-The local currency closed flat against the U.S. Dollar at 83.50 on Thursday.

Source: Cogencis

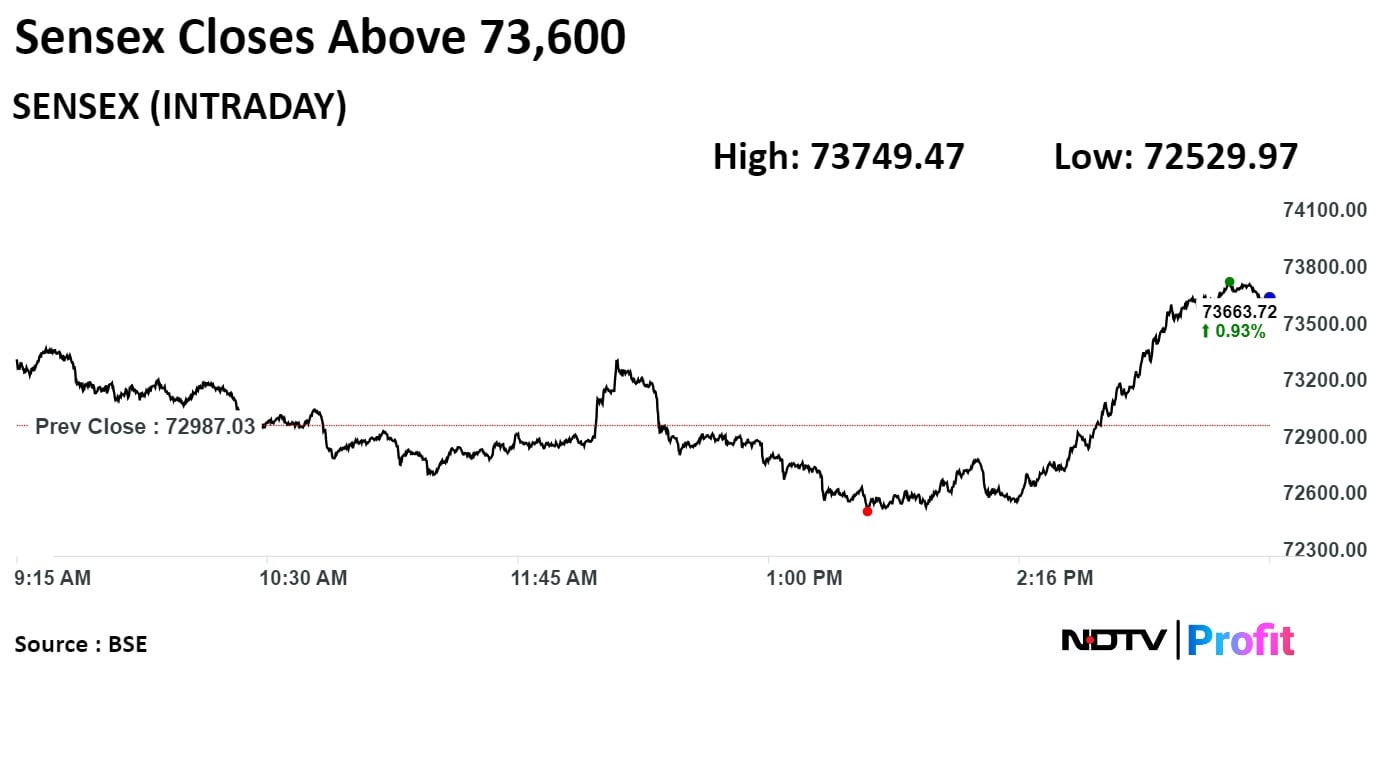

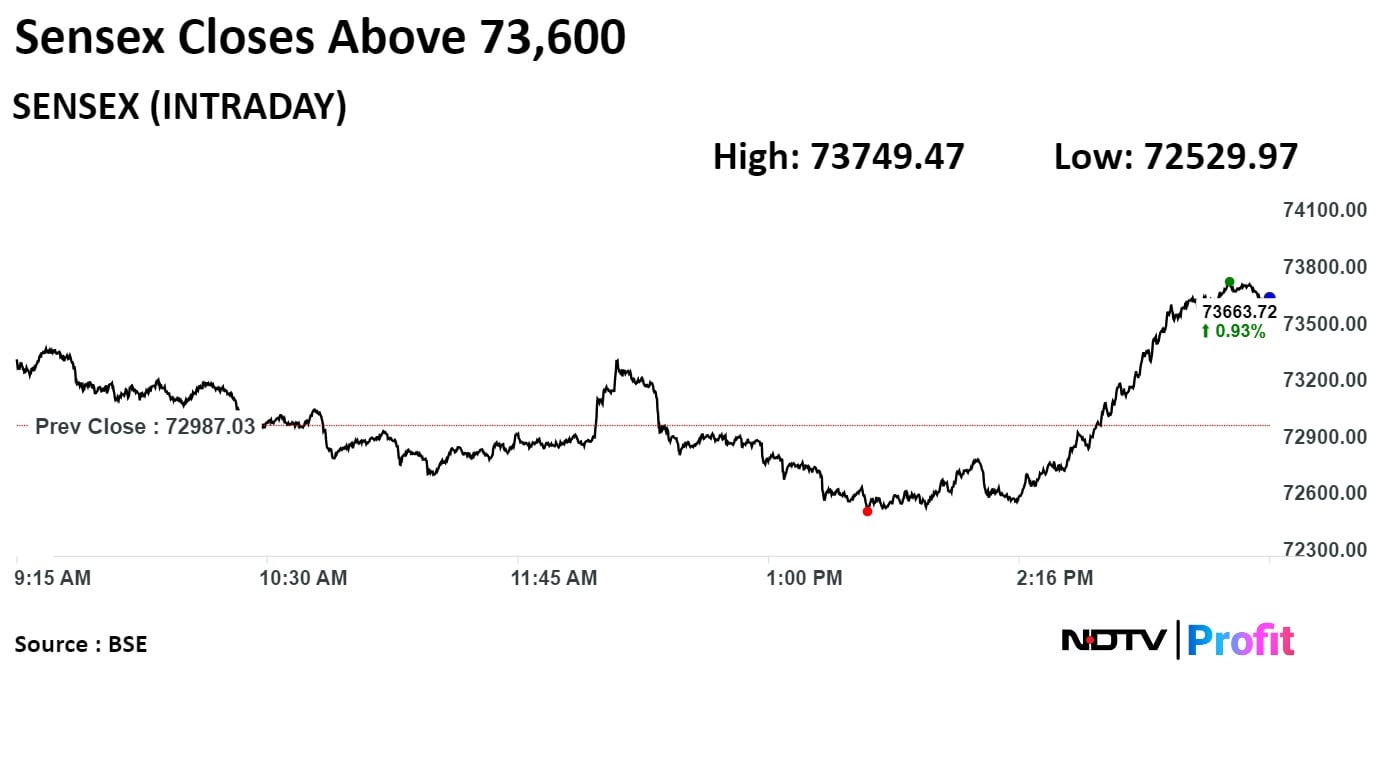

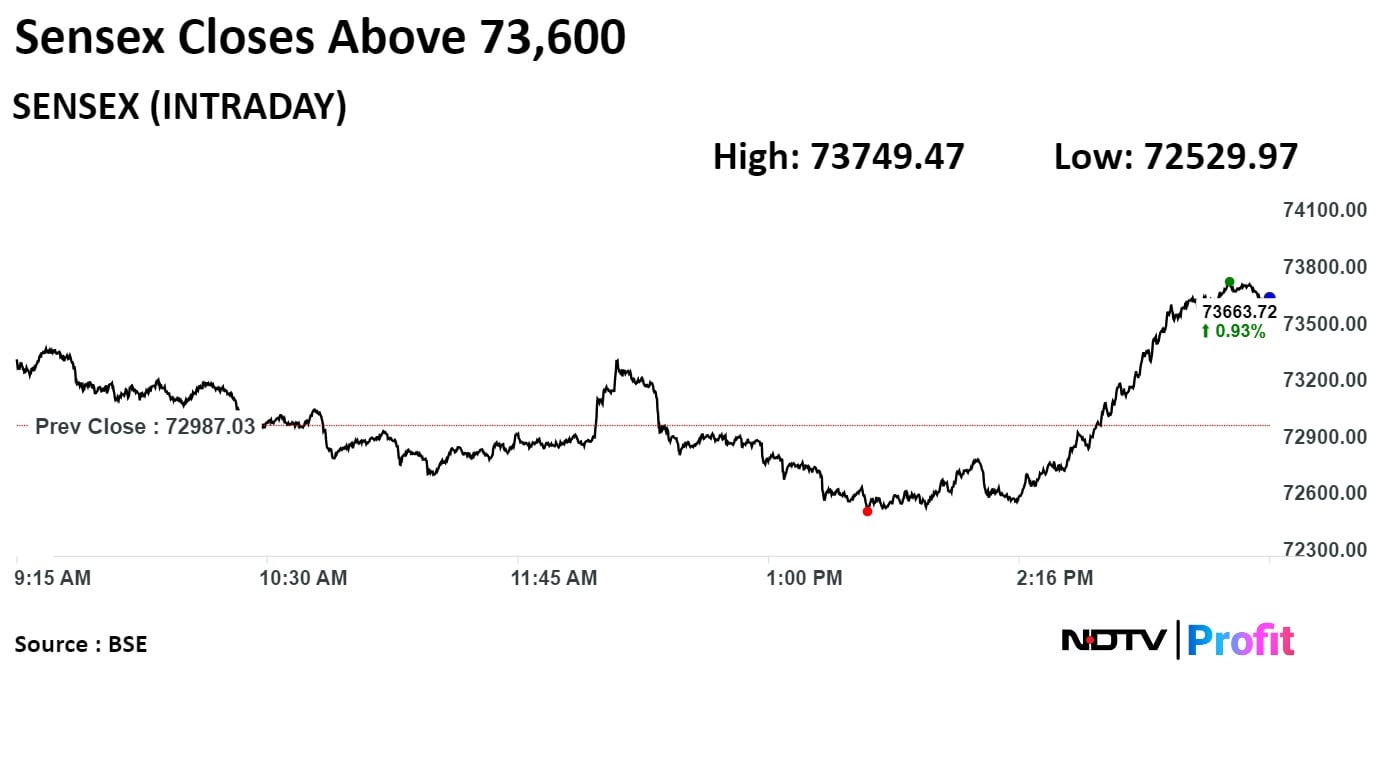

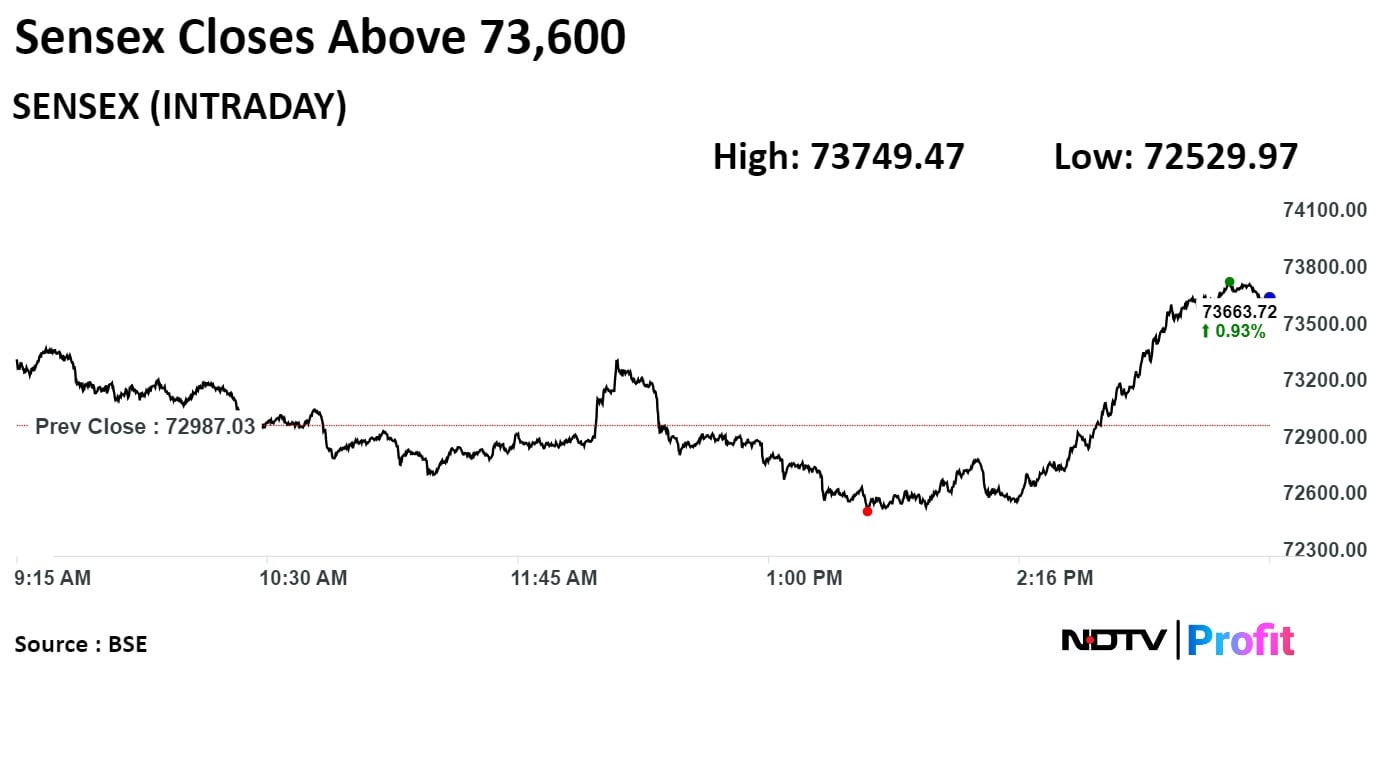

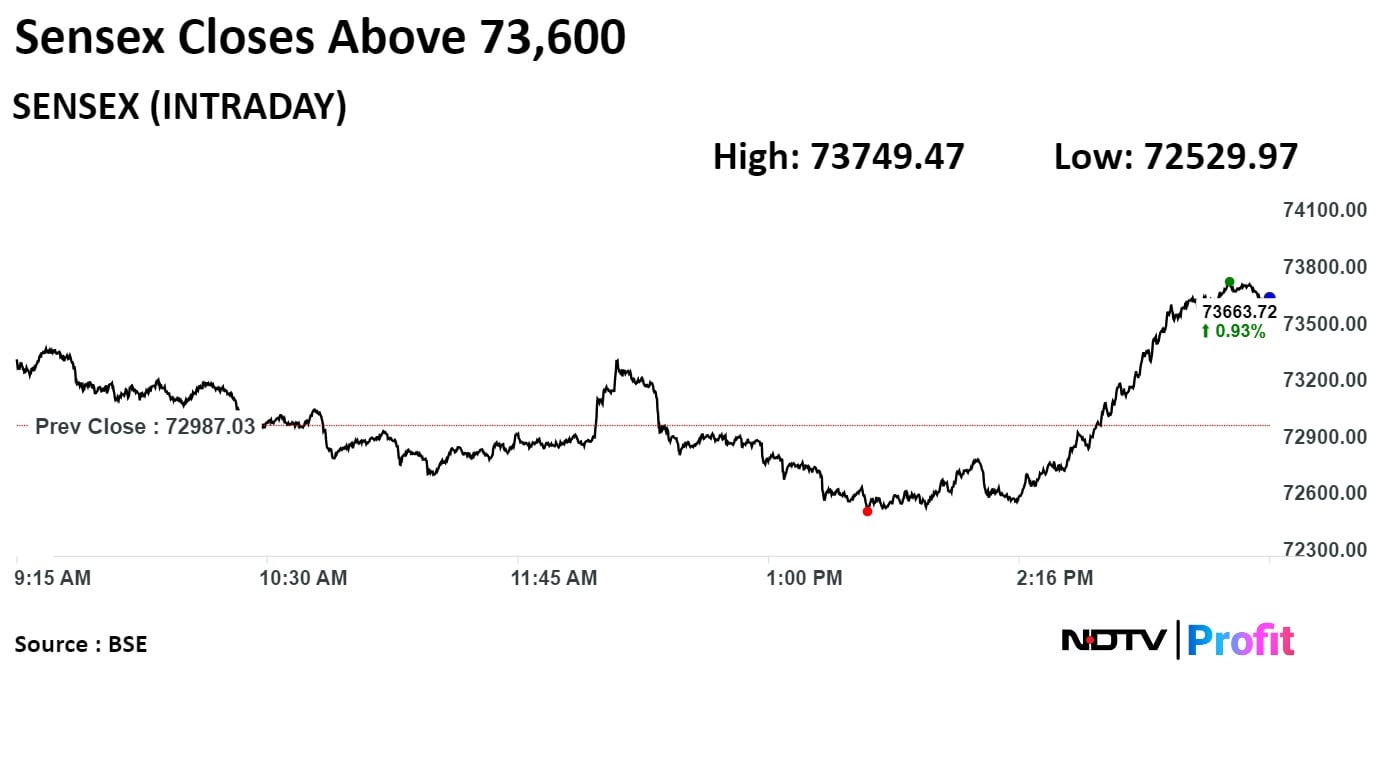

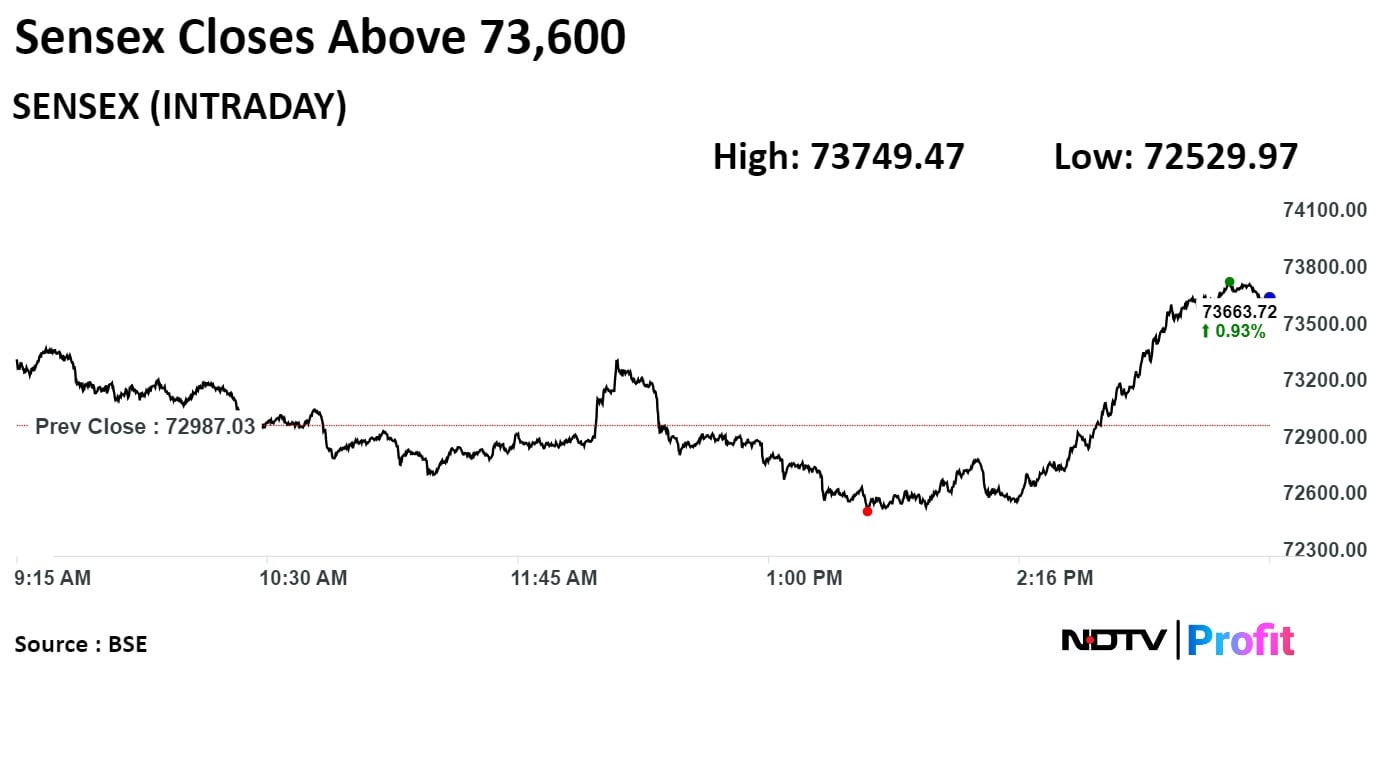

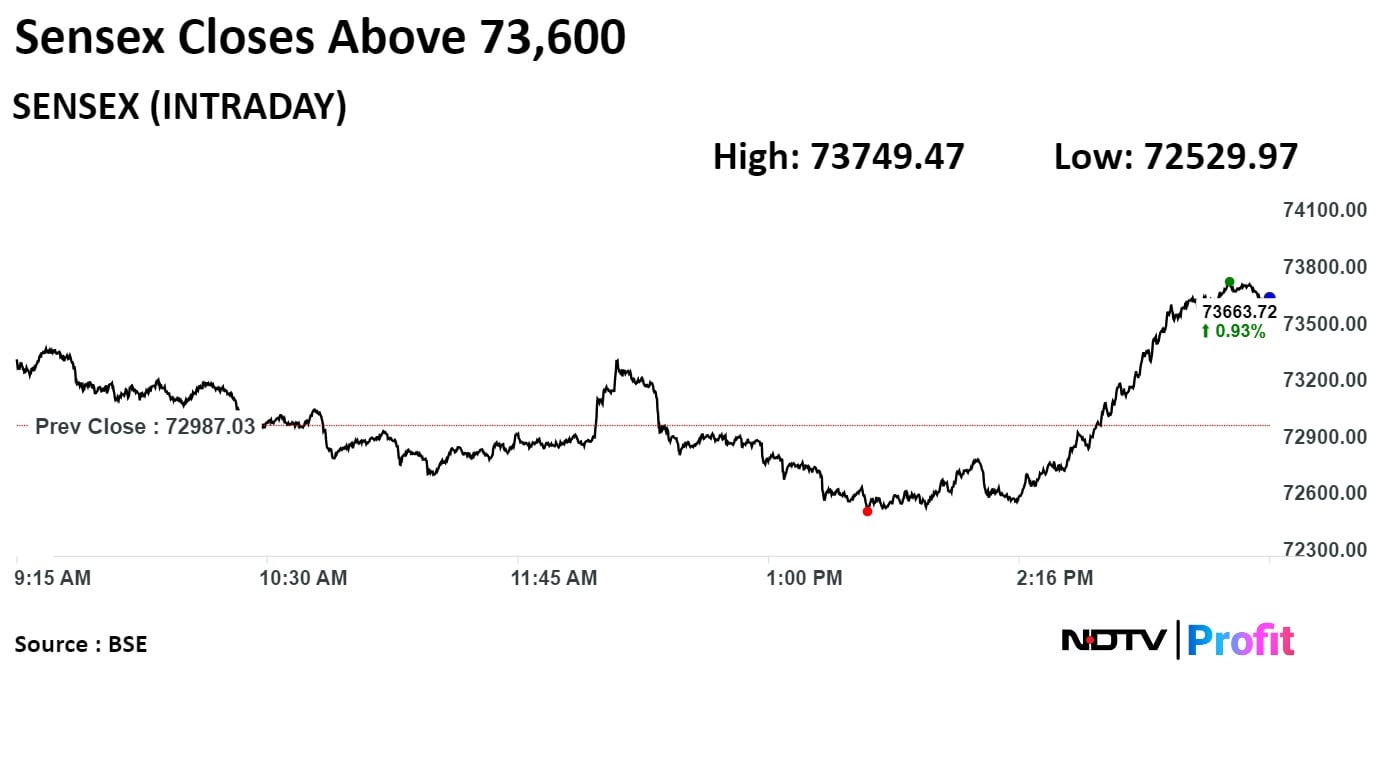

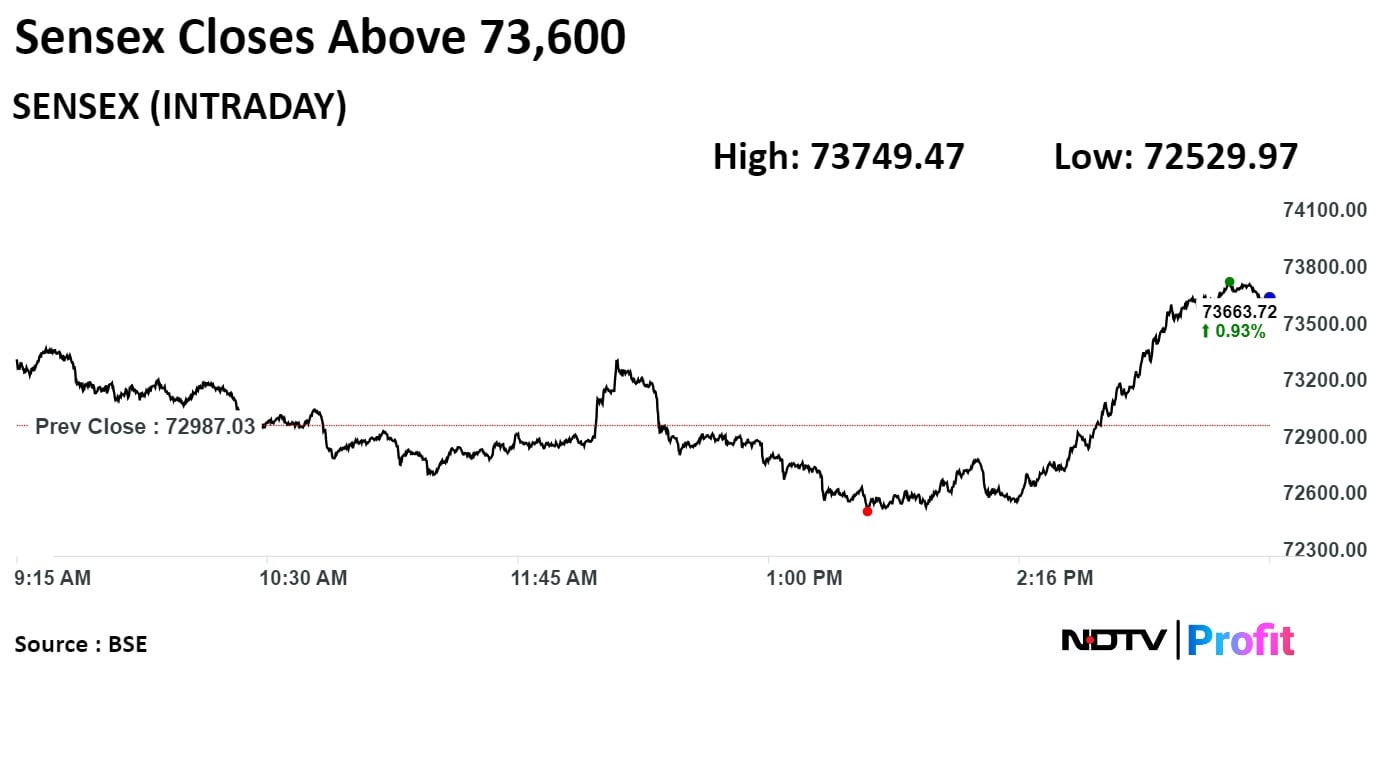

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

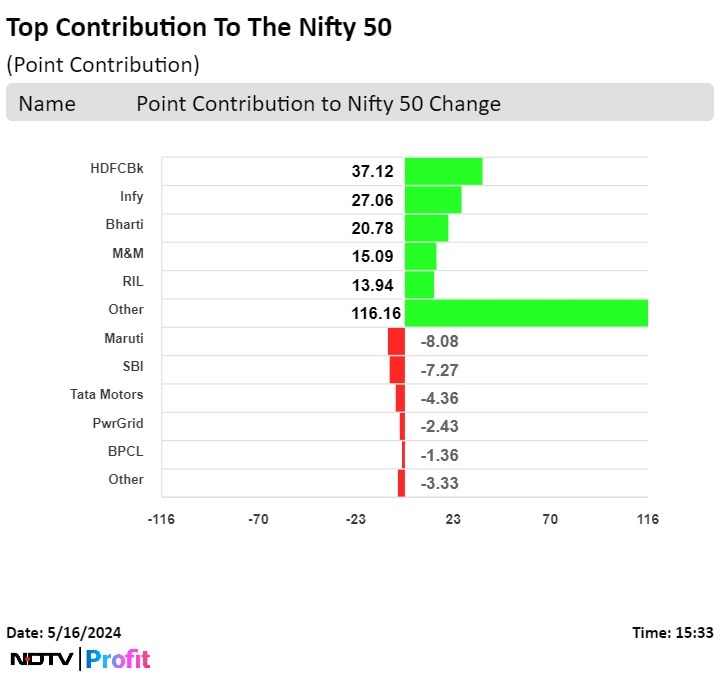

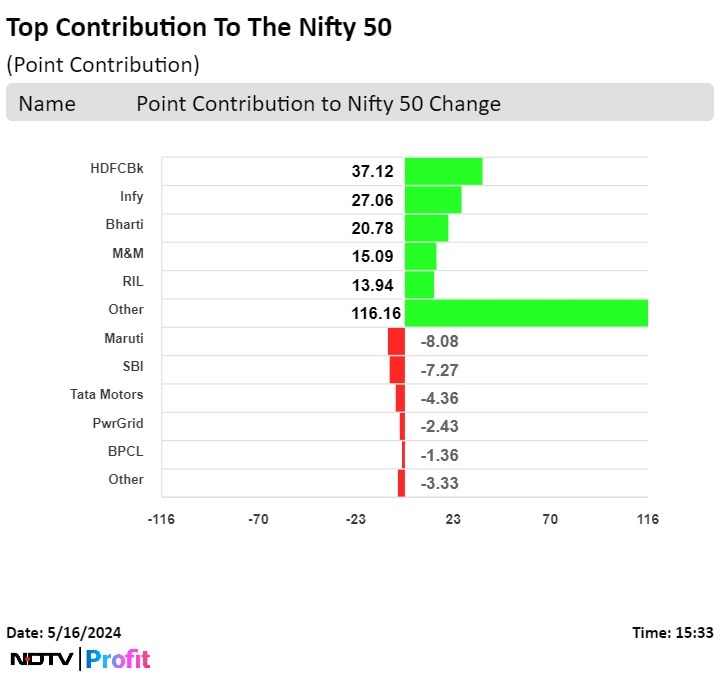

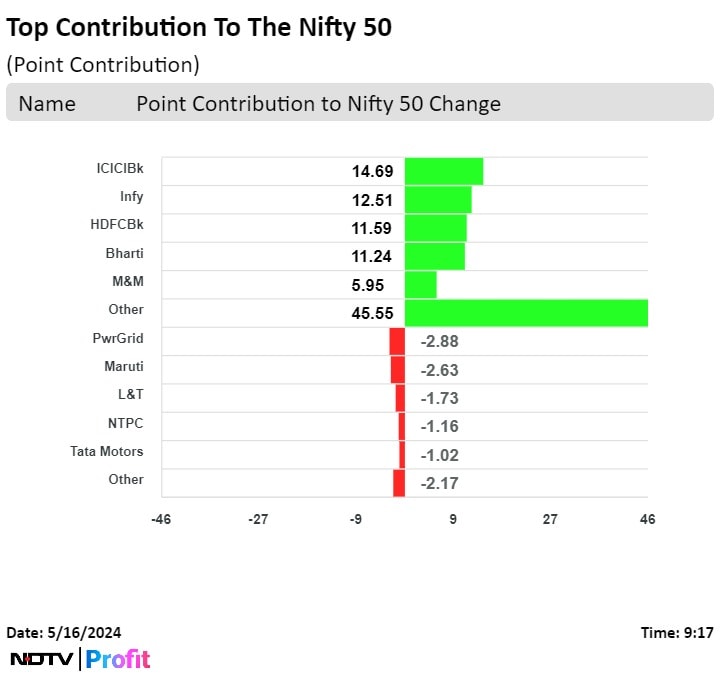

Shares of HDFC Bank Ltd., Infosys Ltd., Bharti Airtel Ltd., Mahindra & Mahindra Ltd., and Reliance Industries Ltd. contributed the most to the gains.

Meanwhile, those of Maruti Suzuki Ltd., State Bank Of India, Tata Motors Ltd., Power Grid Corp. Of India, and Bharat Petroleum Corp Ltd. capped the upside.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Shares of HDFC Bank Ltd., Infosys Ltd., Bharti Airtel Ltd., Mahindra & Mahindra Ltd., and Reliance Industries Ltd. contributed the most to the gains.

Meanwhile, those of Maruti Suzuki Ltd., State Bank Of India, Tata Motors Ltd., Power Grid Corp. Of India, and Bharat Petroleum Corp Ltd. capped the upside.

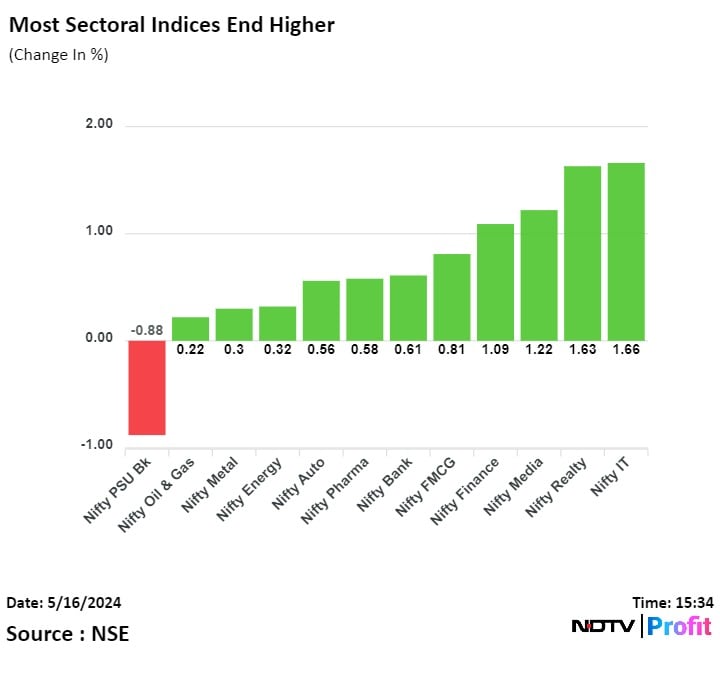

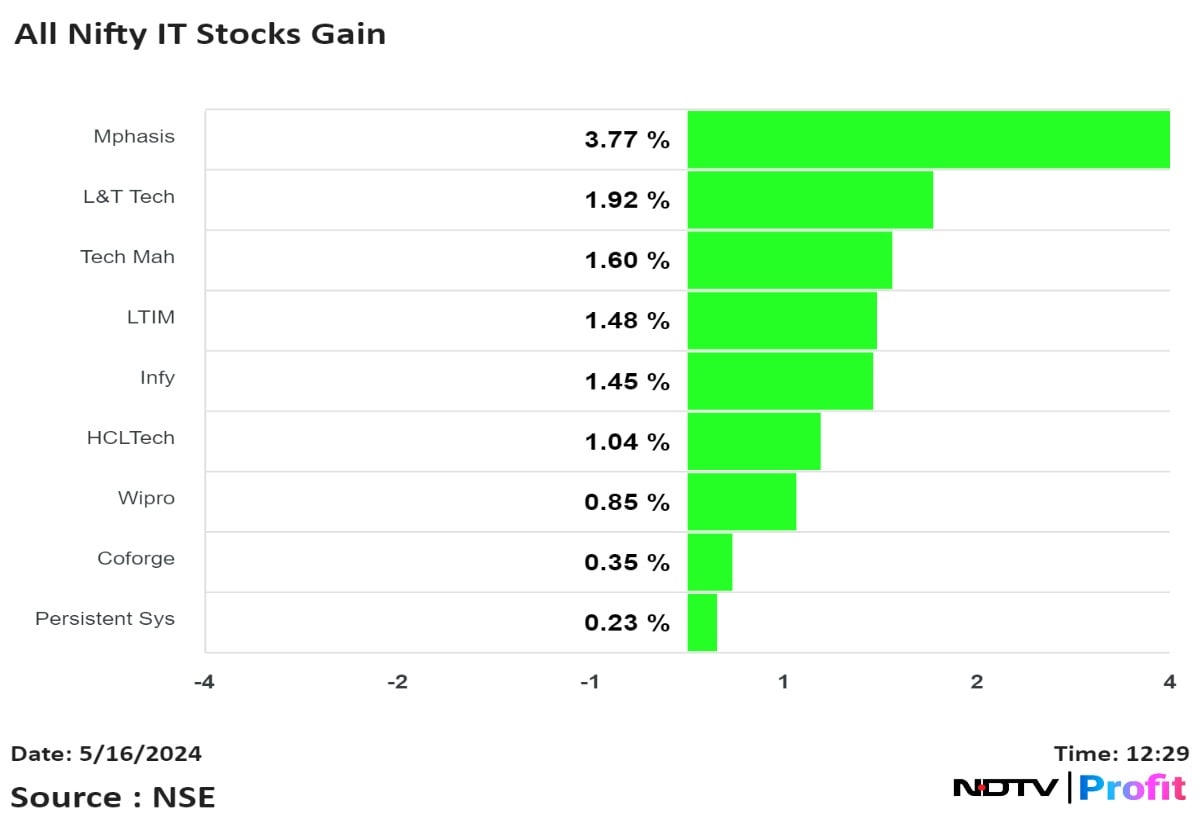

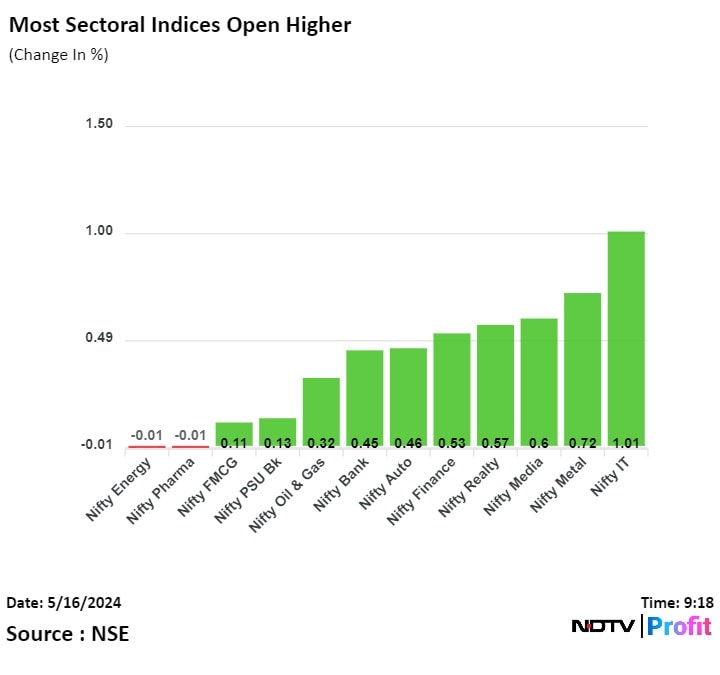

Most sectoral indices ended higher with Nifty IT and Nifty Realty leading.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Shares of HDFC Bank Ltd., Infosys Ltd., Bharti Airtel Ltd., Mahindra & Mahindra Ltd., and Reliance Industries Ltd. contributed the most to the gains.

Meanwhile, those of Maruti Suzuki Ltd., State Bank Of India, Tata Motors Ltd., Power Grid Corp. Of India, and Bharat Petroleum Corp Ltd. capped the upside.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

Benchmark equity indices recovered in the last hour of trade and surged to their highest level in seven sessions. The Nifty reclaimed 22,400 for the first time after May 6.

The Nifty closed 0.92% or 203.30 points higher at 22,403.85 and the Sensex closed 676.69 points or 0.93% higher at 73,663.72.

