Rupee Closes Weaker Against U.S. Dollar

-The local currency closed 6 paise weaker against the U.S. Dollar at 83.49

-It closed at 83.43 on Friday.

Source: Bloomberg

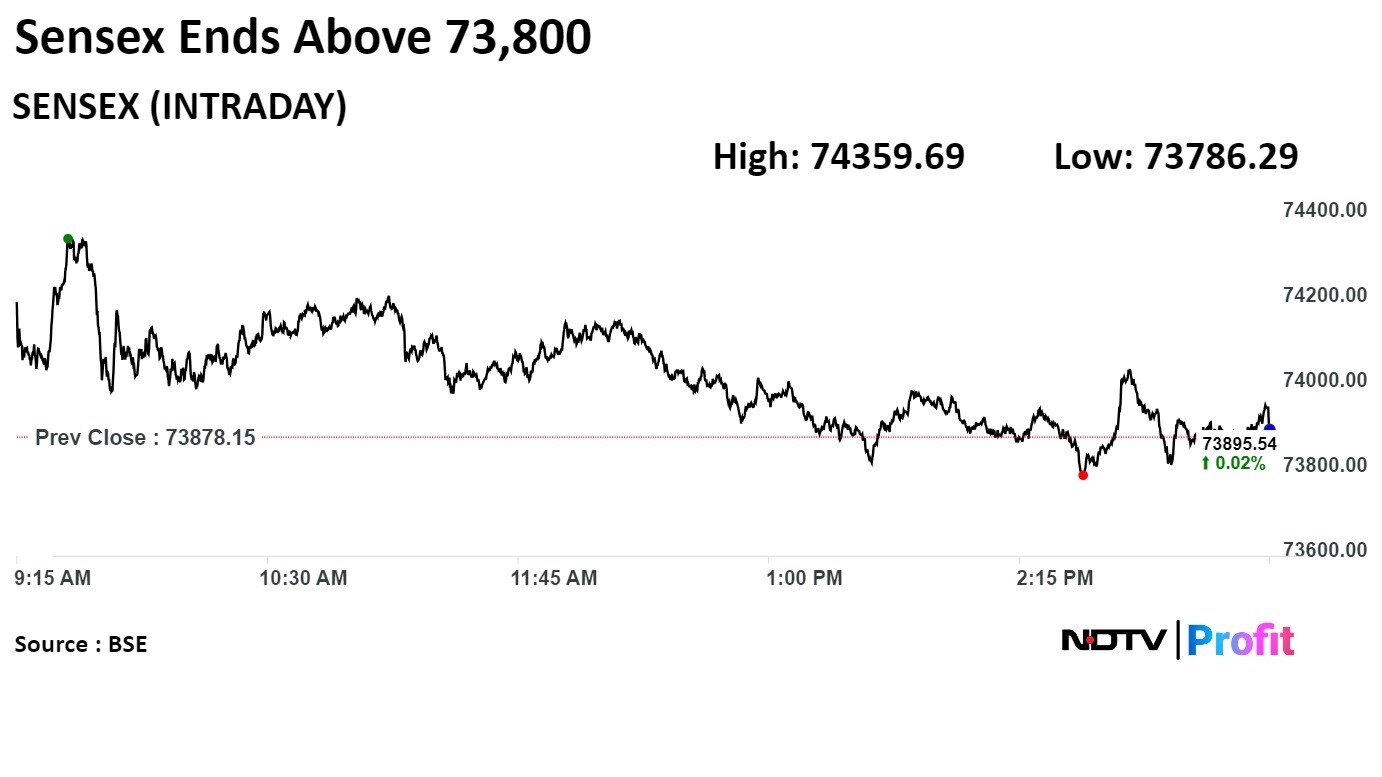

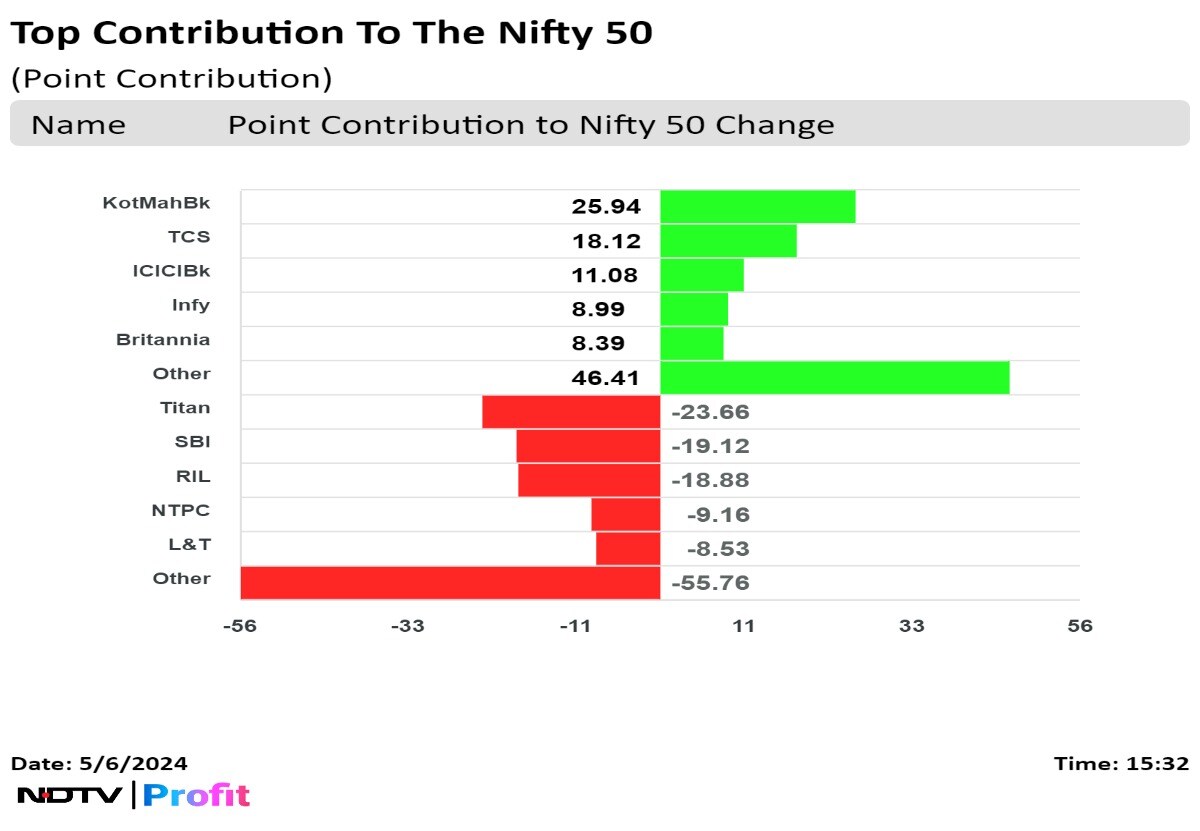

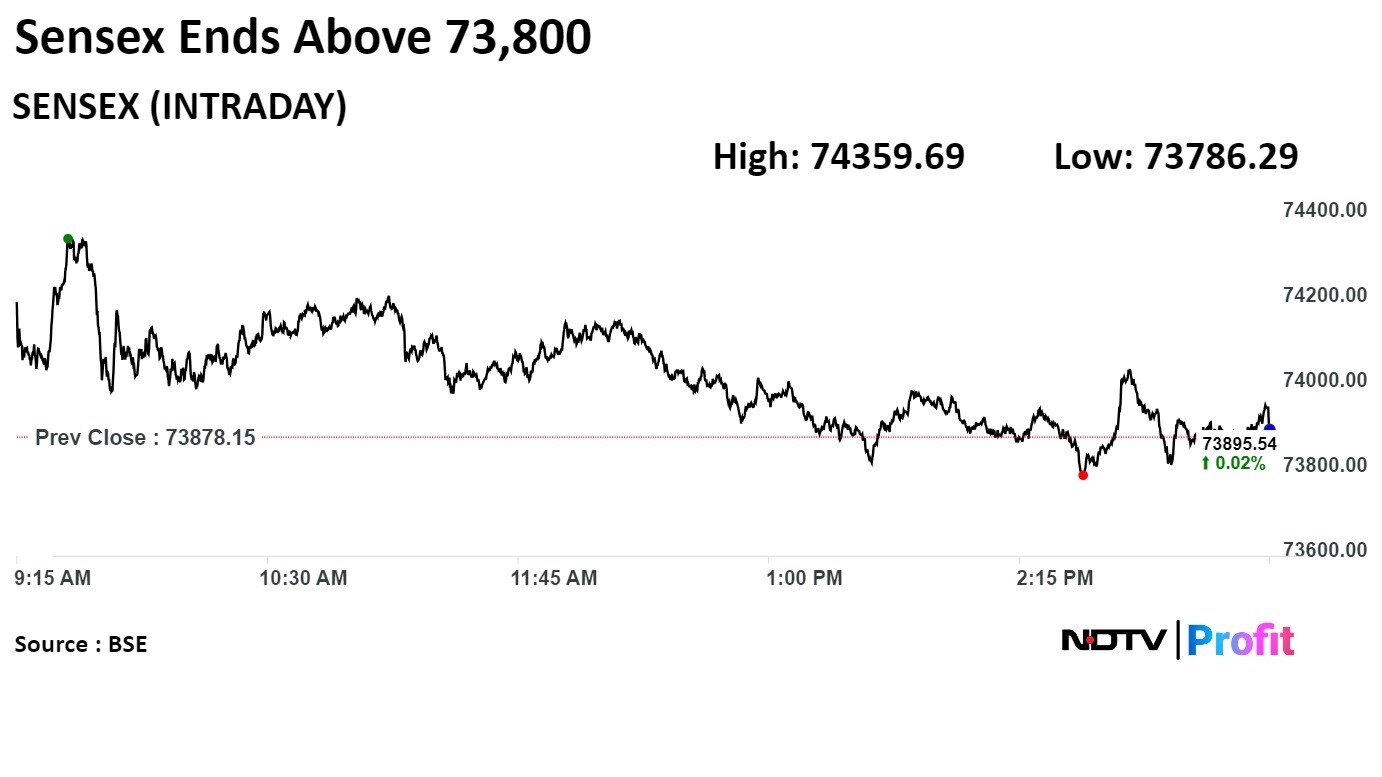

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

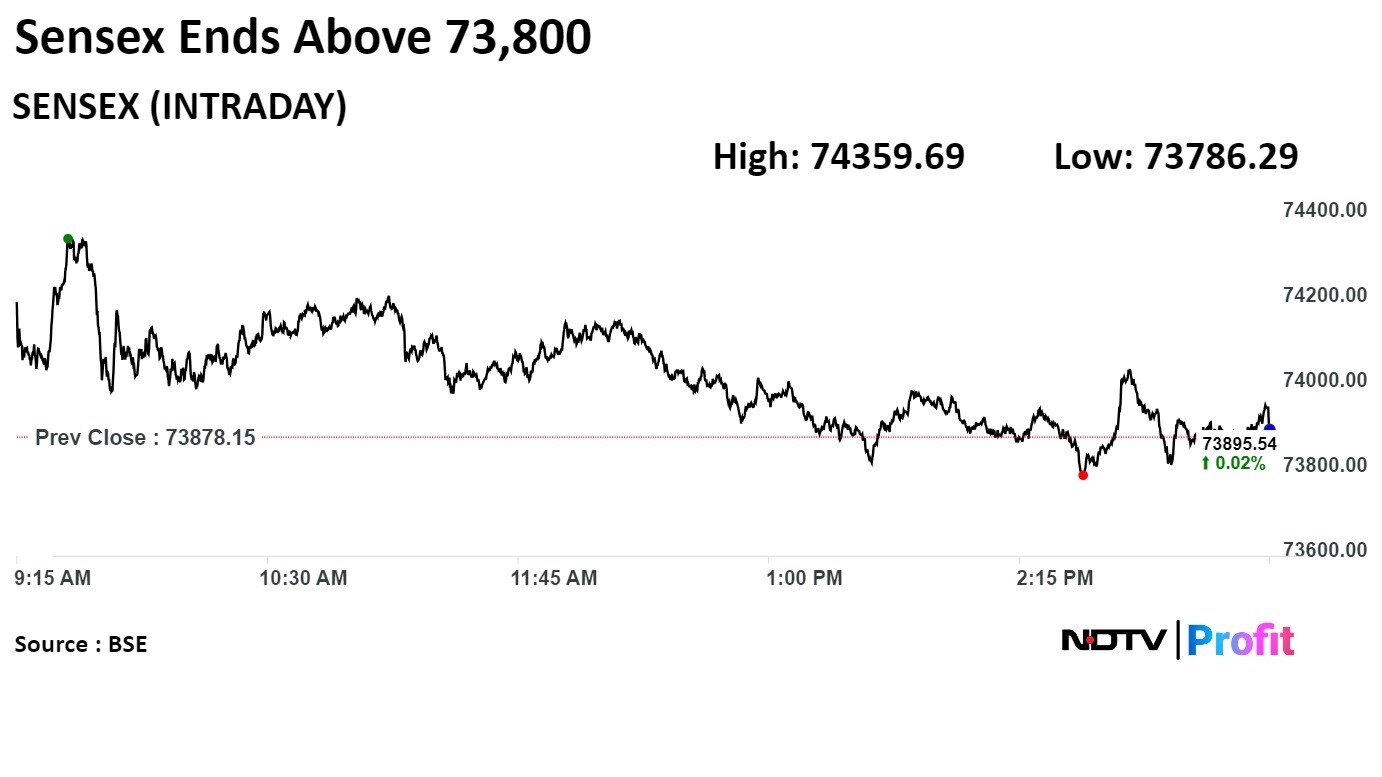

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

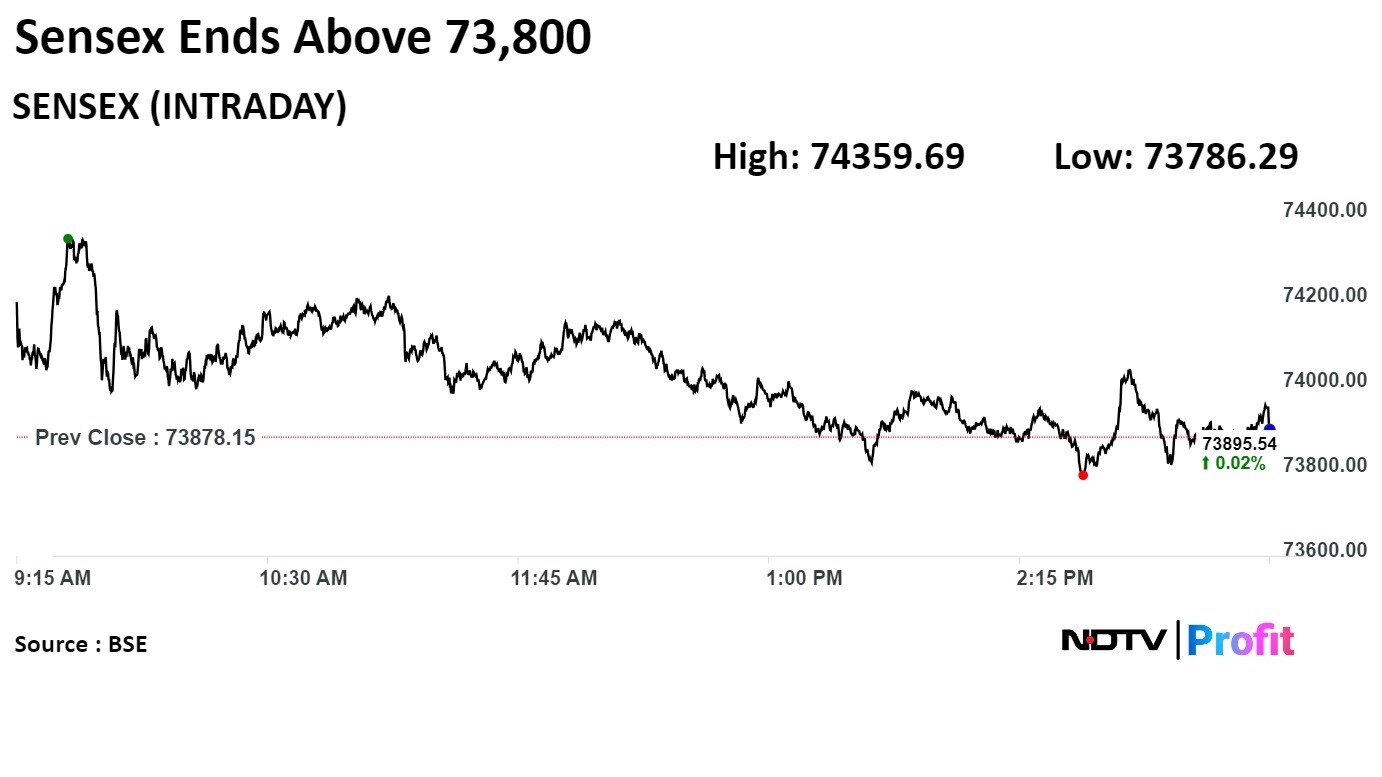

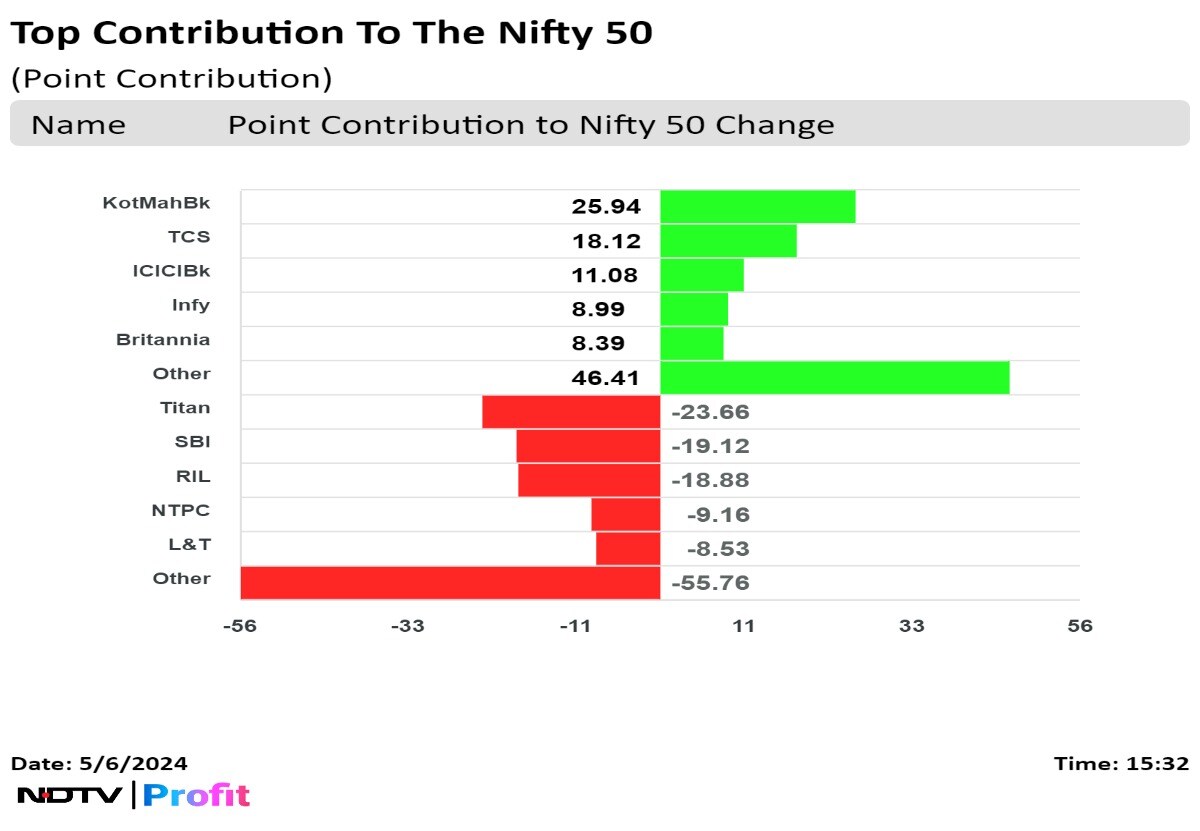

Shares of Titan Co. Ltd., State Bank Of India, Reliance Industries Ltd., NTPC Ltd., and Larsen & Toubro Ltd. led to the fall.

On the other hand, those of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Infosys Ltd., and Britannia Industries Ltd. minimised the losses.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Shares of Titan Co. Ltd., State Bank Of India, Reliance Industries Ltd., NTPC Ltd., and Larsen & Toubro Ltd. led to the fall.

On the other hand, those of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Infosys Ltd., and Britannia Industries Ltd. minimised the losses.

