The local currency weakened 2 paise to close at 83.56 against the U.S dollar.

It closed at 83.54 on Thursday.

Source: Bloomberg

The local currency weakened 2 paise to close at 83.56 against the U.S dollar.

It closed at 83.54 on Thursday.

Source: Bloomberg

.jpeg)

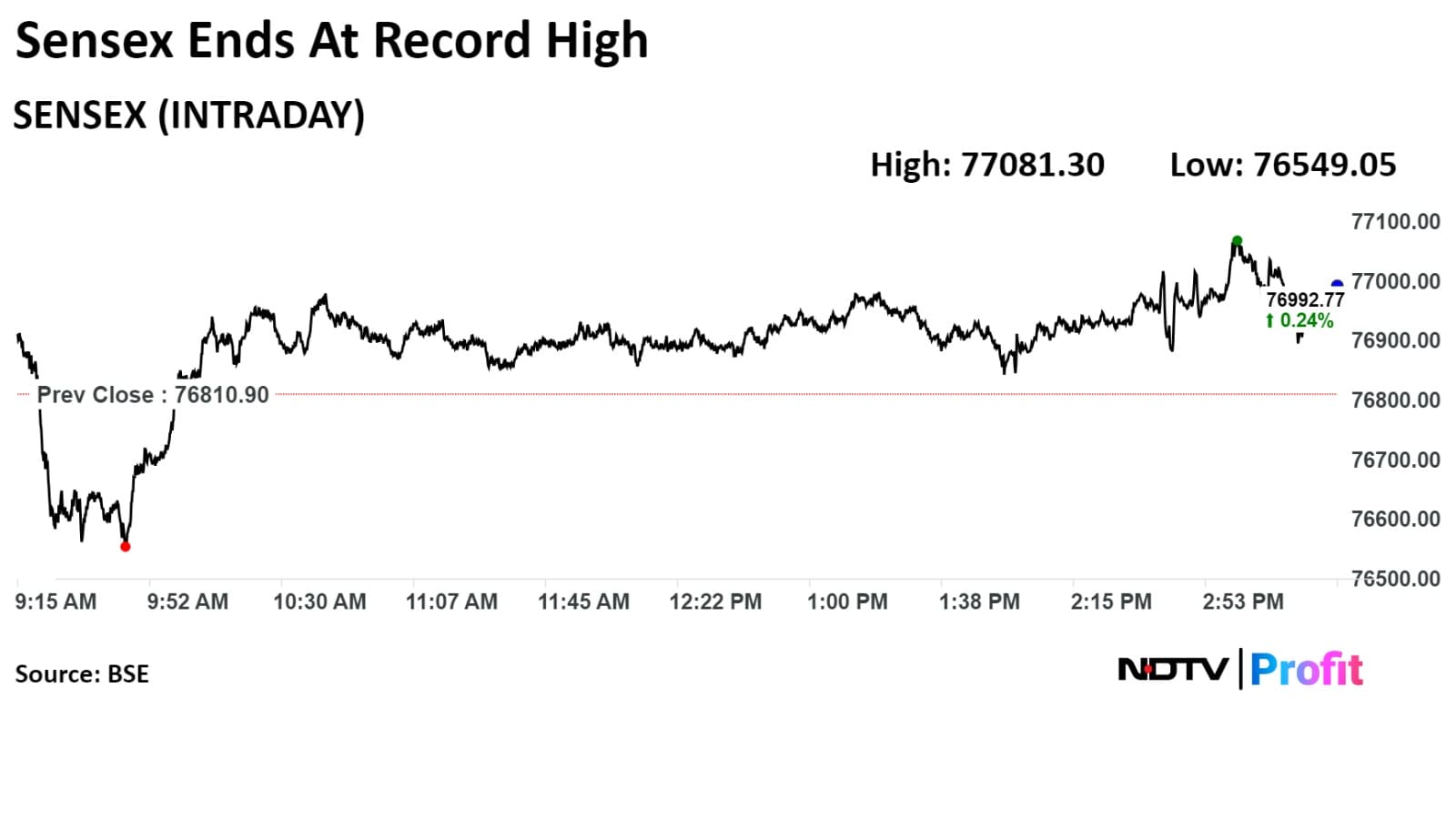

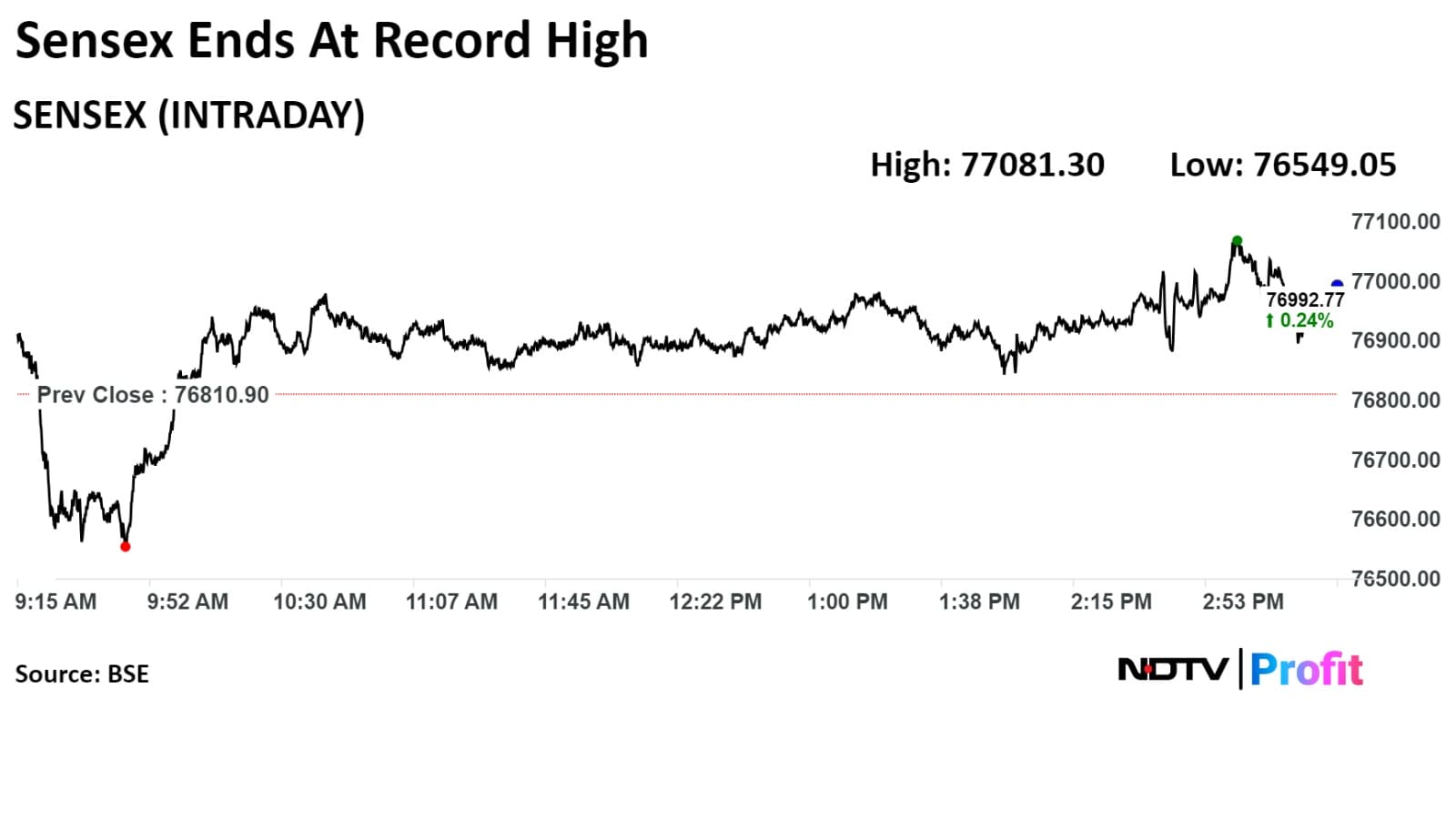

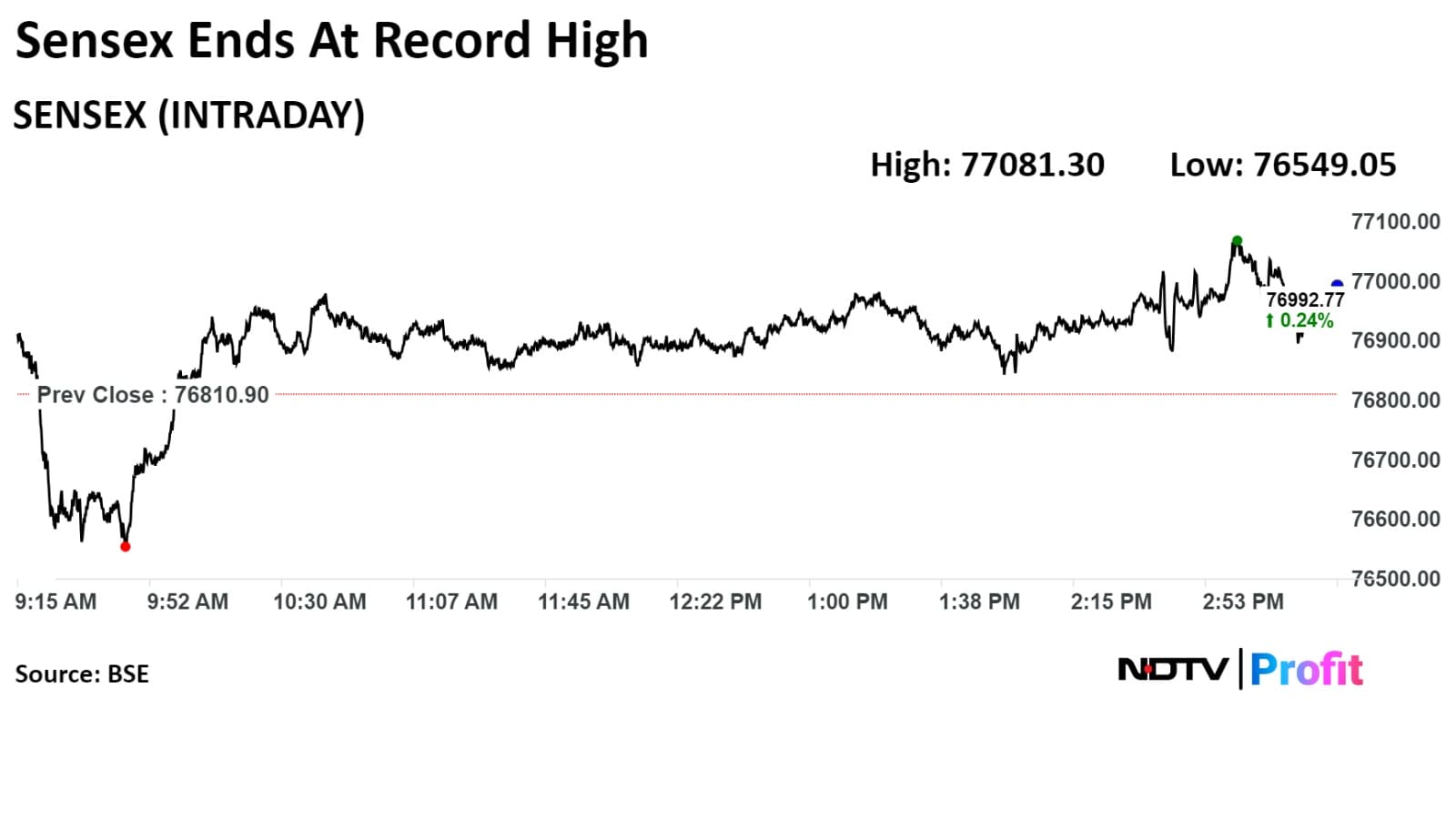

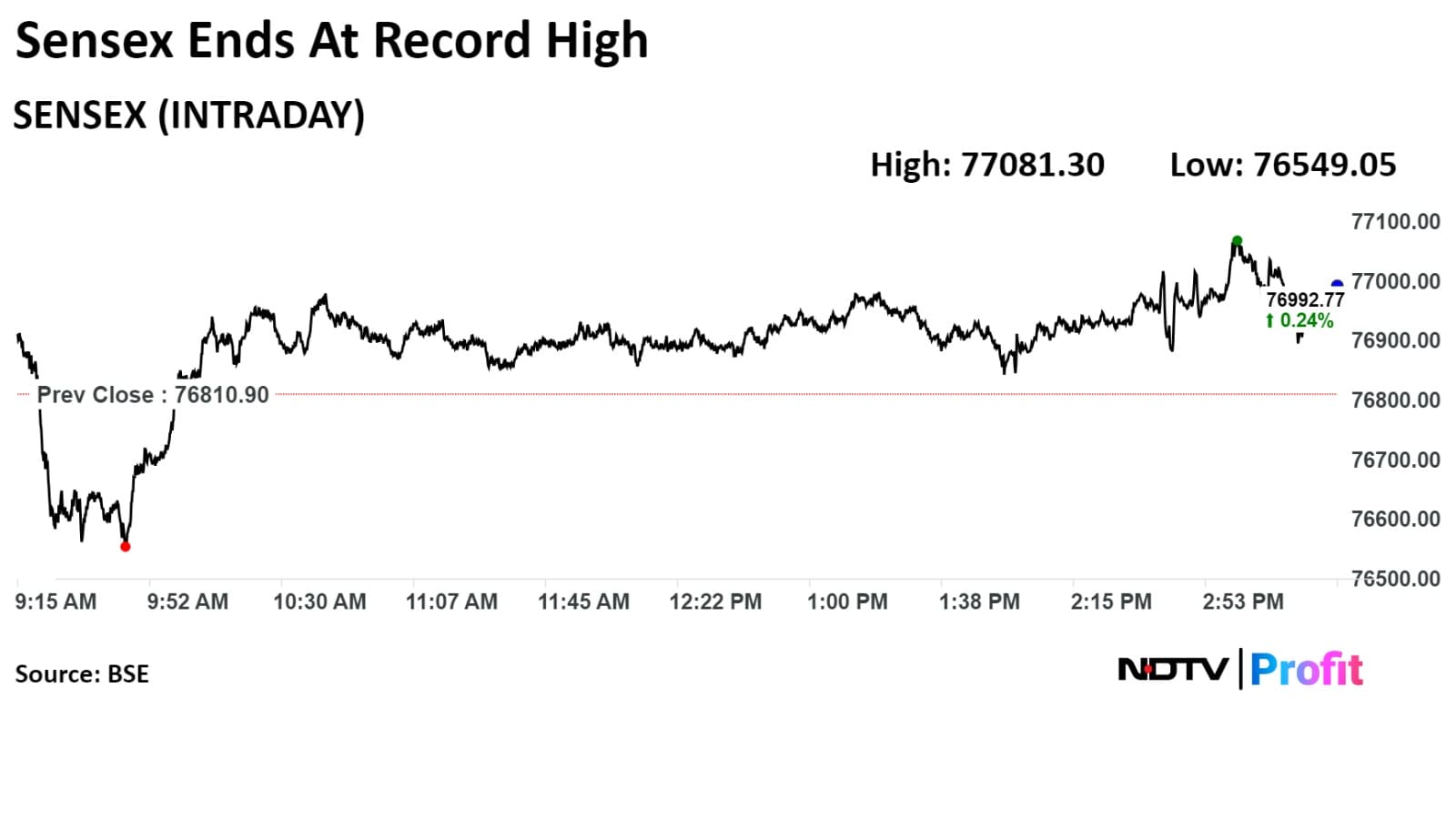

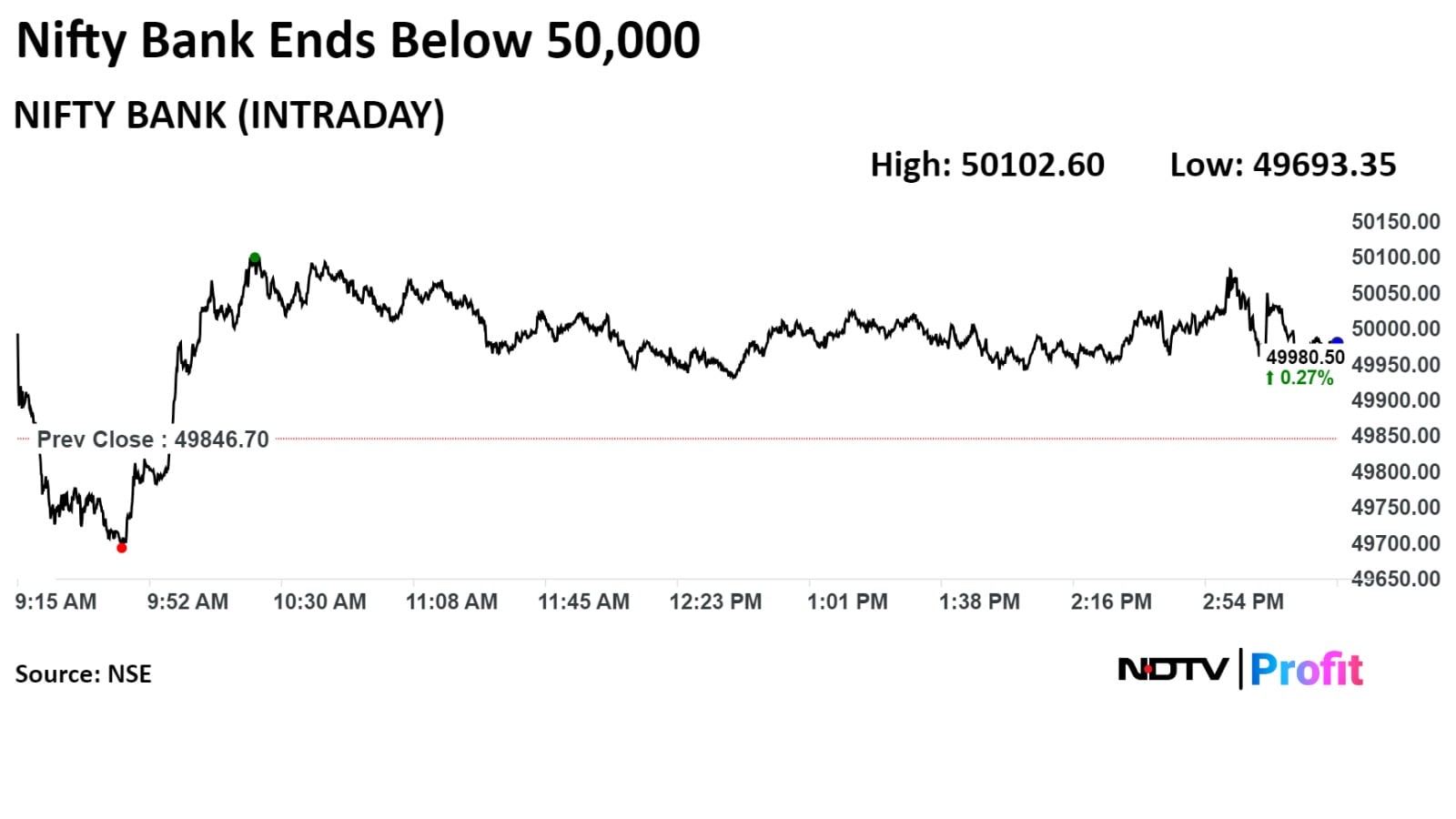

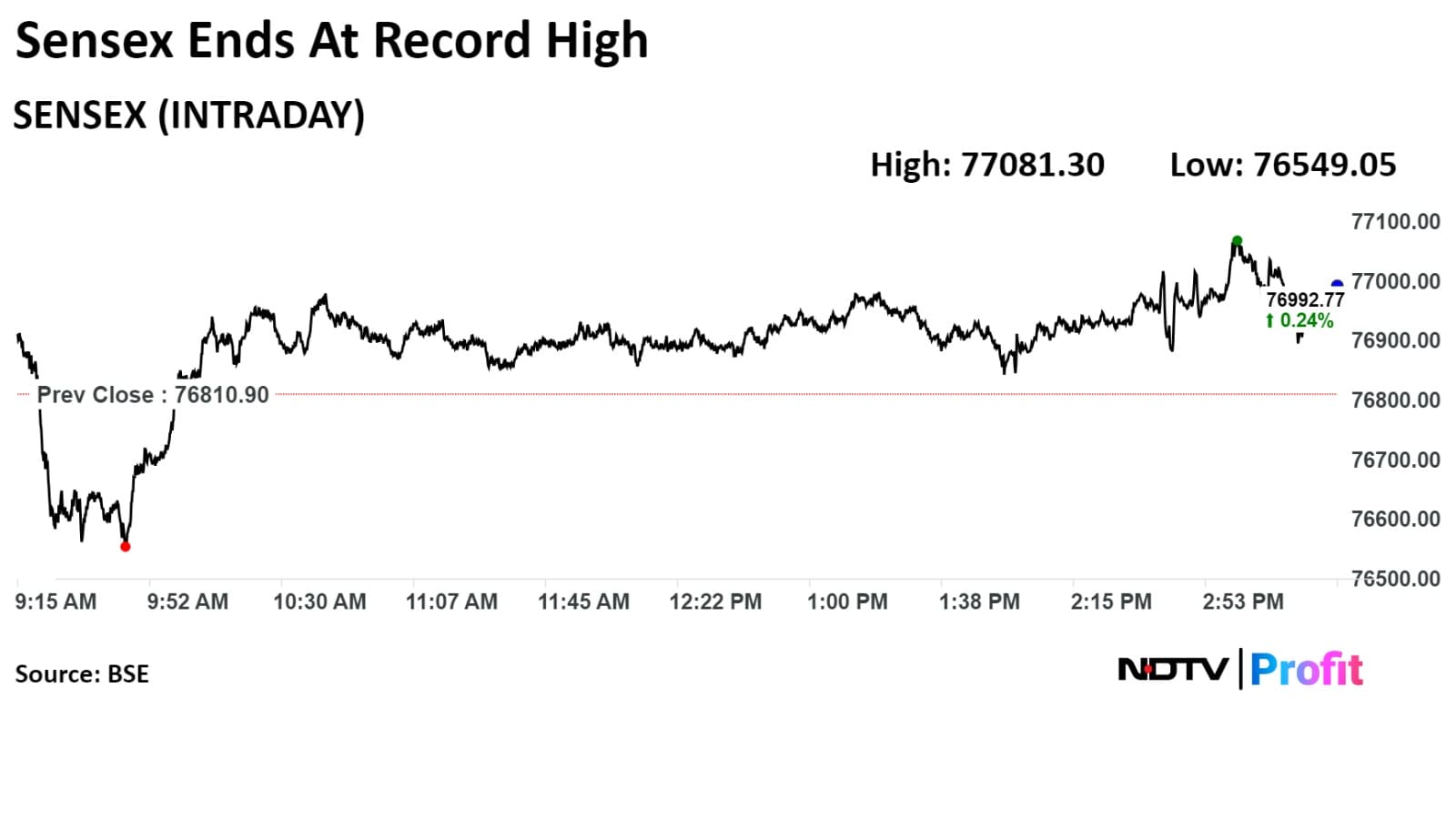

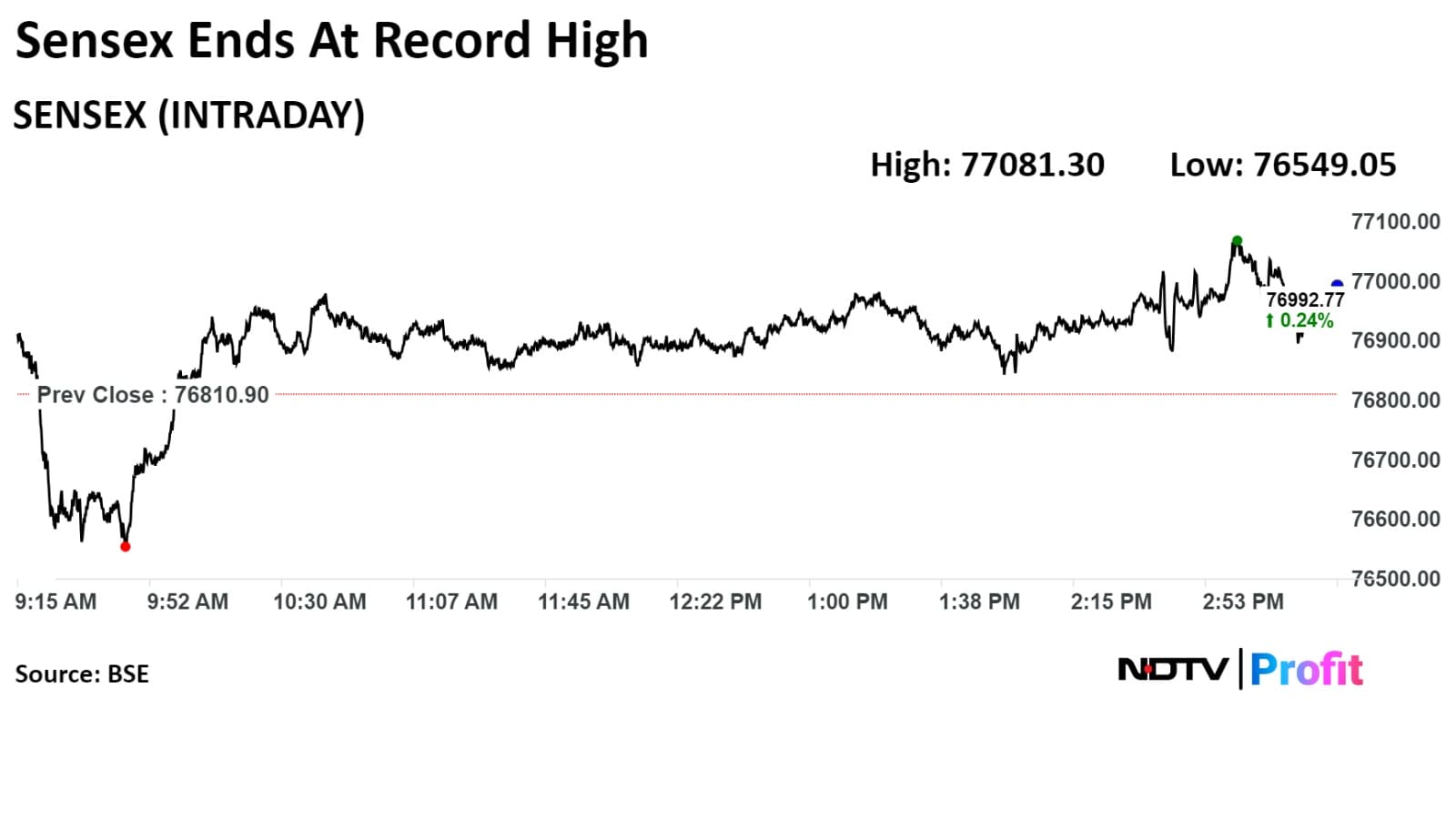

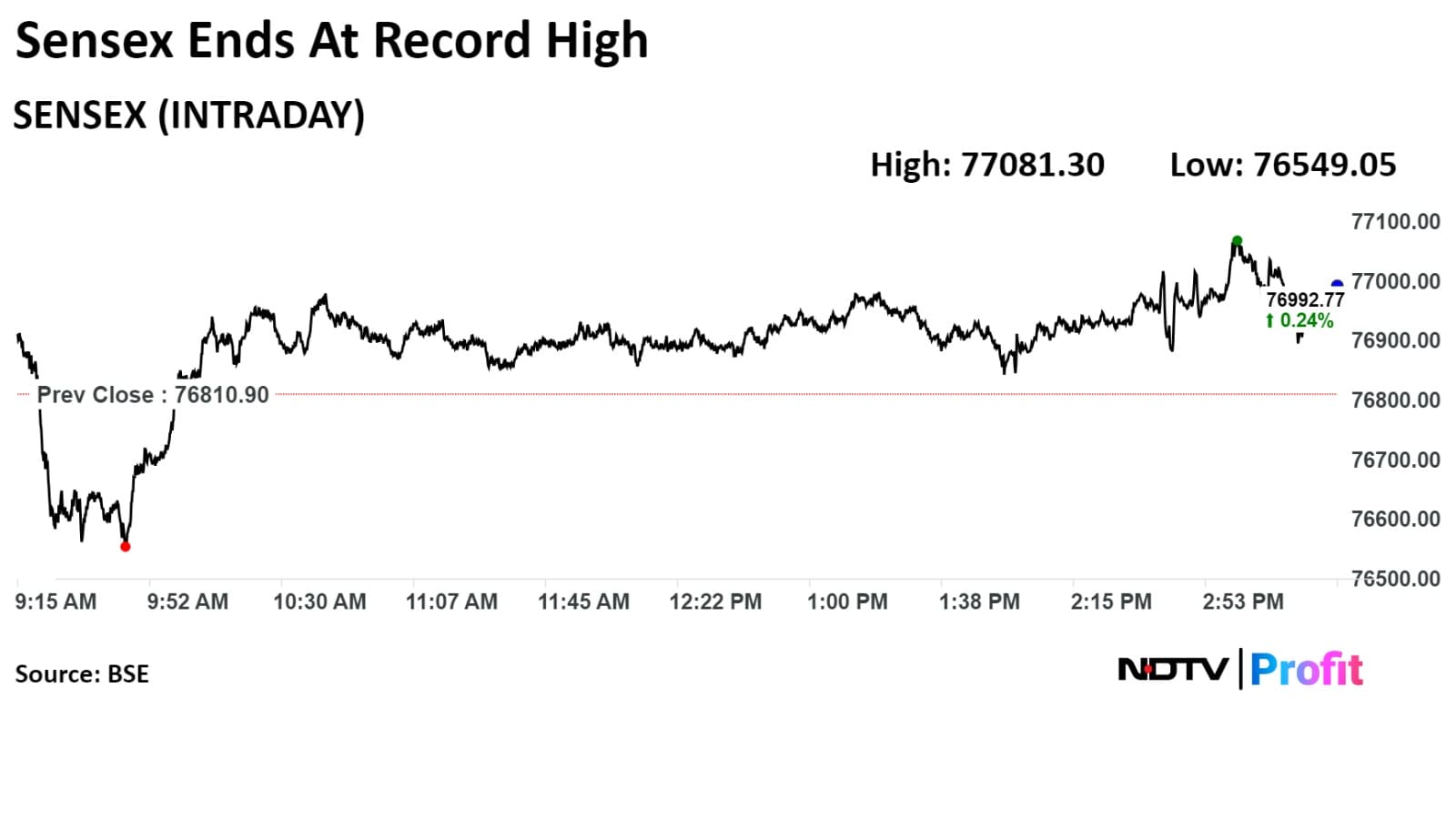

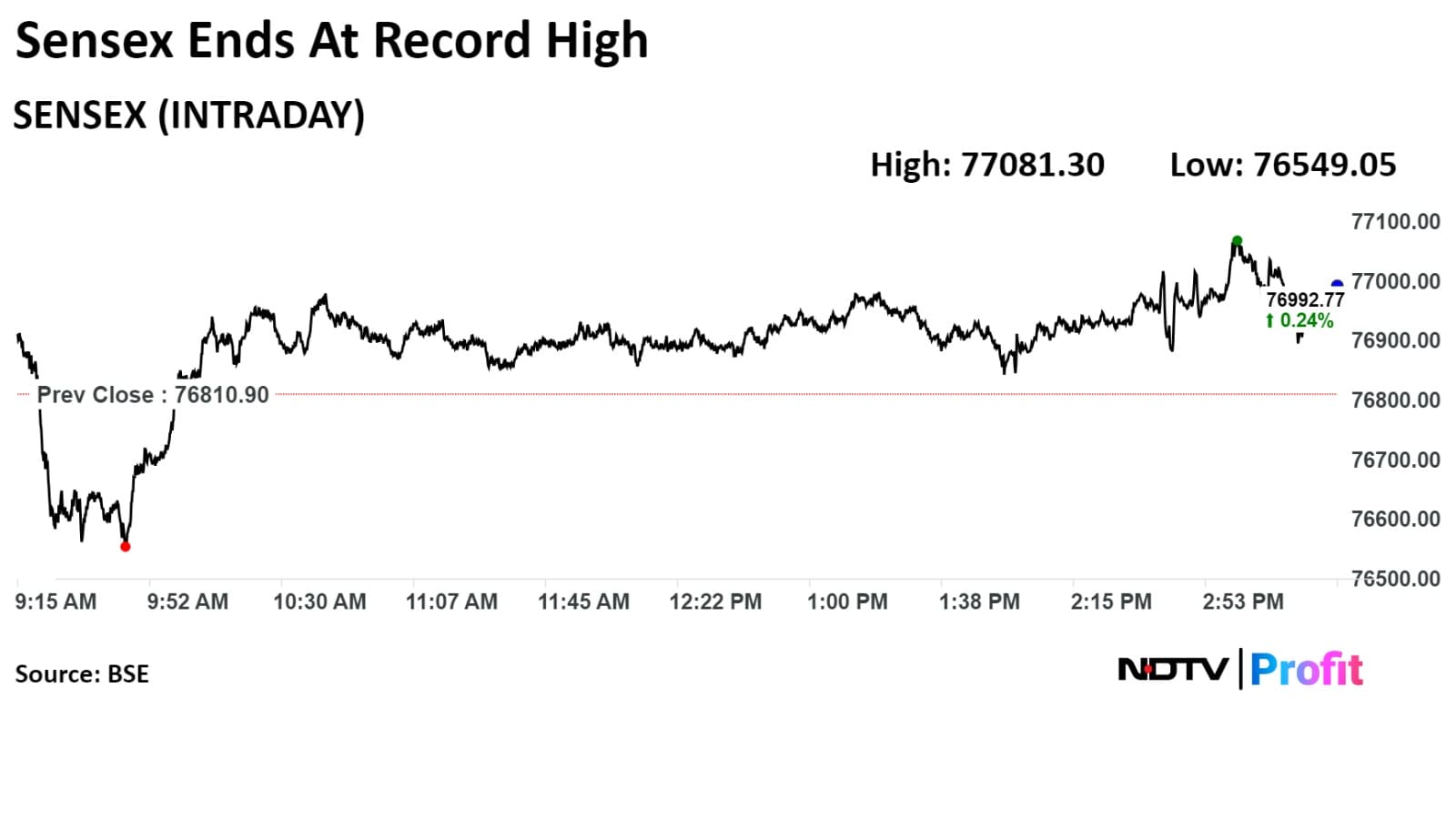

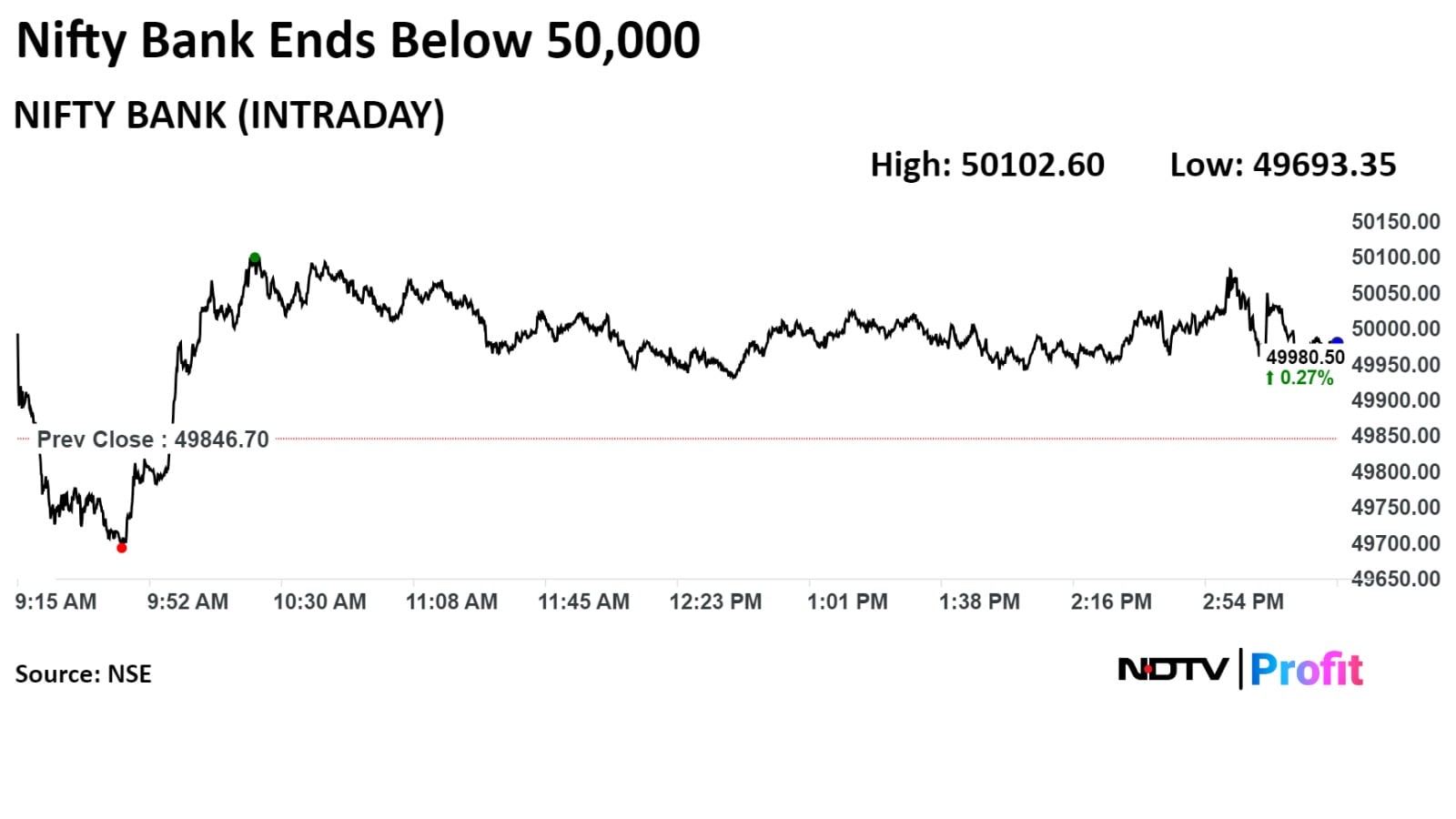

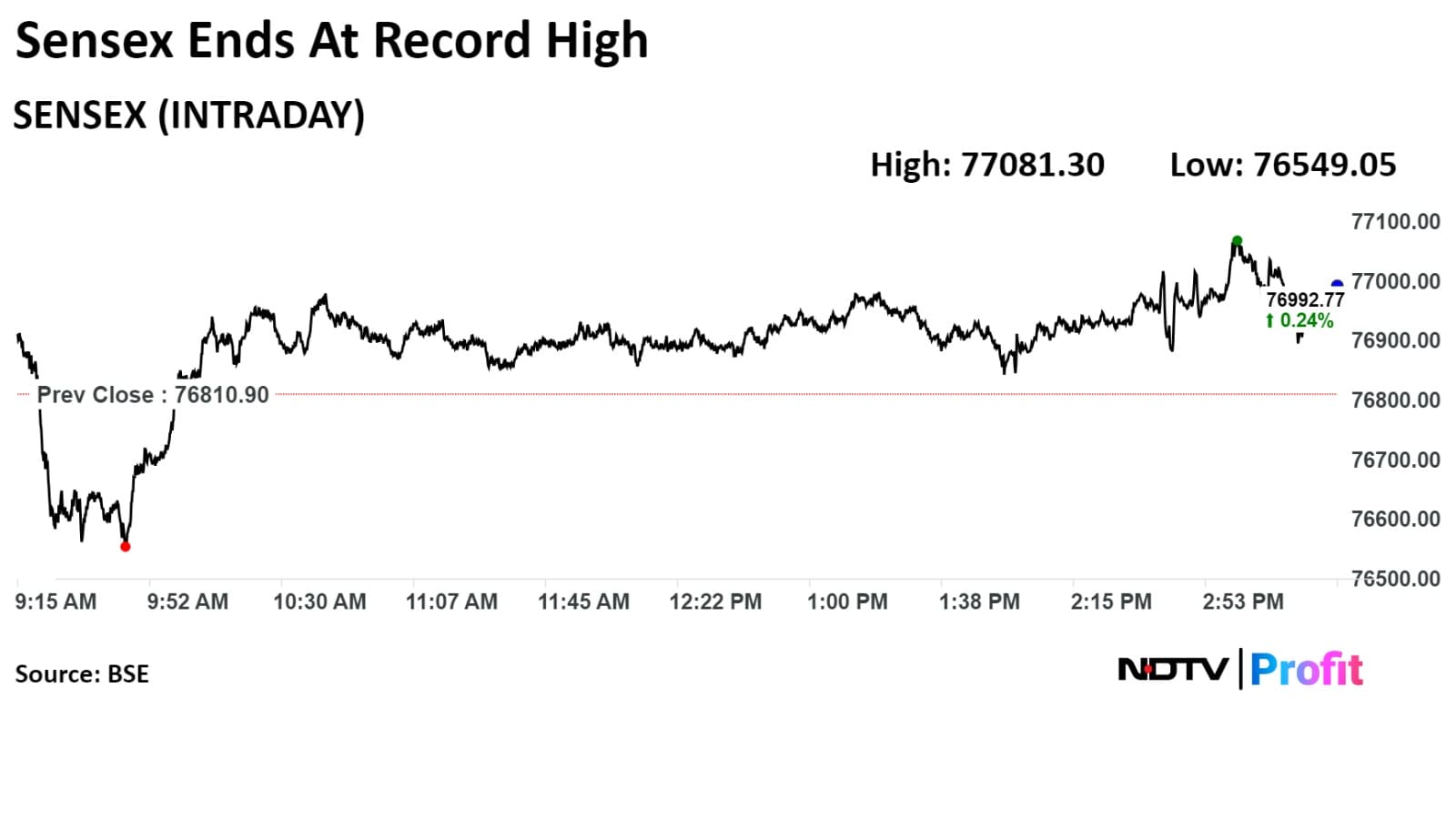

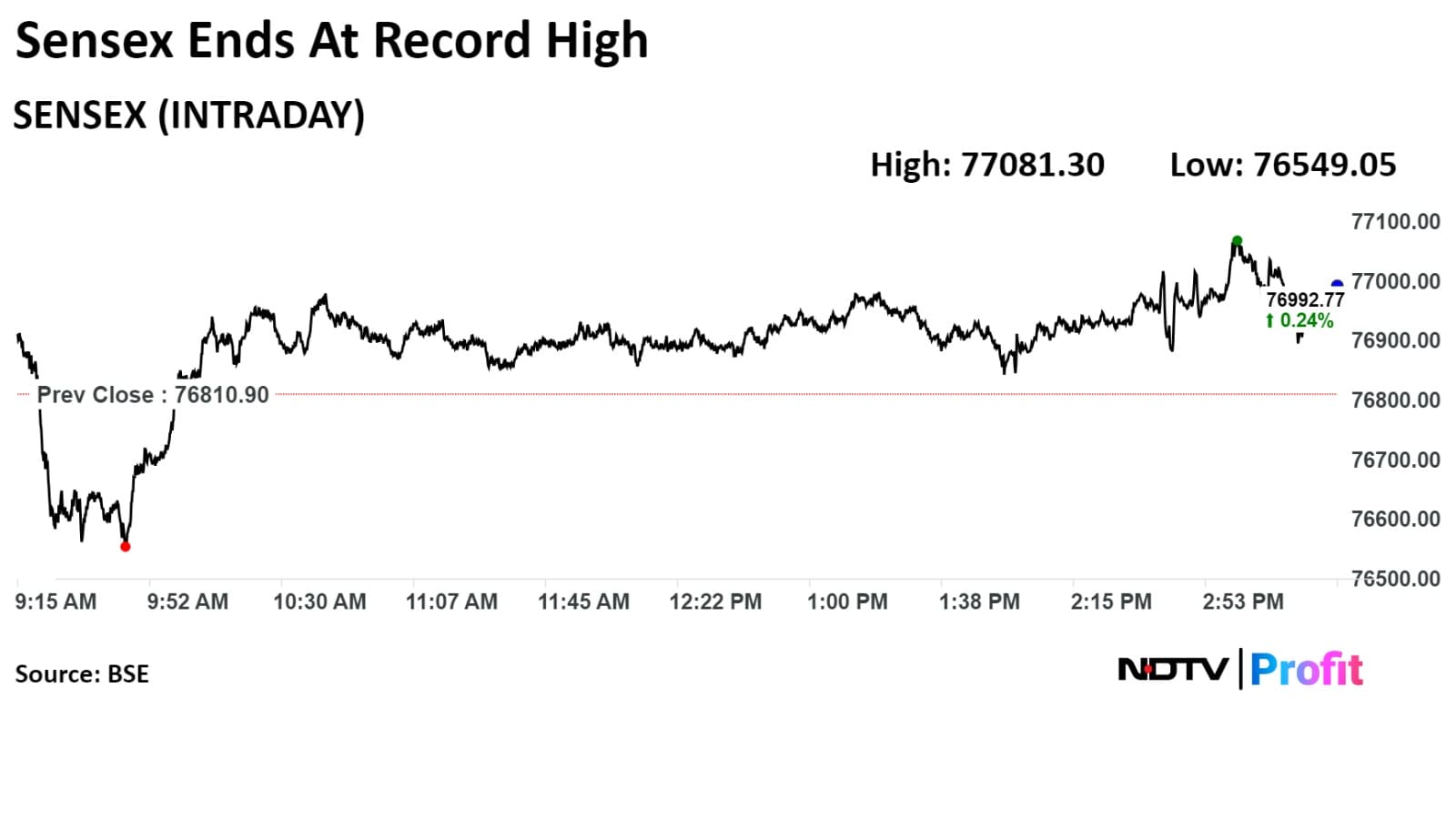

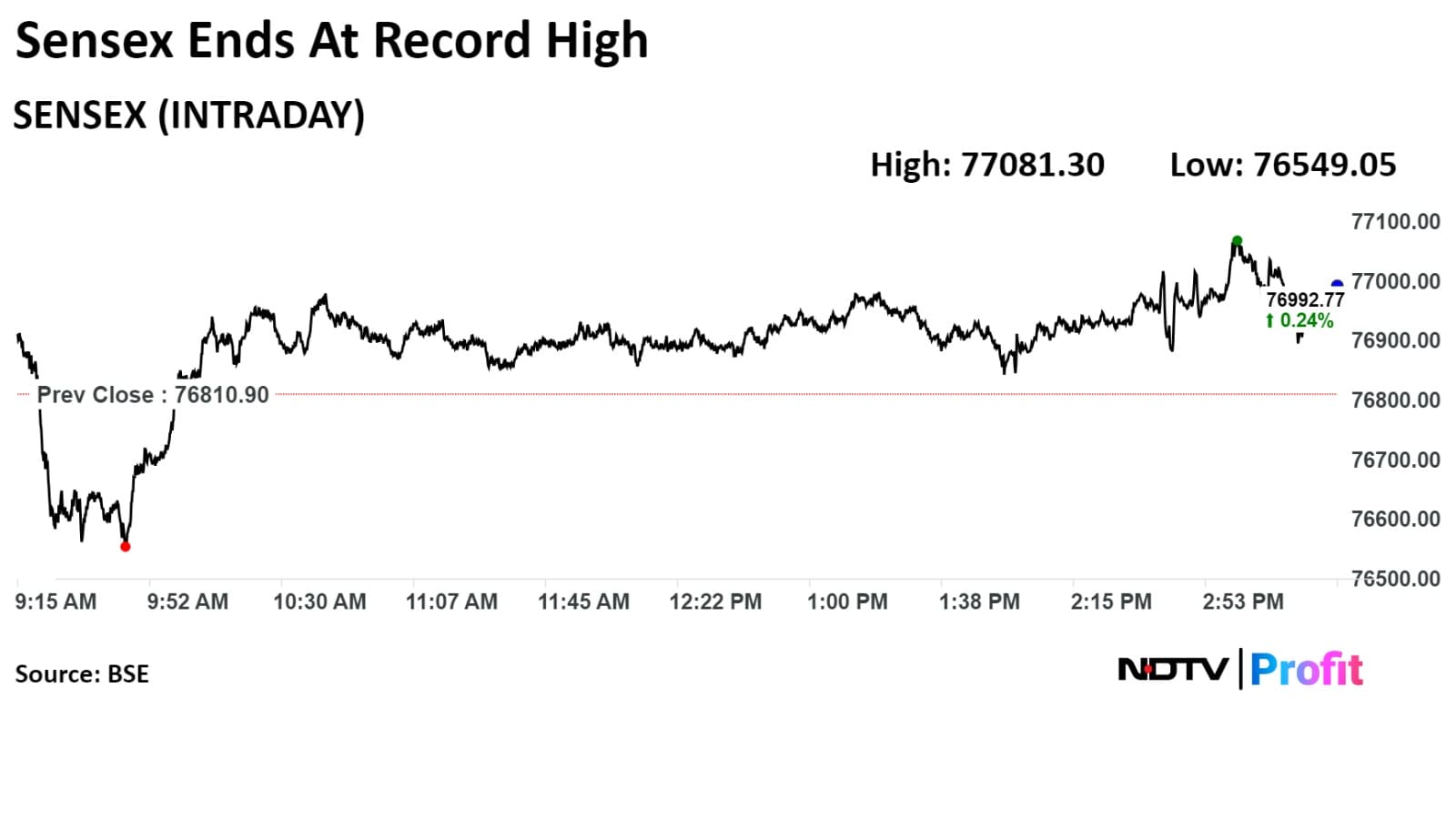

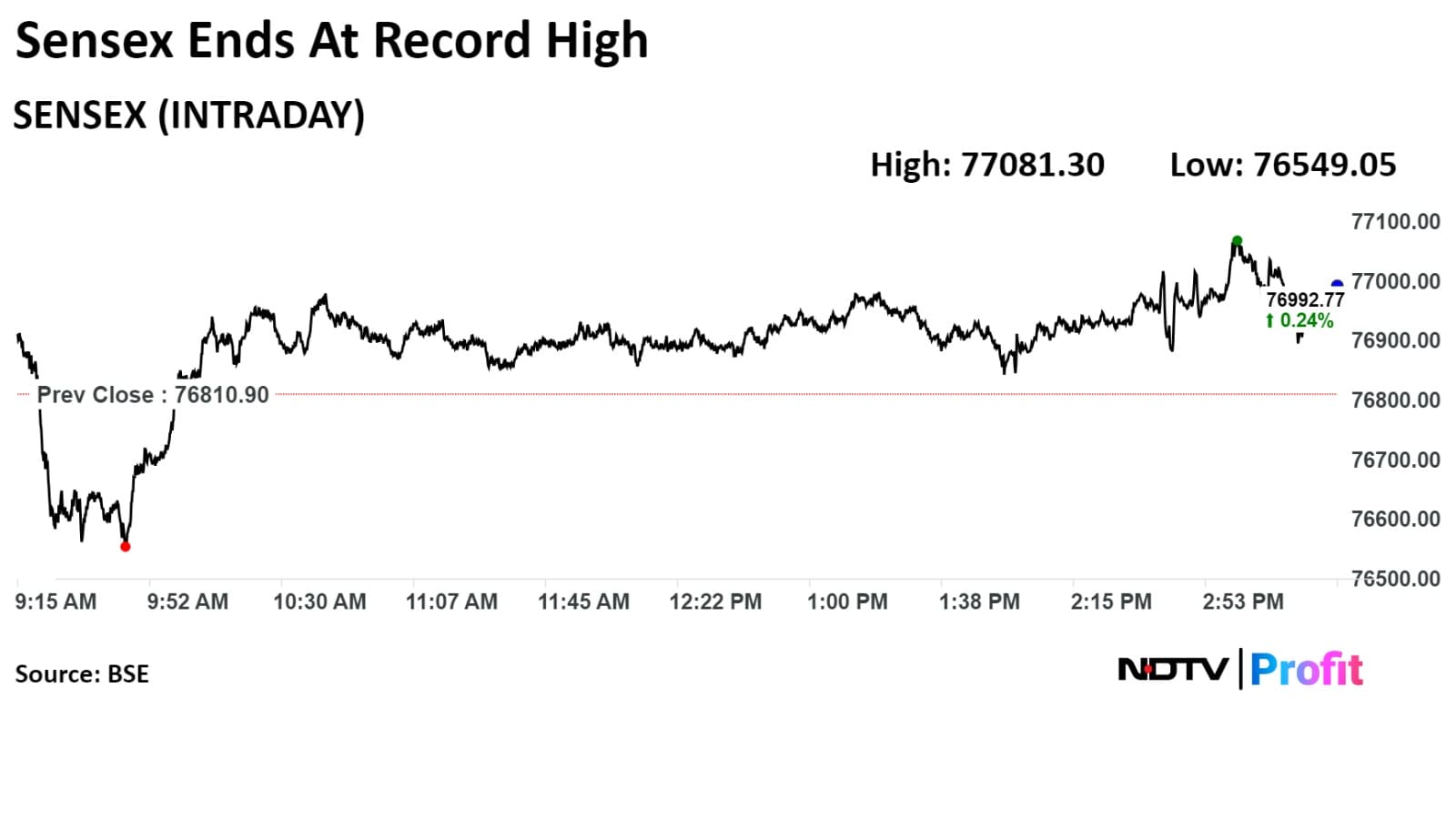

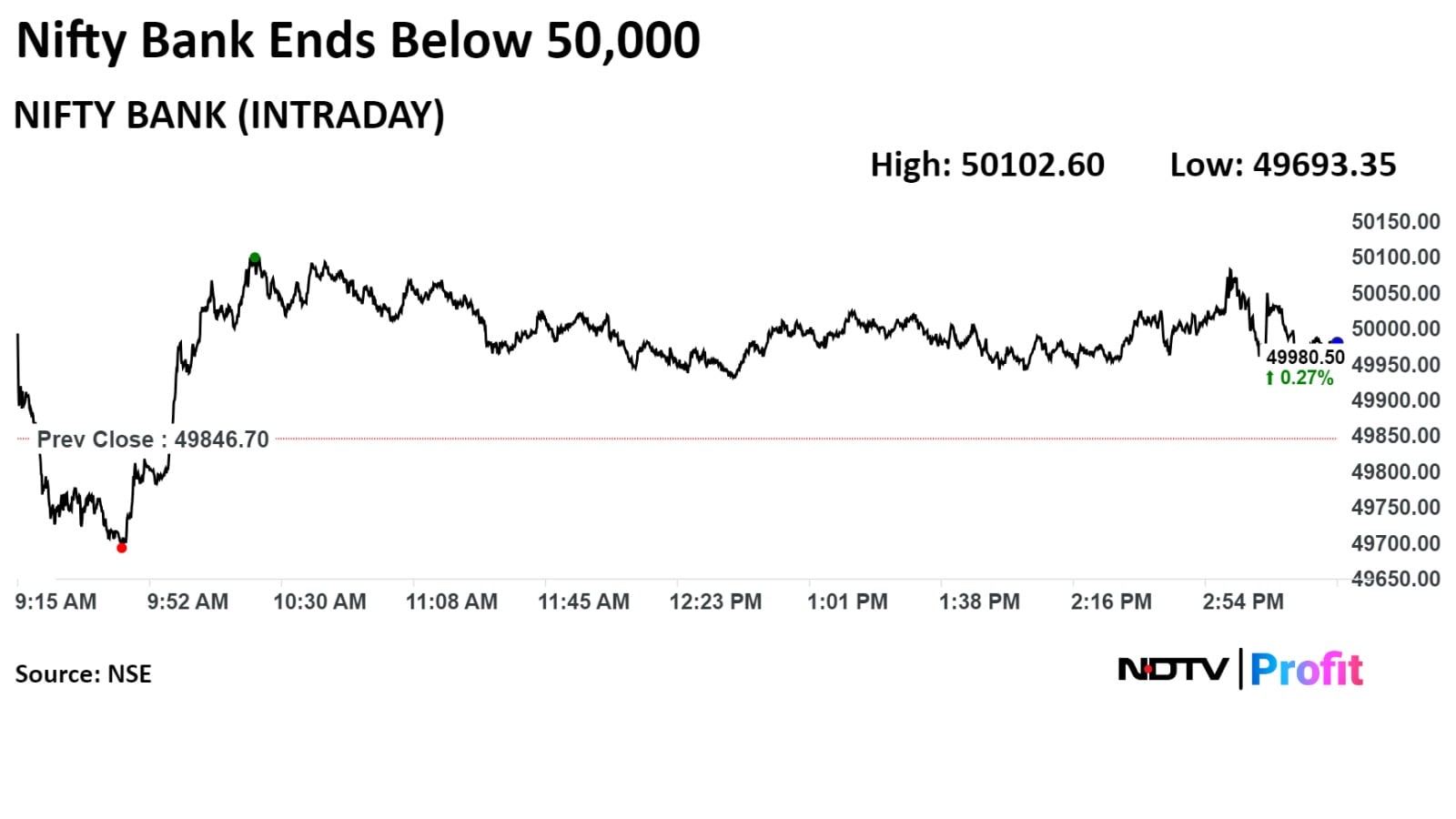

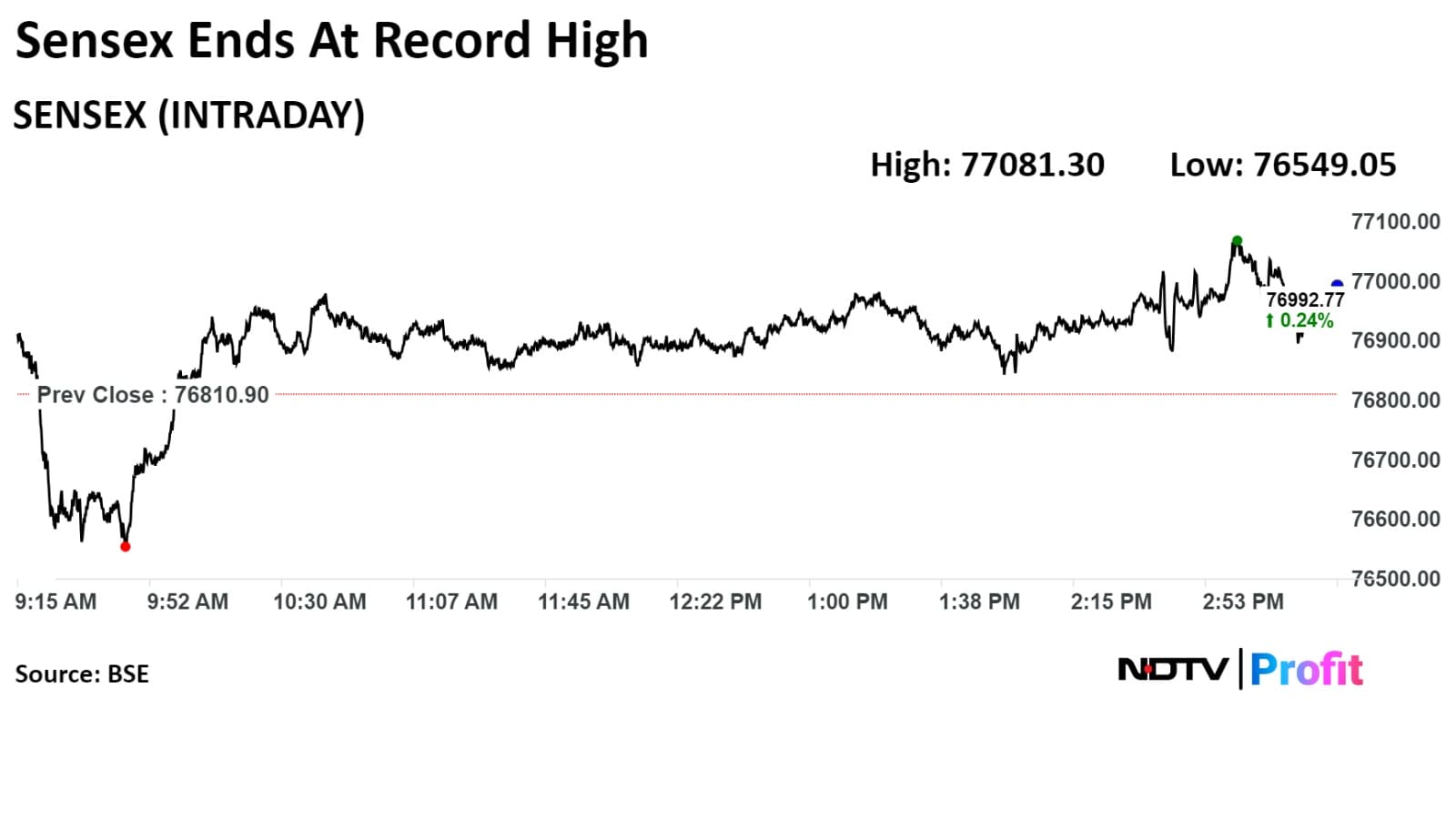

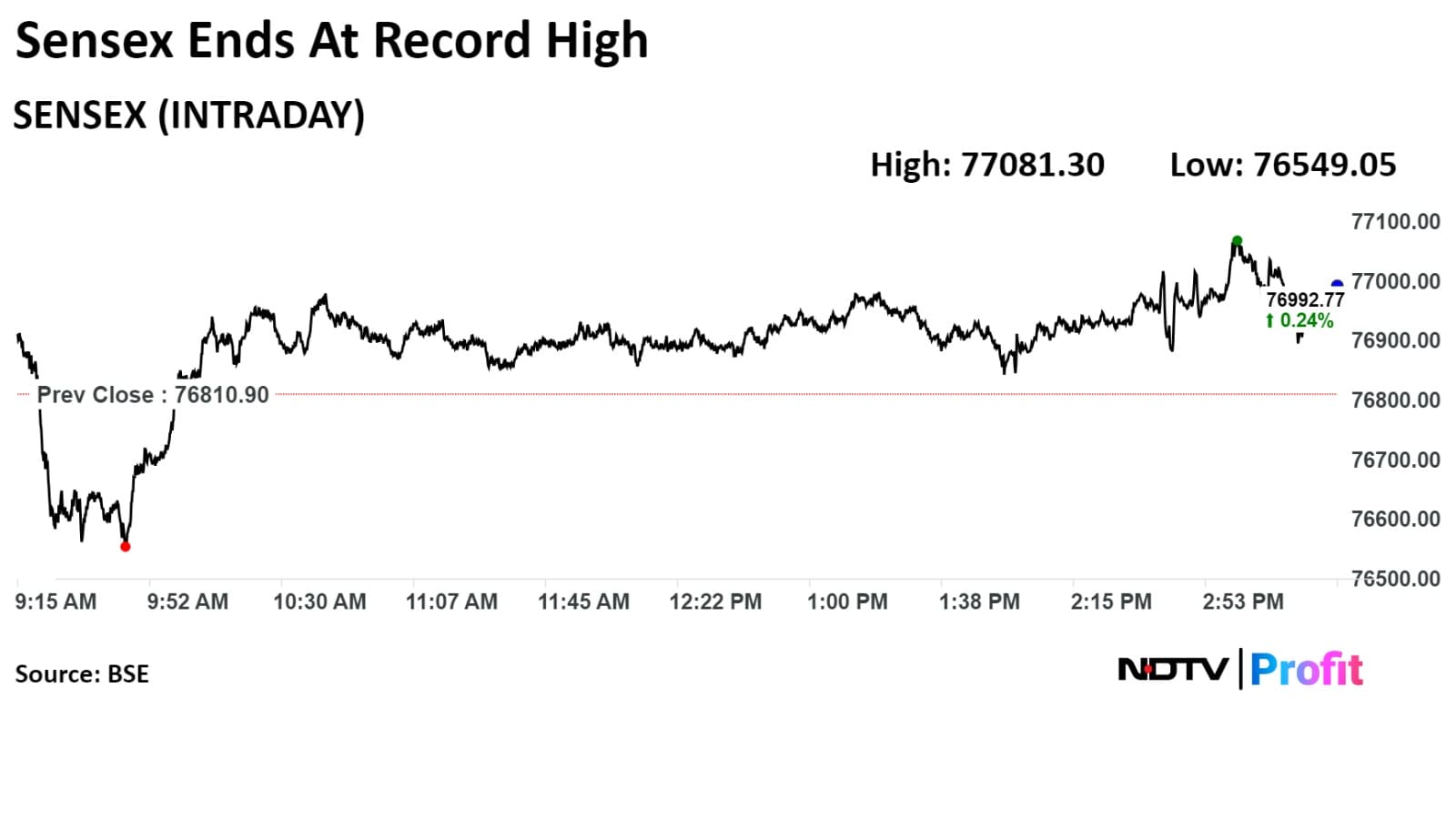

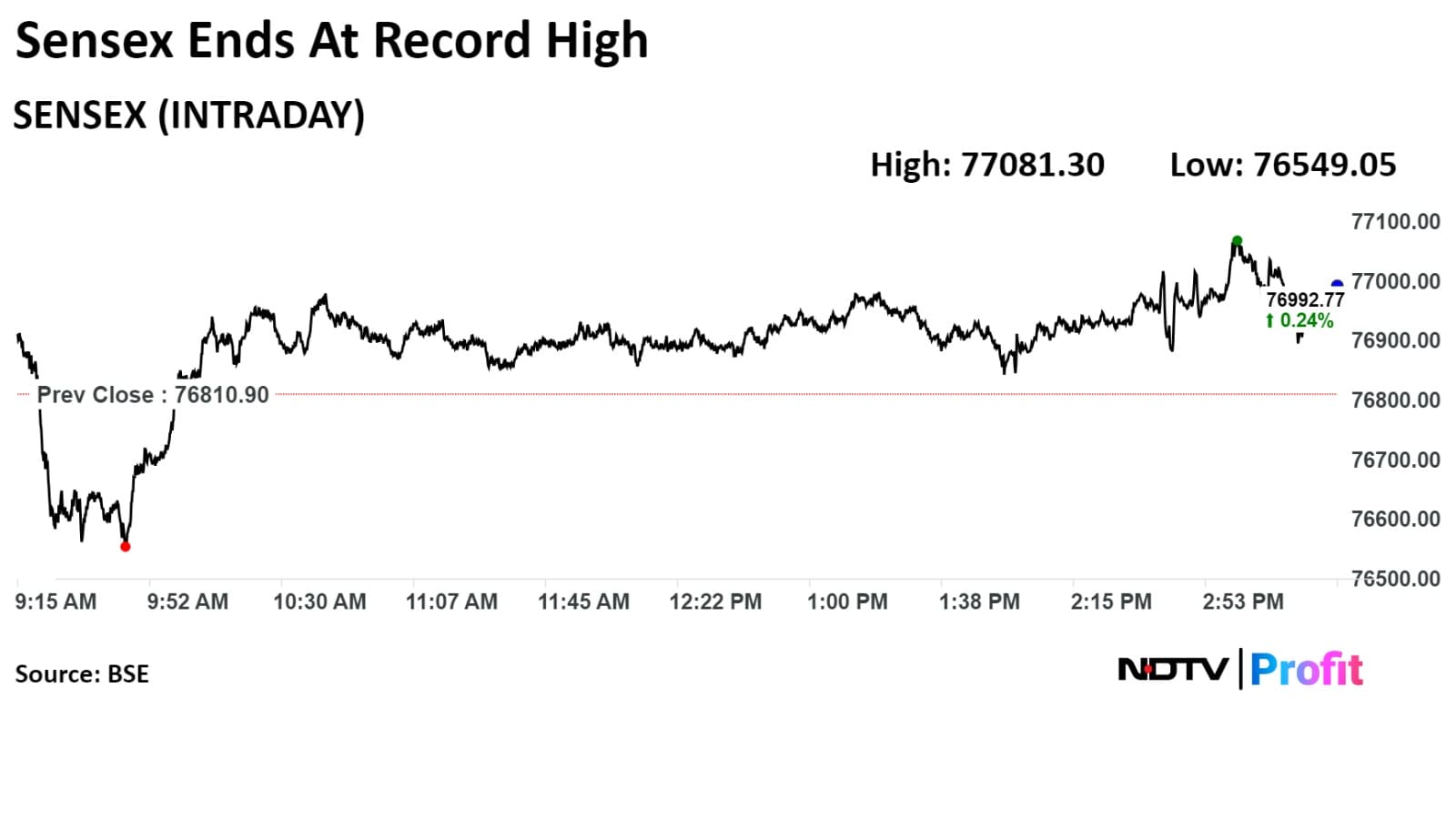

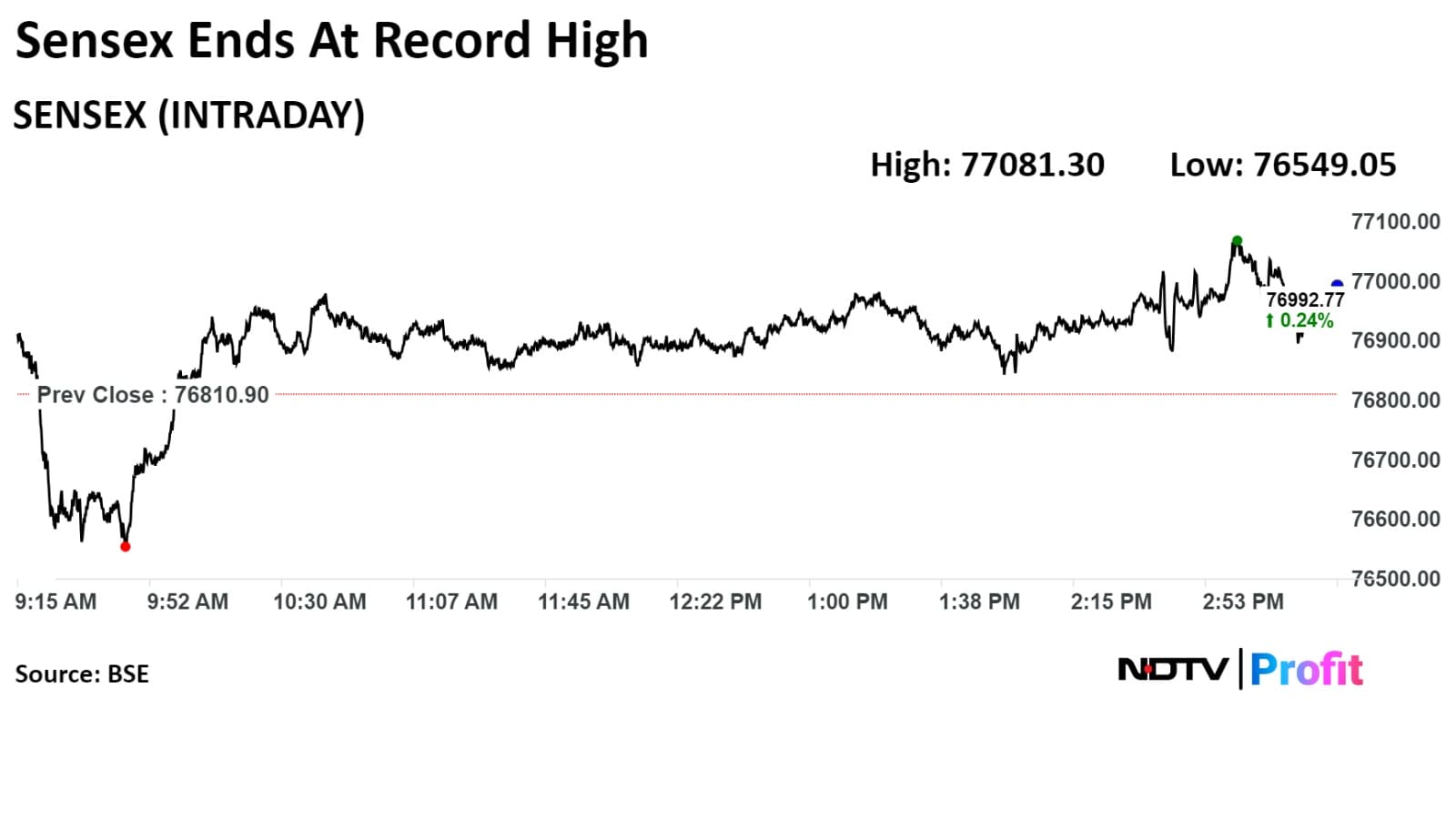

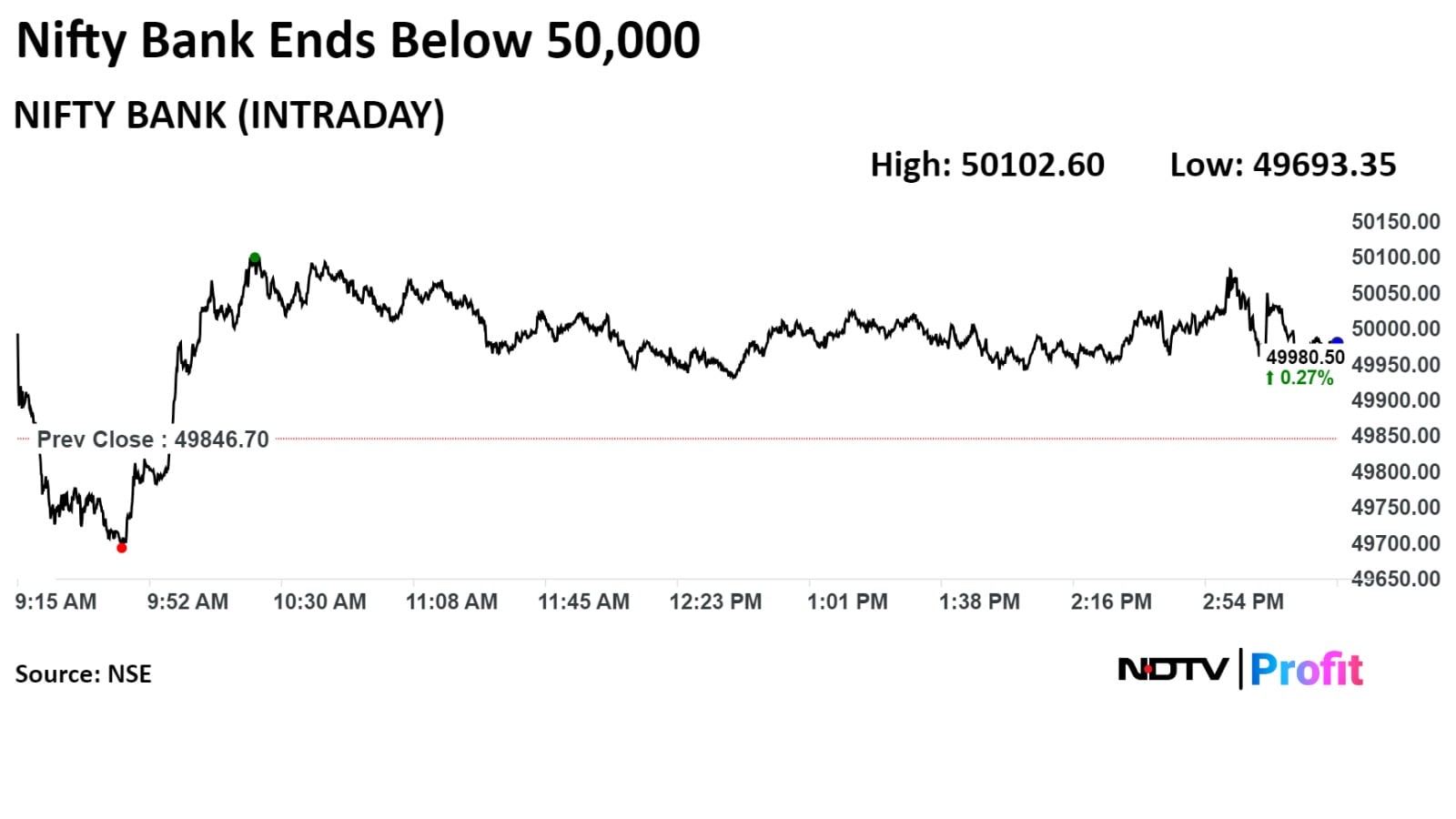

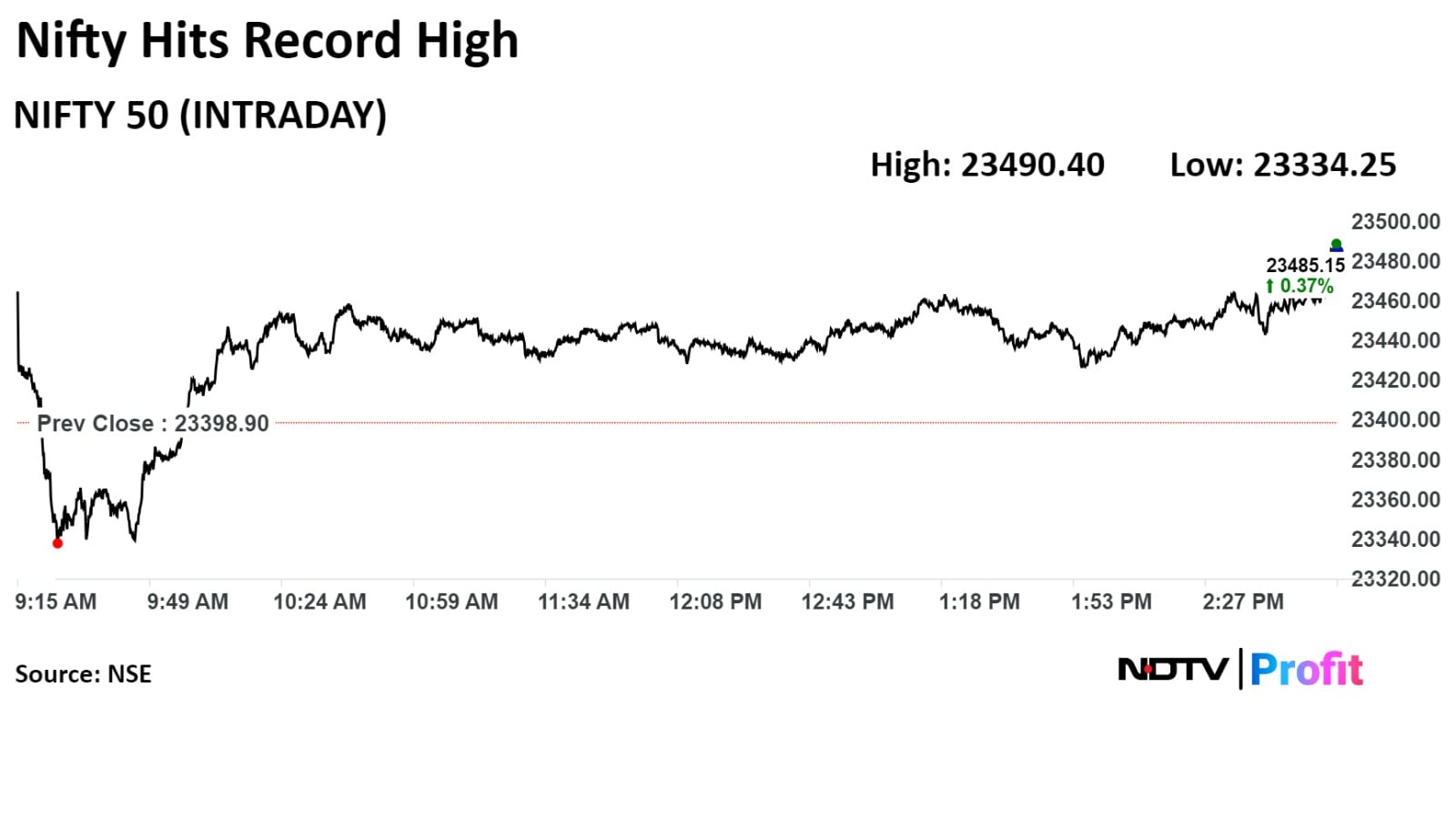

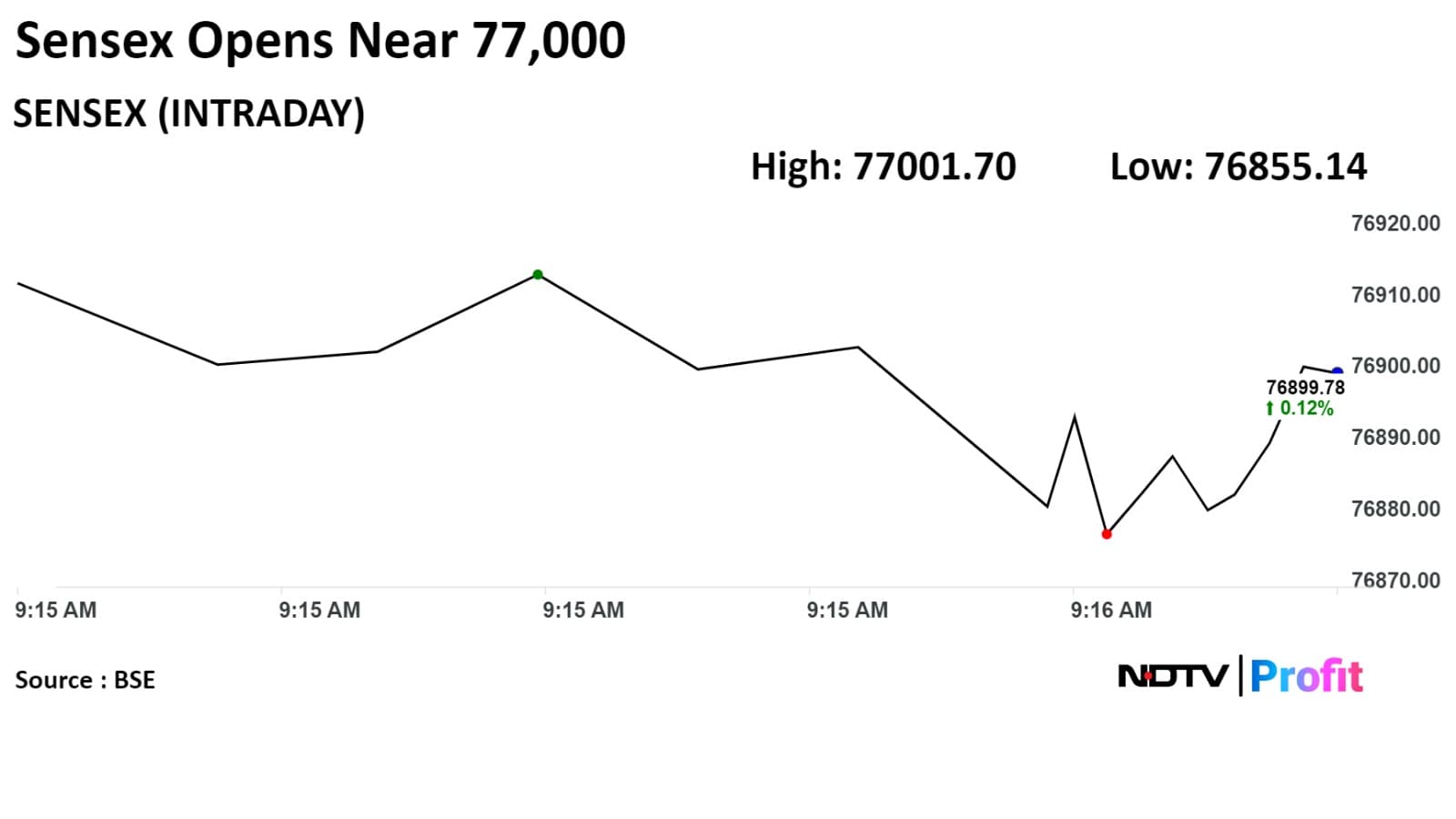

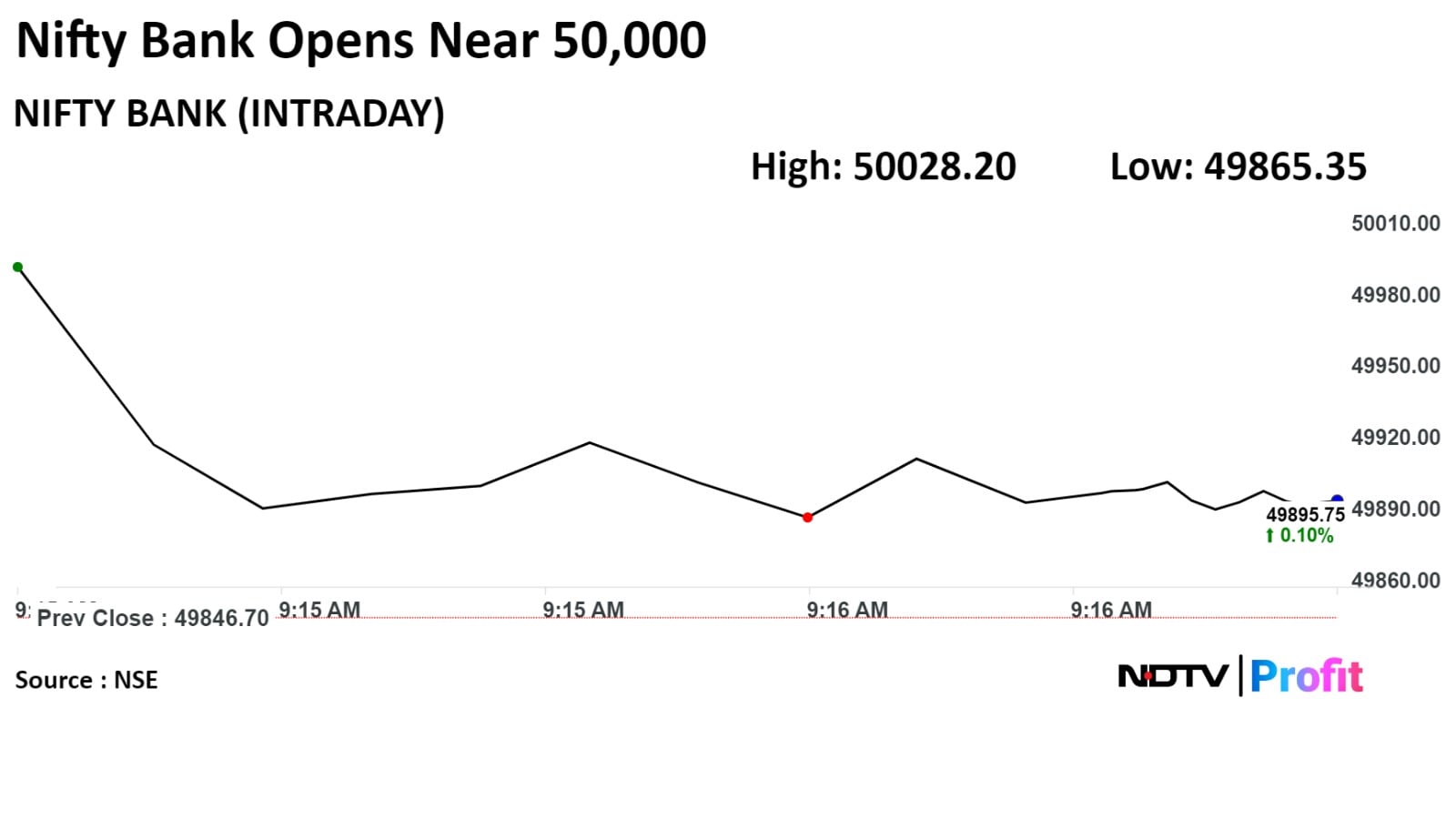

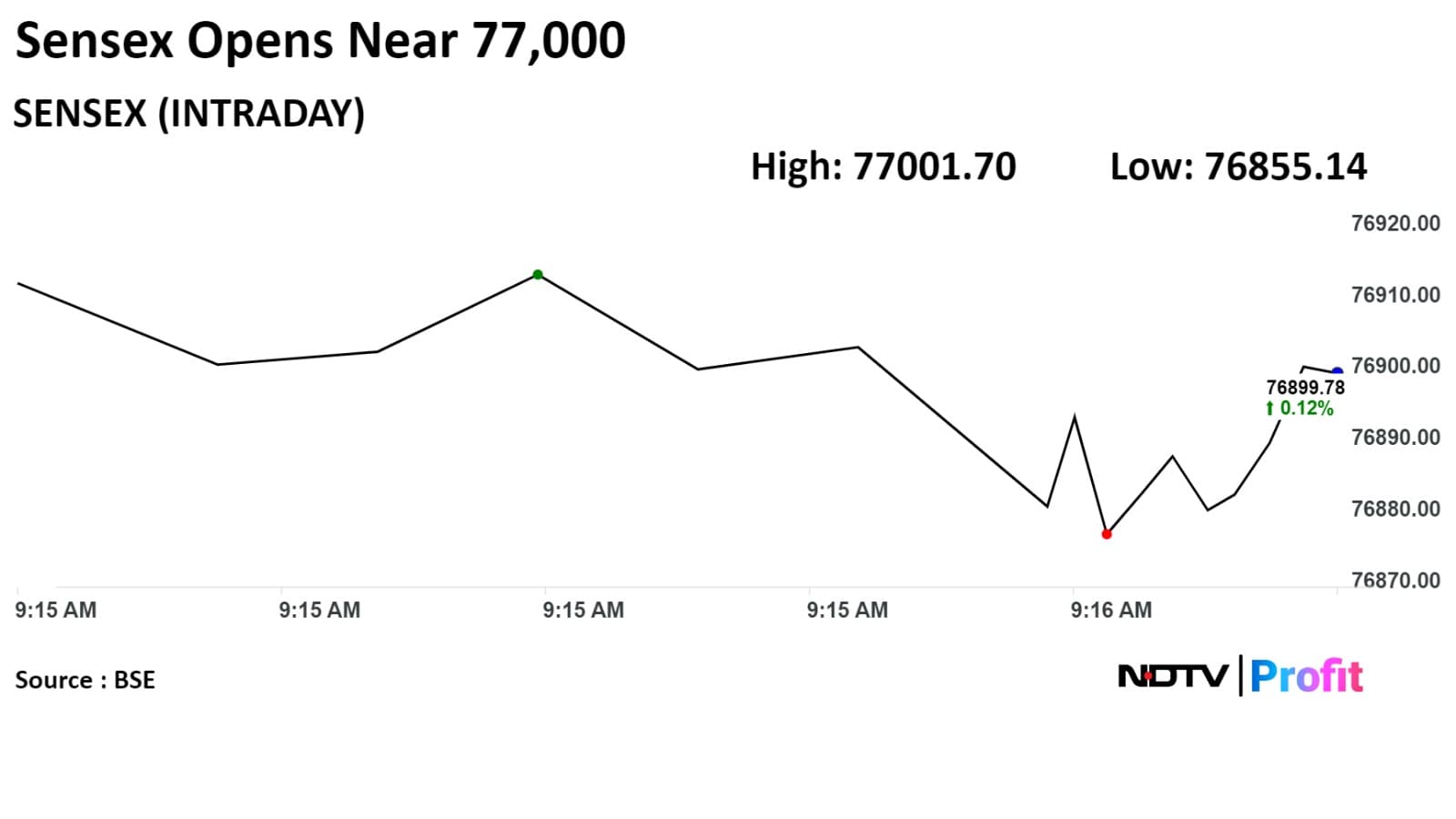

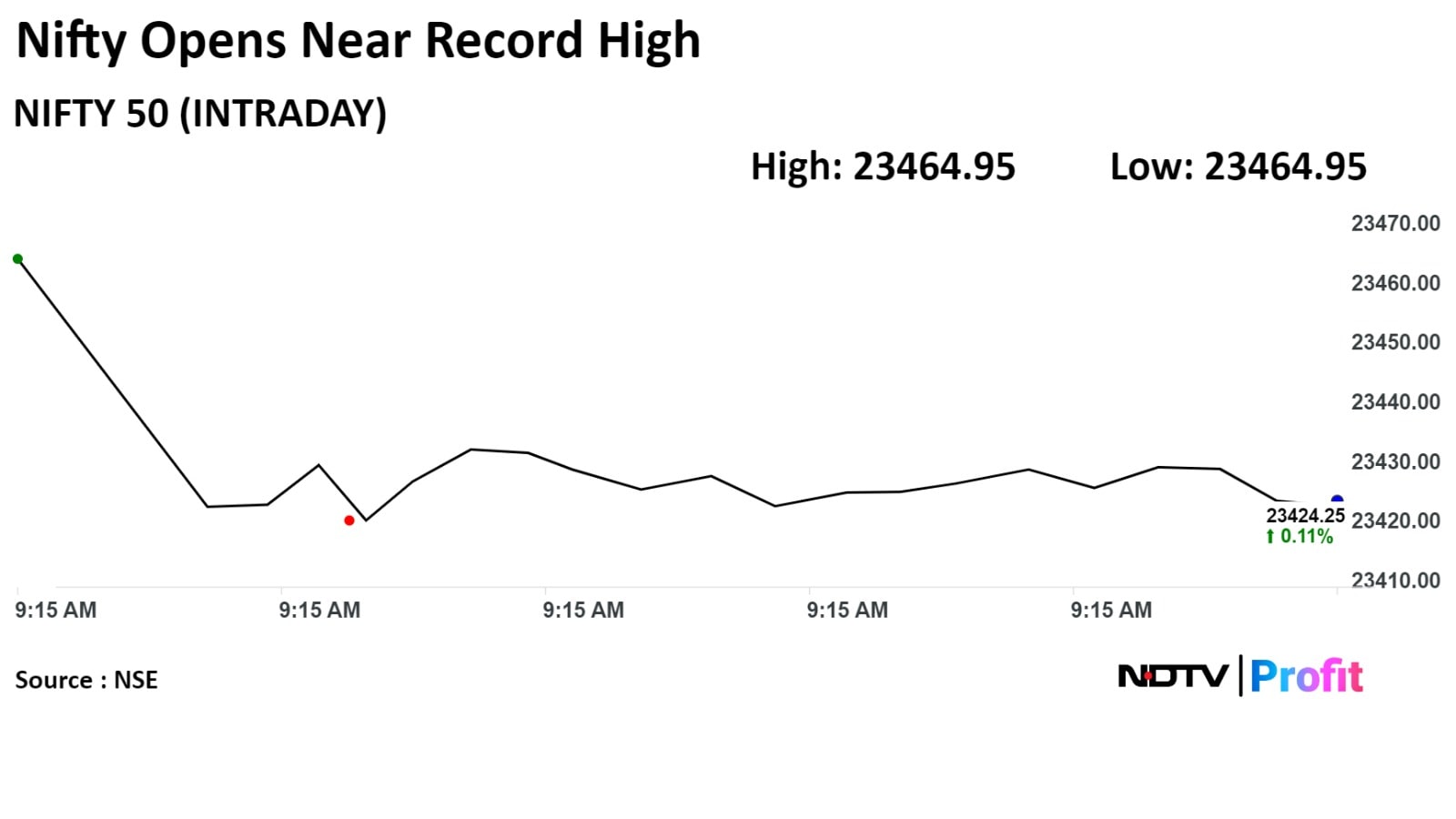

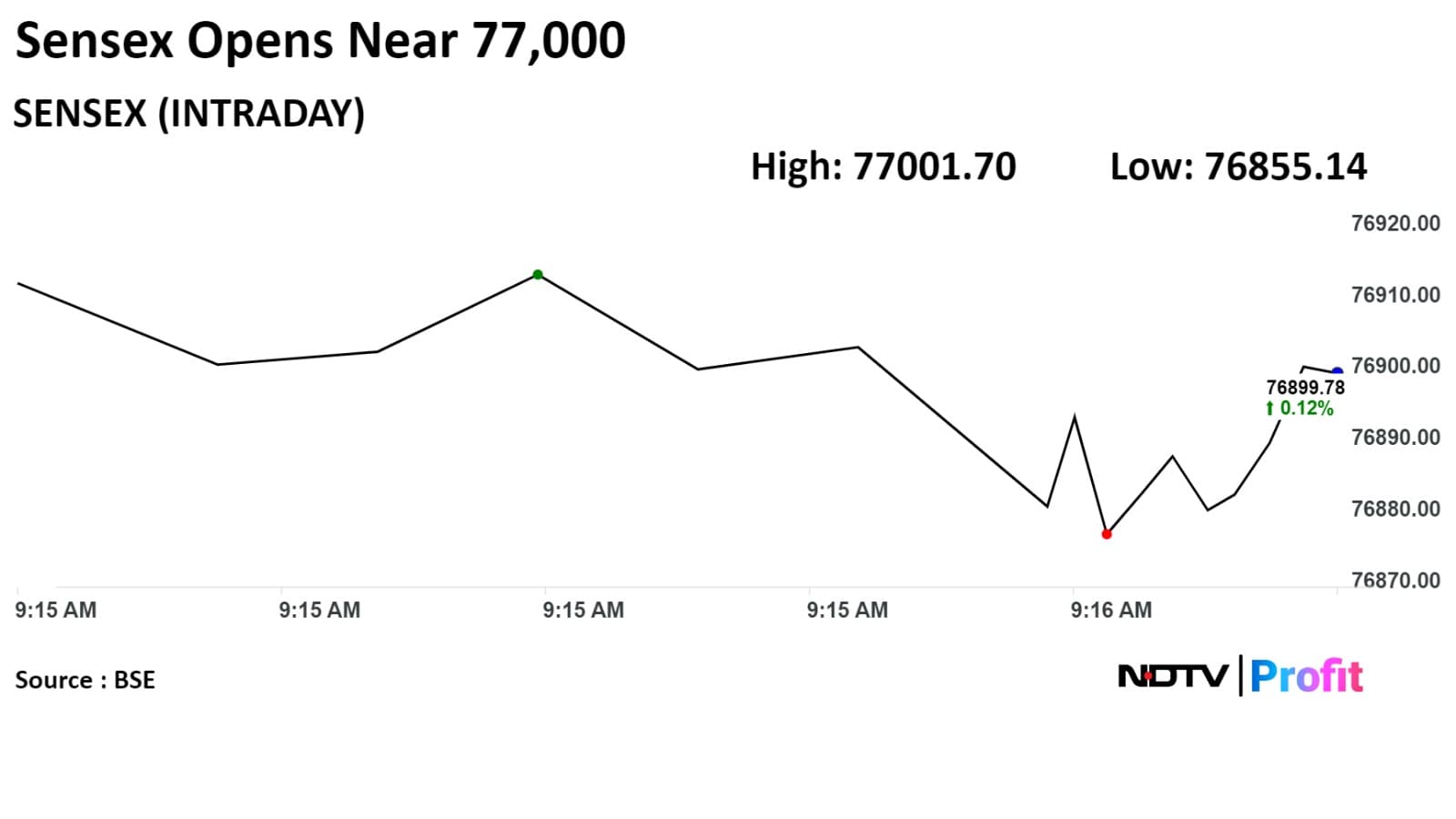

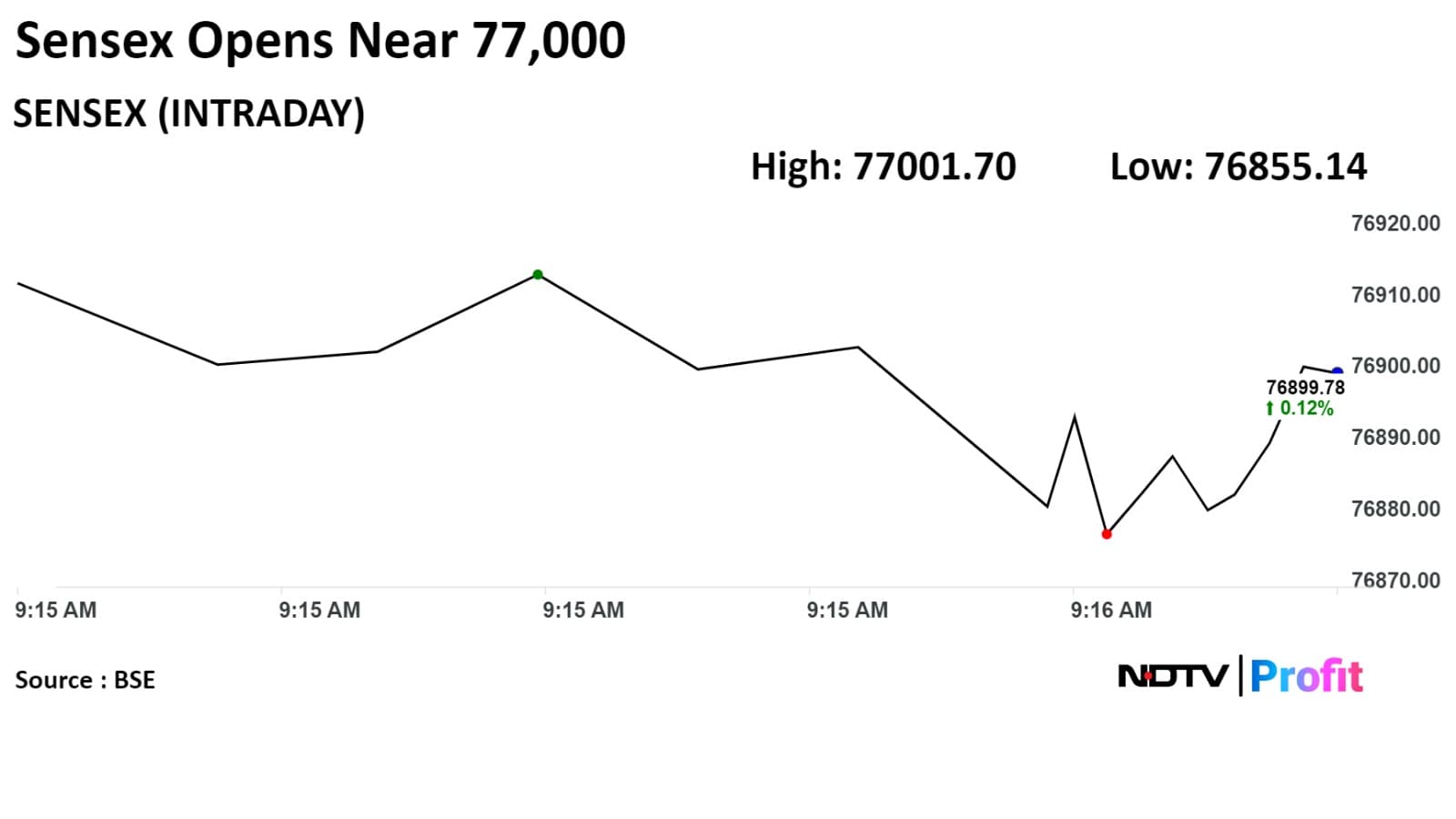

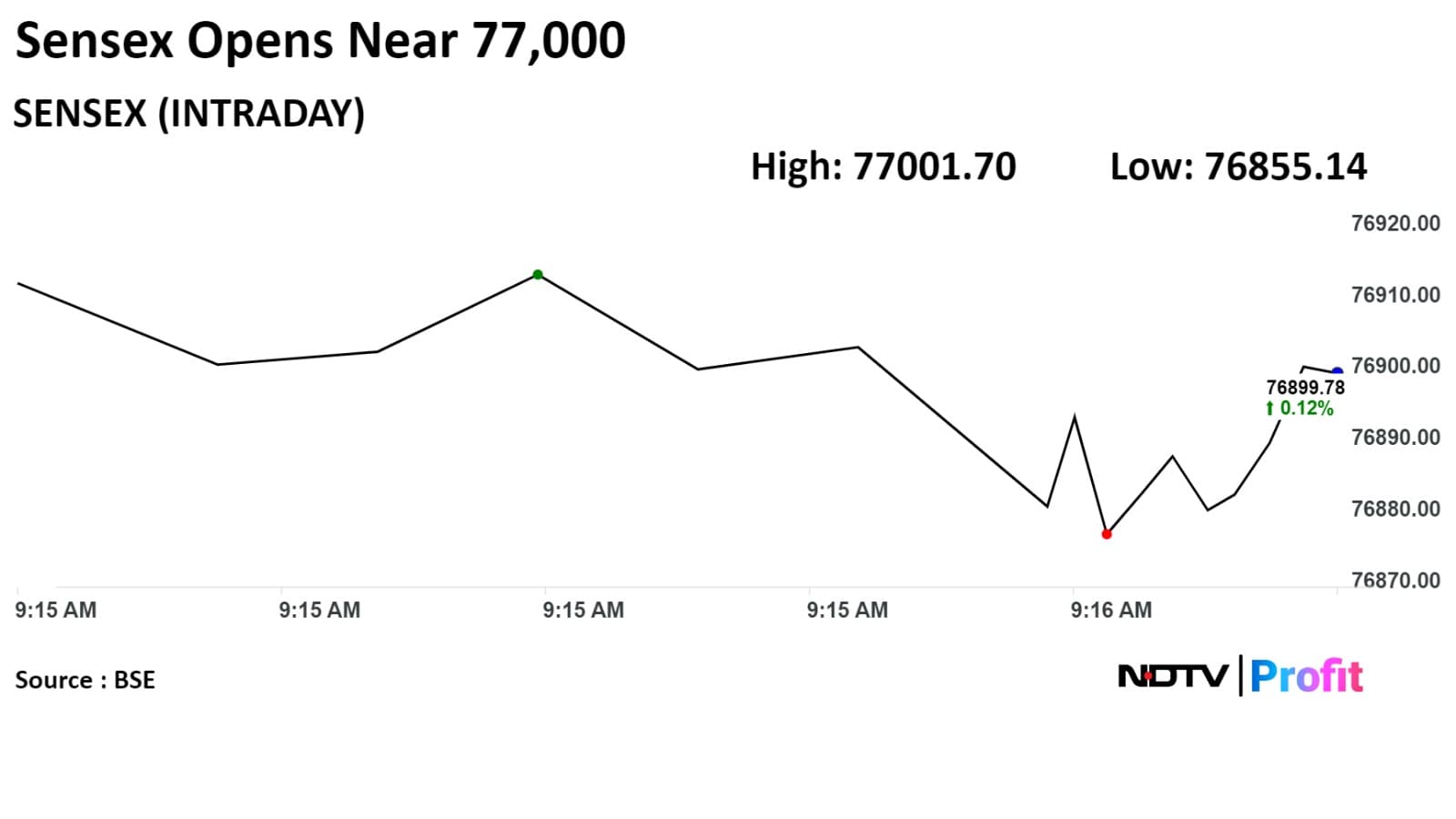

