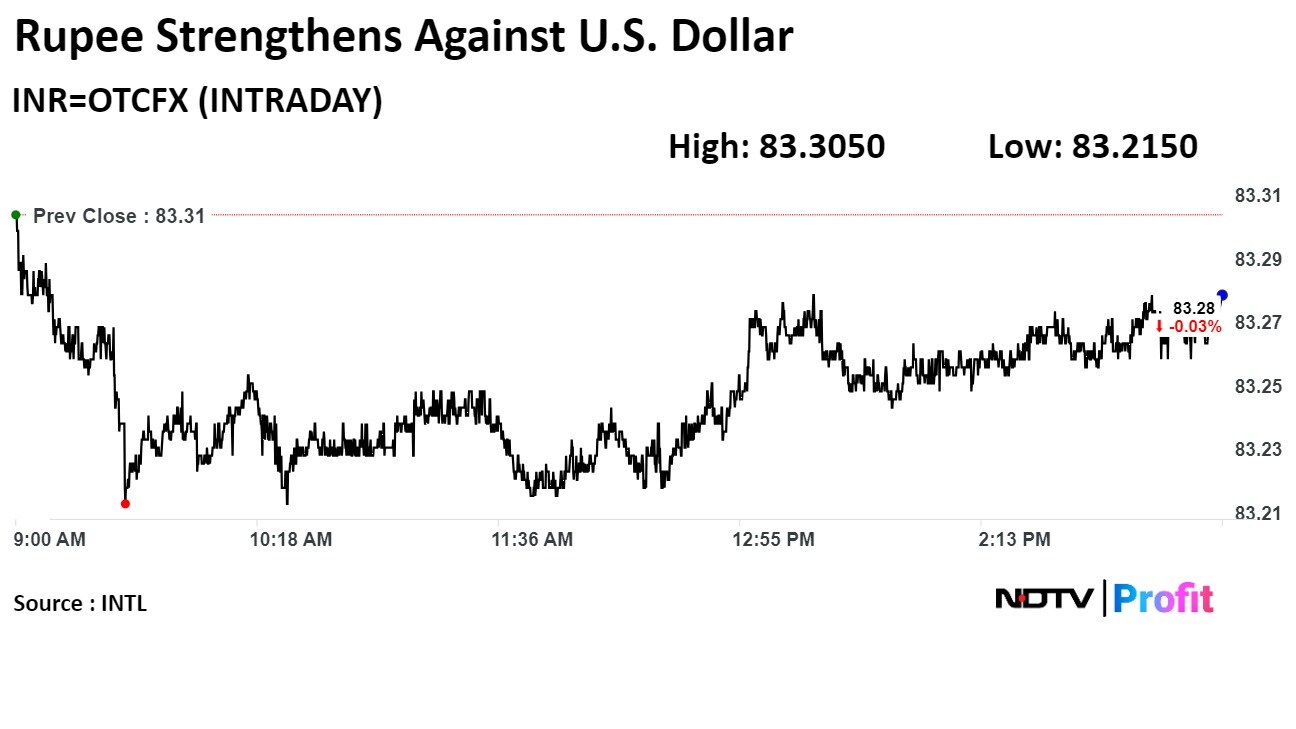

The local currency strengthened by 3 paise to close at 83.28 against the US dollar.

It closed at 83.31 on Tuesday.

Source: Bloomberg

The local currency strengthened by 3 paise to close at 83.28 against the US dollar.

It closed at 83.31 on Tuesday.

