Overseas investors turned net sellers on Wednesday after staying net buyers for eighth consecutive sessions.

Foreign portfolio investors sold stocks worth Rs 79.88 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned net buyers after one session of selling and bought stocks worth Rs 1,372.18 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 1,31,731 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The yield on the 10-year bond closed flat at 7.25% on Wednesday.

Source: Bloomberg

The local currency strengthens 6 paise to close at 83.33 against the U.S dollar on Wednesday.

It closed at 83.39 on Tuesday

Source: Cogencis

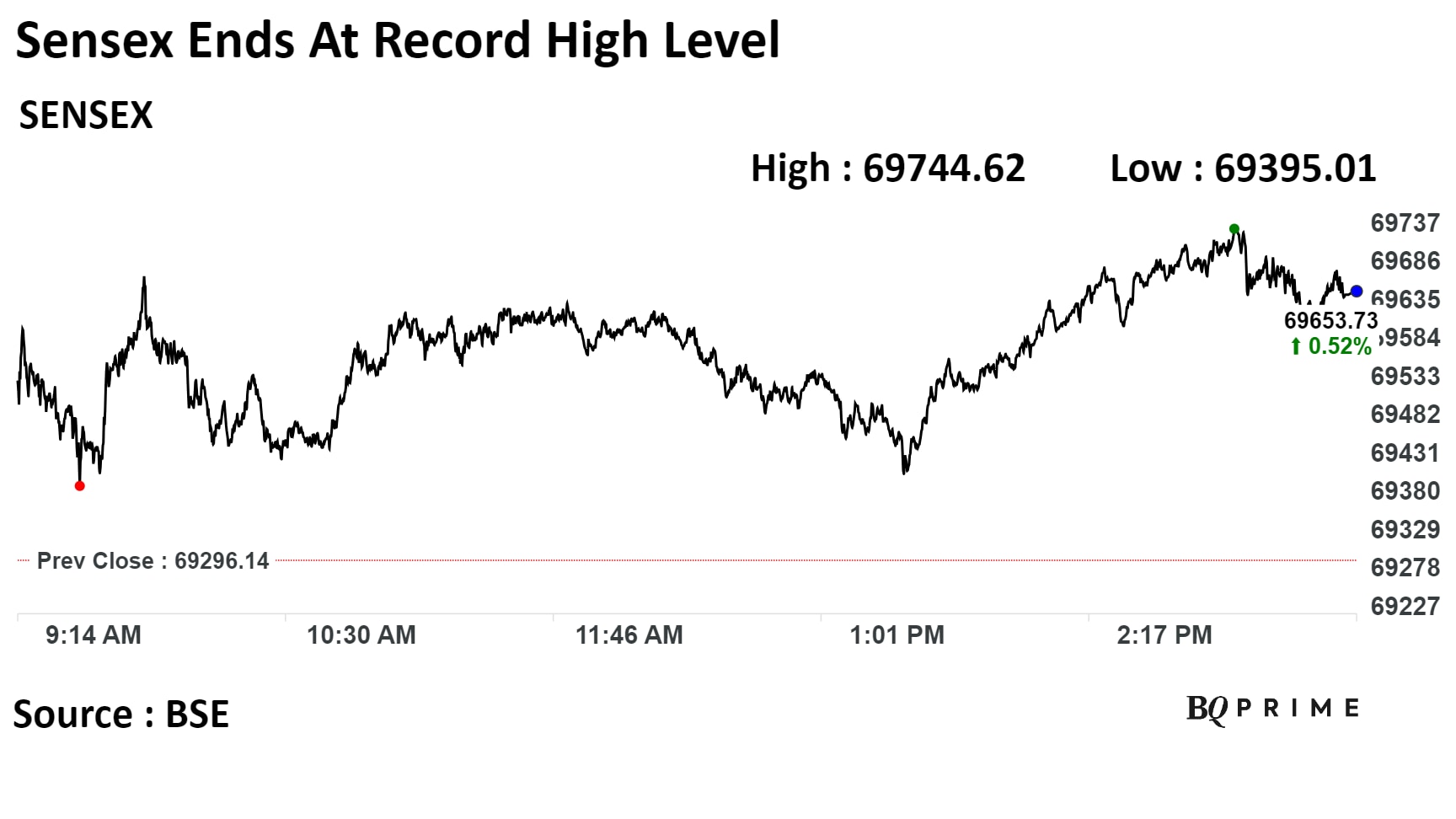

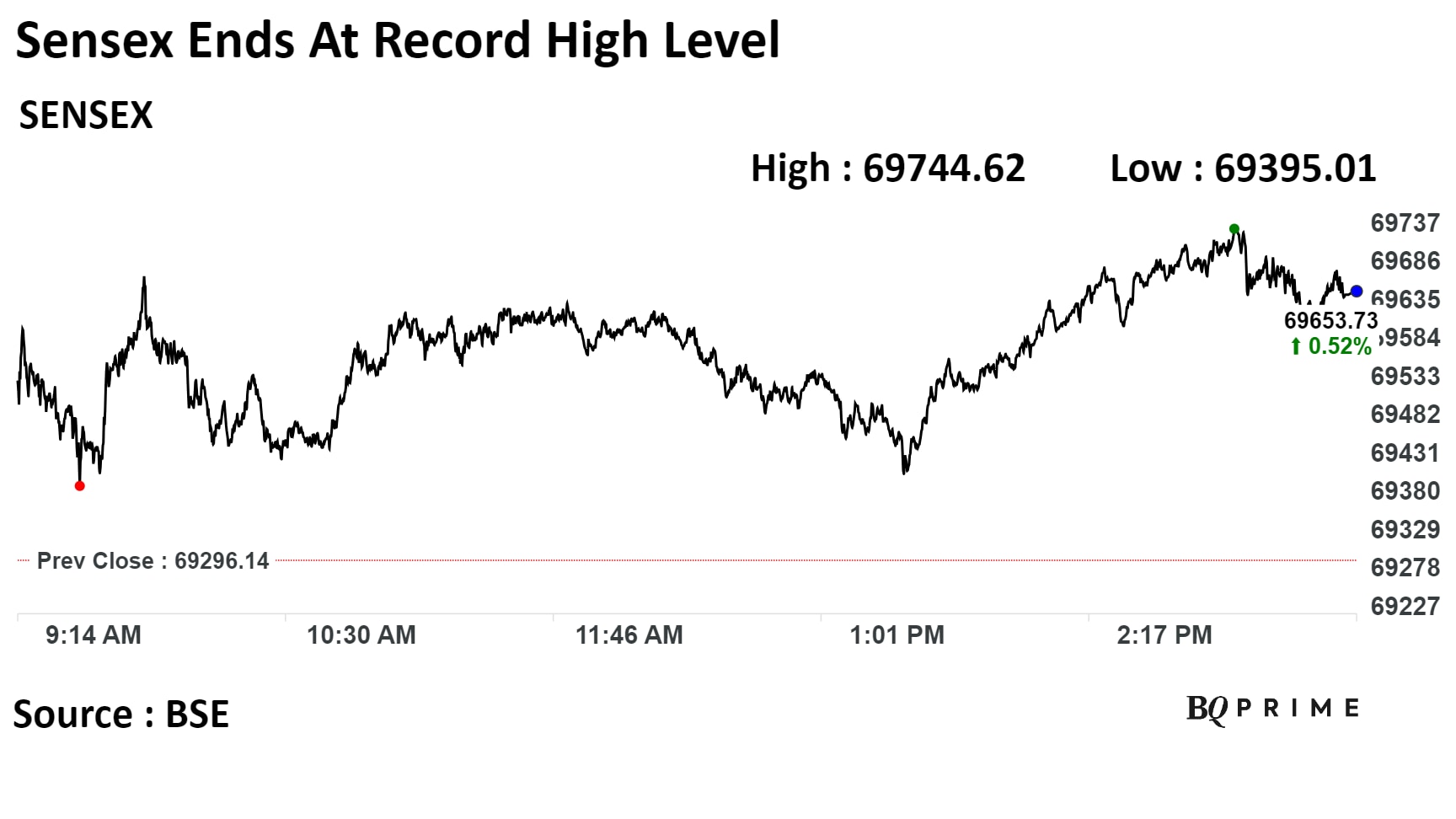

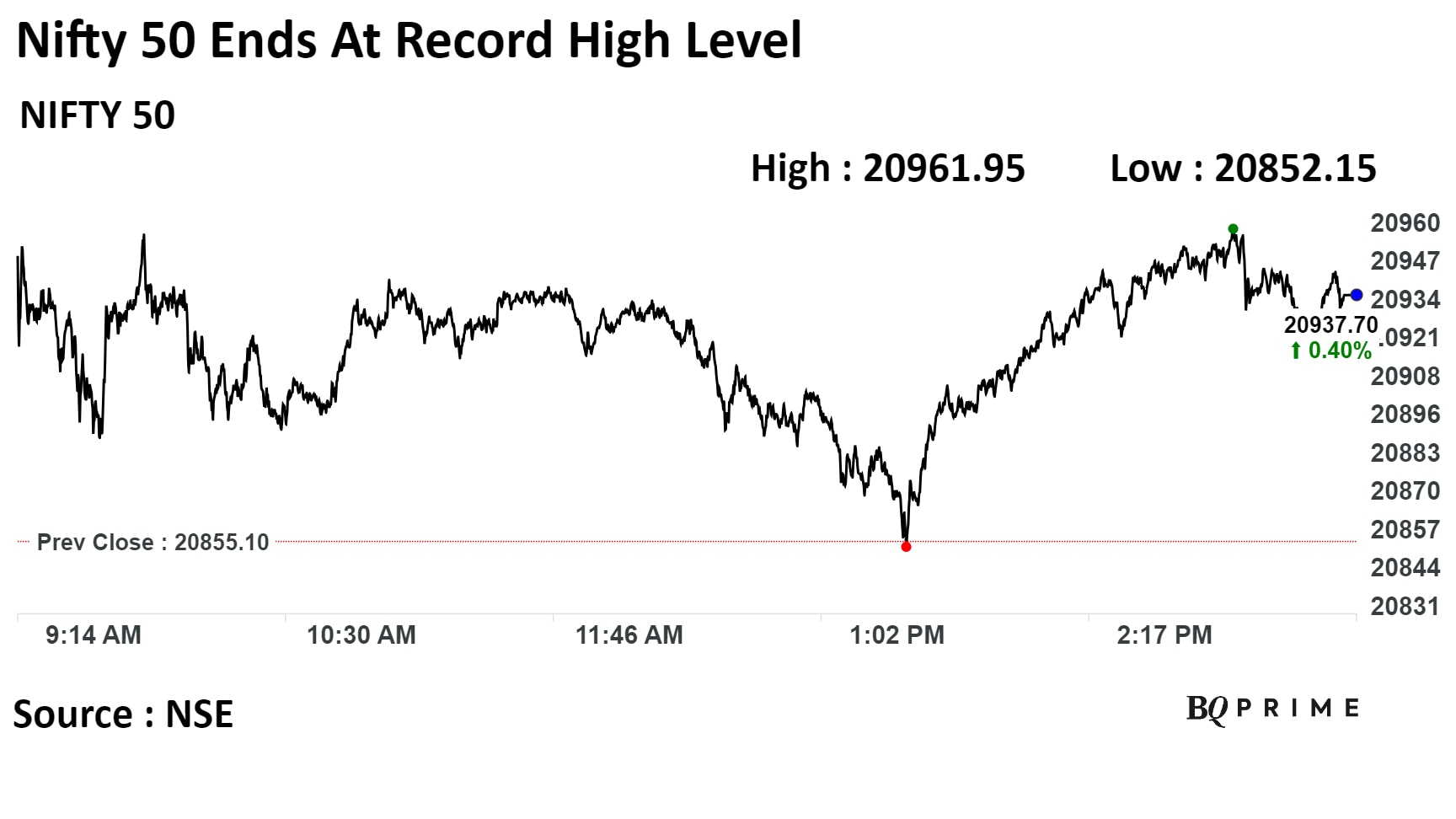

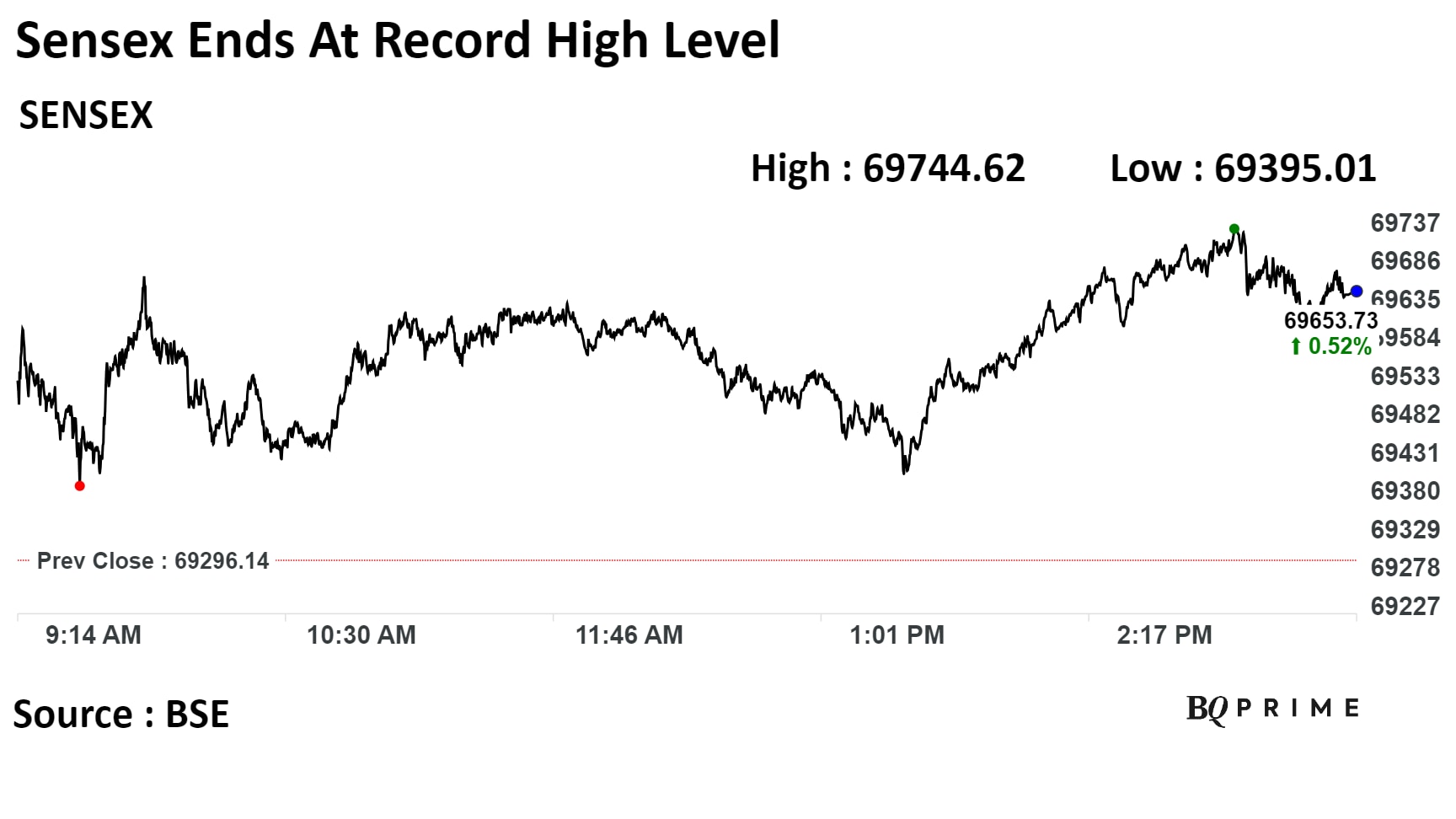

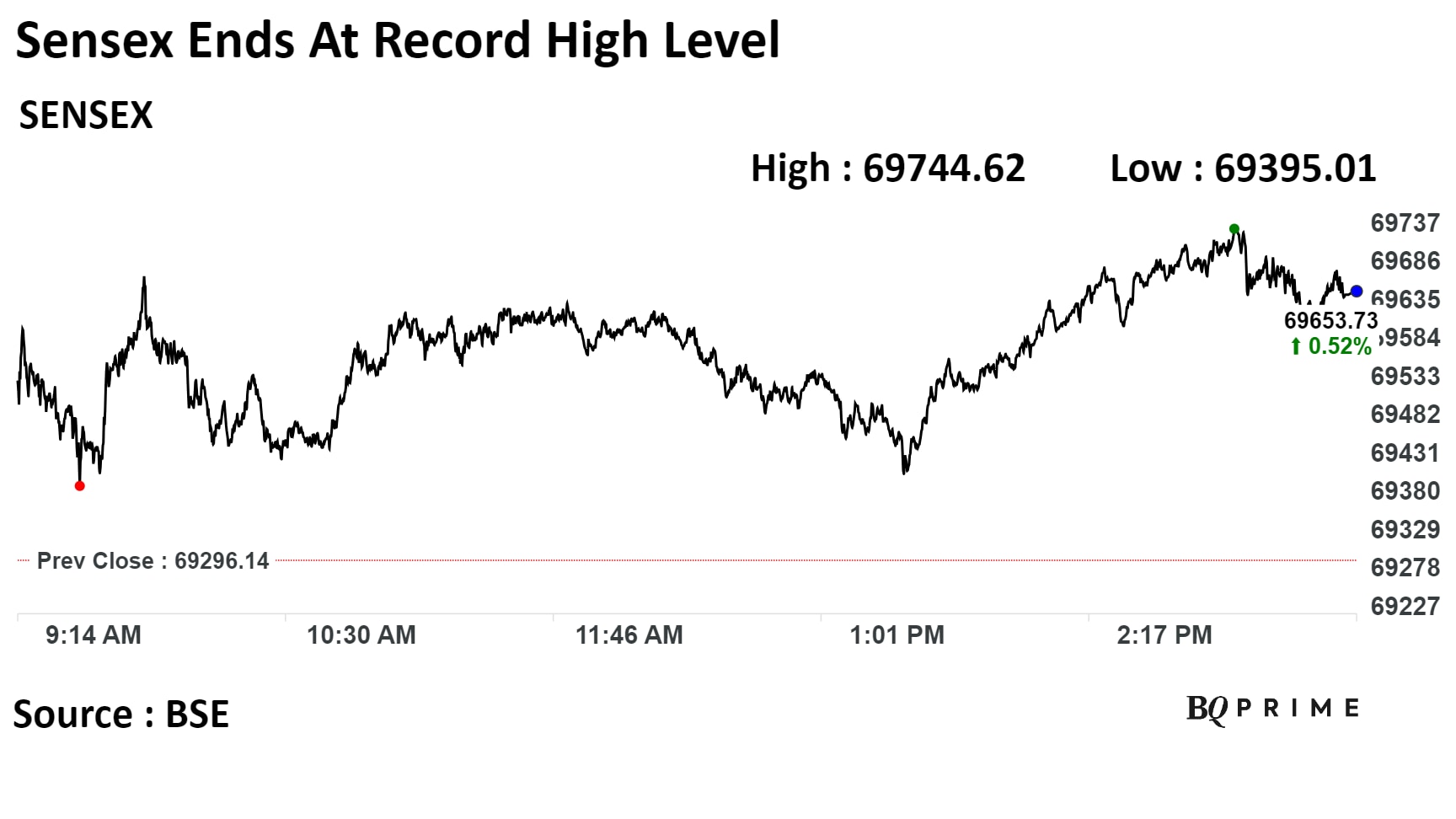

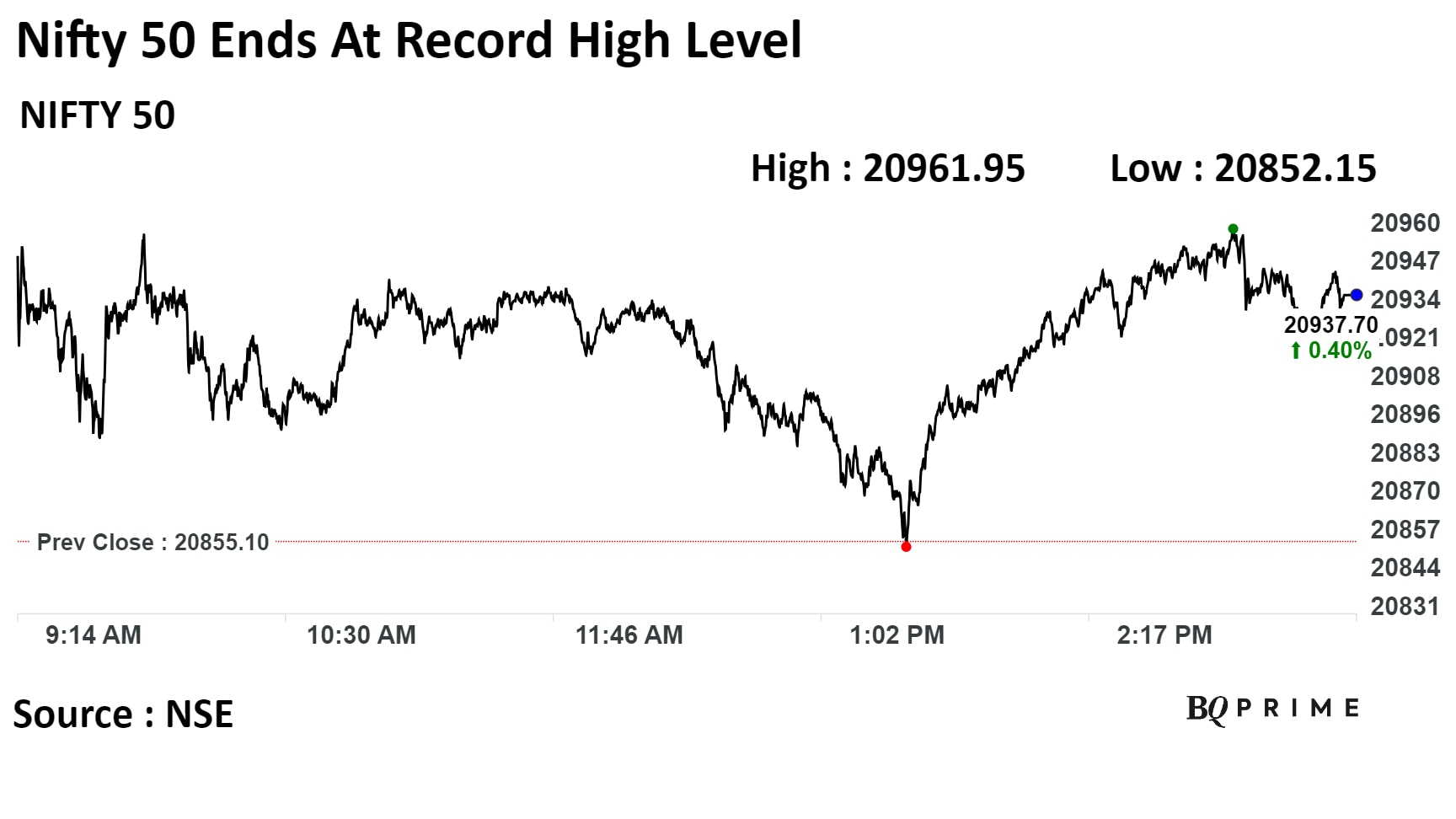

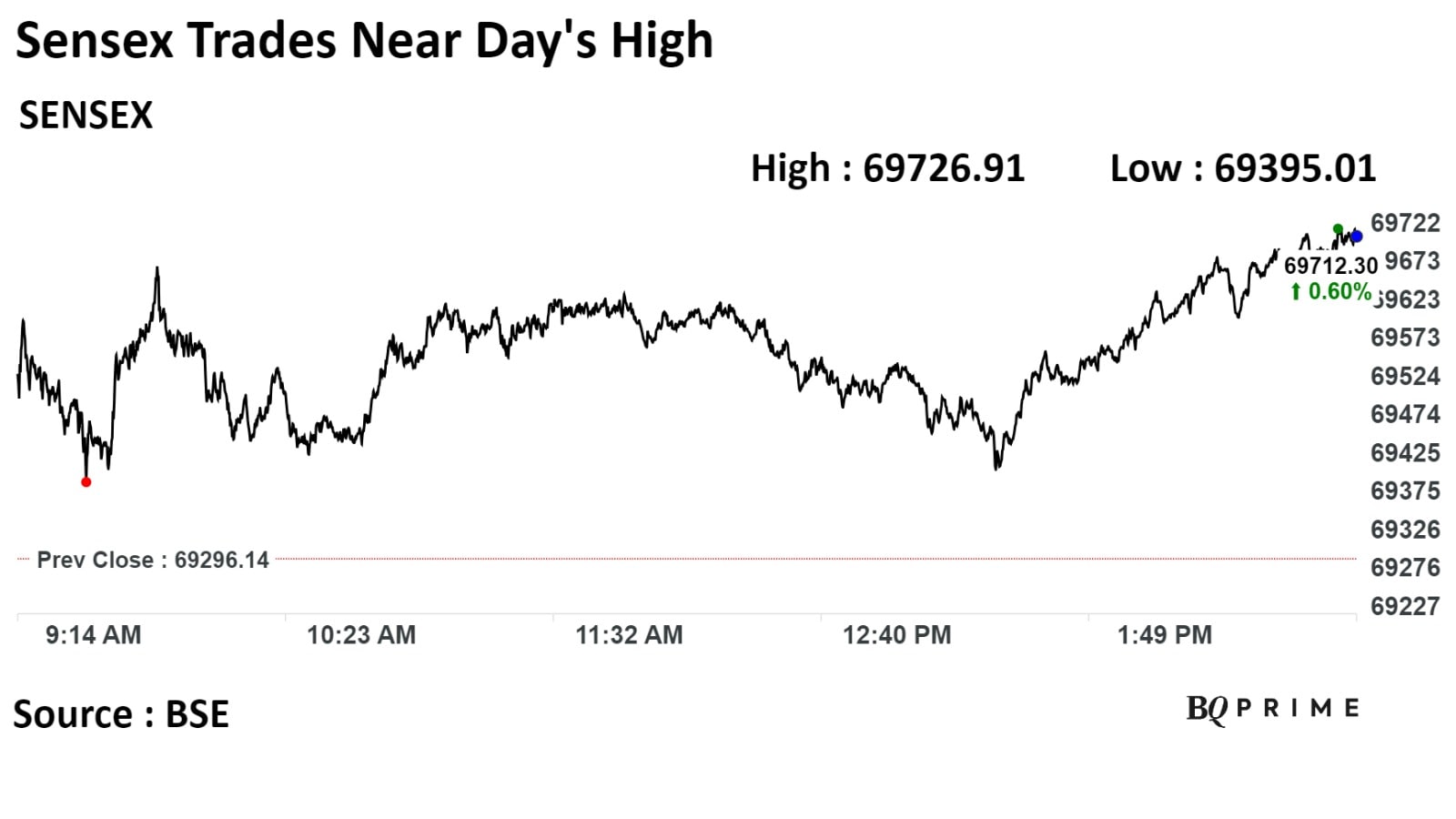

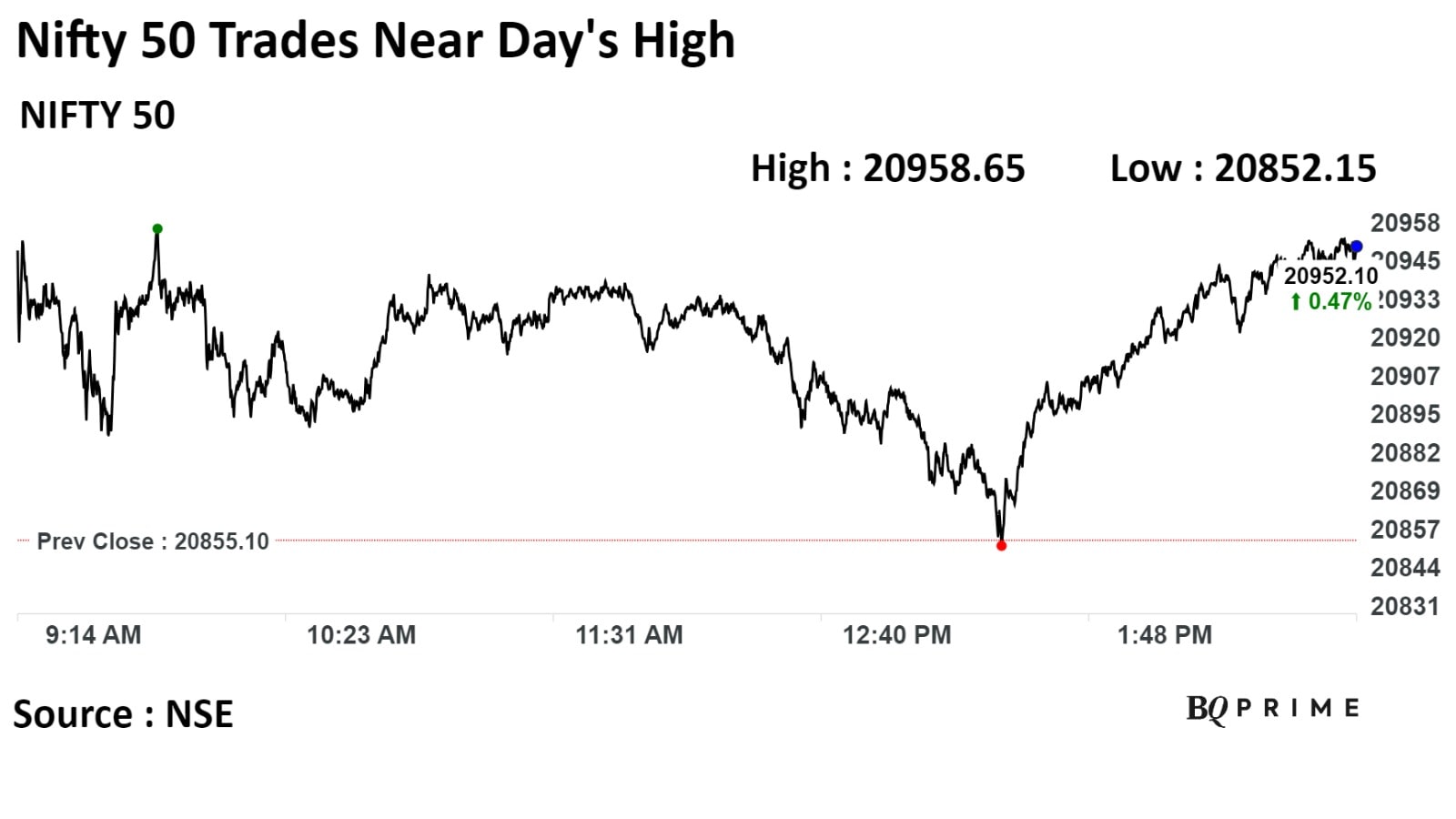

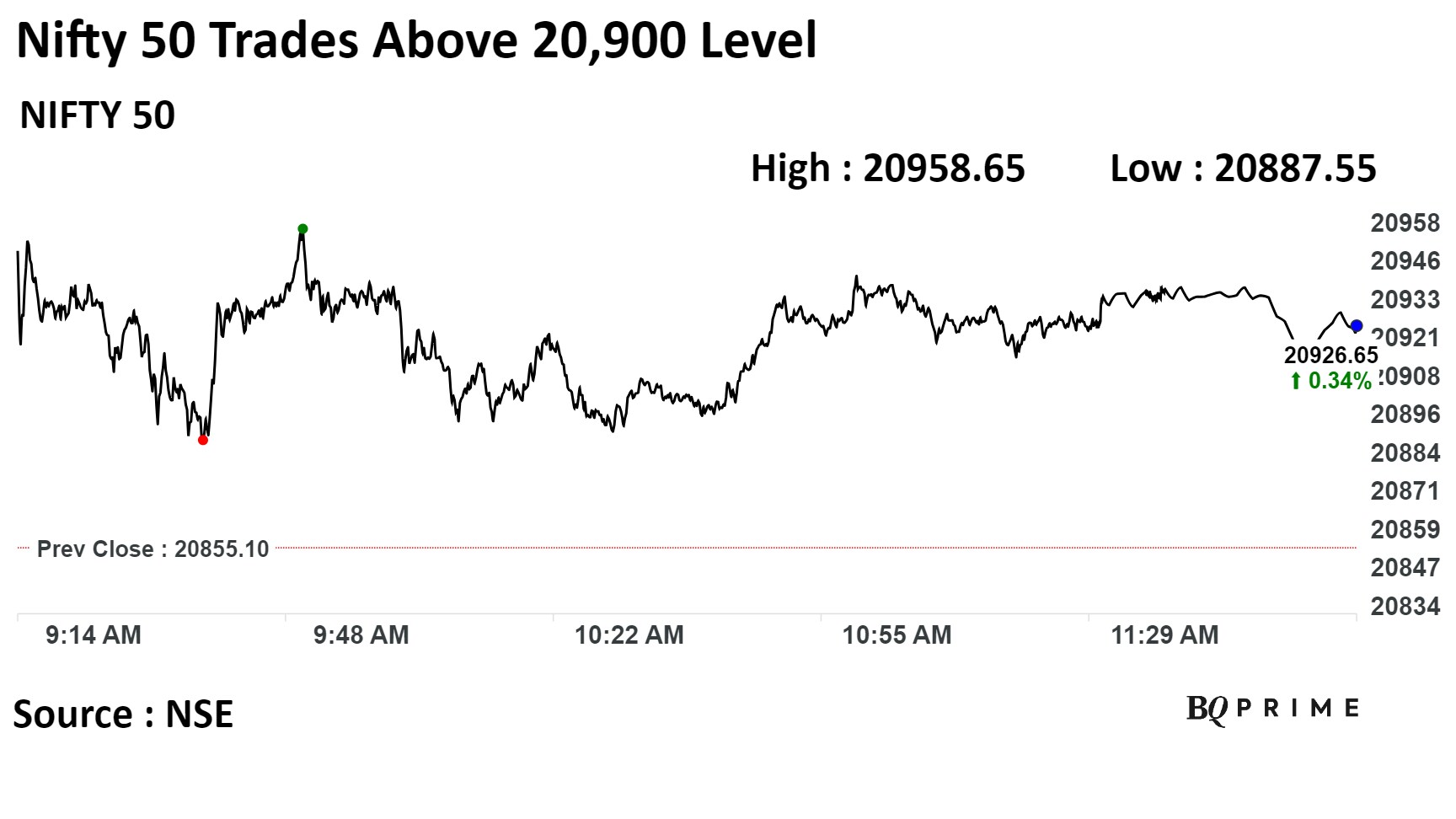

