Overseas investors stay net sellers for three consecutive sessions on Tuesday.

Foreign portfolio investors sold stocks worth Rs 455.59 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors continues as buyers and purchased stocks worth Rs 721.52 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 96,433 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The yield on the 10-year bond closed flat at 7.27% on Tuesday.

Source: Bloomberg

The local currency ended flat at around 83.354, which was the lowest-ever close against the U.S. dollar on Tuesday.

It had closed at all time weakest level of 83.346 against the U.S. dollar on Monday.

Source: Bloomberg

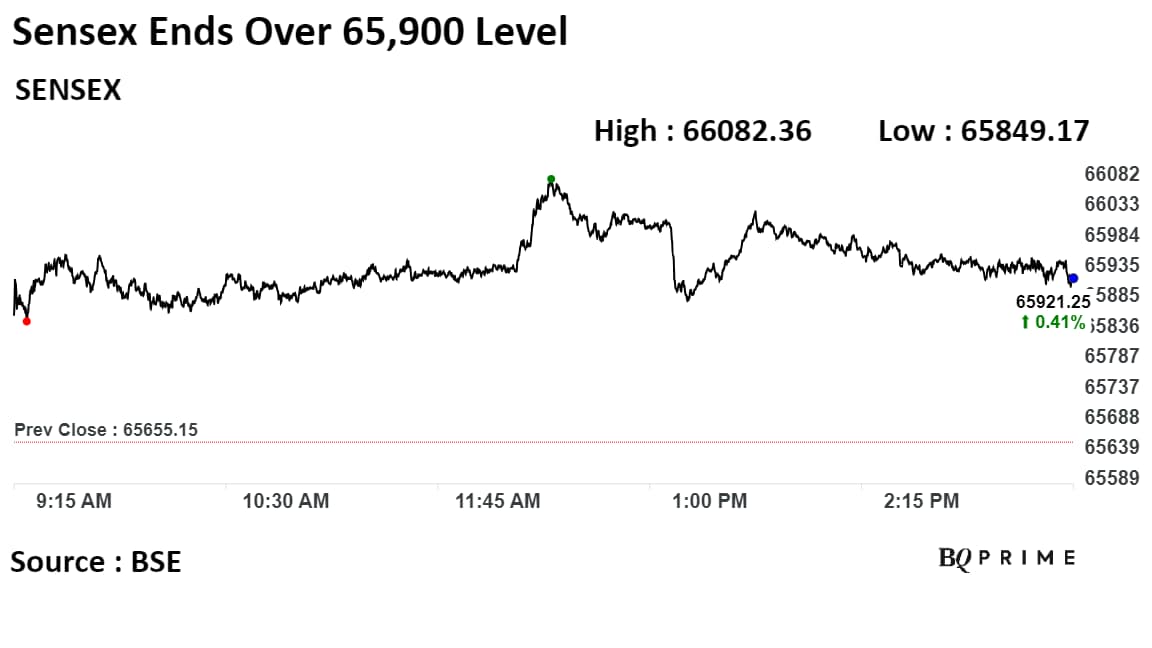

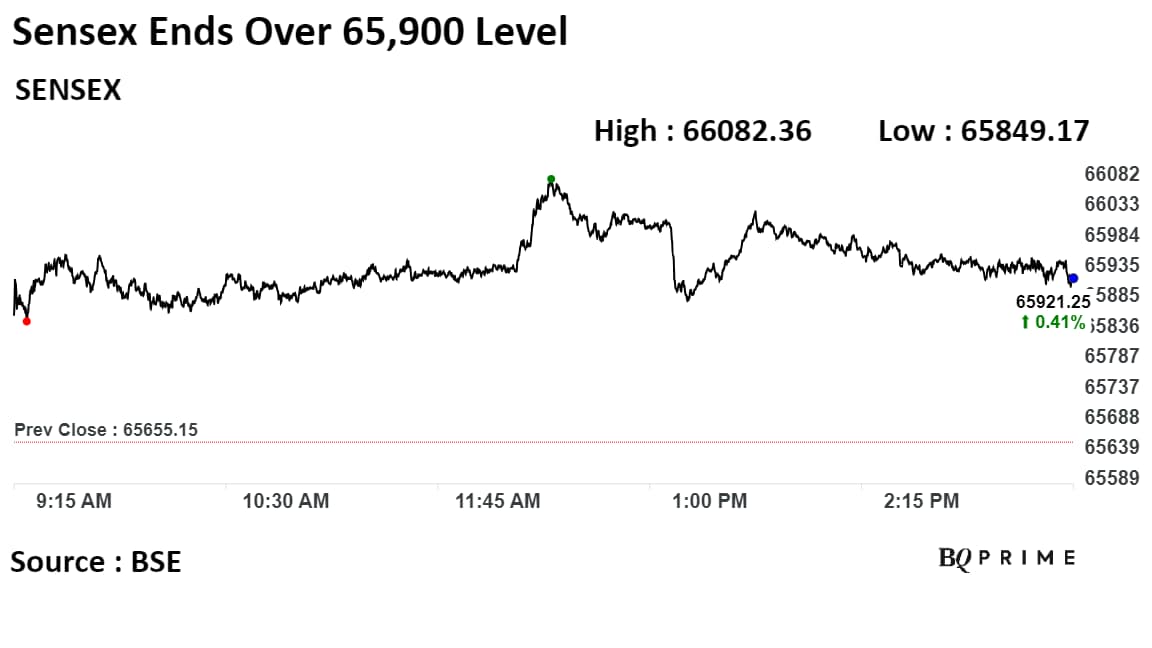

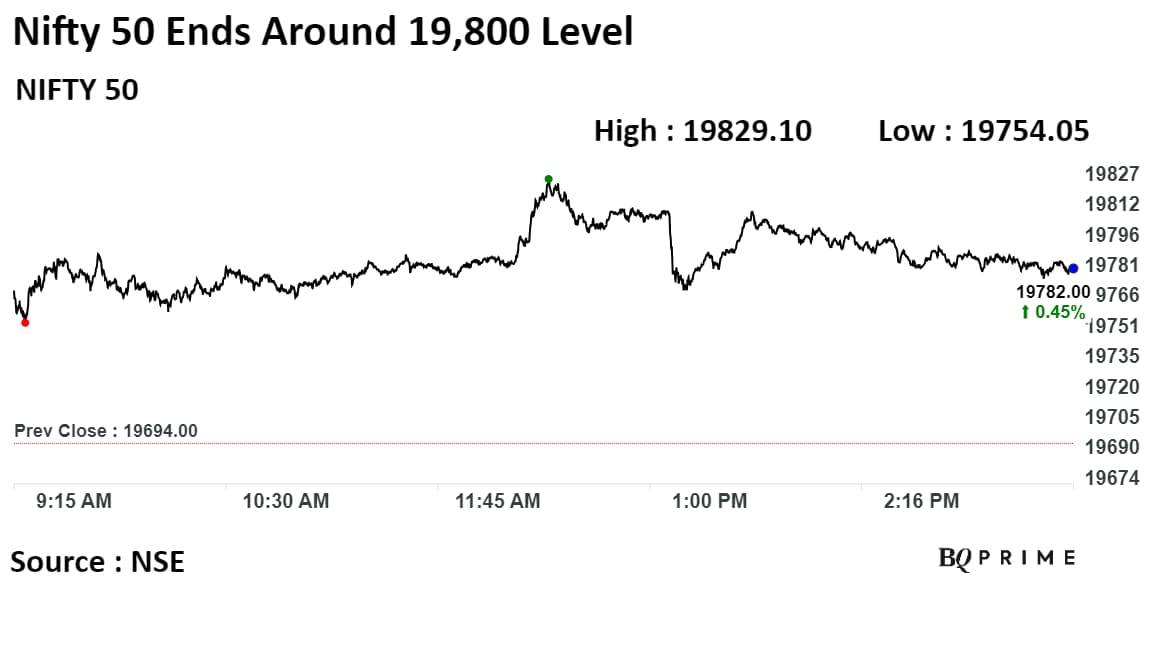

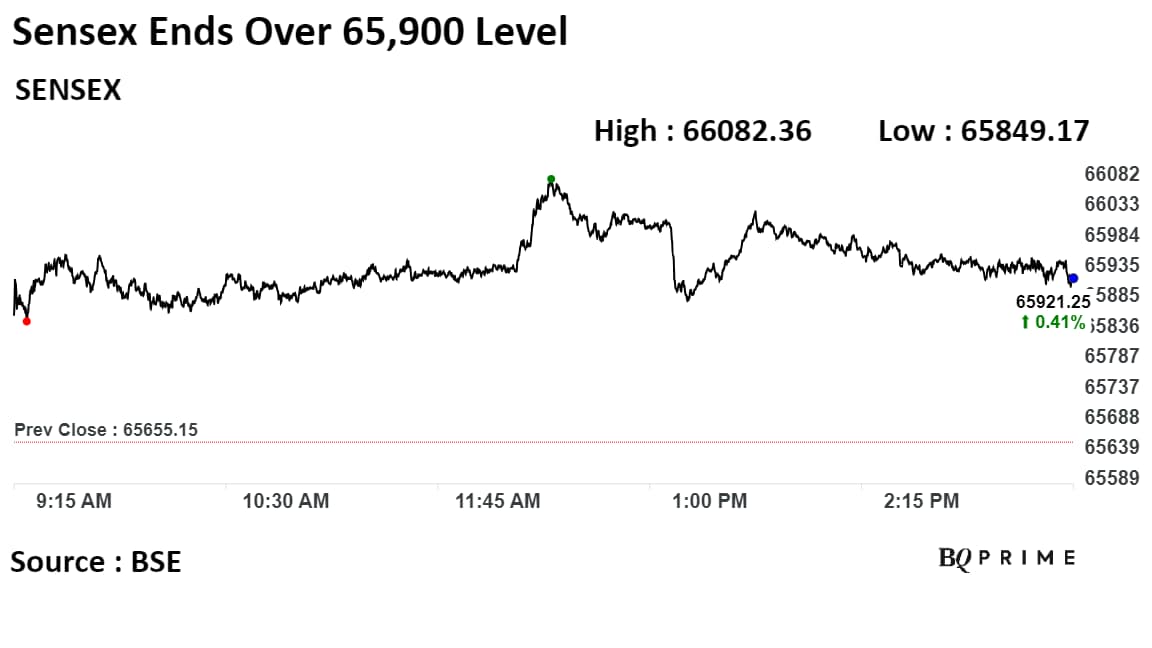

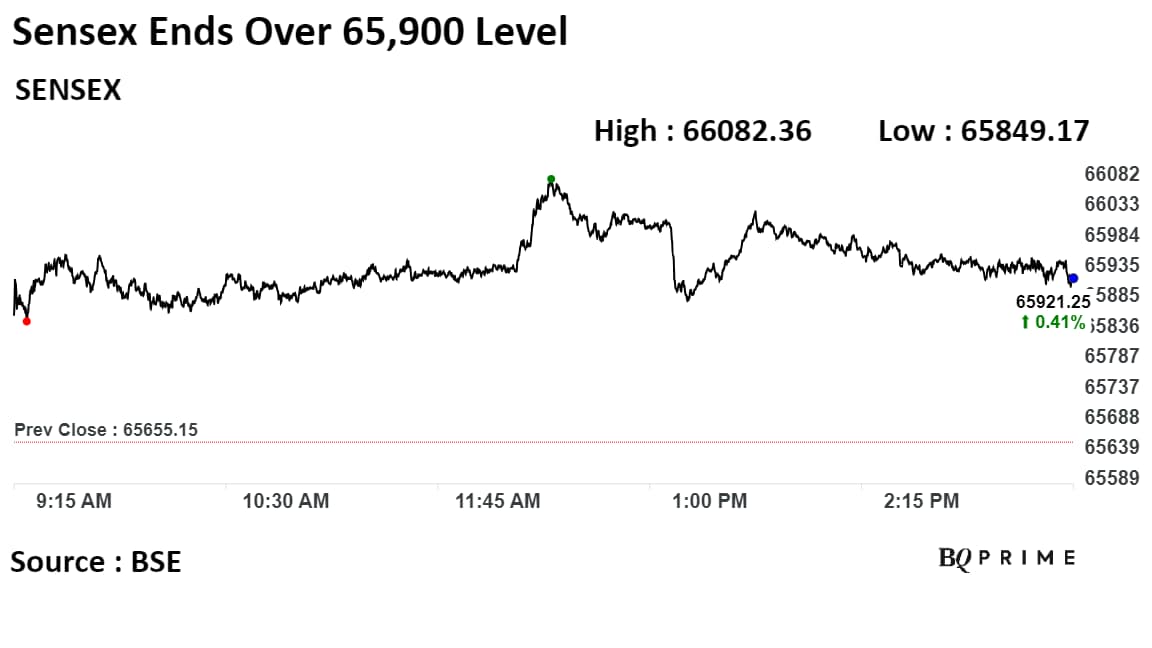

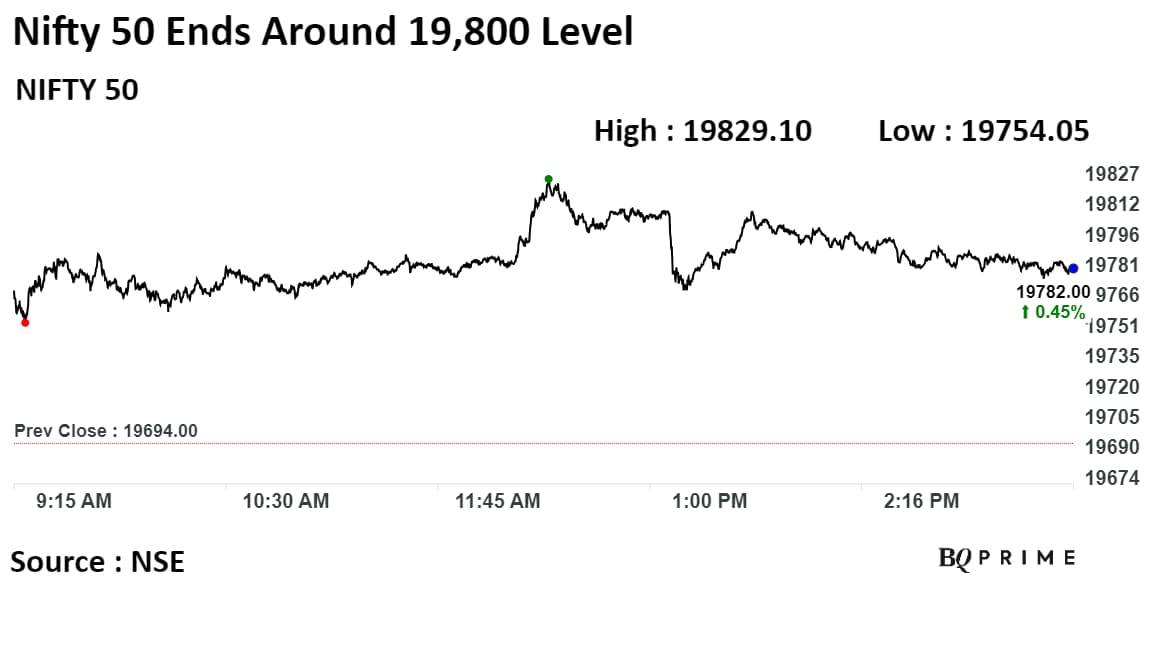

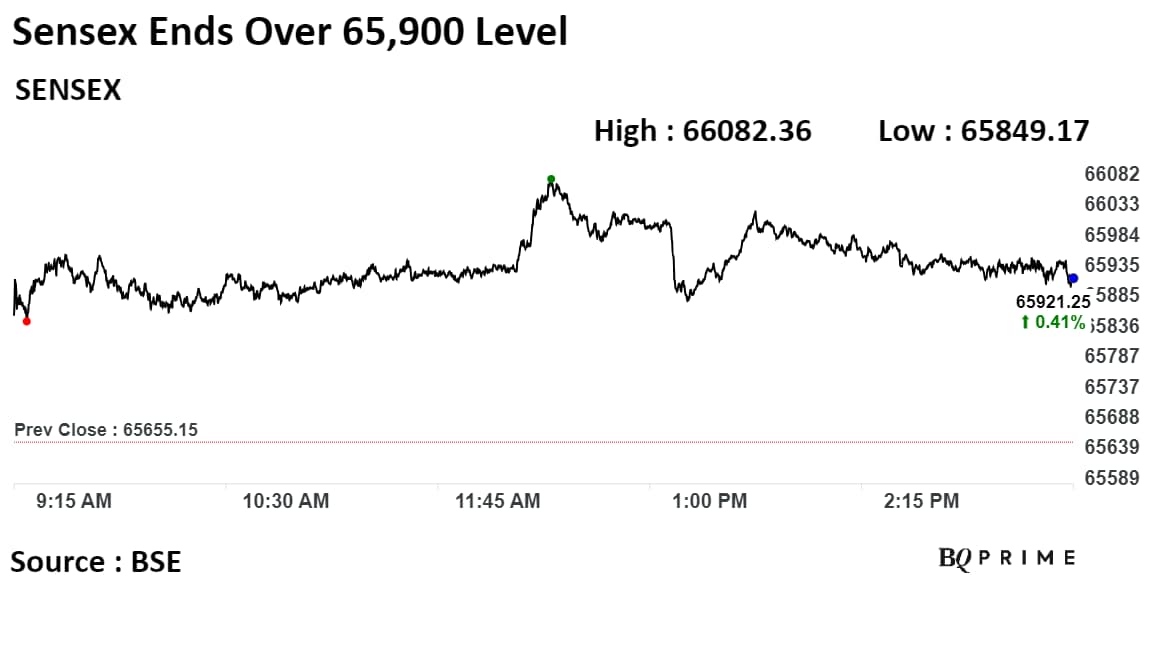

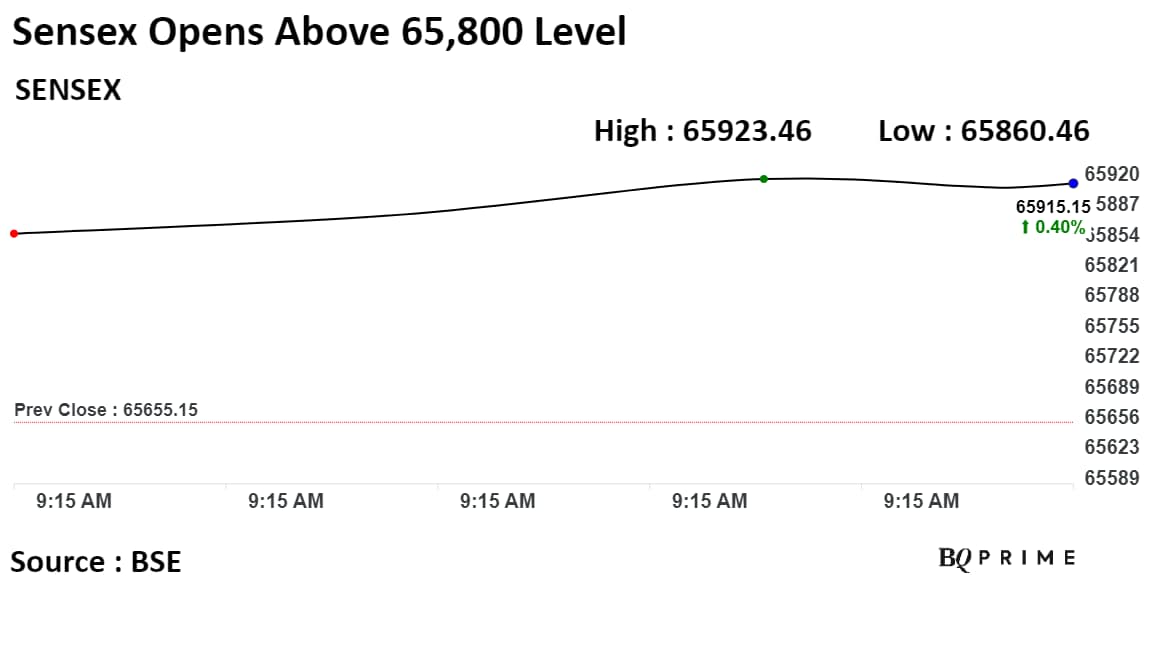

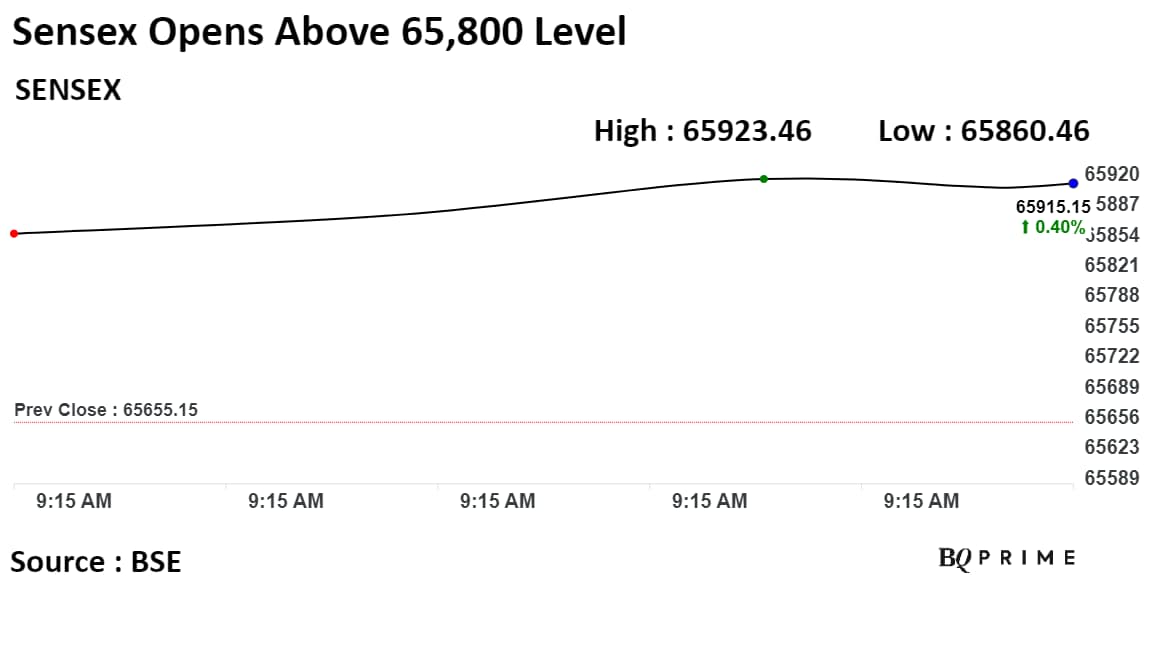

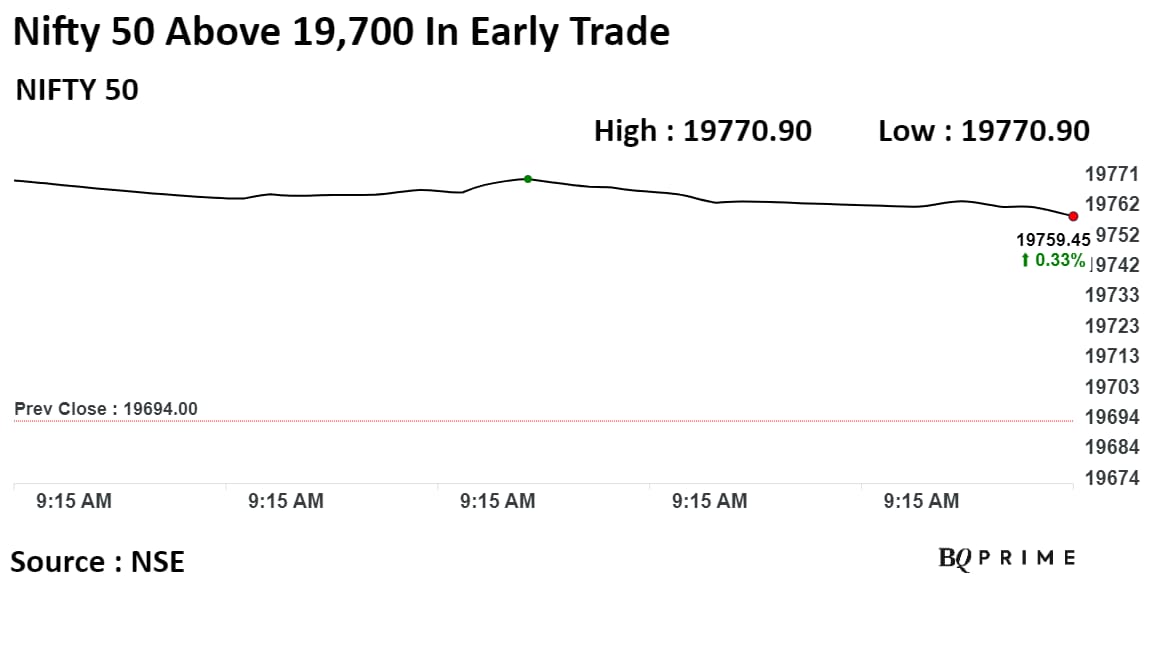

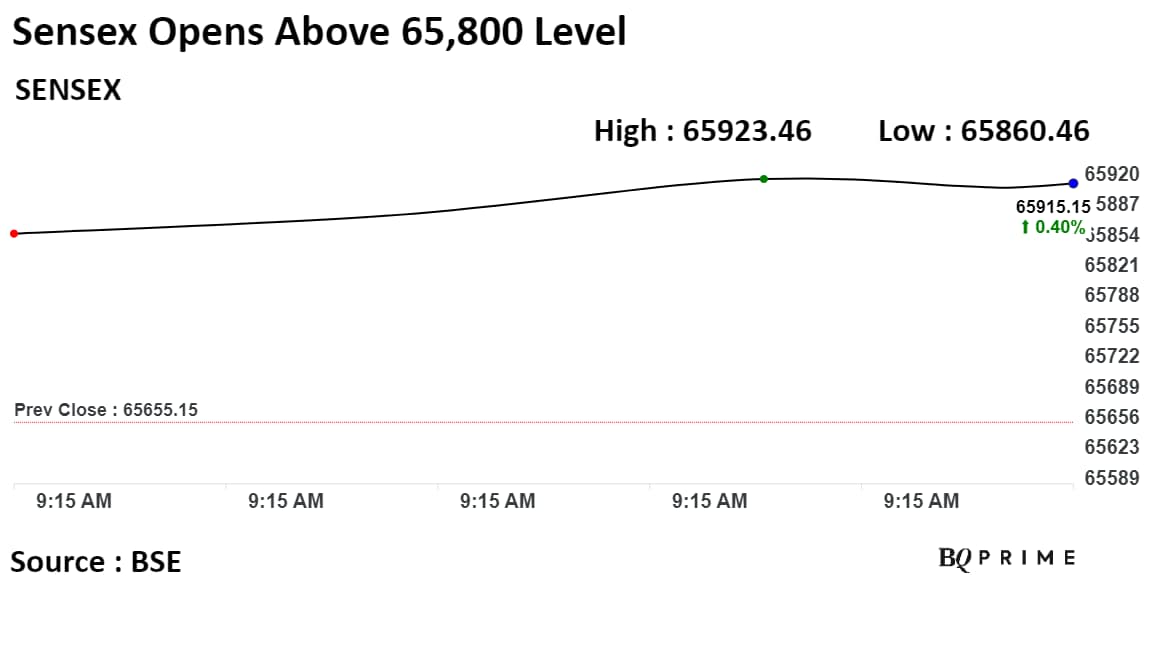

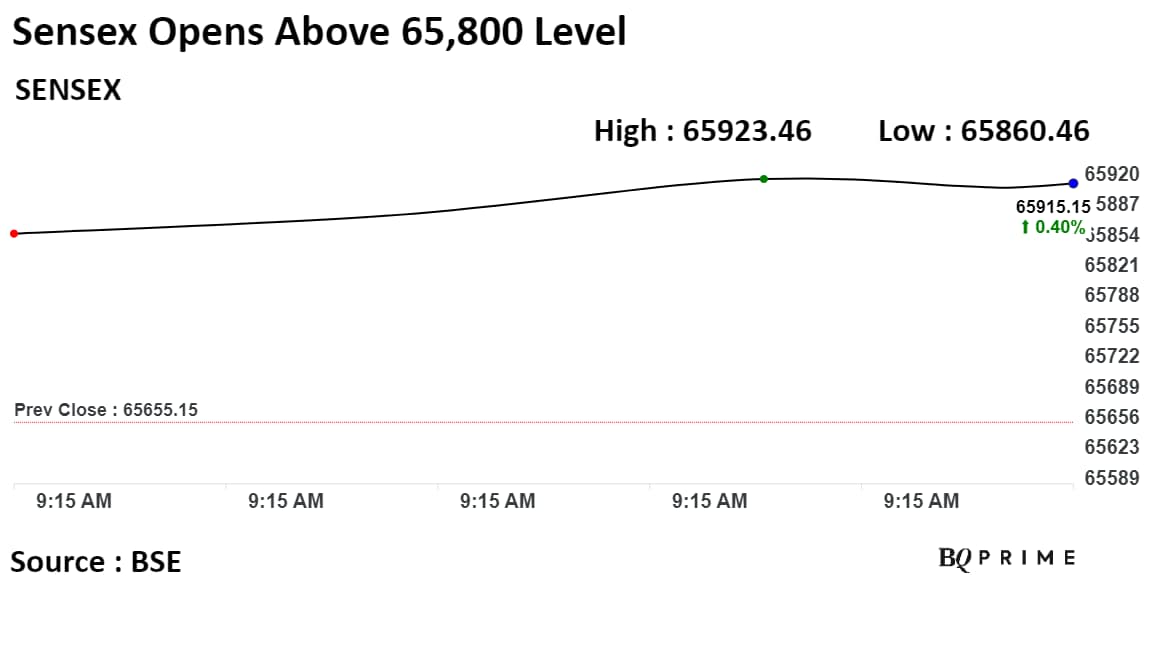

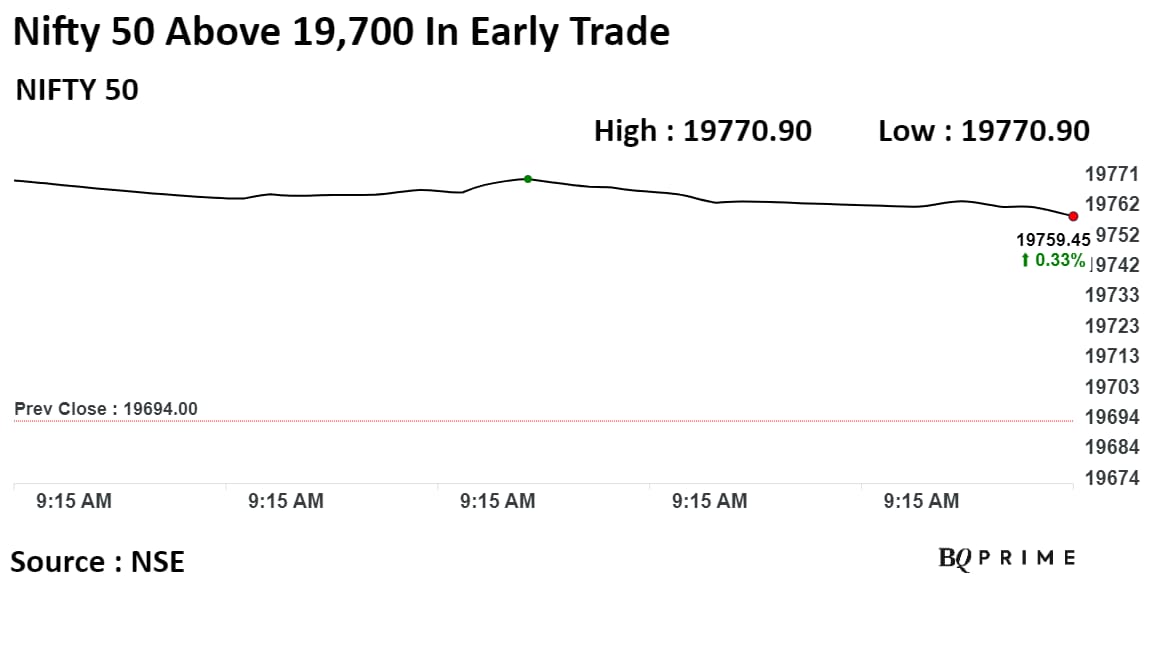

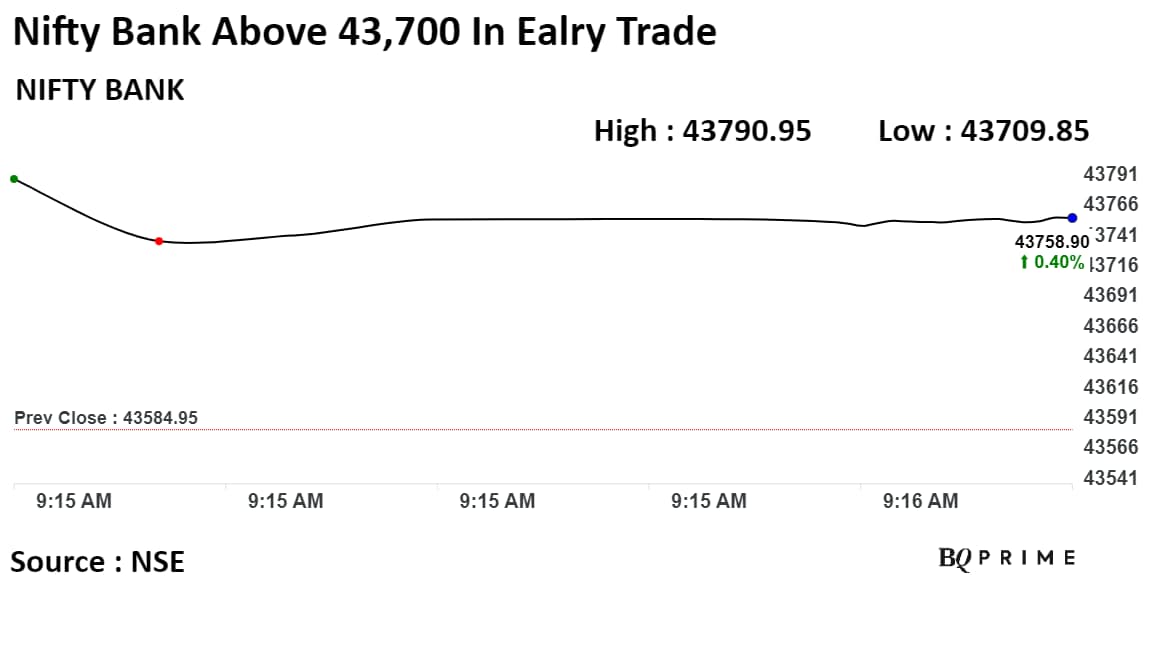

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

India's benchmark stock indices advanced on Tuesday, after snapping two days of decline as heavyweights Reliance Industries Ltd., and HDFC Bank Ltd. led.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal and consumer durables advanced the most, while fast-moving consumer goods and public-sector banks faced pressure.

The S&P BSE Sensex Index closed up 276 points, or 0.42, at 65,930.77 while the NSE Nifty 50 was 89 points or 0.45% higher at 19,783.40.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid.

