The yield on the 10-year bond closed flat at 7.16% on Monday.

Source: Bloomberg

The local currency weakened 6 paise to close at 83.06 against the U.S dollar on Monday.

It closed at Rs 83 on Friday.

Source: Bloomberg

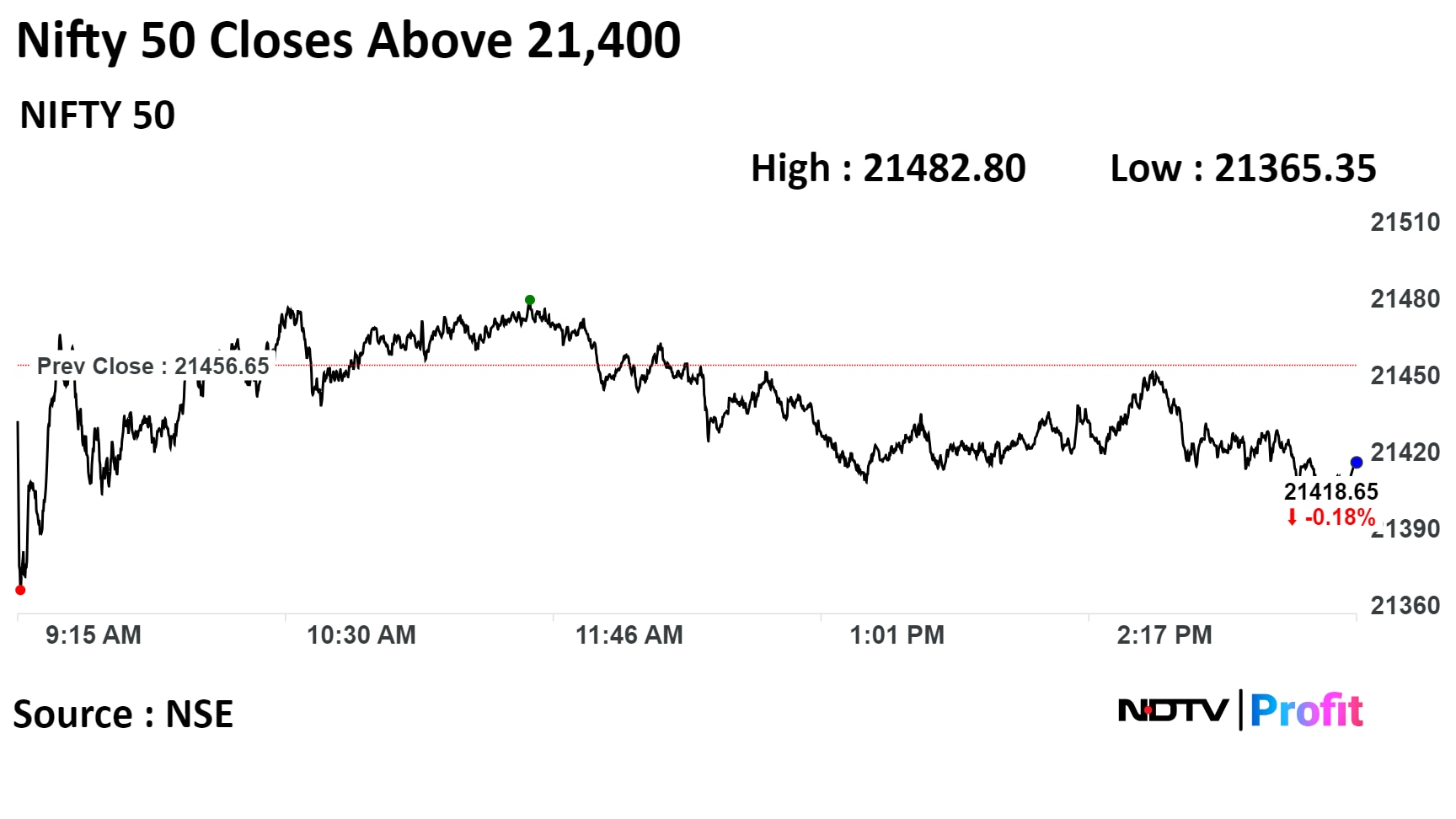

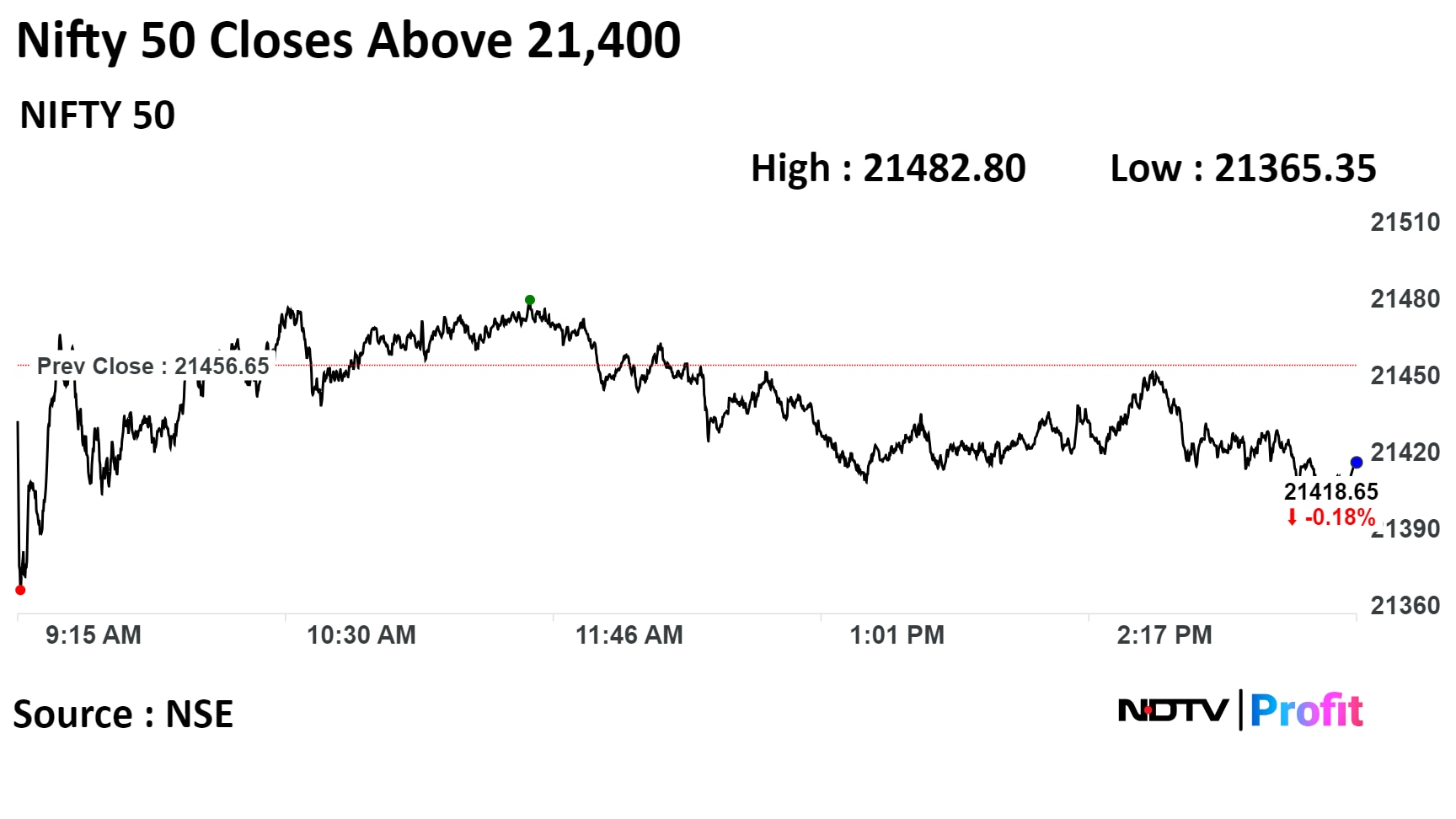

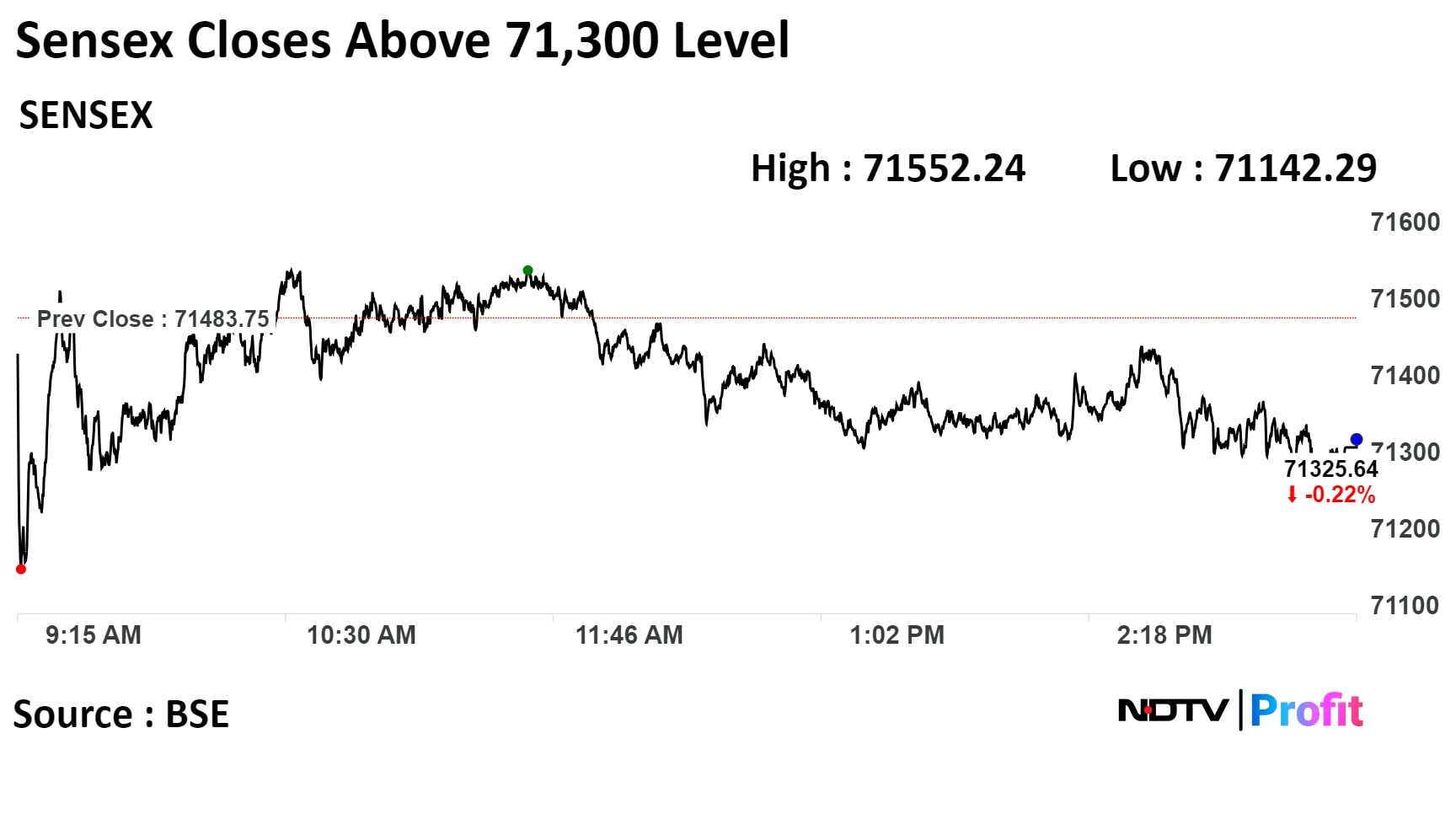

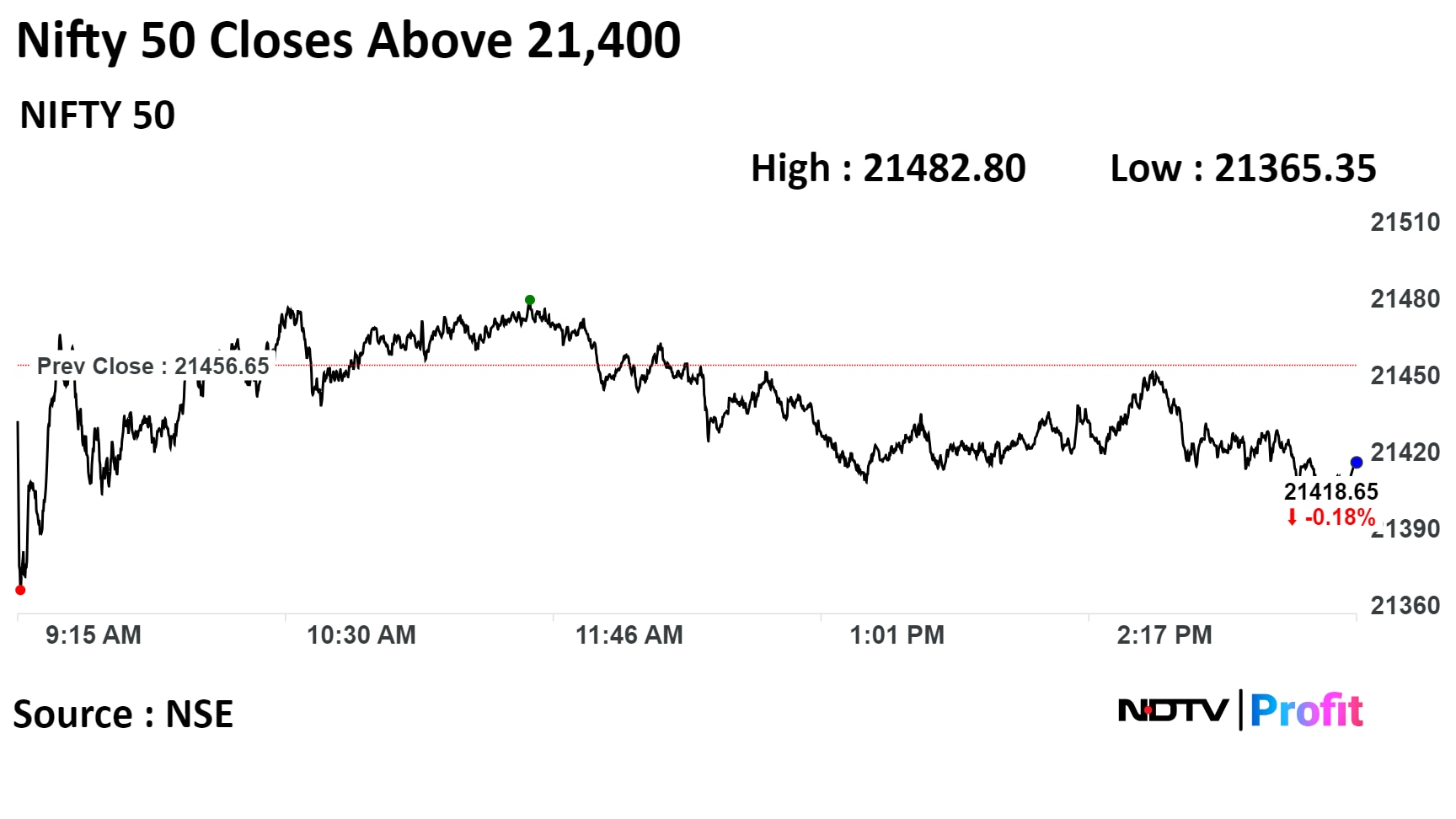

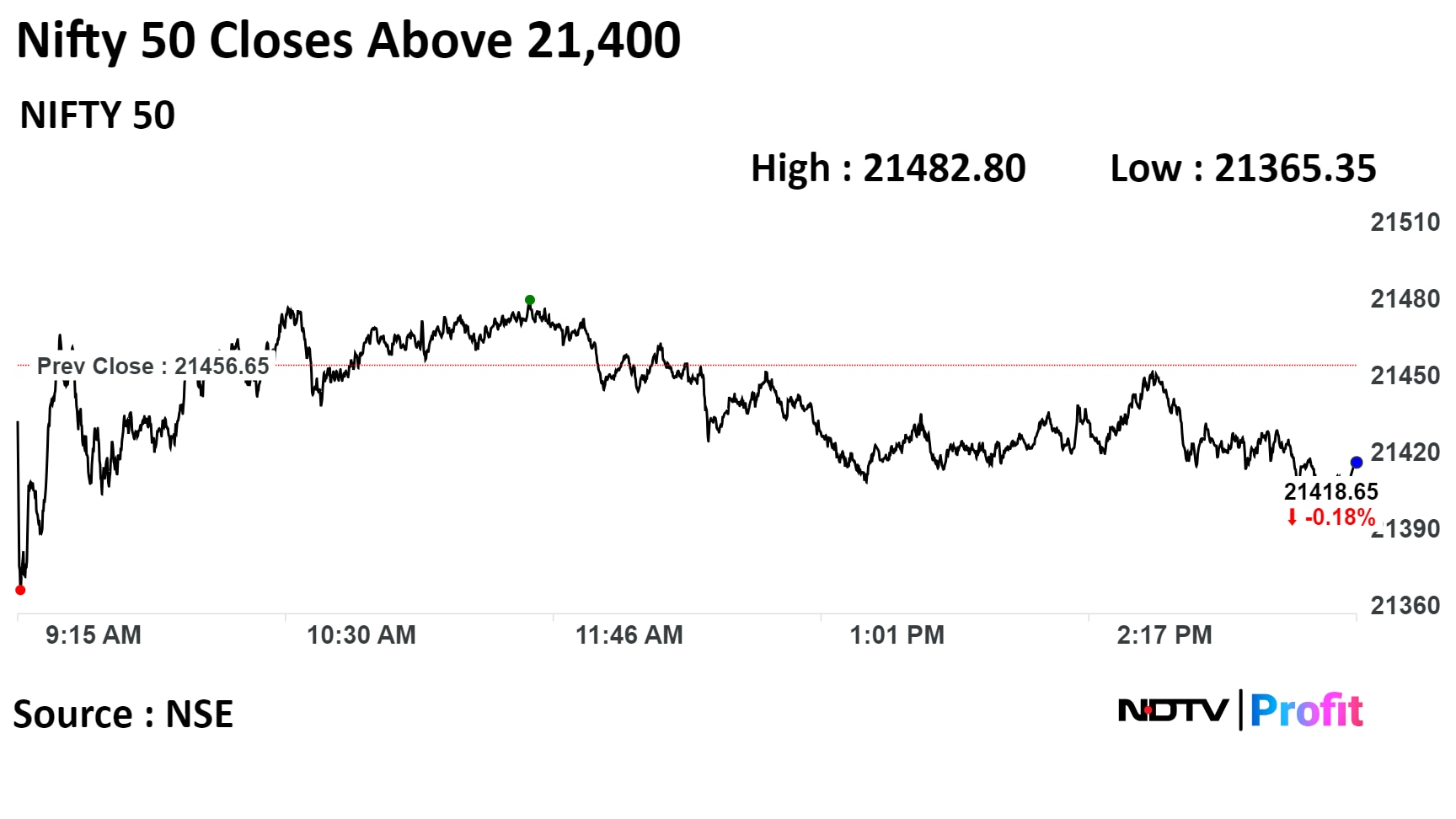

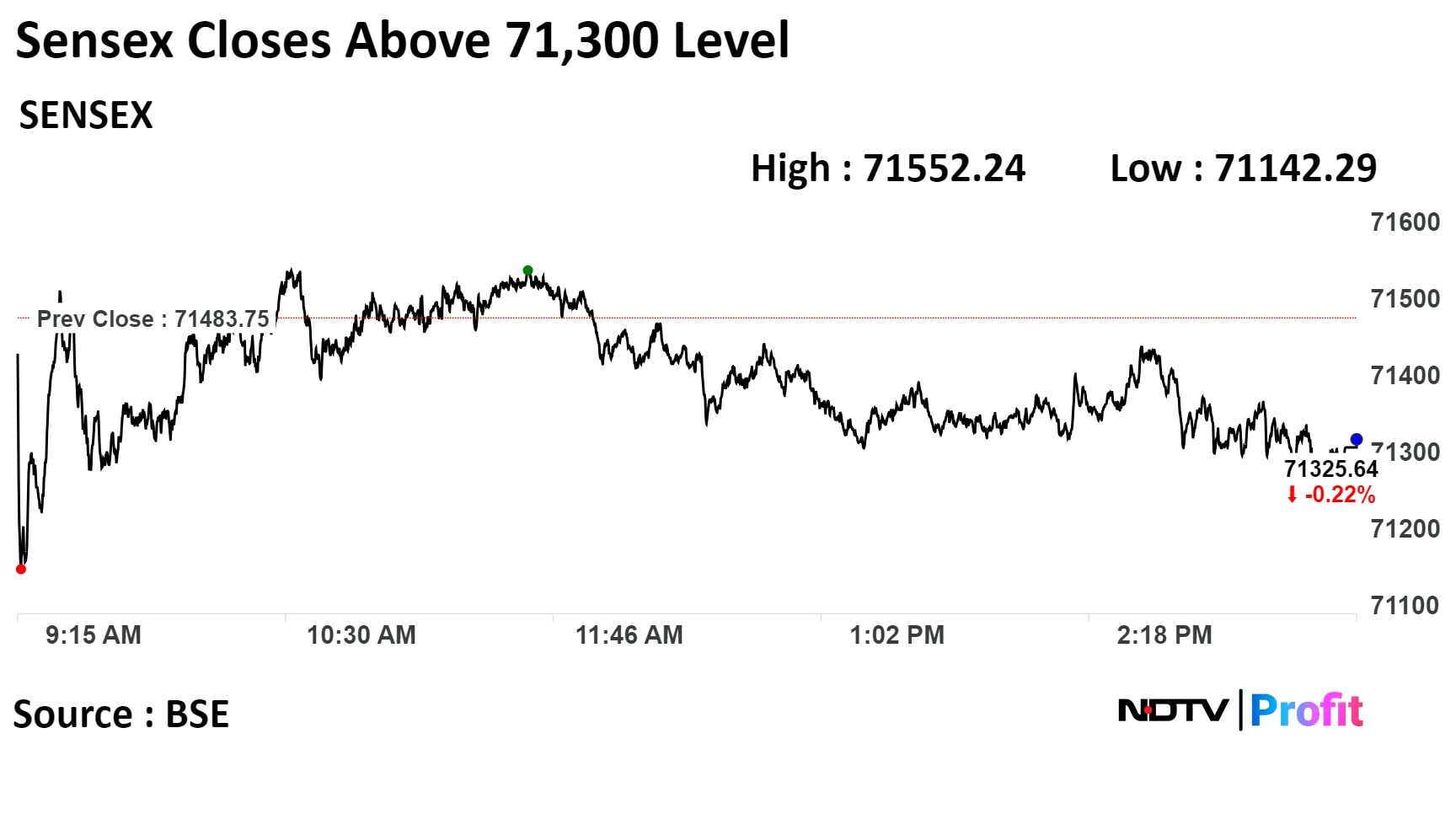

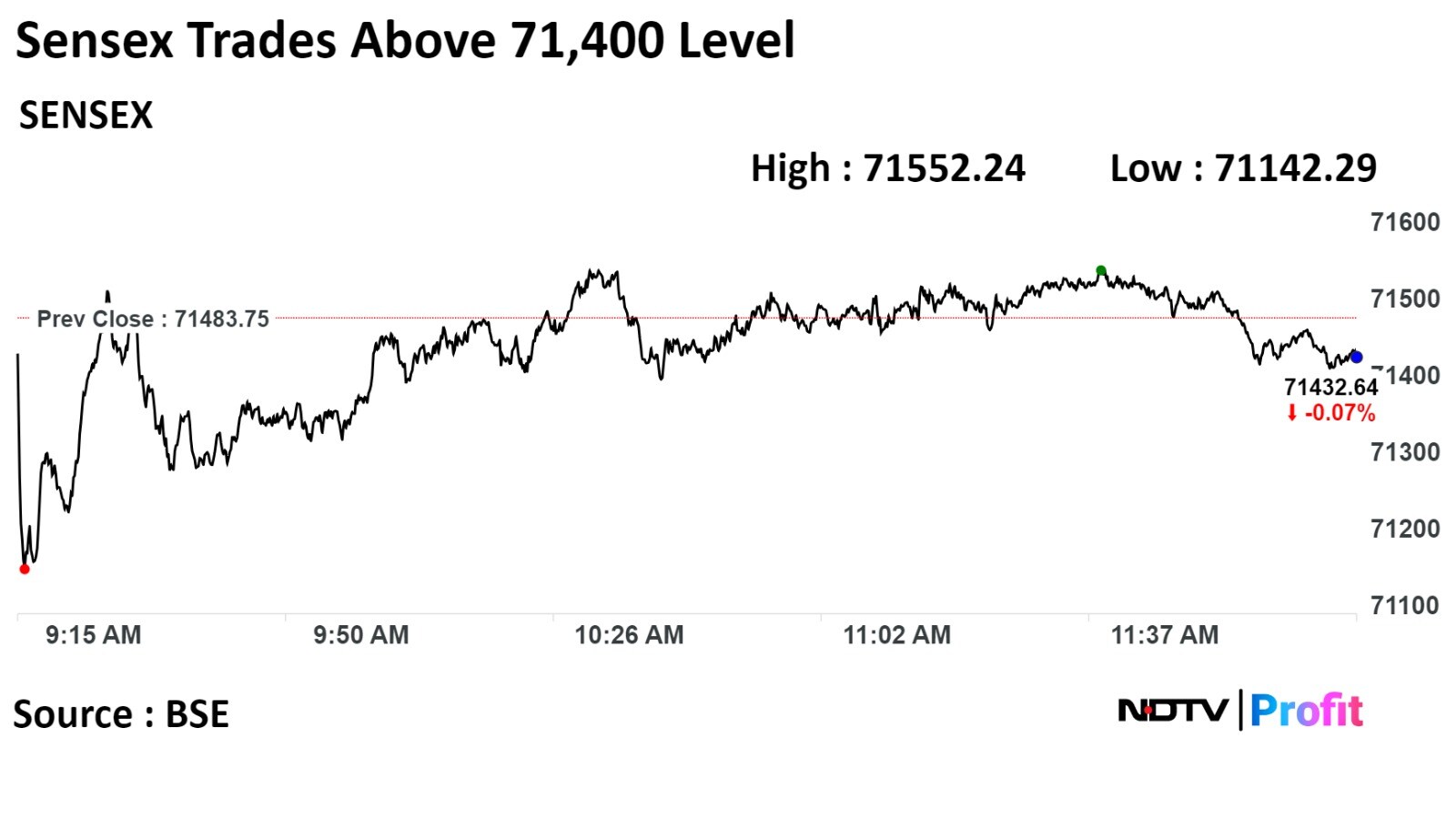

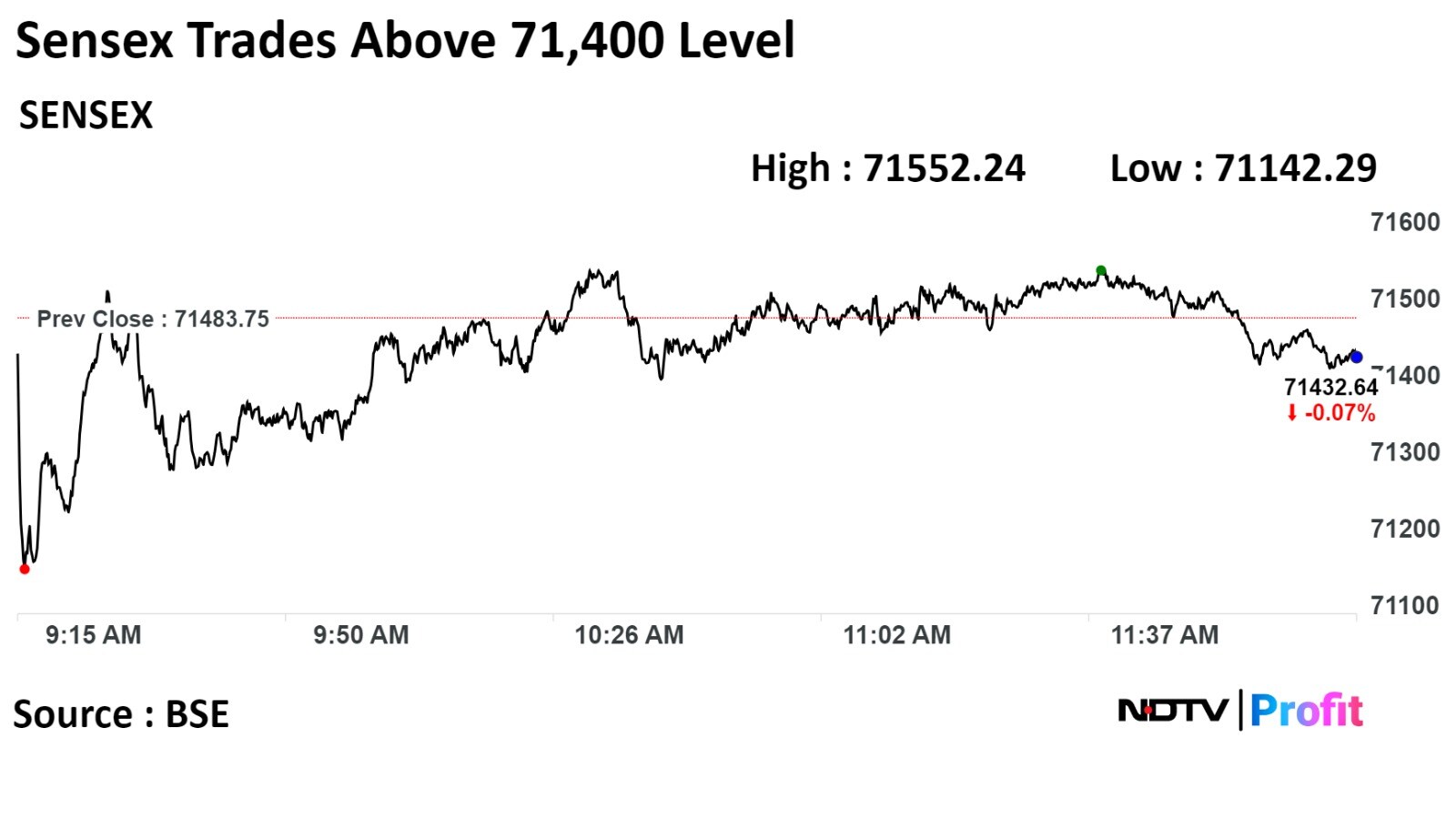

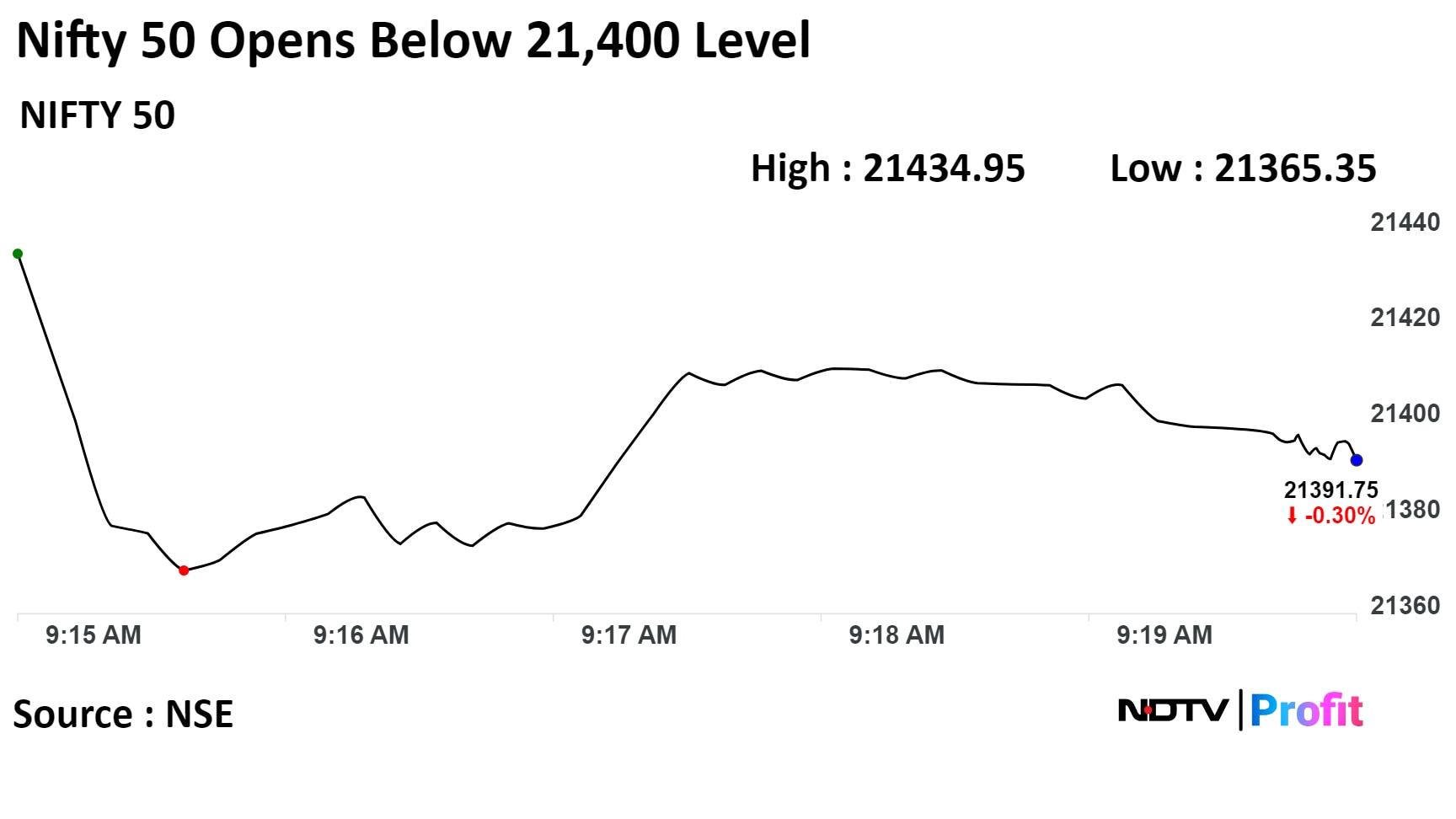

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

A decline below 21350 could lead a correction towards 21220/21100 in the short term. Conversely, resistance is anticipated at 21500 on the higher end, said Rupak De, Senior Technical analyst at LKP Securities.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

A decline below 21350 could lead a correction towards 21220/21100 in the short term. Conversely, resistance is anticipated at 21500 on the higher end, said Rupak De, Senior Technical analyst at LKP Securities.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

A decline below 21350 could lead a correction towards 21220/21100 in the short term. Conversely, resistance is anticipated at 21500 on the higher end, said Rupak De, Senior Technical analyst at LKP Securities.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

Benchmark indices closed lower, snapping a three day rally, after rising to near their lifetime high levels. Today's fall was because of the losses in shares of banks, fast moving consumer goods, and information technology stocks.

The Nifty 50 index closed 38 points or 0.18% lower at 21,418.65 while the Sensex shed 168.66 points or 0.24% to close at 71,315.09.

"The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data," according to Vinod Nair, Head of Research at Geojit Financial Services.

"We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP," he added.

A decline below 21350 could lead a correction towards 21220/21100 in the short term. Conversely, resistance is anticipated at 21500 on the higher end, said Rupak De, Senior Technical analyst at LKP Securities.

Most of the indices in Asia closed lower as investors await Japan's central bank's Tuesday meeting on expectations that it might go further away from its ultra dovish policies.

The sentiment was also dampened after several Fed officials including New York Fed President John Williams, New York Fed President John Williams, and Chicago Fed President Austan Goolsbee hinted that the U.S. Federal Reserve might not cut rates next year. Following this, markets in Europe also opened lower.

Shares of ICICI Bank Ltd., Infosys Ltd., ITC Ltd., Axis Bank Ltd., and Tech Mahindra Ltd. dragged the index lower.

