Overseas investors stayed sellers on Wednesday for the third consecutive day.

Foreign portfolio investors sold stocks worth Rs 2,213.56 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers for the eleventh day and mopped up equities worth Rs 1,102.41 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 12,801 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The local currency weakened by 5 paise to close at 83.43 against the U.S. Dollar.

It closed at 83.38 a dollar on Tuesday.

Source: Bloomberg

The local currency weakened by 5 paise to close at 83.43 against the U.S. Dollar.

It closed at 83.38 a dollar on Tuesday.

Source: Bloomberg

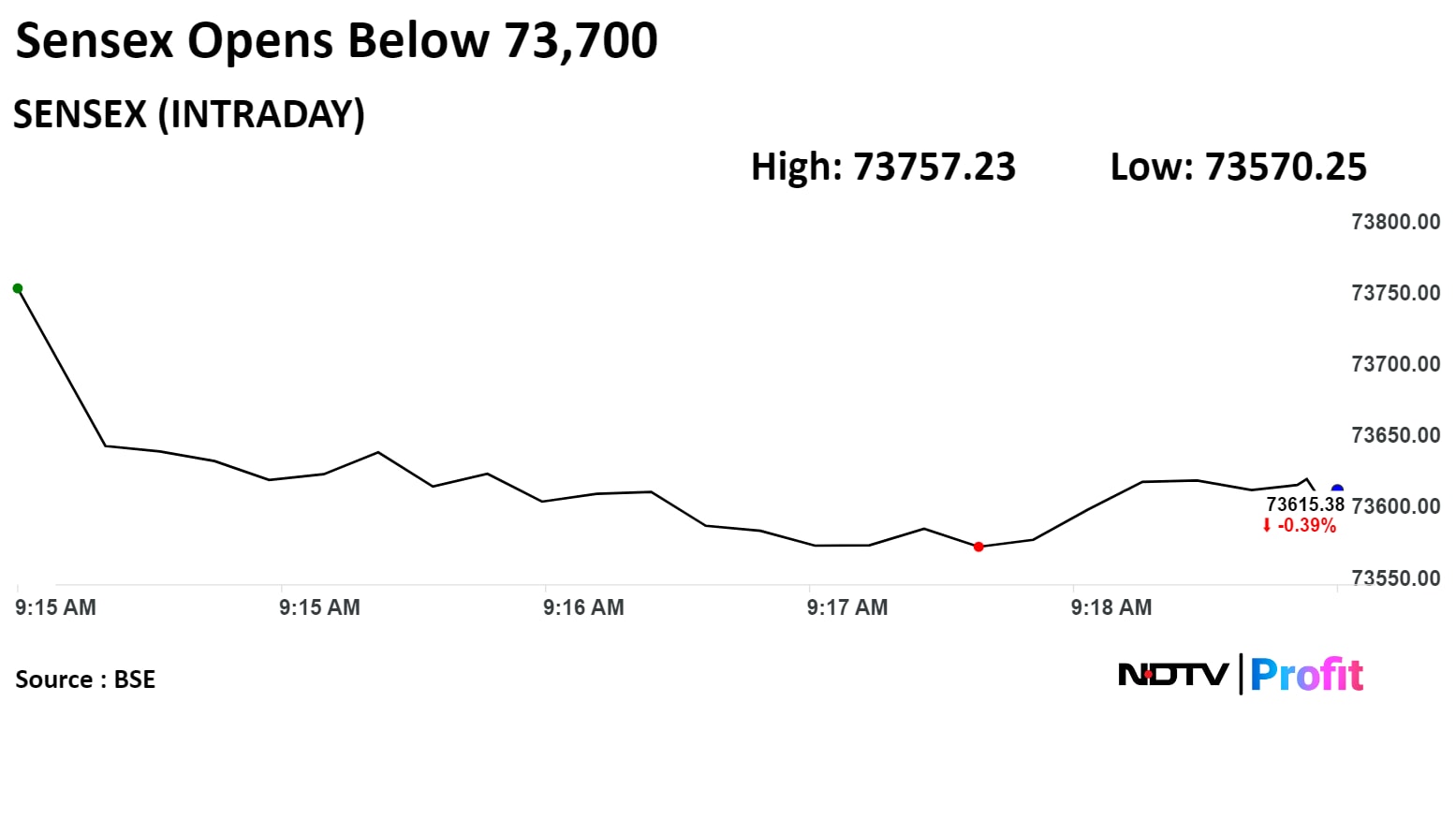

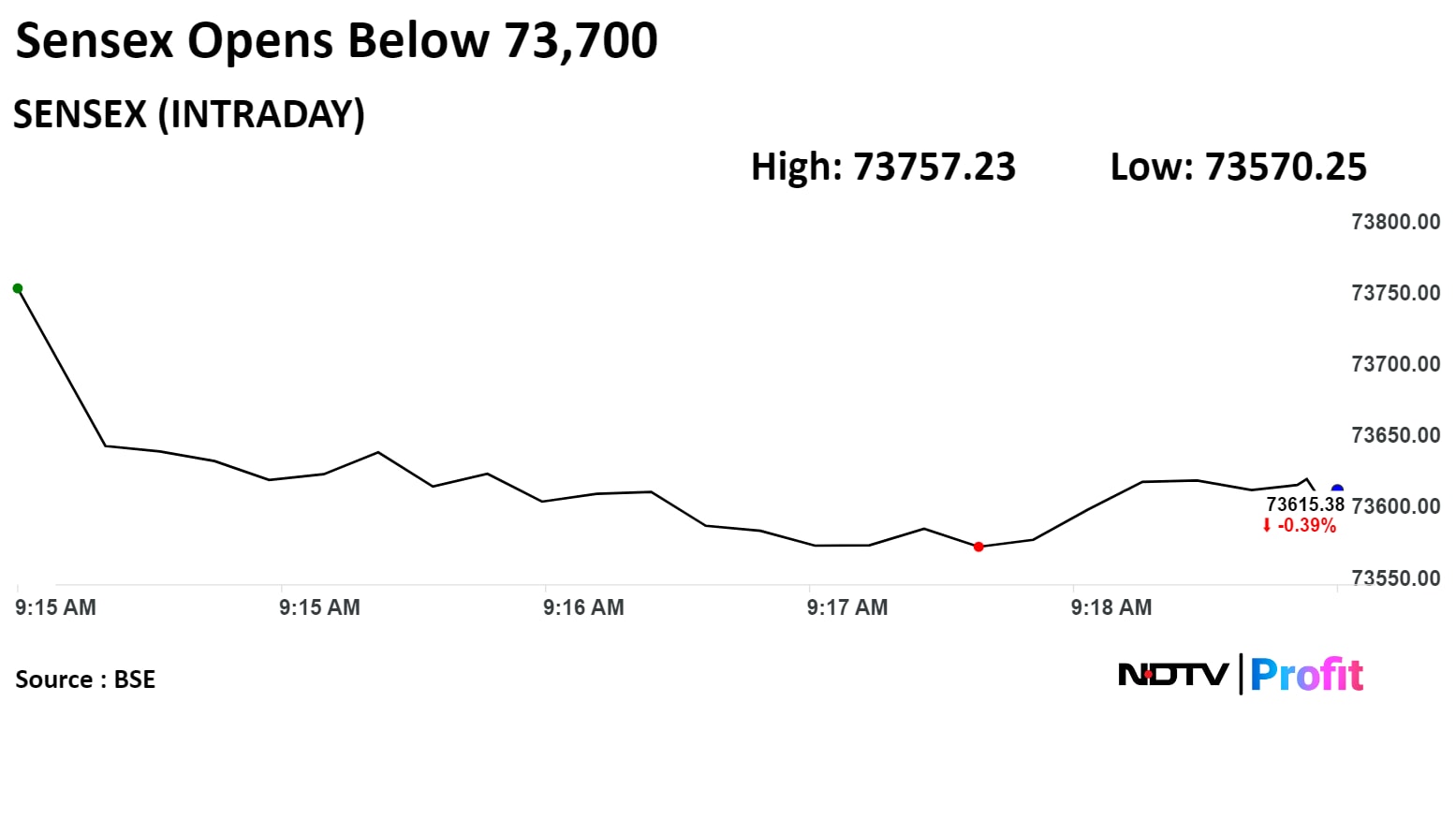

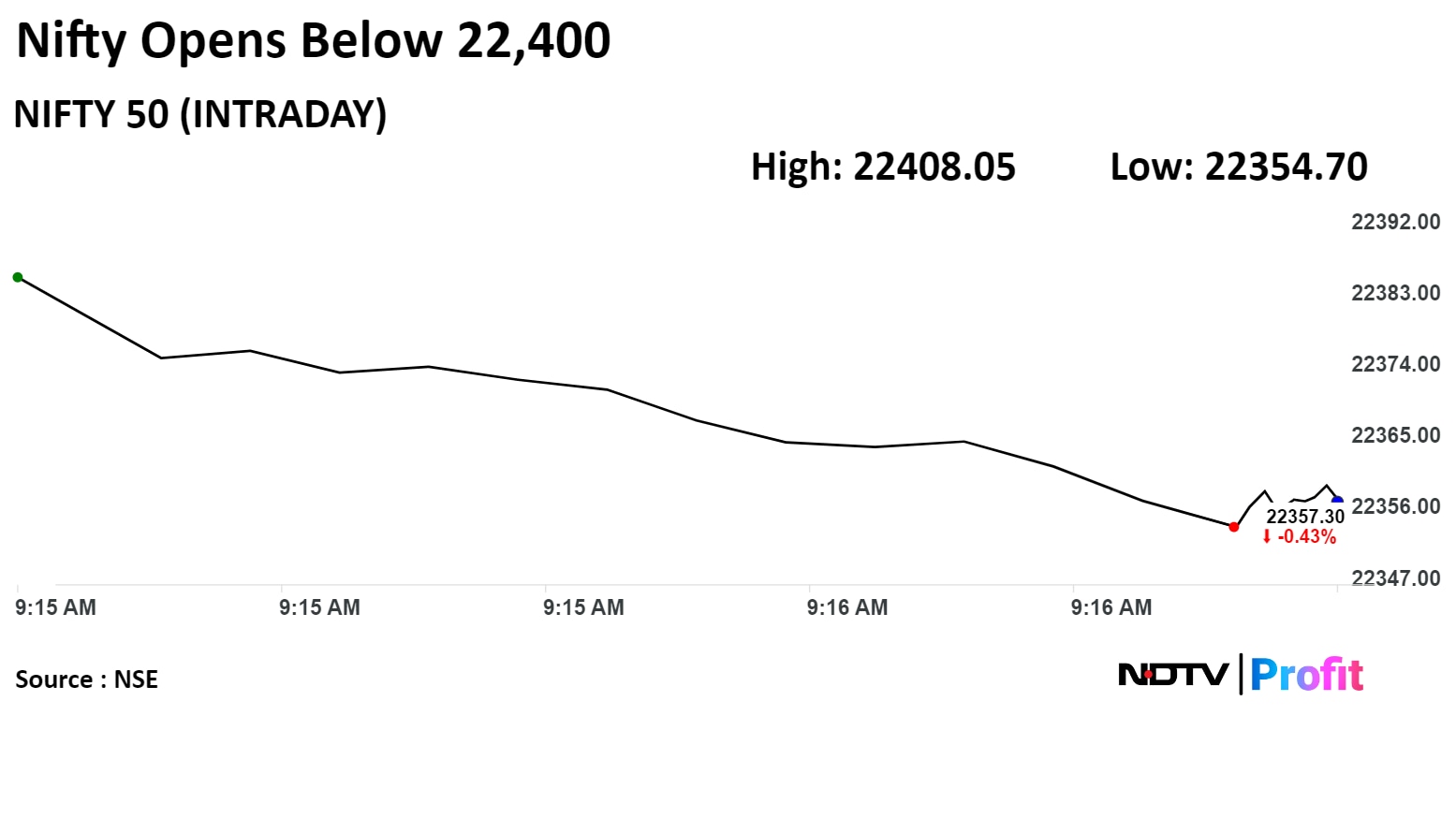

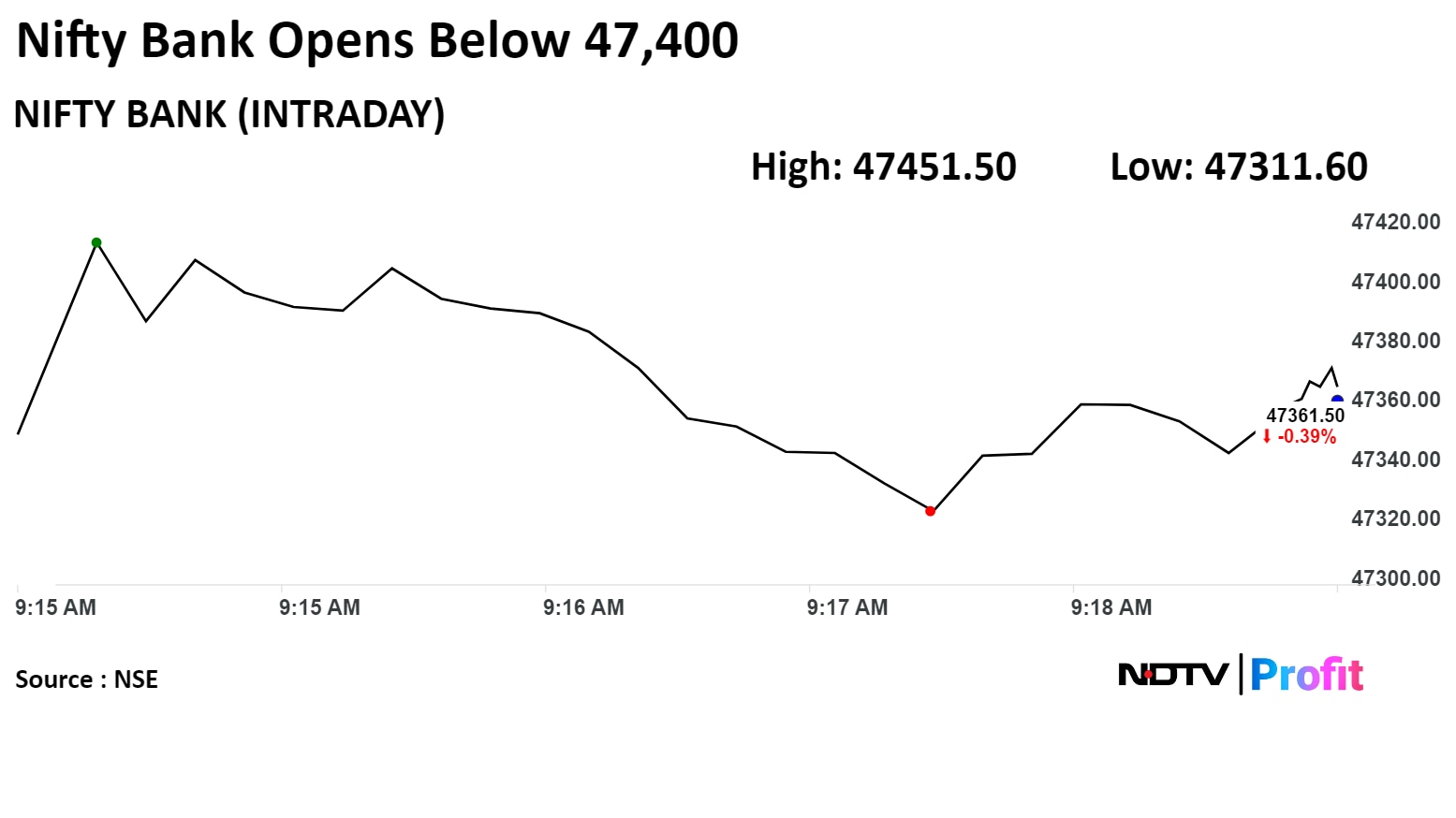

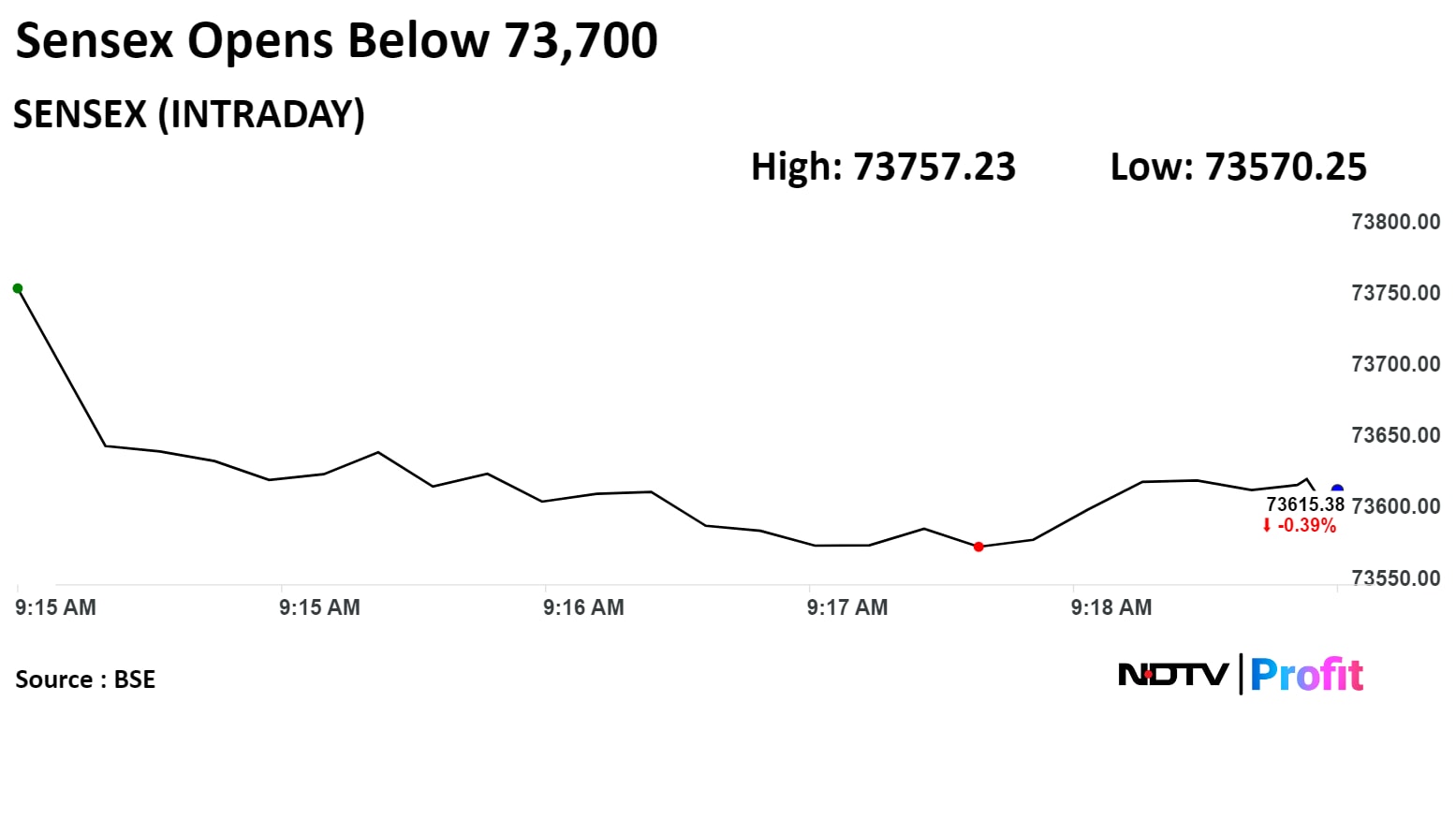

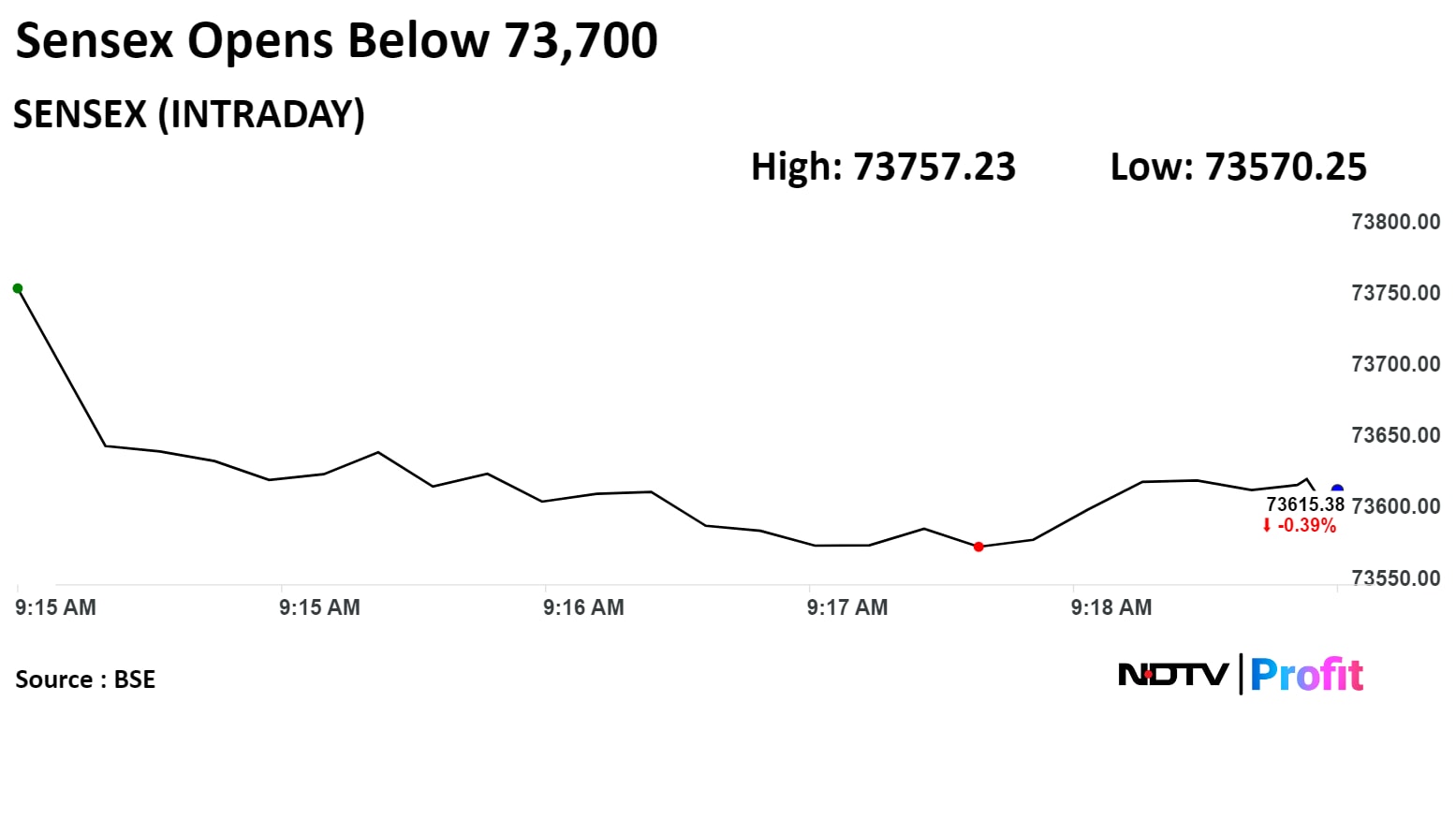

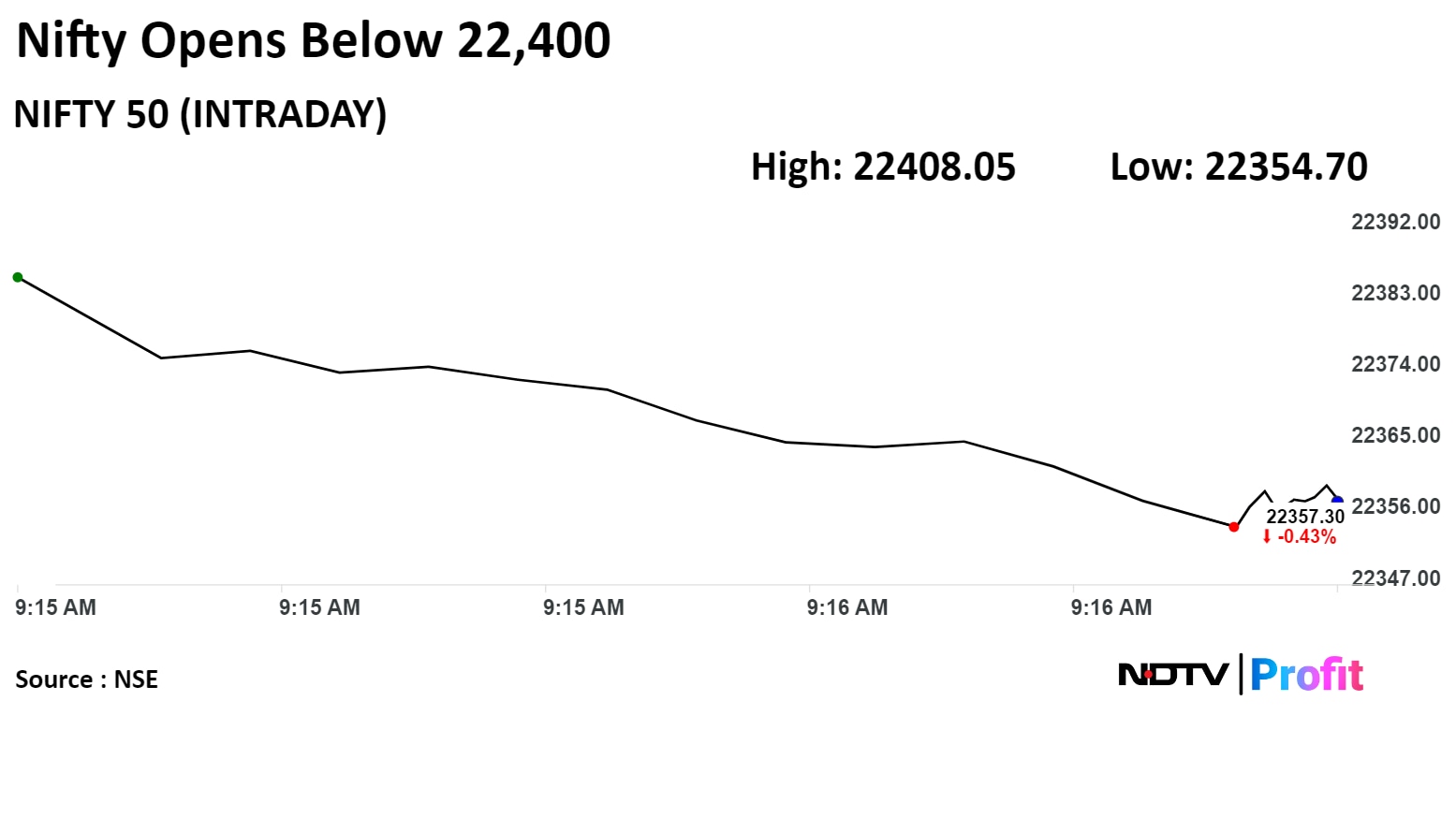

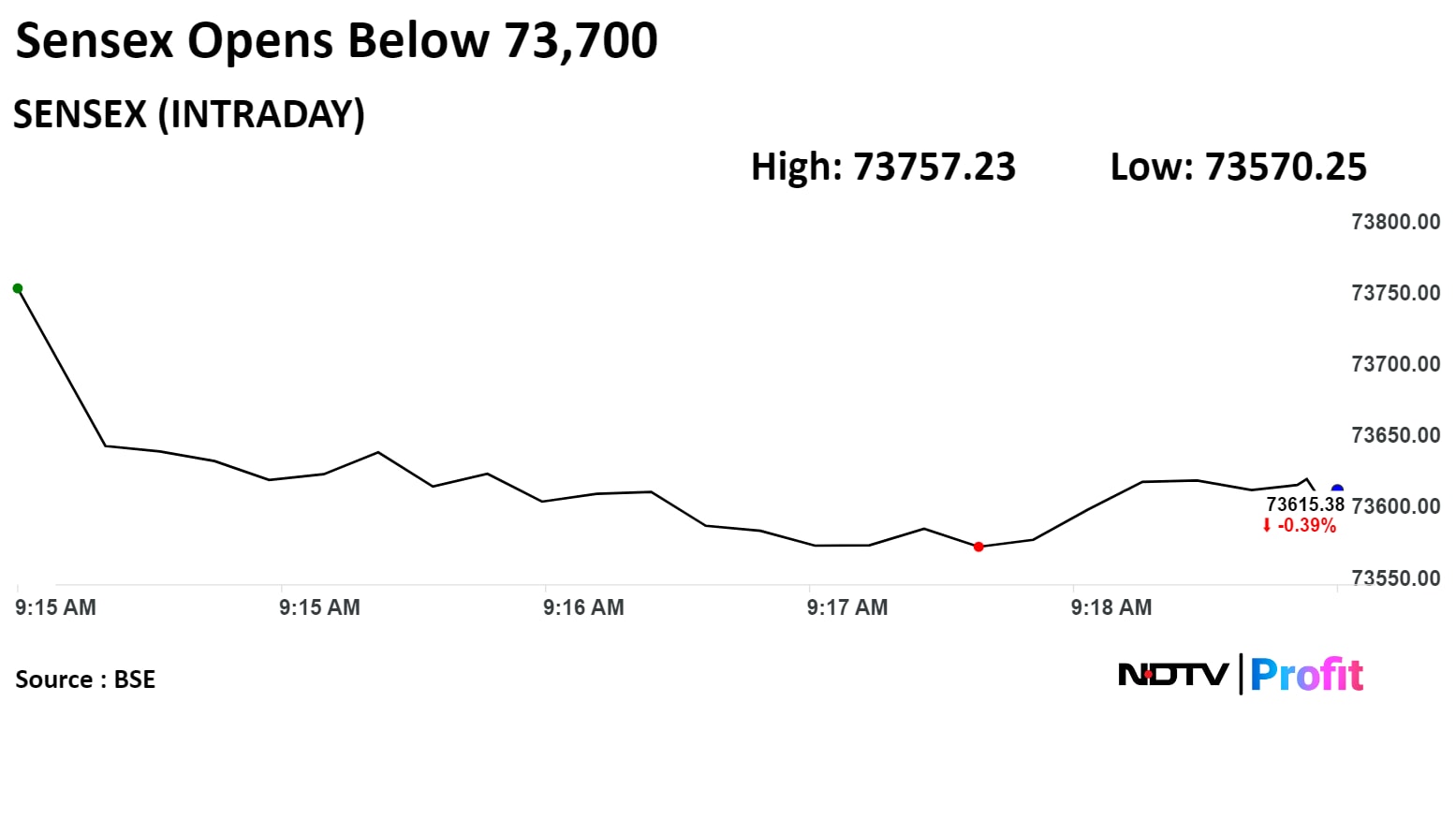