Source: Bloomberg

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

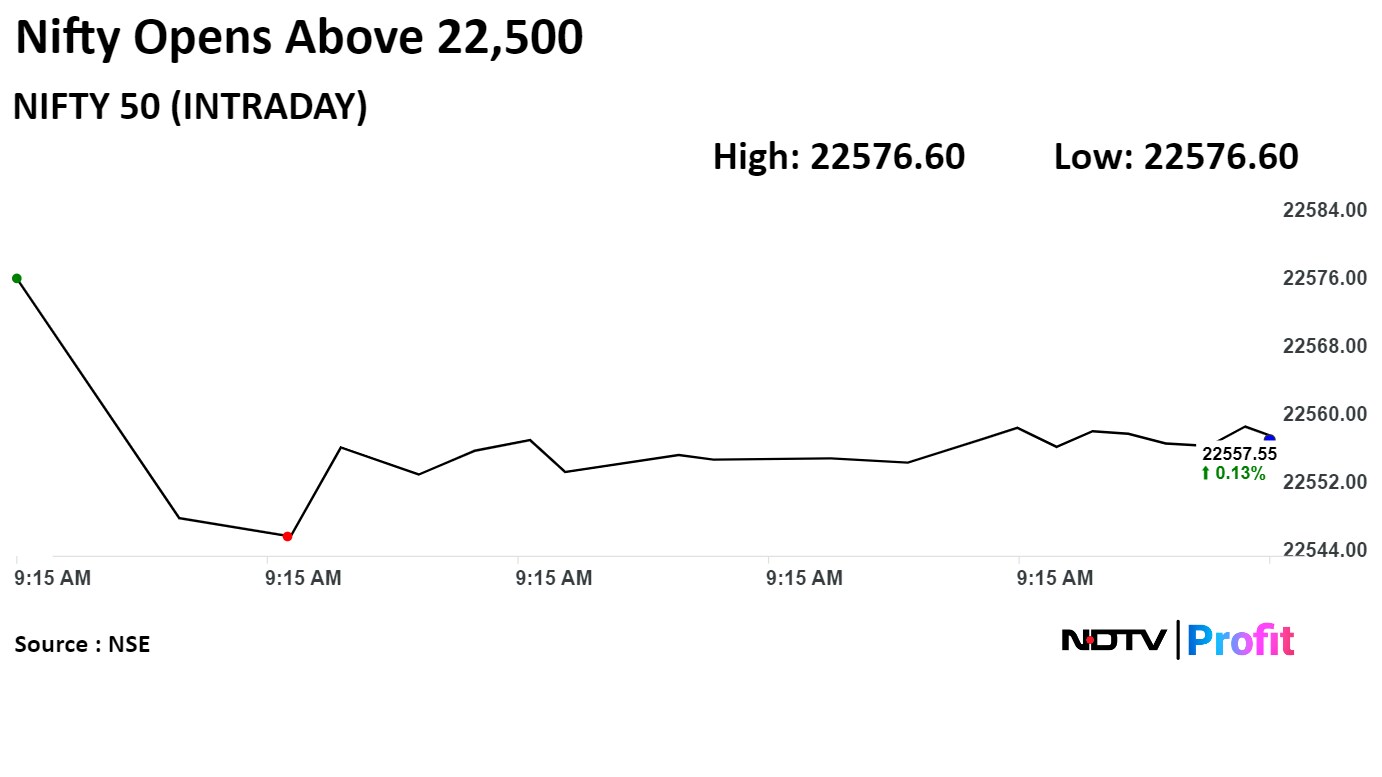

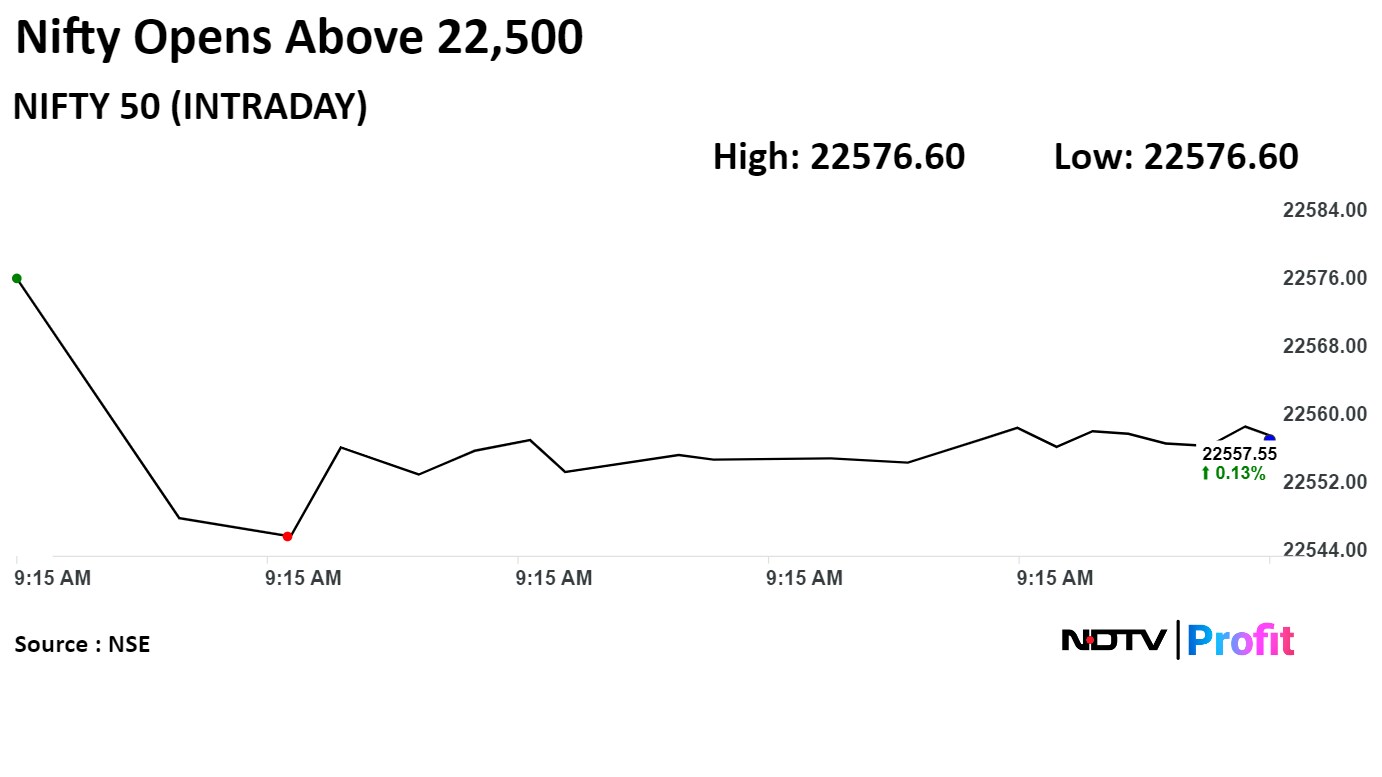

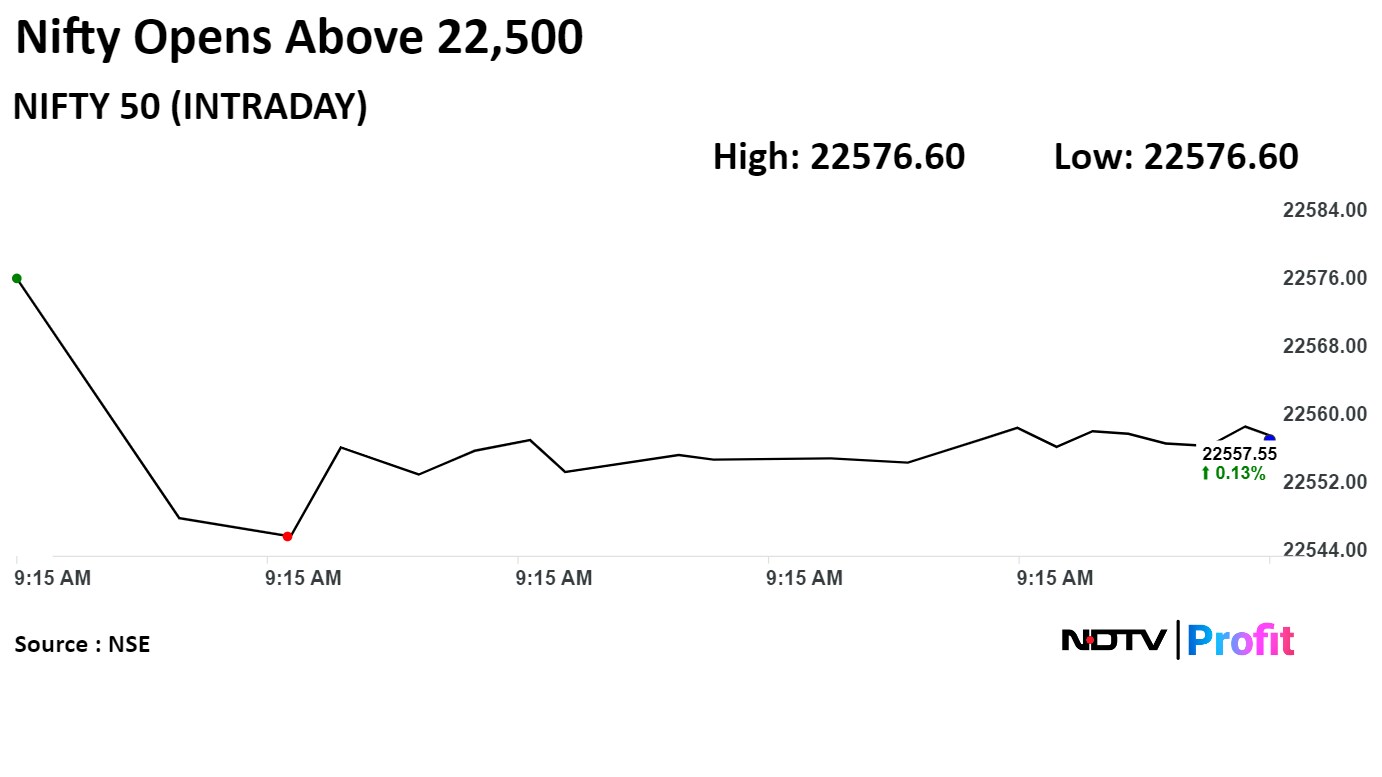

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

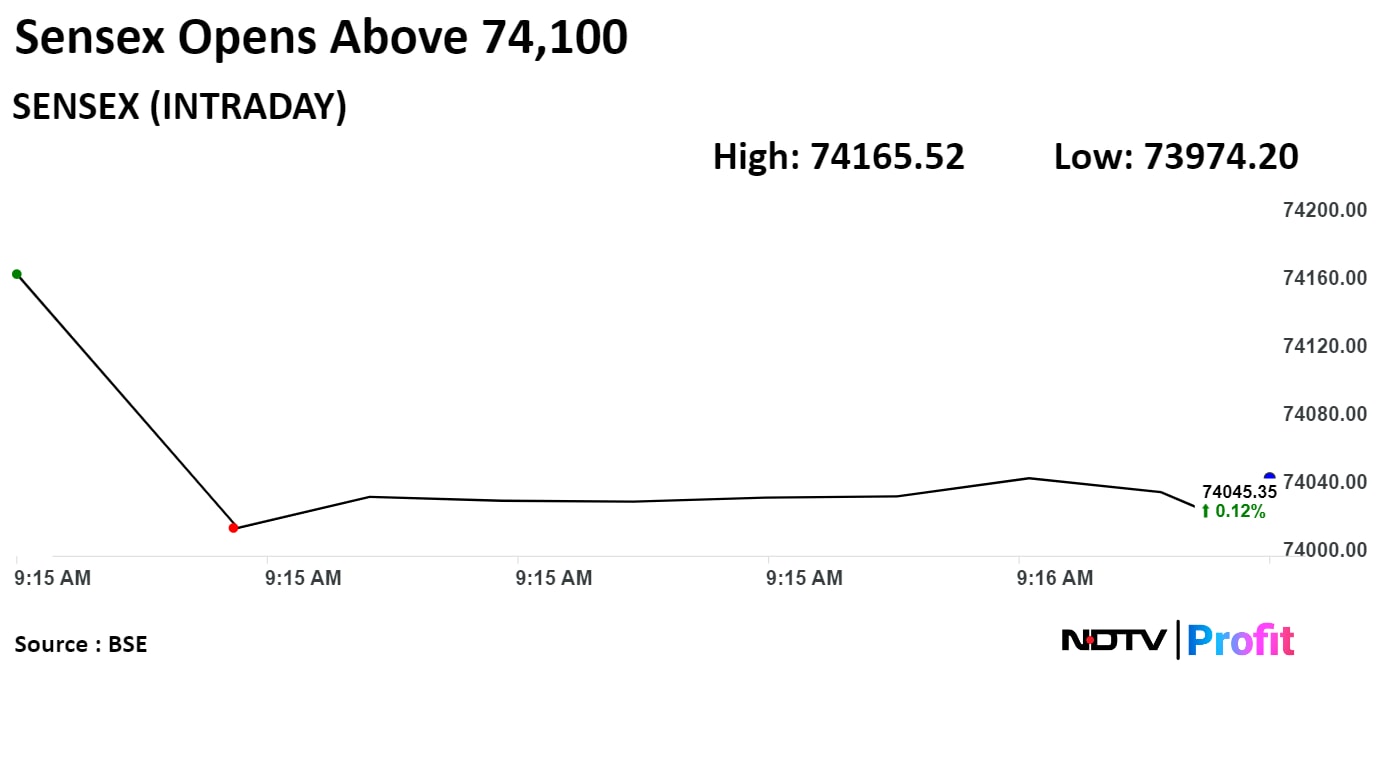

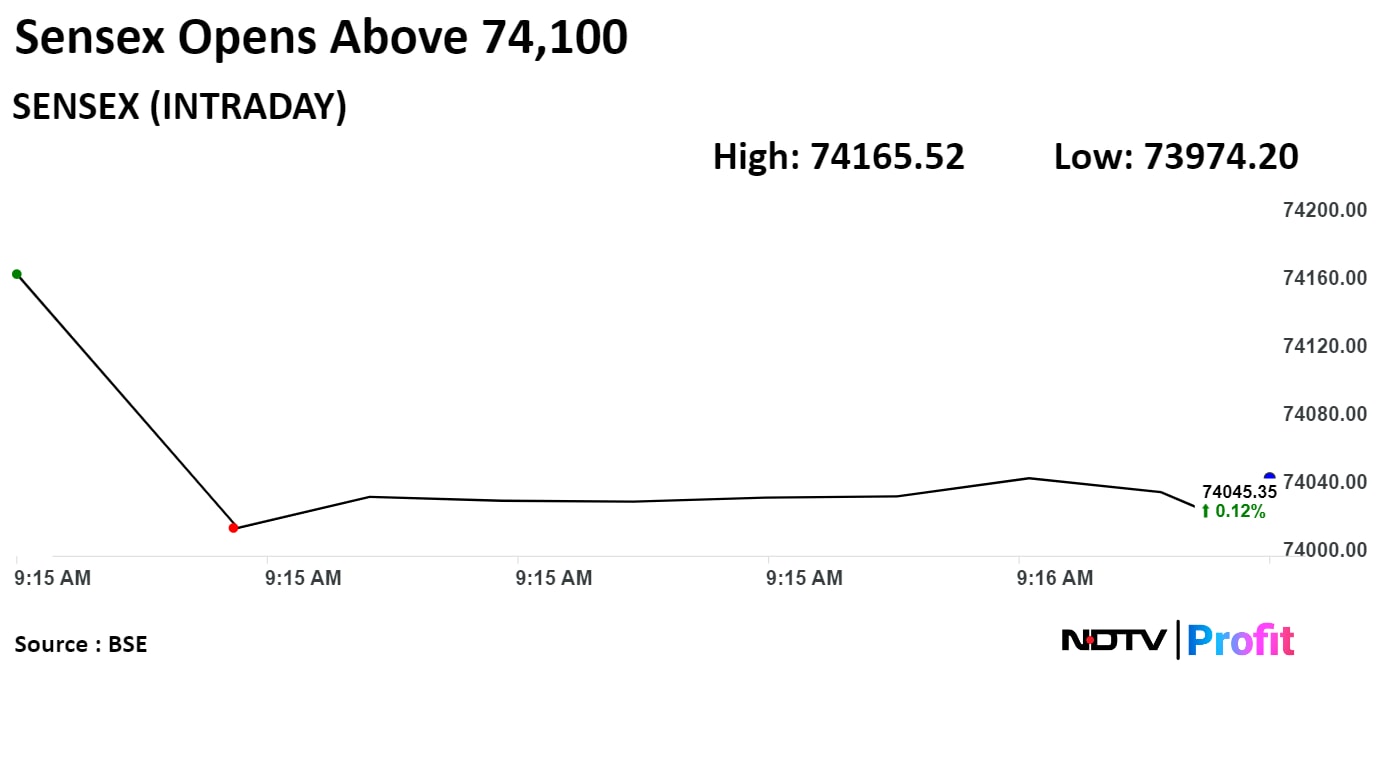

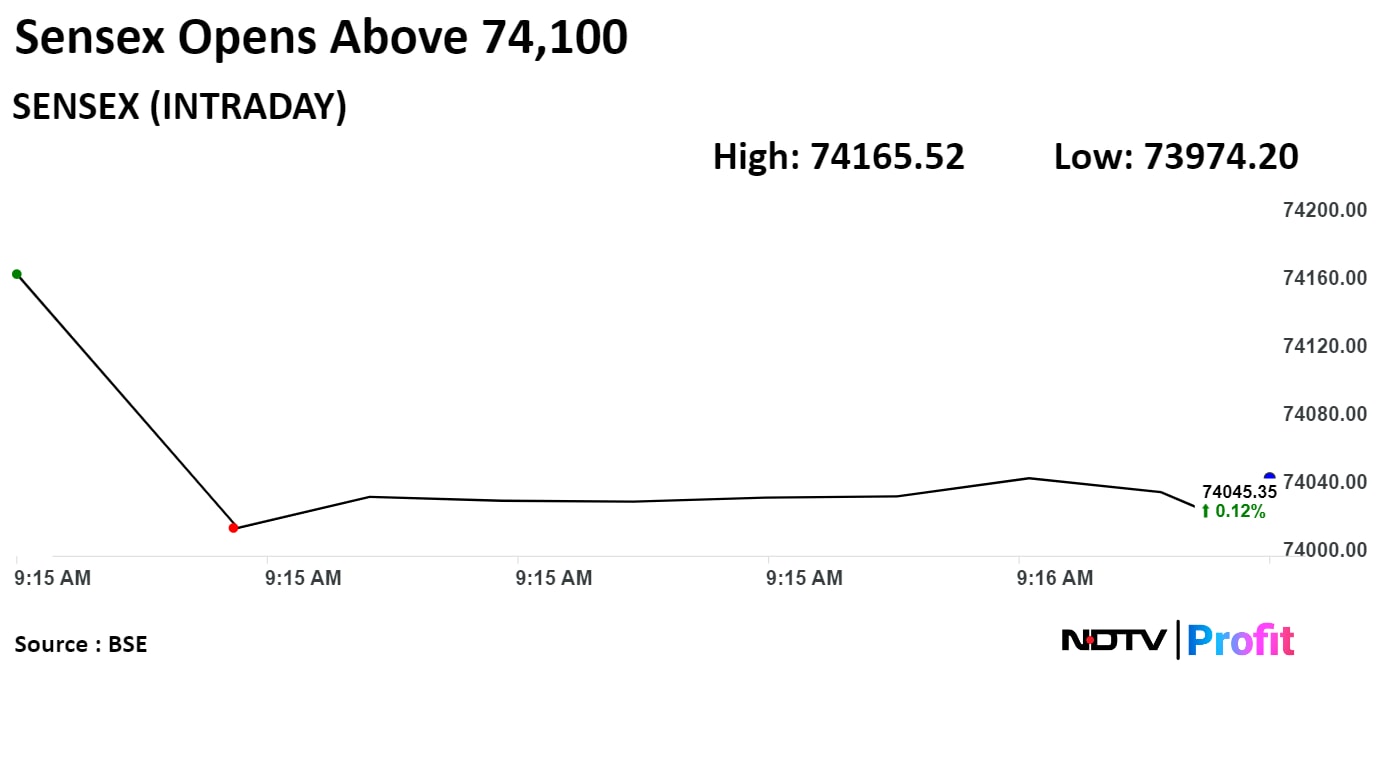

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

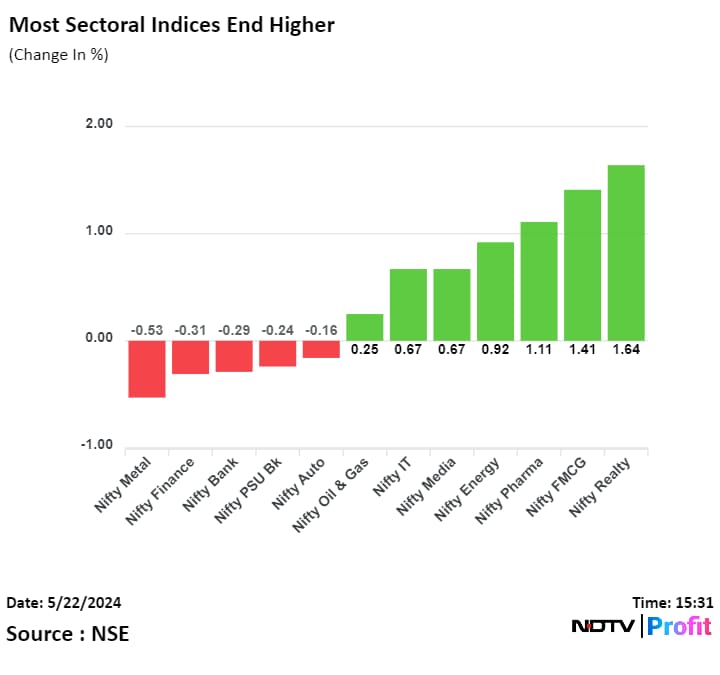

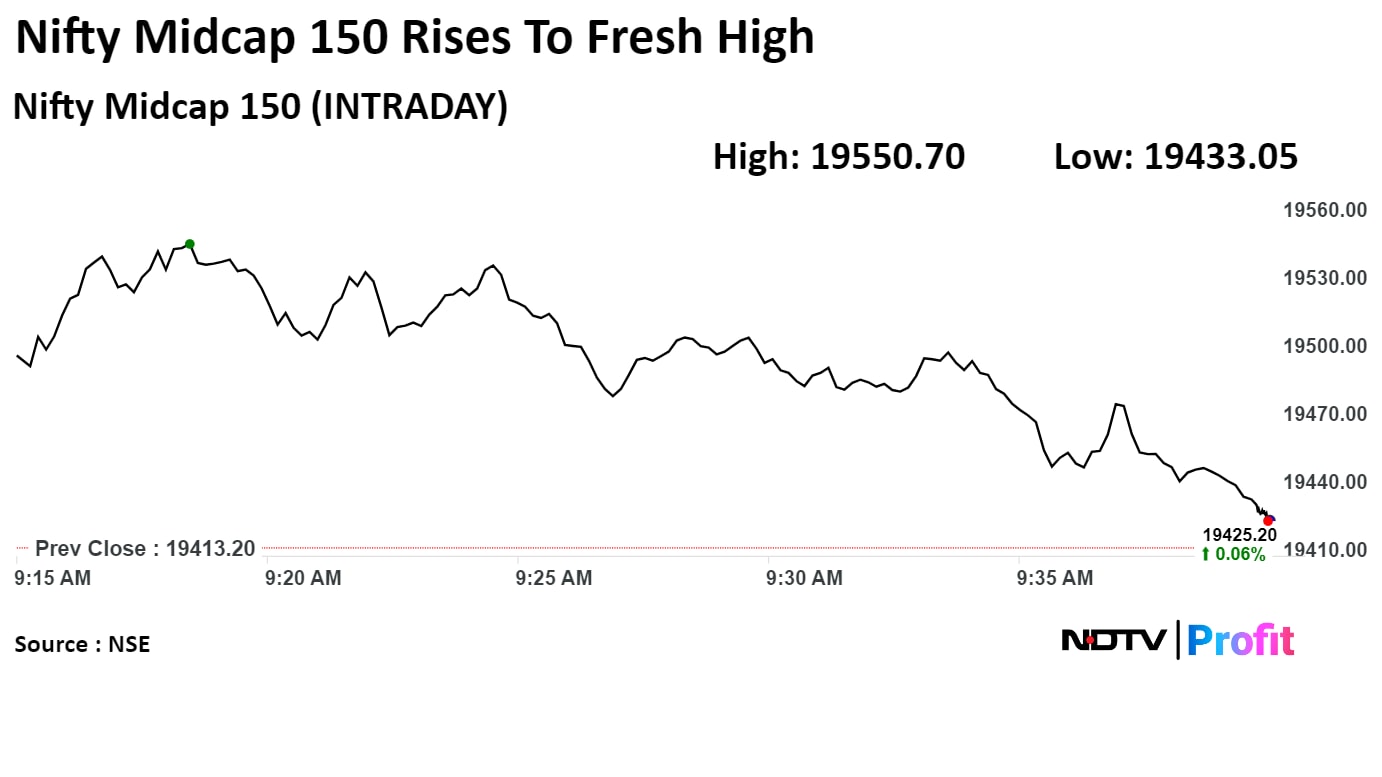

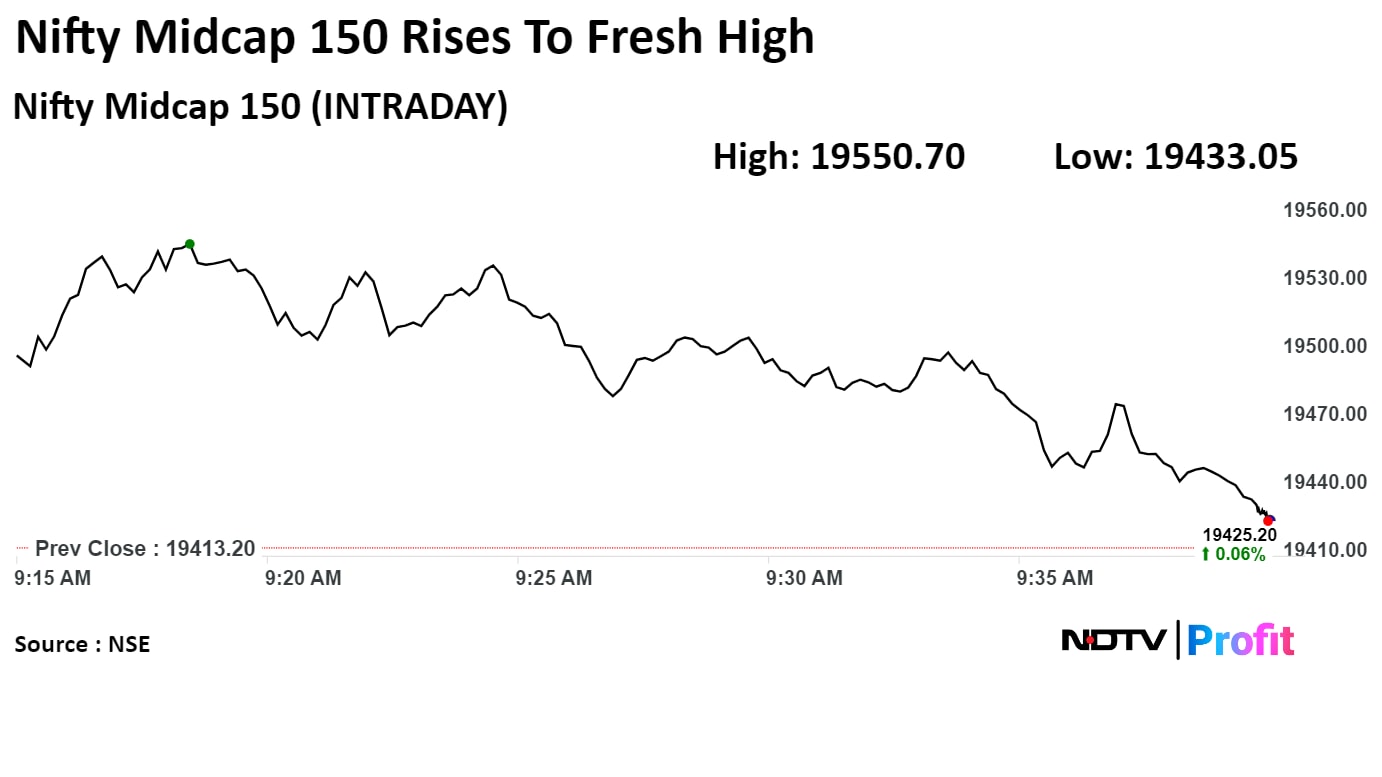

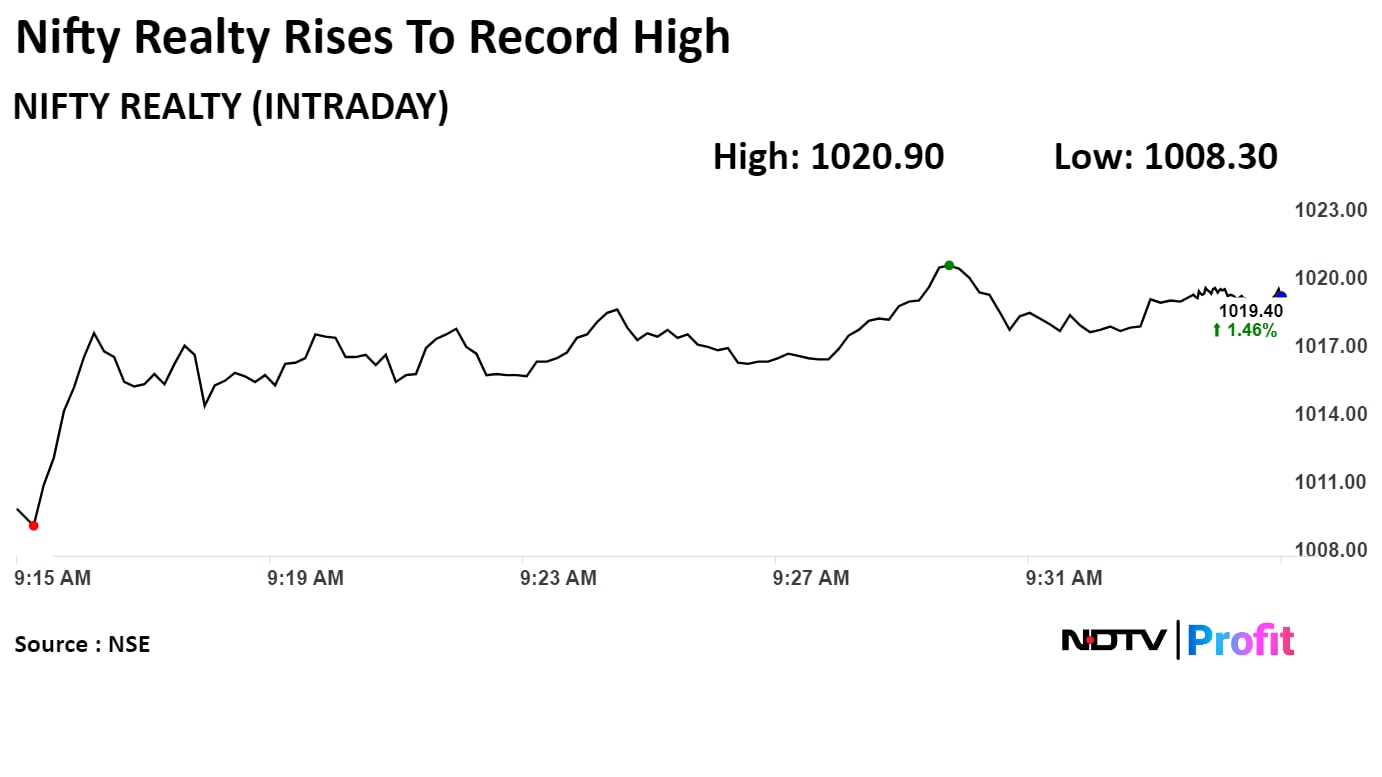

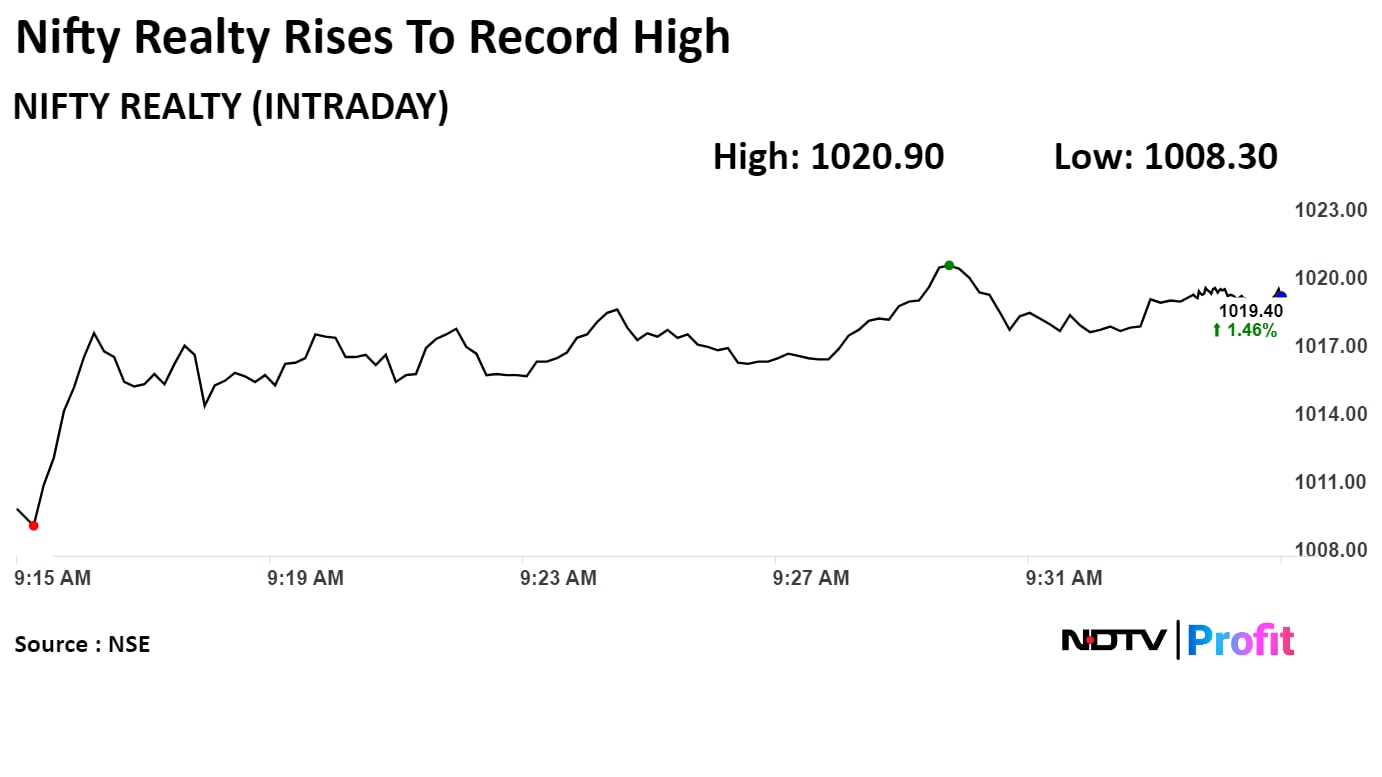

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

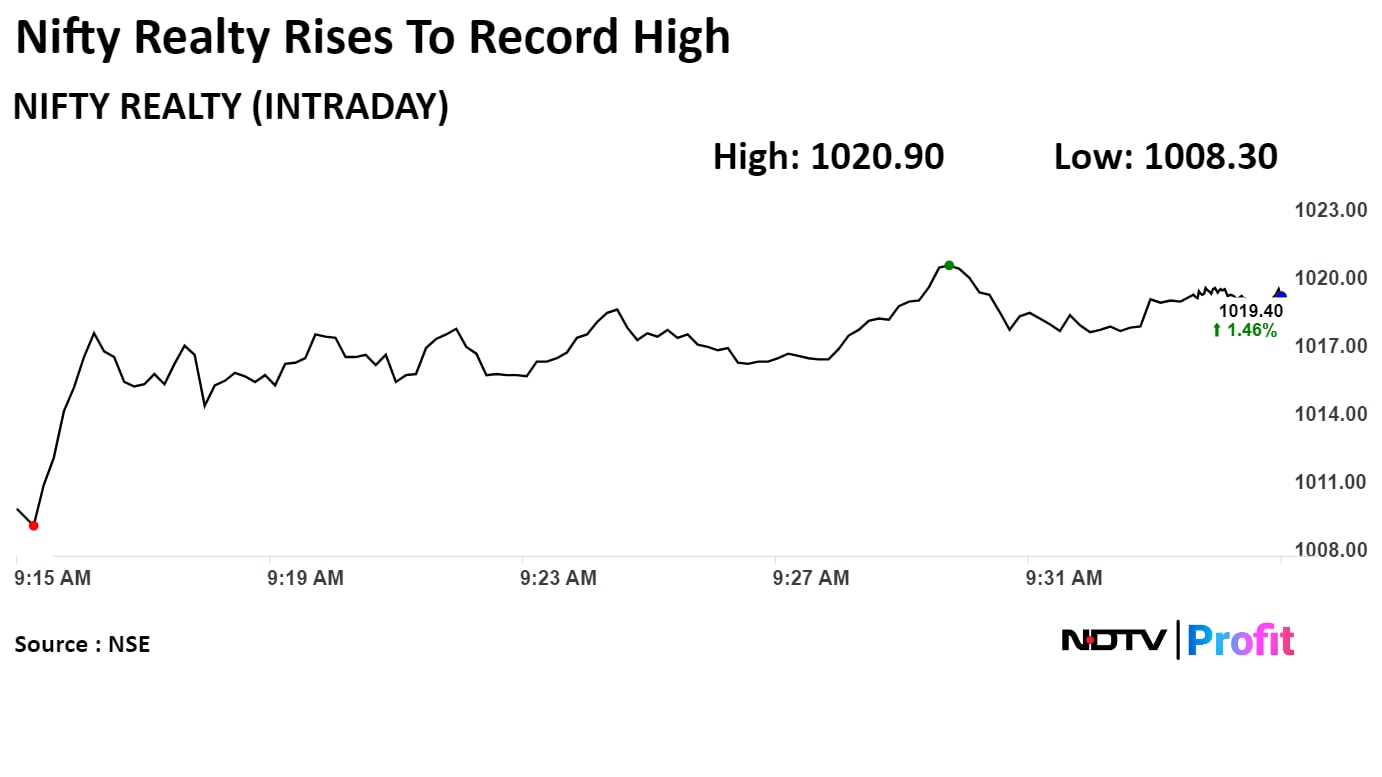