"The Index has not only decisively breached its strong resistance zone of 22,240-22,330 but managed to cross its 50DMA also which suggests a continuation of the current up-move to 22,520 while support level is shifted higher at 22,260," said Aditya Gaggar, director of Progressive Shares.

.jpeg)

Shares of HDFC Bank Ltd., Infosys Ltd., Bharti Airtel Ltd., Mahindra & Mahindra Ltd., and Reliance Industries Ltd. contributed the most to the gains.

Meanwhile, those of Maruti Suzuki Ltd., State Bank Of India, Tata Motors Ltd., Power Grid Corp. Of India, and Bharat Petroleum Corp Ltd. capped the upside.

Most sectoral indices ended higher with Nifty IT and Nifty Realty leading.

Broader markets ended higher on BSE. The S&P BSE Midcap ended 1.07% and the S&P BSE Smallcap settled 0.85% up.

On BSE, 19 sectors advanced, and one declined out of 20. The S&P BSE Capital Goods was the best performing sector on Thursday. The S&P BSE Utilities was the worst performing sector

Market breadth was skewed in favour of buyers. Around 2,140 stocks rose, 1,689 stocks declined, and 123 stocks remained unchanged on BSE.

Revenue at Rs 450 crore vs Rs 428 crore, up 5%

EBITDA at Rs 49 crore vs Rs 65 crore, down 24.5%

Margin at 11% vs 15.1%

Net profit at Rs 22 crore vs Rs 26 crore, down 14.6%

Revenue down 16% at Rs 1,611 crore vs Rs 1,929 crore

Ebitda down 1% at Rs 354 crore vs Rs 357 crore

Margin at 21.9% vs 18.5%

Net profit up 10% at Rs 243 crore vs Rs 221 crore

Revenue at Rs 657 crore vs Rs 605 crore, up 8.7%

EBITDA at Rs 219 crore vs Rs 186 crore, up 18.3%

Margin at 33.4% vs 30.7%

Net profit of Rs 88 crore vs loss of Rs 503 crore

Revenue at Rs 32,756 crore vs Rs 34,698 crore, down 5.6%

EBITDA at Rs 3,848 crore vs Rs 4,208 crore, down 8.6%

Margin at 11.7% vs 12.1%

Net profit at Rs 2,474 crore vs Rs 3,193 crore, down 22.5%

Net loss of Rs 64 crore vs loss of Rs 28 crore

EBITDA loss at Rs 38 crore vs EBITDA of Rs 8 crore

Revenue at Rs 211 crore vs Rs 269 crore, down 21.3%

Revenue at Rs 14,769 crore vs Rs 12,495 crore, up 18.2%

EBITDA at Rs 5,901 crore vs Rs 3,246 crore, up 81.8%

Margin at 40% vs 26%

Net profit at Rs 4,309 crore vs Rs 2,831 crore, up 52.2%

Revenue at Rs 2,079 crore vs Rs 2,112 crore, down 1.5%

EBITDA at Rs 111 crore vs Rs 147 crore, down 24.4%

Margin at 5.4% vs 7%

Net loss of Rs 31 crore vs profit of Rs 4 crore

Revenue up 12% to Rs 25,436 crore (Estimate: Rs 24,029 crore).