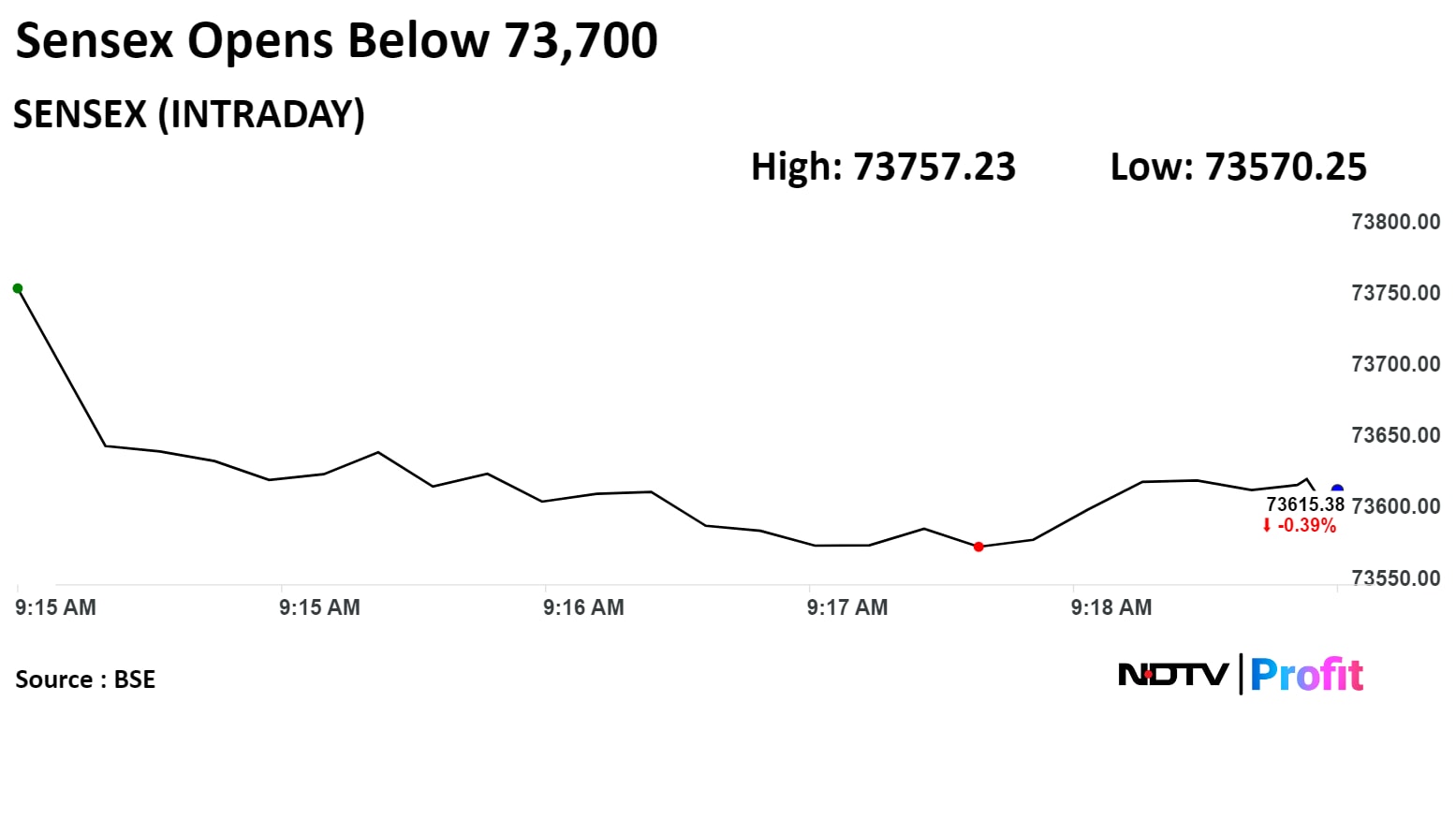

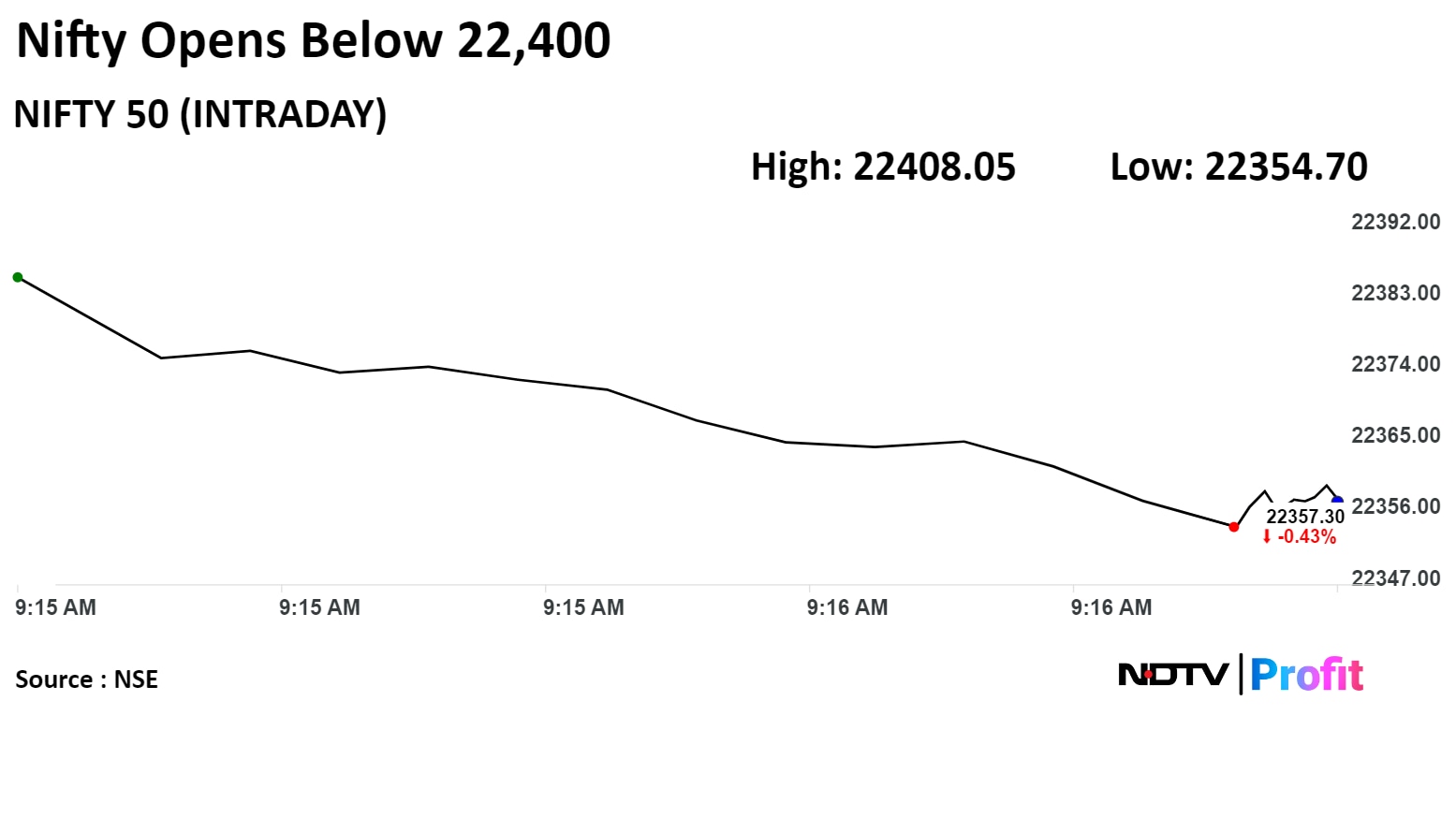

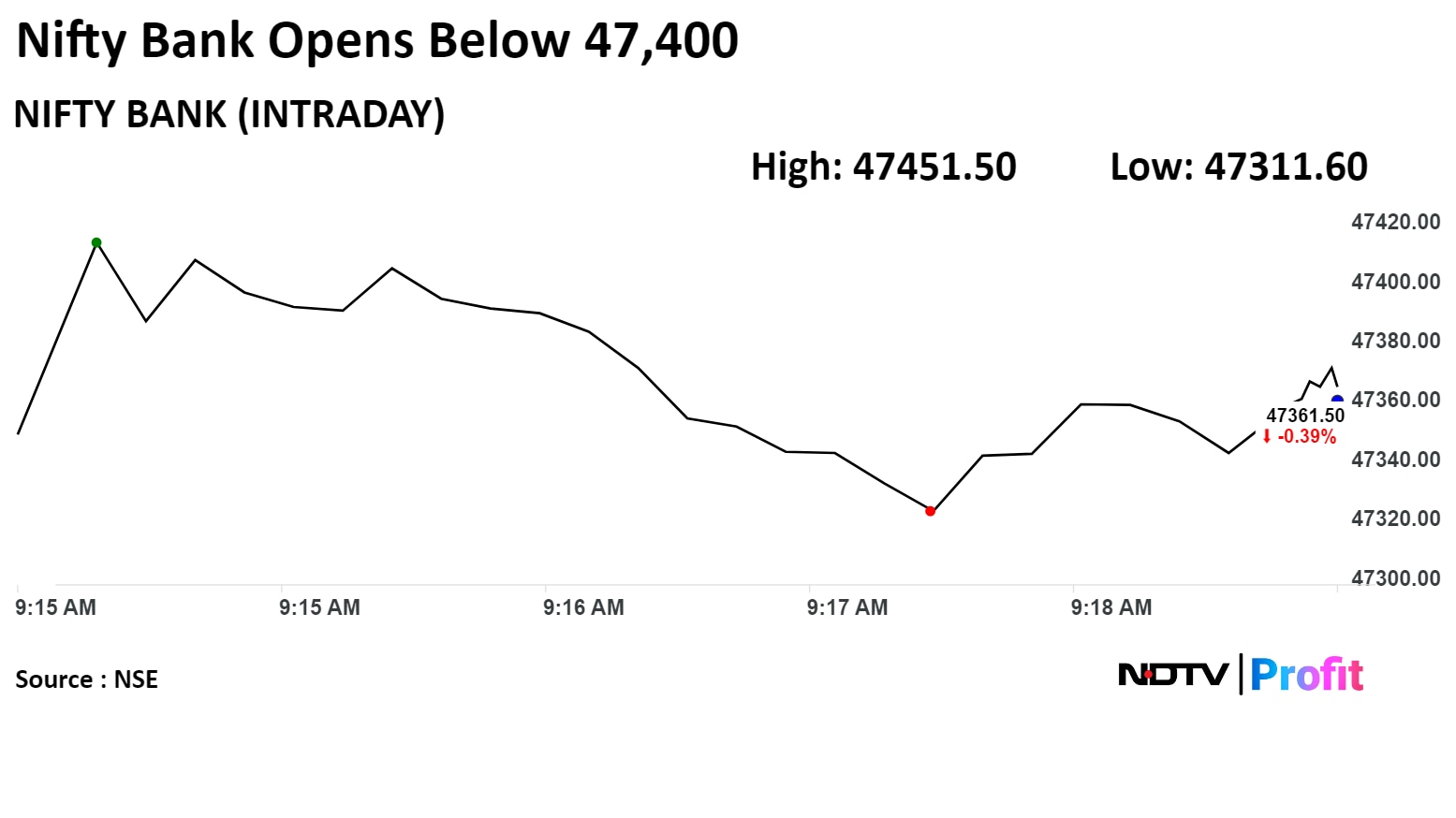

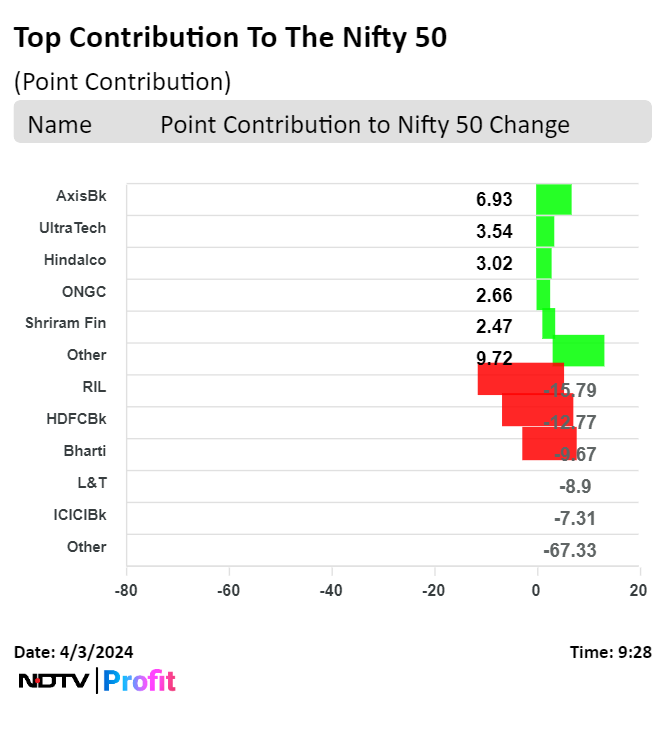

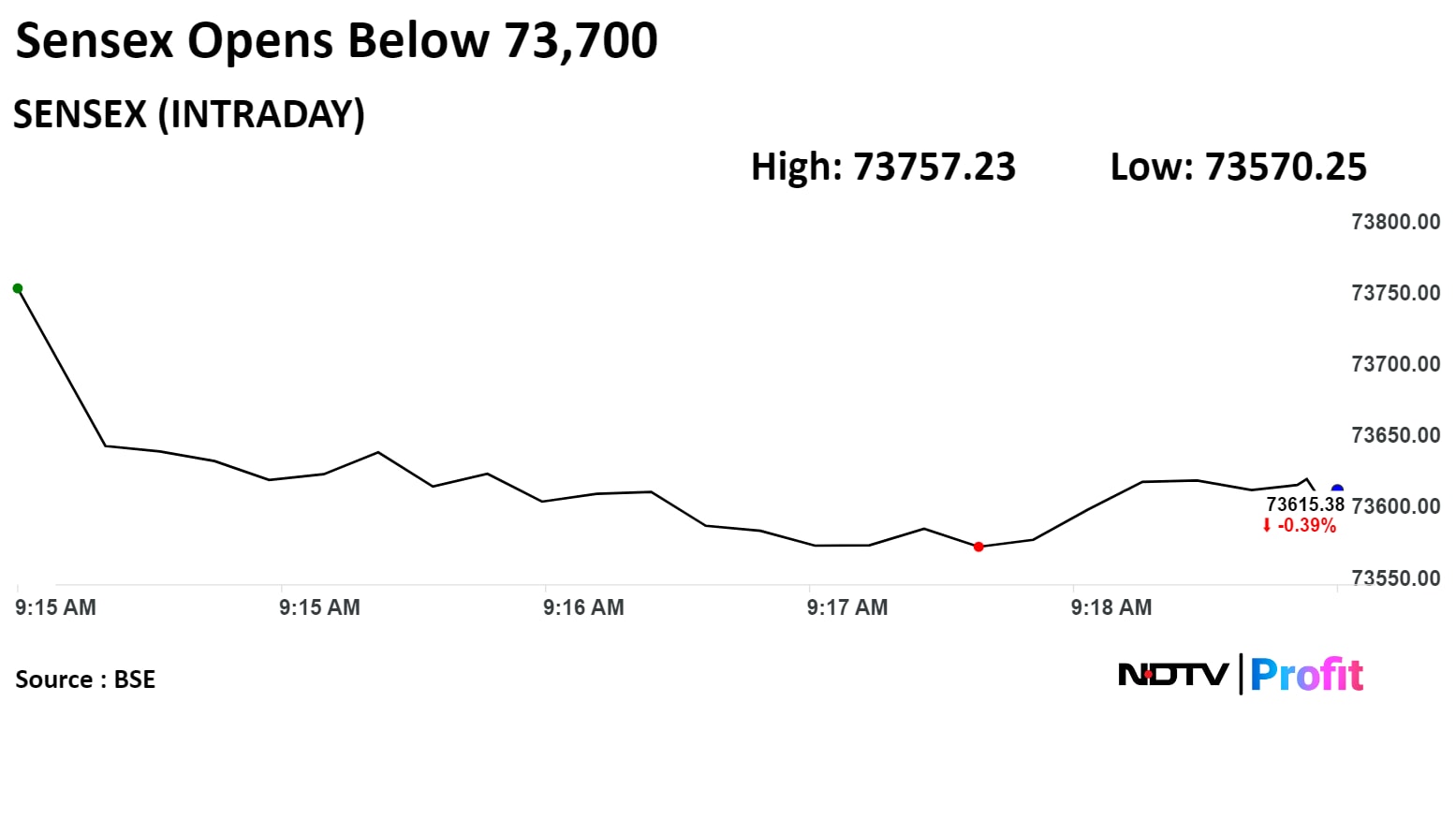

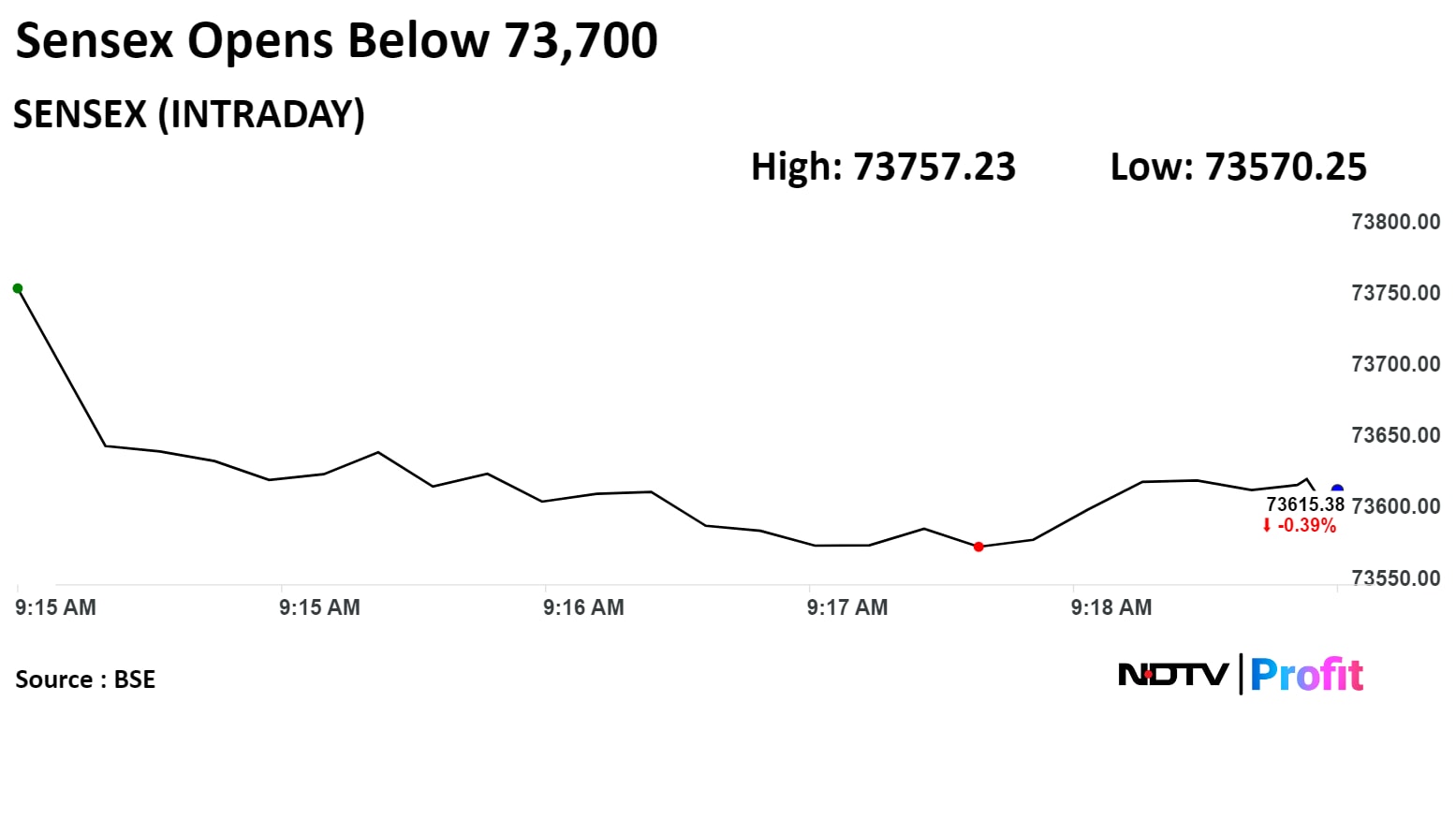

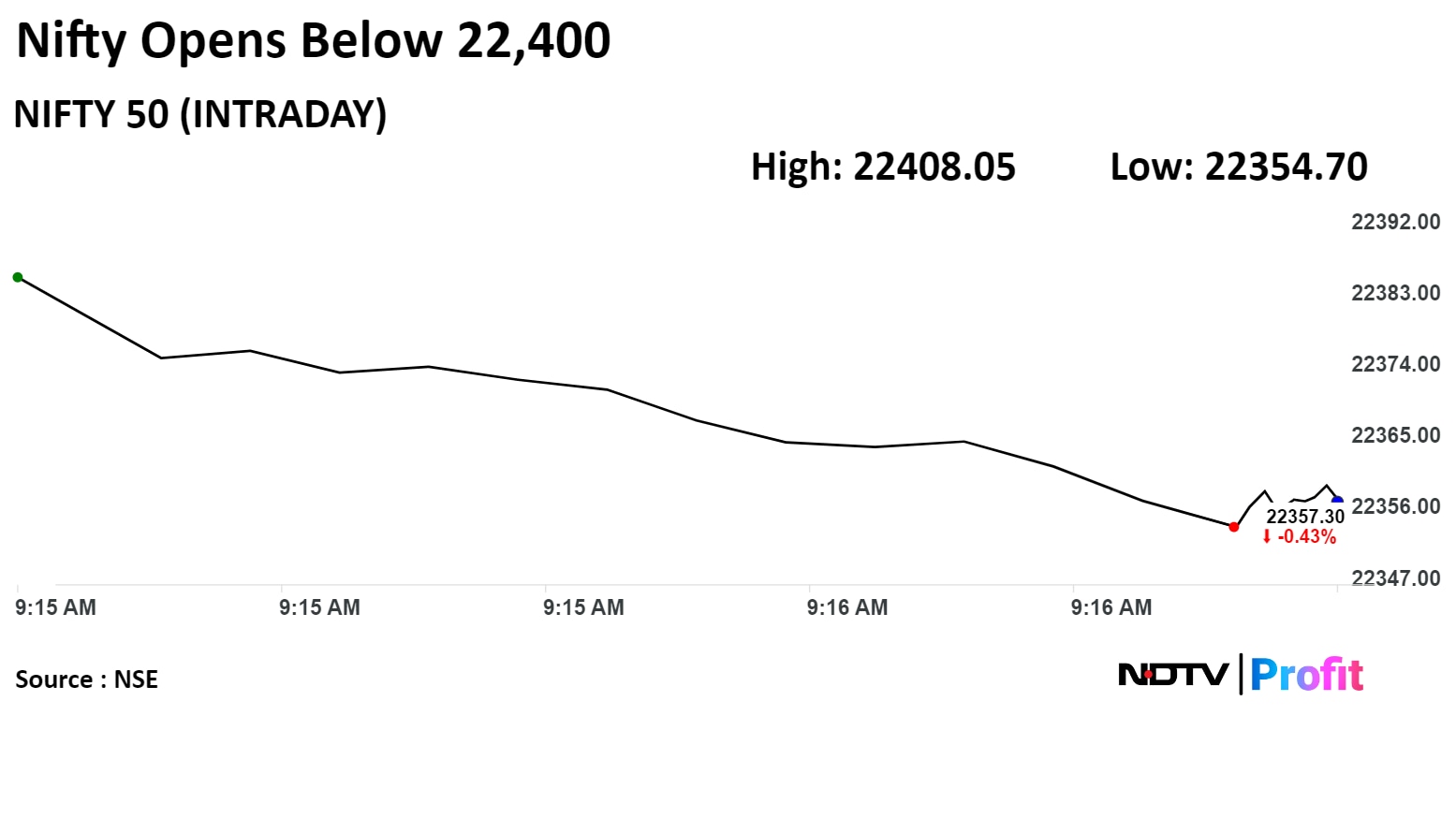

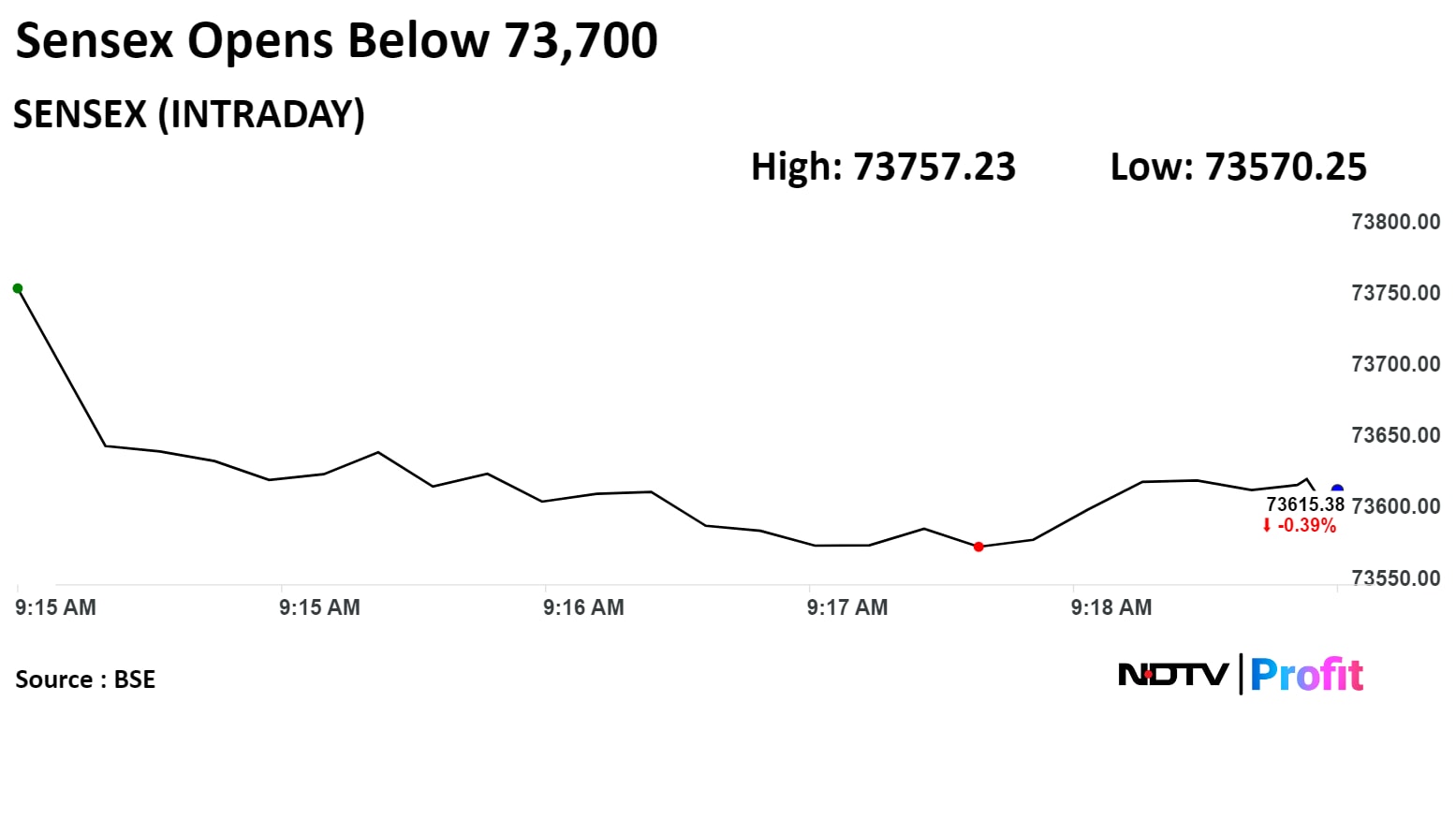

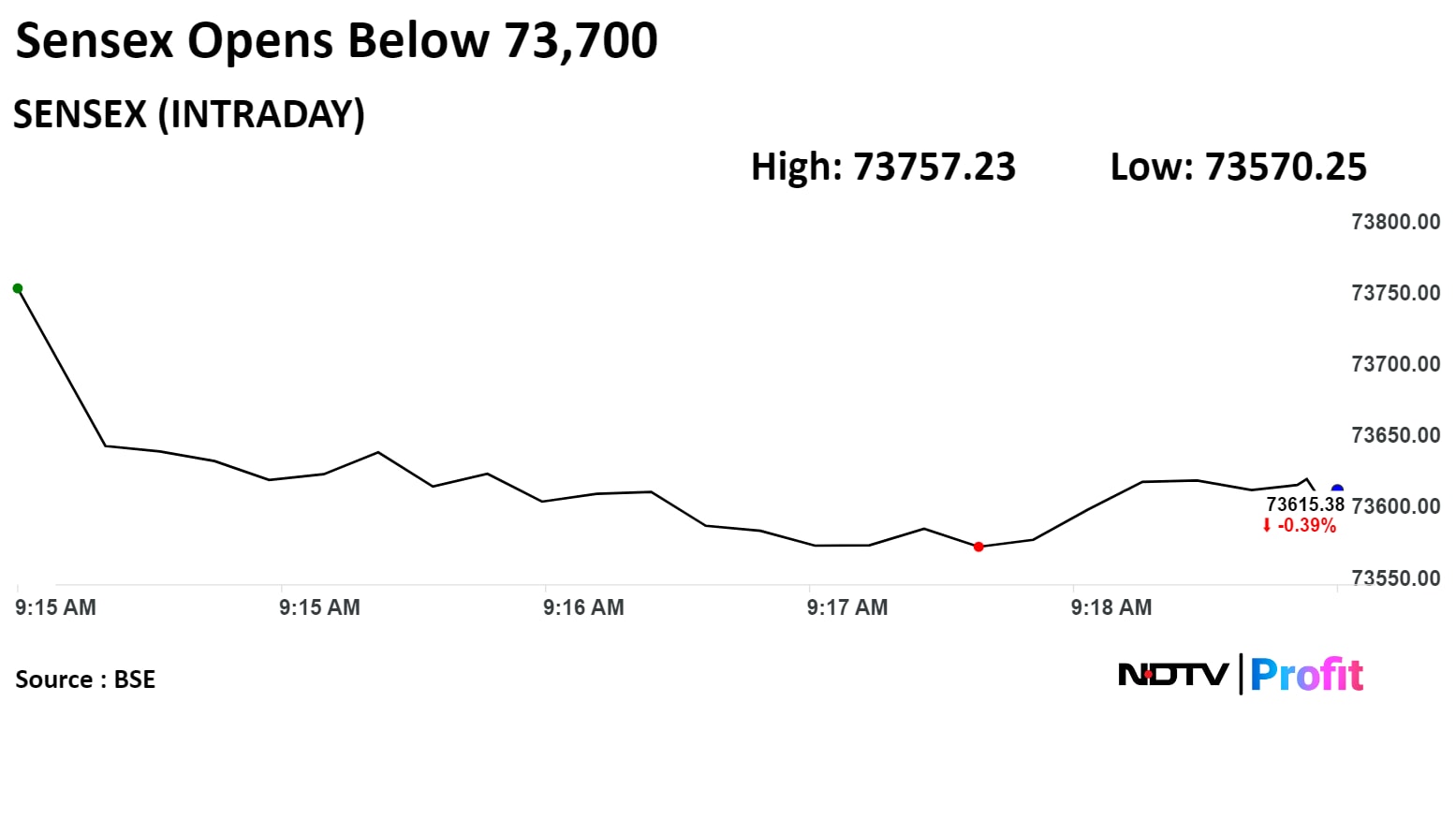

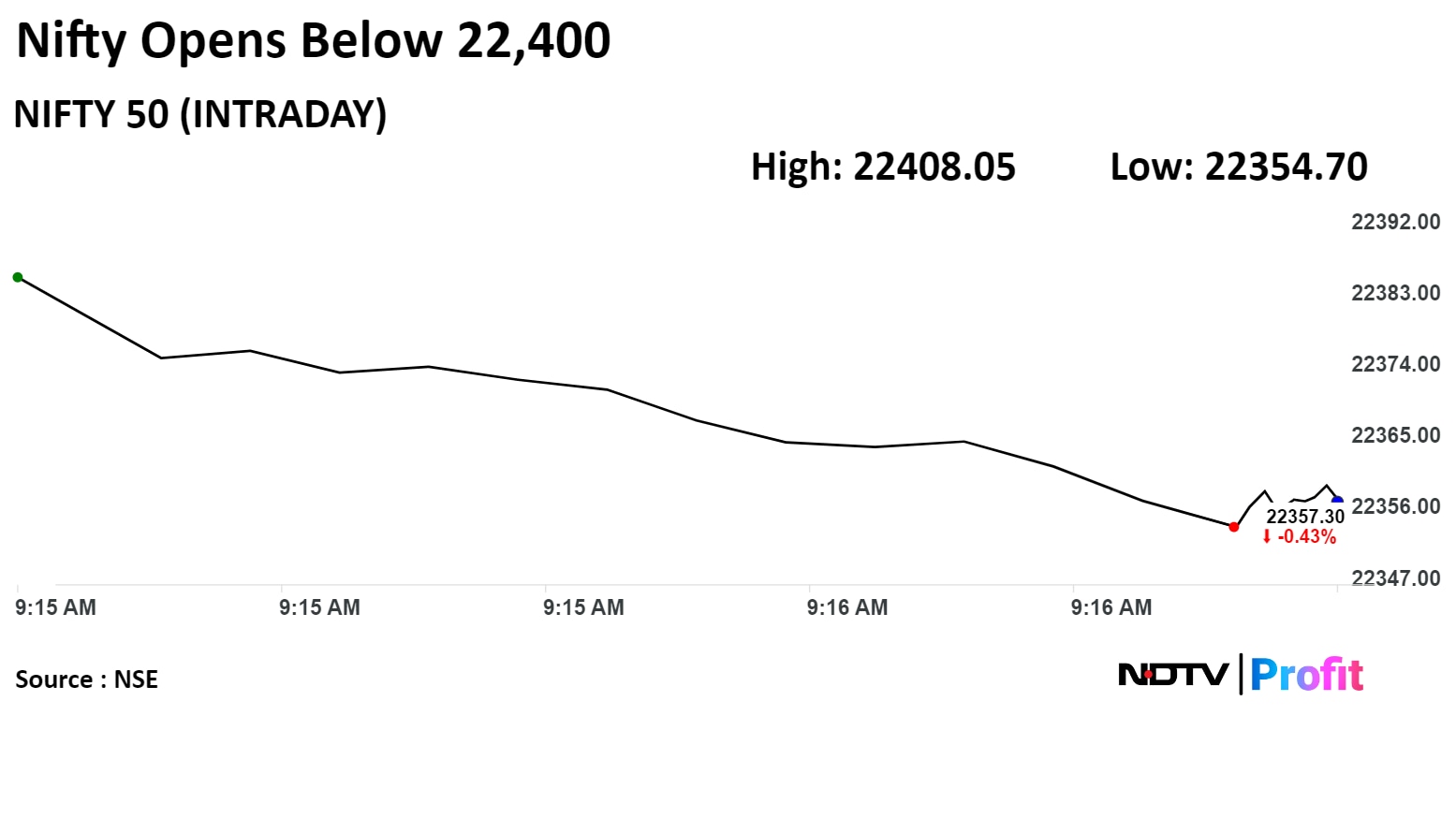

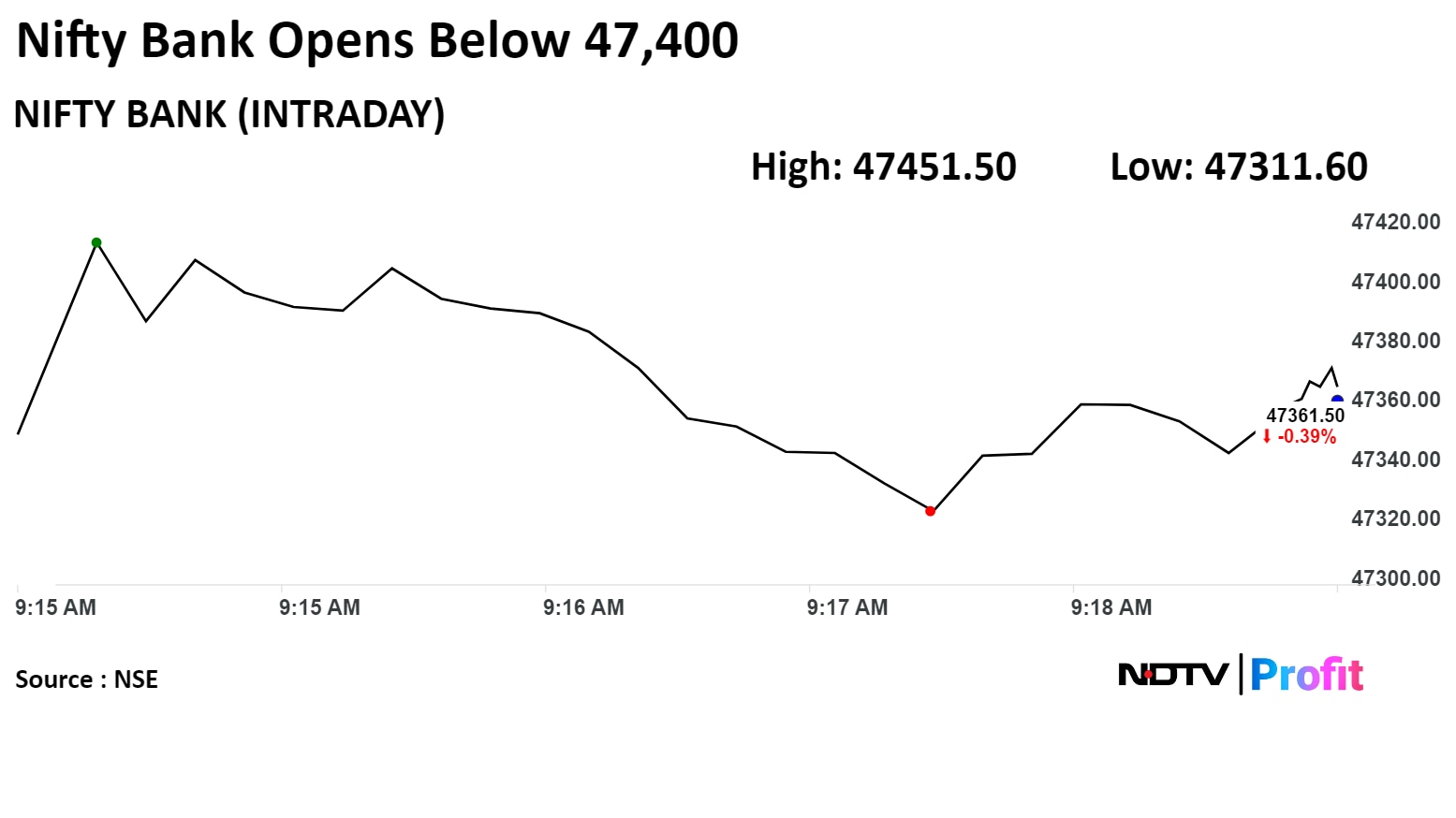

