-The local currency closed 15 paise higher at 83.41 against the US Dollar.

-It's the highest closing level since Jun 7.

-It closed at 83.56 on Friday.

Source: Cogencis

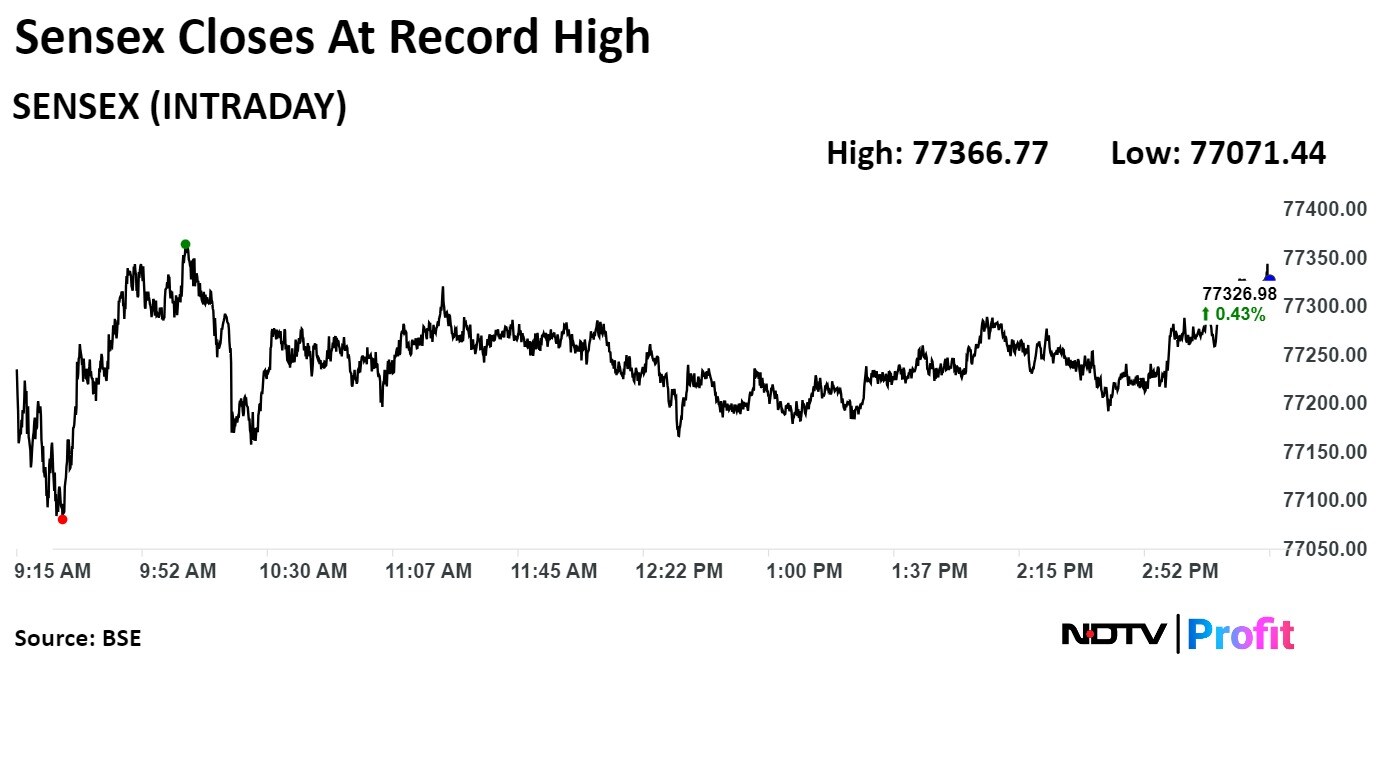

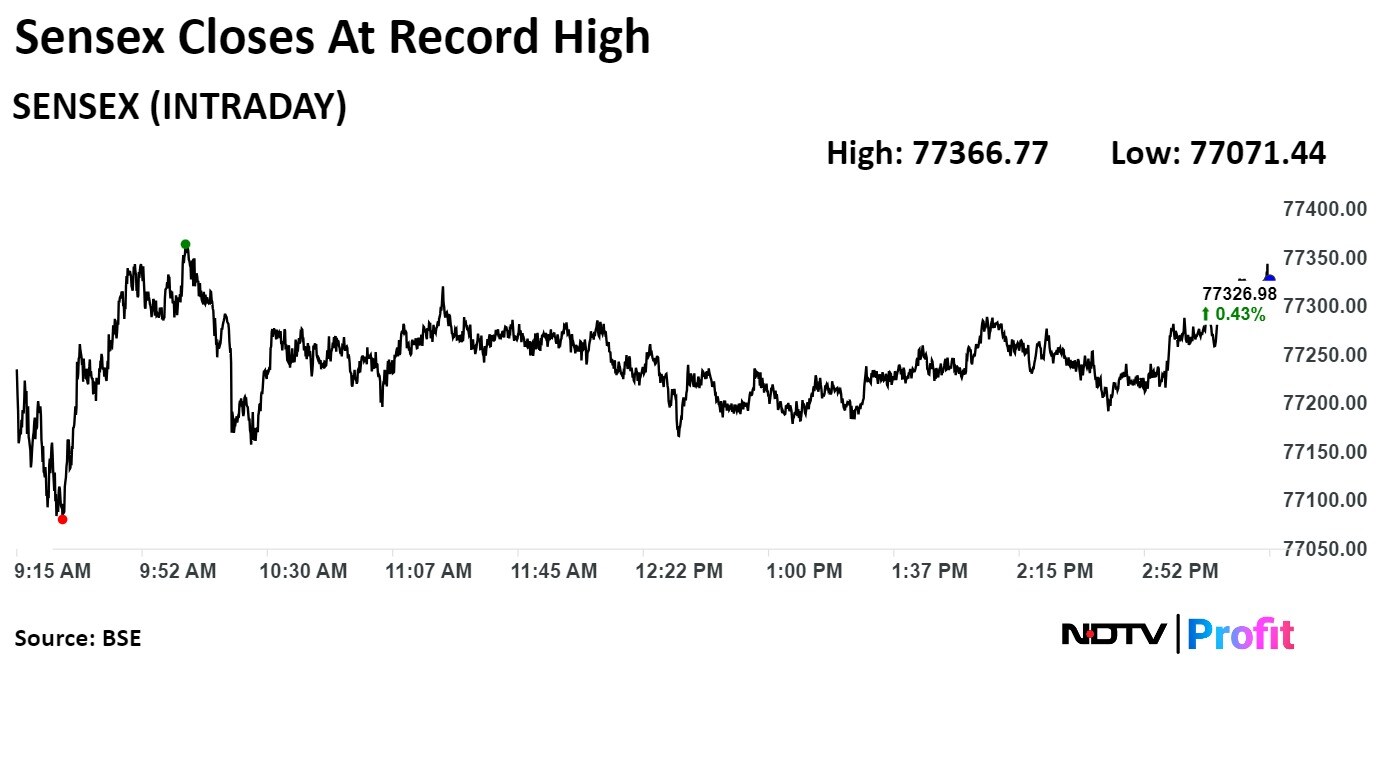

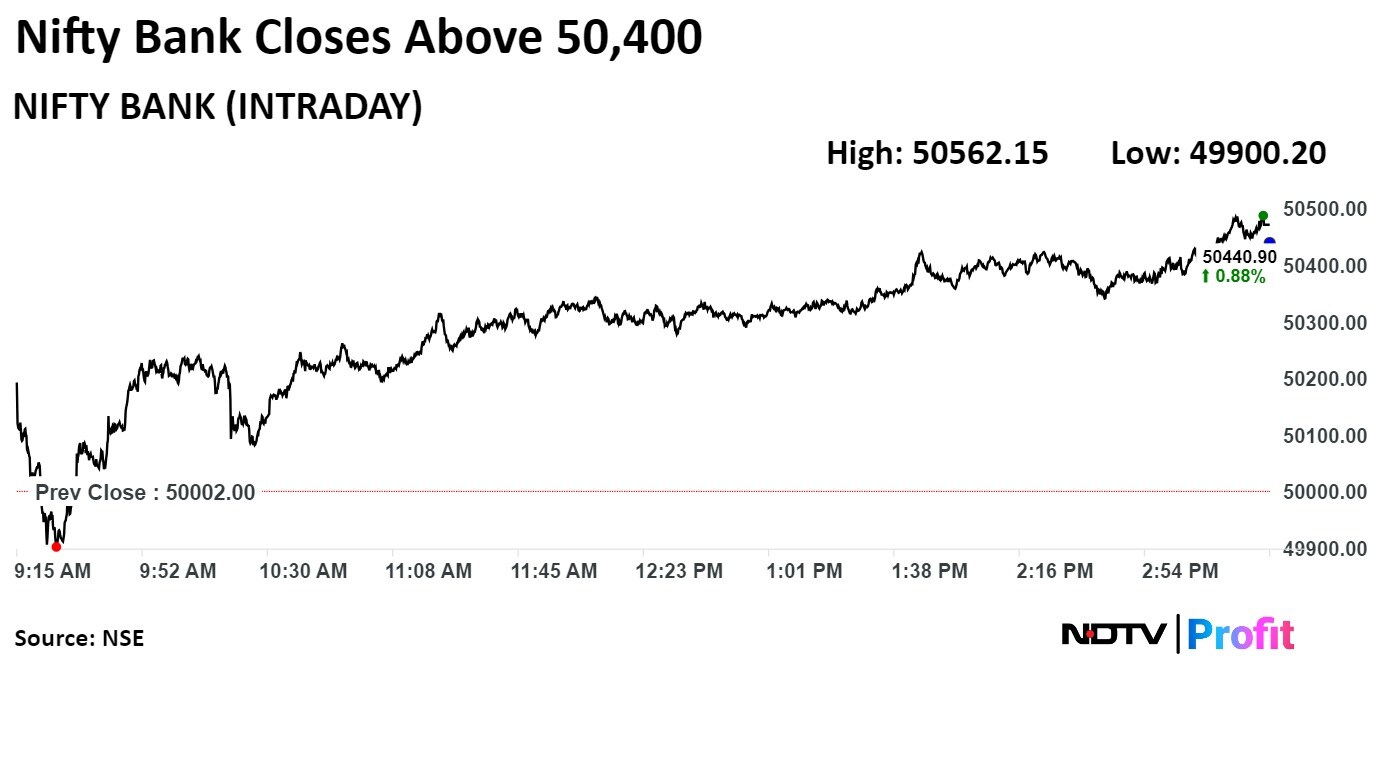

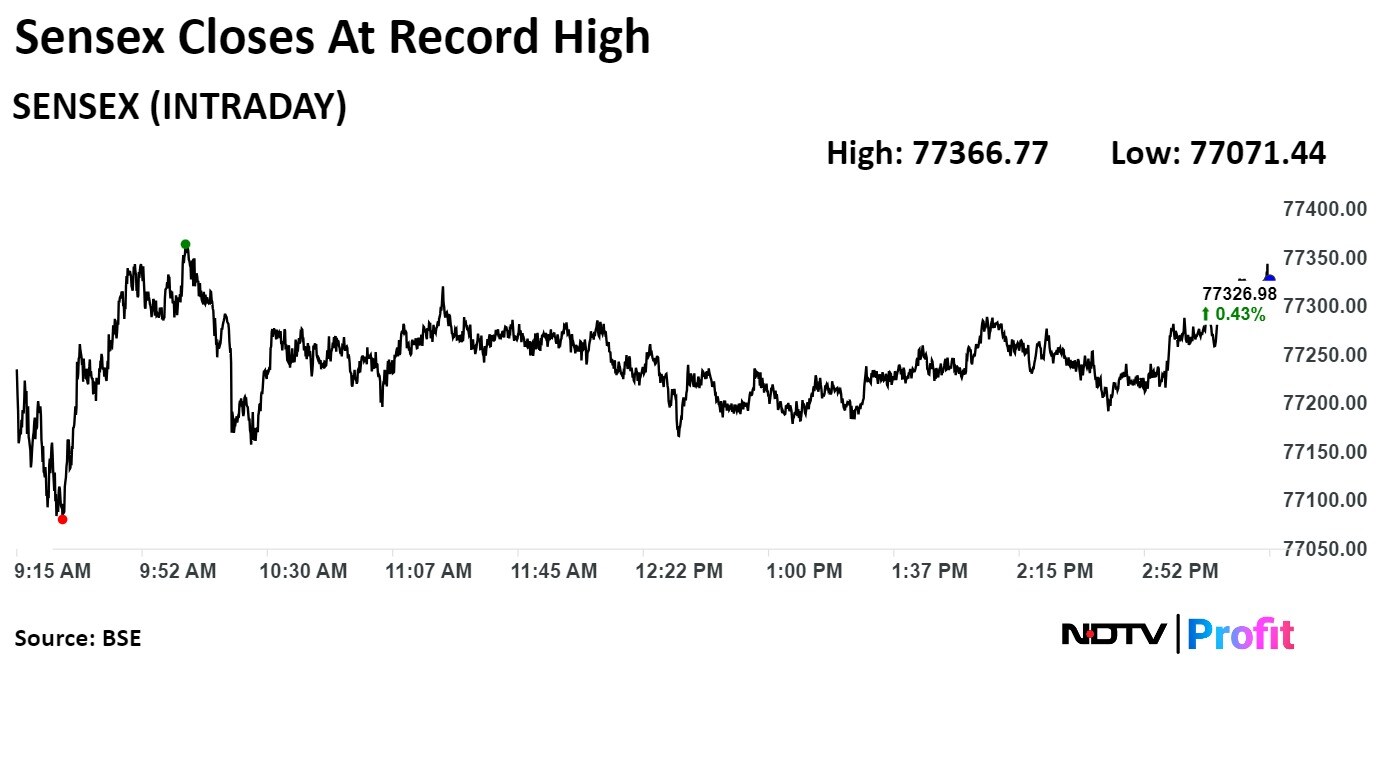

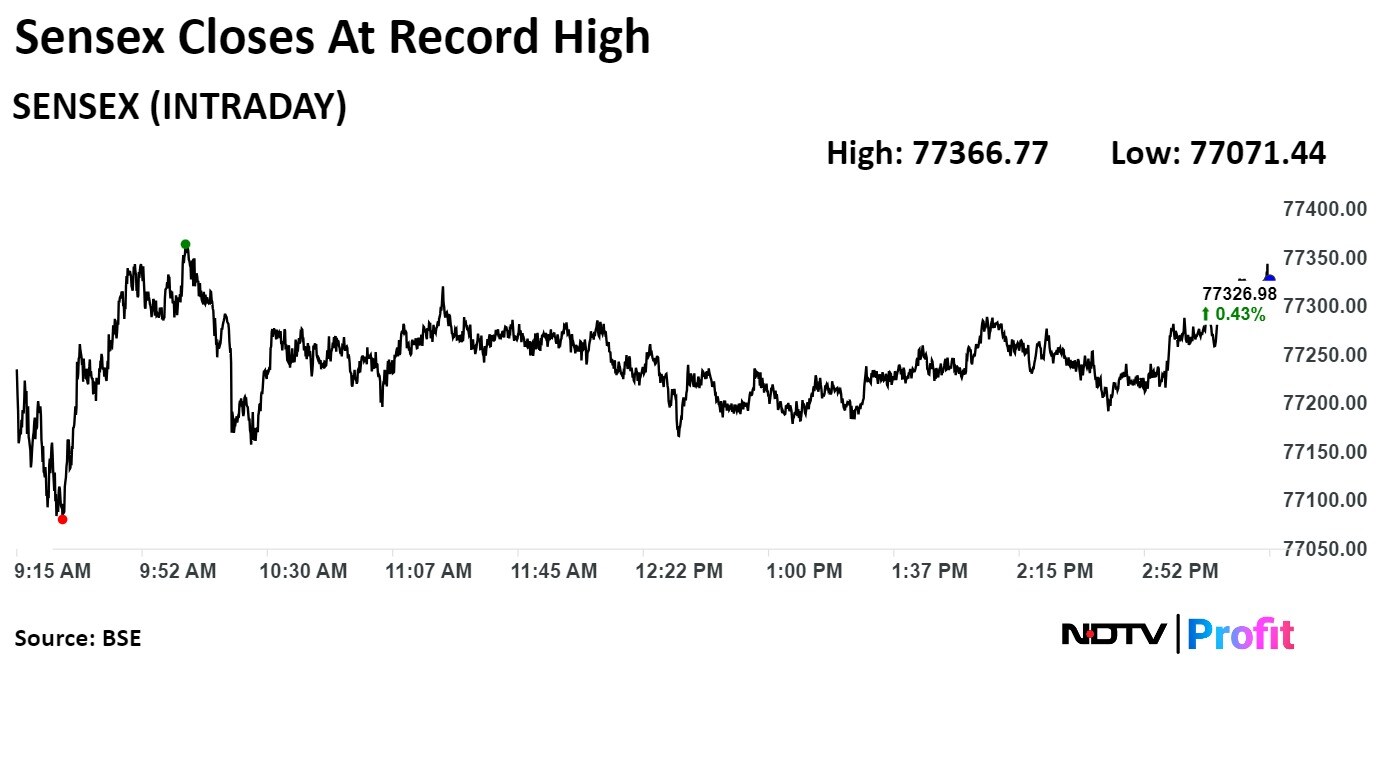

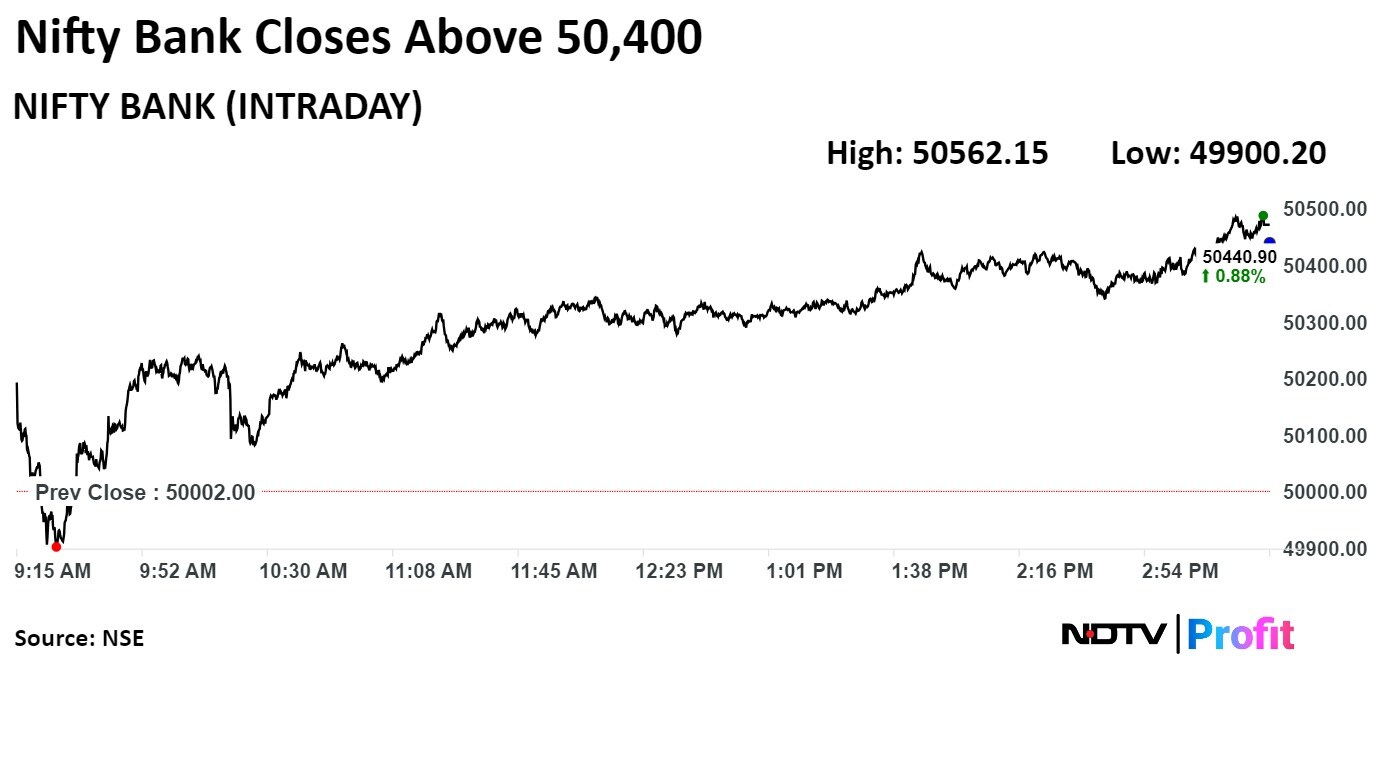

