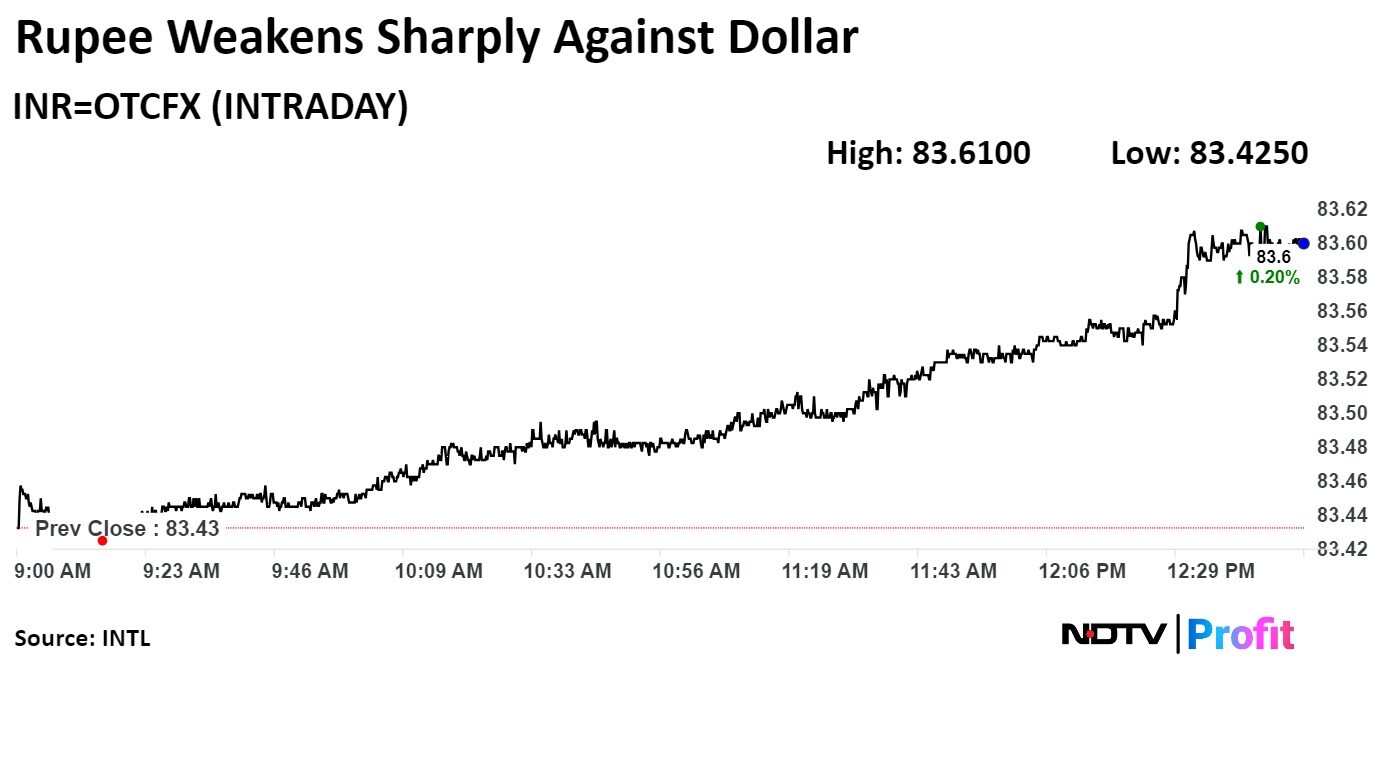

-The local currency weakened 14 paise to close at 83.57 against the US dollar.

-It closed at 83.43 on Tuesday.