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

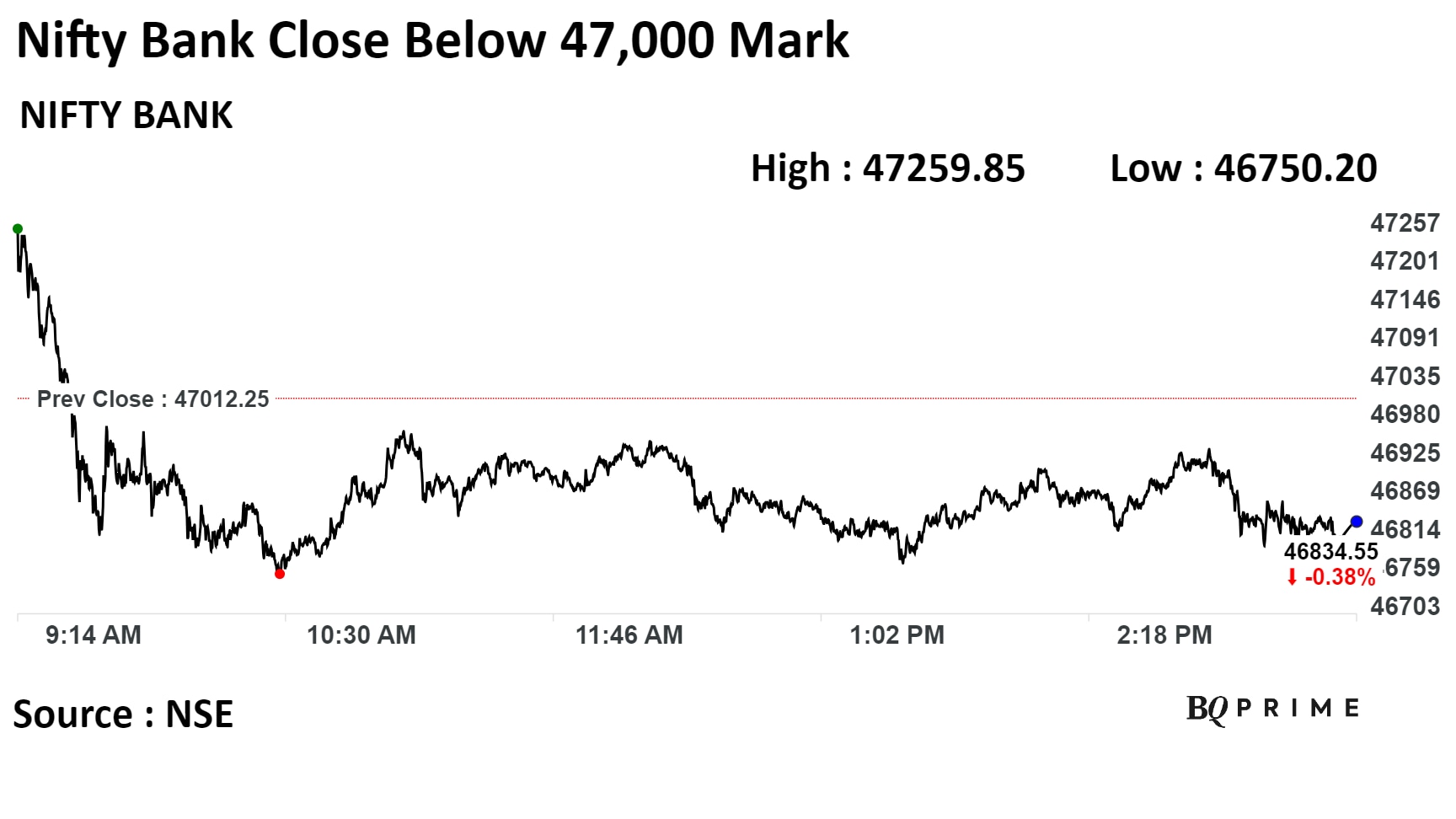

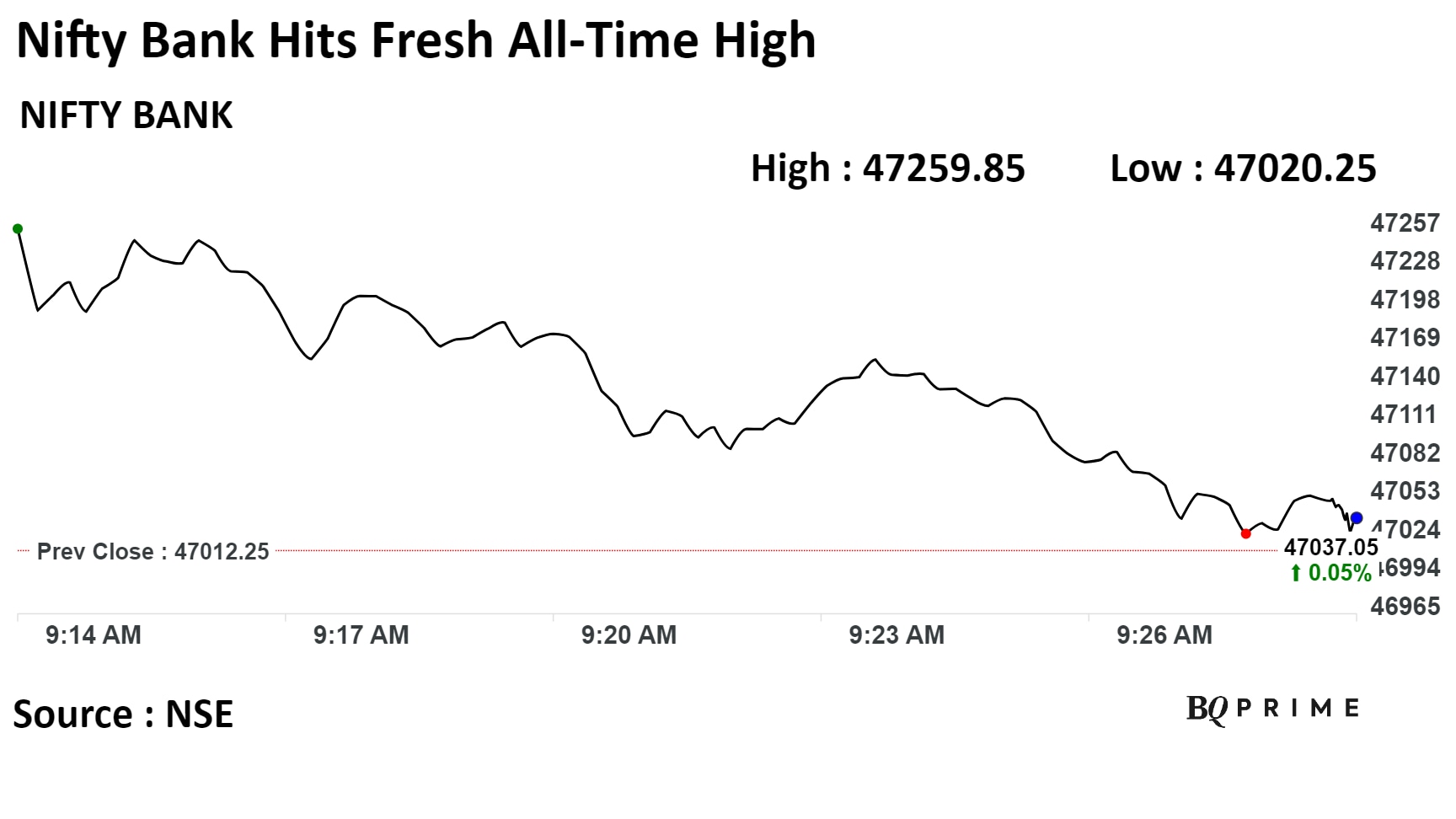

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Indian benchmark indices ended at a record high for third consecutive day as ITC Ltd., Reliance Industries Ltd., Infosys Ltd., and Larsen & Toubro Ltd. gained

The NSE Nifty 50 ended 79.15 points, or 0.38% higher, at 20,934.25, , while the S&P BSE Sensex closed 357.59 points, or 0.52% higher at 69,653.73.