Whereas, those of Hindalco Industries Ltd., Reliance Industries Ltd., Bajaj Auto Ltd., Sun Pharmaceutical Industries Ltd., and HCL Technologies Ltd. limited the losses.

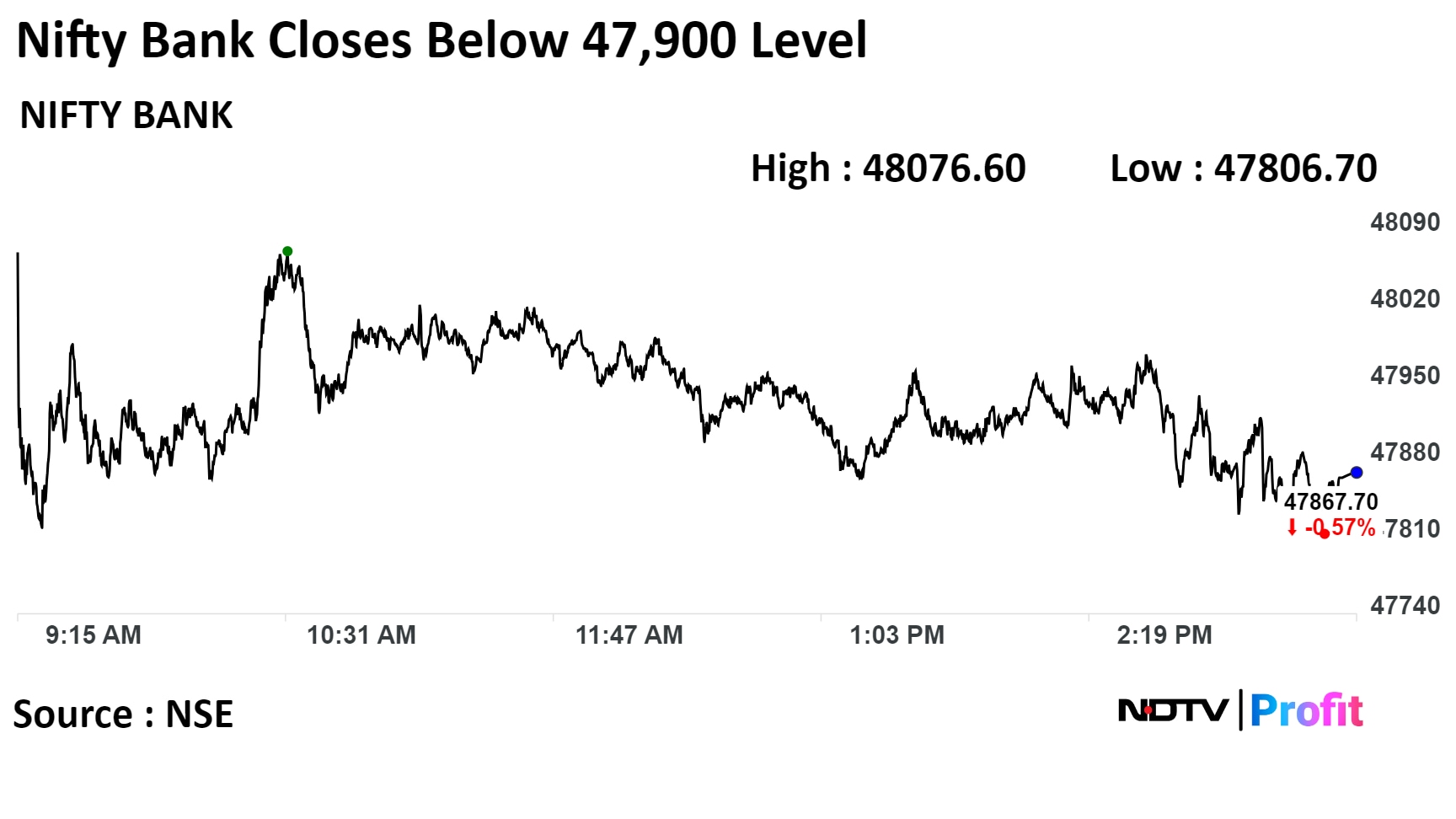

Eight sectoral indices on the NSE fell and six advanced. Nifty Media rose the most followed by Nifty Pharma. Nifty Realty, Nifty PSU Bank, and Nifty Bank fell the most.

The broader markets outperformed as the BSE MidCap rose 0.28%, while the BSE SmallCap was 0.48% higher. Nine out of the 20 sectors compiled by the BSE declined, while 11 advanced.

The market breadth was skewed in the favour of buyers. As many as 2,176 stocks advanced, 1,711 declined and 141 remained unchanged on the BSE.

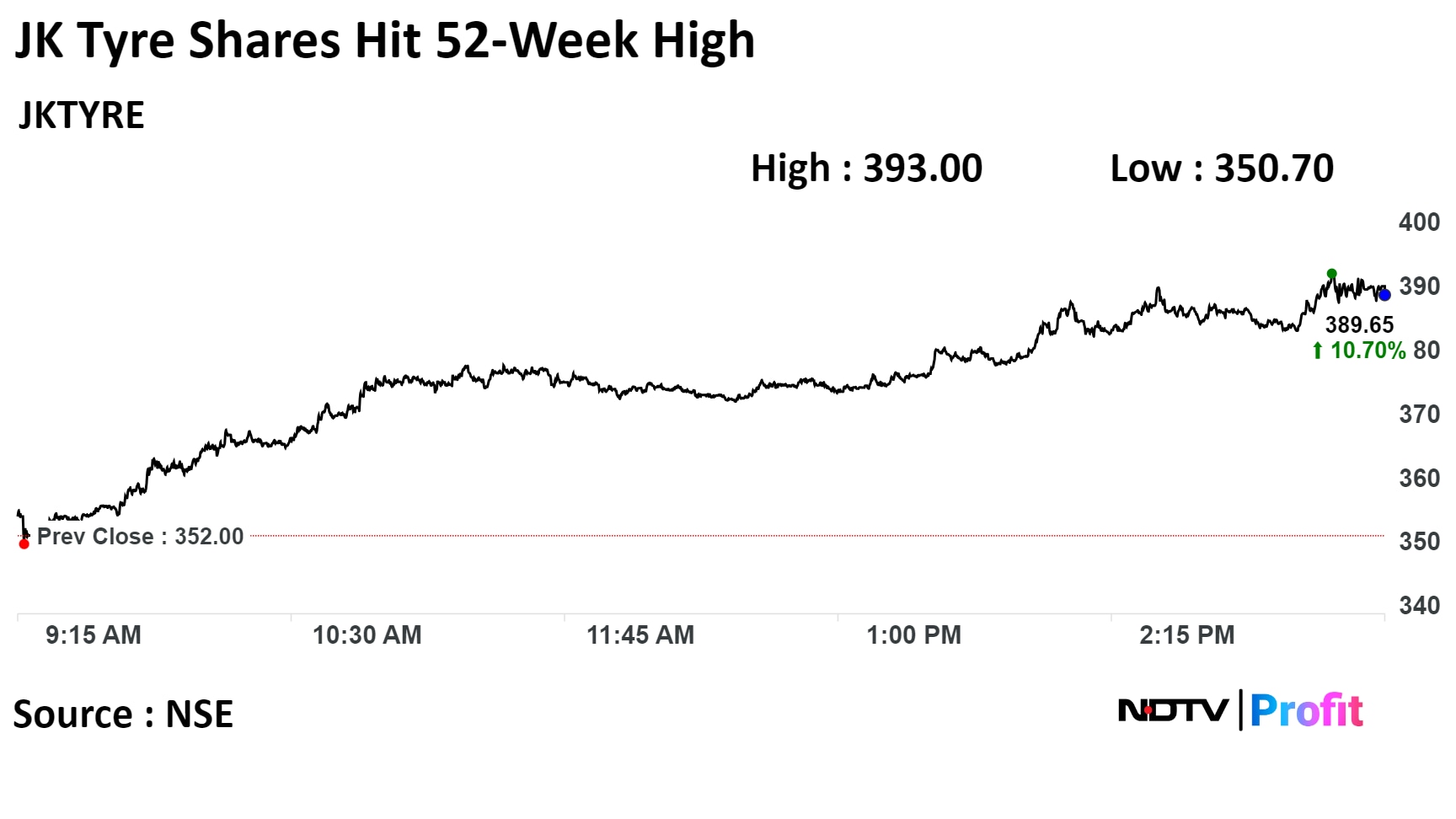

Shares of JK Tyre & Industries Ltd rose to hit a 52-week high after an extraordinary general meeting held by on Monday approved raising up to Rs 500 crore by way of qualified institutions placement.

Shares of JK Tyre & Industries Ltd rose to hit a 52-week high after an extraordinary general meeting held by on Monday approved raising up to Rs 500 crore by way of qualified institutions placement.

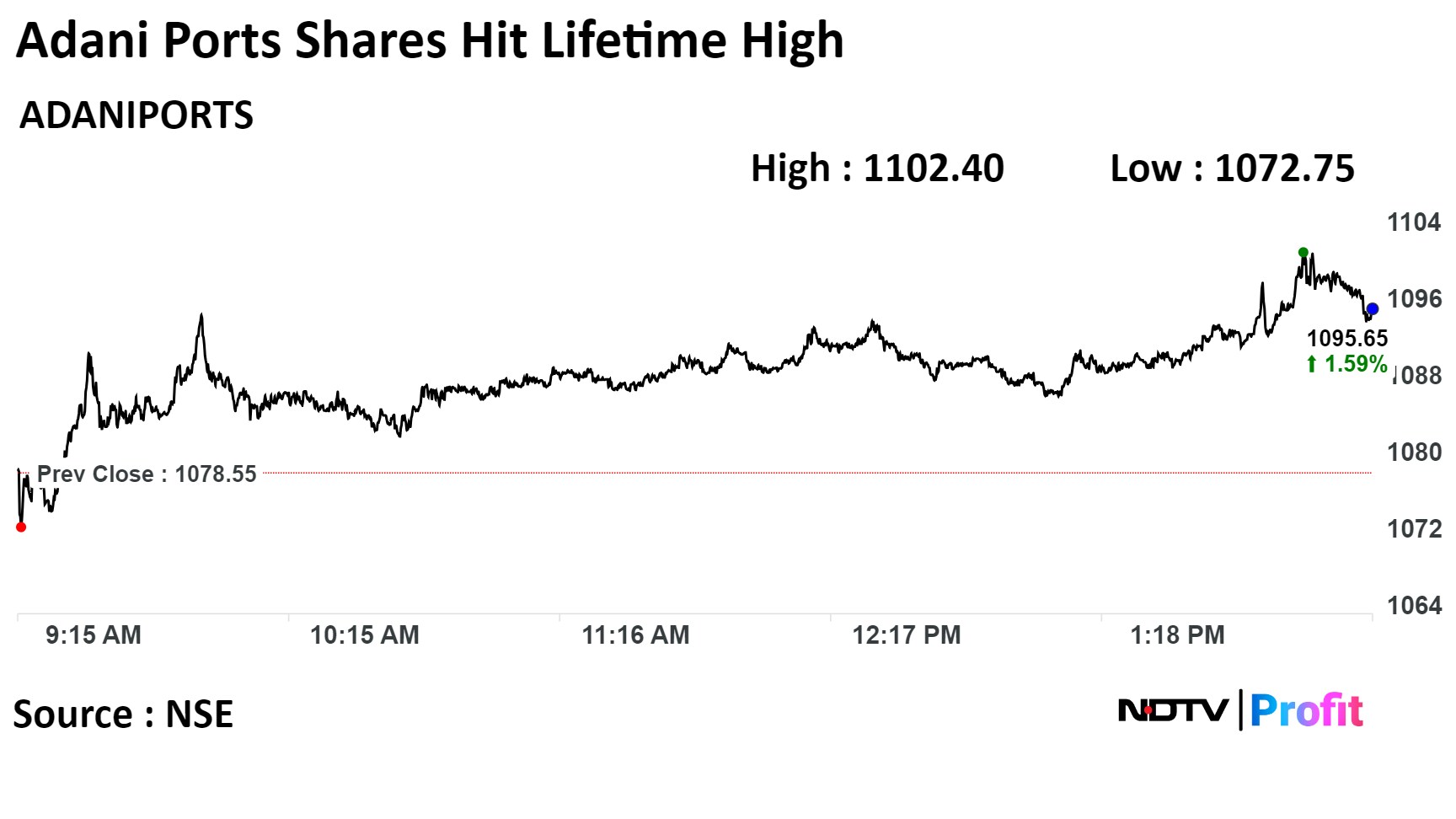

The scrip rose as much as 2.2% to Rs 1,102.40 piece, the highest level. It pared gains to trade 1.51% higher at Rs 1,094.85 apiece, as of 2:23 p.m. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 33.91% on a year-to-date basis. The relative strength index was at 97, indicating that the stock may be overbought.

Out of 20 analysts tracking the company, 19 maintain a 'buy' rating and one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside of 11.34%.

Shares of IRCTC rose as much as 8.13% to Rs 844.30 apiece highest in over one year. It last traded at the same levels on Feb. 1, 2022. The shares at 2:00 p.m. were trading 7.95% higher at Rs 842.95 apiece. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 31.72% on a year-to-date basis. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 79.

Out of 8 analysts tracking the company, 3 maintain a 'buy' rating, 2 recommend a 'hold,' and 3 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 25.1%.

Shares of IRCTC rose as much as 8.13% to Rs 844.30 apiece highest in over one year. It last traded at the same levels on Feb. 1, 2022. The shares at 2:00 p.m. were trading 7.95% higher at Rs 842.95 apiece. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 31.72% on a year-to-date basis. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 79.

Out of 8 analysts tracking the company, 3 maintain a 'buy' rating, 2 recommend a 'hold,' and 3 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 25.1%.

UCO Bank had lodged an FIR with CBI on Nov 15 regarding erroneous credit of Rs 820 crore

The government took stock of the preparedness of the banks in tackling the challenges arising from cyber security

Source: Ministry of Finance

In pact as bancassurance partner for life insurance category.

Source: Exchange Filing

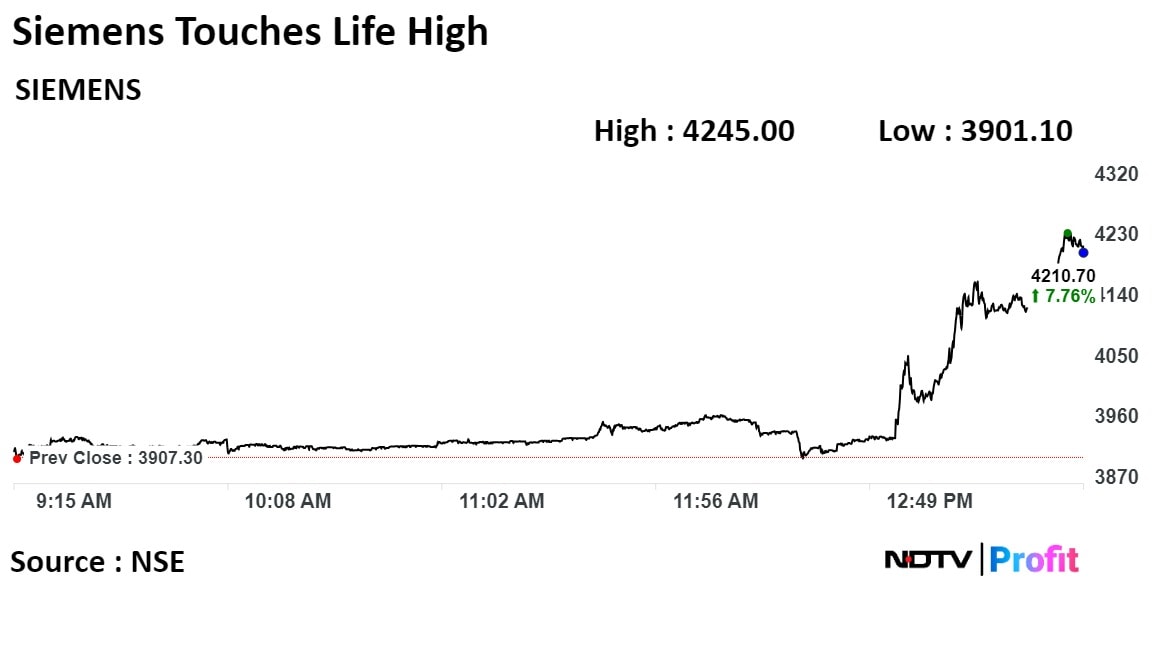

Siemens Ltd. shares touch life-time high on Monday after the board of directors authorized the management to commence exploratory steps for potential demerger of the company's energy business into a separate entity.

The decision by the board of directors comes after the company's promoters requested the board to consider, evaluate and begin taking exploratory steps towards the demerger of the company.

The board also approved the immediate incorporation of a wholly owned subsidiary in Mumbai, India. This subsidiary may be required if and when the board approves the implementation of the demerger.

Siemens shares rose as much as 8.64% to Rs 4,245 apiece to reach its all time high as of 1:39 p.m. This compares to a 0.16% decline in the NSE Nifty 50 Index.

It has risen 50.01% on a year-to-date basis. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 82.

Out of 26 analysts tracking the company, 17 maintain a 'buy' rating, 3 recommend a 'hold,' and 6 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 42.6%.

Siemens Ltd. shares touch life-time high on Monday after the board of directors authorized the management to commence exploratory steps for potential demerger of the company's energy business into a separate entity.

The decision by the board of directors comes after the company's promoters requested the board to consider, evaluate and begin taking exploratory steps towards the demerger of the company.

The board also approved the immediate incorporation of a wholly owned subsidiary in Mumbai, India. This subsidiary may be required if and when the board approves the implementation of the demerger.

Siemens shares rose as much as 8.64% to Rs 4,245 apiece to reach its all time high as of 1:39 p.m. This compares to a 0.16% decline in the NSE Nifty 50 Index.

It has risen 50.01% on a year-to-date basis. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 82.

Out of 26 analysts tracking the company, 17 maintain a 'buy' rating, 3 recommend a 'hold,' and 6 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 42.6%.