Ebitda up 22% to Rs 3,446crore (Estimate: Rs 3,057 crore).

Ebitda margin at 13.5% versus 12.5% (Estimate: 12.7%).

Net profit up 32% to Rs 2,038 crore (Estimate: Rs 1,815 crore).

Revenue up 12% to Rs 25,436 crore (Estimate: Rs 24,029 crore).

Ebitda up 22% to Rs 3,446crore (Estimate: Rs 3,057 crore).

Ebitda margin at 13.5% versus 12.5% (Estimate: 12.7%).

Net profit up 32% to Rs 2,038 crore (Estimate: Rs 1,815 crore).

.png)

Net profit at Rs 121 crore vs Rs 101 crore, up 20%

Revenue at Rs 453 crore vs Rs 389 crore, up 16%

EBITDA at Rs 145 crore vs Rs 124 crore, up 16.4%

EBITDA margin at 31.9%, flat YoY

Revenue up 11% at Rs 727 crore vs Rs 653 crore

EBITDA up 33% at Rs 66 crore vs Rs 49 crore

Margin at 9.1% vs 7.6%

Net profit up 28% at Rs 49 crore vs Rs 38 crore

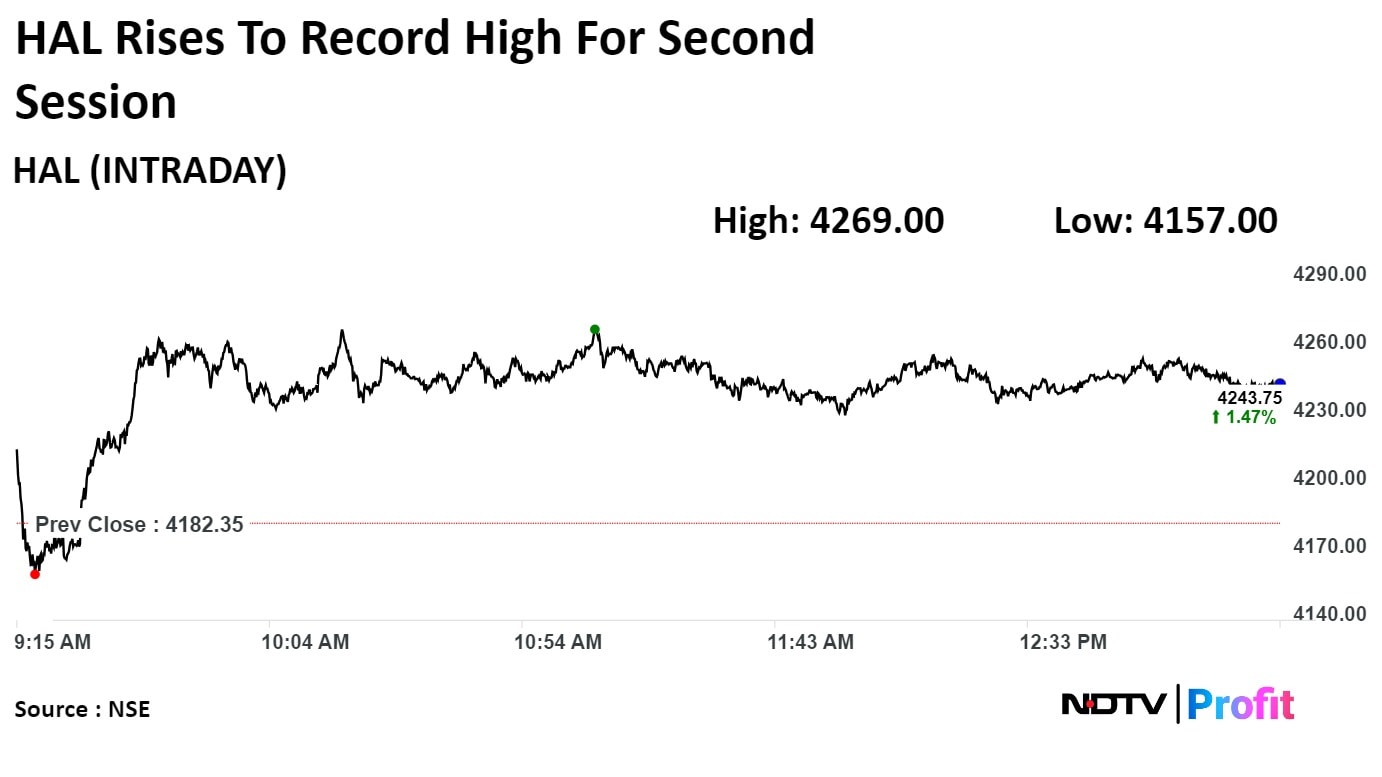

The stock rose as much as 2.07% to hit its lifetime high of Rs 4,269, before paring gains to trade 1.54% to Rs 4,249. This compares to a 0.5% decline in the Nifty. It has risen 51.55% on an year-to-date basis and 172.61% in the last 12 months.

The stock rose as much as 2.07% to hit its lifetime high of Rs 4,269, before paring gains to trade 1.54% to Rs 4,249. This compares to a 0.5% decline in the Nifty. It has risen 51.55% on an year-to-date basis and 172.61% in the last 12 months.

Revenue at Rs 1,145 crore vs Rs 835 crore, up 37%

EBITDA at Rs 85 crore vs Rs 55 crore, up 53%

EBITDA margin 7.4% vs 6.6%

Net profit at Rs 42 crore vs Rs 15 crore

Revenue at Rs 1,145 crore vs Rs 835 crore, up 37%

EBITDA at Rs 85 crore vs Rs 55 crore, up 53%

EBITDA margin 7.4% vs 6.6%

Net profit at Rs 42 crore vs Rs 15 crore

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

.png)

ICICI Bank Ltd., State Bank of India, Maruti Suzuki India Ltd., Reliance Industries Ltd., Tata Motors Ltd. weighed on the Nifty 50.

Bharti Airtel Ltd., Infosys Ltd., HDFC Bank Ltd., Tech Mahindra Ltd., and HCL Technologies Ltd. limited the losses in the index.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

.png)

ICICI Bank Ltd., State Bank of India, Maruti Suzuki India Ltd., Reliance Industries Ltd., Tata Motors Ltd. weighed on the Nifty 50.

Bharti Airtel Ltd., Infosys Ltd., HDFC Bank Ltd., Tech Mahindra Ltd., and HCL Technologies Ltd. limited the losses in the index.

.png)

On NSE, nine sectors declined and three advanced. The NSE Nifty PSU Bank declined the most, and the NSE Nifty Realty was the top performing sector.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

.png)

ICICI Bank Ltd., State Bank of India, Maruti Suzuki India Ltd., Reliance Industries Ltd., Tata Motors Ltd. weighed on the Nifty 50.

Bharti Airtel Ltd., Infosys Ltd., HDFC Bank Ltd., Tech Mahindra Ltd., and HCL Technologies Ltd. limited the losses in the index.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

India's benchmark stock indices erased all morning gains to trade lower by midday on Thursday as continued selling by foreign investors on the jitter weighed on the stock. The indices had opened on a strong note owing to the softer US CPI data, which increased hope of a Fed rate cut by September.

At 11:52 a.m., the NSE Nifty 50 was trading 46.75 points, or 0.21%, lower at 22,153.80, and the S&P BSE Sensex fell 92.08 points, or 0.13%, to trade at 72,894.95. Intraday, the NSE Nifty 50 rose 0.53% to 22,330.00, and the S&P BSE Sensex rose 0.56% to 73,396.75.

"The Indian market rose today, buoyed by gains on Wall Street, driven by robust US inflation data. Although the market has been confident over the past four days, ongoing selling by foreign institutional investors is still a big worry," said Shrey Jain, founder and chief executive officer at SAS Online.

For the Nifty 50, the 22,000 Put strike has significant open interest, indicating it will likely act as an immediate support. Conversely, the 22,500 level is expected to serve as a hurdle, with the 22,500 Call strike holding approximately 21 million shares, Jain said.

.png)

.png)

.png)

ICICI Bank Ltd., State Bank of India, Maruti Suzuki India Ltd., Reliance Industries Ltd., Tata Motors Ltd. weighed on the Nifty 50.

Bharti Airtel Ltd., Infosys Ltd., HDFC Bank Ltd., Tech Mahindra Ltd., and HCL Technologies Ltd. limited the losses in the index.

.png)

On NSE, nine sectors declined and three advanced. The NSE Nifty PSU Bank declined the most, and the NSE Nifty Realty was the top performing sector.

.png)

Broader markets outperformed the benchmark indices, with the S&P BSE Midcap rising 0.52% and Smallcap gaining 0.69% through midday on Thursday.

On BSE, 11 sectors declined and nine advanced. The S&P BSE Auto index was the worst performing sector, and the S&P BSE Realty was the top performing sector.

Market breadth was skewed in favour of buyers. Around 1,988 stocks rose, 1,597 declined, and 142 remained unchanged on BSE.

NSE notice of potential suspension of trading for failure to report Q2 & Q3 earnings by June 11

Working to finalize and release the quarterly results within the stipulated timelines

Source: Exchange filing

.png)

Shares of NLC India Ltd. slumped over 7% on NSE Thursday after the company reported 86.4% fall in its net profit.

Its net profit declined 86.4% on year to Rs 114 crore in January-March from 837. The fall in its profit was due to lower revenue.

NLC India is public-sector navratana company, which is deals in energy sector.

Shares of NLC India Ltd. slumped over 7% on NSE Thursday after the company reported 86.4% fall in its net profit.

Its net profit declined 86.4% on year to Rs 114 crore in January-March from 837. The fall in its profit was due to lower revenue.

NLC India is public-sector navratana company, which is deals in energy sector.

Shares of Bharti Airtel surged to a life-high on Thursday after multiple brokerages raised their target price, citing in-line fourth-quarter estimates and positive subscriber additions.

Shares of Bharti Airtel surged to a life-high on Thursday after multiple brokerages raised their target price, citing in-line fourth-quarter estimates and positive subscriber additions.

(1).png)

Airtel's stock rose as much as 3.58% during the day to Rs 1,356.85 apiece on the NSE. It was trading 2.47% higher at Rs 1,342 apiece, compared to a 0.03% decline in the benchmark Nifty 50 as of 10:35 a.m.

The stock has risen 70% in the last 12 months and 30% on an year-to-date basis. The total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 65.

Twenty three out of the 32 analysts tracking the company have a 'buy' rating on the stock, seven recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 7.8%.

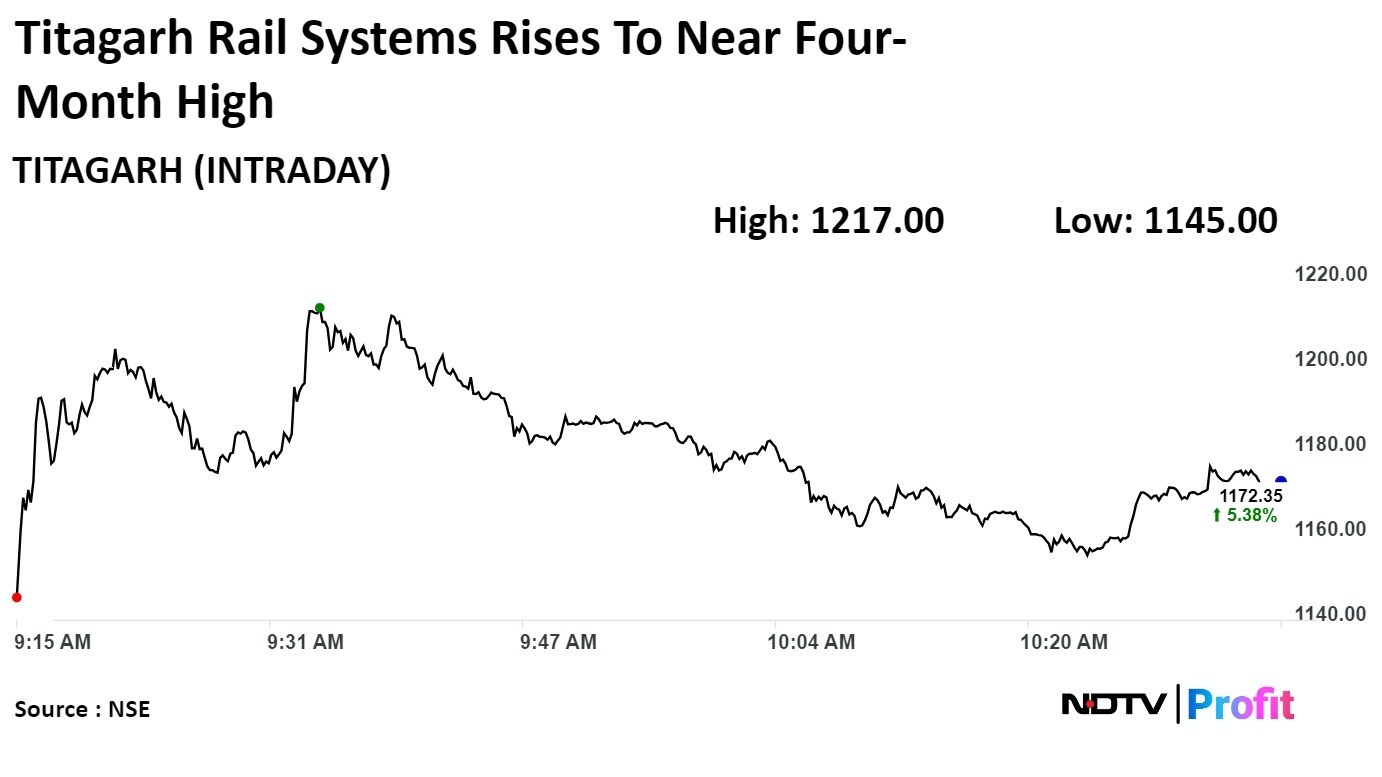

Titagarh Rail Systems Ltd. surges to highest level since mid-January after the company reported net profit above estimates.

Titagarh Rail Systems Ltd. surges to highest level since mid-January after the company reported net profit above estimates.

Titagarh Rail Systems Ltd. rose 9.39% to Rs 1,217.00, the highest level since Jan 20. It was trading 4.09% higher at Rs 1,158.00 as of 10:33 a.m, as compared to 0.01% advance in the NSE Nifty 50 index.

The scrip gained 256.53% in 12 months, and it has risen 11.97% on year to date basis. Total traded volume so far in the day stood at 8.8 times its 30-day average. The relative strength index was at 72.76, which implied the stock is overbought.

Out of 10 analysts tracking the company, nine maintain a 'buy' rating, one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.6%.

Price target of Rs 995, 36.7% downside

Believes business development needs faster uptick to match peerset growth

Q4 bookings more than doubled driven by a tower launch

Management expects to lease 80-85% for new 2.4 msf office building

Co expects better sales trajectory in FY25 given partner overhang is now behind

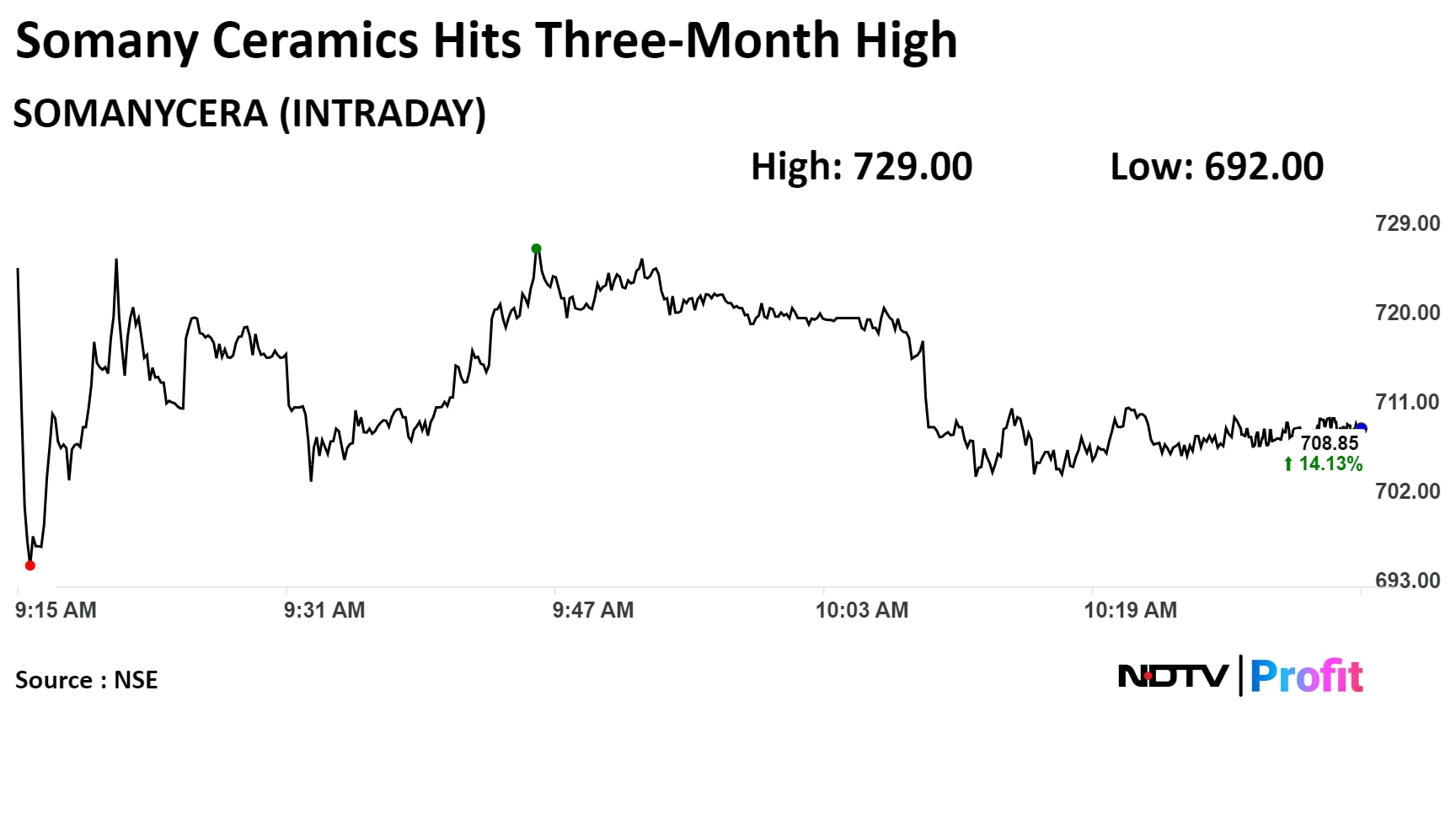

Shares of Somany Ceramics jumped to its highest level in three months after brokerage firm Nuvama raised its target price for the stock following the company's Q4 results.

Somany Ceramics Q4 FY24 (Consolidated, YoY)

Revenue up 8.6% at Rs 738 crore vs Rs 679 crore (Bloomberg estimate Rs 700 crore).

Ebitda up 30.3% at Rs 79 crore vs Rs 61 crore (Bloomberg estimate Rs 68.37 crore).

Margin at 10.8% vs 9% (Bloomberg estimate 9.8%).

Net profit up 38.9% at Rs 34 crore vs Rs 24 crore (Bloomberg estimate Rs 31.45 crore).

Nuvama noted that despite weak demand, the company strengthened working capital to 8 days compared to 31 YoY, improved cash flows to Rs 3.9 billion versus Rs 1.6 billion YoY, and pared debt. The brokerage has retained its 'buy' for the stock and raised target to Rs 914 to Rs 907.

" While demand is muted, SOMC is confident of outgrowing the industry, and expects low double-digit volume growth (versus industry’s 5–6%) with improved EBITDA margin," Nuvama said.

Shares of Somany Ceramics jumped to its highest level in three months after brokerage firm Nuvama raised its target price for the stock following the company's Q4 results.

Somany Ceramics Q4 FY24 (Consolidated, YoY)

Revenue up 8.6% at Rs 738 crore vs Rs 679 crore (Bloomberg estimate Rs 700 crore).

Ebitda up 30.3% at Rs 79 crore vs Rs 61 crore (Bloomberg estimate Rs 68.37 crore).

Margin at 10.8% vs 9% (Bloomberg estimate 9.8%).

Net profit up 38.9% at Rs 34 crore vs Rs 24 crore (Bloomberg estimate Rs 31.45 crore).

Nuvama noted that despite weak demand, the company strengthened working capital to 8 days compared to 31 YoY, improved cash flows to Rs 3.9 billion versus Rs 1.6 billion YoY, and pared debt. The brokerage has retained its 'buy' for the stock and raised target to Rs 914 to Rs 907.

" While demand is muted, SOMC is confident of outgrowing the industry, and expects low double-digit volume growth (versus industry’s 5–6%) with improved EBITDA margin," Nuvama said.

The scrip rose as much as 17.37% to Rs 729 apiece, the lowest level since February 7. It pared gains to trade 13.98% higher at Rs 708 apiece, as of 10:38 a.m. This compares to a flat NSE Nifty 50 Index.

It has fallen 1.31% on a year-to-date basis and risen 11.76% in the last twelve months. Total traded volume on the NSE so far in the day stood at 31.12 times its 30-day average. The relative strength index was at 74.08, indicating that the stock may be overbought.

Out of the 22 analysts tracking the company, 21 maintain a 'buy' rating, one recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 23%.