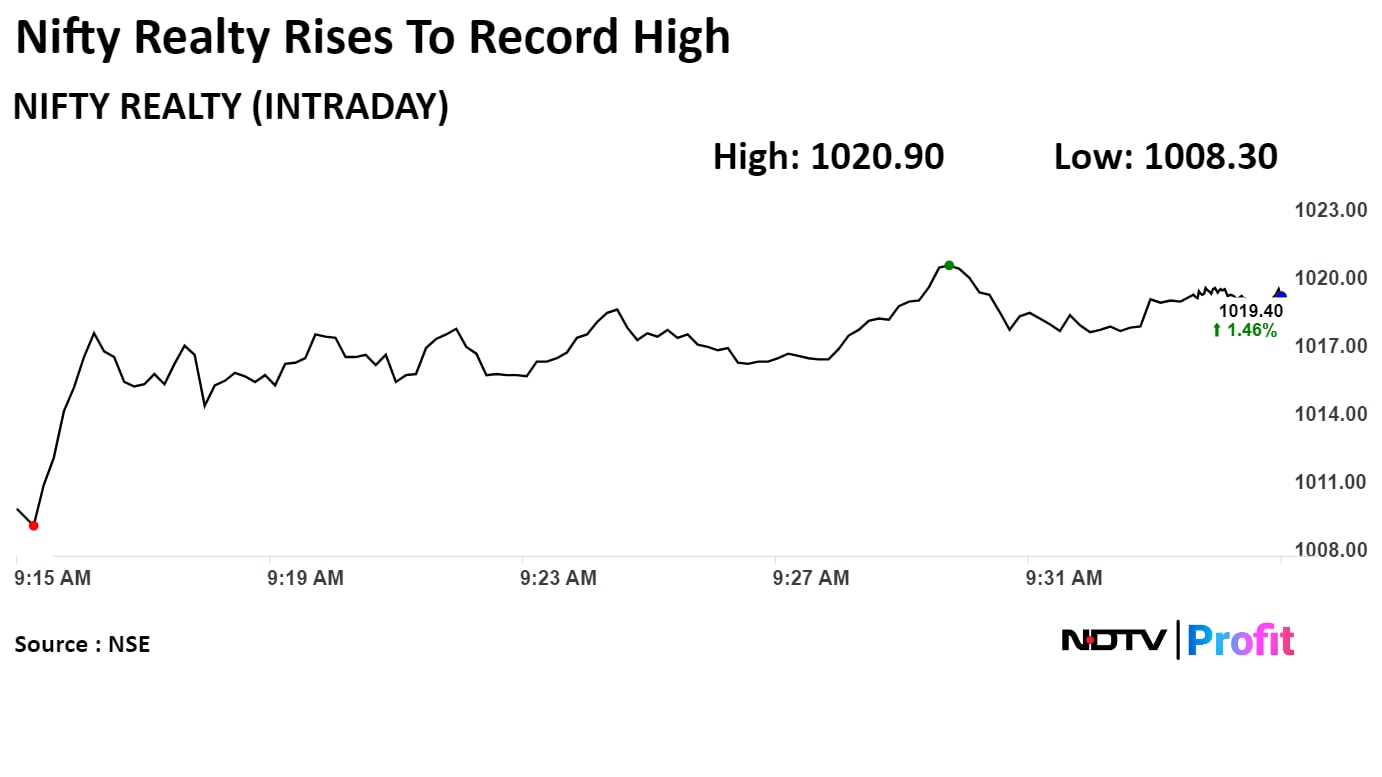

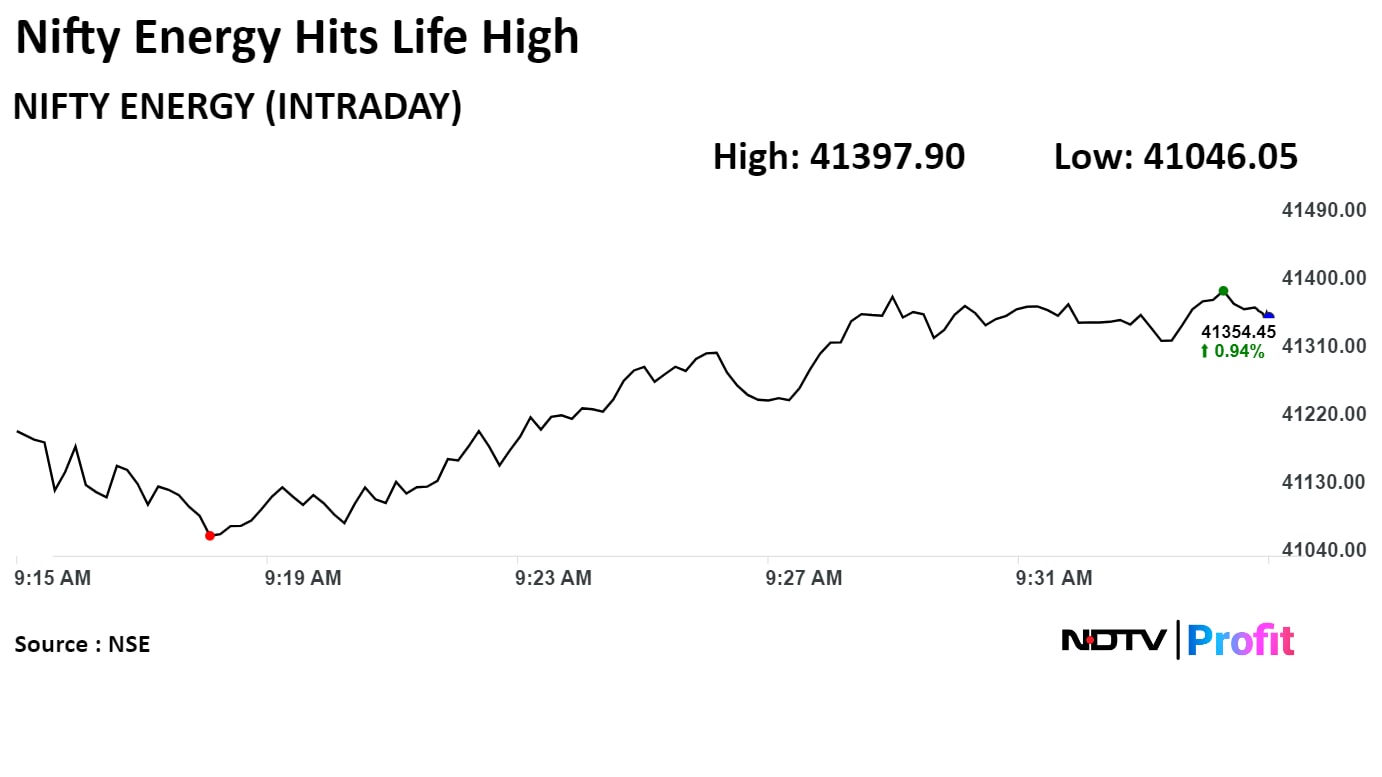

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

.png)

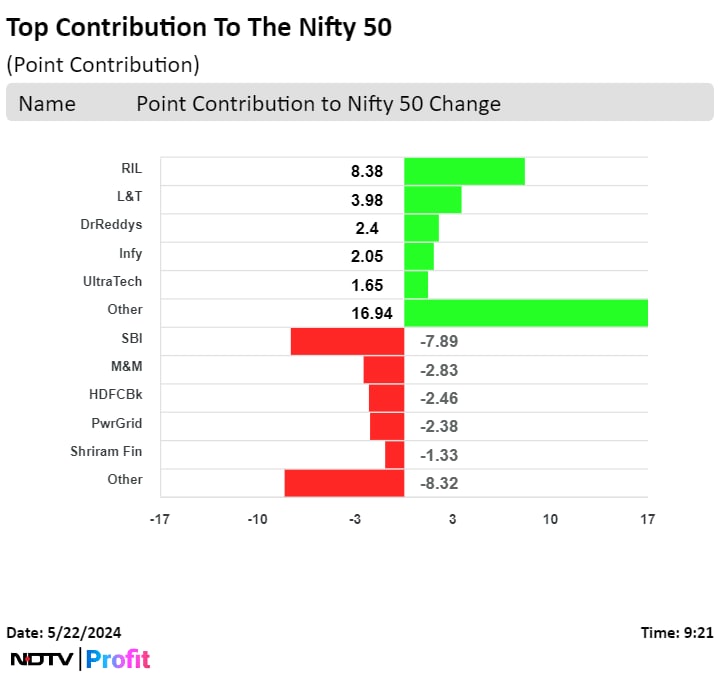

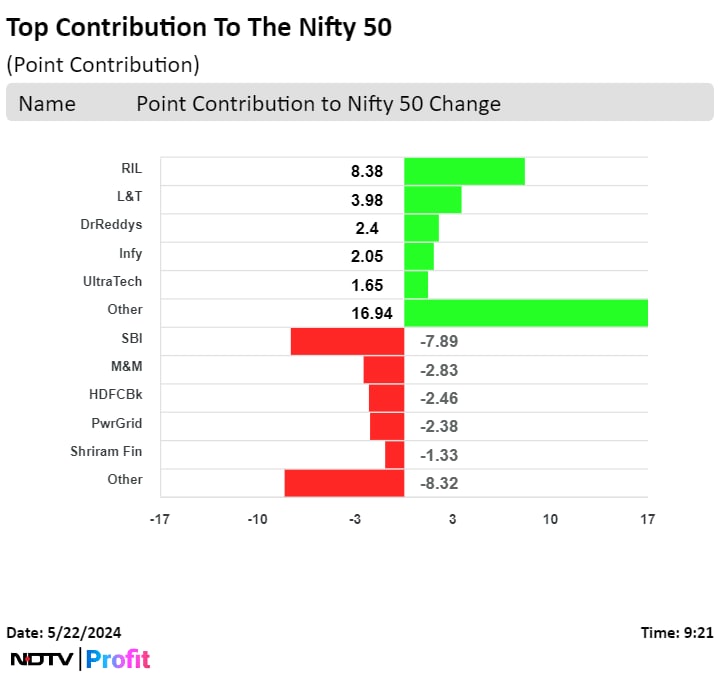

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd., HDFC Bank Ltd. added to the index.

State Bank of India, ICICI Bank Ltd., Axis Bank Ltd., Shriram Finance Ltd., and Hindalco Industries Ltd. weighed on the benchmark indices.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

.png)

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd., HDFC Bank Ltd. added to the index.

State Bank of India, ICICI Bank Ltd., Axis Bank Ltd., Shriram Finance Ltd., and Hindalco Industries Ltd. weighed on the benchmark indices.

