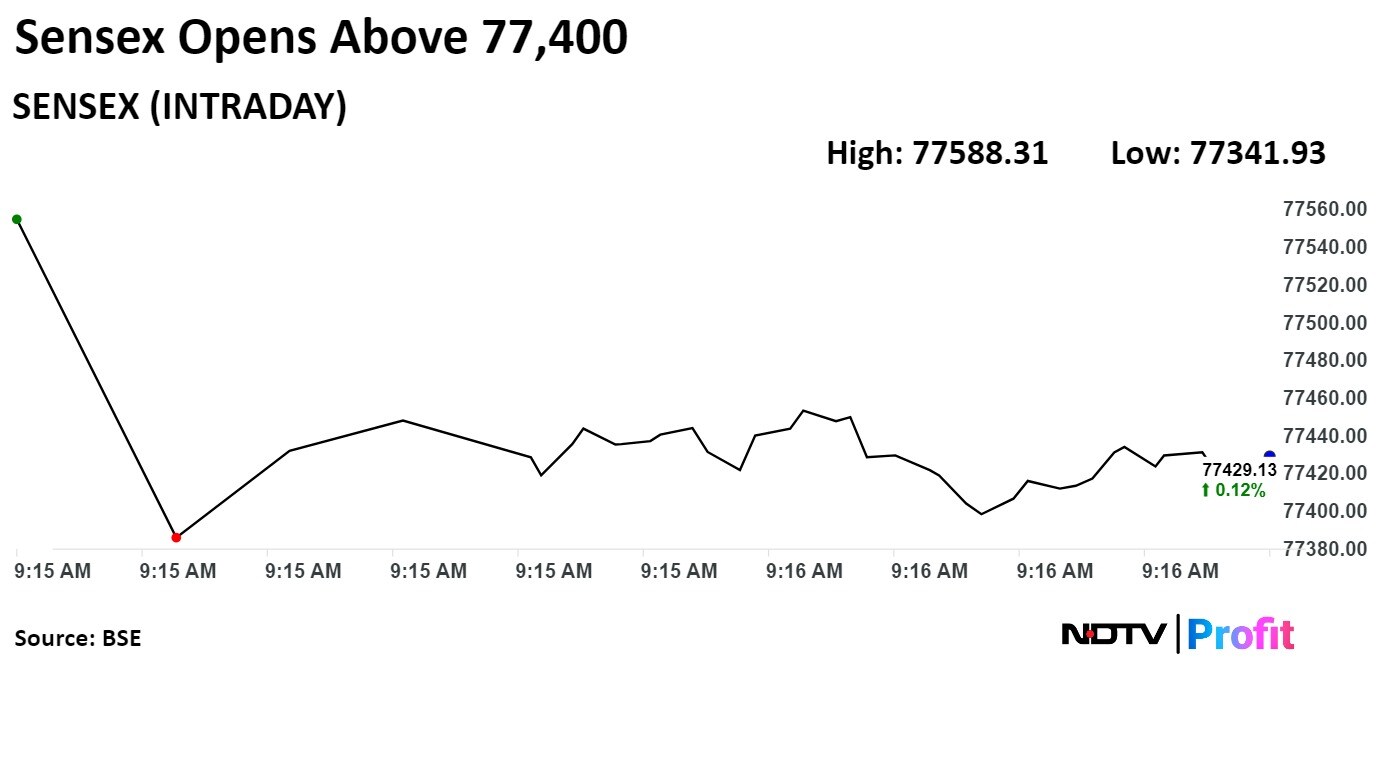

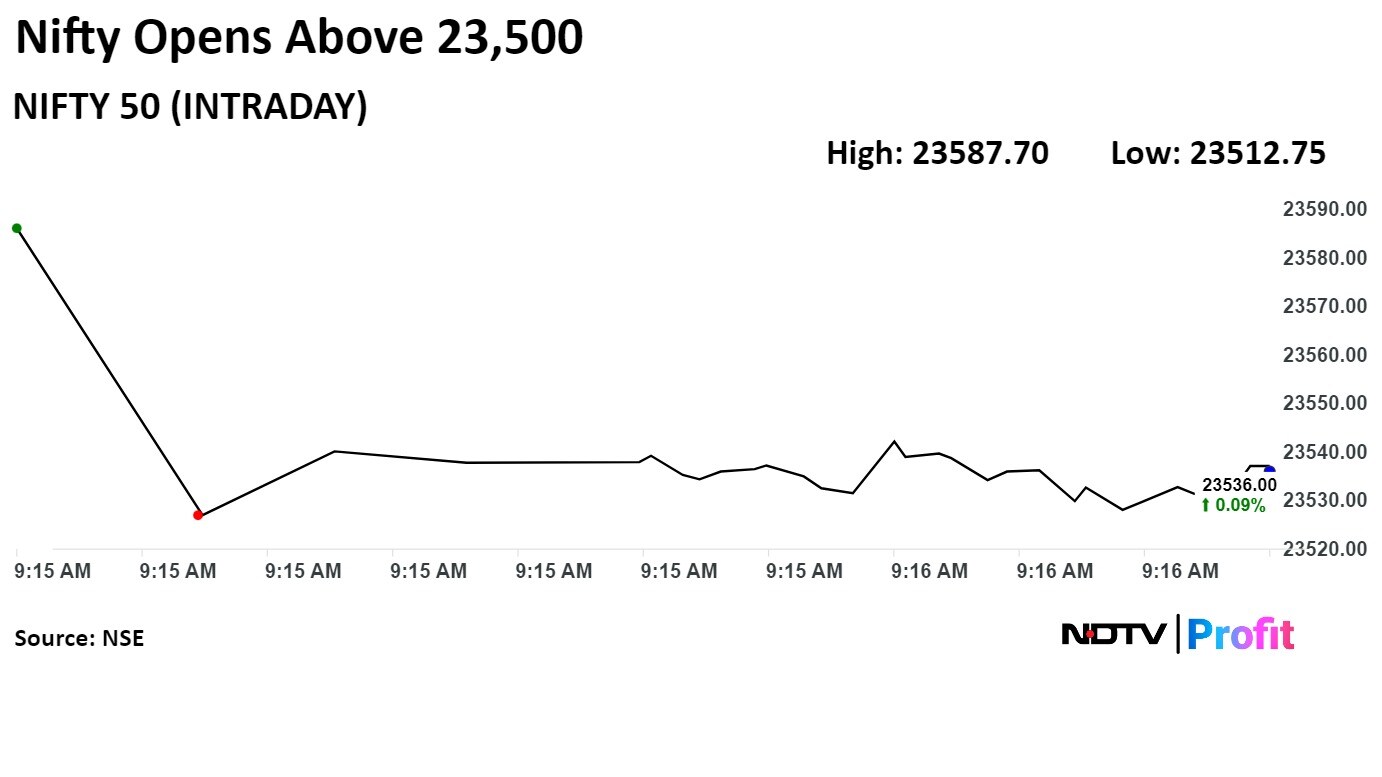

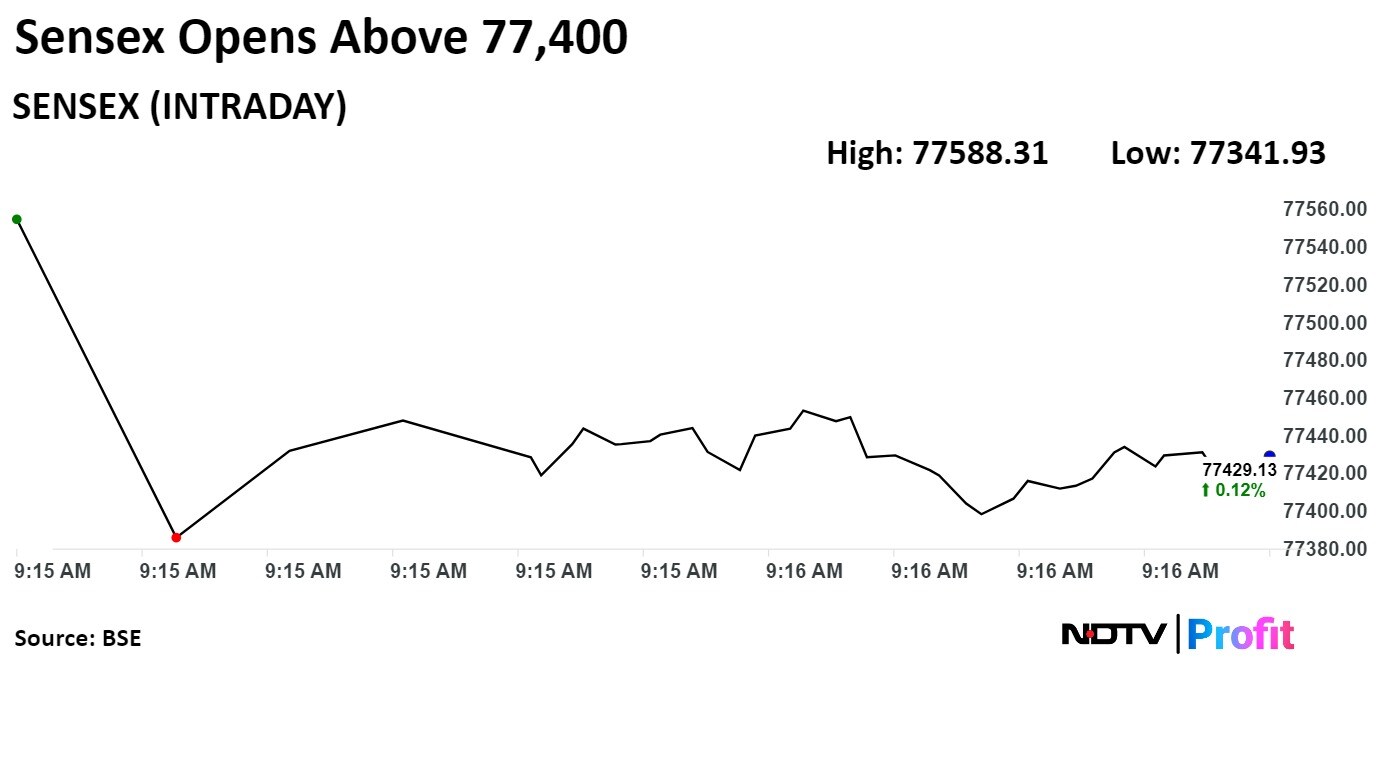

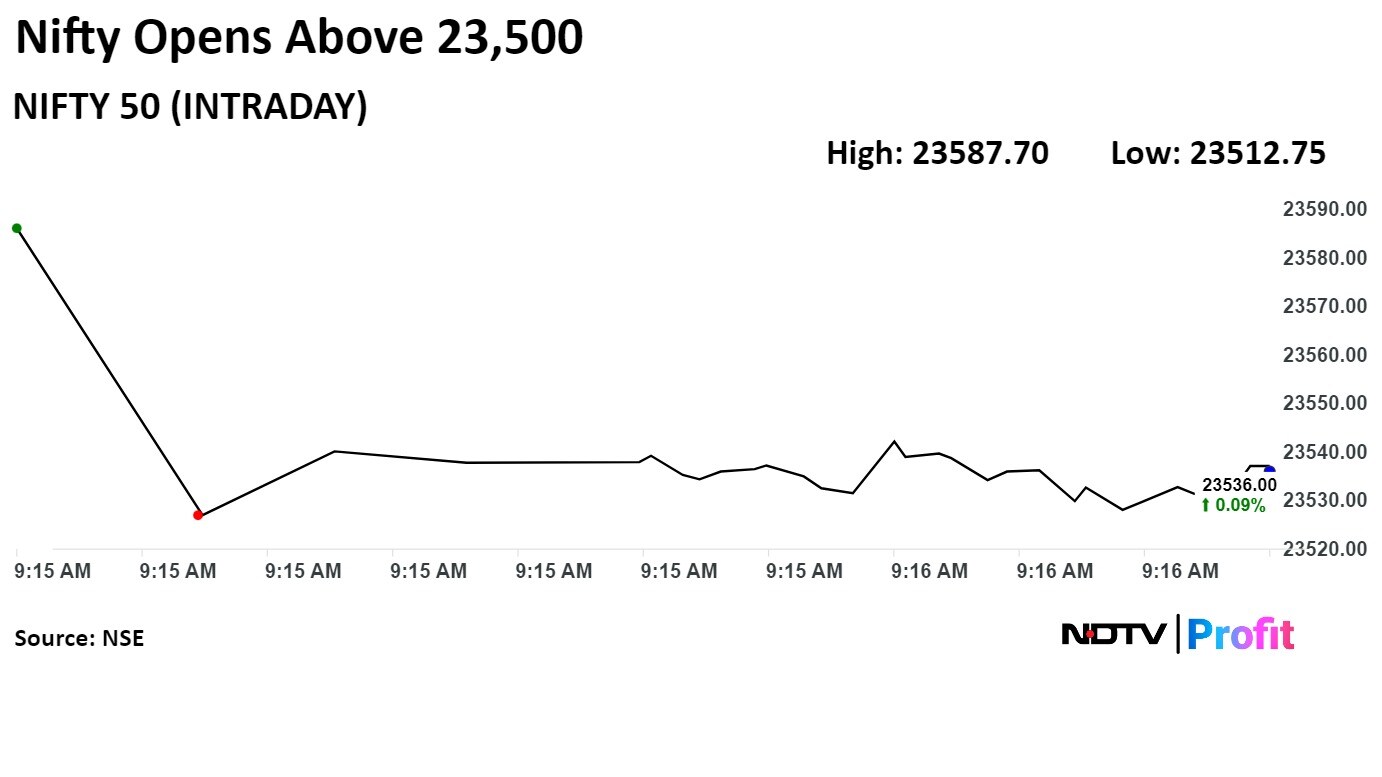

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

Reliance Industries Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., and Axis Bank Ltd. were the contributors to the Nifty 50.

Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., Titan Co., and Bajaj Finance Ltd. weighed on the index.

On the NSE, eight sectors advanced, one remained flat, and three declined. The NSE Nifty Metal led the sector with the most gains. The NSE Nifty Pharma was the worst performer.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

Reliance Industries Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., and Axis Bank Ltd. were the contributors to the Nifty 50.

Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., Titan Co., and Bajaj Finance Ltd. weighed on the index.

On the NSE, eight sectors advanced, one remained flat, and three declined. The NSE Nifty Metal led the sector with the most gains. The NSE Nifty Pharma was the worst performer.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

Reliance Industries Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., and Axis Bank Ltd. were the contributors to the Nifty 50.

Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., Titan Co., and Bajaj Finance Ltd. weighed on the index.

On the NSE, eight sectors advanced, one remained flat, and three declined. The NSE Nifty Metal led the sector with the most gains. The NSE Nifty Pharma was the worst performer.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

India's benchmark stock indices were trading higher through midday on Thursday, tracking gains in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Kotak Mahindra Bank Ltd.

At 12:04 p.m., the NSE Nifty 50 index was trading 34.20 points, or 0.15%, higher at 23,550.20, and the S&P BSE Sensex gained 112.62 points, or 0.15%, to trade at 77,450.21.

Intraday, the Nifty 50 rose 0.30% to 23,587.70, and the Sensex rose 0.32% to 77,588.31.

"For the past two trading sessions, we have seen a consistent up-move. The Nifty 50 index snapped its five-day winning streak Wednesday and formed a small bearish candlestick pattern, which basically indicates some amount of profit taking is very likely," according to Nilesh Jain, vice president, technical and derivative research, Centrum Broking.

Centrum Broking expects some consolidation, with a slightly positive bias going forward. On the upside, 23,700 is the resistance for the Nifty, and on the downside, there is multiple support at 23,500, 23,400-23,350, Jain said. "Some amount of volatility is also expected going forward, as month-end futures and options expire next week."

As of 12:05 p.m., the NSE India Volatility Index was trading 1.84% lower at 13.46, compared to Wednesday's close of 13.71.

.png)

.png)

Reliance Industries Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., Hindustan Unilever Ltd., and Axis Bank Ltd. were the contributors to the Nifty 50.

Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., Titan Co., and Bajaj Finance Ltd. weighed on the index.

On the NSE, eight sectors advanced, one remained flat, and three declined. The NSE Nifty Metal led the sector with the most gains. The NSE Nifty Pharma was the worst performer.

.png)

.png)

Broader markets outperformed benchmark indices, with the S&P BSE Midcap and Smallcap trading 0.43% and 1.00% higher, respectively, through midday on Thursday.

On BSE, 13 sectors advanced, three declined, and four remained little changed. The S&P BSE Metal gained nearly 2% to become the top performing sector, while the S&P BSE Healthcare was the worst-performing sector.

Market breadth was skewed in favour of the buyers. Around 2,353 stocks rose, 1,307 stocks fell, and 159 stocks remained unchanged on BSE.

Suzlon Energy rose as much as 5% to hit Rs 51.34, its highest level since June 4. Five analysts tracking the company has 'buy' rating on the stock and average 12 month target price implies upside of 13.4%, according to Bloomberg.

Suzlon Energy rose as much as 5% to hit Rs 51.34, its highest level since June 4. Five analysts tracking the company has 'buy' rating on the stock and average 12 month target price implies upside of 13.4%, according to Bloomberg.

.png)

Approves raising up to Rs 1,000 crore via NCDs

Source: Exchange filing

Approves raising up to Rs 1,000 crore via NCDs

Source: Exchange filing

.png)

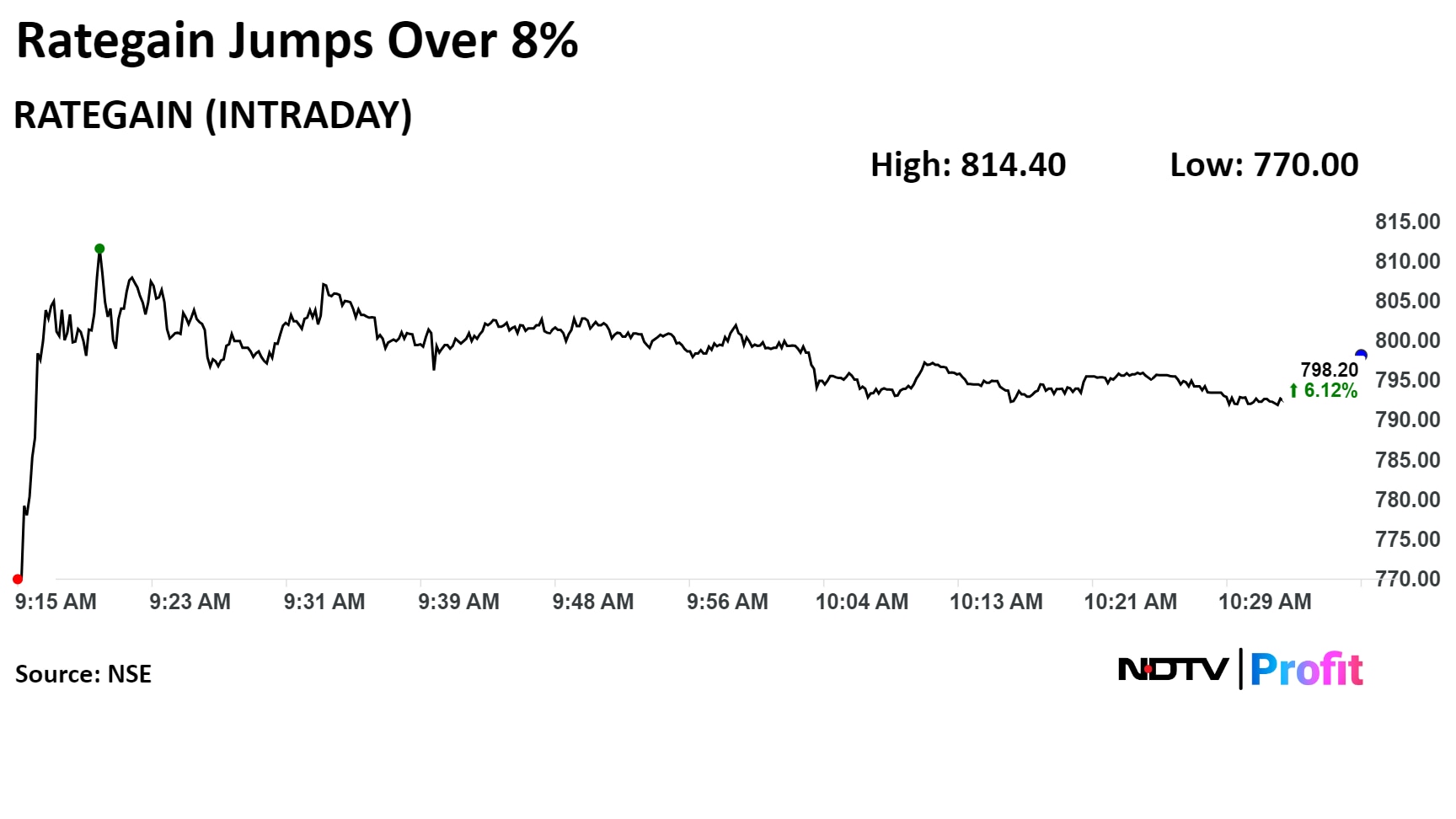

Rategain Travel Technologies Ltd. has risen as much as 8.28% to Rs 814.40 apiece, the highest level since May 21. It was trading 6.02% higher at Rs 797.40 apiece, as of 10:38 a.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 94.04% in 12 months, and 9.47% on year to date basis. Total traded volume so far in the day stood at 8.3 times its 30-day average. The relative strength index was at 65.13.

Six analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.3%.

Rategain Travel Technologies Ltd. has risen as much as 8.28% to Rs 814.40 apiece, the highest level since May 21. It was trading 6.02% higher at Rs 797.40 apiece, as of 10:38 a.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 94.04% in 12 months, and 9.47% on year to date basis. Total traded volume so far in the day stood at 8.3 times its 30-day average. The relative strength index was at 65.13.

Six analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.3%.

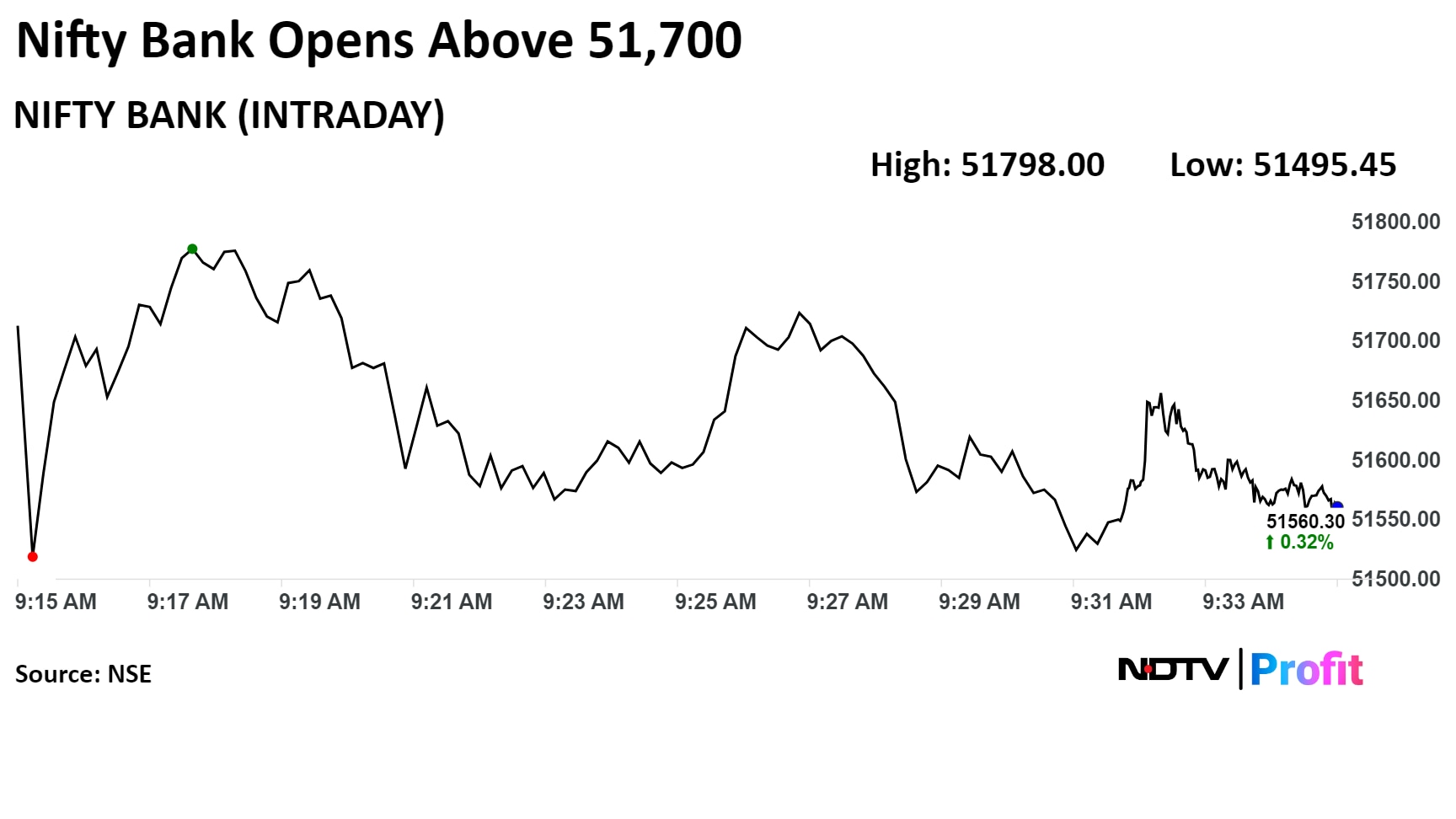

Stick to private sector banks - valuations attractive with 16-18% ROE

Private banks less affected by expected credit loss regulations and carry contingency buffers

Stay away from PSU Banks, Insurance and Fintechs due to regulations, declining fundamentals, unfavourable risk reward

PSU Banks will see falling ROEs

Recommendation Changes

Upgrades Kotak Mahindra Bank and City Union Bank from neutral

Kotak's target revised from Rs 1,860 to Rs 2,025 and City Union Bank target revised from Rs 160 to Rs 180

Stocks have underperformed

Valuations are cheap

Risk-reward is favourable

Upgrades SBI Life from Neutral to Outperform target of Rs 1,600 revised to Rs 1,750

Downgrades SBI from Neutral to Underperform Target of Rs 615 revised to Rs 665

Downgrades Bajaj Finance from Neutral to Underperform; Reduces target from Rs 8,100 to Rs 6,600 citing lower growth, falling ROE, delayed rate cut cycle

Top Picks

Axis, IndusInd, HDFC Bank

NBFC: Shriram Finance, LIC Housing

Insurance: SBI Life

Shares of CE Info Systems (MapMyIndia) surged over 9% today after Goldman Sachs initiated coverage with a Buy recommendation and a Target Price of Rs.2,800 on the stock.