Today, Indian benchmark indices at record high level, and traded near fresh highs throughout the day.

The substantial buying from both FIIs and DIIs, as mentioned above, is expected to provide strong support for the market to move higher in the coming days, according to Mandar Bhojane, Research Analyst at Choice Broking.

The NSE Nifty Media, and Oil and Gas sectoral indices rose the most.The NSE Nifty Healthcare declined the most among sectorial indices.

Meanwhile, the Nifty Bank index rose as much as 0.53% and touched a life-time high level of 47,259.85. However, the index came off the record high and ended 0.38% up at 46,834.55.

"Bank Nifty after the breakout confirmation extended the gains further moving past the 47000 zone to make new high. Bank Nifty would have a daily range of 46700–47500 levels," said Vaishali Parekh, Vice President - Technical Research, Prabhudas Liladher.

Rise in ITC Ltd., Larsen & Toubro Ltd., Reliance Industries Ltd., Infosys Ltd., added positively to the benchmark indices.

Meanwhile, a decline in Bharti Airtel Ltd., NTPC Ltd., Adani Enterprises Ltd., Axis Bank Ltd., and ICICI Bank Ltd. weighed on the indices.

Nine out of 14 sectors advances while three declined. Nifty Media and Nifty IT rose the most.

The broader markets underperformed the S&P BSE MidCap Index was rose 0.17%, whereas S&P BSE SmallCap Index was 0.25% higher. Six out of 20 sectors compiled by BSE advanced, while 14 sectors declined.

The market breadth was split between buyers and sellers. 1930 stocks advanced while 1824 declined, and 141 remained unchanged on the BSE.

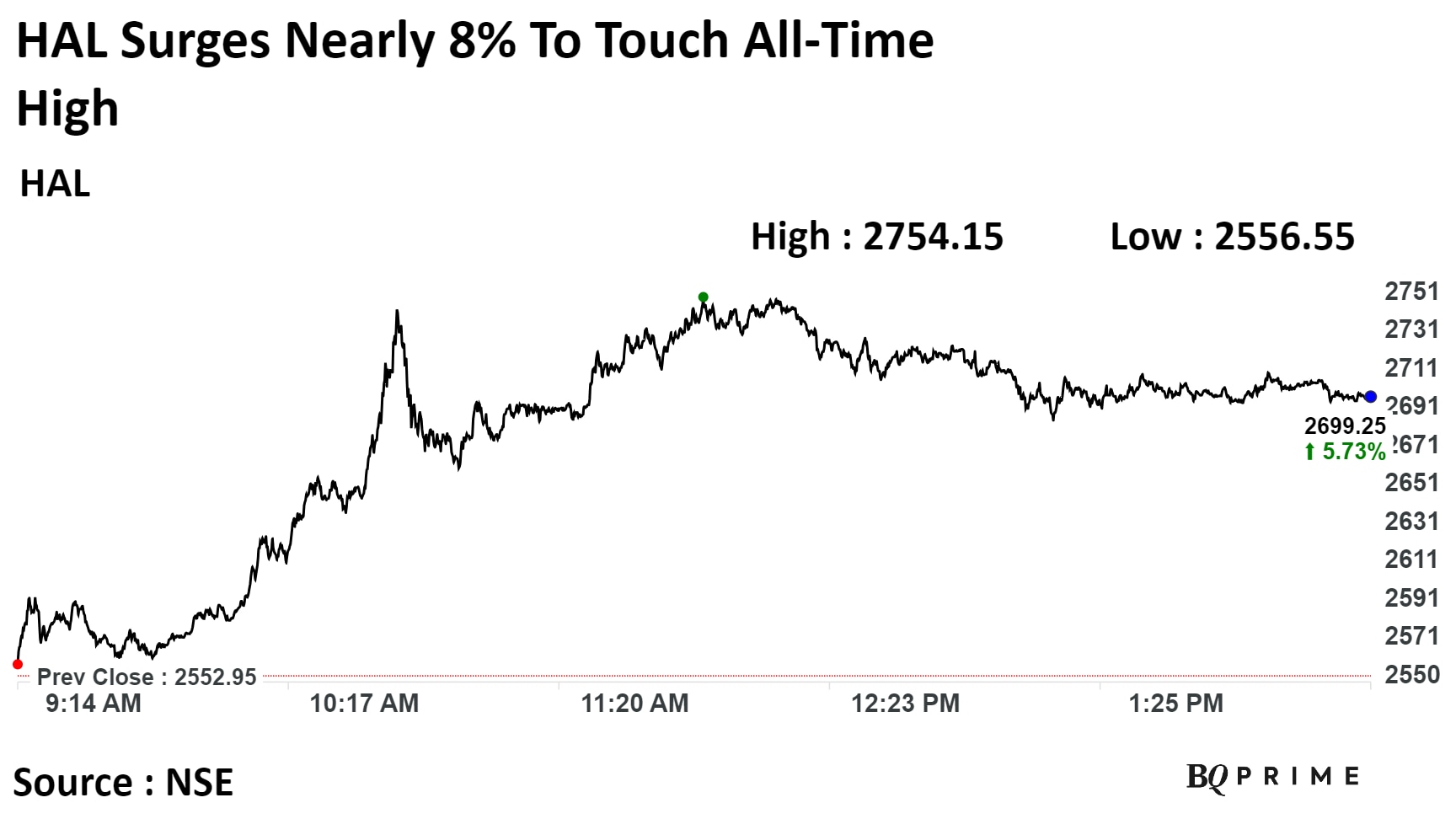

Shares of Hindustan Aeronautics Ltd surged nearly 8%, and touched a life-time high on Wednesday.

This happened one day before HAL Avionics Expo-2023 starts in New Delhi where HAL will be demonstrating it's contribution towards achieving self-reliance in avionics.

HAL will unveil a comprehensive range of avionics products, which it designed and developed, in the expo, according to a PTI report.

Shares of Hindustan Aeronautics Ltd surged nearly 8%, and touched a life-time high on Wednesday.

This happened one day before HAL Avionics Expo-2023 starts in New Delhi where HAL will be demonstrating it's contribution towards achieving self-reliance in avionics.

HAL will unveil a comprehensive range of avionics products, which it designed and developed, in the expo, according to a PTI report.

HAL's stock rose as much as 7.88% during the day to Rs 2,754 apiece, the highest level since its listing on the exchanges on Mar 27, 2018. It pared gains to trade 5.76% higher at Rs 2,700 apiece, as of 02:23 p.m. This compares to a 0.43% advance in the NSE Nifty 50 Index.

It has risen 113.18% on a year-to-date basis. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 90.96, which implied the share is overbought.

Out of 13 analysts tracking the company, 12 maintain a 'buy' rating, and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 10.5%.

17.8 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 208.45 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Zydus Lifesciences received approval from the U.S. Food and Drug Administrations for Methylene Blue Injection. Methylene Blue is a generic of Provayblue

Source: Exchange Filing

Malabar India Fund Limited has divested a total of 4,91,587 shares representing 2.16% stake in Prataap Snacks. The company sold the equity shares in open market between Jul 13, 2021 and Nov 23, 2023.

Post the sale of stake, Malabar India Fund holds 3.41% stake in Prataap Snacks representing 8,13,620 shares.

Malabar India had purchased the shares of the yellow diamond chips maker in the pre-IPO sale for Rs 938.09 per share.

Prataap Snacks shares rose as much as 6% to Rs 1,100.30 apiece highest since Dec. 17, 2018. It pared gains to trade 1.58% higher at Rs 1,054 apiece, as of 1:08 a.m. This compares to a 0.11% advance in the NSE Nifty 50 Index.

29.9 lakh shares changed hands in a large trade

0.3% equity changed hands at Rs 581.10 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Power Grid Corporation India Ltd. emerged as a successful bidder for transmission project in Karnataka.

Source: Exchange Filing

Hero MotoCorp Ltd. has signed a pact with Aether Energy for combined EV charging network which will cover 100 cities with over 1900 fast charging points.

Source: Exchange Filing

12.7 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 2,465.40 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Power Finance Corporation has incorporated SPV Gola B Ramgarh transmission as subsidiary arm of PFC Consulting Ltd.