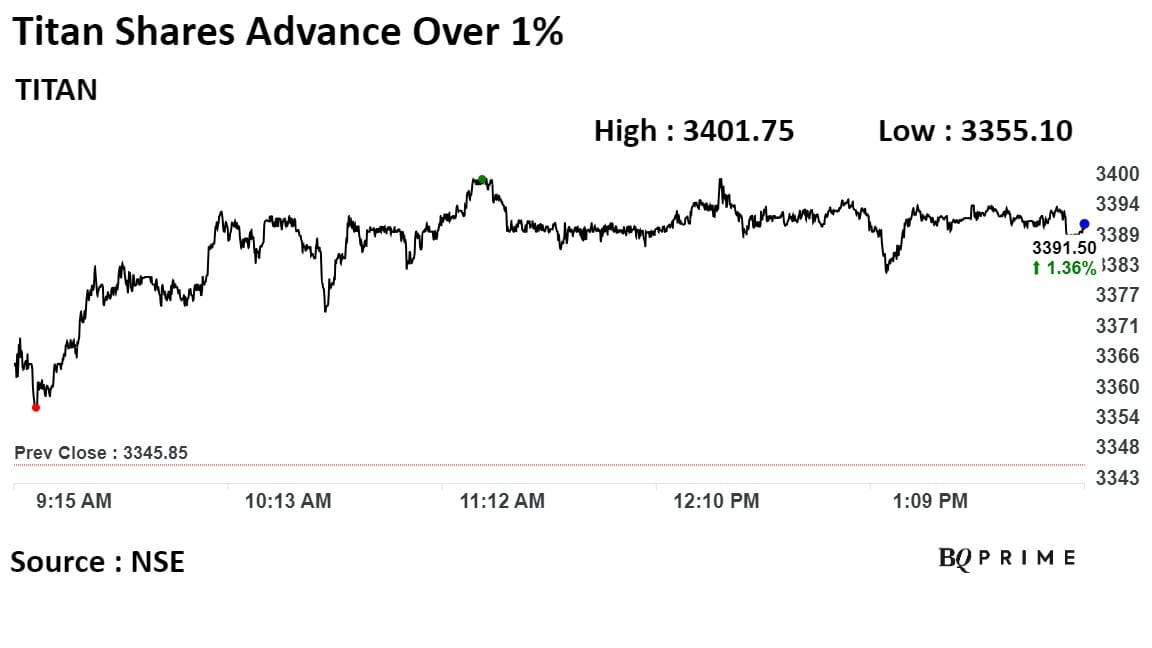

Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., and Titan Co. were positively adding to the change in the Nifty 50 Index.

Whereas, Coal India Ltd., ONGC Ltd., Larsen & Toubro Ltd., State Bank of India, and Tata Consultancy Services Ltd. were negatively contributing to the change.

We remain cautiously optimistic on the market from a medium-term perspective, said Vinay Paharia, CIO, PGIM India Mutual Fund. "Our caution is because markets are trading at a premium to its current fair value. However, this fair value is likely to grow at a strong pace in the medium-term, hence we remain optimistic from a medium to long-term perspective."

The broader markets ended higher; the S&P BSE MidCap Index was up 0.14%, whereas S&P BSE SmallCap Index was 0.20% higher.

Twelve out of 20 sectors compiled by BSE advanced, while eight sectors declined. S&P BSE Consumer Durables anf S&P BSE Realty rose the most.

The market breadth was skewed in the favour of the buyers. About 2,029 stocks rose, 1,688 declined, while 137 remained unchanged on the BSE.

As the market remains rangbound, it is likely to wait till the State elections outcome is known, saysD r. V K Vijayakumar, chief investment strategist at Geojit Financial Services.

"If the state election outcome indicates political stability after the general elections of 2024, that will act as the trigger for the rally. And, if such a rally happens, it is likely to be led by large-caps across the board in sectors like banking, I.T., automobiles, capital goods, telecom, real estate and construction-related segments," said he added.

