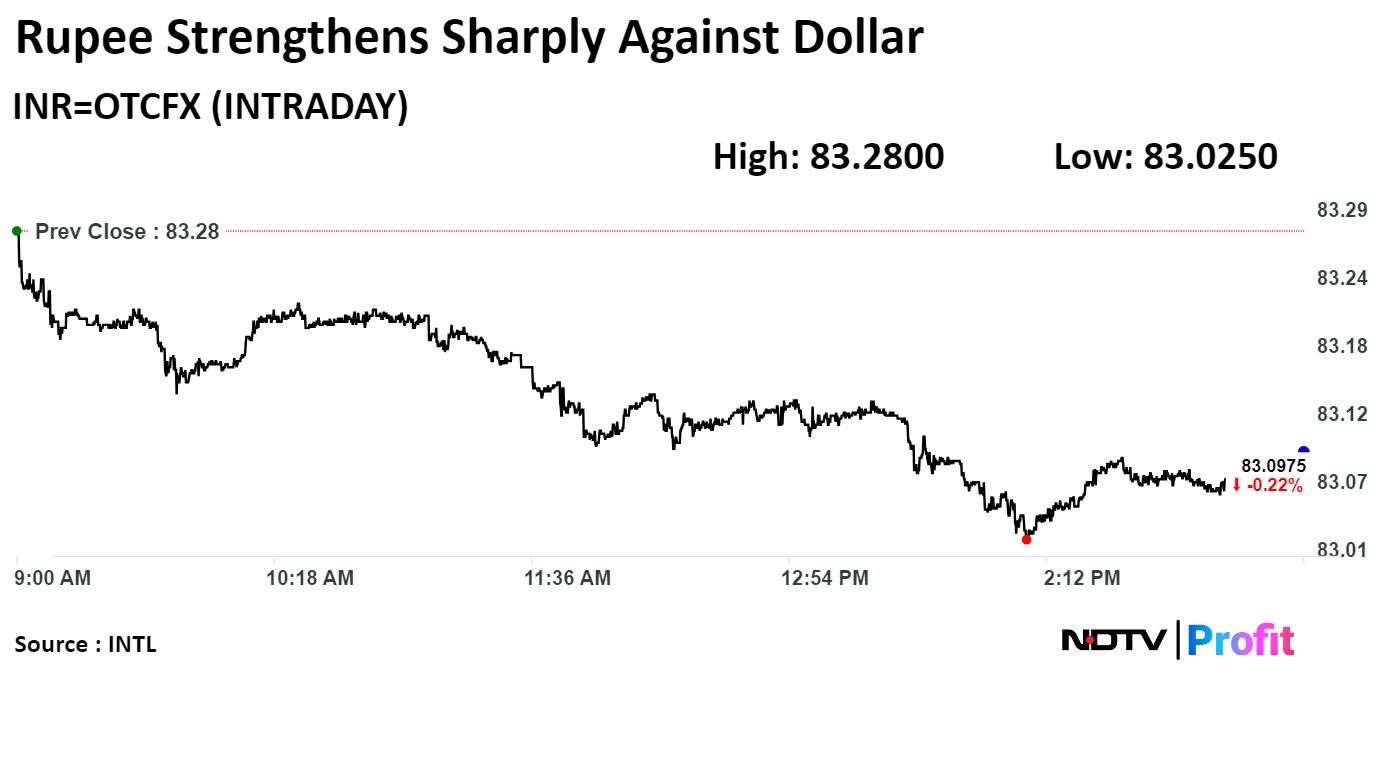

The local currency strengthened by 19 paise to close at 83.09 against the US dollar.

The rupee strengthened by 20 paise intraday to 83.08 against the US dollar.

It closed at 83.28 on Wednesday.

Source: Bloomberg

The local currency strengthened by 19 paise to close at 83.09 against the US dollar.

The rupee strengthened by 20 paise intraday to 83.08 against the US dollar.

It closed at 83.28 on Wednesday.

