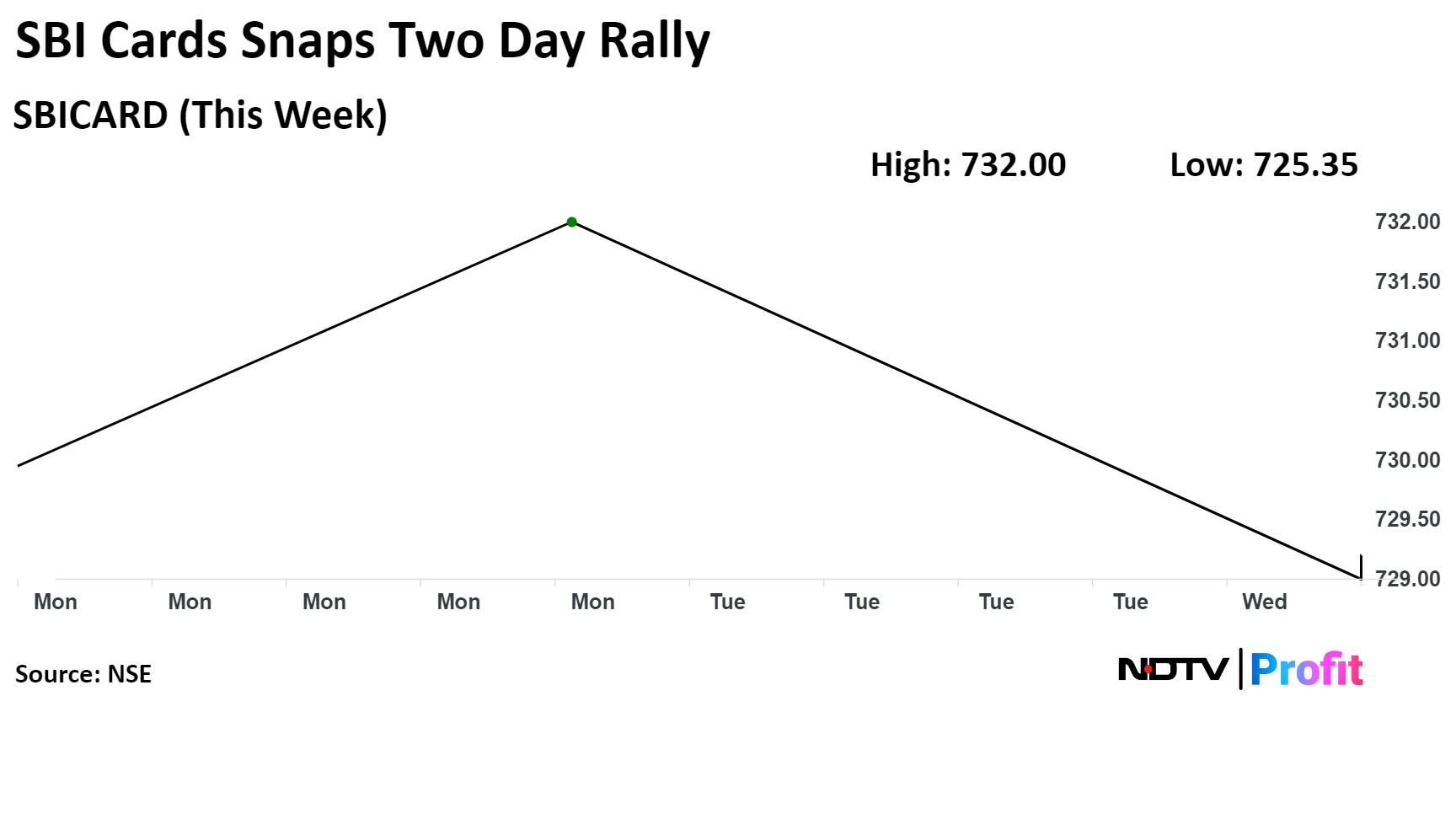

Shares of SBI Cards & Payment Services Ltd. fell after a two-day rally as its credit card market share declined in May.

According to Morgan Stanley, the company's market share fell 102 basis points year-on-year to 18.5%. Its total credit cards in force have risen by 12% year-on-year, which is significantly lower than the industry's growth rate of 18%, the brokerage said.

The momentum in SBI Card's year-on-year growth for June 2024 was lower compared to May 2024's average, indicating a slowdown in the company's expansion efforts, the Reserve Bank of India noted in a notification.

While the volume of transactions at SBI Card rose 25% year-on-year in May 2024, it lagged behind the industry's more robust 32% year-on-year rise.

A potential rise in credit costs, a continuous increase in interest rates, a significant slowdown in asset growth due to quality concerns, and investors' bearish sentiment are some of the risks, according to Morgan Stanley.

Shares of the company fell as much as 0.85%, before paring loss to trade 0.39% lower at Rs 729.30 apiece as of 10:11 a.m. This compares to a 0.07% decline in the NSE Nifty 50.

The stock has fallen 3.99% year-to-date and 13.92% in the last 12 months, according to NSE data. Total traded volume so far in the day stood at 0.10 times its 30-day average. The relative strength index was at 57.61.

Out of 29 analysts tracking the company, eight maintain a 'buy' rating, eight recommend a 'hold' and 13 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.