Source: Exchange Filing

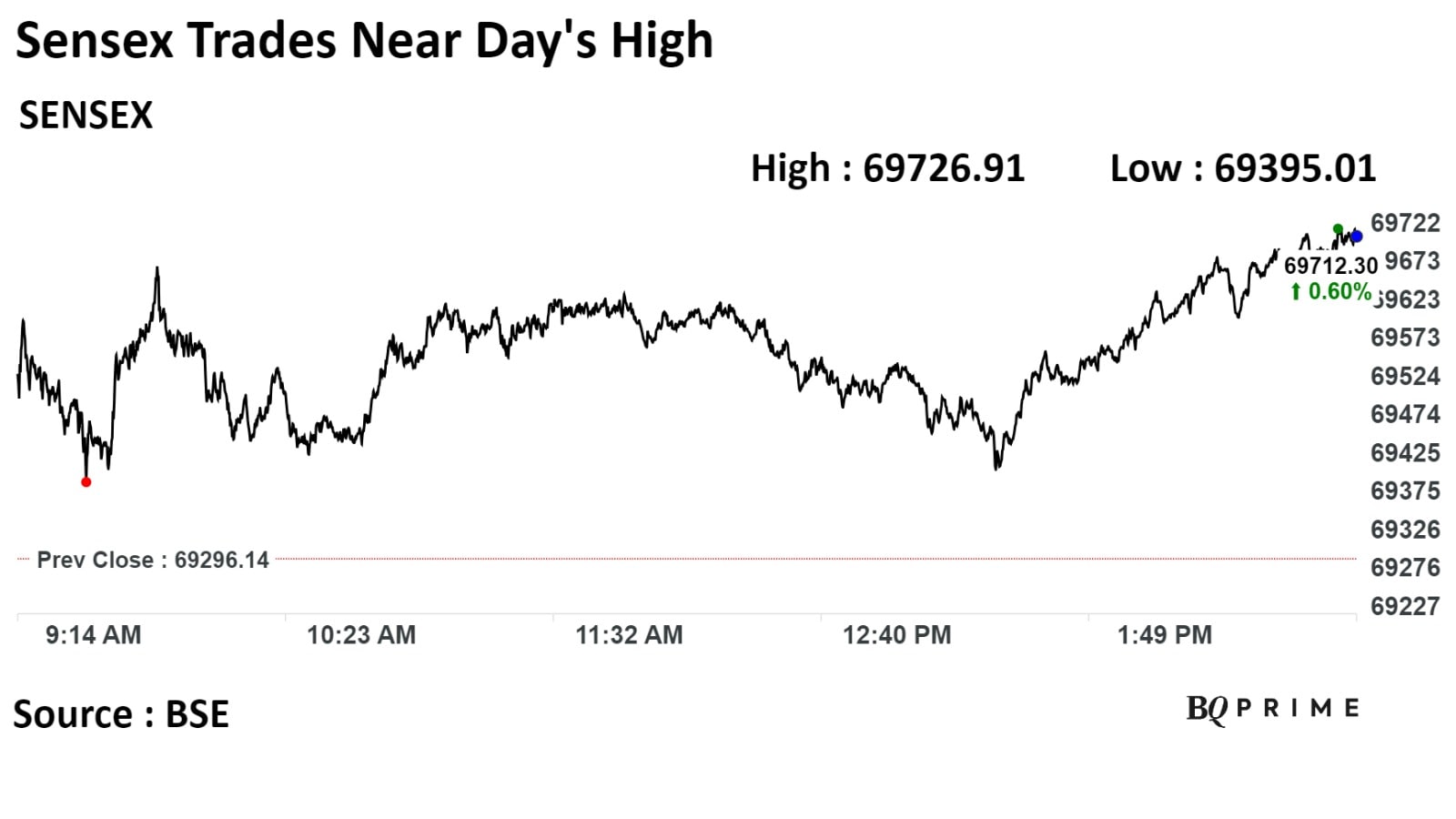

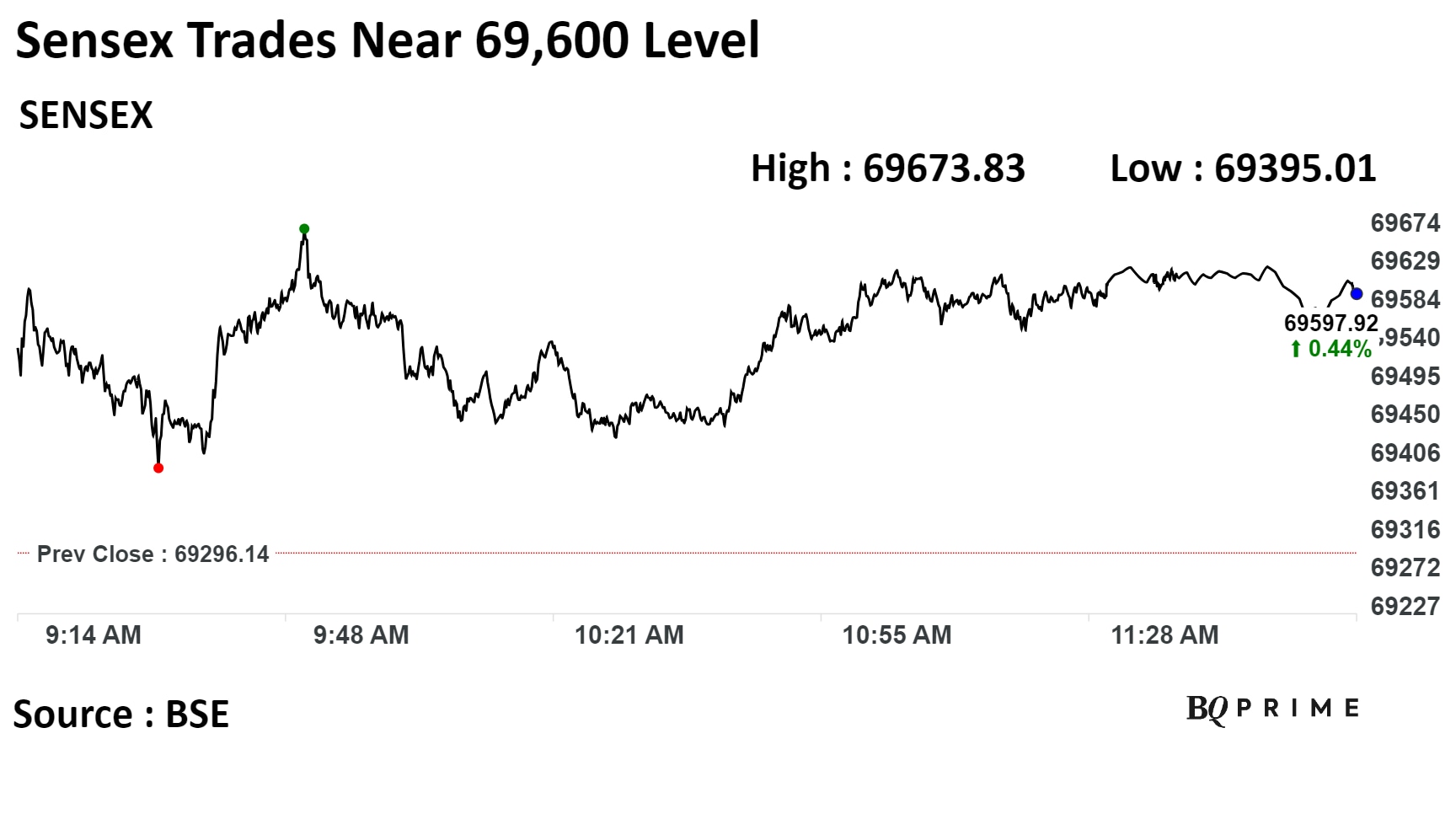

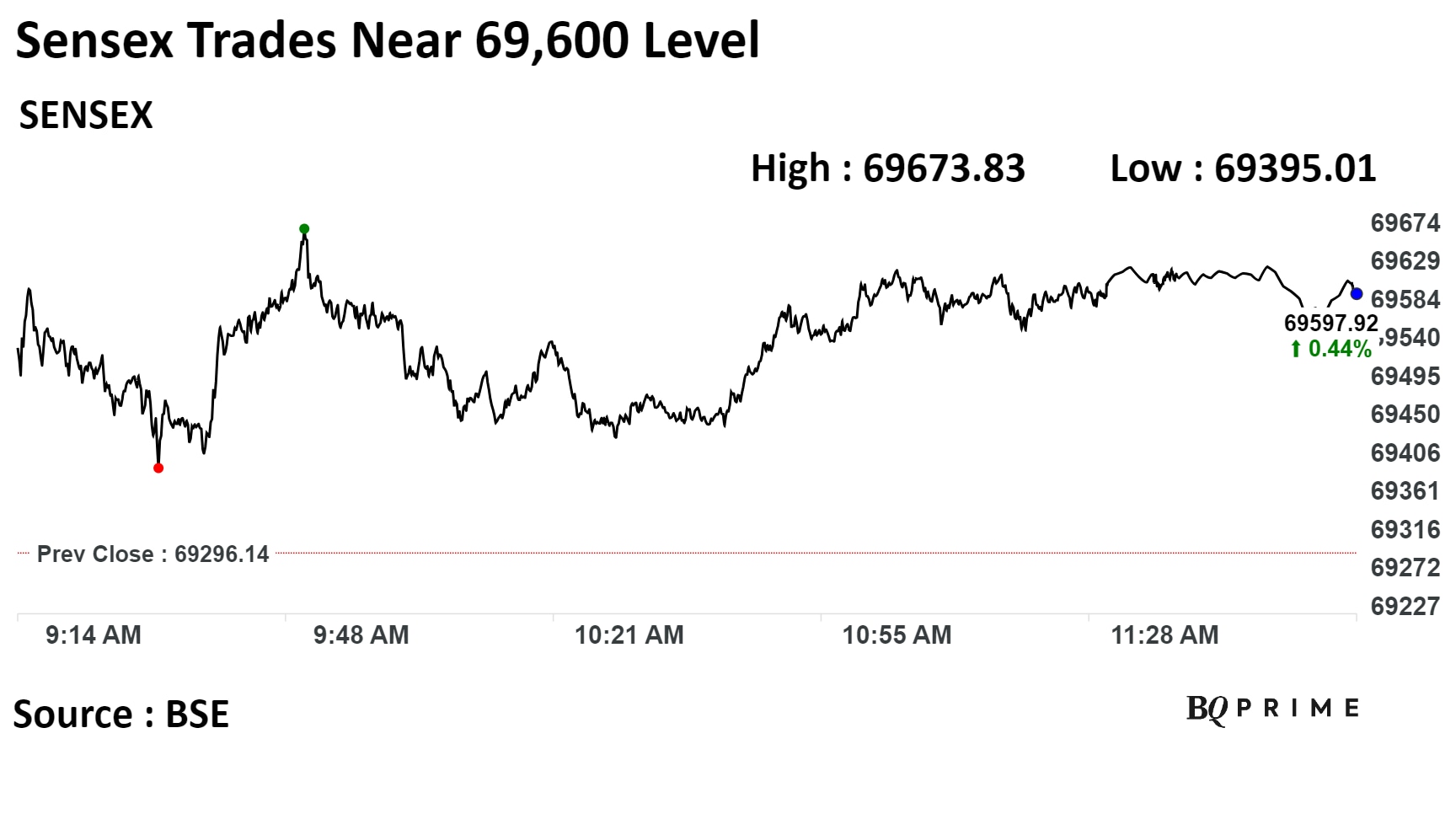

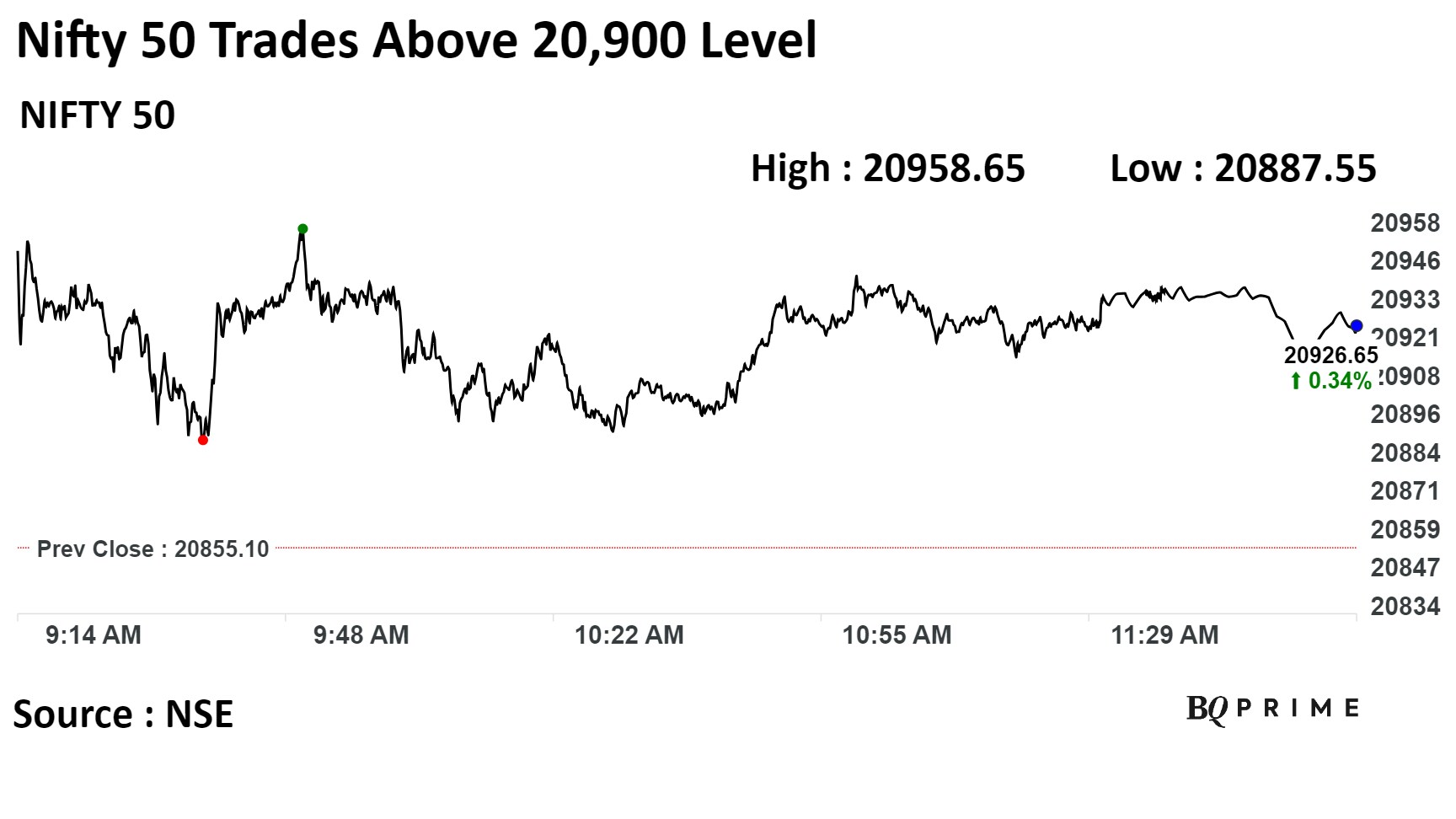

The benchmark indices were trading with steady gains through midday on Wednesday after opening at new record highs.

As of 12:05 p.m., the NSE Nifty 50 was 0.36% or 74 points higher at 20,929.35 points and the S&P BSE Sensex was 0.45% or 309 points up at 69,605.42.

Intra-day, the Nifty rose to a lifetime high of 20,958.65, while the Sensex hit a record high of 69,673.83.

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

"Equity market benchmarks, Sensex and Nifty, have extended their upward trend for the seventh consecutive session, driven by consistent buying from foreign institutional investors and a decline in crude oil prices," Shrey Jain, chief executive officer of SAS Online, said.

Regarding the Nifty, its immediate support is identified at the 20,675 and 20,725 levels, with a potential for profit-booking around the 21,000 mark, Jain said. "As for the Bank Nifty, a robust support zone lies within the 46,450–46,650 range."

ITC Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., HDFC Bank Ltd. and Infosys Ltd., contributed the most to the gains.

ICICI Bank Ltd., Bharti Airtel Ltd., UltraTech Cement Ltd., Axis Bank Ltd. and NTPC Ltd. weighed on the indices.

Sectoral indices were mixed with eight rising and six falling. The Nifty Energy and Media gained 1.5% and 1.45% respectively, while Realty and Bank fell the most.

The broader markets underperformed their larger peers, with the BSE MidCap gaining 0.22% and the SmallCap gaining 0.25%.

Five out of the 20 sectors compiled by the BSE declined, while 15 advanced.

The market breadth was skewed in favour of the buyers. About 1,978 stocks rose, 1,630 fell and 143 remained unchanged on the BSE.

Sterling and Wilson Renewable Energy Ltd share was trading in an upper circuit after CNBC-TV18 reported that it is likely to raise Rs 1,500 crore via QIP as soon as next week to reduce its debt.

BQ Prime reached out to the spokesperson of Sterling and Wilson Renewable Energy Ltd., and they declined to comment.

The scrip rose and hit an uppar circuit of 4.99% to Rs 388.25 apiece. It continued to trade at upper circuit of 4.99% higher at Rs 388.25 apiece, as of 12:26 p.m. This compares to a 0.33% advance in the NSE Nifty 50 Index.

It has risen 45.28% on a year-to-date basis. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 77.57, which implied the stock is overbought.

One analyst tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.9%.