Source: Bloomberg

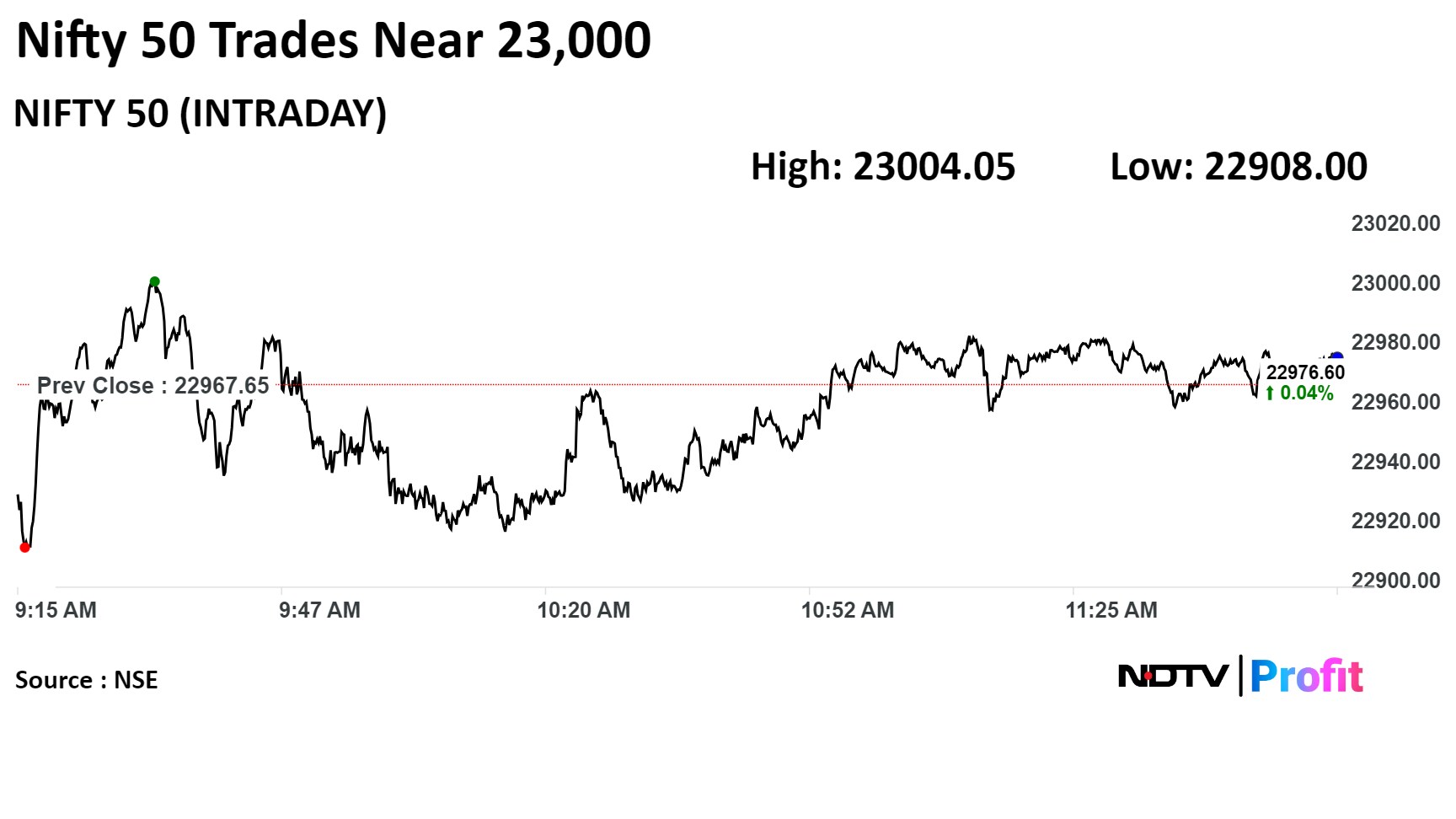

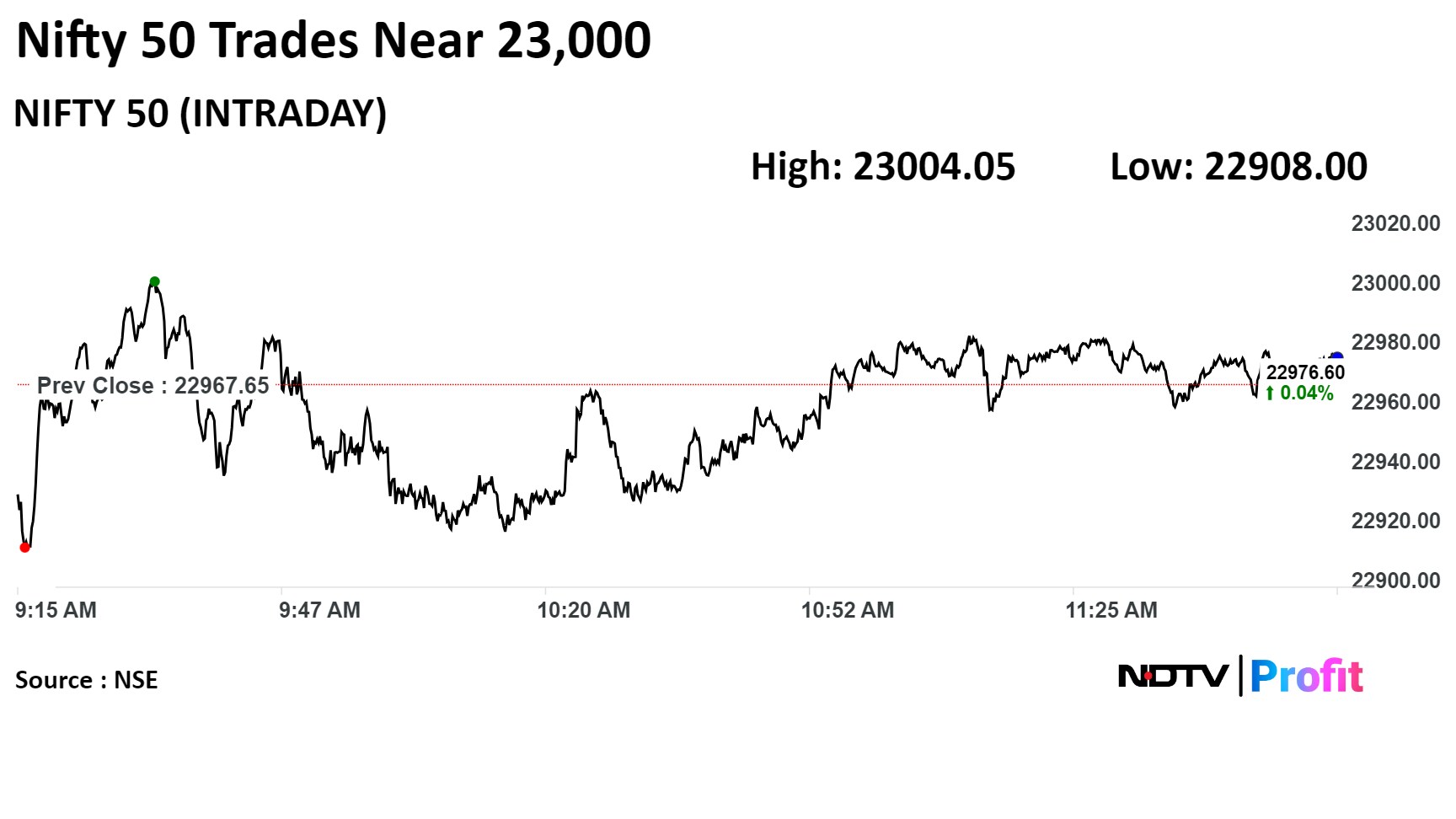

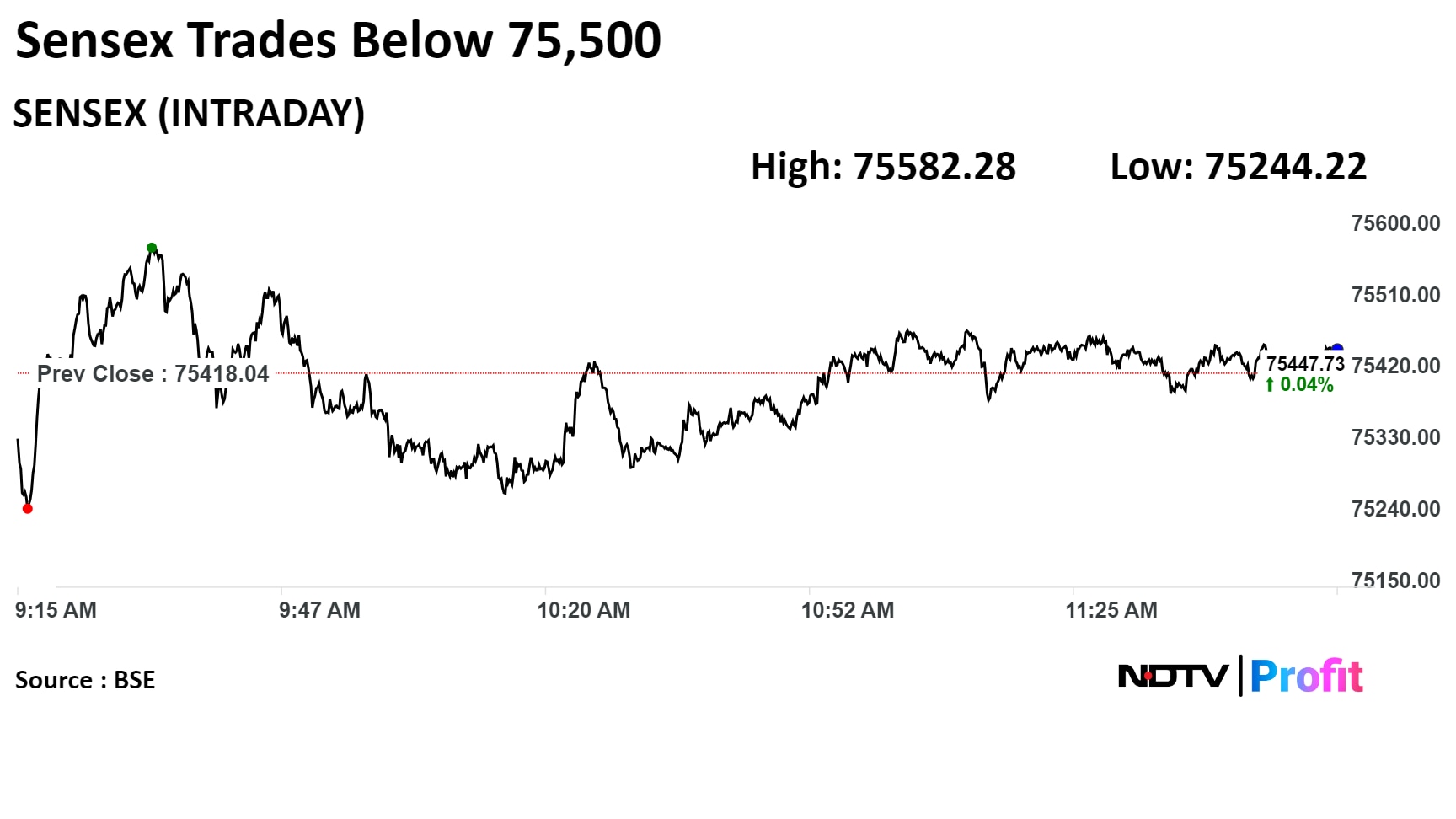

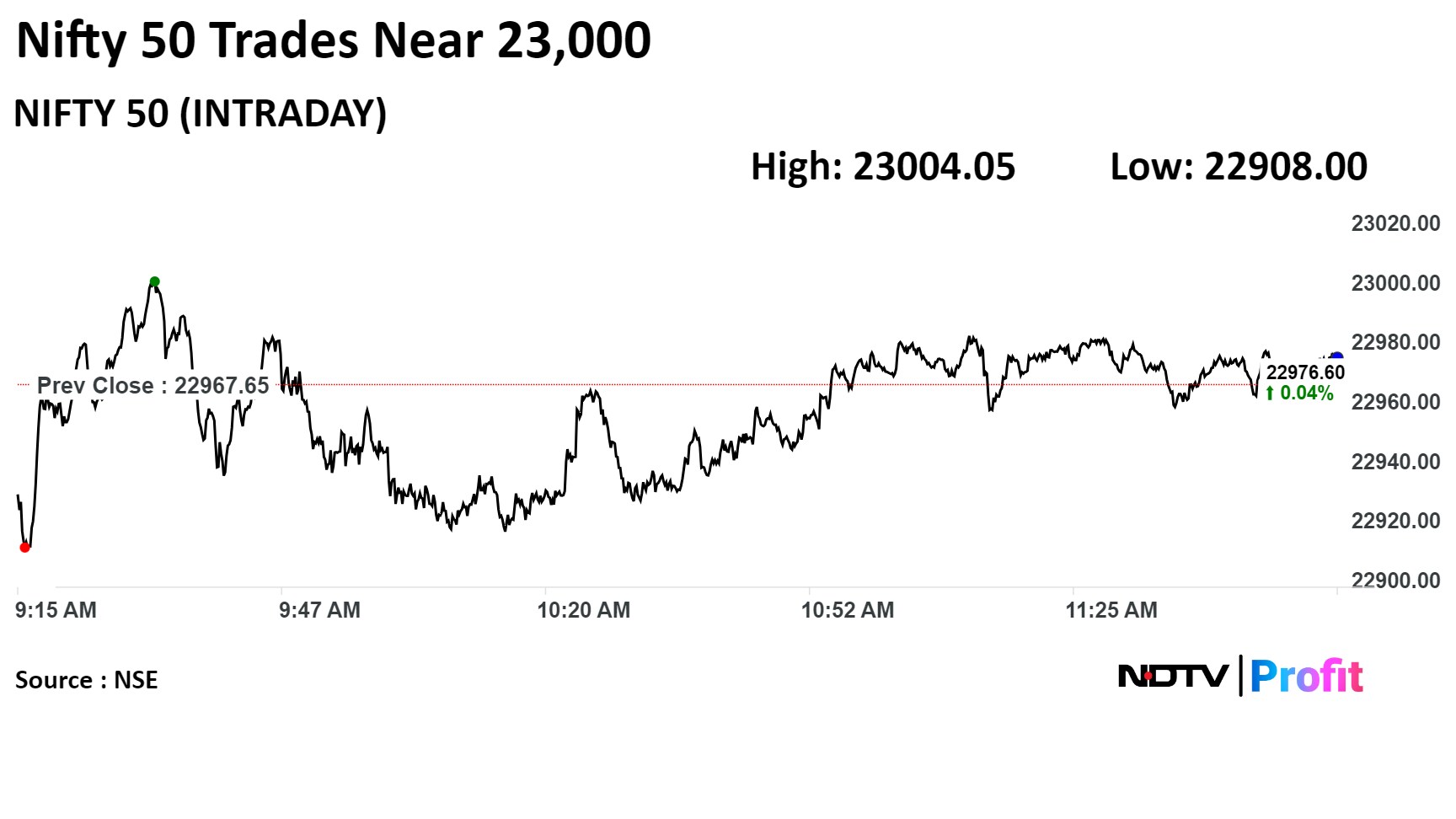

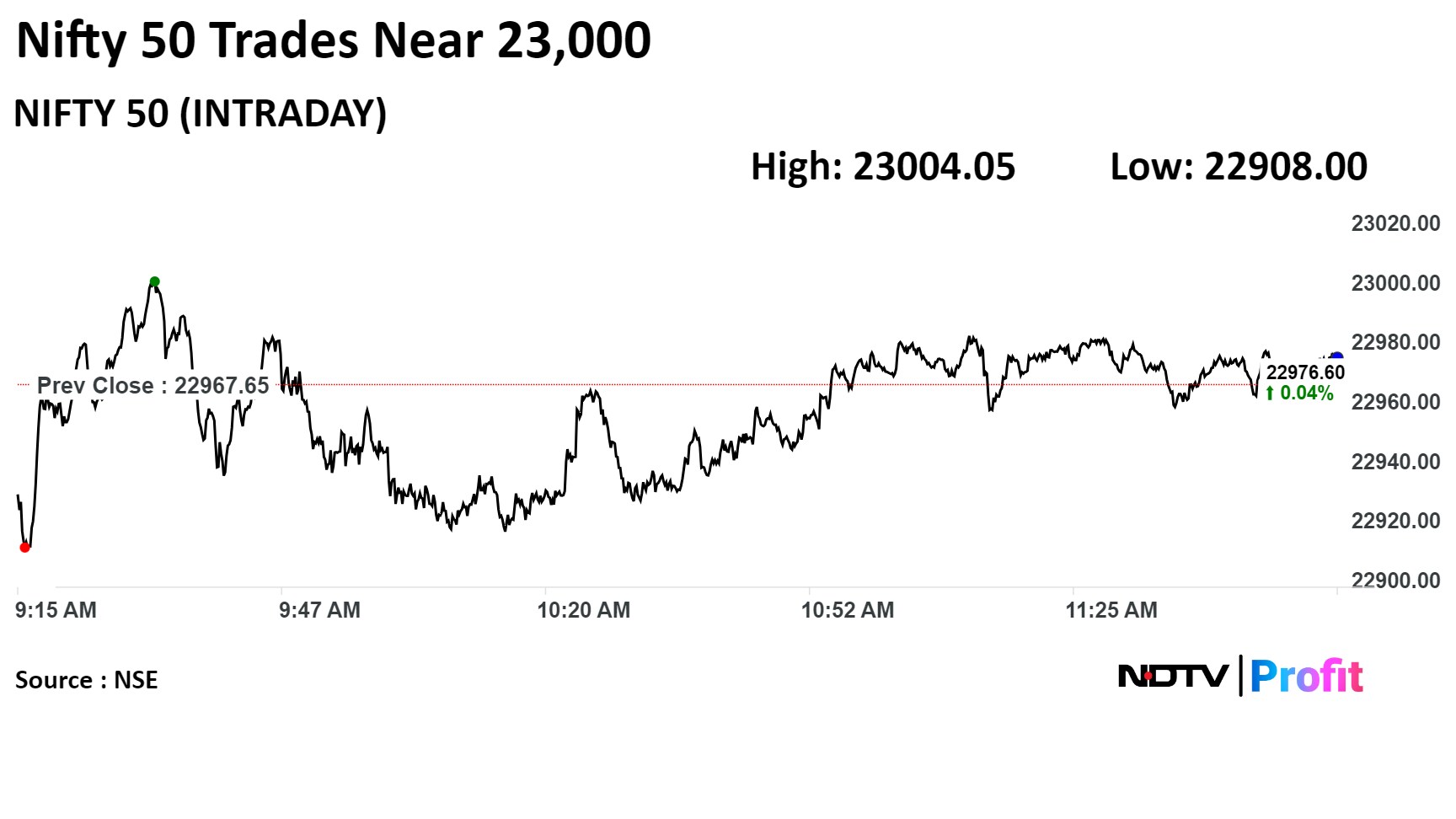

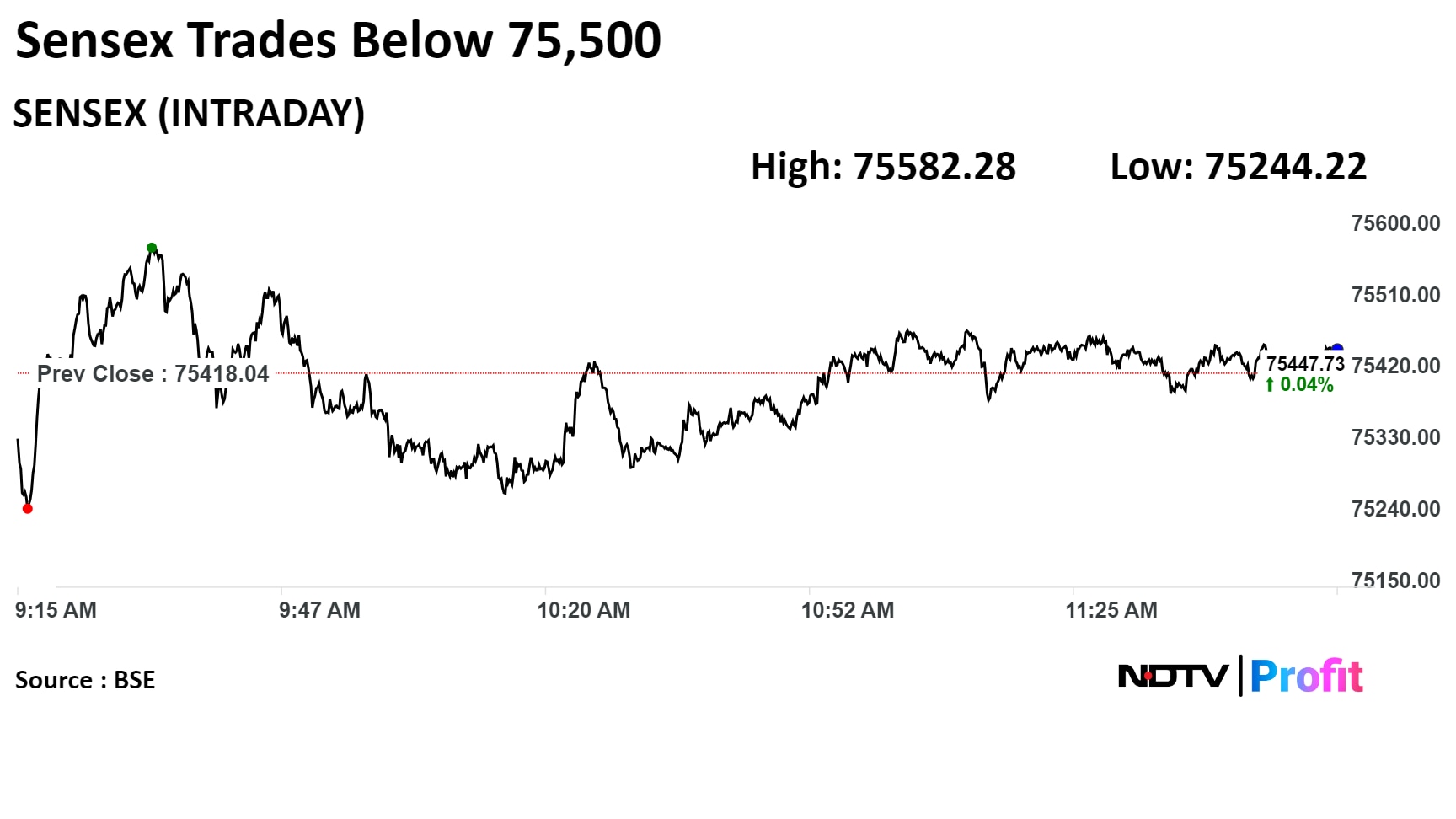

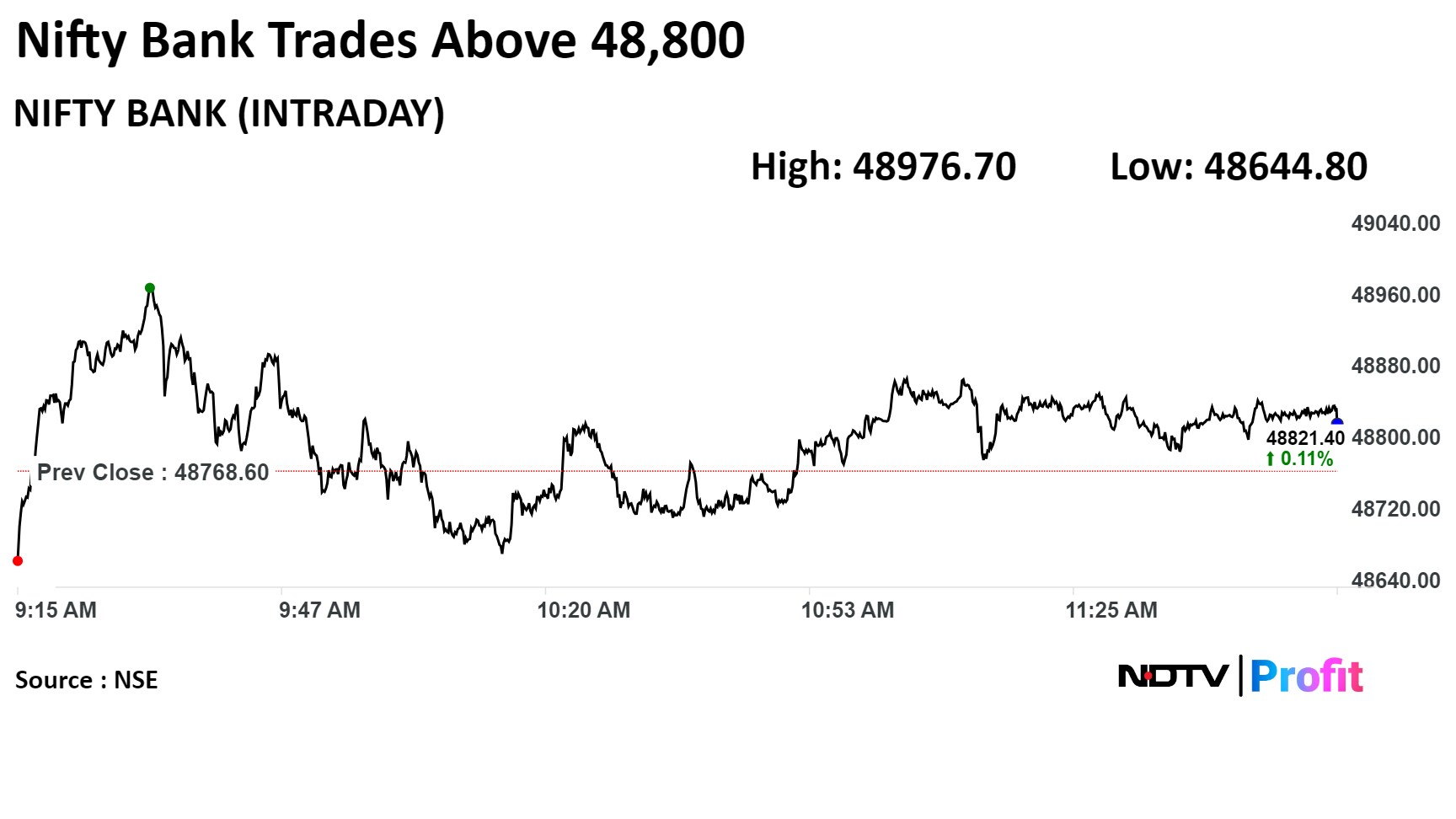

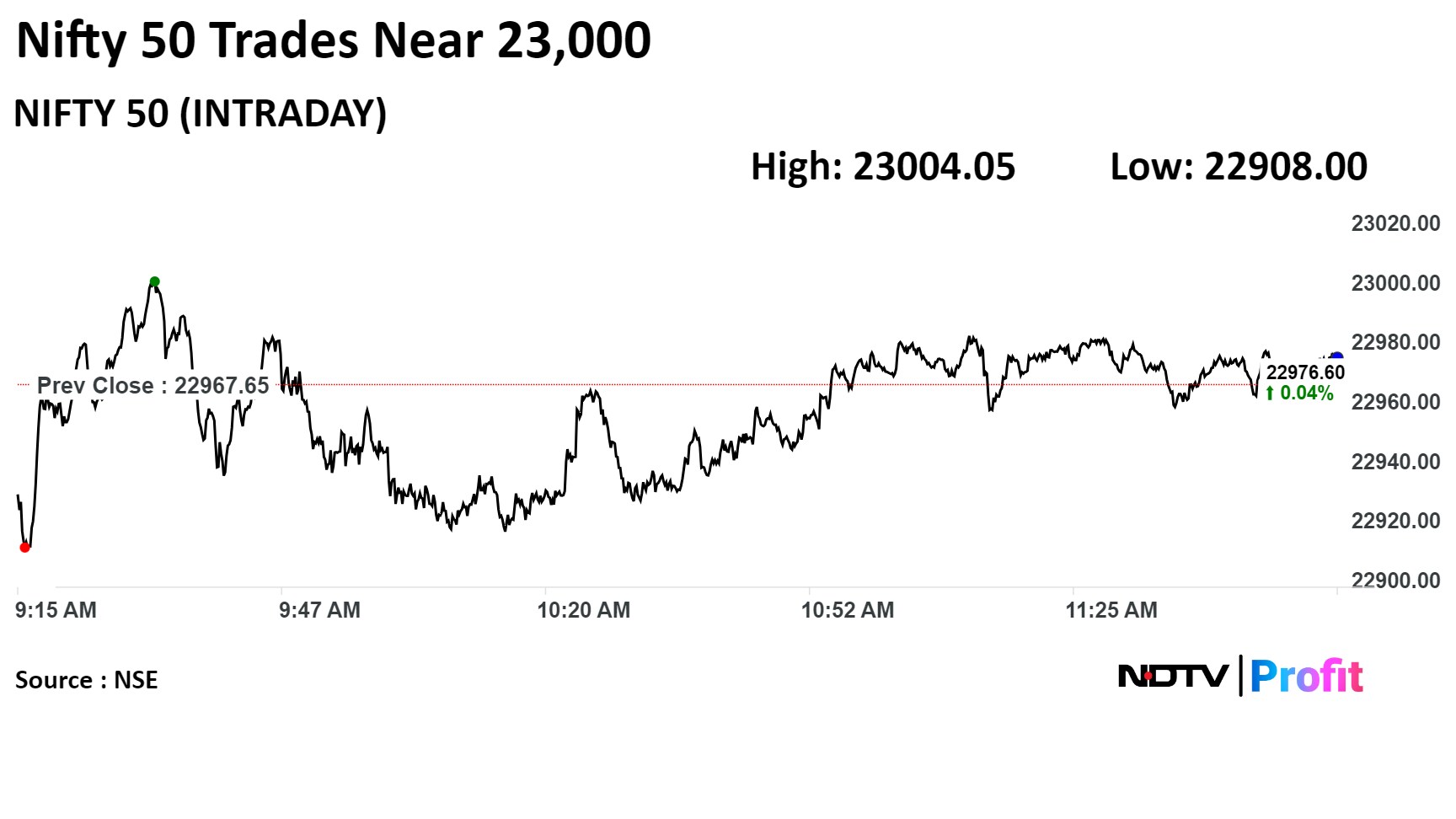

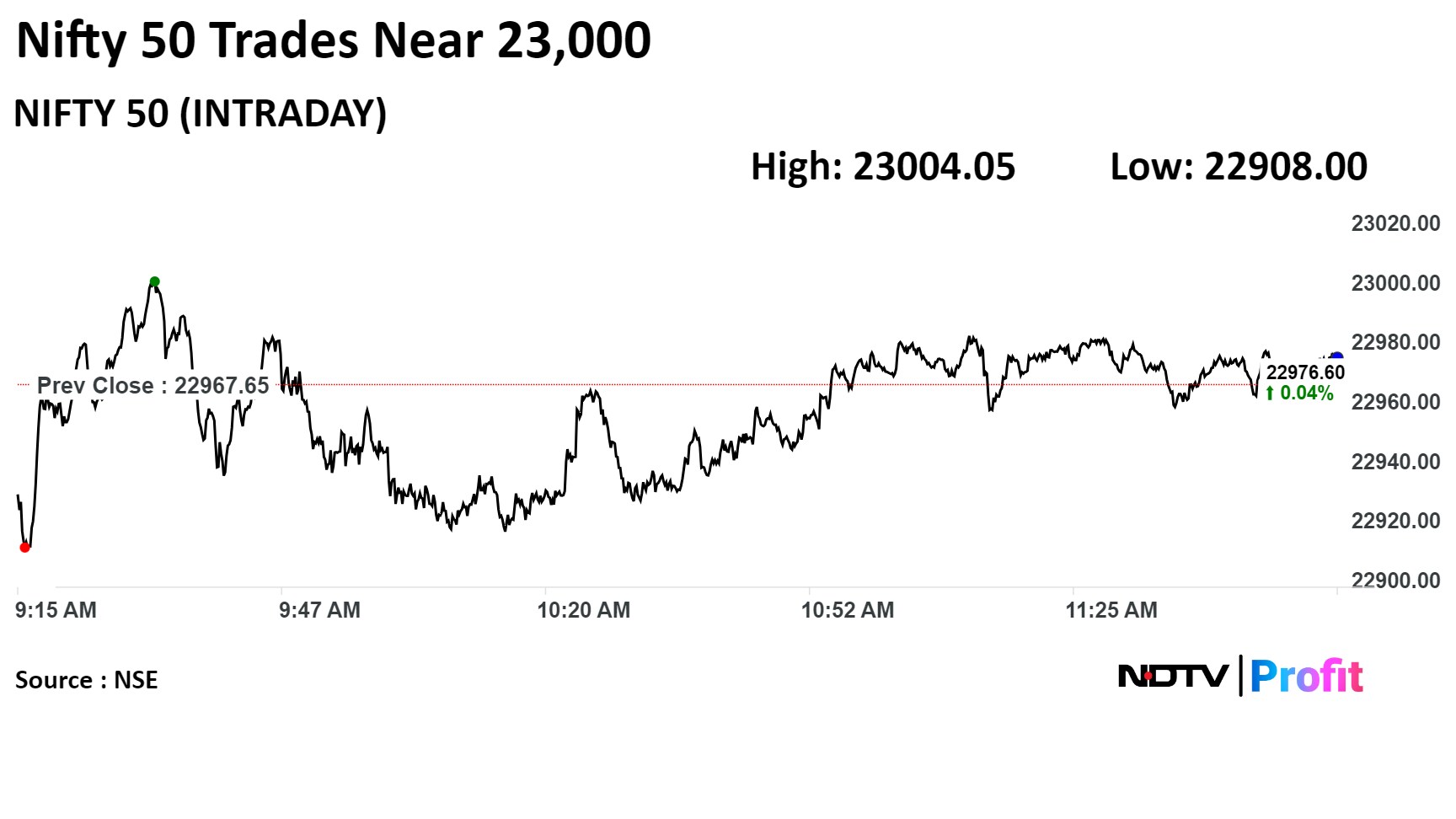

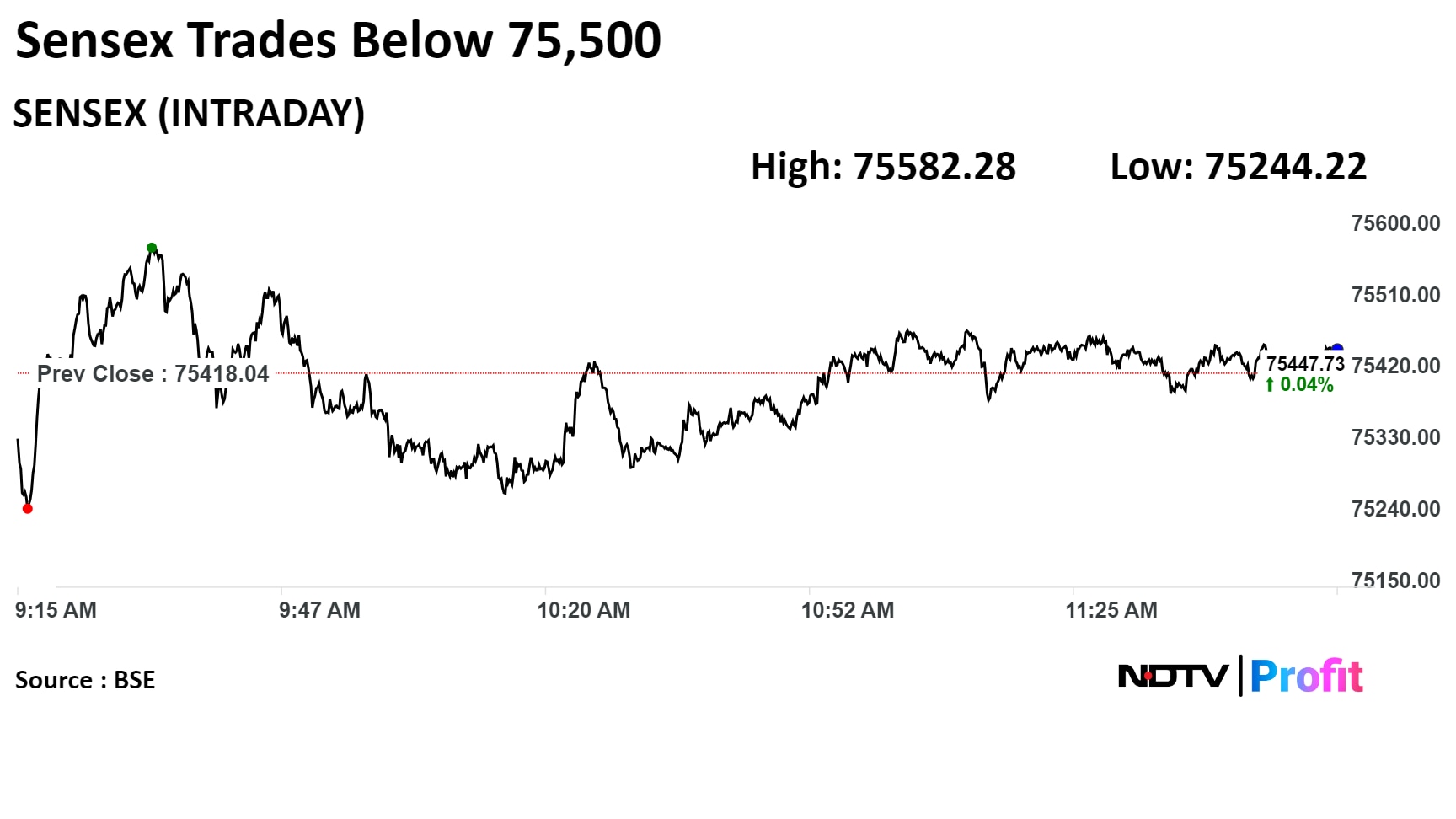

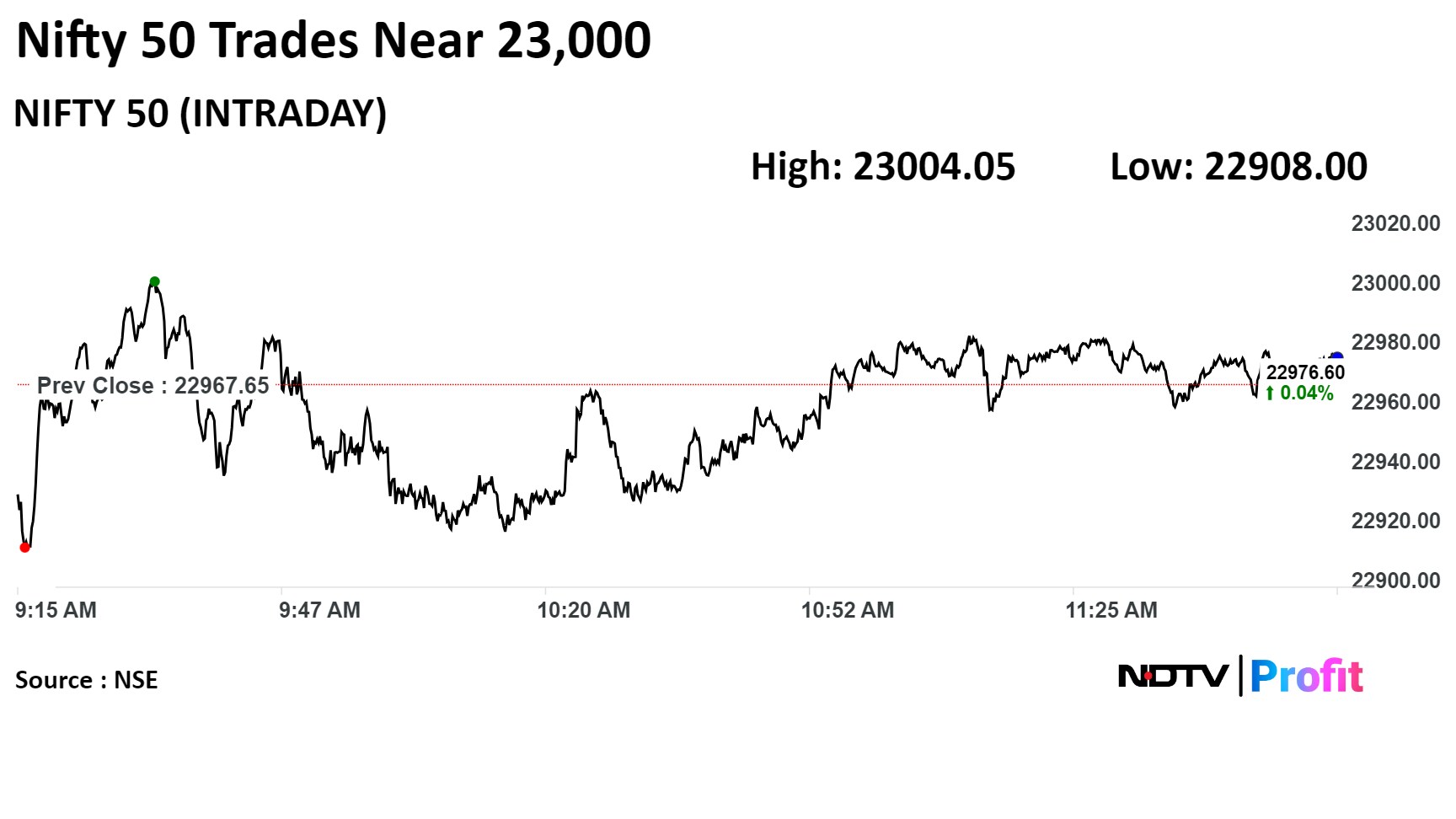

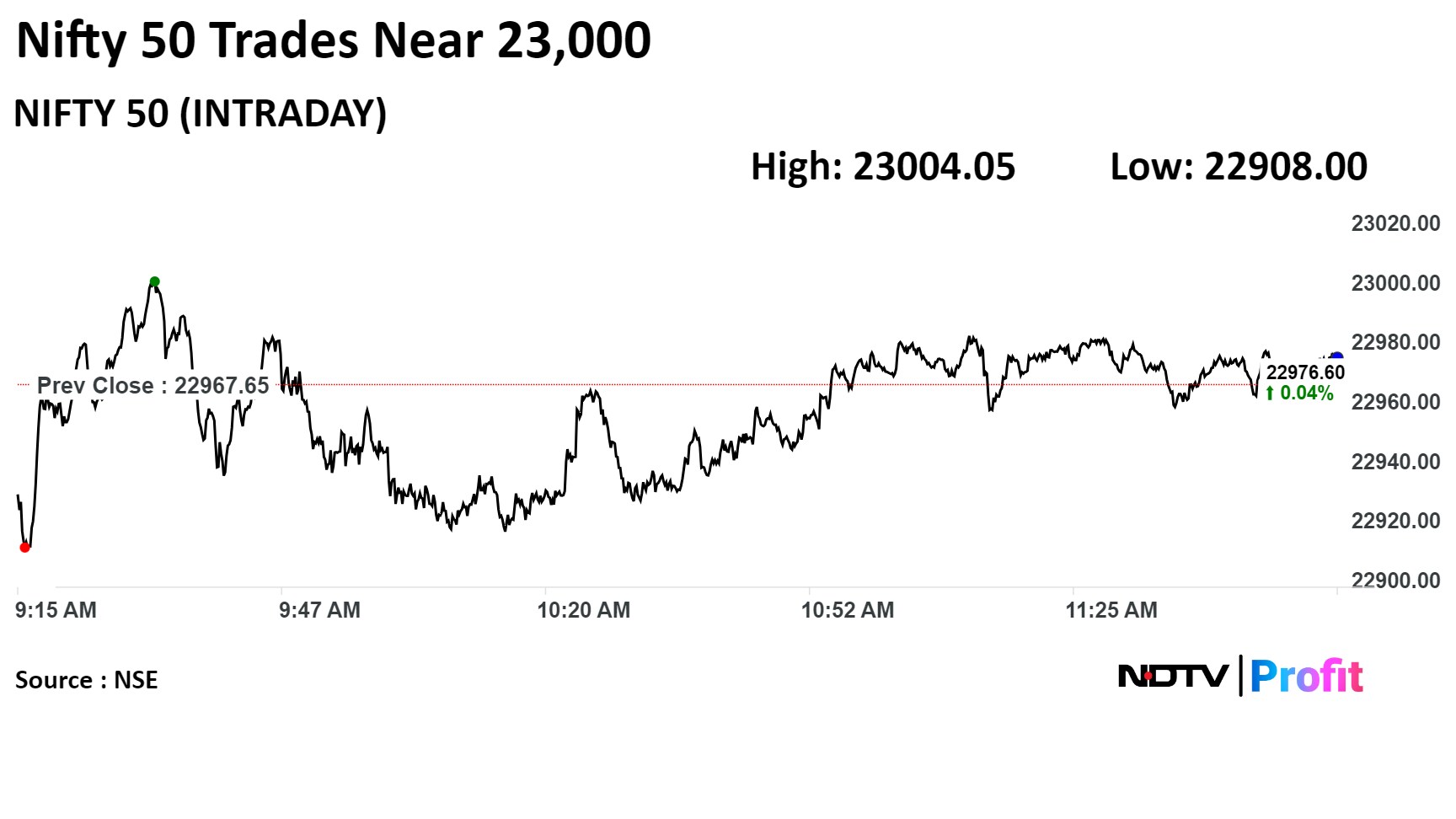

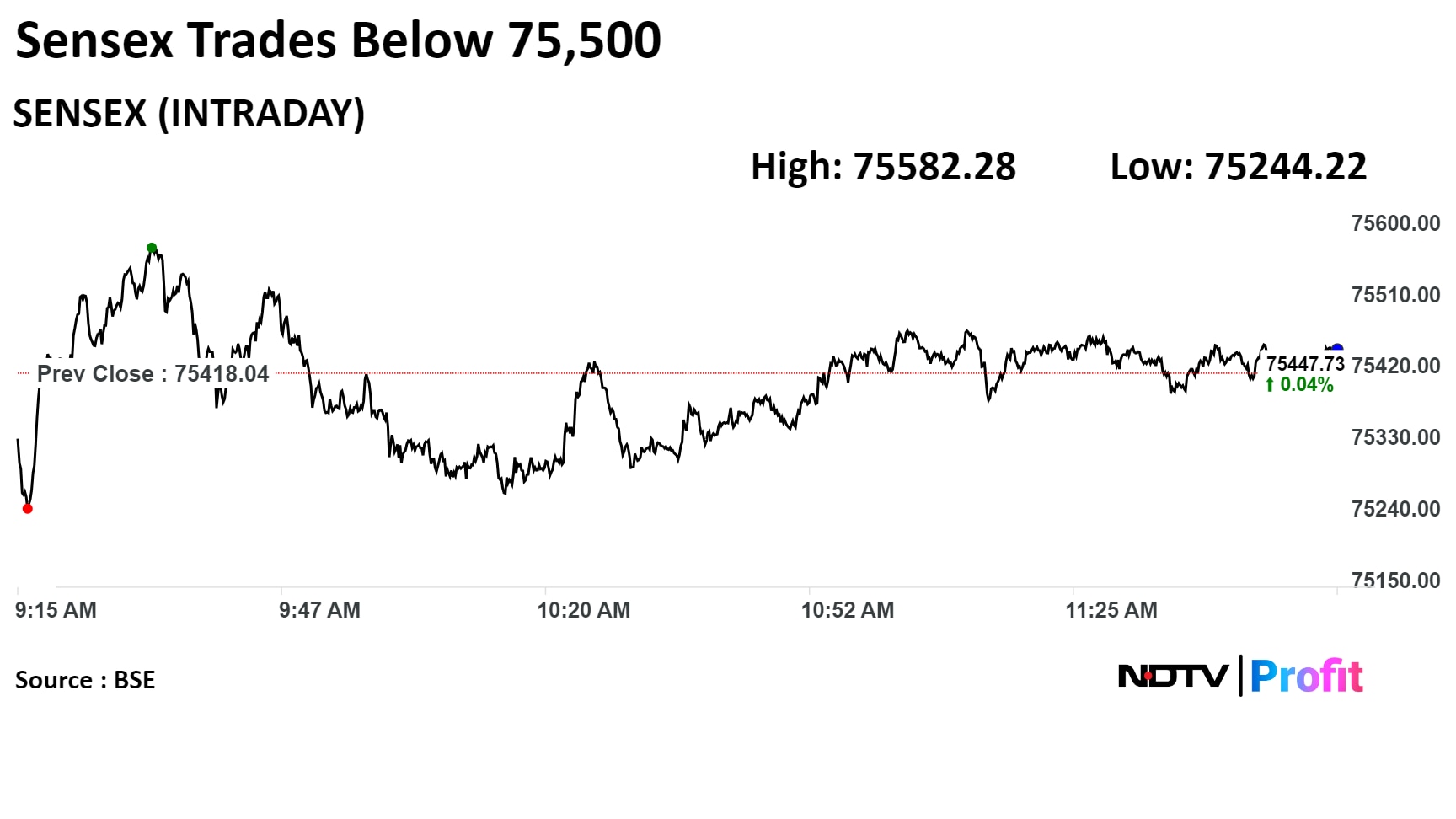

