-The local currency strengthened by 7 paise to end at 83.47 against the US dollar.

-It closed at 83.54 on Thursday.

Source: Bloomberg

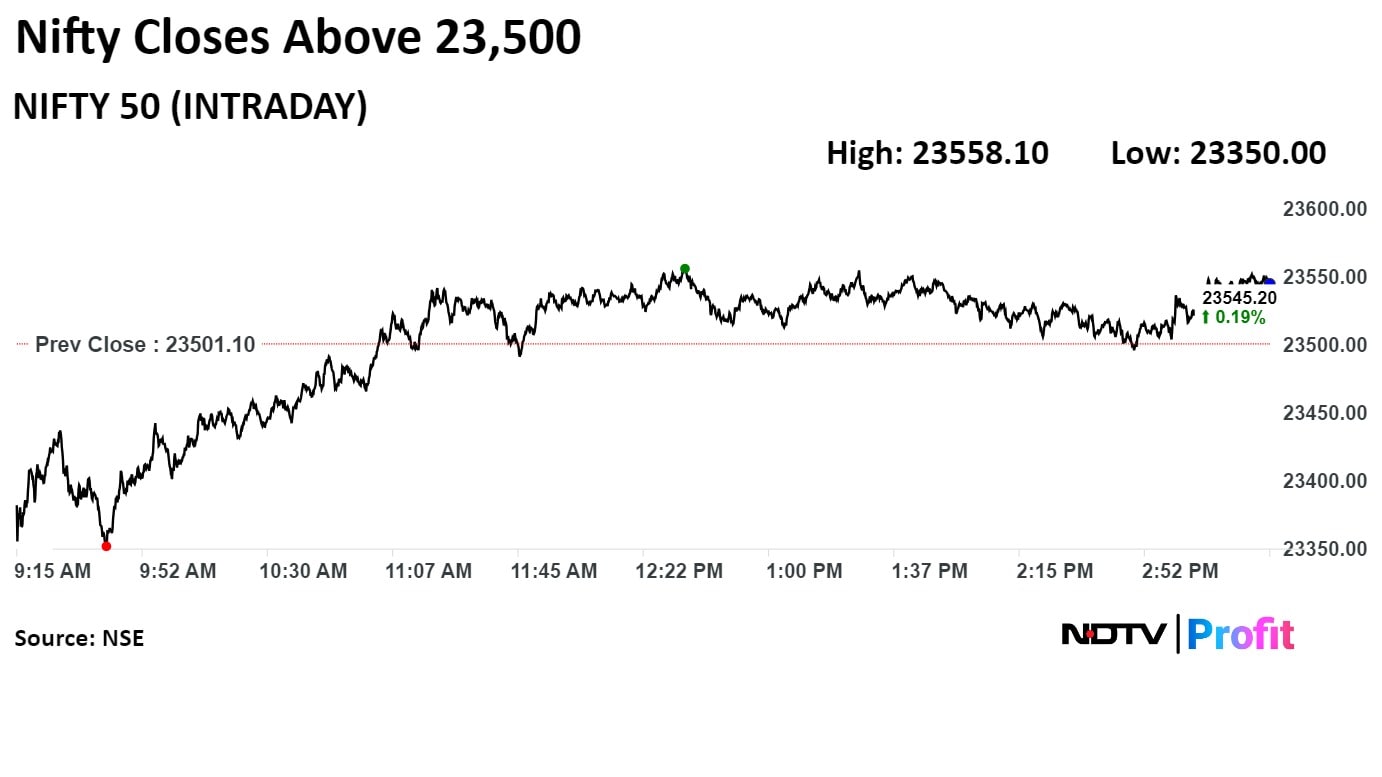

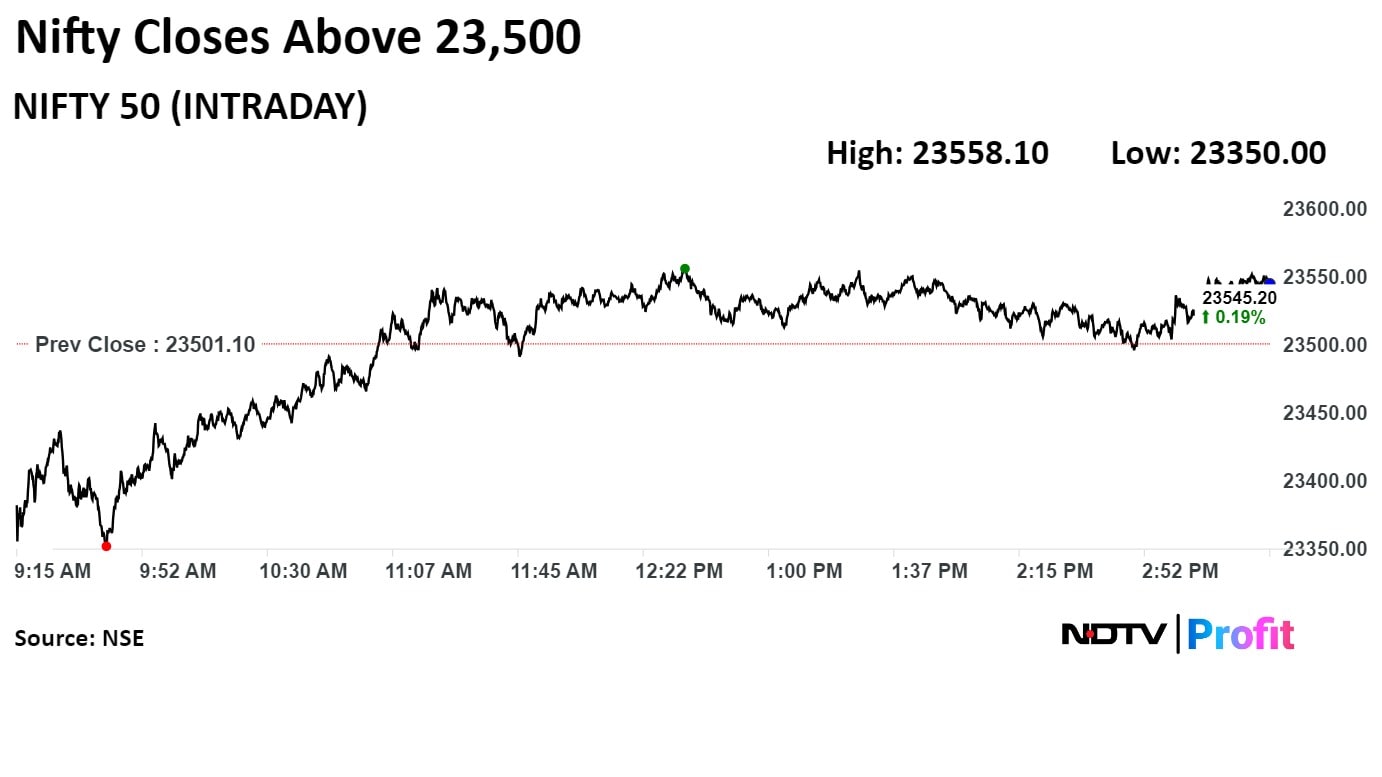

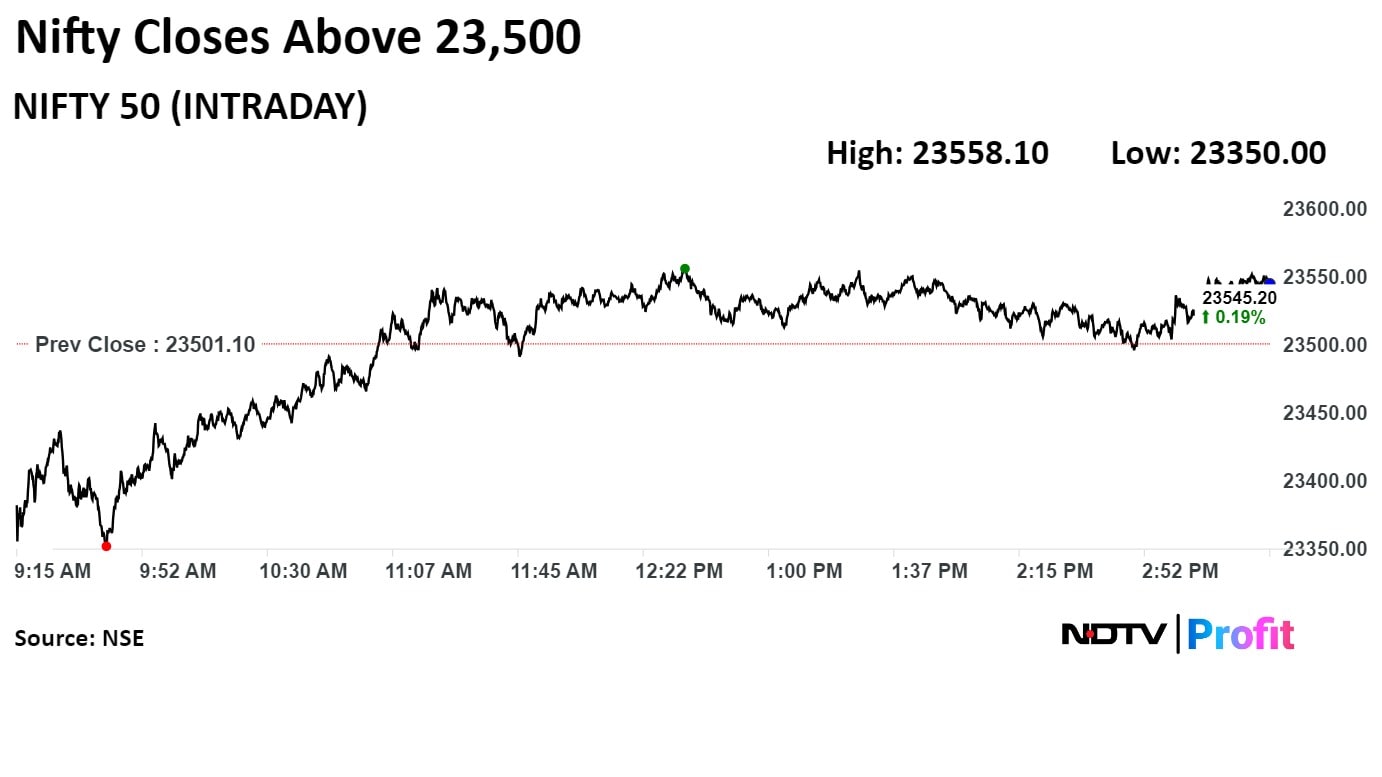

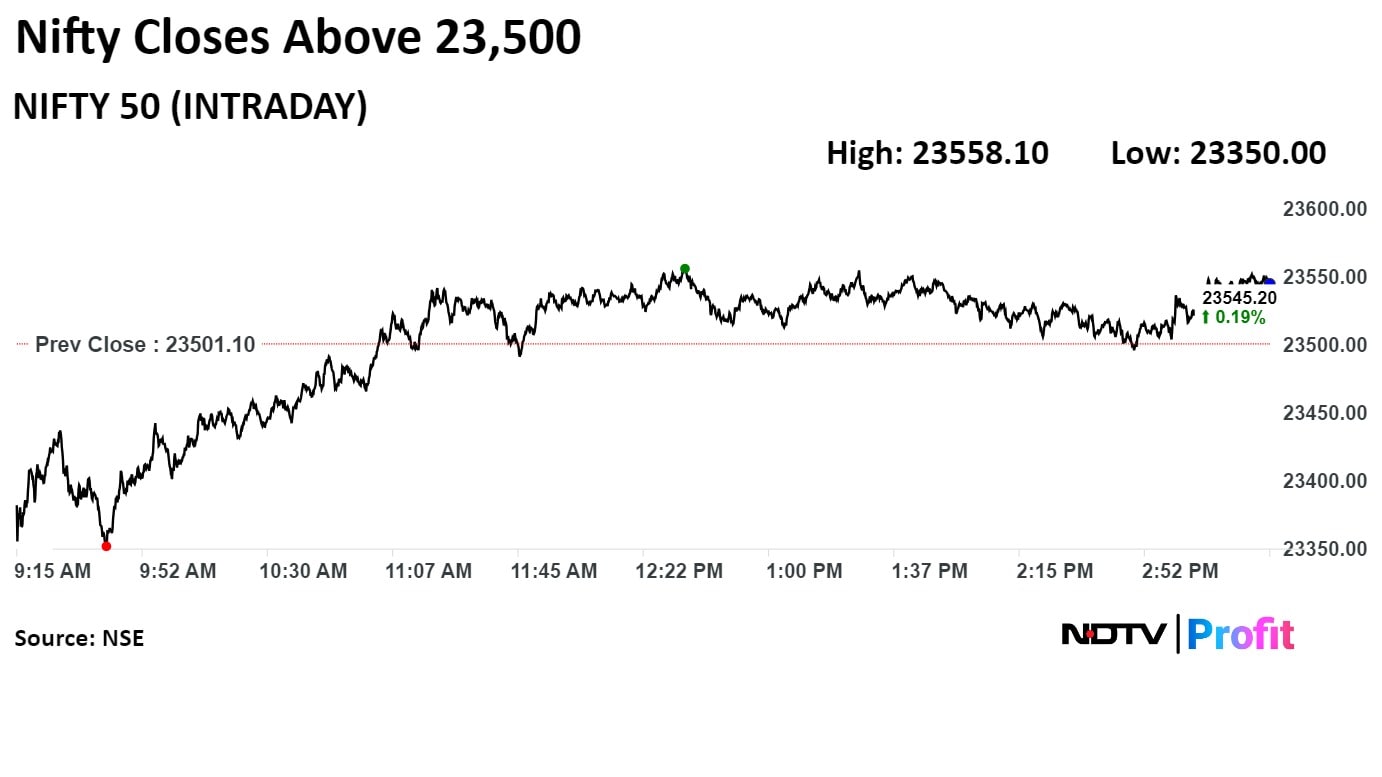

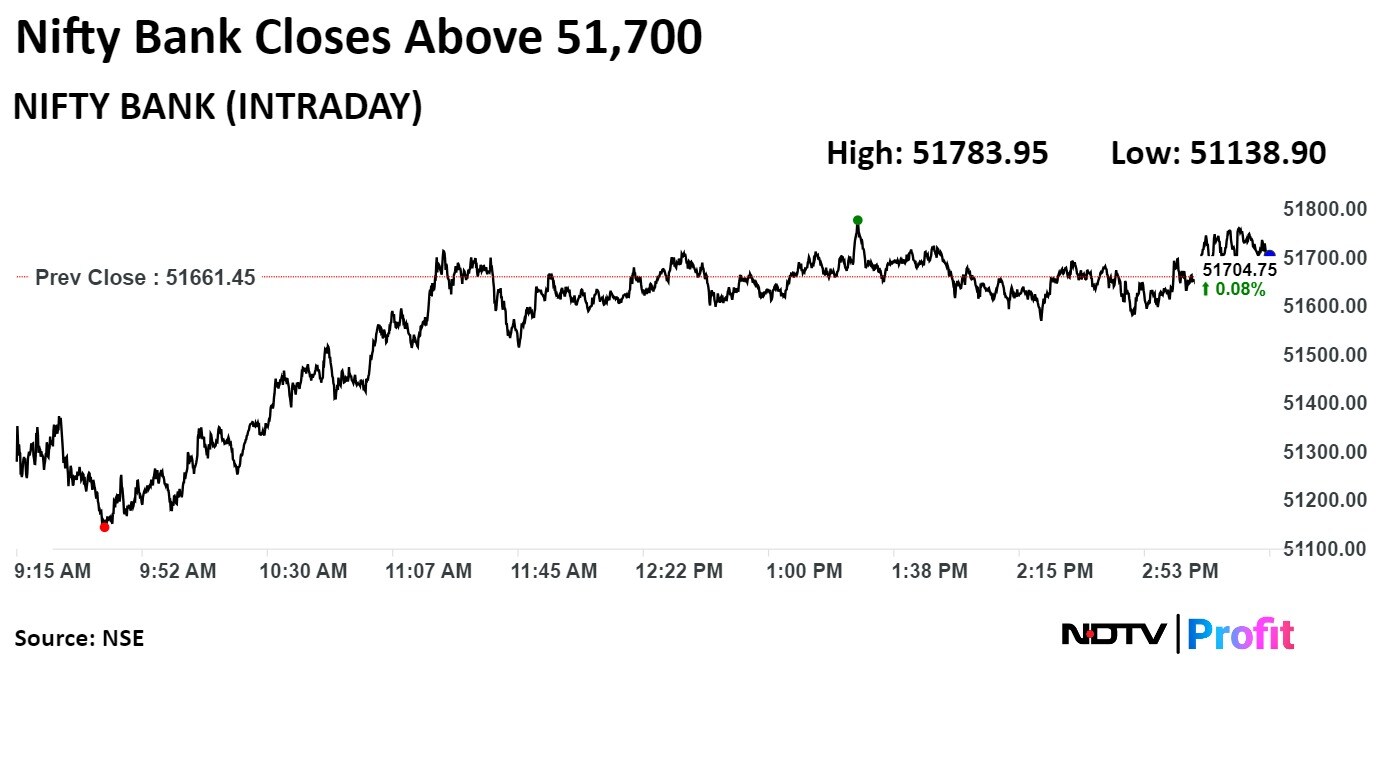

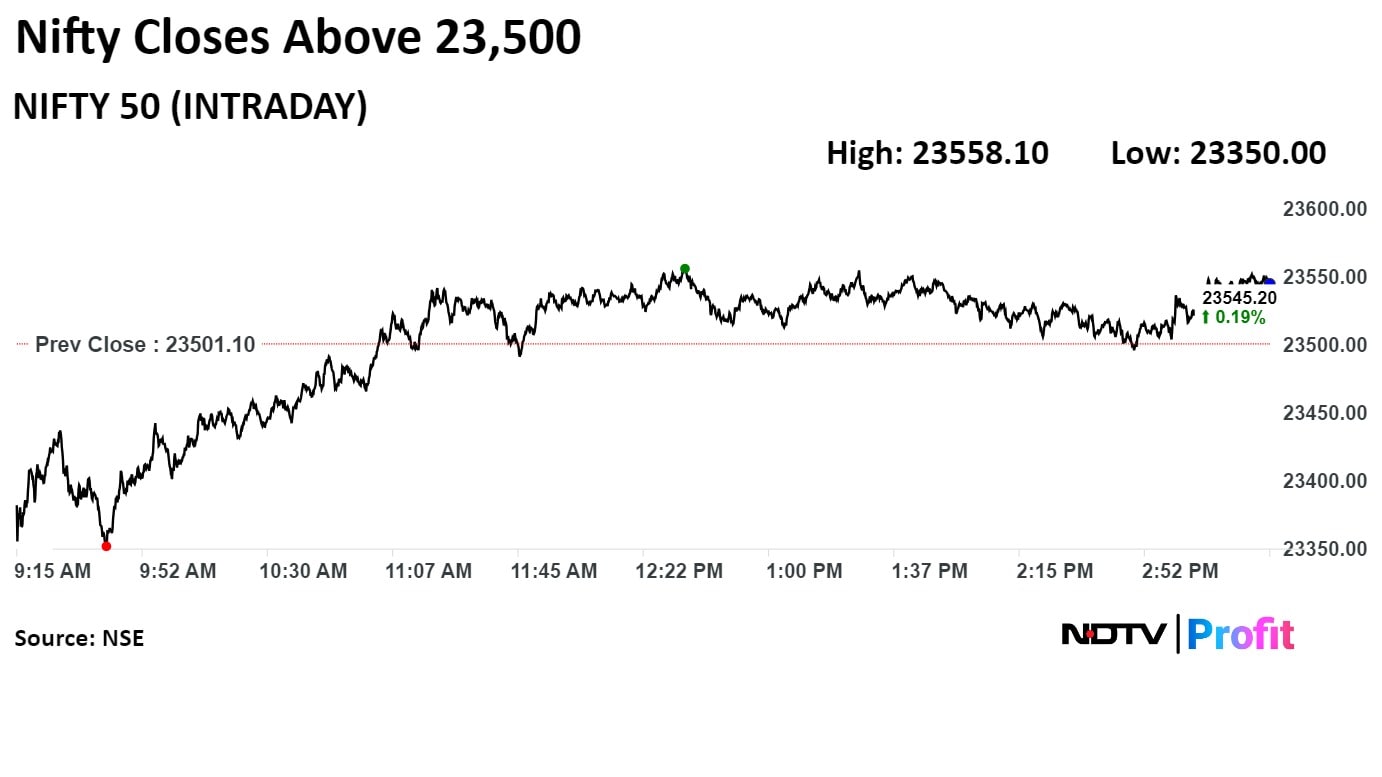

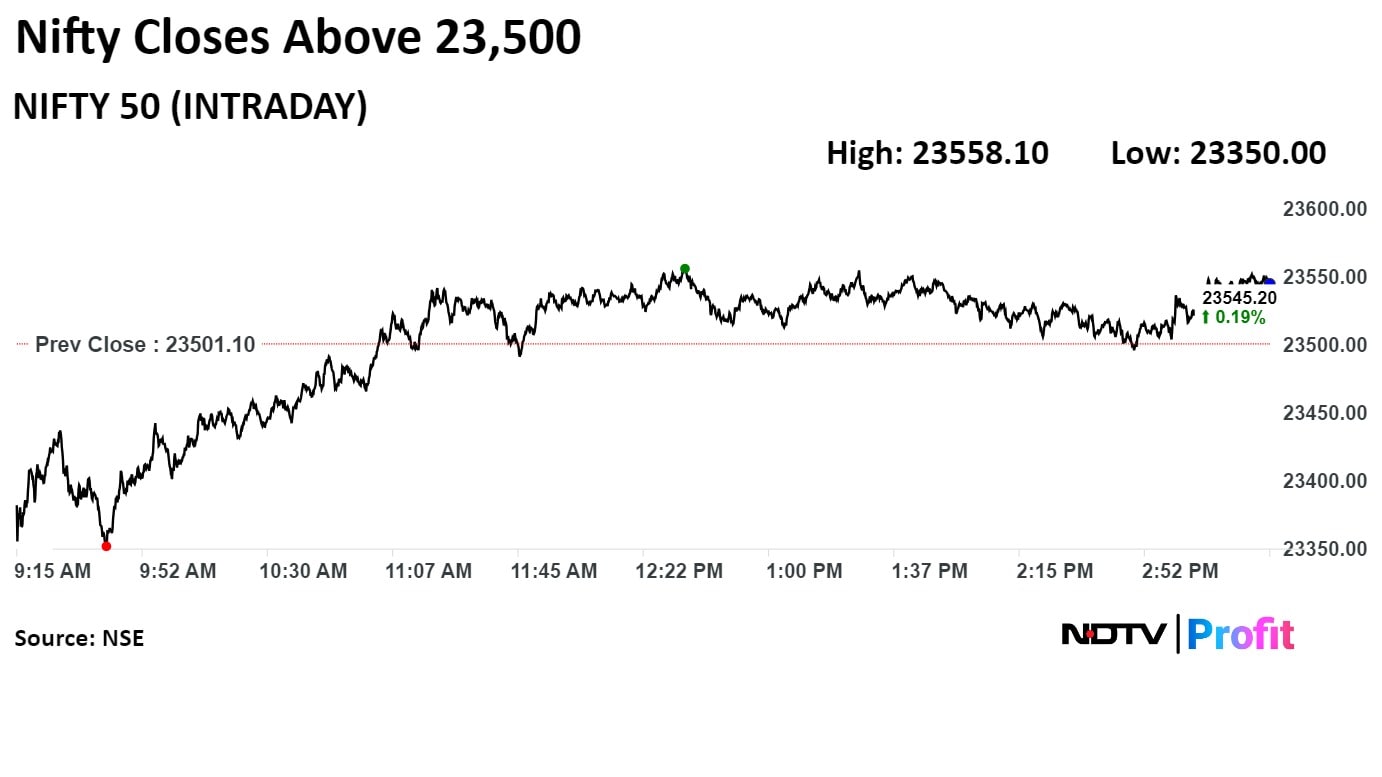

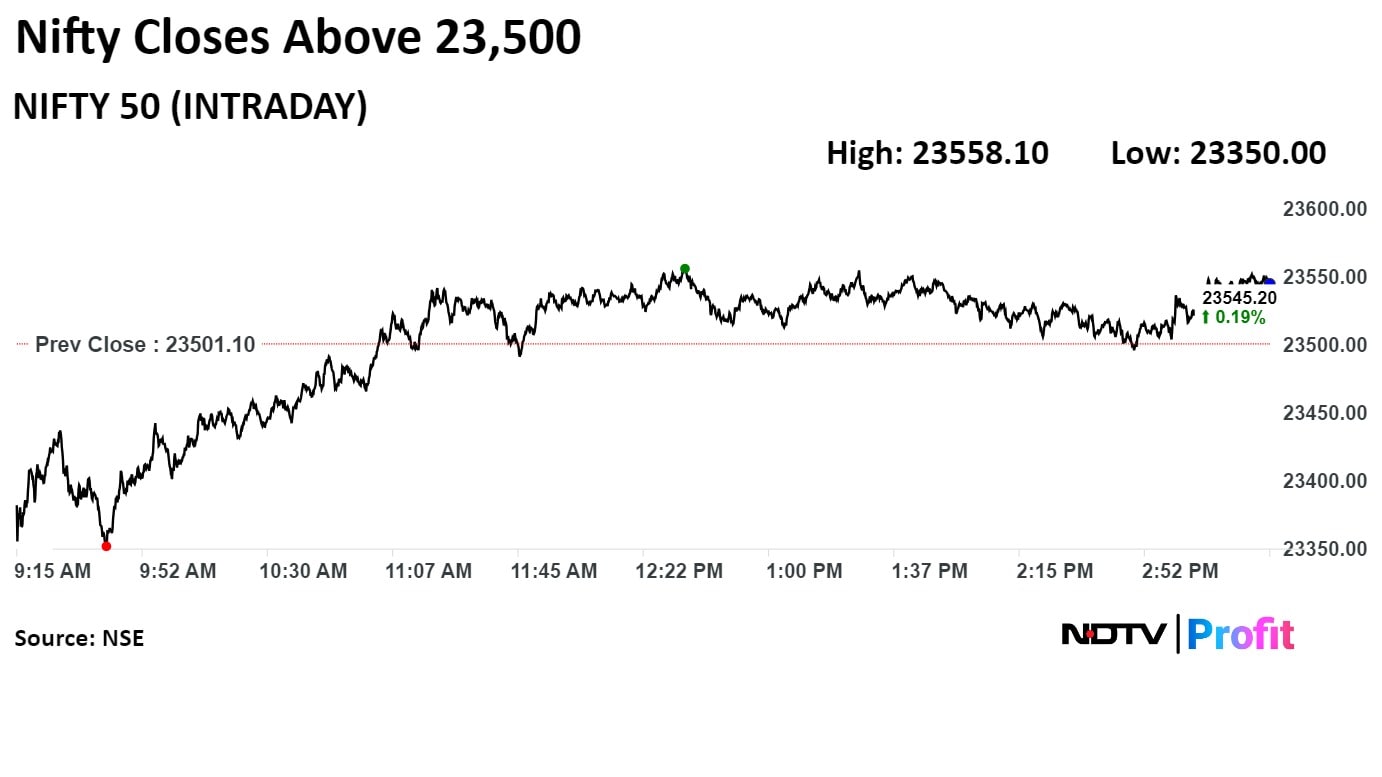

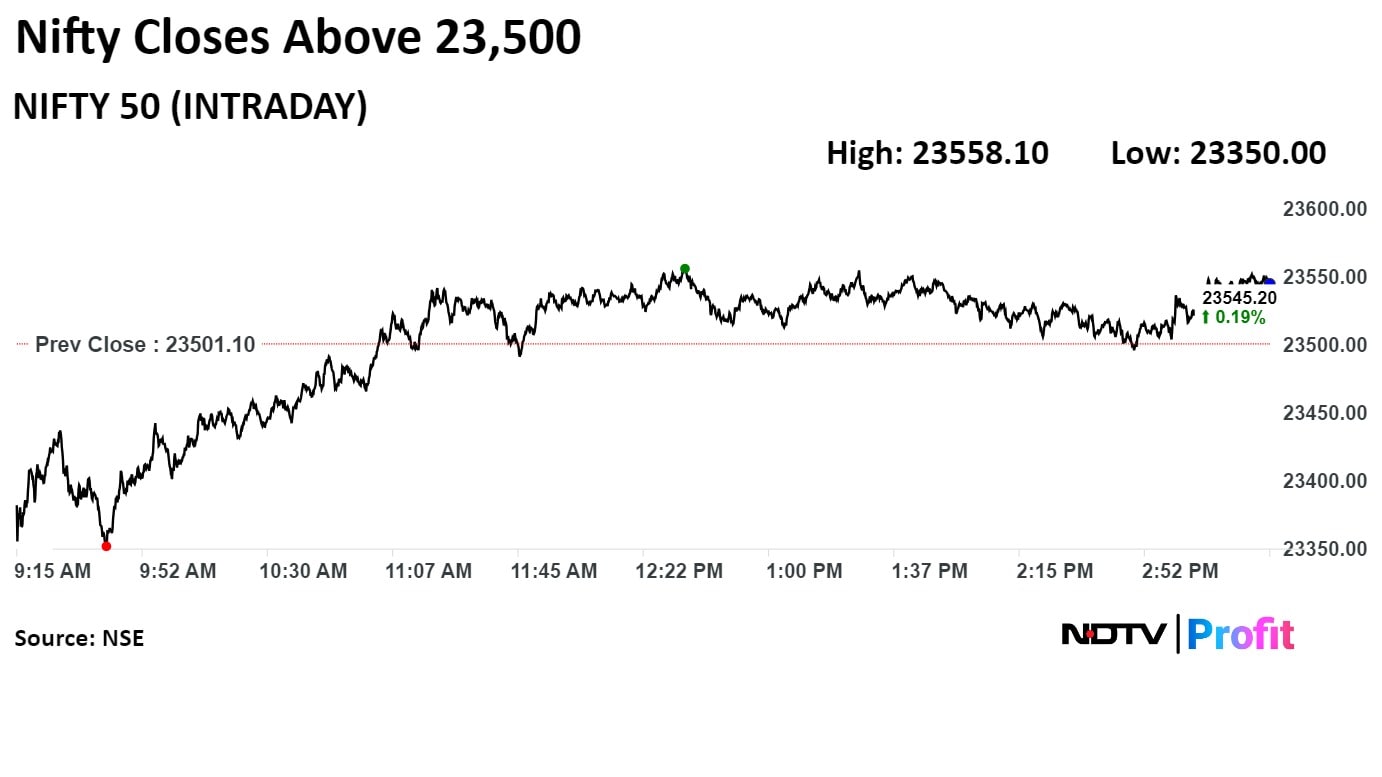

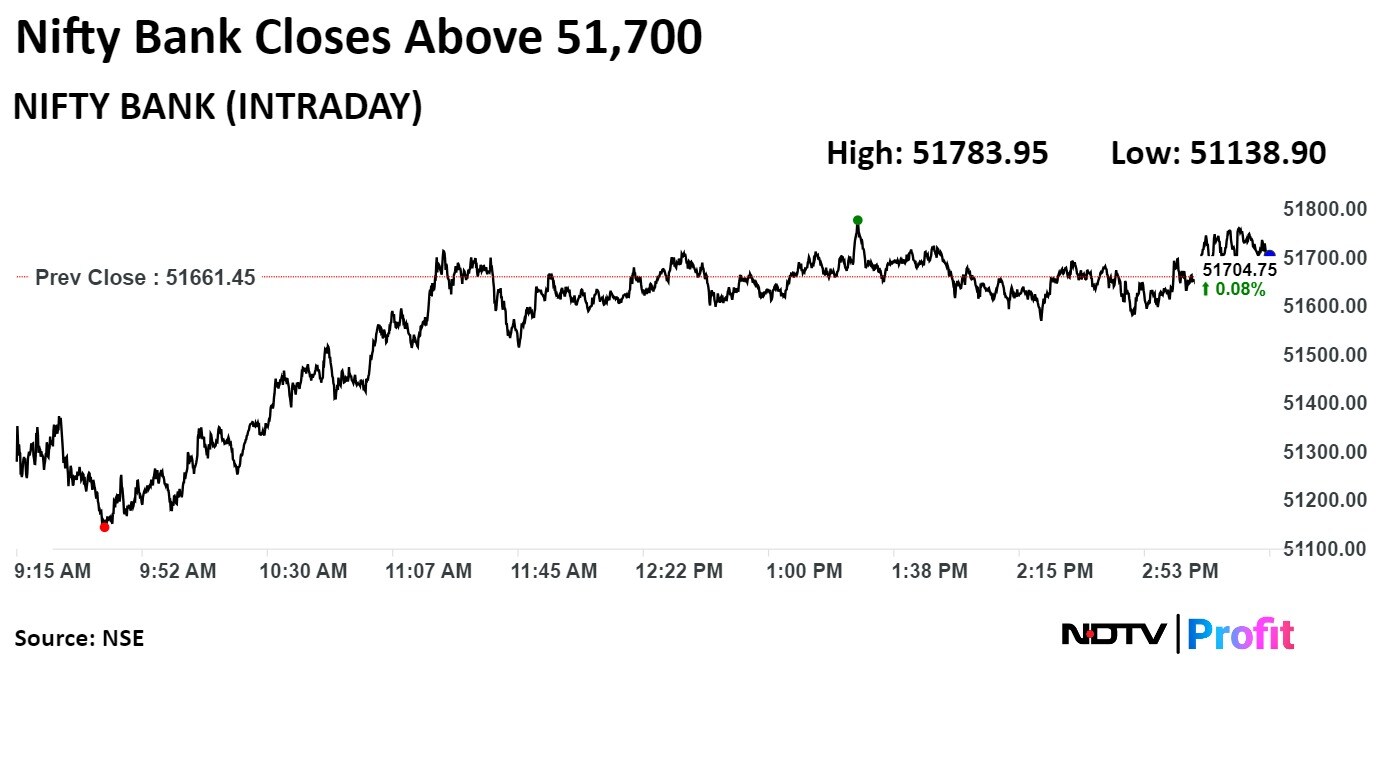

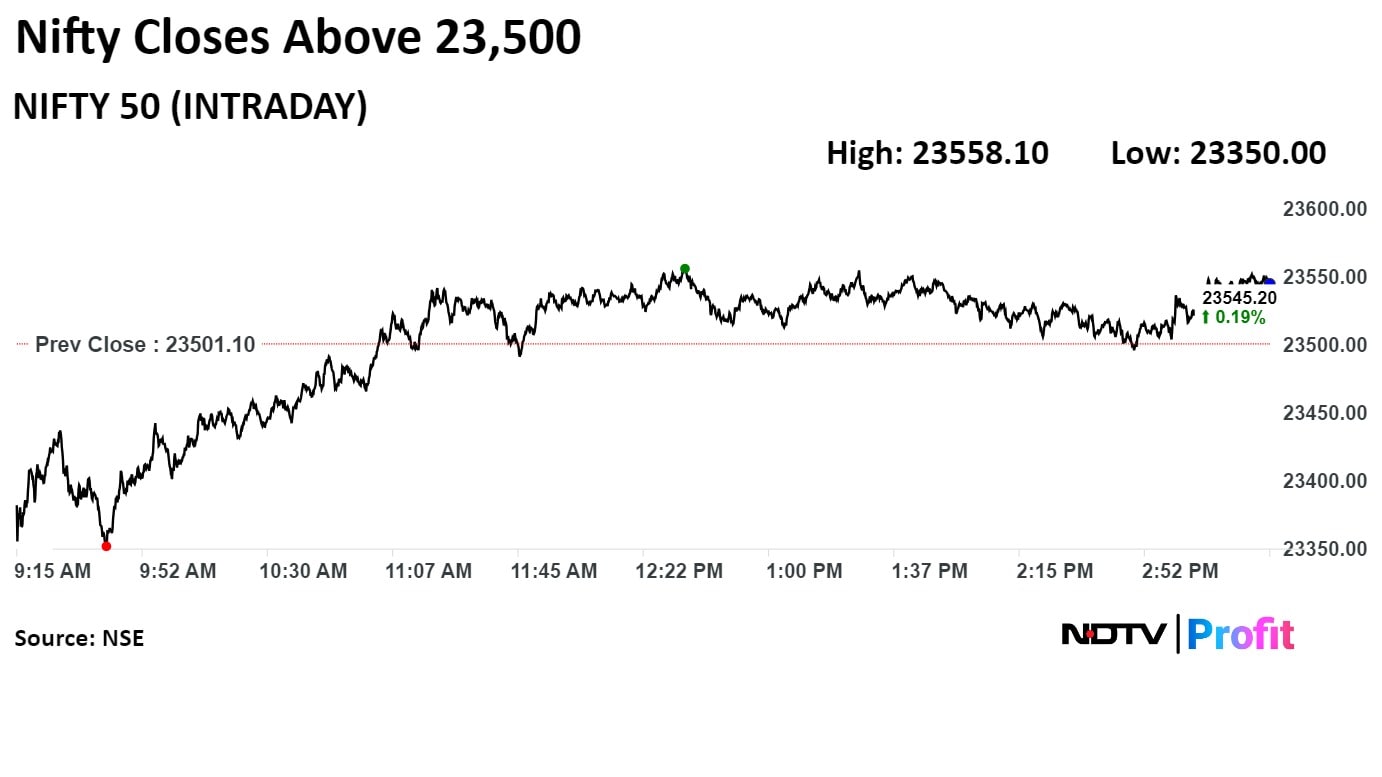

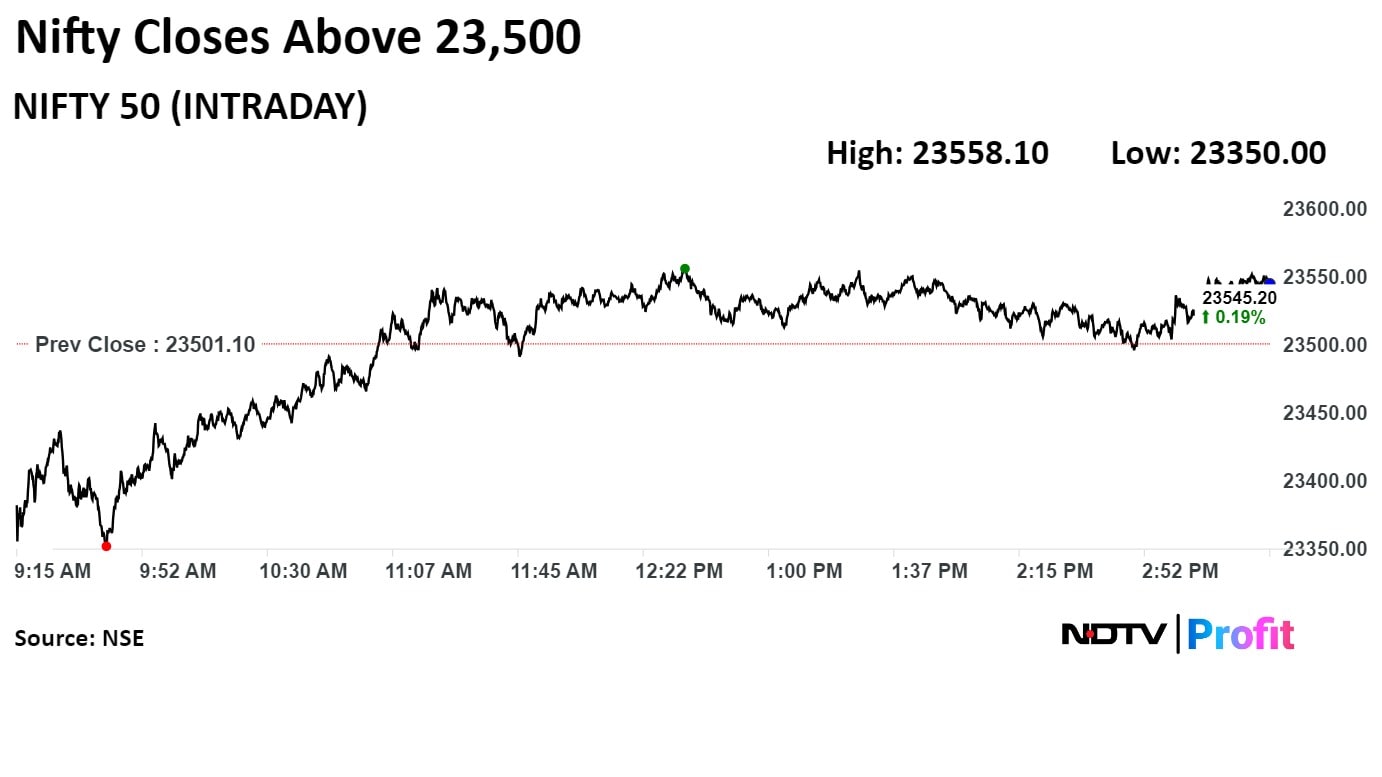

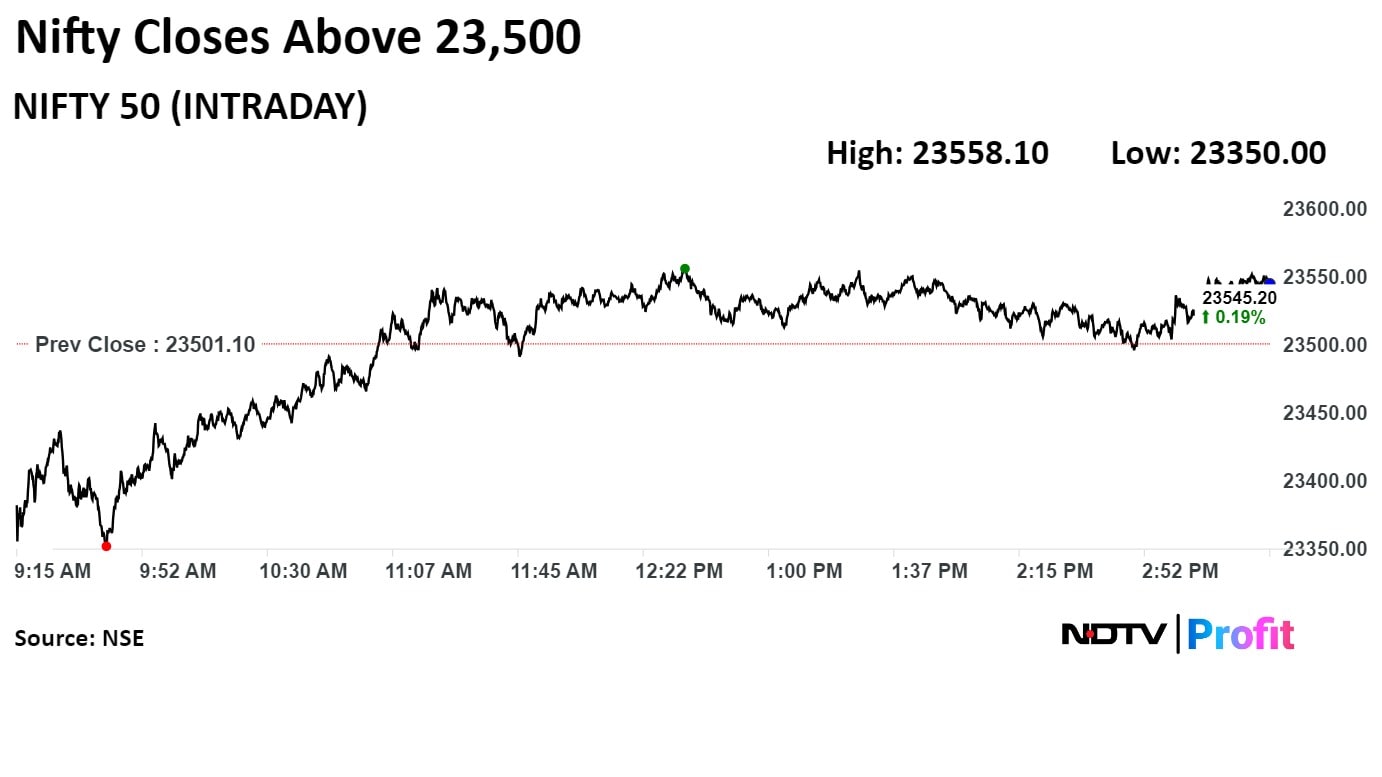

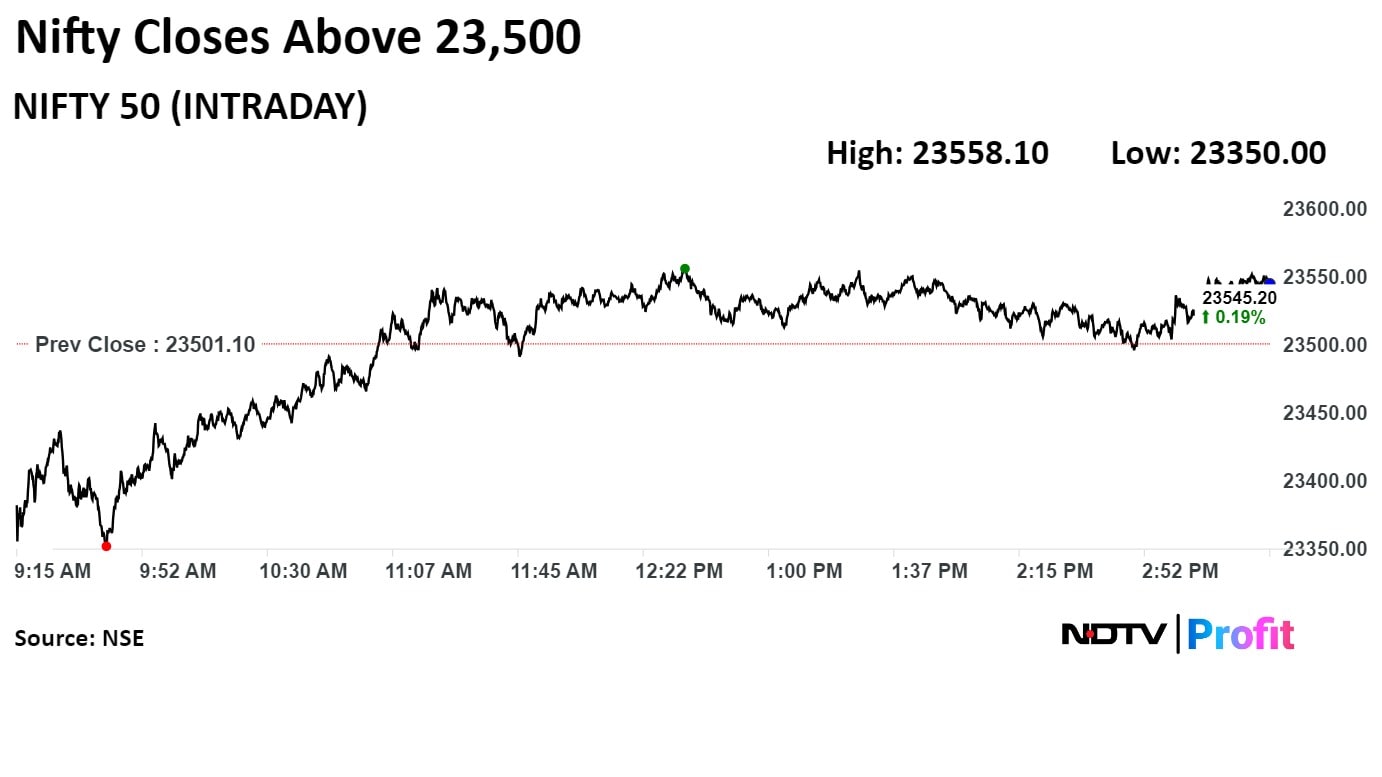

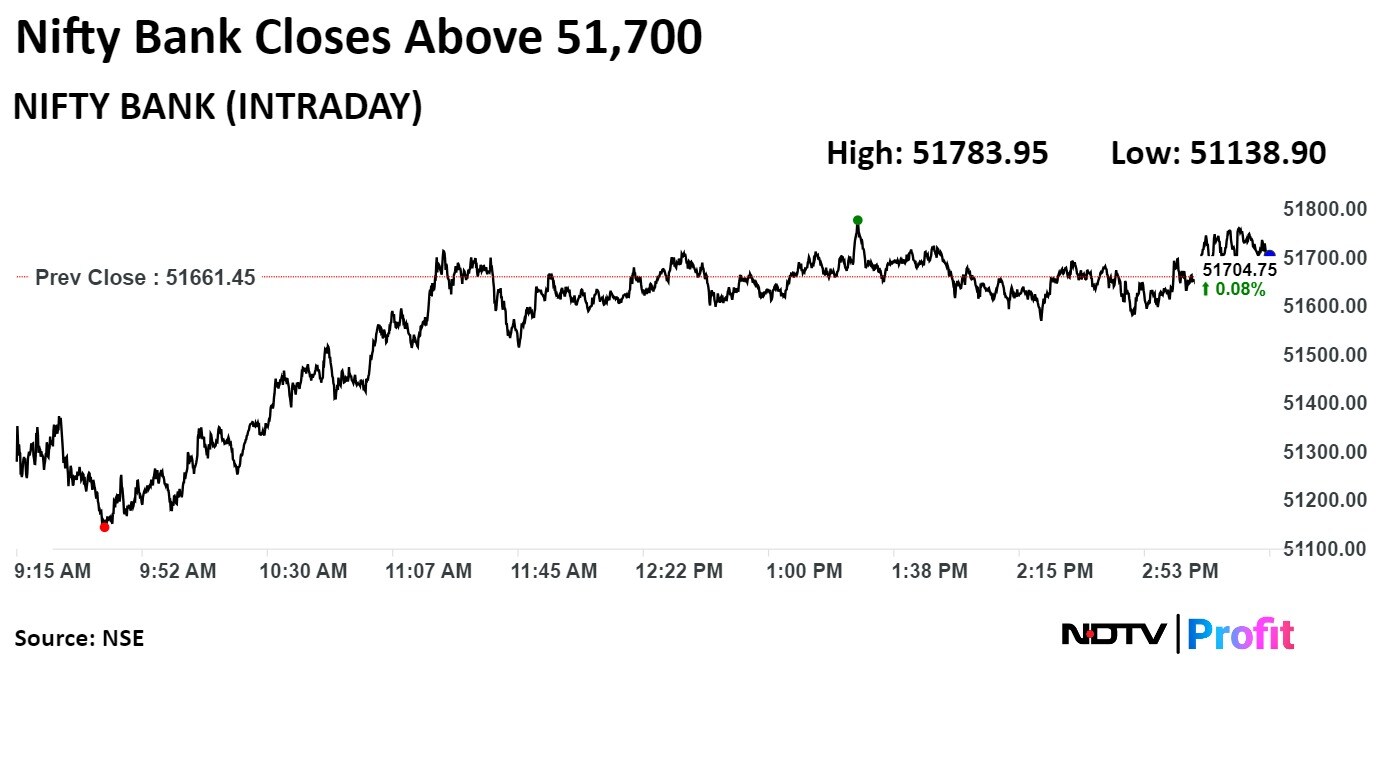

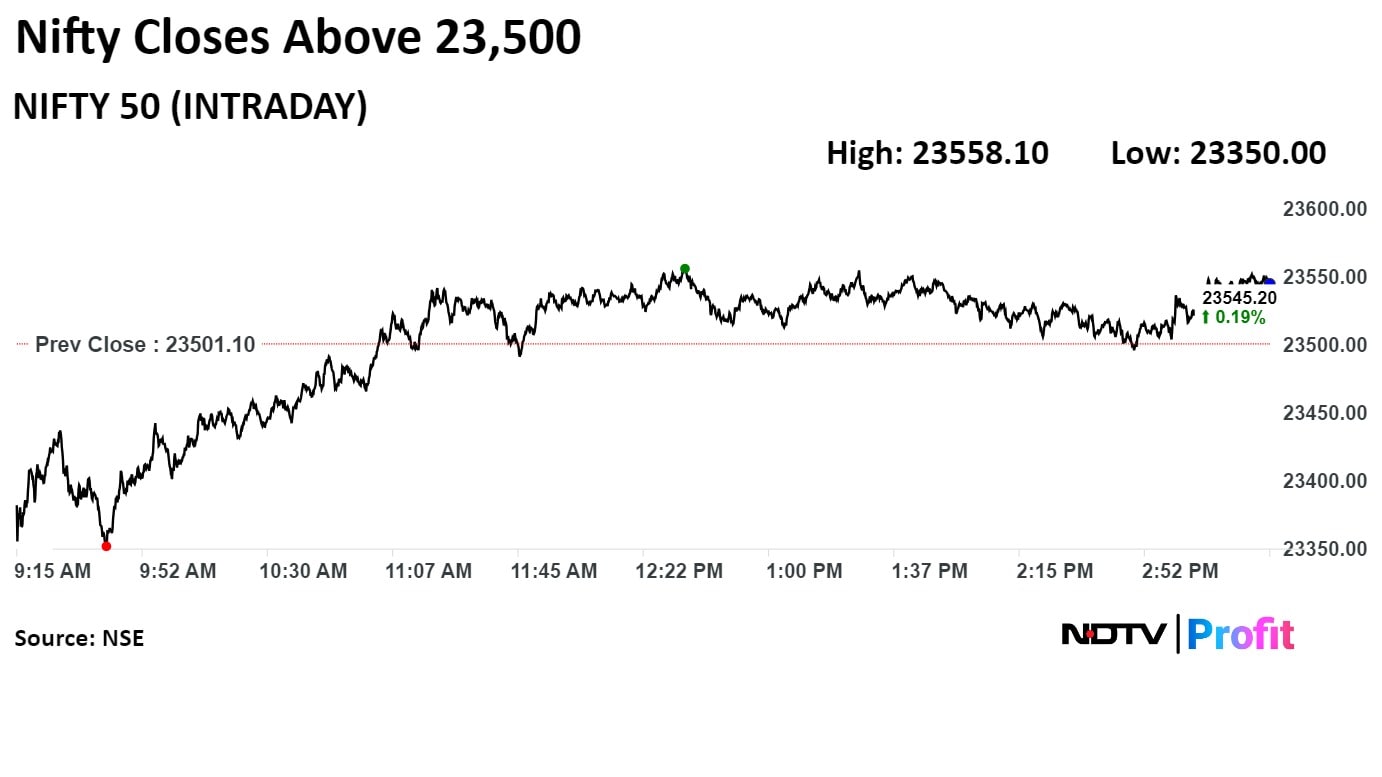

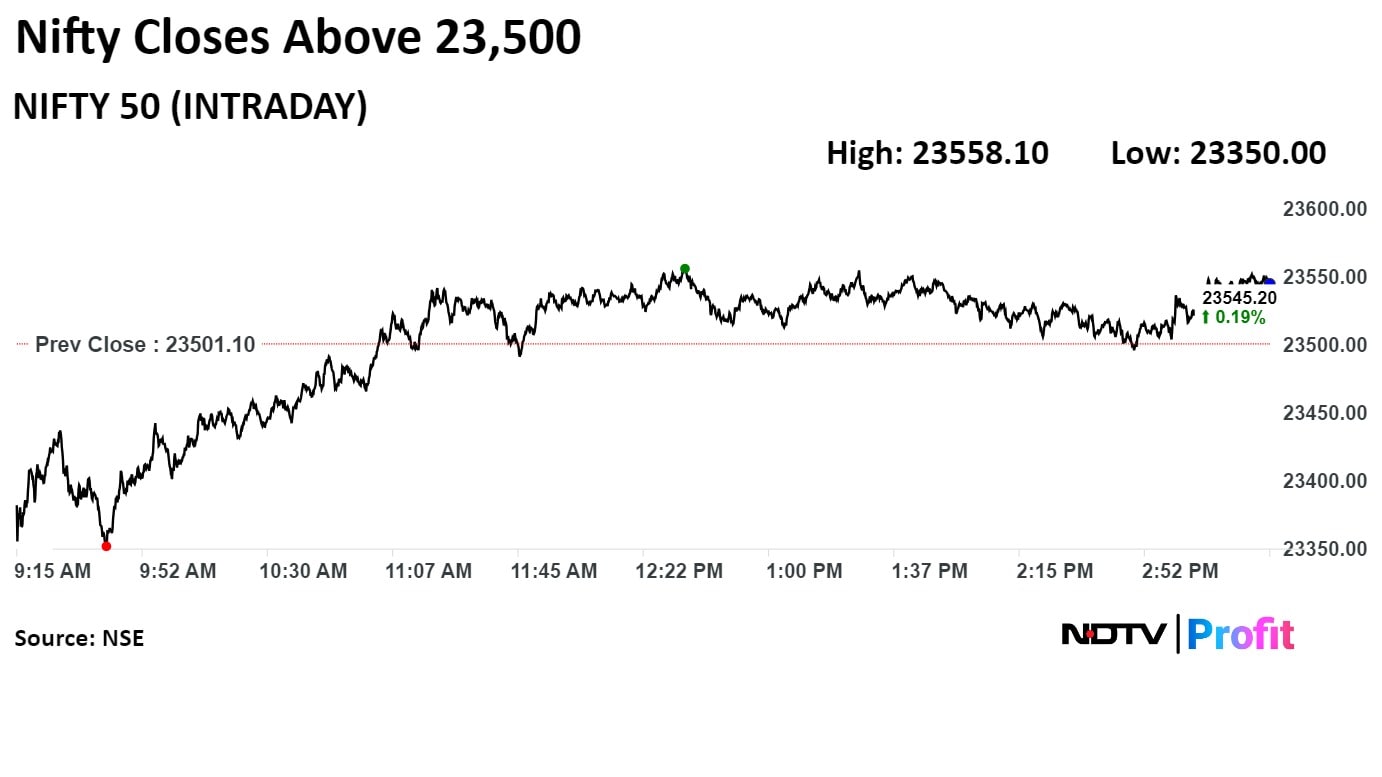

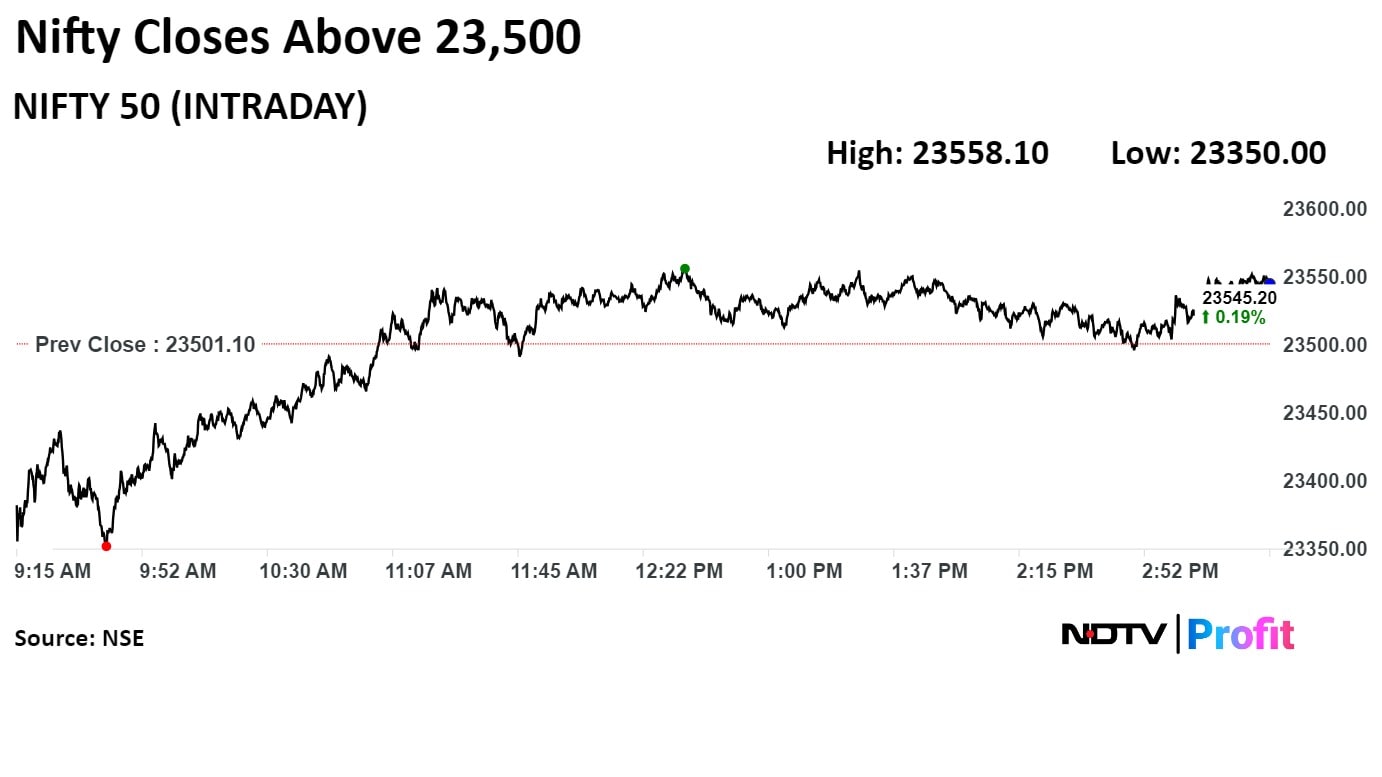

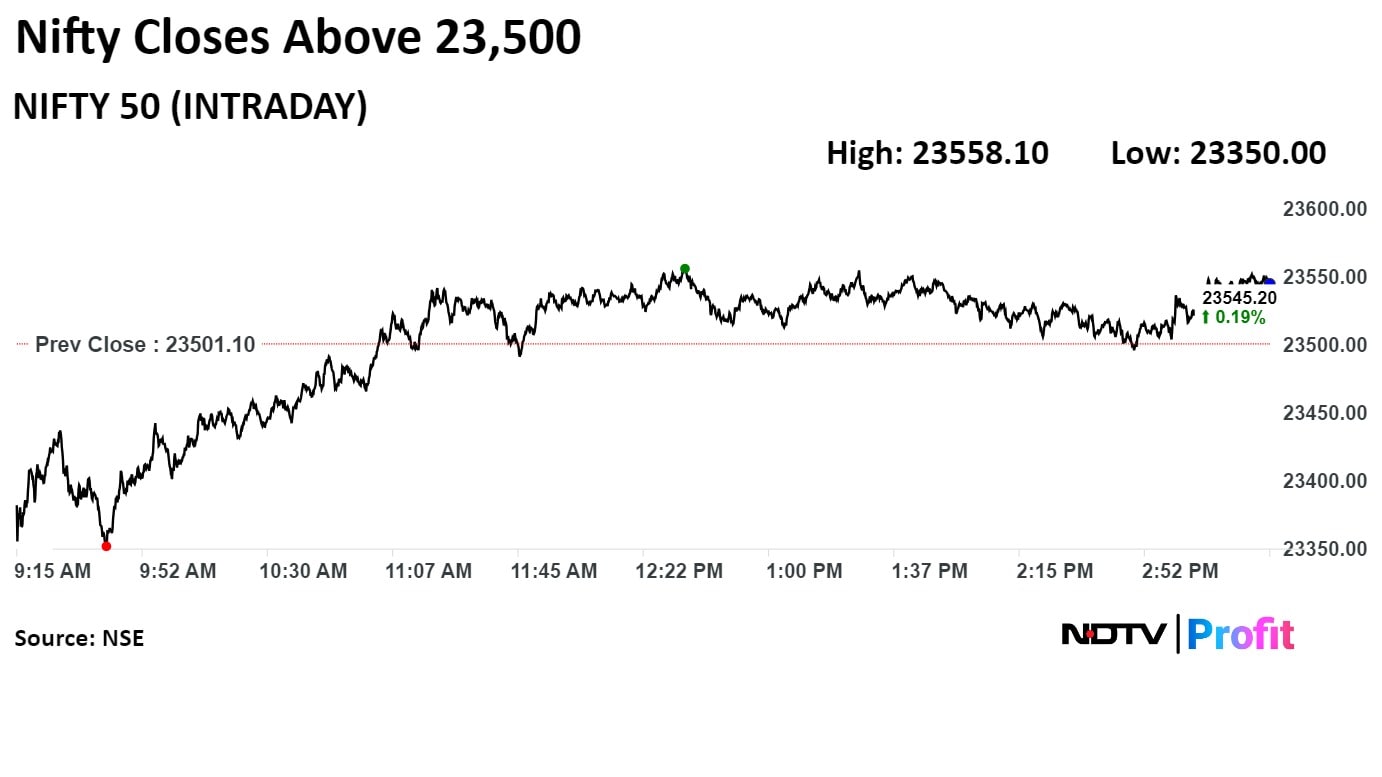

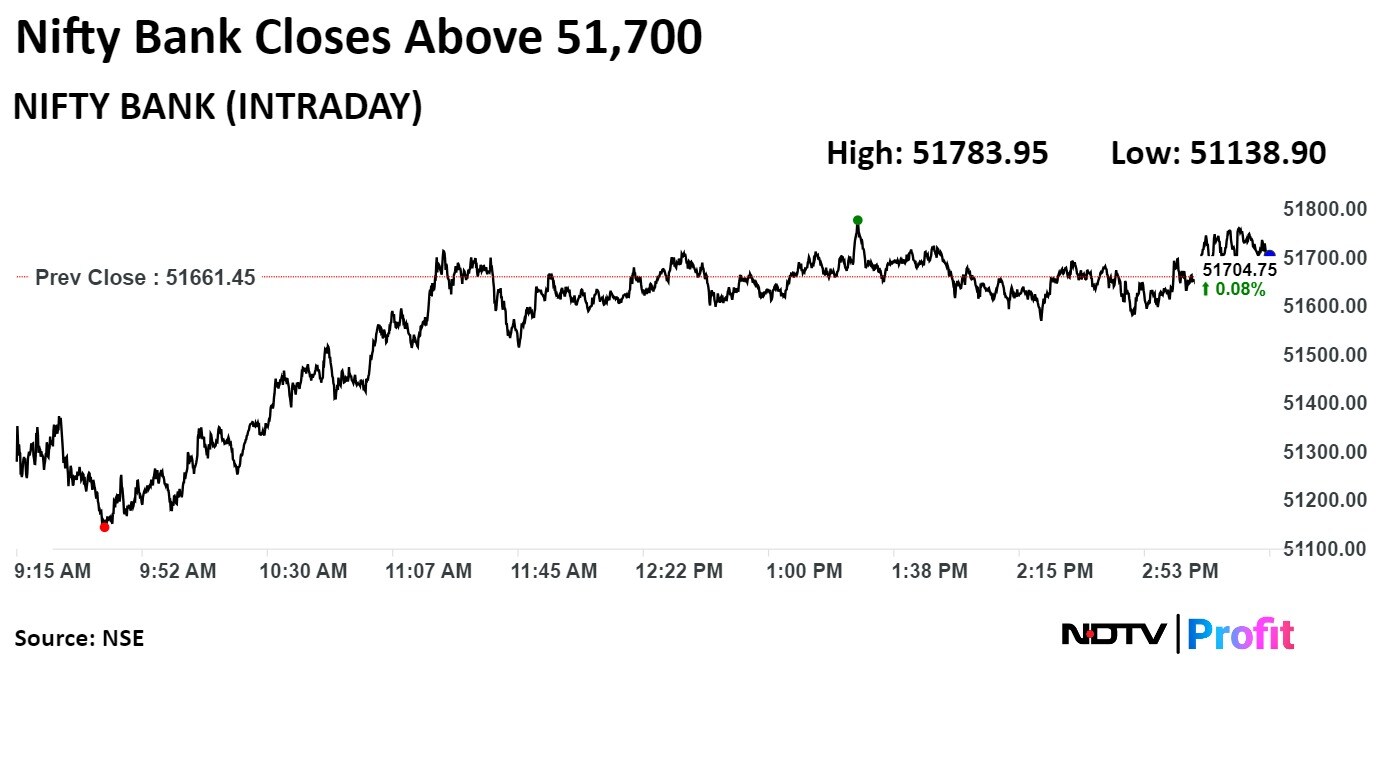

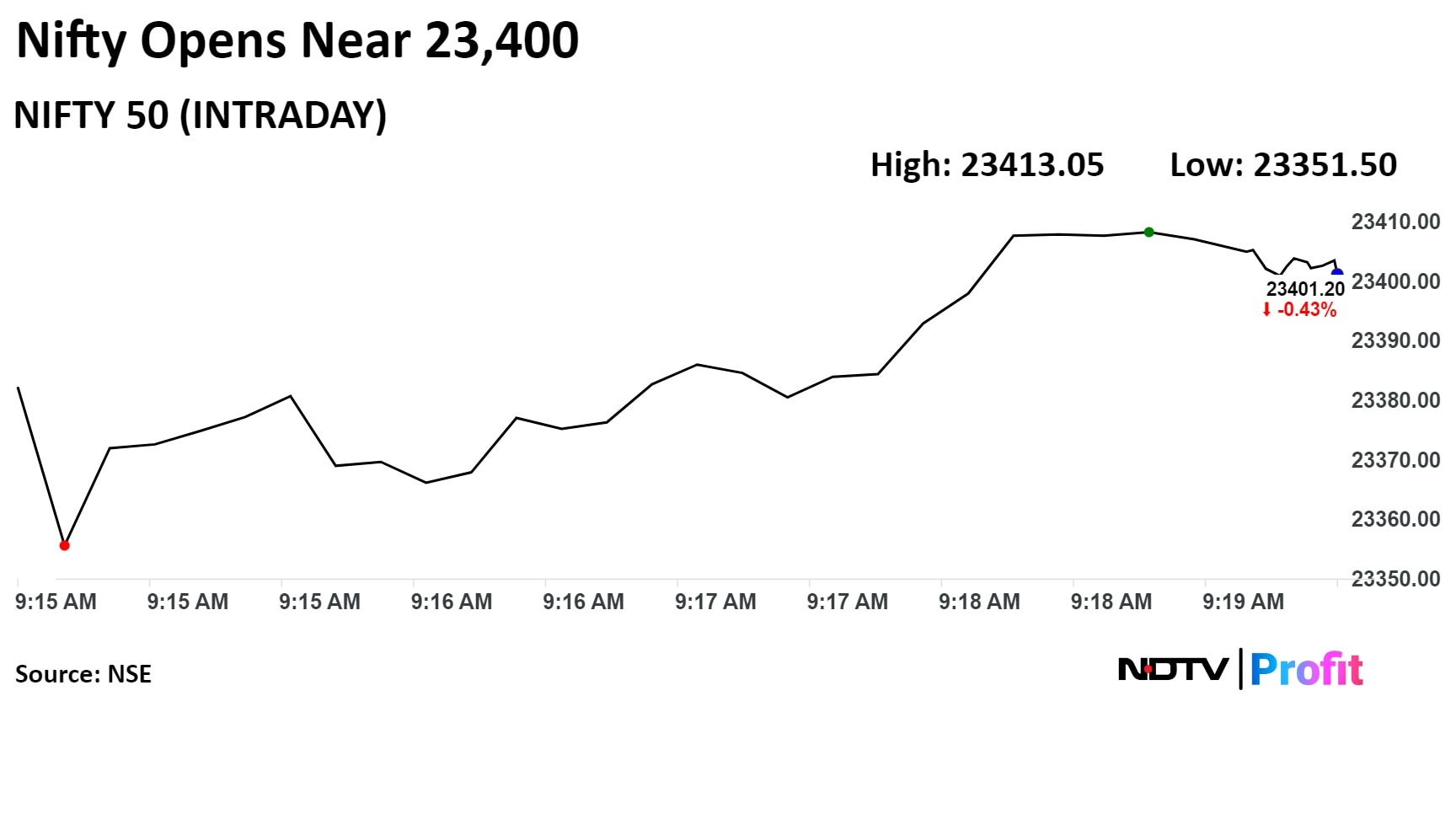

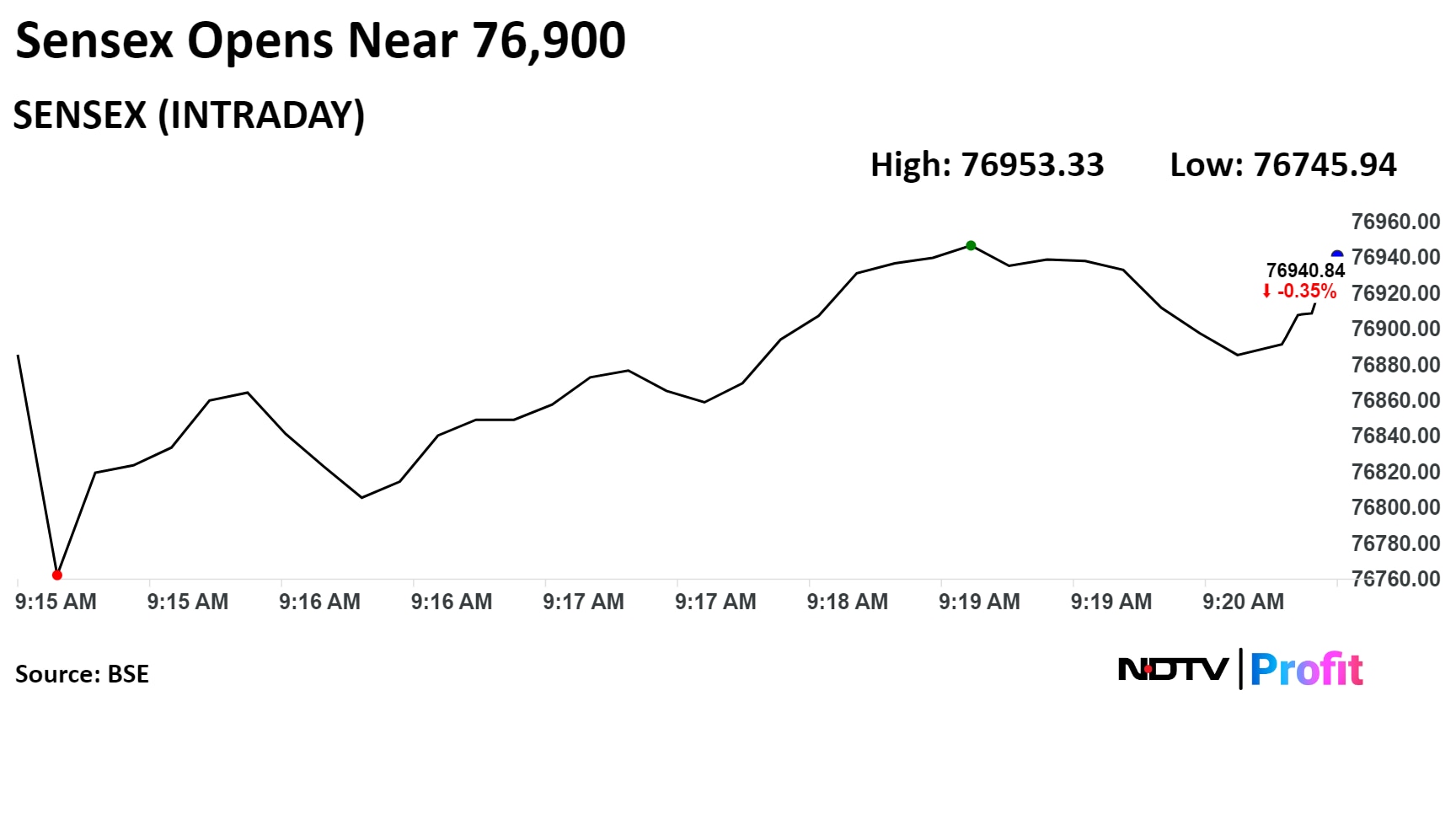

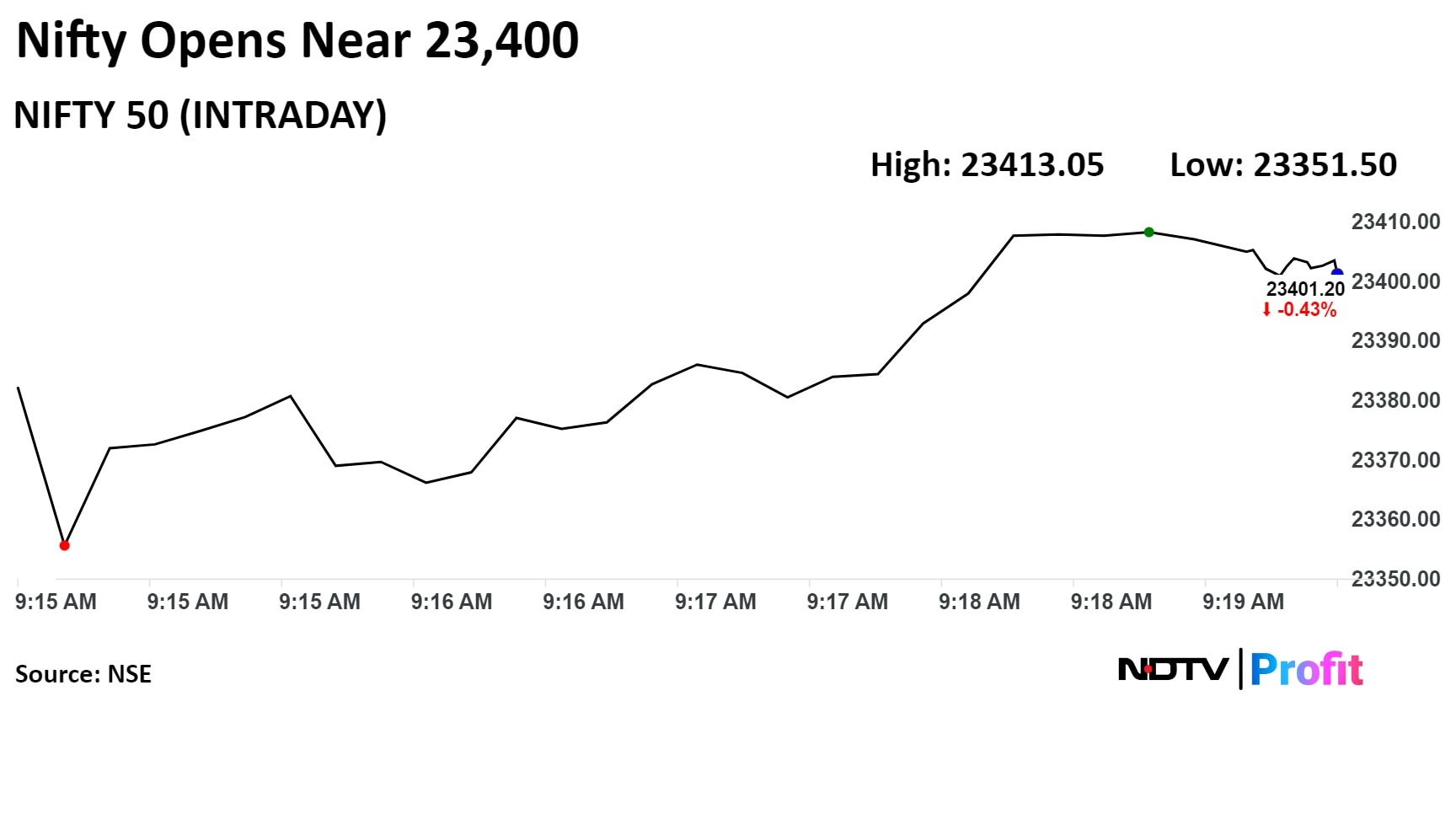

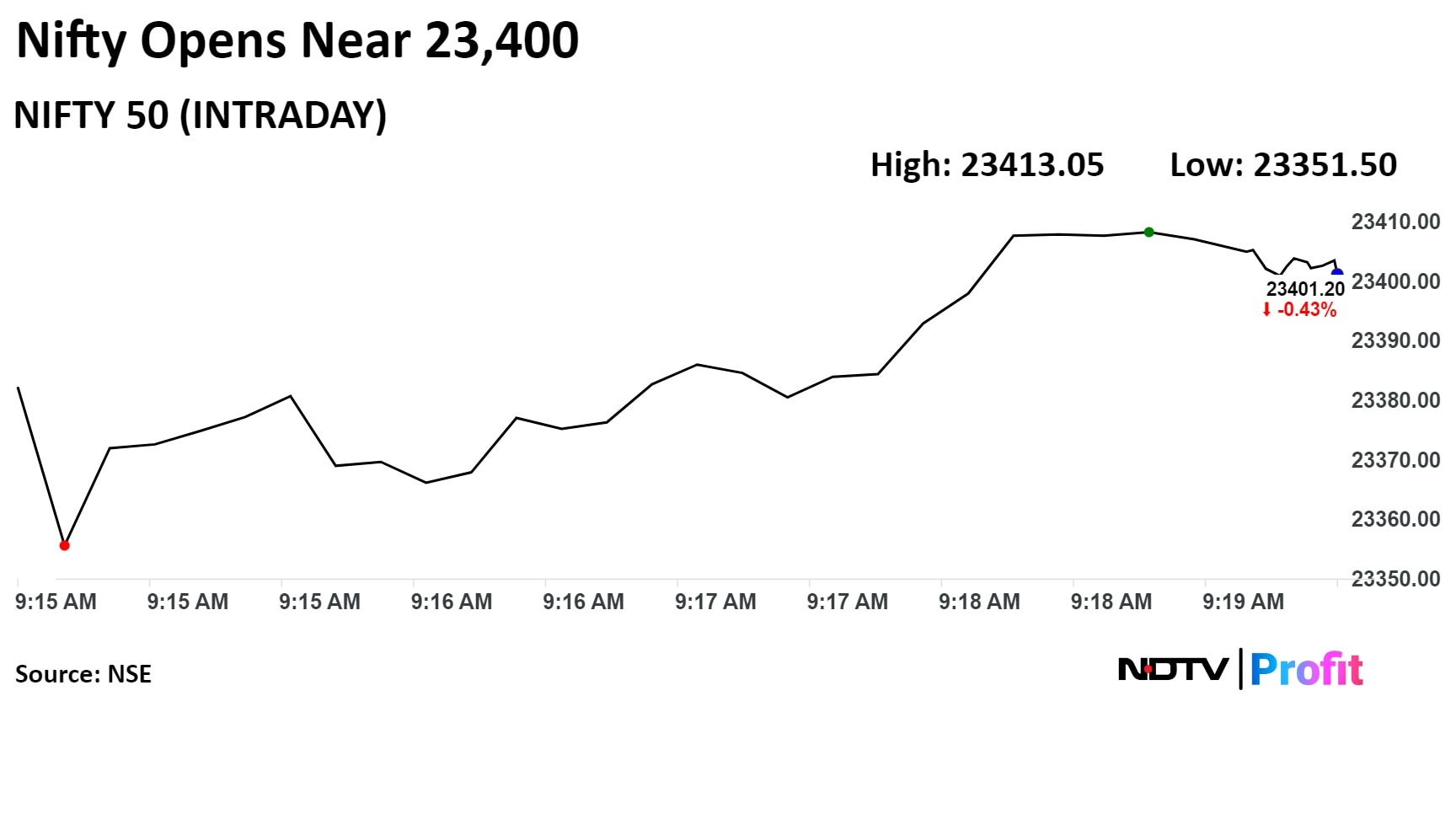

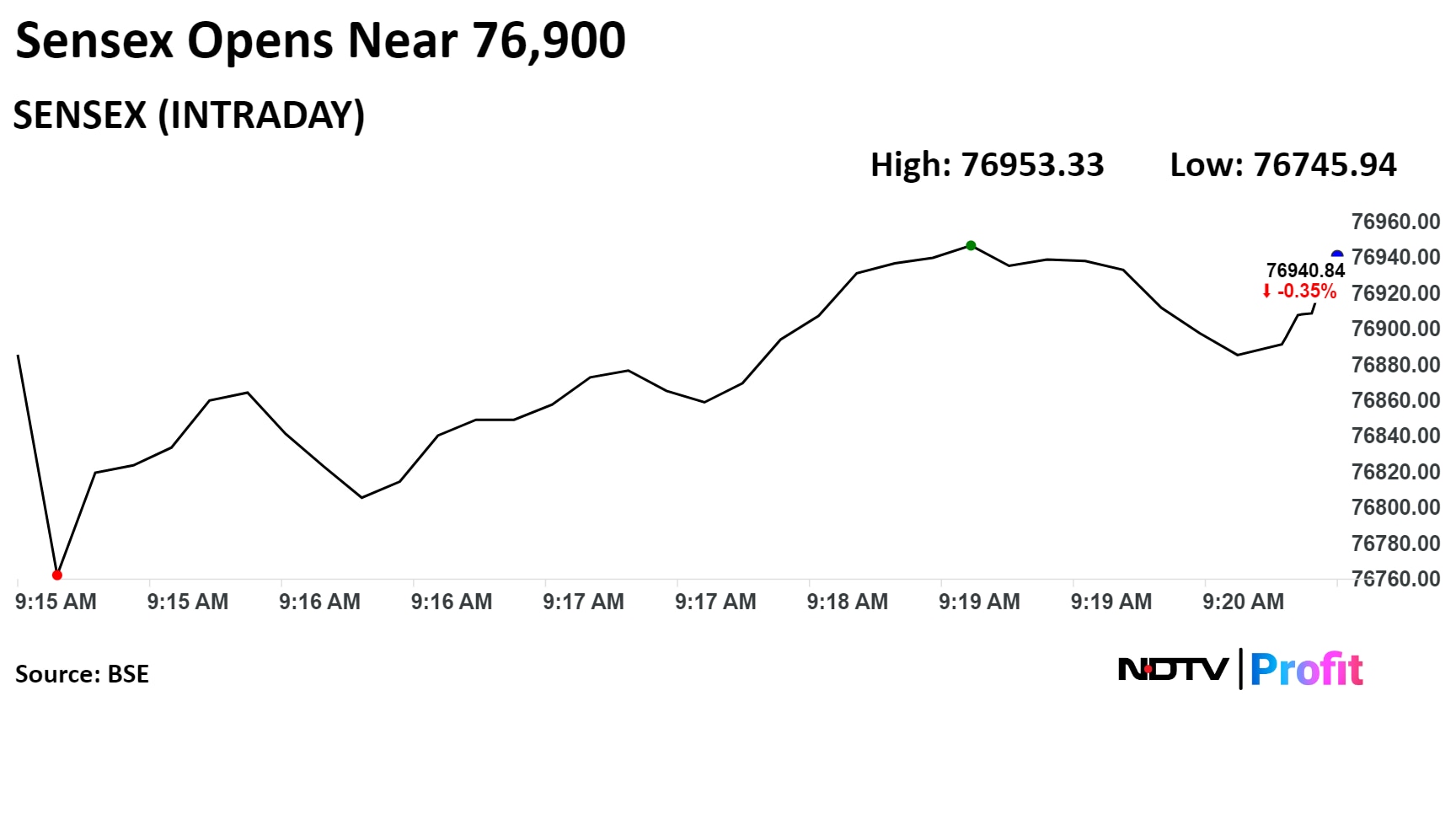

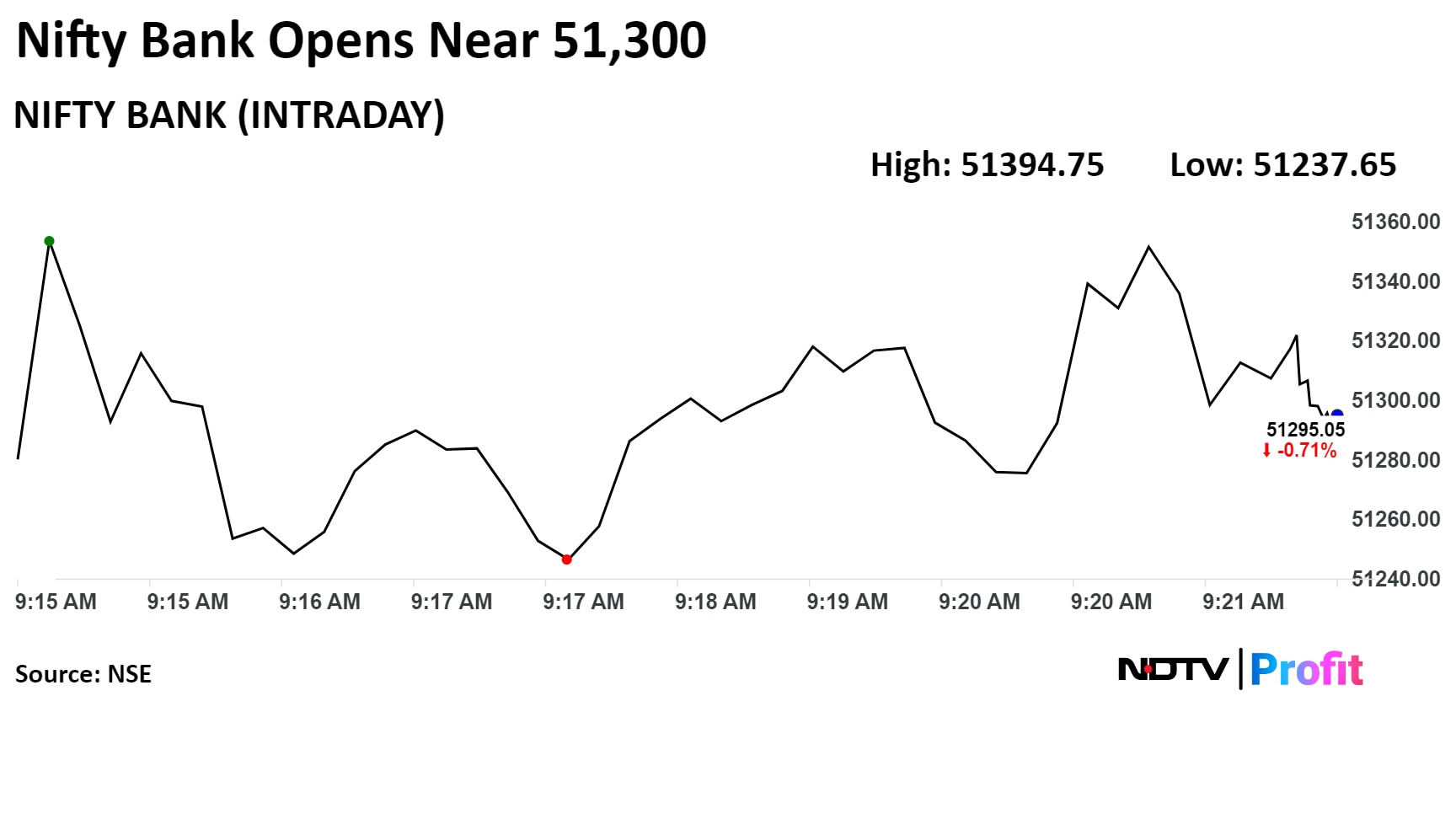

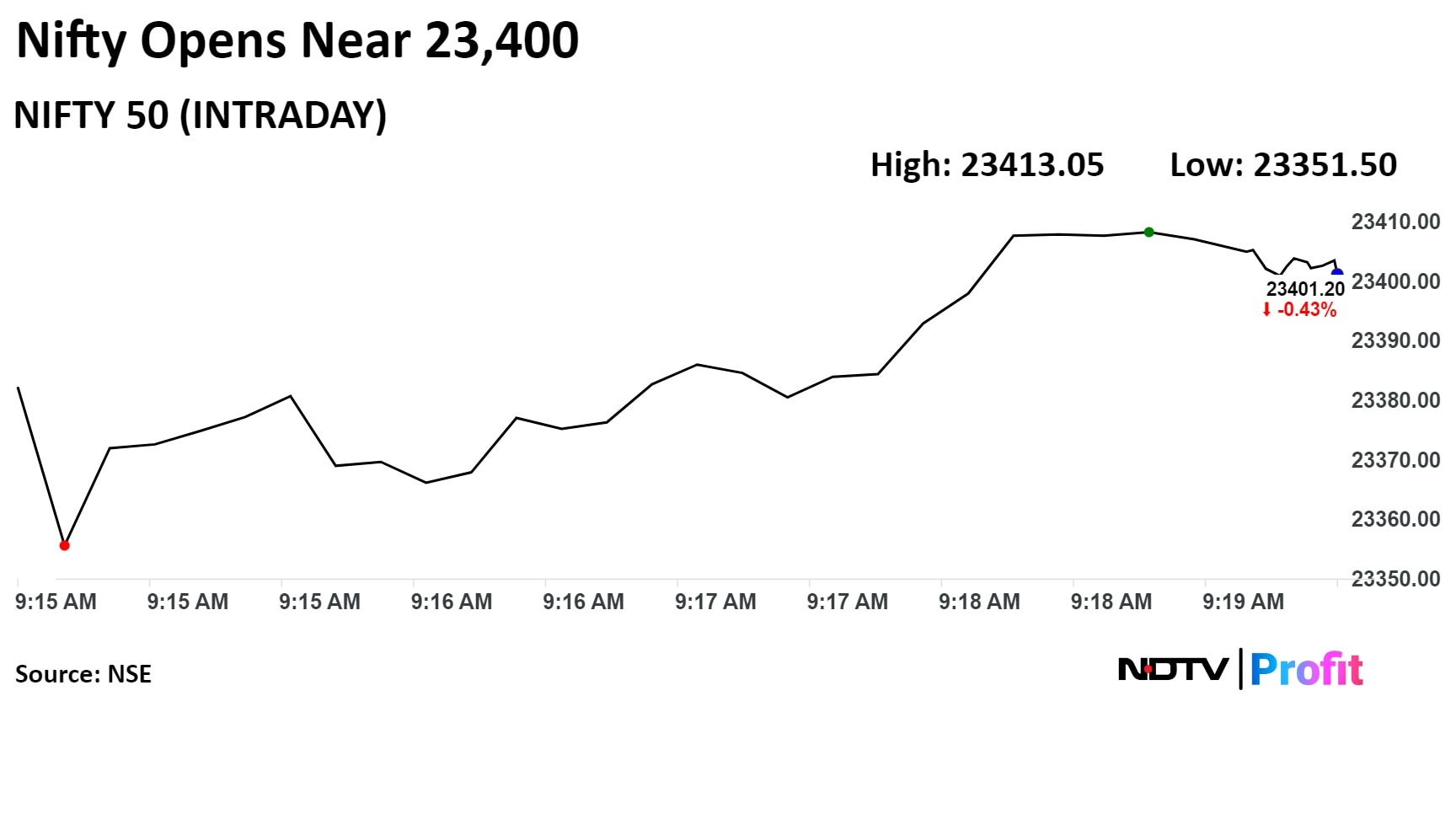

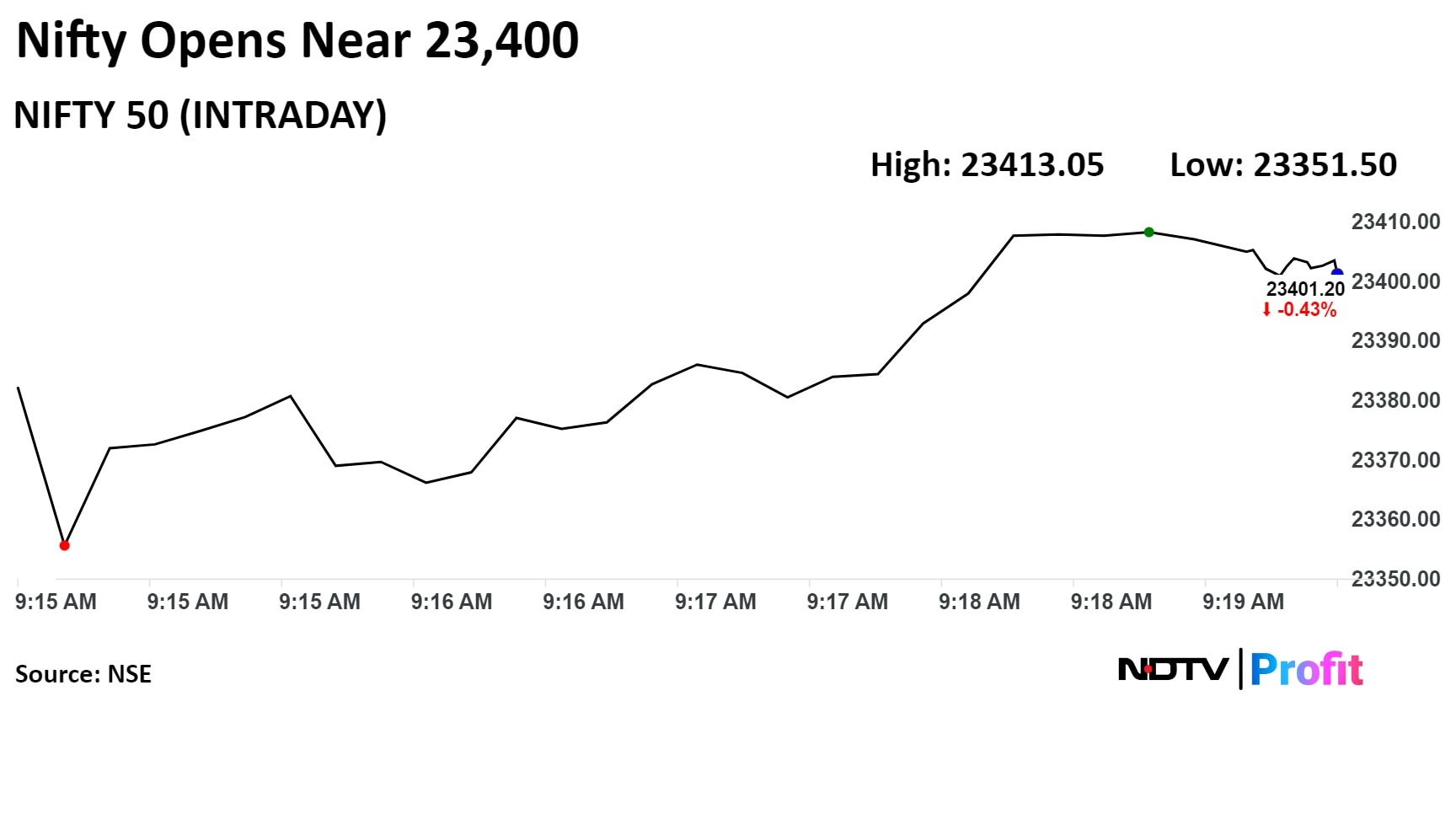

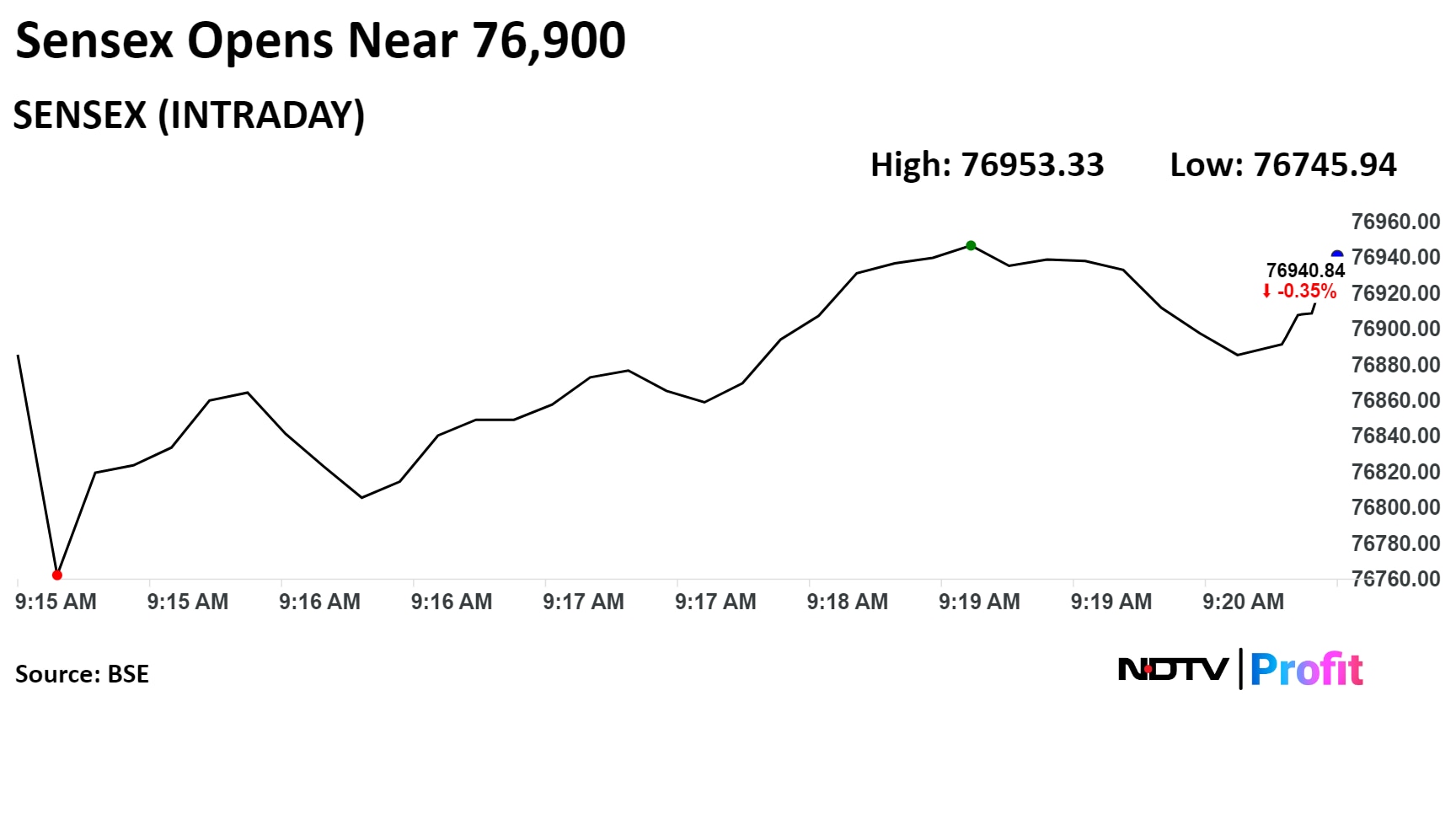

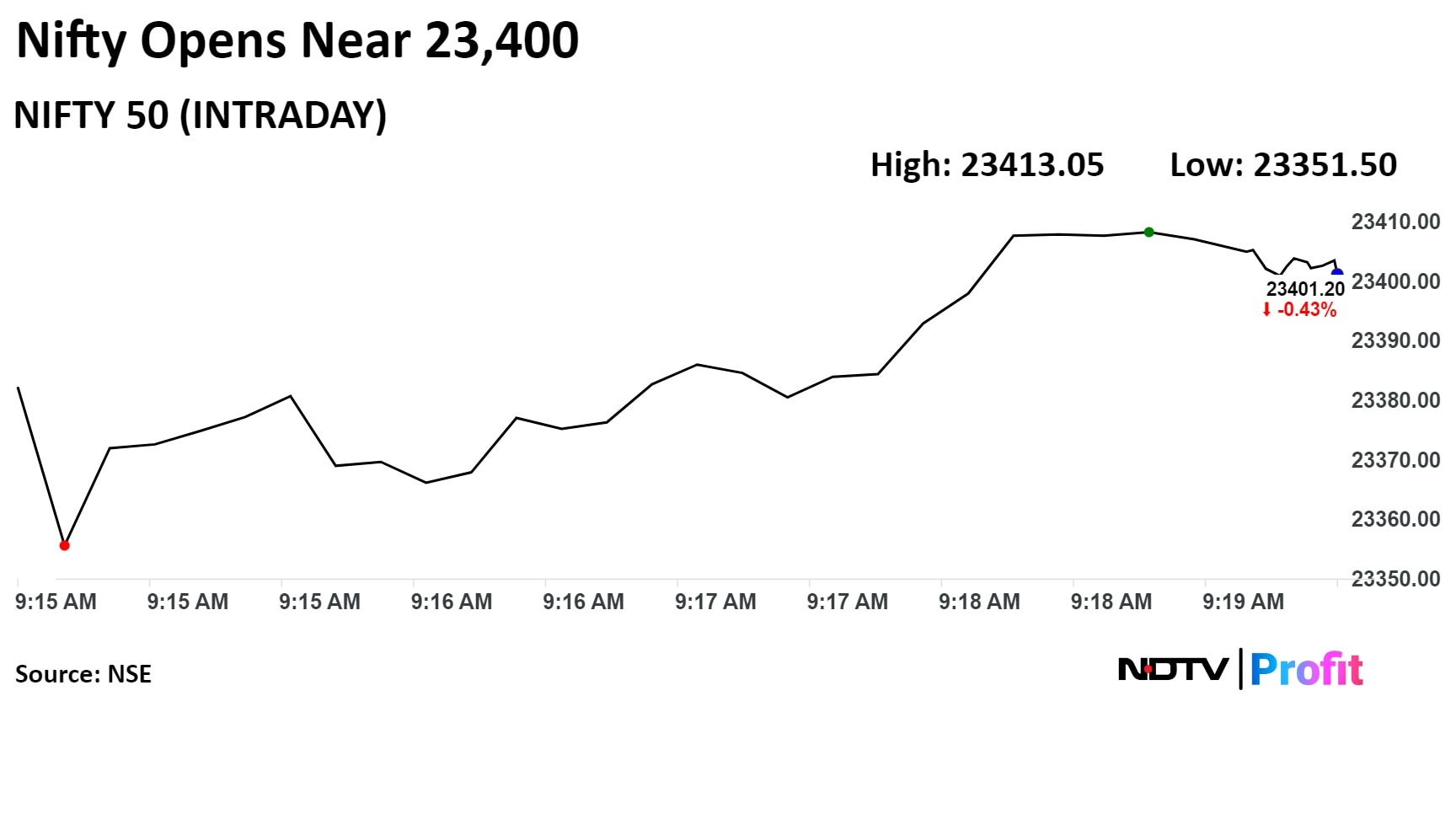

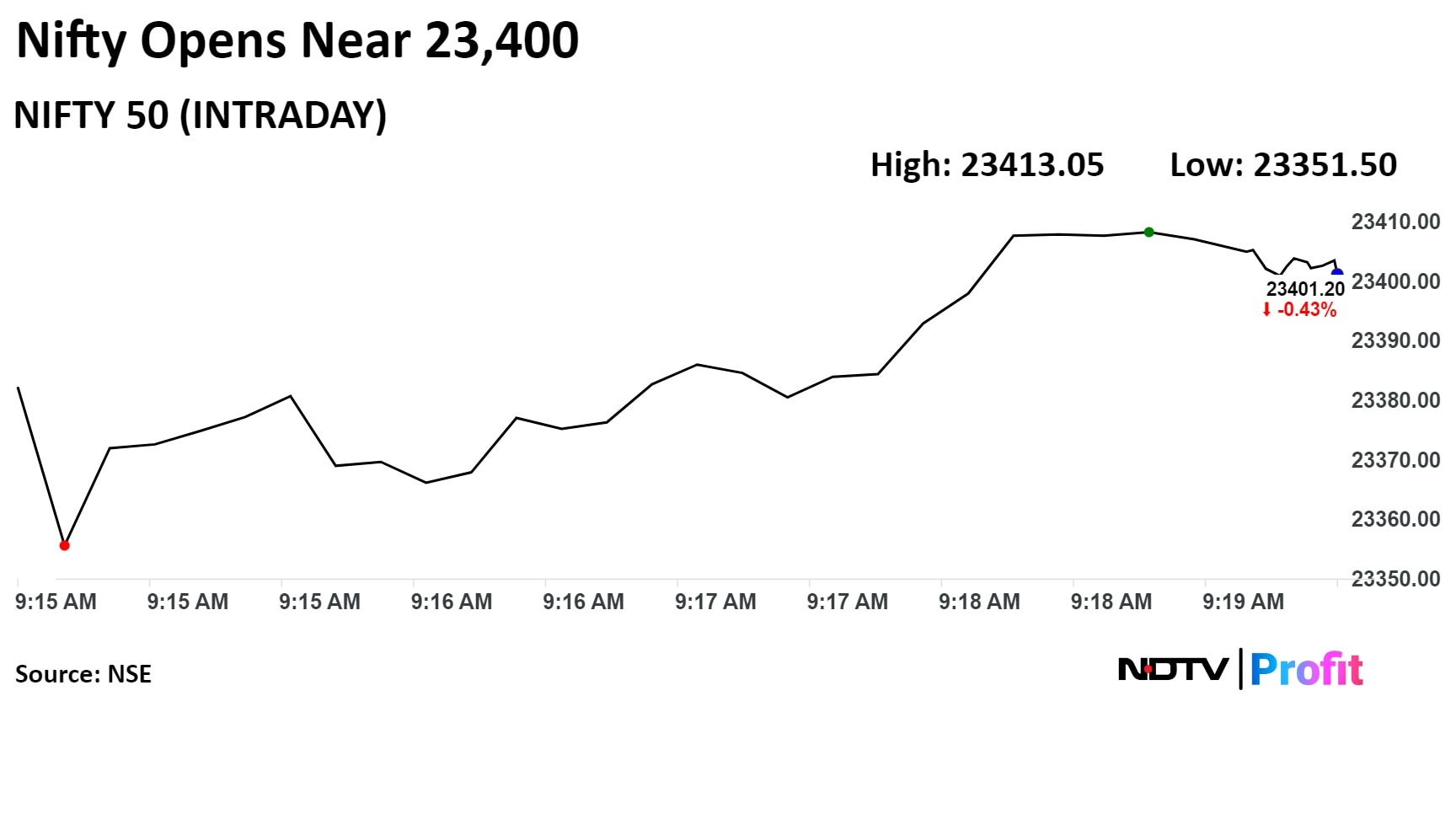

