The local currency closed flat at Rs 83.05 against the U.S dollar.

Source: Bloomberg

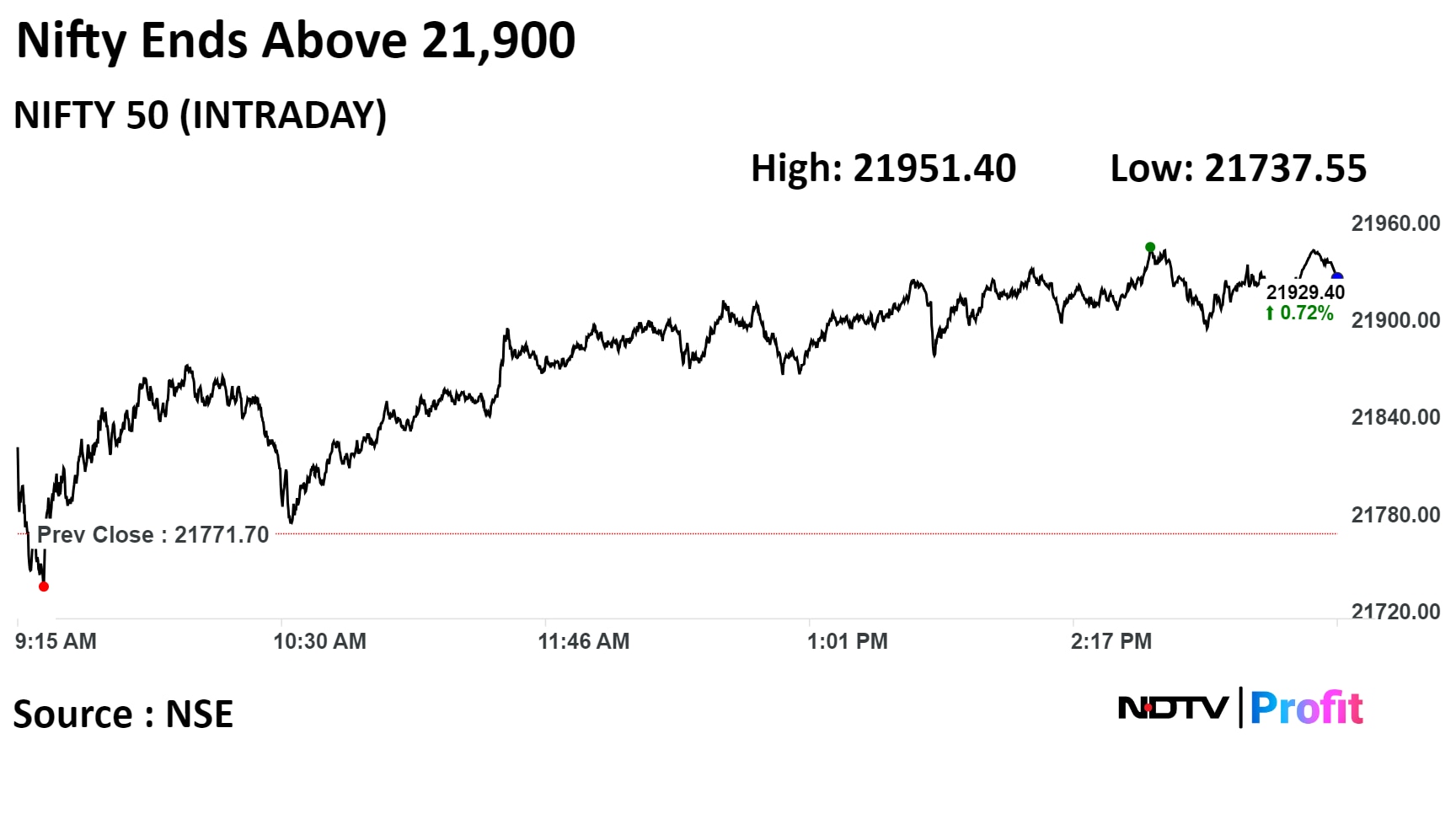

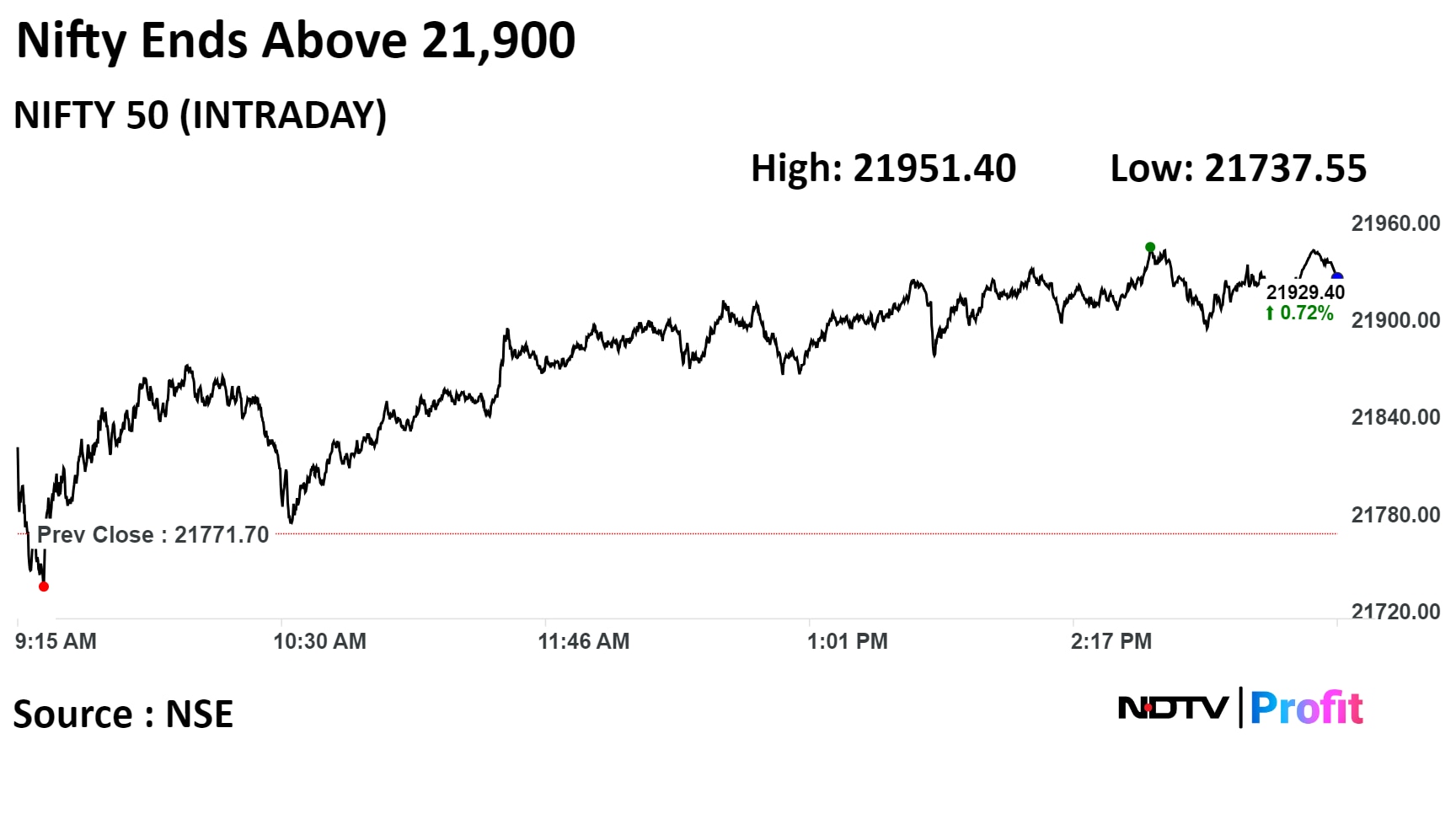

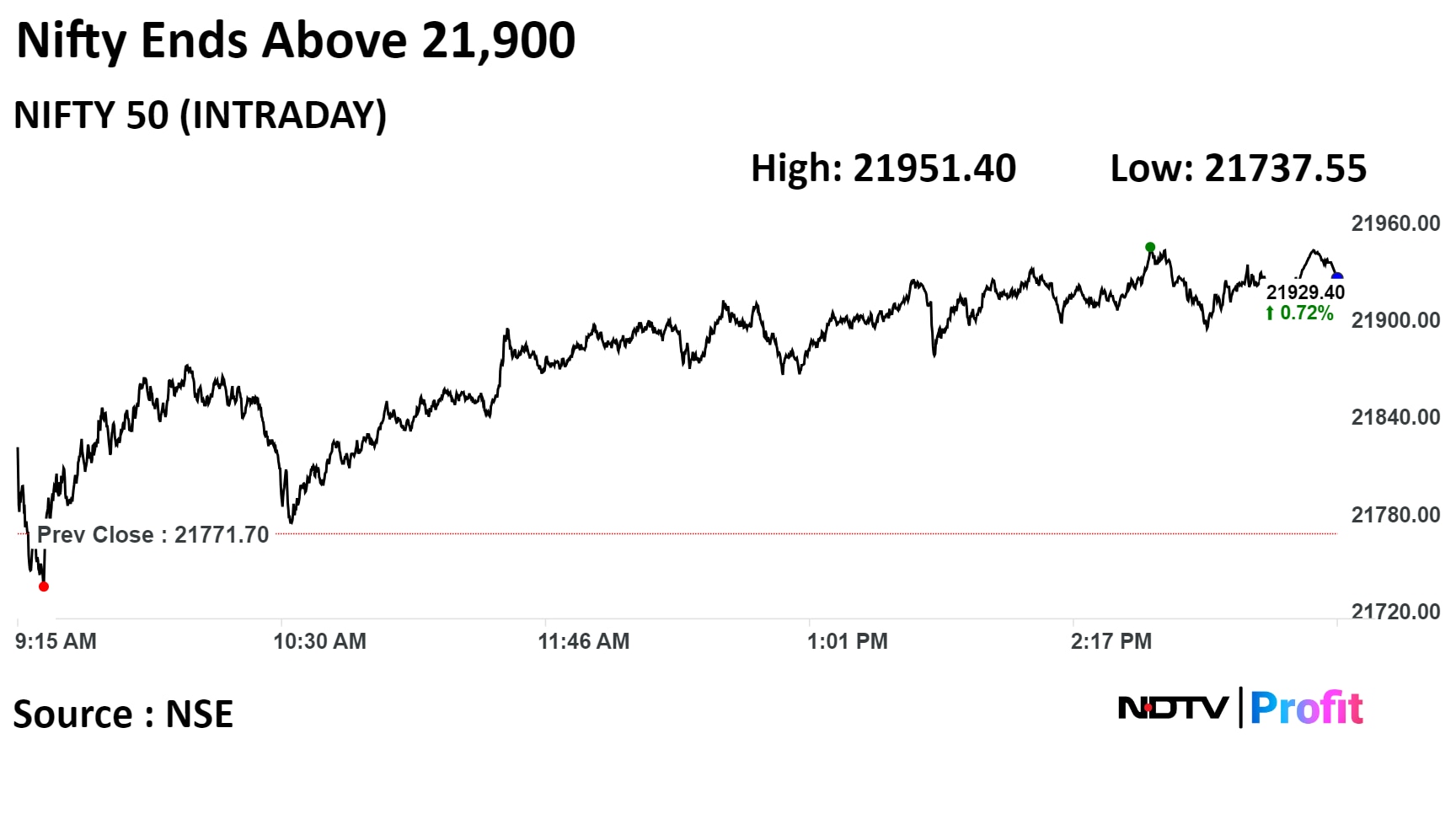

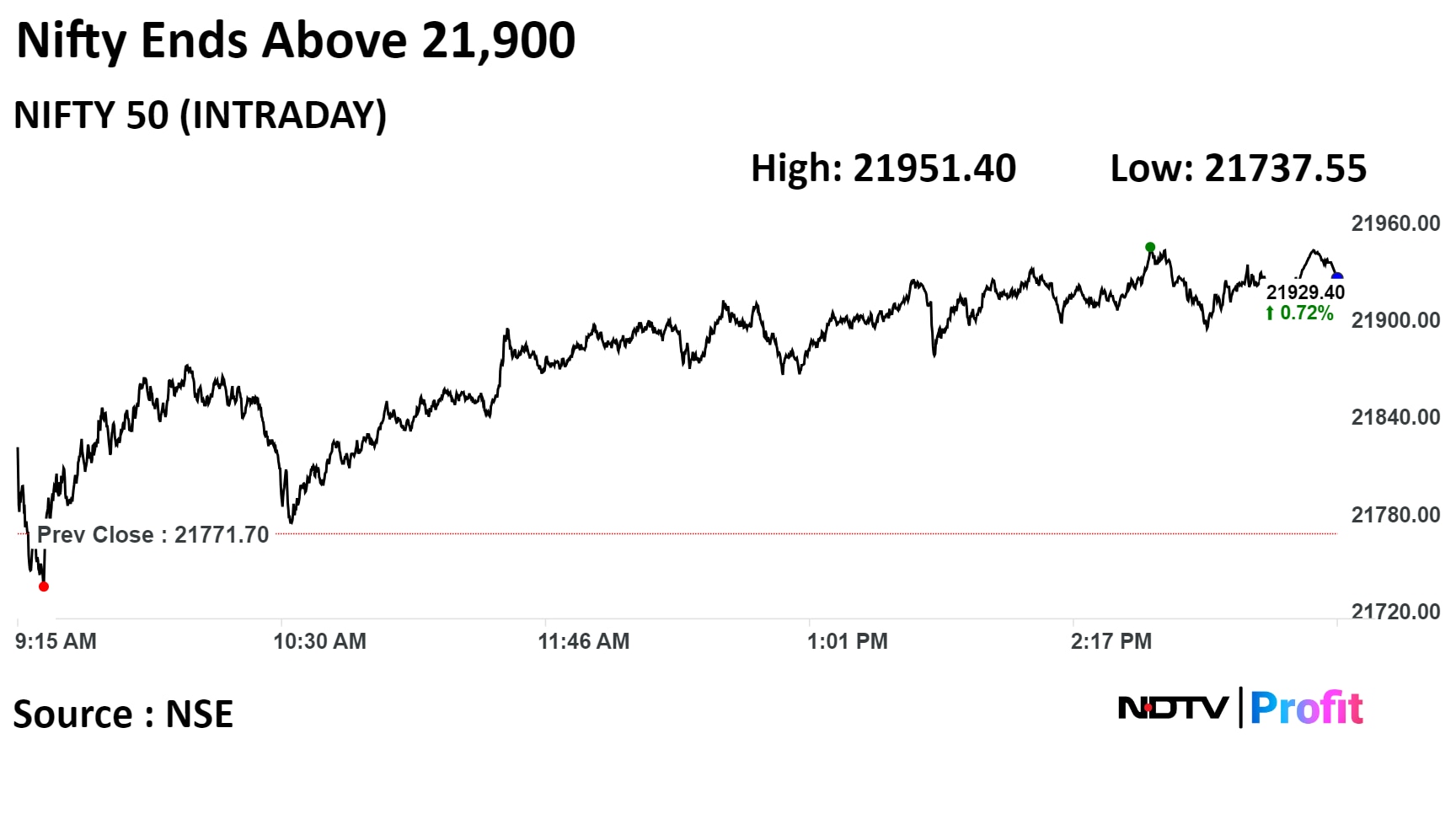

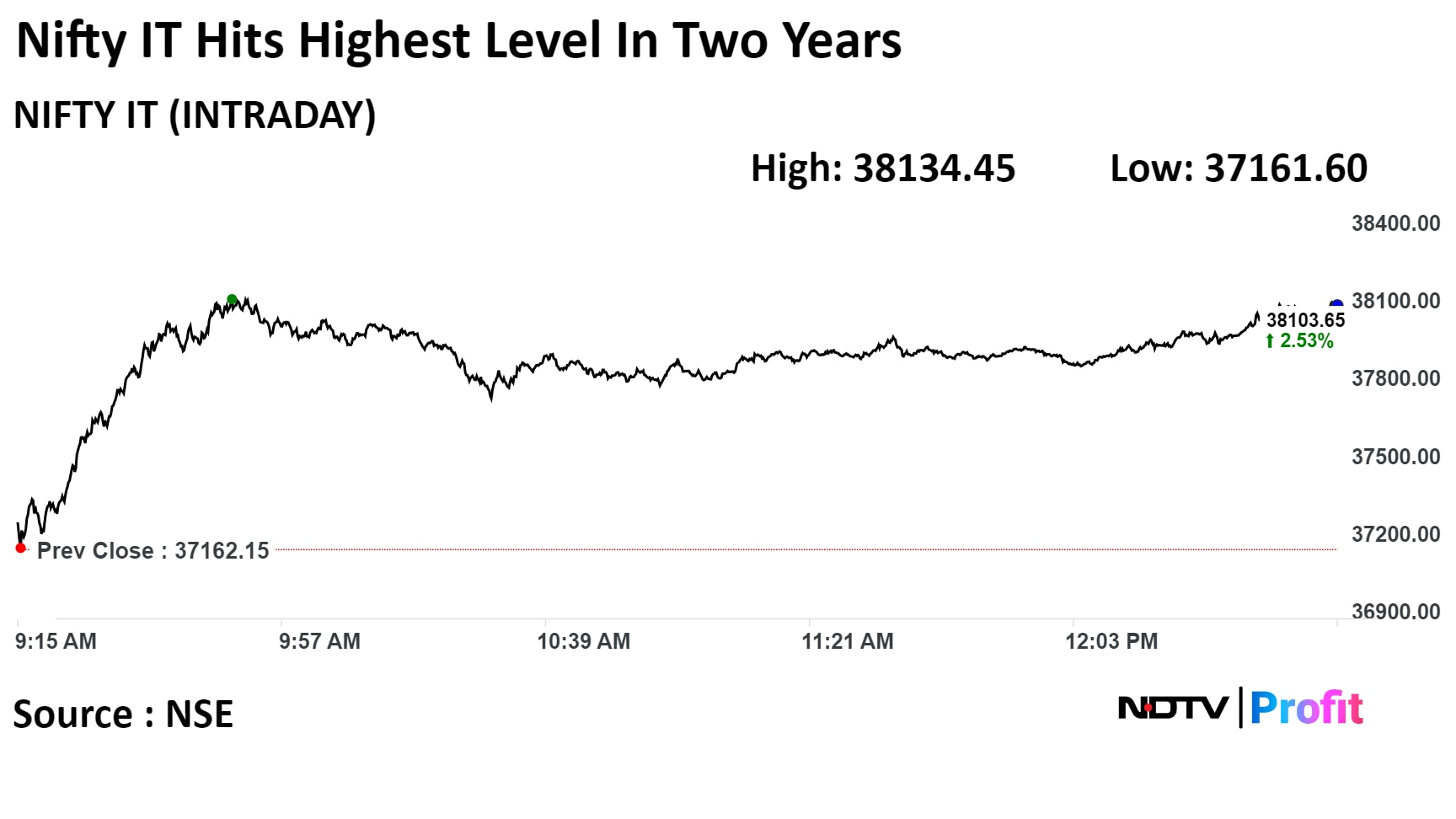

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

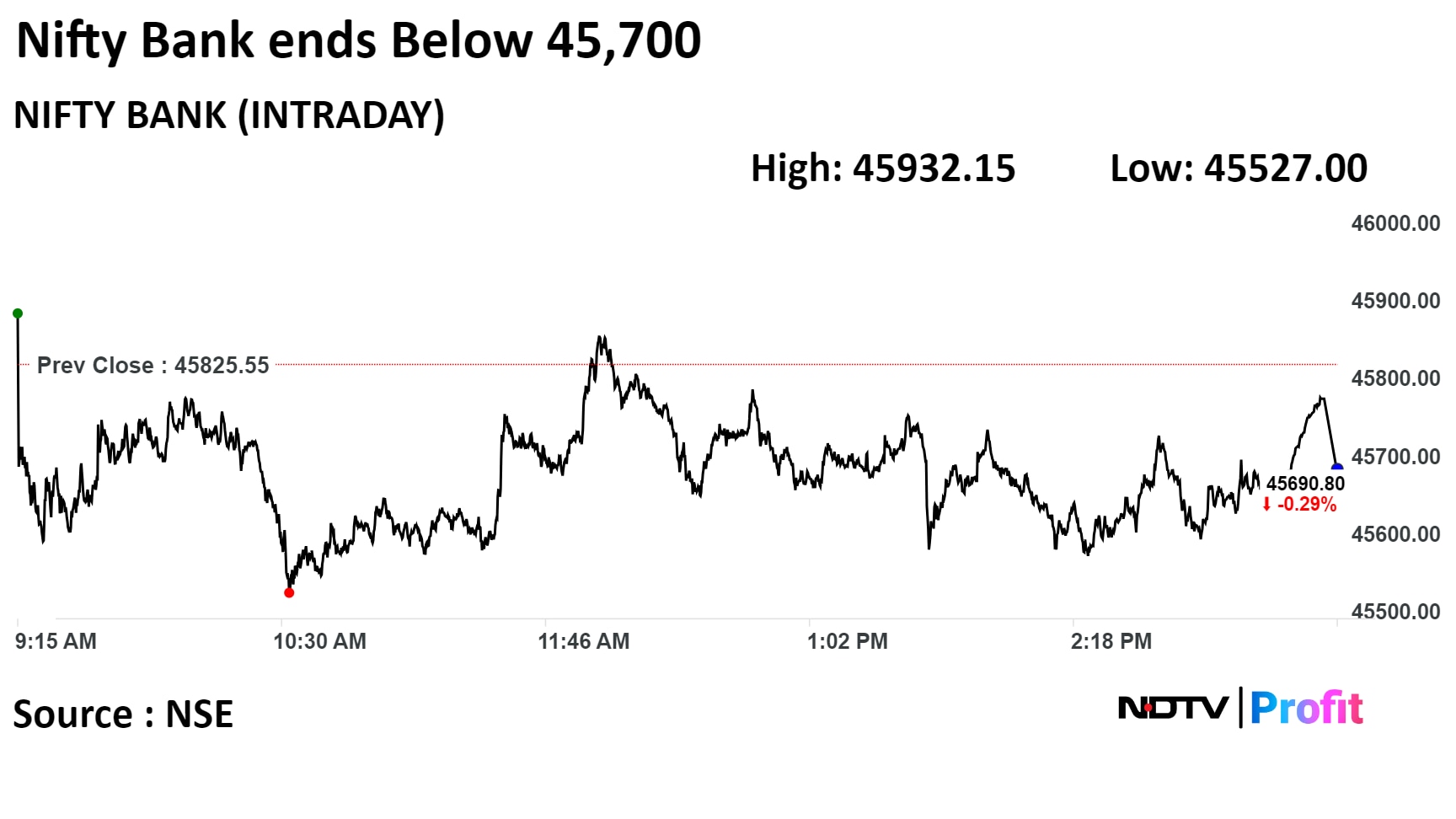

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Benchmark equity indices ended higher today with shares of information technology companies contributing the most to the gains.

The Nifty 50 added 167.45 points or 0.77% to close at 21,939.15 and the Sensex gained 487.62 points or 0.68% to close at 72,219.04. Intraday, the Nifty 50 gained as much as 0.83% and the Sensex gained as much as 0.7%.

"Despite strong market momentum intraday profit booking was seen in banking stocks," said Shrikant Chouhan, head of Equity Research at Kotak Securities. "Technically, after early morning intraday correction the Nifty took the support near 21700/71600 and reversed sharply. From the day’s lowest point market rallied over 210 points."

Chouhan said, "We are of the view that as long as index is trading above 21700/71600 the positive momentum is likely to continue. Above the same the index could rally till 22100/73400, further upside may also continue which could lift the index till 22200/73700.On the flip side below 21700/71600, traders may prefer to exit out from the trading long position."

Tata Consultancy Services Ltd., Infosys Ltd., Larsen and Toubro Ltd., HCL Technologies Ltd., and Maruti Suzuki Ltd. were positively adding to the change in the Nifty 50 Index.

Whereas, Reliance Industries Ltd., ITC Ltd., Power Grid Corp Ltd., Axis Bank Ltd., and Kotak Mahindra Bank Ltd. were negatively contributing to the change.

Sectorally, Nifty IT and Nifty Oil and gas advanced the most, while Nifty PSU Banks and FMCG declined on Tuesday.

The broader markets outperformed as the BSE MidCap rose 1.06%, while the BSE SmallCap was 1.23% higher. Sixteen out of the 20 sectors compiled by the BSE advanced, while four declined.

The market breadth was skewed in the favour of buyers. About 2,354 stocks advanced, 1,504 declined, and 86 remained unchanged on the BSE.