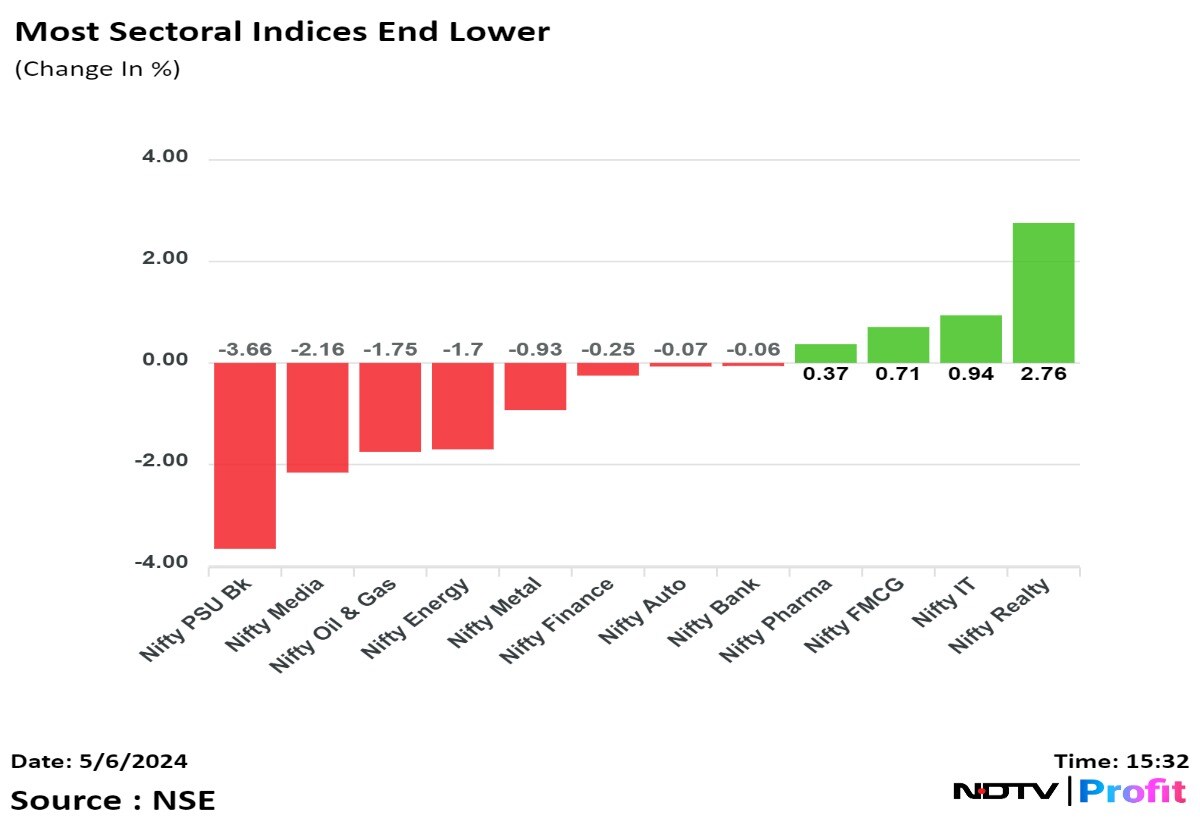

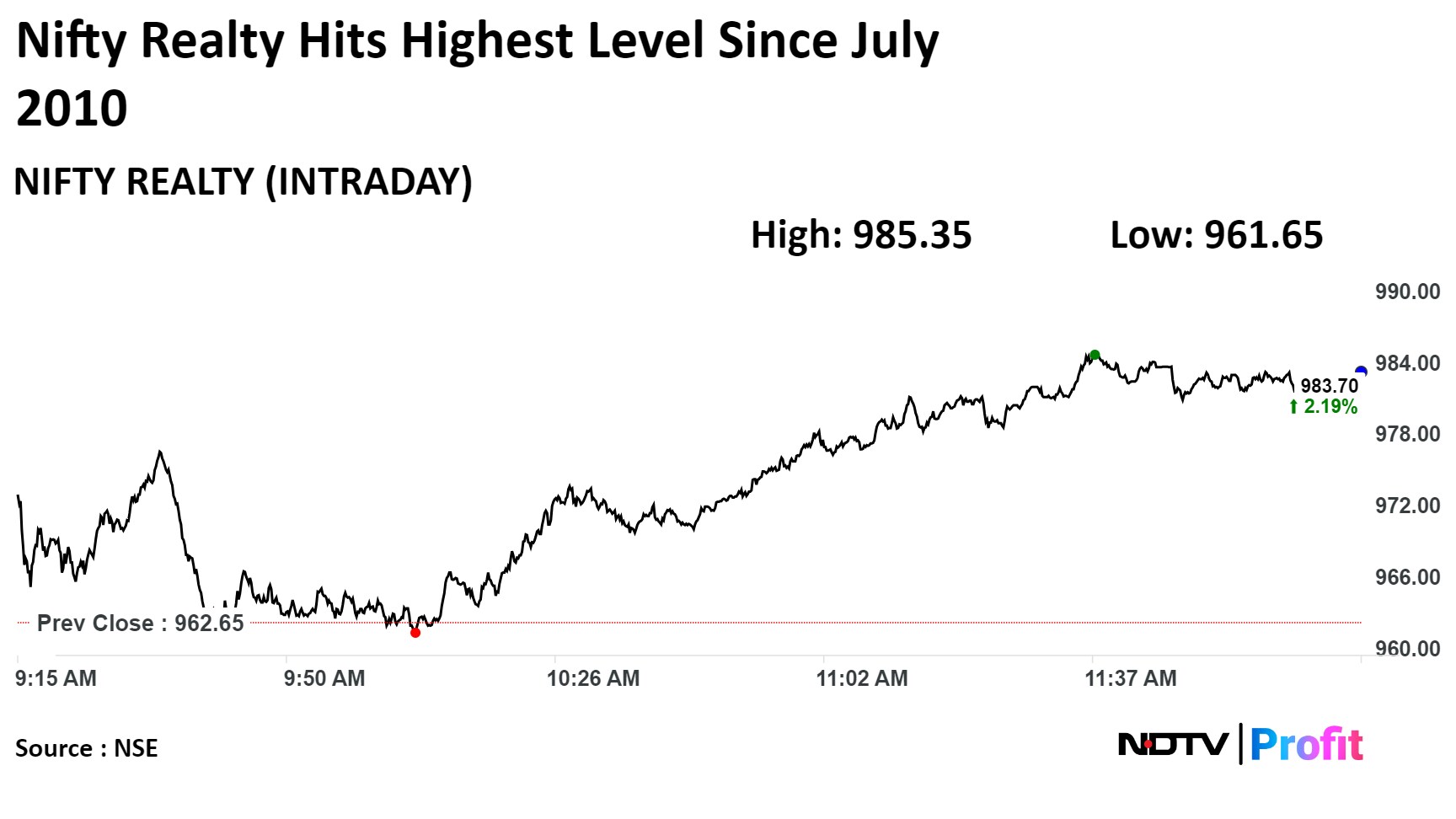

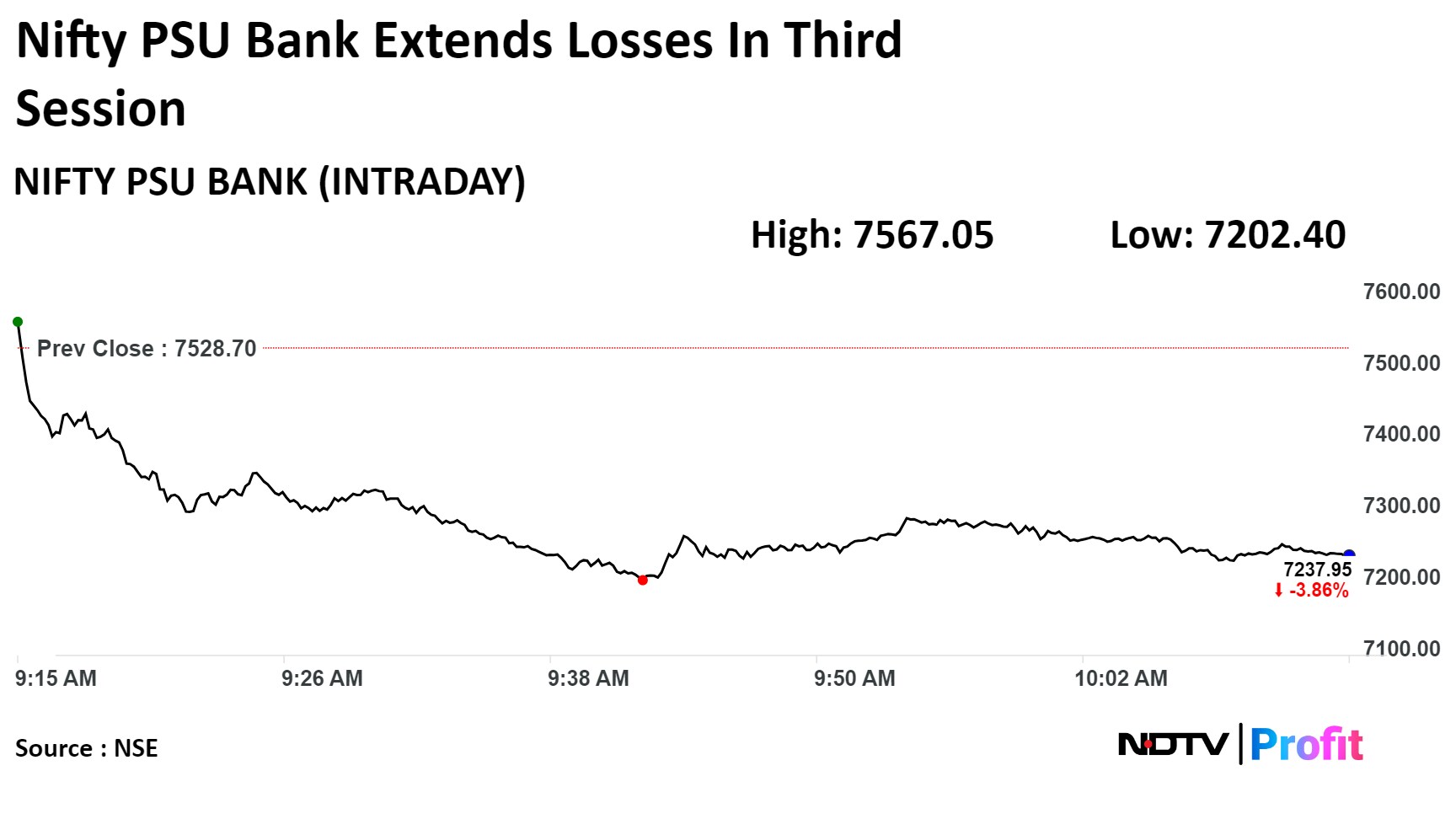

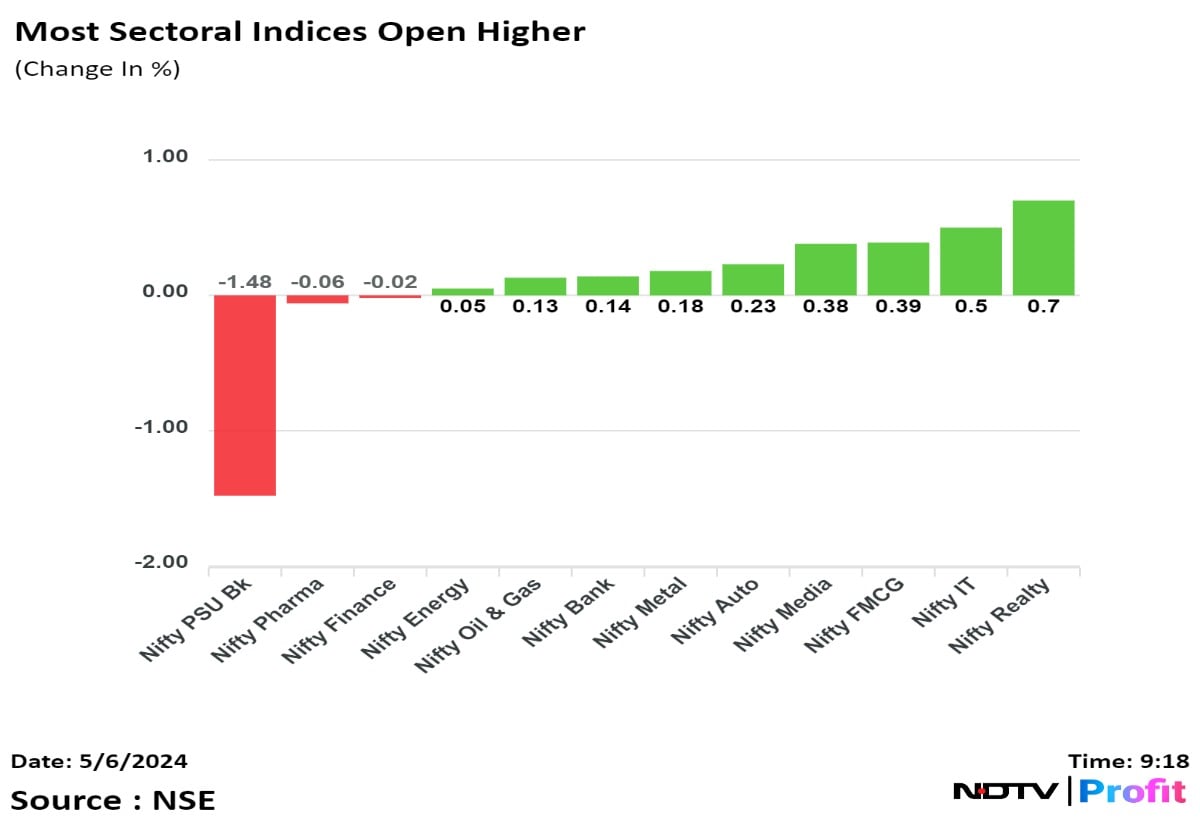

Most sectoral indices ended lower with Nifty PSU Bank falling the most. Nifty Realty gained nearly 3%.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Shares of Titan Co. Ltd., State Bank Of India, Reliance Industries Ltd., NTPC Ltd., and Larsen & Toubro Ltd. led to the fall.

On the other hand, those of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Infosys Ltd., and Britannia Industries Ltd. minimised the losses.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Benchmark equity indices were little changed from Friday at close after a volatile session today. Shares of Titan Co., SBI, and RIL dragged them but the losses were limited on the back of gains in Kotak Mahindra Bank.

The Nifty closed at 22,442.7, down 33.15 points or 0.15% and the Sensex closed 17.39 points higher at 73,895.54.

"Indian bourses began the week on a strong note but a steep correction in the PSU stocks put pressure on the Index to trade lower," said Aditya Gaggar, director of Progressive Shares. "A vertical fall in the Mid and Smallcaps dented the market sentiments further."

"The Index has formed a small red candle but on the downside, the zone of 22,330-22,380 will act as a strong support while the higher side seems to be capped at 22,580," Gaggar added.

Shares of Titan Co. Ltd., State Bank Of India, Reliance Industries Ltd., NTPC Ltd., and Larsen & Toubro Ltd. led to the fall.

On the other hand, those of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Infosys Ltd., and Britannia Industries Ltd. minimised the losses.

Most sectoral indices ended lower with Nifty PSU Bank falling the most. Nifty Realty gained nearly 3%.

On BSE, 13 sectors declined, and seven advanced out of 20. The S&P BSE Consumer Durables was the worst performing sector among peers, and the S&P BSE Realty was the top performing sector.

Broader markets underperformed benchmark indices. The S&P BSE Midcap ended 0.95% down, and the S&P BSE Smallcap settled 1.06% down.

Market breadth was skewed in favour of the sellers. Around 2,625 stocks declined, 1,296 stocks advanced, and 173 stocks remained unchanged on BSE.

Revenue at Rs 691.08 crore vs Rs 664.8 crore, up 3.95%

EBITDA at Rs 125.01 crore vs Rs 129.33 crore, down 3.34%

Margin at 18.08% vs 19.45%

Net profit at Rs 92.68 crore vs Rs 98.49 crore, down 5.89%

Saudi Arabia-based associate company East Pipes signs off contract worth Rs 133 crore with Maramer Contracting

Duration of contract is for 6 months, financial impact of which will be realised in Q2 and Q3 of FY25

Source: Exchange filing

Stock surges more than 10% in today's trading session and up 109% in one year. The stock hit its upper circuit limit of 10% after which the limit was revised to 15%.

Stock surges more than 10% in today's trading session and up 109% in one year. The stock hit its upper circuit limit of 10% after which the limit was revised to 15%.

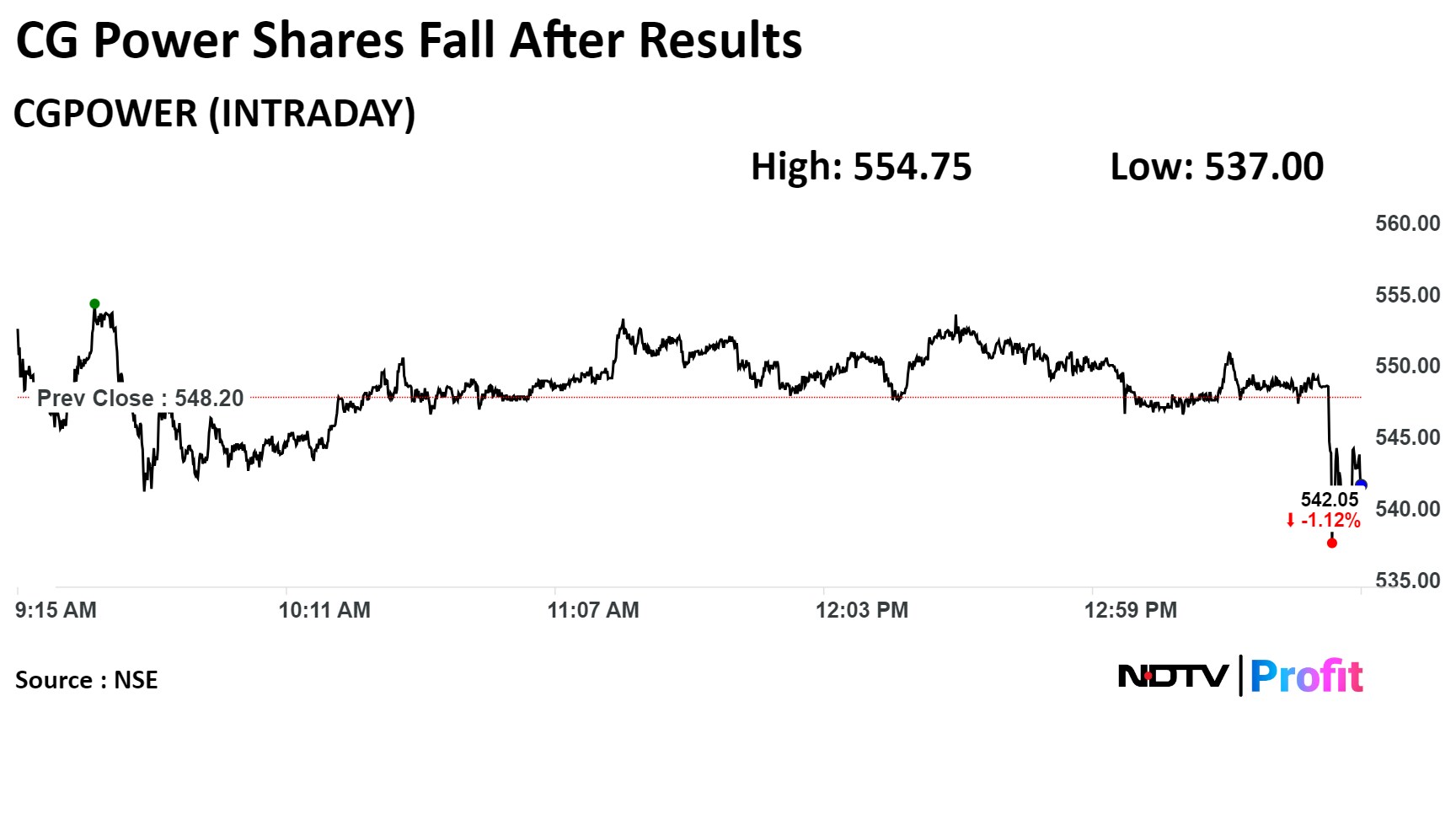

Revenue at Rs 2,191.72 crore vs Rs 1,902.79 crore, up 15.18%

EBITDA at Rs 283.83 crore vs Rs 275.34 crore, up 3.08%

Margin at 12.95% vs 14.47%

Net profit at Rs 233.81 crore vs Rs 426.22 crore, down 45.14%

Revenue at Rs 2,191.72 crore vs Rs 1,902.79 crore, up 15.18%

EBITDA at Rs 283.83 crore vs Rs 275.34 crore, up 3.08%

Margin at 12.95% vs 14.47%

Net profit at Rs 233.81 crore vs Rs 426.22 crore, down 45.14%

Net profit at Rs 2,247 crore vs Rs 1,447 crore, up 55% (YoY)

Gross NPA at 3.95% vs 4.47% (QoQ)

Net NPA at 0.43% vs 0.53% (QoQ)

NII at Rs 6,015 crore vs Rs 5,508 crore, up 9% (YoY)

Board recommends dividend of Rs 12/share

Net profit at Rs 104 crore vs Rs 97 crore, up 7%

Revenue at Rs 2,075 crore vs Rs 1,881 crore, up 10%

EBITDA at Rs 243 crore vs Rs 191 crore, up 27%

EBITDA margin at 11.7% vs 10.1%

Board recommends a final dividend of Rs 3.75/share and a special dividend of Rs 1/share

Board reappoints Jayesh Shah as Director & Group CFO w.e.f. Oct 1, 2024

Appoints Susheel Kaul as MD & President (Textiles) w.e.f. May 6, 2024

Source: Exchange Filing

In pact with AWS to accelerate GenAI adoption for digital solutions

Source: Exchange filing

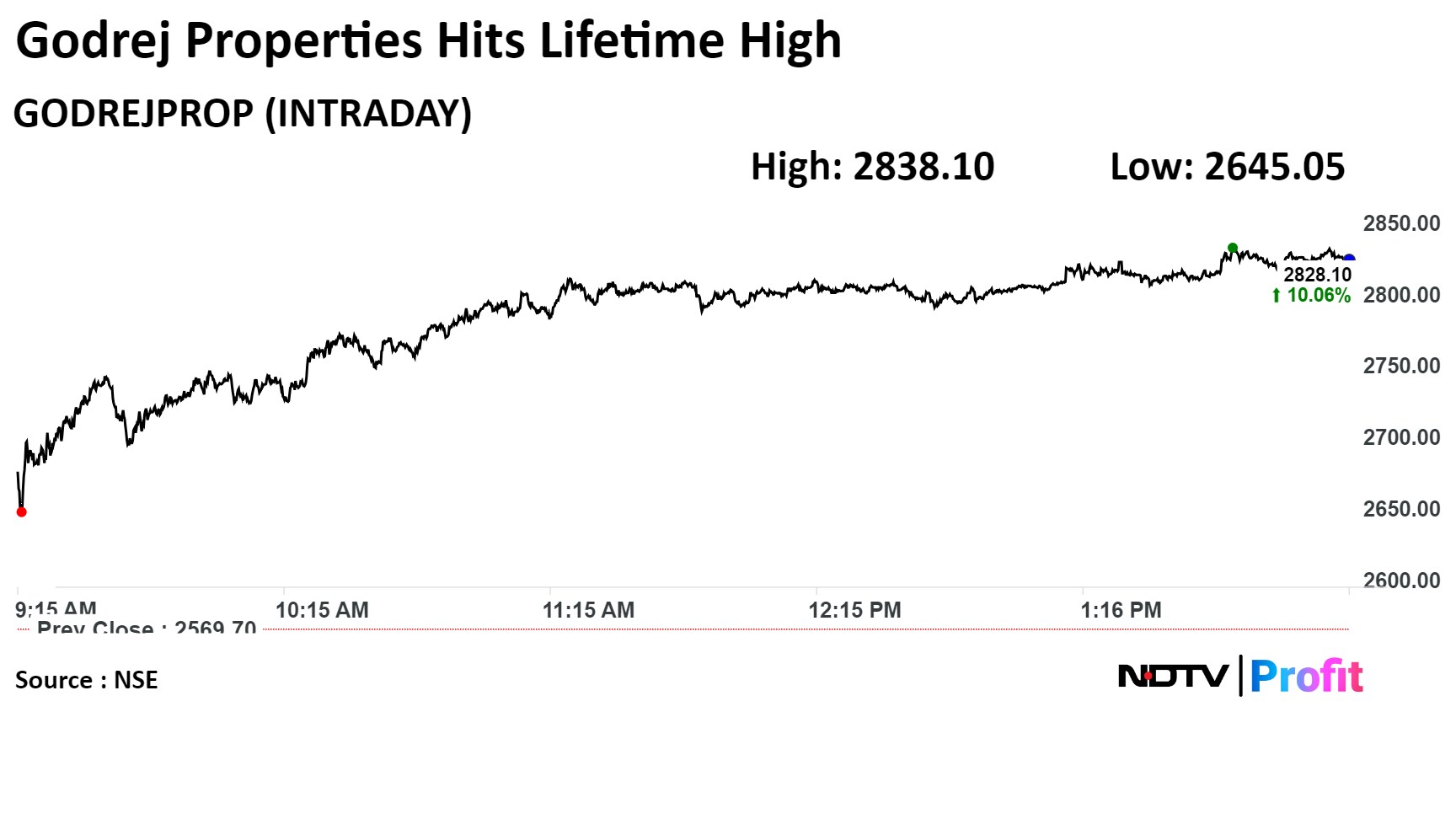

Nifty Realty rose as much as 2.36% to hit its highest level since 16 July 2010. Shares of Godrej Properties contributed the most to rise in the index.

Nifty Realty rose as much as 2.36% to hit its highest level since 16 July 2010. Shares of Godrej Properties contributed the most to rise in the index.

Sanjay Panicker elevated as executive director effective today

Panicker to superannuate from his position on Dec 31, 2031

Source: Exchange filing

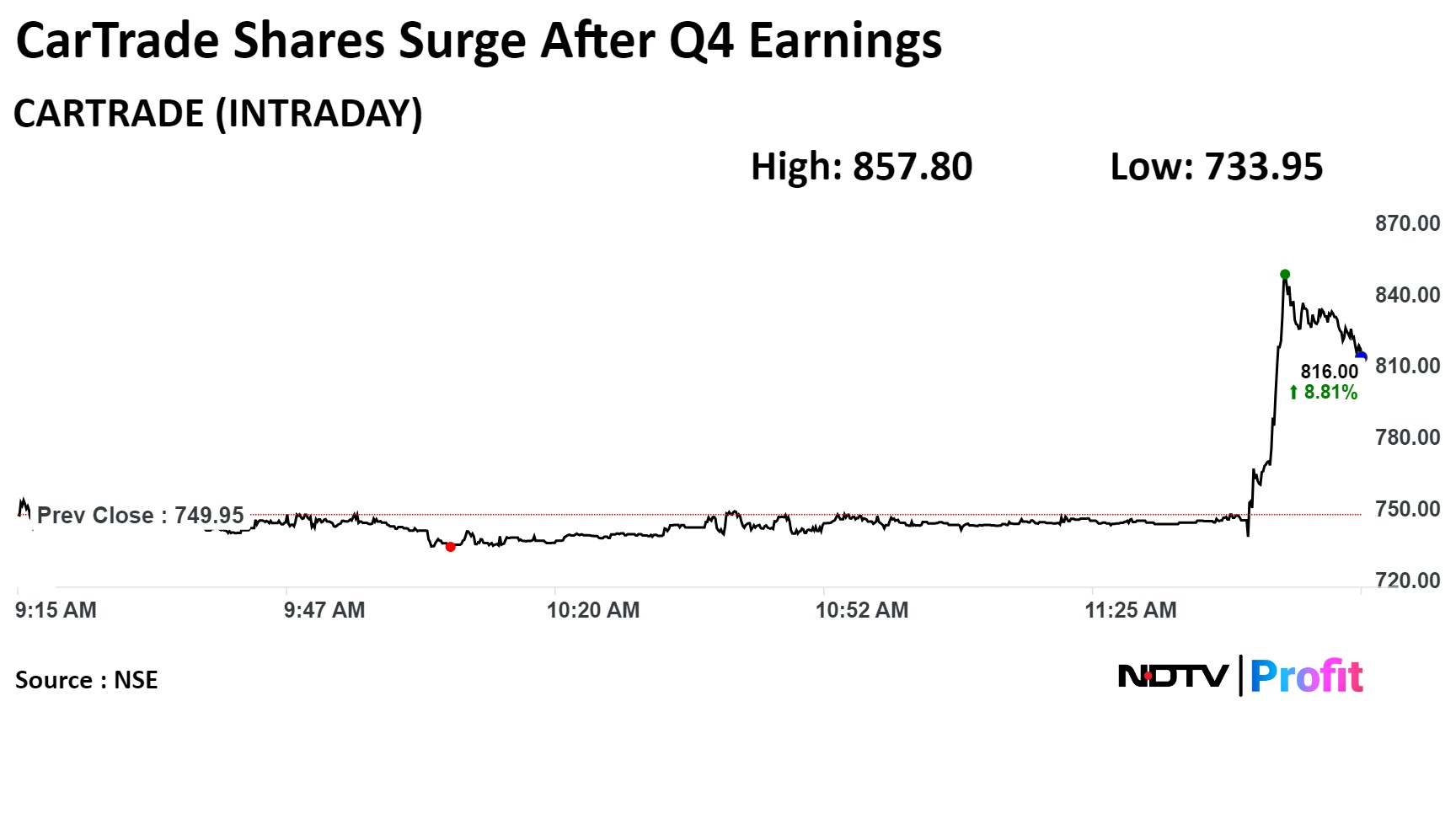

Revenue at Rs 145 crore vs Rs 139 crore, up 4%

EBITDA at Rs 27.3 crore vs Rs 25.3 crore, up 7.7%

EBITDA margin at 18.8% vs 18.3%

Net profit at Rs 25 crore vs loss of Rs 24 crore

Revenue at Rs 145 crore vs Rs 139 crore, up 4%

EBITDA at Rs 27.3 crore vs Rs 25.3 crore, up 7.7%

EBITDA margin at 18.8% vs 18.3%

Net profit at Rs 25 crore vs loss of Rs 24 crore

Gets Colombia approval for softgel capsules division at Puducherry

Source: Exchange filing

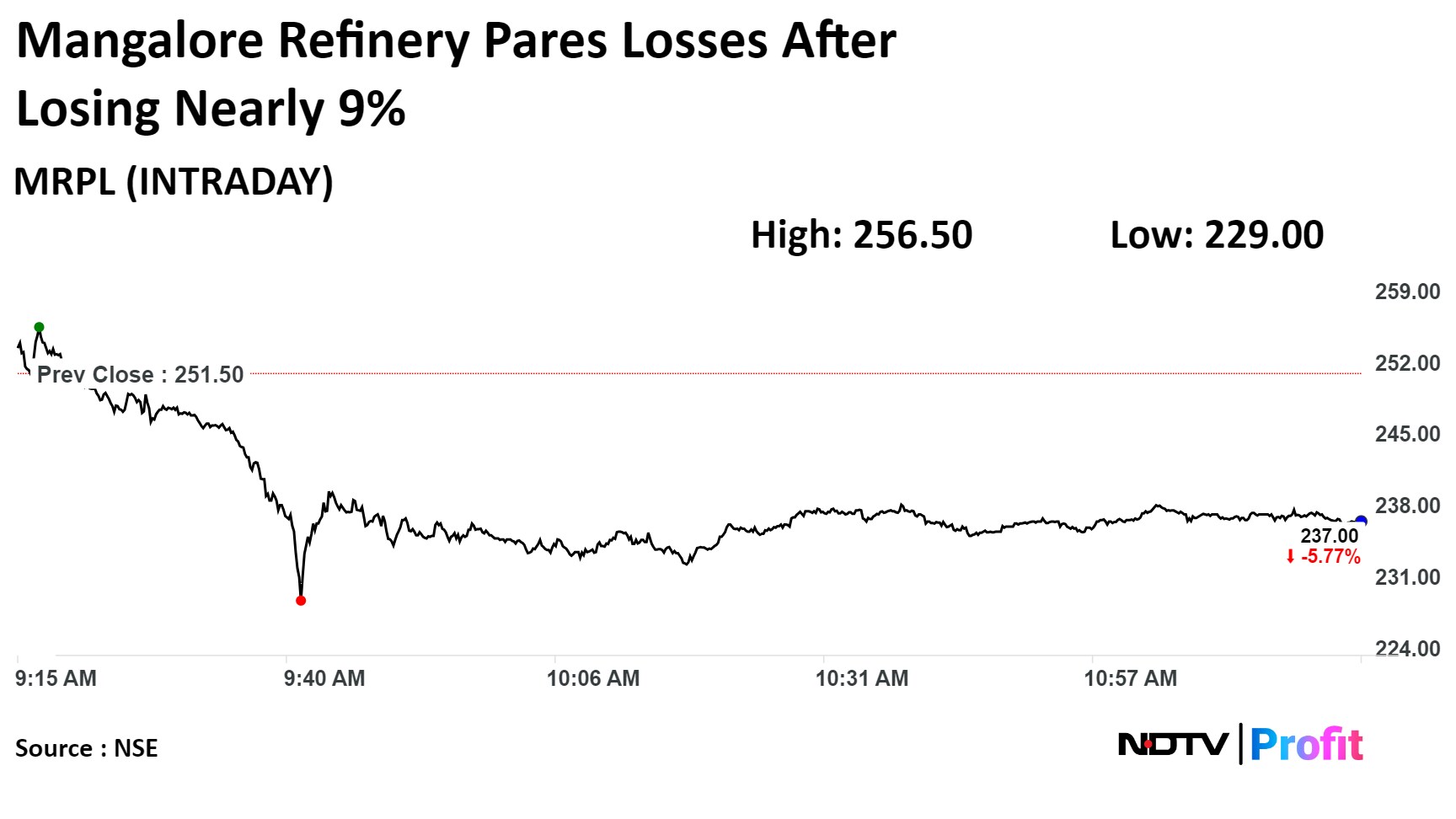

The scrip fell as much as 8.95% to Rs 229 apiece, its lowest level since April 22. The stock has risen 77.69% on a year-to-date basis and 261.8% in the last twelve months.

The scrip fell as much as 8.95% to Rs 229 apiece, its lowest level since April 22. The stock has risen 77.69% on a year-to-date basis and 261.8% in the last twelve months.