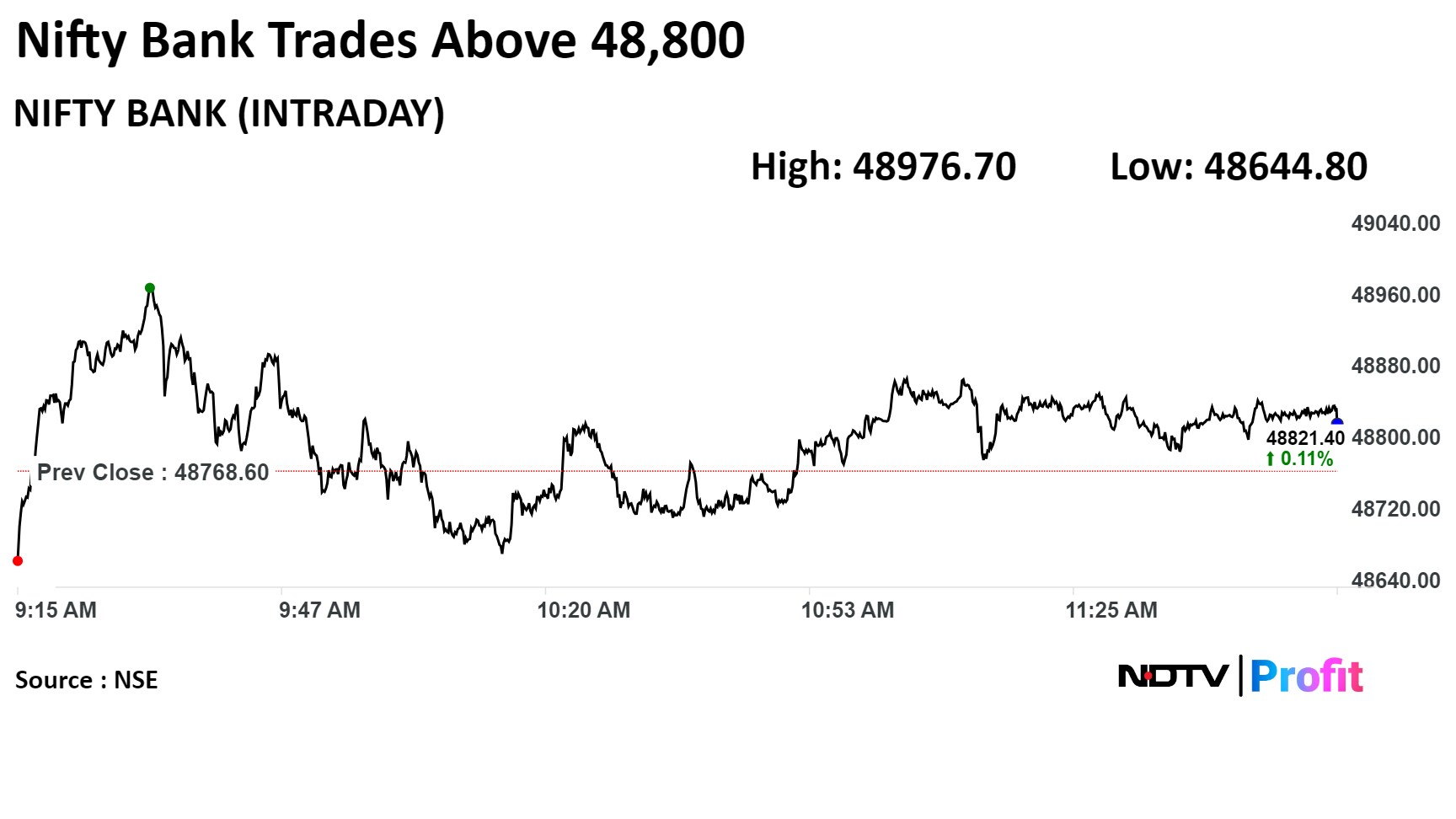

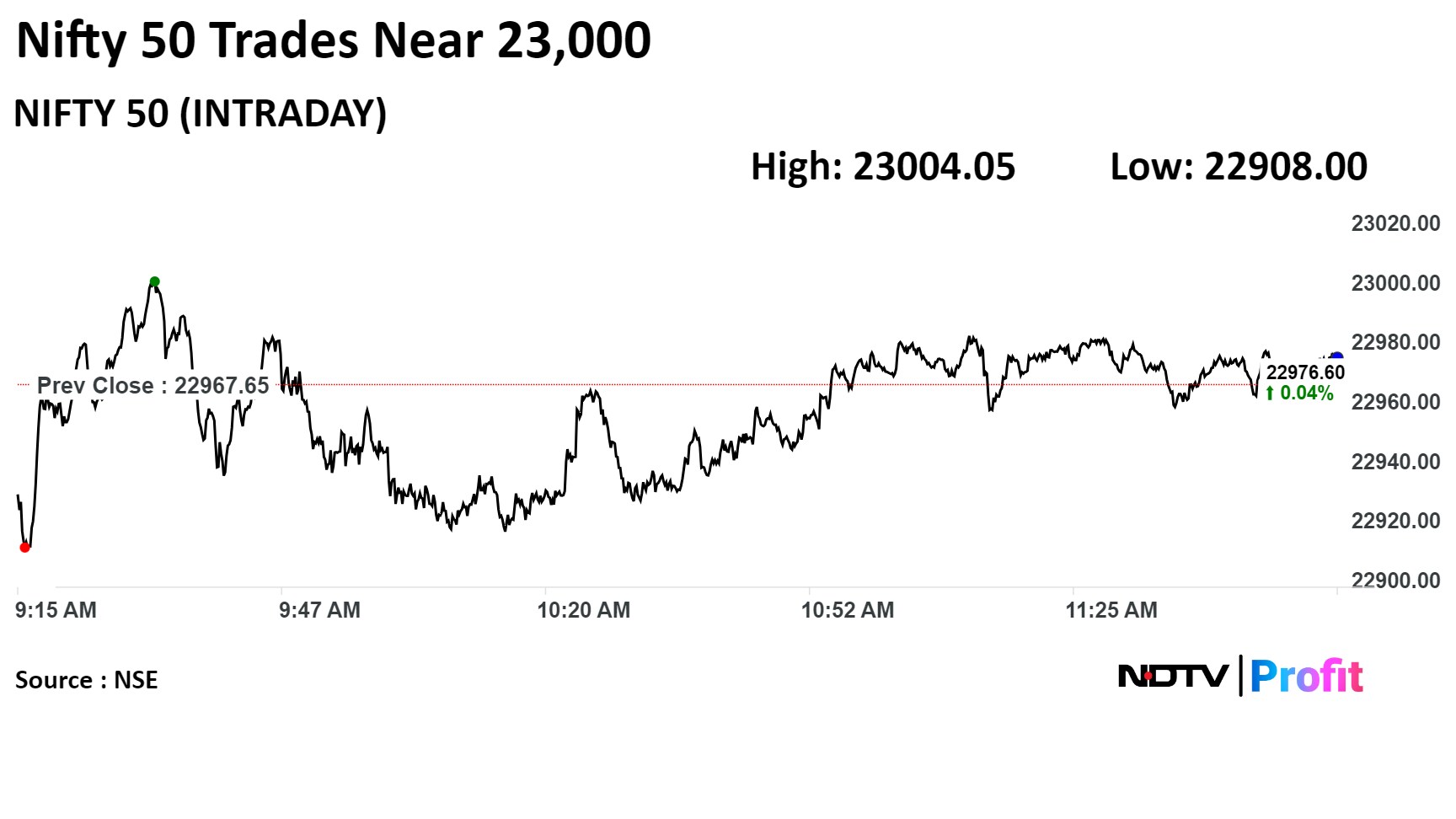

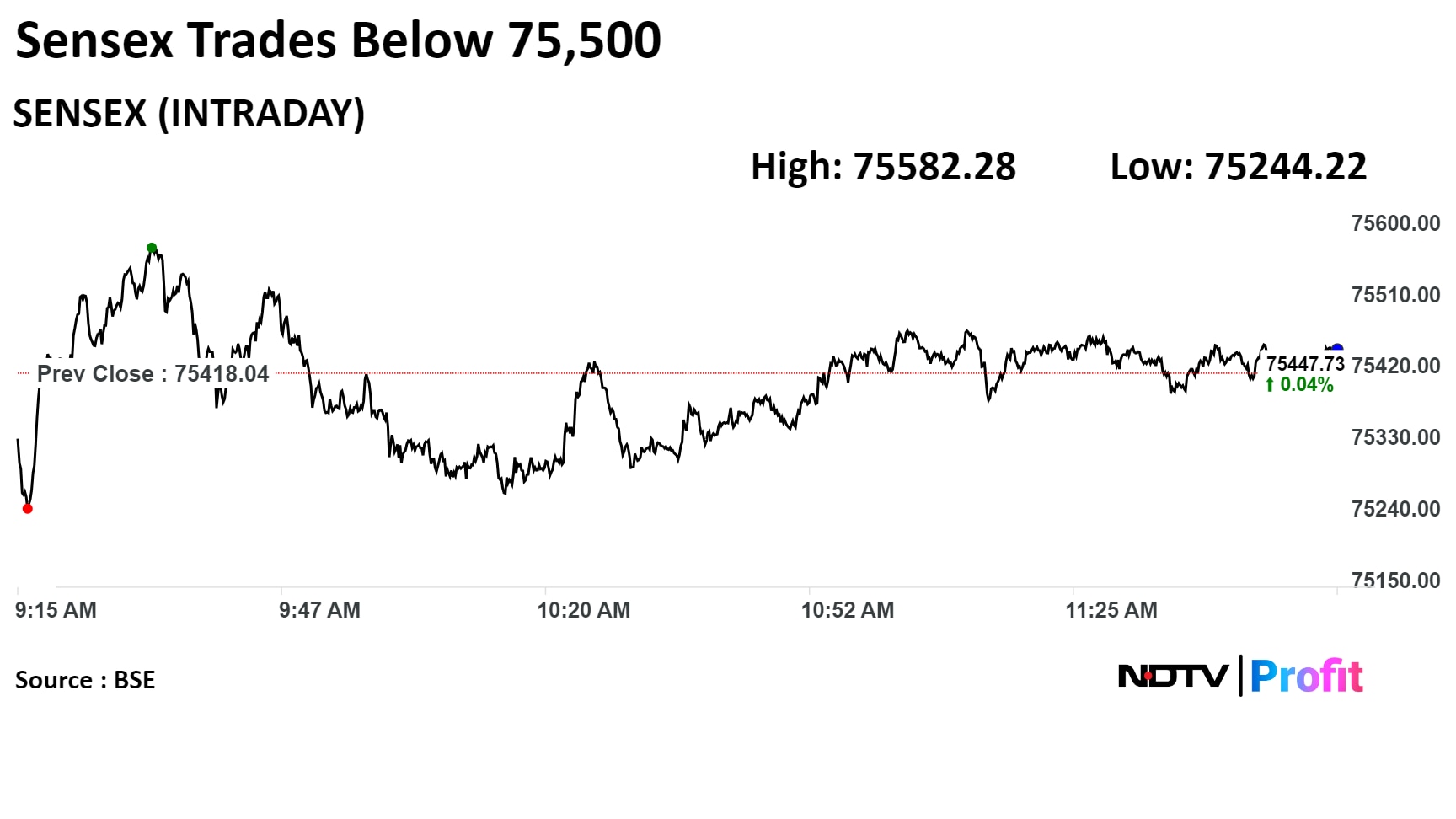

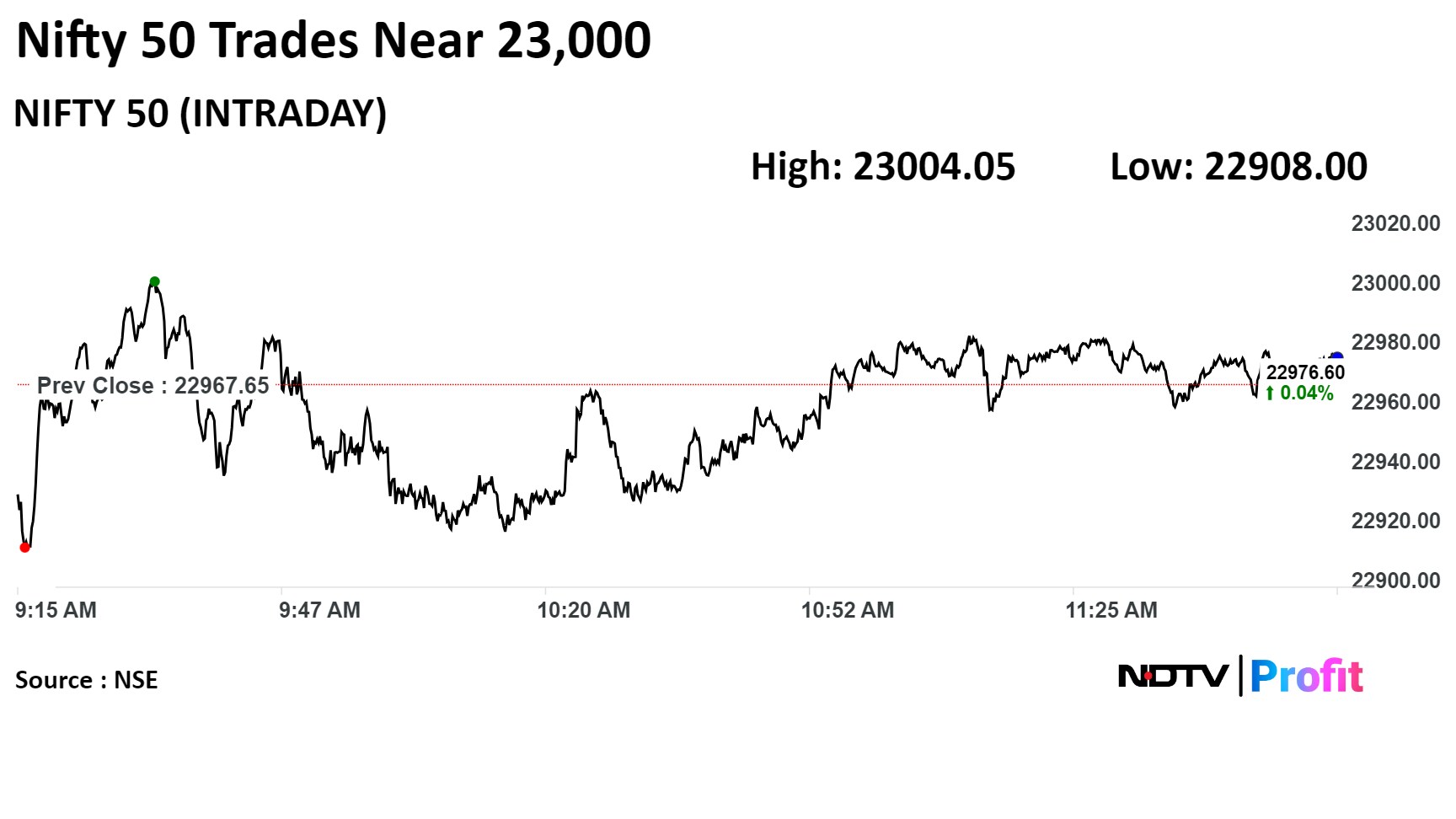

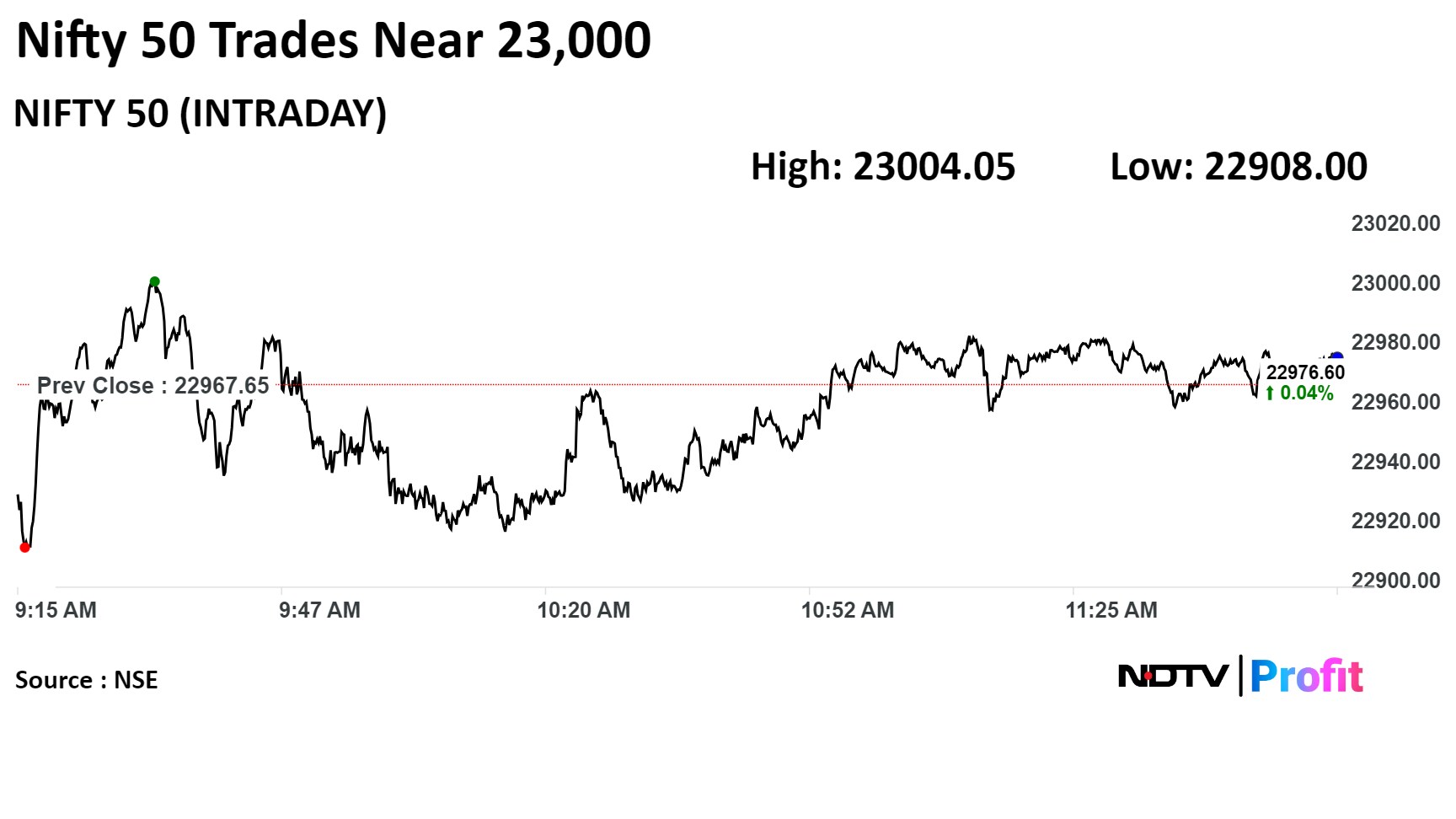

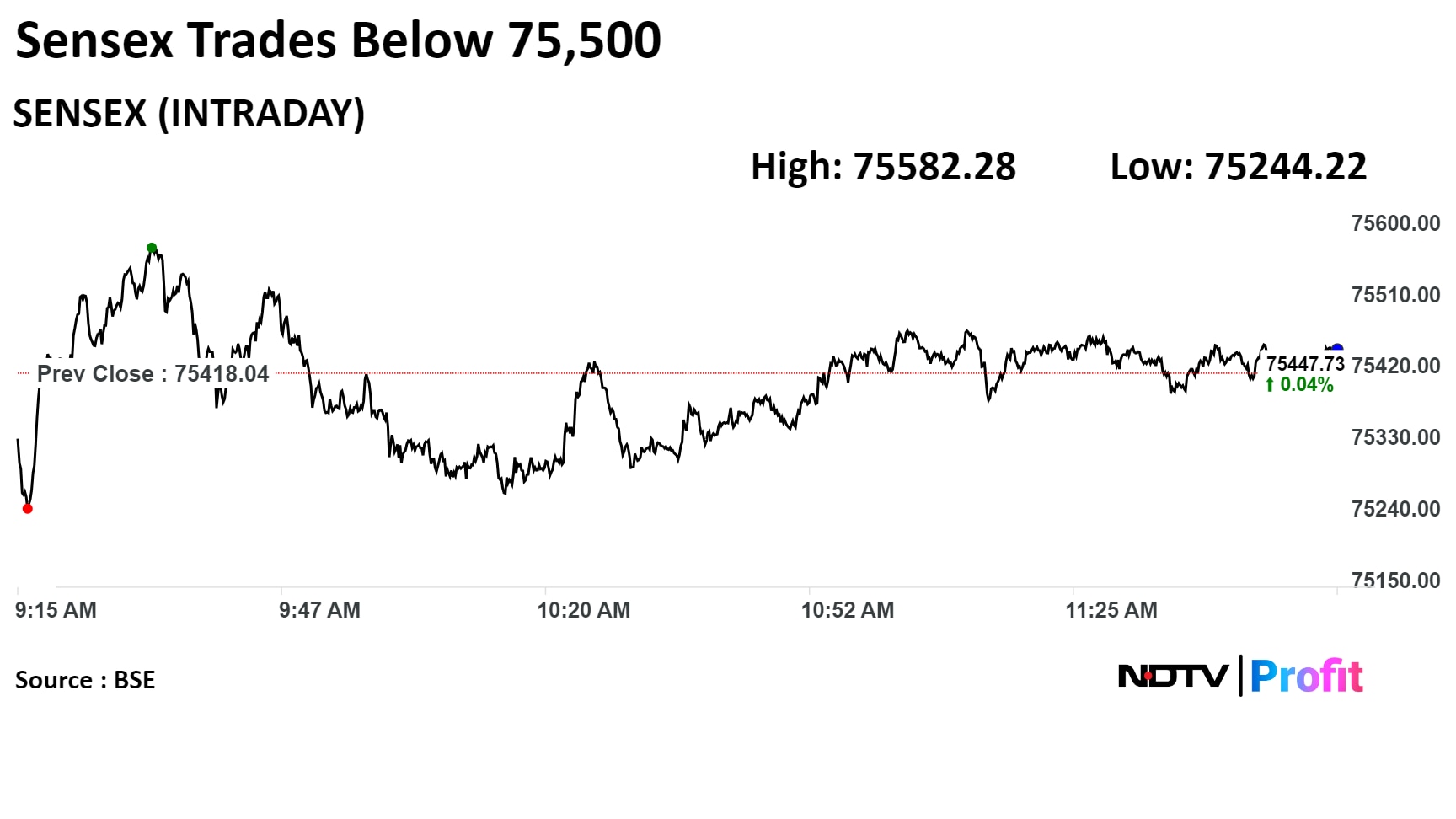

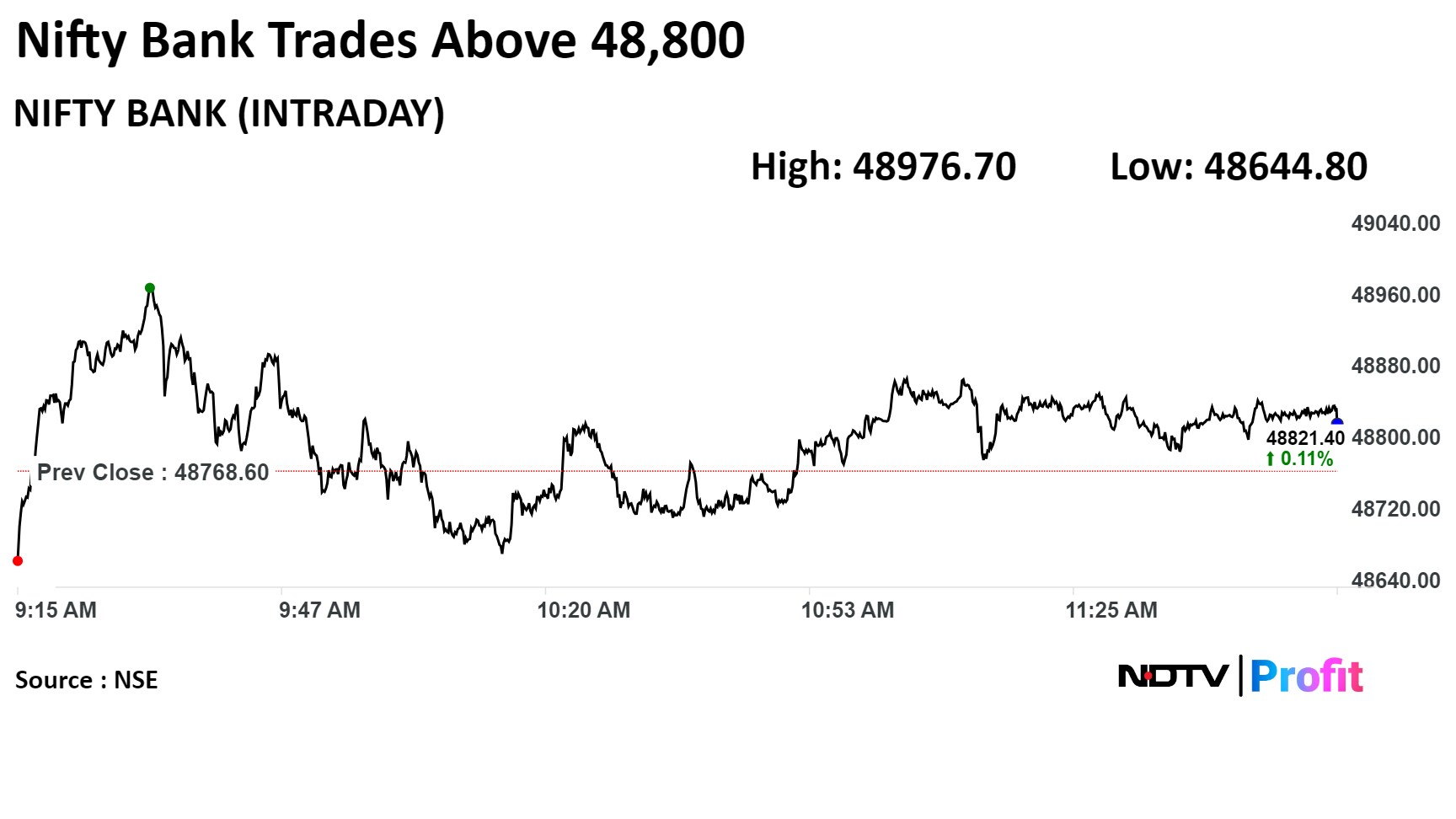

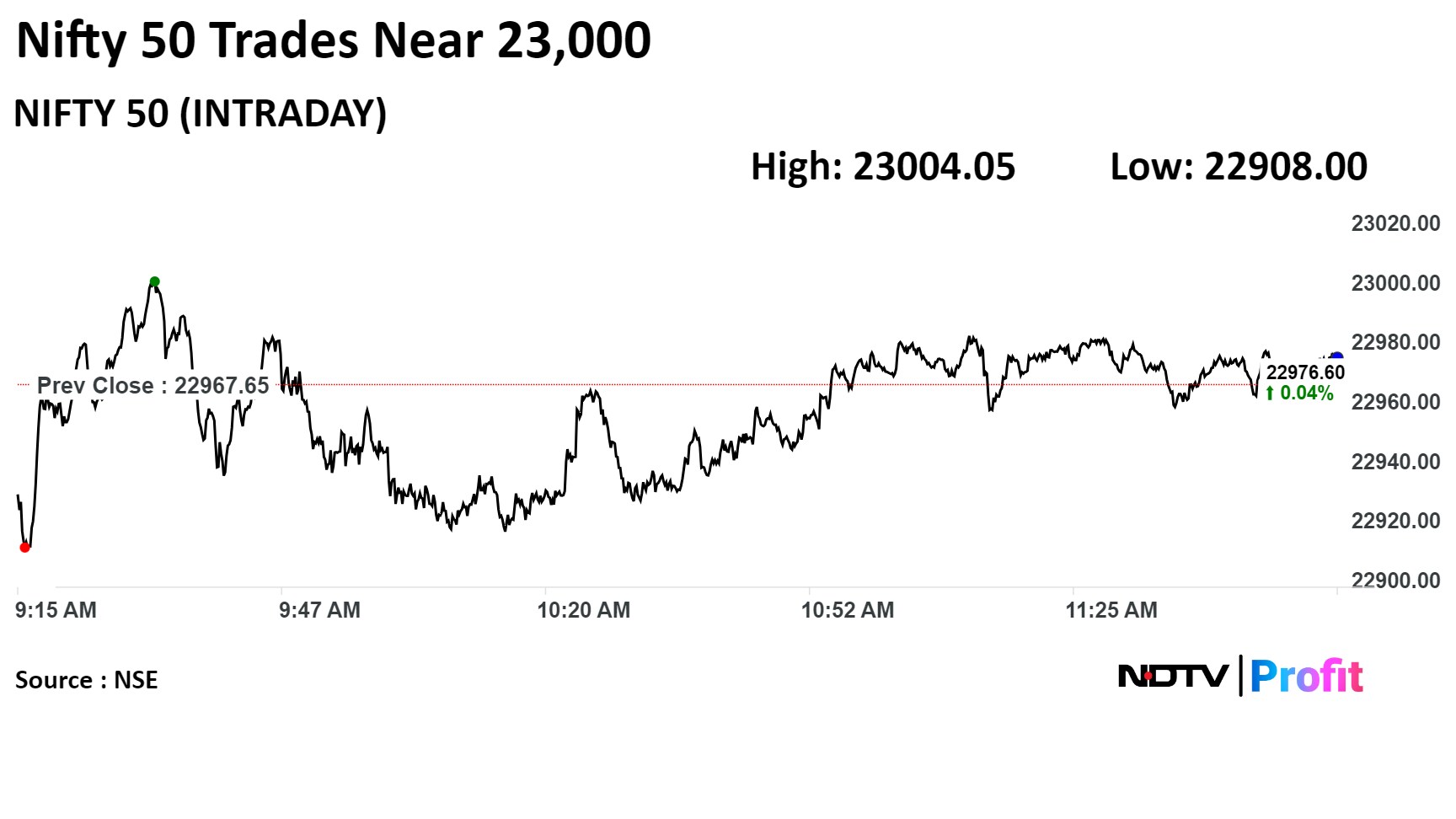

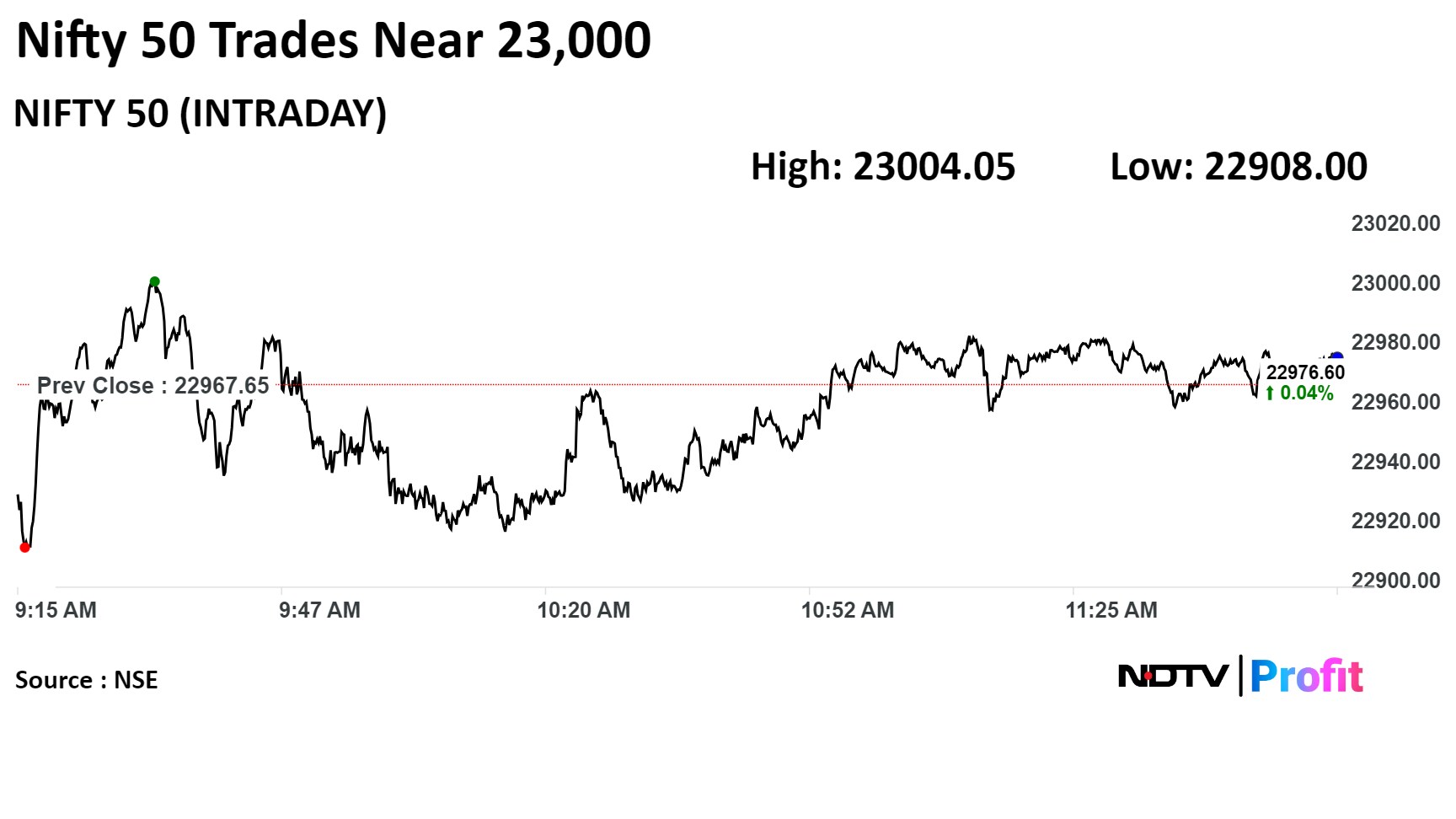

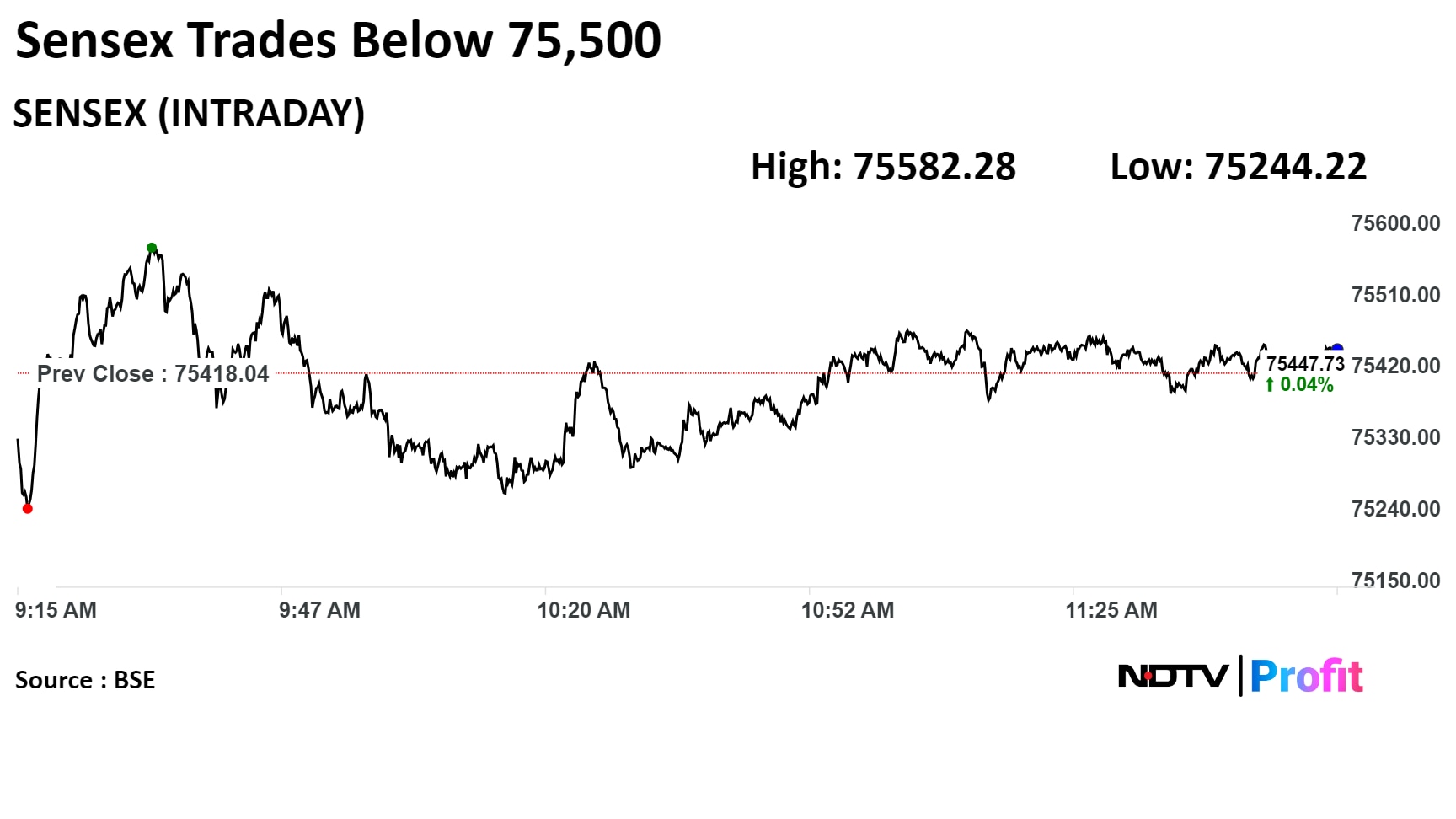

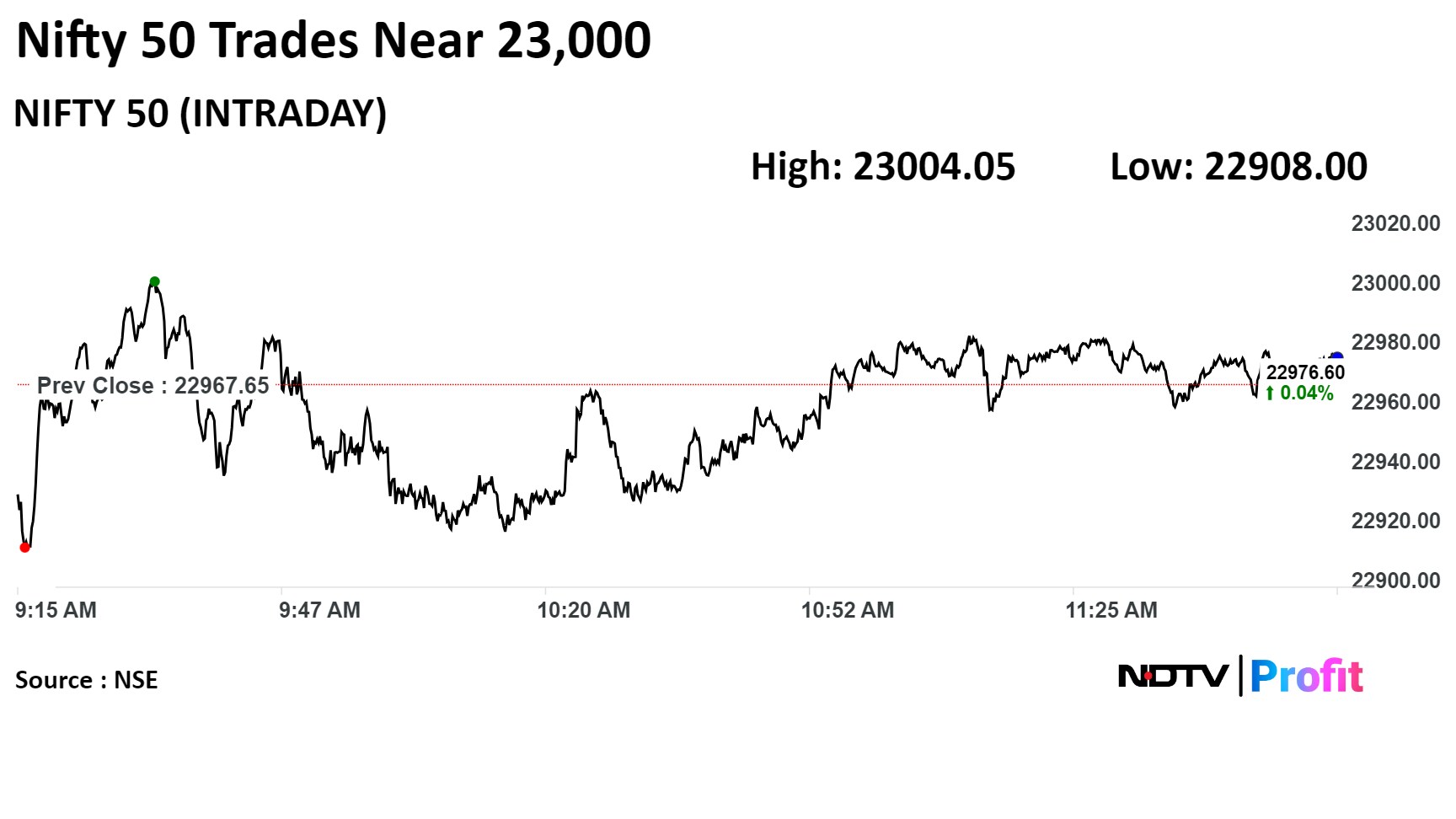

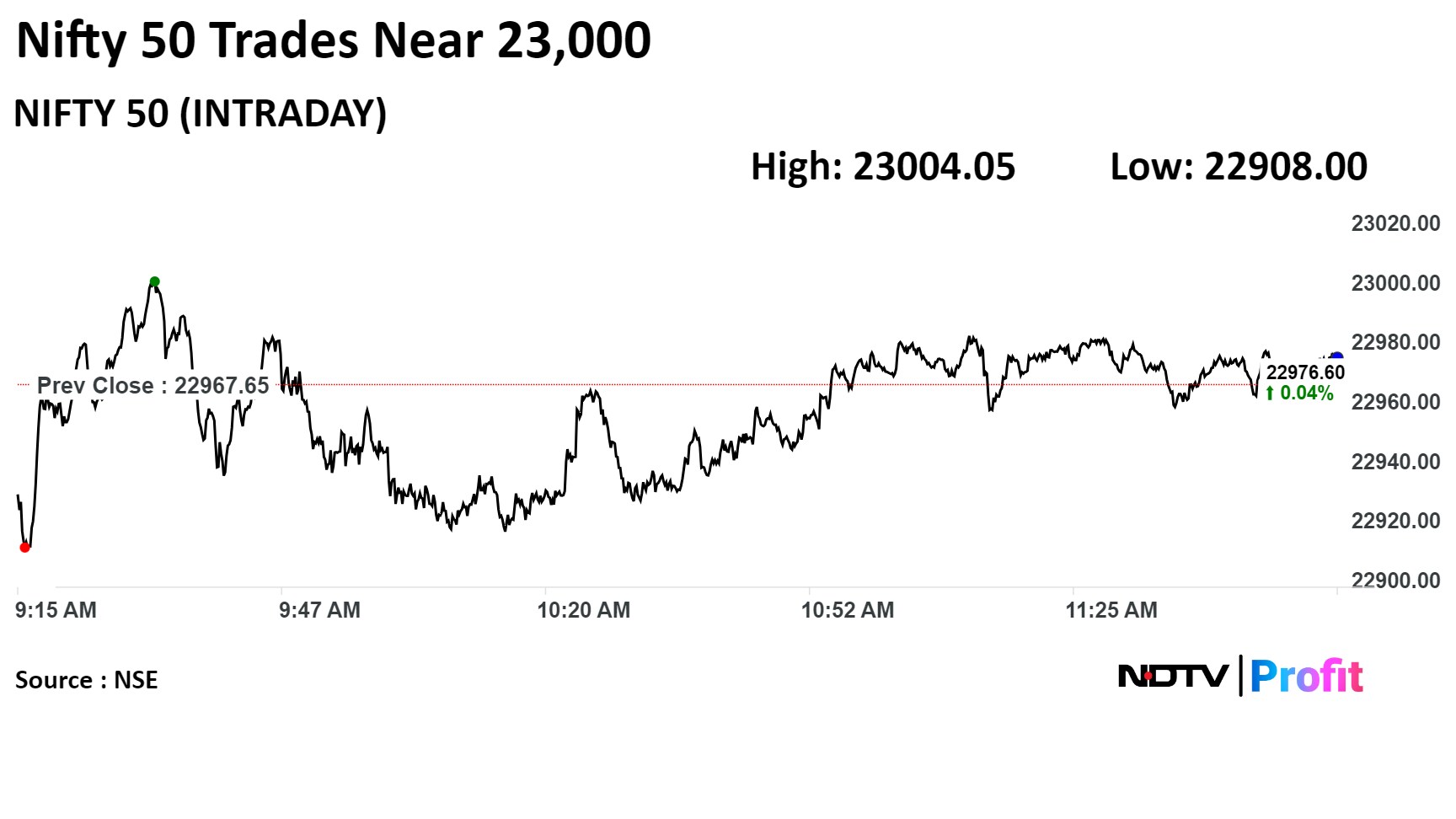

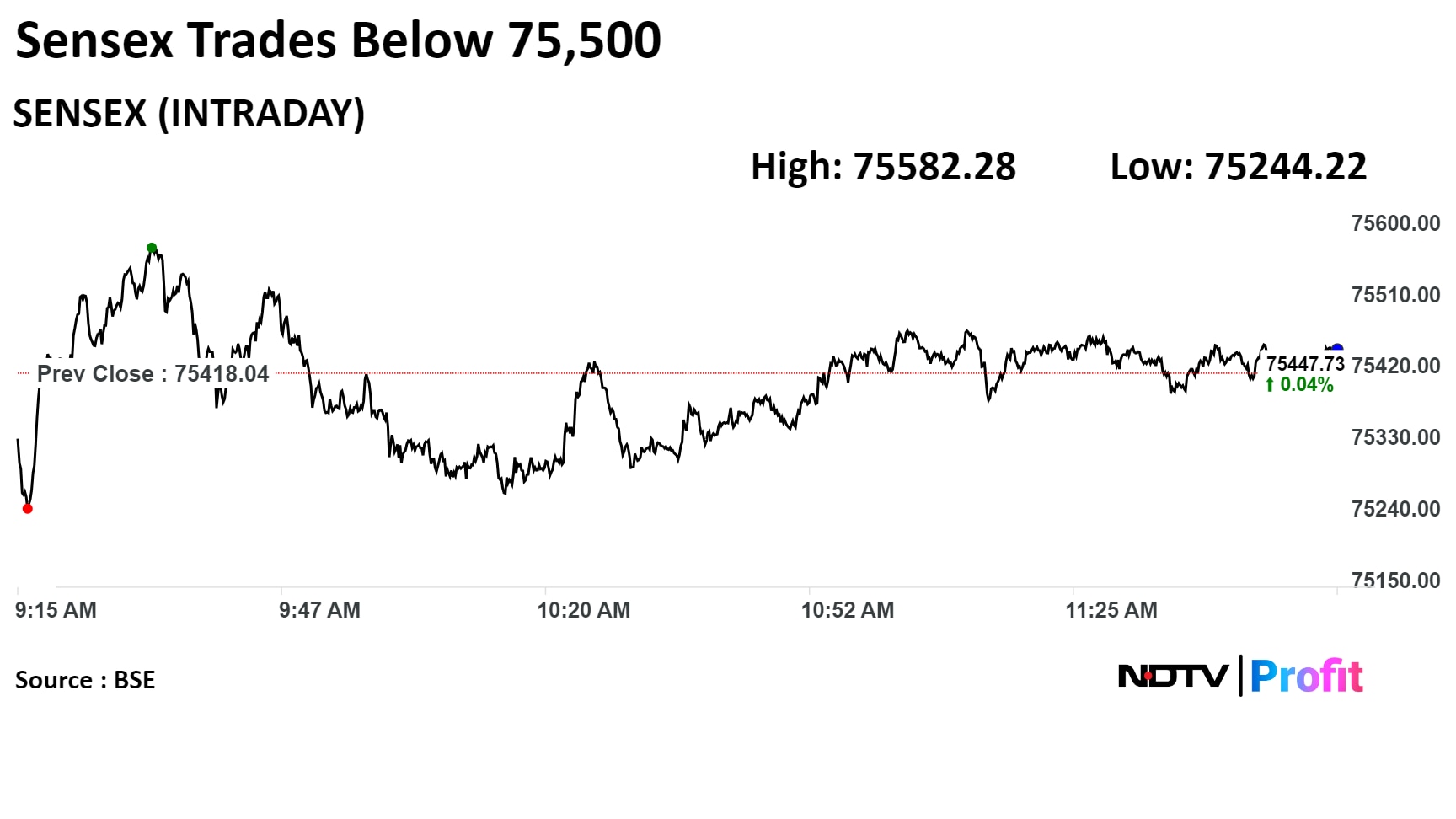

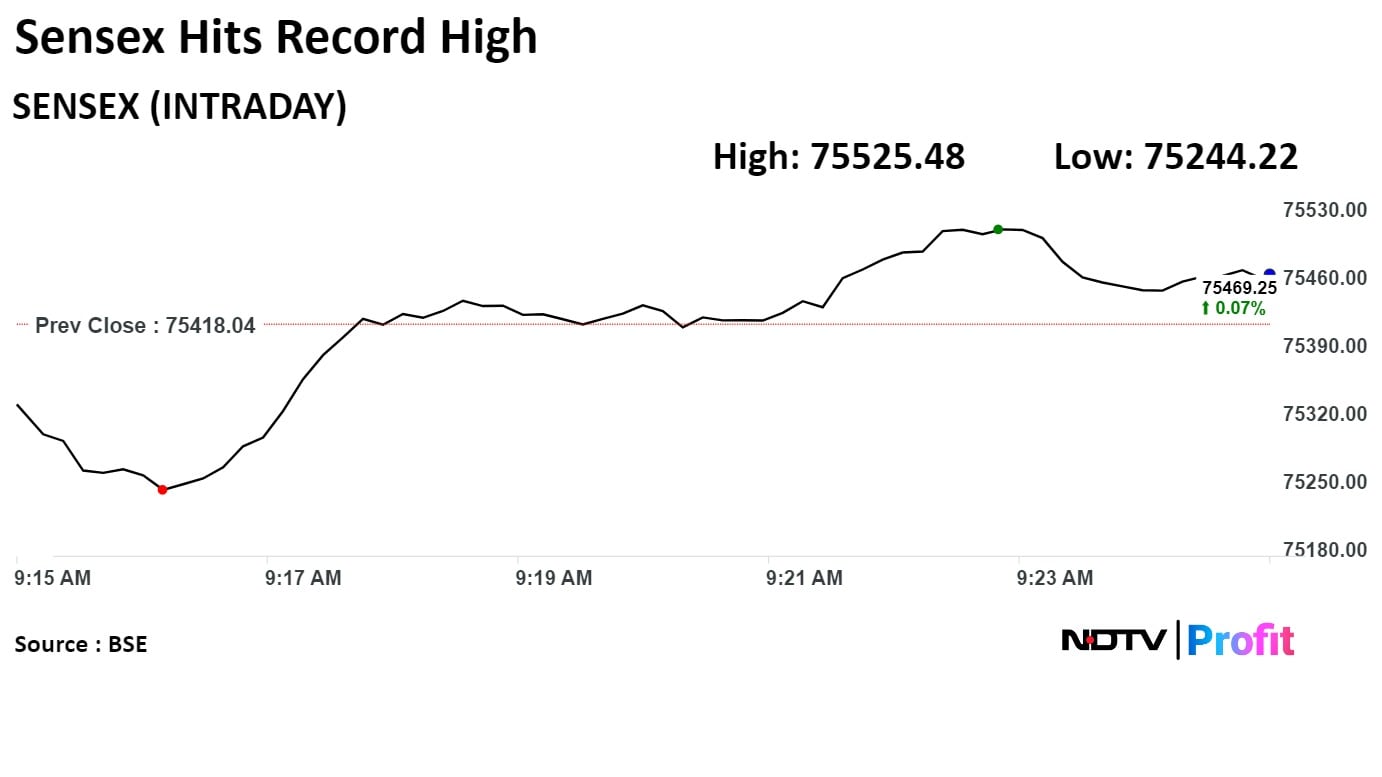

