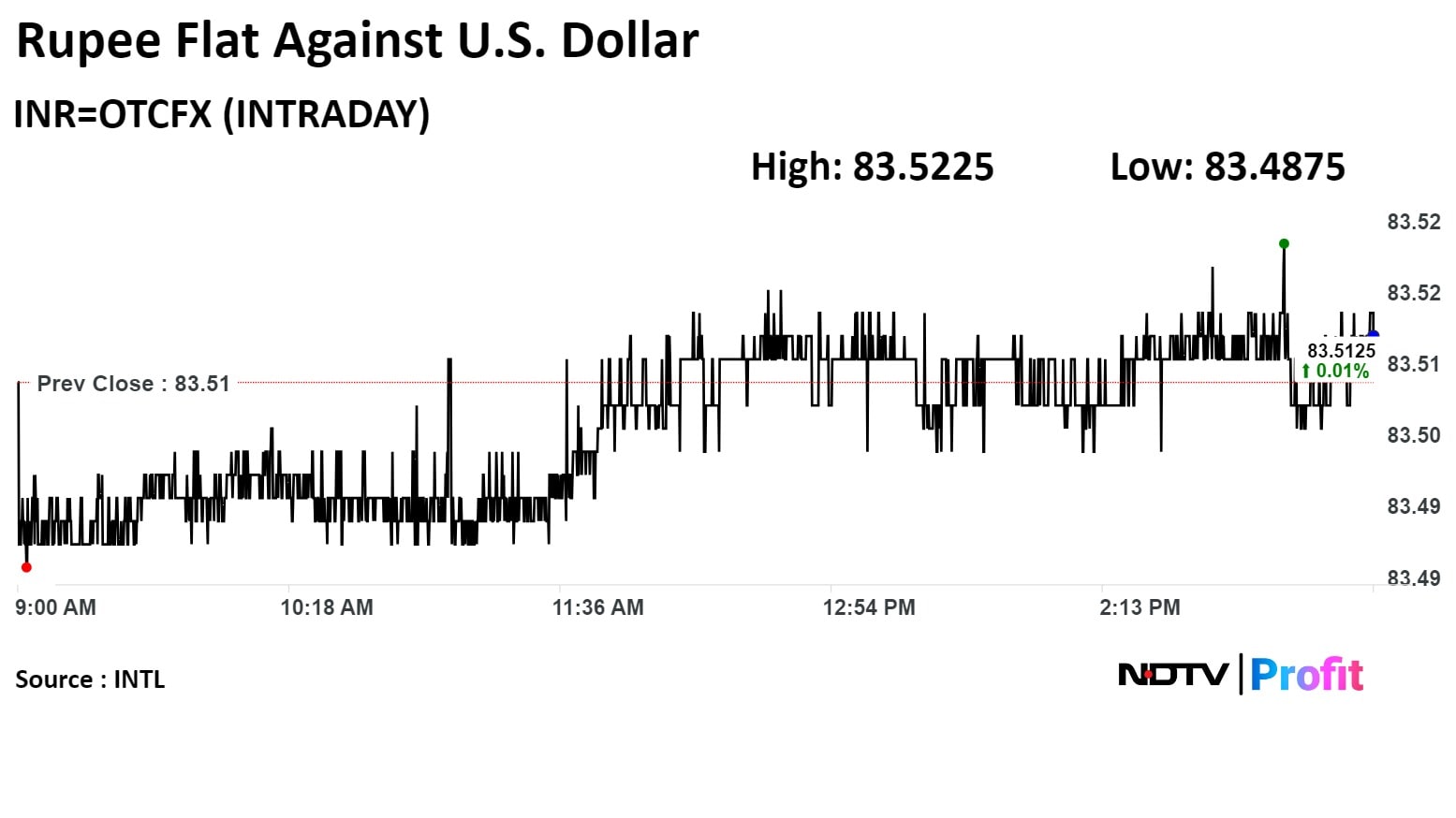

The local currency closed flat against the U.S. Dollar at 83.51.

Source: Bloomberg

The local currency closed flat against the U.S. Dollar at 83.51.