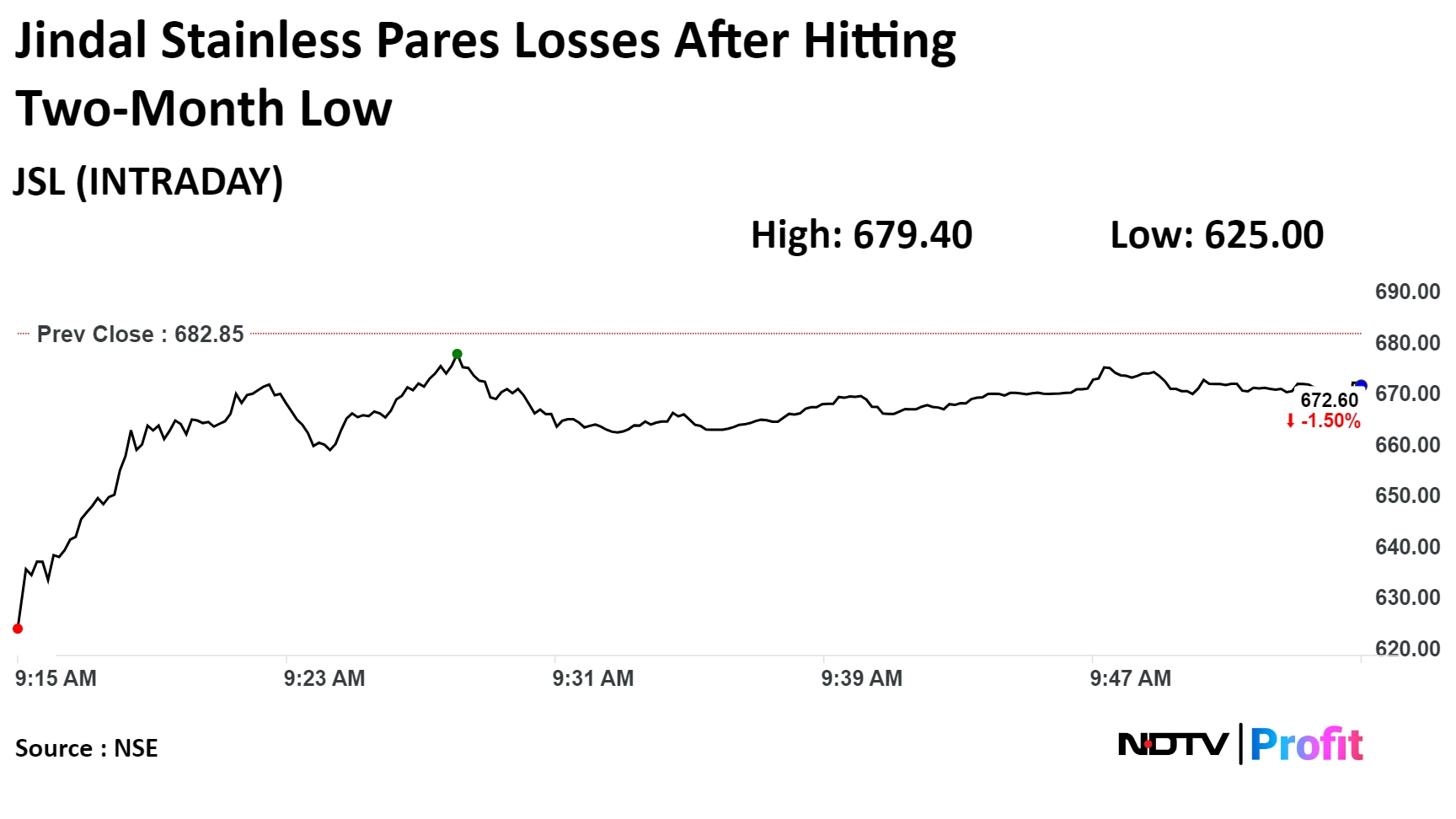

Shares of Jindal Stainless fell to its lowest level in two months after the company reported a fall in its net profit for the quarter ended March to Rs 501 crore.

In its press release, the company said that its margins remained under pressure on account of negative inventory valuation due to continuously falling nickel prices. Moreover, its key export markets, such as Europe and the US, remained weak.

Shares of Jindal Stainless fell to its lowest level in two months after the company reported a fall in its net profit for the quarter ended March to Rs 501 crore.

In its press release, the company said that its margins remained under pressure on account of negative inventory valuation due to continuously falling nickel prices. Moreover, its key export markets, such as Europe and the US, remained weak.

The scrip fell as much as 8.47% to Rs 625 apiece, the lowest level since March 14. It pared losses to trade 1.77% lower at Rs 670,40 apiece, as of 9:58 a.m. This compares to a 0.20% advance in the NSE Nifty 50 Index.

It has risen 18.11% on a year-to-date basis and 129.88% in the last twelve months. Total traded volume on the NSE so far in the day stood at 1.65 times its 30-day average. The relative strength index was at 43.88.

Out of the 10 analysts tracking the company, seven maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.9%.

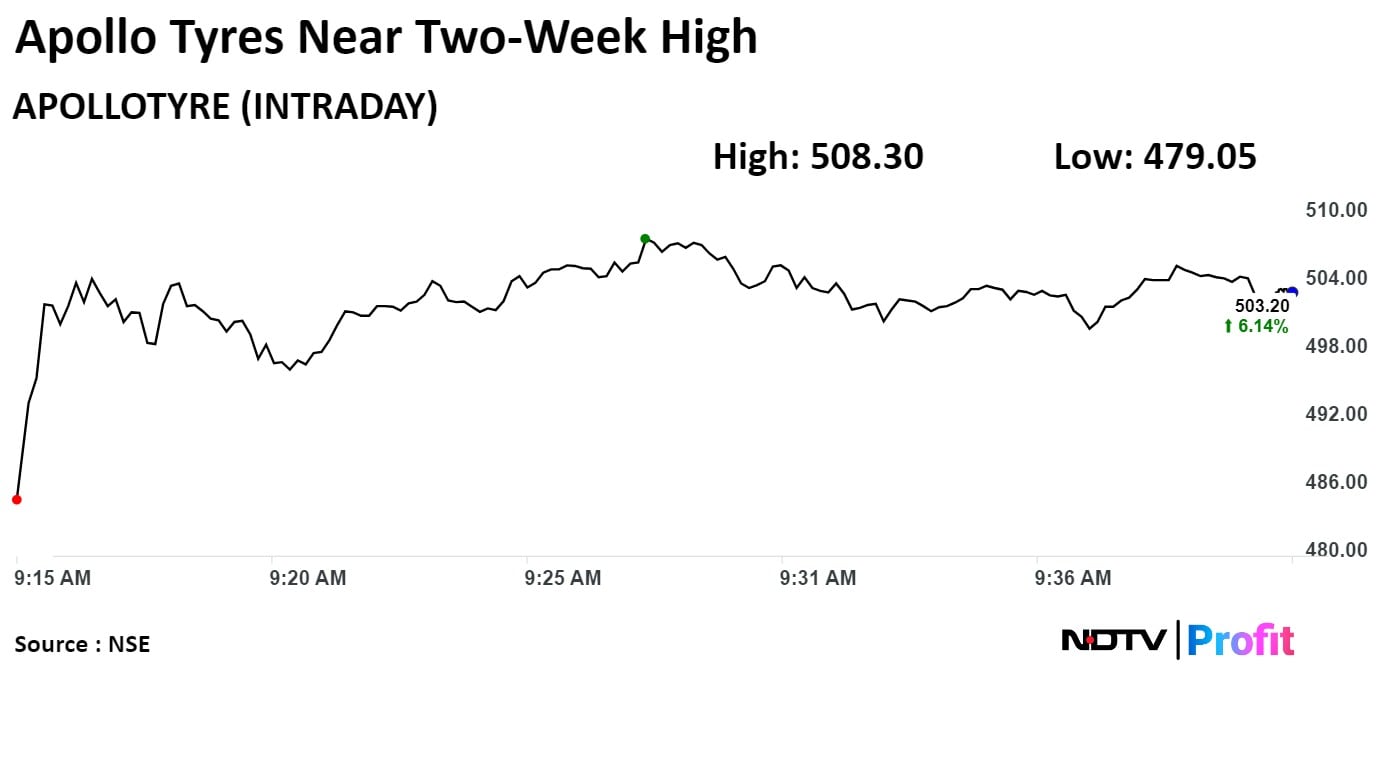

Apollo Tyres Ltd. rose as much as 7.21% to Rs 508.30, the highest level since May 3. It was trading 5.70% higher at Rs 501.10 as of 09:39 a.m., as compared to 0.26% advance in the NSE Nifty 50 index.

It has gained 28.89% in 12 months, and on year to date basis, it has risen 6.2%. Total traded volume so far in the day stood at 1.88 times its 30-day average. The relative strength index was at 59.64.

Out of 27 analysts tracking the company, 17 maintain a 'buy' rating, five recommend a 'hold,' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.8%.

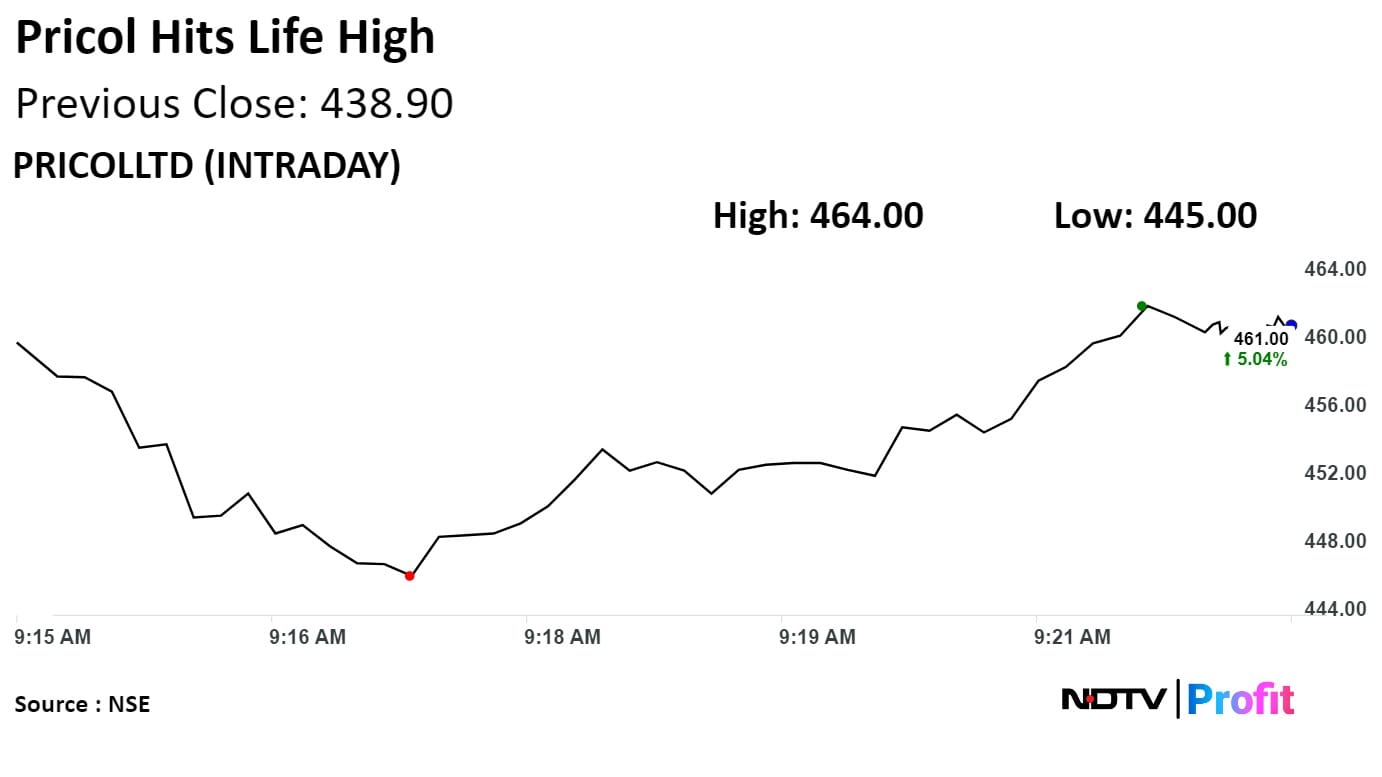

Pricol Ltd. rose to the record high on Thursday after the company reported a rise in its net profit during January-March quarter. Its net profit rose 39.3% on the year to Rs 42 crore from Rs 30 crore.

Pricol Ltd. rose to the record high on Thursday after the company reported a rise in its net profit during January-March quarter. Its net profit rose 39.3% on the year to Rs 42 crore from Rs 30 crore.

Pricol Ltd. rose as much as 5.72% to Rs 464.00, the highest level since its listing on April 3, 1996. It was trading 4.45% higher at Rs 458.45 as of 09:24 a.m., as compared to 0.51% advance in the NSE Nifty 50 index.