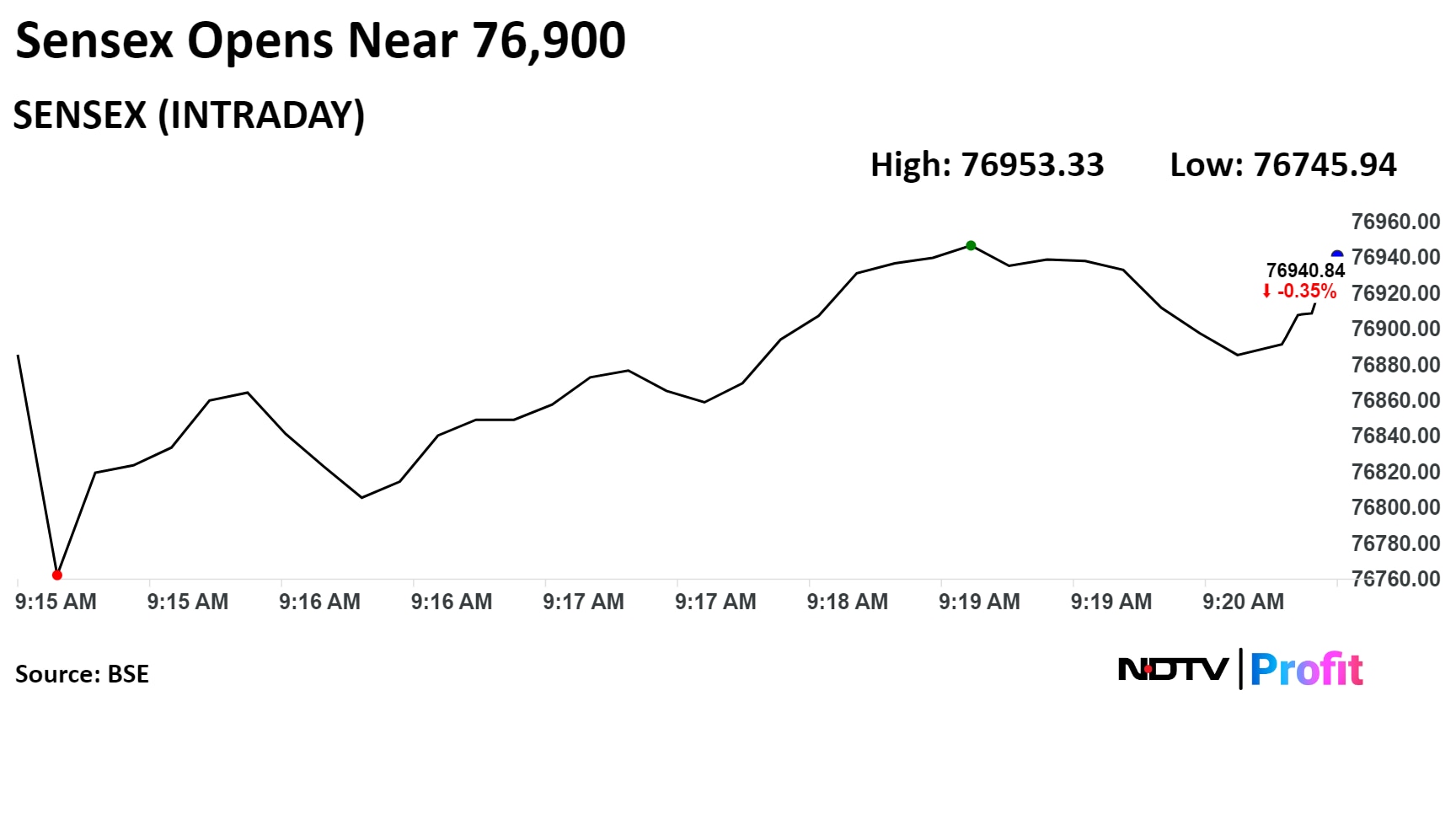

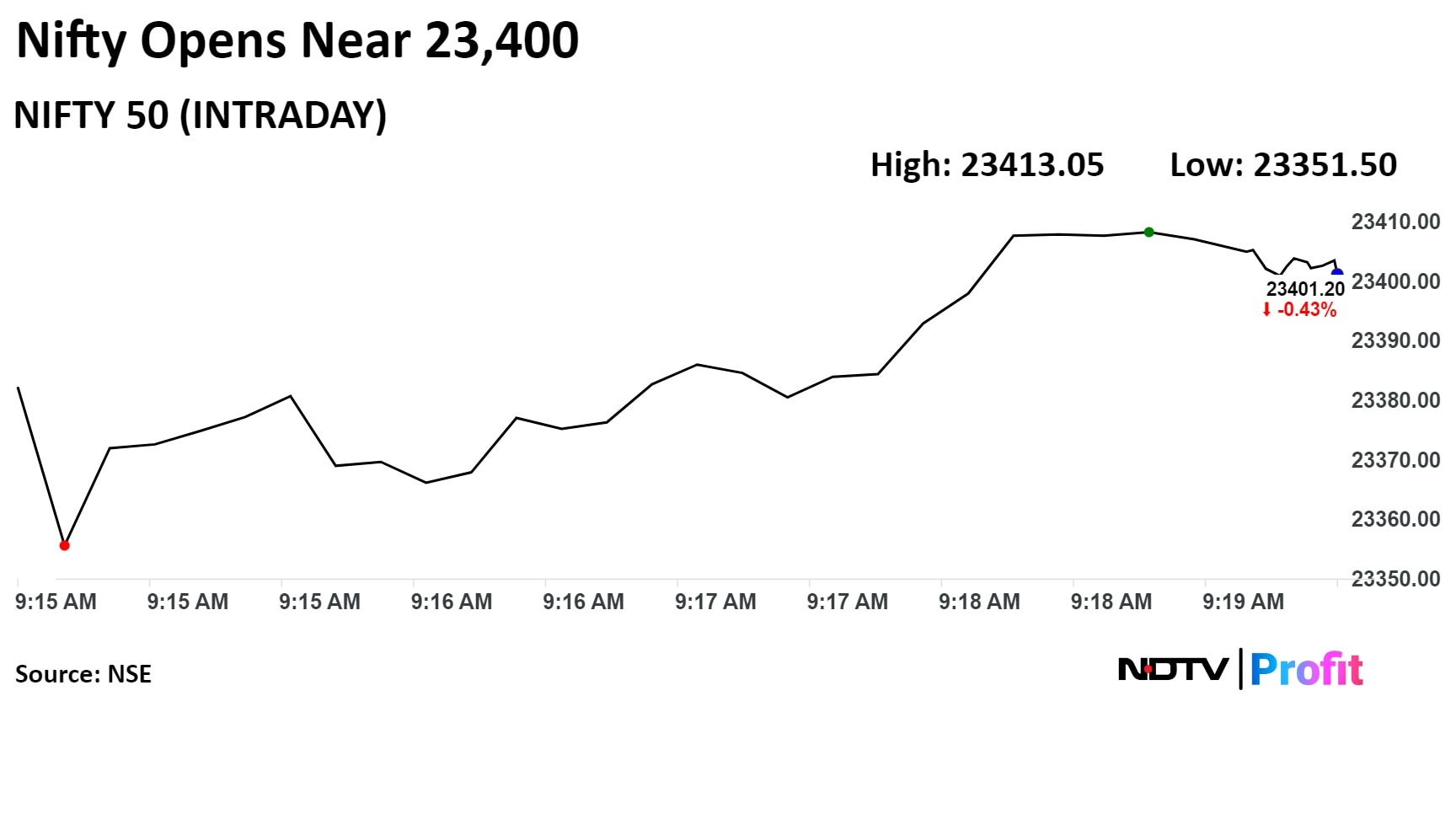

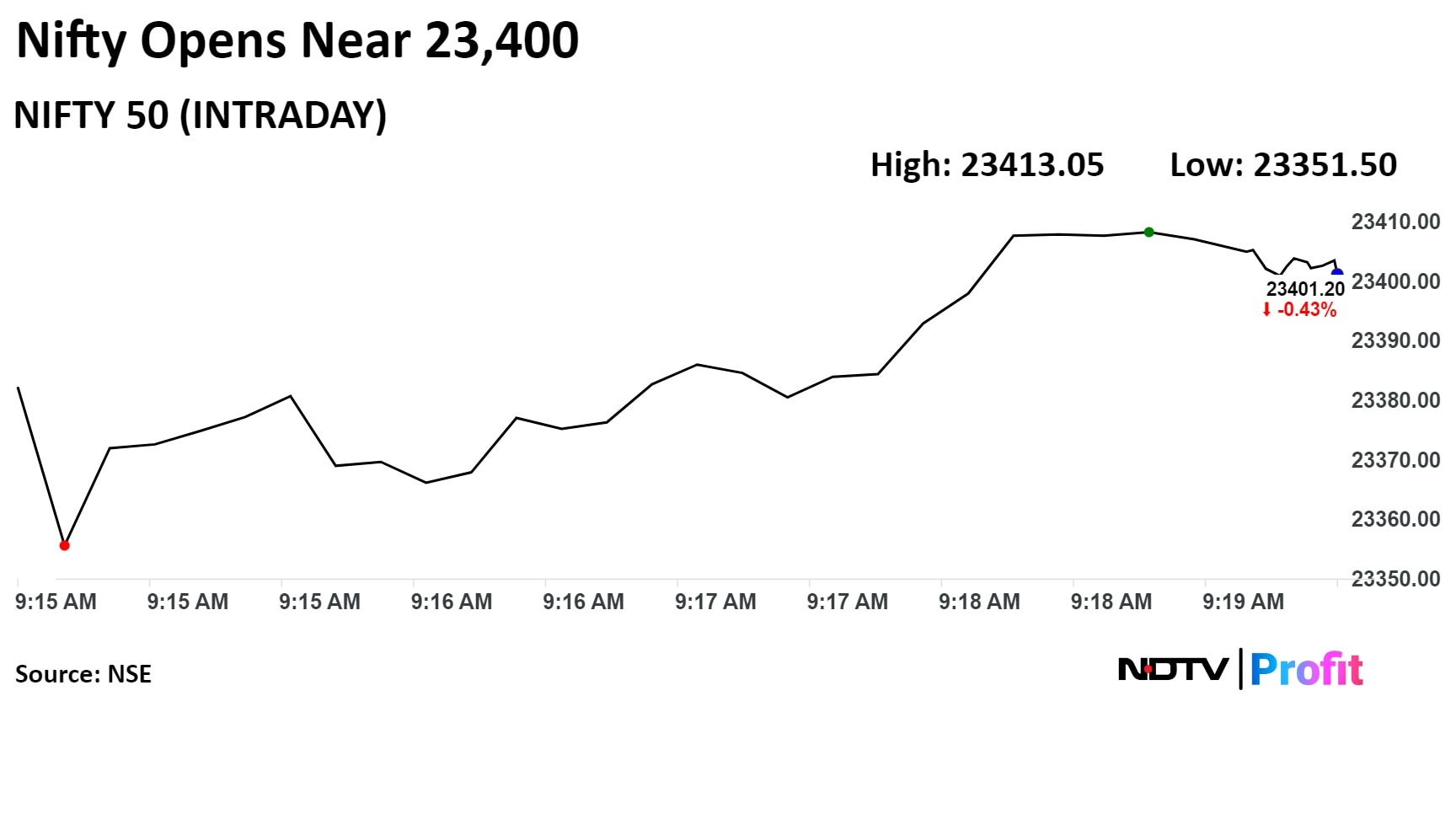

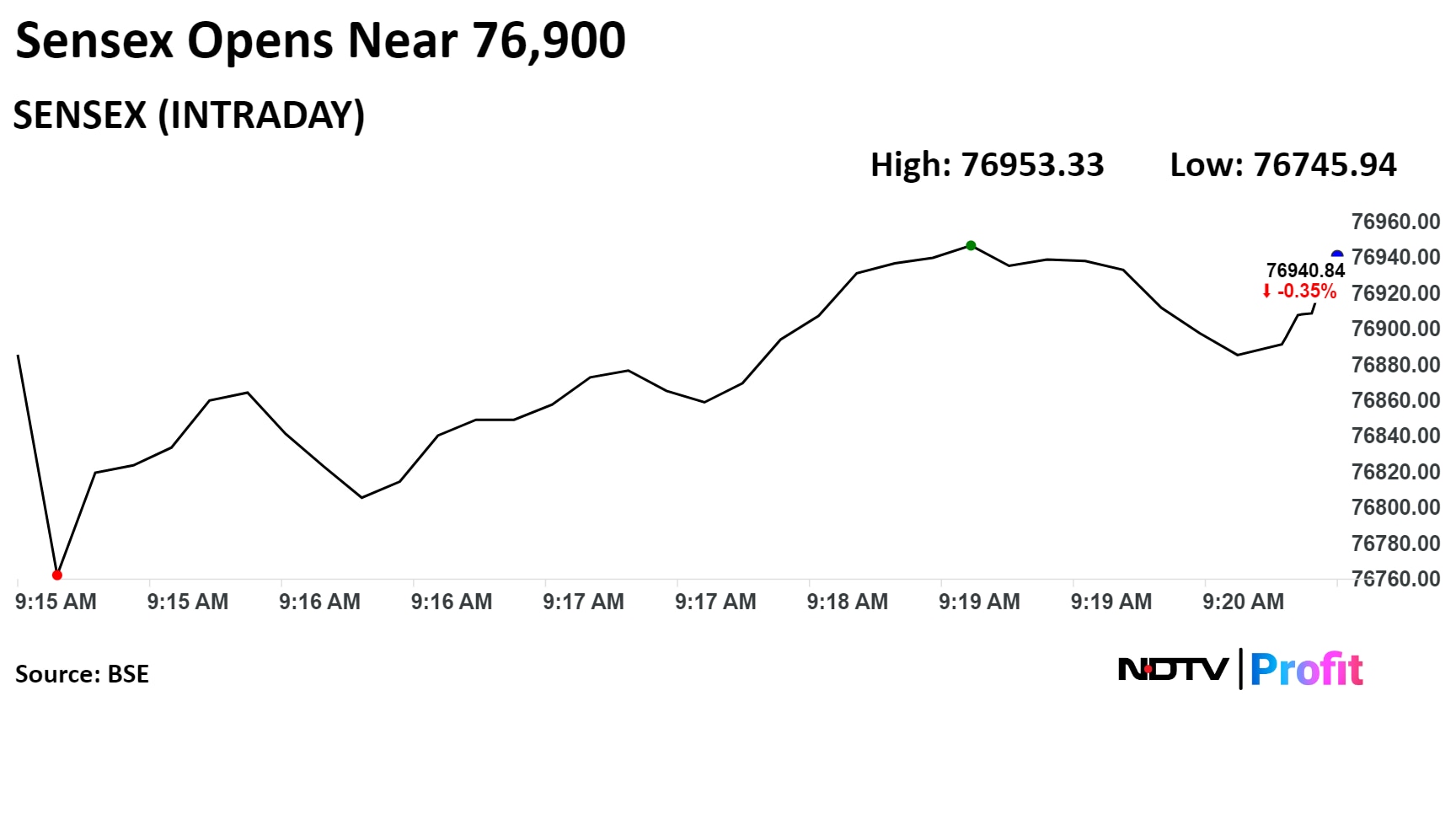

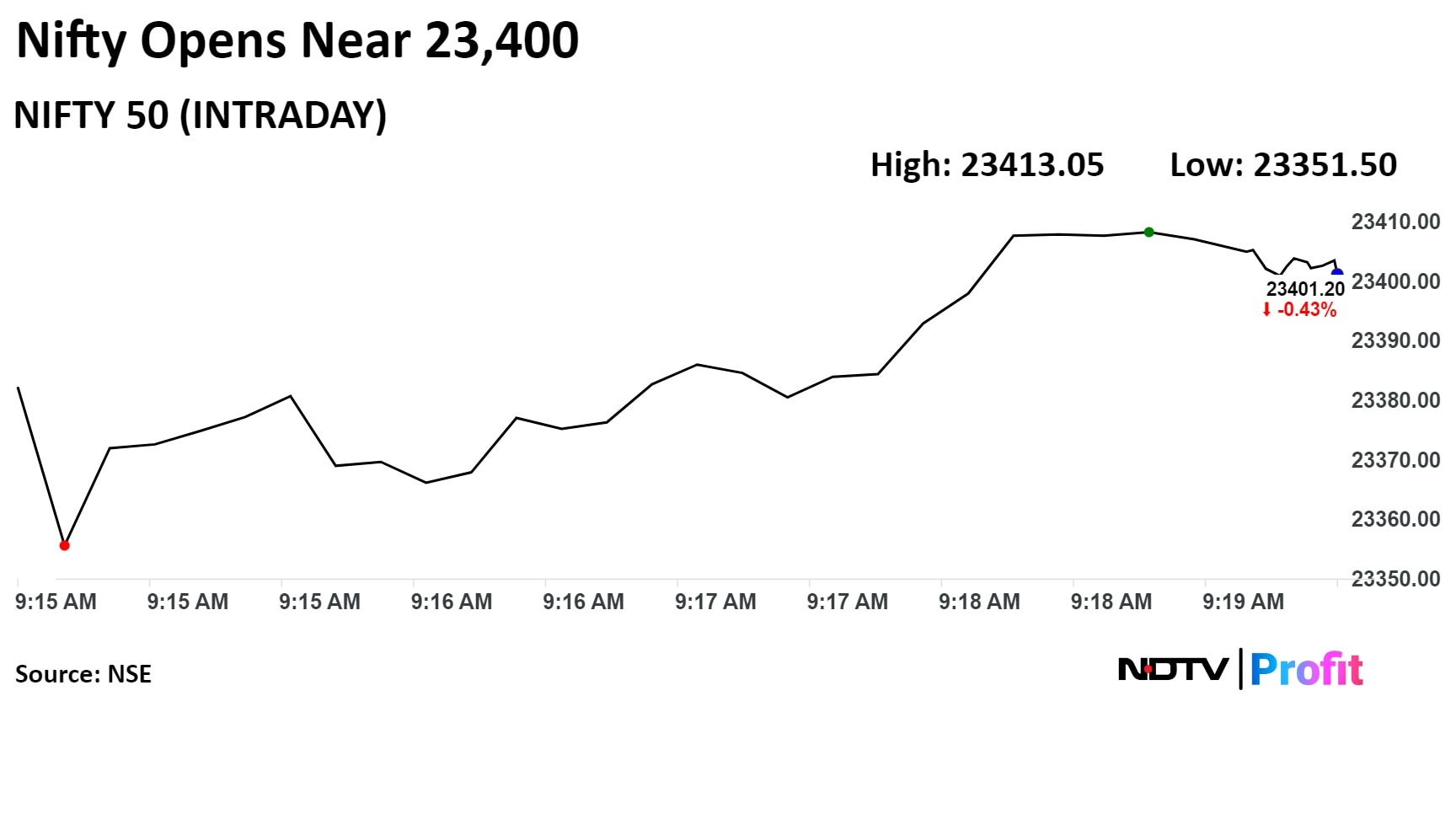

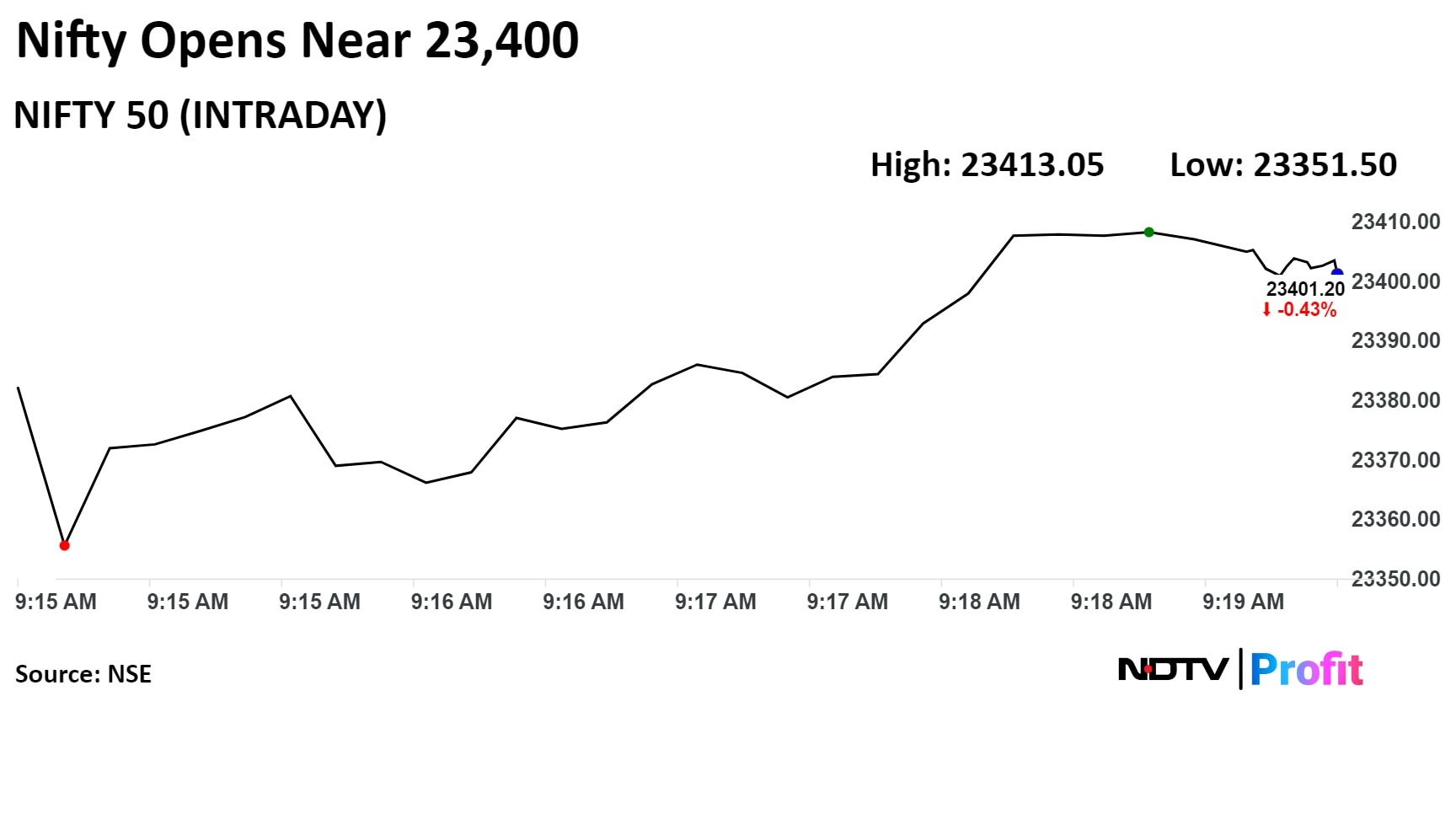

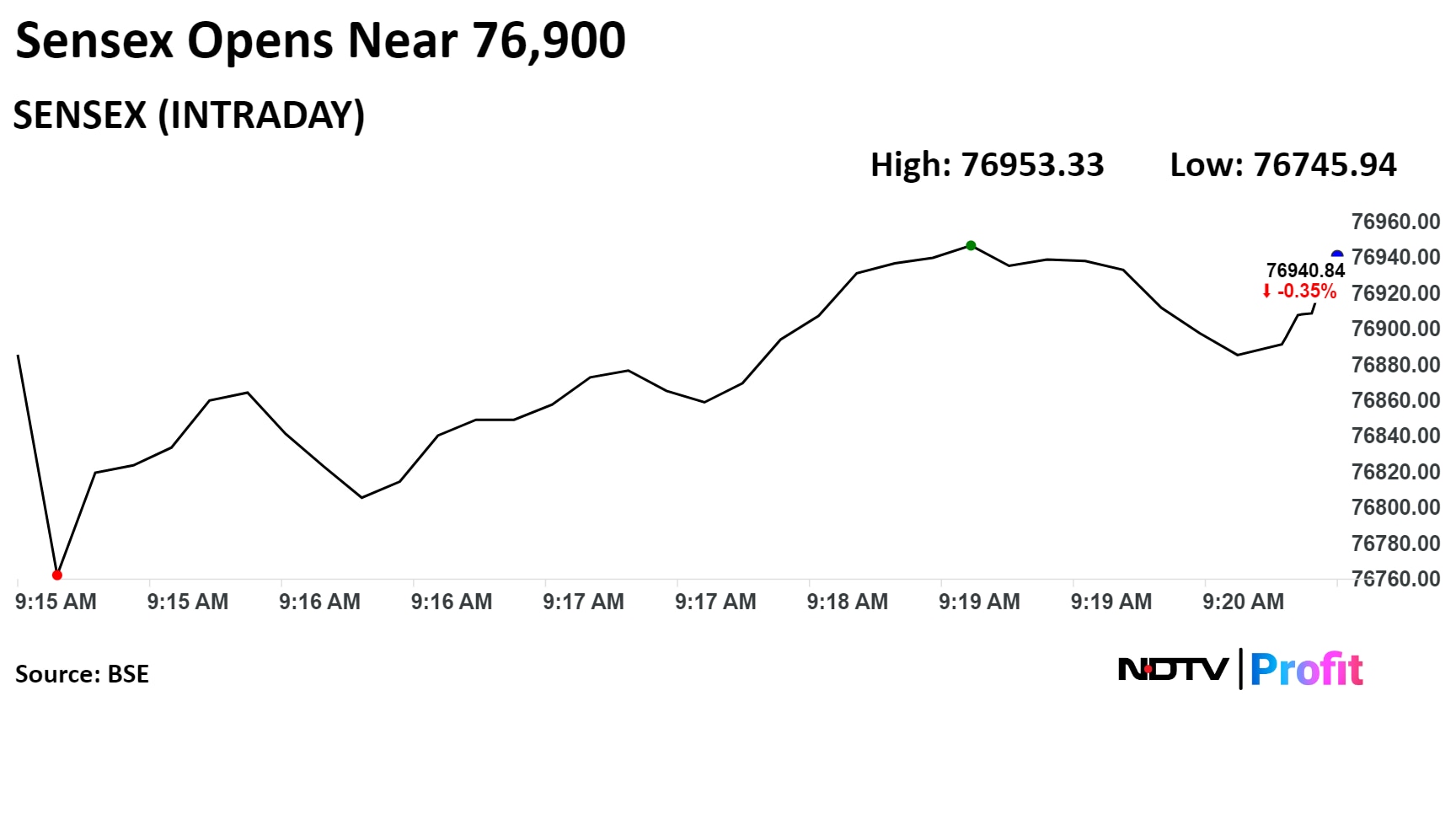

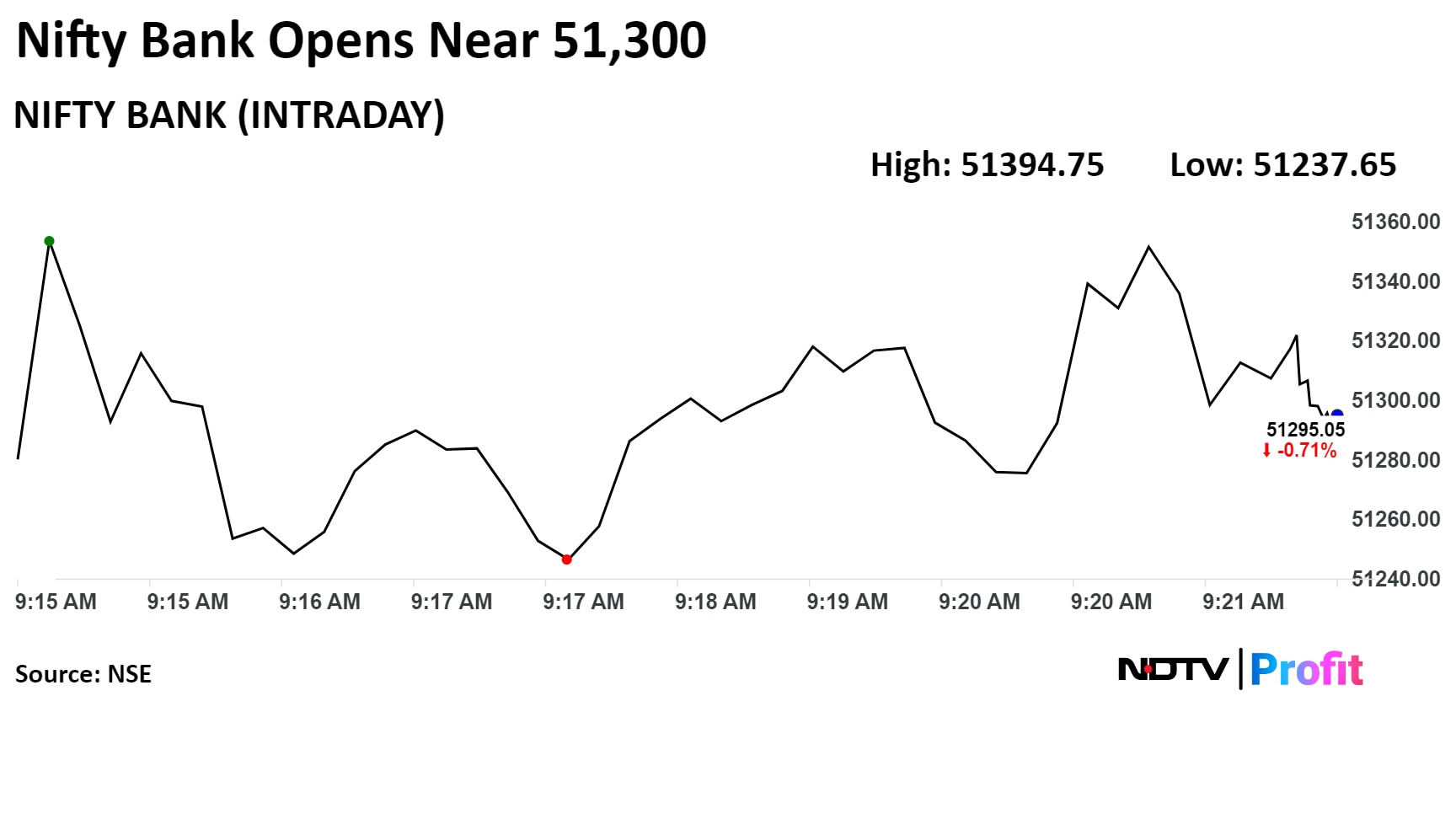

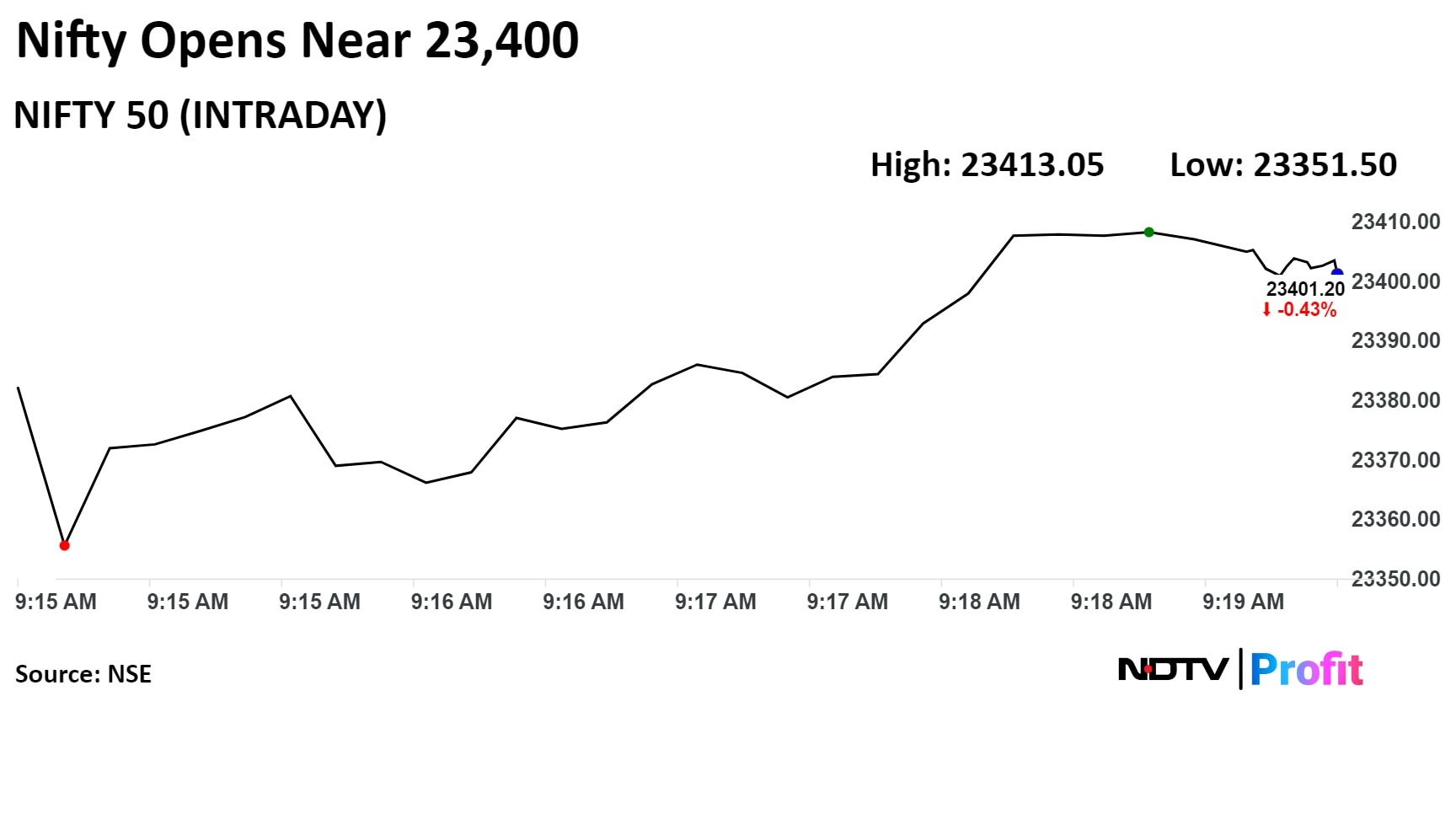

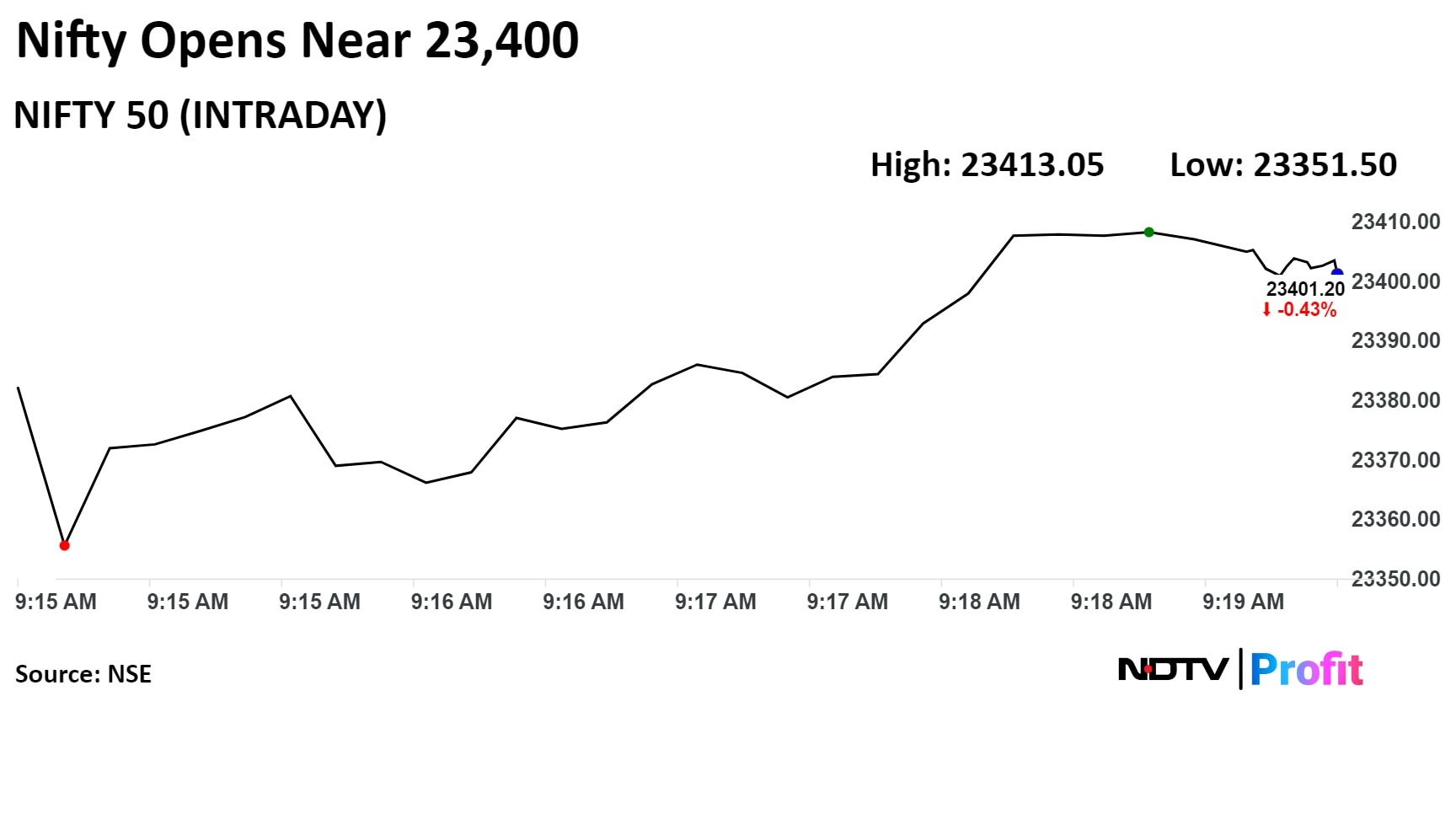

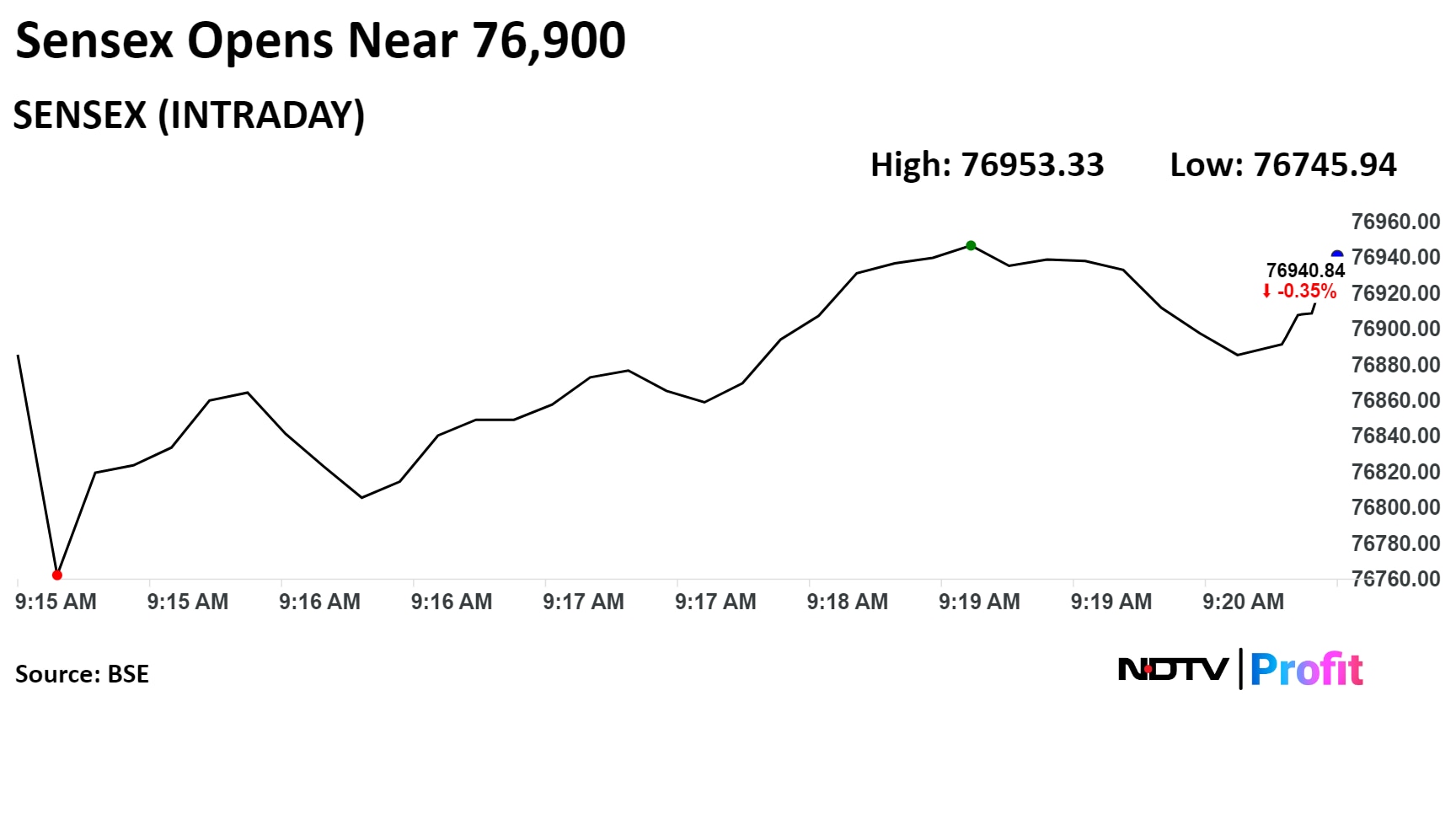

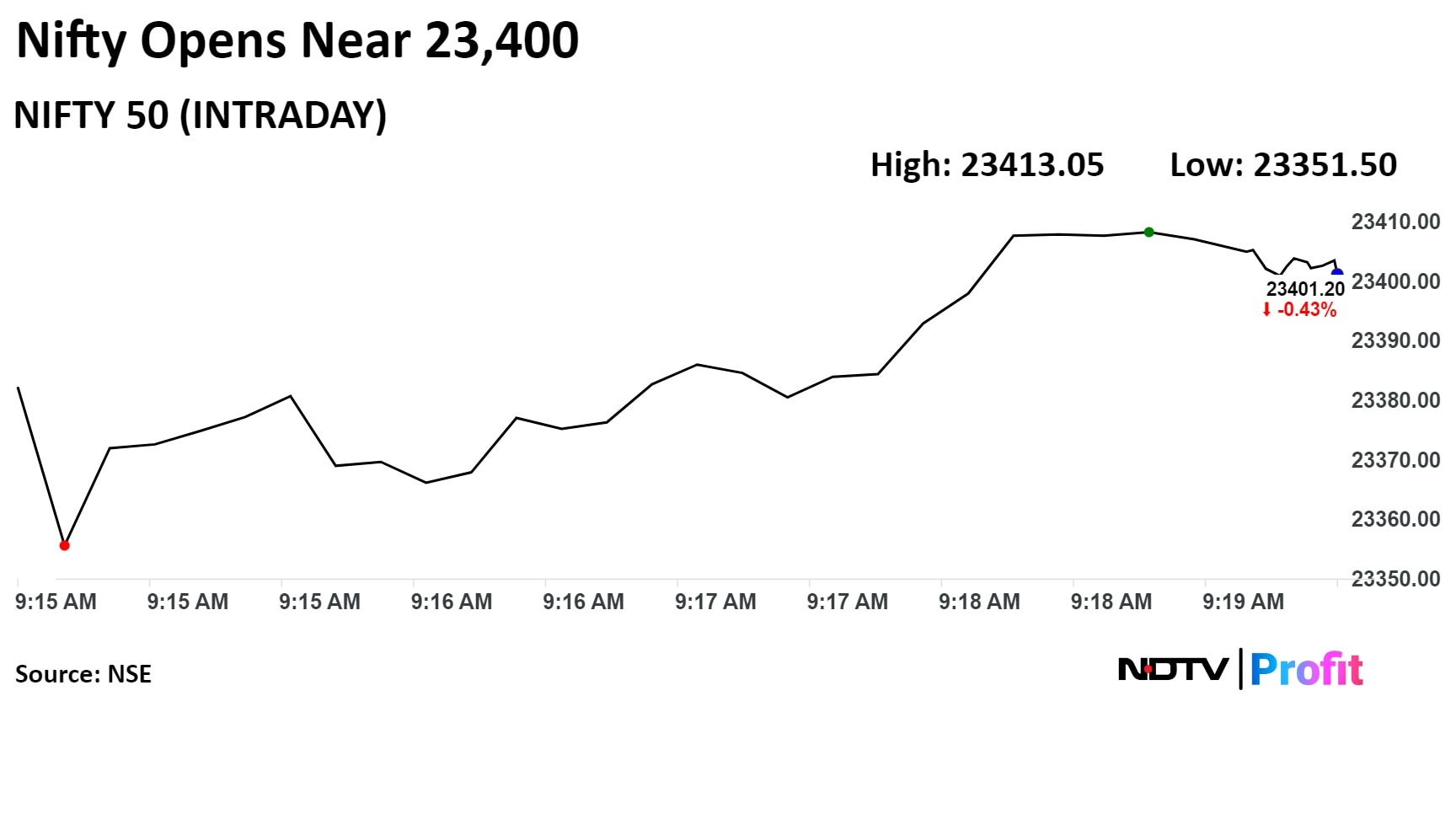

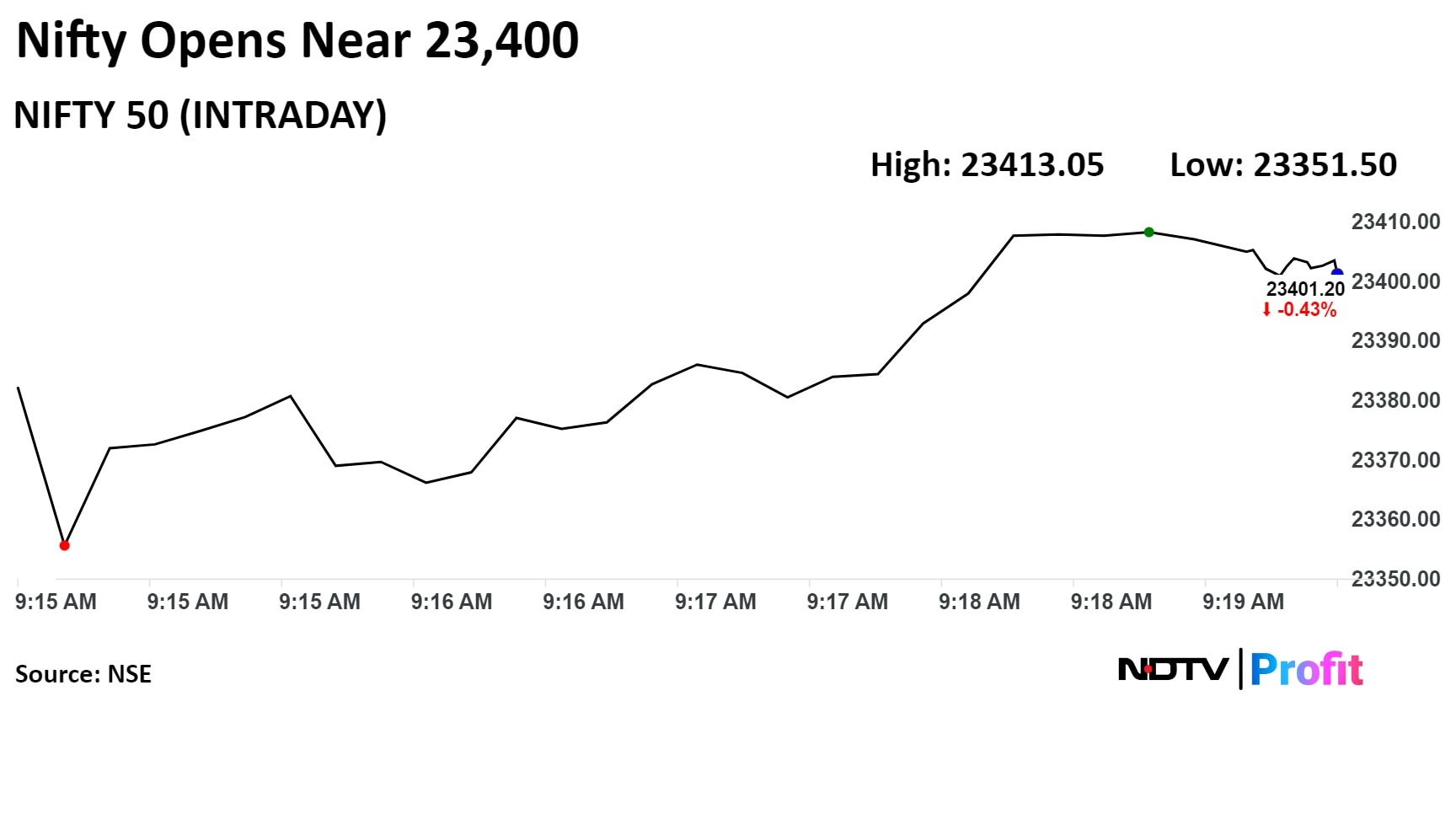

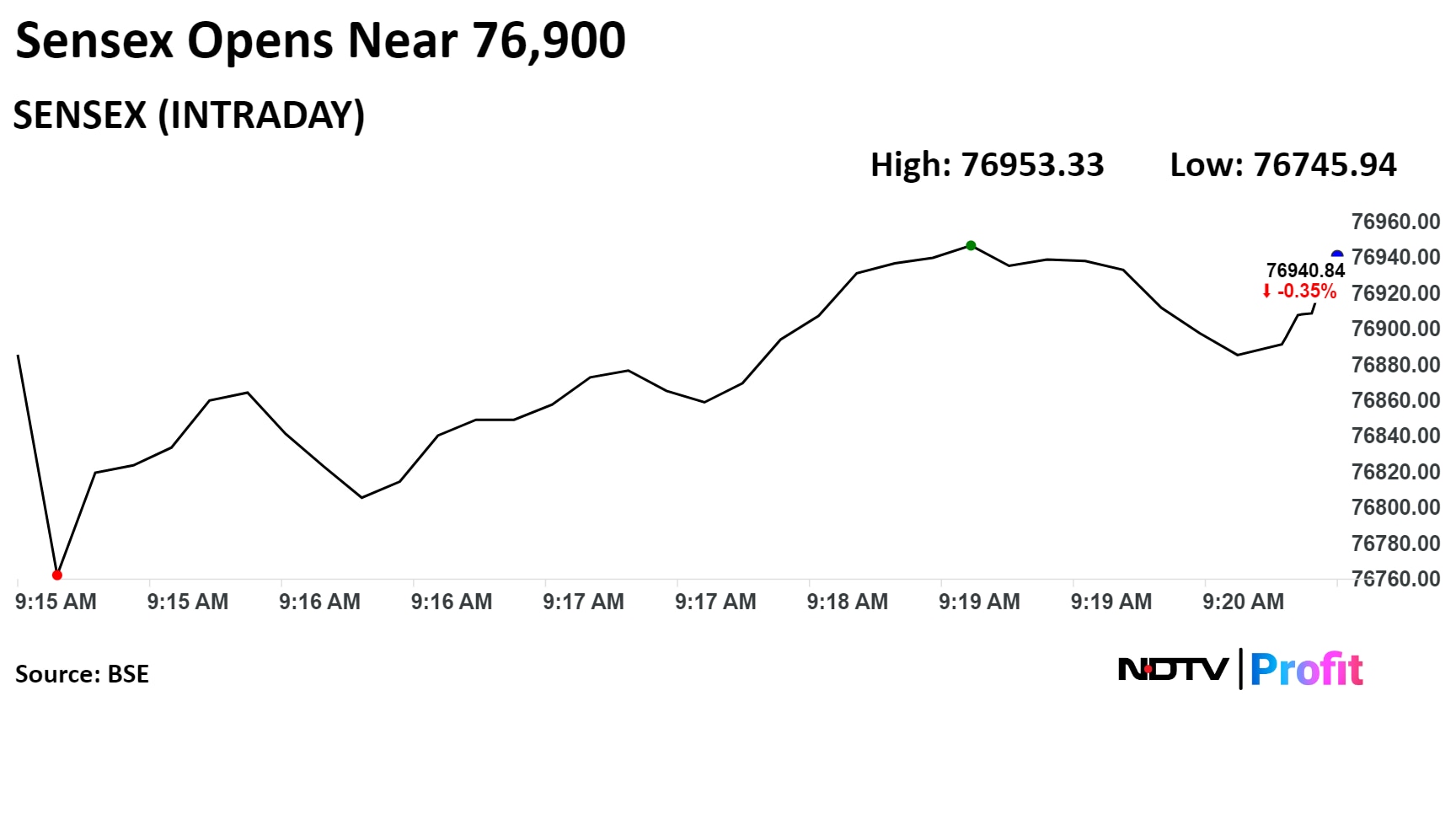

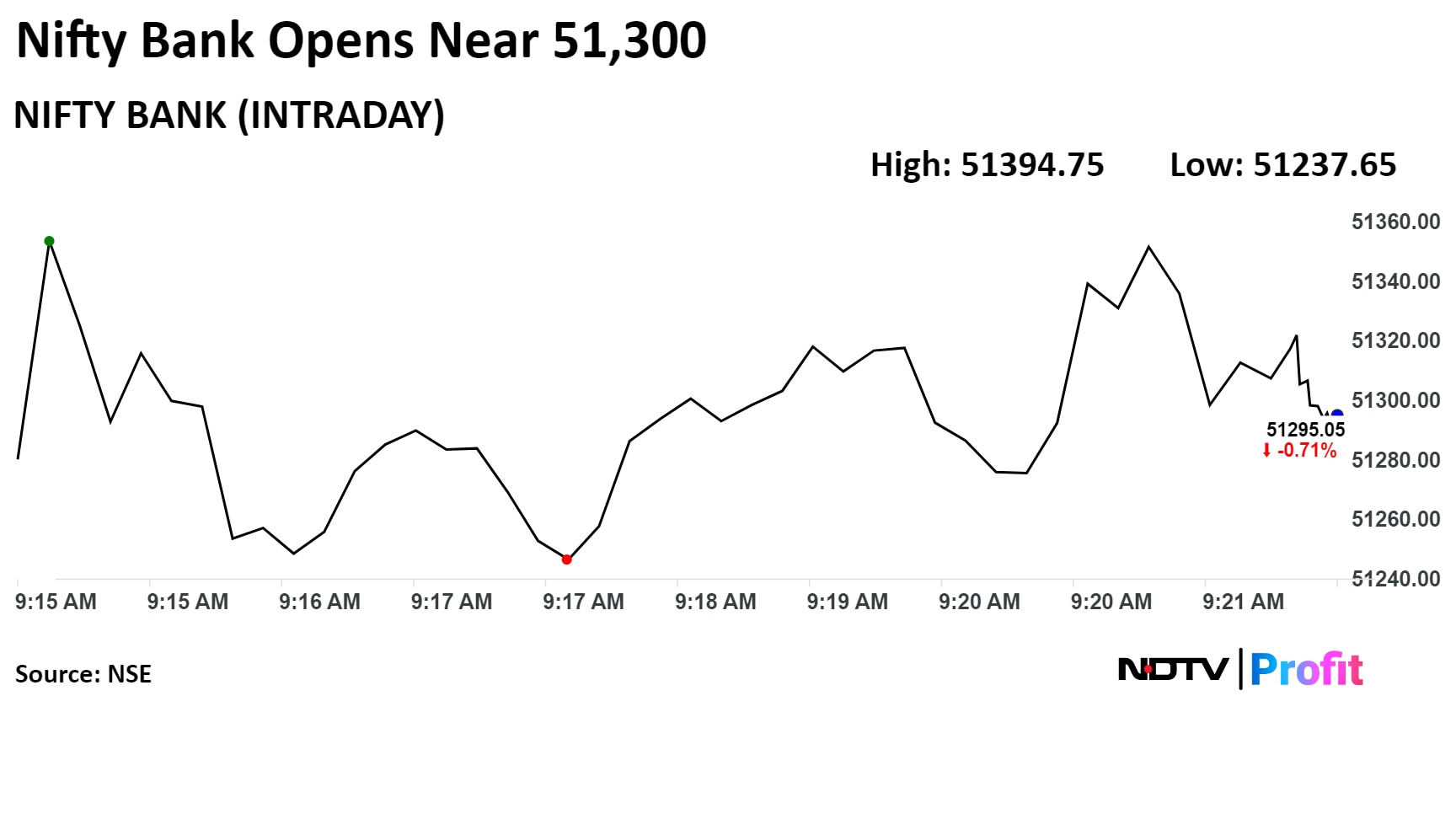

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

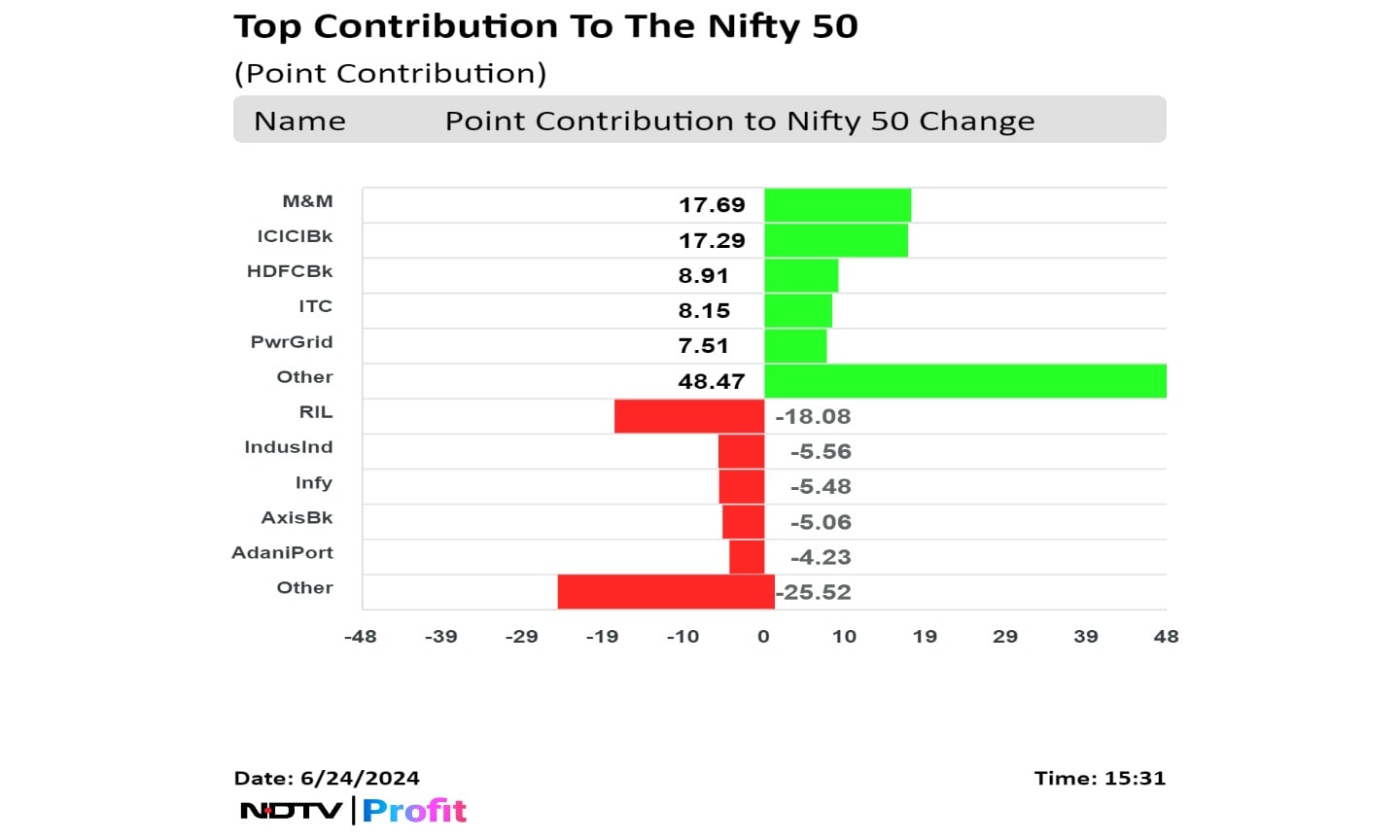

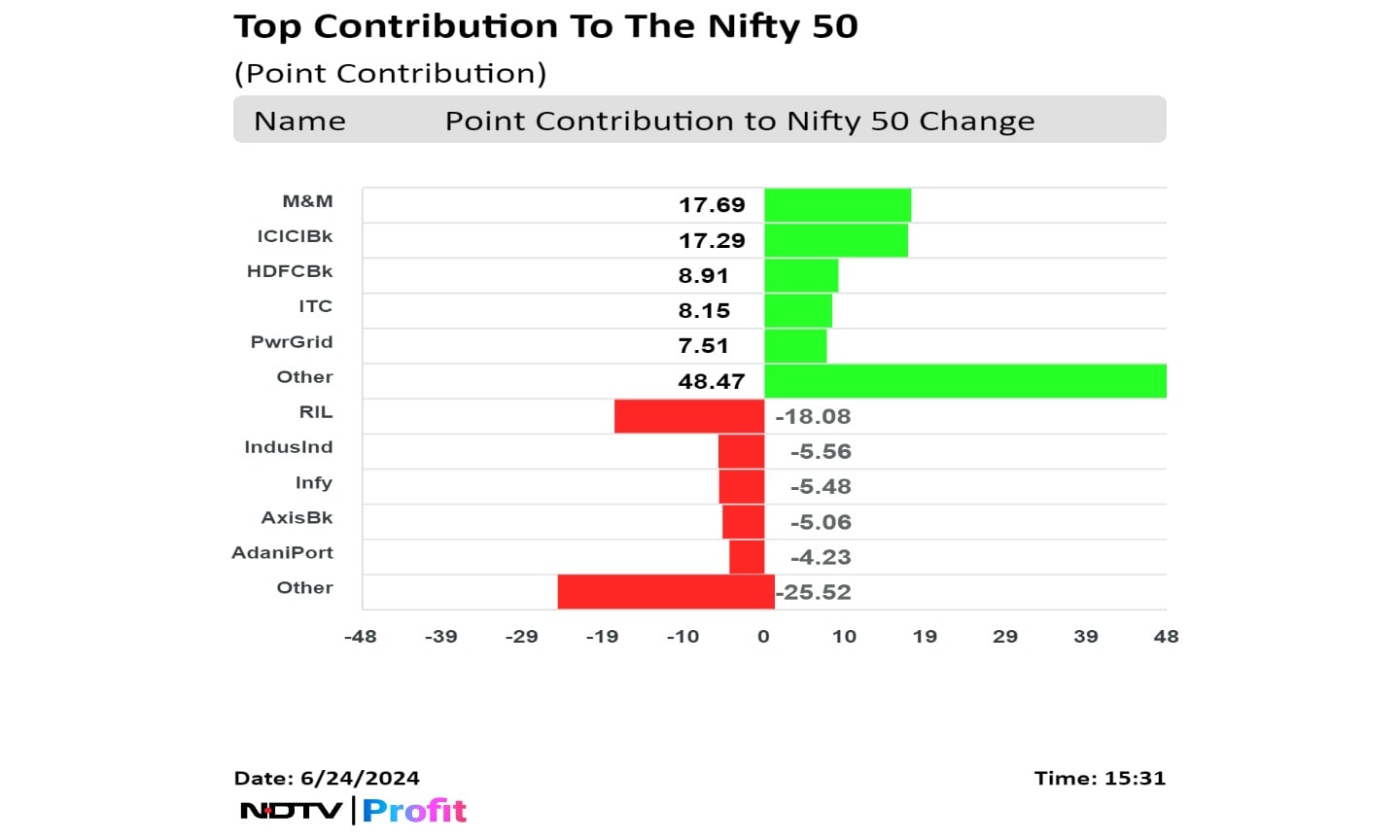

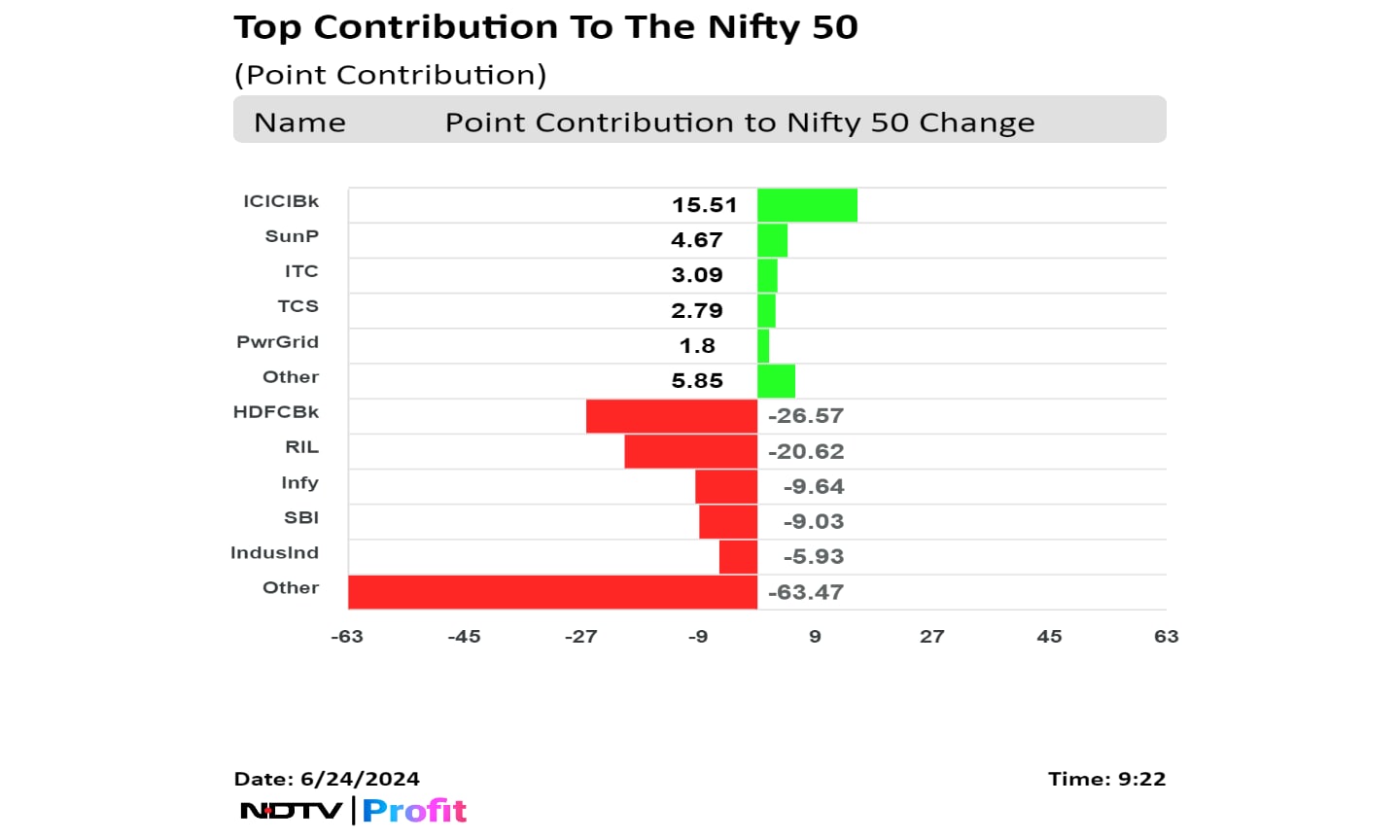

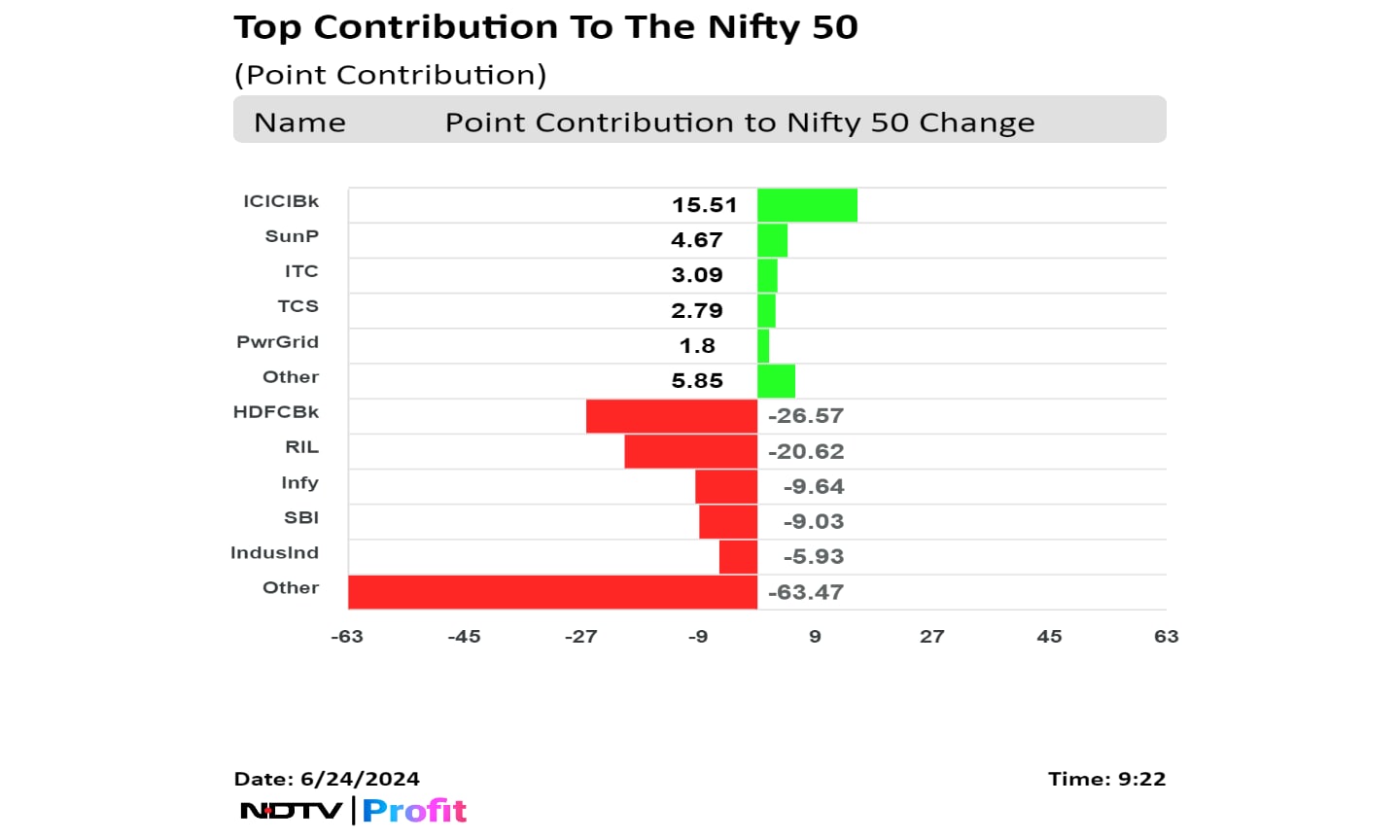

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., ITC Ltd., and Power Grid Corp. Of India contributed the most to the gains.

While those of Reliance Industries Ltd., IndusInd Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Adani Ports & Special Economic Zone capped the upside.

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., ITC Ltd., and Power Grid Corp. Of India contributed the most to the gains.

While those of Reliance Industries Ltd., IndusInd Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Adani Ports & Special Economic Zone capped the upside.