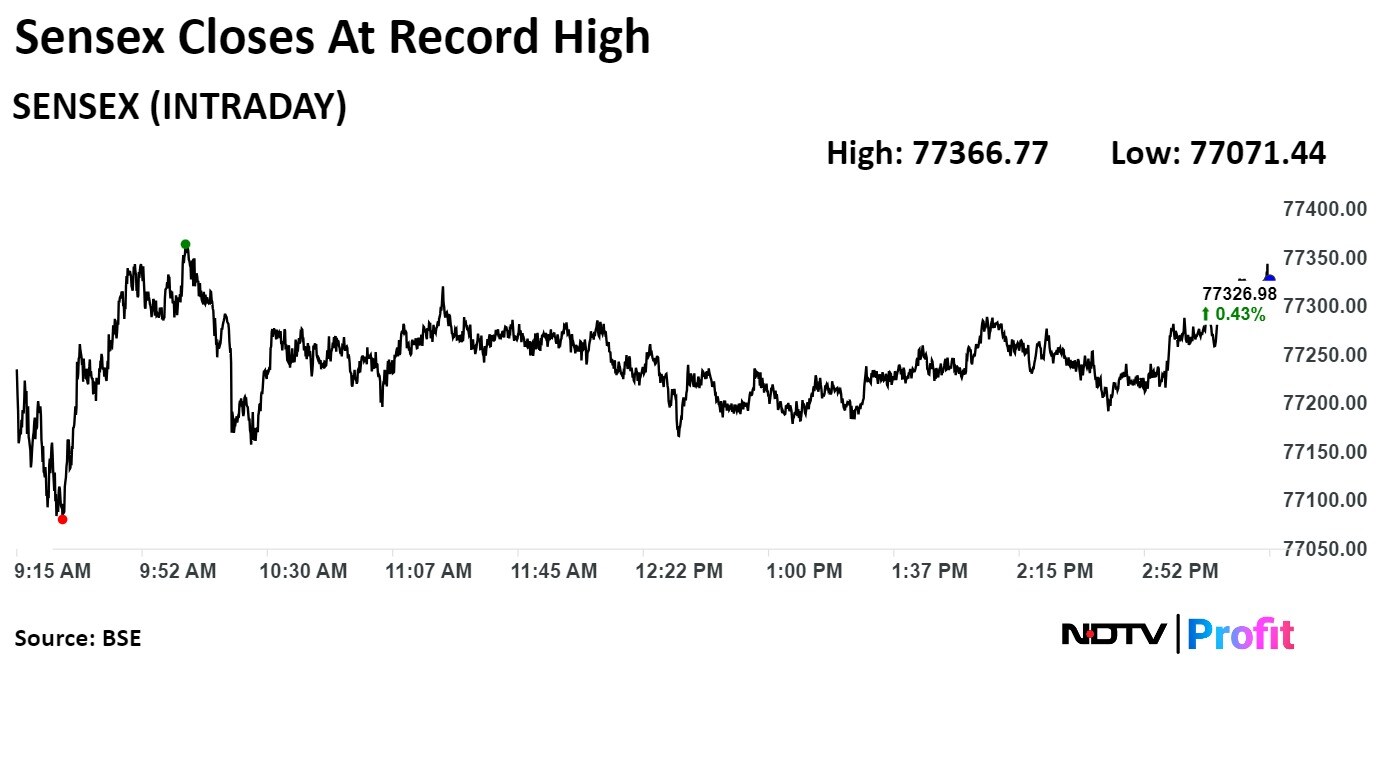

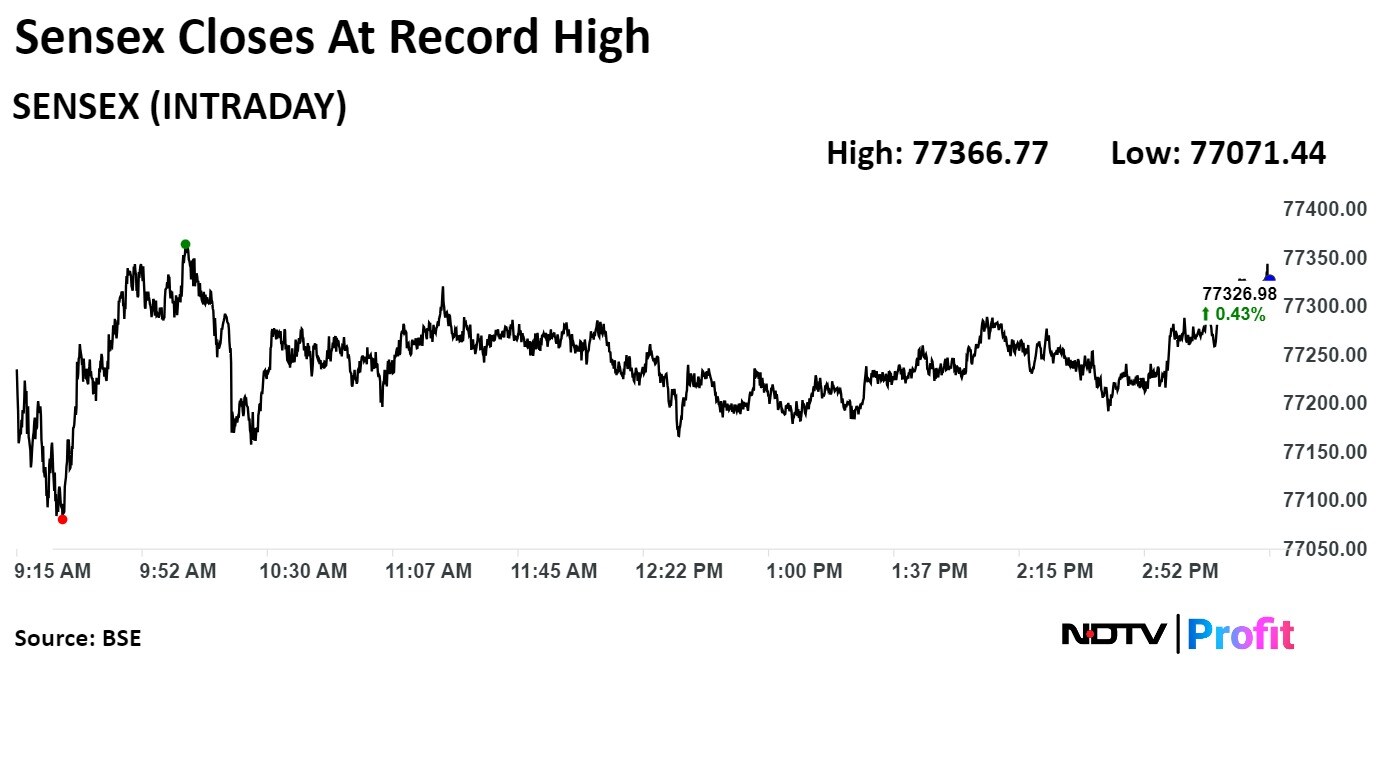

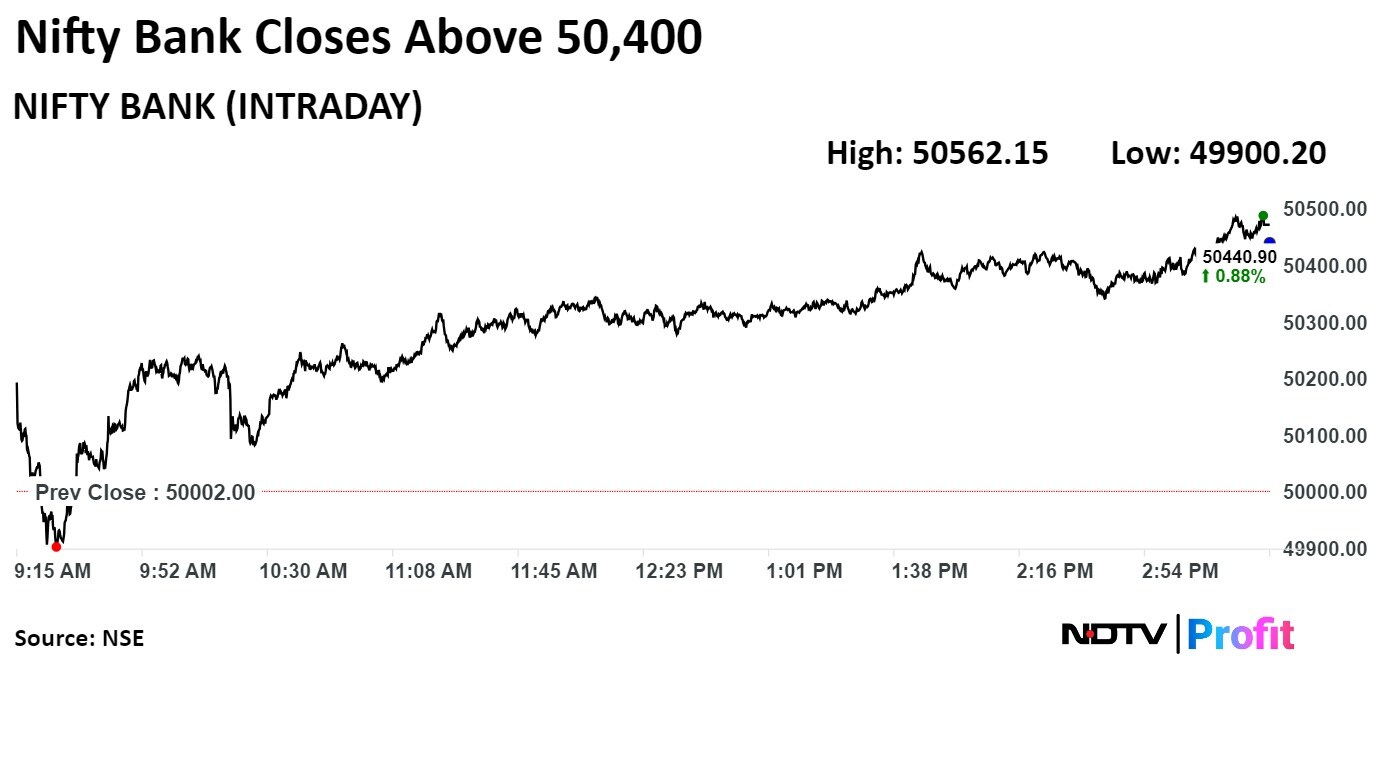

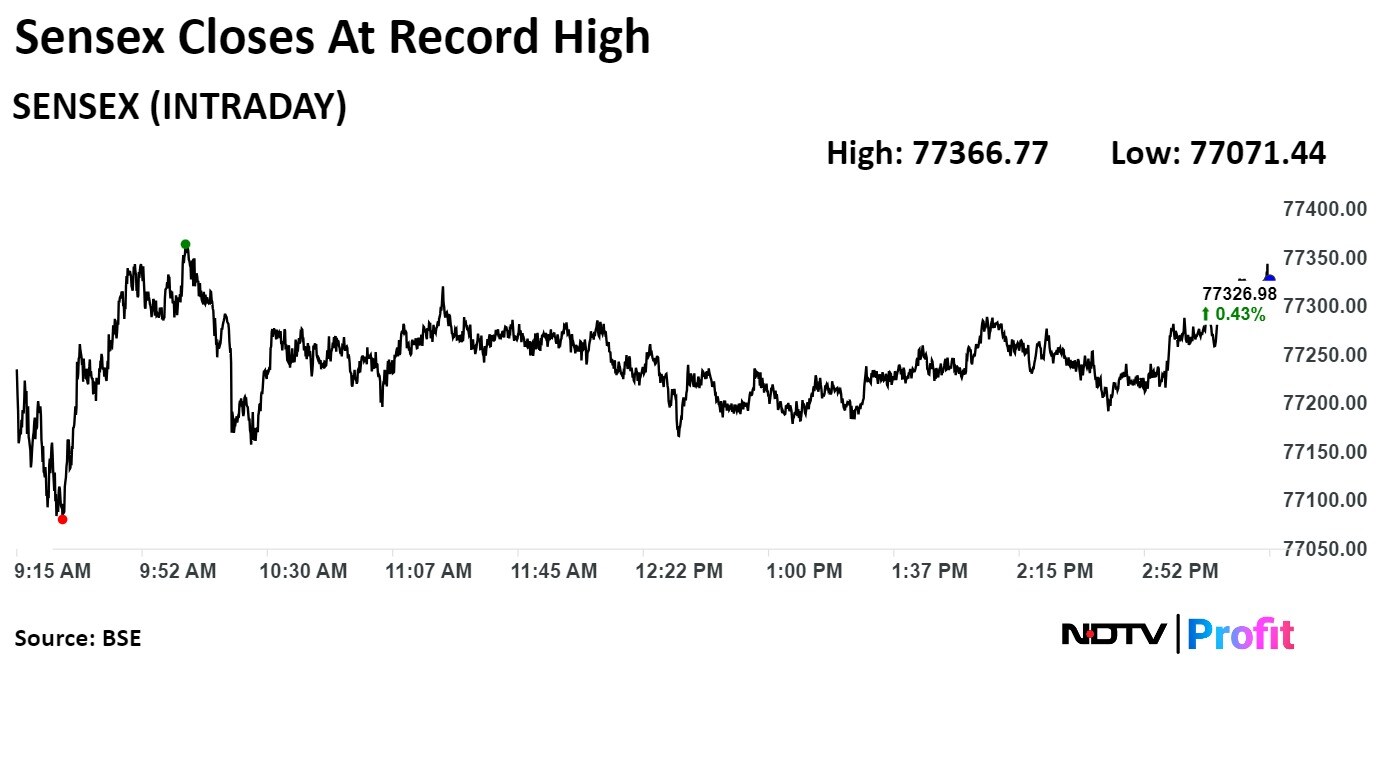

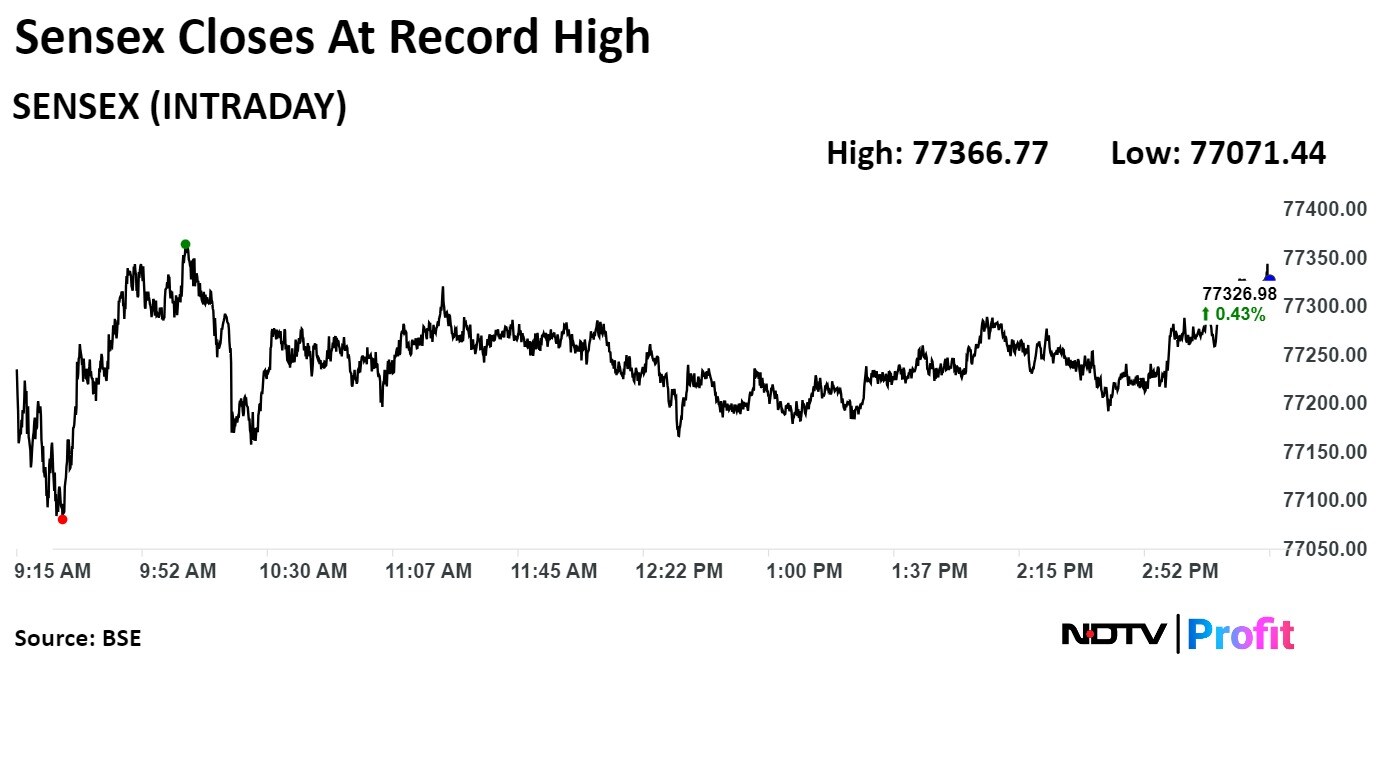

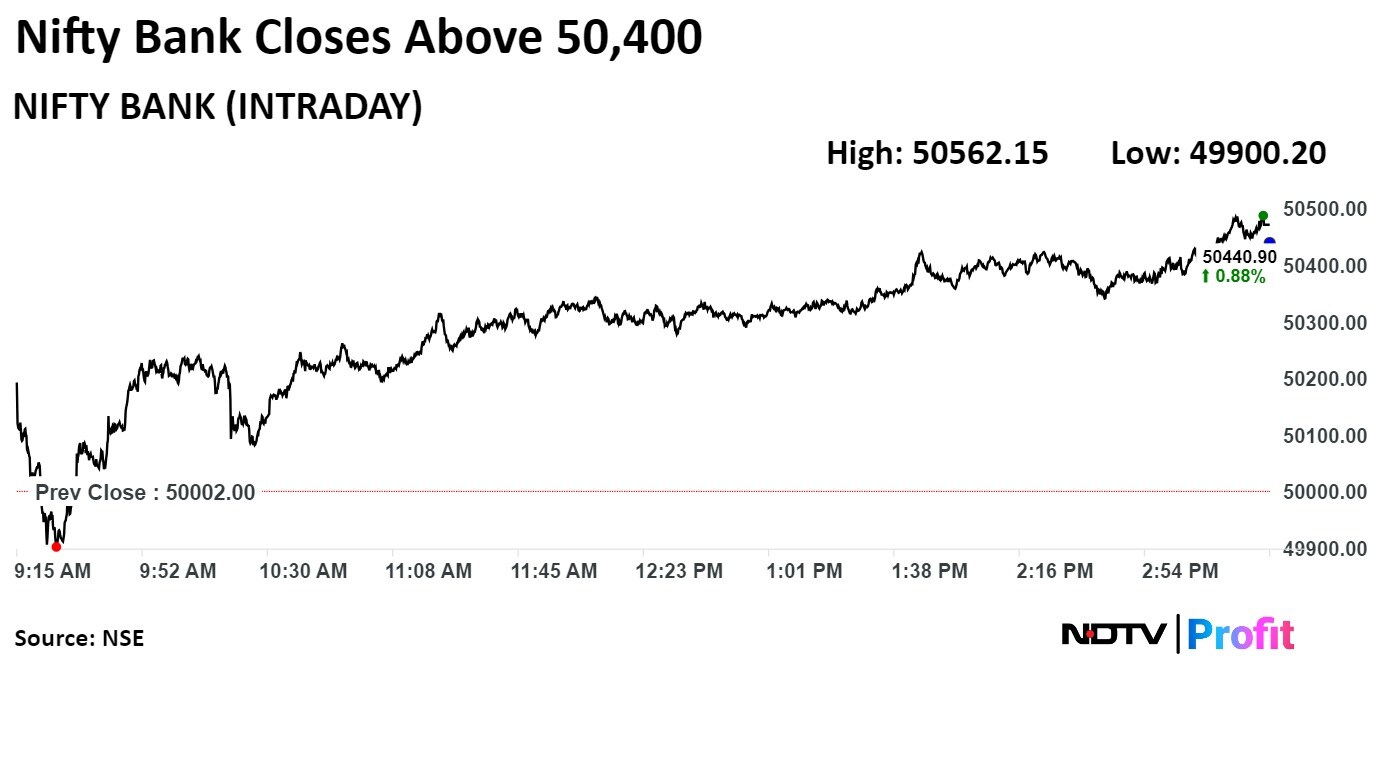

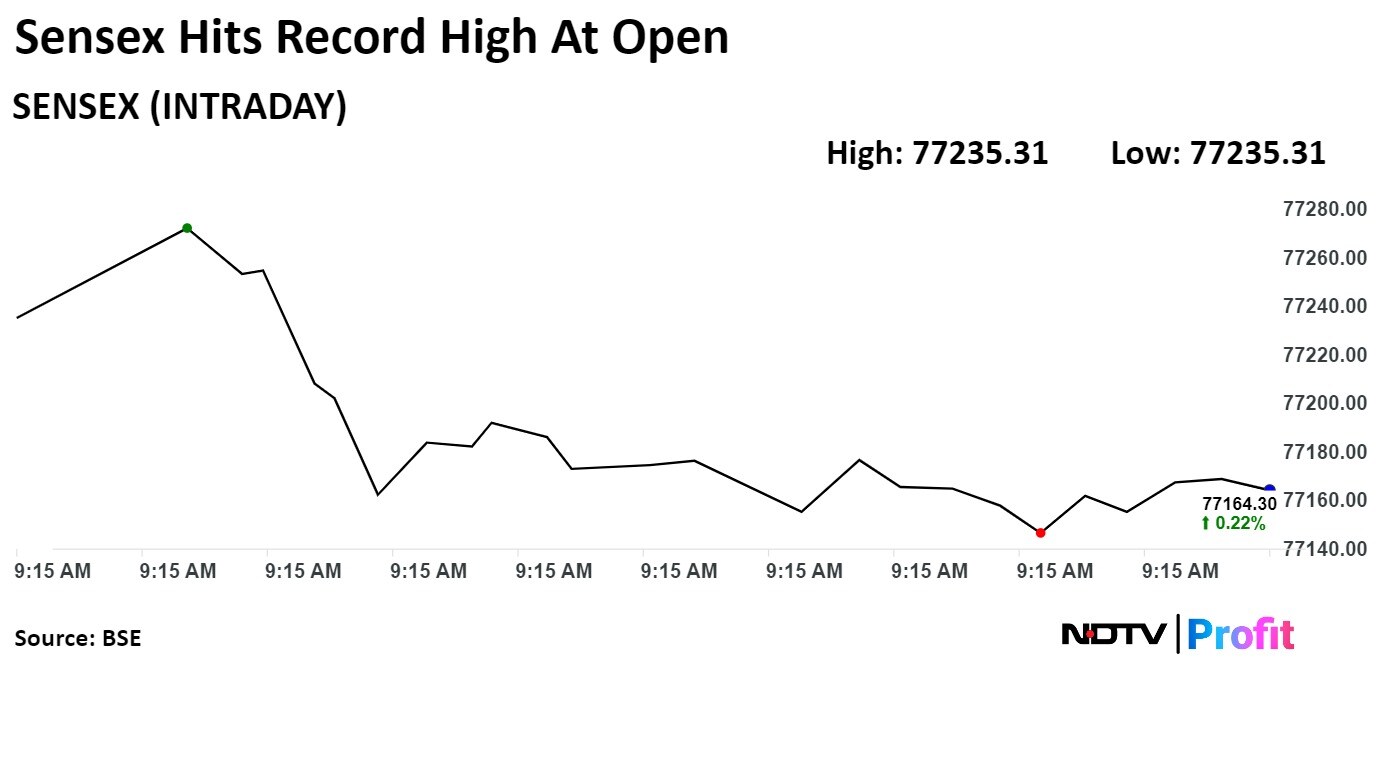

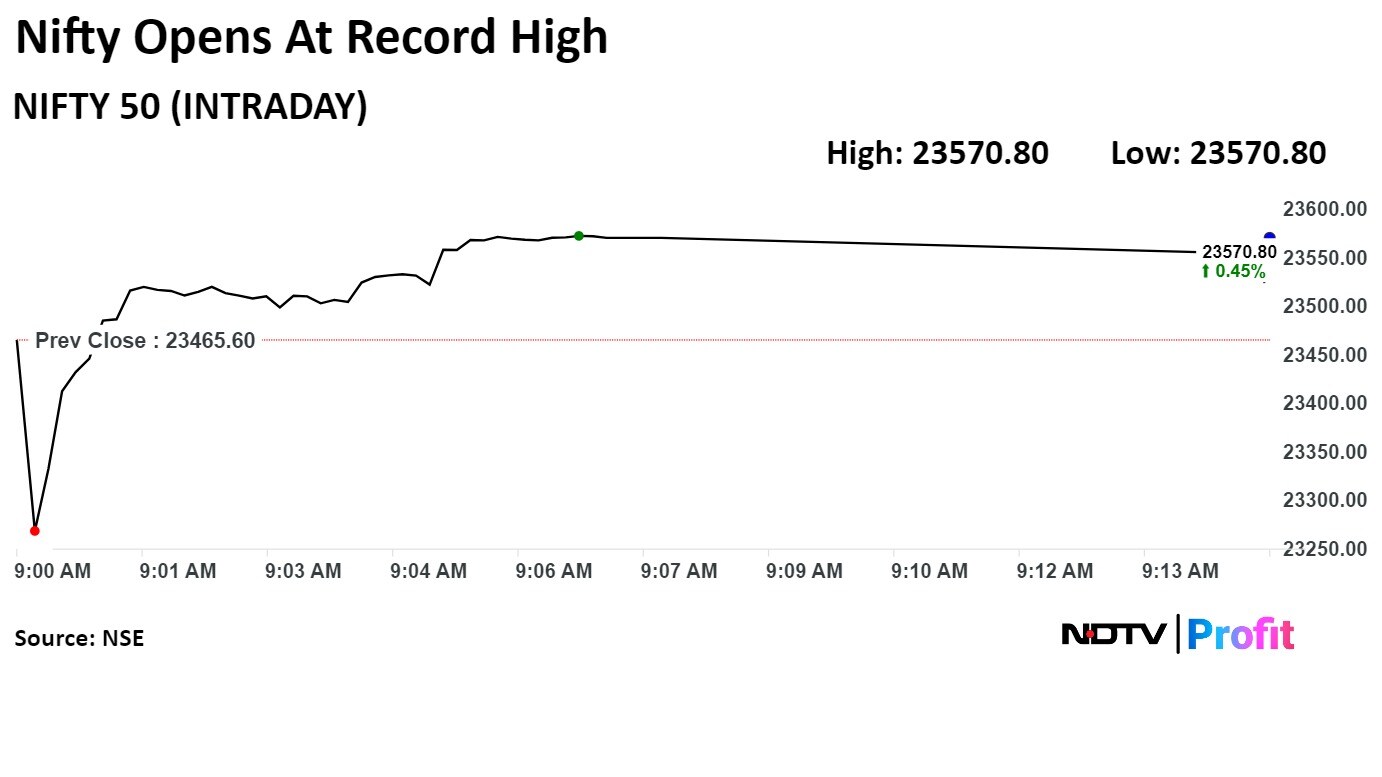

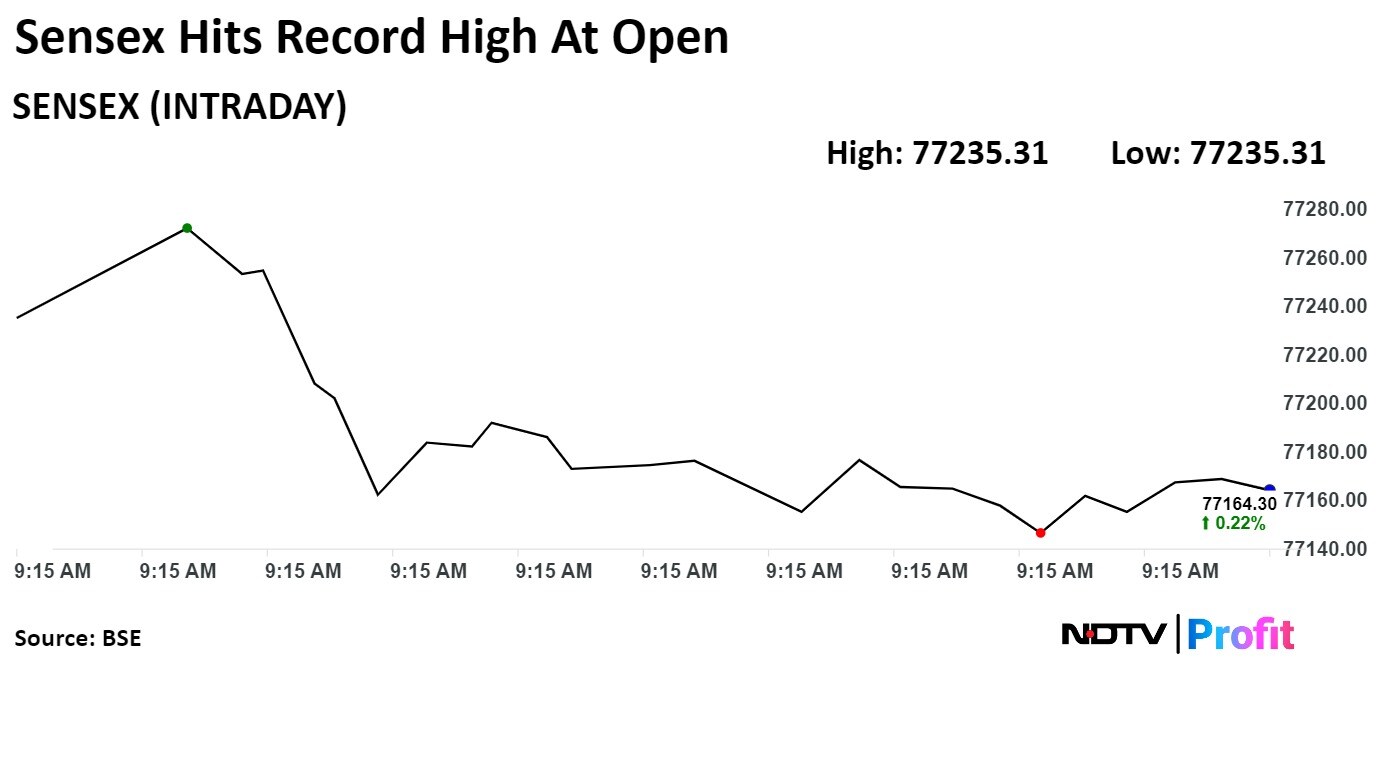

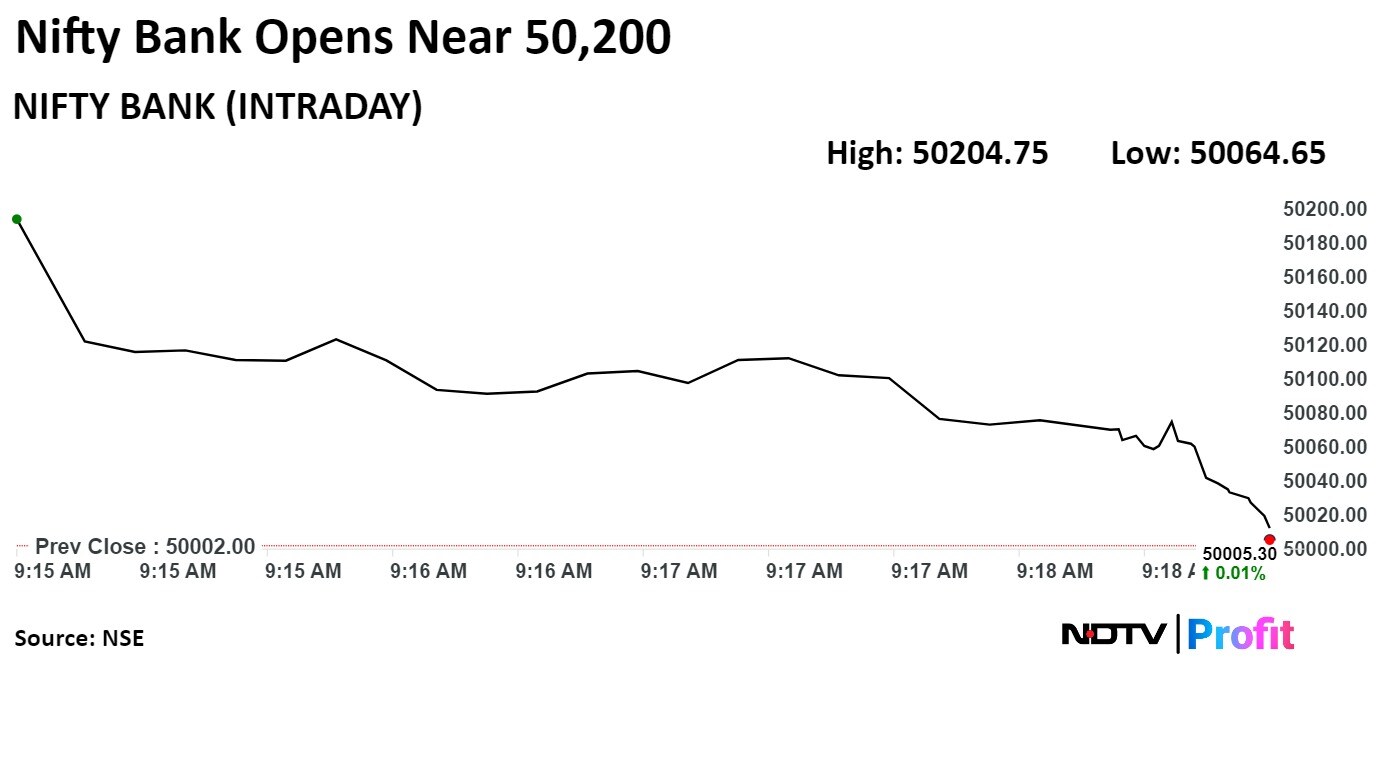

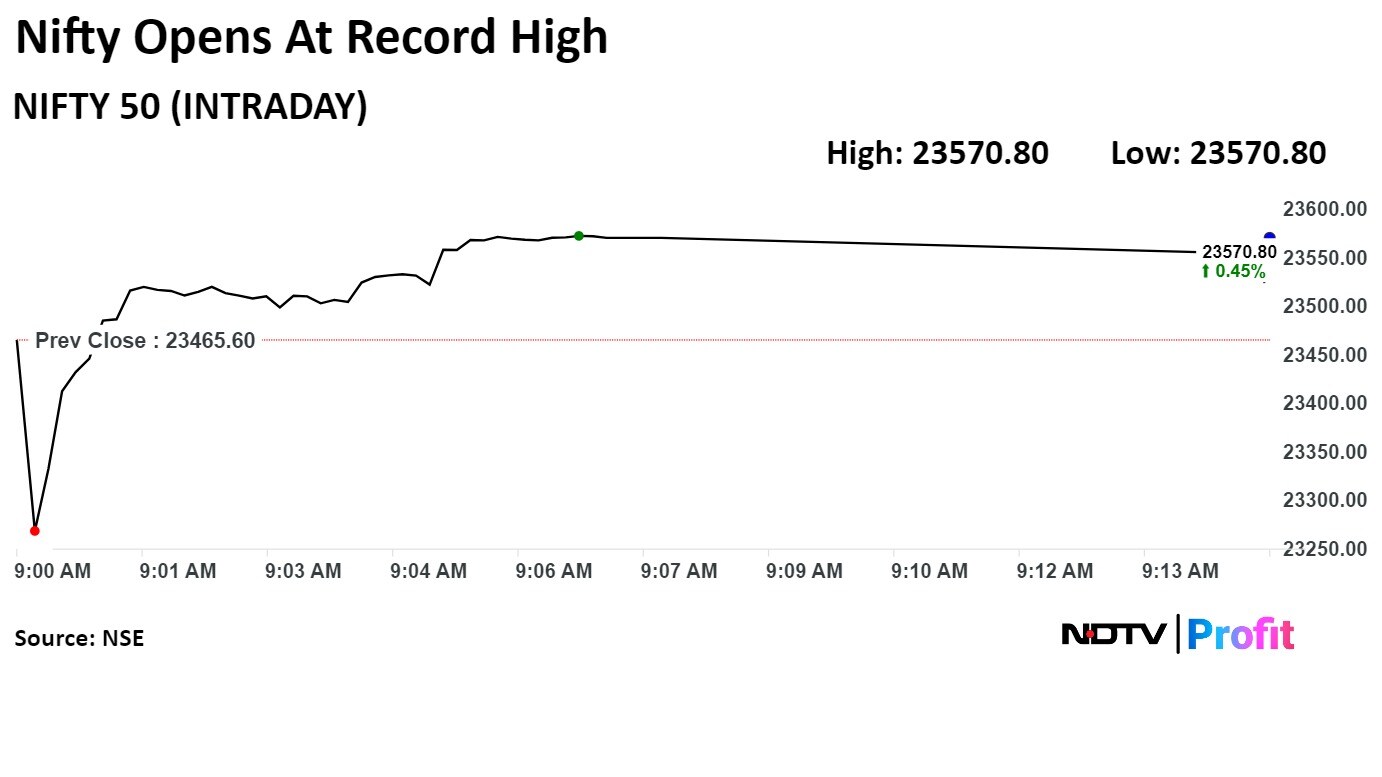

