-The local currency closed flat against the US dollar at 83.55.

Source: Cogencis

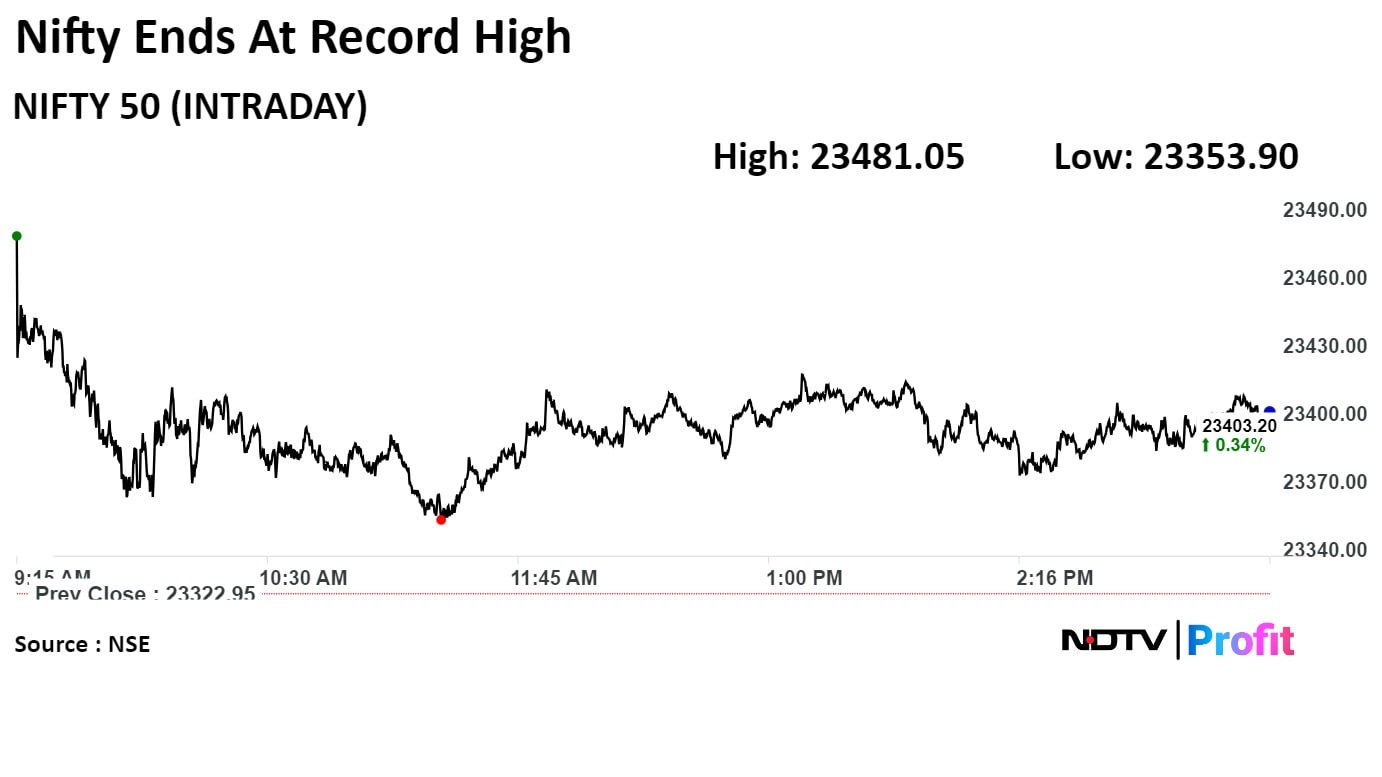

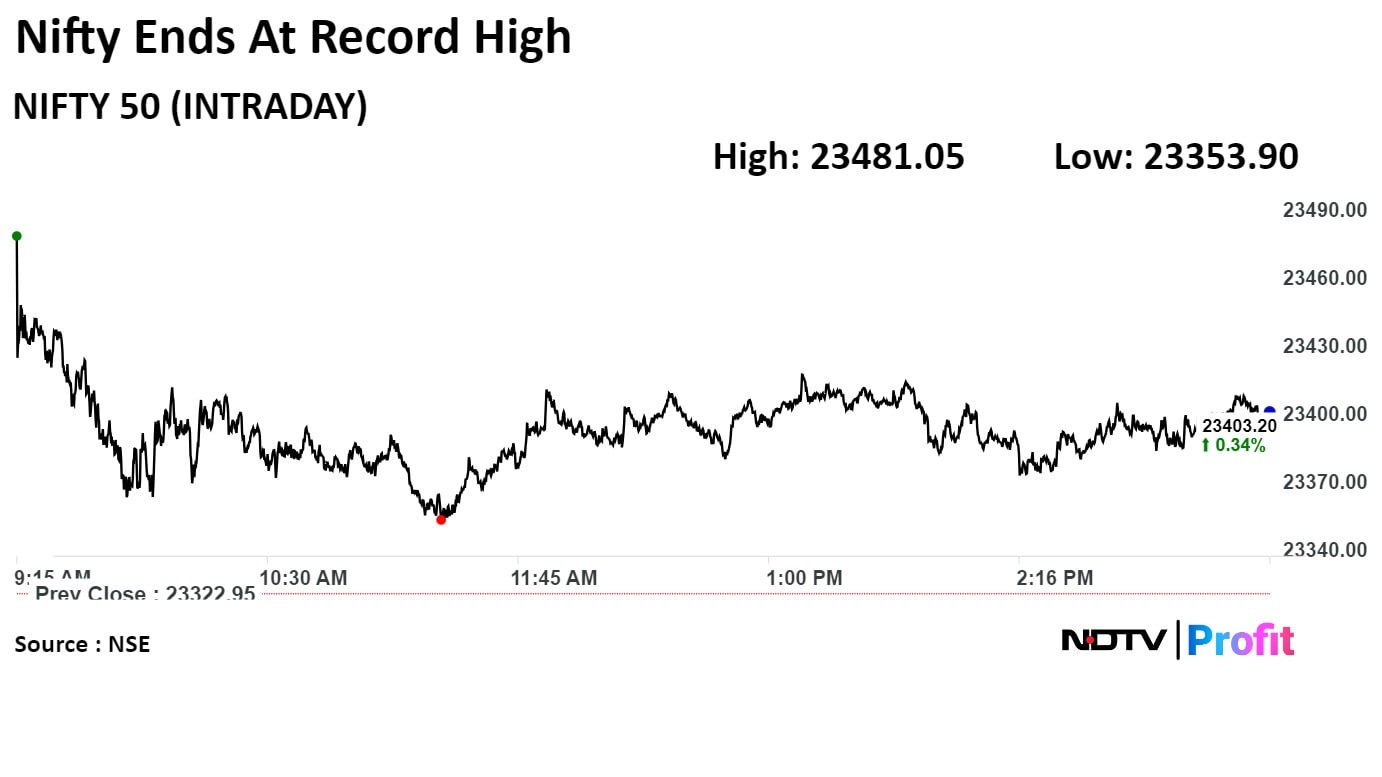

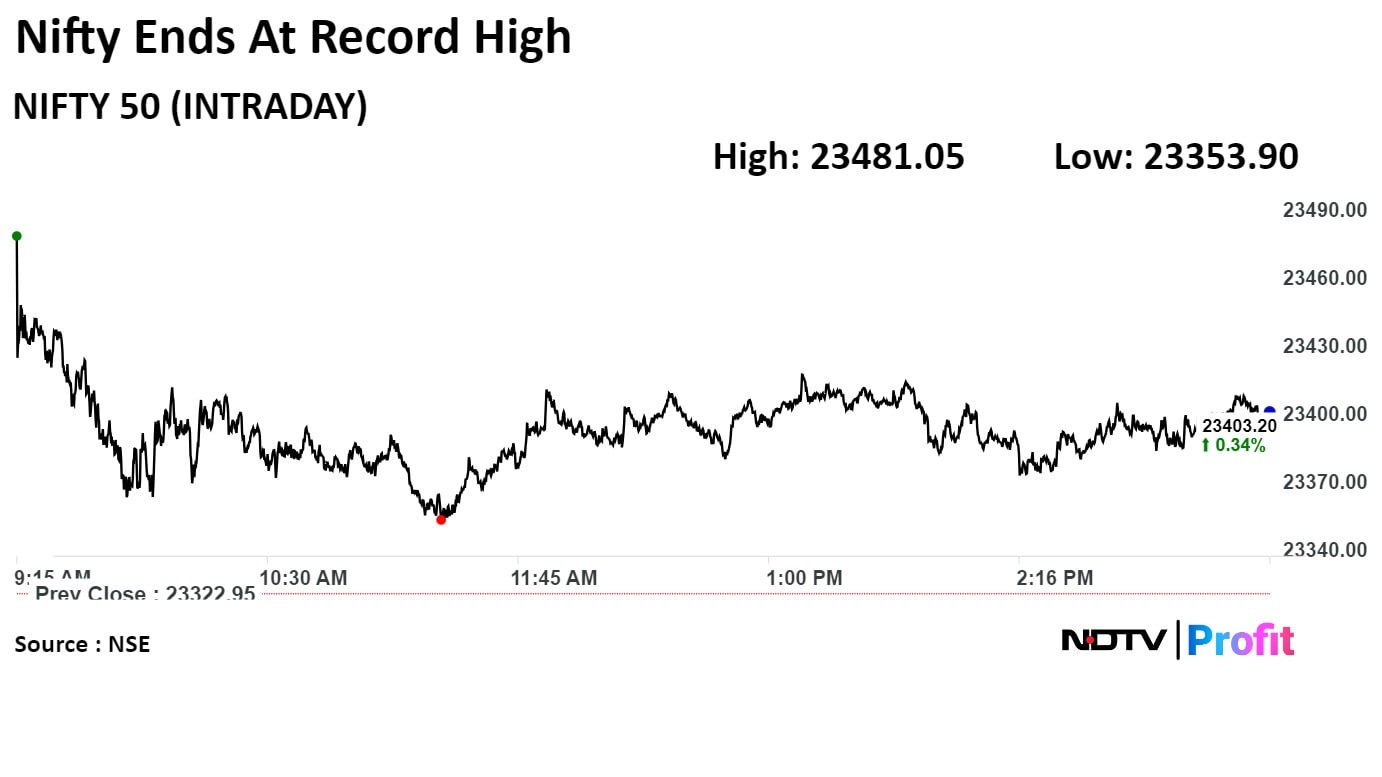

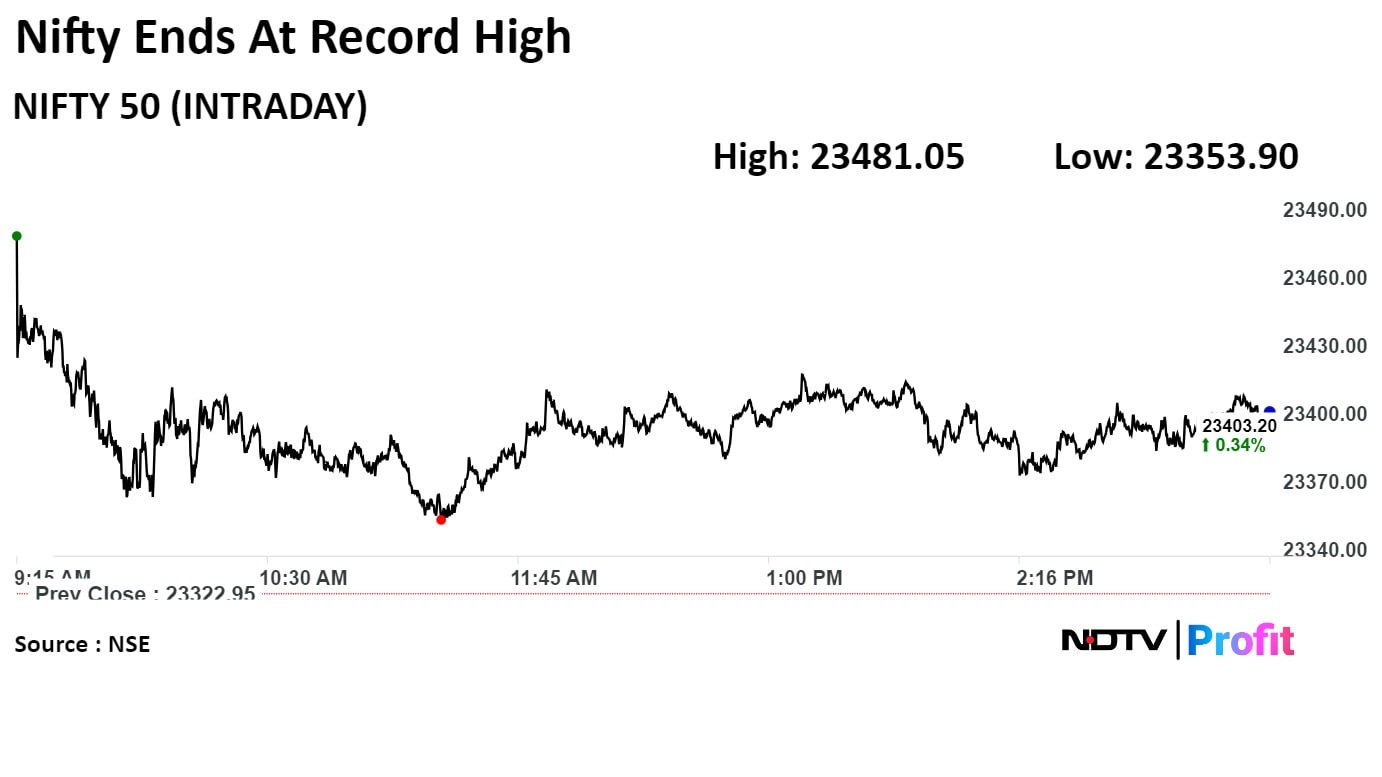

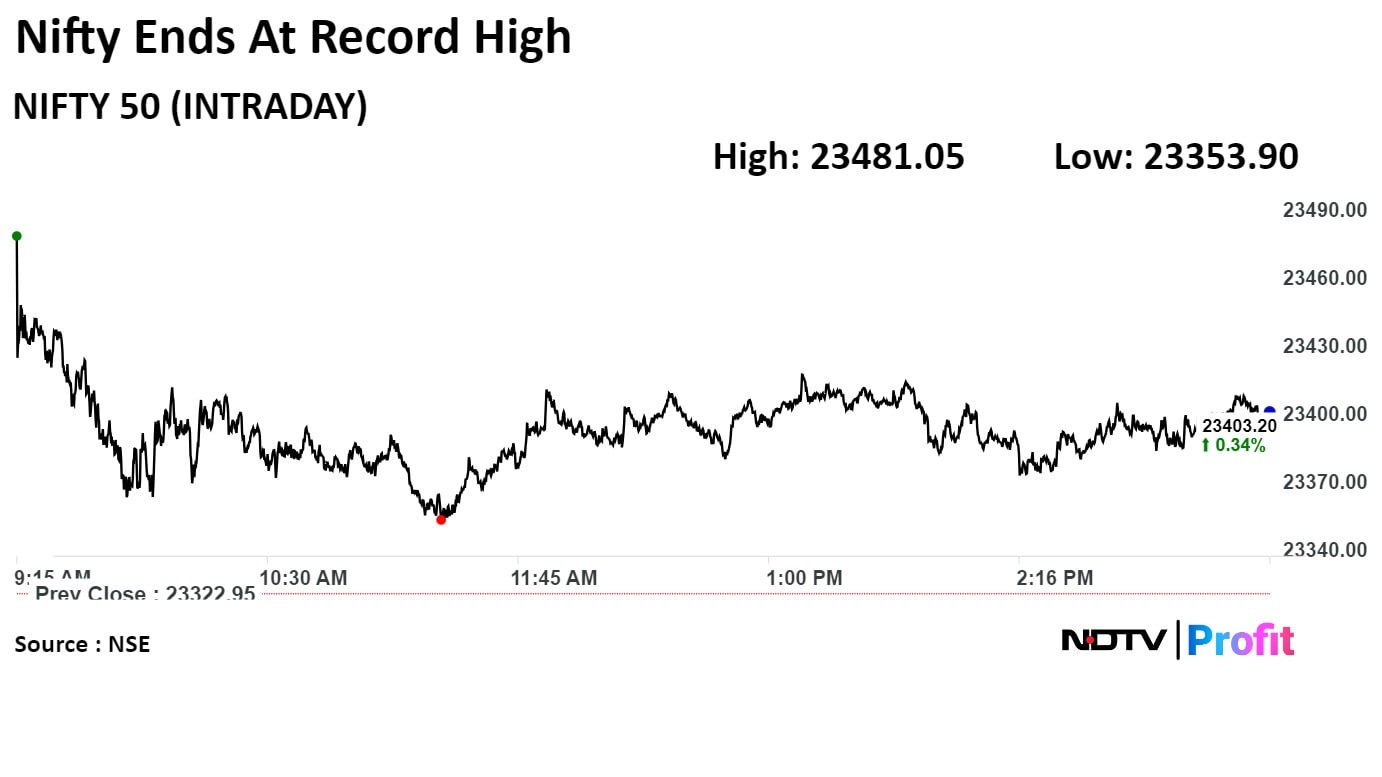

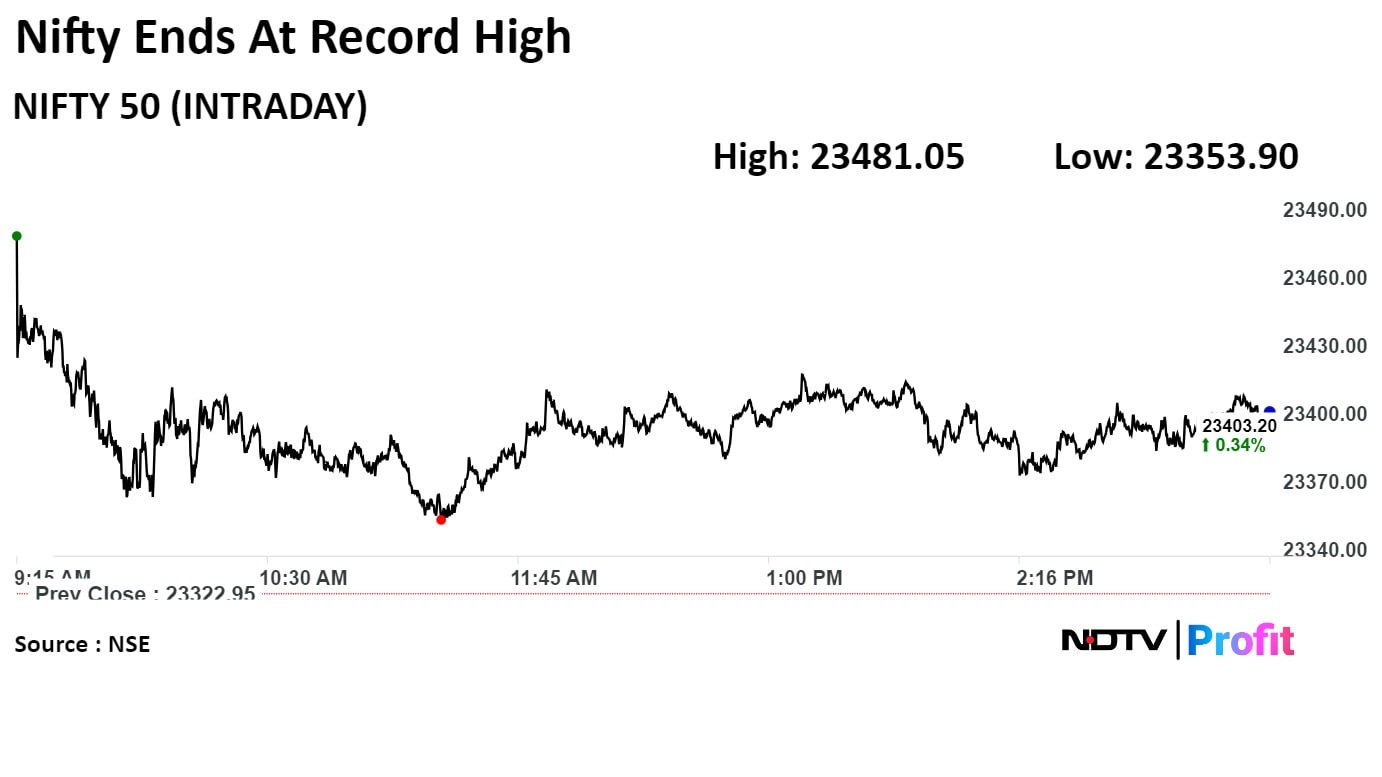

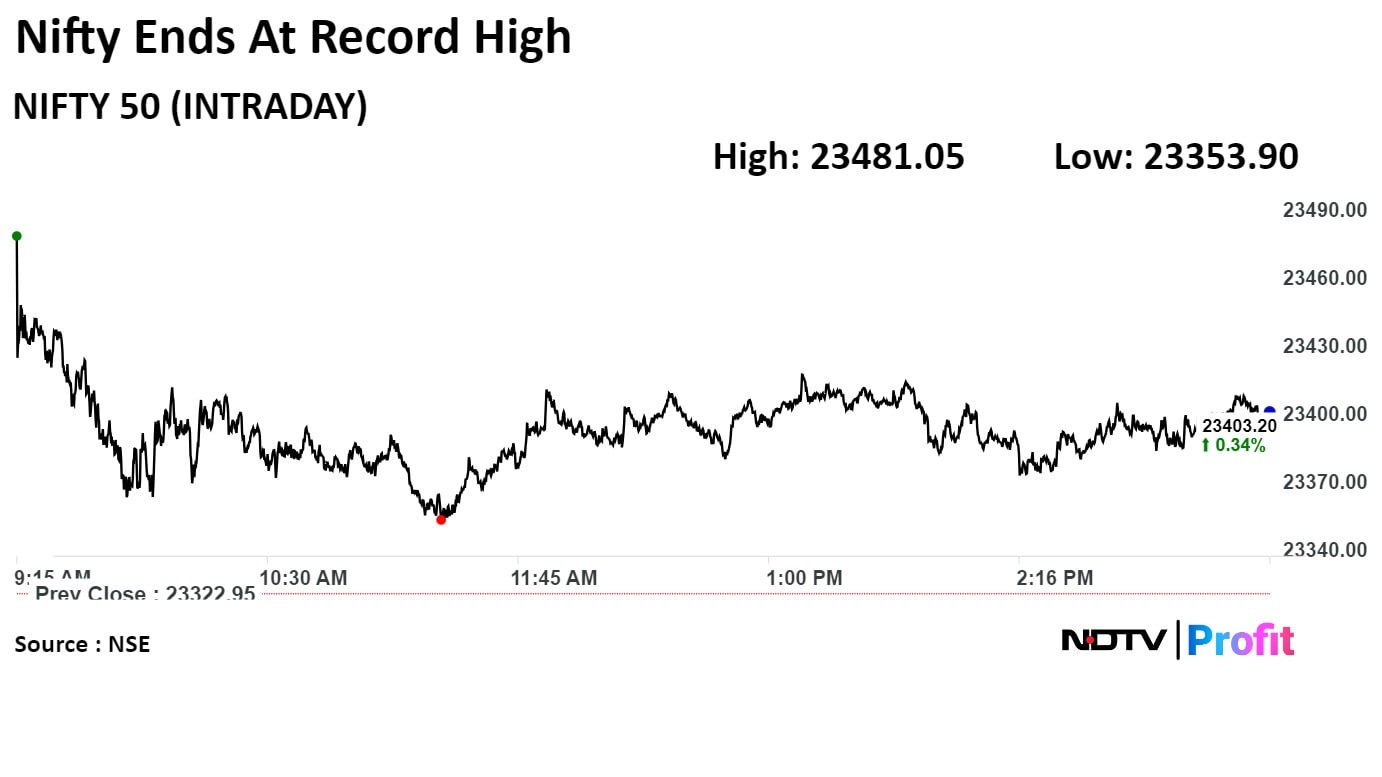

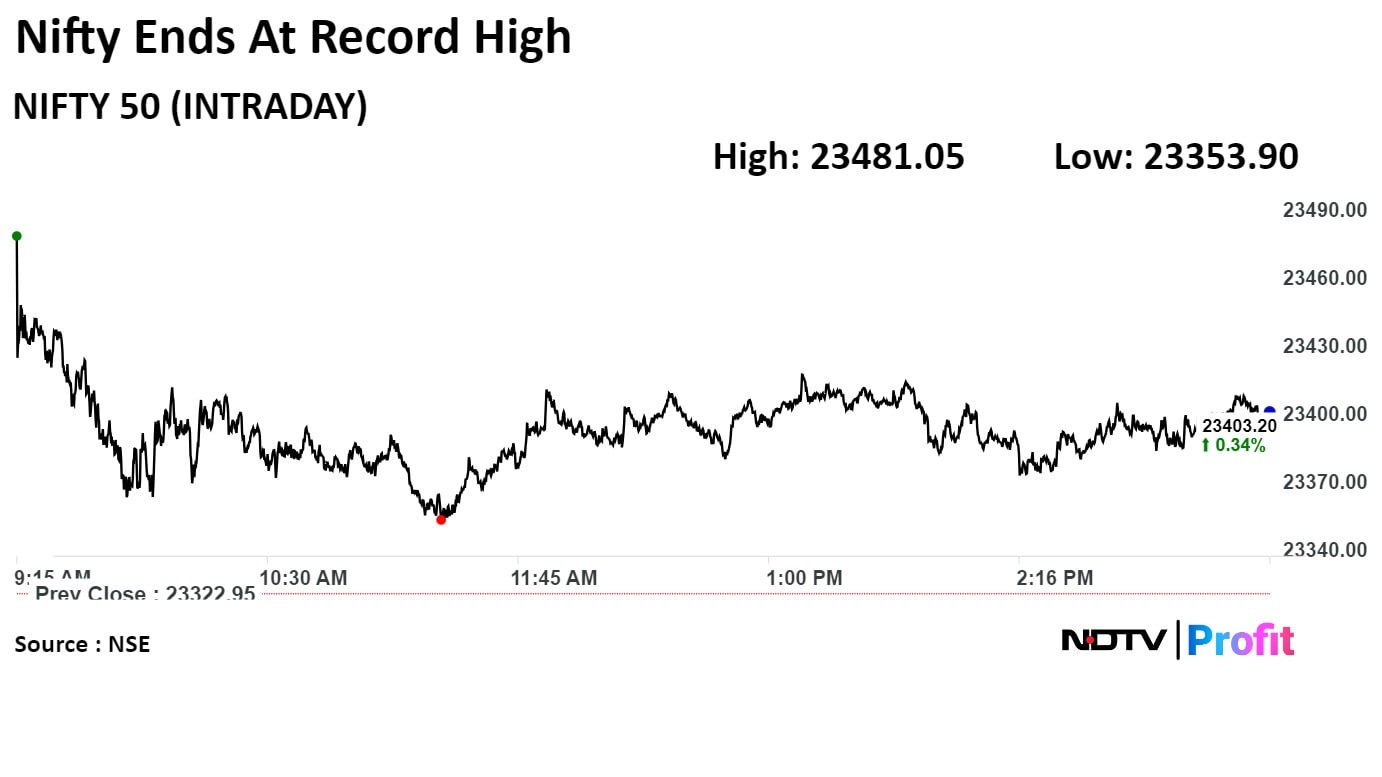

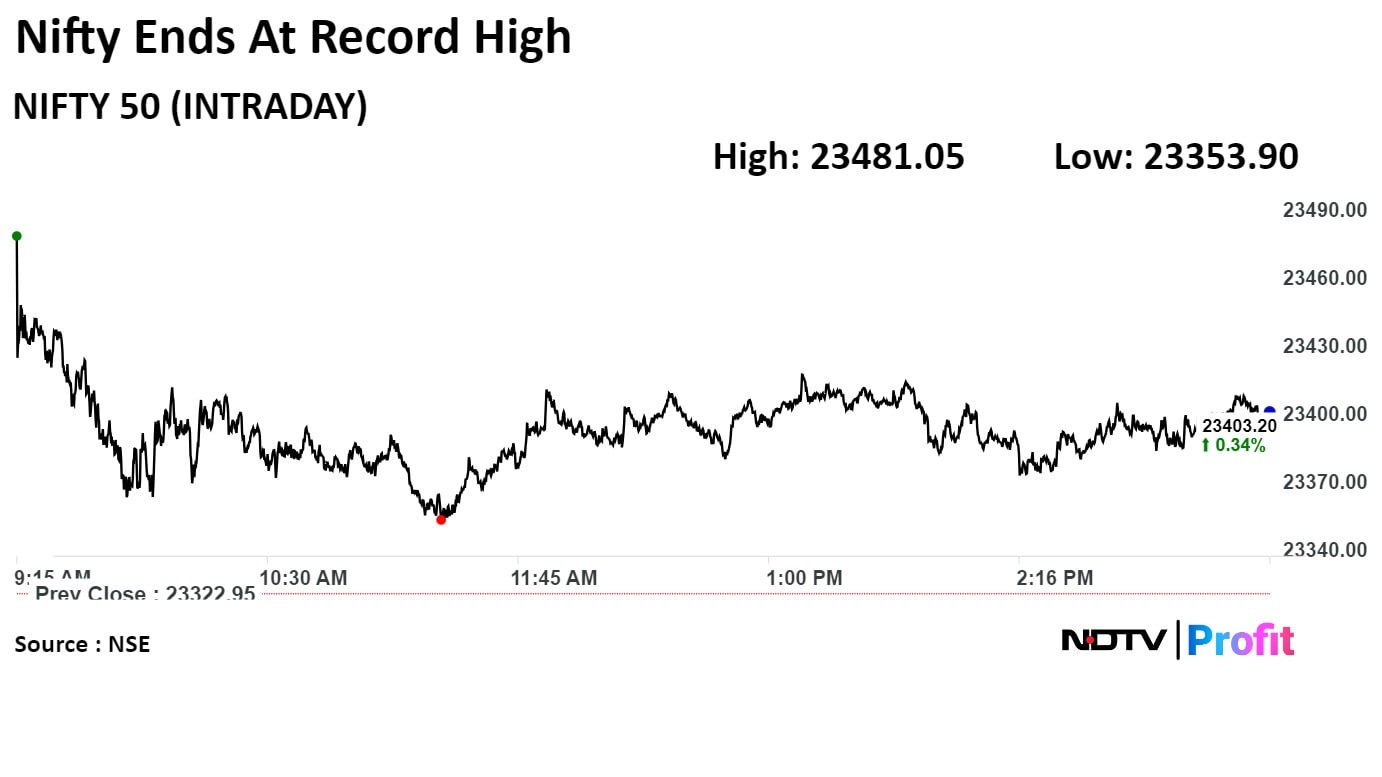

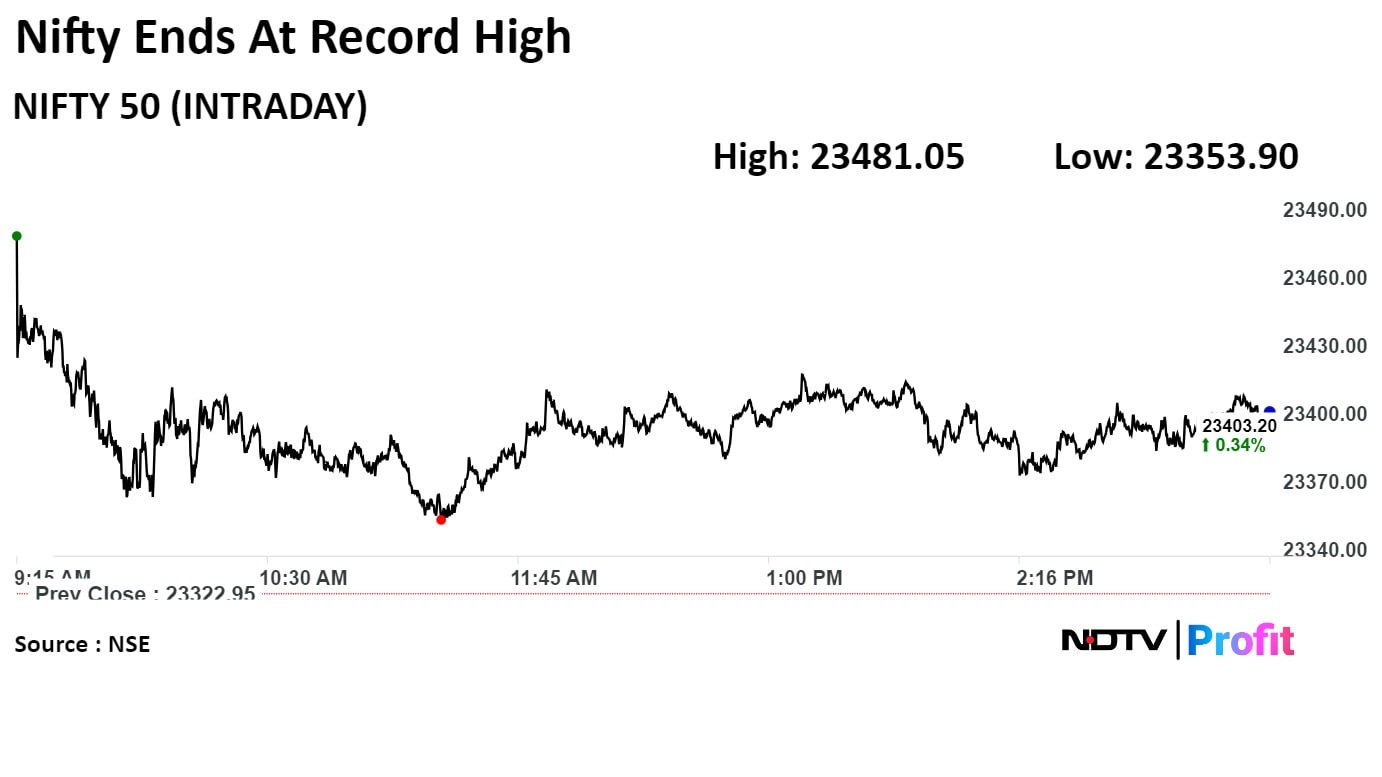

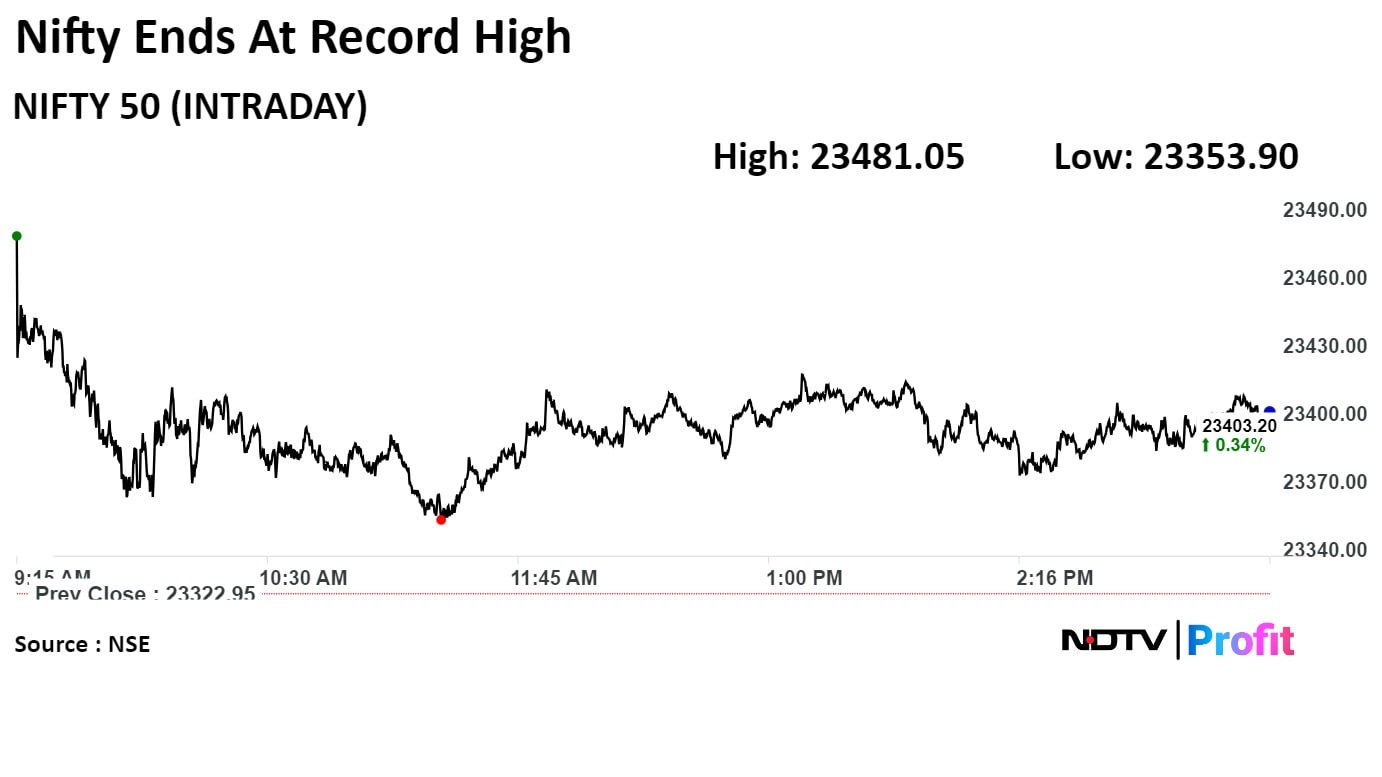

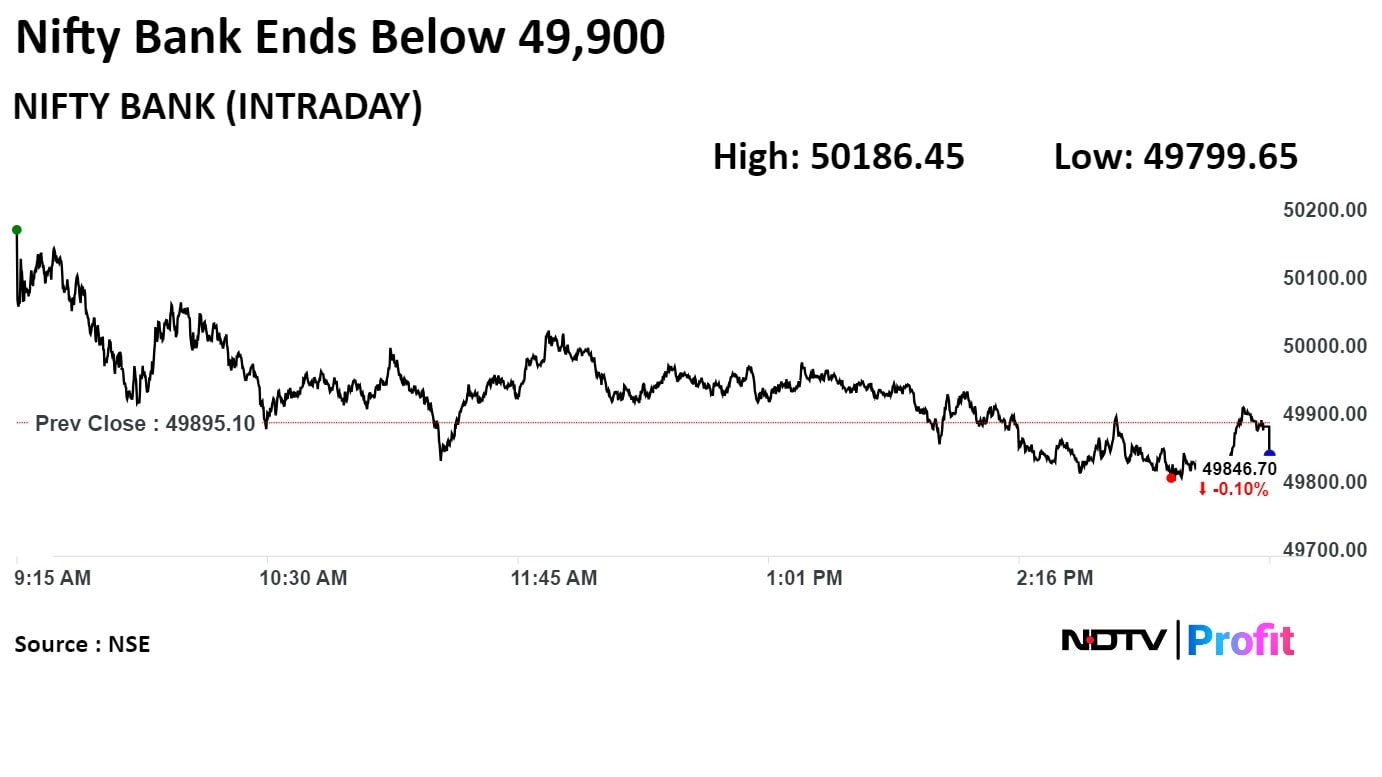

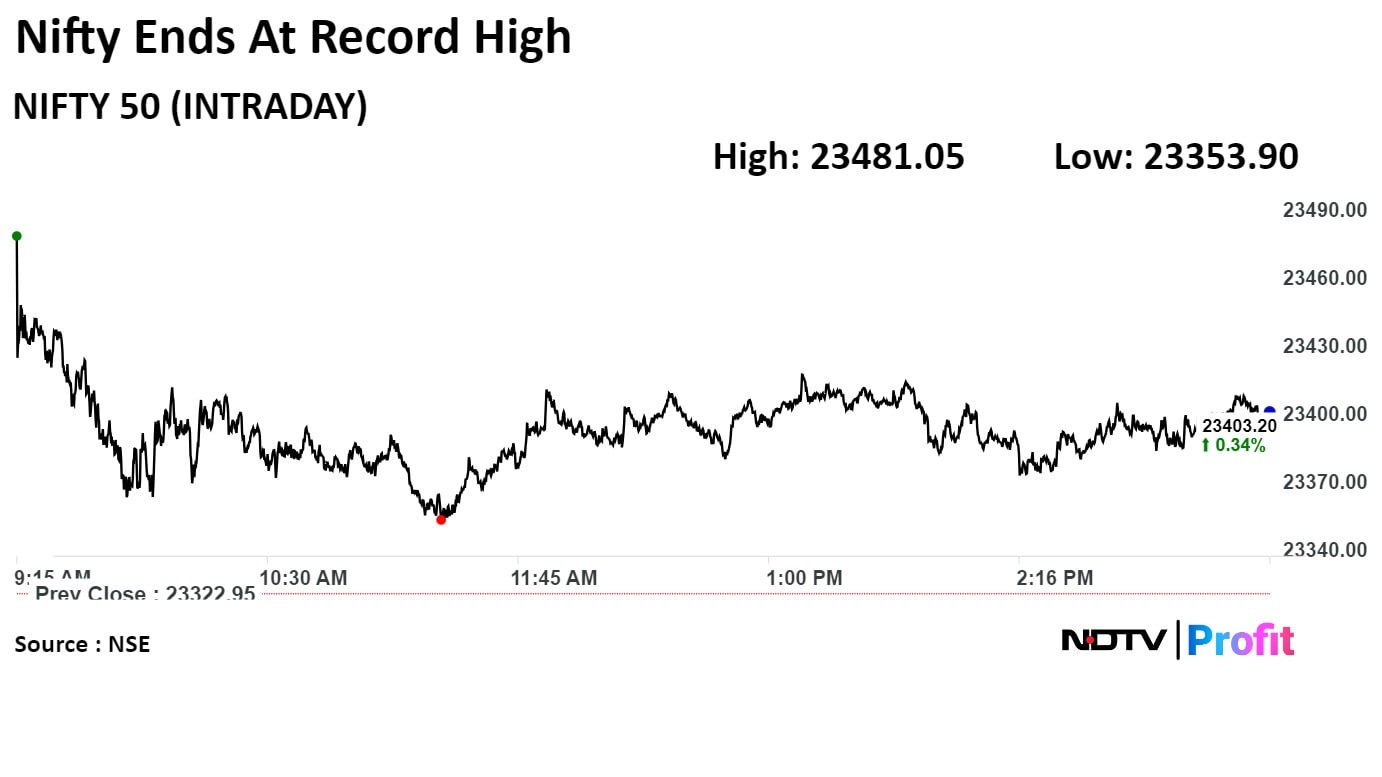

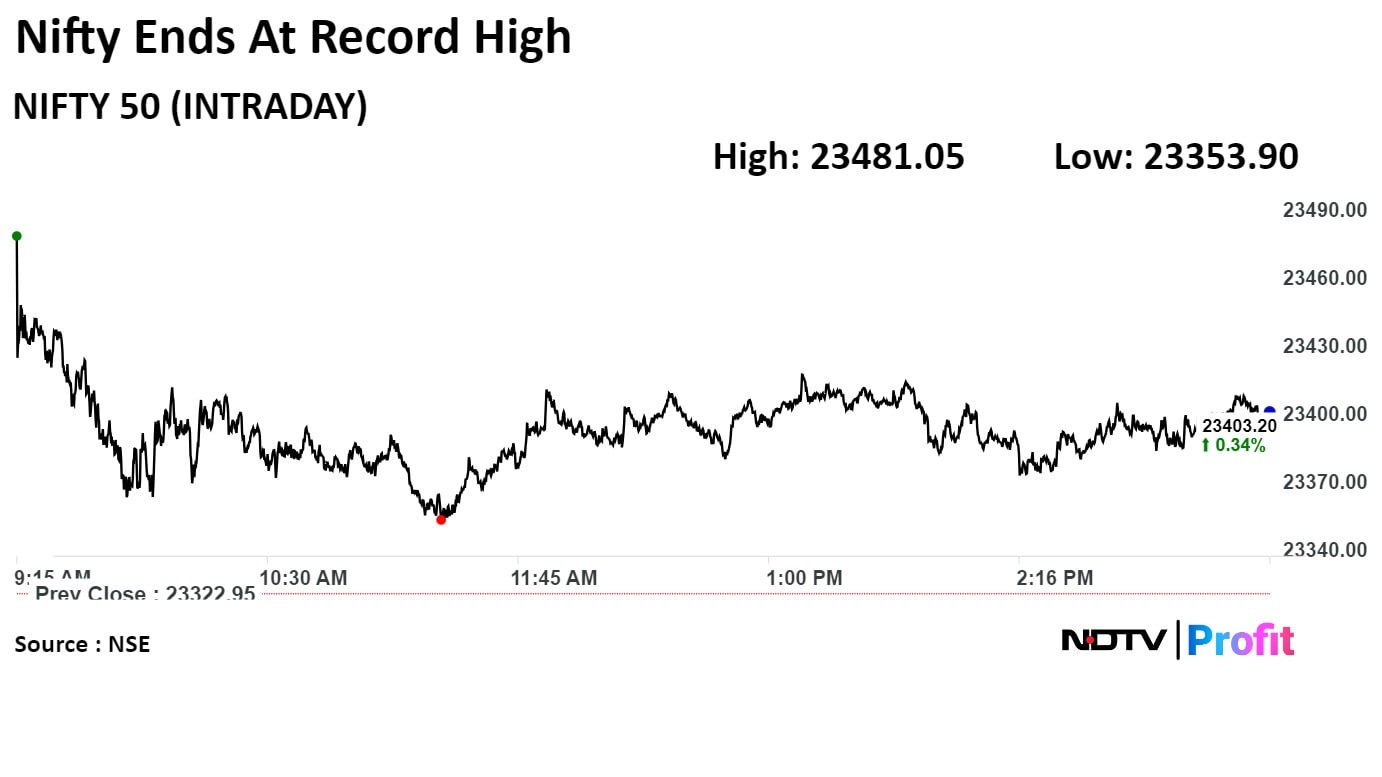

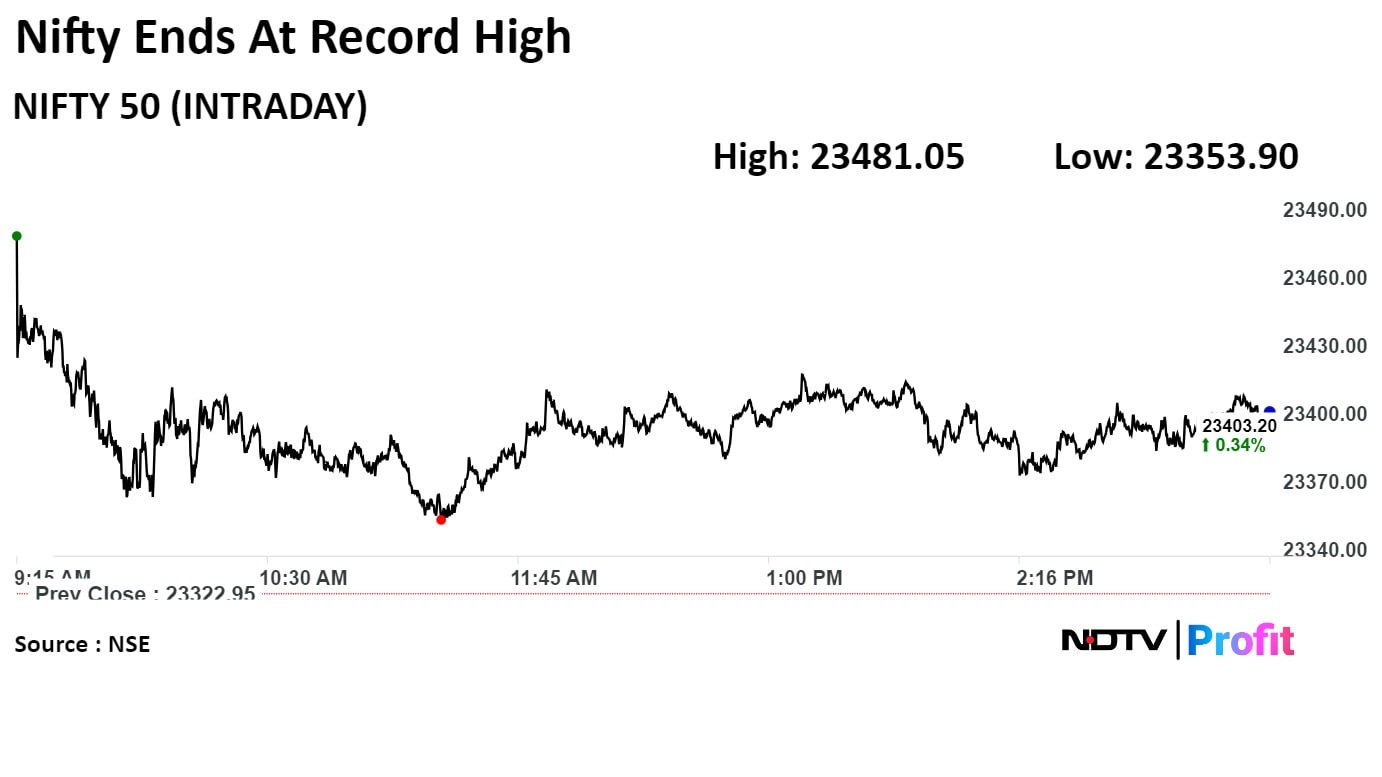

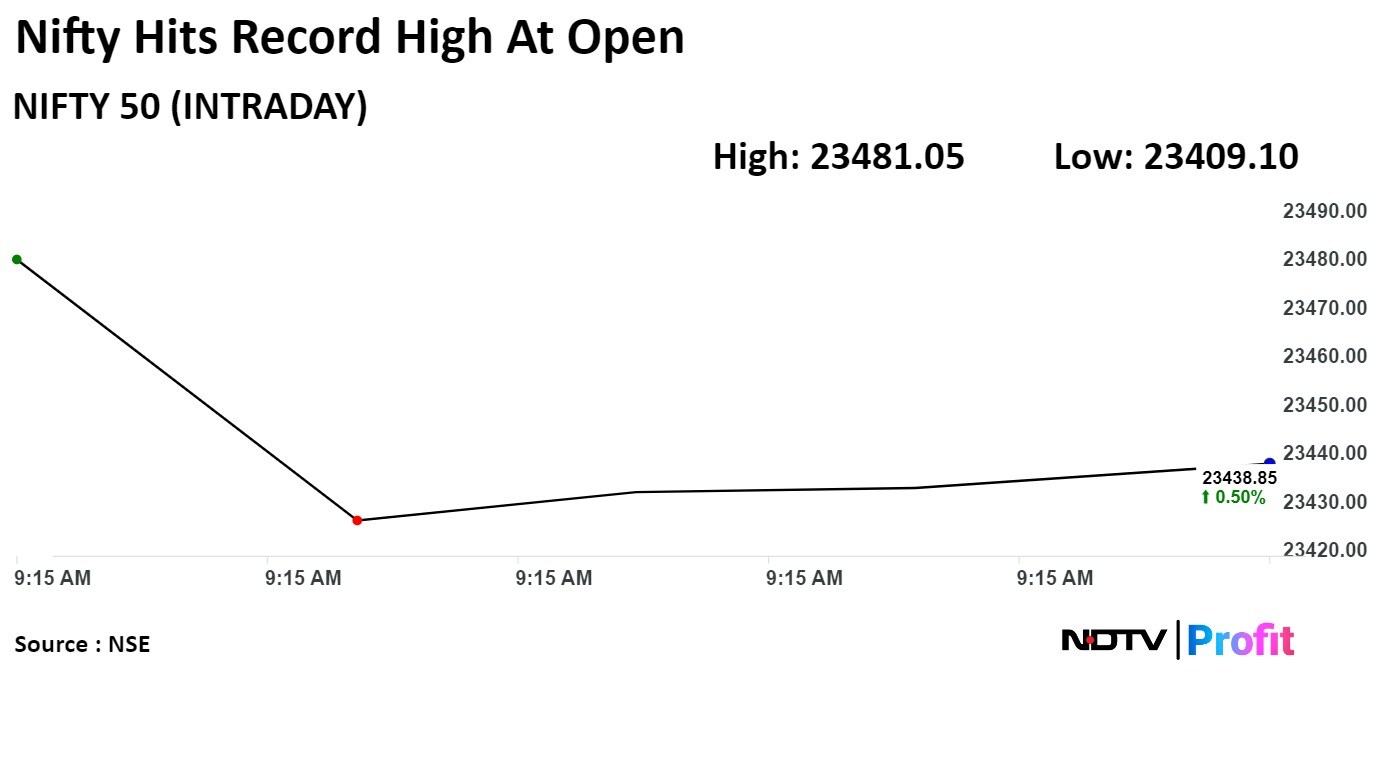

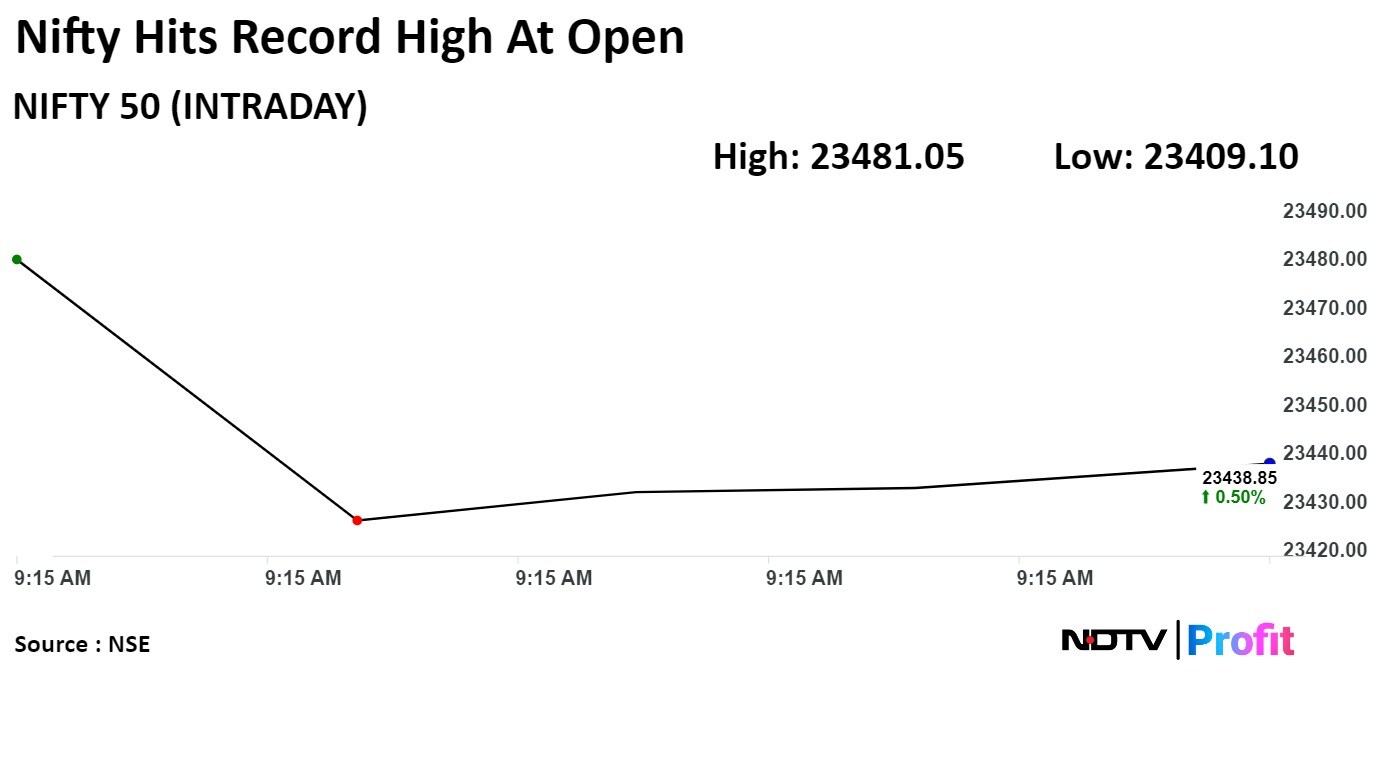

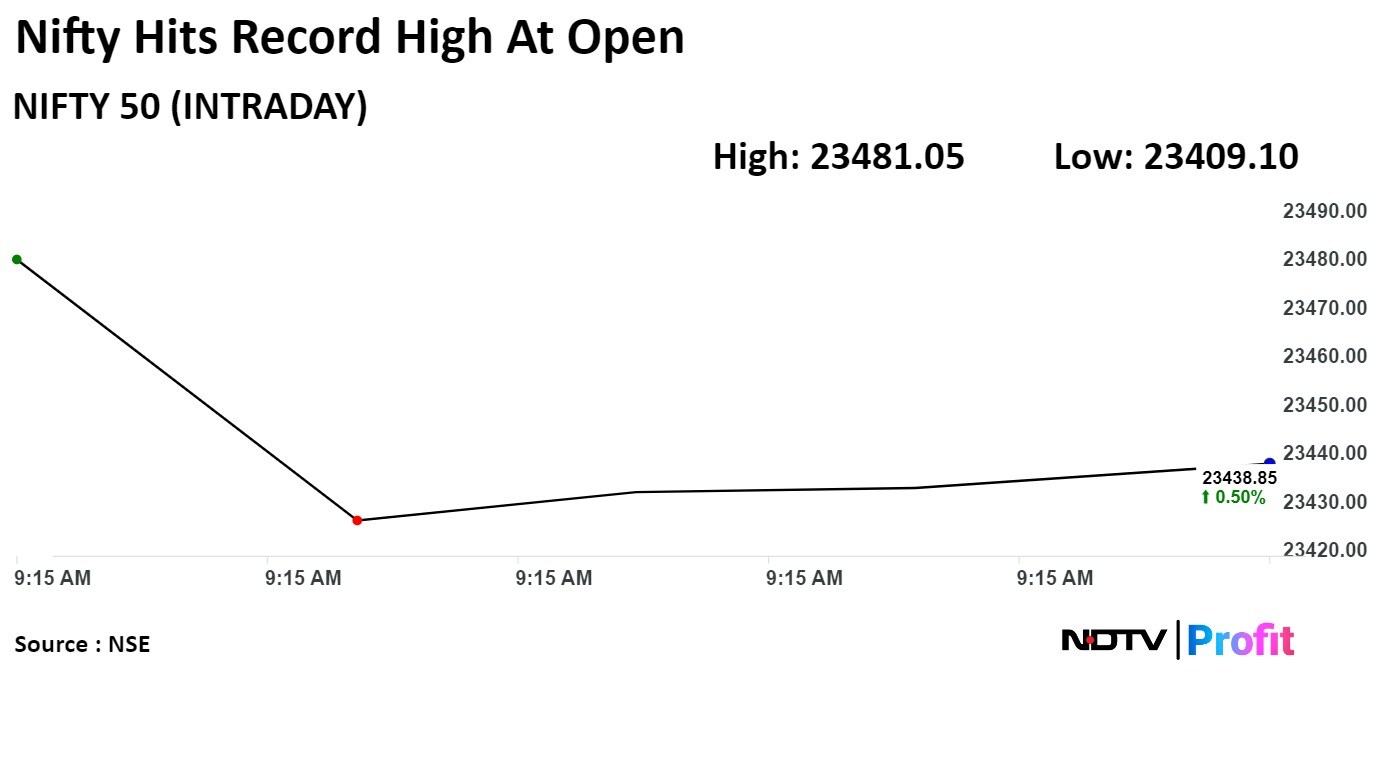

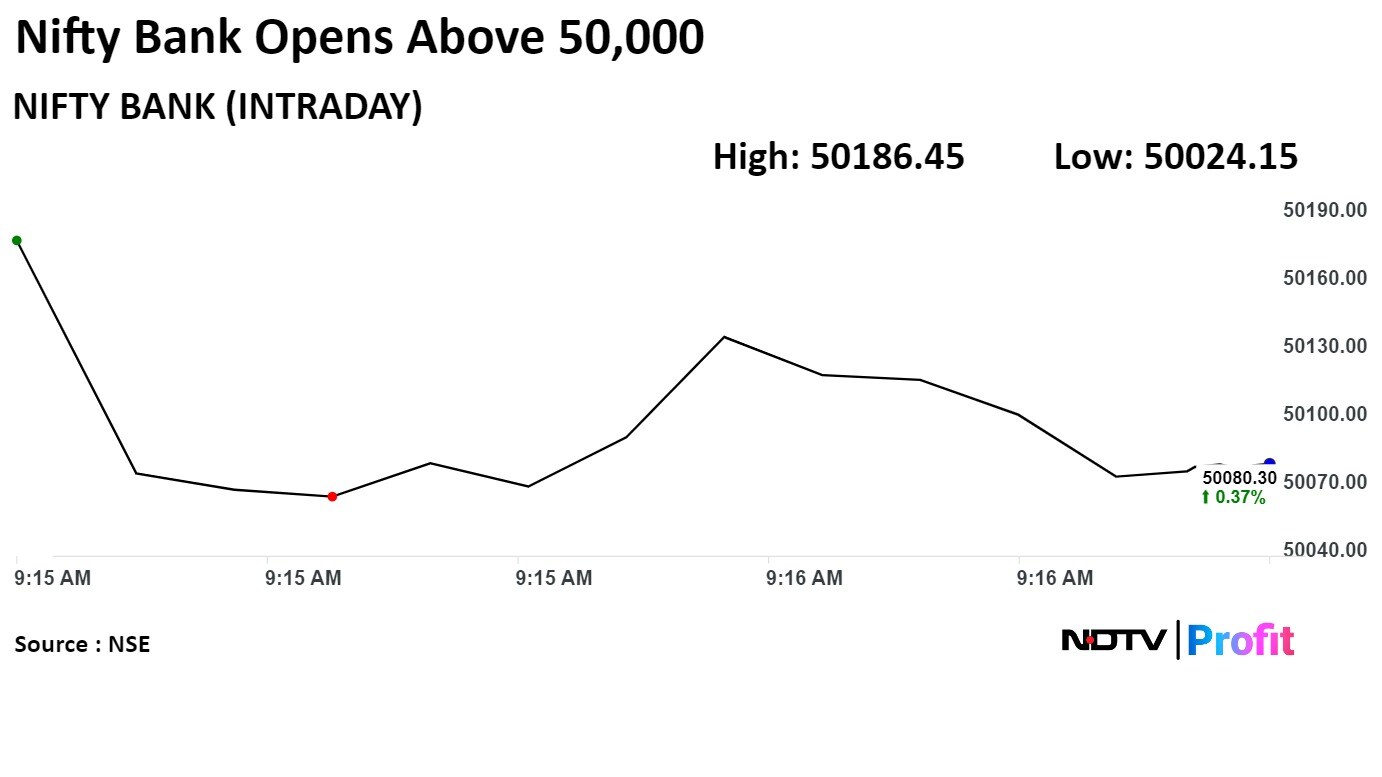

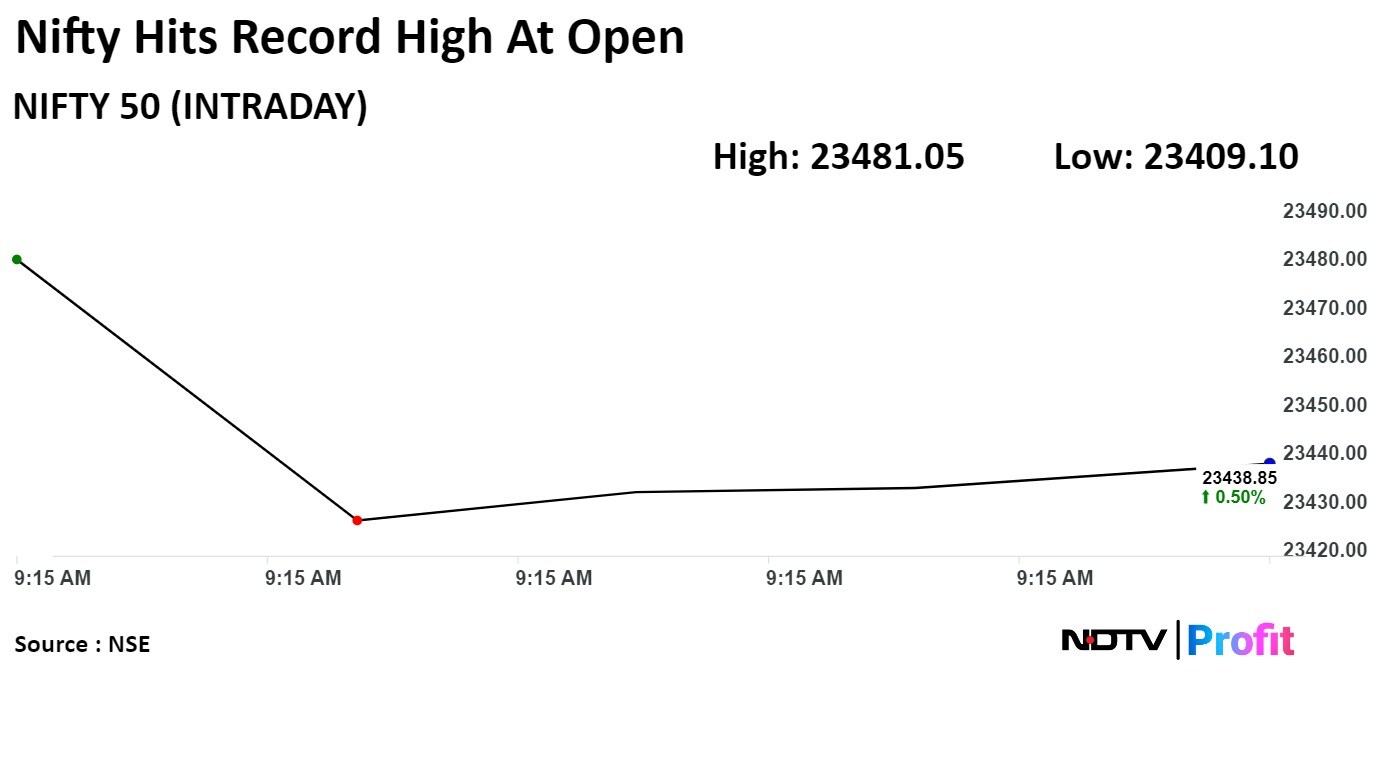

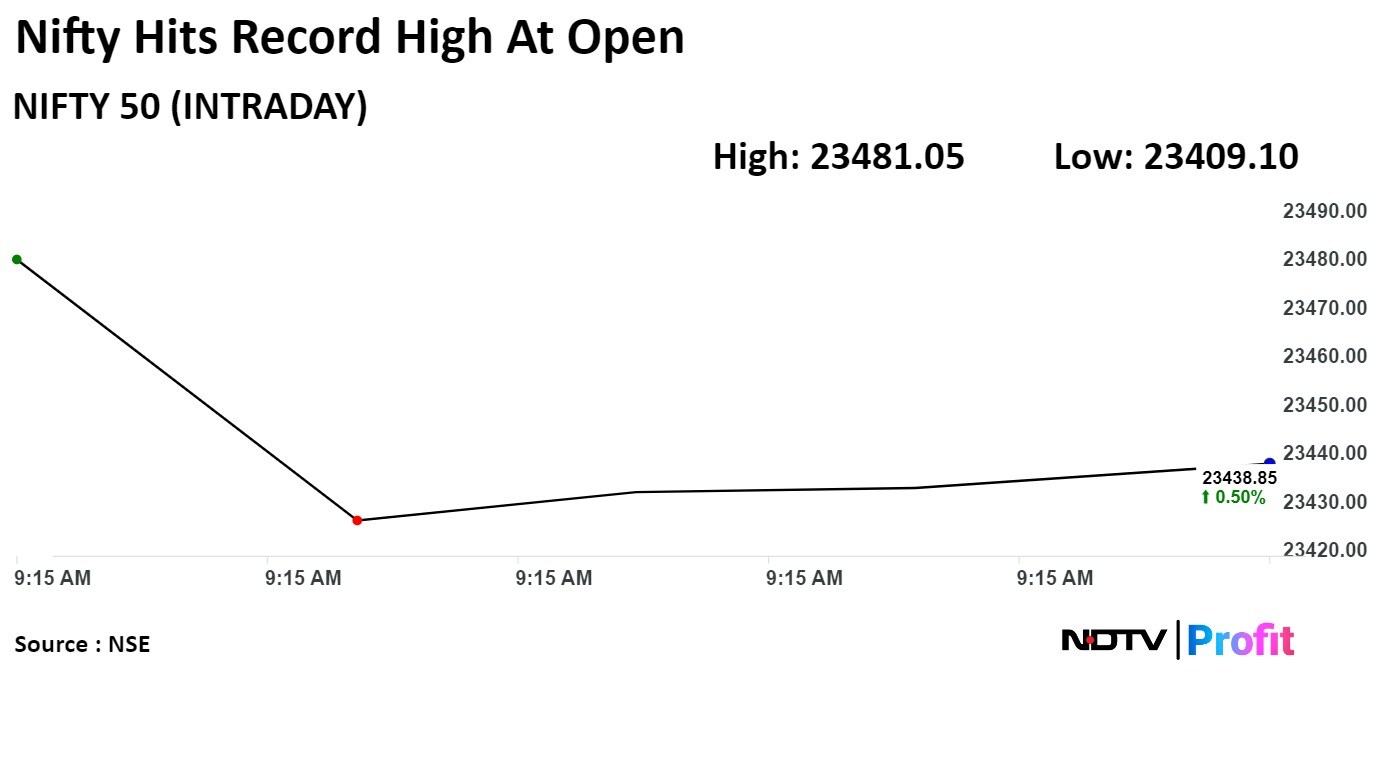

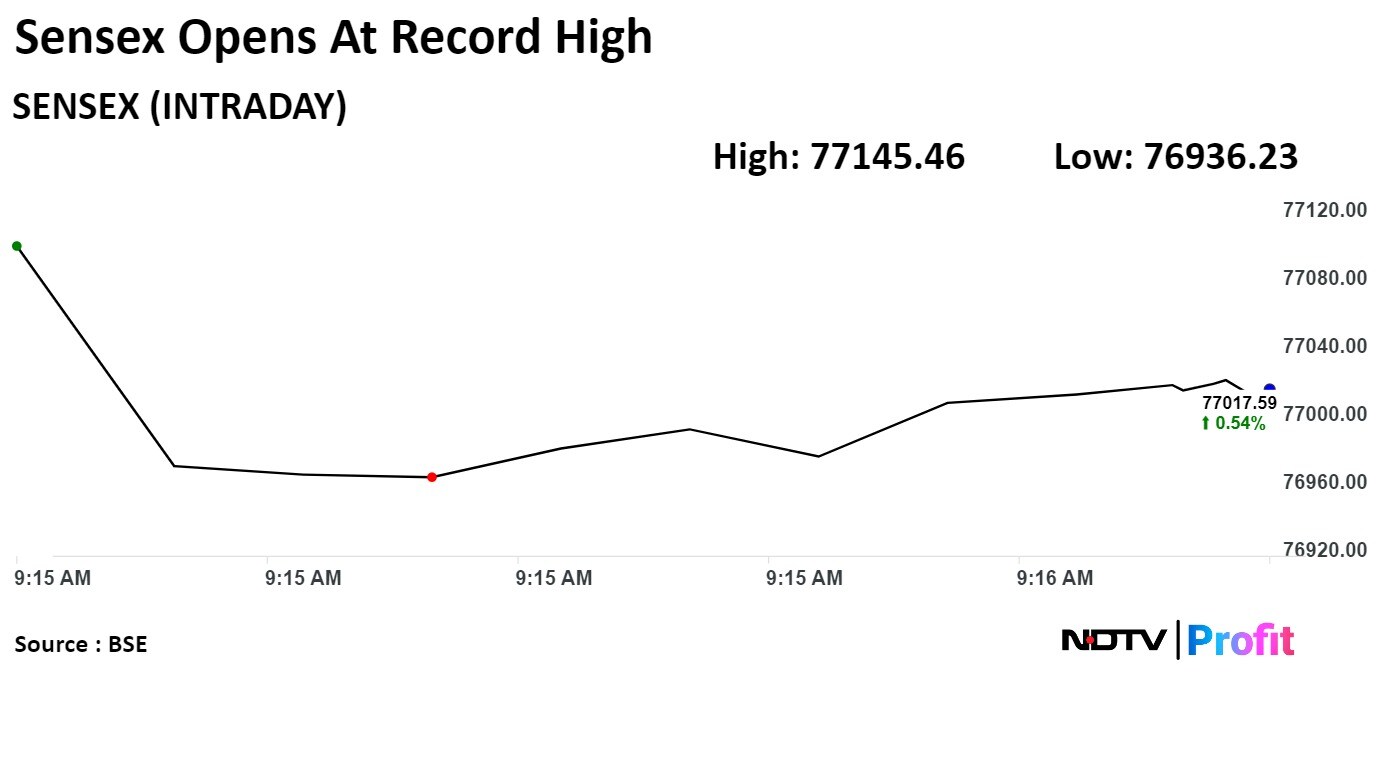

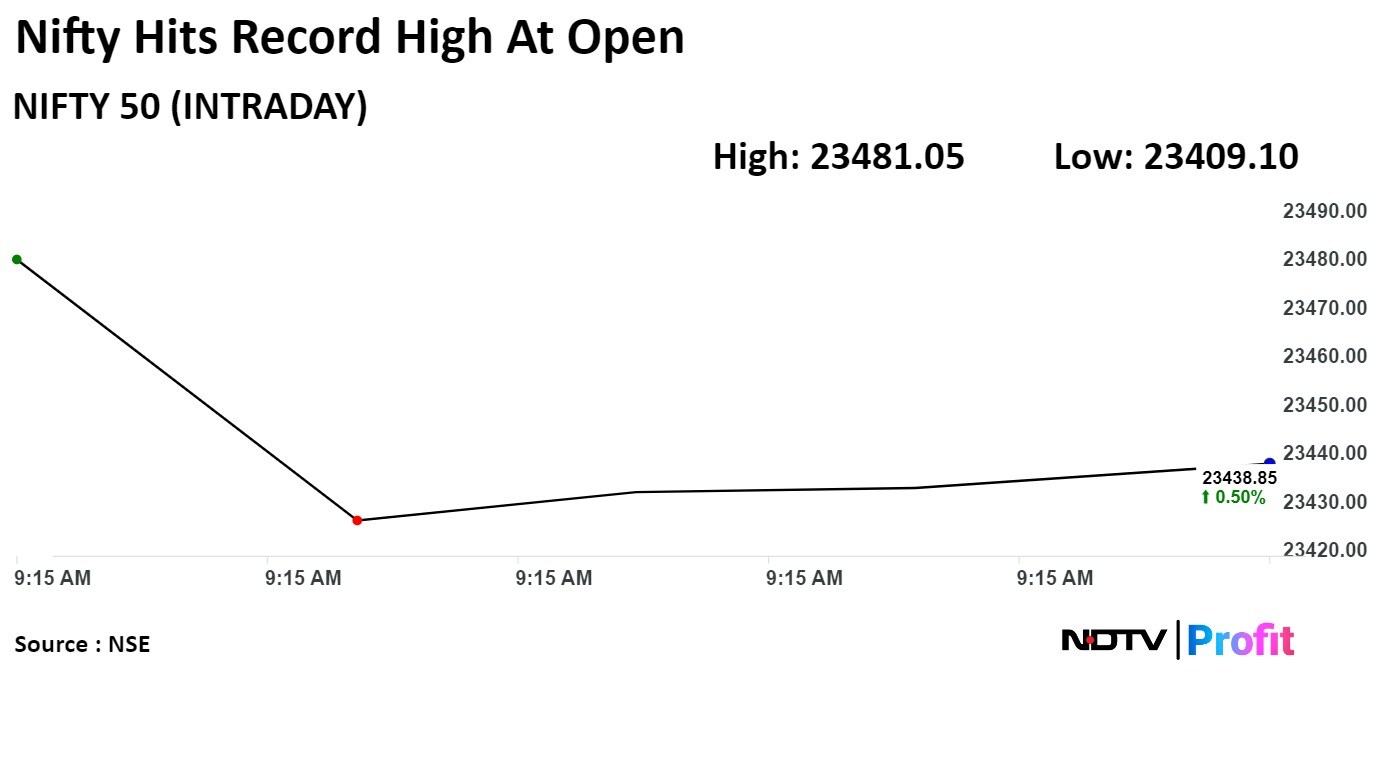

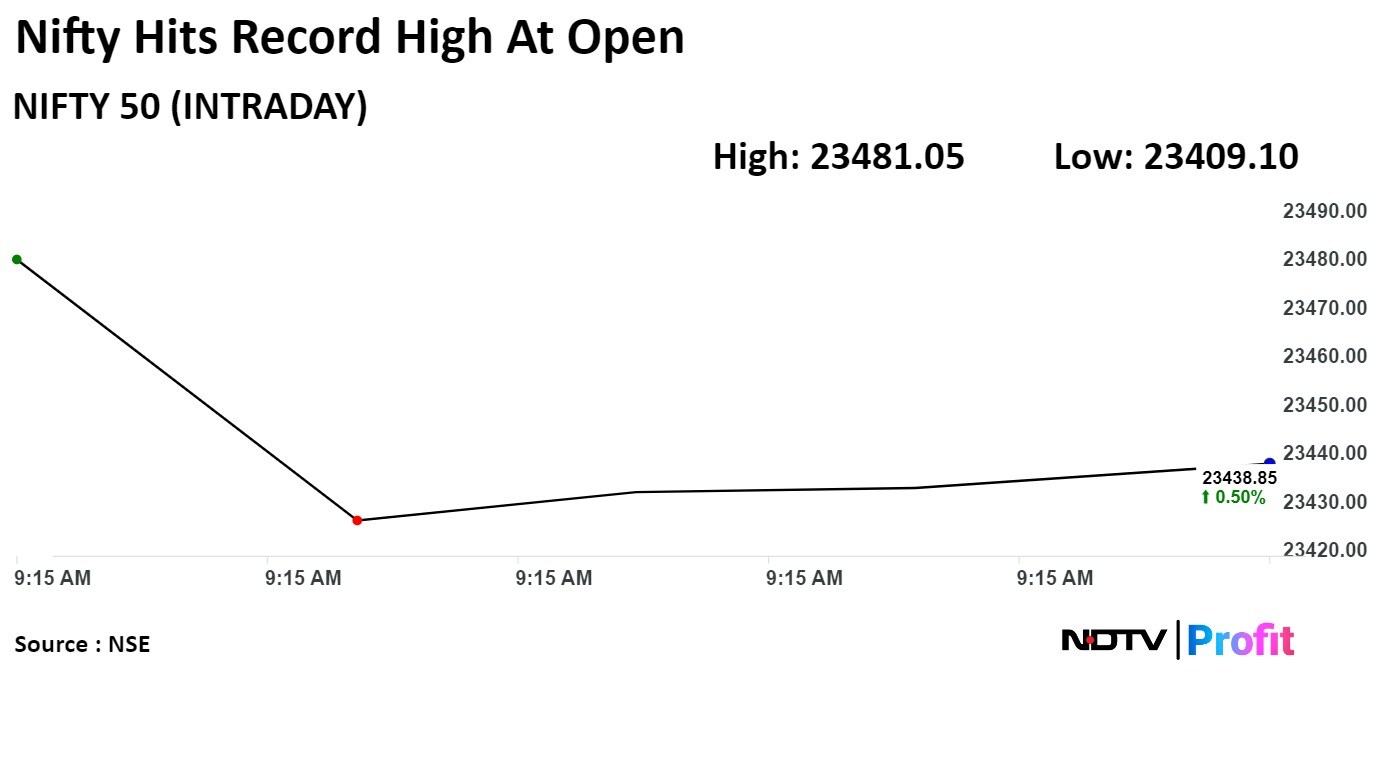

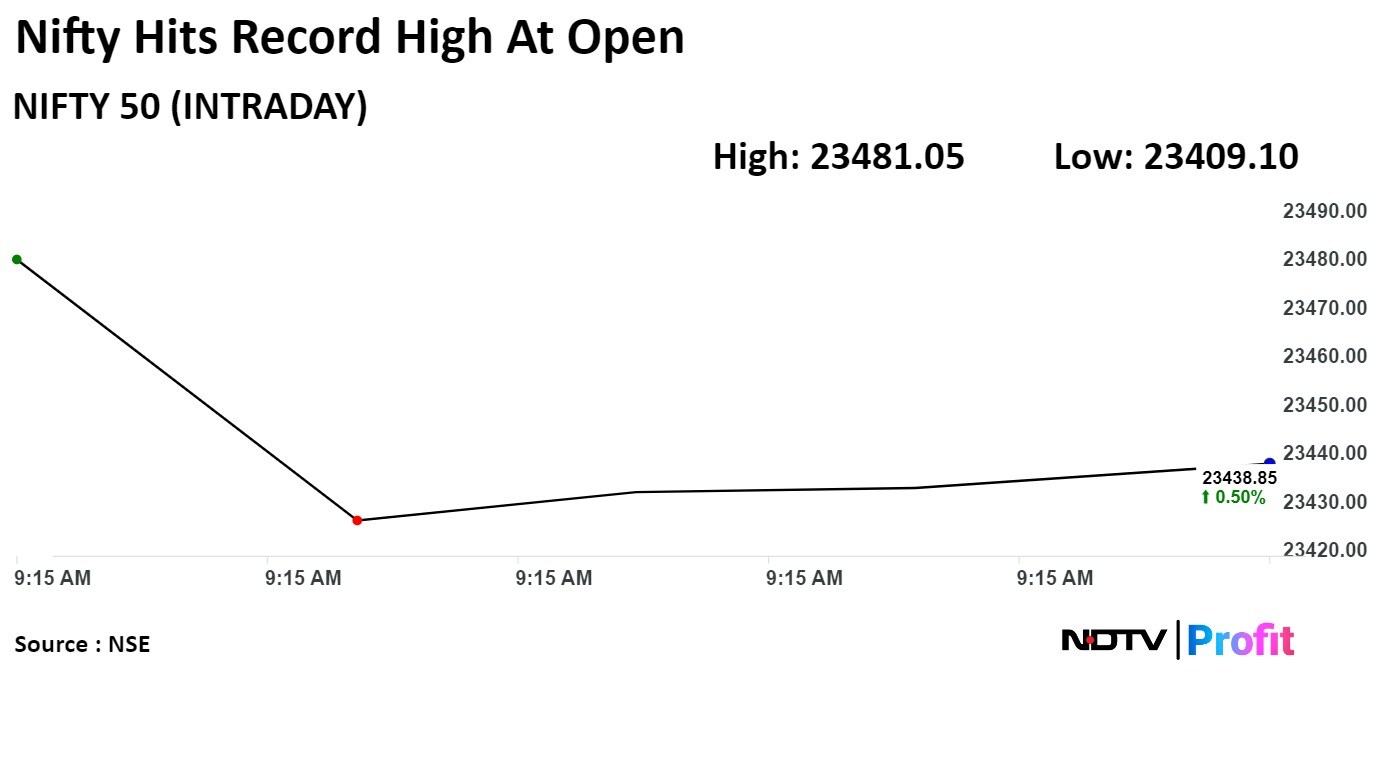

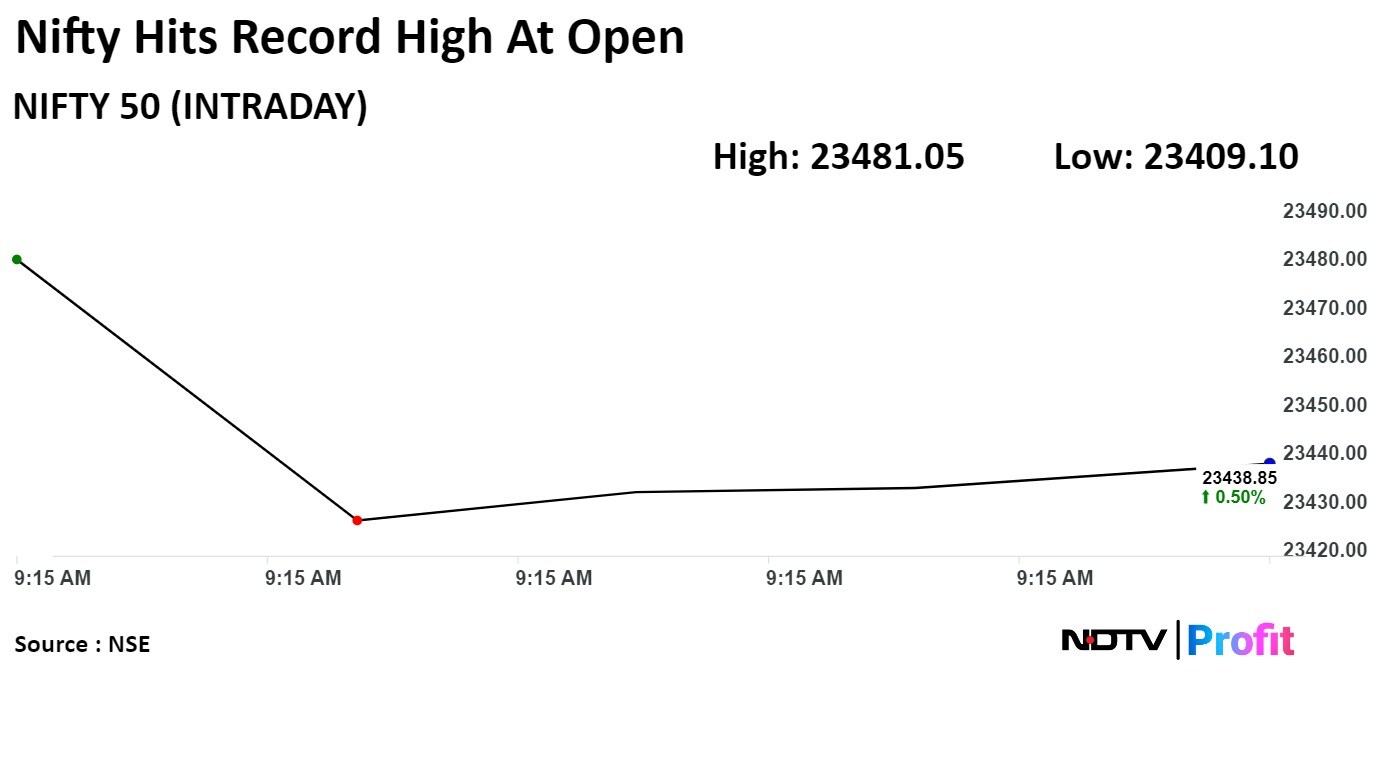

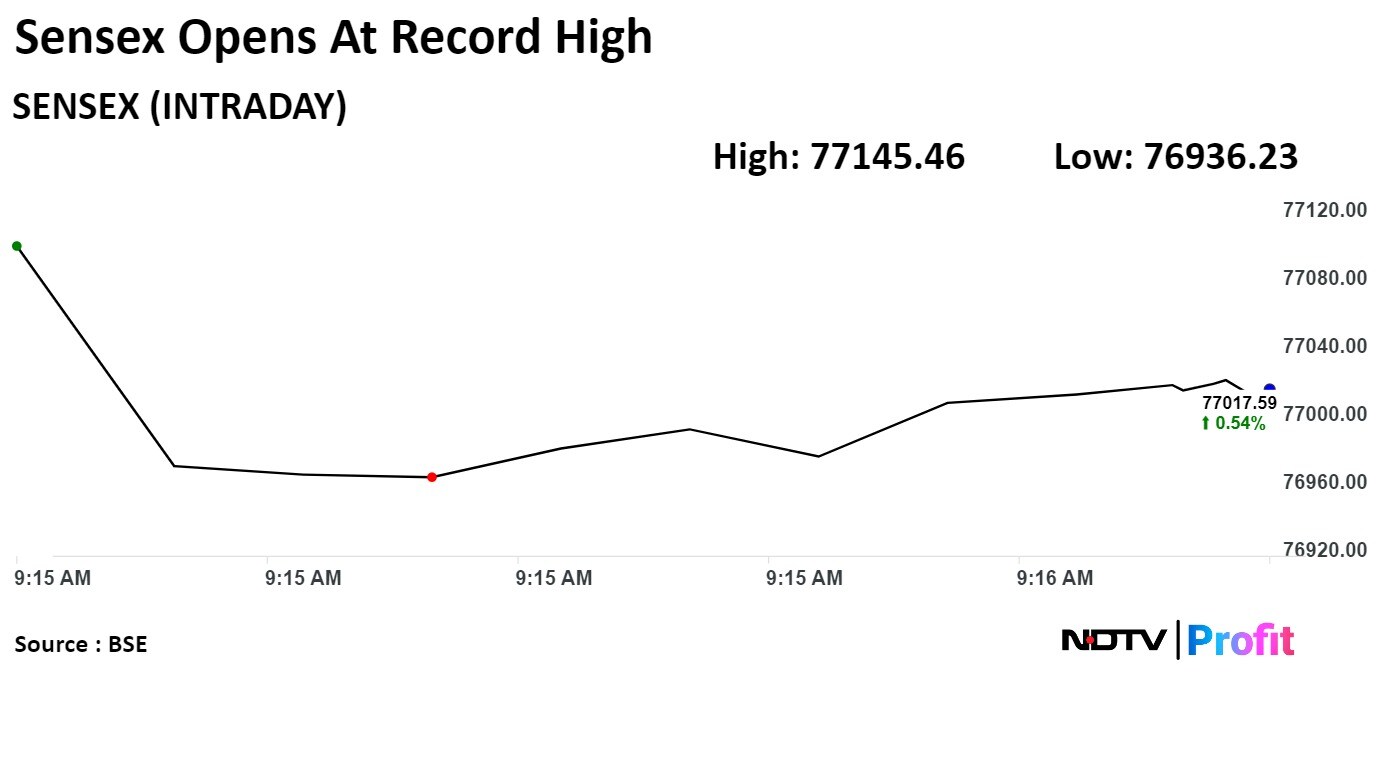

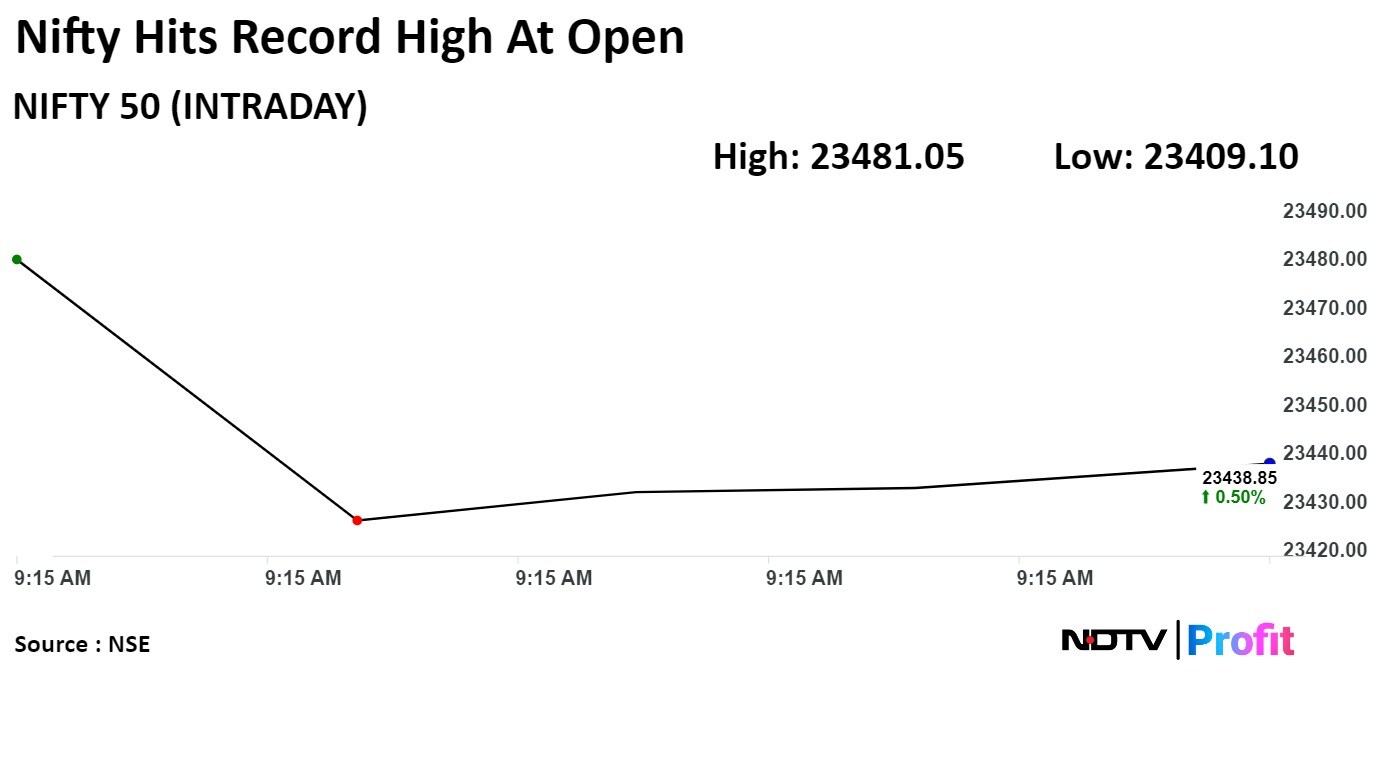