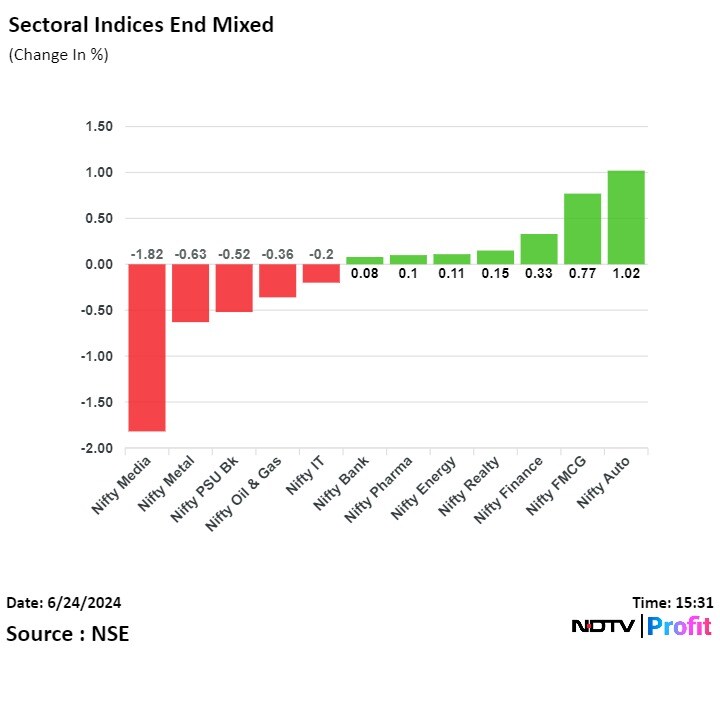

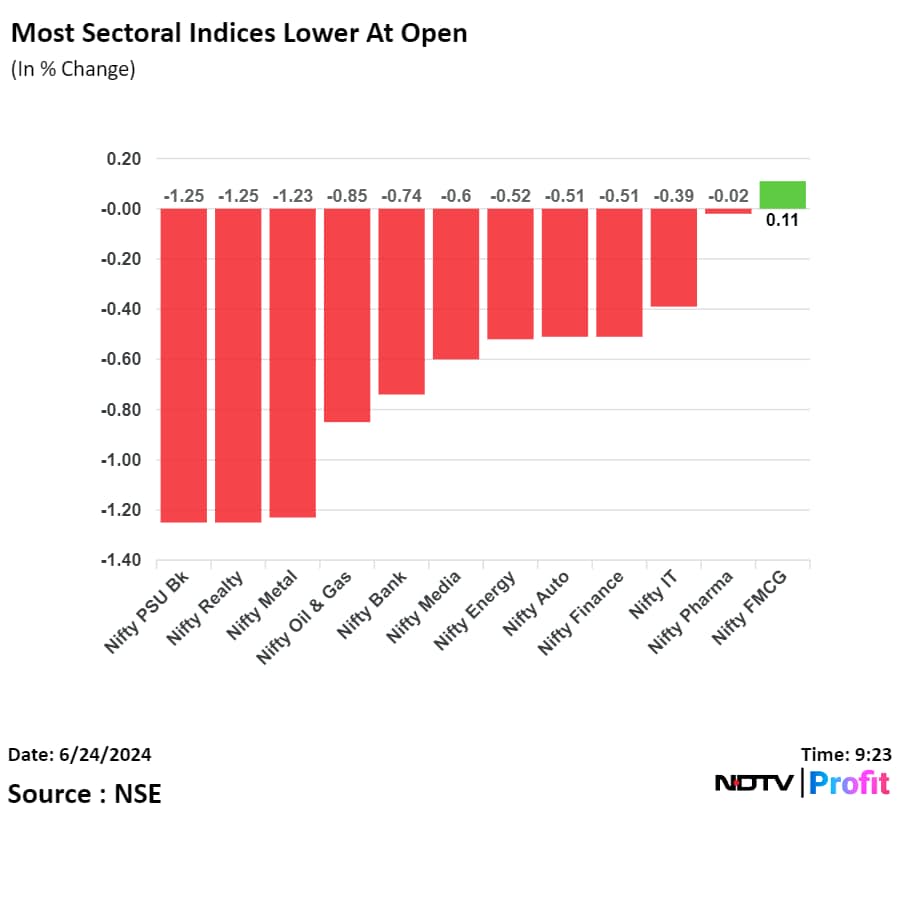

Sectoral indices were mixed at close. Nifty Auto rose the most and Nifty Media was the top loser.

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., ITC Ltd., and Power Grid Corp. Of India contributed the most to the gains.

While those of Reliance Industries Ltd., IndusInd Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Adani Ports & Special Economic Zone capped the upside.

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

Benchmark equity indices ended the first day of the week on a positive note after a lower open as shares of private banks and M&M gained but those of heavyweight Reliance capped the upside.

The Nifty closed at 23537.85, up 0.16% or 36.75 points and the Sensex closed at 77341.08, up by 0.17% or 131.18 points. Intraday, both the Nifty and Sensex fell 0.6%.

"The Index reversed from the lower end of the consolidation to form a green candle with the downside being protected at 23,400 while the higher side is also capped at 23,660," said Aditya Gaggar, director of Progressive Shares. "A precise close on either side will provide a clear picture."

.jpeg)

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., ITC Ltd., and Power Grid Corp. Of India contributed the most to the gains.

While those of Reliance Industries Ltd., IndusInd Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Adani Ports & Special Economic Zone capped the upside.