10 lakh shares changed hands in a large trade

0.13% equity changed hands at Rs 369.30 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Top Gainers

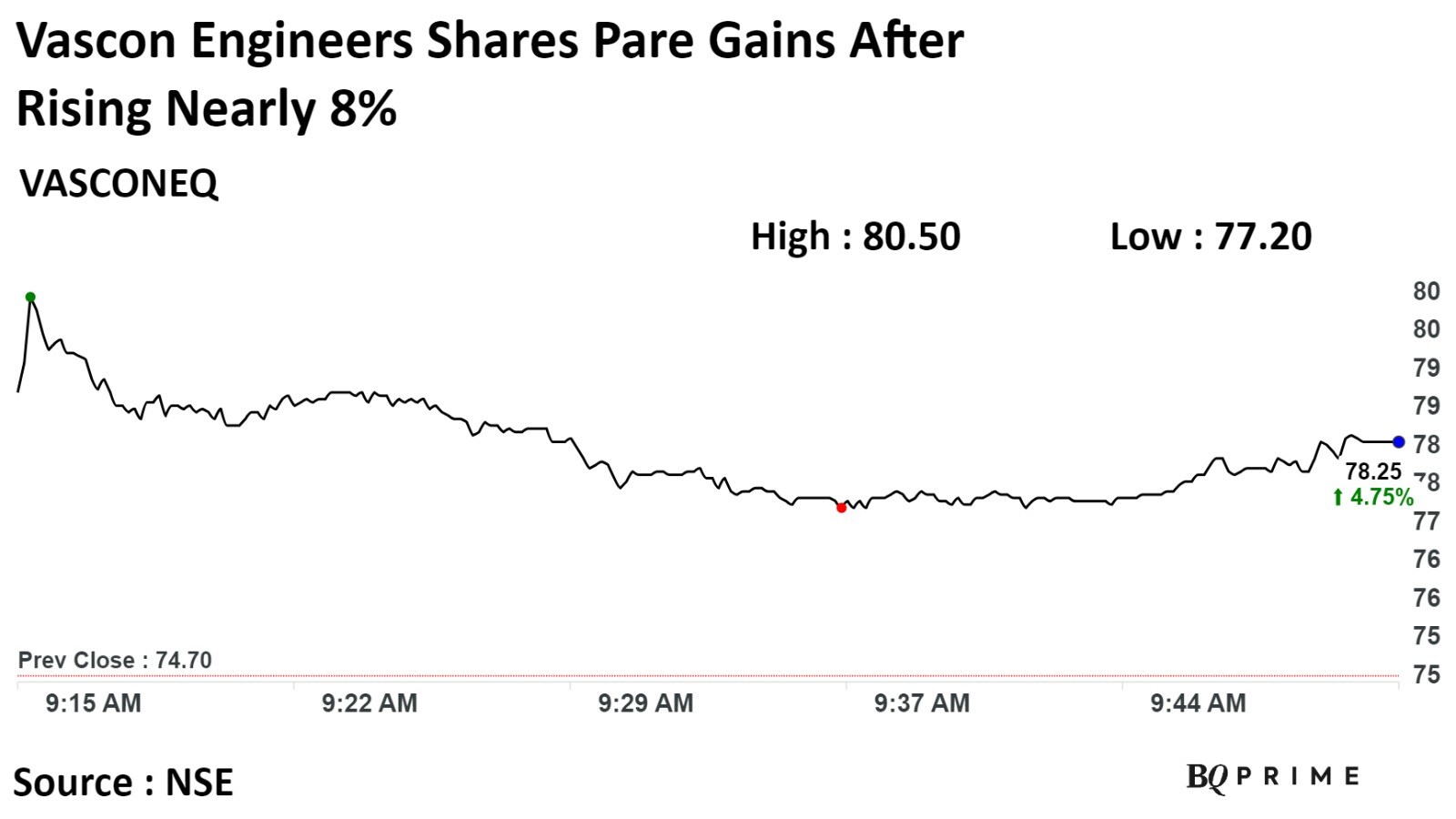

Rattanindia Enterprises up 13.56% at Rs 73.70 apiece

DCX Systems up 9.68% at Rs 352.35 apiece

Titagarh Rail Systems up 8.36% at Rs 1,015 apiece

Technocraft Industries up 7.81% at Rs 2,079.85 apiece

BEML up 7.60% at Rs 2,445.5 apiece

Top Losers

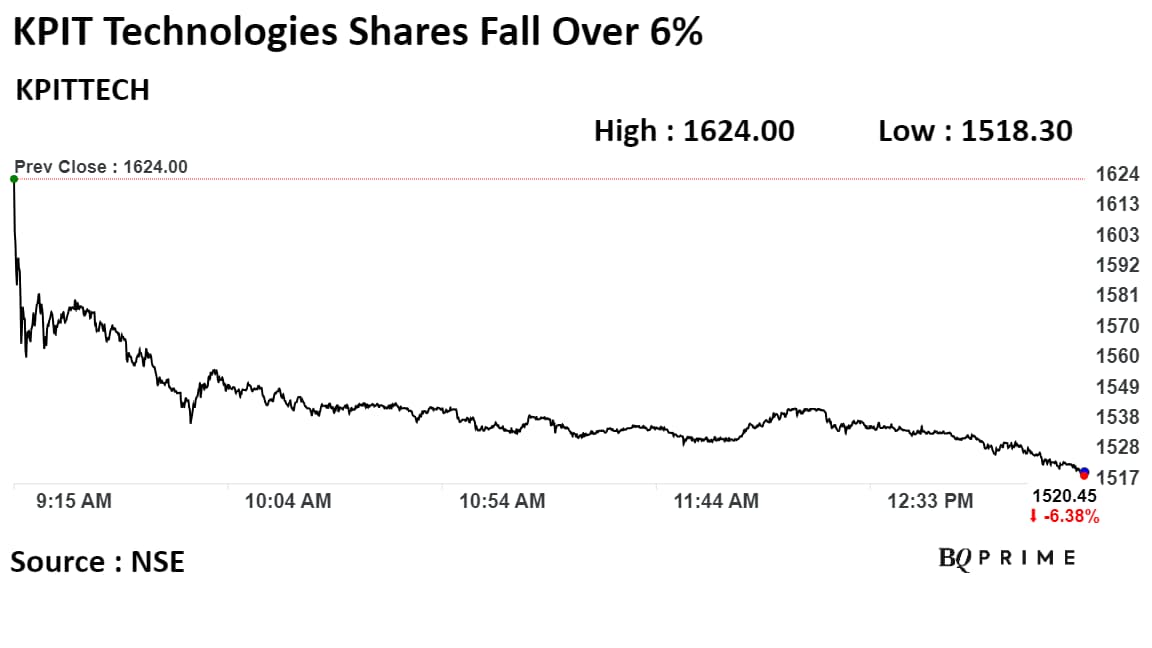

KPIT Technologies down 6.17% at Rs 1524 apiece

Rattanindia Power down 4.93% at Rs 9.65 apiece

Suzlon Energy down 4.96% at 39.30 apiece

Tata Investment Corporation down 3.57% at Rs 4,346 apiece

Coal India down 3.90% at Rs 334.20 apiece

Shares fell 6.52% to Rs 1,518.10 apiece, the lowest level since Nov. 20.

Shares fell 6.52% to Rs 1,518.10 apiece, the lowest level since Nov. 20.