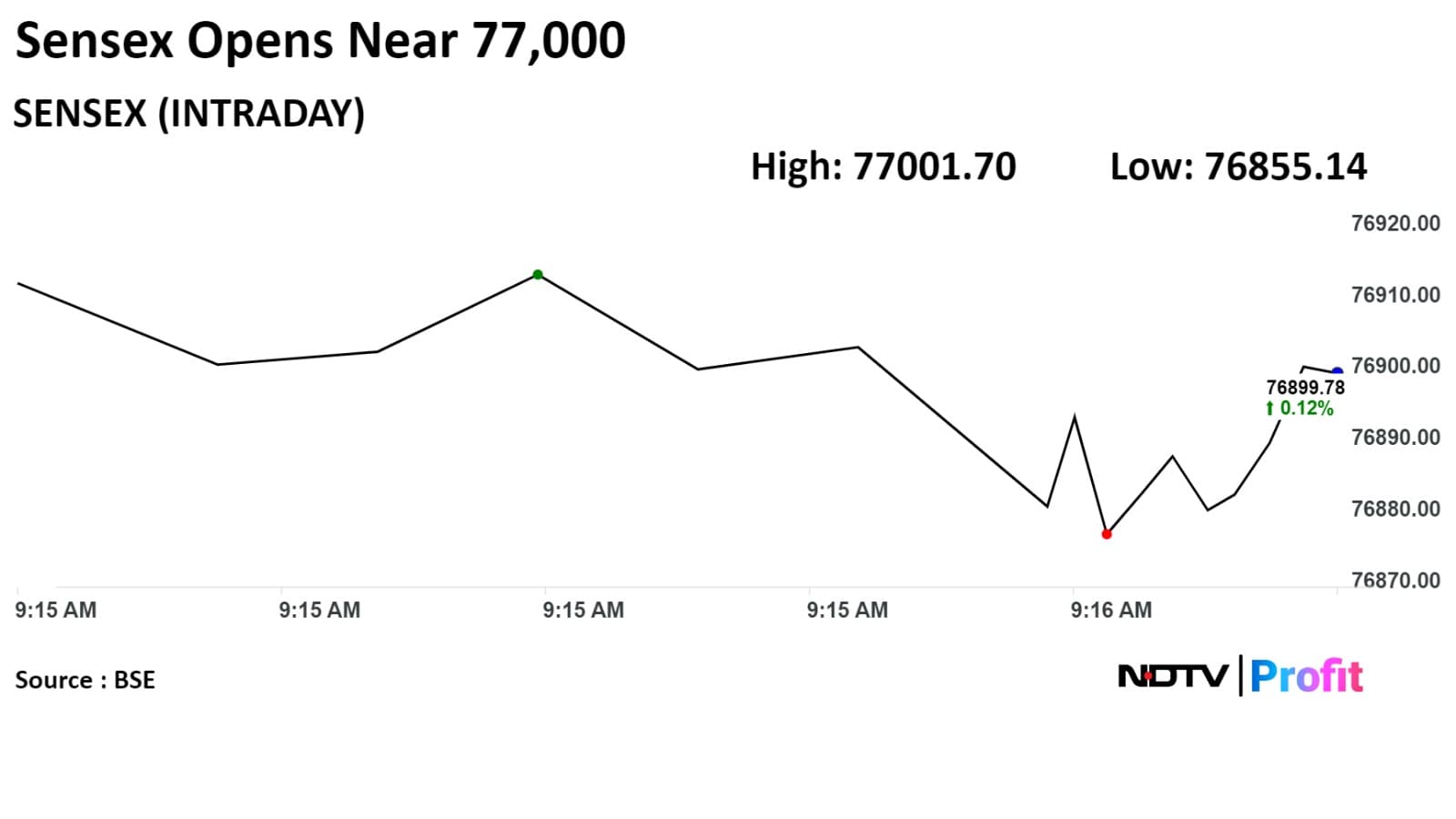

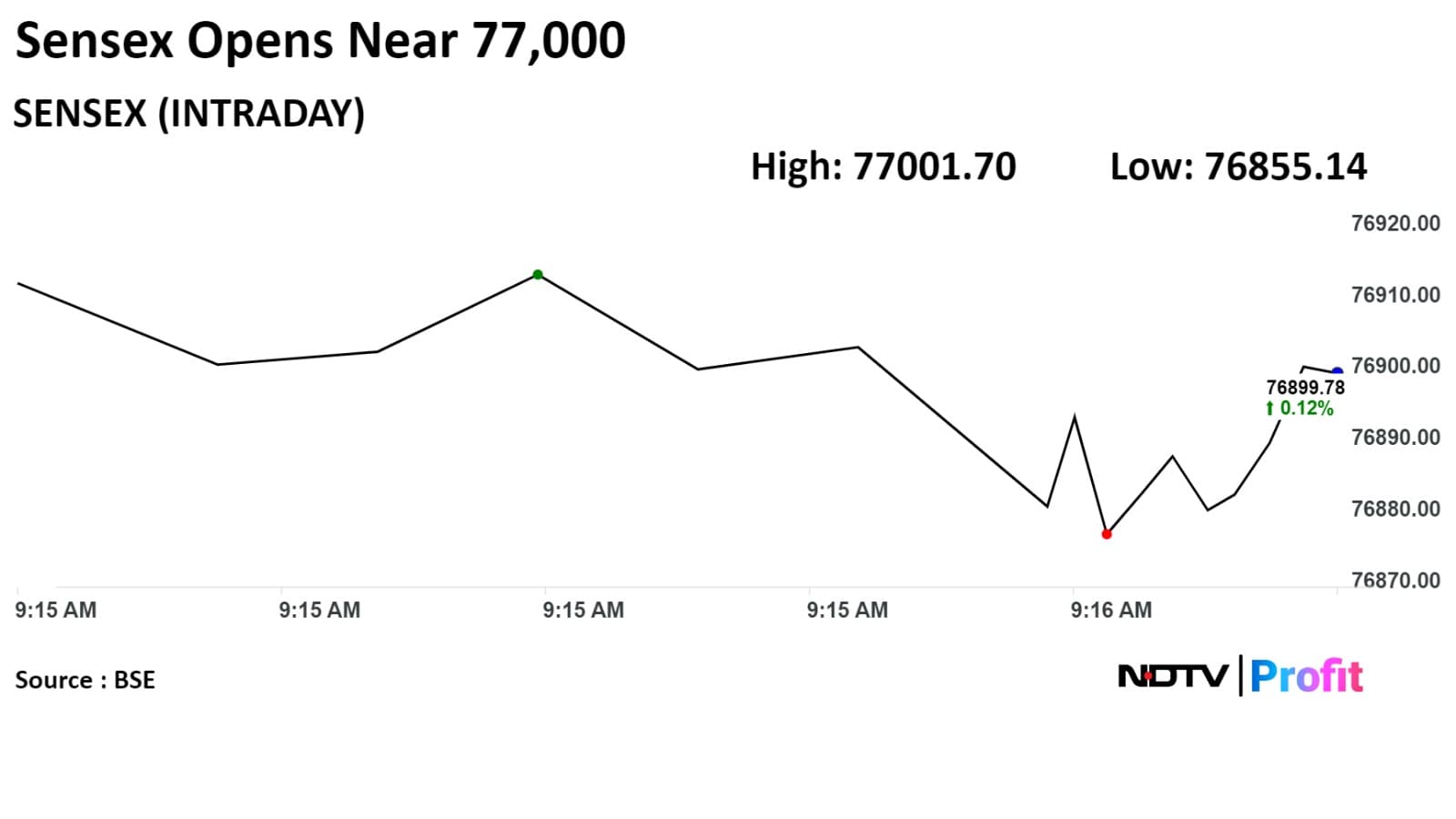

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

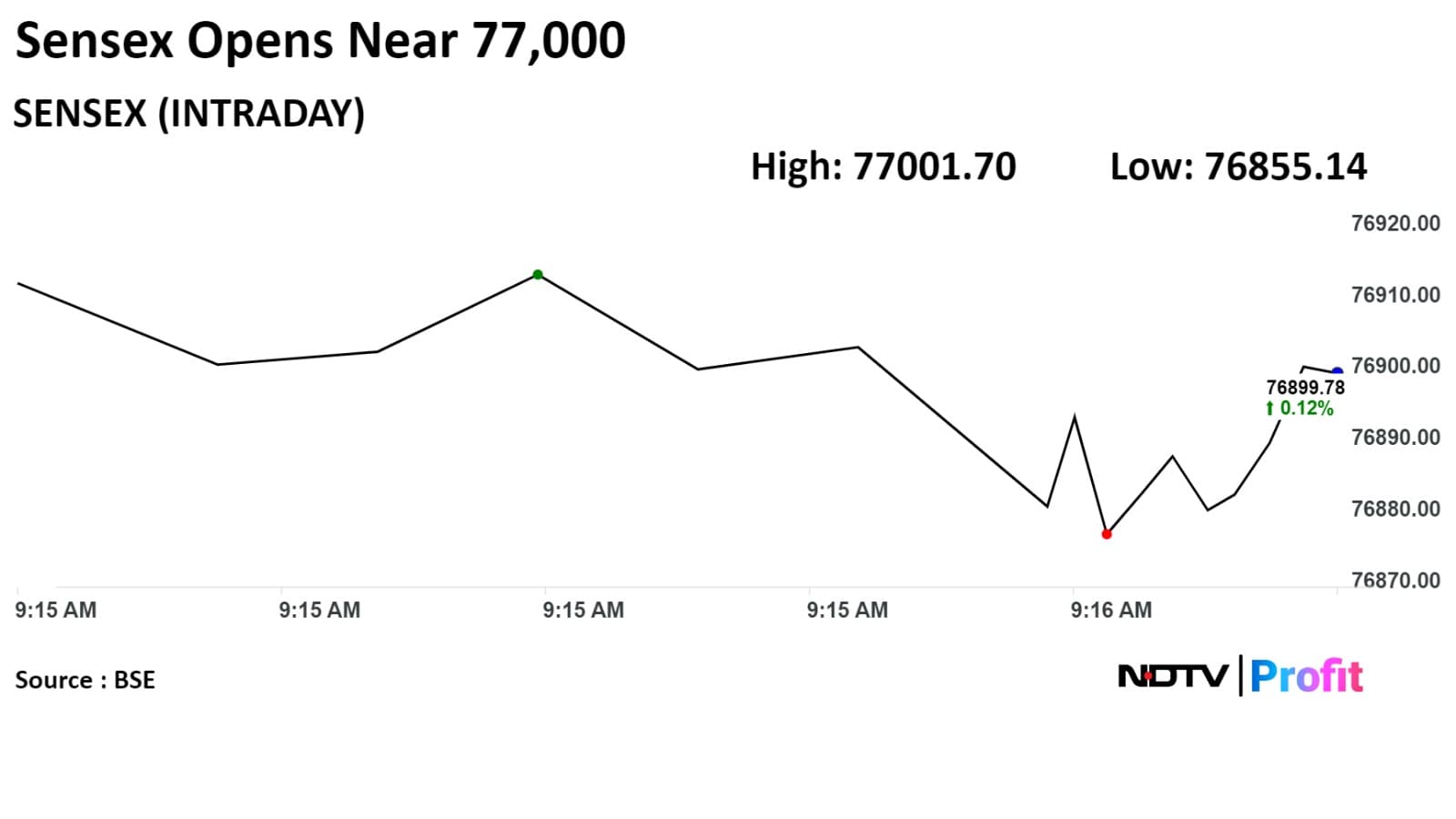

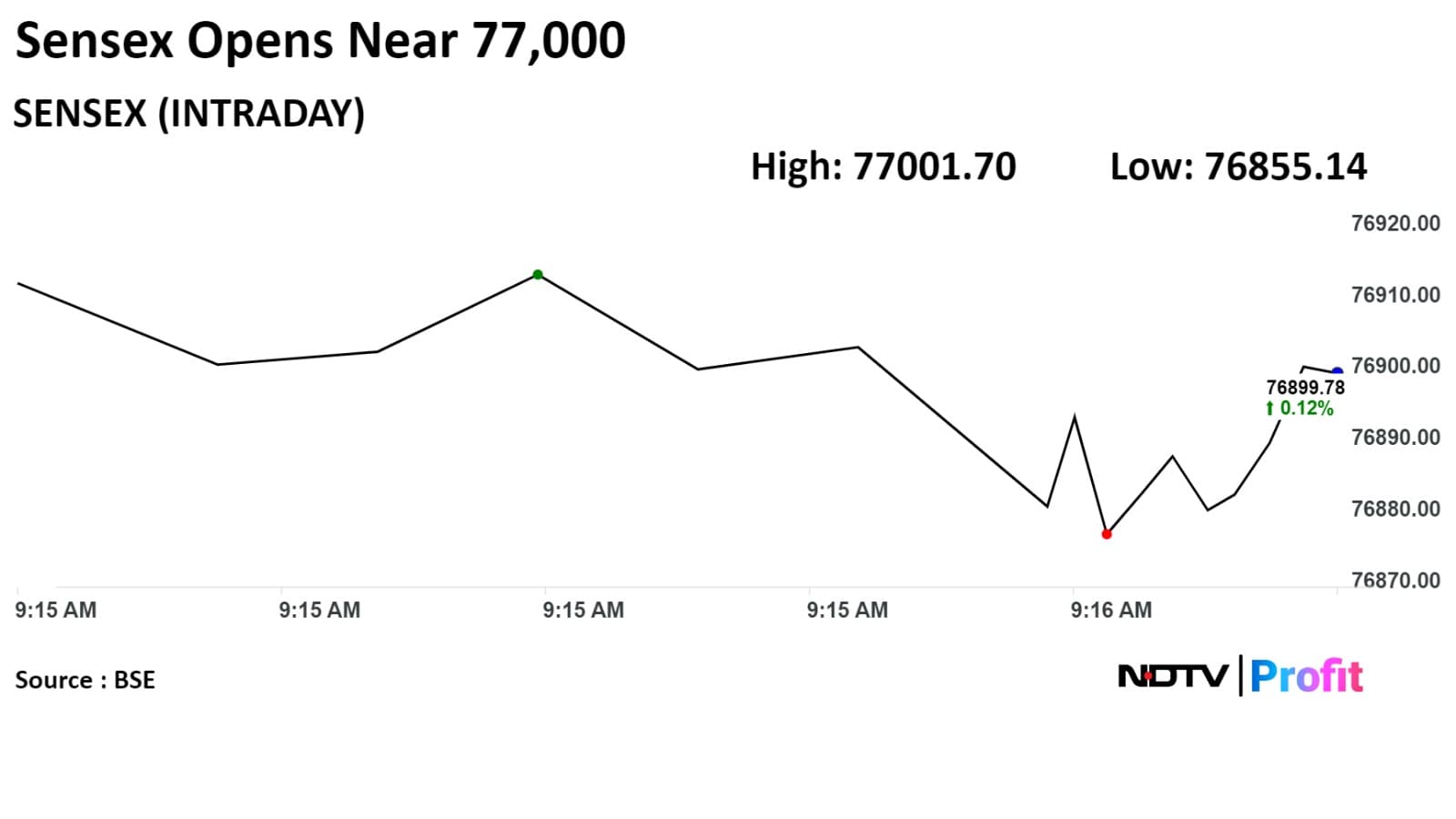

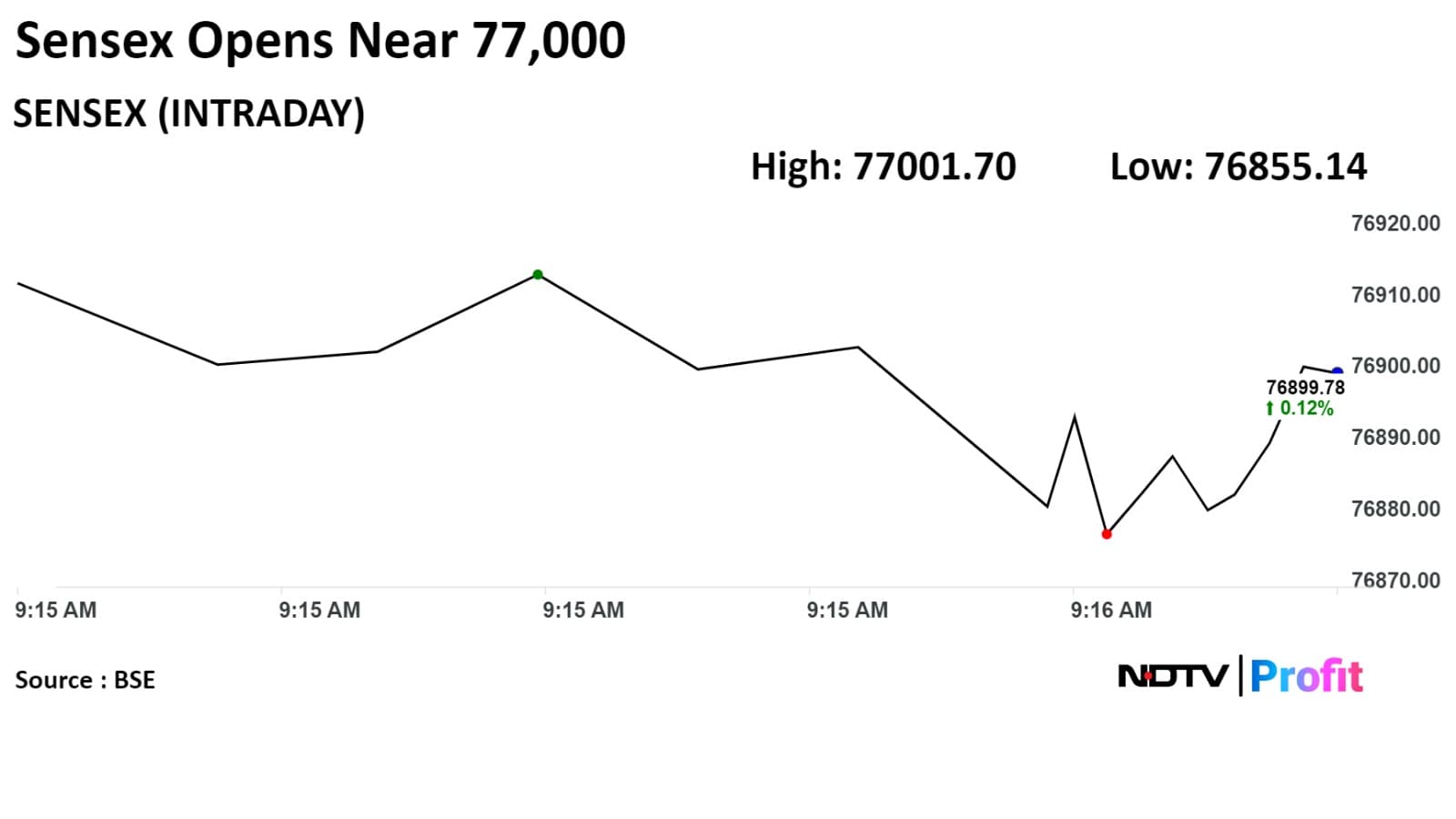

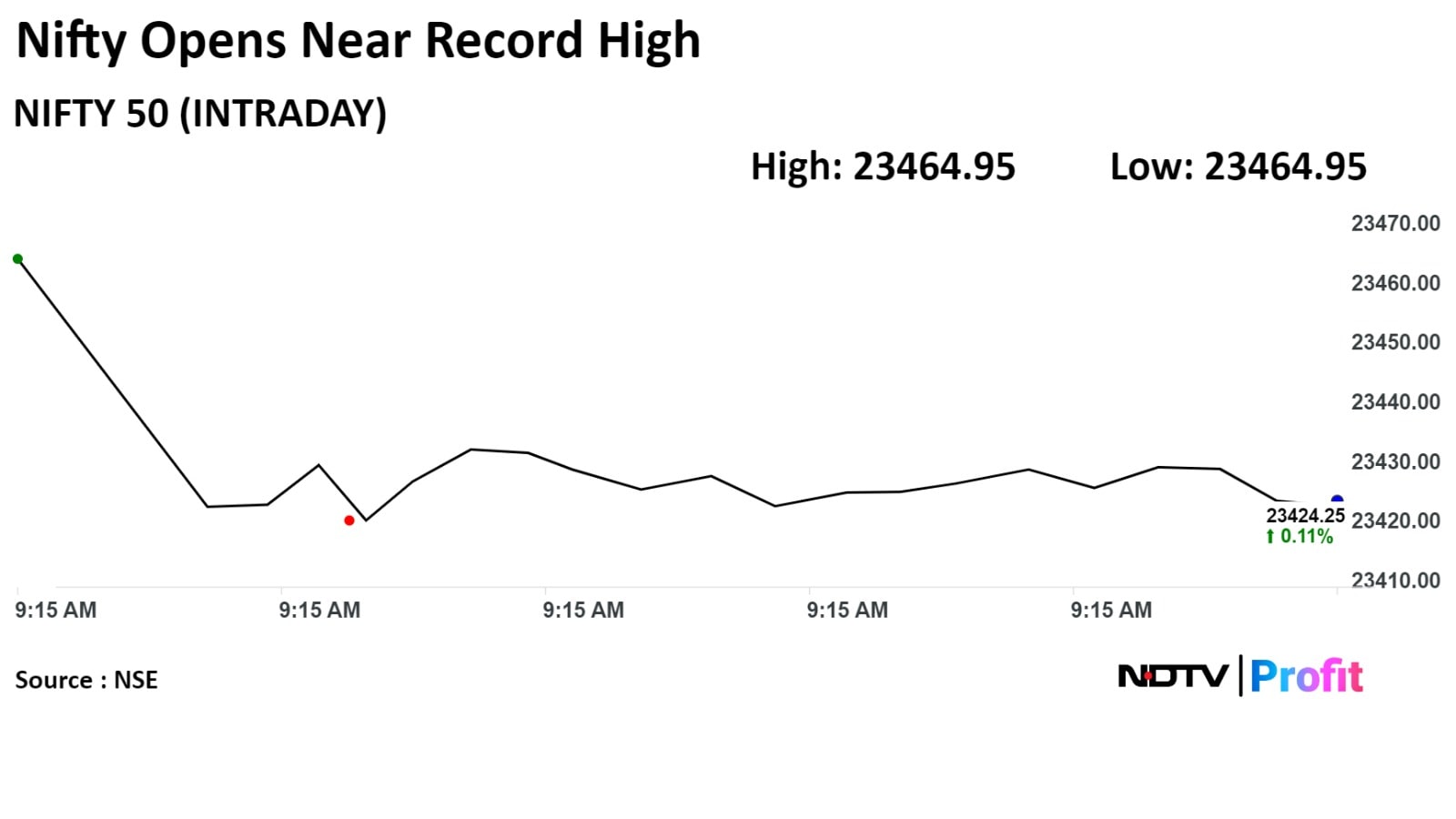

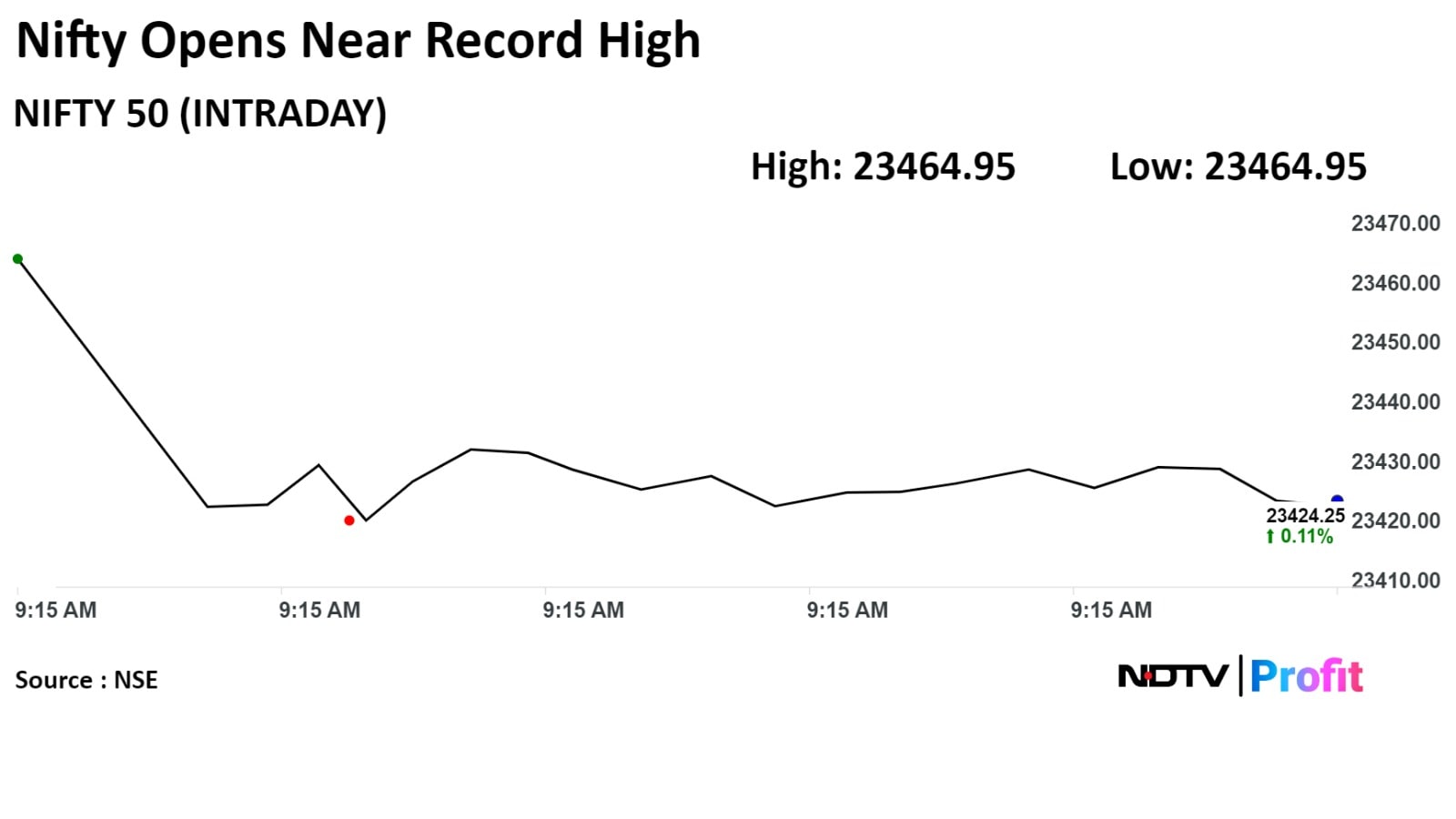

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

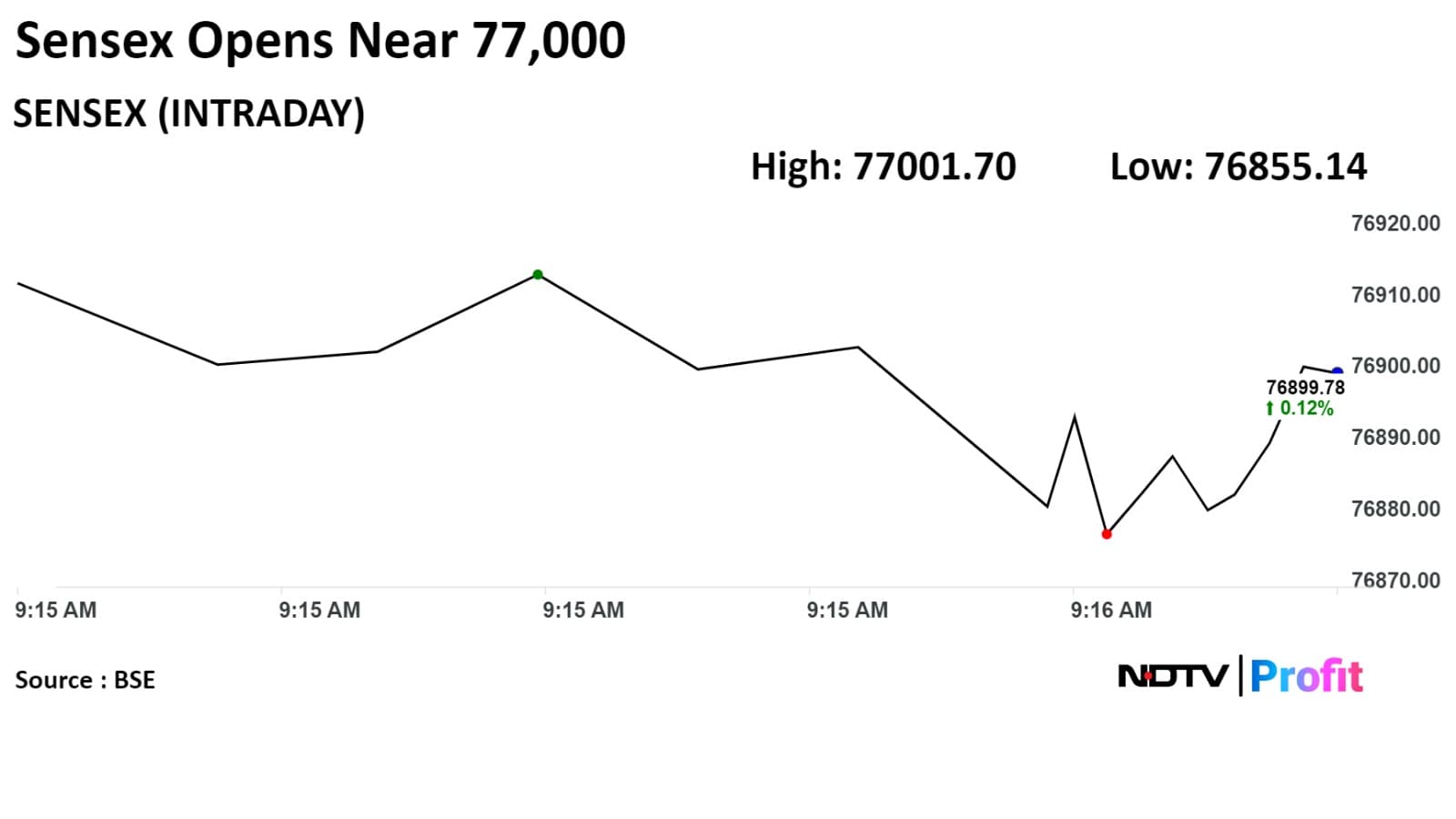

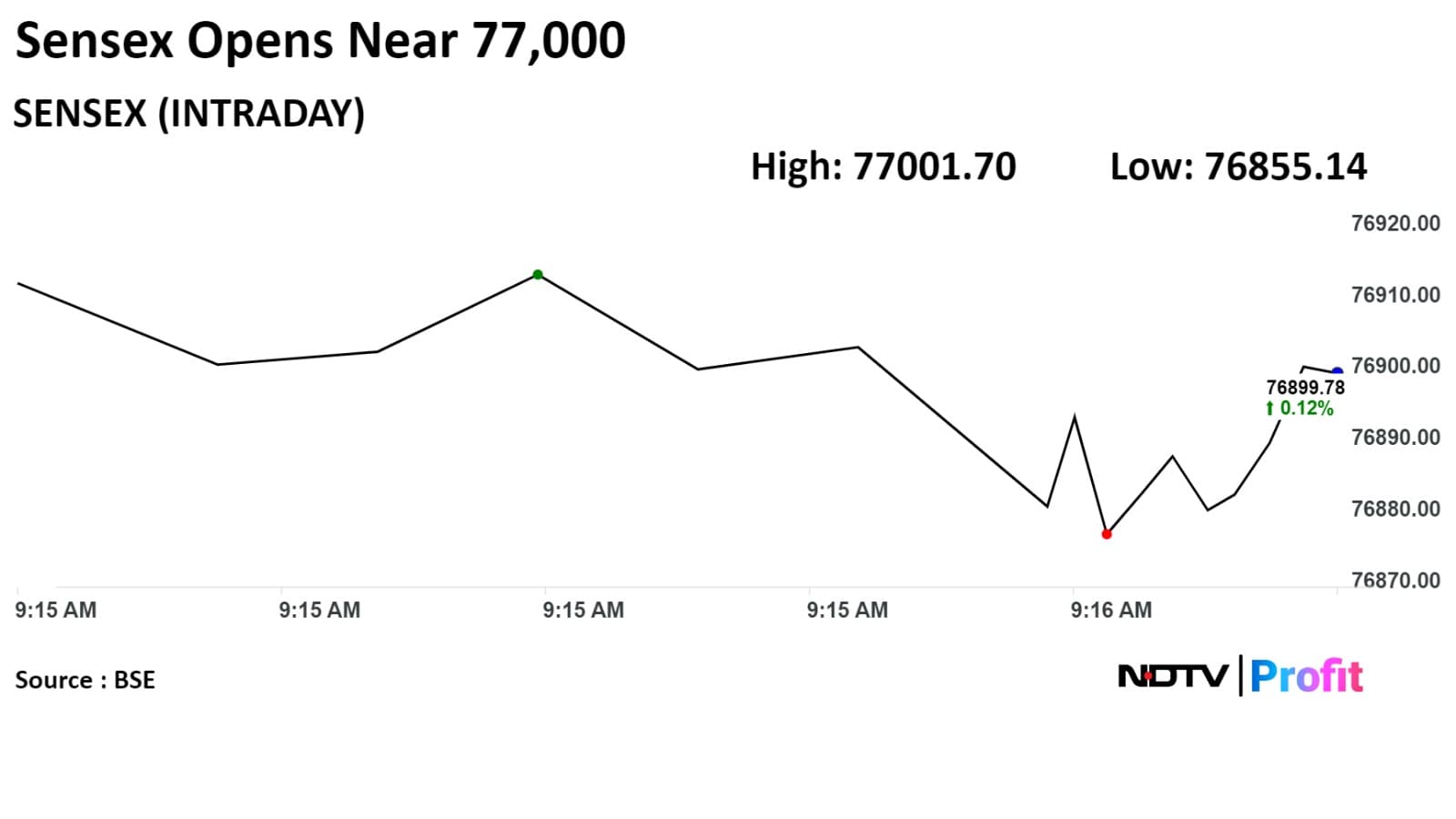

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

The benchmarks rose for second week in a row. The NSE Nifty 50 rose 0.75% and the S&P BSE Sensex rose 0.39% this week.

HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Titan Co., and Axis Bank Ltd. added to the benchmark indices.

Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Infosys Ltd., State Bank of India, and HCL Technologies Ltd. weighed on the benchmark index.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

The benchmarks rose for second week in a row. The NSE Nifty 50 rose 0.75% and the S&P BSE Sensex rose 0.39% this week.

HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Titan Co., and Axis Bank Ltd. added to the benchmark indices.

Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Infosys Ltd., State Bank of India, and HCL Technologies Ltd. weighed on the benchmark index.

.png)

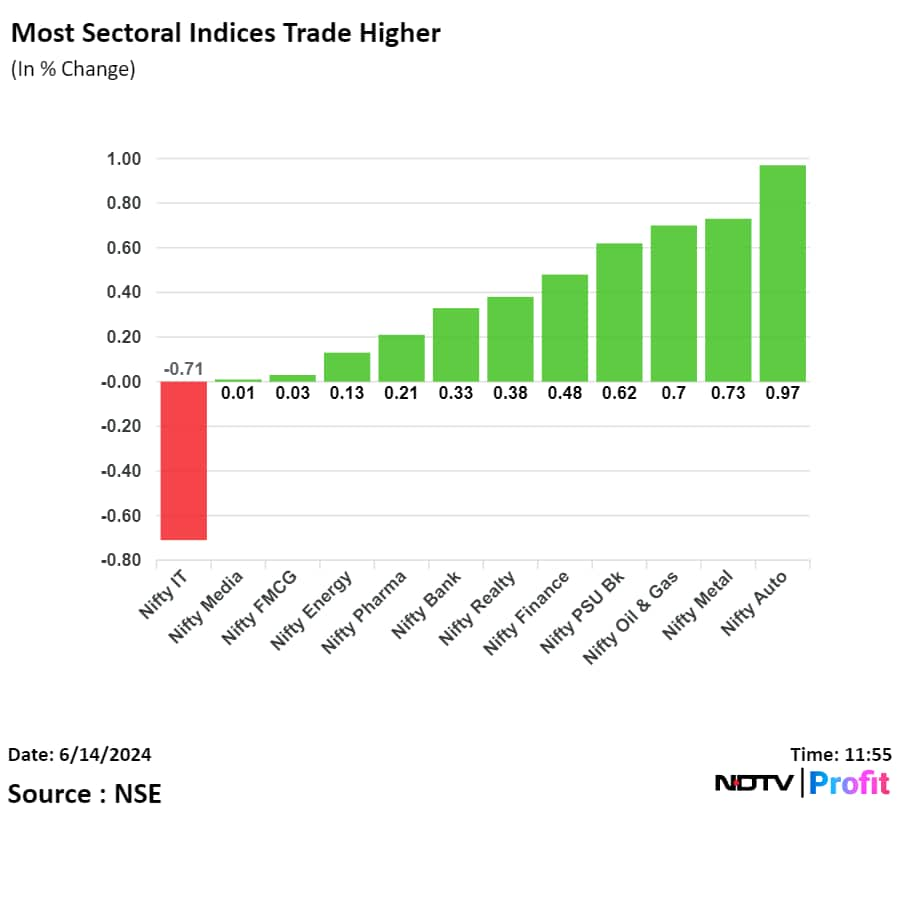