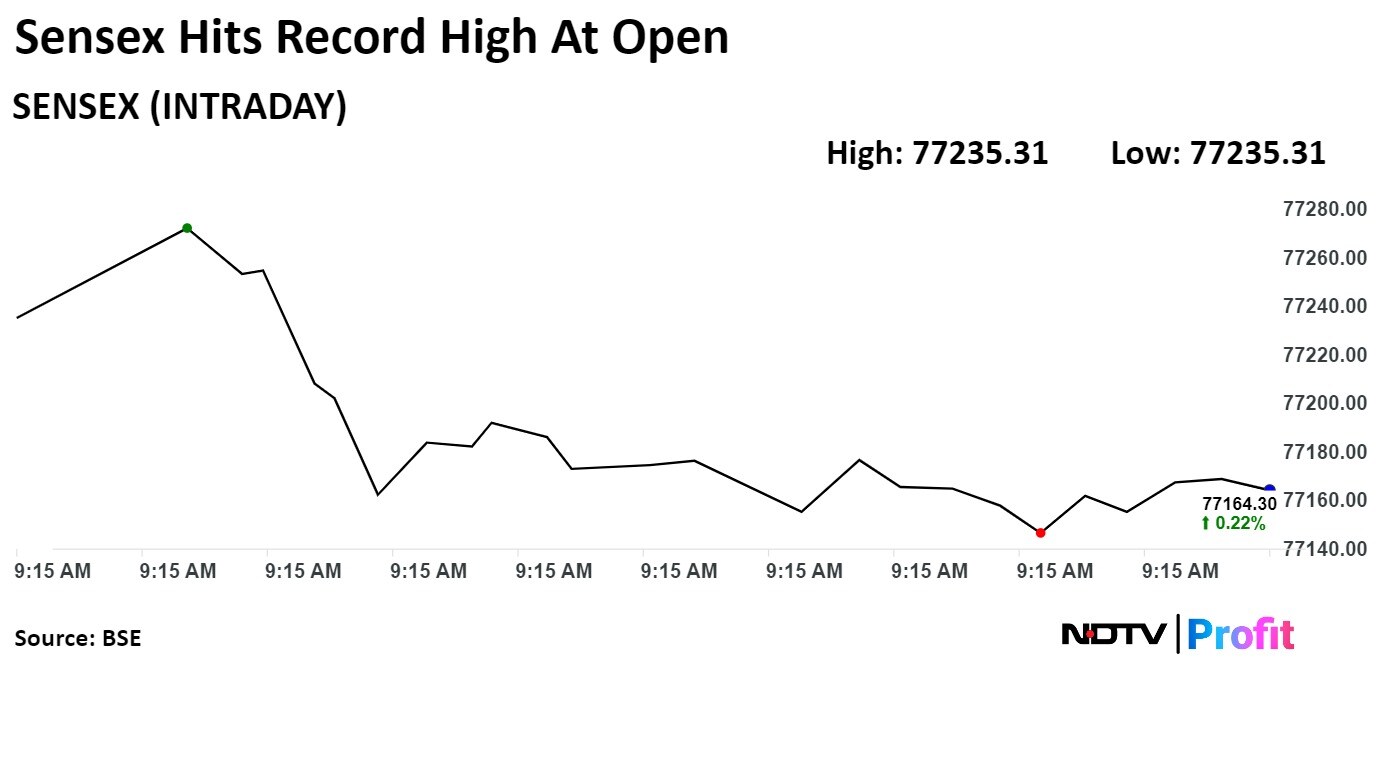

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

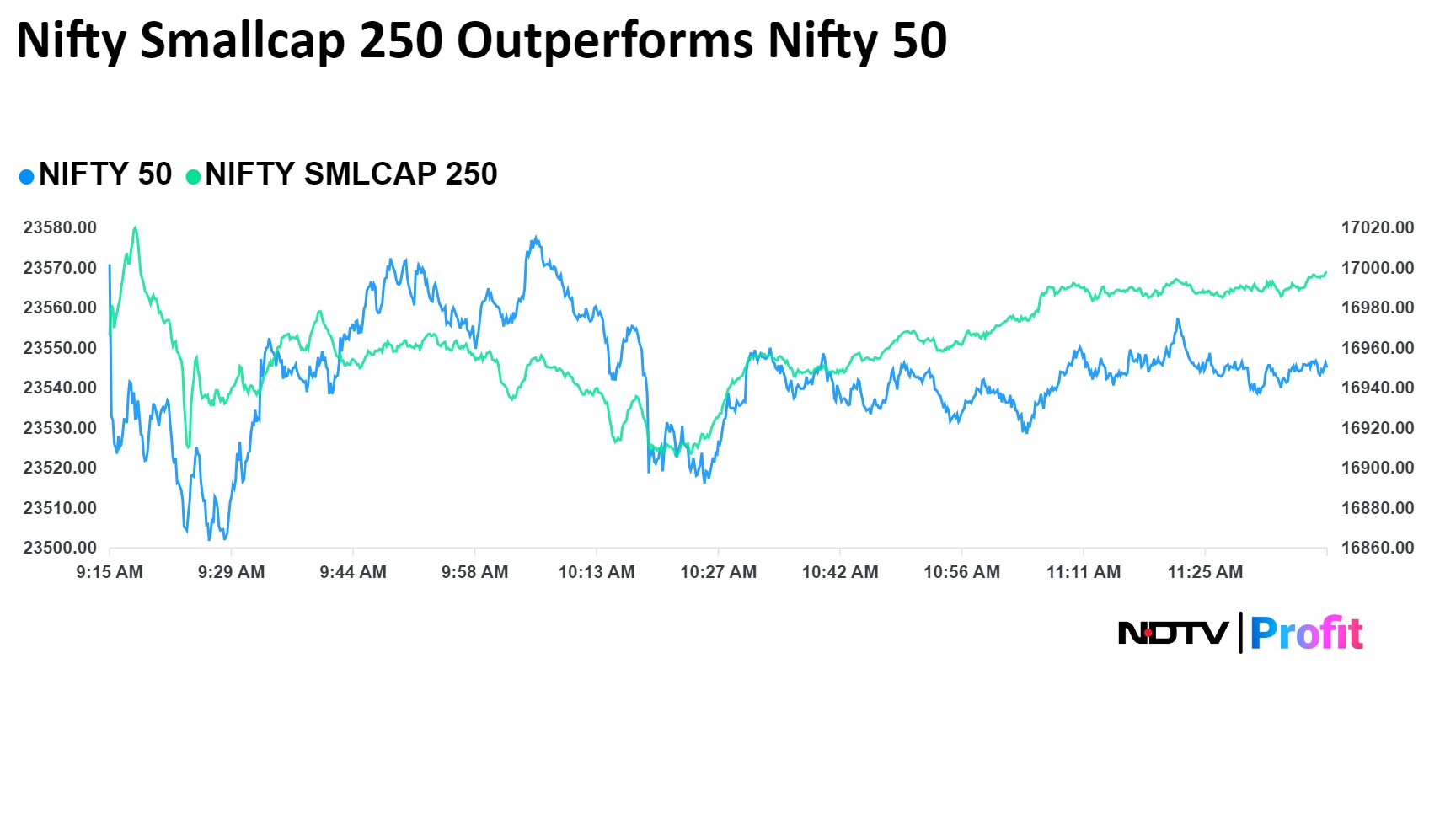

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

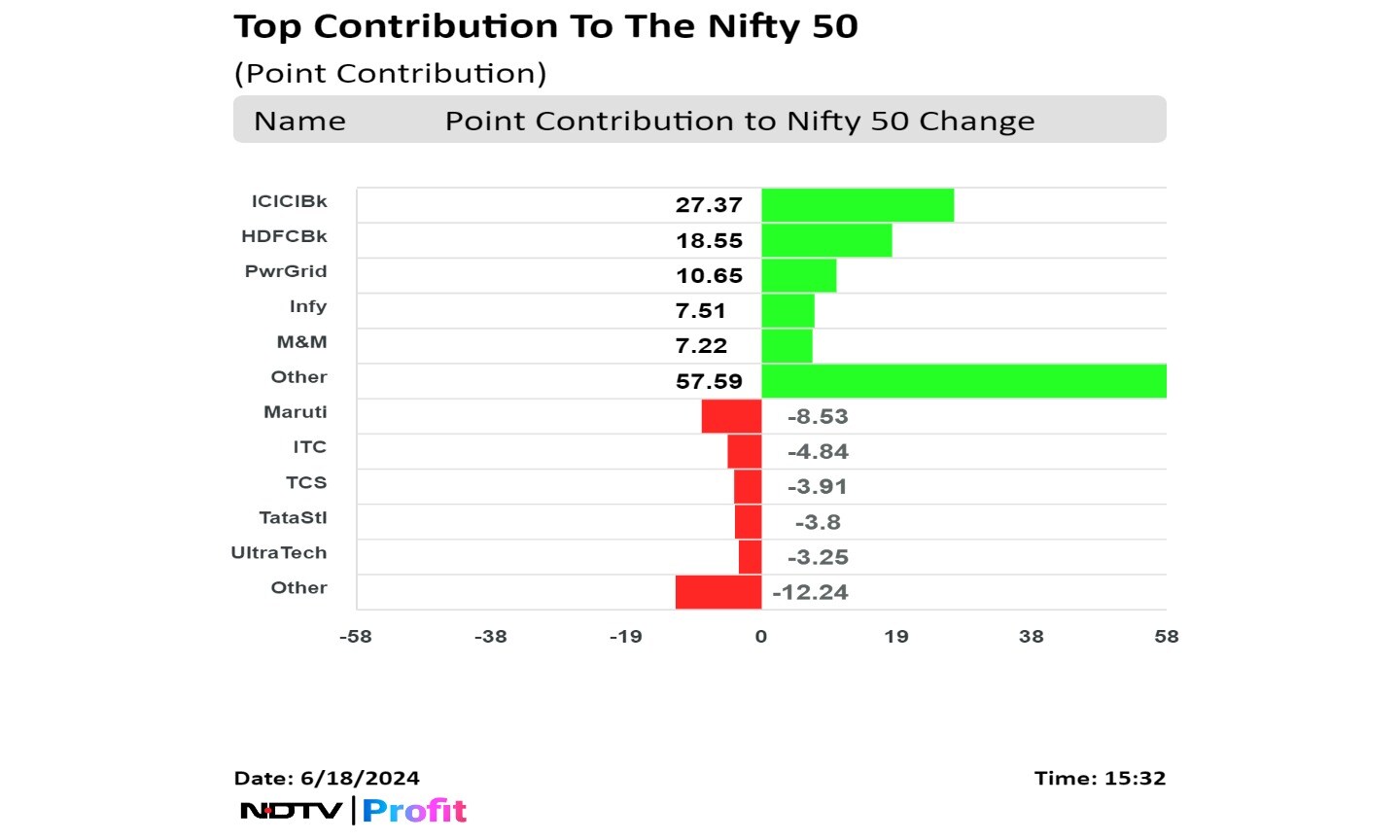

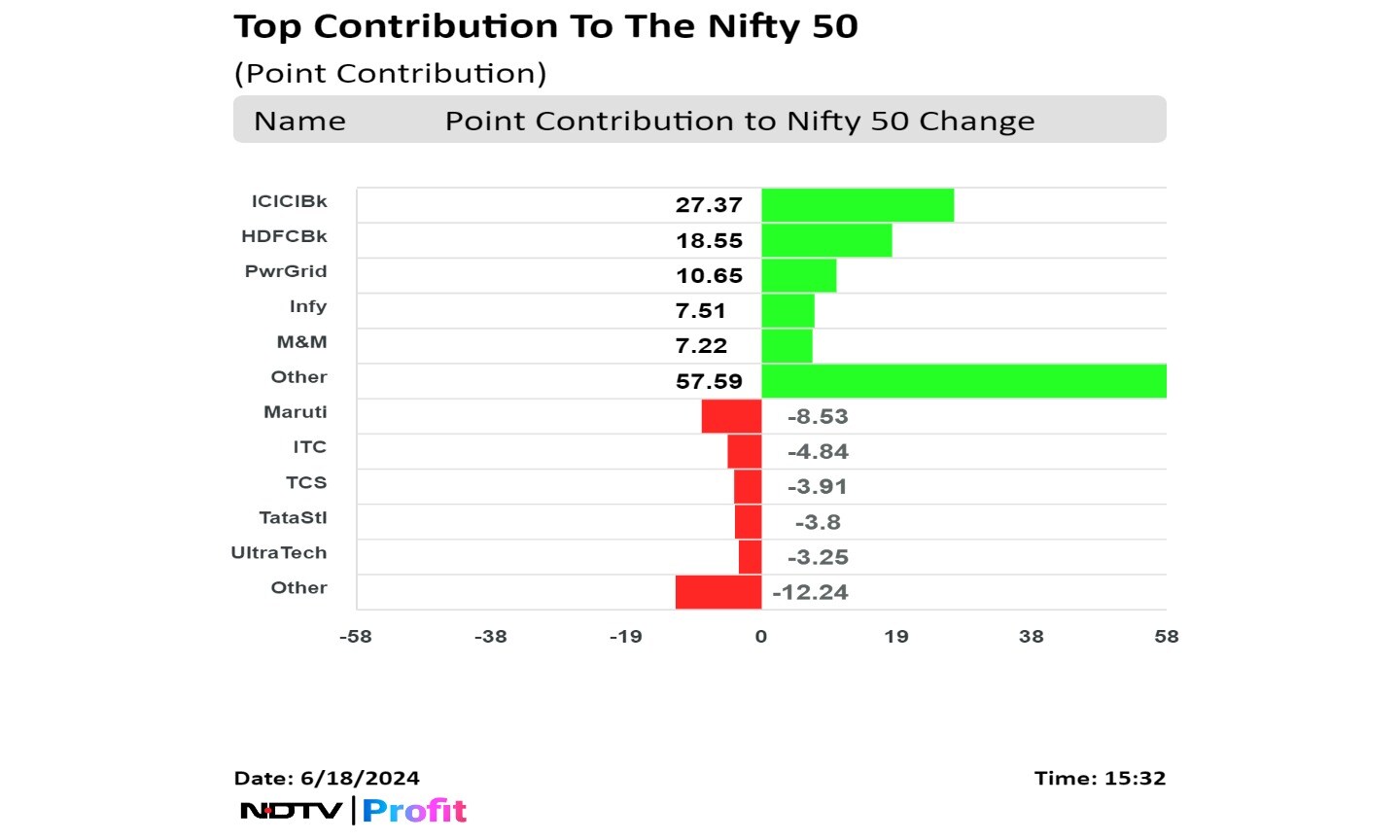

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Power Grid Corp. Of India, Infosys Ltd., and Mahindra & Mahindra Ltd. contributed the most to the gains.

