(Bloomberg) -- The world's largest technology companies extended losses in late hours as Microsoft Corp.'s results fueled concern the artificial-intelligence frenzy that has powered the bull market might have gone too far.

A $280 billion exchange-traded fund tracking the Nasdaq 100 (ticker: QQQ) got hit as the software maker plunged 6% amid slower cloud growth. The results overshadowed Advanced Micro Devices Inc.'s solid outlook. Intel Corp. rose on plans to cut thousands of jobs to reduce costs. All that will set the scene for earnings from other technology heavyweights, with markets also gearing up for Wednesday's Federal Reserve decision.

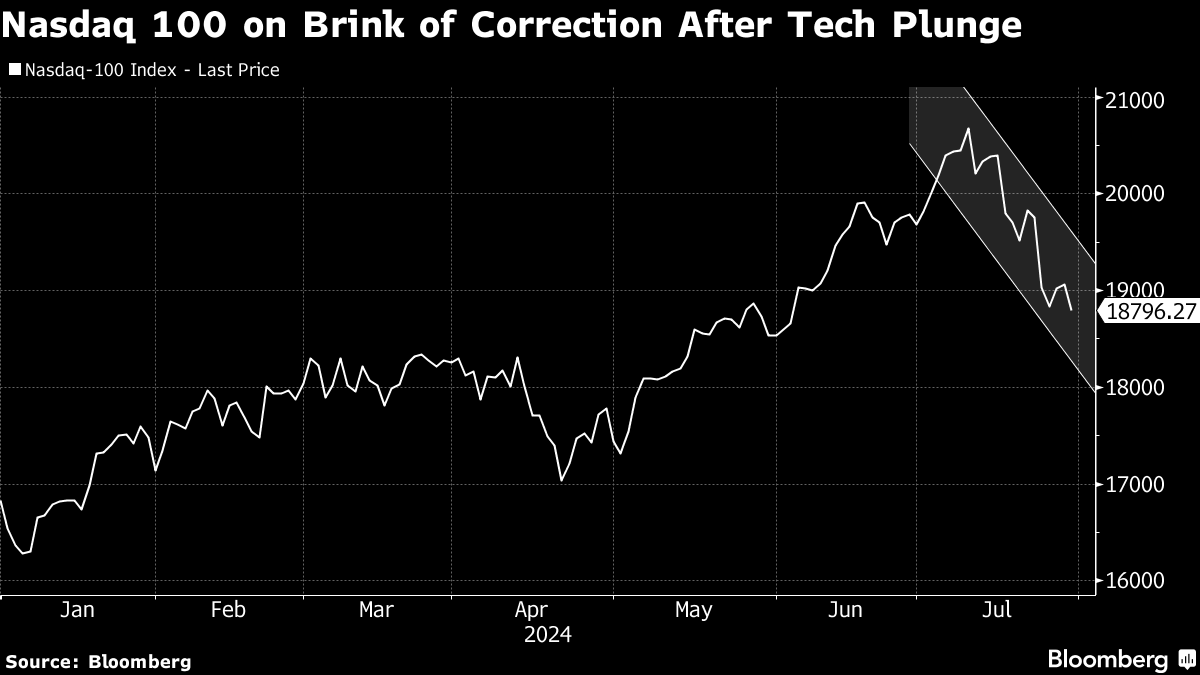

A rotation out of big tech has dragged the Nasdaq 100 down 9% from its all-time high — leaving it on the cusp of a correction. The shift into cyclical pockets of the market began in earnest after signs of cooling inflation stoked bets the Fed will cut rates in September.

“If the Fed does not signal a September rate cut, markets could get a bit ugly given recent tech weakness — especially if earnings underwhelm,” said Tom Essaye at The Sevens Report.

The S&P 500 fell to around 5,435. The Nasdaq 100 slid 1.4%. A gauge of the “Magnificent Seven” megacaps sank 2%. The Russell 2000 of small firms rose 0.3%. Nvidia Corp. tumbled 7%, wiping $193 billion from its market value.

Bonds and gold climbed amid a flare-up in geopolitical risks. Israel's military struck Beirut, aiming at a Hezbollah commander. Oil remained lower. Bank of Japan Governor Kazuo Ueda will be under intense scrutiny when he unveils plans for quantitative tightening and a decision on the policy rate.

Goldman Sachs Group Inc.'s chief David Solomon told CNBC that one or two Fed rate cuts later this year are looking increasingly likely. That's after predicting just two months ago there would be no reductions in 2024.