Executes long-term contract for purchase of 7.5 MMTPA LNG with QatarEnergy

LNG supplies will be made on delivered basis starting from 2028 till 2048

LNG volumes under new SPA to also be offtaken by GAIL, IOCL & BPCL after regasification from Dahej

Source: Exchange Filing

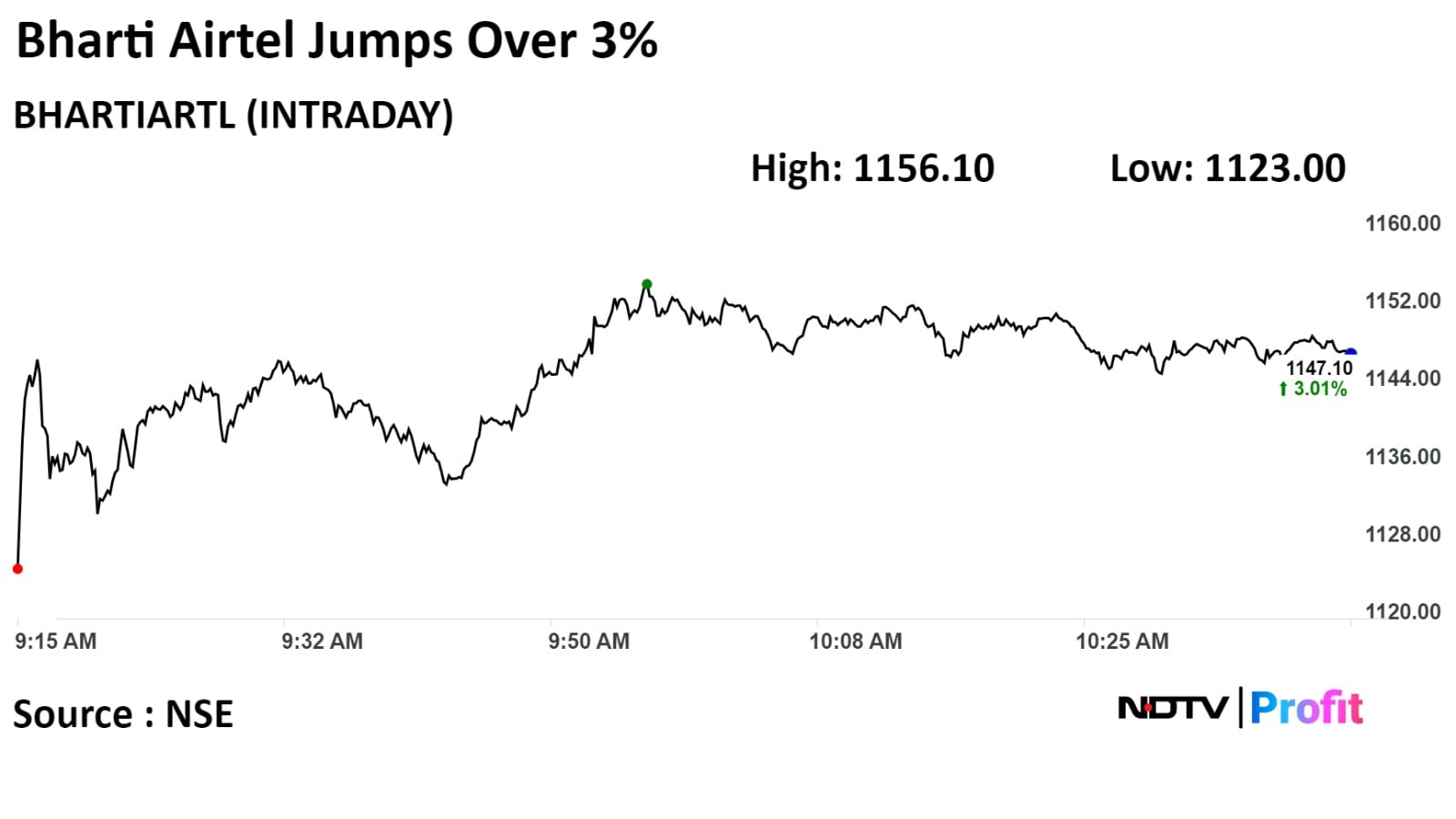

Capex is going to be elevated this year

Vast part of 5G rolled out this year, rural is a big part

Capex to moderate in FY25

Source: Earnings Call

Revenue at Rs 4749.71 crore vs Rs 2402.32 crore, up 97.71%

Ebitda at Rs 462.97 crore vs Rs 166.38 crore, up178.26%

Margin at 9.74% vs 6.92%

Net profit at Rs 293.7 crore vs Rs 23.22 crore, up 1164.85%

Revenue at Rs 2,312 crore vs Rs 2016.11 crore, up 14.67%

Ebitda at Rs 378.5 crore vs Rs 144.41 crore, up 162.1%

Margin at 16.37% vs 7.16%

Net profit at Rs 109.14 crore vs loss of Rs 49.91 crore

Addition of the 4.X MW WTG series to IWL’s product portfolio provides a significant edge to IWL given the demand upsurge and technology requirements over the next decade, the company said.

Source: Exchange Filing

Share subscription pact with TSA Process Equipments

Group in pact to acquire a 51% stake in TSA Process Equipments for Rs 71.14 crore

To acquire remaining 49% in TSA Process over 2 years

Source: Exchange Filing

Revenue at Rs 4348.57 crore vs Rs 8296.21 crore, down 47.59%

Ebitda at Rs 628.47 crore vs Rs 670.02 crore, down 6.21%

Margin at 14.45% vs 8.07%

Net profit at Rs 459.4 crore vs Rs 323.91 crore, up 41.82%

Revenue at Rs 279.7 crore vs Rs 275.1 crore, up 1.67%

Ebit at Rs 100.9 crore vs Rs 104.6 crore, down 3.54%

Margin at 36.07% vs 38.02%

Net profit at Rs 88.5 crore vs Rs 83.8 crore, up 5.6%

Revenue at Rs 797.9 cr vs Rs 833.6 cr, up 4.3%

Ebitda at Rs 157.85 cr vs Rs 126.91 cr, up 24.4%

Margin at 19.78% vs 15.22%, up 455 bps

Net profit at Rs 107.5 cr vs Rs 84.1 cr, up 27.8%

Revenue up 13.5% at Rs 2,046.6 crore vs Rs 1,803.3 crore

EBITDA up 25.4% at Rs 432.1 crore vs Rs 344.7 crore

Margin up 199 bps at 21.11% vs 19.11%

Net profit up 32.1% at Rs 185 crore vs Rs 140 crore

HDFC Bank's co-branded card partnership is with One97 Communications, not Paytm Payments Bank, says Parag Rao, group head – payments, consumer finance at HDFC Bank

--We are in wait and watch mode

--A significant traction seen on PayZapp app and Vyapaar app over last week

Source: HDFC Bank event

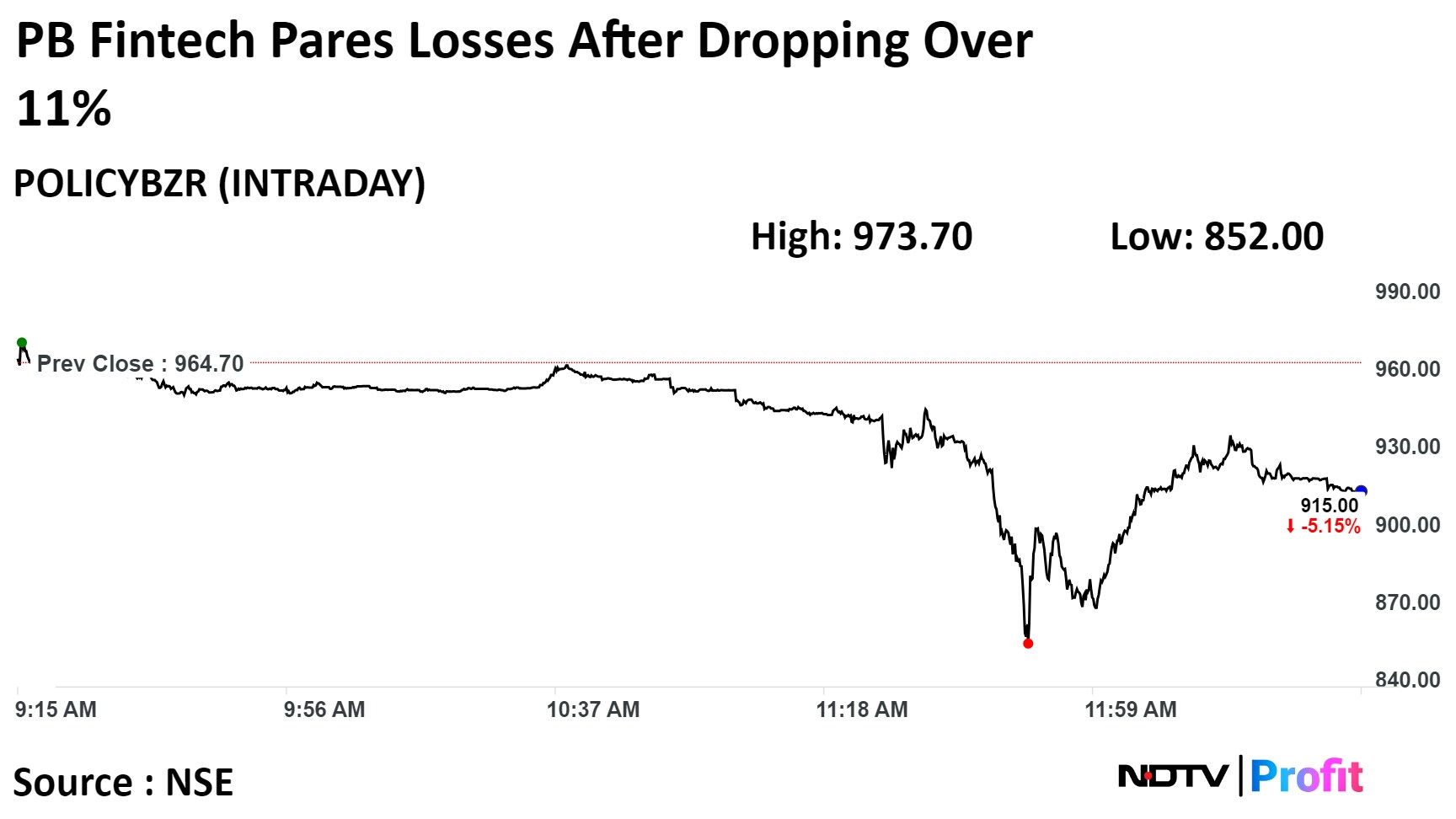

PB Fintech shares tumbled nearly 12% following media report that the parent company, which oversees online marketplaces Policybazaar and Paisabazaar, has come under the scrutiny of income tax authorities due to regulatory lapses and non-compliance with KYC norms.

The company in an exchange filing said there is no update after Dec 14 regarding IT survey at Paisabazaar Marketing and Consulting and that it will continue providing any further details that might be required by the IT Dept.

PB Fintech shares tumbled nearly 12% following media report that the parent company, which oversees online marketplaces Policybazaar and Paisabazaar, has come under the scrutiny of income tax authorities due to regulatory lapses and non-compliance with KYC norms.

The company in an exchange filing said there is no update after Dec 14 regarding IT survey at Paisabazaar Marketing and Consulting and that it will continue providing any further details that might be required by the IT Dept.

Shares of the company fell as much as 11.68%, to most since Aug 16,2022, It is trading 4.14% lower at Rs 919.95 at 12:37 p.m. This compares to a 0.63% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 3 times its 30-day average. The relative strength index was at 54.

Of the 17 analysts tracking the company, 11 maintain a 'buy', three recommends a 'hold,' and three suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.7%