.png)

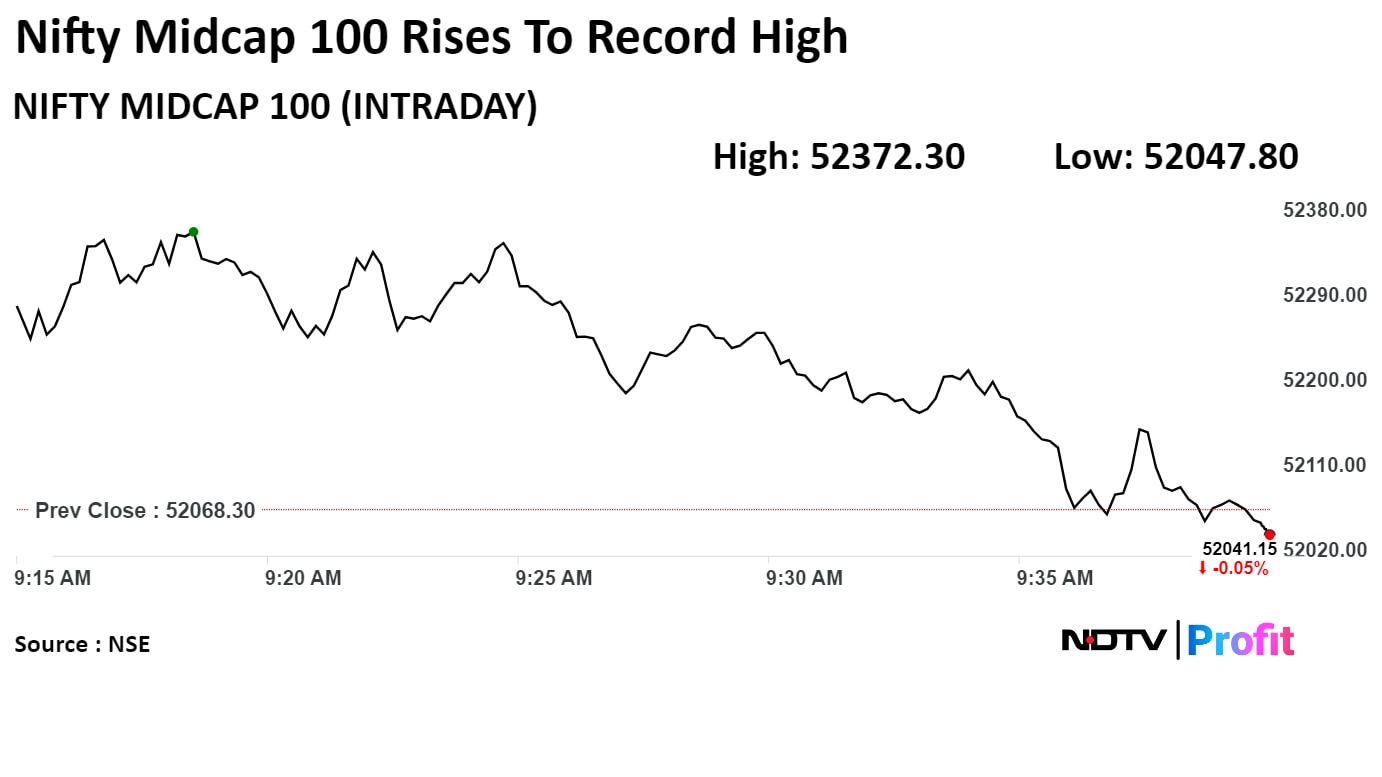

On NSE, seven sector advanced, and five declined out of 12. The NSE Nifty Realty rose the most among its peers, and the NSE Nifty Metal was the worst performing sector.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

.png)

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd., HDFC Bank Ltd. added to the index.

State Bank of India, ICICI Bank Ltd., Axis Bank Ltd., Shriram Finance Ltd., and Hindalco Industries Ltd. weighed on the benchmark indices.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

India's benchmark indices ended the range-bound session higher tracking gains in shares of Reliance Industries Ltd., Infosys Ltd., and Hindustan Unilever Ltd.

The NSE Nifty 50 settled 68.75 points or 0.31% higher at 22,597.80. This index settled higher four fifth consecutive session and recorded longest winning streak since April 25.

The S&P BSE Sensex 267.75 points or 0.36% higher at 74,221.06.

During the last leg of the trade, the NSE Nifty 50 rose 0.45% to 22,629.50, and the S&P BSE Sensex rose 0.48% to 74,307.79.

"Markets remained volatile for another session but ended with modest gains. After a flat start, Nifty fluctuated within a narrow range for most of the session, closing at 22,586. Sector trends were mixed, with FMCG and realty showing decent gains, while metal and banking lagged. The broader indices mirrored the same pattern, resulting in flat market breadth," said Ajit Mishra, senior vice president, research, Religare Broking Ltd.

All key sectors are contributing to the index's recovery, but the banking sector's underperformance is limiting momentum. Amid the market's choppiness, we anticipate the Nifty index will retest its record high soon. We continue to recommend a stock-specific approach, using dips or periods of consolidation to accumulate quality stocks, Mishra said.

.png)

.png)

"A late surge in heavyweight counters pushed the Index higher to settle the session at 22,597.80 with gains of 68.75 points," said Aditya Gaggar, director, Progressive Shares.

Among the sectors, FMCG was the top performer of the day followed by Realty and Energy. On the flip side, Metal sector witnessed a round of profit booking after a spectacular rally in the previous session. Midcap segment underperformed the benchmark index but ended in green; while on the other hand, Smallcaps ended in the red. Back-to-back green candles on the daily chart indicate a strong bullish momentum and now the immediate hurdle for the Index stands at its previous high 22,780 while the support level shifted higher at 22,470, Gaggar said.

.png)

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd., HDFC Bank Ltd. added to the index.

State Bank of India, ICICI Bank Ltd., Axis Bank Ltd., Shriram Finance Ltd., and Hindalco Industries Ltd. weighed on the benchmark indices.

.png)

On NSE, seven sector advanced, and five declined out of 12. The NSE Nifty Realty rose the most among its peers, and the NSE Nifty Metal was the worst performing sector.

On BSE, broader markets ended on a mixed note. The S&P BSE Midcap ended 0.05% lower, and the S&P BSE Smallcap settled 0.18% higher.

On BSE, 15 sectors advanced, and five declined out of 20. The S&P BSE Realty was the top performing sector, and the S&P BSE Bankex was the top loser.

Market breadth was even split between buyers and sellers. Around 1,923 stocks declined, 1,906 stocks advanced, and 119 stocks remained unchanged on BSE.

Revenue up 9.62% at Rs 11,983 crore vs Rs 10,931 crore,

EBITDA up 9.26% at Rs 3092 crore vs Rs 2829 crore

Margin down 8 bps at 25.8% vs 25.9%

Net profit up 33.76% at Rs 2654 crore vs Rs 1984 crore

Margin at 27% vs 28%

Ebitda rose 12.1 to Rs 382 crore from Rs 340 crore

Revenue rose 17.2% to Rs 1,423 crore from Rs 1,215 crore

Net profit rose 0.2% to Rs 252 crore from Rs 251 crore

Net profit fell 9.6% to Rs 28 crore from Rs 31 crore

Revenue fell 0.6% to Rs 2,432 crore from Rs 2,445 crore

EBIT rose 2.6% to Rs 23.1 crore from Rs 22.5 crore

EBIT margin at 0.94% vs 0.92%

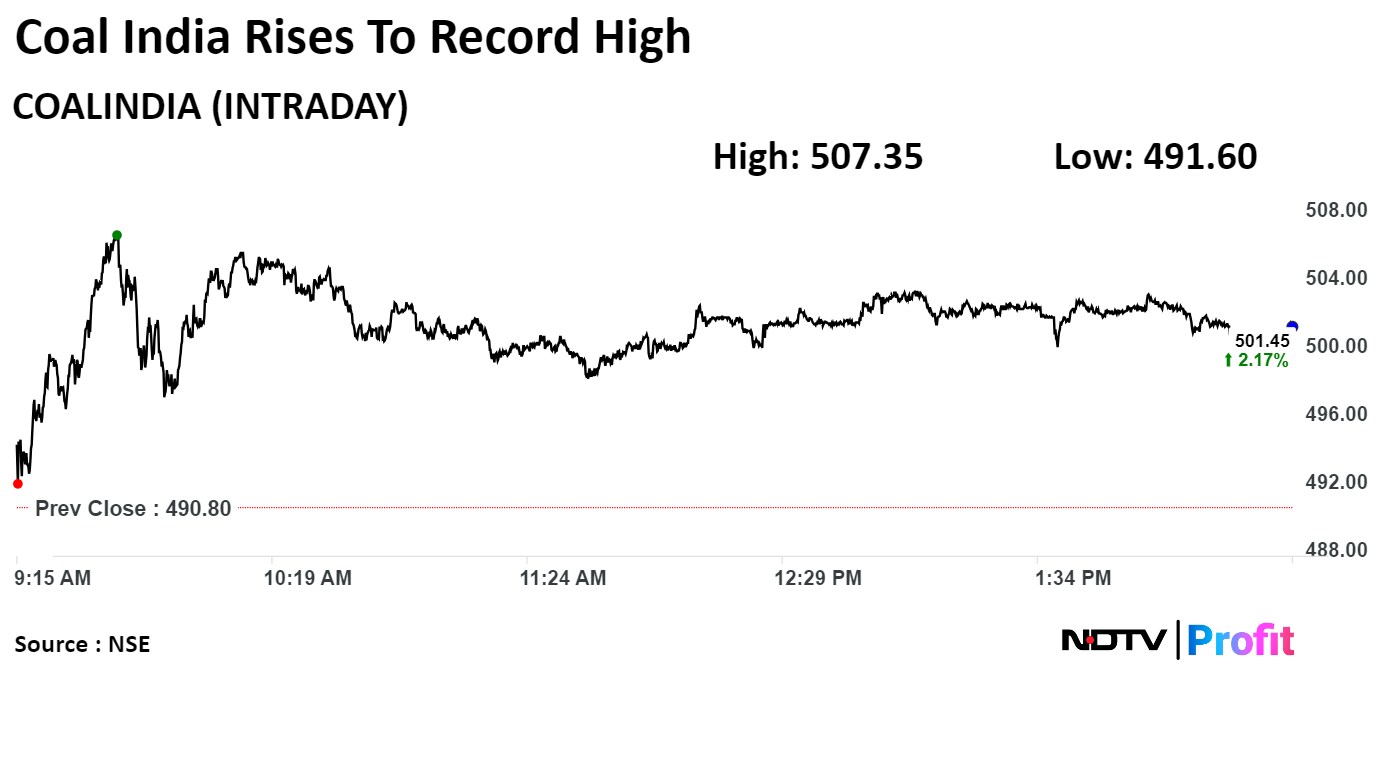

Shares of Coal India Ltd. rose 3.40% to Rs 507.35, the highest level since its listing on Nov 4, 2010. It was trading 2.19% higher at Rs 501.40 as of 2:41 p.m., as compared to 0.27% advance in the NSE Nifty 50 index.

Shares of Coal India Ltd. rose 3.40% to Rs 507.35, the highest level since its listing on Nov 4, 2010. It was trading 2.19% higher at Rs 501.40 as of 2:41 p.m., as compared to 0.27% advance in the NSE Nifty 50 index.

Revenue up 17.4% at Rs 1284 crore vs Rs 1,093 crore

Ebitda down 2.9% at Rs 130 crore vs Rs 133 crore

Margin at 10.1% vs 12.2%

Net profit up 11% at Rs 113 crore vs Rs 101 crore

Burgan Bank selects Tata Consultancy Services Ltd.'s BaNCS for core banking.

Source: Exchange filing

Revenue rose 10% to Rs 1,084 crore from Rs 986 crore

Ebitda rose 48% to Rs 230 crore from Rs 156 crore

Ebitda margin fell 540 basis points to 21.2% from 15.8%

Net profit at Rs 10.4 cror vs loss of Rs 14 crore

The IPO has been subscribed 1.02 times as of 1:51 p.m. on Wednesday.

Institutional investors: Nil.

Non-institutional investors: 1.07 times.

Retail investors: 3.93 times.

Employee reserved: 2.64 times.

BEML Ltd. rose as much as 12.01% to Rs 4,680 apiece, the highest level since its listing on Nov 5, 2003. It pared gains to trade 8.92% higher at Rs 4,550.00 apiece, as of 1:34 p.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 216.39% in 12 months, and on year to date basis, it has risen 60.92%. Total traded volume so far in the day stood at 5.4 times its 30-day average. The relative strength index was at 78.30, which implied the stock is overbought.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.4%.

BEML Ltd. rose as much as 12.01% to Rs 4,680 apiece, the highest level since its listing on Nov 5, 2003. It pared gains to trade 8.92% higher at Rs 4,550.00 apiece, as of 1:34 p.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 216.39% in 12 months, and on year to date basis, it has risen 60.92%. Total traded volume so far in the day stood at 5.4 times its 30-day average. The relative strength index was at 78.30, which implied the stock is overbought.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.4%.

Mahindra & Mahindra Financial Services Ltd. received a certificate of registration from IRDAI to act as a Corporate Agent.

Certification will help the company to undertake business in life, health & general insurance.