Source: Bloomberg

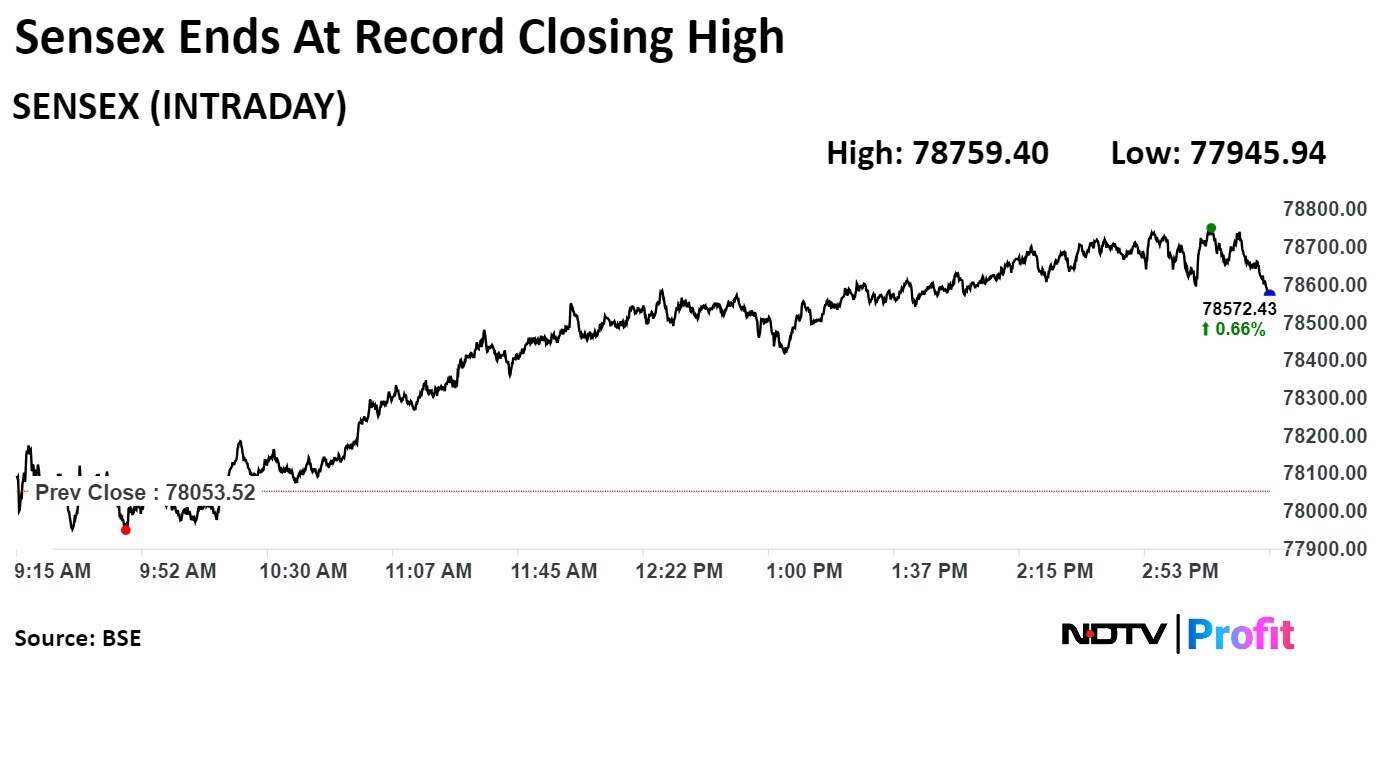

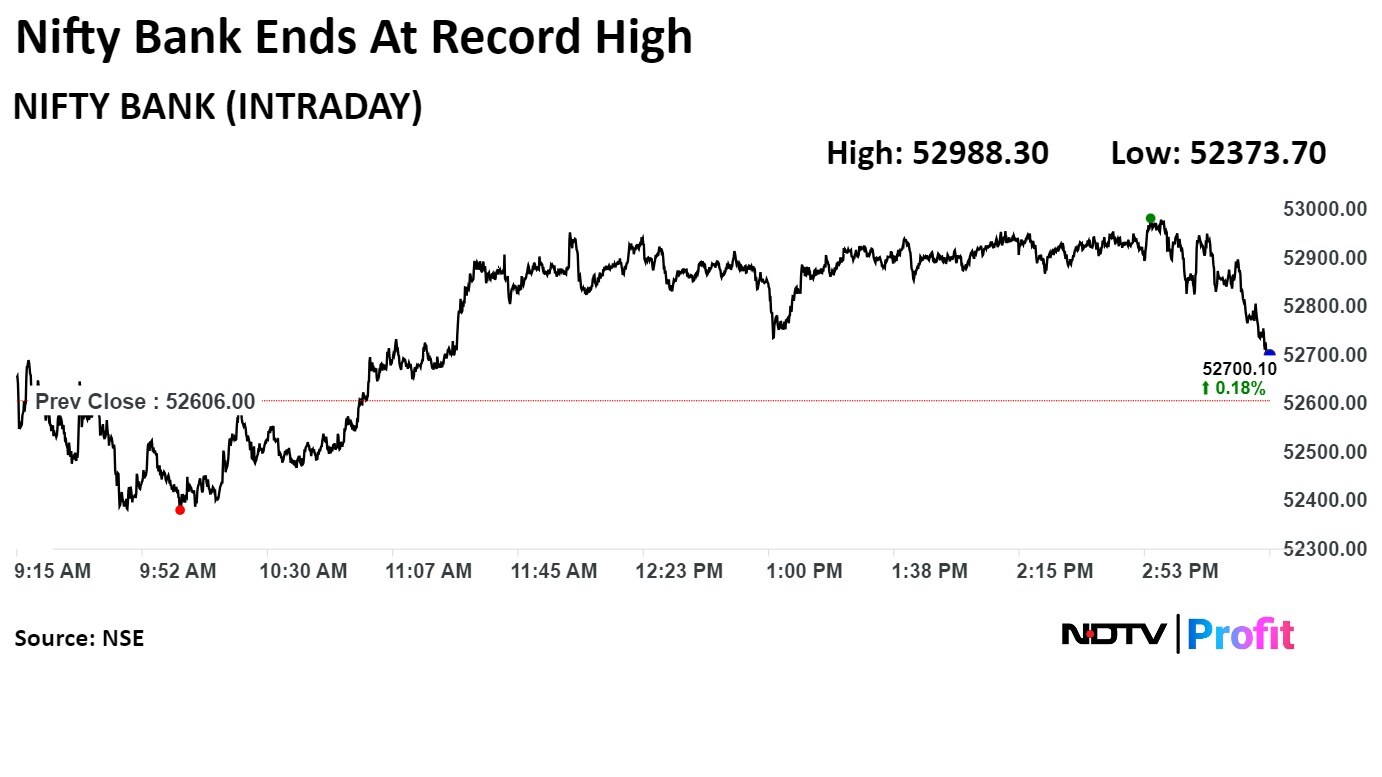

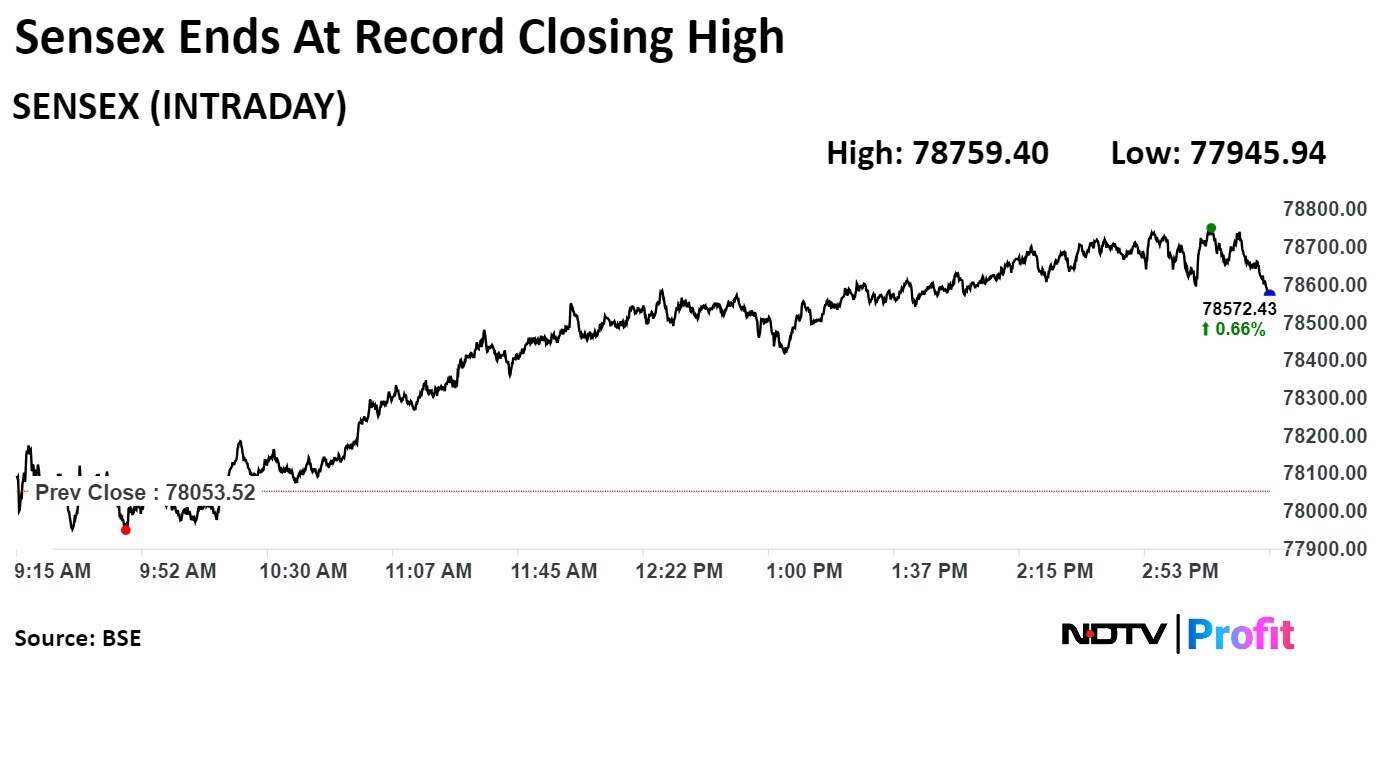

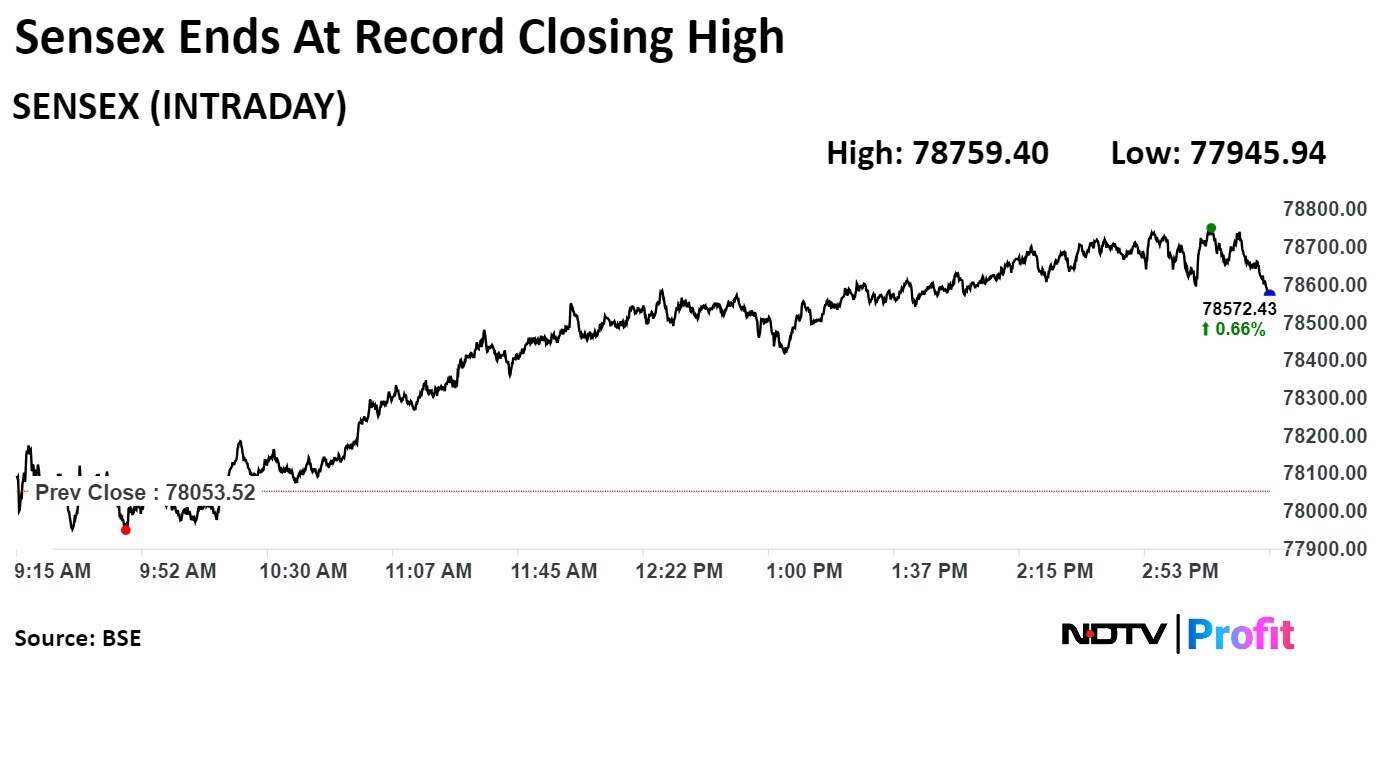

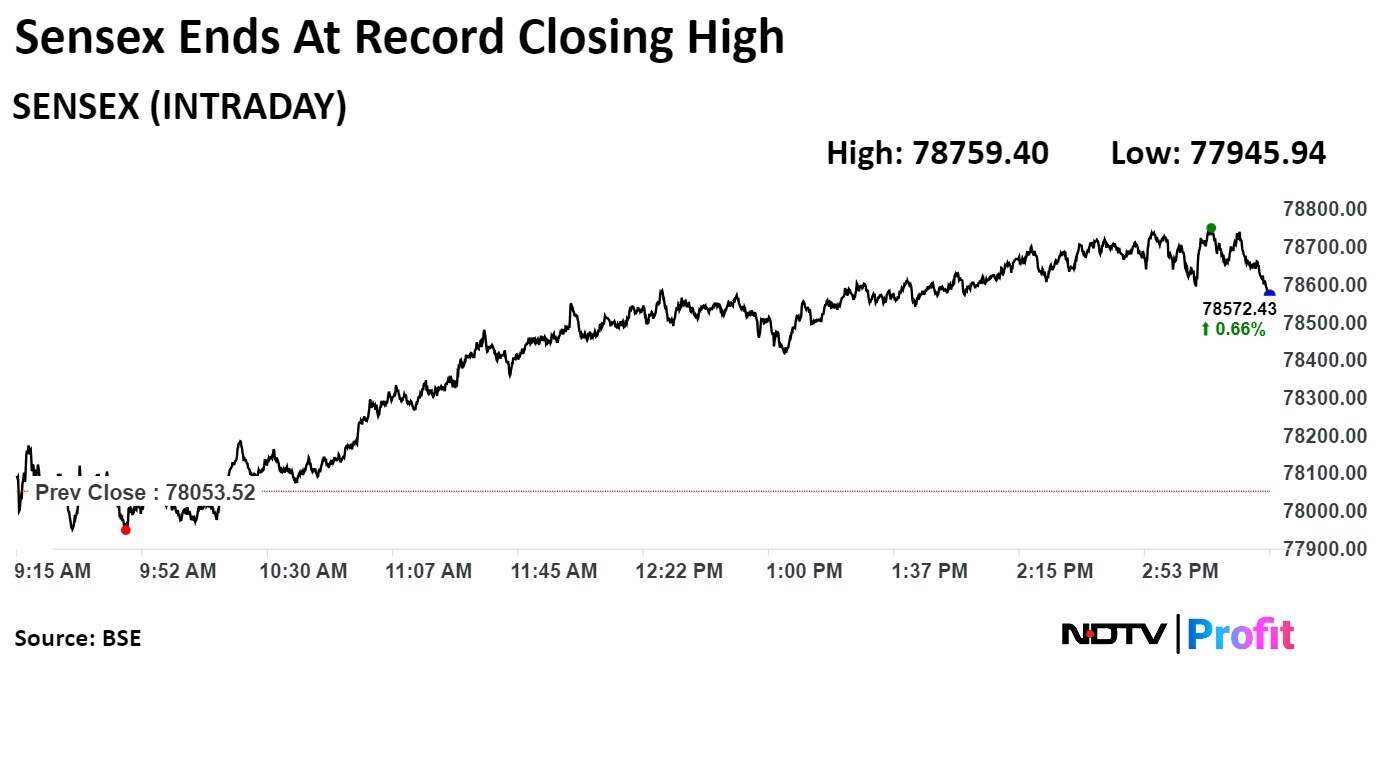

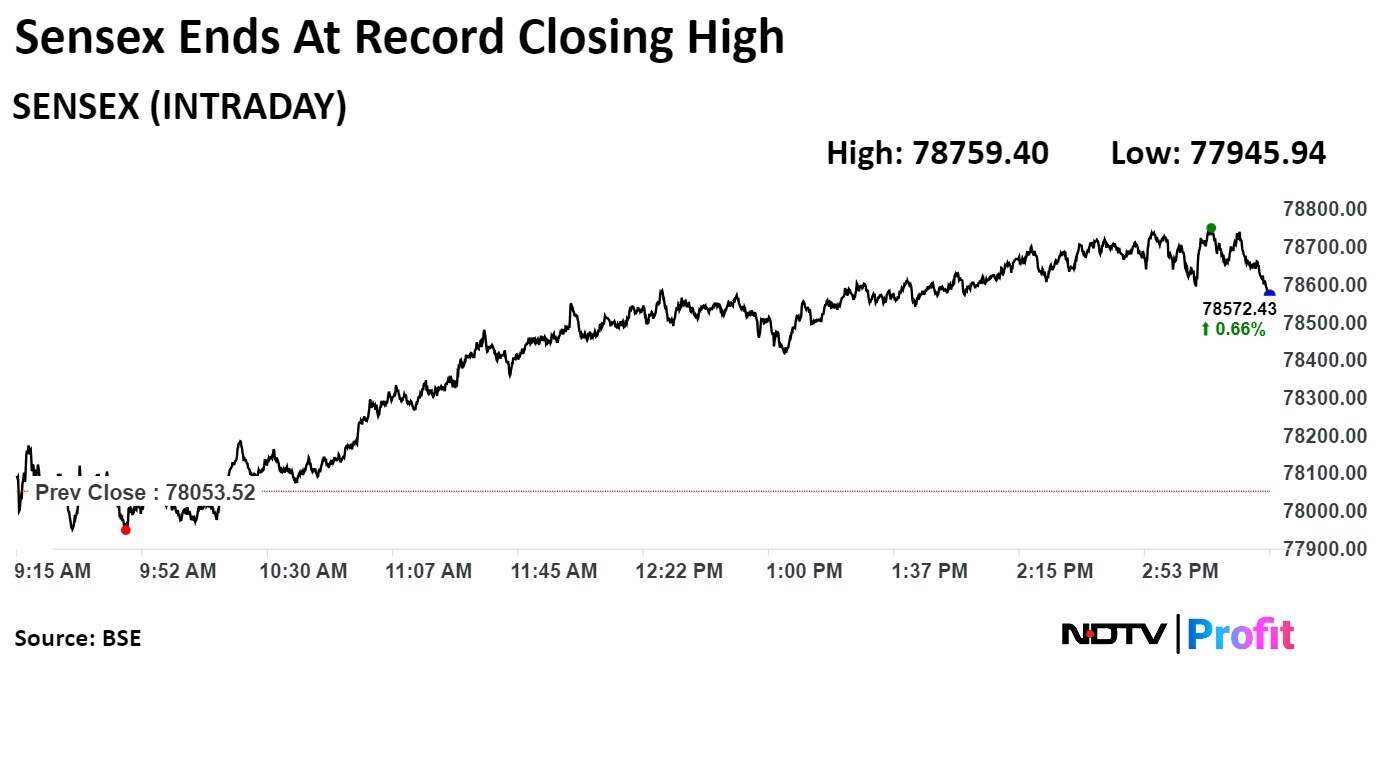

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

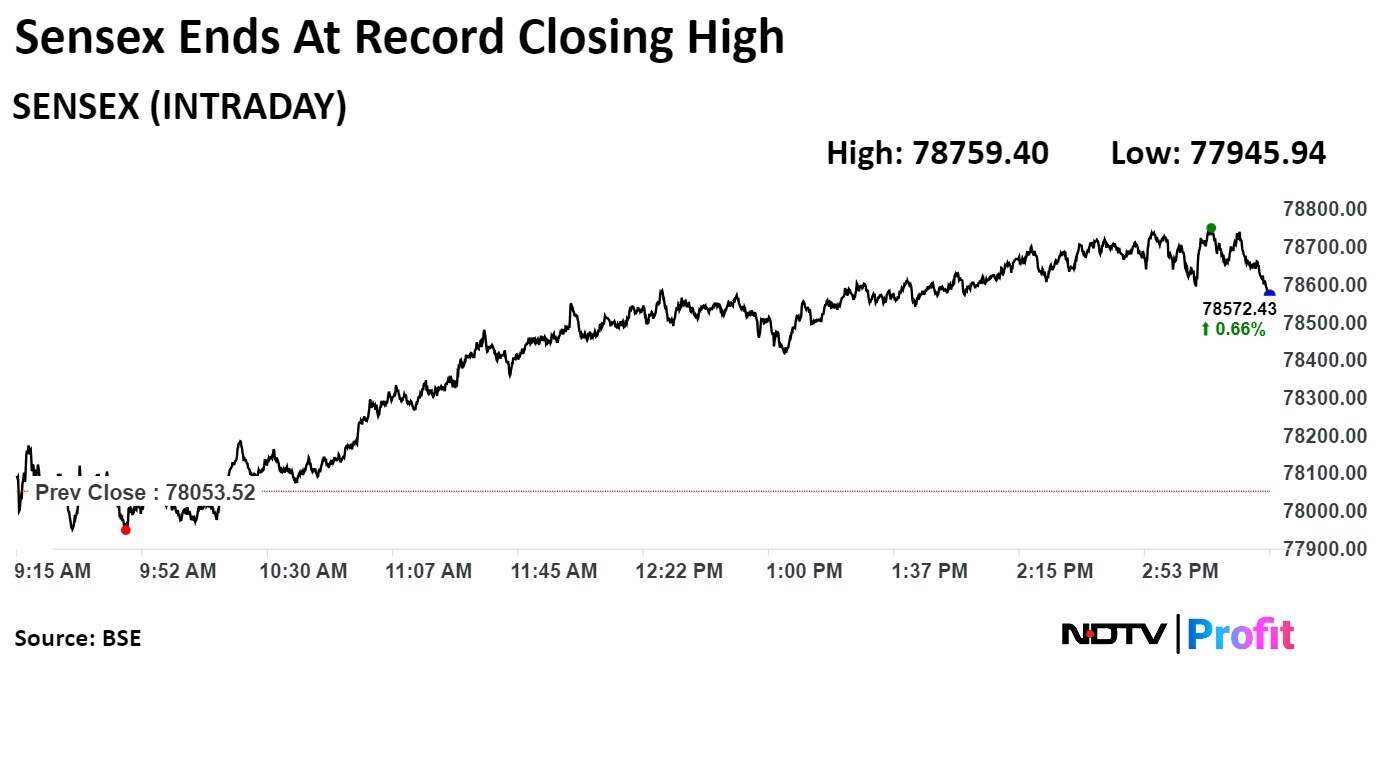

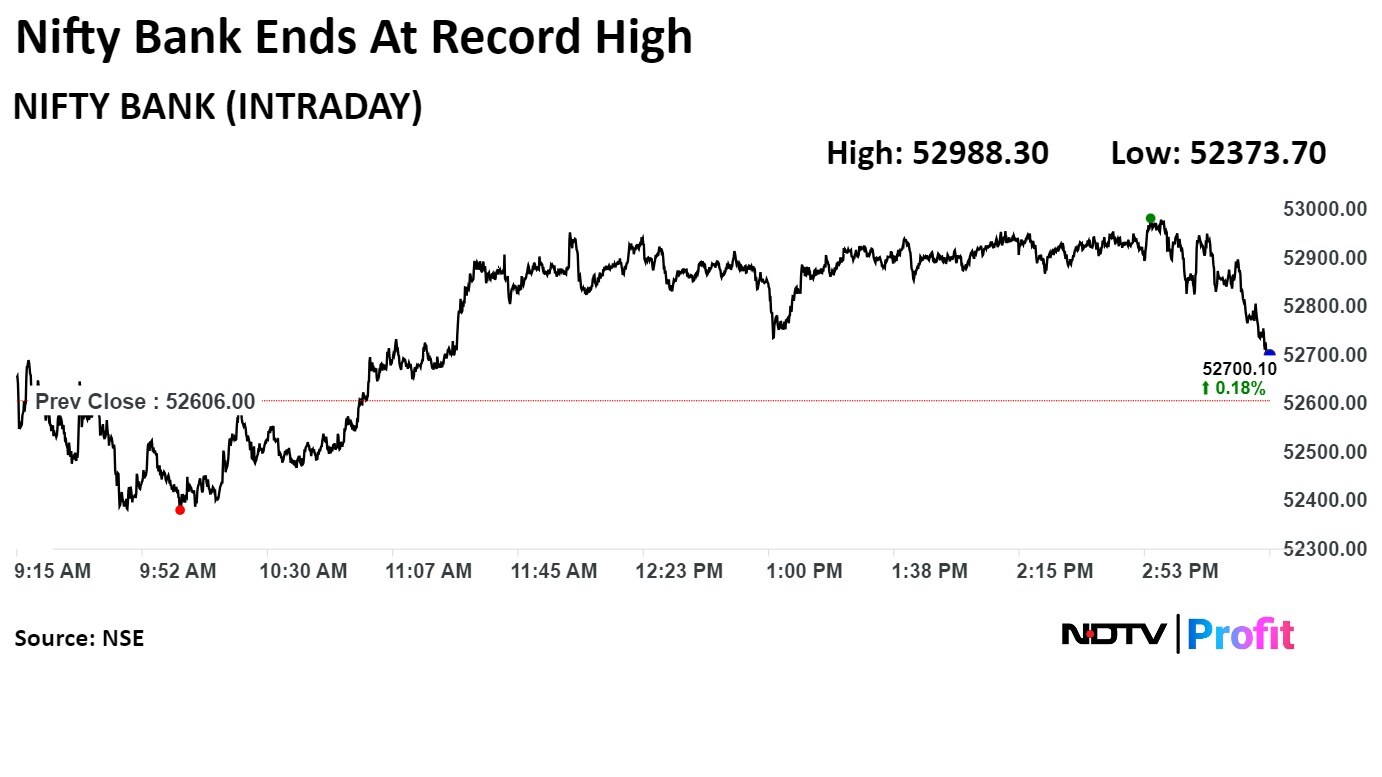

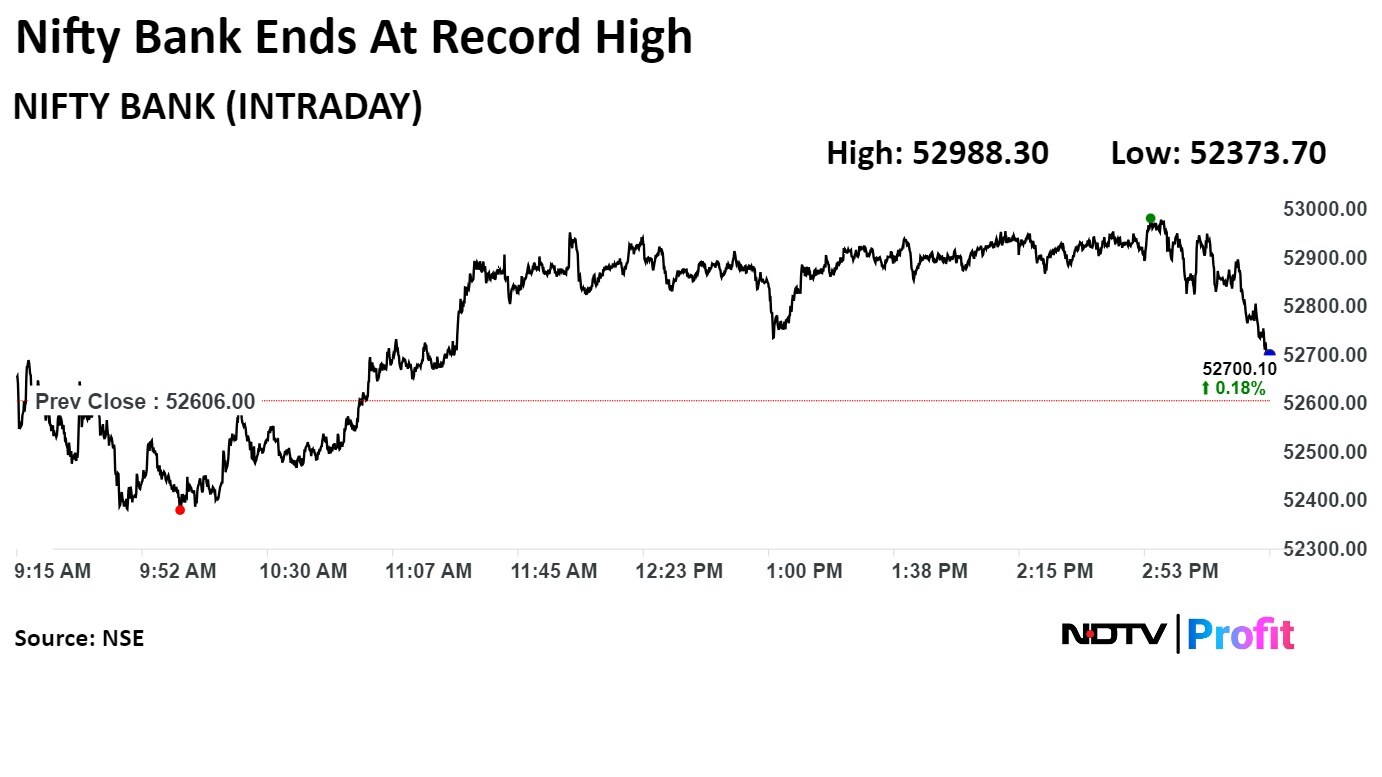

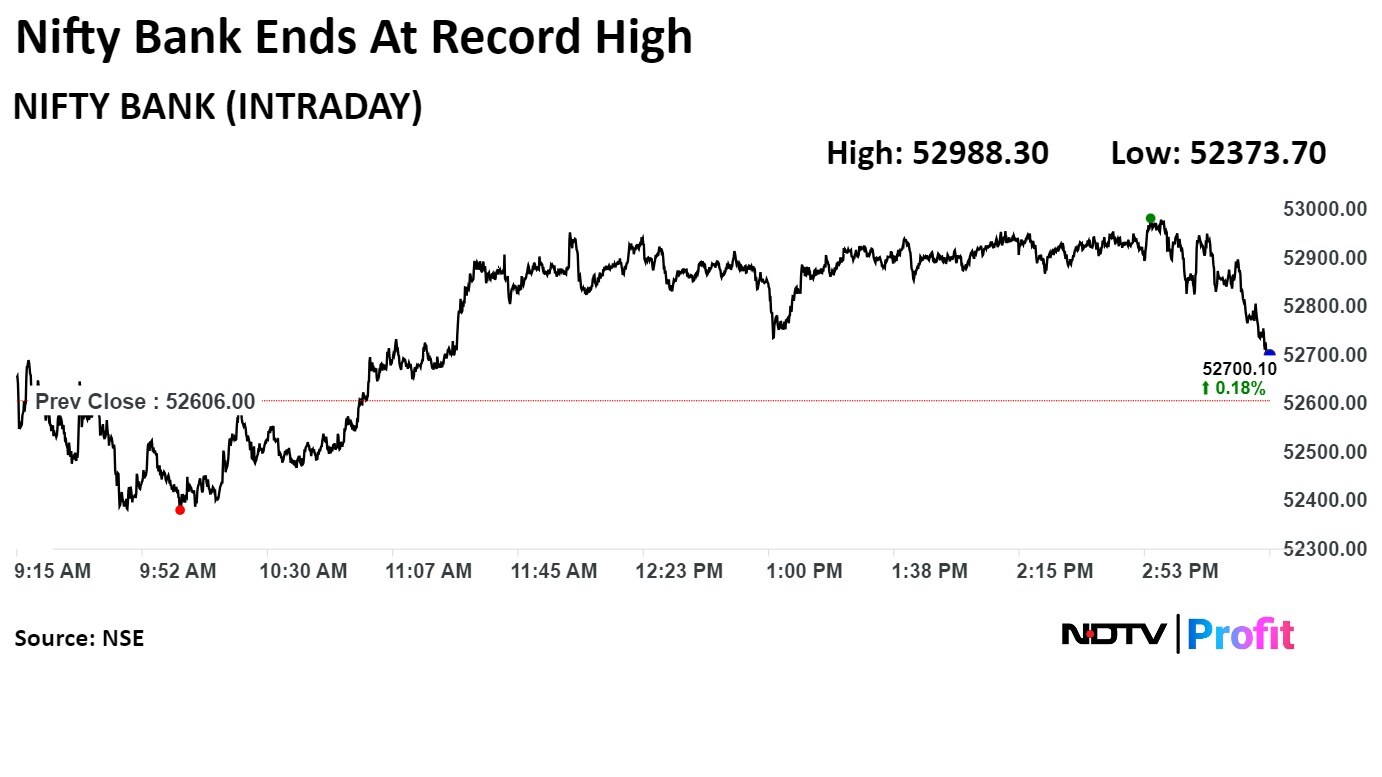

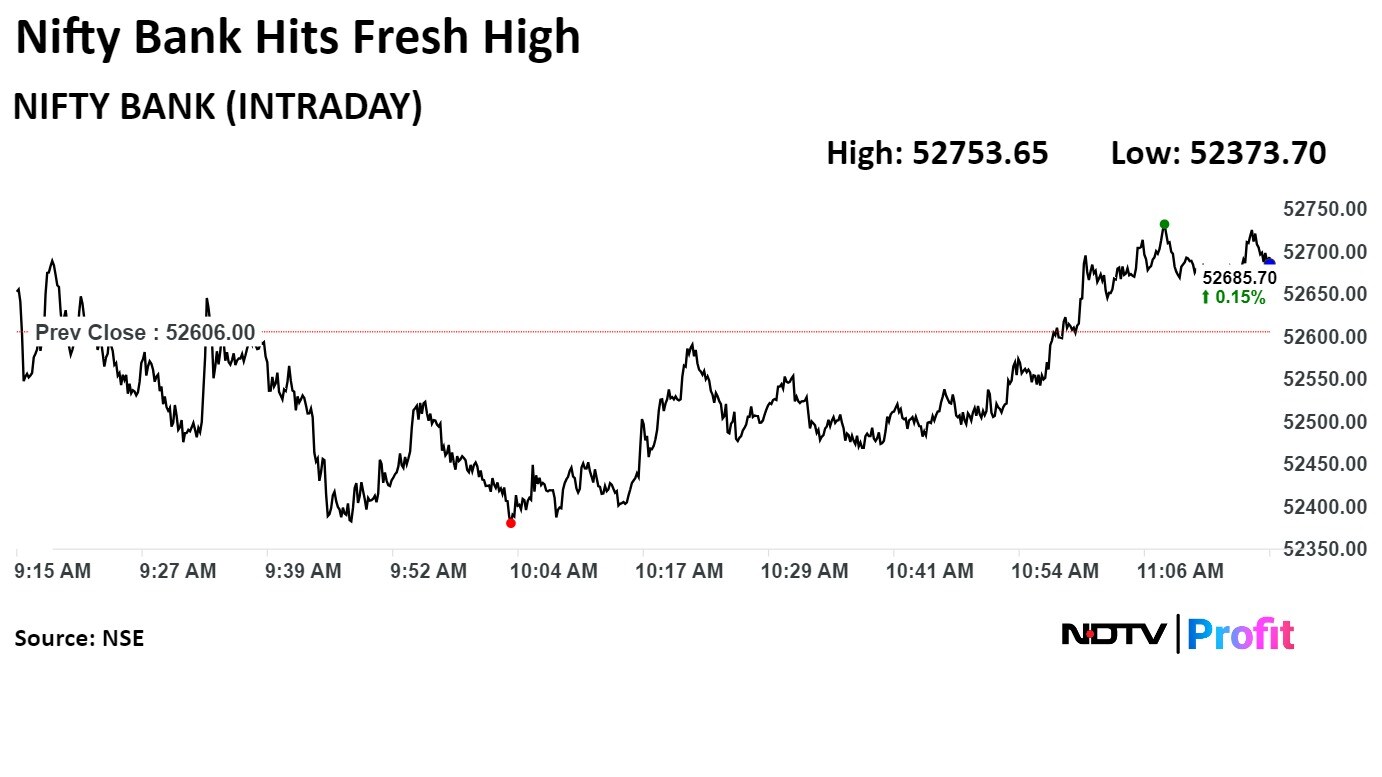

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

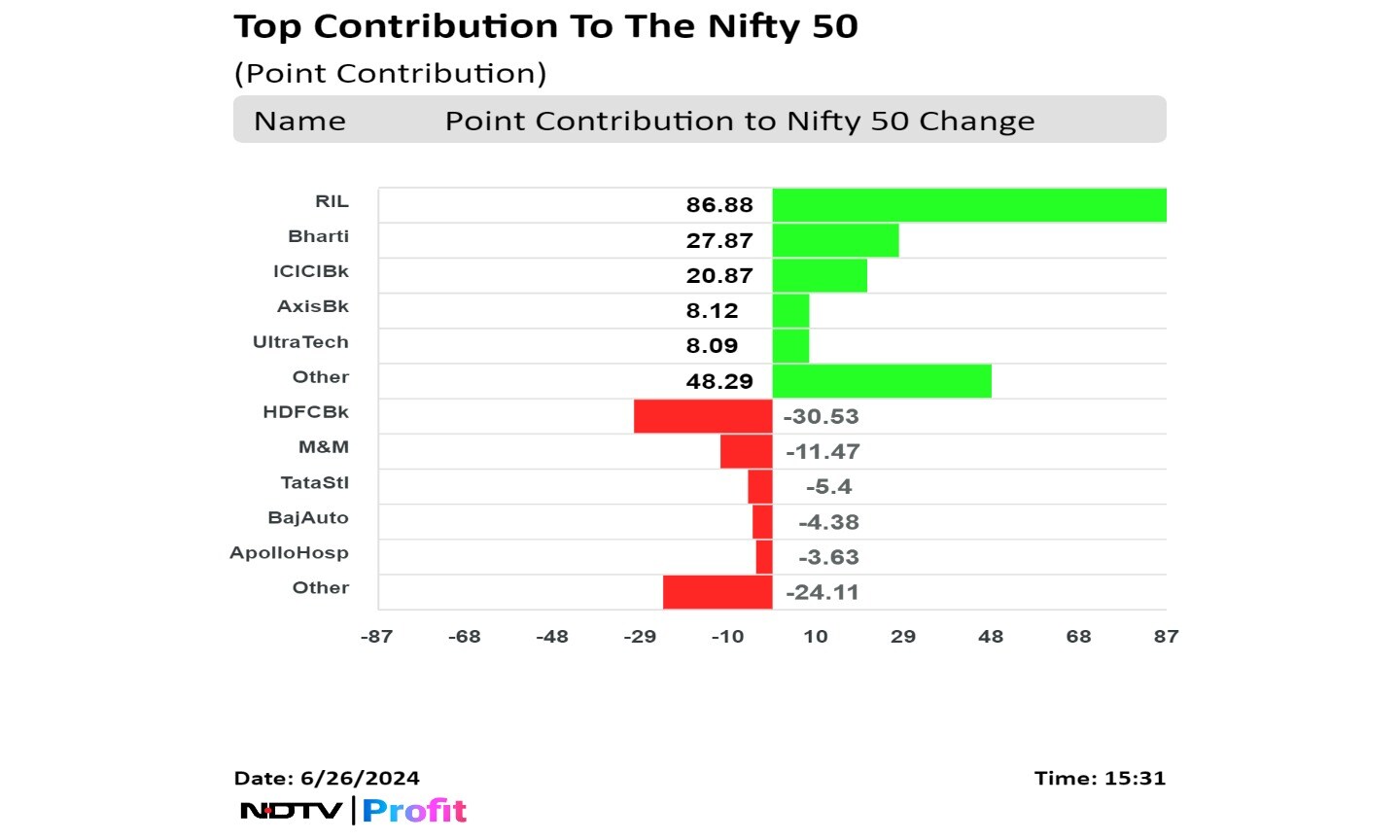

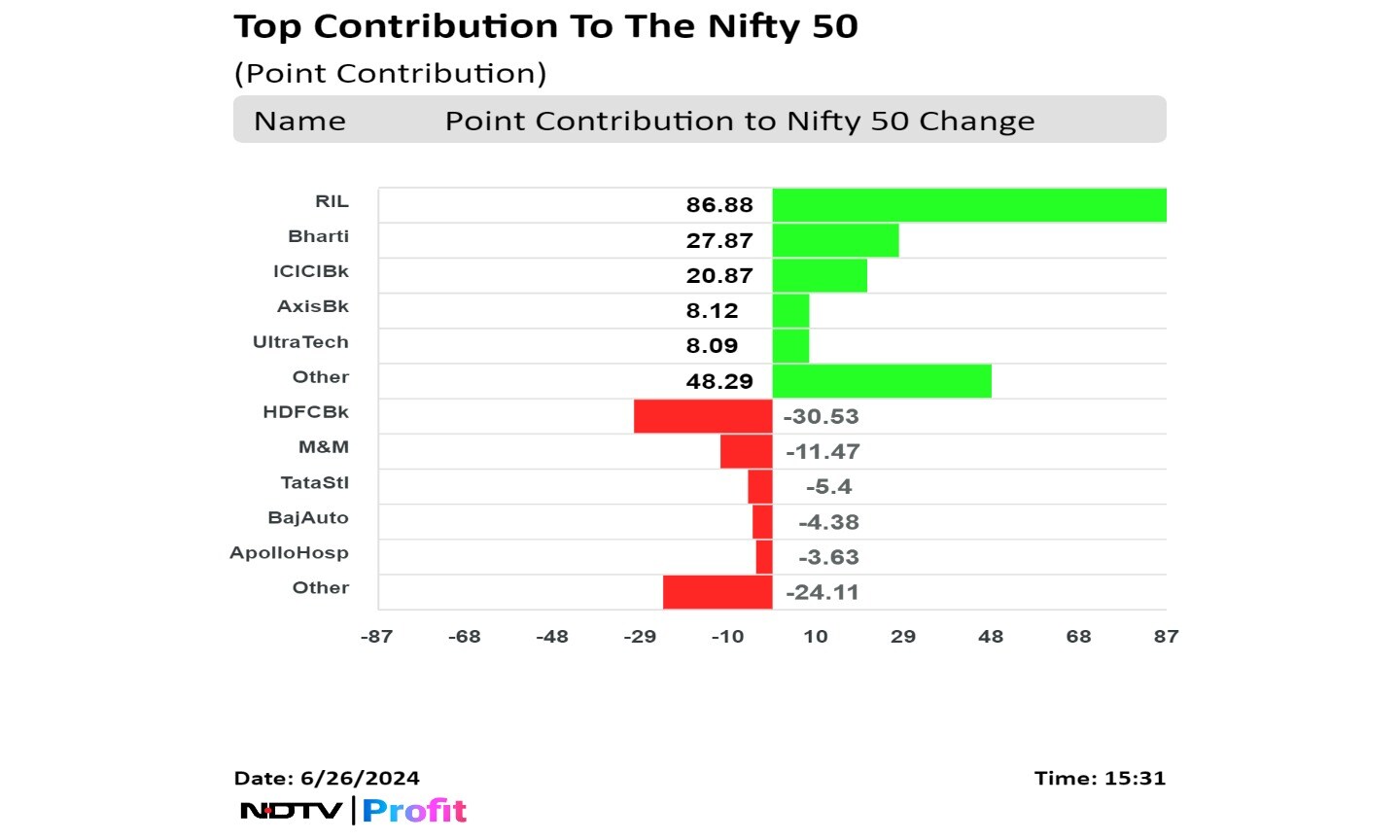

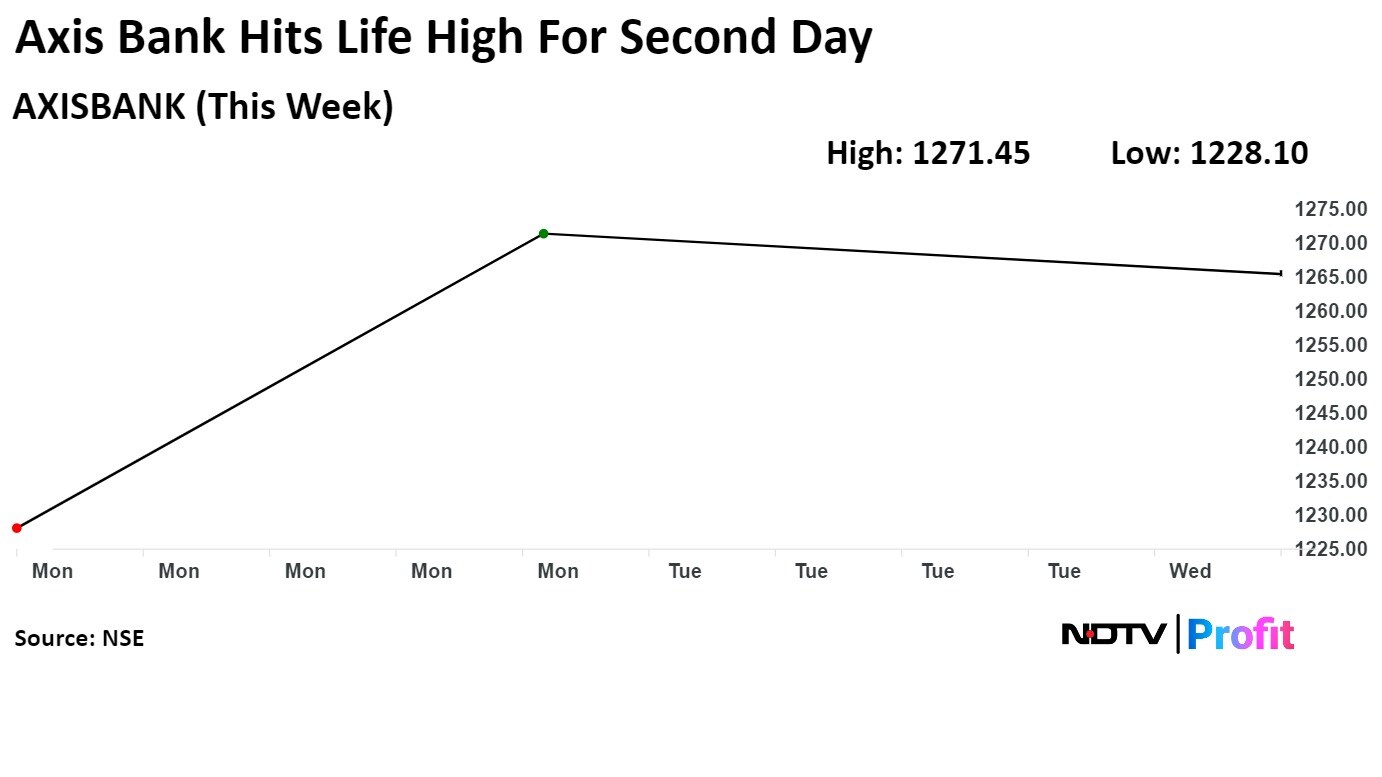

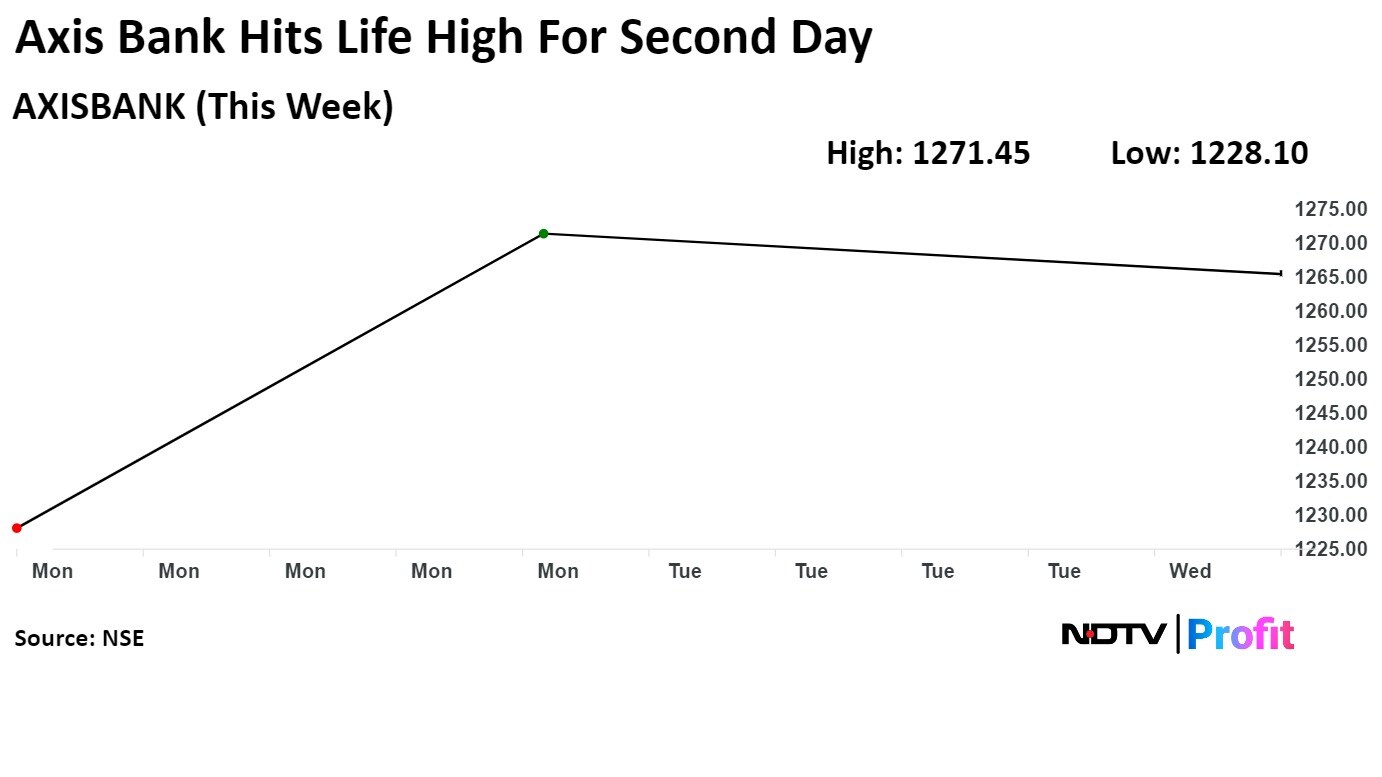

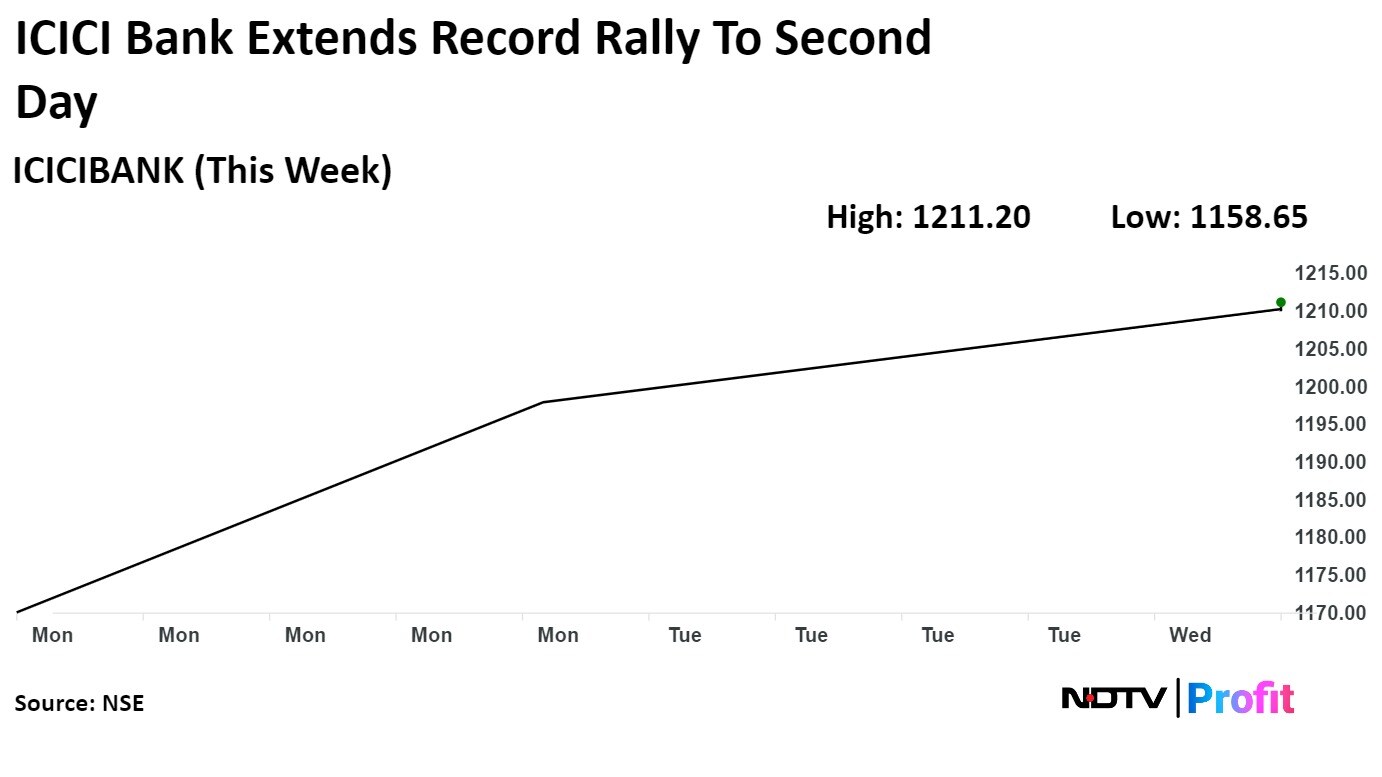

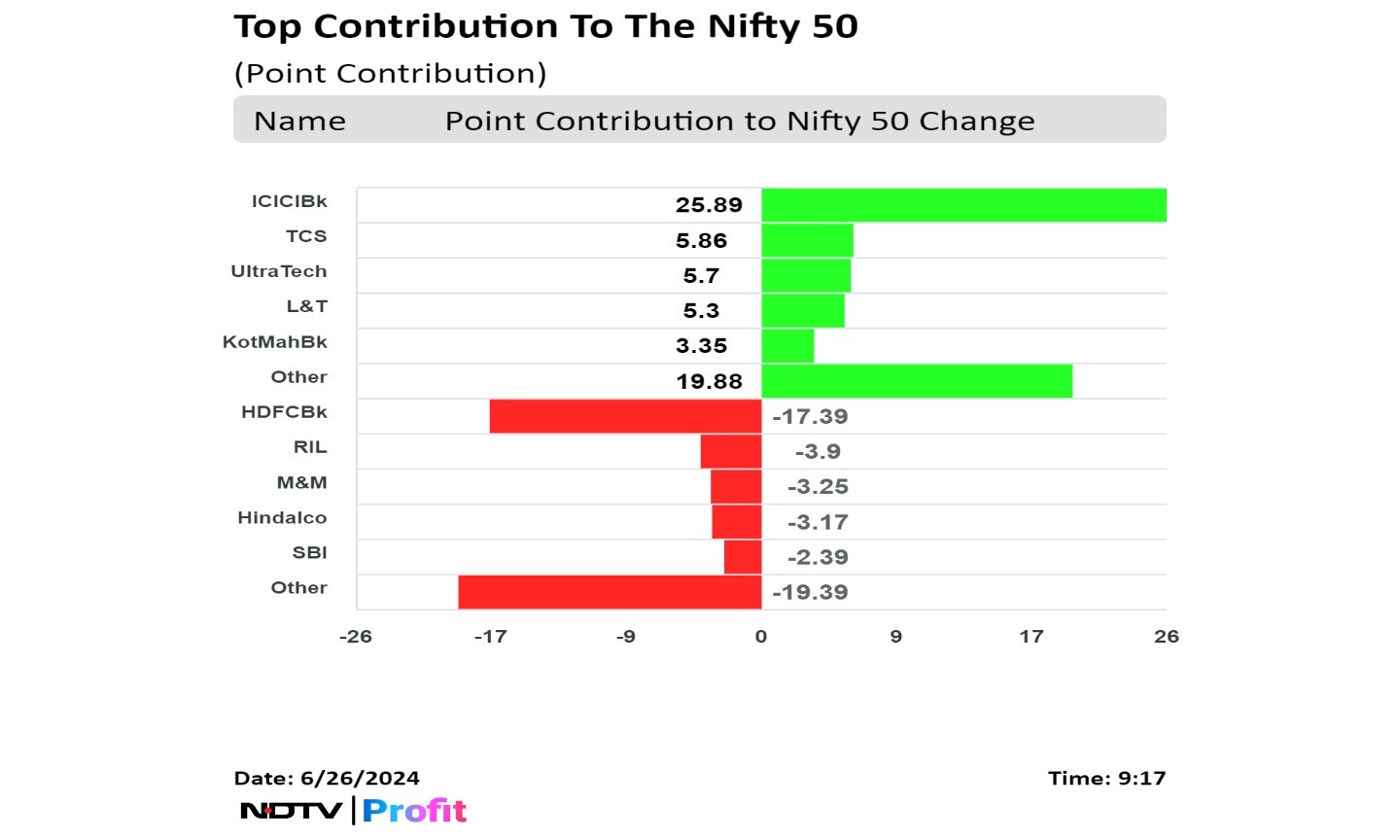

Shares of Reliance Industries Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Axis Bank Ltd., and UltraTech Cement Ltd. contributed the most to the gains.

While those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Steel Ltd., Bajaj Auto Ltd., and Apollo Hospitals Enterprises Ltd. weighed on the index.