Services PMI at 60.8 in April vs 61.2 in March

Composite PMI at 61.5 in April vs 61.8 in March

Source: S&P Global

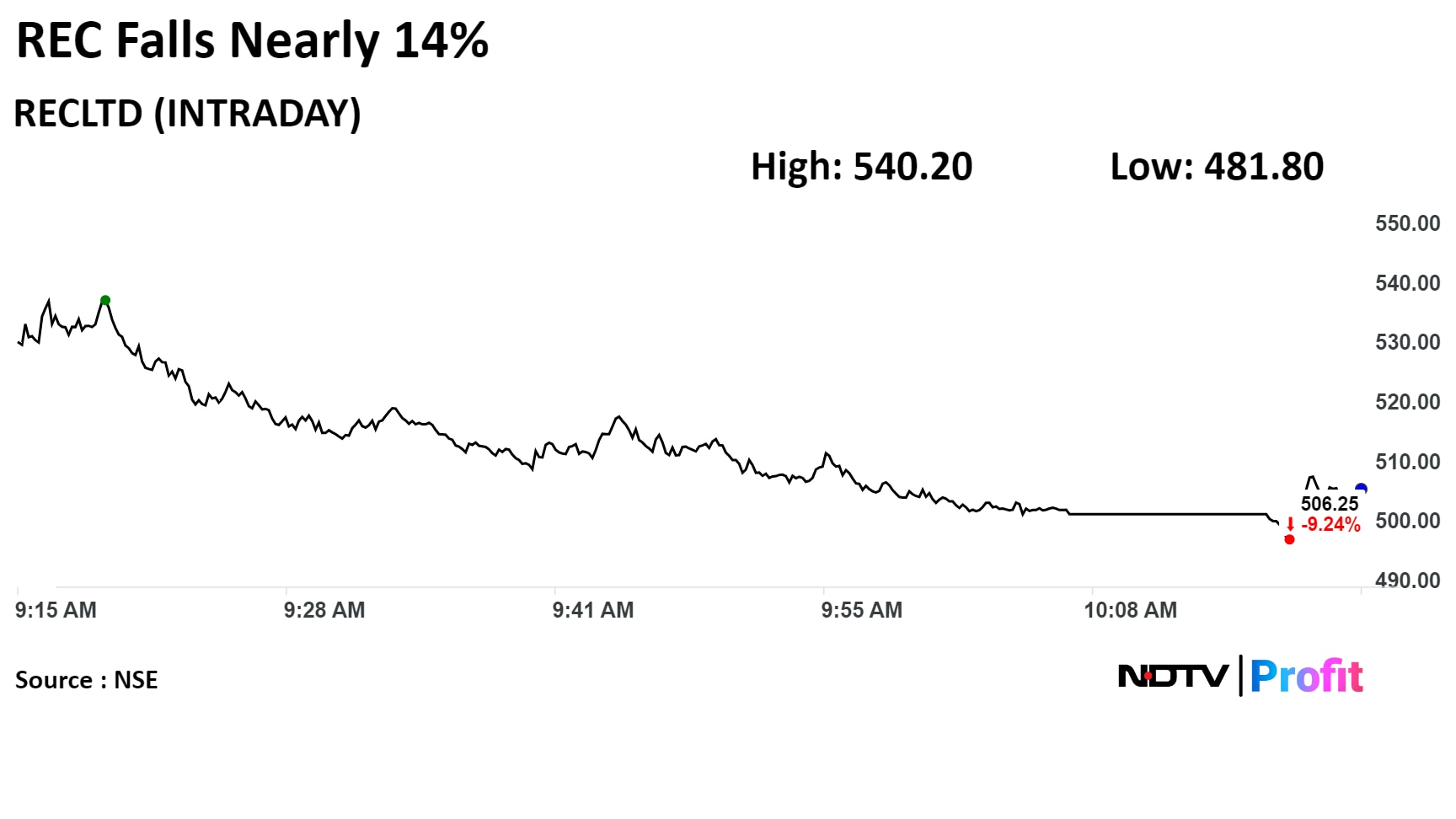

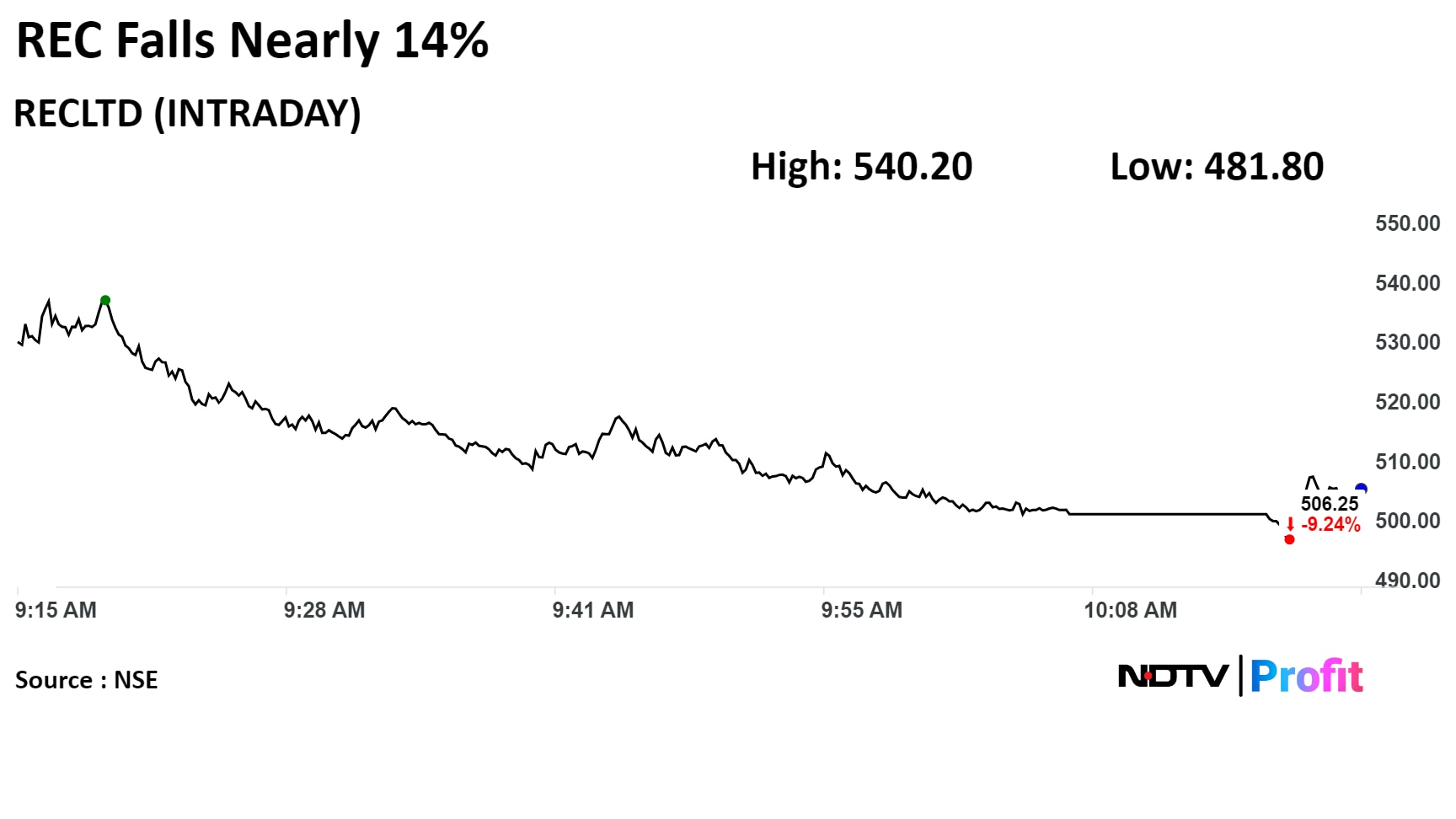

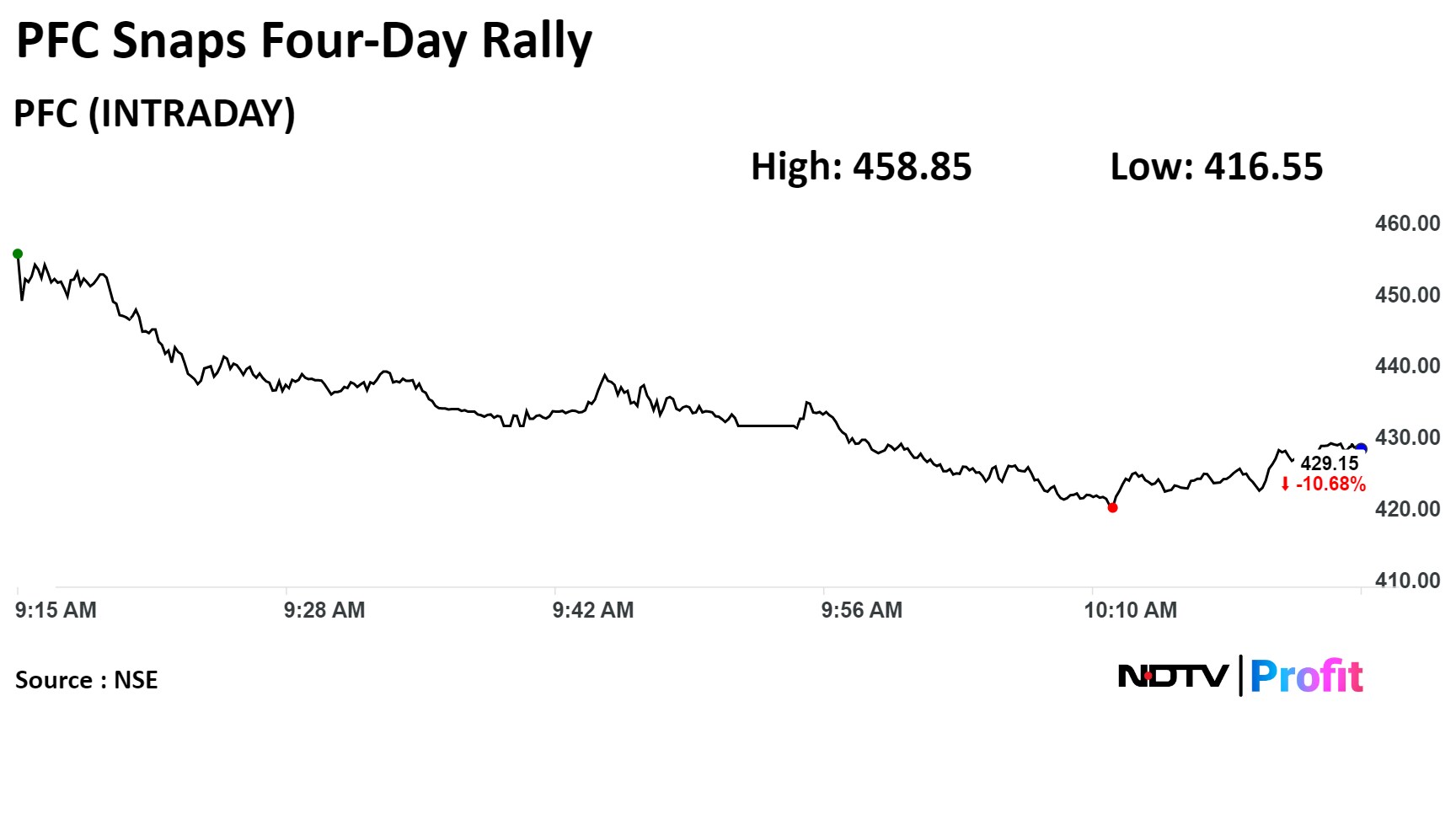

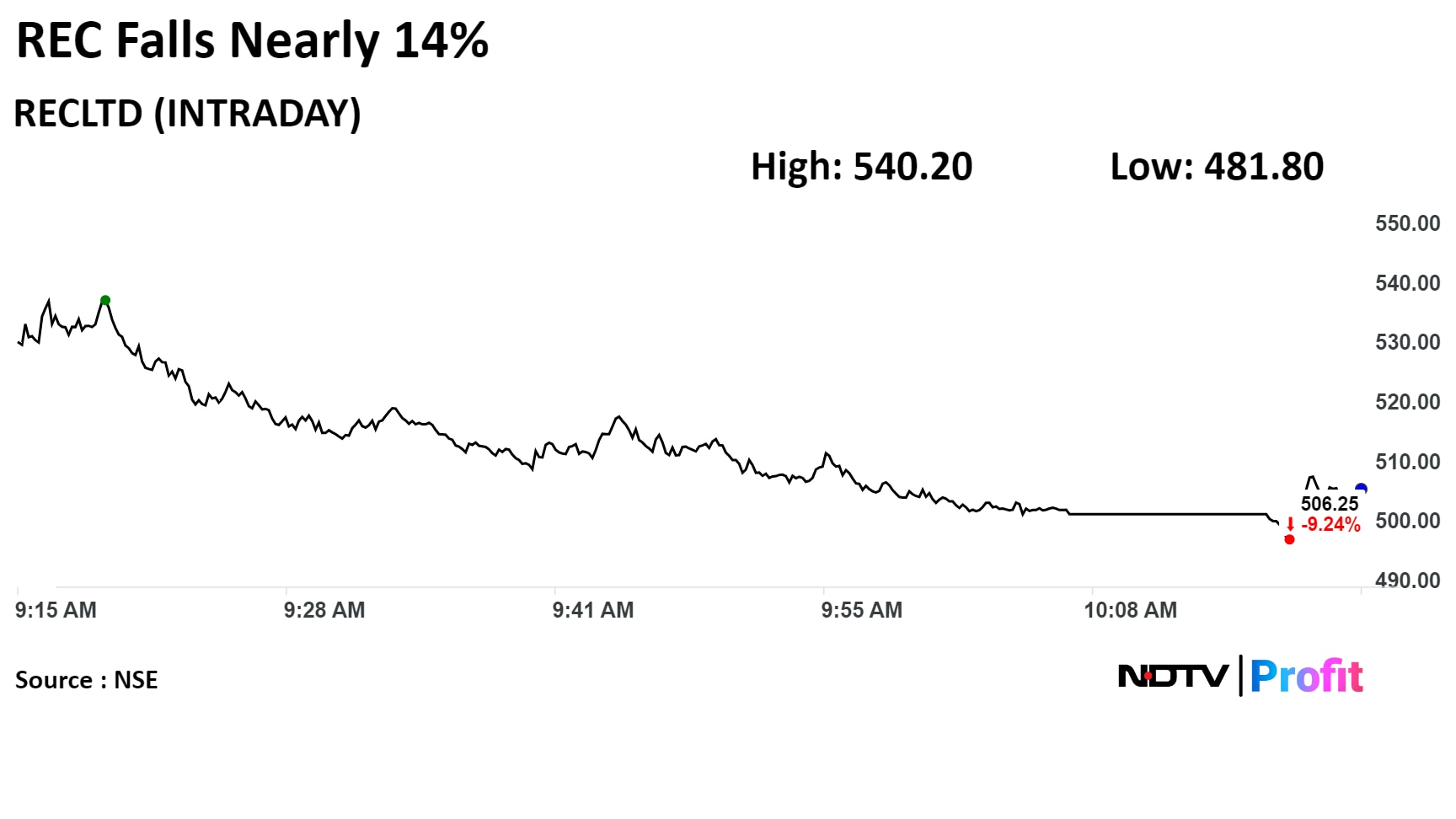

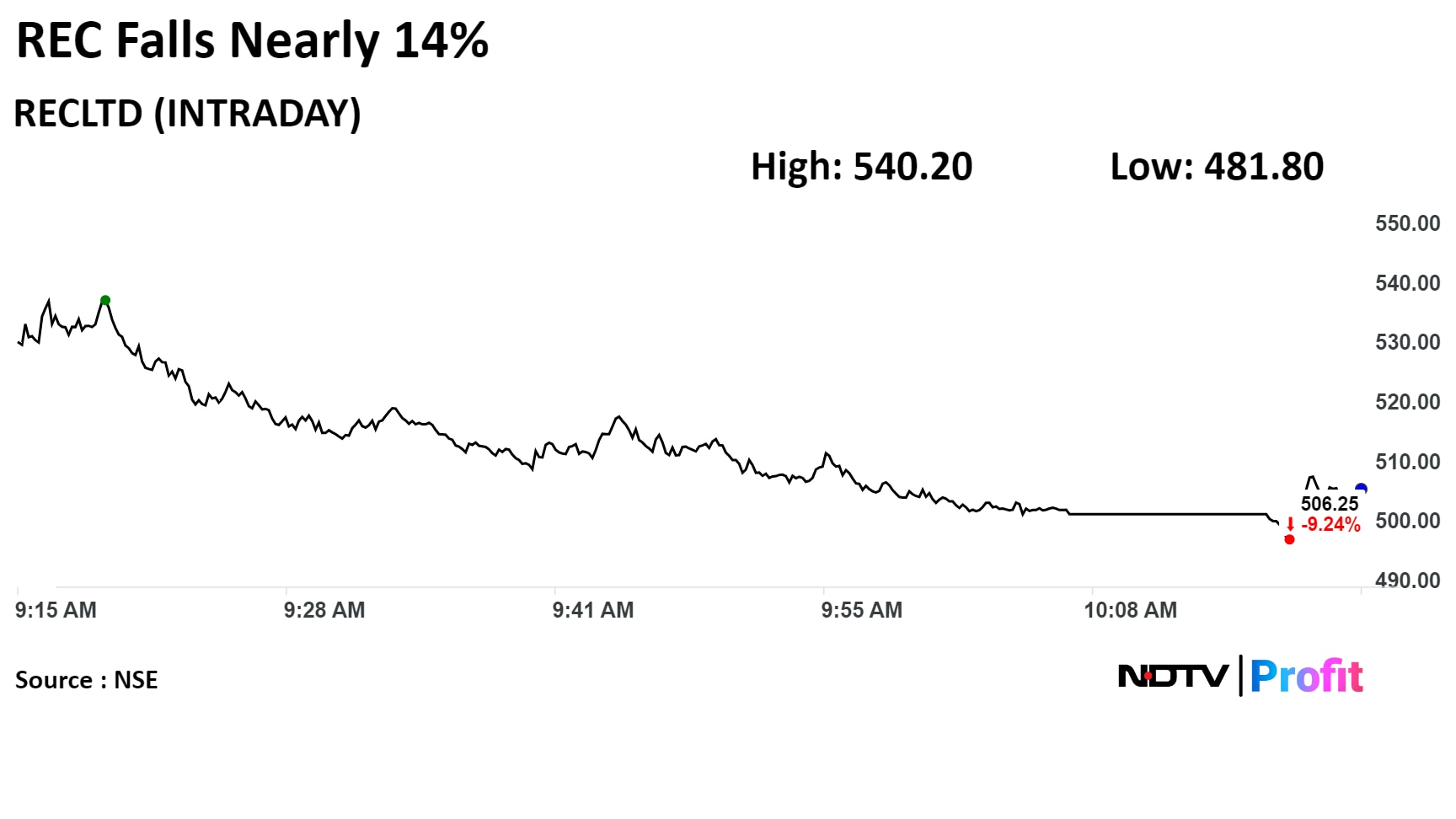

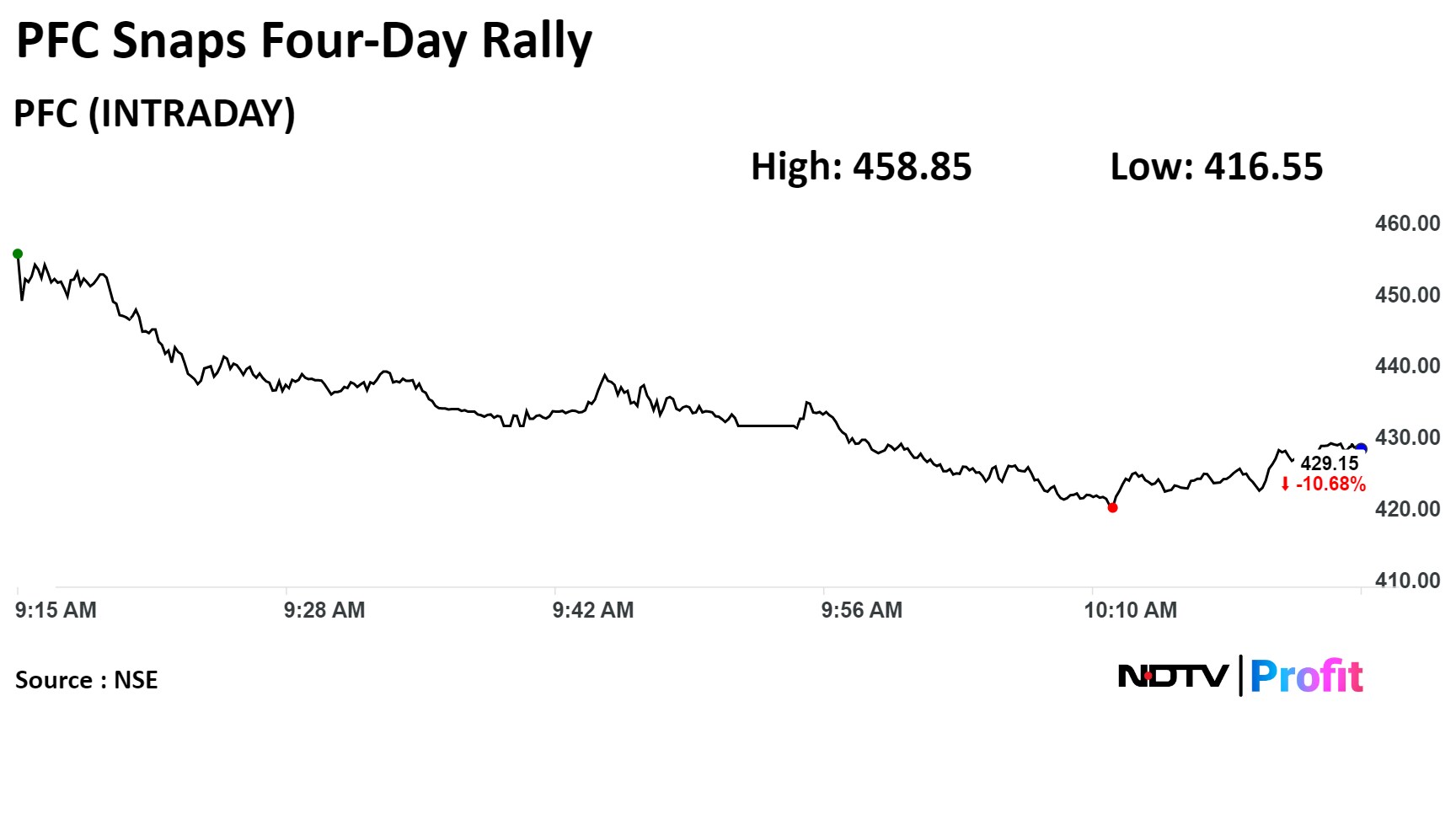

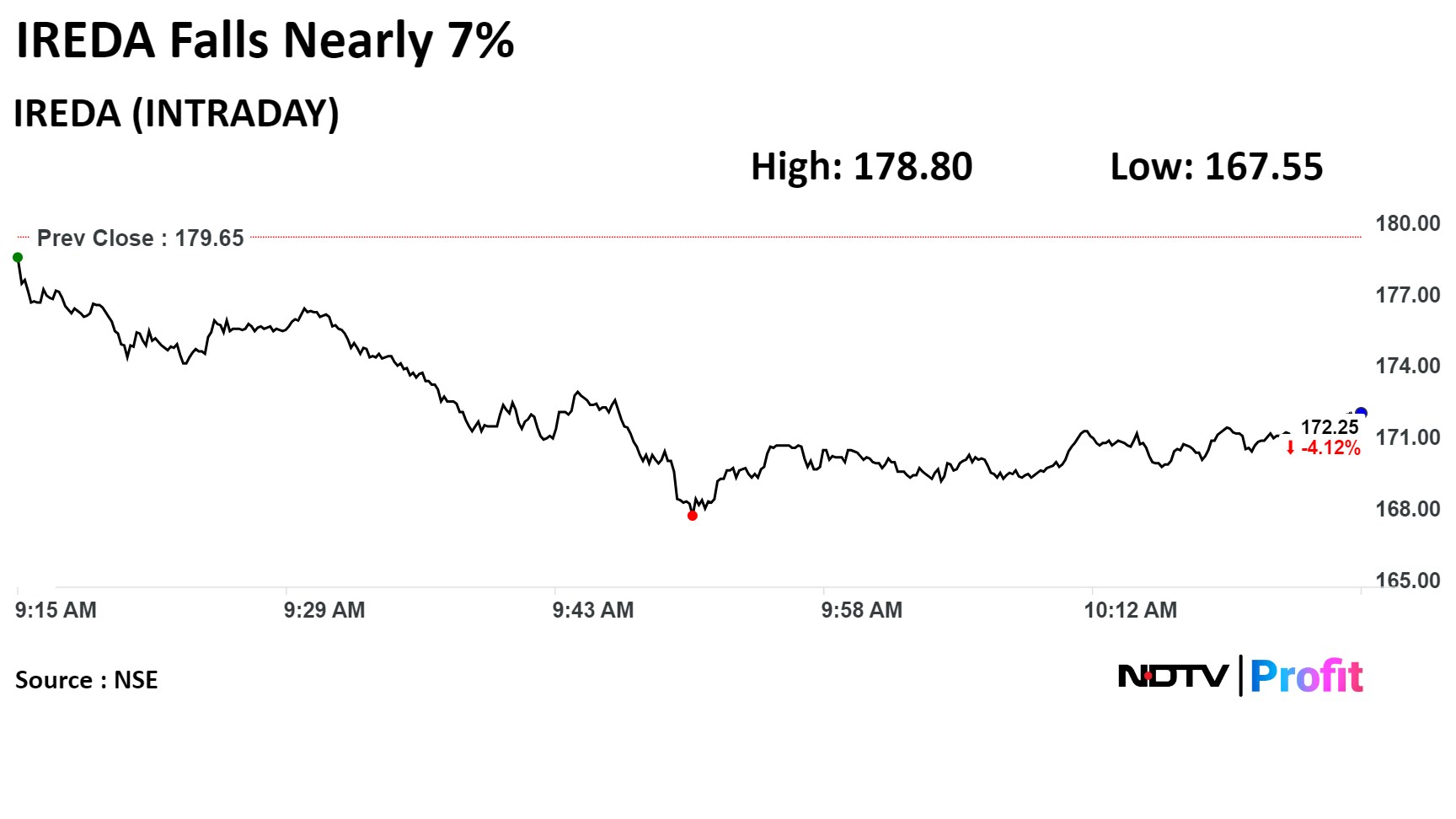

The Reserve Bank proposed tighter rules to govern lending to projects under implementation. The central bank's draft rules include a classification of the projects as per their phase and higher provisioning of up to 5% during the construction phase, even if the asset is standard.

The Reserve Bank proposed tighter rules to govern lending to projects under implementation. The central bank's draft rules include a classification of the projects as per their phase and higher provisioning of up to 5% during the construction phase, even if the asset is standard.