Source: Bloomberg

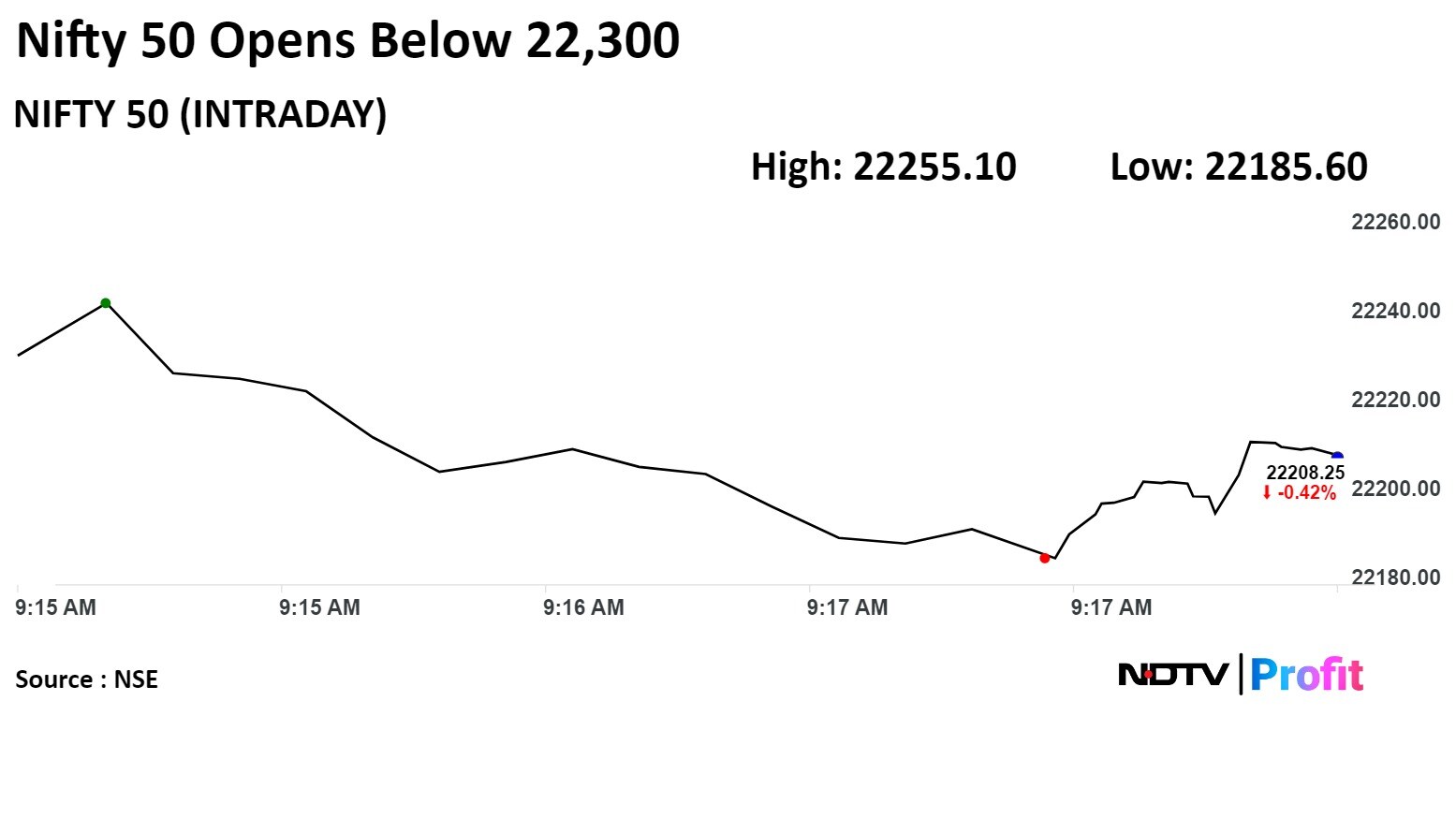

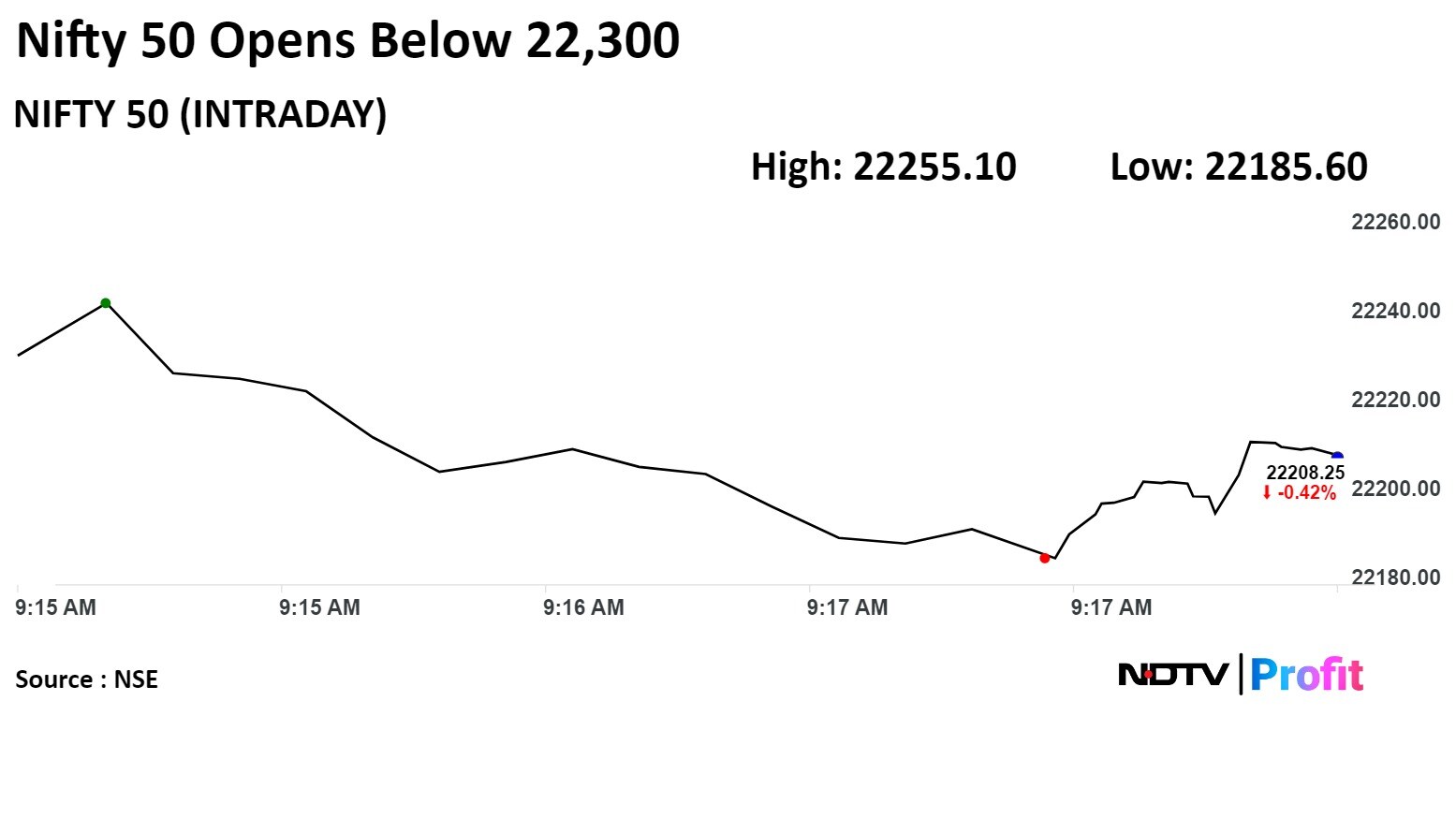

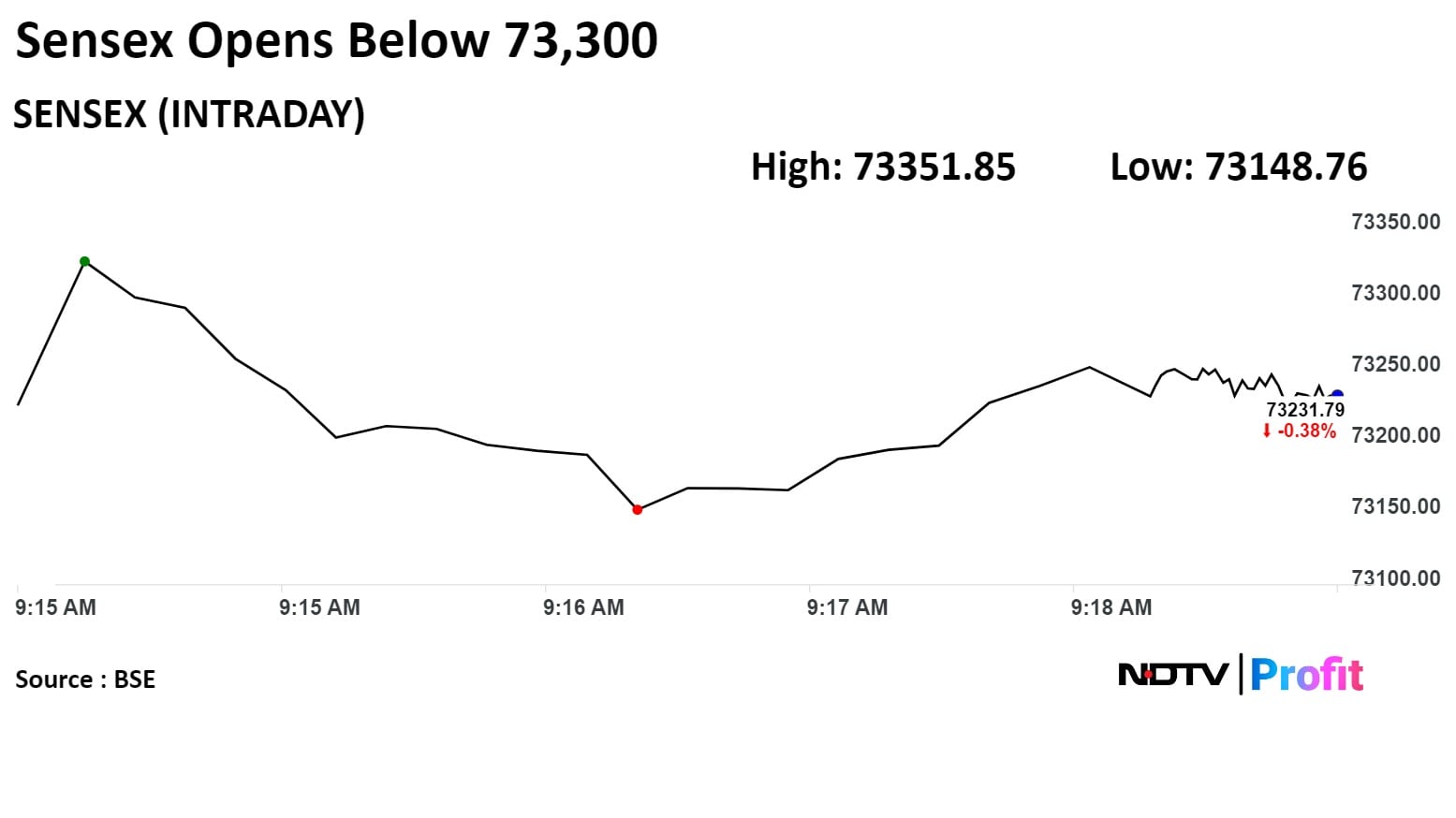

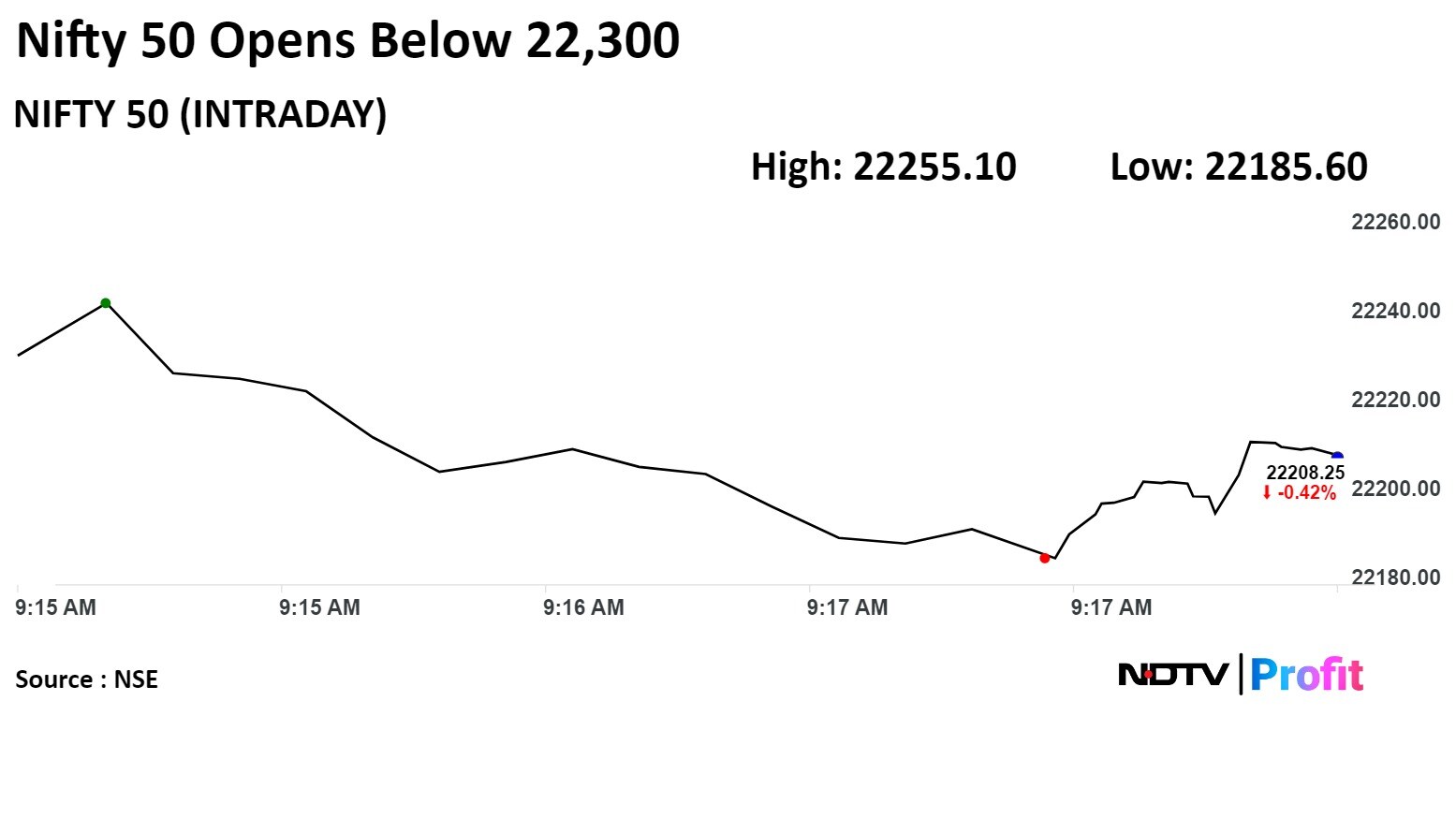

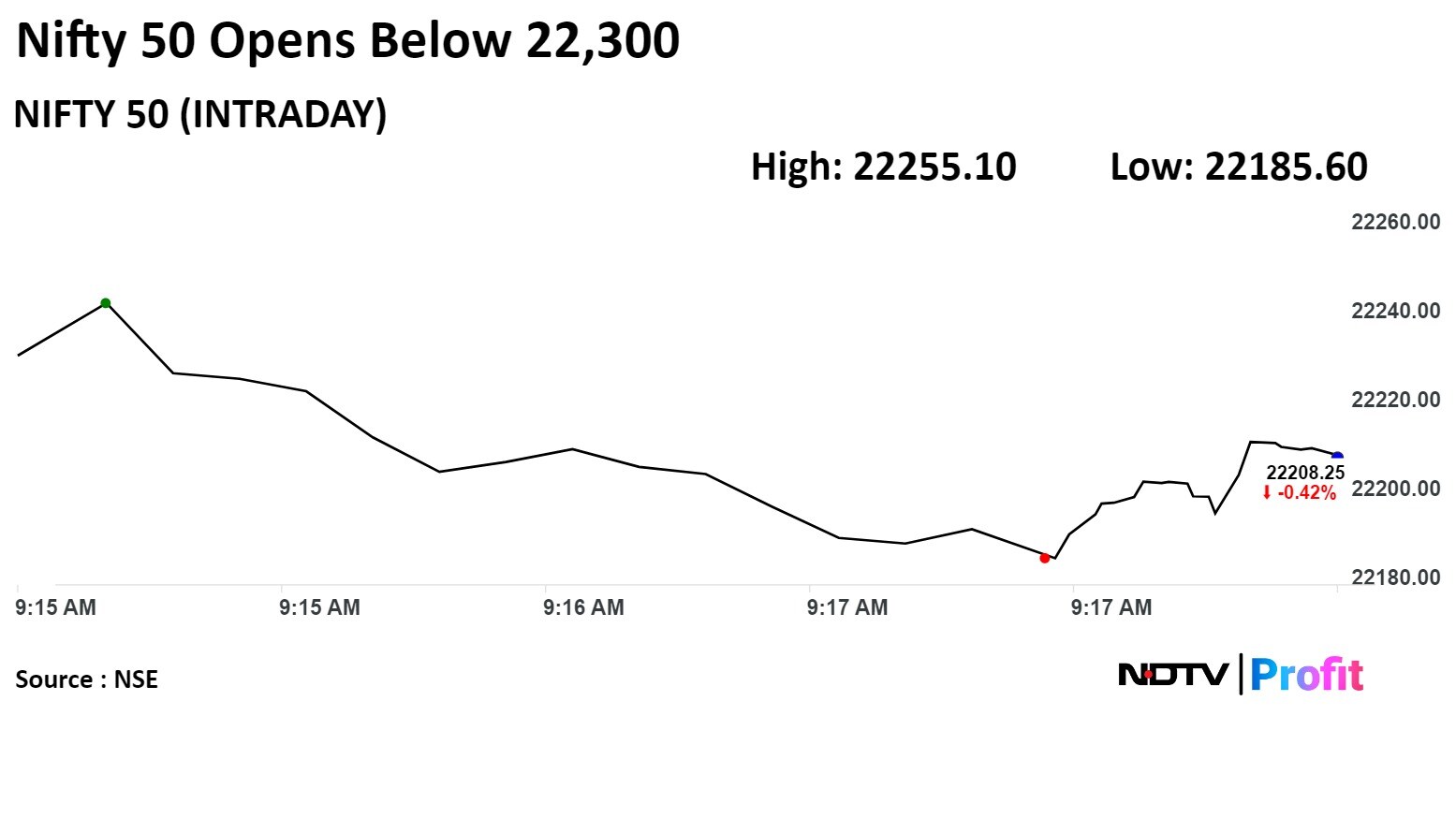

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

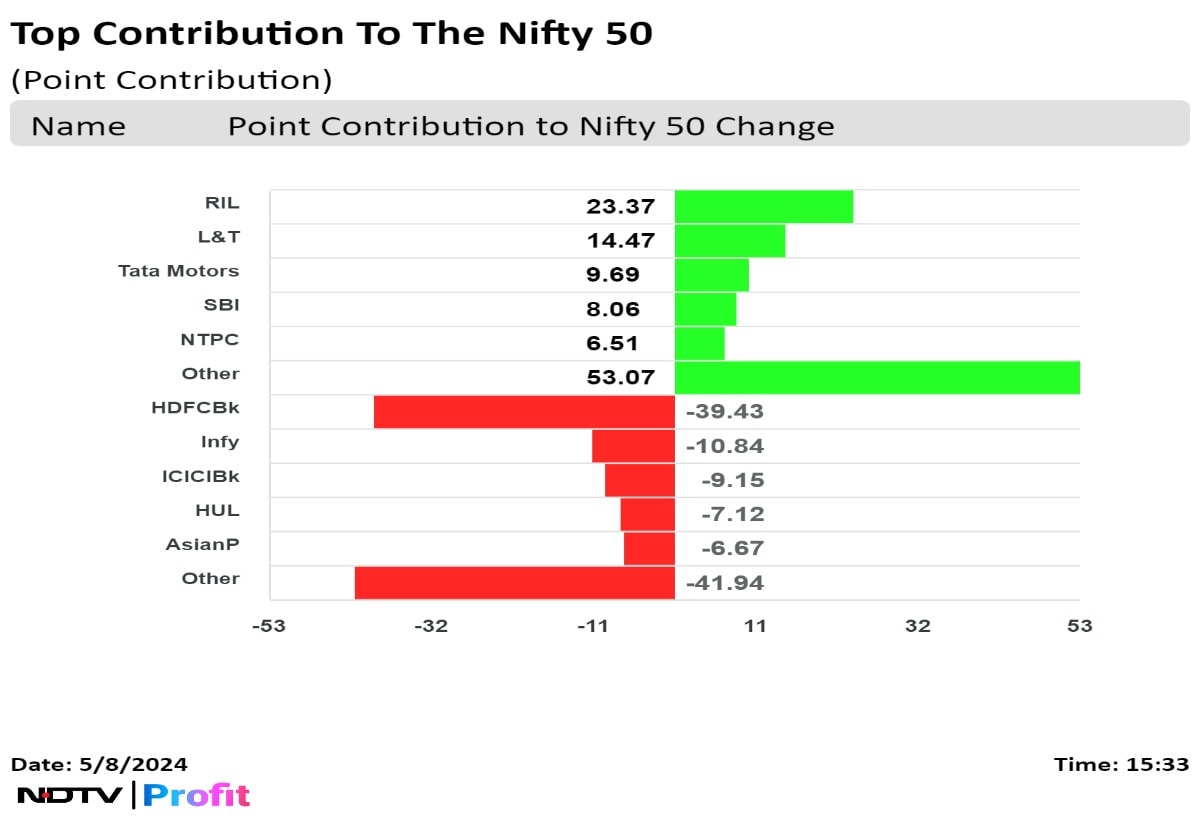

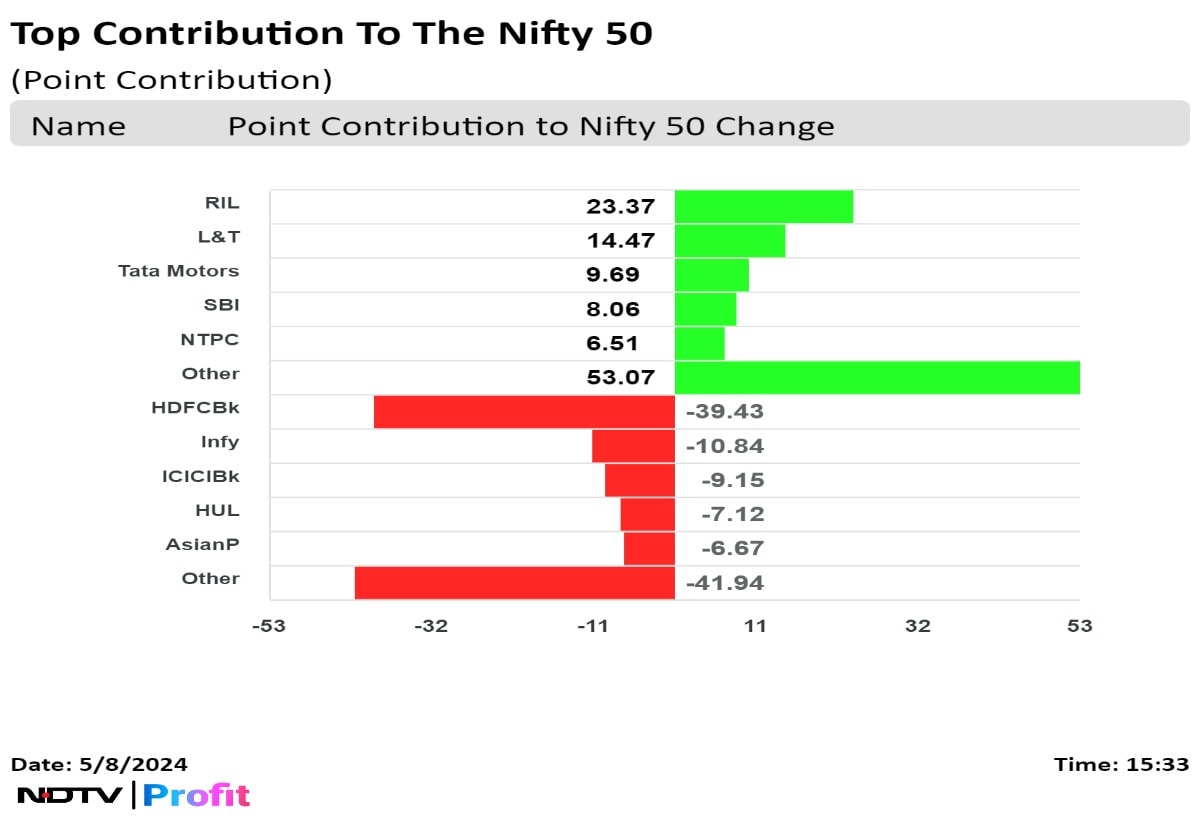

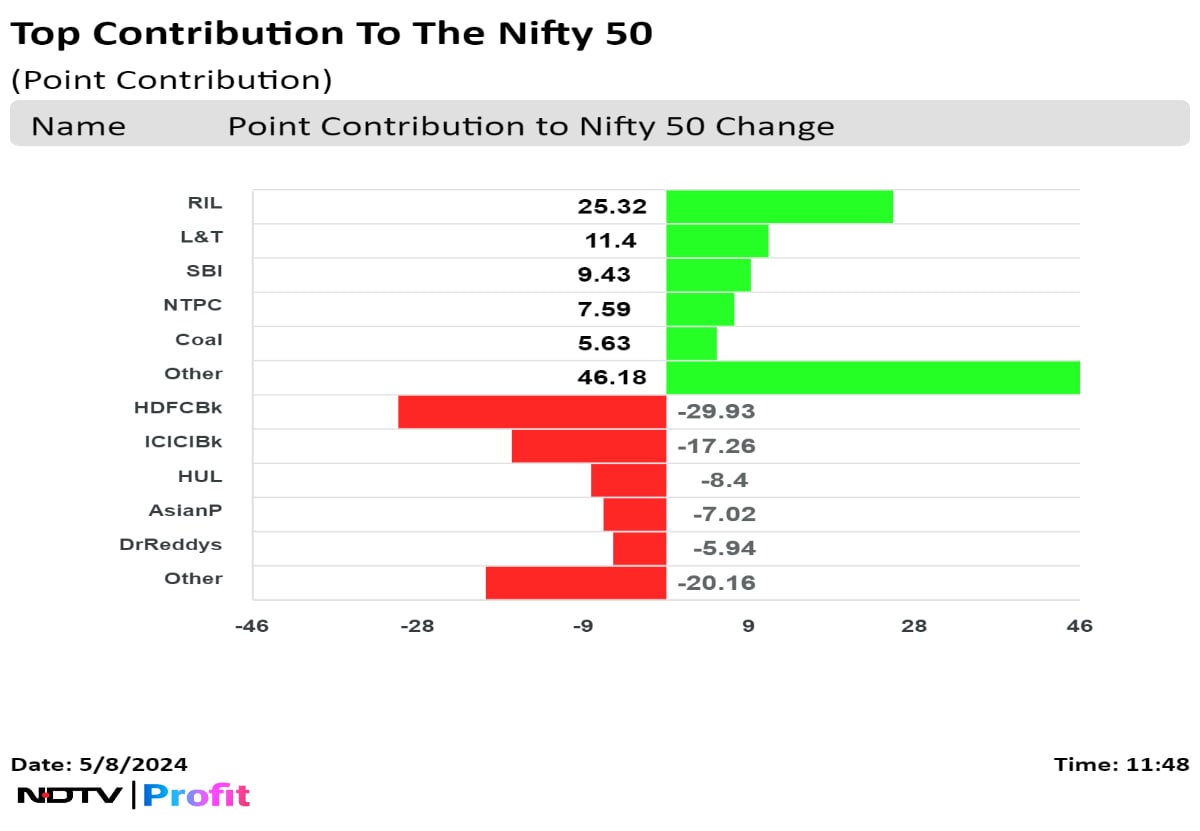

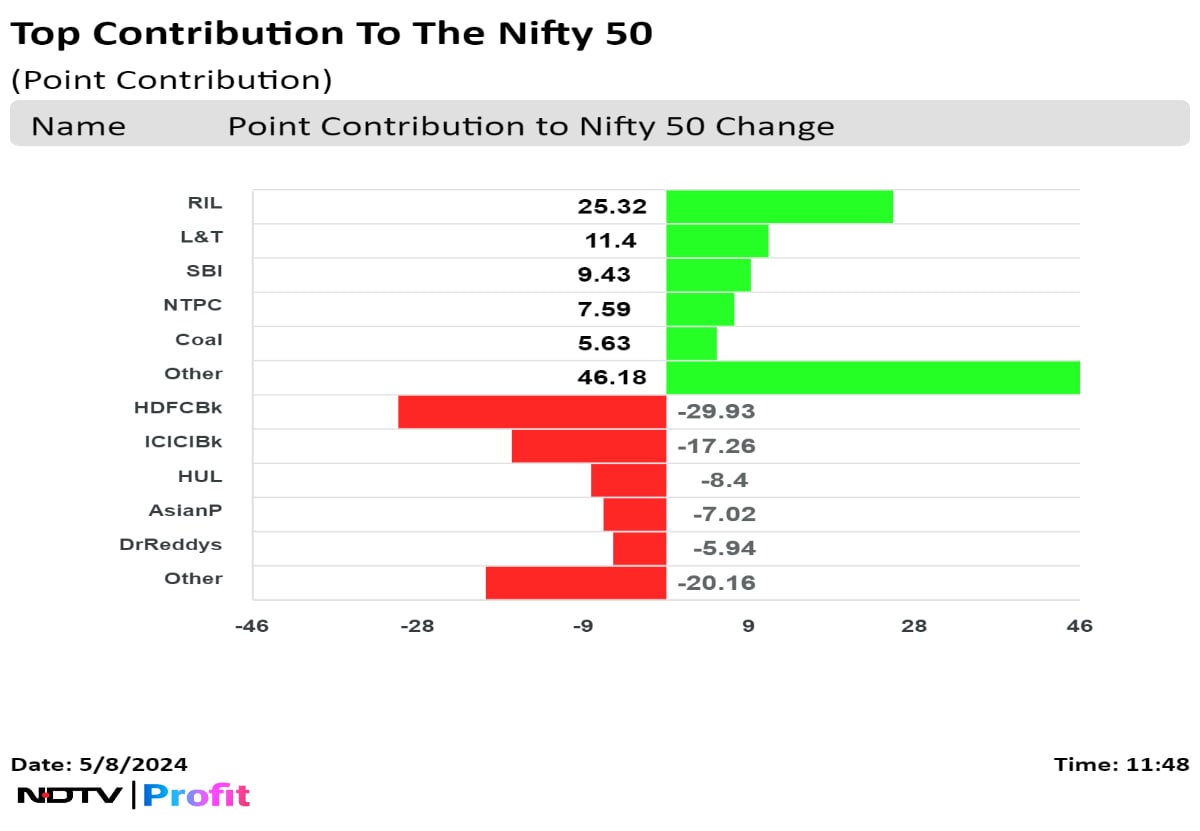

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., Tata motors Ltd., State Bank of India and NTPC Ltd. were positively contributing to changes in the Nifty.

HDFC Bank, Infosys Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd. and Asian Paints Ltd. added negatively to the index.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., Tata motors Ltd., State Bank of India and NTPC Ltd. were positively contributing to changes in the Nifty.

HDFC Bank, Infosys Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd. and Asian Paints Ltd. added negatively to the index.