While those of Maruti Suzuki Ltd., ITC Ltd., Tata Consultancy Services Ltd., Tata Steel Ltd., and UltraTech Cement Ltd. capped the upside.

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Power Grid Corp. Of India, Infosys Ltd., and Mahindra & Mahindra Ltd. contributed the most to the gains.

While those of Maruti Suzuki Ltd., ITC Ltd., Tata Consultancy Services Ltd., Tata Steel Ltd., and UltraTech Cement Ltd. capped the upside.

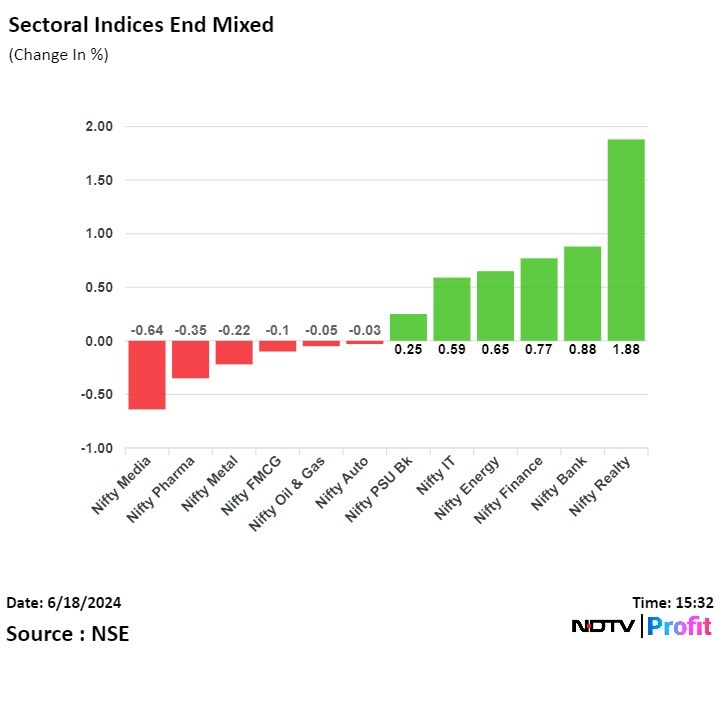

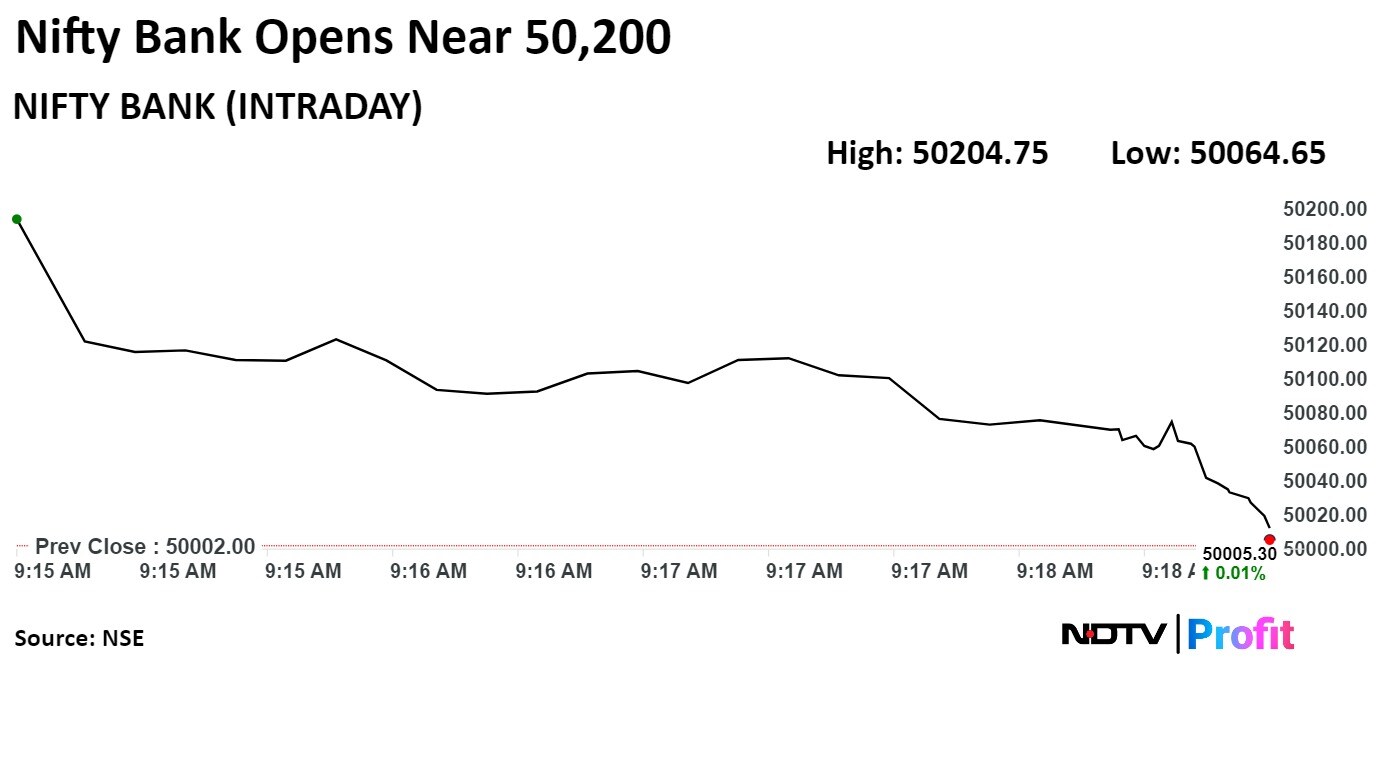

Sectoral indices were mixed at close. Nifty Realty and Nifty Bank were the top gainers while Nifty Media and Nifty Pharma fell the most.

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Power Grid Corp. Of India, Infosys Ltd., and Mahindra & Mahindra Ltd. contributed the most to the gains.

While those of Maruti Suzuki Ltd., ITC Ltd., Tata Consultancy Services Ltd., Tata Steel Ltd., and UltraTech Cement Ltd. capped the upside.

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

Indian equity indices saw another day of records as the benchmarks extended gains to the fourth session with the financial pack contributing the most.

Intraday, the Nifty hit its all-time high of 23,579.05 points and Sensex hit 77,366.77 points for the first time. Broader indices joined the benchmarks as Nifty Smallcap 250 hit its lifetime high of 17,028.10 and Nifty Midcap 100 hit its all-time high of 55,523.30.

The Nifty closed at their highest level at 23557.90, up by 0.39% or 92.30 and the Sensex also recorded its highest close of 77,301.14 up by 0.40%or 308.37 points.

"For the trend following traders now, 23500/77000 would be the key support level," said Shrikant Chouhan, Head Equity Research, Kotak Securities. "As long as the market is trading above the same, the bullish sentiment is likely to continue. "

.jpeg)

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Power Grid Corp. Of India, Infosys Ltd., and Mahindra & Mahindra Ltd. contributed the most to the gains.

While those of Maruti Suzuki Ltd., ITC Ltd., Tata Consultancy Services Ltd., Tata Steel Ltd., and UltraTech Cement Ltd. capped the upside.

Sectoral indices were mixed at close. Nifty Realty and Nifty Bank were the top gainers while Nifty Media and Nifty Pharma fell the most.

Market breadth was skewed in favour of buyers. Around 2,177 stocks rose, 1,822 stocks decline, and 151 stocks remained unchanged on BSE.

Broader markets ended higher. The S&P BSE Midcap and Smallcap settled 0.43% and 0.96% higher, respectively.

The stock rose to its lifetime high of Rs 2334.55.

The stock rose to its lifetime high of Rs 2334.55.

.png)

Demand shot up to 89 GW in North India on June 17

25-30% power imported from neighboring regions

All power utilities advisee to maintain high state of alert and minimise outages.

North India facing severe heat wave conditions

IIMD forecasts heat wave to abate from June 20

Source: PIB

.png)

US FDA completes audit at manufacturing facility in Canada, issues 15 observations

Source: Exchange Filing

UK-based arm to invest additional €3 million in Ethris

Source: Exchange filing

Domestic Business CEO Manjari Upadhye resigns effective July 11

Source: Exchange Filing

Total passenger traffic at 1.08 crore in May, up 7% YoY

Total aircraft movement at 69,055, up 6% YoY

Source: Exchange filing

Alembic Pharmaceutical Ltd. received a final US Food and Drug Adminstration approval for ANDA of Dabigatran Etexilate capsules.

Dabigatran Etexilate is equivalent to Pradaxa Capsules.

Alert: Dabigatran is used to treat stroke and blood clots in adults.

Source: Exchange Filing

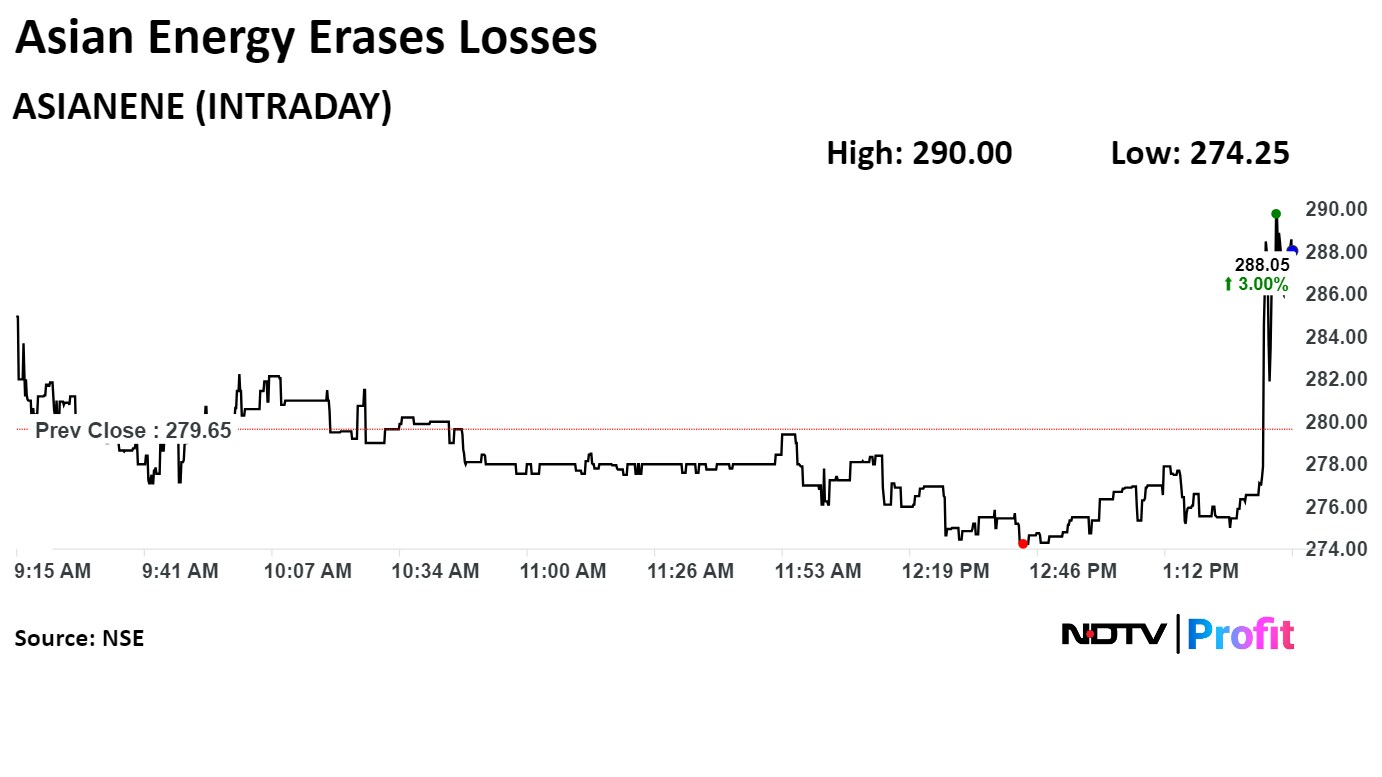

Asian Energy JV received an order worth Rs 148 crore for coal evacuation system.

Source: Exchange filing

Asian Energy JV received an order worth Rs 148 crore for coal evacuation system.

Source: Exchange filing

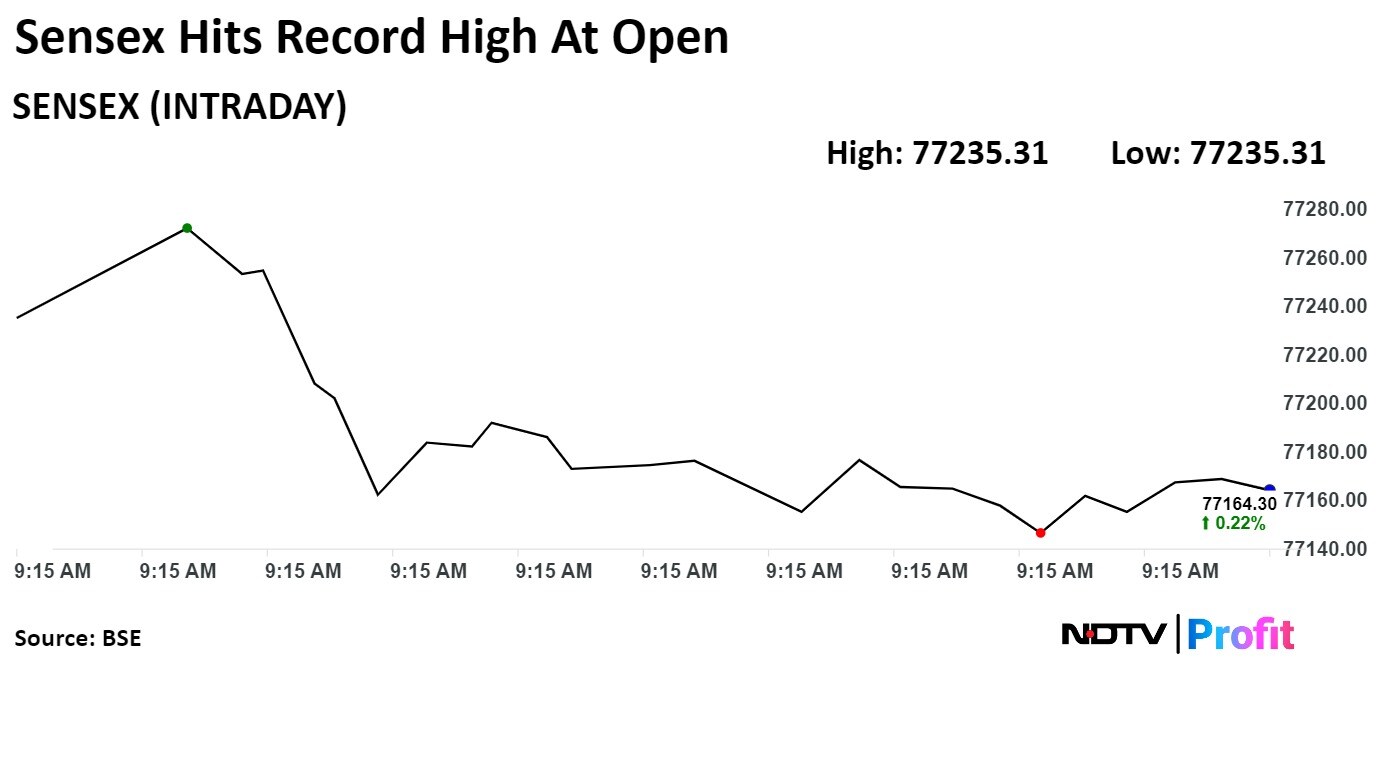

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

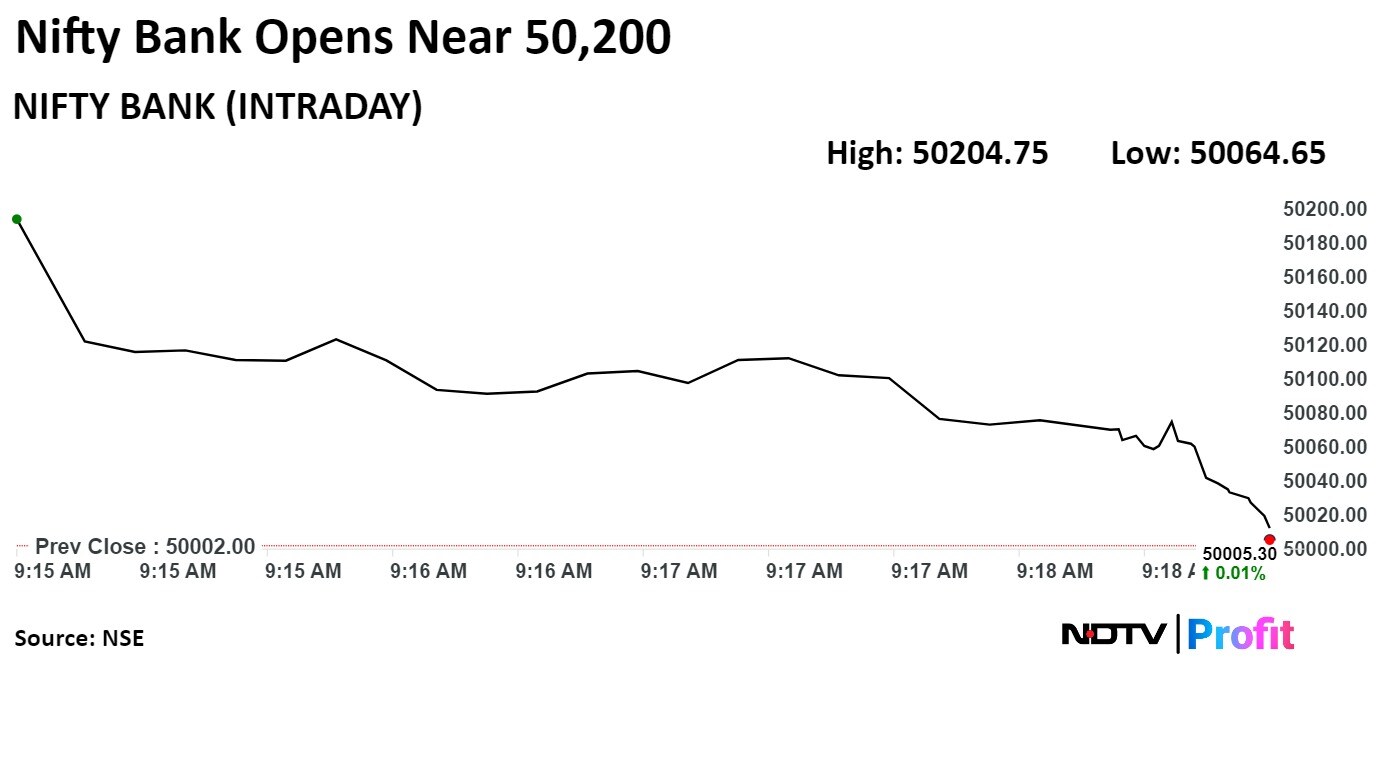

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

.png)

ICICI Bank, HDFC Bank, Infosys Ltd., Mahindra & Mahindra Ltd. and State Bank of India led the gains in the Nifty.

Maruti Suzuki India Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd., Tata Motors Ltd. and Kotak Mahindra Bank Ltd. weighed on the index.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

.png)

ICICI Bank, HDFC Bank, Infosys Ltd., Mahindra & Mahindra Ltd. and State Bank of India led the gains in the Nifty.

Maruti Suzuki India Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd., Tata Motors Ltd. and Kotak Mahindra Bank Ltd. weighed on the index.

.png)

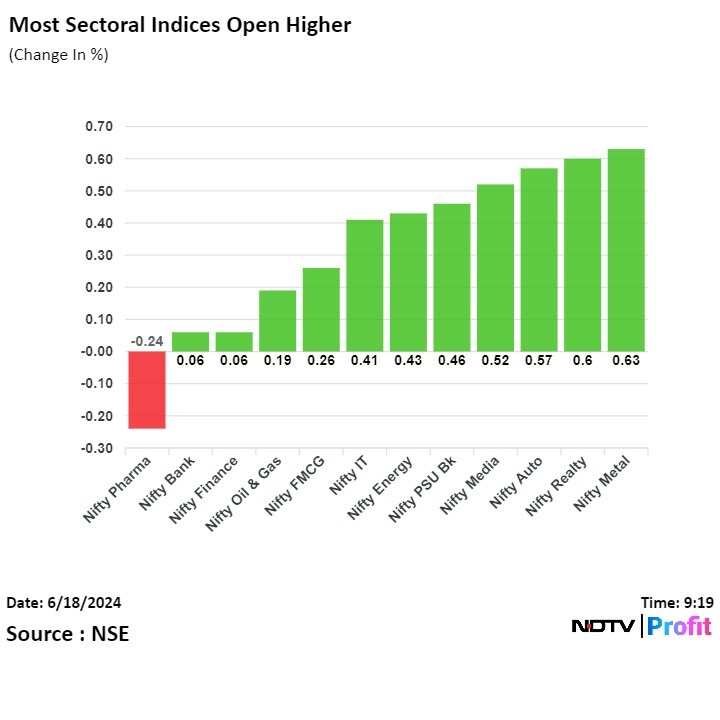

Nine out of the 12 sectors on the NSE advanced, with the Nifty IT rising the most. The Nifty Pharma touched a record high in the morning trade before falling to become the worst performing sector. Earlier in the day, the Nifty Realty and Auto also rose to an all-time high.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

.png)

ICICI Bank, HDFC Bank, Infosys Ltd., Mahindra & Mahindra Ltd. and State Bank of India led the gains in the Nifty.

Maruti Suzuki India Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd., Tata Motors Ltd. and Kotak Mahindra Bank Ltd. weighed on the index.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

Benchmark equity indices continued to trade higher through midday on Tuesday, tracking gains in shares of ICICI Bank Ltd. and HDFC Bank Ltd. As of 12:16 p.m., the NSE Nifty 50 was 66.10 points or 0.28% higher at 23,531.70, and the S&P BSE Sensex was 241.73 points or 0.31% higher at 77,234.51.

During the day, the Nifty rose as much as 0.48% to record high 23,579.05, and the Sensex rose 0.49% to a fresh intraday high of 77,366.77.

For the Nifty, JM Financial Services expects continuation of the upward move till the 23,700–750 level as the current resistance level is broken.

Perhaps that could be the levels where some profit booking can be expected. As of now, the markets look quite good to test the level. A very important support level is 23,400, according to Soni Patnaik, assistant vice president of JM Financial Services.

.png)

.png)

The markets look strong and put writing is seen shifting higher. The only concern is that the Nifty Bank has not performed, according to Sneha Seth, a senior analyst from Angel One.

.png)

ICICI Bank, HDFC Bank, Infosys Ltd., Mahindra & Mahindra Ltd. and State Bank of India led the gains in the Nifty.

Maruti Suzuki India Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd., Tata Motors Ltd. and Kotak Mahindra Bank Ltd. weighed on the index.

.png)

Nine out of the 12 sectors on the NSE advanced, with the Nifty IT rising the most. The Nifty Pharma touched a record high in the morning trade before falling to become the worst performing sector. Earlier in the day, the Nifty Realty and Auto also rose to an all-time high.

.png)

The broader markets rose as the BSE MidCap and SmallCap were trading 0.32% and 0.79% higher respectively as of 11:57 a.m. Both the indices scaled an all-time high in the first half of the trade. The Nifty Midcap 150 and Smallcap 250 indices rose to the highest level.

Seventeen out of the 20 sectors on the BSE advanced, with Consumer Durables rising the most and Healthcare declining the most.

The market breadth was skewed in favour of the buyers as 2,120 stocks rose, 1,727 declined and 177 remained unchanged on the BSE.