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Shares of Reliance Industries Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Axis Bank Ltd., and UltraTech Cement Ltd. contributed the most to the gains.

While those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Steel Ltd., Bajaj Auto Ltd., and Apollo Hospitals Enterprises Ltd. weighed on the index.

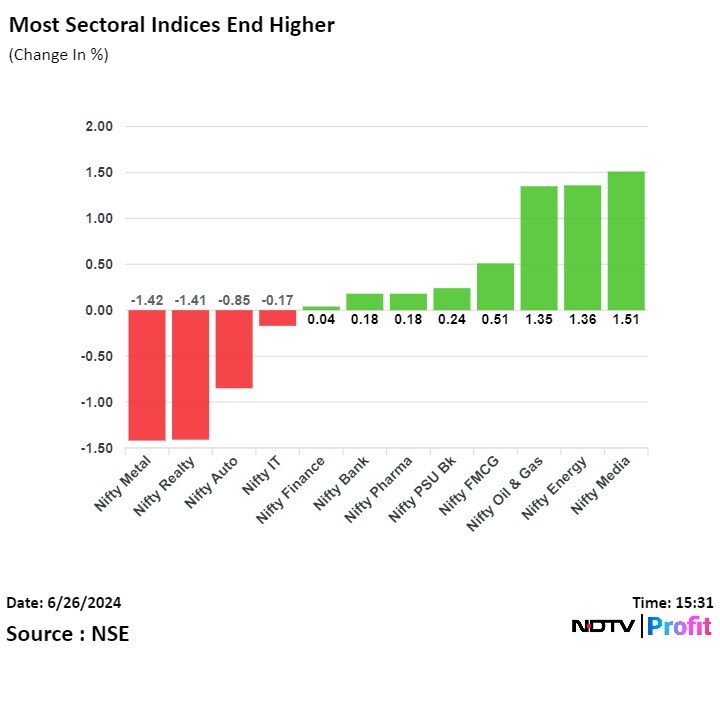

Most sectoral indices ended higher with Nifty Media and Nifty Energy leading the gains.

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Shares of Reliance Industries Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Axis Bank Ltd., and UltraTech Cement Ltd. contributed the most to the gains.

While those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Steel Ltd., Bajaj Auto Ltd., and Apollo Hospitals Enterprises Ltd. weighed on the index.

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Benchmark equity indices extended their record run for the second consecutive session today ahead of the expiry of their monthly derivative contracts expiry.

The Nifty Bank, whose monthly contracts expired today also recorded its highest close.

The Nifty closed higher by 0.62% or 147.50 points higher at 23,868.80 points after hitting an intraday high of 23,889.90 and the Sensex rose to its record high of 78,759.40 points intraday and closed 0.8% or 620.73 points higher at 78,674.25.

Aditya Gaggar, Director of Progressive Shares said, "As indicated yesterday, the Index is performing as per our expectations but we believe that a profit-booking correction can be seen because the ongoing rally is on a weak foot and is mainly driven by select heavyweights."

Shares of Reliance Industries Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Axis Bank Ltd., and UltraTech Cement Ltd. contributed the most to the gains.

While those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Steel Ltd., Bajaj Auto Ltd., and Apollo Hospitals Enterprises Ltd. weighed on the index.

Most sectoral indices ended higher with Nifty Media and Nifty Energy leading the gains.

Market breadth was evenly split between buyers and sellers. Around 1,911 stocks advanced, 1,971 stocks declined, and 126 stocks remained unchanged on BSE.

Broader markets ended on a mixed note. The S&P BSE Midcap settled 0.29% lower, and Smallcap ended 0.15% higher.

On BSE, 11 sectors advanced, and nine declined. The S&P BSE Telecommunication rose the most, and the S&P BSE Metal declined the most.