Rattanindia Enterprises up 10.79%, hits life high at 72.7 apiece

PCBL up 5.23%, hits life high at 248.6 apiece

KEI Industries at 5.88%, hits life high at 2,945.45 apiece

Latent View Analytics up 4.65%, hits life high at 487.8 apiece

Varroc Engineering up 3.09%, hits 52 week high at 583.5 apiece

BASF India up 4.57%, hits 52 week high at 3,178 apiece

KNR Constructions up 6.18%, hits 52 week high at 299.45 apiece

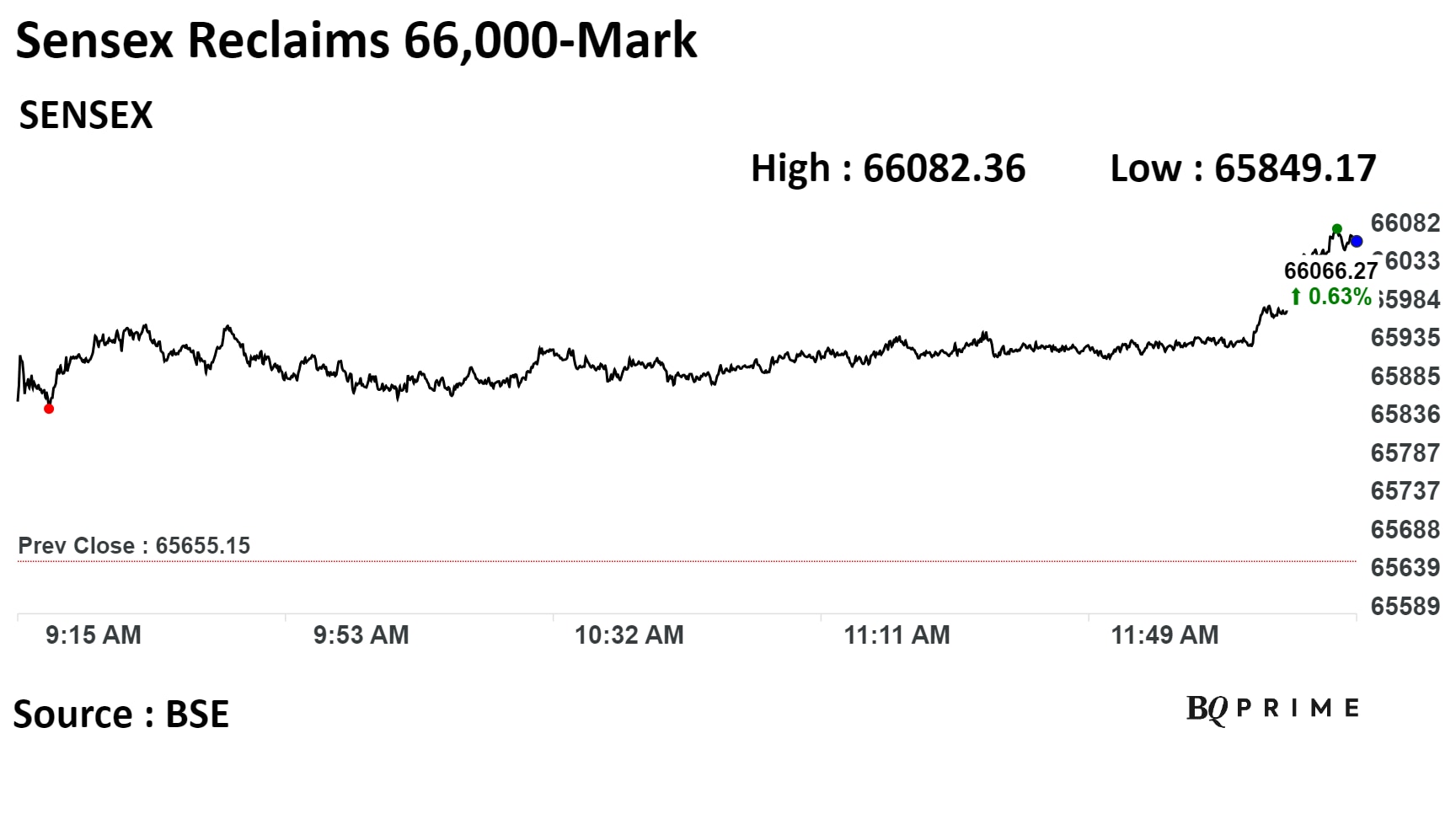

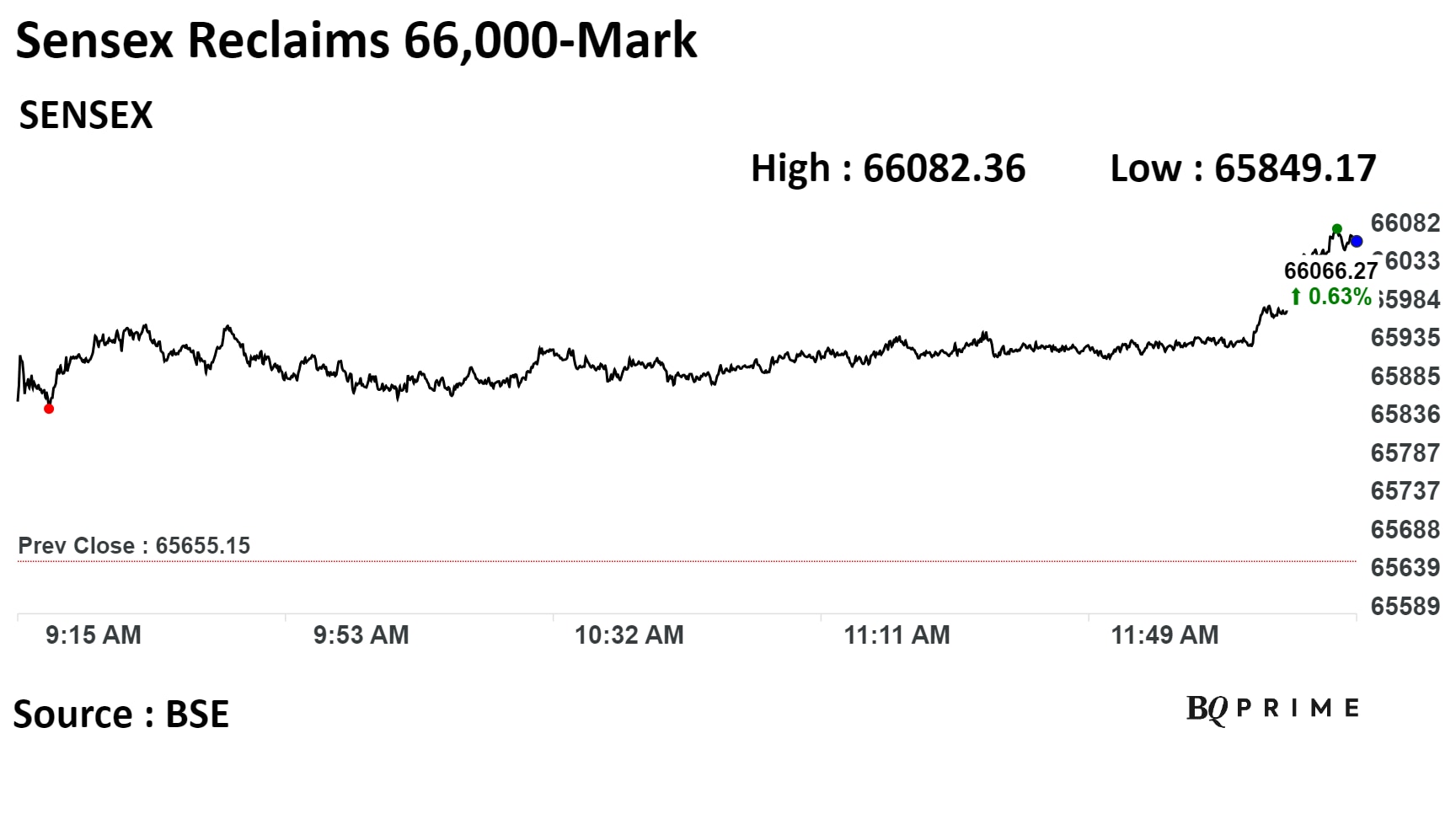

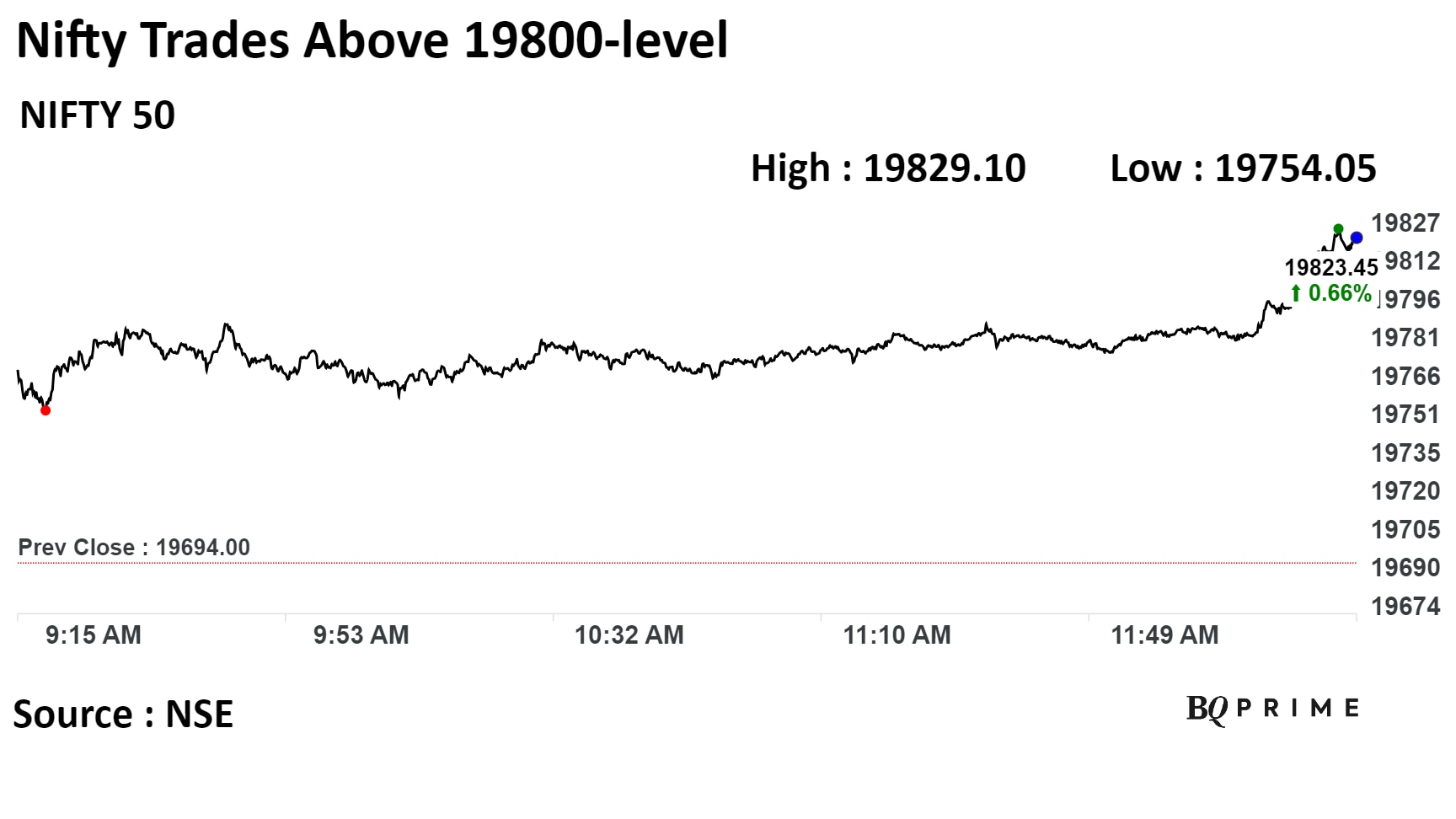

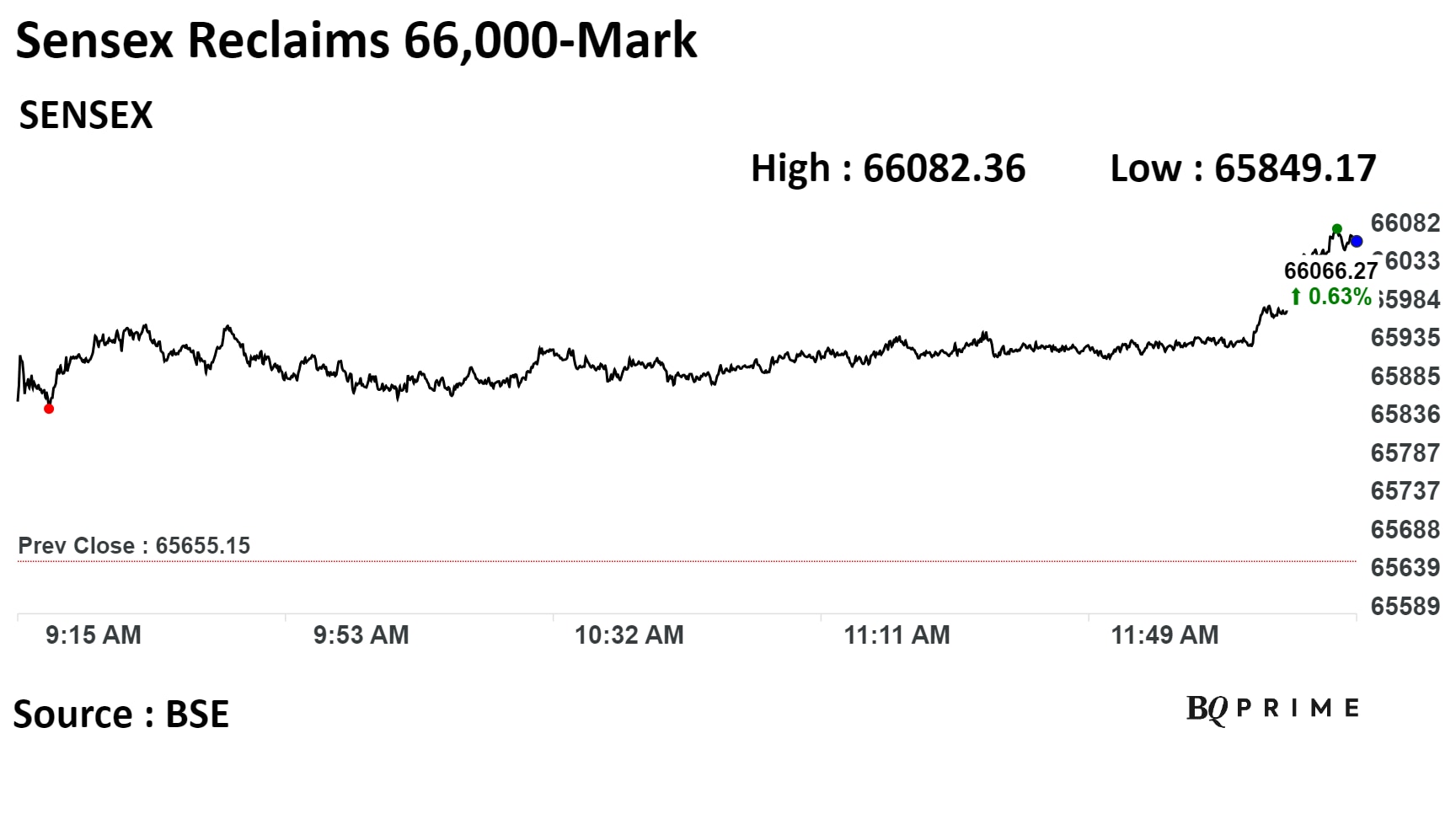

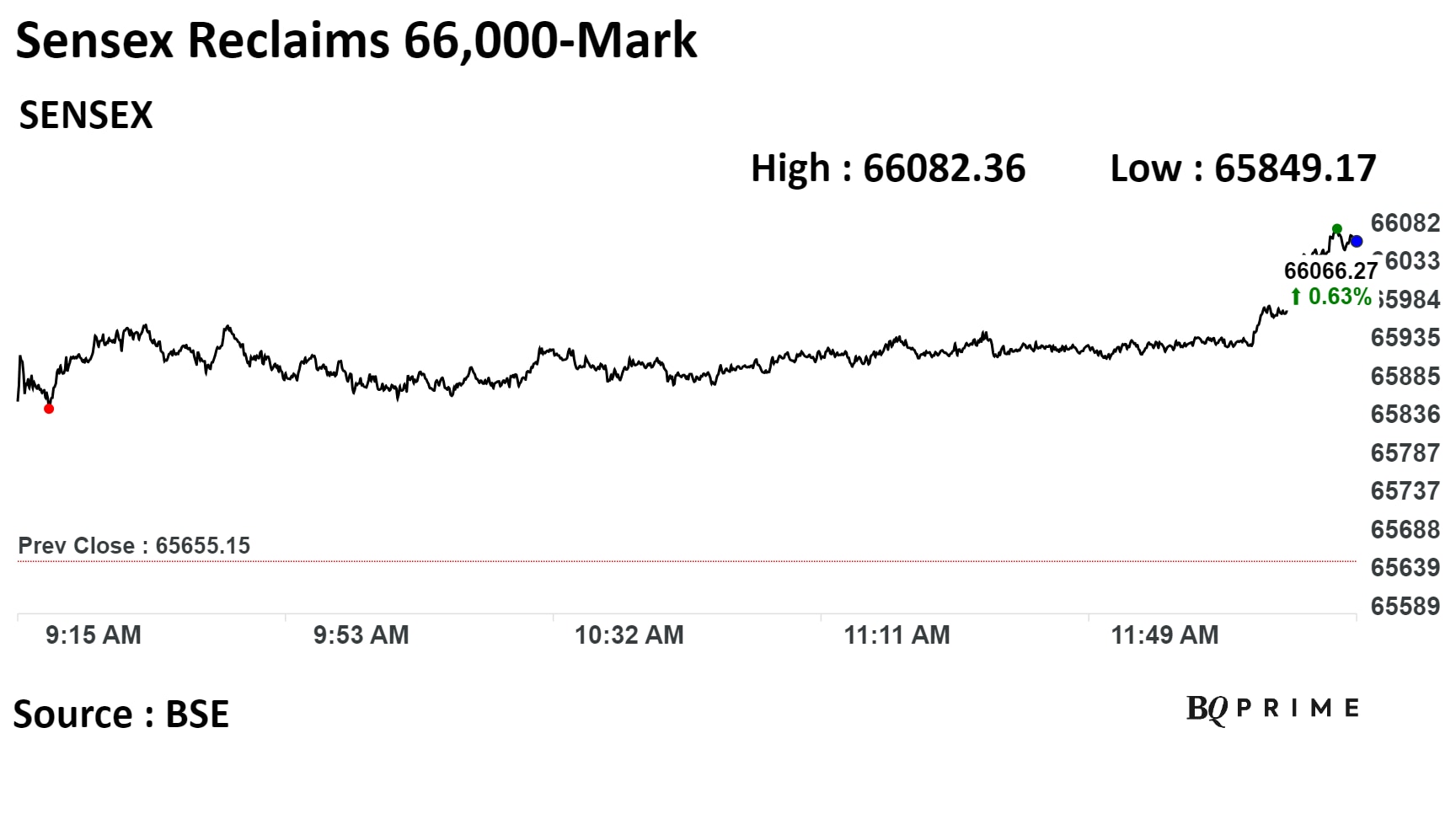

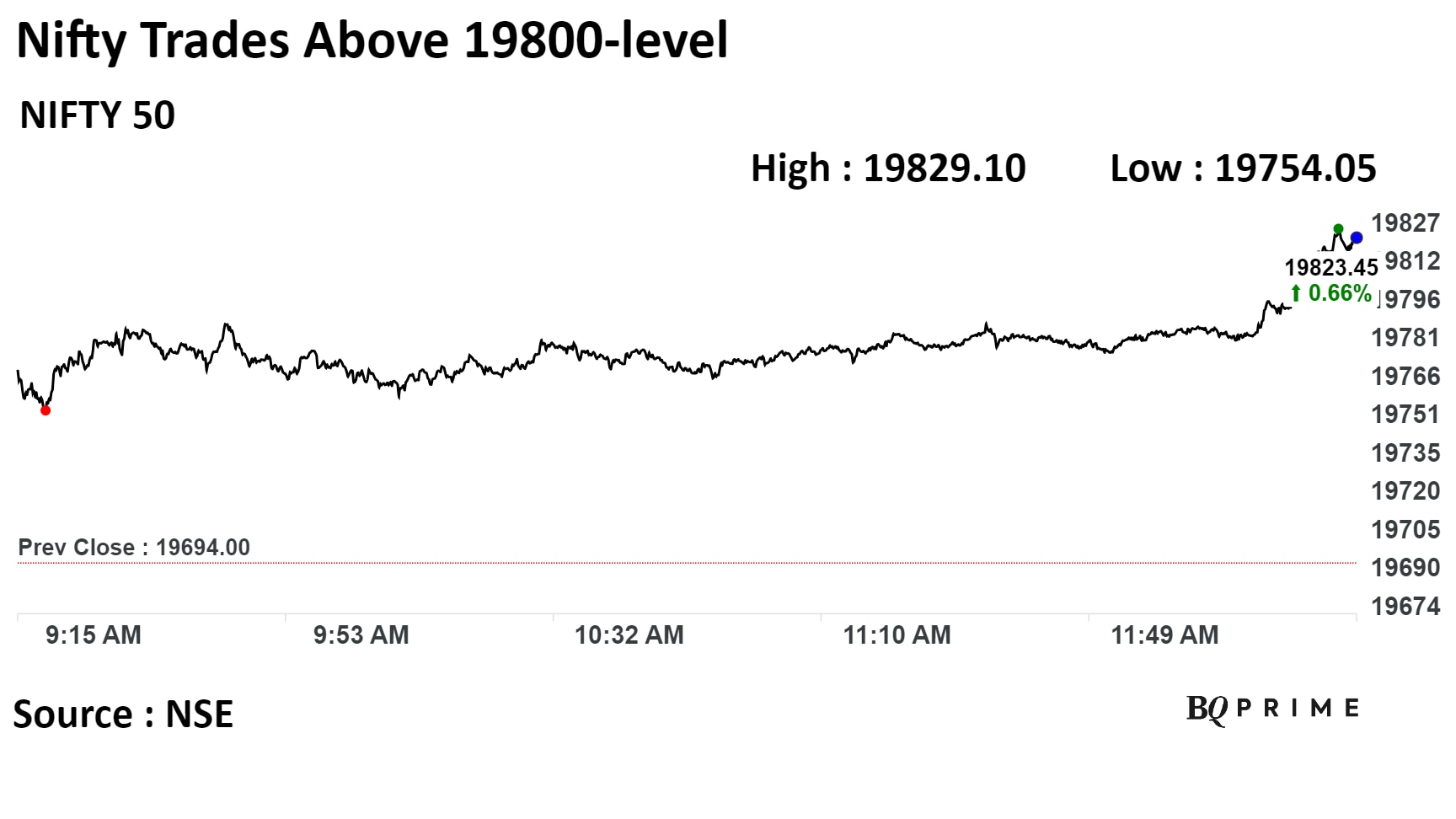

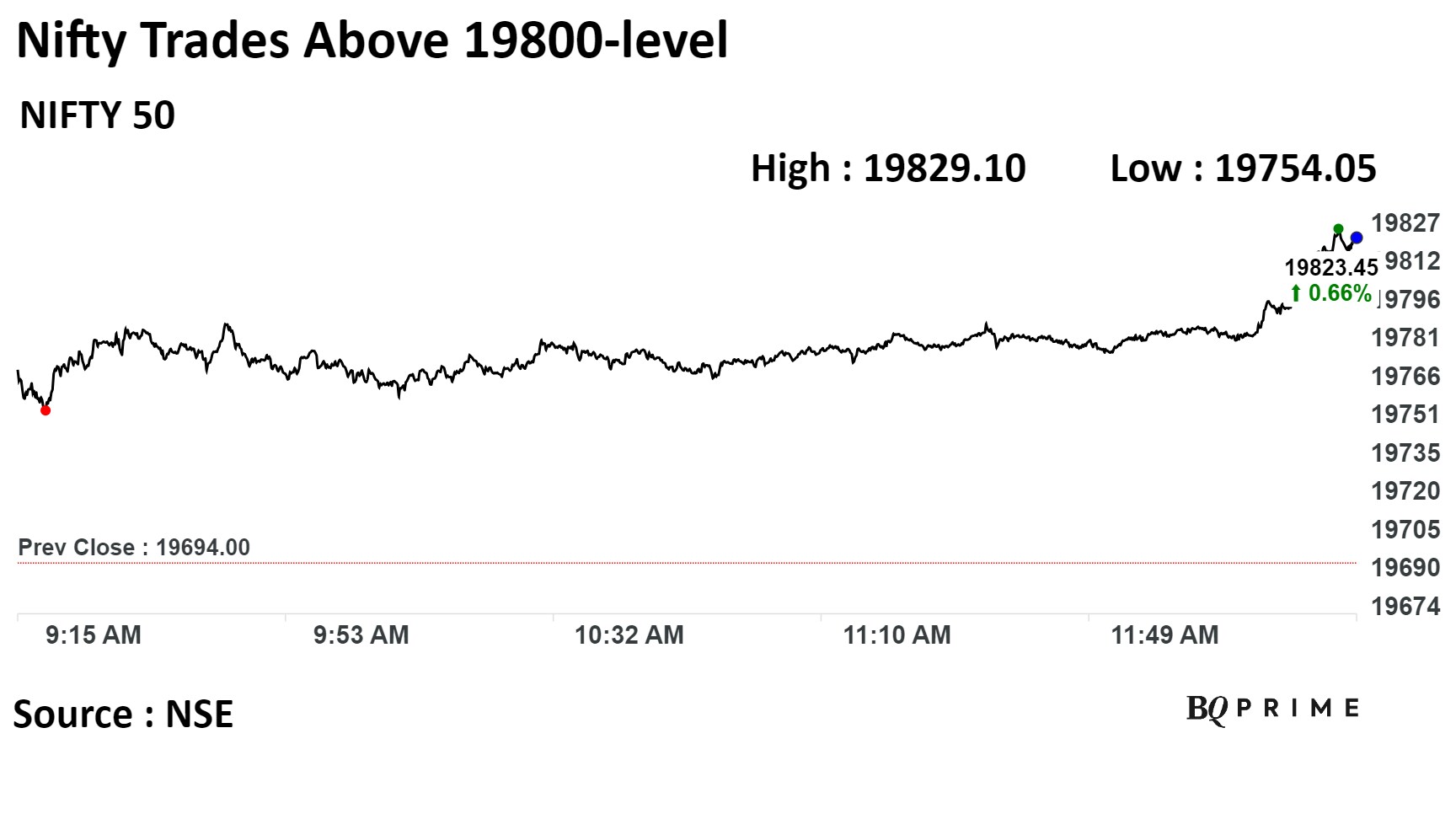

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

India's benchmark stock indices rose through midday on Tuesday led by heavyweights HDFC Bank Ltd and Reliance Industries Ltd.

Among sectoral indices, realty, metal, and consumer durables advanced the most while FMCG and PSU Banks faced pressure.

Intraday, Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Sensex traded above 66,000-level and Nifty crossed 19,800-level.

The index is moving sideways as of now and would need a decisive breach on either side of 19,800 or 19,650 level for the confirmation of further directional move, said Vaishali Parekh, vice president - technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600 while the resistance is seen at 19,850," she added.

As of 12:29 p.m., the S&P BSE Sensex Index was up 399 points, or 0.61%, at 66,054.17 while the NSE Nifty 50 was 122 points or 0.62% higher at 19,815.60.

"Upside may remain limited as investors await the minutes of the Federal Reserve's latest monetary policy meeting for additional clues on the outlook for rates," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Buying on intraday corrections and selling on rallies would be the ideal strategy for day traders, said Shrikant Chouhan – head equity research at Kotak Securities Ltd. "For bulls, the uptrend below 19,575 and 65,250 will be weak," he added.

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and South Korea's Kospi rose the most by 0.8% each. Indices in Japan also recovered after falling in early trade.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial-intelligence bid. Shortly after the U.S. bond auction results on Monday, U.S. 10-year yields reversed course and fell to around 4.4%.

HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Adani Enterprises Ltd., and Titan Company Ltd. were positively adding to the change in the Nifty 50 Index.

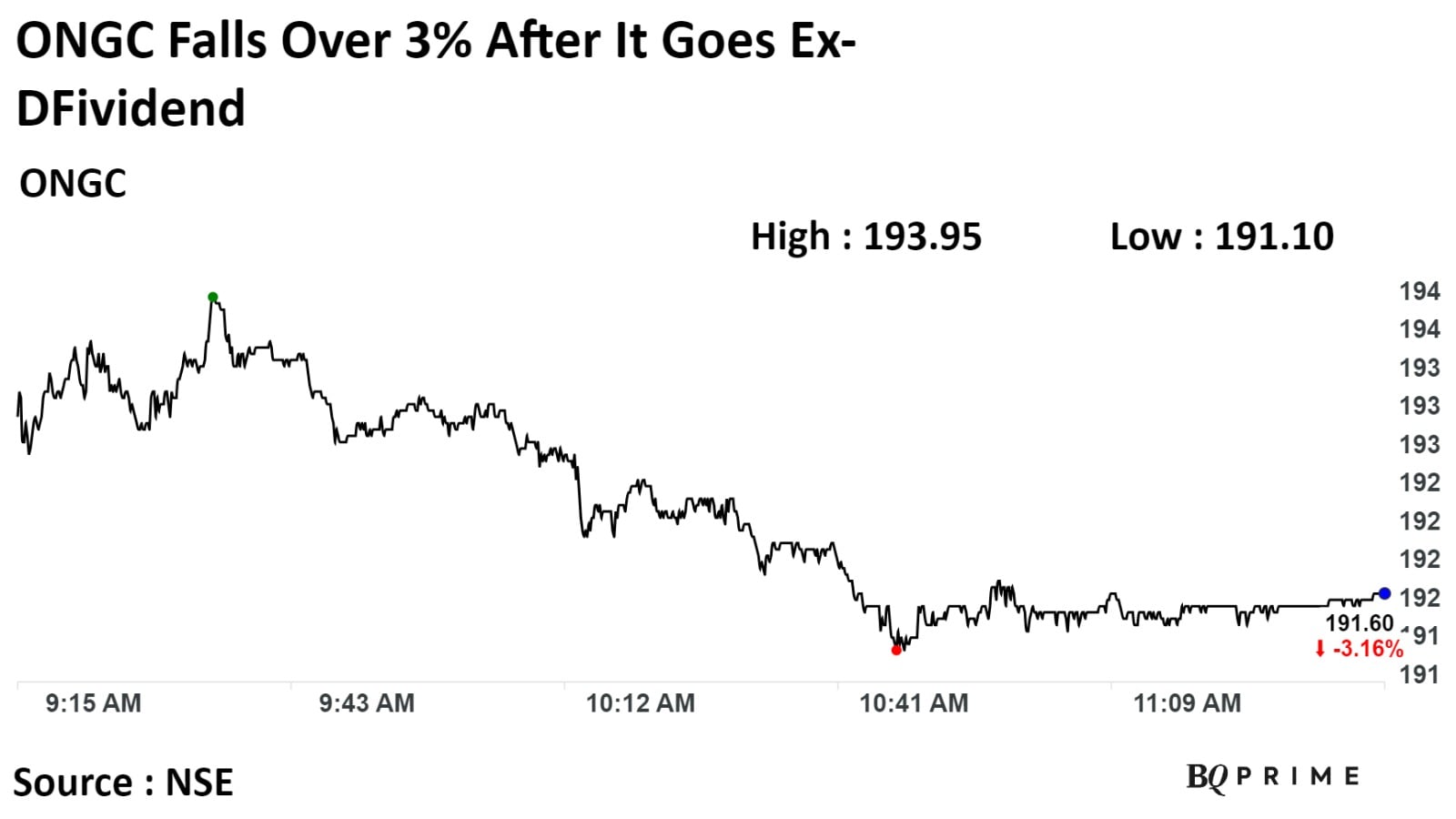

Whereas, Tech Mahindra Ltd., NTPC Ltd., Larsen & Toubro Ltd., Oil and Natural Gas Corporation Ltd., and Coal India Ltd. were negatively contributing to the change.

The broader markets outperformed; the S&P BSE MidCap Index was up 0.25%, whereas S&P BSE SmallCap Index was 0.42% higher.

Fourteen out of 20 sectors compiled by BSE advanced, while six sectors declined S&P BSE Realty rose the most.

