Overseas investors began the year as net sellers of Indian equities on Monday.

Foreign portfolio investors offloaded stocks worth Rs 855.8 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers and bought equities worth Rs 410.46 crore, the NSE data showed.

India received the highest-ever foreign portfolio inflows in 2023 and surpassed emerging market peers, amid global volatility and valuation concerns.

The yield on the 10-year bond closed 3 bps higher at 7.20% on Monday.

Source: Bloomberg

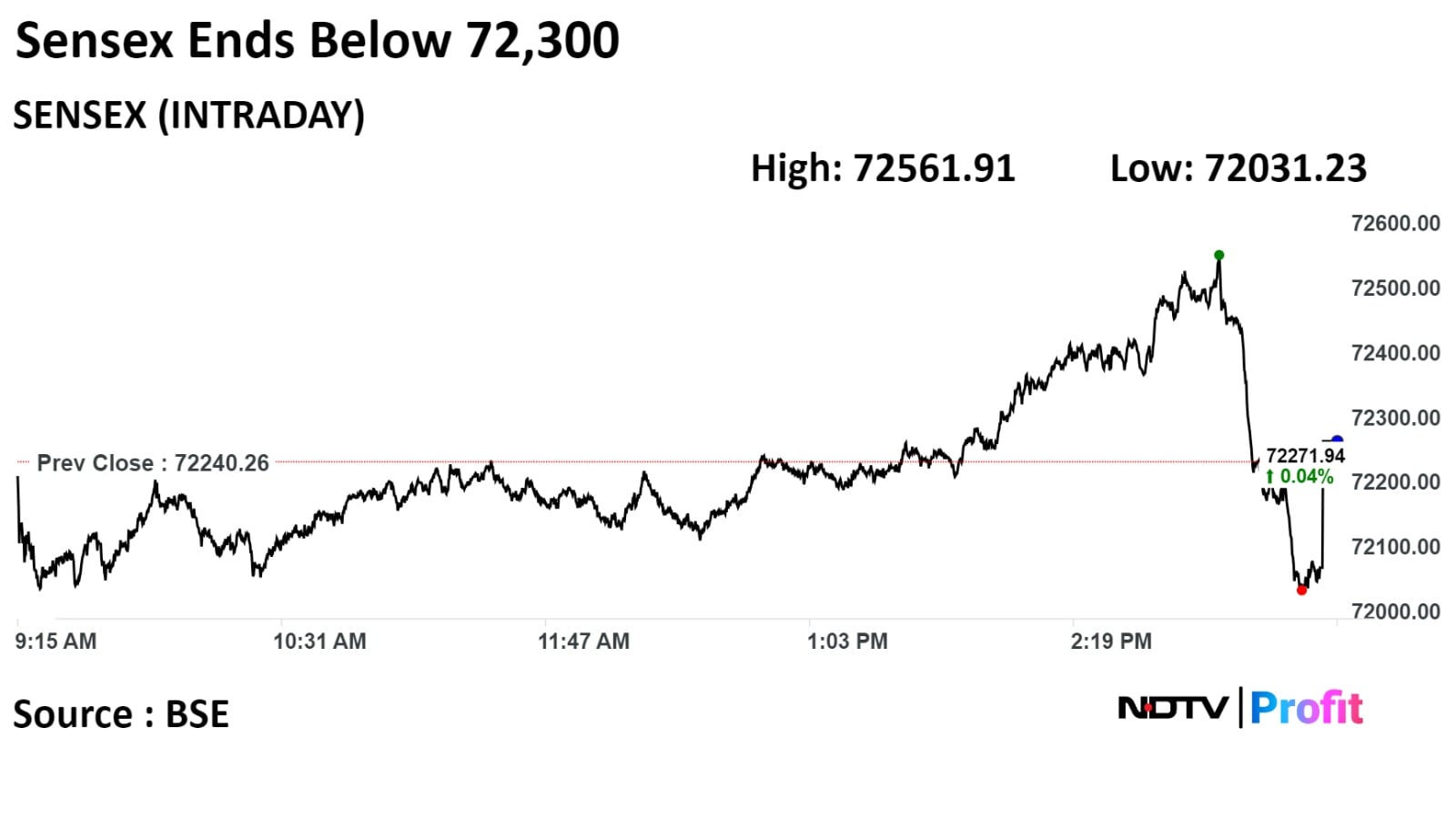

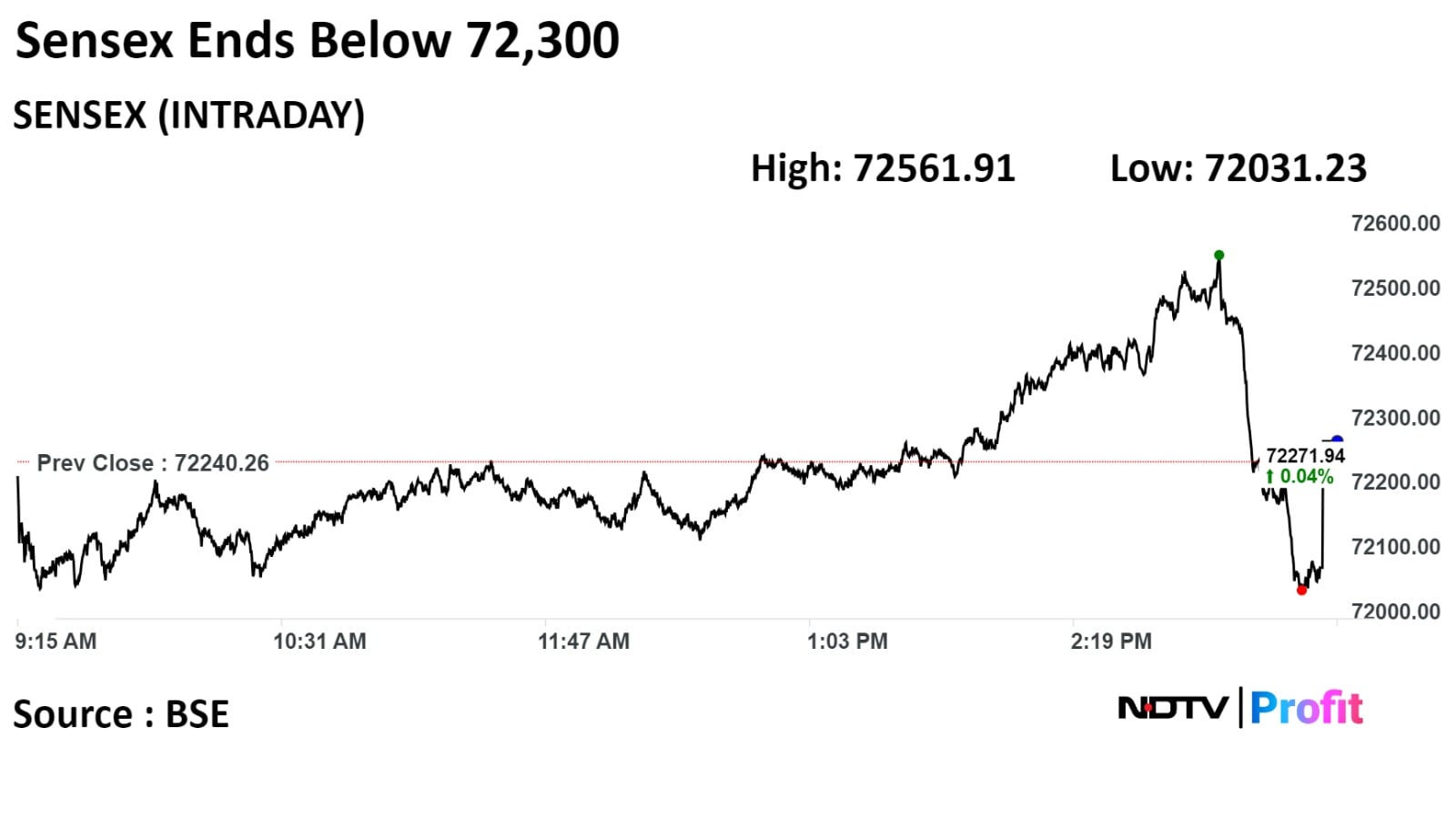

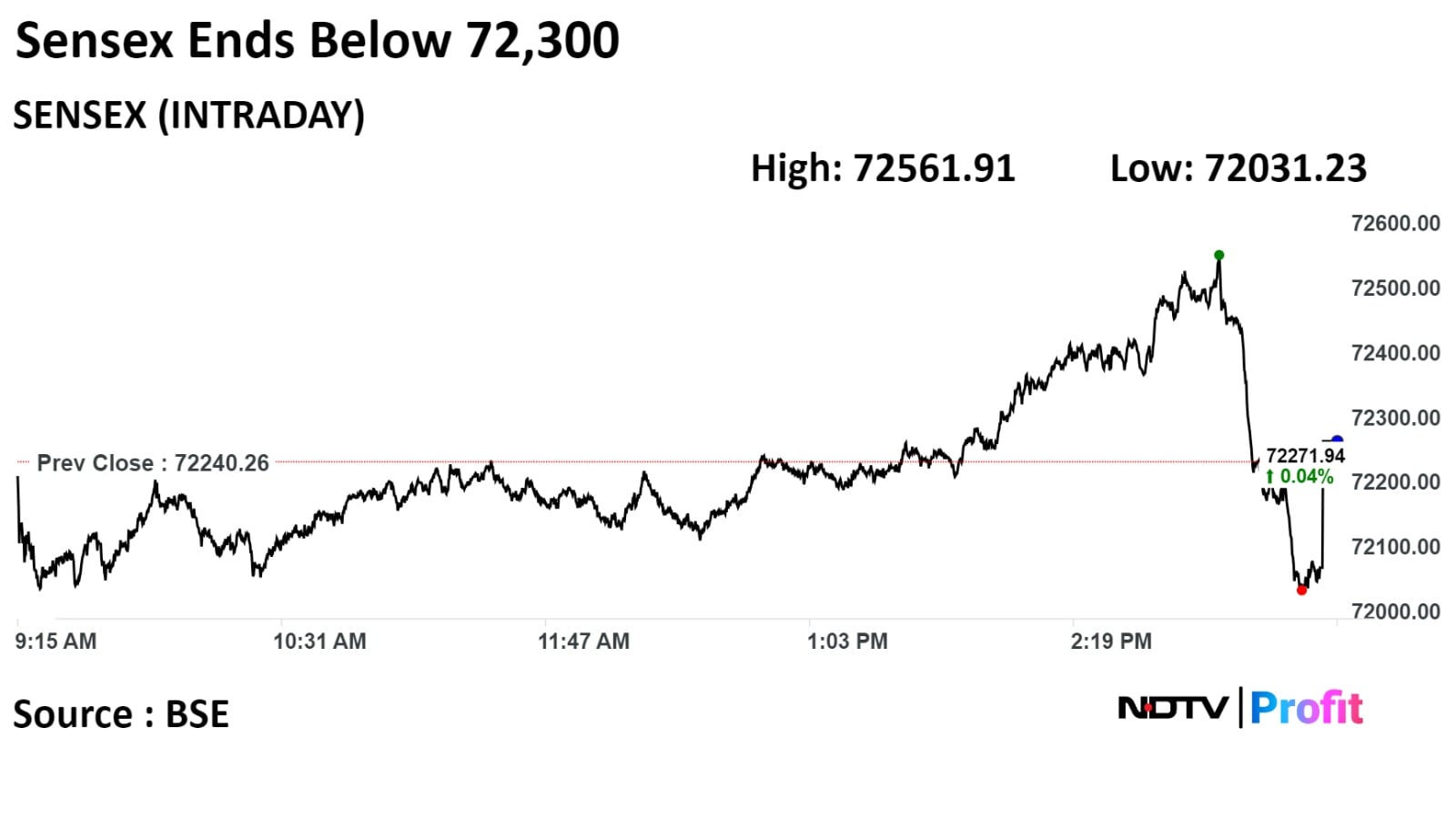

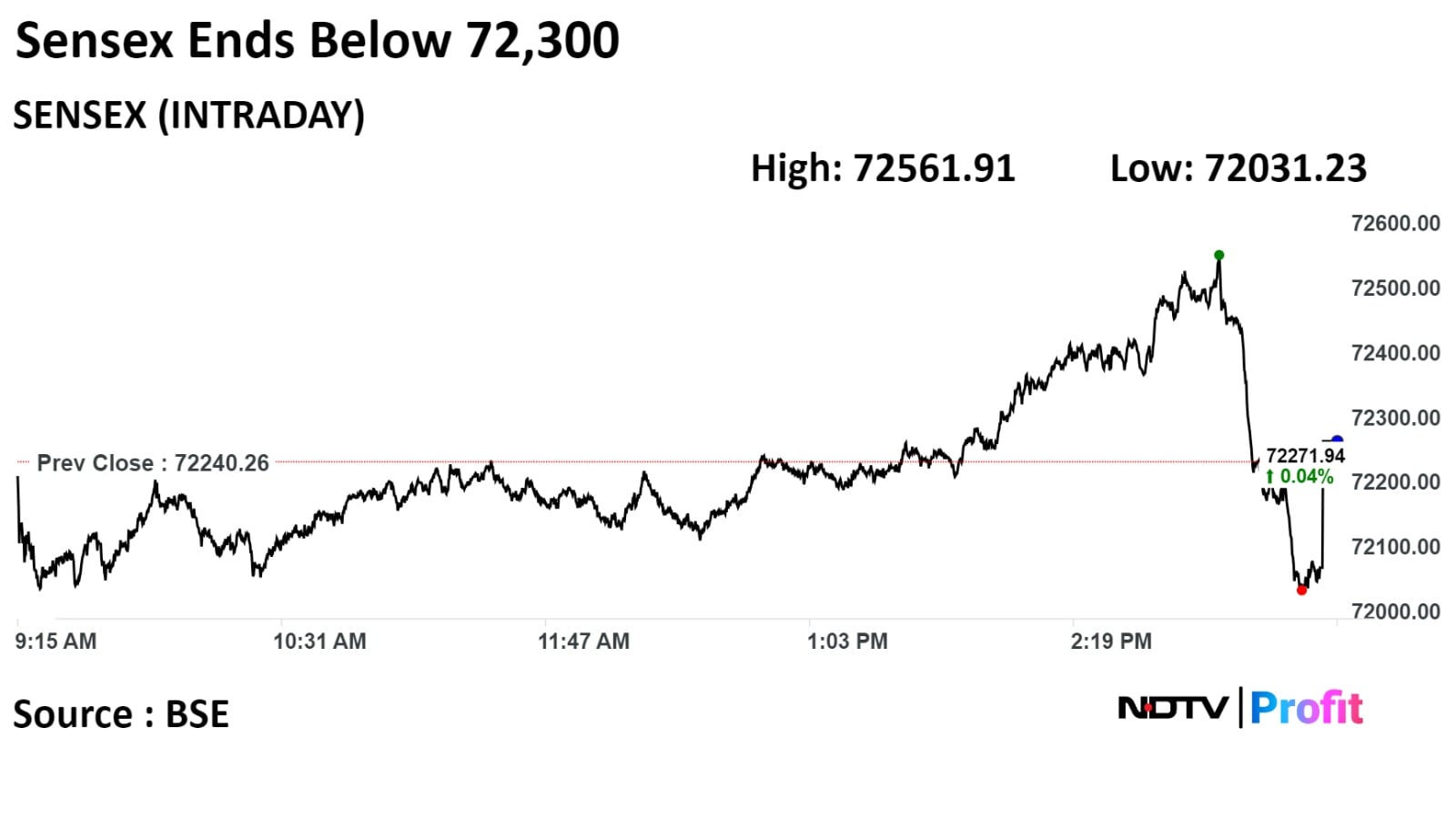

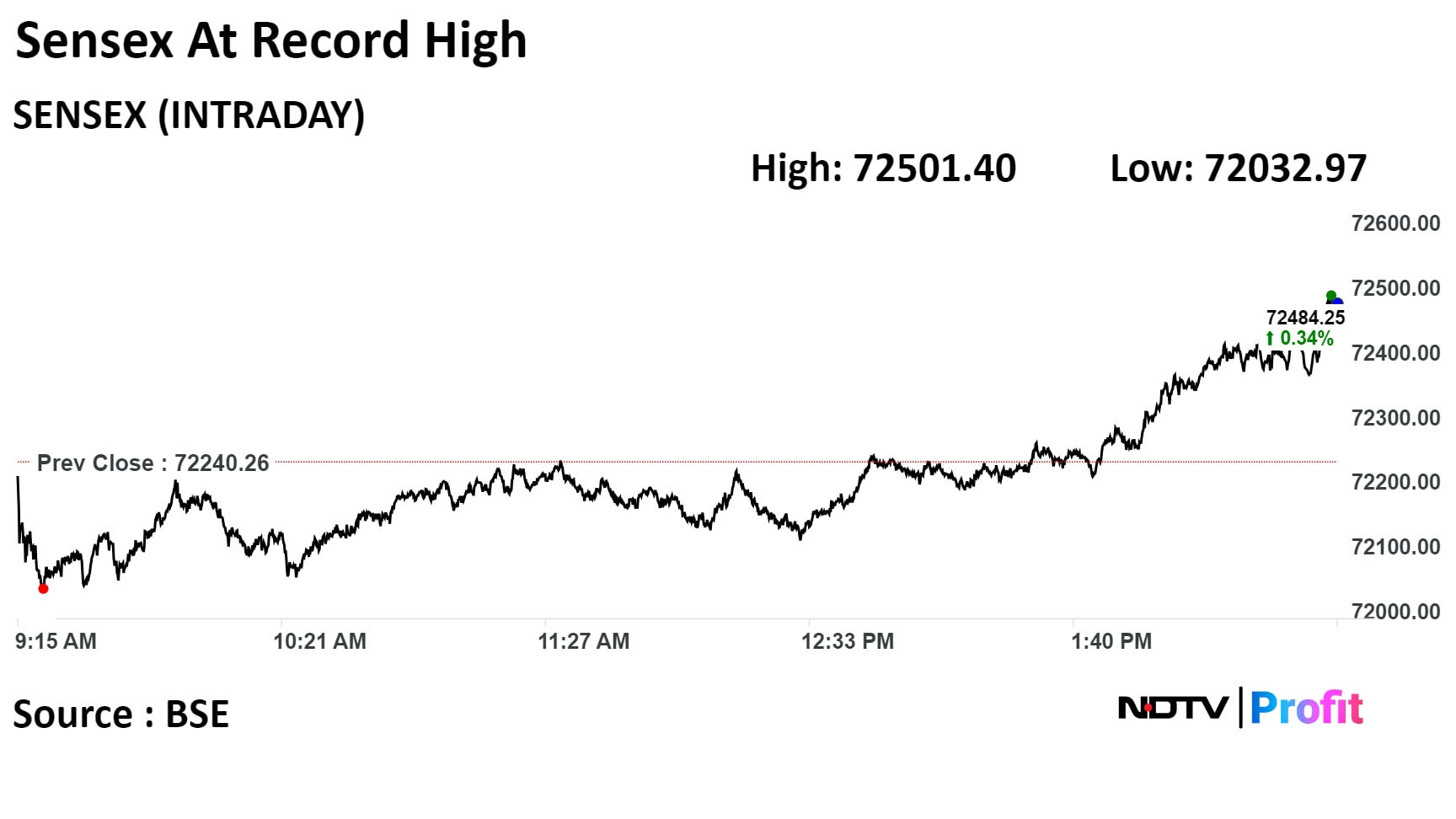

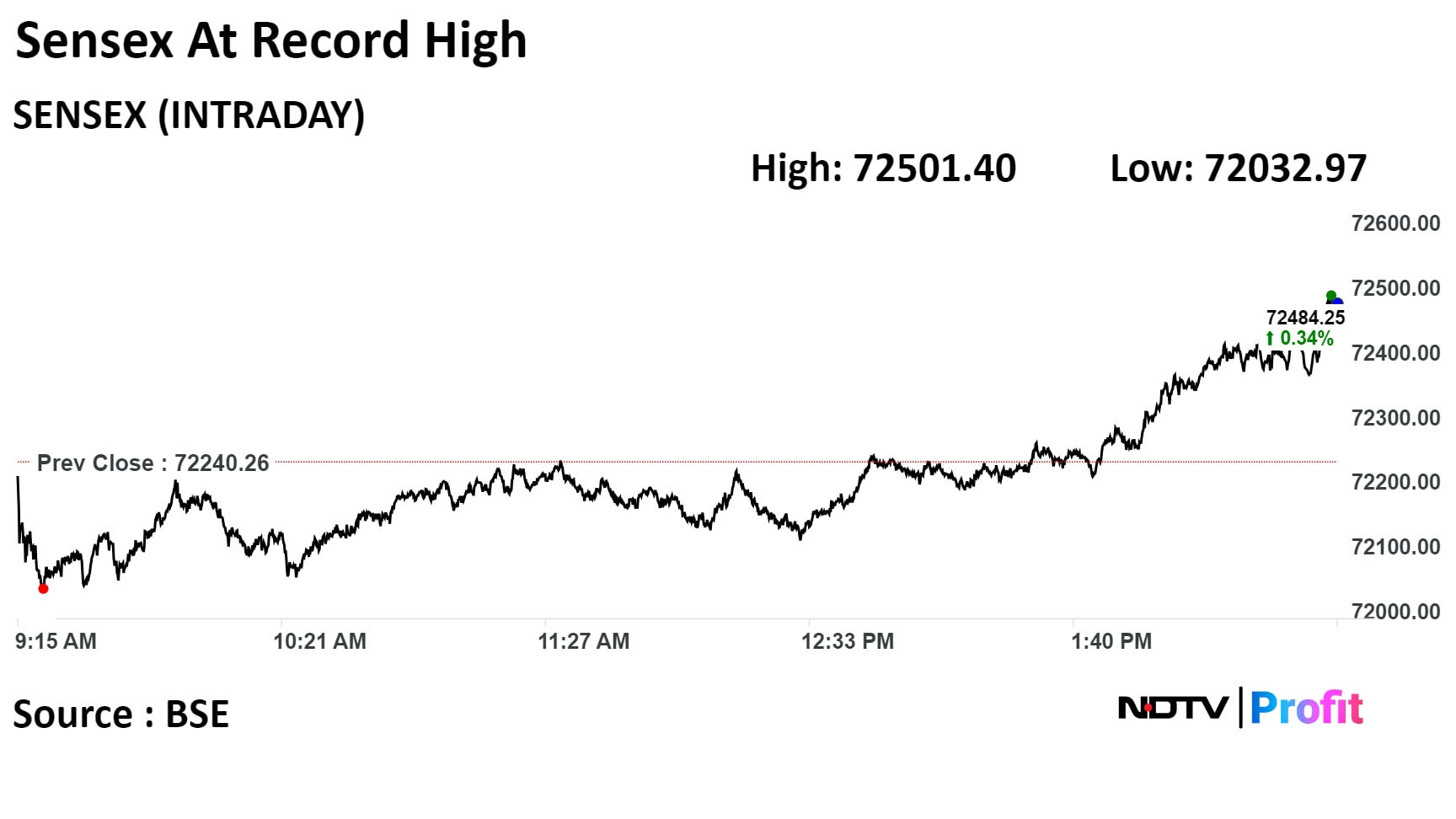

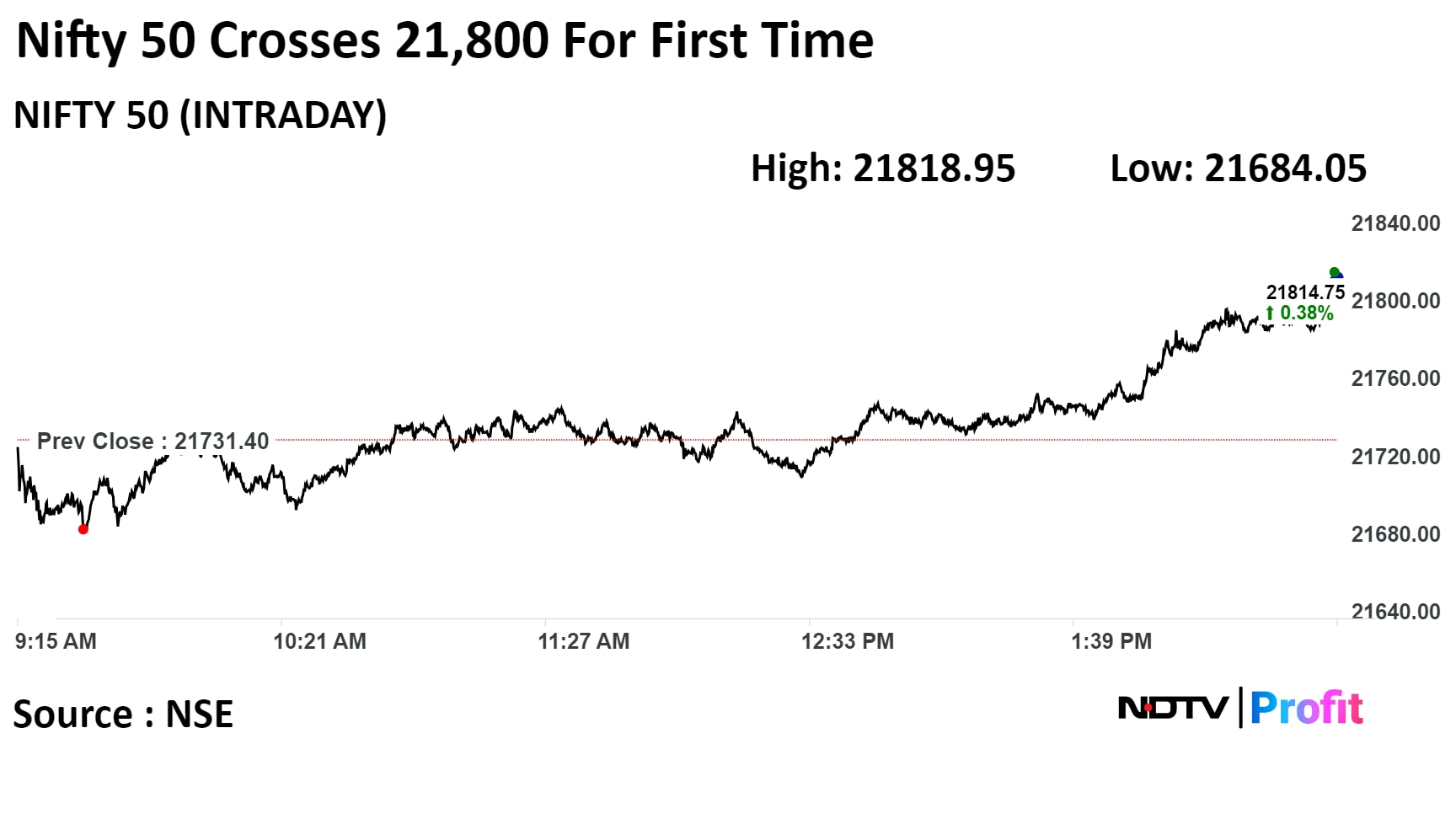

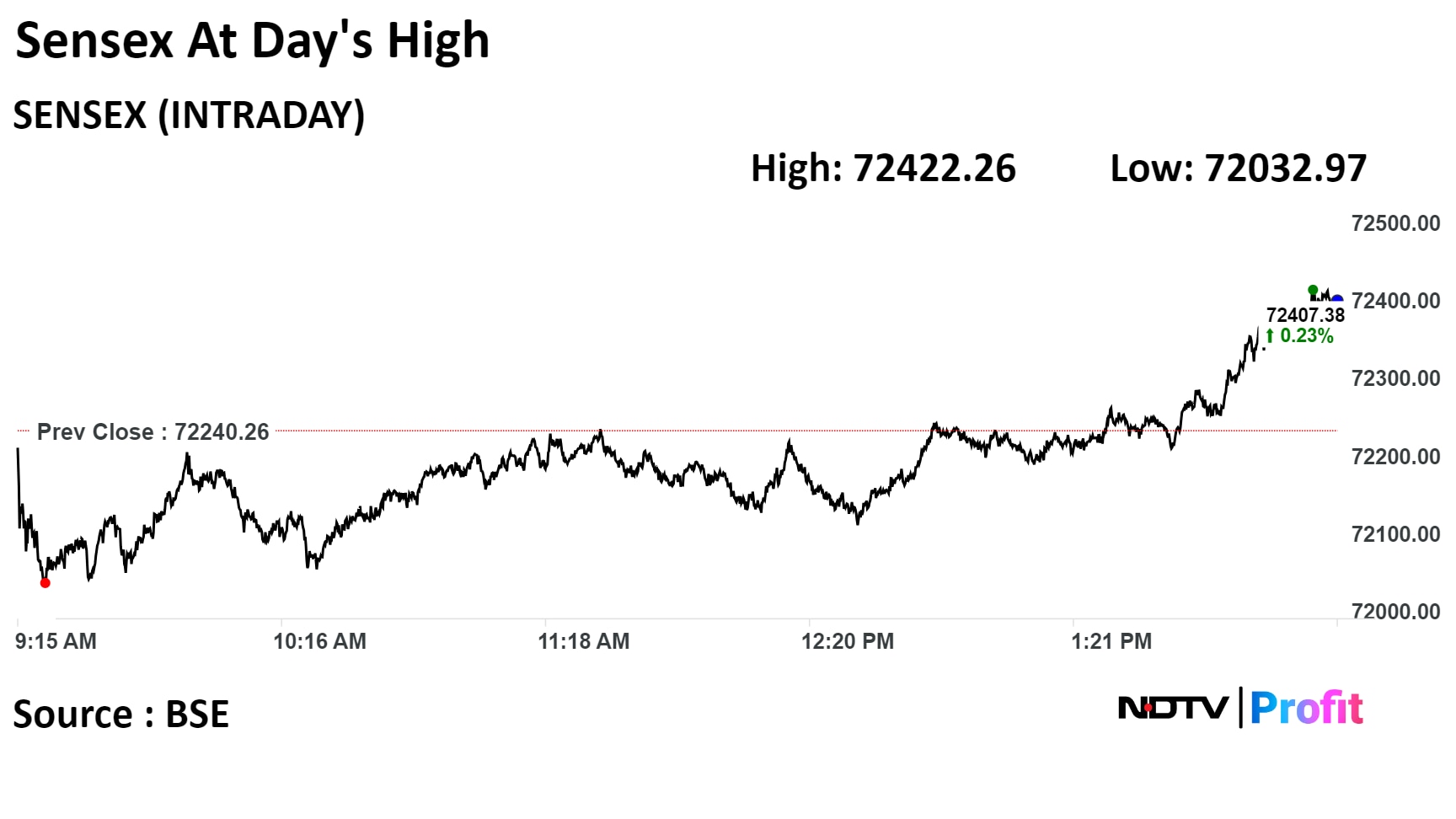

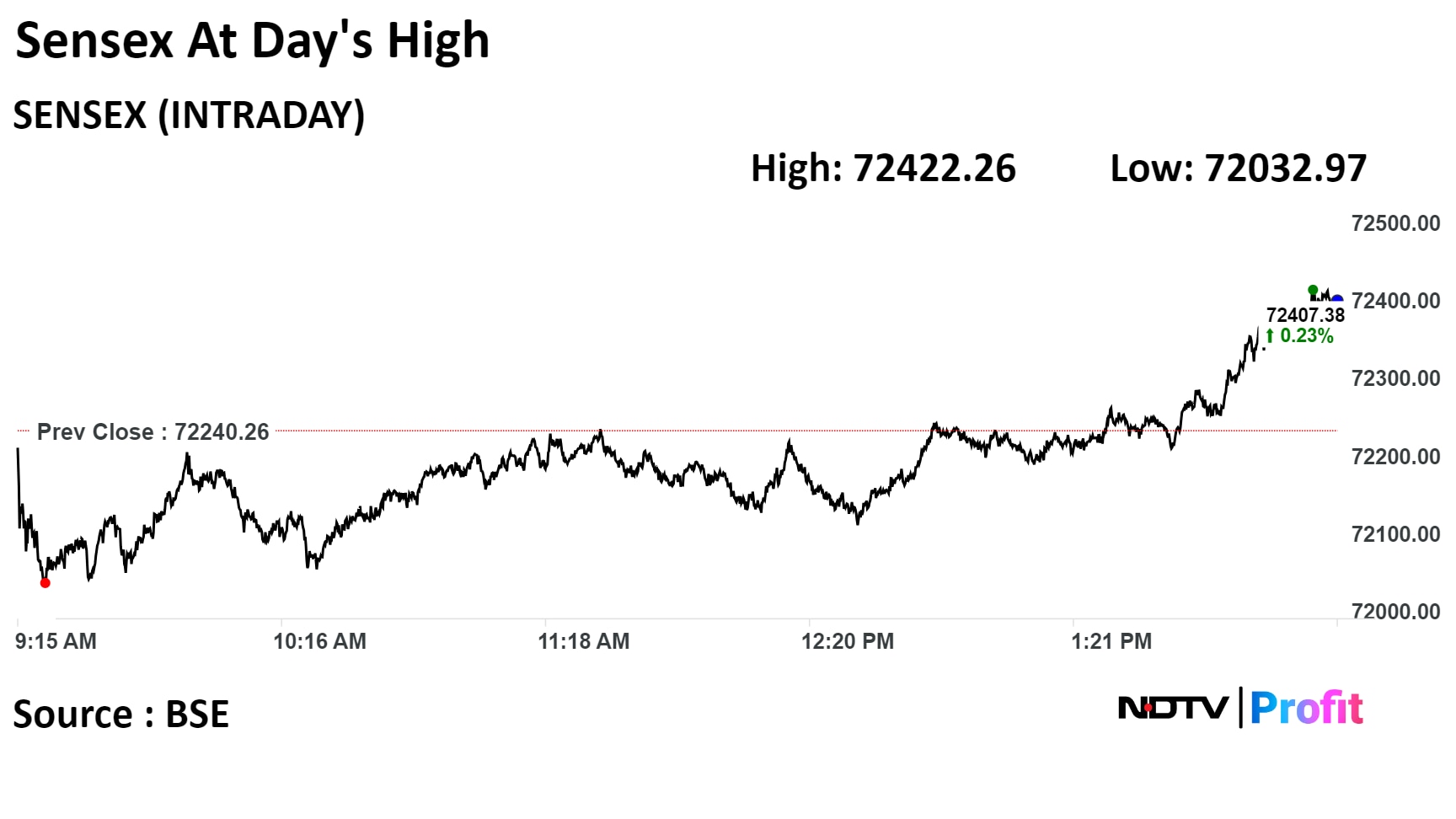

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

"The markets started the new year on a tepid note but PSU Banks and IT stocks took the lead and supported the Index to recoup its losses. In the last session, FMCG and Metal counters propelled the rally; however, due to a steep profit booking fall in the last session, the Index erased its gains to end the first trading session of the new year at 21,741.90 with a marginal gain of 10.50 points," Aditya Gaggar, director of progressive shares said

"Mid and Smallcaps extended their morning gains and outperformed the Frontline Index. On the daily chart, the Index has formed a Gravestone DOJI candlestick pattern which indicates the rejection at the higher end. The possibility of a bearish divergence still persists and if the same is confirmed, then we can see a correction to 21,500; on the flip, a convincing close above 21,800 will be considered as a failure of divergence," he added.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

Benchmark indices came of their life highs and ended the first day of the year with little change from Friday's close as financial services stocks dragged while IT stocks kept them from falling.

The S&P BSE Sensex settled 0.04% or 31.68 points higher at 72,271.94, while the NSE Nifty 50 ended 0.05% or 10.50 higher at 21,741.90

Intraday, the NSE Nifty 50 rose 0.47% or 102.95 points to 21, 834.35, and the S&P BSE Sensex rose 0.45% or 321.65 points to 72,561.91.

"The markets started the new year on a tepid note but PSU Banks and IT stocks took the lead and supported the Index to recoup its losses. In the last session, FMCG and Metal counters propelled the rally; however, due to a steep profit booking fall in the last session, the Index erased its gains to end the first trading session of the new year at 21,741.90 with a marginal gain of 10.50 points," Aditya Gaggar, director of progressive shares said

"Mid and Smallcaps extended their morning gains and outperformed the Frontline Index. On the daily chart, the Index has formed a Gravestone DOJI candlestick pattern which indicates the rejection at the higher end. The possibility of a bearish divergence still persists and if the same is confirmed, then we can see a correction to 21,500; on the flip, a convincing close above 21,800 will be considered as a failure of divergence," he added.

HDFC Bank Ltd, Bharti Airtel Ltd, Mahindra & Mahindra Ltd, Eicher Motors Ltd, and Axis Bank Ltd weighed on the indices.

ITC Ltd, Infosys Ltd, Nestle India Ltd, Adani Enterprises Ltd, and ICICI Bank Ltd added positively to the indices.