Revenue up 68.4% at Rs 330.4 crore vs Rs 196.2 crore

EBITDA loss of Rs 41.6 crore vs EBITDA loss of Rs 16.8 crore

Net profit up 11.2% at Rs 62.7 crore vs Rs 56.4 crore

Revenue at Rs 738.4 crore vs Rs 694.8 crore, up 6.3%

Ebitda at Rs 85.02 crore vs Rs 80.05 crore, up 6.2%

Margin flat at 11.51% vs 11.52%

Net profit at Rs 61.6 crore vs Rs 57.6 crore, up 6.9%

Price target of Rs 515

Positive NIM surprise offset by higher credit cost

Overall growth of 5% lagged 10-12% growth guidance

Overall growth to pick up in FY24;competition from banks to challenge growth

Co expects to meet 50-55bp credit guidance for FY24

Reduction of credit cost in Fy25 to provide buffer to ROA

Price target of Rs 385

Believes Q3 lease signings hinted at sustained recovery trajectory

Sees signs of breadth improvement in Noida and Pune

Maintains expectation of distribution to grow in FY25

Expect current pipeline to lead to good Q4 occupancy leve

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

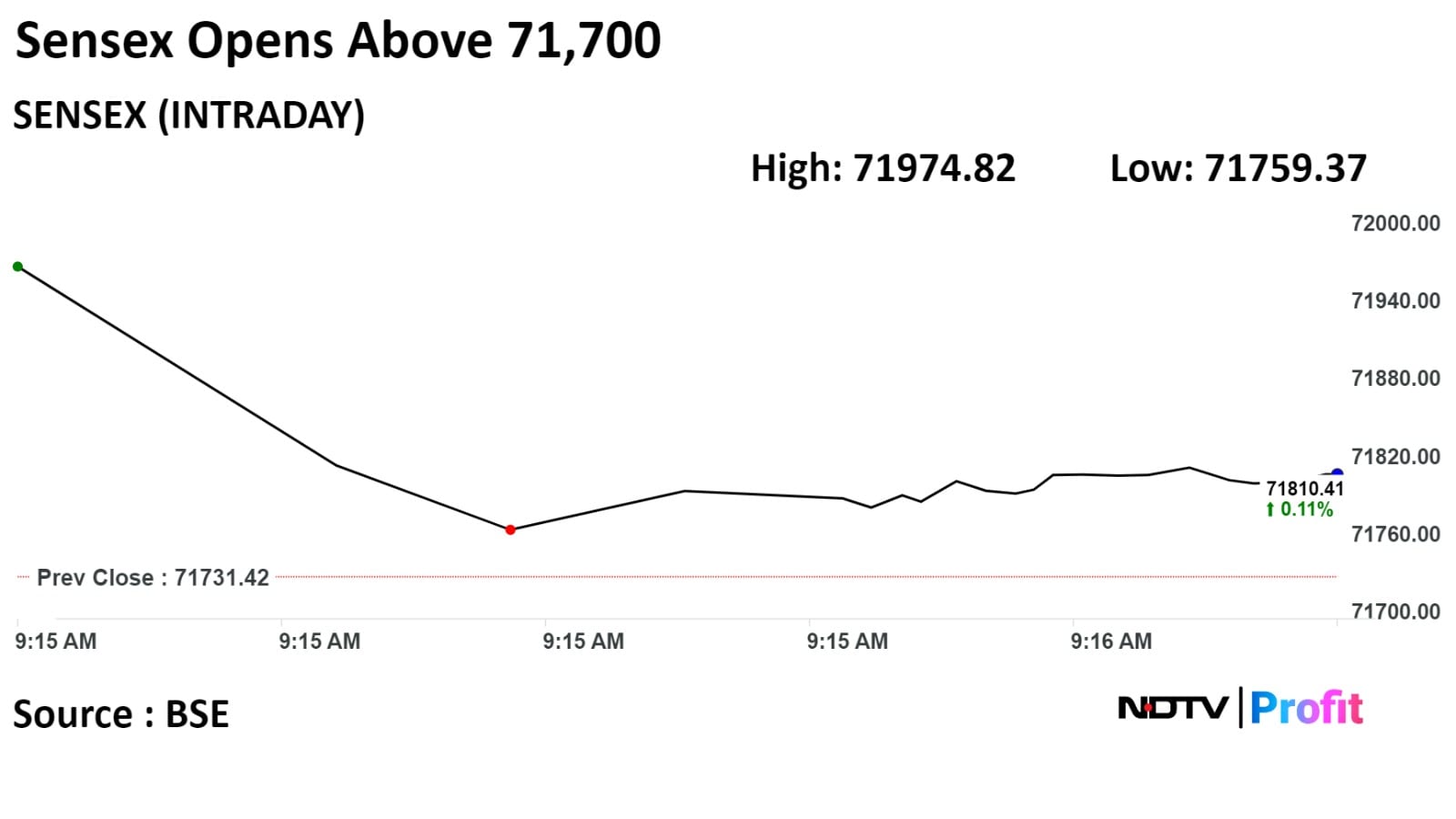

In the realm of Bank Nifty futures, the opening is foreseen around the 46000 mark, according to Jain. He said, "Notably, significant Open Interest is observed in the 46000 Call strike, suggesting a potential ceiling on the upside. On the downside, immediate support is identified at 45500 levels."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

Benchmark equity indices traded near the highest levels of the session, driven by gains in the shares of information technology companies and Bharti Airtel.

At 12:13 p.m., the Nifty 50 traded 125.90 points or 0.58% higher at 21,897.60 and the Sensex traded at 72,107.22, up 375.80 points or 0.52%.

"We anticipate Nifty encountering resistance around the 21900 mark due to notable Call writing observed in both ATM and OTM strikes," said Shrey Jain, founder and CEO of SAS Online. "Support levels for Nifty are projected within the range of 21,650 to 21,725."

In the realm of Bank Nifty futures, the opening is foreseen around the 46000 mark, according to Jain. He said, "Notably, significant Open Interest is observed in the 46000 Call strike, suggesting a potential ceiling on the upside. On the downside, immediate support is identified at 45500 levels."

Shares of Tata Consultancy Services Ltd., Infosys Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd. contributed the most to the gains.

Meanwhile, those of ITC Ltd., Power Grid Corp. of India Ltd., Reliance Industries Ltd., HDFC Bank Ltd., and NTPC Ltd. capped the upside.

Most sectoral indices gained with Nifty IT and Nifty Oil & Gas gaining nearly 2%.

The broader markets outperformed; the S&P BSE MidCap Index was up 0.62%, and S&P BSE SmallCap Index was 0.99% higher.

Sixteen out of 20 sectors compiled by BSE advanced, while four sectors declined. S&P BSE Teck rose the most.

The market breadth was skewed in the favour of the buyers. About 2,261 stocks rose, 1,475 declined, while 126 remained unchanged on the BSE.

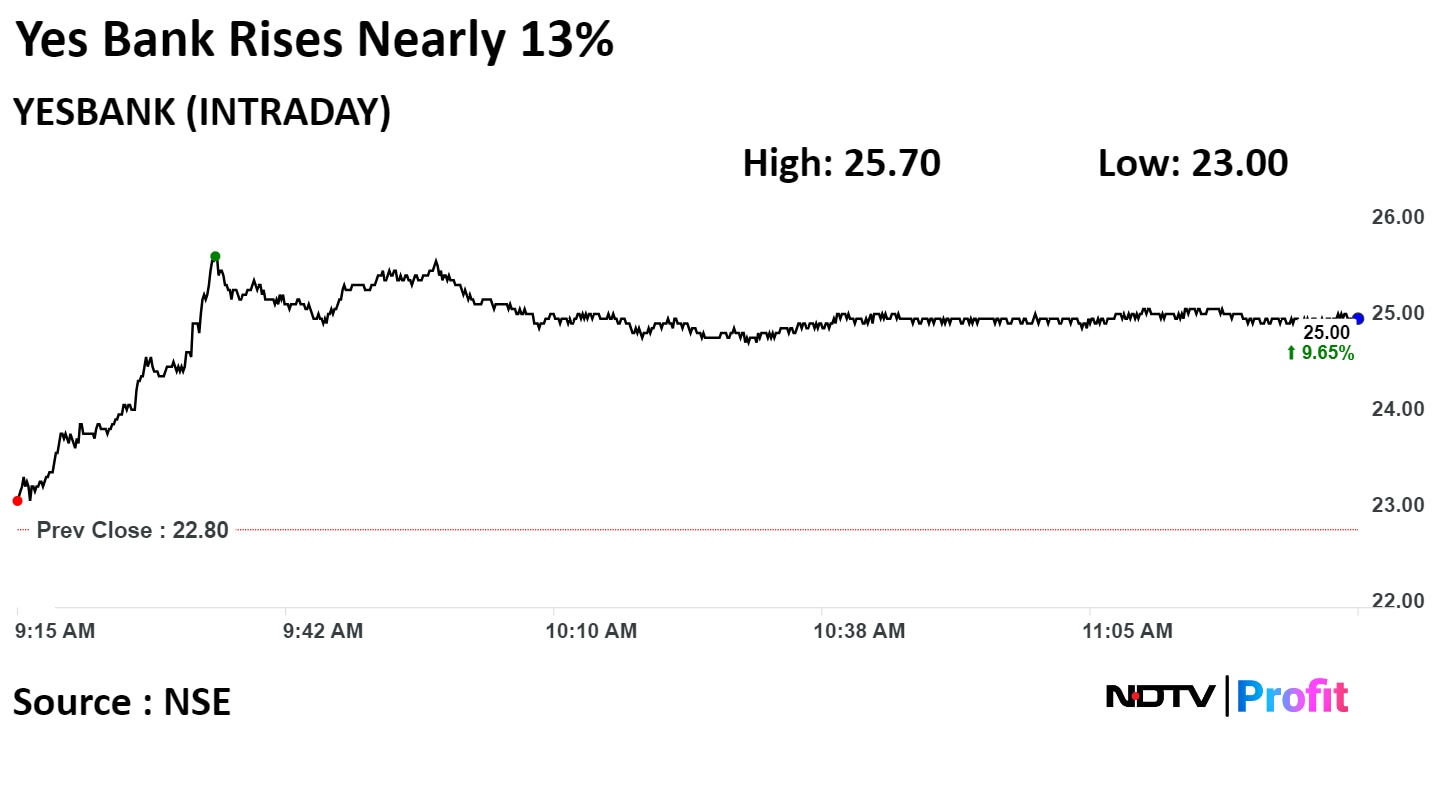

Shares of Yes Bank Ltd. surged nearly 13% on Tuesday after HDFC Bank Group received regulatory approval to increase stake in the private lender.

HDFC Bank Group received the green signal from Reserve Bank of India to acquire as much as 9.5% stake in six banks — Axis Bank Ltd., Suryoday Small Finance Bank Ltd, ICICI Bank Ltd., Bandhan Bank Ltd., Yes Bank Ltd., and IndusInd Bank Ltd.

Shares of Yes Bank Ltd. surged nearly 13% on Tuesday after HDFC Bank Group received regulatory approval to increase stake in the private lender.

HDFC Bank Group received the green signal from Reserve Bank of India to acquire as much as 9.5% stake in six banks — Axis Bank Ltd., Suryoday Small Finance Bank Ltd, ICICI Bank Ltd., Bandhan Bank Ltd., Yes Bank Ltd., and IndusInd Bank Ltd.

Shares of Yes Bank Ltd. rose 12.71%, the highest level since Feb. 2, before paring gains to trade 9.65% higher as of 11:36 a.m. This compares to a 0.5% advance in the NSE Nifty 50.

The stock has risen 50.75% in the past 12 months. Total traded volume so far in the day stood at three times its 30-day average. The relative strength index was at 59.9.

Of the 13 analysts tracking the company, six maintain a 'buy' rating, six recommend a 'hold,' and one suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 22.4%.

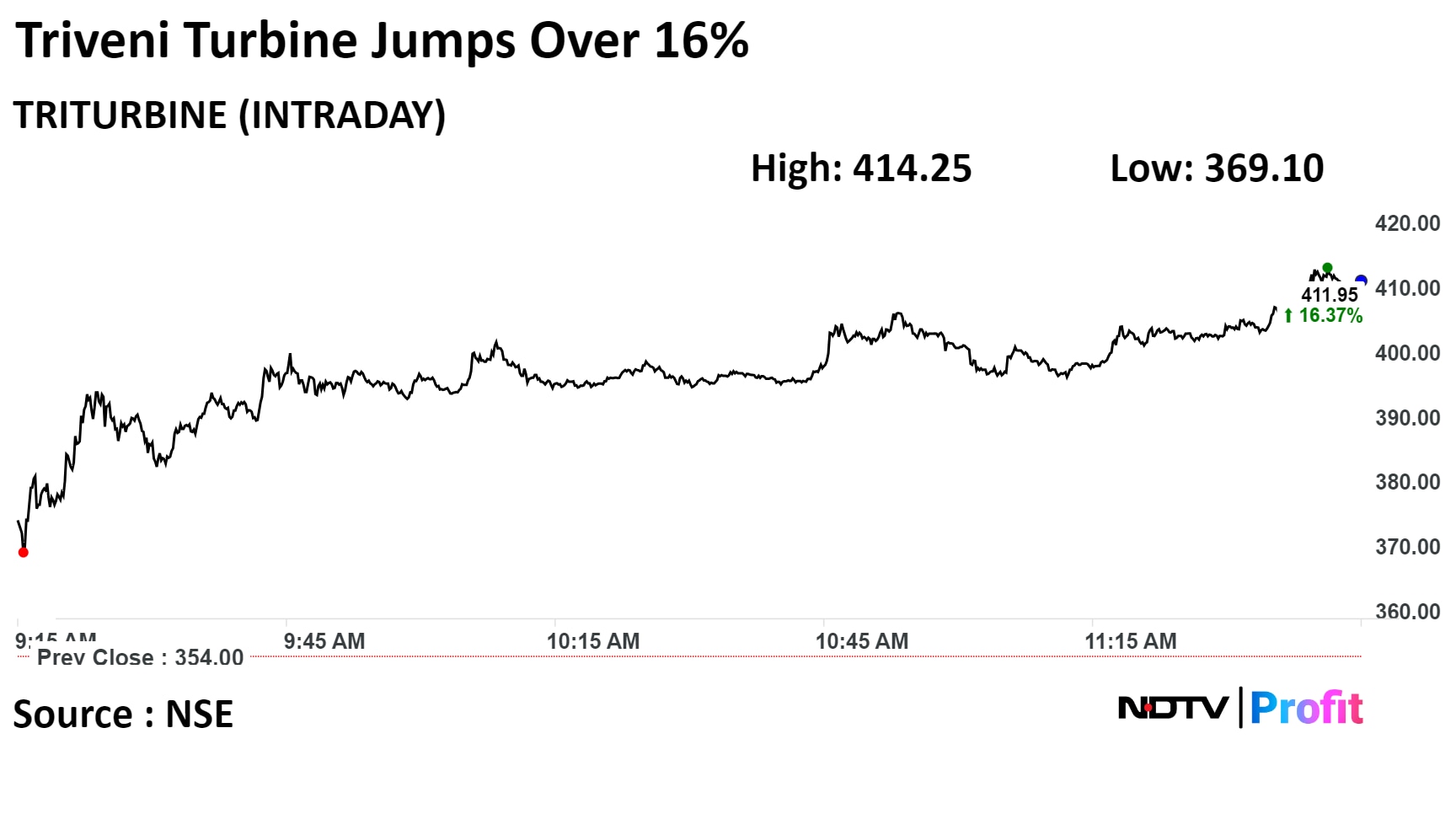

Shares of Triveni Turbine Ltd. jumped over 16% today after the company detailed its earnings for the quarter ended December. The company reported a 29.8% on year increase in net profit to Rs 68.3 crore vs Rs 52.6 crore.

