Markets in Asia-Pacific logged losses in early trade on Wednesday after an overnight sluggish session on Wall Street, while market participants await Nvdia Corp.'s earnings.

The Nikkei 225 was 0.35% lower at 38,154.53 as of 06:25 a.m. The Kospi 0.25% lower at 2,683.57.

The S&P ASX 200 was 0.38% lower at 8,040.10 as of 06:26 a.m. before the release of July inflation figure from Australia.

Market participants await Nvidia Corp.'s earning, scheduled to be released later on Wednesday, to check if enthusiasm over artificial intelligence is still going to trigger a bull run.

Both the S&P 500 and Nasdaq Composite ended 0.16% higher, on Tuesday. The Dow Jones Industrial Average settled 0.02% higher.

The October contract of brent crude on Intercontinental Exchange was trading 0.49% higher at $79.94 per barrel as of 06:32 a.m.

The GIFT Nifty was trading 0.03%, or 7 points lower at 25,003.0 as of 06:32 a.m.

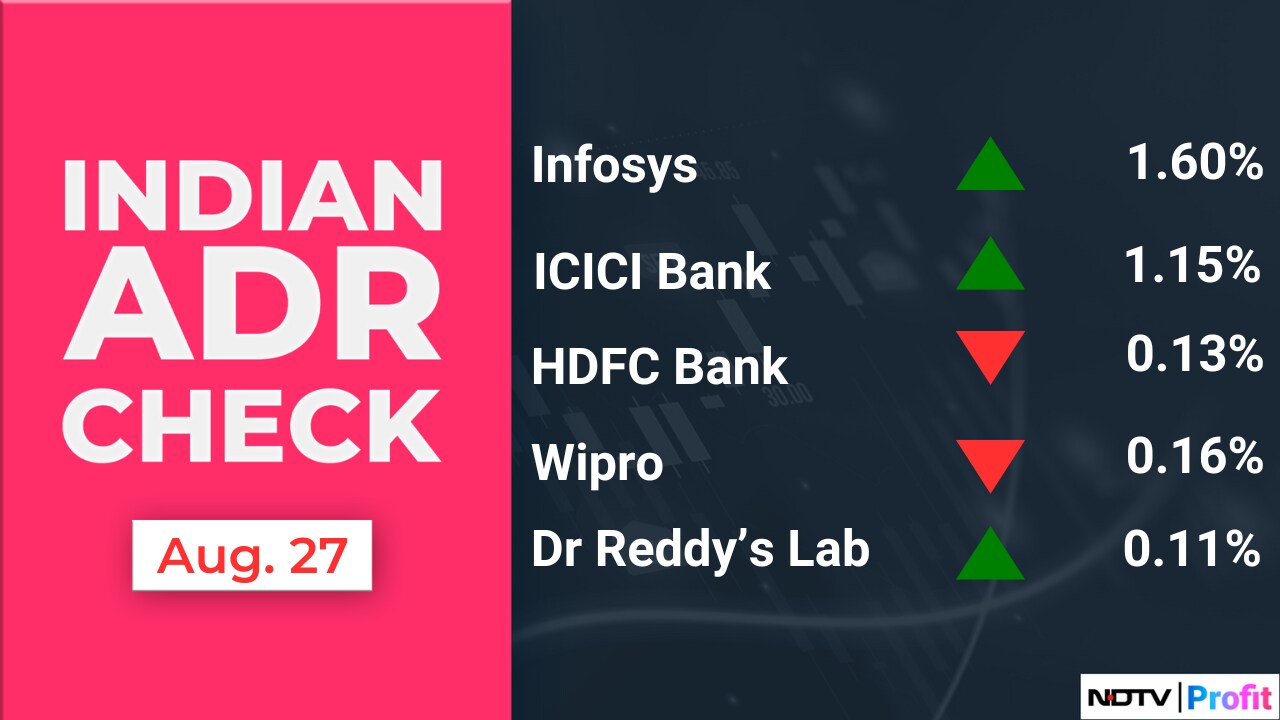

The Indian benchmark stock indices ended a lackluster session on Tuesday with little change as gains in Infosys Ltd., and Larsen & Toubro Ltd. supported the indices, while losses in Reliance Industries Ltd. and Hindustan Unilever Ltd. weighed on the indices.

The NSE Nifty 50 ended 7.15 points or 0.03% higher at 25,017.75, and the S&P BSE Sensex closed 13.65 points or 0.02% up at 81,711.76.

Overseas investors stayed net buyers of Indian equities on Tuesday for the fourth consecutive session. Foreign portfolio investors bought stocks worth Rs 1,503.8 crore, while domestic investors turned net sellers after remaining buyers for 16 sessions and offloaded equities worth Rs 604.1 crore, according to provisional data from the National Stock Exchange.

The Indian currency depreciated 2 paise to close at 83.92 against the US dollar.

Stocks to Watch

ICICI Prudential Life Insurance Company: The company received a GST demand and penalty order worth Rs 429 crore from the Maharashtra tax authority.

Godrej Agrovet: The company completed the acquisition of an additional 49% stake in arm Godrej Tyson foods from Tyson India Holdings. Godrej Tyson Foods has become a wholly owned subsidiary of the company effective from Tuesday.

Gensol Engineering: The company launched US subsidiary Scorpion Trackers and targets a 2,000 MW annual supply by 2028.

PNC Infratech: The company was declared the lowest bidder for a highway project worth Rs 380 crore in Uttar Pradesh and Bihar.

Aditya Birla Capital: The company made an investment of Rs 300 crore via rights in unit Aditya Birla Housing Finance.

Indostar Capital Finance: The company sold a portion of its stressed book to Pridhvi Asset Reconstruction. The sale includes certain Stage 2-tagged accounts with outstanding dues of Rs 357 crore.