First cabinet CCEA likely tomorrow at 5:00 pm.

Source: NDTV

Key Infra Sectors: Renewable energy, roads, real estate

Expects investments in key infra sectors to grow 38% in FY25/26

Expects investments in mentioned sectors to hit Rs 15 lakh crores

Surge on need of higher green power share, better connectivity, rising residential and commercial demand

Renewables: Sustainable energy transition a key growth driver

Roads: Order books at 2.5 times of revenue, to support 11% growth in highway construction

Real estate: Expect commercial office net leasing demand to grow 8-10% in FY25/26

The local currency strengthened by 17 paise to 83.39 against the US Dollar.

It is the highest level since June 7.

The currency opened at 83.51 a dollar.

It closed at 83.56 on Friday.

Source: Cogencis

Ajith Kumar KK to take charge as MD and CEO for 3 years effective June 20

Source: Exchange filing

Piramal Finance crosses Rs 50,000 crore in retail loans, aims to double retail AUM by FY28

Source: Exchange filing

.png)

Ratio between GDRs and shares has been changed to 1:1 from 1:60

59 new GDRs were issued for every GDR held, in accordance with the new ratio

Source: Exchange filing

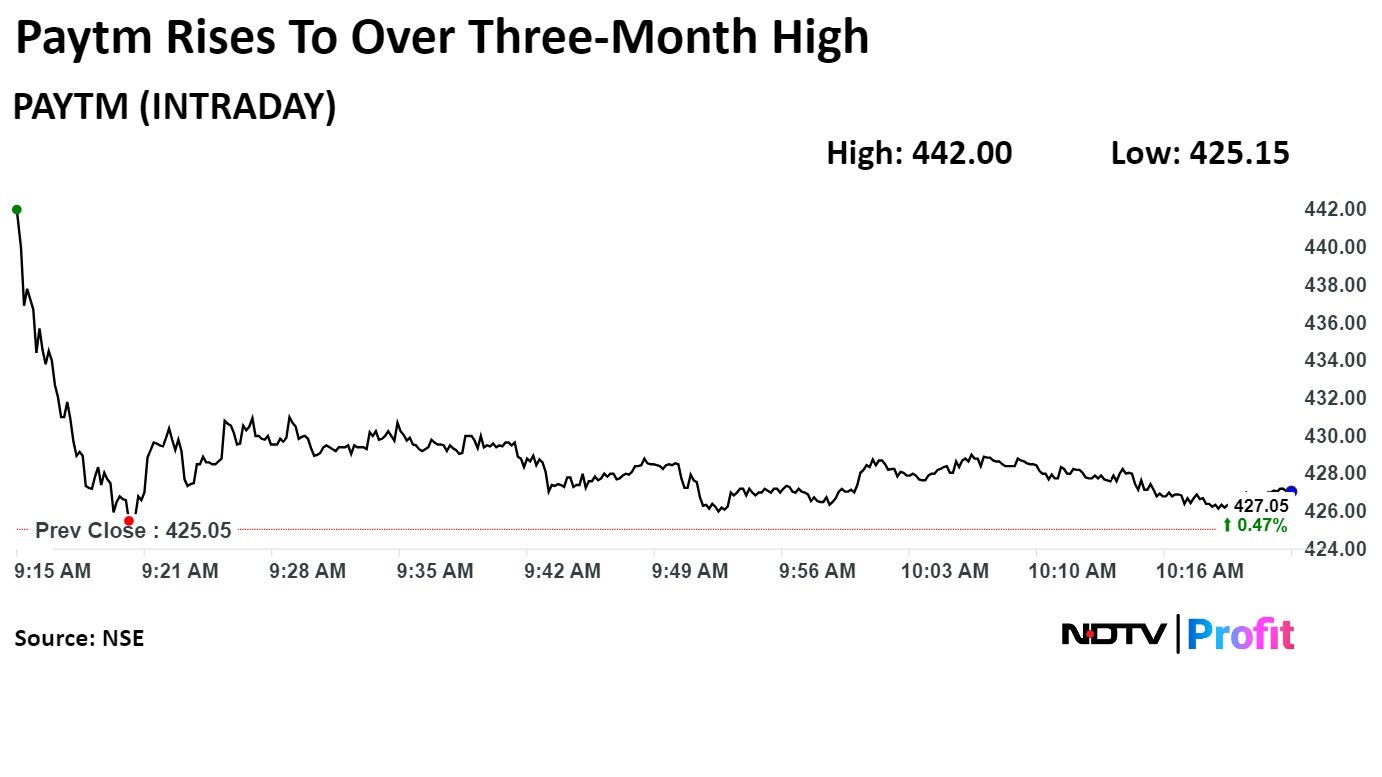

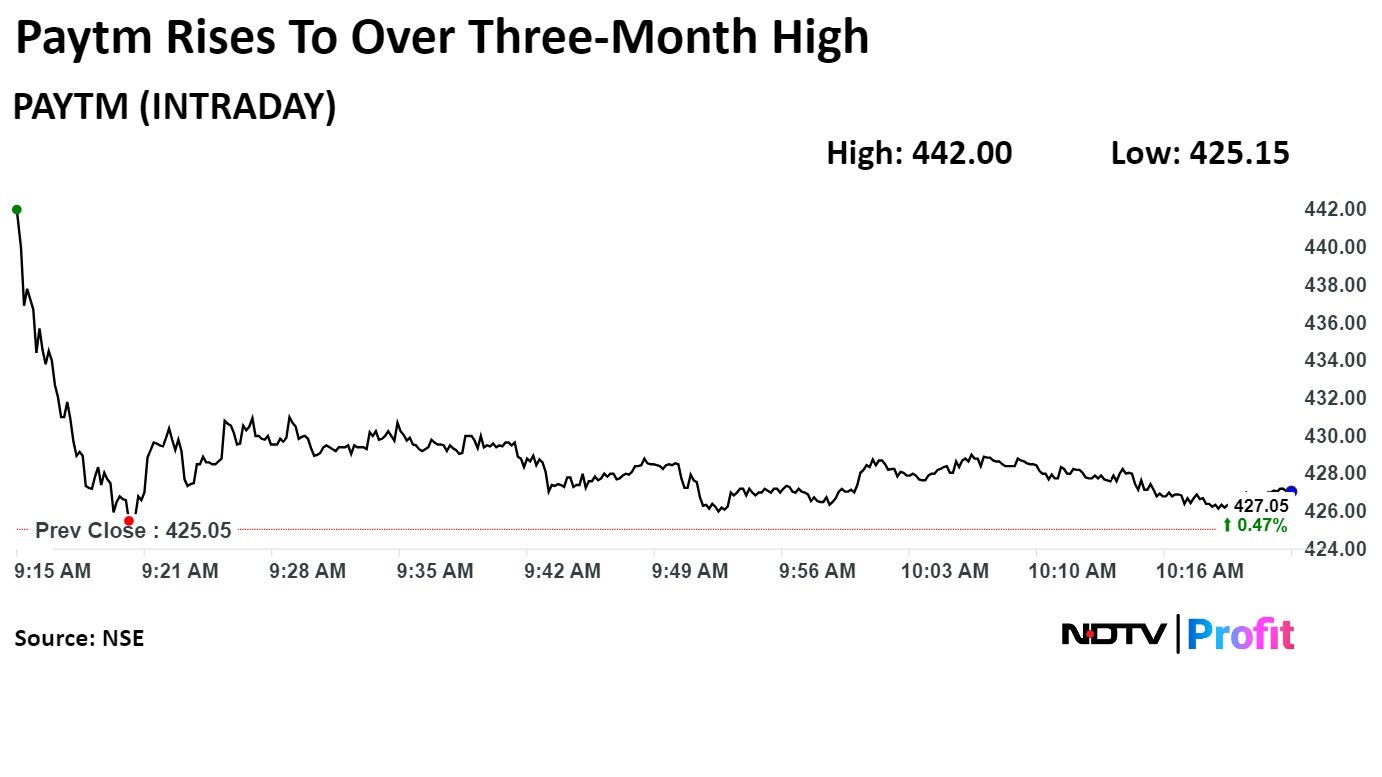

Shares of One 97 Communications Ltd. rose to the highest level in over three months on Tuesday as Paytm parent confirmed to be in talks with Zomato Ltd. to sell its entertainment business.

The potential sale of its entertainment business, which includes movies and ticketing business, a component of the fintech company's marketing service is one option under discussion, One 97 Communications said in an exchange filing.

Shares of One 97 Communications Ltd. rose to the highest level in over three months on Tuesday as Paytm parent confirmed to be in talks with Zomato Ltd. to sell its entertainment business.

The potential sale of its entertainment business, which includes movies and ticketing business, a component of the fintech company's marketing service is one option under discussion, One 97 Communications said in an exchange filing.

Shares of One 97 Communications Ltd. rose to the highest level in over three months on Tuesday as Paytm parent confirmed to be in talks with Zomato Ltd. to sell its entertainment business.

The potential sale of its entertainment business, which includes movies and ticketing business, a component of the fintech company's marketing service is one option under discussion, One 97 Communications said in an exchange filing.

Shares of One 97 Communications Ltd. rose to the highest level in over three months on Tuesday as Paytm parent confirmed to be in talks with Zomato Ltd. to sell its entertainment business.

The potential sale of its entertainment business, which includes movies and ticketing business, a component of the fintech company's marketing service is one option under discussion, One 97 Communications said in an exchange filing.

.jpeg)

Declared successful bidder for Todupura Iron Ore Block District in Karauli, Rajasthan

Source: Exchange filing

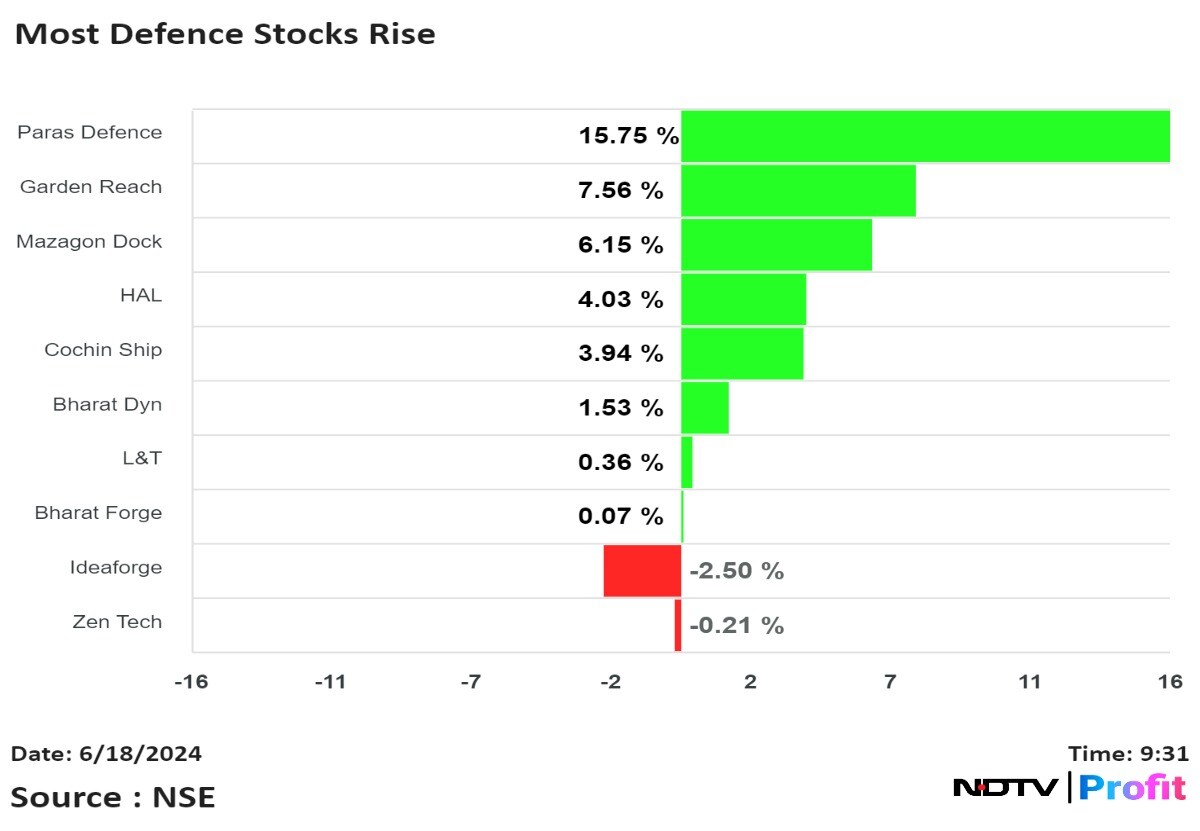

Shares of Hindustan Aeronautics Ltd touched a new life high of Rs 5,498.6 after it informed the exchanges that the Ministry of Defence has issued a Request for Proposal to the company for the procurement of 156 Light Combat Helicopters.

Shares of Hindustan Aeronautics Ltd touched a new life high of Rs 5,498.6 after it informed the exchanges that the Ministry of Defence has issued a Request for Proposal to the company for the procurement of 156 Light Combat Helicopters.

.png)

Maintains 'Underweight' with target Rs 7, Downside: 58%

Capex priority will be on 4G coverage followed by capacity enhancement

Company believes capex can drive substantial gains over next 12 months

In talks with lenders to raise Rs 250 billion in debt for capex

Needs government support in FY26/27 after expiry of spectrum moratorium for spectrum repayments

Intends to generate internal cash generation up to repay annual government dues from FY28

Given its cash crunch, company prefers converting deferred amounts of debt into equity from FY26

Even after this, company would still have $21 billion in debt with no clarity on repayment

Remain underweight as equity story is complicated

Maintains 'Underweight' with target Rs 7, Downside: 58%

Capex priority will be on 4G coverage followed by capacity enhancement

Company believes capex can drive substantial gains over next 12 months

In talks with lenders to raise Rs 250 billion in debt for capex

Needs government support in FY26/27 after expiry of spectrum moratorium for spectrum repayments

Intends to generate internal cash generation up to repay annual government dues from FY28

Given its cash crunch, company prefers converting deferred amounts of debt into equity from FY26

Even after this, company would still have $21 billion in debt with no clarity on repayment

Remain underweight as equity story is complicated

.png)

.png)

Lists at Rs 138.10 on NSE vs issue price of Rs 93

Lists at Rs 135 on BSE vs issue price of Rs 93

Lists at a premium of 45.2% on BSE

Source: Exchanges

Gets order in the range of Rs 1,000-2,500 crore for its buildings and factories business

Source: Exchange filing

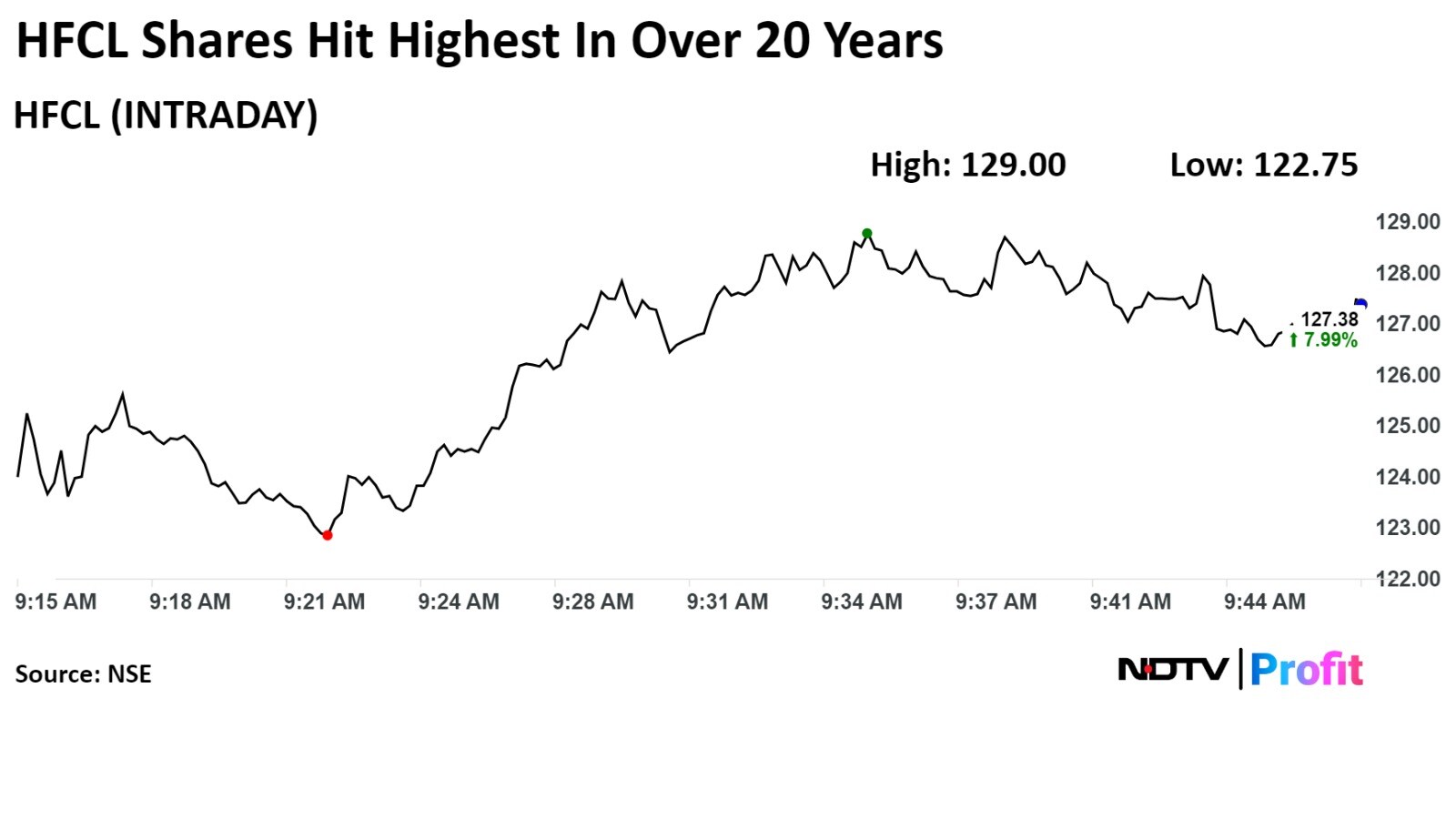

Shares of HFCL Limited hit a 22 year high on Tuesday, as the European Commission determined that HFCL was the only Indian company not engaged in dumping of optical fibre cables in European markets in a statement issued on 14 June, 2024.

Shares of HFCL Limited hit a 22 year high on Tuesday, as the European Commission determined that HFCL was the only Indian company not engaged in dumping of optical fibre cables in European markets in a statement issued on 14 June, 2024.

The scrip rose as much as 1.33% to hit Rs 1,507, its highest since June 12.

The scrip rose as much as 1.33% to hit Rs 1,507, its highest since June 12.

.png)

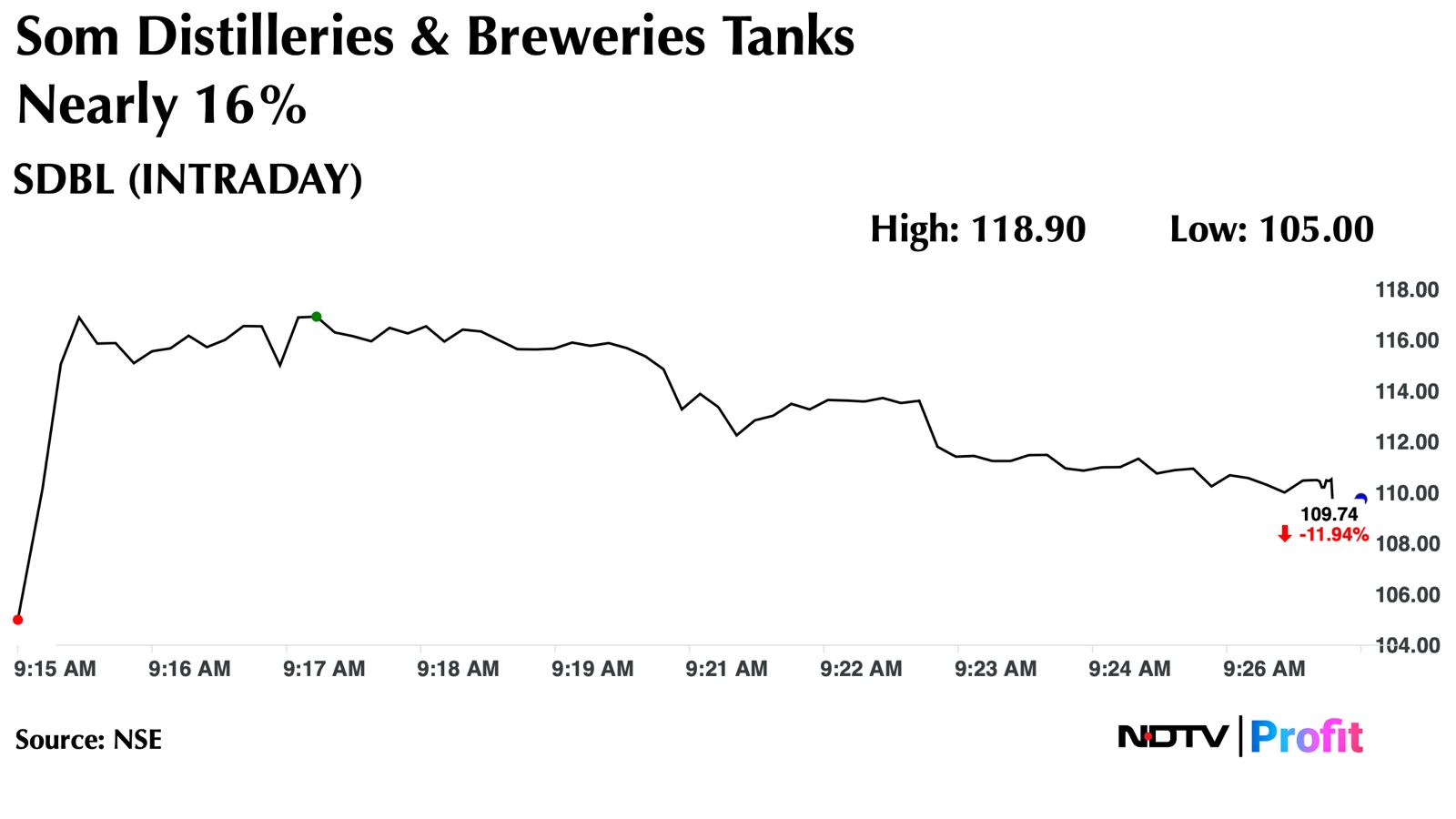

Shares of Som Distilleries and Breweries Ltd. went down nearly 16% on Tuesday after one of the company's contractors came under police investigation for child labour concerns.

The company blamed the associate private firm for not verifying employees age and terminated all contracts with them.

Shares of Som Distilleries and Breweries Ltd. went down nearly 16% on Tuesday after one of the company's contractors came under police investigation for child labour concerns.

The company blamed the associate private firm for not verifying employees age and terminated all contracts with them.

Som Distilleries and Breweries Ltd. fell as much as 15.74% during the day to Rs 105 apiece on the NSE, the lowest since March 28. It was trading 6.69% lower at Rs 115.98 apiece, compared to a 0.25% advance in the benchmark NSE Nifty 50 as of 9:18 a.m.

It has risen 12.05% in the last 12 months. The relative strength index was at 37.25.

One analyst tracking the stock has a 'buy' rating according to Bloomberg data.