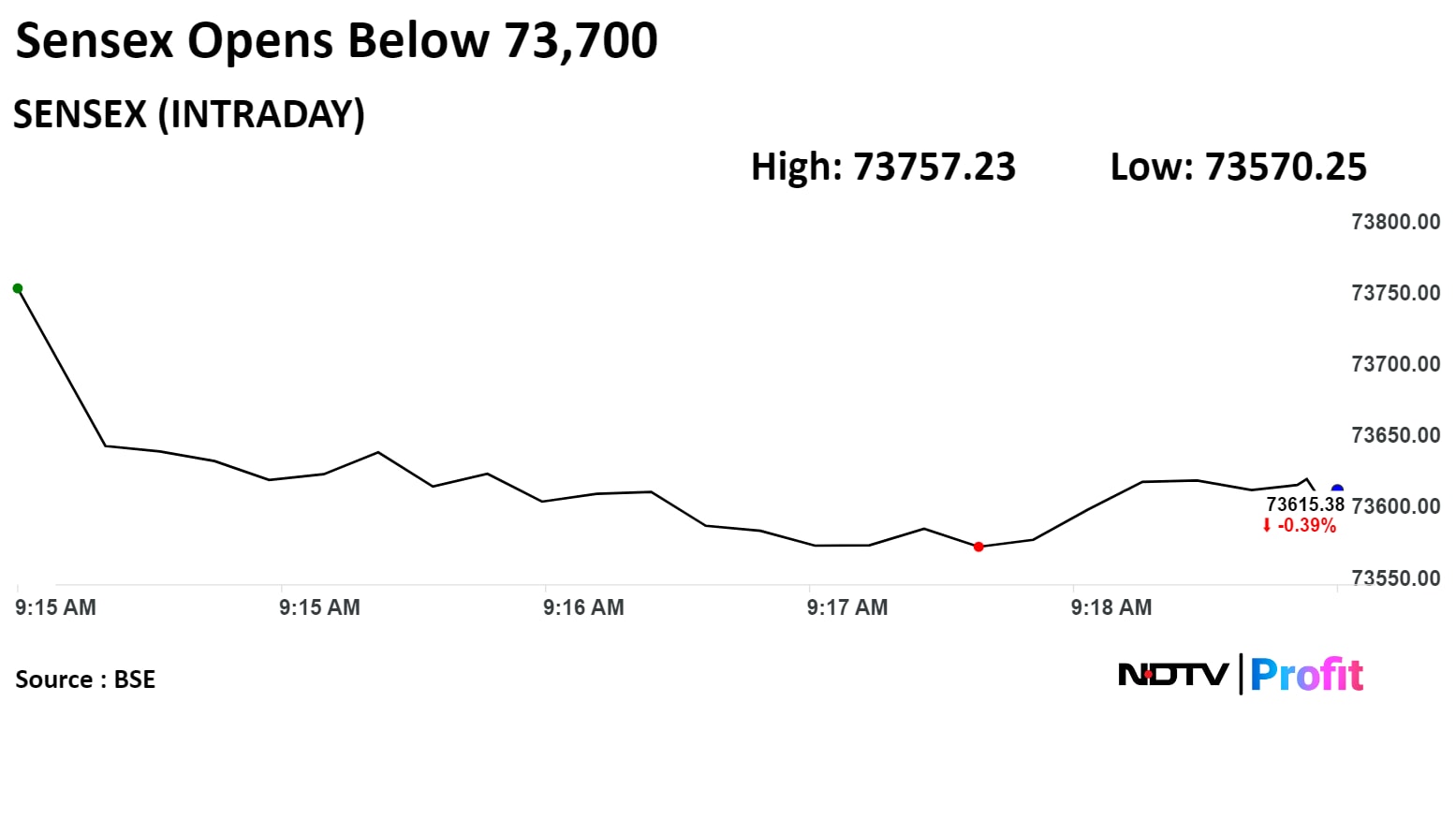

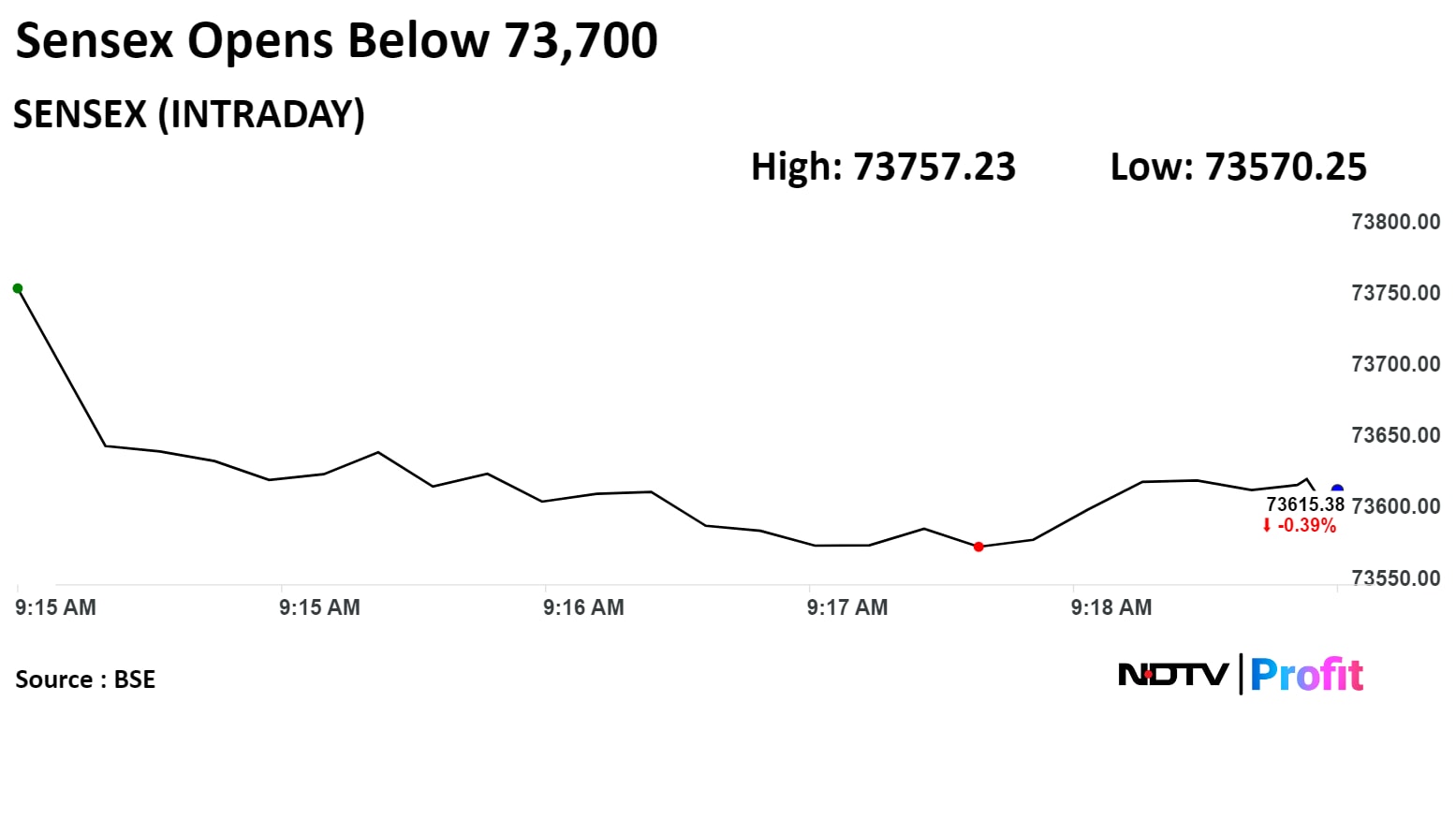

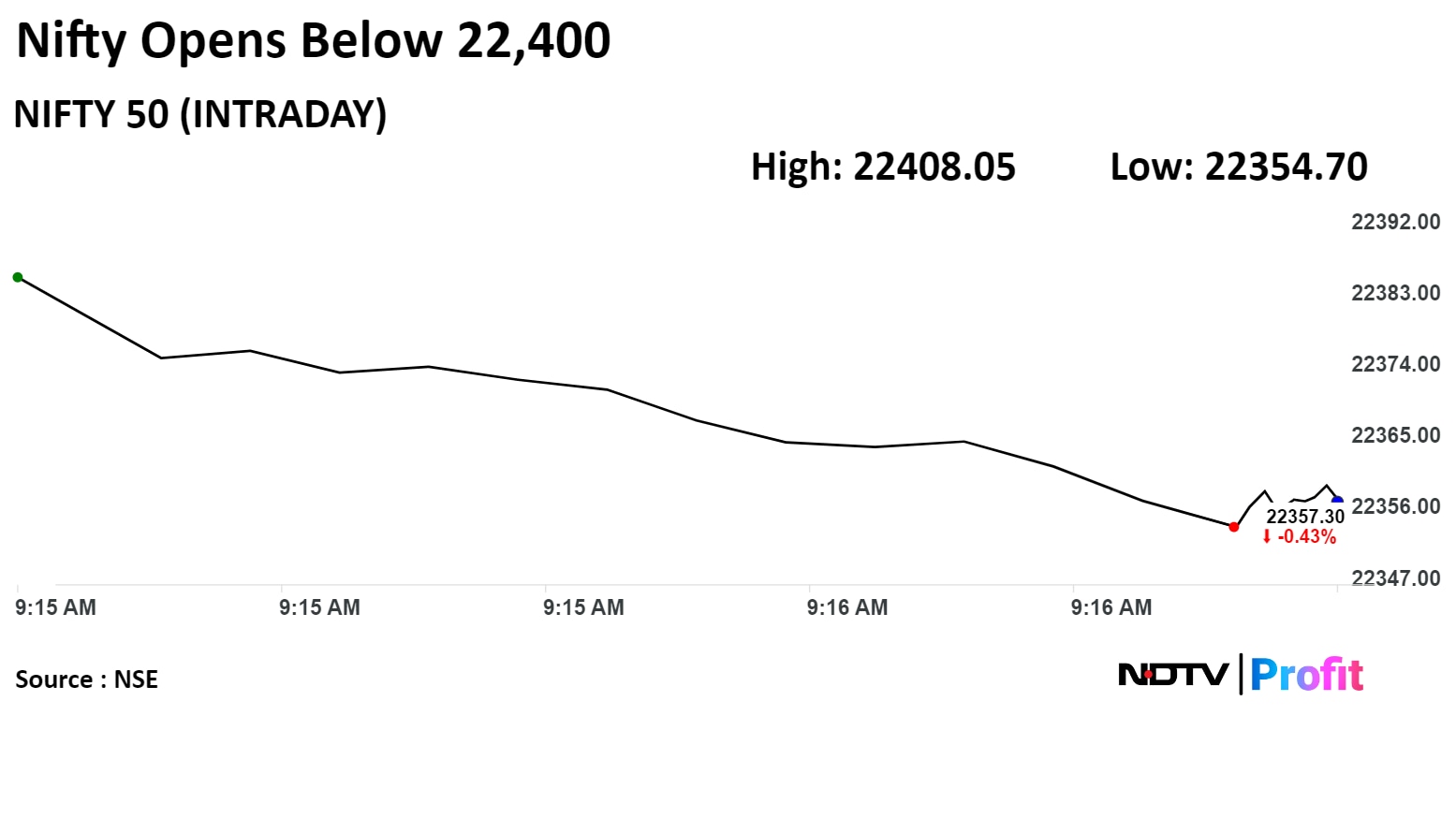

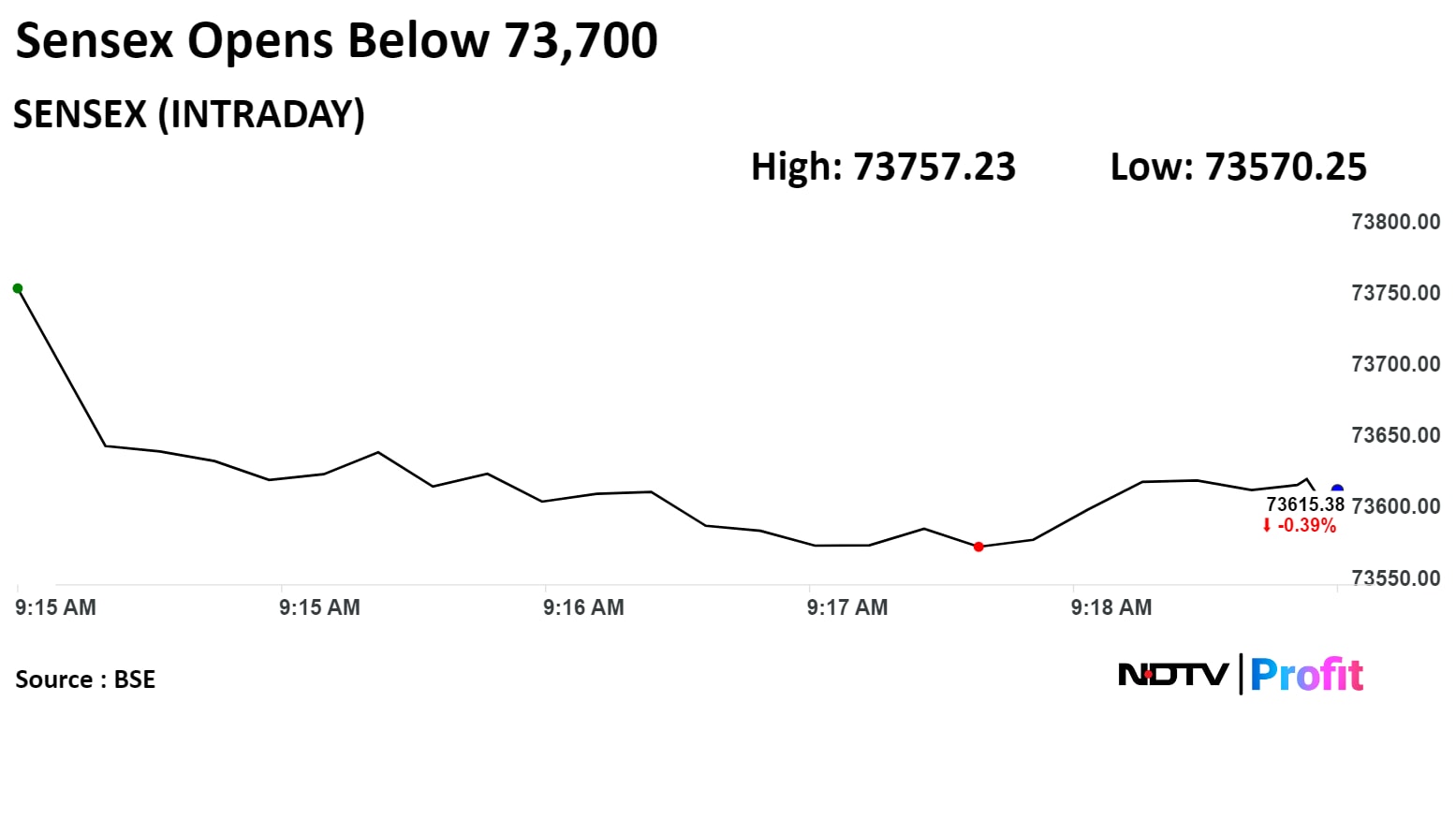

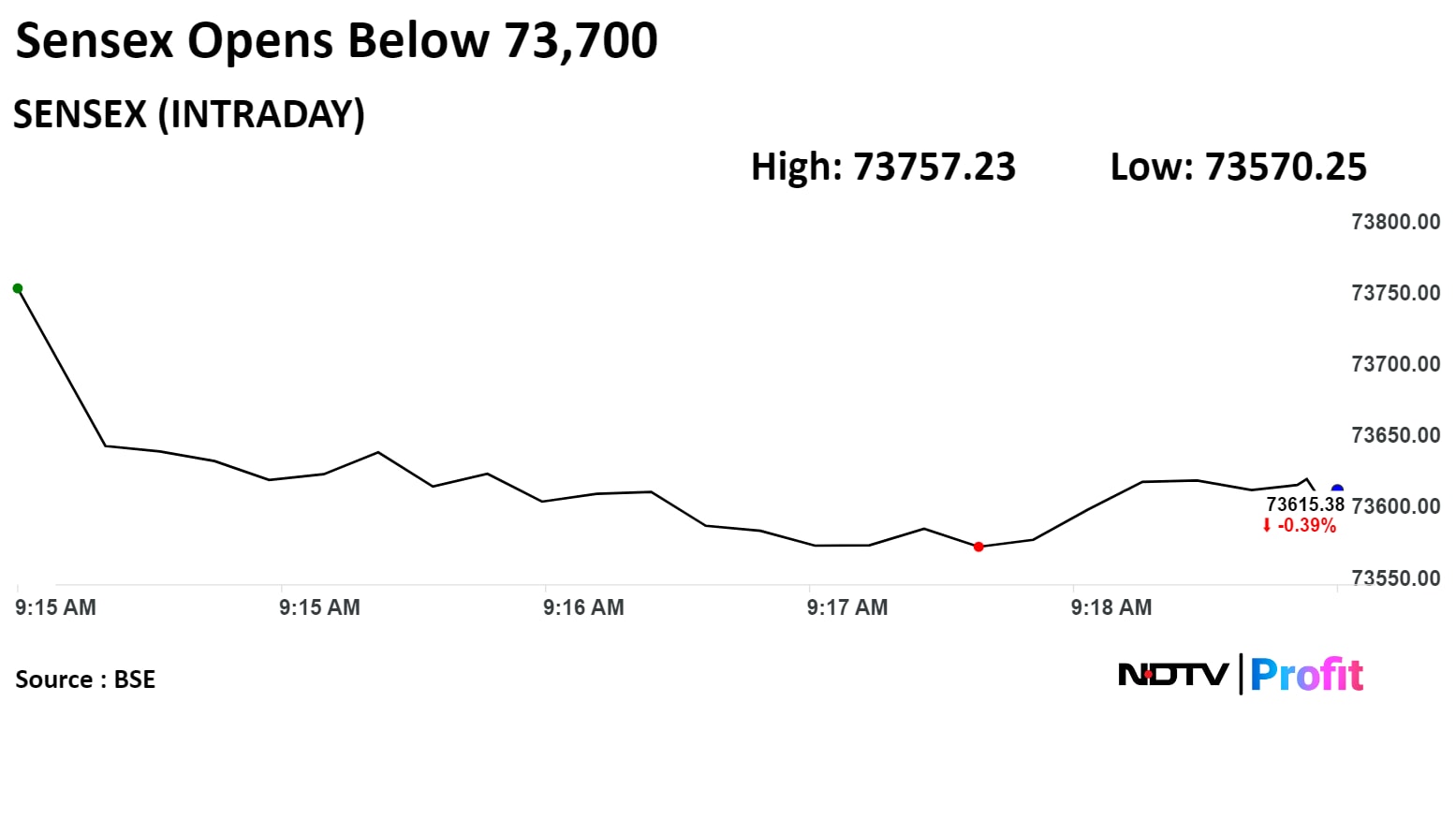

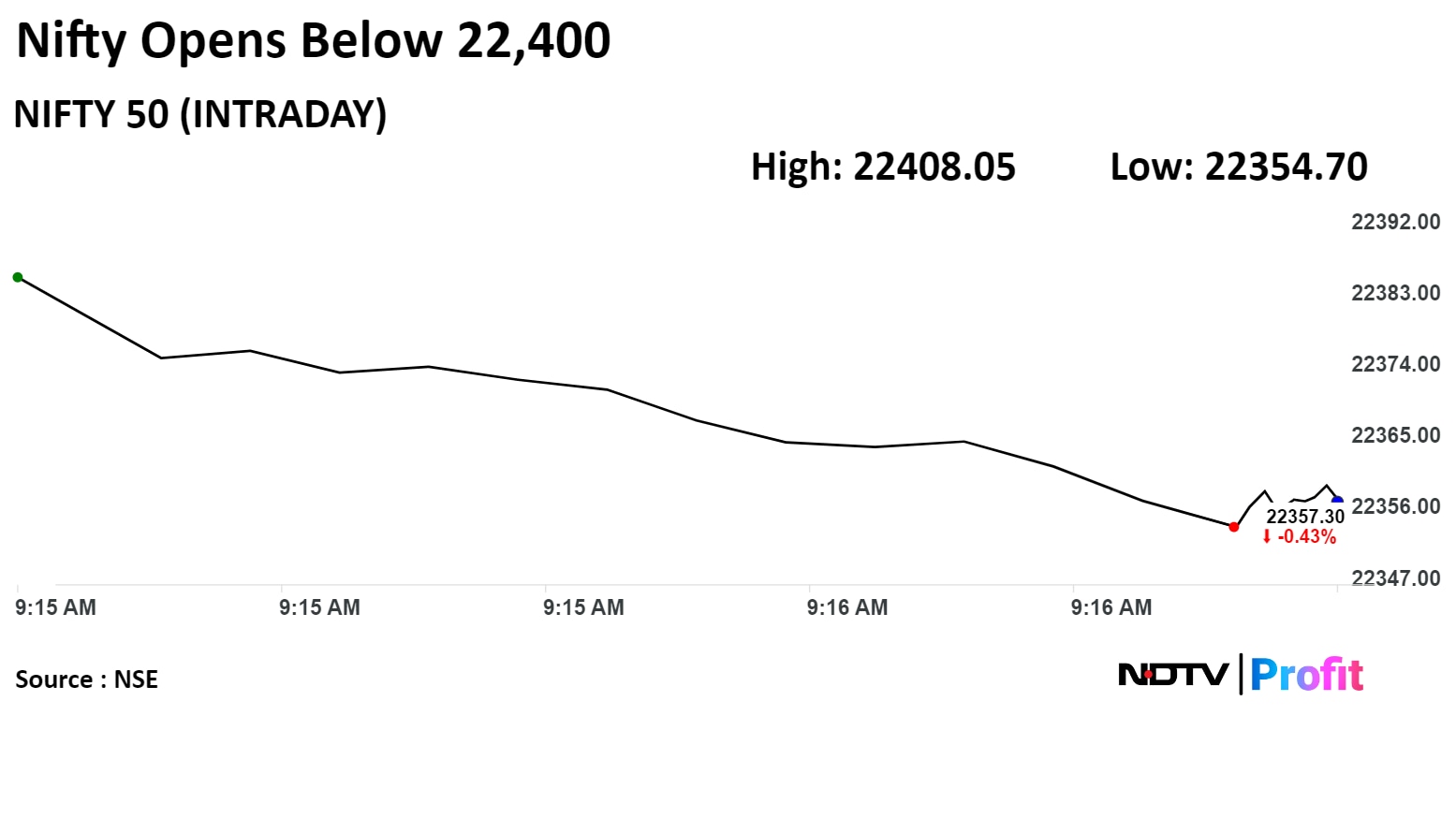

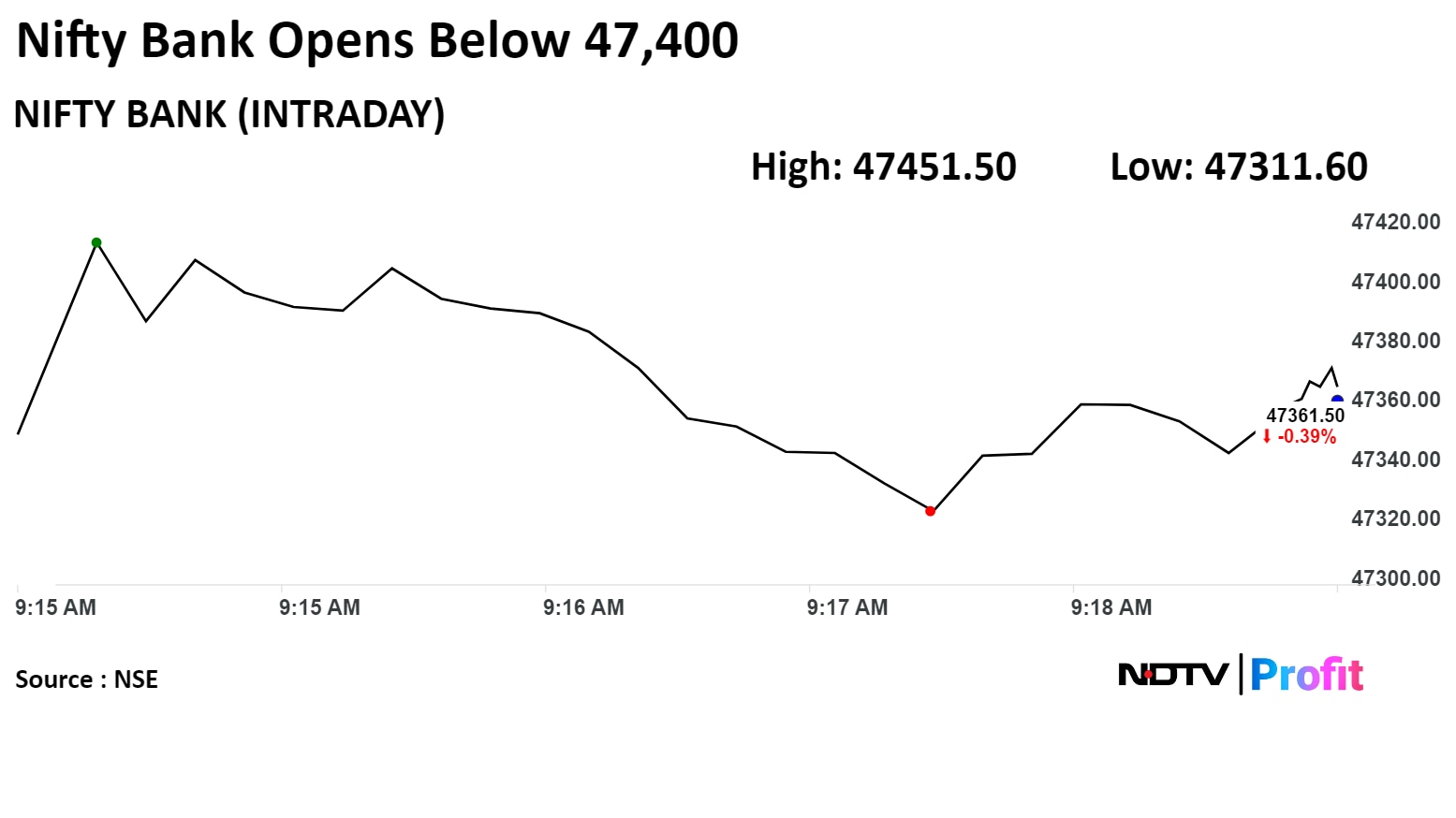

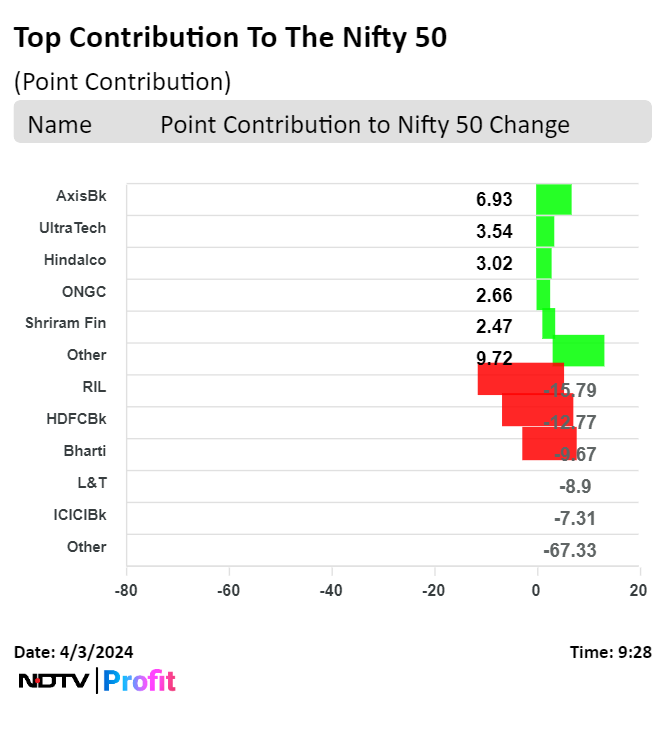

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

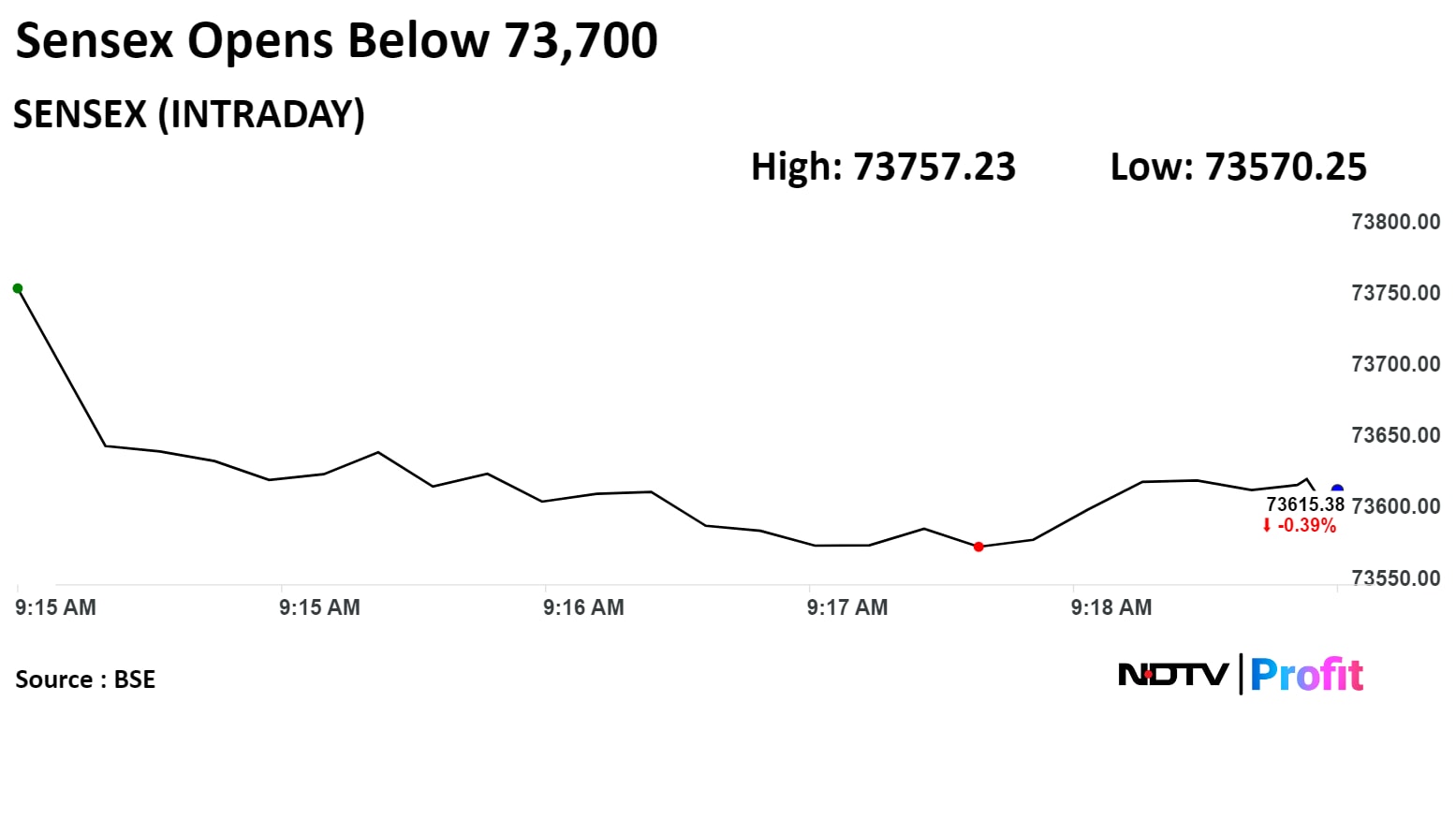

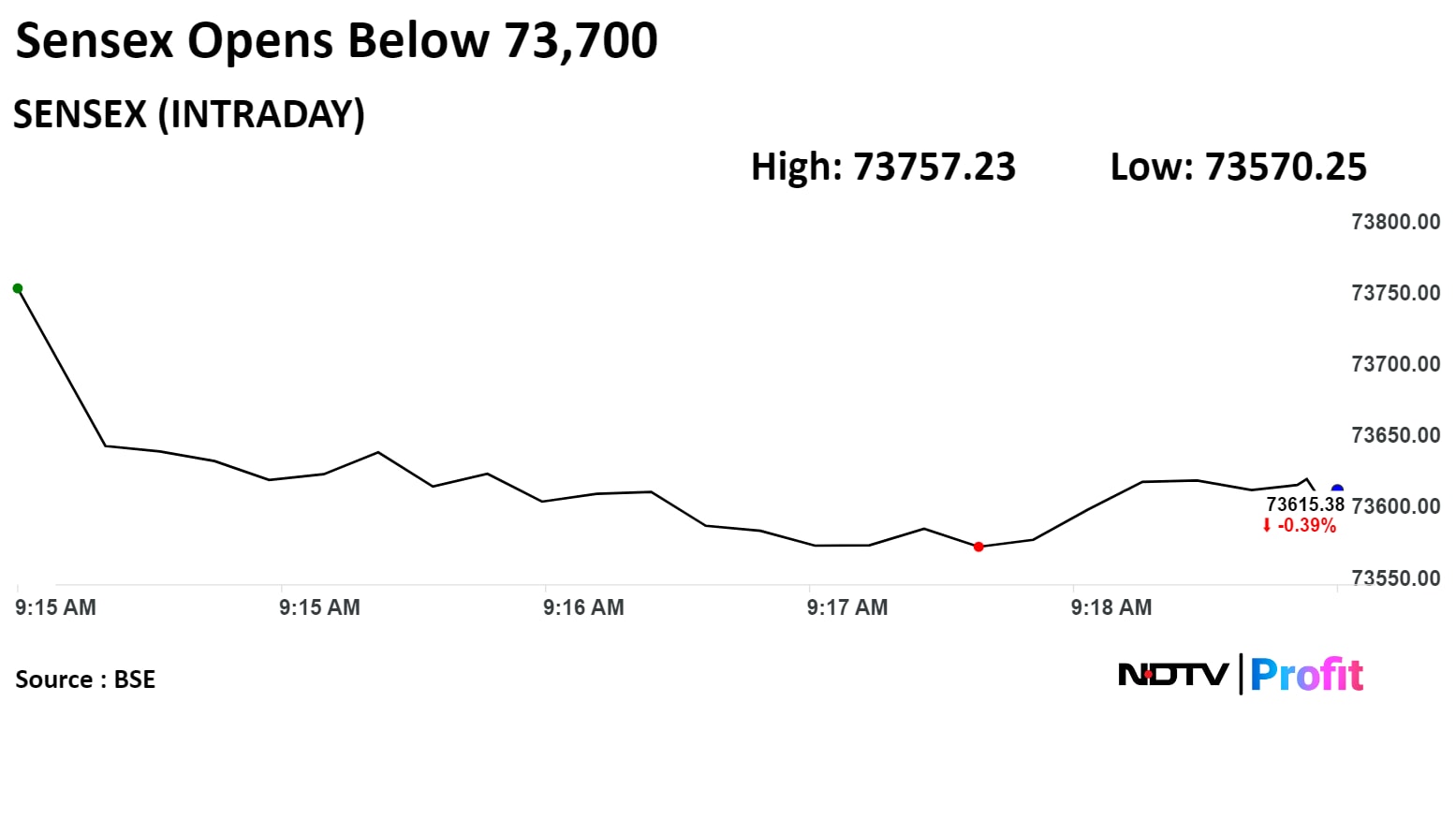

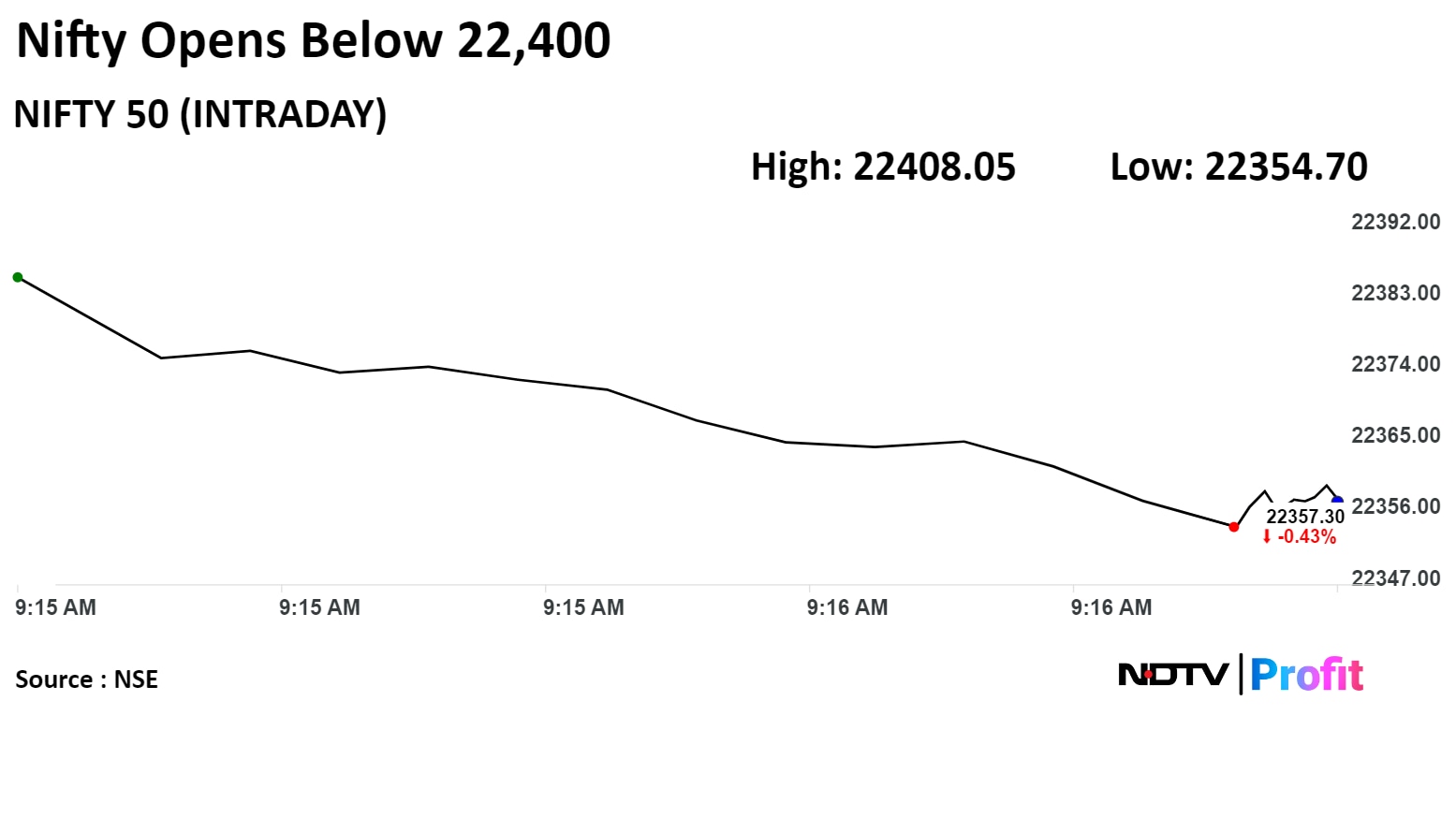