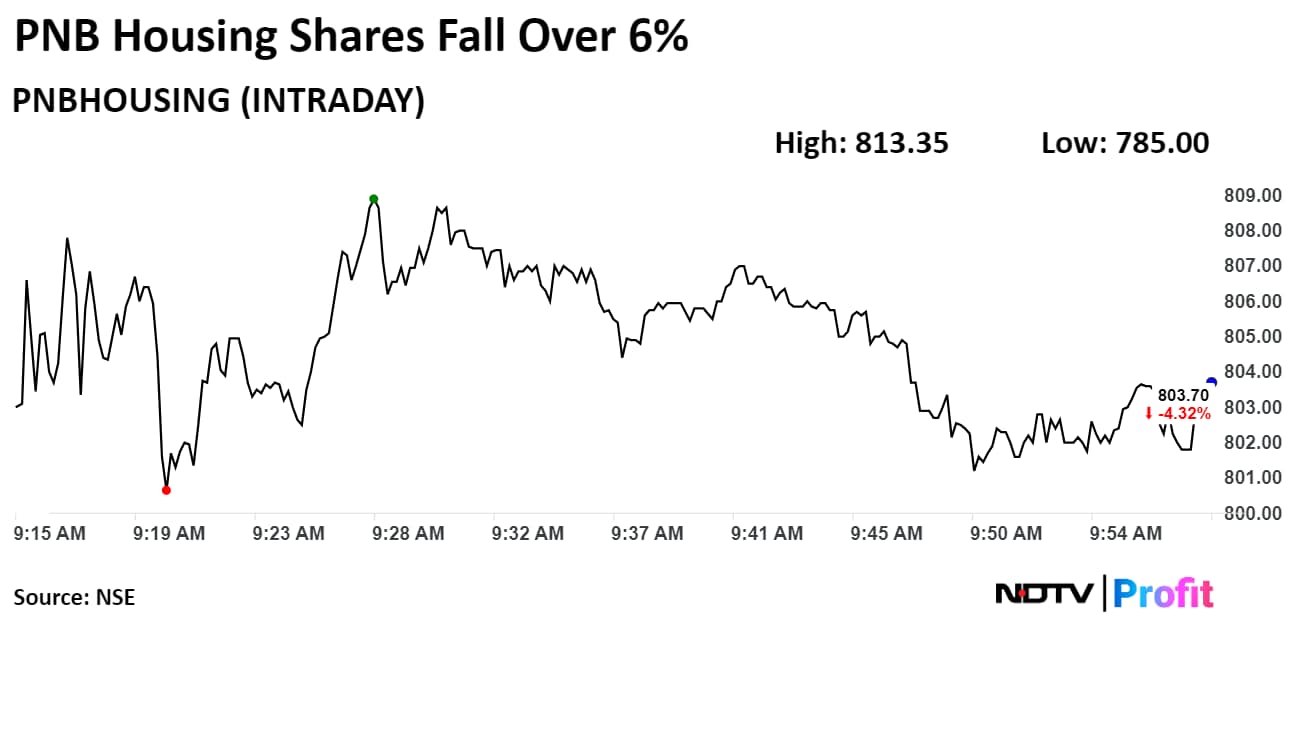

PNB Housing Finance's stock fell as much as 6.55% during the day to Rs 785 apiece on the NSE. It was trading 4.55% lower at Rs 801.75 apiece, compared to a 0.16% decline in the benchmark Nifty 50 as of 9:56 a.m.

It has risen 36% in the last 12 months and 2.7% on an year-to-date basis. The total traded volume so far in the day stood at 23 times its 30-day average. The relative strength index was at 54.

Nine out of the 11 analysts tracking the company have a 'buy' rating on the stock,and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 14.4%.

PNB Housing Finance's stock fell as much as 6.55% during the day to Rs 785 apiece on the NSE. It was trading 4.55% lower at Rs 801.75 apiece, compared to a 0.16% decline in the benchmark Nifty 50 as of 9:56 a.m.

It has risen 36% in the last 12 months and 2.7% on an year-to-date basis. The total traded volume so far in the day stood at 23 times its 30-day average. The relative strength index was at 54.

Nine out of the 11 analysts tracking the company have a 'buy' rating on the stock,and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 14.4%.

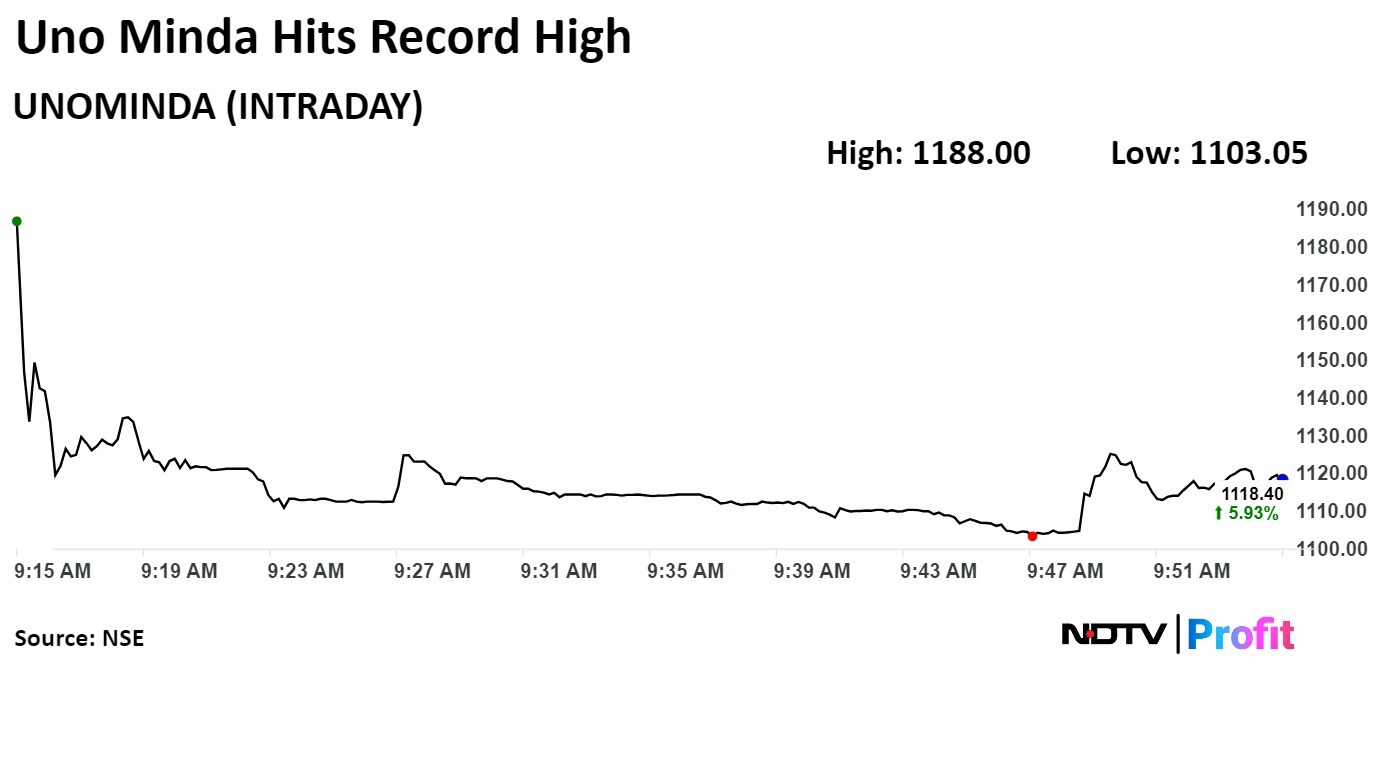

Uno Minda Ltd. climbed to fresh high on Thursday after Goldman Sachs initiated coverage with a 'Buy' rating citing the company is well positioned for growth in the industry.

Uno Minda Ltd. climbed to fresh high on Thursday after Goldman Sachs initiated coverage with a 'Buy' rating citing the company is well positioned for growth in the industry.

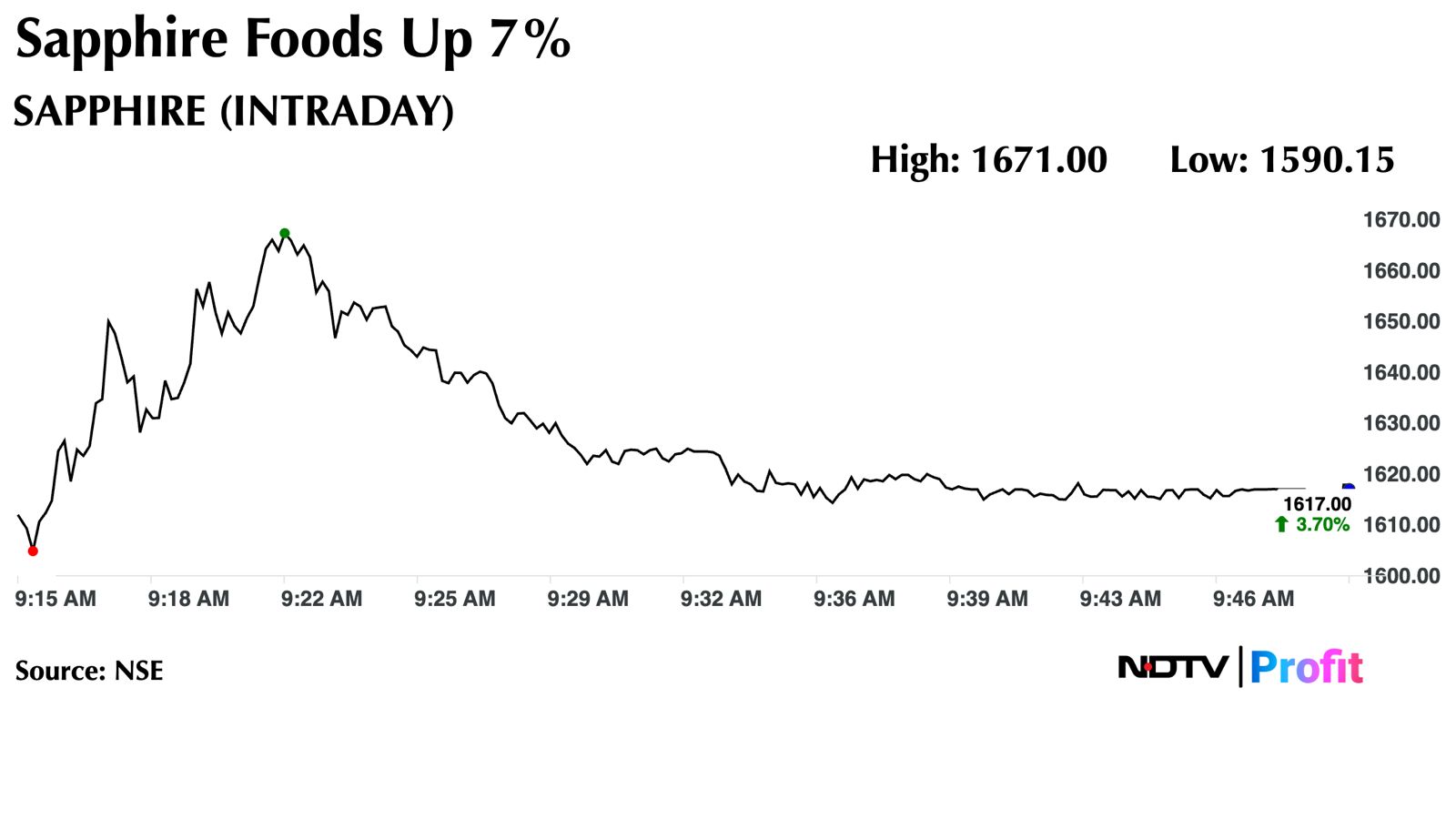

Shares of Sapphire Foods, the restaurant operator for KFC, Taco Bell and Pizza Hut went up by 7% on Thursday after the company announced on Wednesday that its board of directors have approved the subdivision of the company’s shares.

