Asian markets rose as investors assesses Japan's inflation data. At 7:14 a.m., both Australia's ASX 200 and Japan's Nikkei were 0.8% higher, Hong Kong's Hang Seng rose 0.1%, and South Korea's Kospi climbed more than 1%.

In US, indices ended higher. S&P 500 rose 0.53% to 5,948.71, Dow Jones was up 1.06% at 43,870.35, and Nasdaq Composite closed up 0.03% at 18,972.42.

At 7:19 a.m., Brent Crude rose 0.3% to $74.44 a barrel and GIFT Nifty traded 0.1% down at 23,443.50.

The NSE Nifty 50 and the BSE Sensex closed at the lowest level in over five months on Thursday. The Nifty 50 ended 168.60 points or 0.72% down at 23,349.90, and the Sensex closed 422.59 or 0.54% down at 77,155.79.

Globally, market sentiment weakened after Ukraine said Russia fired an intercontinental ballistic missile during an overnight attack. Intraday, both Nifty and Sensex fell around 1% to hit their lowest since June 10 and June 24, respectively.

Overseas investors remained net sellers of Indian equities for the 37th consecutive session on Thursday, while domestic institutional investors stayed net buyers.

Foreign portfolio investors net sold stocks worth Rs 5,320.68 crore, according to provisional data shared by the National Stock Exchange. The domestic institutional investors were net buyers of shares worth Rs 4,200.16 crore.

Stocks To Watch

Tata Power: The company signed a memorandum of understanding with Asian Development Bank for $4.25 billion to finance key clean energy power projects.

SJVN: The company signed an MoU with the Rajasthan Energy Department to spearhead the development of renewable energy in the state. Under the MoU, SJVN would develop 5 GW pumped storage projects and 2 GW floating solar projects in the state.

Afcons Infrastructure: The company received a letter of acceptance from the Uttarakhand Project Development and Construction Corp. for civil works worth Rs 1,274 crore.

Mphasis: The company has been named as the 'official digital partner' of MoneyGram Haas F1 Team. It will collaborate with MoneyGram Haas F1 Team to develop cutting-edge solutions aimed at enhancing the team's performance on the track and driving operational efficiency off the track.

Raymond: The BSE and NSE have issued a no objection letter for the demerger between Raymond and Raymond Realty.

LIC: The company increased its shareholding in LTIMindtree from 5.033% to 7.034%.

ICICI Prudential Life Insurance: The company to make an investment up to 10% of share capital in Bima Sugam India Federation.

Wipro: The company has fixed Dec. 3 as a record date for the purpose of determining the equity shareholders of the company eligible for bonus equity shares.

Protean eGov Technologies: NSE Investments to sell up to 20.3% stake in the company, including oversubscription option. The offer for sale floor price at Rs 1,550 per share.

Medplus Health: The company received a suspension order of drug licence for Karnataka store.

Hyundai Motor India: The company to set up two renewable energy plants in Tamil Nadu.

Popular Vehicles and Services: The company's arm has inaugurated a new 3S facility exclusively offering Bharat Benz vehicles in Maharashtra.

Man Industries: The company will monetise assets of arm Merino Shelters and incorporate a wholly owned subsidiary branch in Taiwan.

Listing

Zinka Logistics Solution: The company's shares will debut on the stock exchange on Friday. The Rs 1,114-crore IPO has been subscribed 1.86 times on the final day. The bids were led by the portion reserved for employees (9.88 times), followed by qualified institutional investors (2.76 times), retail investors (1.66 times) and non-institutional investors. The issue price for the same is Rs 273.

IPO Offering

NTPC Green Energy: The public issue was subscribed 0.93 times on day 2. The bids were led by retail investors (2.38 times), followed by portion reserved for shareholders (1.01 times), qualified institutional investors (0.75 times), non-institutional investors (0.34 times) and portion reserved for employees (0.4 times).

Enviro Infra Engineers: The company will offer shares for bidding on Friday. The price band is set from Rs 140 to Rs 148 per share. The Rs 650.43-crore IPO is a combination of a fresh issue of Rs 572.46 crore and the rest offer for sale. The company raised Rs 195 crore from anchor investors.

Insider Trades

Bigbloc Construction: Promoter Narayan Sitaram Saboo bought 40,000 shares on Nov. 19.

Indoco Remedies: Promoter Aditi Panandikar bought 15,130 shares on Nov. 19.

BMW Industries: Promoter Ram Gopal Bansal bought 1.22 lakh shares on Nov. 18 and 19.

Trading Tweaks

Price band changes from 20% to 10%: Orient Technologies.

Ex/ record dividend: Amrutanjan Health Care, Panama Petrochem, Steelcast, FDC, Orient Technology, MSTC.

Moved into short term ASM: Honasa Consumer.

Moved out short term ASM: KRN Heat Exchanger and Refrigeration, ITI.

Who's Meeting Whom?

V-Mart Retail: To meet investors and analysts on Nov. 29 and Dec. 2.