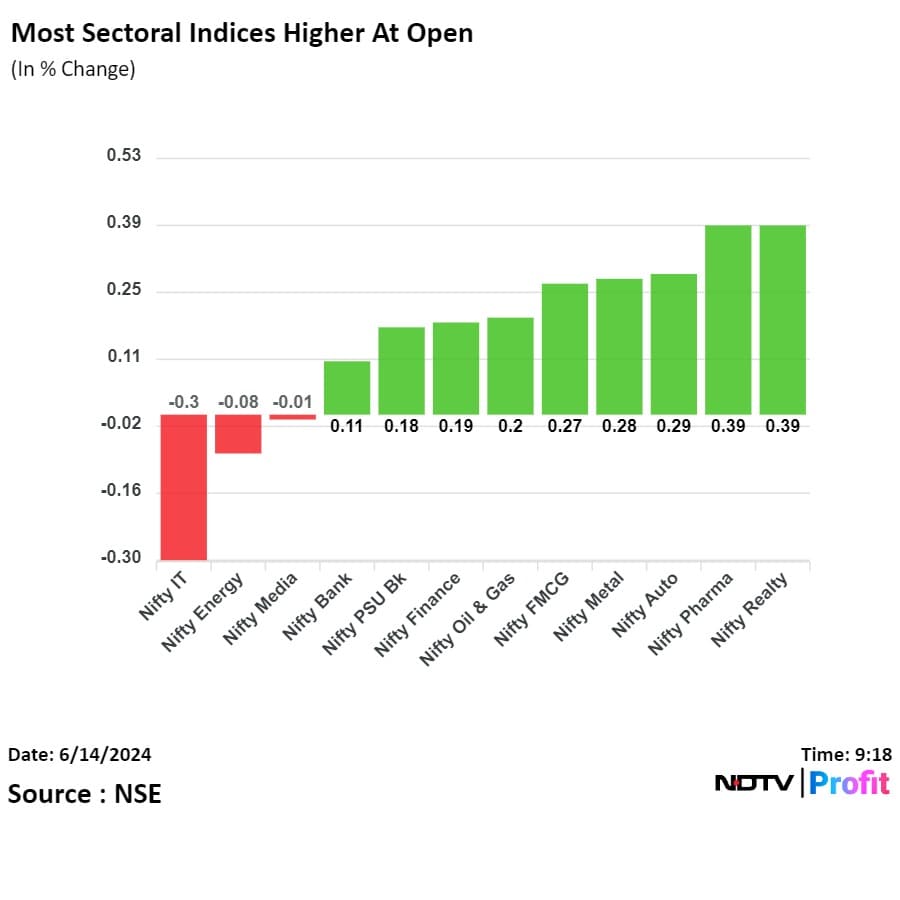

This week, 10 sectors advanced, and two declined out of 12 on NSE. The NSE Nifty Realty turned out to be the best performing sector, while the NSE Nifty IT emerged as the top loser.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

The benchmarks rose for second week in a row. The NSE Nifty 50 rose 0.75% and the S&P BSE Sensex rose 0.39% this week.

HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Titan Co., and Axis Bank Ltd. added to the benchmark indices.

Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Infosys Ltd., State Bank of India, and HCL Technologies Ltd. weighed on the benchmark index.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

Indian benchmark indices ended at fresh closing high in the last session of the eventful week, tracking sharp gains in shares of HDFC Bank Ltd., Reliance Industries Ltd.

During the last leg of the trade, the NSE Nifty 50 rose 0.39% to 23,490.05 the highest level since the index's inception on April 22, 1996.

The Sensex rose 0.35% to 77,081.30, the highest closing level so far. However, the index didn't record a fresh life-time high like its peer.

.jpeg)

The benchmarks rose for second week in a row. The NSE Nifty 50 rose 0.75% and the S&P BSE Sensex rose 0.39% this week.

HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Titan Co., and Axis Bank Ltd. added to the benchmark indices.

Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Infosys Ltd., State Bank of India, and HCL Technologies Ltd. weighed on the benchmark index.

.png)

This week, 10 sectors advanced, and two declined out of 12 on NSE. The NSE Nifty Realty turned out to be the best performing sector, while the NSE Nifty IT emerged as the top loser.

.png)

Broader indices outperformed. S&P BSE Midcap ended 1.18% higher and the S&P BSE Smallcap rose 1.03%.

Broader indices outperformed. S&P BSE Midcap ended 1.18% higher and the S&P BSE Smallcap rose 1.03%.

Market breadth was skewed in the favour of buyers. As many as 2,245 stocks rose, 1,622 fell, and 113 remained unchanged on the BSE.

Minda Corp Ltd. has signed a joint venture agreement with HSIN Chong Machinery works for manufacturing automotive sunroof solutions for passenger cars.

The 50-50 JV is to be operational through incorporation of new JV entity.

Source: Exchange filing

EIH Associated Hotels's board recommended bonus shares in the ratio of 1:1.

Source: Exchange filing

The NSE Nifty 50 index rose 0.39% to 23,490.05, the highest level since the index's inception. It was trading 0.37% higher at 23,483.80 as of 3:05 as HDFC Bank Ltd., and Reliance Industries Ltd.

The NSE Nifty 50 index rose 0.39% to 23,490.05, the highest level since the index's inception. It was trading 0.37% higher at 23,483.80 as of 3:05 as HDFC Bank Ltd., and Reliance Industries Ltd.