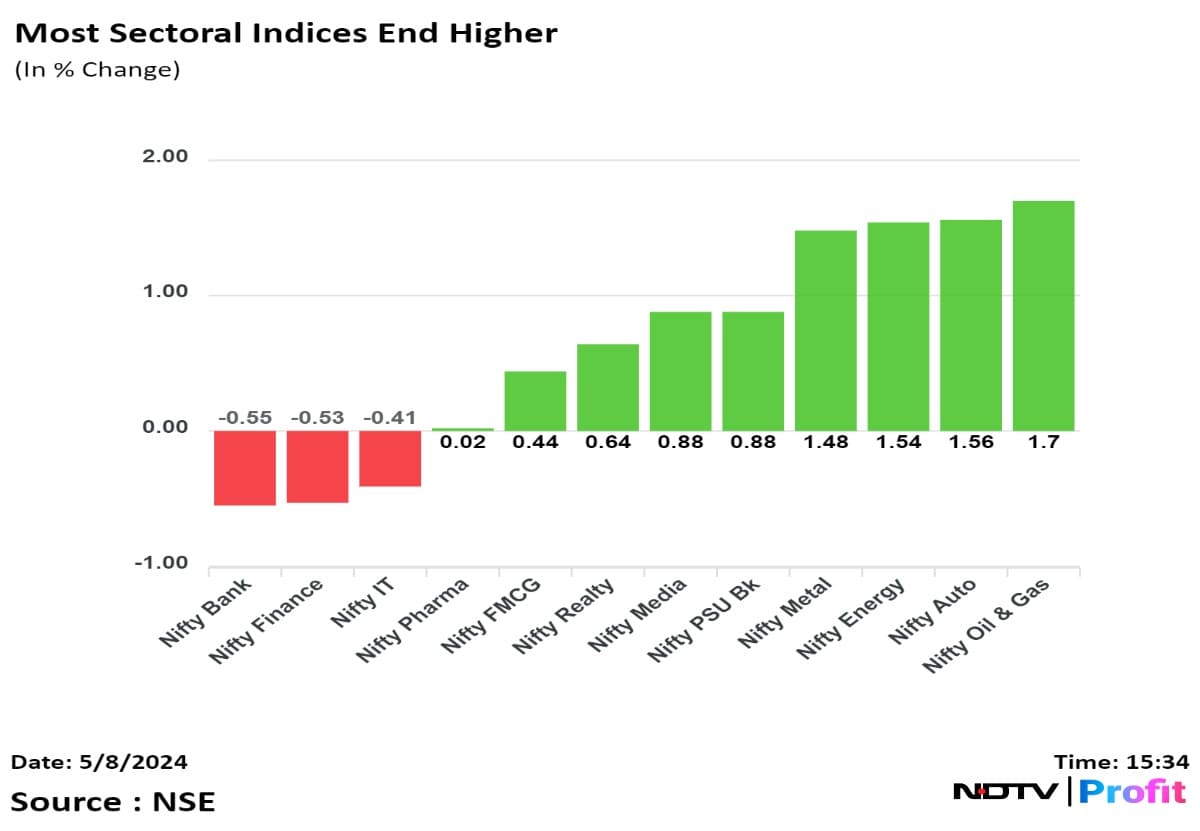

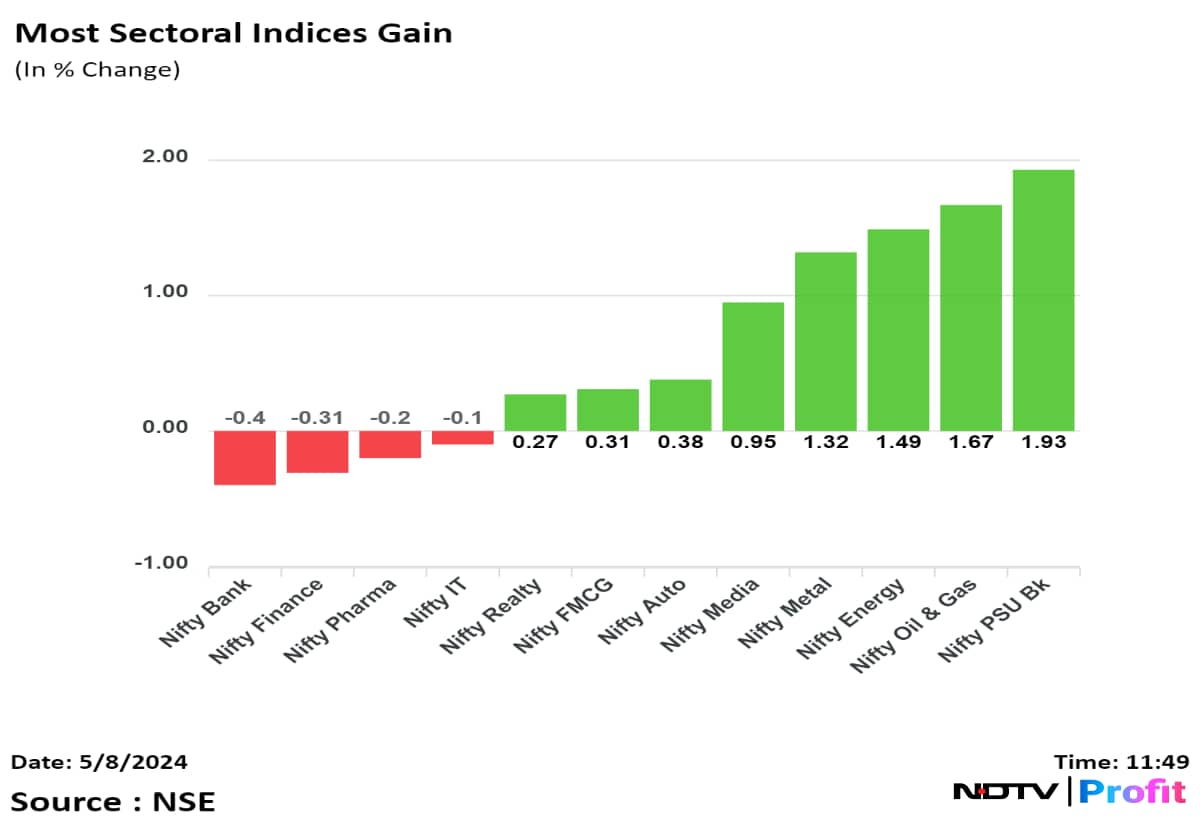

The sectors on the NSE ended higher, with the Nifty Oil and Gas and Nifty Auto advancing the most. Nifty Bank and Nifty Finance fell the most by 0.55% and 0.53%, respectively.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., Tata motors Ltd., State Bank of India and NTPC Ltd. were positively contributing to changes in the Nifty.

HDFC Bank, Infosys Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd. and Asian Paints Ltd. added negatively to the index.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

In yet another range-bound trade, India's benchmark indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points or 0.06%, to end at 73,466.39

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 earlier in the session. Volatility gauge, India VIX, ended 0.46% higher during the session.

"A lower percentage of the voter base turning up for the polls has led to a spike in India VIX," according to Aditya Agarwala, co-founder and director at Invest4Edu Pvt.

The Indian market echoed subdued investor sentiments akin to those of its Asian peers, and on worries about declining voter turnout, according to Vinod Nair, Head of Research, Geojit Financial Services. "Despite domestic Q4 earnings largely meeting estimates, the earnings landscape appears to be moderating."

The Indian rupee closed flat against the U.S. Dollar at Rs 83.5. The yield on the 10-year bond was trading higher at 7.14%.

Most stocks in Asia ended lower on Wednesday, as investors seek firm evidence of an earnings recovery before taking this month’s rally further, Bloomberg reported. Hong Kong's Hang Seng fell by 0.90, while S&P ASX closed higher by 0.14%.

Brent crude was trading 1.38% lower at $82.01 a barrel. Gold was lower by 0.16% at $2,310.36 an ounce.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., Tata motors Ltd., State Bank of India and NTPC Ltd. were positively contributing to changes in the Nifty.

HDFC Bank, Infosys Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd. and Asian Paints Ltd. added negatively to the index.

The sectors on the NSE ended higher, with the Nifty Oil and Gas and Nifty Auto advancing the most. Nifty Bank and Nifty Finance fell the most by 0.55% and 0.53%, respectively.

Broader markets outperformed the Frontline Index as Mid and Smallcaps soared over 0.50% each, Aditya Gaggar Director of Progressive Shares said. "Nothing has changed technically for the Index i.e. bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle."

Broader markets outperformed. The S&P BSE Midcap ended 1.52% higher ans S&P BSE Smallcap closed 0.78% higher.

Six out of 20 sectoral indices on the BSE ended lower while 14 advanced. S&P BSE Capital Goods was the top gainer.

The market breadth was skewed in the favour of buyers. Around 2,133 stocks rose, 1661 fell, and 132 remained unchanged on the BSE.

Do not see pressure on core capital and margins due to RBI's project finance draft norms, says Canara Bank MD & CEO K Satyanarayana Raju

--We will pass on the cost to infra borrowers

--Total exposure to project finance stands at about Rs 1- 1.1 lakh crore

--Entire project finance portfolio will not attract 5%

--Seeking clarifications from RBI on project finance norms

Source: Post-earnings call

Revenue at Rs 562.28 crore vs Rs 556.37 crore, up 1.06%

EBITDA at Rs 74.91 crore vs Rs 88.66 crore, down 15.5%

Margin at 13.32% vs 15.93%, down 261 bps

Net profit at Rs 0.76 crore vs Rs 20.09 crore, down 96.21%

Net profit at Rs 1,016 crore vs Bloomberg estimates of Rs 1,048 crore

Revenue at Rs 9,519 crore vs Bloomberg estimates of Rs 9,401 crore

EBITDA at Rs 1,359 crore vs Bloomberg estimates of Rs 1,323 crore

Margin at 14.3% vs Bloomberg est of 14.1%

Board recommends a final dividend of Rs 40/share

US FDA inspection at Kurkumbh facility in Maharashtra closes with 1 observation Source

Source: Exchange filing

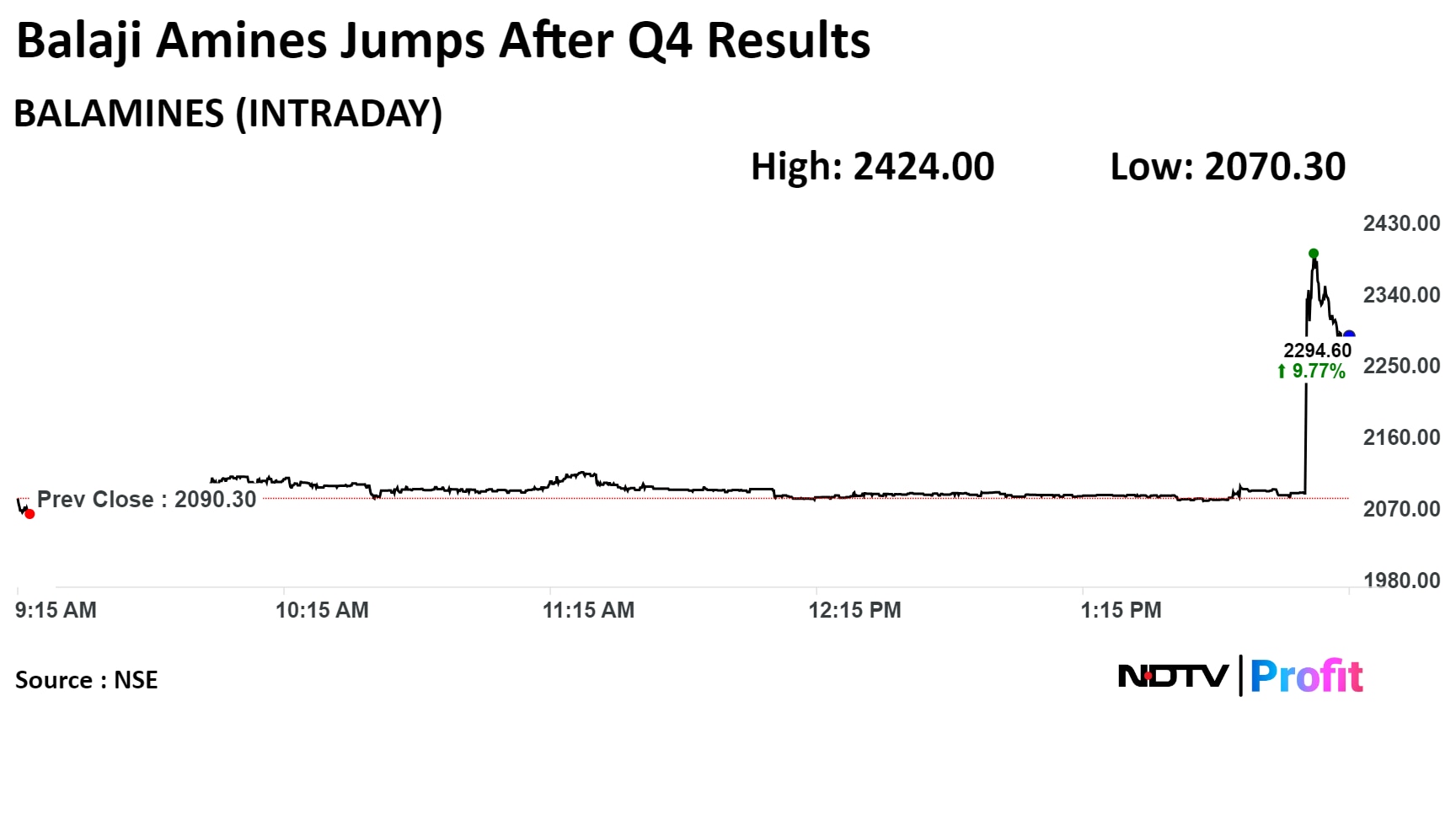

Revenue at Rs 413.94 crore vs Rs 471.39 crore, down 12.19%

EBITDA at Rs 97.72 crore vs Rs 93.13 crore, up 4.92%

Margin at 23.6% vs 19.75%, up 385 bps

Net profit at Rs 72.48 crore vs Rs 55.21 crore, up 31.28%

Revenue at Rs 413.94 crore vs Rs 471.39 crore, down 12.19%

EBITDA at Rs 97.72 crore vs Rs 93.13 crore, up 4.92%

Margin at 23.6% vs 19.75%, up 385 bps

Net profit at Rs 72.48 crore vs Rs 55.21 crore, up 31.28%

Net profit at Rs 3,757 crore vs Rs 3,175 crore, up 18% YoY

Gross NPA at 4.23% vs 4.39% QoQ

Gross NPA at 4.23% vs 4.39% QoQ

NII at Rs 9,580 crore vs Rs 8,617 crore, up 11% YoY

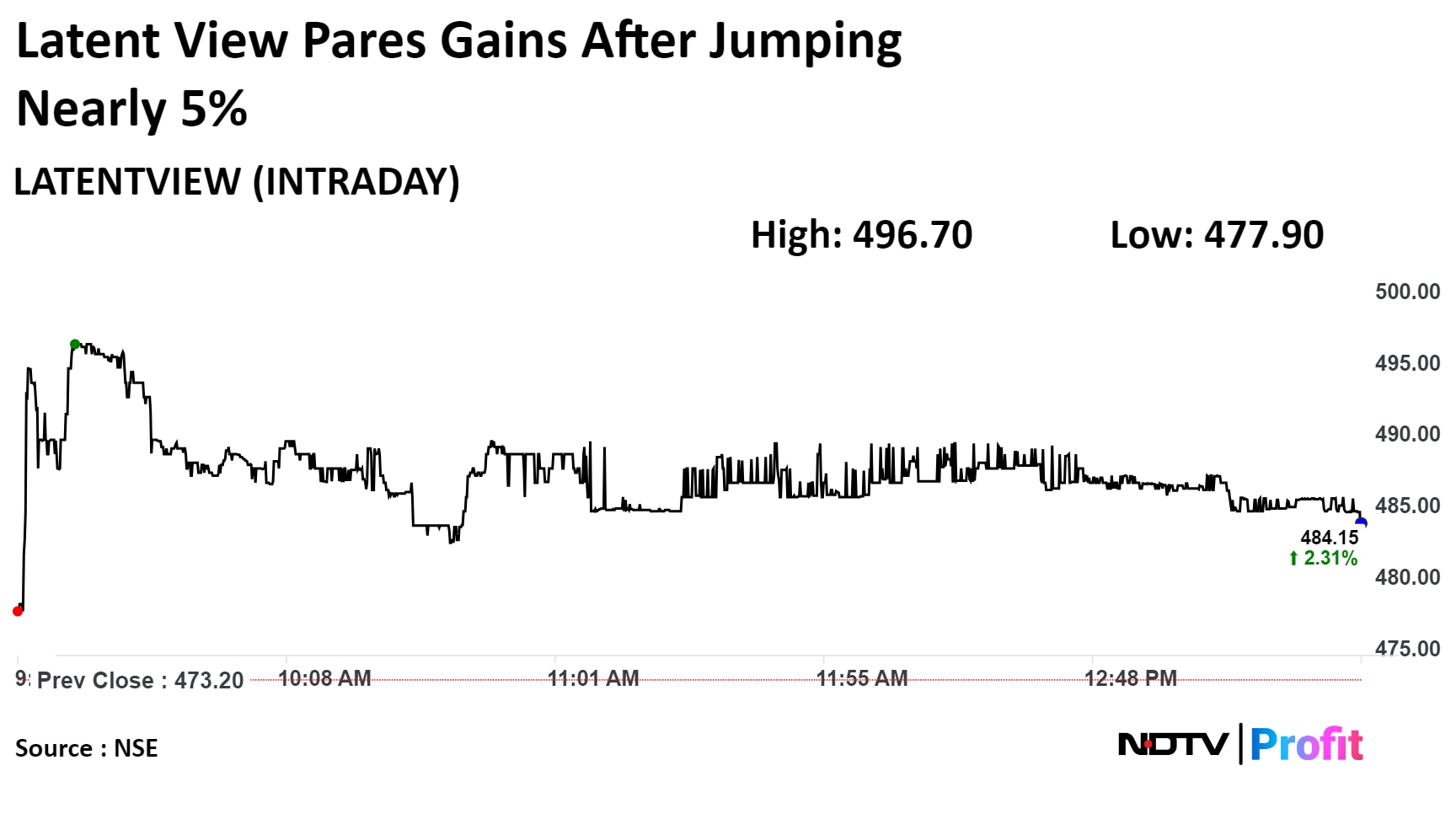

Shares of Latent View Analytics gained as much as 4.97% after the company's net profit was in line with Bloomberg estimates.

Latent View Analytics (Consolidated, QoQ)

Revenue up 3.59% at Rs 172 crore vs Rs 166 crore (Bloomberg estimate Rs 173 crore).

EBIT up 10.61% at Rs 37.93 crore vs Rs 34.29 crore (Bloomberg estimate Rs 37.2 crore).

Margin up 140 bps at 22.09% vs 20.69% (Bloomberg estimate 21.5%).

Net profit down 2.75% at Rs 45.24 crore vs Rs 46.52 crore (Bloomberg estimate Rs 44.6 crore).

Shares of Latent View Analytics gained as much as 4.97% after the company's net profit was in line with Bloomberg estimates.

Latent View Analytics (Consolidated, QoQ)

Revenue up 3.59% at Rs 172 crore vs Rs 166 crore (Bloomberg estimate Rs 173 crore).

EBIT up 10.61% at Rs 37.93 crore vs Rs 34.29 crore (Bloomberg estimate Rs 37.2 crore).

Margin up 140 bps at 22.09% vs 20.69% (Bloomberg estimate 21.5%).

Net profit down 2.75% at Rs 45.24 crore vs Rs 46.52 crore (Bloomberg estimate Rs 44.6 crore).

In pact to establish a real estate development platform

Platform to deploy up to Rs 765 crore for residential re-development in the Mumbai Metropolitan Region and other areas

Co to invest Rs 90 crore in platform for 11.76% stake

Source: Exchange filing

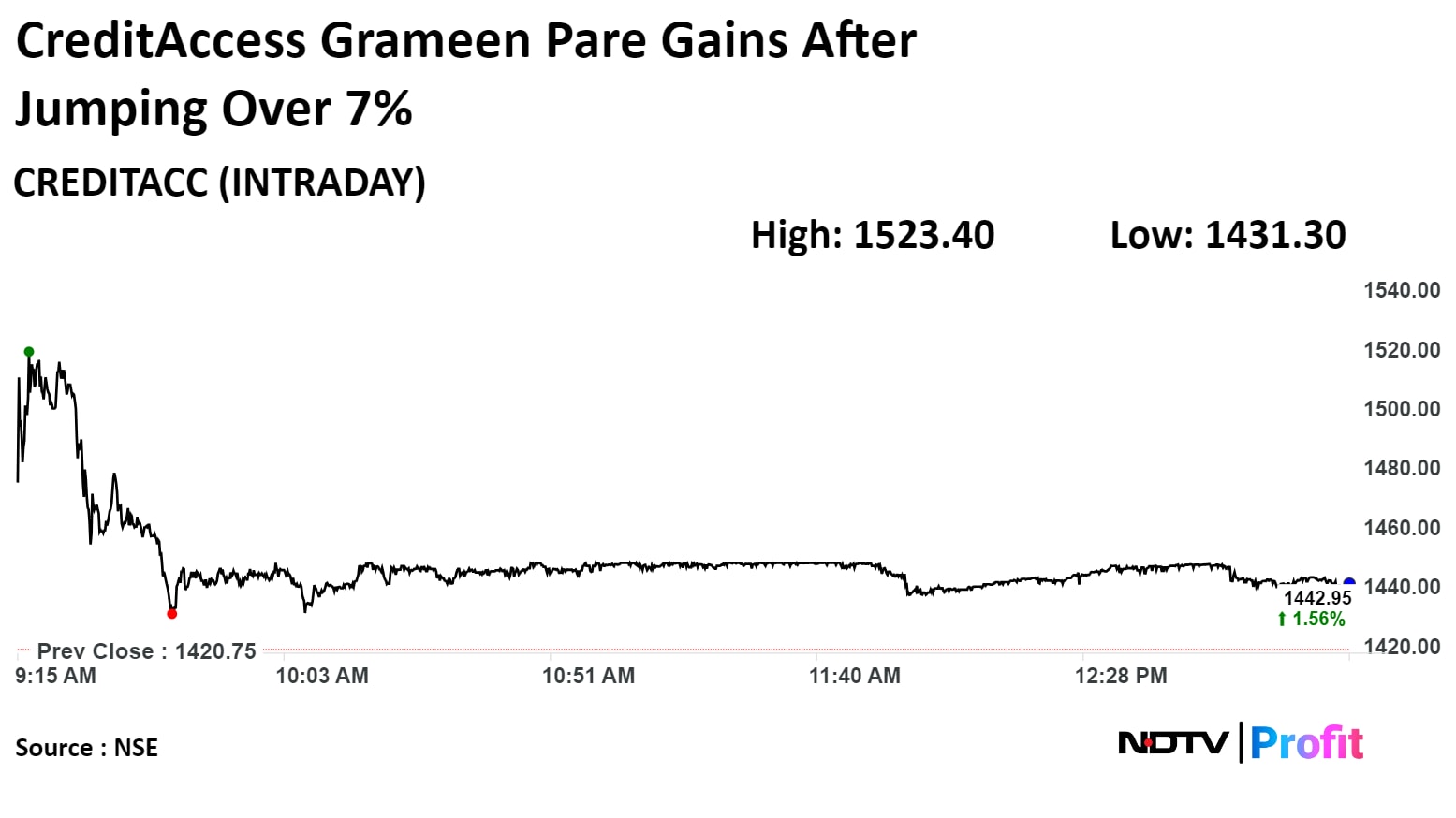

Shares of CreditAccess Grameen Ltd. rose over 7% after the microfinance company reported a 34% jump in net profit at Rs 397 crore in the fourth quarter of the financial year 2024.