Gets contract for construction work at Dahej LNG terminal

Source: Exchange filing

Starts cement grinding capacity of 2 MTPA at its new cement facility in Prayagraj

Source: Exchange filing

Vi has engaged with Samsung for 4G-5G Radio Network Deployment.

To expand Vi’s 4G footprint & introduce 5G, Vi has been in an active discussion with Samsung for the last 12-18 months on network trials in Chennai.

• Further to the encouraging trial response and at par performance with incumbent suppliers, Vi has extended Samsung deployments in Karnataka and Bihar circles.

• These setups have enabled Vi to fulfil its 5G Minimum Rollout Obligation (MRO) in these three circles (Chennai, Karnataka and Bihar) with NSA vRAN architecture.

Source: Exchange Filing

Vi has engaged with Samsung for 4G-5G Radio Network Deployment.

To expand Vi’s 4G footprint & introduce 5G, Vi has been in an active discussion with Samsung for the last 12-18 months on network trials in Chennai.

• Further to the encouraging trial response and at par performance with incumbent suppliers, Vi has extended Samsung deployments in Karnataka and Bihar circles.

• These setups have enabled Vi to fulfil its 5G Minimum Rollout Obligation (MRO) in these three circles (Chennai, Karnataka and Bihar) with NSA vRAN architecture.

Source: Exchange Filing

.png)

Board approves raising up to Rs 1,050 crore via preferential issue

Of this, Rs 400 crore to be raised via issuance of shares at Rs 138/share

Remaining Rs 650 crore to be raised via convertible warrants of Rs 145 apiece

Source: Exchange filing

A total of 1.48 crore shares changed hands in a large trade at Rs 75.81.

Source: Cogencis

A total of 1.48 crore shares changed hands in a large trade at Rs 75.81.

Source: Cogencis

.png)

Board approves proposal to raise up to Rs 200 crore via multiple instruments including share issue

Source: Exchange filing

Board approves final dividend of Rs 13/share for FY24

Source: Exchange filing

Board of company approved to merge with Medinova Diagnostic Services .

Source: Exchange Filing

Brazil-based arm sets up new manufacturing plant, starts commercial production

Capacity of Brazil-based arm's new plant stands at 20,000 units/year

Source: Exchange Filing

The local currency weakened 18 paise against the US Dollar to 83.61.

It closed at 83.43 on Tuesday.

Source: Cogencis

The local currency weakened 18 paise against the US Dollar to 83.61.

It closed at 83.43 on Tuesday.

Source: Cogencis

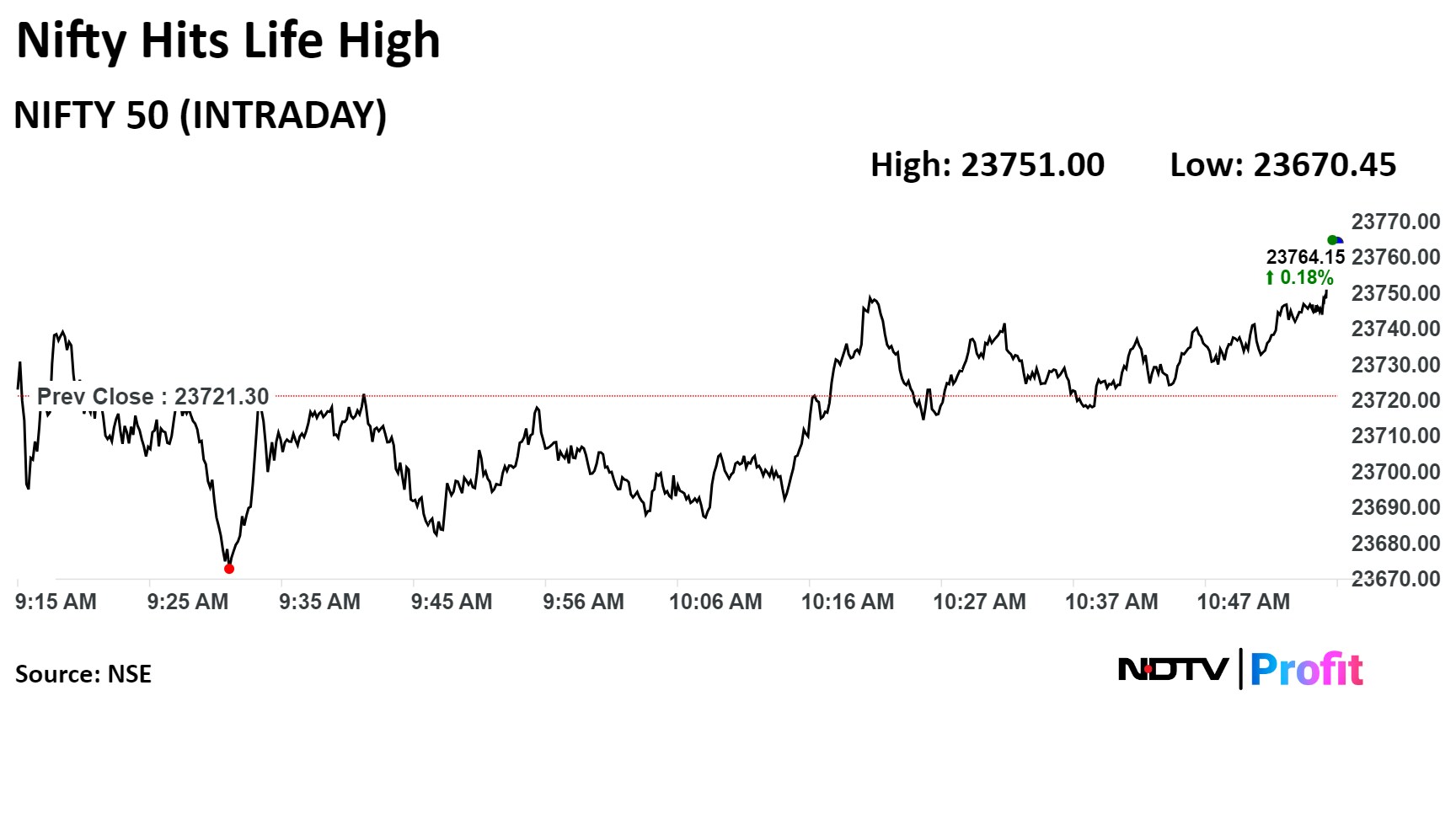

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

.png)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., UltraTech Cement Ltd., Kotak Mahindra Bank Ltd., and Bharti Airtel Ltd. contributed to gains in the Nifty.

While those of HDFC Bank Ltd., Mahindra and Mahindra Ltd., Tata Steel Ltd., Bajaj Steel Industries Ltd., and Hindalco Industries Ltd. weighed the index.

On NSE, nine out of 12 sectors advanced. Nifty Metal fell the most, while Nifty Media was the top performer.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

.png)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., UltraTech Cement Ltd., Kotak Mahindra Bank Ltd., and Bharti Airtel Ltd. contributed to gains in the Nifty.

While those of HDFC Bank Ltd., Mahindra and Mahindra Ltd., Tata Steel Ltd., Bajaj Steel Industries Ltd., and Hindalco Industries Ltd. weighed the index.

On NSE, nine out of 12 sectors advanced. Nifty Metal fell the most, while Nifty Media was the top performer.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

.png)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., UltraTech Cement Ltd., Kotak Mahindra Bank Ltd., and Bharti Airtel Ltd. contributed to gains in the Nifty.

While those of HDFC Bank Ltd., Mahindra and Mahindra Ltd., Tata Steel Ltd., Bajaj Steel Industries Ltd., and Hindalco Industries Ltd. weighed the index.

On NSE, nine out of 12 sectors advanced. Nifty Metal fell the most, while Nifty Media was the top performer.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

India's benchmark stock indices hit a fresh lifetime high during midday on Wednesday after a muted start on Wednesday. Reliance Industries Ltd., ICICI Bank Ltd. and Ultratech Cement Ltd. led the gains.

As of 11:51 a.m., Nifty was trading 92.95 points, or 0.39%, higher at 23,814.25, and Sensex gained 397.13 points, or 0.51%, to trade at 78,450.66. Intraday, the Nifty and Sensex hit new record highs of 23,825.75 and 78,483.55, respectively.

"On the higher side, the move can get extended to 23,950–24,000 levels from its 350-point range breakout, and on the downside, 23,350 will be a support," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

However, RSI and other key technical indicators are at the higher end of the range and could be volatile with respect to the monthly expiry, he said.

.png)

.png)

.png)

Shares of Reliance Industries Ltd., ICICI Bank Ltd., UltraTech Cement Ltd., Kotak Mahindra Bank Ltd., and Bharti Airtel Ltd. contributed to gains in the Nifty.

While those of HDFC Bank Ltd., Mahindra and Mahindra Ltd., Tata Steel Ltd., Bajaj Steel Industries Ltd., and Hindalco Industries Ltd. weighed the index.

On NSE, nine out of 12 sectors advanced. Nifty Metal fell the most, while Nifty Media was the top performer.

.png)

.png)

Broader markets rose, with the S&P BSE Midcap gaining 0.07% and the S&P BSE Smallcap rising 0.51% through midday on Wednesday.

On BSE, 14 sectors out of 20 advanced, and six declined. S&P BSE Energy was the top performer, and the S&P BSE Metal was the worst performer.

Market breadth was skewed in the favour of buyers. Around 1,986 stocks advanced, 1,594 stocks declined, and 144 stocks remained unchanged on BSE.

Board approves appointment of SN Subrahmanyan as Non-Executive Chairman

Source: Exchange Filing

Gets regulator nod to set up gas network at Jalandhar

Source: Exchange Filing

.png)

Bloomberg reported 1.21 million shares in the company were traded in a bulk.

Bloomberg reported 1.21 million shares in the company were traded in a bulk.

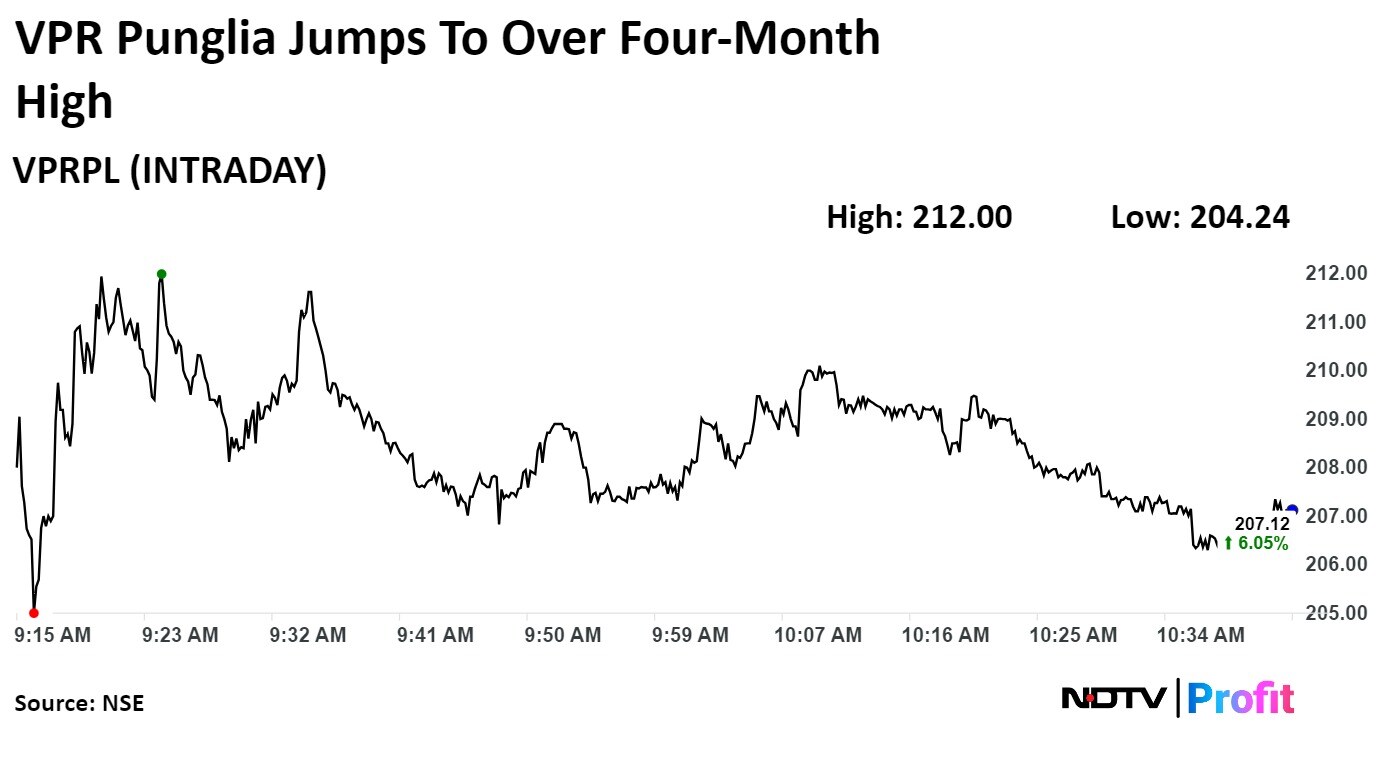

Shares of Vishnu Prakash R Punglia Ltd. jumped to the highest level in over four months after bagging an order worth Rs 273.11 crore from U.P. Jal Nigam (Urban) Prayagraj.

Shares of Vishnu Prakash R Punglia Ltd. rose 8.55% to Rs 212.00, the highest level since Feb 9. It was trading 5.73% higher at Rs 206.50 as of 10:50 a.m., as compared to 0.07% advance in the NSE Nifty 50 index.

The scrip gained 42.17% in 12 months while it declined 4.45% on year to date basis. Total traded volume so far in the day stood at 9.1 times its 30-day average. The relative strength index was at 69.08.

Shares of Vishnu Prakash R Punglia Ltd. jumped to the highest level in over four months after bagging an order worth Rs 273.11 crore from U.P. Jal Nigam (Urban) Prayagraj.

Shares of Vishnu Prakash R Punglia Ltd. rose 8.55% to Rs 212.00, the highest level since Feb 9. It was trading 5.73% higher at Rs 206.50 as of 10:50 a.m., as compared to 0.07% advance in the NSE Nifty 50 index.

The scrip gained 42.17% in 12 months while it declined 4.45% on year to date basis. Total traded volume so far in the day stood at 9.1 times its 30-day average. The relative strength index was at 69.08.

Shares of Vedanta Ltd. fell over 6% after a large block deal on Wednesday. About 4% shares changed hands, with promoter sales raising roughly Rs 6,000 crore.

This transaction comes at a crucial time for Vedanta Resources Ltd., as it seeks to address its high debt levels and upcoming repayment obligations.

Shares of Vedanta Ltd. fell over 6% after a large block deal on Wednesday. About 4% shares changed hands, with promoter sales raising roughly Rs 6,000 crore.

This transaction comes at a crucial time for Vedanta Resources Ltd., as it seeks to address its high debt levels and upcoming repayment obligations.

.png)

Shares of Akme Fintrade (India) Ltd. listed on the National Stock Exchange at Rs 127 per share, a premium of 5.8% over its issue price of Rs 120 per share. On the BSE, the shares debuted at Rs 125.7 apiece, a premium of 4.75%.

Shares of Dee Development Engineers Ltd. listed on that National Stock Exchange at Rs 339 apiece a premium of 67% over its issue price of Rs 203 per share. On the BSE the stock debuted at Rs 325 per share, marking a premium of 60.1%.

In pre-market, 30 lakh shares change hands in multiple large trades, according to Bloomberg.

In pre-market, 30 lakh shares change hands in multiple large trades, according to Bloomberg.