Source: Exchange filing

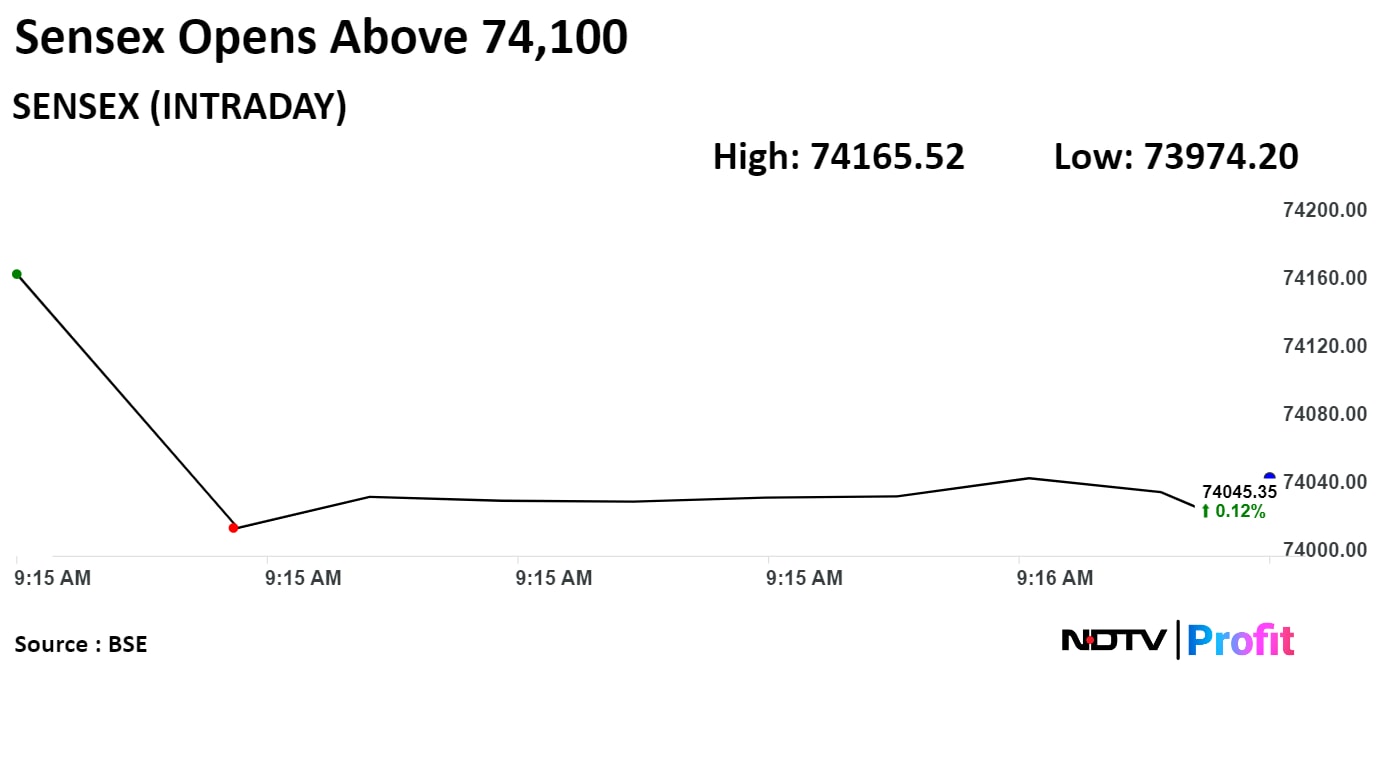

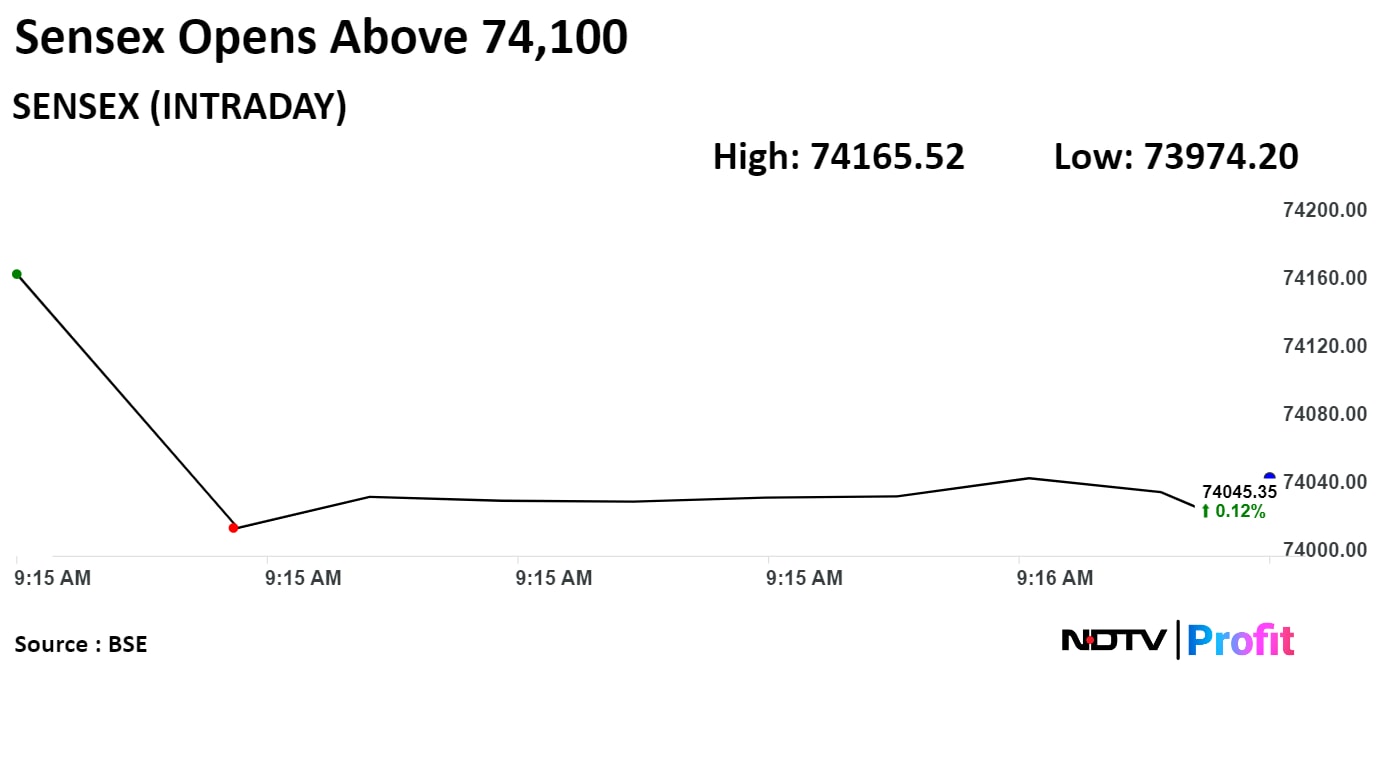

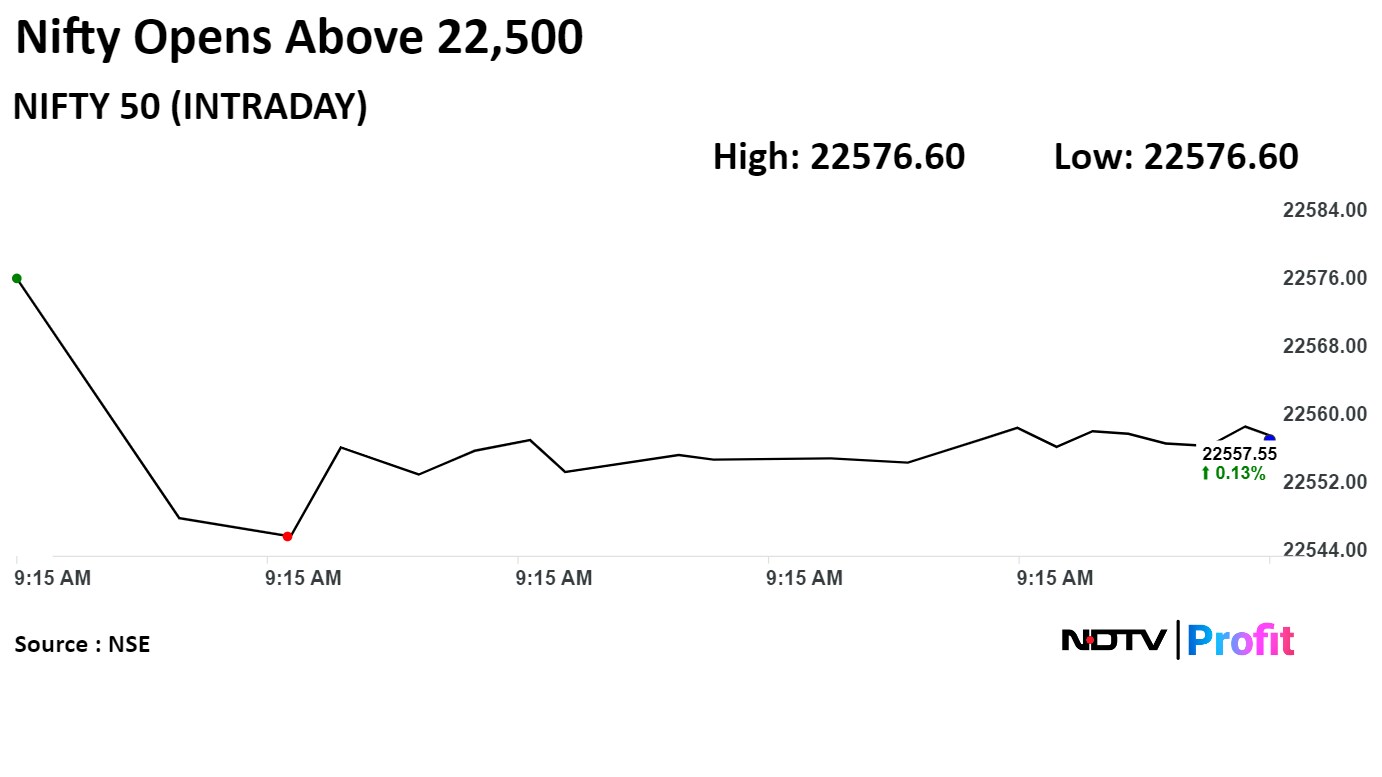

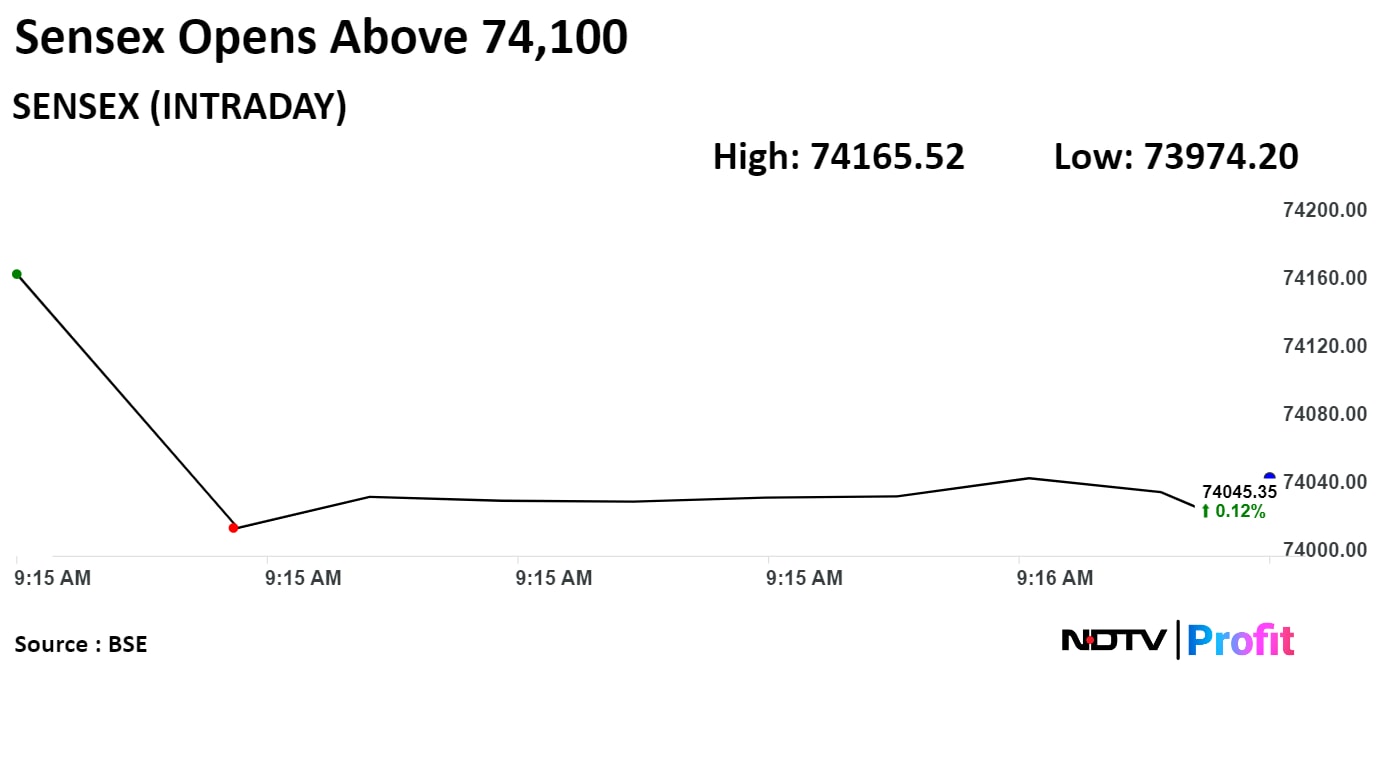

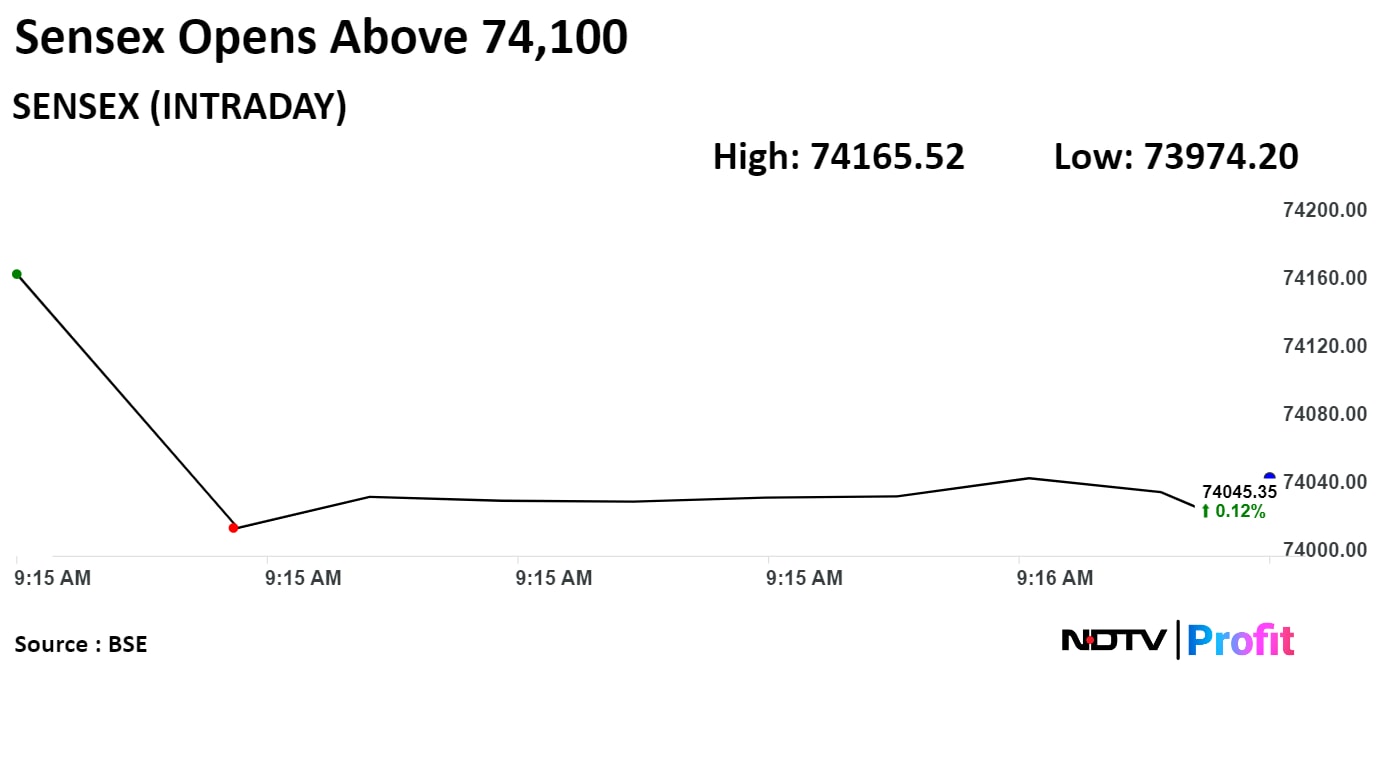

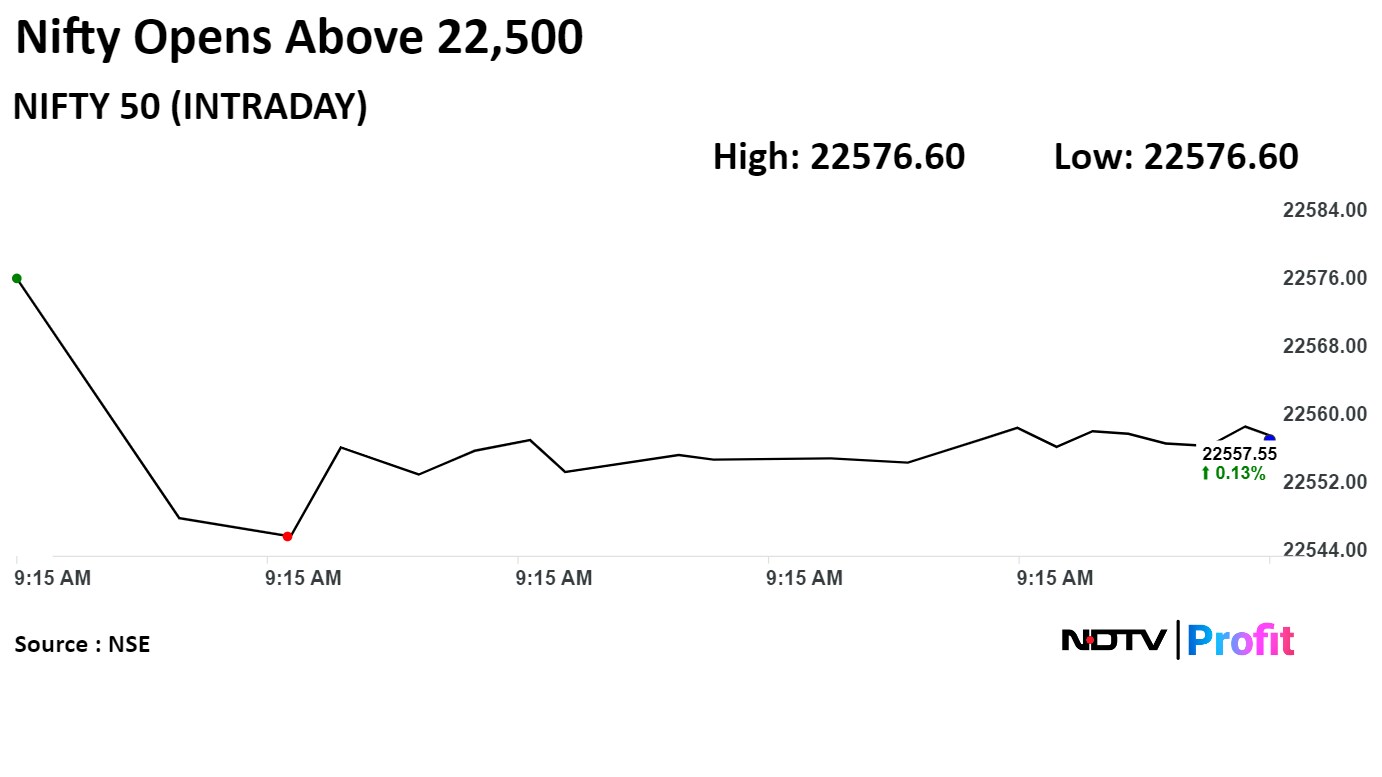

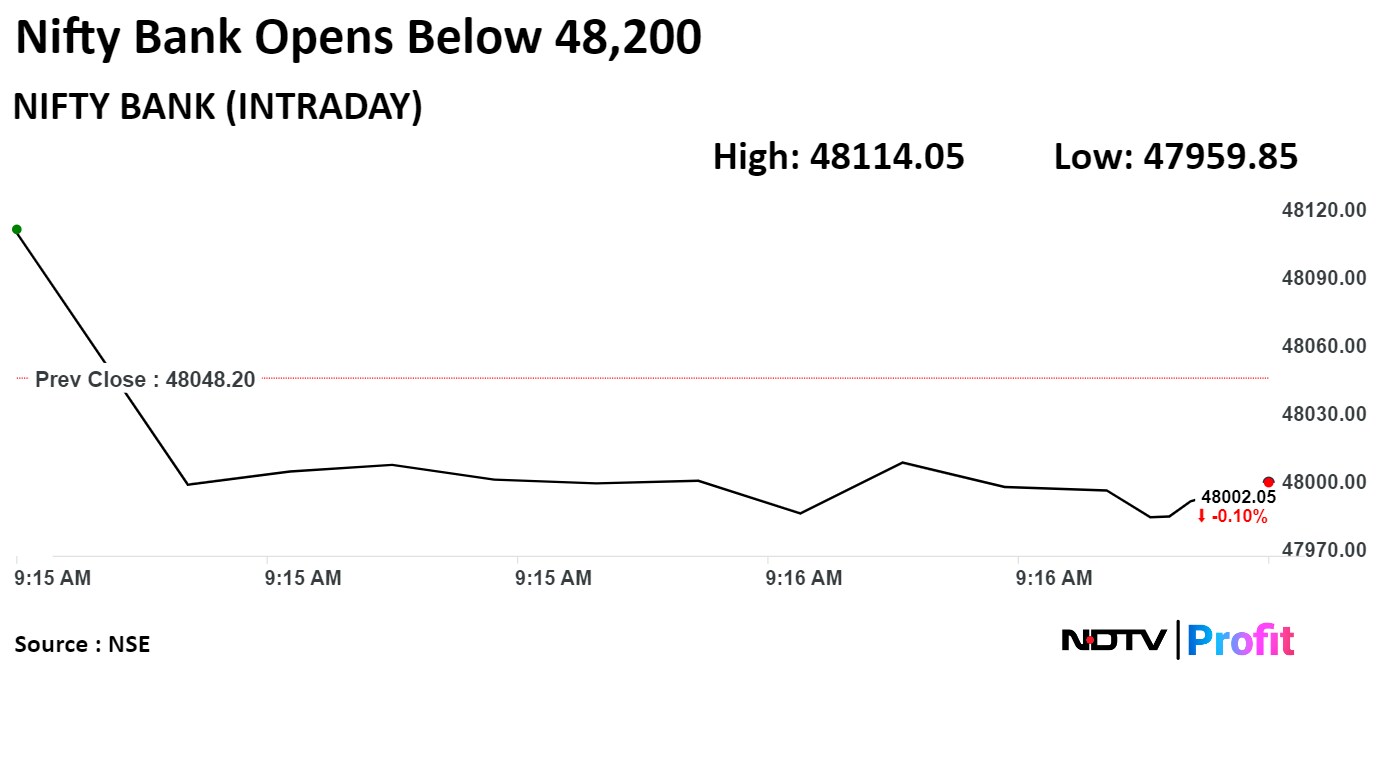

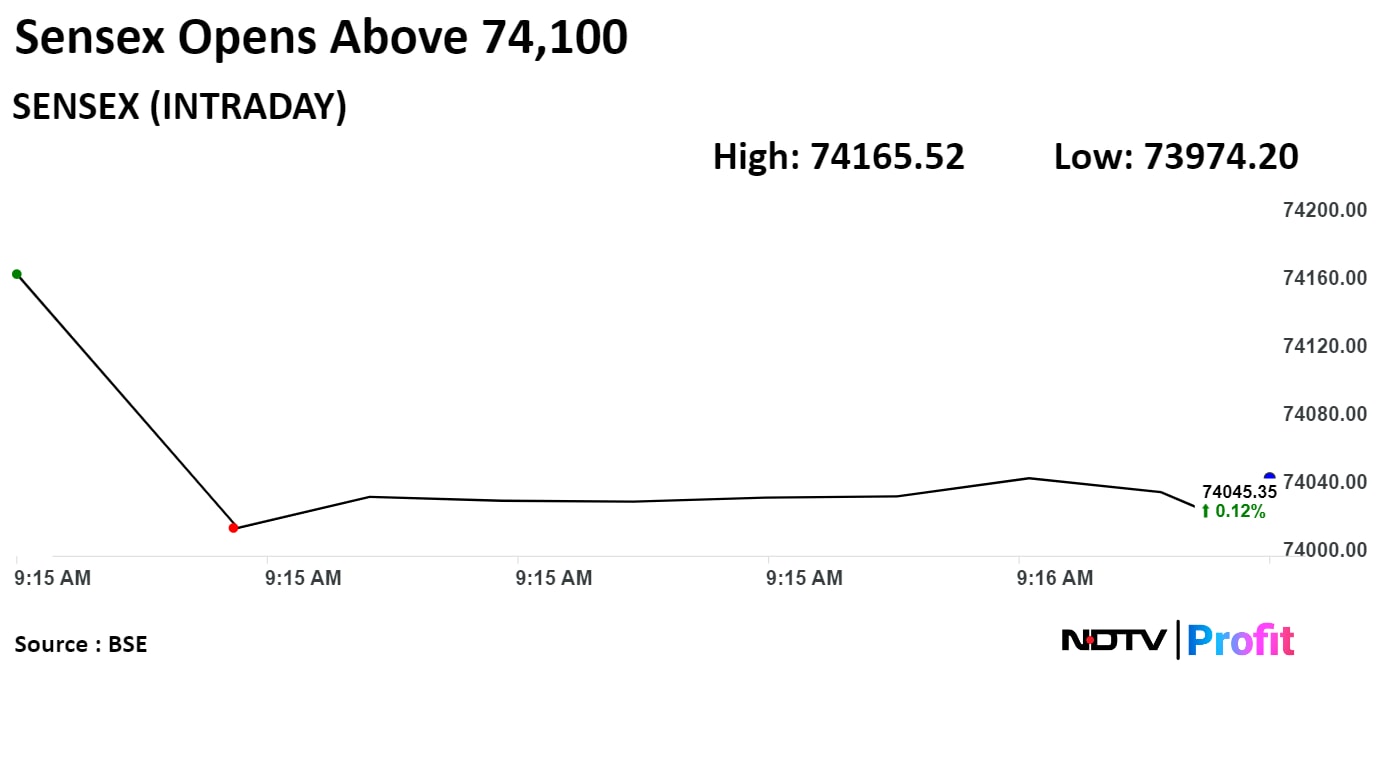

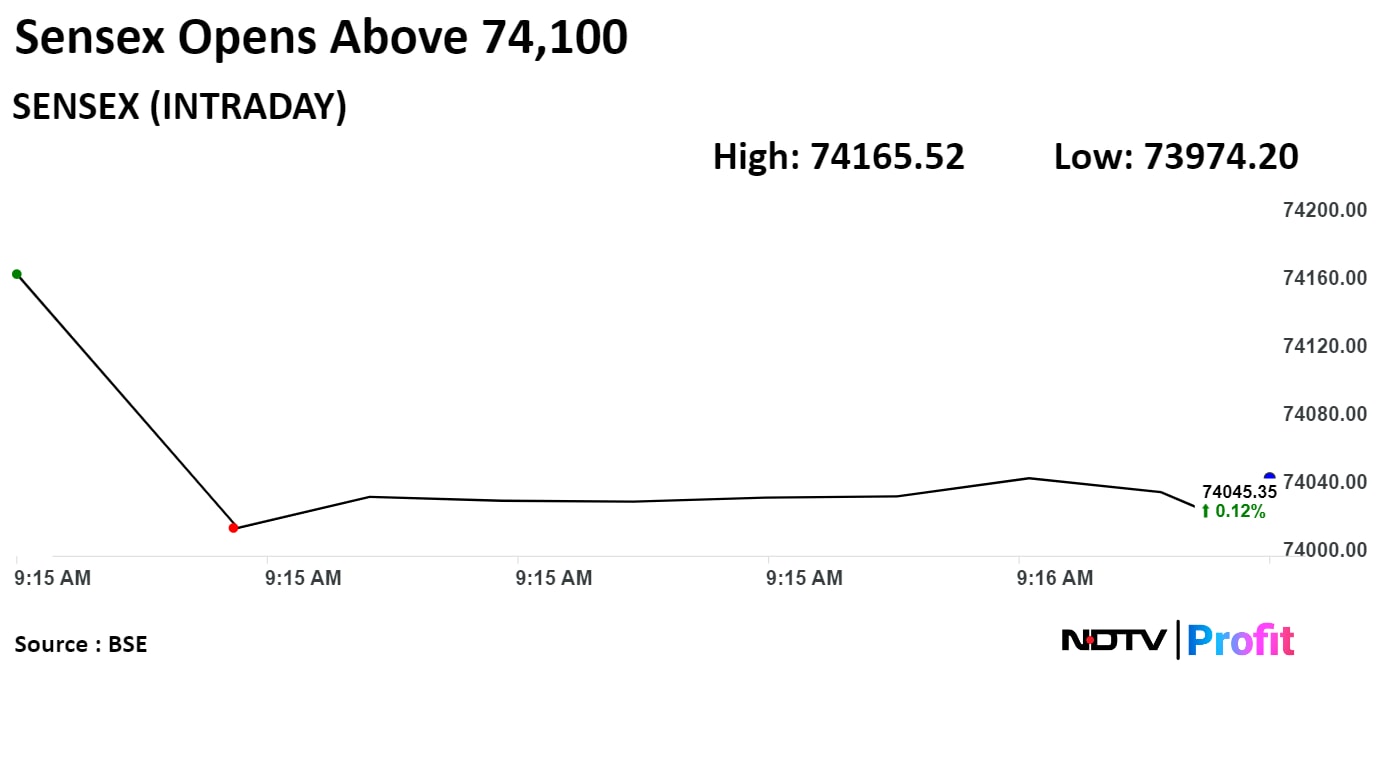

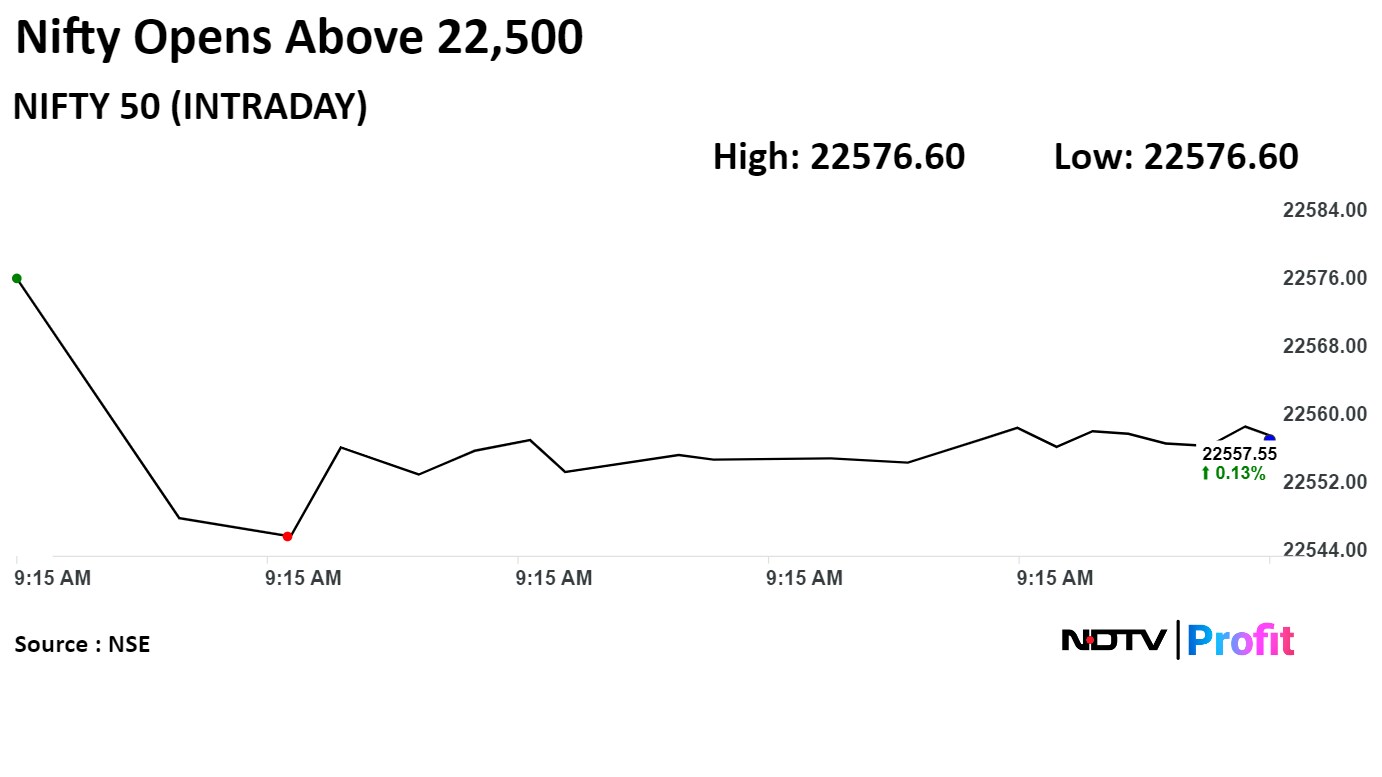

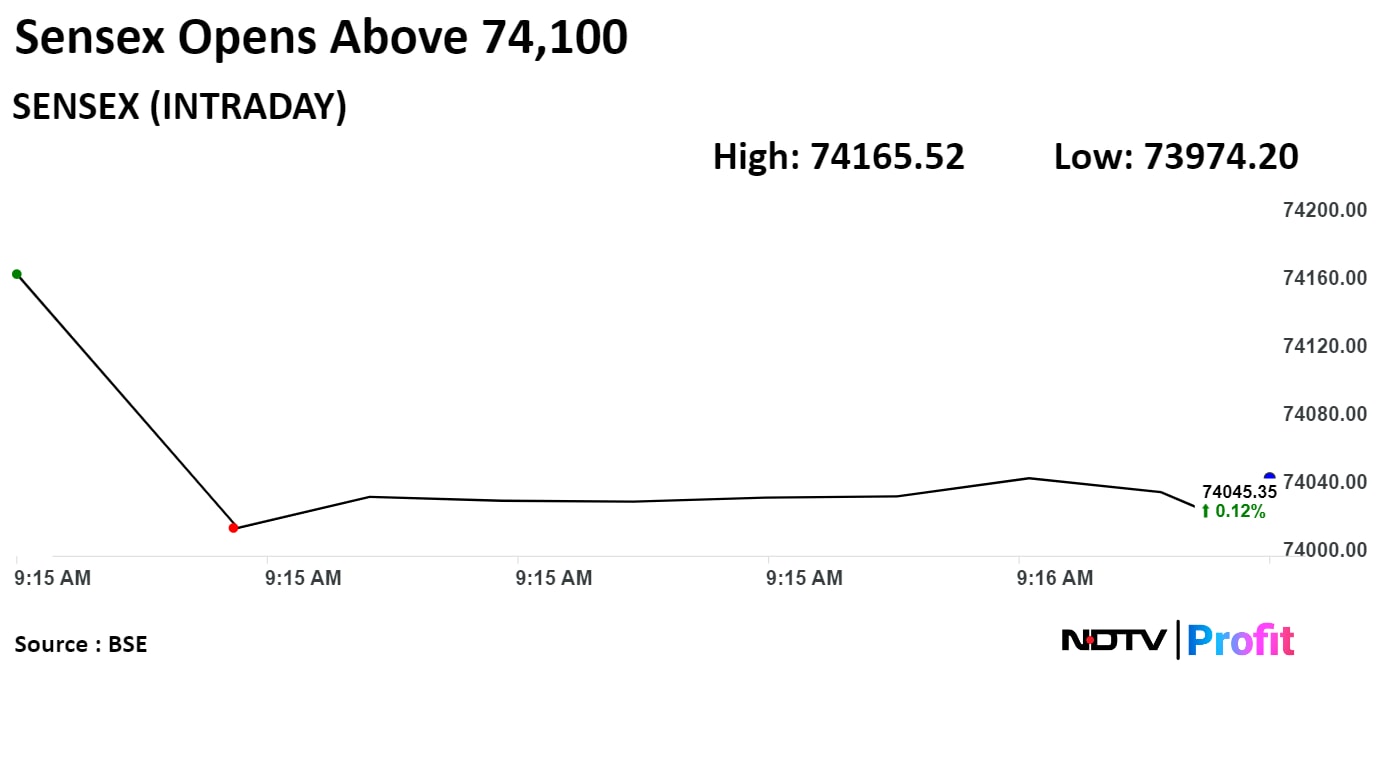

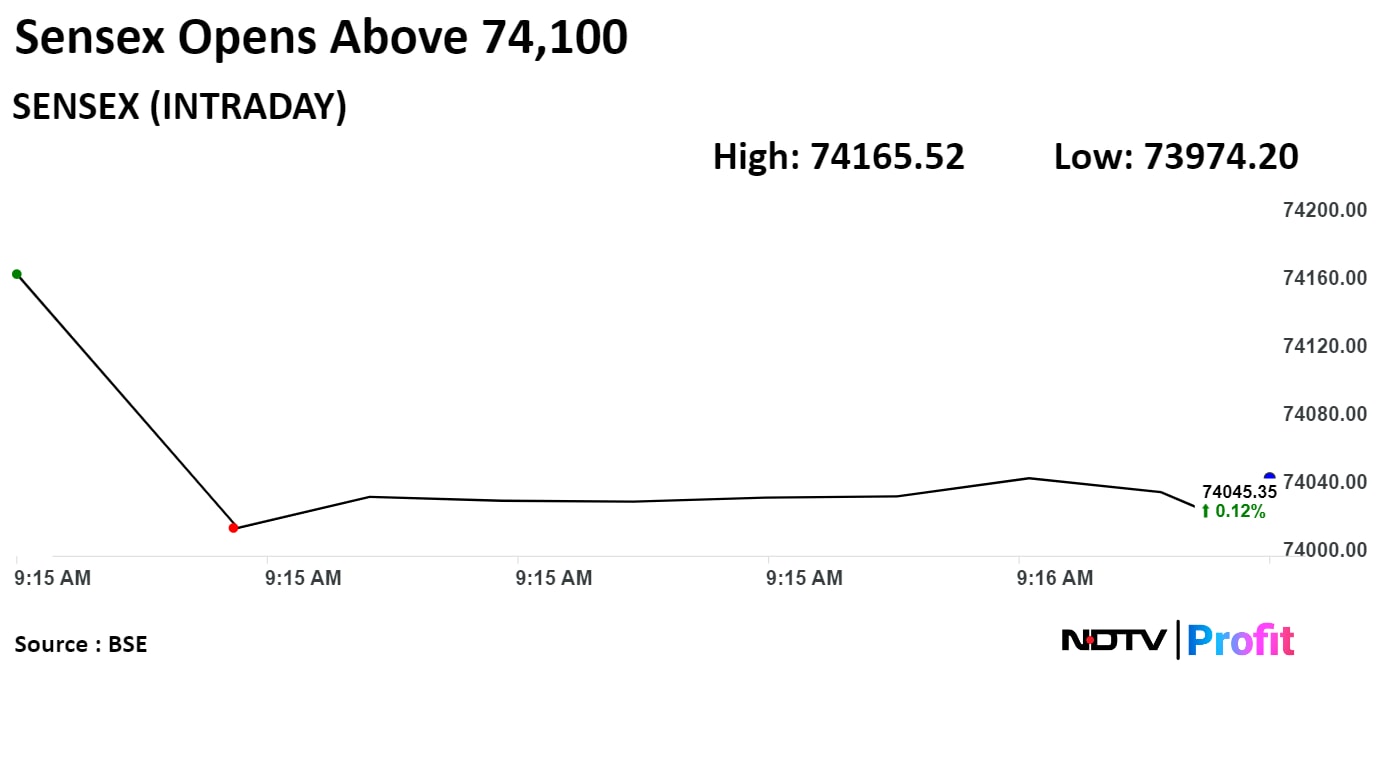

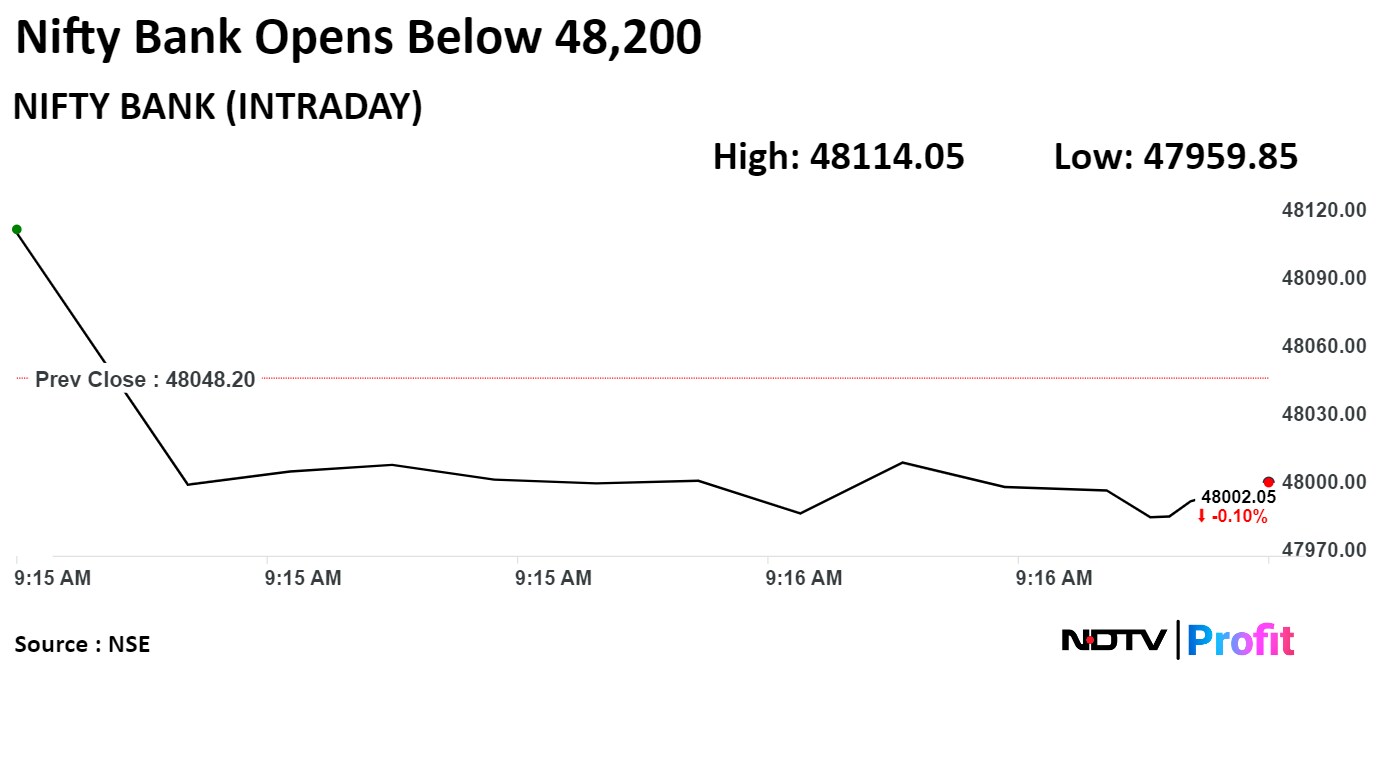

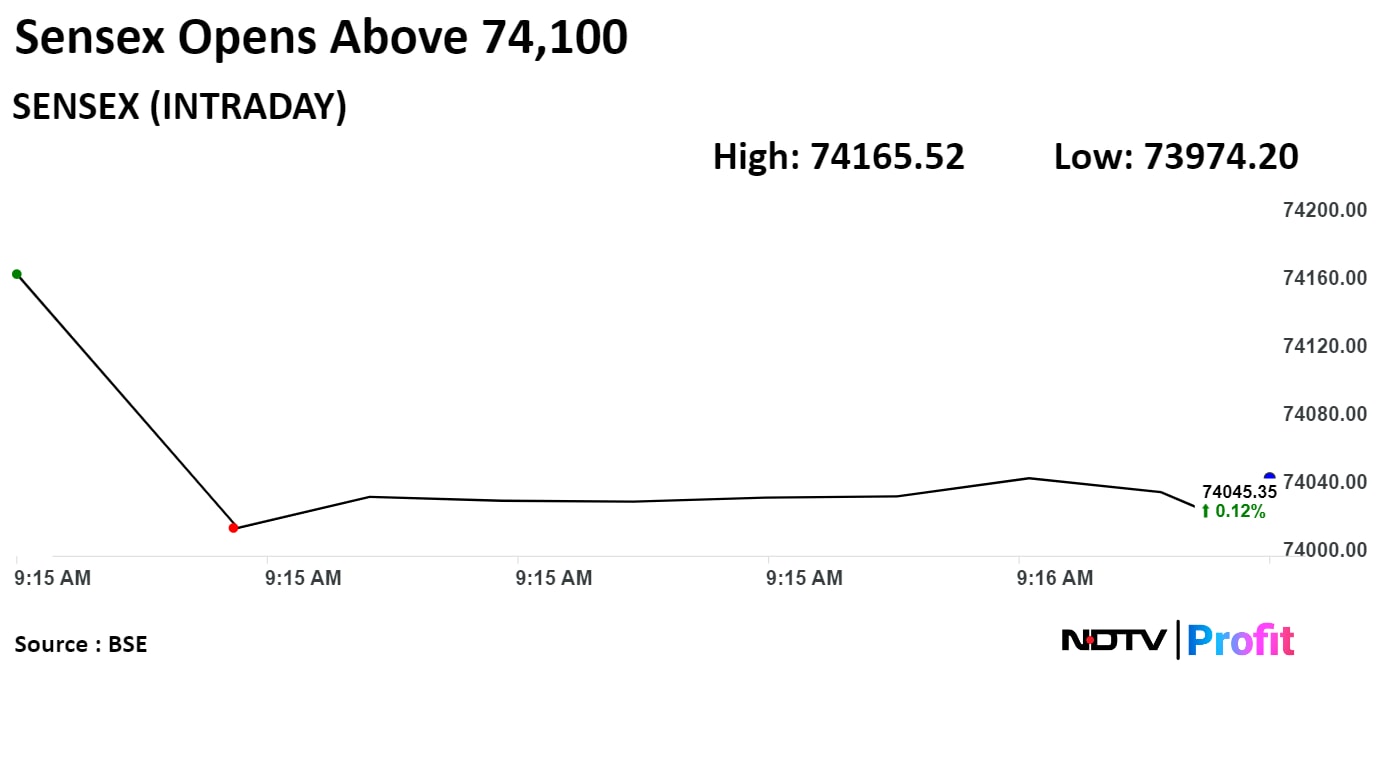

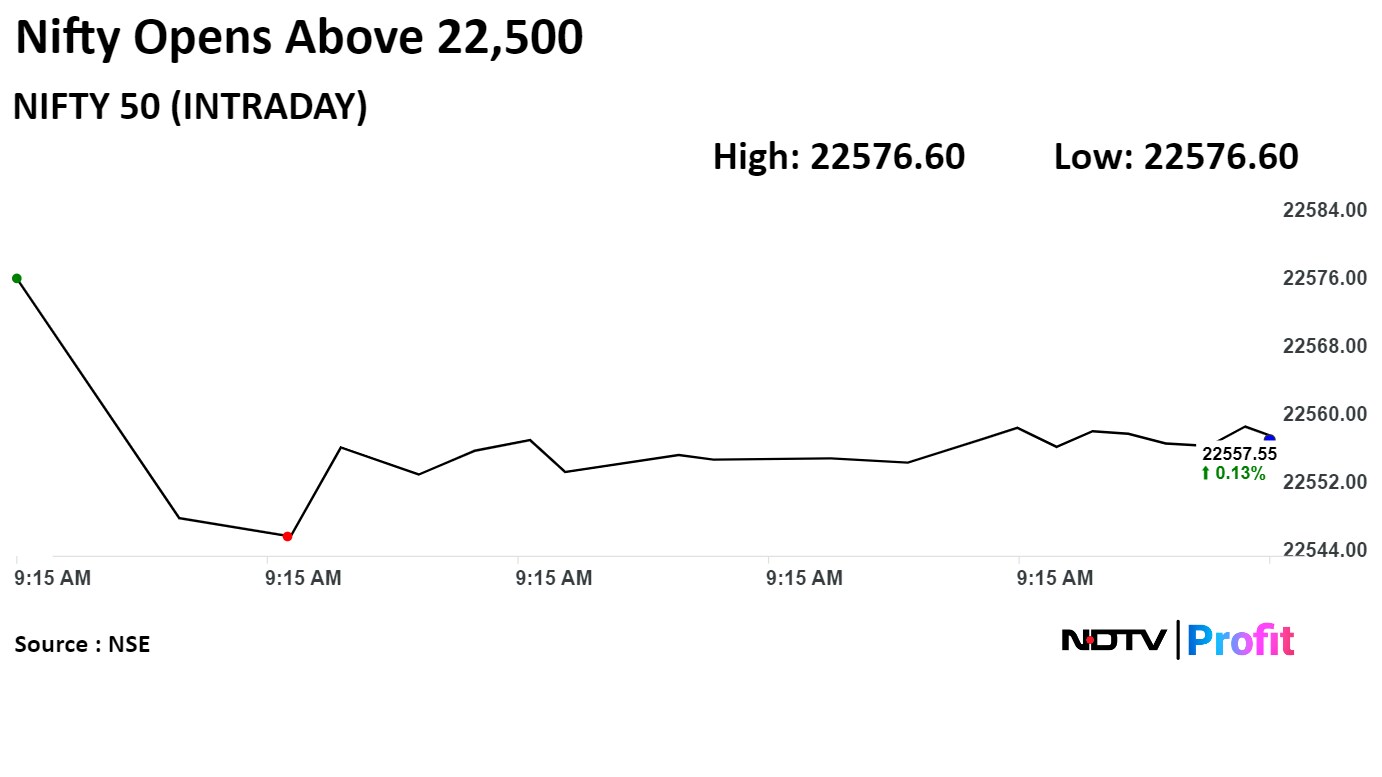

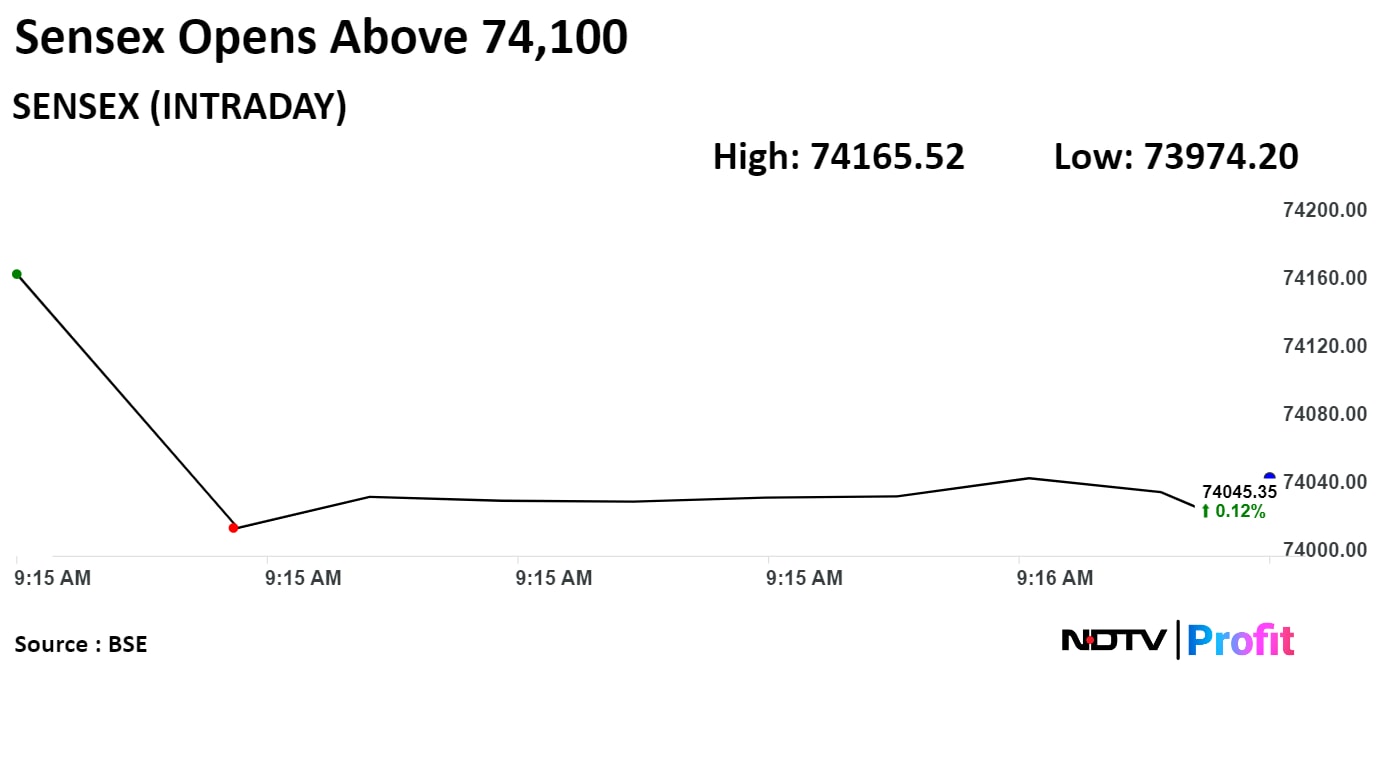

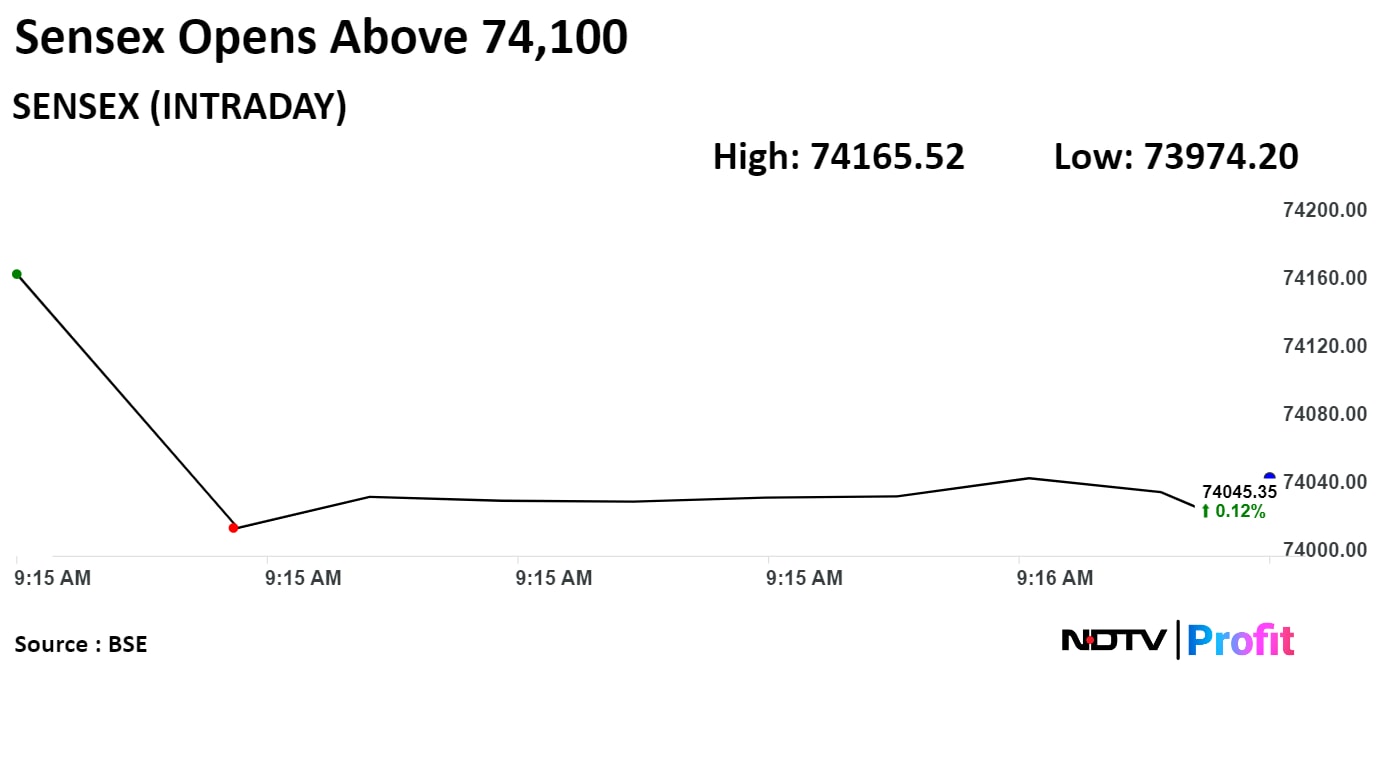