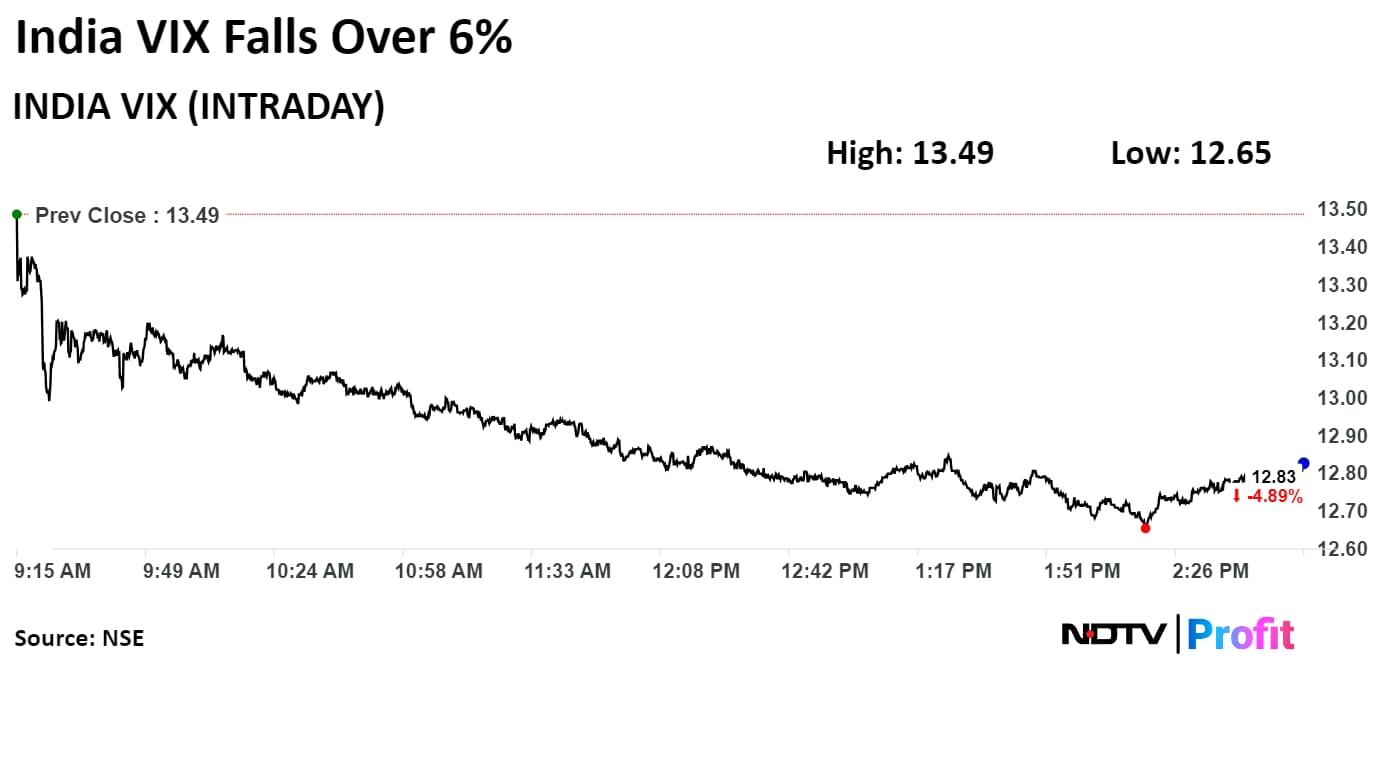

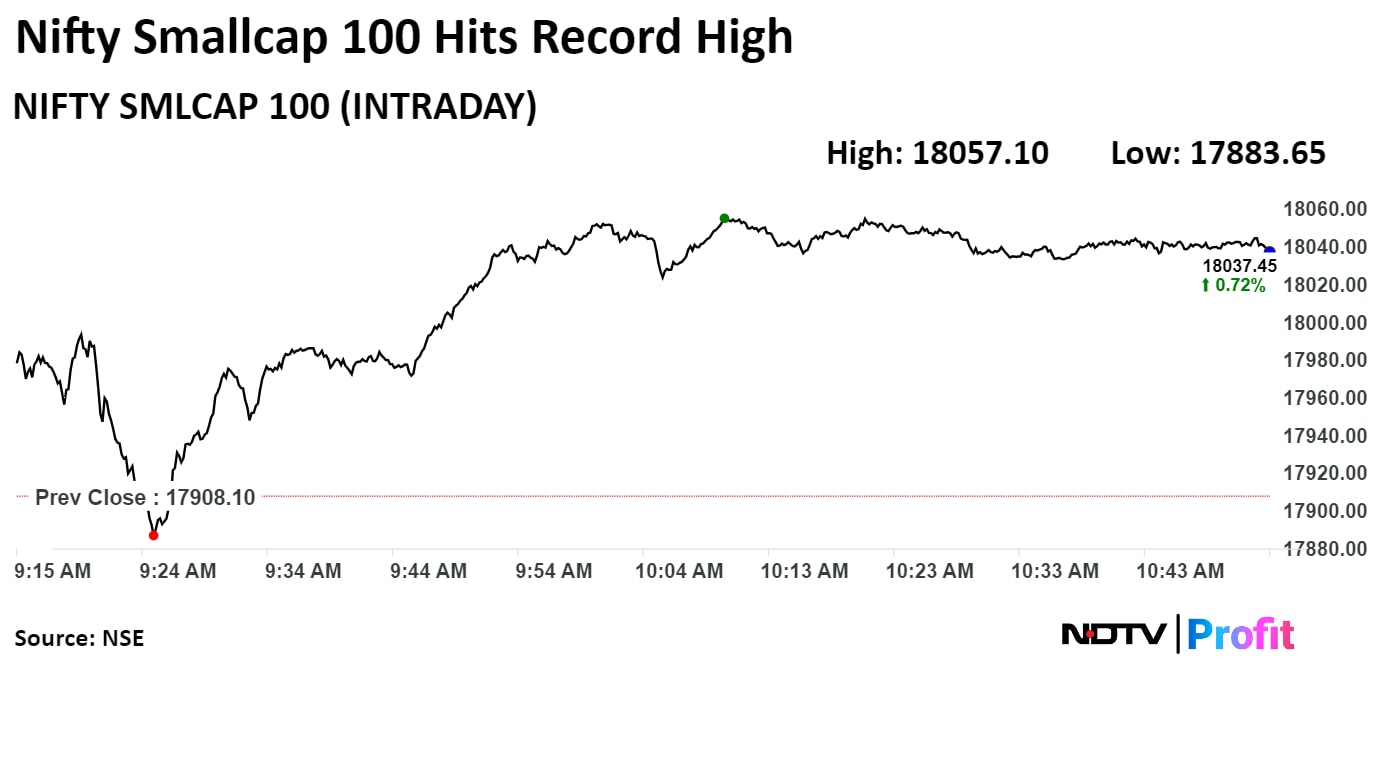

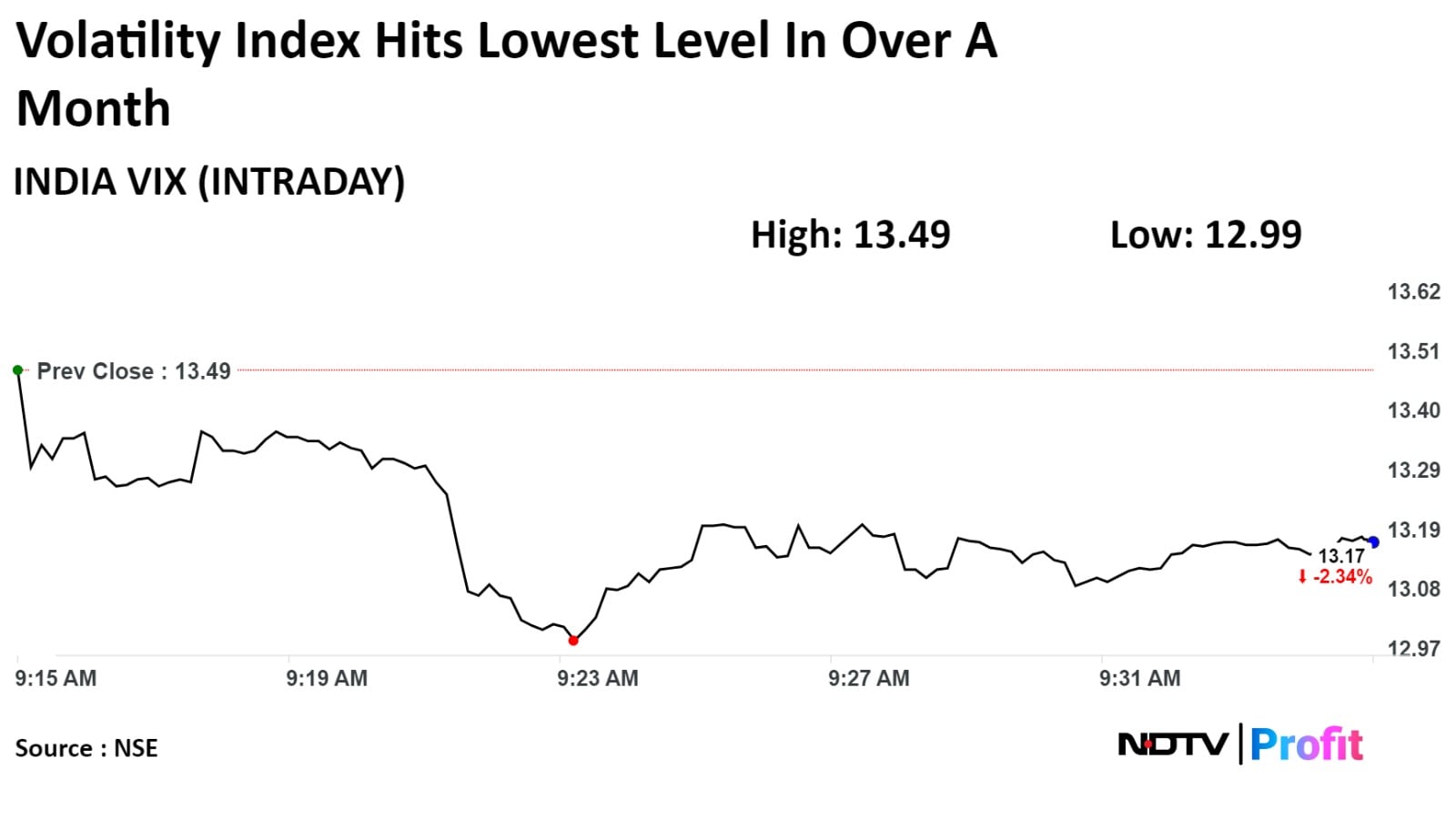

The India Volatility Index declined 6.17% to 12.65, the lowest level since April 30.

The India Volatility Index declined 6.17% to 12.65, the lowest level since April 30.

Outstanding issues to seal the India-UK Free Trade Agreement is to be resolved once the general elections in UK are over.

Source: Trade Briefing, Ministry of Commerce and Industry

Shares of Prestige Estates Projects Ltd. surged on Friday after CLSA raised its target price, citing substantial operating cash flow supporting capex and project pipeline growth.

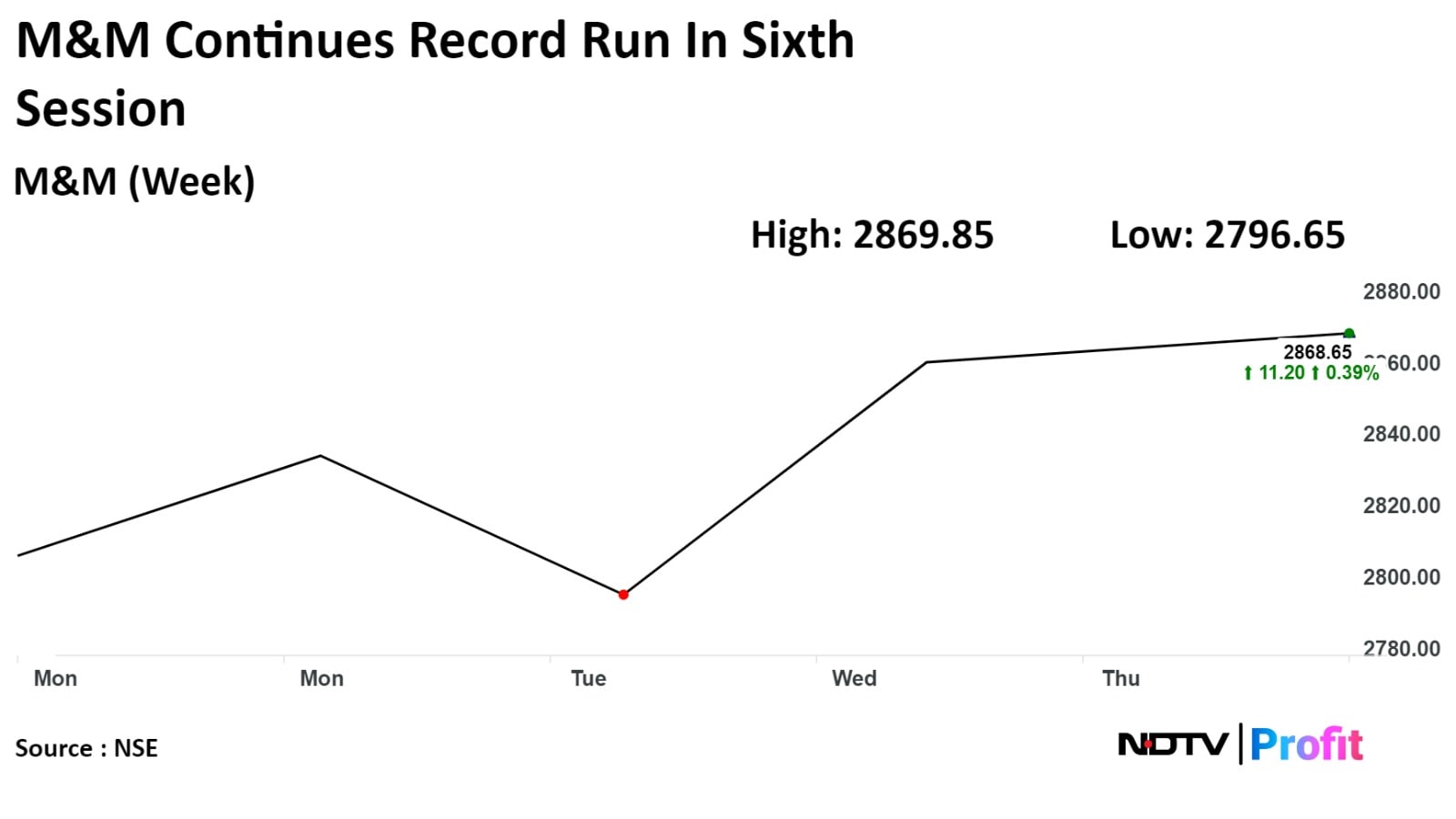

Mahindra & Mahindra Ltd. has crossed Tata Motors Ltd.'s market cap today. Market-cap of Mahindra & Mahindra Ltd. was at Rs 3.6 lakh crore as of 1:50 p.m., compared to Rs 3.3 lakh crore market cap of Tata Motors Ltd.

The stock jumped in the eighth session today and rose as much as 5.56% to hit its lifetime high of Rs 10,959. It has risen 69.5% year to date and 154% in the twelve months.

The stock jumped in the eighth session today and rose as much as 5.56% to hit its lifetime high of Rs 10,959. It has risen 69.5% year to date and 154% in the twelve months.

.png)