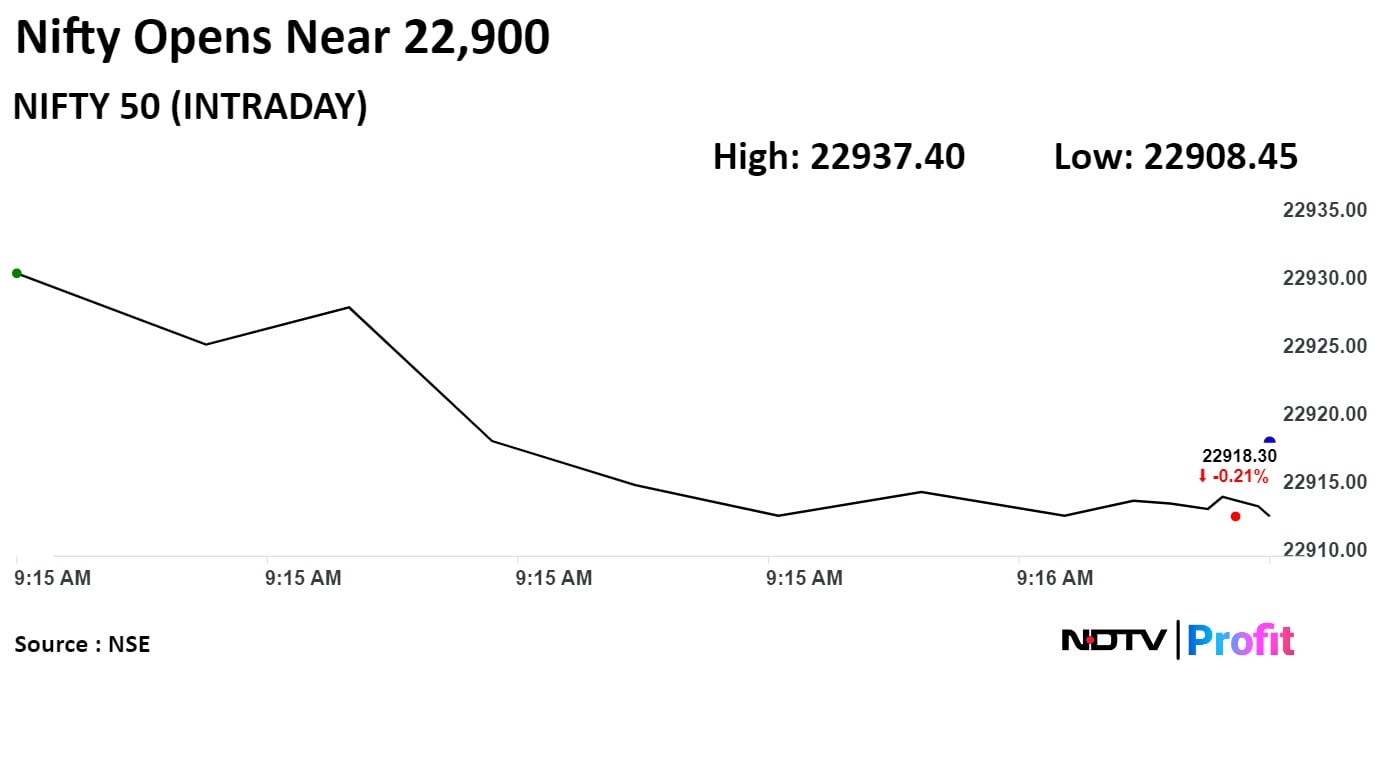

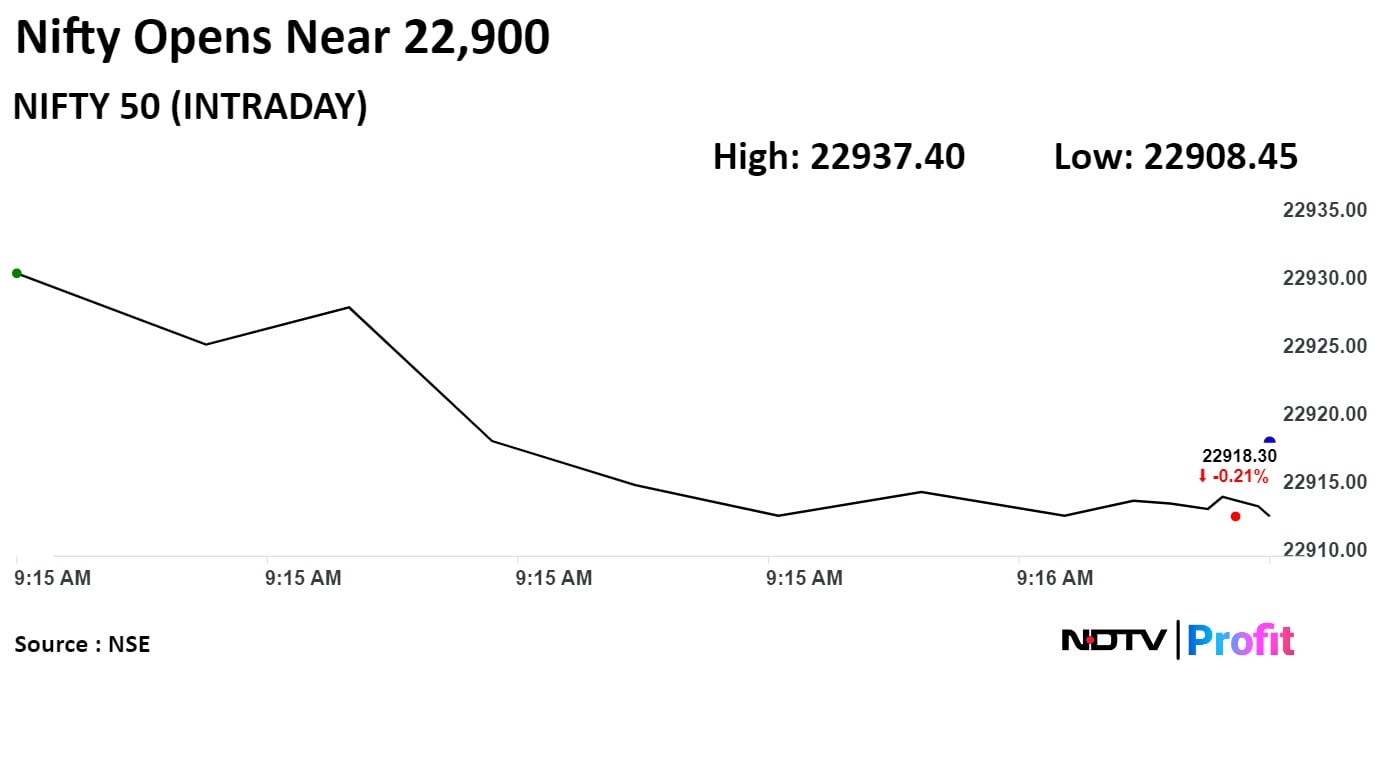

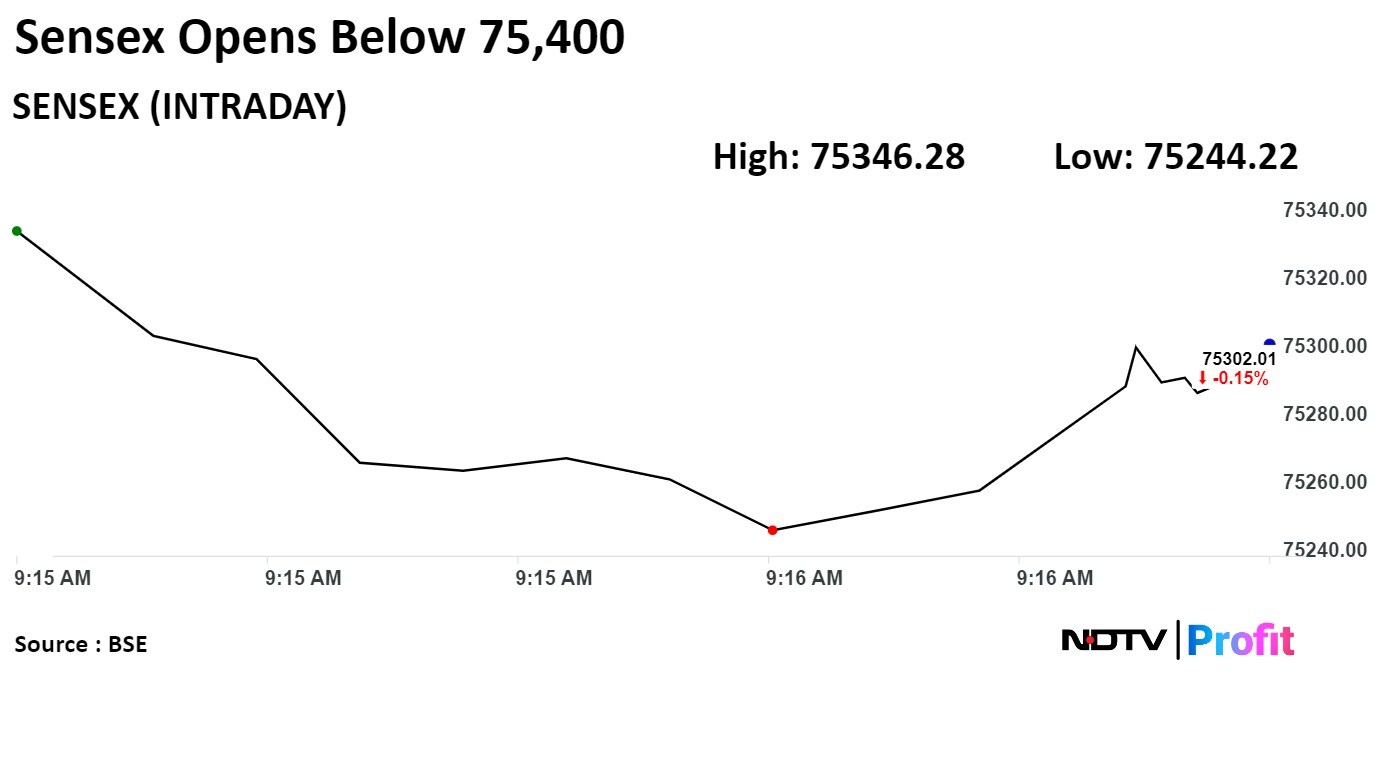

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

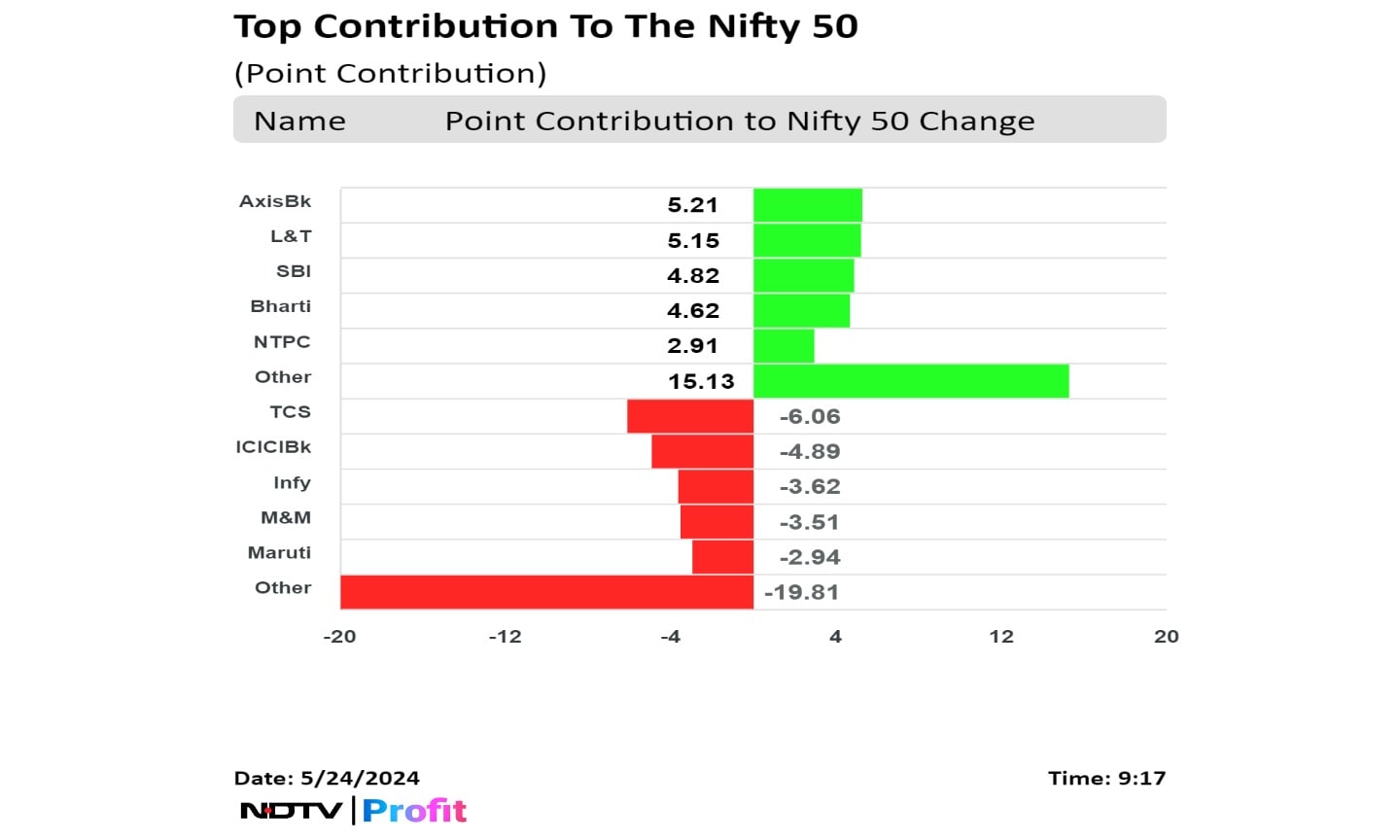

The NSE Nifty 50 and the S&P BSE Sensex rose 2.02% and 1.90%, respectively this week, the highest percentage gain since Feb 4.

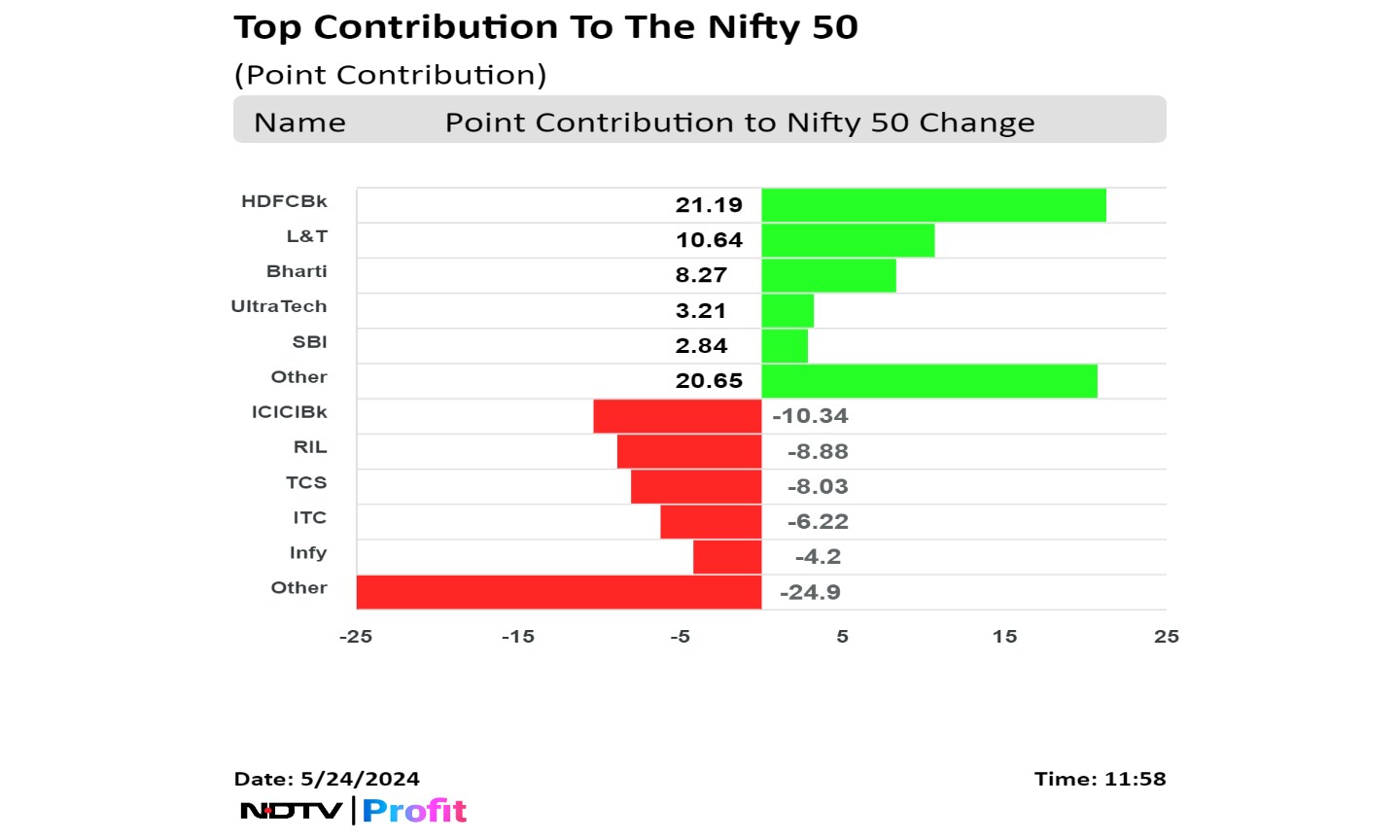

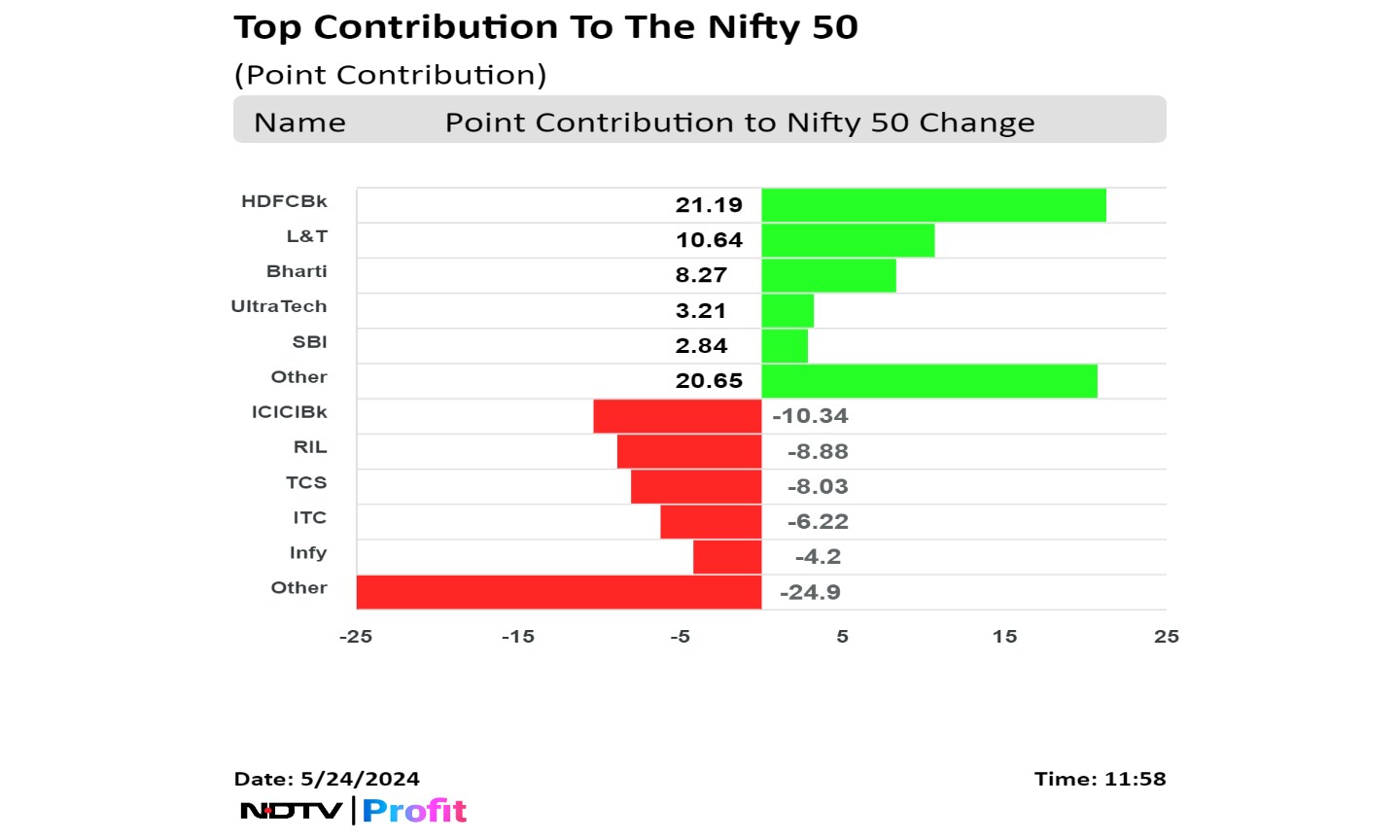

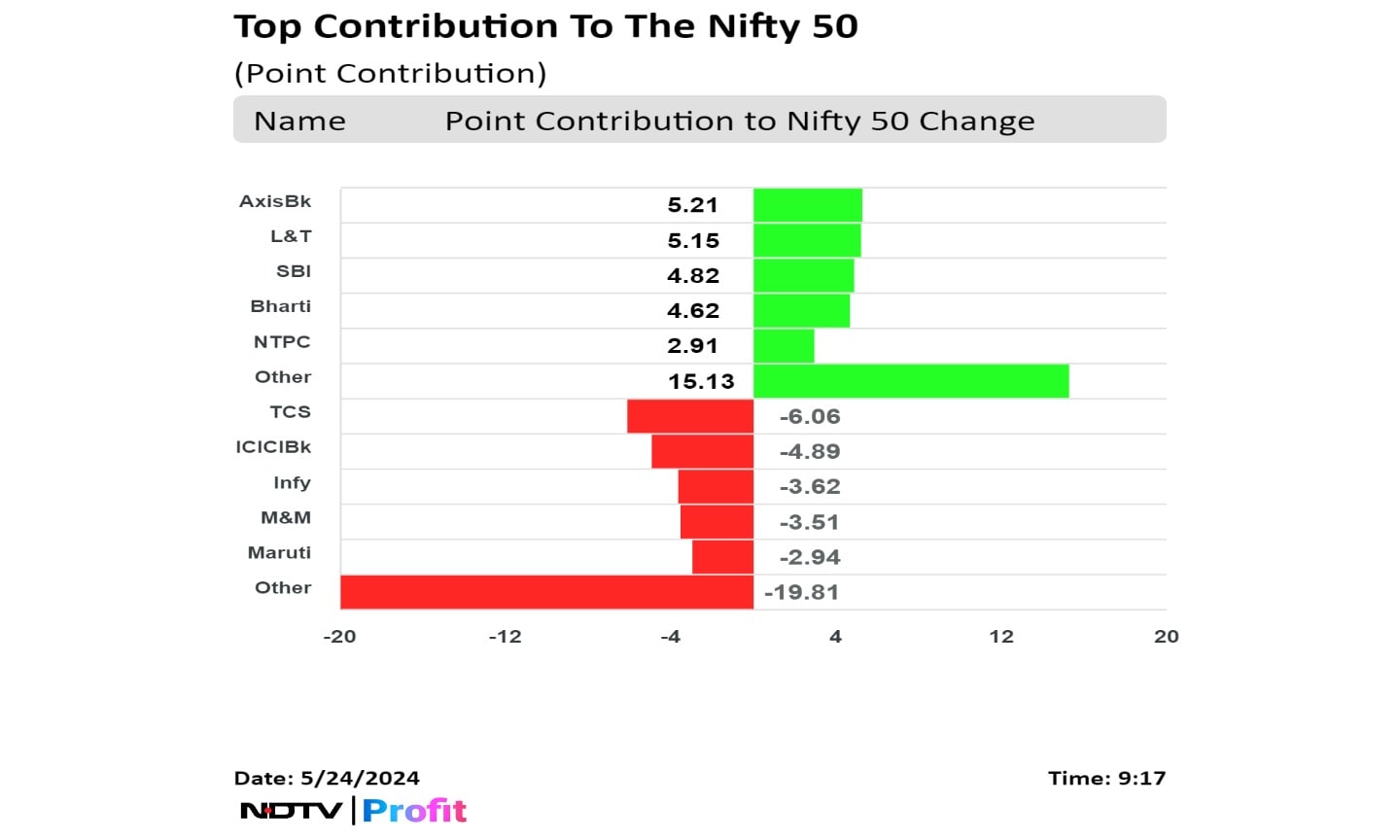

HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and NTPC Ltd added to the index.