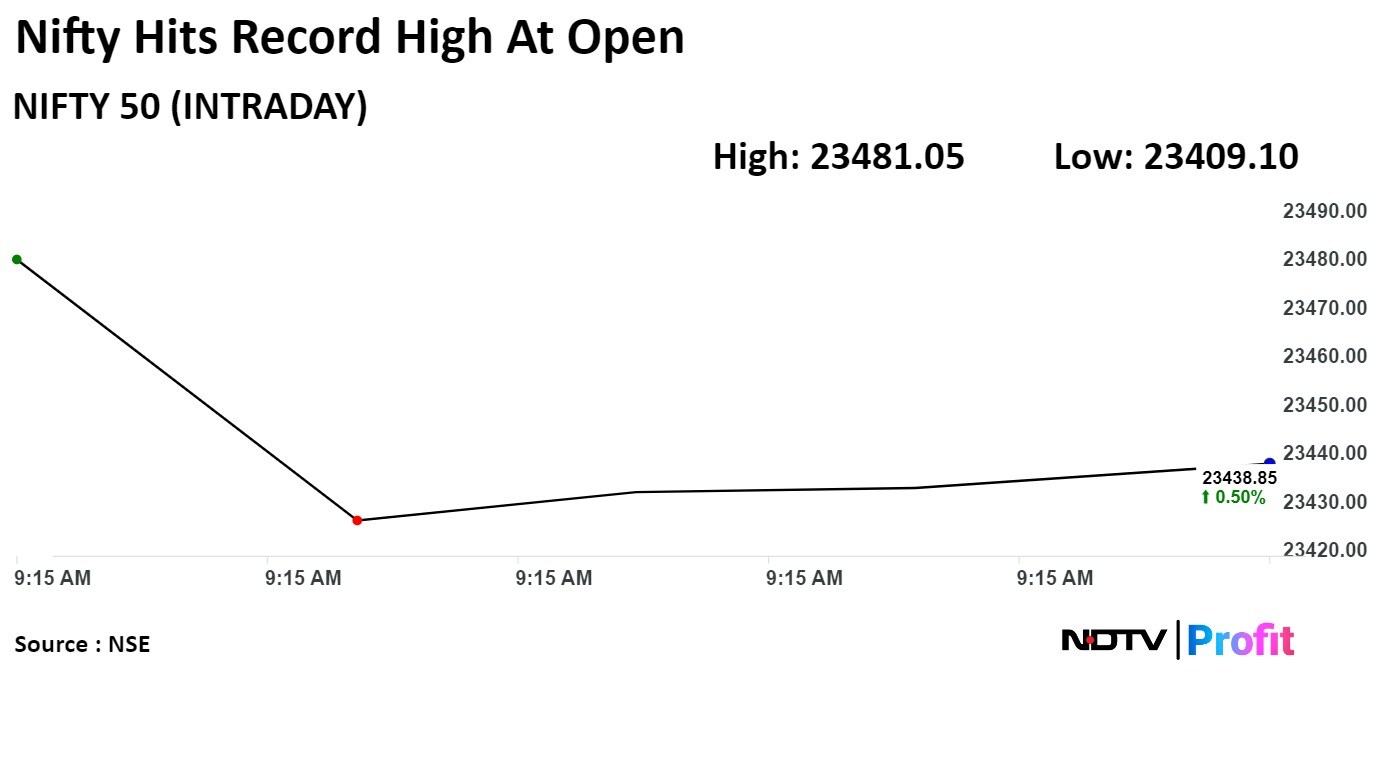

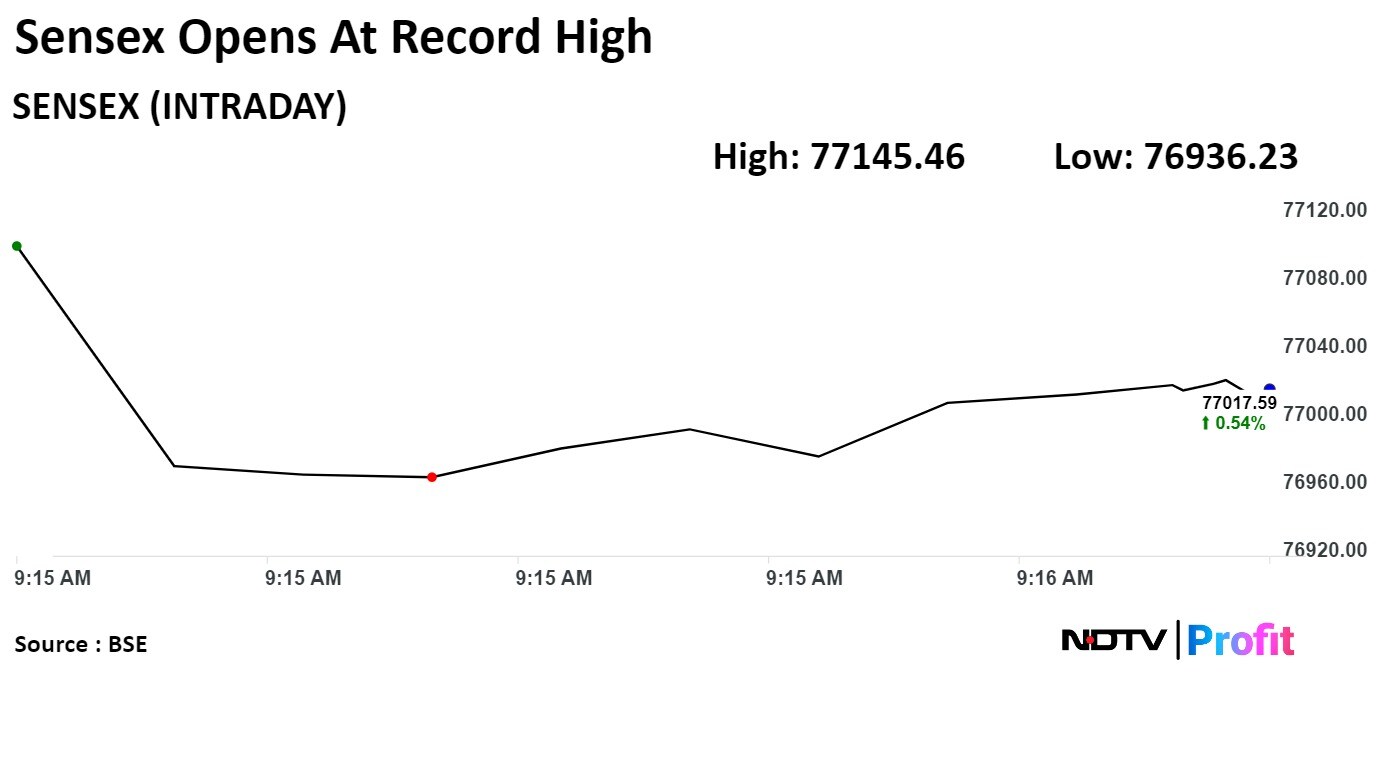

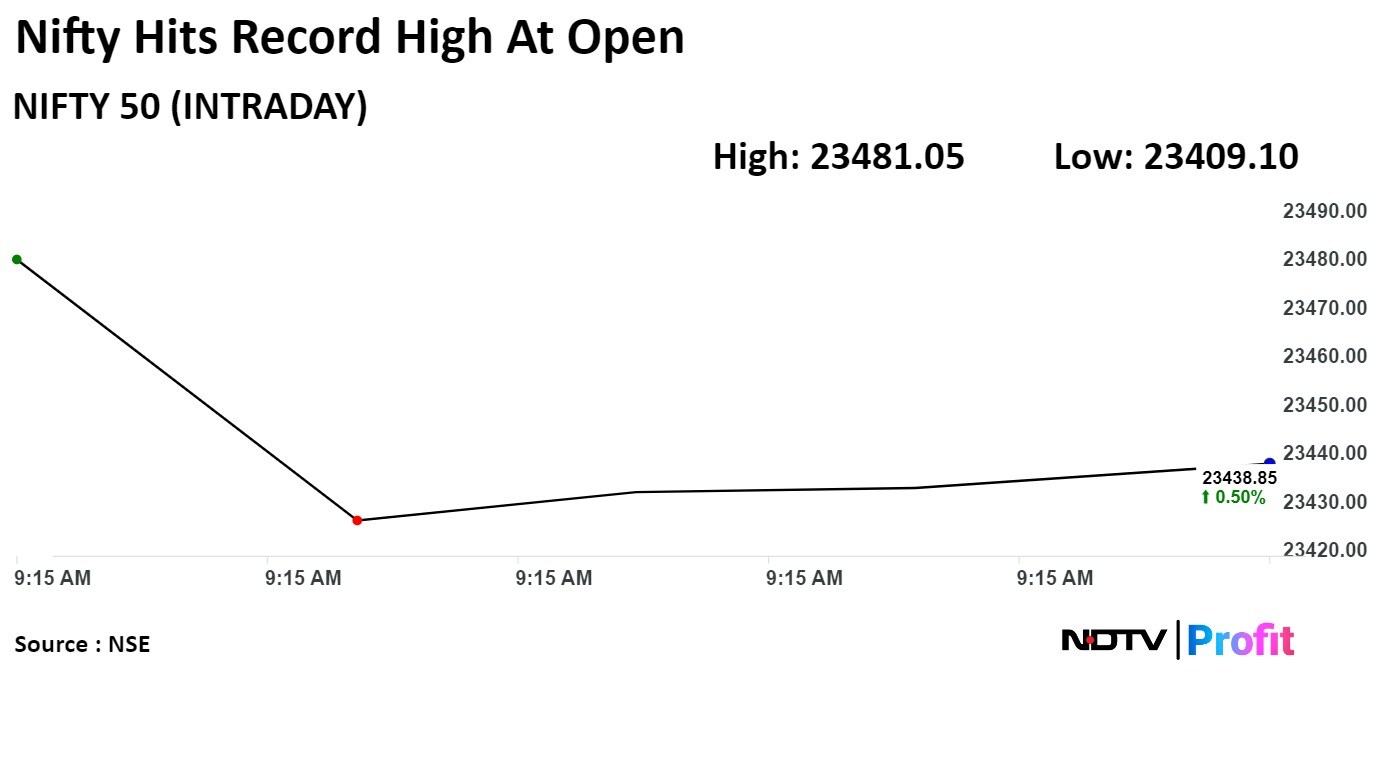

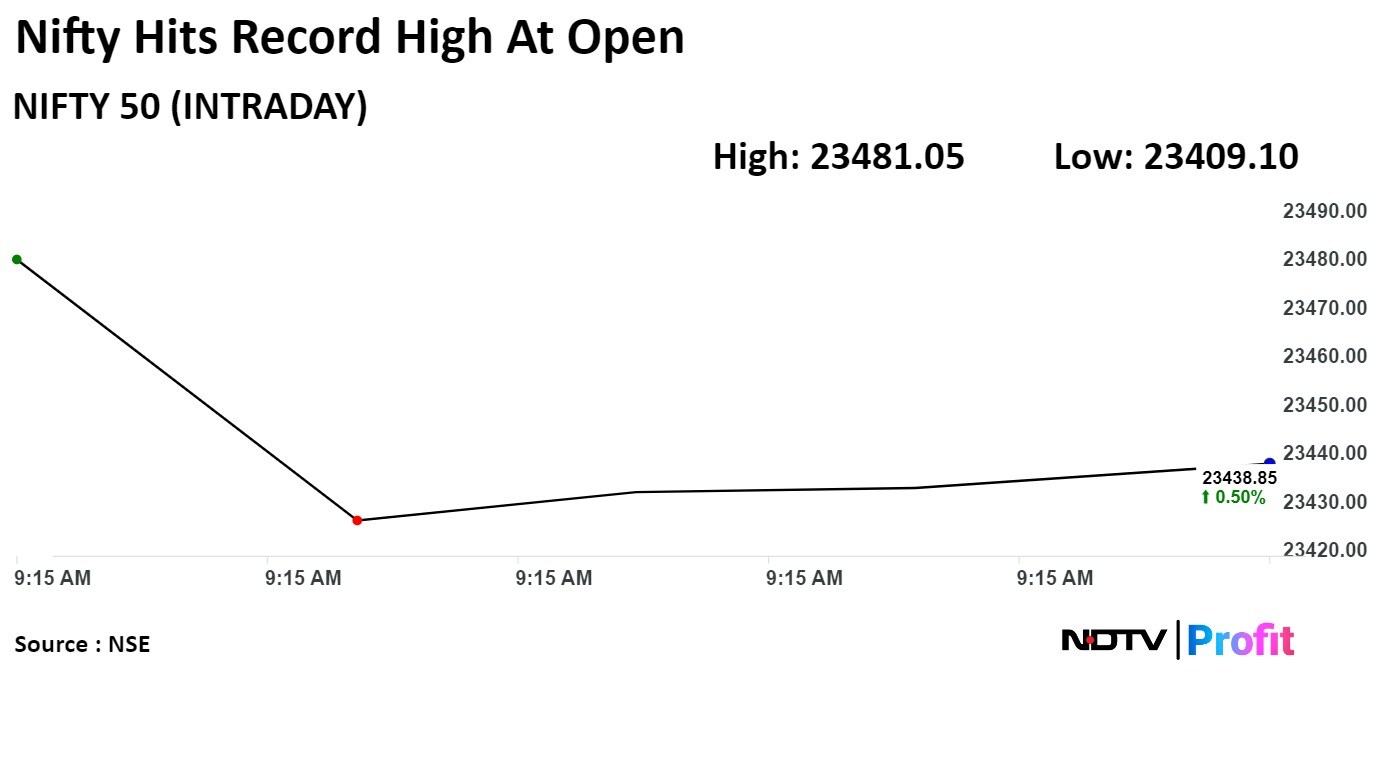

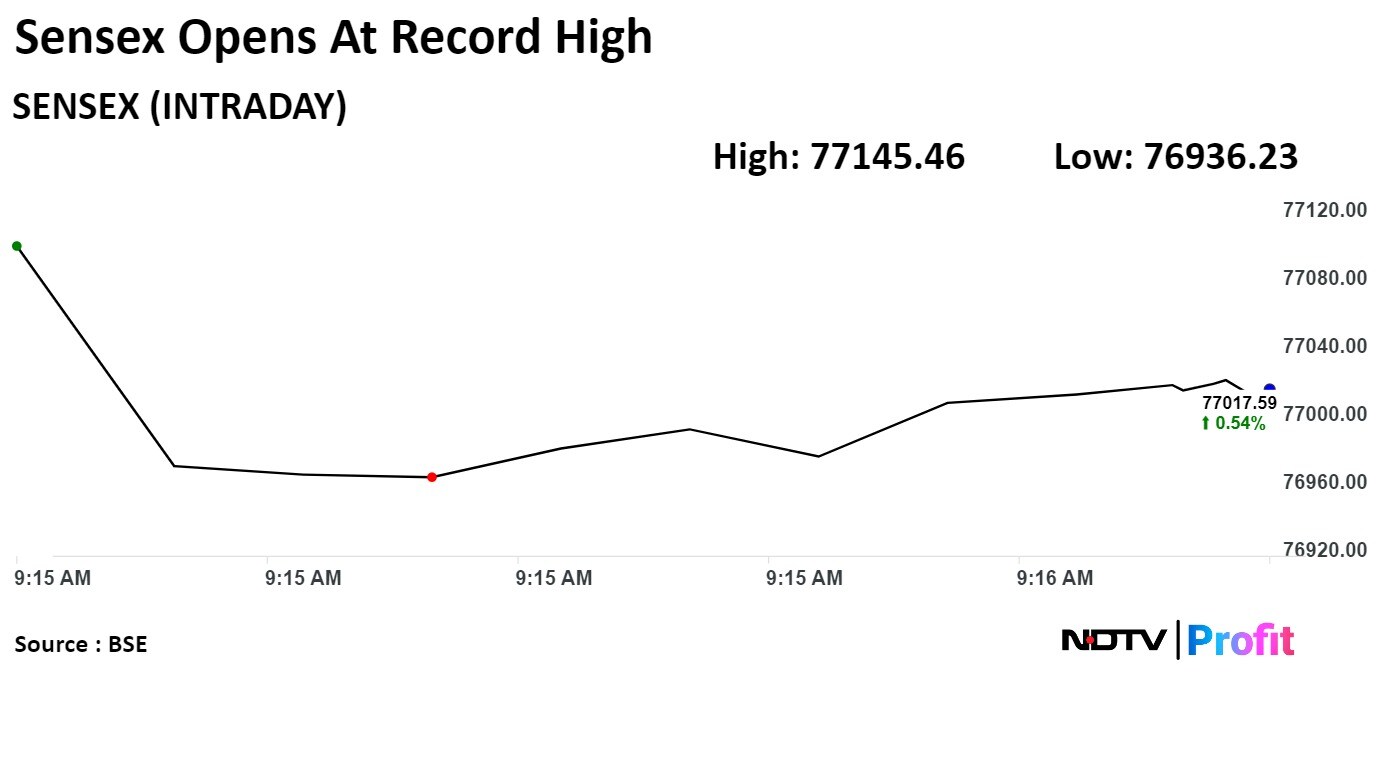

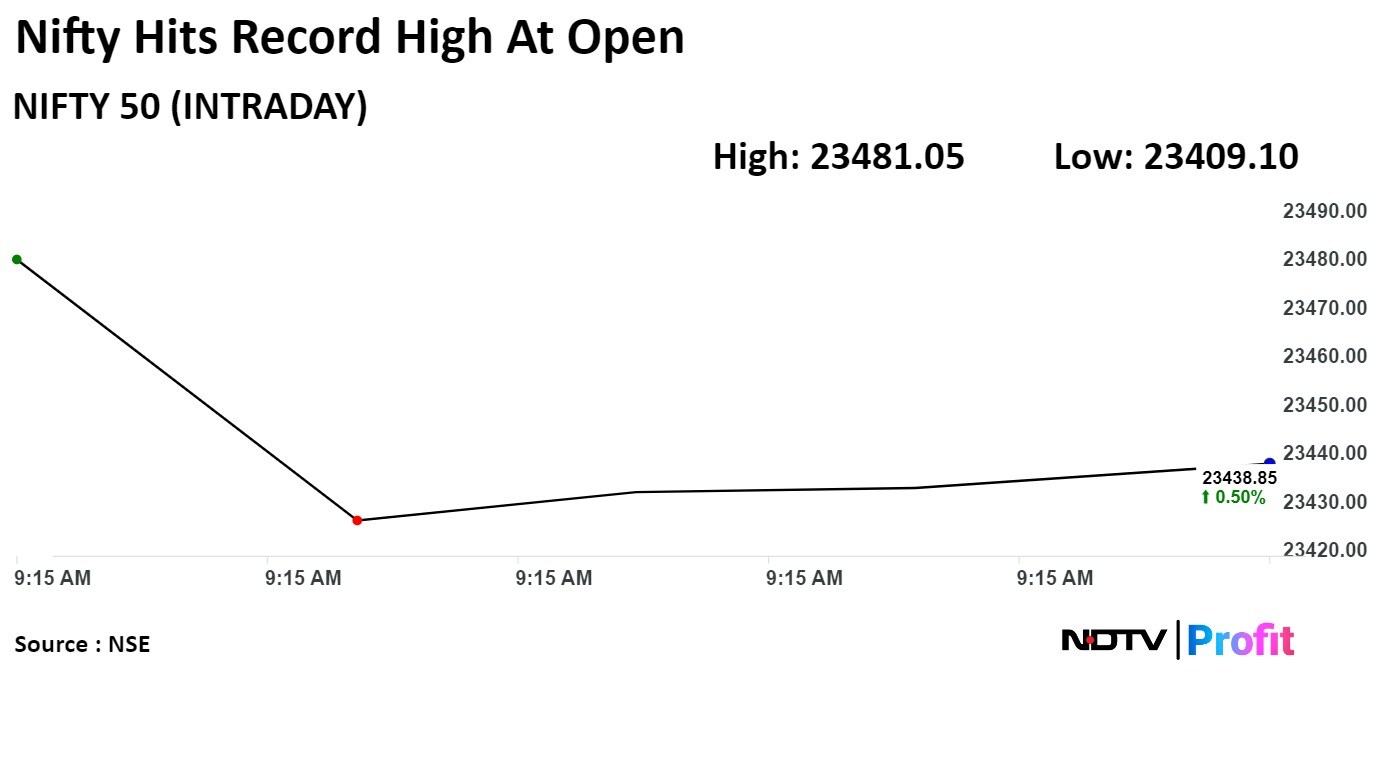

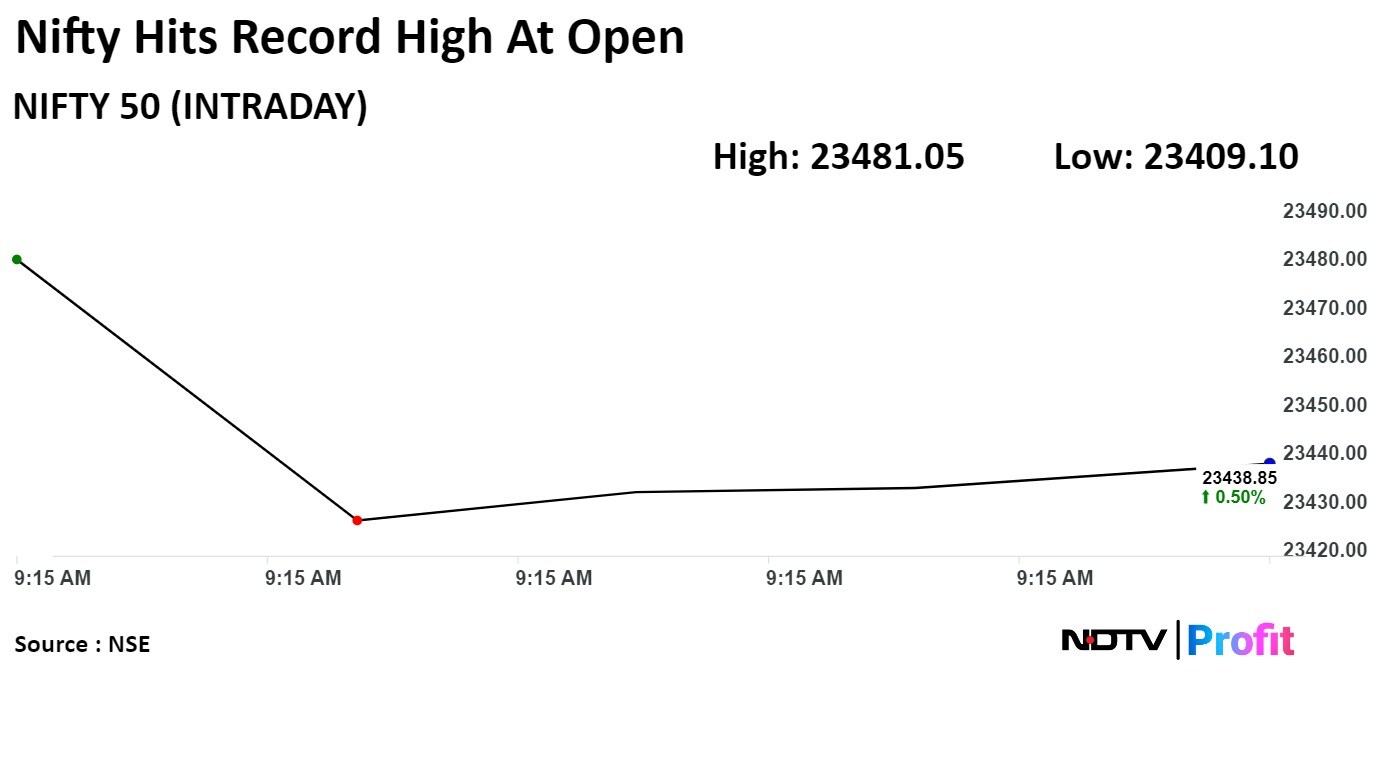

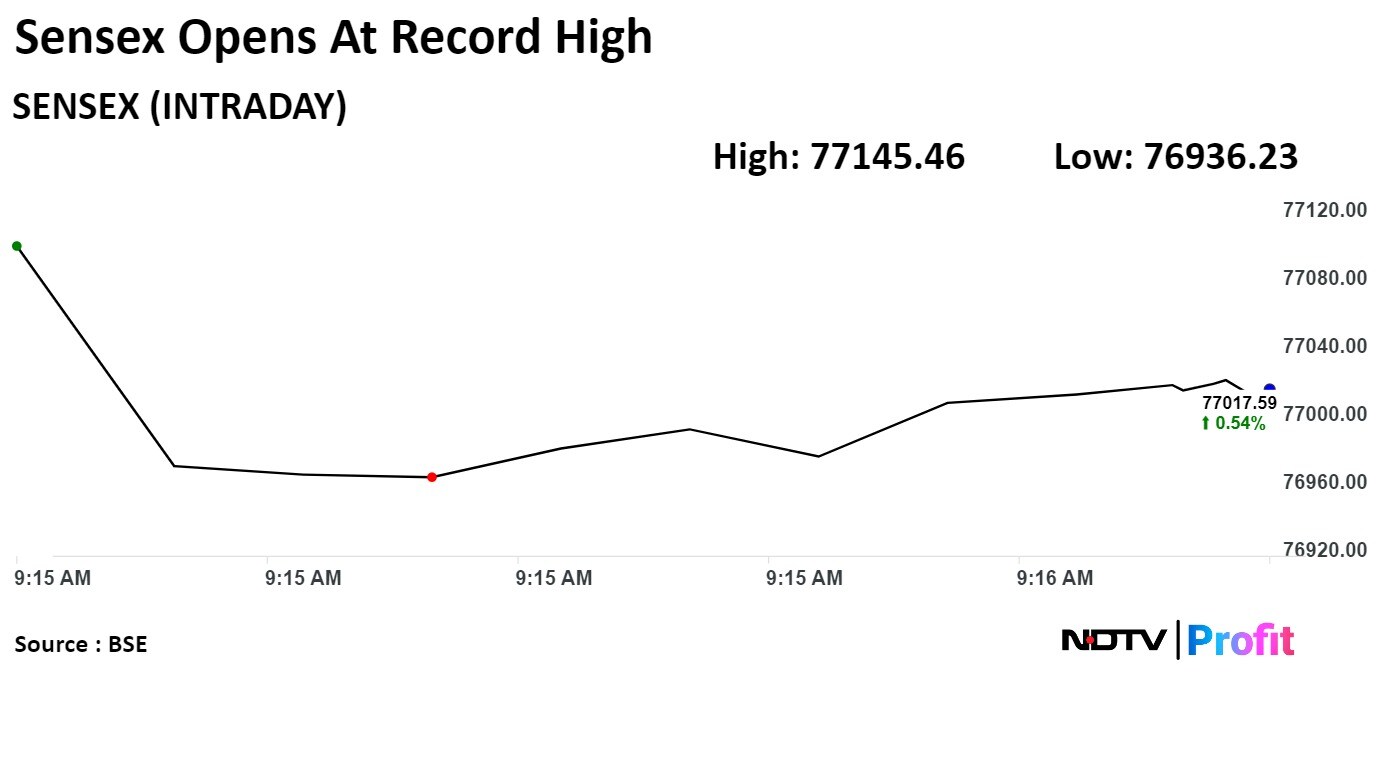

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

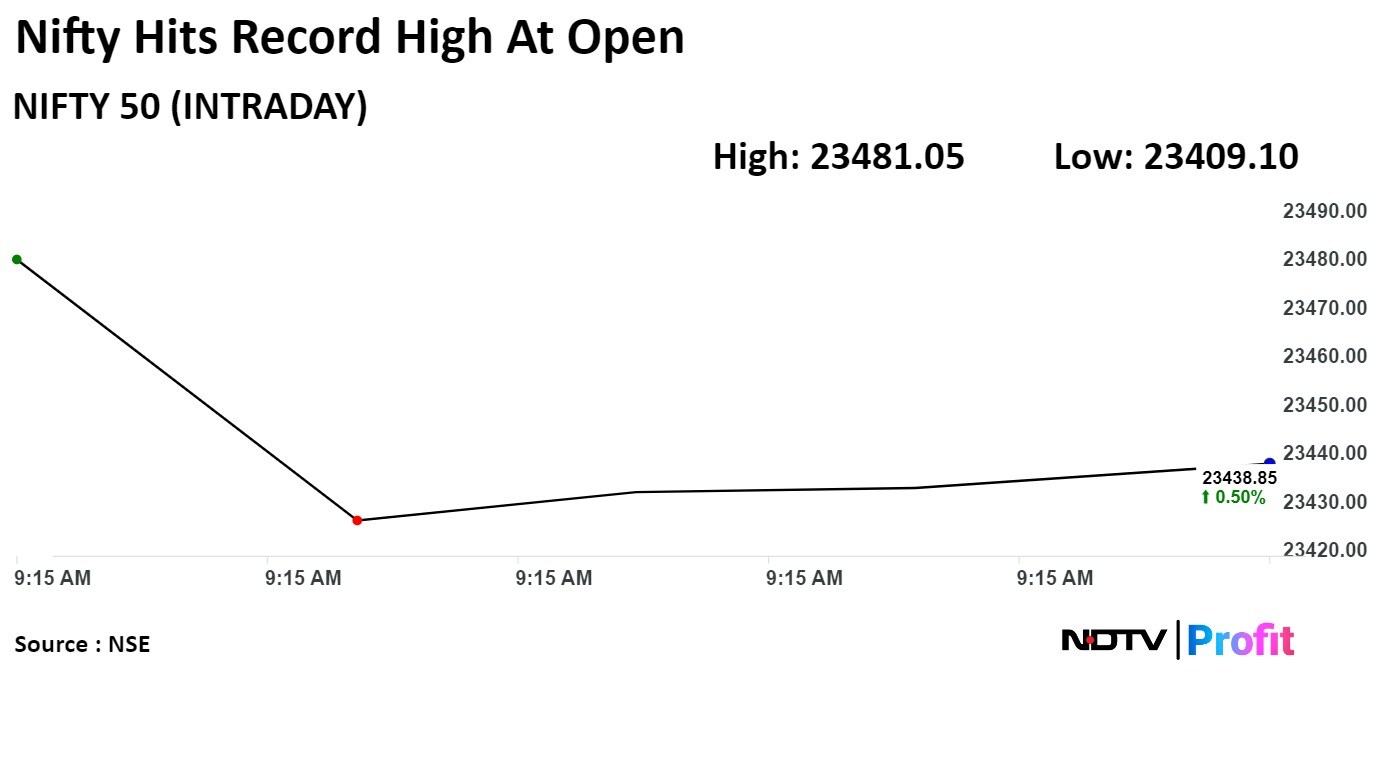

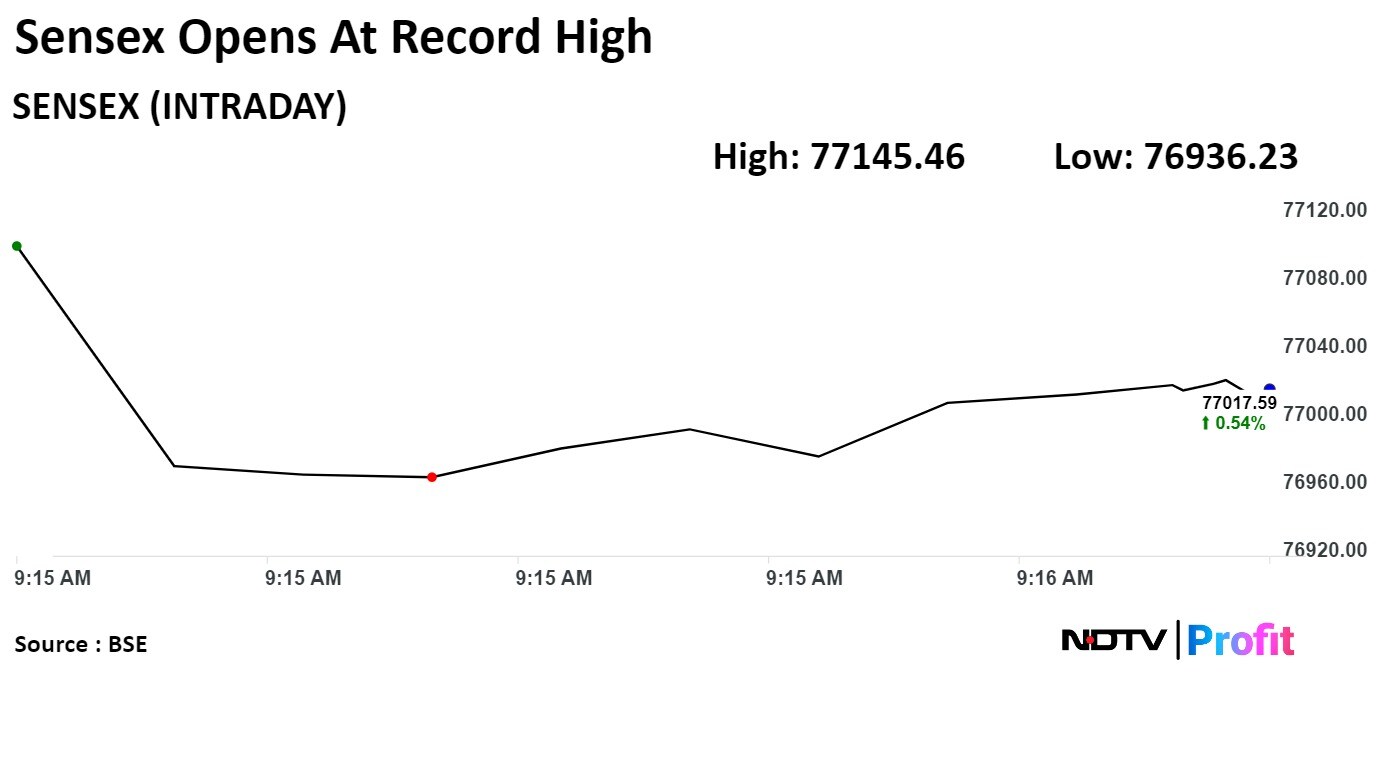

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

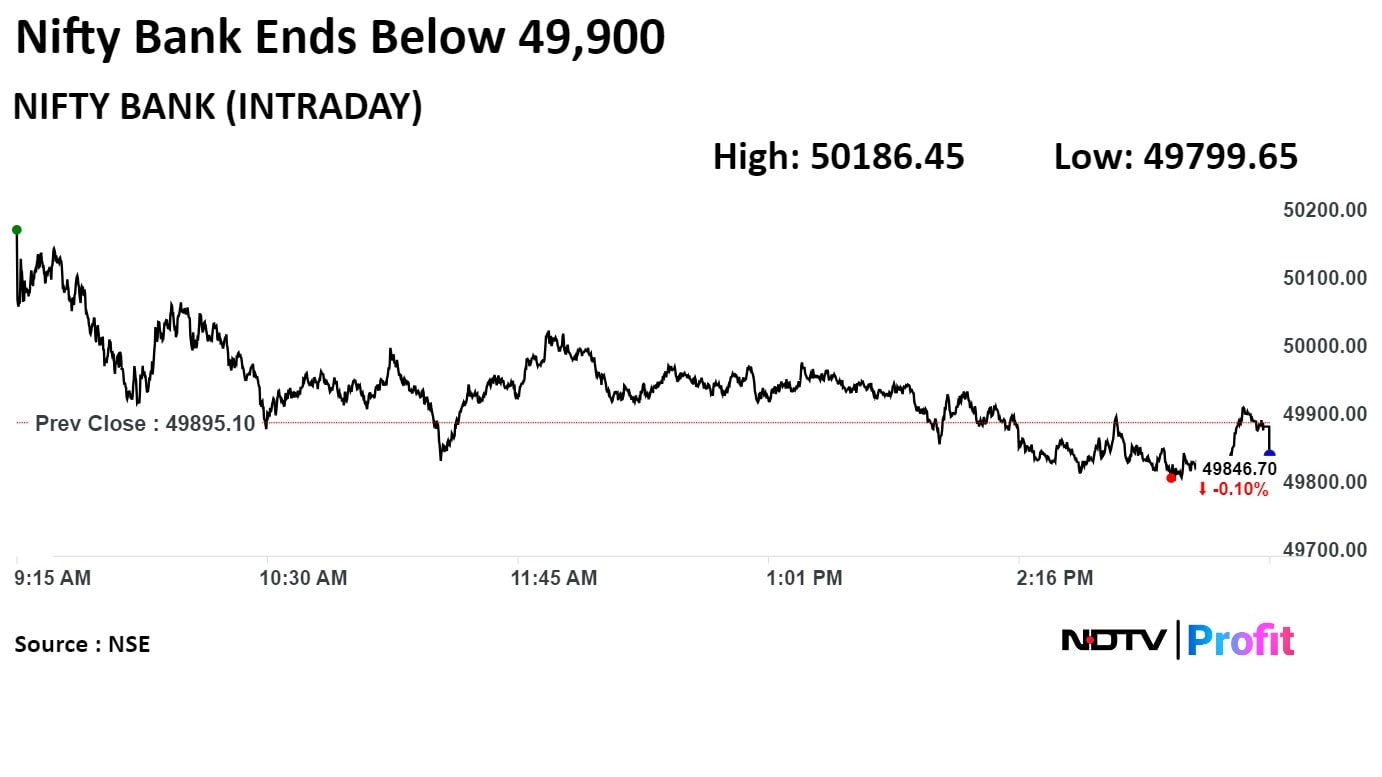

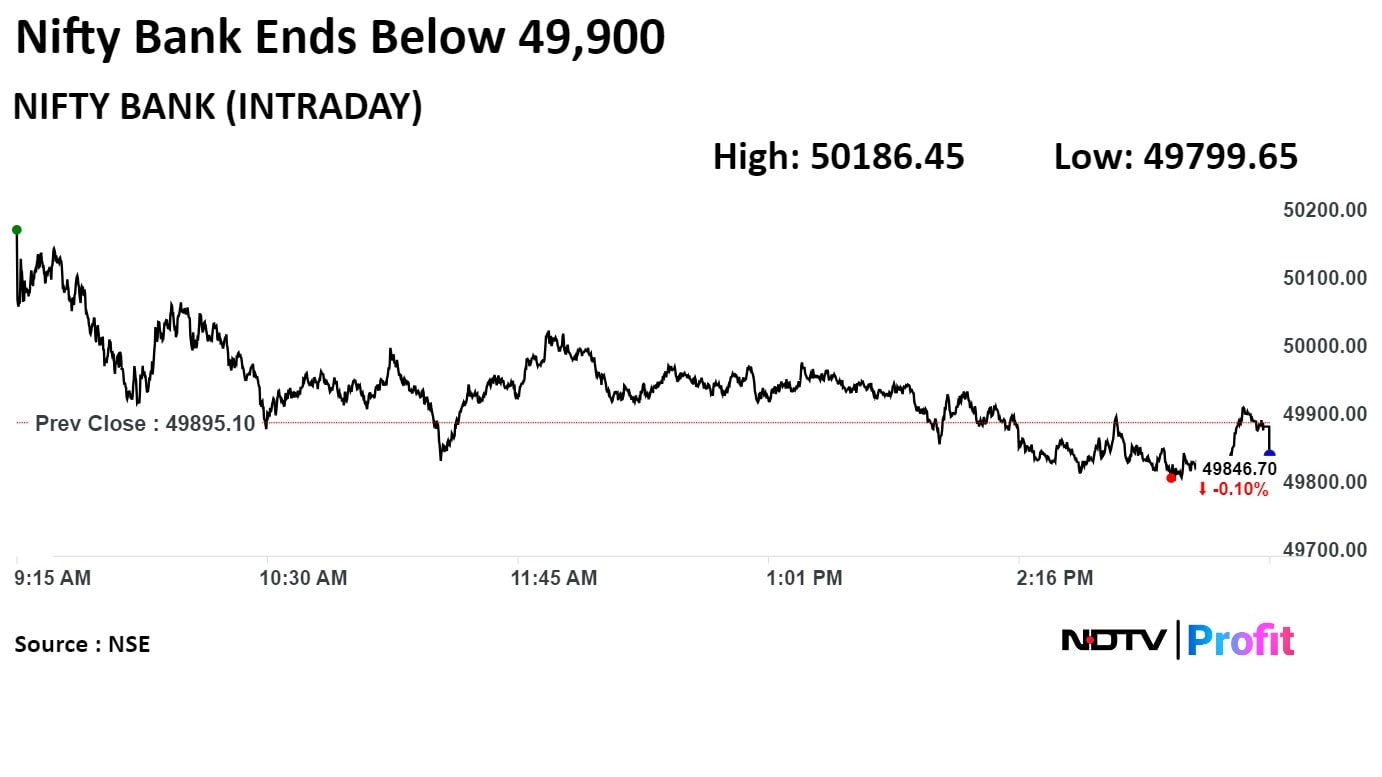

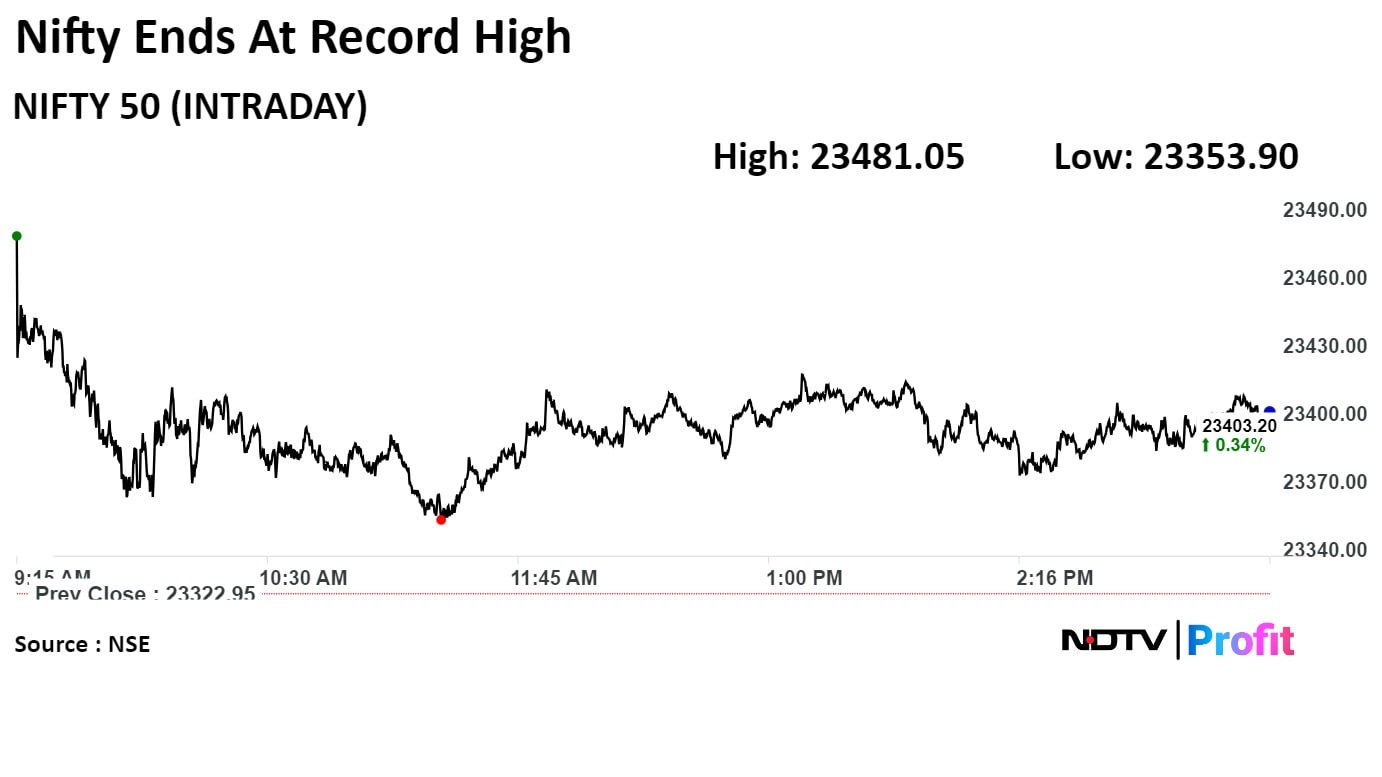

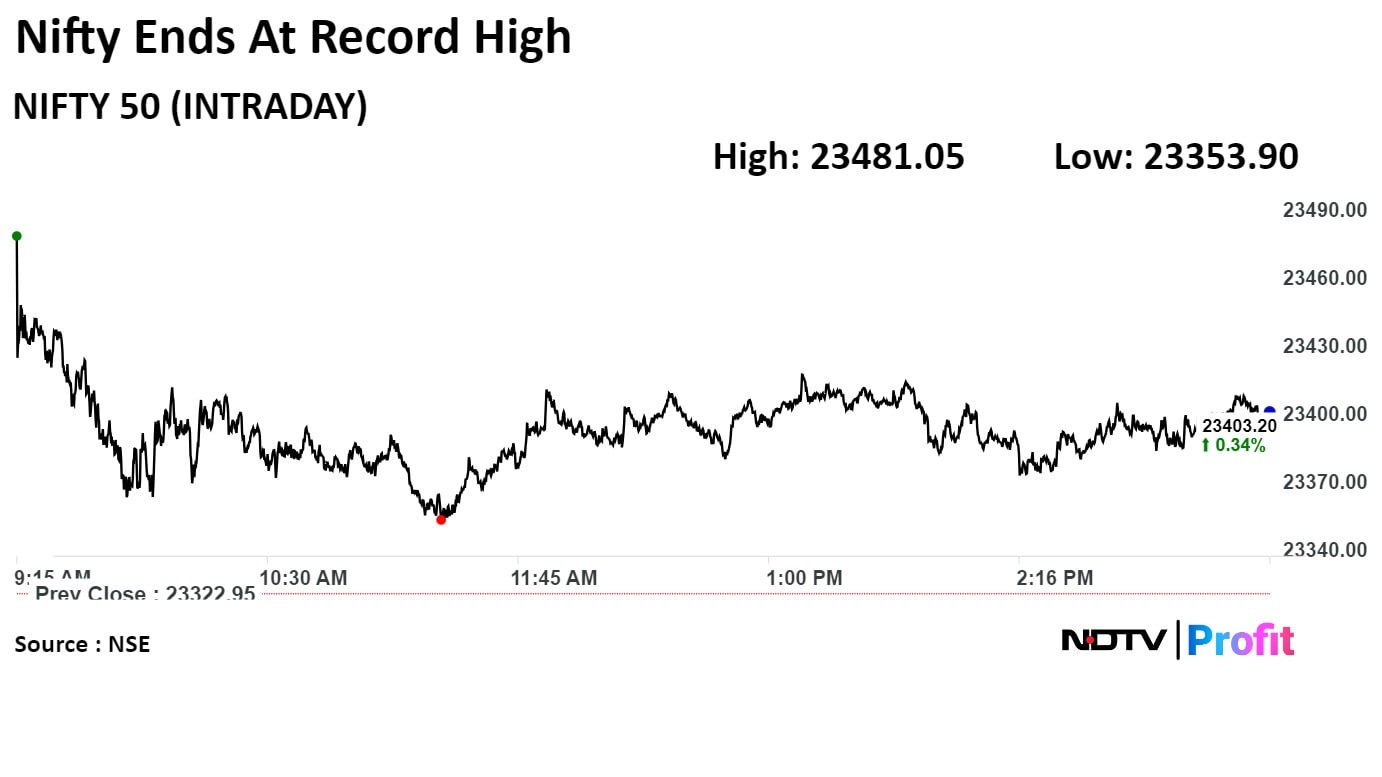

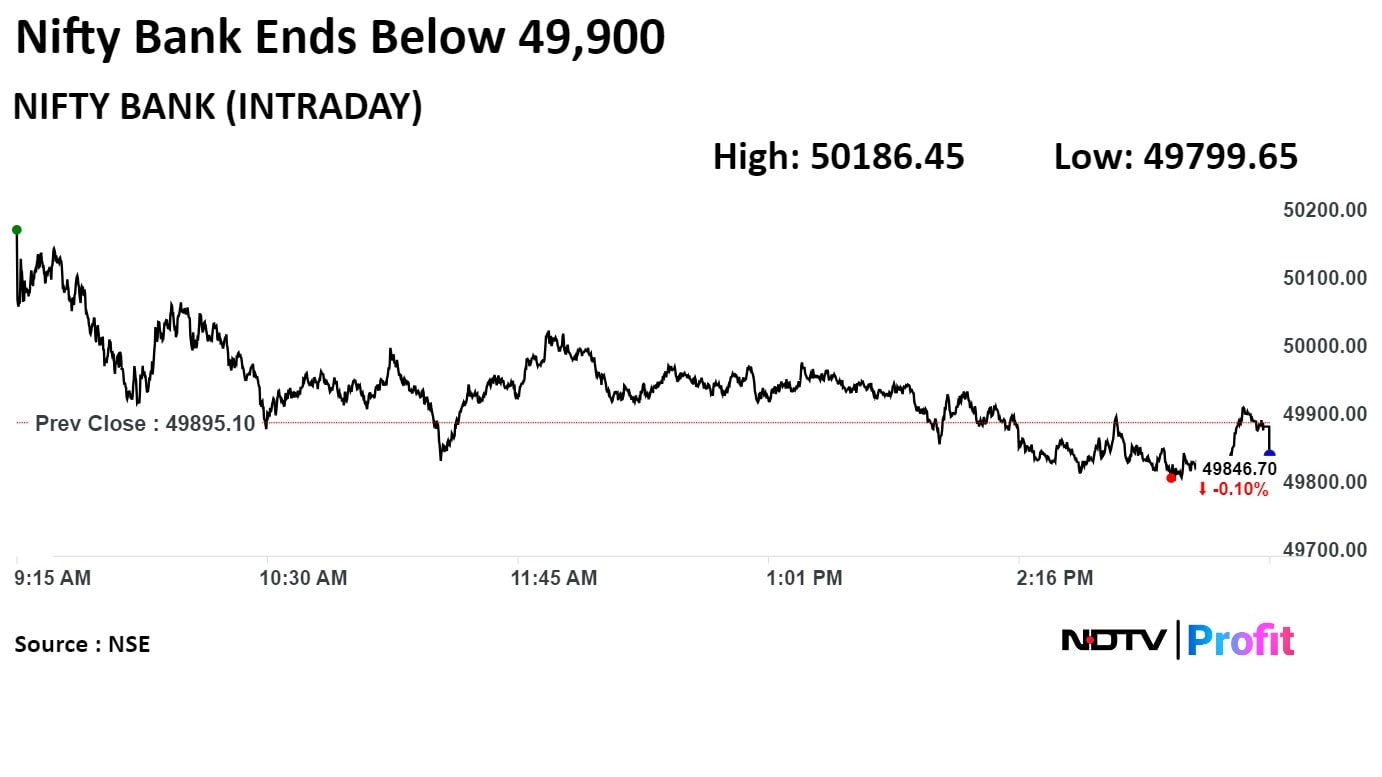

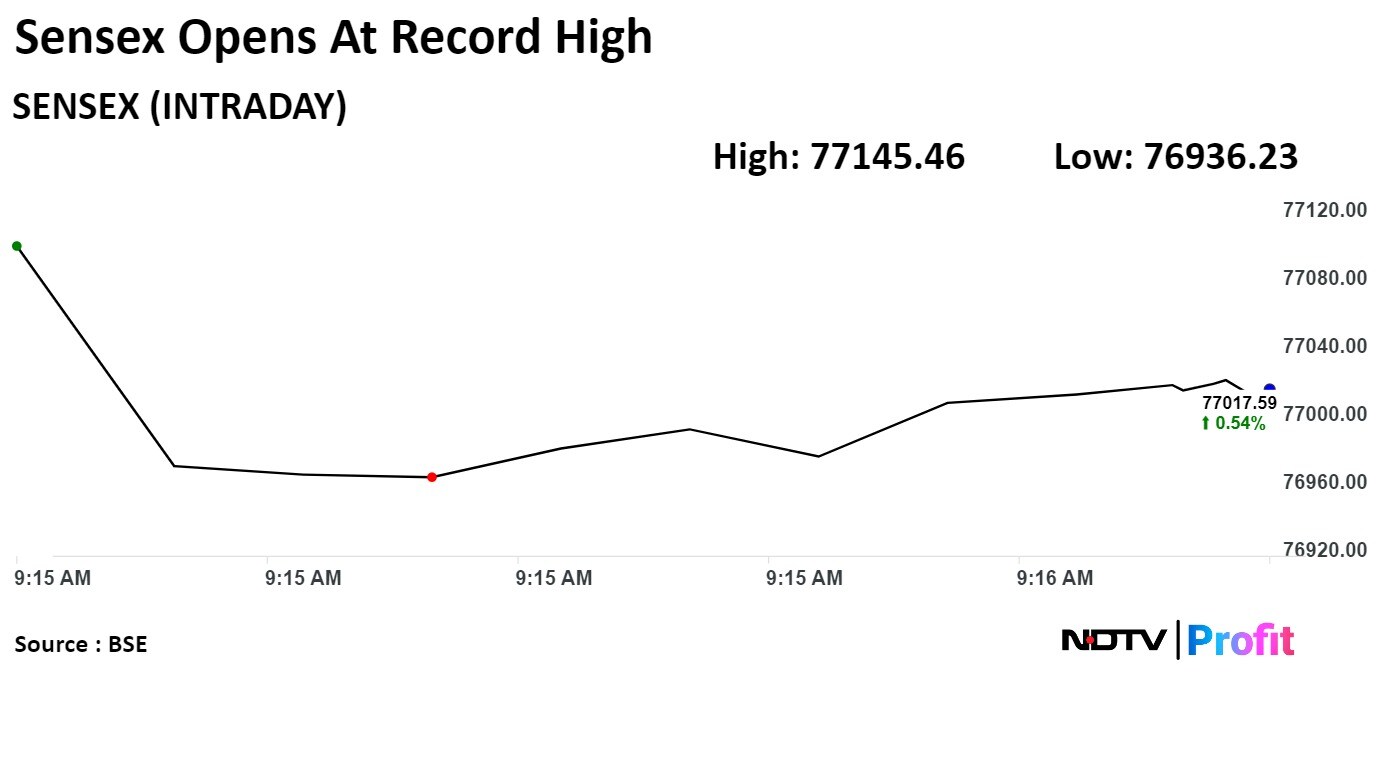

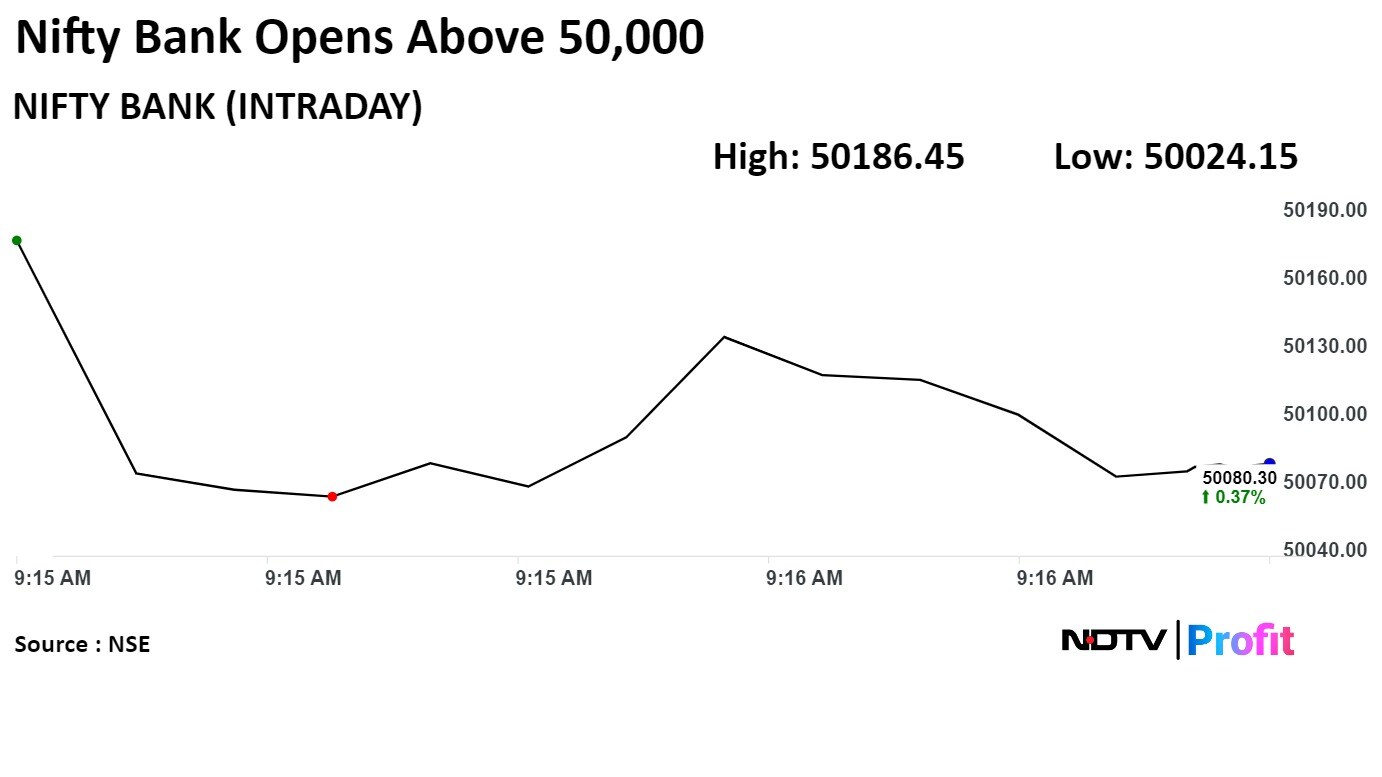

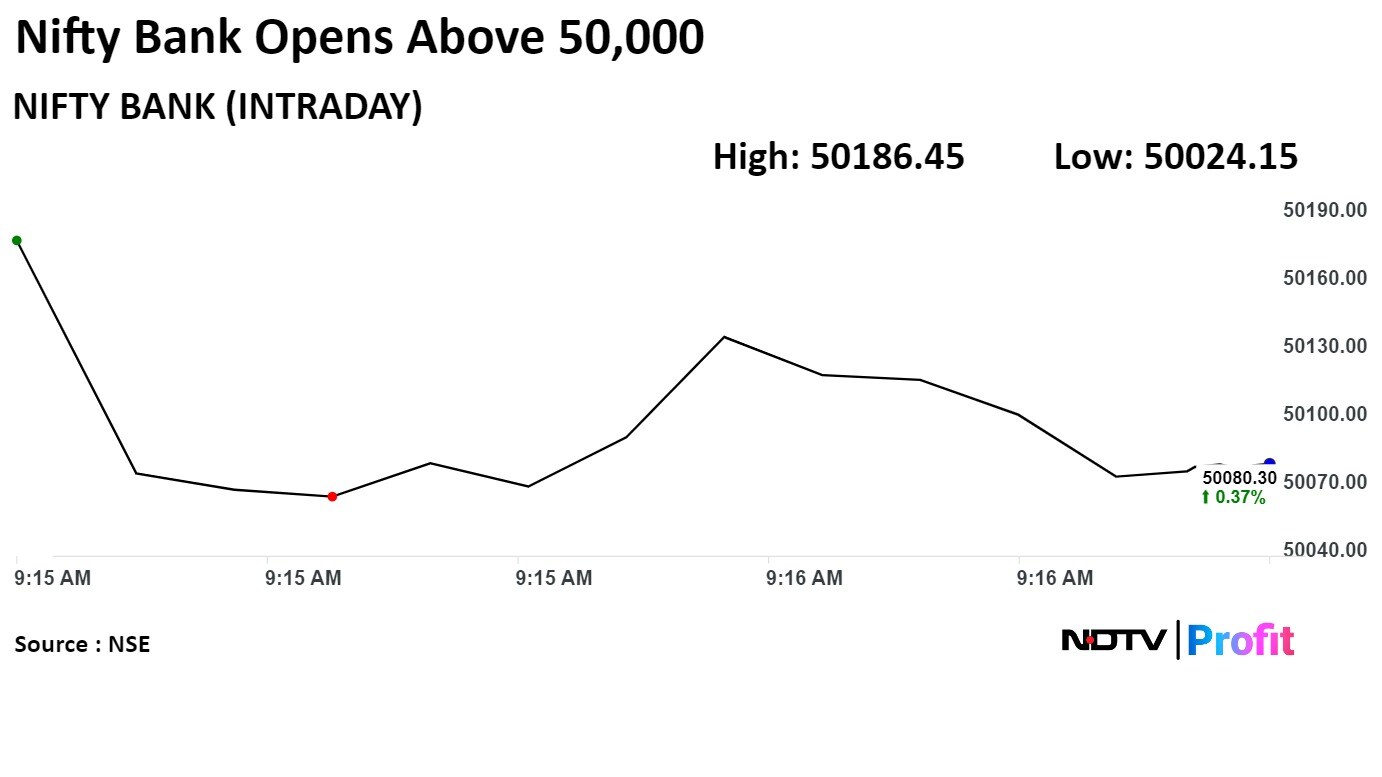

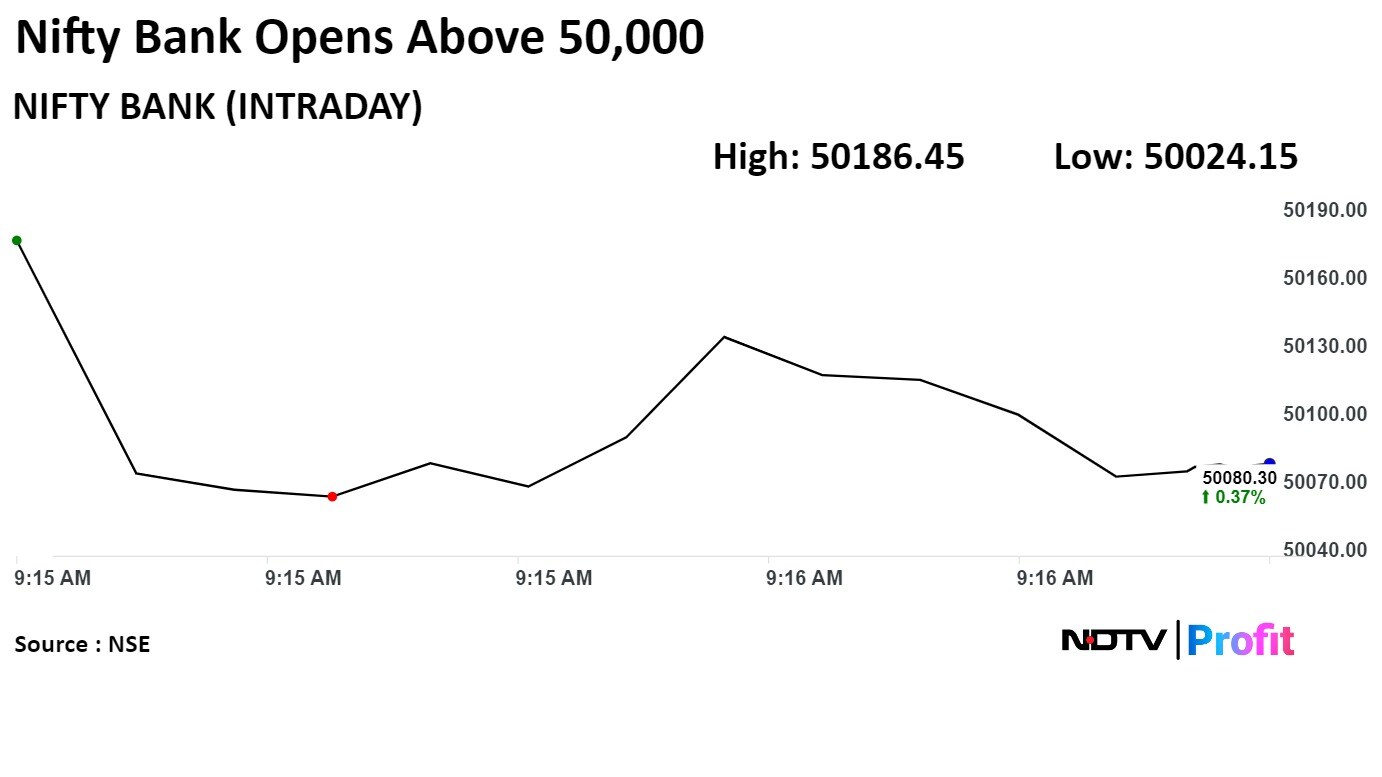

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

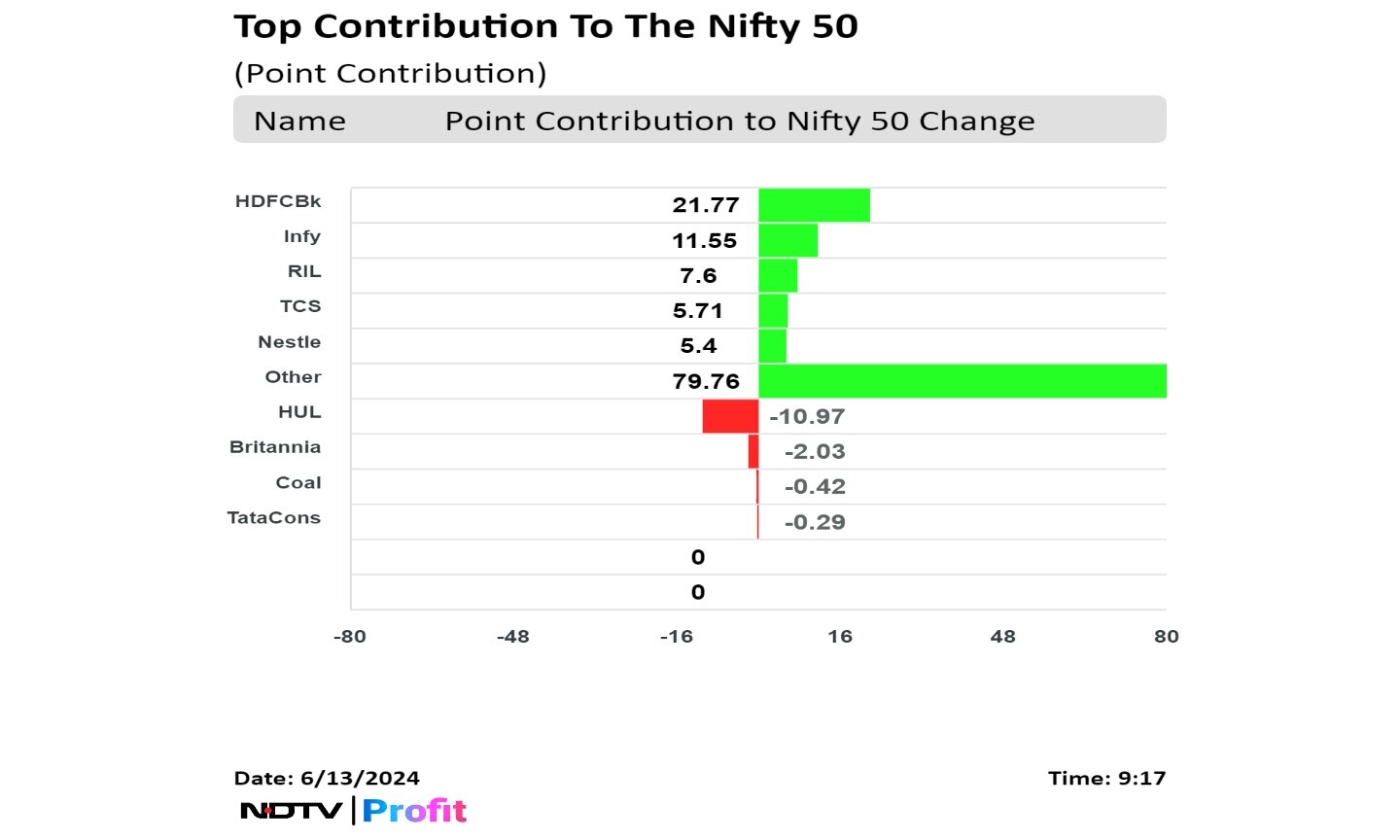

Shares of Larsen & Toubro Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Consultancy Services Ltd., and Titan Co. Ltd. contributed the most to the gains.

While those of ICICI Bank Ltd., Hindustan Unilever Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and ITC Ltd. capped the upside.