On NSE, nine sectoral indices advanced out of 12, while three declined. Nifty Media and Nifty Oil & Gas sector rose the most, while Nifty Financial Services emerged as the top loser among sectors.

Broader markets outperformed, with S&P BSE MidCap index rising 0.54%, and S&P BSE SmallCap gaining 0.73%. Around 17 sectors, out of 20 compiled by the BSE, advanced, and three declined. BSE Energy and BSE Telecommunication gained the most among sectoral indices.

The market breadth was skewed in the favour of buyers. About 2,524 stocks rose, 1,371 declined, while 152 remained unchanged on the BSE.

11 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 106.05 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Citi Research has increased the target price of Tata Consultancy Services Ltd. from Rs 3,170 to Rs 3,470. The research firm has also revised FY24-26E EPS estimates by 0-1%. It maintains 'sell' rating on the stock.

Key Upside Risks

Aggressive pent-up demand from corporates in the US/Europe

Any significant depreciation of the rupee against the USD/EUR/GBP

Any margin-accretive acquisition

Relative preference for IT in the India context.

Japanese Prime Minister Fumio Kishida issues instructions to authorities following earthquake.

No irregularities in nuclear power plants so far

Residents advised to evacuate immediately

Waves can be repeated and could get higher

Wajima city in Ishikawa Prefecture has been hit by tsunami waves as high as 1.2 metres on Monday following a massive earthquake with an magnitude of 7.4 in the region.

Toyama, Toyama prefecture, also reported tsunami of 50 centimeters.

In Niigata, Sado Island 3 metre waves has been observed

Source: NHK World

India's benchmark indices were trading marginally lower through midday on Monday amid lack of fresh triggers as most markets across the globe remained closed for New Year festivities.

At 12:07 p.m., the NSE Nifty 50 was trading 6.95 points, or 0.03%, lower at 21,732.80, while the S&P BSE Sensex declined 97 points, or 0.13%, to 72,143.19.

So far in the day, Nifty fell 0.22% to 21,684.05 and the Sensex declined 0.29% to 72,033.97.

India's benchmark indices were trading marginally lower through midday on Monday amid lack of fresh triggers as most markets across the globe remained closed for New Year festivities.

At 12:07 p.m., the NSE Nifty 50 was trading 6.95 points, or 0.03%, lower at 21,732.80, while the S&P BSE Sensex declined 97 points, or 0.13%, to 72,143.19.

So far in the day, Nifty fell 0.22% to 21,684.05 and the Sensex declined 0.29% to 72,033.97.

India's benchmark indices were trading marginally lower through midday on Monday amid lack of fresh triggers as most markets across the globe remained closed for New Year festivities.

At 12:07 p.m., the NSE Nifty 50 was trading 6.95 points, or 0.03%, lower at 21,732.80, while the S&P BSE Sensex declined 97 points, or 0.13%, to 72,143.19.

So far in the day, Nifty fell 0.22% to 21,684.05 and the Sensex declined 0.29% to 72,033.97.

India's benchmark indices were trading marginally lower through midday on Monday amid lack of fresh triggers as most markets across the globe remained closed for New Year festivities.

At 12:07 p.m., the NSE Nifty 50 was trading 6.95 points, or 0.03%, lower at 21,732.80, while the S&P BSE Sensex declined 97 points, or 0.13%, to 72,143.19.

So far in the day, Nifty fell 0.22% to 21,684.05 and the Sensex declined 0.29% to 72,033.97.