Triveni Turbine Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 32.5% at Rs 431.7 crore vs Rs 325.8 crore (Bloomberg estimate Rs 419.2 crore).

Ebitda up 32.6% at Rs 83.71 crore vs Rs 63.12 crore (Bloomberg estimate Rs 82.42 crore).

Margin at 19.4% (Bloomberg estimate 19.70%).

Net profit up 29.8% at Rs 68.3 crore vs Rs 52.6 crore (Bloomberg estimate Rs 65.98 crore).

Board declares interim dividend of Rs 1.3 per share.

Shares of Triveni Turbine Ltd. jumped over 16% today after the company detailed its earnings for the quarter ended December. The company reported a 29.8% on year increase in net profit to Rs 68.3 crore vs Rs 52.6 crore.

Triveni Turbine Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 32.5% at Rs 431.7 crore vs Rs 325.8 crore (Bloomberg estimate Rs 419.2 crore).

Ebitda up 32.6% at Rs 83.71 crore vs Rs 63.12 crore (Bloomberg estimate Rs 82.42 crore).

Margin at 19.4% (Bloomberg estimate 19.70%).

Net profit up 29.8% at Rs 68.3 crore vs Rs 52.6 crore (Bloomberg estimate Rs 65.98 crore).

Board declares interim dividend of Rs 1.3 per share.

The scrip rose as much as 16.38% to Rs 412 apiece, the highest level since January 20. It pared gains to trade 16.27% higher at Rs 411.67 apiece, as of 11:52 a.m. This compares to a 0.49% advance in the NSE Nifty 50 Index.

It has jumped 56.23% in the last twelve months. Total traded volume so far in the day stood at 45 times its 30-day average. The relative strength index was at 57.05.

Out of eight analysts tracking the company, seven maintain a 'buy' rating and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 54%.

Price Target of Rs 170

Well placed to deliver on near term targets, aided by cyclical tailwinds for NIMs and asset quality

Focus on profitable growth - core segments growing 15%

Mid-teens growth + 1-1.2% RoA quite achievable

Upside risk from pickup in capex cycle

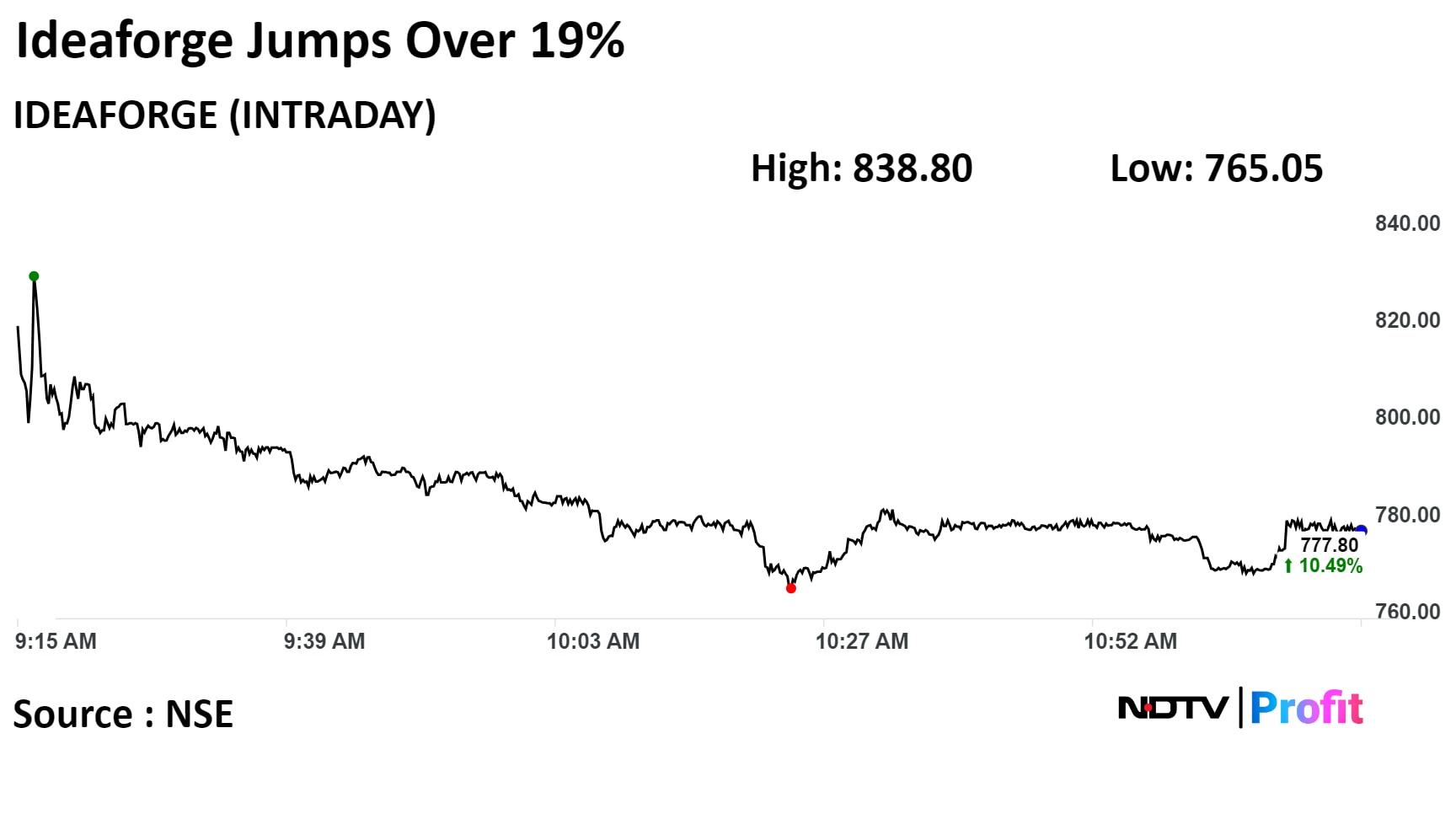

Shares of Ideaforge Technologies Ltd jumped over 19% after the company reported a Rs 14.79 crore profit in the December quarter as against a loss of Rs 7.80 crore in the corresponding quarter an year ago.

Ideaforge Technologies Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1,065.93% at Rs 90.89 crore vs Rs 7.79 crore.

Ebitda at Rs 19.58 crore vs loss of Rs 16.18 crore.

Margin at 21.54%.

Net profit at Rs 14.79 crore vs loss of Rs 7.80 crore.

Shares of Ideaforge Technologies Ltd jumped over 19% after the company reported a Rs 14.79 crore profit in the December quarter as against a loss of Rs 7.80 crore in the corresponding quarter an year ago.

Ideaforge Technologies Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1,065.93% at Rs 90.89 crore vs Rs 7.79 crore.

Ebitda at Rs 19.58 crore vs loss of Rs 16.18 crore.

Margin at 21.54%.

Net profit at Rs 14.79 crore vs loss of Rs 7.80 crore.

The scrip rose as much as 19.16% to Rs 838.80 apiece, the highest level since January 5. It pared gains to trade 9.97% higher at Rs 774.10 apiece, as of 11:21 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has fallen 40.22% in the last twelve months. Total traded volume so far in the day stood at 38 times its 30-day average. The relative strength index was at 55.66.

One analyst tracking the company has a buy rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 108.8%.

Gets order from Ahmedabad Municipal Corp for construction work of slum rehabilitation

Source: Exchange Filing

Bharti Airtel Ltd.'s effective premiumisation is yielding results and the focused strategy of capital expenditure leading to market share gains, according to brokerages. Shares of Bharti Airtel rose over 3% in trade on Tuesday, compared with 0.35% gains in Nifty 50 as on 9:55 am.

Bharti Airtel Ltd.'s effective premiumisation is yielding results and the focused strategy of capital expenditure leading to market share gains, according to brokerages. Shares of Bharti Airtel rose over 3% in trade on Tuesday, compared with 0.35% gains in Nifty 50 as on 9:55 am.

22 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 580.75 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Secures order worth Rs 2,500-5,000 crore for transportation infra business in Assam

To construct 12.2 km cable stayed bridge across river Brahmaputra

Source: Exchange filing

"There is no demand for tax deposition in the said notice. The Company is in the process of preparing its response and would comply with the said notice," the company said while clarifying a report titled "I-T Department issues final notice to Shree Cement after tax liability probe of Rs 4,000 crore."

Source : Exchange Filing

10.8 lakh shares or 0.01% equity changed hands in a large trade

Buyers and sellers not known immediately

Source: Bloomberg

Lists at premium of 125.93% to the issue price on NSE

Lists at Rs 309 on BSE vs issue price Rs 135

Lists at premium of 128.89% to the issue price on BSE

Source: Exchanges

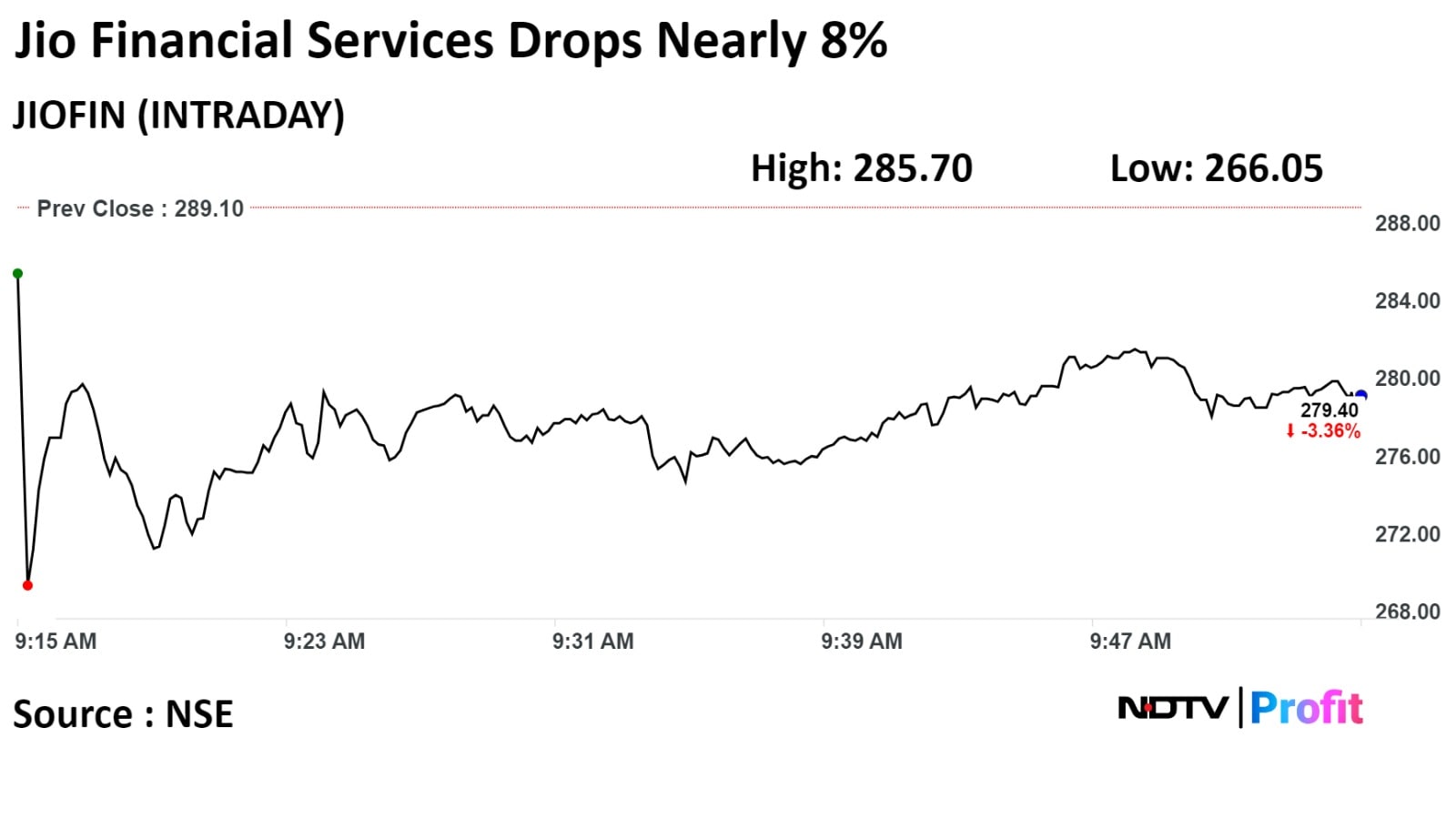

Jio Financial Services Ltd. shares tumbled nearly 8% after the company has denied being in talks to acquire the crisis-hit Paytm wallet of One 97 Communications.

"We have always made and will continue to make disclosures in compliance with our obligations under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015", the company said in an exchange filing.

Jio Financial Services Ltd. shares tumbled nearly 8% after the company has denied being in talks to acquire the crisis-hit Paytm wallet of One 97 Communications.

"We have always made and will continue to make disclosures in compliance with our obligations under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015", the company said in an exchange filing.