Sectoral indices were mixed at close. Nifty Auto rose the most and Nifty Media was the top loser.

Market breadth was skewed in favour of buyers. Around 2,120 stocks rose, 1,872 stocks declined, and 164 stocks remained unchanged on BSE.

Broader markets outperformed benchmark indices. The S&P BSE Midcap and Smallcap ended 0.37% and 0.27% higher, respectively.

On BSE, 13 sectoral indices advanced and seven declined out of 20. The S&P BSE Metal was the worst performing sector, and the S&P BSE Auto rose the most to become the top performing sector.

Unit Birla Estates acquires 16.5 acres land parcel in Pune having revenue potential of Rs 2,500 crore

Source: Exchange filing

Prosus marks down Byju's investment value to zero at the end of FY24

Writes off fair value of 9.6% effective interest, loss of $493 million recognised

Marked down due to significant decrease in value for equity investors

Source - Prosus annual report

Gujarat plant gets CE certification from Bureau Veritas, France

Source: Exchange Filing

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

.png)

ICICI Bank Ltd., Mahindra & Mahindra Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd. and Sun Pharmaceutical Industries Ltd. led the gains in the Nifty.

Reliance Industries Ltd., Infosys Ltd., Axis Bank Ltd., IndusInd Bank Ltd., and Adani Ports & Special Economic Zone Ltd. weighed on the index the most.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