.png)

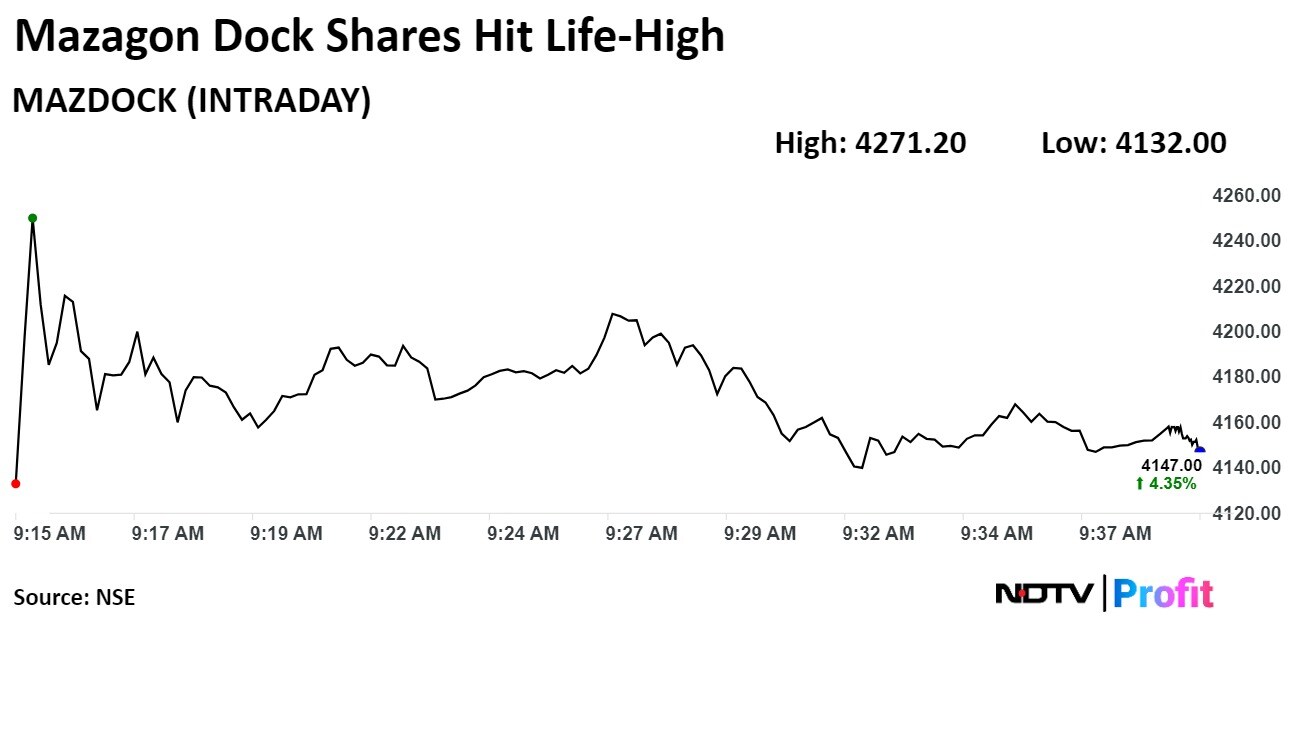

Mazagon Dock Shipbuilders Shipbuilders Ltd. hit its life high on Wednesday after the news of it being granted the status of Navratna. The company notified via exchanges that Department of Public Enterprises approved its proposal on Tuesday.

The shipbuilding yard was founded in 2015 and is now the 18th public sector undertaking to be granted the Navratna status.

Mazagon Dock Shipbuilders Shipbuilders Ltd. hit its life high on Wednesday after the news of it being granted the status of Navratna. The company notified via exchanges that Department of Public Enterprises approved its proposal on Tuesday.

The shipbuilding yard was founded in 2015 and is now the 18th public sector undertaking to be granted the Navratna status.