Proposed guidelines suggest around 5% of standard provisions to be set aside for under-construction project

finance advances

Sharp increase from the current standard provisioning requirement of 0.4%

Provisioning requirement only gradually reduces to 2.5% and then 1%

Will increase provisioning requirements significantly; reduce profitability by as much as 50%

Organic equity accrual is severely impaired

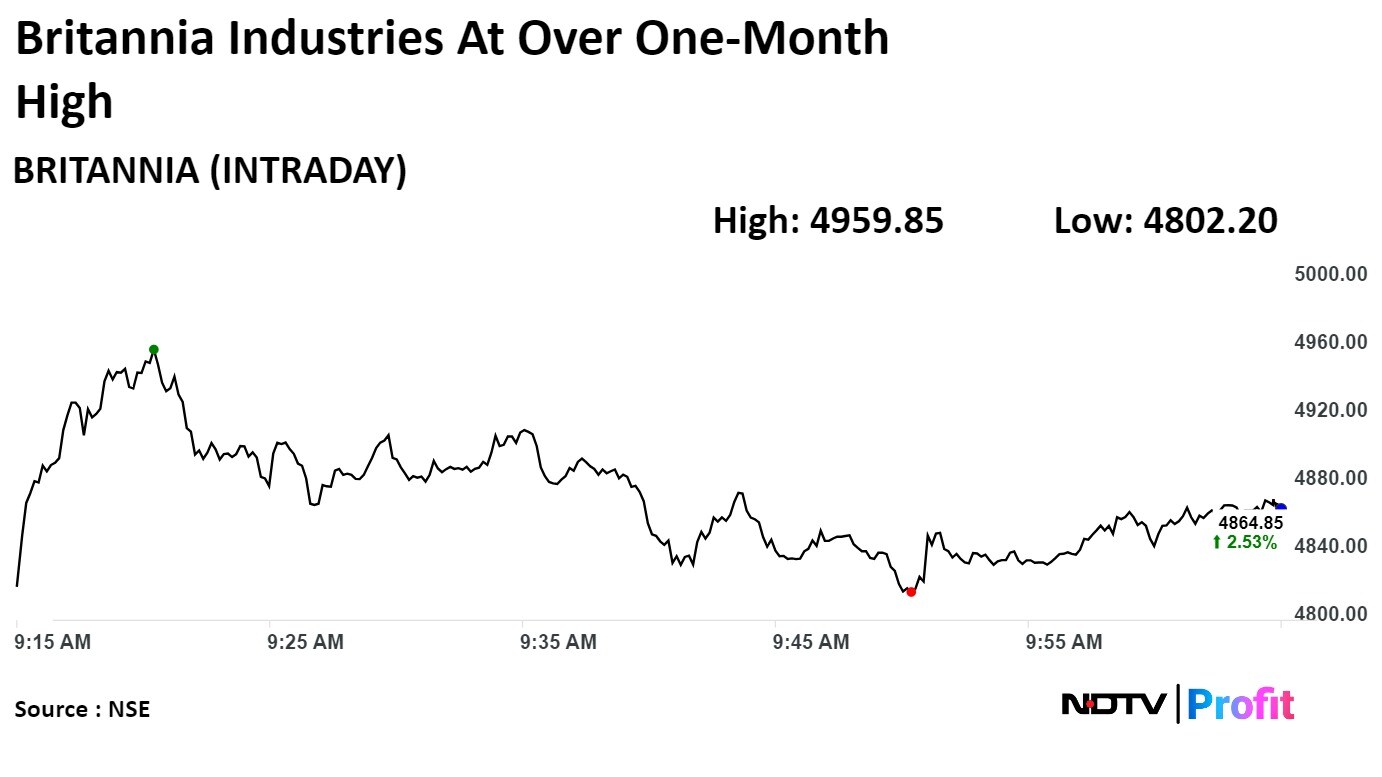

Britannia Industries Ltd. rose as much as 4.54% to Rs 4,959.85 apiece, the highest level since April 1. It was trading 2.35% higher at Rs 4,864.10 apiece, as of 10:03 a.m. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 5.52% in 12 months, and on year-to-date basis, it has declined 8.88%. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 55.19.

Out of 41 analysts tracking the company, 21 maintain a 'buy' rating, 13 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Britannia Industries Ltd. rose as much as 4.54% to Rs 4,959.85 apiece, the highest level since April 1. It was trading 2.35% higher at Rs 4,864.10 apiece, as of 10:03 a.m. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 5.52% in 12 months, and on year-to-date basis, it has declined 8.88%. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 55.19.

Out of 41 analysts tracking the company, 21 maintain a 'buy' rating, 13 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Britannia Industries (Consolidated, YoY)

Revenue up 1.14% at Rs 4,069 crore vs Rs 4,023 crore (Bloomberg estimate Rs 4,109 crore).

Ebitda down 1.67% at Rs 787 crore vs Rs 801 crore, (Bloomberg estimate Rs 782 crore).

Margin down 55 bps at 19.35% vs 19.9%, (Bloomberg estimate 19%).

Net profit down 3.76% at Rs 537 crore vs Rs 558 crore (Bloomberg estimate Rs 542 crore).

Recommended final dividend of Rs 73.5 per share.

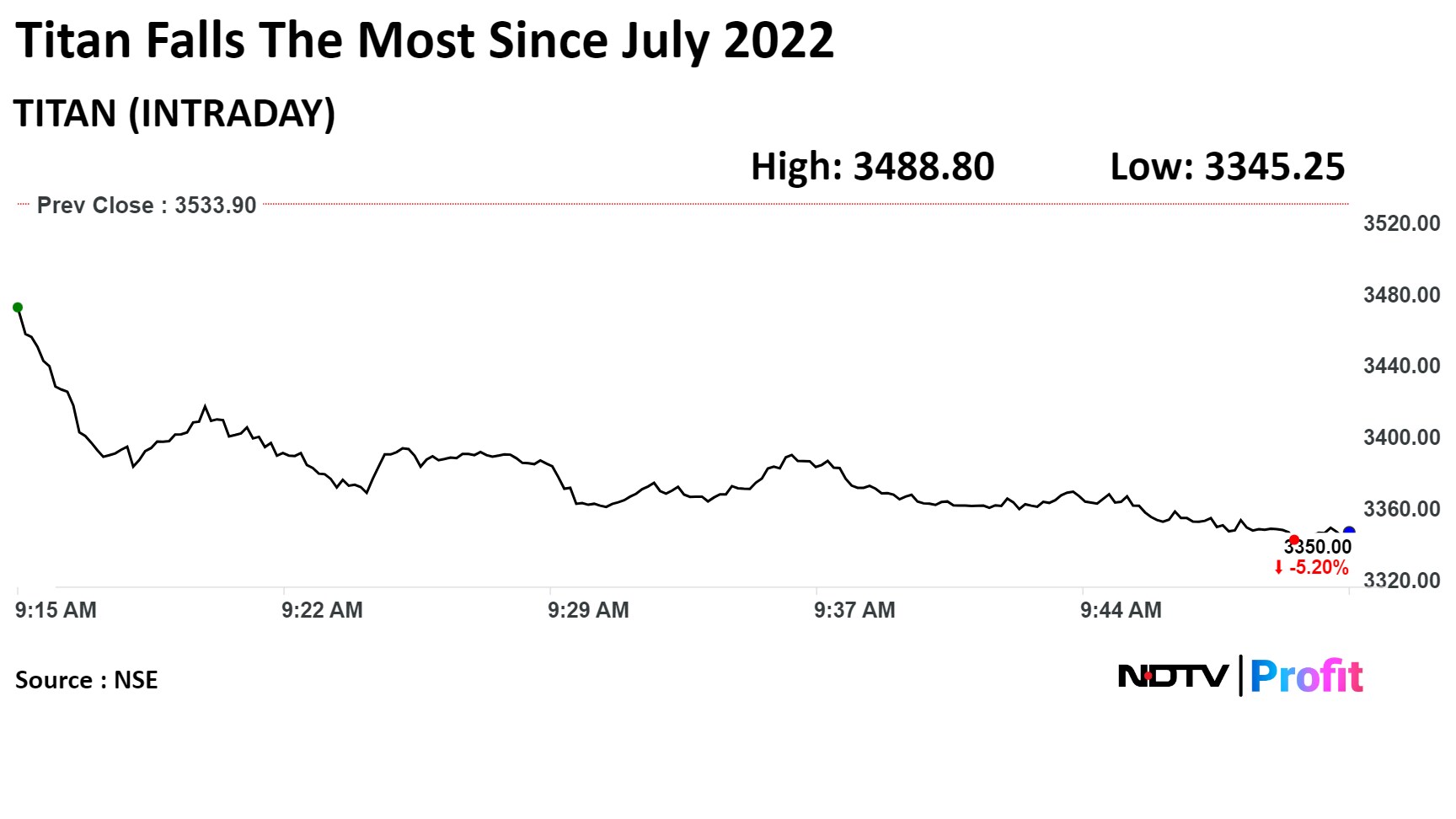

Titan (Consolidated, YoY)

Revenue up 20.59% at Rs 12,494 crore vs Rs 10,360 crore (Bloomberg estimate Rs 10,567 crore).

Ebitda up 9.36% at Rs 1,191 crore vs Rs 1,089 crore (Bloomberg estimate Rs 1,294 crore).

Margin down 97 bps at 9.53% vs 10.51% (Bloomberg estimate 12.2%).

Net profit up 4.75% at Rs 771 crore vs Rs 736 crore (Bloomberg estimate Rs 876 crore).

Titan (Consolidated, YoY)

Revenue up 20.59% at Rs 12,494 crore vs Rs 10,360 crore (Bloomberg estimate Rs 10,567 crore).

Ebitda up 9.36% at Rs 1,191 crore vs Rs 1,089 crore (Bloomberg estimate Rs 1,294 crore).

Margin down 97 bps at 9.53% vs 10.51% (Bloomberg estimate 12.2%).

Net profit up 4.75% at Rs 771 crore vs Rs 736 crore (Bloomberg estimate Rs 876 crore).

The scrip fell as much as 5.7% to Rs 3,332.45 apiece, the lowest level since May 3. It pared losses to trade 5.6% lower at Rs 3,334 apiece, as of 9:57 a.m. This compares to a flat NSE Nifty 50 Index.

It has fallen 9.37% on a year-to-date basis and risen 18% in the last twelve months. Total traded volume so far in the day stood at 1.90 times its 30-day average. The relative strength index was at 27.71, indicating that the stock may be oversold.

Losses in the shares of Titan Co. Ltd and State Bank Of India weighed on the Nifty.

Losses in the shares of Titan Co. Ltd and State Bank Of India weighed on the Nifty.

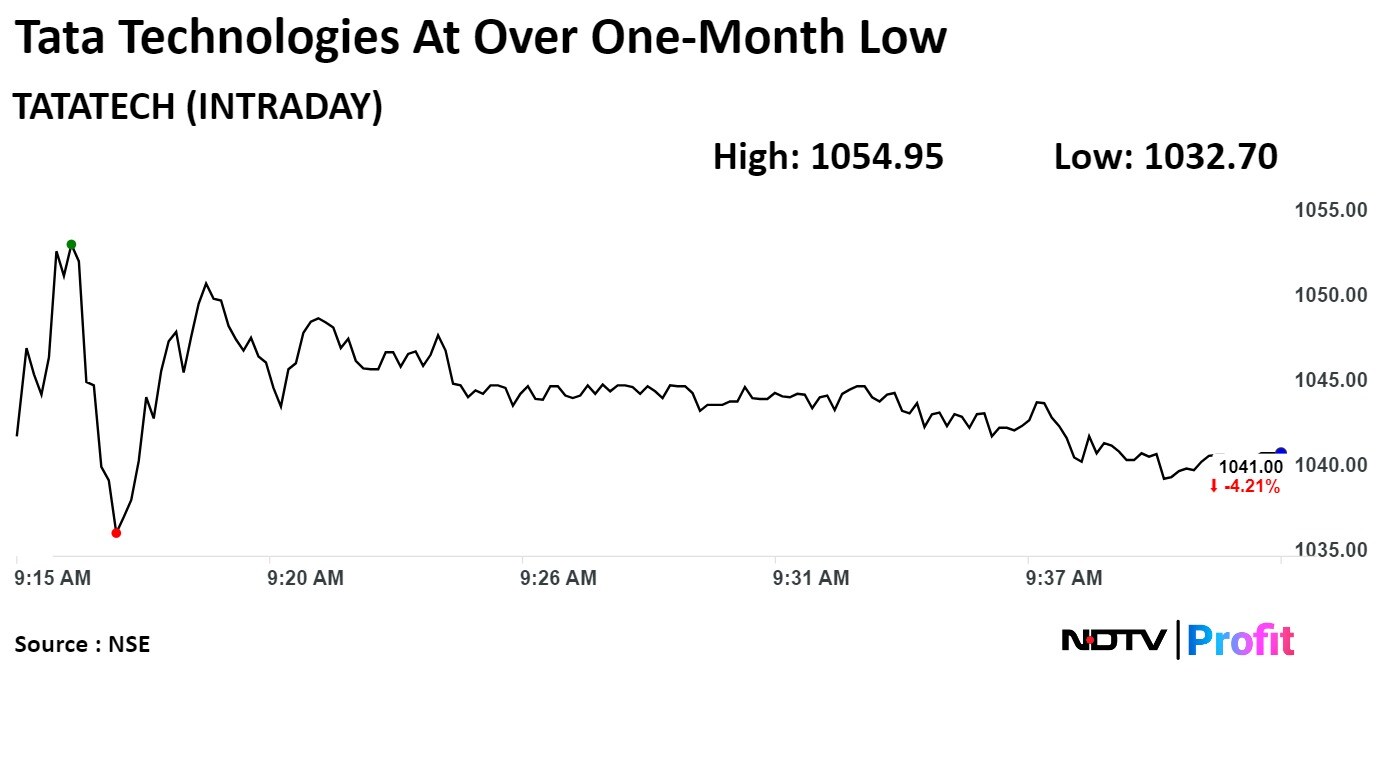

The scrip fell as much as 4.98% to Rs 1,023.70 apiece, the lowest level since March 28. It was trading 4.03% lower at Rs 1,042.30 apiece, as of 09:37 a.m. This compares to a 0.30% advance in the NSE Nifty 50 Index.

It has declined 20.62% in five months, and on year-to-date basis, it has declined 11.74. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 41.40.

Out of seven analysts tracking the company, two maintain a 'buy' rating, and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.3%

RBI issued draft harmonised prudential framework for lenders

Tighten certain lending criteria, which should improve the project viability in our view

Phased increase standard asset provisioning to 1-5% of loans from current 0.4%

Additional provisioning requirement to be 0.5-3% of banks’ networth

No ROE impact on power financiers - can hurt Tier 1,2 ratios and weigh valuations

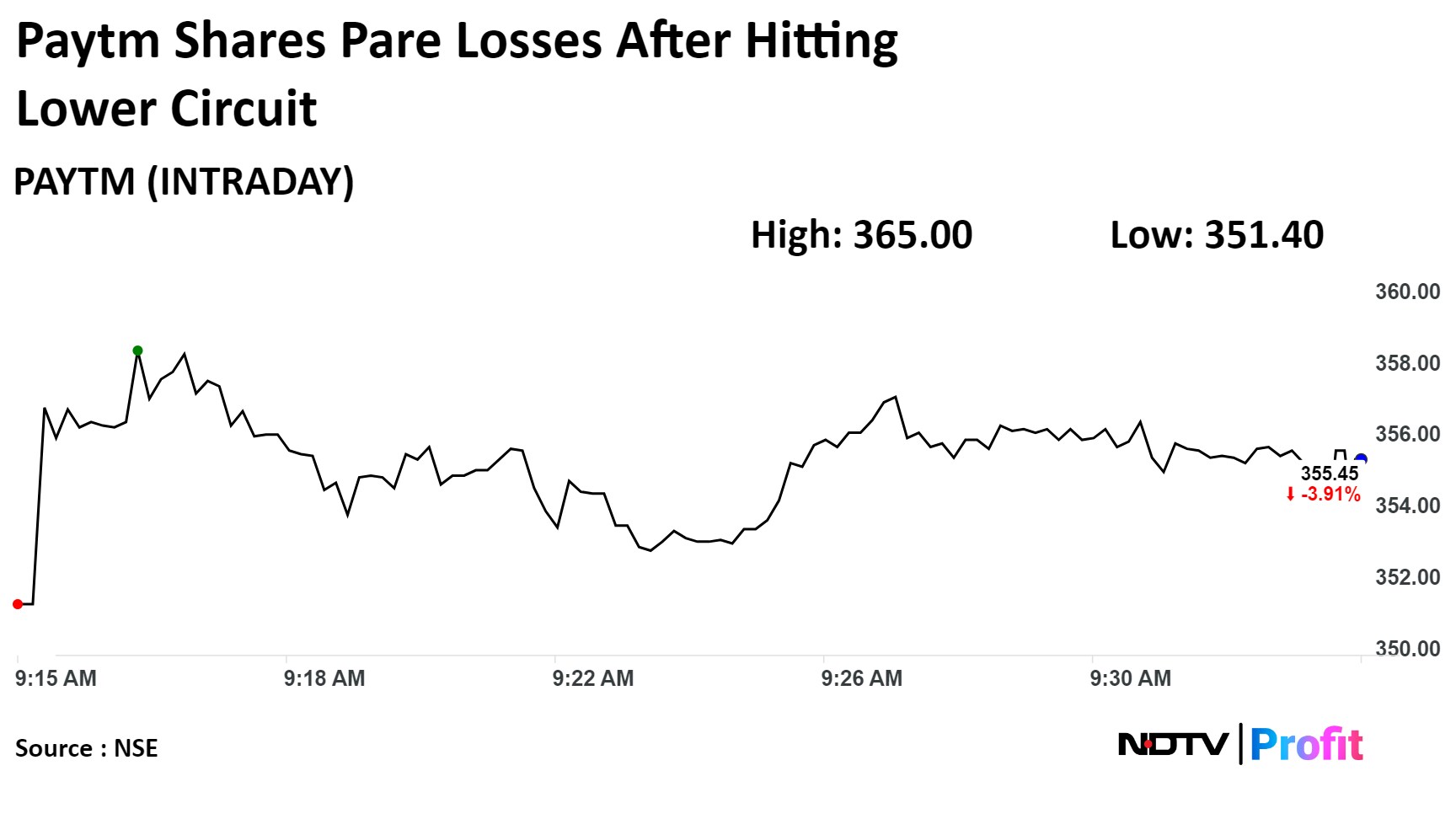

The scrip fell as much as 5% to Rs 351 apiece, the lowest level since March 13. It was trading 4.19% lower at Rs 354.40 apiece, as of 09:55 a.m. This compares to a 0.01% advance in the NSE Nifty 50 Index.

It has declined 51% in 12 months, and on year-to-date basis, it has declined 44.2 Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 28.45

Out of 15 analysts tracking the company, five maintain a 'buy' rating, four recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 36.4%.

The scrip fell as much as 5% to Rs 351 apiece, the lowest level since March 13. It was trading 4.19% lower at Rs 354.40 apiece, as of 09:55 a.m. This compares to a 0.01% advance in the NSE Nifty 50 Index.

It has declined 51% in 12 months, and on year-to-date basis, it has declined 44.2 Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 28.45

Out of 15 analysts tracking the company, five maintain a 'buy' rating, four recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 36.4%.

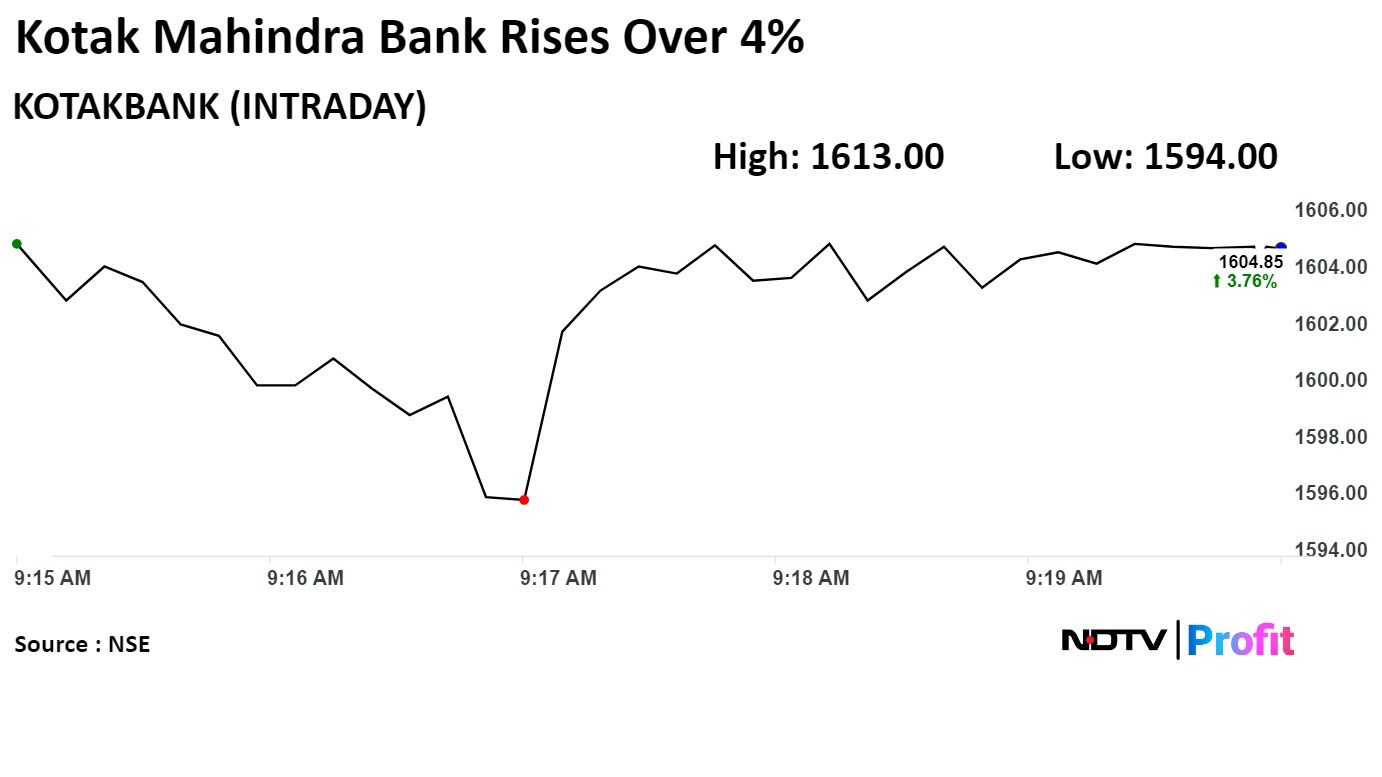

Kotak Mahindra Bank Ltd. rose as much as 4.29% to Rs 1,613.00 apiece, the highest level since April 30. It was trading 4.01% higher at Rs 1,608.75 apiece, as of 09:26 a.m. This compares to a 0.35% advance in the NSE Nifty 50 Index.

It has declined 17.87% in 12 months, and on year-to-date basis, it has risen 15.66%. Total traded volume so far in the day stood at 7.0 times its 30-day average. The relative strength index was at 37.81.

Out of 43 analysts tracking the company, 25 maintain a 'buy' rating, 12 recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.9%.

Kotak Mahindra Bank Ltd. rose as much as 4.29% to Rs 1,613.00 apiece, the highest level since April 30. It was trading 4.01% higher at Rs 1,608.75 apiece, as of 09:26 a.m. This compares to a 0.35% advance in the NSE Nifty 50 Index.

It has declined 17.87% in 12 months, and on year-to-date basis, it has risen 15.66%. Total traded volume so far in the day stood at 7.0 times its 30-day average. The relative strength index was at 37.81.

Out of 43 analysts tracking the company, 25 maintain a 'buy' rating, 12 recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.9%.