.png)

ICICI Bank Ltd., Mahindra & Mahindra Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd. and Sun Pharmaceutical Industries Ltd. led the gains in the Nifty.

Reliance Industries Ltd., Infosys Ltd., Axis Bank Ltd., IndusInd Bank Ltd., and Adani Ports & Special Economic Zone Ltd. weighed on the index the most.

.png)

Seven out of the 12 sectors on the NSE advanced. The Nifty Media led the losses, while FMCG was the top performer.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

.png)

ICICI Bank Ltd., Mahindra & Mahindra Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd. and Sun Pharmaceutical Industries Ltd. led the gains in the Nifty.

Reliance Industries Ltd., Infosys Ltd., Axis Bank Ltd., IndusInd Bank Ltd., and Adani Ports & Special Economic Zone Ltd. weighed on the index the most.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

The benchmark stock indices erased losses from the morning session to trade higher through midday on Monday, tracking gains in share prices of ICICI Bank Ltd., Mahindra & Mahindra Ltd. and HDFC Bank Ltd. As of 11:57 a.m., the NSE Nifty 50 was trading 26.20 points or 0.11% higher at 23,527.30, and the S&P BSE Sensex was 111.10 points or 0.14% up at 77,321.00.

Earlier in the day, the Nifty 50 declined as much as 0.64% to 23,350, and the Sensex declined 0.60% to 76,745.94.