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Shares of Larsen & Toubro Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Consultancy Services Ltd., and Titan Co. Ltd. contributed the most to the gains.

While those of ICICI Bank Ltd., Hindustan Unilever Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and ITC Ltd. capped the upside.

.jpeg)

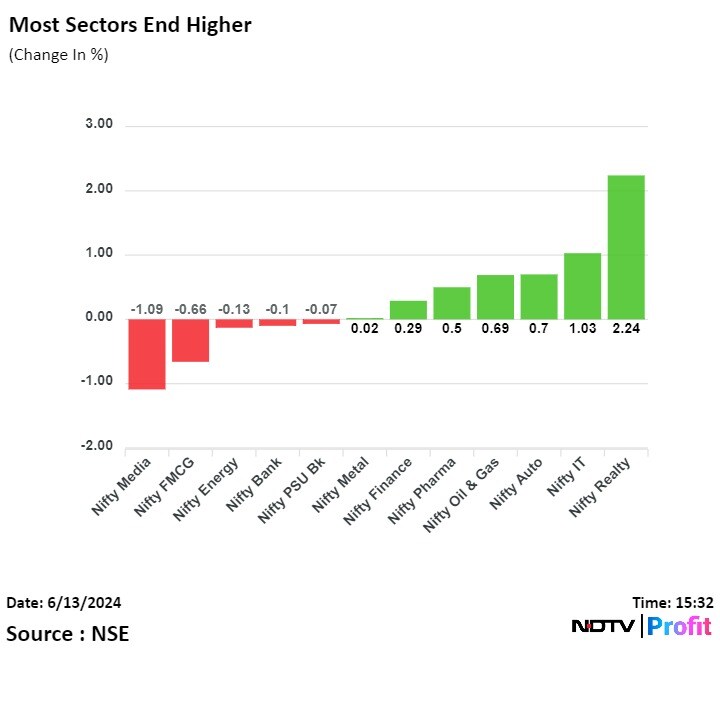

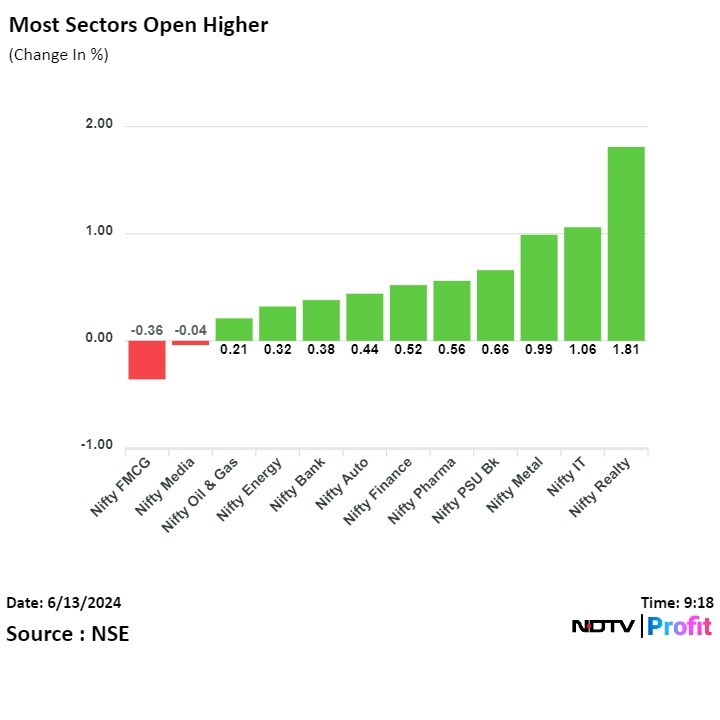

Seven sectoral indices on the NSE ended higher with Nifty Realty rising the most.

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Shares of Larsen & Toubro Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Consultancy Services Ltd., and Titan Co. Ltd. contributed the most to the gains.

While those of ICICI Bank Ltd., Hindustan Unilever Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and ITC Ltd. capped the upside.

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

Benchmark equity indices extended their rally for third consecutive session to close at their highest levels as macro data uplifted the sentiment. The markets rose tracking various data points including one-year low domestic inflation in May, April IIP at 5% as well as softer-than-expected US inflation.