Shares of CreditAccess Grameen Ltd. rose over 7% after the microfinance company reported a 34% jump in net profit at Rs 397 crore in the fourth quarter of the financial year 2024.

On the NSE, CreditAccess Grameen rose as much as 7.23% during the day to Rs 1,523.40 apiece, the highest jump since Jan 05. It was trading 1.54% higher at Rs 1,442.65 per share, compared to a 0.18% advance in the benchmark Nifty 50 at 1:12 p.m.

The share price has fallen 9.49% on a year-to-date basis but 45.97% in the last 12 months. The total traded volume so far in the day stood at 8.1 times its 30-day average. The relative strength index was at 47.19.

Nineteen out of the 20 analysts tracking the company have a 'buy' rating on the stock and one recommend 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 27.6%.

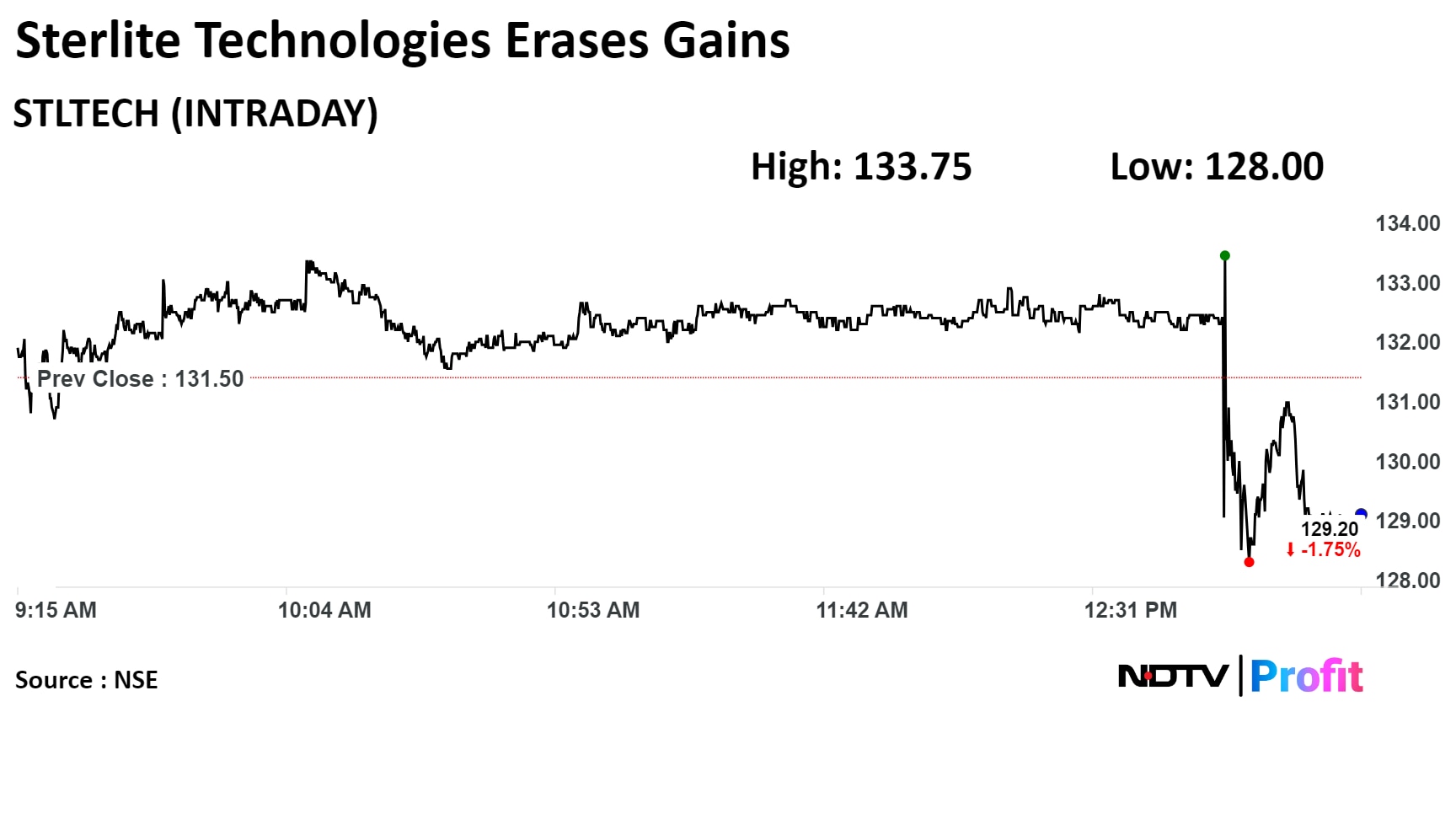

Revenue at Rs 1,140 crore vs Rs 1,872 crore, down 39.11%

EBITDA at Rs 53 crore vs Rs 256 crore, down 79.29%

Margin at 4.64% vs 13.67%, down 902 bps

Net loss at Rs 82 crore vs profit of Rs 63 crore

Revenue at Rs 1,140 crore vs Rs 1,872 crore, down 39.11%

EBITDA at Rs 53 crore vs Rs 256 crore, down 79.29%

Margin at 4.64% vs 13.67%, down 902 bps

Net loss at Rs 82 crore vs profit of Rs 63 crore

Revenue at Rs 4164.2 crore vs Rs 3629.1 crore, up 14.74%

EBITDA at Rs 643.28 crore vs Rs 438.51 crore, up 46.69%

Margin at 15.44% vs 12.08%, up 336 bps

Net profit at Rs 227.12 crore vs Rs 127.74 crore, up 77.79%

Revenue at Rs 4164.2 crore vs Rs 3629.1 crore, up 14.74%

EBITDA at Rs 643.28 crore vs Rs 438.51 crore, up 46.69%

Margin at 15.44% vs 12.08%, up 336 bps

Net profit at Rs 227.12 crore vs Rs 127.74 crore, up 77.79%

Letter expresses issues at Air India Express, after acquisition by Tata

Voice growing unrest and dissatisfaction among employees

Issues Expressed In The Letter

Terminations of several employees contrary to assurances by Finance Minister

Hiring concerns: People with less experience assigned higher designations

Remuneration issues: HRA, TA, DA and DH removed from compensation after merger

Improper implementation of SOPs

Source: Copy of letter reviewed by NDTV Profit

MoU for supply of indigenous marine grade steel

Source: PIB

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., NTPC Ltd., State Bank Of India, and Coal India Ltd. were contributing to the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd., Asian Paints Ltd., and Dr Reddy's Laboratories Ltd. were weighing on the index.

Most sectoral indices erased early loss and rose with Nifty PSU Bank and Nifty Oil and Gas leading.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., NTPC Ltd., State Bank Of India, and Coal India Ltd. were contributing to the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd., Asian Paints Ltd., and Dr Reddy's Laboratories Ltd. were weighing on the index.

Most sectoral indices erased early loss and rose with Nifty PSU Bank and Nifty Oil and Gas leading.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., NTPC Ltd., State Bank Of India, and Coal India Ltd. were contributing to the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd., Asian Paints Ltd., and Dr Reddy's Laboratories Ltd. were weighing on the index.

Most sectoral indices erased early loss and rose with Nifty PSU Bank and Nifty Oil and Gas leading.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Benchmark equity indices erased most of their losses and traded flat through midday on Wednesday as losses in the shares of HDFC Bank Ltd. and ICICI Bank Ltd. were offset by gains in Reliance Industries Ltd. and Larsen & Toubro Ltd.

At 11:52 a.m., the NSE Nifty 50 was trading flat at 22,306.95, and the S&P BSE Sensex was also flat at 73,467.70.

The benchmarks have been a little jittery, said Amit Goel, founder of Amit Ventures. He is more concerned about the Nifty, which has created a double-top formation.

He expects the index to remain rangebound but with a bearish bias until the general elections are over.

Goel sees no strong traction till the index crosses the 22,800 mark, and if it falls to the 22,000–21,900 mark, investors should start building long positions.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., NTPC Ltd., State Bank Of India, and Coal India Ltd. were contributing to the Nifty.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd., Asian Paints Ltd., and Dr Reddy's Laboratories Ltd. were weighing on the index.

Most sectoral indices erased early loss and rose with Nifty PSU Bank and Nifty Oil and Gas leading.

Broader markets outperformed their larger peers, with the S&P BSE Midcap rising 0.56% and S&P BSE Smallcap gaining 0.6% through midday on Wednesday.

Six out of 20 sectoral indices on the BSE declined, while 14 gained. S&P BSE Energy was the top gainer and S&P BSE Auto fell the most.

The market breadth was skewed in favour of the buyers. Around 2,102 stocks rose, 1,447 declined, and 165 remain unchanged.

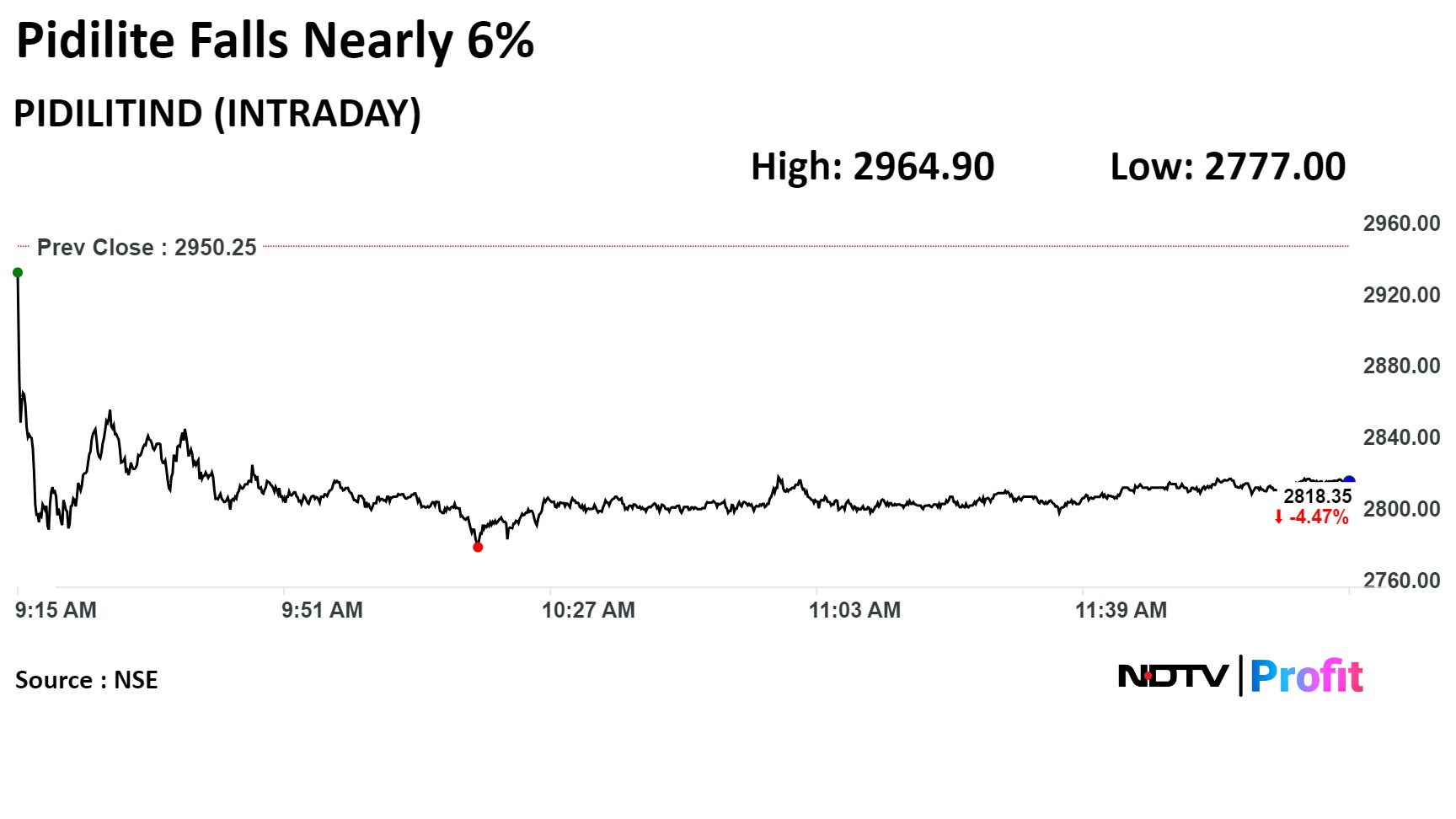

Shares of Pidilite Industries Ltd. fell to its lowest level in nearly two months after the company's net profit for the quarter ended March was lower than Bloomberg's estimates.

Citi Research in a note said, "With soft RM prices likely to be largely offset by subdued revenue growth (double-digit volume growth offset by price cuts) and higher investment in brands and customer-facing initiatives, overall earnings growth may lag revenue growth ahead."

The brokerage reiterated its "sell" rating for the stock and a price target of Rs 2,200, implying a downside of 25.43%.

Pidilite Industries (Consolidated, YoY)

Revenue up 7.9% at Rs 2902 crore vs Rs 2689 crore (Bloomberg estimate Rs 2,831 crore).

EBITDA up 25.64% at Rs 576.93 crore vs Rs 459.16 crore (Bloomberg estimate Rs 621 crore).

Margin up 280 bps at 19.88% vs 17.07% (Bloomberg estimate 21.9%).

Net profit up 6.45% at Rs 304 crore vs Rs 286 crore (Bloomberg estimate Rs 425 crore).

Board recommended dividend of Rs 16 per share.

Shares of Pidilite Industries Ltd. fell to its lowest level in nearly two months after the company's net profit for the quarter ended March was lower than Bloomberg's estimates.

Citi Research in a note said, "With soft RM prices likely to be largely offset by subdued revenue growth (double-digit volume growth offset by price cuts) and higher investment in brands and customer-facing initiatives, overall earnings growth may lag revenue growth ahead."

The brokerage reiterated its "sell" rating for the stock and a price target of Rs 2,200, implying a downside of 25.43%.

Pidilite Industries (Consolidated, YoY)

Revenue up 7.9% at Rs 2902 crore vs Rs 2689 crore (Bloomberg estimate Rs 2,831 crore).

EBITDA up 25.64% at Rs 576.93 crore vs Rs 459.16 crore (Bloomberg estimate Rs 621 crore).

Margin up 280 bps at 19.88% vs 17.07% (Bloomberg estimate 21.9%).

Net profit up 6.45% at Rs 304 crore vs Rs 286 crore (Bloomberg estimate Rs 425 crore).

Board recommended dividend of Rs 16 per share.

The scrip fell as much as 5.87% to Rs 2,777 apiece, the lowest level since March 14. It pared losses to trade 4% lower at Rs 2,831.35 apiece, as of 12:44 p.m. This compares to a 0.09% advance in the NSE Nifty 50 Index.

It has risen 4.20% on a year-to-date basis and 8.38% in the last twelve months. Total traded volume so far in the day stood at 3.17 times its 30-day average. The relative strength index was at 39.27.

Out of the 19 analysts tracking the company, eight maintain a 'buy' rating, four recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.6%.

Shares of Jindal Saw fell today after the its results for the quarter ended March fell short of what Bloomberg had estimated. The company's net profit rose 61.46% to Rs 480 crore as against Bloomberg estimates of Rs 576 crore.

Jindal Saw (Consolidated, YoY)

Revenue up 4.56% at Rs 5425 crore vs Rs 5188 crore (Bloomberg estimate Rs 5,785 crore).

Ebitda up 53.4%at Rs 920 crore vs Rs 600 crore (Bloomberg estimate Rs 1064 crore).

Margin up 540 bps at 16.96% vs 11.56% (Bloomberg estimate Rs 18.4%).

Net profit up 61.46% at Rs 480 crore vs Rs 298 crore (Bloomberg estimate Rs 576 crore).

Shares of Jindal Saw fell today after the its results for the quarter ended March fell short of what Bloomberg had estimated. The company's net profit rose 61.46% to Rs 480 crore as against Bloomberg estimates of Rs 576 crore.

Jindal Saw (Consolidated, YoY)

Revenue up 4.56% at Rs 5425 crore vs Rs 5188 crore (Bloomberg estimate Rs 5,785 crore).

Ebitda up 53.4%at Rs 920 crore vs Rs 600 crore (Bloomberg estimate Rs 1064 crore).

Margin up 540 bps at 16.96% vs 11.56% (Bloomberg estimate Rs 18.4%).

Net profit up 61.46% at Rs 480 crore vs Rs 298 crore (Bloomberg estimate Rs 576 crore).

The scrip fell as much as 6.67% to Rs 530.05 apiece, the lowest level since April 25. It pared gains to trade 5.98% lower at Rs 533.90 apiece, as of 11:36 a.m. This compares to a 0.17% decline in the NSE Nifty 50 Index.

It has risen 29.58% on a year-to-date basis and 119.57% in the last twelve months. Total traded volume so far in the day stood at 2.33 times its 30-day average. The relative strength index was at 53.85.

Out of the two analysts tracking the company, one maintain a 'buy' rating, one recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.7%.

