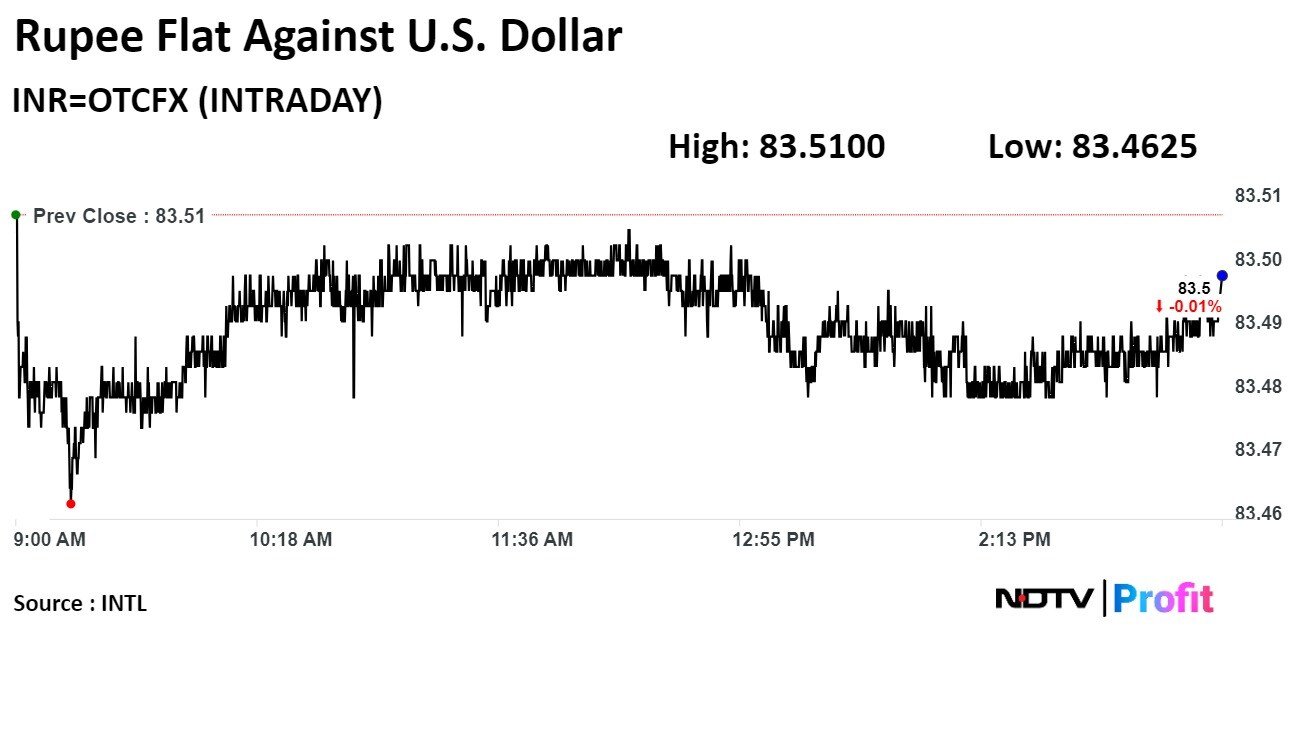

The local currency closed flat at 83.50 against the U.S dollar.

It closed at 83.51 on Tuesday.

Source: Bloomberg

The local currency closed flat at 83.50 against the U.S dollar.

It closed at 83.51 on Tuesday.