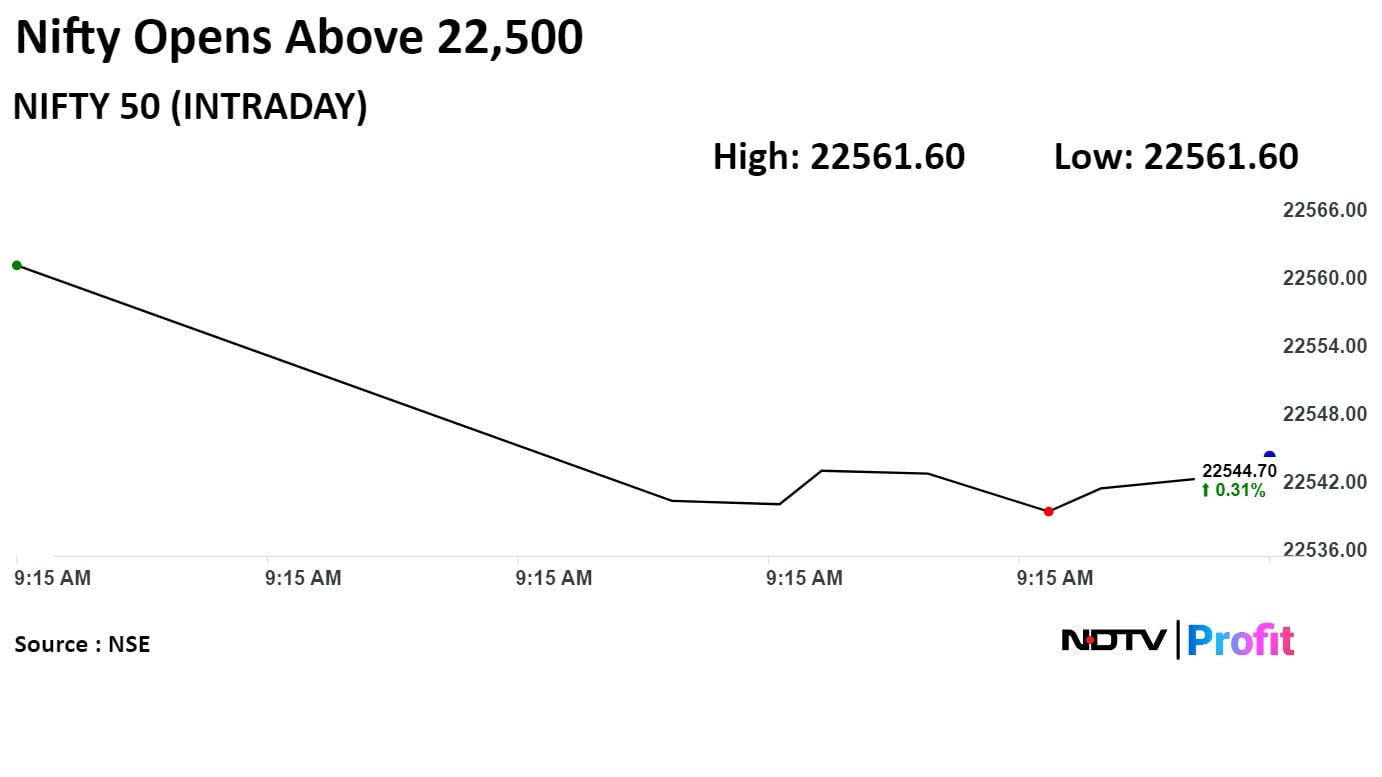

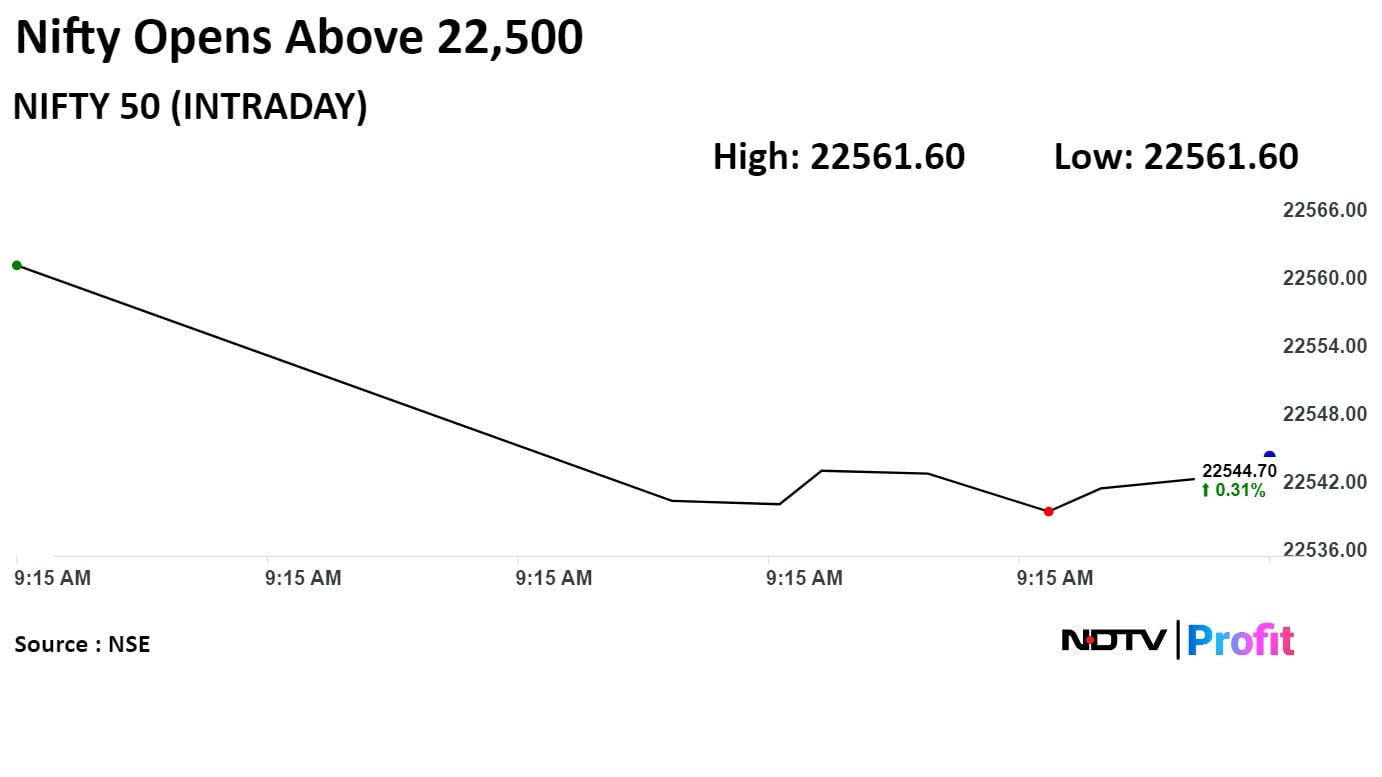

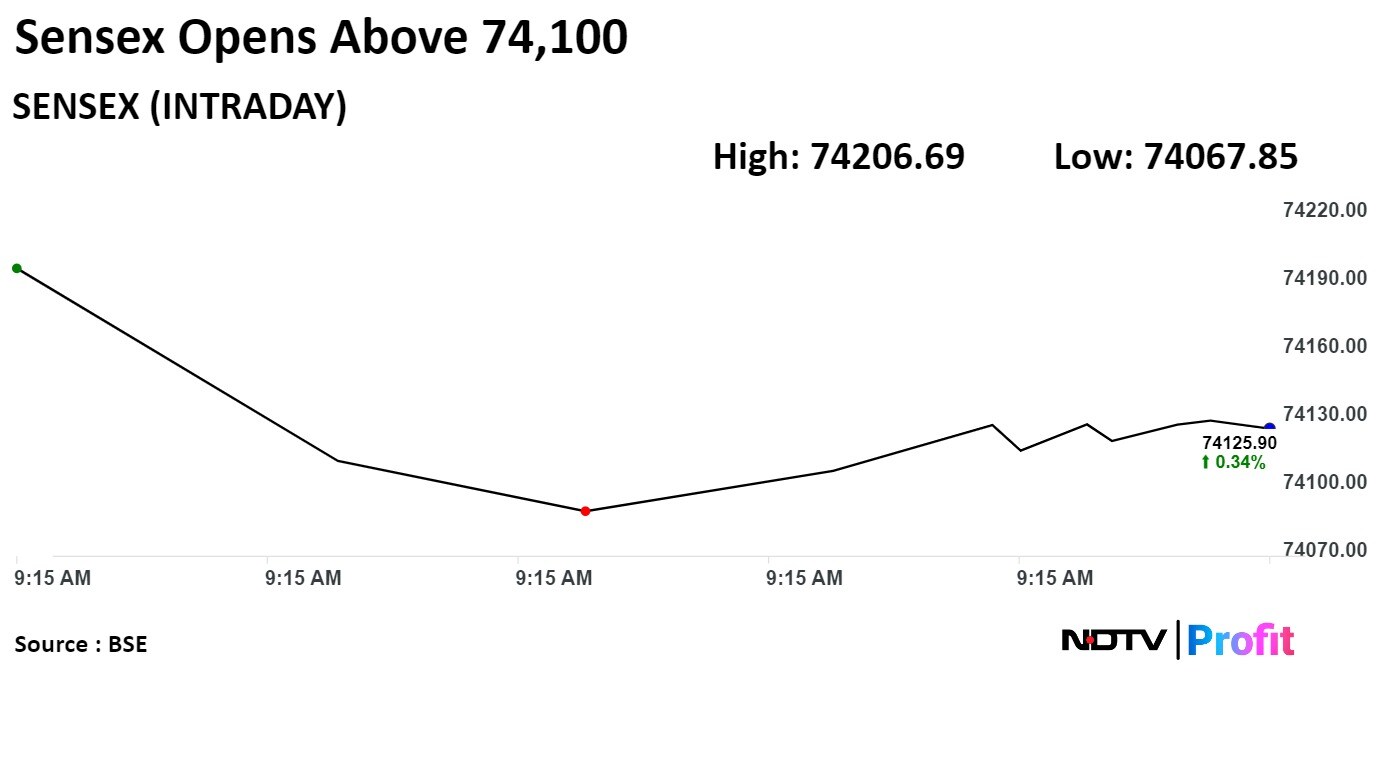

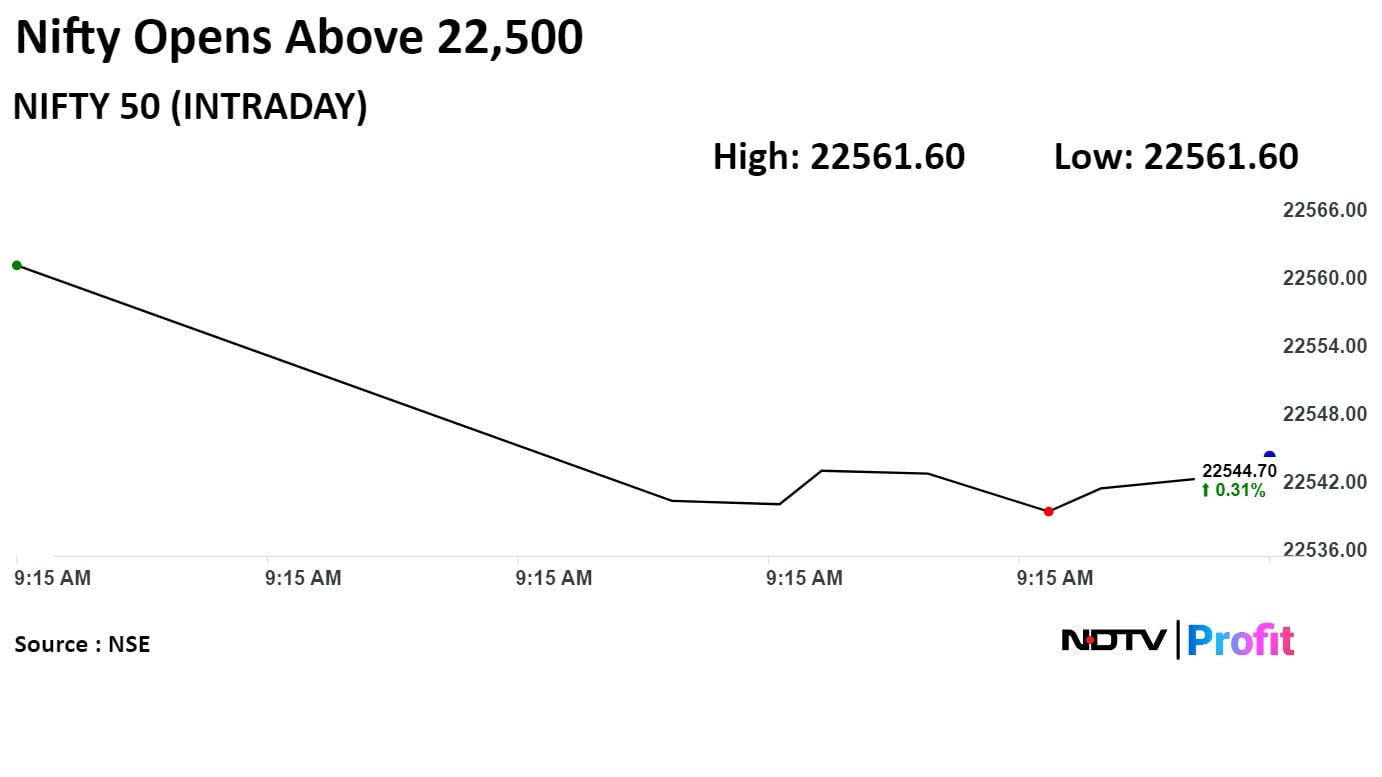

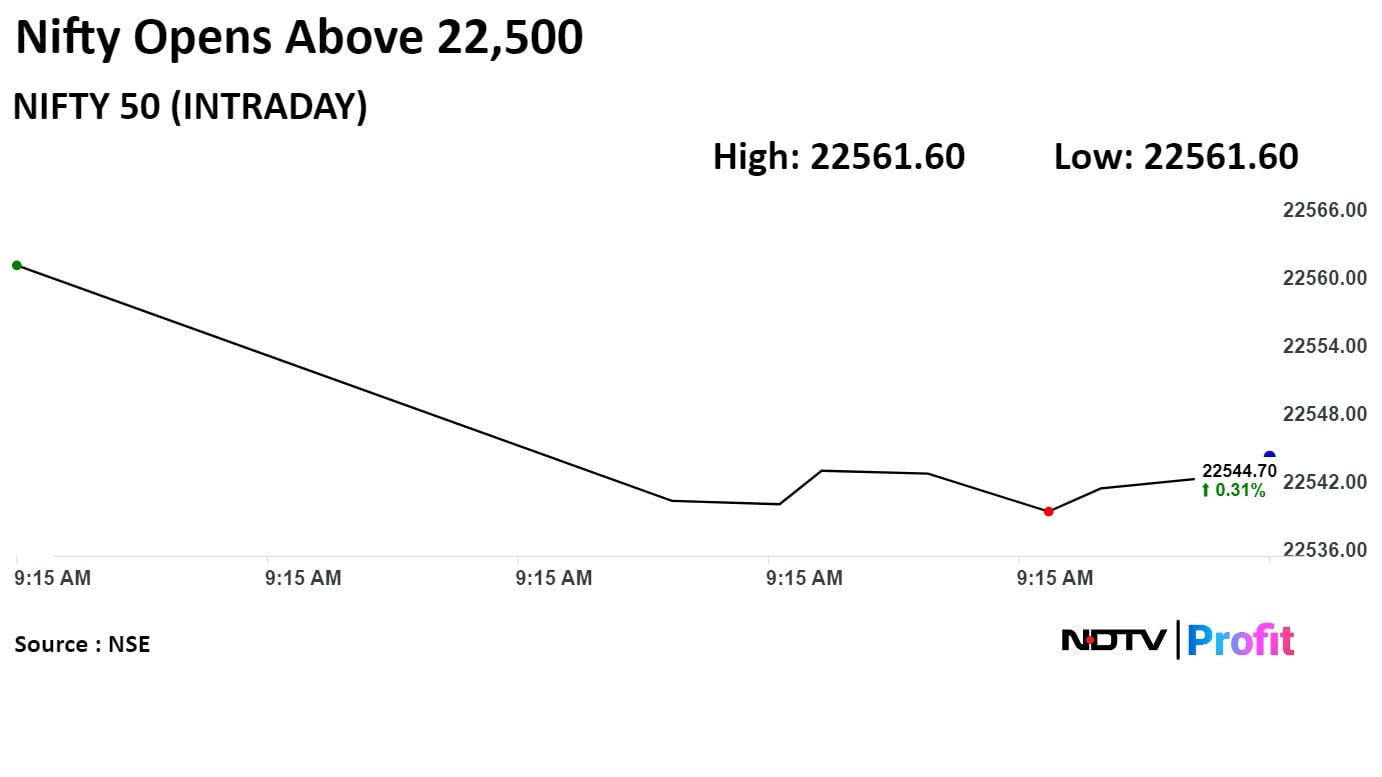

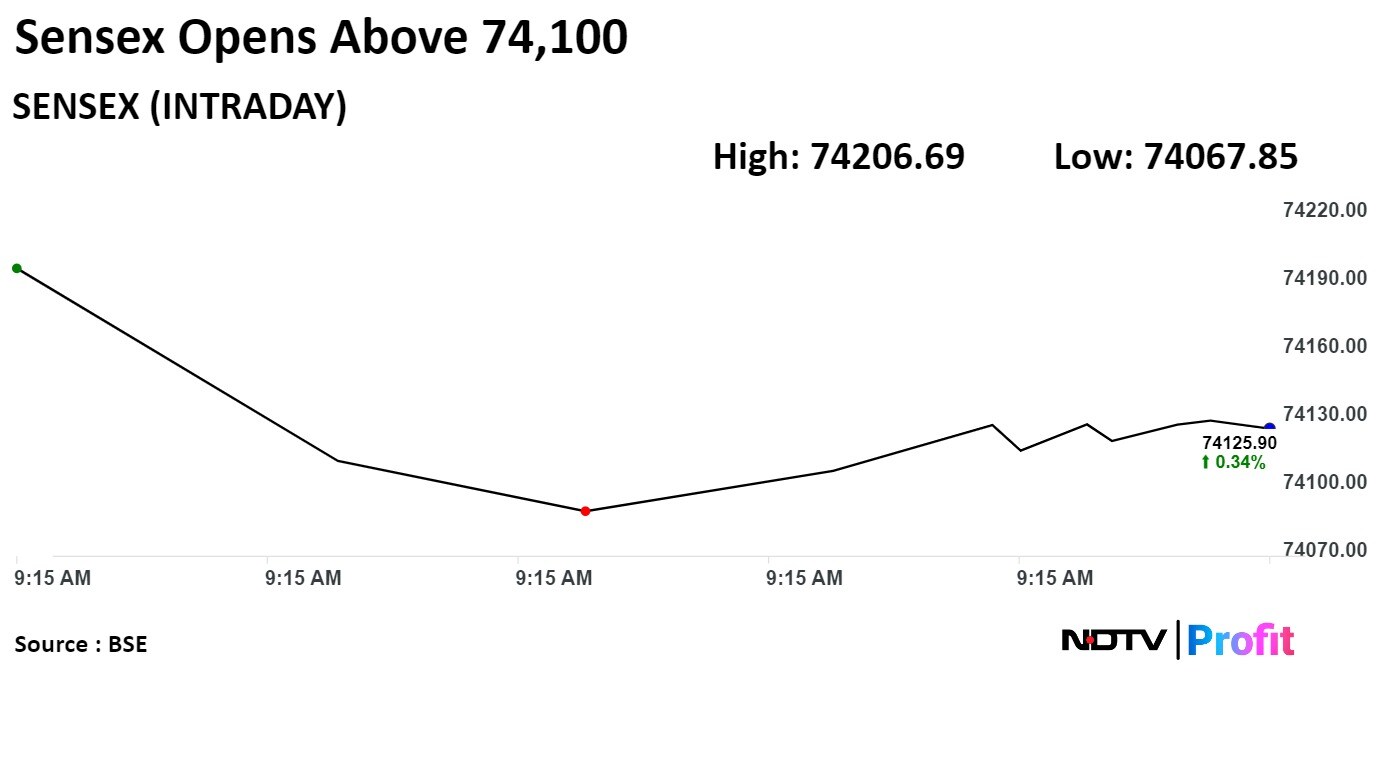

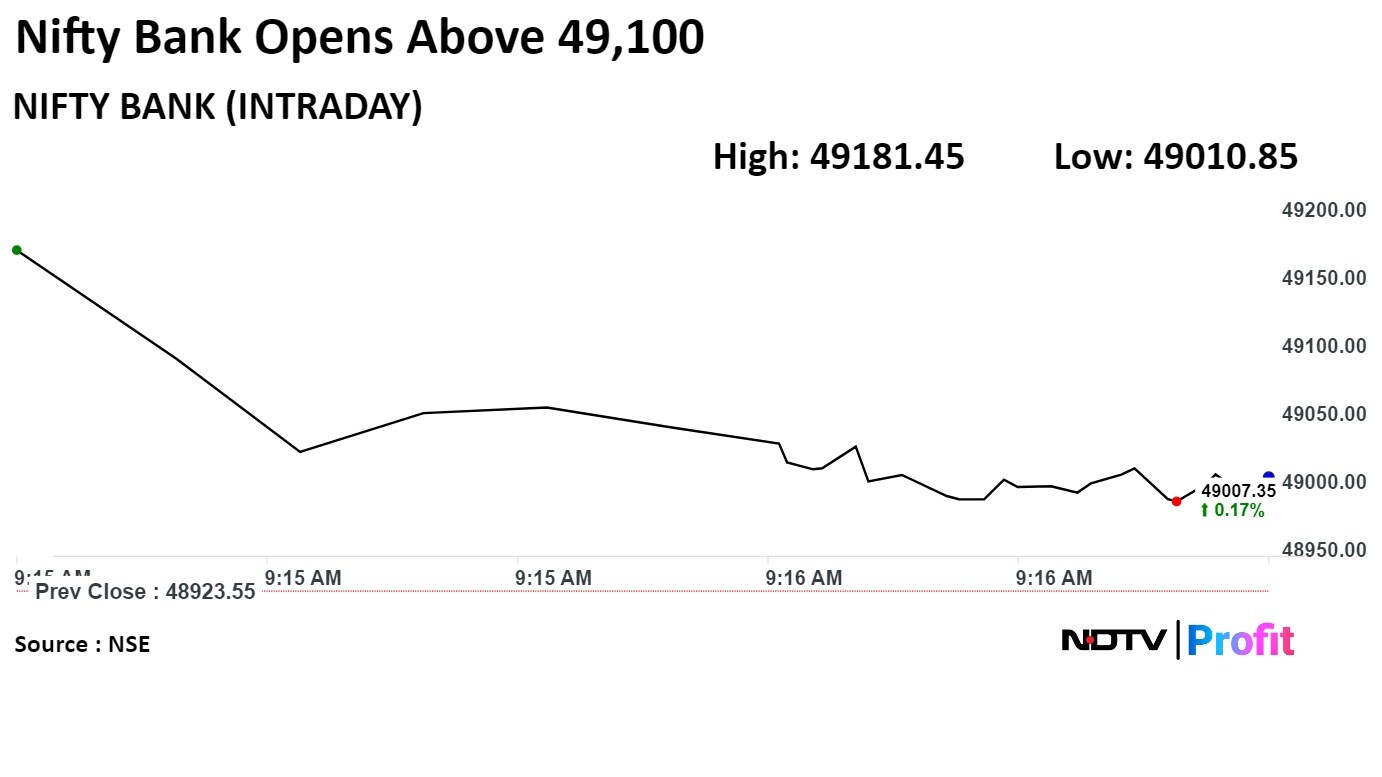

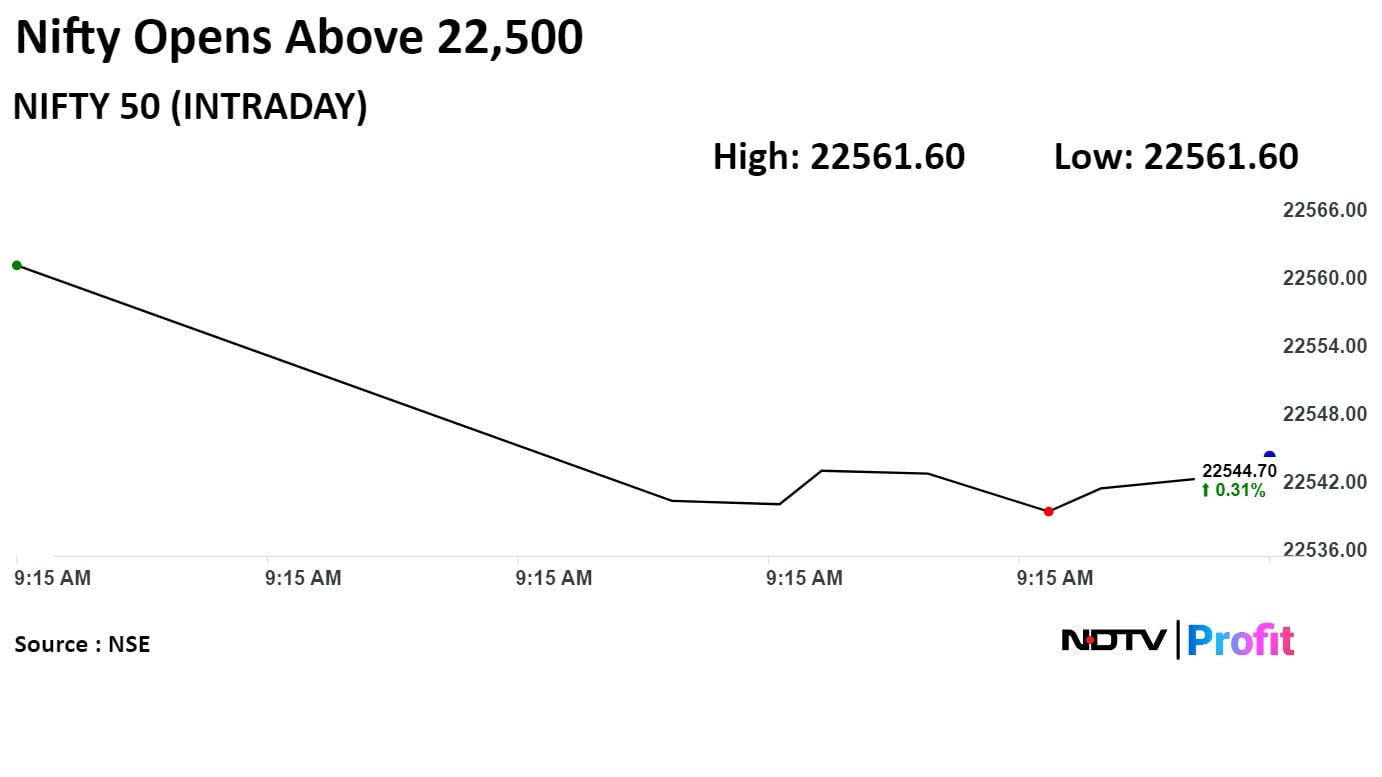

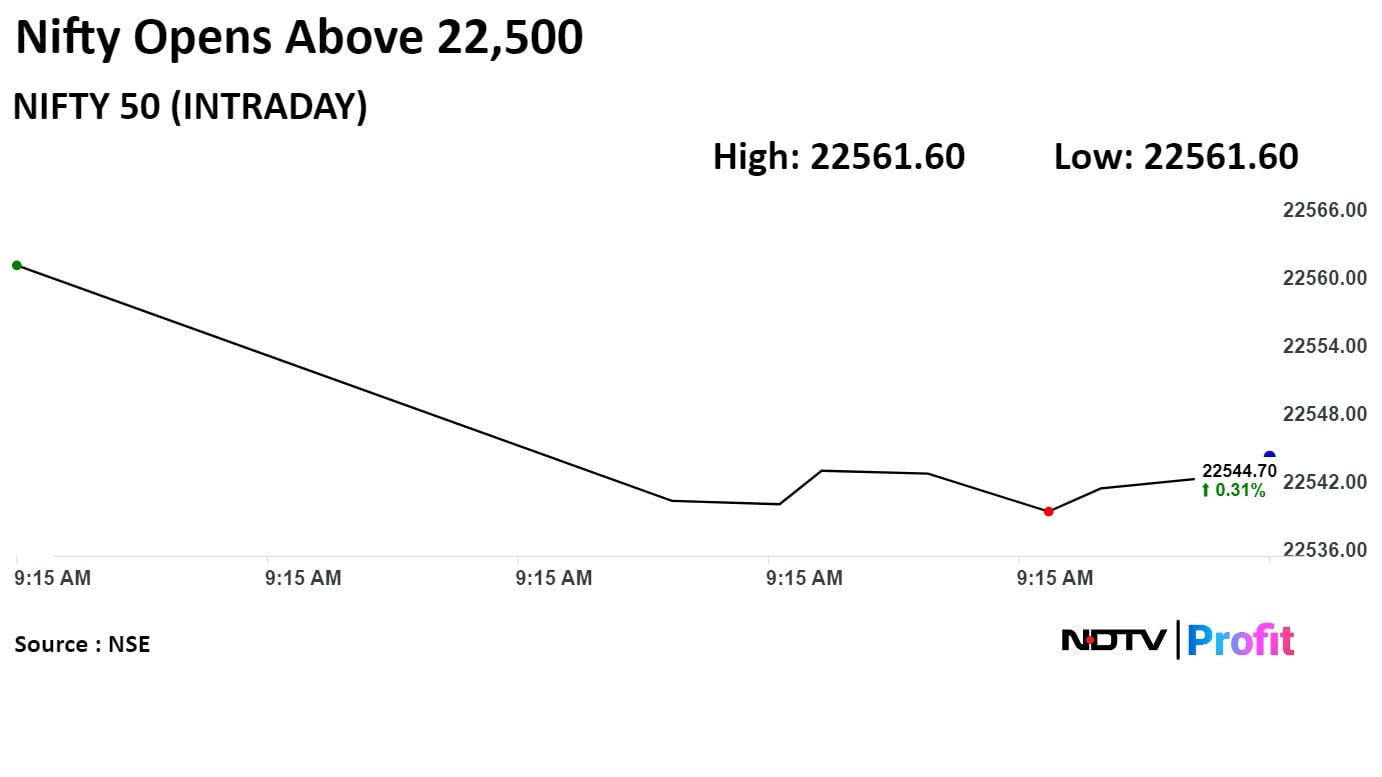

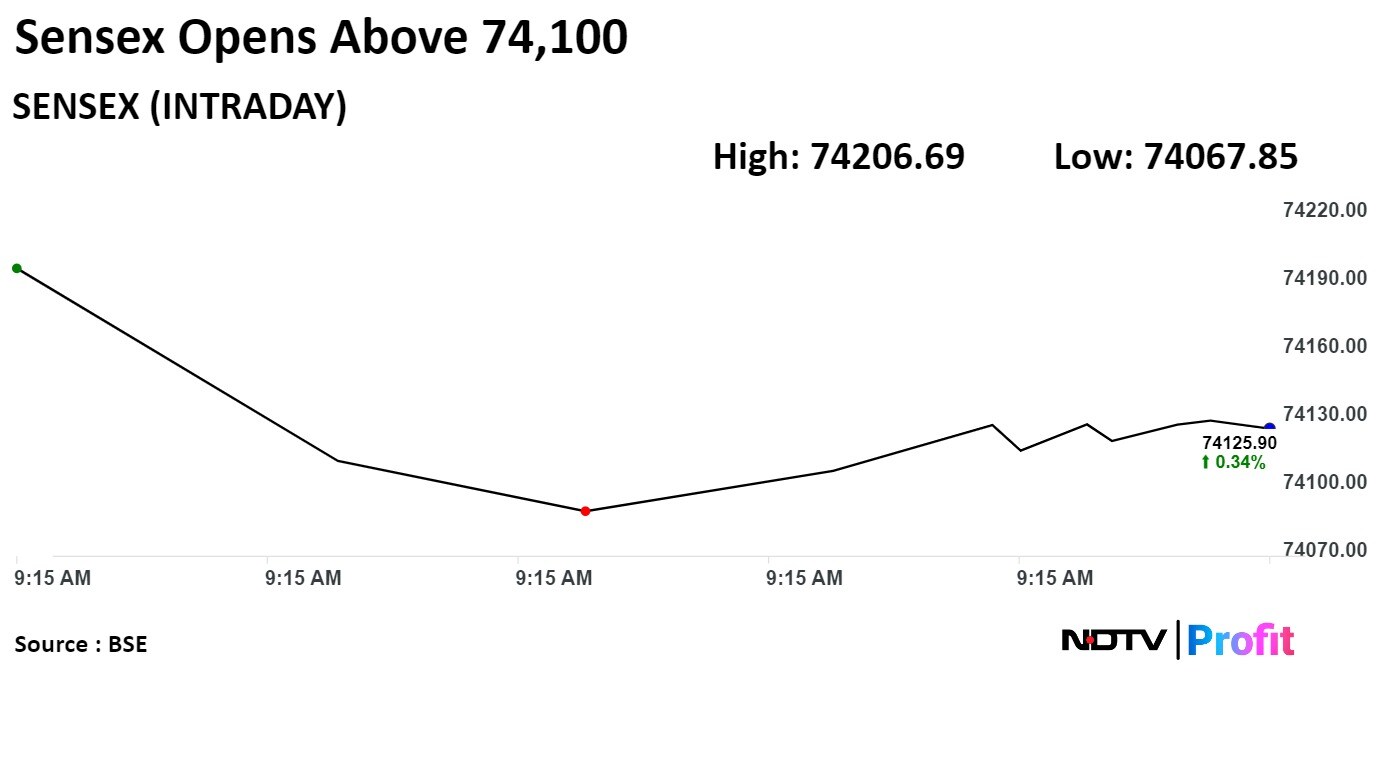

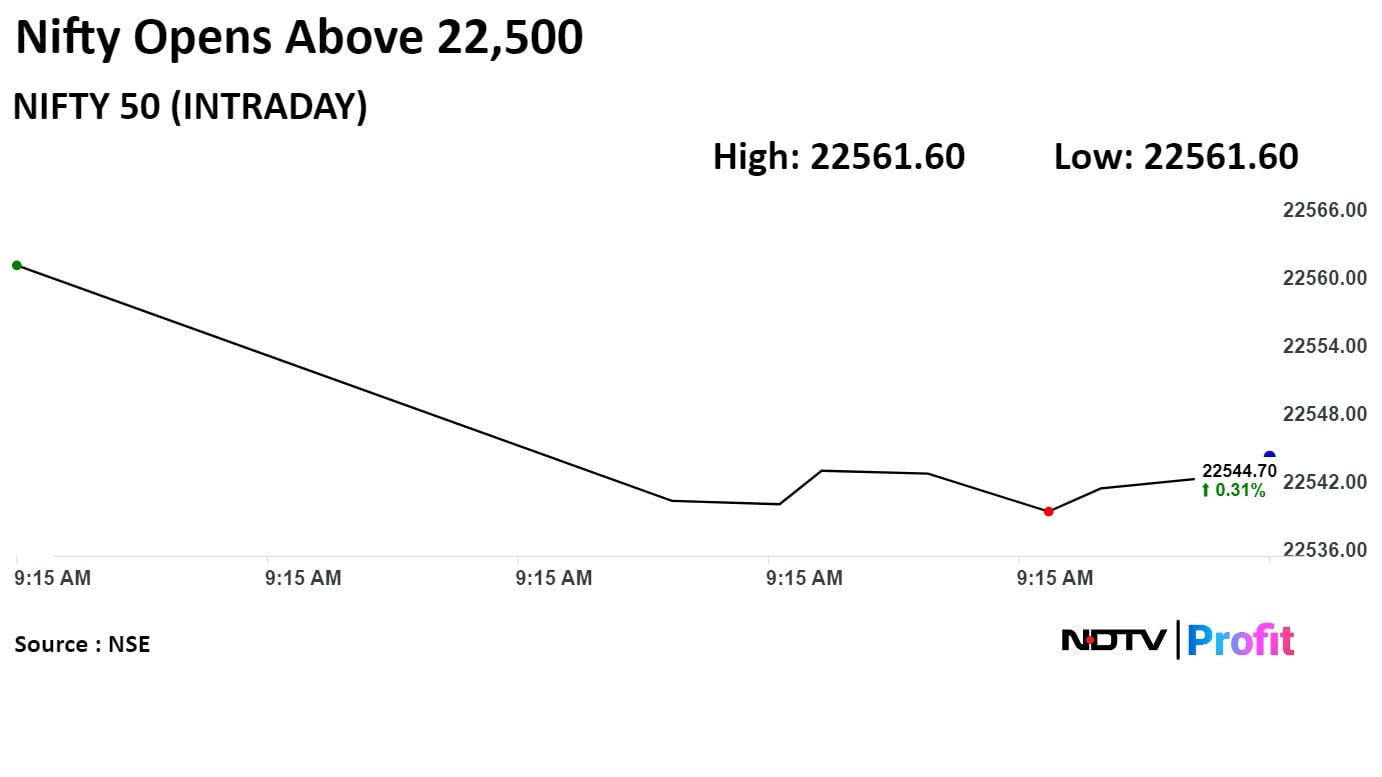

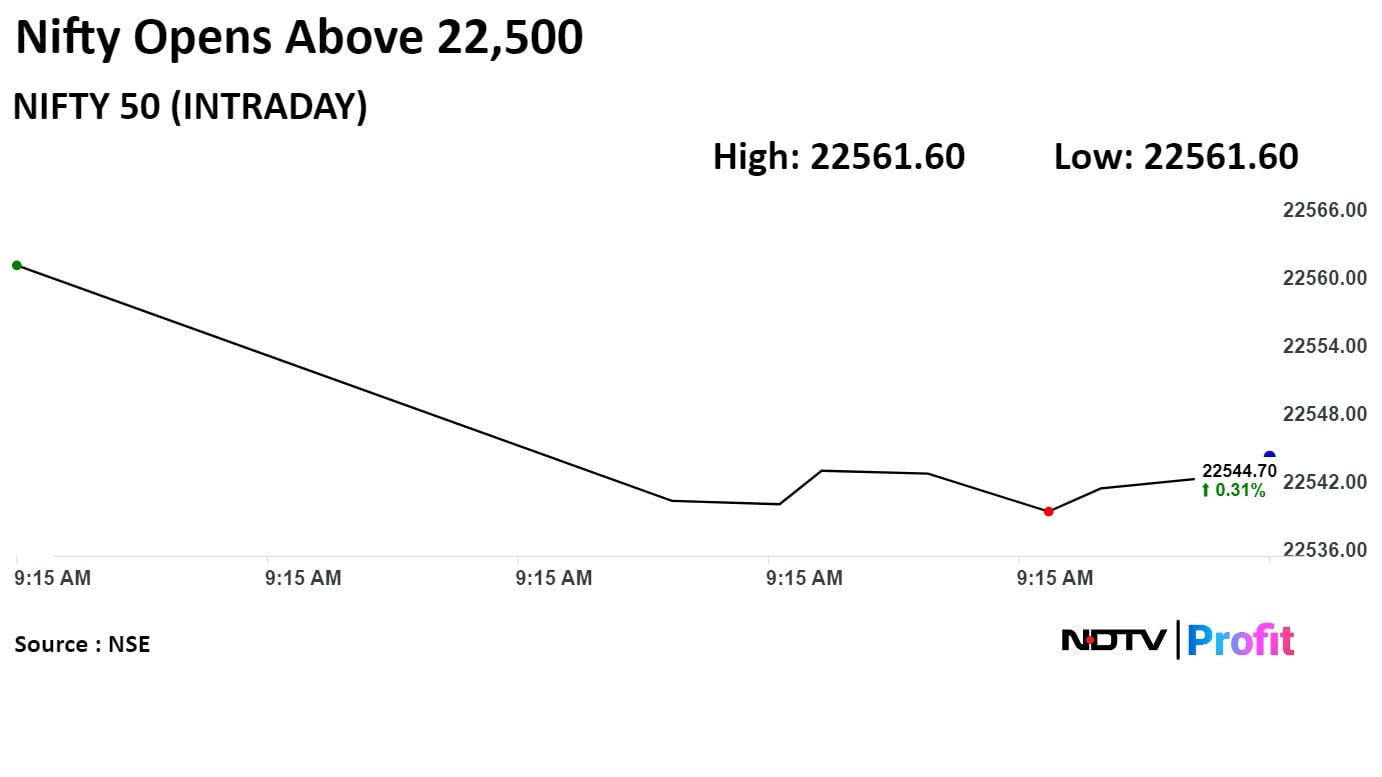

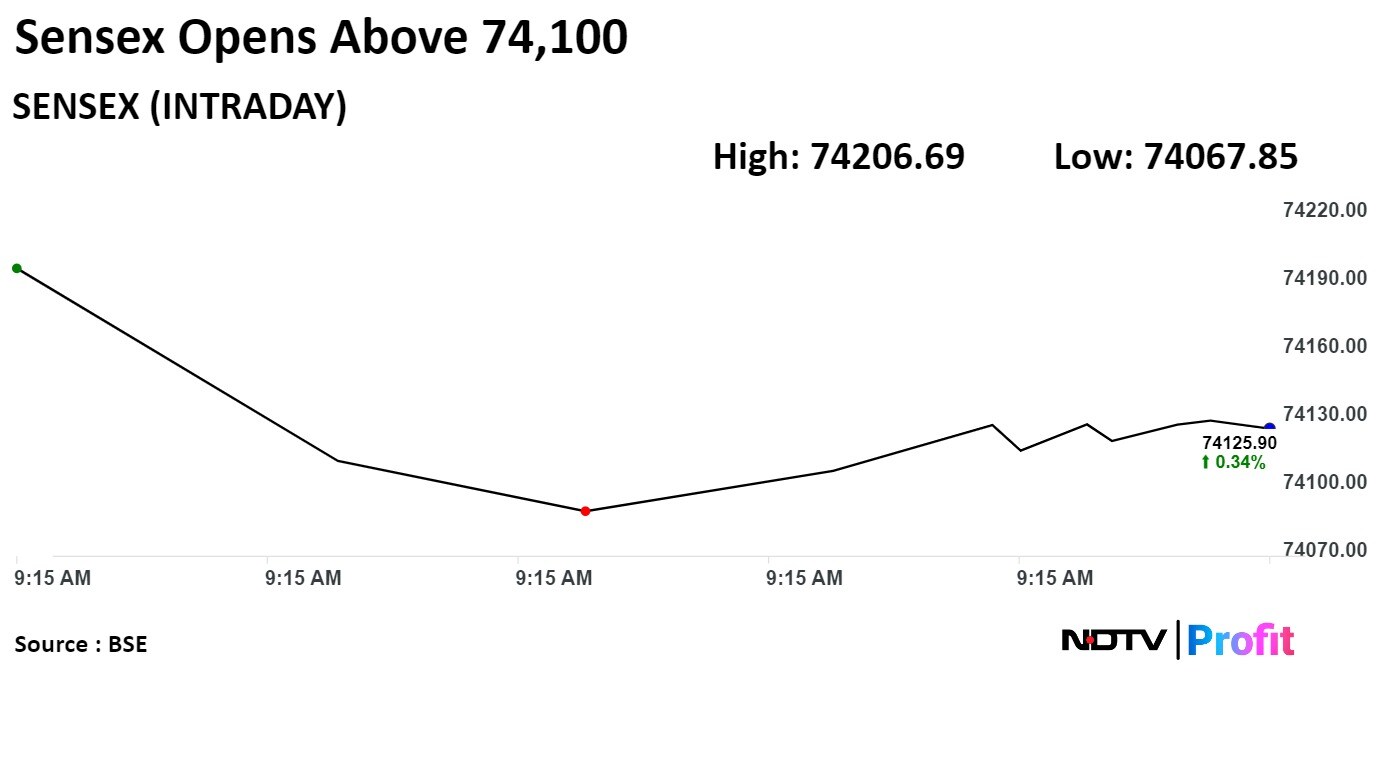

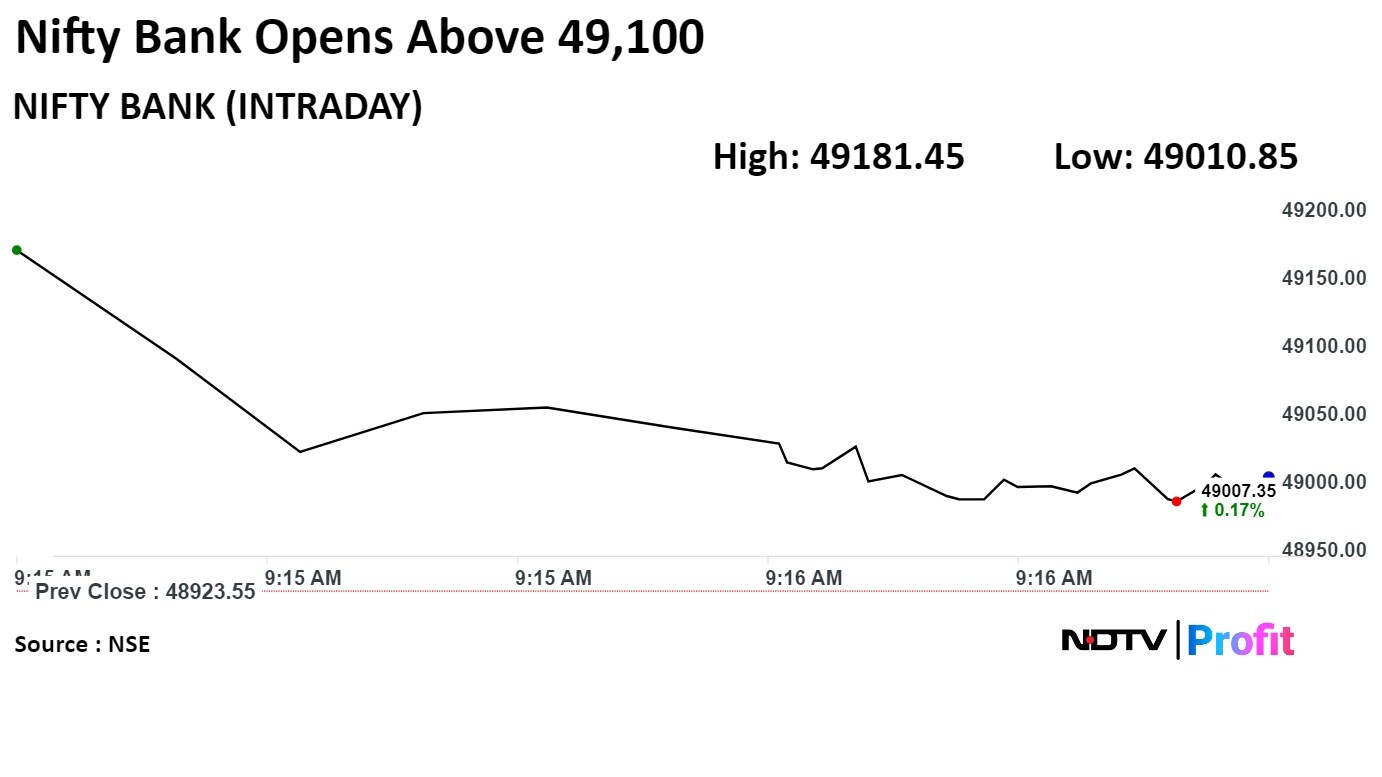

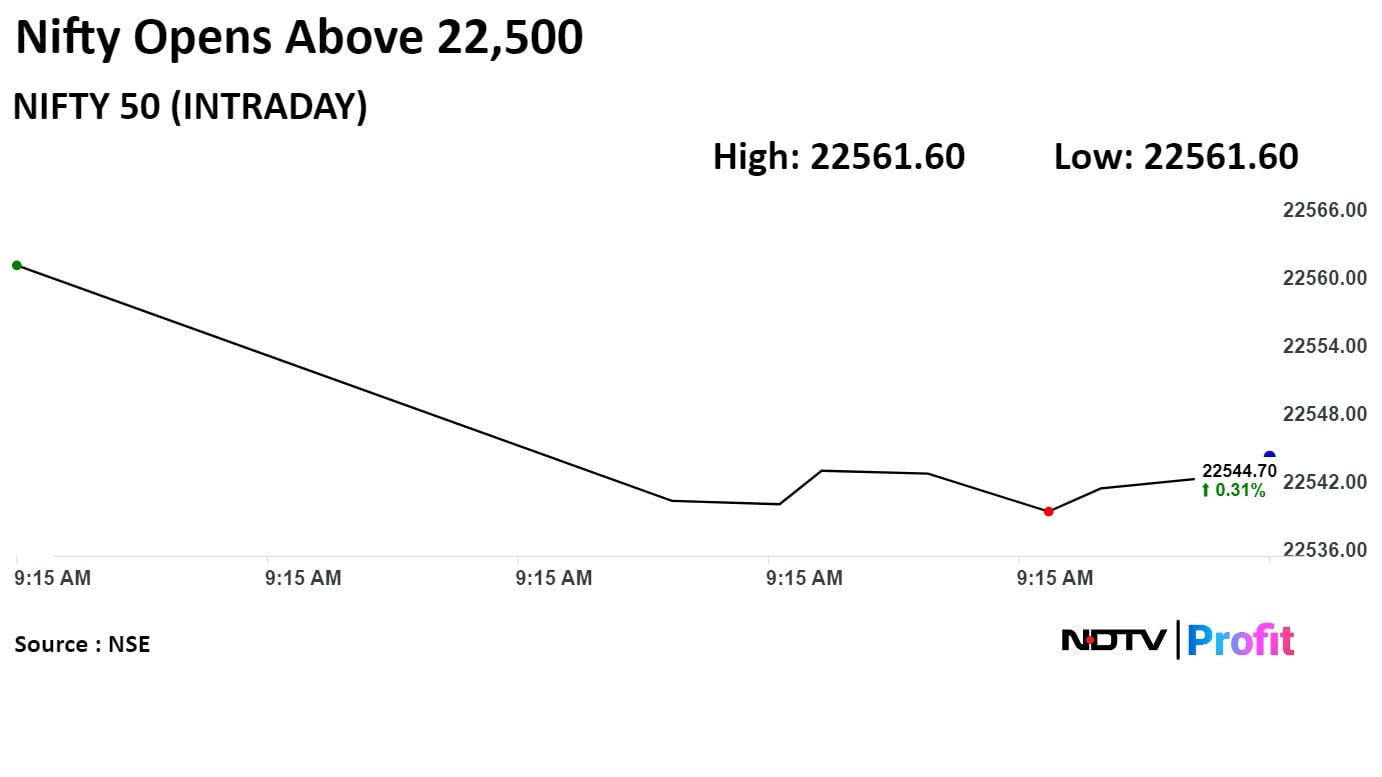

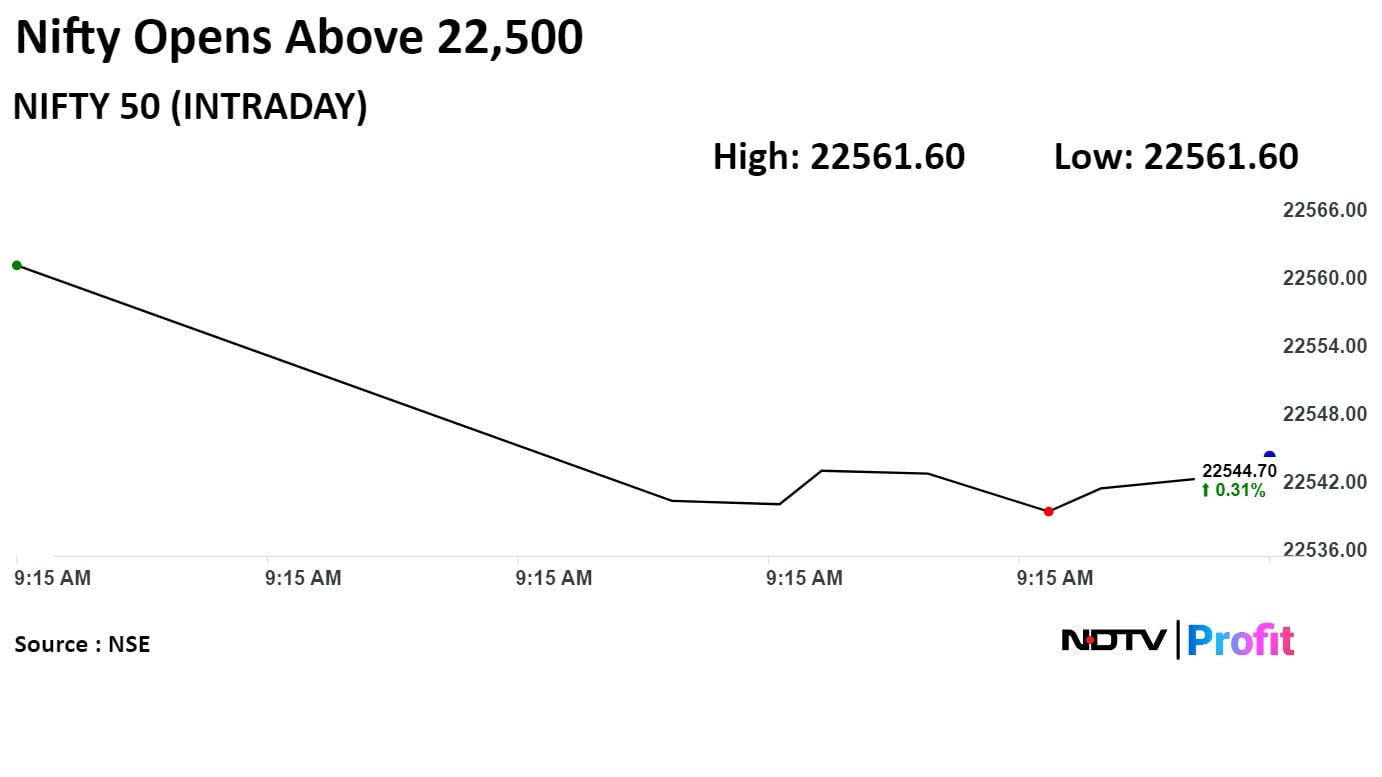

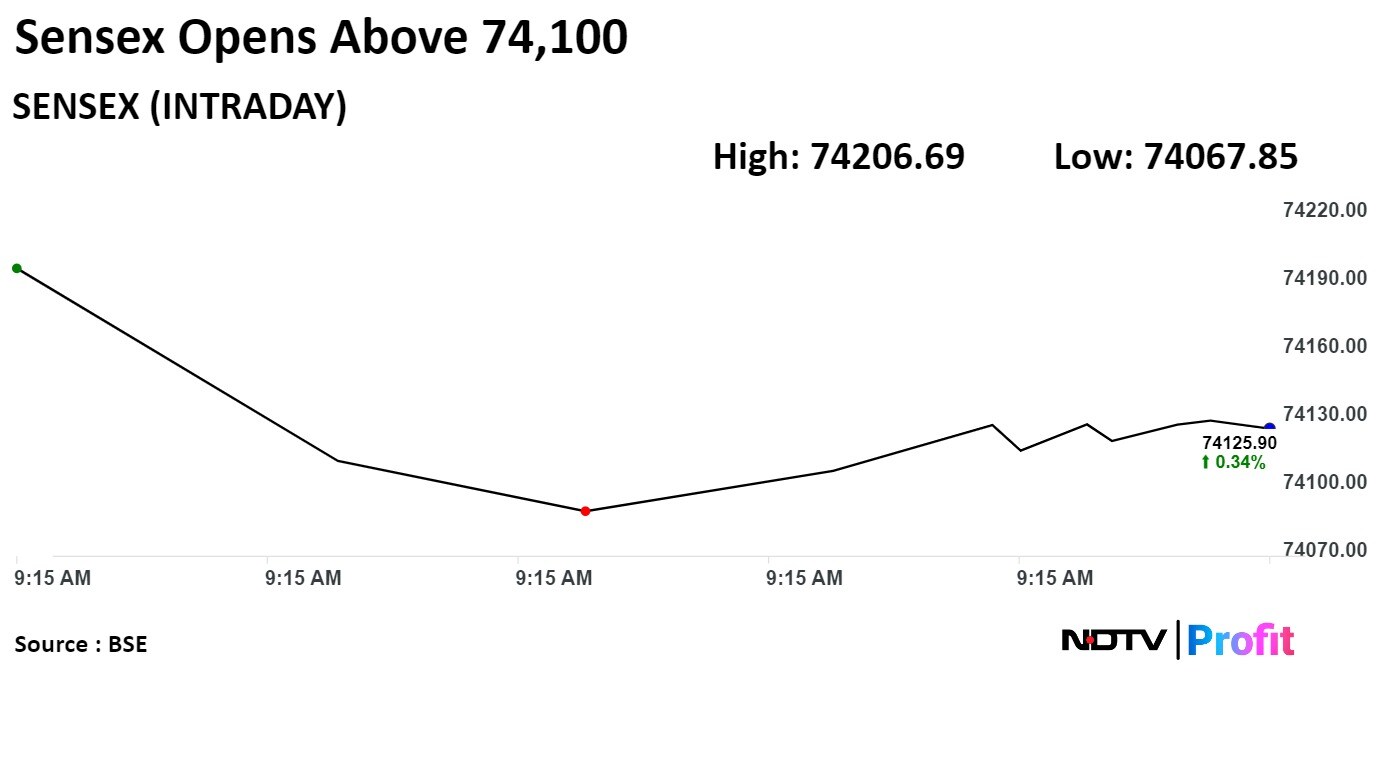

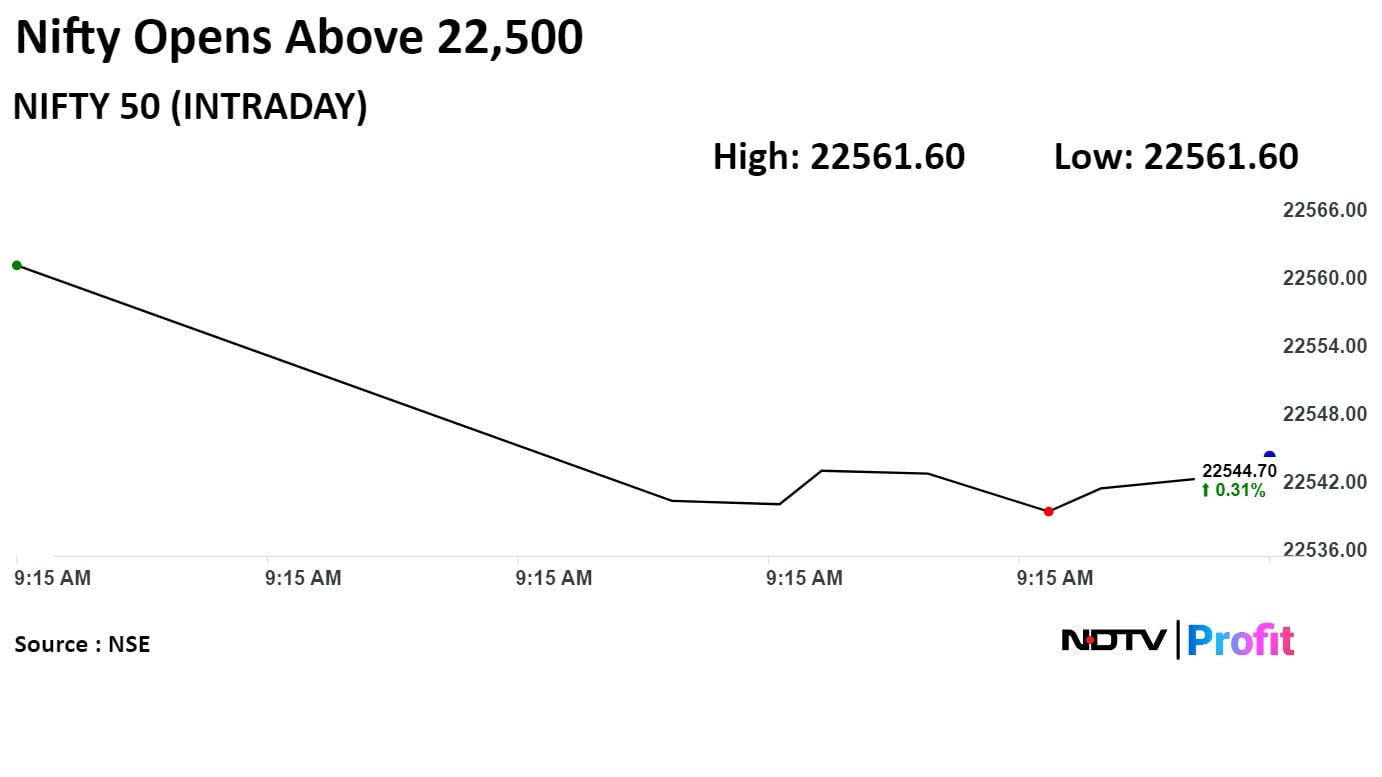

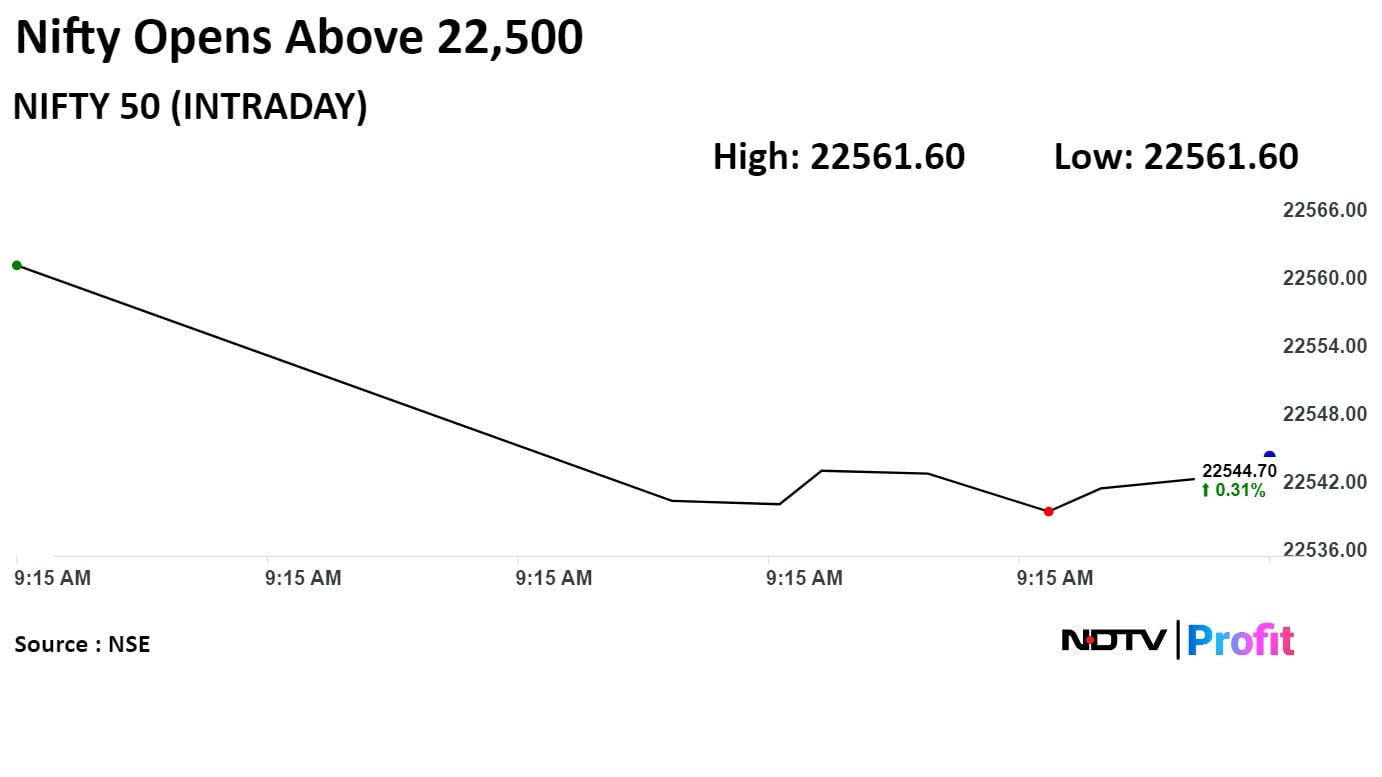

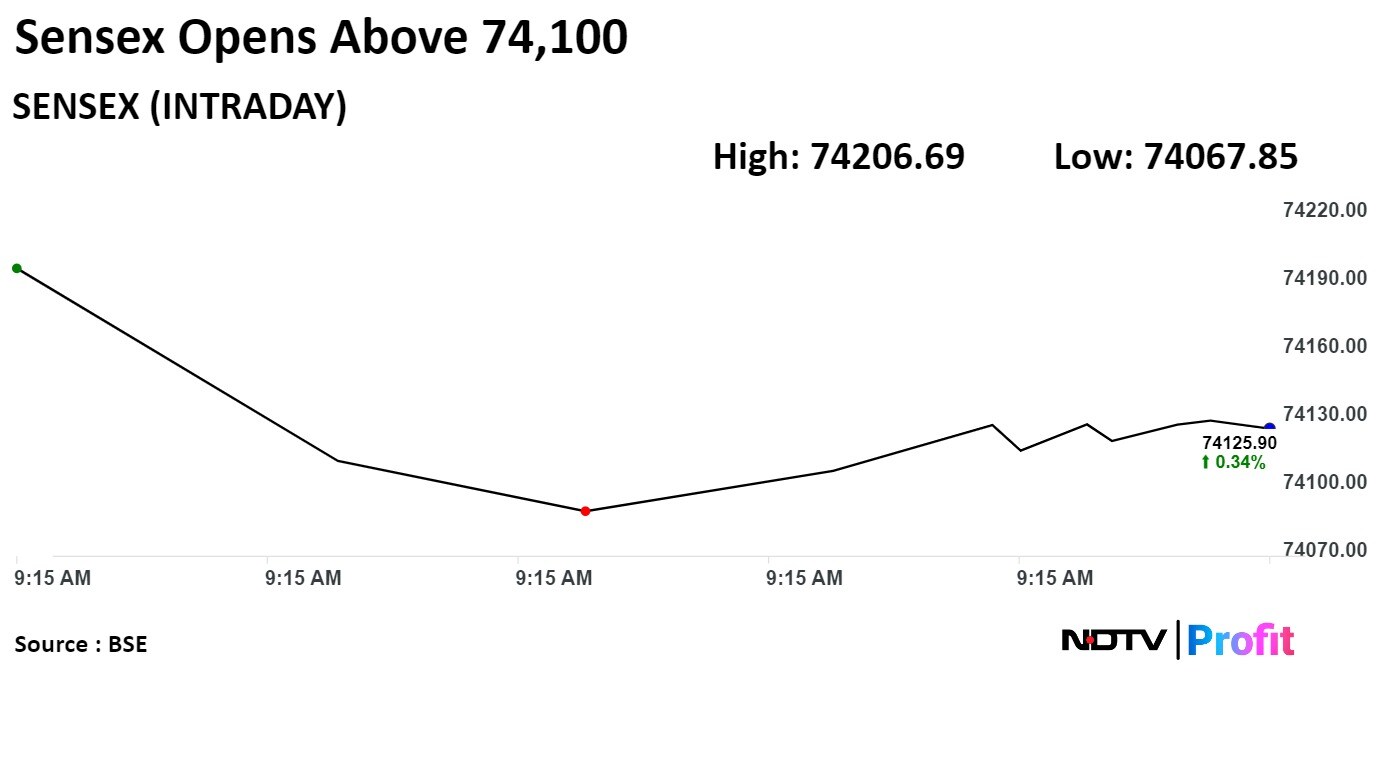

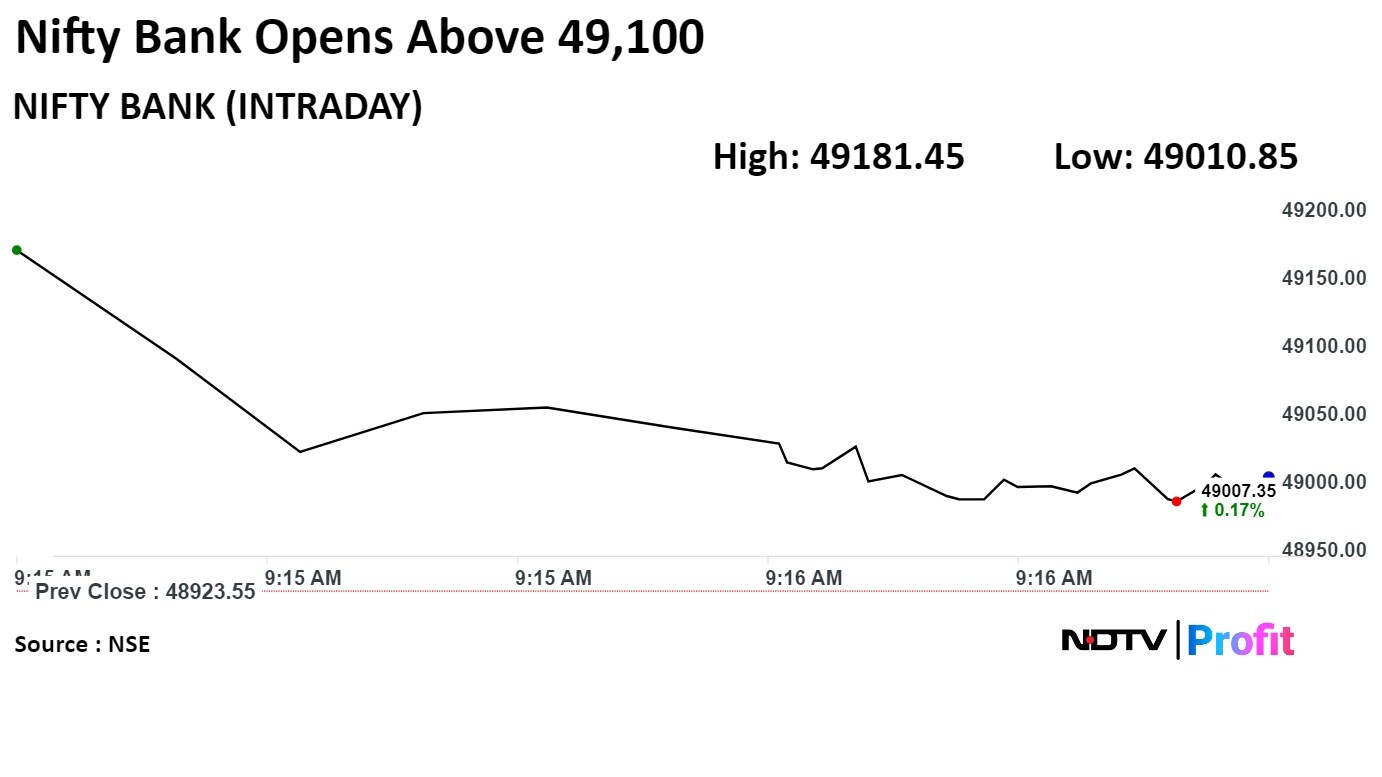

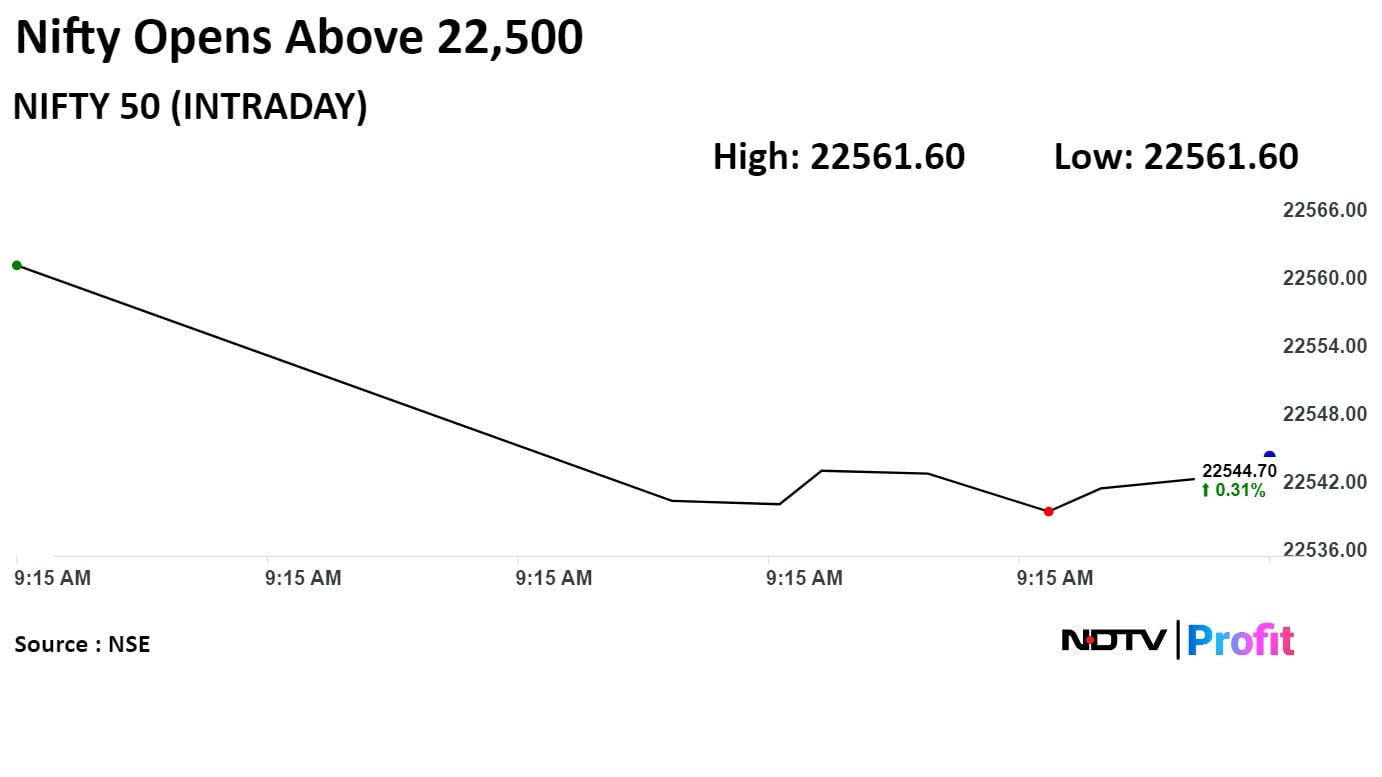

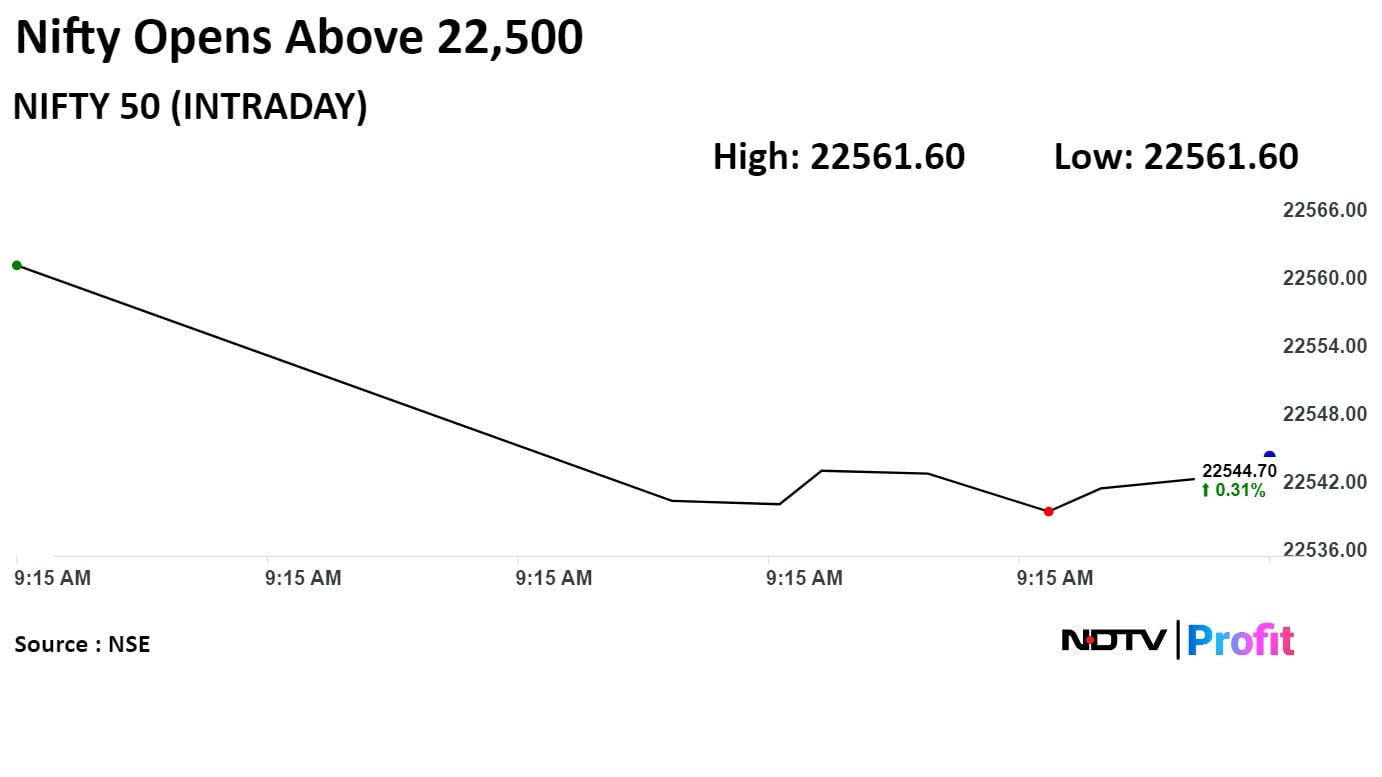

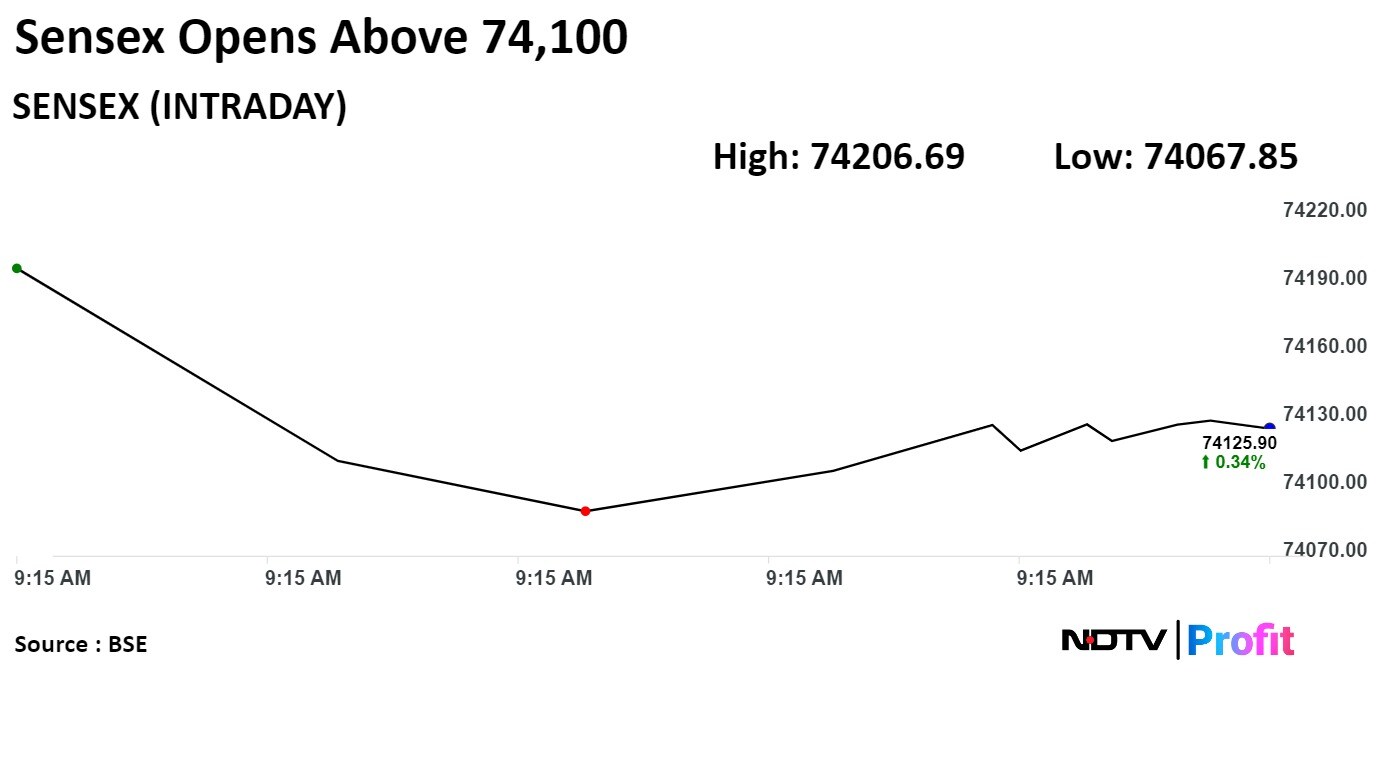

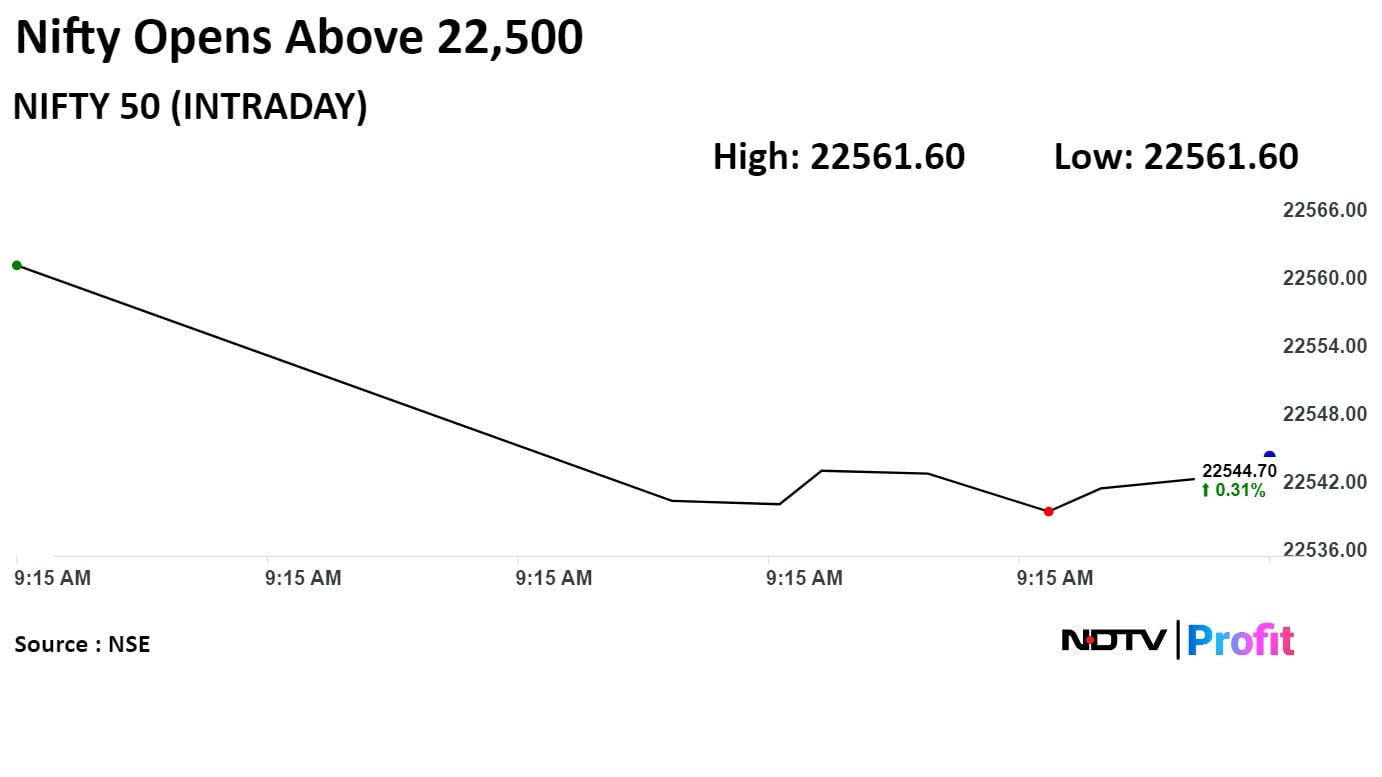

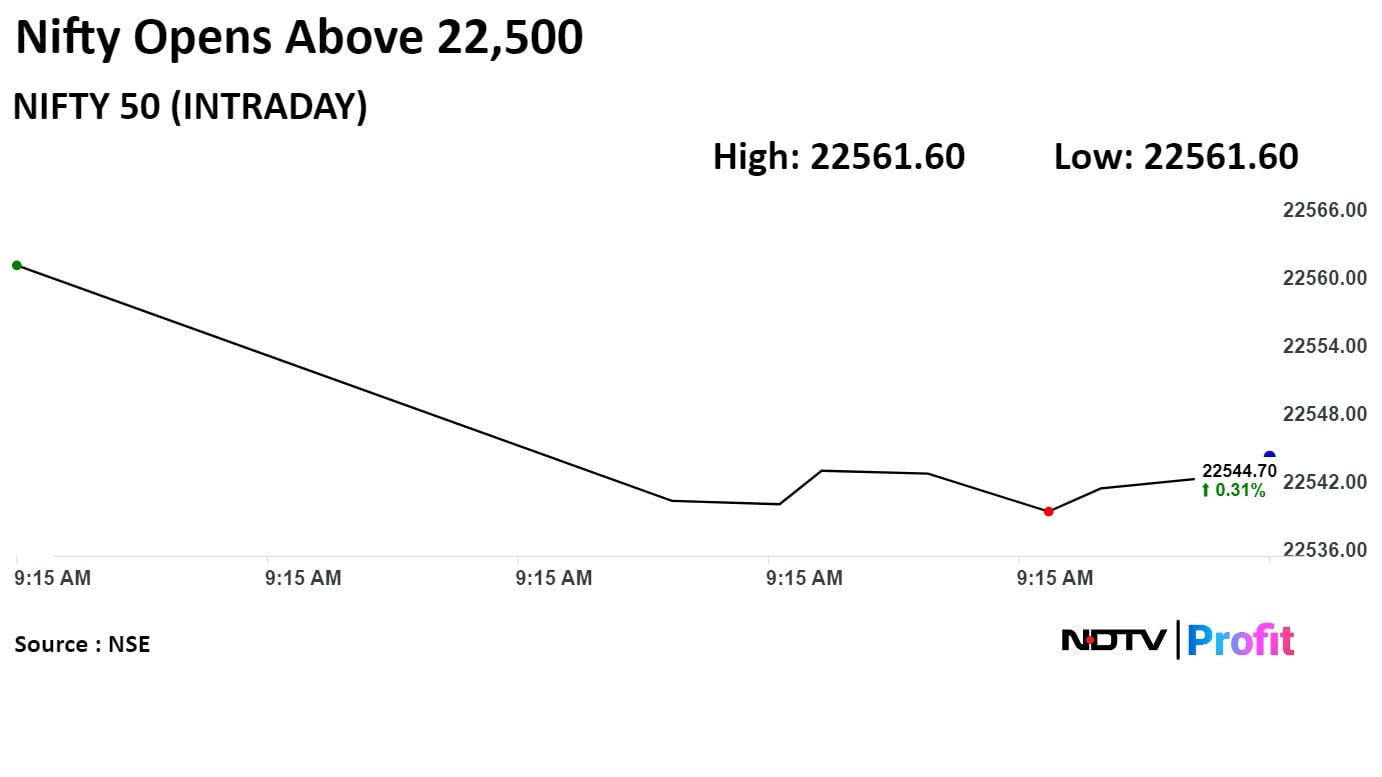

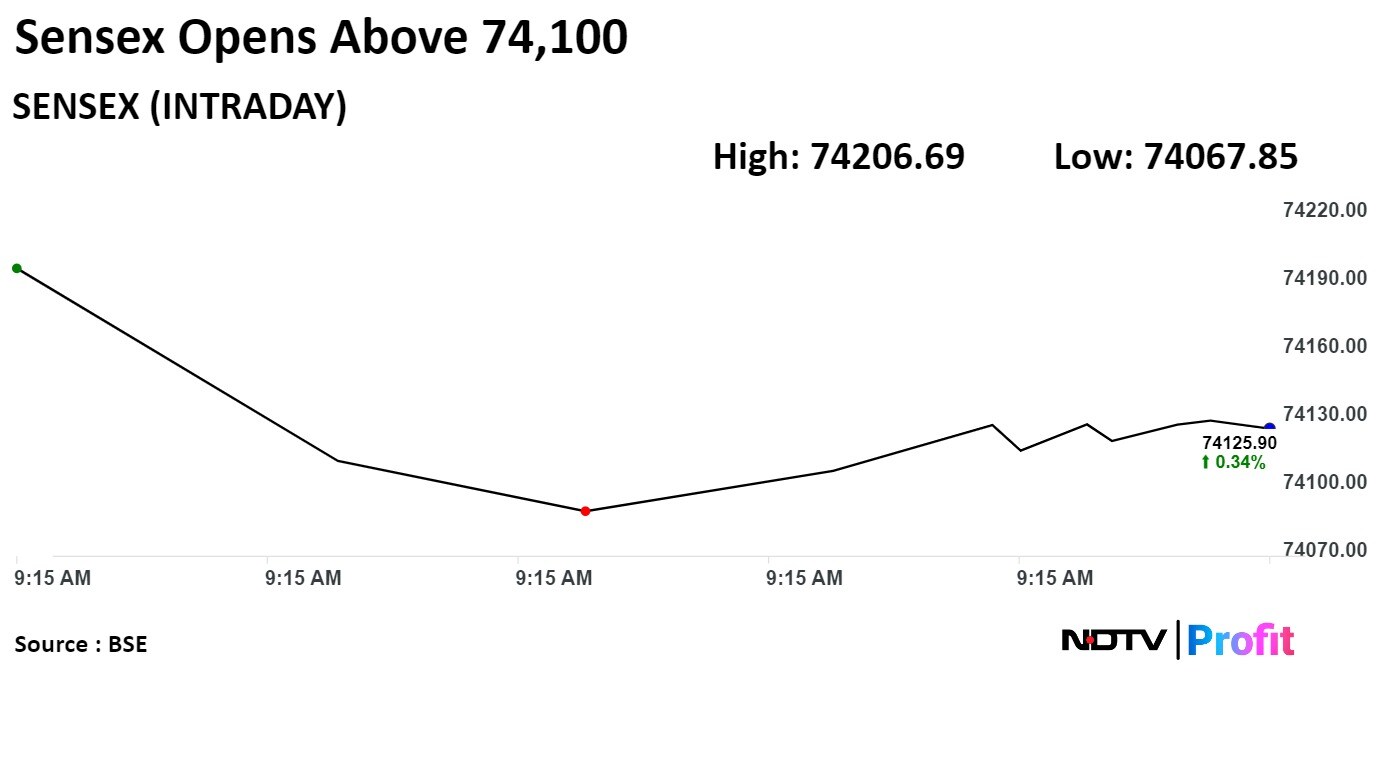

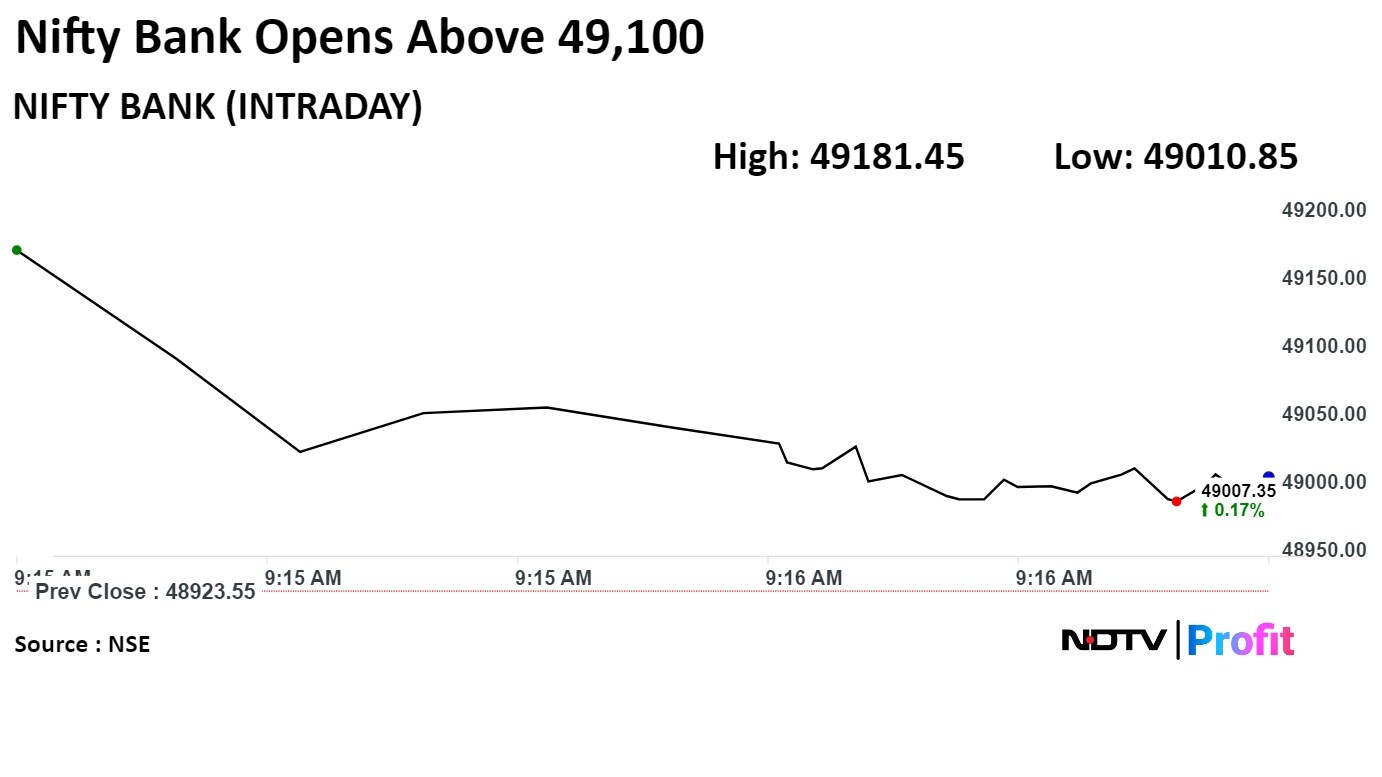

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

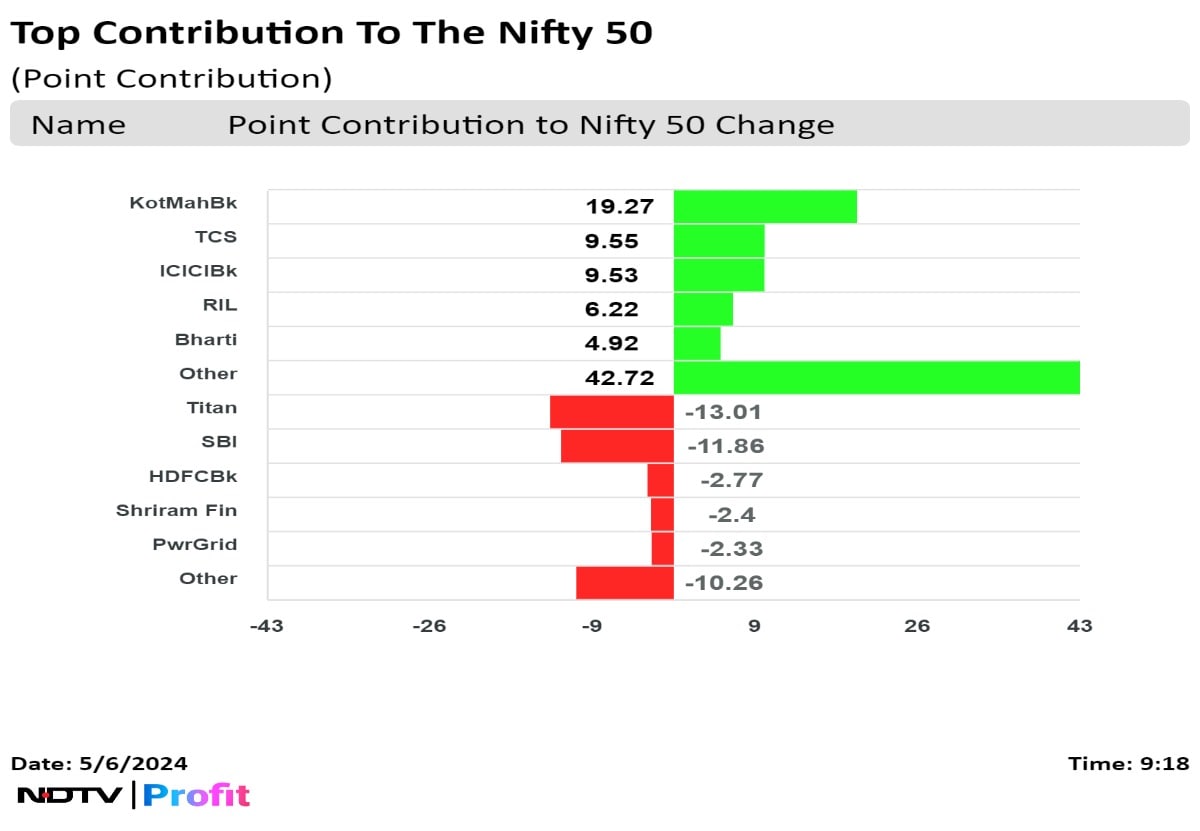

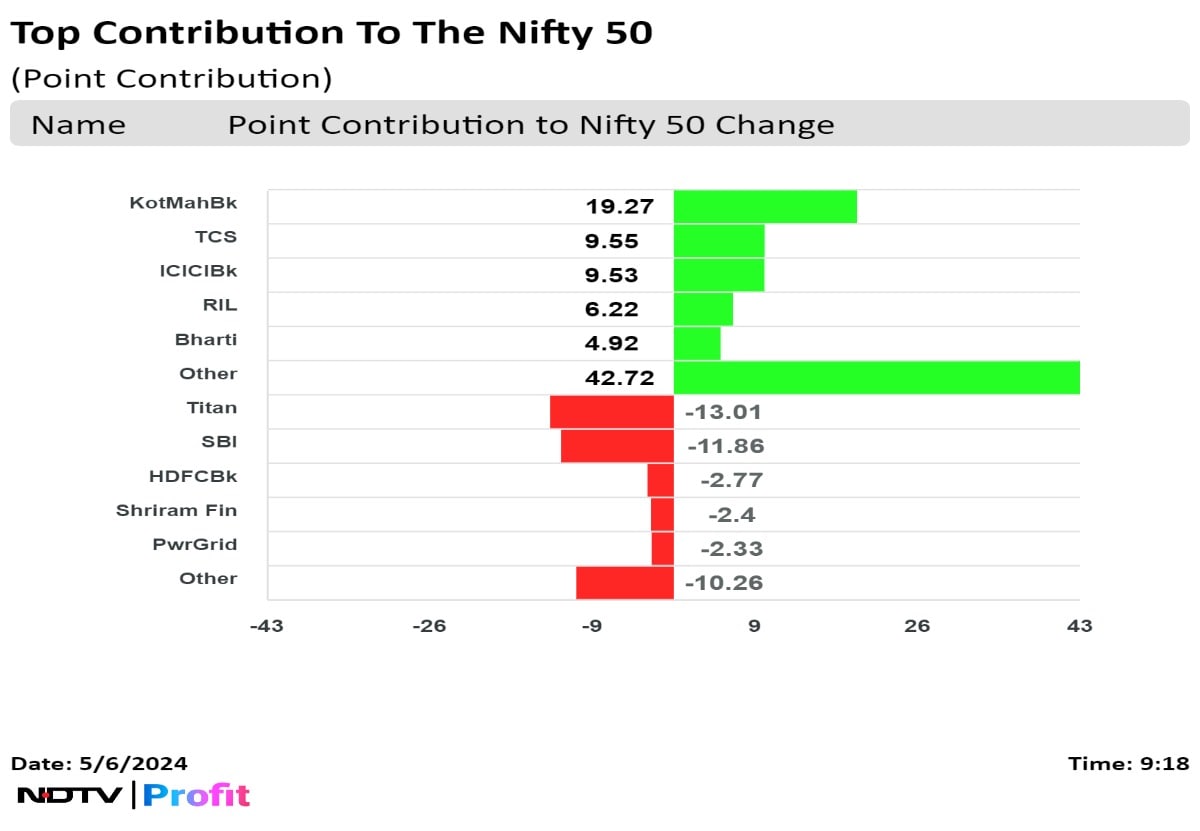

Shares of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Reliance Industries Ltd., and Bharti Airtel Ltd. contributed the most to the gains.

While those of Titan Co. Ltd., State Bank Of India, HDFC Bank Ltd., Shriram Finance Ltd., and Power Grid Corp. Of India capped the upside.

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Shares of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Reliance Industries Ltd., and Bharti Airtel Ltd. contributed the most to the gains.

While those of Titan Co. Ltd., State Bank Of India, HDFC Bank Ltd., Shriram Finance Ltd., and Power Grid Corp. Of India capped the upside.

Most sectoral indices rose except Nifty PSU Bank which fell 1.5% and Nifty Pharma and Nifty Financial Services traded flat. Nifty Realty was the top gainer.

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Shares of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Reliance Industries Ltd., and Bharti Airtel Ltd. contributed the most to the gains.

While those of Titan Co. Ltd., State Bank Of India, HDFC Bank Ltd., Shriram Finance Ltd., and Power Grid Corp. Of India capped the upside.

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Benchmark equities recovered from Friday's fall and opened higher on the back of gains in Kotak Mahindra Bank. Sentiment across the globe was uplifted as a slowdown in the US jobs market indicated that the Federal Reserve will be able to start cutting rates as early as September.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

"DOJI and bearish engulfing in weekly and daily charts denoted a trend reversal with a negative divergence in RSI," said Aditya Gaggar, director of Progressive Shares. "We anticipate that the Index is likely to oscillate in a wide range of 22,160-22,770."

Shares of Kotak Mahindra Bank Ltd., Tata Consultancy Services Ltd., ICICI Bank Ltd., Reliance Industries Ltd., and Bharti Airtel Ltd. contributed the most to the gains.

While those of Titan Co. Ltd., State Bank Of India, HDFC Bank Ltd., Shriram Finance Ltd., and Power Grid Corp. Of India capped the upside.

Most sectoral indices rose except Nifty PSU Bank which fell 1.5% and Nifty Pharma and Nifty Financial Services traded flat. Nifty Realty was the top gainer.

Broader markets underperformed. The S&P BSE Midcap was down 0.41% and S&P BSE Smallcap lost 0.16%.

Eight out of 20 sectoral indices on the BSE fell while 12 gained. Nifty Realty was the top gainer.

Market breadth was skewed in the favour of buyers. Around 1,535 stocks rose, 1,401 fell, and 139 remained unchanged on the BSE.

At pre-open, the Nifty was at 22,561.60, higher by 85.75 points or 0.38% and Sensex rose 340.91 points or 0.46% to 74,219.06.

The yield on the 10-year bond opened 3 bps lower at 7.12%.

It closed at 7.15% on Friday.

Source: Bloomberg

The local currency opened flat against the U.S. Dollar at 83.43.

Source: Bloomberg

EBITDA in line due to higher gross margins

Expect RM basket to inch up sequentially

EPR related provisions and uptick in rubber prices

Maintain 12X June 2026E consolidated EPS