Shares of Jio Financial Services fell as much as 7.97%, to Rs 266.05. It is trading 3.42% lower at Rs 279.20 at 9:54 a.m. This compares to a 0.39% advance in the NSE Nifty 50.

The relative strength index was at 72, implying the stock is overbought.

Air Seychelles to use co's Airgain platform for pricing insights

Source: Exchange Filing

11.5 lakh shares or 0.01% equity changed hands in a large trade

Buyers and sellers not known immediately

Source: Bloomberg

10.2 lakh shares or 0.03% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

23.4 lakh shares or 0.02% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

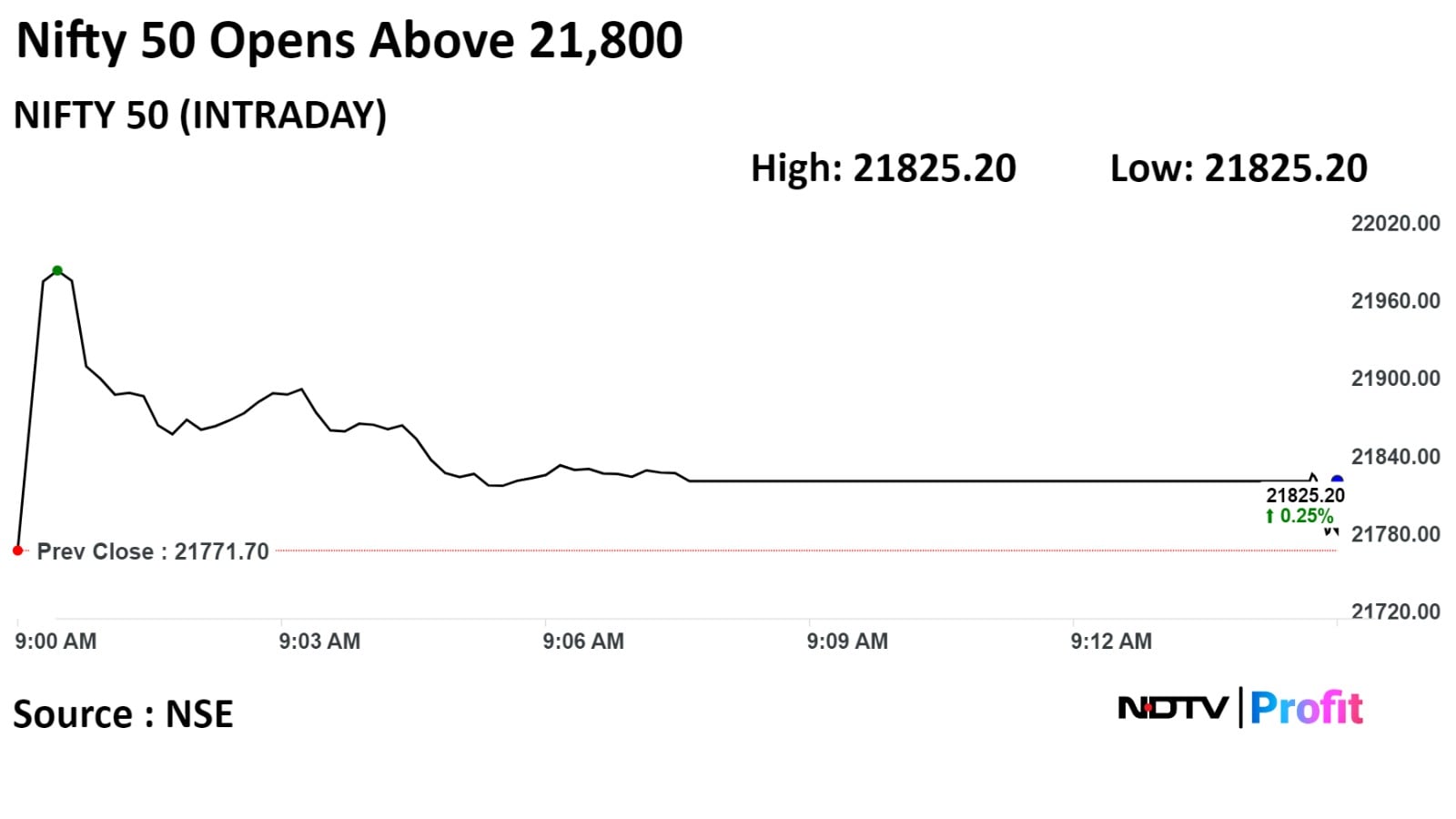

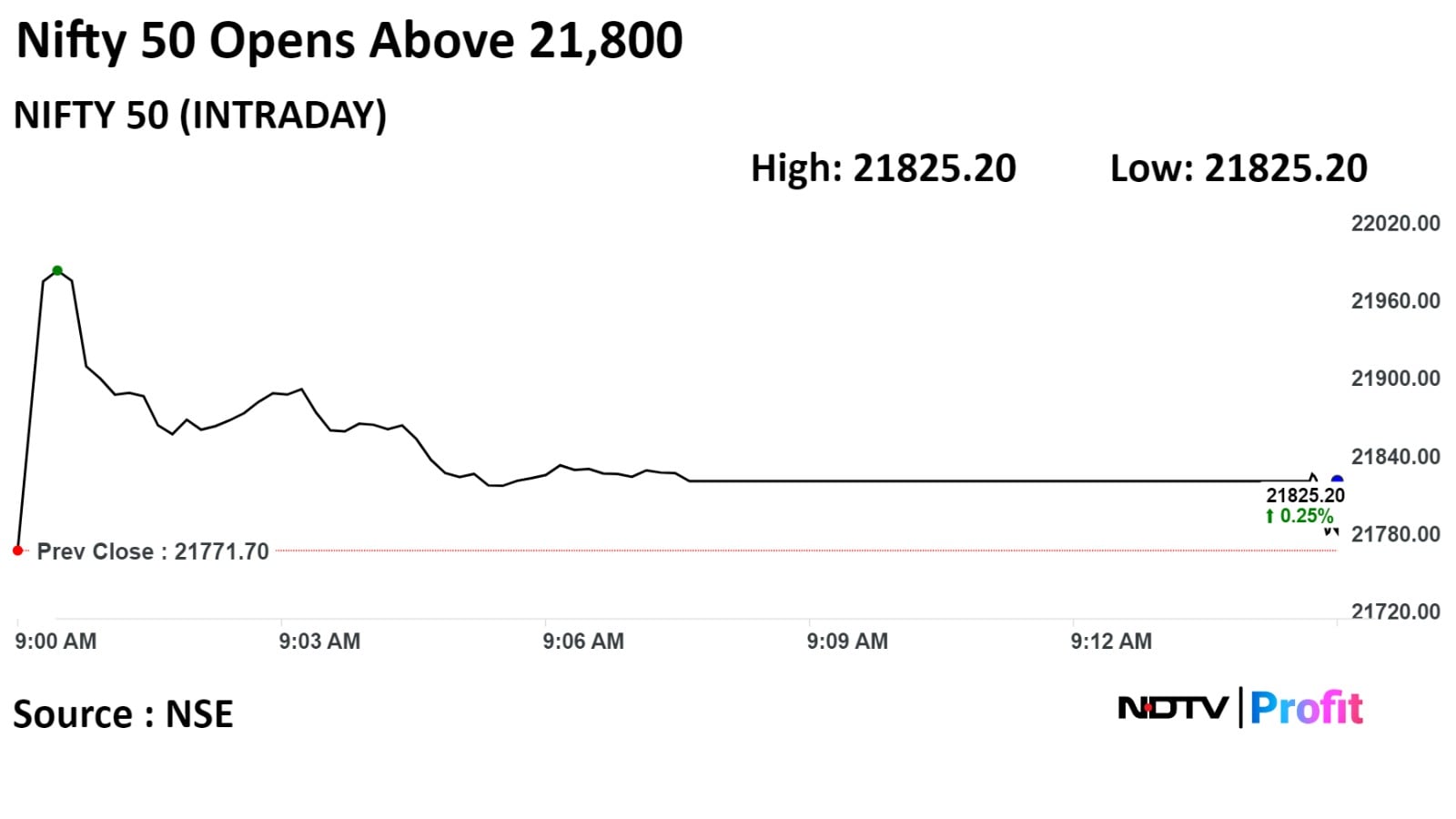

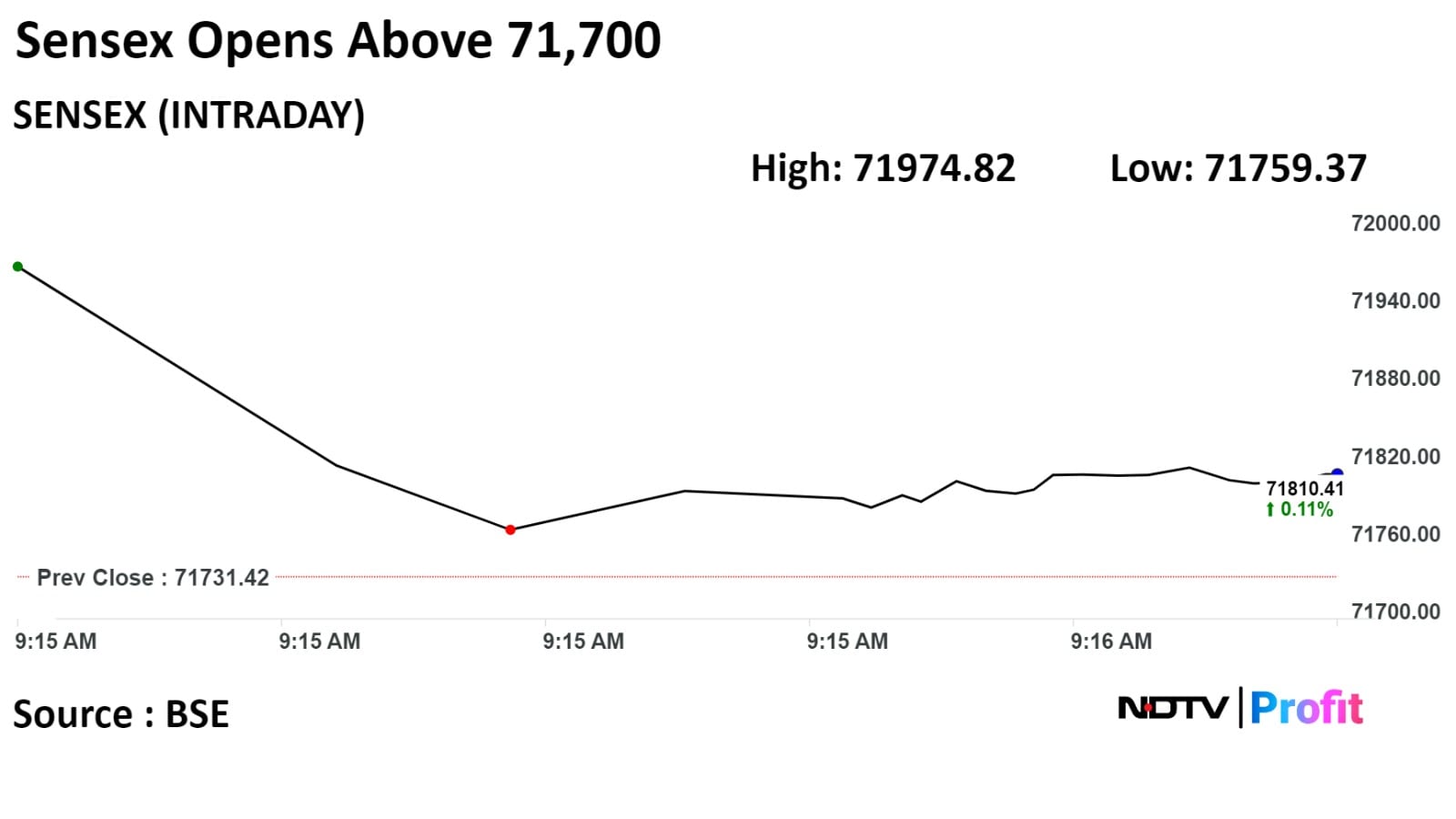

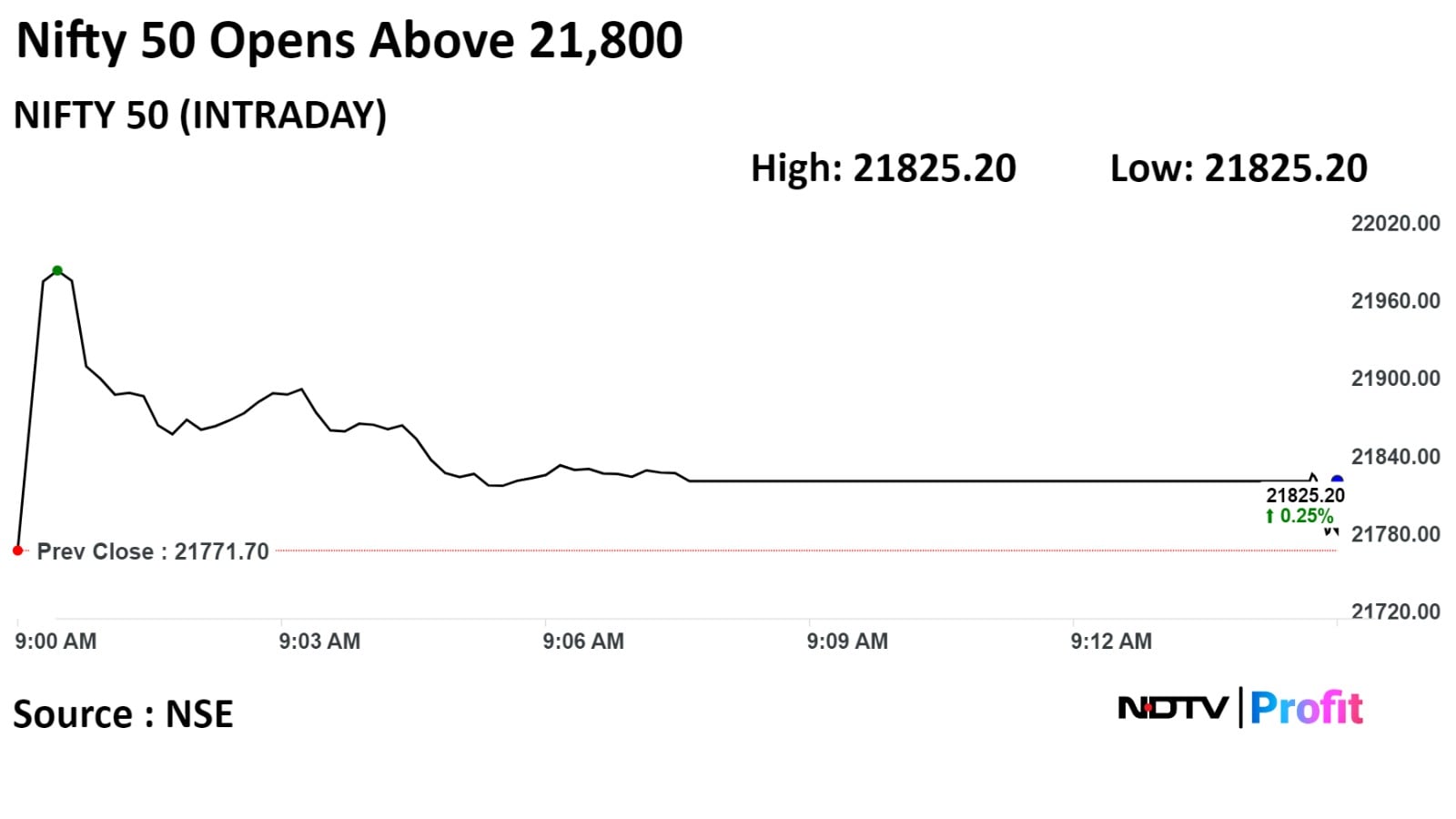

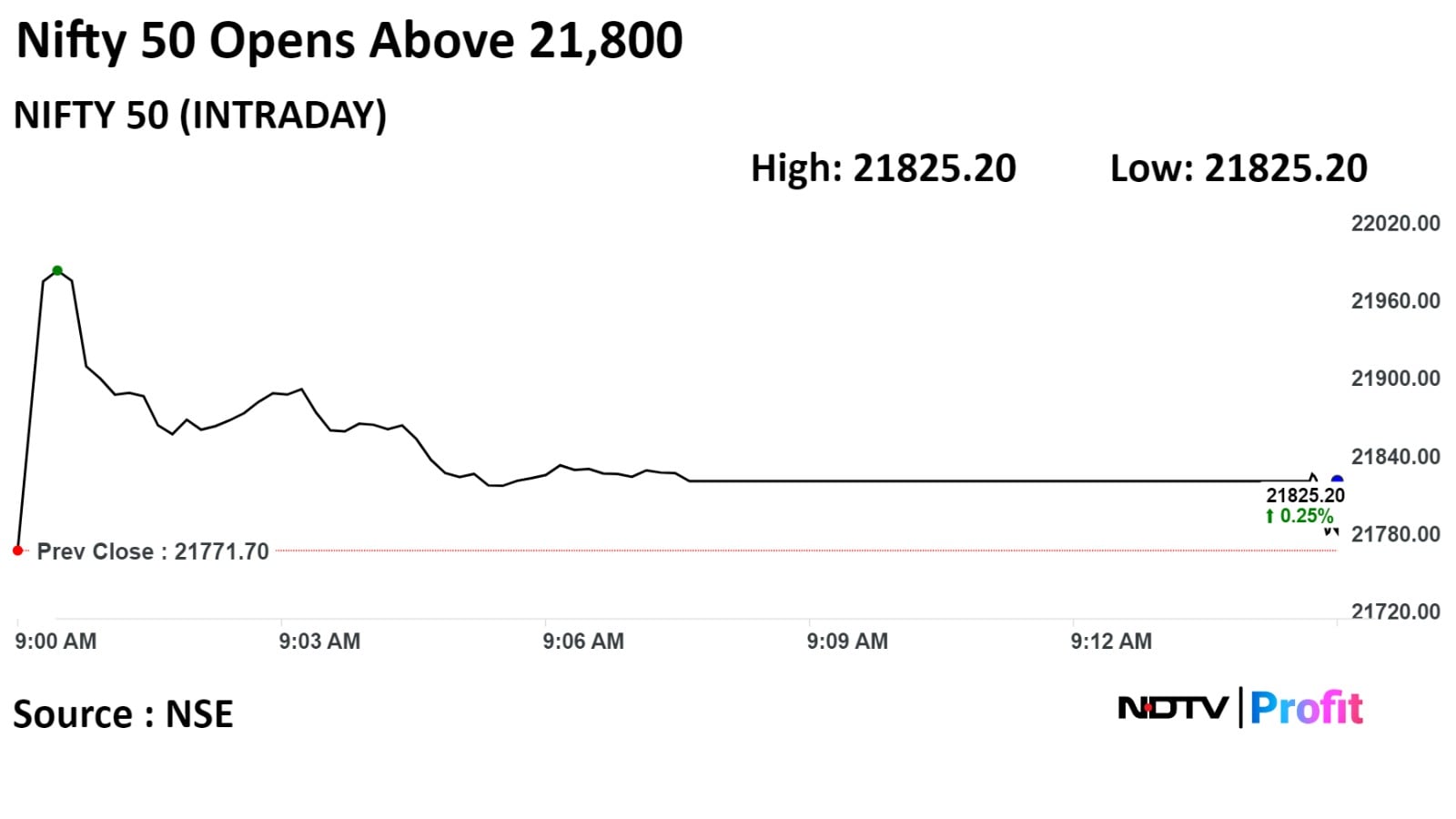

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Benchmark equity indices opened higher today on the back of gains in the shares of Bharti Airtel, TCS, and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

"It is important to cross the barrier zone for continuation of the further upward move," Prabhudas Lilladher said in a report. "The support for the day is seen at 21600 while the resistance would be at 21900."

Shares of Bharti Airtel Ltd., Tata Consultancy Services Ltd., HCL Technologies Ltd., Larsen & Toubro Ltd, and Maruti Suzuki Ltd. contributed the most to the gains.

Meanwhile, those of Reliance Industries Ltd., Power Grid Corp. of India Ltd., HDFC Bank Ltd., NTPC Ltd., and ICICI Bank Ltd. capped the upside.

Most sectoral indices rose with Nifty Media and Nifty Realty gaining the most. On the other hand, Nifty Bank and Nifty Financial Services fell.

The market breadth was skewed in the favour of buyers. Around 1,871 shares rose, 1058 fell and 88 were unchanged.

The broader markets also gained; the S&P BSE MidCap Index was up 0.21%, whereas S&P BSE SmallCap Index was 0.67% higher.

89.3 lakh shares or 1.4% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

Nod for acquiring stake in Axis, IndusInd, YES, ICICI, Bandhan and Suryoday Small Finance Banks

Source: Exchange filing

At pre-open, the S&P BSE Sensex Index was up 240.76 points, or 0.34%, at 71,972.18 while the NSE Nifty 50 was 53.50 points or 0.25% higher at 21,825.20.

The yield on the 10-year bond opened flat at 7.09%.

Source: Bloomberg

The local currency strengthened 2 paise to open at Rs 83.04 against the U.S dollar.

It closed at 83.06 on Monday

Source: Bloomberg

HDFC Bank group gets RBI nod to acquire aggregate holding of up to 9.5% stake in Bank

Approval to stand cancelled if HDFC Bank group fails to acquire major shareholding one year

If aggregate holding falls below 5%, RBI nod will be required to increase it to 5% or more

Source: Exchange filing

Upgrade TCS to Buy from Hold

Downgrade Infy to Hold from Buy

3Q24 had unexpected positive surprises from top-tier companies;mid-tier is now showing cracks

Cloud results were positive read-across for sector

Not optimistic on major surge in spend by banks

Growth forecast for FY25 remains in range of 6-7%

Resilient near-term margin beat looks unsustainable

Valuation gap to TCS is down to only c10%

Near-term growth and margin outlook for TCS seems better

Margin outlook and large deal ramp-ups concerns in Infy

Morgan Stanley Maintains OVERWEIGHT on Ashok Leyland Ltd.

Price Target of Rs 223

EBITDA stood at Rs 11.1bn, 9% ahead of estimates

PAT stood at Rs 5.8bn, 3% below estimate

Full-year FY24 EPS estimate is Rs 8.72

Gross margin improved 130bps QoQ