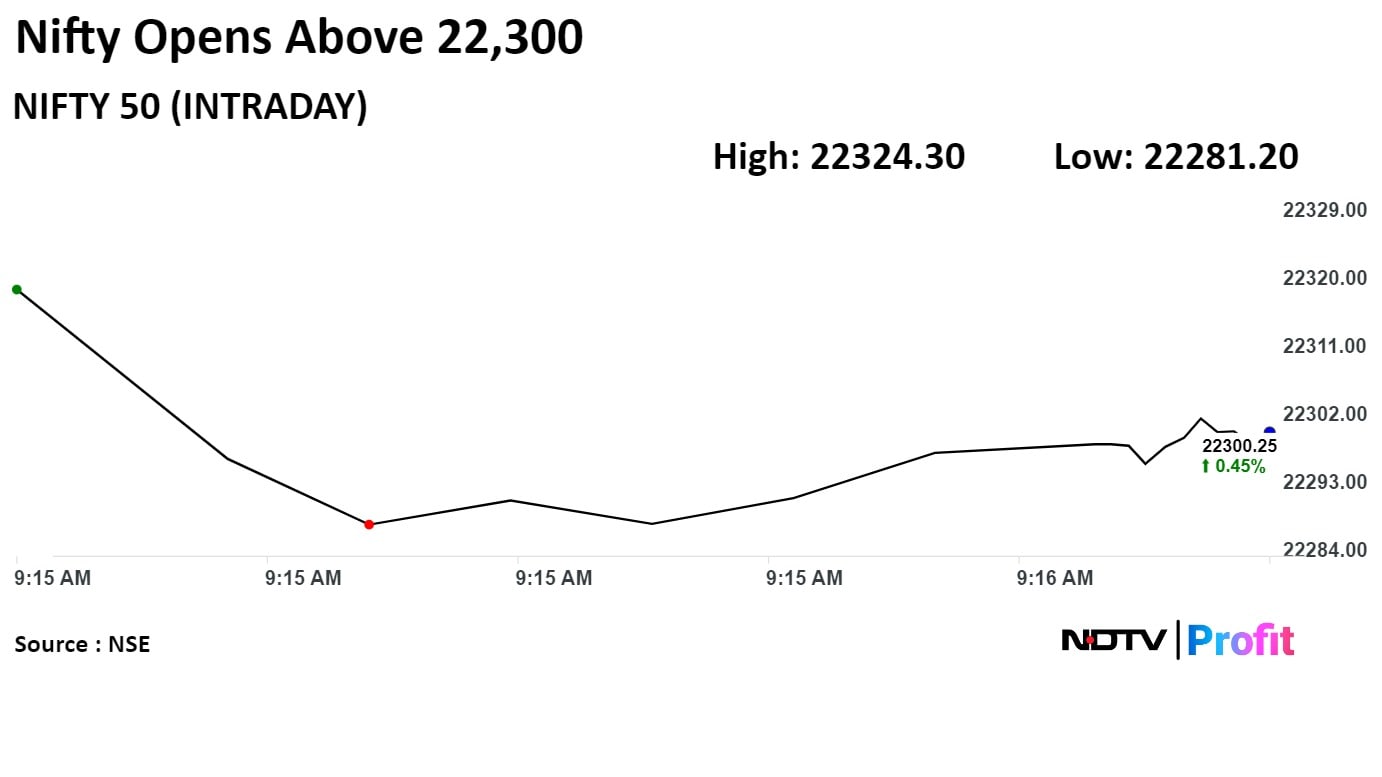

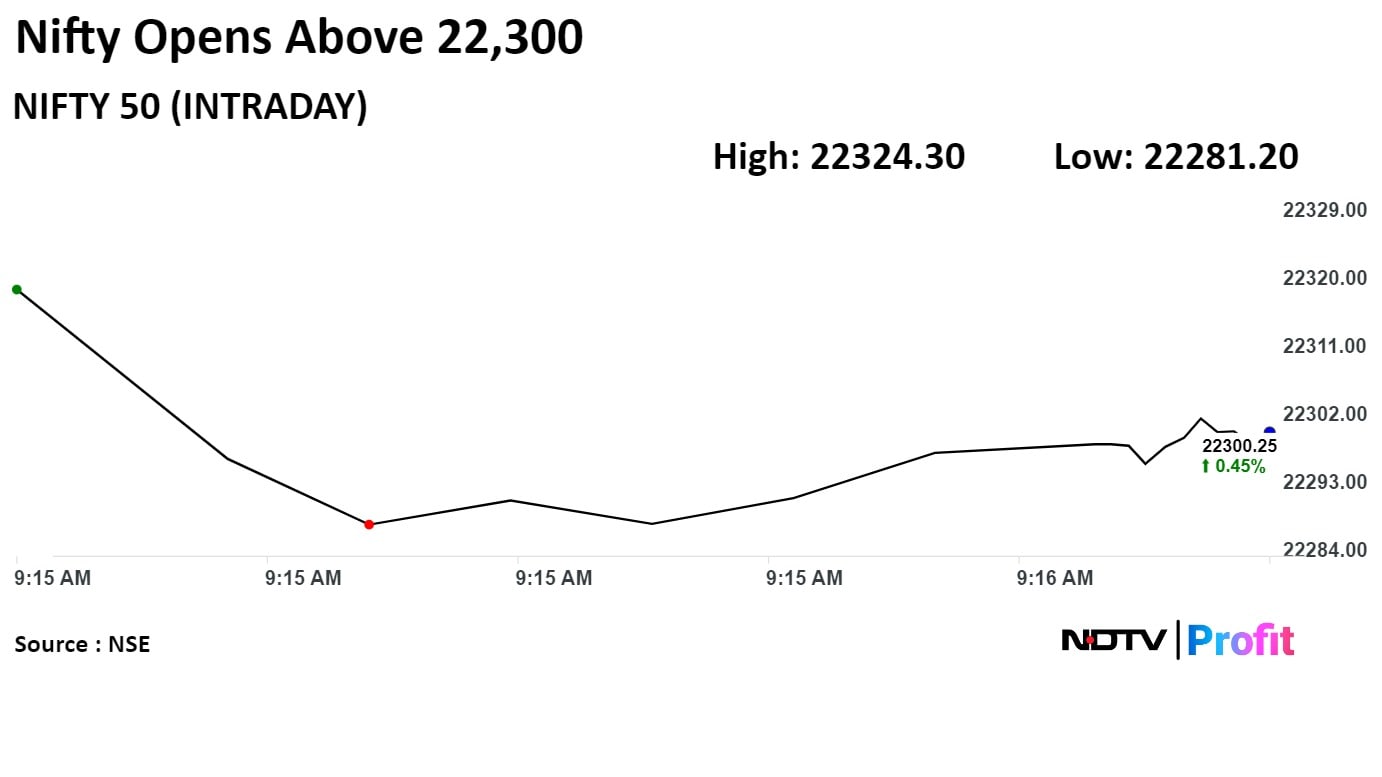

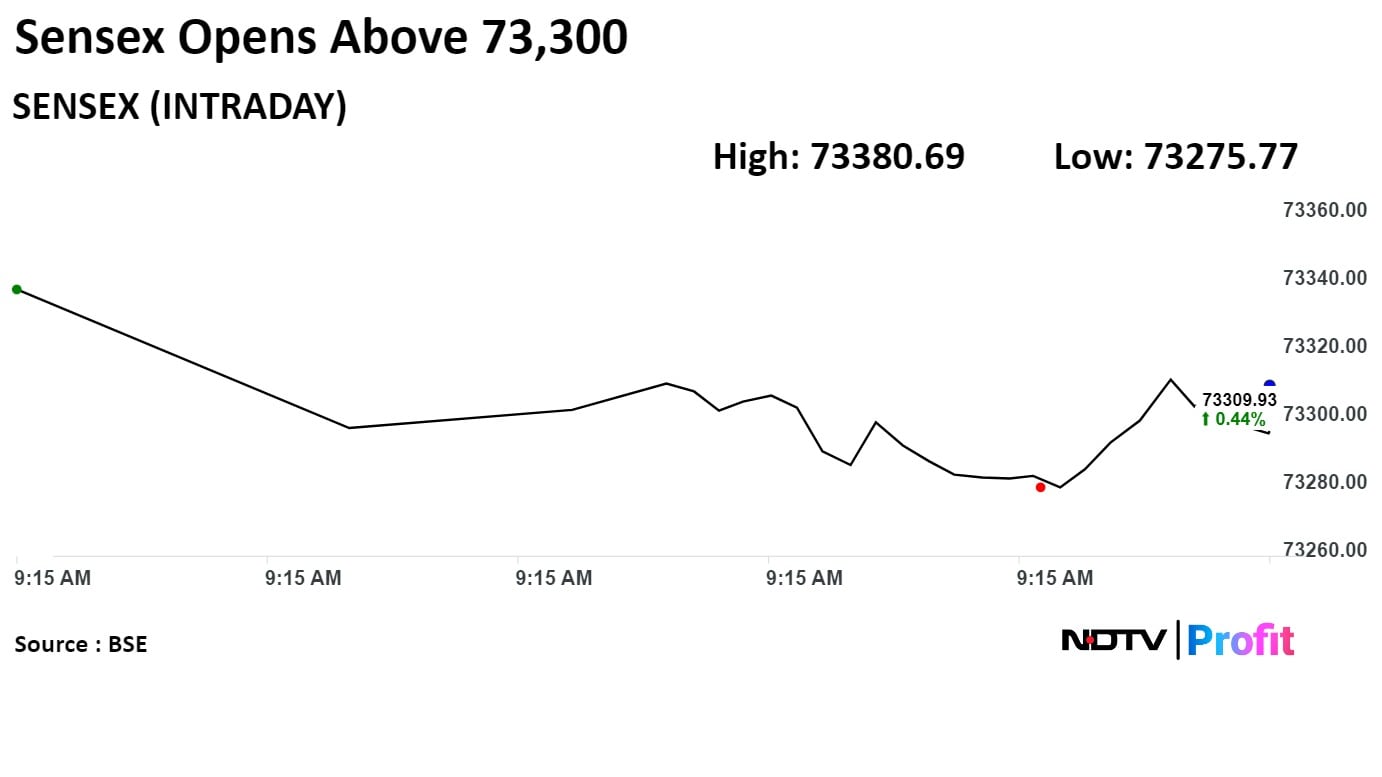

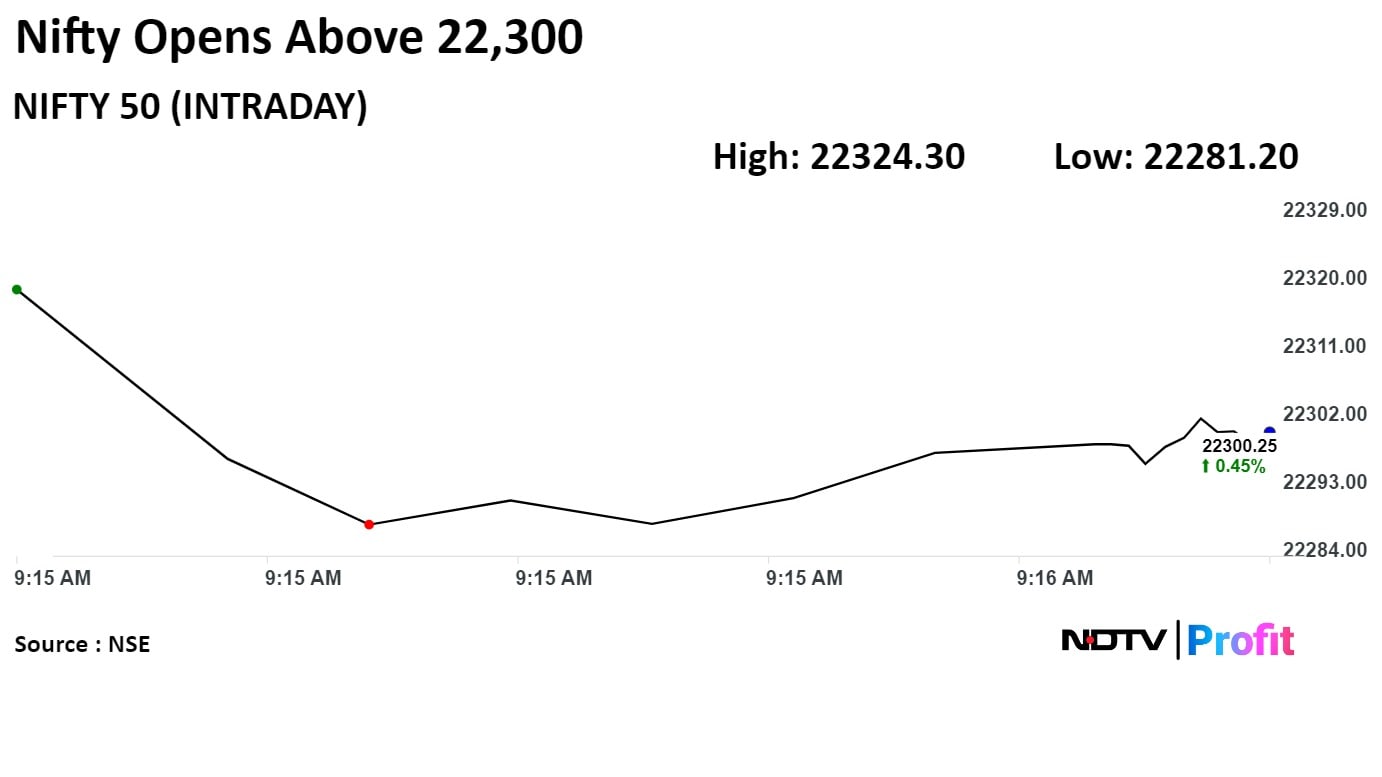

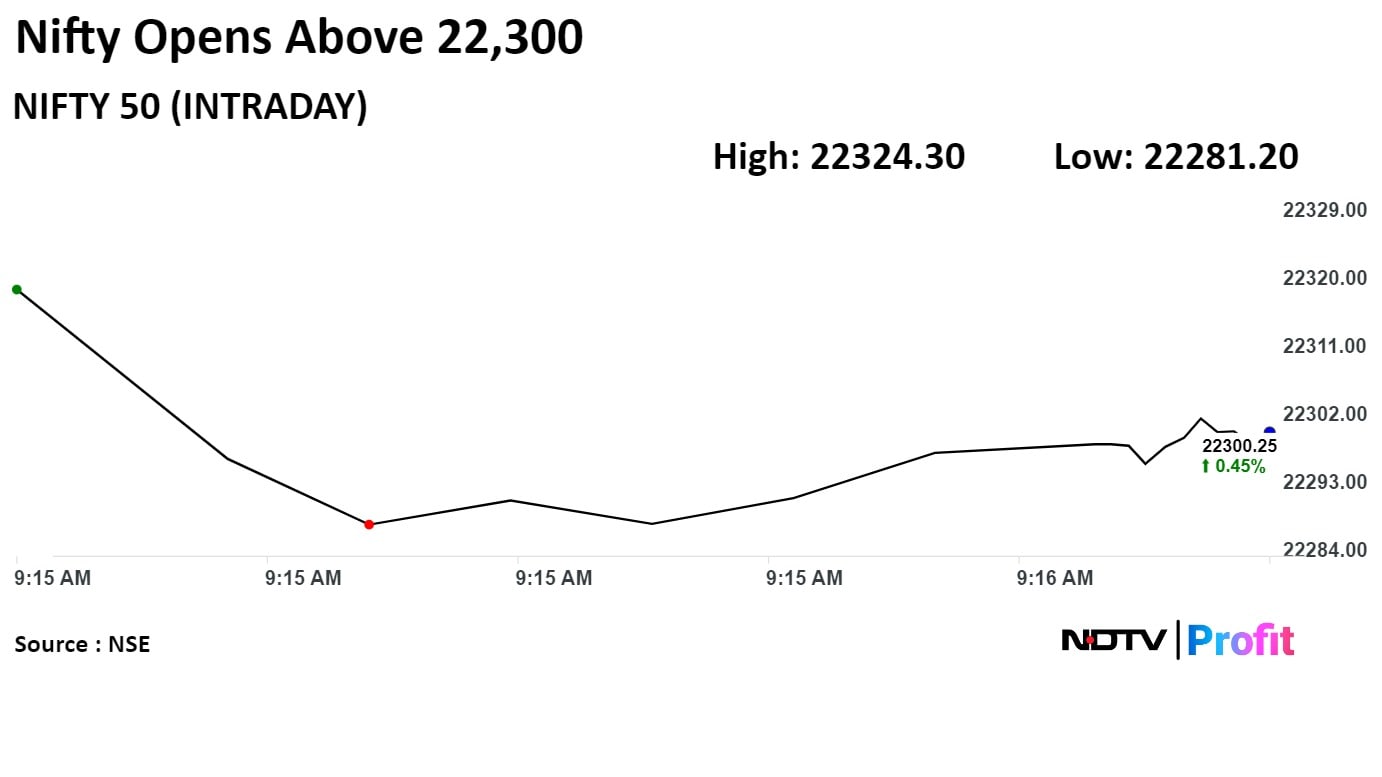

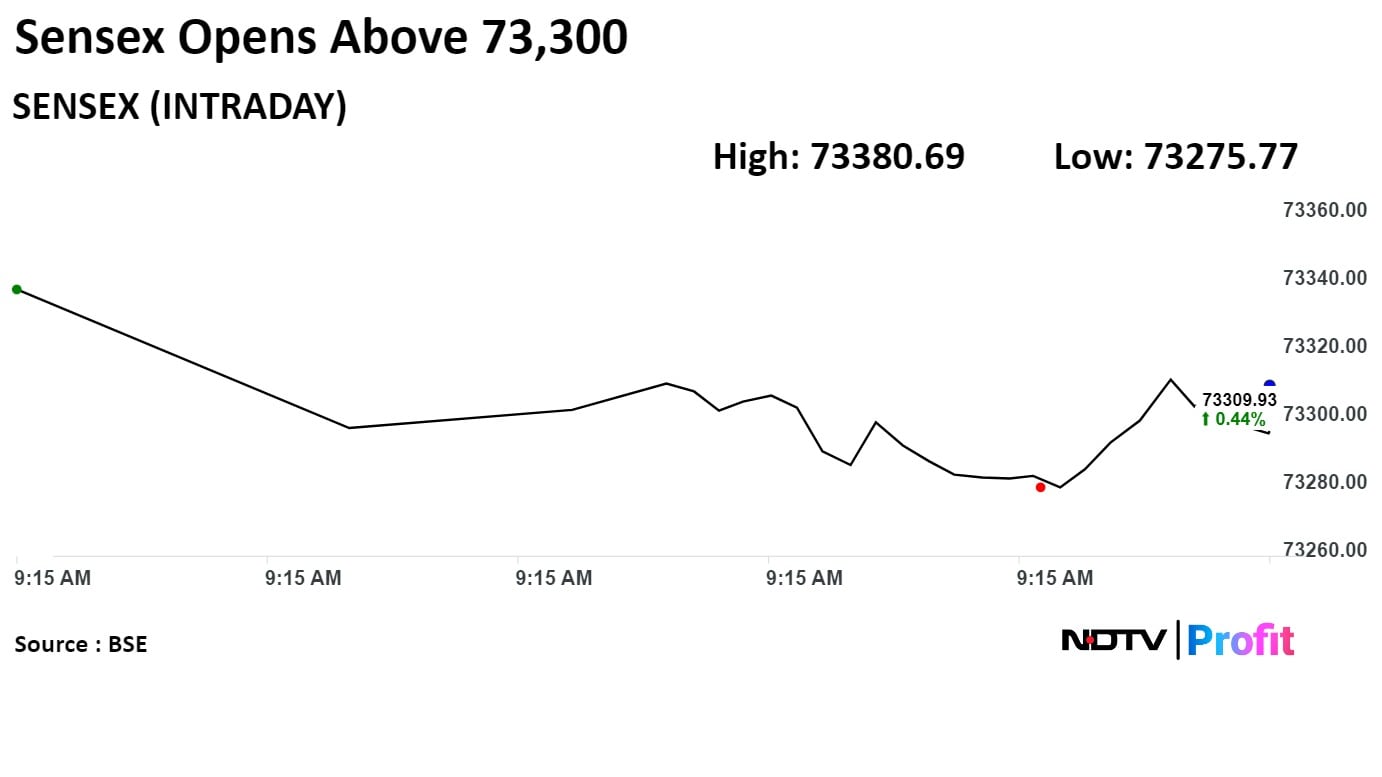

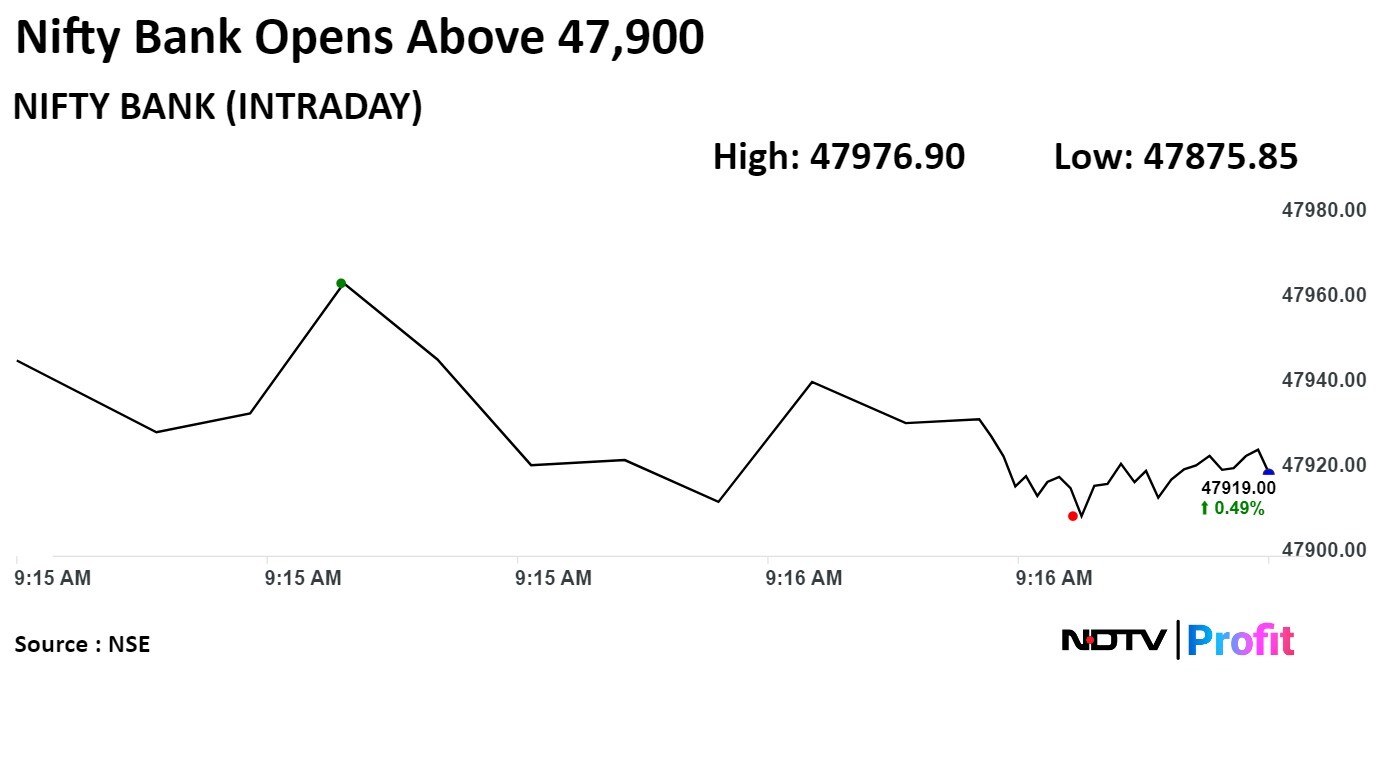

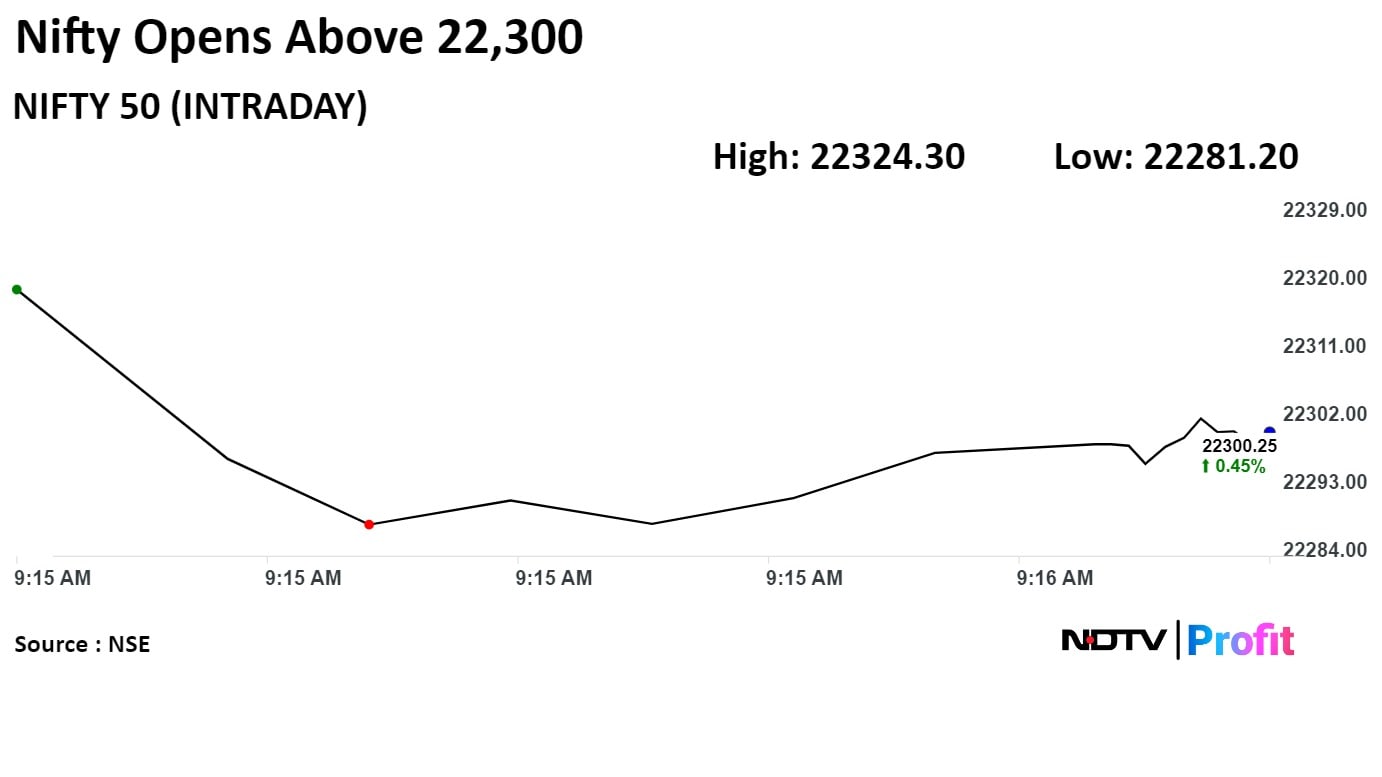

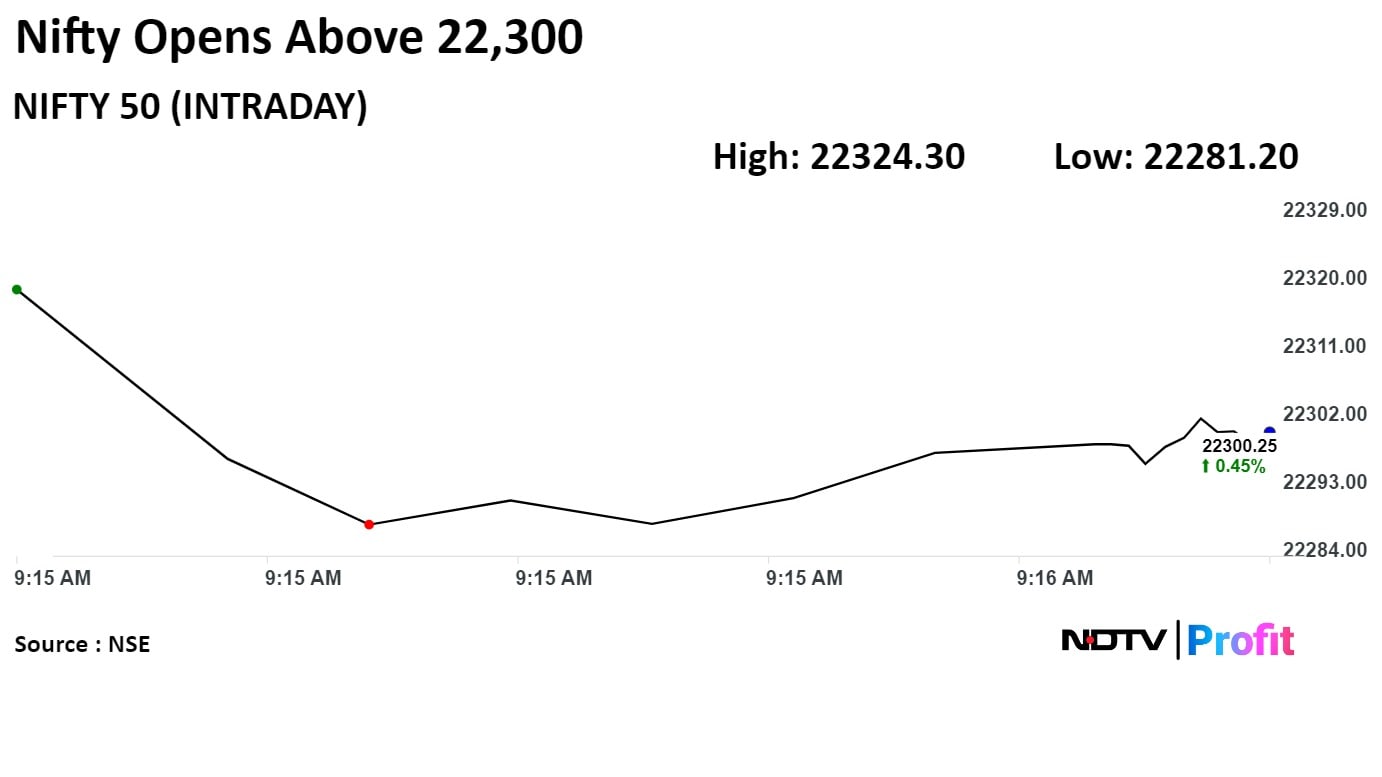

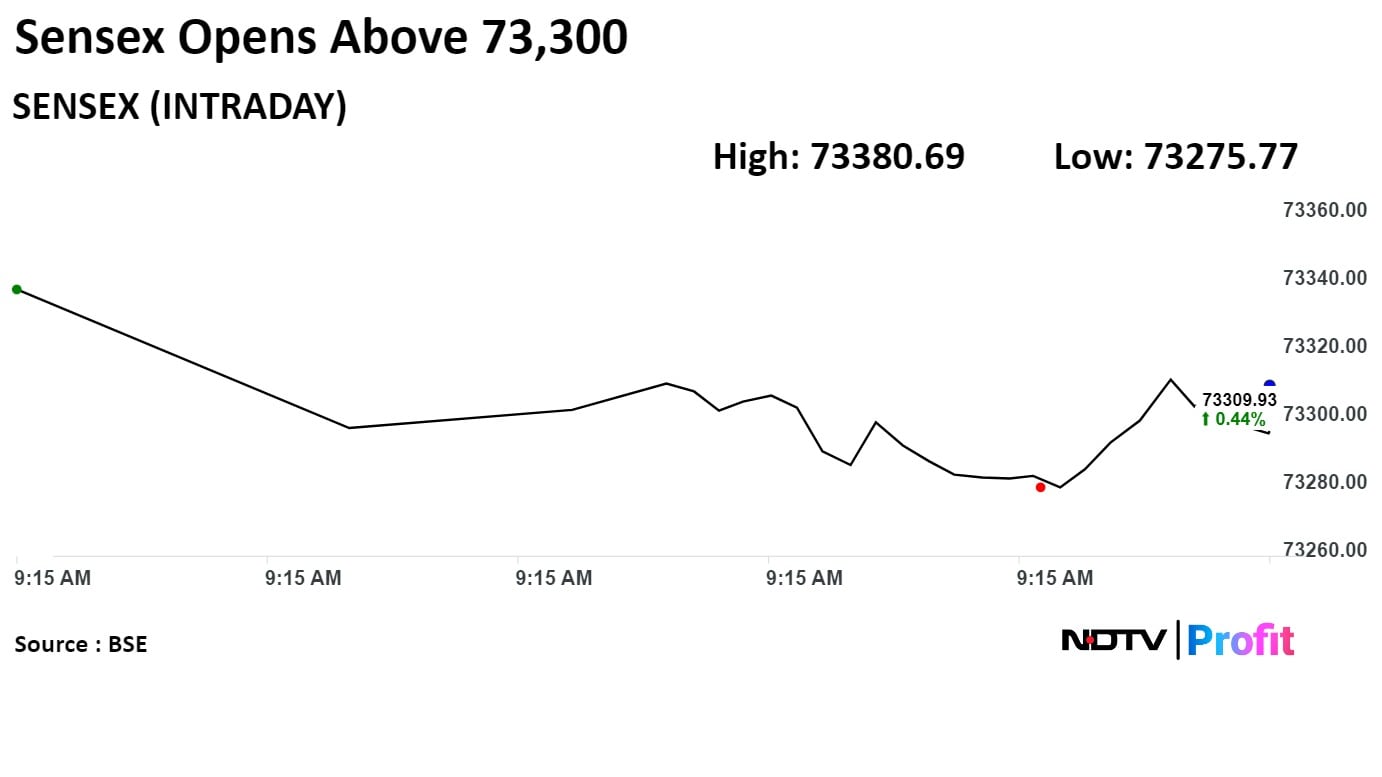

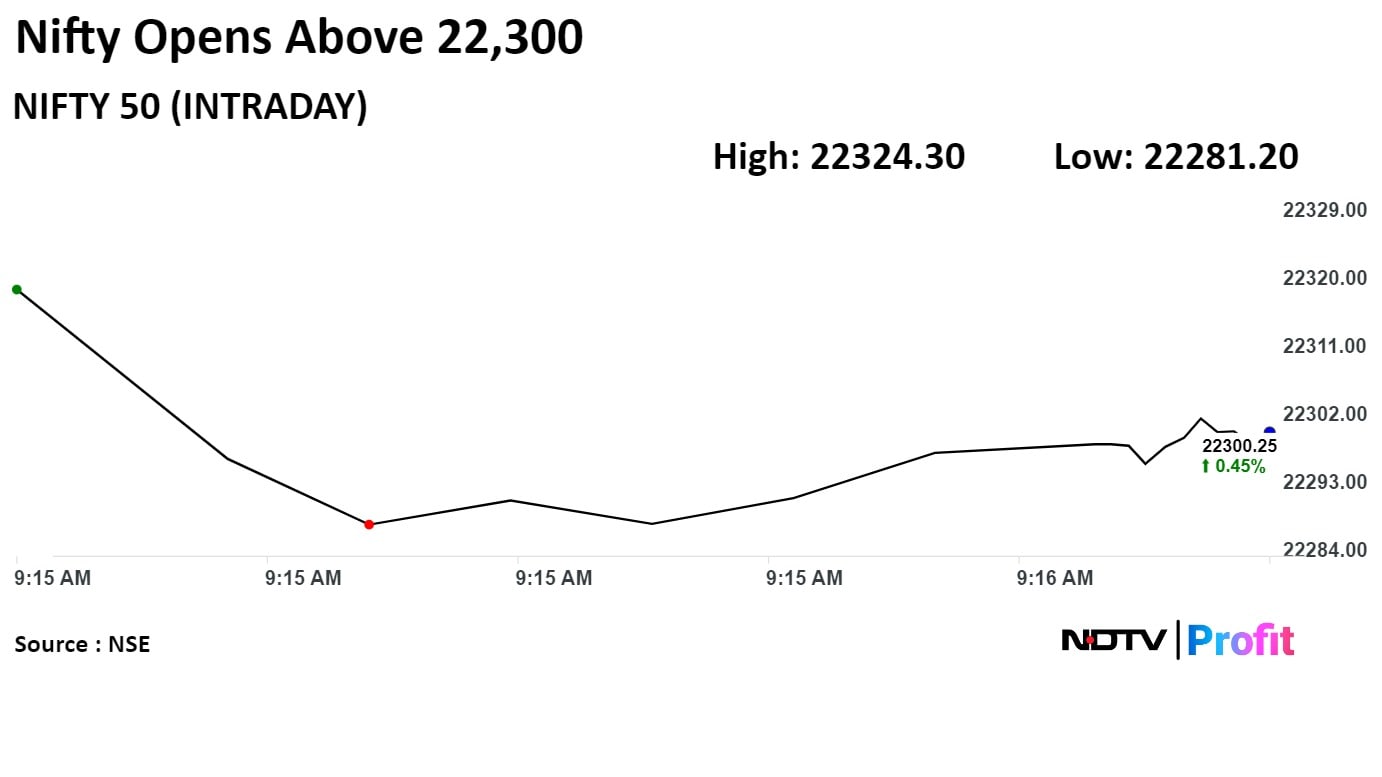

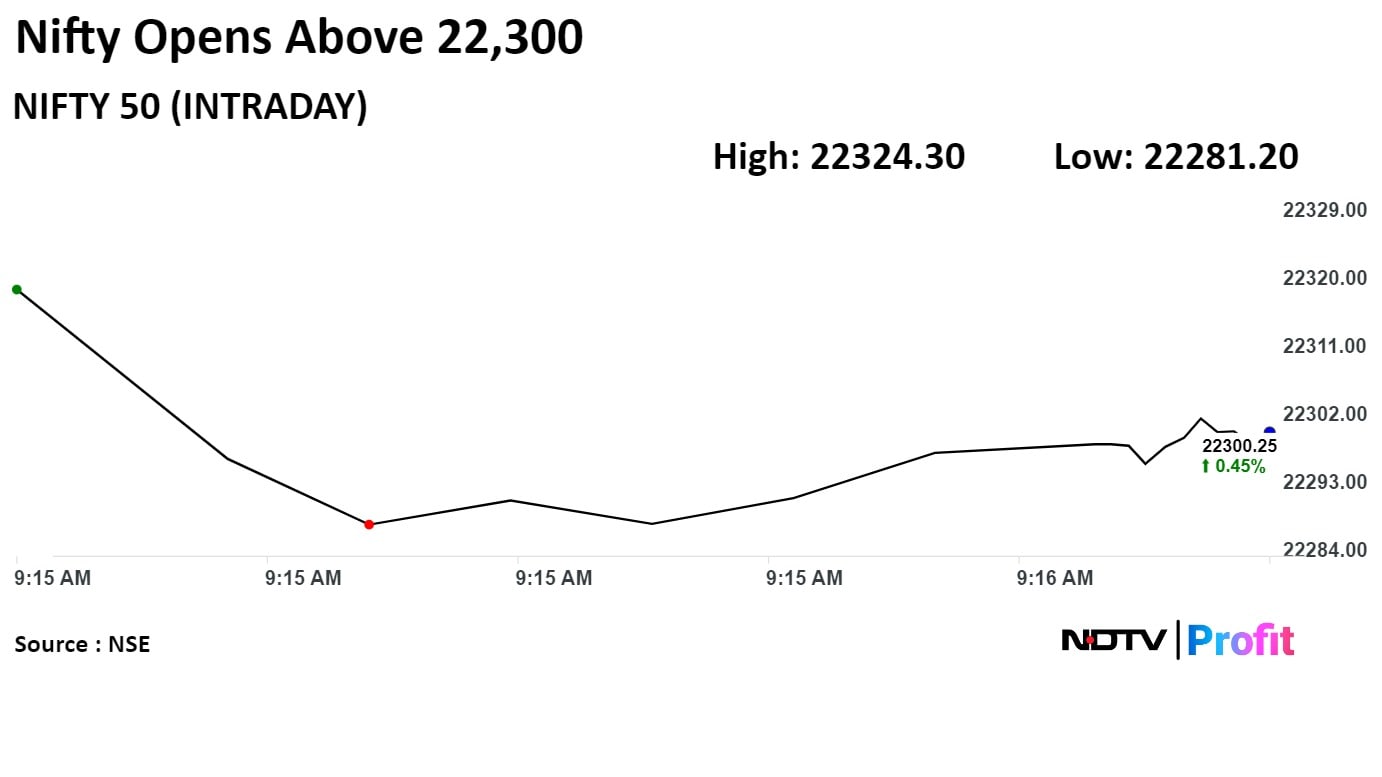

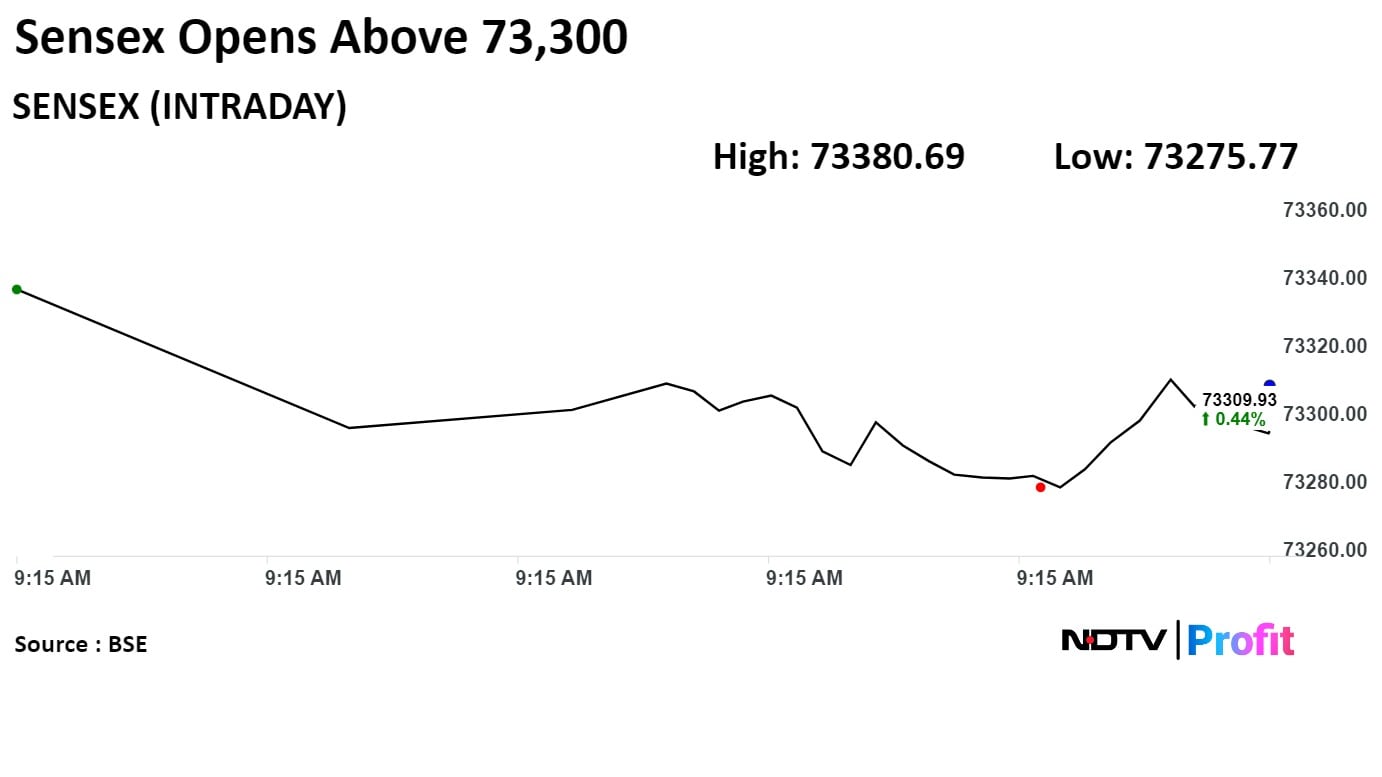

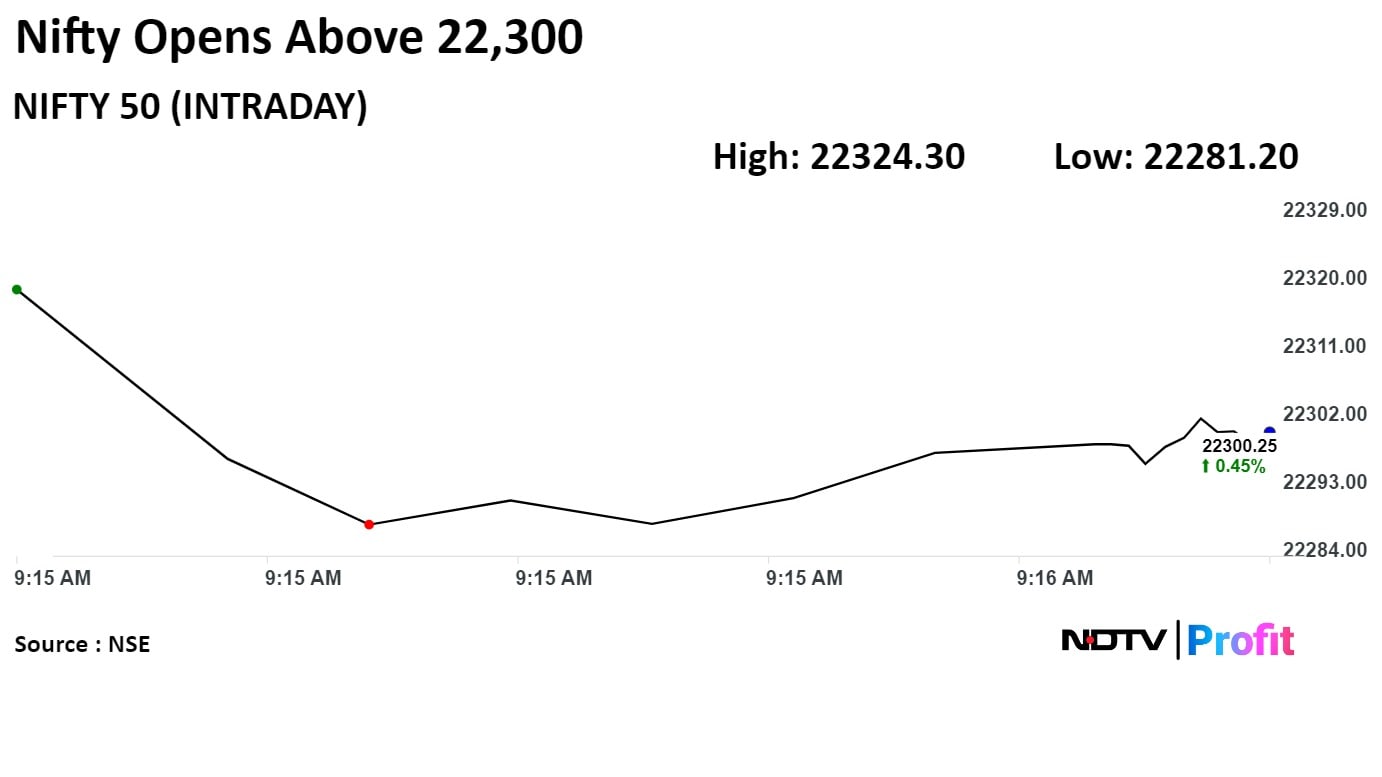