Shares of Sapphire Foods, the restaurant operator for KFC, Taco Bell and Pizza Hut went up by 7% on Thursday after the company announced on Wednesday that its board of directors have approved the subdivision of the company’s shares.

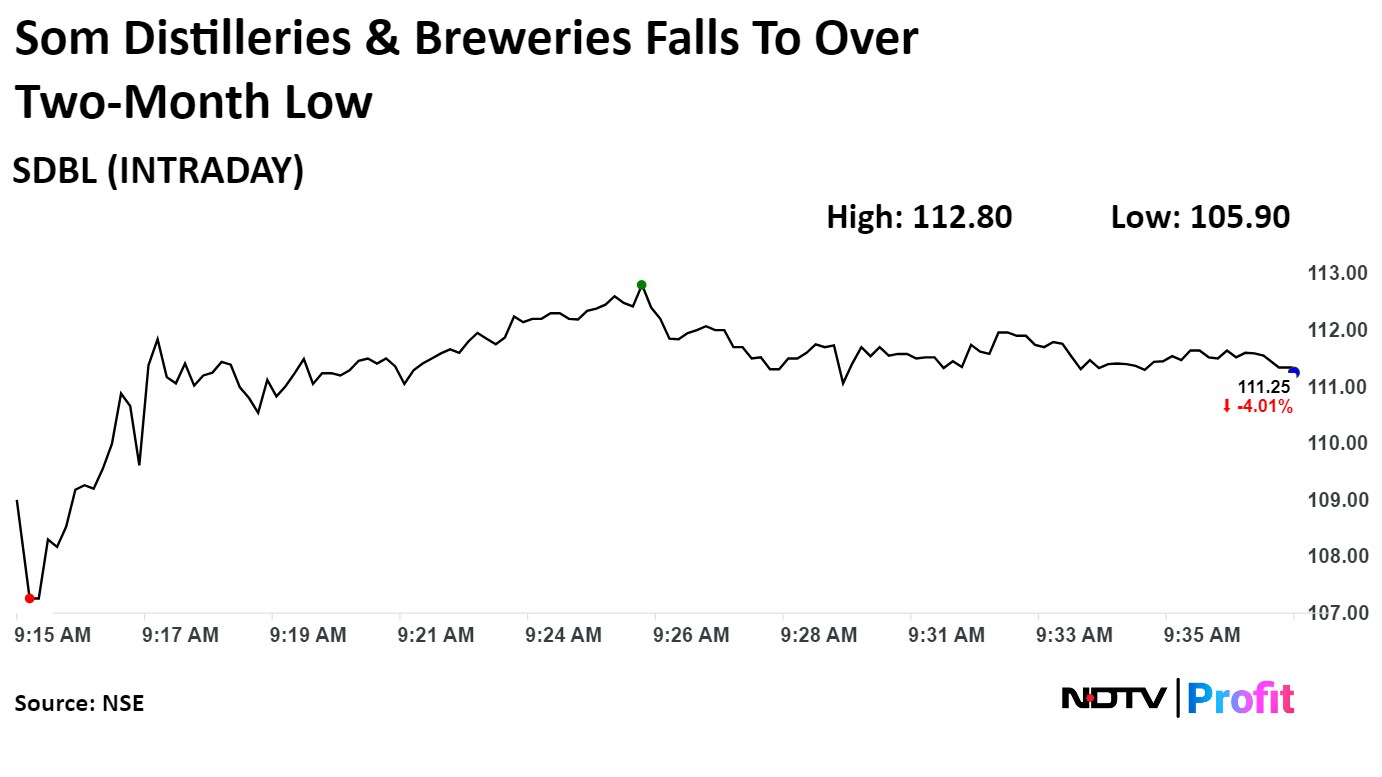

Shares of Som Distilleries & Breweries Ltd. plunged nearly 9% on Thursday to the lowest level in over two months after the sister company's licence was suspended after children were rescued from its factory.

Shares of Som Distilleries & Breweries Ltd. plunged nearly 9% on Thursday to the lowest level in over two months after the sister company's licence was suspended after children were rescued from its factory.

On the NSE, Som Distilleries' stock fell as much as 8.62% during the day to Rs 105.90 apiece, the lowest since April 1. It pared losses to trade 3.77% lower at Rs 111.53 per share, compared to a 0.05% decline in the benchmark Nifty at 9:35 a.m.

The share price has risen 7.1% in the last 12 months but fell 2.07% on a year-to-date basis. The total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 36.11.

An analyst tracking the company has a 'buy' rating on the stock, according to Bloomberg data.