"Technically, it has formed a bullish candle on the weekly chart and formed a higher bottom on the daily chart, which is largely positive," said Shrikant Chouhan, head of equity research at Kotak Securities. "Our view is that the broader market structure is still bullish, but due to a temporary overbought situation, we may see some profit-booking at higher levels."

For traders following the trend, 21,600/71,900 can act as a crucial support for both the indices, he said. "If the indices manages to sustain above it, then they can go up to 21,850–21,925/72,500–72,700," Chouhan said.

However, a downtrend below 21,600/71,900 will be vulnerable, he said. "A close below 21,600/72,500 may send the indices to 21,500-21,380/71,600-71,500."

"Technically, it has formed a bullish candle on the weekly chart and formed a higher bottom on the daily chart, which is largely positive," said Shrikant Chouhan, head of equity research at Kotak Securities. "Our view is that the broader market structure is still bullish, but due to a temporary overbought situation, we may see some profit-booking at higher levels."

For traders following the trend, 21,600/71,900 can act as a crucial support for both the indices, he said. "If the indices manages to sustain above it, then they can go up to 21,850–21,925/72,500–72,700," Chouhan said.

However, a downtrend below 21,600/71,900 will be vulnerable, he said. "A close below 21,600/72,500 may send the indices to 21,500-21,380/71,600-71,500."

Coal India Ltd., ITC Ltd., Tata Motors Ltd., ICICI Bank Ltd. and Adani Enterprises Ltd. contributed the most to Nifty 50.

HDFC Bank Ltd., Bharti Airtel Ltd., Mahindra & Mahindra Ltd., Hindustan Unilever Ltd. and Reliance Industries Ltd weighed on the index.

All sectors gained on the NSE, with the Nifty PSU Bank emerging as the top performer.

The broader markets outperformed the benchmark indices, with the BSE Midcap rising 0.74% and the Smallcap gaining 0.84% through midday trade on Monday.

Nineteen out of the 20 sectors, except Teck, advanced on the BSE, with Telecommunication rising the most.

The market breadth remained skewed in favour of the buyers as 2,595 stocks rose, 1,137 declined and 185 remained unchanged on the BSE.

Dec commercial vehicle sales at 8,026 units, up 11%

Dec exports at 321 units, down 3.3%

Dec domestic sales at 7,468 units, up 11.9%

Dec truck and buses sales at 7,789 units, up 11.2%

Source: Exchange Filing

Atul Auto Ltd's total sales of April-December at 18,298 units, up 1.29% YoY

December sales at 2,503 units, up 16.36% YoY

Source: Exchange Filing

The shares of Samvardhana Motherson International Ltd rose as much as 6.33% to Rs 108.40 apiece, the highest level since Feb 20, 2022. It was trading 5.54% higher at Rs 107.60 apiece, as of 12:43 p.m. This compares to a 0.02% advance in the NSE Nifty 50 Index.

It has risen 5.49% on a year-to-date basis. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 75.08.

Out of 22 analysts tracking the company, 20 maintain a 'buy' rating, one recommends a 'hold,' and one suggests a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.4%.

The shares of Samvardhana Motherson International Ltd rose as much as 6.33% to Rs 108.40 apiece, the highest level since Feb 20, 2022. It was trading 5.54% higher at Rs 107.60 apiece, as of 12:43 p.m. This compares to a 0.02% advance in the NSE Nifty 50 Index.

It has risen 5.49% on a year-to-date basis. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 75.08.

Out of 22 analysts tracking the company, 20 maintain a 'buy' rating, one recommends a 'hold,' and one suggests a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.4%.