Banks to seek graded provisioning requirement for higher rated project loans

Bankers feel 5% flat provisions are too onerous

Banks to seek Rs 1,500 crore cut-off for guidelines to apply

Banks to ask RBI for more lenient terms on project finance draft guidelines

Banks in the process of assessing financial impact of draft guidelines

IBA to approach RBI to ease norms

Banks to seek clarification on calculation of net present value of loan assets

Banks to seek DFS support in discussions with RBI

Source: People In The Know

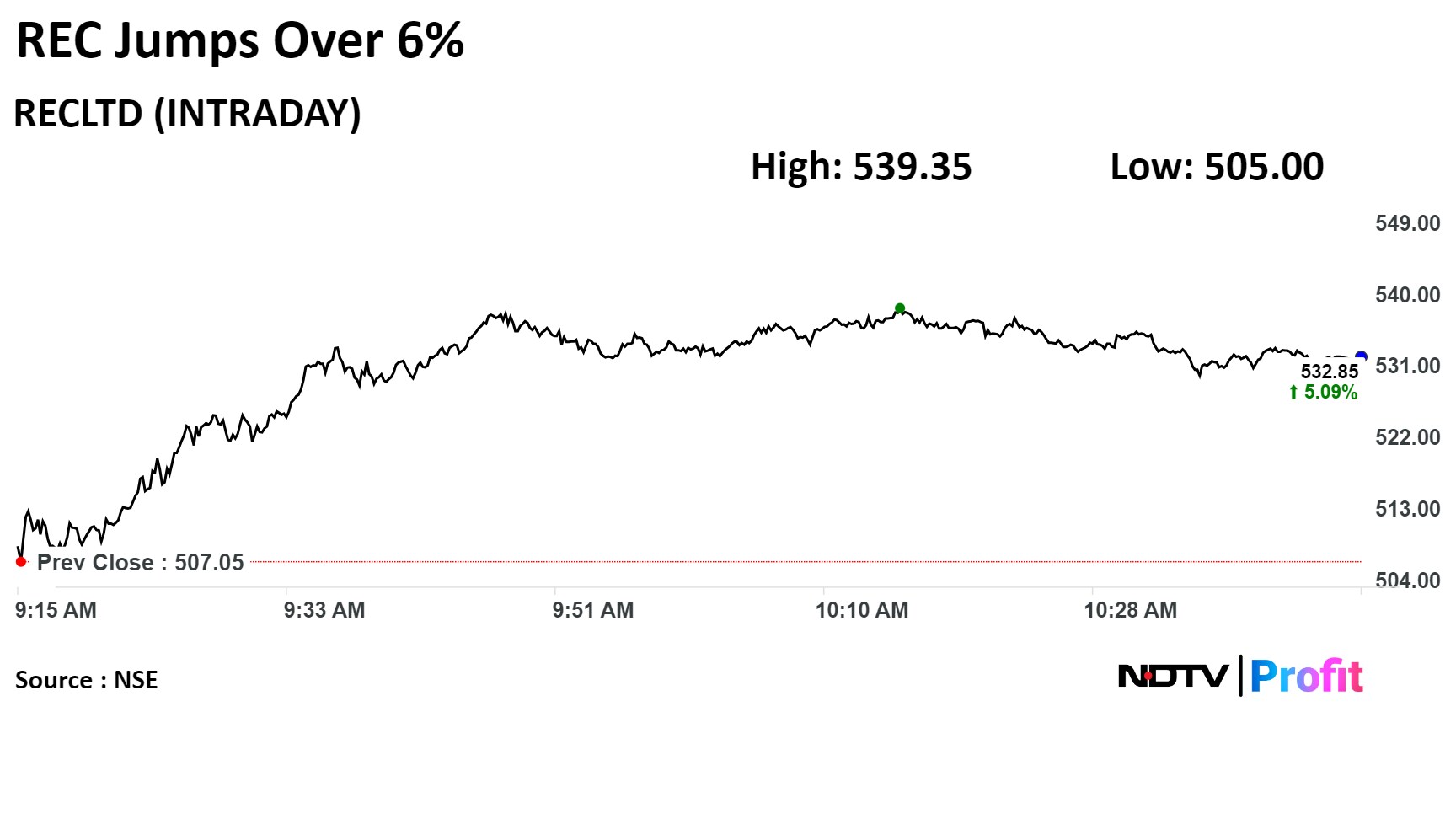

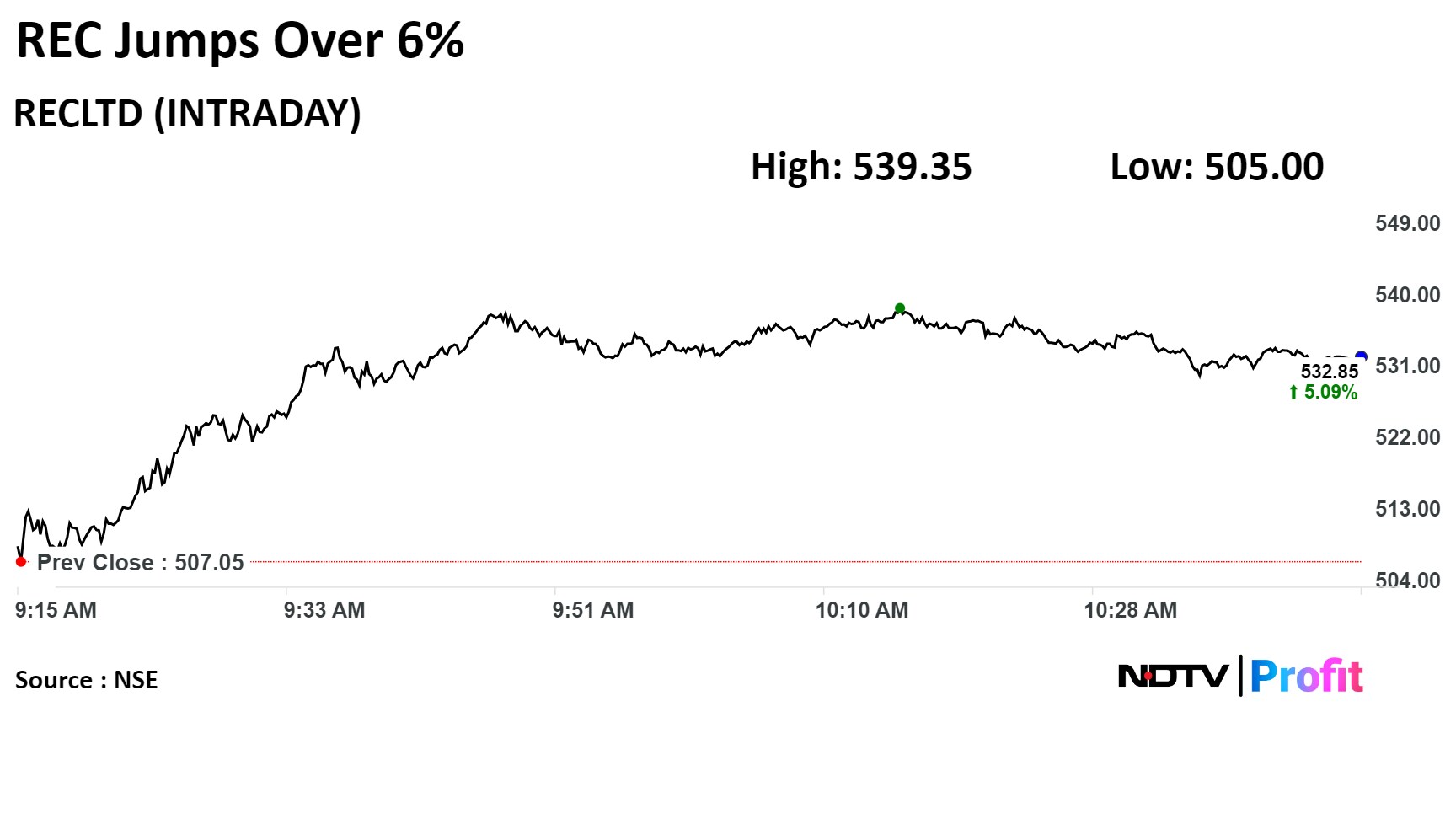

Shares of REC Ltd. snapped their two day fall and rose today after the company said that the new RBI draft guideline will not impact the company's profitability, book value or net worth.

The impact of the said guidelines will be on Tier 1 capital only, however, 80% of current projects already commissioned, the company said in an investor call.

The stock had fallen over 10% in the last two sessions when the RBI's draft guidelines mentioned that 5% general provision should be made on all existing and fresh project loans which are in the "construction phase," meaning before commercial operations commence.

The company said that the guidelines are unlikely to have an impact on borrowing costs for borrowers in renewable projects and borrowers of non-renewable projects are unlikely to be subjected to higher rates as they have plenty of supply borrowers.

Moreover, metro projects supported by the State Govt will not attract the draft proposed regulation, according to the company. However, in case of an impact, the capability will pass on the rates.

It also said that an impairment reserve is not required since its provisioning is more than required by IRAC norms.

Shares of REC Ltd. snapped their two day fall and rose today after the company said that the new RBI draft guideline will not impact the company's profitability, book value or net worth.

The impact of the said guidelines will be on Tier 1 capital only, however, 80% of current projects already commissioned, the company said in an investor call.

The stock had fallen over 10% in the last two sessions when the RBI's draft guidelines mentioned that 5% general provision should be made on all existing and fresh project loans which are in the "construction phase," meaning before commercial operations commence.

The company said that the guidelines are unlikely to have an impact on borrowing costs for borrowers in renewable projects and borrowers of non-renewable projects are unlikely to be subjected to higher rates as they have plenty of supply borrowers.

Moreover, metro projects supported by the State Govt will not attract the draft proposed regulation, according to the company. However, in case of an impact, the capability will pass on the rates.

It also said that an impairment reserve is not required since its provisioning is more than required by IRAC norms.

The scrip rose as much as 6.37% to Rs 539.35 apiece, the highest level since May 6. It pared gains to trade 5.2% higher at Rs 533.80 apiece, as of 10:49 a.m. This compares to a 0.4% decline in the NSE Nifty 50 Index.

It has risen 29.37% on a year-to-date basis an 276.86% in the last twelve months. Total traded volume so far in the day stood at 1.09 times its 30-day average. The relative strength index was at 64.68.

Out of the six analysts tracking the company, five maintain a 'buy' rating, one recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11%.

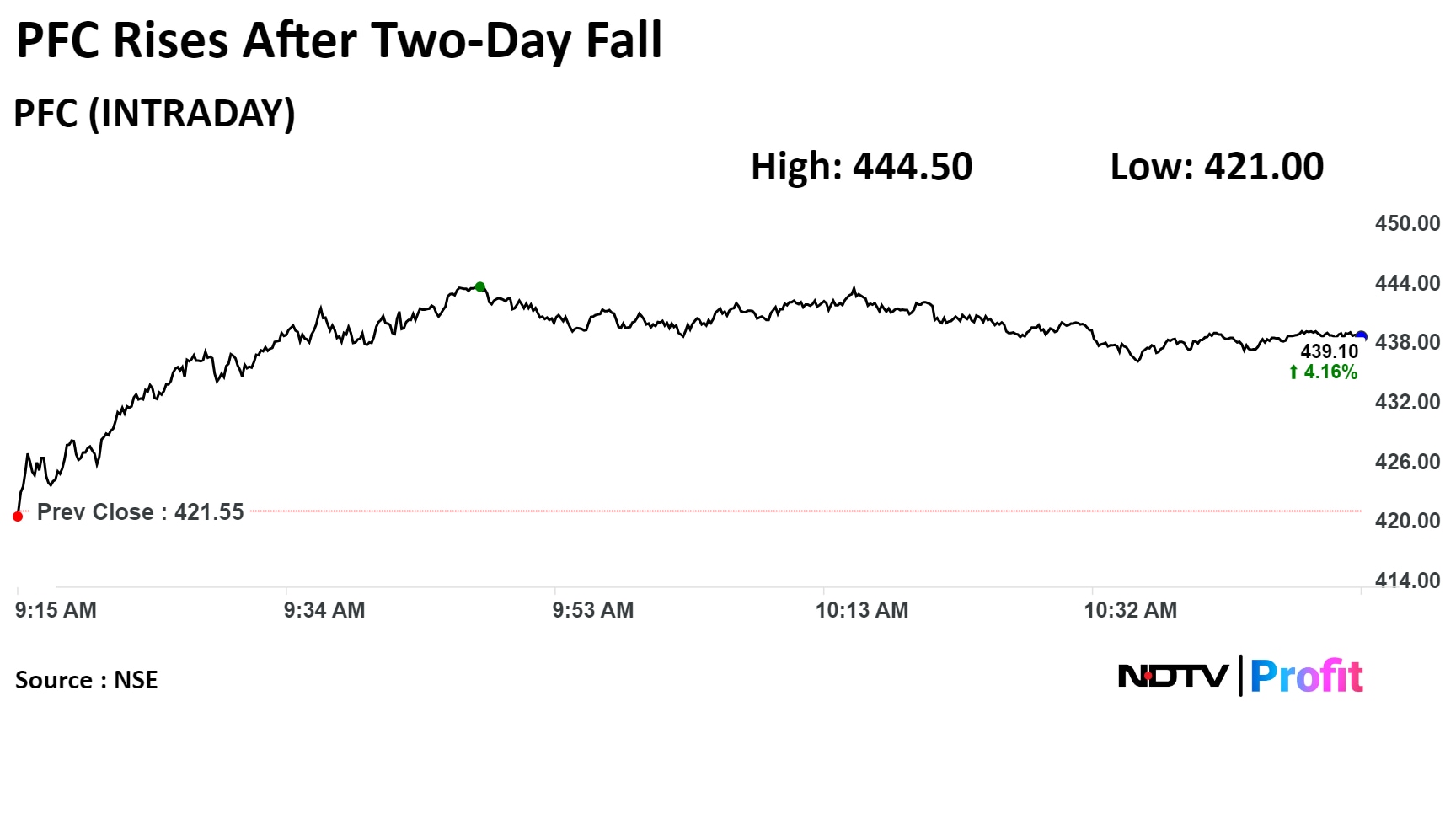

Shares of PFC had also fallen nearly 12% in their two day fall. Today, they rose as much as 5.44% to Rs 444.50, its highest level since May 6.

Shares of REC Ltd. snapped their two day fall and rose today after the company said that the new RBI draft guideline will not impact the company's profitability, book value or net worth.

The impact of the said guidelines will be on Tier 1 capital only, however, 80% of current projects already commissioned, the company said in an investor call.

The stock had fallen over 10% in the last two sessions when the RBI's draft guidelines mentioned that 5% general provision should be made on all existing and fresh project loans which are in the "construction phase," meaning before commercial operations commence.

The company said that the guidelines are unlikely to have an impact on borrowing costs for borrowers in renewable projects and borrowers of non-renewable projects are unlikely to be subjected to higher rates as they have plenty of supply borrowers.

Moreover, metro projects supported by the State Govt will not attract the draft proposed regulation, according to the company. However, in case of an impact, the capability will pass on the rates.

It also said that an impairment reserve is not required since its provisioning is more than required by IRAC norms.

Shares of REC Ltd. snapped their two day fall and rose today after the company said that the new RBI draft guideline will not impact the company's profitability, book value or net worth.

The impact of the said guidelines will be on Tier 1 capital only, however, 80% of current projects already commissioned, the company said in an investor call.

The stock had fallen over 10% in the last two sessions when the RBI's draft guidelines mentioned that 5% general provision should be made on all existing and fresh project loans which are in the "construction phase," meaning before commercial operations commence.

The company said that the guidelines are unlikely to have an impact on borrowing costs for borrowers in renewable projects and borrowers of non-renewable projects are unlikely to be subjected to higher rates as they have plenty of supply borrowers.

Moreover, metro projects supported by the State Govt will not attract the draft proposed regulation, according to the company. However, in case of an impact, the capability will pass on the rates.

It also said that an impairment reserve is not required since its provisioning is more than required by IRAC norms.

The scrip rose as much as 6.37% to Rs 539.35 apiece, the highest level since May 6. It pared gains to trade 5.2% higher at Rs 533.80 apiece, as of 10:49 a.m. This compares to a 0.4% decline in the NSE Nifty 50 Index.

It has risen 29.37% on a year-to-date basis an 276.86% in the last twelve months. Total traded volume so far in the day stood at 1.09 times its 30-day average. The relative strength index was at 64.68.

Out of the six analysts tracking the company, five maintain a 'buy' rating, one recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11%.

Shares of PFC had also fallen nearly 12% in their two day fall. Today, they rose as much as 5.44% to Rs 444.50, its highest level since May 6.

Gets orders worth Rs 5,000-10,000 crore including floating solar plants

Source: Exchange filing

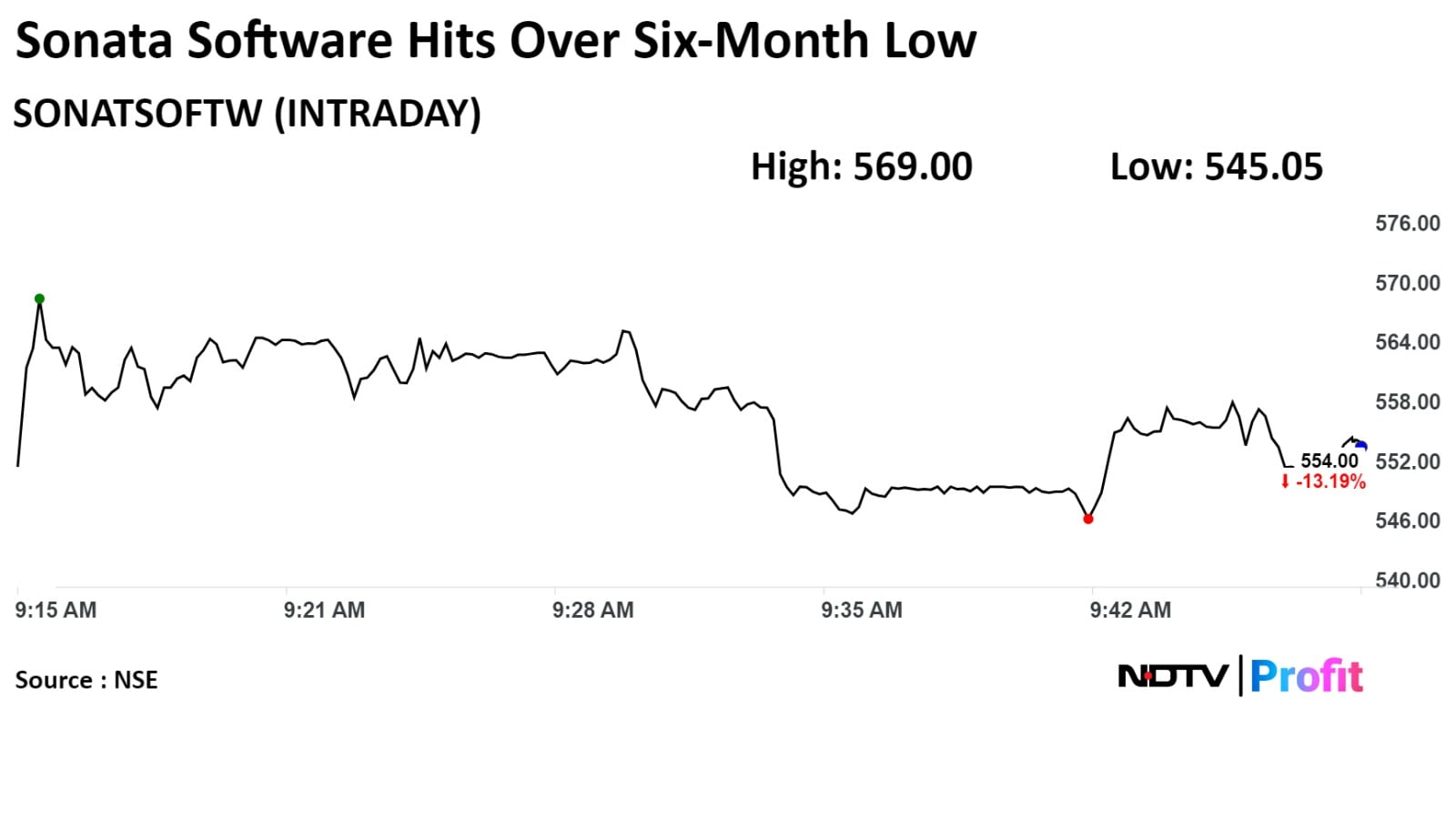

Shares of Sonata Software recorded their steepest fall in over three years after the company reported a sequential fall in its net profit and revenue for the quarter ended March.