Source: Bloomberg

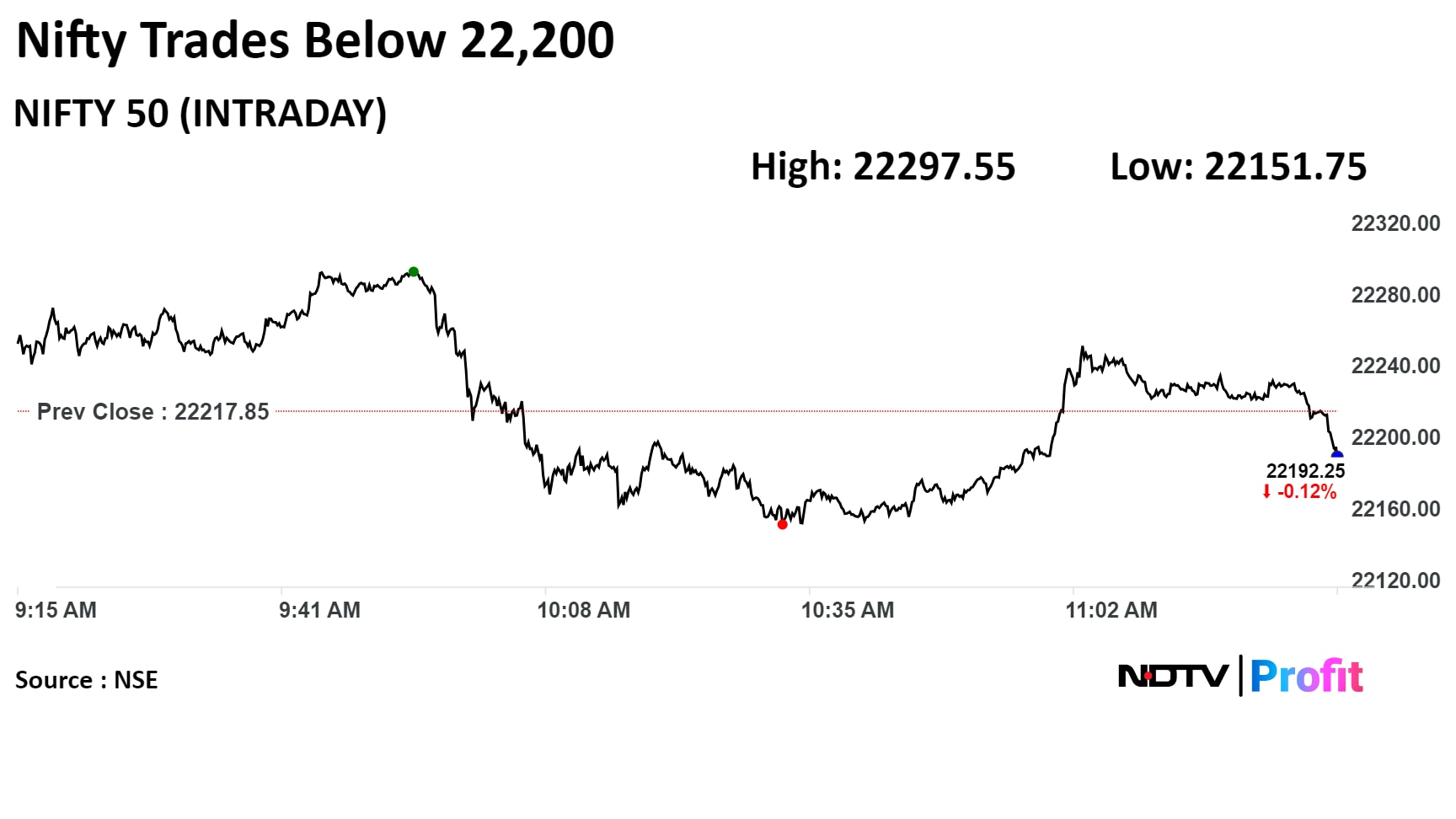

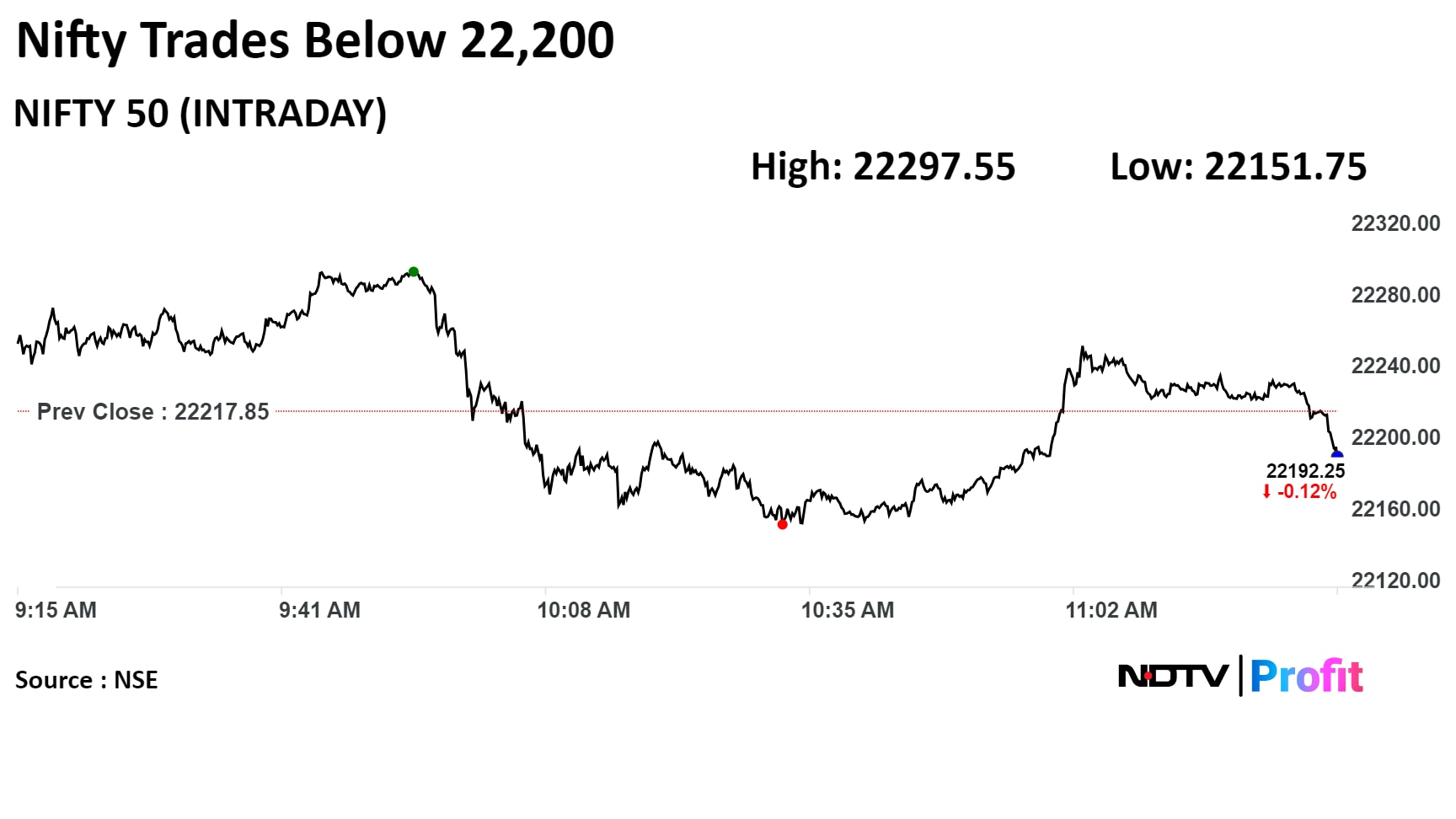

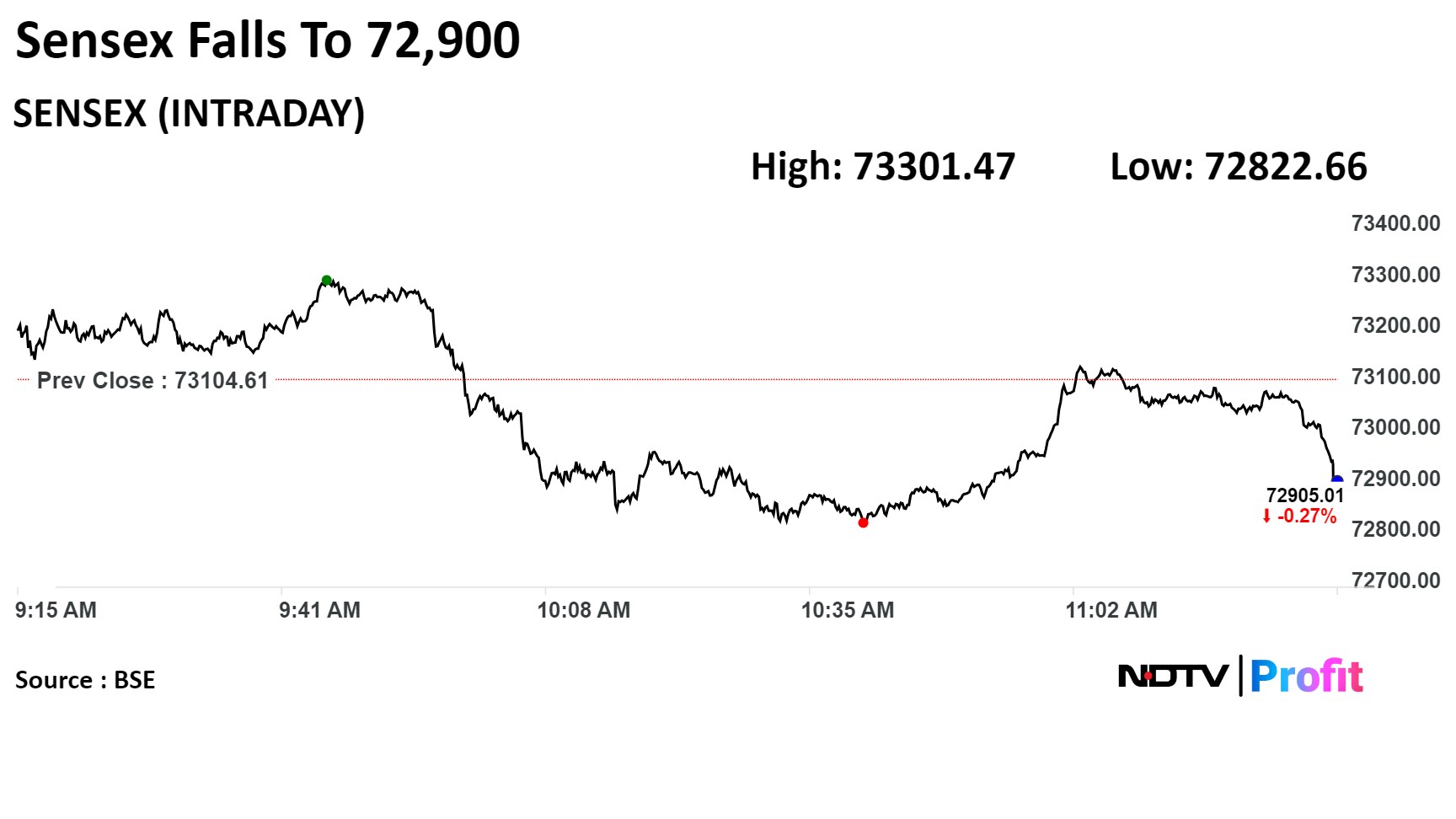

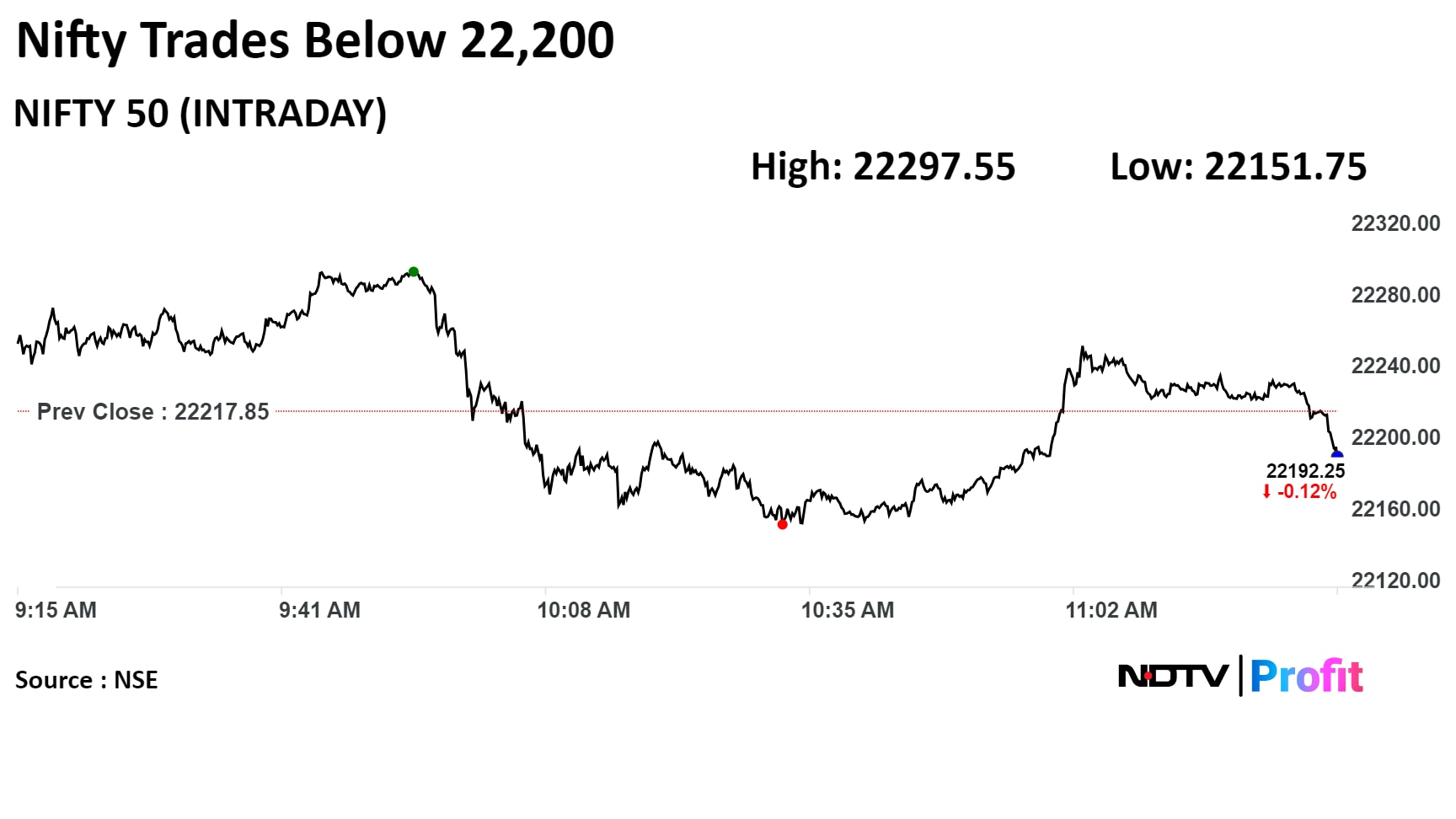

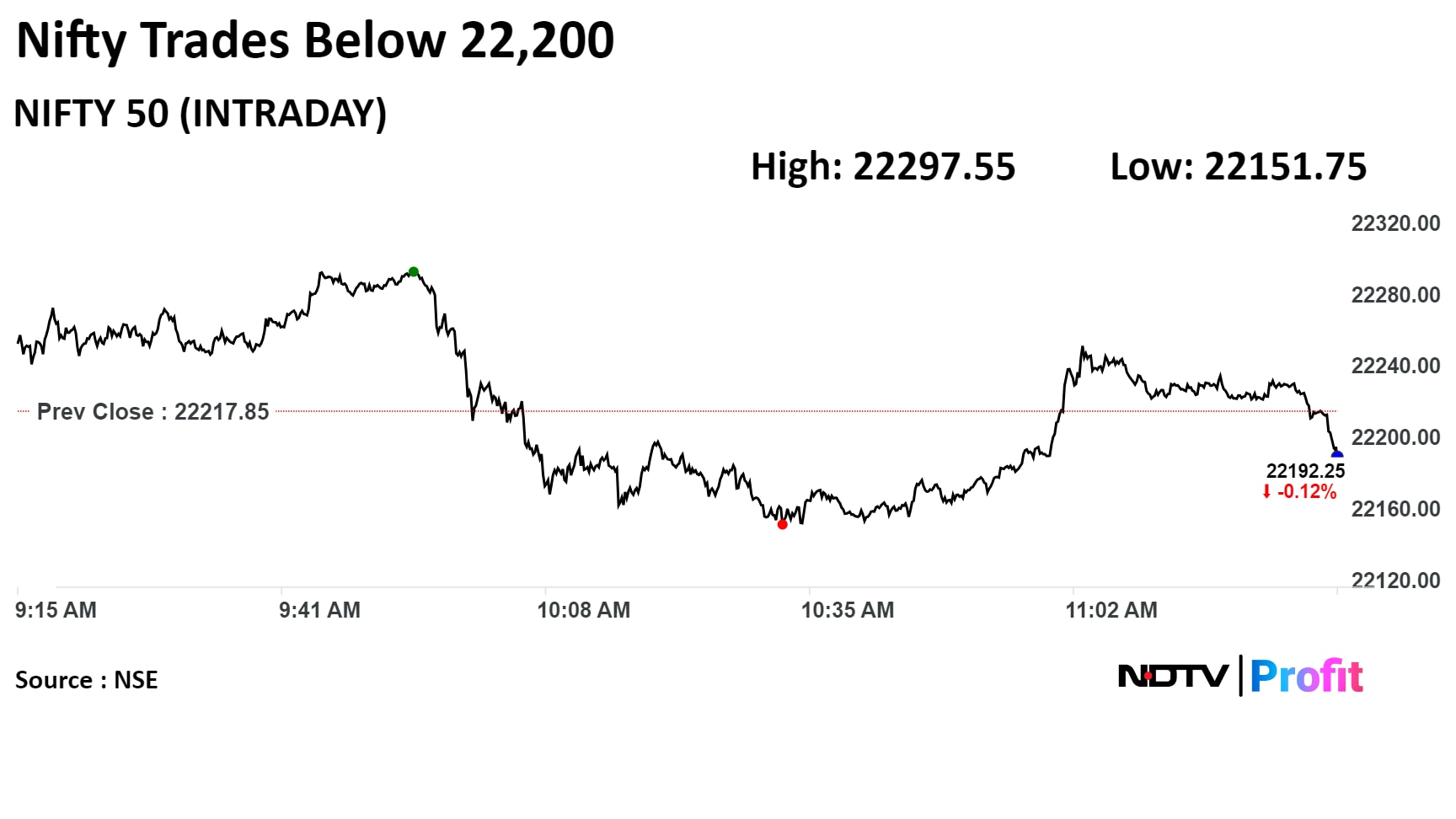

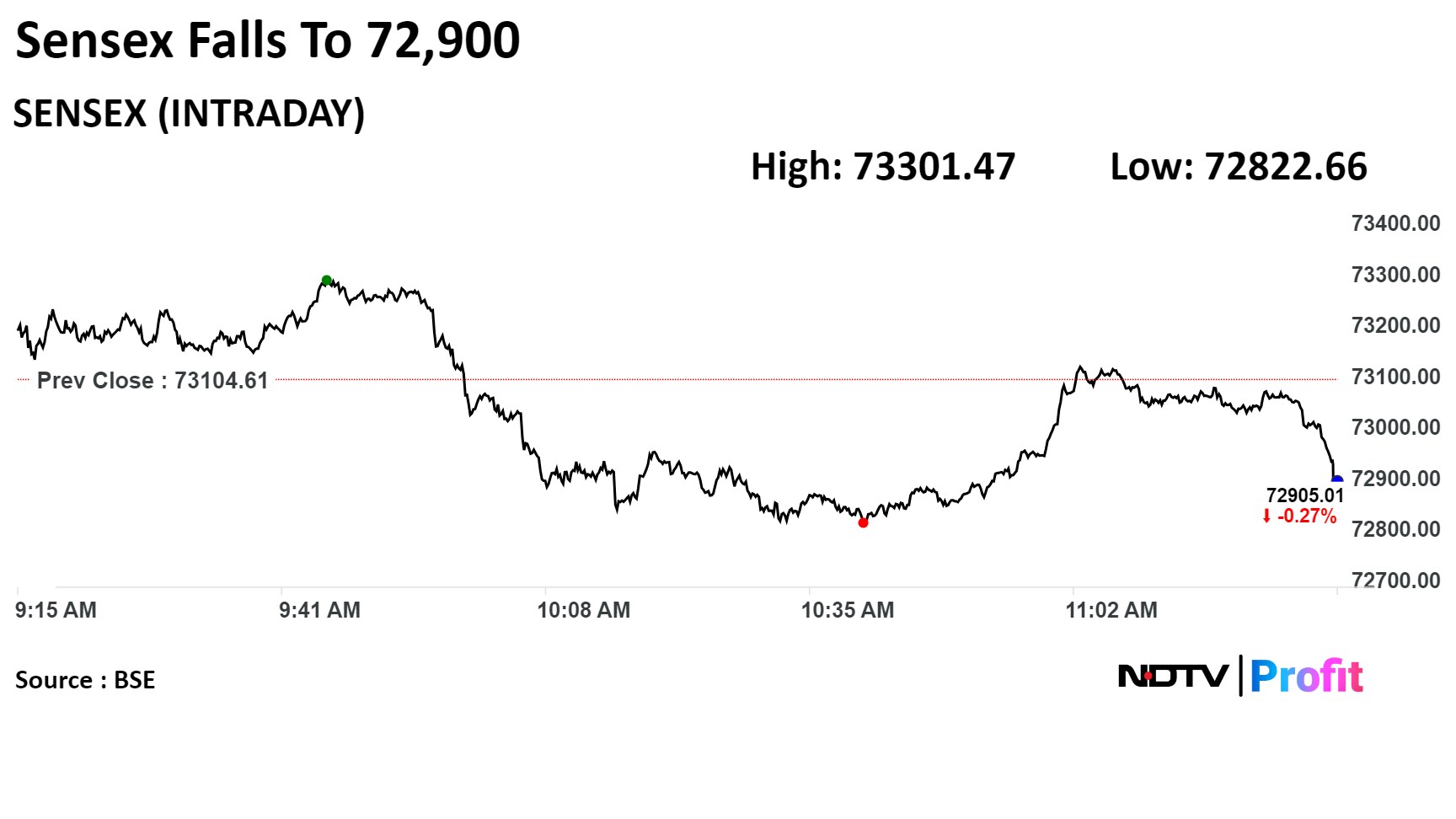

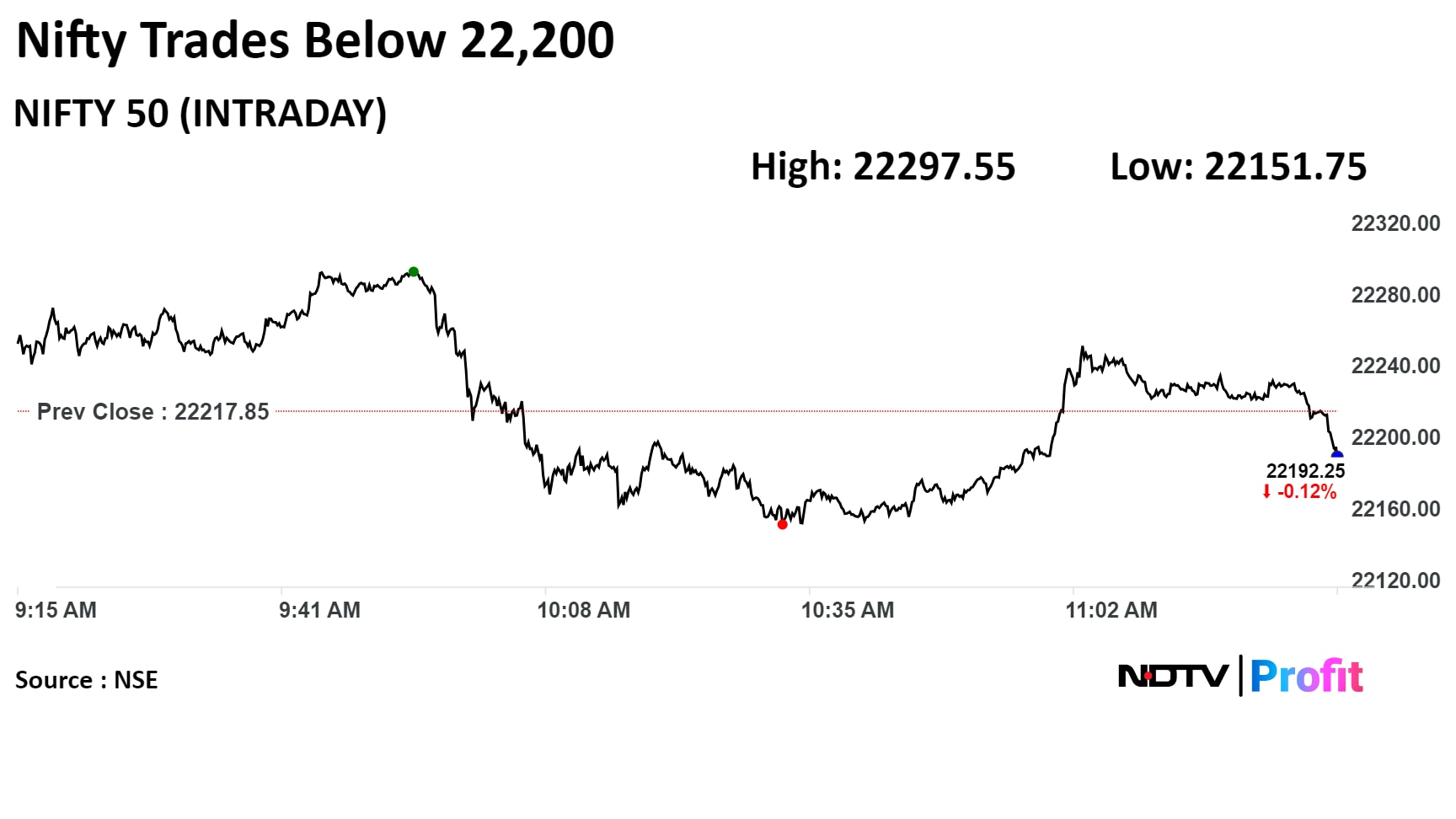

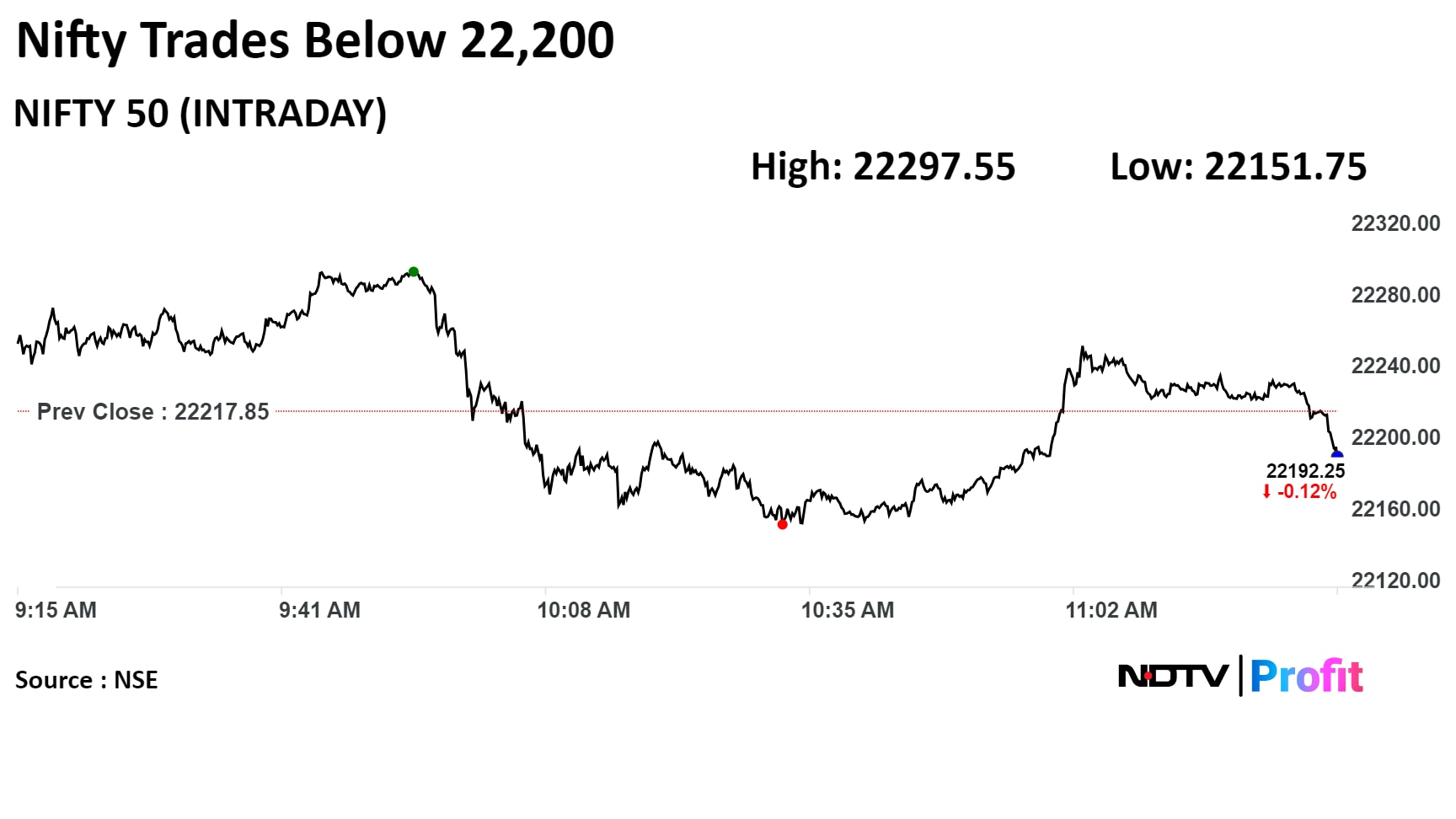

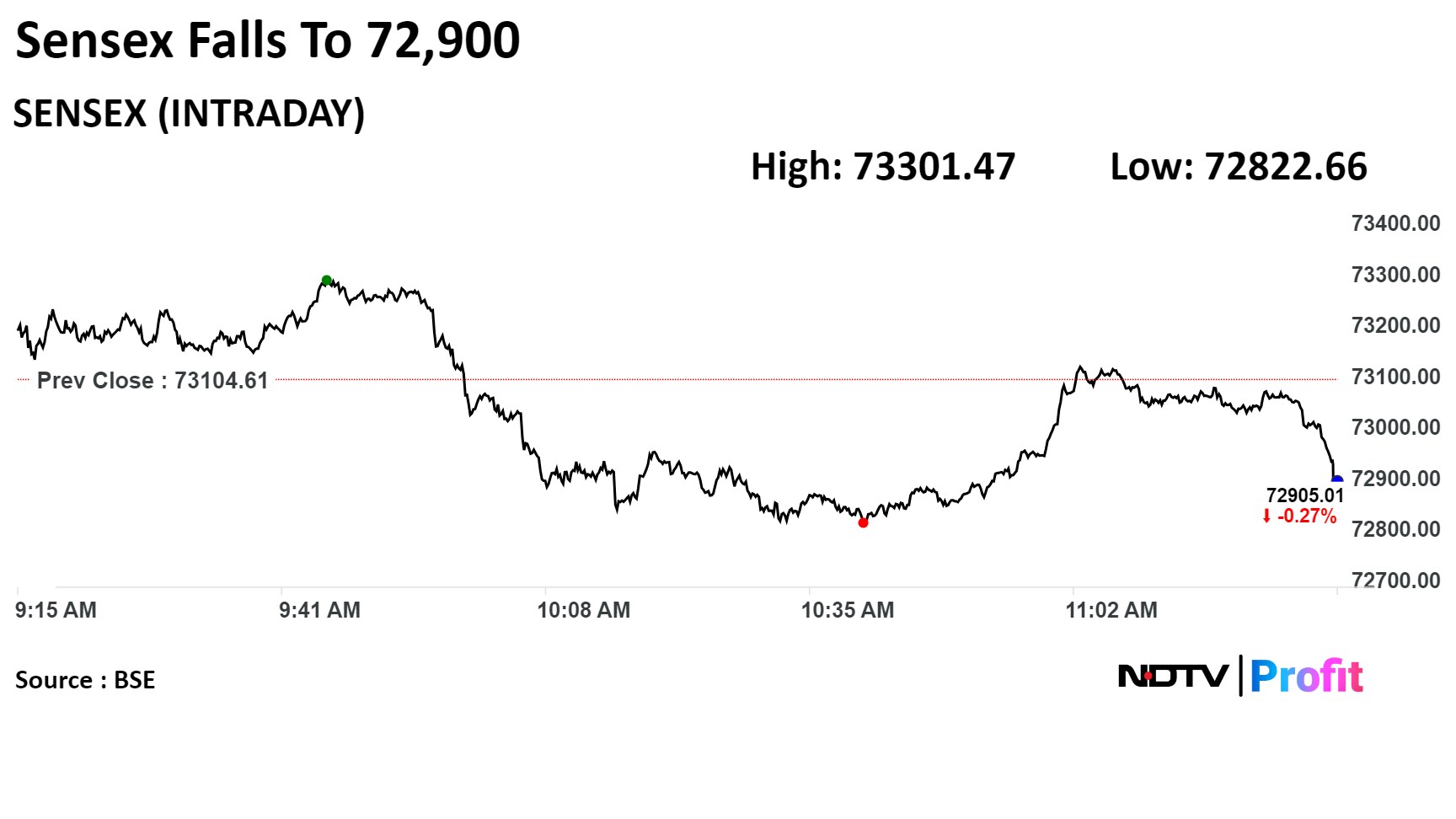

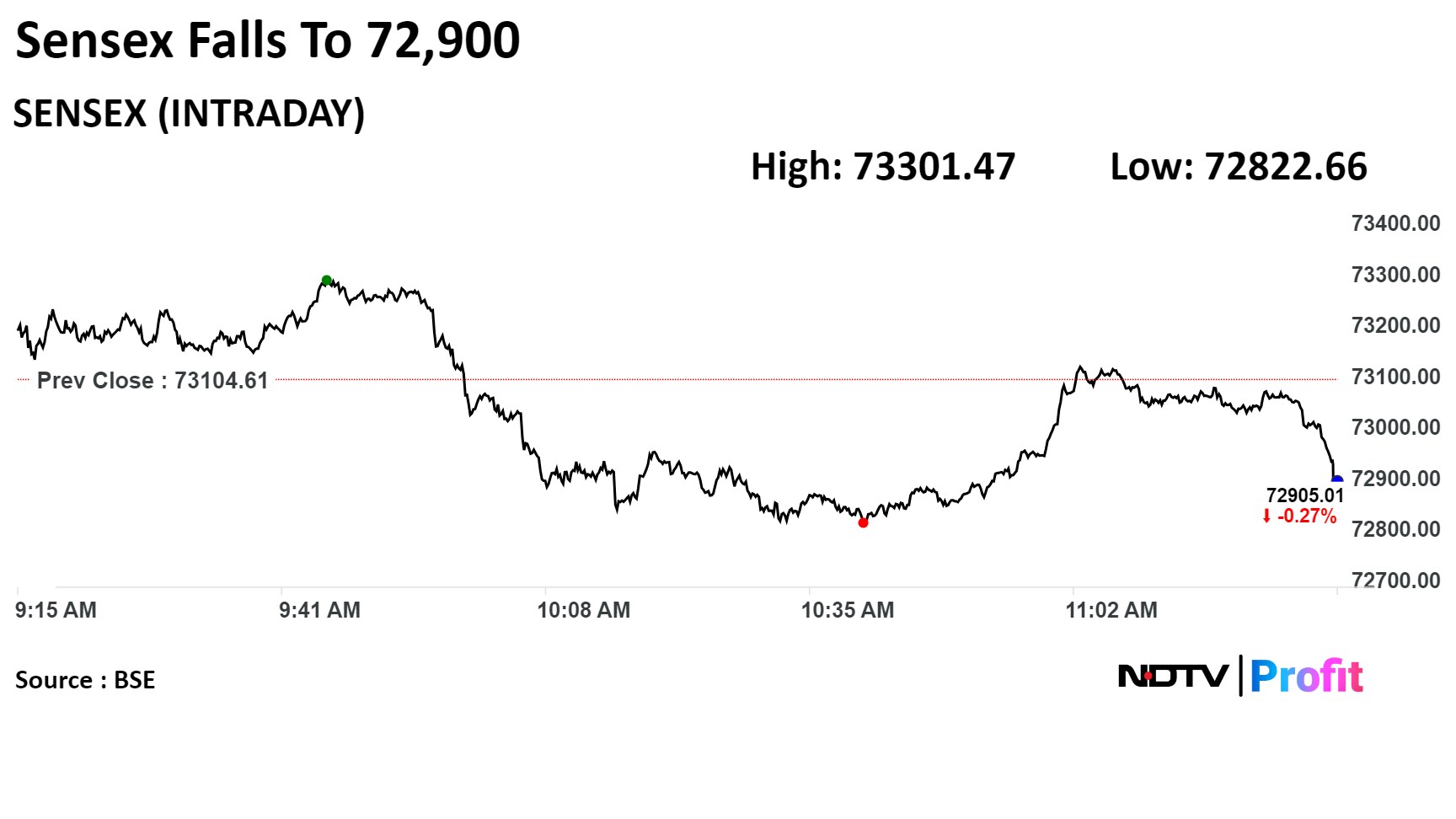

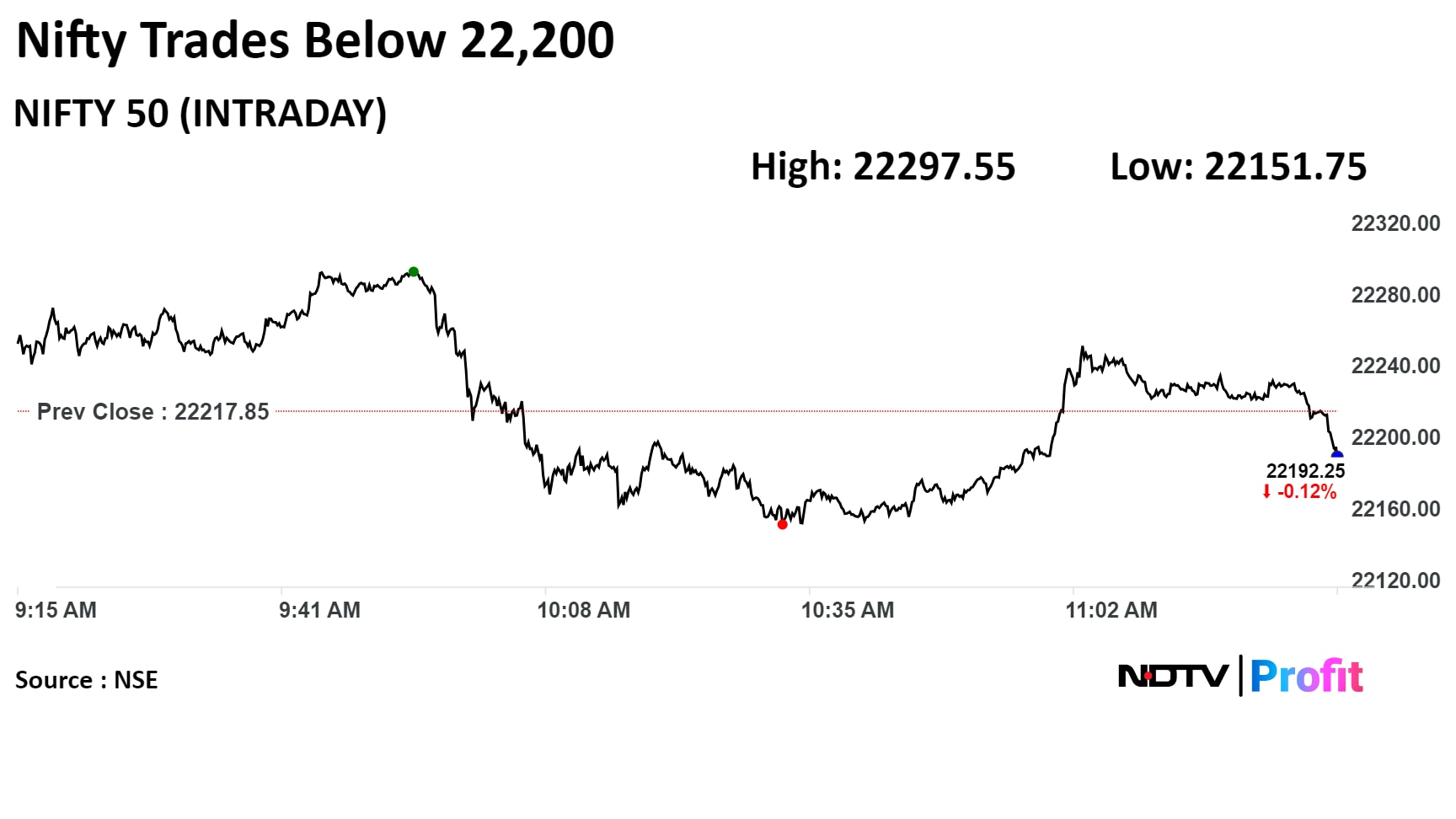