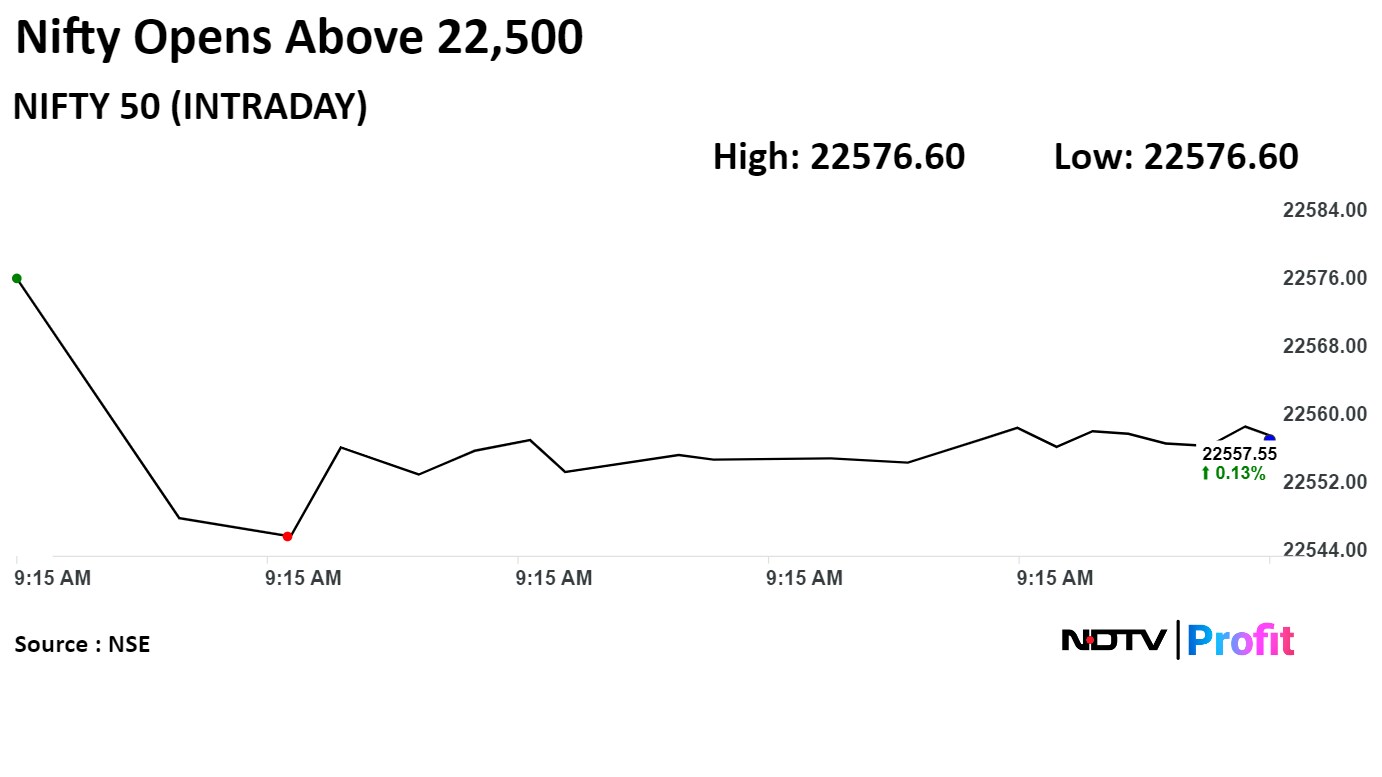

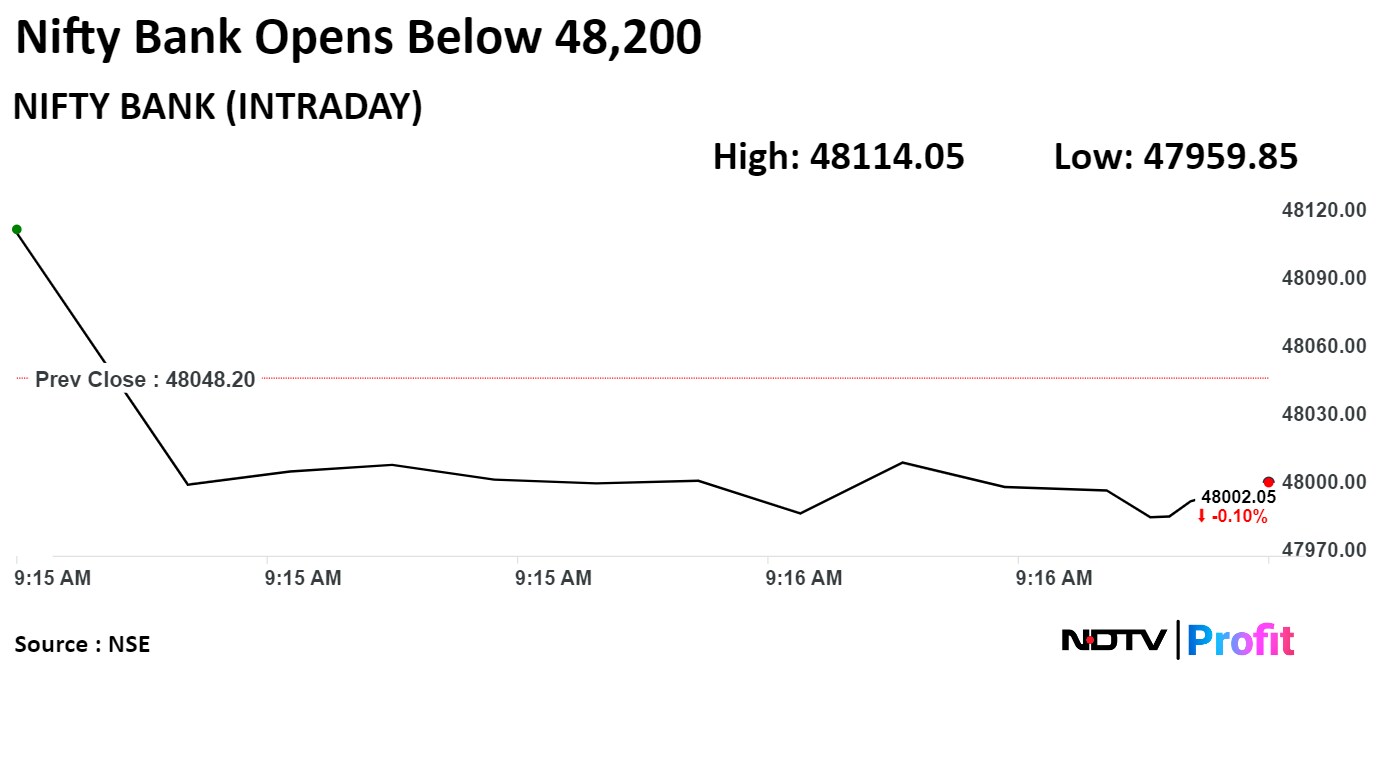

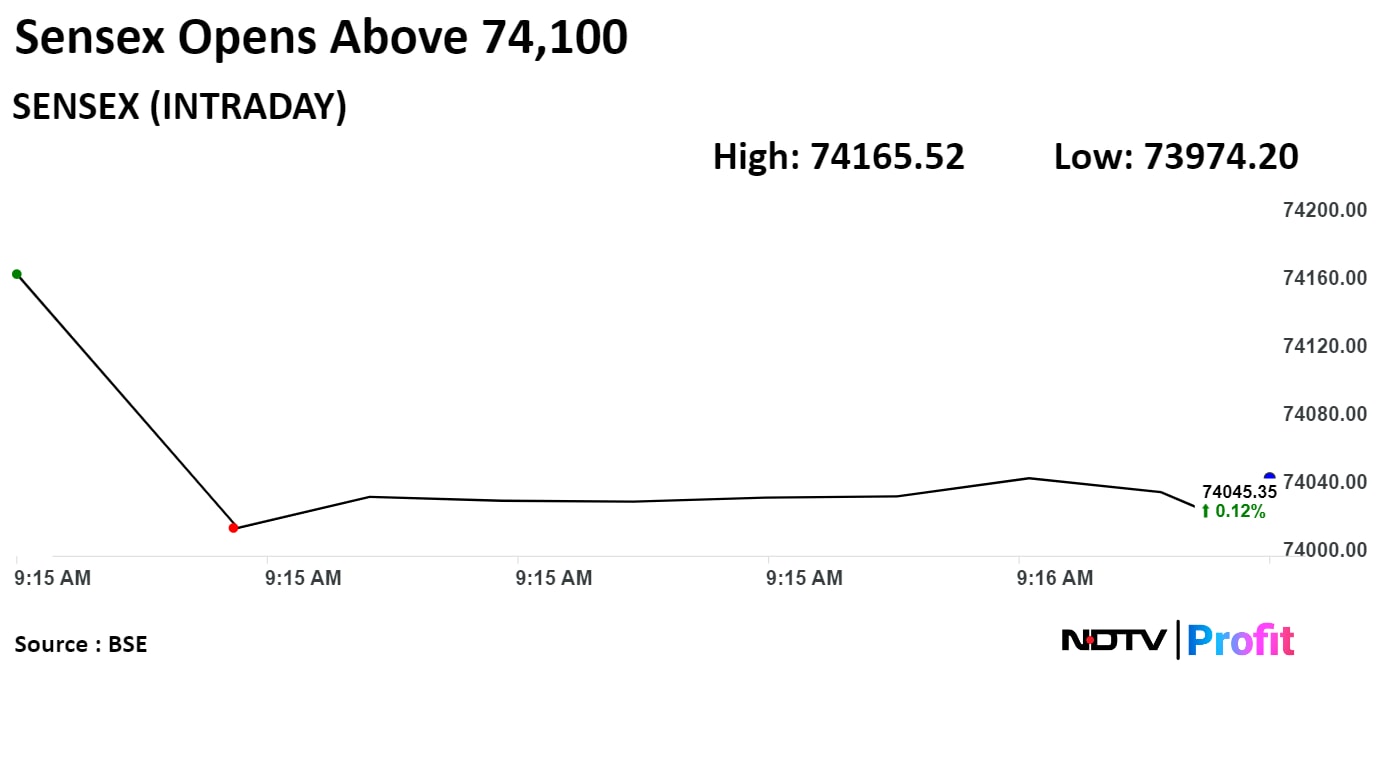

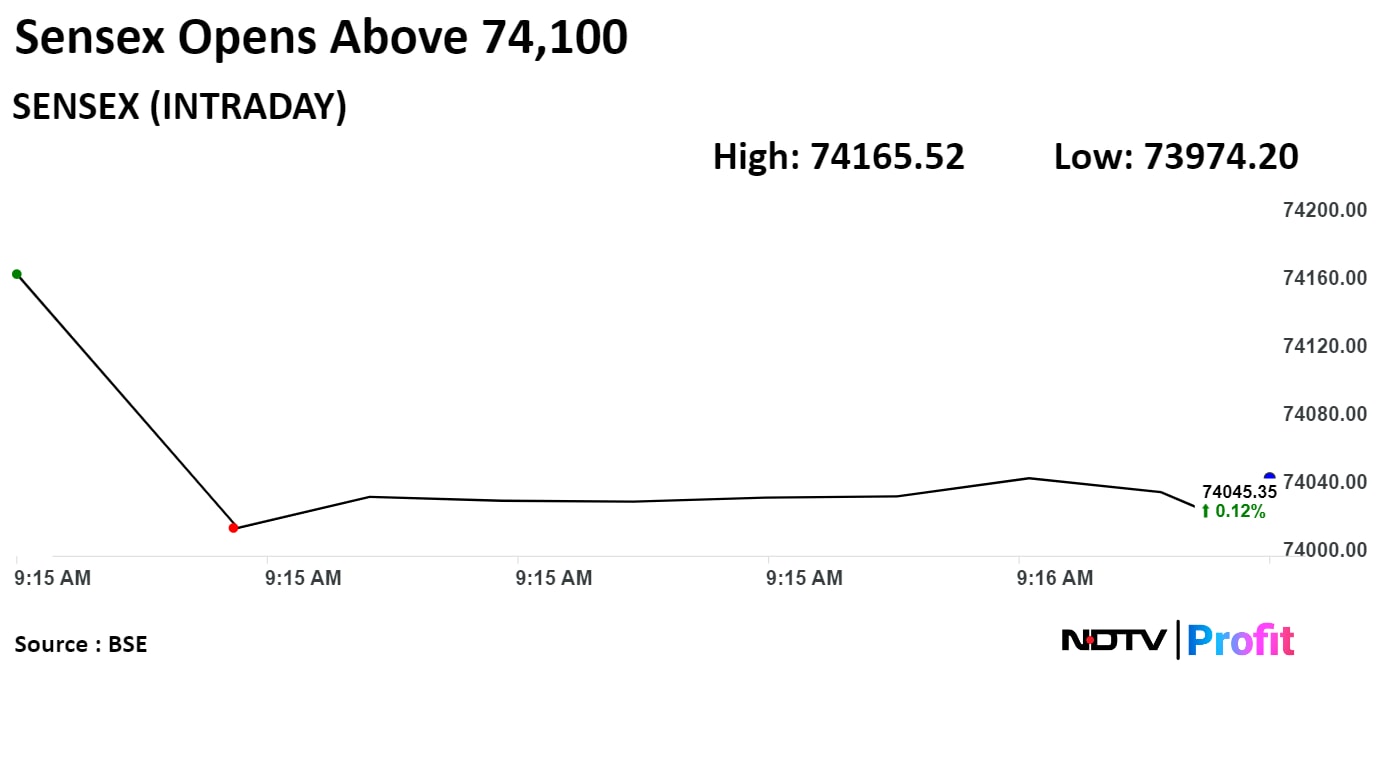

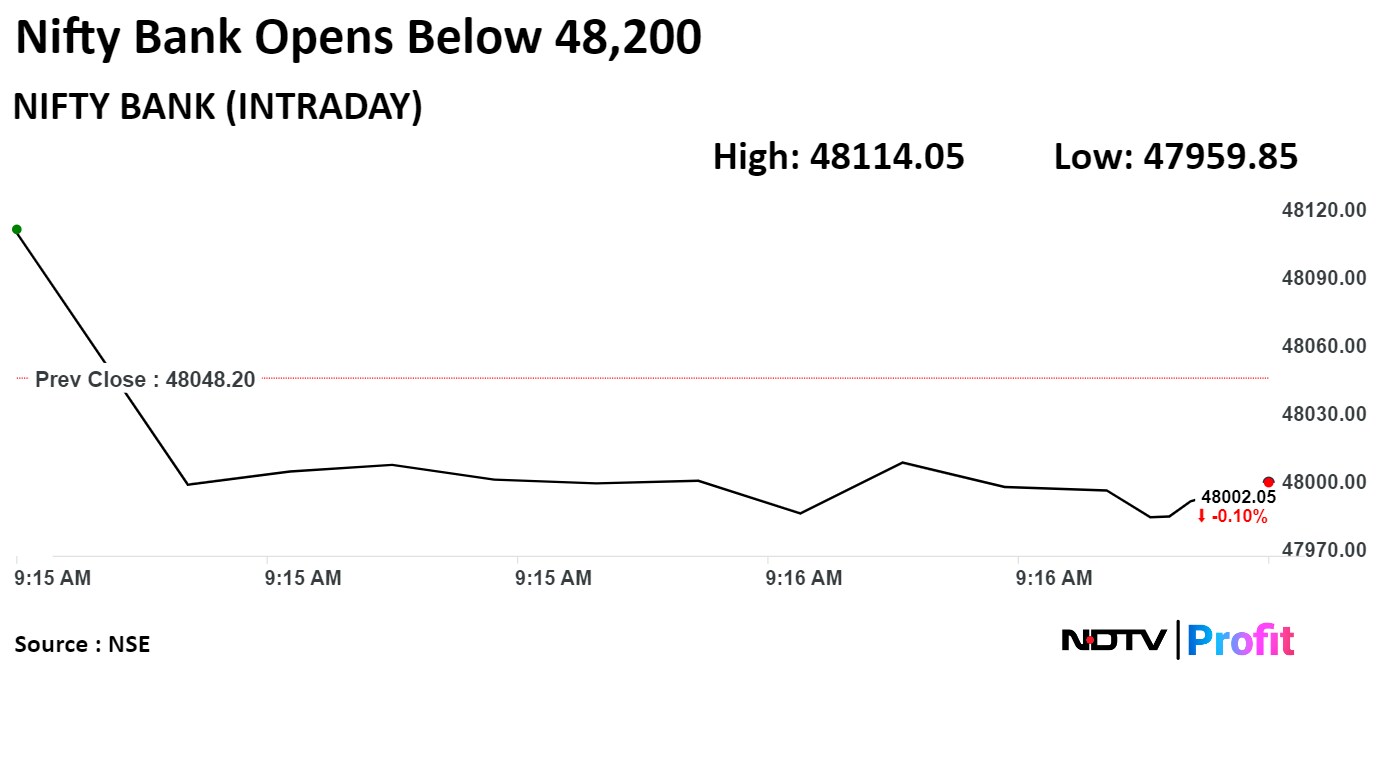

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

.png)

.png)

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd. and Larsen & Toubro Ltd. led the gains in the Nifty.

ICICI Bank, SBI, Axis Bank, HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. weighed on the benchmark the most.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

.png)

.png)

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd. and Larsen & Toubro Ltd. led the gains in the Nifty.

ICICI Bank, SBI, Axis Bank, HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. weighed on the benchmark the most.

