-The local currency weakened by 15 paise to close at 83.46 against the US dollar.

-It closed at 83.31 on Thursday.

Source: Bloomberg

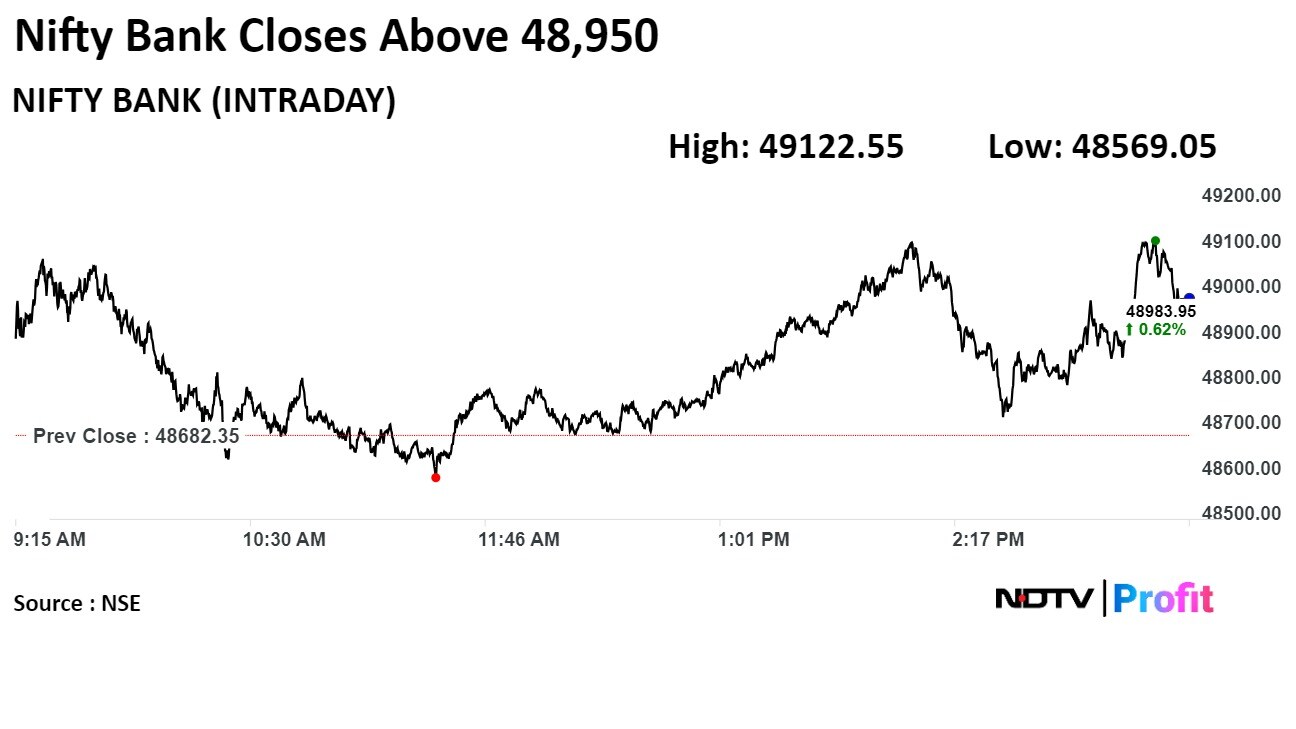

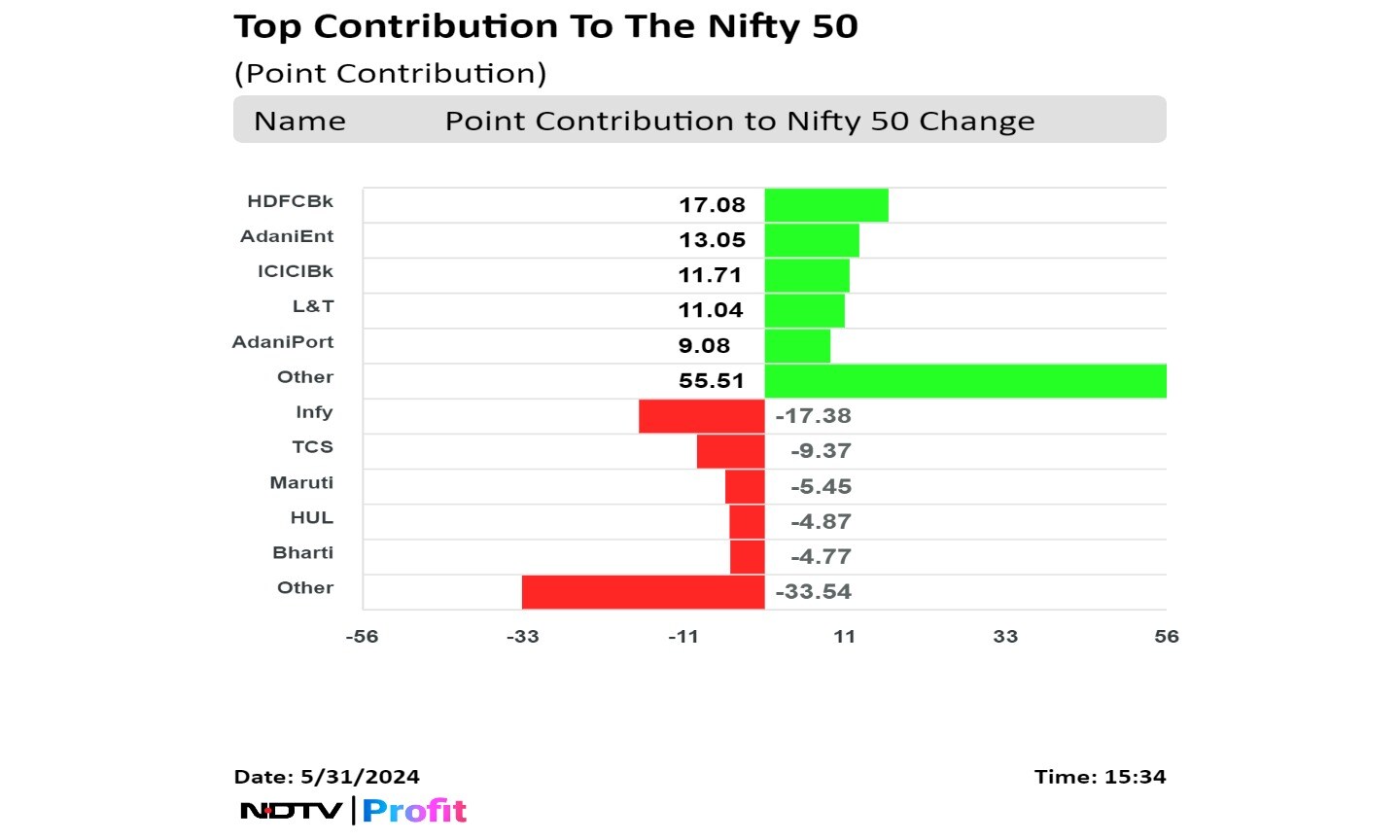

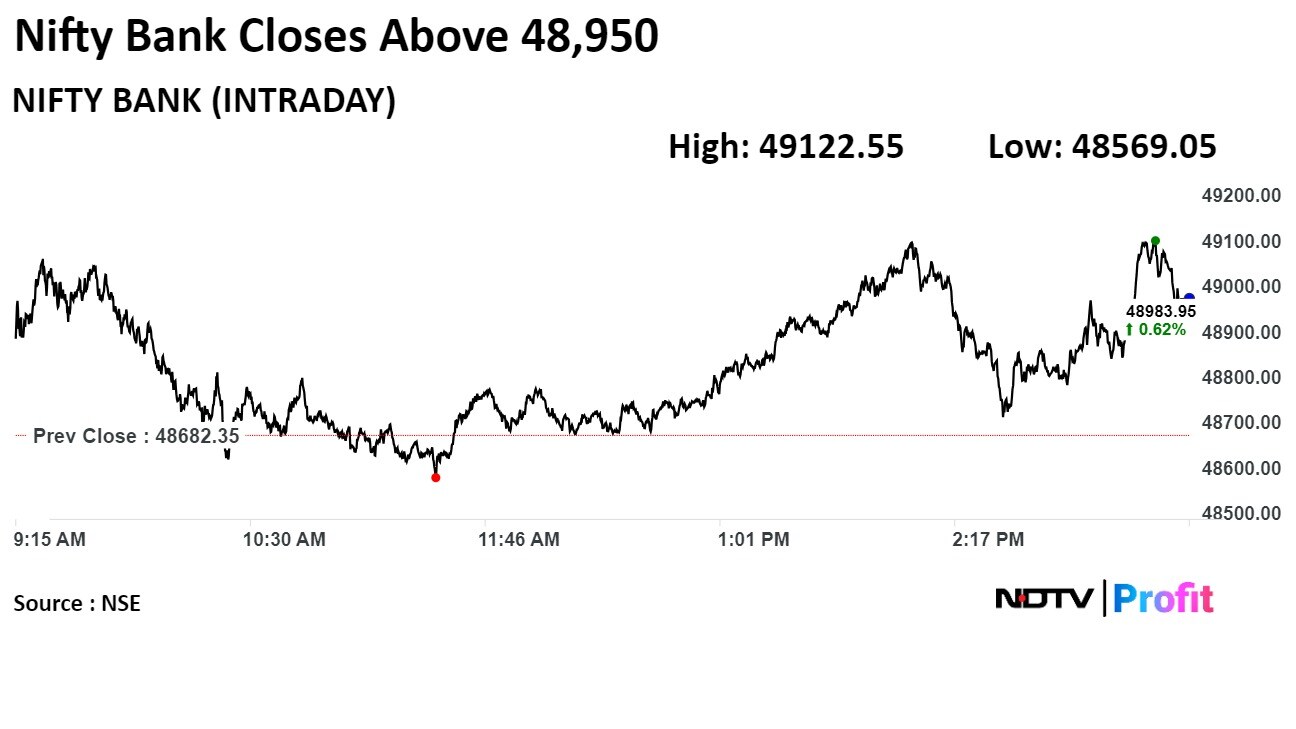

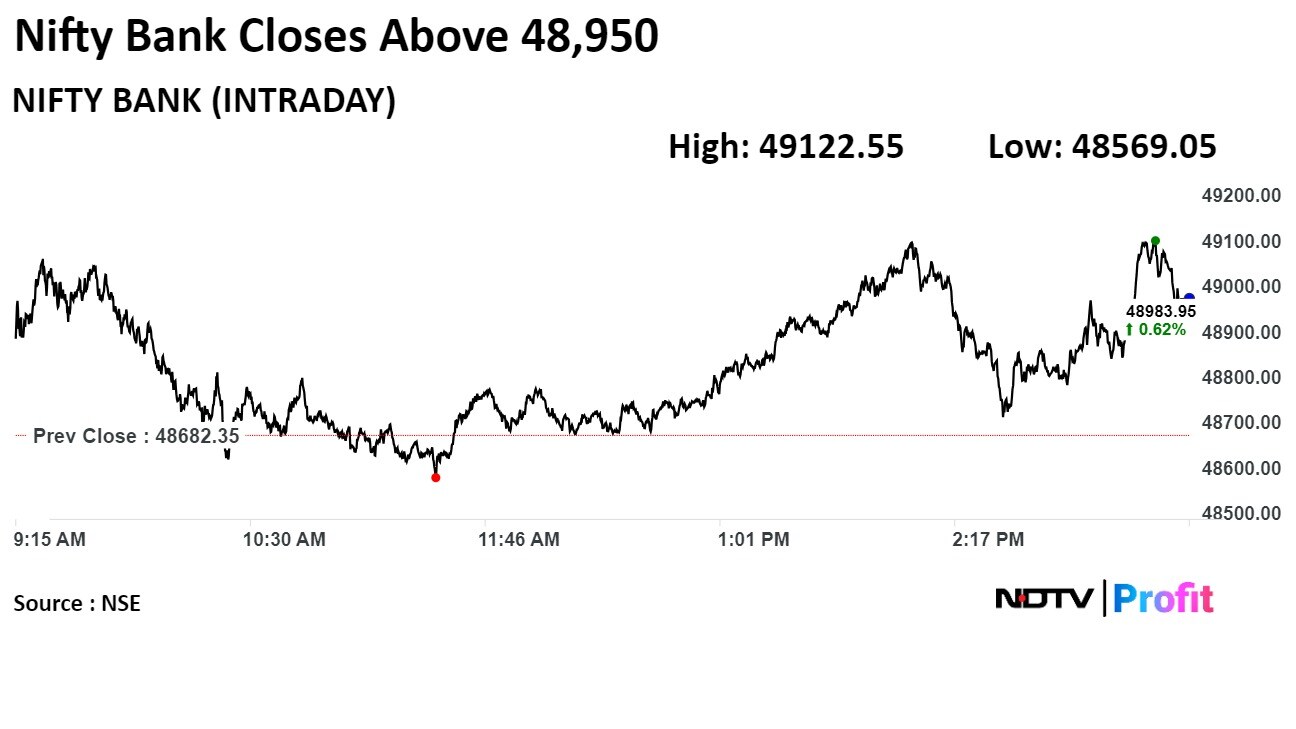

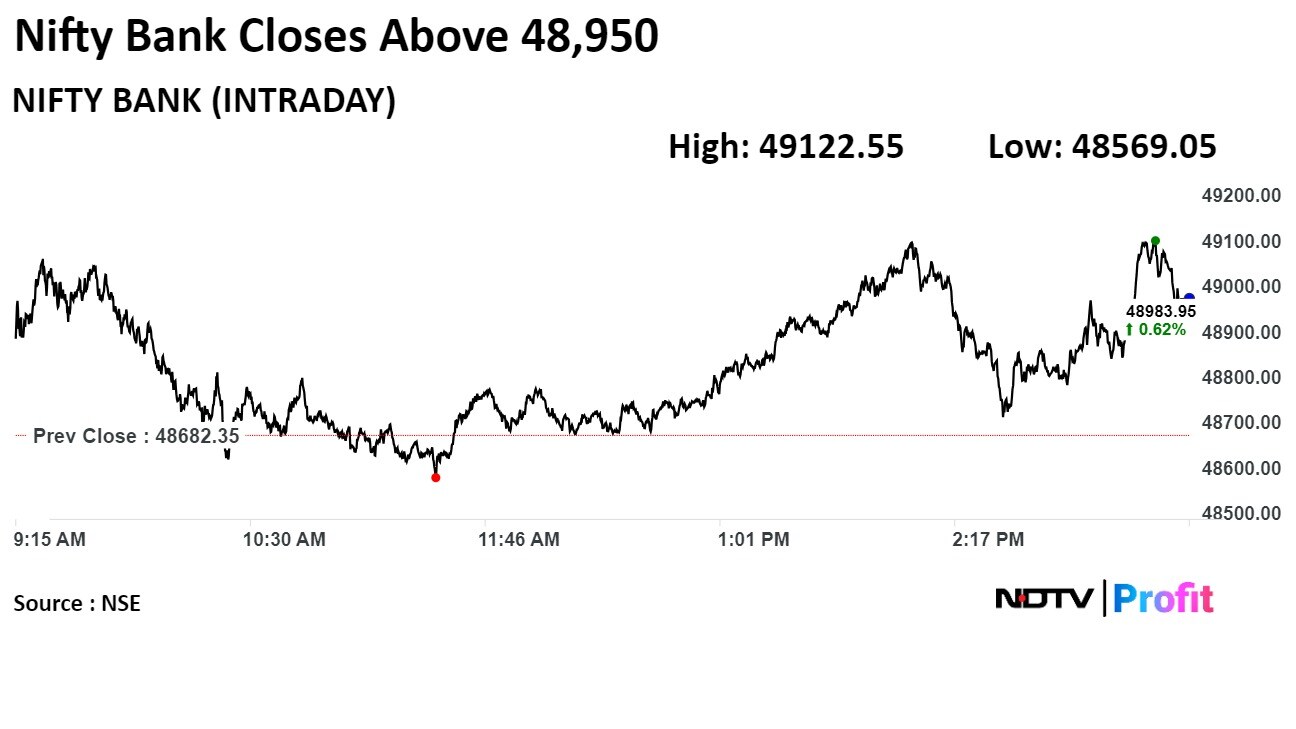

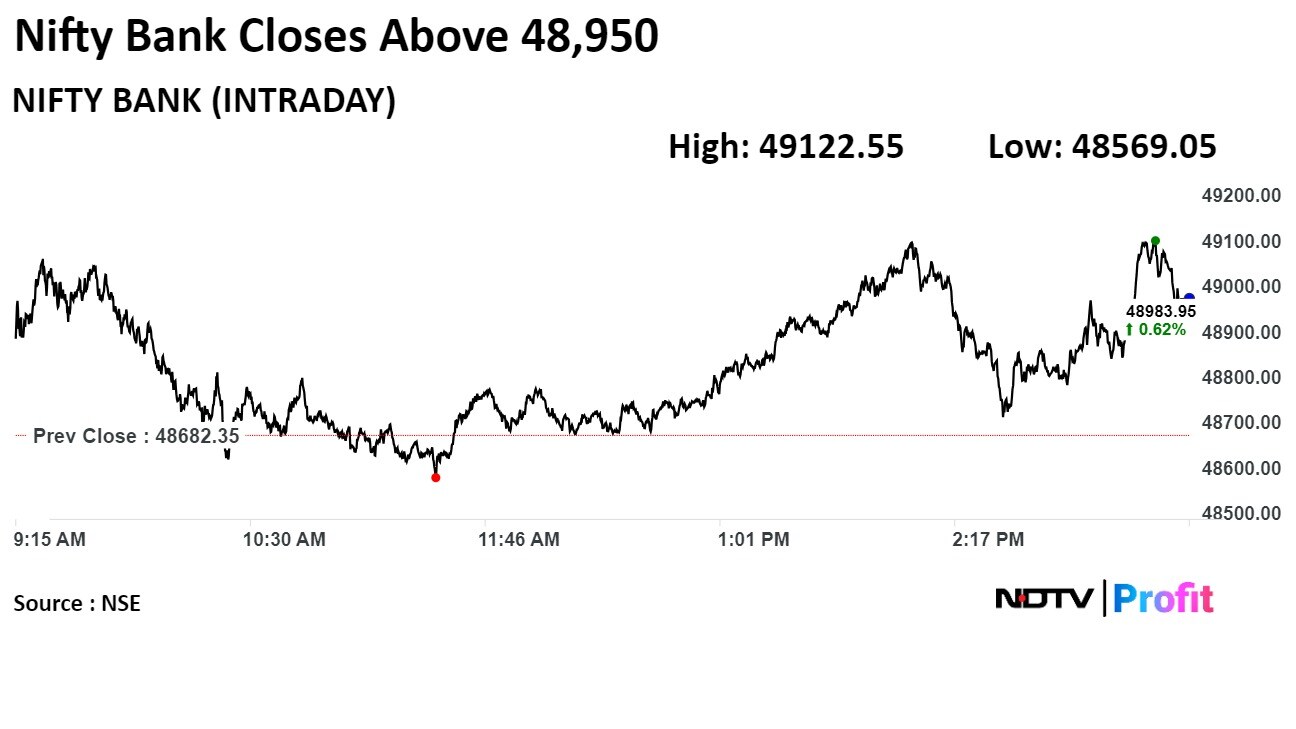

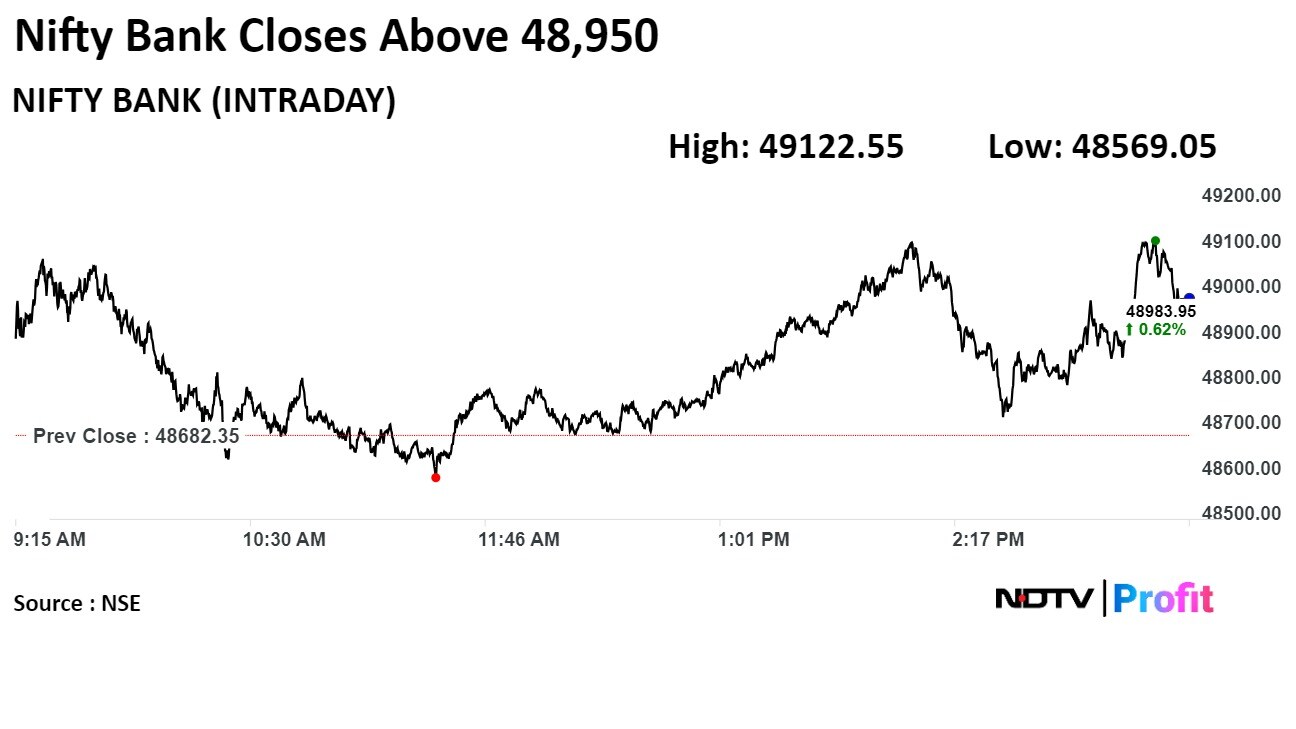

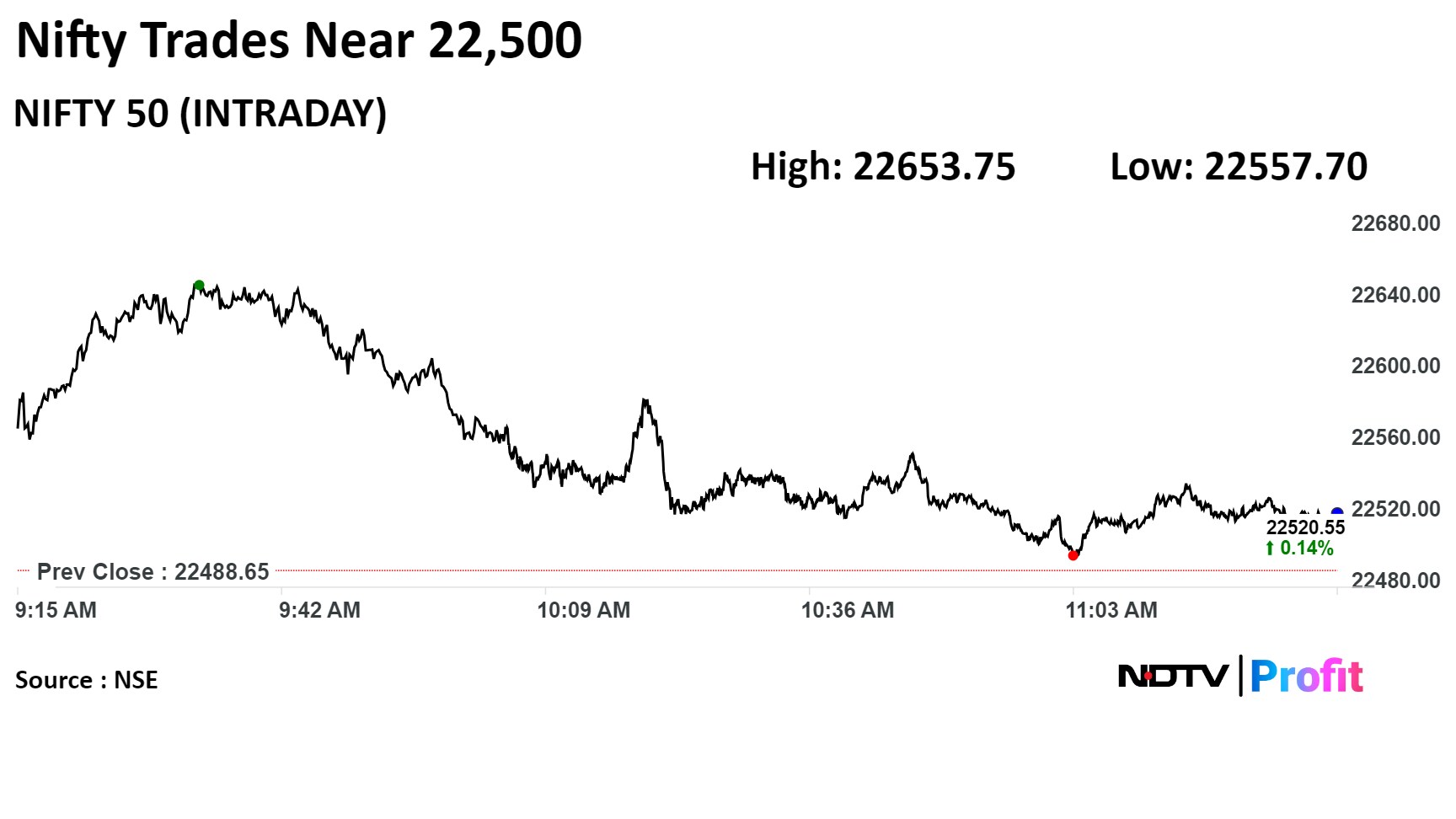

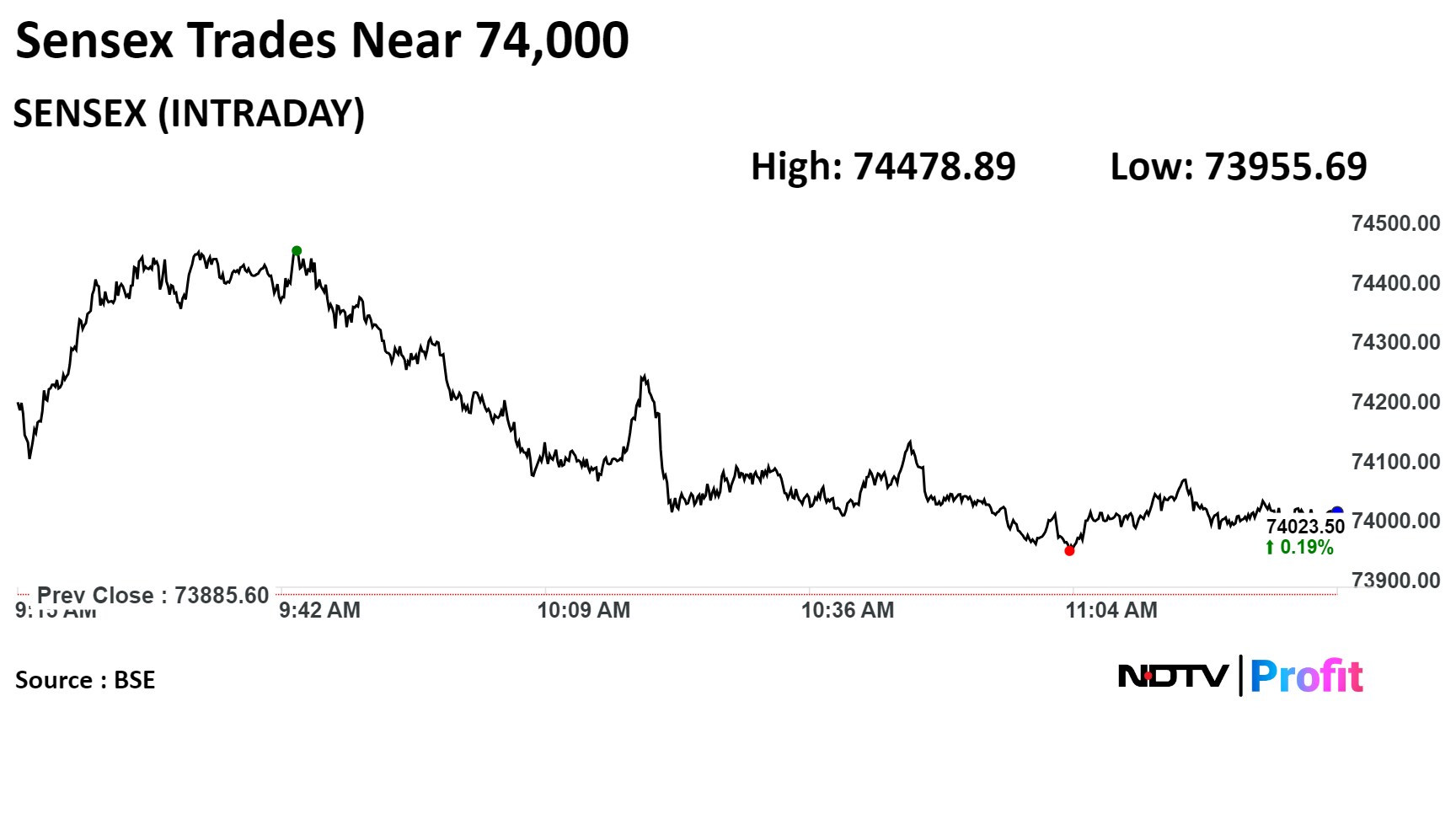

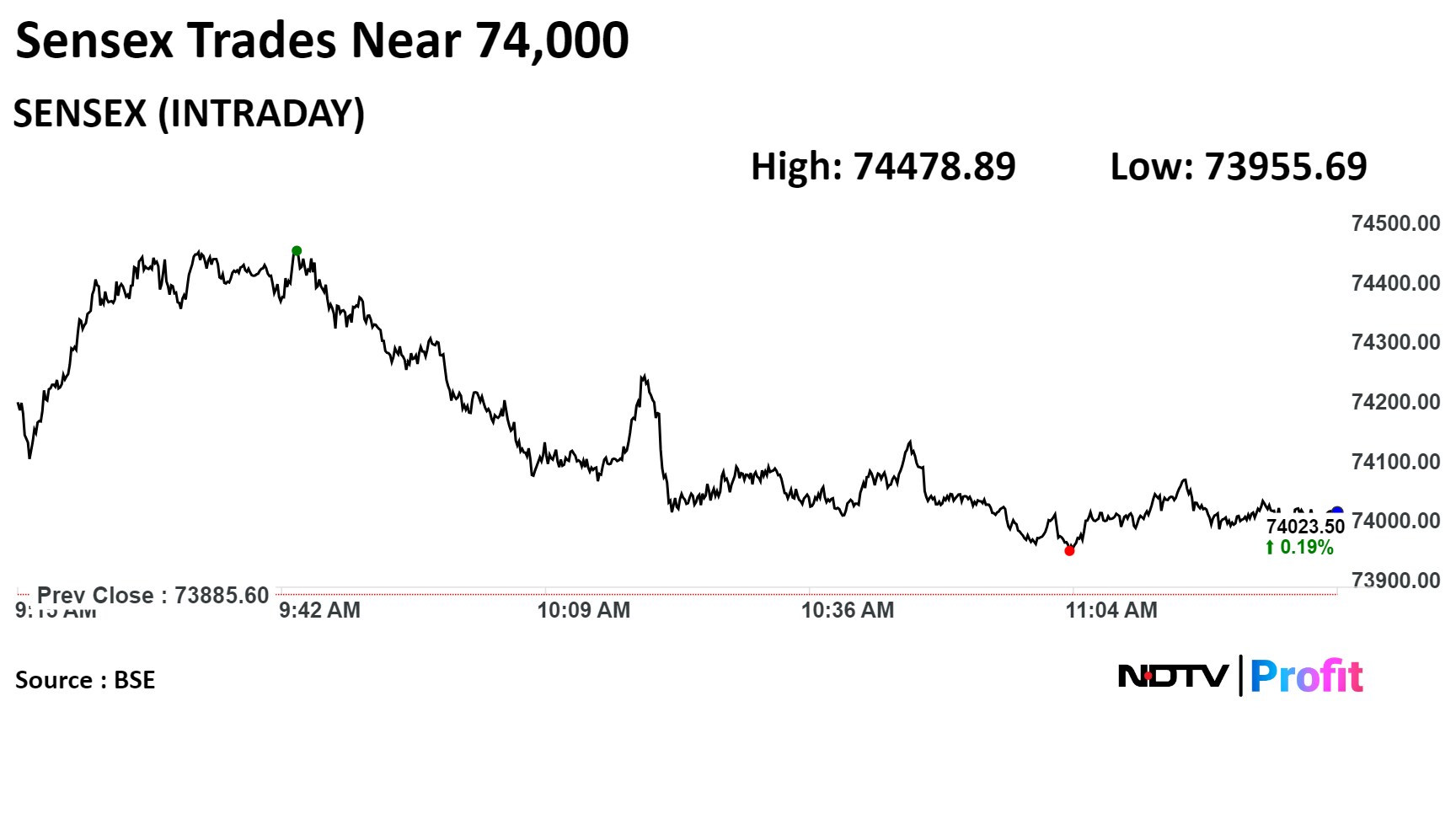

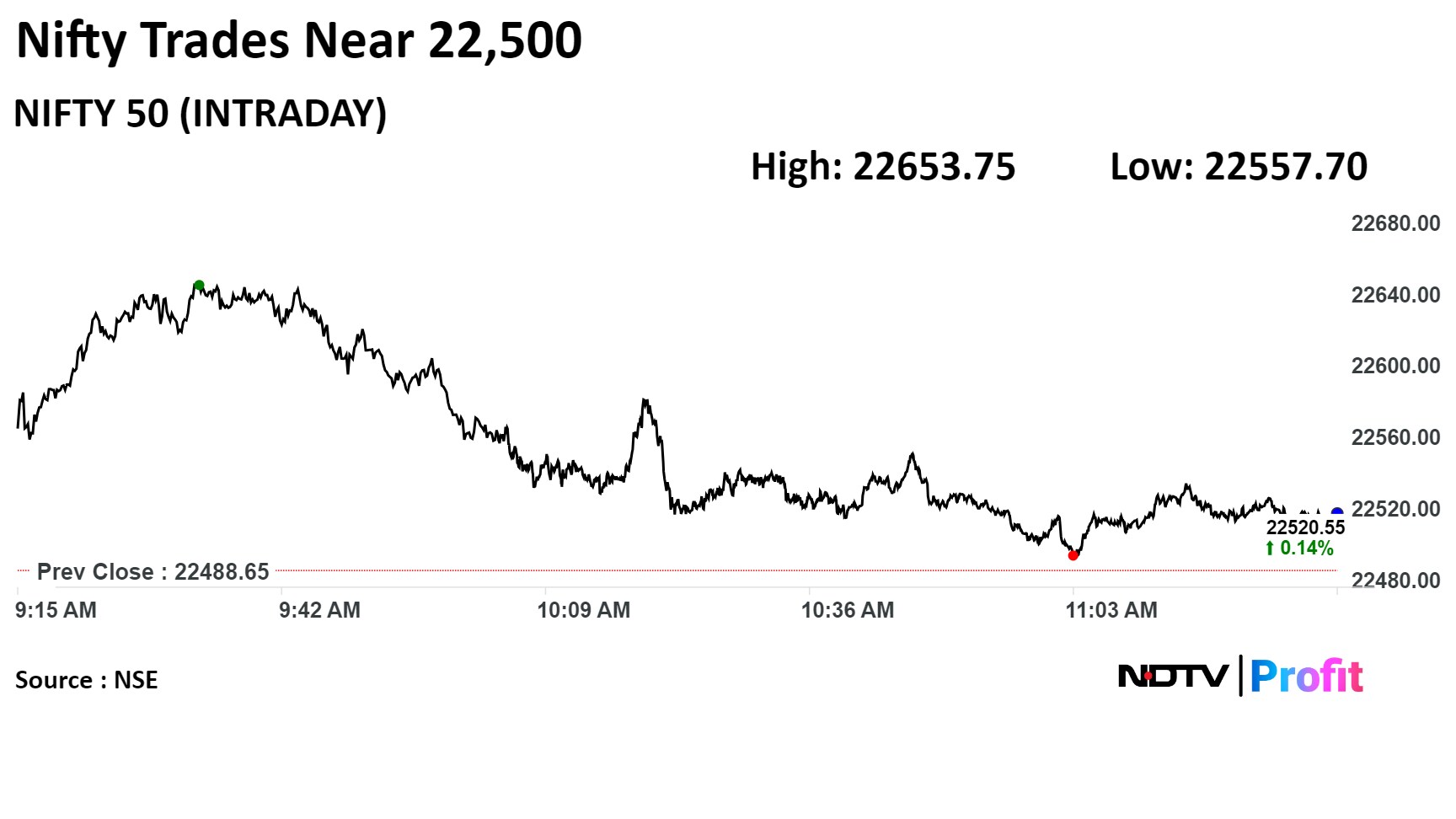

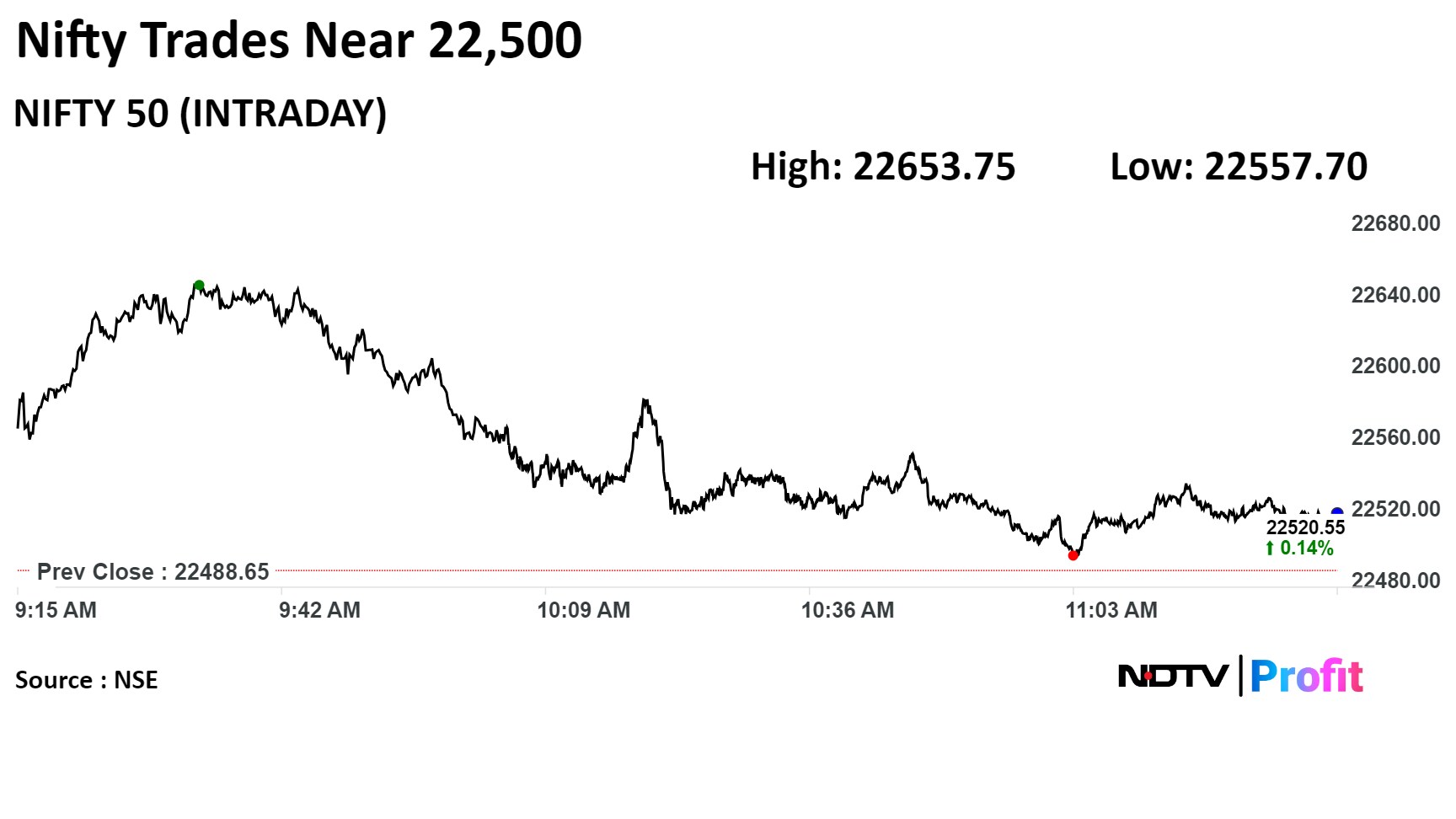

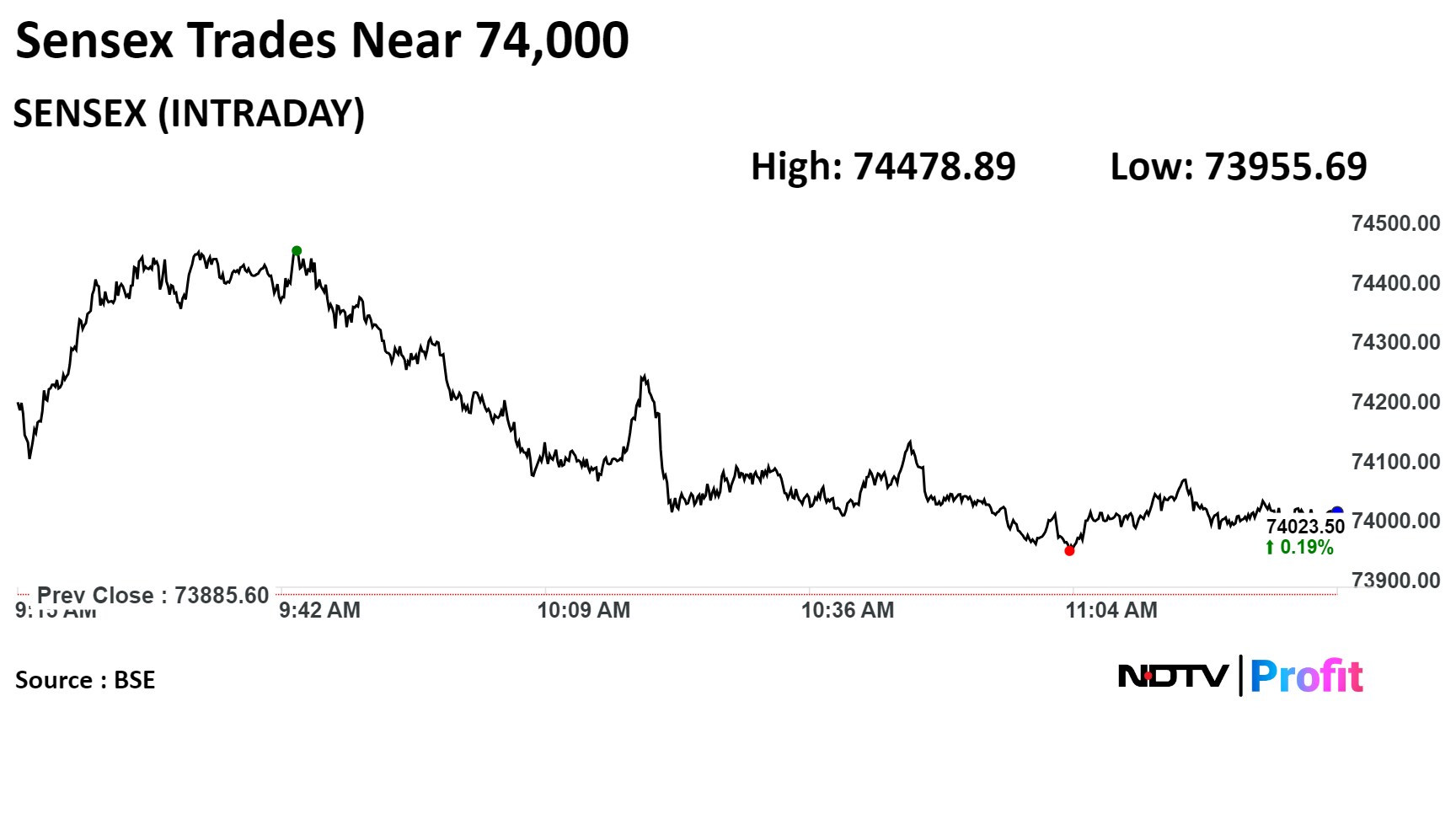

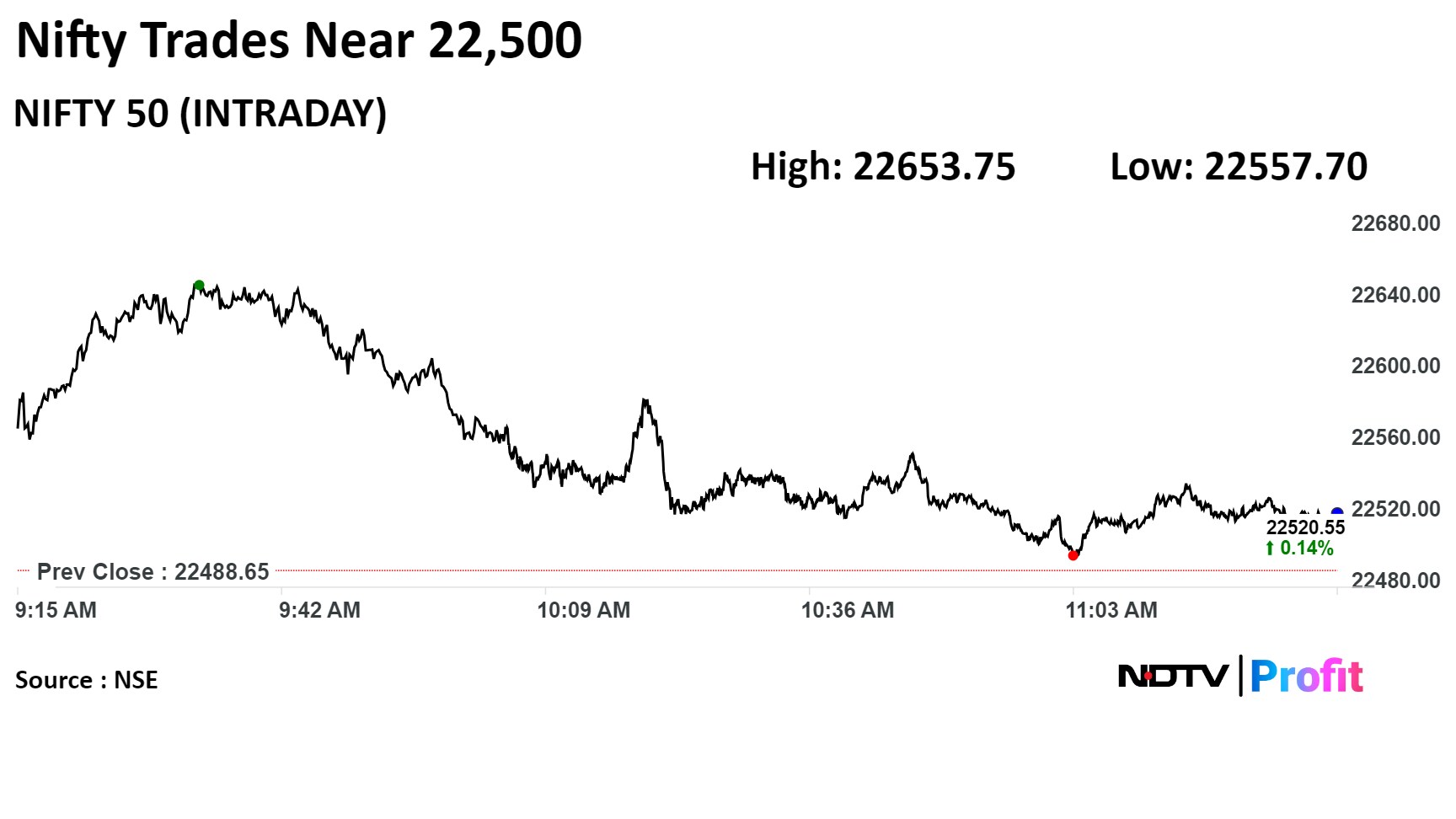

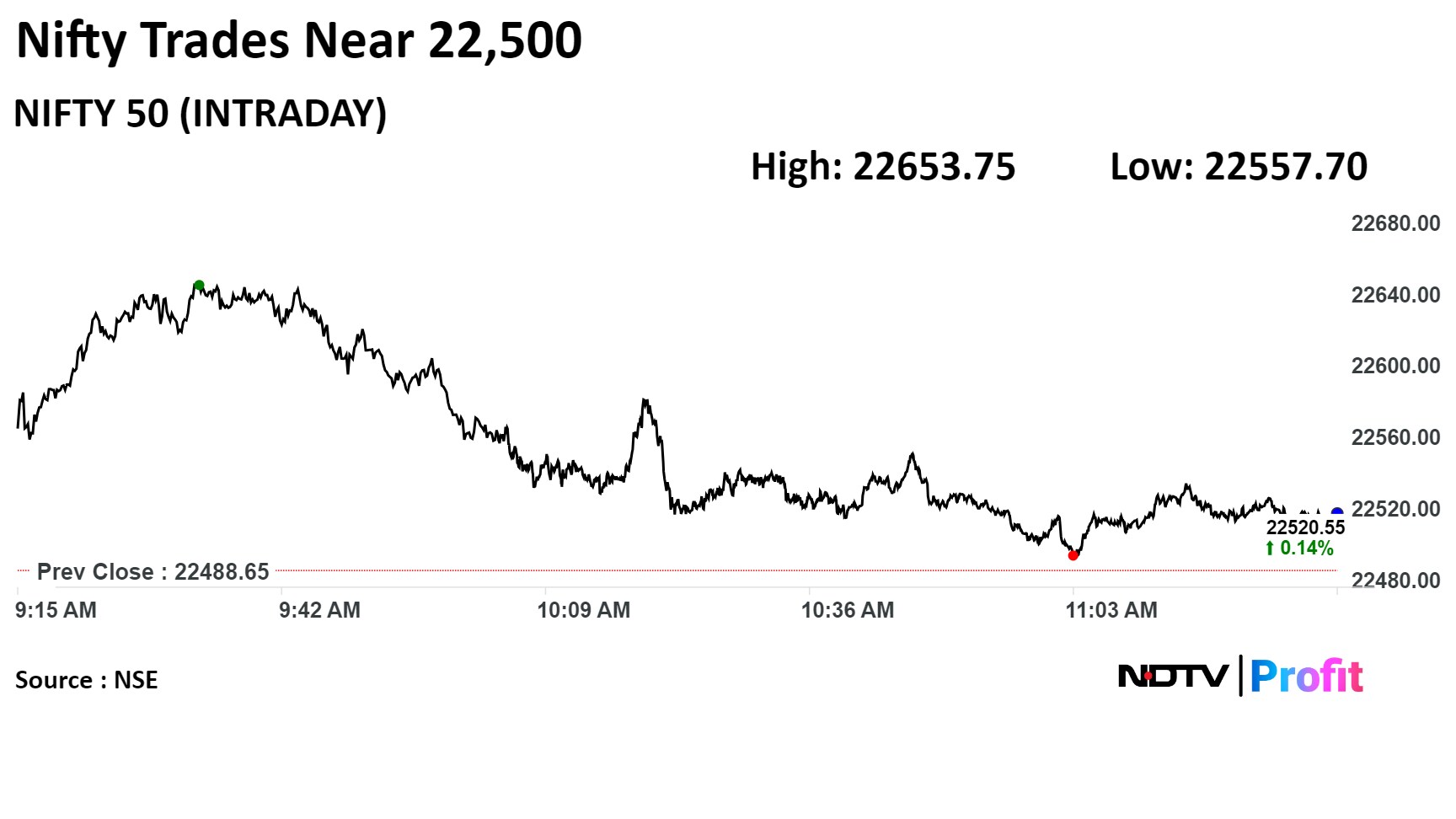

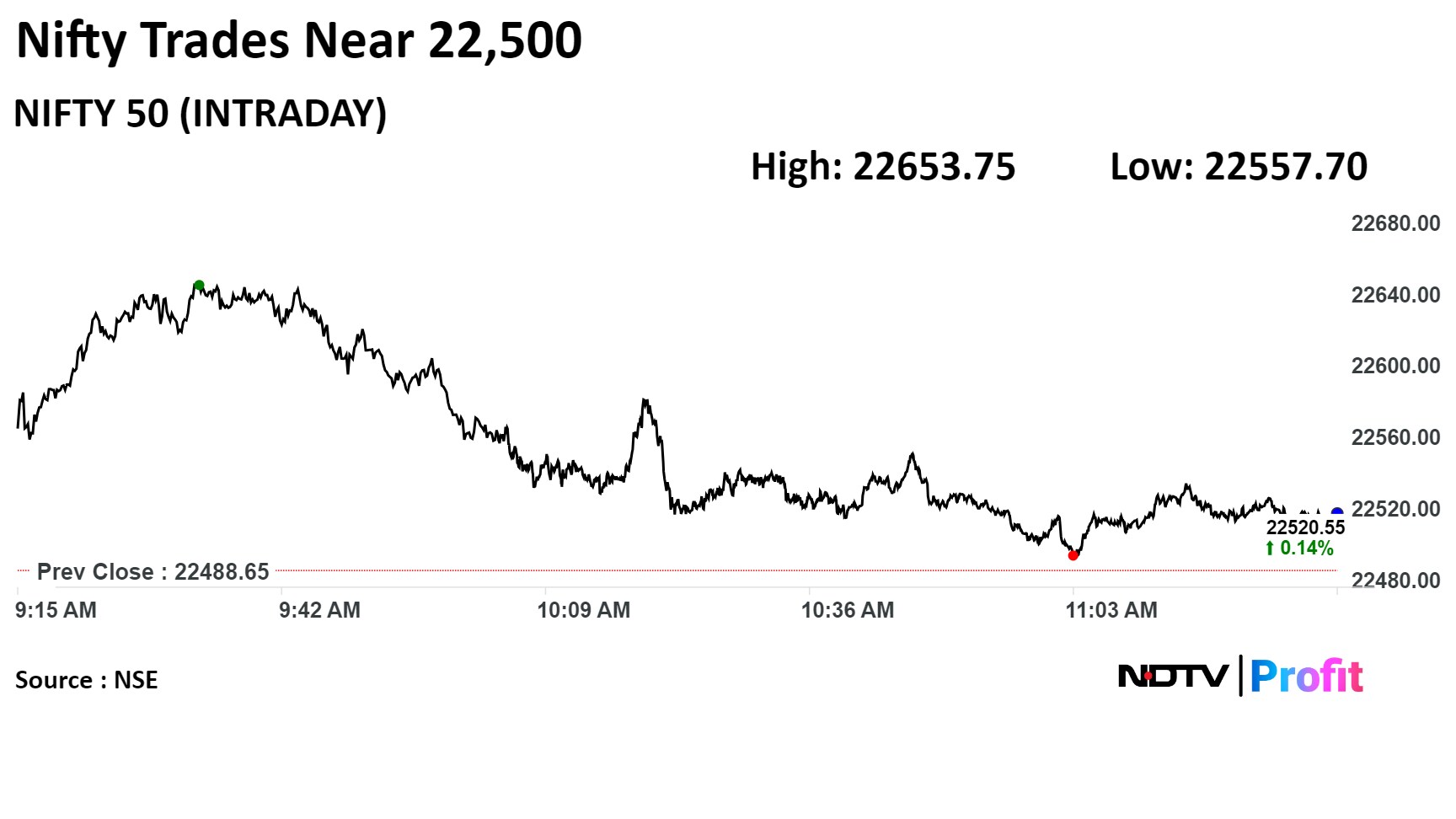

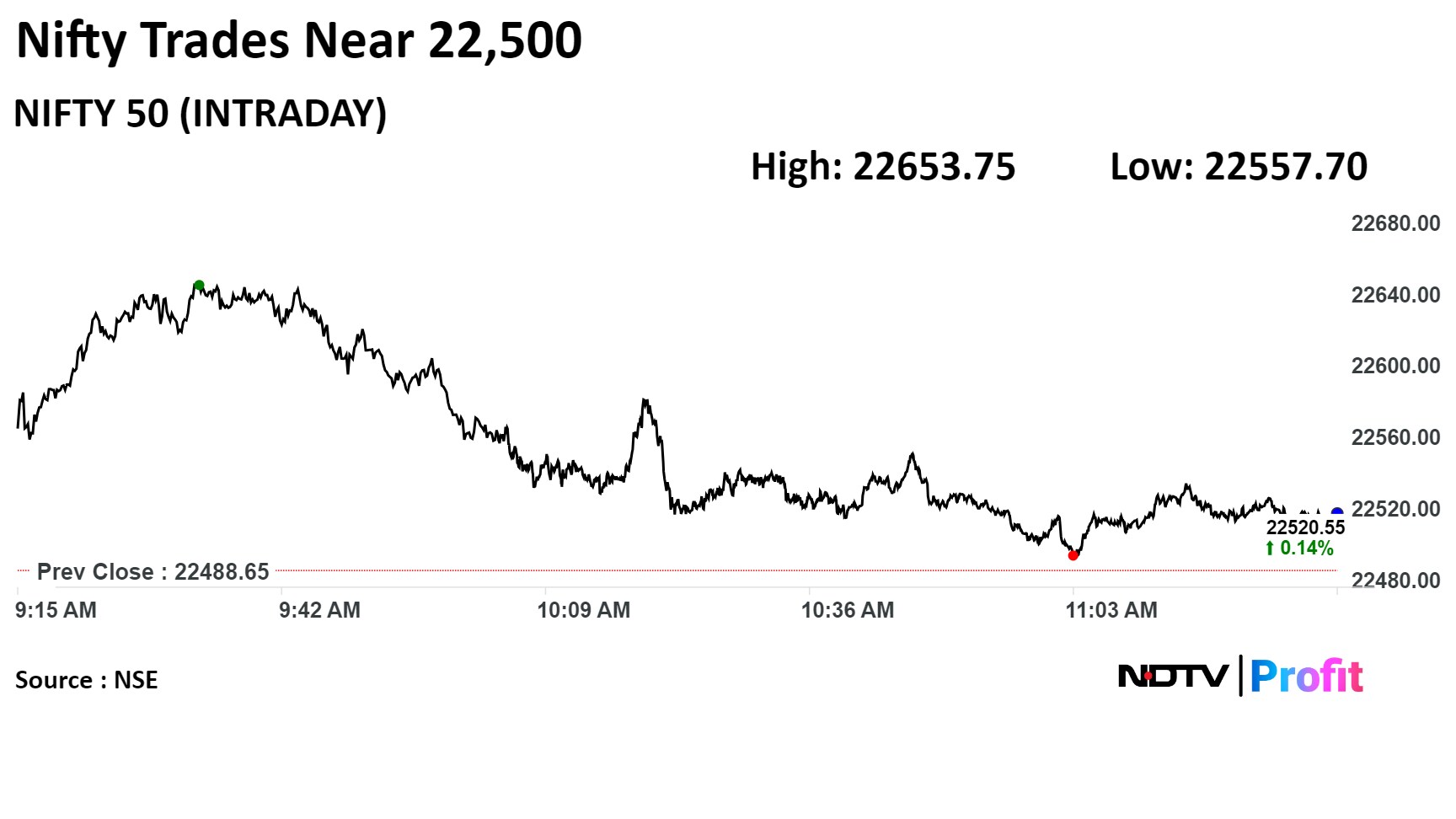

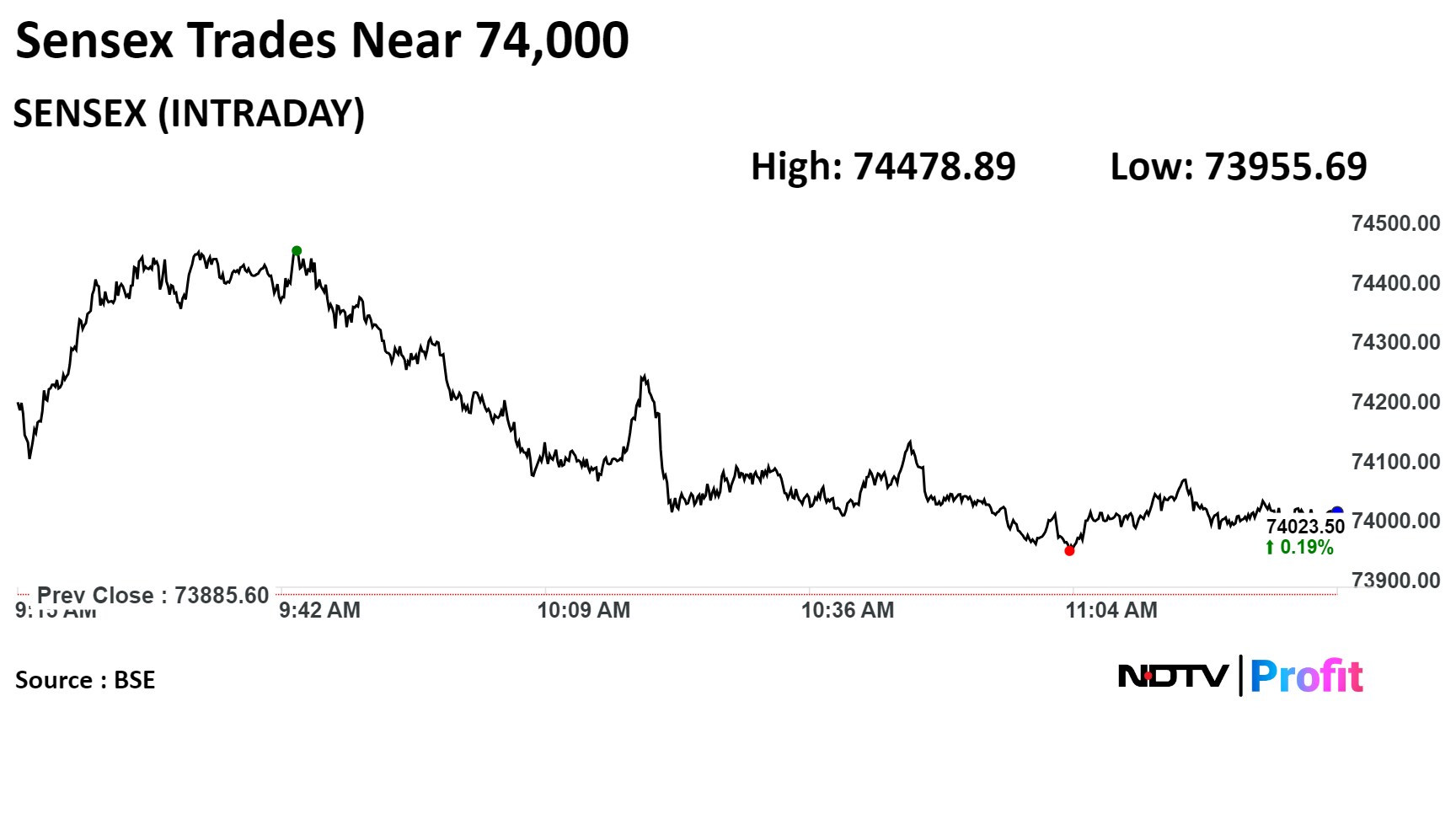

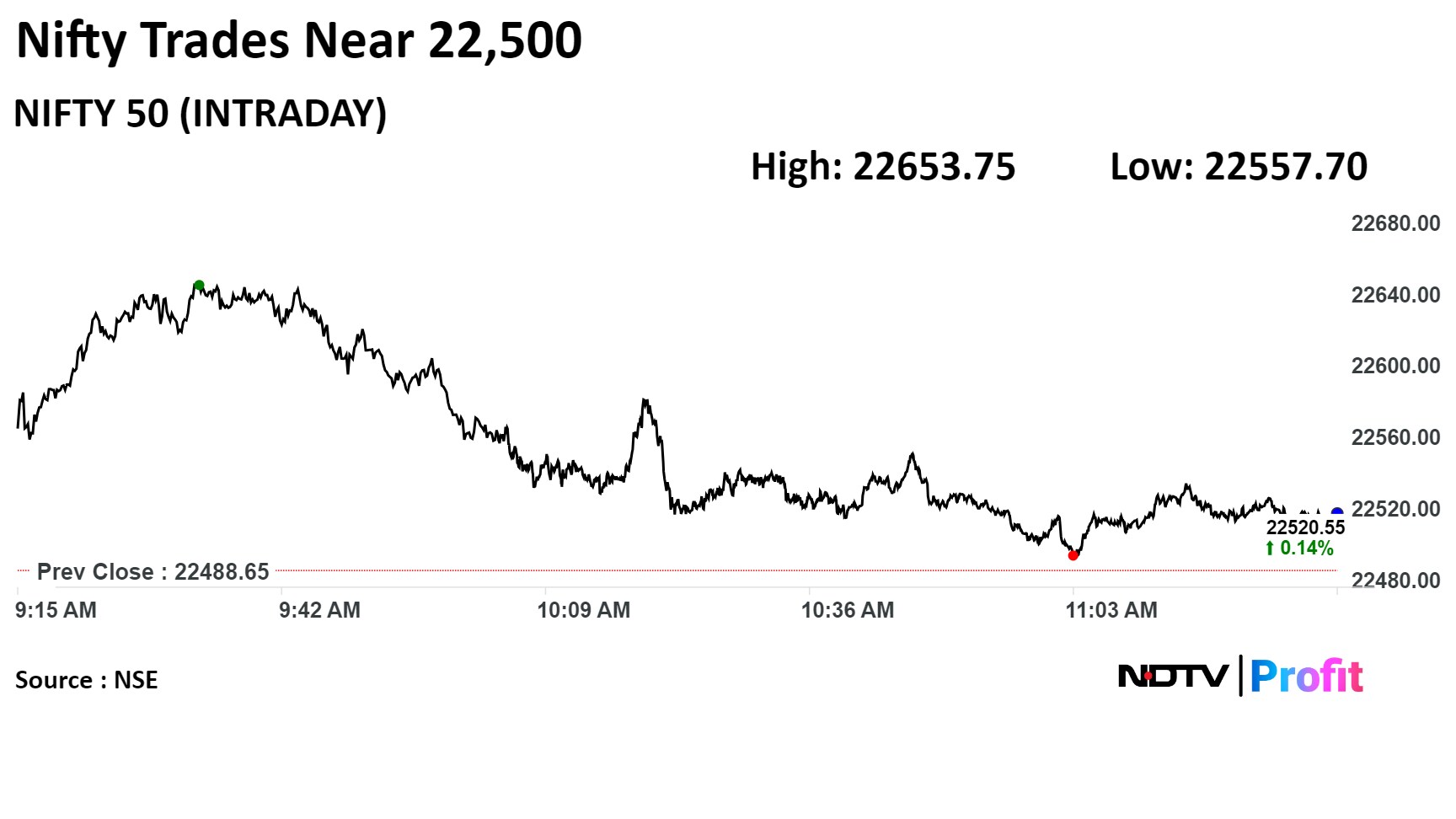