Both the indices recorded their highest close as well. The Nifty closed at 23398.90, up 0.33% or 75.95 points and Sensex closed at 76810.90, up 0.27% or 204.33 points.

Intraday, the Nifty recorded a new high of 23,481.05 points and Sensex also hit its record high of 23,481.05.

Rajesh Palviya, SVP - Technical and Derivatives Research at Axis Securities said that he expects short covering to set in once the Nifty crosses 23,500, and it will take the Nifty to 23,700.

"For Bank Nifty, the major support zone is placed at 50,000 mark," said Palviya. "It may remain in consolidation until it takes out that level."

.jpeg)

Shares of Larsen & Toubro Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., Tata Consultancy Services Ltd., and Titan Co. Ltd. contributed the most to the gains.

While those of ICICI Bank Ltd., Hindustan Unilever Ltd., Axis Bank Ltd., Bharti Airtel Ltd., and ITC Ltd. capped the upside.

.jpeg)

Seven sectoral indices on the NSE ended higher with Nifty Realty rising the most.

Broader markets outperformed benchmark indices. The S&P BSE Midcap and Smallcap settled 0.79% and 0.89% higher, respectively.

On BSE, 15 sectors advanced, and five declined out of 20. The S&P BSE Realty rose the most among sectors, and the S&P BSE Utilities fell the most.