The market breadth was skewed in the favour of the buyers. About 2,103 stocks rose, 1,460 declined, while 152 remained unchanged on the BSE.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

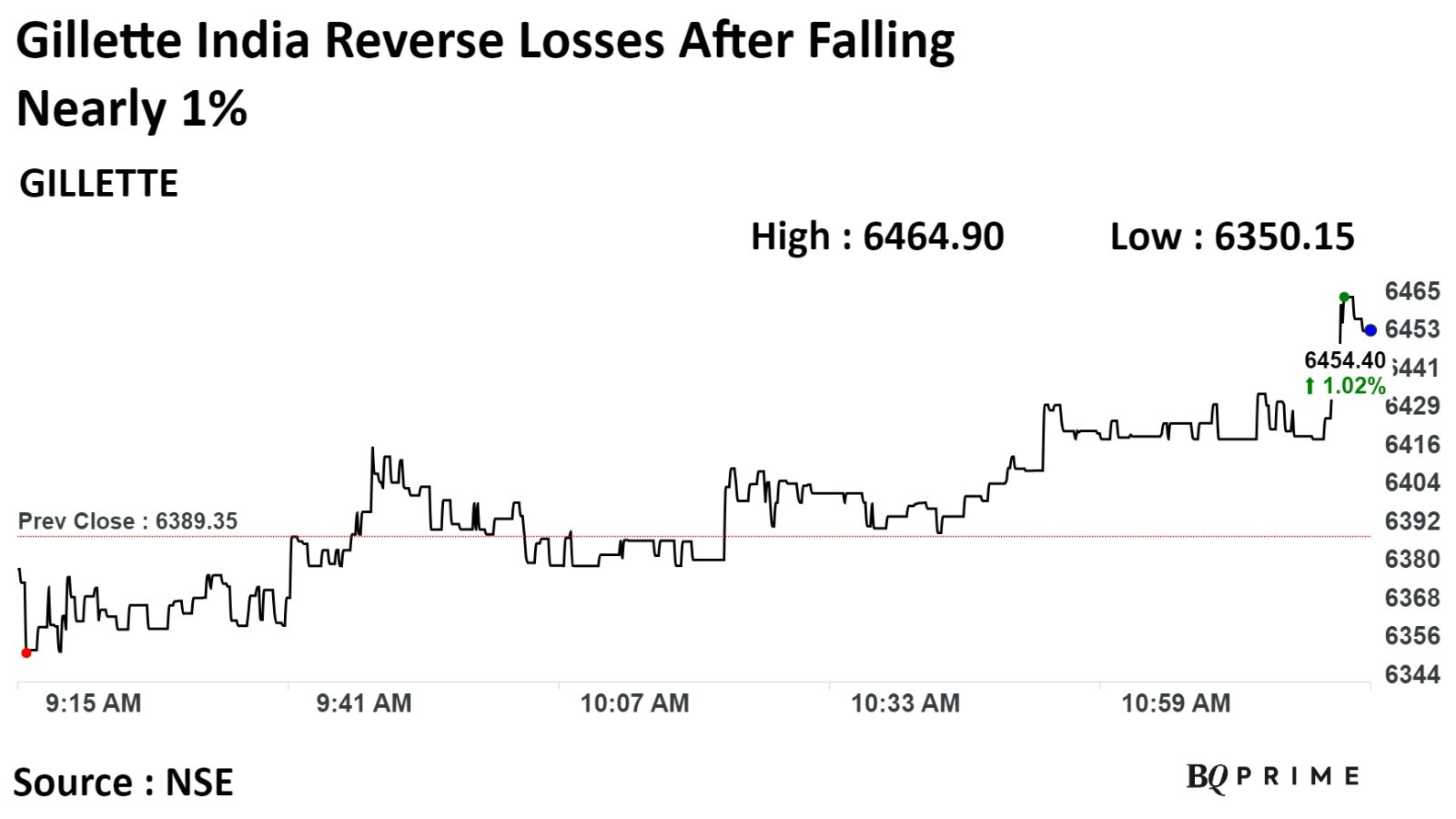

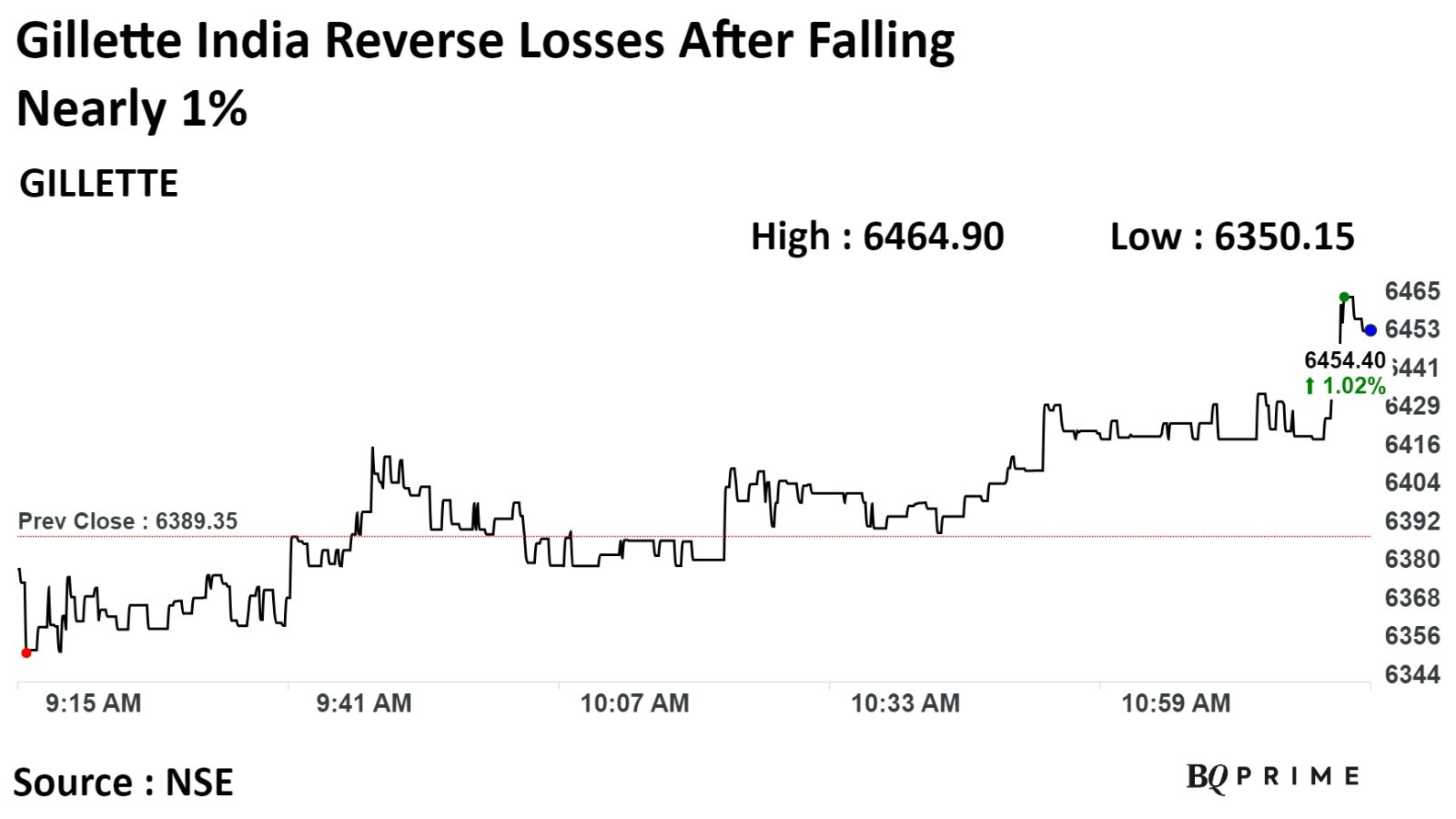

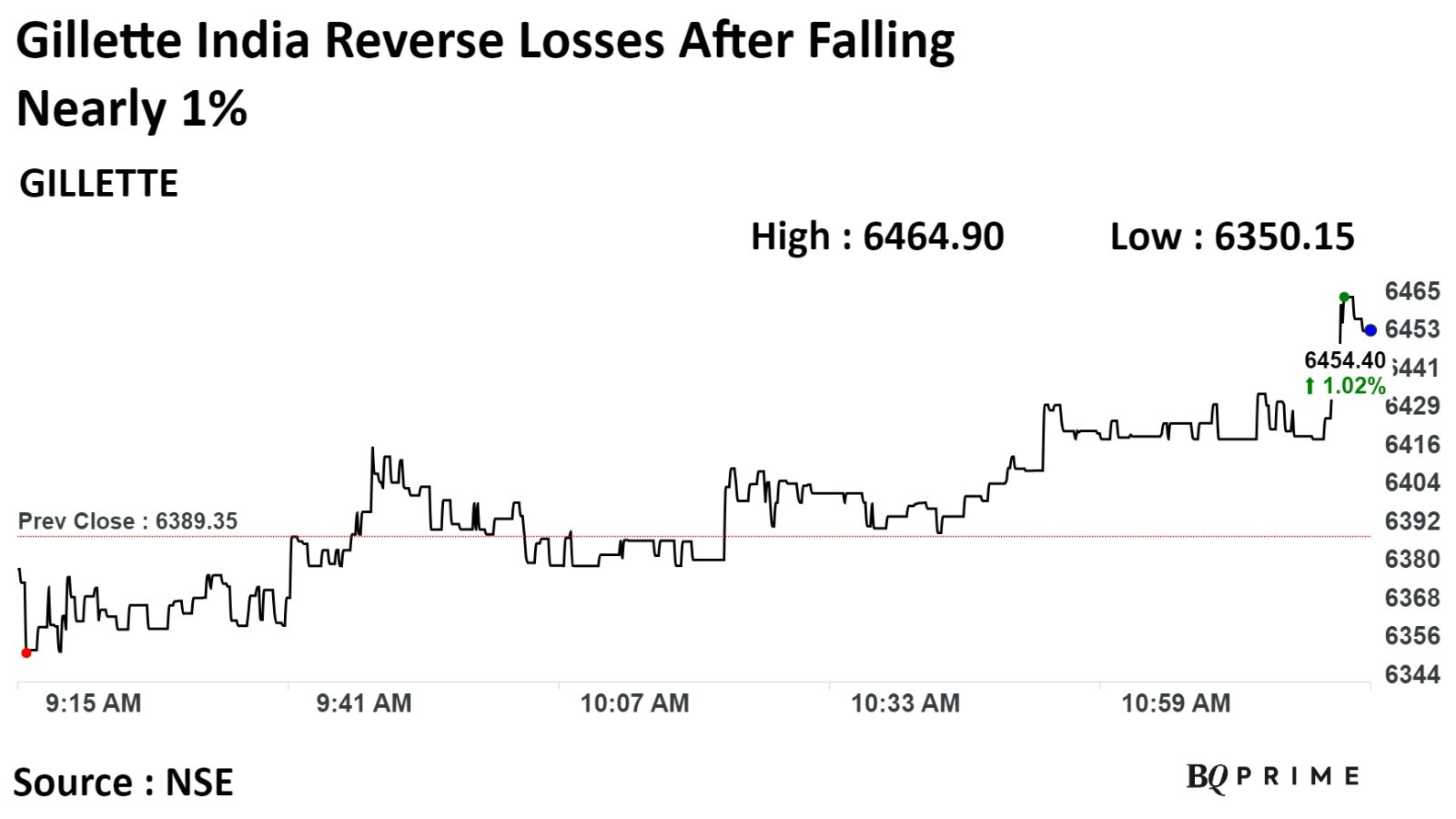

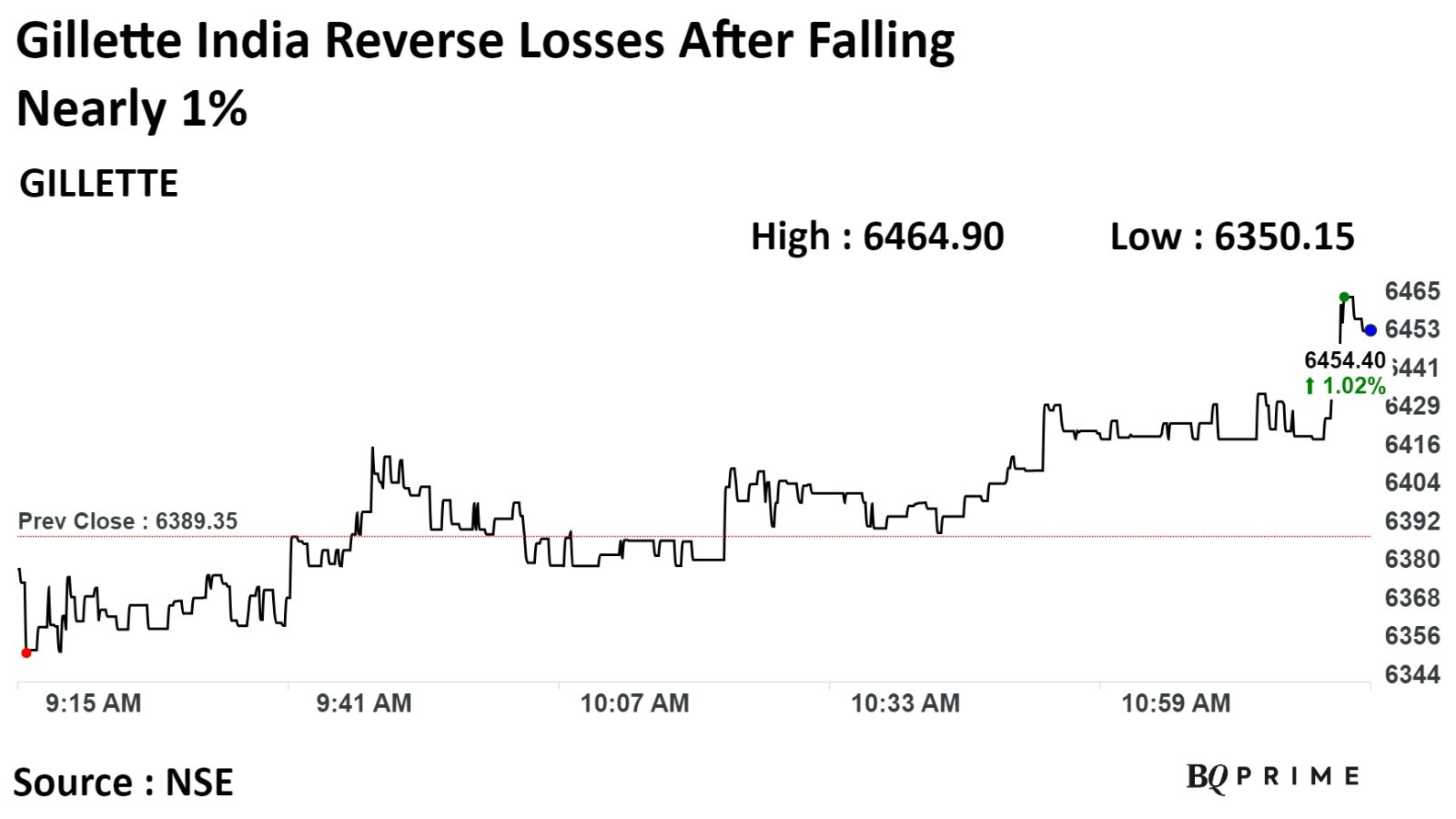

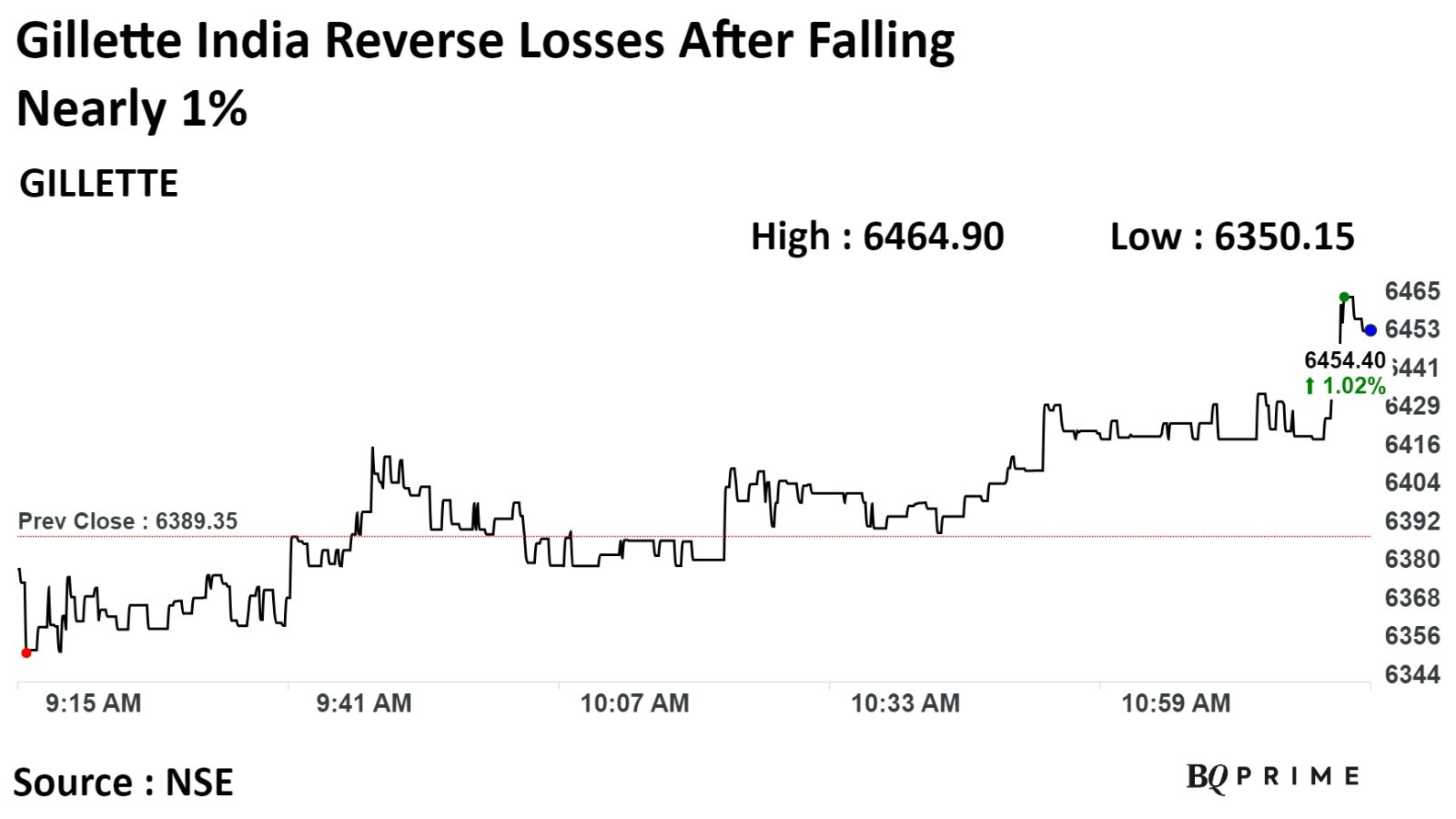

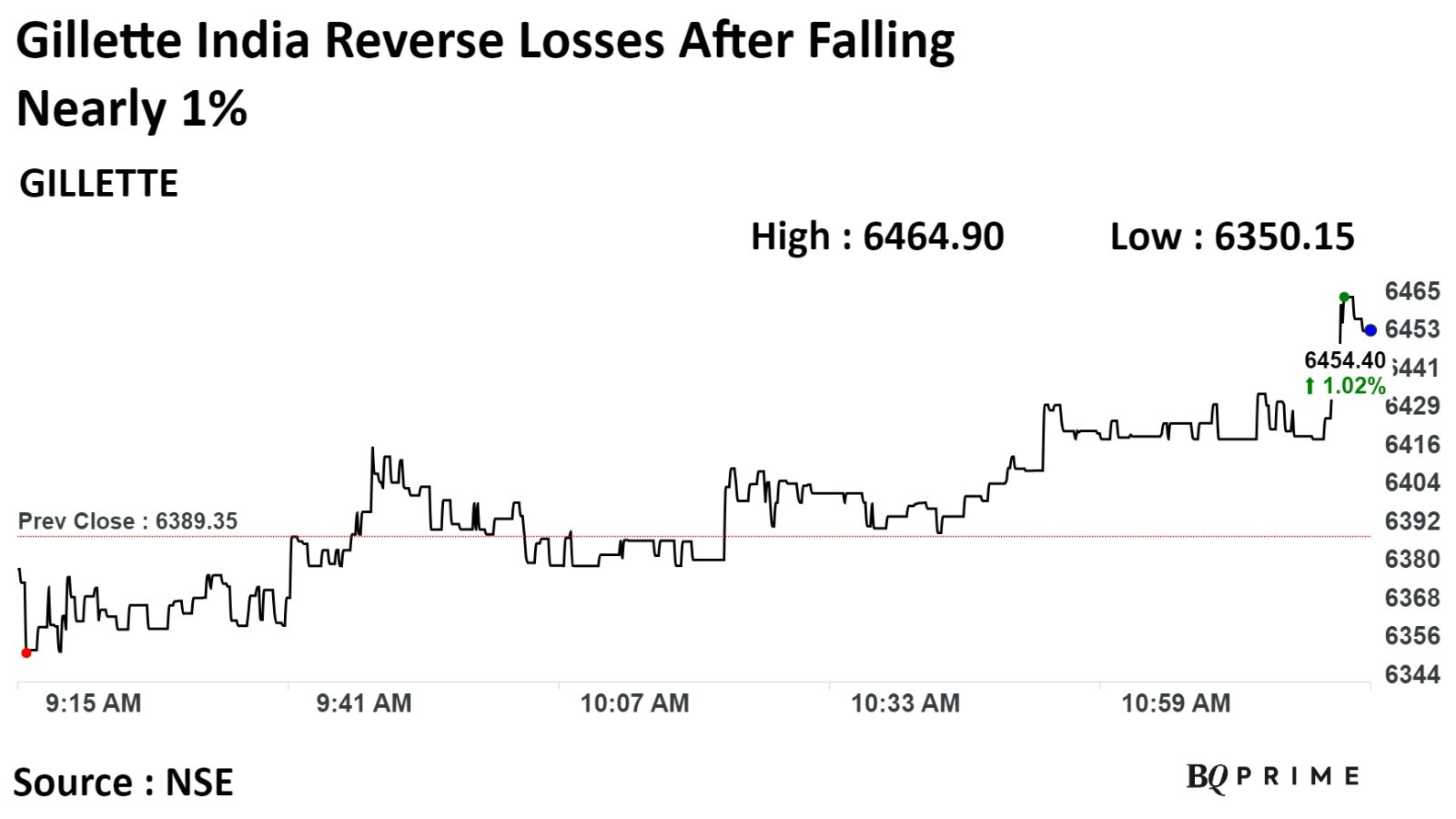

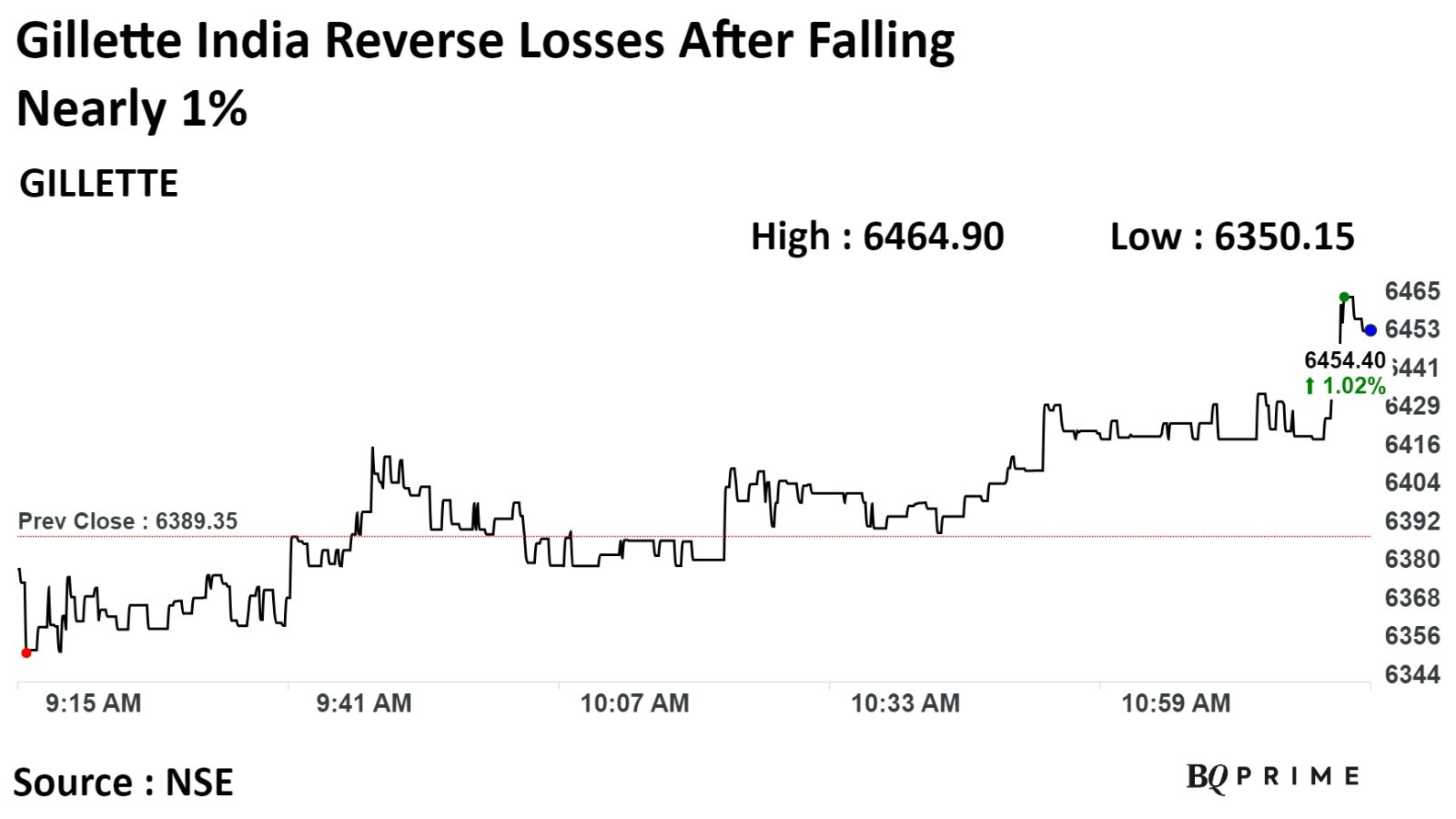

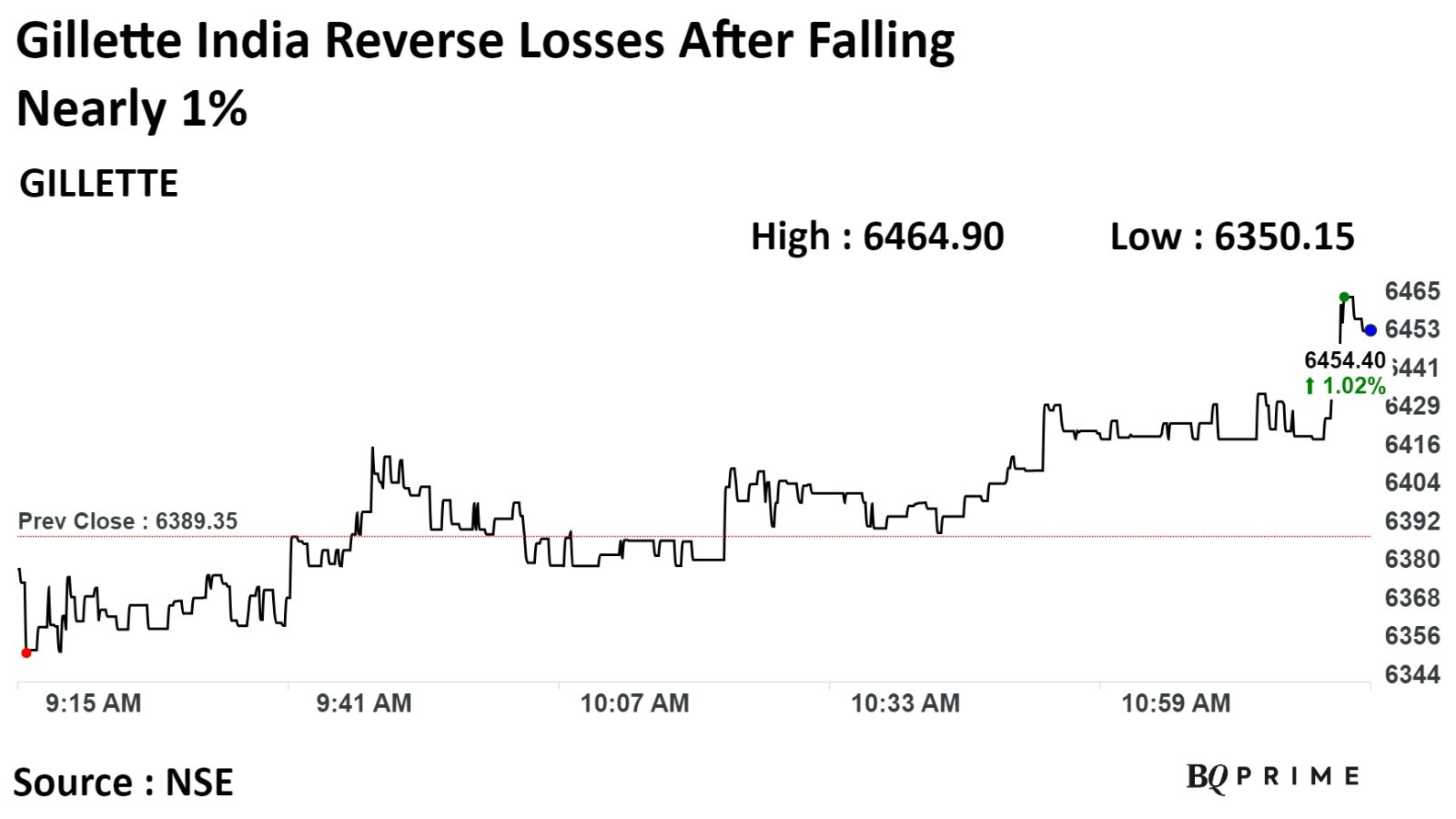

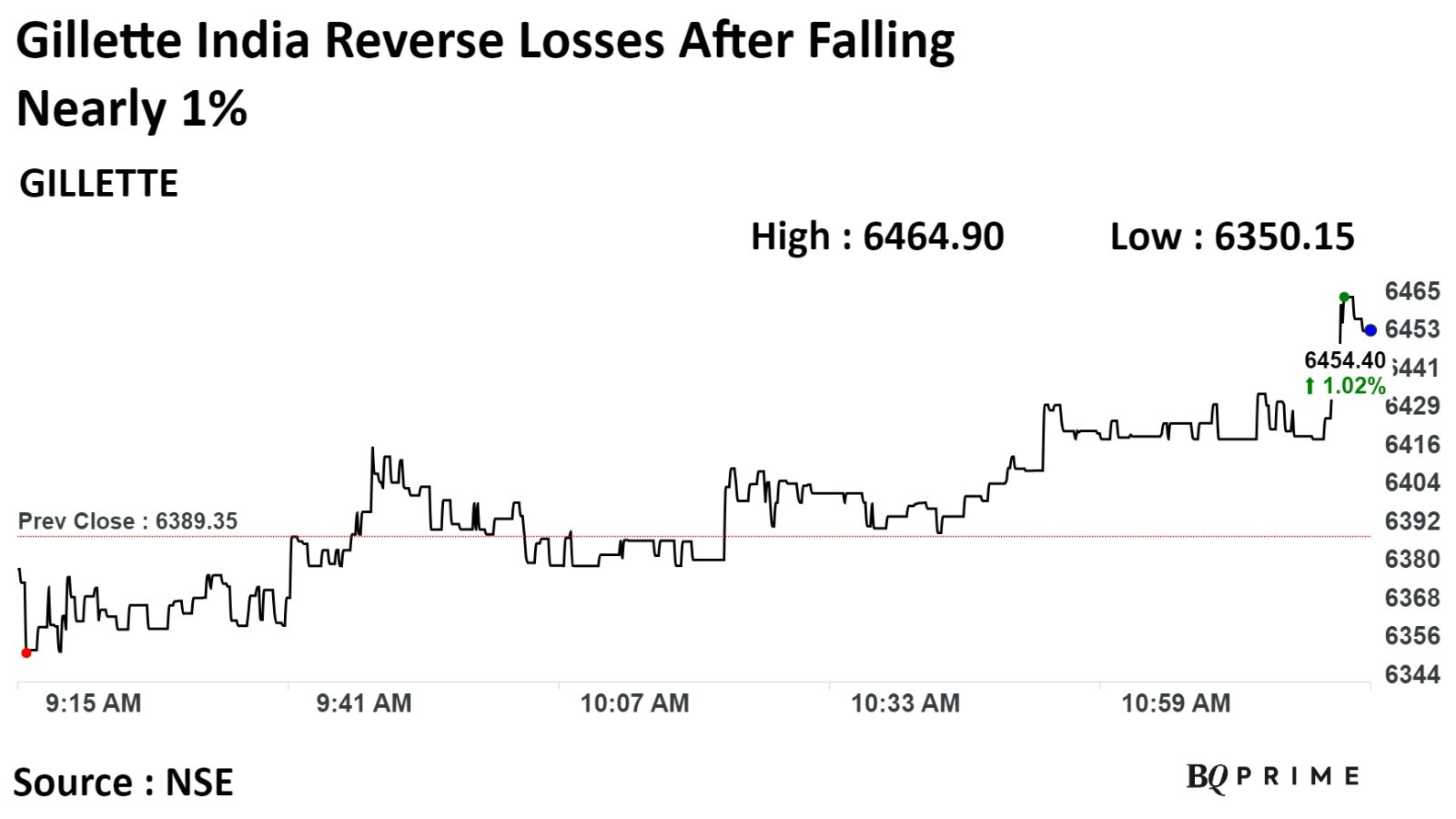

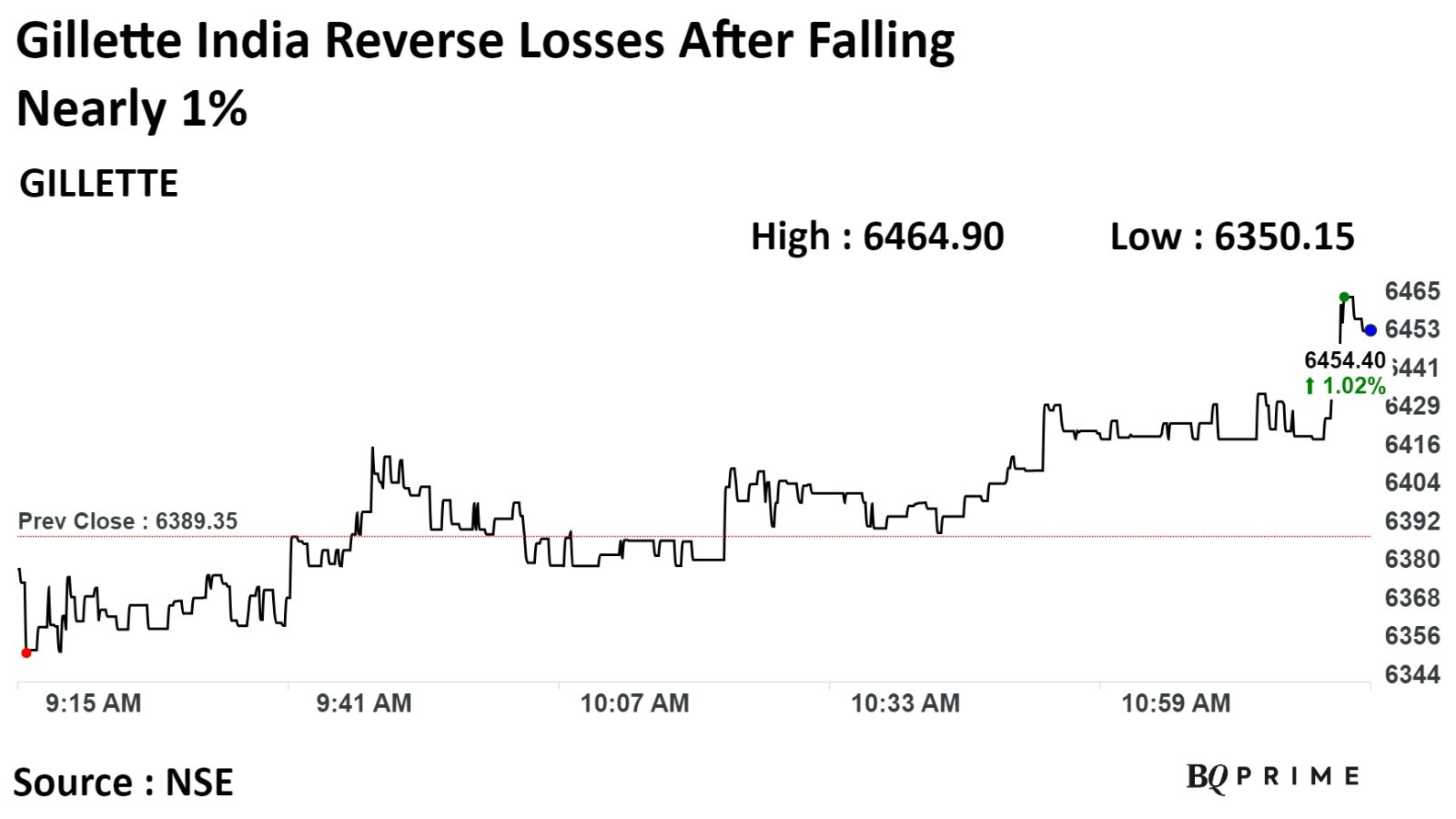

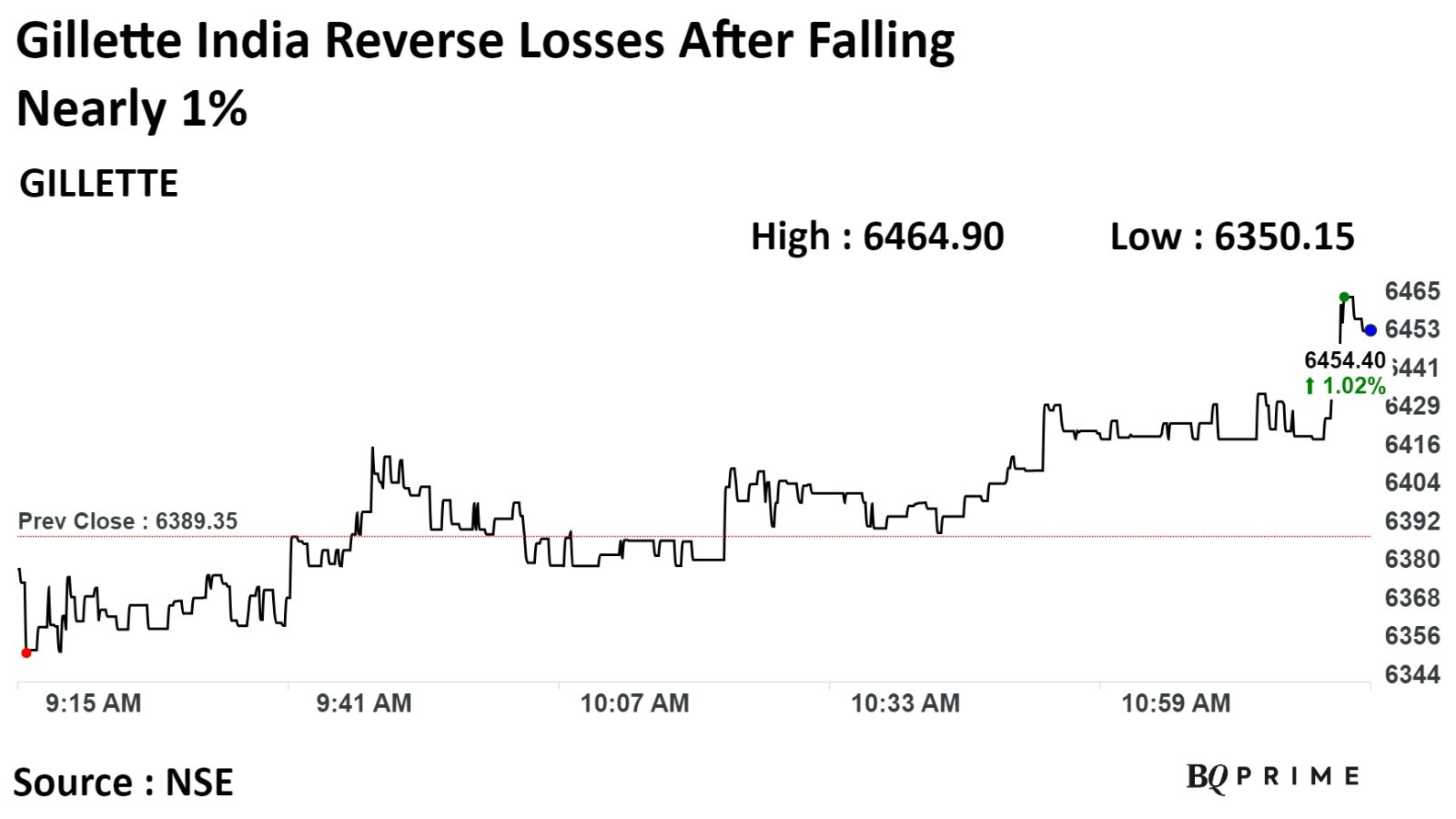

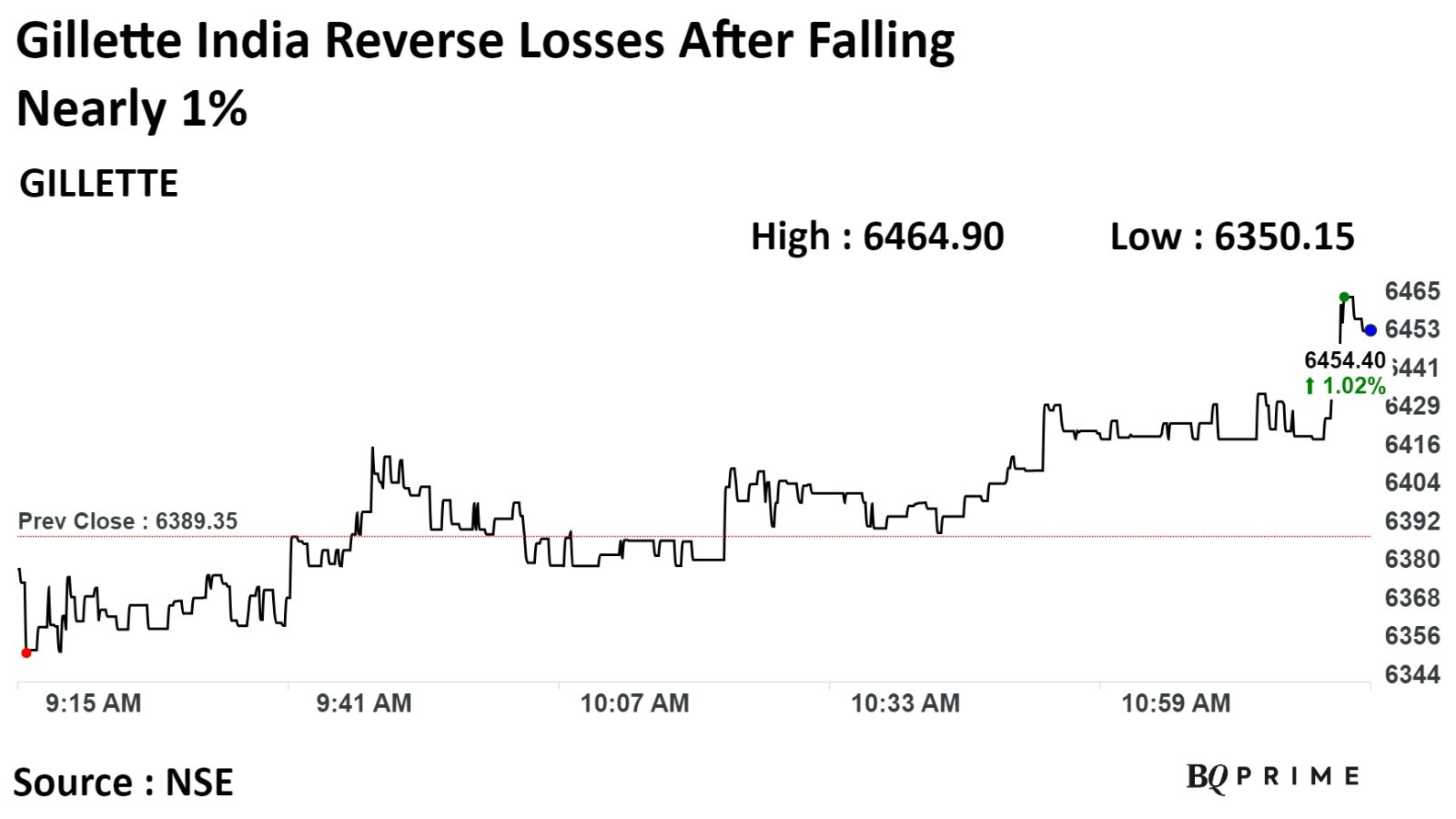

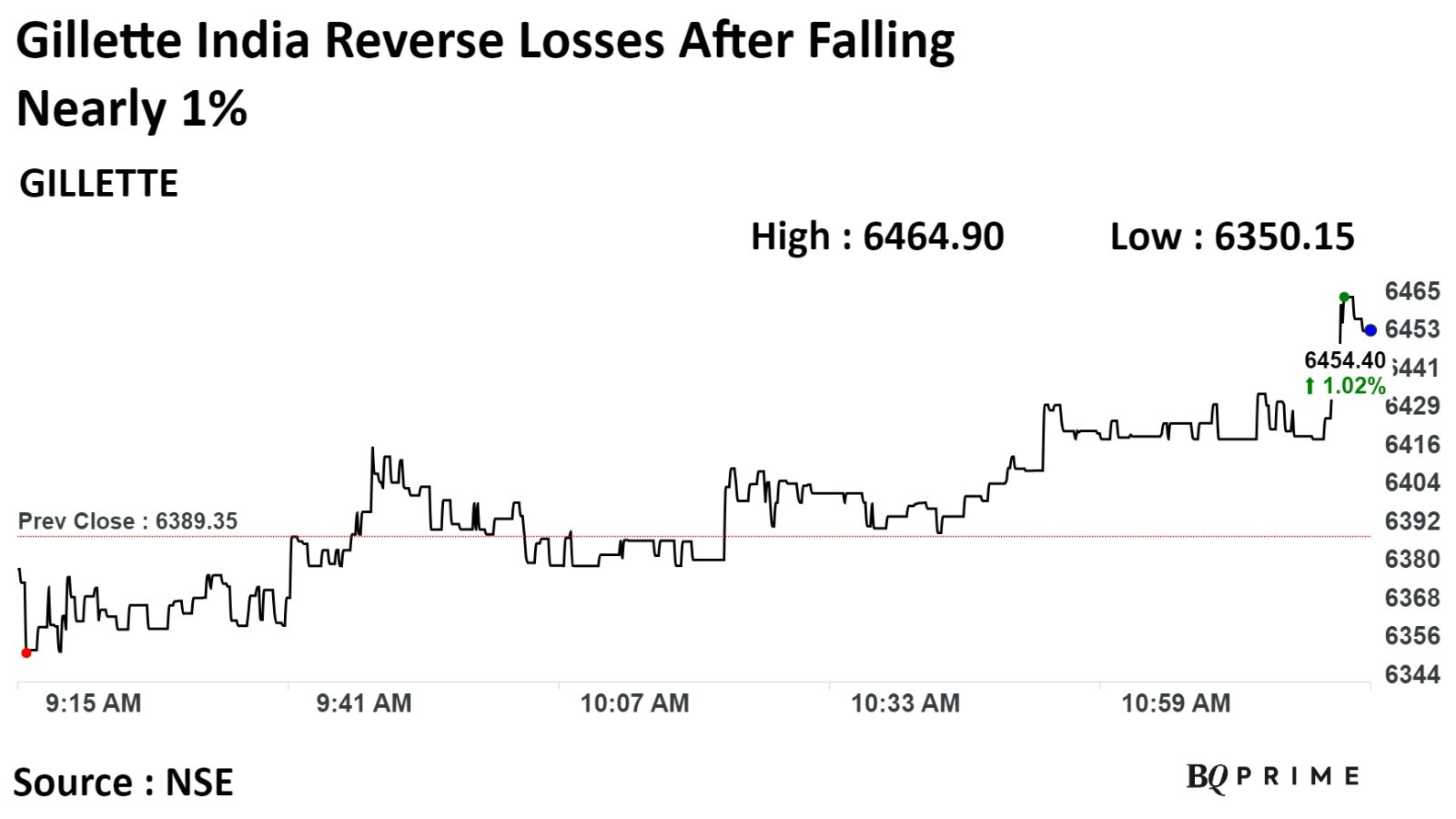

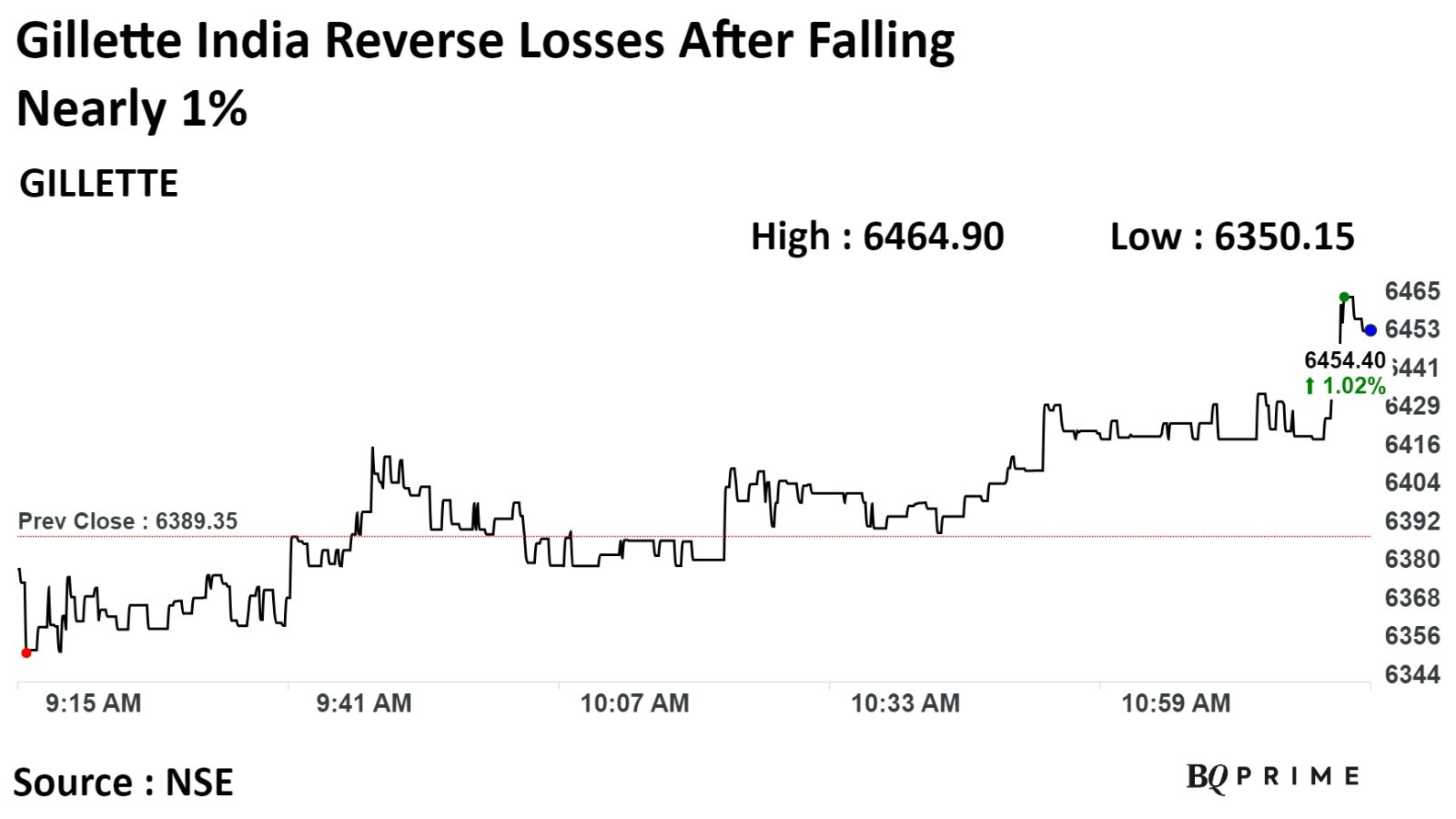

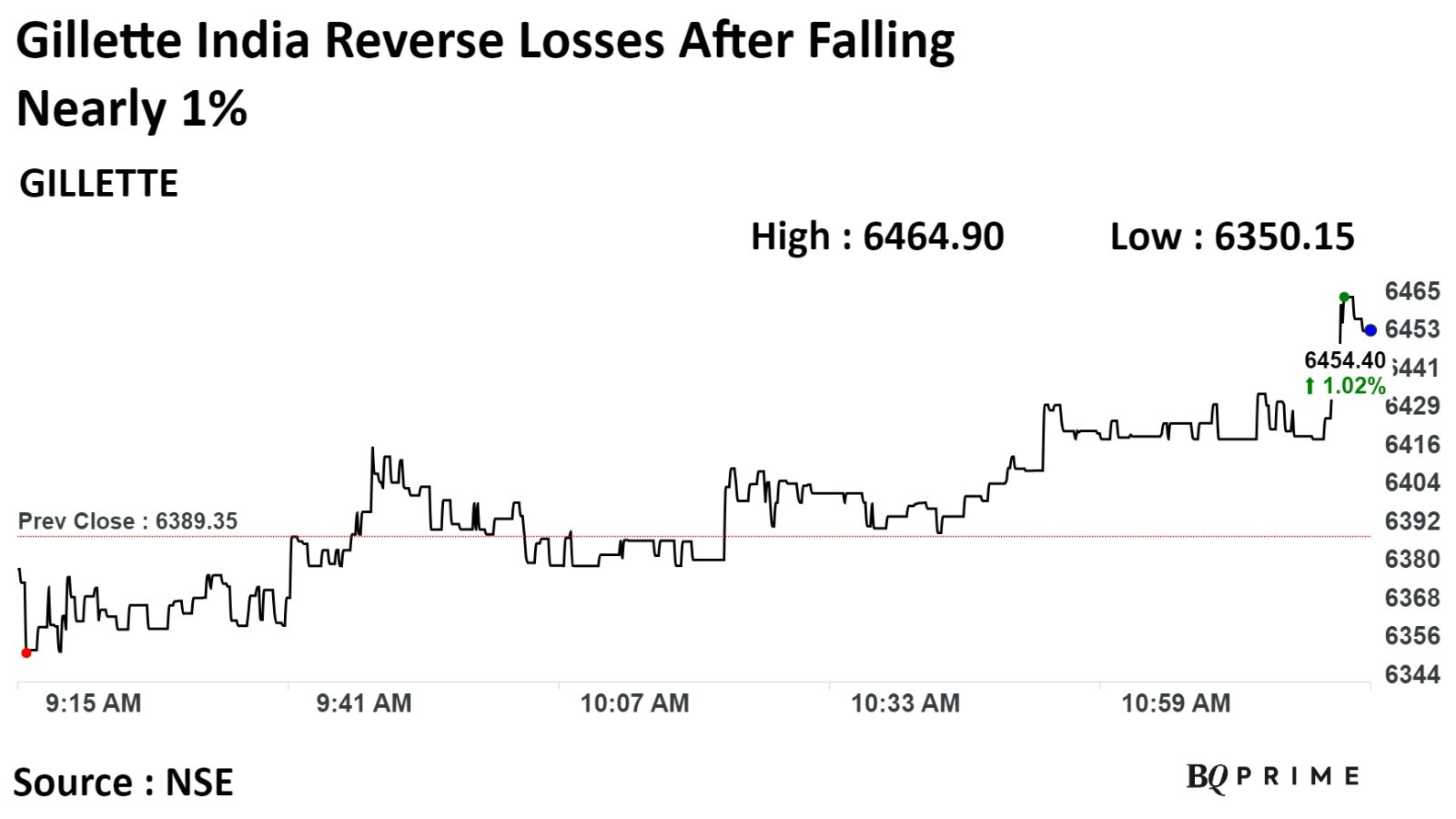

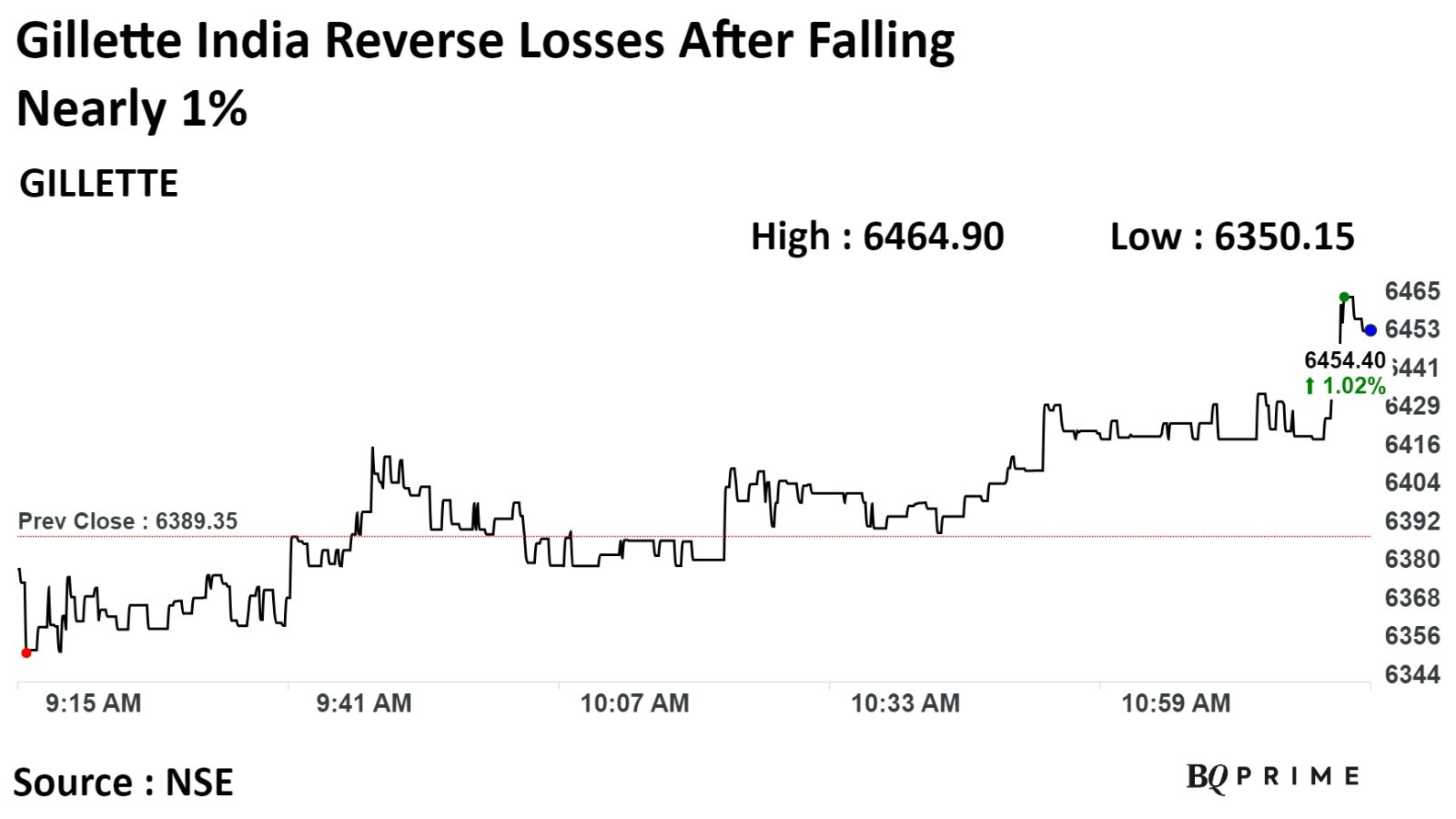

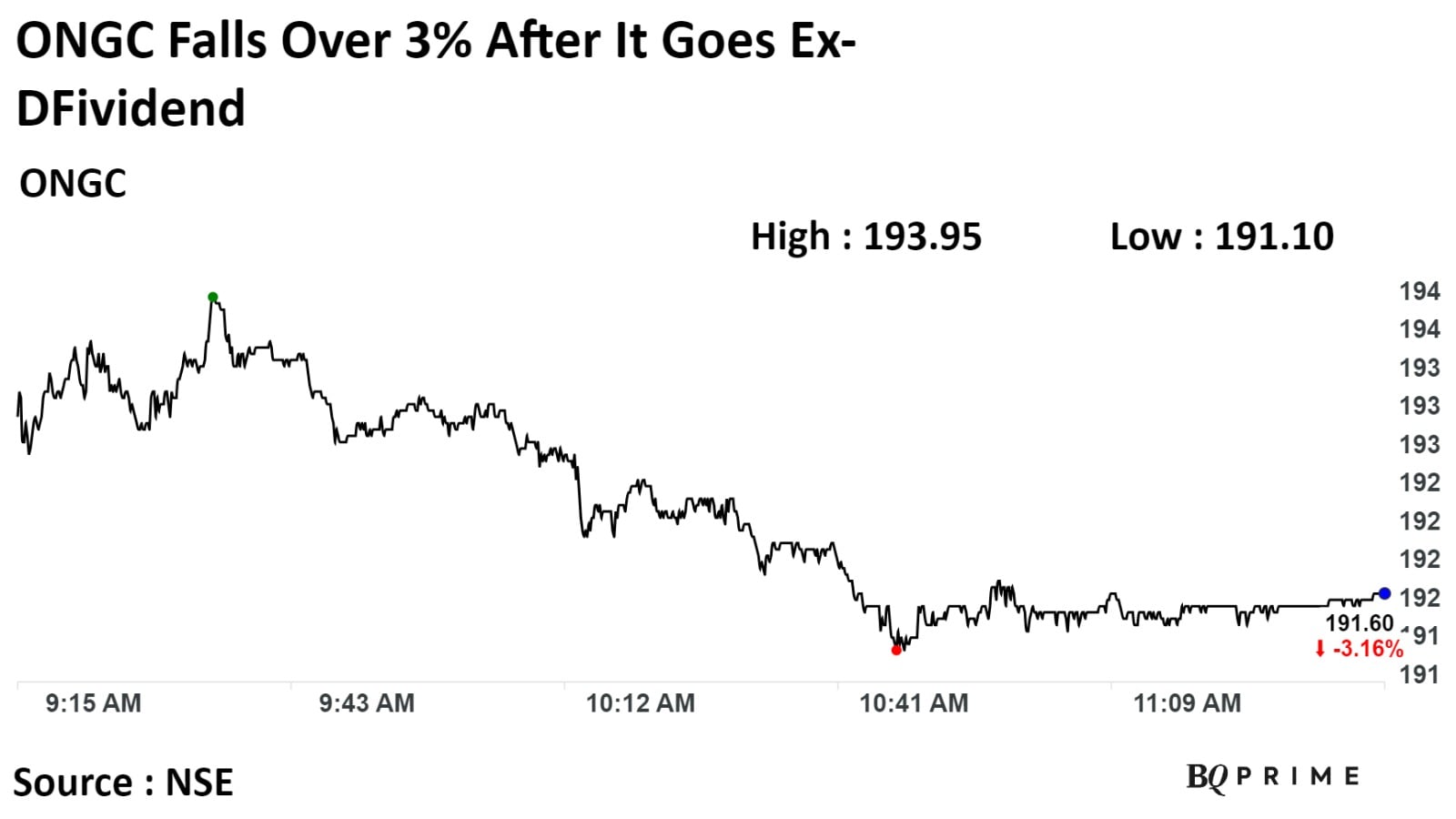

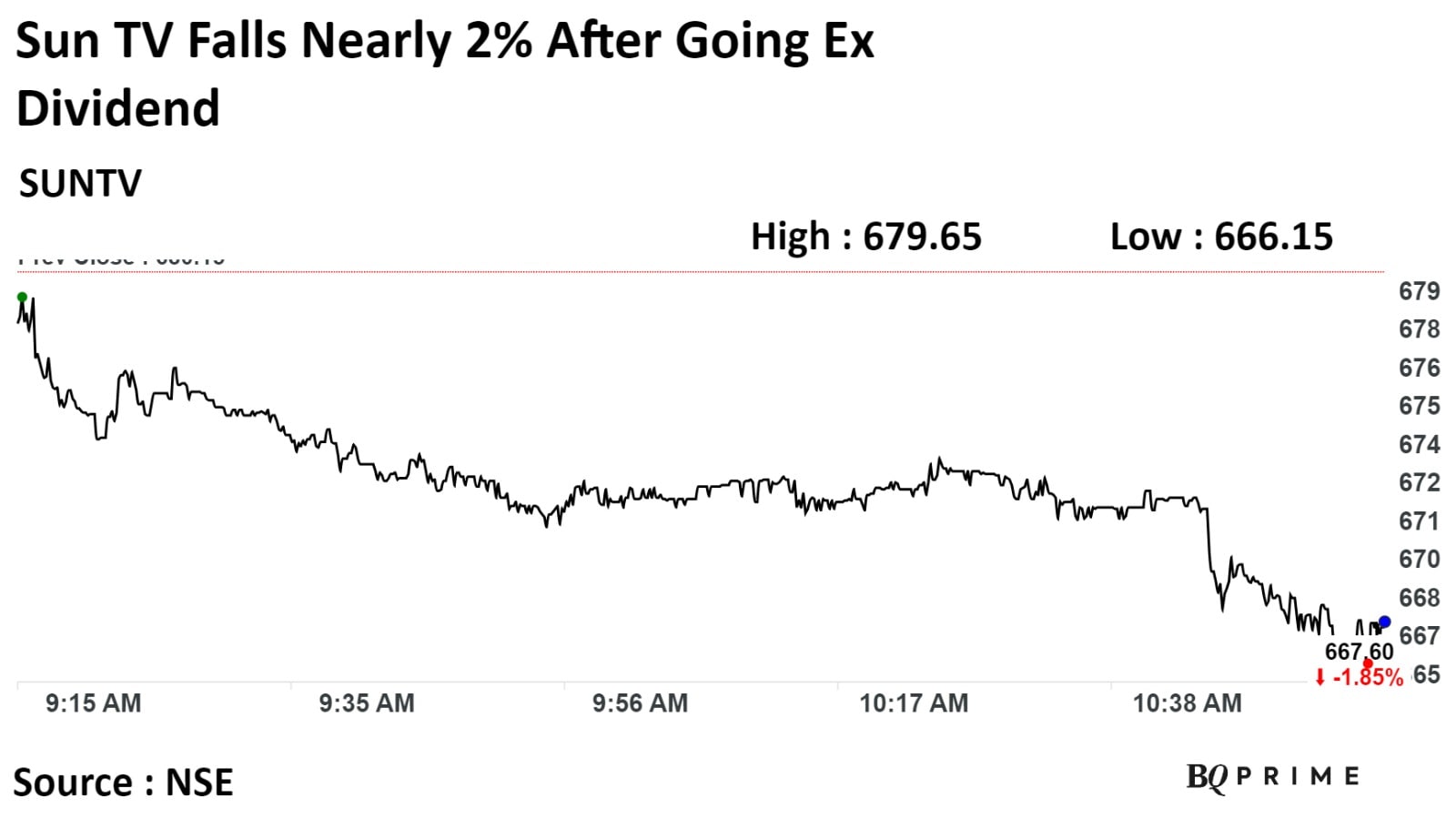

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.

The scrip fell as much as 4.27% to Rs. 333.00 apiece. It pared losses to trade 3.15% lower at Rs 336.90 apiece, as of 10:09 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 49.19% on a year-to-date basis. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 61.08.

Out of 23 analysts tracking the company, 18 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 59.9%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.

The scrip fell as much as 4.27% to Rs. 333.00 apiece. It pared losses to trade 3.15% lower at Rs 336.90 apiece, as of 10:09 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 49.19% on a year-to-date basis. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 61.08.

Out of 23 analysts tracking the company, 18 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 59.9%.

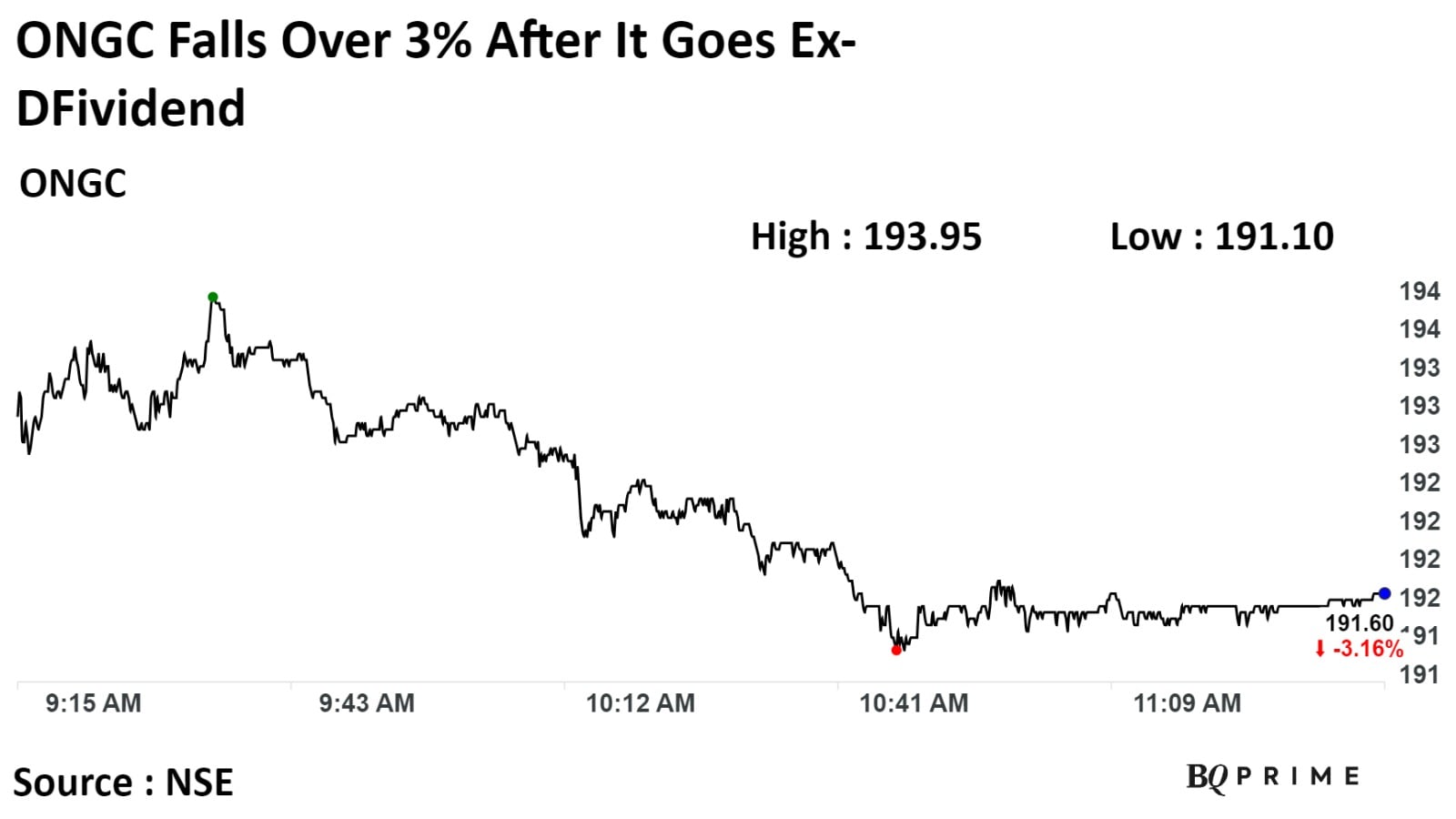

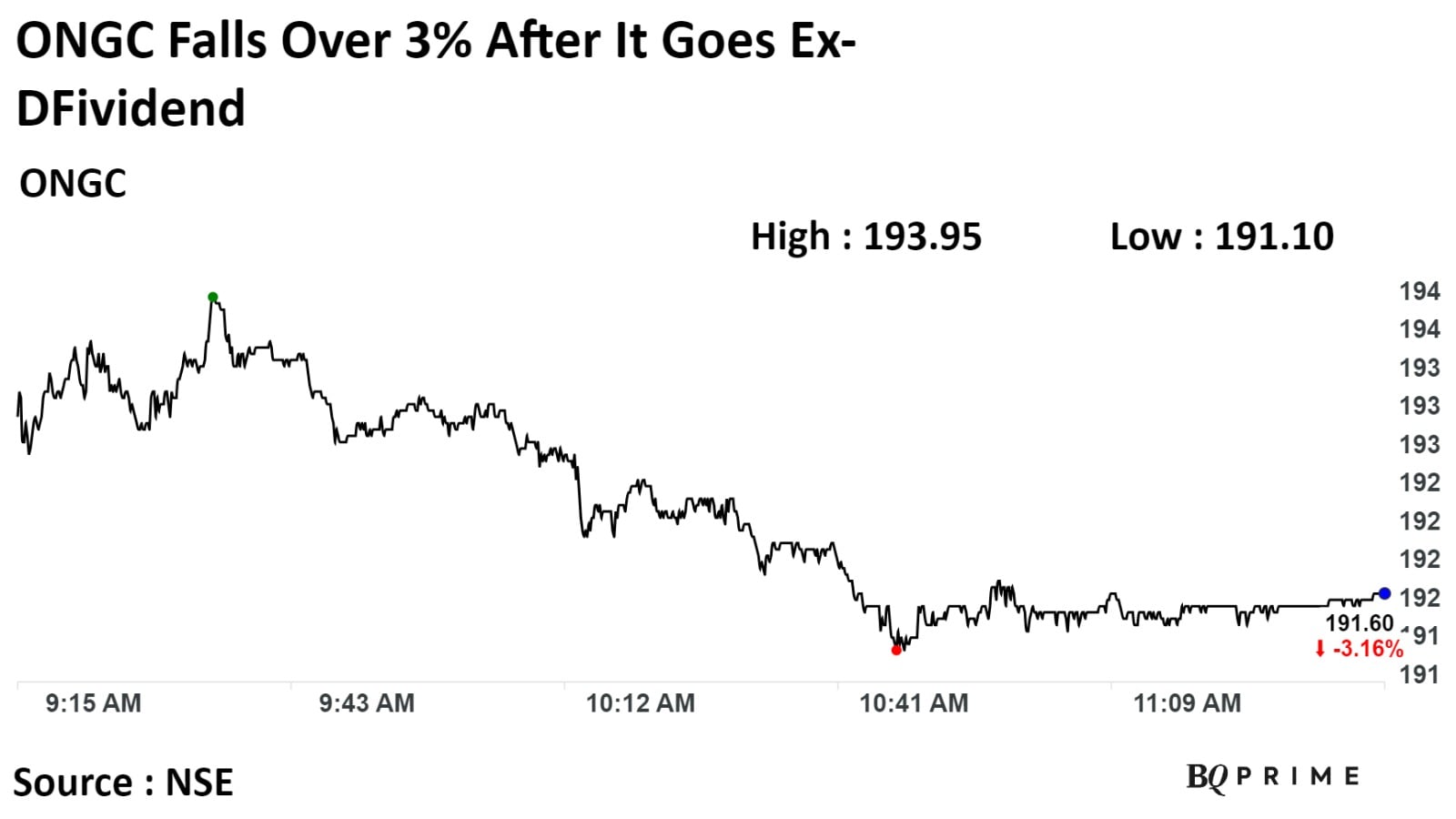

