Overseas investors stay net buyers for the fourth consecutive day of Indian equities on Tuesday.

Foreign portfolio investors mopped stocks worth Rs 4,710.86 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned net sellers and off-loaded equities worth 958.49 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 138931 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

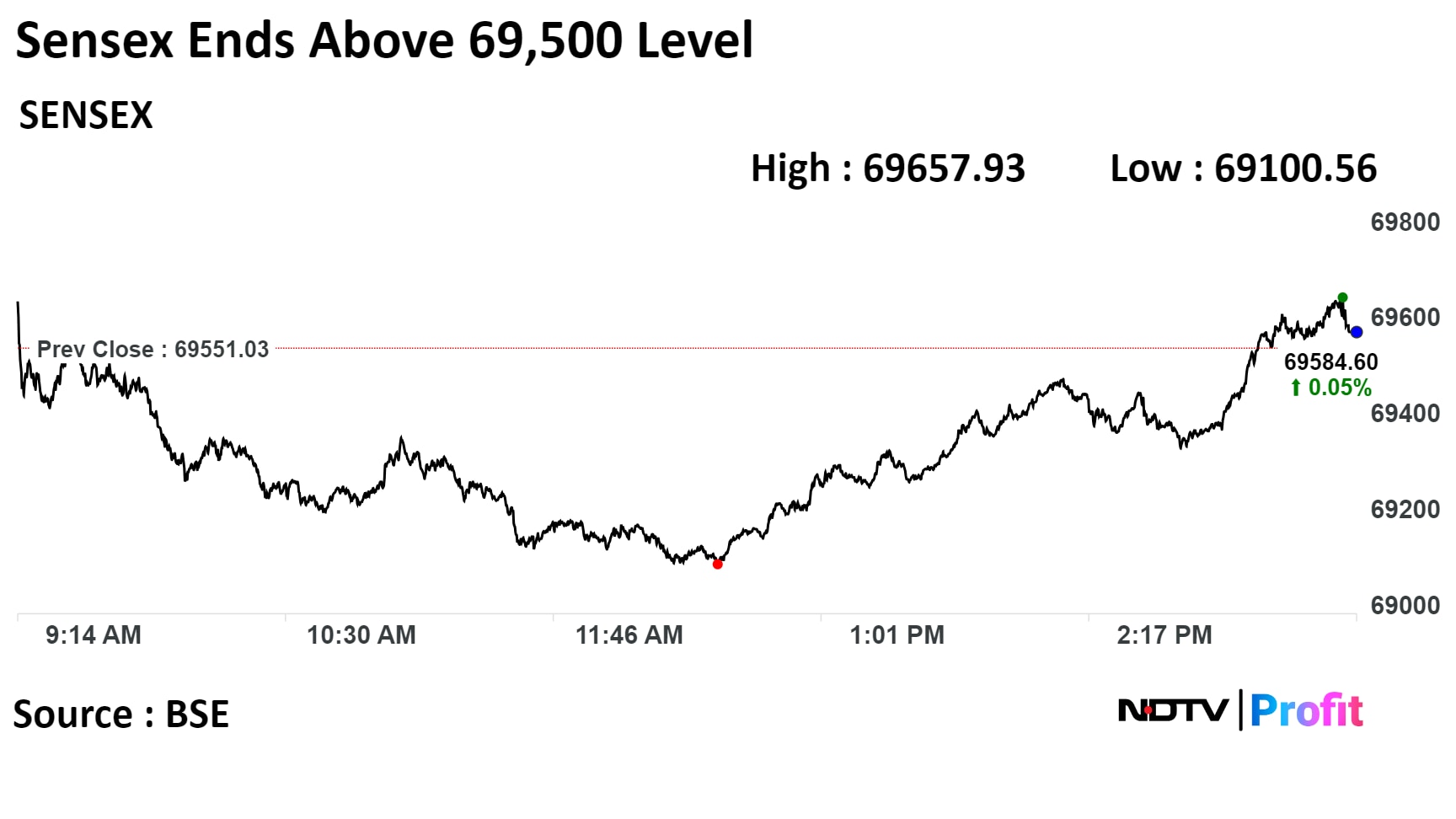

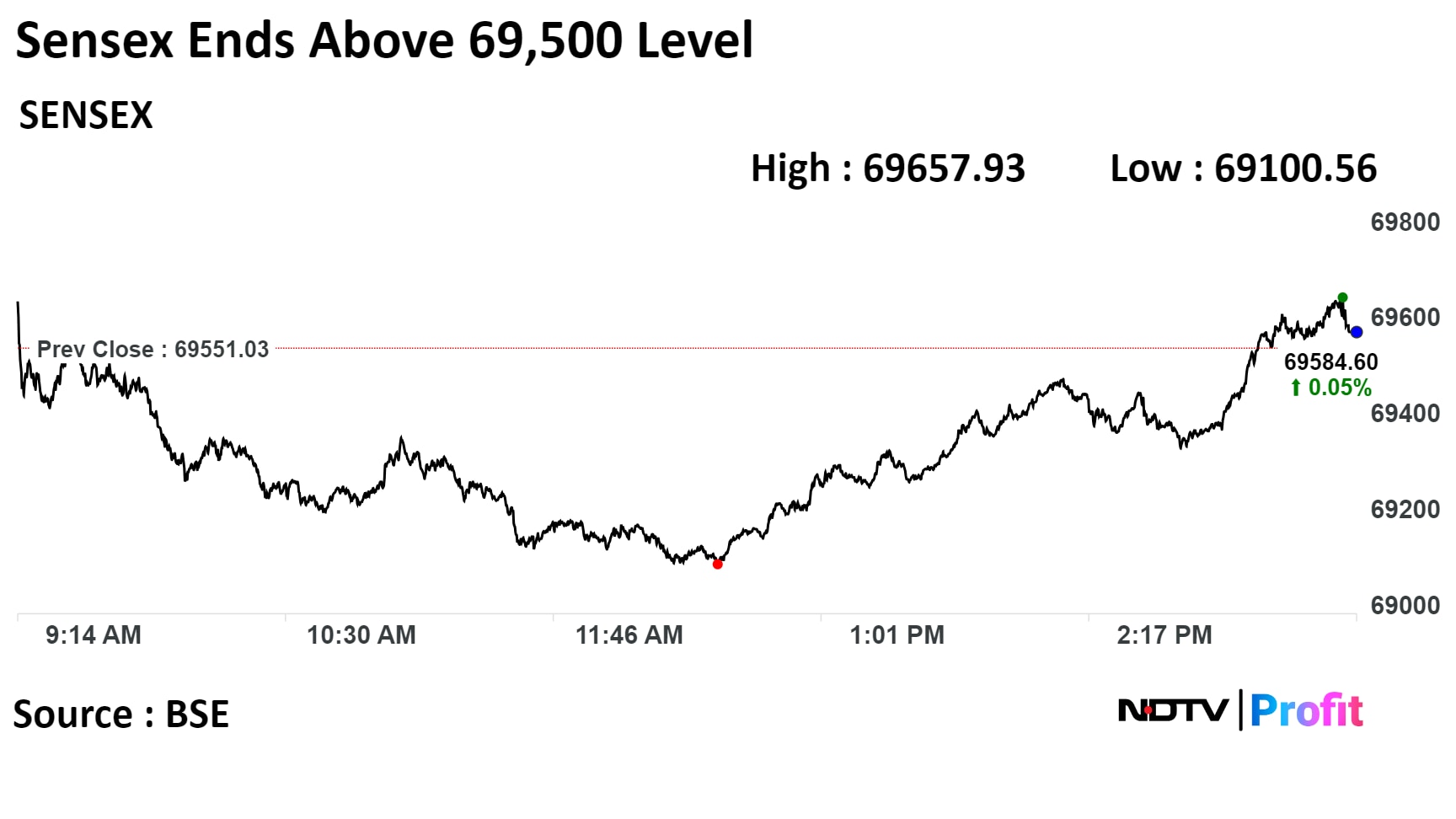

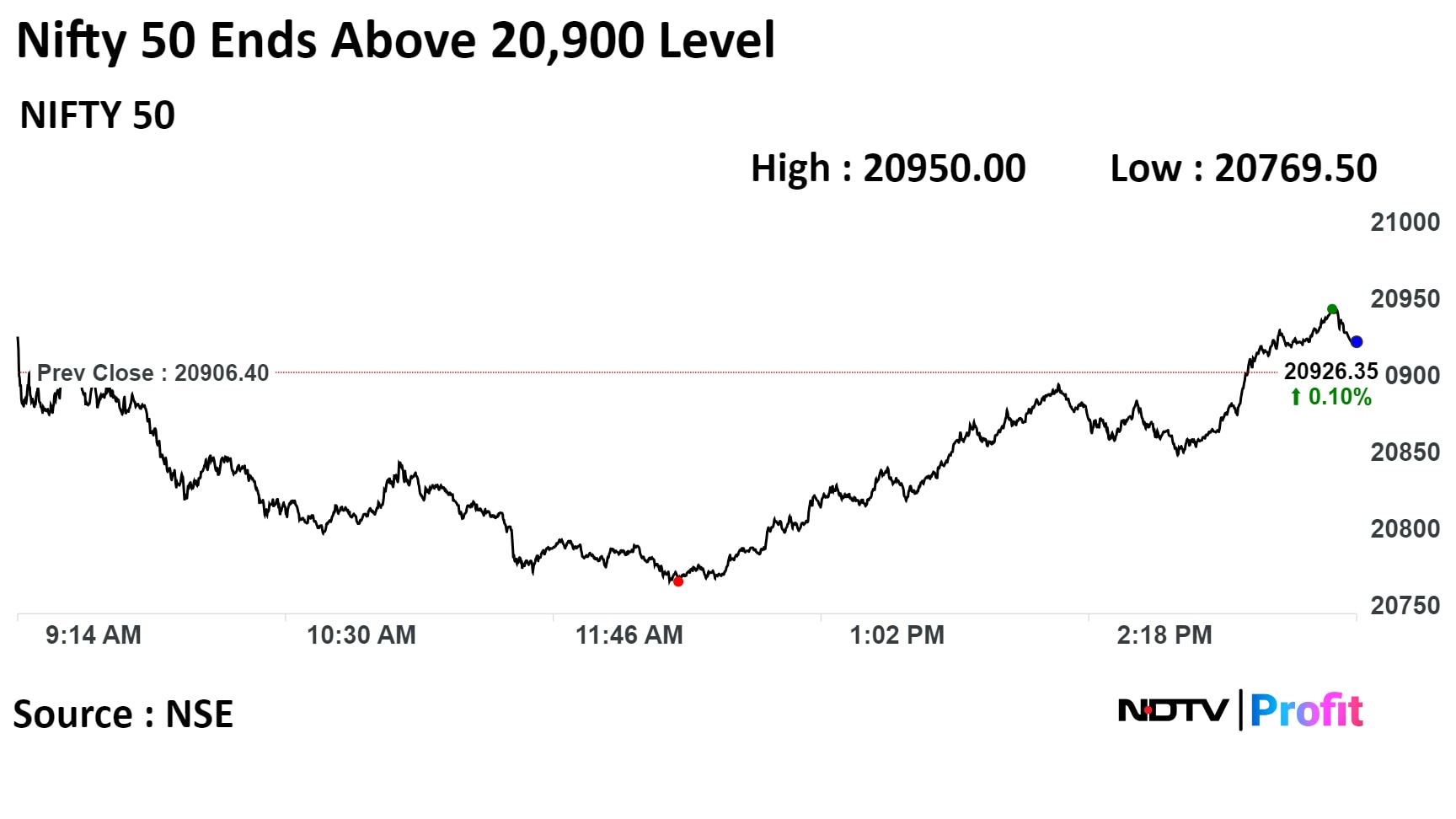

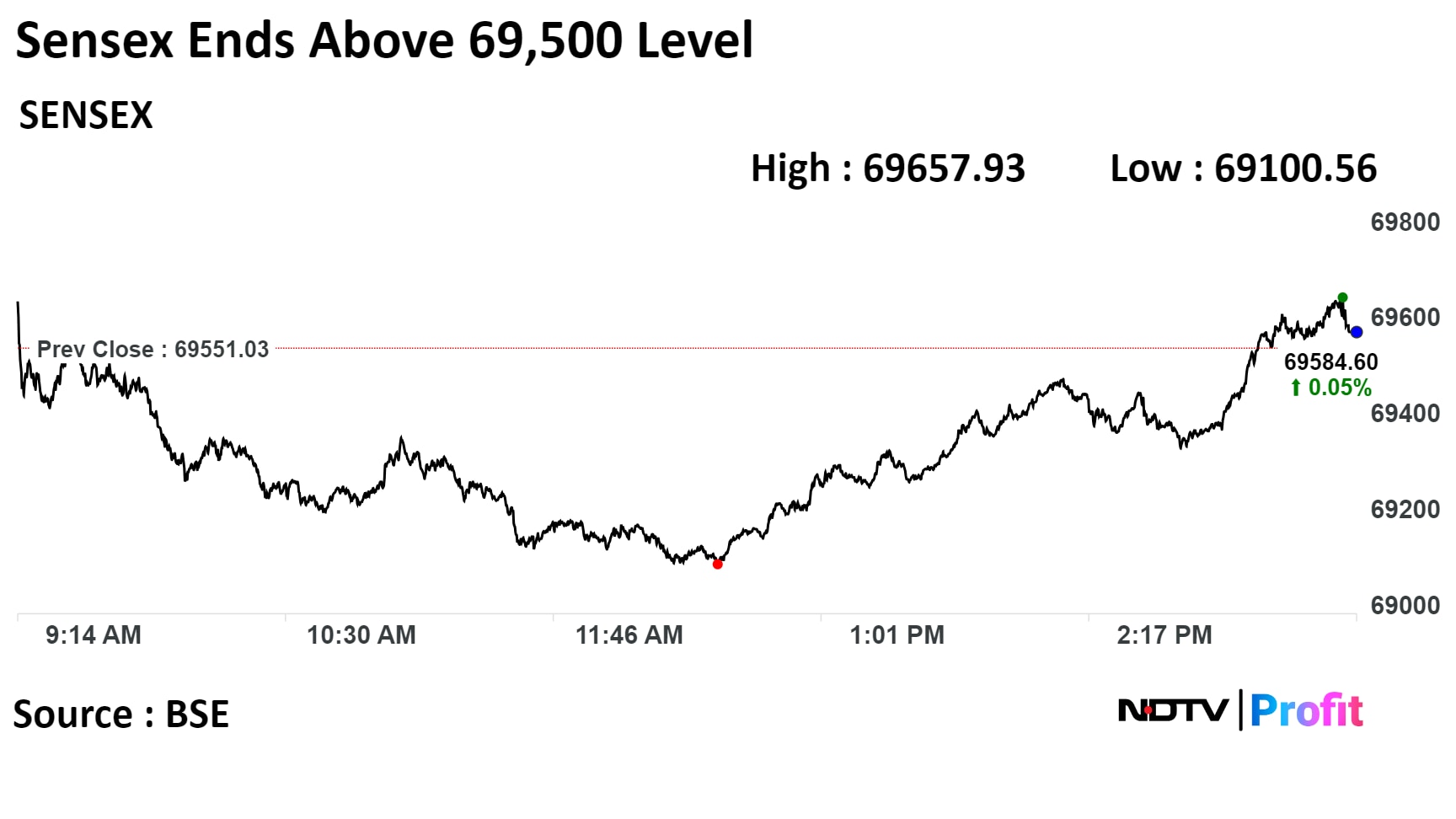

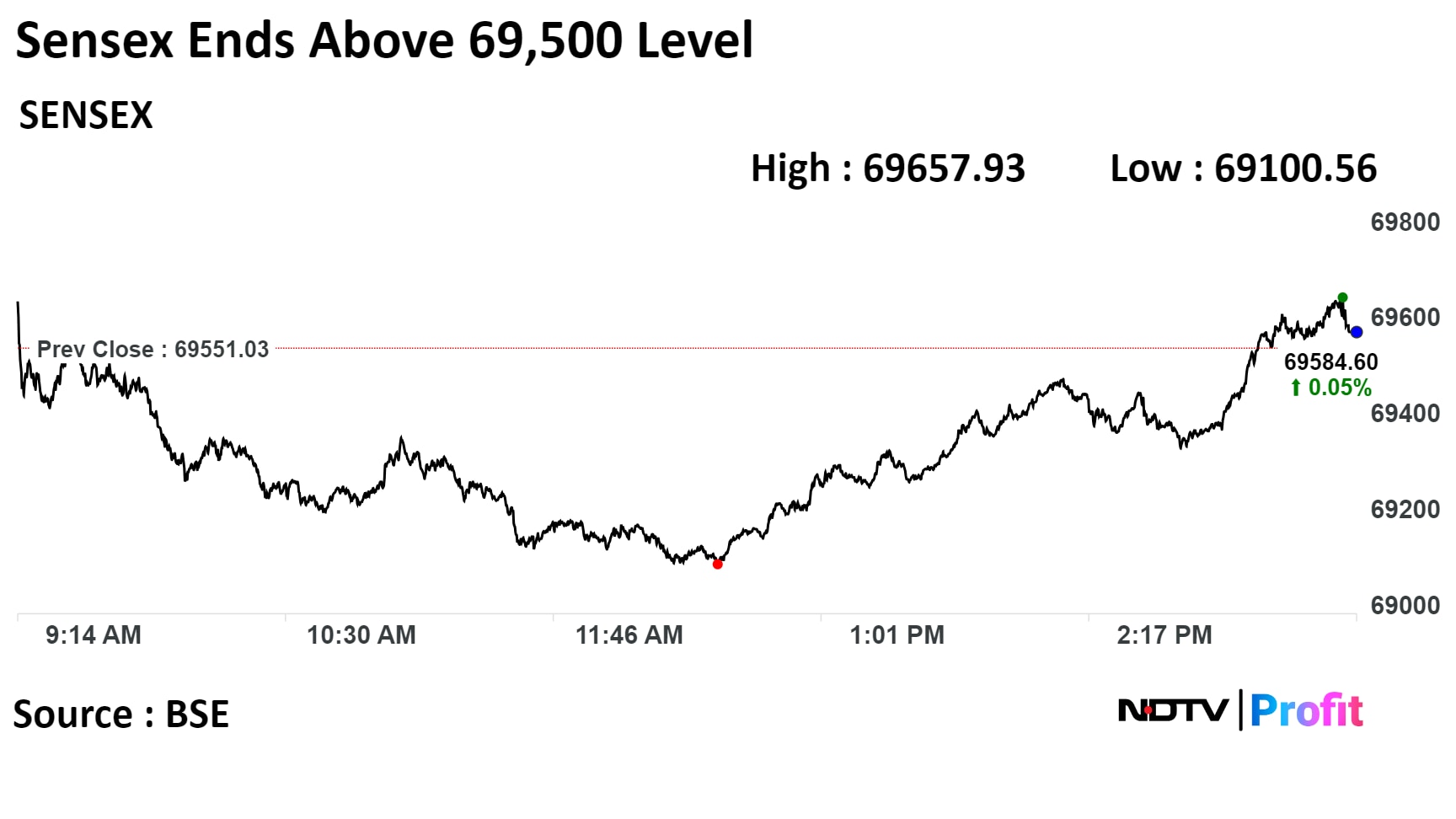

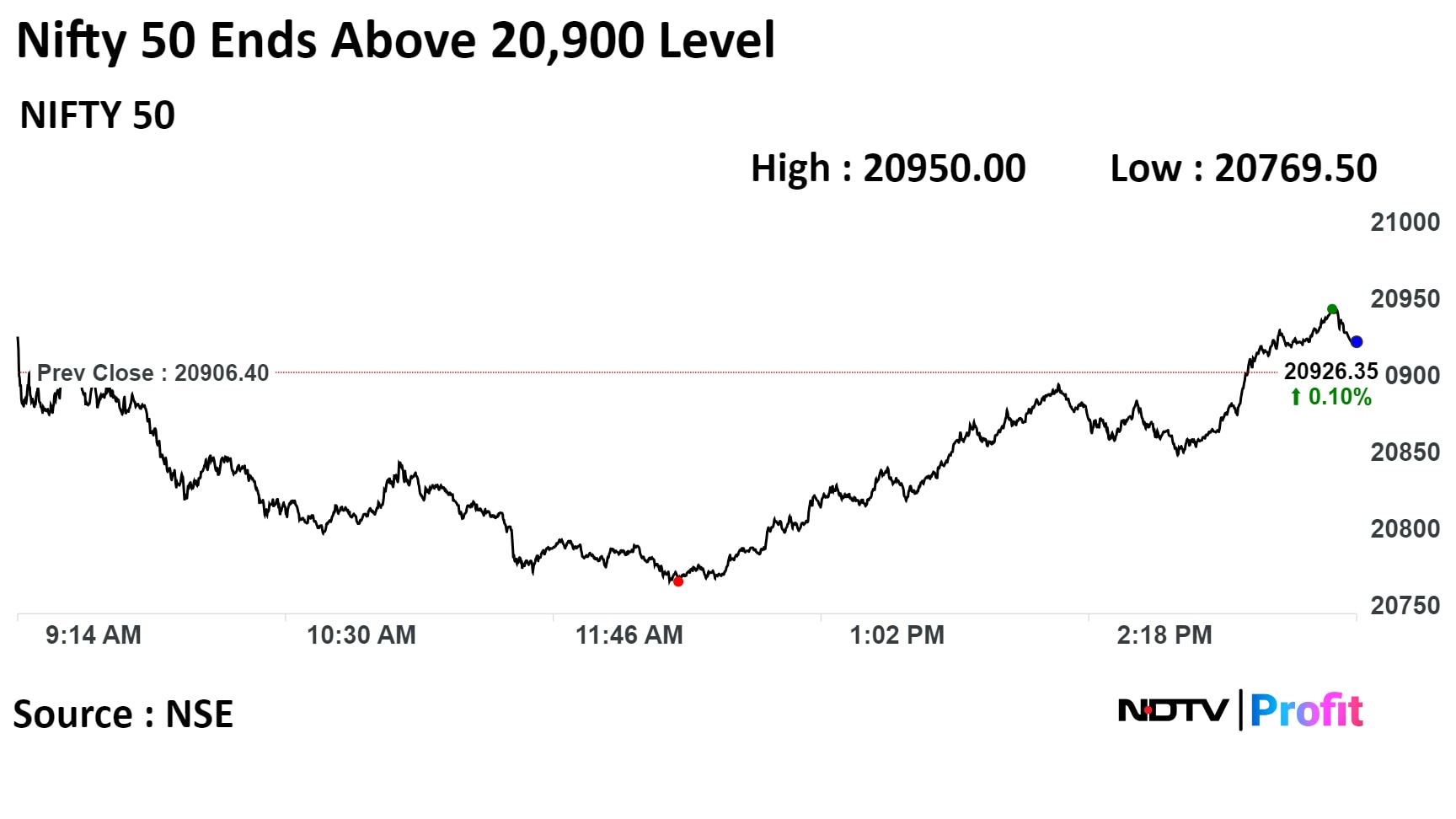

The NSE Nifty 50 ended 20 points or 0.1%, higher at 20,926.35, while the S&P BSE Sensex settled 34 points or 0.05%, higher at 69,584.60.

The yield on the 10-year bond closed flat at 7.26% on Wednesday.

Source: Bloomberg

The local currency depreciated nearly 2 paise to close at all time weakest level of 83.402 against the U.S. dollar on Wednesday.

It closed at 83.39 on Tuesday

Source: Bloomberg

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Indian benchmark indices settled largely flat on caution before the outcome of the U.S. Federal Reserve's two-day policy meet due at midnight.

The NSE Nifty 50 ended 19.95 points, or 0.1% higher, at 20,926.35, while the S&P BSE Sensex settled 33.57 points, or 0.05% higher at 69,584.60 on Wednesday.

Intraday, both the benchmark indices fell 0.65% as traders booked profit at higher levels tracking rally from last week. The NSE Nifty 50 declined 0.65% to 20,769.50, and the BSE Sensex fell 0.65% to 69,100.56.

Market participants exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech. Traders will closely monitor it for fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

Larsen & Toubro Ltd., NTPC Ltd., Hindalco Industries Ltd., ITC Ltd., and State Bank of India added to the Indices.

Infosys Ltd., Axis Bank Ltd., Tech Mahindra Ltd., Tata Consultancy Services Ltd., and UltraTech Cement Ltd. weighed on the indices.