Market breadth was skewed in favour of buyers. Around 2,353 stocks rose, 1,536 stocks fall, and 95 stocks remained unchanged on BSE.

Rajib Kumar Mishra ceases to be Chairman after SEBI announced restrictions due to lax corporate governance

Source: Exchange filing

Indian ship recycling industry to see 15% revenue growth in FY25

Growth on rising number of ageing vessels, competition

Increased availability to bring company input costs down

Higher capacity utilization to improve profitability by 75bps

Higher cash generation, lack of capex, to keep credit profiles stable

Expect Indian ship recyclers to see 20-23% volume growth

Key competitors: Bangladesh, Pakistan face severe foreign currency crisis

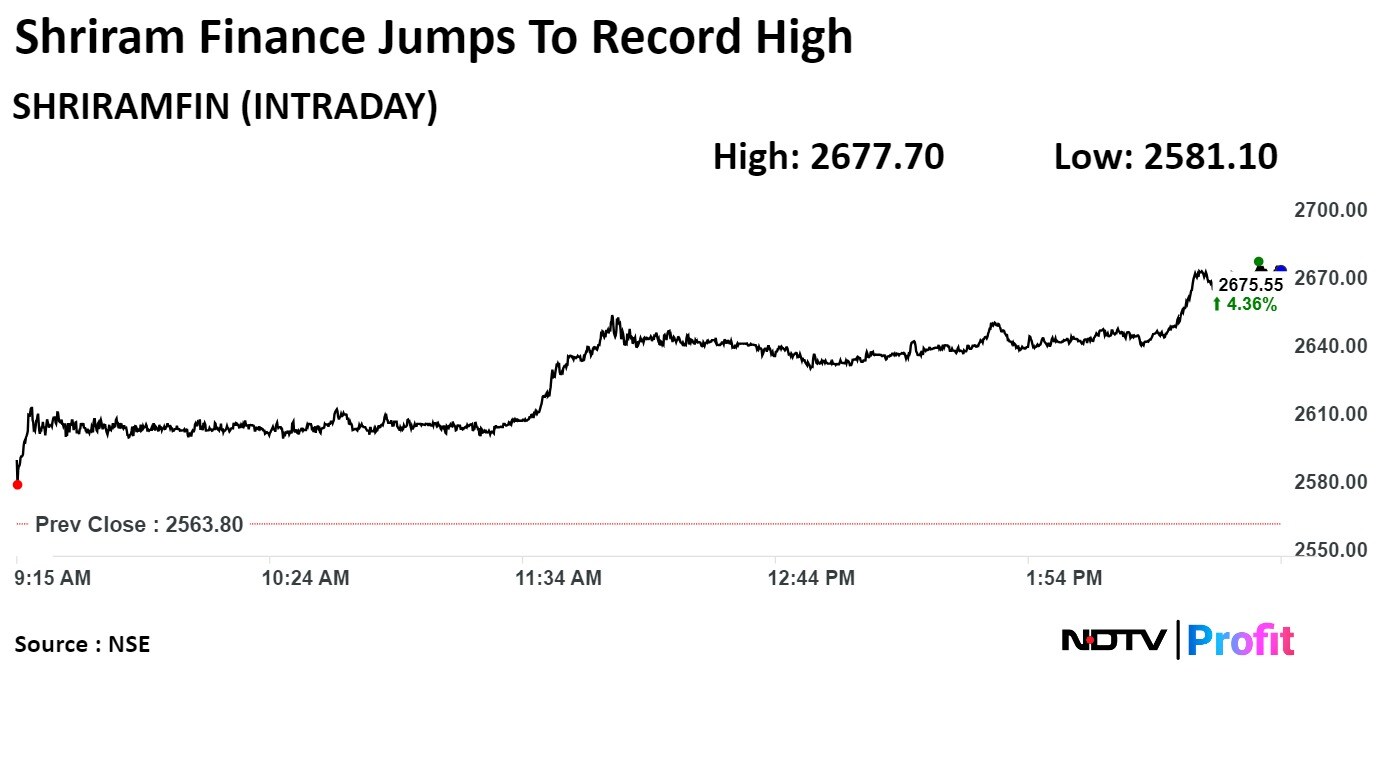

Shriram Finance Ltd. rose as much as 4.31% to Rs 2,677.70 apiece, the highest level since its listing on Dec 11, 1996. It was trading 4.11% higher at Rs 2,672.30 apiece, as of 2:59 p.m. This compares to a 0.33% advance in the NSE Nifty 50 Index.

The market cap of the stock rose Rs 4,122.16 crore to Rs 1 lakh crore as of 3:02 p.m.

It has risen 85.29% in 12 months, and 30.15% on year to date basis. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 65.33.