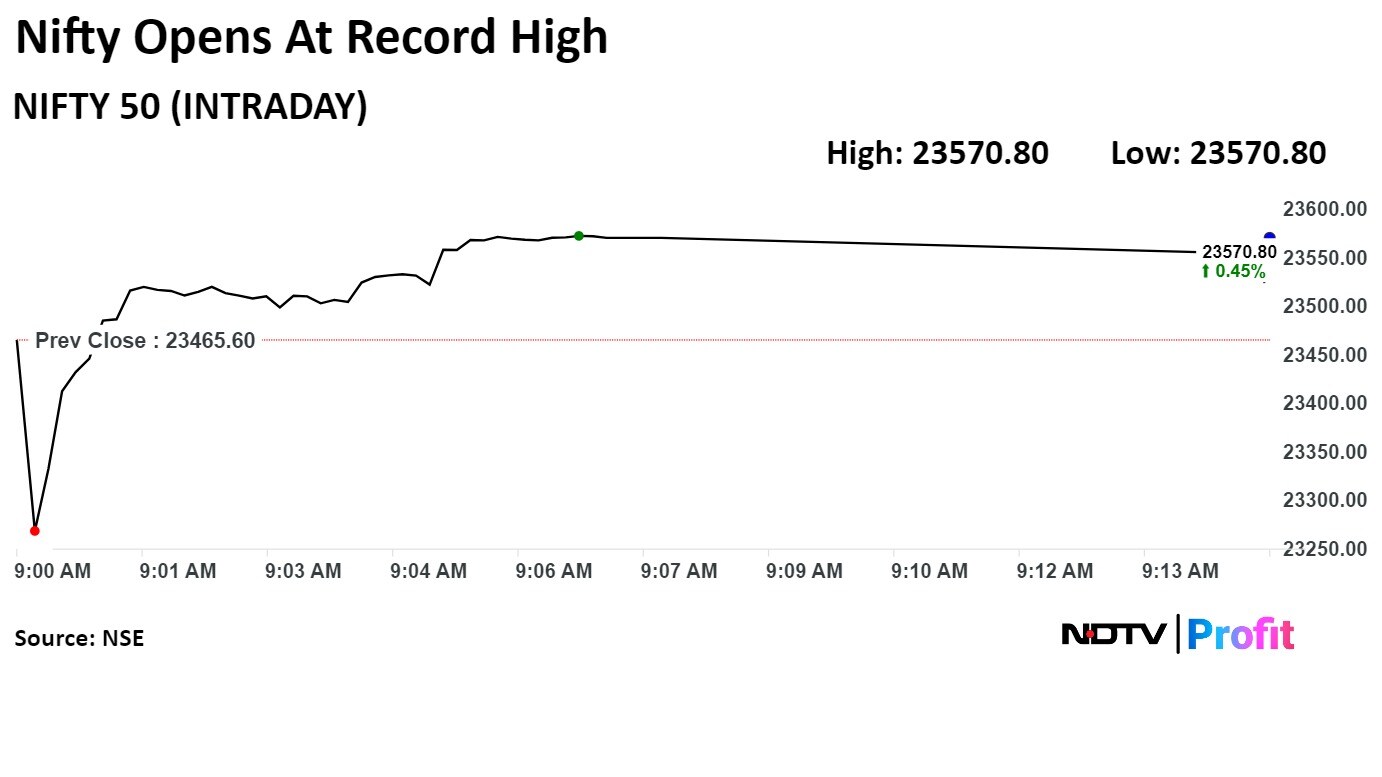

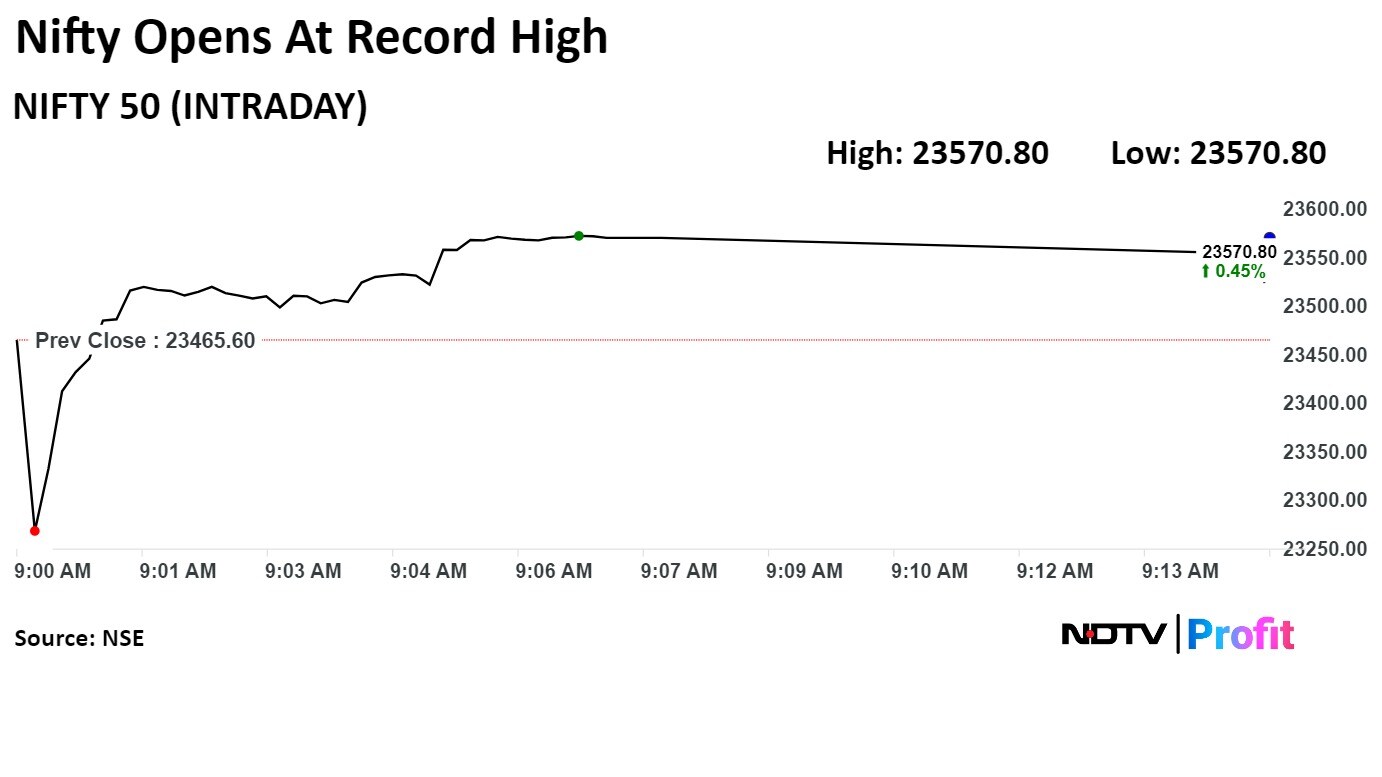

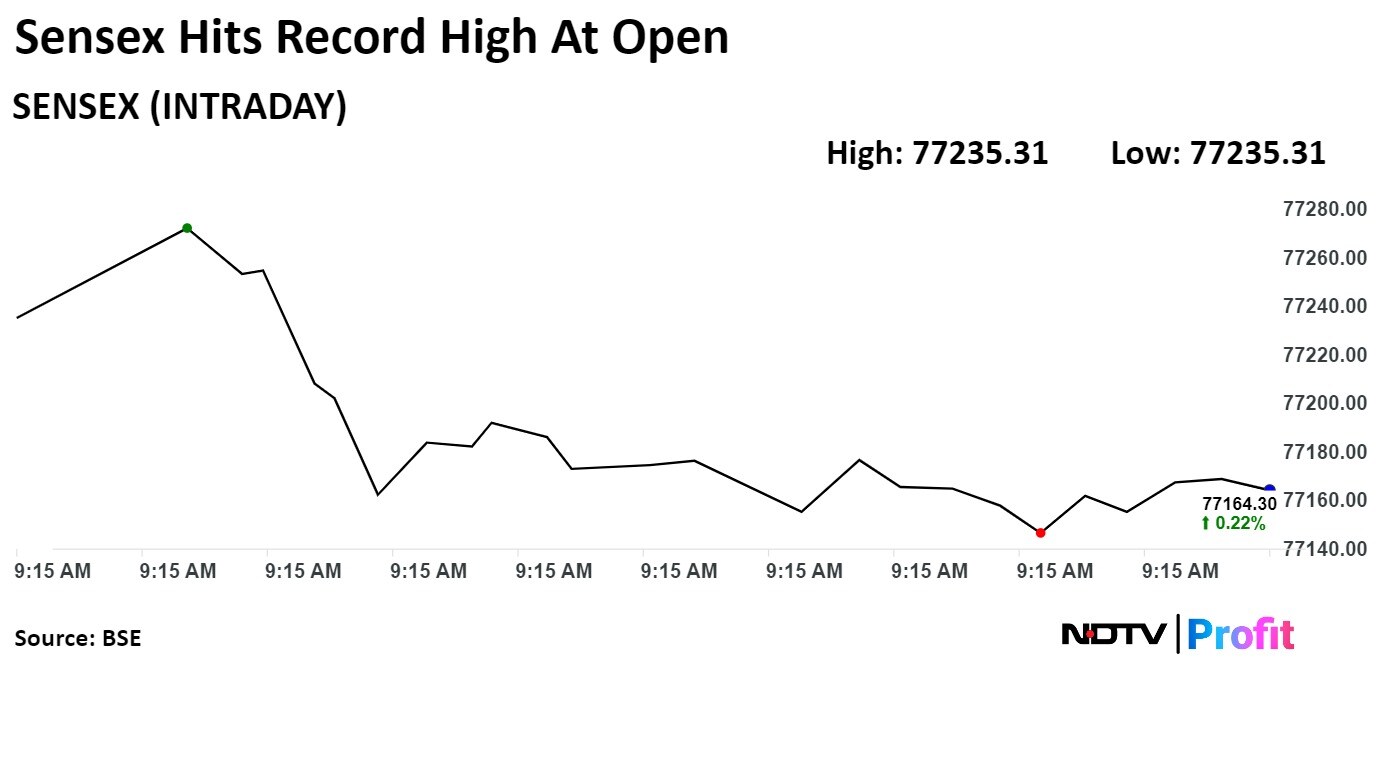

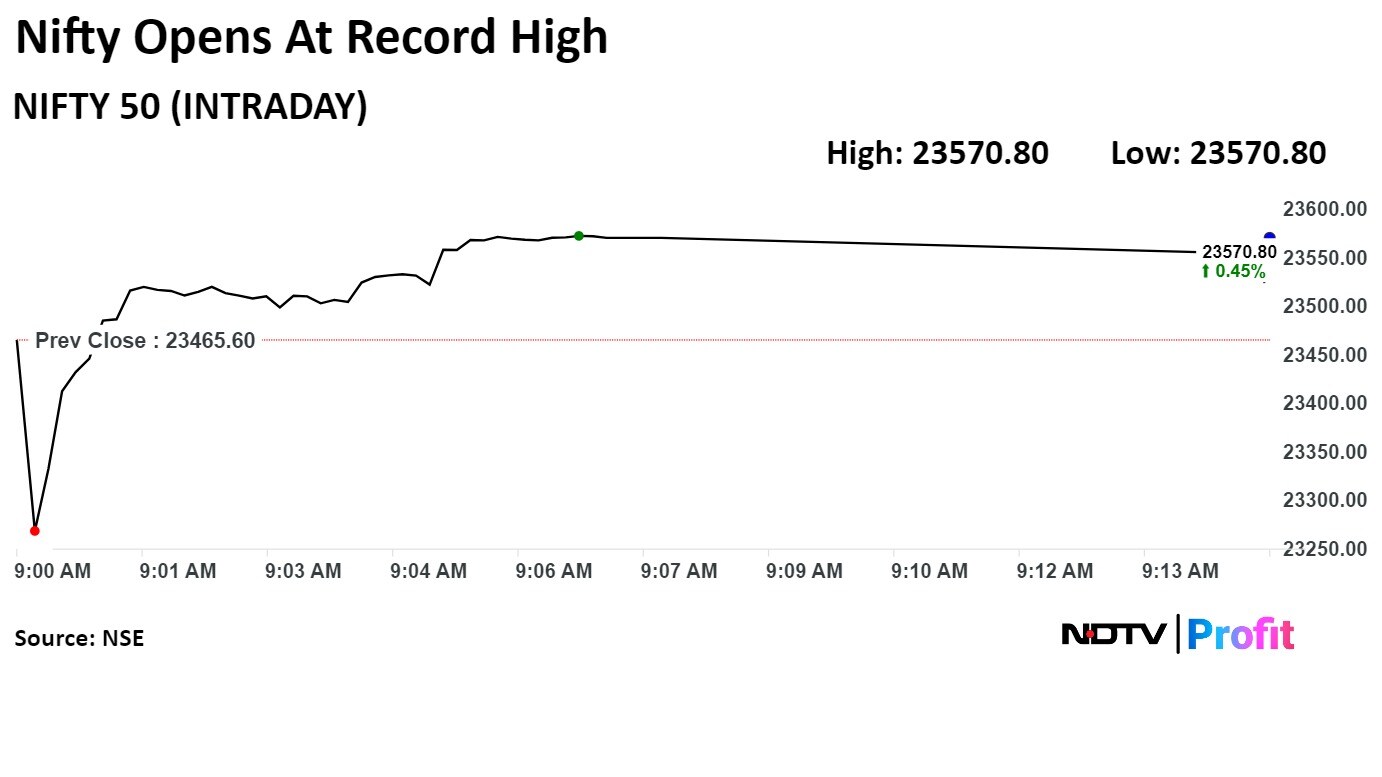

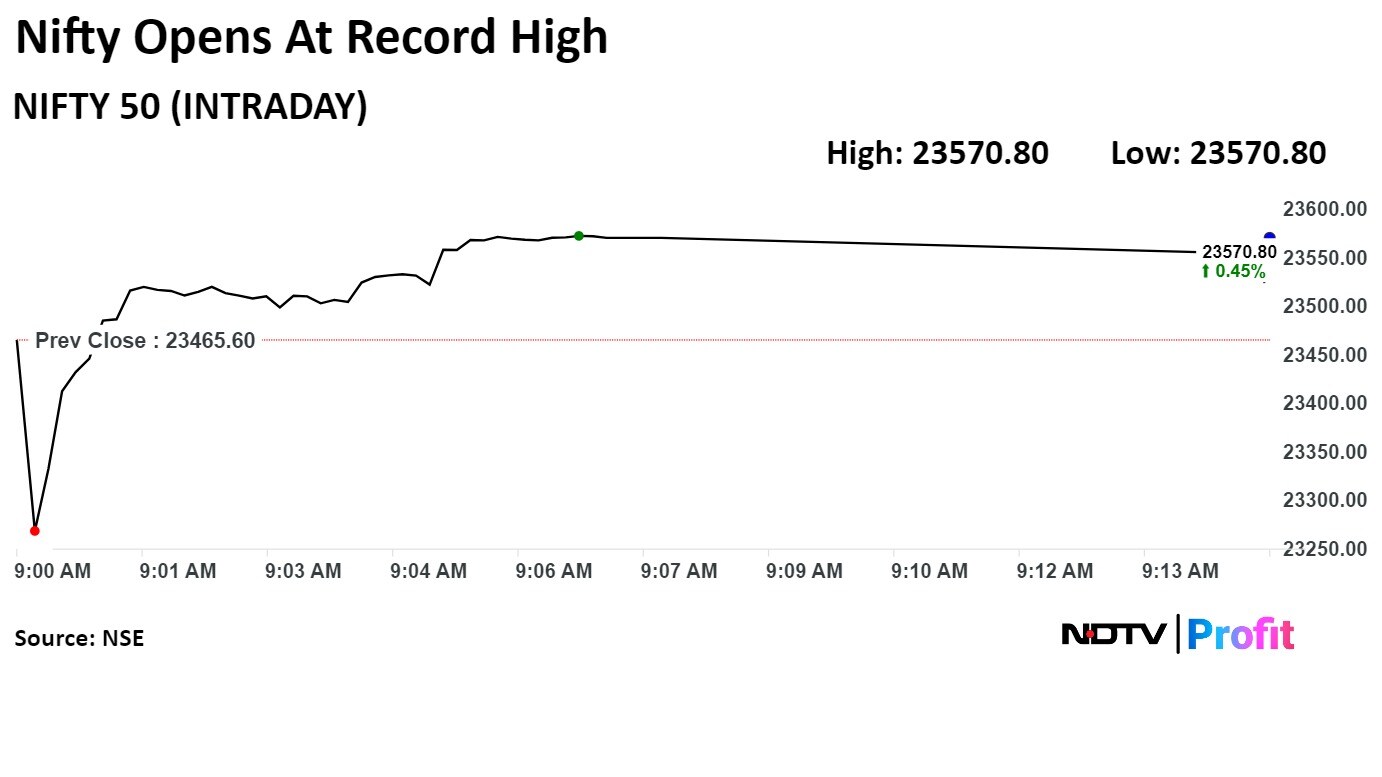

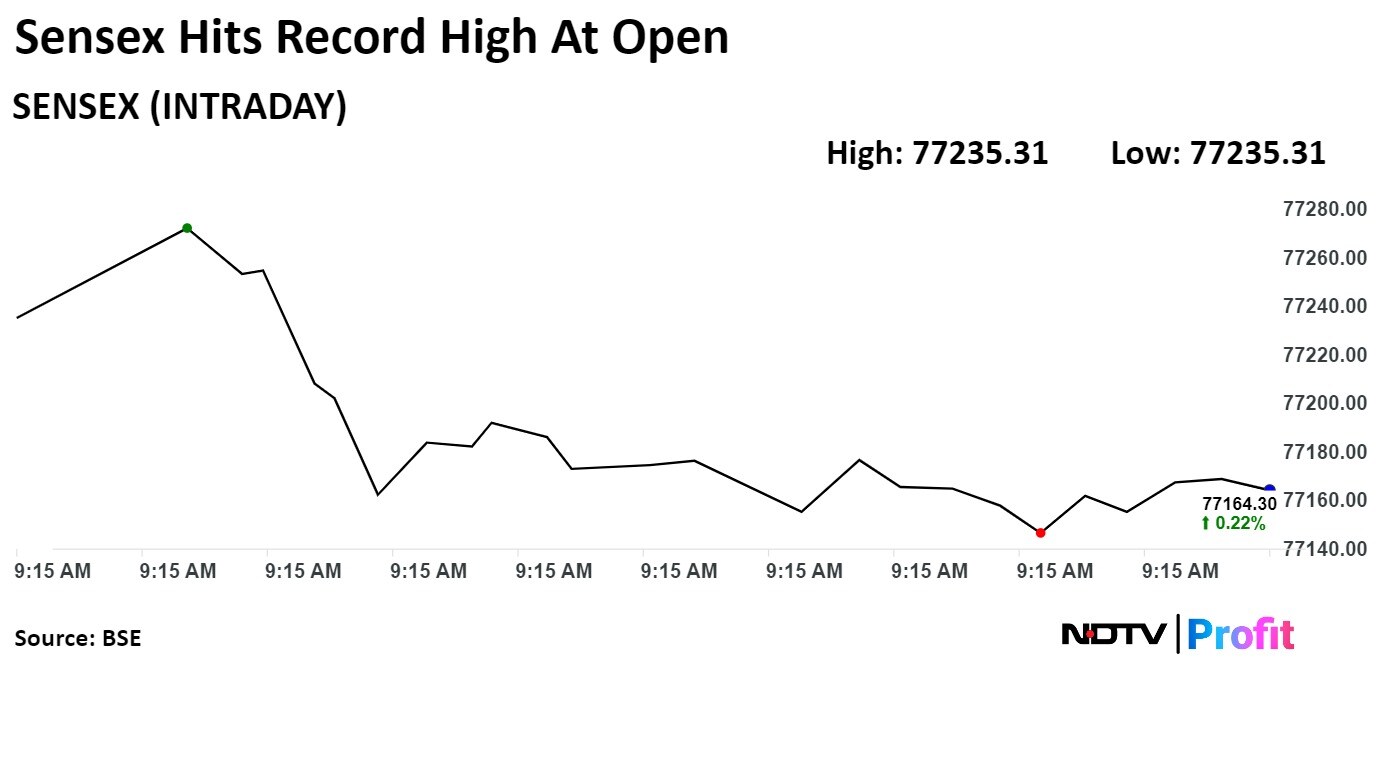

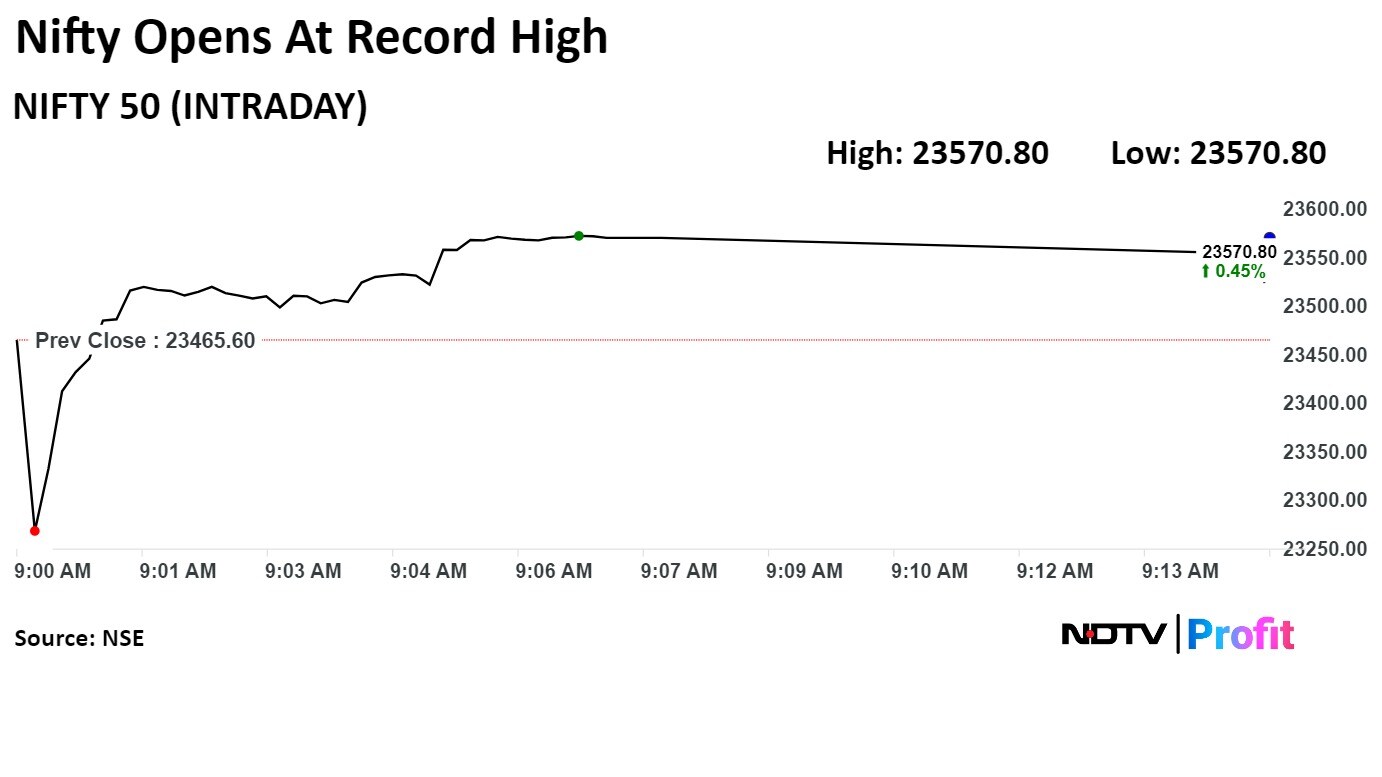

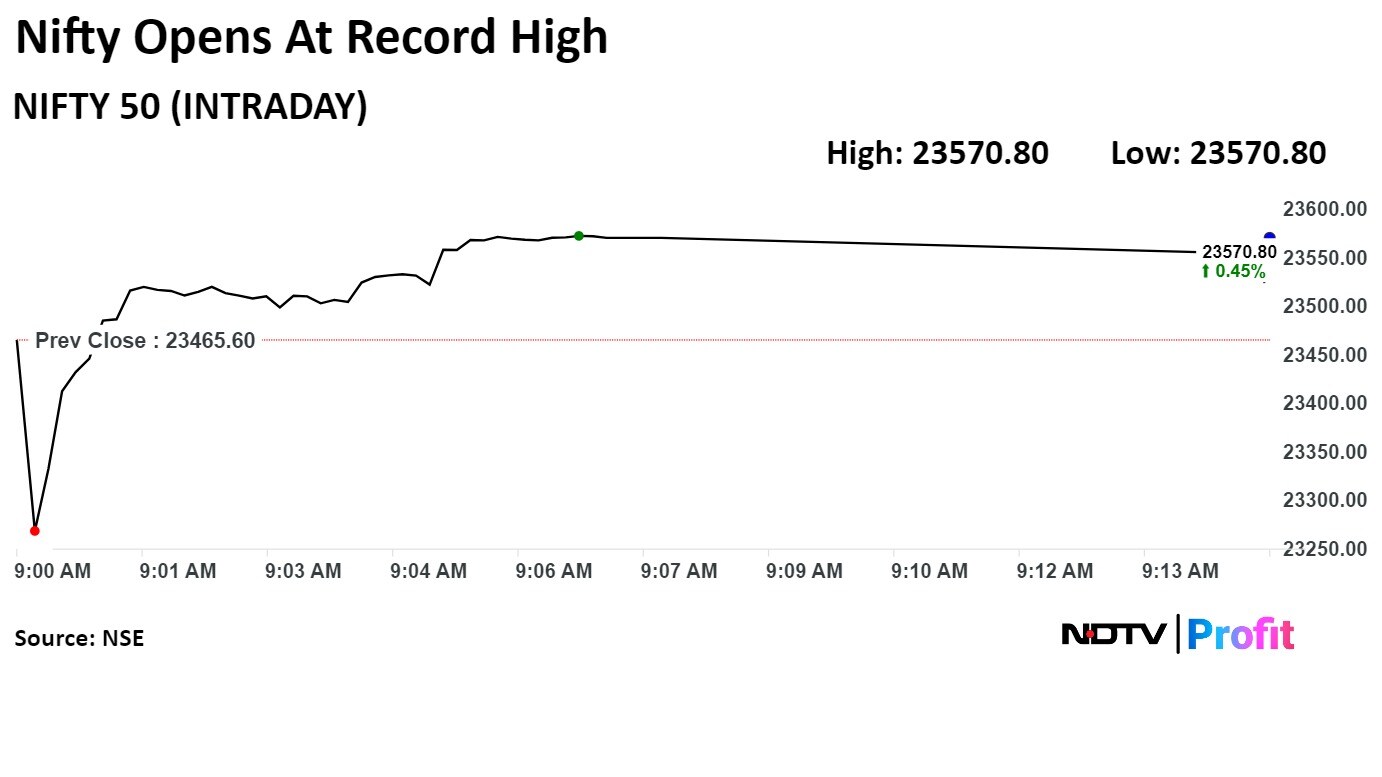

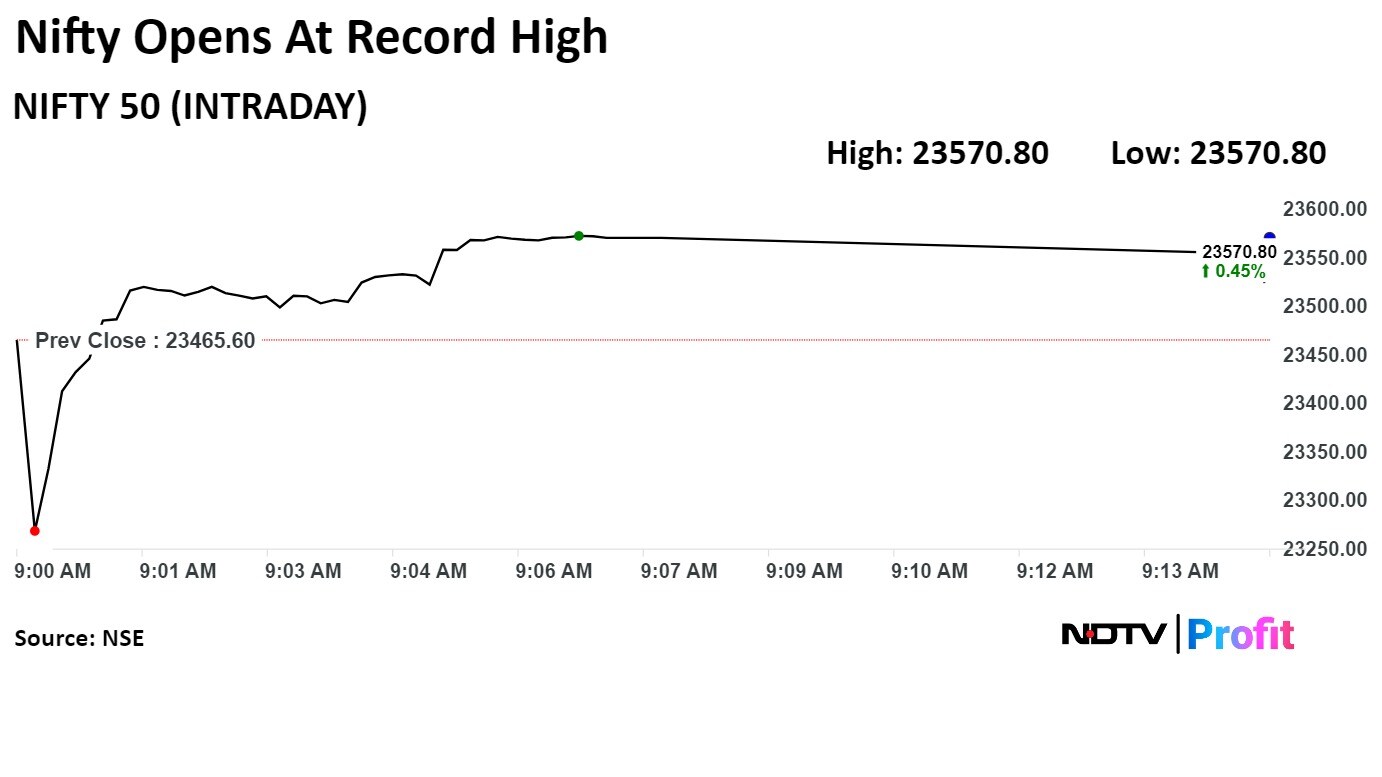

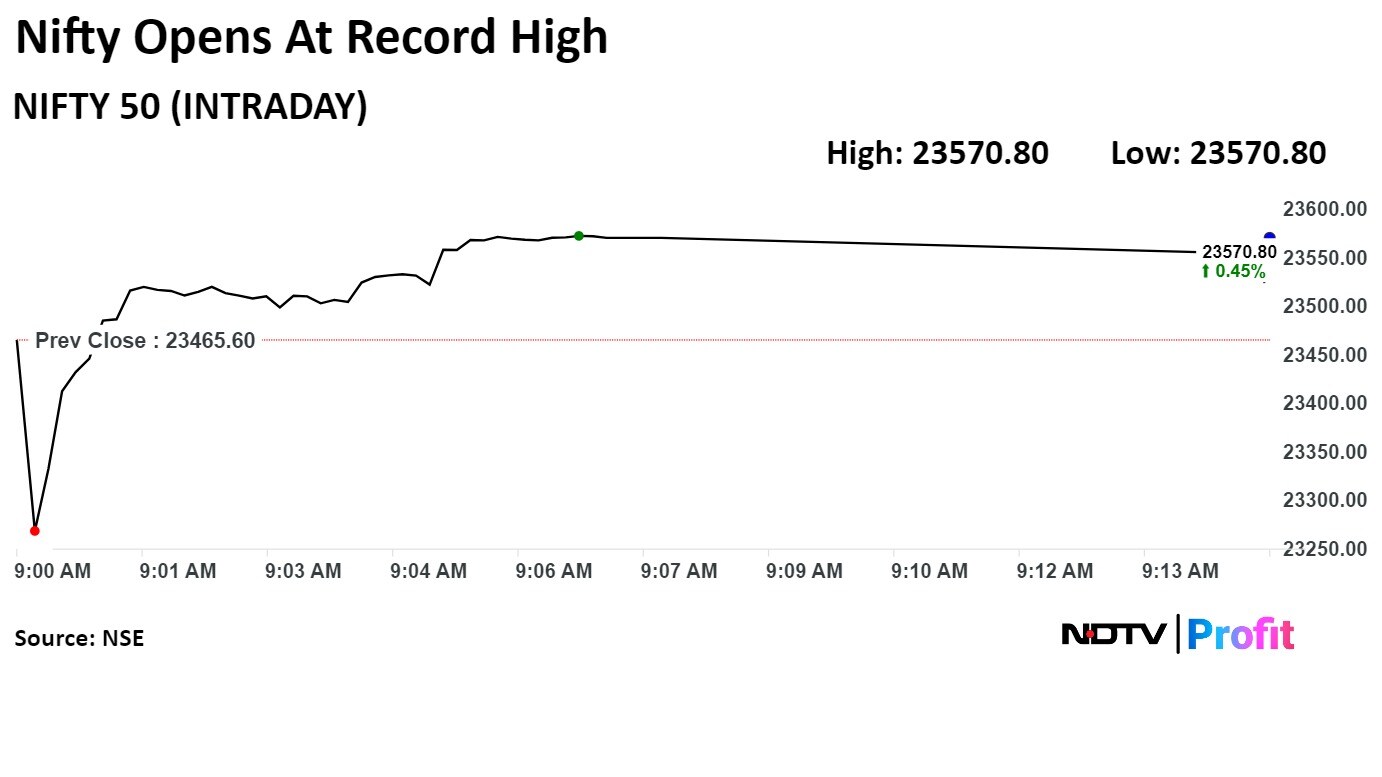

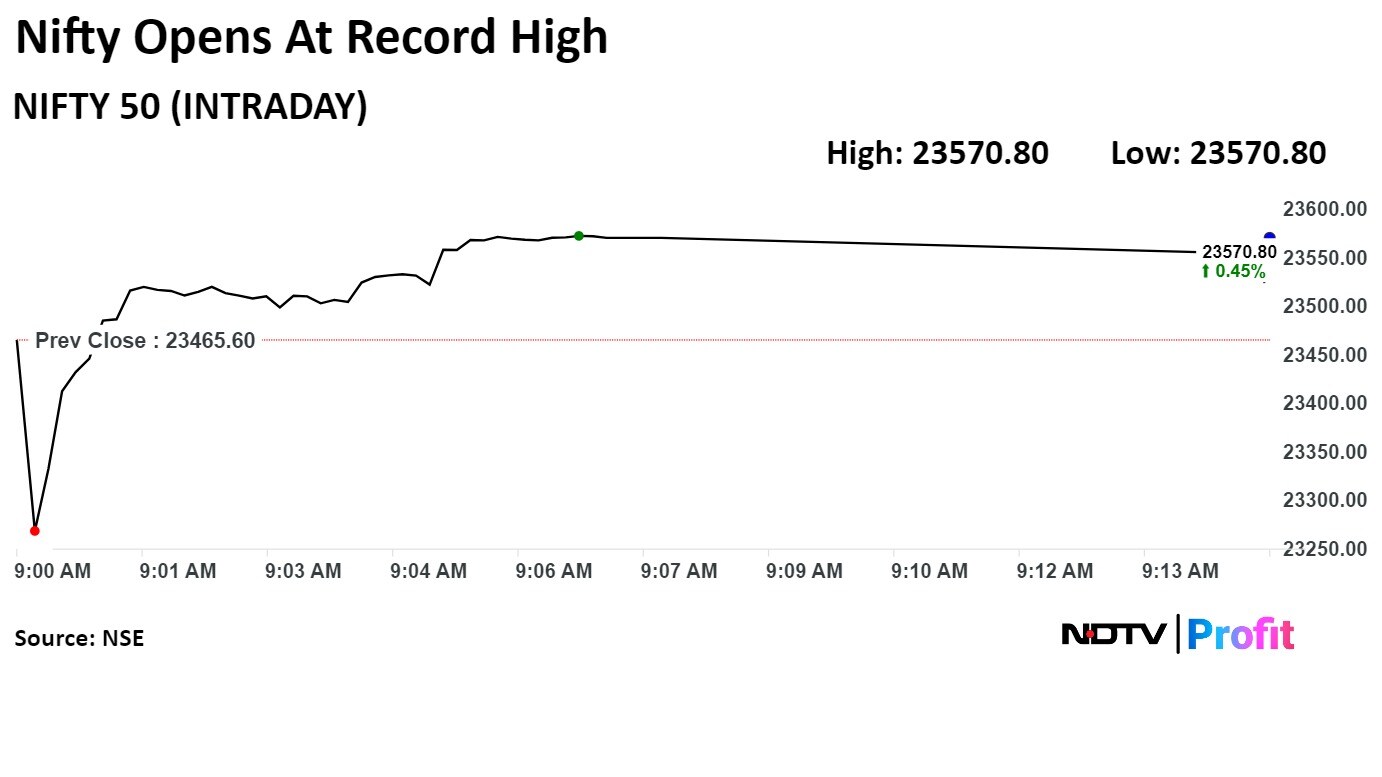

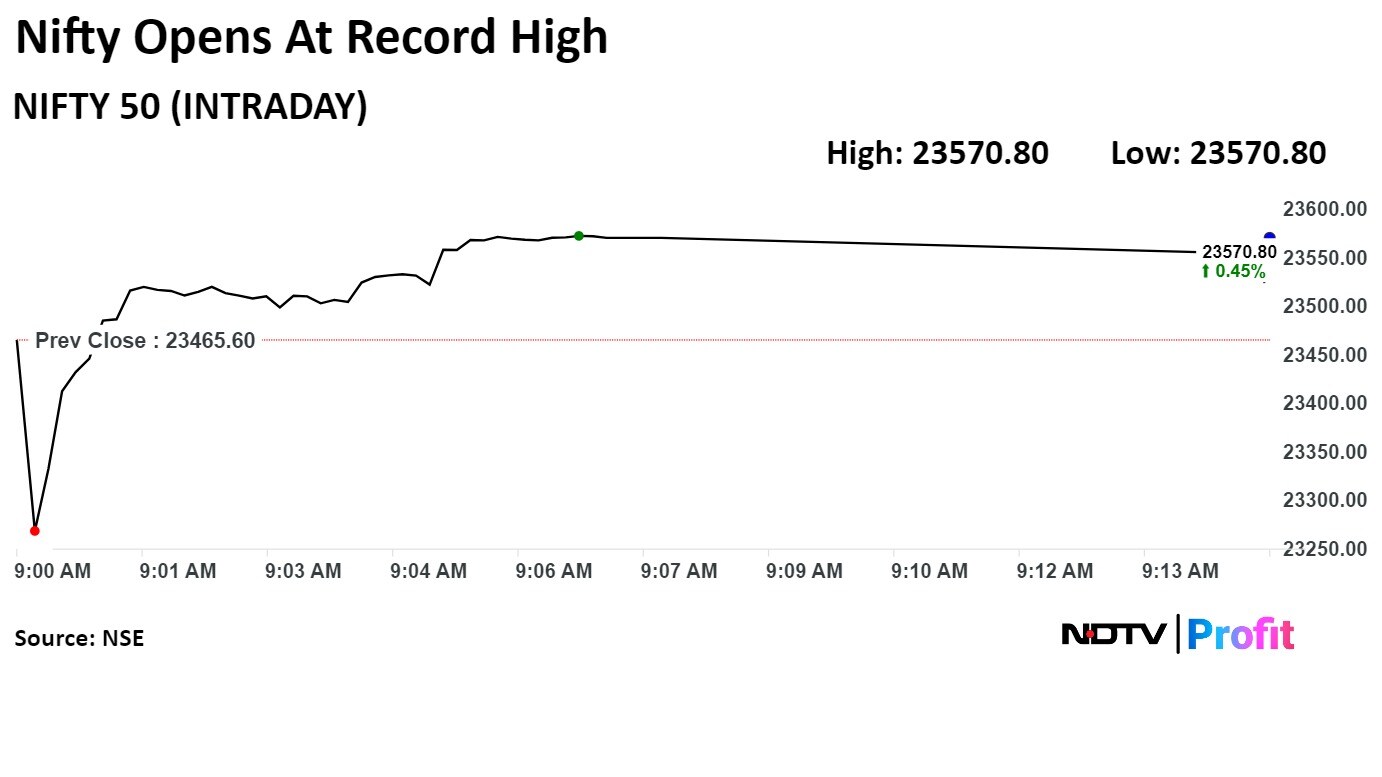

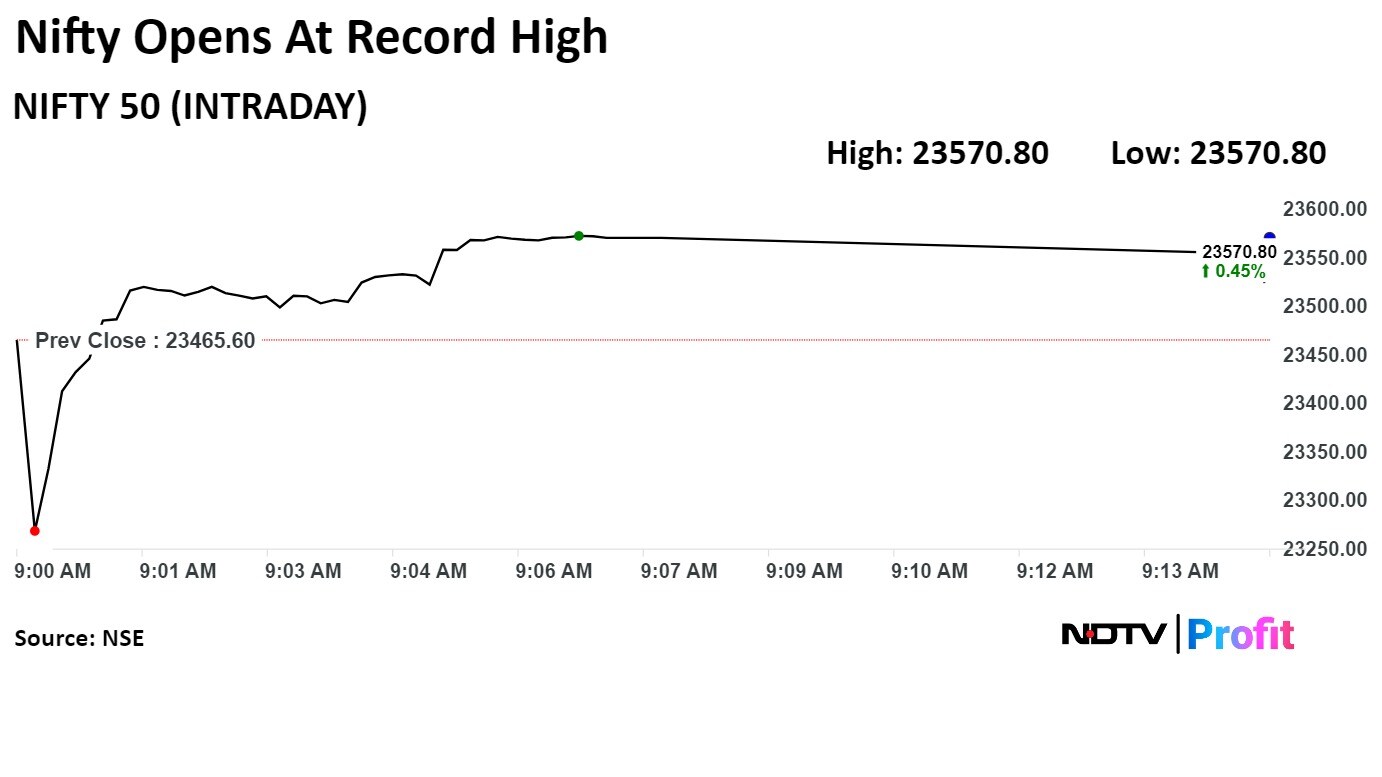

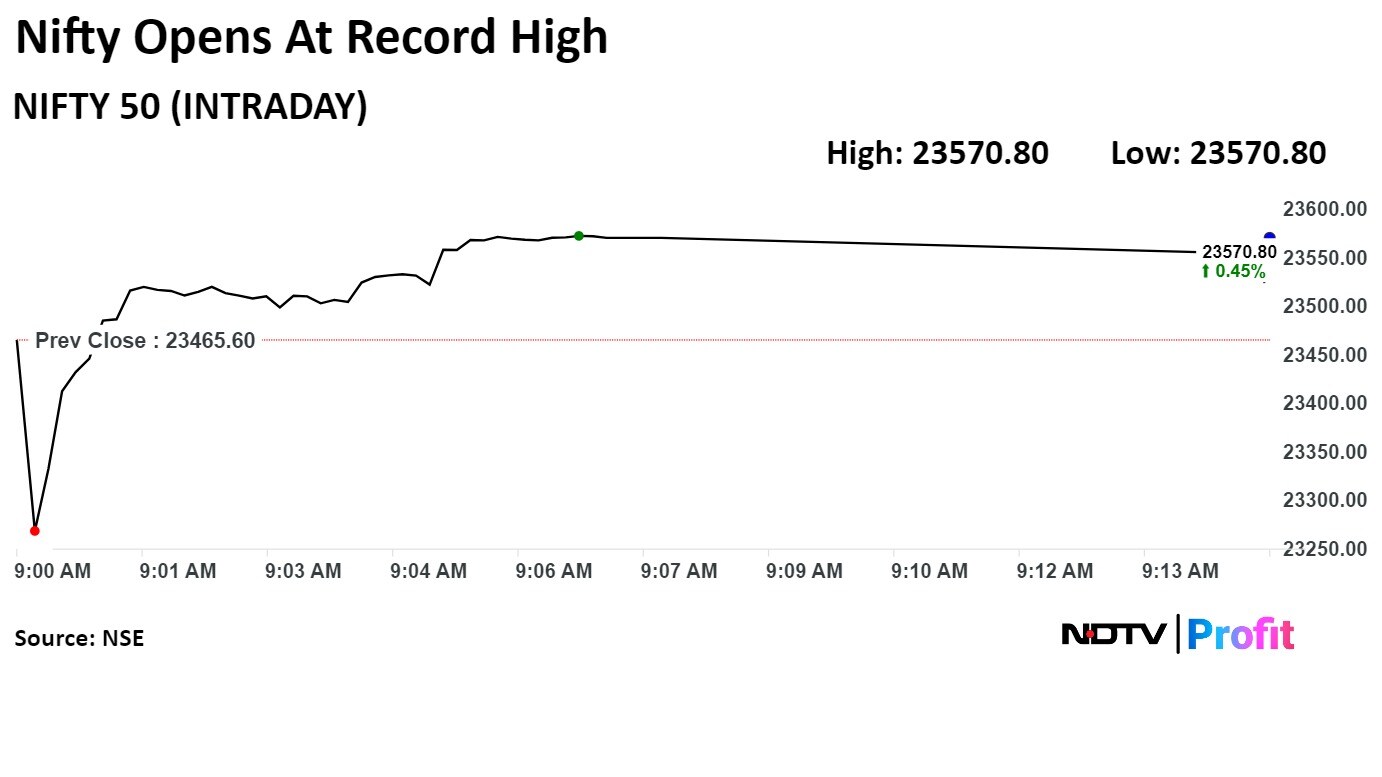

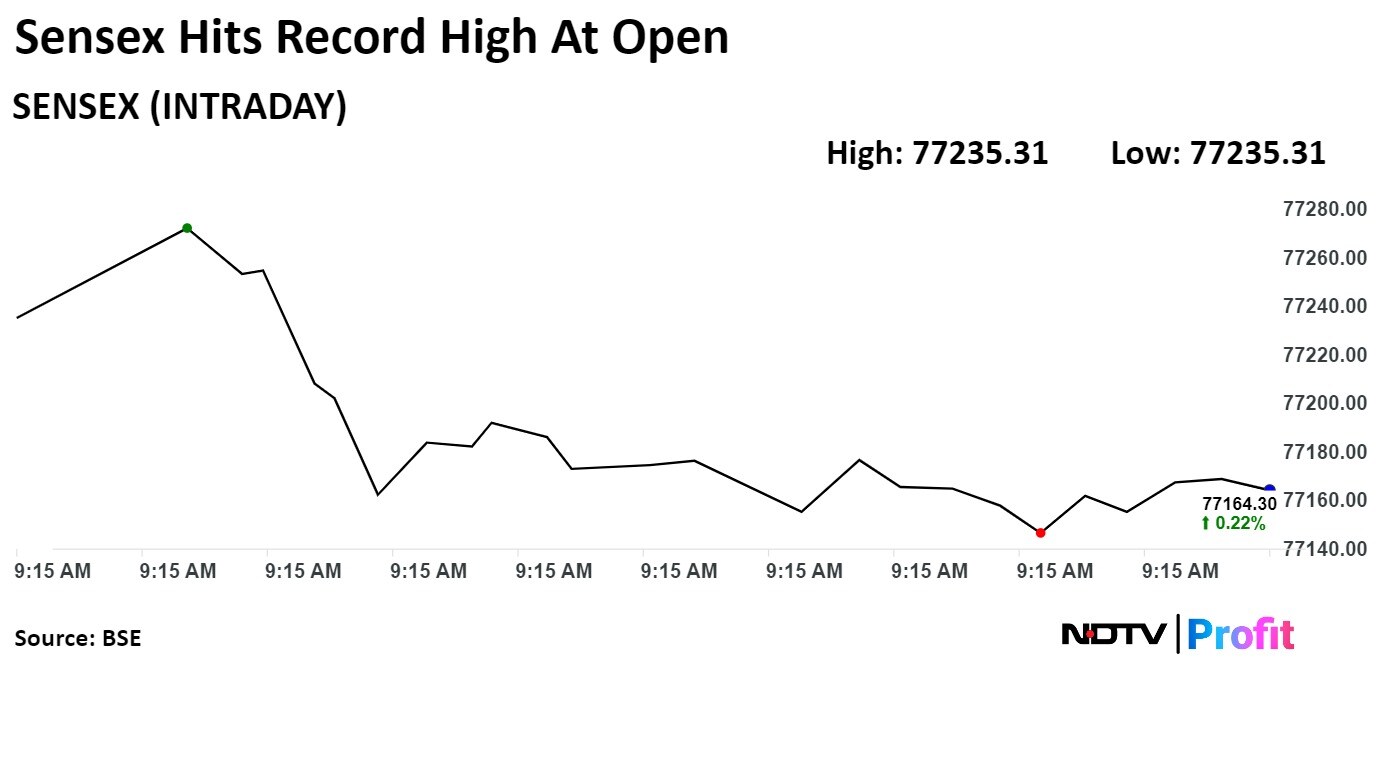