Oil and Natural Gas Corporation Ltd's board of director set the interim dividend price at Rs. 5.75 per share with face value of Rs. 5 each. for the current financial year.

Shares of Oil India Ltd fell as much as 1.26% to Rs. 310.05 apiece. It pared losses to trade 0.83% lower at Rs. 311.40 apiece, as of 10:39 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 49.9% on a year-to-date basis.The relative strength index was at 49.63.

Out of 27 analysts tracking the company, 20 maintain a 'buy' rating, 4 recommend a 'hold,' and 3 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 50.3%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.

The scrip fell as much as 4.27% to Rs. 333.00 apiece. It pared losses to trade 3.15% lower at Rs 336.90 apiece, as of 10:09 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 49.19% on a year-to-date basis. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 61.08.

Out of 23 analysts tracking the company, 18 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 59.9%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.

The scrip fell as much as 4.27% to Rs. 333.00 apiece. It pared losses to trade 3.15% lower at Rs 336.90 apiece, as of 10:09 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 49.19% on a year-to-date basis. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 61.08.

Out of 23 analysts tracking the company, 18 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 59.9%.

Oil and Natural Gas Corporation Ltd's board of director set the interim dividend price at Rs. 5.75 per share with face value of Rs. 5 each. for the current financial year.

Shares of Oil India Ltd fell as much as 1.26% to Rs. 310.05 apiece. It pared losses to trade 0.83% lower at Rs. 311.40 apiece, as of 10:39 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 49.9% on a year-to-date basis.The relative strength index was at 49.63.