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

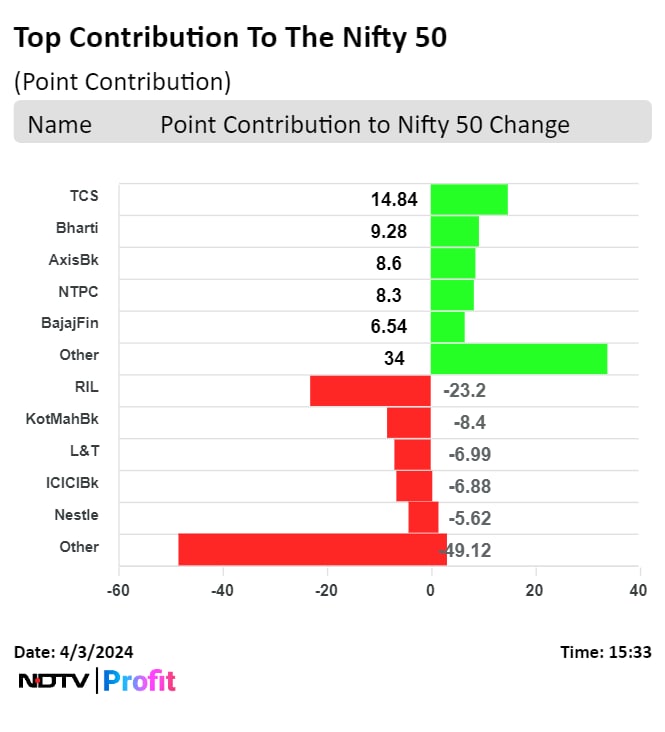

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd.,Nestle India Ltd., and ICICI Bank Ltd. added to the gains in the index.

Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., NTPC Ltd., and Bajaj Finance Ltd. limited losses in the index.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd.,Nestle India Ltd., and ICICI Bank Ltd. added to the gains in the index.

Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., NTPC Ltd., and Bajaj Finance Ltd. limited losses in the index.

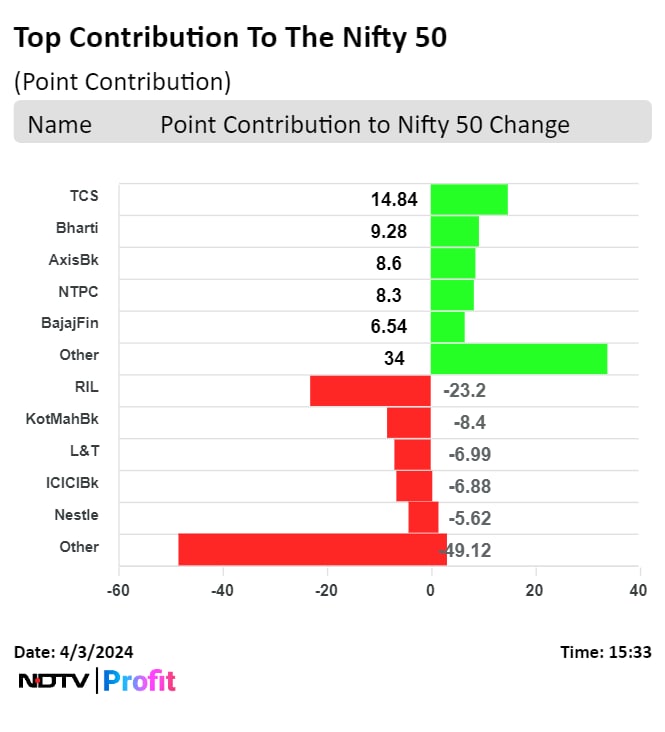

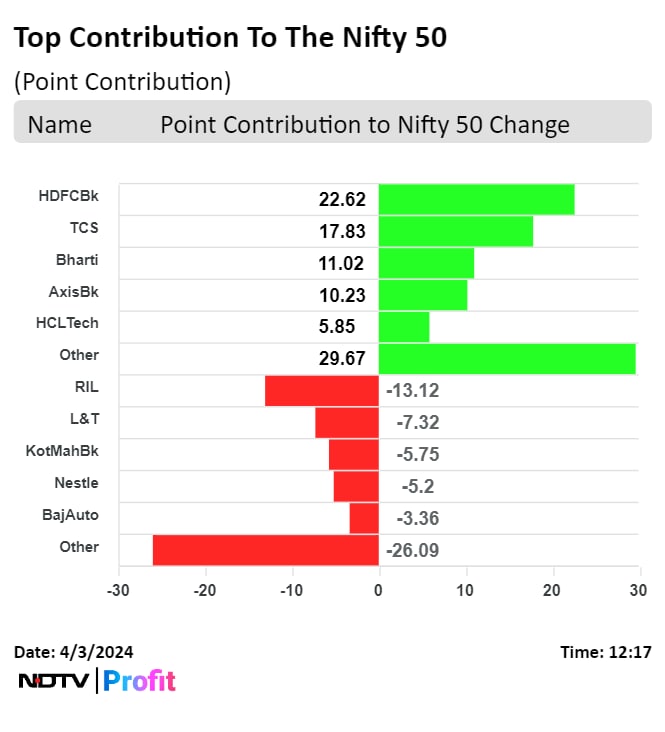

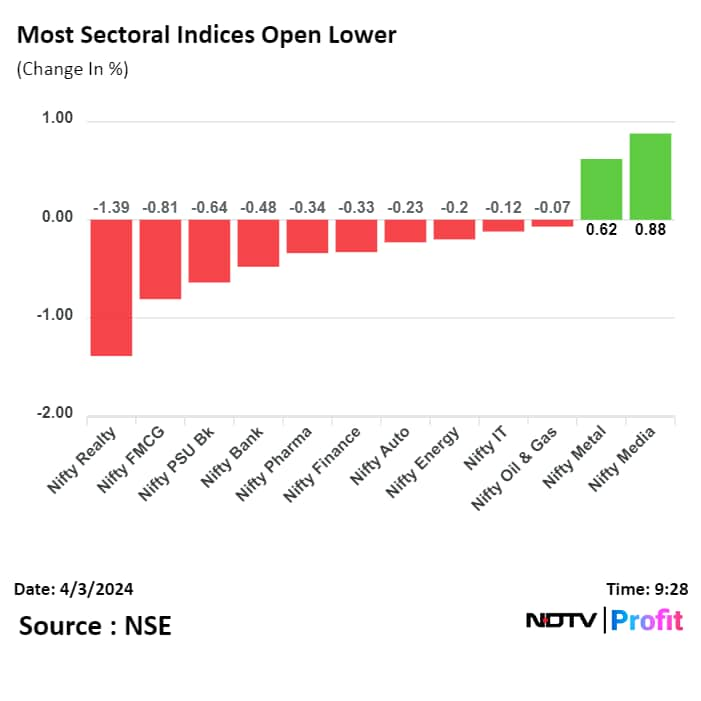

On NSE, five sectors advanced, three remained flat, and four declined. The NSE Nifty Realty fell the most among peers, while the NSE Nifty PSU Bank become the top performing sector.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd.,Nestle India Ltd., and ICICI Bank Ltd. added to the gains in the index.

Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., NTPC Ltd., and Bajaj Finance Ltd. limited losses in the index.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

India's benchmark indices ended Wednesday's choppy session flat as market participants await the Federal Reserve Chair Jerome Powell's speech, later today. Losses in shares of heavy-weight Reliance Industries Ltd., and Kotak Mahindra Bank Ltd. dragged the indices.