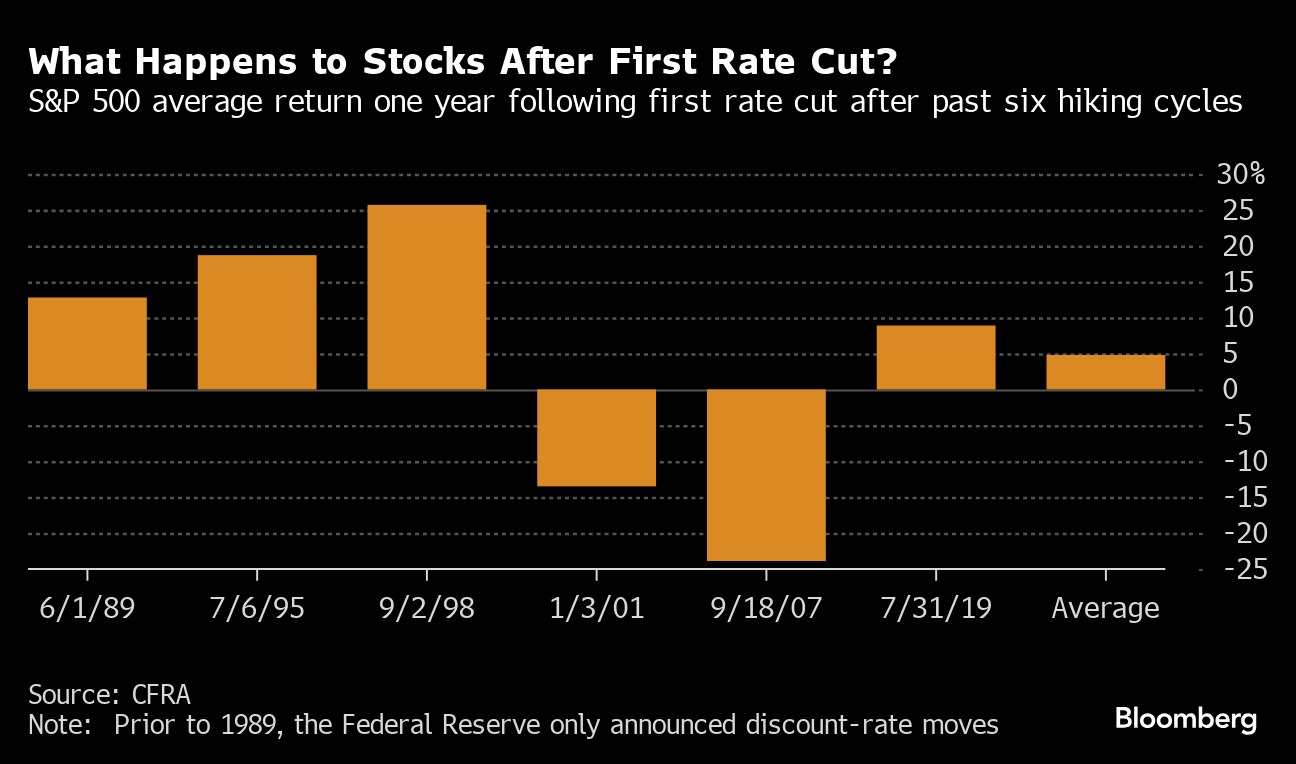

If the Fed is about to begin a rate cutting cycle, stock bulls have history on their side. In the six prior hiking cycles, the S&P 500 has risen an average 5% a year after the first cut, according to calculations by the financial research firm CFRA. What's more, the gains also broadened, with the small-cap Russell 2000 Index climbing 3.2% 12 months later, the data show.

To Bank of America Corp.'s Savita Subramanian, the S&P 500 has probably already logged the gains it will see this year, but the benchmark still presents ample opportunities for investors.

While neutral on the index overall, she says there's potential for strong returns in a few areas: among dividend payers, “old school” capital-expenditure beneficiaries like infrastructure, construction and manufacturing stocks, and other themes that don't revolve around artificial intelligence.

Corporate Highlights:

- Starbucks Corp. posted a second consecutive quarter of declining sales as pullback from coffee treats hurt results.

- Pinterest Inc. warned that revenue in the current quarter will be lower than analysts' predictions.

- Match Group Inc. said it plans to cut 6% of its global staff as it shuts down livestreaming services across some of its dating apps and faces activist pressure to deliver on a turnaround.

- For the first time since the throes of the pandemic, Goldman Sachs Group Inc. is worth more than its longtime Wall Street rival Morgan Stanley.

- Pfizer Inc. raised its profit expectations for the year, citing new cancer drugs, as it seeks to dig out of a Covid-related hole in sales.

- Merck & Co. got hit as light sales of its Gardasil HPV vaccine in China dimmed quarterly profit and sales that beat Wall Street estimates.

Key events this week:

- Eurozone CPI, Wednesday

- Bank of Japan policy decision, Wednesday

- US ADP employment change, Wednesday

- Fed rate decision, Wednesday

- Meta Platforms earnings, Wednesday

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

- US initial jobless claims, ISM Manufacturing, Thursday

- Amazon, Apple earnings, Thursday

- Bank of England rate decision, Thursday

- US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% as of 4 p.m. New York time

- The Nasdaq 100 fell 1.4%

- The Dow Jones Industrial Average rose 0.5%

- The MSCI World Index fell 0.3%

- Bloomberg Magnificent 7 Total Return Index fell 2%

- The Russell 2000 Index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0811

- The British pound fell 0.2% to $1.2832

- The Japanese yen rose 0.5% to 153.26 per dollar

Cryptocurrencies

- Bitcoin fell 2.1% to $65,939.38

- Ether fell 1.5% to $3,272.72

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.14%

- Germany's 10-year yield declined two basis points to 2.34%

- Britain's 10-year yield was little changed at 4.04%

Commodities

- West Texas Intermediate crude fell 0.9% to $75.09 a barrel

- Spot gold rose 1% to $2,407.48 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.