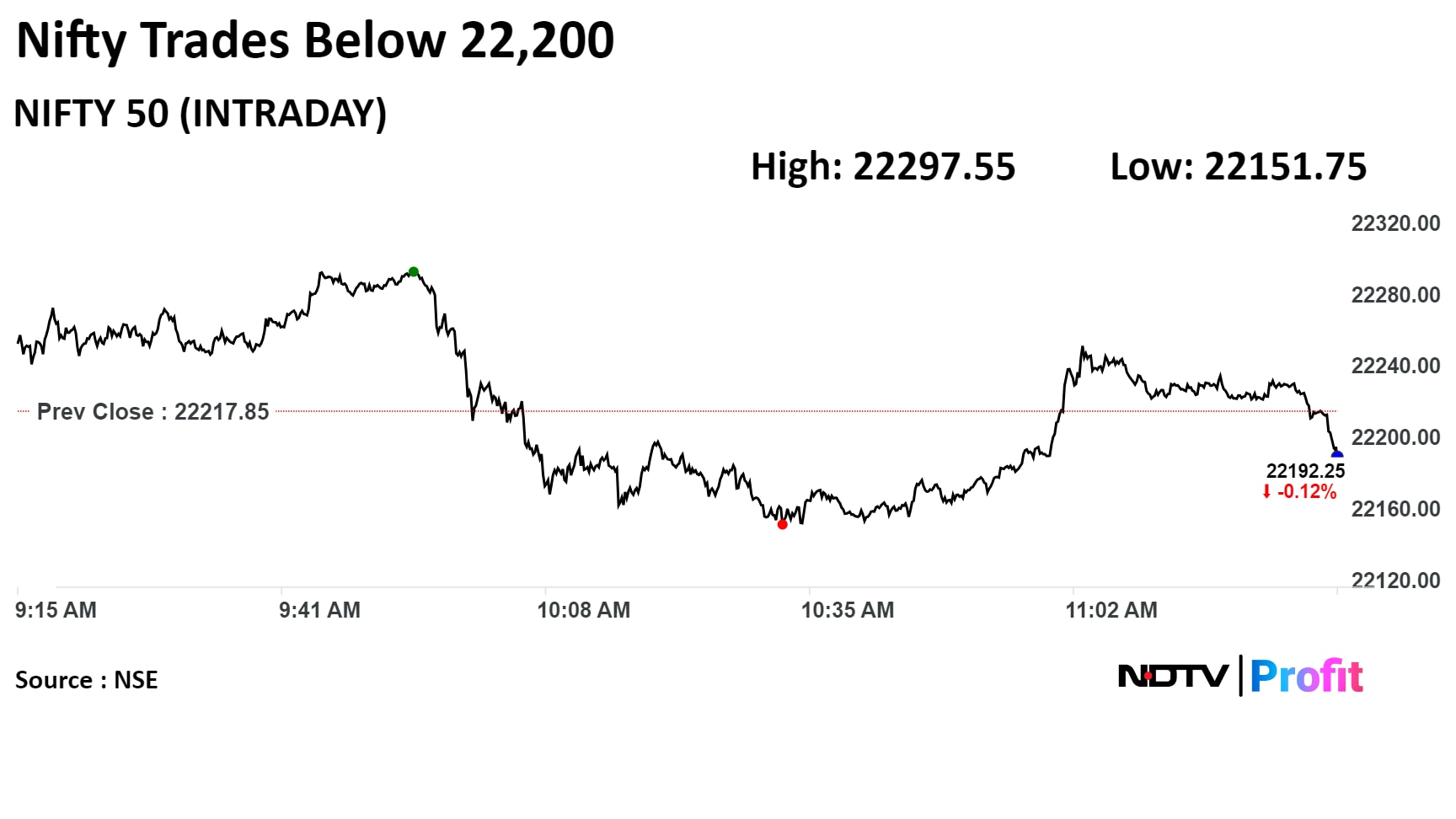

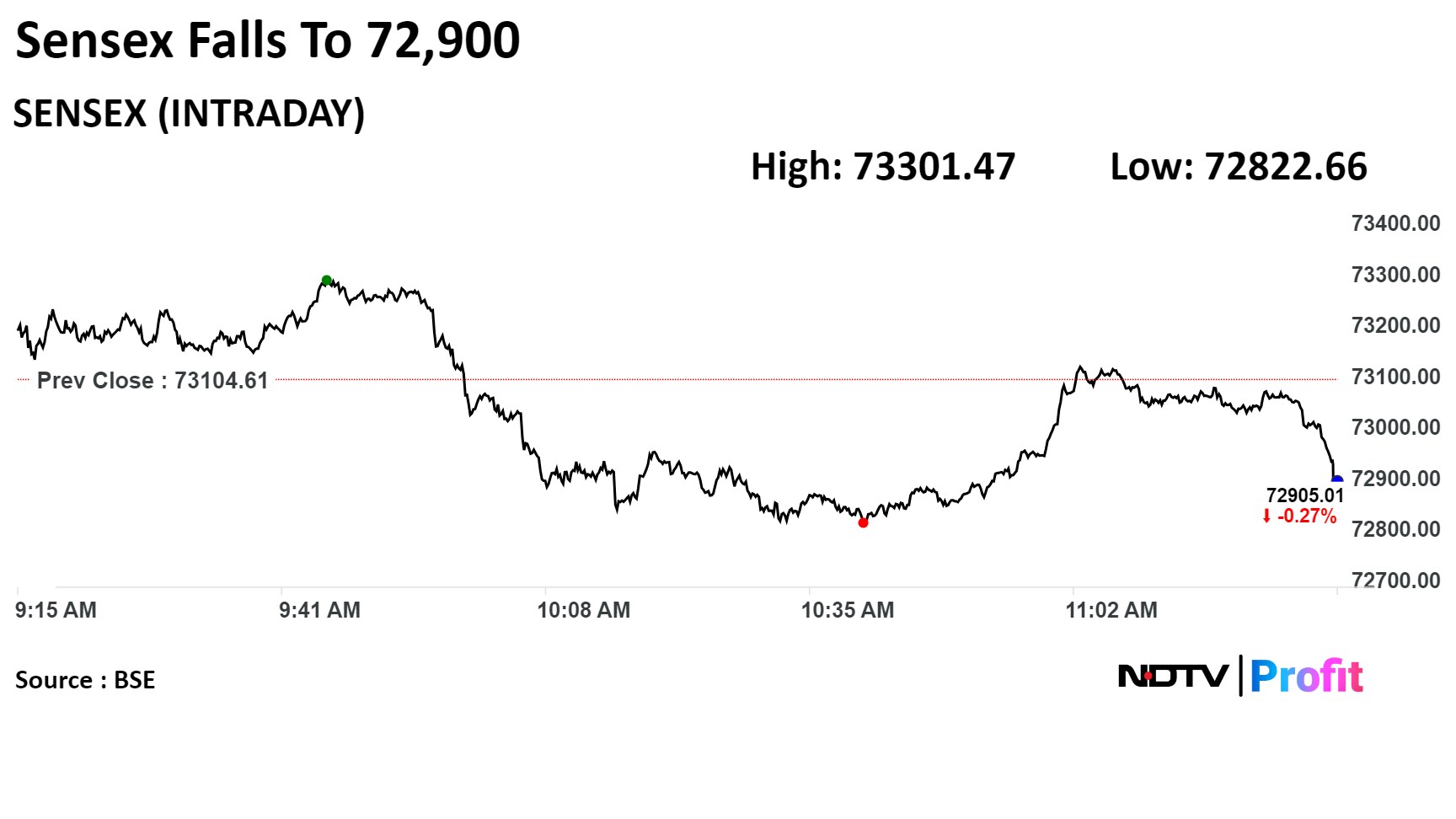

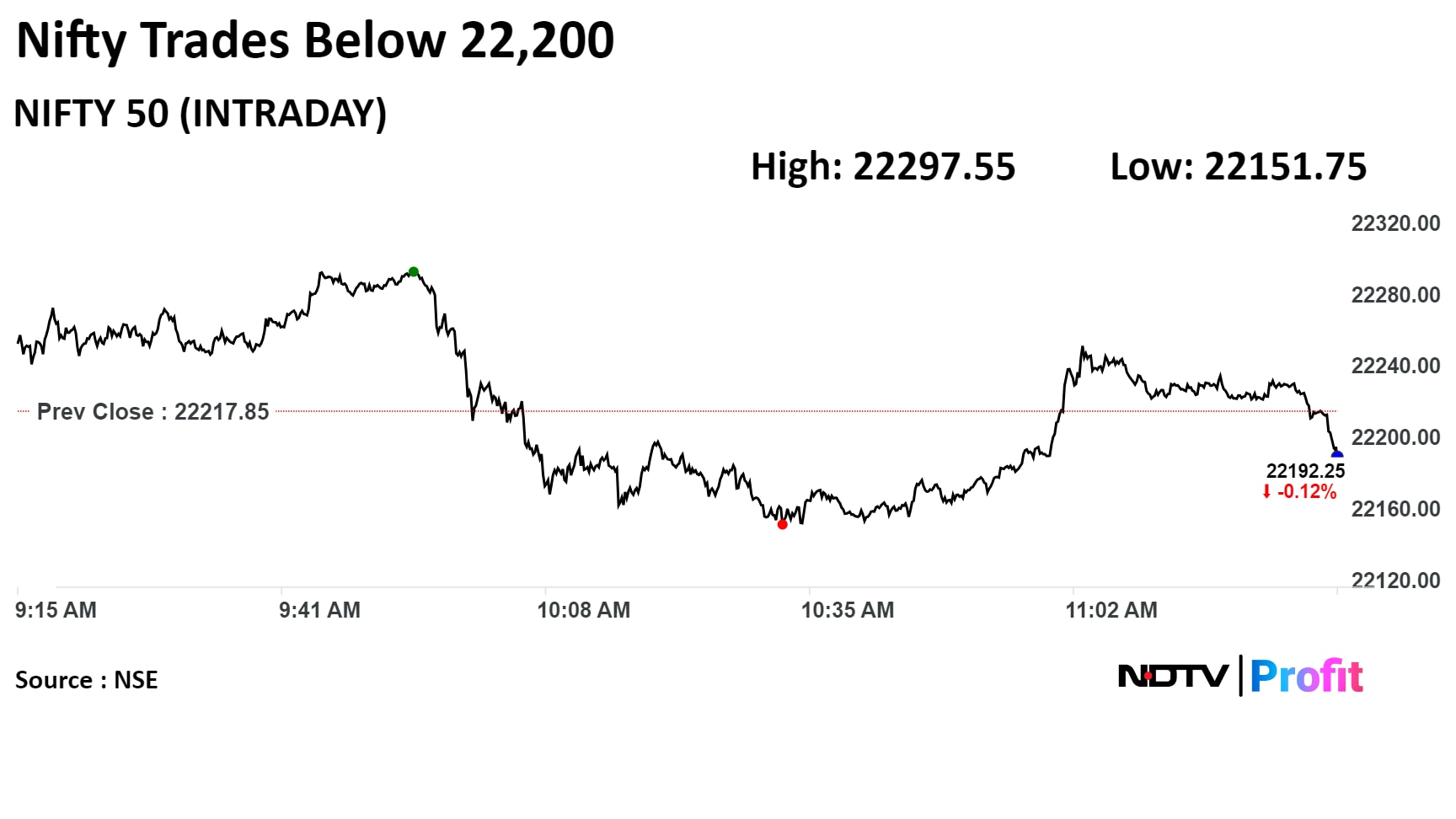

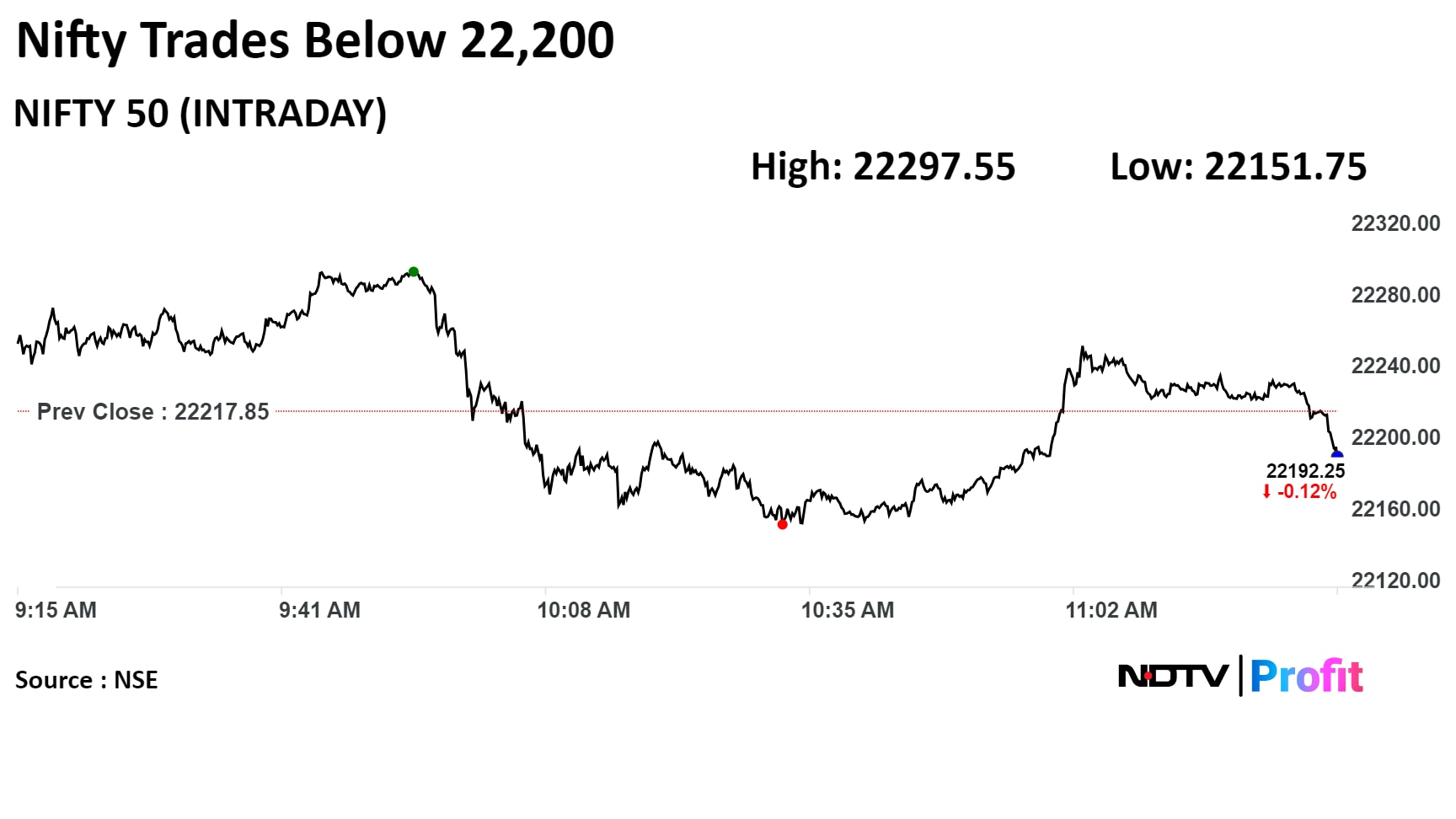

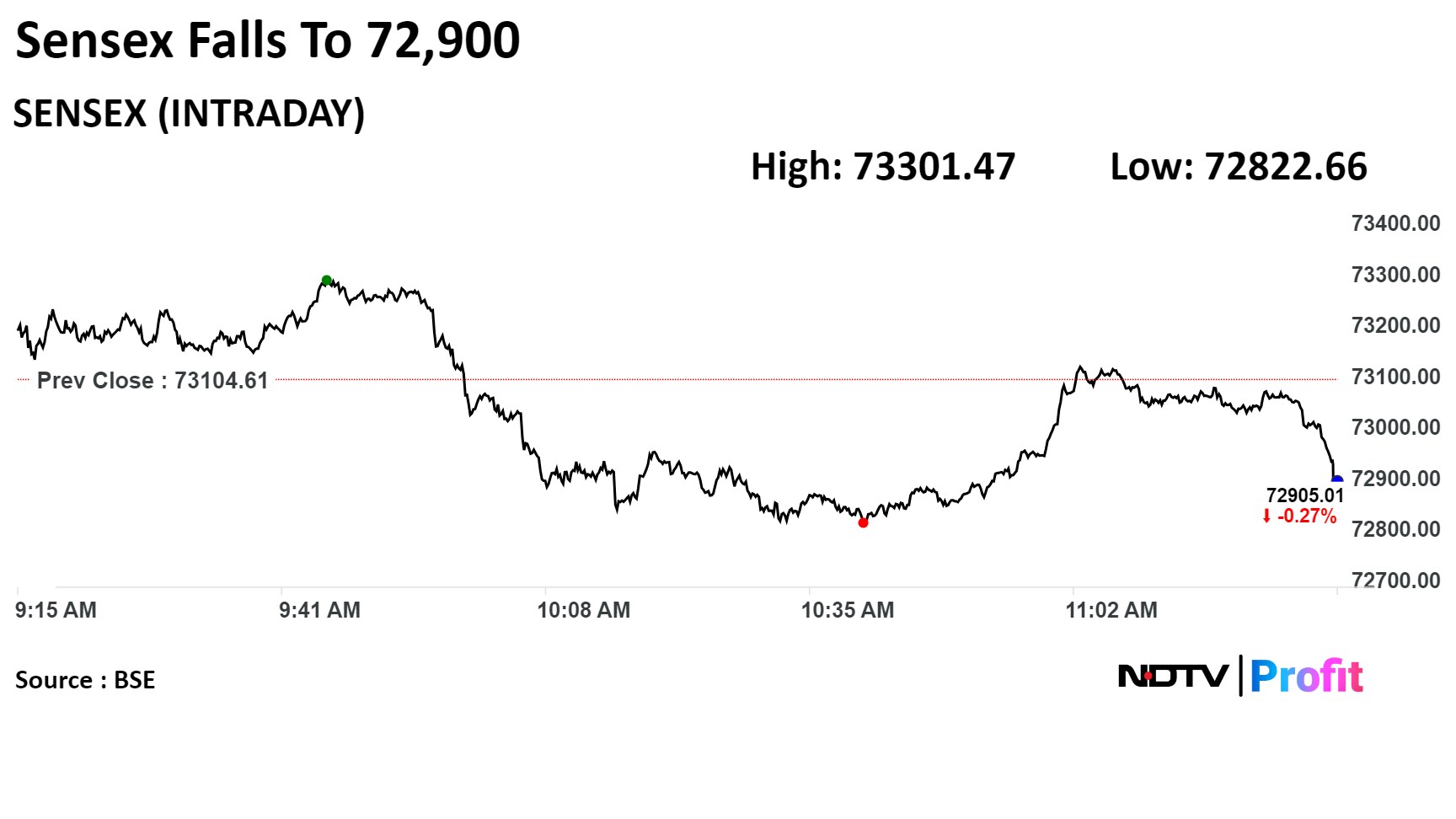

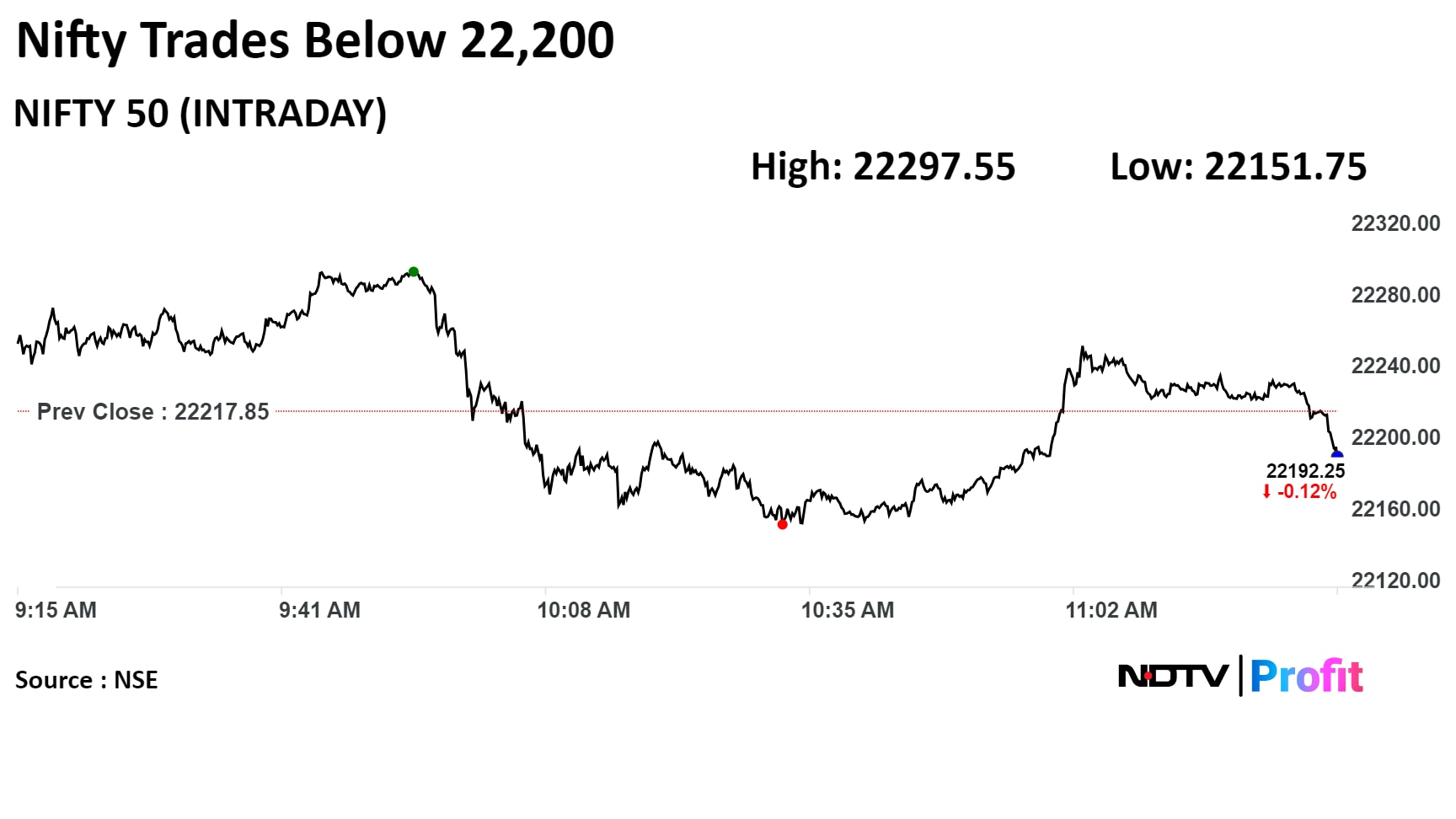

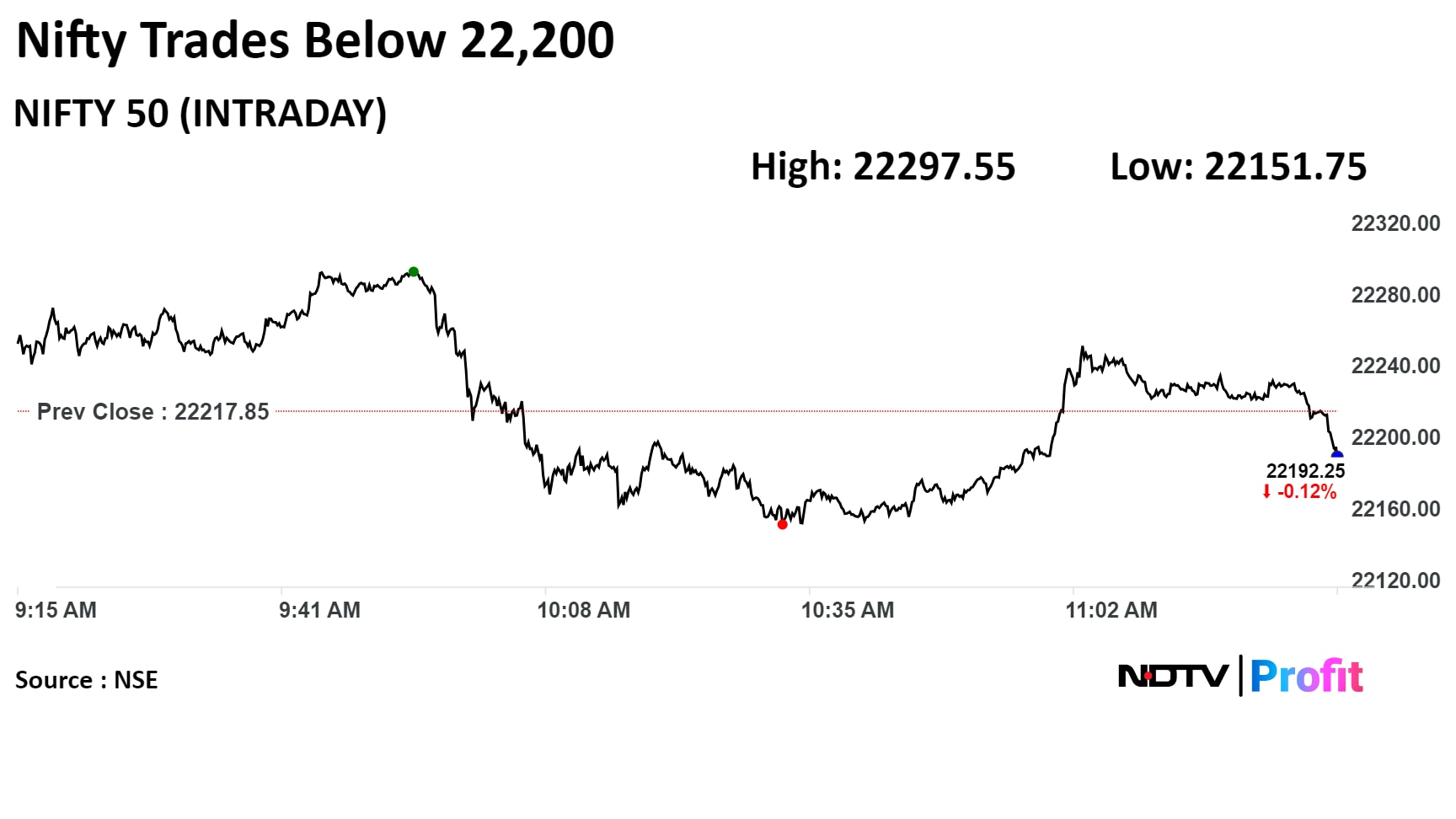

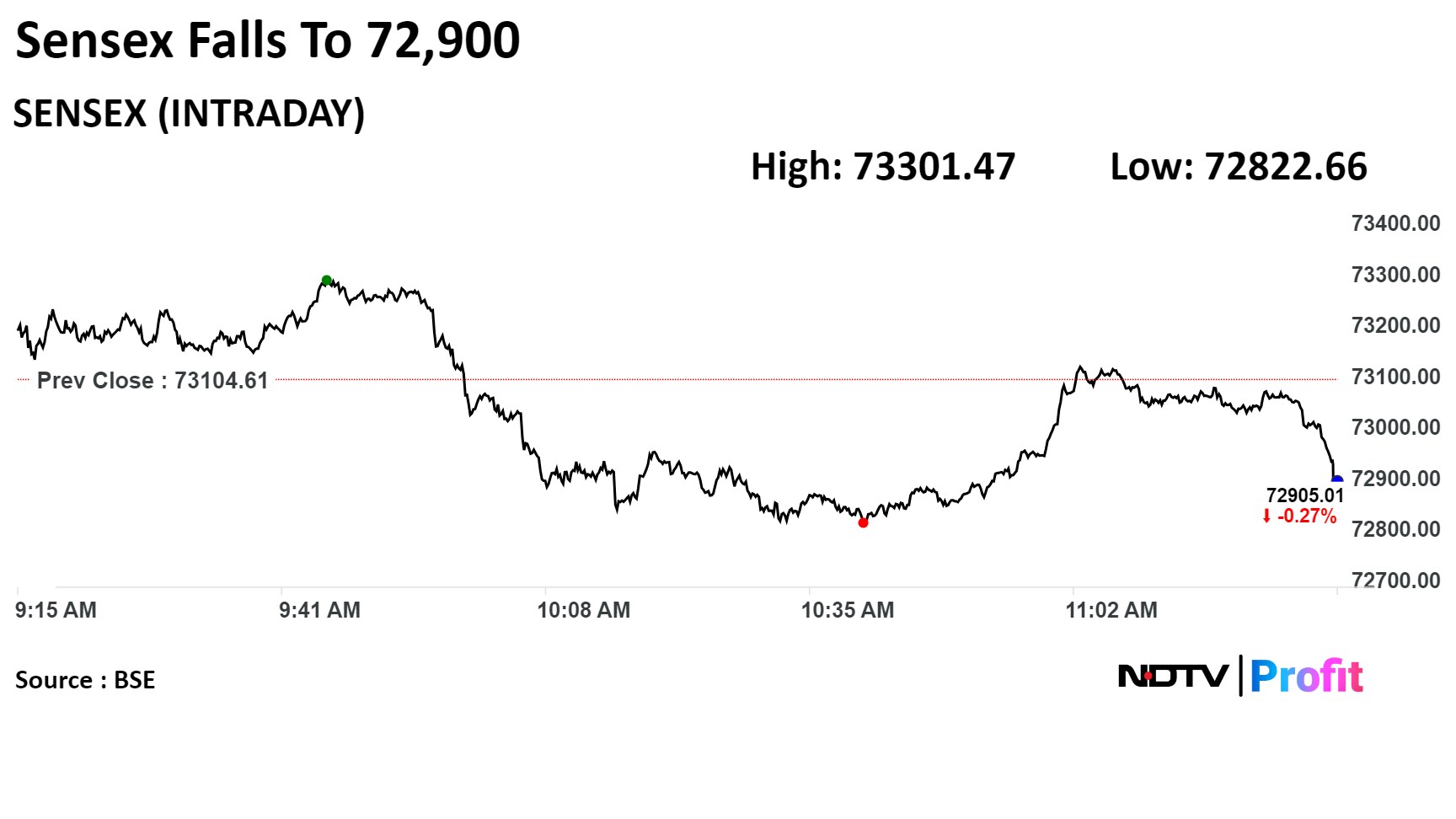

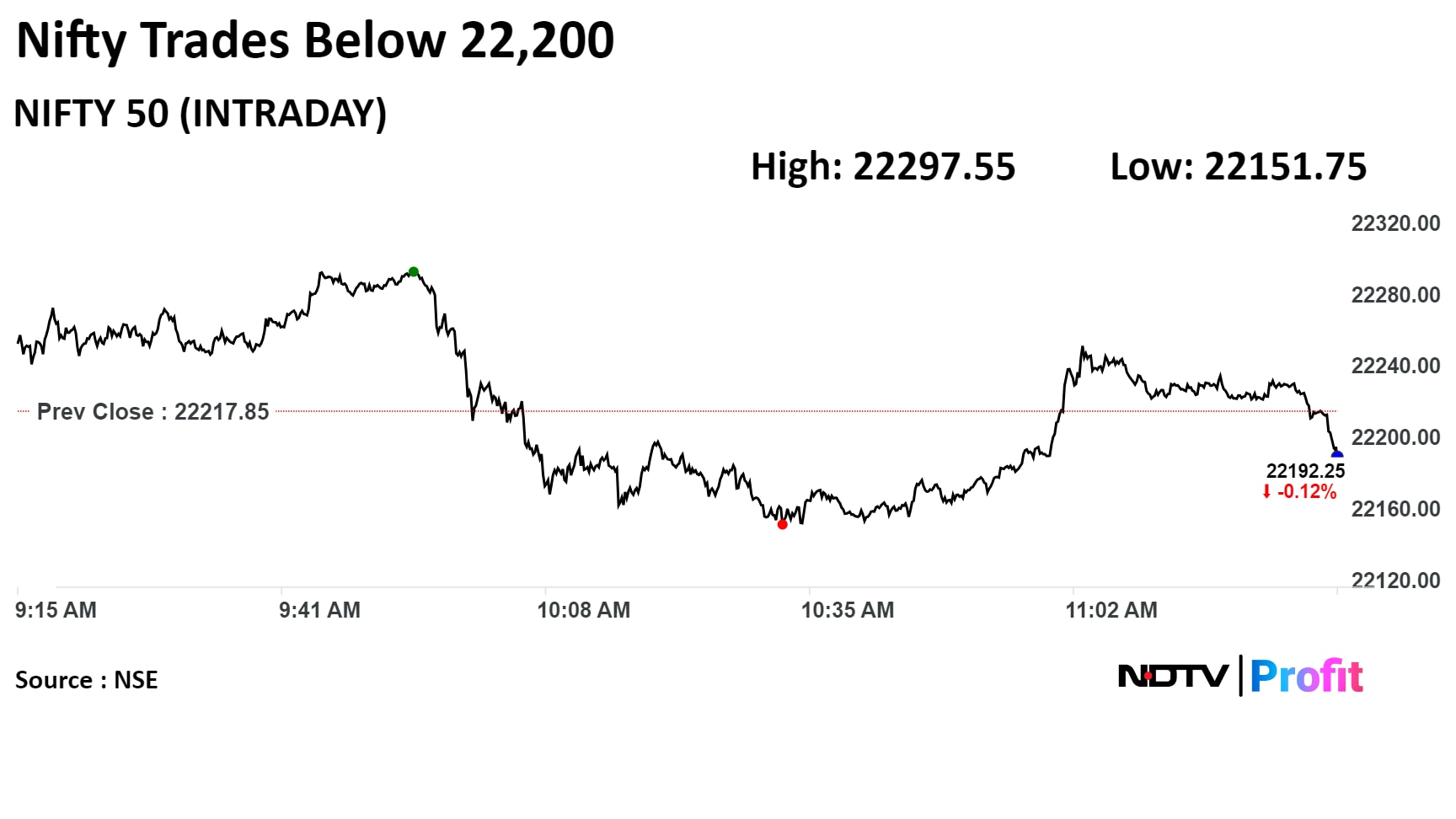

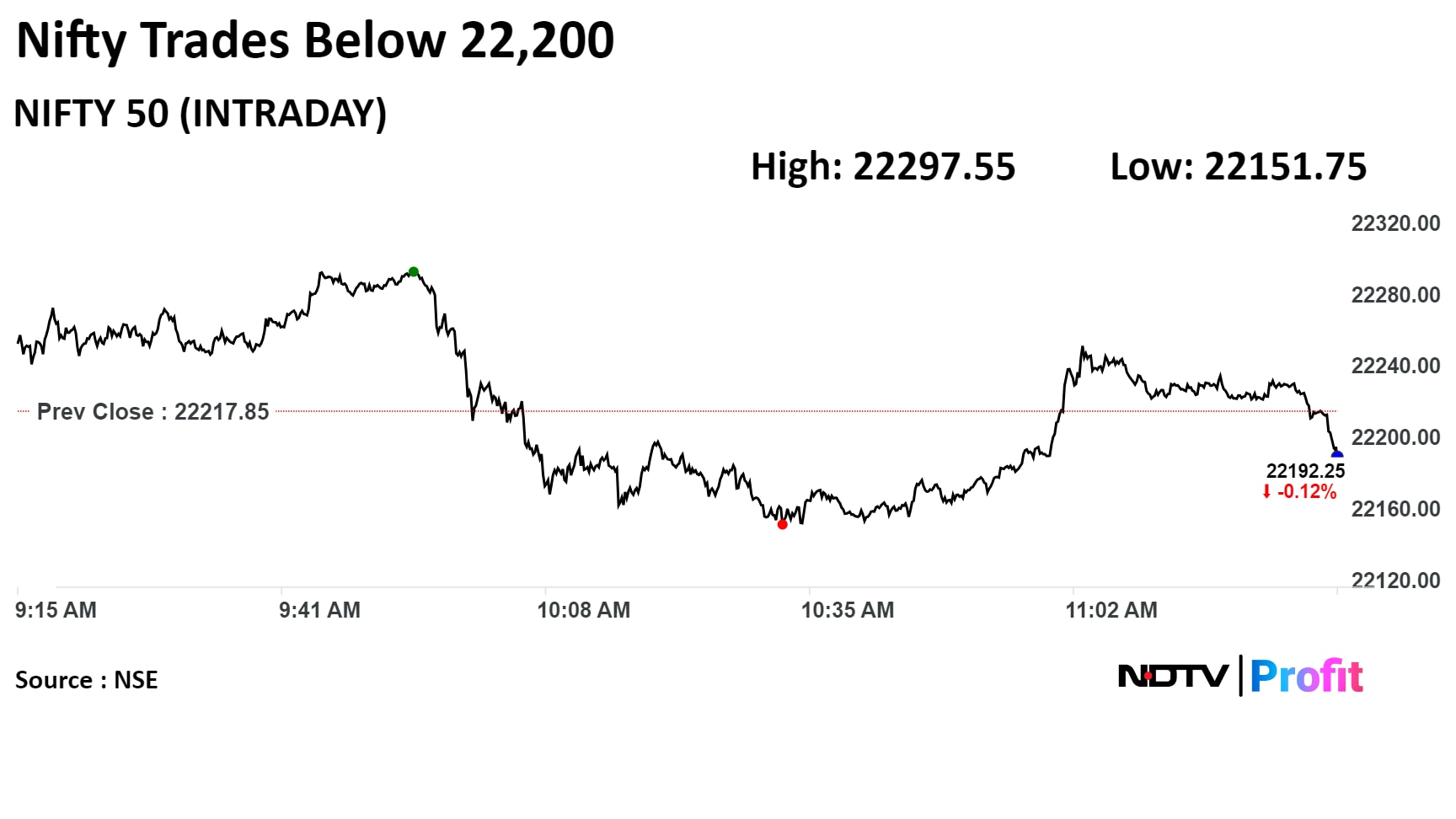

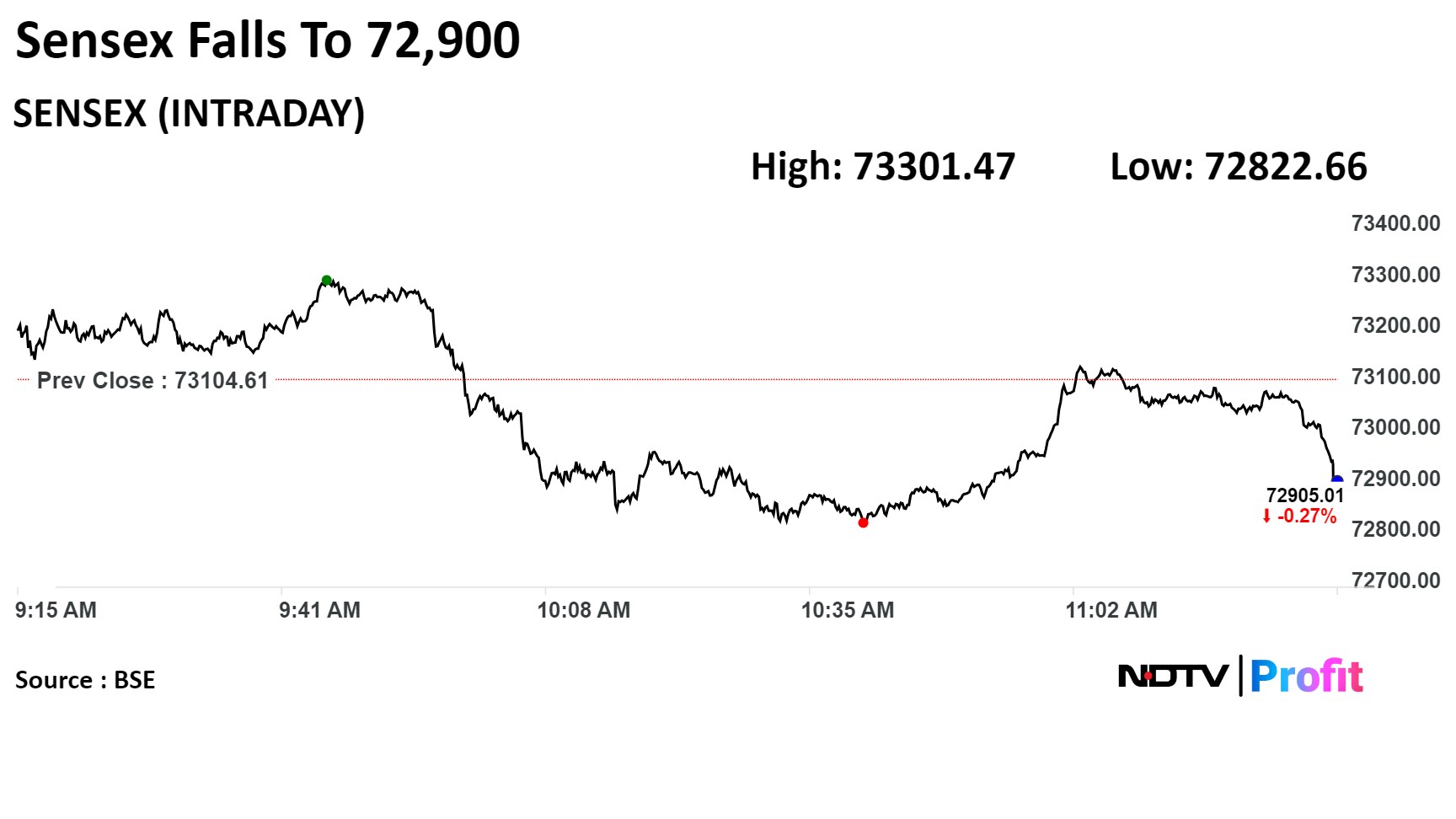

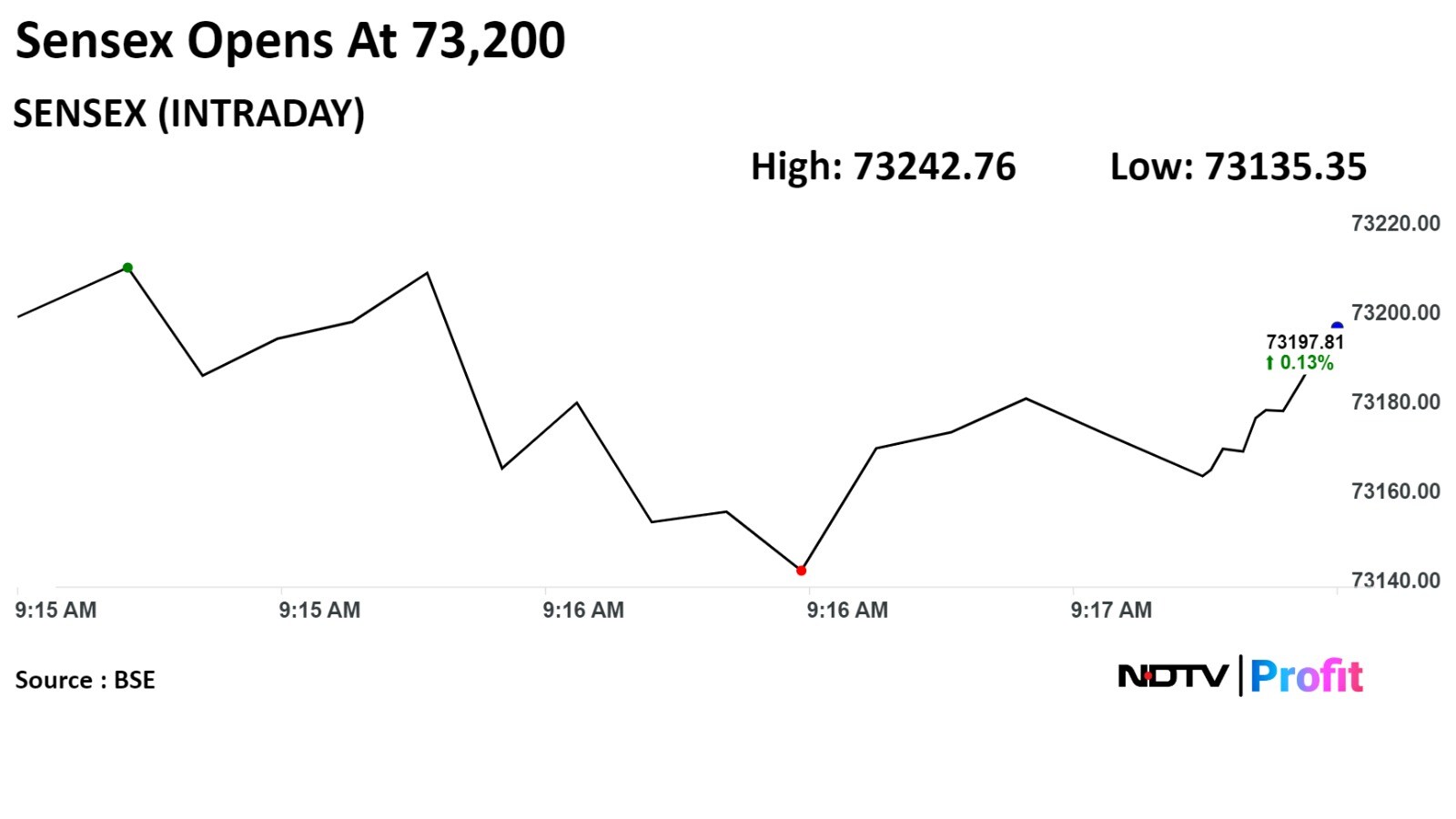