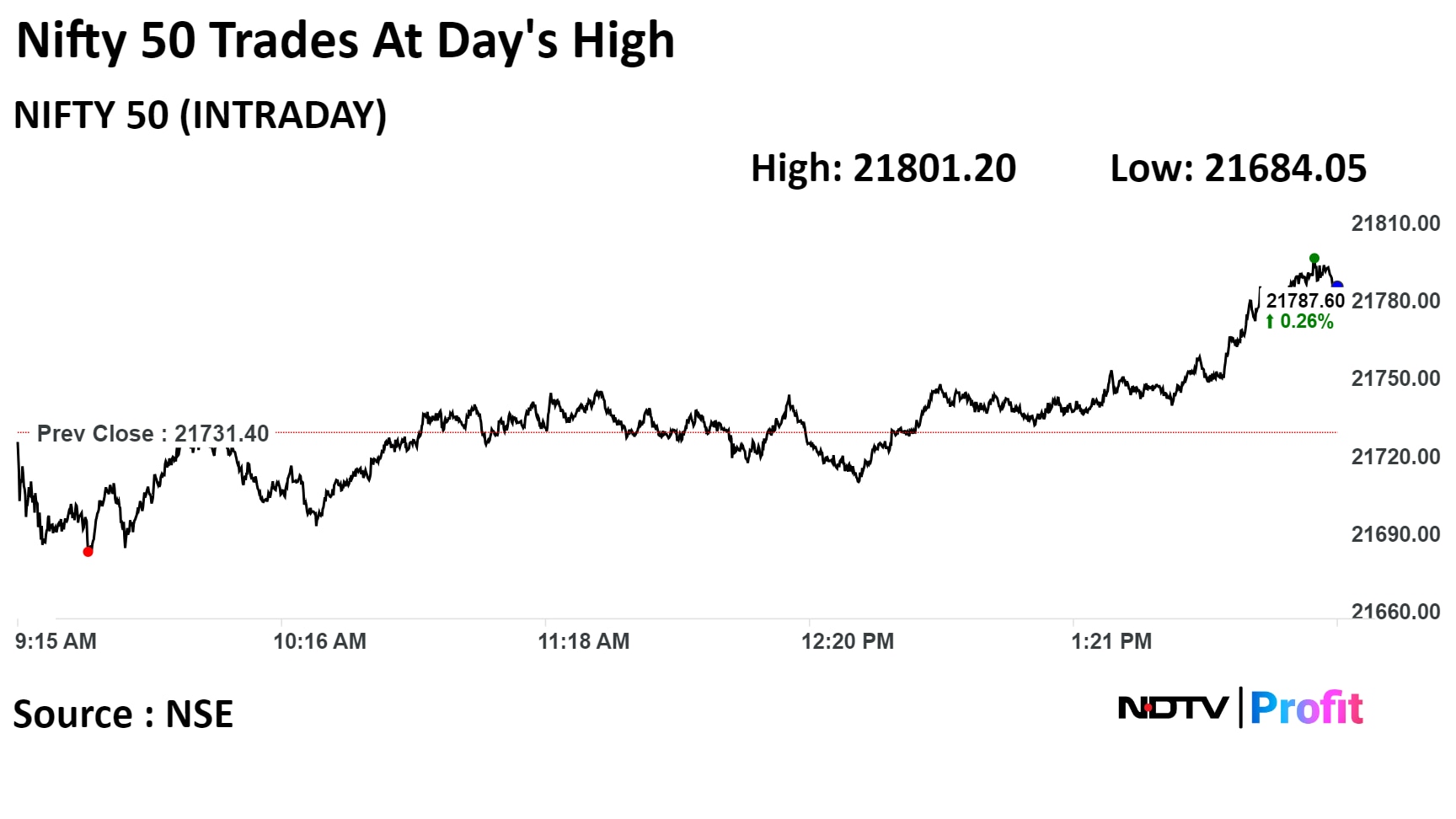

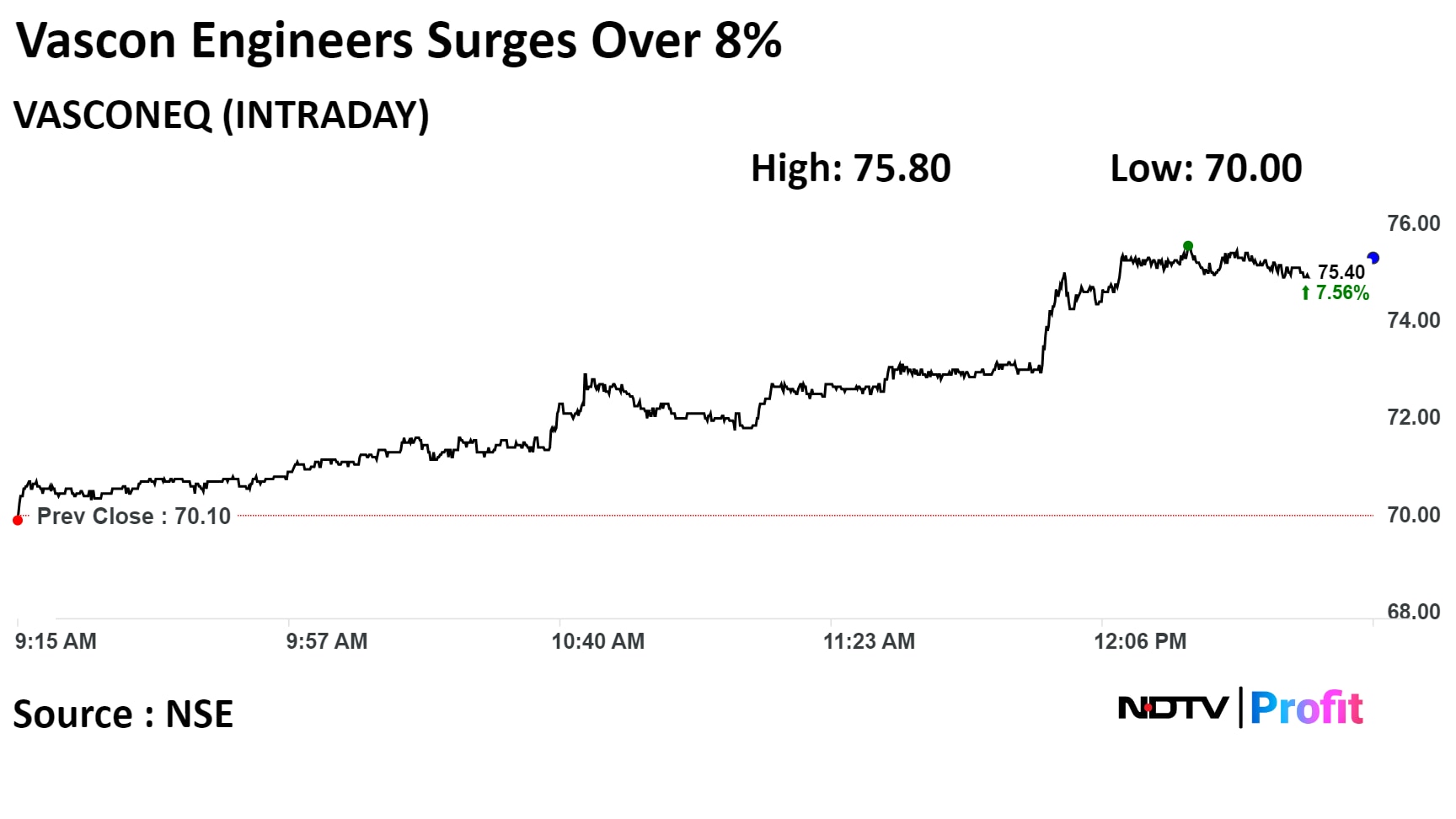

The shares of Vascon Engineers Ltd surged 8.13% to Rs 75.80 apiece, the highest level since Dec 18, 2023. It was trading 7.13% higher at Rs 75.10 apiece, as of 12:37 p.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 6.9% on a year-to-date basis. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 54.32.

The shares of Vascon Engineers Ltd surged 8.13% to Rs 75.80 apiece, the highest level since Dec 18, 2023. It was trading 7.13% higher at Rs 75.10 apiece, as of 12:37 p.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 6.9% on a year-to-date basis. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 54.32.

Asian Paints Ltd received tax demand worth Rs 13.83 crore and penalty of Rs 1.38 crore from Tamil Nadu GST Authority

Source: Exchange Filing

15 lakh shares changed hands in a large trade

0.01% equity changed hands at Rs 67 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Shivalik Bimetal Controls Ltd at 9.96x its 30 day average

Jbm Auto Ltd at 7.53x its 30 day average

Kaveri Seed Company Ltd at 7.52x its 30 day average

India Glycols Ltd at 5.28x its 30 day average

Vodafone Idea Ltd at 3.41x its 30 day average

Avanti Feeds Ltd at 3.38x its 30 day average

KPI Green Energy Ltd recommended issuing one bonus share for every two shares held

Source: Exchange Filing

Dec passenger sales at 35,174 units, up 24% YoY

Dec auto sales at 60,188 units, up 6.2% YoY

Dec tractor sales at 18,028 units, down 17% YoY

Dec commercial vehicle sales at 17,888 units, down 11% YoY

Dec exports at 1,819 units, down 41% YoY

Dec tractor exports at 1,110 units, down 31% YoY

Source: Exchange Filing

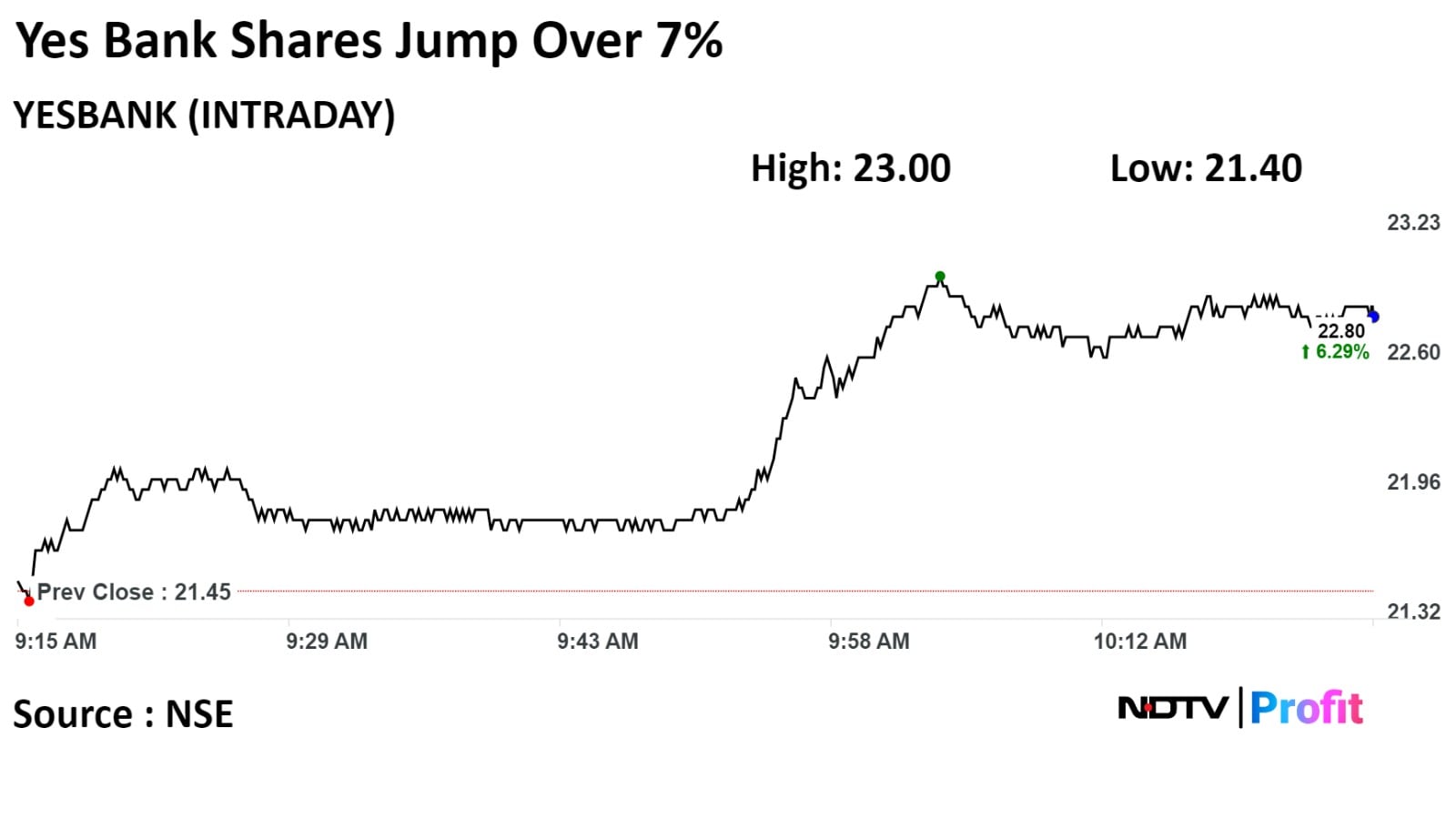

Shares of Yes Bank Ltd. jumped on Monday after the lender received Rs 150 crore from a single trust in the security receipts portfolio.

"Since this amount is more than the materiality threshold, as prescribed under the amended listing regulations, the said event, is being hereby disclosed under Regulations 30 of listing regulations," an exchange filing said on Sunday.

On Dec. 17, 2022, the bank had sold its NPA Portfolio to JC Flowers ARC.

Shares of Yes Bank Ltd. jumped on Monday after the lender received Rs 150 crore from a single trust in the security receipts portfolio.

"Since this amount is more than the materiality threshold, as prescribed under the amended listing regulations, the said event, is being hereby disclosed under Regulations 30 of listing regulations," an exchange filing said on Sunday.

On Dec. 17, 2022, the bank had sold its NPA Portfolio to JC Flowers ARC.

Shares of the bank rose as much as 7.23%, the highest level since Dec. 19, before paring gains to trade 5.1% higher at 10:40 a.m. This compares to a 0.04% decline in the NSE Nifty 50.

The stock has risen 5.36% year-to-date. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 66.7.

Of the 13 analysts tracking the company, four recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 32.2%.

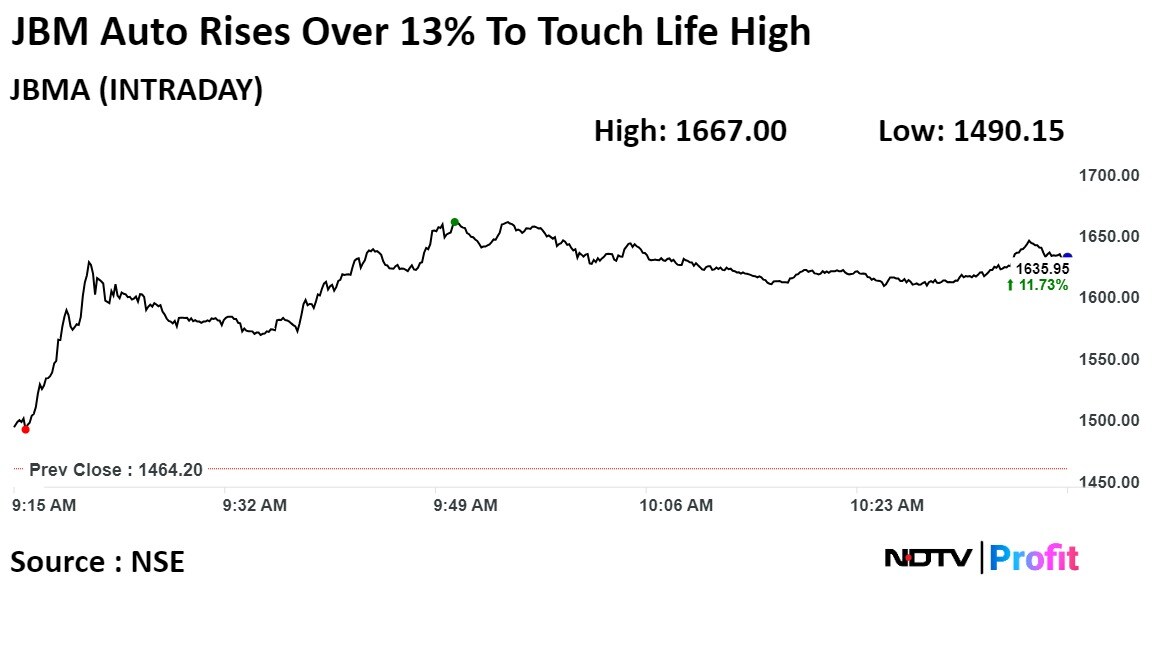

The shares of JBM Auto Ltd rose as much as 13.85% to 1,667 apiece, to touch its life-time high. This is the highest level since Aug. 29, 2023. It pared gains to trade 12.34% higher at Rs 1,644.90 apiece, as of 10:31 a.m. This compares to a 0.05% decline in the NSE Nifty 50 Index.

It has risen 12.57% on a year-to-date basis. Total traded volume so far in the day stood at 27 times its 30-day average. The relative strength index was at 80.

The one analyst tracking the company maintains a 'sell' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 214.7%.

The shares of JBM Auto Ltd rose as much as 13.85% to 1,667 apiece, to touch its life-time high. This is the highest level since Aug. 29, 2023. It pared gains to trade 12.34% higher at Rs 1,644.90 apiece, as of 10:31 a.m. This compares to a 0.05% decline in the NSE Nifty 50 Index.

It has risen 12.57% on a year-to-date basis. Total traded volume so far in the day stood at 27 times its 30-day average. The relative strength index was at 80.

The one analyst tracking the company maintains a 'sell' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 214.7%.

Dec sales volume up 8% YoY

Dec truck volume up 15% YoY

Dec tractor volume down 35% YoY

Dec 2 and 3 wheeler volume down 35% YoY

Dec net turnover at Rs 332 crore vs Rs 334 crore down 0.68% YoY

Source: Exchange Filing

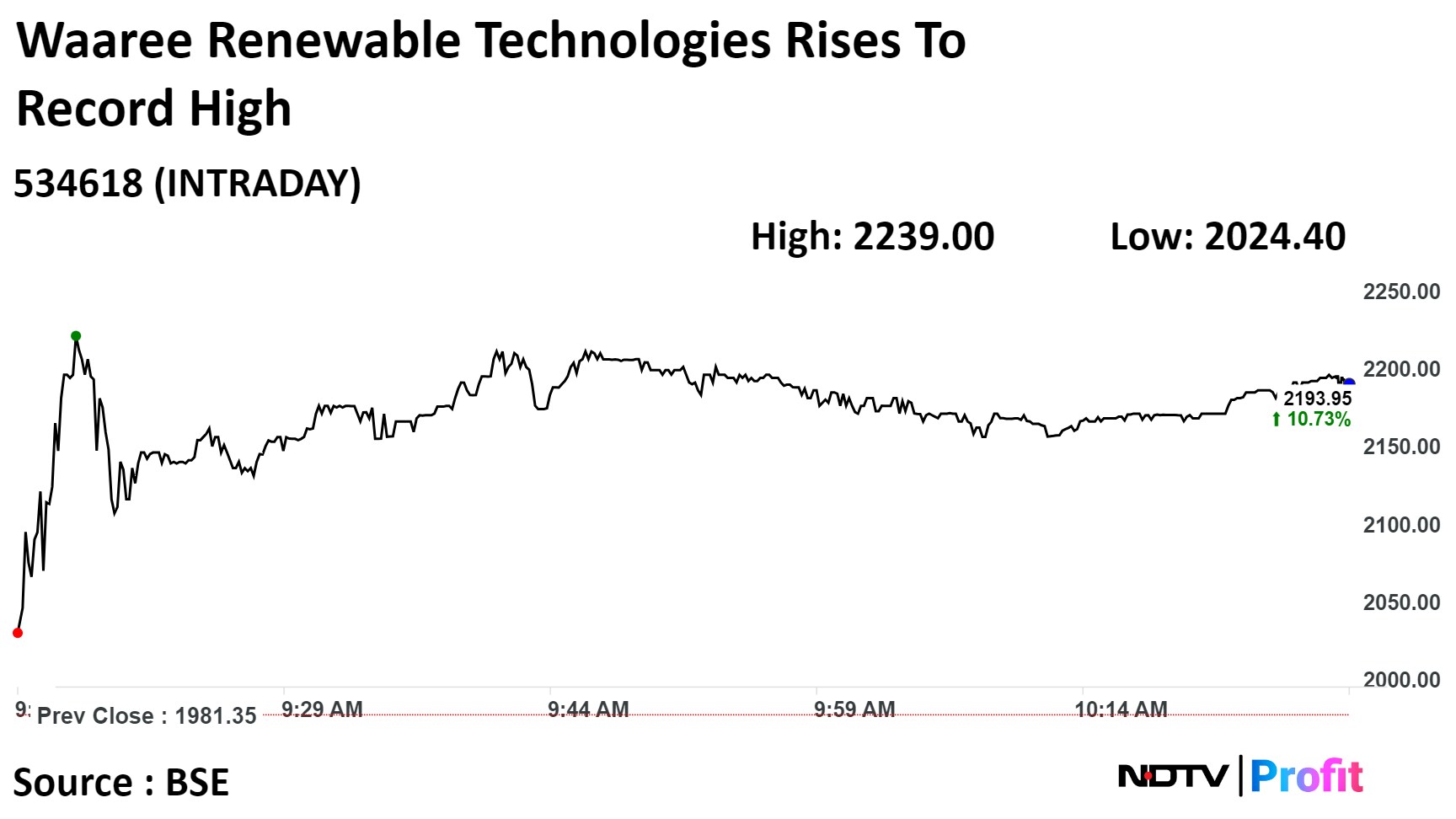

Waaree Renewable Technologies Ltd jumped 13% and touched a record high on Monday, as its parent company filed for initial public offer.