Citigroup has upgraded the target price for Adani Ports and Special Economic Zone Ltd to Rs 1,213 from Rs. 972 apiece. The upward revision was done taking the possibility of a re-rating into consideration. The agency rates the stock as a 'buy', citing attractive valuations and a strong business, according to a note on Tuesday.

Maruti Suzuki India Ltd. is expected to start EV production in Gujarat plant in FY25.

Source: Bloomberg

Hindustan Zinc Ltd. will pay interim dividend of Rs 6 per share, aggregating to a total of Rs 2,535 crore.

Source: Exchange Filing

Ministry of Coal has finalised the value of Utkal-C Block land compensation at Rs 353 crore. Utkal-C mine infrastructure compensation is under progress.

Source: Exchange Filing

HCL Technologies Ltd. signed a pact with Husqvarna Group for IT and digital transformation. The contract from Husqvarna Group is for 5 years, according to an exchange filing by the HCL technologies.

Lupin received approval from the U.S. Food and Drug Adminstration for Varenicline tablets. Varenicline is used as an aid to smoking cessation treatment.

Source: Exchange Filing

10 lakh shares changed hands in a large trade

0.04% equity changed hands at Rs 400.20 apiece

Buyers and sellers not known immediately

Source: Bloomberg

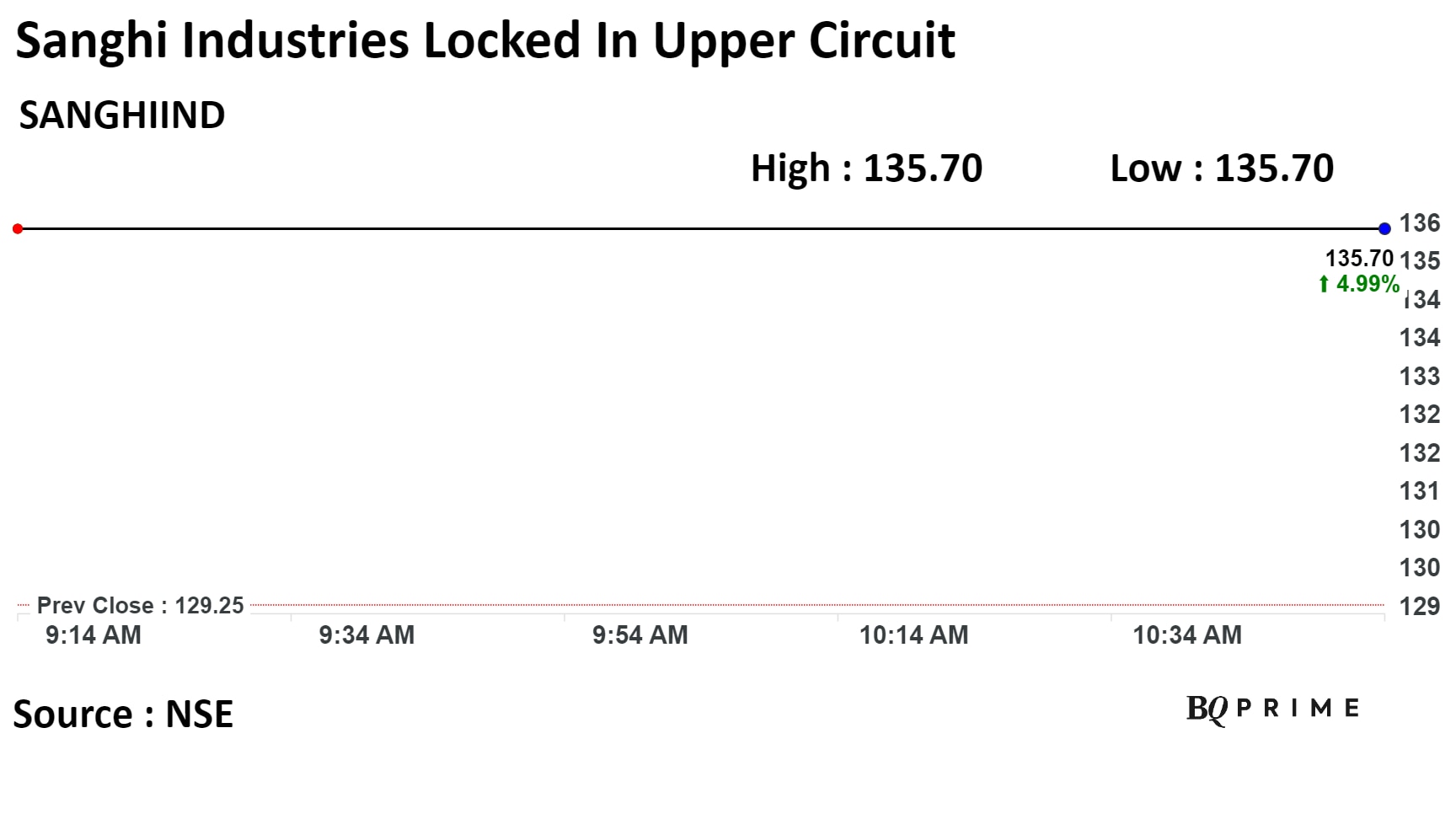

Shares of Sanghi Industries were locked in upper circuit of 4.99% at Rs 135.70 apiece, as of 10:49 a.m. This compares to a 0.33% advance in the NSE Nifty 50.

The stock has risen 93.58% on a year-to-date basis. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 74.47, indicating that the stock may be overbought.

The two analysts tracking the company maintain a 'buy' rating. The average 12-month consensus price target implies an upside of 40%.

10.3 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 209.10 apiece

Buyers and sellers not known immediately

Source: Bloomberg

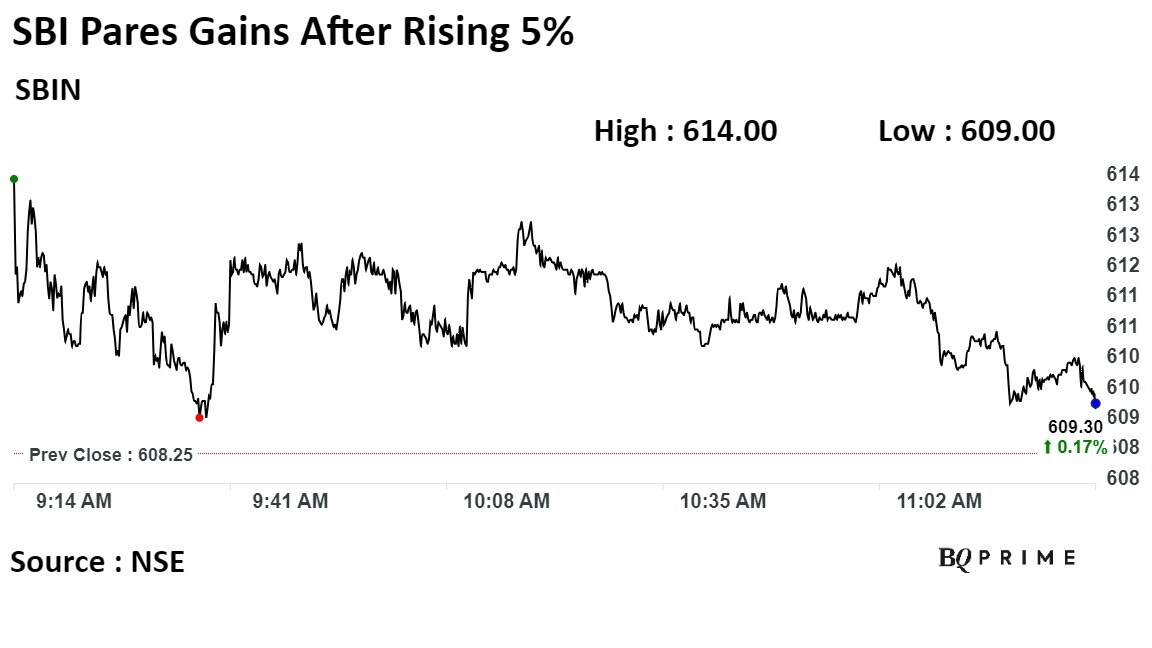

SBI shares rose as much as 5.75% to Rs 614 apiece to reach 52-week high, the highest level since August. It pared gains to trade 0.30% higher at Rs 610 apiece, as of 11:13 a.m. This compares to a 0.20% advance in the NSE Nifty 50 Index.

It has fallen 0.57% on a year-to-date basis. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 73.

Out of 52 analysts tracking the company, 47 maintain a 'buy' rating, 3 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.5%.

Nomura said slower public capital expenditure, consumption, and weak global growth to pull down India's GDP growth below 5.7% in 2024 from 7.0% expected in 2023.

However, Nomura has raised India's GDP growth expectation in calendar year 2023 to 7.0% from earlier 6.3%. For the financial year ending in March 2024, Nomura raised GDP forecast to 6.7% from earlier 5.9%

Market will be largely focused on India's bond index inclusion and general elections. Weaker victory or election results turning out in favour of opposition alliance in election could lead to market disappointment causing short-term capital outflows.

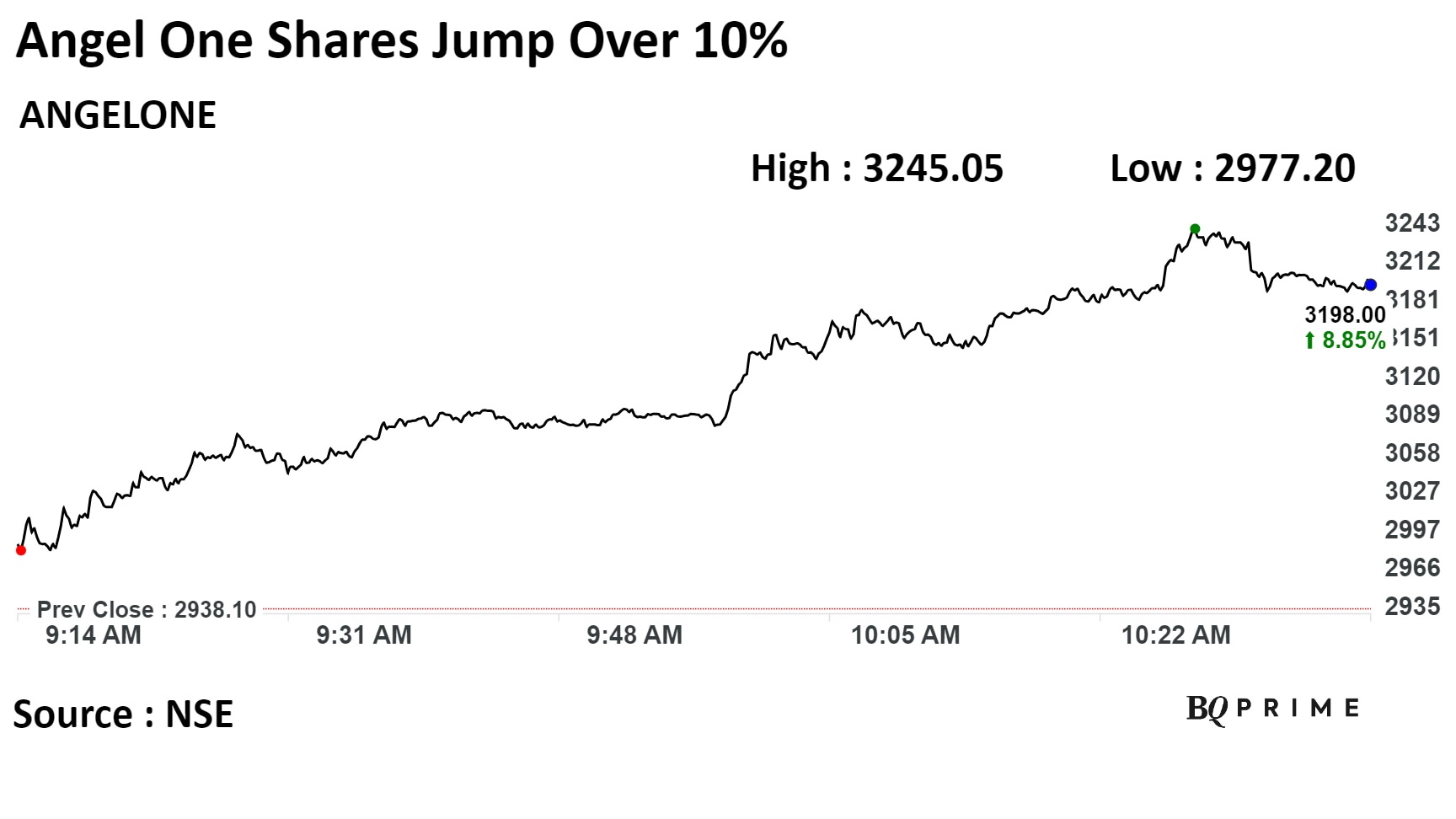

Shares of Angel One Ltd jumped to hit its lifetime high today after the company announced its monthly business update data for the Month of November.

The brokerage's client base grew 3.8% over October and 51.3% year-on-year to 1.84 crore in November 2023, an exchange filing by the company said.

Orders for the reporting month rose 1.2% over the previous month and 51.4% year on year to 10.72 crore.

Shares of Angel One Ltd jumped to hit its lifetime high today after the company announced its monthly business update data for the Month of November.

The brokerage's client base grew 3.8% over October and 51.3% year-on-year to 1.84 crore in November 2023, an exchange filing by the company said.

Orders for the reporting month rose 1.2% over the previous month and 51.4% year on year to 10.72 crore.

The scrip rose as much as 10.45% to Rs 3,245.05 apiece, its highest level. It pared gains to trade 8.5% higher at Rs 3,187.85 apiece, as of 10:45 a.m. This compares to a 0.3% advance in the NSE Nifty 50 Index.