There was some profit booking at these levels. A small bearish candle on the weekly chart and a double top formation on the intraday chart indicates potential weakness from current levels, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The medium-term market structure remains positive. Kotak Securities expects weak sentiment to remain as long as the market is trading below 23,700/77,800.

.png)

.png)

.png)

ICICI Bank Ltd., Mahindra & Mahindra Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd. and Sun Pharmaceutical Industries Ltd. led the gains in the Nifty.

Reliance Industries Ltd., Infosys Ltd., Axis Bank Ltd., IndusInd Bank Ltd., and Adani Ports & Special Economic Zone Ltd. weighed on the index the most.

.png)

Seven out of the 12 sectors on the NSE advanced. The Nifty Media led the losses, while FMCG was the top performer.

.png)

The broader markets outperformed the benchmark indices as the BSE MidCap and the SmallCap indices were trading 0.19% and 0.55% higher respectively.

On the BSE, 12 out of the 20 sectors advanced, with Capital Goods being the top performer and Realty emerging as the top loser.

The market breadth was skewed in favour of the buyers as 2,128 stocks advanced, 1,621 declined and 200 remained unchanged on the BSE.

The stock jumped as much as 4.49% to hit its all-time high of Rs 4,075. It has risen over 107% on an year-to-date basis and 110% in the last twelve months.