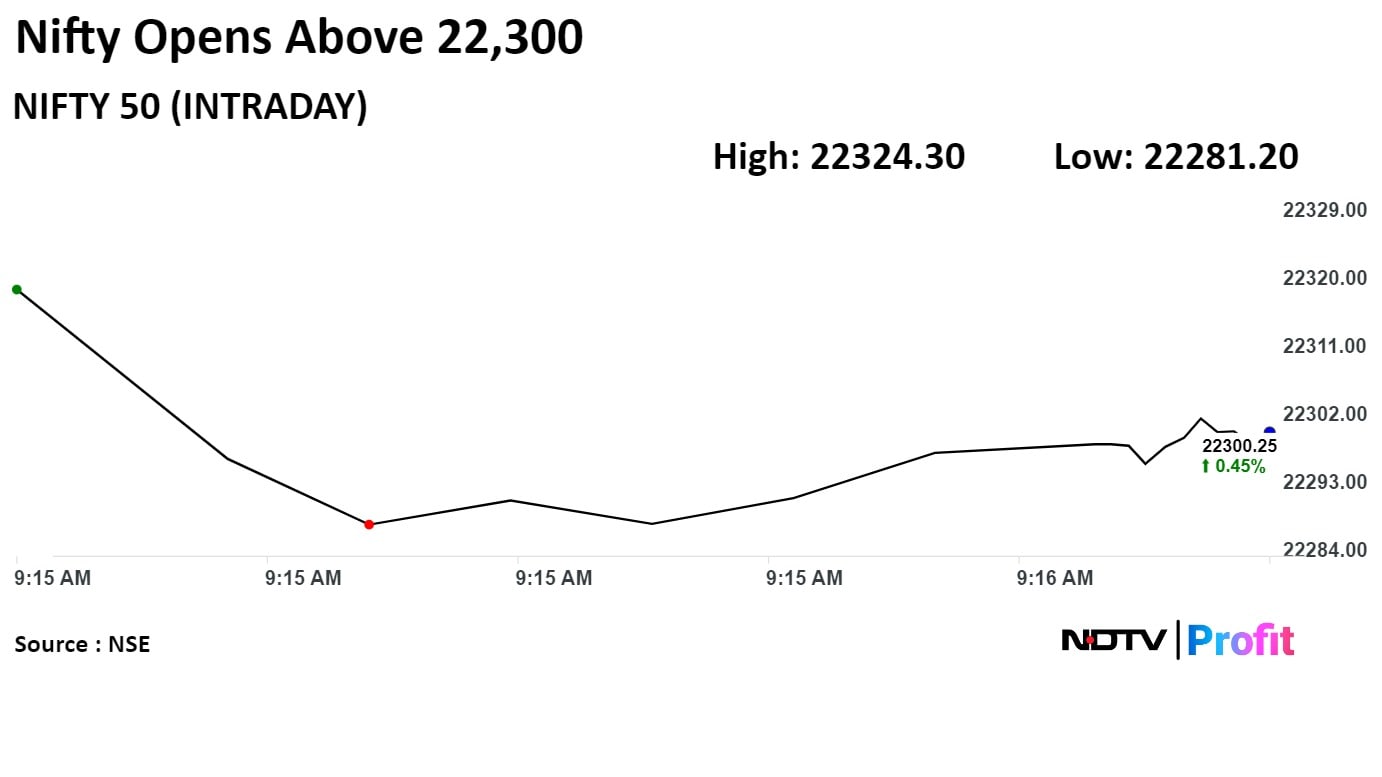

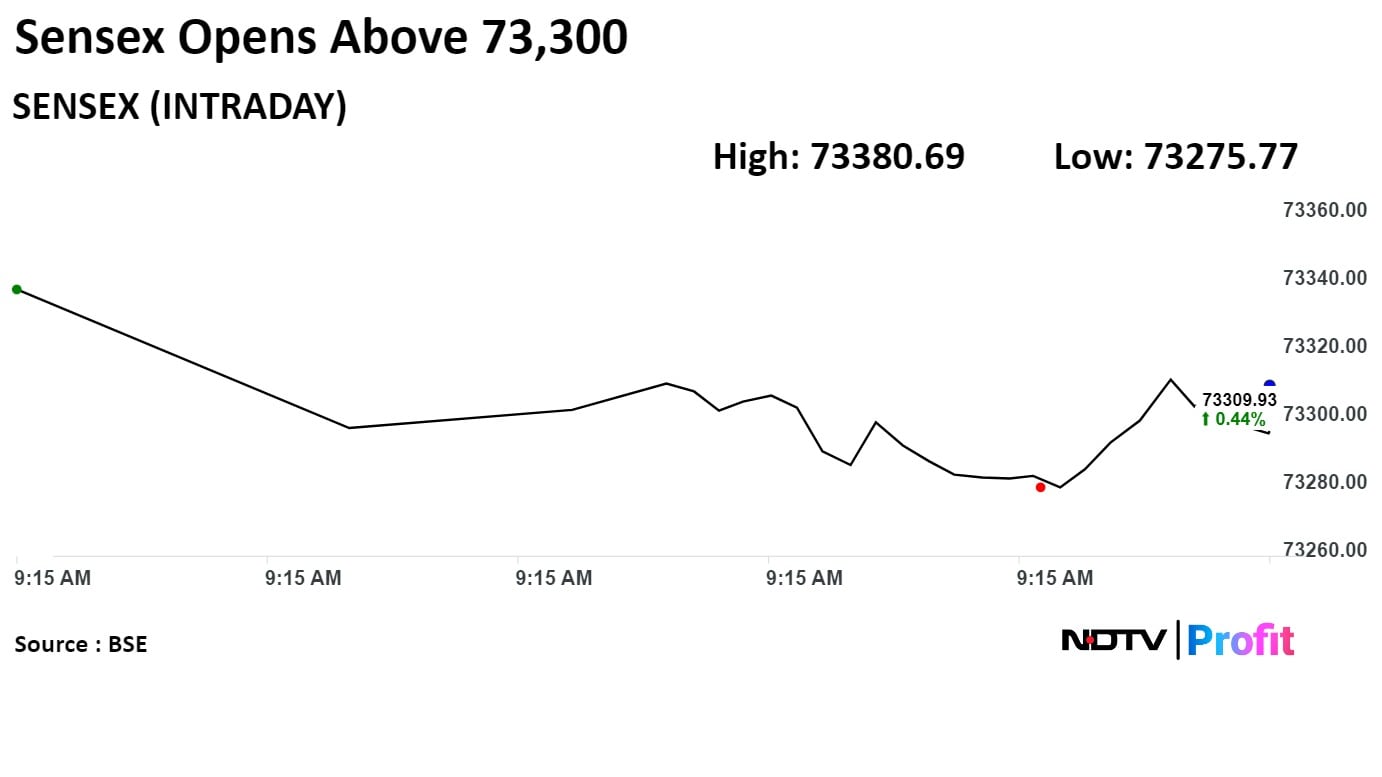

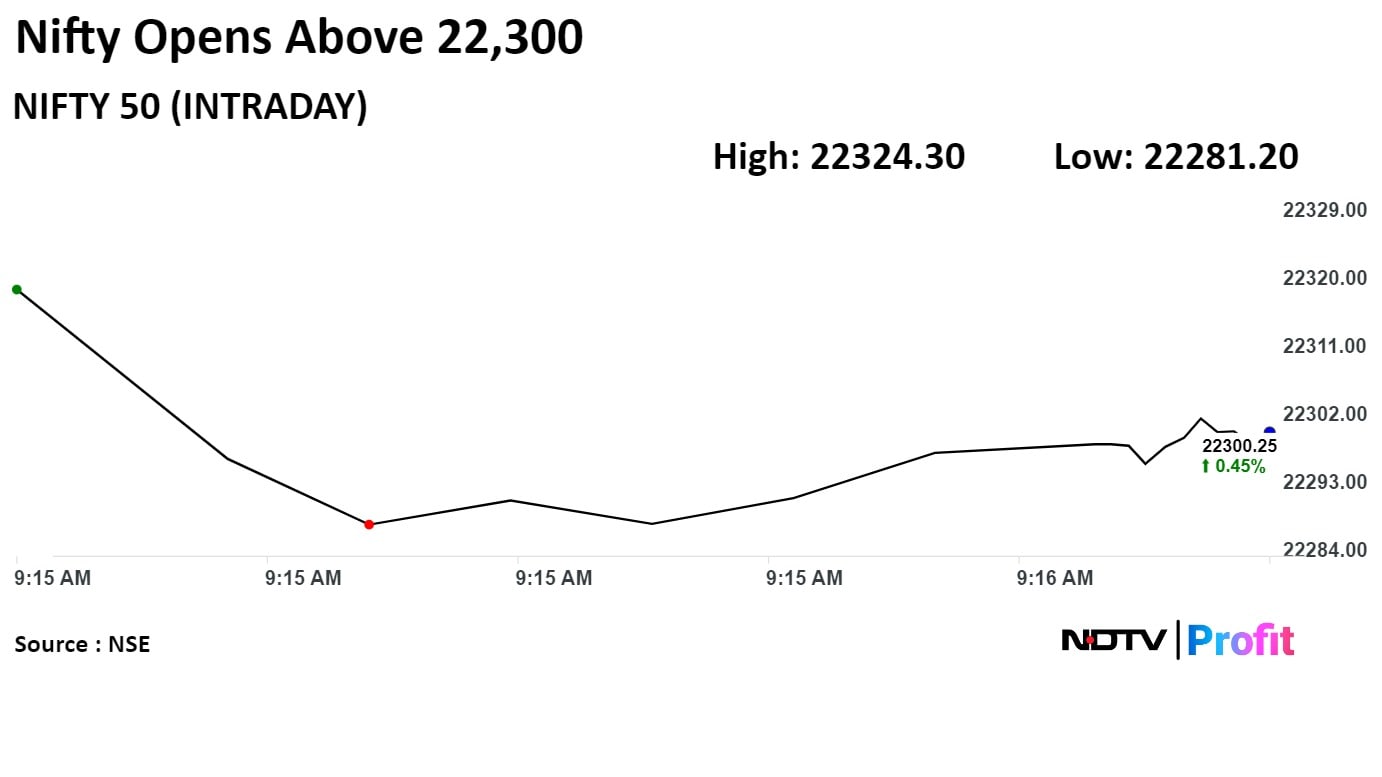

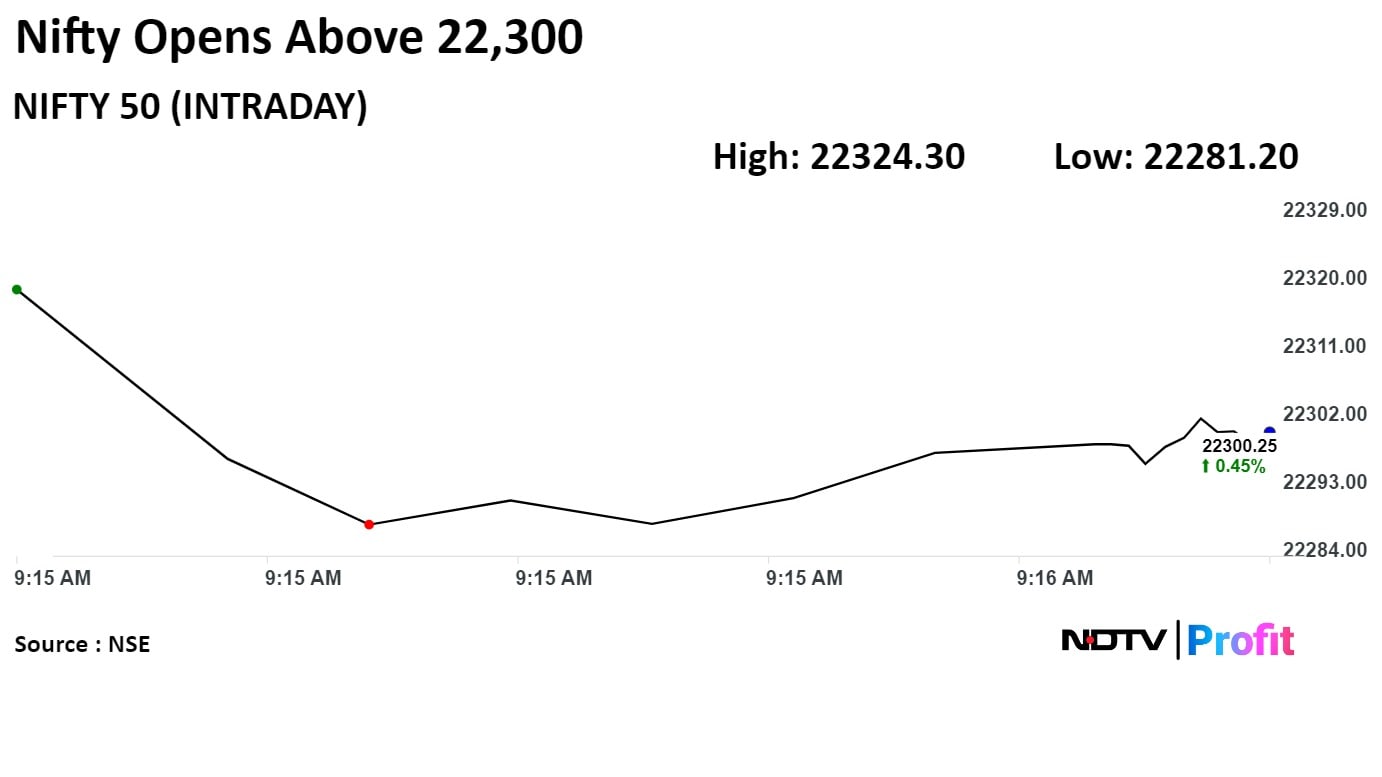

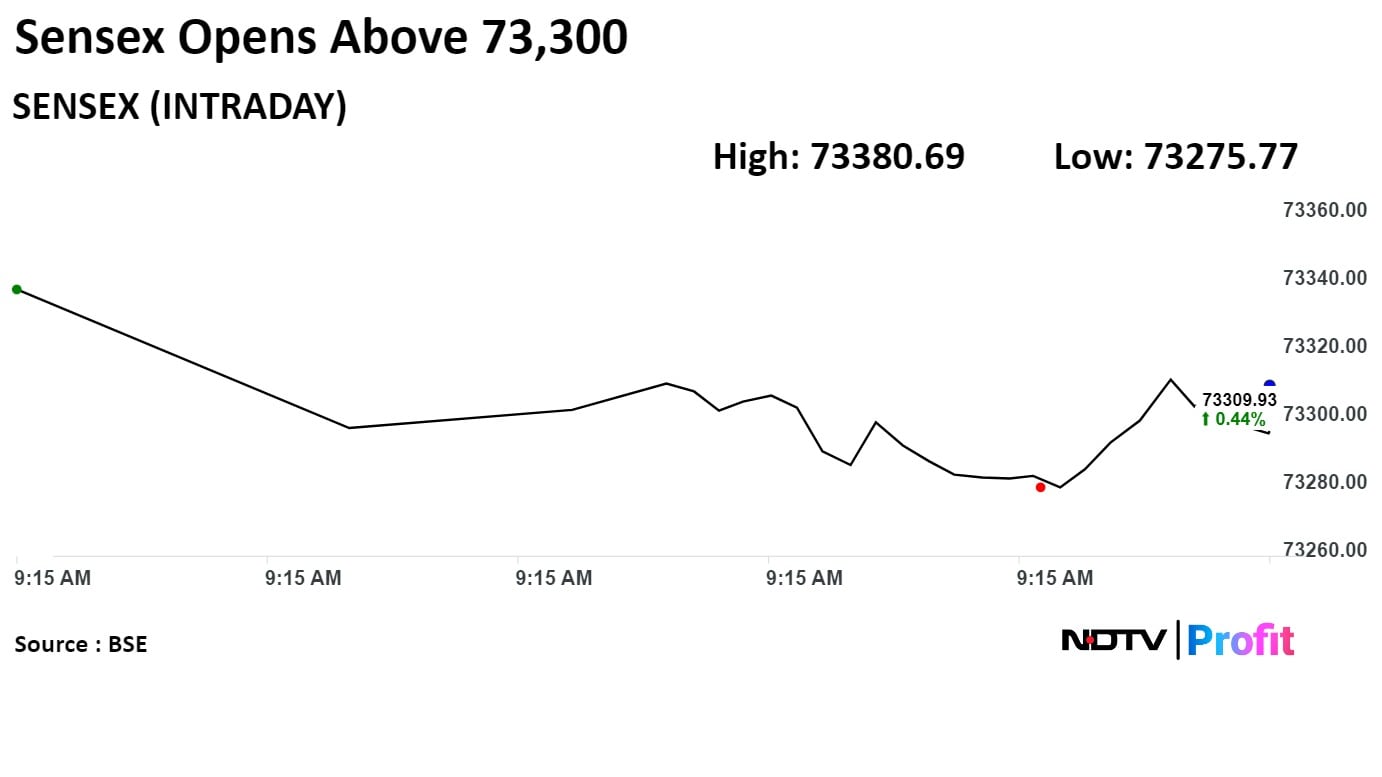

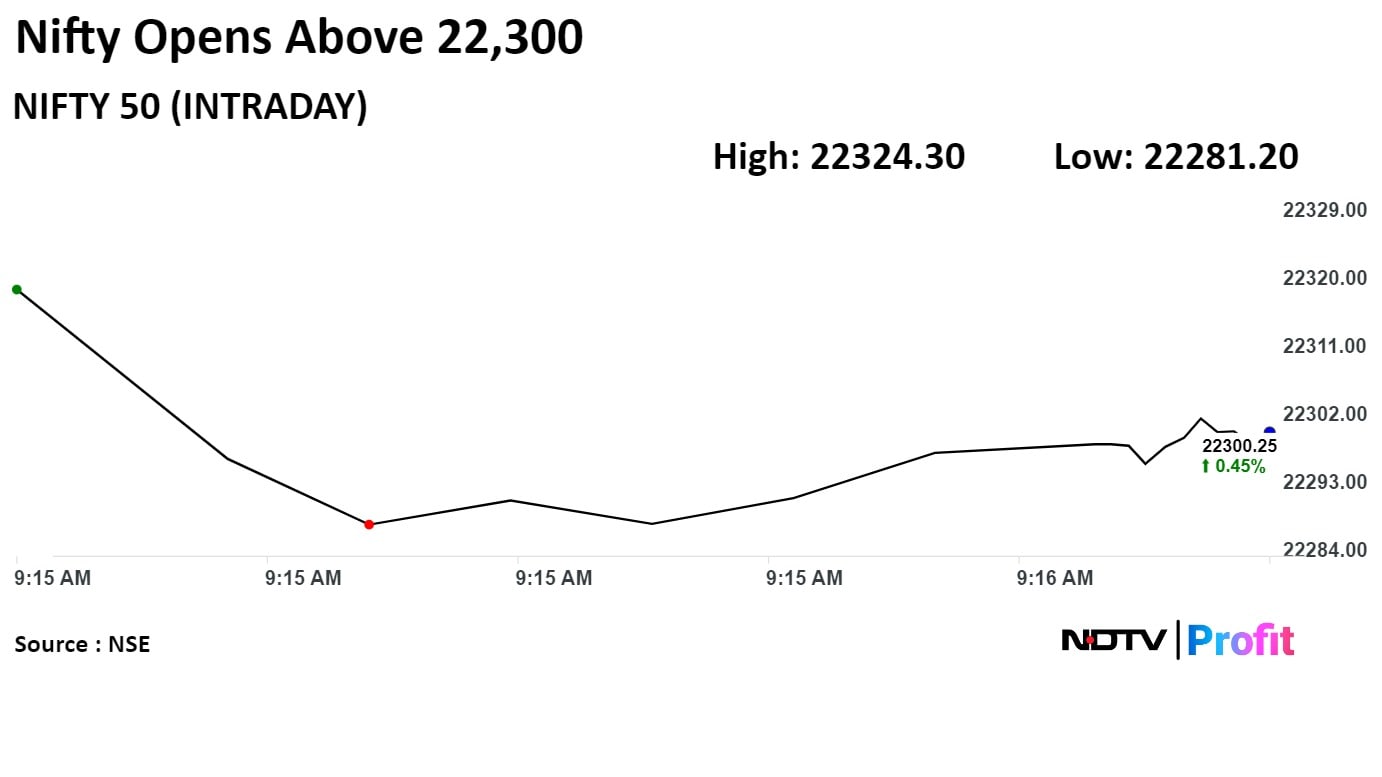

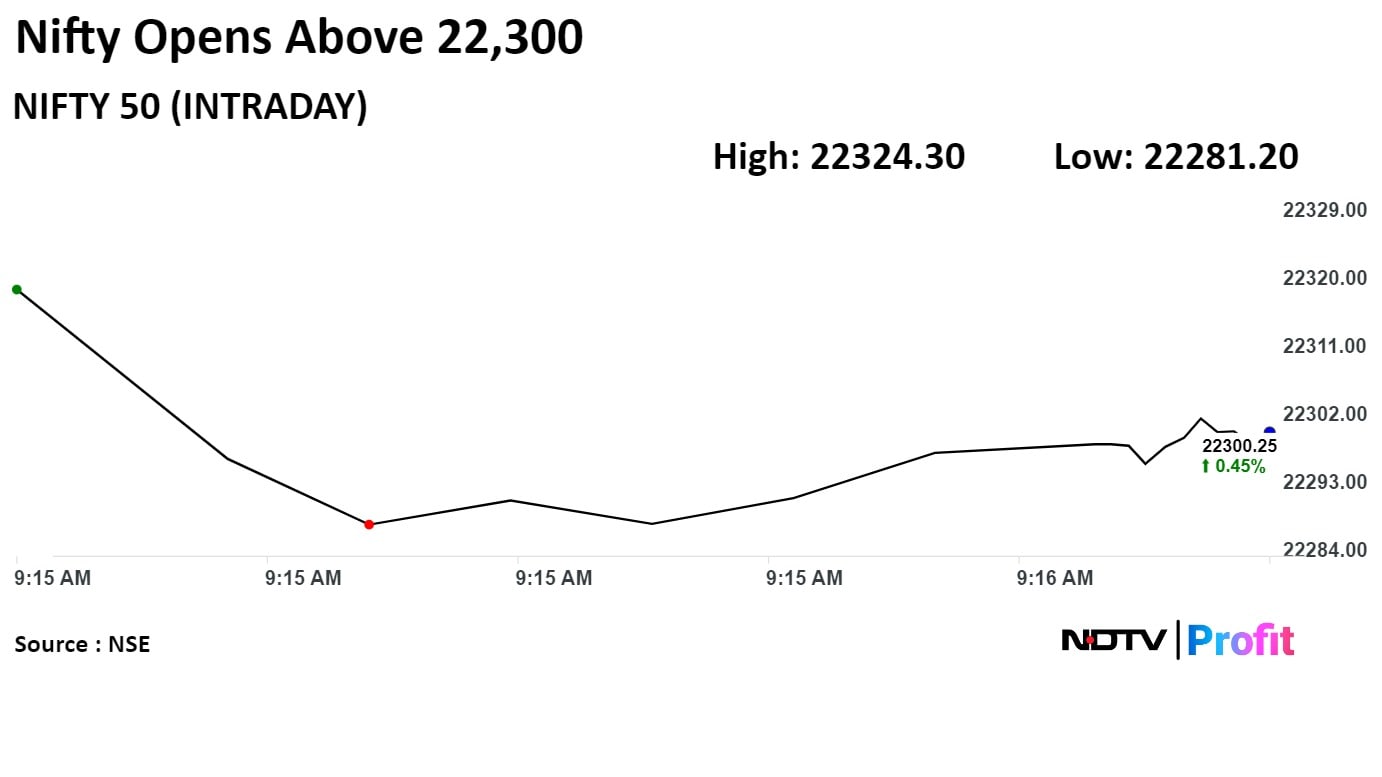

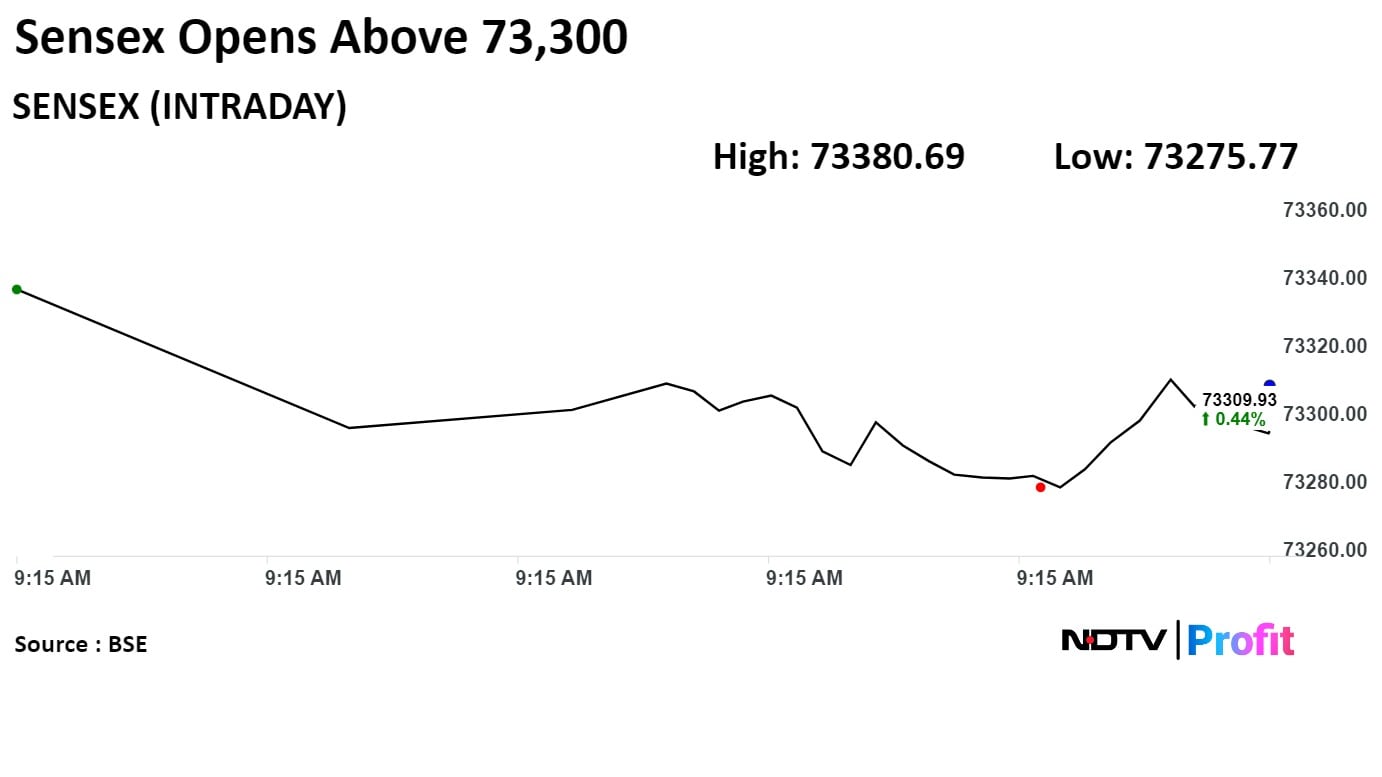

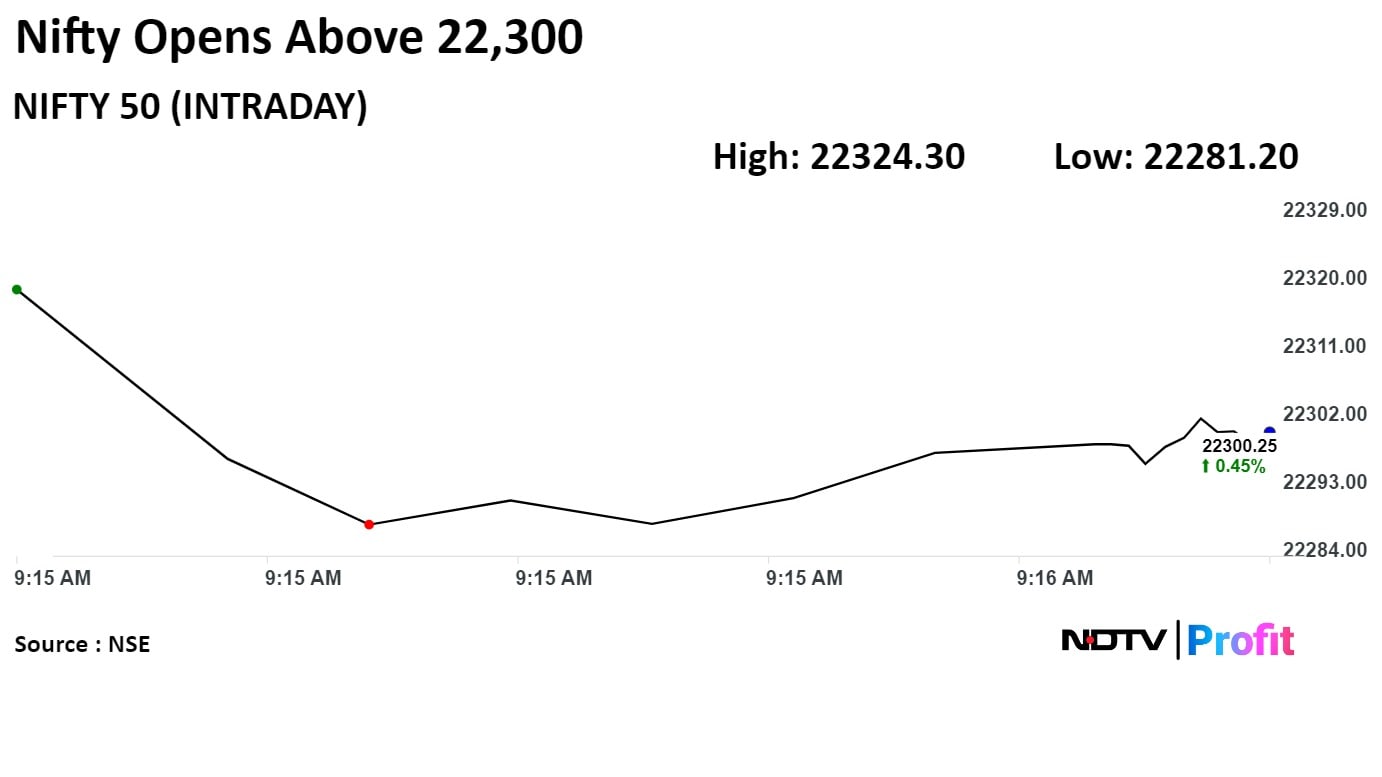

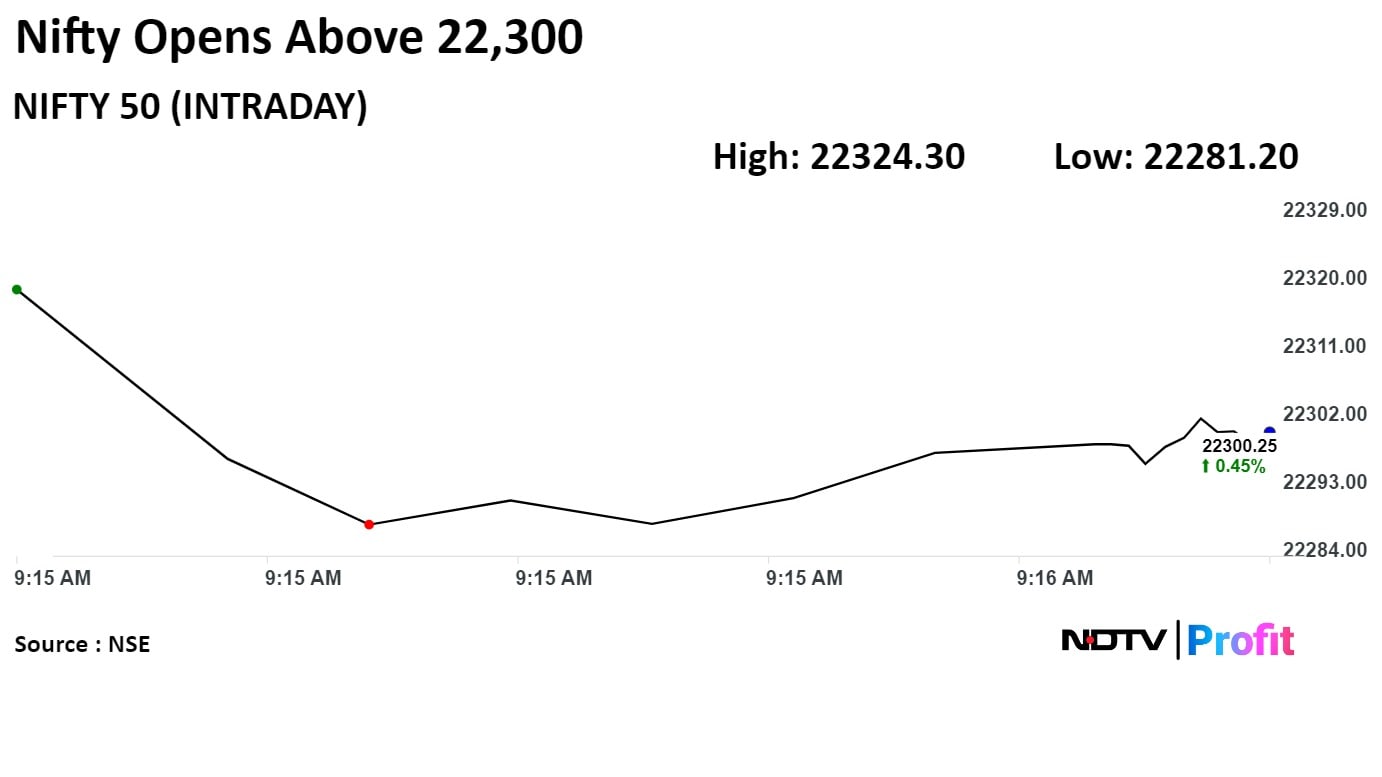

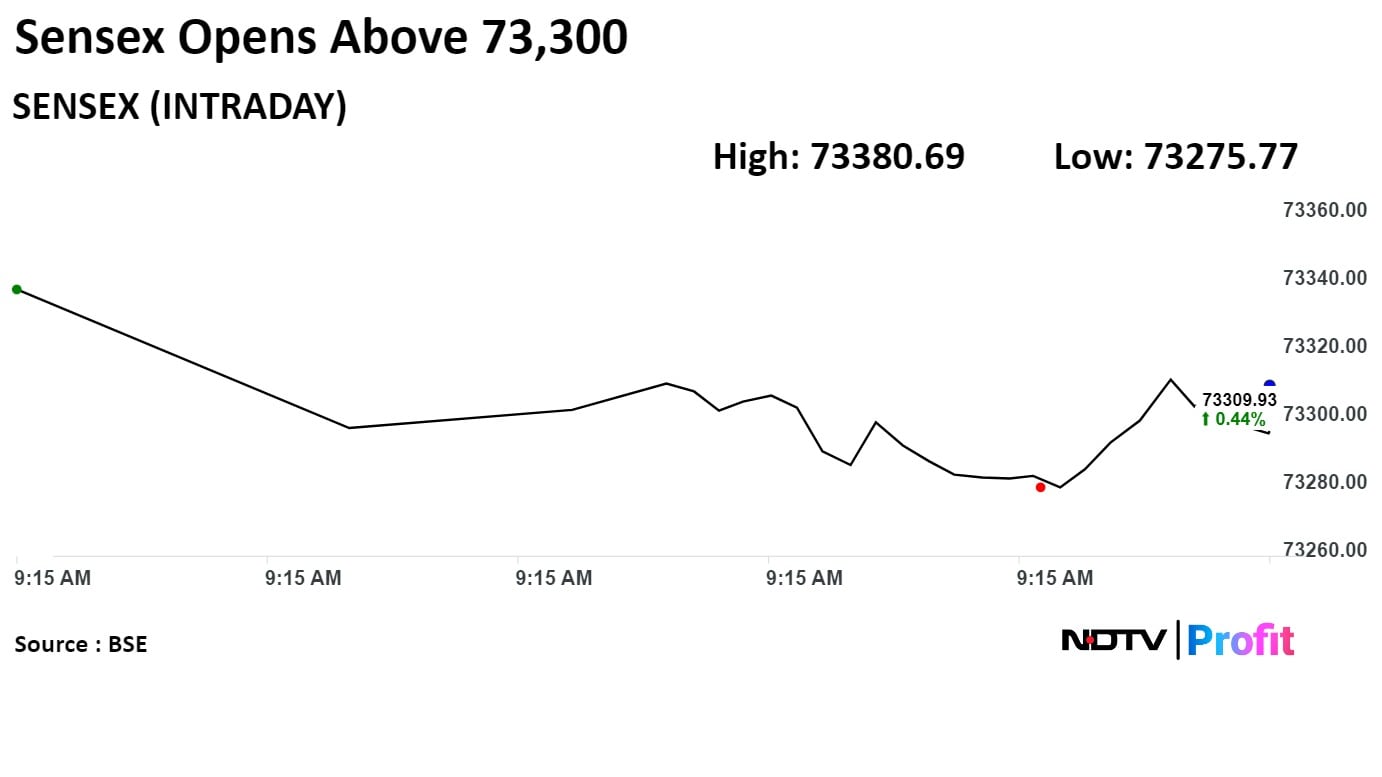

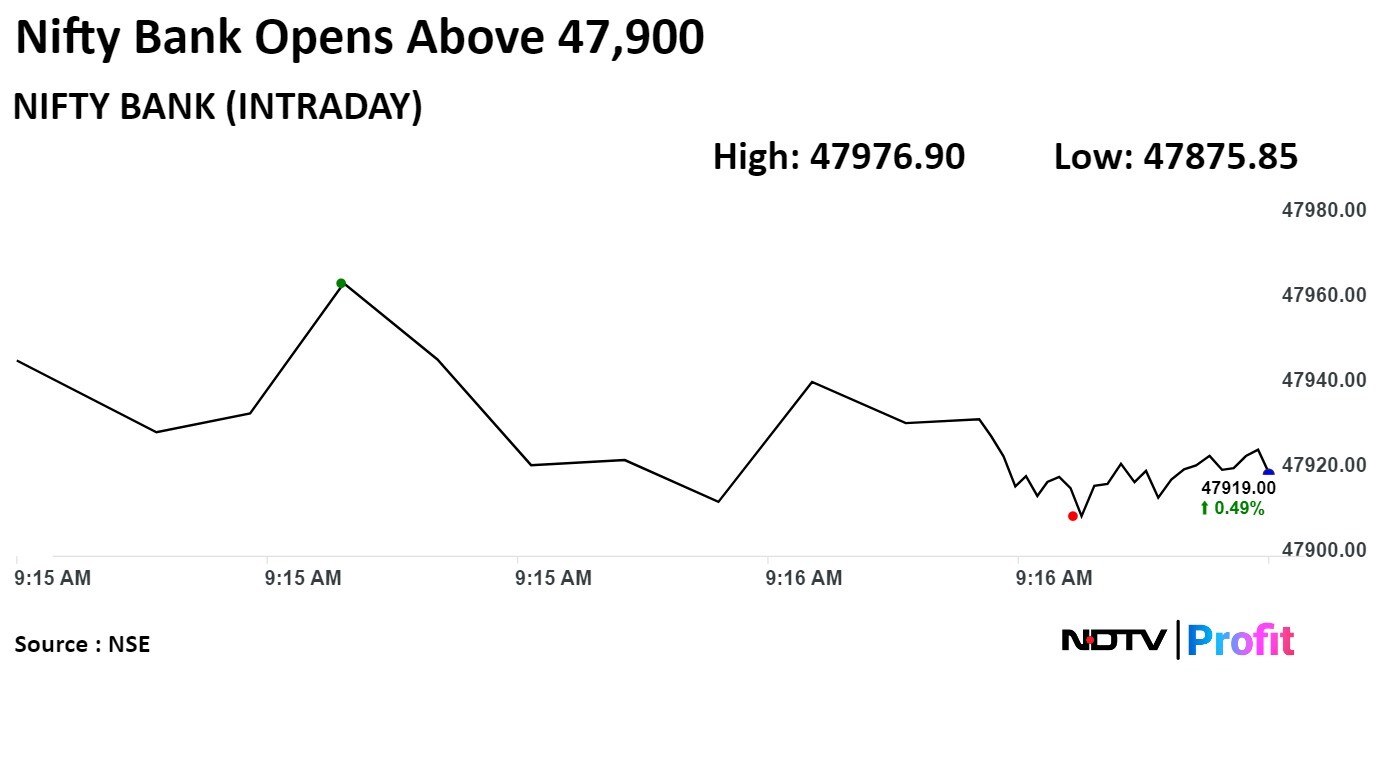

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.