The company's revenue was slightly higher than what Bloomberg had estimated but net profit missed the expectations.

Sonata Software (Consolidated, QoQ)

Revenue down 12.11% at Rs 2,192 crore vs Rs 2,493 crore (Bloomberg estimate Rs 2179 crore).

EBIT down 36.51% at Rs 110 crore vs Rs 174 crore (Bloomberg estimate Rs 168.5 crore).

EBIT margin down 193 bps at 5.03% vs 6.97% (Bloomberg estimate 7.73%).

Net profit down 22.85% at Rs 33.22 crore vs Rs 43.06 crore (Bloomberg estimate Rs 128.25 crore).

Board recommends final dividend of Rs 4.4 per share.

Shares of Sonata Software recorded their steepest fall in over three years after the company reported a sequential fall in its net profit and revenue for the quarter ended March.

The company's revenue was slightly higher than what Bloomberg had estimated but net profit missed the expectations.

Sonata Software (Consolidated, QoQ)

Revenue down 12.11% at Rs 2,192 crore vs Rs 2,493 crore (Bloomberg estimate Rs 2179 crore).

EBIT down 36.51% at Rs 110 crore vs Rs 174 crore (Bloomberg estimate Rs 168.5 crore).

EBIT margin down 193 bps at 5.03% vs 6.97% (Bloomberg estimate 7.73%).

Net profit down 22.85% at Rs 33.22 crore vs Rs 43.06 crore (Bloomberg estimate Rs 128.25 crore).

Board recommends final dividend of Rs 4.4 per share.

The scrip fell as much as 14.6% to Rs 545.05 apiece, the lowest level since Oct. 26. It pared losses to trade 12.97% lower at Rs 555.05 apiece, as of 10:08 a.m. This compares to a 0.9% decline in the NSE Nifty 50 Index.

It has fallen 25.24% on a year-to-date basis and 14.3% in the last twelve months. Total traded volume so far in the day stood at 6.96 times its 30-day average. The relative strength index was at 17.91, indicating that the stock may be oversold.

Out of the six analysts tracking the company, fove maintain a 'buy' rating and one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 45.8%.

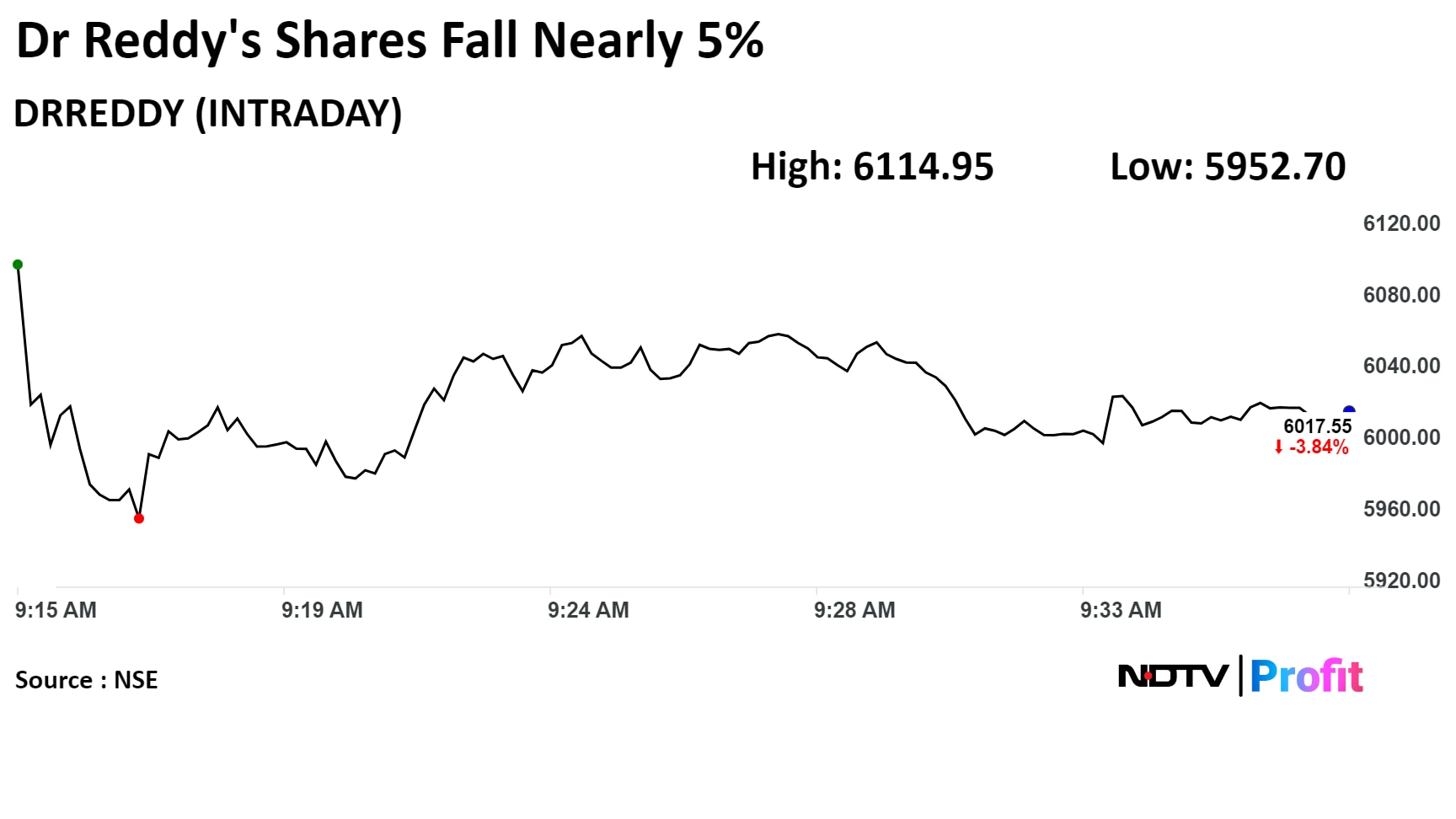

The stock extended losses in the third consecutive day today and fell nearly 5% to hit Rs 5,952.70, its lowest level since April 25.

The stock extended losses in the third consecutive day today and fell nearly 5% to hit Rs 5,952.70, its lowest level since April 25.

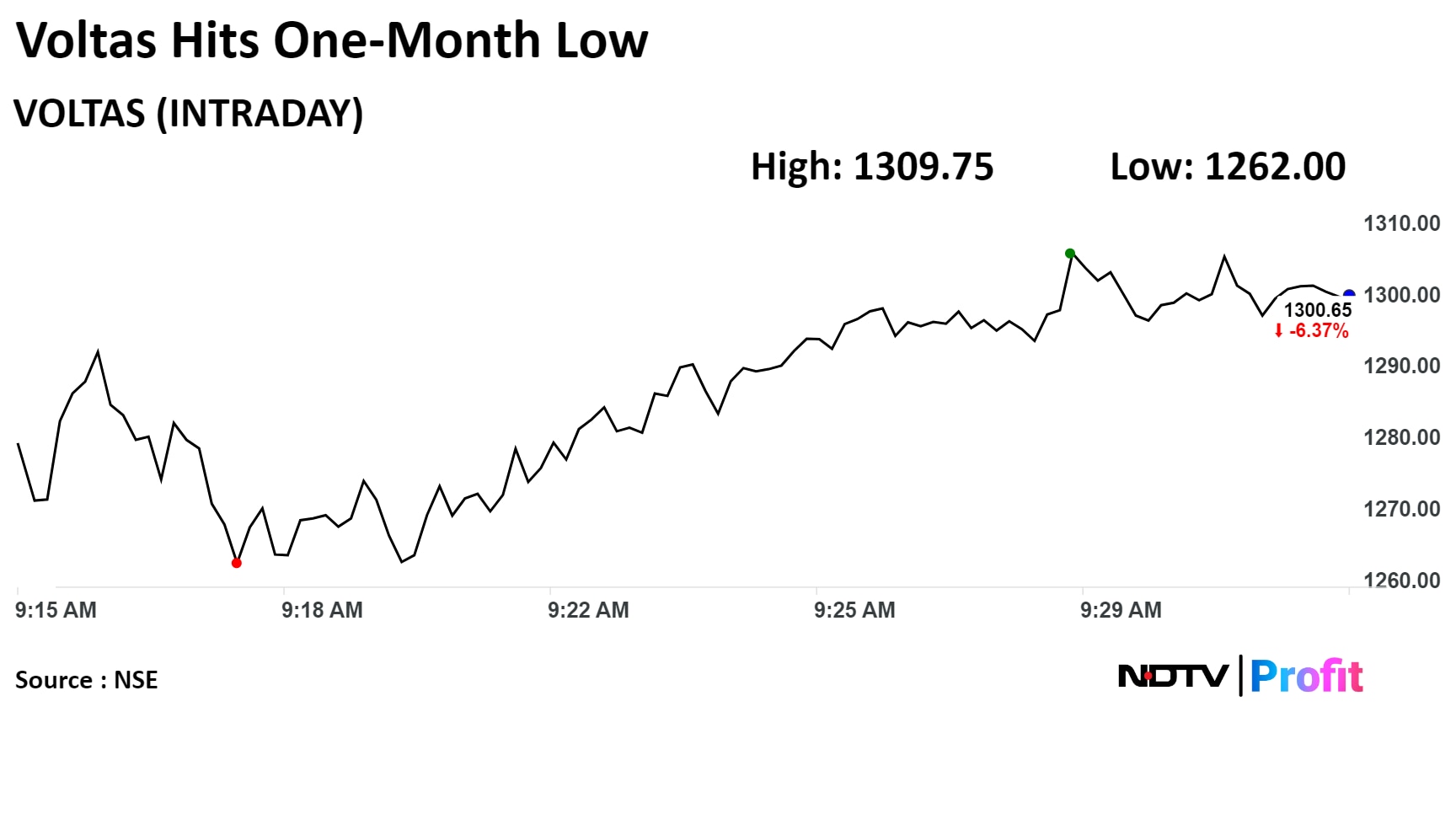

The stock fell as much as 9.16% to hit its lowest level since April 5. It has risen 33% on a year-to-date basis and 58.42% in the last twelve months.

The stock fell as much as 9.16% to hit its lowest level since April 5. It has risen 33% on a year-to-date basis and 58.42% in the last twelve months.