SBI, SBI Cards: Dinesh Khara retires as chairman today. Khara resigned as director of SBI Card & Payment Services.

Awfis Space Solutions: The company signed the largest managed aggregation deal of 3 lakh sq. ft. with Nyati Group.

Skipper: The company approved raising up to Rs 600 crore via equity and debt.

Jio Financial Services: The company subscribed to an additional 6.8 crore shares of Jio Payments Bank for Rs 68 crore. The company's holding in payment bank units increased to 82.17% from 78.95%.

Bank of Baroda: The company announced that it has raised Rs 5,000 crore by issuing long-term infrastructure bonds. The lender said it is a 10-year bond issued at a coupon of 7.30%, as per an official statement.

Yes Bank: Amit Sureka, Country Head of Financial Markets, ceased to be part of senior management of the bank.

Medplus Health Services: Warburg Pincus affiliate exited the company by selling an entire 11.35% stake via an open market transaction.

IndiaMART InterMESH: The company incorporated a new unit, IIL Digital for digital marketplaces and software solutions.

UPL: The company arm acquired the remaining 20% stake in PT Excel for $6.9 million.

Infibeam Avenues: The company's artificial intelligence arm introduced a women's safety feature in 'AI Facility Manager' for CCTVs.

NBCC (India): The company is to consider a proposal for the issue of bonus shares on August 31.

Carysil: The company's UK unit will acquire the remaining 30% stake of Yorkshire-based Carysil Brassware for £350,000.

Listing Day

Orient Technologies: The company's shares will debut on the stock exchanges on Wednesday at an issue price of Rs 206 apiece. The Rs 214.76-crore IPO was subscribed 151.71 times on its third and final day. Bids were led by institutional investors (189.9 times), retail investors (66.87 times), and non-institutional investors (300.6 times).

IPO Offering

Premier Energies: The public issue was subscribed to 16.96 times on day one. The bids were led by retail investors (24.49 times), non-institutional investors (20.97 times), and qualified institutional investors (0.16 times).

ECOS (India) Mobility & Hospitality: The company will offer its shares for bidding on Wednesday. The price band is set from Rs 318 to Rs 334 per share. The Rs 601.2-crore IPO issue is entirely an offer for sale. The company raised 180.3 crore from anchor investors.

Block Deals

Trent: Dodona Holdings sold 6.78 lakh shares (0.19%) at Rs 6,925 apiece. On the other hand, Siddhartha Yog bought 6.78 lakh shares (0.19%) at Rs 6925 apiece.

Bulk Deals

Tata Technologies: TPG Rise Climate sold 1.21 crore shares (2.98%) at Rs 1,014 apiece, while Copthall Mauritius Investment bought 40.1 lakh shares (0.98%) and Ghisallo Master Fund bought 31.22 lakh shares (0.76%) at Rs 1,013 apiece.

Aavas Financiers: Amansa Holdings sold 17.5 lakh shares (2.21%) at Rs 1,690 apiece, while Nippon India Mutual Fund A/C - Nippon India Multi Cap Fund bought 10 lakh shares (1.26%) at Rs 1,690 apiece.

Rolex Rings: ICICI Prudential Mutual Fund sold 3.19 lakh shares (1.17%) at Rs 2,425 apiece, Ashokkumar Dayashankar Madeka sold 2.72 lakh shares (0.99%) at Rs 2,419 apiece and Sanjaykumar Bhagvanji Bole sold 1.74 lakh shares (0.64%) at Rs 2419 apiece. On the other hand, SBI Mutual Fund bought 2.8 lakh shares (1.02%) at Rs 2421.66 apiece, India Acorn Icav bought 2.03 lakh shares (0.74%) at Rs 2421.63 apiece and Kotak Mahindra Mutual Fund bought 1.7 lakh shares (0.62%) at Rs 2,425 apiece. Franklin Templeton Mutual Fund also bought 1.56 lakh shares (0.57%) at Rs 2421.08 apiece.

FedBank Financial Services: Anil Kothuri sold 20 lakh shares (0.54%) at Rs 121 apiece.

Insider Trades

Info Edge (India): Promoter Hitesh Oberoi sold 40,223 shares on Aug. 26 and Promoter Endeavour Holding Trust sold 39,095 shares on Aug. 26.

ADF Foods: Promoter Krish Bhavesh Thakkar sold 75,000 shares between Aug 23 and 26.

Trading Tweaks

Price Band change from 20% to 10%: Goldiam International, NIIT.

Ex/record dividend: GE T&D, Hindustan Zinc, Force Motors, Sigachi Industries.

Ex/record AGM: Gandhar Oil Refinery, Force Motors, Sigachi Industries.

Moved in short term ASM Framework: Hinduja Global Solutions, NIIT.

F&O Cues

Nifty August futures down by 0.17% to 25,001 at a discount of 16 points.

Nifty August futures open interest up by 2.3%.

Nifty Bank August futures down by 0.01% to 51,213 at a discount of 65 points.

Nifty Bank August futures open interest down by 6%.

Research Reports

Sumitomo Chemical - Maintain Buy On Healthy Long-Term Fundamentals: Nirmal Bang

JSW Cement DRHP Analysis - Leadership In The Fast-Growing GGBS Boosts Outlook: Systematix

Raymond Lifestyle - On A Transformative Journey: Motilal Oswal

Syrma - ‘Building For Tomorrow' Action Plan Based On Innovation, Reliability, Agility: Dolat Capital

Federal Bank - Going From Strength To Strength: Axis Securities

Amber Enterprises - Electronics, Mobility Are The Future Growth Levers: Nirmal Bang

Aether Industries - Expansion, Diversification: HDFC Securities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.