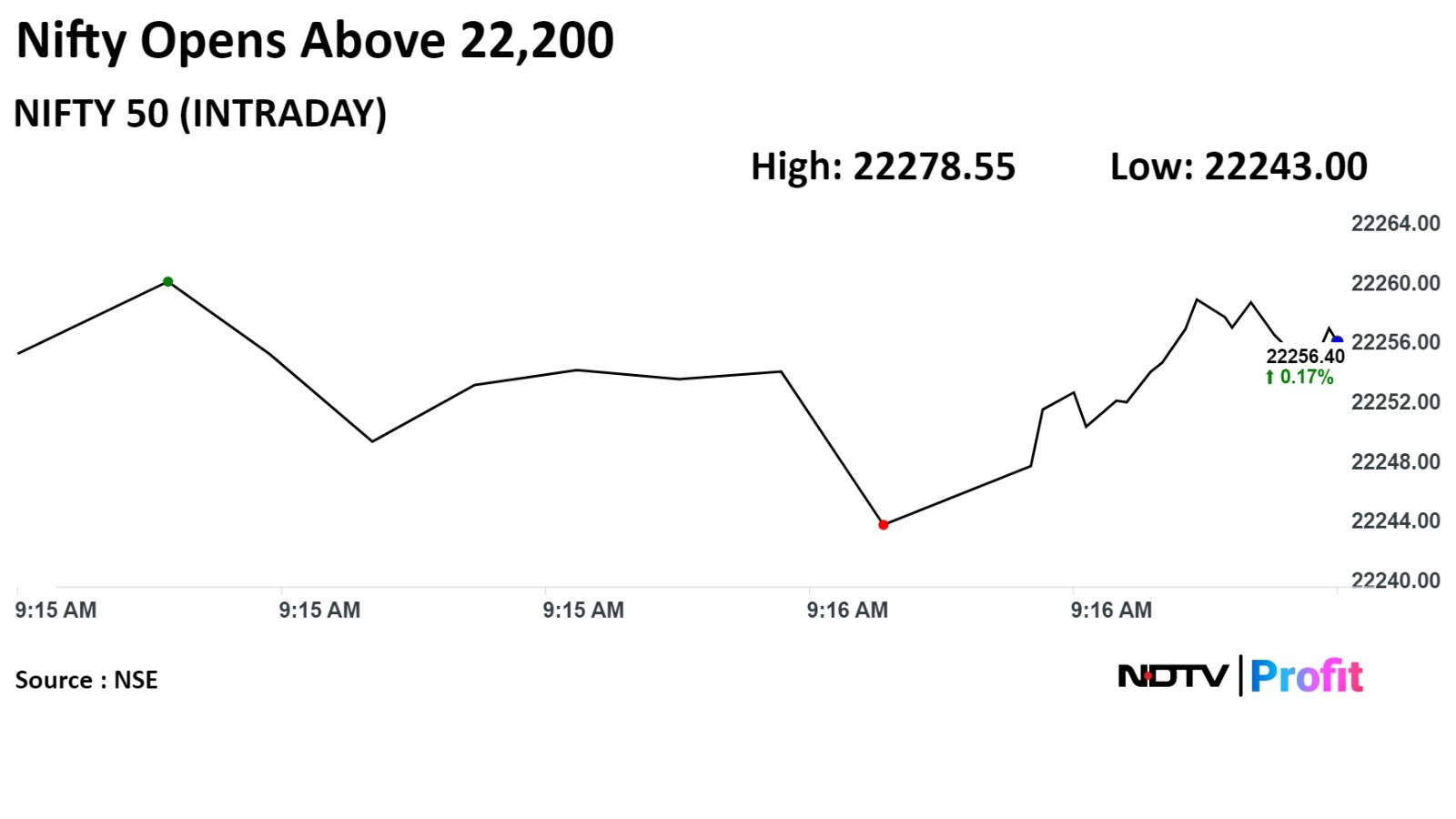

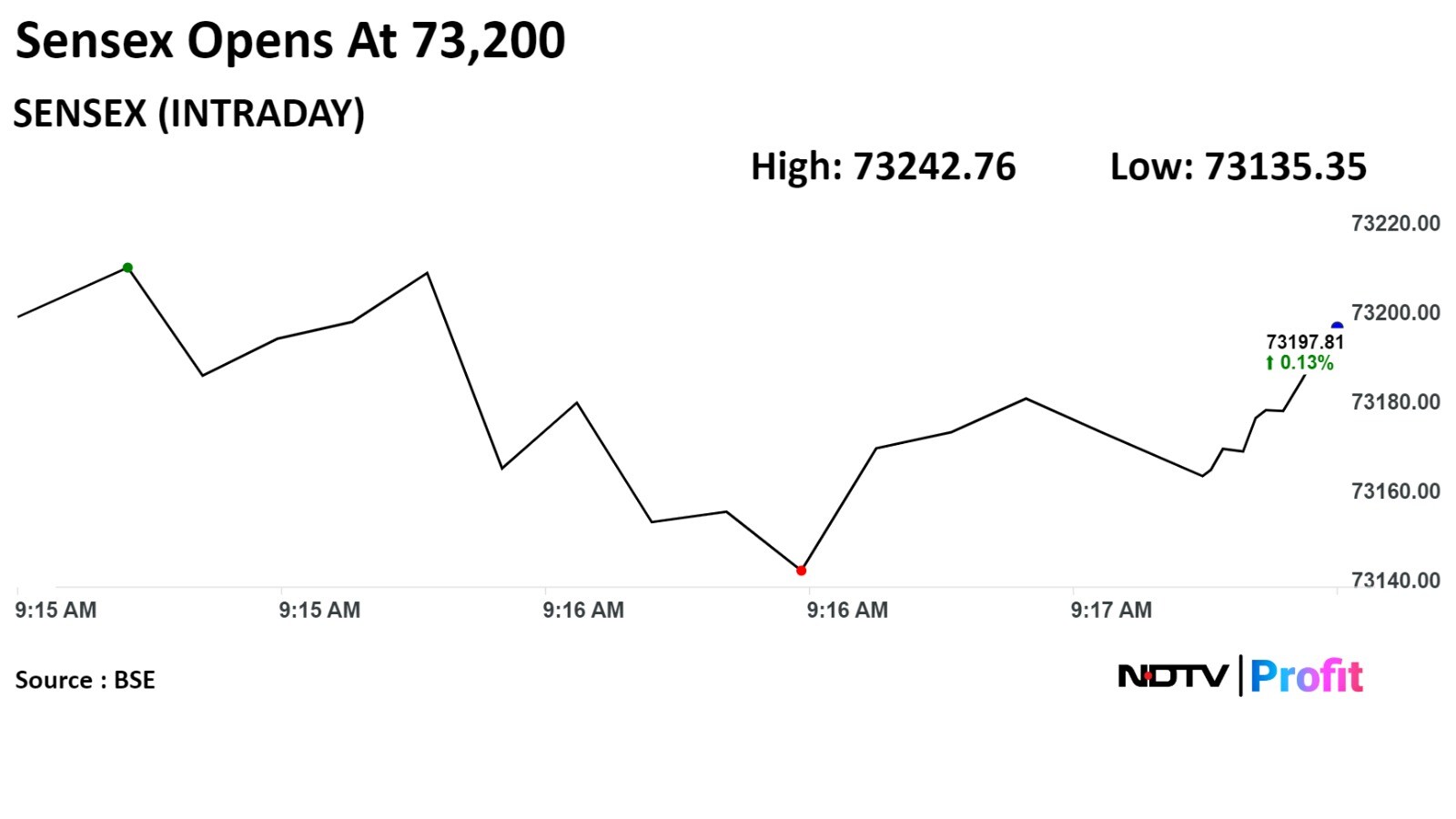

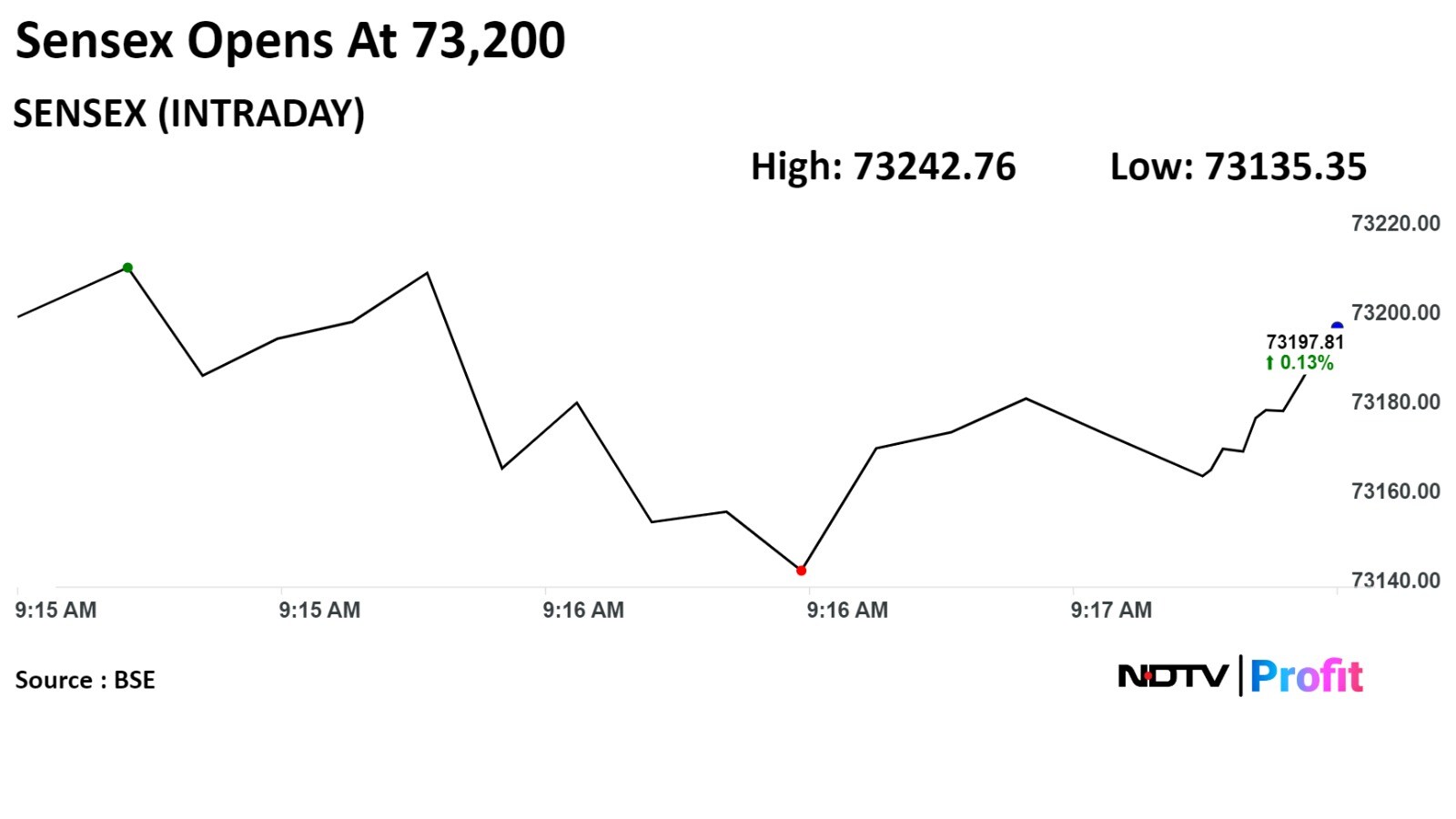

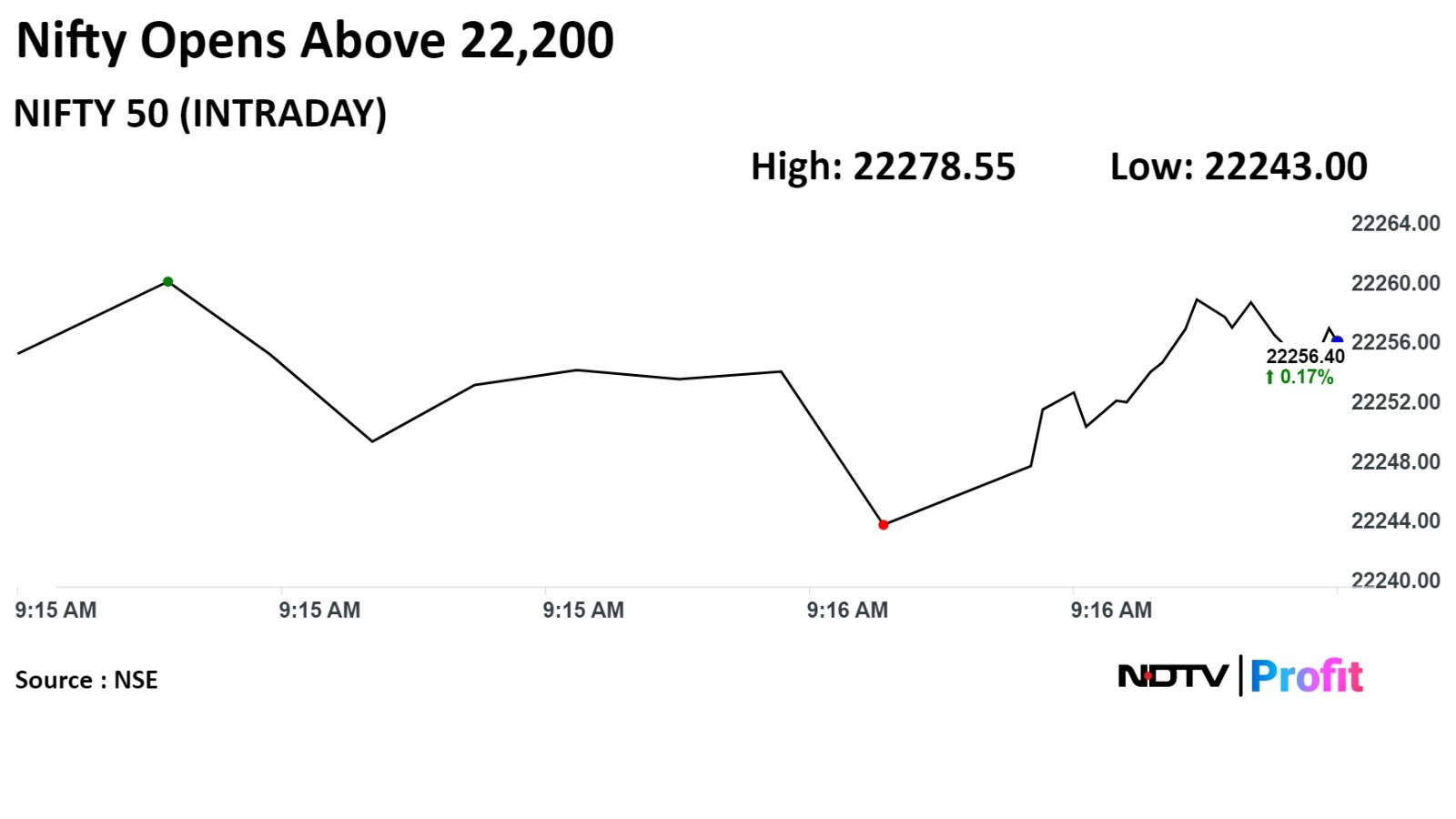

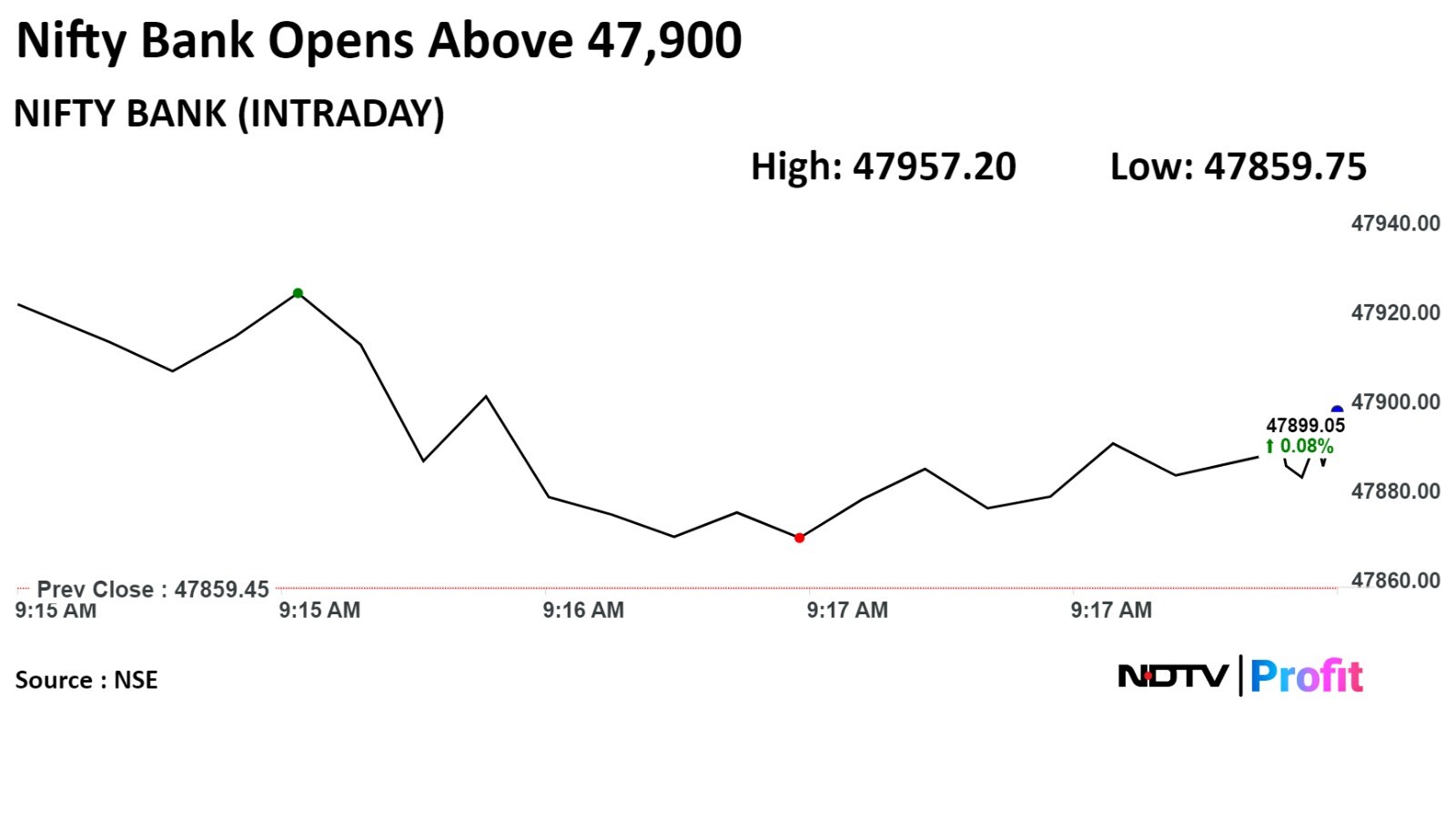

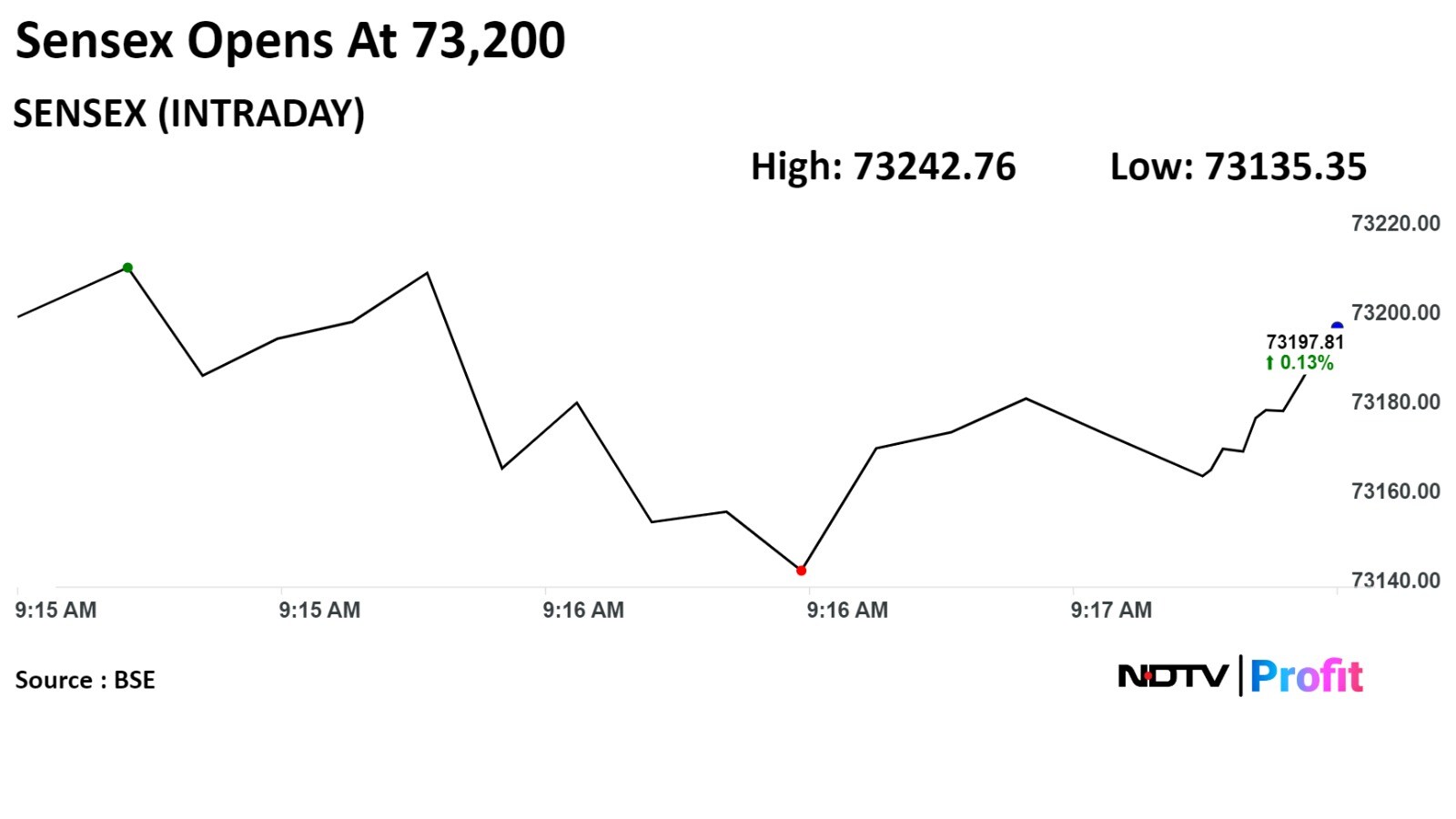

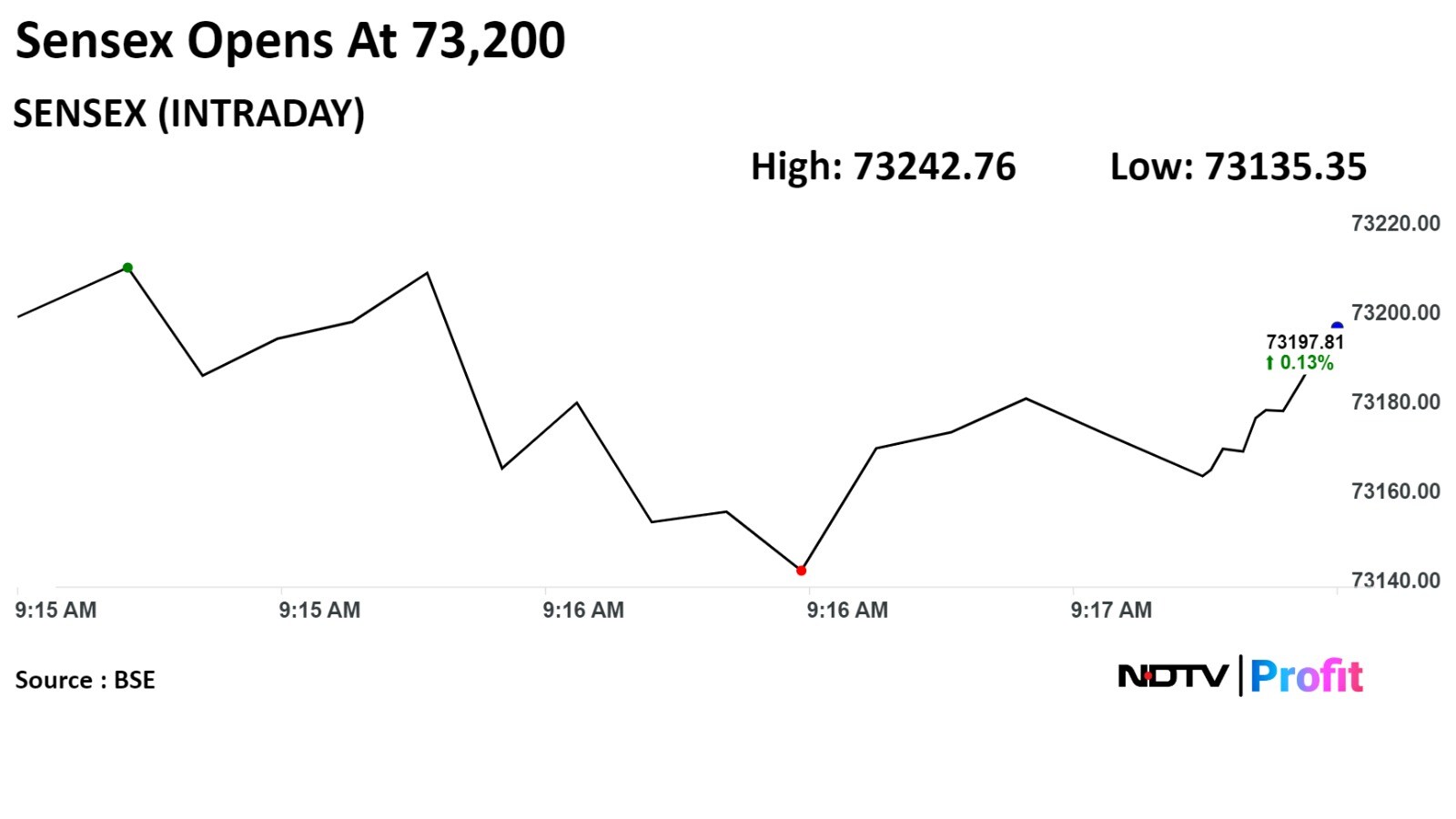

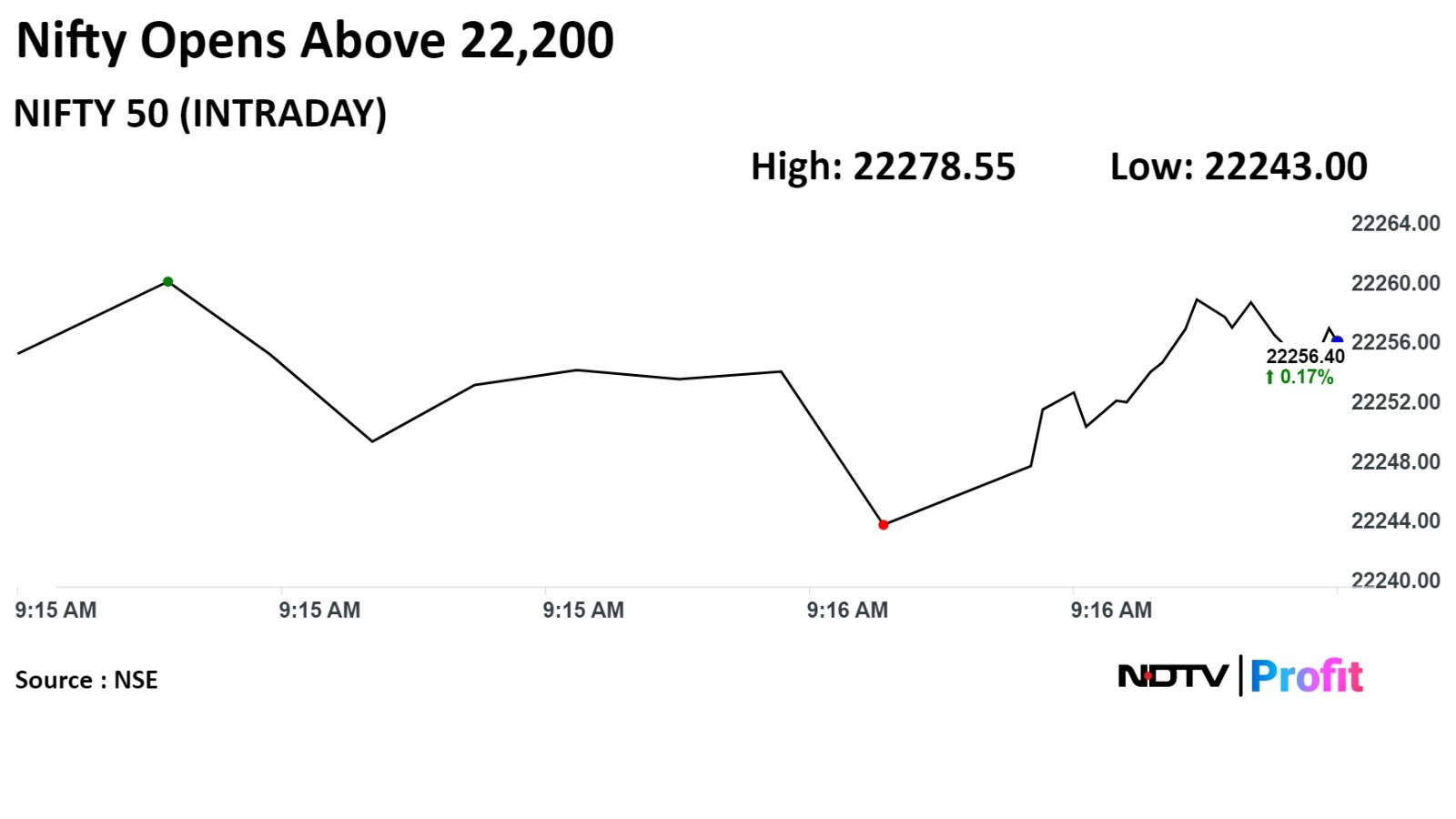

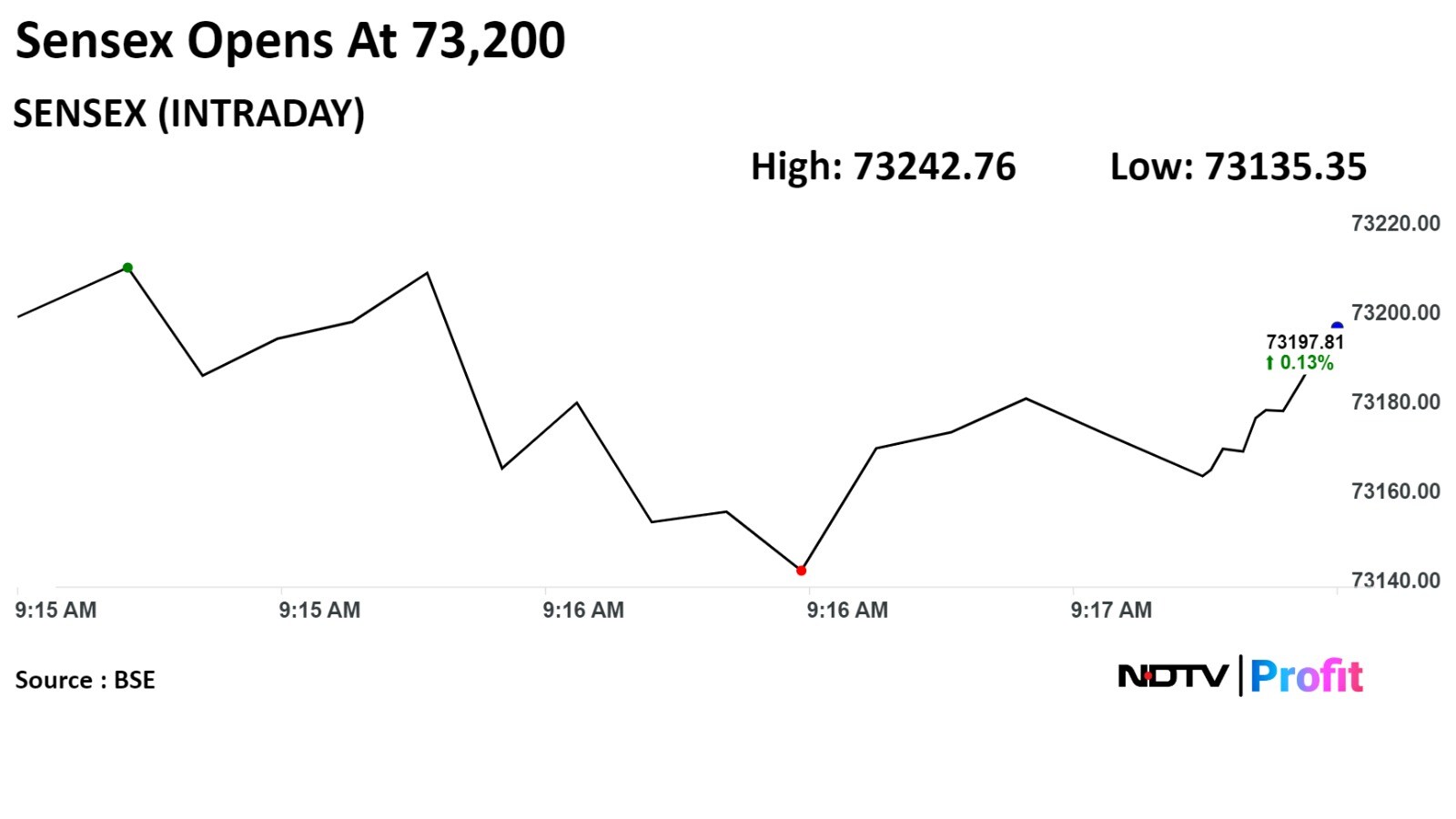

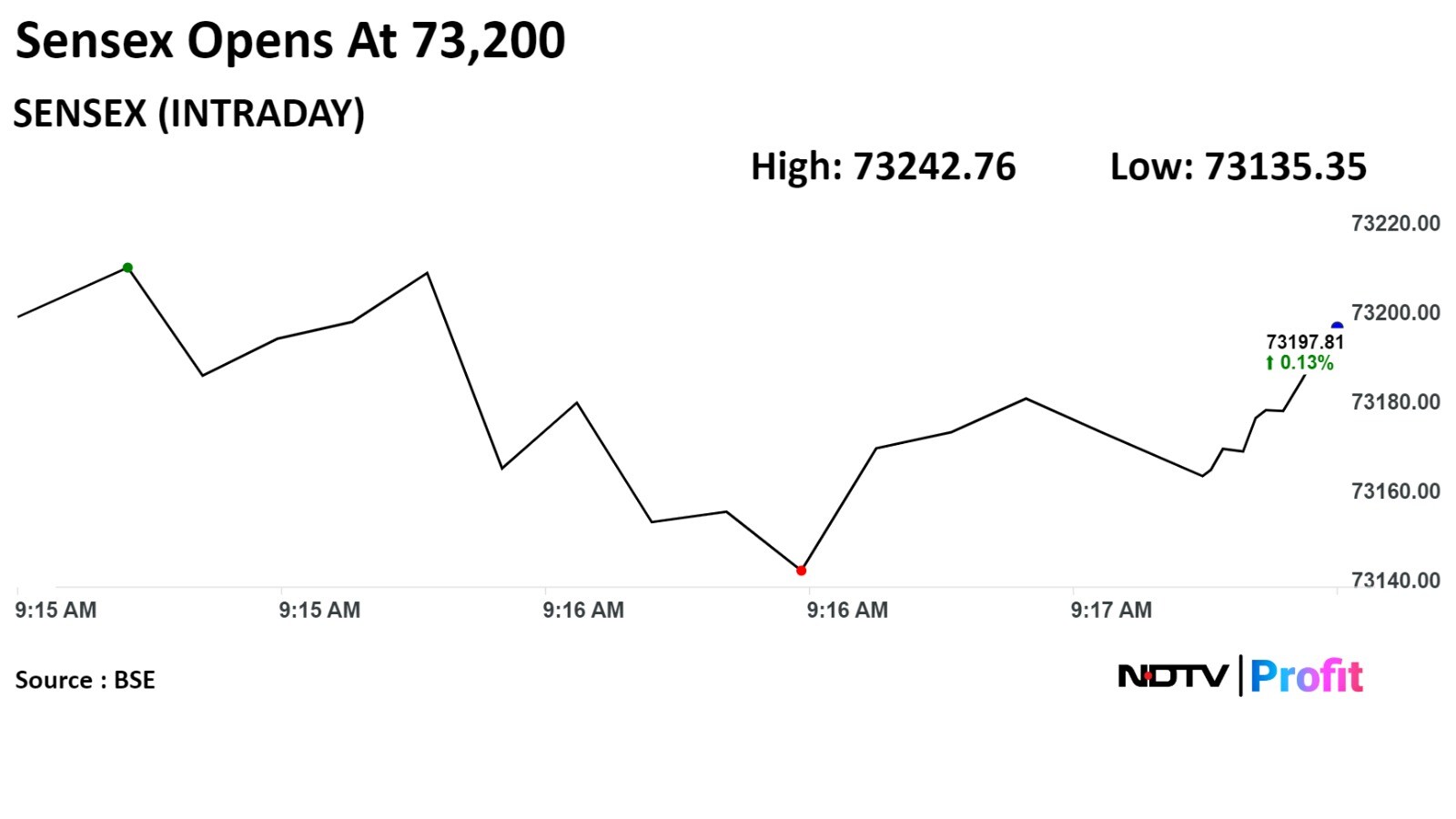

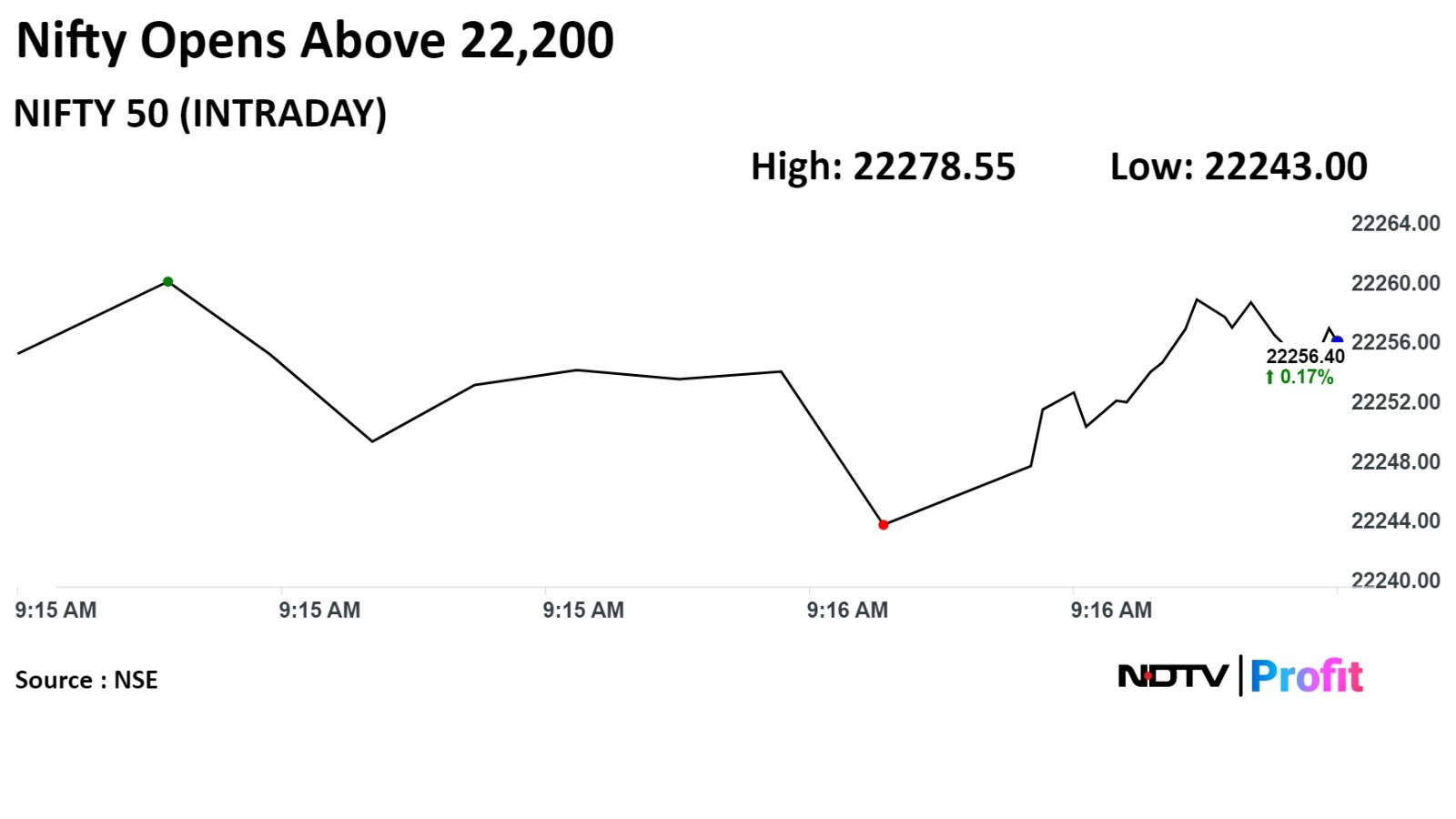

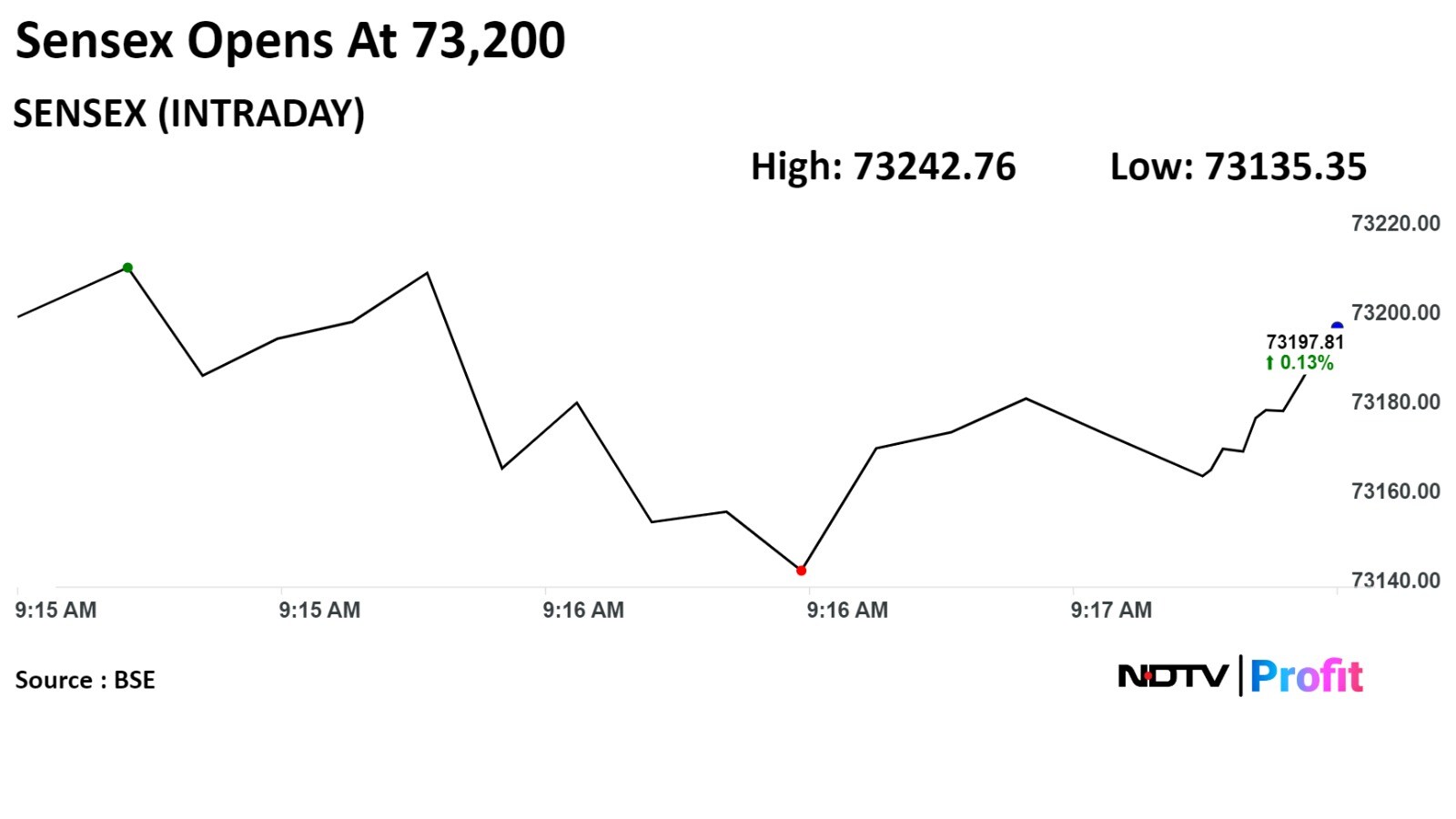