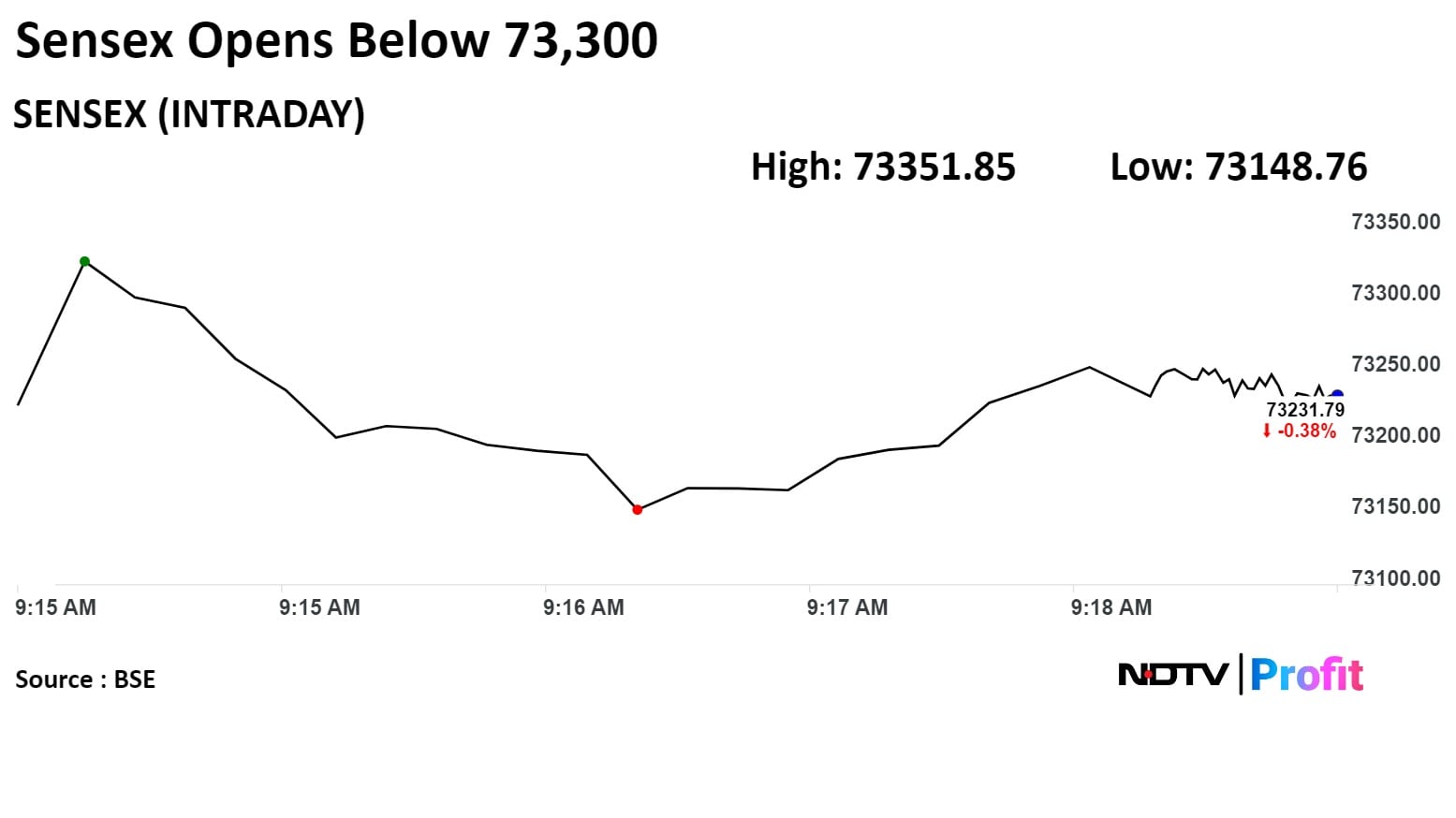

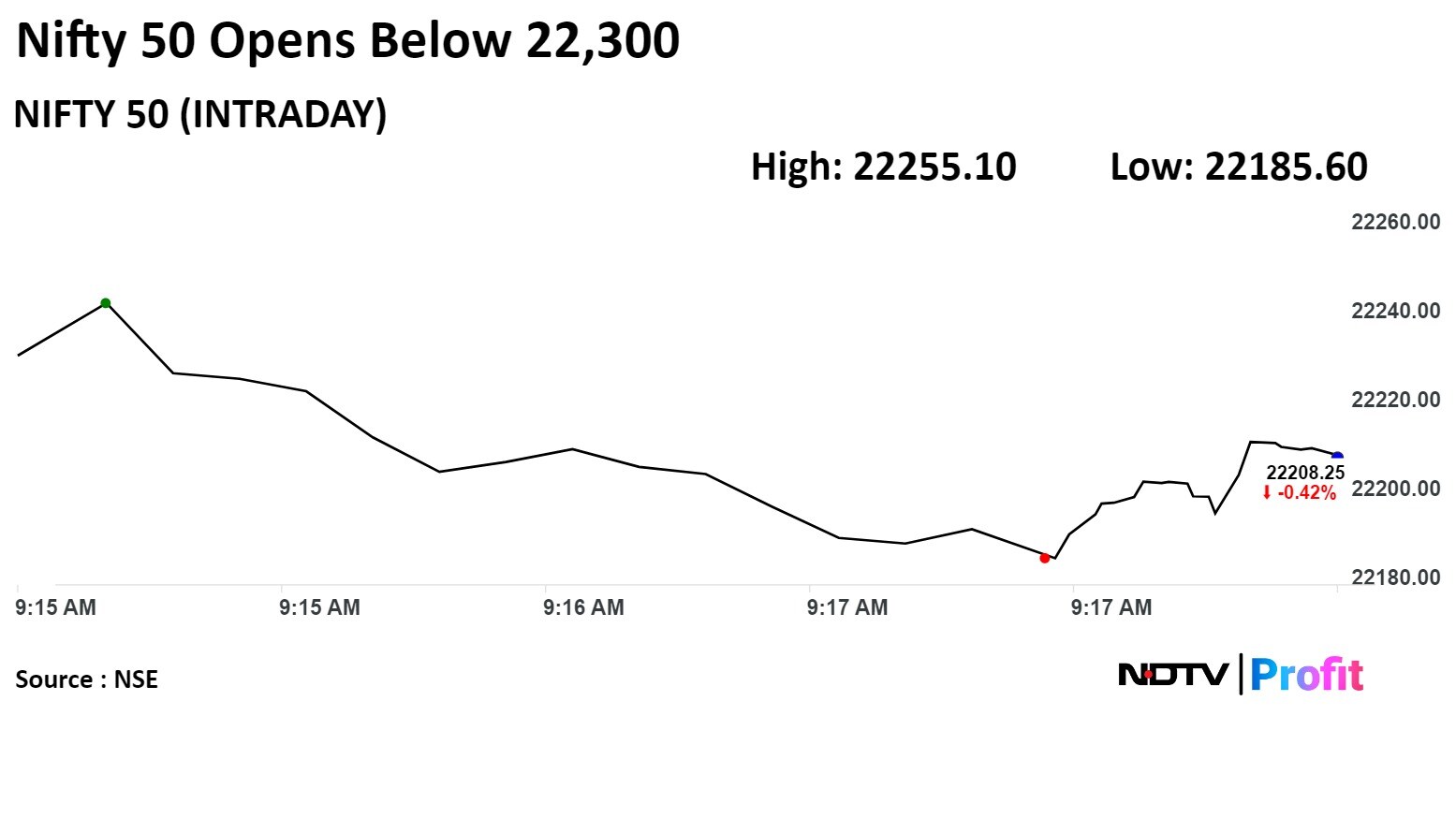

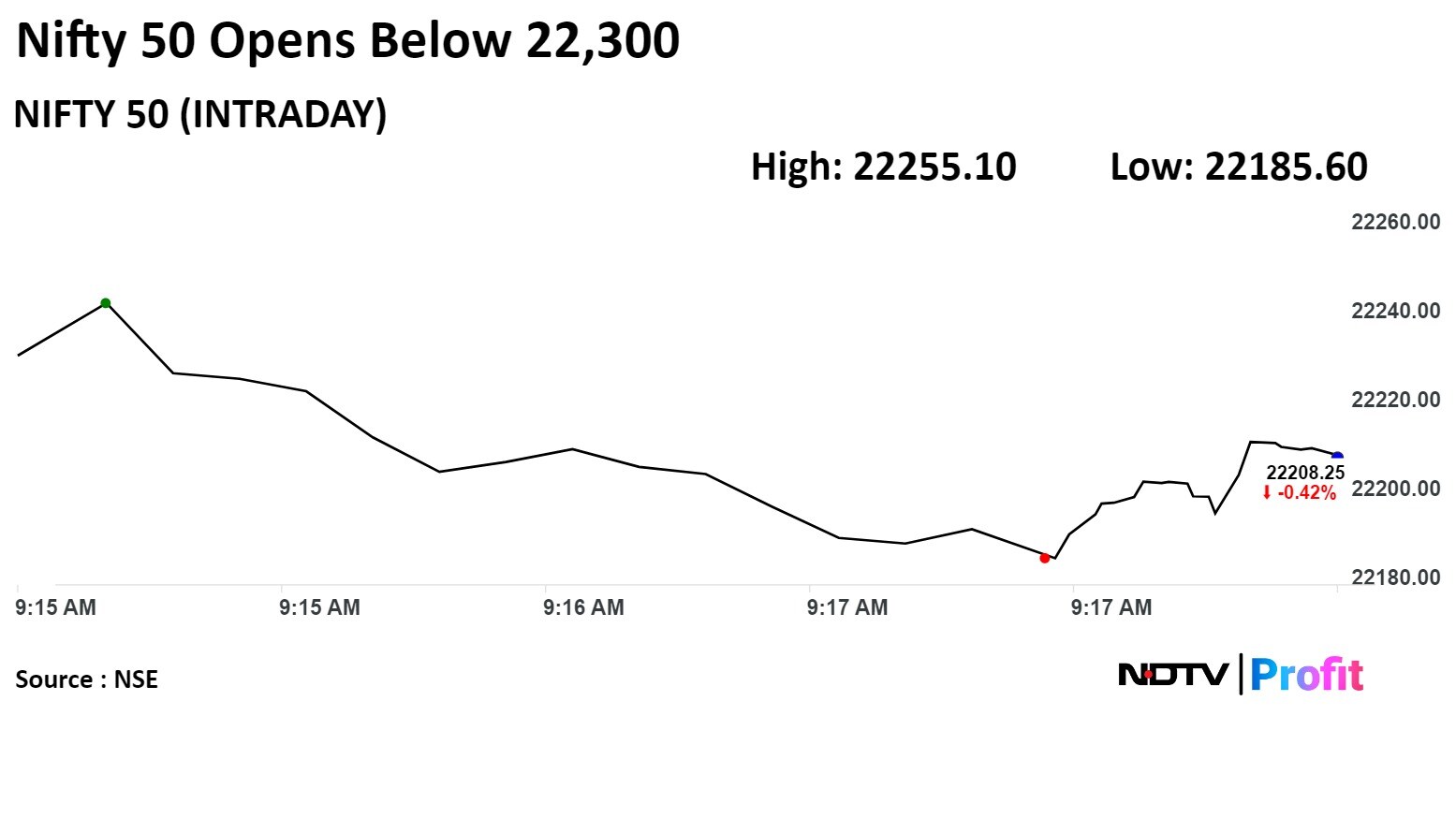

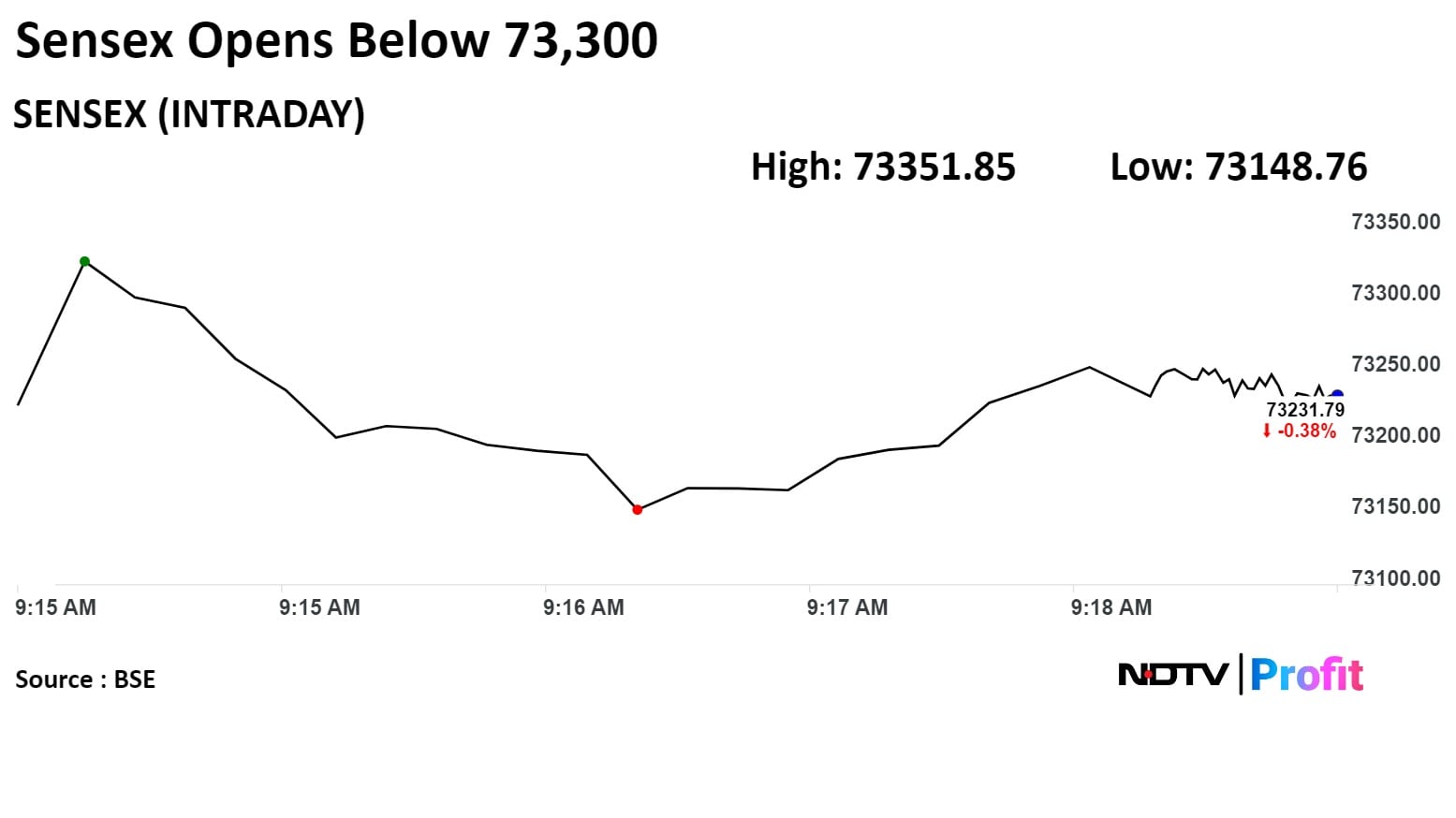

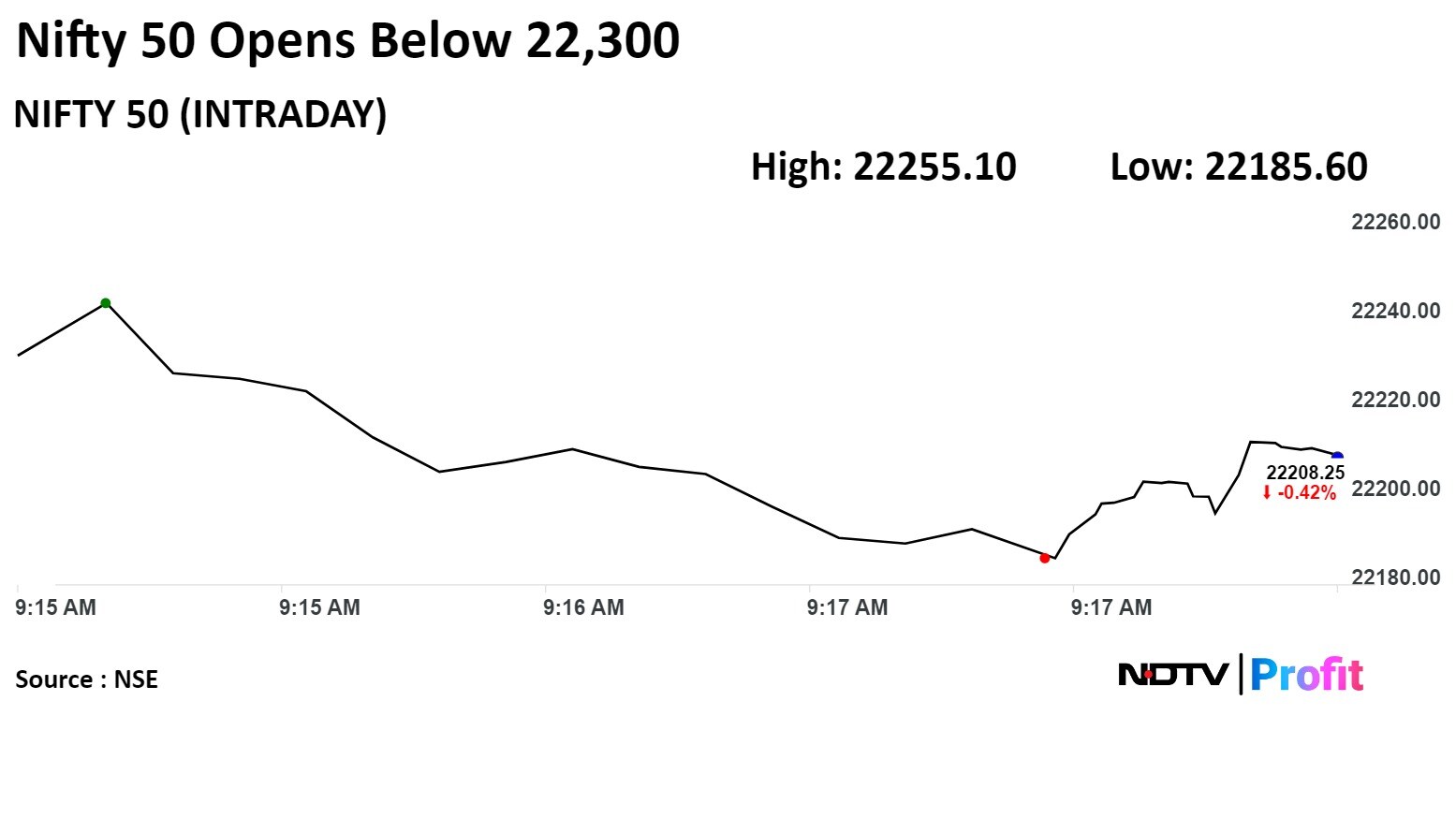

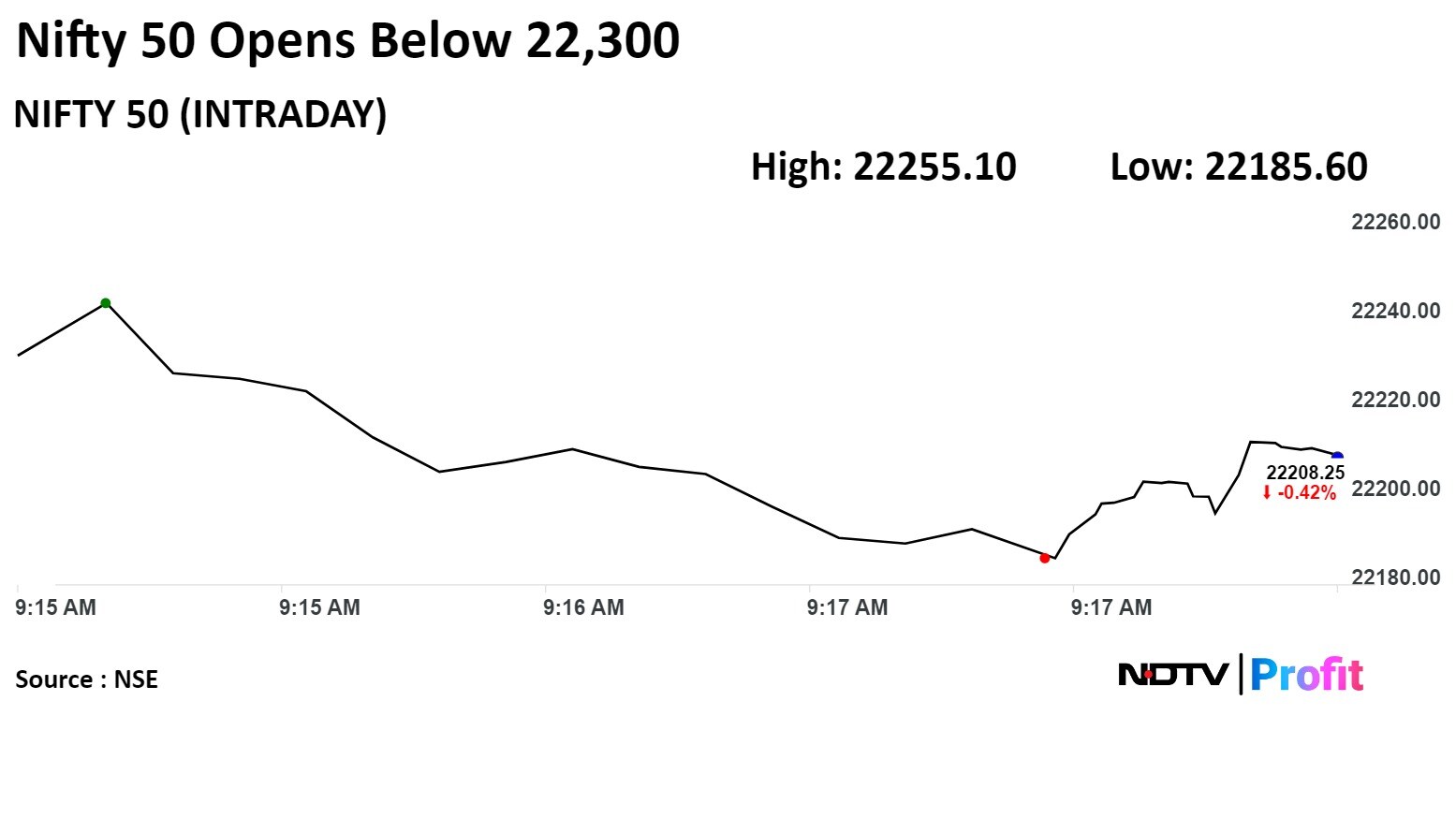

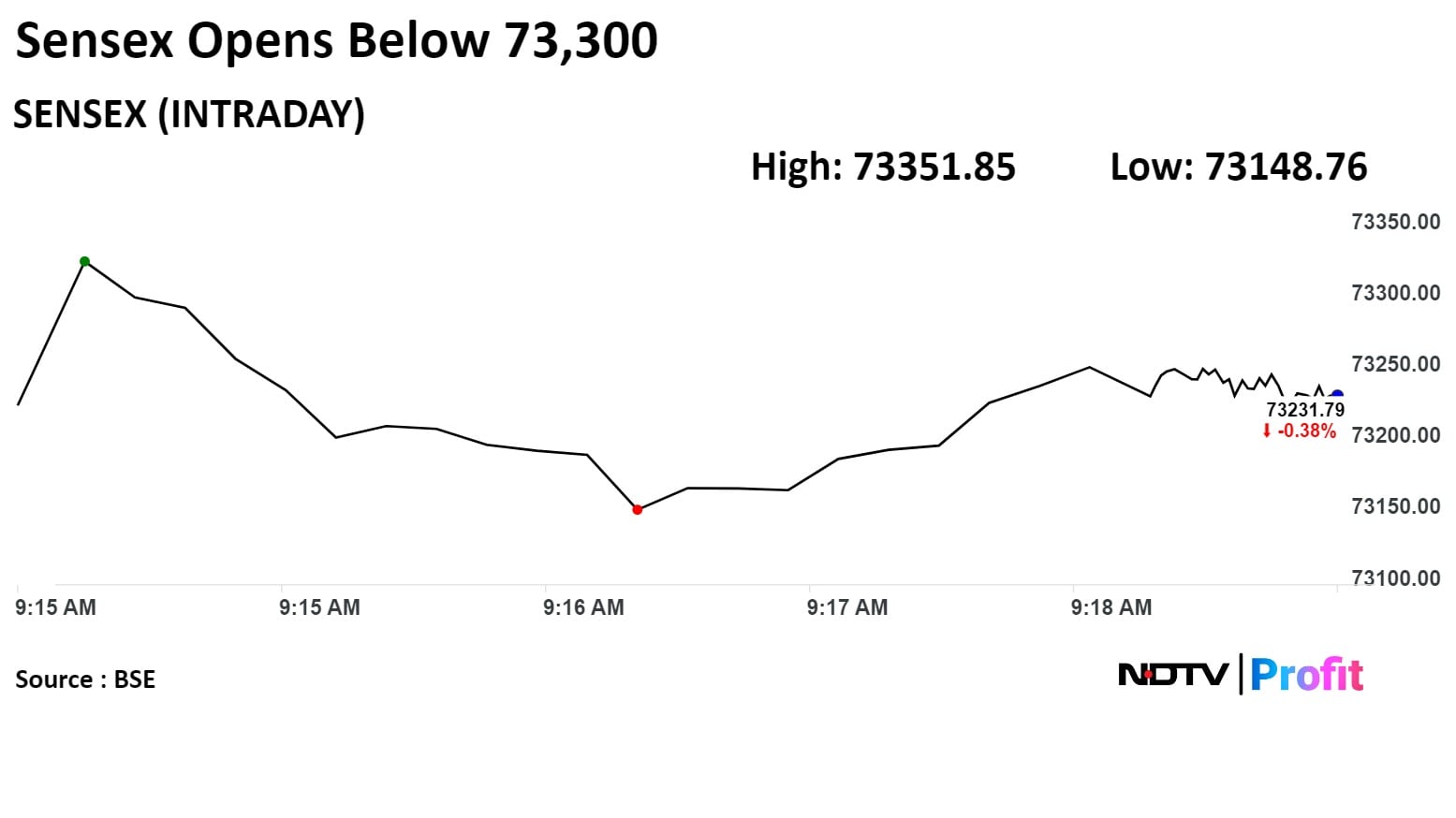

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

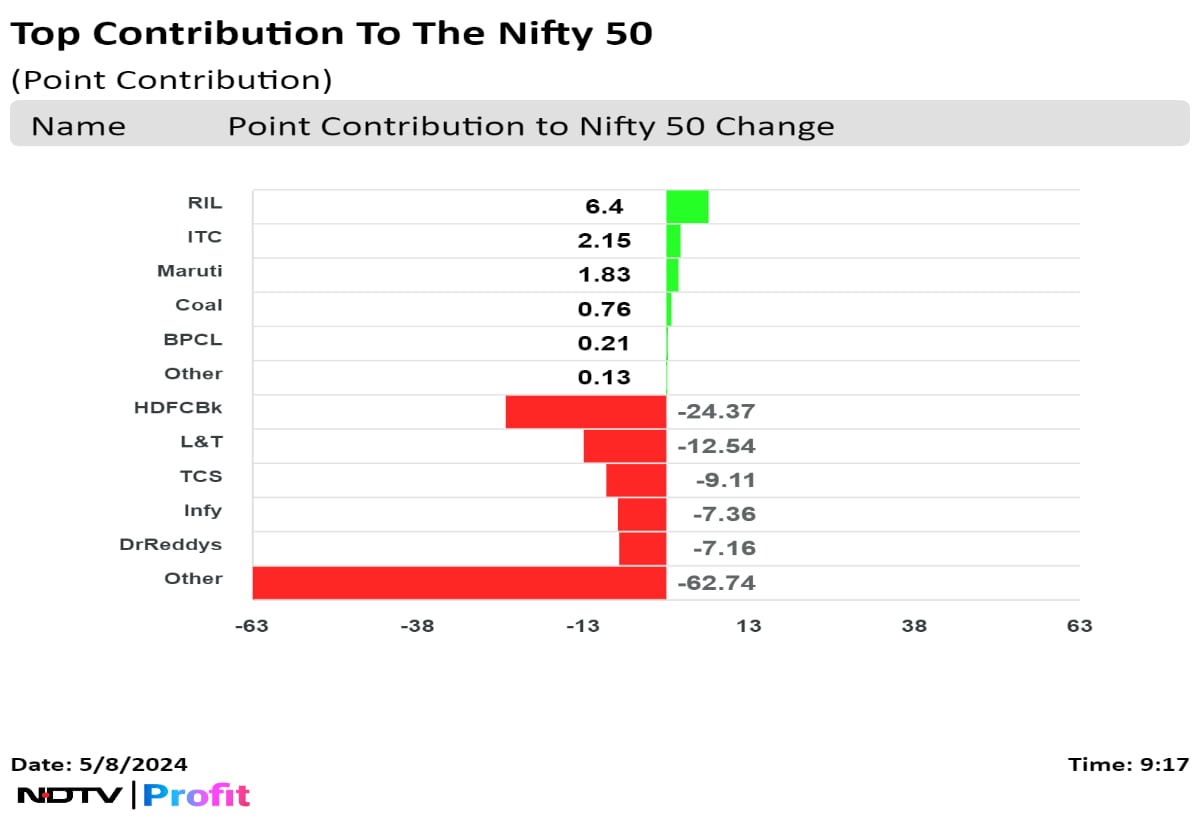

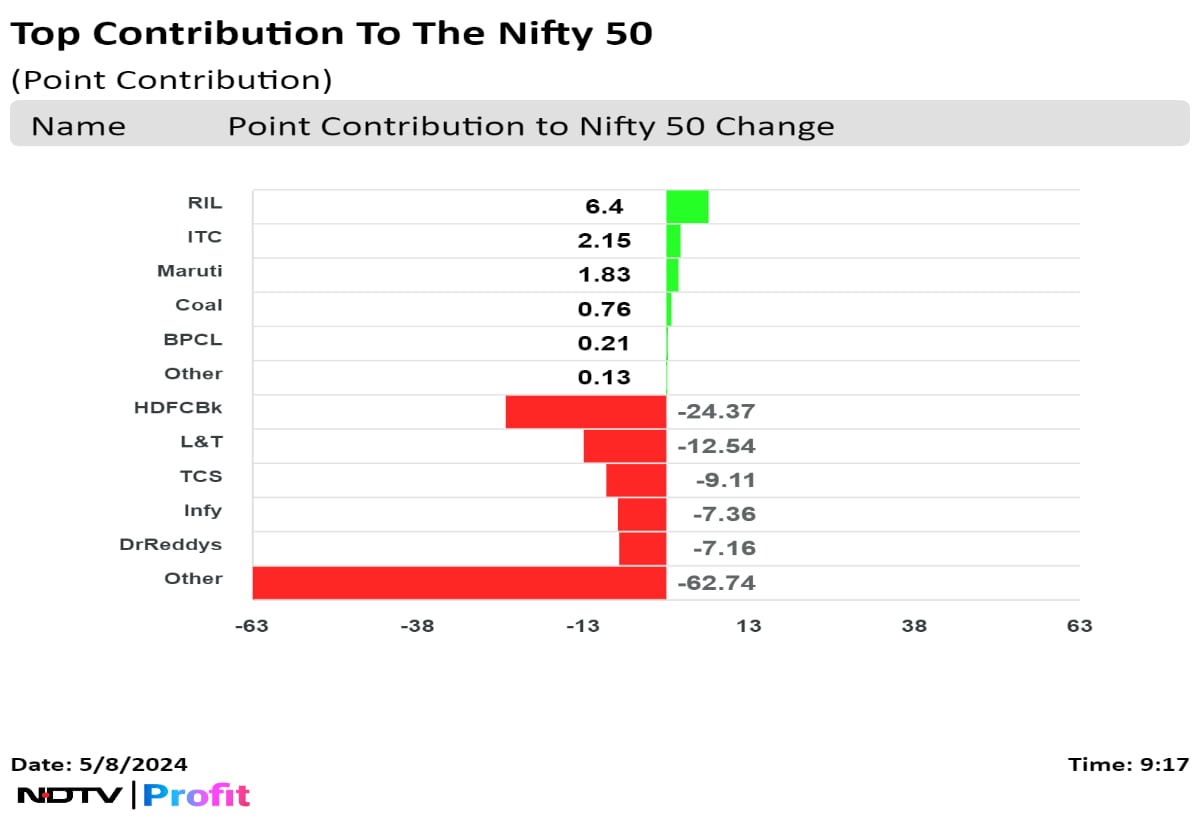

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., and Dr. Reddy's Laboratories Ltd. dragged the Nifty.

While those of Reliance Industries Ltd., ITC Ltd., Maruti Suzuki Ltd., Coal India Ltd., and Bharat Petroleum Corp. Ltd minimised the losses.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., and Dr. Reddy's Laboratories Ltd. dragged the Nifty.

While those of Reliance Industries Ltd., ITC Ltd., Maruti Suzuki Ltd., Coal India Ltd., and Bharat Petroleum Corp. Ltd minimised the losses.

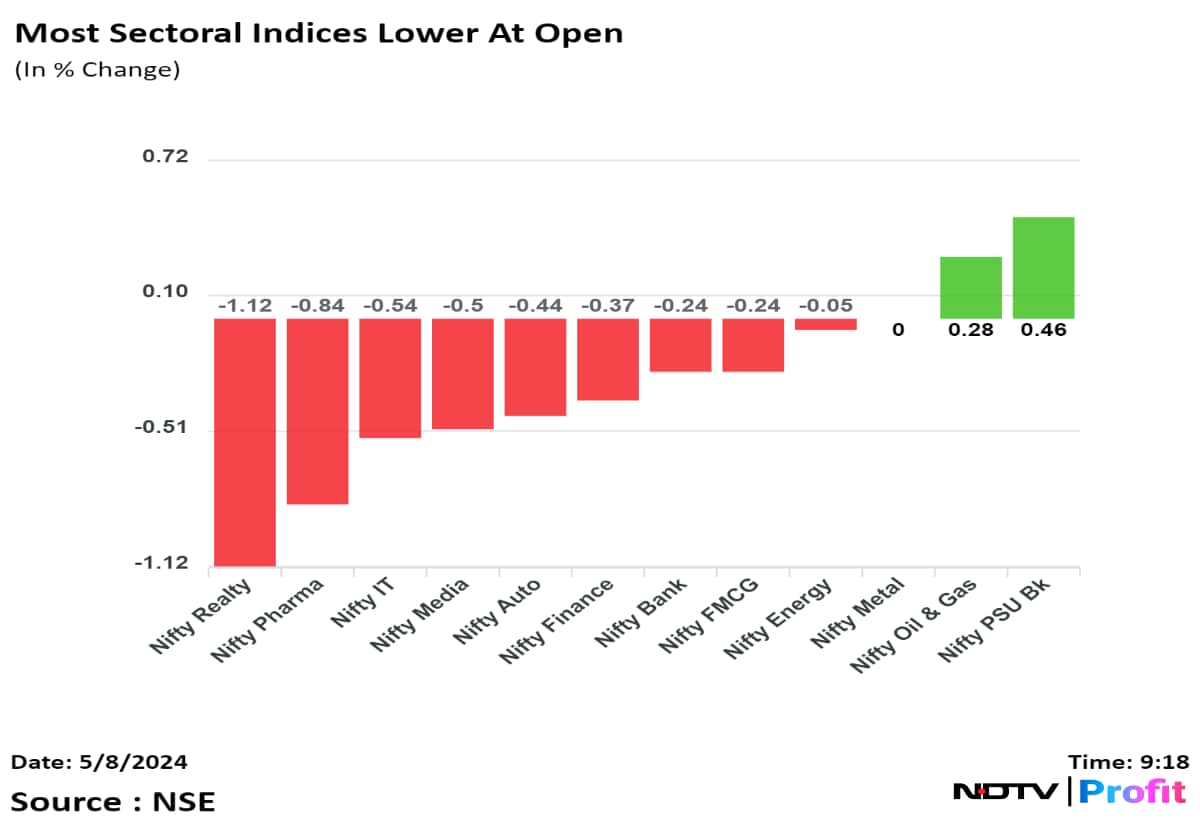

Most sectoral indices were lower at open. Onlt Nifty PSU Bank and Nifty Oil & Gas gained. Nifty Realty and Nifty Pharma were among the top losers.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., and Dr. Reddy's Laboratories Ltd. dragged the Nifty.

While those of Reliance Industries Ltd., ITC Ltd., Maruti Suzuki Ltd., Coal India Ltd., and Bharat Petroleum Corp. Ltd minimised the losses.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices extended losses in the fourth consecutive session and opened lower with shares of HDFC Bank dragging the most.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

"The previous bullish gap zone of 22,160-22,200 will be considered support while 22,400 is an immediate hurdle," said Aditya Gaggar, director of Progressive Shares.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., and Dr. Reddy's Laboratories Ltd. dragged the Nifty.

While those of Reliance Industries Ltd., ITC Ltd., Maruti Suzuki Ltd., Coal India Ltd., and Bharat Petroleum Corp. Ltd minimised the losses.

Most sectoral indices were lower at open. Onlt Nifty PSU Bank and Nifty Oil & Gas gained. Nifty Realty and Nifty Pharma were among the top losers.

Broader markets outperformed. The S&P BSE Midcap was up 0.30% and S&P BSE Smallcap gained 0.27%.

Eleven out of 20 sectors on the BSE fell and nine gained. S&P BSE Oil & Gas was the top gainer and S&P BSE Realty fell the most.

The market breadth was skewed in the favour of buyers. As much as 1,747 stocks rose, 1,135 declined, and 100 remained unchanged on the BSE.

At pre-open, the Nifty was at 22,231.20, down 71.30 points or 0.32% and the Sensex was down 286.85 points or 0.39% at 73,225.

Two-wheeler retail sales up by33% YoY to 16,43,510 units

Three-wheeler retail sales up 9% YoY to 80,105 units

Car retail sales up 16% YoY to 3,35,123 units

CV retail sales up 1% YoY at 90,707 units

Tractor retail sales up 1.37% YoY to 56,625 units

Factors driving retail sales growth:

New launches in PV and 2W category

Bulk and corporate deals in CVs

Stable fuel prices, healthy monsoon outlook

Festive demand, wedding season

Incoming challenges

Ongoing Lok Sabha elections

Limited financing options

Overcapacity in the CV segment

Extreme summers

Source: FADA Statement

The yield on the 10-year bond opened flat at 7.13%.

Source: Bloomberg

The local currency opened flat against the U.S. Dollar at 83.50.

Source: Bloomberg

Price target of Rs 6,499, implying 3.9% upside

Q4FY24 Sales/EBITDA/PAT were 1%/2%/15% higher than consensus expectations

Key reason for earnings surprise was higher North America Generic (NAG) revenue

NAG revenue declined by $9mn sequentially vs estimate of $40mn decline

Contribution from gRevlimid led to EBITDA beat despite higher R&D costs

Target price unchanged at Rs 325

Board approved first interim dividend of Rs 10/sh implying 37% payout on FY25 estimates

Sees likely limited upside to zinc/silver prices and stretched valuations

If NCLT approves transfer from GR to RE, sees potential for additional dividend of Rs25/sh

Estimate FY25e net debt at Rs 25.3 billion

Nomura maintains 'Buy' on Voltas; Target Rs 1,450 (+5%)

Revenue was 4% above estimates, 9% above Bloomberg estimates

Margins disappointed across segments

Unitary Cooling Products margin came at 9.2% vs 10% estimated

UCP business outperformed

Services margin declined to 30.6% vs 32% estimated

Expect 20% and 15% volume growth in FY25 / FY26

SOTP based TP of Rs 1,450, currently trading at 42x EPS

UBS Maintains Buy on Voltas; Target Rs 1,800 (+30%)

Despite operating leverage benefit; RAC product category margins declined 90 bps YoY

Market share trend in Q1FY25 should start showing improving trend

Rs 1.1 bn loss in project business (mainly Qatar) provided for in Q4, impacting results

UCP segment margins will continue to see gradual improvement

Citi Raises Target To Rs 435 (25% downside)

Maintains 'Sell' on JSW Energy,

Q4 net generations, ebitda in line with estimates

Maintains sell rating on higher valuations

Receiving LoA/LoIs for 3.2/3.6 GW L1 bids provides visibility

3.6 GW won capacity to be commission post FY26

Raise FY25 EPS by 14%

Jefferies Raises Target To Rs 690 (19% upside)

Maintains 'Buy' on JSW Energy,

Q4 Ebitda in line, driven by capacity additions, higher merchant sales

Mytrah acquisition to have Rs 1650 annual Ebitda run rate by FY25

Revise FY25-26 merchant tariff higher to Rs 6/unit given peak demand trend

Forecasts 33% EPS CAGR in FY24-27