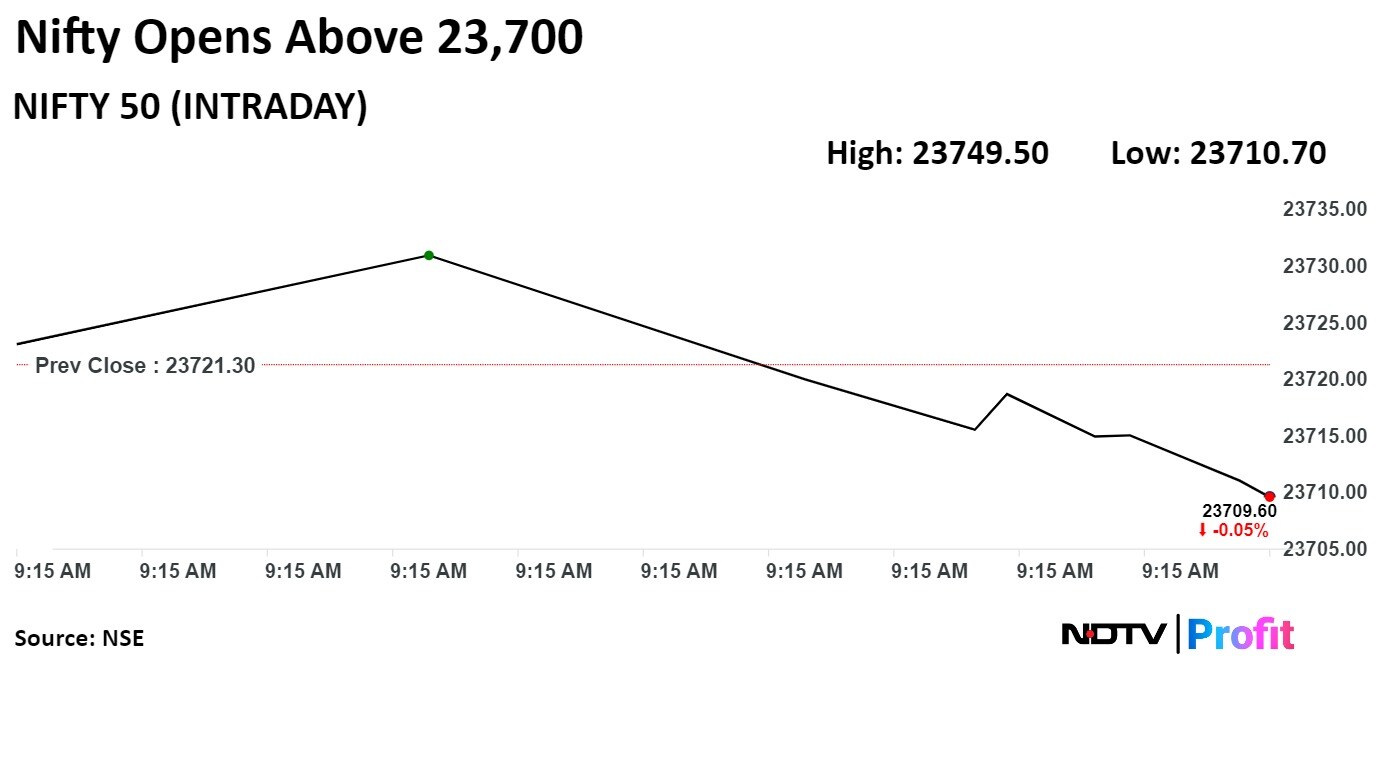

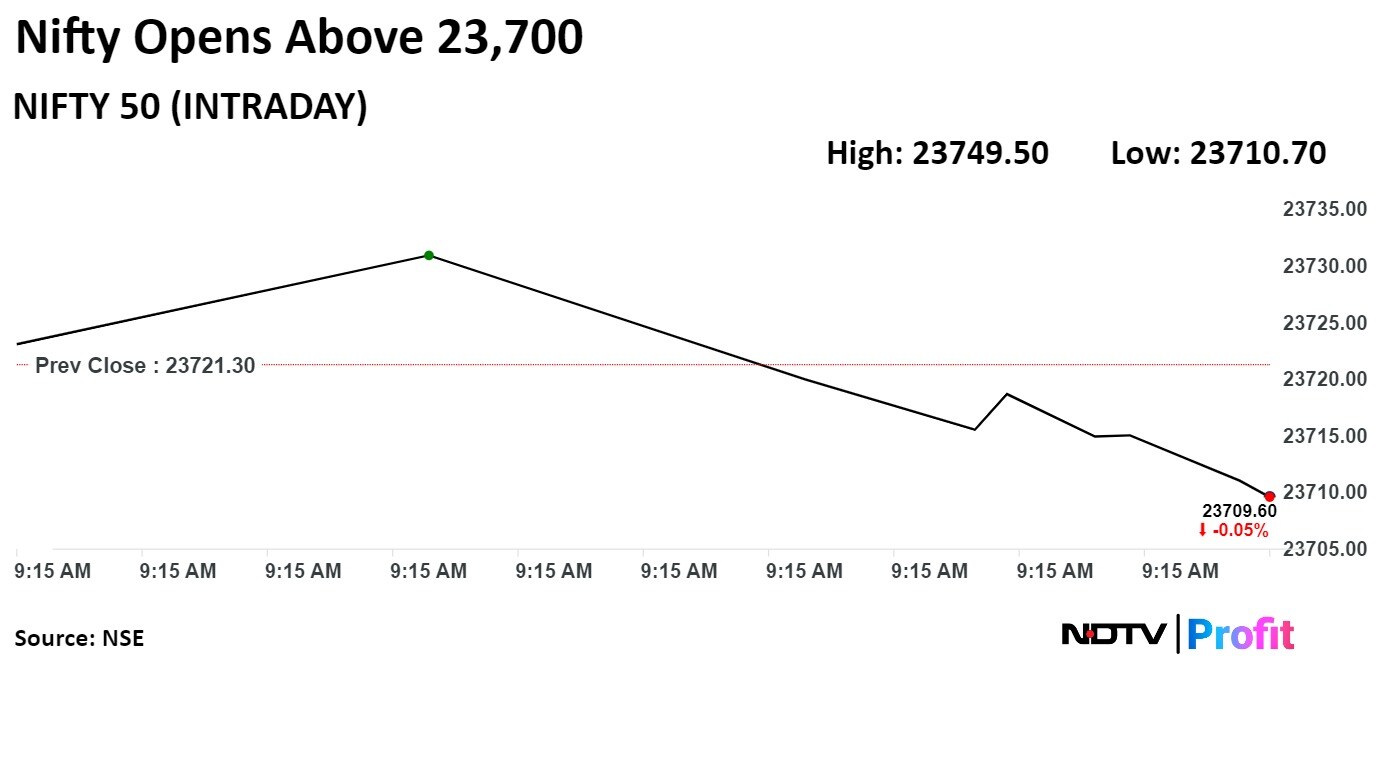

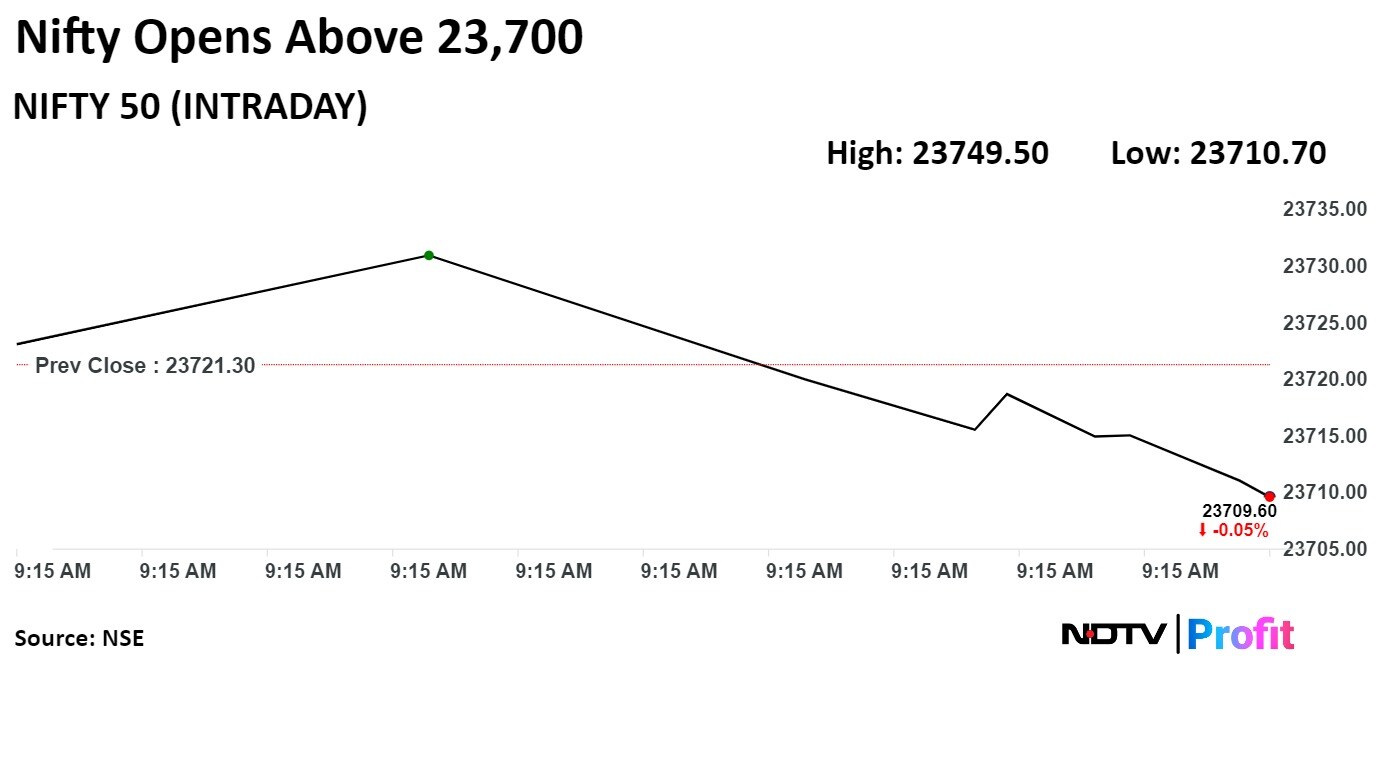

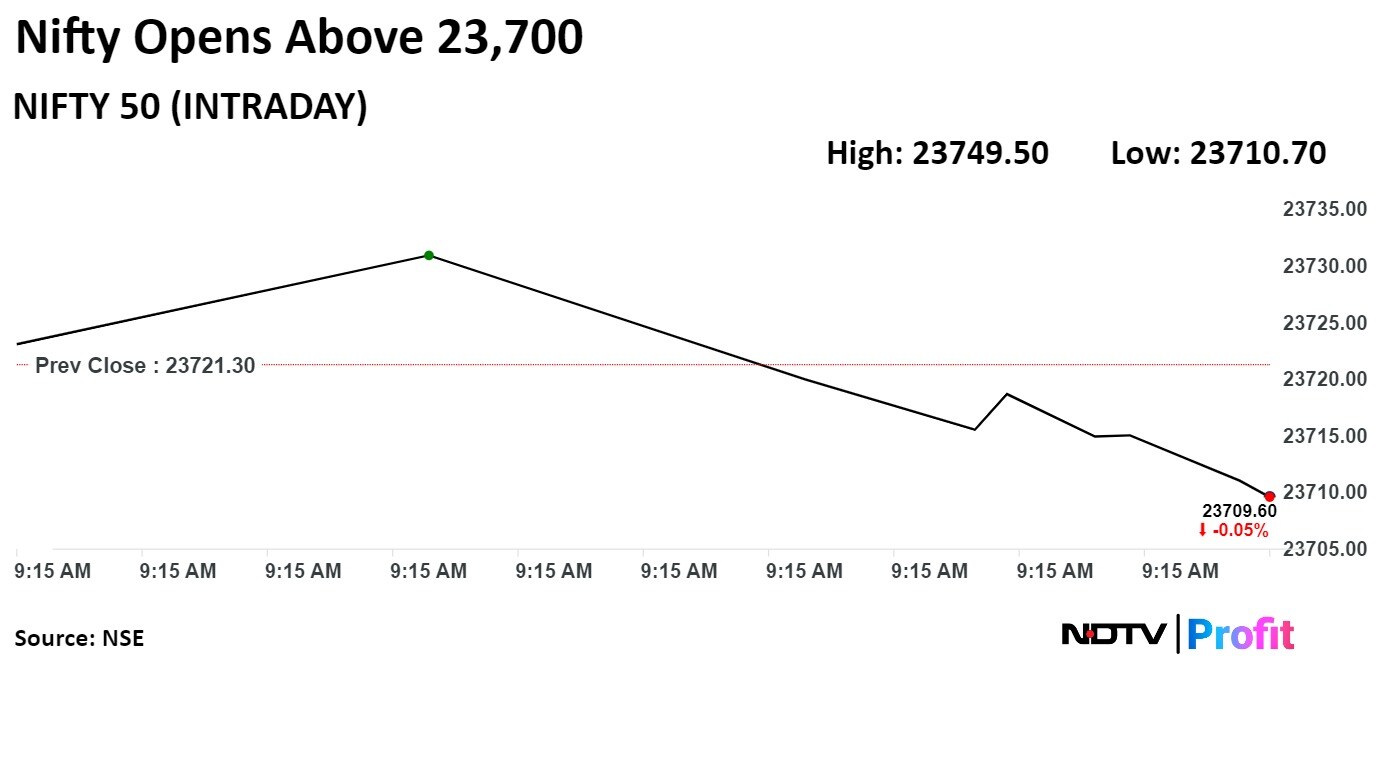

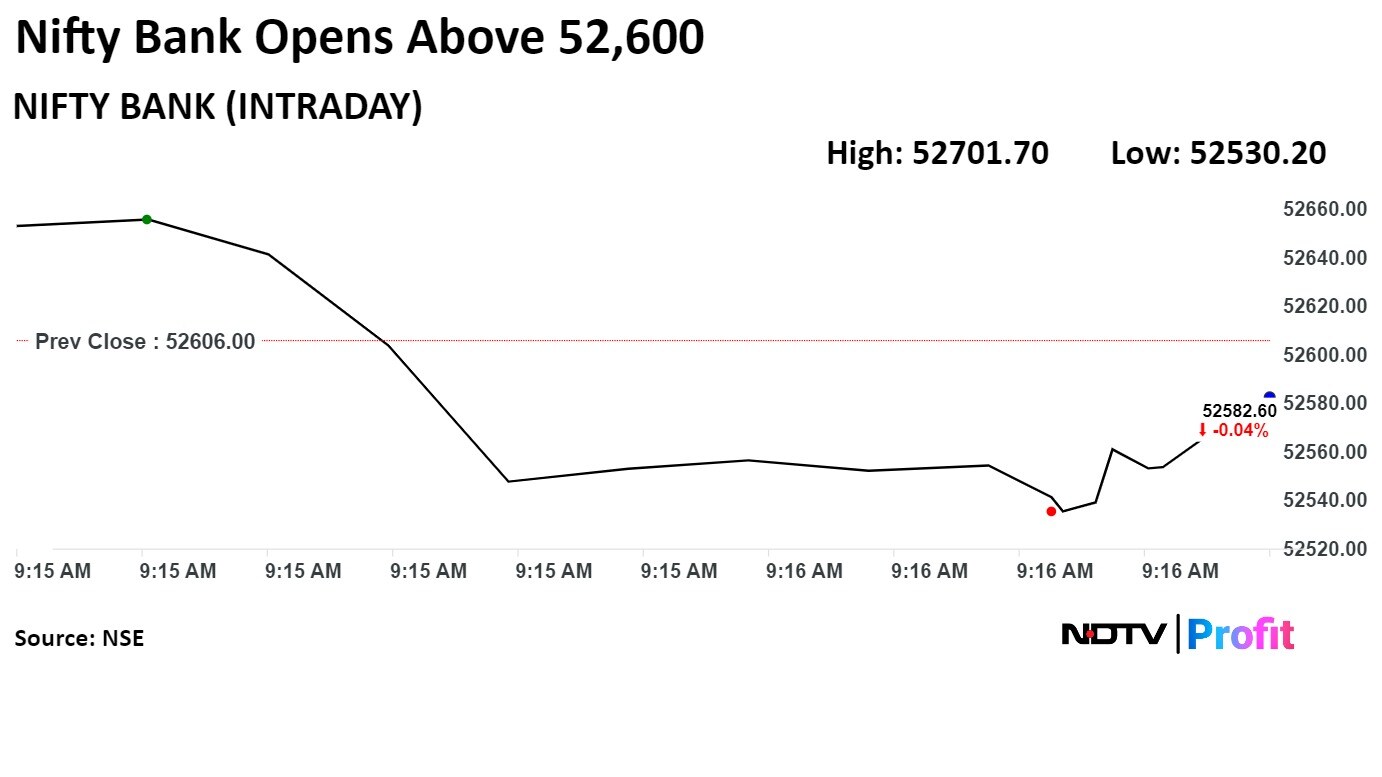

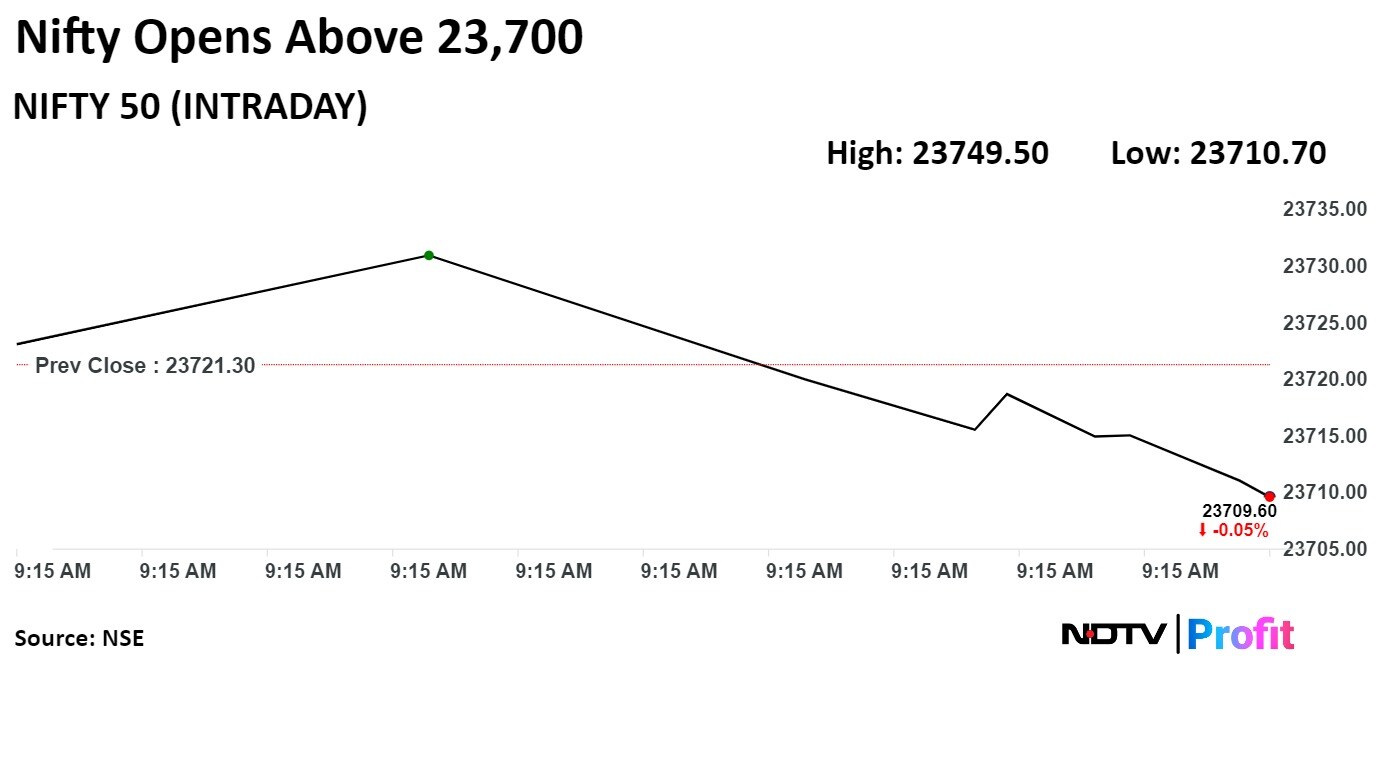

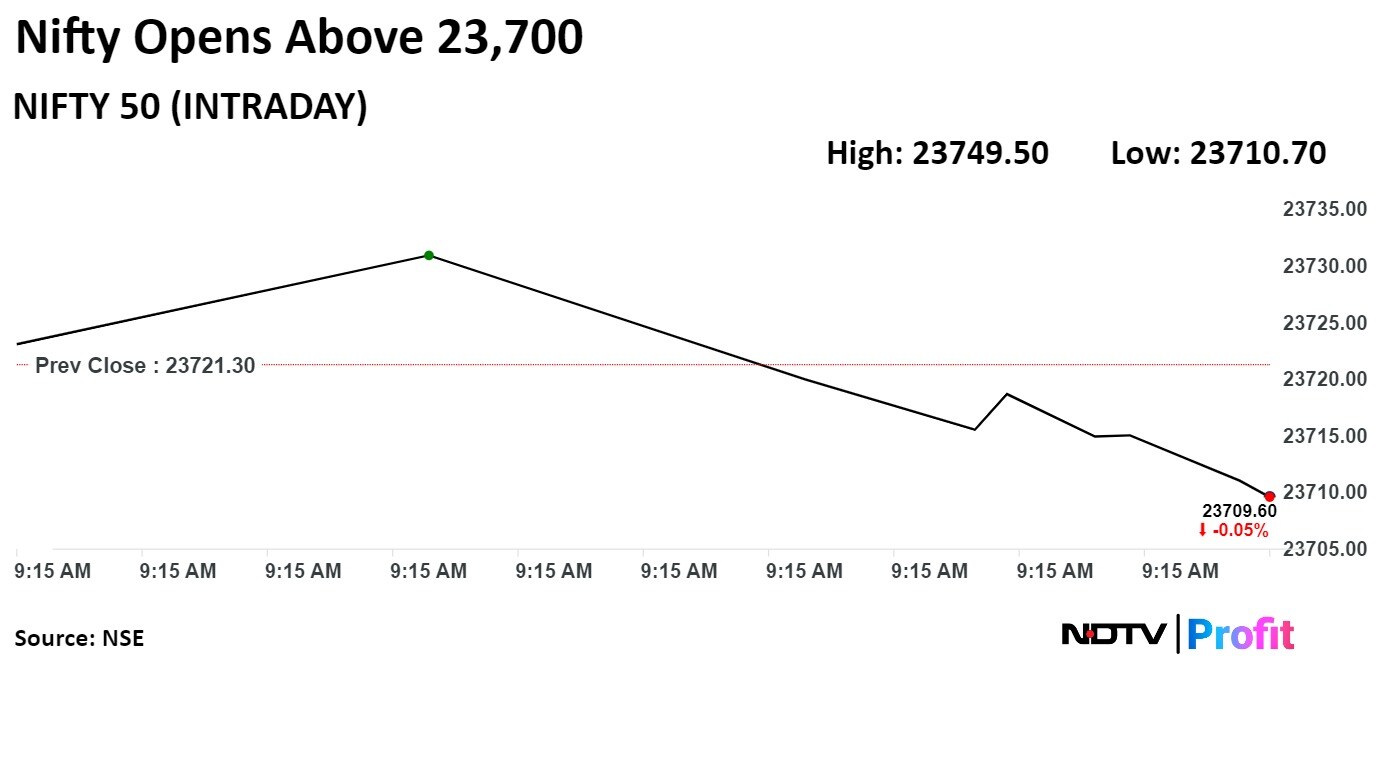

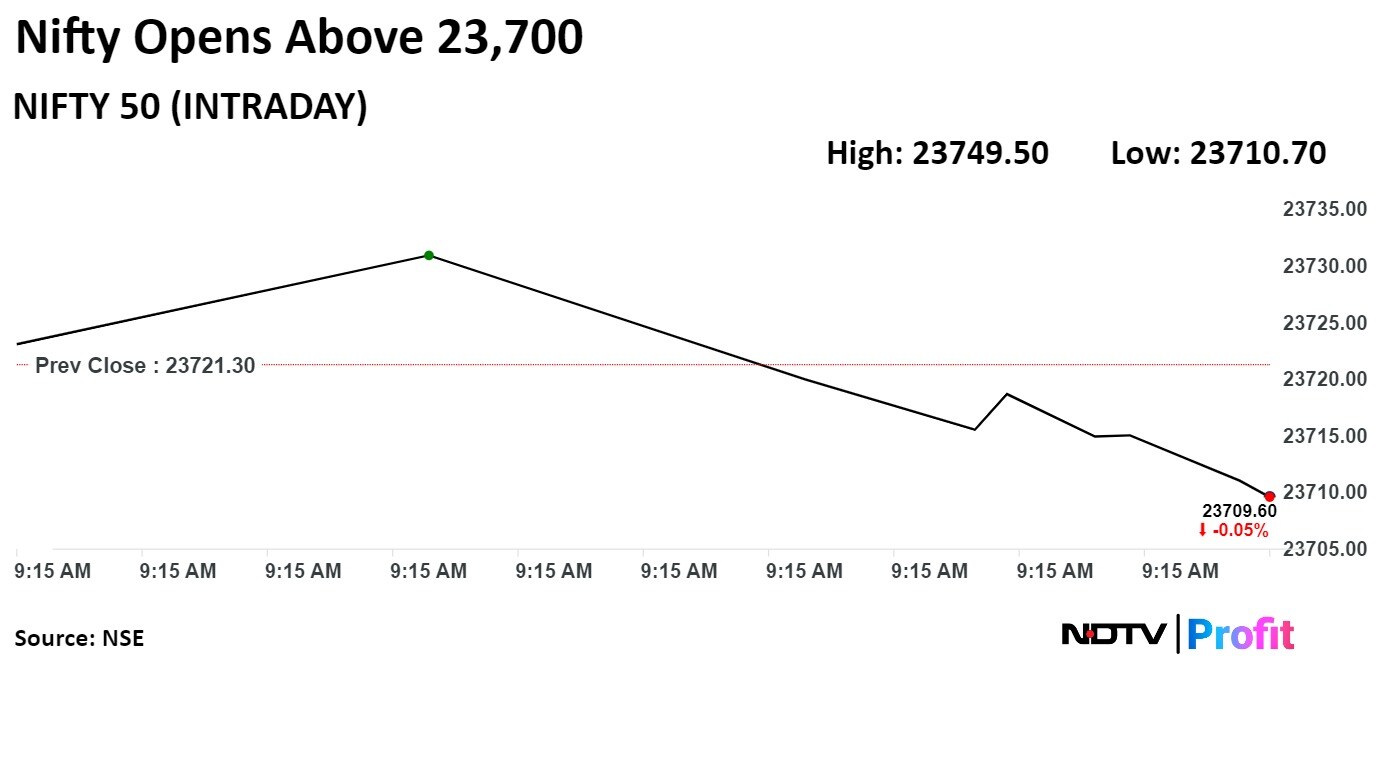

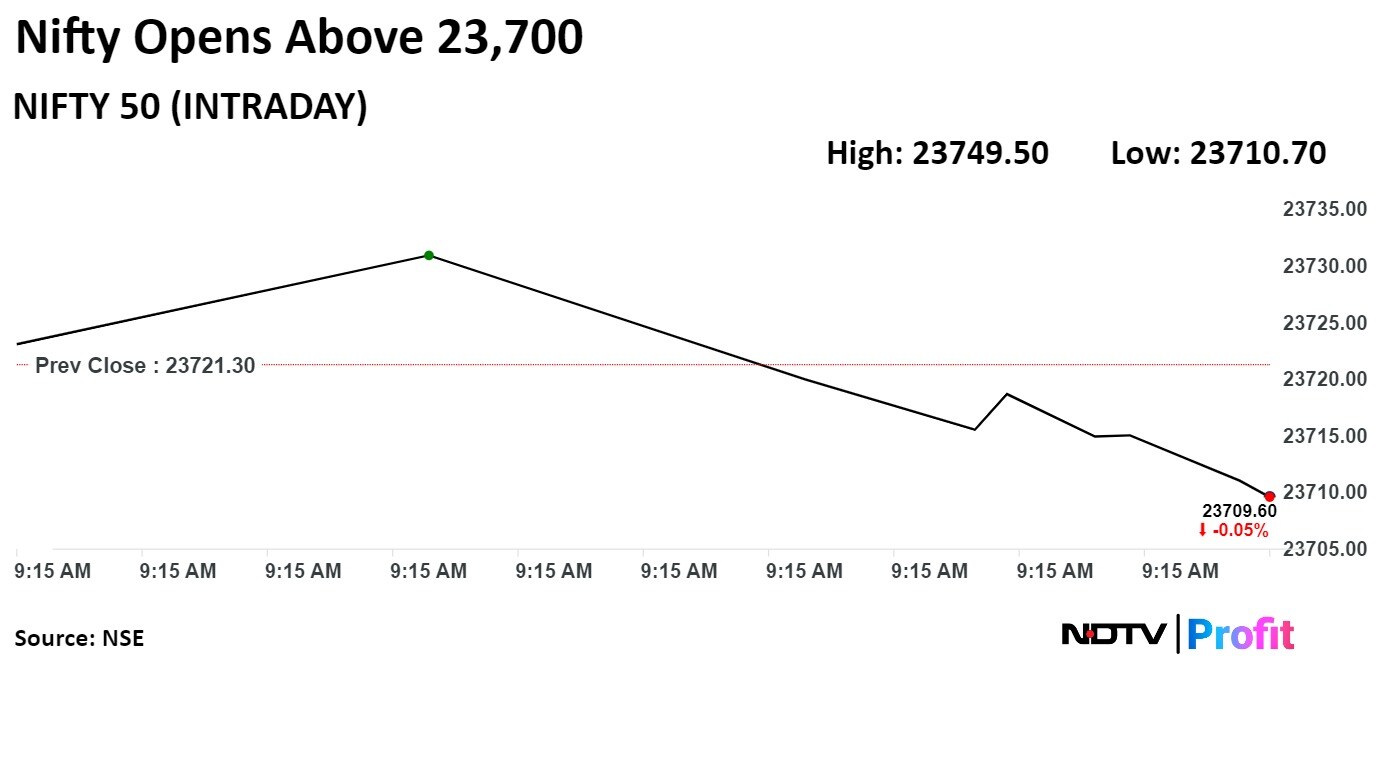

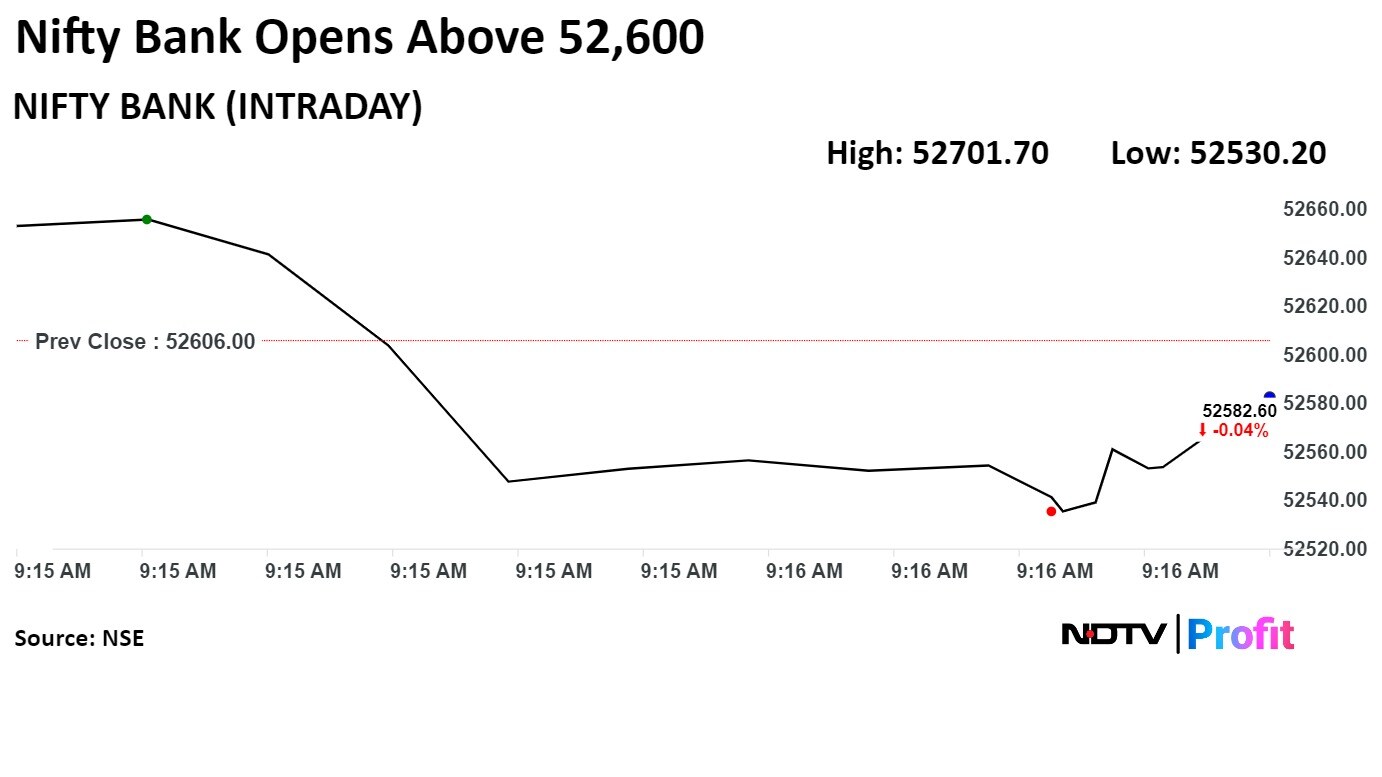

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

.jpeg)

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

.jpeg)

Shares of ICICI Bank Ltd., Tata Consultancy Services Ltd., UltraTech Cement Ltd., Larsen & Toubro Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains.

While those of HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Hindalco Industries Ltd., and State Bank Of India capped the upside.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

.jpeg)

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

Benchmark equity indices were muted at open a day after hitting their respective records as heavyweights weighed on them but ICICI Bank continued to gain and kept the indices from falling.

Soon after opening, Sensex hit its record high of 78,188.16 points and Nifty hit a high of 23,749.50 as against its record high of 23,754.15.

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

.jpeg)

Shares of ICICI Bank Ltd., Tata Consultancy Services Ltd., UltraTech Cement Ltd., Larsen & Toubro Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains.

While those of HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Hindalco Industries Ltd., and State Bank Of India capped the upside.

Maintains 'Buy' with target Rs 830, upside 22%

Demand continues to stay robust from both infrastructure and plumbing

Focused on increasing market share by rationalising pricing strategy & improving supply chain

Management is confident of 15% volume growth along with 12–14% margin in FY25

Margins can see an upside if PVC price rally continues

Will leading to re-stocking and inventory gains supporting margins

On track to reduce receivables from mid-80s to 65–70 days

Believe India’s real estate revival & infra push has paved way for plastic pipe players

Gets investment commitment worth Rs 60 crore for 2 gold projects

Source: Exchange Filing

At pre-open, both the Nifty and Sensex were flat at 23,723.10 and 78,098.84 respectively.

The yield on the 10-year bond opened flat at 6.99%.

It closed at 6.99% on Tuesday.

Source: Cogencis

The local currency weakened 2 paise to open at 83.45 against the US dollar.

It closed at 83.43 on Tuesday.

Source: Bloomberg

Target Price Rs 170, downside of 18%

RBI action similar to what was seen in some other banks during succession

RBI-appointed directors generally were appointed with a tenure of two years but for Bandhan its 1 year

Target price Rs 730; 33.8% upside potential

Expect Revenue/EBITDA/PAT annual growth of 25%/29%/29% over FY24-26

Expect RoCE/RoE of 30.4%/24.1% in FY26

Valuing at 30 times FY26

Shunt resistor the mainstay of revenue

Dominant domestic player in bimetal

Electrical contacts posed for strong growth

Longstanding customer relationships a key strength

Acquires 14.28% stake in Indian Foundation for Quality Management for Rs 12.5 crore

Source: Exchange Filing

Price target of Rs 1,050, implying 37% upside

Expect 19% loan CAGR by FY24-FY27

Driven by share of affordable and emerging prime loans doubling to 40% mix

Expect company's affordable book to grow at around 100% CAGR over next three years

Expect spreads to expand by 5-10 bps with COF benefit from rating upgrade

Risks: AQ and scale up challenges in affordable and emerging, interest rate cycle

Expect 75% pre-sales growth for coverage stocks led by DLF and Godrej Properties

Channel checks suggest momentum tapered in June due to elections

Believes overall 15-35% guidance by residential developers should be met

Impact of pricing deltas visible in NCRs with inventory off lows

Prefers Godrej Properties, Lodha, Sunteck

Cumulative bidding amount Rs 75 billion

Limited bidding activity, No demand for 5G bands

Highest deviation in bid prices seen in the 1800 MHz band in Bihar circle

Details of bids by each player will be known only at the end of the auction

No demand yet in the 800MHz band.

35% of total spectrum won in the 900MHz band (where Bharti Airtel and Vodafone Idea have footprint)

18% of total available spectrum won in 1800 MHz band where all 3 players have 25-30% share

Maintains 'equalweight' with target of Rs 750 implying 3% upside

Market share in credit cards at 18.5% (down 102bps YoY and down 3bps QoQ)

Monthly credit card spending market share increased MoM to 16% vs 15.7% (down vs May-23 16.9%)

RBI's notification impacting corporate credit card spending

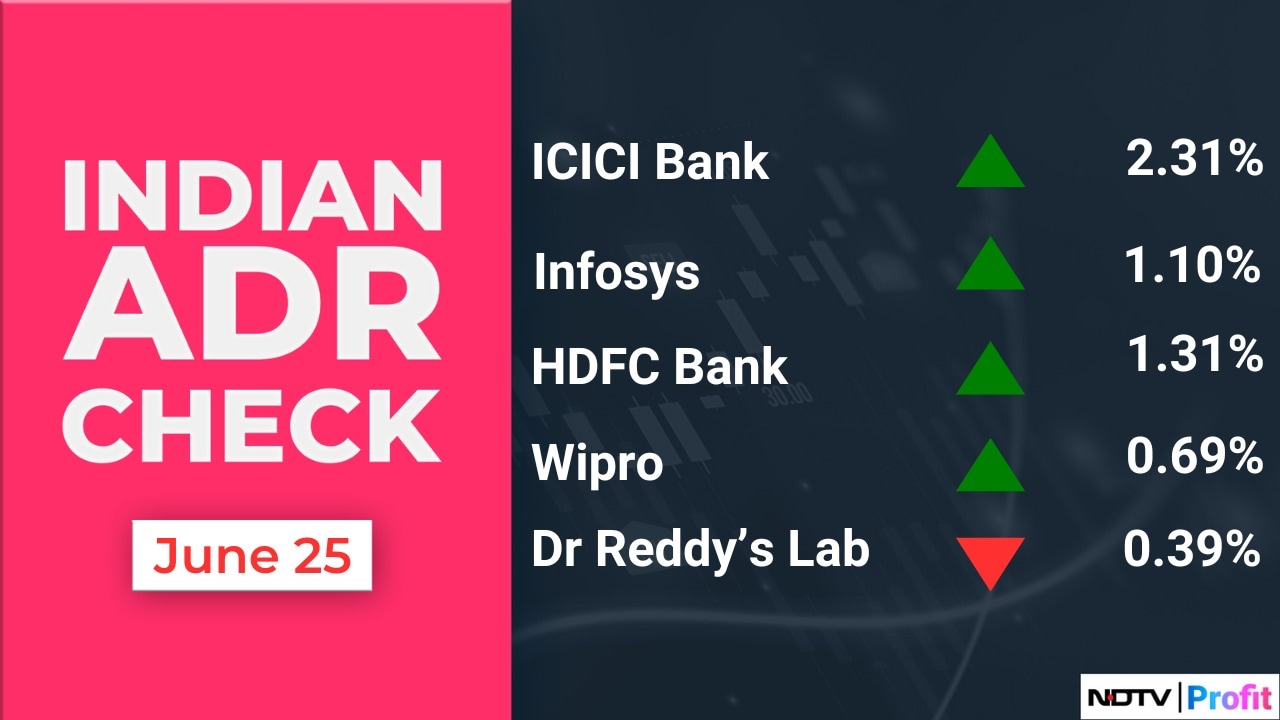

Target price at Rs 1,350, upside 15%

Deposit growth of 20% among the best of large banks

Slower cost growth to offset margin normalisation

Asset quality holding up, corporate book could see recoveries

ICICI Bank among top picks

Expect 18% ROE to sustain

Valuations based on SOTP valuations which includes 2.4 times Jun-26 PBV

