(Bloomberg) -- European stocks and US equity futures paused Wednesday as traders sought fresh catalysts to extend the latest tech-driven gains.

Contracts on the S&P 500 were steady in holiday-thinned trade, after the index hit its 31st record high of 2024, powered by another surge in artificial intelligence bellwether Nvidia Corp., now the world's most valuable company. Nasdaq 100 futures advanced to a record high. The pan-European Stoxx 600 slipped 0.2% after two days of gains, while bond yields across the euro area edged higher.

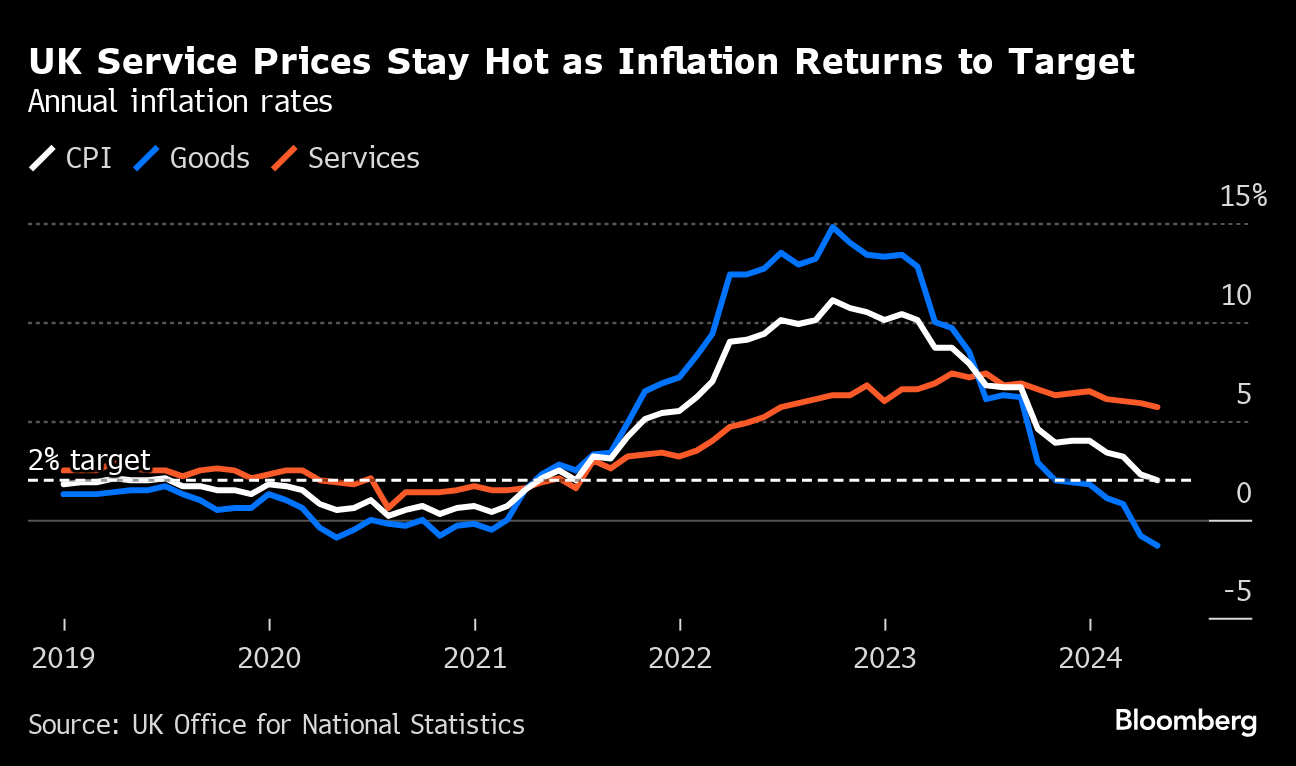

Despite a recent wobble driven by French political tensions, European stocks still stand about 2% off their latest record highs. Wall Street, meanwhile, has been lifted by the continued AI frenzy and resilient economic growth that should continue to support corporate earnings, especially in the technology sector. UK data on Wednesday added to signs inflation is slowing across the developed world, potentially allowing central banks to cut interest rates.

“We are in a soft landing scenario, central banks have started easing policy or will start to ease soon, and we may be facing a wave of positive productivity shock thanks to technology,” said Benoit Anne, head of investment solutions at MFS Investment Management. “Put all that together and you have a very supportive environment for global equities.”

While US Treasuries aren't trading on Wednesday, government bond yields across Europe edged higher. UK 10-year government borrowing costs rose about three basis points and the pound firmed, despite data showing inflation had slowed to the Bank of England's 2% target, as price pressures remained sticky in the key services sector.

The data all but rules out a rate cut at the BOE's Thursday meeting, according to Zara Nokes, global market analyst at JPMorgan Asset Management.

“If this stickiness in domestic price pressures continues, alongside ongoing resilience in economic activity, an August rate cut could well be off the table too,” she said.

Investors also kept an eye on developments in France, which got a scolding from the European Union for breaking the bloc's deficit and debt rules. French 10-year bond yields rose almost four basis points, while the spread relative to their German peers stayed at the widest since 2017 amid concerns that the upcoming snap election will result in a win for far-right groups with high-spending policies.

While the selloff in French assets has abated somewhat, the political risks are keeping investors and companies on edge. On Wednesday, Italian sneaker firm Golden Goose Group SpA pulled the plug on its initial public offering, citing a “significant deterioration in market conditions.”

Key events this week:

- US Juneteenth holiday, Wednesday

- China loan prime rates, Thursday

- Eurozone consumer confidence, Thursday

- UK BOE rate decision, Thursday

- US housing starts, initial jobless claims, Thursday

- Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

- US existing home sales, Conf. Board leading index, Friday

- Fed's Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

- The MSCI World Index was little changed as of 5 p.m. New York time

- The MSCI Asia Pacific Index rose 1%

- S&P/BMV IPC rose 0.2%, climbing for the third straight day

- Ibovespa Index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0745

- The British pound was unchanged at $1.2720

- The Japanese yen was unchanged at 158.09 per dollar

- The offshore yuan was little changed at 7.2816 per dollar

- The Mexican peso was little changed at 18.4249 per dollar

- The Brazilian real was little changed at 5.4346 per dollar

Cryptocurrencies

- Bitcoin was little changed at $64,850.94

- Ether was little changed at $3,551.59

Bonds

- The yield on 10-year Treasuries was little changed at 4.22%

- Germany's 10-year yield was little changed at 2.40%

- Britain's 10-year yield advanced two basis points to 4.07%

Commodities

- Spot gold was little changed

- Brent crude fell 0.3%, more than any closing loss since June 7

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Julien Ponthus and Sebastian Boyd.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.