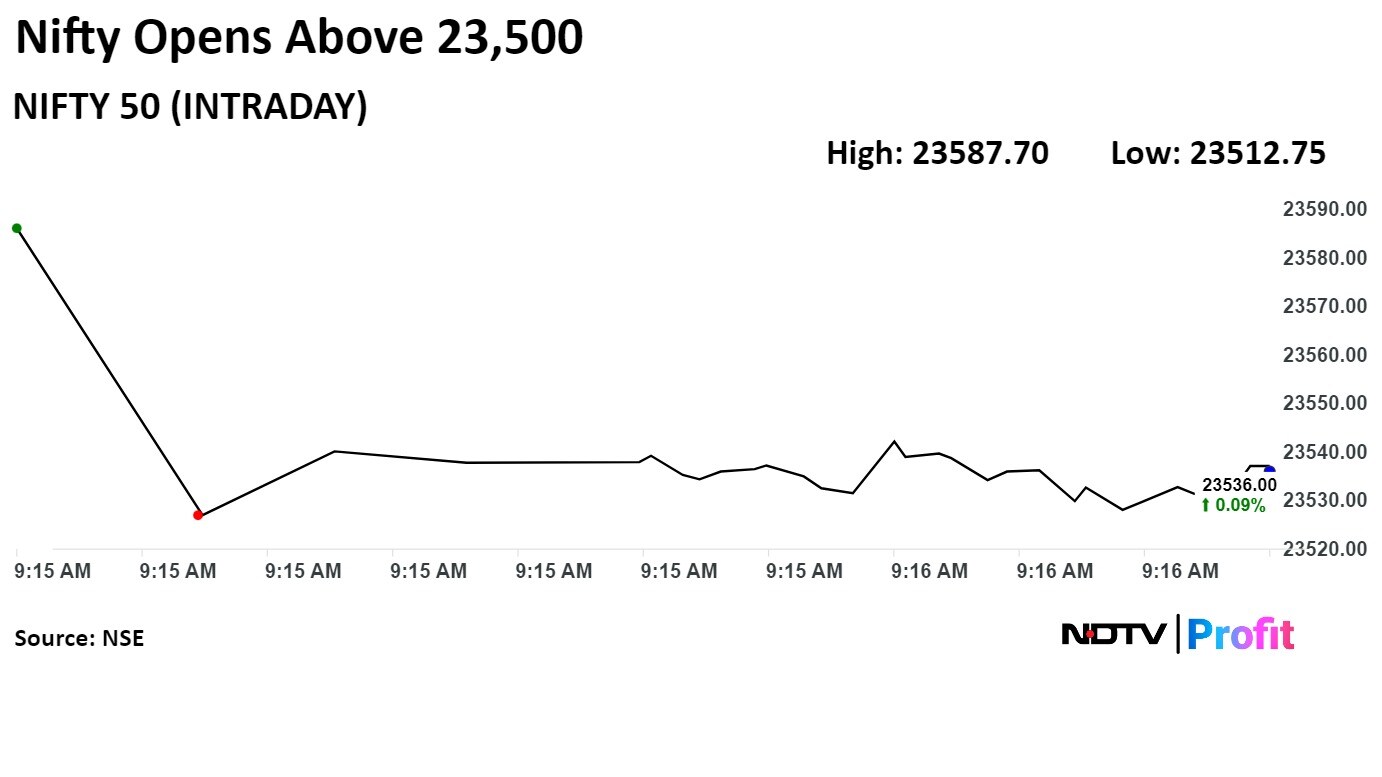

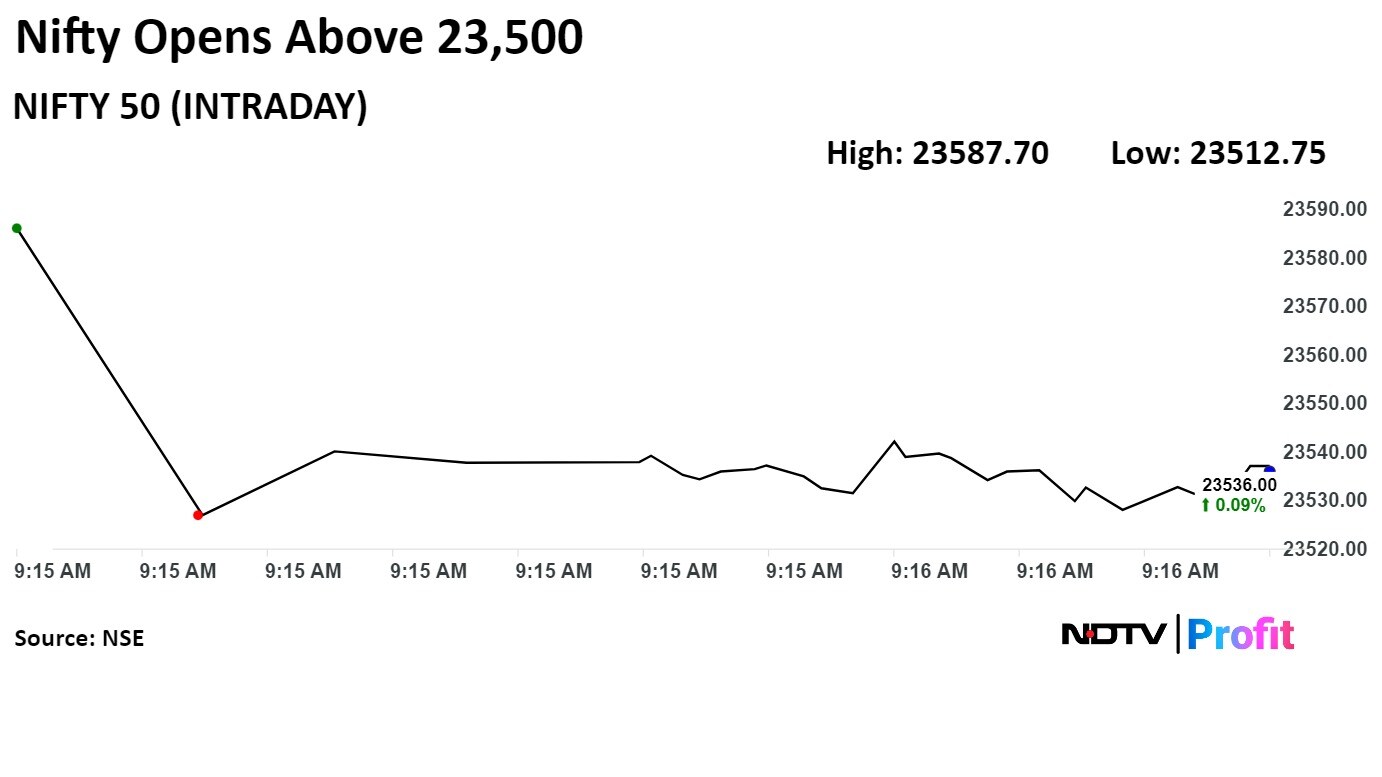

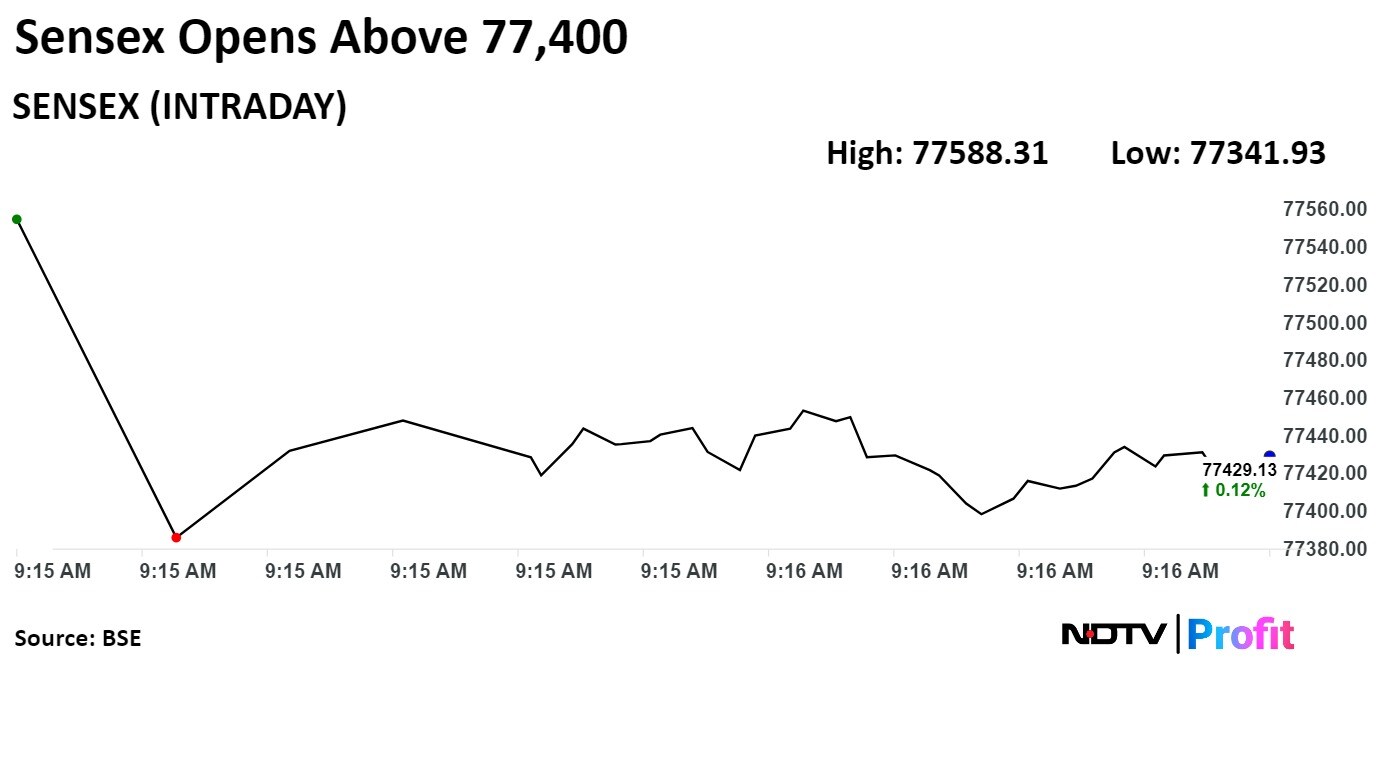

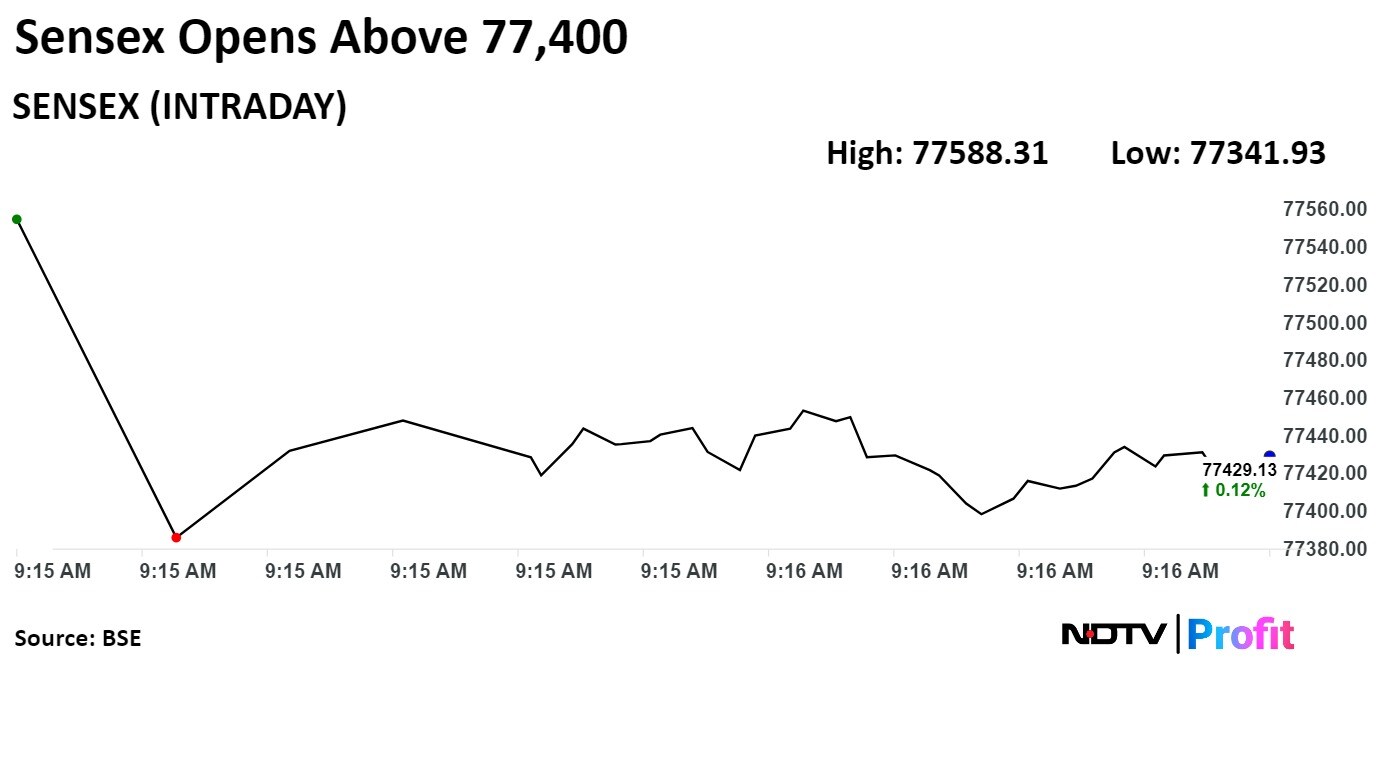

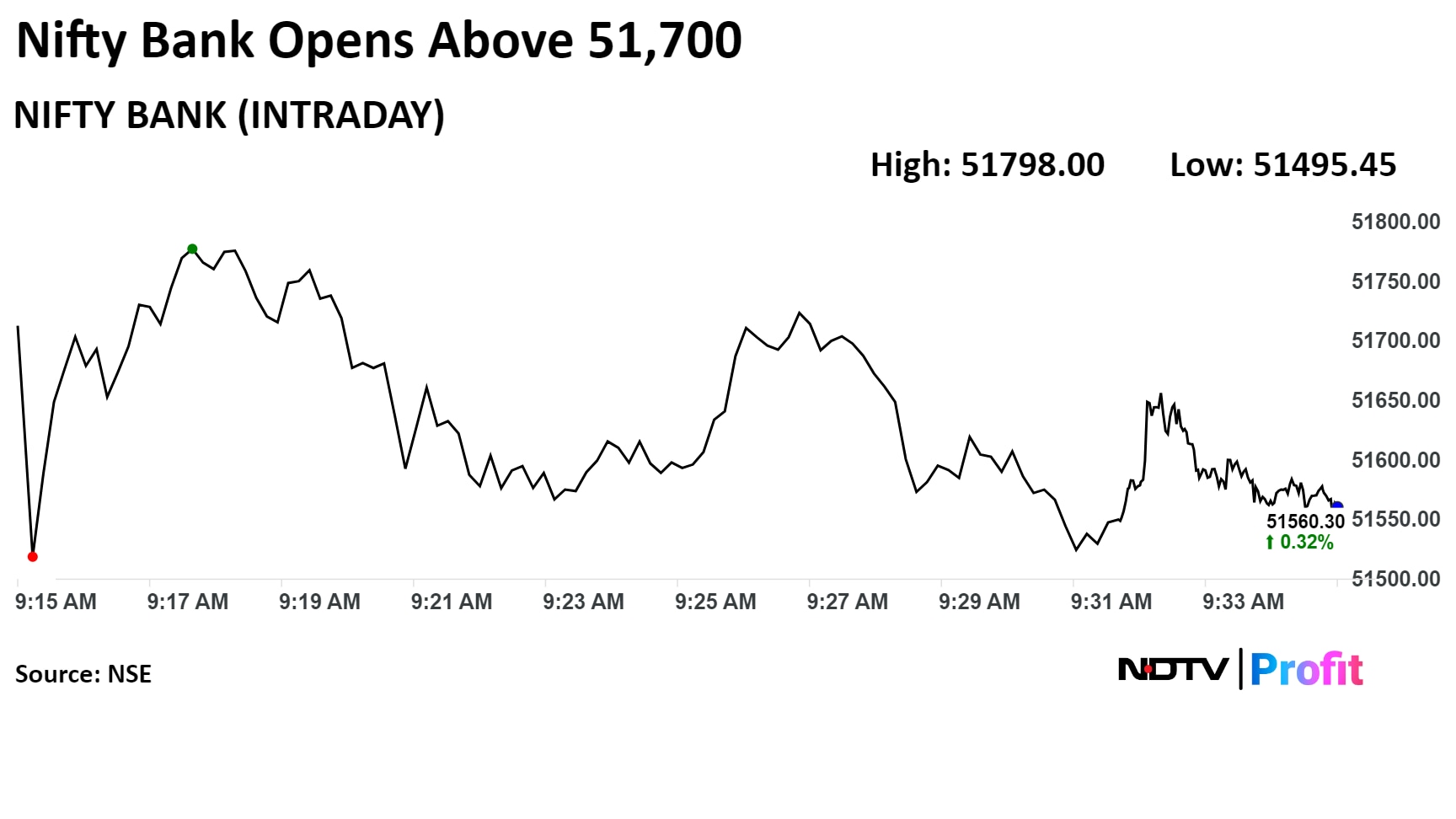

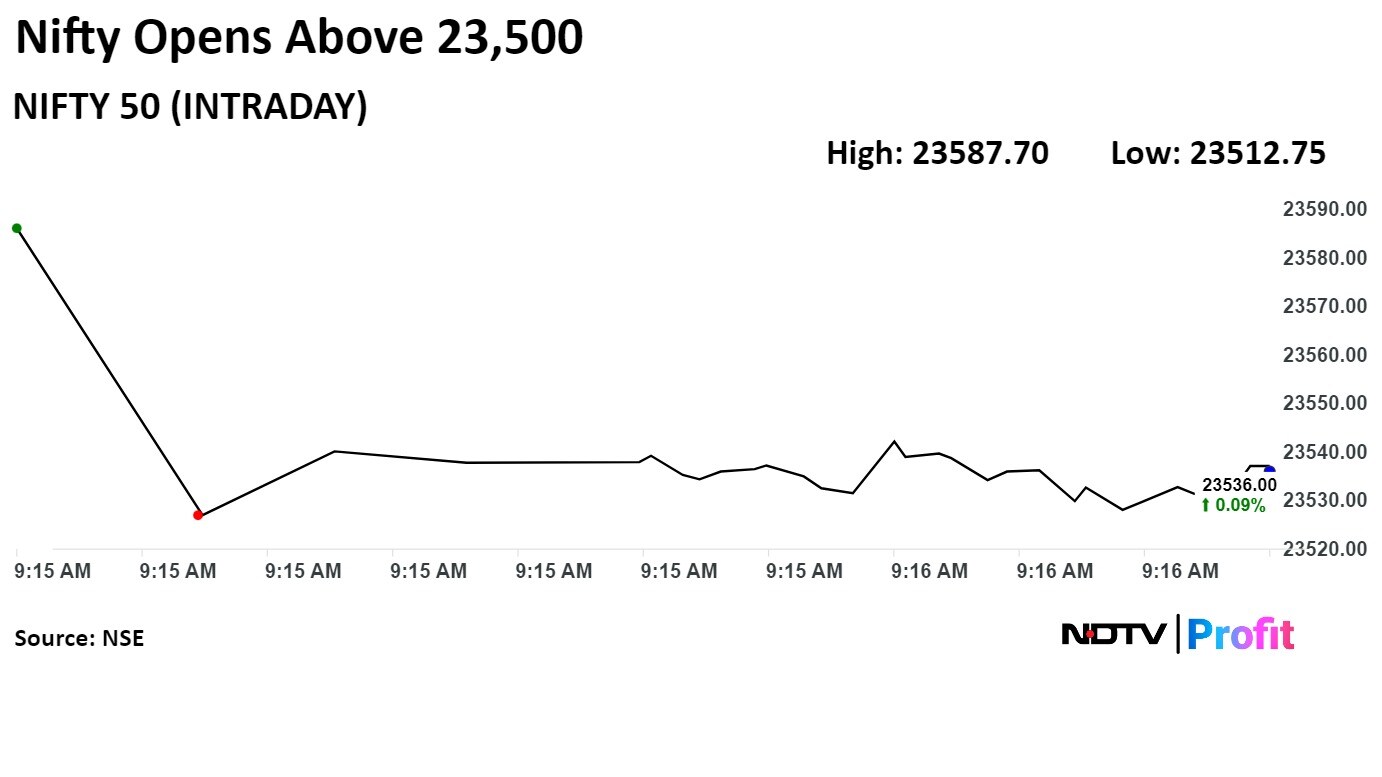

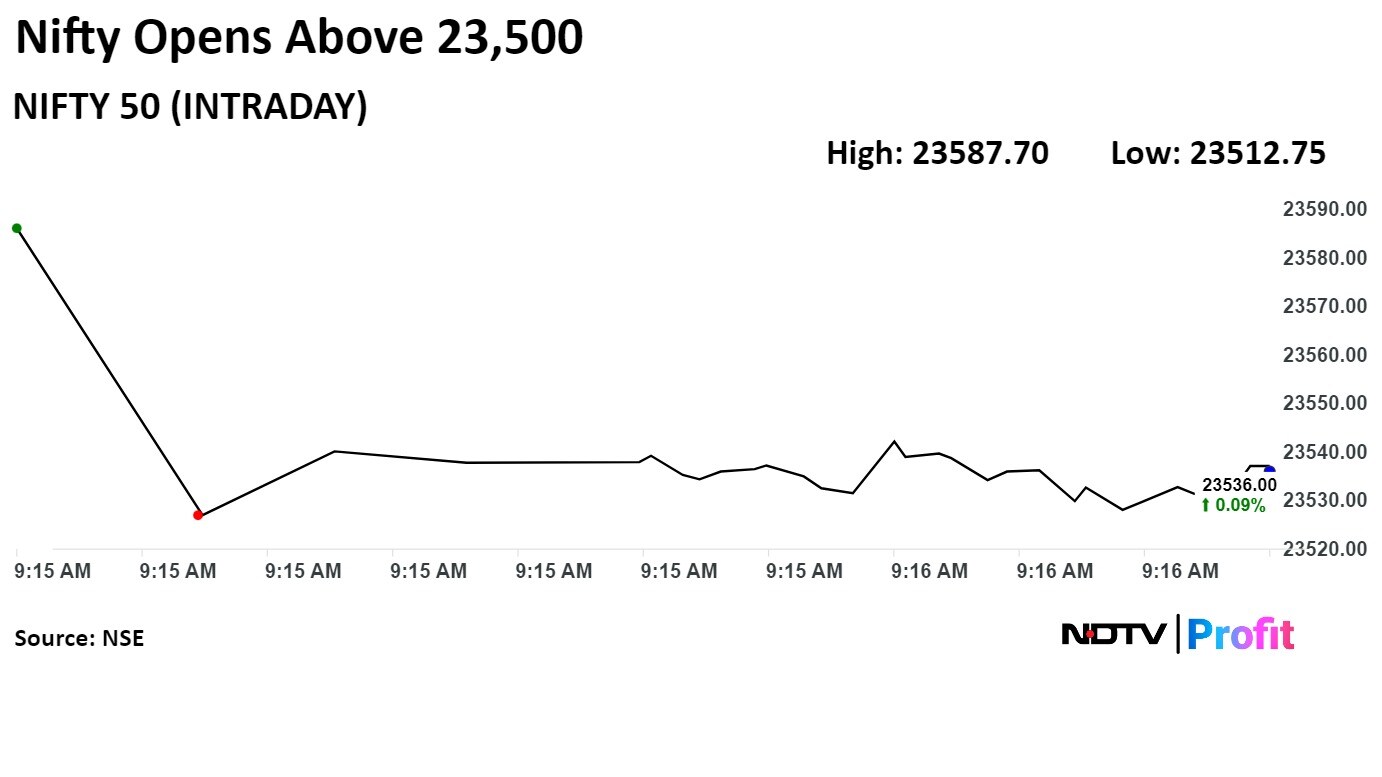

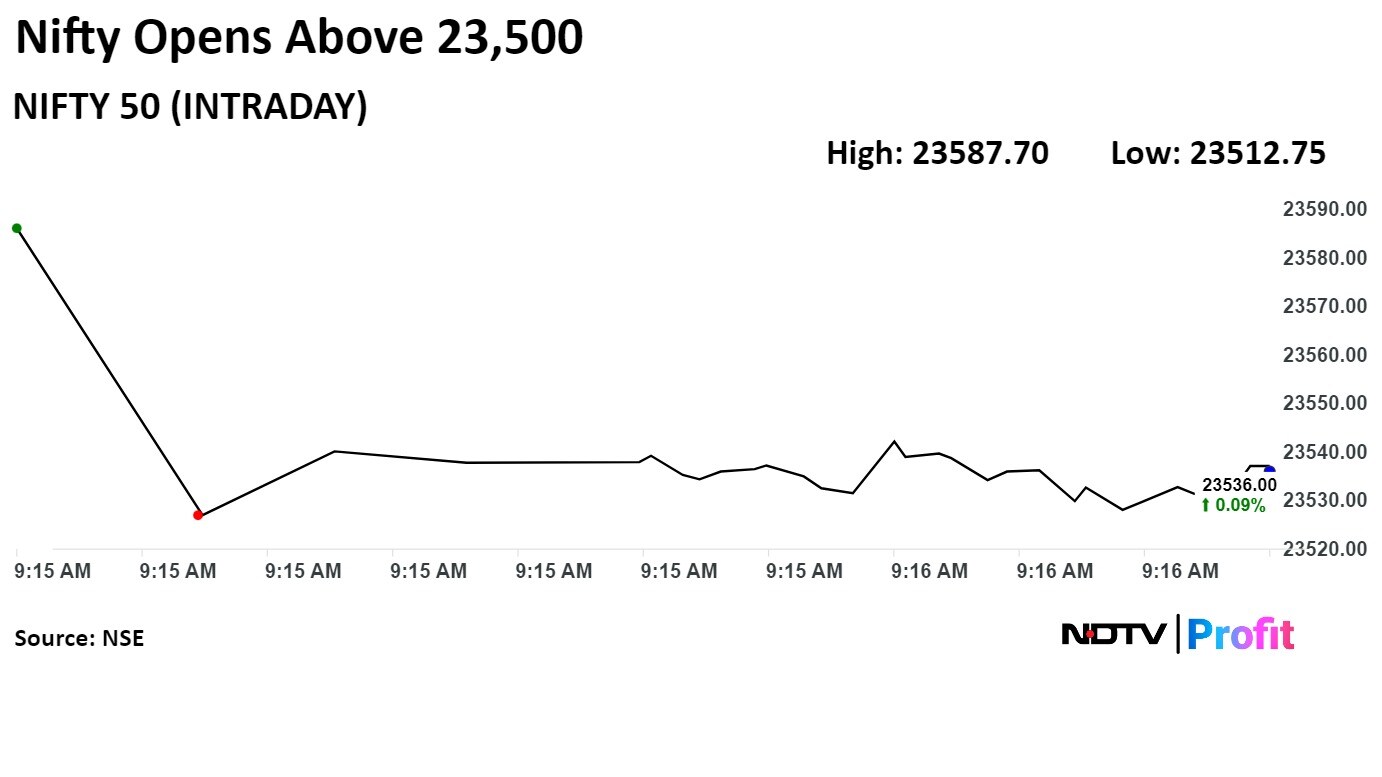

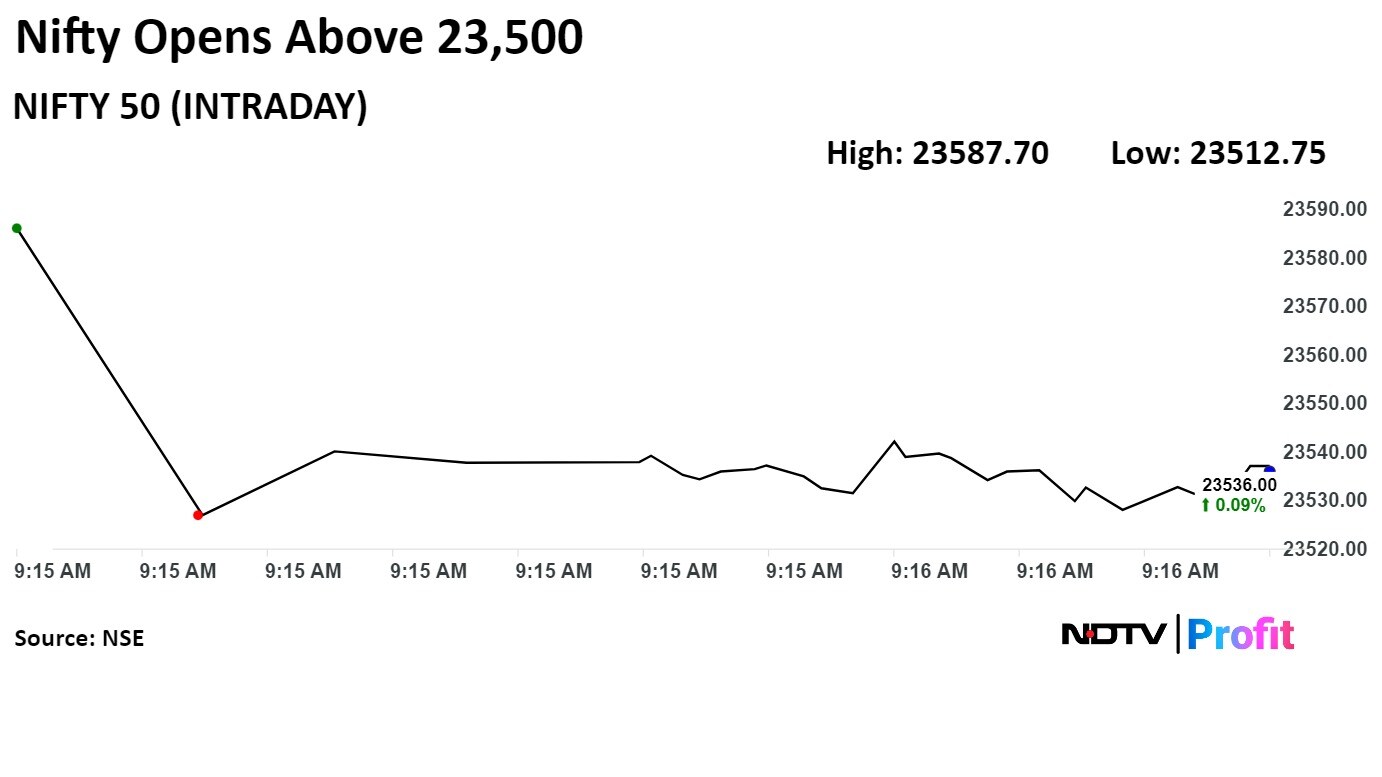

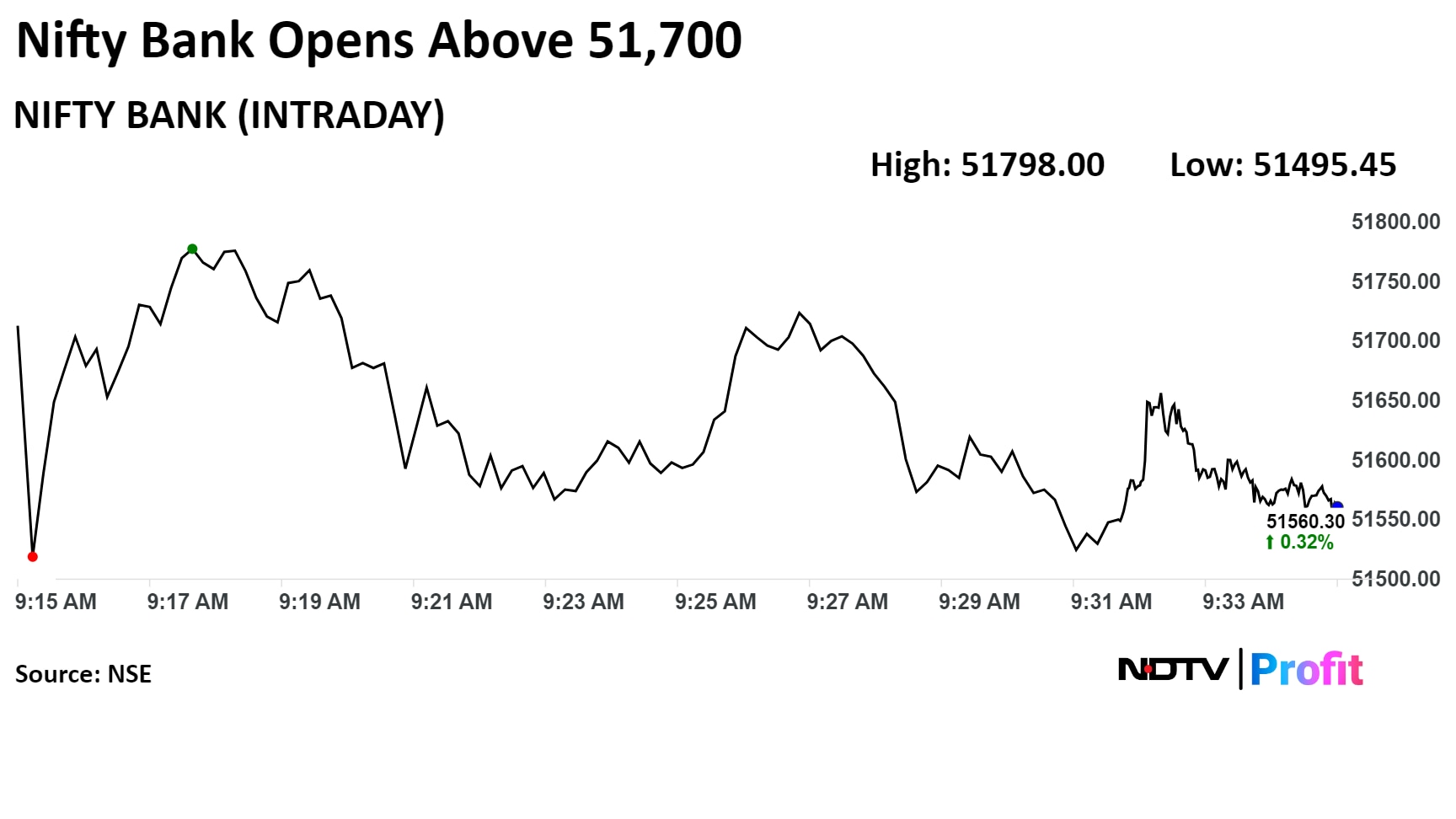

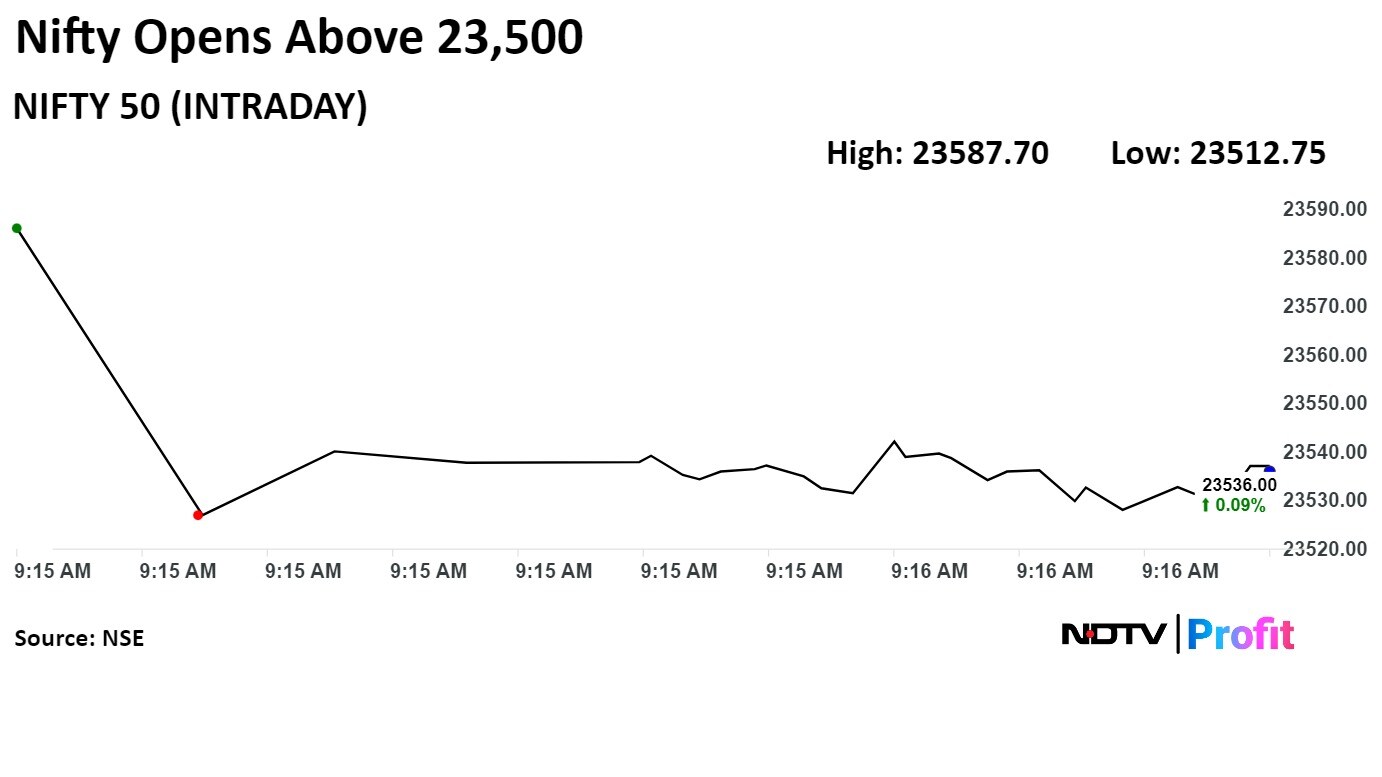

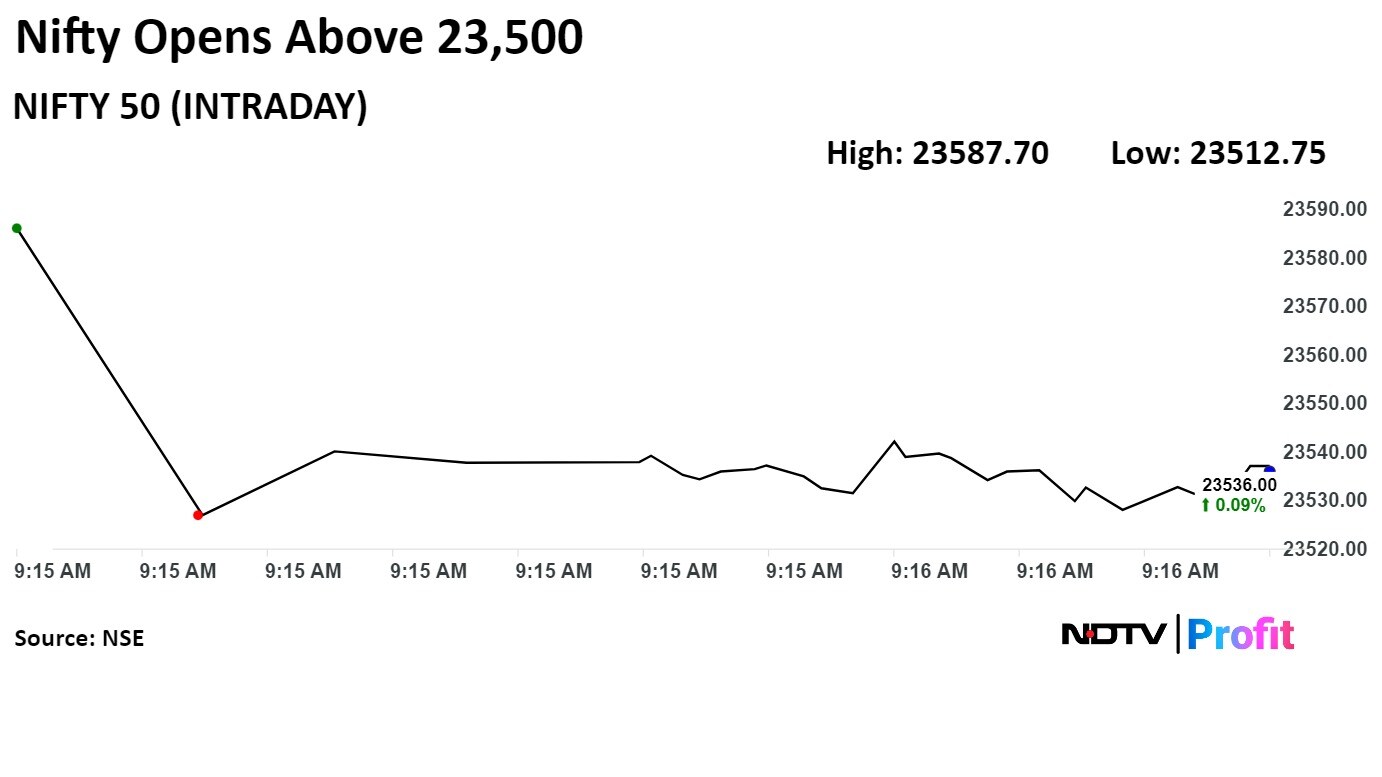

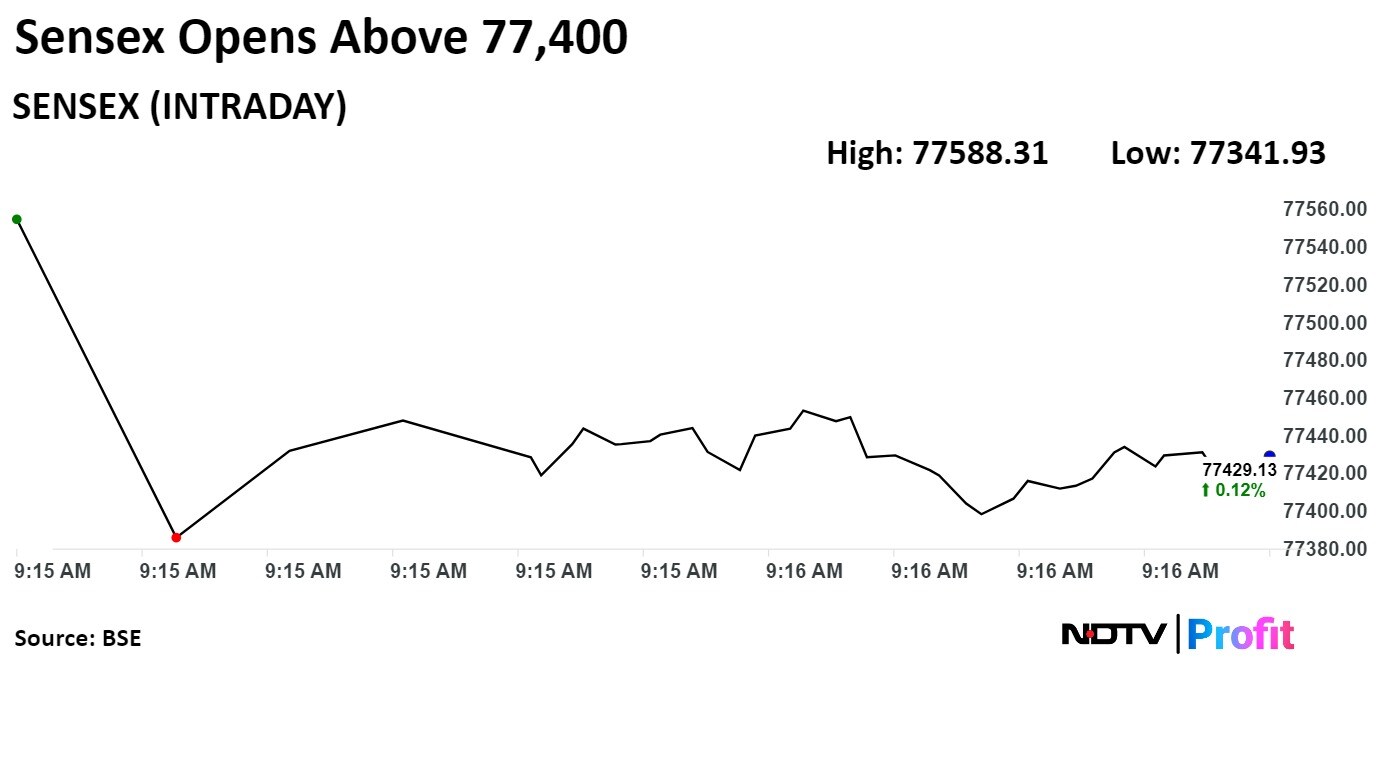

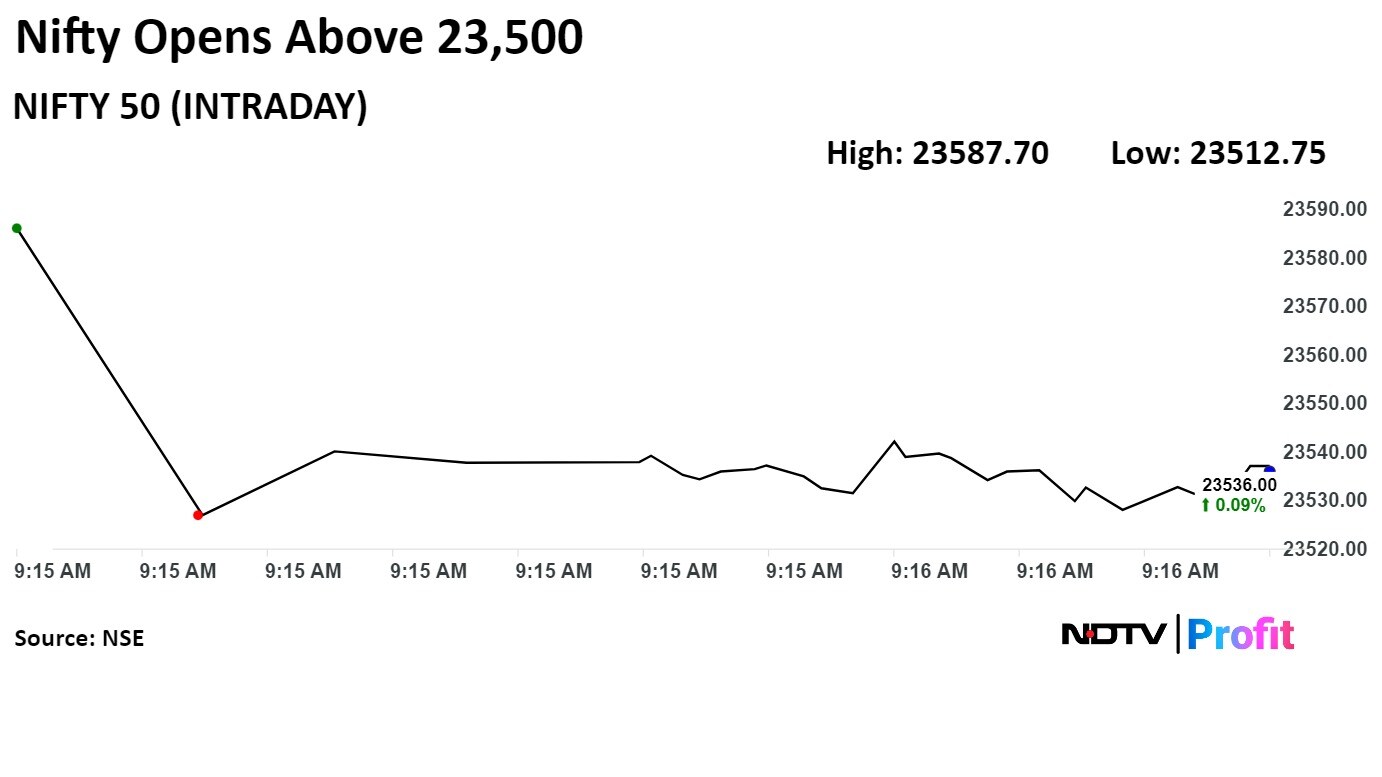