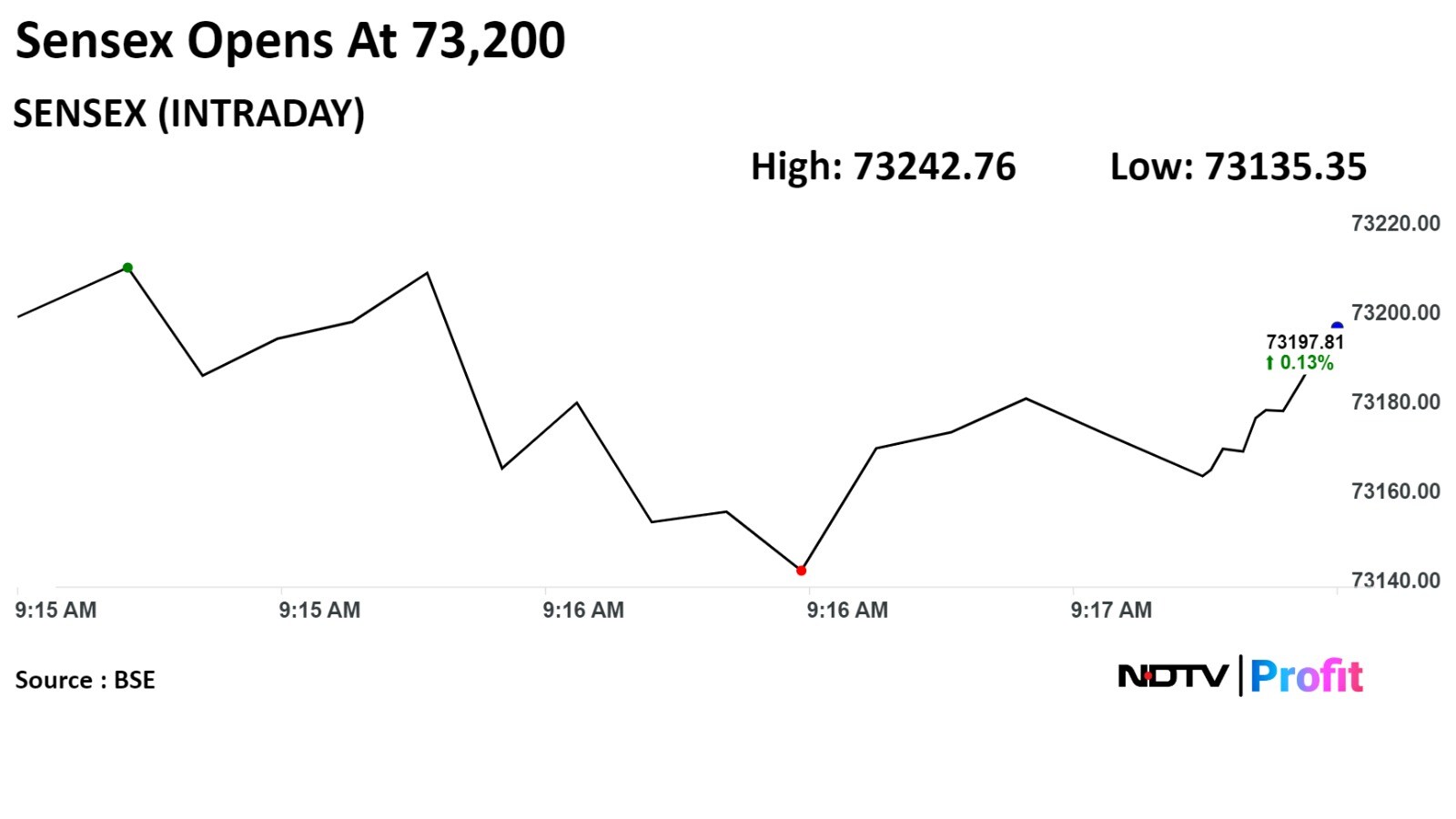

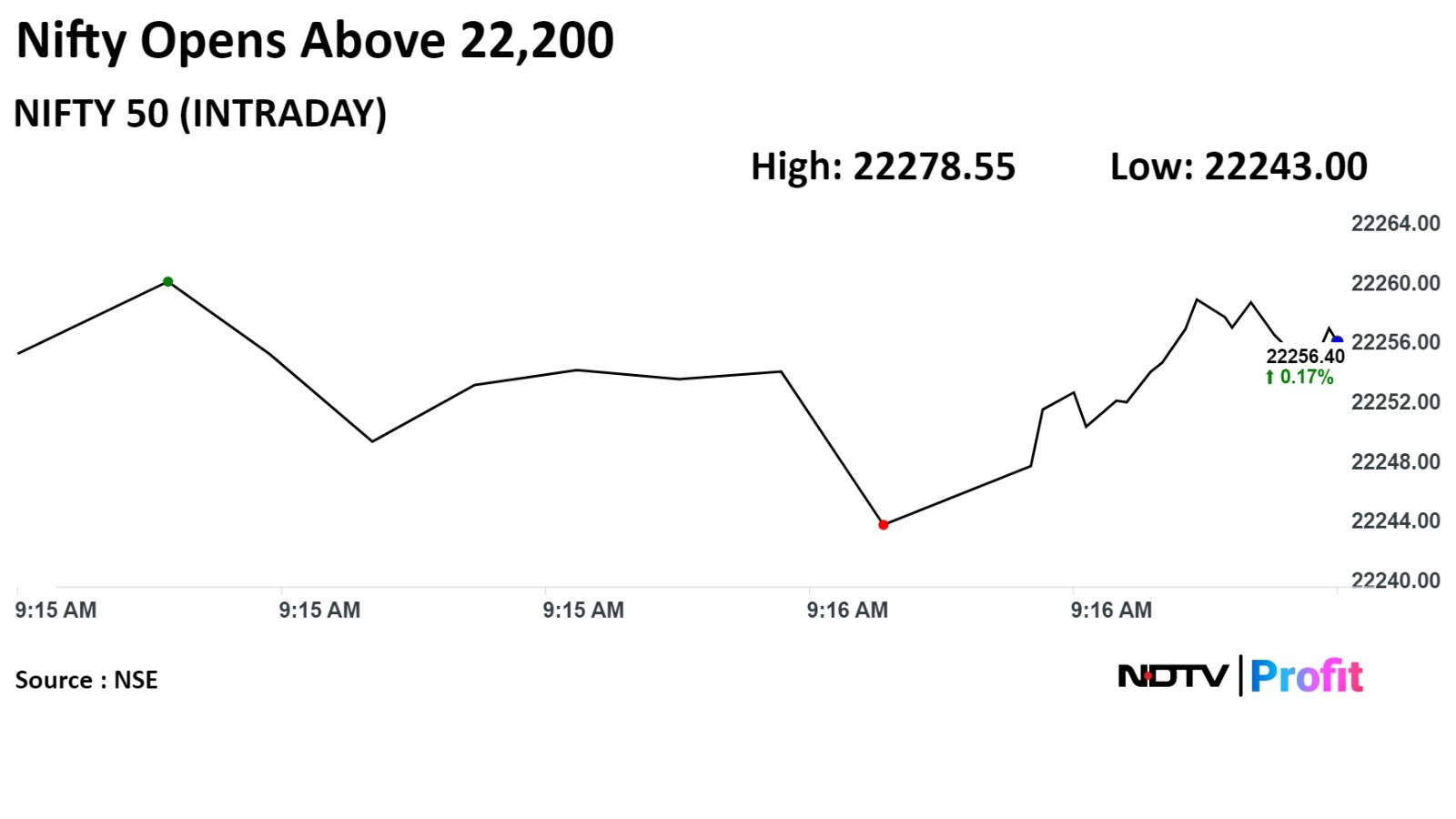

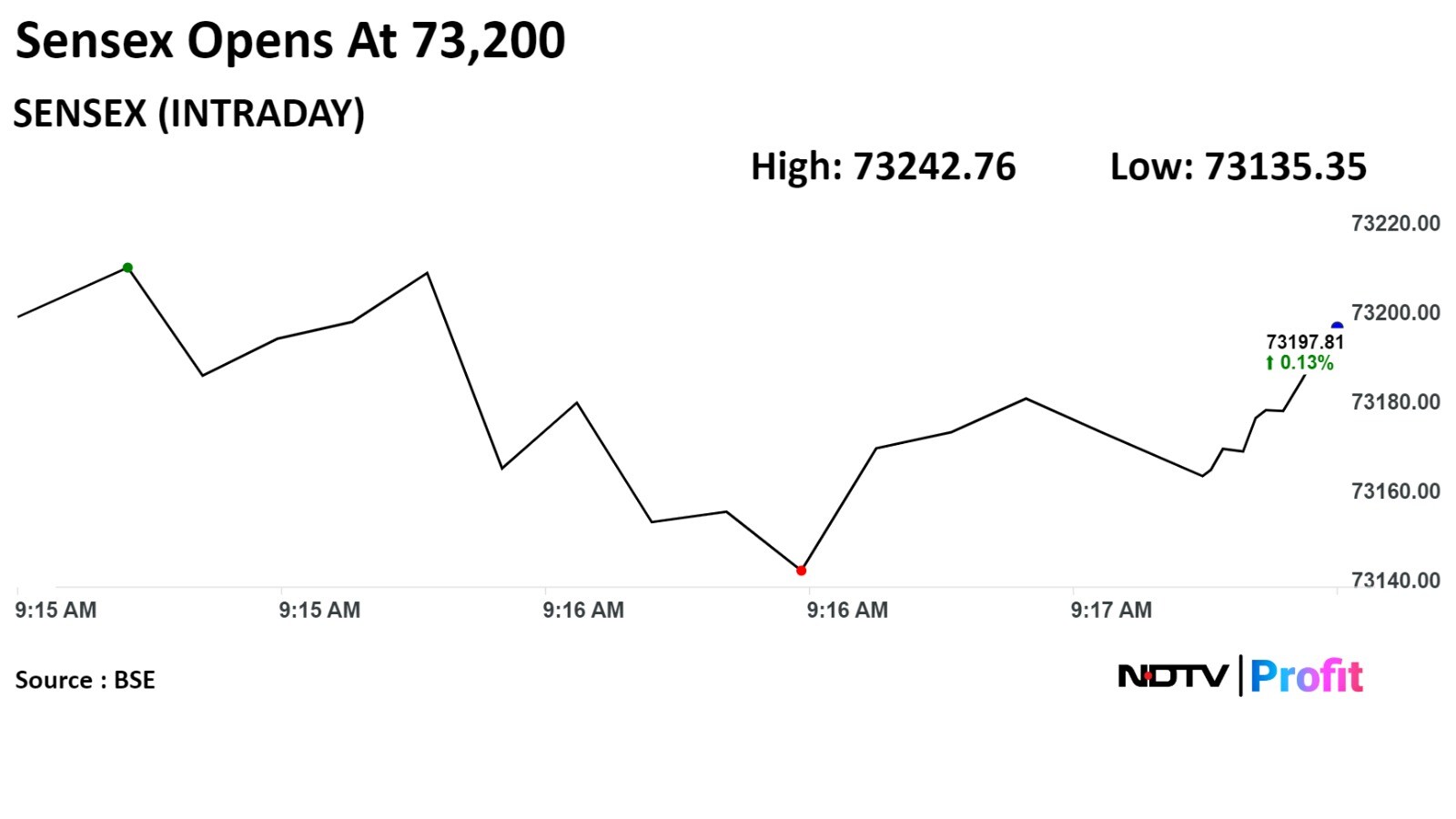

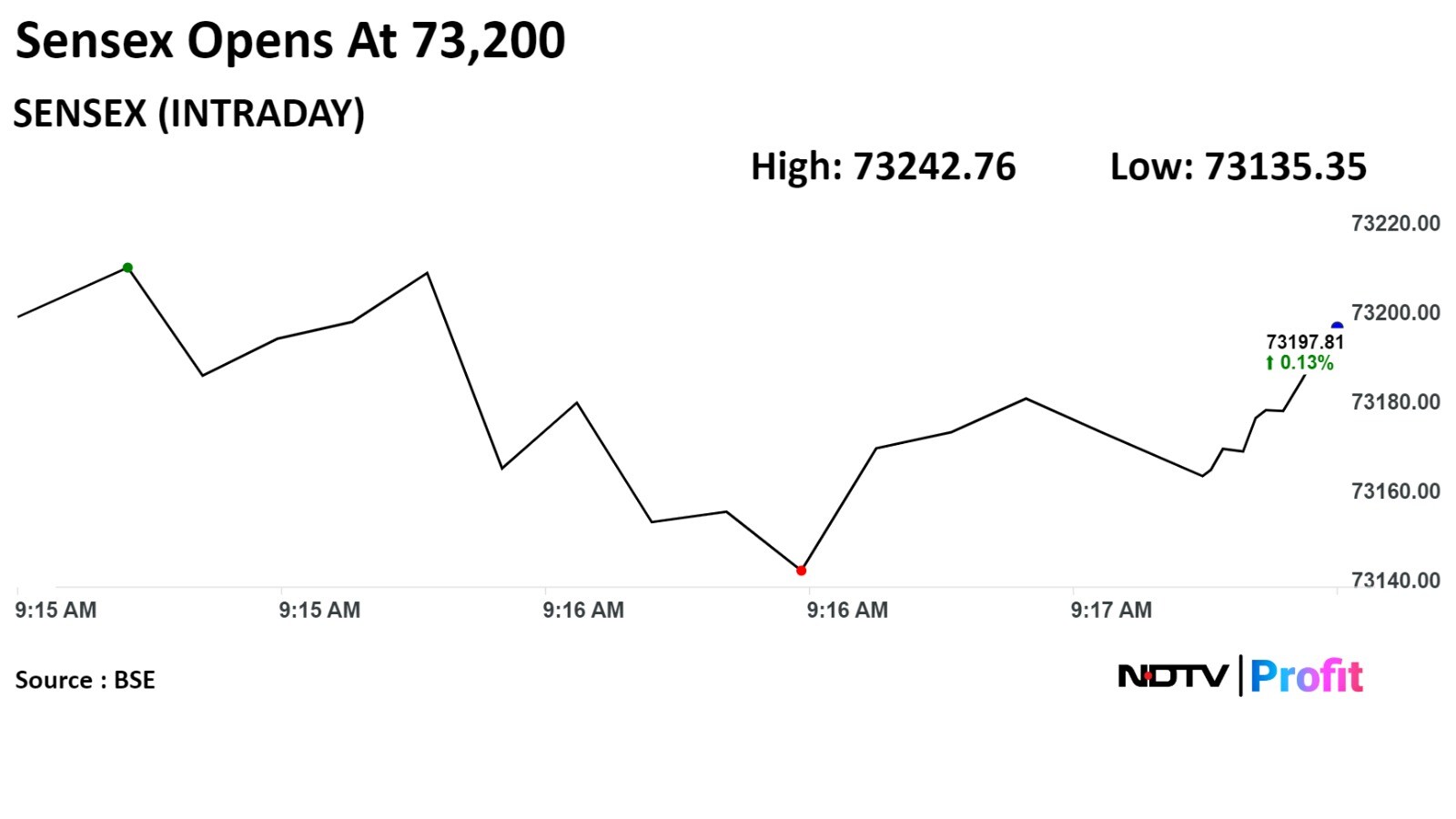

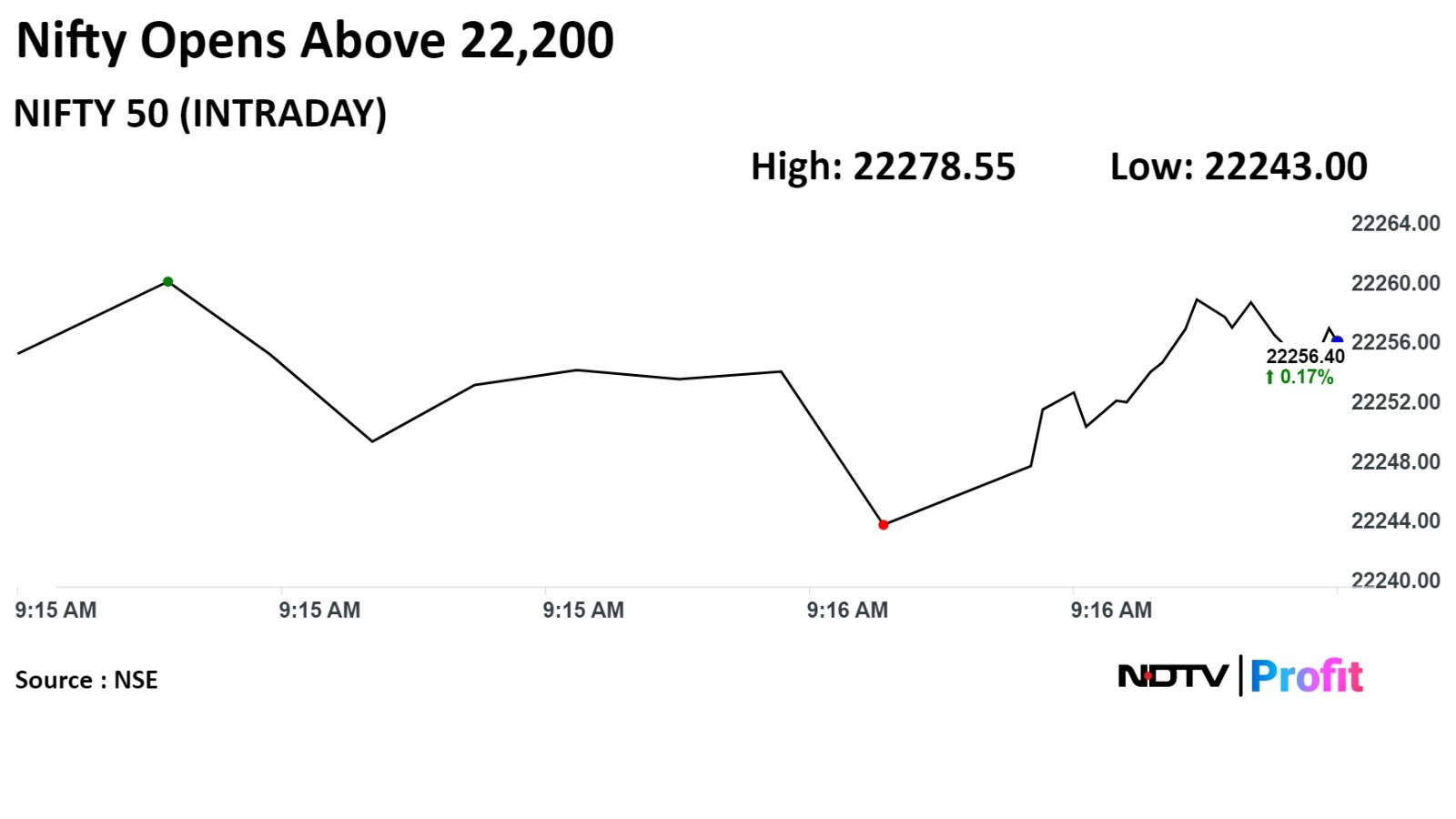

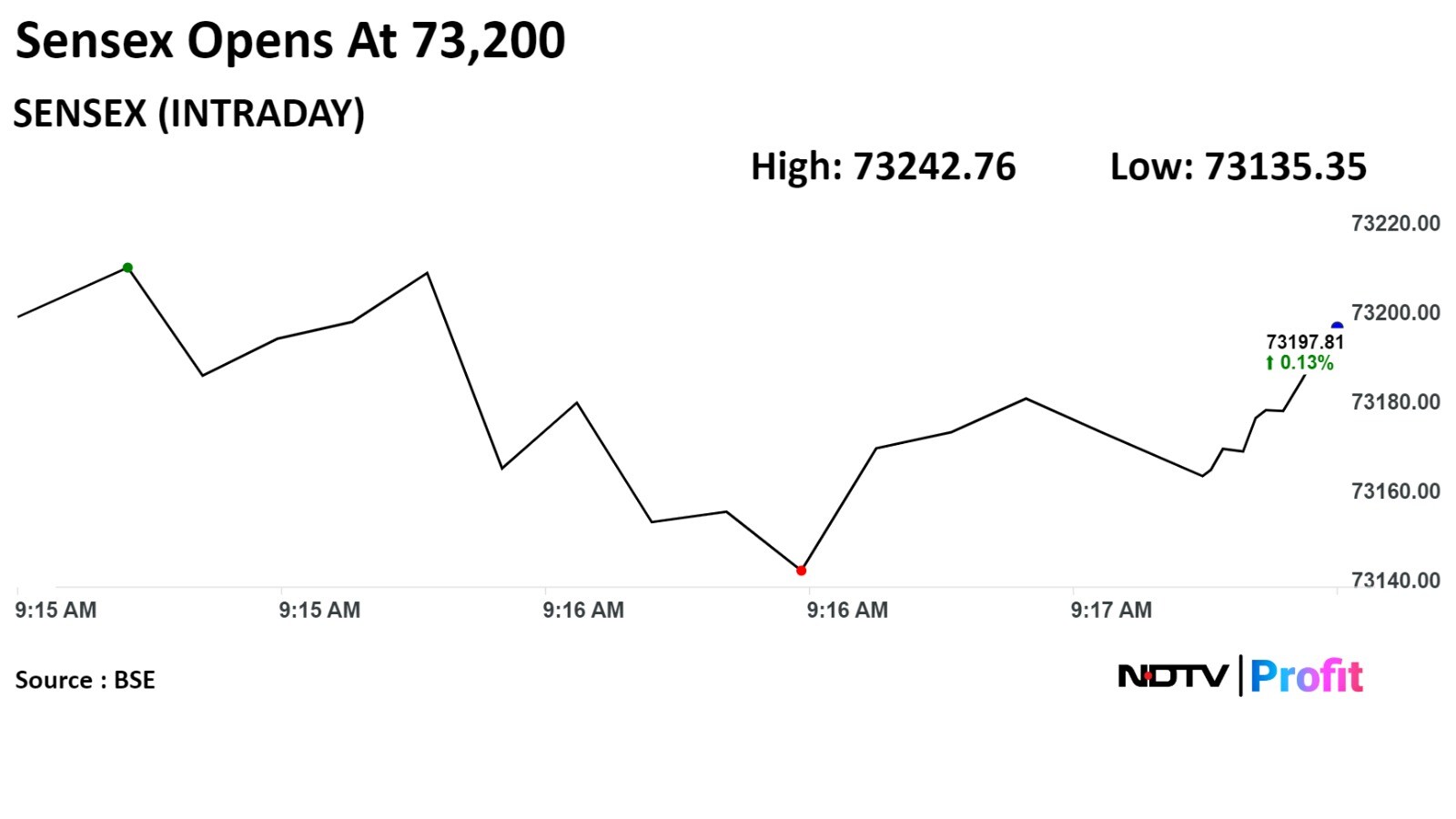

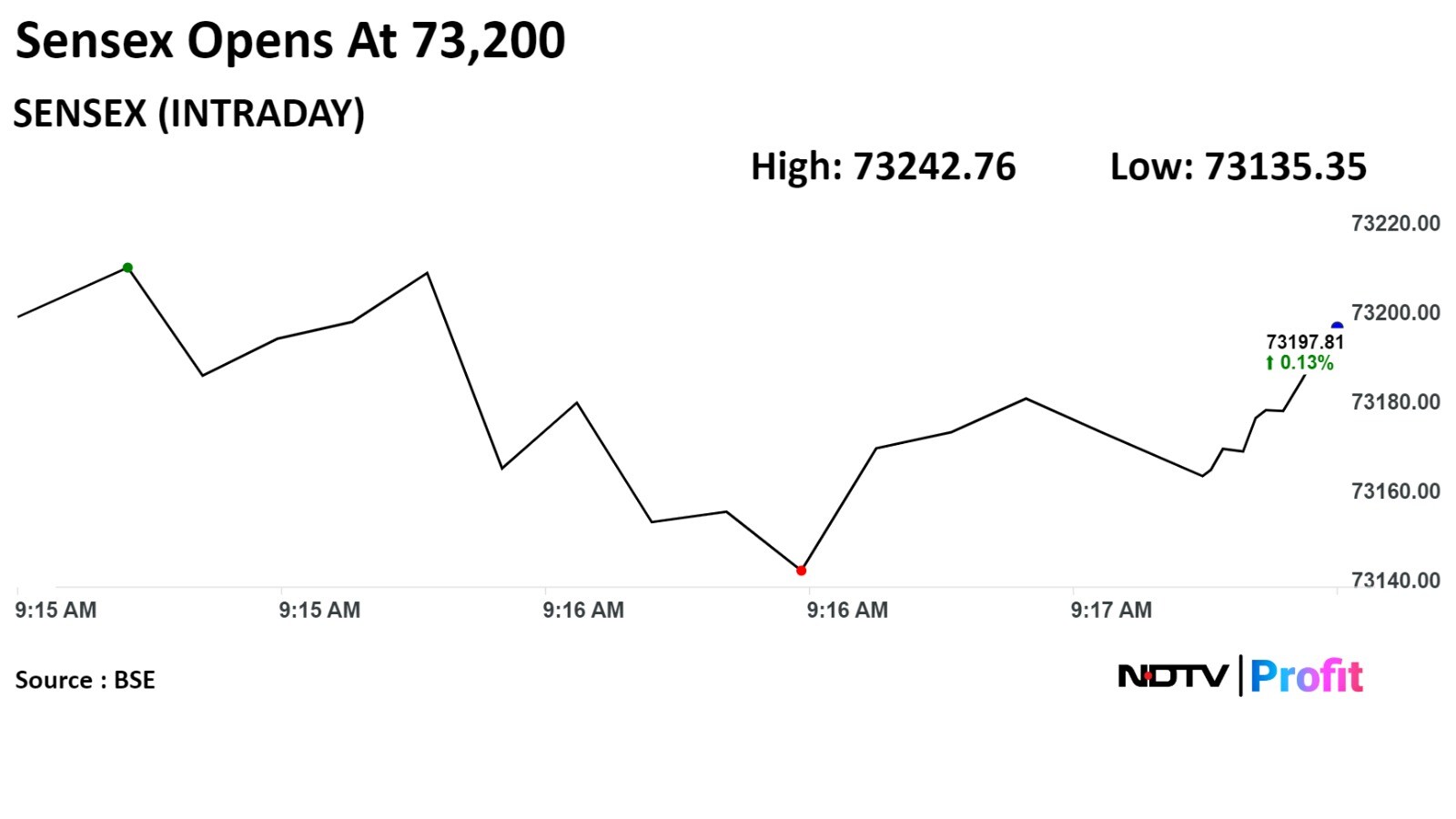

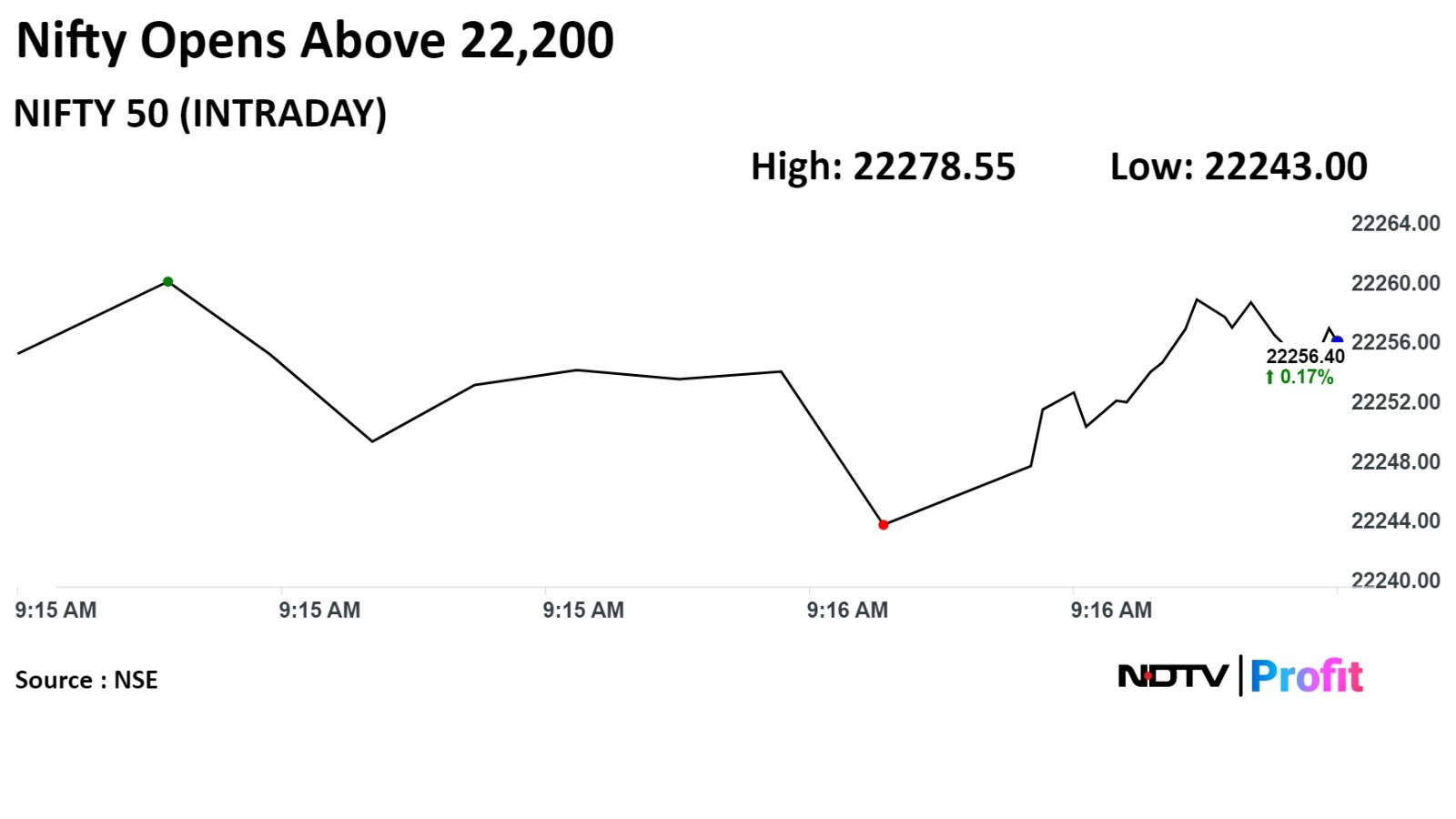

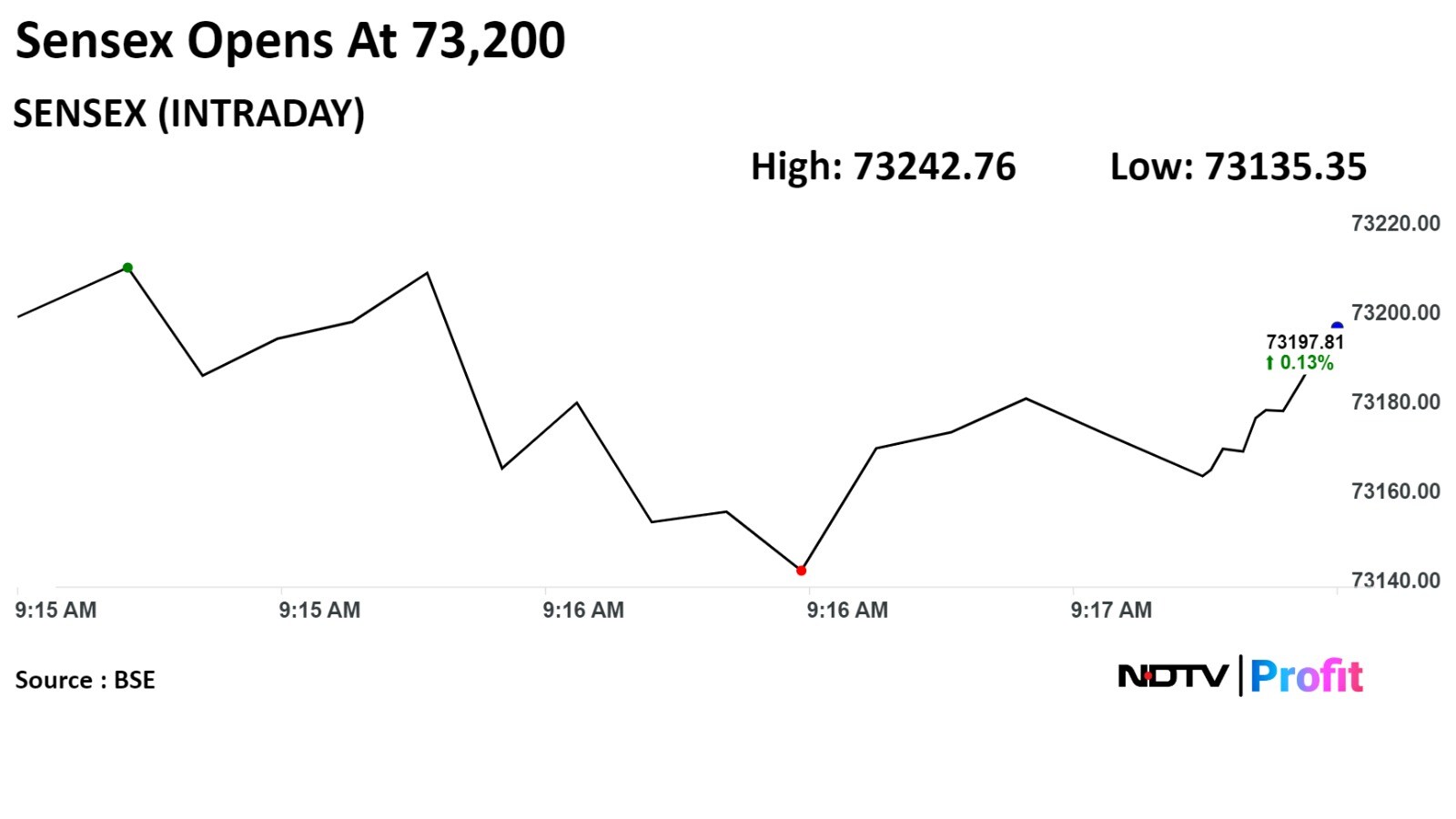

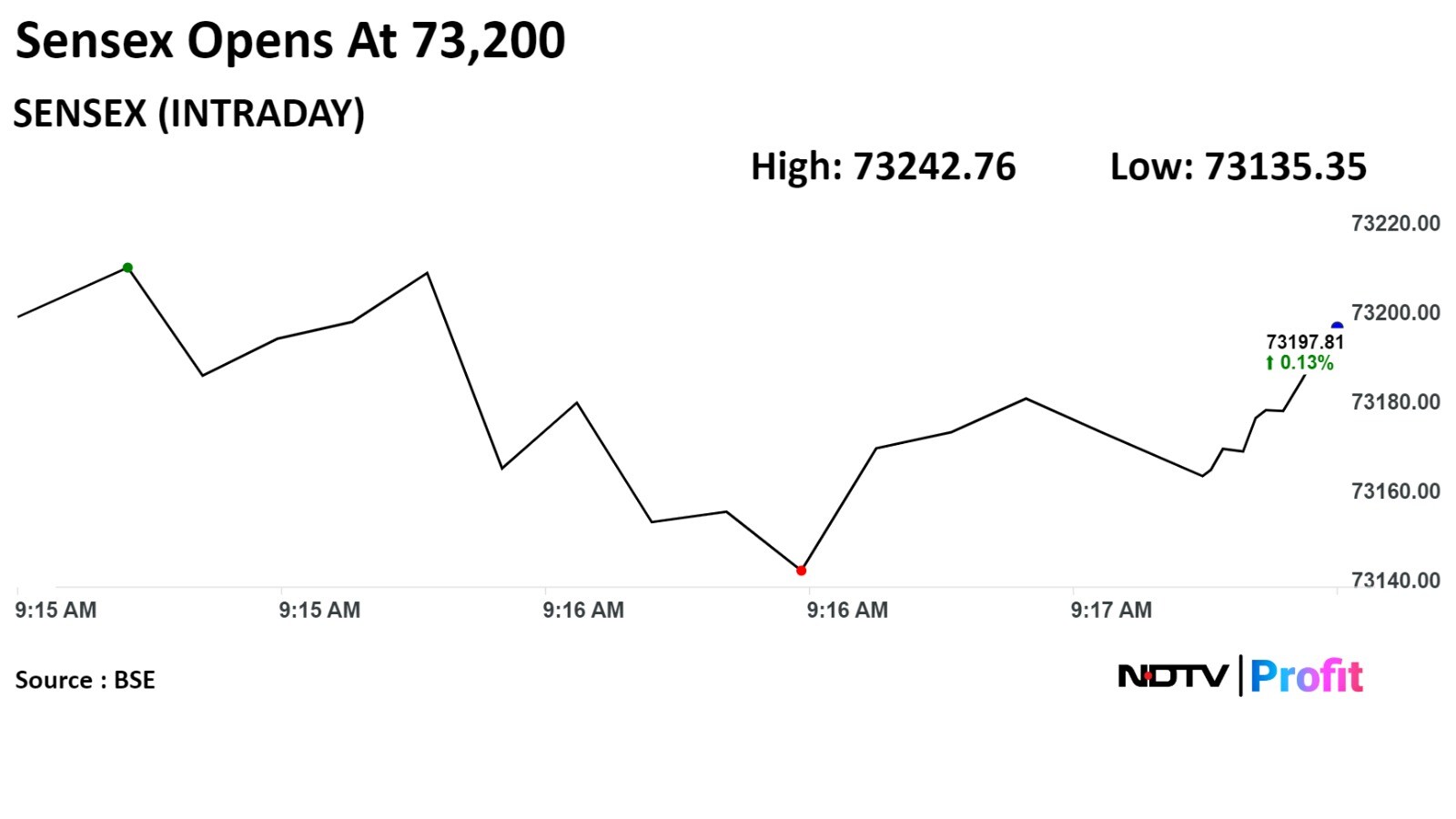

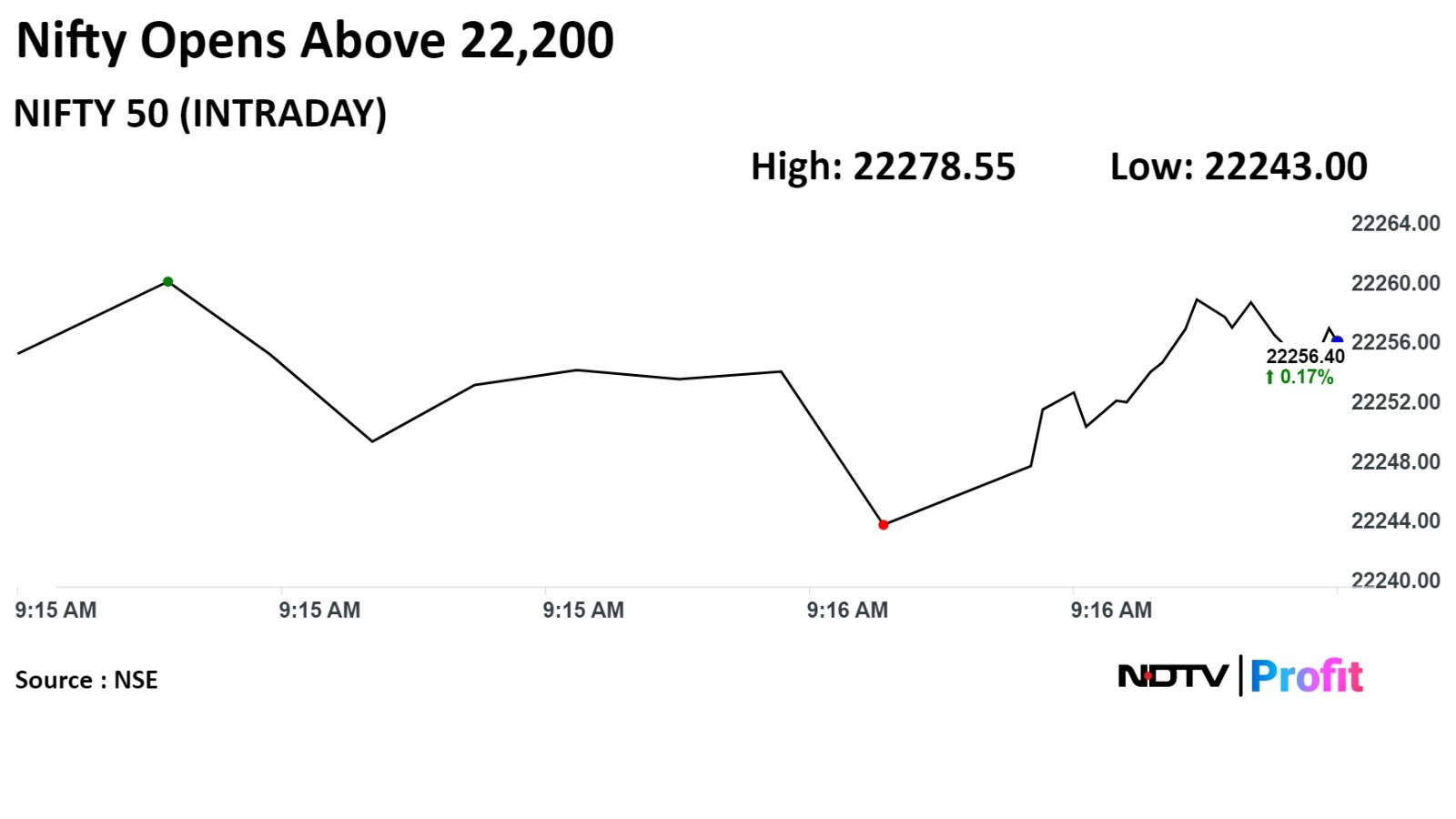