Waaree Energies Ltd filed draft red herring prospectus with the regulator for IPO, which is consists of a fresh issue of shares worth Rs 3,000 crore and an offer for sale for 32 lakh shares of face value Rs 10 each.

Waaree Renewable Technologies Ltd jumped 13% and touched a record high on Monday, as its parent company filed for initial public offer.

Waaree Energies Ltd filed draft red herring prospectus with the regulator for IPO, which is consists of a fresh issue of shares worth Rs 3,000 crore and an offer for sale for 32 lakh shares of face value Rs 10 each.

Shares of Waaree Renewable Technologies Ltd rose 13.00% to Rs 2,239.00 apiece, the highest level since it was listed on BSE on Aug 9, 2021. It pared gains to trade 9.04% higher at Rs 2,160.50apiece, as of 10:13 a.m. This compares to a 0.09% decline in the NSE Nifty 50 Index.

It has risen 10.13% on a year-to-date basis. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 86.27, which implied the stock is overbought.

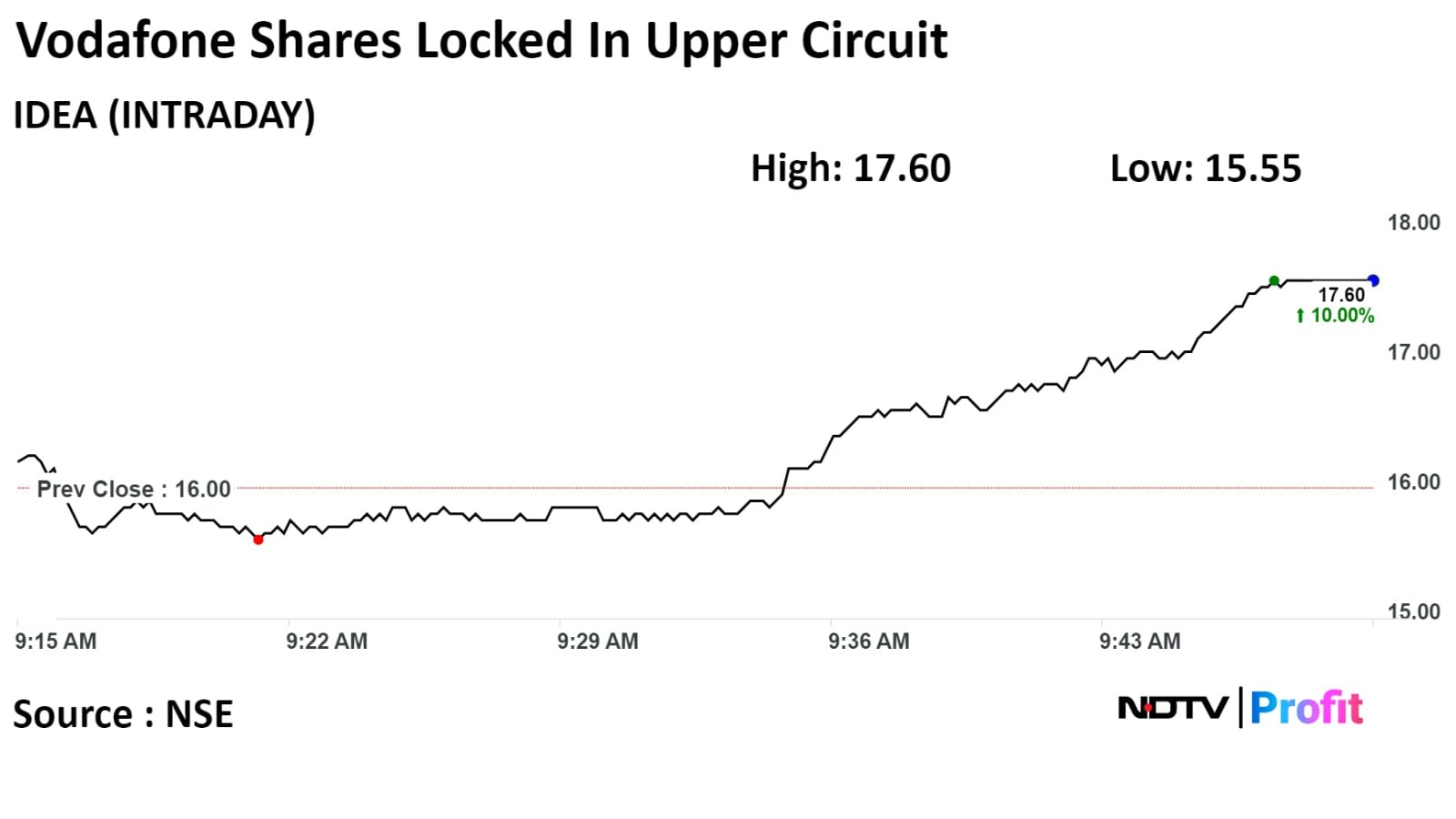

Shares of Vodafone Idea Ltd. jumped to hit a multi-year high as the market await Elon Musk's announcement at the Vibrant Gujarat Business Summit between to be held between January 10 and 12 after several reports said Elon Musk might tie-up with the company to enter the Indian telecom space.

The market is expecting government to sell its 33.1% stake in Vodafone to Musk for his telecom company Starlink's entry the Indian market.

Shares of Vodafone Idea Ltd. jumped to hit a multi-year high as the market await Elon Musk's announcement at the Vibrant Gujarat Business Summit between to be held between January 10 and 12 after several reports said Elon Musk might tie-up with the company to enter the Indian telecom space.

The market is expecting government to sell its 33.1% stake in Vodafone to Musk for his telecom company Starlink's entry the Indian market.

The scrip's upper circuit limit has been revised to 15% from 10%. It rose as much as 15% to hit Rs. 18.35, its highest level since 29 March, 2019. As of 10:09 a.m., it pared gains to trade 11.25% higher at Rs 17.80. This compares to a 0.08% decline in the NSE Nifty 50 Index.

It has risen 13.44% on a year-to-date basis. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 78, indicating that the stock may be overbought.

Out of 15 analysts tracking the company, two recommend a 'hold,' and thirteen suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 63.5%.

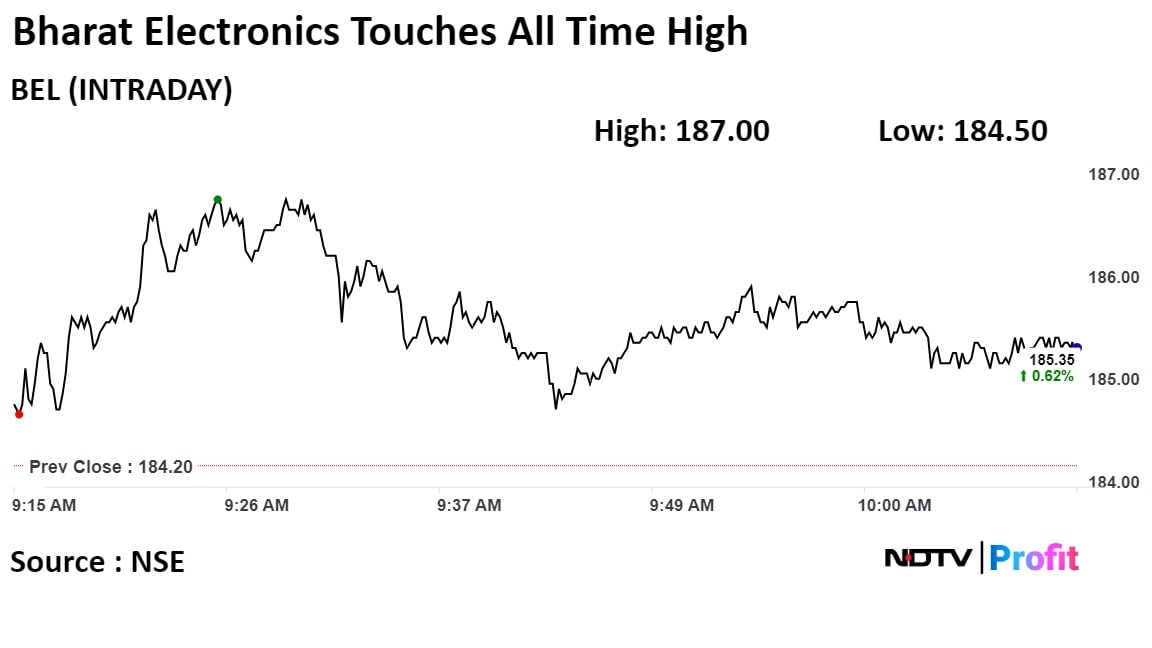

The shares of Bharat Electronics Ltd rose to touch a new life high on Monday.

The scrip rose as much as 1.52% to 187 apiece, the highest level since Dec. 29, 2023. It pared gains to trade 0.62% higher at Rs 185.35 apiece, as of 10:09 a.m. This compares to a 0.11 decline in the NSE Nifty 50 Index.

It has risen 0.57% on a year-to-date basis. The relative strength index was at 79.

Out of 29 analysts tracking the company, 23 maintain a 'buy' rating, 4 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 89.1%.

The shares of Bharat Electronics Ltd rose to touch a new life high on Monday.

The scrip rose as much as 1.52% to 187 apiece, the highest level since Dec. 29, 2023. It pared gains to trade 0.62% higher at Rs 185.35 apiece, as of 10:09 a.m. This compares to a 0.11 decline in the NSE Nifty 50 Index.

It has risen 0.57% on a year-to-date basis. The relative strength index was at 79.

Out of 29 analysts tracking the company, 23 maintain a 'buy' rating, 4 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 89.1%.

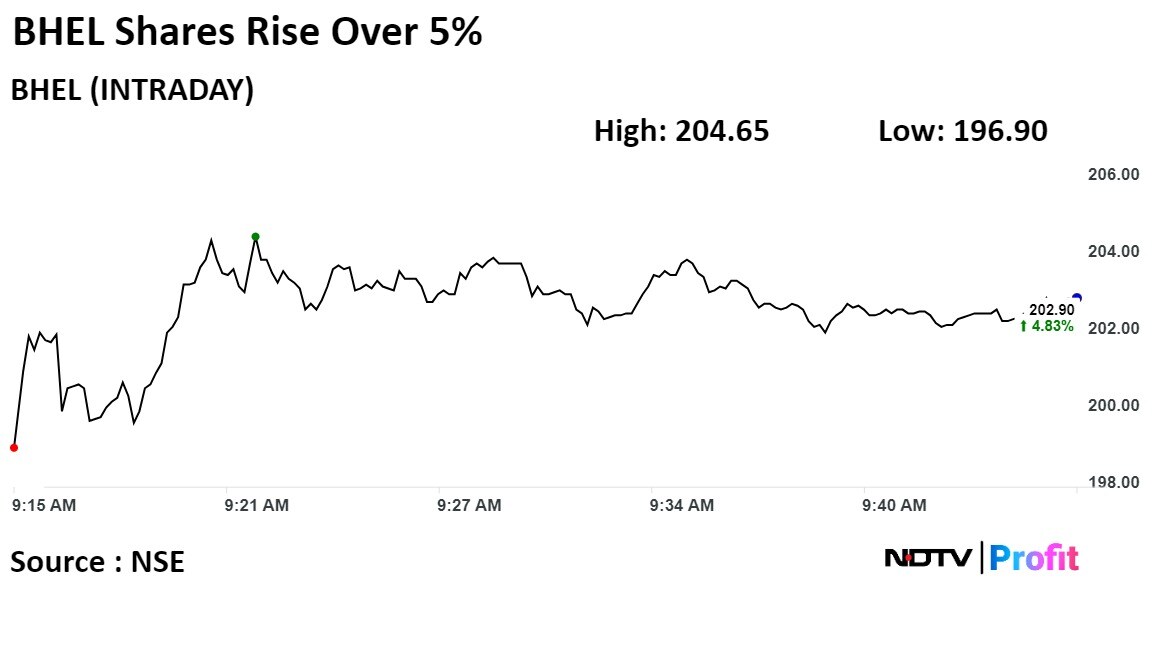

Shares of Bharat Heavy Electricals Ltd. rose over 5% on Monday after it won bids for Talabira power project in Odisha.

The company has emerged as the lowest bidder for Rs 19,000 crore contract from NLC India Ltd.

NLC India on Monday awarded contract for a 800x3 MW ultra super critical power project in Odisha to BHEL, people in know told NDTV Profit.

The coal to be used for the project will be sourced from captive Talabira coal mines.

Shares of Bharat Heavy Electricals Ltd. rose over 5% on Monday after it won bids for Talabira power project in Odisha.

The company has emerged as the lowest bidder for Rs 19,000 crore contract from NLC India Ltd.

NLC India on Monday awarded contract for a 800x3 MW ultra super critical power project in Odisha to BHEL, people in know told NDTV Profit.

The coal to be used for the project will be sourced from captive Talabira coal mines.

Shares of the company was trading 5.11% higher at Rs 203.45 apiece as of 9:35 a.m. This compares to a 0.14% decline in the NSE Nifty 50.

The stock had surged 5.73% to Rs 204.65 apiece so far today, the highest percentage jump since Dec. 28. It has risen 4.93% on a year-to-date basis. Total traded volume so far in the day stood at 8.6 times its 30-day average. The relative strength index was at 75.

Out of 19 analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and 13 suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 157.6%.

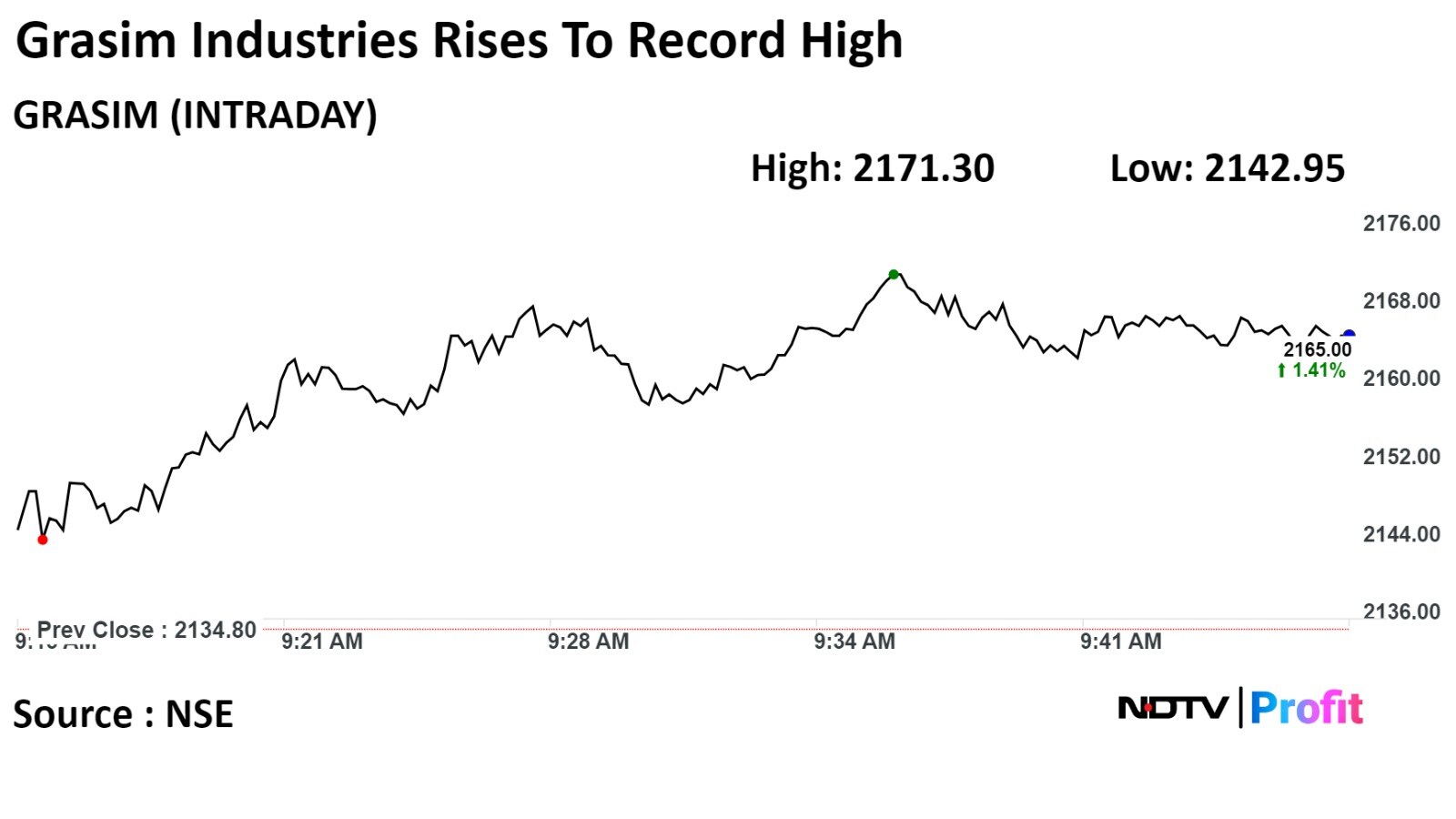

Shares of the Grasim Industries Ltd climbed to record high on the first trading session of the year. The company informed the exchanges Friday that it has commissioned additional 1.23 lakh tons of annual advanced materials capacity at the Bharuch plant in Gujarat.