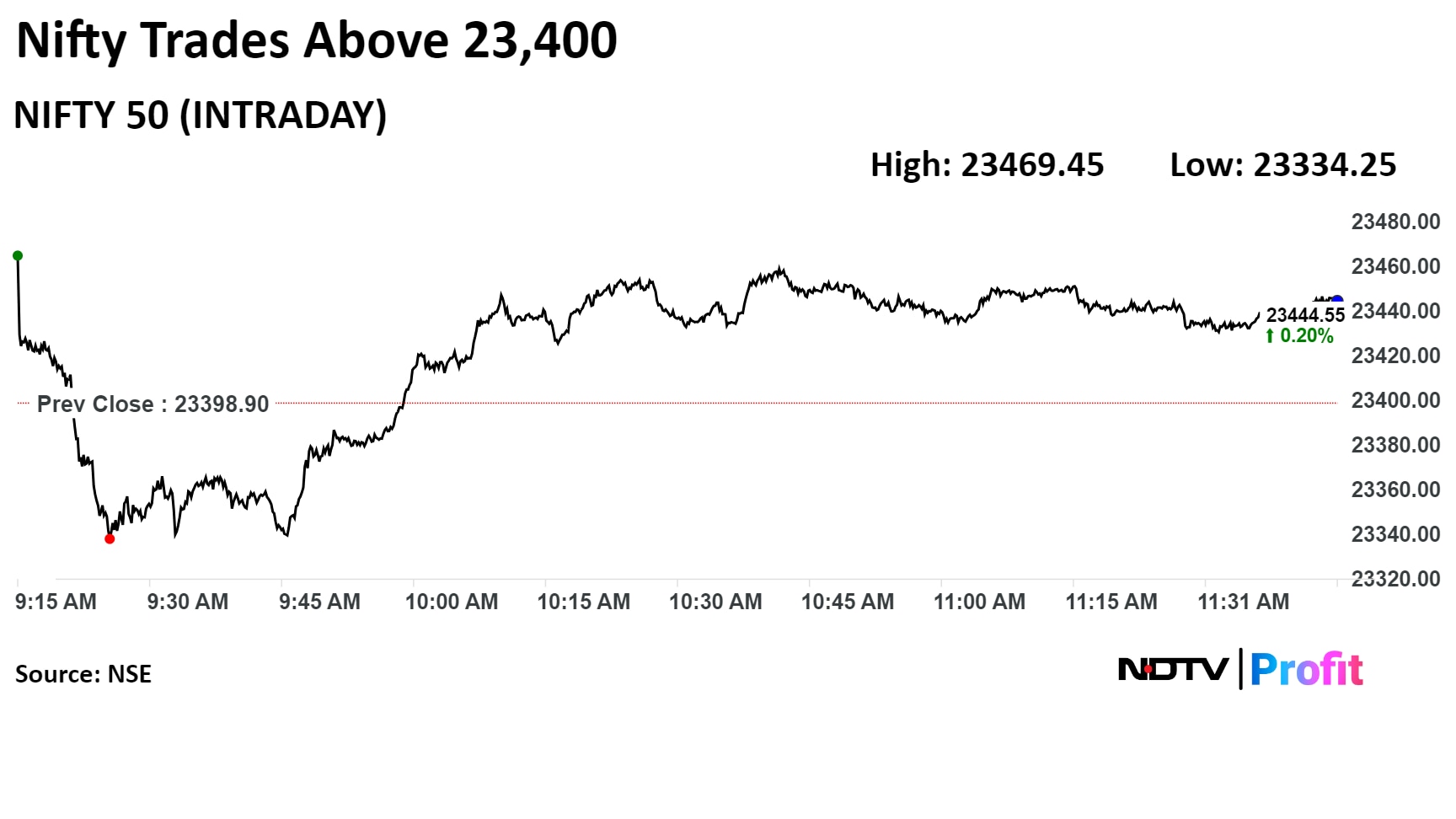

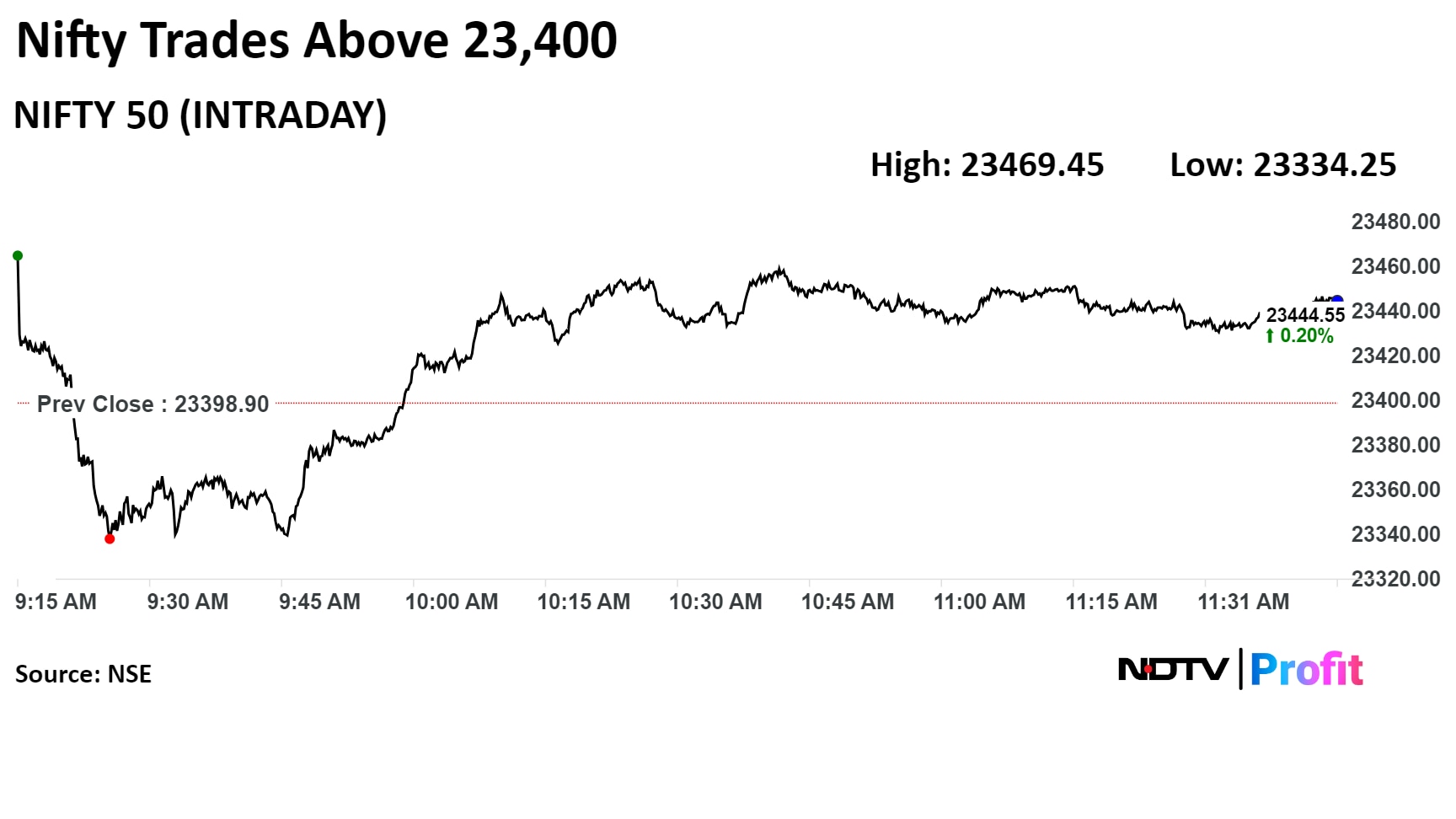

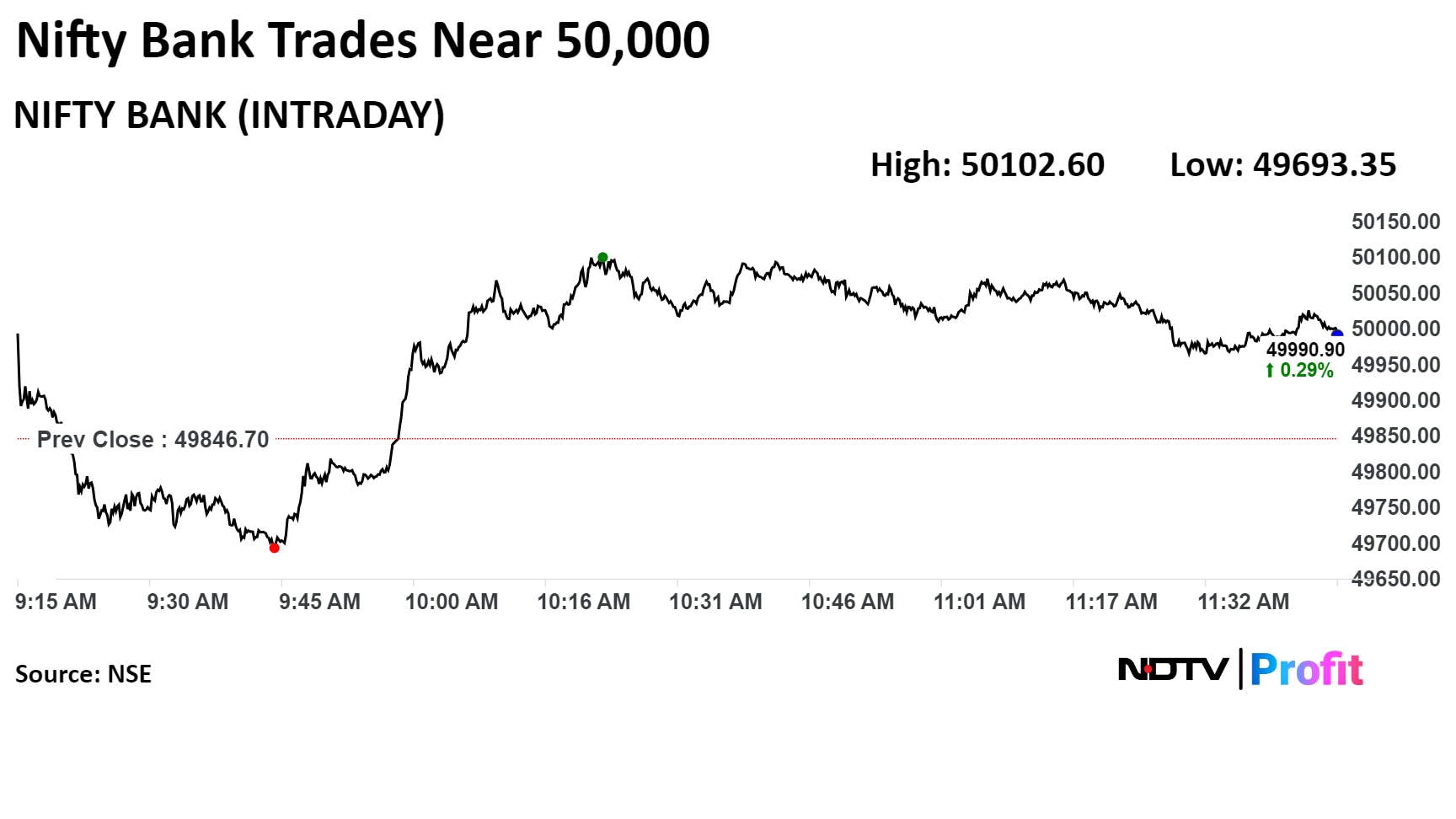

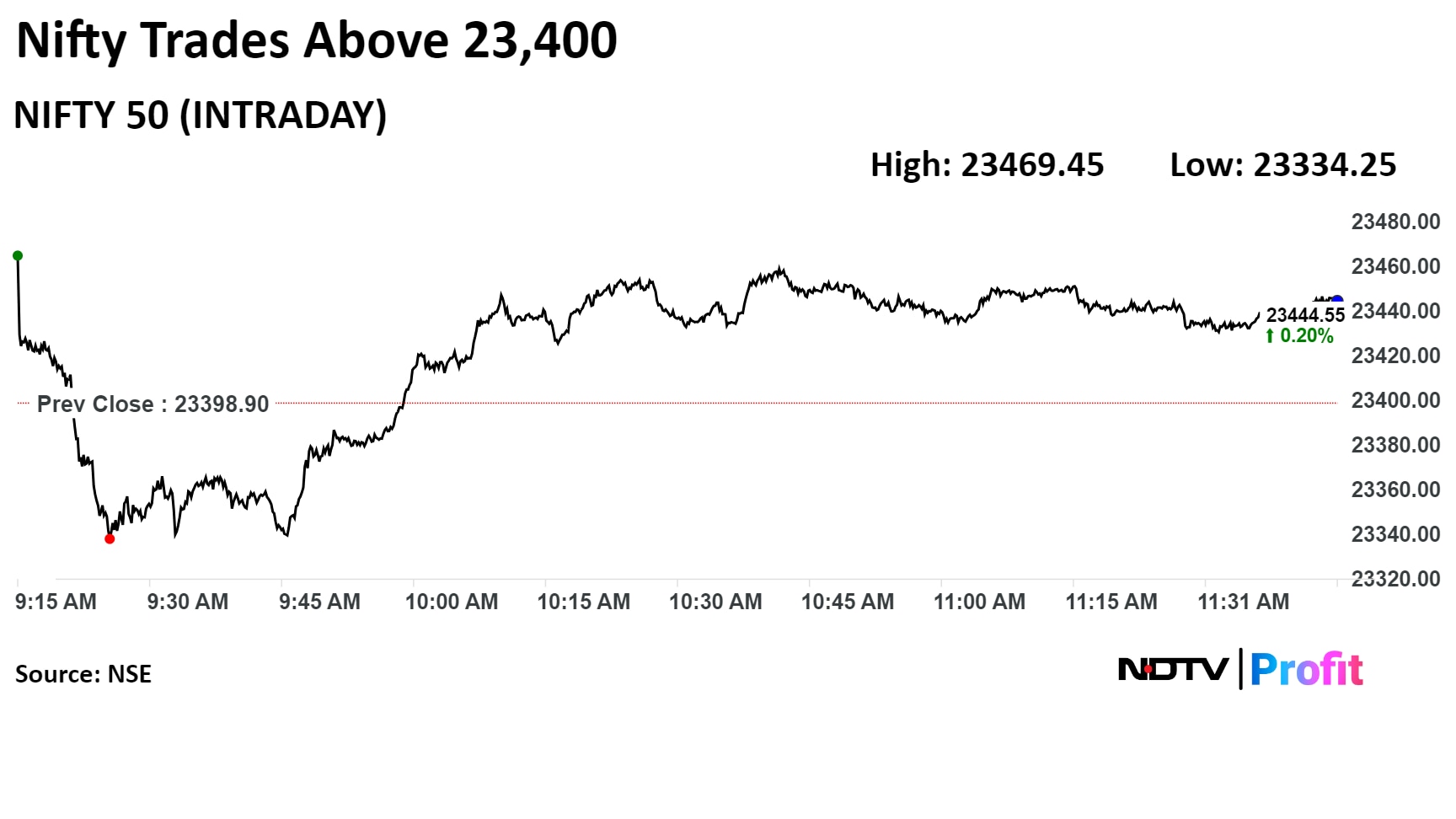

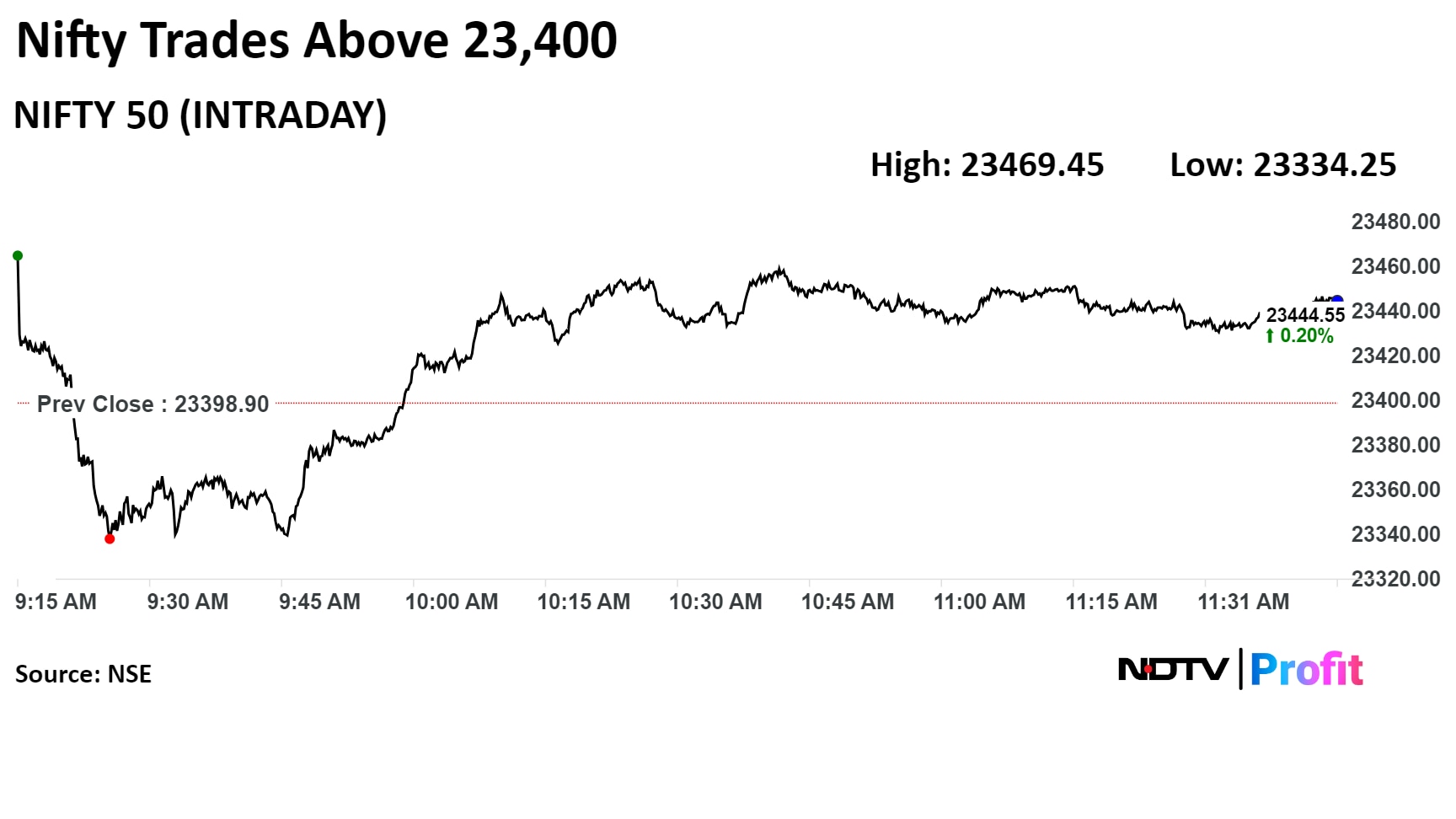

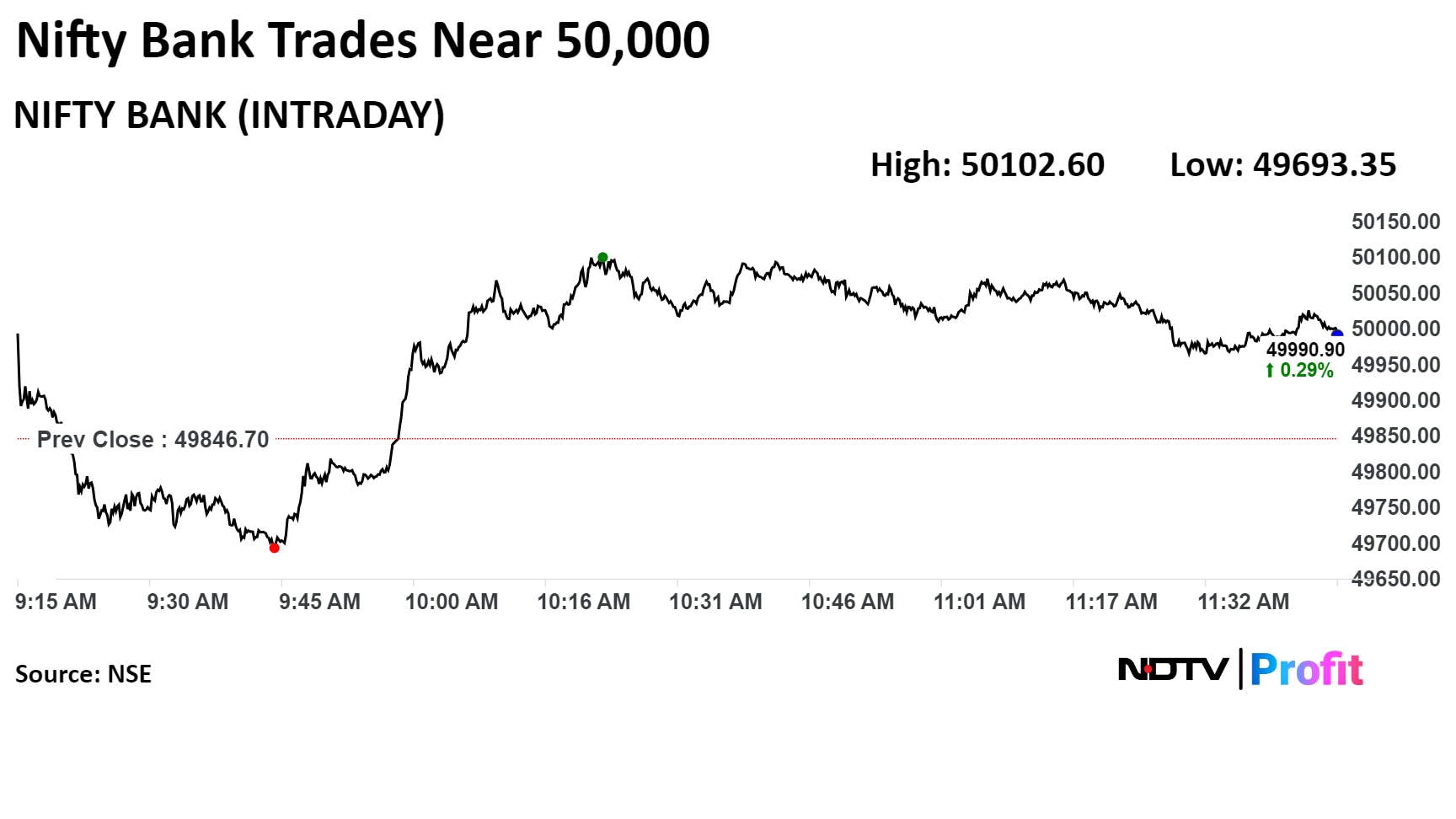

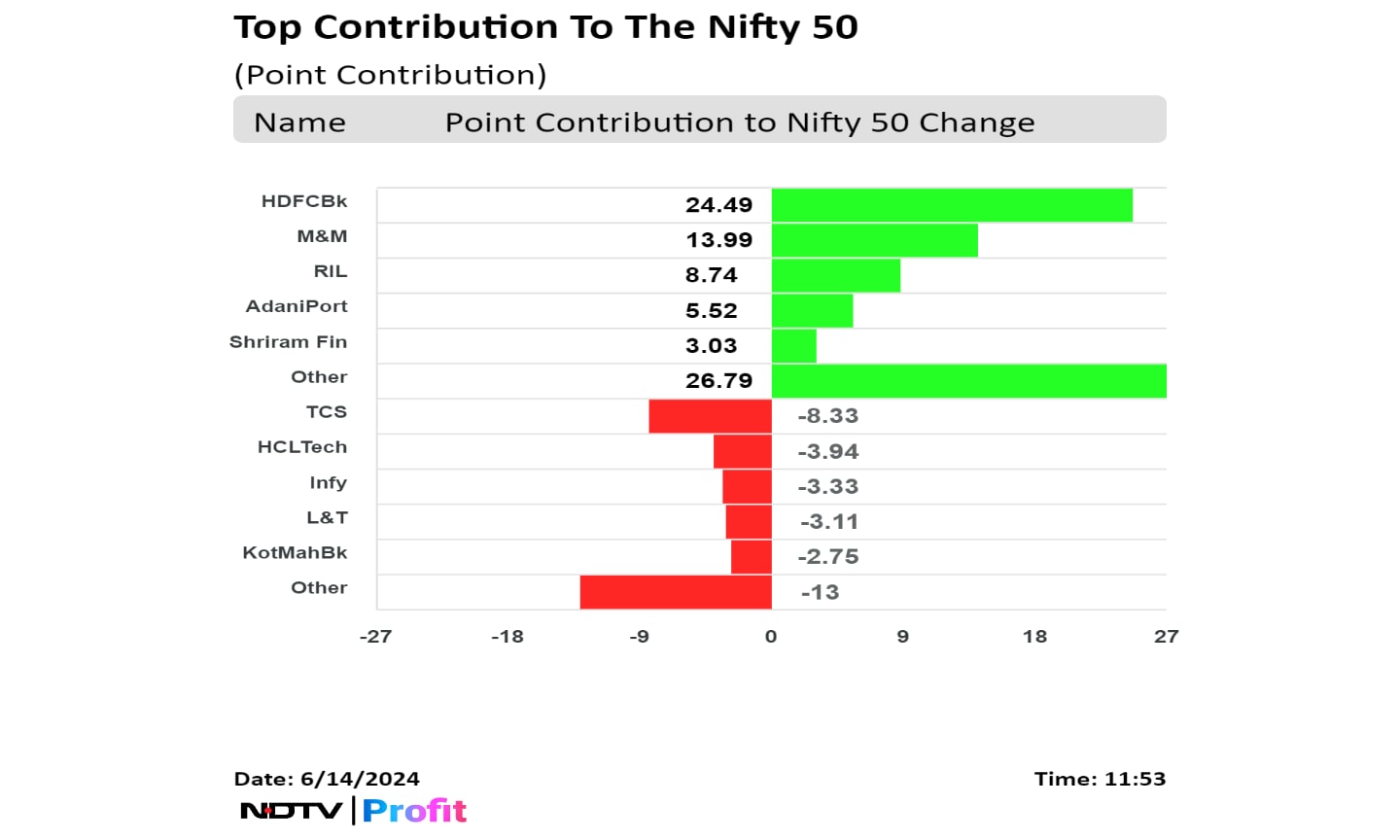

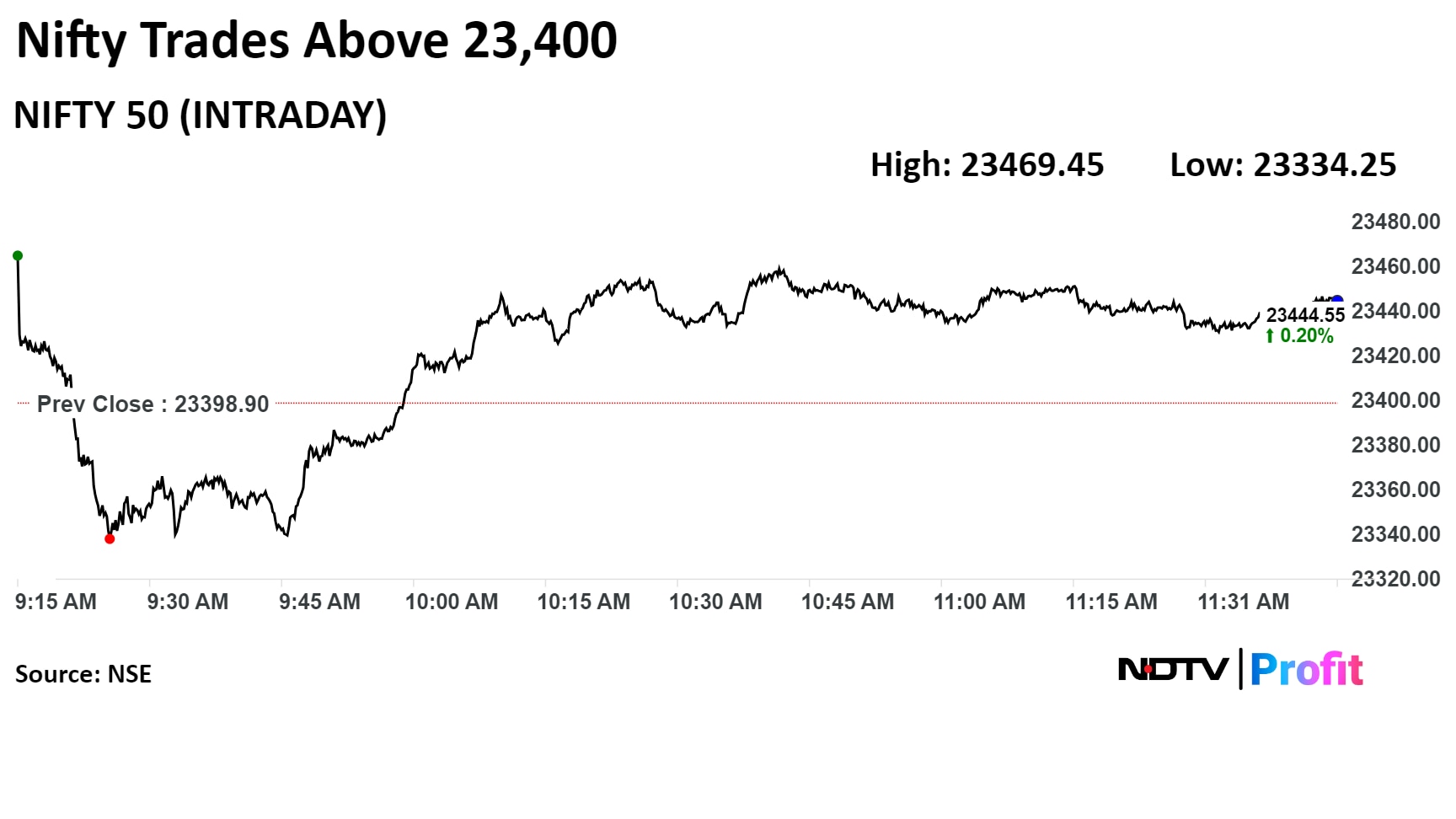

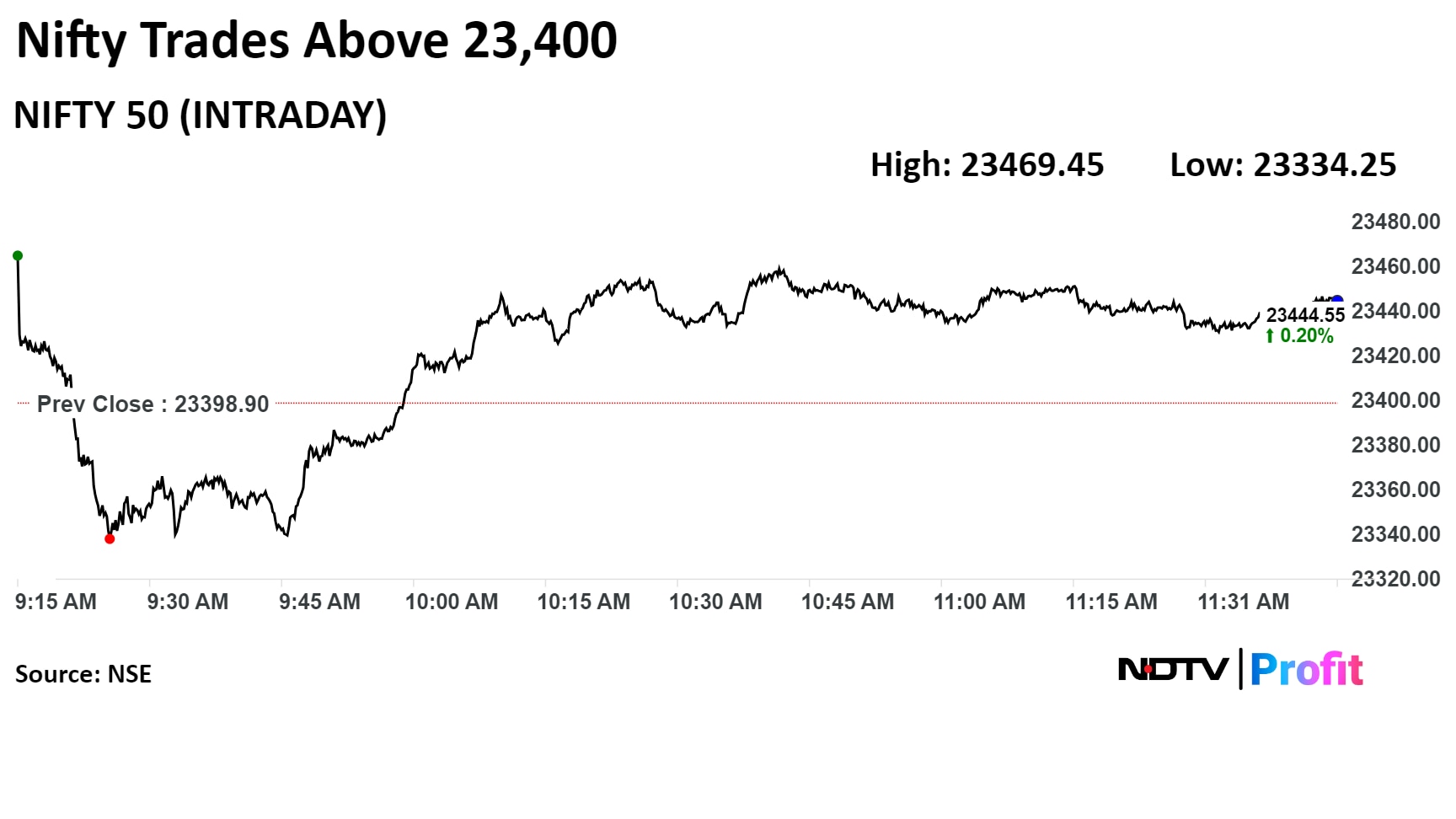

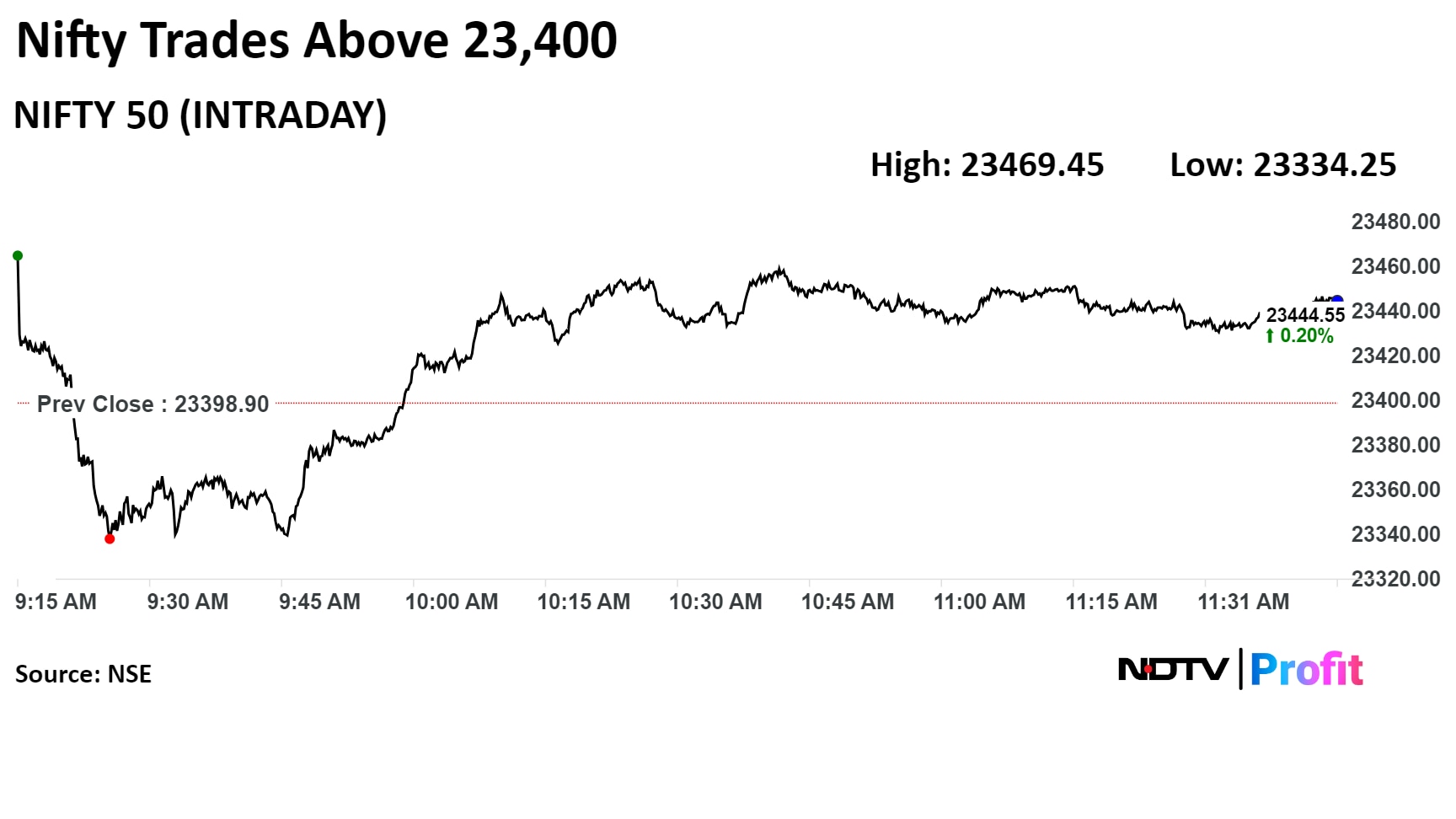

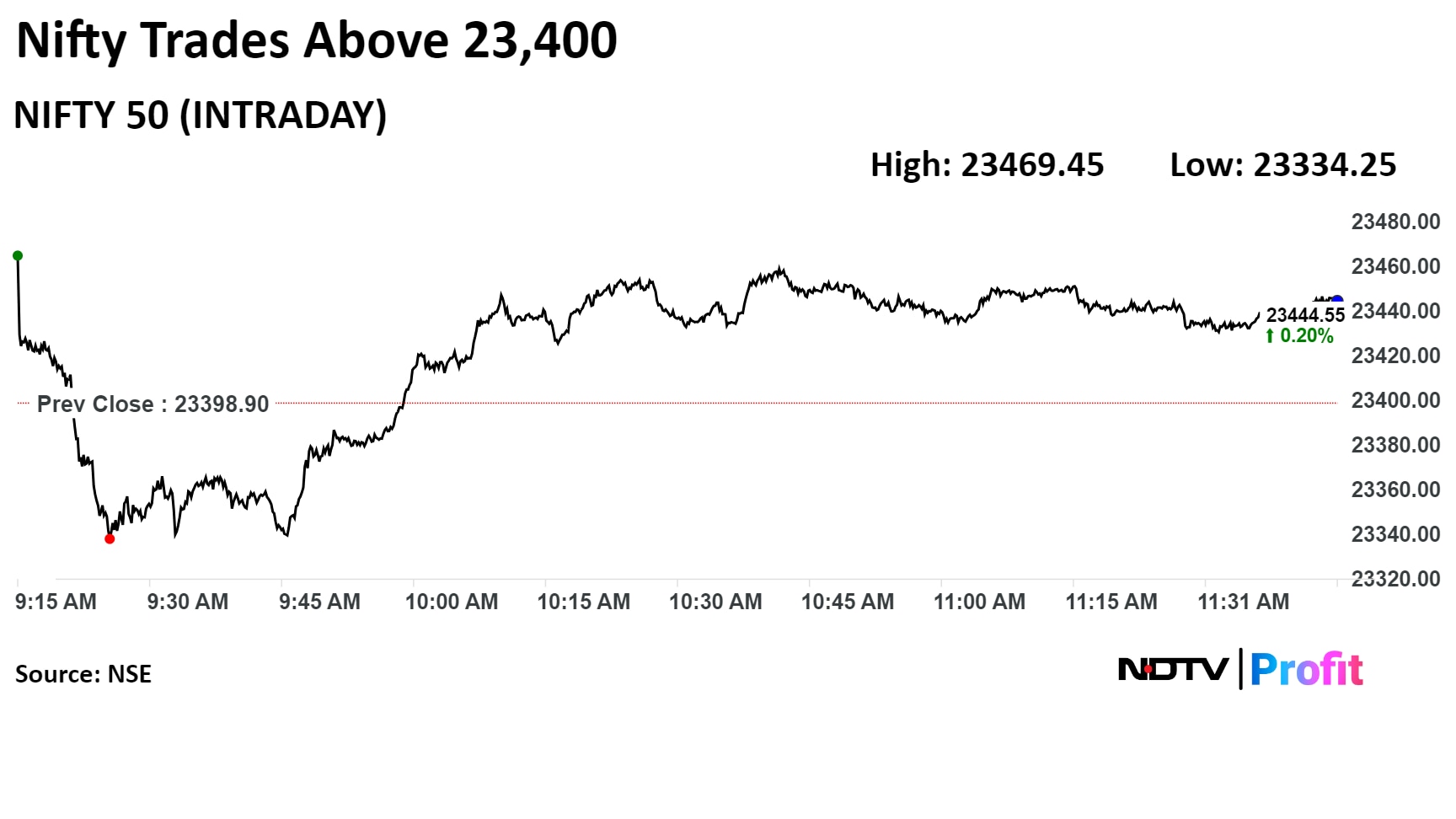

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

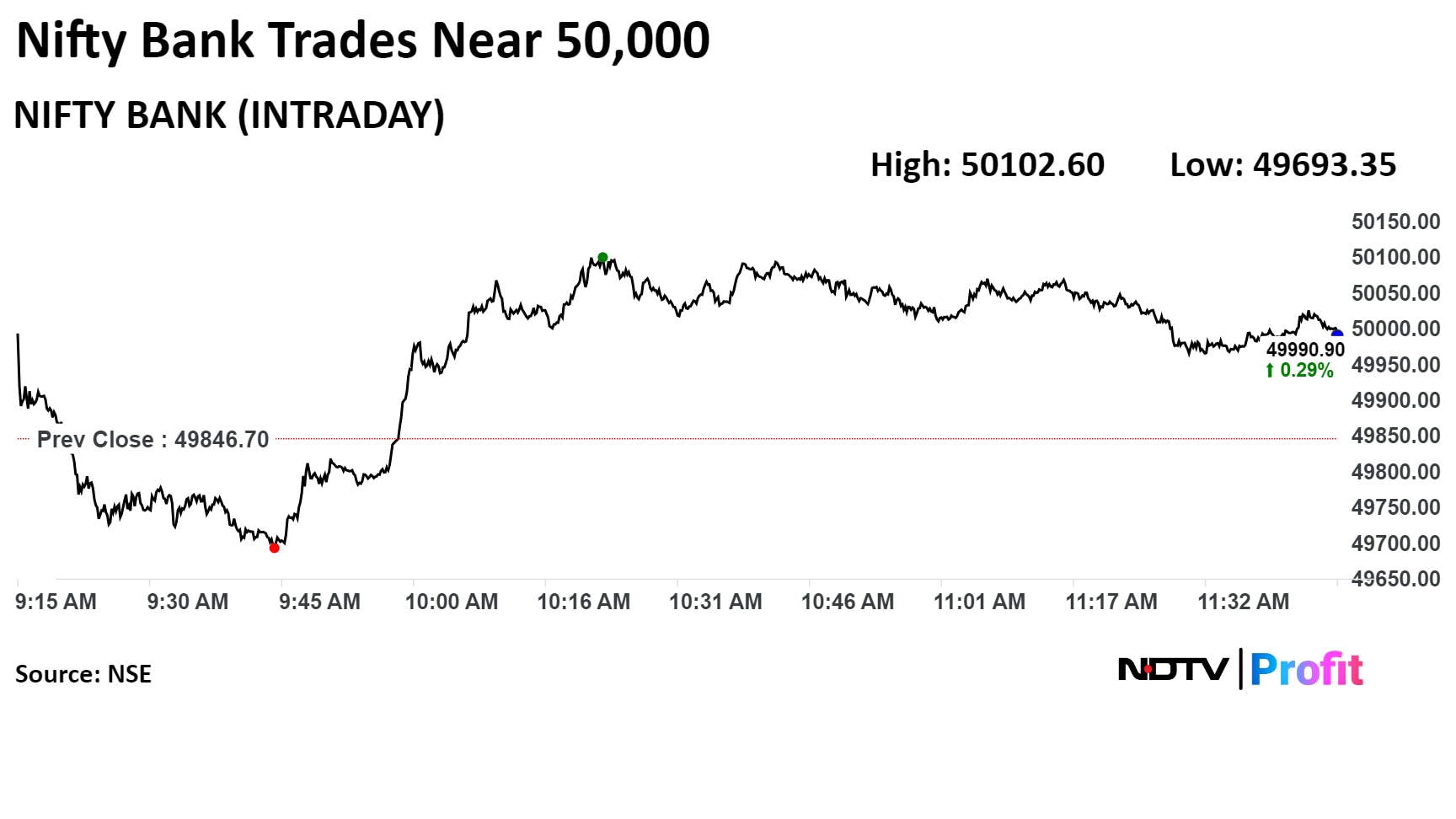

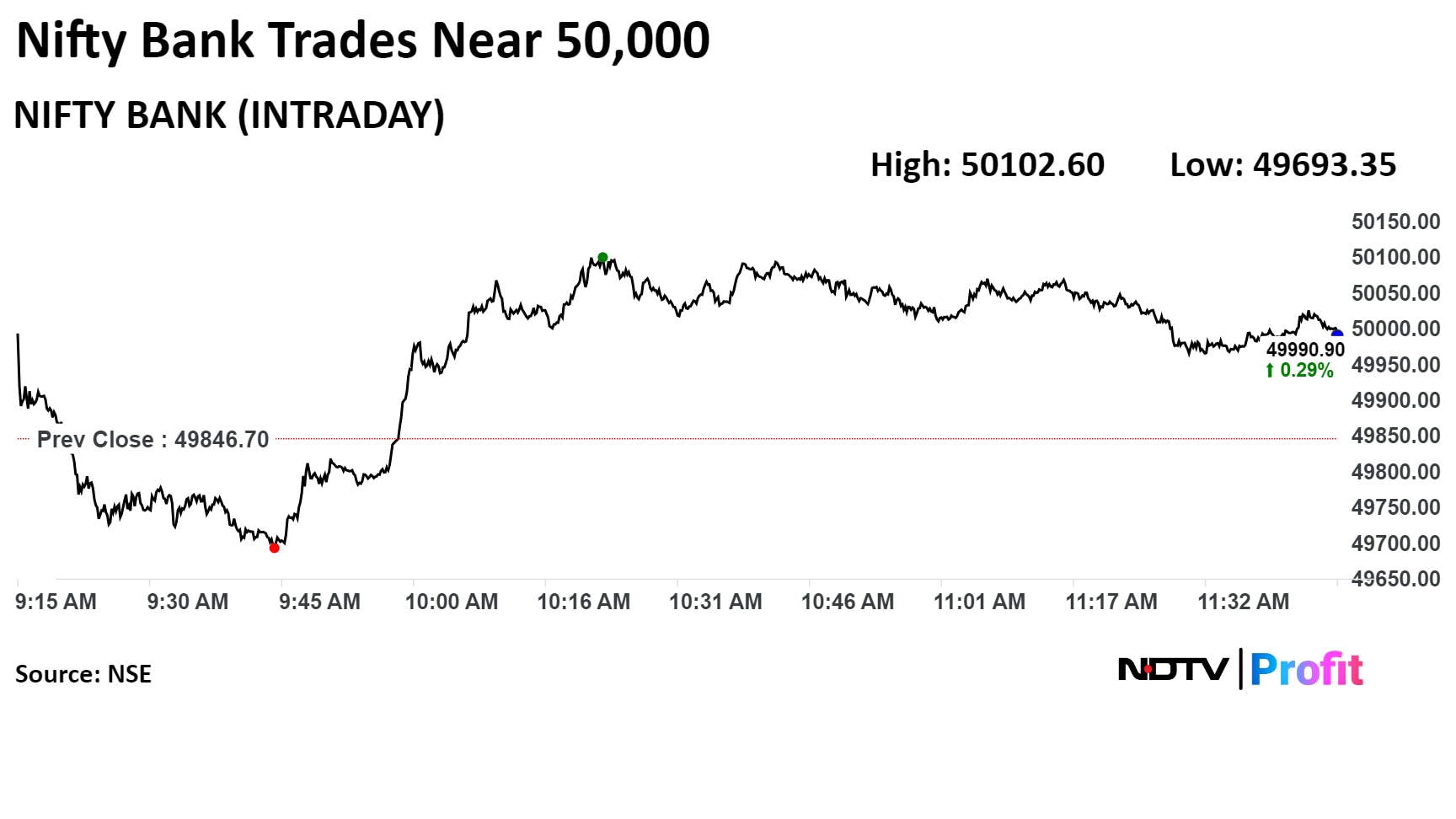

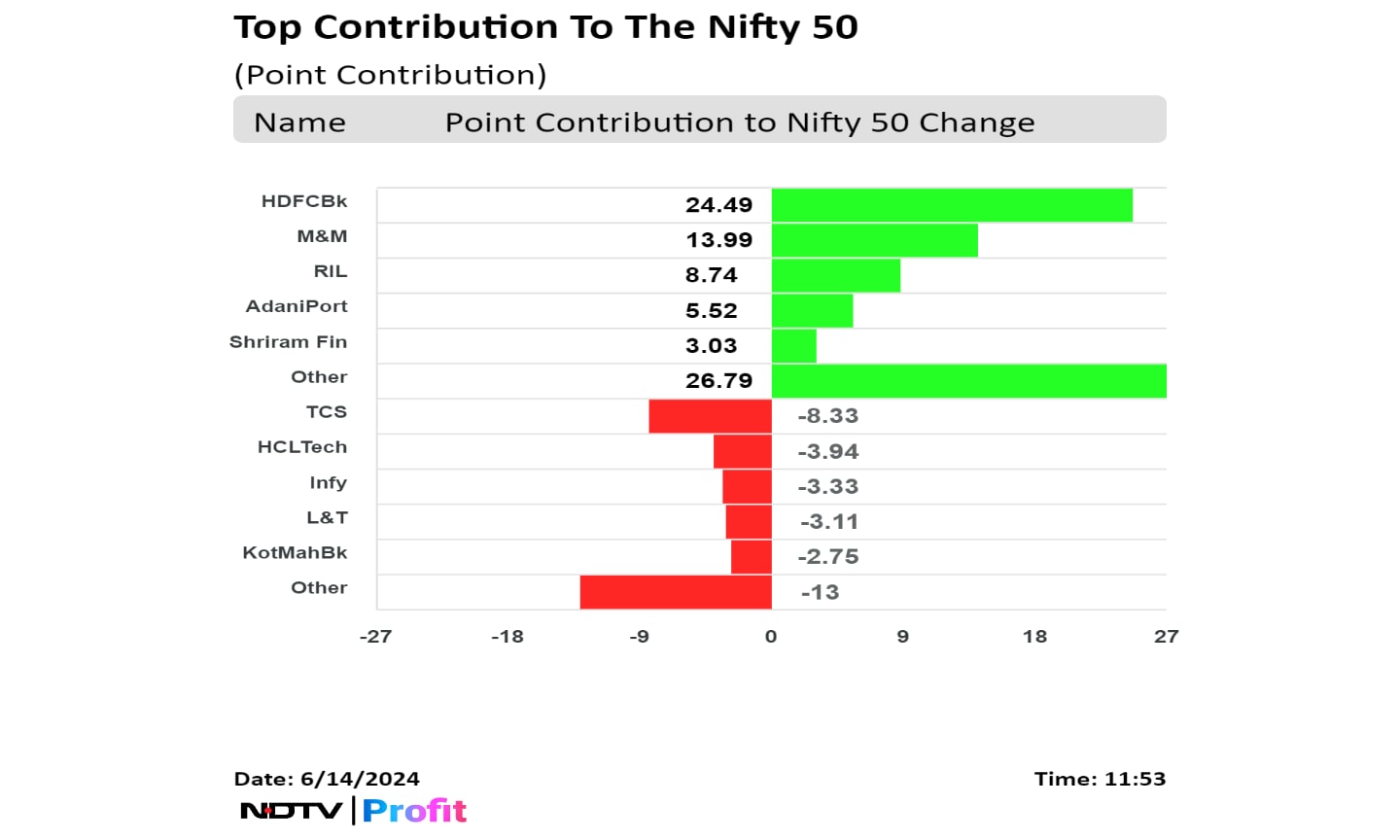

Shares of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., Adani Ports & Special Economic Zone Ltd. and Shriram Finance Ltd. contributed the most to the gains in the Nifty.

Tata Consultancy Services Ltd., HCL Technologies Ltd., Infosys Ltd., Larsen & Toubro Ltd. and Kotak Mahindra Bank Ltd. dragged the index.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

Shares of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., Adani Ports & Special Economic Zone Ltd. and Shriram Finance Ltd. contributed the most to the gains in the Nifty.

Tata Consultancy Services Ltd., HCL Technologies Ltd., Infosys Ltd., Larsen & Toubro Ltd. and Kotak Mahindra Bank Ltd. dragged the index.

Except the Nifty IT, all sectoral indices on the NSE rose. The Nifty Auto and Metal were the top gainers.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

Shares of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., Adani Ports & Special Economic Zone Ltd. and Shriram Finance Ltd. contributed the most to the gains in the Nifty.

Tata Consultancy Services Ltd., HCL Technologies Ltd., Infosys Ltd., Larsen & Toubro Ltd. and Kotak Mahindra Bank Ltd. dragged the index.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

The benchmark equity indices traded with minor gains through midday on Friday as shares of financial services stocks led the gains, while those IT companies limited the upside. At 11:59 a.m., the NSE Nifty 50 was trading 46.80 points or 0.20% higher at 23,445.70, while the S&P BSE Sensex was 103.02 points or 0.13% up at 76,913.92.

In the last three–four sessions, the markets have been opening positively, but they have not been able to sustain the high levels, according to Kush Bohra, founder of kushbohra.com. He advises investors to be a little cautious and buy on dips to 23,000–22,800 of the Nifty.

Shares of HDFC Bank Ltd., Mahindra & Mahindra Ltd., Reliance Industries Ltd., Adani Ports & Special Economic Zone Ltd. and Shriram Finance Ltd. contributed the most to the gains in the Nifty.

Tata Consultancy Services Ltd., HCL Technologies Ltd., Infosys Ltd., Larsen & Toubro Ltd. and Kotak Mahindra Bank Ltd. dragged the index.

Except the Nifty IT, all sectoral indices on the NSE rose. The Nifty Auto and Metal were the top gainers.

The broader indices outperformed the benchmarks as the BSE MidCap rose 0.85% and the SmallCap was 1.05% higher.

Eighteen out of the 20 sectoral indices on the BSE advanced, with Industrials and Capital Goods rising the most.

The market breadth was skewed in favour of the buyers as 2,342 stocks rose, 1,360 declined and 138 remained unchanged on the BSE.

Shares of Mazagon Dock Shipbuilders Ltd. rose 5.89% to Rs 3,589.70, the highest level since listing on Oct 12, 2020. It was trading 5.36% higher at Rs 3,571.65 as of 1:09 p.m. as compared to 0.22% advance in the NSE Nifty 50 index.

Shares of Mazagon Dock Shipbuilders Ltd. rose 5.89% to Rs 3,589.70, the highest level since listing on Oct 12, 2020. It was trading 5.36% higher at Rs 3,571.65 as of 1:09 p.m. as compared to 0.22% advance in the NSE Nifty 50 index.

.png)

Hyundai India to file IPO papers with SEBI today.

On offer are 142 million shares, or 17.5% of company

Citi, HSBC, Kotak, Morgan Stanley are merchant bankers

Source: People In The Know To NDTV Profit

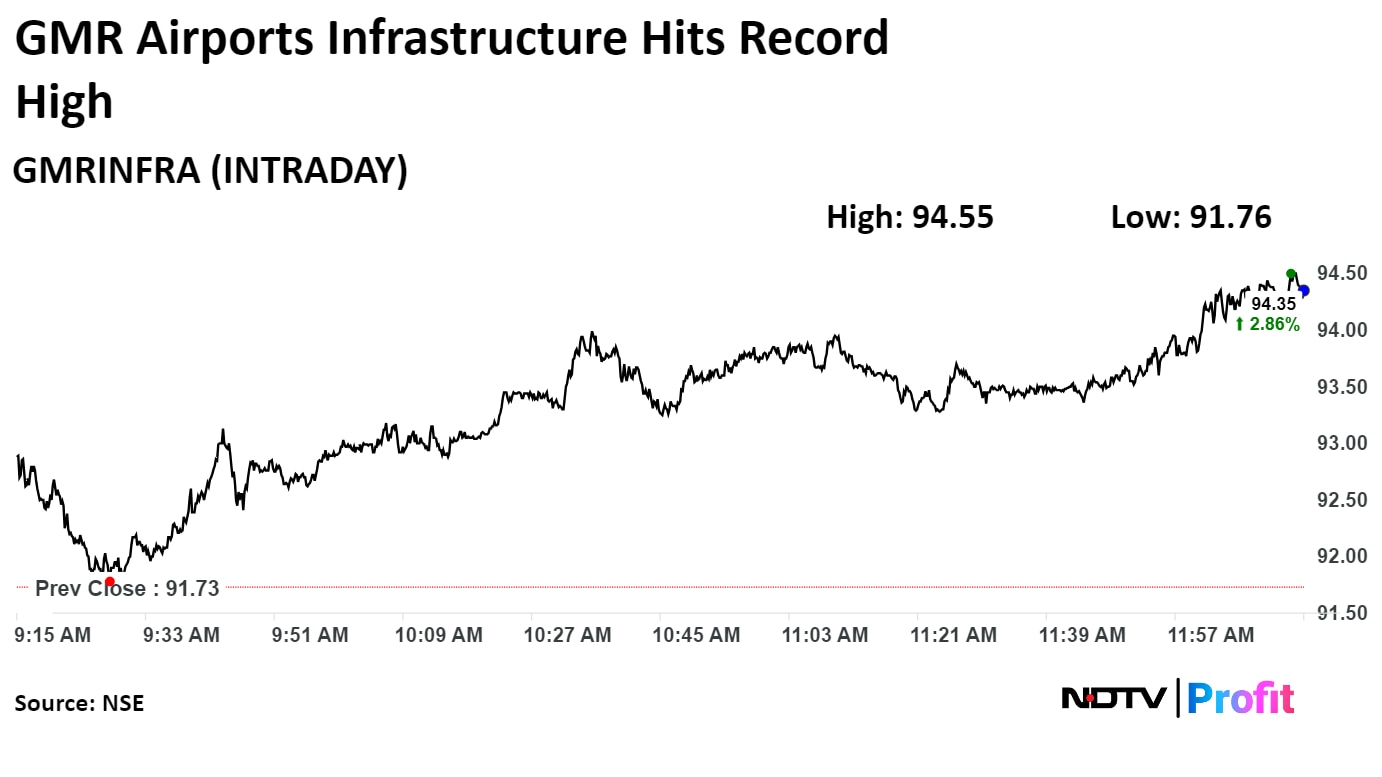

Shares of GMR Airports Infrastructure Ltd. rose 3.07% to Rs 94.55, the highest level since Aug 21, 2006. It was trading 2.45% higher at Rs 93.98 as of 12:52 p.m., as compared to 0.20% advance in the NSE Nifty 50 index.

Shares of GMR Airports Infrastructure Ltd. rose 3.07% to Rs 94.55, the highest level since Aug 21, 2006. It was trading 2.45% higher at Rs 93.98 as of 12:52 p.m., as compared to 0.20% advance in the NSE Nifty 50 index.

The Bank of Japan kept its benchmark rate unchanged at 0.00-0.1% on Friday.

The central bank kept its bond-buying program unchanged.

The Japanese central bank may possibly raise the benchmark overnight call rate in July, depending on data, Governor Kazuo Ueda said.