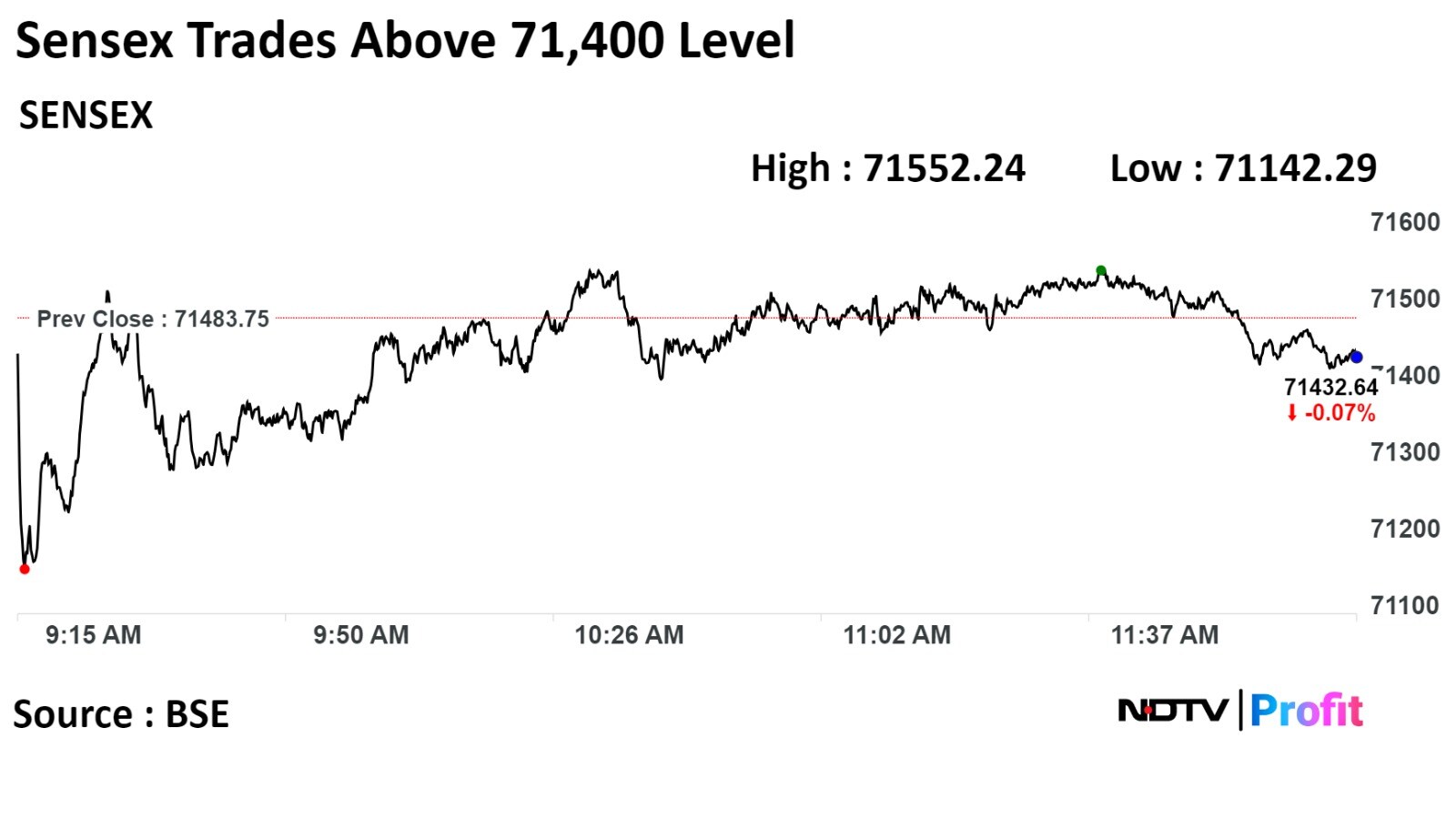

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

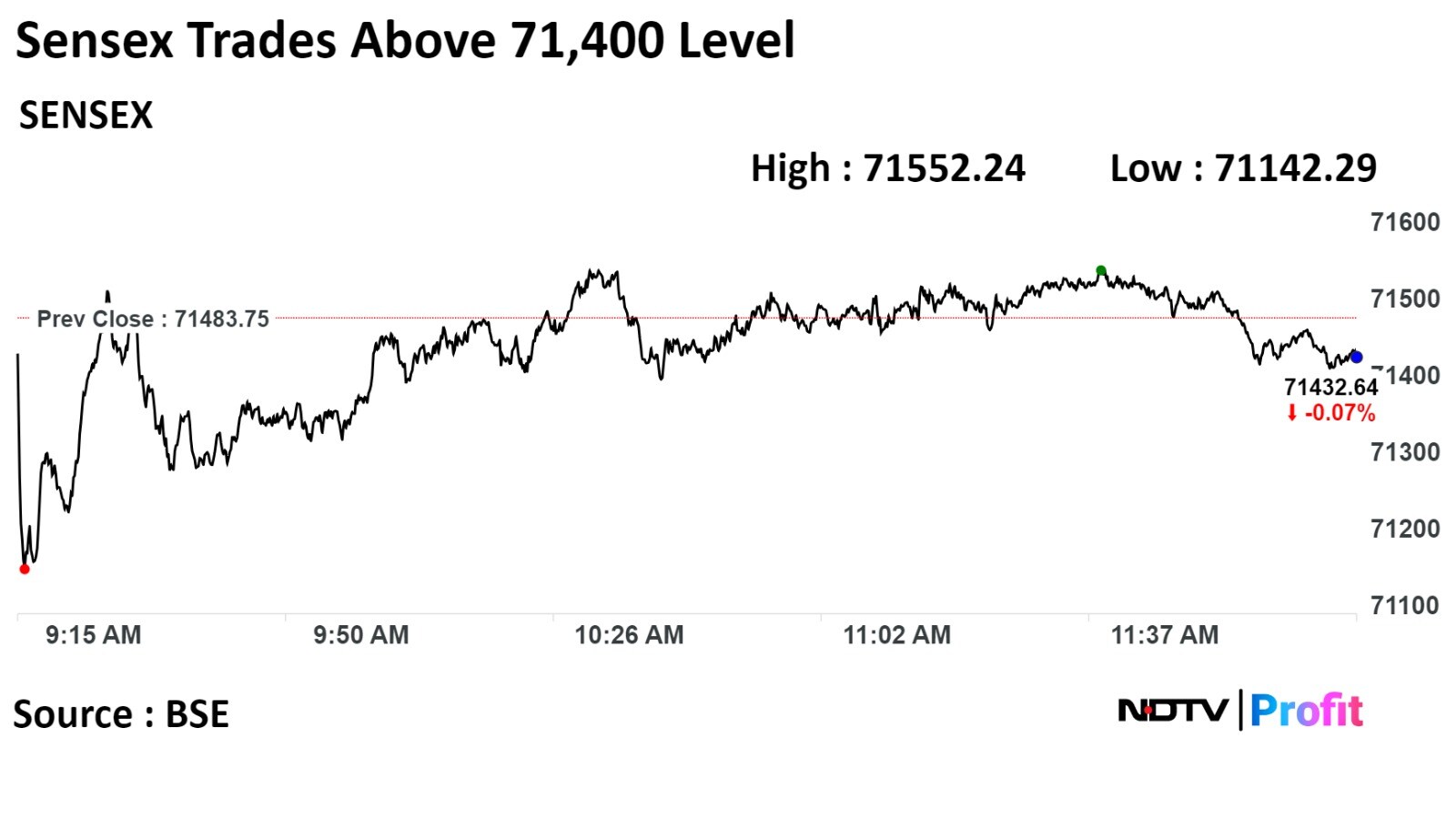

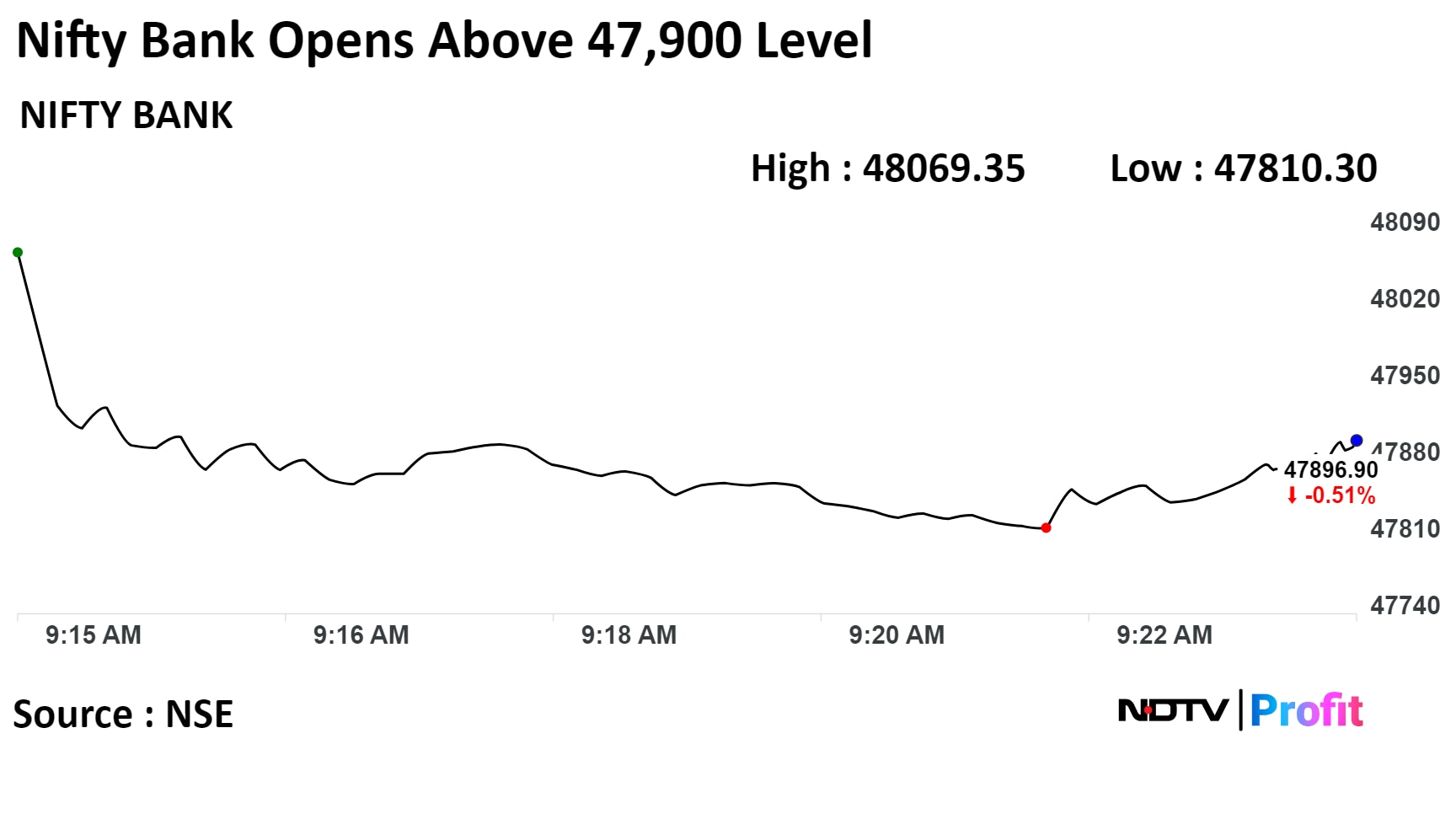

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

The benchmark indices remained largely flat during midday on Monday as ICICI Bank Ltd., ITC Ltd. and Power Grid Corp. dragged.

As of 12:23 p.m., the NSE Nifty 50 was flat at 21,456.80, while the S&P BSE Sensex was 64 points or 0.1% down at 71,420.12.

The Nifty, which went up by around 500 points last week, almost reached 21,500 mainly because the foreign portfolio investors put a lot of money into the market, according to Shrey Jain, chief executive officer of SAS Online.

"Right now, the market seems quite positive. But there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction," Jain said.

For the Nifty, the support range is identified at 21,000–21,075, with resistance evident at 21,500. A breach of this resistance level can potentially trigger a further rally, according to Jain. "For the banking index, we anticipate the levels between 47,575 and 47,750 to serve as mid-term support."

Hindalco Industries Ltd., Sun Pharmaceutical Industries Ltd., Tech Mahindra Ltd., Reliance Industries Ltd. and Bajaj Auto Ltd. were leading the gains.

ICICI Bank Ltd., ITC Ltd., Power Grid Corp., Bharti Airtel Ltd. and JSW Steel Ltd., were weighing on the indices.

Nine out of the 14 sectors advanced on the NSE. The Nifty Pharma rose the most, posting a 1.32% gain, while Realty declined the most.

The broader market outperformed the benchmark indices, with the BSE MidCap rising 0.45% and SmallCap gaining 0.65%.

Thirteen out of the 20 sectors compiled by the BSE advanced, with Services rising the most.

The market breadth was skewed in favour of the buyers. As many as 2,274 stocks rose, 1,494 declined and 153 remained unchanged on the BSE.

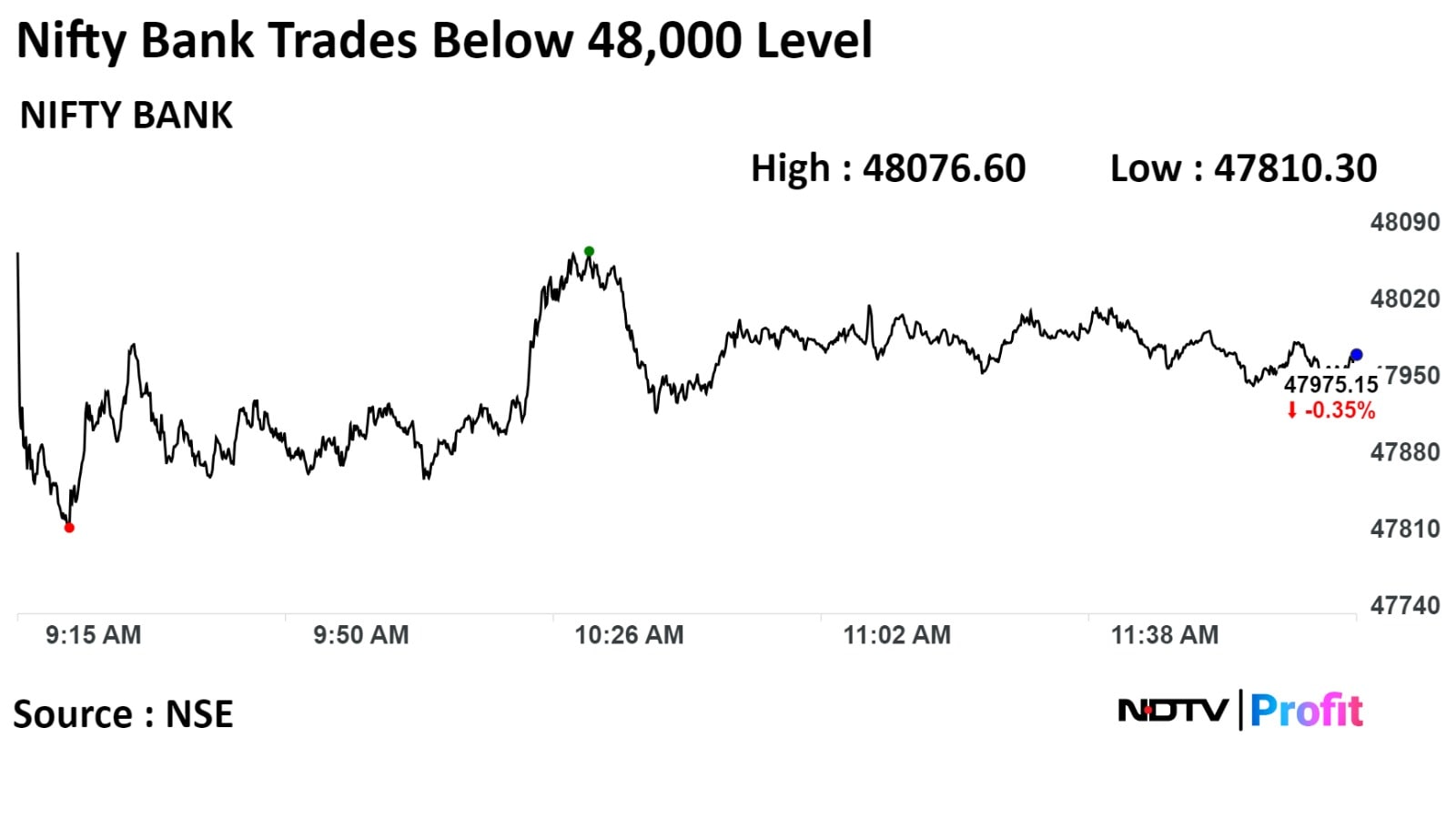

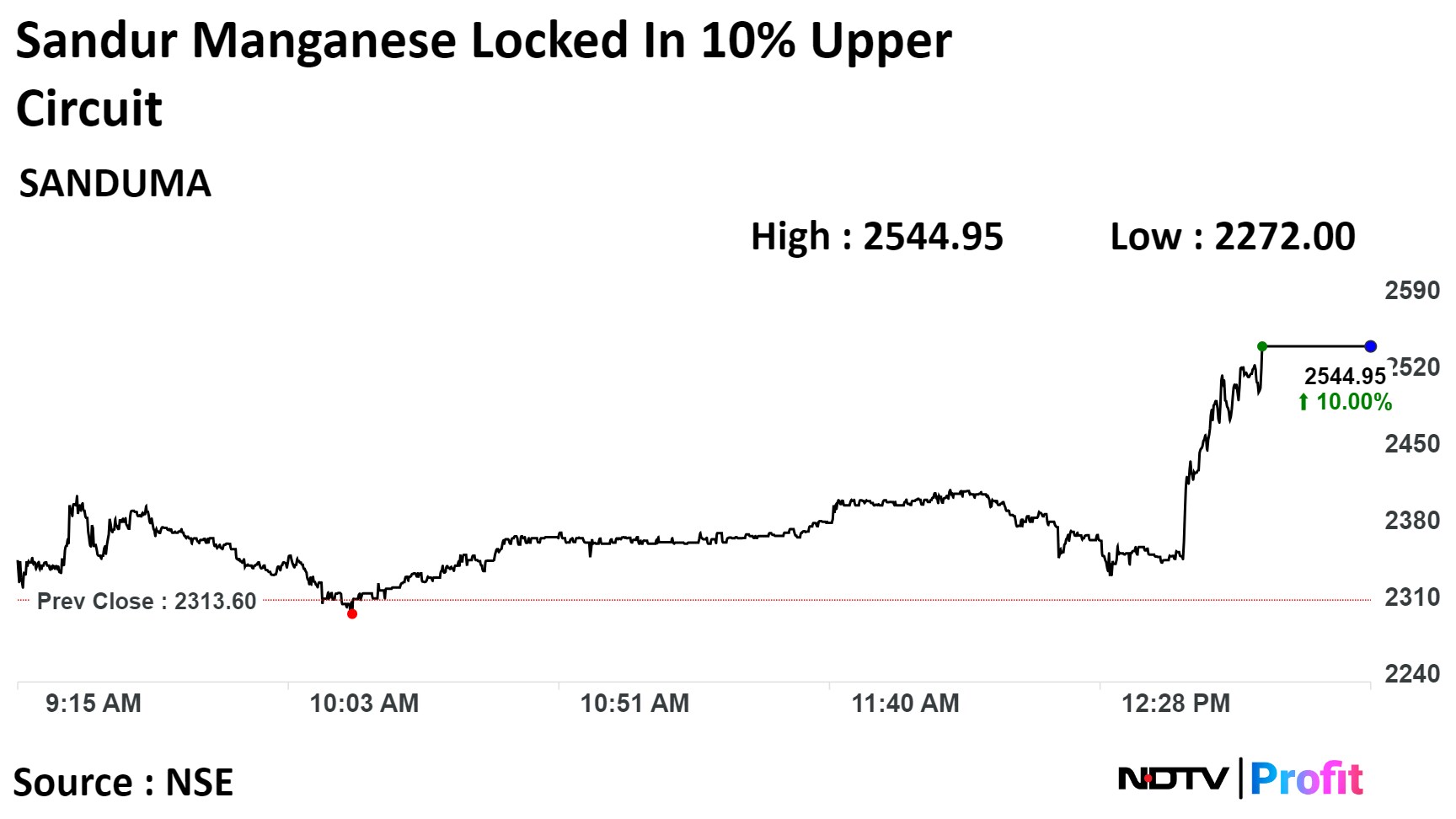

Shares of Sandur Manganese & Iron Ores Ltd were locked in their upper circuit limit of 10% after the company said its board has approved a bonus issue.