Out of 38 analysts tracking the company, 36 maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Shriram Finance Ltd. rose as much as 4.31% to Rs 2,677.70 apiece, the highest level since its listing on Dec 11, 1996. It was trading 4.11% higher at Rs 2,672.30 apiece, as of 2:59 p.m. This compares to a 0.33% advance in the NSE Nifty 50 Index.

The market cap of the stock rose Rs 4,122.16 crore to Rs 1 lakh crore as of 3:02 p.m.

It has risen 85.29% in 12 months, and 30.15% on year to date basis. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 65.33.

Out of 38 analysts tracking the company, 36 maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Board approves raising up to Rs 225 crore via QIP

Source: Exchange Filing

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

.png)

.png)

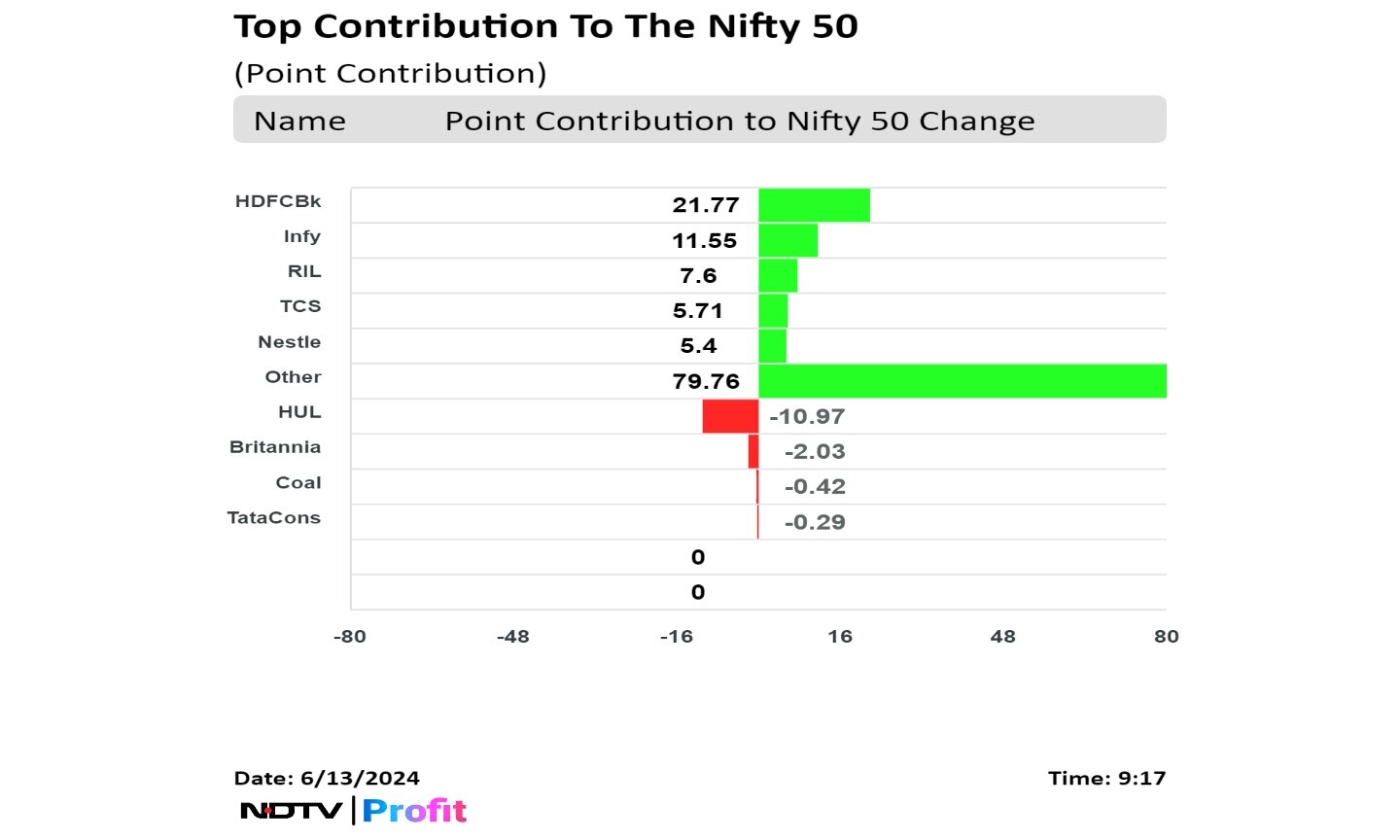

Shares of HDFC Bank Ltd., HDFC Life Insurance Co., Infosys Ltd., Larsen & Toubro Ltd. and Tata Consultancy Services Ltd. were positively contributing to gains in the Nifty.

Shares of Hindustan Unilever Ltd., NTPC Ltd., Power Grid Corp. of India, Coal India Ltd., and Tata Steel Ltd. were weighing on the index.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

.png)

.png)

