(Bloomberg) -- Stocks fluctuated after a rally that drove the market to fresh all-time highs. Treasury yields edged higher as traders geared up for a $25 billion sale of 30-year bonds.

The equity market lost a bit of steam after the S&P 500 came very close to hitting the 5,000 mark for the first time. Longer-dated bonds underperformed, with the Treasury getting ready to test the market appetite after successful debt sales this week. Wall Street will also be positioning for Friday's consumer-price index revisions because of what happened a year ago: the update was significant enough to cast doubt on overall inflation progress.

Thirty-year bonds “can be tricky, but our bet is that there should be good demand” in the auction, said Andrew Brenner at NatAlliance Securities. “As for headline risk, there is some talk that tomorrow's CPI revisions could throw cold water on the recent good inflation numbers, but this is a wonky number. We think the next move comes off the CPI number next Tuesday.”

In economic news, US initial jobless claims fell for the first time in three weeks, suggesting employers are still largely holding on to their workers. Federal Reserve Bank of Richmond President Thomas Barkin reiterated policymakers have time to be patient about the timing of rate cuts, pointing to a strong labor market and continued disinflation.

The S&P 500 was little changed. As the earnings season rolled in, Walt Disney Co. and Arm Holdings Plc jumped on upbeat outlooks, while PayPal Holdings Inc. sank on an underwhelming forecast. Treasury 10-year yields rose three basis points to 4.15%. Bitcoin hovered near $45,000.

To Larry Tentarelli at Blue Chip Daily Trend Report, a strong jobs market and strong consumer continue to bode well for the economy and should push back on immediate recession concerns. He's betting the Fed will be able to cut rates in either May or June.

“The Fed has said it wants to see ‘more of the same' from the economy to push forward with rate cuts — and today's moderate jobless claims number certainly fits the bill,” said Chris Larkin at E*Trade from Morgan Stanley. “But Fed members have also been busy downplaying expectations this week, suggesting they may not cut as many times as the markets expect, and leaving the timing open to debate.”

The next few inflation reports may determine whether stocks will be able to keep setting new record highs in the near term, Larkin noted.

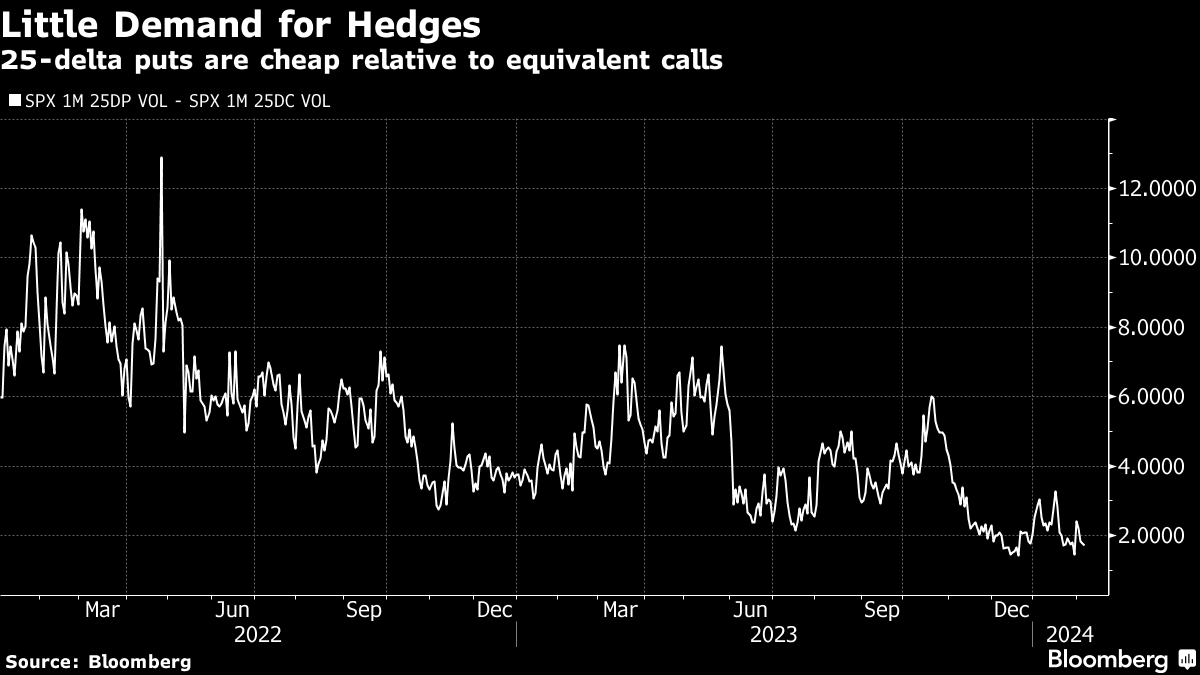

The equity market appears overbought, but many traders don't want to miss out on continued gains. That has prompted outsized interest in options contracts that provide upside exposure for minimal premium.

The premium in implied volatility of 3-month 10-delta calls to 40-delta calls hovers around its highest in a decade, as pointed out in a note from Susquehanna International Group. That relationship signals added demand for call options implying higher gains relative to those seeking more modest advances. Increasingly, traders are turning to the cheap contracts to position for broad market advances without having to purchase pricey benchmarks.

Corporate Highlights:

- Walt Disney Co. reported better-than-expected earnings for its fiscal first quarter and issued an upbeat profit outlook for the year, giving Chief Executive Officer Bob Iger ammunition to deflect proxy challenges at its shareholder meeting this spring.

- Chip designer Arm Holdings Plc issued a surprisingly bullish earnings forecast, showing its push beyond smartphones is helping fuel growth.

- PayPal Holdings Inc. said it expects earnings to be flat this year as it continues to cut costs and streamline its operations.

- Harley-Davidson Inc. eked out a fourth-quarter profit that beat estimates as sales fell as the rugged American brand boost incentives to offset high-borrowing costs on slow-selling motorcycles.

- Under Armour Inc. raised its outlook for full-year earnings, with cost cuts in its turnaround effort making up for a continued decline in revenue.

- Philip Morris International Inc. forecast high single digit profit growth in 2024 as shipments of its Zyn nicotine pouches surge in the US, offsetting lower cigarette sales.

- SoftBank Group Corp. swung to its first profit after four quarters of losses and sketched out how it will reposition its strategy around artificial intelligence and its prized asset, Arm Holdings.

Key events this week:

- US CPI revisions, Friday

- Germany CPI, Friday

- President Joe Biden hosts German Chancellor Olaf Scholz at the White House, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 9:54 a.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0764

- The British pound fell 0.1% to $1.2608

- The Japanese yen fell 0.7% to 149.26 per dollar

Cryptocurrencies

- Bitcoin rose 2.1% to $45,127.57

- Ether rose 0.2% to $2,434.3

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.15%

- Germany's 10-year yield advanced three basis points to 2.34%

- Britain's 10-year yield advanced four basis points to 4.03%

Commodities

- West Texas Intermediate crude rose 2% to $75.31 a barrel

- Spot gold fell 0.3% to $2,029.08 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Carly Wanna, Alexandra Semenova and Allegra Catelli.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.