Most markets in Asia–Pacific were trading lower. Market participants parse Australia CPI data which came lower than expected.

The Nikkei 225 was trading 0.36% down, while the S&P ASX 200 was 0.45% higher. The Kospi was 0.13% down, as of 06:39 a.m.

On Tuesday, the S&P 500 and Dow Jones Industrial Average notched a fresh high as Israel and Hezbollah reached a ceasefire agreement, Bloomberg reported. The indices ended 0.28% and 0.57% higher, respectively.

The brent crude was trading 0.03% down at $72.79 a barrel as of 06:32 a.m. The Bloomberg spot gold was trading 0.16% down at $2,628.95 an ounce.

The GIFT Nifty was trading 0.08% down at 24,229.00, as of 6:43 a.m.

The NSE Nifty 50 and the BSE Sensex failed to keep up the recovery in a choppy session on Tuesday as the benchmark indices reversed a two–session rally, dragged down by Mahindra & Mahindra Ltd. and Larsen & Toubro Ltd.

The Nifty 50 ended 27.40 points or 0.11% down at 24,194.50, and the Sensex closed 105.79 points or 0.13% lower at 80,004.06.

Overseas investors remained net buyers of Indian equities for the second consecutive day on Tuesday, while domestic institutional investors remained net sellers for the second straight day.

Foreign portfolio investors net bought stocks worth Rs 1,157.7 crore while the DIIs were net sellers of shares worth Rs 1,910.9 crore, according to provisional data shared by the National Stock Exchange.

The Indian rupee weakened by 6 paise to close at 84.34 against US dollar.