Source: Bloomberg

Zydus Lifesciences Ltd. has received a US Food and Drug Administration's tentative nod for Azilsartan Medoxomil and Chlorthalidone tablets.

Alert: Azilsartan Medoxomil and Chlorthalidone are used in treatment of high blood pressure.

Source: Exchange filing

Bajaj Finance Housing Ltd. filed draft papers with SEBI for Rs 7,000 crore IPO.

Source: SEBI

WPI inflation rose to 2.61% on the year in May from 1.26% in April

WPI food inflation rose to 7.40% on year in May from 5.52% in April

Fuel and power inflation rose to 1.35% on year in May from 1.38% in April

Manufactured products inflation rose to 0.78% on year in May from -0.42% in April

WPI core inflation rose 0.4% on the year in May from -0.7% in April

Source: Ministry of Commerce

Jindal Stainless Ltd. has bought remaining 46% stake in Chromeni Steels for Rs 278 crore.

Source: Exchange filing

Shares of Mahindra & Mahindra Ltd. rose 2.21% to Rs 2,925.00, the highest level since its listing on Jan 3, 1996. It was trading 2.03% higher at Rs 2,919.75 as of 11:29 a.m., as compared to 0.15% advance in the NSE Nifty 50 index.

Shares of Mahindra & Mahindra Ltd. rose 2.21% to Rs 2,925.00, the highest level since its listing on Jan 3, 1996. It was trading 2.03% higher at Rs 2,919.75 as of 11:29 a.m., as compared to 0.15% advance in the NSE Nifty 50 index.

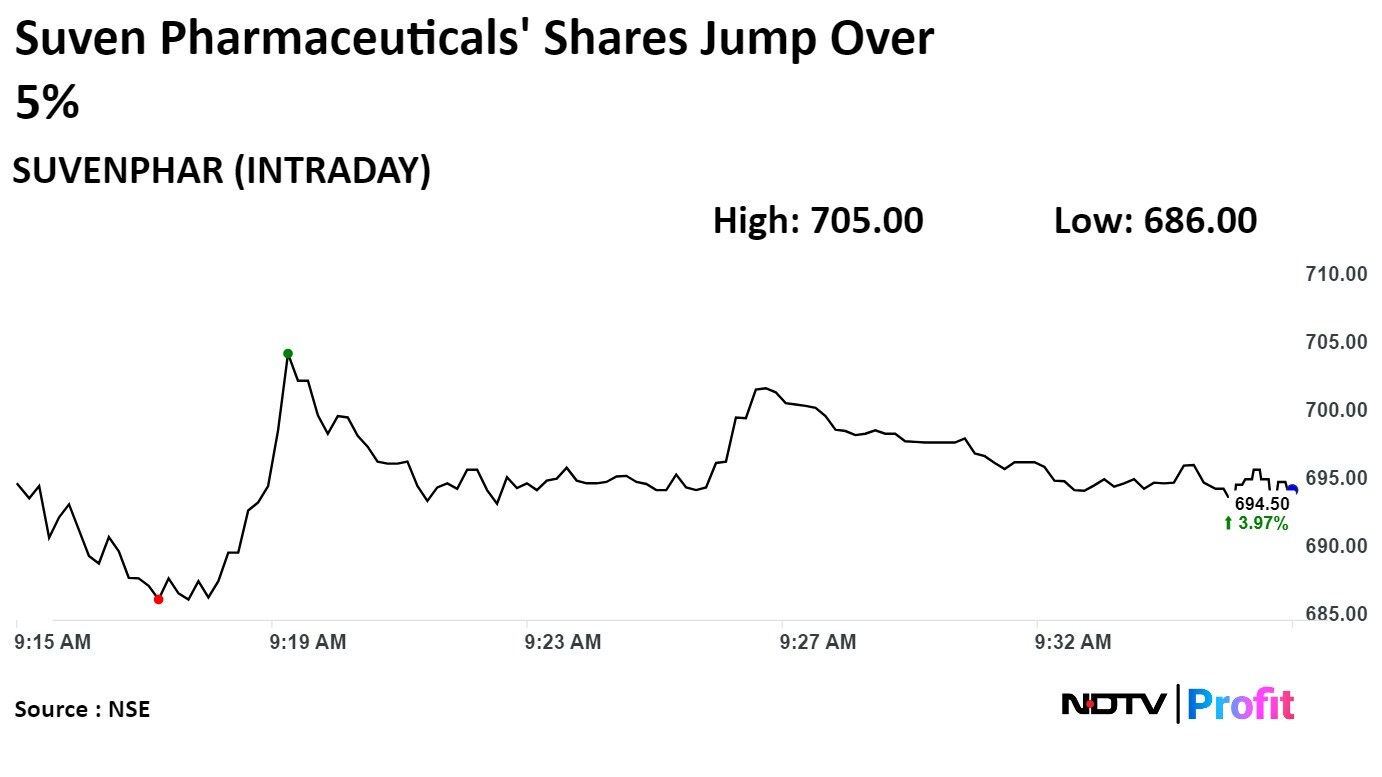

Shares of Suven Pharmaceutical Ltd. gained 5% on Friday after it acquired a 100% stake in contract development and manufacturing firm Sapala Organics Pvt.

Shares of the company rose over 5% to trade at Rs 705.00 apiece, before paring gains to trade 3.47% higher at Rs 691.10 apiece as of 10:02 a.m. This compares to a 0.07% rise in the NSE Nifty 50.

The stock has fallen 4.32% year-to-date and 42.35% in the last 12 months. Total traded volume so far today stood at 1.63 times its 30-day average. The relative strength index was at 64.86%.

One analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 15.8%.

Shares of Suven Pharmaceutical Ltd. gained 5% on Friday after it acquired a 100% stake in contract development and manufacturing firm Sapala Organics Pvt.

Shares of the company rose over 5% to trade at Rs 705.00 apiece, before paring gains to trade 3.47% higher at Rs 691.10 apiece as of 10:02 a.m. This compares to a 0.07% rise in the NSE Nifty 50.

The stock has fallen 4.32% year-to-date and 42.35% in the last 12 months. Total traded volume so far today stood at 1.63 times its 30-day average. The relative strength index was at 64.86%.

One analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 15.8%.

Lupin Ltd. has announced a closure of the U.S. Food and Drug Administration's inspection at injectable facility with zero 483 observations.

Source: Exchange filing

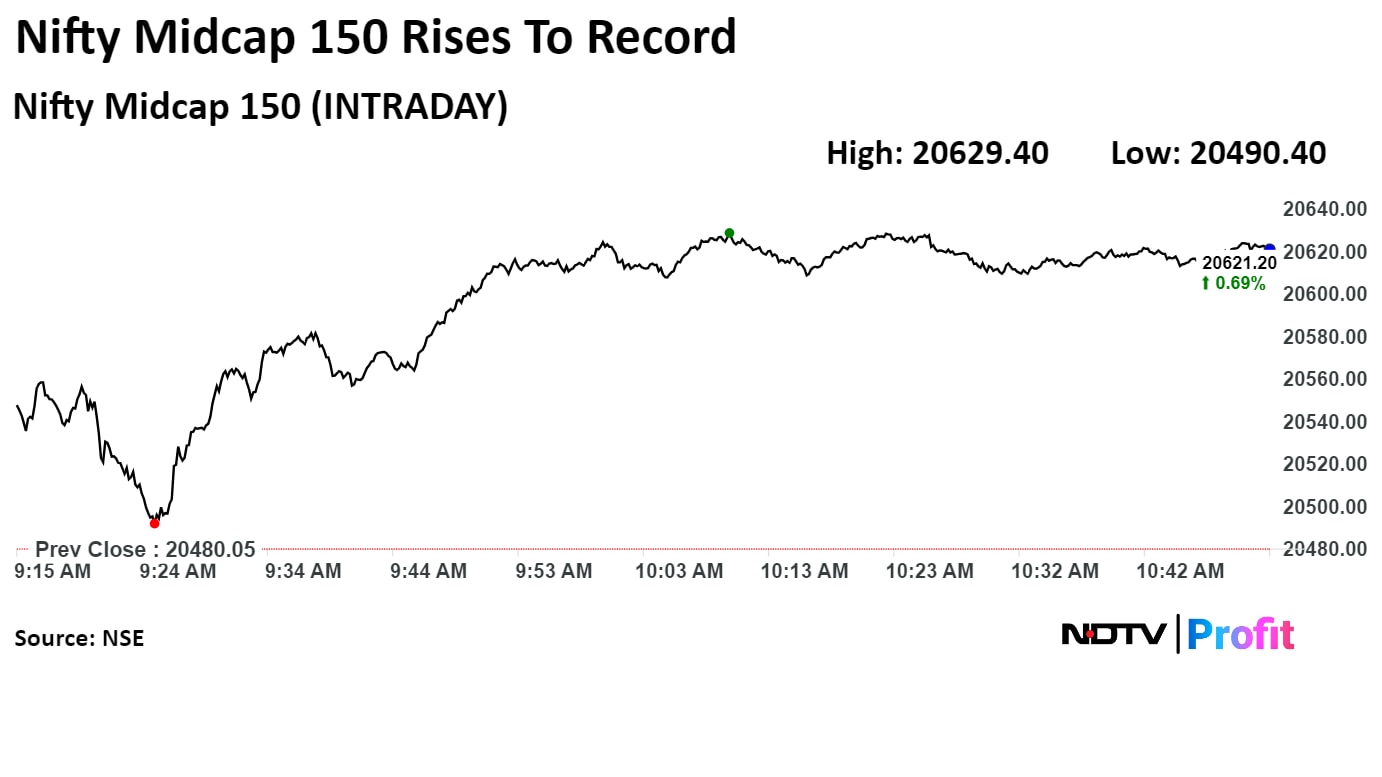

The NSE Nifty Midcap 150 rose 0.73% to 20,629.40, the highest level since its incorporation on April 1, 2016. It was trading 0.65% at 20,612.35 as of 11:03 a.m., as compared to 0.16% advance in the NSE Nifty 50 index.

The NSE Nifty Midcap 150 rose 0.73% to 20,629.40, the highest level since its incorporation on April 1, 2016. It was trading 0.65% at 20,612.35 as of 11:03 a.m., as compared to 0.16% advance in the NSE Nifty 50 index.

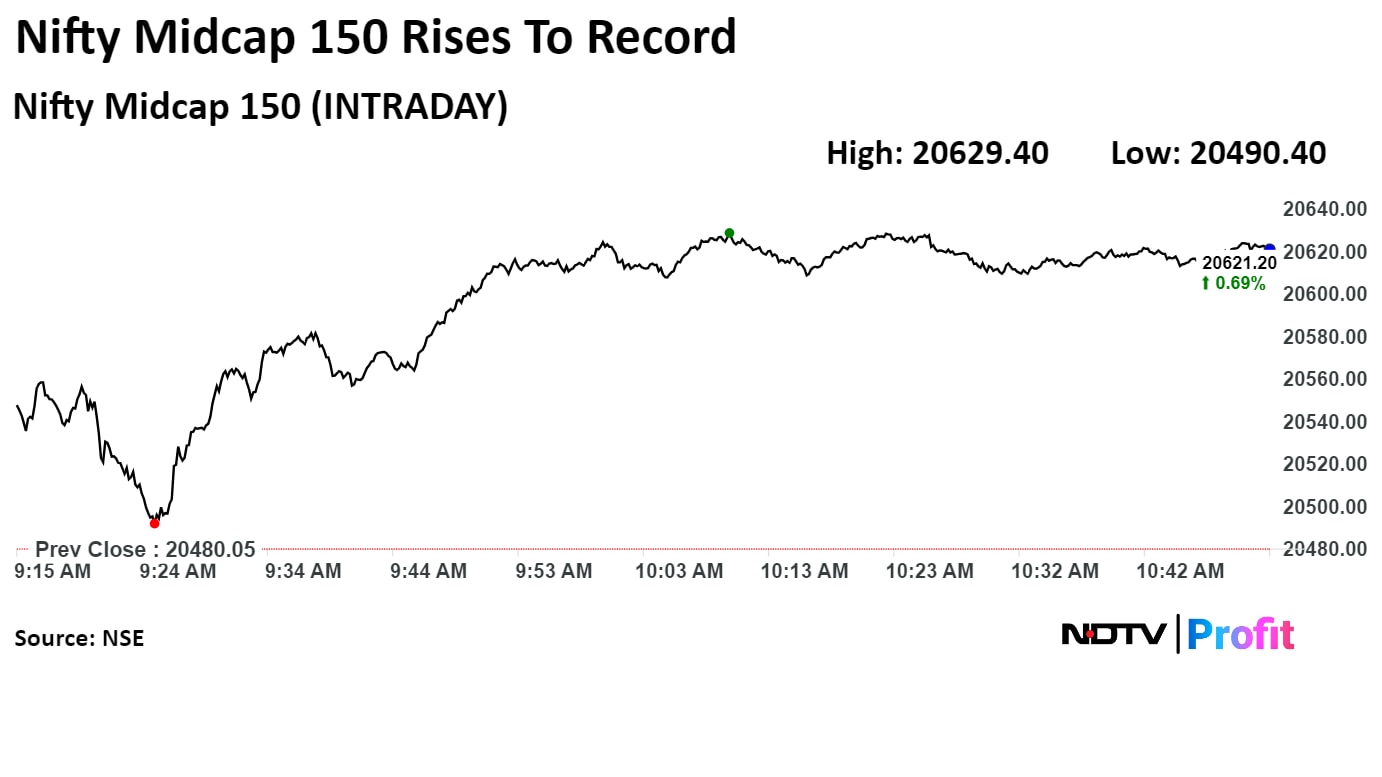

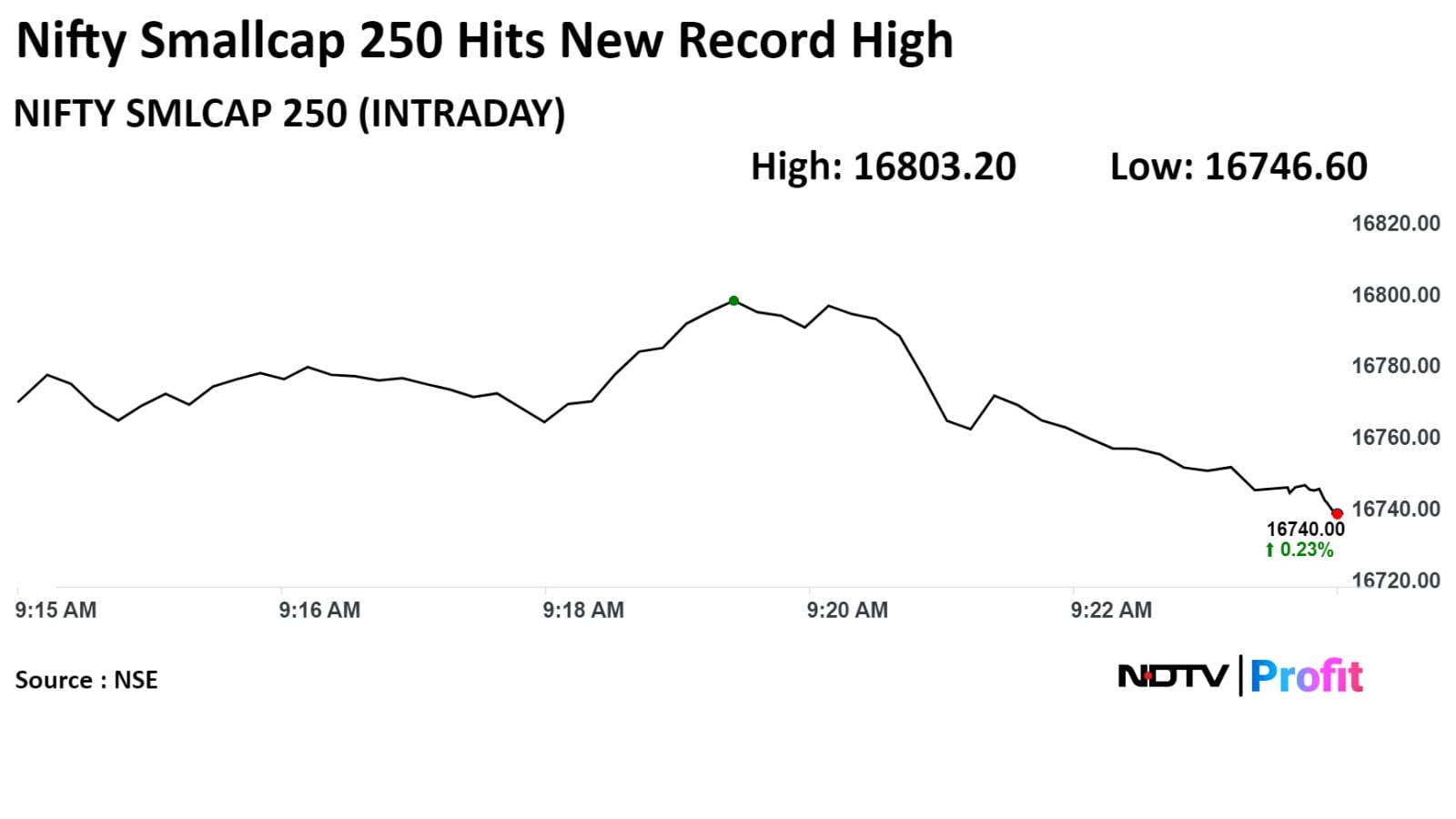

The NSE Nifty Smallcap 100 rose 0.83% to 18,057.10, the highest level since its incorporation on March 30, 2011. It was trading 0.68% higher at 18,030.35 as of 11:05 a.m. as compared to 0.20% advance in the NSE Nifty 50 index.

The NSE Nifty Midcap 150 rose 0.73% to 20,629.40, the highest level since its incorporation on April 1, 2016. It was trading 0.65% at 20,612.35 as of 11:03 a.m., as compared to 0.16% advance in the NSE Nifty 50 index.

The NSE Nifty Midcap 150 rose 0.73% to 20,629.40, the highest level since its incorporation on April 1, 2016. It was trading 0.65% at 20,612.35 as of 11:03 a.m., as compared to 0.16% advance in the NSE Nifty 50 index.

The NSE Nifty Smallcap 100 rose 0.83% to 18,057.10, the highest level since its incorporation on March 30, 2011. It was trading 0.68% higher at 18,030.35 as of 11:05 a.m. as compared to 0.20% advance in the NSE Nifty 50 index.

The NSE Nifty Auto rose 0.42% to 25,500.85, the highest level since its inception on July 12, 2011. It was trading 0.31% higher at 25,471.75 as of 10:56 a.m., as compared to 0.12% advance in the NSE Nifty 50 index.

The NSE Nifty Auto rose 0.42% to 25,500.85, the highest level since its inception on July 12, 2011. It was trading 0.31% higher at 25,471.75 as of 10:56 a.m., as compared to 0.12% advance in the NSE Nifty 50 index.

The NSE Nifty Pharma rose 0.40% to 19,918.65, the highest level since July 1, 2005. It was trading 0.31% higher at 19,900.40 as of 10:58 a.m., as compared to 0.19% advance in the NSE Nifty 50 index.

The NSE Nifty Auto rose 0.42% to 25,500.85, the highest level since its inception on July 12, 2011. It was trading 0.31% higher at 25,471.75 as of 10:56 a.m., as compared to 0.12% advance in the NSE Nifty 50 index.

The NSE Nifty Auto rose 0.42% to 25,500.85, the highest level since its inception on July 12, 2011. It was trading 0.31% higher at 25,471.75 as of 10:56 a.m., as compared to 0.12% advance in the NSE Nifty 50 index.

The NSE Nifty Pharma rose 0.40% to 19,918.65, the highest level since July 1, 2005. It was trading 0.31% higher at 19,900.40 as of 10:58 a.m., as compared to 0.19% advance in the NSE Nifty 50 index.

The India Volatility Index declined 3.71% to 12.98, the lowest level since May 2. The index was trading 3.43% down at 13.02 as of 10:50 a.m., as compared to 0.23% advance in the NSE Nifty Index.

The India Volatility Index declined 3.71% to 12.98, the lowest level since May 2. The index was trading 3.43% down at 13.02 as of 10:50 a.m., as compared to 0.23% advance in the NSE Nifty Index.

FSN E-Commerce Ventures Ltd. expects 2000 bps EBITDA margin improvement by FY26-end vs FY24

It aims mid-term GMV of 9 times of FY24

The company's mid-term EBITDA margin in the range of 3-5%

Source: Exchange filing

Shares of Vodafone Idea Ltd. rose nearly 2% on Friday after its board approved to raise Rs 2,458 crore by issuing preferential shares.

The telecom giant plans to issue 166 crore shares with a face value of Rs 10 each on preferential basis in one or more tranches to Nokia Solutions Ltd., and Ericsson India Ltd. to pay off part of the outstanding dues. Both are Vodafone Idea's long-term network equipment supplier.

Vodafone Idea will issue 102.7 crore shares at an issue price of Rs 14.80 per share to Nokia Solutions, aggregating up to Rs 1,520 crore. To Ericsson India, it will allot 63.37 crore shares at the same issue price, which totals to Rs 938 crore, according to an exchange filing.

Shares of Vodafone Idea Ltd. rose nearly 2% on Friday after its board approved to raise Rs 2,458 crore by issuing preferential shares.

The telecom giant plans to issue 166 crore shares with a face value of Rs 10 each on preferential basis in one or more tranches to Nokia Solutions Ltd., and Ericsson India Ltd. to pay off part of the outstanding dues. Both are Vodafone Idea's long-term network equipment supplier.

Vodafone Idea will issue 102.7 crore shares at an issue price of Rs 14.80 per share to Nokia Solutions, aggregating up to Rs 1,520 crore. To Ericsson India, it will allot 63.37 crore shares at the same issue price, which totals to Rs 938 crore, according to an exchange filing.

.png)

Shares of Vodafone Idea Ltd. rose 1.93% to Rs 16.38, the highest level since Jun 3. It was trading 0.44% higher at Rs 16.14 as of 10:23 a.m., as compared to 0.23% advance in the NSE Nifty 50 index.

The scrip gained 104.30% in 12 months, and 1% on year to date basis. Total traded volume on NSE so far in the day stood at 0.27 times its 30-day average. The relative strength index was at 60.73.

Out of 19 analysts tracking the company, two maintain a 'buy' rating, six recommend a 'hold,' and 11 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 31.8%.

Shares of Shriram Finance Ltd. rose 2.34% to Rs 2,747.00, the highest level since Dec 11, 1996. It was trading 1.98% higher as of 09:46 a.m., as compared to 0.22% decline in the NSE Nifty 50 index.

The scrip gained 94.45% in 12 months, and risen 33.29% on year to date basis. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 68.14.

Shares of Shriram Finance Ltd. rose 2.34% to Rs 2,747.00, the highest level since Dec 11, 1996. It was trading 1.98% higher as of 09:46 a.m., as compared to 0.22% decline in the NSE Nifty 50 index.

The scrip gained 94.45% in 12 months, and risen 33.29% on year to date basis. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 68.14.

.png)

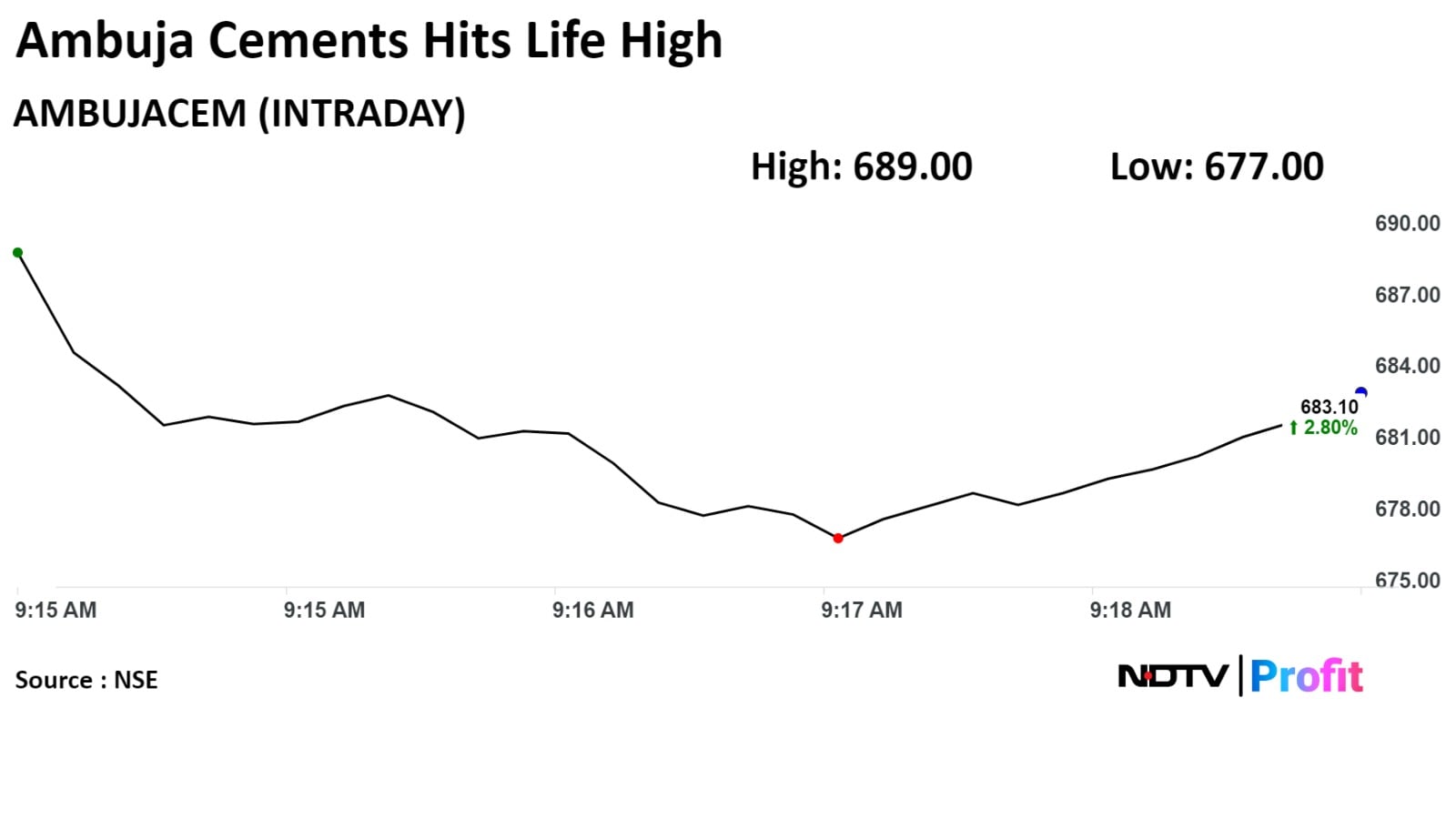

Shares of Ambuja Cements Ltd. rose to the highest level since its listing on Friday after the company said it'll acquire Penna Cement Industries Ltd..

The cement-maker has entered into an binding agreement to acquire Penna Cement's 100% stake for Rs 10,422 crore. The acquisition process will likely conclude within three-four months, according to an exchange filing.

Shares of Ambuja Cements Ltd. rose to the highest level since its listing on Friday after the company said it'll acquire Penna Cement Industries Ltd..

The cement-maker has entered into an binding agreement to acquire Penna Cement's 100% stake for Rs 10,422 crore. The acquisition process will likely conclude within three-four months, according to an exchange filing.

.jpeg)

.jpeg)