The company will issue five new fully paid-up equity shares of Rs 10 each for every one existing fully paid-up equity share of Rs 10 each held by the eligible shareholders as on the record date, according to an exchange filing by the company.

The company has also increased its authorised share capital to Rs 200 crore from Rs 115 crore.

Shares of Sandur Manganese & Iron Ores Ltd were locked in their upper circuit limit of 10% after the company said its board has approved a bonus issue.

The company will issue five new fully paid-up equity shares of Rs 10 each for every one existing fully paid-up equity share of Rs 10 each held by the eligible shareholders as on the record date, according to an exchange filing by the company.

The company has also increased its authorised share capital to Rs 200 crore from Rs 115 crore.

The scrip rose as much as its 10% upper circuit limit to Rs 2,544.95 apiece, the highest level since listing. This compares to a 0.17% decline in the NSE Nifty 50 Index.

Total traded volume so far in the day stood at 5.9 times its 30-day average. The relative strength index was at 83.76, indicating that the stock may be overbought.

Promoters seek demerger of co's energy business into a separate entity

Management to start exploratory steps to examine potential demerger of energy business

Source: Exchange Filing

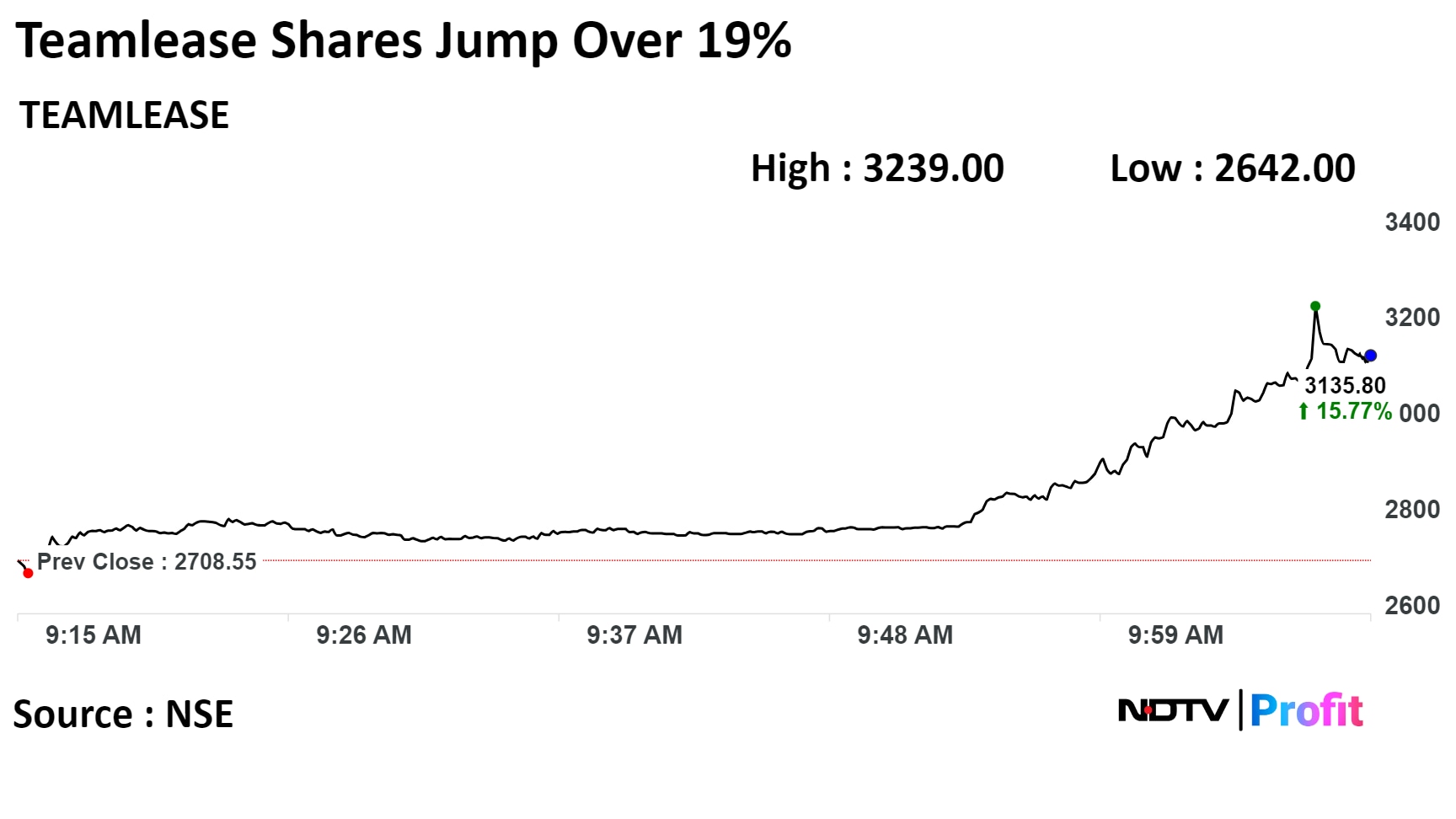

Archean Chemical Industries at 12.42 times of its 30 day average

Teamlease Services at 11.93 times of its 30 day average

Fine Organic Industries at 11.54 times of its 30 day average

HFCL at 8 times of its 30 day average

Rajratan Global Wire at 6.87 times of its 30 day average

Kewal Kiran Clothing at 6.75 times of its 30 day average

To issue five new shares for every one held

Approves increase of authorised share capital to Rs 200 crore from Rs 115 crore

Source: Exchange Filing

Top Gainers

Teamlease Services up 9.6% at Rs 2968.55

Rajratan Global Wire Ltd 8.1% at Rs 792.35

Rajesh Exports up 8.1% at Rs 395.7

National Aluminium Co up 7.81% at Rs 119.35

HFCL Ltd up 7.15% at Rs 79.4

Top Losers

Archean Chemical Industries down 4.59% at Rs 601.45

SJVN down 3.37% at Rs 93.05

Fusion Micro Finance down 2.93% at Rs 591

Union Bank Of India down 2.96% at Rs 124.45

Amber Enterprises India down 2.77% at Rs 3229.45

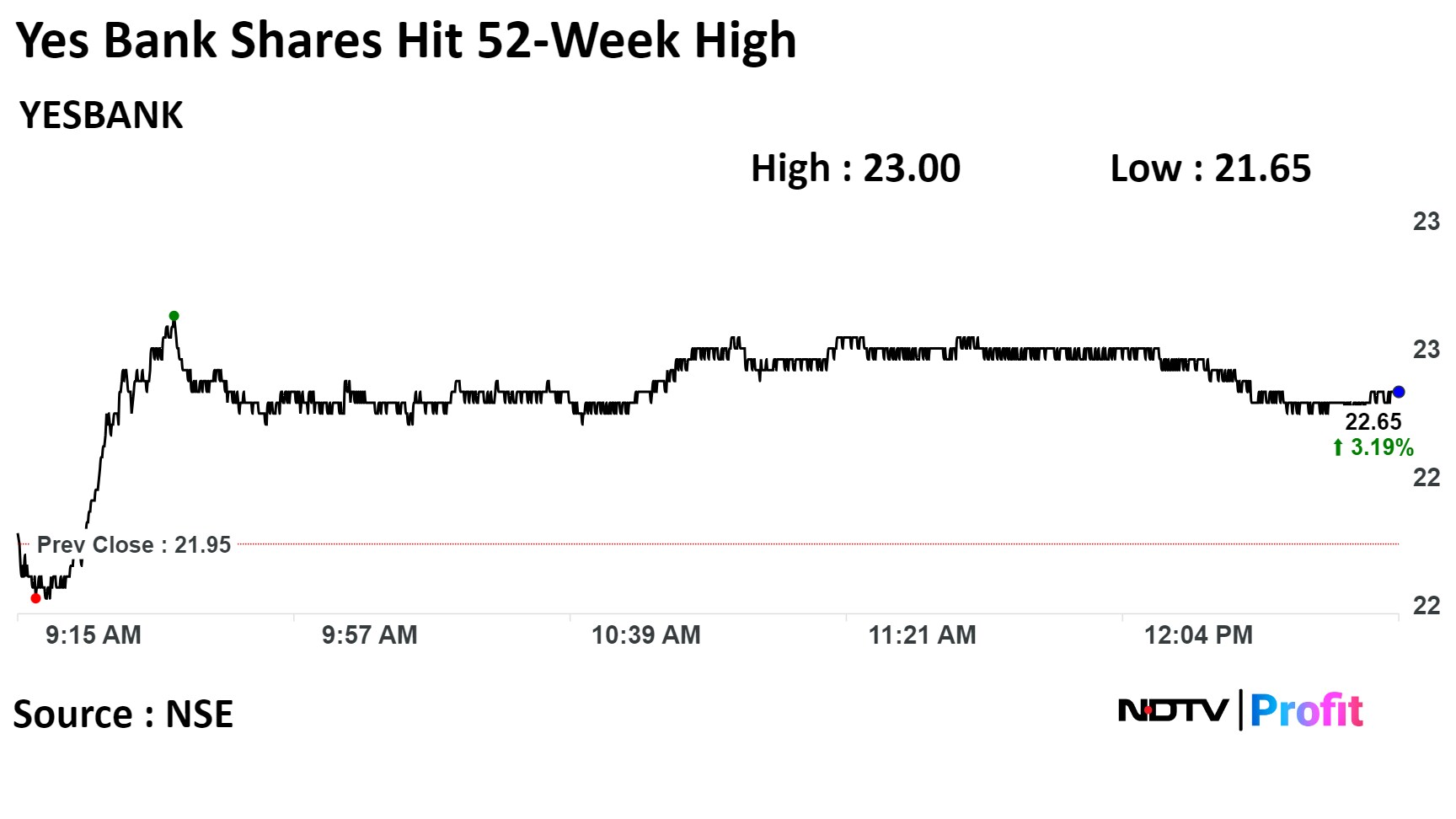

The scrip rose as much as 4.78% to Rs 286 piece, the highest level since Dec 2022. It pared gains to trade 2.96% higher at Rs 22.60 apiece, as of 12:53 p.m. This compares to a 0.07% decline in the NSE Nifty 50 Index.

It has risen 9.95% on a year-to-date basis. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 77.92, indicating that the stock may be overbought.

Out of 14 analysts tracking the company, one maintain a 'buy' rating, four recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 45%.

The scrip rose as much as 4.78% to Rs 286 piece, the highest level since Dec 2022. It pared gains to trade 2.96% higher at Rs 22.60 apiece, as of 12:53 p.m. This compares to a 0.07% decline in the NSE Nifty 50 Index.

It has risen 9.95% on a year-to-date basis. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 77.92, indicating that the stock may be overbought.

Out of 14 analysts tracking the company, one maintain a 'buy' rating, four recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 45%.

LIC cuts 2% stake in co from April 2022 to Dec 2023

Source: Exchange Filing

Gold outlook promising amid likely rate cuts by Fed in 2024

Expect average CPI inflation of 5.4% in FY24

FY24 real GDP growth outlook raised to 6.8% from 6.2%

Jan-Jun likely to be eventful for Indian and global markets

See Nifty 50 EPS of Rs 1,080 in FY25

Gets order worth Rs 150 Crore for various construction works from SAIL Durgapur Steel Plant

Project to be executed in 3 years

Source: Exchange Filing

Vedanta Holdings Mauritius II undertakes agreement not to dispose of shares of Vedanta

Negative lien created on Vedanta shares held by Twin Star, Welter

Vedanta Resources and its subsidiaries to retain control or own at least 50.1% of Vedanta

Source: Exchange Filing

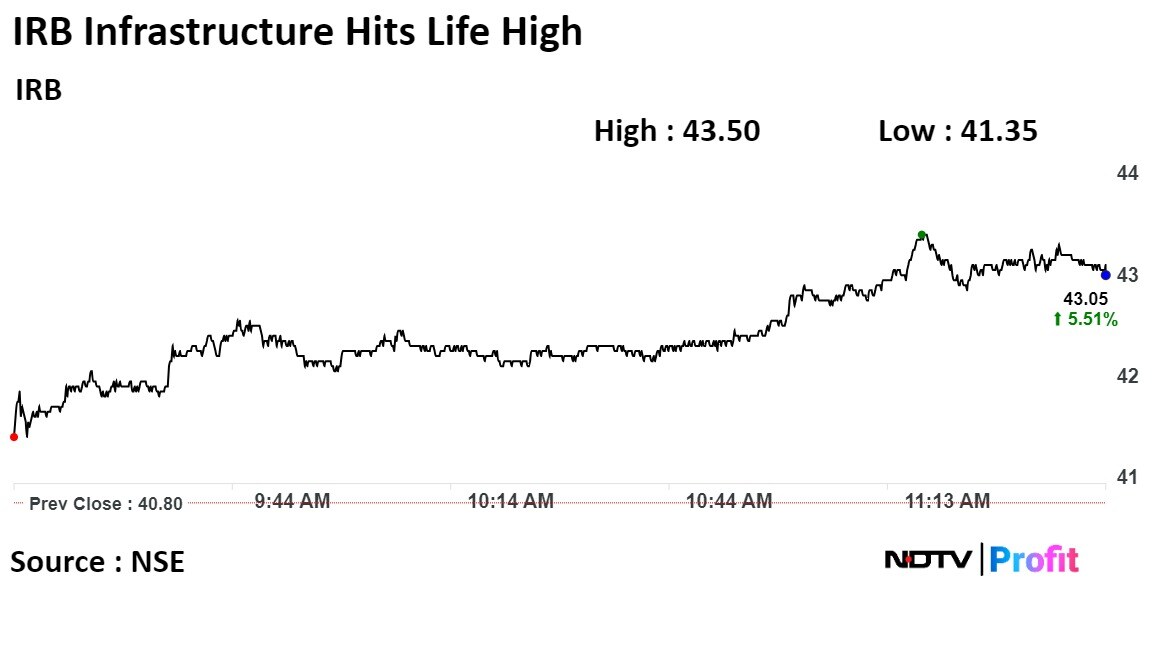

Shares of IRB Infrastructure hits all-time high after it was received the letter of award for the Kota Bypass and Cable Stay Bridge.

The National Highway Authority of India issued a letter of award to IRB Infrastructure Trust for tolling, operating, maintenance and transfer of Kota Bypass and Cable Stay Bridge on NH-76 and Gwalior-Jhansi section on NH-44 for an upfront consideration of Rs 1,683 crore, the company said through an exchange filing.

IRB Infrastructure shares rose as much as 6.62% to 43.50 apiece to reach its all-time high. It pared gains to trade 2.55% higher at Rs 43.35 apiece, as of 11:37 a.m. This compares to a 0.08% advance in the NSE Nifty 50 Index.

It has risen 48.7% on a year-to-date basis. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 75.

Out of 9 analysts tracking the company, 6 maintain a 'buy' rating and 3 recommend 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 40.9%.

Shares of IRB Infrastructure hits all-time high after it was received the letter of award for the Kota Bypass and Cable Stay Bridge.

The National Highway Authority of India issued a letter of award to IRB Infrastructure Trust for tolling, operating, maintenance and transfer of Kota Bypass and Cable Stay Bridge on NH-76 and Gwalior-Jhansi section on NH-44 for an upfront consideration of Rs 1,683 crore, the company said through an exchange filing.

IRB Infrastructure shares rose as much as 6.62% to 43.50 apiece to reach its all-time high. It pared gains to trade 2.55% higher at Rs 43.35 apiece, as of 11:37 a.m. This compares to a 0.08% advance in the NSE Nifty 50 Index.