Most sectoral indices advanced with the Nifty PSE rising the most. Ten out of 14 sectors on NSE rose, while four declined. Nifty IT sector fell the most.

Broader market outperformed benchmark Indices with the S&P BSE MidCap rising 1.06%, and S&P BSE SmallCap gaining 0.73. Around fifteen out of 20 sectors on BSE advanced while five declined. BSE Realty and BSE Power rose the most

The market breadth was skewed in the favour of the buyers. Around 2179 stocks advanced, 1597 declined, and 114 remained unchanged.

SmallCap 100 hits fresh life high of 14,647.15, extends gains for third session.

SmallCap 100 has gainer for 13 of the last 14 sessions.

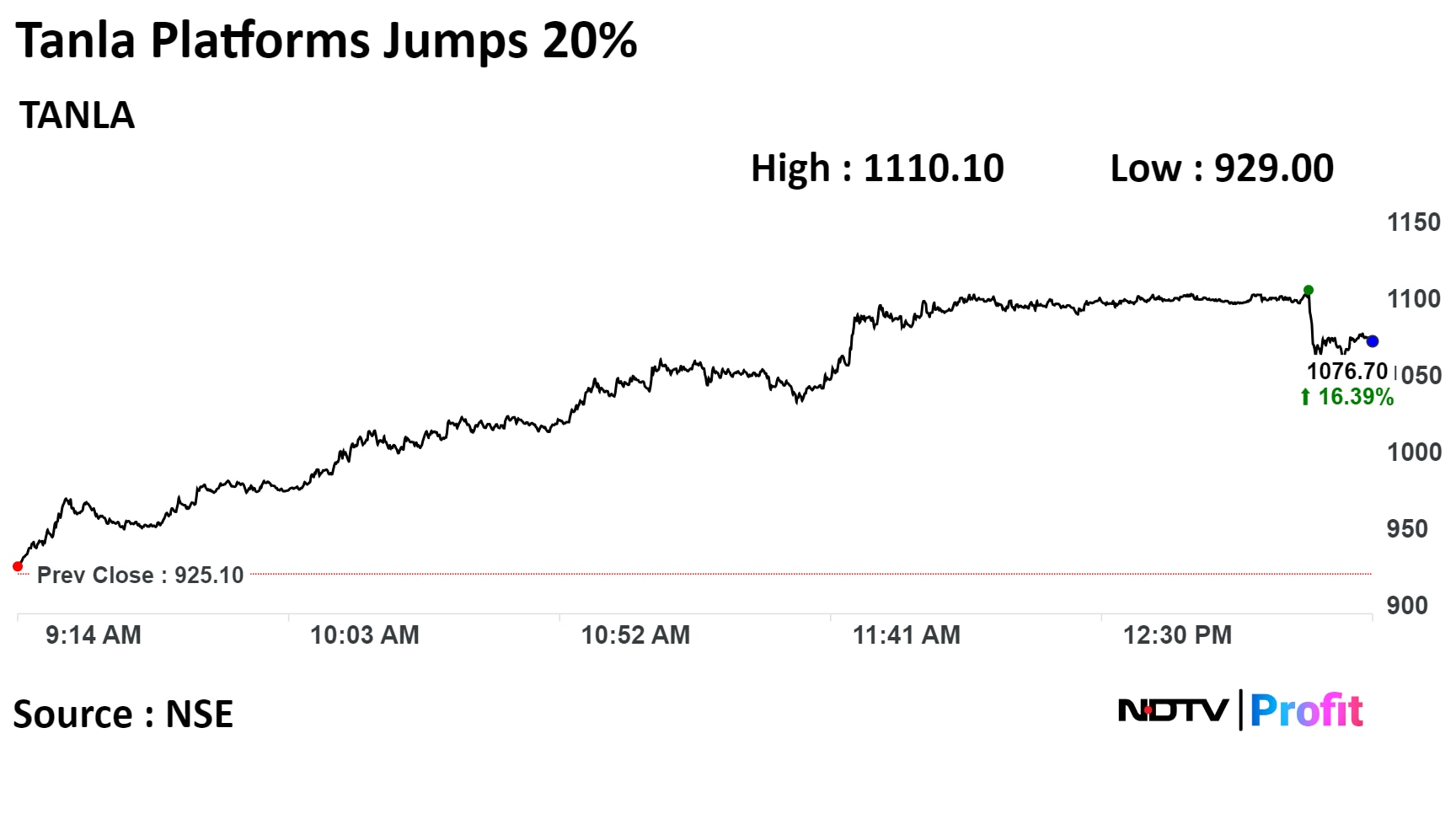

Tanla Platforms, NLC India, VIP Industries top gainers today.

Index has gained 6.9% in the past 14 sessions

SmallCap 100 hits fresh life high of 14,647.15, extends gains for third session.

SmallCap 100 has gainer for 13 of the last 14 sessions.

Tanla Platforms, NLC India, VIP Industries top gainers today.

Index has gained 6.9% in the past 14 sessions

IDFC First Bank Ltd's 46.6 lakh shares changed hands in a large trade

The private lender's 0.1% equity changed hands at Rs 87.30 apiece

Buyers and sellers not known immediately

Source: Bloomberg

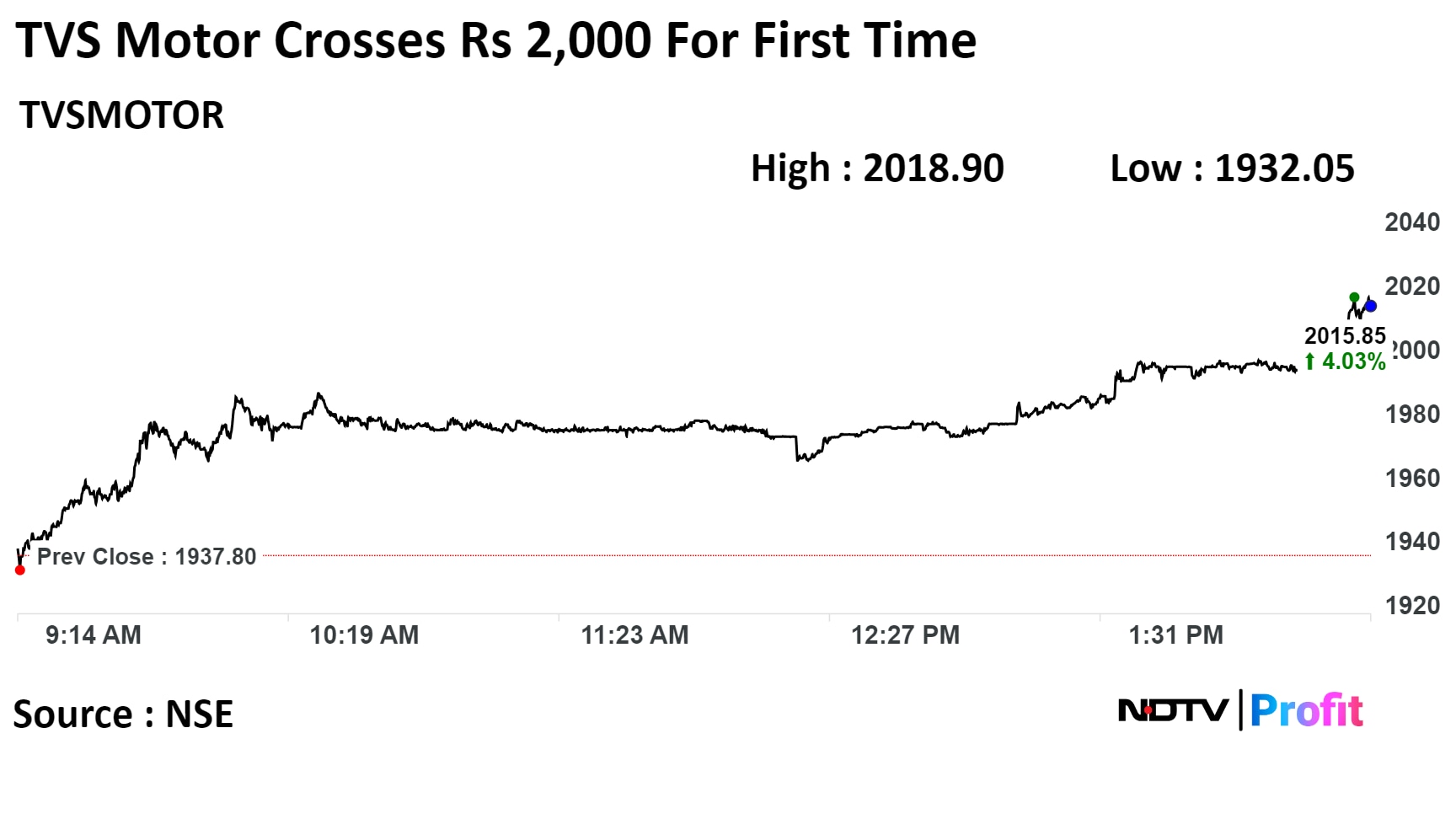

TVS Motor Company Ltd. rose as much as 3.35% to Rs 2,002 apiece, since it's listing on Jul 10, 2000. It was trading 3.39% higher at Rs 2,003 apiece, as of 2:29 p.m. This compares to a 0.15 decline in the NSE Nifty 50 Index as of 2:29 p.m.

It has risen 85.09% on a year-to-date basis. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 84.06.

Out of 43 analysts tracking the company, 25 maintain a 'buy' rating, 11 recommend a 'hold,' and 7 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 13.6%.

Mahindra & Mahindra Ltd.'s existing shareholders, and new investors set out terms and condition for investing Rs 875 crore in to Classic Legends Pvt. Ltd.

The investment will happen by way of subscription to compulsorily convertible preference shares, and equity shares of Classic Legends Pvt. Ltd.

Mahindra & Mahindra to invest Rs 525 crore, and balance Rs 350 crore to be invested by existing shareholders, new investors.

Source: Exchange Filing

Lok Sabha's security was breached when at least one visitor jumped into the well of the lower house from the gallery as seen in the footage of Sansad TV.

Visitors were jumping over the bench causing commotion in the house during ongoing session.

2.81crore shares changed hands in a large trade

0.5% equity changed hands at Rs 74.95 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Tanla Platforms Ltd. stock rose as much as 20% during the day to Rs 1,110 apiece. The shares were trading 16.51% higher at Rs 1,077.85 apiece compared to a 0.39% decline in the benchmark Nifty 50 at 1:17 p.m.

The stock has risen 50.88% on a year-to-date basis. The total traded volume so far in the day stood at 47 times its 30-day average. RSI is at 81, indicating the stock may be overbought

All the three anlayst tracking the stock maintains a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 22.6%.

Tanla Platforms Ltd. stock rose as much as 20% during the day to Rs 1,110 apiece. The shares were trading 16.51% higher at Rs 1,077.85 apiece compared to a 0.39% decline in the benchmark Nifty 50 at 1:17 p.m.

The stock has risen 50.88% on a year-to-date basis. The total traded volume so far in the day stood at 47 times its 30-day average. RSI is at 81, indicating the stock may be overbought

All the three anlayst tracking the stock maintains a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 22.6%.

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Indian benchmark indices were trading at day's low as traders booked profit at higher levels after the recent rally last week.

As of 12:18 p.m., S&P BSE Sensex was 424.41 points, or 0.62% lower at 69,117.87, while the NSE Nifty 50 was down 130.95 points or 0.63% at 20,774.34.

Market participants also exercised caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later on Wednesday. This also weighed on the investors' sentiment.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%. The highlight of the key event will be Federal Reserve Chair Jerome Powell's speech, which investors will monitor to get fresh cues about the central bank's rate trajectory going forward.

The U.S. Consumer Price Index rose 0.1% on sequential basis in November after being unchanged in October, which sparked fears among investors that the Federal Reserve may not start cutting rates aggressively.

"We believe the intraday formation is weak, but fresh selling is possible only after rejection for Nifty below 20,800, and for Sensex below 69,300. The market may slip to 20,700-20,600 or even 20,500/69,000-68,700-68,400," said Shrikant Chouhan, head equity research, Kotak Securities Ltd.

He advises to sell if Nifty breaches 20,800 levels with a stop loss at 21,050. "As long as the index is trading above 20,800/69,300, the chances of hitting 21,050-21,200/69,900-70,300 would brighten."