Key risks: execution delay, aggressive bidding

Target price Rs 1,076 (+4%)

Rail freight market share to improve from 29% to 35% by FY31

Volume growth to benefit the Co

Expect margins of double stacking to be retained by the Co

Seen strong rally on bidding war for govt stake

Citi Maintains 'Buy' On Indraprastha Gas

Q4 EBITDA 12% below brokerage estimate

Lower margins on higher opex, volume mix

Industrial volumes in line with estimates, CNG volumes disappointing

Partial impact of CNG price was felt in Q4

Await for management commentary before reviewing estimate

Jefferies Raises Target To Rs 450 (1.4% upside)

Maintains 'Hold' on Indraprastha Gas

Q4 Ebitda missed estimates by 18% on higher gas costs

FY24 volumes 3% below mgmt guidance

Pressure on near-term profitability on lower volume growth, full impact of CNG price cut from Q1FY25

Expect CNG volume growth of 5% CAGR over FY24-26

Pressure on FY25 profitability due to rising APM gas shortfall, limited HPHT gas tie ups

EV adoption in Delhi NCR puts 30% volume risk

Growth in new GAs may not compensate for slowdown in NCR

Gaurav Gupta resigns as Head of Finance effective May 7

Source: Exchange filing

Citi Research Maintains Neutral, Target Rs 15, upside of 21%

We are enthused by the Rs 200 billion equity raise

This will enable VI to accelerate network investments and narrow the gap with peers on 4G coverage & 5G rollouts

Tariff hikes & arresting the subscriber decline is driving our high risk rating

We incorporate the equity raise, increase our FY25-26E EBITDA by 5-18%

Nuvama Maintains Hold on VI; Target: Rs 14

Management upbeat, post the capital raise

Tariff hike a necessity for industry

Expects all 3 players to participate in Tariff hikes

Hopeful of some relief on AGR front

Assessment: Better than before, but not yet out of the woods

Revenue up 57% at Rs 1,115 crore vs Rs 712 crore

Ebitda up 60% at Rs 147 crore vs Rs 92 crore

Margin at 13.2% vs 12.9%

Net profit up 167% at Rs 105 crore vs Rs 39 crore

U.S. Dollar Index at 105.51

U.S. 10-year bond yield at 4.46%

Brent crude down 0.28% at $82.93 per barrel

Nymex crude down 0.24% at $78.19 per barrel

Bitcoin was down 0.79% at $62,475.30

GIFT Nifty traded at 22,395, down 11 points or 0.05% as of 6:53 a.m.

U.S. Dollar Index at 105.51

U.S. 10-year bond yield at 4.46%

Brent crude down 0.28% at $82.93 per barrel

Nymex crude down 0.24% at $78.19 per barrel

Bitcoin was down 0.79% at $62,475.30

GIFT Nifty traded at 22,395, down 11 points or 0.05% as of 6:53 a.m.

Nifty May futures down by 0.78% to 22,381.8 at a premium of 79.3 points.

Nifty May futures open interest down by 3.8%.

Nifty Bank May futures down by 1.46% to 48,349.05 at a premium of 63.7 points.

Nifty Bank May futures open interest up by 6.93%.

Nifty Options May 9 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 22,000.

Bank Nifty Options May 8 Expiry: Maximum call open Interest at 49,500 and maximum put open interest at 47,000.

Securities in ban period: Aditya Birla Fashion, Balarampur Chini Mills, Biocon, GMR Infra, Vodafone Idea, PNB, SAIL, and Zee Entertainment Enterprises.

Moved out of short-term ASM framework: Dolat Algotech, Vesuvius India.

Ex/record Dividend: Laurus labs.

Cartrade Tech: Sector Investment Funds PLC - Sector Global Emerging Markets Fund bought 2.42 lakh shares (0.51%) at Rs 854.93 apiece.

Cigniti Technologies: Rajasthan Global Securities bought 1.5 lakh shares (0.54%) at Rs 1320.79 apiece.

Indegene: The public issue was subscribed to 7.35 times on day 2. The bids were led by institutional investors (5.59 times), non-institutional investors (18.03 times), retail investors (3.82 times) and a portion reserved for employees (3.18 times).

TBO Tek: The company will offer its shares for bidding on Wednesday. The price band is set from Rs 875 to Rs 920 per share. The Rs 1,550.8-crore IPO is a combination of a fresh issue of Rs 400 crore and the rest of the offer for sale. The company has raised Rs 696 crore through anchor investors.

Aadhar Housing Finance: The company will offer its shares for bidding on Wednesday. The price band is set from Rs 300 to Rs 315 per share. The Rs 3,000-crore IPO is a combination of a fresh issue of Rs 1,000 crore and the rest of the offer for sale. The company has raised Rs 898 crore through anchor investors.

Patel Engineering: The company and its joint venture partner emerged as the lowest bidders for an irrigation project worth Rs 343 crore. The company’s share in the irrigation project stands at Rs 120 crore.

Mahindra and Mahindra: The NCLT approved the merger of Mahindra Heavy Engines, Mahindra Two Wheelers and Trringo.com with the company.

Tata Elxsi: The company collaborated with Arm to accelerate the software-defined vehicle journey for OEMs.

LTIMindtree: The company and IBM will set up a joint generative AI centre of excellence in India.

Dixon Technologies: The company's arm, Dixon Electro Appliances, entered into a pact with Nokia for the development and manufacturing of telecom products.

Dr Reddy's Laboratories (Consolidated, YoY)

Revenue up 12.6% at Rs 7,114 crore vs Rs 6,315.2 crore (Bloomberg estimate Rs 7,026 crore).

Ebitda up 19.4% at Rs 1,831 crore vs Rs 1,534 crore (Bloomberg estimate Rs 1809 crore).

Margin at 25.7% vs 24.3% (Bloomberg estimate 25.8%).

Net profit up 36.4% at Rs 1,310 crore vs Rs 960 crore (Bloomberg estimate Rs 1,214 crore).

Board recommended final dividend of Rs 40 per share.