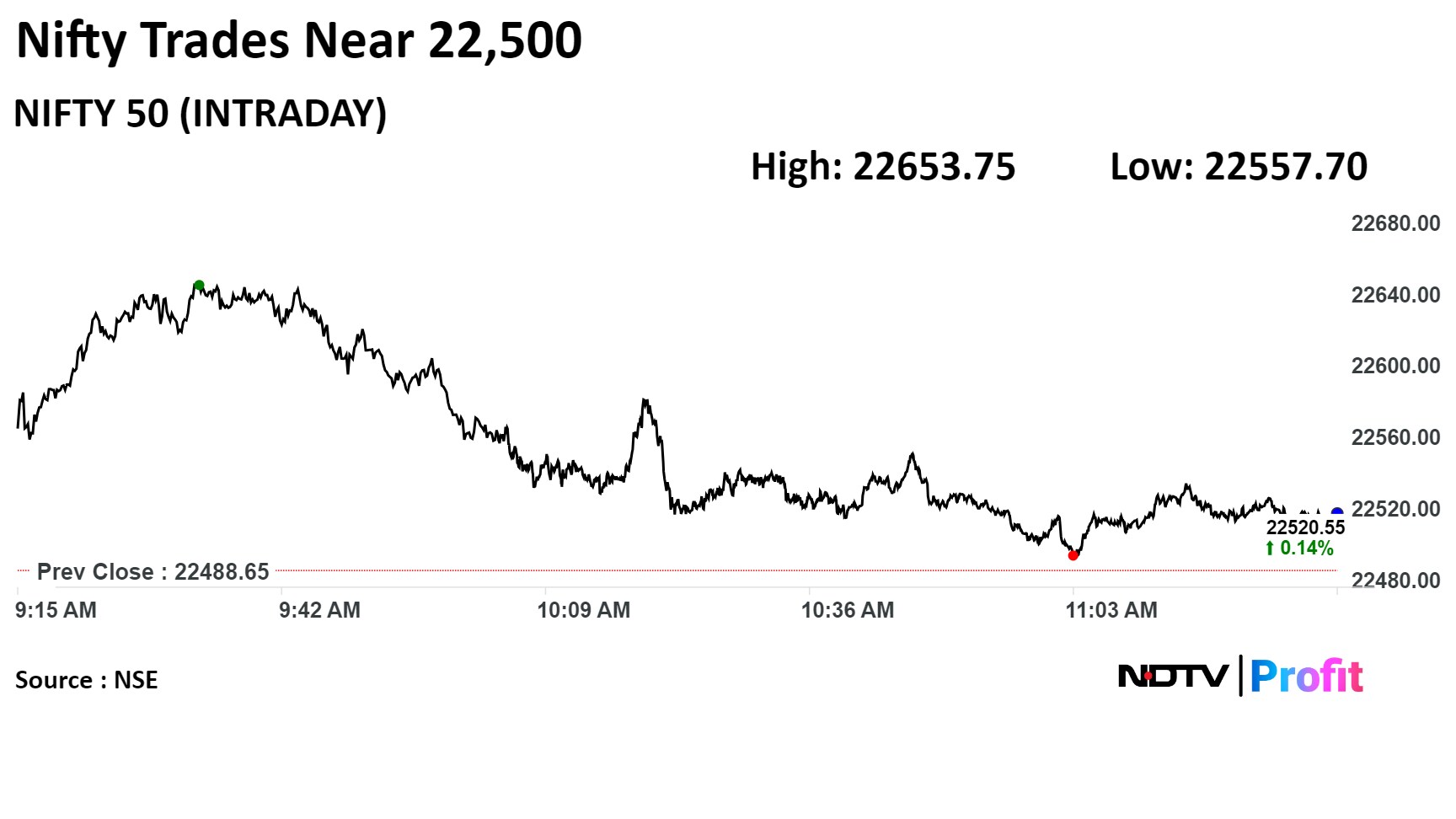

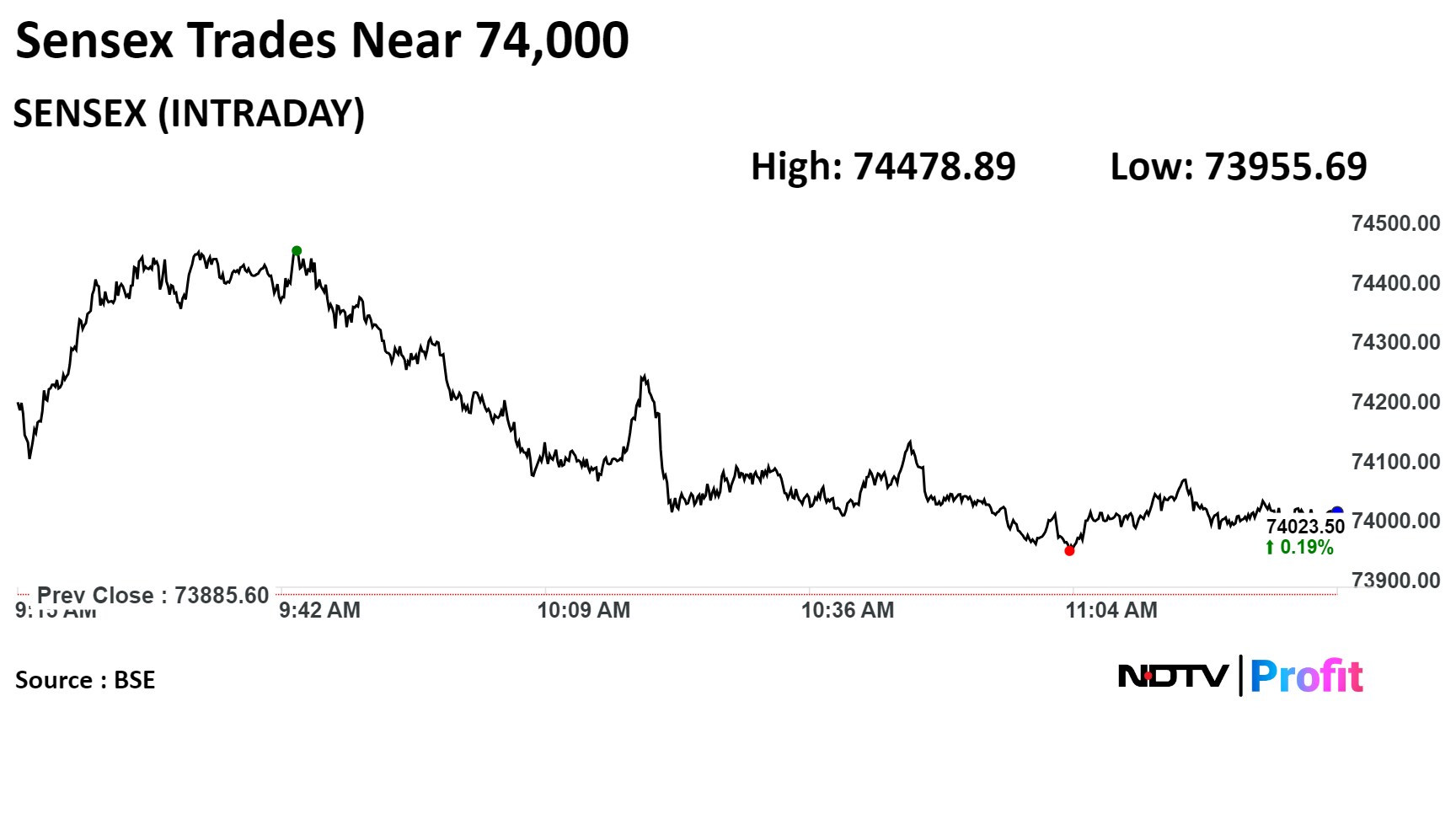

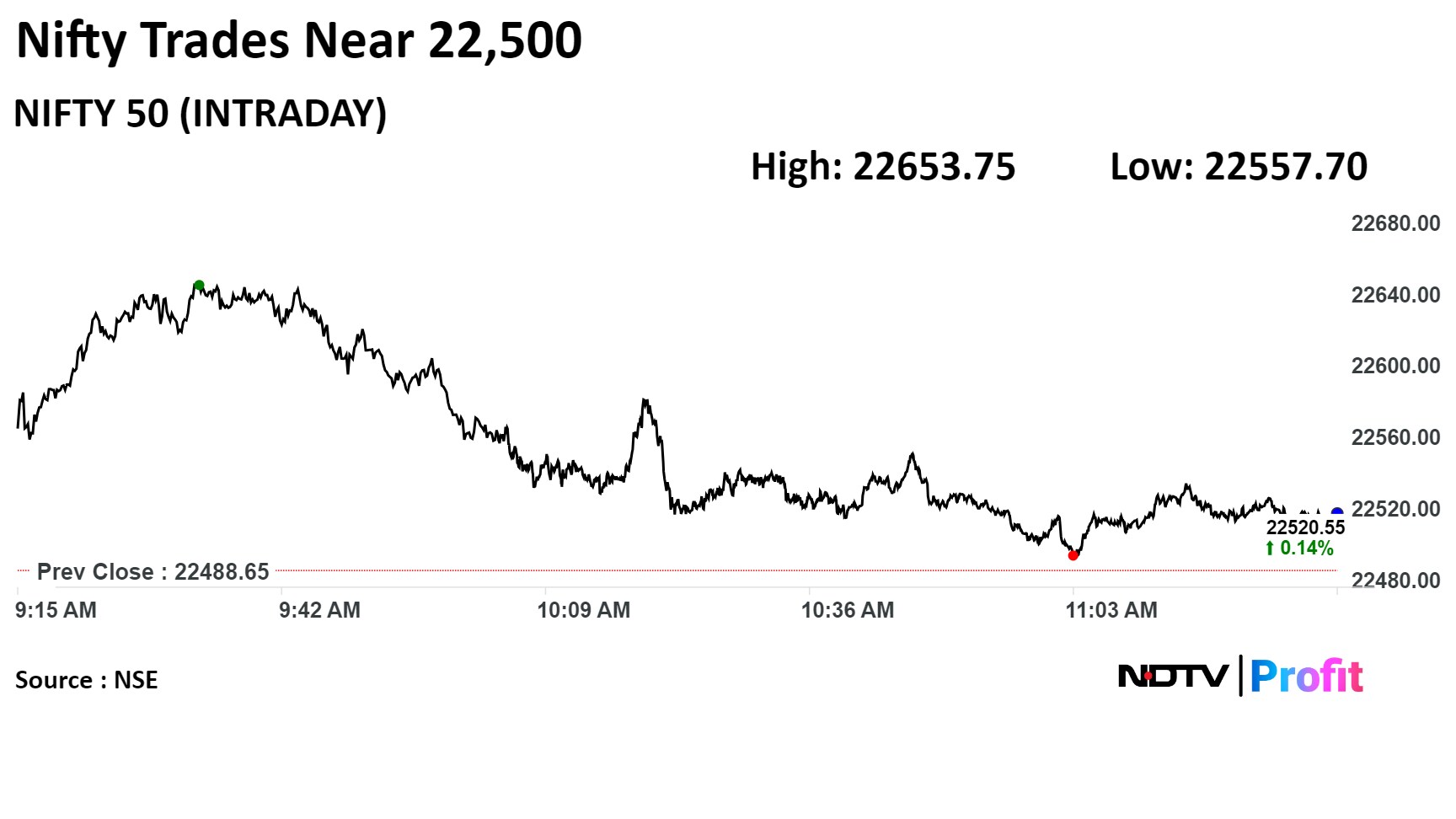

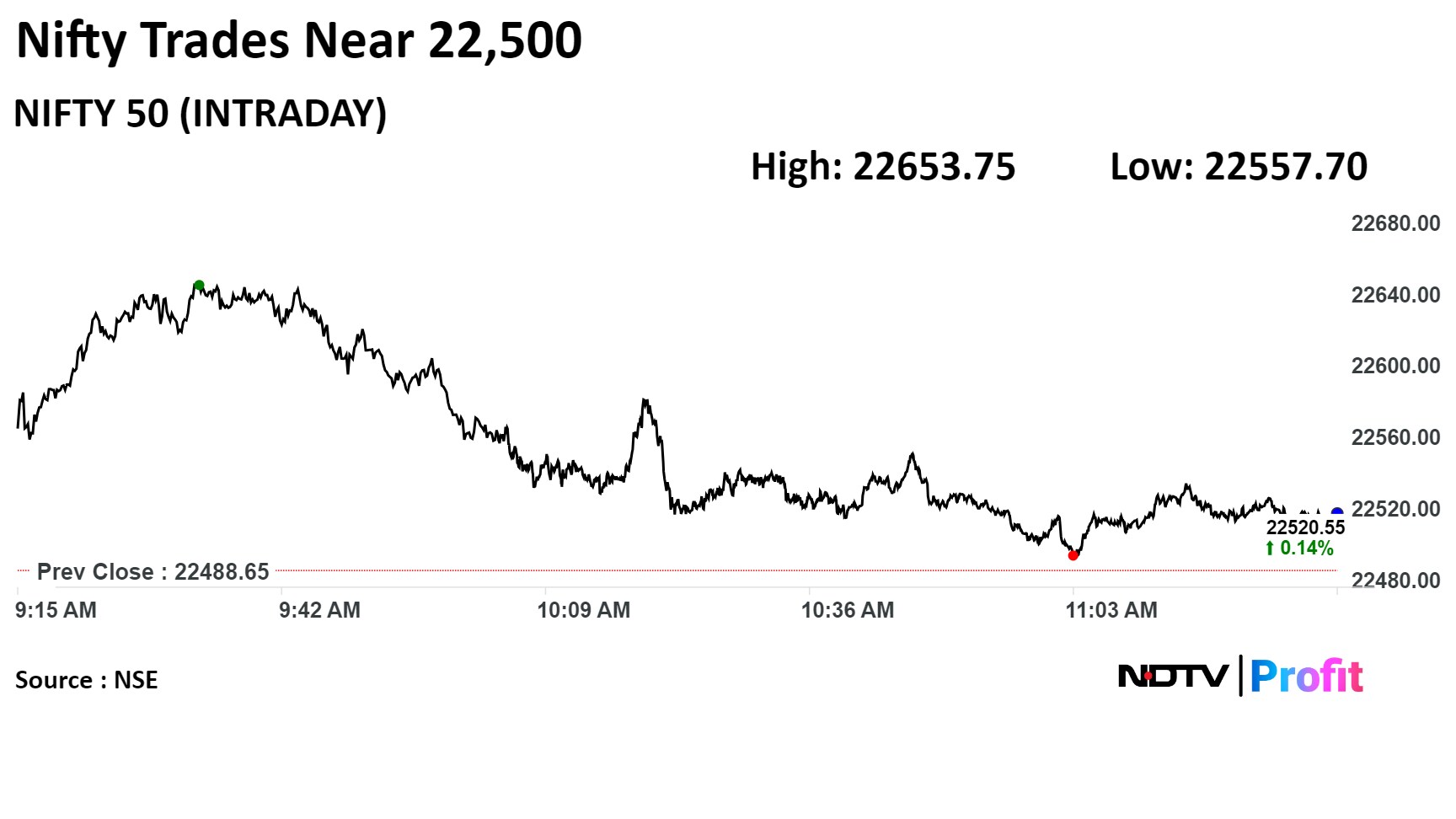

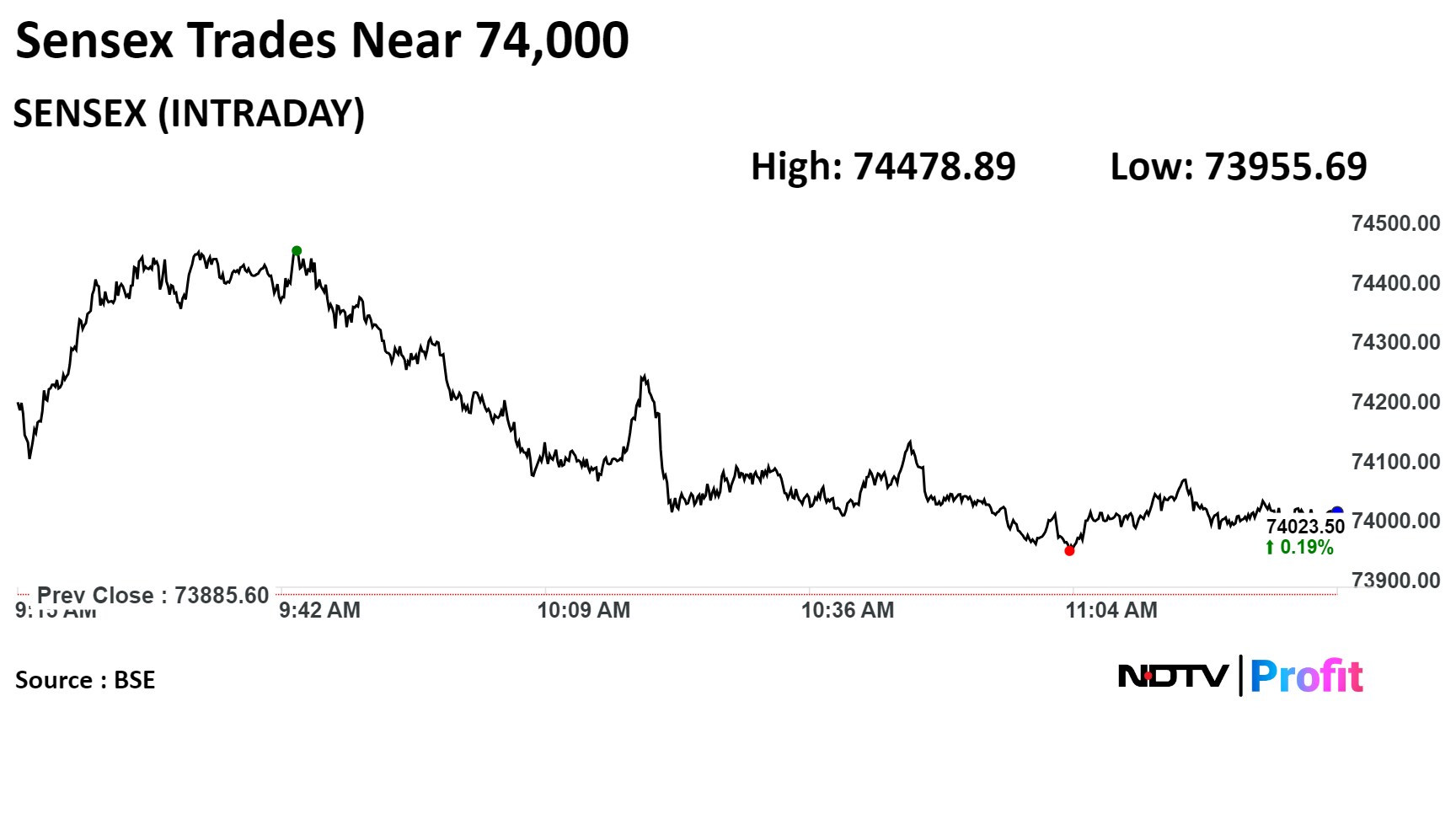

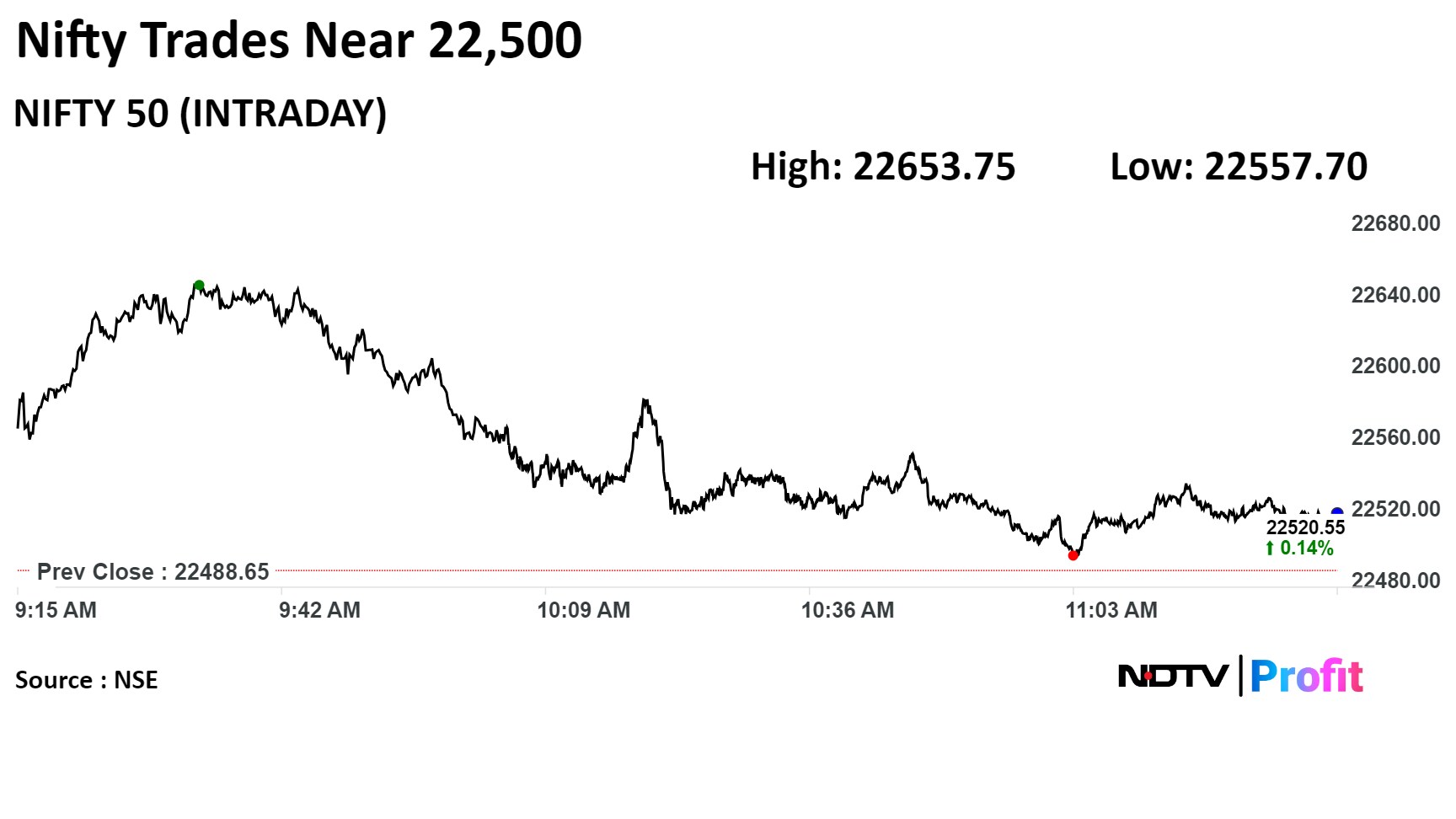

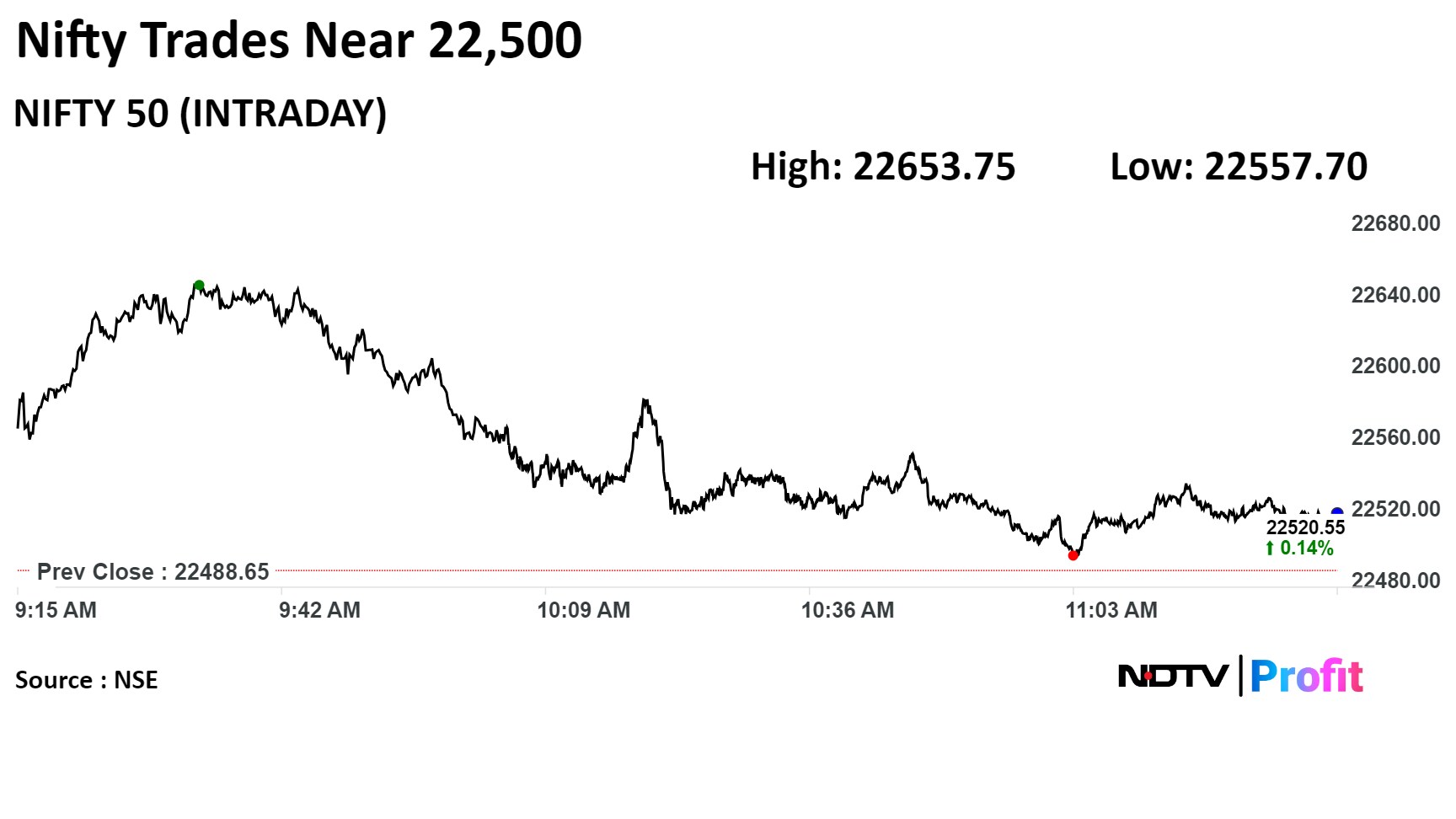

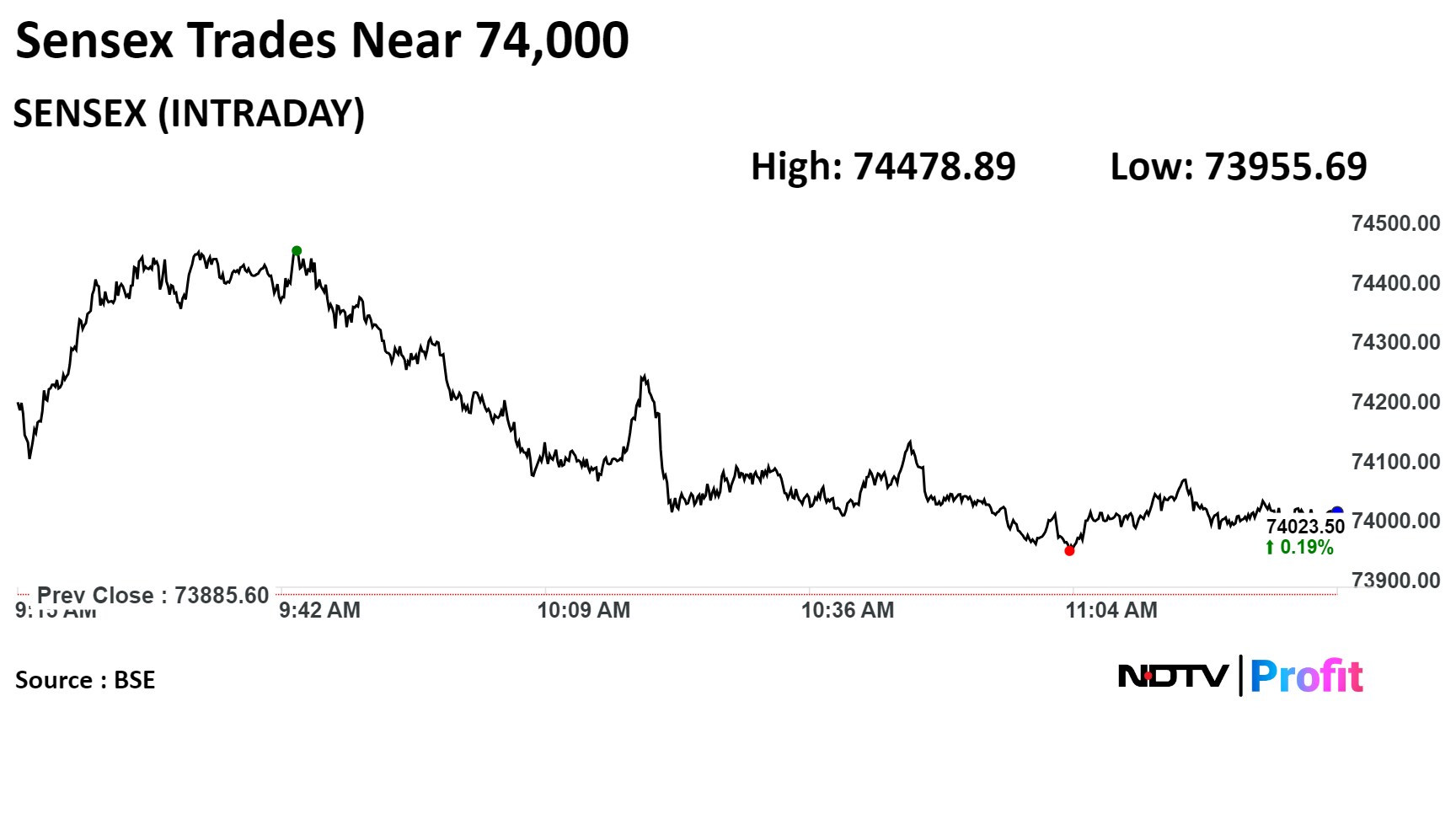

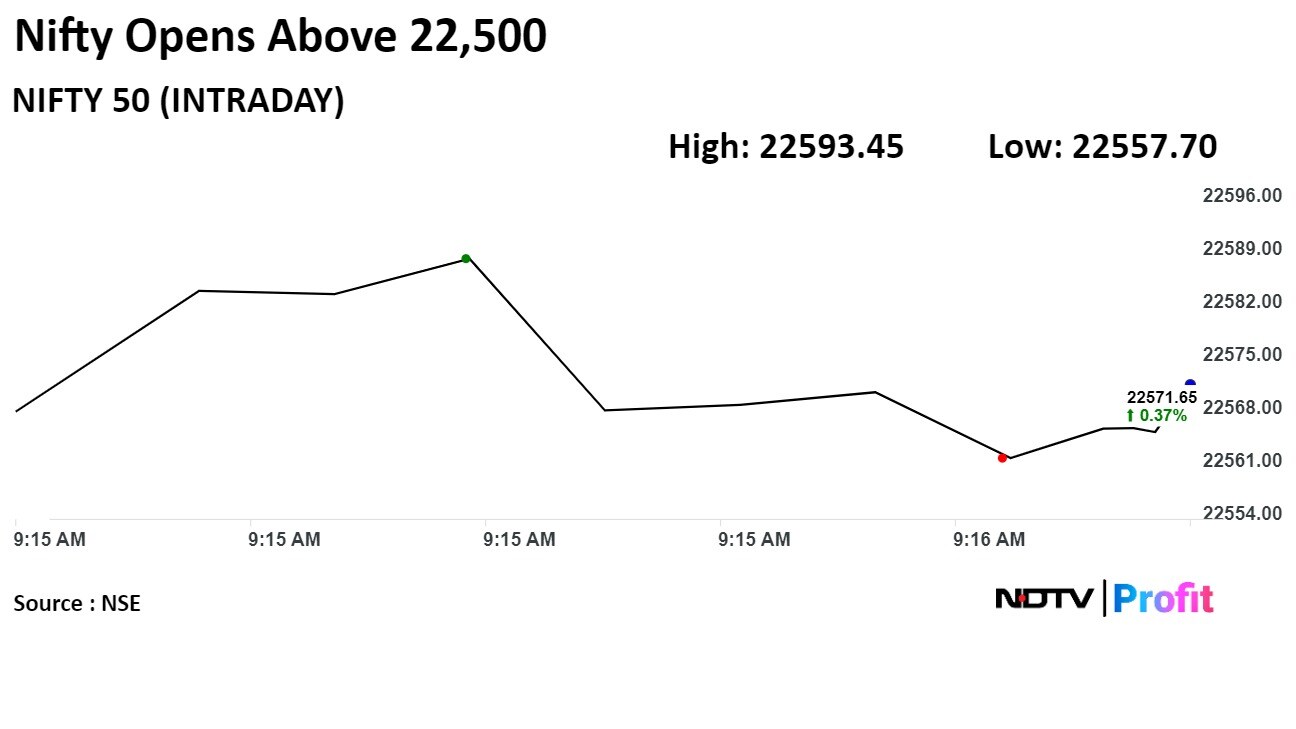

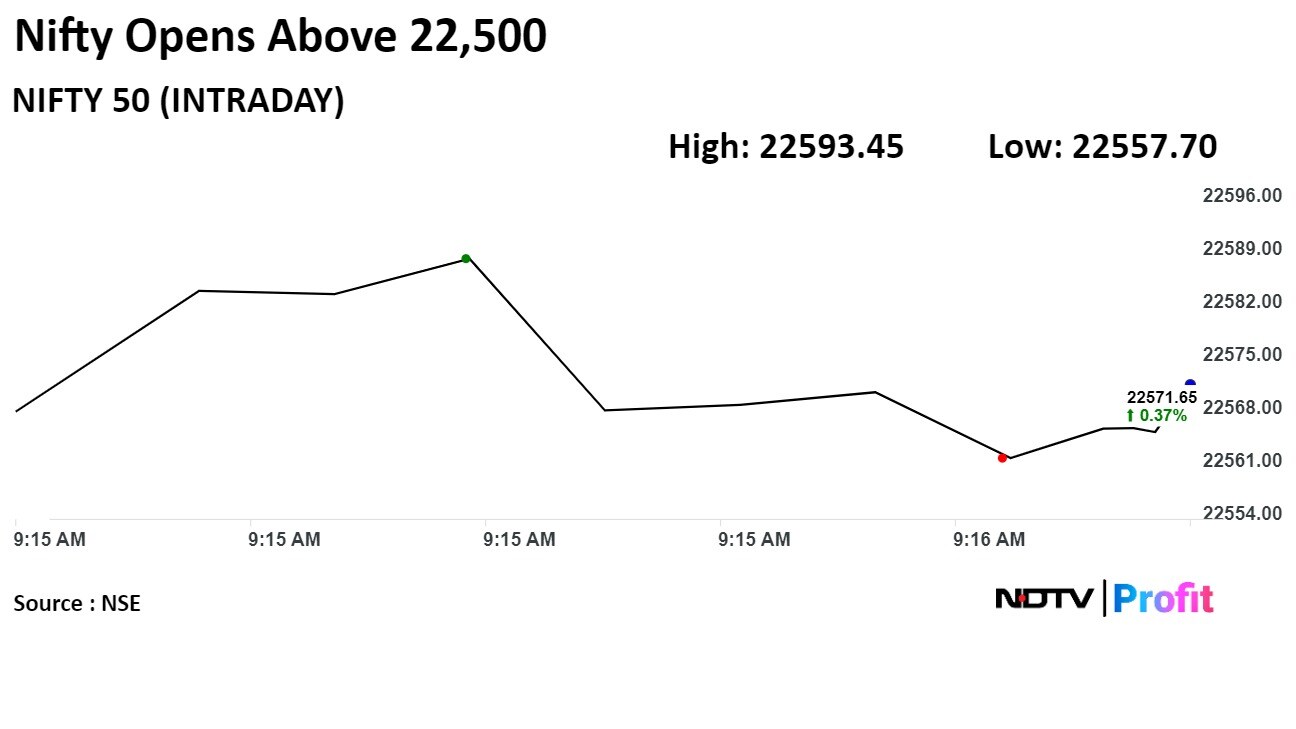

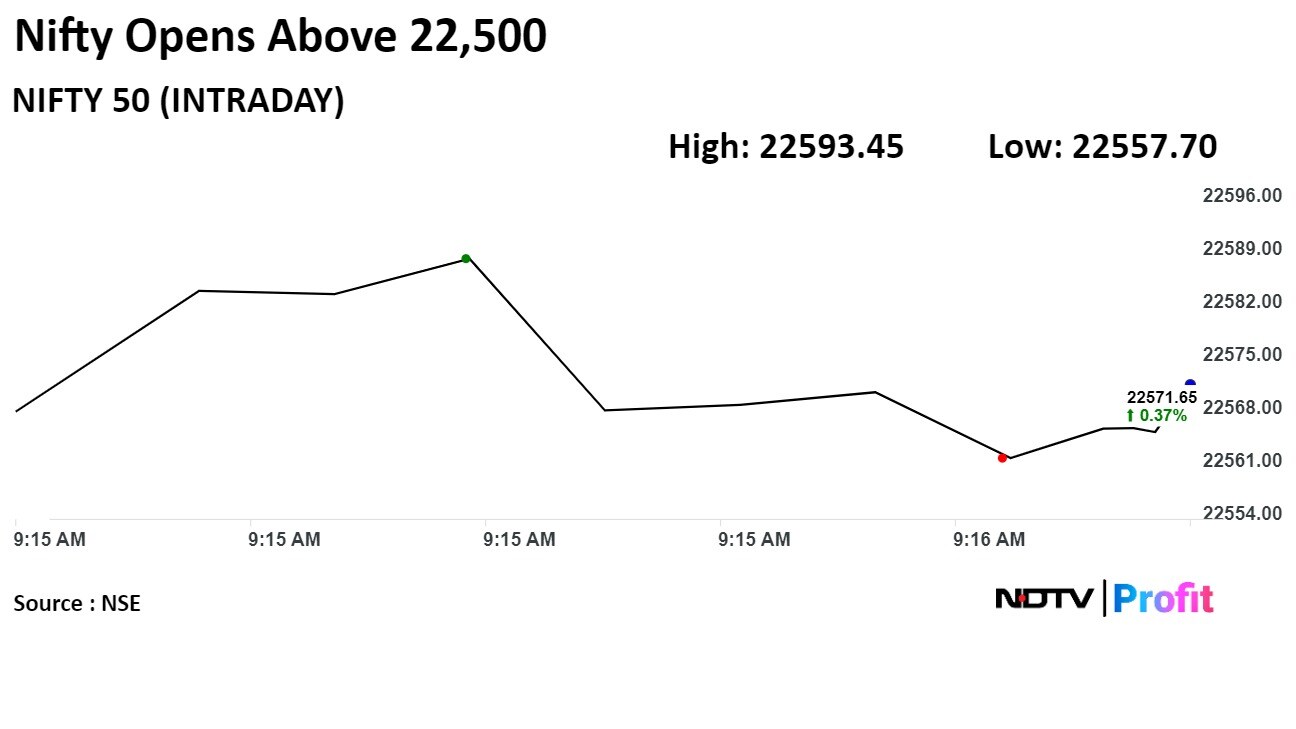

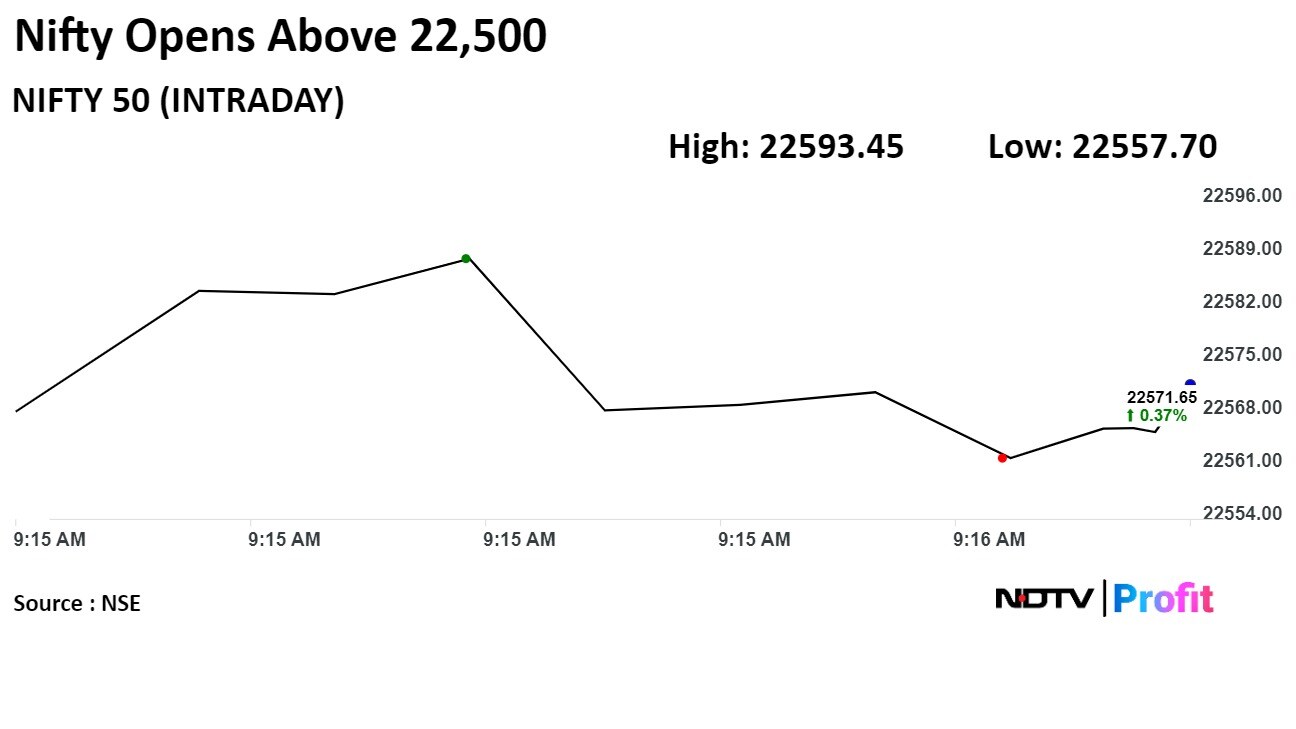

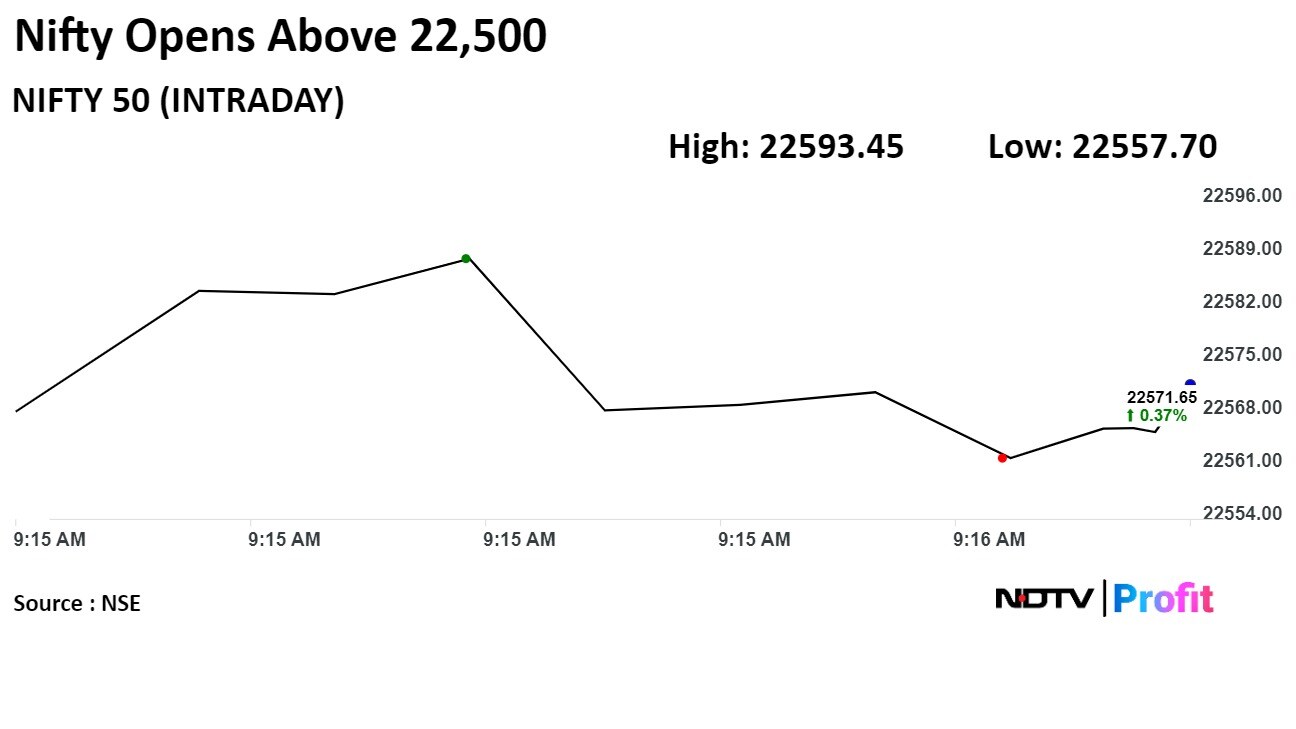

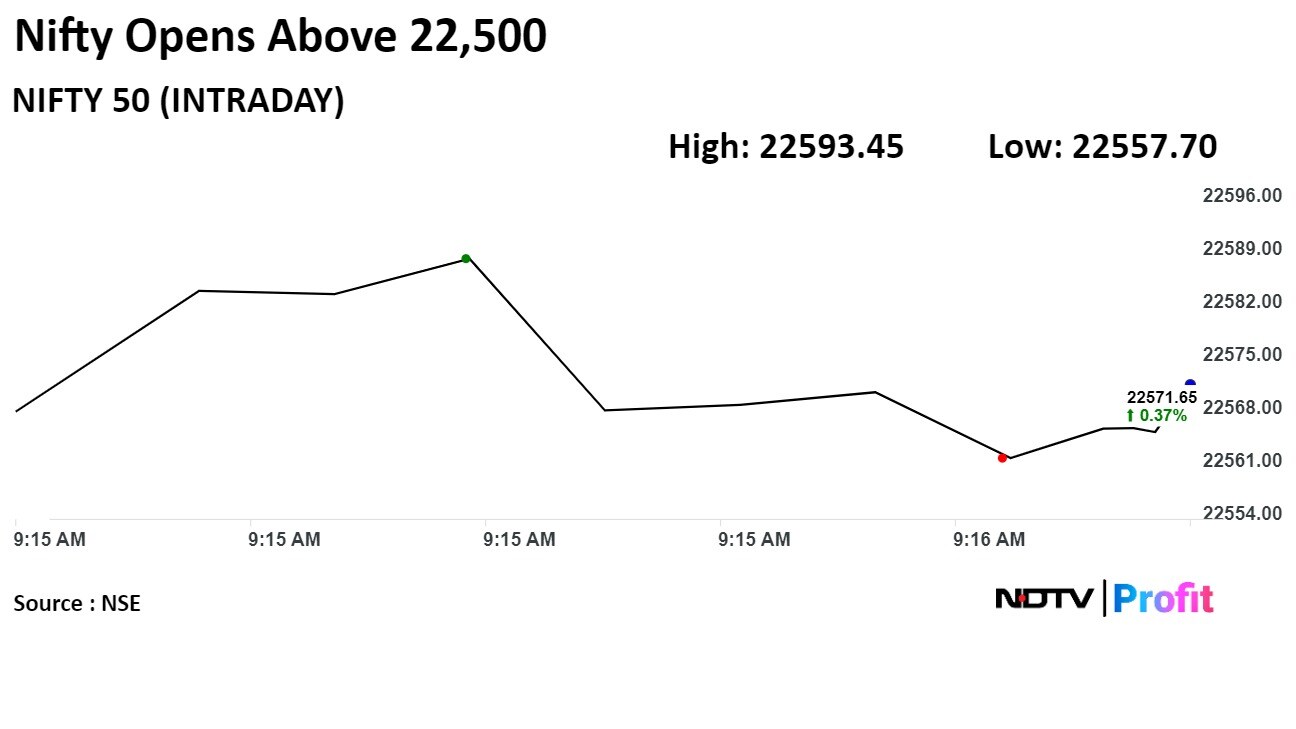

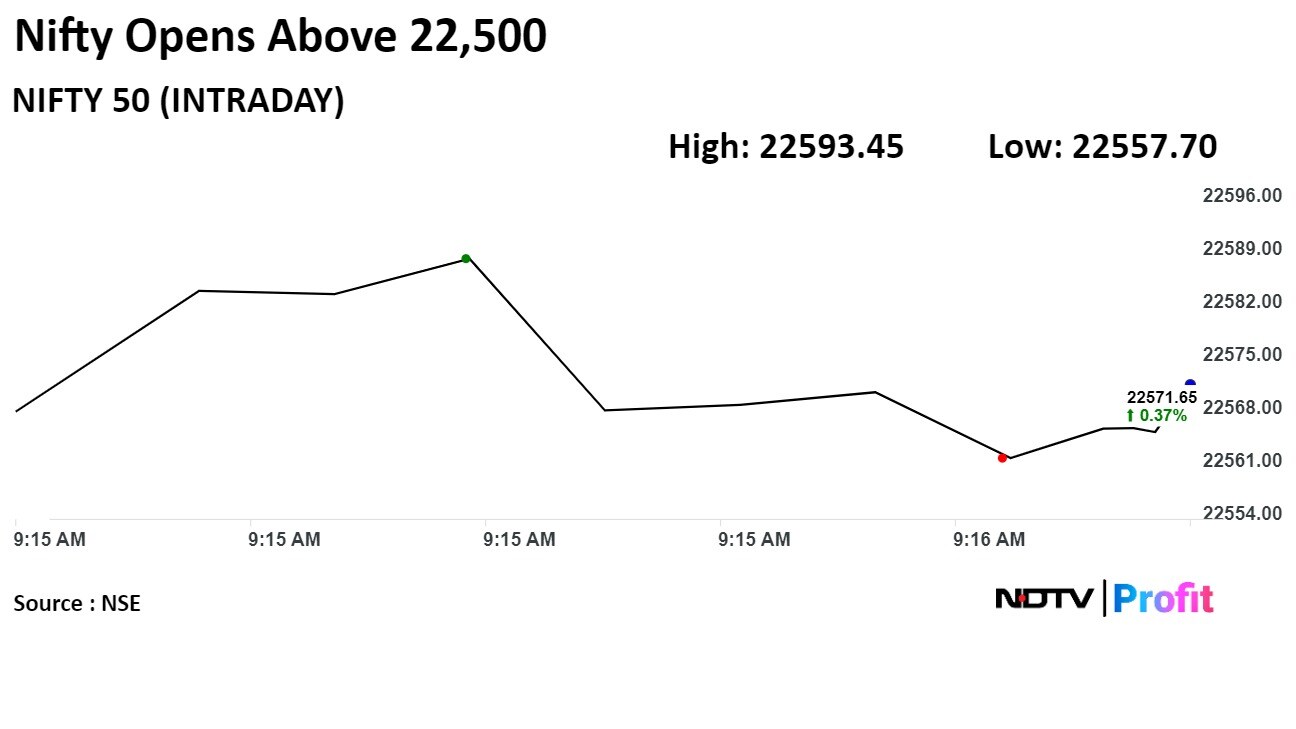

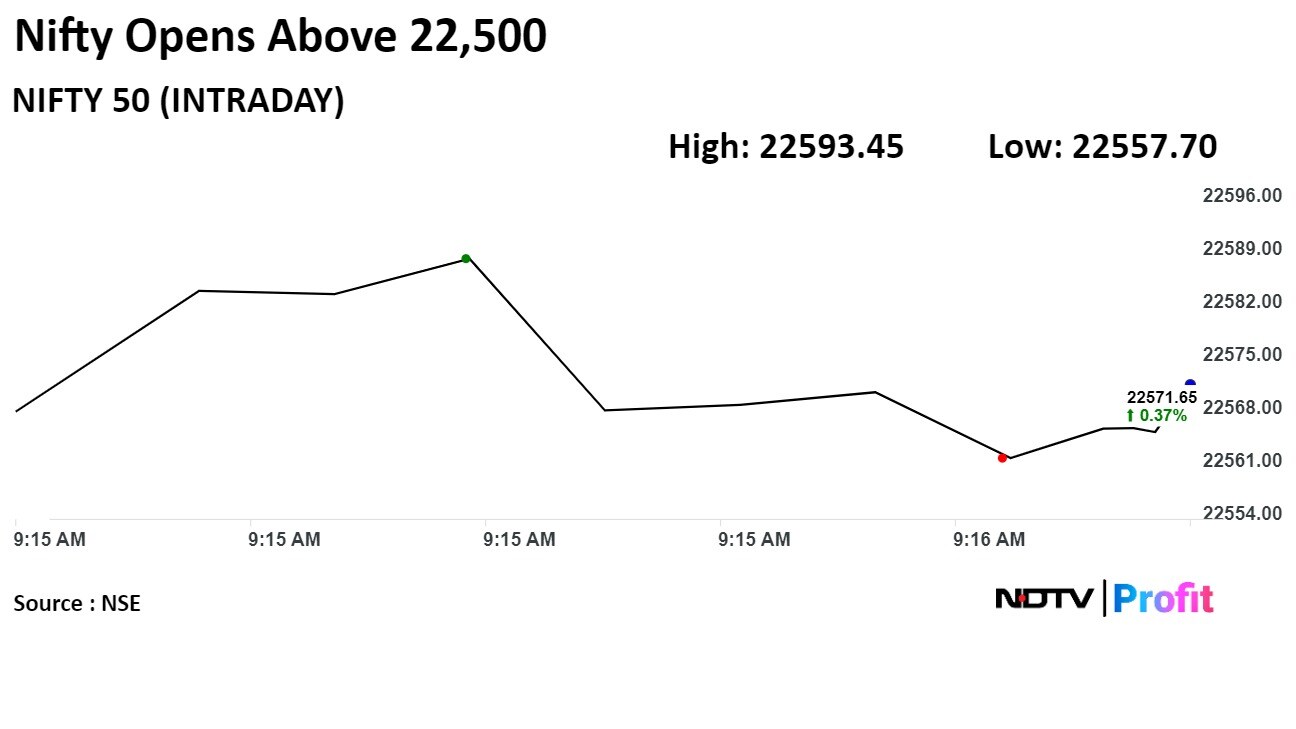

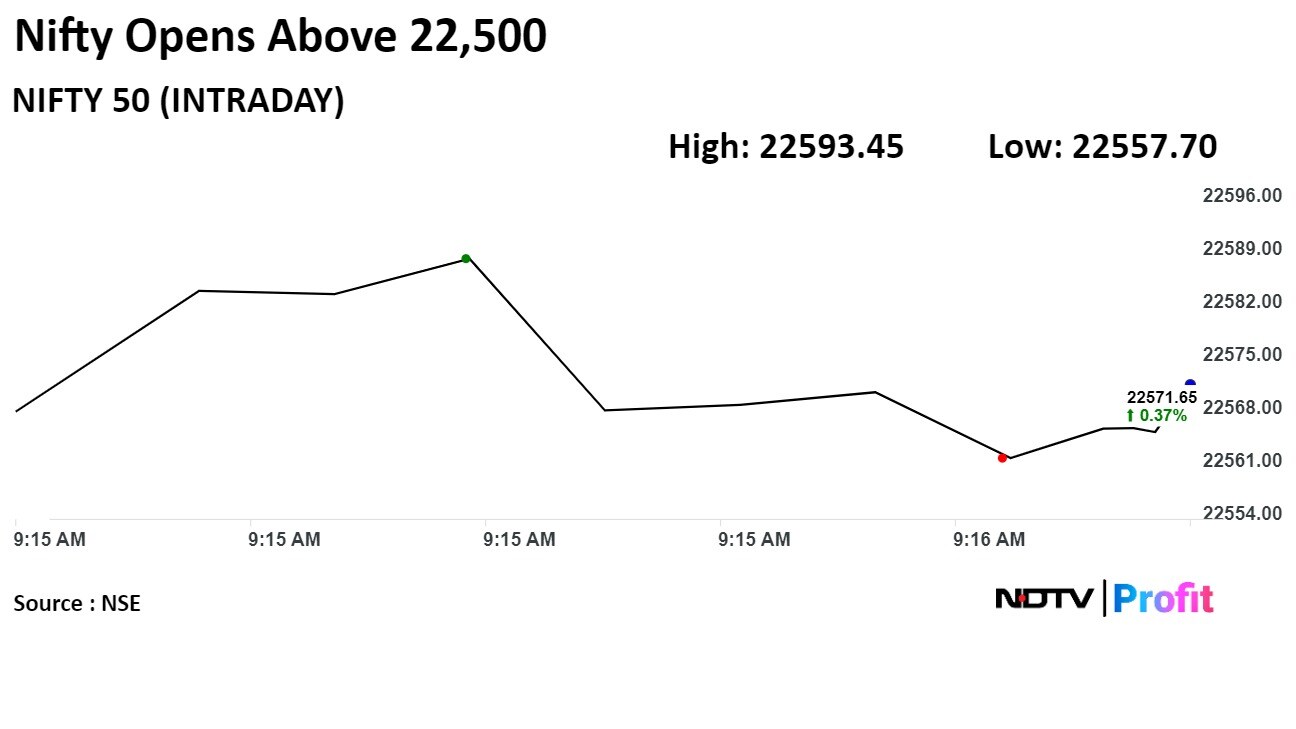

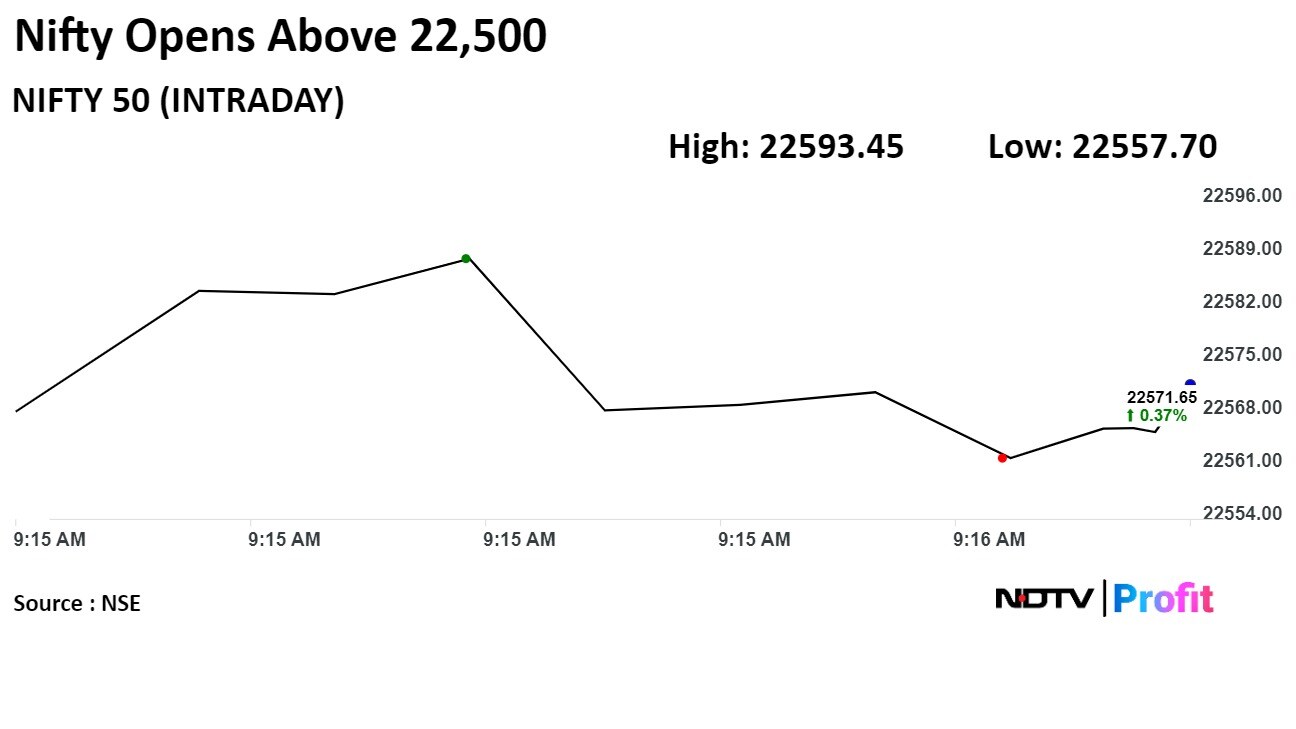

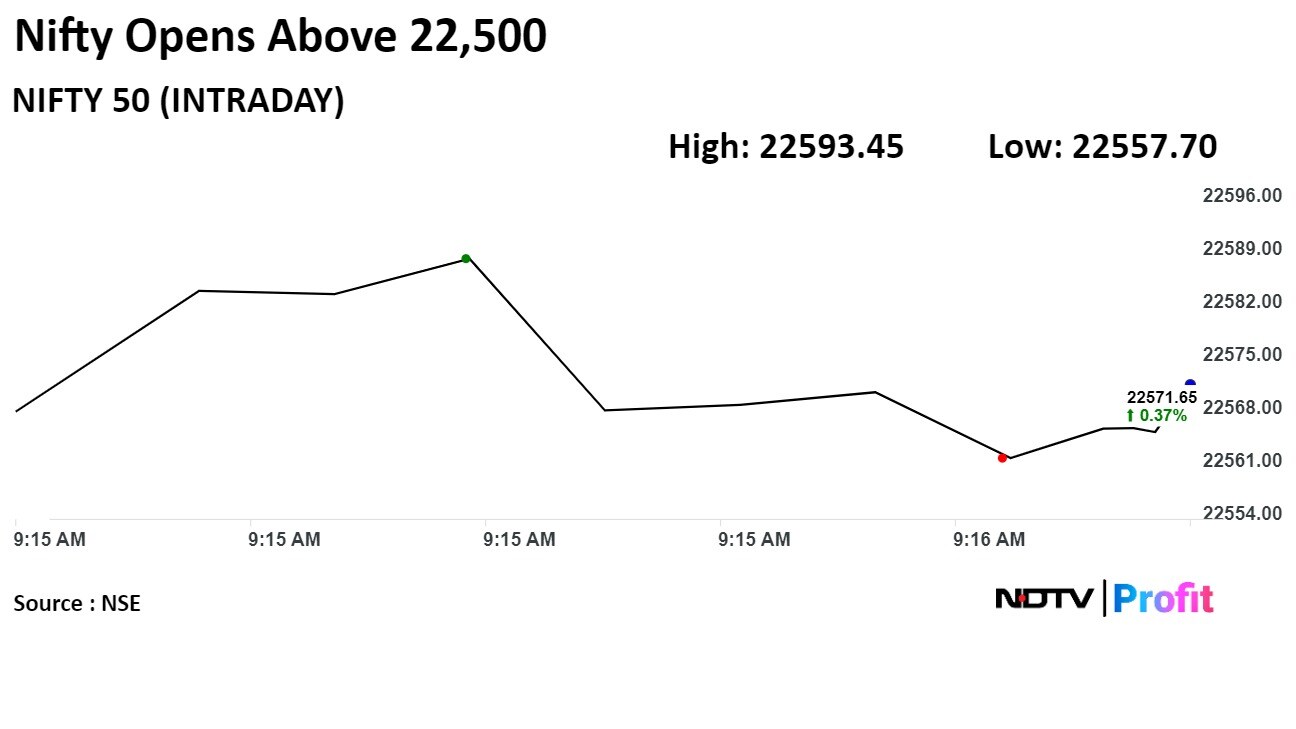

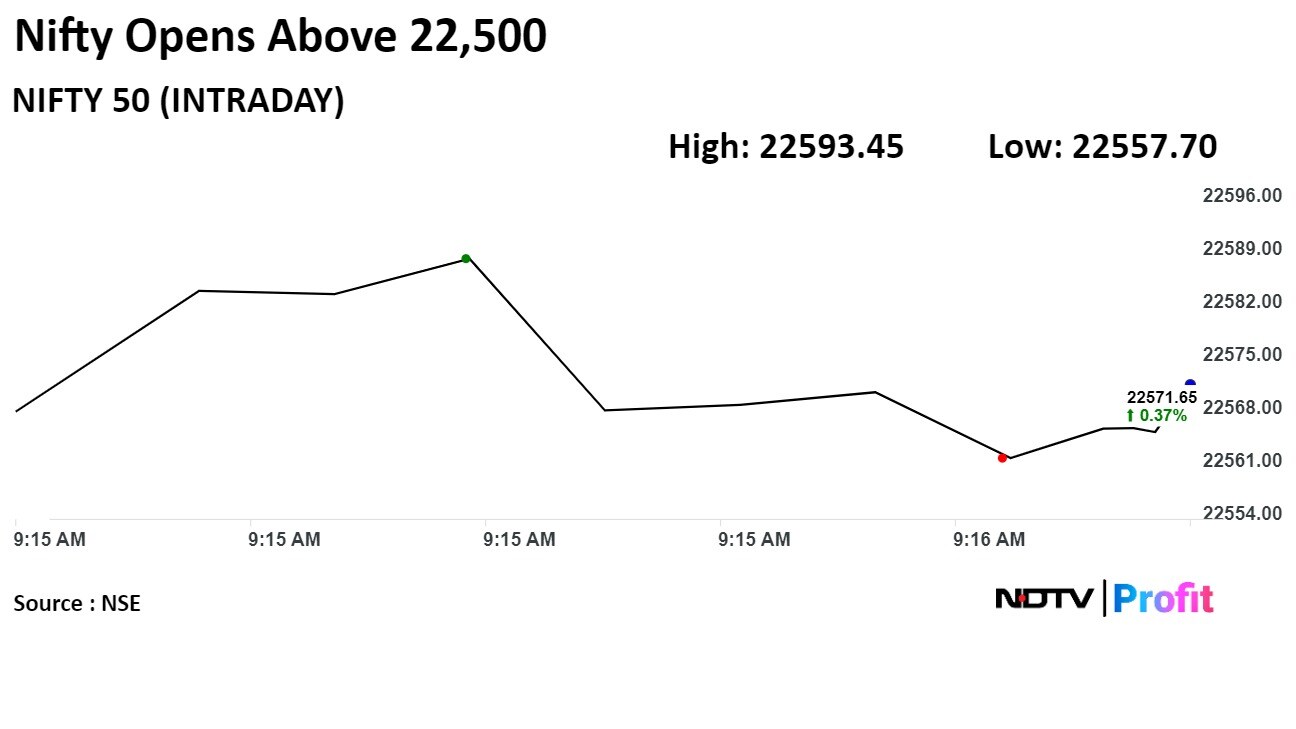

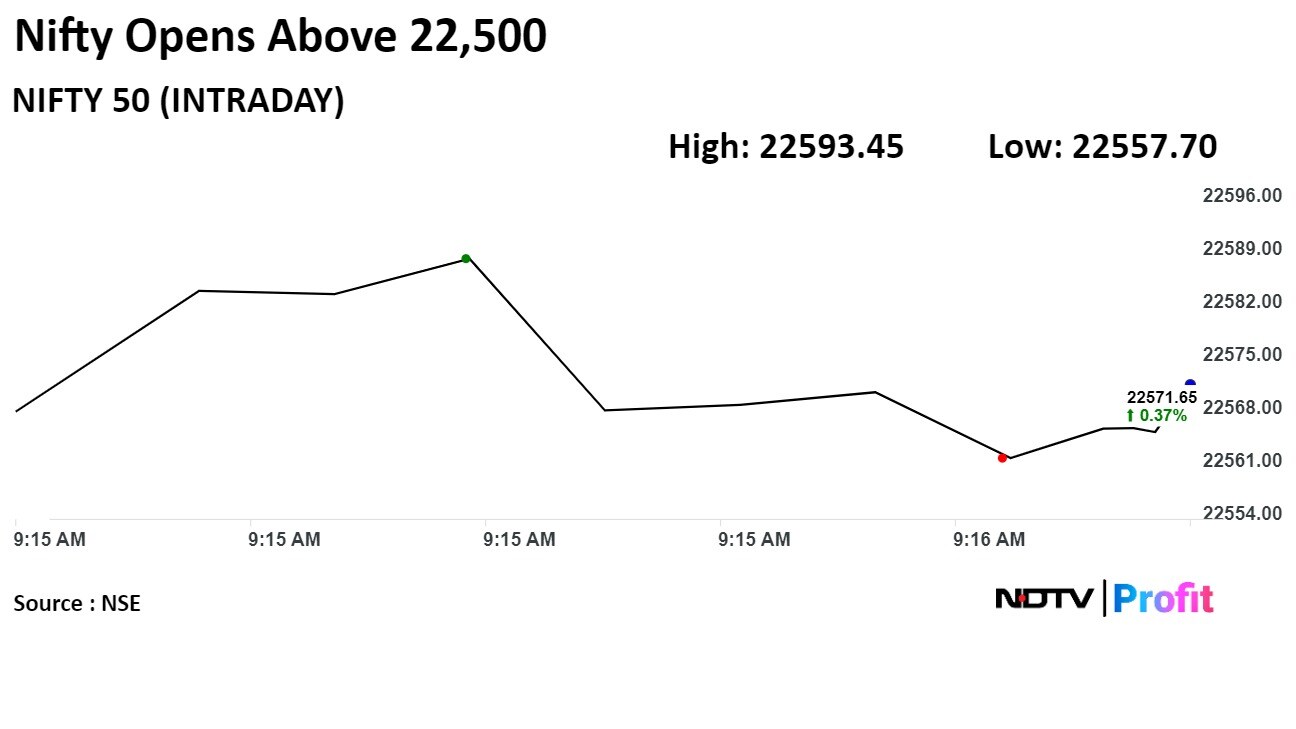

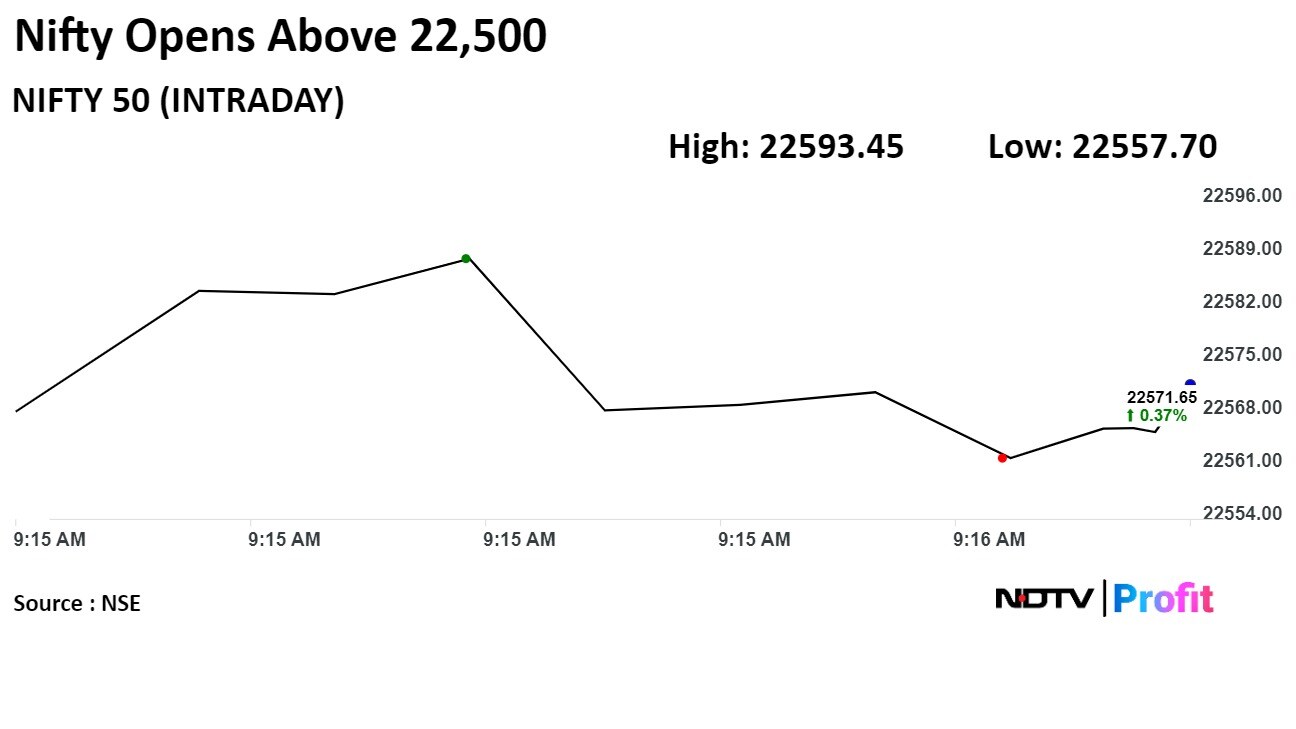