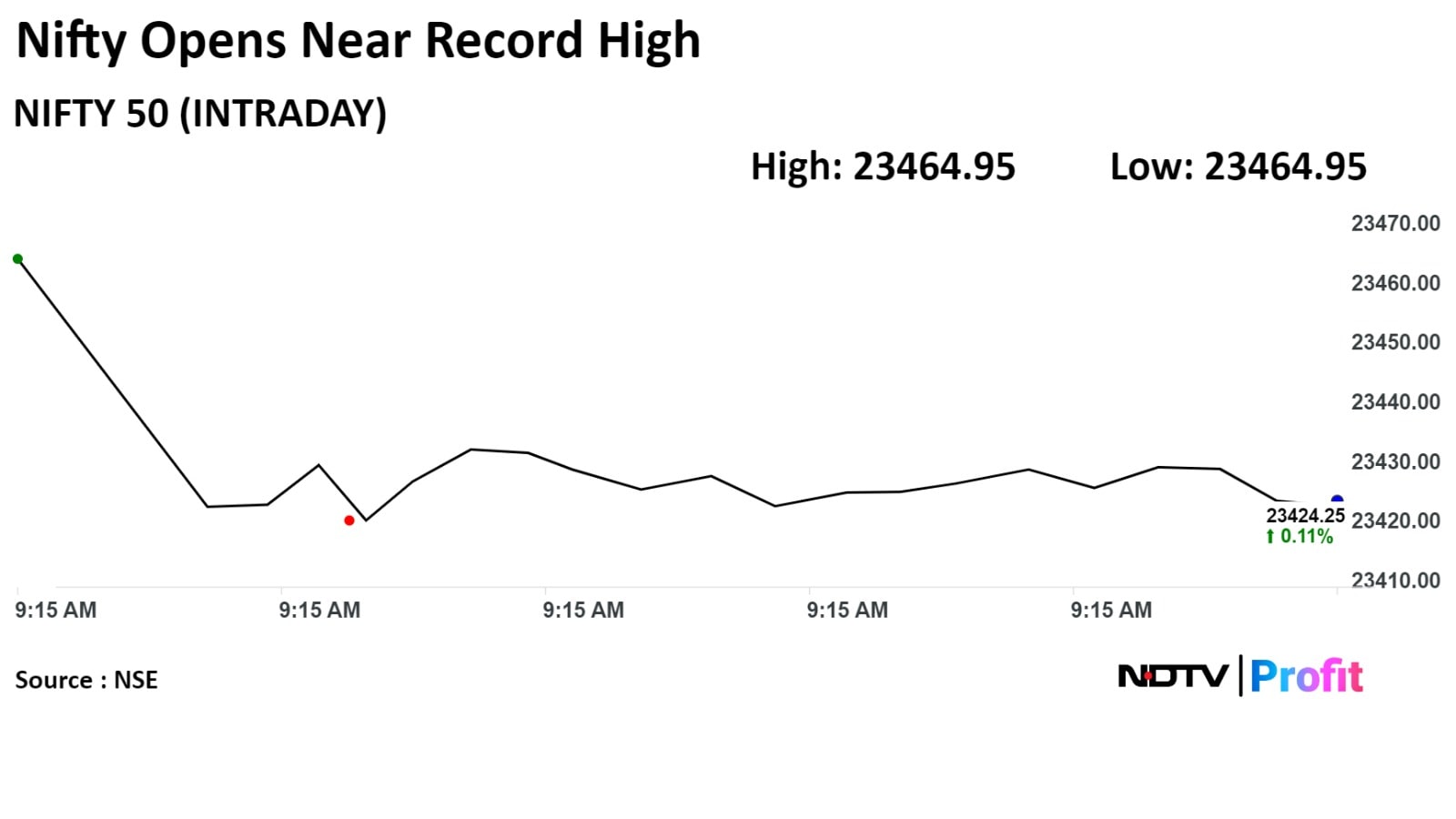

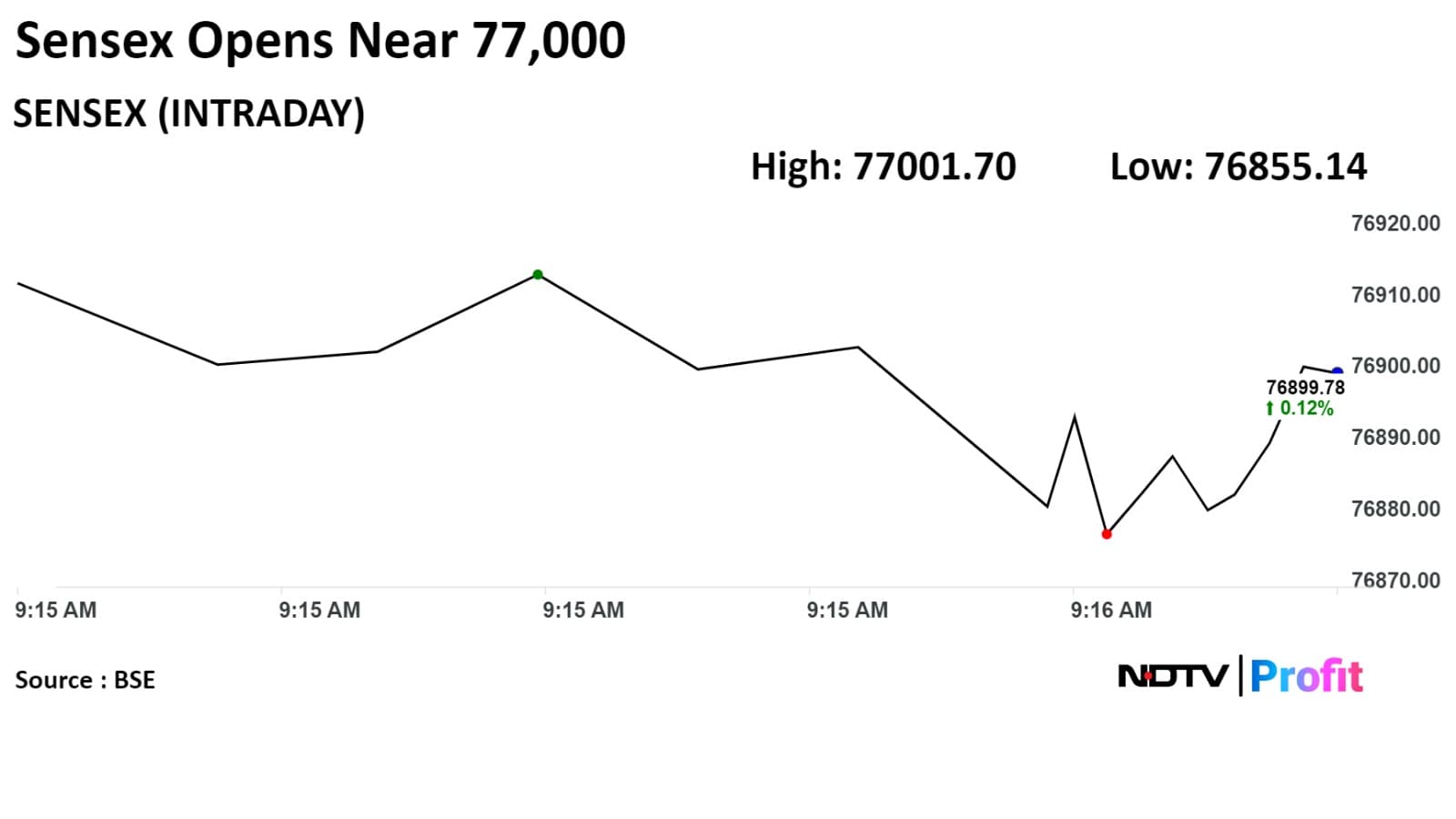

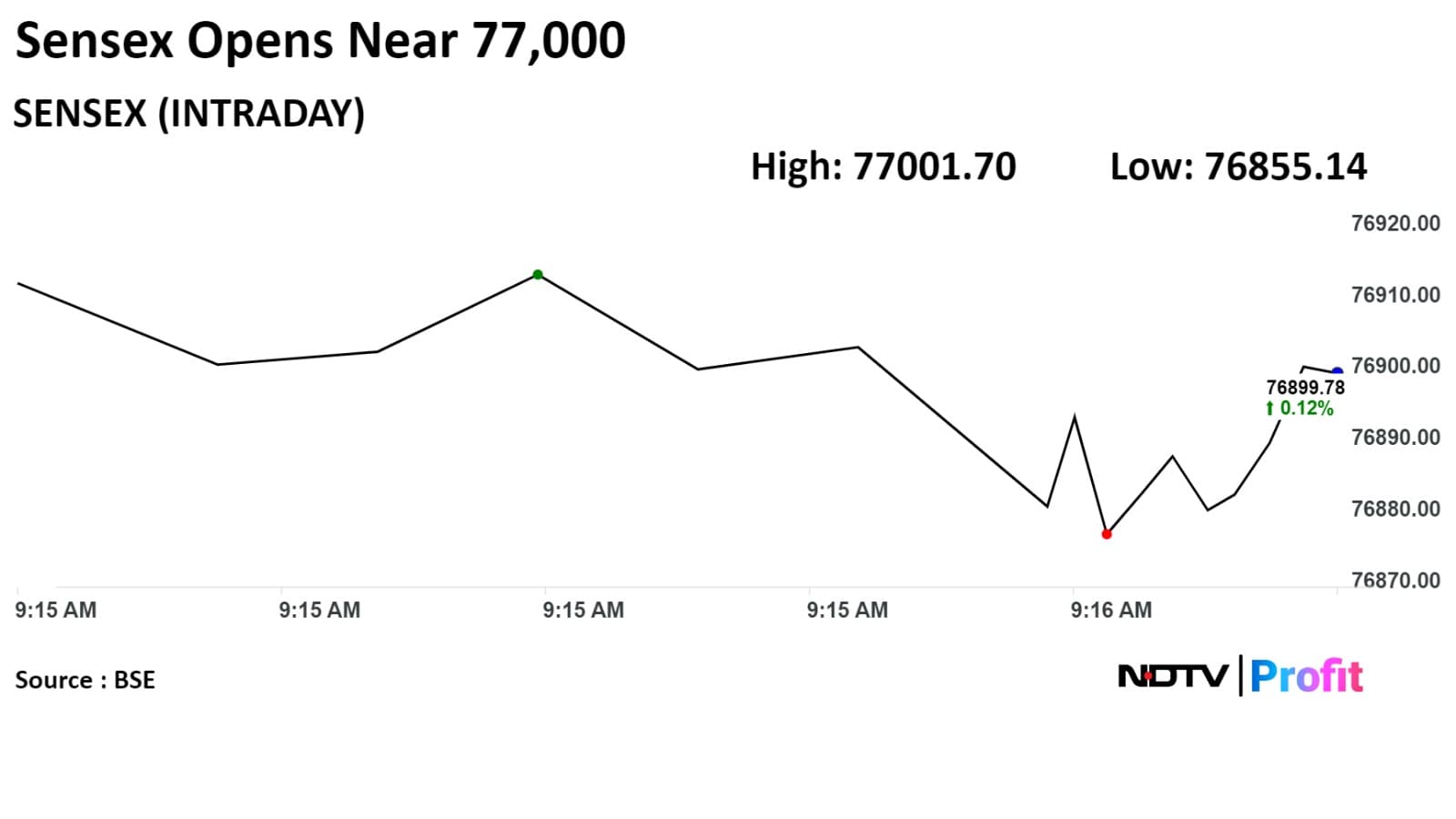

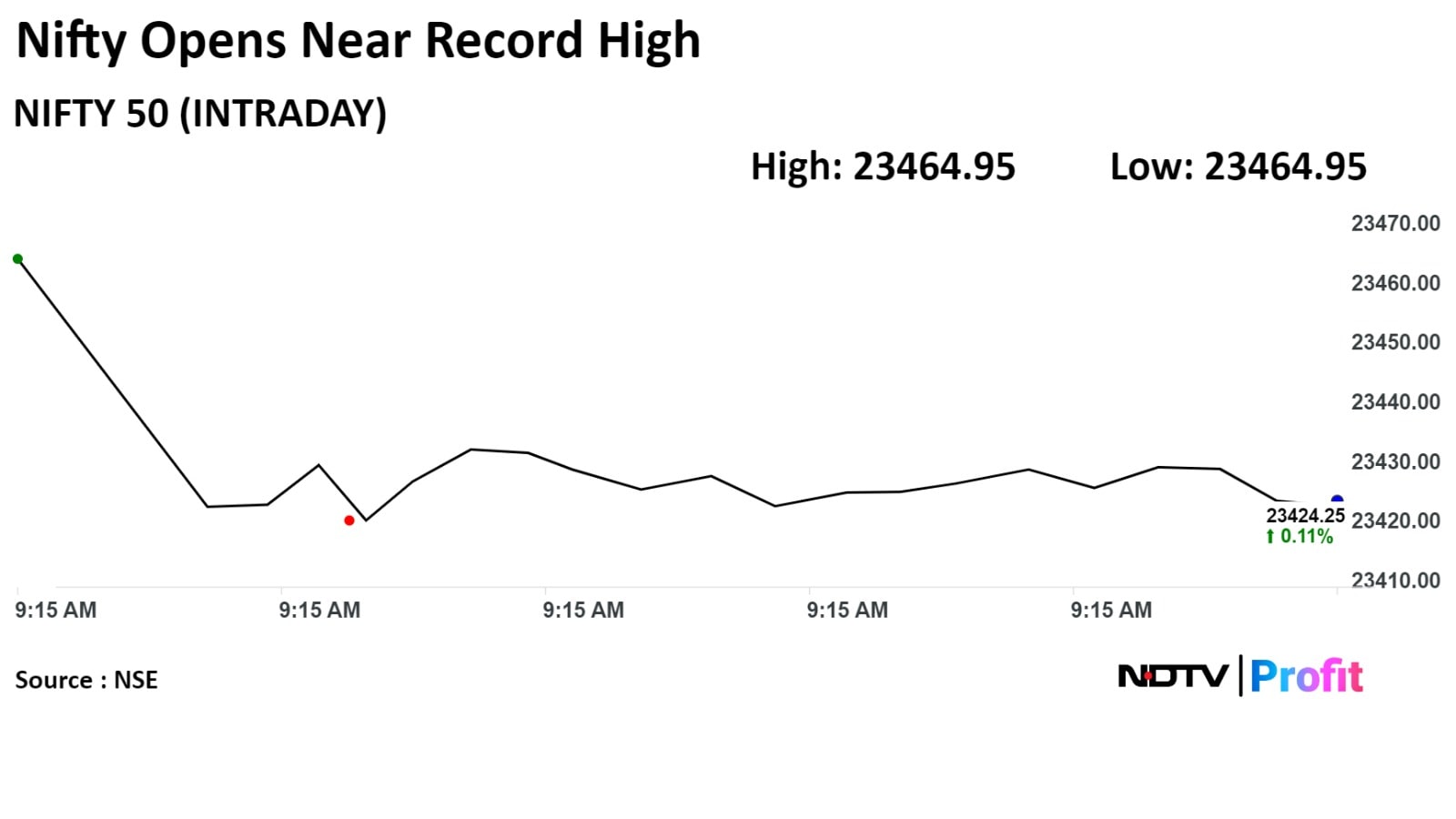

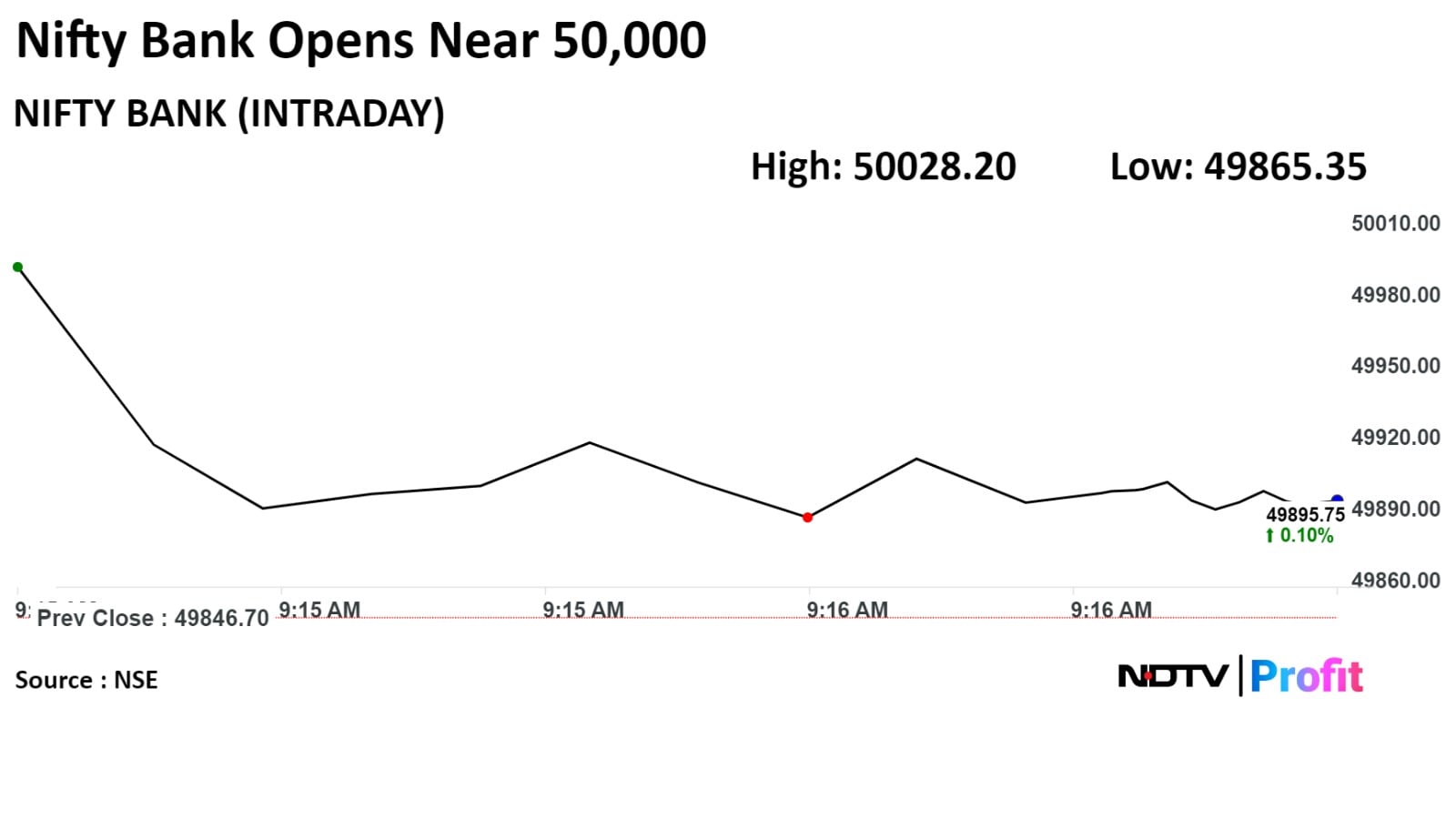

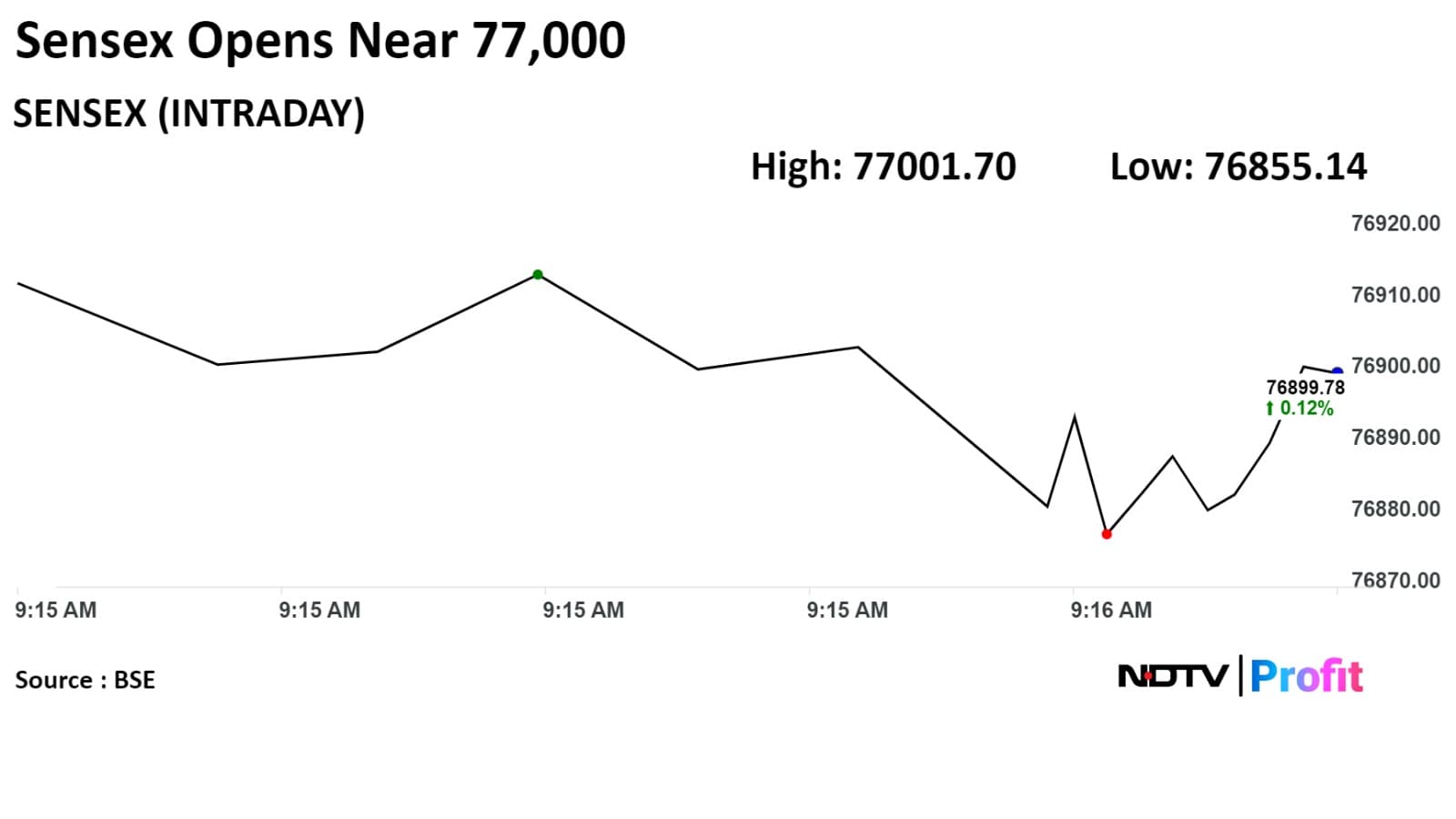

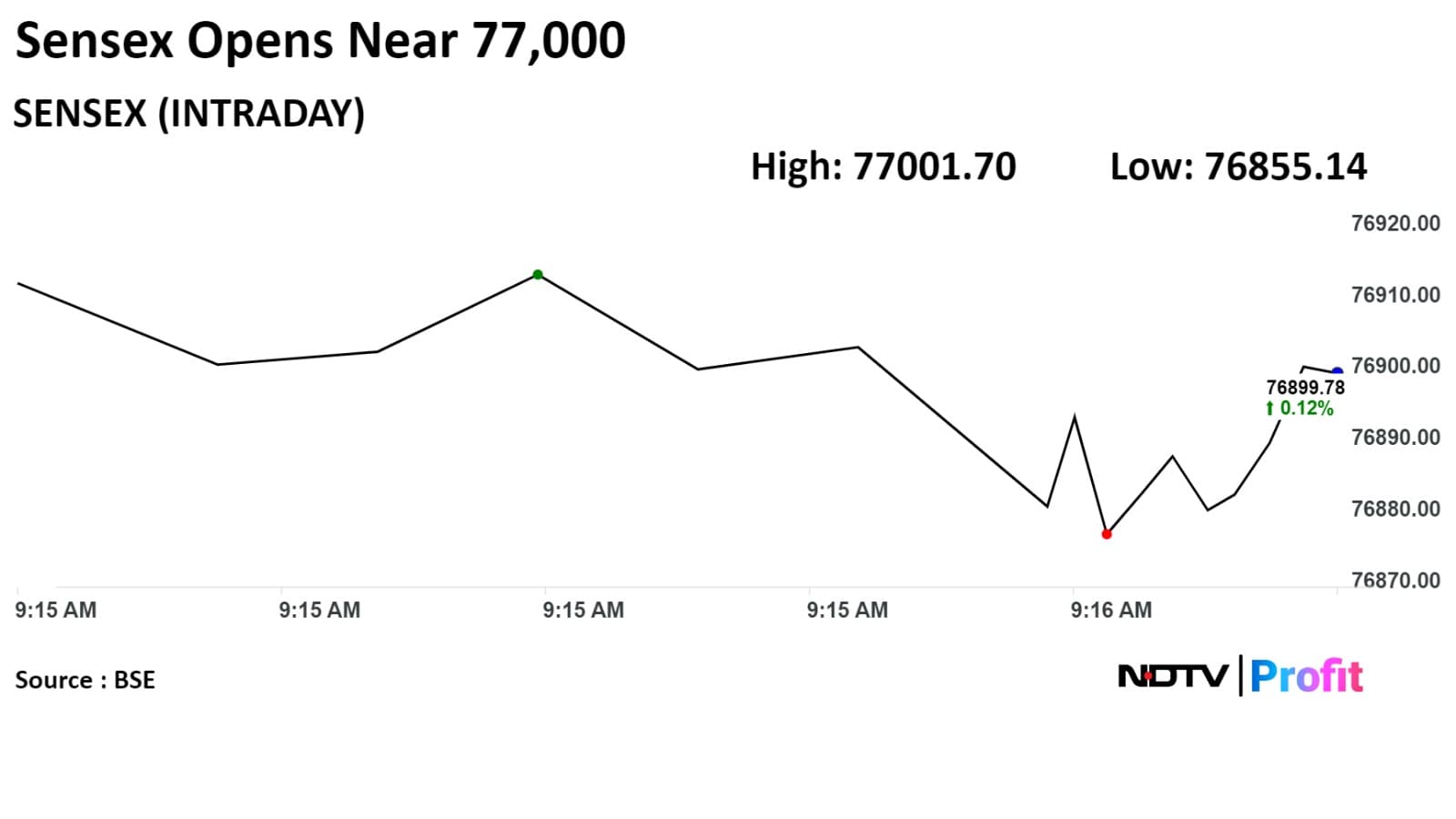

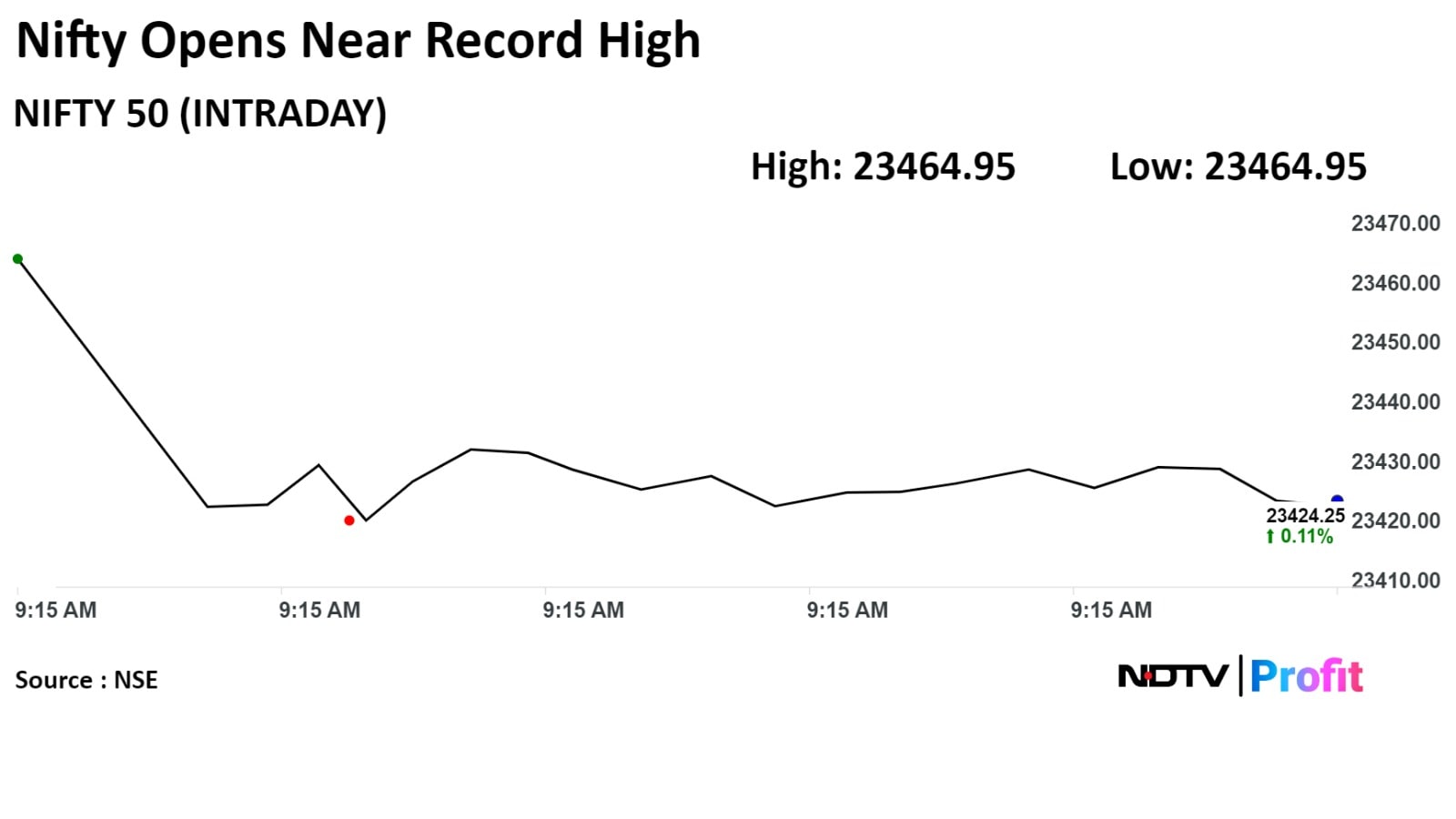

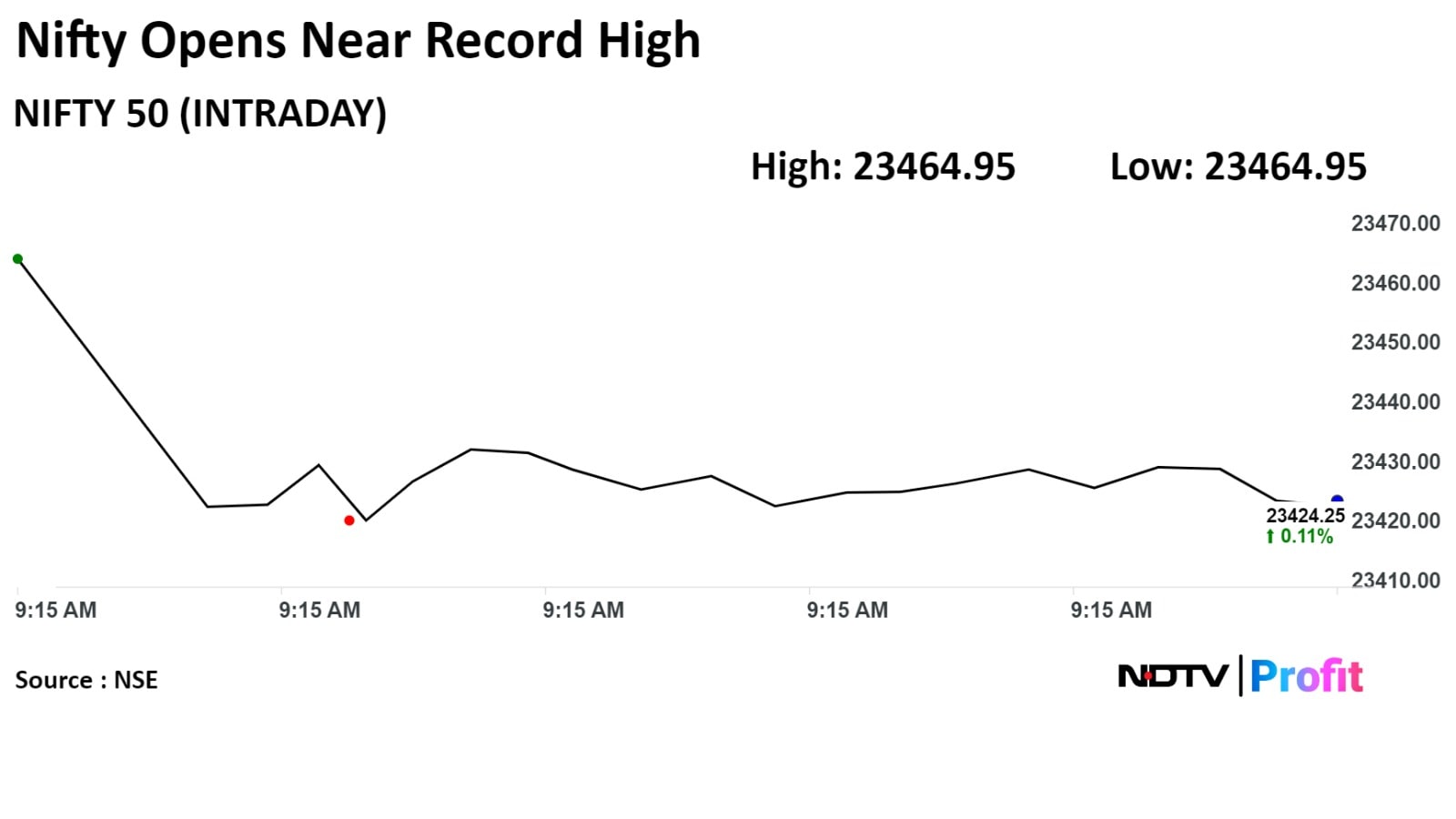

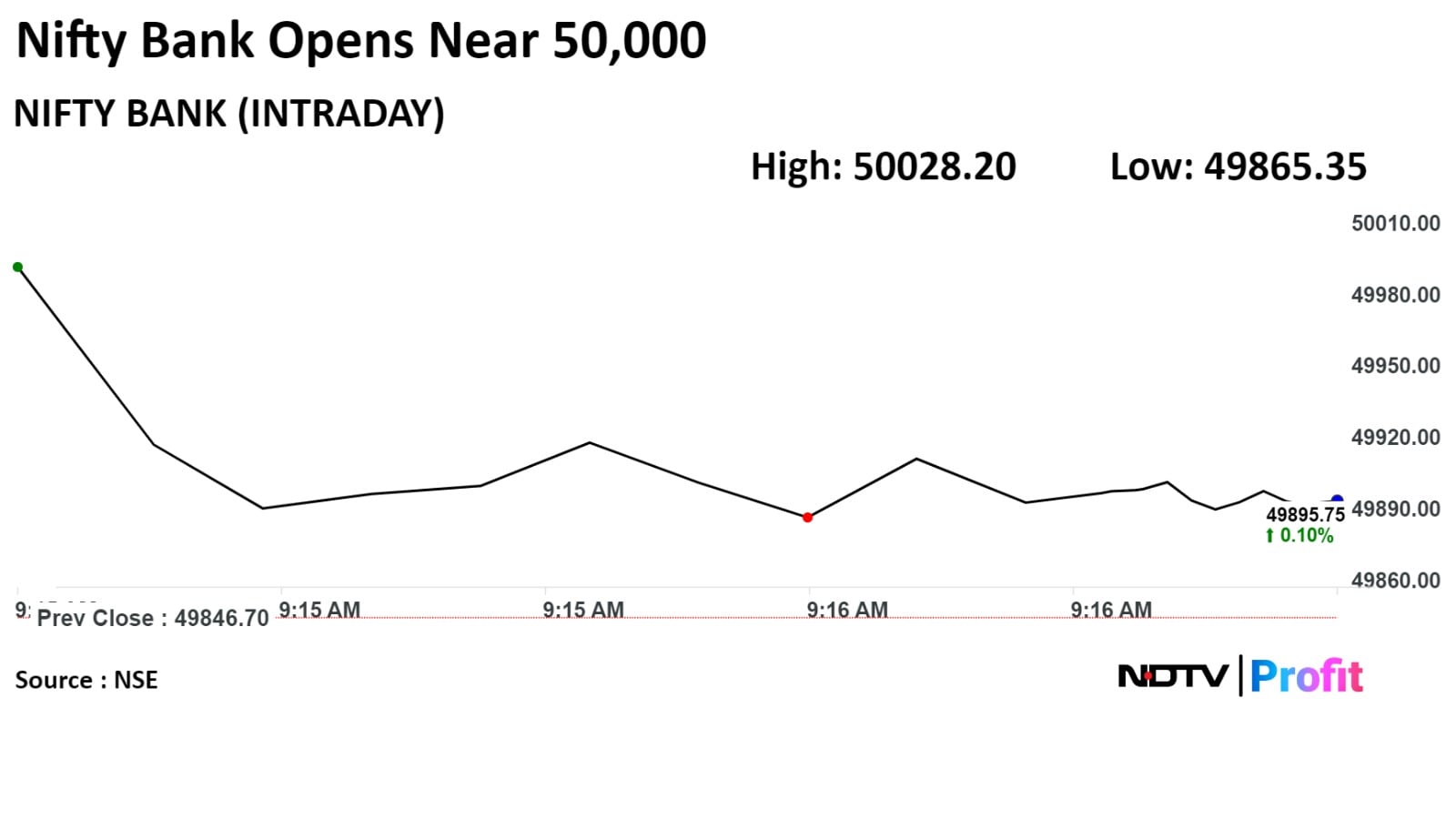

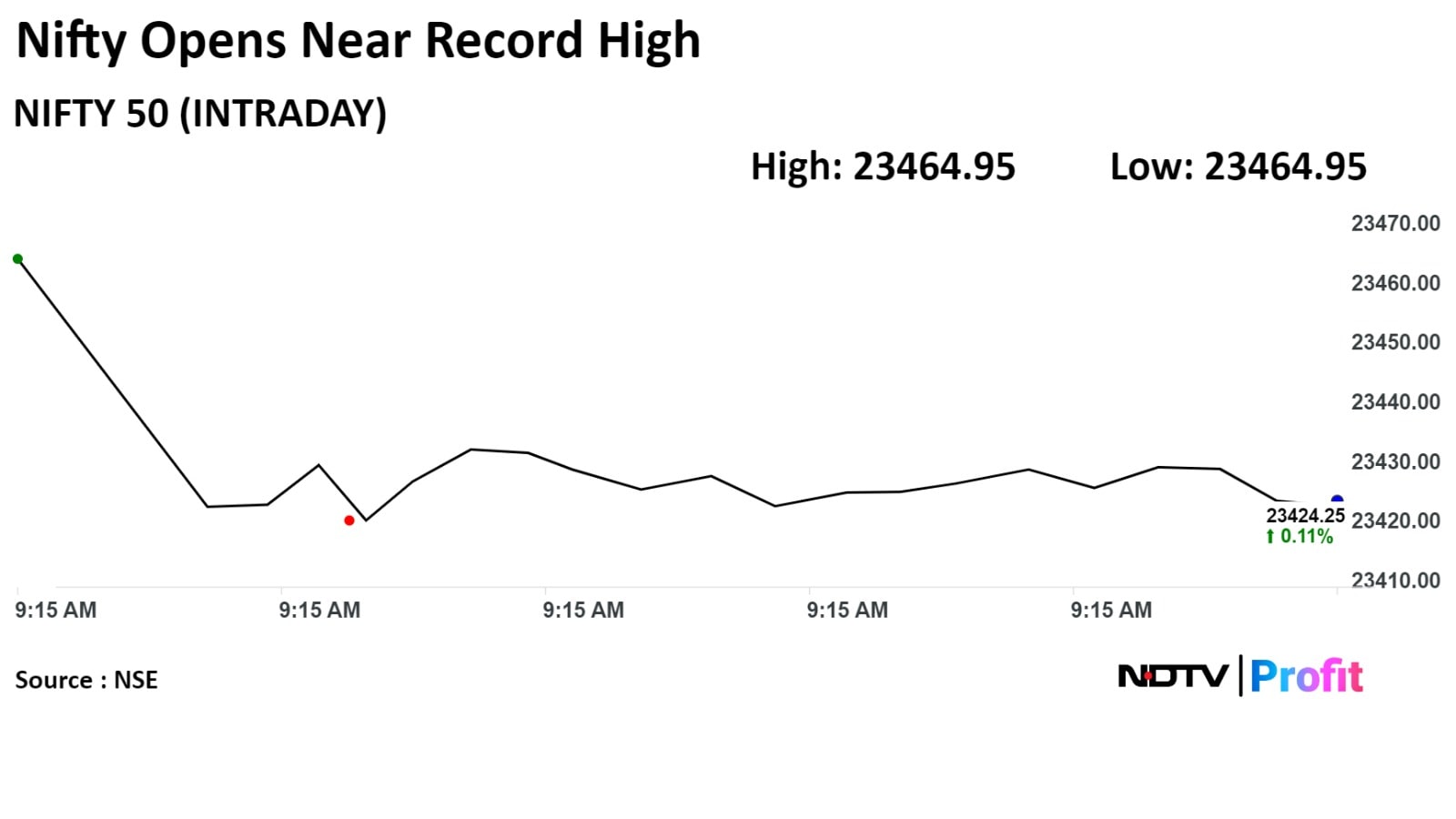

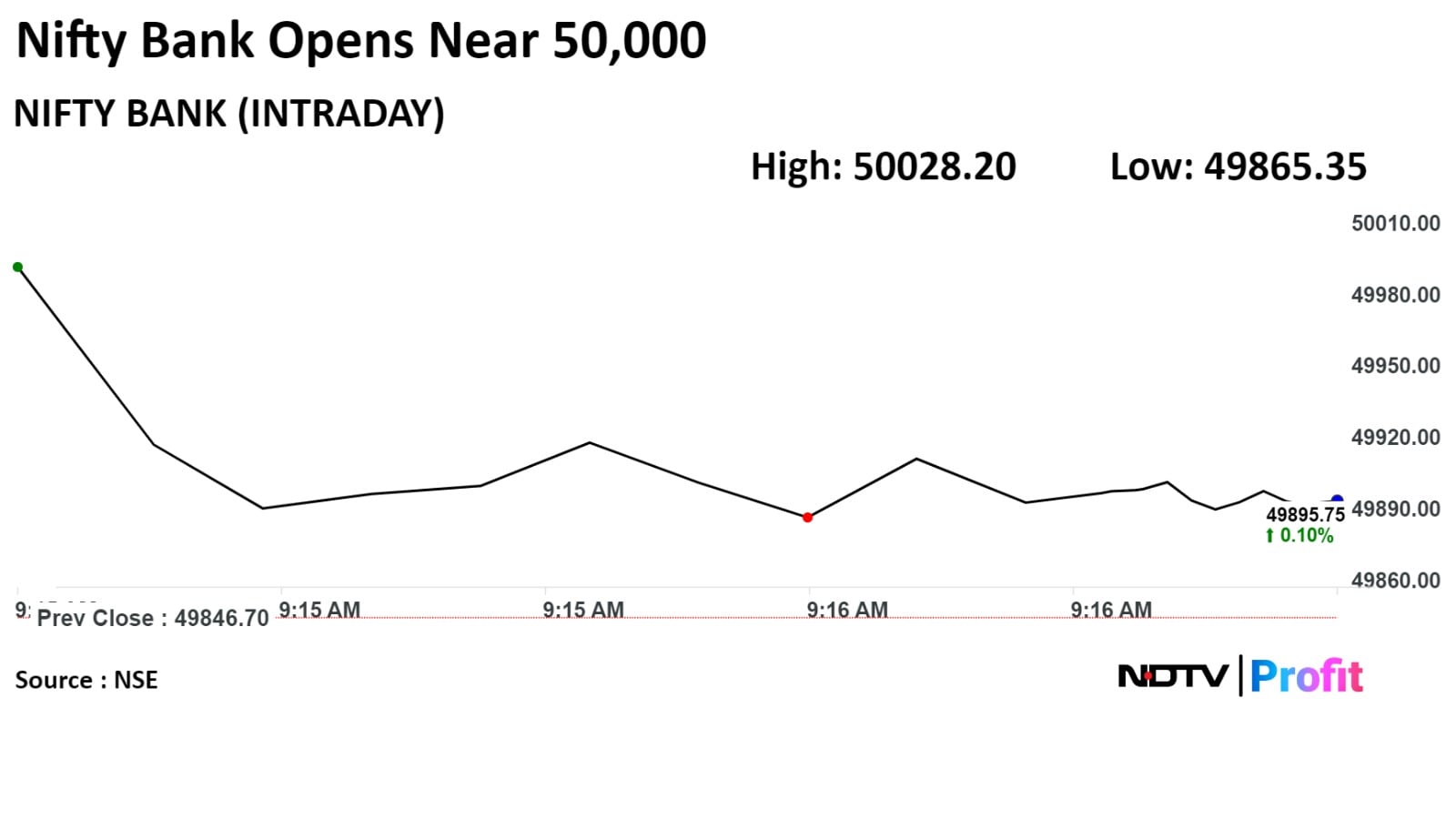

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

Mahindra & Mahindra Ltd., HDFC Bank Ltd., Hindustan Unilever Ltd., Shriram Finance Ltd., and Bajaj Finance Ltd. added to the benchmark indices.

ICICI Bank Ltd., Reliance Industries Ltd., Infosys Ltd., NTPC Ltd., and Bajaj Auto Ltd. weighed on the index.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

Mahindra & Mahindra Ltd., HDFC Bank Ltd., Hindustan Unilever Ltd., Shriram Finance Ltd., and Bajaj Finance Ltd. added to the benchmark indices.

ICICI Bank Ltd., Reliance Industries Ltd., Infosys Ltd., NTPC Ltd., and Bajaj Auto Ltd. weighed on the index.

.png)

On NSE, nine sectors advanced, three declined out of 12. The NSE Nifty Realty rose the most, and the NSE Nifty IT declined the most.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

Mahindra & Mahindra Ltd., HDFC Bank Ltd., Hindustan Unilever Ltd., Shriram Finance Ltd., and Bajaj Finance Ltd. added to the benchmark indices.

ICICI Bank Ltd., Reliance Industries Ltd., Infosys Ltd., NTPC Ltd., and Bajaj Auto Ltd. weighed on the index.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.

On the other hand, if the index moves below 23,300/76,700, a quick intraday correction cannot be ruled out and it can retest 23,200-23,100/76,400-76,200 levels. Reduce long positions around 23600 levels whereas buying is advisable only on dips around 23,200-23,100 levels, he added.

India's benchmark indices opened higher on Friday despite a decline in Asian peers as heavyweight HDFC Bank Ltd., Mahindra & Mahindra Ltd., and Larsen & Toubro Ltd. rose.

As of 09:17 a.m., the NSE Nifty 50 index was 25.05 points or 0.11% higher at 23,423.95, and the S&P BSE Sensex was 75.50 points or 0.1% higher at 76,886.40.

"For trend following traders currently, 23,300/76,700 would act as a sacrosanct support zone. Above that, the positive formation is likely to continue. On the higher side, we can expect 23,500-23,600/77,000-77,300 in the near future," said Shrikant Chouhan, head, equity research, Kotak Securities.