Hero MotoCorp Ltd., ITC Ltd., NTPC Ltd., Larsen & Toubro Ltd. and Power Grid Corp. were positively contributing to changes in the Nifty.

While, Axis Bank Ltd., ICICI Bank Ltd., Infosys Ltd., Tech Mahindra Ltd. and Tata Consultancy Services Ltd. were negatively contributing to the change.

Ten sectors out of 14 on NSE fell, with Nifty IT declining the most. Among the four sectors that gained, Nifty PSE rose the most.

The broader markets advanced; S&P BSE MidCap was 0.17% higher and S&P BSE SmallCap was up 0.11%.

Sixteen of the 20 sectors compiled by BSE declined, while four advanced. S&P BSE IT and S&P BSE TECK fell the most.

The market breadth was skewed in the favour of buyers. Around 1,901 stocks rose, 1,730 shares declined, and 151 remained unchanged.

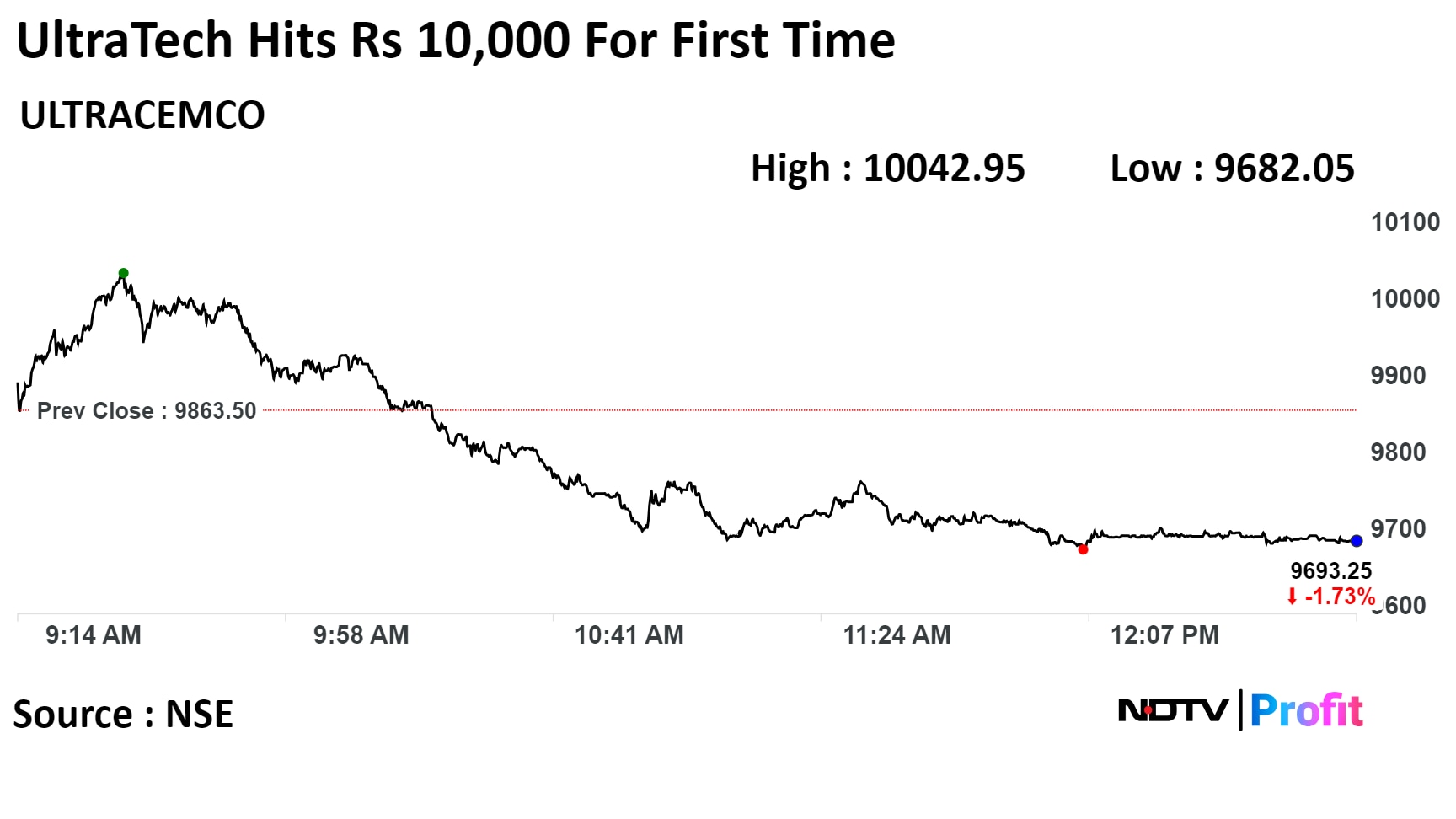

Price of the UltraTech Cement Ltd share rose to Rs 10,042, touching the five digit mark for the first time on Wednesday.

UltraTech Cement Ltd rose as much as 1.82% before reversing gains.

Price of the UltraTech Cement Ltd share rose to Rs 10,042, touching the five digit mark for the first time on Wednesday.

UltraTech Cement Ltd rose as much as 1.82% before reversing gains.

The scrip rose as much as 1.82% to Rs 10,042.95, the highest level since Aug 24, 2004. It erased gains to trade 1.70% lower at Rs 9,696.00 apiece, as of 12:42 p.m. This compares to a 0.55% decline in the NSE Nifty 50 Index.

It has risen 39.37% on a year-to-date basis. Total traded volume so far in the day stood at 7.1 times its 30-day average. The relative strength index was at 72.33, which implied the stock is overbought.

Out of 43 analysts tracking the company, 32 maintain a 'buy' rating, 9 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 3.32%.

Top Gainers

Tanla Platforms Ltd up 18.66% at Rs 1097.7

Ptc India Ltd up 8.78% at Rs 184.6

Bhansali Engineering Polymers Ltd up 8.74% at Rs 102.6

Nazara Technologies Ltd up 7.27% at Rs 864

Schneider Electric Infrastructure Ltd up 7.27% at Rs 417.5

Top Losers

Adani Total Gas Ltd down 9.5% at Rs 1008.4

Adani Energy Solutions Ltd down 6.65% at Rs 1016.75

Sunteck Realty Ltd down 5.22% at Rs 473.4

Sobha Ltd down 5.2% at Rs 965.1

Adani Green Energy Ltd down 4.5% at Rs 1398.05

The company saw 0.3% equity change hands in multiple large trades at Rs 109.80 apiece, according to Bloomberg data. The buyers and sellers were not known immediately.

The company saw 0.3% equity change hands in multiple large trades at Rs 109.80 apiece, according to Bloomberg data. The buyers and sellers were not known immediately.

Bank Of India stock fell as much as 6.48% during the day on the NSE, to Rs 108.20 apiece, the lowest since Oct 23, when it fell over 9%. The stock was trading 4.11% lower at Rs 110.95 apiece compared to a 0.42% advance in the benchmark Nifty 50 at 11:24 a.m.

The stock has risen 25.72% year-to-date. Total traded volume so far in the day stood at 18 times its 30-day average.

Of the five analysts tracking the company, four maintain a 'buy' and one recommends a 'hold,', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.6%.

DOMS Industries IPO gets fully subscribed on Day 1

Overall subscription at 1.19x as of 11:15 am

Retail subscription at 4.55x as of 11:15 am

NII subscription at 1.24x as of 11:15 am

Source: BSE

Granules India got ANDA approval from US FDA for Pantoprazole Sodium tablets.

Alert: Pantoprazole Sodium is used for short-term treatment of Gastroesophageal Reflux Disease.

Sources: Exchange Filing

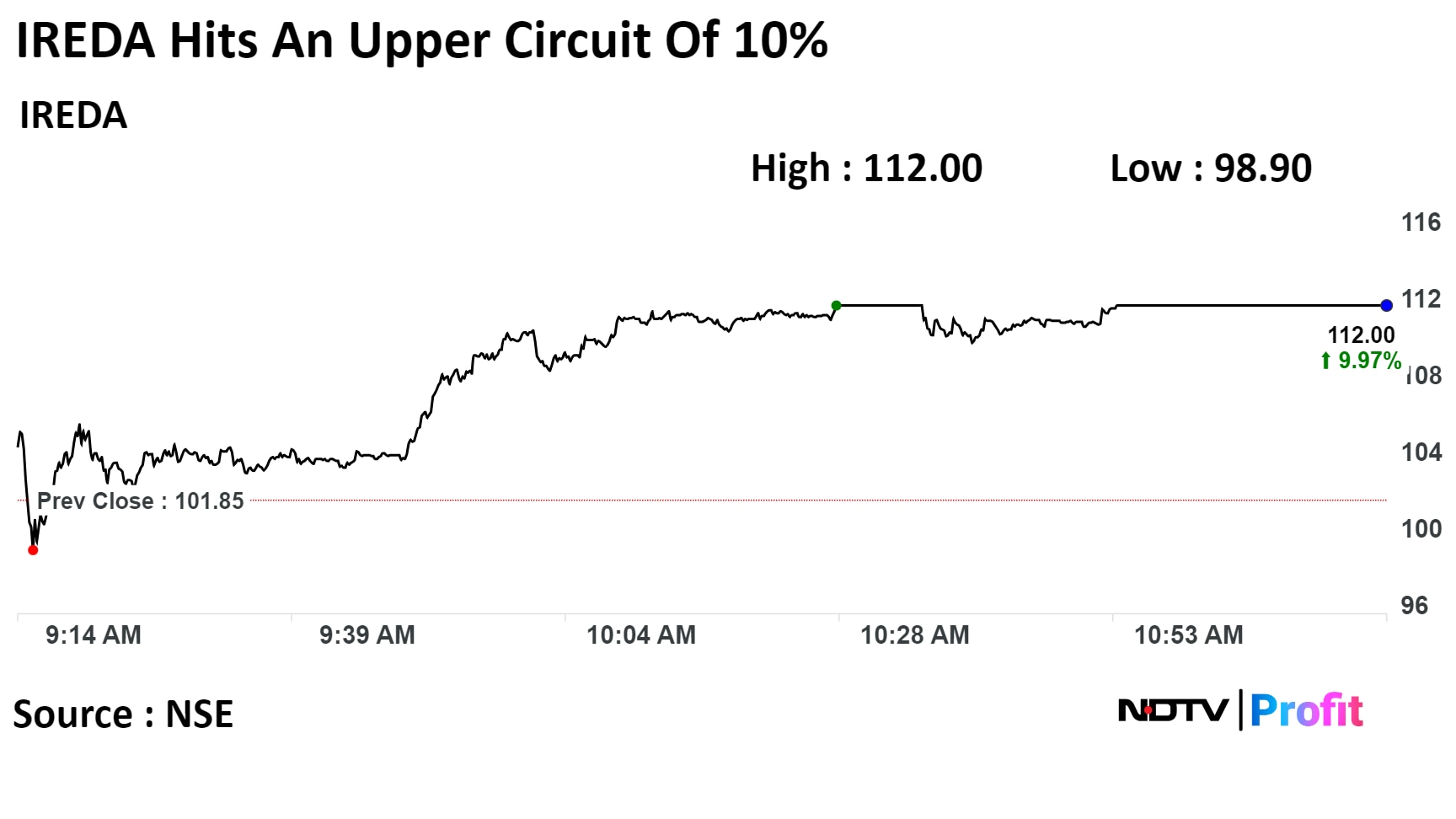

The scrip surged 9.97% to Rs 112.00 apiece, the highest level since its listing on Nov 29, 2023. It was trading at upper circuit 9.97% higher at Rs 112.00 apiece, as of 11:13 a.m. This compares to a 0.35% decline in the NSE Nifty 50 Index.

10 lakh shares changed hands in a large trade

0.01% equity changed hands at Rs 88.60 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Nifty IT top loser, down 1.72%

Losses led by TCS, Infosys and Coforge

All stocks in the red

Tanla Platforms at 11.69x its 30-day average, up 10%

Sunteck Realty at 8.52x its 30-day average, down 8%

Bank of India at 6.67x its 30-day average, down 5%

Vaibhav Global at 6.27x its 30-day average, down 5%

Shares of Laurus Labs Ltd. declined nearly 4% on Wednesday as the company received five observation from the U.S. Food and Drug Administration after inspection at its Andhra Pradesh unit.