Stocks To Watch

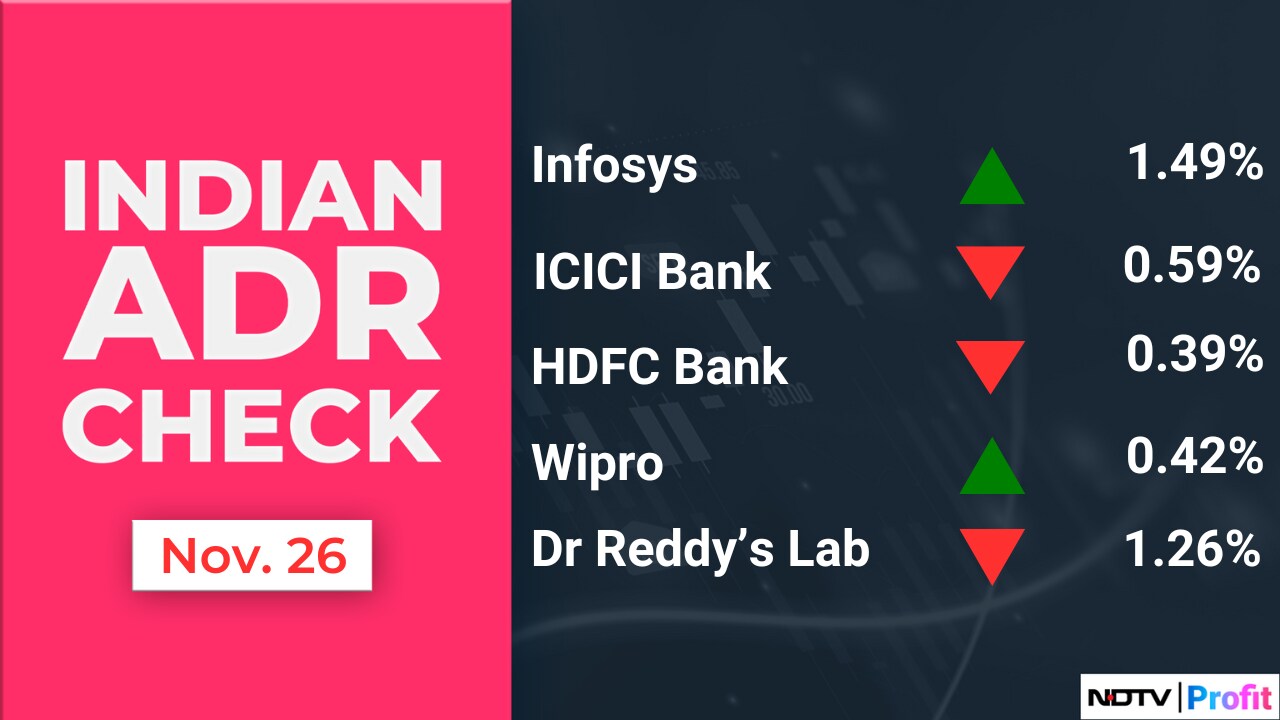

Wipro: The company extended its partnership with automotive solutions company Marelli for additional four years and received a $100 million deal from Marelli.

Infosys: The company will pay 90% variable pay to its employees for the second quarter of the fiscal. This comes as the company beat market expectations in the quarter and raised its full year guidance.

Zee Entertainment Enterprises: The Arbitral Tribunal dismissed the claims made by the company and its subsidiary, Margo Networks, against Railtel Corp. The claims were related to the alleged wrongful termination of a content-on-demand agreement with Railtel Corp.

Olectra Greentech: The company gave REC guarantee for Rs 2,500 crore loan to promoter's arm.

Aster DM Healthcare: The company has entered into an agreement with the key promoters and minority shareholders of its arm Prerana Hospital (Aster Aadhar), for acquiring additional equity shares representing 13% stake of Prerana Hospital.

Adani Enterprises: The company's arm Adani Airport holding's joint venture completed the acquisition of 74% stake of Cococart Ventures.

NTPC: The company's arm incorporated Mahagenco NTPC Green Energy as a 50:50 joint venture with the Maharashtra government for development of renewable energy projects.

Adani Green Energy: The company's arm Adani Saur Urja incorporated a wholly owned subsidiary Adani Hydro Energy Five.

Patanjali Foods: Life Insurance Corporation of India raised its stake in the company to 5.020% from 4.986%.

India Glycols: The company incorporated IGL Spirits as its wholly owned subsidiary.

Kotak Mahindra Bank: The CCI approved Kotak Mahindra Bank's

acquisition of personal loans business of Standard Chartered Bank, India Branch.

Lumax Auto Technologies: The company has acquired 60% stake in Greenfuel Energy Solutions for Rs 153 crore via arm Lumax Resources to foray into the green and alternate fuels segment.

Exide Industries: The company made an additional investment of Rs 100 crore in its arm Exide Energy. The total investment in the arm now stands at Rs 3,052 crore.

RailTel Corp.: The company has received a Rs 15 crore work order from Kakinada Smart City for the SITC, as well as the operations and maintenance of the existing Integrated Command and Communication Centre of KSCCL, Kakinada.

Sky Gold: The company has approved a bonus issue in the proportion of 9:1.

GE Vernova T&D India: The promoter will exercise the option to oversubscribe in the offer for sale.

Zaggle Prepaid Ocean Services: The company has entered into an agreement with MasterCard to recommend Zaggle SaaS platform, payment and card products to corporate customers.

Sarveshwar Foods: The company's Singapore unit received 12,000 MT order for Indian long grain parboiled rice from Monarda Commodities. The total value of the order is for Rs 44.5 crore. The arm eyes for Rs 200 crore annual revenue.

Dabur India: The company received an updated GST demand worth Rs 321 crore including interest.

UltraTech Cement: The NCLT has approved the composite scheme of arrangement between Kesoram Industries and UltraTech Cement, along with their respective shareholders and creditors. It also authorised the allotment of NCDs worth up to Rs 1,000 crore on a private placement basis.

BLS E-Services: The company has completed the acquisition of 57% controlling stake in Aadifidelis Solutions for an enterprise value of Rs 190 crore.

BLS International Services: The company's Singapore-based subsidiary acquired Beijing Biaoshi Enterprise Consulting. BLS International FZE, a subsidiary of the company, acquired a 51% stake in its UK arm.

Can Fin Homes: The company has declared an interim dividend for Rs 6 per share.