Reliance Industries Ltd., Tata Consultancy Services Ltd., ITC Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. weighed on the benchmark.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

The NSE Nifty 50 and the S&P BSE Sensex rose 2.02% and 1.90%, respectively this week, the highest percentage gain since Feb 4.

HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and NTPC Ltd added to the index.

Reliance Industries Ltd., Tata Consultancy Services Ltd., ITC Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. weighed on the benchmark.

.jpeg)

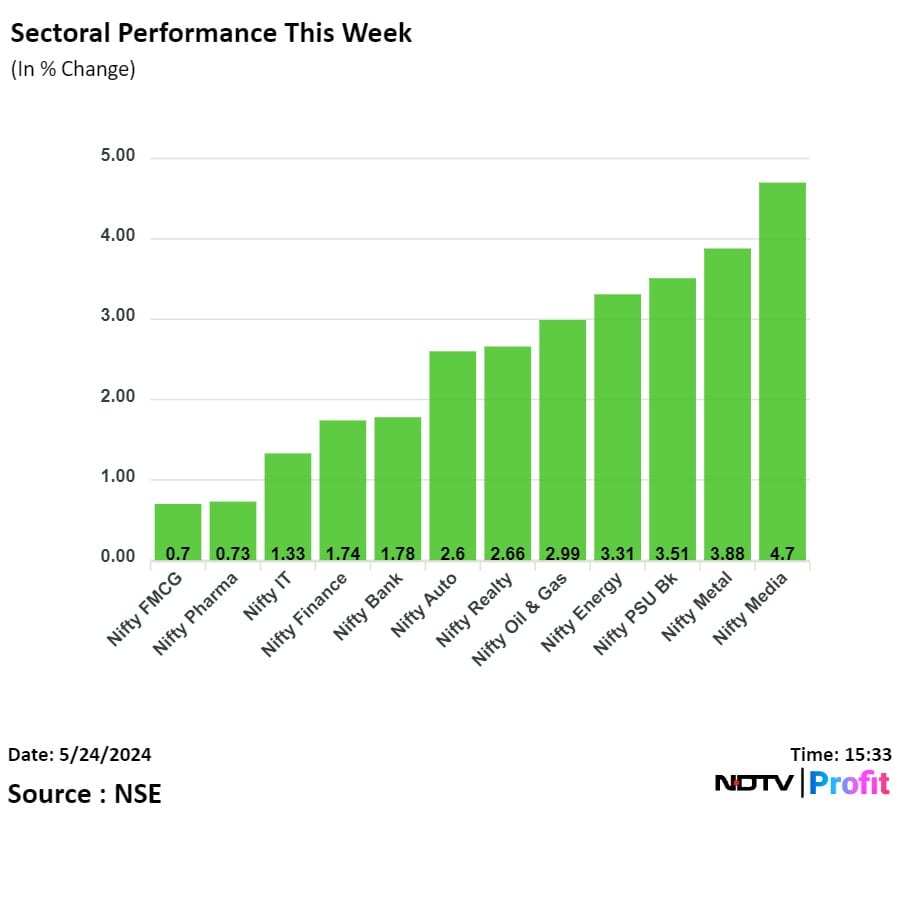

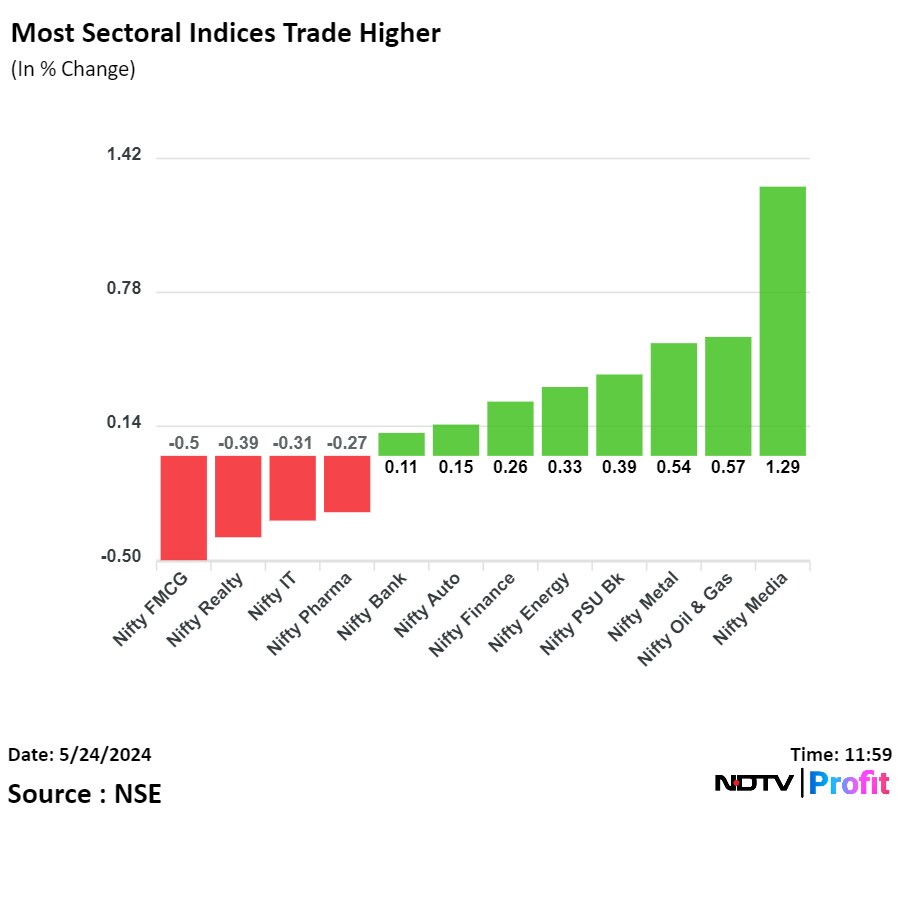

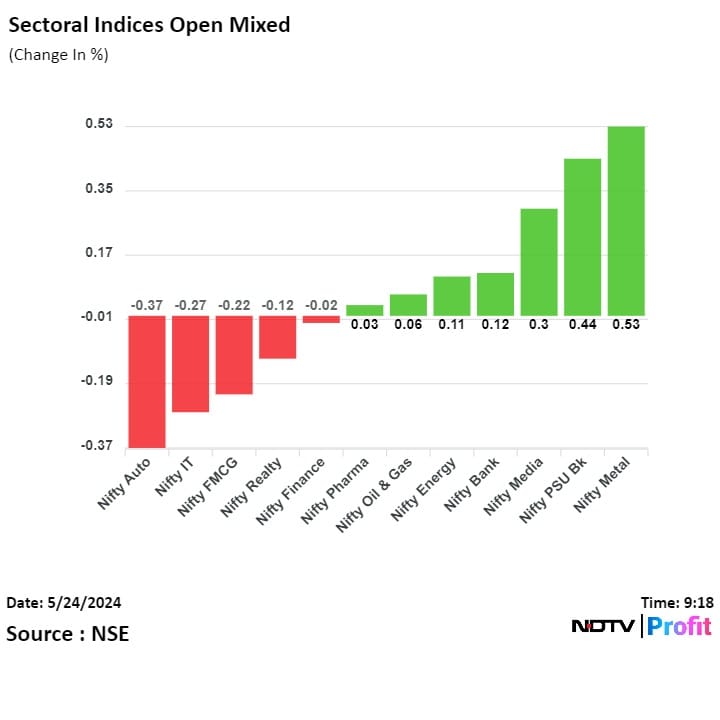

On NSE, all 12 sectors gained in the week ended on May 24. The NSE Nifty Media was the top performer with over 4% gain, and the NSE Nifty FMCG sector was top loser with barely 1% gain.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

The NSE Nifty 50 and the S&P BSE Sensex rose 2.02% and 1.90%, respectively this week, the highest percentage gain since Feb 4.

HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and NTPC Ltd added to the index.

Reliance Industries Ltd., Tata Consultancy Services Ltd., ITC Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. weighed on the benchmark.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

After scaling fresh highs in early trade, India's benchmark indices settled flat on Friday as ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. declined. Rise in shares of HDFC Bank Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. supported the benchmarks

The NSE Nifty 50 settled 10.55 points or 0.05% lower at 22,957.10, and the S&P BSE Sensex ended 7.65 points or 0.010% down at 75,410.39.

Intraday, the NSE Nifty 50 index rose 0.23% to record high of 23,026.40, and the S&P BSE Sensex rose 0.29% to fresh high of 75,636.50.

However, the benchmark NSE Nifty 50 snapped a six-day winning streak on Friday, while the S&P BSE Sensex reversed a two-day gains.

.jpeg)

"The improvement in market sentiment over the past week suggests that market expectations surrounding the ongoing Lok Sabha elections have steadied. Furthermore, better-than-expected 4QFY24 earnings in some key pockets supported momentum," Shrikant Chouhan, head, Equity Research at Kotak Securities.

The NSE Nifty 50 and the S&P BSE Sensex rose 2.02% and 1.90%, respectively this week, the highest percentage gain since Feb 4.

HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and NTPC Ltd added to the index.

Reliance Industries Ltd., Tata Consultancy Services Ltd., ITC Ltd., Infosys Ltd., and Mahindra & Mahindra Ltd. weighed on the benchmark.

.jpeg)

On NSE, all 12 sectors gained in the week ended on May 24. The NSE Nifty Media was the top performer with over 4% gain, and the NSE Nifty FMCG sector was top loser with barely 1% gain.

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.23% higher, and the S&P BSE Smallcap settled 0.20% down.

On BSE, eight sectoral indices advanced out of 20, and 12 declined. The S&P BSE Telecommunications was the top performing sector, and the S&P BSE Services fell the most.

Market breadth was skewed in favour of sellers. Around 2,143 stocks declined, 1,700 stocks rose, and 102 remained unchanged on BSE.

Revenue at Rs 2,600 crore vs Rs 2,305 crore, up 12.8%

EBITDA at Rs 736 crore vs Rs 411 crore, up 79.3%

Margin at 28.3% vs 17.8%

Net profit at Rs 396 crore vs Rs 146 crore

Revenue at Rs 376 crore vs Rs 306 crore, up 22.7%

EBITDA at Rs 38 crore vs Rs 29 crore, up 31.4%

Margin at 10% vs 9.4%

Net profit at Rs 8 crore vs Rs 7 crore, up 15.8%

Current CFO Gopal Mahadevan re-designated as Director - Strategic Finance and M&A for 2 years effective May 24

Source: Exchange filing

Total income at Rs 1,513 crore vs Rs 1,215 crore, up 24.5%

Net profit at Rs 428 crore vs Rs 309 crore, up 38.6%

Revenue up 30% at Rs 2,196 crore vs Rs 1,694 crore

EBITDA up 54% at Rs 357 crore vs Rs 233 crore

Margin at 16.3% vs 13.7%

Net profit down 6.3% at Rs 285 crore vs Rs 304 crore

Exceptional loss of Rs 27 crore in current quarter vs exceptional gain of Rs 252 crore in Q4 FY23

Total income at Rs 2,194 crore vs Rs 1,862 crore, up 17.8%

Net profit at Rs 700 crore vs Rs 639 crore, up 9.54%

Board recommends final dividend of Rs 2.65/share

Approves sale of 3 leased-out floors at its Noida property

Source: Exchange filing

Total income at Rs 1,570 crore vs Rs 1,105 crore, up 42.1%

Net profit at Rs 506 crore vs Rs 316 crore, up 60%

Board recommends final dividend of Rs 16 per share

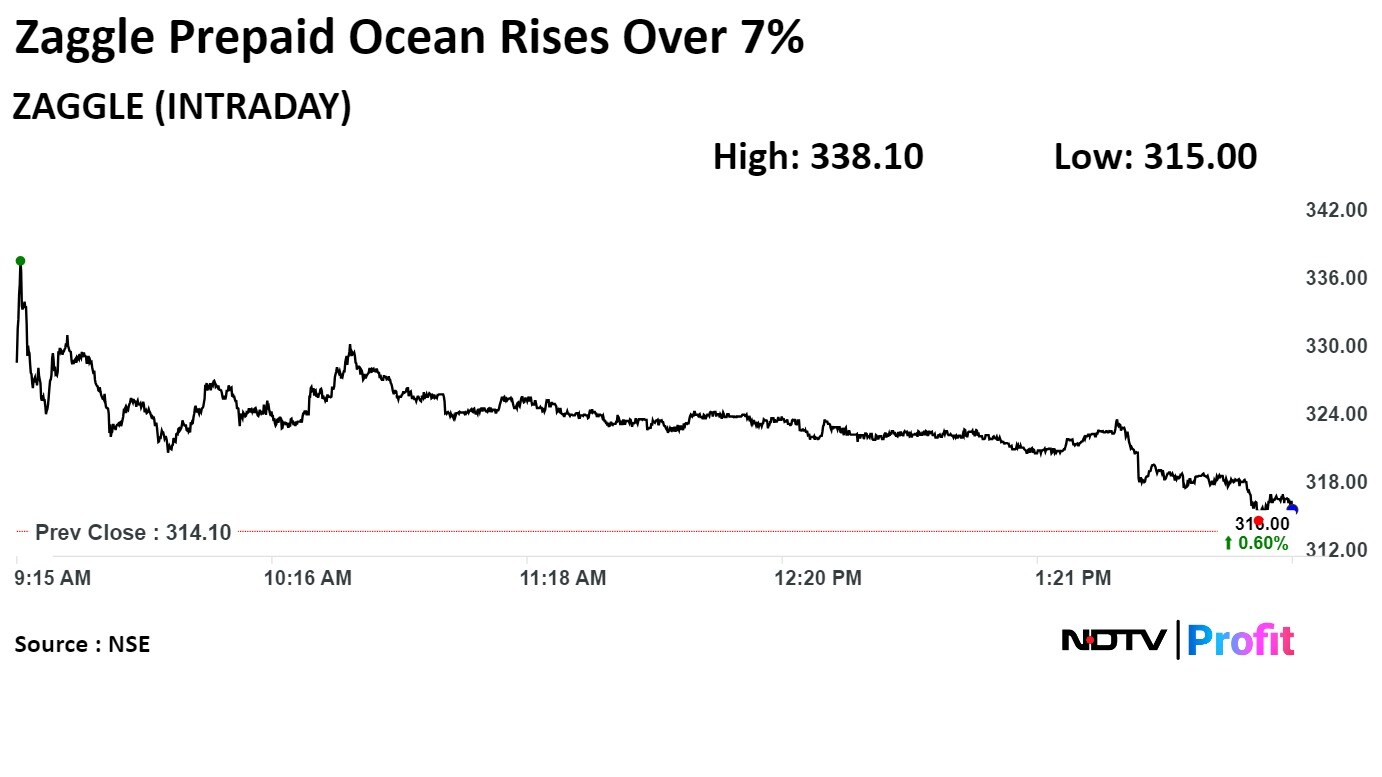

Zaggle Prepaid Ocean Services Ltd. rose 7.64% to Rs 338.10, the highest level since March 11. It pared gains to trade 0.59% higher at Rs 316.20 as of 2:27 p.m., as compared to 0.09% advance in the NSE Nifty 50 index.

Zaggle Prepaid Ocean Services Ltd. rose 7.64% to Rs 338.10, the highest level since March 11. It pared gains to trade 0.59% higher at Rs 316.20 as of 2:27 p.m., as compared to 0.09% advance in the NSE Nifty 50 index.

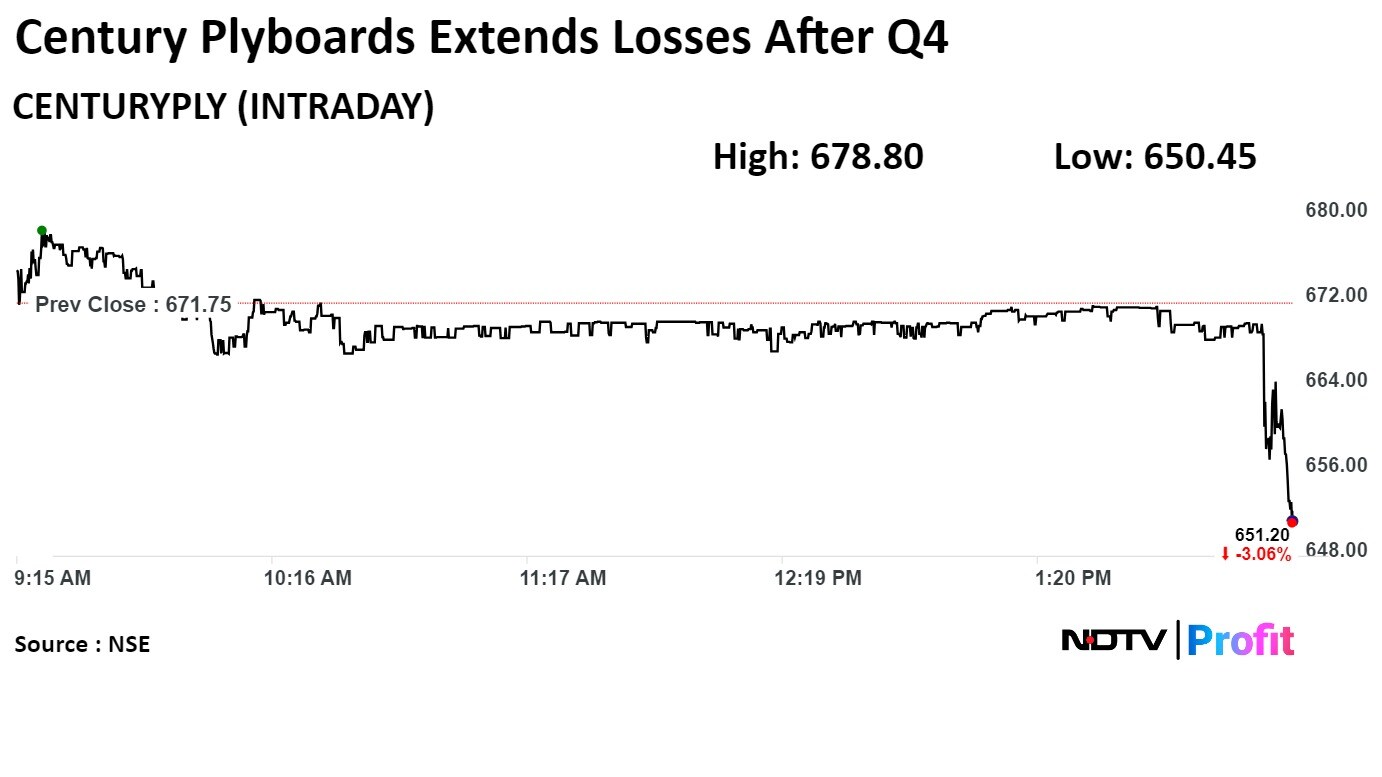

Revenue at Rs 1,061 crore vs Rs 965 crore, up 10%

EBITDA at Rs 137 crore vs Rs 164 crore, down 16.2%

Margin at 12.9% vs 17%

Net profit at Rs 78 crore vs Rs 115 crore, down 31.6%

Revenue at Rs 1,061 crore vs Rs 965 crore, up 10%

EBITDA at Rs 137 crore vs Rs 164 crore, down 16.2%

Margin at 12.9% vs 17%

Net profit at Rs 78 crore vs Rs 115 crore, down 31.6%

Revenue down 3.1% at Rs 11,267 crore vs Rs 11,626 crore

Ebitda up 24.8% at Rs 1,592 crore vs Rs 1276 crore

Margin at 14.1% vs 10.9%

Net profit up 19.8% at Rs 900 crore vs Rs 751 crore

Revenue down 3.1% at Rs 11,267 crore vs Rs 11,626 crore

Ebitda up 24.8% at Rs 1,592 crore vs Rs 1276 crore

Margin at 14.1% vs 10.9%

Net profit up 19.8% at Rs 900 crore vs Rs 751 crore

.png)

Revenue at Rs 55,994 crore vs Rs 55,857 crore, up 0.2%

EBITDA at Rs 6,681 crore vs Rs 5,327 crore, up 25.4%

Margin at 11.9% vs 9.5%, up 239 bps

Net profit at Rs 3,174 crore vs Rs 2,411 crore, up 31.6%

Revenue at Rs 55,994 crore vs Rs 55,857 crore, up 0.2%

EBITDA at Rs 6,681 crore vs Rs 5,327 crore, up 25.4%

Margin at 11.9% vs 9.5%, up 239 bps

Net profit at Rs 3,174 crore vs Rs 2,411 crore, up 31.6%

.png)

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd. and State Bank of India led the gains in the Nifty.

Infosys Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Reliance Industries Ltd. weighed on the index the most.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd. and State Bank of India led the gains in the Nifty.

Infosys Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Reliance Industries Ltd. weighed on the index the most.

On the NSE, most sectoral indices gained, with Nifty Media leading gains. Nifty FMCG and Nifty Realty were top losers.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd. and State Bank of India led the gains in the Nifty.

Infosys Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Reliance Industries Ltd. weighed on the index the most.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Benchmark equity indices came off their record highs through midday on Friday as shares of Reliance Industries Ltd., ICICI Bank Ltd. and Tata Consultancy Services Ltd. weighed on them. At noon, the NSE Nifty 50 and the S&P BSE Sensex were trading flat at 22,971.35 and 75,440.71 respectively.

The previous day's move was not expected and the VIX and the Nifty are moving in the same direction, noted Milan Vaishnav, founder of Gemstone Equity Research. "From a technical perspective, this is slightly unhealthy because if we look at historical instances, we see major tops getting formed when this happens."

However, 23,000 continues to remain a psychologically important level, he noted. "I expect the Nifty to oscillate in a wider range, but I don't expect it to go beyond 23,200–23,300 level, even if there's upside volatility around June 4," he said, pointing out that profit taking is likely at higher levels.

Shares of HDFC Bank Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd. and State Bank of India led the gains in the Nifty.

Infosys Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Reliance Industries Ltd. weighed on the index the most.

On the NSE, most sectoral indices gained, with Nifty Media leading gains. Nifty FMCG and Nifty Realty were top losers.

The broader markets outperformed the benchmark indices. The BSE MidCap rose 0.43% higher and the BSE SmallCap was 0.37% higher.

On the BSE, 12 out of the 20 sectors advanced. Telecommunication was the top performing sector, while Services fell the most.

The market breadth was split between buyers and sellers as 1,895 stocks declined, 1,747 rose and 145 remained unchanged on the BSE.

The local currency strengthened by 20 paise intraday to 83.08 against the US dollar.

Previous intraday high of 83.04 was recorded on March 21, 2024

It closed at 83.28 on Wednesday.

Source: Bloomberg

Revenue down 8.5% at Rs 668 crore vs Rs 730 crore

Ebitda down 35% at Rs 53 crore vs Rs 81 crore

Margin at 7.9% vs 11.1%

Net profit down 66.3% at Rs 15.5 crore vs Rs 46 crore

Shares of Johnson Controls-Hitachi Air Conditioning India Ltd hit an upper circuit of 20% and rose to the level of Rs 1,486.85, the highest level since its listing on Jan 3, 2000. It remained locked in the upper circuit as of 1:26 p.m., as compared to 0.16% advance in the NSE Nifty 50 index.

The scrip gained 42.41% in 12 months, and on year to date basis, it has risen 33.22%. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 74.80.

Out of two analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 27.4%.

Shares of Johnson Controls-Hitachi Air Conditioning India Ltd hit an upper circuit of 20% and rose to the level of Rs 1,486.85, the highest level since its listing on Jan 3, 2000. It remained locked in the upper circuit as of 1:26 p.m., as compared to 0.16% advance in the NSE Nifty 50 index.

The scrip gained 42.41% in 12 months, and on year to date basis, it has risen 33.22%. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 74.80.

Out of two analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 27.4%.

.jpeg)

All stocks of the Nifty Auto, but M&M, index were in the green.

All stocks of the Nifty Auto, but M&M, index were in the green.

.png)

.png)

.png)

.png)