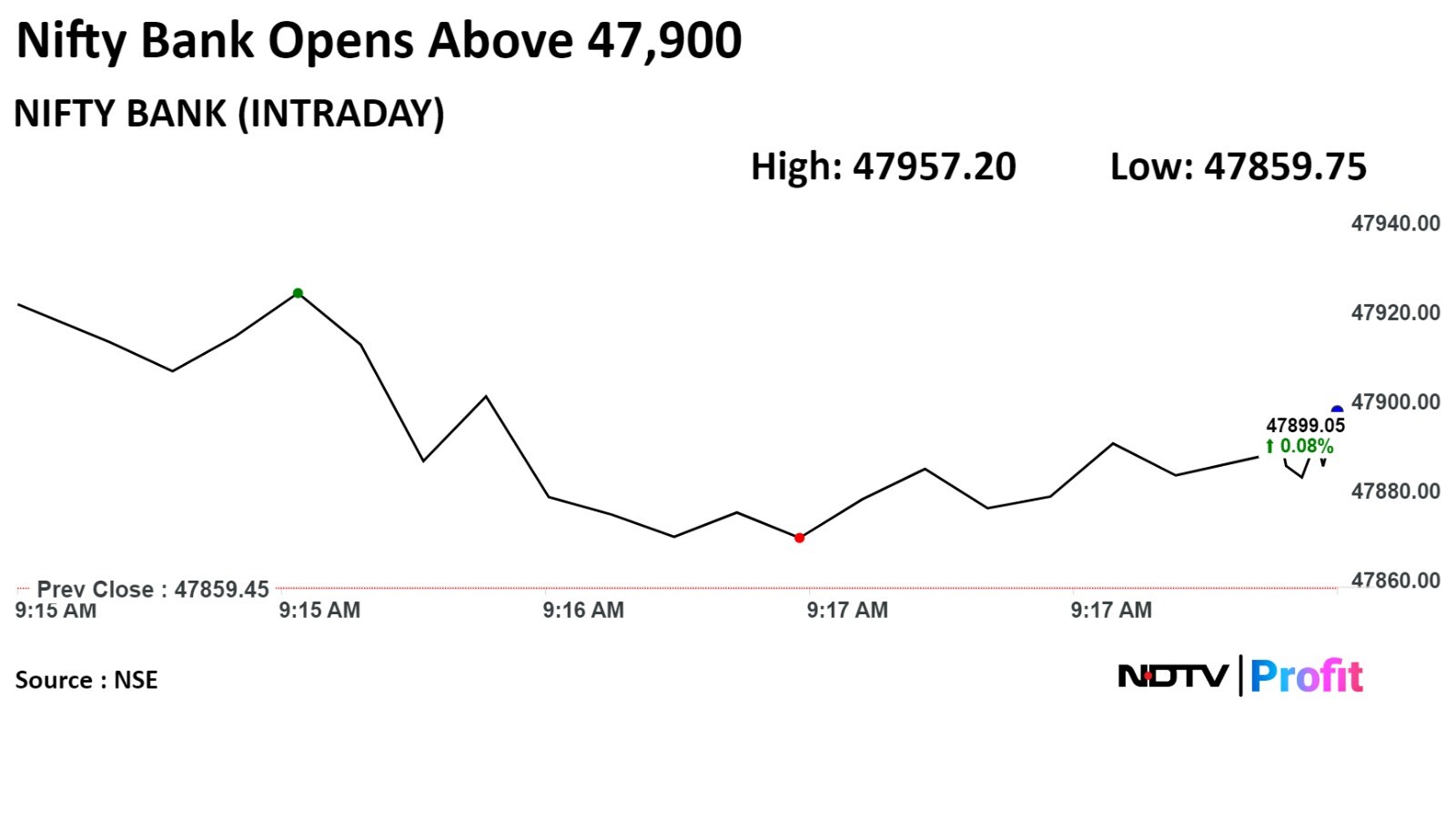

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

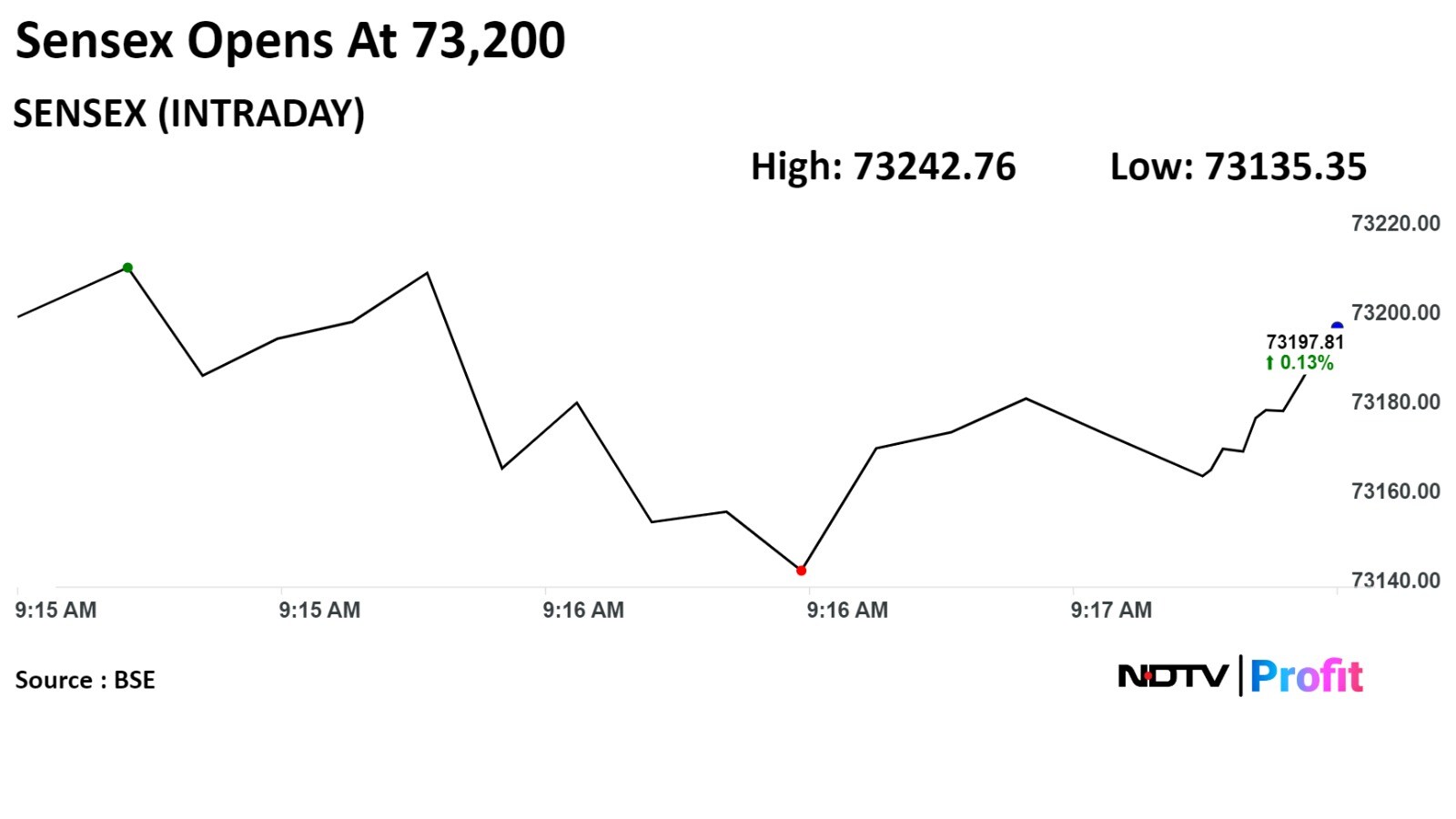

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

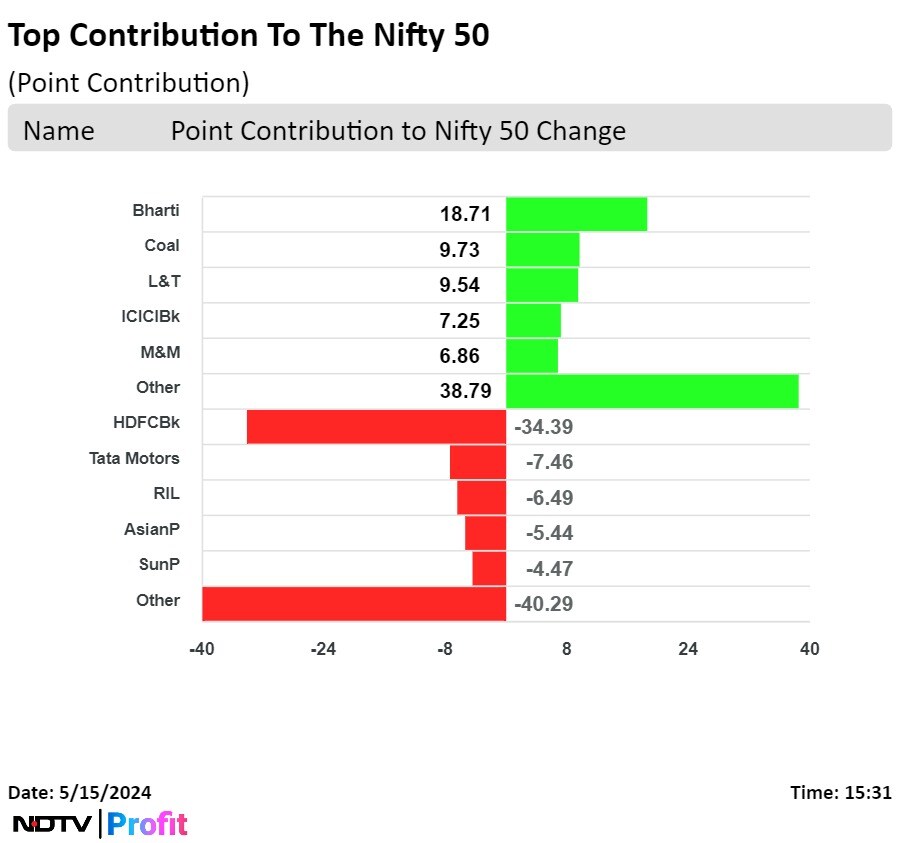

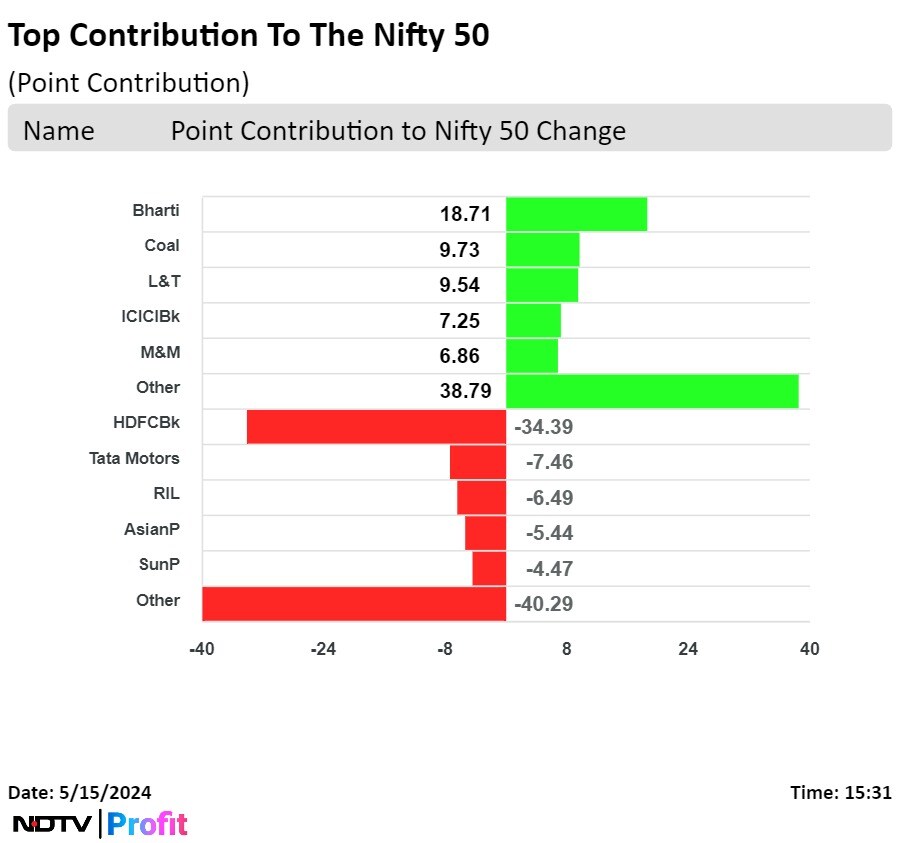

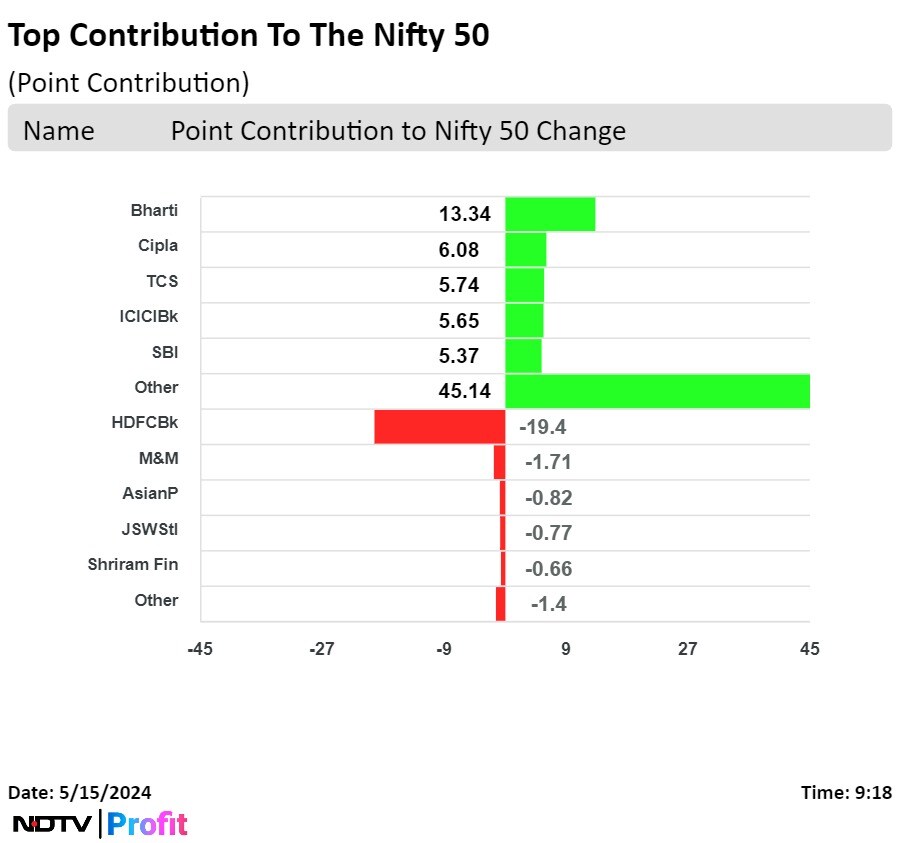

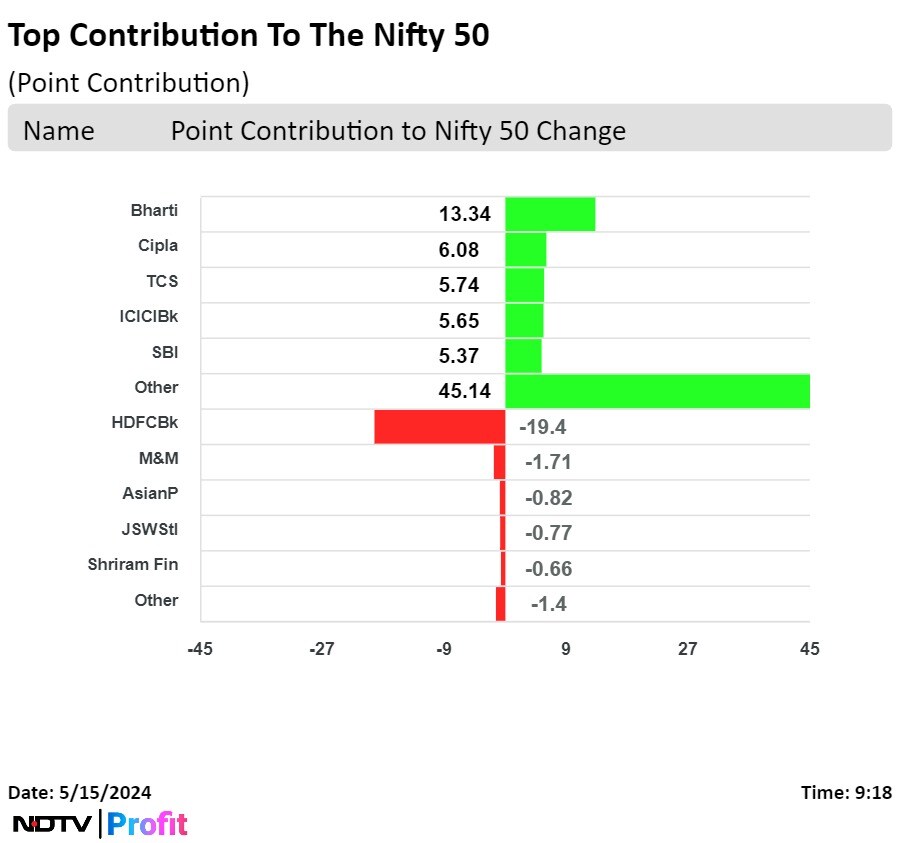

HDFC Bank Ltd., Tata Motors Ltd., Reliance Industries Ltd., Asian paints Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the index.