Indian Shelter Finance Corp: To meet Investors and analysts on Nov. 26 and 28.

Aurobindo Pharma: To meet investors and analysts on Nov. 26.

Polycab India: To meet investors and analysts on Nov. 26.

Jyothy Labs: To meet investors and analysts on Dec. 10.

Godrej Consumer Products: To meet investors and analysts on Nov. 26.

F&O Cues

Nifty November futures down by 0.78% to 23,350 at a premium 0.95 points.

Nifty November futures open interest down by 2.29%.

Nifty Options Nov. 28 Expiry: Maximum call open interest at 24,000 and maximum put open interest at 21,700.

Securities in ban period: Aarti Industries, Aditya Birla Fashion Retail, Adani Enterprises, GNFC, Granules, Hindustan Copper, IGL, National Aluminium.

Money Market

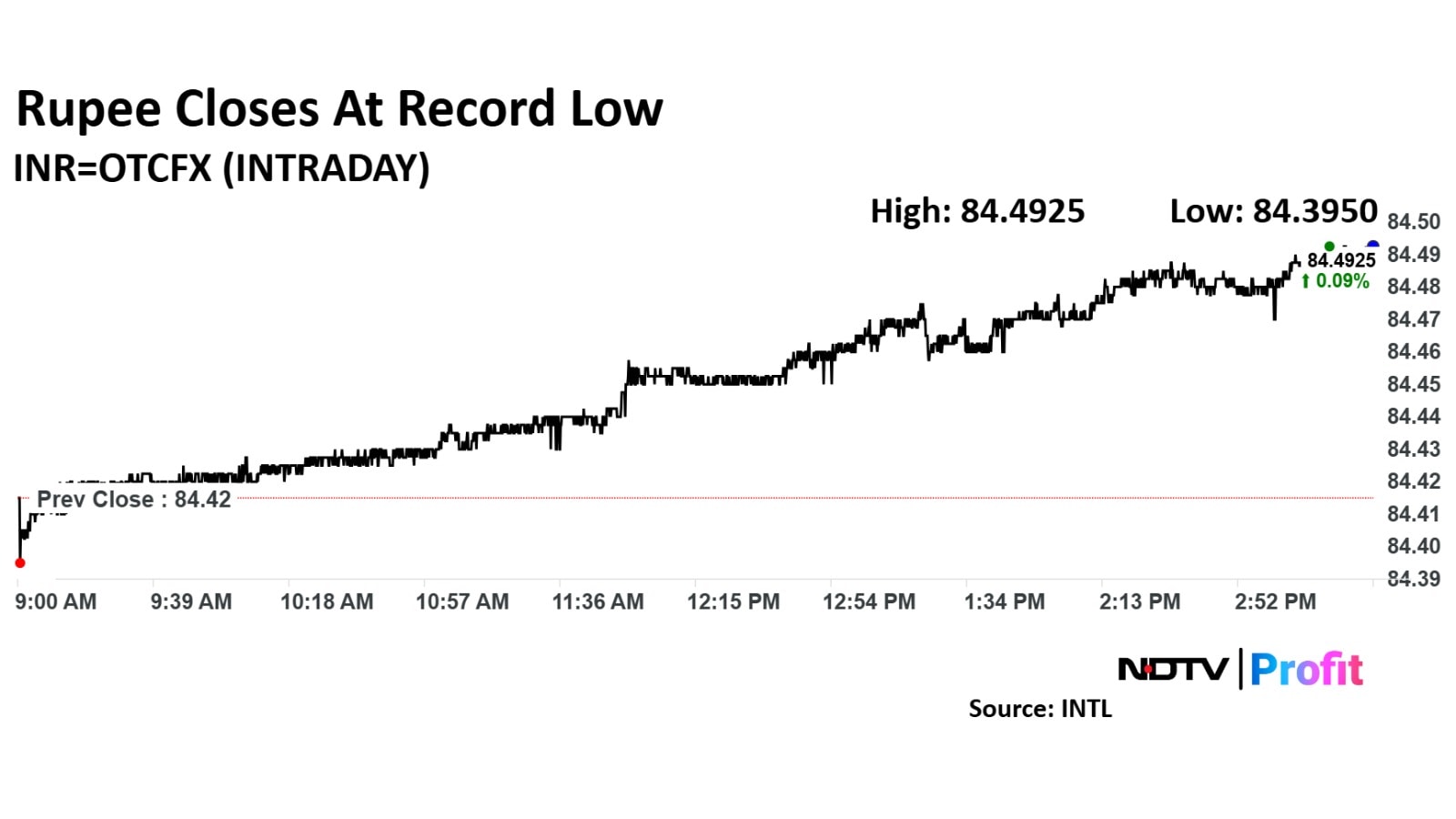

The Indian rupee closed at a record low against the US dollar on Thursday.

The local currency closed nine paise higher at Rs 84.50, according to Bloomberg data, as the Reserve Bank of India continued intervention. It had closed at Rs 84.41 on Tuesday.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.