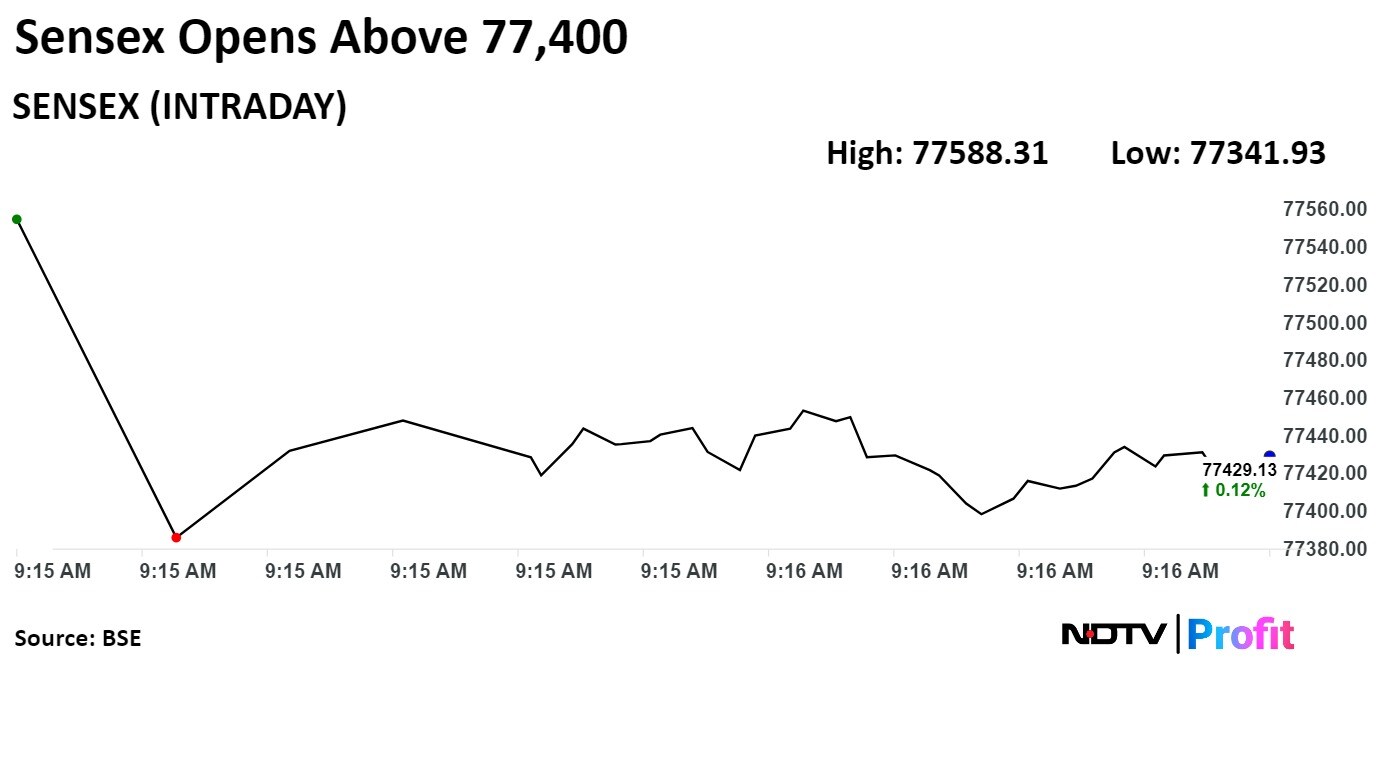

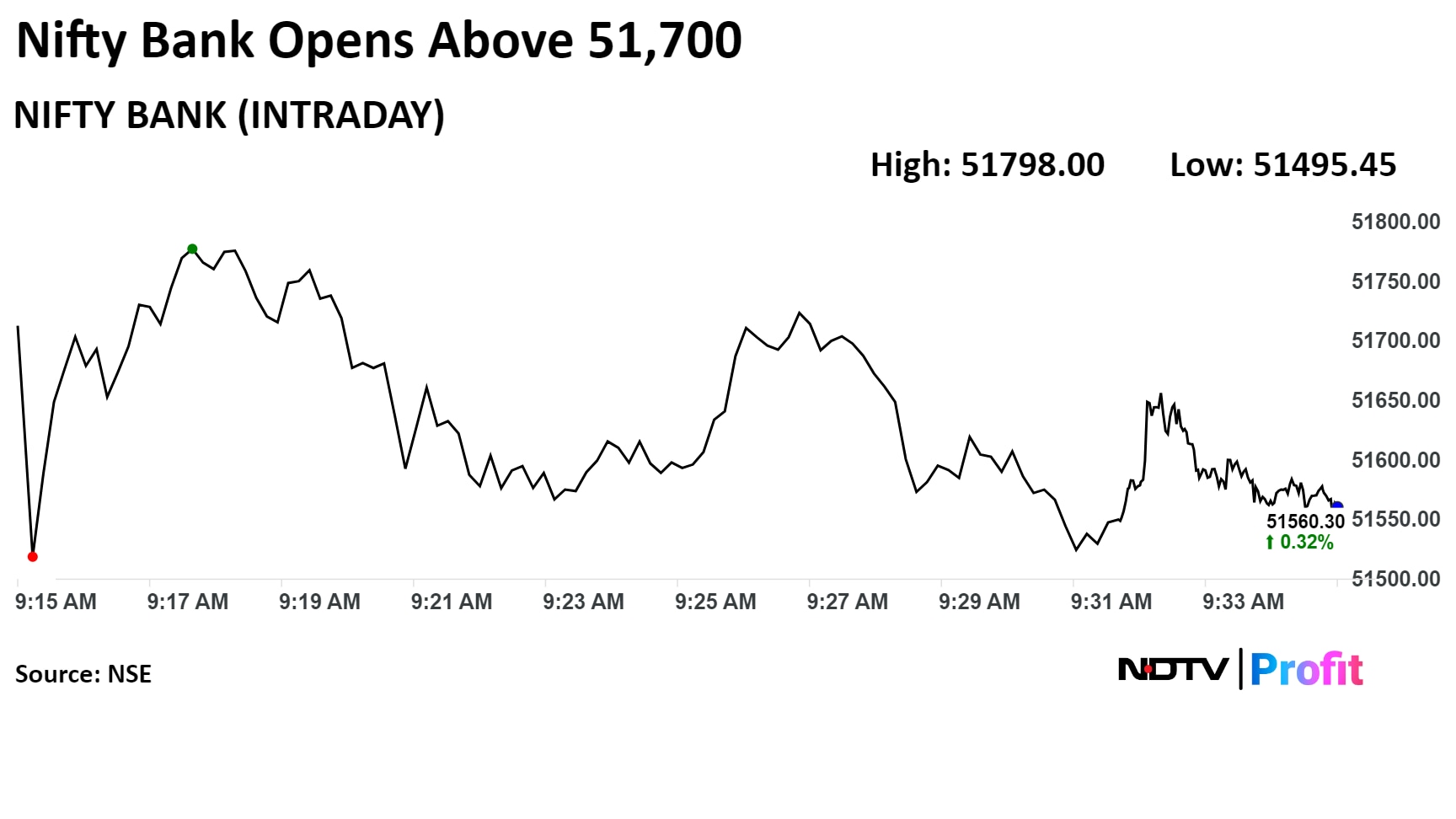

Benchmark equity indices opened higher on gains in HDFC Bank and Kotak Mahindra Bank but slipped into losses as heavyweight Reliance Industries and Infosys weighed.

At pre-open, the Nifty was at 23,586.15, up 70.15 points or 0.30% and the Sensex was at 77,554.83, up by 217.24 points or 0.28%.

"Market will be focused on the GST Council meeting on 22nd June later this week," said Vikas Jain, senior research analyst at Reliance Securities. "Technically, Nifty continues to hold above 23500 zones, indicating an uptrend to continue."

Benchmark equity indices opened higher on gains in HDFC Bank and Kotak Mahindra Bank but slipped into losses as heavyweight Reliance Industries and Infosys weighed.

At pre-open, the Nifty was at 23,586.15, up 70.15 points or 0.30% and the Sensex was at 77,554.83, up by 217.24 points or 0.28%.

"Market will be focused on the GST Council meeting on 22nd June later this week," said Vikas Jain, senior research analyst at Reliance Securities. "Technically, Nifty continues to hold above 23500 zones, indicating an uptrend to continue."

Benchmark equity indices opened higher on gains in HDFC Bank and Kotak Mahindra Bank but slipped into losses as heavyweight Reliance Industries and Infosys weighed.

At pre-open, the Nifty was at 23,586.15, up 70.15 points or 0.30% and the Sensex was at 77,554.83, up by 217.24 points or 0.28%.

"Market will be focused on the GST Council meeting on 22nd June later this week," said Vikas Jain, senior research analyst at Reliance Securities. "Technically, Nifty continues to hold above 23500 zones, indicating an uptrend to continue."