It has risen 48.7% on a year-to-date basis. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 75.

Out of 9 analysts tracking the company, 6 maintain a 'buy' rating and 3 recommend 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 40.9%.

15.9 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 90 apiece

Buyers and sellers not known immediately

Source: Bloomberg

SIX is the operator of the Swiss, Spanish financial market infrastructures.

Source: Exchange Filing

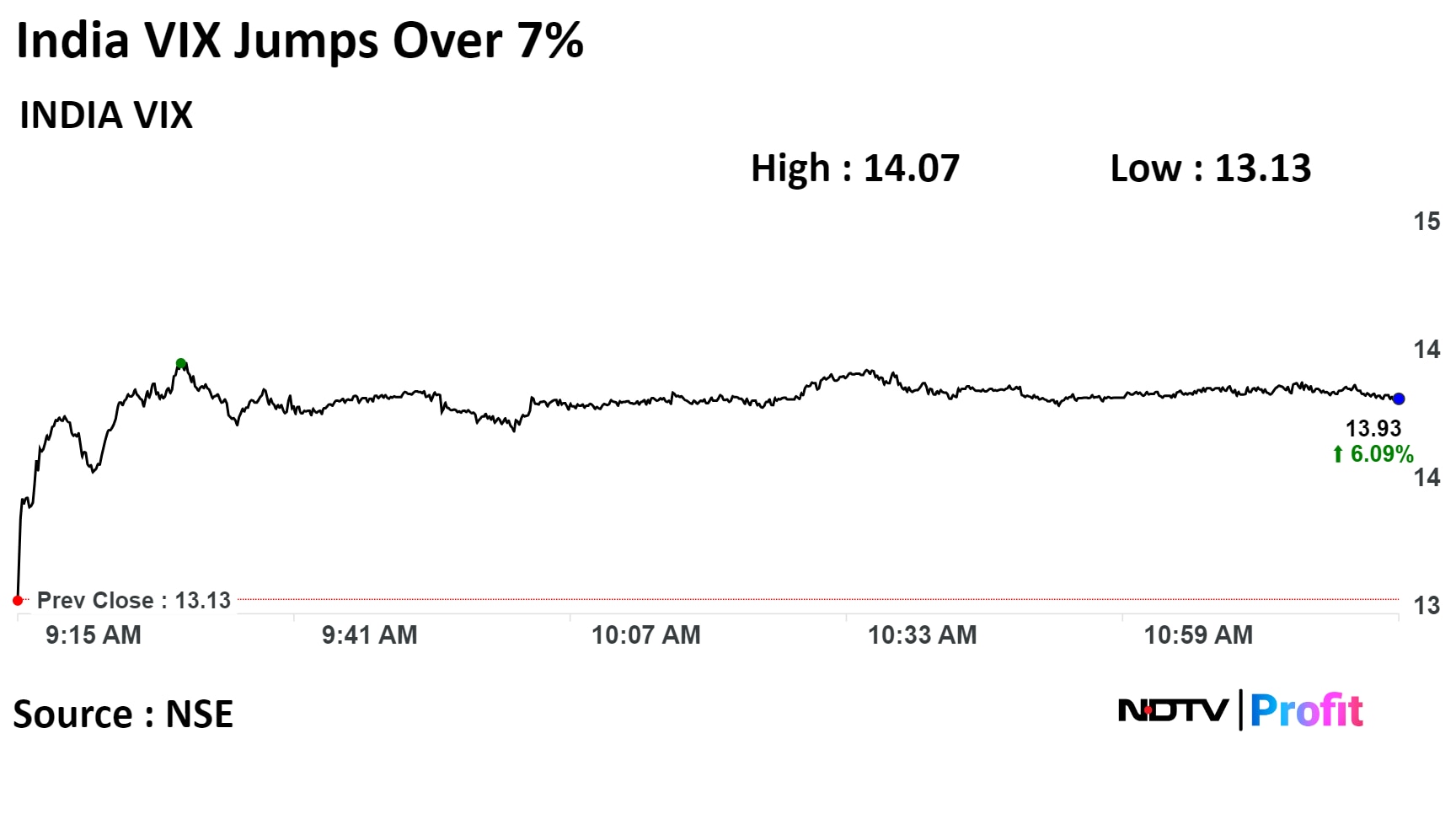

India VIX or the volatility index jumped as much 7.22% today to hit its highest level since December 6.

India VIX or the volatility index jumped as much 7.22% today to hit its highest level since December 6.

Sixteen stocks on the Nifty 500 have hit their life highs and 43 stocks on the Nifty 500 have hit their 52-Week highs today.

Zensar Technologies Ltd

HCL Technologies Ltd

Bharat Electronics Ltd

Sun Pharmaceutical Industries Ltd

Zydus Lifesciences Ltd

State Bank Of India

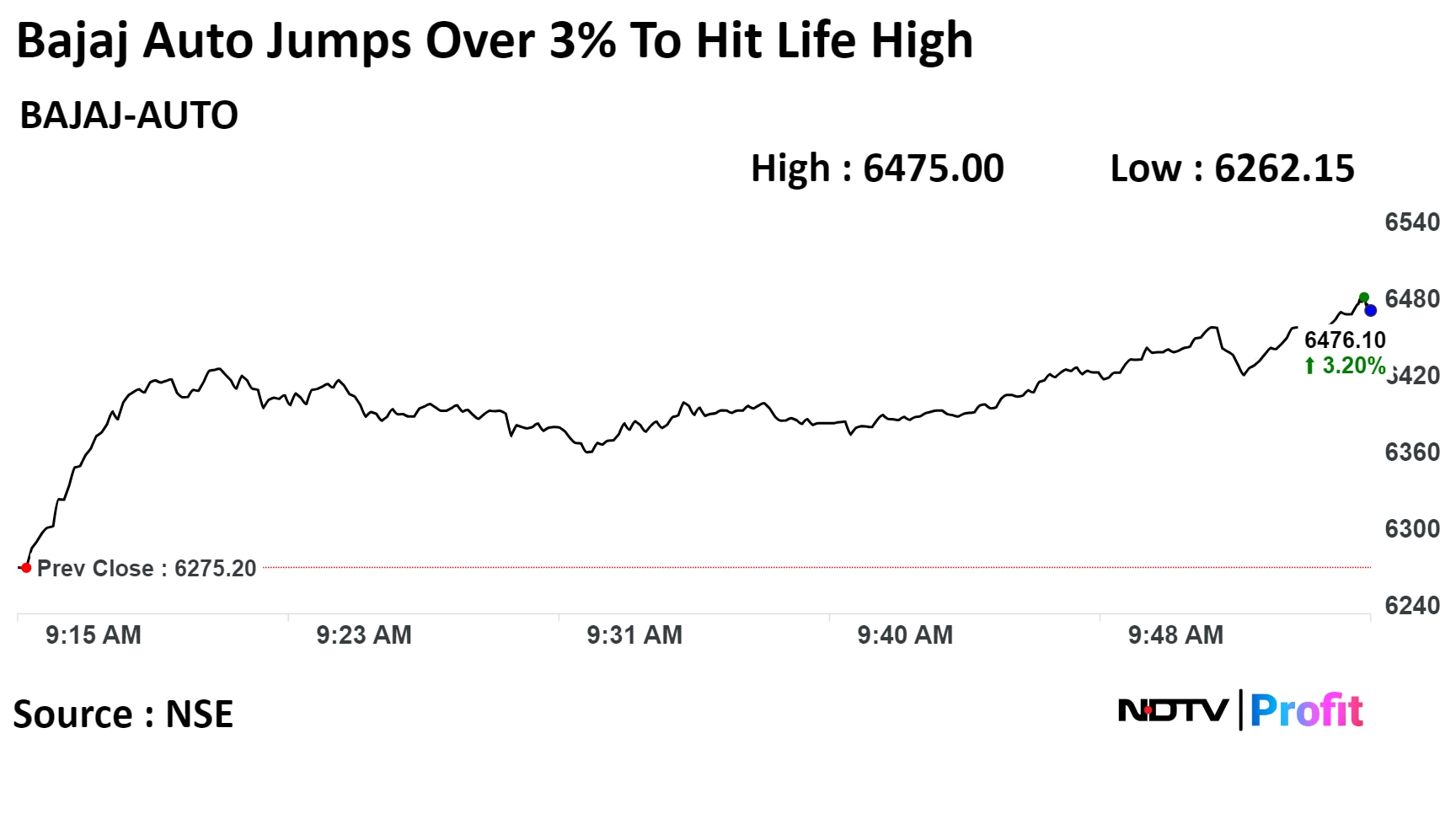

Bajaj Auto Ltd

Hitachi Energy India Ltd

Bharat Dynamics Ltd

The Landmark Cars Ltd surged nearly 9% on Monday as the company informed the exchanges it has received an approval from Mercedes-Benz India for opening workshop at Hyderabad.

Further, the company also got and letter of intent from the MG Motor India Pvt Ltd for opening dealership in Ahmedabad.

The Landmark Cars Ltd surged nearly 9% on Monday as the company informed the exchanges it has received an approval from Mercedes-Benz India for opening workshop at Hyderabad.

Further, the company also got and letter of intent from the MG Motor India Pvt Ltd for opening dealership in Ahmedabad.

The shares of Gandhar Oil Refinery (India) Ltd. slumped on Monday to touch its lowest since listing, after the company reported a decline in its second-quarter net profit.

The net profit of the company that recently debuted on the indices fell 11.3% in comparison to the previous quarter to Rs 48.1 crore. In addition, the revenue and the earning before interest, tax, depreciation and amortisation margin also saw a decline.

Gandhar Oil shares fell as much as 9.09% to 281.55 apiece to touch its lowest since the listing. It pared losses to trade 5.47% lower at Rs 292.75 apiece, as of 10:14 a.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

Total traded volume so far in the day stood at 0.8 times its 30-day average.

The shares of Gandhar Oil Refinery (India) Ltd. slumped on Monday to touch its lowest since listing, after the company reported a decline in its second-quarter net profit.

The net profit of the company that recently debuted on the indices fell 11.3% in comparison to the previous quarter to Rs 48.1 crore. In addition, the revenue and the earning before interest, tax, depreciation and amortisation margin also saw a decline.

Gandhar Oil shares fell as much as 9.09% to 281.55 apiece to touch its lowest since the listing. It pared losses to trade 5.47% lower at Rs 292.75 apiece, as of 10:14 a.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

Total traded volume so far in the day stood at 0.8 times its 30-day average.

Shares of Mazagon Dock Shipbuilders Ltd. jumped more than 4% today following Friday's news of the company signing a letter of intent with a European client.

The contract is for construction of three units of 7,500 DWT Multi-Purpose Hybrid Powered Vessels for a value of approx. 42 million USD, the company said in an exchange filing.

Shares of Mazagon Dock Shipbuilders Ltd. jumped more than 4% today following Friday's news of the company signing a letter of intent with a European client.

The contract is for construction of three units of 7,500 DWT Multi-Purpose Hybrid Powered Vessels for a value of approx. 42 million USD, the company said in an exchange filing.

The scrip rose as much as 4.43% to Rs 2,175 piece, the highest level since October 16. It pared gains to trade 2.9% higher at Rs 2,143.55 apiece, as of 10:58 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 170.28% on a year-to-date basis. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 62.74.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 7%.

10.3 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 1850.20 apiece

Buyers and sellers not known immediately

Source: Bloomberg

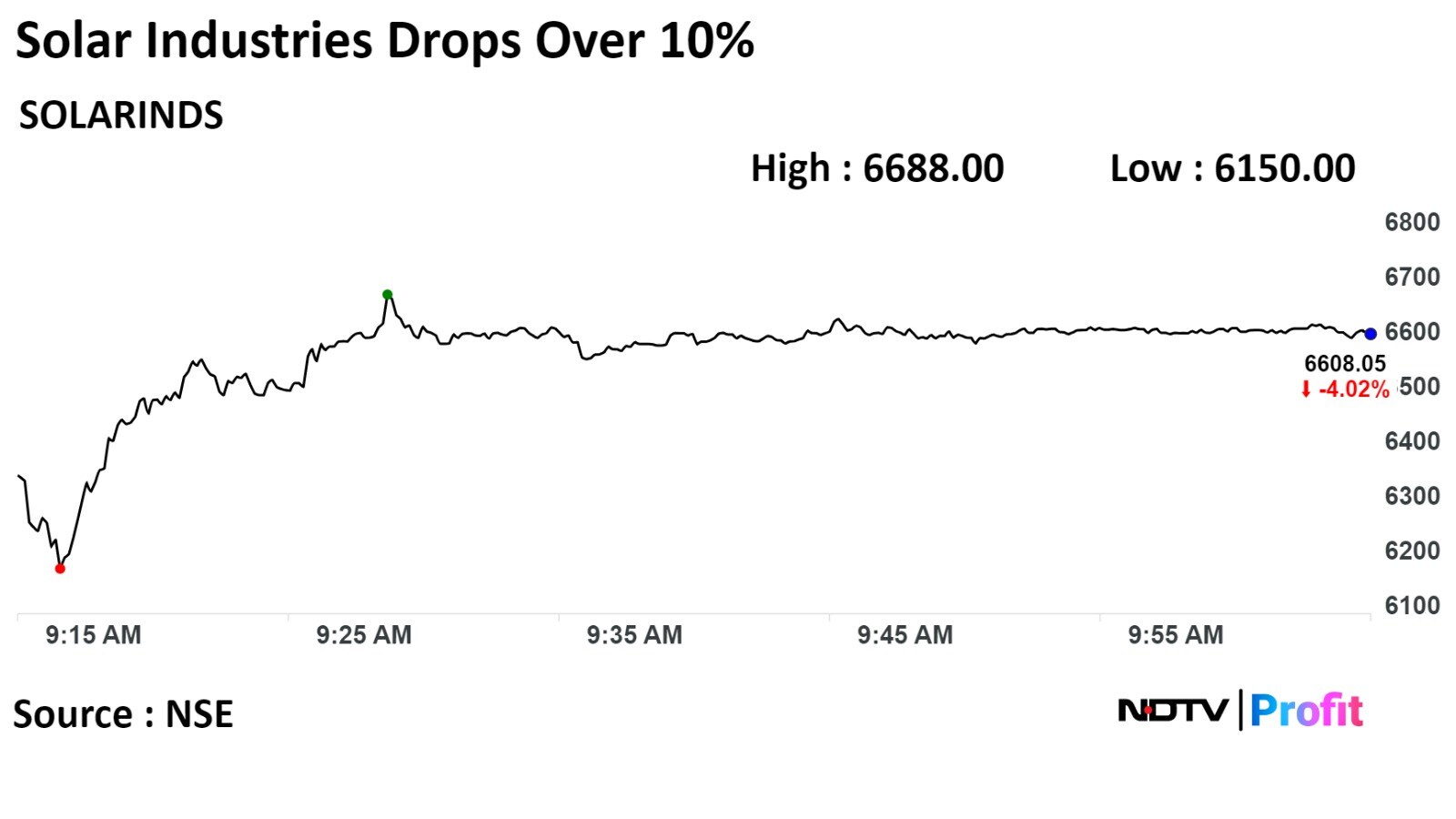

Solar Industries Ltd slumped over 10% on Monday after the company informed the exchanges an explosion at the processing unit in Nagpur which resulted death of nine people.

Solar Industries Ltd slumped over 10% on Monday after the company informed the exchanges an explosion at the processing unit in Nagpur which resulted death of nine people.

The scrip plunged 10.67% to Rs 6,150 apiece, the lowest level since Dec 1. It pared losses to trade 2.78% lower at Rs 191.40 apiece, as of 10:22 a.m. This compares to a 0.14% decline in the NSE Nifty 50 Index.

It has risen 53.38% on a year-to-date basis. Total traded volume so far in the day stood at 5.3 times its 30-day average. The relative strength index was at 59.28.

Out of 8 analysts tracking the company, 6 maintain a 'buy' rating, 2 recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 7.1%

The scrip rose as much as 3.37% to Rs 6,486.75 piece, its lifetime high. It pared gains to trade 2.82% higher at Rs 6,451.90 apiece, as of 10:18 a.m. This compares to a 0.01% advance the NSE Nifty 50 Index.

It has risen 78.53% on a year-to-date basis. Total traded volume so far in the day stood at three times its 30-day average. The relative strength index was at 78.39, indicating that the stock may be overbought.

Out of 47 analysts tracking the company, 26 maintain a 'buy' rating, 12 recommend a 'hold,' and 9 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 13%.

The scrip rose as much as 3.37% to Rs 6,486.75 piece, its lifetime high. It pared gains to trade 2.82% higher at Rs 6,451.90 apiece, as of 10:18 a.m. This compares to a 0.01% advance the NSE Nifty 50 Index.

It has risen 78.53% on a year-to-date basis. Total traded volume so far in the day stood at three times its 30-day average. The relative strength index was at 78.39, indicating that the stock may be overbought.

Out of 47 analysts tracking the company, 26 maintain a 'buy' rating, 12 recommend a 'hold,' and 9 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 13%.