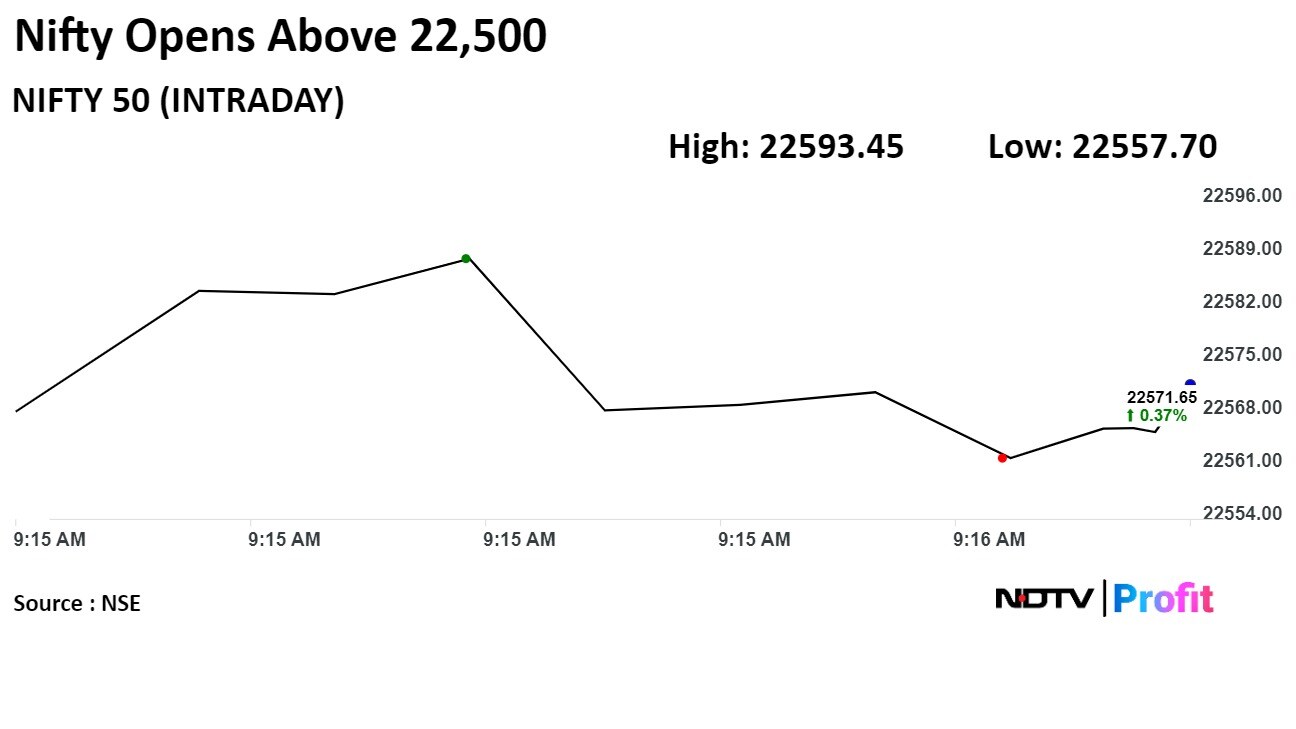

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

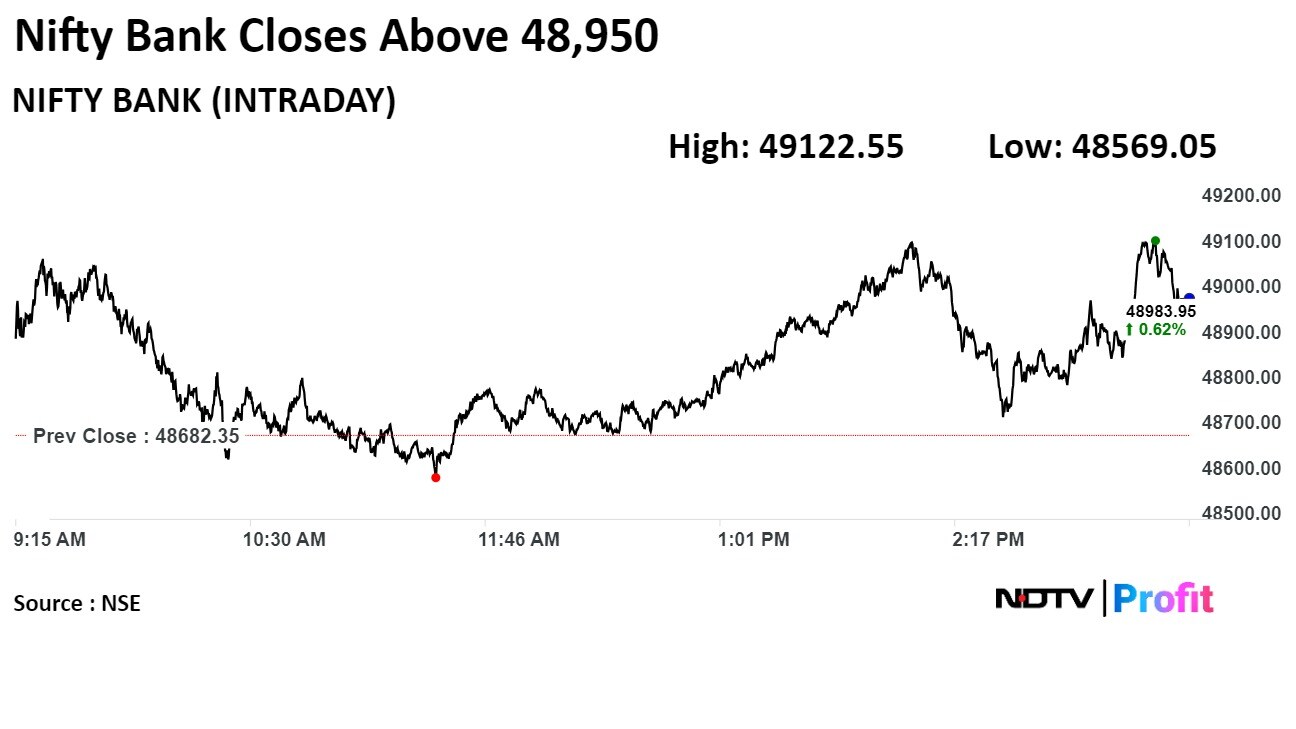

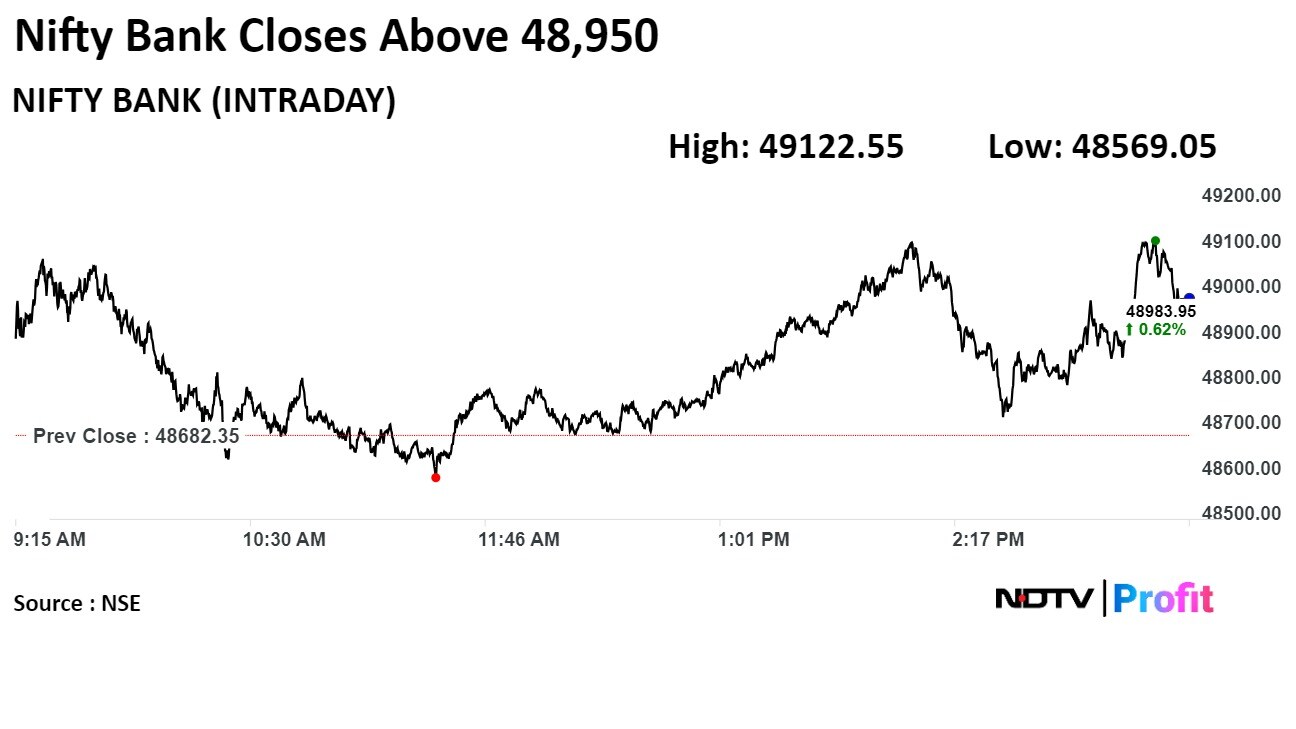

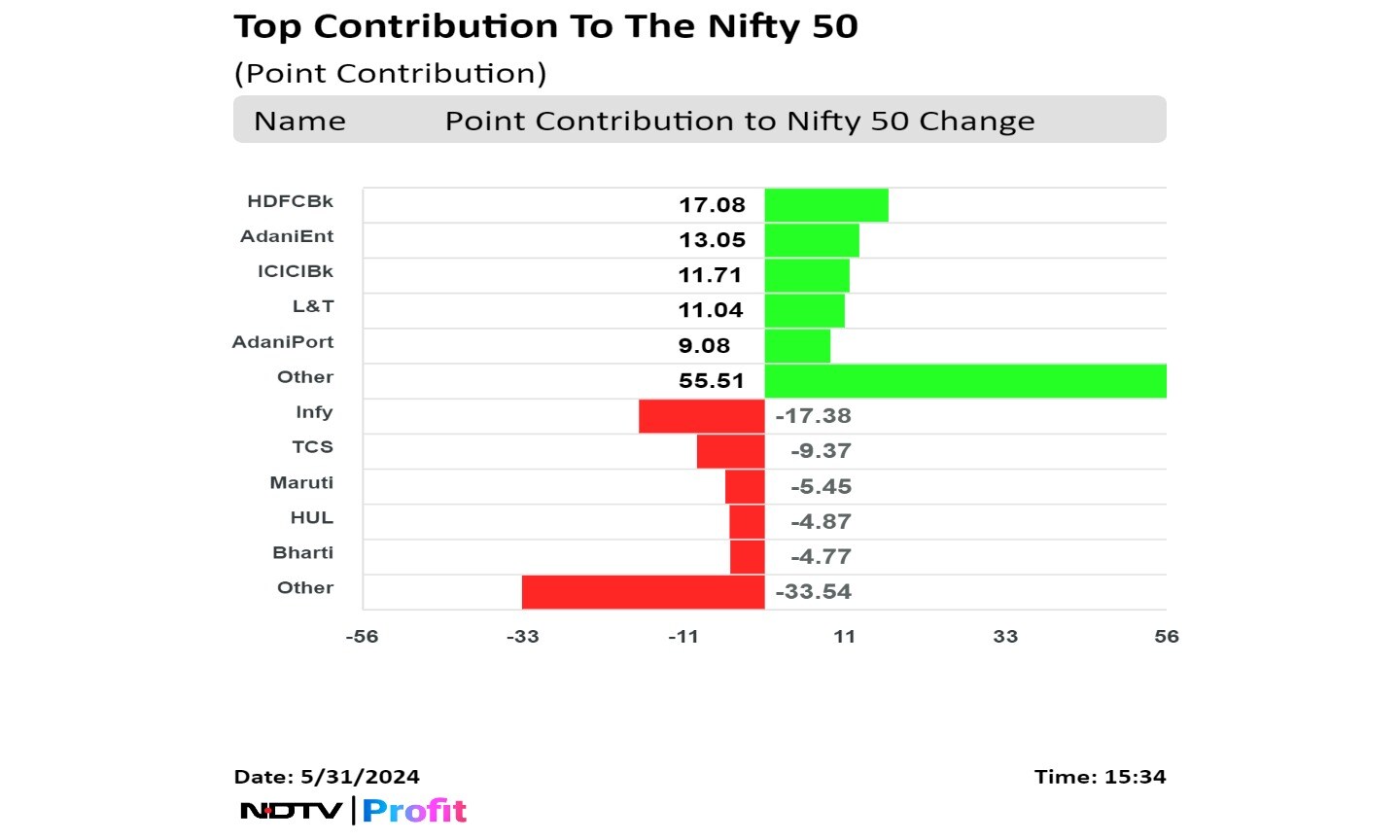

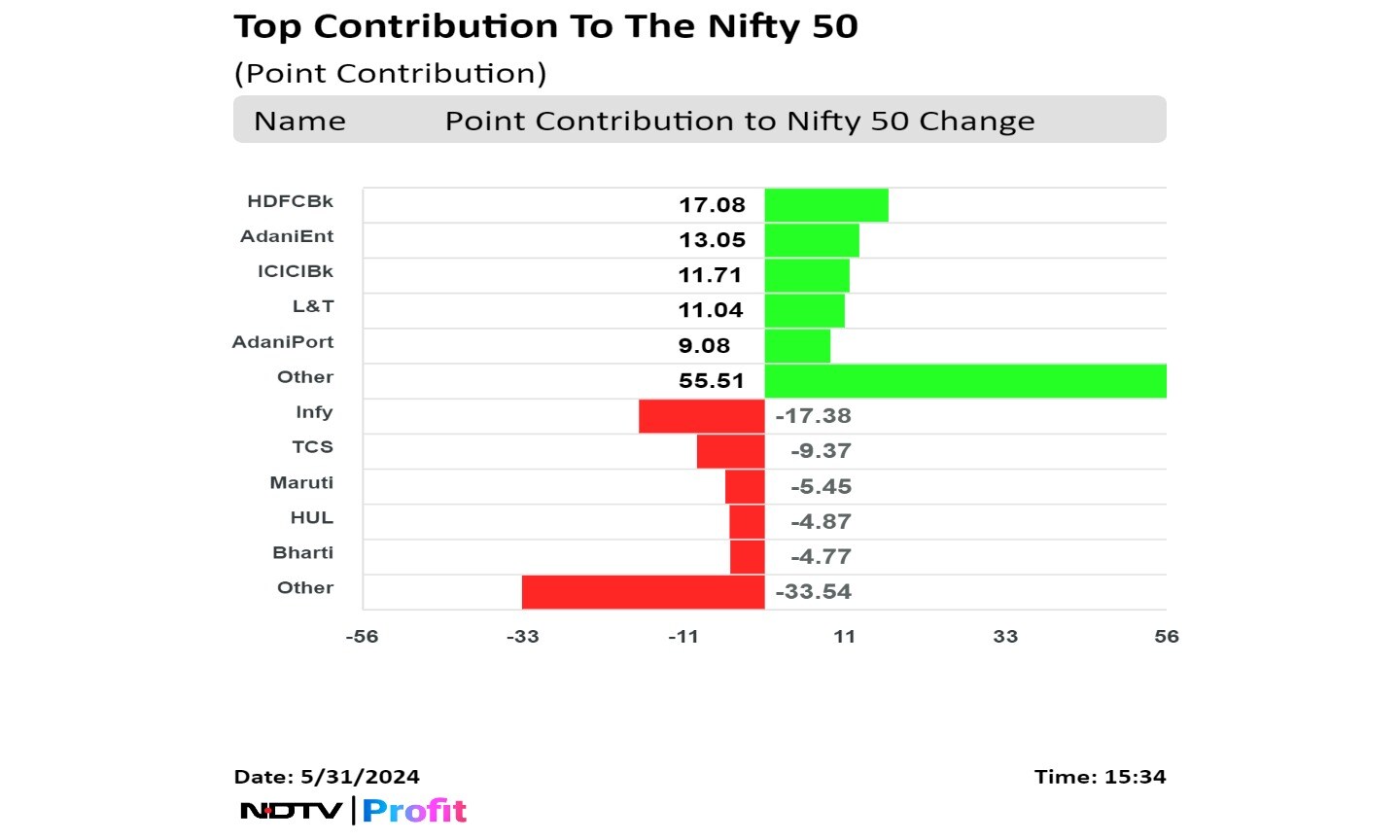

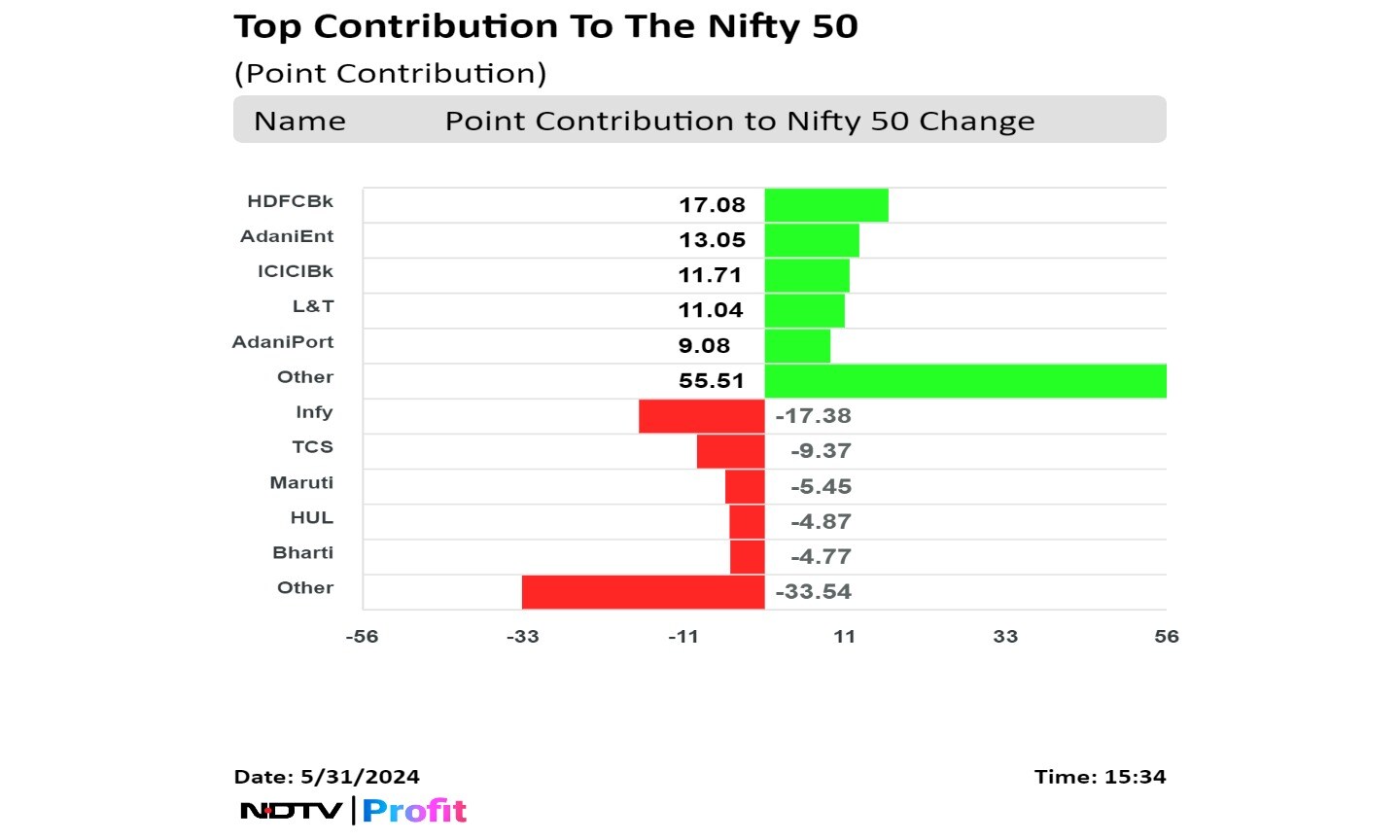

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

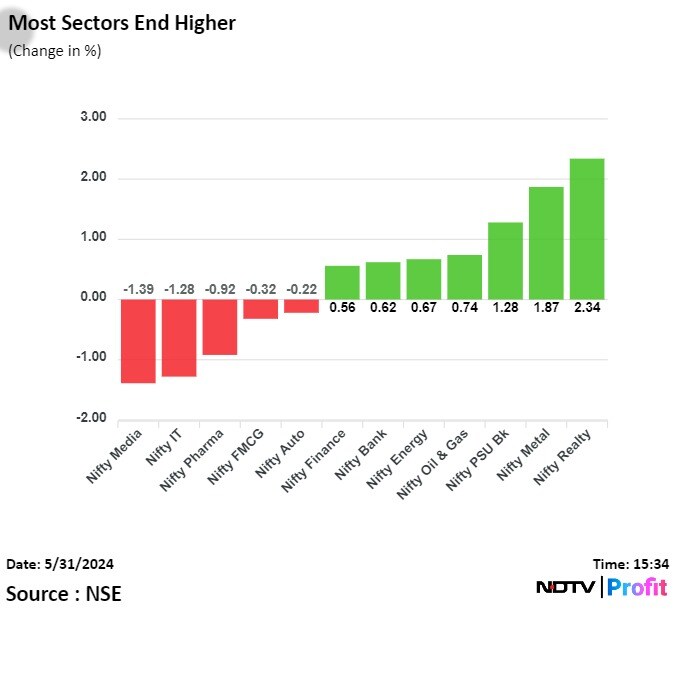

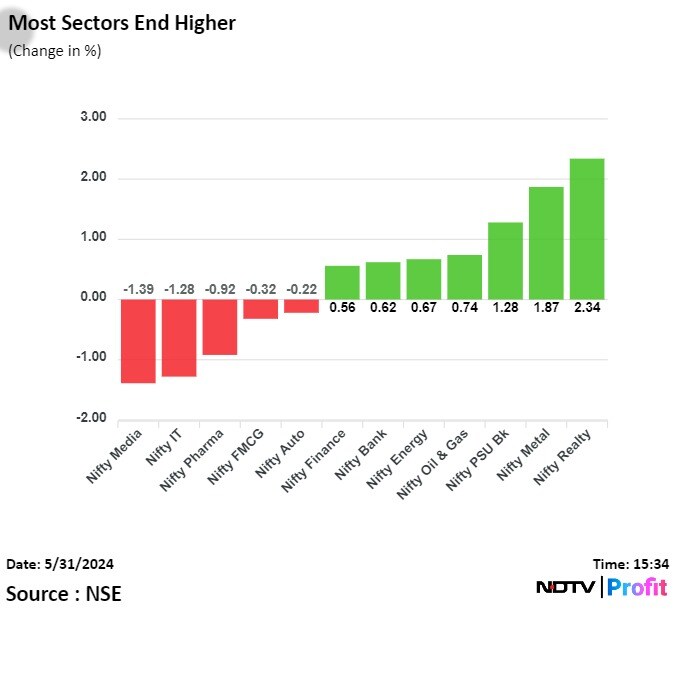

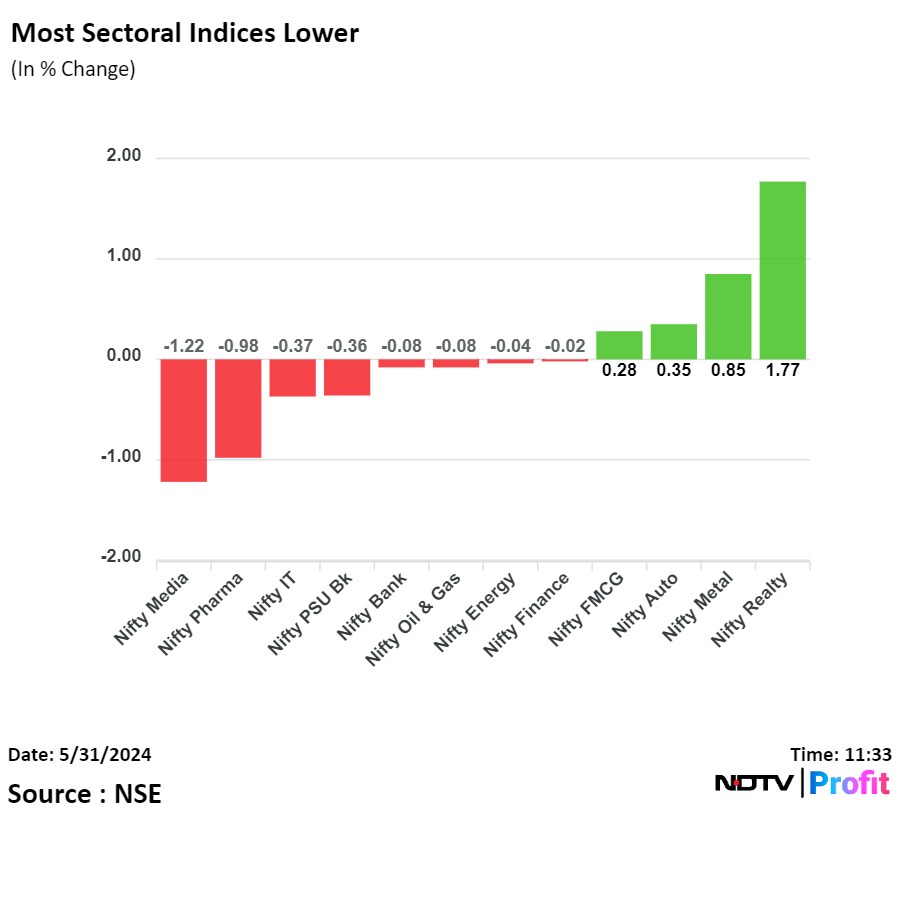

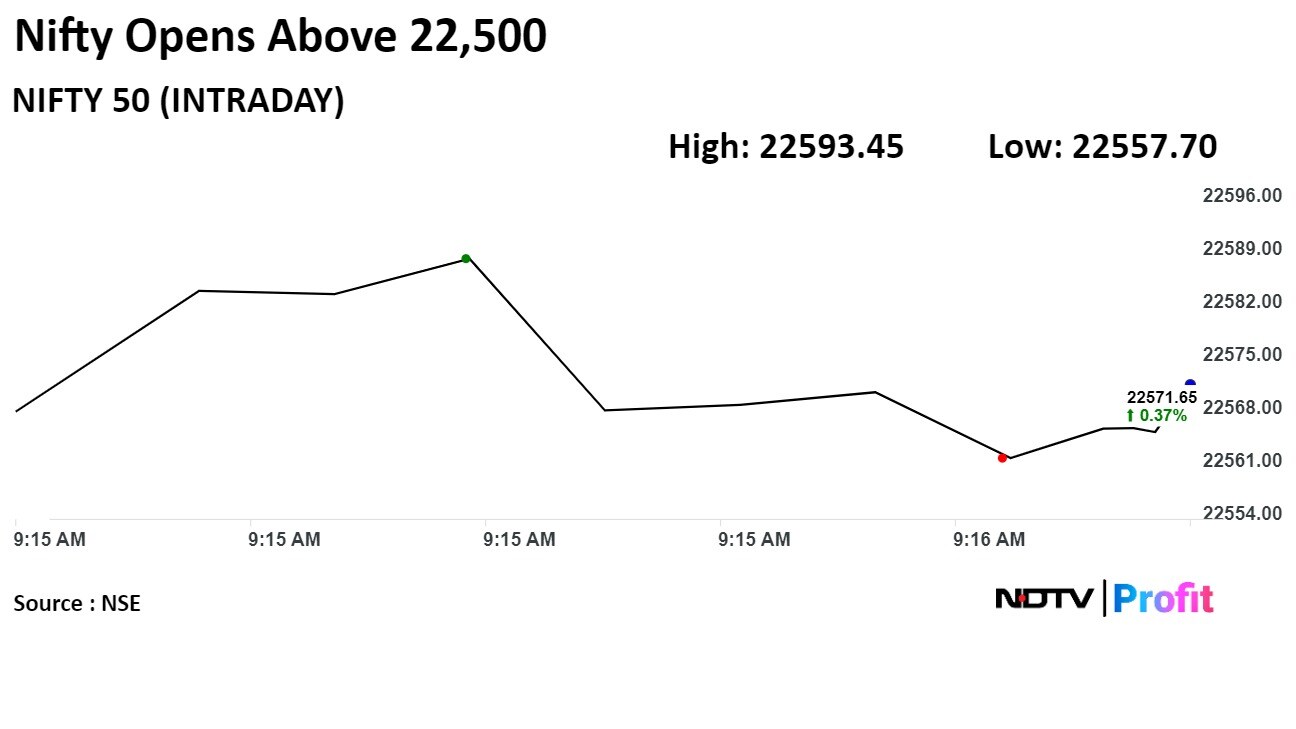

Most sectoral indices ended higher with Nifty Realty and Nifty Metal leading.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Most sectoral indices ended higher with Nifty Realty and Nifty Metal leading.

The broader markets were higher as the BSE MidCap closed 0.06% higher and the BSE SmallCap ended 0.76% higher.

Six out of the 20 sectoral indices on the BSE fell. Utilities rose the most and Information Technology was the top loser.