Morgan Stanley has Equal Weight rating on Bharti Airtel with Target Price of Rs 1,015

Beat in India mobile business revenues and EBITDA led by improving subscriber mix

Capex was stable QoQ and surprised positively

Consolidated reported net debt came down QoQ to Rs 2,021 billion

Issues clarification on media reports of JFS acquiring wallet business

Calls report speculative and factually incorrect

Says there have not been any negotiations in this regard

Source: Exchange filing

U.S. Dollar Index at 104.39

U.S. 10-year bond yield at 4.13%

Brent crude up 0.21% at $78.15 per barrel

Nymex crude up 0.19% at $72.92 per barrel

GIFT Nifty was down 21.5 points or 0.1% at 21,814.50 as of 8:09 a.m

Bitcoin was up 0.68% at $42,628.42

U.S. Dollar Index at 104.39

U.S. 10-year bond yield at 4.13%

Brent crude up 0.21% at $78.15 per barrel

Nymex crude up 0.19% at $72.92 per barrel

GIFT Nifty was down 21.5 points or 0.1% at 21,814.50 as of 8:09 a.m

Bitcoin was up 0.68% at $42,628.42

Jefferies Maintains 'buy' on Embassy REIT

Price target raised to Rs 414 apiece from Rs 394 apiece

Recorded 3.5 msf leasing in Q3, met its FY24 guidance in 9M

Sees distribution decline of 6.0% QoQ/2.1%YoY at Rs 5.20/unit as disappointment

Vacancy levels still 10% below pre-COVID levels

Management expects occupancy to rise further in 4Q

Believes REIT trades at 9% discount to independent valuer NAV

Jefferies rated 'buy' on Coforge

Price target of Rs 7,400 apiece.

Remains top pick

Demand recovery to come with lag even if US sees rate cuts in 2024.

Co expect steady growth in FY25 led by healthy order wins

Gross margin expansion to drive up adjusted Ebitda margins in FY25.

Proposed change to ESOP scheme may impact EBIT margins in FY25; FY26 margins not at risk.

Jefferies Maintains 'buy' on Varun Beverages; raises target to Rs 1,480 apiece

2% Per-case realisations growth drove 20% India rev growth

Swelled debt levels due to capex, brokerage positive on growth mindset

Strong opportunity in dairy beverages & juices

HDFC Bank Group gets RBI nod to acquire aggregate holding of up to 9.5% stake in IndusInd Bank

Approval to stand cancelled if the group fails to acquire major shareholding within one year

If aggregate holding falls below 5%, RBI nod will be required to increase it to 5% or more

Source: Exchange filing

Nifty February futures down by 0.75 % to 21,787 at a premium of 15.3 points.

Nifty February futures open interest down by 0.12%.

Nifty Bank February futures down by 0.60% to 46,040.40 at a premium of 214.85 points.

Nifty Bank February futures open interest down by 2.15%.

Nifty Options Feb. 8 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 21,000.

Bank Nifty Options Feb. 7 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 44,000.

Securities in ban period: Hindustan Copper, India Cements, Indus Tower, National Aluminium, UPL, Zee Entertainment Enterprise.

BLS E-Services: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 135 apiece. The Rs 310.91 crore IPO was subscribed 162.47 times on its third and final day. Bids were led by non-institutional investors (300.14 times), retail investors (237 times) and institutional investors (123.3 times).

Apeejay Surrendra Park Hotels: The public issue was subscribed 2.53 times on day 1. The bids were led by retail investors (5.74 times), non-institutional investors (3.24 times) and institutional investors (1.17 times) and reserved for employees (0.76 times).

One 97 Communication: Paytm operator One97 Communications Ltd. has denied reports of investigation or violation of foreign exchange rules by the company or its associate Paytm Payments Bank.