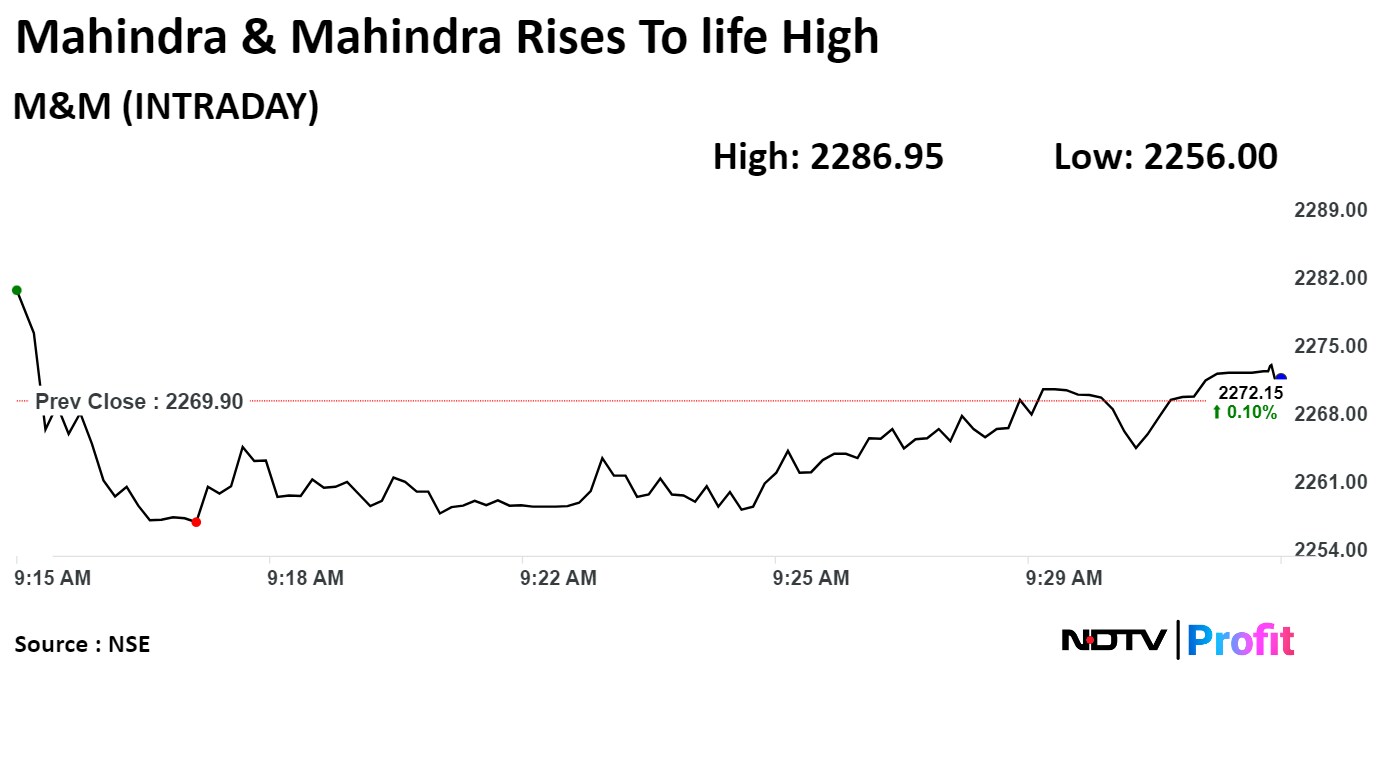

Bharti Airtel Ltd., Coal India Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., and Mahindra & Mahindra Ltd. added to the index.

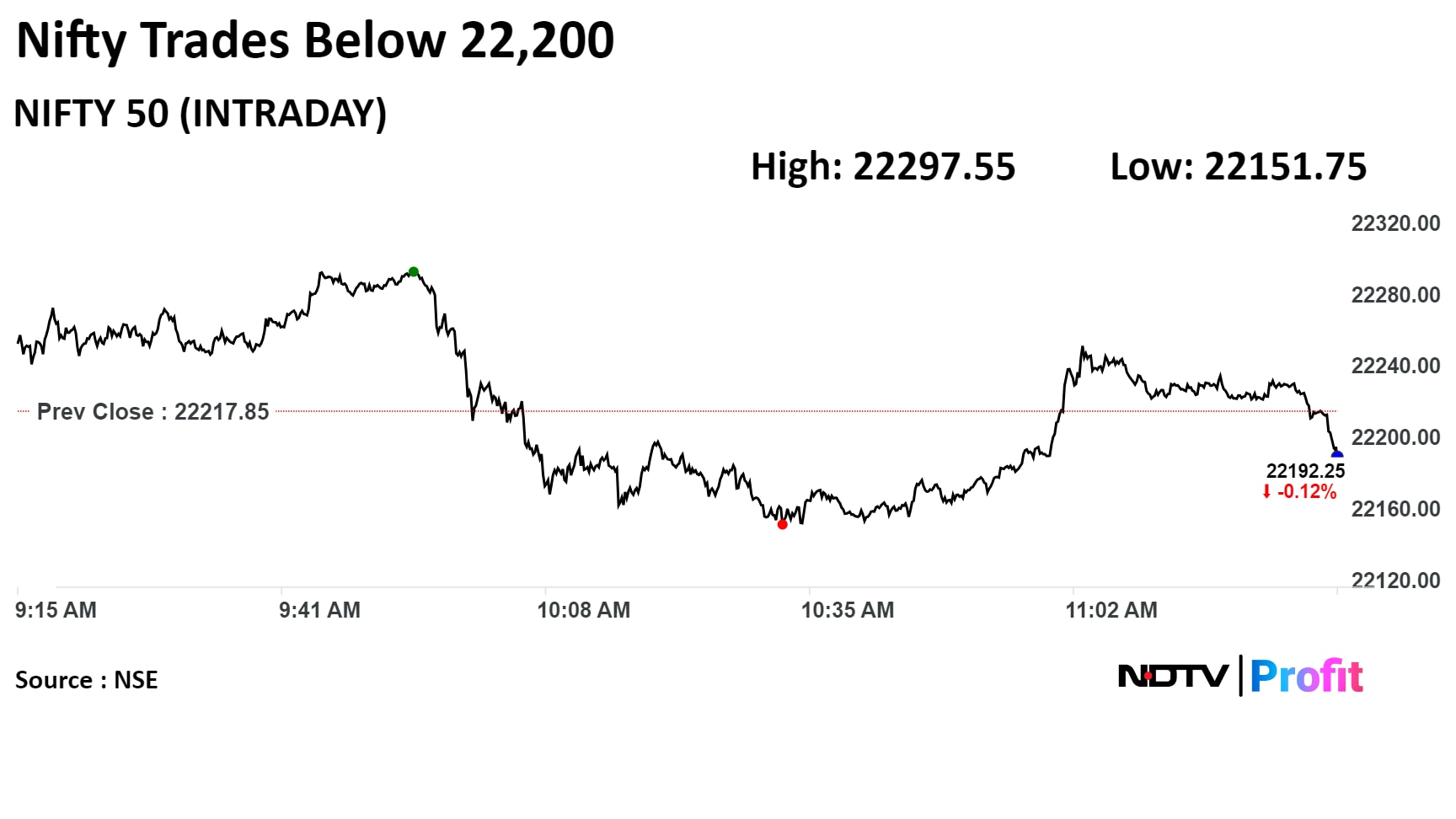

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

HDFC Bank Ltd., Tata Motors Ltd., Reliance Industries Ltd., Asian paints Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the index.

Bharti Airtel Ltd., Coal India Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., and Mahindra & Mahindra Ltd. added to the index.

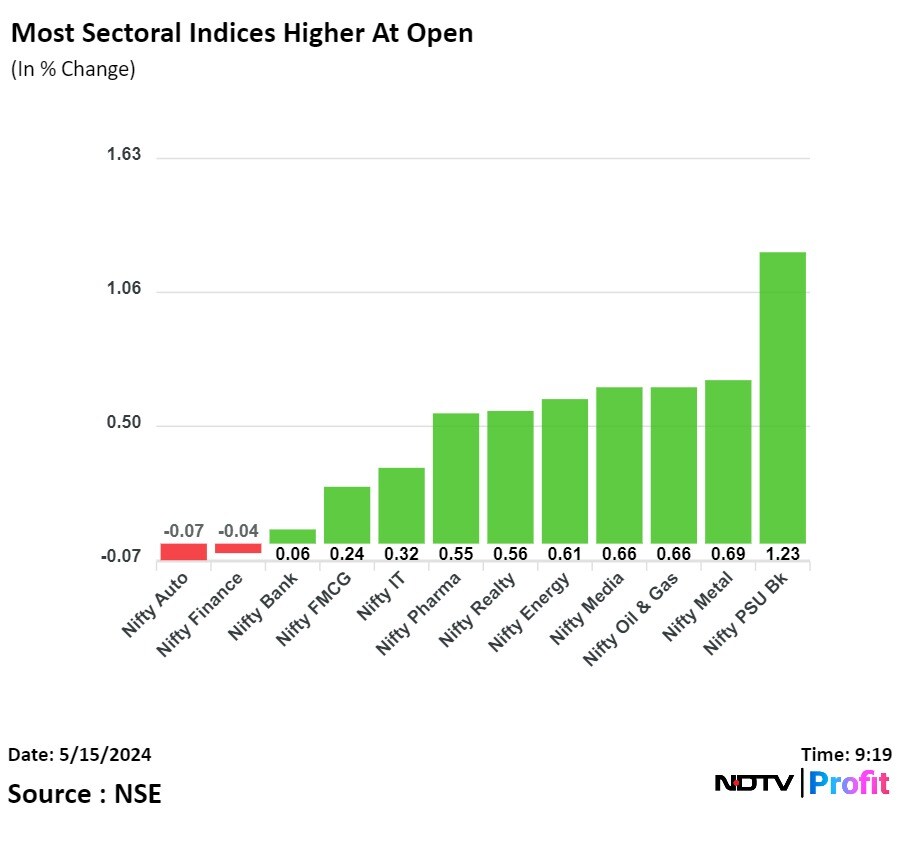

On NSE, five sectors declined, five advanced, while two remained flat out of 12. The NSE Nifty FMCG index was the top loser among peers, and the NSE Nifty PSU Bank was the top gainer.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

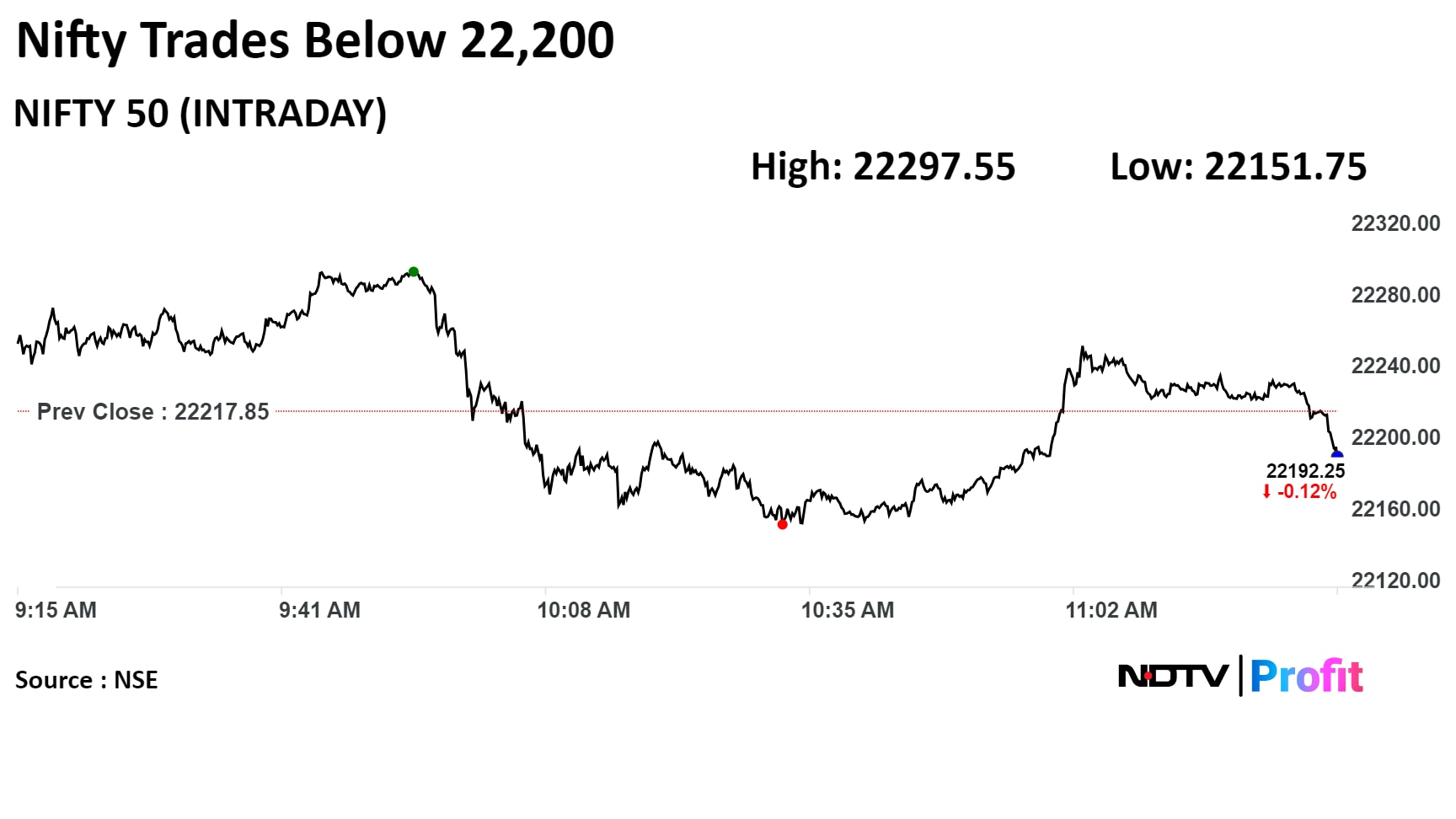

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

HDFC Bank Ltd., Tata Motors Ltd., Reliance Industries Ltd., Asian paints Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the index.

Bharti Airtel Ltd., Coal India Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., and Mahindra & Mahindra Ltd. added to the index.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

Snapping a three-day winning streek, India's benchmark indices ended lower as losses in shares of heavyweight HDFC Bank Ltd., Tata Motors Ltd. pressured.

The NSE Nifty 50 settled 17.30 points or 0.08% lower at 22,200.55, and the S&P BSE Sensex ended 117.58 points or 0.16% down at 72,987.03.

Intraday, the NSE Nifty 50 rose 0.36% to 22,297.55, and the S&P BSE Sensex rose 0.27% to 73,301.47.

Market participants await for the U.S. CPI print for April, scheduled for release later today, which will provide fresh clues about the Federal Reserve's policy outlook.

The core U.S. CPI, which excludes volatile food and energy costs, is expected to come at 0.3% on month in April from 0.4%, according to a Bloomberg's survey.

.jpeg)

"Rangebound trade comes to an end on a negative note at 22,200.55. With gain of more than 1%, PSU Banking and Energy were the top performers; and on the flip side, FMCG was the major laggard followed by Auto," said Aditya Gaggar, Director, Progressive Shares.

"Despite a rangebound trade in Nifty50, Mid, and Smallcaps continued to showcase a strong outperformance by advancing over 0.50%. After a steep rally in the preceding days, the Index found resistance around its crucial hurdle of 22,240-22,330; a convincing move above the mentioned levels will push the Index further higher to 22,400 while on the lower side, 22,100 will be considered as a strong support," he added.

HDFC Bank Ltd., Tata Motors Ltd., Reliance Industries Ltd., Asian paints Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the index.

Bharti Airtel Ltd., Coal India Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., and Mahindra & Mahindra Ltd. added to the index.

On NSE, five sectors declined, five advanced, while two remained flat out of 12. The NSE Nifty FMCG index was the top loser among peers, and the NSE Nifty PSU Bank was the top gainer.

.jpeg)

Broader markets outperformed benchmark indices. The S&P BSE Midcap ended 0.60% higher, and the S&P BSE Smallcap settled 0.96% up.

On BSE, 16 sector advanced, and four declined out of 20. The S&P BSE FMCG was the worst performing sector. S&P BSE Capital goods gained the most.

Market breadth was skewed in favour of buyers. Around 2,214 stocks rose, 1,577 stocks declined, and 144 stocks remained unchanged on BSE.

Rane Holdings Ltd. appointed J Ananth as CFO with effect from July 1.

Source: Exchange filing

Mobile churn reduced from 2.9% to 2.4% QoQ

Highest ARPU in the industry at Rs 209

Need to do more work in broadband services

Africa accounts for 25% of the total business

India mobile accounts for 58%

India non mobile accounts for 17%

Rural market continues to grow exponentially

Bharti Airtel is to roll out of 25,000 sites this year, lower than last year

Source: Gopal Vittal, MD and CEO, Bharti Airtel at Earnings Call

Services estimate better than what was projected last month.

New benchmark established at $778.21 billion FY24 in merchandise and services trade.

Source: Trade Briefing

Revenue up 5% at Rs 228 crore from Rs 217 crore

Ebitda down 10% at Rs 94 crore from Rs 105 crore

Margin at 41.5% vs 48.4%

Net profit down 13% at Rs 70 crore vs Rs 81 crore

Revenue up 3% to Rs 1,105 crore from Rs 1,072 crore

Ebitda up 5.8% at Rs 180 crore from Rs 170 crore

Margin up 40 basis points at 16.3% from 15.9%

Net profit up 7.6% at Rs 73 crore from Rs 68 crore

Net profit at Rs 78 crore vs Rs 59 crore, up 31.9%

Revenue at Rs 660 crore vs Rs 617 crore, up 7%

EBITDA at Rs 108 crore vs Rs 91 crore, up 18.7%

Margin at 16.4% vs 14.8%

Redesignates MR Jyothy as Chairperson & MD

In pact for silicone oils in UK

Source: Exchange Filing

In pact for silicone oils in UK

Source: Exchange Filing

Shares of Andhra Paper Ltd. snapped their three-day rally after the company's net profit fell in the quarter ended March.

Net profit of the paper company fell 75.04% year-on-year to Rs 38.41 crore, during the January-March period. Its revenue from operations also declined 38.3% to Rs 364.38 crore.

Shares of the company fell as much as 3.90%, the lowest level since May 10, before paring loss to trade 2.05% lower at 12:43 p.m. This compares to a flat in the NSE Nifty 50.

The stock has fallen 15.9% year-to-date, but risen 15.36% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 48.96.

Shares of Andhra Paper Ltd. snapped their three-day rally after the company's net profit fell in the quarter ended March.

Net profit of the paper company fell 75.04% year-on-year to Rs 38.41 crore, during the January-March period. Its revenue from operations also declined 38.3% to Rs 364.38 crore.

Shares of the company fell as much as 3.90%, the lowest level since May 10, before paring loss to trade 2.05% lower at 12:43 p.m. This compares to a flat in the NSE Nifty 50.

The stock has fallen 15.9% year-to-date, but risen 15.36% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 48.96.

.jpeg)

Canara Bank rose as much as 4.93% to Rs 118.90, the highest level since May 8. It was trading 4.45% higher at Rs 118.40 as of 1:00 p.m., as compared to 0.12% decline in the NSE Nifty 50 index.

The scrip gained 35.26% in 12 months, and on year to date basis, it has risen 91.07%. Total traded volume so far in the day stood at 0.93 times its 30-day average. The relative strength index was at 52.62.