The market breadth was skewed in the favour of sellers. Around 1,978 stocks declined, 1,845 rose, and 92 remained unchanged on the BSE.

This week, the Nifty lost 1.86%.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Most sectoral indices ended higher with Nifty Realty and Nifty Metal leading.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

Benchmark equity indices erased most of their early losses to end marginally higher ahead of India's GDP release due later in the day. On a weekly, basis the Nifty recorded its worst fall since the week ended May 10.

The Nifty ended 0.19% or 42.05 points higher at 22530.70 points while the Sensex closed 0.10% or 75.71 points higher by 73961.31.

"Regional diversions, marginally low voter turnout and strong resistance at current range are prompting investors to adopt a cautious stance," said Vinod Nair, head of research at Geojit Financial Services." They are aligning their investments towards fundamentally strong sectors & stocks to safeguard against any abrupt reactions in the market."

On the global front, he added that the release of inflation data from the US, which are estimated to be high, could sway global market sentiment in the near-term.

.jpeg)

Shares of HDFC Bank Ltd., Adani Enterprises Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Adani Ports and Special Economic Zone Ltd. contributed the most to the gains.

While those of Infosys Ltd., Tata Consultancy Services Ltd., Maruti Suzuki Ltd., Hindustan Unilever Ltd., and Bharti Airtel Ltd. capped the upside.

Most sectoral indices ended higher with Nifty Realty and Nifty Metal leading.

The broader markets were higher as the BSE MidCap closed 0.06% higher and the BSE SmallCap ended 0.76% higher.

Six out of the 20 sectoral indices on the BSE fell. Utilities rose the most and Information Technology was the top loser.