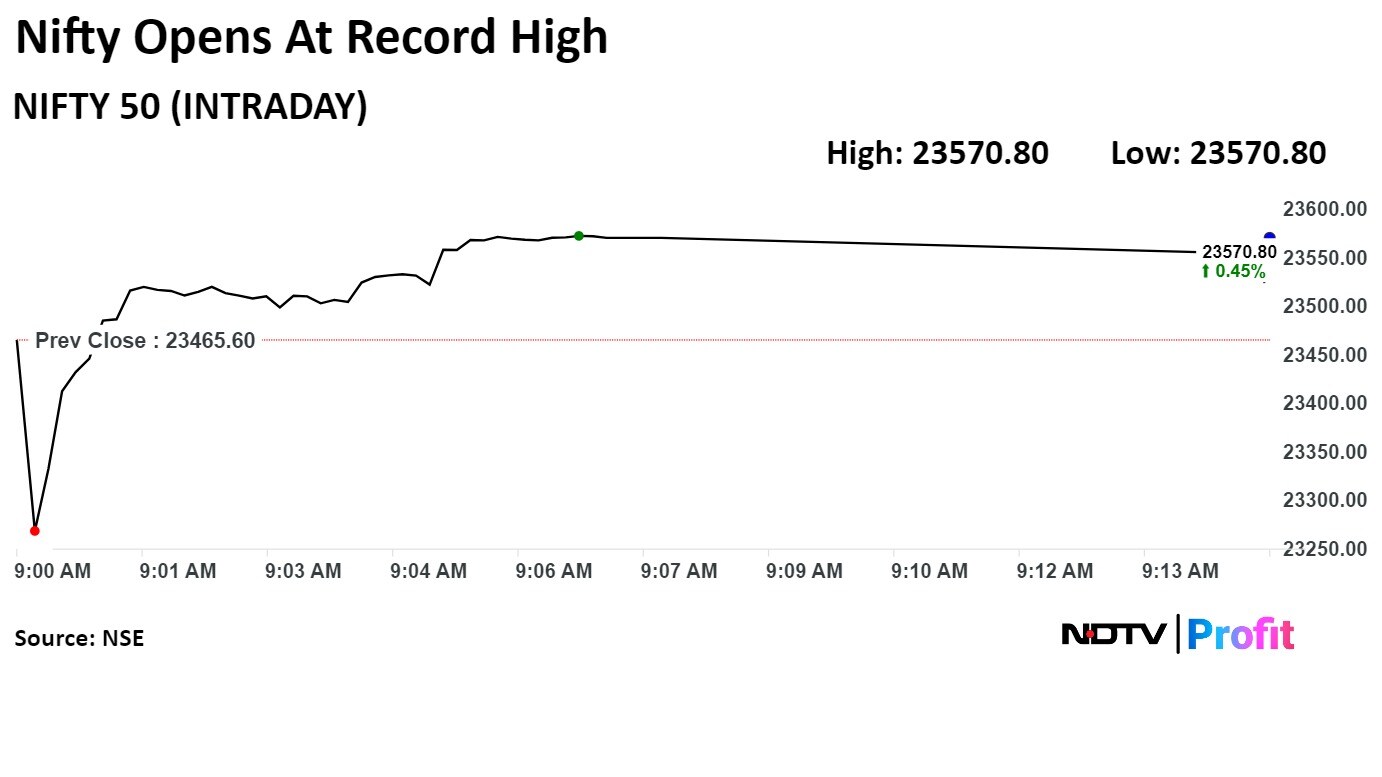

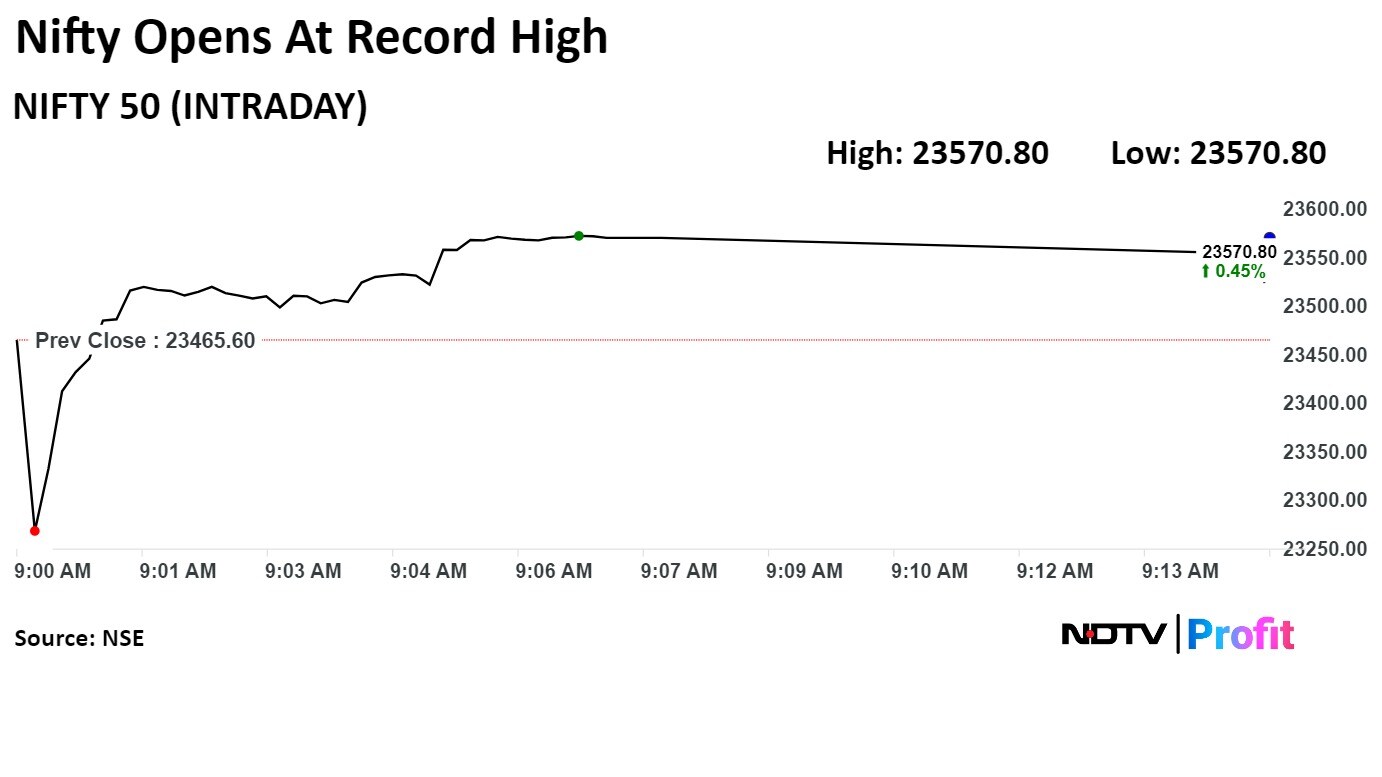

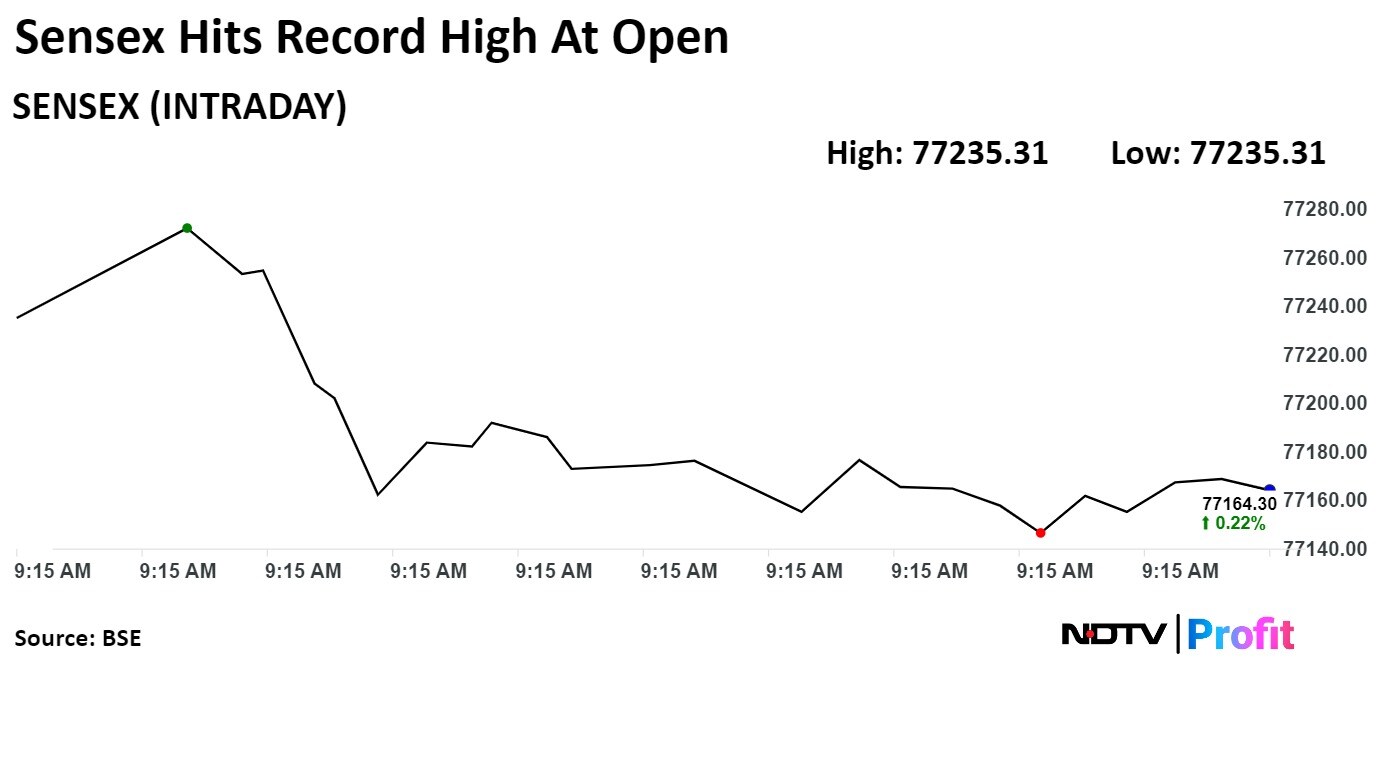

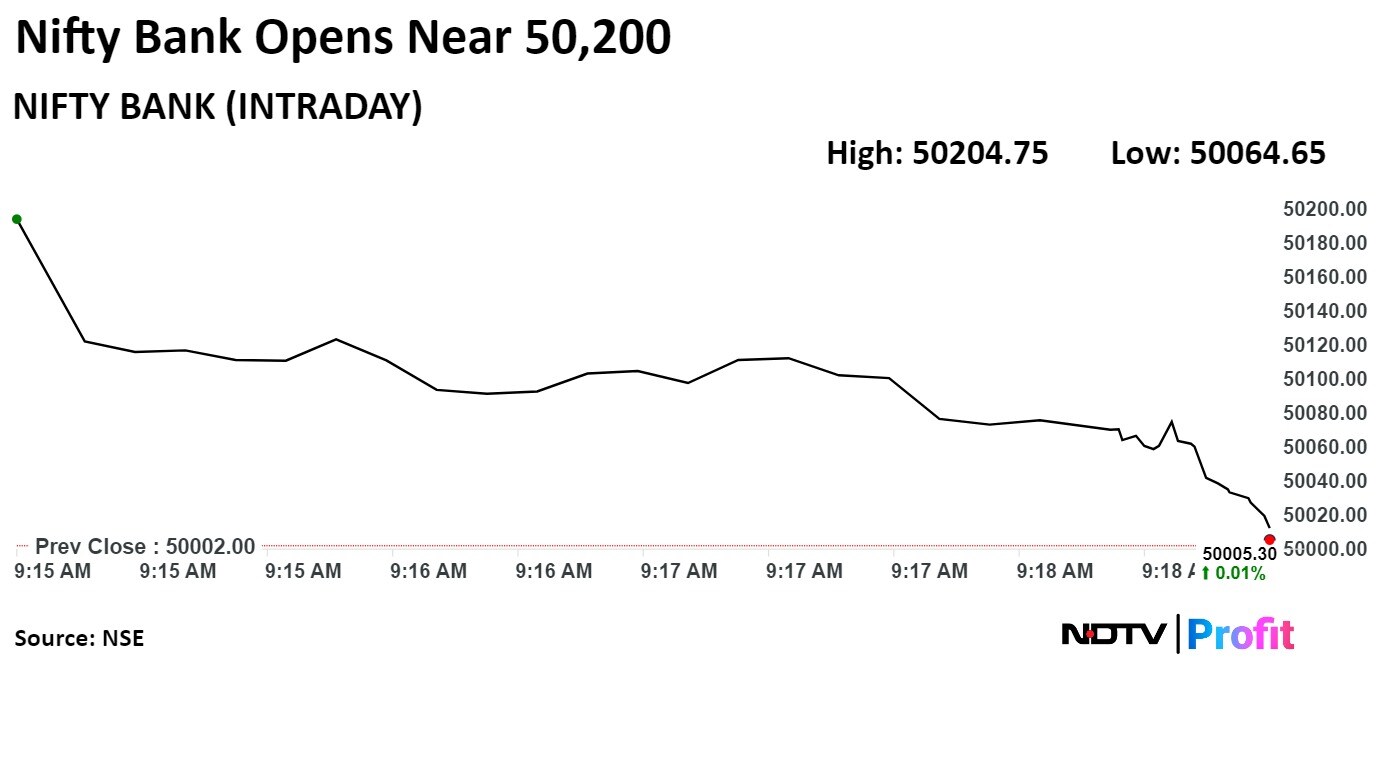

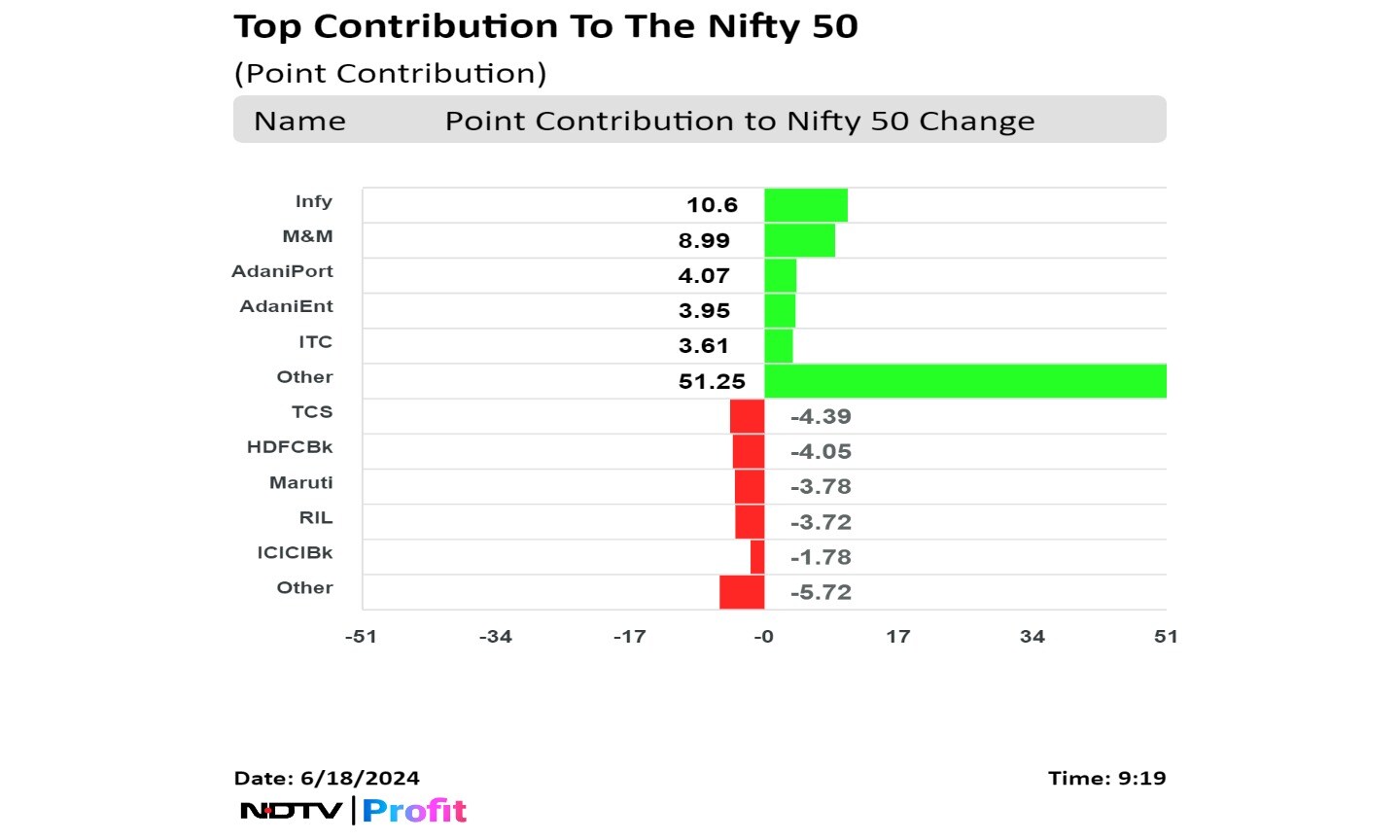

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

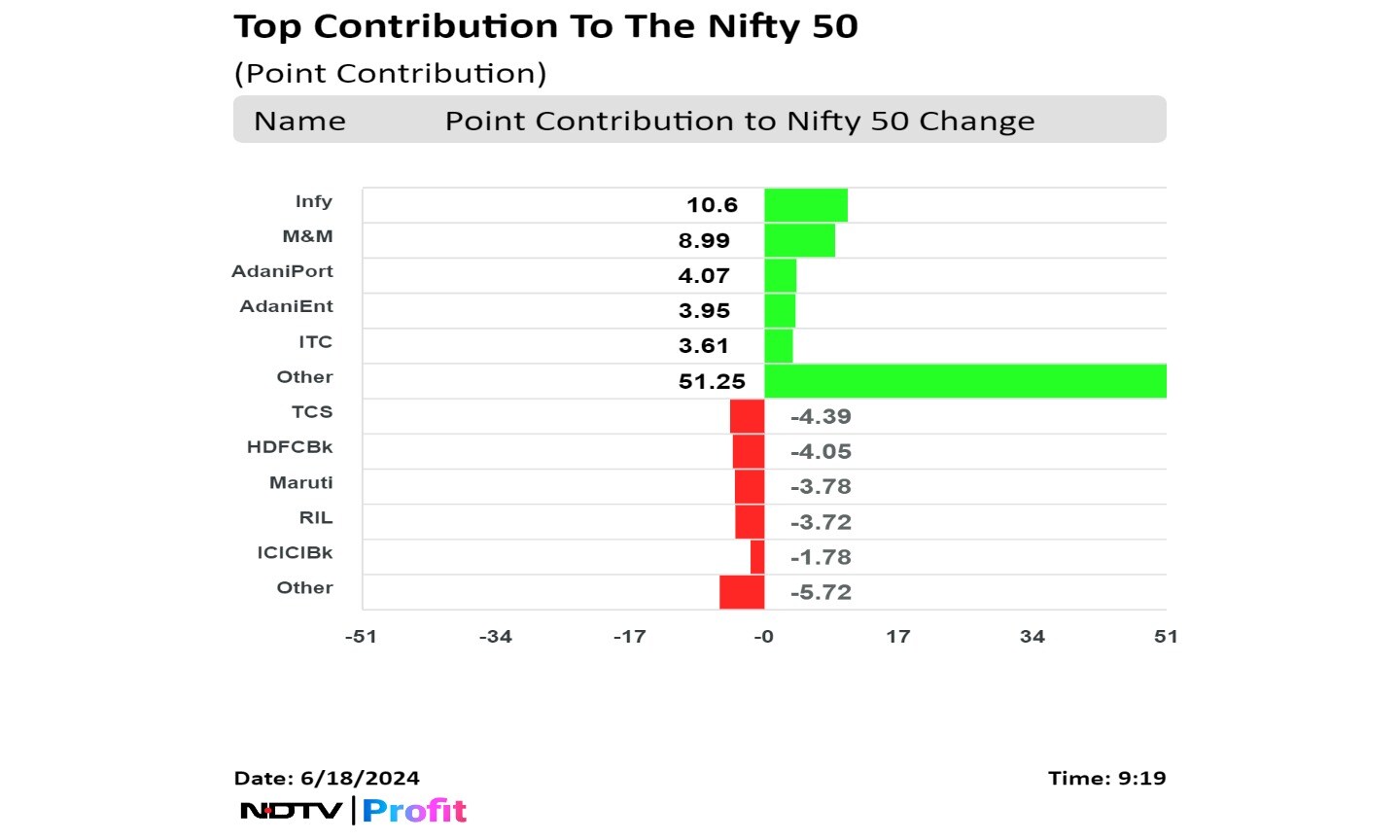

Shares of Infosys Ltd., M&M, Adani Ports & Special Economic Zone, Adani Enterprises, and ITC contributed the most to the gains.

While those of Tata Consultancy Services, HDFC Bank, Maruti Suzuki, Reliance Industries, and ICICI Bank capped the upside.

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."

Benchmark equity indices extended their rally in the fifth consecutive session today with Infosys contributing the most to their gains.

At pre-open, the Nifty was at 23570.80, up by 0.45% or 105.20 points and the Sensex was at 77235.31 higher by 0.32% or 242.54 points.

"Expect the rally in domestic bourses to continue, backed by strong economic data from both India and the US," said Vikas Jain, senior research analyst at Reliance Securities. "Cooling May CPI data to a one-year low, robust IIP data, falling US inflation, and confidence in the NDA coalition's continued focus on economic growth will be positive for market sentiment."