Shares of HDFC Bank Ltd., HDFC Life Insurance Co., Infosys Ltd., Larsen & Toubro Ltd. and Tata Consultancy Services Ltd. were positively contributing to gains in the Nifty.

Shares of Hindustan Unilever Ltd., NTPC Ltd., Power Grid Corp. of India, Coal India Ltd., and Tata Steel Ltd. were weighing on the index.

.png)

Of the 12 sectors on NSE, six sectors advanced, two remained flat, and four declined. The NSE Nifty Media was the worst performing sector, and the NSE Nifty Realty rose the most.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

.png)

.png)

.png)

Shares of HDFC Bank Ltd., HDFC Life Insurance Co., Infosys Ltd., Larsen & Toubro Ltd. and Tata Consultancy Services Ltd. were positively contributing to gains in the Nifty.

Shares of Hindustan Unilever Ltd., NTPC Ltd., Power Grid Corp. of India, Coal India Ltd., and Tata Steel Ltd. were weighing on the index.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.

Still, the structure continued to remain on the positive side, looking at the volatility index, where a sharp sell-off was seen in seven consecutive sessions, he noted. Centrum Broking expects the NSE Nifty 50 to inch towards the 23,500 mark at the spot level. Any dip can be taken as a buying opportunity, and one can keep a stop loss below 23,000. From the expiry point of view, the range for the NSE Nifty 50 could be 223,350–23,450 Jain told NDTV Profit in an interview.

On the domestic front, India's CPI inflation fell to 4.75% on year in May, the lowest level in a year, compared to 4.83% in the preceding month, which boosted investors' sentiment.

The risk sentiment improved after US inflation came softer than expected and the Federal Reserve held its benchmark federal funds target range at 5.24–5.50%, which also supported the markets' record rally.

Indian benchmark indices pared gains through midday on Thursday after hitting a fresh record high as shares of Hindustan Unilever Ltd., NTPC Ltd., and Power Grid Corp. of India dragged.

As of 12:22 p.m., the NSE Nifty 50 was 72.30 points, or 0.31%, higher at 23,395.25 after hitting a record high of 23,481.05. While the S&P BSE Sensex gained 254.51 points, or 0.33%, to trade at 76,861.08 after hitting an all-time high of 77,145.56.

After hitting an all-time high, there is some profit-taking. That indicates markets are cautious at higher levels, said Nilesh Jain, head vice president, technical and derivatives research, Centrum Broking Ltd. The reason is that there's no participation from the NSE Nifty Bank. Markets need strong participation from NSE Nifty Bank for these moves to be sustainable, he said.