Shares of Laurus Labs Ltd. declined nearly 4% on Wednesday as the company received five observation from the U.S. Food and Drug Administration after inspection at its Andhra Pradesh unit.

Shares of the company slumped 3.90%, the lowest since Dec. 7, before paring gains to trade 2.95% lower at 10:01 a.m. This compares to a 0.33% decline in the NSE Nifty 50.

The stock has risen 0.44% year-to-date. Total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 48.49.

Of the 15 analysts tracking the company, nine maintain a 'buy' rating, two recommend a 'hold,' and four suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.9%.

UPL Ltd. got included in Dow Jones Sustainability World and Emerging Markets Indices

Sources: Exchange Filing

Sunteck Realty Ltd.'s 59.5 lakh shares changed hands in a large trade

Sunteck Realty Ltd.'s 4.1% equity changed hands at Rs 484.75 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Axis Bank Ltd.'s 62.8 lakh shares changed hands in multiple pre-market large trades

The private lender's 0.2% equity changed hands at Rs 1,119.70 apiece

Buyers and sellers not known immediately

Source: Bloomberg

0.3% equity changed hands in multiple large trades

Buyers and sellers not known immediately

Source: Bloomberg

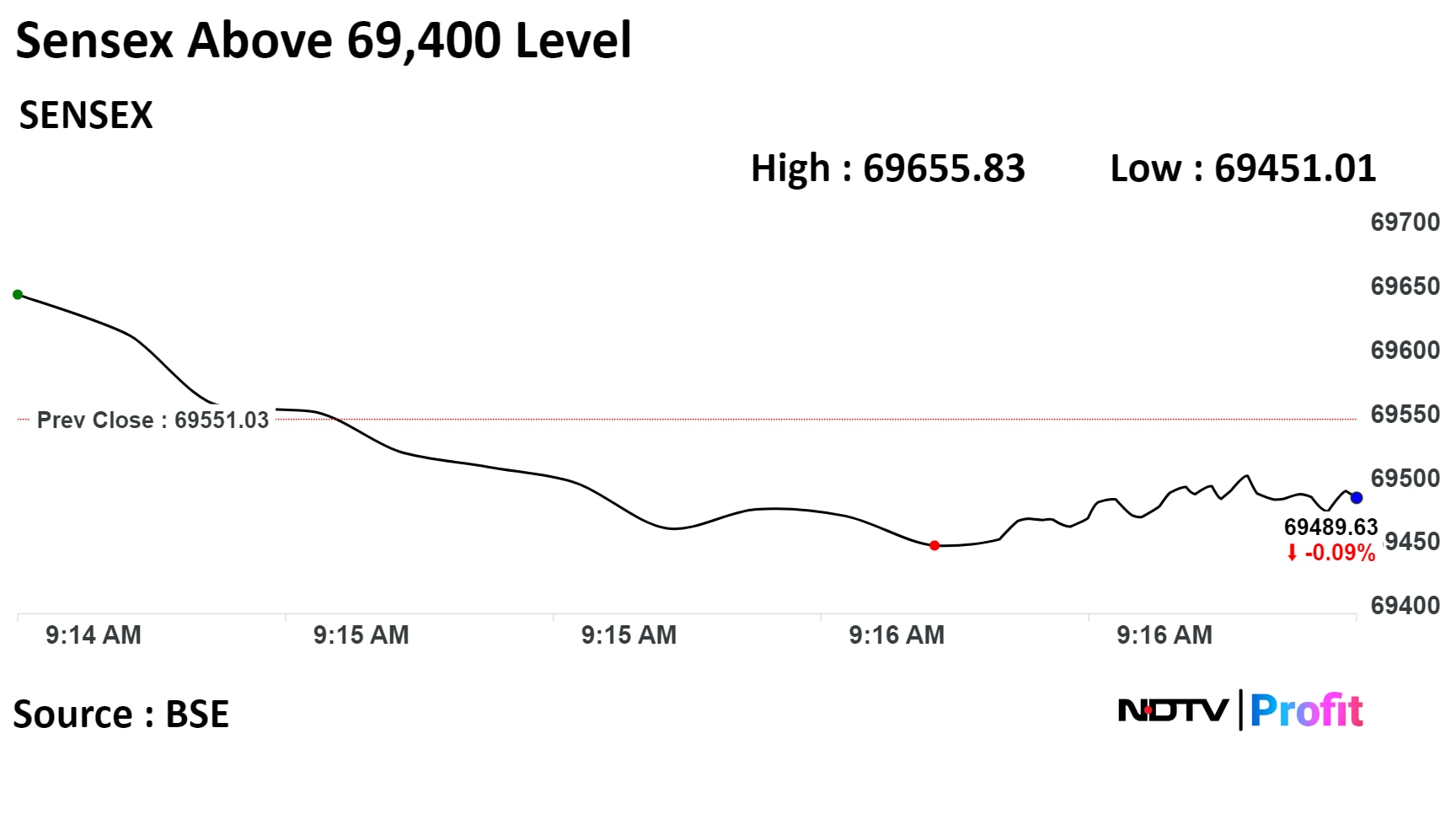

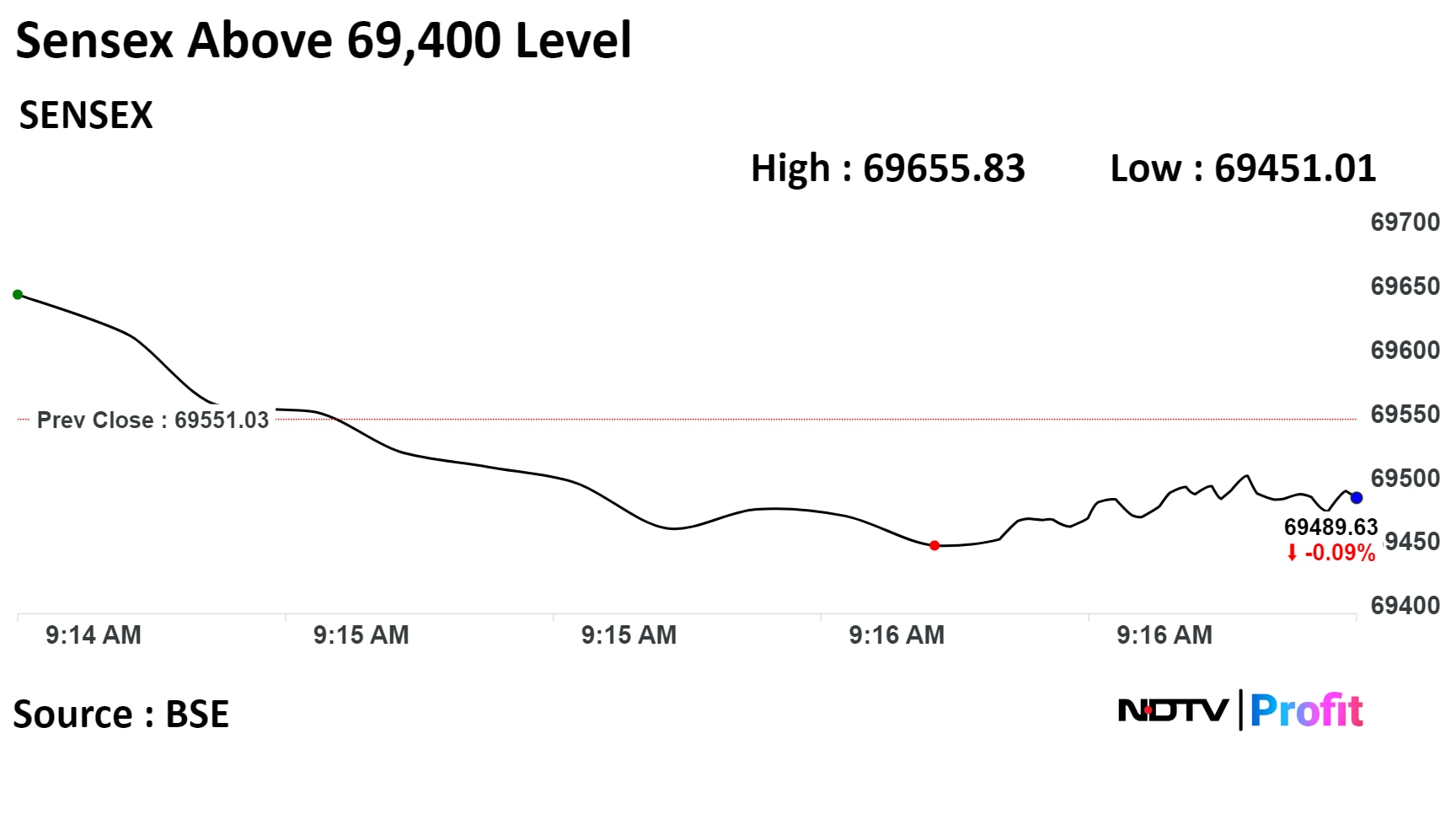

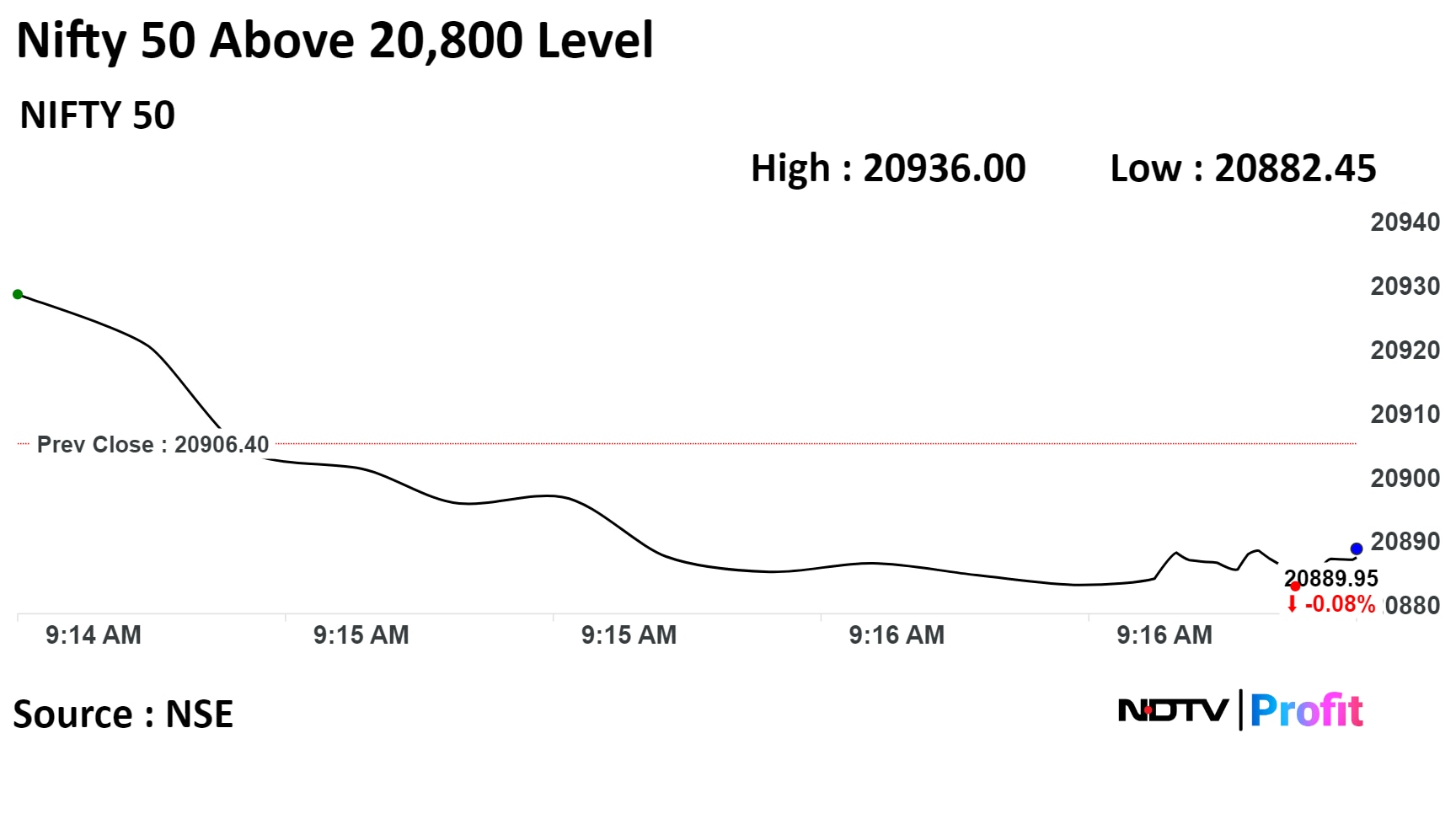

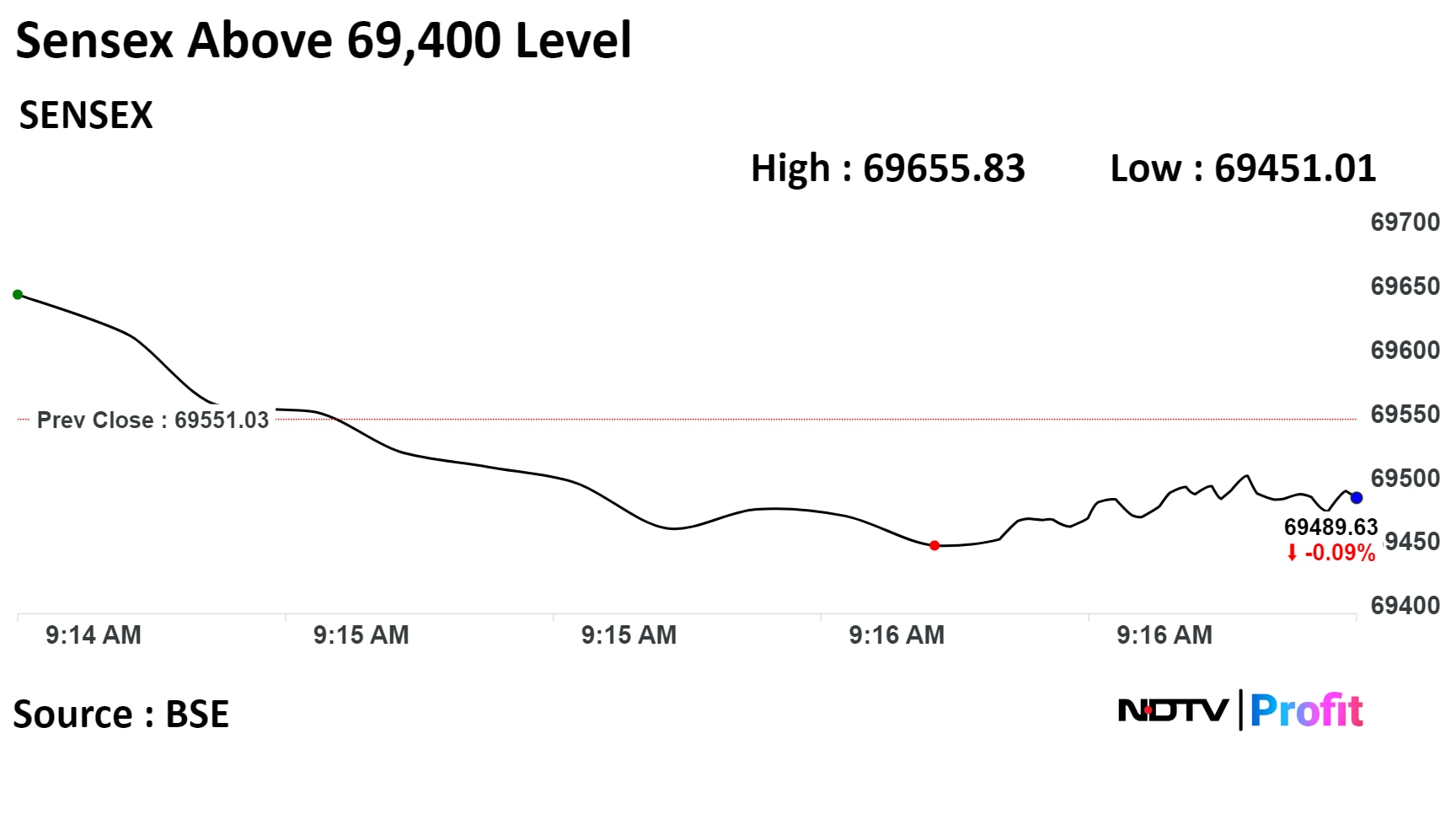

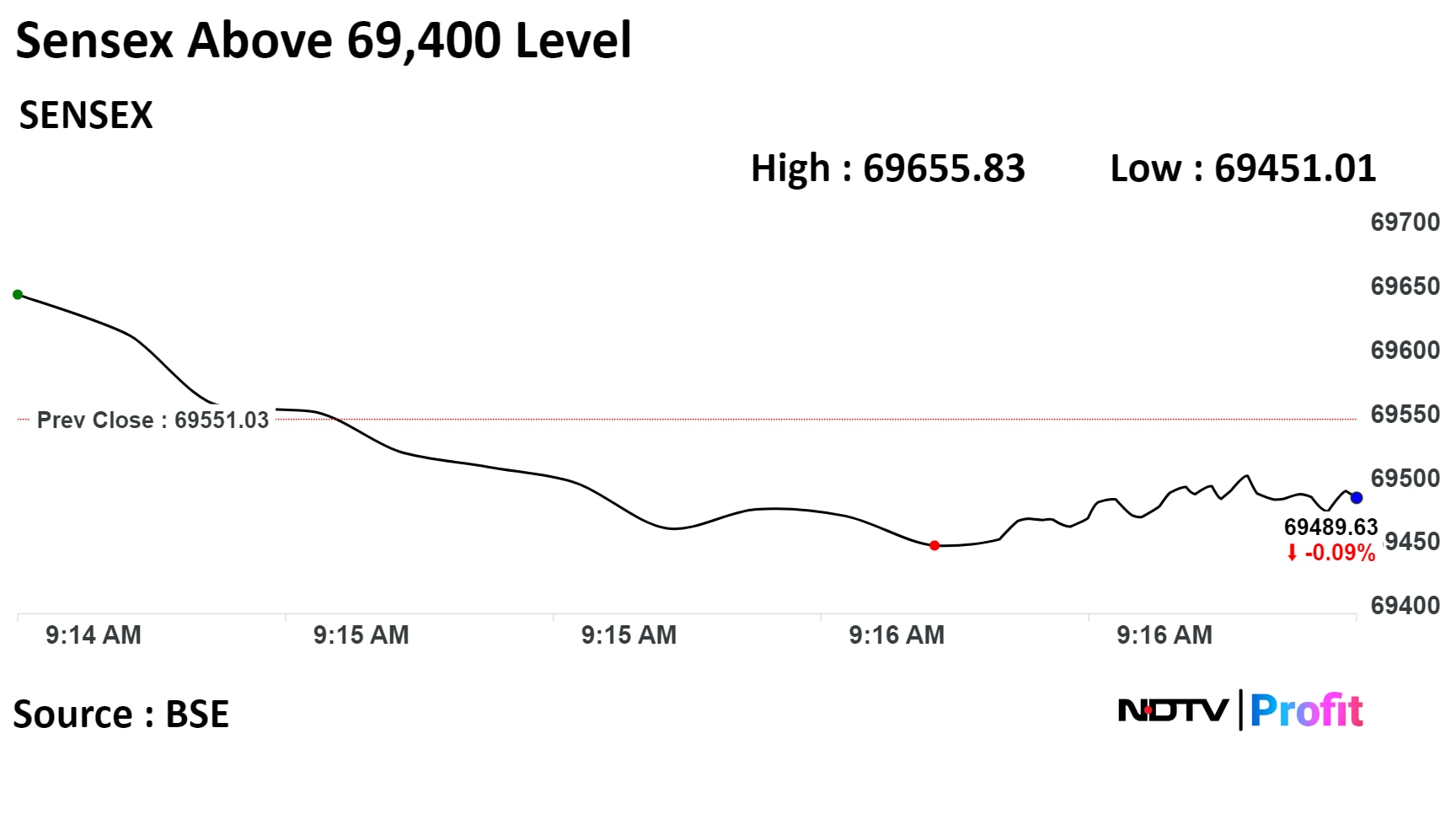

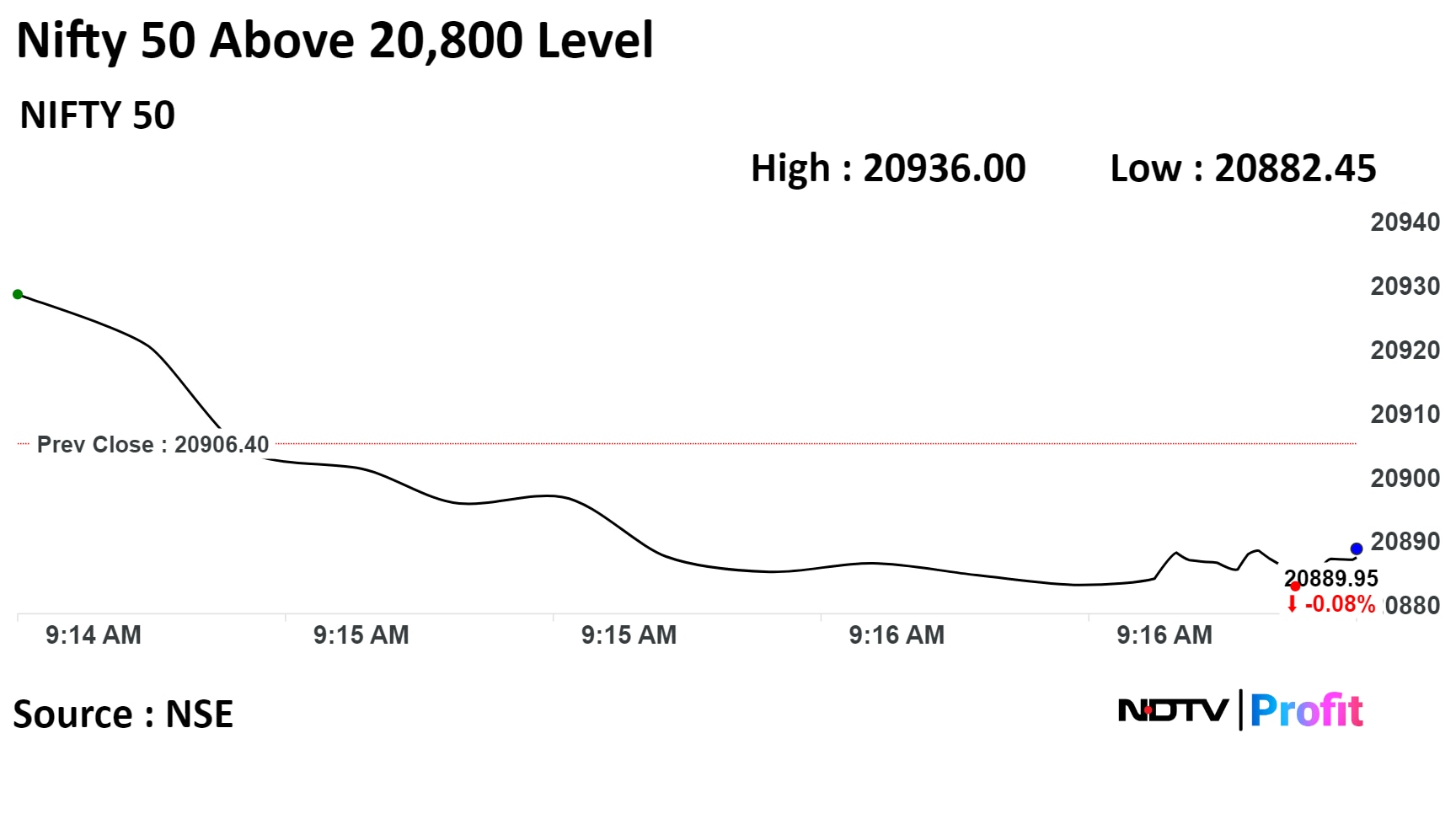

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

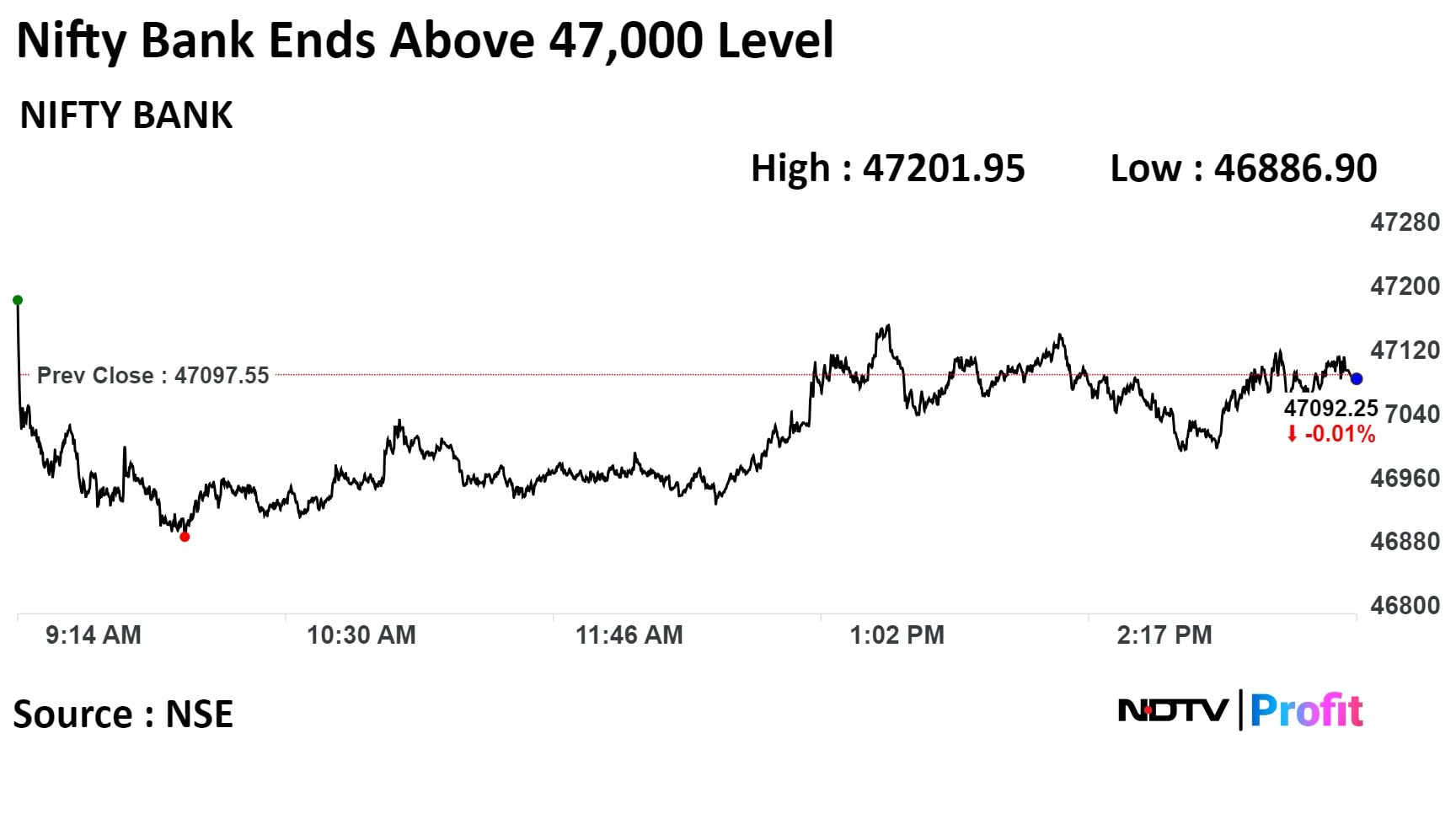

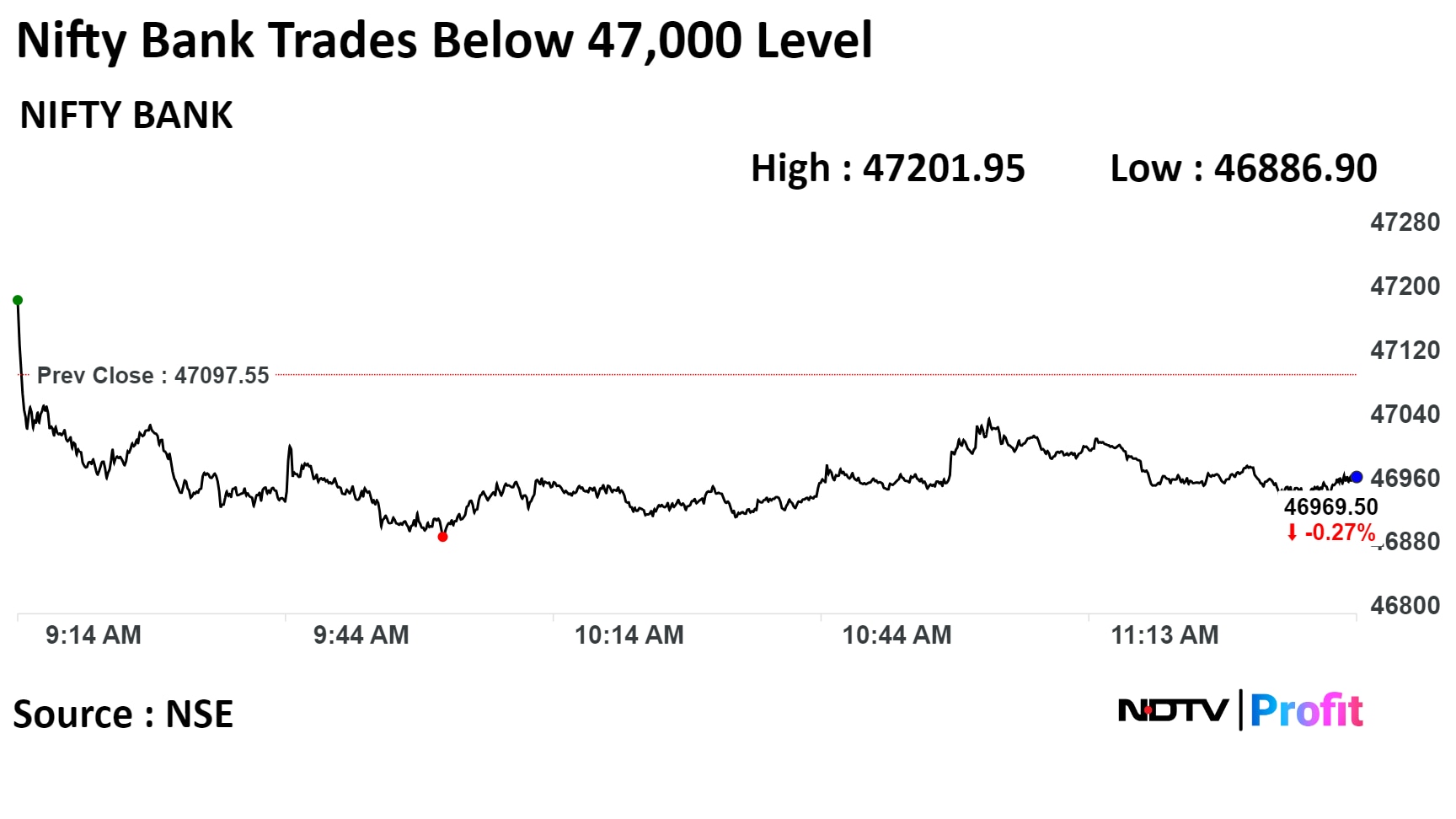

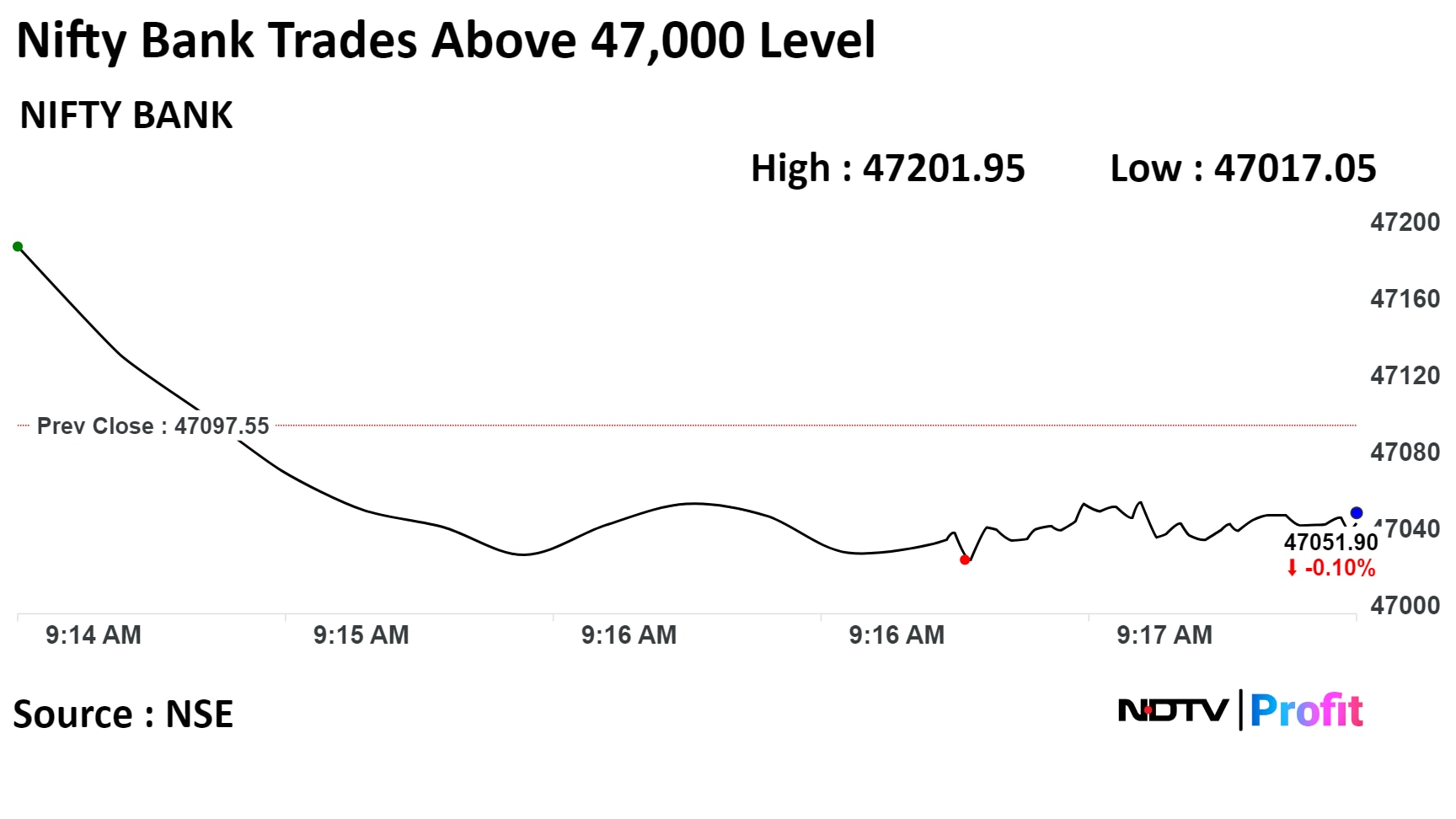

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Indian benchmark indices opened largely flat as ITC Ltd., Larsen & Toubro Ltd., and Oil and Natural Gas Corporation Ltd. gained and ICICI Bank Ltd., Tata Consultancy Services Ltd. weighed.

The NSE Nifty 50 was 20.10 points, or 0.1% lower, at 20,886.30, while the S&P BSE Sensex was trading 108.23 points, or 0.16% lower at 69,442.80.

Market participants may exercise caution before the outcome of the U.S. Federal Open Market Committee's policy meeting, due later today.

Investors largely expect the U.S. central bank may keep the benchmark federal fund rate steady at current level of 5.25-5.50%.

"In yesterday's trade, Nifty paused as bulls retreated amid overbought conditions, raising concerns about today's intraday recovery on Dalal Street. A positive note for Nifty bulls is the 4% drop in WTI crude futures to $68.5 per barrel, while India's rising retail inflation, especially in food, dampens sentiments," said Prashanth Tapse, senior vice president, research, Mehta Equities Ltd. "The US November CPI report adds to the caution, impacting Nifty's outlook. Technically, Nifty faces hurdles at 21100 levels, with support at 20721, and Bank Nifty encounters resistance at 47600 with support at 46507." "The focus turns to the FOMC policy decision and Powell's comments, shaping market expectations. Nifty Bulls may adopt a hesitant stance, with a suggested trade to buy Nifty between 20700-20750 and Bank Nifty between 46500-46600," He added.