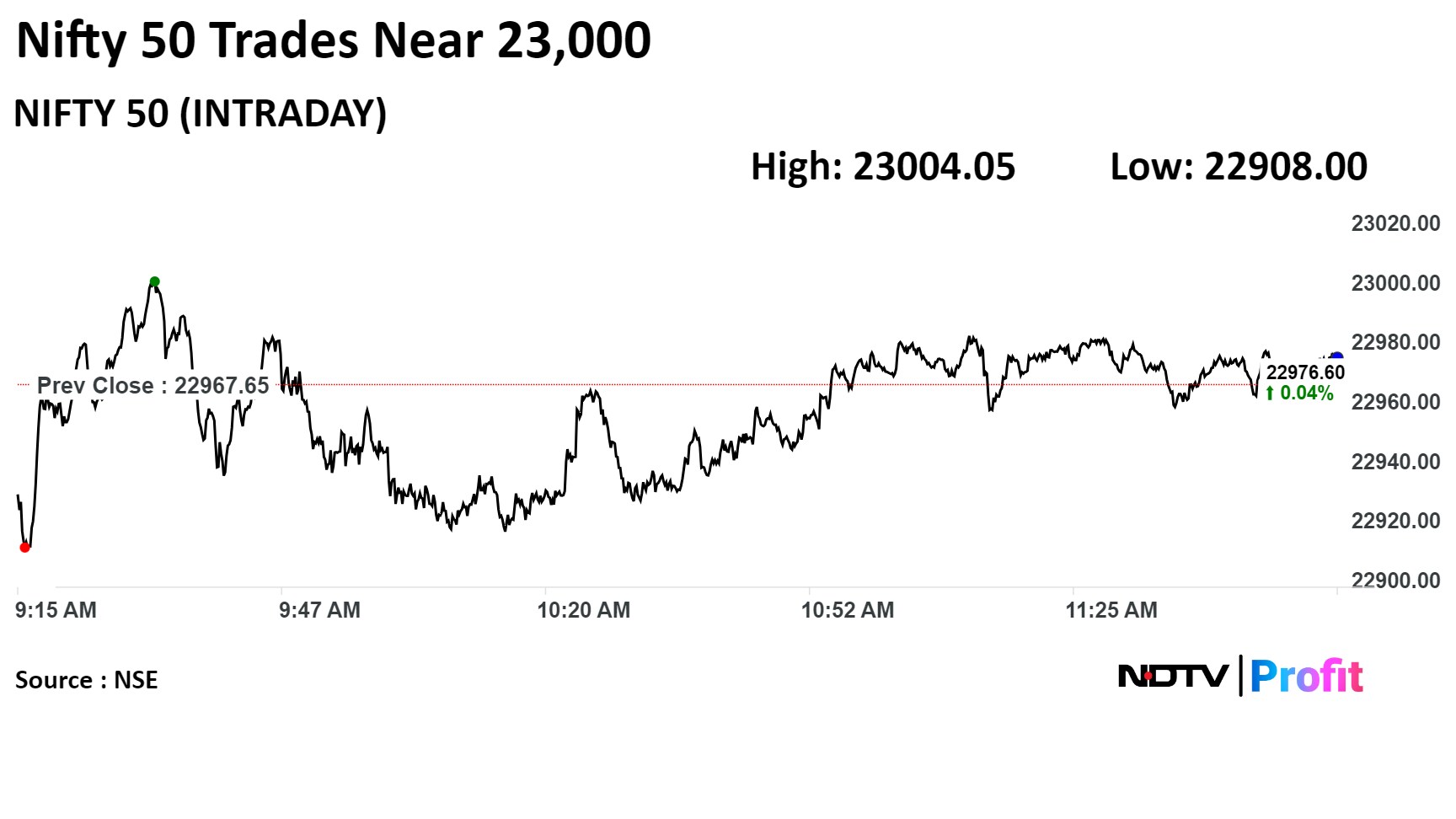

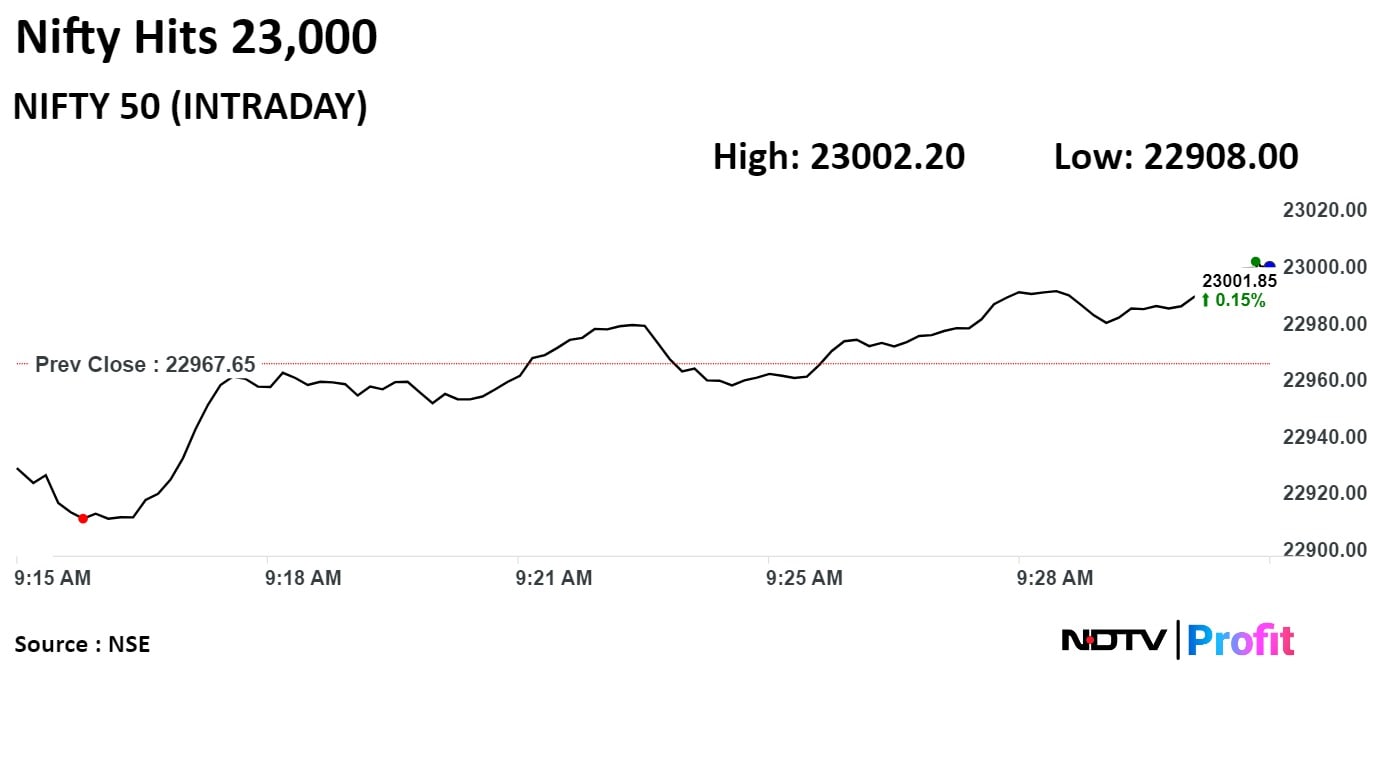

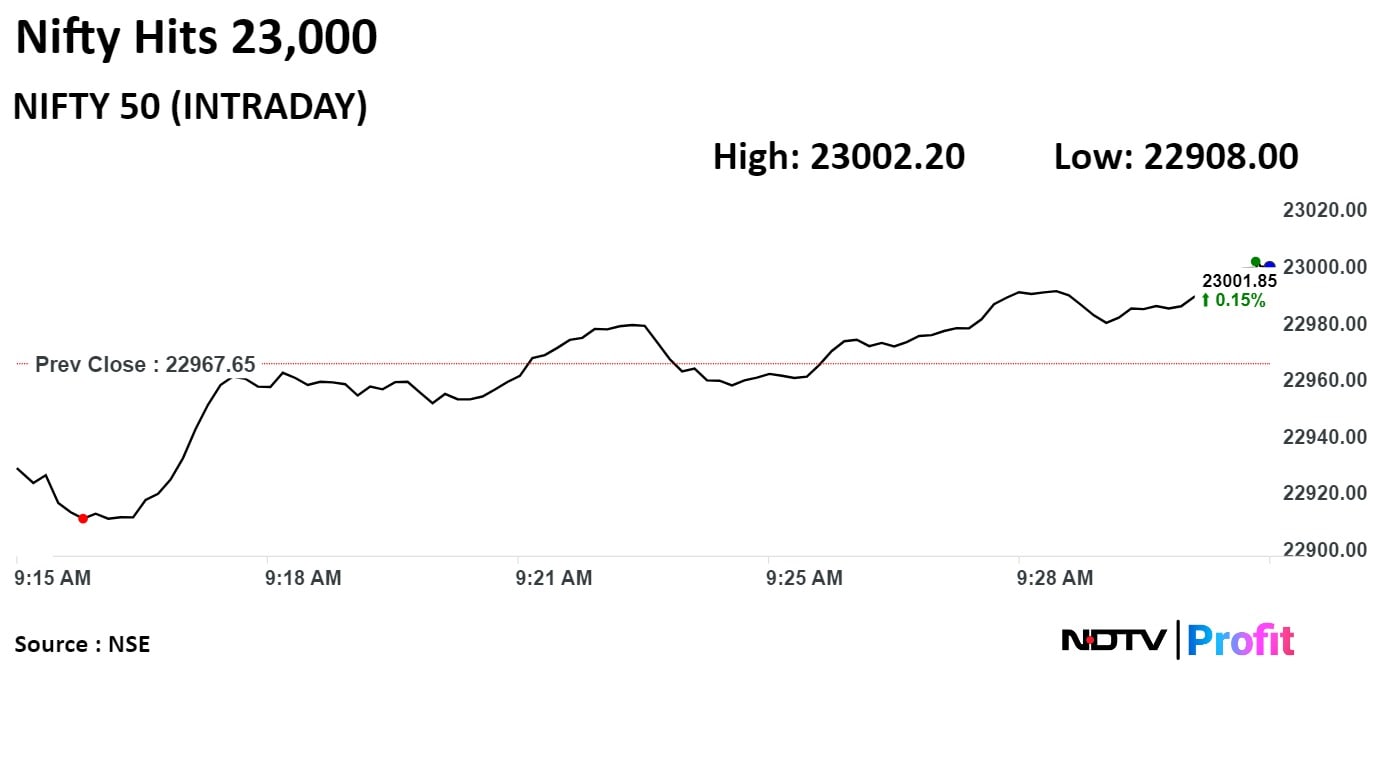

The NSE Nifty 50 index scaled a fresh high and touched 23,000 level for the first time on Friday ahead of the completion of the Lok Sabha election next week. There were sharp gains in construction, metal and mining stocks.

The benchmark took 89 trading sessions to reach the 23,000 mark, which is 63 sessions more than it took to touch the 22,000 mark on Jan 15. Before that, the Nifty took 61 sessions to cross 21,000 level in December.

Shortly after opening lower, the Nifty erased early losses and rose 0.16% or 36.40 points to record high of 23,004.05. As of 12:10 p.m., Nifty 50 was 1.60 points or 0.01% higher at 22,969.25.

Read at

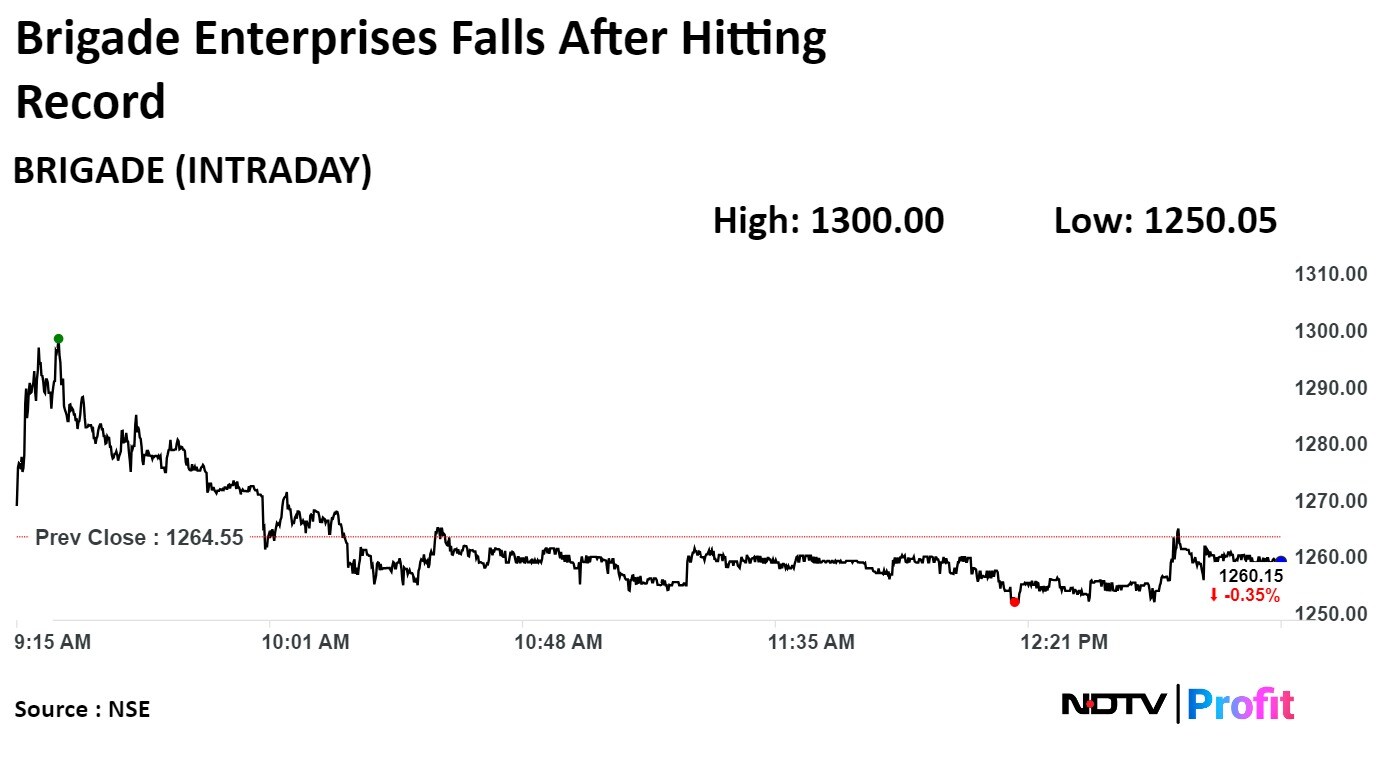

Shares of Brigade Enterprises Ltd. rose to all-time high level on Friday after the company signed a joint development agreement to develop a residential project.

Shares of Brigade Enterprises Ltd. rose to all-time high level on Friday after the company signed a joint development agreement to develop a residential project.

Brigade Enterprises Ltd. rose 2.80% to Rs 1,300, the highest level since its listing on Dec 31, 2007. It erased gains to trade 0.66% lower at Rs 1,256.15 as of 1:05 p.m., as compared to 0.19% advance in the NSE Nifty 50 index.

It has risen 134.41% in 12 months. Total traded volume so far in the day stood at 0.83 times its 30-day average. The relative strength index was at 72.96, which implied the stock is overbought.

Out of 15 analysts tracking the company, 14 maintain a 'buy' rating, and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.2%.

Revenue down 19% at Rs 5,557 crore vs Rs 6860 crore

Ebitda down 27% at Rs 469 crore vs Rs 644 crore

Margin at 8.4% vs 9.4%

Net profit up 2.6% at Rs 294 crore vs Rs 287 crore

A report said that the Indian Army's Central Ordnance Depot, in Mumbai's northern suburb of Kandivali has sought to stop a luxury residential project developed by the Godrej Group.

The scrip fell as much as 5.57% to Rs 2,658.05 apiece. It pared gains to trade 2.7% lower at Rs 2,742 apiece, as of 1:06 p.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 35.99% on a year-to-date basis and 97% in the last 12 months. Total traded volume so far in the day stood at 0.66 times its 30-day average. The relative strength index was at 52.55.

A report said that the Indian Army's Central Ordnance Depot, in Mumbai's northern suburb of Kandivali has sought to stop a luxury residential project developed by the Godrej Group.

The scrip fell as much as 5.57% to Rs 2,658.05 apiece. It pared gains to trade 2.7% lower at Rs 2,742 apiece, as of 1:06 p.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 35.99% on a year-to-date basis and 97% in the last 12 months. Total traded volume so far in the day stood at 0.66 times its 30-day average. The relative strength index was at 52.55.

.png)

Vodafone Idea Ltd. is likely to benefit from a potential reduction or waiver of adjusted gross revenue dues by the Union government, according to UBS Research, which upgraded the stock to 'buy' from 'neutral'. The brokerage hiked the target price from Rs 13.1 per share to Rs 18 apiece, implying a potential upside of 28% from the previous close.

Vodafone Idea Ltd. is likely to benefit from a potential reduction or waiver of adjusted gross revenue dues by the Union government, according to UBS Research, which upgraded the stock to 'buy' from 'neutral'. The brokerage hiked the target price from Rs 13.1 per share to Rs 18 apiece, implying a potential upside of 28% from the previous close.

.png)

Shares of VIL rose as much as 7.11% during the day to Rs 15.05 apiece on the NSE. It was trading 5.69% higher at Rs 14.85 per share, compared to a 0.19% decline in the benchmark Nifty at 10:17 a.m.

The share price stock has risen 138.4% in the last 12 months and fallen 12.5% on a year-to-date basis. The total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 69.12.

Seven out of the 13 analysts tracking the company have a 'buy' rating on the stock, four recommend 'hold' and two suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 28.4%.

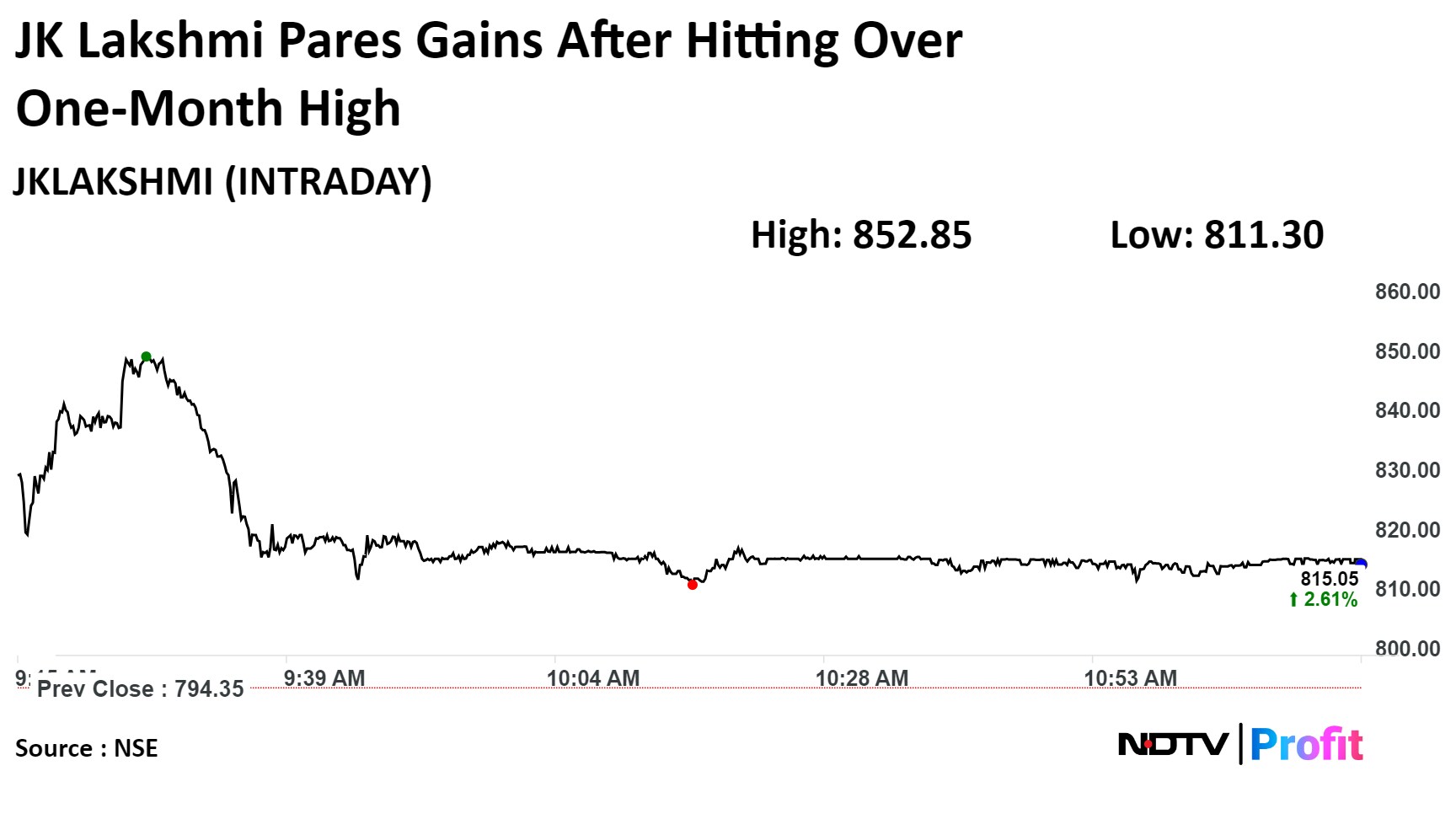

The scrip rose as much as 7.36% to hit its one-month high of Rs 852.85 before paring gains to trade 2.98% higher at Rs 818.

JK Lakshmi Cement Q4 FY24 (Consolidated, YoY)

Revenue down 4.4% at Rs 1,781 crore versus Rs 1,862 crore (Bloomberg estimate Rs 1,928 crore).

Ebitda up 44.6% at Rs 337 crore versus Rs 233 crore (Bloomberg estimate Rs 283 crore).

Margin at 18.9% versus 12.5% (Bloomberg estimate 14.7%).

Net profit up 41.1% at Rs 162 crore versus Rs 115 crore (Bloomberg estimate Rs 143 crore).

The scrip rose as much as 7.36% to hit its one-month high of Rs 852.85 before paring gains to trade 2.98% higher at Rs 818.

JK Lakshmi Cement Q4 FY24 (Consolidated, YoY)

Revenue down 4.4% at Rs 1,781 crore versus Rs 1,862 crore (Bloomberg estimate Rs 1,928 crore).

Ebitda up 44.6% at Rs 337 crore versus Rs 233 crore (Bloomberg estimate Rs 283 crore).

Margin at 18.9% versus 12.5% (Bloomberg estimate 14.7%).

Net profit up 41.1% at Rs 162 crore versus Rs 115 crore (Bloomberg estimate Rs 143 crore).

Unit gets US FDA approval for phenylephrine hydrochloride ophthalmic solution

Source: Exchange Filing

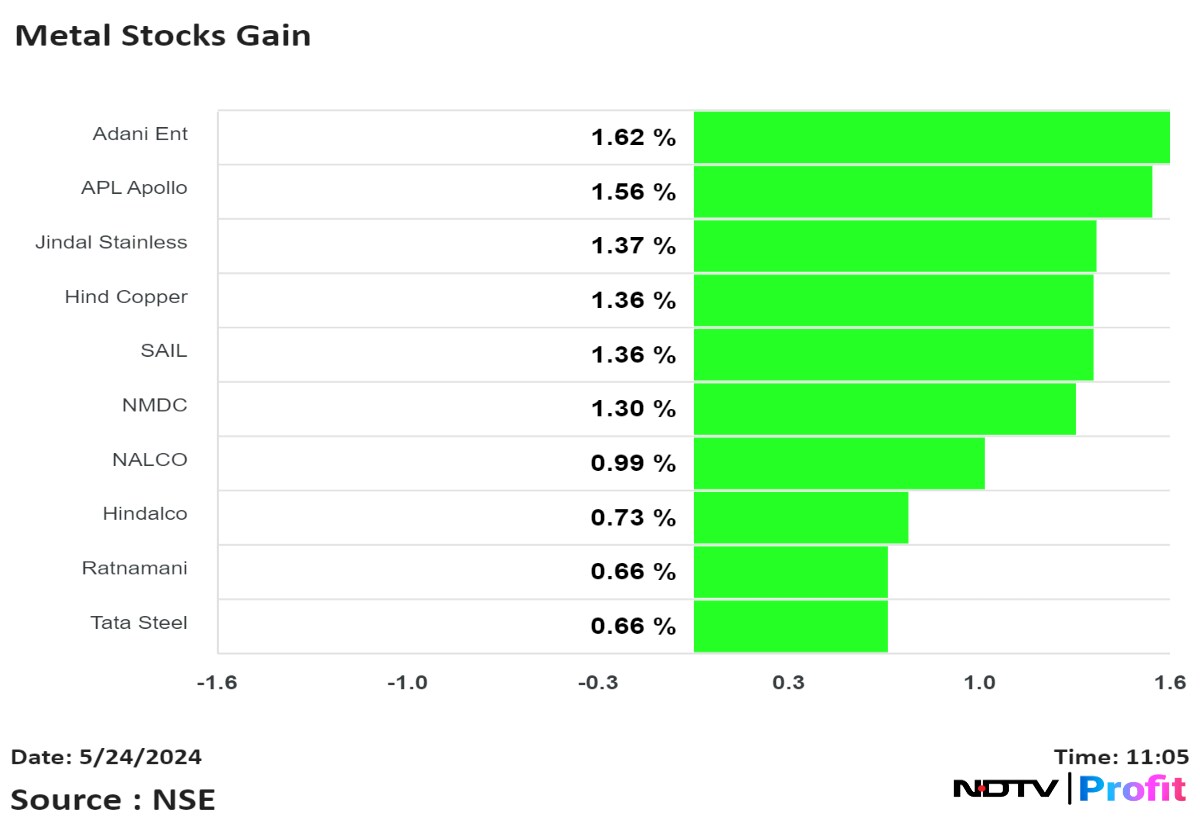

The Nifty Metal index hit a lifetime high of 10060.25 points.

The Nifty Metal index hit a lifetime high of 10060.25 points.

In pact for ticketing and payment solutions

Source: Exchange filing

Shares of Honasa Consumer jumped to their highest level in three months after the company's reported a consolidated net profit of Rs 30.47 crore in the March quarter as against a loss of Rs 161.75 crore in the year-ago period.

Honasa Consumer Q4 FY24 (Consolidated, YoY)

Revenue up 21.5% at Rs 471 crore versus Rs 388 crore.

Ebitda at Rs 33 crore versus Ebitda loss of Rs 3 crore.

Margin at 7%.

Net profit at Rs 30 crore versus loss of Rs 162 crore.

The company said it continued growth momentum in Q4 with increasing profitability and its brand Mamaearth reached 1,88,377 FMCG retail outlets in India as of March 2024, increasing distribution up by 34% on year.

Shares of Honasa Consumer jumped to their highest level in three months after the company's reported a consolidated net profit of Rs 30.47 crore in the March quarter as against a loss of Rs 161.75 crore in the year-ago period.

Honasa Consumer Q4 FY24 (Consolidated, YoY)

Revenue up 21.5% at Rs 471 crore versus Rs 388 crore.

Ebitda at Rs 33 crore versus Ebitda loss of Rs 3 crore.

Margin at 7%.

Net profit at Rs 30 crore versus loss of Rs 162 crore.

The company said it continued growth momentum in Q4 with increasing profitability and its brand Mamaearth reached 1,88,377 FMCG retail outlets in India as of March 2024, increasing distribution up by 34% on year.

.png)

The scrip rose as much as 7.09% to Rs 448 apiece, the highest level since February 23. It pared gains to trade 2.68% higher at Rs 429.65 apiece, as of 10:27 a.m. This compares to a flat in the NSE Nifty 50 Index.

It has fallen 2.56% on a year-to-date basis. Total traded volume on the NSE so far in the day stood at 4.56 times its 30-day average. The relative strength index was at 56.94.

The index took 89 sessions to rise from when it crossed 22,000 level for the first time.

Shares of InterGlobe Aviation rose to their highest level since listing after its net profit doubled in January-March. The scrip rose 2.92% to Rs 4,529.00, the highest level since it was listed on Nov 10, 2015. It was trading 0.64% higher at Rs 4,428.85 as of 09:26 a.m., as compared to 0.03% advance in the NSE Nifty 50 index.

Shares of InterGlobe Aviation rose to their highest level since listing after its net profit doubled in January-March. The scrip rose 2.92% to Rs 4,529.00, the highest level since it was listed on Nov 10, 2015. It was trading 0.64% higher at Rs 4,428.85 as of 09:26 a.m., as compared to 0.03% advance in the NSE Nifty 50 index.

.jpeg)

The stock rose 95.87% in 12 months, and it has risen 49.29% on year to date basis. Total traded volume so far in the day stood at 1.36 times its 30-day average. The relative strength index was at 75.89.

