(Bloomberg) -- A rally in some of the world's largest technology companies fueled a rebound in stocks, with traders also weighing the latest economic data and Fedspeak for clues on the US central bank's next steps.

After a back-to-back slide, the S&P 500 bounced back as volatility in the bond market abated. The megacap space, which bore the brunt of the selling in the past few days, outperformed as Apple Inc. climbed on an analyst upgrade while Taiwan Semiconductor Manufacturing Co.'s bullish outlook lifted chipmakers.

Wall Street traders were roughly unfazed by data underscoring the resilience of the labor market, with jobless claims falling to the lowest since September 2022. While Treasury yields pushed higher in the immediate aftermath of the report, the move quickly lost steam. Among notable speakers, Fed Bank of Atlanta President Raphael Bostic reiterated he doesn't expect policymakers to cut rates until the third quarter.

“Given the underlying strength of the US economy, it's difficult to get too bearish at this point,” said Chris Zaccarelli at Independent Advisor Alliance. “The pervasive pessimism and doubt about the stock market and economy is a contrarian signal and one of the best reasons to push against the crowd. Once the last skeptic has been converted, the market will be again vulnerable to a large shock, but we aren't at that point yet.”

The S&P 500 hovered near 4,750, while the tech-heavy Nasdaq 100 climbed 1%. A gauge of chipmakers climbed 3%. Treasury two-year yields, which are more sensitive to imminent Fed moves, fell to around 4.35%. The dollar fluctuated.

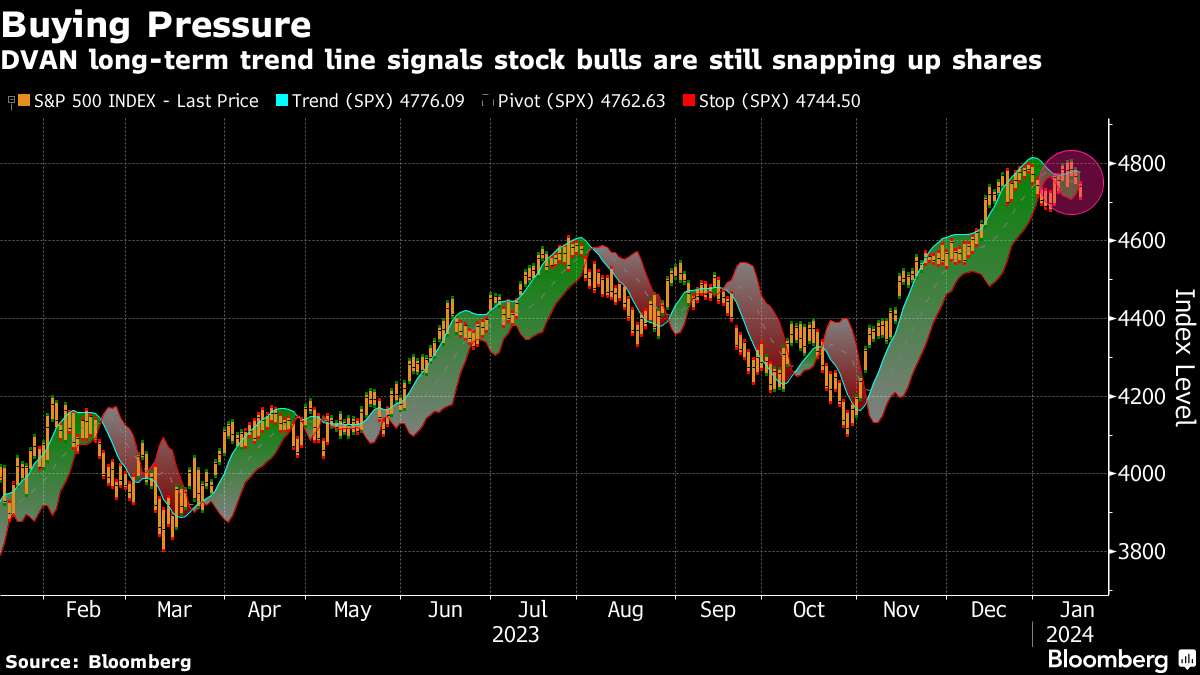

Coming off its best winning streak in two decades, the S&P 500 has run into a roadblock in 2024, with its all-time closing record set two years ago remaining elusive. But a technical gauge that measures the momentum to buy or sell stocks signals that bulls are still stepping in to snap up shares.

“You need to give the stock bulls the benefit of the doubt if traders are still willing to step in and buy at the end of the day,” said Willie Delwiche at Hi Mount Research. The index's DVAN trend line — a proprietary divergence analysis that measures buying or selling pressure — has been on a buying streak since the S&P 500 bottomed in late October, with investors continuing to scoop up shares in multiple trading sessions heading into the closing bell in the past week.

Corporate Highlights:

- Boeing Co. won an order for 150 Max jets from India's newest airline, in a rare spot of good news for the US planemaker since a piece of fuselage blew off an Alaska Airlines flight almost two weeks ago.

- Bayer AG is leaning against breaking up the conglomerate, rejecting pleas from investors frustrated by the company's ongoing struggle to recover from its costly purchase of Monsanto, according to people familiar with the matter.

- Birkenstock Holding Plc, the German sandal maker, forecast bullish sales growth for this year, helped by demand for higher-priced models as well as closed-toed shoes.

- Humana Inc. slashed its 2023 earnings outlook as the costs of members' care exceeded expectations and the Medicare-focused insurer forecast anemic enrollment growth for this year.

- KeyCorp reported fourth-quarter profit that fell short of analysts' estimates and predicted net interest income would decline this year.

- Goodyear Tire & Rubber Co. named Stellantis NV executive Mark Stewart as chief executive officer following a pressure campaign by shareholder activist Elliott Investment Management.

- Discover Financial Services posted a 62% drop in fourth-quarter profit as the company continued to grapple with the fallout from compliance and risk-management lapses that led to the resignation of its chief executive officer last year.

- Honda Motor Co. expects sales in the US to hit 1.4 million vehicles this year for the first time in three years, fueled mostly by demand for its hybrid and gas-powered models.

Key events this week:

- Canada retail sales, Friday

- Japan CPI, tertiary index, Friday

- US existing home sales, University of Michigan consumer sentiment, Friday

- ECB President Christine Lagarde and IMF Managing Director Kristalina Georgieva speak in Davos, Friday

- San Francisco Fed President Mary Daly speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.3% as of 9:48 a.m. New York time

- The Nasdaq 100 rose 1%

- The Dow Jones Industrial Average fell 0.3%

- The Stoxx Europe 600 rose 0.4%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3% to $1.0853

- The British pound fell 0.1% to $1.2658

- The Japanese yen was little changed at 148.05 per dollar

Cryptocurrencies

- Bitcoin fell 0.3% to $42,512.06

- Ether was little changed at $2,521.79

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.12%

- Germany's 10-year yield advanced two basis points to 2.33%

- Britain's 10-year yield declined six basis points to 3.93%

Commodities

- West Texas Intermediate crude rose 0.3% to $72.81 a barrel

- Spot gold rose 0.3% to $2,013.26 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.