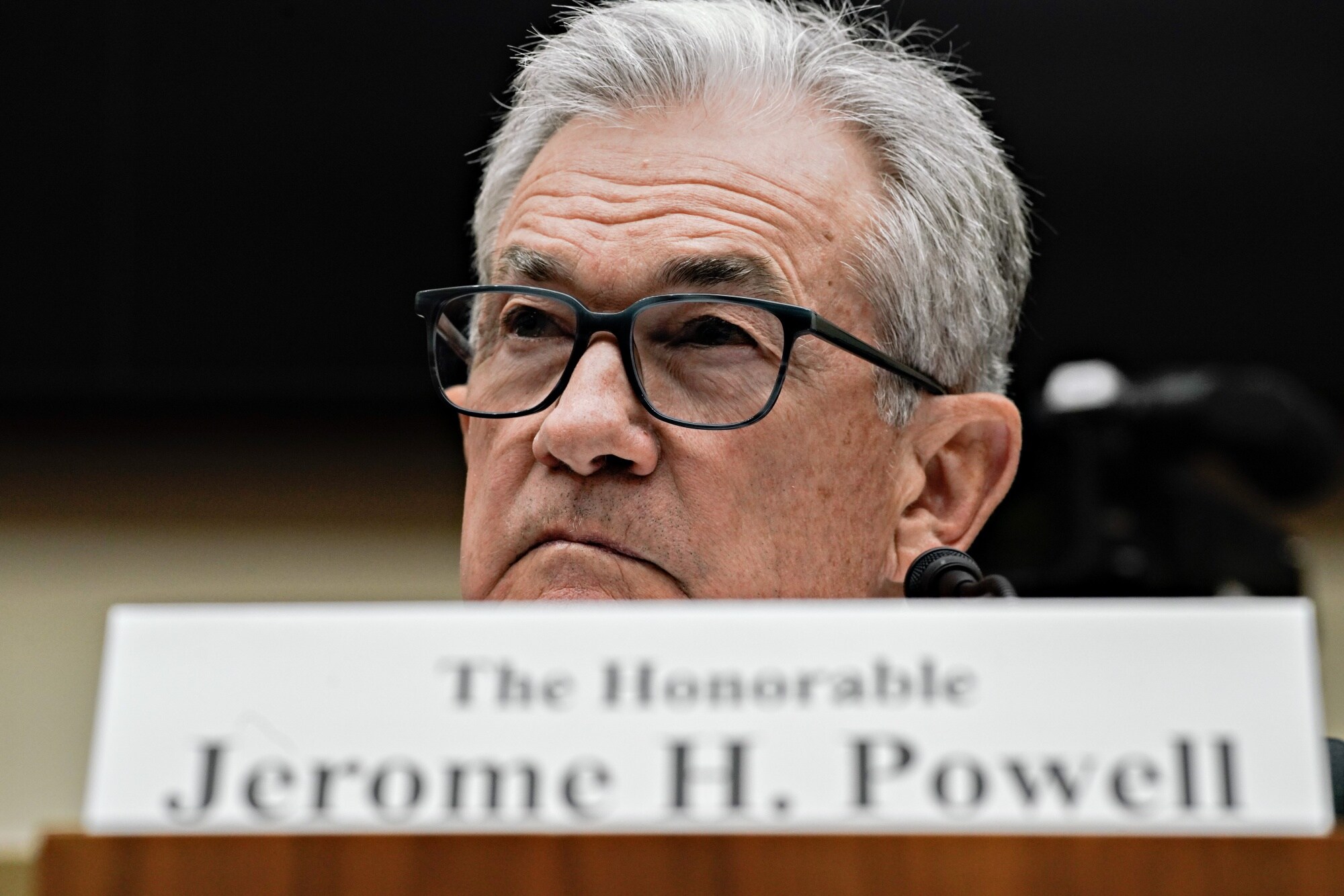

(Bloomberg) -- Stocks rose and bond yields fell after Jerome Powell — as expected — reiterated the Federal Reserve is in no rush to cut interest rates.

The S&P 500 reclaimed its 5,100 mark, with Nvidia Corp. up and Tesla Inc. down. CrowdStrike Holdings Inc. surged about 15% on a bullish forecast. Treasury 10-year yields fell five basis points to 4.1%. Bitcoin resumed its rally to top $66,000. The loonie rose as the Bank of Canada said it's still “too early” to consider rate cuts.

The Fed chief said it will likely be appropriate to begin lower borrowing costs “at some point this year,” but made clear they're not ready yet. That's a slight contrast with the claims of a few other officials that cuts are more likely to be “later this year”, according to Andrew Hunter at Capital Economics.

“His remarks do not change our view that the Fed is likely to start cutting rates in June,” Hunter added.

In other economic news, a report known as JOLTS showed US job openings remained elevated in January. Meantime, companies boosted hiring in February at a moderate pace, with private payrolls increasing by 140,000 — while trailing estimates. The Fed will also release its Beige Book survey of regional business contacts.

Corporate Highlights:

- Abercrombie & Fitch Co. reported fourth-quarter earnings that exceeded forecasts, underscoring the apparel retailer's ability to maintain momentum despite uncertain economic conditions.

- Nordstrom Inc. is forecasting muted revenue and comparable sales growth this year as sluggish demand at its high-end namesake stores offsets an improving outlook at its off-price Rack stores.

- Foot Locker Inc. reported sales that surpassed Wall Street's expectations, overcoming concerns of a pullback in consumer spending on sportswear.

- JD.com Inc. initiated a $3 billion stock repurchase program and reported a better-than-expected 3.6% rise in revenue, helped by a broader product lineup and price cuts to target cost-conscious Chinese consumers.

- Grifols SA slumped after Moody's Investors Service placed the Spanish blood plasma company's rating on review for downgrade and short seller Gotham City Research raised new questions on its accounting methods.

Key Events This Week:

- China trade, forex reserves, Thursday

- European Central Bank's rate decision, Thursday

- US initial jobless claims, trade, Thursday

- President Joe Biden delivers the State of the Union address, Thursday

- Fed Chair Jerome Powell testifies before the Senate Banking Committee, Thursday

- Cleveland Fed President Loretta Mester speaks, Thursday

- Eurozone GDP, Friday

- US nonfarm payrolls, unemployment, Friday

- New York Fed President John Williams speaks, Friday

- ECB Governing Council member Robert Holzmann speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.5% as of 10:22 a.m. New York time

- The Nasdaq 100 rose 0.6%

- The Dow Jones Industrial Average rose 0.4%

- The Stoxx Europe 600 rose 0.4%

- The MSCI World index rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.3% to $1.0887

- The British pound rose 0.1% to $1.2722

- The Japanese yen rose 0.4% to 149.40 per dollar

Cryptocurrencies

- Bitcoin rose 4.1% to $65,945.79

- Ether rose 6.9% to $3,767.15

Bonds

- The yield on 10-year Treasuries declined five basis points to 4.10%

- Germany's 10-year yield was little changed at 2.32%

- Britain's 10-year yield declined one basis point to 4.00%

Commodities

- West Texas Intermediate crude rose 2.1% to $79.80 a barrel

- Spot gold rose 0.6% to $2,141.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.