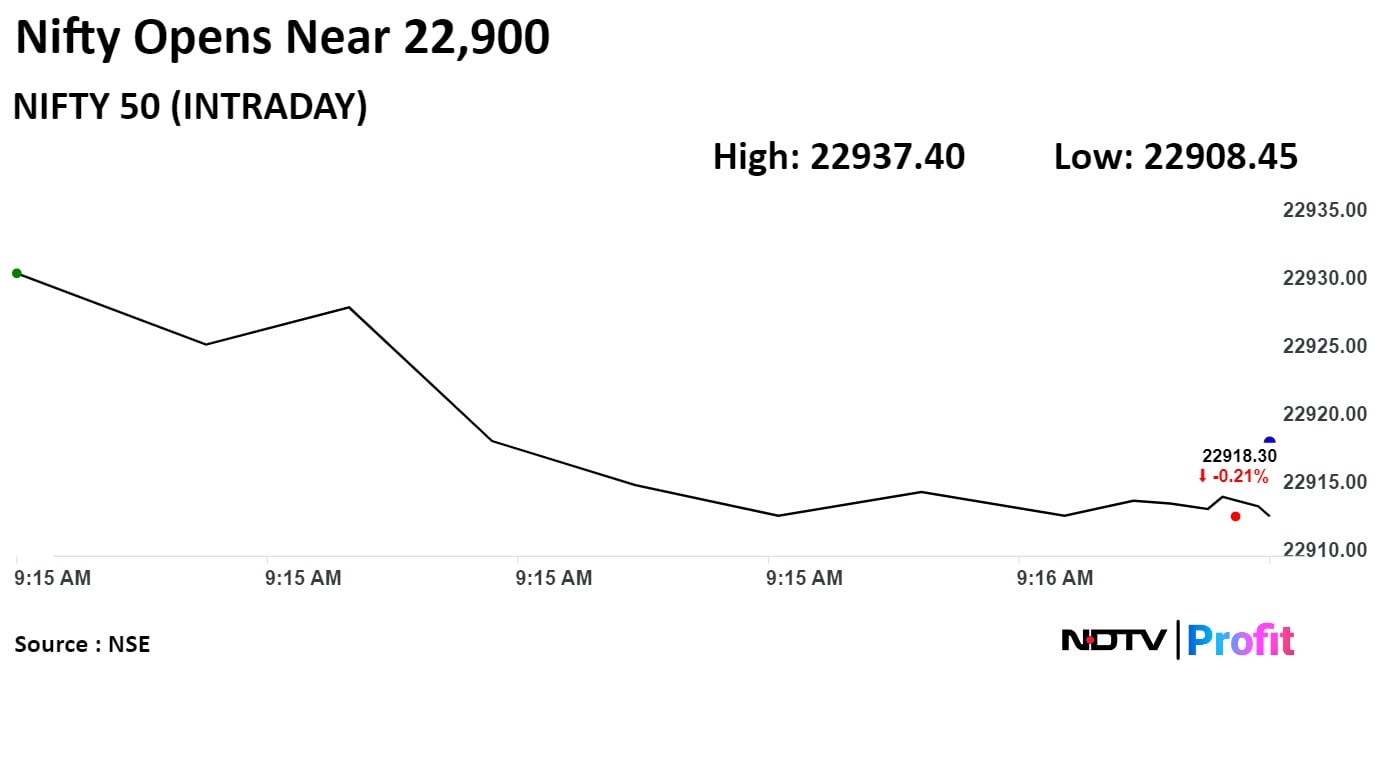

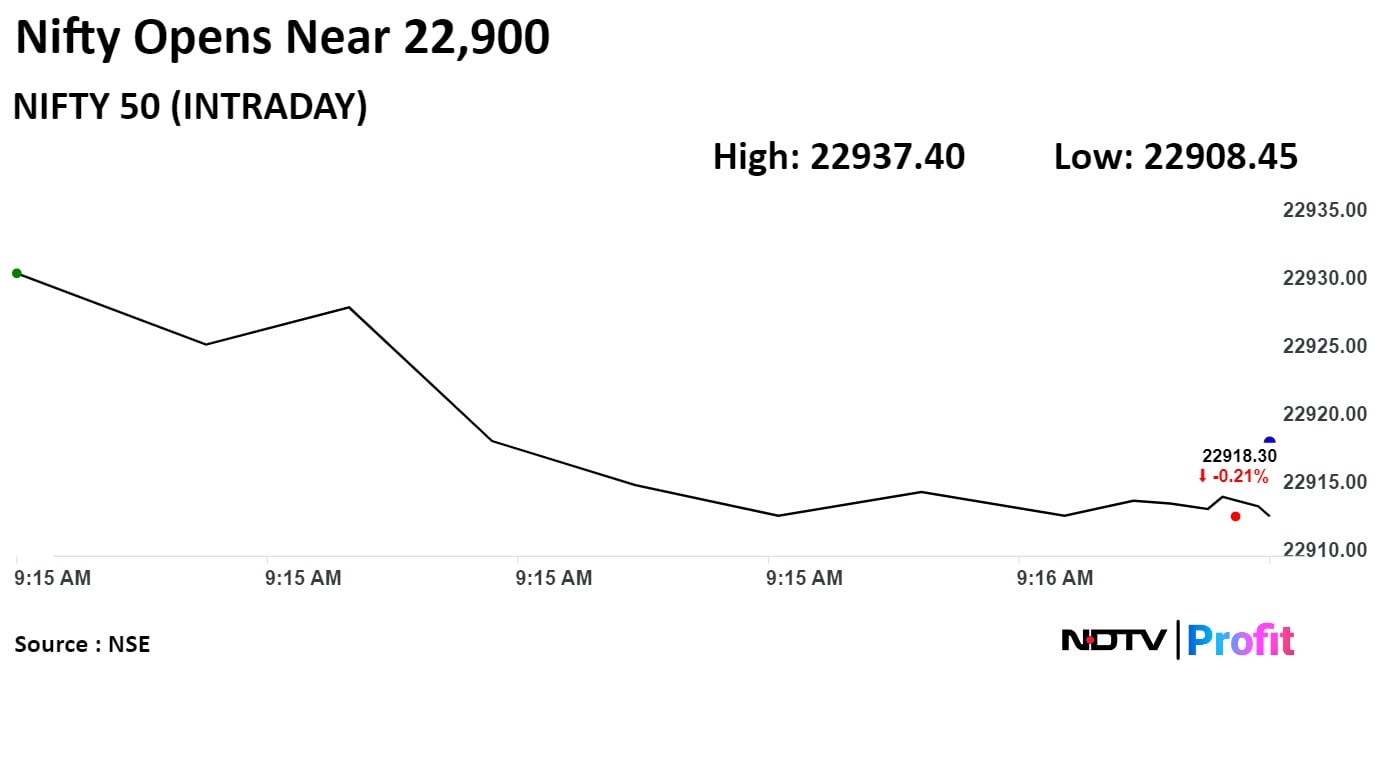

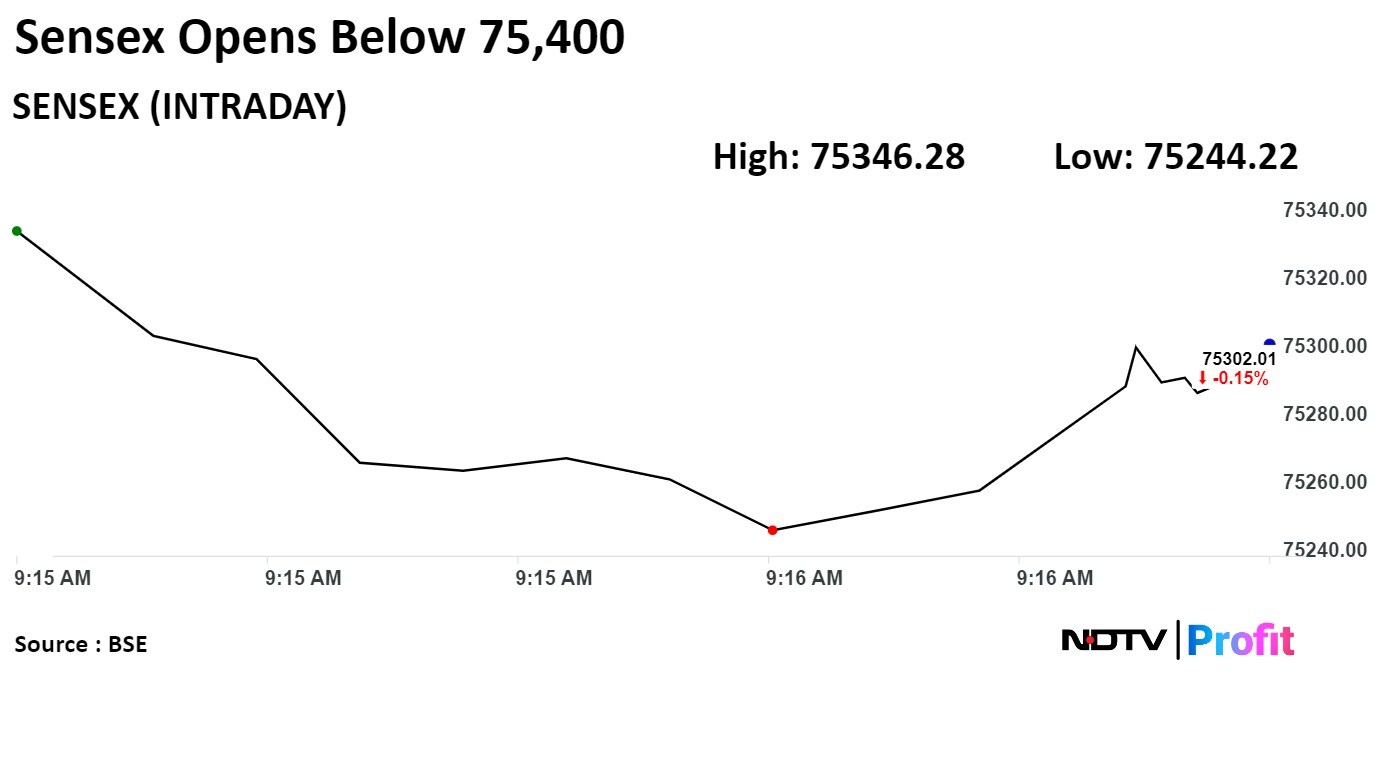

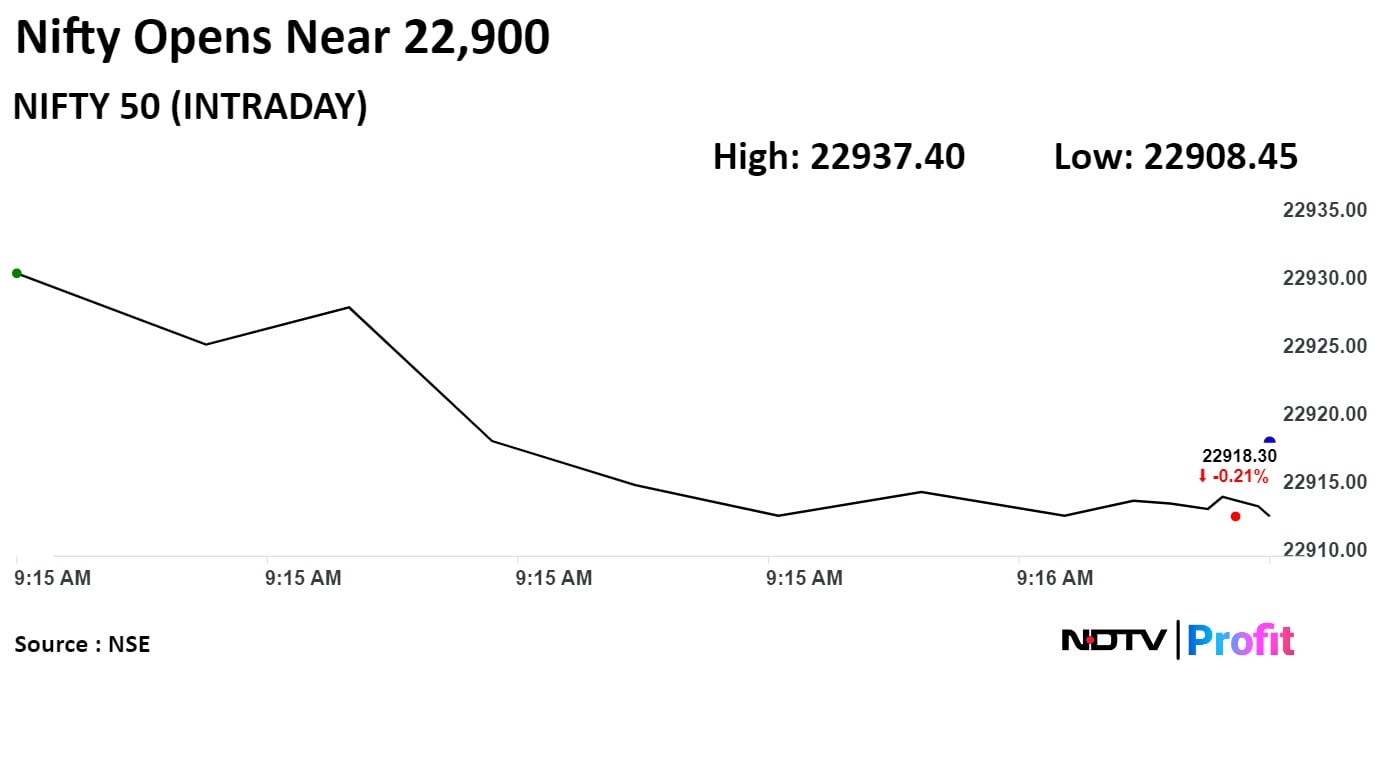

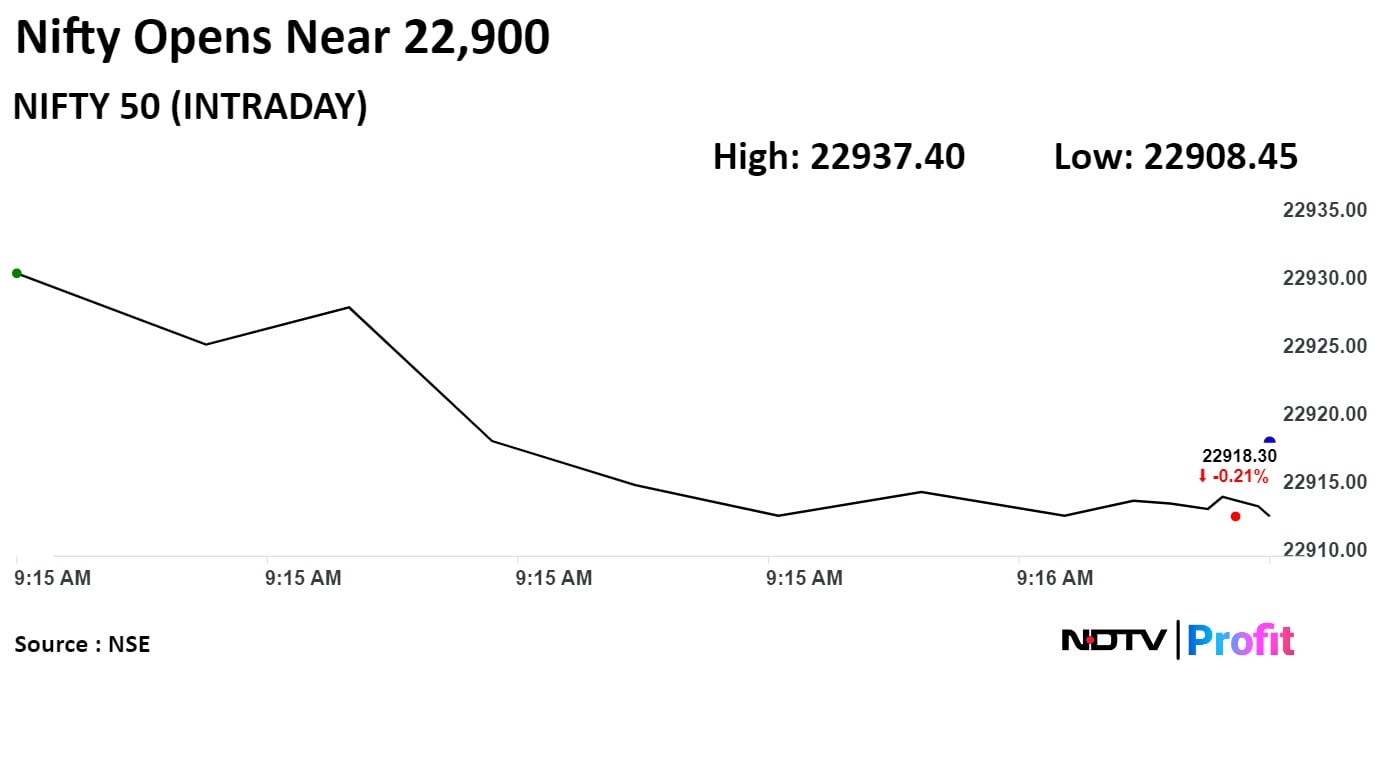

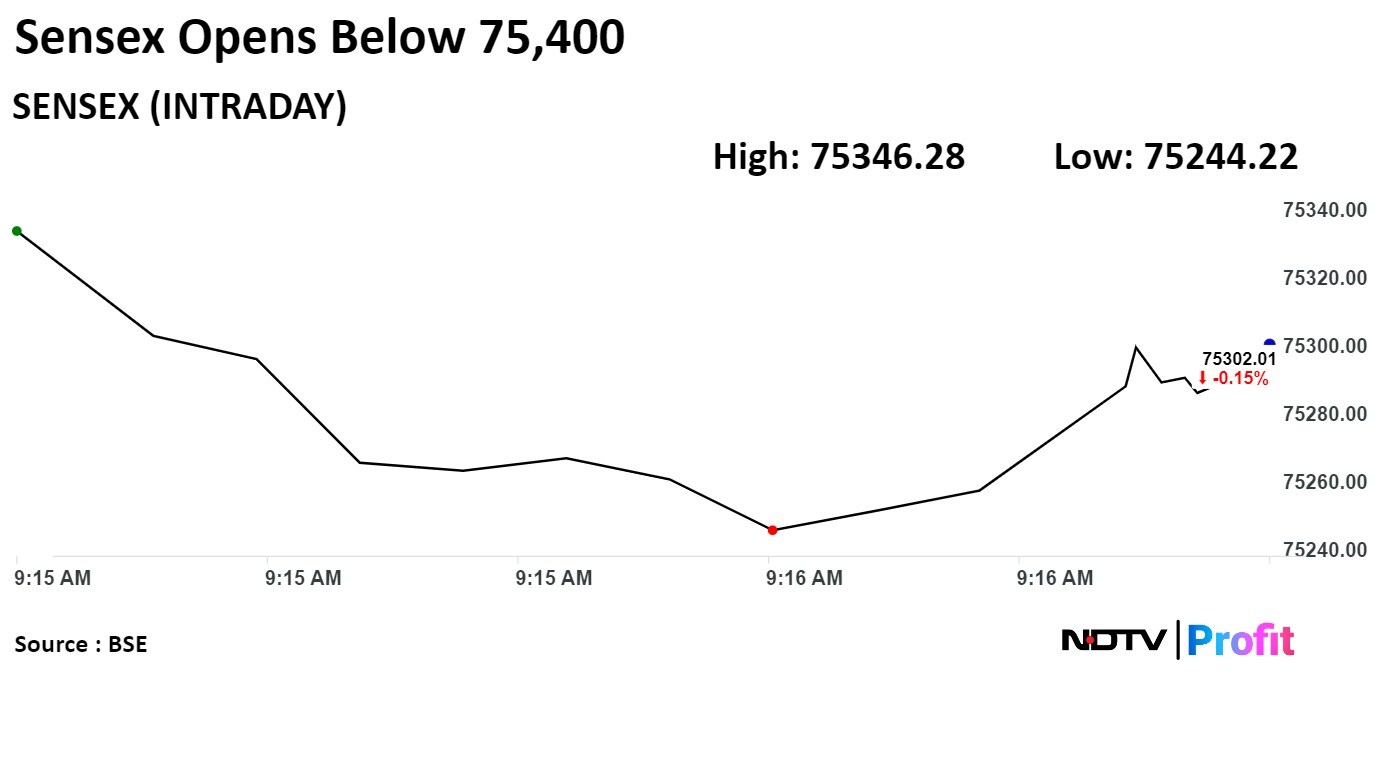

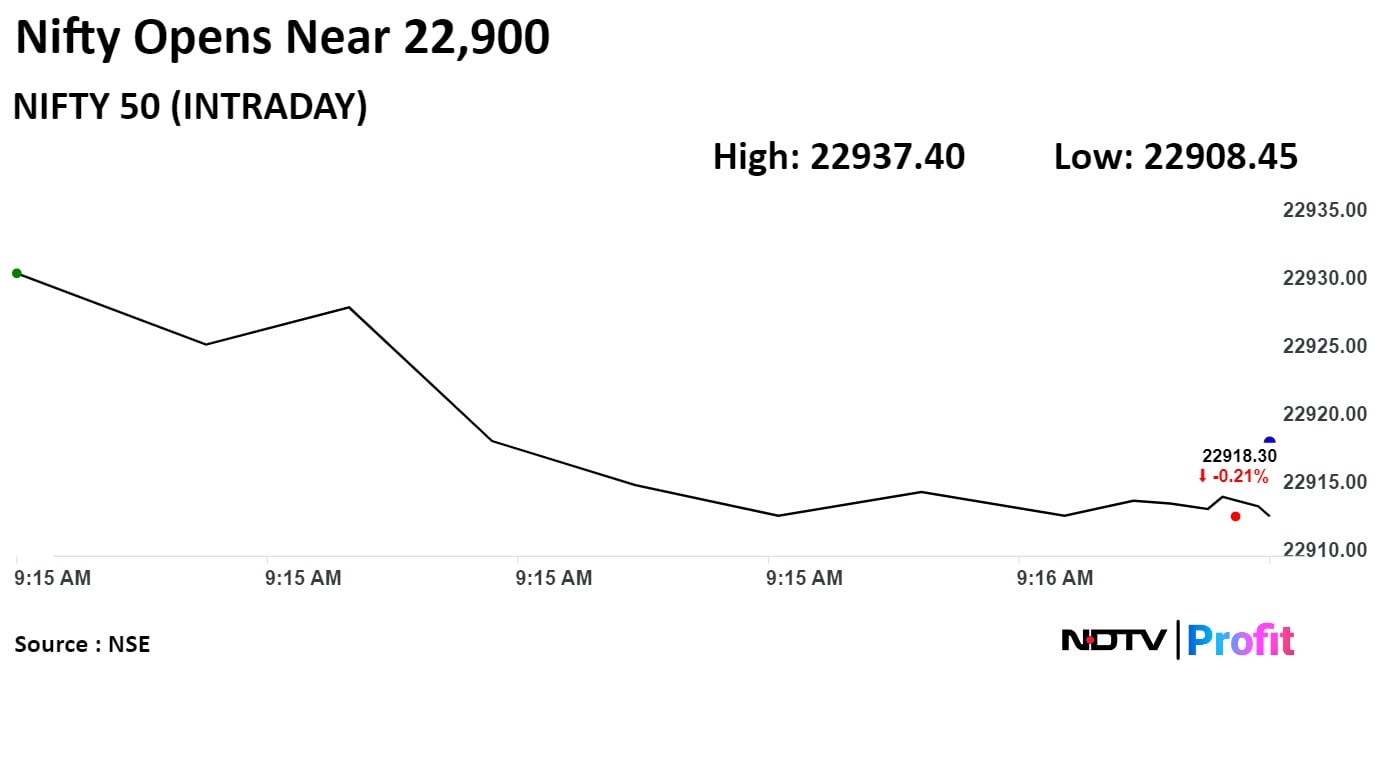

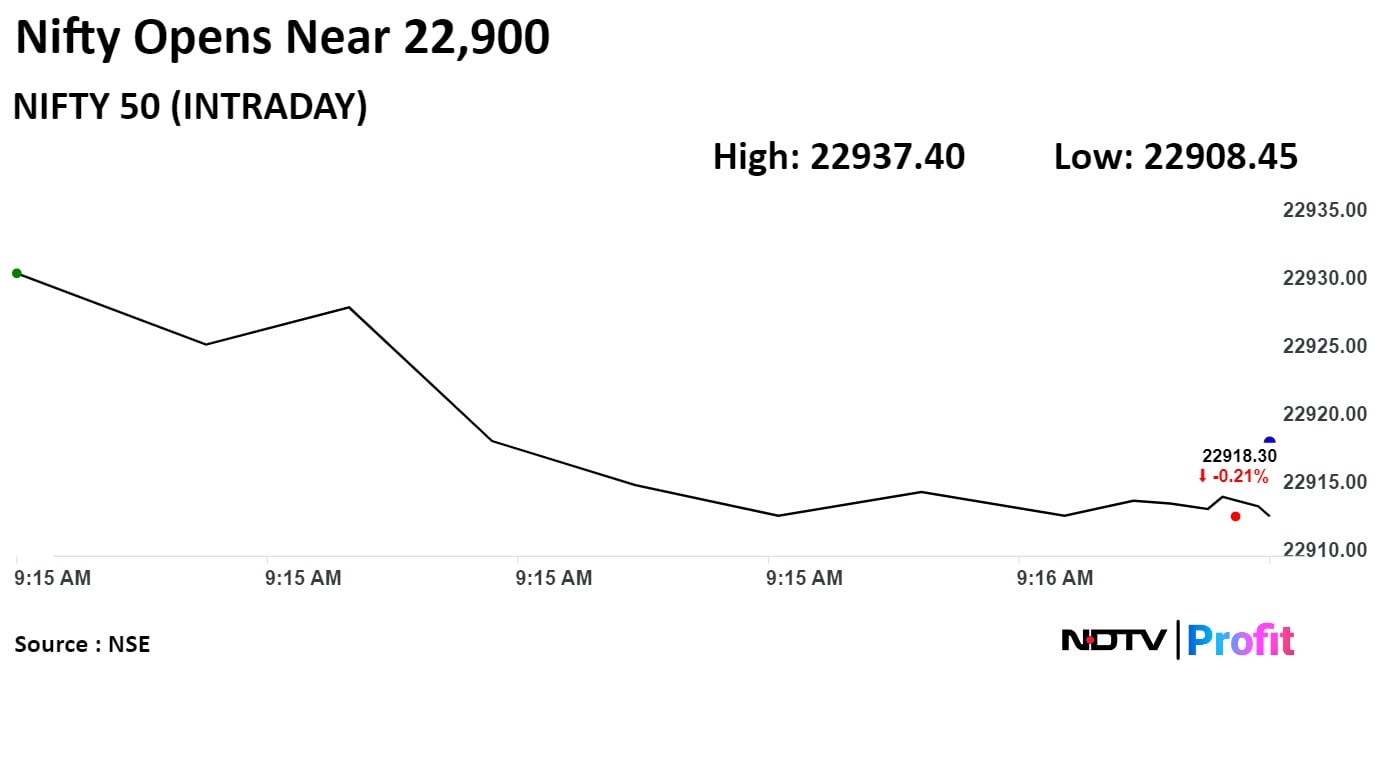

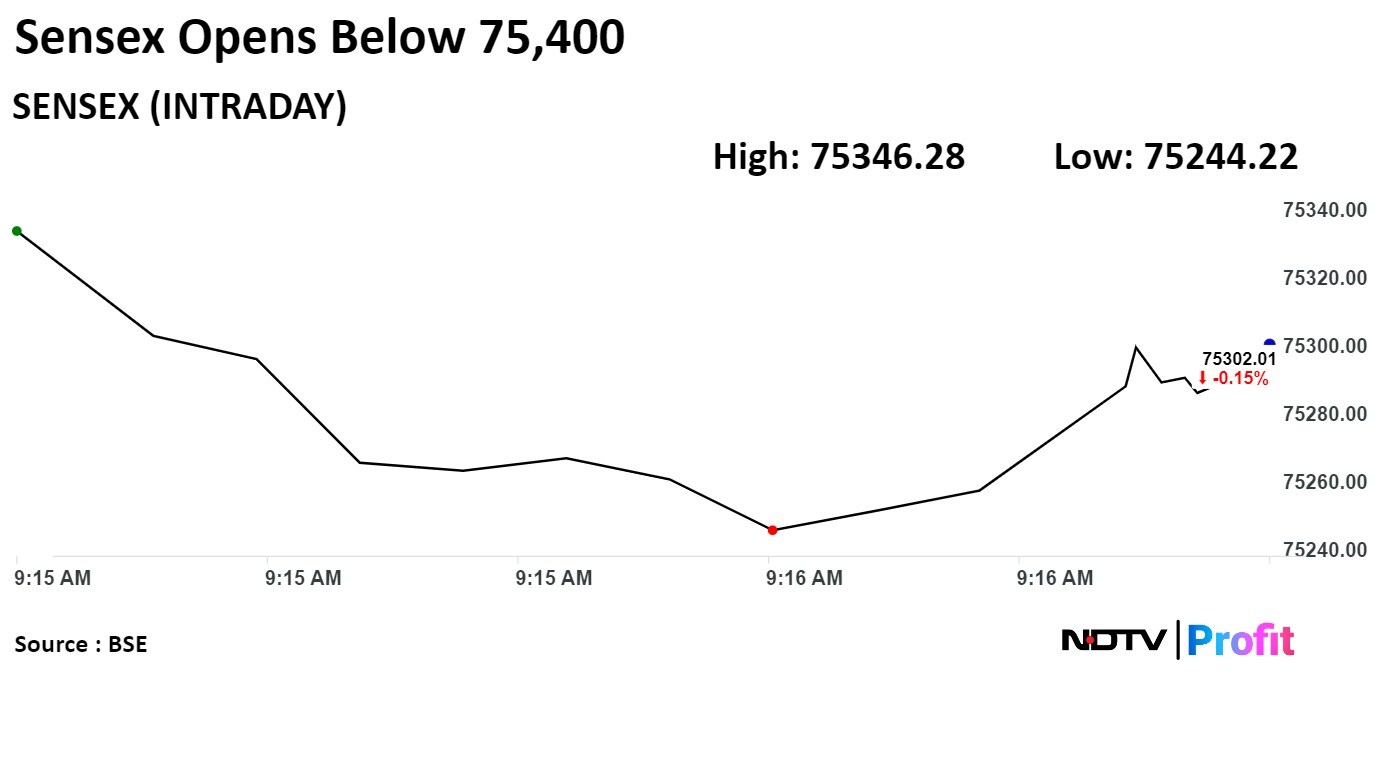

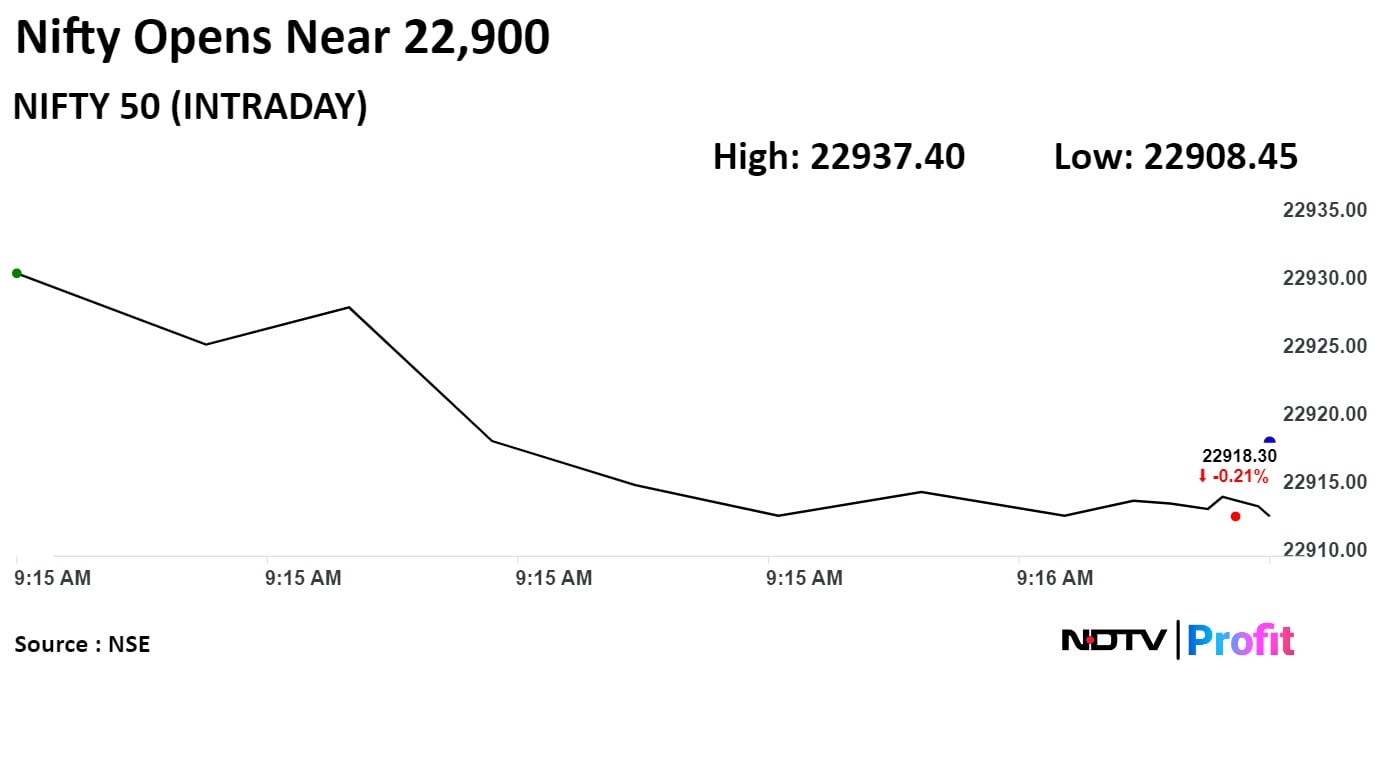

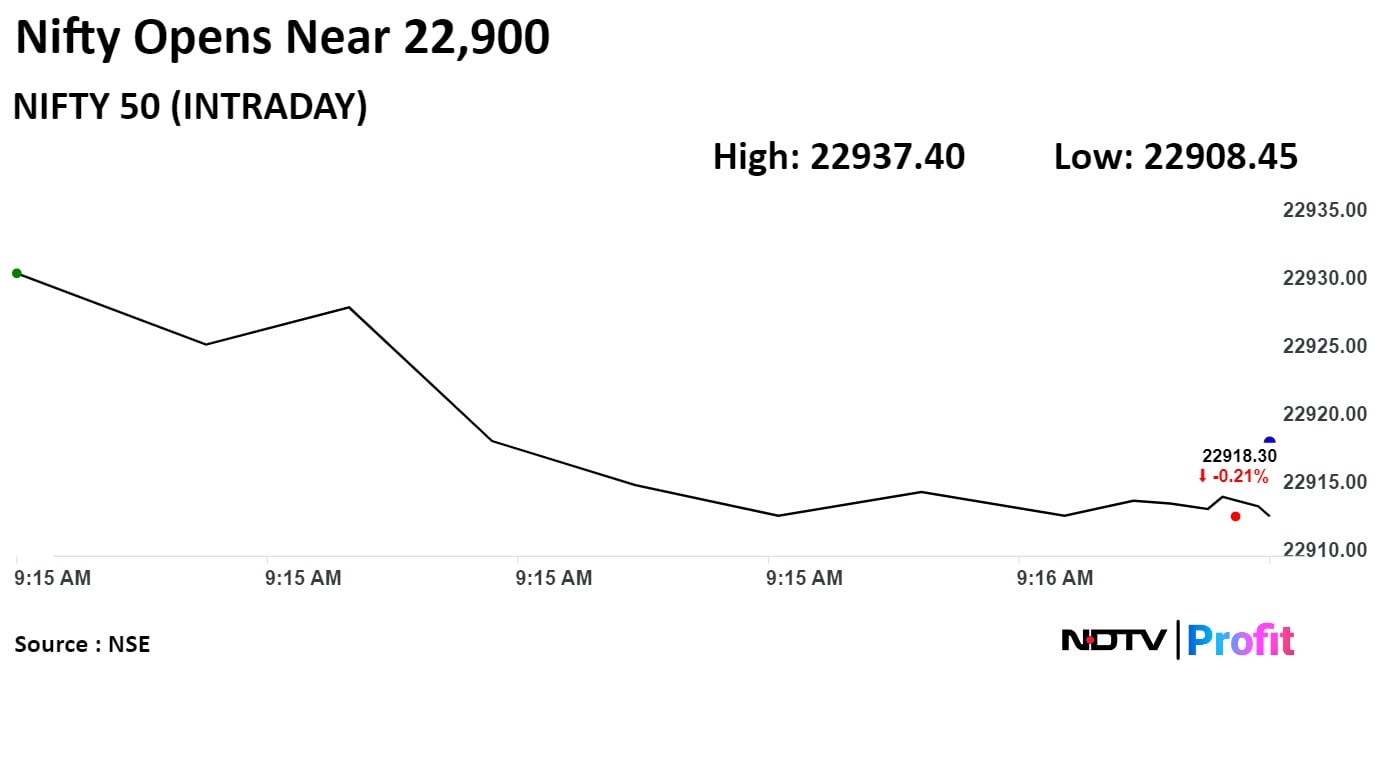

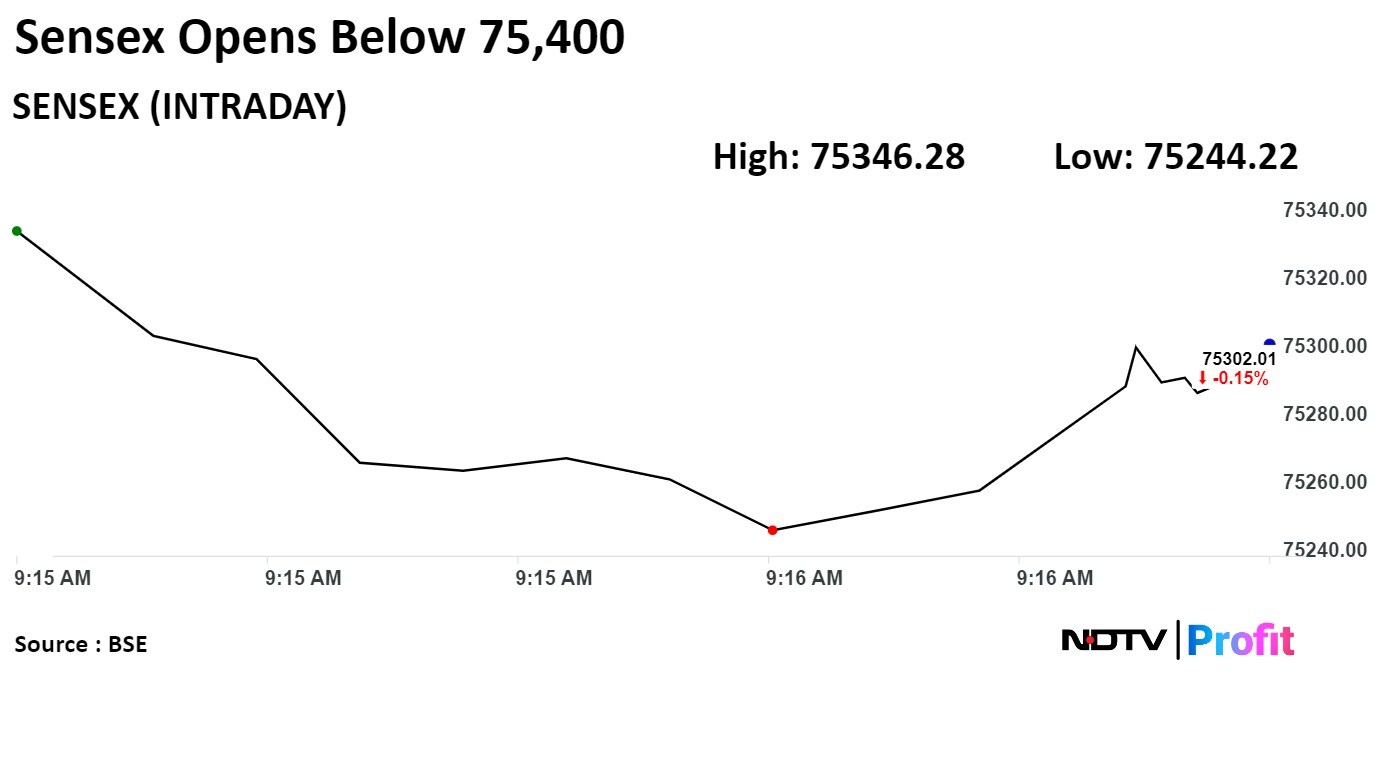

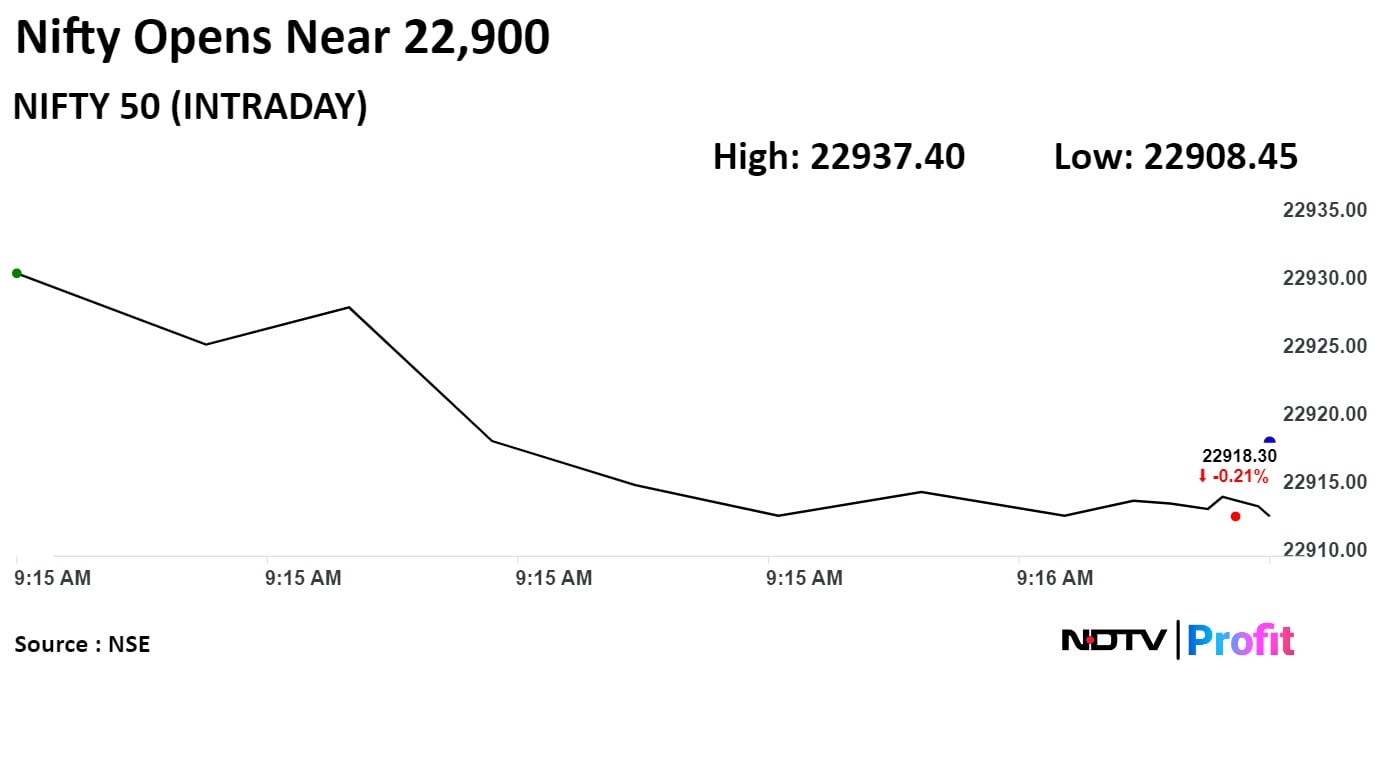

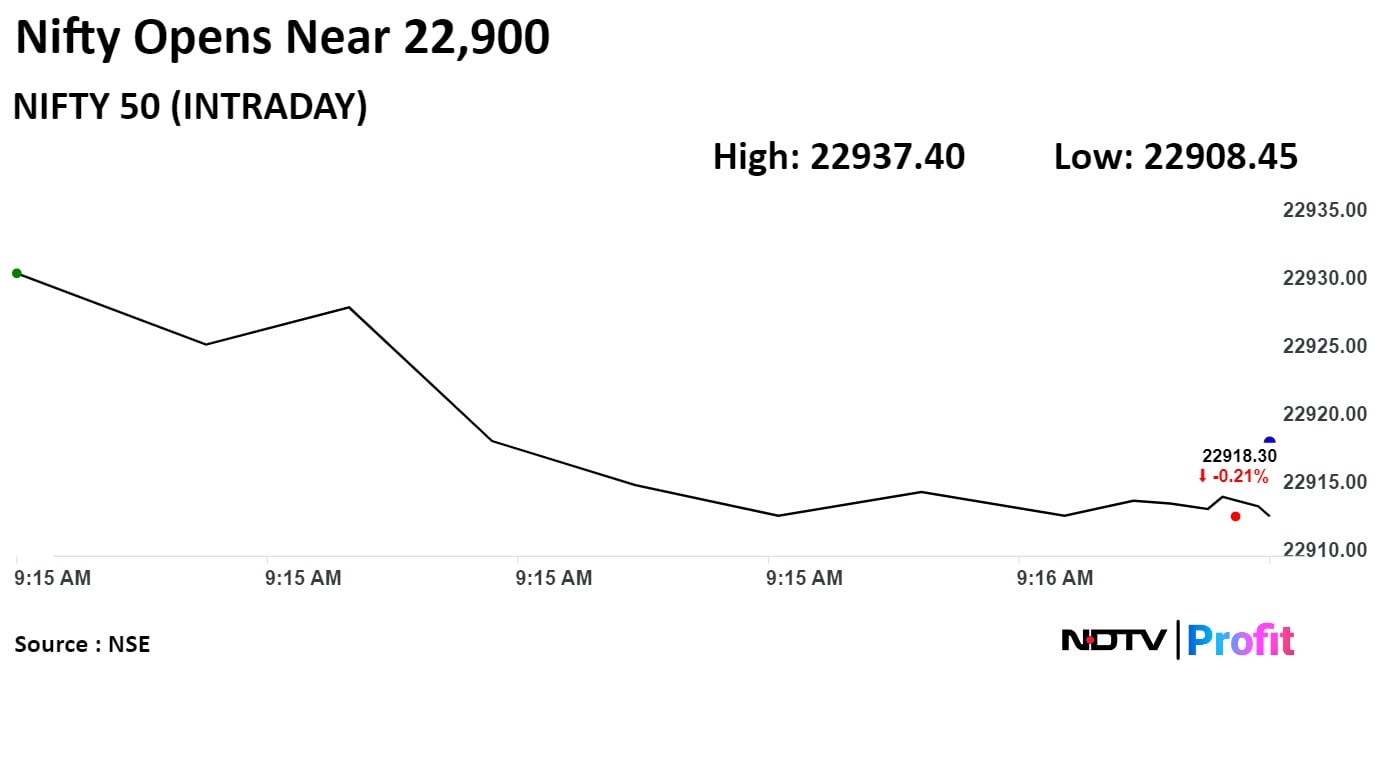

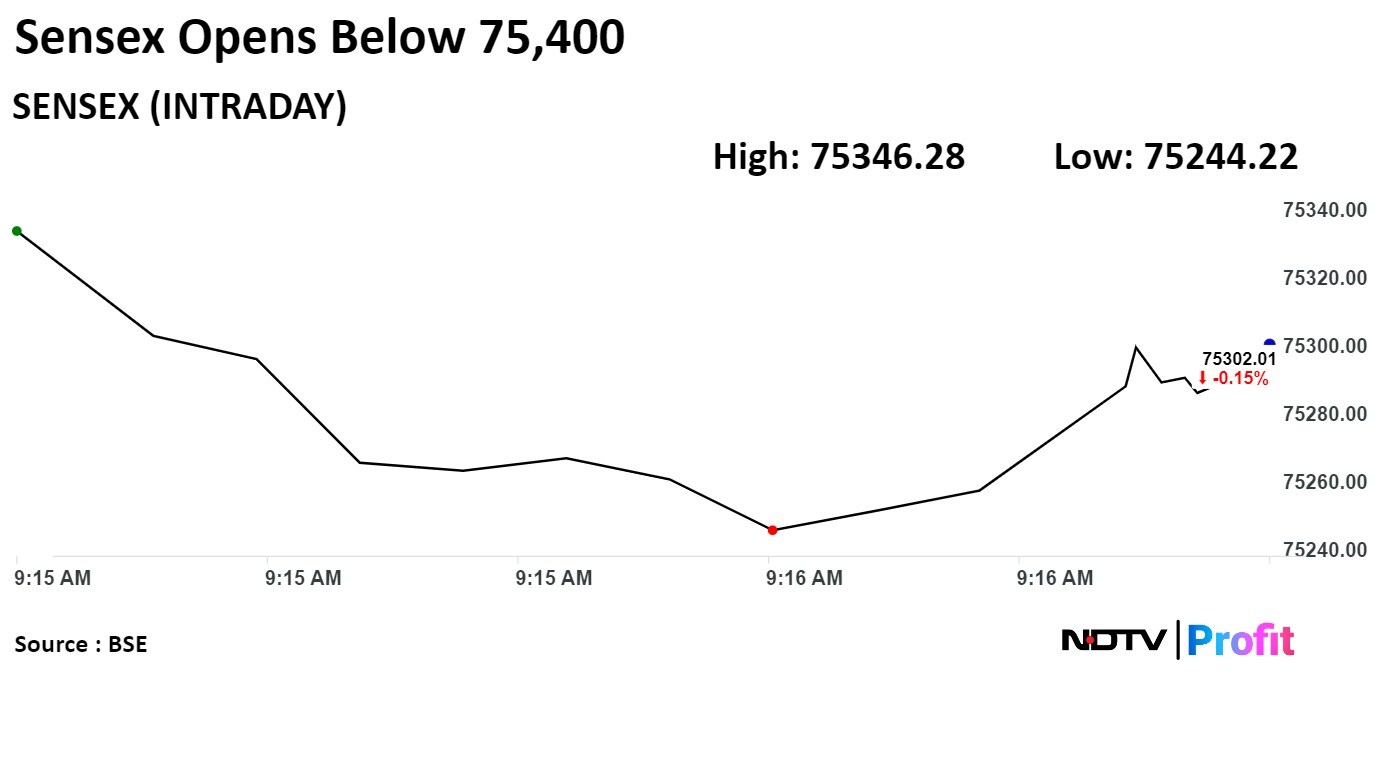

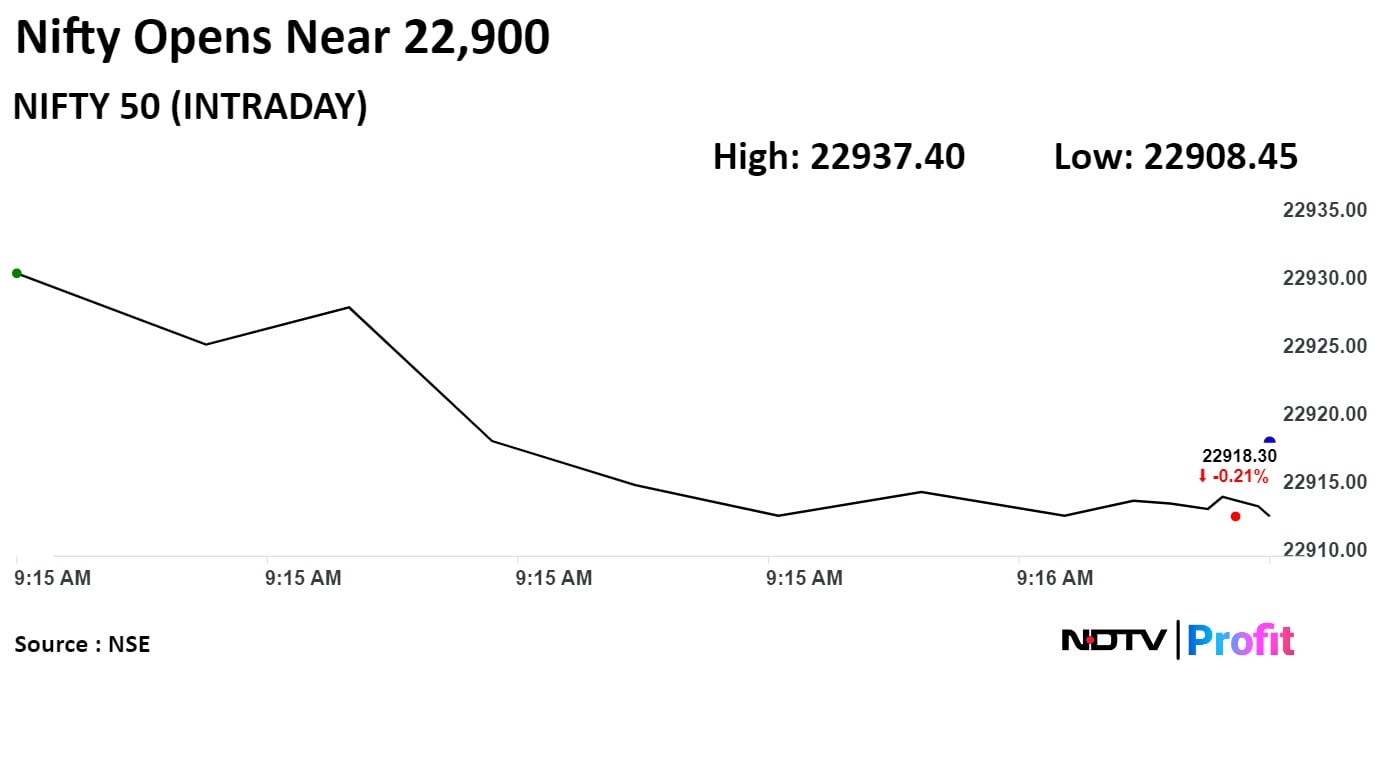

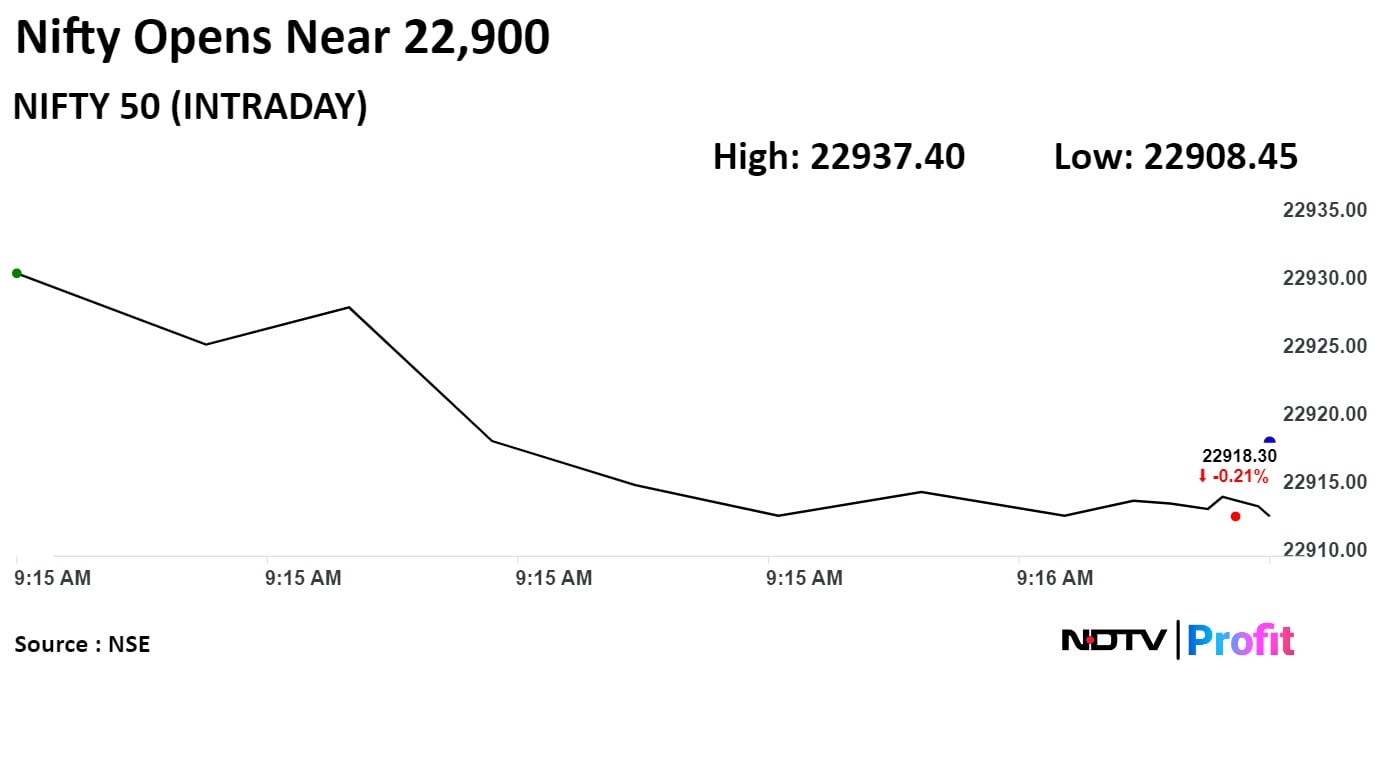

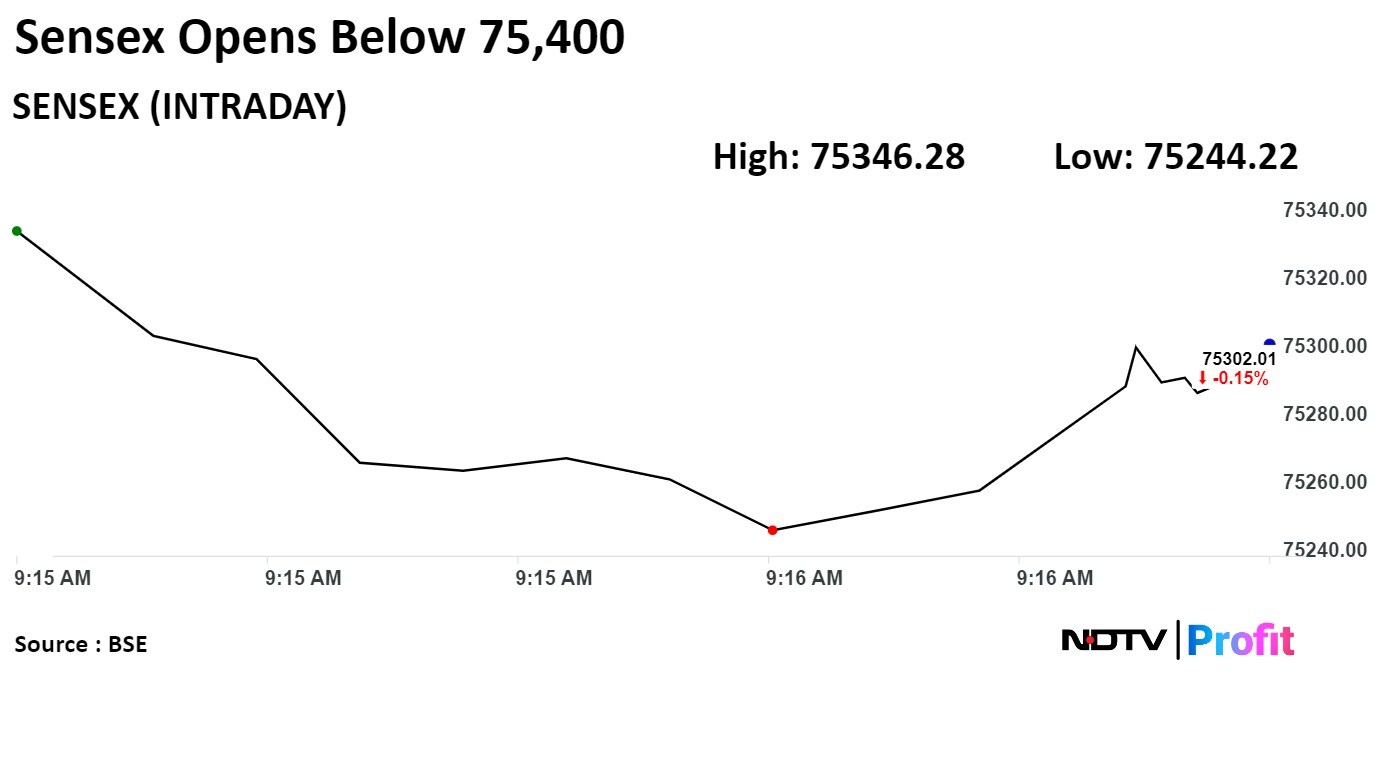

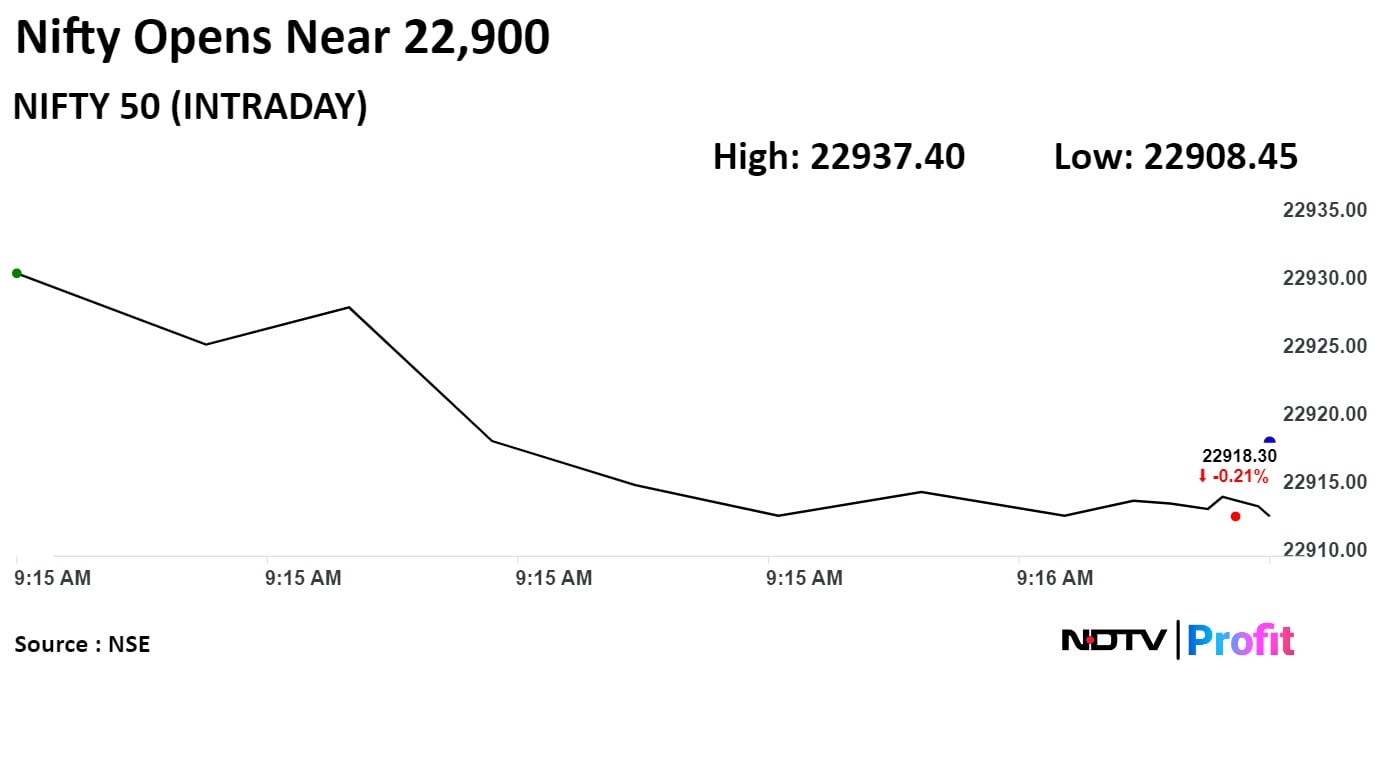

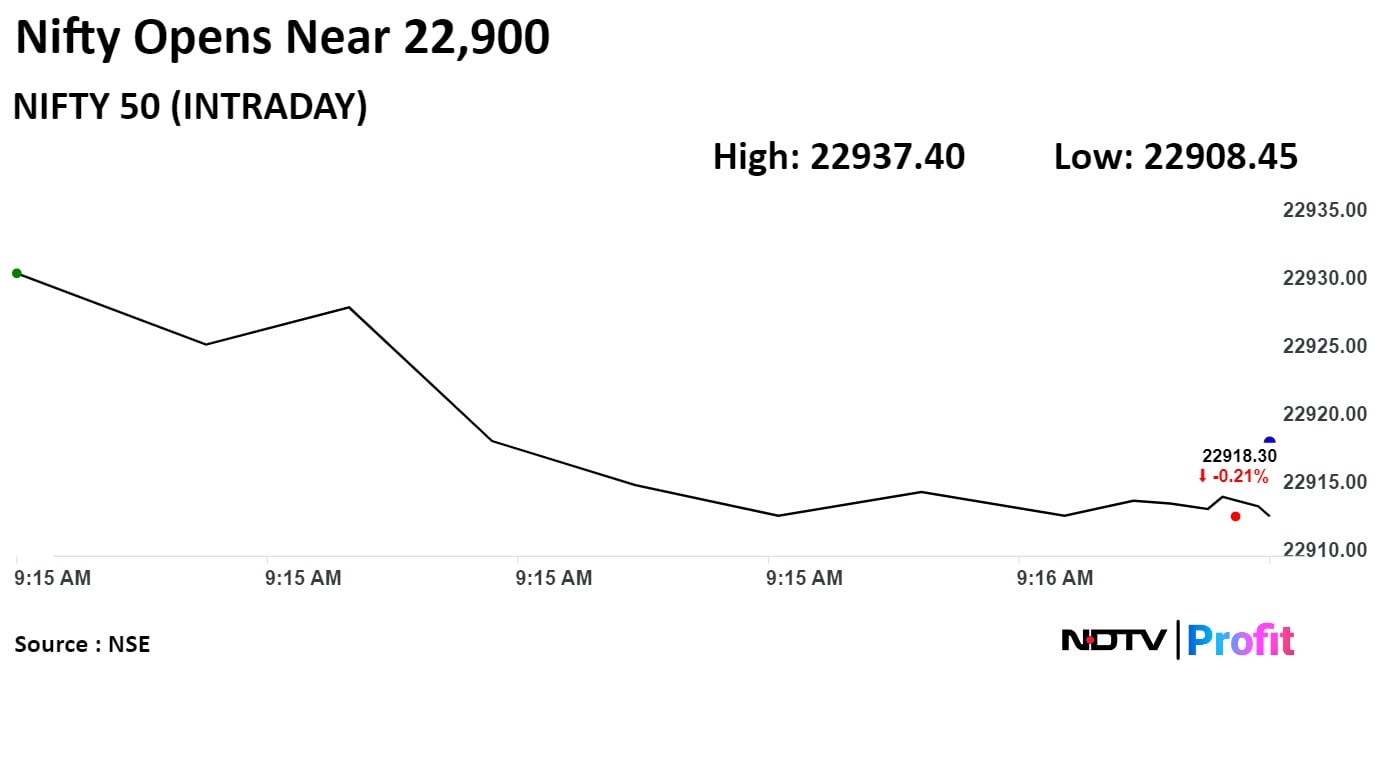

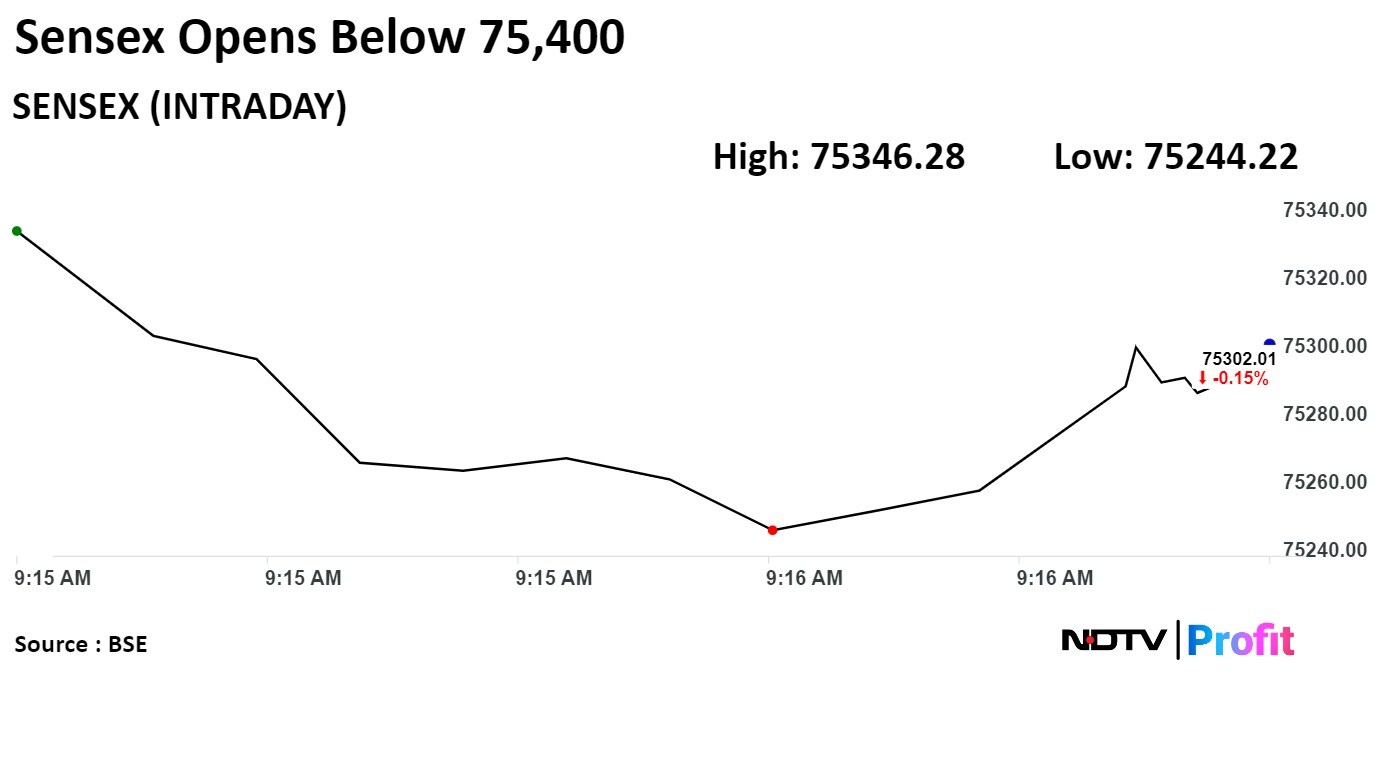

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

.jpeg)

Shares of Tata Consultancy Services Ltd., ICICI Bank Ltd., Infosys Ltd., Mahindra & Mahindra Ltd., and Maruti Suzuki Ltd. weighed on the Nifty.

While those of Axis Bank Ltd., Larsen & Toubro Ltd., State Bank Of India, Bharti Airtel Ltd., and NTPC minimised the losses.

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.

At pre-open, the Nifty was at 22,930.75, up 36.90 points or 0.16% while the Sensex fell to 75,335.4, down by 82.59 points or 0.11%.

"Considering yesterday's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support," said Aditya Gaggar, director of Progressive Shares.

Prabhudas Lilladher, in a report said, "The support for the day is seen at 75000/22800 levels, while the resistance is seen at 76000/23200 levels."

Benchmark equity indices opened lower after Thursday's record rally as losses in the shares of ICICI Bank, Tata Consultancy Services, and Reliance Industries weighed on them.