Grasim Industries's total capacity of advance material stands at 2,46,000 tons per annum. The expansion shall facilitate the growth of the specialty chemical business, according to the exchange filings.

The board of the company is also scheduled on Jan 4 to meet and discuss right issue terms.

Shares of the Grasim Industries Ltd climbed to record high on the first trading session of the year. The company informed the exchanges Friday that it has commissioned additional 1.23 lakh tons of annual advanced materials capacity at the Bharuch plant in Gujarat.

Grasim Industries's total capacity of advance material stands at 2,46,000 tons per annum. The expansion shall facilitate the growth of the specialty chemical business, according to the exchange filings.

The board of the company is also scheduled on Jan 4 to meet and discuss right issue terms.

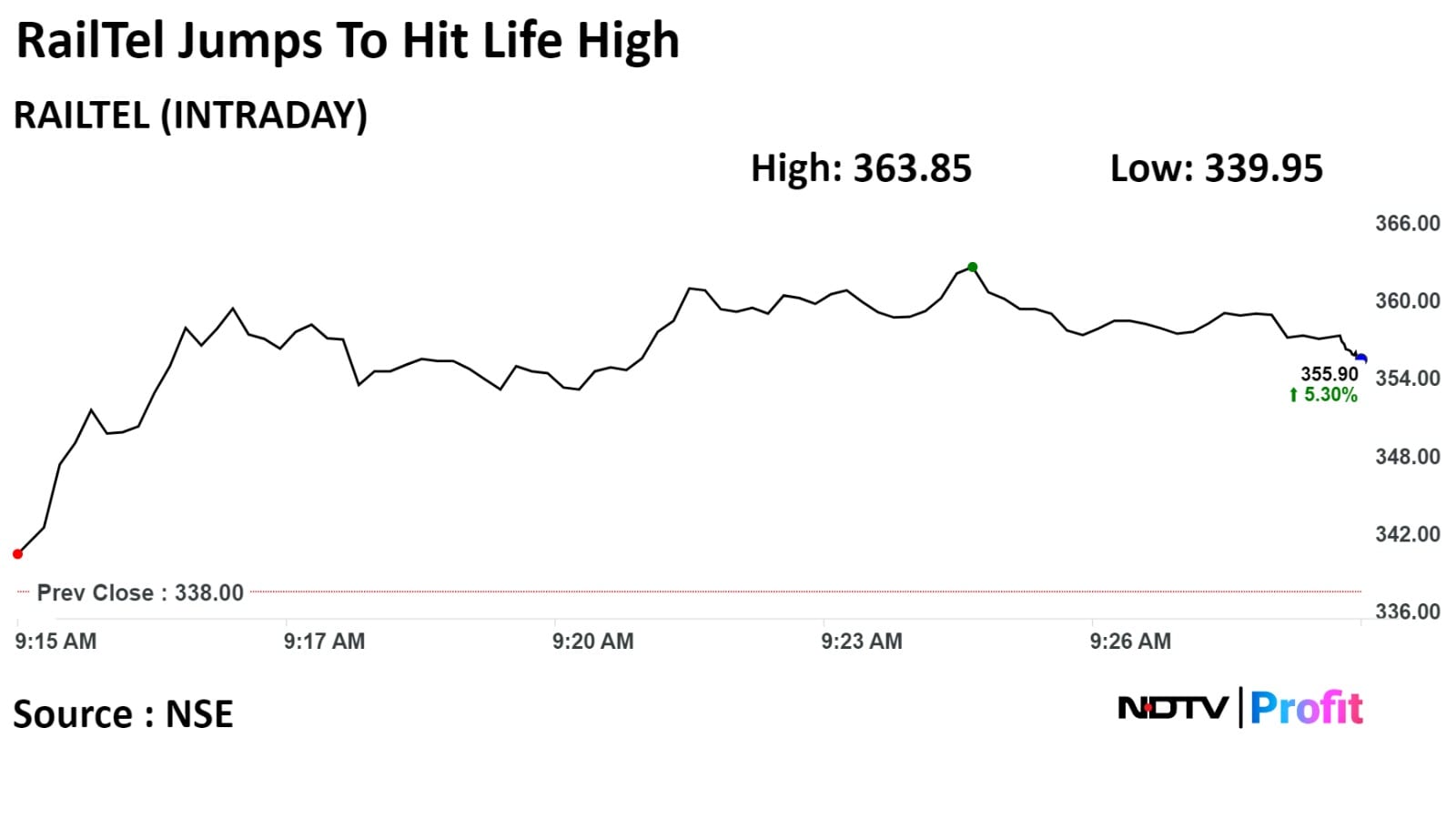

Shares of RailTel Corp. of India Ltd. jumped in the second consecutive session today to hit their lifetime high of Rs. 363.85. The stock has gained over 21% since 22 December. The relative strength index of the stock was at 73, hinting that the stock may be overbought.

Out of 3 analysts tracking the company, two maintain a 'buy' rating and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 25.5%.

Shares of RailTel Corp. of India Ltd. jumped in the second consecutive session today to hit their lifetime high of Rs. 363.85. The stock has gained over 21% since 22 December. The relative strength index of the stock was at 73, hinting that the stock may be overbought.

Out of 3 analysts tracking the company, two maintain a 'buy' rating and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 25.5%.