It has risen 144.48% on a year-to-date basis. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 71, hinting that the stock may be overbought.

All eight analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 34.7%.

Jindal Drilling gets 3-yr Rig contract from ONGC at $86,327 per day

Source: Exchange Filing

Adani Group stocks added as much as Rs 1.38 lakh crore in investor wealth, taking their total market capitalisation to Rs 15.26 lakh crore, intraday.

As of 9:25, the shares added Rs 1.05 crore in market value taking the capitalisation to Rs 14.86 lakh crore.

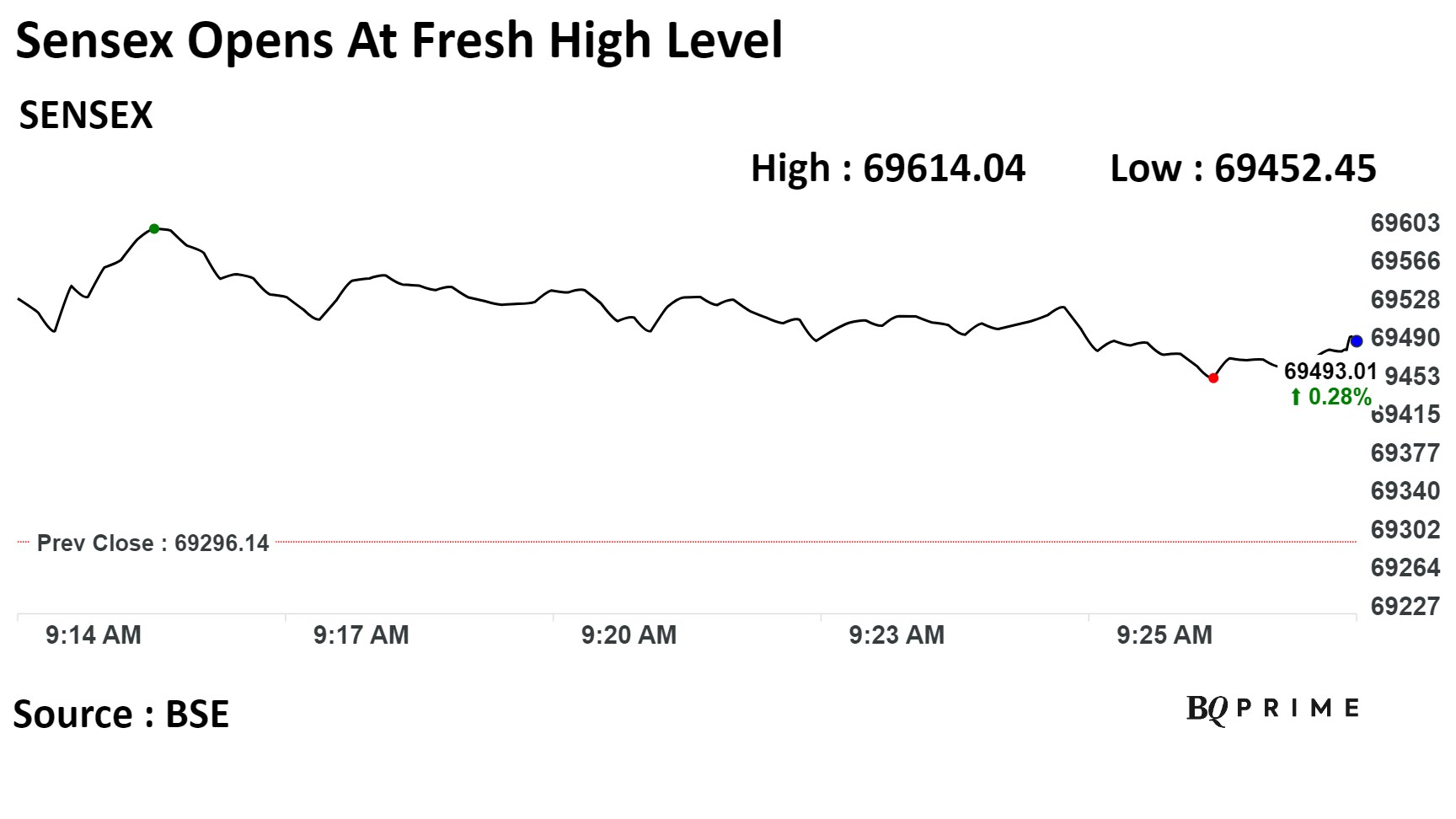

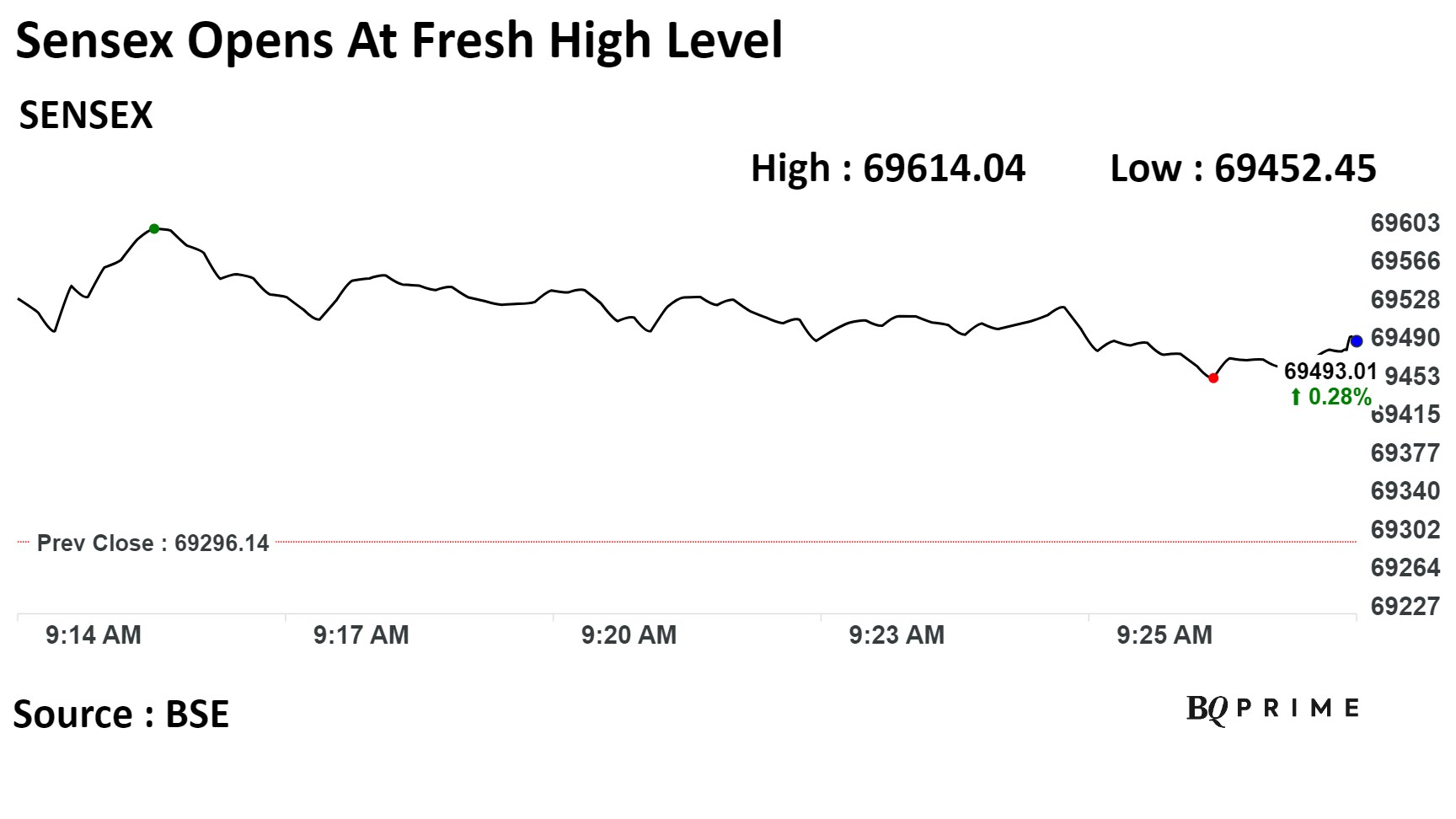

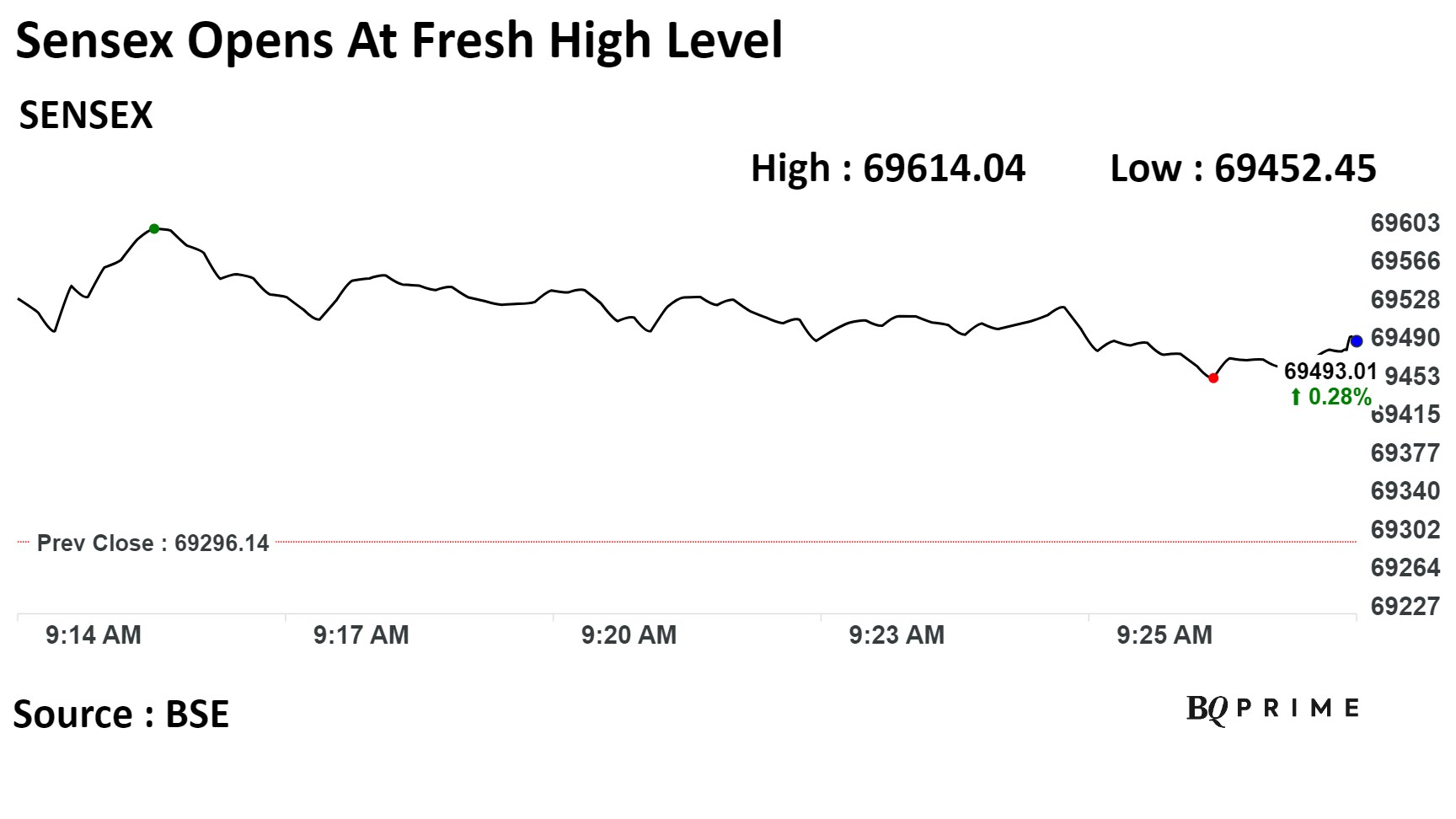

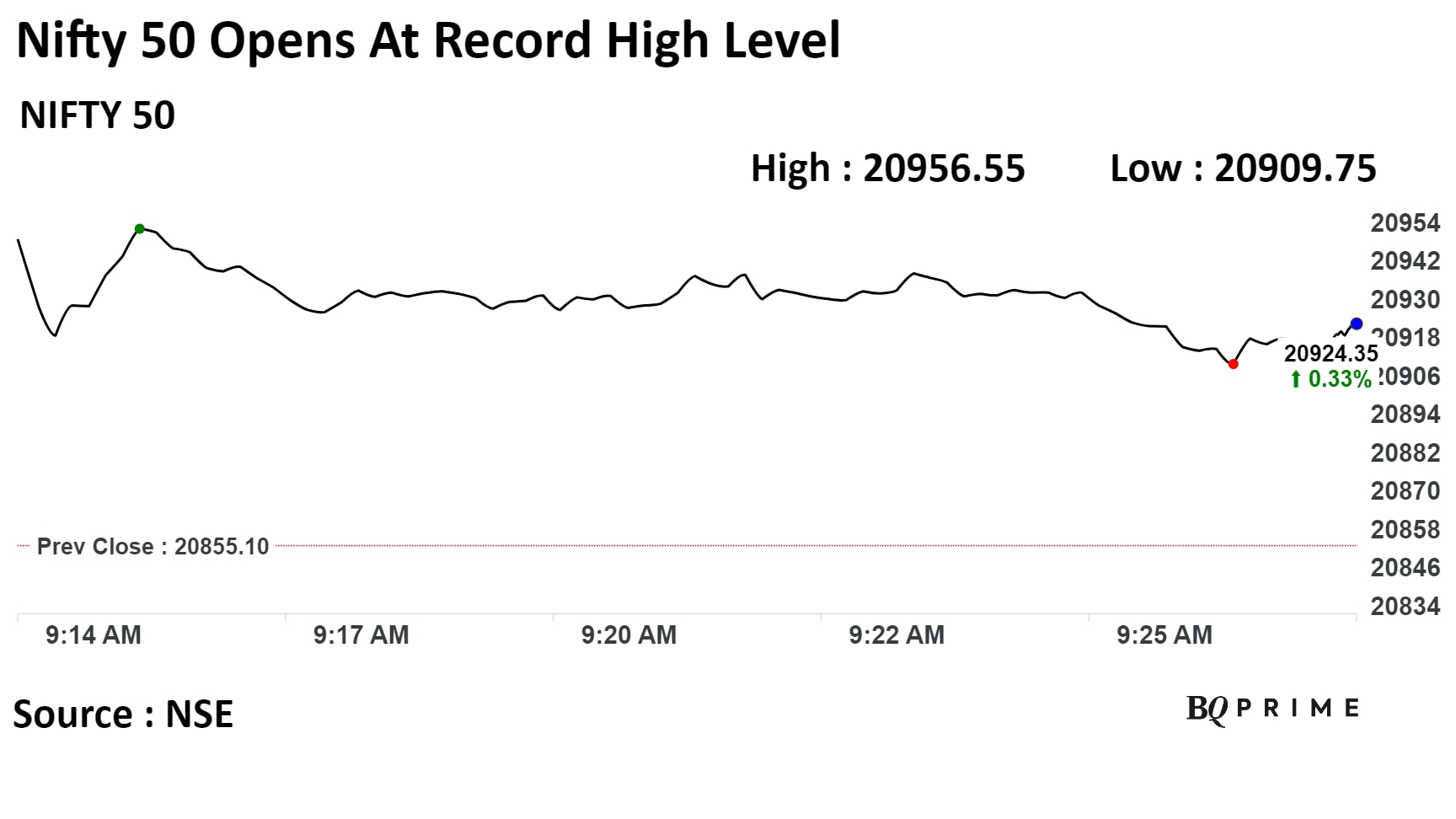

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

India's benchmark indices opened at fresh high as ITC Ltd., Adani Enterprises Ltd., Adani Ports and Special Economic Zones Ltd., and Axis Bank Ltd. gained. Nifty Bank index also opened at a record high level.

At 09:25 a.m., the NSE Nifty 50 was 77.60 points, or 0.37% higher, at 20,934.85, , while the S&P BSE Sensex was trading 214.08 points, or 0.32% higher at 69,515.65.

"Technically, the short-term texture of the market is still on the long side. A breakout continuation formation on weekly charts and uptrend continuation formation on intraday charts indicating further uptrend from the current levels. We believe that, as long as the index is trading above 20700/69000 the positive sentiment is likely to continue. Above 20700, the index could rally till 20950-21000 for Nifty 50, 69600-69800 for Sensex," said Shrikant Chouhan, head equity research, Kotak Securities.

"On the flip side, below 20700 in case of Nifty 50, and 69000 in case of Sensex, traders may prefer to exit from the long trading positions. Below 20700, we could see one quick intraday correction till 20600-20500 in Nifty 50 68700-68400 in Sensex. For the Bank Nifty, 47900-48000, could be the next resistance zone and supports have shifted to 46300-46400 levels," he added.

ITC Ltd., Adani Enteprises Ltd., Adani Ports and Special Economic Zones Ltd., Larsen & Toubro Ltd., Axis Bank Ltd. were adding positively to the indices.

Ultratech Cement Ltd., Bharti Airtel Ltd., Bajaj Auto Ltd., Hindalco Industries Ltd., and ICICI Bank Ltd., was weighing on the indices.

Ten out of 14 sectoral indices rose, and four declined. Nifty Energy, and Media increased the most, where Nifty Realty declined the most.

The market breadth was skewed in favour of the buyers. About 1,697 stocks rose, 1332 declined, and 119 remained unchanged on the BSE.

Broader indices underperformed with the BSE Sensex SmallCap rising 0.12% and Sensex MidCap gaining 0.25%.

Fisteen sectors out of 20 sectors compiled by BSE advanced, while 5 sectors declined. S&P BSE Oil and Gas, IT rose the most.

The yield on the 10-year bond opened flat at 7.25% on Wednesday.

Source: Bloomberg

The local currency strengthened 3 paise to open at 83.36 against the U.S dollar on Wednesday.

It closed at 83.39 on Tuesday

Source: Bloomberg

10.8 lakh shares changed hands in a pre-market large trade

0.14% equity changed hands at Rs 393.50 apiece

Buyers and sellers not known immediately

Source: Bloomberg

U.S. Dollar index at 103.95.

U.S. 10-year bond yield at 4.18%.

Brent crude up 0.23% at $77.38 per barrel.

Nymex crude up 0.14% at $72.42 per barrel.

GIFT Nifty was up 30.0 or 0.14% at 21,029.5 as of 7:23 a.m.

Bitcoin was down 0.15% at $43,834.90.

Move out of short-term ASM framework: Honasa Consumer.

Nifty December futures rose 0.69% to 20,942 at a premium of 87.5 points.

The Nifty December futures open interest rose by 3.22% to 6,782 shares.

Nifty Bank December futures rose by 1.06% to 47,152.40 at a premium of 140.15 points.

Nifty Bank December futures open interest fell by 1.92% to 2,844 shares.

Nifty Options Dec. 7 Expiry: Maximum call open interest at 21,000 and maximum put open interest at 20,700.

Bank Nifty Options Dec. 6 Expiry: Maximum Call Open Interest at 48000 and Maximum Put Open Interest at 45,000.

Securities in the ban period: Delta Corp., Indiabulls Housing Finance, India Cements, Zee Entertainment Enterprises.

Tide Water Oil: Promoter Standard Grease and Specialities bought 7.63 lakh shares on Dec. 4.

Uttam Sugar Mills: Promoter group Shubham Sugars bought 32,000 shares on Dec. 5.

Bajaj Electricals: Promoter group Niraj Holdings bought 4.7 lakh shares on Nov. 23. Rajivnayan Bajaj A/c Rishab Family Trust sold 4.7 lakh shares on Nov. 23.

Star Cement: Promoter group Rajendra Udyog HUF sold 15,750 shares on Nov. 30.

Thirumalai Chemicals: Promoter group Narayan Santhanam sold 8,000 shares on Dec. 4.

Sapphire Foods India: Arinjaya (Mauritius) sold 27 lakh shares (4.24%), while the Singapore government bought 20.19 lakh shares (3.17%) at Rs 1,400 apiece.

Sanghi Industries: Ambuja Cements bought 13.34 crore shares (51.67%) at Rs 121.9 apiece, while Aditya Sanghi sold 88.92 lakh shares (3.44%), Alok Sanghi sold 88.92 lakh shares (3.44%), Anita Sanghi sold 10.20 lakh shares (0.39%), Flarezeal Solutions LLP sold 40 lakh shares (1.54%), Ravi Sanghi sold 4.4 crore shares (17.20%), Samruddhi Investors Services sold 6.15 crore shares (23.82%), and Sanghi Polymers P sold 47 lakh shares (1.81%) at Rs 121.9 apiece.

Swan Energy: 2I Capital PCC sold 30 lakh shares (1.13%) at Rs 414 apiece and Ares Diversified sold 55 lakh shares (2.08%) at Rs 414.09 apiece. SBI Life Insurance bought 20 lakh shares (0.75%) at Rs 414 apiece, Societe Generale bought 20 lakh shares (0.68%) at Rs 414 apiece, and Setu Securities bought 10 lakh shares (0.37%) at Rs 414.5 apiece, among others.

Honasa Consumer: Fireside Ventures sold 60.9 lakh shares (1.89%) at Rs 378 apiece.

State Bank of India: The lender has proposed to acquire a 20% stake from SBI Capital Markets in SBI Pension Funds for Rs 229.5 crore. Post-acquisition, it will have an 80% stake in the SBI Pension Fund.

Ashok Leyland: The automaker increased its stake in Switch Mobility's holding company to 92.19% from 91.63%. It had deployed around Rs 662.5 crore as the first tranche of a planned Rs 1,200-crore investment.