Nifty would need a decisive breach above the 22,300 levels to continue with the positive upward movement and expect for next targets of 22550-22600 levels, said Prabhudas Lilladher in a report. "The support would be maintained near 22000 zone as of now which needs to be sustained. "

The report said, "Sensex has trading in INSIDE BAR pattern and needs a decisive breakout above the 50 DMA level of 73500 to trigger and establish for a fresh further upward directional move."

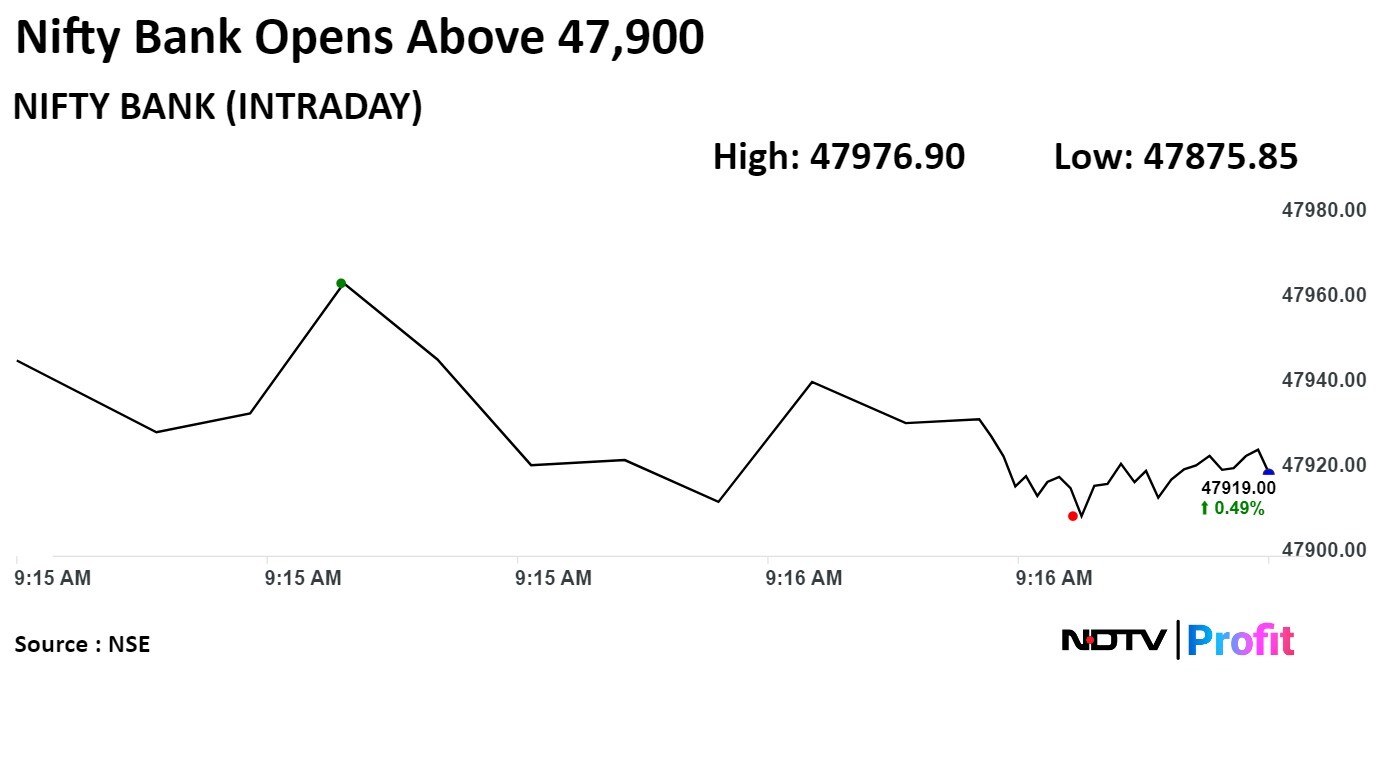

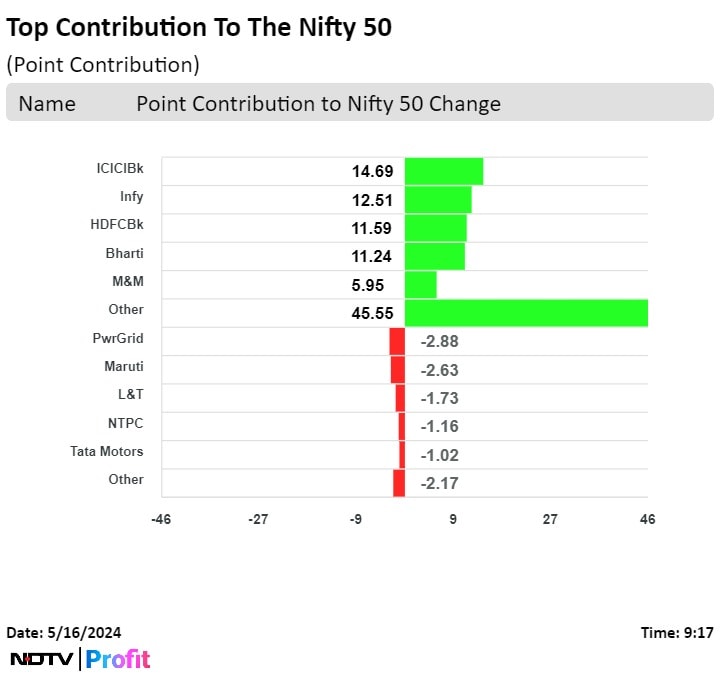

Shares of ICICI Bank Ltd., Infosys Ltd., HDFC Bank Ltd., Bharti Airtel Ltd., and Mahindra & Mahindra Ltd. contributed the most to the gains.

Meanwhile, those of Power Grid Corp Of India, Maruti Suzuki Ltd., Larsen & Toubro Ltd., NTPC Ltd., and Tata Motors Ltd. capped the upside.

Benchmark equity indices opened higher tracking the sentiment in global markets after slower than expected US inflation reinforced hopes of a September rate cut in the country.

At pre-open, the Nifty was at 22,319.20, up 118.65 points or 0.53% while the Sensex rose 351.21 points or 0.48% to 73,338.24.