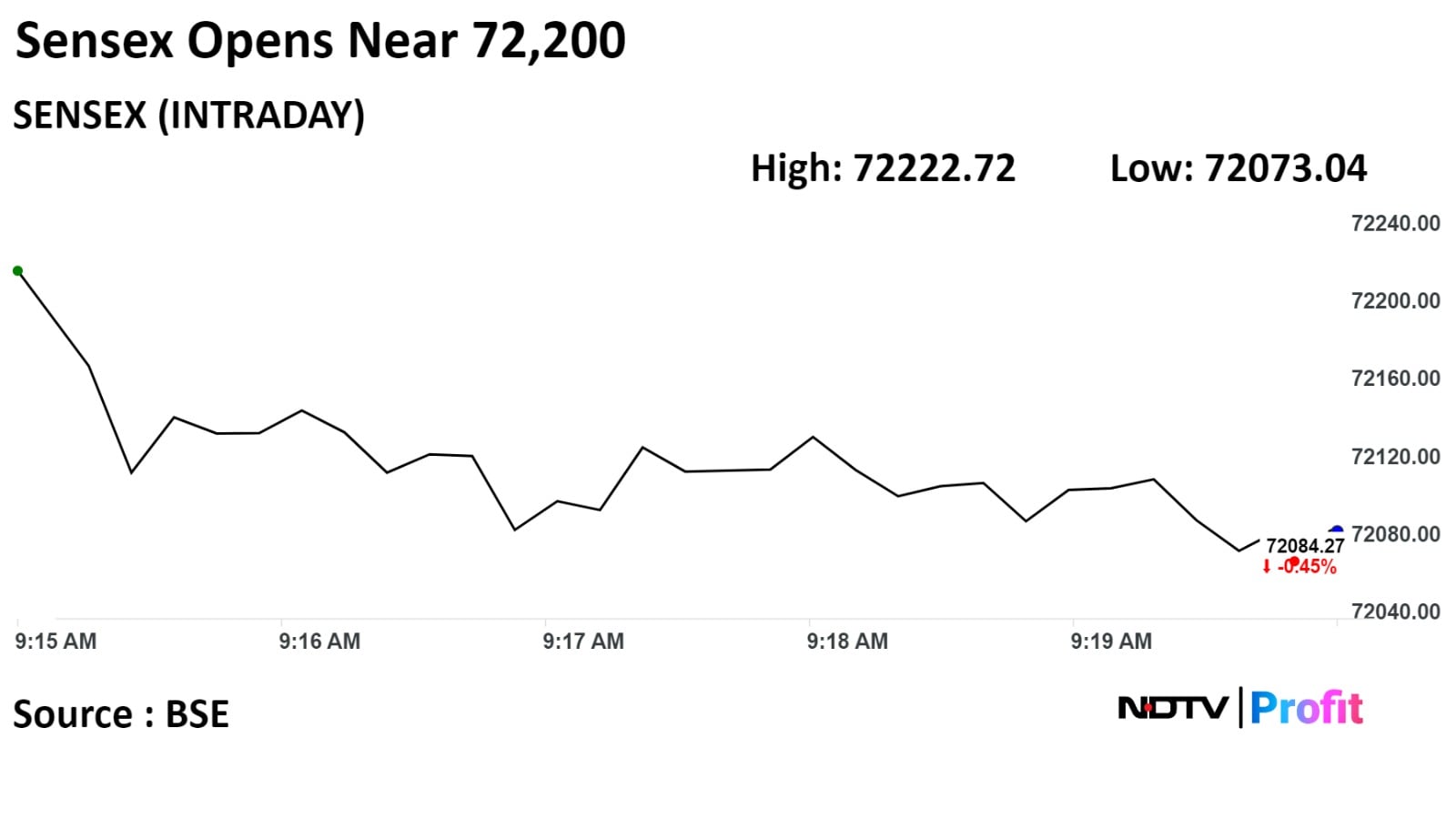

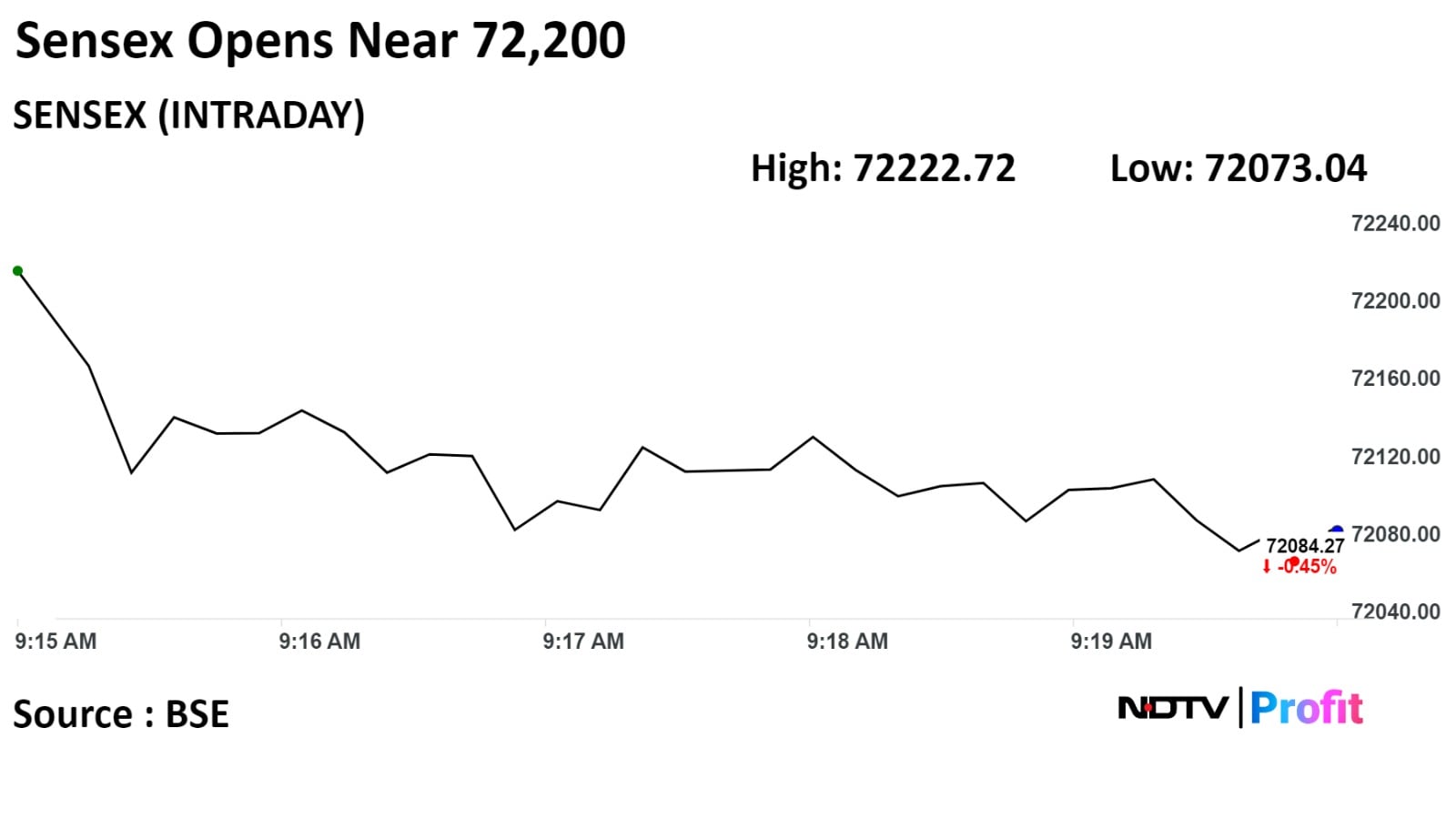

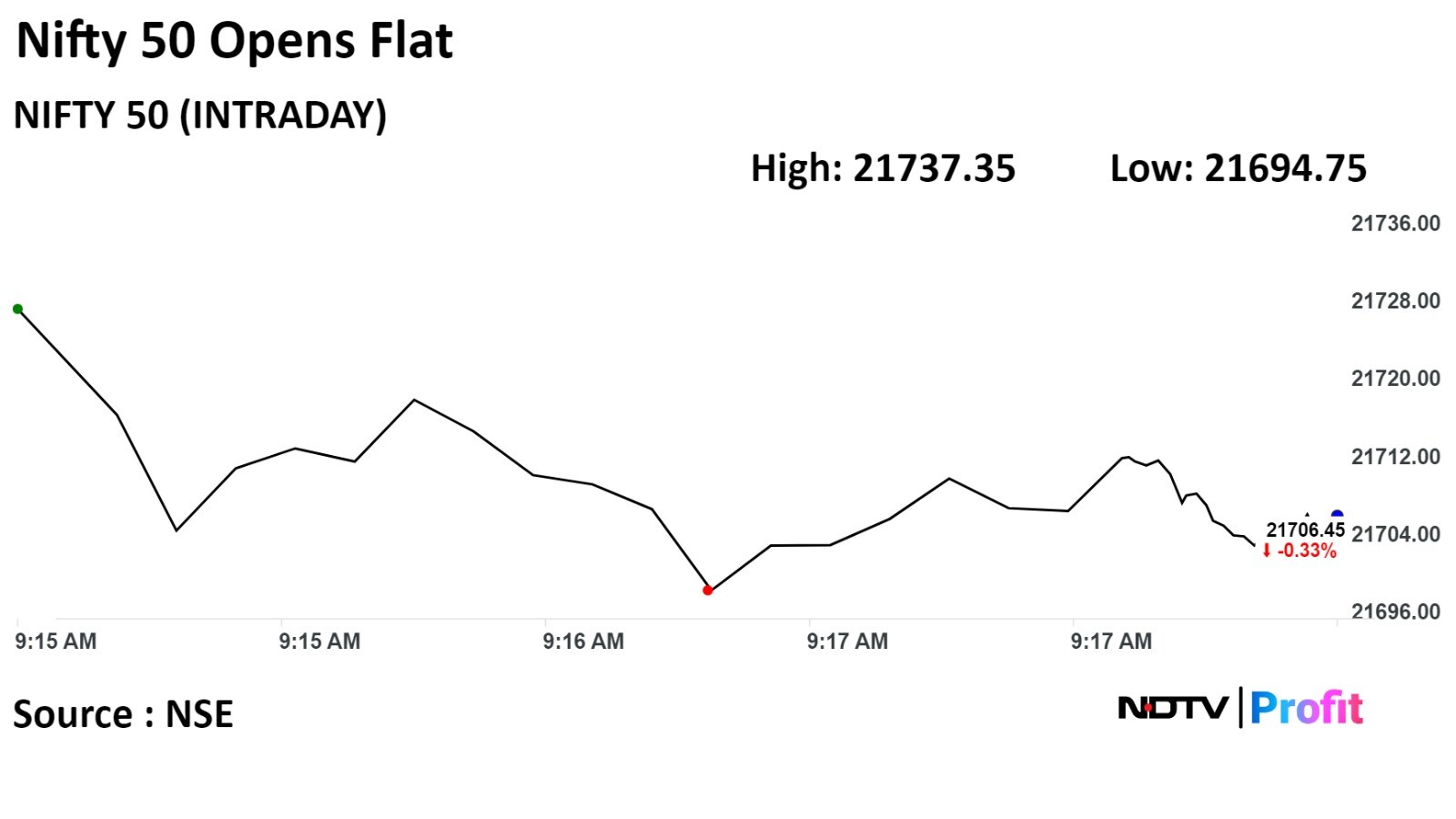

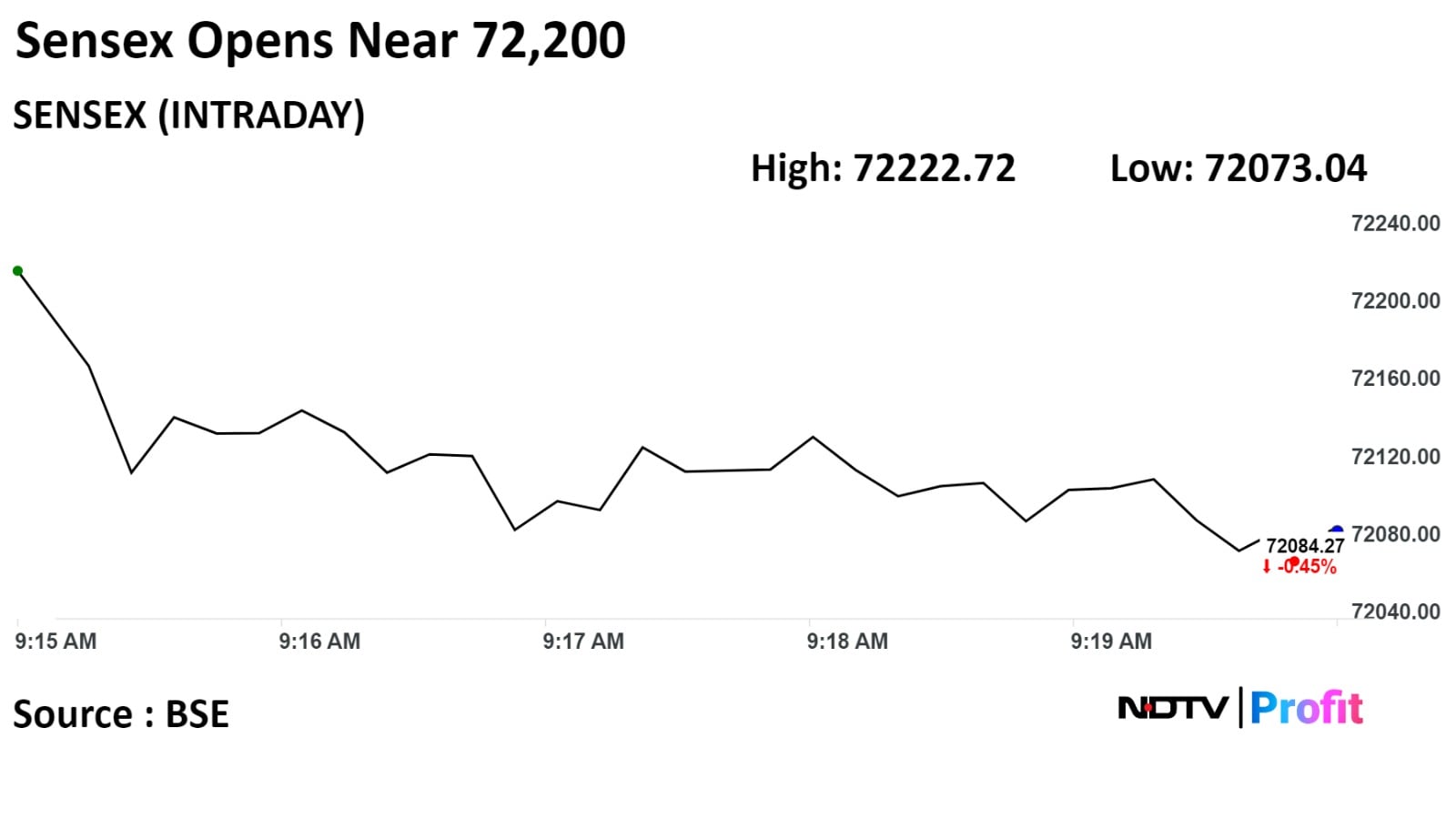

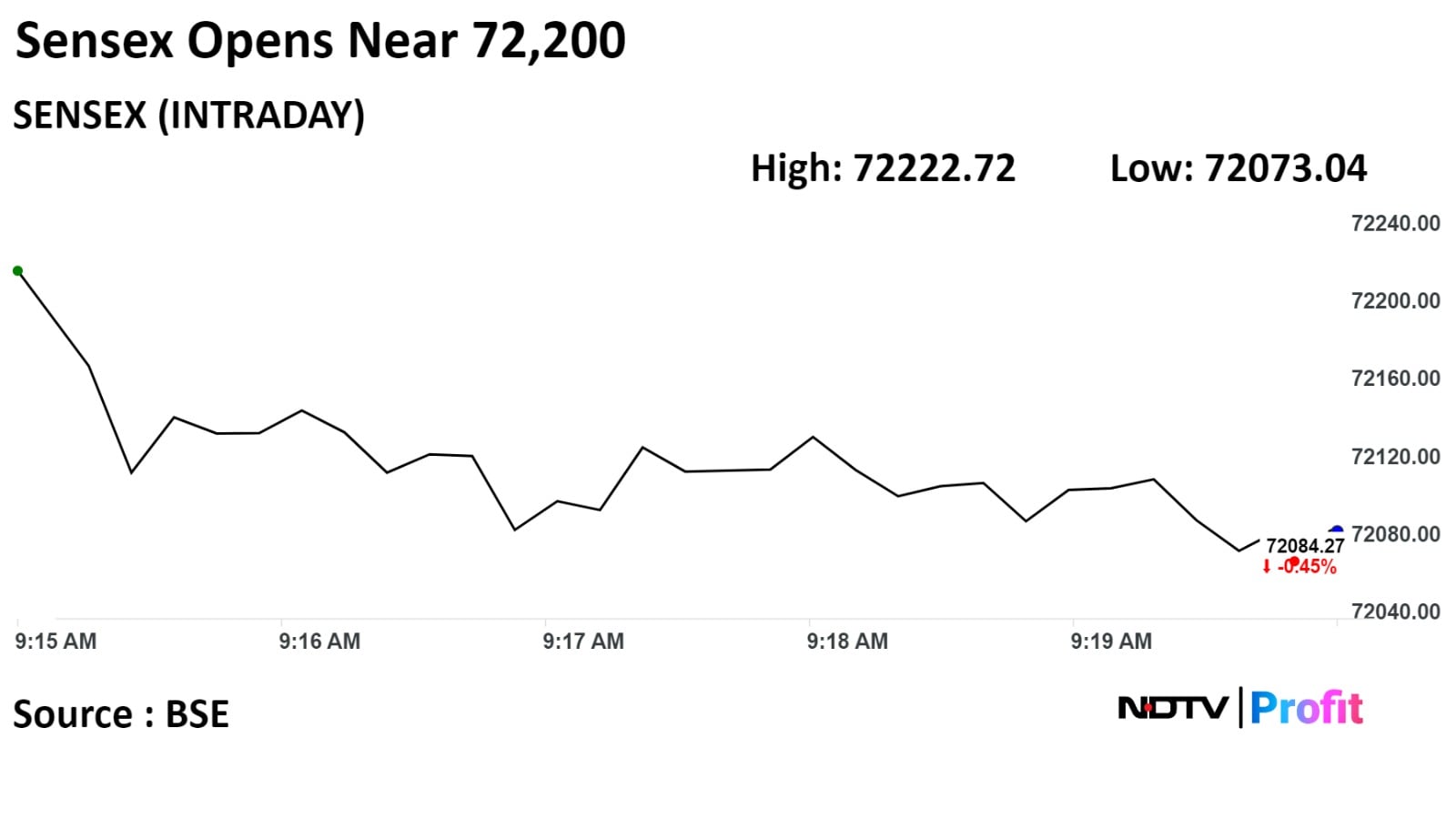

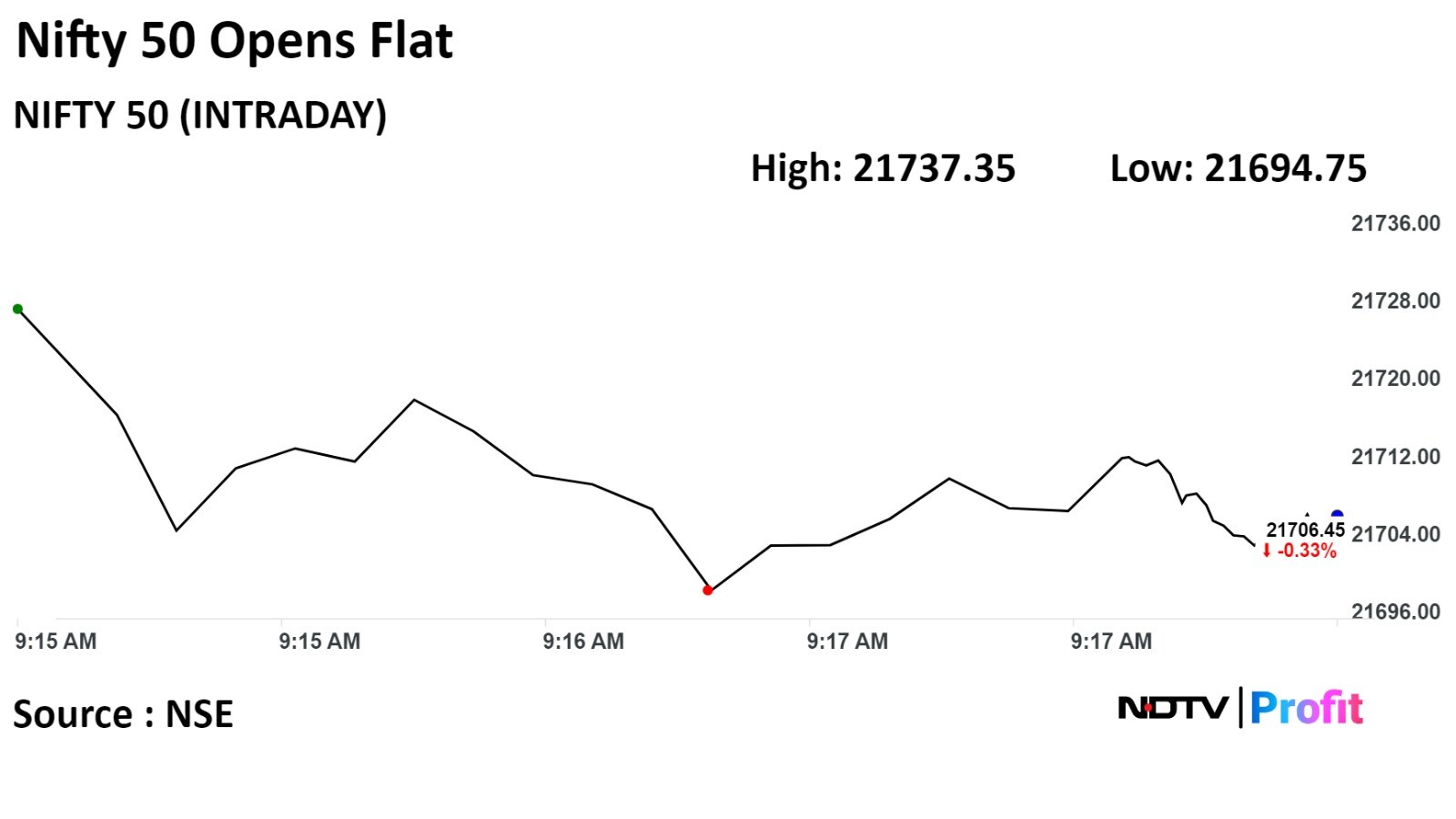

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

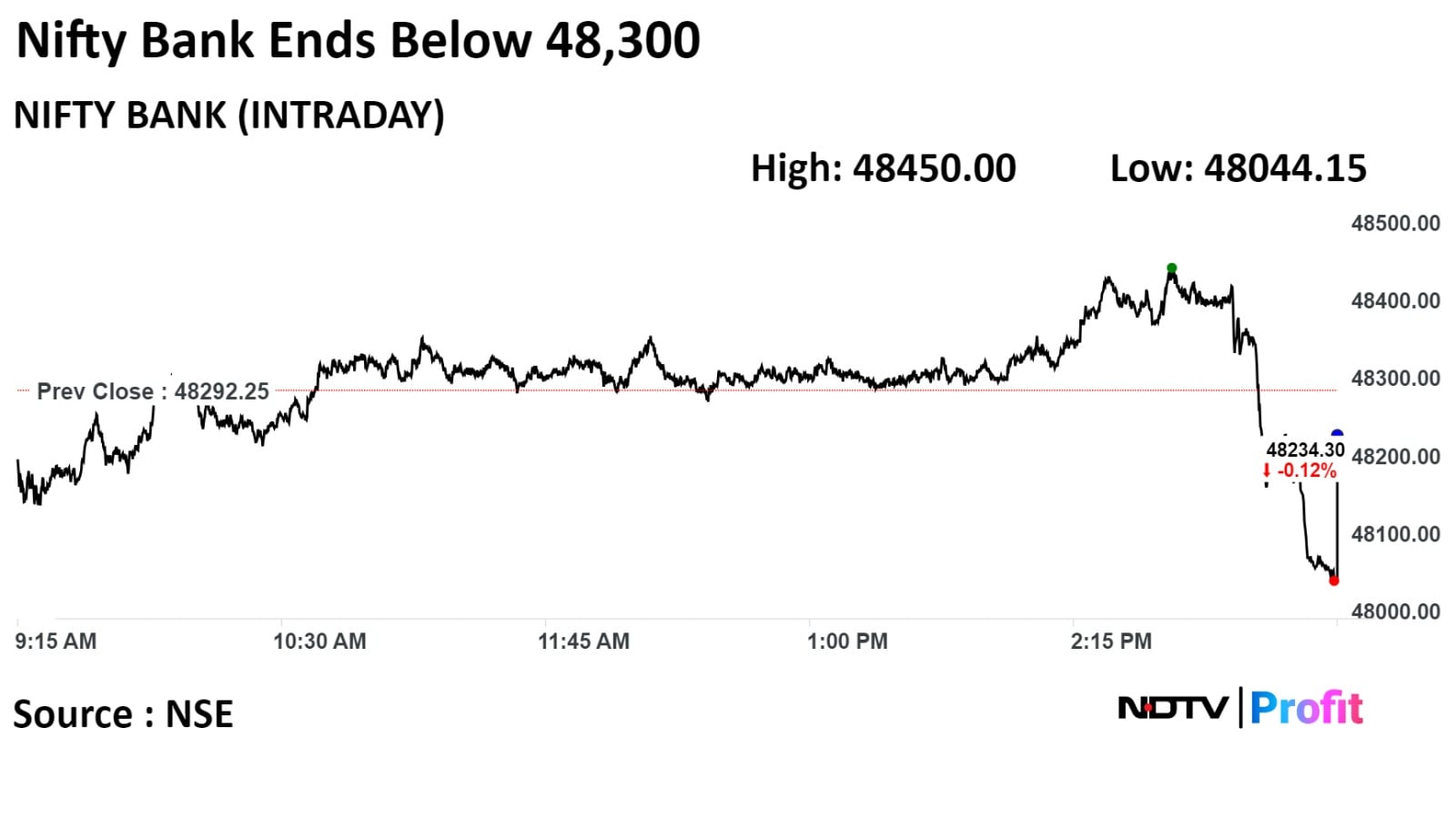

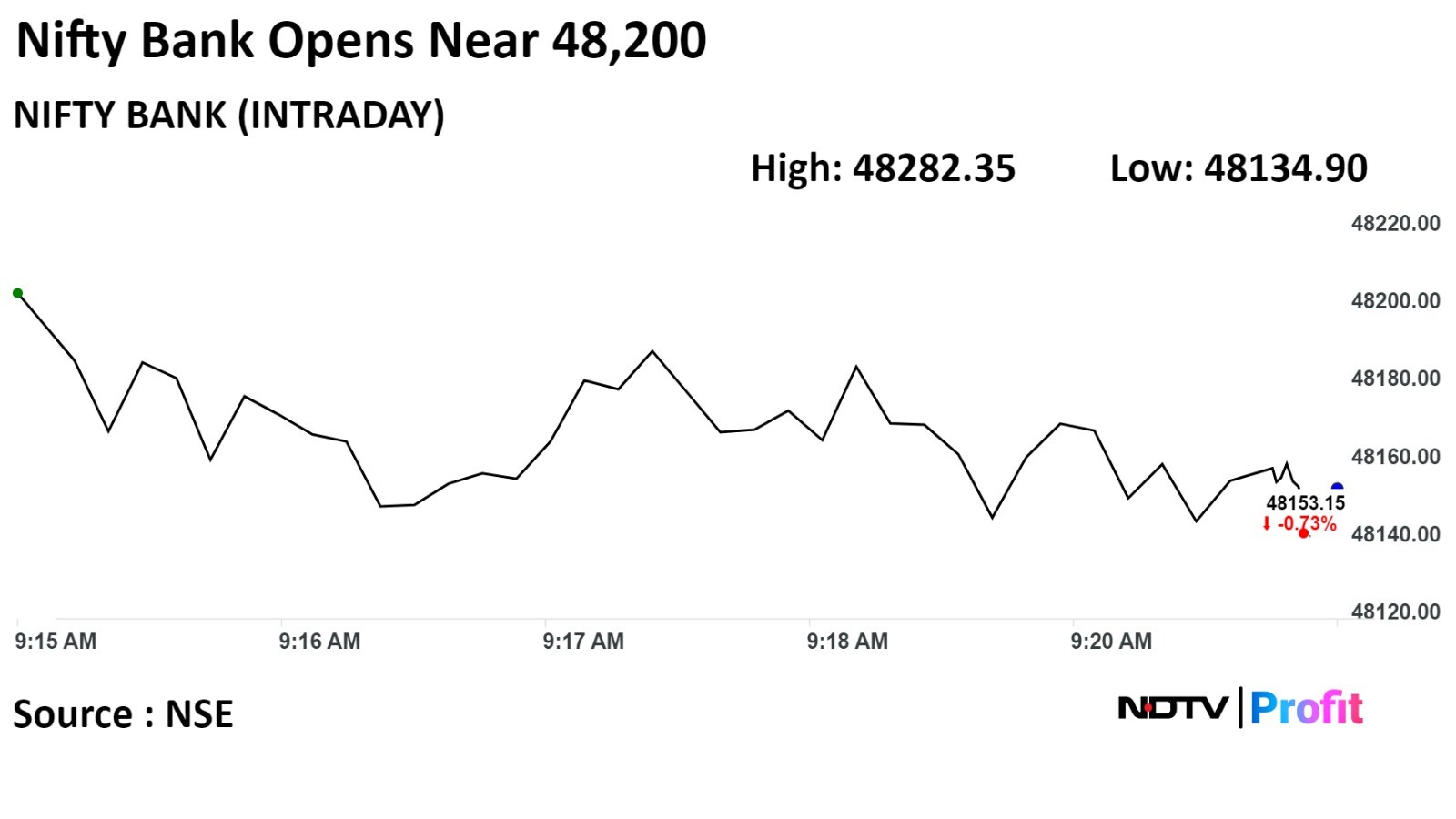

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

India's benchmark indices opened largely flat as Tata Motors Ltd, ITC Ltd gained, while Reliance Industries Ltd, HDFC Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 0.16% down at 21,700.00, while the BSE Sensex was 0.26% down at 72,067.51.

"We foresee theNifty holding the 21,600-21,500 zone in case of a dip during consolidation and maintain our positional target of 22,200 levels. Participants are advised to stay focused on stock selection and give preference to index majors. The Bank Nifty displayed a neutral candlestick pattern at the top, indicating indecision. A breakout above the 48,500 level could lead to further upside, targeting 48,800.On the contrary, a crucial support level is identified at 48,000, suggesting the possibility of the price remaining sideways in the range of 48,000 to 48,500," Mandar Bhojane, technical research analyst atChoice Broking said.

"For tradersand investors, it is advisable to consider buying opportunities during dips inthe Nifty while maintaining an appropriate stop-loss. Stay vigilant and makeinformed decisions in today's market,"

Tata Motors Ltd, State Bank of India, ITC Ltd, Coal India Ltd, and Grasim Industries Ltd added positively to the indices.

Hindustan Unilever Ltd, Aixs Bank Ltd, Bharti AIrtel Ltd, Reliance Industries Ltd, HDFC Bank Ltd weighed on the indices.

Sectoral indices on NSE were trading on a mixed note. Seven out of 14 sectors advanced, four declined, and one remained flat. Nifty Media rose the most, and Nifty IT declined the most.

Broader market outperformed benchmark indices. The S&P BSE MidCap index rose 0.43%, while SmallCap gained 0.63%. Around 15 sectors out of 20 on BSE fell, while five rose. BSE Oil and Gas rose the most.

The market breadth was skewed in the favour of the buyers. Around 2,274 stocks rose, 787 stocks declined, while 135 remained unchanged on BSE.

At pre open, the benchmark BSE Sensex was 0.03% down at 72,219.01, while the NSE Nifty 50 was 0.02% down at 21, 727.75.

The local currency strengthened 3 paise to open at 83.18 against the U.S dollar on Monday.

It closed at 83.21 on Friday.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.18% on Monday.

Source: Bloomberg

NLC India awards contract for Talabira power project in Odisha to BHEL Ltd

Other bidder was L&T MHI

Talabira project is a 800x3 MW ultra super critical Power project

Coal will be sourced from captive Talabira Coal Mines for the project.

Sources: People In The Know

HFCL Gets order worth Rs 1,127.3 crore from BSNL

The order is for supplying equipment, services on turnkey basis across India

The order is to be executed within 18 months from the date of purchase

Source: Exchange Filing

HDFC Bank: Buy with price target of Rs 1,870

Axis Bank: Buy with price target of Rs 1,125

ICICI Bank: Buy with price target of Rs 1,125

SBI: Buy with price target of Rs 692

Kotak: Hold with price target of Rs 1,940

IndusInd Bank: Buy with price target of Rs 1,640

Federal Bank: Hold with price target of Rs 164

U.S. Dollar Index at 101.33

U.S. 10-year bond yield at 3.88%

Brent crude down 0.14% at $77.04 per barrel

Nymex crude down 0.17% at $71.65 per barrel

GIFT Nifty was at 21,777 as of 07:31 a.m.

Bitcoin was up 0.08% at $42,542.36

Dalmia Bharat got a 'buy' with target price Rs 2,800 from Motilal Oswal

Company has underperformed the index and cement stocks

Underperformance due to delay in acquisition of JPA assets

Optimistic long term due to:

Plan to increase capacity at 14-17% CAGR upto 2031

Sustainable growth through better mix

Maintain net debt to Ebitda at less than 2 times

Emkay maintains 'buy' rating for Emami with target price Rs 625

13% upmove last week due to attractive valuations

Better focus to aid topline delivery, seasonality is key

Expect near-term performance to be muted

Winter centric portfolios to support topline

Professionals roped in to get the right fit for wider consumer needs

Expect mid single digit earnings growth in Q3FY24

Target price based on 31 times PE, in line with 10-year average

Century Textiles and Industries: To meet investors and analysts on Jan. 4.

Tata Consultancy Services: To meet investors and analysts on Jan. 11

Price band revised from 10% to 20%: PTC India Financial Services.

Price band revised from 5% to 20%: Centum Electronics, JBM Auto, KSolves India.

Moved into a short-term ASM framework: Mangalam Cement.

Moved out of short-term ASM framework: Kiri Industries, NINtec Systems, and PC Jeweller.

Nifty January futures up by 0.49% to 21,885.95 at a premium of 154.55 points.

Nifty January futures open interest down by 0.7%.

Nifty Bank January futures up by 0.25% to 48,628.8 at a premium of 336.55 points.

Nifty Bank January futures open interest down by 0.5%.

Nifty Options Jan 4 Expiry: Maximum Call open interest at 22,000 and Maximum Put open interest at 21,500.

Bank Nifty Options Jan Expiry: Maximum Call Open Interest at 51,000 and Maximum Put Open Interest at 46,000.

Securities in ban period: Hindustan Copper.

VIP Industries: Promoter Kiddy Plast bought 4,150 shares on Dec. 28. The promoter group DGP Enterprises bought 4,400 shares on Dec. 28. Promoter Dilip G. Piramal bought 7,100 shares on Dec. 28.

Paisalo Digital: Promoter group Equilibrated Venture CFLOW bought 9.72 lakh shares on Dec. 29.

Nahar Spinning Mills: Promoter group Nahar Capital and Financial Services bought 22,000 shares between Dec. 27 and Dec. 28.

Wardwizard Innovations and Mobility: Promoter group Wardwizard Solutions India sold 26 lakh shares on Dec. 27.