Canara Bank: The bank looks to raise up to Rs 3,500 crore via tier-I bonds. The bidding starts on Dec. 7.

Bank of India: The lender opened its QIP issue at a floor price of Rs 105.42 per equity share.

Somany Ceramics: Sets Dec. 15 as the record date for the Rs 125 crore buyback—15.18% stake at Rs 850 per share.

Power Grid Corp: The company emerged as a successful bidder to establish the inter-state transmission system project in Khavda RE Park, Gujarat.

HDFC Bank: The lender has sought shareholders' approval to appoint Sashidhar Jagdishan as the managing director and chief executive officer, V Srinivasa Rangan as executive director and MD Ranganath and Sandeep Parekh as independent directors.

UCO Bank: The Central Bureau of Investigation has carried out searches in 13 locations in connection with the company's IMPS glitch case.

Dalmia Bharat: The company approved the appointment of Puneet Dalmia as MD and CEO for five years with effect from Dec. 8.

Ion Exchange: The International Chamber of Commerce has rejected Ethingen arbitration's claim of Rs 149.6 crore for damages against the company.

Axiscades Technologies: The company has acquired a 99.99% stake in Epcogen for Rs 26.3 crore.

Sanghi Industries: The company and Incor Realty Projects have mutually agreed to an upward revision of the sale consideration of Rs 125 crore on account of certain improvements in the land condition and certain other factors.

Ganesh Benzoplast: The board has approved allotment of 17 lakh shares at Rs.160 apiece on preferential basis to Malabar India Fund Ltd. and 1.80 lakh shares of face value Re. 1 per share at a price of Rs. 175 to Susram Financial Services and Realty Pvt Ltd.

Force Motors: The company's November production stood at 2,216 units. It recorded a monthly sales volume of 1,732 units.

Greenpanel Industries: The company's operation in Chittoor, Andhra Pradesh, was disrupted due to the cyclone.

Asian markets were trading on a mixed note Wednesday as traders assessed latest jobs data from the U.S. and treasury yields declined.

The U.S. Jobs and Labor Turnover Survey data showed jobs in the world's largest economy declined by 6,17,000 to 8.73 million in October.

The fall in jobs fueled investors' expectation that the Federal Reserve might have done with the rate hike and may soon start cutting rates. Traders are expecting a rate cut as soon as March, according to CME FedWatch Tool.

U.S. treasury yields slumped on anticipation of rate cuts by the Federal Reserve in the backdrop of slowing inflation and softening job market. The yield on the benchmark 10-year U.S. Treasury note was at 4.18% on Tuesday, compared to Monday's close of 4.28%.

Markets in Japan and Australia were trading higher. Data from Australian Bureau of Statistics showed the country's gross domestic product grew 2.1% in July–September period, beating analysts' expectation of 1.7% growth.

Share indices in China fell after Moody's cut the Chinese government's credit outlook from stable to negative, which dented risk appetite among investors.

The S&P 500 index and Dow Jones Industrial Average fell by 0.06% and 0.22% respectively on Tuesday. The Nasdaq 100 rose by 0.24%.

India's benchmark indices closed at an all-time high on Tuesday for the second consecutive session as it rose for the sixth straight session, led by gains in the banking and Adani Group stocks.

The NSE Nifty 50 closed 168 points, or 0.81%, higher at 20,855.10, while the S&P BSE Sensex ended 431 points, or 0.63%, up at 69,296.14. Both the indices also hit new intraday highs.

Overseas investors stayed net buyers in Indian equities for the eighth consecutive session on Tuesday. Foreign portfolio investors mopped up stocks worth Rs 5,223.5 crore, while domestic institutional investors turned net sellers and offloaded stocks worth Rs 1,399.2 crore, the NSE data showed.

The rupee ended 1 paise lower against the dollar at Rs 83.38 on Tuesday.

Asian markets were trading on a mixed note Wednesday as traders assessed latest jobs data from the U.S. and treasury yields declined.

The U.S. Jobs and Labor Turnover Survey data showed jobs in the world's largest economy declined by 6,17,000 to 8.73 million in October.

The fall in jobs fueled investors' expectation that the Federal Reserve might have done with the rate hike and may soon start cutting rates. Traders are expecting a rate cut as soon as March, according to CME FedWatch Tool.

U.S. treasury yields slumped on anticipation of rate cuts by the Federal Reserve in the backdrop of slowing inflation and softening job market. The yield on the benchmark 10-year U.S. Treasury note was at 4.18% on Tuesday, compared to Monday's close of 4.28%.

Markets in Japan and Australia were trading higher. Data from Australian Bureau of Statistics showed the country's gross domestic product grew 2.1% in July–September period, beating analysts' expectation of 1.7% growth.

Share indices in China fell after Moody's cut the Chinese government's credit outlook from stable to negative, which dented risk appetite among investors.

The S&P 500 index and Dow Jones Industrial Average fell by 0.06% and 0.22% respectively on Tuesday. The Nasdaq 100 rose by 0.24%.

India's benchmark indices closed at an all-time high on Tuesday for the second consecutive session as it rose for the sixth straight session, led by gains in the banking and Adani Group stocks.

The NSE Nifty 50 closed 168 points, or 0.81%, higher at 20,855.10, while the S&P BSE Sensex ended 431 points, or 0.63%, up at 69,296.14. Both the indices also hit new intraday highs.

Overseas investors stayed net buyers in Indian equities for the eighth consecutive session on Tuesday. Foreign portfolio investors mopped up stocks worth Rs 5,223.5 crore, while domestic institutional investors turned net sellers and offloaded stocks worth Rs 1,399.2 crore, the NSE data showed.

The rupee ended 1 paise lower against the dollar at Rs 83.38 on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.