Gets establishment inspection report from U.S. FDA for inspection carried out at its Panelav facility in Gujarat

Source: Exchange filing

Average daily orders at 67.7 lakh, down 7.8% MoM

Gross client acquisition at 7.6 lakh, down 10.2% MoM

Client base at 2.29 crore, up 3.4% MoM

Source: Exchange filing

Motilal Oswal Retains 'Sell' on MRF; Target Rs 92,000

EBITDA margin to deteriorate due to RM pressure and EPR provisions

Believe EPR costs would be recurring in nature

Combined with rising RM costs, could hurt EBITDA margin in the upcoming quarters

Lower FY25E/FY26E EPS by 12%/10% to factor in commodity headwind and EPR provisions

Stock trades at 25x FY26E EPS above its 10-year LPA of 22x

Believe this does not reflect weakening competitive position and deteriorating return profile

Kotak Retains Sell With Target Of Rs 87,000

4QFY24 EBITDA came in 14% below our estimates

Stock is currently trading at 30 times FY2025E consolidated EPS, is expensive

Cut FY2025-26E consolidated EPS estimates by 6-10%

Lower EBITDA margin assumptions and higher depreciation expense

Aggressive pricing, RM uptick and EPR to affect margins

Nuvama Maintains 'Hold' With Target Price Rs 4,821

Reported miss in EBITDA/PAT of 3%/5.3%

Commentary on general merchandise and apparel share increasing,

Resulted in 30bp YoY improvement in gross margins

DMart Ready's steady performance, now present in 23 cities

Factoring in 41 stores robust addition and runway for similar addition in coming years

Increase earnings multiple to pre-covid average of 75x PE versus 70x earlier

Motilal Oswal Reiterates 'Buy' With Target Rs 5,310

Gap between revenue/sqft up 6.2% YoY and revenue/store up 7% YoY continued to shrink

Indicating improvement in share of largeformat stores,a positive trend

Healthy cost efficiencies and recovery in discretionary demand likely to drive growth

Bernstein Rates Kotak Mahindra Bank "Market Perform"

Target Price Rs 1650

Healthy loan growth and shift to unsecured segments continue

Solid deposit growth even if led by Term deposits

NIM improves 6 bps QoQ

Opex growth - no surprises

Asset quality remains healthy

A stellar quarter, if only numbers mattered

Nuvama maintains Reduce on Kotak

Target price: Rs 1,530

Many one-offs; core NIM declines; LCR deposit grows 3% QoQ

CEO gives colour on digital ban; some questions go unanswered

Low, net-PBT impact of ~INR4.5bn from the digital ban

Unclear how the ban impacts customer acquisition, yields, asset growth and opex including tech spends

Valuation based on 1.8x FY25E PBV

Jefferies Retains 'Hold'; Target Price Reduced To Rs 1,790 vs 1970 Earlier

Profit was ahead of estimates, adjusted for one-timers, grew 5%

Slippages and credit costs normalising

Core margins contract 5bps, down to 5.3%

RBI resolution & controlled attrition key

Raise estimates marginally by 2% for FY25/26 and see 12% Expect 12% CAGR in profit over FY24-27

Valuations based on 1.9x June2026 adjusted PBV

JP Morgan Upgrades Kotak To 'Overweight'; Target Rs 2,070

Impact of RBI actions on FY25/26 growth should be minimal

Impact of RBI action should be 2% of FY26 PBT

Expect earnings CAGR of 16-17% in the next 2years

Valuations of 10x FY26E PE are compelling

U.S. Dollar Index at 105.11

U.S. 10-year bond yield at 4.51%

Brent crude up 0.40% at $83.29 per barrel

GIFT Nifty traded down 8 points or 0.04% at 22,685

Nymex crude up 0.41% at $78.43 per barrel

Bitcoin was up 0.70% at $64,193.05

U.S. Dollar Index at 105.11

U.S. 10-year bond yield at 4.51%

Brent crude up 0.40% at $83.29 per barrel

GIFT Nifty traded down 8 points or 0.04% at 22,685

Nymex crude up 0.41% at $78.43 per barrel

Bitcoin was up 0.70% at $64,193.05

Services PMI falls to 52.5 in April, matching estimates

Composite PMI rises to 52.8 in April vs 52.7 in March

Highest reading for composite PMI since May 2023

Source: Bloomberg

Nifty May futures down by 0.98% to 22,575.2 at a premium of 99.35 points.

Nifty May futures open interest down by 5.4%.

Nifty Bank May futures down by 0.68% to 49,094.75 at a premium of 171.2 points.

Nifty Bank May futures open interest down by 8.67%.

Nifty Options May 9 Expiry: Maximum Call open interest at 22,800 and Maximum Put open interest at 22,000.

Bank Nifty Options May 8 Expiry: Maximum Call Open Interest at 49,500 and Maximum Put open interest at 47,000.