Out of 27 analysts tracking the company, 20 maintain a 'buy' rating, 4 recommend a 'hold,' and 3 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 50.3%.

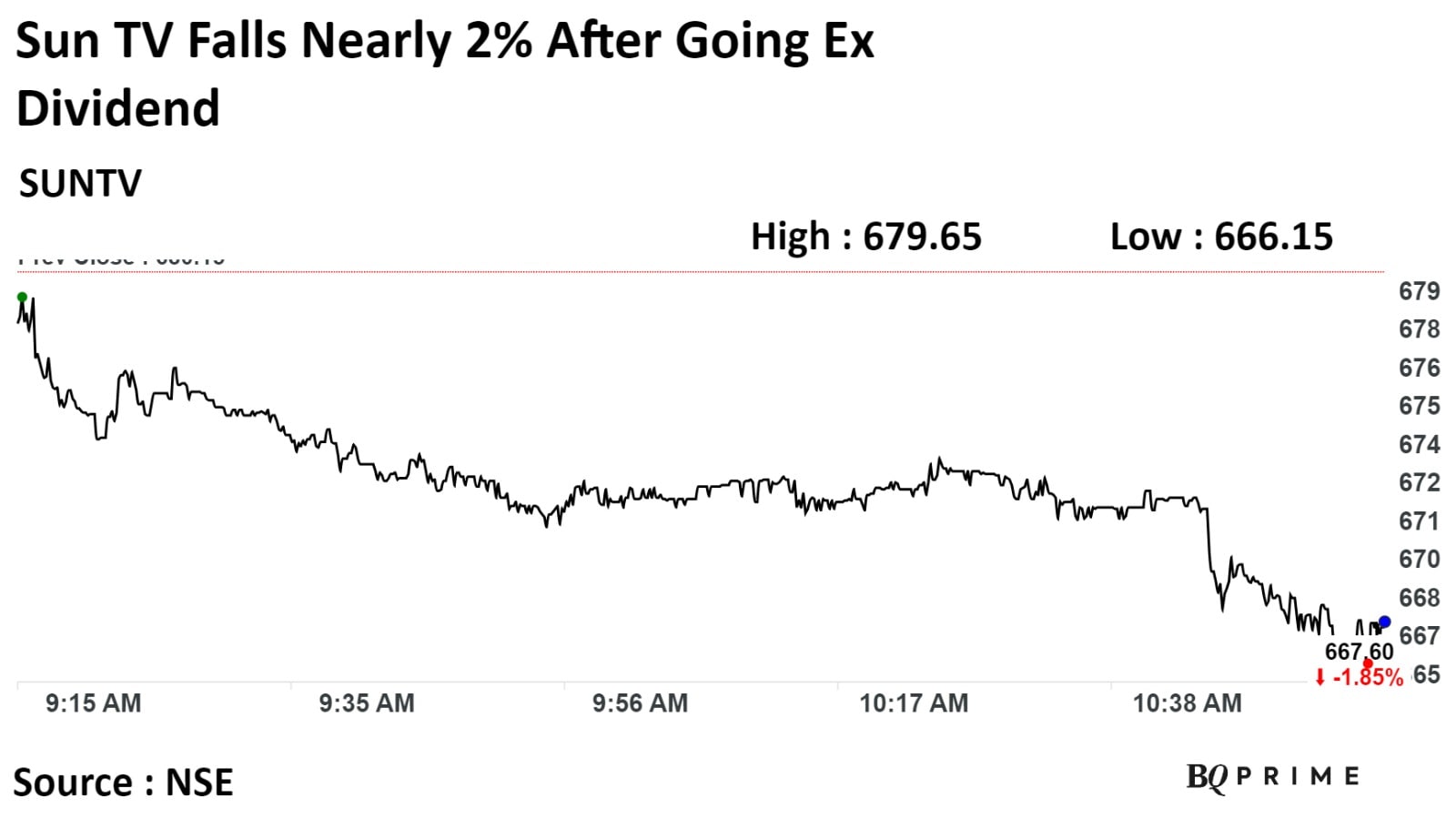

Sun TV Network Ltd has set the interim dividend price at Rs. 5 per share with the face value of Rs.5.

The scrip fell as much as 1.35% to Rs. 671.0 apiece. It pared losses to trade 1.15% lower at Rs. 672.35 apiece, as of 10:32 a.m. This compares to a 0.43% advance in the NSE Nifty 50 Index.

It has risen 38.03% on a year-to-date basis. The relative strength index was at 61.22.

Out of 19 analysts tracking the company, 12 maintain a 'buy' rating, 4 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 44.1%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.

The scrip fell as much as 4.27% to Rs. 333.00 apiece. It pared losses to trade 3.15% lower at Rs 336.90 apiece, as of 10:09 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 49.19% on a year-to-date basis. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 61.08.

Out of 23 analysts tracking the company, 18 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 59.9%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.

The scrip fell as much as 4.27% to Rs. 333.00 apiece. It pared losses to trade 3.15% lower at Rs 336.90 apiece, as of 10:09 a.m. This compares to a 0.37% advance in the NSE Nifty 50 Index.

It has risen 49.19% on a year-to-date basis. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 61.08.

Out of 23 analysts tracking the company, 18 maintain a 'buy' rating, 1 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 59.9%.

Oil and Natural Gas Corporation Ltd's board of director set the interim dividend price at Rs. 5.75 per share with face value of Rs. 5 each. for the current financial year.