The market breadth was skewed in the favour of sellers. Around 1,978 stocks declined, 1,845 rose, and 92 remained unchanged on the BSE.

This week, the Nifty lost 1.86%.

Intraday, the local currency weakened by 15 paise to 83.46 against the U.S dollar.

It closed at 83.31 on Thursday.

Source: Exchange Filing

Board approves raising up to Rs 8,500 crore via debt instruments for FY25

Source: Exchange Filing

Unit gets order in the range of Rs 100-250 crore from Adani Harbor Services unit

Order from Adani unit for constructing 3 tugs of 70 T bollard pull power

Source: Exchange filing

Shares of Zomato Ltd. fell to their lowest level in over two months after Macquarie noted JioMart's entry into quick commerce business might weigh on the performance of Blinkit.

The brokerage continues to see downside to consensus forecasts and margins for Blinkit, with rising competitive intensity despite a large potential total addressable market.

Shares of Zomato Ltd. fell to their lowest level in over two months after Macquarie noted JioMart's entry into quick commerce business might weigh on the performance of Blinkit.

The brokerage continues to see downside to consensus forecasts and margins for Blinkit, with rising competitive intensity despite a large potential total addressable market.

.png)

Shares of the company fell as much as 5.18%, the lowest level since March 22, before paring loss to trade 3.9% lower at Rs 173.65 apiece, as of 12:40 p.m. This compares to a 0.16% advance in the NSE Nifty 50.

The stock has risen 40.3% year-to-date and 151.41% in the last 12 months. Total traded volume so far in the day stood at 0.95 times its 30-day average. The relative strength index was at 34.79.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating, one recommends a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 27.4%.