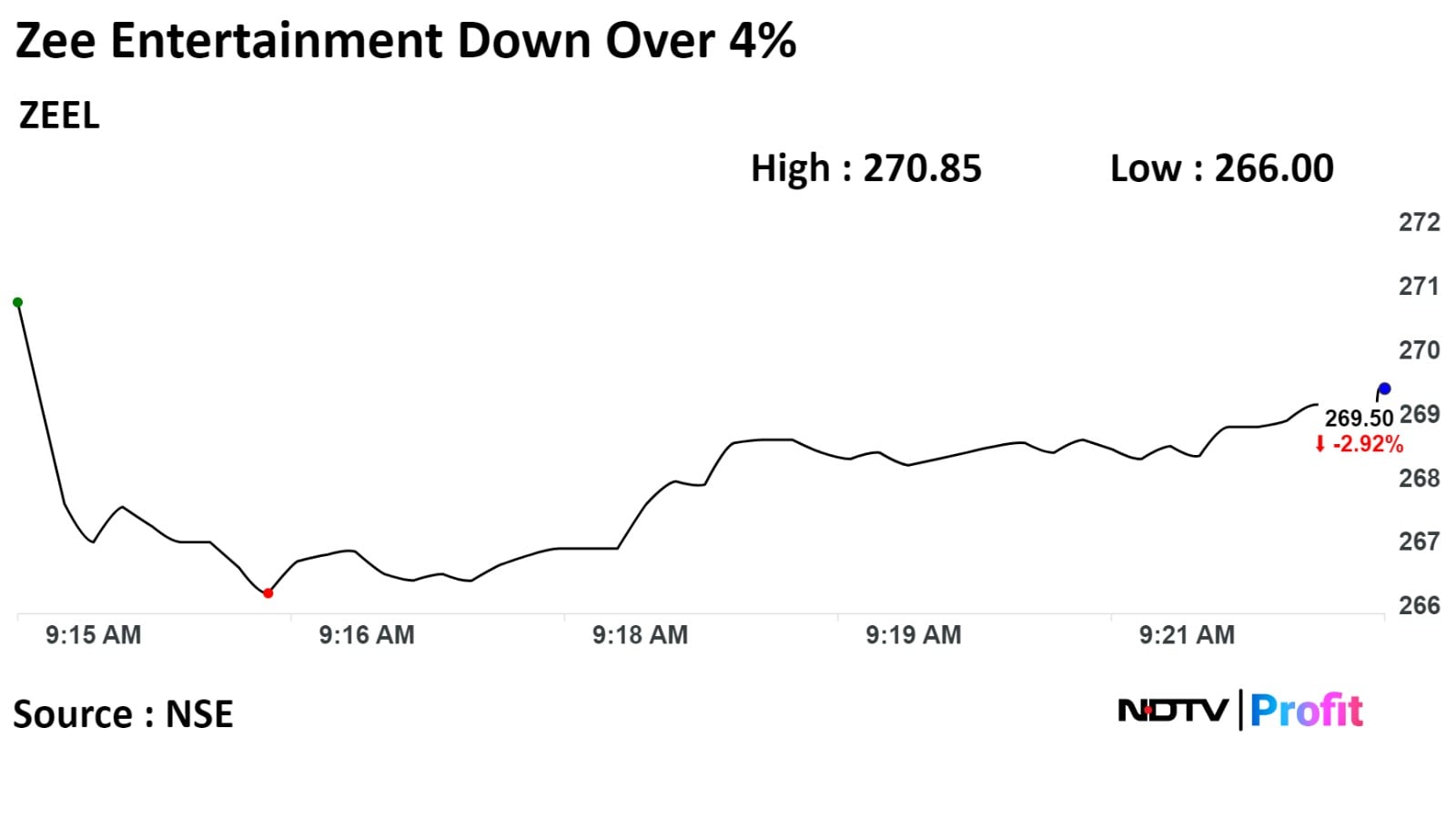

Shares of the Zee Entertainment Enterprises Ltd tumbled over 4% on Monday after it informed the exchanged it has sought more time to merge with Culver Max Entertainment Pvt.

The entertainment company has requested Culver Max Entertainment Pvt formerly known as Sony Pictures Networks India Pvt.— and Bangla Entertainment Pvt. to extend the timeline required to make their merger effective.

Shares of the Zee Entertainment Enterprises Ltd tumbled over 4% on Monday after it informed the exchanged it has sought more time to merge with Culver Max Entertainment Pvt.

The entertainment company has requested Culver Max Entertainment Pvt formerly known as Sony Pictures Networks India Pvt.— and Bangla Entertainment Pvt. to extend the timeline required to make their merger effective.

The scrip fell as much as 4.18% to Rs 266.00 apiece. It was trade 2.76% lower at Rs 269.95 apiece, as of 09:35 a.m. This compares to a 0.09% decline in the NSE Nifty 50 Index.

It has risen 11.75% on a year-to-date basis. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 51.97.

Out of 23 analysts tracking the company, 17 maintain a 'buy' rating, 4 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.2%.