Shares of Oil India Ltd fell as much as 1.26% to Rs. 310.05 apiece. It pared losses to trade 0.83% lower at Rs. 311.40 apiece, as of 10:39 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 49.9% on a year-to-date basis.The relative strength index was at 49.63.

Out of 27 analysts tracking the company, 20 maintain a 'buy' rating, 4 recommend a 'hold,' and 3 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 50.3%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

Gujarat Pipavav Ports rose to over a 5-year high as it went ex-dividend for the upcoming dividend. The interim dividend price was set up at Rs. 3.60 per share for this financial year. The dividend payment is likely to be on Dec 5, according exchange filing.

Meanwhile, out of other companies which are going ex-dividend today, Gillette India's shares reversed losses. Shares of Oil India Ltd, Coal India Ltd, Oil and Oil and Natural Gas Corporation and Sun TV declined Tuesday as the companies went ex-dividend for the upcoming dividend.

The scrip rose to a over 5-year high 4.13% to 143.55 apiece, the highest level since Jun 6, 2018. It pared gains to trade 1.52% higher at Rs 139.95 apiece, as of 11:07 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 38.85% on a year-to-date basis. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 63.89.

Out of 13 analysts tracking the company, 9 maintain a 'buy' rating, 3 recommend a 'hold,' and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 61.8%.

The scrip fell as much as 0.67% to Rs. 6,350.15 apiece. It reversed losses to trade 0.48% higher at Rs 6,420.00 apiece, as of 11:01 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has risen 27.57% on a year-to-date basis. The relative strength index was at 59.83.

Out of 2 analysts tracking the company, all maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 27.5%.

Coal India's shares fell over 4% as the company went ex-dividend on Tuesday. The dividend price was set at Rs. 15.25 per share.