The stock jumped as much as 4.49% to hit its all-time high of Rs 4,075. It has risen over 107% on an year-to-date basis and 110% in the last twelve months.

.png)

Before Monday's rise, the index had fallen 2.5% in its four-day fall.

Before Monday's rise, the index had fallen 2.5% in its four-day fall.

.png)

Gets order for construction of district jail at Uttar Pradesh

Source: Exchange Filing

Gets two work orders worth Rs 180 crore

Source: Exchange Filing

Shares of Cipla Ltd. fell to the lowest level in over two weeks after it has received six observation for its facility in Goa from the US Food and Drug Administration.

Shares of Cipla Ltd. fell to the lowest level in over two weeks after it has received six observation for its facility in Goa from the US Food and Drug Administration.

Gets order worth nearly Rs 100 crore from REC in Hyderabad

Source: Exchange Filing

Gets order worth nearly Rs 100 crore from REC in Hyderabad

Source: Exchange Filing

.png)

Power transmission & distribution vertical gets order in the range of Rs 1,000-2,500 crore to build solar PV plant

Source: Exchange Filing

Shares of TBO Tek Ltd. surged to a record high on Monday after Goldman Sachs initiated coverage with a 'buy' rating, citing a strong execution track record, strong free cash flow generation, an asset-light balance sheet, and low competition, among other positives in the business model.