Ola Electric Mobility: The company launched Gig and S1 Z range of scooters to democratise electric mobility. Ola Gig, Ola Gig+, Ola S1 Z, and Ola S1 Z+ starting at introductory price of Rs 39,999, Rs 49,999, Rs 59,999, and Rs 64,999, respectively.

Indian Overseas Bank: The company has received an income tax refund of Rs 1,238 crore.

Earnings Post Market Hours

Siemens India Q4 FY24 (Consolidated, YoY)

Revenue up 11.5% at Rs 6,461 crore versus Rs 5,808 crore.

Ebitda up 34% at Rs 938 crore versus Rs 700 crore.

Margin at 14.5% versus 12%.

Net profit up 45.4% at Rs 831 crore versus Rs 572 crore.

Board recommended dividend of Rs 12 per share.

Listing Day

NTPC Green Energy: The company's shares will debut on the stock exchange on Wednesday. The Rs 10,000-crore IPO has been subscribed 2.42 times till the final day. The bids were led by retail investors (3.44 times), followed by qualified institutional investors (3.32 times), non-institutional investors (0.81 times) and portion reserved for employees (0.8 times). The issue price for the same is Rs 108.

IPO Offering

Enviro Infra Engineers: The public issue was subscribed 89.9 times on day 3. The bids were led by qualified institutional investors (157.05 times), non-institutional investors (153.8 times), retail investors (24.48 times), portion reserved for employees (37.77 times).

Block Deals

Quick Heal Technologies: Anupama Kailash Katkar bought 15.52 lakh shares (2.89%) at Rs 579.05 apiece, while Kailash Sahebrao Katkar sold 15.52 lakh shares (2.89%) at Rs 579.05 apiece.

Bulk Deals

Aptus Value Housing Finance: Westbridge Crossover Fund LLC sold 32.9 lakh shares (0.65%) at Rs 320.39 apiece.

Insider Trade

Mangalam Cement: Promoter Rambara Trading bought 50,000 shares on Nov. 22.

Star Cement: Promoter Sarika Jalan sold 28,353 shares between 19 Nov. and 21.

BMW Industries: Promoter Ram Gopal Bansal bought 50,000 shares on Nov. 21.

G N A Axles: Promoter Ranbir Singh bought 27491 shares between Nov. 13 and 22.

Ethos: Promoter Saboo Ventures LLP sold 30,000 shares on Nov. 25.

Bharat Wire Ropes: Promoter Manan Mittal bought 22,796 shares on Nov. 19.

Sheela Foam: Promoter Rahul Gautam bought 25,000 shares on Nov. 25.

Salasar Techno Engineering: Promoter Alok Kumar sold 6.65 lakh shares, promoter Tripti Gupta sold 5.5 lakh shares, promoter Shikhar Gupta sold 6.69 lakh shares, promoter Shikhar Fabtech Pvt. sold 6.24 lakh shares between Nov. 22 and Nov. 25.

Trading Tweaks

Ex/ record dividend: Natco Pharma, IPCA Laboratories, Happiest Minds, Pearl Global, Ingersoll Rand.

Who's Meeting Whom?

Safari Industries: To meet Investors and analysts on Nov. 29.

Jana Small Finance Bank: To meet Investors and analysts on Nov. 29.

Biocon: To meet Investors and analysts on Nov. 26.

BSE: To meet Investors and analysts on Dec. 3.

Intellect Design: To meet Investors and analysts on Nov. 26.

SIS: To meet Investors and analysts on Nov. 29

F&O Cues

Nifty November futures down by 0.28% to 24,205 at a premium of 11 points.

Nifty November futures open interest down by 14.25%.

Nifty Options Nov. 28 Expiry: Maximum call open interest at 22,350 and maximum put open interest at 21,950.

Securities in ban period: Nil

Money Market

The Indian rupee closed weak against the US dollar on Tuesday, with analysts seeing banks turning cautious over their dealings with the domestic unit.

The local currency slipped by six paise to close at 84.34, after opening flat against the greenback earlier in the day. The slip in rupee's value comes a day after the currency appreciated by 17 paise to close at 84.28 on Monday.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.