Larsen & Toubro Ltd., ITC Ltd., NTPC Ltd., ICICI Bank Ltd., and UltraTech Cement Ltd. were adding positively to the indices.

HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., Axis Bank Ltd., and Kotak Bank Ltd. were weighing on the indices.

The market breadth was skewed in the favour of the buyers. Around 1835 stocks advanced, 1109 declined, while 88 remained unchanged.

At pre-open, the S&P BSE Sensex Index was up 97.53 points, or 0.14%, at 69,648.56, while the NSE Nifty 50 was 23.35 points or 0.11% higher at 20,929.75.

The local currency opened flat at 83.39 against the U.S dollar on Wednesday.

Source: Bloomberg

The yield on the 10-year bond opened 2 bps lower at 7.25% on Wednesday.

It closed at 7.27% on Tuesday

Source: Bloomberg

MOSL reiterates buy rating with TP Rs 453 upside -18%

Anticipates stable tax environment in cigarettes will lead to enhanced volumes

Believes ITC to be good defensive bet in the ongoing volatile interest rate environment

Expects ITC to post 13% earnings CAGR over FY23-25

Muthoot Microfin Ltd. set its IPO price band from Rs 277 to Rs 291.

Alert: Bidding for the issue to open on Dec 18, close on Dec 20.

Source: Company Statement

Jeffries gave a 'buy' rating with target price Rs 530 with an upside 17%

The brokerage said ITC's share of non-cigarette EBITDA will continue to rise

Rural demand has bottomed out; ITC's FMCG business to upturn

U.S. Dollar Index at 103.84

U.S. 10-year bond yield at 4.19%

Brent crude down 0.30% at $73.02 per barrel

Nymex crude down 0.25% at $68.44 per barrel

Bitcoin was up 0.09% at $41,127.29

Price band revised from 20% to 10%: IREDA.

Price band revised from 10% to 5%: Netweb Technologies India, GTL Infrastructure, Cupid.

Ex/record date dividend: Rashtriya Chemicals and Fertilizers.

Ex/record date AGM: Rashtriya Chemicals and Fertilizers, IFCI.

Moved into a short-term ASM framework: Sandur Manganese & Iron Ores, Patel Engineering, Genesys International Corp.

Nifty December futures down 0.35% to 21,099.75 at a premium of 193.35 points.

Nifty December futures open interest down 0.7%.

Nifty Bank December futures down 0.46% to 47,275 at a premium of 177.45 points.

Nifty Bank December futures open interest up 4.7%.

Nifty Options Dec. 14 Expiry: Maximum call open interest at 21,000 and maximum put open interest at 20,900.

Bank Nifty Options Dec. 13 Expiry: Maximum call open interest at 47,500 and maximum put open interest at 46,000.

Securities in the ban period: Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, India Cements, National Aluminium, SAIL, Zee Entertainment.

Mankind Pharma: Beige sold 1.44 crore shares (3.59%) at Rs 1,832.43 apiece and 35 lakh shares (0.87%) at Rs 1,832.3 apiece; Cairnhill Cipef sold 69.62 lakh shares (1.73%) at Rs 1,832.3 apiece; and Hema Cipef (I) sold 56.26 lakh shares (1.4%) at Rs 1,832.8 apiece. Kotak Funds India Midcap Fund bought 20.29 lakh shares (0.5%) at Rs 1,832.3 apiece.

Zee Entertainment Enterprises: Plutus Wealth Management bought 90 lakh shares (0.93%) at Rs 292.34 apiece.

Karur Vysya Bank: SBI Mutual Fund bought 45 lakh shares (1.49%) at Rs 162 apiece.

Dhanuka Agritech: Promoter Ram Gopal Agarwal bought 10,100 shares on Dec. 8. Promoter Group Satya Narain Agarwal and Abhishek Dhanuka sold 10,000 and 100 shares respectively between Dec. 6 and 7.

KCP: Promoter group Subbarao Vallabhaneni sold 14,000 shares on Dec. 14.

Vishnu Chemicals: To meet investors and analysts on Dec. 15.

Quick Heal Technologies: To meet investors and analysts on Dec. 15.

JTL Industries: To meet investors and analysts on Dec. 15.

Sansera Engineering: To meet investors and analysts on Dec. 15.

ASK Automotive: To meet investors and analysts on Dec. 14.

Advanced Enzymes Technologies: To meet investors and analysts on Dec. 15.

Agi Greenpac: To meet investors and analysts on Dec. 13.

Persistent Systems: To meet investors and analysts on Dec. 13.

Crisil: To meet investors and analysts on Dec. 13.

Can Fin Homes: To meet investors and analysts on Dec. 15.

Indian Bank: The bank opened its qualified institutional placement to raise up to Rs 4,000 crore. The floor price for the QIP is set at Rs 414.44 per share, which indicates a discount of 5.28% to the stock's previous close of Rs 437.55 on the NSE.

Reliance Industries: The company invested Rs 418 crore in five subsidiaries of Mercury Holdings. Mercury Holdings is a joint venture between Brookfield Infrastructure and Digital Realty.

Shilpa Medicare: The company received approval from TGA, Australia, for the manufacturing, labelling, packaging and testing of medicinal oral mouth-dissolving films.

UNO Minda: The National Company Law Tribunal has sanctioned the scheme of amalgamation of Minda iConnect Pvt. with itself, formerly known as Minda Industries Ltd.

Cummins India: The company collaborated with Repos Energy and launched Datum, an innovative fuel management system for diesel applications.

Bank of Baroda: The bank's capital-raising committee will be meeting on Dec. 15 to discuss fundraising.

Laurus Labs: The FDA inspection at the Andhra Pradesh plant between Dec. 4 and Dec. 12 ended with five observations.

Wipro: The IT major and RSA signed a new multi-year contract to accelerate RSA's cloud migration.

KIOCL: The company has temporarily suspended operations at its plant in Mangaluru due to the non-availability of iron-ore fines.

Shalby: The company is availing of an enhanced and renewed SBLC facility of Rs 1,700 million from ICICI Bank to guarantee the scheduled principal and interest payments of the step-down subsidiary of the company under the working capital facility arrangement sanctioned by IBG‐ New York Branch.

Zydus Wellness: The company's arm, Heinz India, gets an assessment order worth Rs 5.66 crore from the Punjab Tax Authority for 2016–17.

Axita Cotton: The company has fixed Dec. 25 as the record date for the issue of bonus shares in the ratio of 1:3.

Life Insurance Corp.: The company increased its stake in Atul from 4.997% to 5.117%.

Allcargo Terminals: The company's November CFS volume stood at 47.1 TEUs, up 2% year-on-year.

Infibeam Avenues: The company announced that its flagship payment gateway brand, CCAvenue, is gearing up to introduce Bandhan Bank's EMI facilities to over 10 million merchants.

Cyient: The company inaugurates the CyientifIQ Experience Centre, an immersive showcase of intelligent engineering and technology solutions in action.

Jammu & Kashmir Bank: The bank will consider raising funds in its board meeting on Dec. 14.

Orient Green Power: The company will consider raising funds in its board meeting on Dec. 15.

Indian Bank: The bank opened its qualified institutional placement to raise up to Rs 4,000 crore. The floor price for the QIP is set at Rs 414.44 per share, which indicates a discount of 5.28% to the stock's previous close of Rs 437.55 on the NSE.

Reliance Industries: The company invested Rs 418 crore in five subsidiaries of Mercury Holdings. Mercury Holdings is a joint venture between Brookfield Infrastructure and Digital Realty.

Shilpa Medicare: The company received approval from TGA, Australia, for the manufacturing, labelling, packaging and testing of medicinal oral mouth-dissolving films.

UNO Minda: The National Company Law Tribunal has sanctioned the scheme of amalgamation of Minda iConnect Pvt. with itself, formerly known as Minda Industries Ltd.

Cummins India: The company collaborated with Repos Energy and launched Datum, an innovative fuel management system for diesel applications.

Bank of Baroda: The bank's capital-raising committee will be meeting on Dec. 15 to discuss fundraising.

Laurus Labs: The FDA inspection at the Andhra Pradesh plant between Dec. 4 and Dec. 12 ended with five observations.

Wipro: The IT major and RSA signed a new multi-year contract to accelerate RSA's cloud migration.

KIOCL: The company has temporarily suspended operations at its plant in Mangaluru due to the non-availability of iron-ore fines.

Shalby: The company is availing of an enhanced and renewed SBLC facility of Rs 1,700 million from ICICI Bank to guarantee the scheduled principal and interest payments of the step-down subsidiary of the company under the working capital facility arrangement sanctioned by IBG‐ New York Branch.

Zydus Wellness: The company's arm, Heinz India, gets an assessment order worth Rs 5.66 crore from the Punjab Tax Authority for 2016–17.

Axita Cotton: The company has fixed Dec. 25 as the record date for the issue of bonus shares in the ratio of 1:3.

Life Insurance Corp.: The company increased its stake in Atul from 4.997% to 5.117%.

Allcargo Terminals: The company's November CFS volume stood at 47.1 TEUs, up 2% year-on-year.

Infibeam Avenues: The company announced that its flagship payment gateway brand, CCAvenue, is gearing up to introduce Bandhan Bank's EMI facilities to over 10 million merchants.

Cyient: The company inaugurates the CyientifIQ Experience Centre, an immersive showcase of intelligent engineering and technology solutions in action.

Jammu & Kashmir Bank: The bank will consider raising funds in its board meeting on Dec. 14.

Orient Green Power: The company will consider raising funds in its board meeting on Dec. 15.

Doms Industries: The pencil-maker's public issue will open for bids on Wednesday. The company plans to raise Rs 1,200 crore, consisting of a fresh issue of Rs 350 crore and an offer for sale of Rs 850 crore. The price band is in the range of Rs 750–790 per share. It has raised Rs 537.7 crore from anchor investors.

India Shelter Finance Corp.: The company's public issue will open for bids on Wednesday. It plans to raise Rs 1,200 crore, which consists of a fresh issue of Rs 800 crore and an offer for sale of Rs 400 crore. The price is in the range of Rs 469–493 per share. It has raised Rs 360 crore from anchor investors.

Asia-Pacific markets were trading on a mixed note on Wednesday as traders await the outcome of the US Federal Reserve policy.

Markets in Japan, and Australia rose, while in China and South Korea shares were in red.

The US central bank is expected to hold the benchmark federal fund rate steady at 5.25–5.50% at the end of the policy meeting. However, market participants will closely monitor Chair Jerome Powell's speech for further cues about the rate trajectory.

Data from the Labor Department showed Wednesday that the consumer price index in the world's largest economy came at 3.1% in November in line with Bloomberg Survey's forecast. The core CPI, which excludes food and energy costs, was at 4.0% in November.

However, Wednesday's CPI print showed price rise in energy and rent, which made traders pull back their bets on aggressive rate cuts by the Fed next year.

Market participants expect the Federal Reserve to cut rates as early as March 2024, according to the CME FedWatch tool.

The S&P 500 index and Nasdaq 100 rose 0.46% and 0.82% respectively as of Tuesday. The Dow Jones Industrial Average rose by 0.48%.

Brent crude was trading 3.67% lower at $73.24 a barrel. Gold was up 0.06% at $1,980.78 an ounce.

The GIFT Nifty was 15.5 or 0.07% up at 21,040.5 at 6.29 a.m.

India's benchmark indices snapped their two-session rally and closed lower as heavyweights HDFC Bank Ltd., Reliance Industries Ltd. and Infosys Ltd. dragged.

The NSE Nifty 50 closed 91 points, or 0.43%, lower at 20,906.40, while the S&P BSE Sensex ended 378 points, or 0.54%, down at 69,551.03. Intraday, the Nifty hit a record high of 21,037.90 points and the Sensex rose to 70,033.64, crossing the 70,000 level for the second consecutive session.

Overseas investors remained net buyers of Indian equities for the third consecutive session on Tuesday. Foreign portfolio investors mopped up stocks worth Rs 76.9 crore, while domestic institutional investors turned net buyers and bought equities worth Rs 1,923.3 crore, the NSE data showed.

The rupee closed flat at Rs 83.39 against the dollar on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.