.png)

On the NSE, seven sectors declined and five advanced, with the Nifty FMCG leading. The Nifty Realty, Energy and Metal hit a record high earlier in the day.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

.png)

.png)

.png)

Reliance Industries Ltd., Infosys Ltd., Hindustan Unilever Ltd., ITC Ltd. and Larsen & Toubro Ltd. led the gains in the Nifty.

ICICI Bank, SBI, Axis Bank, HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. weighed on the benchmark the most.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.

"The big question is whether Nifty will break out of consolidation and move higher. It has now reached the 22,570–22,600 zone," Shrey Jain, chief executive officer of SAS Online, said. "Today, substantial put writing across multiple strikes indicates limited downside potential, while resistance is likely at the 22,700 level."

For the day's weekly expiry, significant open interest at the 48,000 call and put levels suggests potential consolidation around the current levels in the Nifty Bank, according to Jain.

The benchmark stock indices pared some gains from Wednesday morning, tracking decline in shares of ICICI Bank Ltd., State Bank of India and Axis Bank Ltd. As of 11:53 a.m., the NSE Nifty 50 was trading 31.75 points or 0.14% higher at 22,560.80, and the S&P BSE Sensex was 139.77 points or 0.19% up at 74,093.08.

During the day, the Nifty rose 0.21% to 22,577.40 and the Sensex rose 0.29% to 74,165.52.