Securities in ban period: Aditya Birla Fashion, Balrampur Chini Mills, Biocon, GMR Infra, Vodafone Idea.

Nifty May futures down by 0.98% to 22,575.2 at a premium of 99.35 points.

Nifty May futures open interest down by 5.4%.

Nifty Bank May futures down by 0.68% to 49,094.75 at a premium of 171.2 points.

Nifty Bank May futures open interest down by 8.67%.

Nifty Options May 9 Expiry: Maximum Call open interest at 22,800 and Maximum Put open interest at 22,000.

Bank Nifty Options May 8 Expiry: Maximum Call Open Interest at 49,500 and Maximum Put open interest at 47,000.

Securities in ban period: Aditya Birla Fashion, Balrampur Chini Mills, Biocon, GMR Infra, Vodafone Idea.

Moved out of short-term ASM framework: Action Construction Equipment, Authum Investment and Infrastructure, Amara Raja Energy and Mobility, Gravita India, Hind Rectifiers, Tejas Networks.

Moved into short-term ASM framework: Jana Small Finance Bank, Ram Ratna Wires.

Price Band change from 20% to 10%: Newgen Software Technologies.

Yes Bank: CA Basque Investments sold 59.40 crore shares (2.06%) at Rs 24.27 apiece while Goldman Sachs (Singapore) PTE.- ODI bought 36.92 crore shares (1.28%) at Rs 24.26 apiece.

Cigniti Technologies: Rajasthan Global Securities bought 2.77 lakh shares (1.01%) at Rs 1,348.76 apiece.

Gravita India: Abudhabi Investment Authority Monsoon bought 7.5 lakh shares (1.08%) while Rajat Agrawal sold 7.5 lakh shares (1.08%) at Rs 934.4 apiece.

Indegene India: The company will offer its shares for bidding on Monday. The price band is set from Rs 430 to Rs 452 per share apiece. The Rs 1,841.76 crore IPO is combination of fresh issue of Rs 760 crore and rest offer for sale. The company has raised Rs 548 crore from anchor investors.

HDFC Bank: The RBI has approved the re-appointment of Atanu Chakraborty as part-time chairman for 3 years, effective May 5.

Dr Reddy’s: The company announced the launch of Doxycycline capsules in the US.

Vodafone Idea: The company to focus on expanding 4G in 17 priority circles to improve competitiveness.

Life Insurance Corp: IRDAI has allowed the company to replenish excess expenses from holders' accounts starting Q1 FY25 under respective segments.

Aurobindo Pharma: The USFDA inspected Unit II of the company's arm's Rajasthan facility from April 25 to May 3 and closed with seven observations.

Adani Energy: The company arm, Adani Electricity Mumbai, completed the acquisition of a 100% stake in Pointleap Projects.

Goa Carbon: The company has temporarily shut down operations at the Odisha plant for maintenance purposes.

DCM Shriram: The company commissioned its Caustic Soda Expansion Project in Gujarat. With this commissioning, the Bharuch complex will be the single largest caustic soda complex in the country, thereby driving economies of scale.

Britannia Industries (Consolidated, YoY)

Revenue up 1.14% at Rs 4,069 crore. (Bloomberg estimate: Rs 4,109 crore).

Ebitda down 1.67% at Rs 787 crore. (Bloomberg estimate: Rs 782 crore).

Margin down 55 bps at 19.35%. (Bloomberg estimate: 19%).

Net profit down 3.76% at Rs 537 crore. (Bloomberg estimate: Rs 542 crore).

Recommended final dividend of Rs 73.5 per share.

Tata Tech (Consolidated, QoQ)

Revenue up 0.89% at Rs 1,301 crore. (Bloomberg estimate: Rs 1,287 crore).

EBIT at up 0.76% Rs 211 crore. (Bloomberg estimate: Rs 213.4 crore).

Margin down 2 bps at 16.21%. (Bloomberg estimate: 16.5%).

Net profit down 7.62% at Rs 157 crore. (Bloomberg estimate: Rs 177 crore).

Board recommended final dividend of Rs 8.4 per share and special dividend of Rs 1.65 per share.

Titan (Consolidated, YoY)

Revenue up 20.59% at Rs 12,494 crore. (Bloomberg estimate: Rs 10,567 crore).

Ebitda up 9.36% at Rs 1,191 crore. (Bloomberg estimate: Rs 1,294 crore).

Margin down 97 bps at 9.53%. (Bloomberg estimate: 12.2%).

Net profit up 4.75% at Rs 771 crore. (Bloomberg estimate: Rs 876 crore).

Mangalore Refinery and Petrochemicals (Consolidated, QoQ)

Revenue up 2.91% at Rs 25,329 crore.

Ebitda up 100.92% at Rs 2330 crore.

Margin up 449 bps at 9.19%.

Net profit up 190.39% at Rs 1,139 crore.

Board recommends final dividend of Rs 2 per share.

Inox Wind (Consolidated, YoY)

Revenue up 176.66% at Rs 528 crore. (Bloomberg estimate: Rs 856 crore).

Ebitda at Rs 102.2 crore vs loss of Rs 30.92 crore (Bloomberg estimate: Rs 113 crore).