Shares of TBO Tek Ltd. surged to a record high on Monday after Goldman Sachs initiated coverage with a 'buy' rating, citing a strong execution track record, strong free cash flow generation, an asset-light balance sheet, and low competition, among other positives in the business model.

.png)

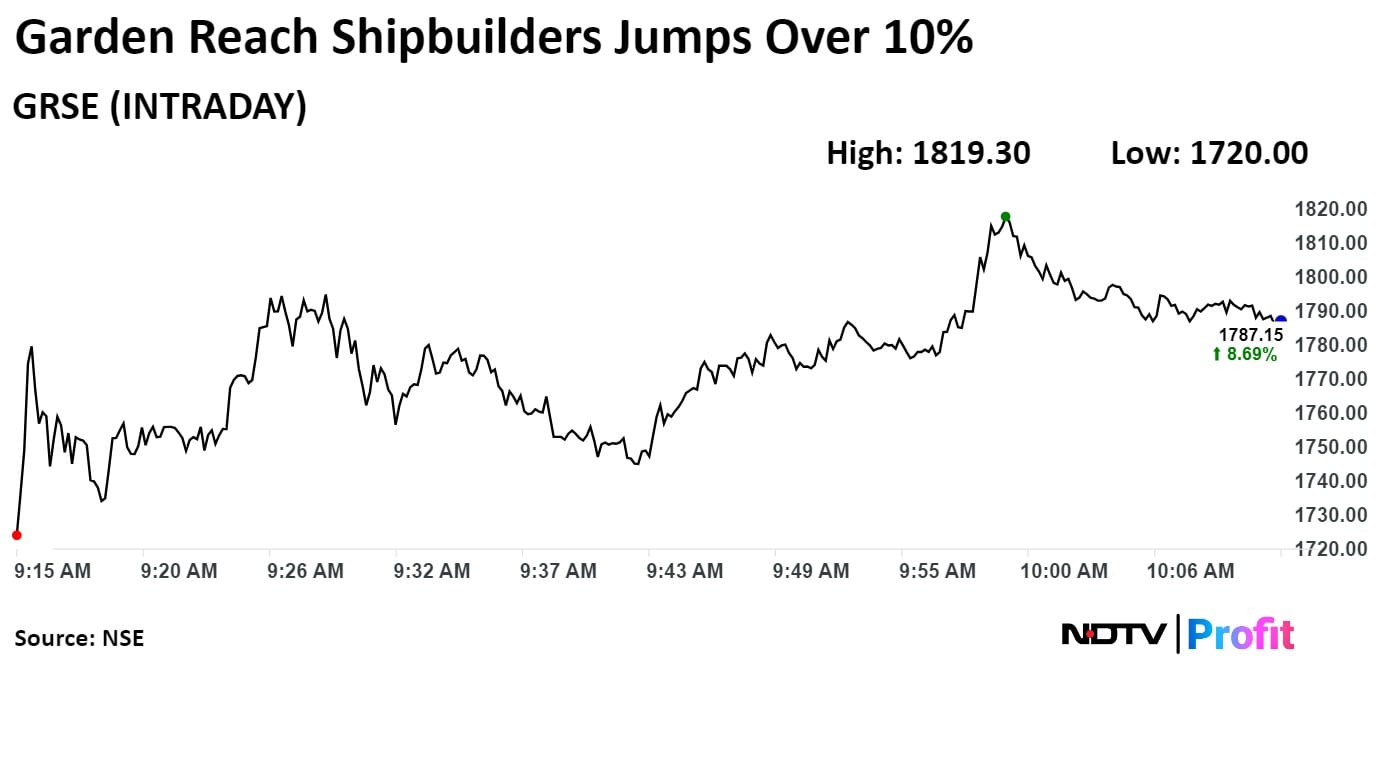

Shares of Garden Reach & Shipbuilders Ltd. jumped over 10% on Monday after the company secured an order worth $54 million for multi-purpose vehicles from a German company.

Shares of Garden Reach & Shipbuilders Ltd. jumped over 10% on Monday after the company secured an order worth $54 million for multi-purpose vehicles from a German company.

Shares of Garden Reach Shipbuilders & Engineers Ltd. jumped 10.65% to Rs 1,891.30, the highest level since June 19 It was pared gains to trade 8.93% as of 10:08 a.m., as compared to 0.30% decline in the NSE Nifty 50 index.

The scrip gained 201.63% in 12 months, and 103.57% on year to date basis. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 68.00.

Out of five analysts tracking the company, three maintain a 'buy' rating, and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 29.6%.

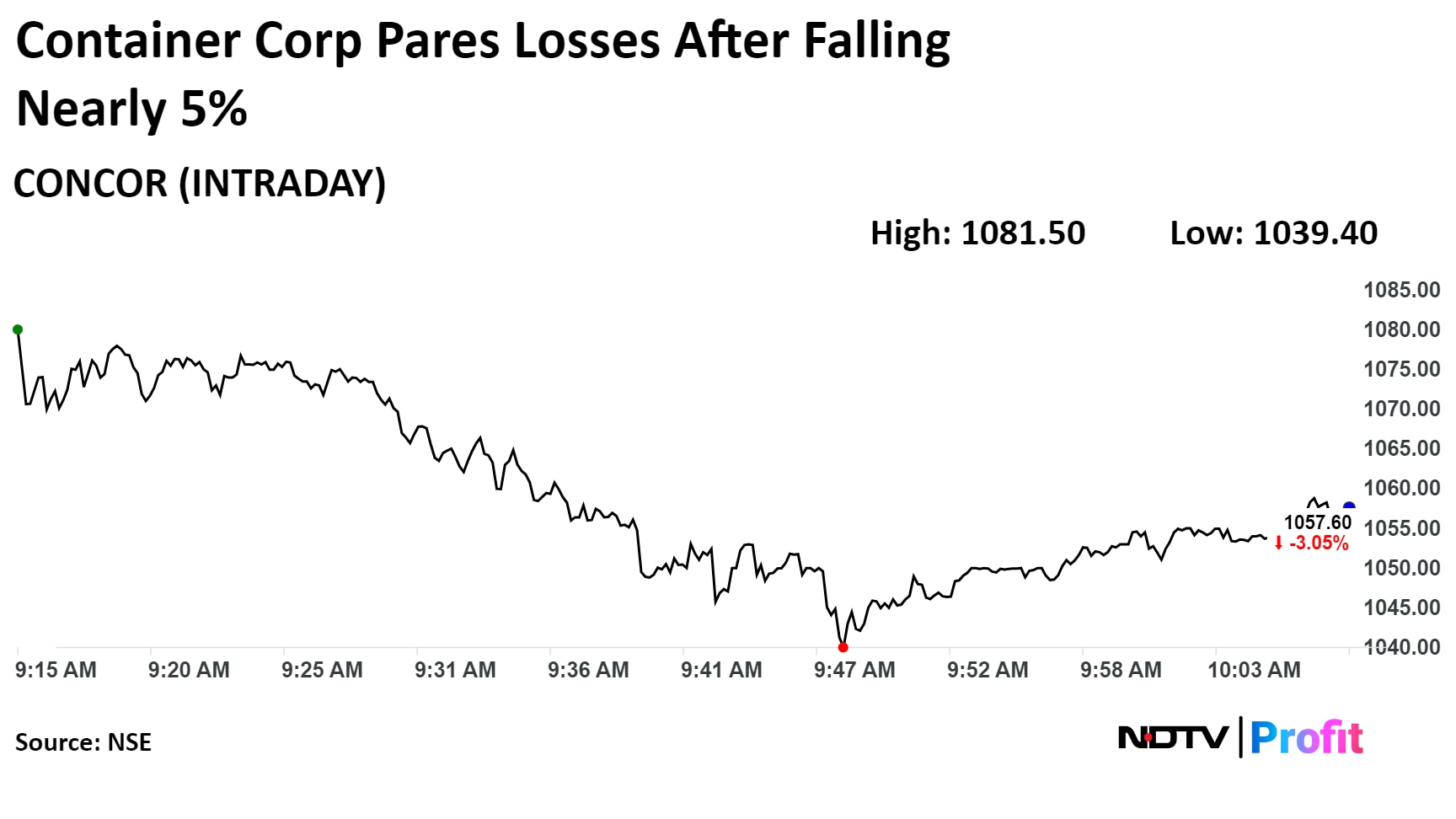

Kotak maintains 'Sell' on Container Corp at Rs 740 target (29% downside)

Rail freight rate data suggest company's pricing is at 5% premium to peers

Expects market share loss to continue

Recent unconfirmed news flow suggests divestment process could defer to beyond FY25

Current market trades at expensive 42x one-year forward earnings

Kotak maintains 'Sell' on Container Corp at Rs 740 target (29% downside)

Rail freight rate data suggest company's pricing is at 5% premium to peers

Expects market share loss to continue

Recent unconfirmed news flow suggests divestment process could defer to beyond FY25

Current market trades at expensive 42x one-year forward earnings

Morgan Stanley maintains 'Overweight' on Zomato at Rs 235 target (21% upside potential)

Zepto's recent fund raise increases Quick Commerce channel relevance, competitive intensity

Zepto raises $665 million at $3.6 billion valuation

Zepto to use fund raise to enter new markets, increase penetration in existing cities

Recent fundraises in space reflect growing importance of quick commerce

Implication on Zomato:

To maintain/improve market positioning given expansion plan

Lowers expectations on break-even levels expected in quick commerce segment

Push out of profitability for quick commerce a possibility

Correction in stock to be buying opportunity for long-term investors

Maintains 'Overweight' on Zomato at Rs 235 target (21% upside)

Maintains 'Overweight' on PB Fintech at Rs 1020 target (23% downside)

Zomato, PB Fintech's track record, outlook, valuations outweigh others

Macro & micro factors aligned for India internet stocks

Rising dispersion of stock returns implies greater focus on stock election

Firms reprioritizing growth despite slow margin improvement in near term

Key catalyst: Strong revenue growth momentum

Expects Zomato, PB Fintech to surprise on revenue growth.

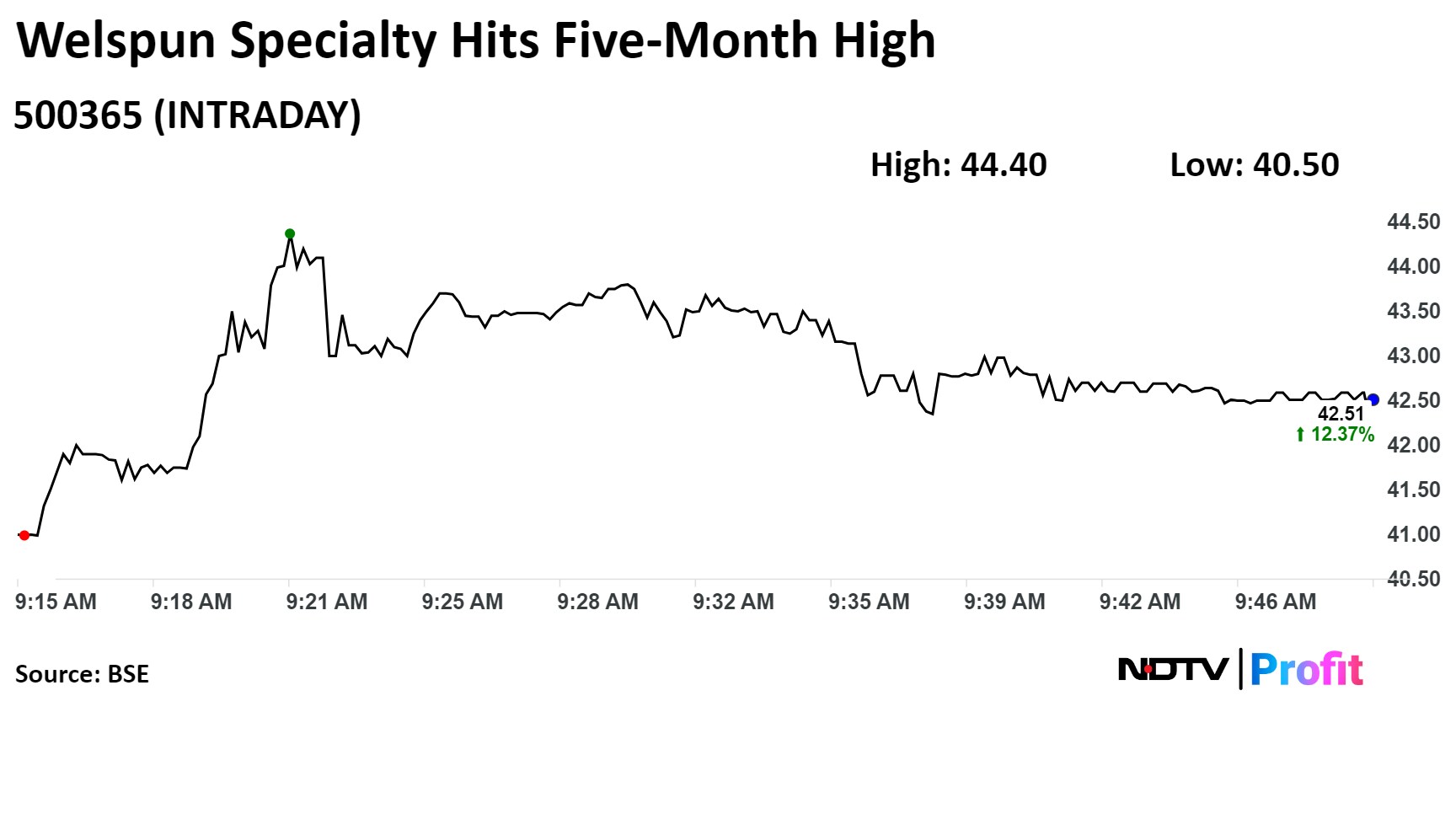

Shares of Welspun Specialty Solutions Limited surged the most in nearly five months on Monday after it was notified by Bharat Heavy Electricals Ltd. (BHEL) as the lowest bidder for a supply contract worth Rs 117 crore.

Shares of Welspun Specialty Solutions Limited surged the most in nearly five months on Monday after it was notified by Bharat Heavy Electricals Ltd. (BHEL) as the lowest bidder for a supply contract worth Rs 117 crore.

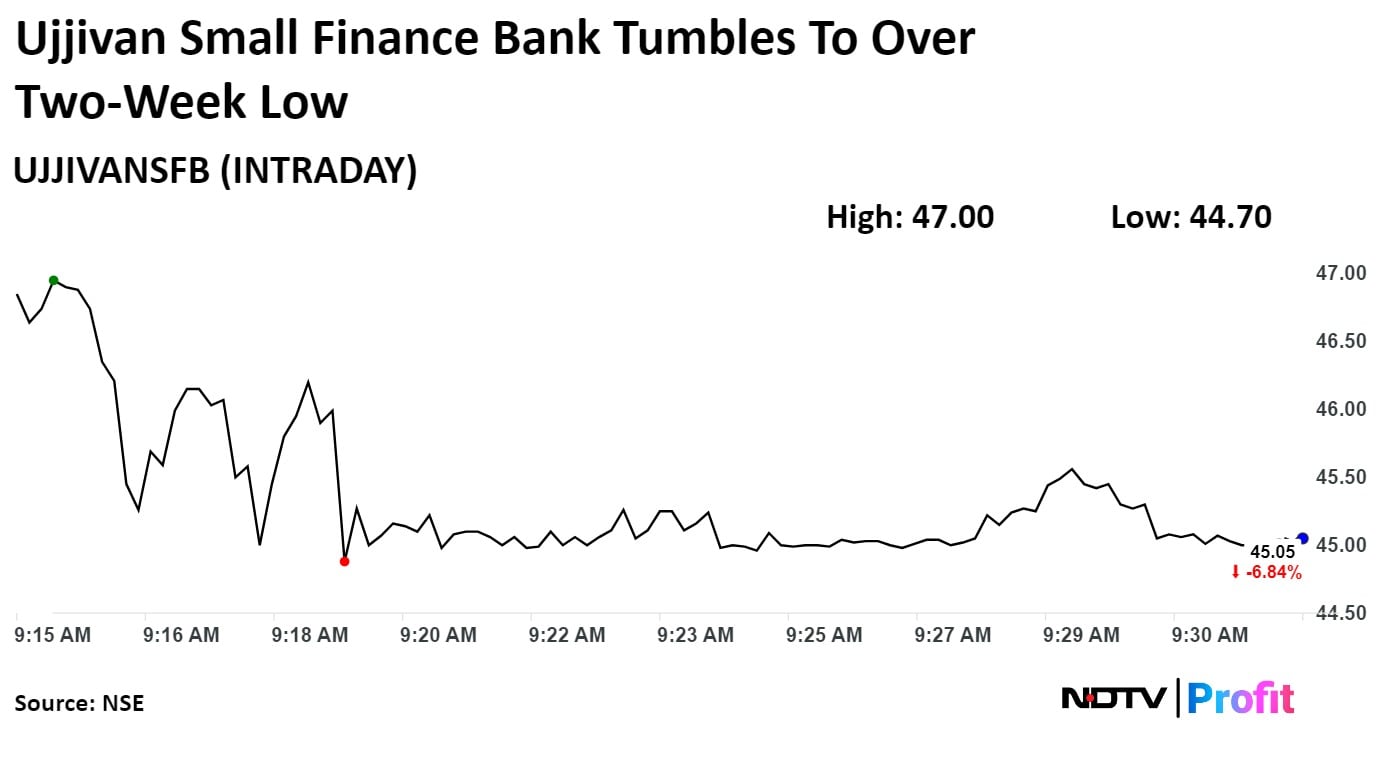

Ujjivan Small Finance Bank Ltd.'s shares declined to the lowest level in over two weeks after it slashed its loan growth guidance for fiscal 2025.

The small finance bank has cut down loan growth guidance by 500 basis points for fiscal 2025 due to stress noticed in certain pockets of the business, the lender said Sunday in an analyst presentation.

Ujjivan Small Finance Bank Ltd.'s shares declined to the lowest level in over two weeks after it slashed its loan growth guidance for fiscal 2025.

The small finance bank has cut down loan growth guidance by 500 basis points for fiscal 2025 due to stress noticed in certain pockets of the business, the lender said Sunday in an analyst presentation.

.png)

.png)

.png)

Rising freight rates in Asia add to pipeline price pressures

Higher costs point to faster pickup in PPI inflation, pressure on profit margins

WCI composite freight index up over 240% YoY as of June 20

Higher rates on tight capacity, strong demand, frontloading of shipments

Expects tight supply demand conditions to persist in 2024

Rising shipping costs add to import price inflation

While firms could absorb some cost increase, it would squeeze profit margins

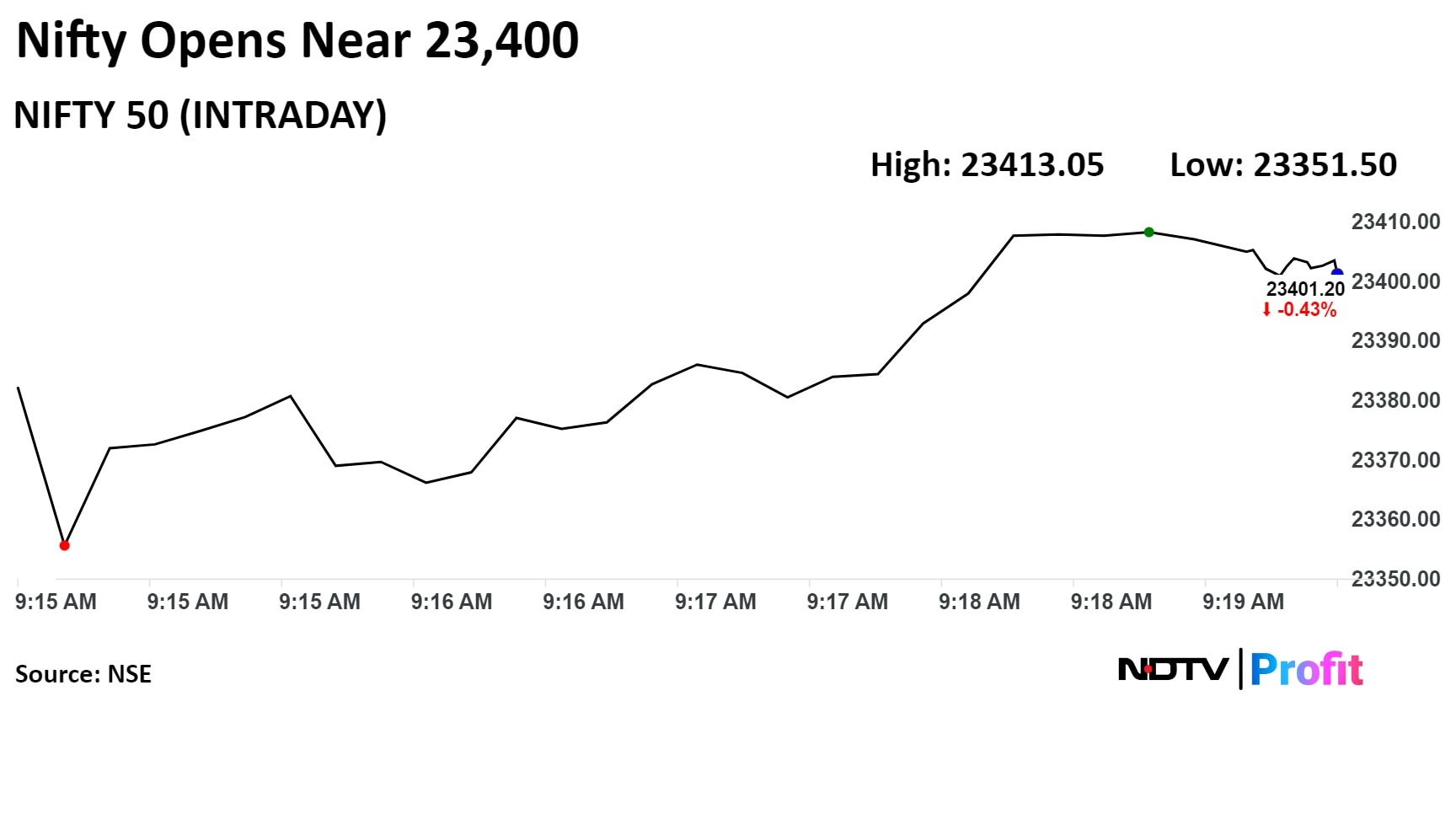

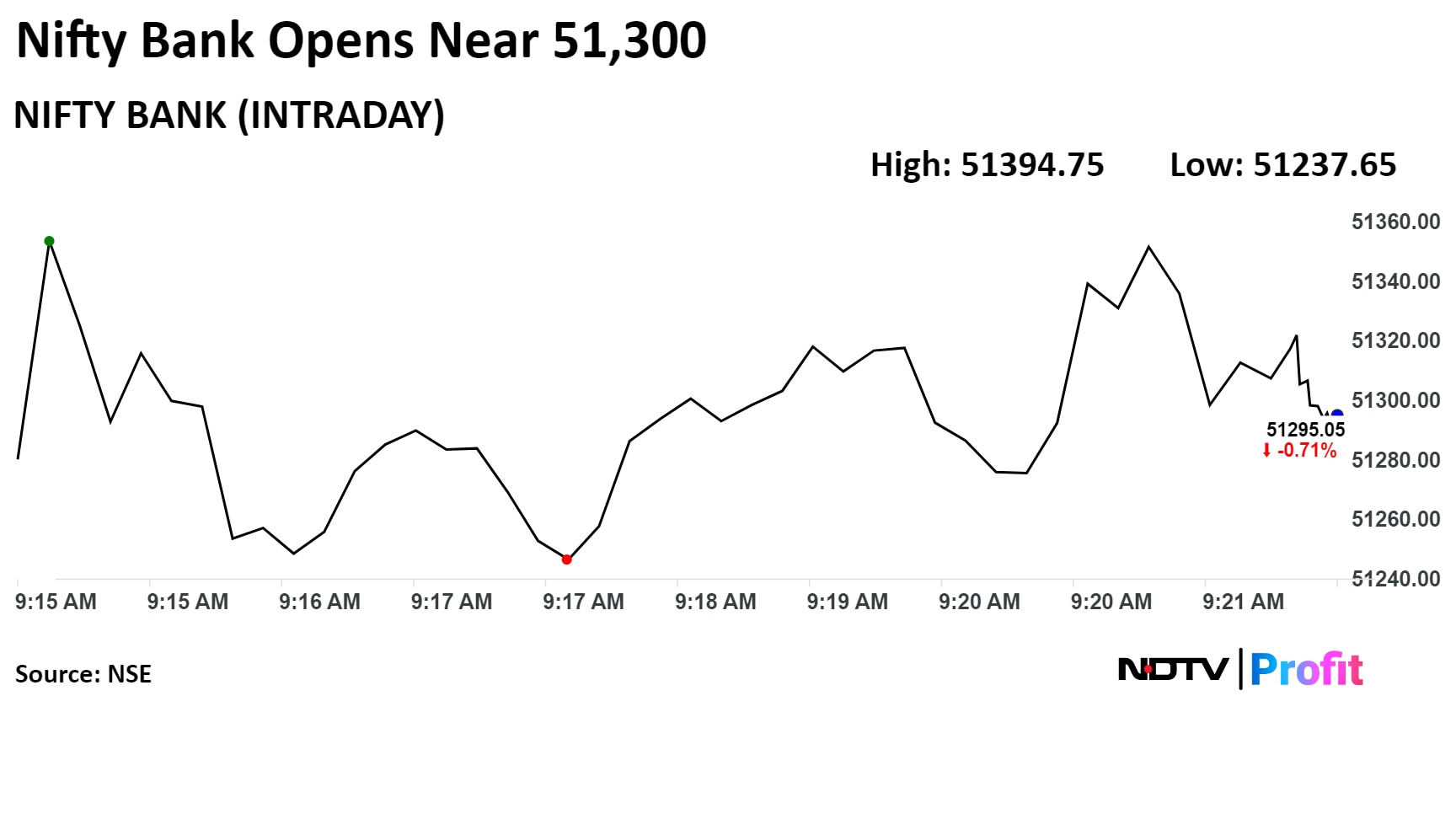

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Infosys Ltd., State Bank Of India, and IndusInd Bank Ltd. dragged the indices.

While those of ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Power Grid Corp. cushioned the fall.

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Infosys Ltd., State Bank Of India, and IndusInd Bank Ltd. dragged the indices.

While those of ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Power Grid Corp. cushioned the fall.

Except Nifty FMCG, all sectoral indices fell. Nifty PSU Bank and Nifty Realty were the top losers.

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Benchmark indices extended Friday's losses and opened lower with most stocks trading lower. Only eight Nifty stocks out of 50 rose and rest fell.

At pre-open, the NSE Nifty 50 was 0.51% or 118.80 points lower at 23,382.30, and the S&P BSE Sensex was 0.42% or 324.18 points lower at 76,885.65.

"Nifty 50 has made multiple tops near to 23,700 levels and witnessed profit booking, and we expect some profit booking to test the lower range of 23,200 levels," said Vikas Jain, senior research analyst at Reliance Securities. "We expect the volatility to increase with respect to rollover movement in individual sectors and stocks and on the higher side 23,800 will act as resistance."

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Infosys Ltd., State Bank Of India, and IndusInd Bank Ltd. dragged the indices.