Higher growth numbers will also help stabilise other rating metrics including fiscal metrics

India’s potential growth is expected to be around 7%. This is sustainable. If not for some bottlenecks this could be even higher

Source: S&P Global Ratings

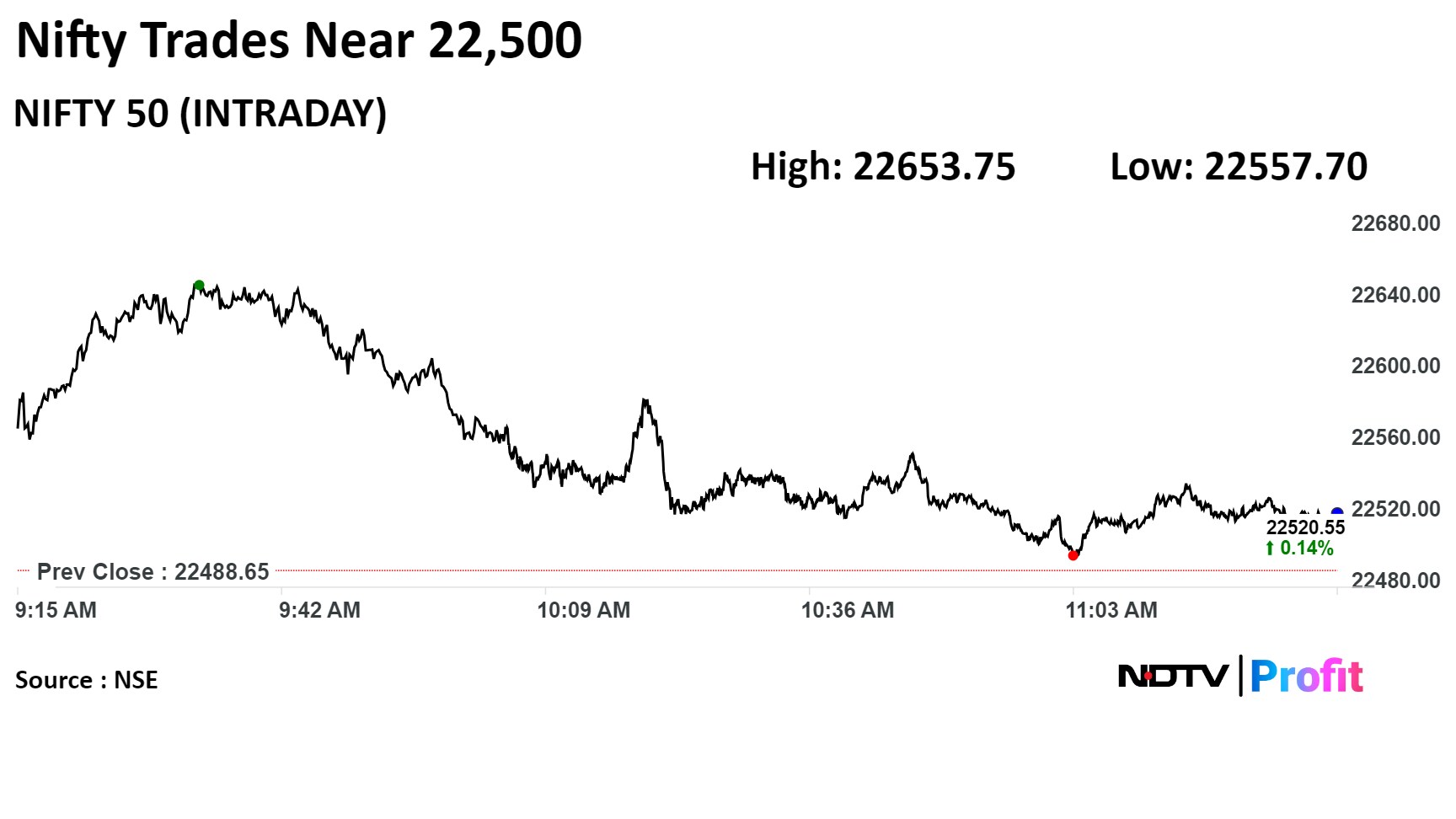

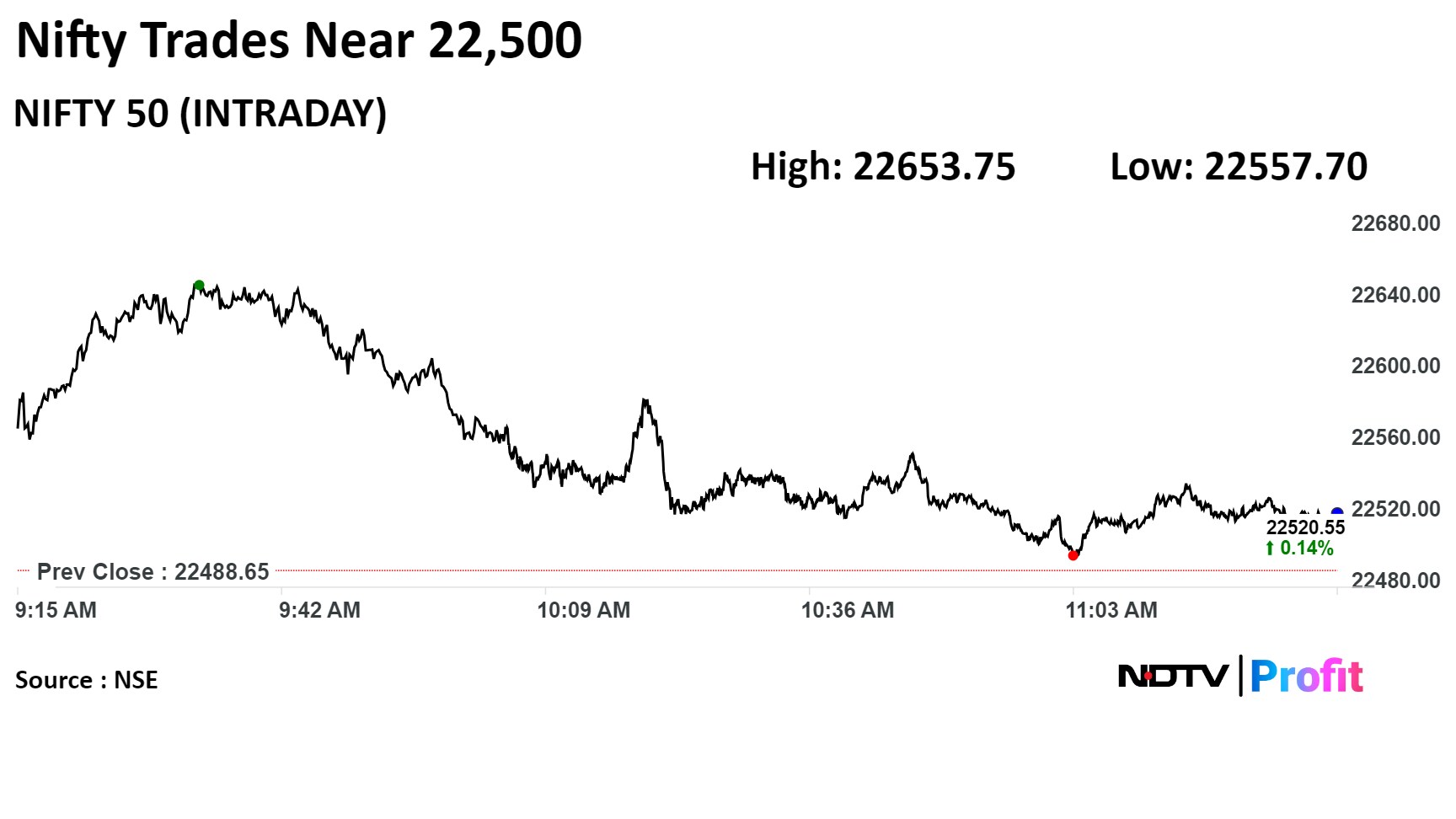

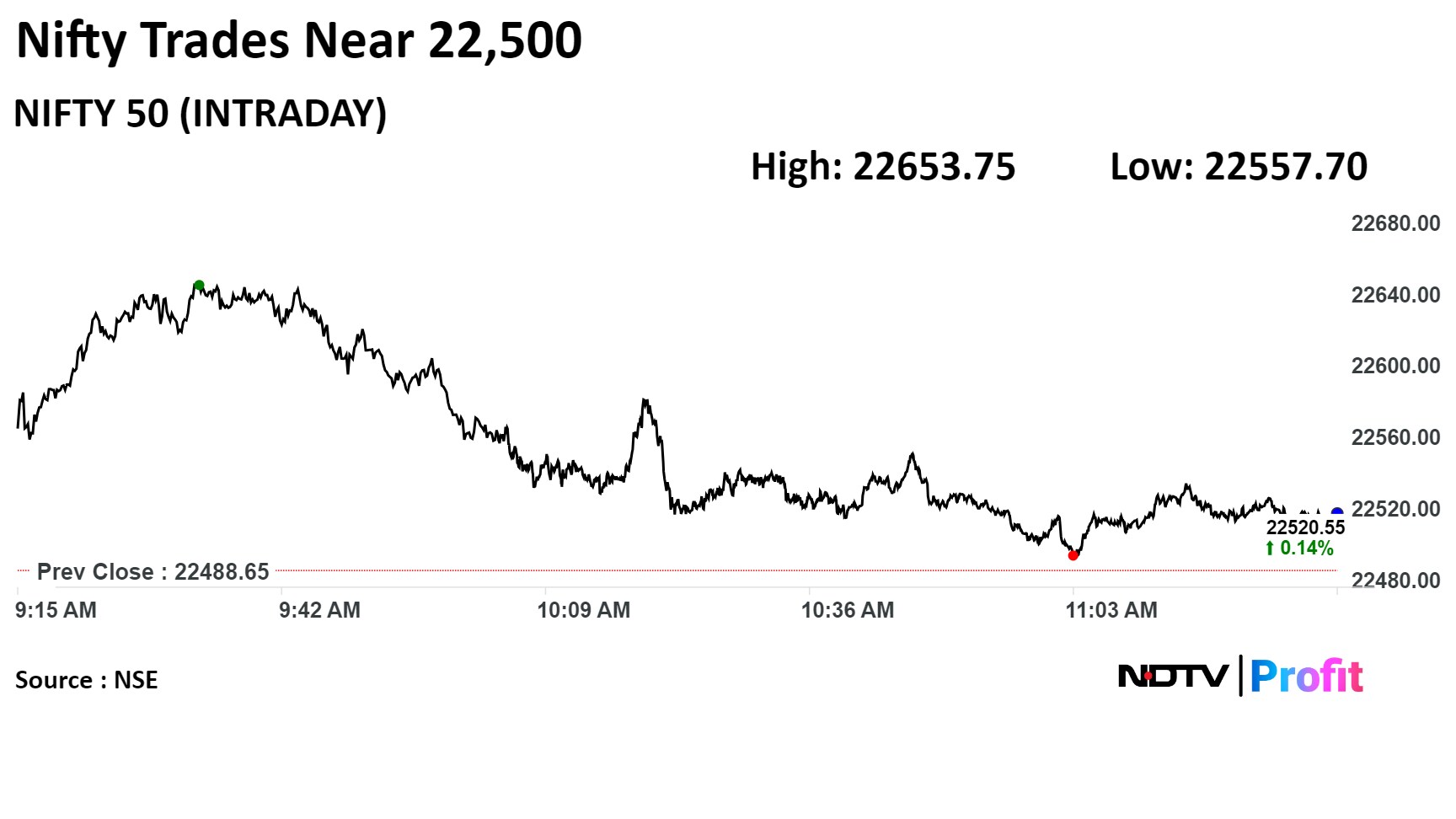

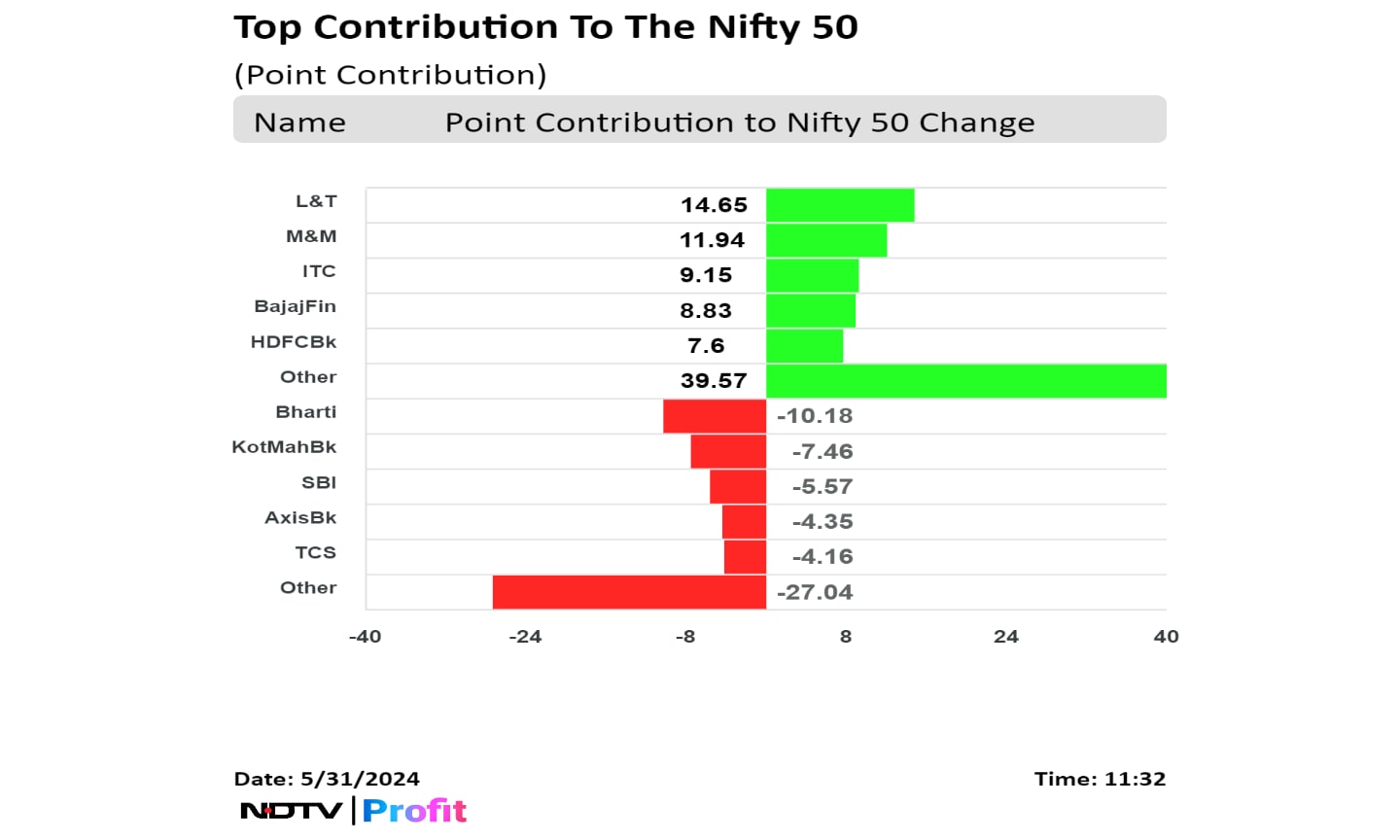

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

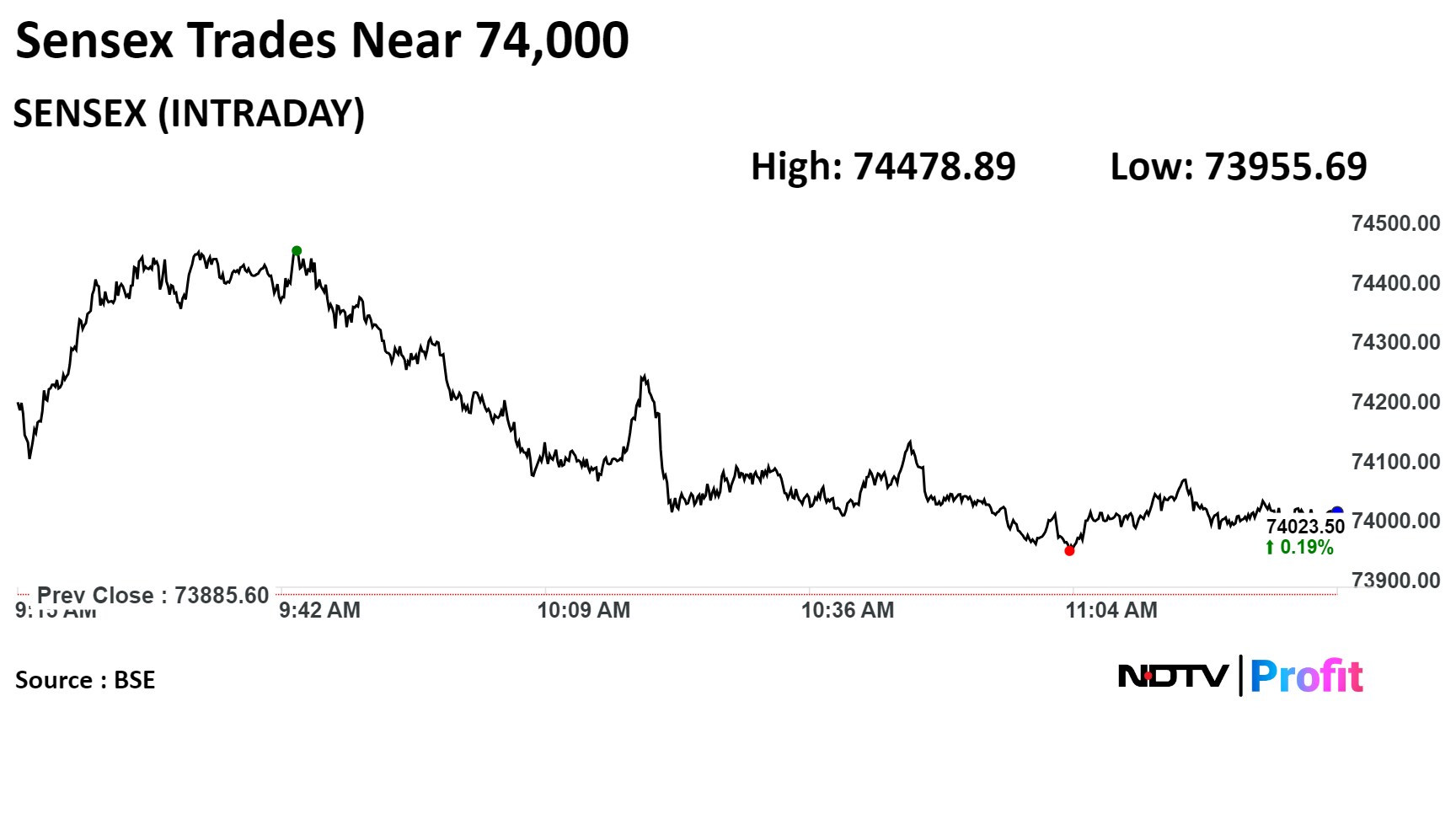

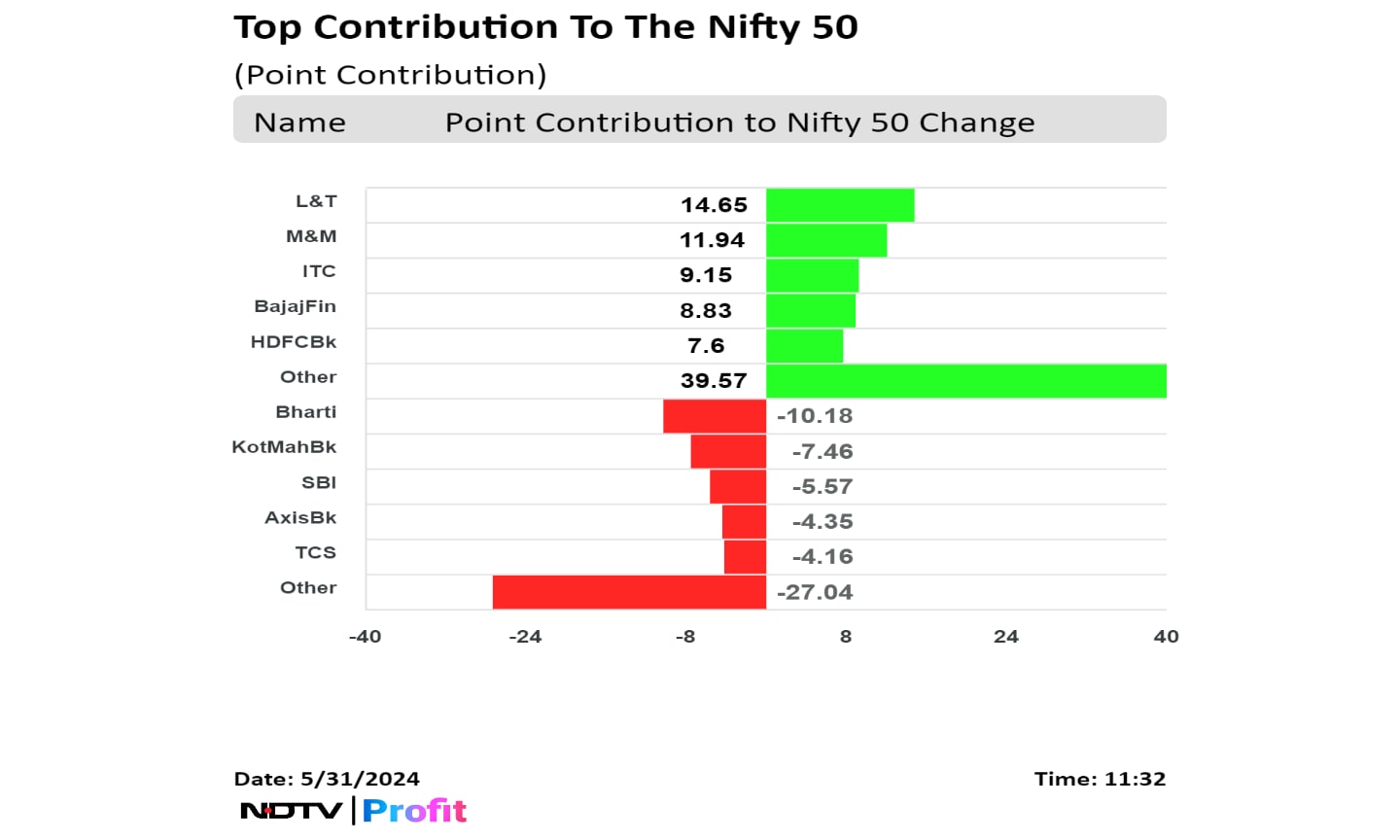

Shares of Larsen & Toubro Ltd., Mahindra & Mahindra Ltd., ITC Ltd., Bajaj Finance Ltd., and HDFC Bank Ltd. contributed the most to the gains.

Those of Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., State Bank Of India, Axis Bank Ltd., and Tata Consultancy Services Ltd. weighed on the Nifty.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Shares of Larsen & Toubro Ltd., Mahindra & Mahindra Ltd., ITC Ltd., Bajaj Finance Ltd., and HDFC Bank Ltd. contributed the most to the gains.

Those of Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., State Bank Of India, Axis Bank Ltd., and Tata Consultancy Services Ltd. weighed on the Nifty.

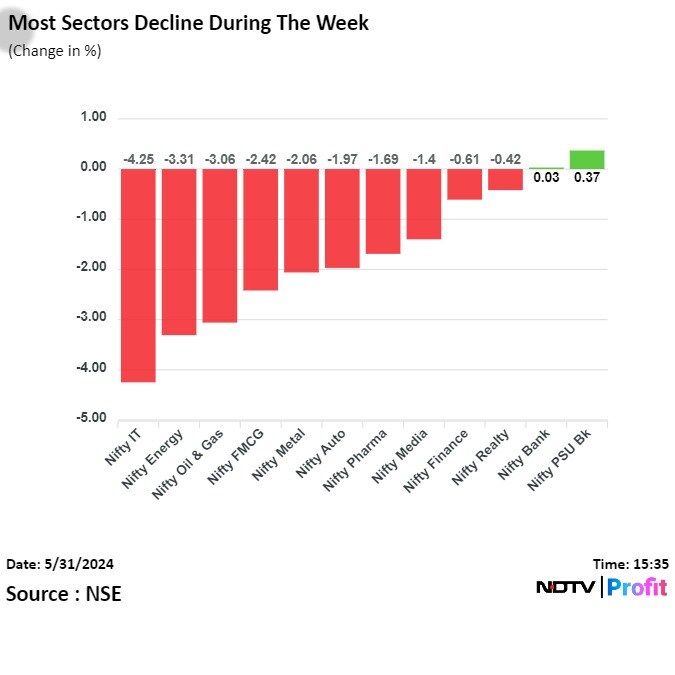

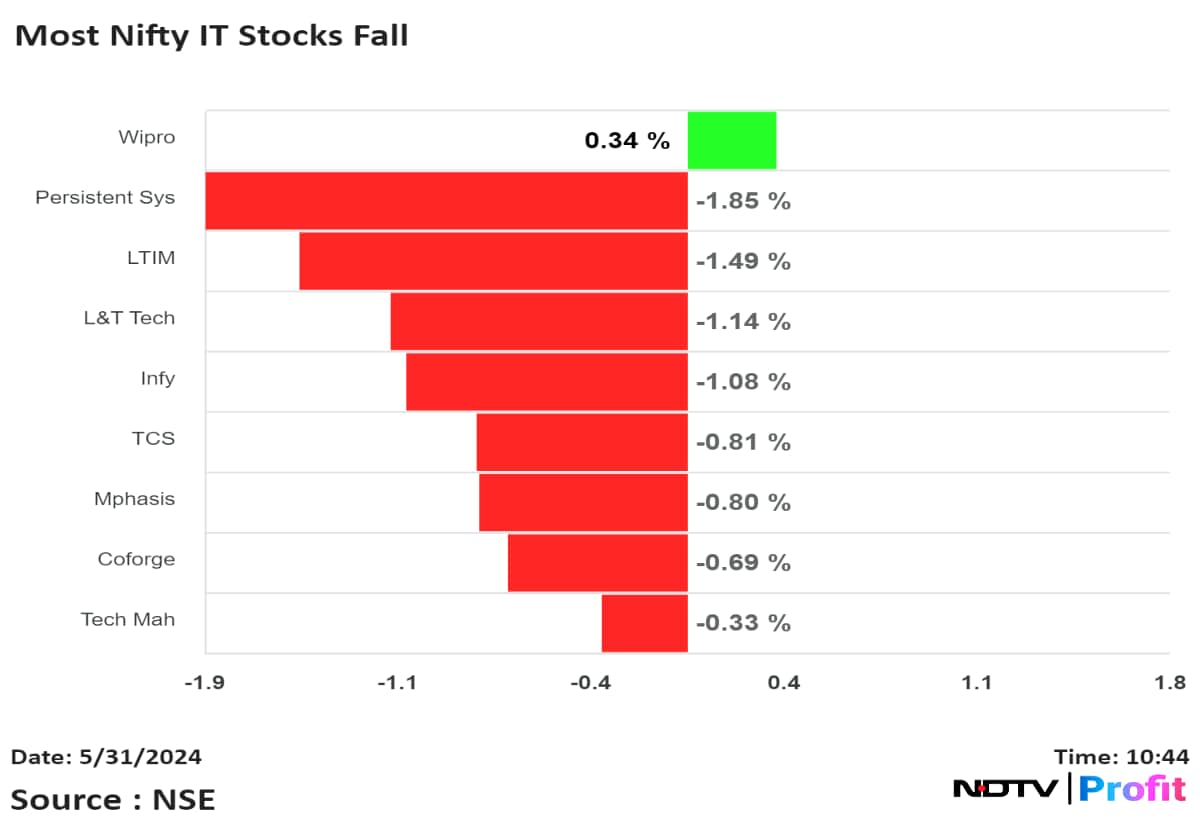

Most sectoral indices fell with Nifty Media losing the most. Nifty Realty was the top gainer.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Shares of Larsen & Toubro Ltd., Mahindra & Mahindra Ltd., ITC Ltd., Bajaj Finance Ltd., and HDFC Bank Ltd. contributed the most to the gains.

Those of Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., State Bank Of India, Axis Bank Ltd., and Tata Consultancy Services Ltd. weighed on the Nifty.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.

At 11:35 a.m., the Nifty traded higher by 32.20 points or 0.14% at 22,520.85 while the Sensex rose to 74,051.08, up by 165.48 points or 0.22%.

Milan Vaishnav, founder of Gemstone Equity Research said, "Election results might come on Tuesday but the polls will make the market volatile on Monday."

He added that options data indicate that market participants are preparing for a 700 point move on the either side of the Nifty in the next two-three sessions.

Benchmark equity indices traded near day's low through the midday after snapping their five-day losing streak at open.