Jio Financial Services: The company has denied being in talks to acquire the crisis-hit Paytm wallet of One 97 Communications.

Zee Entertainment Enterprise: The National Company Law Tribunal will hear on Tuesday a plea filed by the company regarding the recently terminated merger with Sony Group Corp.'s Indian subsidiary.

Adani Total Gas, INOX India: The two companies have entered into a mutual support agreement under which ATGL and INOXCVA will mutually accord a “preferred partner” status for the delivery of LNG and LCNG equipment.

Pidilite Industries: The company announced the inauguration of a new manufacturing facility in Sandila, near Lucknow, for its tile adhesive brand, Roff.

Triveni Turbine: The company incorporated a wholly-owned subsidiary, ‘Triveni Turbines Americas Inc.' in Texas, USA.

Styrenix Performance Materials: The company was awarded the contract to Mott Macdonald to set up the brownfield expansion project to increase the annual capacity of ABS from 85 KT to 210 KT.

Indian Energy Exchange: The total volume stood at 10,893 MU, up 26.1% year-on-year for the month of January.

Hindalco Industries: The company bought a 26% stake in Ayana Renewable Power for Rs 1.63 crore.

JK Cements: The company approved the merger of units Acro Paints and JK Maxx.

SP Apparels: The company acquired a 100% stake in Youn brand apparel, a subsidiary of Bannari Amman Spinning Mills for Rs 223 crore.

Action Construction Equipment, Agi Greenpac, Akzo Nobel India, Anant Raj, Birla Corporation, Brigade Enterprises, Britannia Industries, Computer Age Management Services, Chambal Fertilisers and Chemicals, Cigniti Technologies, Dollar Industries, E.I.D. Parry, EIH Hotels, Endurance Technologies, Eveready Industries India, FIEM Industries, Go Fashion (India), Godrej Properties Godawari Power & Ispat, Gujarat State Fertilizers and Chemicals, Hawkins Cookers, IOL Chemicals & Pharmaceuticals, J.B. Chemicals and Pharmaceuticals, JK Tyre and Industries, Kingfa Science and Technology, Lemon Tree Hotels, Max Financial Services, Navin Fluorine International, NLC India, FSN E-Commerce Ventures, Procter & Gamble Health, PNC Infratech, Radico Khaitan, Redington, Timken India, Trident, TTK Prestige, Tata Teleservices, Usha Martin, Vakrangee, V-Mart Retail, and Welspun Corp.

Bharti Airtel Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 2.3% at Rs 37,899.5 crore vs Rs 37,043.8 crore (Bloomberg estimate Rs 38,051.3 crore).

Ebitda up 1.54% at Rs 19,814.8 crore vs Rs 19,513.7 crore (Bloomberg estimate Rs 19,841.04 crore).

Margin narrowed by 39 bps to 52.28% vs 52.67% (Bloomberg estimate 52.10%).

Net profit up 37.41% at Rs 2,876.4 crore vs Rs 2,093.2 crore (Bloomberg estimate Rs 2,596.3 crore).

Tata Chemicals Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 10.1% at Rs 3,730 crore vs Rs 4,148 crore (Bloomberg estimate Rs 3,824.7 crore).

Ebitda down 41.2% at Rs 542 crore vs Rs 922 crore (Bloomberg estimate Rs 732.97 crore).

Margin narrowed by 769 bps to 14.5% vs 22.2% (Bloomberg estimate 19.7%).

Net profit down 54.4% at Rs 194 crore vs Rs 425 crore (Bloomberg estimate Rs 283.2 crore).

Ashok Leyland Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 6.66% at Rs 11,092.7 crore vs Rs 10,399.74 crore.

Ebitda up 45.87% at Rs 1,961.28 crore vs Rs 1,344.47 crore.

Margin expanded by 475 bps to 17.68% vs 12.92%.

Net profit up 73.35% at Rs 608.85 crore vs Rs 351.21 crore.

Avanti Feeds Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 13.7% at Rs 1,253.2 crore vs Rs 1,102.6 crore (Bloomberg estimate Rs 1,014.9 crore).

Ebitda up 20.4% at Rs 97 crore vs Rs 80.59 crore (Bloomberg estimate Rs 73.1 crore).

Margin expanded 43 bps to 7.7% vs 7.3% (Bloomberg estimate 7.2%).

Net profit up 18% to Rs 83.31 crore vs Rs 70.59 crore (Bloomberg estimate Rs 57.8 crore.).

Responsive Industries Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1.3% at Rs 267.3 crore vs Rs 263.9 crore.

Ebitda up 83.9% at Rs 66.45 crore vs Rs 36.14 crore.

Margin expanded 1,116 bps to 24.9% vs 13.7%.

Net profit at Rs 44.71 crore vs Rs 16.82 crore.

Ask Automotive Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 19.6% at Rs 761.7 crore vs Rs 637 crore.

Ebitda up 41.6% at Rs 80.07 crore vs Rs 56.53 crore.

Margin expanded by 163 bps to 10.51% vs 8.87%.

Net profit up 71.3% at Rs 49.94 crore vs Rs 29.15 crore.

eMudhra Q3 Earnings FY24 (Consolidated, YoY)

Total income from operations was up 2.9% at Rs 99.51 crore vs Rs 96.7 crore.

EBIT down 8.3% at Rs 21.48 crore vs Rs 23.43 crore.

Margin narrowed by 264 bps to 21.6% vs 24.2%.

Net profit up 6.6% at Rs 20 crore vs Rs 18.76 crore.

Appointed Ritesh Raj Pariyani as chief financial officer and key managerial personnel of the company, with effect from Feb. 5.

Triveni Turbine Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 32.5% at Rs 431.7 crore vs Rs 325.8 crore (Bloomberg estimate Rs 419.2 crore).

Ebitda up 32.6% at Rs 83.71 crore vs Rs 63.12 crore (Bloomberg estimate Rs 82.42 crore).

Margin at 19.4% (Bloomberg estimate 19.70%).

Net profit up 29.8% at Rs 68.3 crore vs Rs 52.6 crore (Bloomberg estimate Rs 65.98 crore).

Board declares interim dividend of Rs 1.3 per share.

Paradeep Phosphates Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 41% at Rs 2,595 crore vs Rs 4,398.4 crore.

Ebitda down 24% at Rs 282.5 crore vs Rs 371.8 crore.

Margin expanded by 243 bps to 10.9% vs 8.5%.

Net profit down 39.6% at Rs 108.9 crore vs Rs 180.3 crore.

GET&D Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 8% at Rs 839 crore vs Rs 776.6 crore (Bloomberg estimate Rs 886.6 crore).

Ebitda at Rs 96.55 crore vs Rs 45.85 crore (Bloomberg estimate Rs 76.2 crore).

Margin expanded by 560 bps to 11.5% vs 5.9% (Bloomberg estimate 8.6%).

Net profit at Rs 49.35 crore vs Rs 4.74 crore (Bloomberg estimate Rs 44.95 crore).

Linde India Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1.3% at Rs 706.2 crore vs Rs 697 crore.

Ebitda up 10.9% at Rs 186.2 crore vs Rs 167.8 crore.

Margin expanded by 228 bps at 26.4% vs 24.1%.

Net profit up 9.1% at Rs 120 crore vs Rs 110 crore.

Suven Pharmaceuticals Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 37.9% at Rs 219.8 crore vs Rs 353.8 crore.

Ebitda down 55.6% at Rs 65.14 crore vs Rs 146.7 crore.

Margin narrowed to 29.6% vs 41.5%.

Net profit down 56.6% at Rs 46.75 crore vs Rs 107.7 crore.

Gulf Oil Lubricants India Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 4.7% at Rs 817.5 crore vs Rs 781.1 crore (Bloomberg estimate Rs 883 crore).

Ebitda up 22.7% at Rs 110.4 crore vs Rs 90.02 crore (Bloomberg estimate Rs 118.4 crore).

Margin expanded by 198 bps to 13.5% vs 11.5% (Bloomberg estimate 13.4%).

Net profit up 26.8% at Rs 79.45 crore vs Rs 62.66 crore (Bloomberg estimate Rs 89.1 crore).

Board approves interim dividend of Rs 16 per share.

CCL Products Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 24.13% at Rs 664.48 crore vs Rs 535.29 crore (Bloomberg estimate Rs 655.5 crore).

Ebitda up 10.12% at Rs 110.92 crore vs Rs 100.72 crore (Bloomberg estimate Rs 121.8 crore).

Margin narrowed by 212 bps at 16.69% vs 18.81% (Bloomberg estimate 18.6%).

Net profit down 13.37% at Rs 63.29 crore vs Rs 73.06 crore (Bloomberg estimate Rs 70.66 crore).

Ideaforge Technologies Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1,065.93% at Rs 90.89 crore vs Rs 7.79 crore.

Ebitda at Rs 19.58 crore vs loss of Rs 16.18 crore.

Margin at 21.54%.

Net profit at Rs 14.79 crore vs loss of Rs 7.80 crore.

Fusion Micro Finance Q3 Earnings (YoY)

Revenue up 31.44% at Rs 613.24 crore vs Rs 466.52 crore.

Net profit up 23.4% at Rs 126.45 crore vs Rs 102.47 crore.

Prince Pipes And Fittings Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 12.37% at Rs 618.62 crore vs Rs 705.89 crore (Bloomberg estimate Rs 646.8 crore).

Ebitda up 8.91% at Rs 75.66 crore vs Rs 69.47 crore (Bloomberg estimate Rs 84.95 crore).

Margin expanded by 238 bps to 12.23% vs 9.84% (Bloomberg estimate 13.10%).

Net profit up 6.32% at Rs 37.63 crore vs Rs 35.39 crore (Bloomberg estimate Rs 48.5 crore).

Bajaj Consumer Care Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 4.3% at Rs 236.38 crore vs Rs 226.63 crore (Bloomberg estimate Rs 236.5 crore).

Ebitda up 12.77% at Rs 33.28 crore vs Rs 29.51 crore (Bloomberg estimate Rs 37.8 crore).

Margin at 14.07% vs 13.02% (Bloomberg estimate 16%).

Net profit up 9.48% at Rs 36.35 crore vs Rs 33.2 crore (Bloomberg estimate Rs 38.4 crore).

BSE Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 82.15% at Rs 3,716 crore vs Rs 2,040 crore.

Ebitda up 135.29% at Rs 920 crore vs Rs 391 crore.

Operating Ebitda margin at 25% vs 19%.

Net profit up 123.06% at Rs 1,064 crore vs Rs 477 crore.

TVS Supply Chain Solutions Q3 Earnings (Consolidated, YoY)

Revenue down 6.39% at Rs 2,221.84 crore vs Rs 2,373.41 crore.

Ebitda down 7.89% at Rs 162.07 crore vs Rs 175.94 crore.

Margin narrowed by 11 bps to 7.29% vs 7.41%.

Net profit down 37.83% at Rs 9.99 crore vs Rs 16.07 crore.

Most other Asian indices declined following the Wall Street crash as strong US economic data further reduced expectations for a swift Federal Reserve pivot to monetary easing. Treasuries gained after another slump Monday.

However, share indices in China rose, with CSI 300 and Hong Kong's Hang Seng jumping over 1%.

Brent crude was trading 0.22% higher at $78.16 a barrel. Gold was up by 0.04% at $2,025.95 an ounce.

The February futures contract of the GIFT Nifty was down 21.5 points, or 0.1%, at 21,814.50 as of 8:09 a.m.

India's benchmark stock indices ended lower on Monday as last-hour selloffs erased all morning gains, led by losses in index heavyweights Reliance Industries Ltd. and Bharti Airtel Ltd.

The Nifty settled 0.38%, or 82.10 points, lower at 21,771.70, while the Sensex fell 0.49%, or 354.21 points, to end at 71,731.42.

Overseas investors remained net buyers of Indian equities for the second consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 518.8 crore, while domestic institutional investors turned net sellers and offloaded equities worth Rs 1,188.6 crore, the NSE data showed.

The Indian rupee weakened 13 paise to close at Rs 83.06 against the U.S. dollar.

Most other Asian indices declined following the Wall Street crash as strong US economic data further reduced expectations for a swift Federal Reserve pivot to monetary easing. Treasuries gained after another slump Monday.

However, share indices in China rose, with CSI 300 and Hong Kong's Hang Seng jumping over 1%.

Brent crude was trading 0.22% higher at $78.16 a barrel. Gold was up by 0.04% at $2,025.95 an ounce.

The February futures contract of the GIFT Nifty was down 21.5 points, or 0.1%, at 21,814.50 as of 8:09 a.m.

India's benchmark stock indices ended lower on Monday as last-hour selloffs erased all morning gains, led by losses in index heavyweights Reliance Industries Ltd. and Bharti Airtel Ltd.

The Nifty settled 0.38%, or 82.10 points, lower at 21,771.70, while the Sensex fell 0.49%, or 354.21 points, to end at 71,731.42.

Overseas investors remained net buyers of Indian equities for the second consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 518.8 crore, while domestic institutional investors turned net sellers and offloaded equities worth Rs 1,188.6 crore, the NSE data showed.

The Indian rupee weakened 13 paise to close at Rs 83.06 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.