Margin at 19.36% (Bloomberg estimate 13.2%).

Net profit at Rs 36.7 crore vs loss of Rs 119.04 crore (Bloomberg estimate: Rs 58.45 crore).

Aarti Drugs (YoY)

Revenue down 19.66% at Rs 559 crore.

Ebitda down 21.98% at Rs 69.06 crore.

Margin down 36 bps at 12.34%.

Net profit down 32.02% at Rs 36.14 crore.

Carborundum Universal (Consolidated, YoY)

Revenue up 0.13% at Rs 1,201 crore. (Bloomberg estimate: Rs 1,235 crore).

Ebitda up 10.03% at Rs 209 crore. (Bloomberg estimate: Rs 189 crore).

Margin up 156 bps at 17.43%. (Bloomberg estimate: 15.3%).

Net profit down 4.18% at Rs 143 crore. (Bloomberg estimate: Rs 119 crore).

Godrej Consumer Products Ltd., CG Power And Industrial Solutions Ltd., Lupin Ltd., Indian Bank Ltd., Marico Ltd., Gujarat Gas Ltd., Gujarat Fluorochemicals Ltd., Grindwell Norton Ltd., Happiest Minds Technologies Ltd., Route Mobile Ltd., Arvind Ltd., and Cartrade Tech Ltd.

Asian indices rose, following their US peers, with Hong Kong's Hang Seng trading 0.20% higher, the CSI 300 trading up 1.25%, and Australia's ASX 200 trading 0.55% higher. Indices in Japan and South Korea will remain closed today on account of the holiday.

Wall Street took a slowdown in the US jobs market as an indication that the Federal Reserve will be able to start cutting rates as early as September, with traders sending stocks up sharply as bond yields fell, Bloomberg said.

The S&P 500 index and Nasdaq Composite rose by 1.26% and 1.99%, respectively, as of Friday. The Dow Jones Industrial Average gained by 1.18%.

Brent crude was trading 0.40% higher at $83.29 per barrel. Gold rose 0.28% to $2,308.12 an ounce.

The May futures contract of the GIFT Nifty was trading 7 points, or 0.03%, lower at 22,685 as of 7:14 a.m.

India's benchmark stock indices reversed early gains to end lower on Friday on profit-booking and caution ahead of US non-farm payroll data. Heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged the indices lower, limiting the weekly gains in both the NSE Nifty 50 and S&P BSE Sensex.

The Nifty 50 ended 172.35 points, or 0.76%, lower at 22,475.85, and the Sensex fell 732.96 points, or 0.98%, to close at 73,878.15.

Overseas investors remained net sellers of Indian equities for the second consecutive session on Friday. Foreign portfolio investors offloaded stocks worth Rs 2,392 crore, and domestic institutional investors stayed net buyers for the eighth day and mopped up equities worth Rs 690.5 crore, according to provisional data from the National Stock Exchange.

The Indian currency strengthened by 3 paise to close at Rs 83.43 against the US dollar.

Asian indices rose, following their US peers, with Hong Kong's Hang Seng trading 0.20% higher, the CSI 300 trading up 1.25%, and Australia's ASX 200 trading 0.55% higher. Indices in Japan and South Korea will remain closed today on account of the holiday.

Wall Street took a slowdown in the US jobs market as an indication that the Federal Reserve will be able to start cutting rates as early as September, with traders sending stocks up sharply as bond yields fell, Bloomberg said.

The S&P 500 index and Nasdaq Composite rose by 1.26% and 1.99%, respectively, as of Friday. The Dow Jones Industrial Average gained by 1.18%.

Brent crude was trading 0.40% higher at $83.29 per barrel. Gold rose 0.28% to $2,308.12 an ounce.

The May futures contract of the GIFT Nifty was trading 7 points, or 0.03%, lower at 22,685 as of 7:14 a.m.

India's benchmark stock indices reversed early gains to end lower on Friday on profit-booking and caution ahead of US non-farm payroll data. Heavyweights Reliance Industries Ltd., Larsen & Toubro Ltd., and HDFC Bank Ltd. dragged the indices lower, limiting the weekly gains in both the NSE Nifty 50 and S&P BSE Sensex.

The Nifty 50 ended 172.35 points, or 0.76%, lower at 22,475.85, and the Sensex fell 732.96 points, or 0.98%, to close at 73,878.15.

Overseas investors remained net sellers of Indian equities for the second consecutive session on Friday. Foreign portfolio investors offloaded stocks worth Rs 2,392 crore, and domestic institutional investors stayed net buyers for the eighth day and mopped up equities worth Rs 690.5 crore, according to provisional data from the National Stock Exchange.

The Indian currency strengthened by 3 paise to close at Rs 83.43 against the US dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.