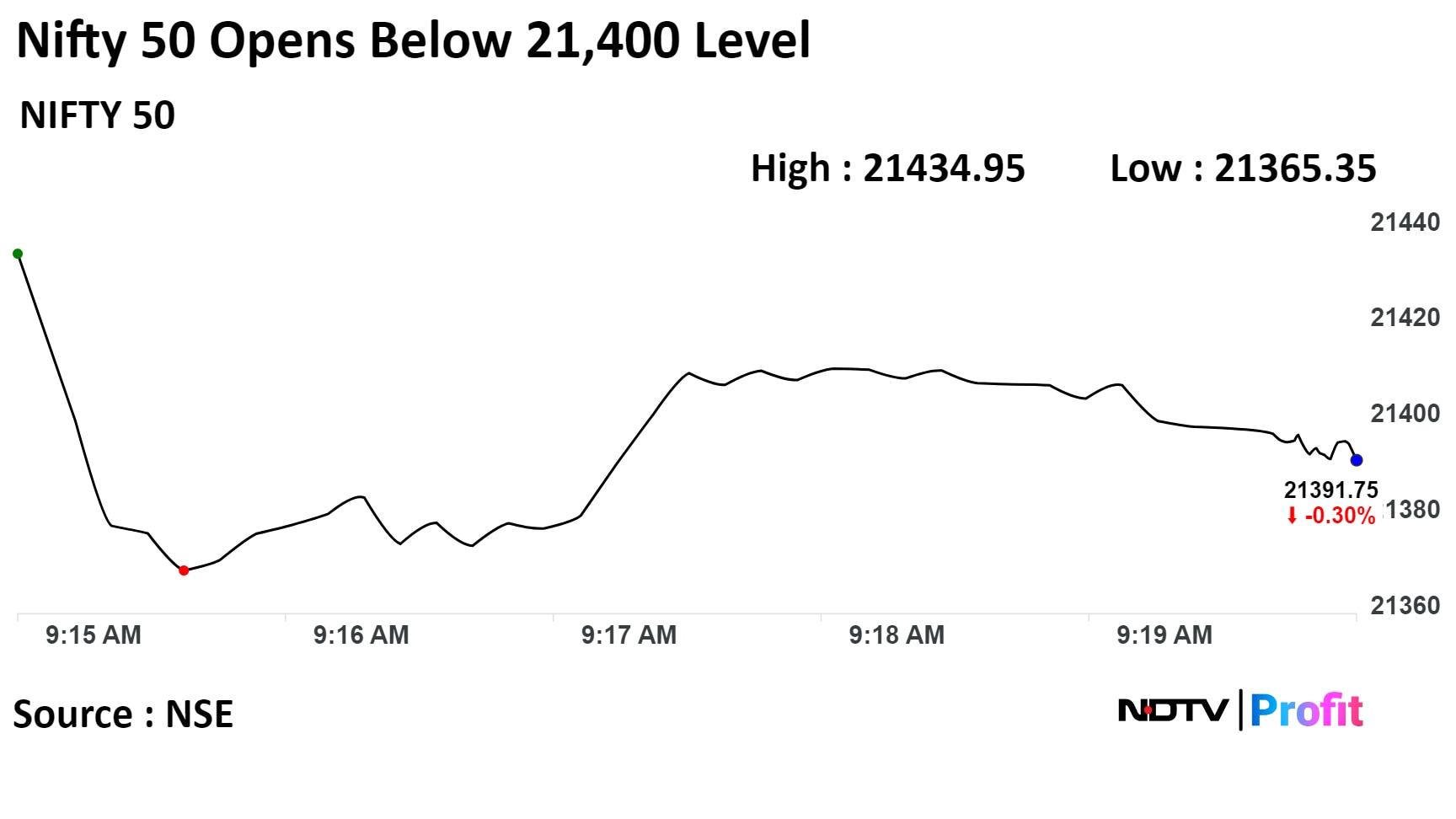

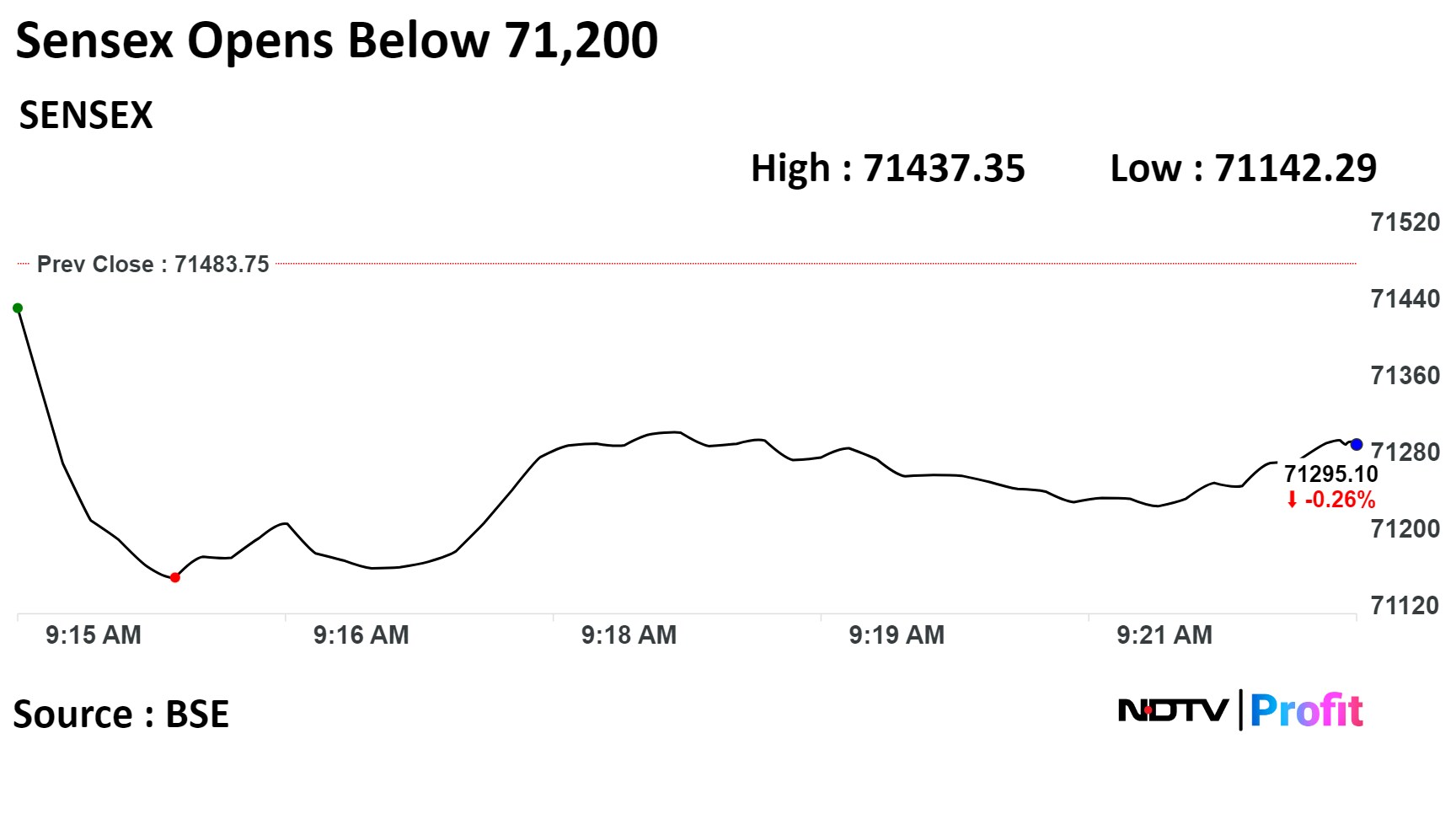

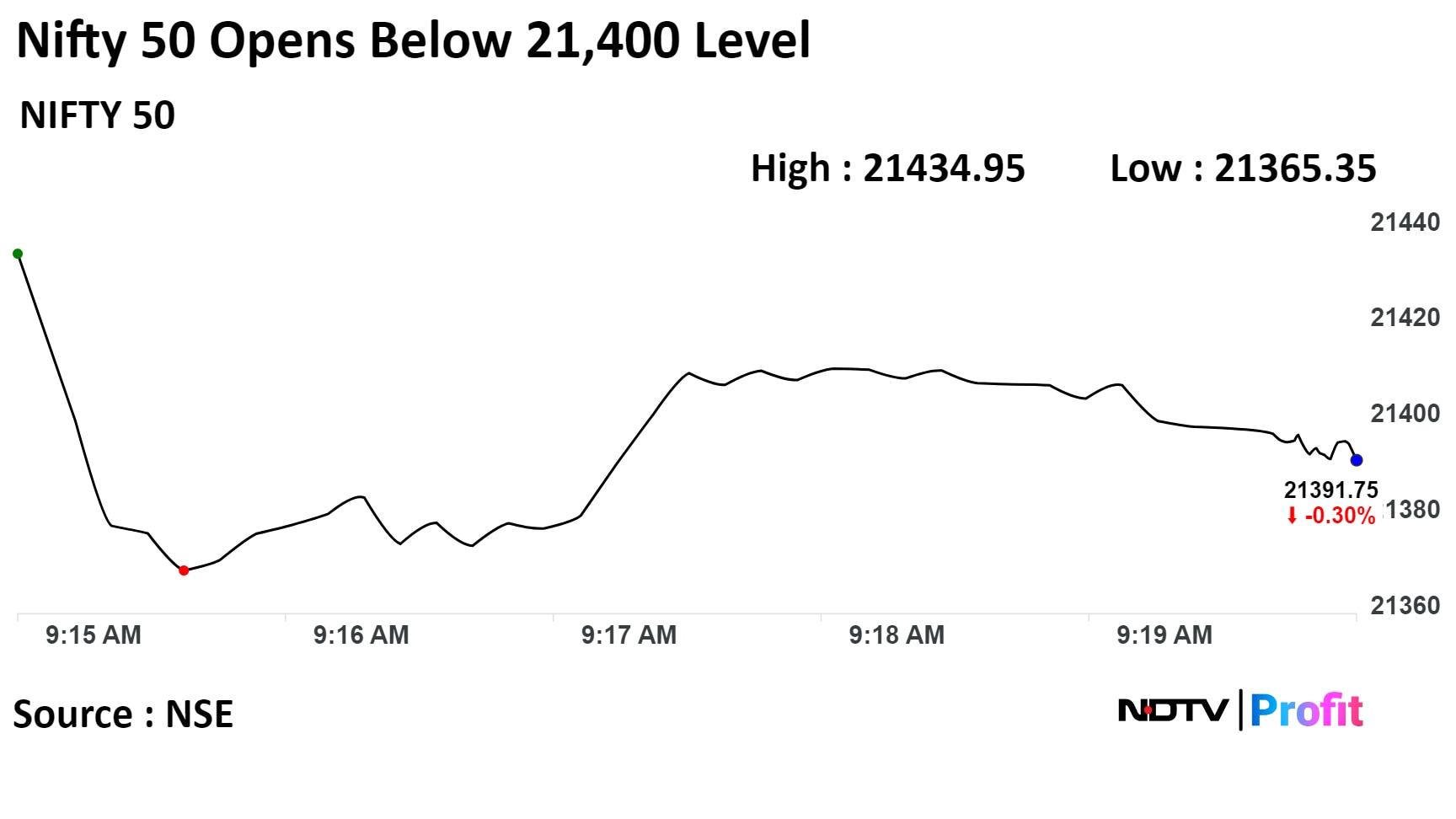

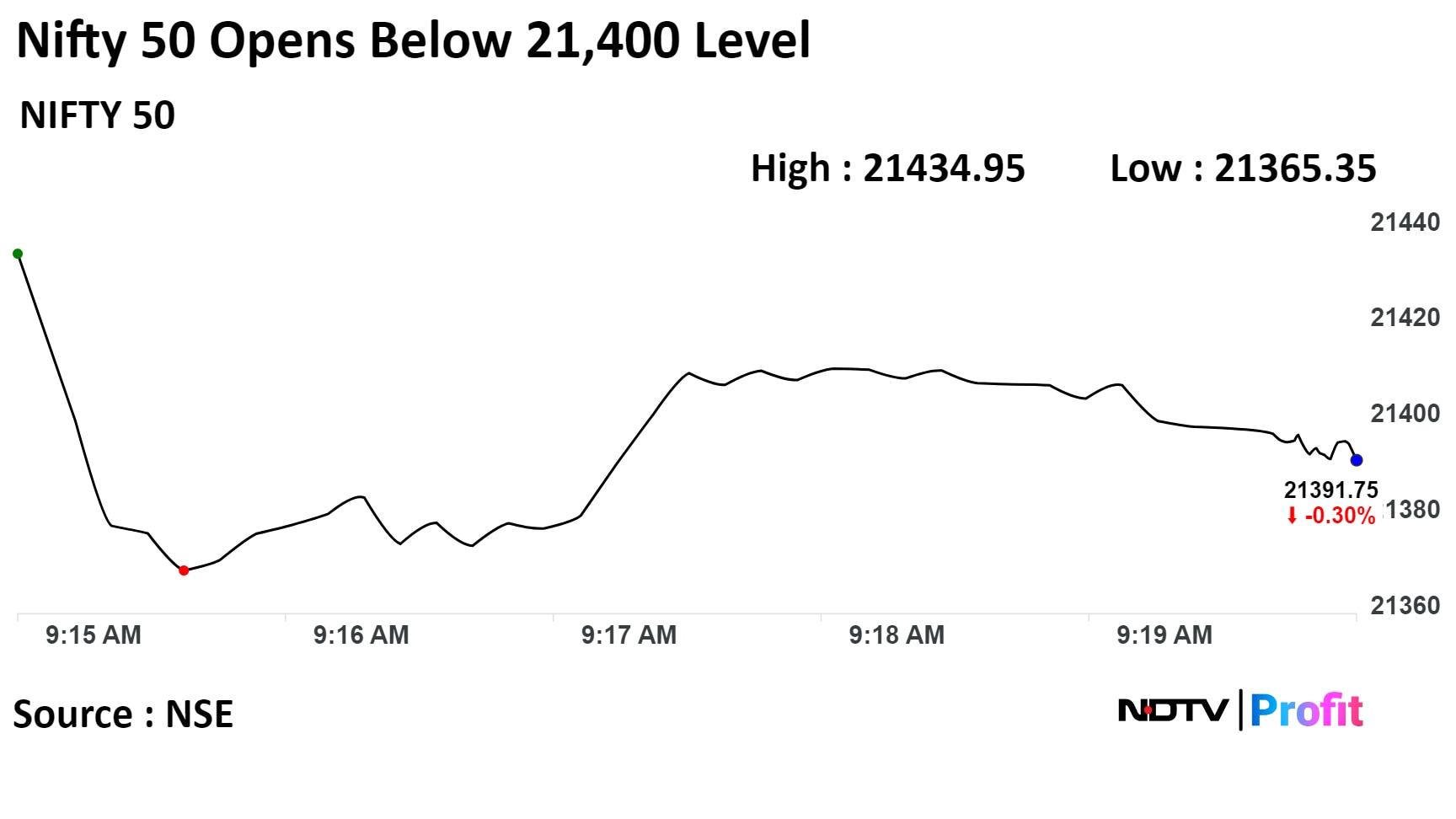

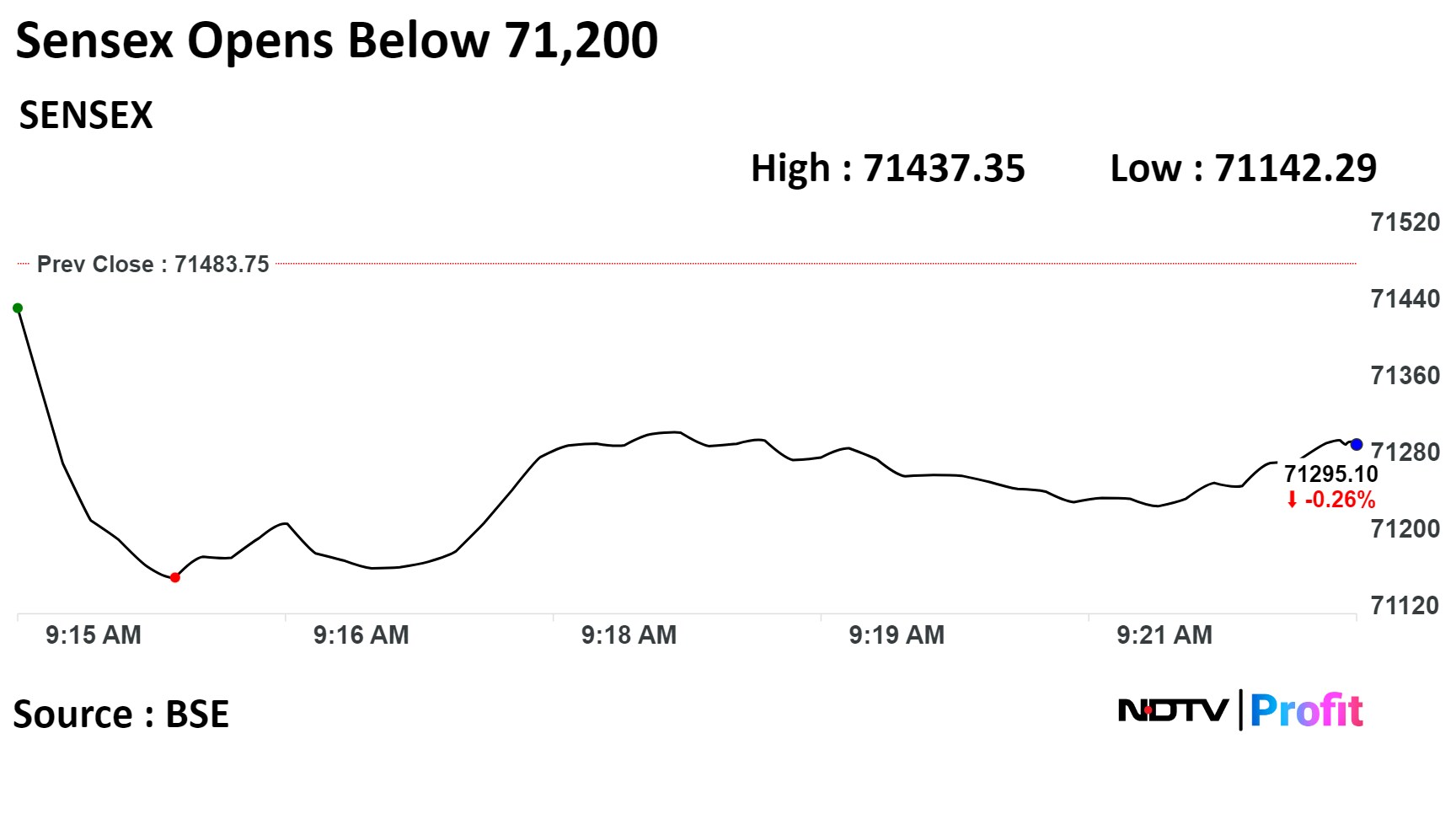

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Benchmark indices opened lower today, snapping their three-day rally due to losses in financial services and information technology stocks.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

"From a technical standpoint, Nifty faces resistance at 21650, with support at 21209, while Bank Nifty hurdles at 48439 with support at 47635," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

Shares of Infosys Ltd., Tech Mahindra Ltd., Titan Co. Ltd., Sun Pharmaceutical Industries Ltd., and Bajaj Auto contributed the most to the gains.

Meanwhile, ICICI Bank Ltd., ITC Ltd., Axis Bank Ltd., Hindalco Industries Ltd., and JSW Steel Ltd. weighed on them.

Only Nifty Pharma, Nifty IT, and Nifty Auto advanced among sectoral indices. Nifty Metal and Nifty Bank fell the most by around 0.6% each whereas Nifty Pharma jumped around 1%.

The broader markets outperformed as the BSE MidCap was up 0.1%, while the BSE SmallCap was 0.4% higher. Eight out of the 20 sectors compiled by the BSE declined, while 12 advanced.

The market breadth was skewed in the favour of buyers. As many as 1,978 stocks advanced, 1,180 declined and 131 remained unchanged on the BSE.

At pre-open, the S&P BSE Sensex Index was down 46.40 points, or 0.07%, at 71,437.35 while the NSE Nifty 50 was down 21.85 points or 0.10% at 21,434.80.

14.4 lakh shares or 1.2% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.16% on Monday.

Source: Bloomberg

The local currency strengthened 3 paise to open at 82.97 against the U.S dollar on Monday.

It closed at Rs 83 on Friday, after hitting a high of Rs 82.95 highest level in nearly three months.

Source: Bloomberg

Plans 1,000 MW renewable power at an investment of Rs 6,000 Crore via internal accruals.

Source: Exchange Filing

Commences planned stake sale of 10-20% in arm; Procedure to be completed in 4-5 months

Nuvama to explore all legal options on SAT order

Source: Exchange Filing

Proposed increase in SVs to lead to reduced value for other three stakeholders

Reduced returns for persistent policyholders, lower payouts to distributors, impact on life insurer's VNB margin

SBI Life remains top pick on lower dependency on non-par savings, lowest-cost model

Continue to favour HDFC Life, valuation of LIC still remains attractive

Ratings And Target Price

HDFC Life: Rates 'add' with price target of Rs 740

ICICI Pru Life: Rates 'add' with price target of Rs 610

LIC: Rates 'buy' with price target of Rs 850

Max Financial: Rates 'add' with price target of Rs 1,090

SBI Life: Rates 'buy' with price target of Rs 1,690

U.S. Dollar Index at 102.61

U.S. 10-year bond yield at 3.93%

Brent crude up 0.43% at $76.88 per barrel

Nymex crude up 0.28% at $71.63 per barrel

GIFT Nifty was up 0.1% at 21,477.50 as of 07:37 a.m.

Bitcoin was down 1.92% at $41,079.43

Price band revised from 20% to 10%: PTC India Financial Services.

Price band revised from 2% to 5%: Sical Logistics.

Moved into a short-term ASM framework: TVS Holdings.

Moved Out of short-term ASM framework: Inox Wind, New Delhi Television, Sastasundar Ventures, TV18 Broadcast.

Nifty December futures up 1.08% to 21,557.10 at a premium of 100.45 points.

Nifty December futures open interest up 0.3%.

Nifty Bank December futures up 0.5% to 48,271.45 at a premium of 127.9 points.

Nifty Bank December futures open interest up 5.14%.

Nifty Options Dec. 21 Expiry: Maximum call open interest at 22,000 and maximum put open interest at 21,300.

Bank Nifty Options Dec. 20 Expiry: Maximum Call Open Interest at 50,000 and Maximum Put open interest at 47,000.

Securities in the ban period: Balrampur Chini Mills, Delta Corp, Hindustan Copper, India Cements, Manappuram Finance, SAIL, Zee Entertainment.

Price band revised from 20% to 10%: PTC India Financial Services.

Price band revised from 2% to 5%: Sical Logistics.

Moved into a short-term ASM framework: TVS Holdings.

Moved Out of short-term ASM framework: Inox Wind, New Delhi Television, Sastasundar Ventures, TV18 Broadcast.

Nifty December futures up 1.08% to 21,557.10 at a premium of 100.45 points.

Nifty December futures open interest up 0.3%.

Nifty Bank December futures up 0.5% to 48,271.45 at a premium of 127.9 points.

Nifty Bank December futures open interest up 5.14%.

Nifty Options Dec. 21 Expiry: Maximum call open interest at 22,000 and maximum put open interest at 21,300.

Bank Nifty Options Dec. 20 Expiry: Maximum Call Open Interest at 50,000 and Maximum Put open interest at 47,000.

Securities in the ban period: Balrampur Chini Mills, Delta Corp, Hindustan Copper, India Cements, Manappuram Finance, SAIL, Zee Entertainment.

PVR Inox: Plenty Private Equity Fund sold 18.38 lakh shares (1.86%), Plenty CI Fund sold 2.49 lakh shares (0.24%) and Multiples Private Equity Fund sold 1.99 lakh (0.20%) at Rs 1,753 apiece. The Singapore government bought 3.5 lakh shares (0.36%), Norges Bank bought 6.66 lakh shares (0.67%), and Morgan Stanley Asia Singapore bought 57,225 shares (0.05%), among others, at Rs 1,753 apiece.

Swan Energy: Albula Investment Fund sold 12 lakh shares (0.45%) at Rs 508.5 apiece and Kasturi Vintrade sold 2 lakh shares (0.07%) at Rs 503.25 apiece. Arial Holdings 1 bought 12 lakh shares (0.45%) at Rs 508.5 apiece and Samco Mutual Fund bought 2 lakh shares (0.07%) at Rs 503.25 apiece.

PB Fintech: SVF Python II Cayman sold 1.14 crore shares (2.53%) at 800.05 apiece. Goldman Sachs bought 1.75 lakh shares (0.03%), Best Investment Corp. bought 11.27 lakh shares (0.25%), and New World Fund bought 16.38 lakh shares (0.36%), among others, at Rs 800.05 apiece.

KFin Technologies: General Atlantic Singapore Fund sold 1.7 crore shares (10%) at Rs 500.5 apiece. ICICI Prudential Life Insurance bought 9 lakh shares (0.52%), ICICI Prudential Mutual Fund bought 13.77 lakh shares (0.81%), Societe Generale bought 22.64 lakh shares (1.33%) at Rs 500 apiece and Unifi Capital bought 25 lakh shares (1.47%) at Rs 500 apiece.

Sterling and Wilson Renewable Energy: Shapoorji Pallonji and company sold 39.14 lakh shares (2.06%) at Rs 415.46 apiece and Plutus Wealth Management LLP bought 25 lakh shares at Rs 410 apiece.

GMR Power and Urban Infra: ASN Investments sold 35 lakh shares (0.57%) at 52.25 apiece.

Doms Industries: The pencil maker's public issue was subscribed 93.52 times on its third and final day. The bids were led by institutional investors (115.97 times), retail investors (69.67 times), non-institutional investors (66.51 times) and portions reserved for employees (29.21 times).

Inox India: The cryogenic tank maker's public issue was subscribed 7.14 times on its second day. The bids were led by non-institutional investors (13.75 times), retail investors (8.71 times) and institutional investors (0.4 times).

India Shelter Finance: The company's public issue was subscribed 36.71 times on its third and final day. The bids were led by institutional investors (89.7 times), non-institutional investors (28.51 times), and retail investors (9.95 times).

Zee Entertainment Enterprises: The company has requested Culver Max Entertainment Pvt.— formerly known as Sony Pictures Networks India Pvt.— and Bangla Entertainment Pvt. to extend the timeline required to make their merger effective.

Mankind Pharma: The company acquired an additional 1.3% stake in Actimed Therapeutics for about £999,900. The company’s stake rises to 10.19%.

NBCC: The company conducted an auction for the sale of 2.23 lakh square feet in the World Trade Centre and sold commercial inventory worth Rs 905 crore. Total sales of commercial inventory through e-auction stand at Rs 9,656.6 crore.

Tata Power: The company signed Rs 418 crore pacts for supplying 152 MWp DCR solar PV modules to NTPC.

Lupin: The pharma major received approval from the United States Food and Drug Administration for its abbreviated new drug application for Allopurinol Tablets USP and Sitagliptin Tablets USP.

Indian Bank: The company raises Rs 4,000 crore by issuing 10.15 crore shares via QIP at Rs 394 per share, which indicates a discount of 4.9% to the floor price of Rs 414.44 per share.

Mahindra & Mahindra: The company's unit incorporated a wholly owned subsidiary named Migos Hybren Pvt. for power and electricity generation.

Adani Green: The company unit incorporated two wholly owned subsidiaries, namely, Adani Renewable Energy Fifty Eight and Adani Renewable Energy Sixty One.

Sumitomo Chemical: The company acquired an 85% stake in Barrix Agro Sciences for Rs 78.2 crore.

Landmark Cars: The company has received a letter of intent from MG Motor India for opening a dealership in Ahmedabad. This dealership will be established by Aeromark Cars Pvt., a wholly owned subsidiary company of Landmark Cars.

TTK Healthcare: The company re-commenced production activities on Friday.

MSTC: The government appointed Manobendra Ghoshal as chairman and managing director.

Mazagon Dock Shipbuilders: The company signed individual shipbuilding contracts with the European client for the construction of three units of 7,500 DWT multi-purpose hybrid-powered vessels for $42 million.

Macrotech Developers: The company disposes of equity and investments in entities in the U.K.

Kokuyo Camlin: The company approved the acquisition of land and a building adjacent to the company’s existing factory at Samba, Jammu for Rs 4.60 crore.

United Spirits: The company gets a claim worth Rs 365.33 crore from an institutional customer in relation to a previously concluded settlement with the customer. The company cannot determine the financial implications of this claim.

Gandhar Oil Refinery: The company reported consolidated revenue of Rs 1,000.9 crore in the second quarter and net profit of Rs 48.1 crore in the second quarter.

Bandhan Bank: Crisil Ratings Ltd. has downgraded its rating on non-convertible debentures of Bandhan Bank Ltd. to 'AA-/Stable’ from ‘AA/Negative’

The rating agency also reaffirmed 'A1+’ rating on the certificate of deposits of Bandhan Bank.

IRB Infrastructure Developers: IRB Infrastructure Trust (the Trust) has received a letter of award from the National Highways Authority of India for the project of tolling, operation, maintenance and transfer of Kota Bypass and Cable Stay Bridge.

Solar Industries India: The company had an explosion incident on Dec. 17, resulting in the deaths of nine workers in the plant.

Welspun Corp: The company's wholly owned subsidiary, Sintex BAPL, has finalised an investment of upto Rs 807 crore to set up

a manufacturing unit in Telangana through a wholly owned step-down subsidiary.

Sugar Stocks: OMCs to revise allocation of quotas to buy ethanol made from cane sugar and B-heavy molasses. Sugar mills to supply ethanol as per revised quantity.

SIS: The company will buy back Rs 90 crore by way of tender offer from existing securities holders. The buyback will open on Dec. 18 and close on Dec. 22.

Vedanta: The board will meet to consider a dividend.

The December futures contract of the GIFT Nifty index opened higher and traded below the 21,500 level.

Most markets in Asia declined on Monday ahead of the caution about the Bank of Japan's policy meeting outcome, and economic data from China.

Brent crude was trading 0.43% higher at $76.8 a barrel. Gold was up 0.14% to 2,022.46 an ounce.

India's benchmark indices closed at a record on Friday, ending higher for the seventh consecutive week as Infosys Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. gained.

The NSE Nifty 50 ended 274 points, or 1.29% higher at 21,456.65, while the S&P BSE Sensex surged 970 points, or 1.37% to close at 71,483.75.

The Nifty Bank breached the 48,200 level for the first time during the last leg of trade. The index settled 0.86%, or 411 points, higher at 48,143.55.

Overseas investors remained net buyers of Indian equities for the sixth consecutive session on Friday. Foreign portfolio investors mopped up stocks worth Rs 9,239.4 crore, while domestic institutional investors turned net sellers after one session of buying and offloaded stocks worth Rs 3,077.4 crore, the NSE data showed.

The Indian rupee strengthened 33 paise to close at Rs 83 against the U.S. dollar on Friday.

The December futures contract of the GIFT Nifty index opened higher and traded below the 21,500 level.

Most markets in Asia declined on Monday ahead of the caution about the Bank of Japan's policy meeting outcome, and economic data from China.

Brent crude was trading 0.43% higher at $76.8 a barrel. Gold was up 0.14% to 2,022.46 an ounce.

India's benchmark indices closed at a record on Friday, ending higher for the seventh consecutive week as Infosys Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. gained.

The NSE Nifty 50 ended 274 points, or 1.29% higher at 21,456.65, while the S&P BSE Sensex surged 970 points, or 1.37% to close at 71,483.75.

The Nifty Bank breached the 48,200 level for the first time during the last leg of trade. The index settled 0.86%, or 411 points, higher at 48,143.55.

Overseas investors remained net buyers of Indian equities for the sixth consecutive session on Friday. Foreign portfolio investors mopped up stocks worth Rs 9,239.4 crore, while domestic institutional investors turned net sellers after one session of buying and offloaded stocks worth Rs 3,077.4 crore, the NSE data showed.

The Indian rupee strengthened 33 paise to close at Rs 83 against the U.S. dollar on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.