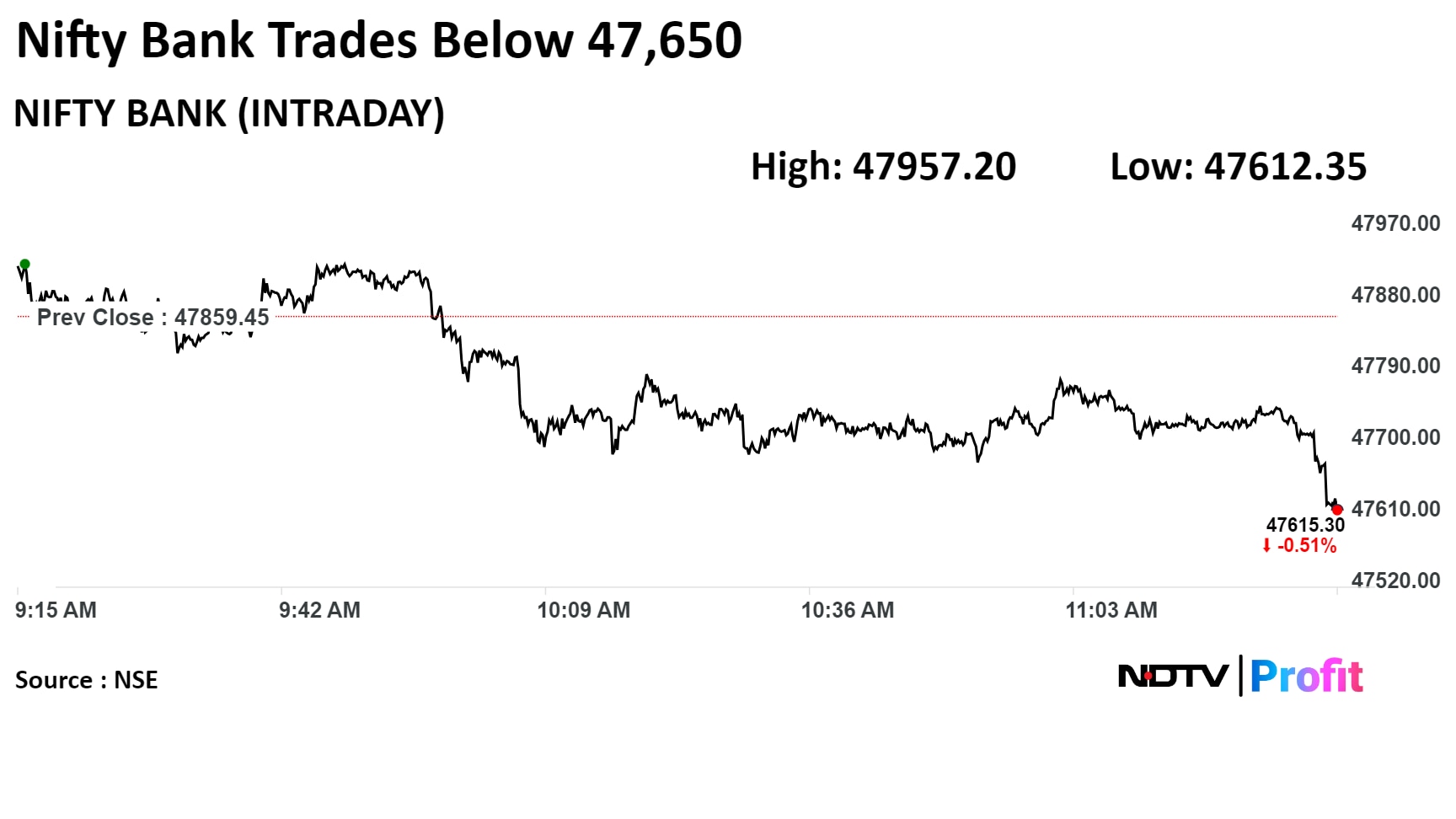

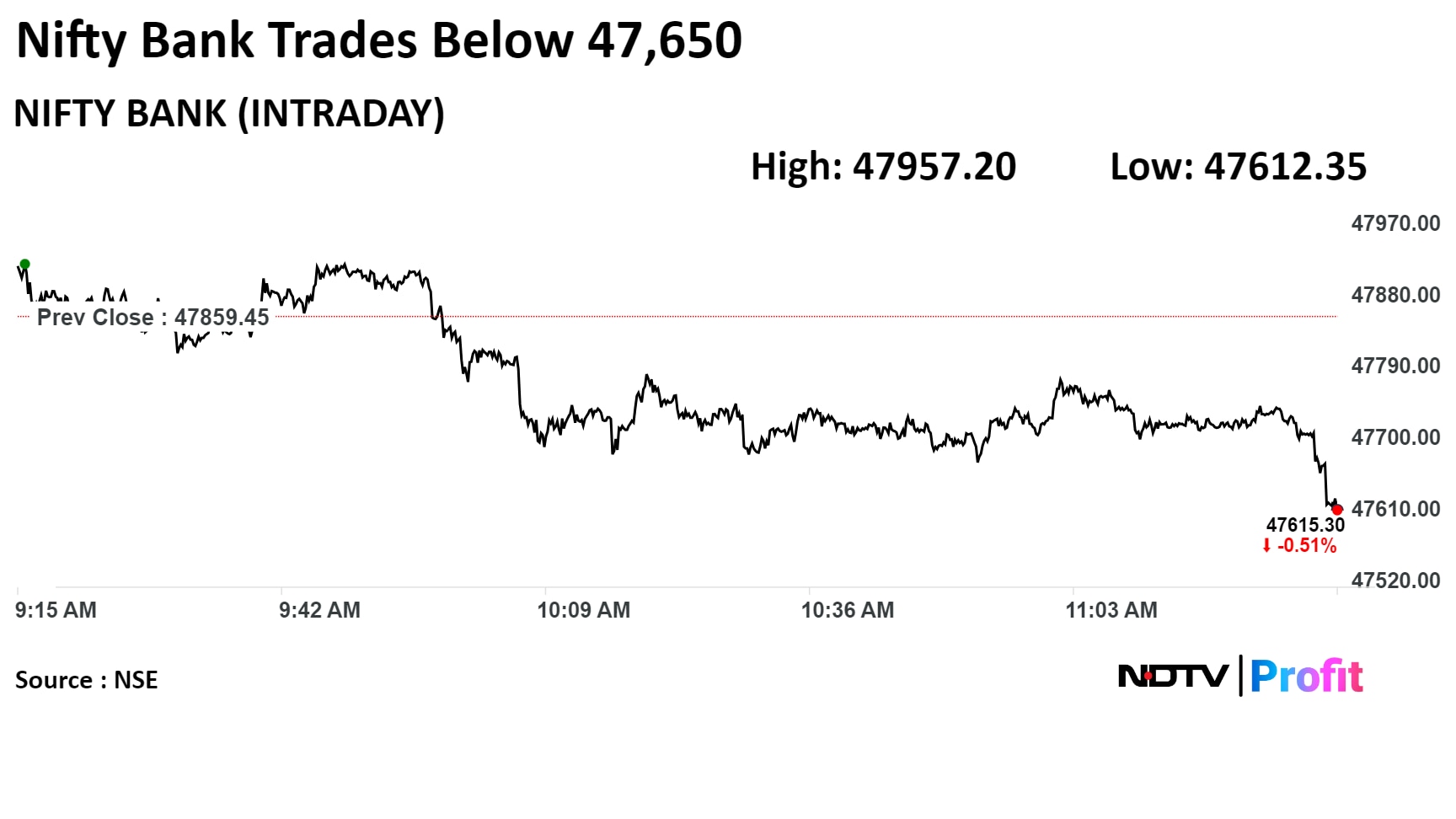

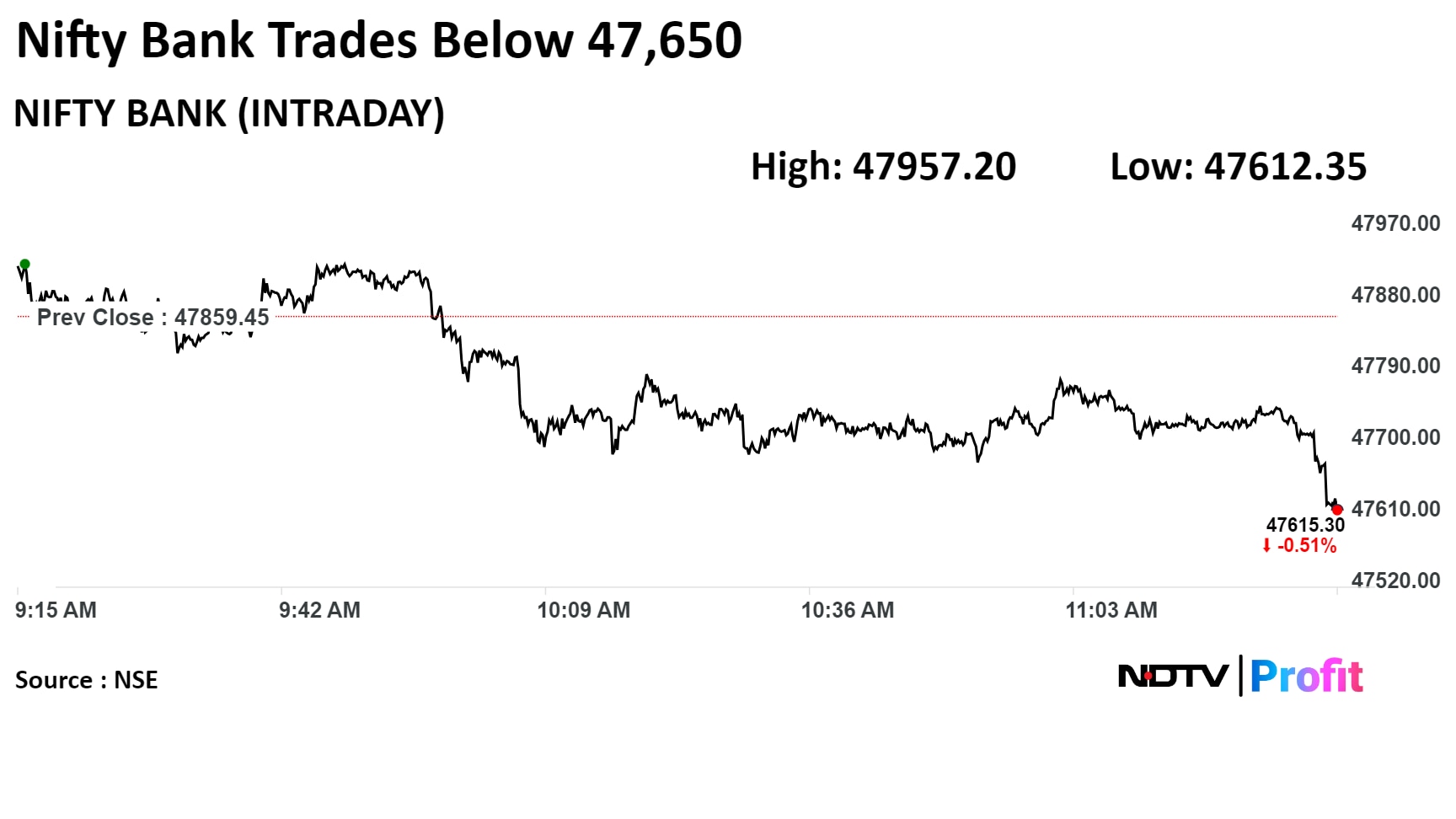

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

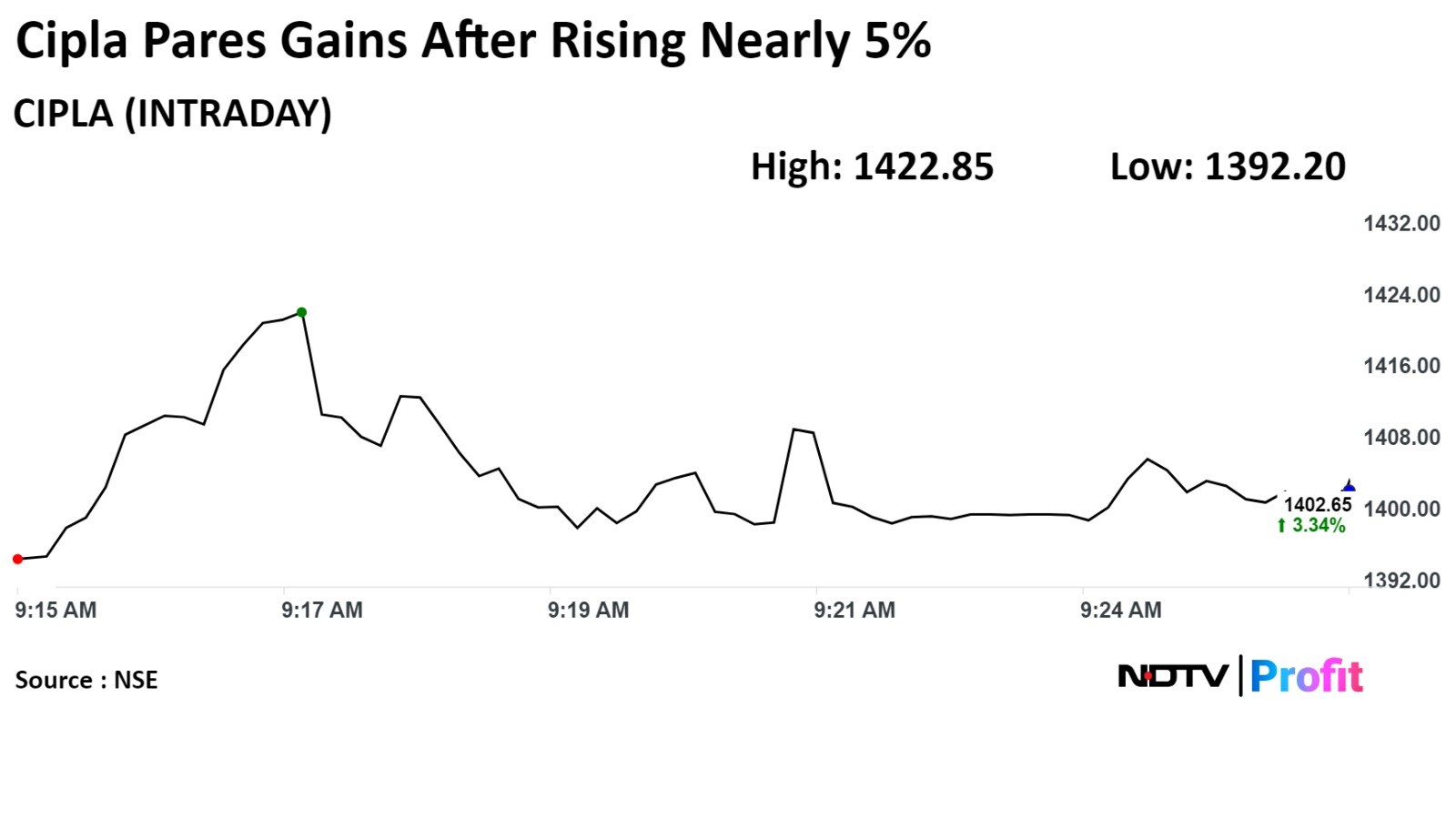

Shares of Coal India Ltd., Cipla Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., and NTPC Ltd. cushioned fall in the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Tata Consultancy Services Ltd., and Hindustan Unilever Ltd. dragged the index.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Shares of Coal India Ltd., Cipla Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., and NTPC Ltd. cushioned fall in the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Tata Consultancy Services Ltd., and Hindustan Unilever Ltd. dragged the index.

.png)

Sectoral indices were mixed on the NSE, with Nifty PSU Bank and Nifty Realty gaining the most, by over 1%. Nifty FMCG and Nifty Bank were the top losers.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Shares of Coal India Ltd., Cipla Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., and NTPC Ltd. cushioned fall in the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Tata Consultancy Services Ltd., and Hindustan Unilever Ltd. dragged the index.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Indian equity benchmark indices erased early gains to trade lower by midday on Wednesday as rate-sensitive banking stocks fell even as investors await US CPI data, due later today, to give direction about Fed rate stance. After its one-day blip, the volatility gauge was again green.

At 11:33 a.m., the NSE Nifty 50 was trading 38 points, or 0.17%, lower at 22,179.85, while the S&P BSE Sensex fell 191.21 points, or 0.26%, to 72,913.40.

Doubling of India VIX level in the last four to five weeks indicates that the market is preparing for sharp volatility, said Milan Vaishnav, founder and technical analyst at Gemstone Equity Research.

The volatility index stood at 20.3, up 0.53%, as of 12:20 p.m. The gauge has risen 62.9% in the last 30 days, and 51.64% since April 19, when Lok Sabha elections began.

For the next two-three weeks, Nifty's resistance has gradually shifted to 22,500, with the 22,775 level being the intermittent top, he said. However, he expects selling pressure to kick in at 22,400–22,500 levels.

On the downside, 22,000-22,100 will act as support, Vaishnav noted. Breaking below 22,000 will lead to incremental weakness, he said.

Shares of Coal India Ltd., Cipla Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., and NTPC Ltd. cushioned fall in the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Tata Consultancy Services Ltd., and Hindustan Unilever Ltd. dragged the index.

.png)

Sectoral indices were mixed on the NSE, with Nifty PSU Bank and Nifty Realty gaining the most, by over 1%. Nifty FMCG and Nifty Bank were the top losers.

.png)

Broader markets outperformed. S&P BSE Midcap rose 0.66% and S&P BSE Smallcap was 0.93% higher.

Sixteen of the 20 sectoral indices rose and four declined. S&P BSE Power rose the most.

The market breadth was skewed in the favour of buyers. Around 2,269 stocks rose, 1,328 fell and 145 remained unchanged on the BSE.

Revenue down 2% to Rs 1,176 crore from Rs 1,196 crore

Ebitda up 12% at Rs 256 crore from Rs 229 crore

Margin up 270 basis points at 21.8% from 19.1%

Net profit up 8% at Rs 130 crore from Rs 120 crore

Oil India Ltd. is to consider bonus issue of shares on May 20.

Source: Exchange filing

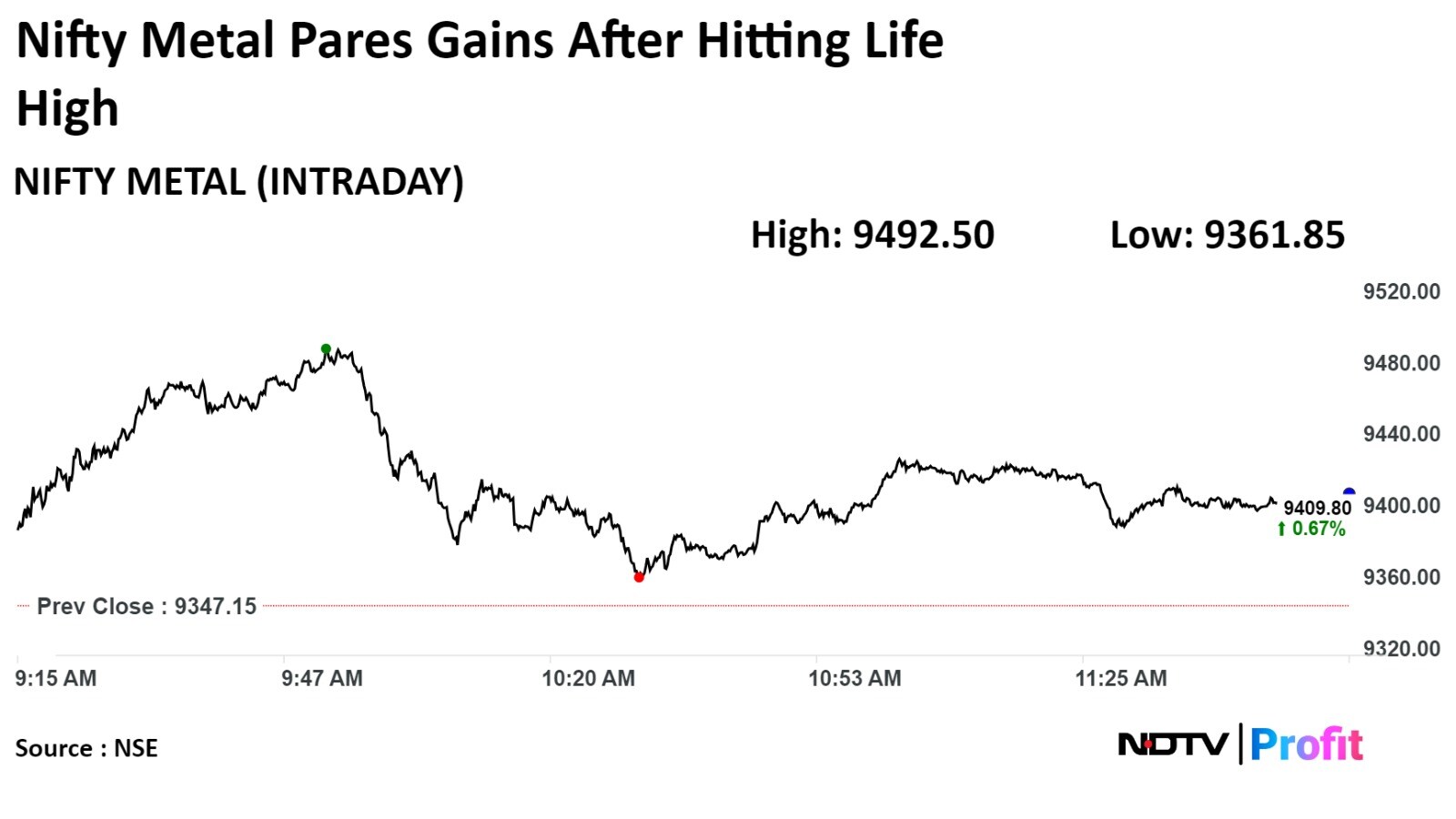

The NSE Nifty Metal index rose 1.56% to 9,492.50, the highest level since its inception on July 12, 2011. It was trading 0.67% higher at 9,410.20 as of 12:37 p.m., as compared to 0.9% decline in the NSE Nifty index.

The NSE Nifty Metal index rose 1.56% to 9,492.50, the highest level since its inception on July 12, 2011. It was trading 0.67% higher at 9,410.20 as of 12:37 p.m., as compared to 0.9% decline in the NSE Nifty index.

Total income rose 20% on the year to Rs 12,249 crore from Rs 10,186 crore.

Net profit rose 18.4% to Rs 4,135 crore from Rs 3,492 crore.

Executive Director Sandeep Kumar appointed as CFO effective immediately.

Source: Exchange filing

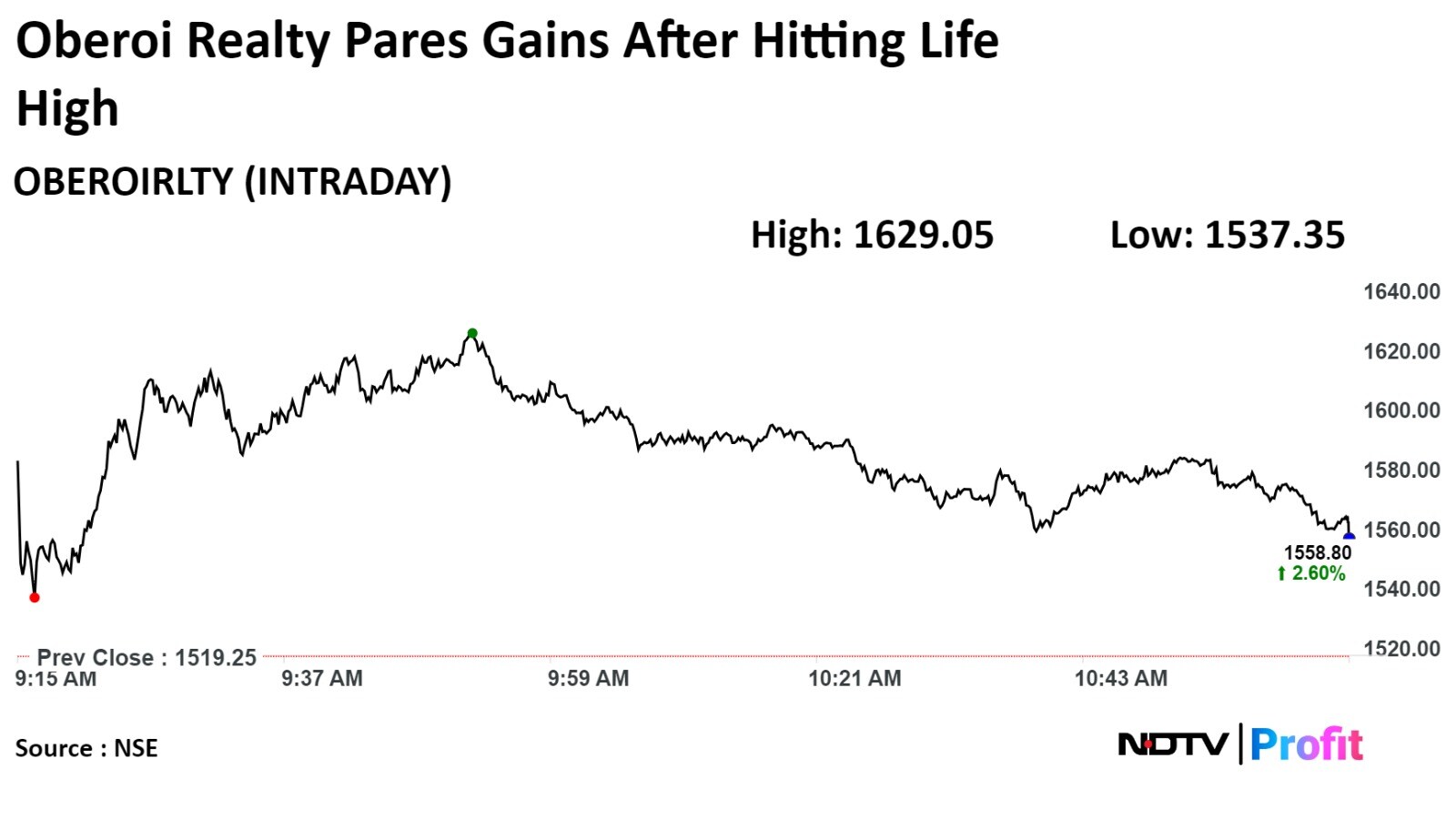

The scrip rose as much as 7.23% to Rs 1,629.05 apiece, the highest level. It pared gains to trade 3.08% higher at Rs 1,566.70 apiece, as of 11:16 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 8.84% on an year-to date basis and 68.99 in the last twelve months. Total traded volume so far in the day stood at 8.10 times its 30-day average. The relative strength index was at 62.33.

Out of 23 analysts tracking the company, eight maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.2%.

The scrip rose as much as 7.23% to Rs 1,629.05 apiece, the highest level. It pared gains to trade 3.08% higher at Rs 1,566.70 apiece, as of 11:16 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 8.84% on an year-to date basis and 68.99 in the last twelve months. Total traded volume so far in the day stood at 8.10 times its 30-day average. The relative strength index was at 62.33.

Out of 23 analysts tracking the company, eight maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.2%.

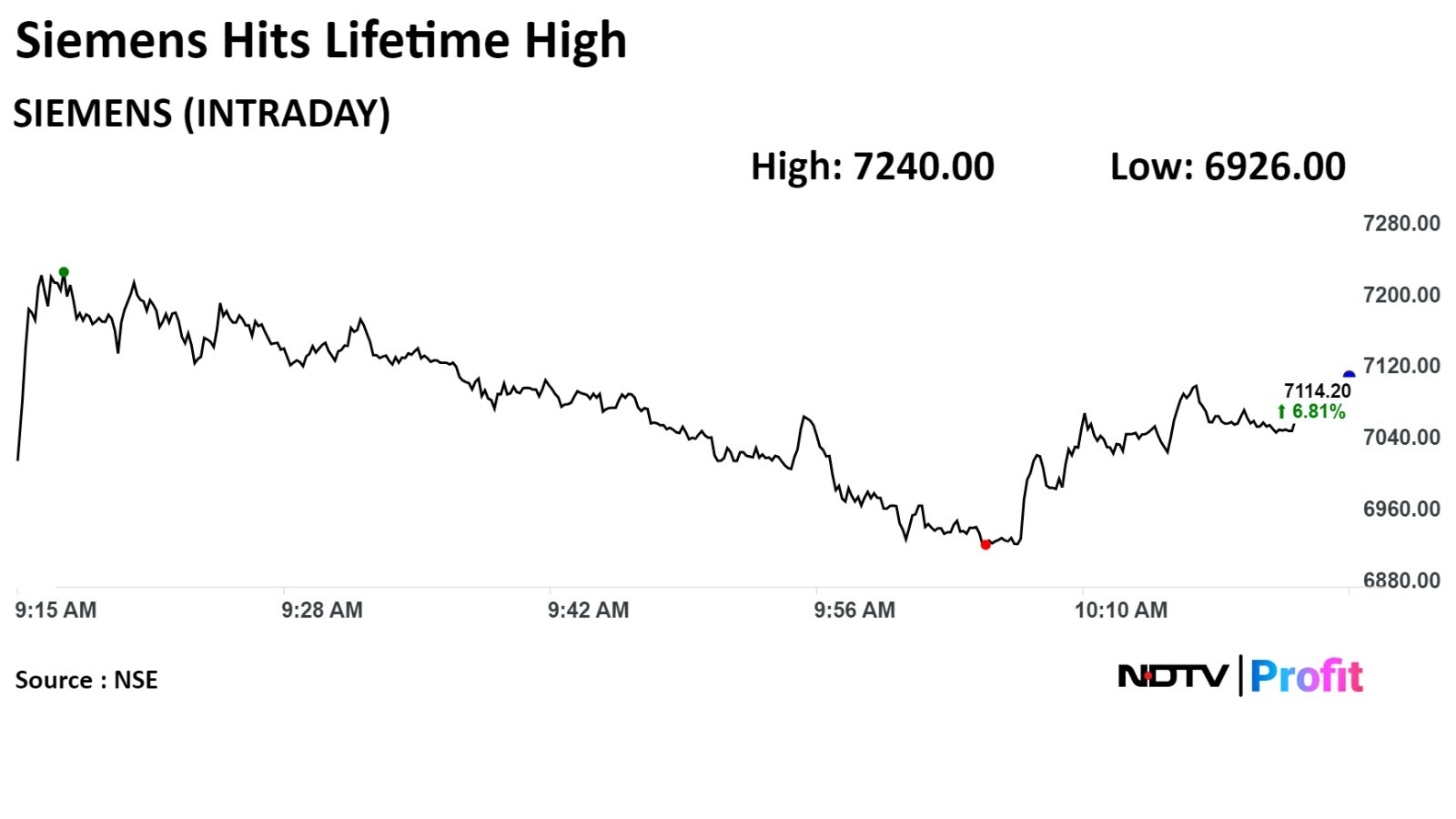

The scrip rose as much as 8.70% to Rs 7,240 apiece, the highest level. It pared gains to trade 7.2% higher at Rs 7,142 apiece, as of 10:26 a.m. This compares to a 0.17% decline in the NSE Nifty 50 Index.

It has risen 77.4% year-to-date and 101.05% in the last twelve months. Total traded volume so far in the day stood at 4.11 times its 30-day average. The relative strength index was at 85.93, indicating that the stock may be overbought.

Out of 26 analysts tracking the company, 17 maintain a 'buy' rating, four recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 15.2%.

The scrip rose as much as 8.70% to Rs 7,240 apiece, the highest level. It pared gains to trade 7.2% higher at Rs 7,142 apiece, as of 10:26 a.m. This compares to a 0.17% decline in the NSE Nifty 50 Index.

It has risen 77.4% year-to-date and 101.05% in the last twelve months. Total traded volume so far in the day stood at 4.11 times its 30-day average. The relative strength index was at 85.93, indicating that the stock may be overbought.

Out of 26 analysts tracking the company, 17 maintain a 'buy' rating, four recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 15.2%.

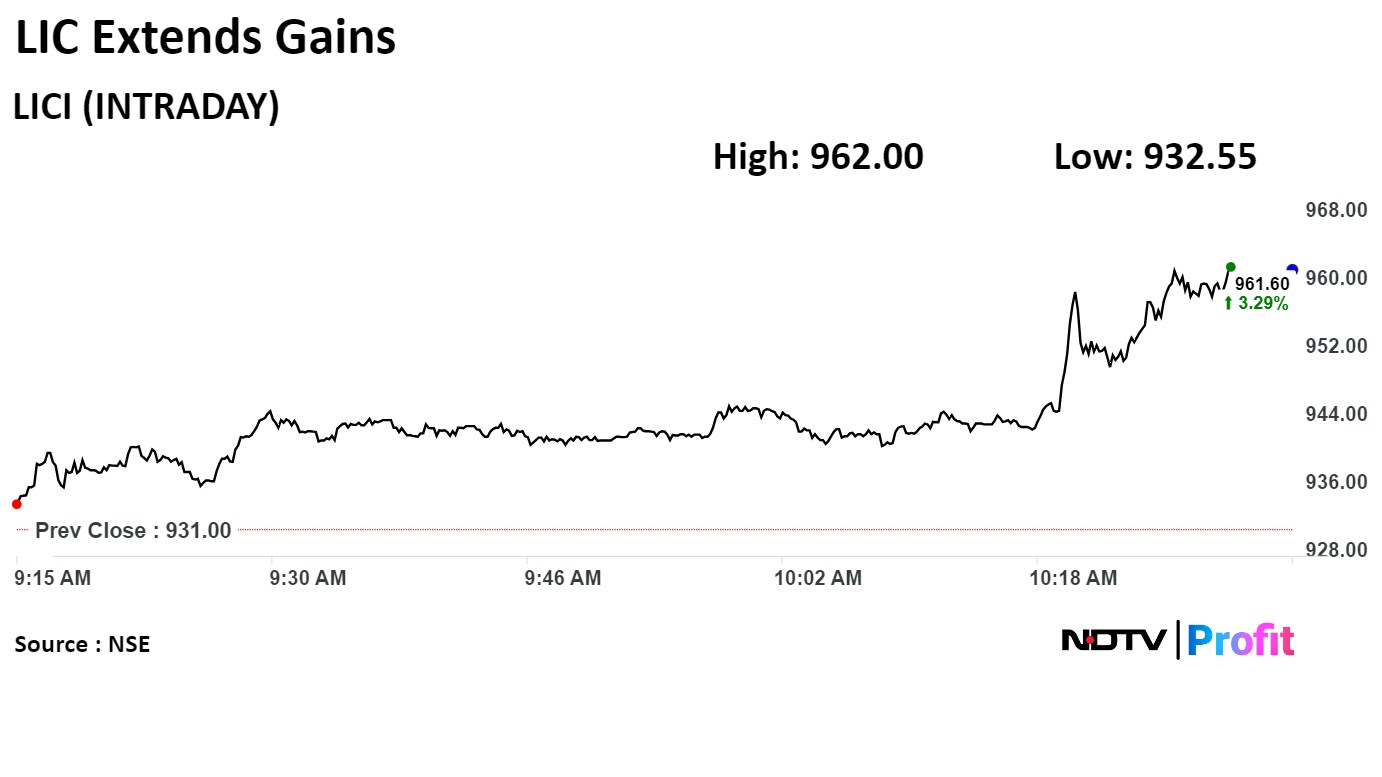

Securities Exchange Board of India granted three more years to achieve 10% public shareholding.

Three more years to achieve 10% public shareholding in addition to earlier period of 5 years from listing.

Revised timeline to achieve 10% public shareholding is on or before May 16, 2027.

Source: Exchange filing

Securities Exchange Board of India granted three more years to achieve 10% public shareholding.

Three more years to achieve 10% public shareholding in addition to earlier period of 5 years from listing.

Revised timeline to achieve 10% public shareholding is on or before May 16, 2027.

Source: Exchange filing

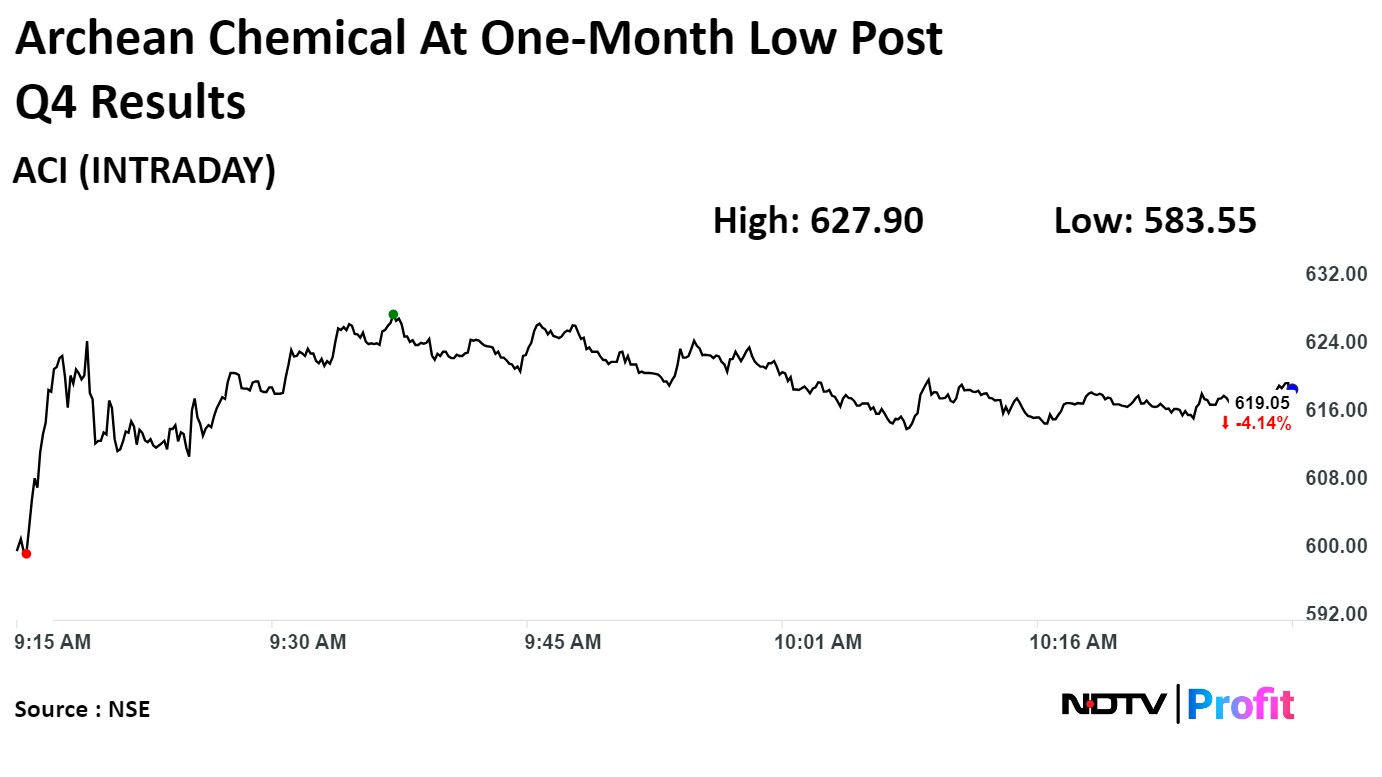

Archean Chemical Industries Ltd. fell to the lowest level since in two months after its consolidated net profit fell 57.9% on year to Rs 58 crore during January-March, from Rs 194 crore.

Bloomberg Survey forecasted Rs 84 net profit for the period.

Archean Chemical Industries Ltd. declined 9.64% to Rs 583.55, the lowest level since March 15. It pared losses to trade 4.29% down at Rs 618.10 as of 10:28 a.m., as compared to 0.14% decline in the NSE Nifty 50 index.