Shalimar Paints: Promoter group Sarita Devi Jain sold 20,000 shares on Dec. 29.

Ultramarine and Pigments: S Narayan sold 4,000 shares and Promoter Deepa Ajay sold 7,000 shares on Dec. 28.

Cigniti Technologies: Promoter C.V. Subramanyam sold 13,815 shares on Dec. 26.

Mangalore Chemicals and Fertilizers: Promoter Zuari Agro Chemicals created a pledge for 10 lakh shares on Dec. 27.

Strides Pharma Science: Shasun Enterprises LLP sold 2.5 lakh shares (0.27%), while Pace Stock Broking Services bought 2.5 lakh shares (0.27%) at Rs 637 apiece.

Ramco Industries: Nalina Ramalakshmi sold 7.2 lakh shares (0.82%), while Ramco Cements bought 7.2 lakh shares (0.82%) at Rs 215 apiece.

Innova Captab: Canara Robeco Mutual Fund bought 9 lakh shares (1.57%) at Rs 474.41 apiece and Invesco Mutual Fund bought 6 lakh shares at Rs 452.1 apiece.

Aditya Vision: Sunita Sinha sold 1.3 lakh shares (1.08%) at Rs 3,463.34 apiece, Nishant Prabhakar sold 1 lakh shares (0.83%) at Rs 3,462.1 apiece while ASK Investment Managers bought 0.65 lakh shares (0.54%) at Rs 3,462.1 apiece.

Azad Engineering: PCA Securities Investment Trust bought 3.39 lakh shares (0.58%) at Rs 703.40 apiece.

Kolte-Patil Developers: Rajesh Anirudha Patil sold 11.4 lakh shares (1.49%), Sunita Milind Kolte sold 7.6 lakh shares (0.99%), Sunita Rajesh Patil sold 3.8 lakh shares (0.49%) at Rs 486 apiece.

Seamec: Gentleman Products P Ltd sold 1.59 lakh shares (0.62%) at Rs 960.06 apiece, Padmashree INC sold 1.48 lakh shares (0.58%) at Rs 960.01 apiece, Puesh Kumar Gupta sold 1.83 lakh shares (0.72%) at Rs 960.02 apiece, Sunil Kumar Bhala (HUF) sold 1.51 lakh shares (0.59%) at Rs 960.05 apiece.

Grasim Industries: The company commissioned an additional 1.23 lakh tonne of annual advanced materials capacity at the Bharuch plant in Gujarat. The total capacity of advanced materials is 2,46,000 tonne per annum. The expansion will facilitate the growth of the specialty chemical business.

Dr. Reddy’s Laboratories: The company’s global arm acquired 6.46% of Israel-based biotechnology company Edity Therapeutics for $1.97 per share to further develop its technology platform.

ACC: The company successfully commissioned a cement manufacturing unit with a capacity of 1.0 MTPA at Ametha, Madhya Pradesh.

Torrent Power: The company incorporated a wholly owned subsidiary for generating electricity from renewable sources in Gujarat.

Hikal: The Gujarat Pollution Control Board imposed a fine worth Rs 17.45 crore for alleged violations of environmental laws.

SKF India: The company has successfully acquired 26.74% of Sun Strength Renewables for Rs 2.31 crore.

Edelweiss Financial Services: The company's unit Zuno General Insurance received a GST demand worth Rs 32.39 crore and penal interest of Rs 3.23 crore.

Aditya Birla Capital: The timeline for the completion of the sale of a 50% stake in Aditya Birla Insurance Brokers has been extended till March 31, subject to receipt of the approval of the Insurance Regulatory and Development Authority of India.

Nazara Technologies: The company’s arm signed agreements for subscribing to a convertible note of Freaks 4U Gaming GmbH at a consideration of Rs 33.26 crore to be paid in cash.

Oil India: The company appointed Anfor Ali Haque as resident chief executive effective Jan. 1.

Nippon Life India AMC: CFO Prateek Jain resigned from the position due to personal reasons.

Most Asian markets are closed on Jan. 1 on account of New Year festivities.

Wall Street’s final session of 2023 saw stocks take a breather after a rally that put the market on pace for its ninth straight week of gains—the longest winning streak since 2004, Bloomberg reported.

The S&P 500 fell 0.28%, while the Nasdaq 100 declined 0.43% on Friday . The Dow Jones Industrial Average settled 0.05% down on Friday.

Brent crude was trading 0.11% lower at $77.04 a barrel. Gold was down 0.13% at $2,062.98 an ounce.

GIFT Nifty was trading 0.27% down at 21,777 as of 7:31 a.m.

India's benchmark indices snapped their four-day record rally and closed the last session of 2023 lower on Friday.

However, the indices ended the year higher, with the NSE Nifty 50 gaining 19.42% and the S&P BSE Sensex rising 18.10%. All stocks of the Sensex ended with yearly gains in 2023, and only two stocks of the Nifty ended lower.

Overseas investors ended the year as net buyers of Indian equities for the third day in a row on Friday. Foreign portfolio investors mopped up stocks worth Rs 1,459.1 crore, while domestic institutional investors bought equities worth Rs 554.4 crore, according to provisional data from the NSE.

The Indian rupee settled 4 paise lower at Rs 83.21 against the U.S. dollar.

Most Asian markets are closed on Jan. 1 on account of New Year festivities.

Wall Street’s final session of 2023 saw stocks take a breather after a rally that put the market on pace for its ninth straight week of gains—the longest winning streak since 2004, Bloomberg reported.

The S&P 500 fell 0.28%, while the Nasdaq 100 declined 0.43% on Friday . The Dow Jones Industrial Average settled 0.05% down on Friday.

Brent crude was trading 0.11% lower at $77.04 a barrel. Gold was down 0.13% at $2,062.98 an ounce.

GIFT Nifty was trading 0.27% down at 21,777 as of 7:31 a.m.

India's benchmark indices snapped their four-day record rally and closed the last session of 2023 lower on Friday.

However, the indices ended the year higher, with the NSE Nifty 50 gaining 19.42% and the S&P BSE Sensex rising 18.10%. All stocks of the Sensex ended with yearly gains in 2023, and only two stocks of the Nifty ended lower.

Overseas investors ended the year as net buyers of Indian equities for the third day in a row on Friday. Foreign portfolio investors mopped up stocks worth Rs 1,459.1 crore, while domestic institutional investors bought equities worth Rs 554.4 crore, according to provisional data from the NSE.

The Indian rupee settled 4 paise lower at Rs 83.21 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.