Coal to remain dominant source of power generation in India over next decade

Domestic production on track to jump, coal imports to still play important role

Expect domestic production to be in 1.5-1.7 billion MT range by 2030

Imports to stay stable at over 150 million MT over next 5-6 years

Indian importers have benefitted from cheaper LNG imports this year

Expect imports to grow further if LNG prices remain attractive against competing fuels

LNG companies face challenges in securing long-term LNG contracts

India to benefit from reforms in domestic gas policies

Hydrogen garners priority status which creates export avenues for India

Domestic players like fertilizers, refineries, steel keen to offtake hydrogen

Need to reduce gap between grey and green hydrogen in domestic market

Target price Rs 215, downside of 17%

11% hike in prices since March, but global prices down now

Citi believes price cut is eminent

NMDCs current prices are at more than35% premium to export parity

Odisha miners cutting prices

Indian exports could slow, since prices globally have weakened

Every Rs 100 per tonne change in price impacts EBITDA by 3-4%

NMDC trades at 7 times EV / EBITDA while 10 year average is 5.3 times

U.S. Dollar Index at 105.65

U.S. 10-year bond yield at 4.26%

Brent crude up 0.13% at $85.12 per barrel

Nymex crude up 0.15% at $80.95 per barrel

Bitcoin was up 0.26% at $62,077

GIFT Nifty traded 25.5 points or 0.11% higher at 23,710.00 as of 7:30 a.m.

U.S. Dollar Index at 105.65

U.S. 10-year bond yield at 4.26%

Brent crude up 0.13% at $85.12 per barrel

Nymex crude up 0.15% at $80.95 per barrel

Bitcoin was up 0.26% at $62,077

GIFT Nifty traded 25.5 points or 0.11% higher at 23,710.00 as of 7:30 a.m.

Nifty June futures up by 0.81% to 23,731.25 at a premium of 10 points.

Nifty June futures open interest down by 12.6%.

Nifty Bank June futures up by 1.73% to 52,626.85 at a premium of 21 points.

Nifty Bank June futures open interest down by 14.7%.

Nifty Options June 27 Expiry: Maximum Call open interest at 24,000 and Maximum Put open interest at 23,000.

Bank Nifty Options June 26 Expiry: Maximum Call Open Interest at 54,000 and Maximum Put open interest at 50,000.

Securities in ban period: GNFC, Indus Tower, PNB, Sail.

Nifty June futures up by 0.81% to 23,731.25 at a premium of 10 points.

Nifty June futures open interest down by 12.6%.

Nifty Bank June futures up by 1.73% to 52,626.85 at a premium of 21 points.

Nifty Bank June futures open interest down by 14.7%.

Nifty Options June 27 Expiry: Maximum Call open interest at 24,000 and Maximum Put open interest at 23,000.

Bank Nifty Options June 26 Expiry: Maximum Call Open Interest at 54,000 and Maximum Put open interest at 50,000.

Securities in ban period: GNFC, Indus Tower, PNB, Sail.

Ex/record dividend: Welspun Living, Aegis Logistics.

Ex/record AGM: Welspun Living.

Moved out short-term Framework: Omaxe, Vardhman Holdings.

Moved in short-term Framework: Bajaj Hindusthan Sugar, IIFL Securities, Marine Electricals (India), Praj Industries.

Happiest Minds Technologies: Ashok Soota sold 91.36 lakh shares (6%) at Rs 834.87 apiece. On the other hand, Mansi Share & Stock Advisors bought 9.3 lakh shares (0.61%) at Rs 837.57 apiece and PRB Securities bought 9.1 lakh shares (0.59%) at Rs 843.6 apiece.

Moschip Technologies: Naveed Ahmed Sherwani sold 17.69 lakh shares (0.97%) at Rs 303.32 apiece.

Restaurant Brands Asia: Goldman Sachs Funds - Goldman Sachs India Equity Portfolio sold 47.97 lakh shares (0.96%) at Rs 104.05 apiece.

DCB Bank: DSP Mutual Fund sold 17 lakh shares (0.54%) at Rs 140.15 apiece, while India First Life Insurance Company Limited bought 20.23 lakh shares (0.64%) at Rs 140.15 apiece.

Dodla Dairy: Mylktree Consultants LLP sold 7.36 lakh shares (1.23%) at Rs 1,000 apiece, while Pinebridge Inv Asia Limited A/C Pb Global Funds-Pinebridge India EQ Fund bought 8.25 lakh shares (1.38%) at Rs 1,000 apiece.

Jupiter Wagons: Copthall Mauritius Investment Ltd bought 32.79 lakh shares (0.82%) at Rs 652 apiece.

Le Travenues Technology: Steadview Capital Master Fund bought 20.13 lakh shares (0.52%) at Rs 163.83 apiece.

Tourism Finance Corporation of India: Giriraj Ratan Damani bought 5 lakh shares (0.55%) at Rs 200.54 apiece.

Dhani Services: Societe Generale bought 1 crore shares (1.63%) at Rs 52.08 apiece, while Bofa Securities Europe SA sold 100 lakh shares (1.63%) at Rs 52.08 apiece.

Ramkrishna Forgings: Societe Generale bought 31.17 lakh shares (1.94%) at Rs 920.75 apiece, while Bofa Securities Europe SA sold 31.17 lakh shares (1.94%) at Rs 920.75 apiece.

Tilaknagar Industries: Societe Generale bought 35.3 lakh shares (1.84%) at Rs 255.45 apiece, while Bofa Securities Europe SA sold 35.3 lakh shares (1.84%) at Rs 255.45 apiece.

Alkem Laboratories: Seema Singh sold 3.58 lakh shares (0.3%) at Rs 4956 apiece, while ICICI Prudential Mutual Fund bought 1.92 lakh shares (0.15%) at Rs 4956 apiece. Morgan Stanley Asia Singapore Pte bought 0.98 lakh shares (0.08%) at Rs 4956 apiece and Aditya Birla Sun Life Mutual Fund bought 0.7 lakh shares (0.05%) at Rs 4956 apiece.