Today, the NSE Nifty ended 18.65 points or 0.083% lower at 22,434.65, the S&P BSE Sensex ended 27.09 points or 0.037% down at 73,876.82.

They will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook forward in the backdrop of robust economic data weighing on rate cut expectation.

Intraday, the NSE Nifty 50 fell 0.48% to 22,346, and the S&P BSE Sensex fell 0.49% to 73,540.27.

"Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and uptick in US bond yields are making investors nervous with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd.,Nestle India Ltd., and ICICI Bank Ltd. added to the gains in the index.

Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., NTPC Ltd., and Bajaj Finance Ltd. limited losses in the index.

On NSE, five sectors advanced, three remained flat, and four declined. The NSE Nifty Realty fell the most among peers, while the NSE Nifty PSU Bank become the top performing sector.

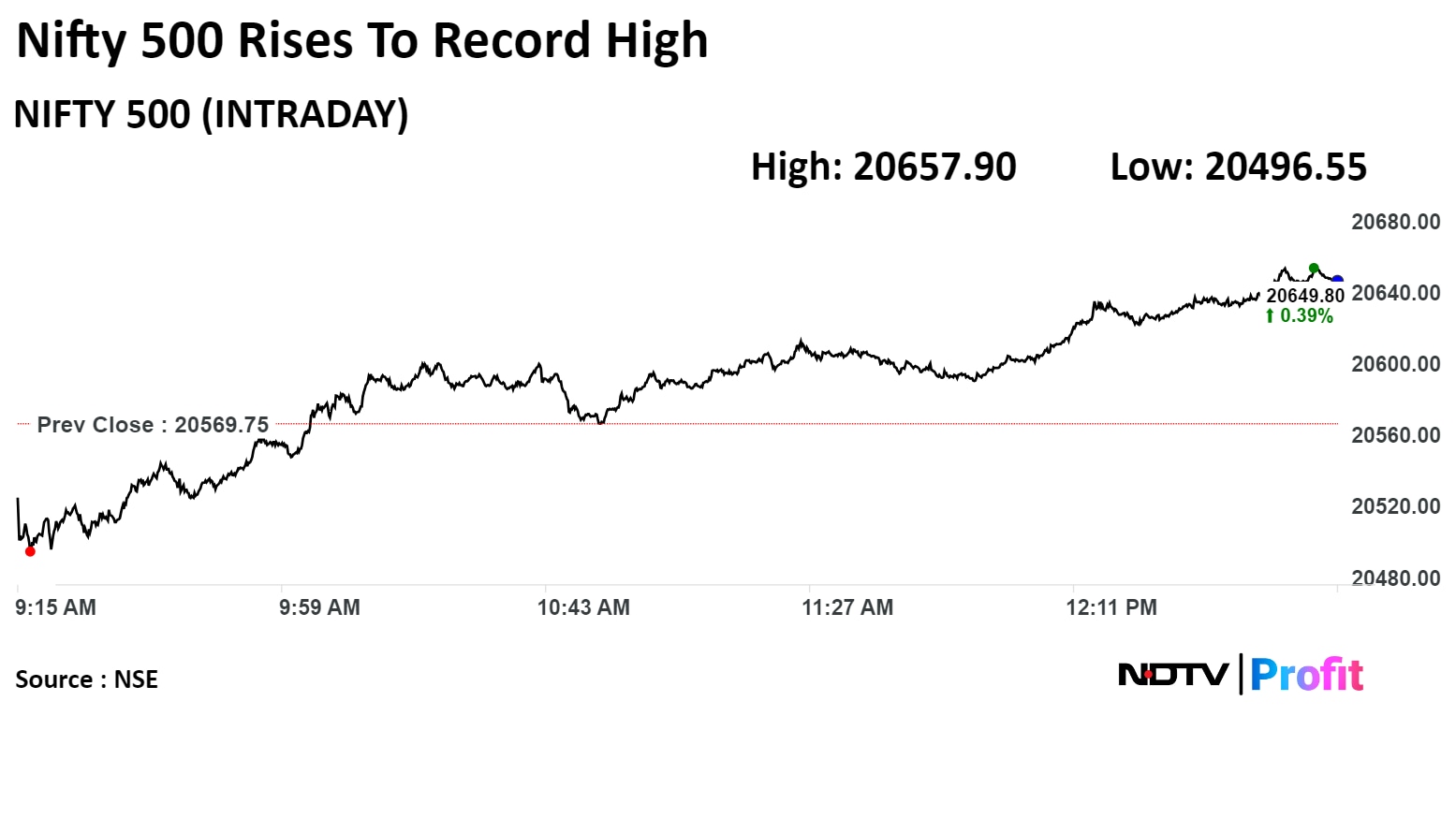

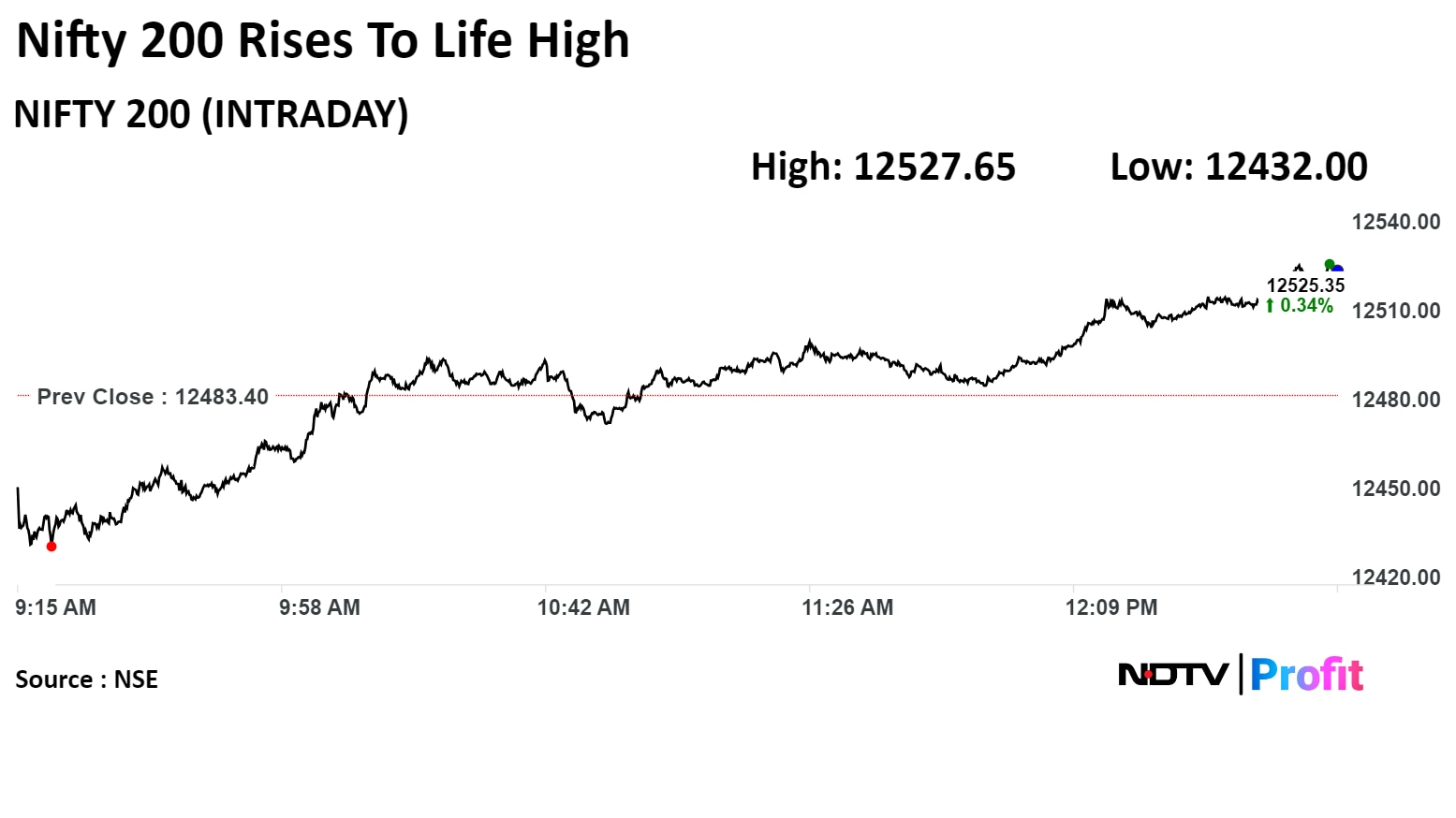

Broader markets outperformed benchmark indices. The S&P BSE Midcap ended 0.6% higher and the S&P BSE Smallcap ended 1.18% higher.

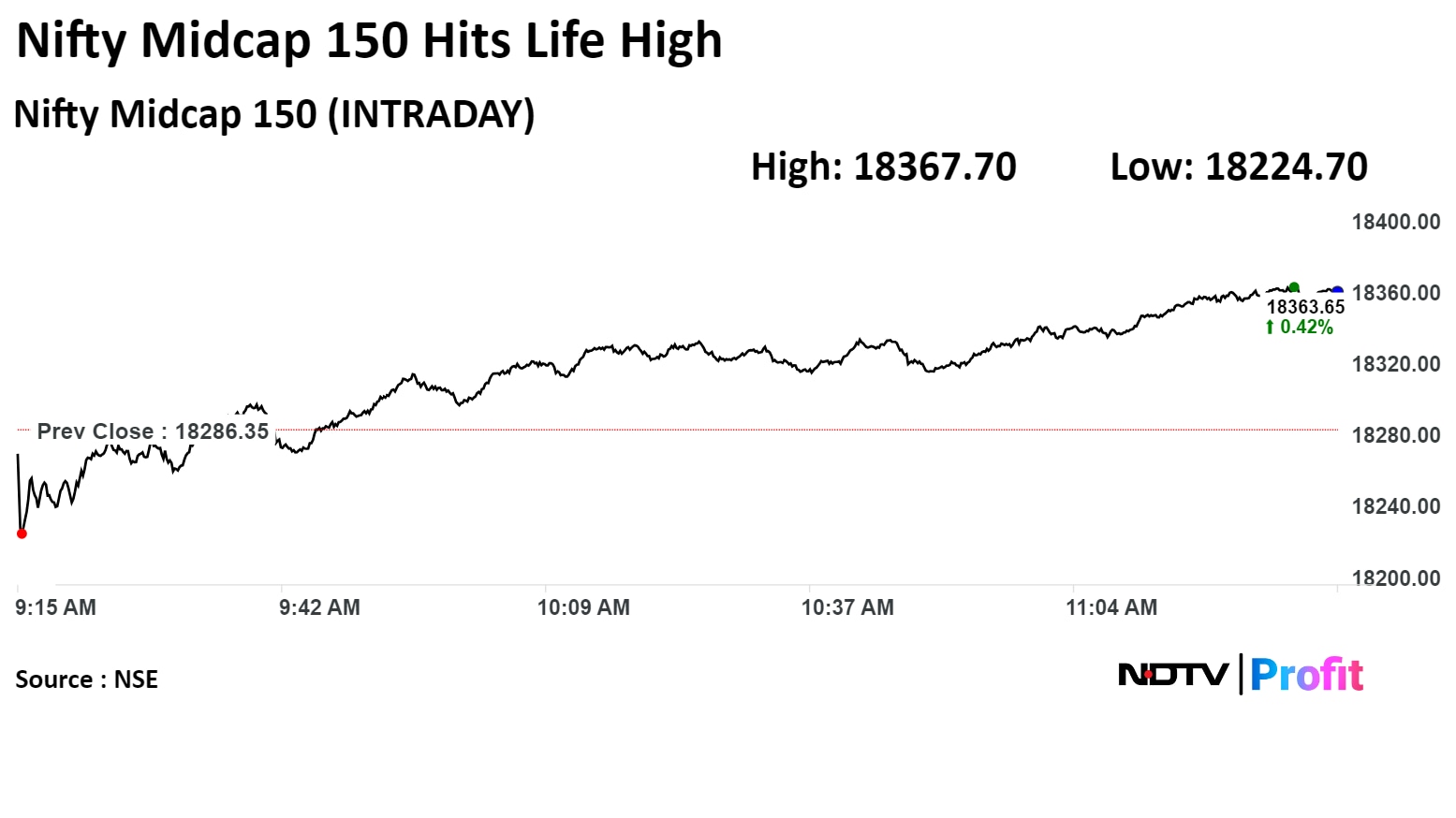

The Nifty Midcap 150 hit a life during the day and settled higher for eight day in a row. The Nifty Smallcap 250 ended higher for nineth day in a row.

On BSE, 12 sectors advanced, and eight declined. The S&P BSE Realty index was the worst performing sector, while the S&P BSE Utilities was the top performing sector.

Market breadth was skewed in favour of buyers. Around 2,803 stocks advanced, 1,051 stocks declined, and 111 stocks remained unchanged on BSE.

Divi's Laboratories Ltd.'s rating has been upgraded to a 'buy' by BofA Securities due to its improving earnings outlook. The research firm has also raised the target price to Rs 4,025 apiece from Rs 3,380 earlier, implying a potential upside of approximately 11% from the current stock price.

The stock rose as much as 2.86% during the day to Rs 3,726 apiece on the NSE. It was trading 2.3% higher at Rs 3,705 per share, compared to a 0.15% advance in the benchmark Nifty 50.

The share price has risen 24.37% in the last 12 months. The relative strength index was at 66.

Twenty-one out of the 39 analysts tracking the company have a 'buy' rating on the stock, 12 recommend 'hold' and six suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.5%.

Divi's Laboratories Ltd.'s rating has been upgraded to a 'buy' by BofA Securities due to its improving earnings outlook. The research firm has also raised the target price to Rs 4,025 apiece from Rs 3,380 earlier, implying a potential upside of approximately 11% from the current stock price.

The stock rose as much as 2.86% during the day to Rs 3,726 apiece on the NSE. It was trading 2.3% higher at Rs 3,705 per share, compared to a 0.15% advance in the benchmark Nifty 50.

The share price has risen 24.37% in the last 12 months. The relative strength index was at 66.

Twenty-one out of the 39 analysts tracking the company have a 'buy' rating on the stock, 12 recommend 'hold' and six suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.5%.

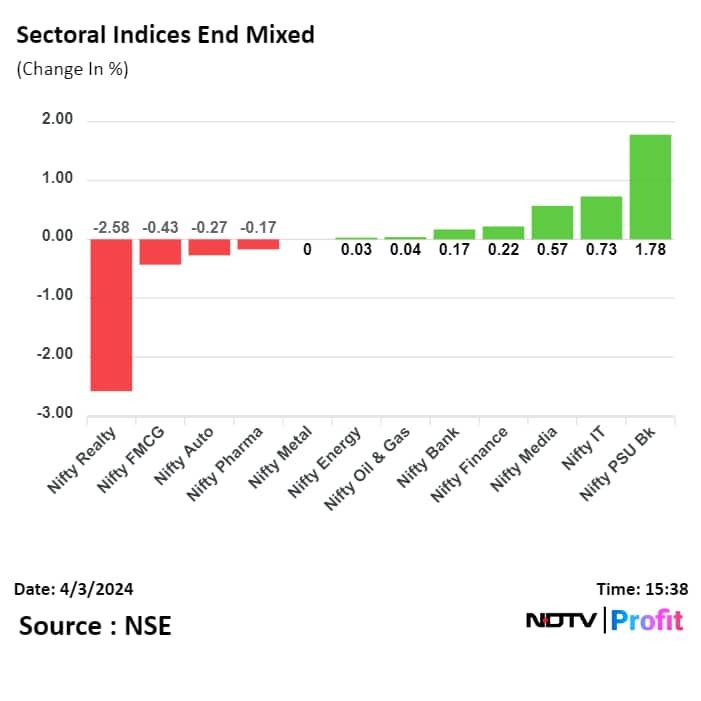

The joint venture between Tata Technologies Ltd. and BMW will reduce the dependence on anchor clients Tata Motors and JLR and increase client connections with other global OEMs, according to JPMorgan.

JPMorgan remains 'underweight' on the company, citing excess valuation. The brokerage has a target price of Rs 800 apiece, implying a downside of 30% from the current market price on NSE.

Shares of Tata Tech rose as much as 4.35% to Rs 1,139.50 apiece on the NSE. It was trading 3.76% higher at Rs 1,133.10 apiece, compared to a 0.22% advance in the benchmark Nifty 50 as of 1:03 p.m.

The stock has declined 13.66% since November 2023. The total traded volume so far in the day stood at 5.8 times its 30-day average. The relative strength index was 63.63.

Out of the six analysts tracking the stock, two have a 'buy' rating and four suggest a 'sell', according to Bloomberg data. The average 12-month analyst price target implies a potential upside of 12.0%.

The joint venture between Tata Technologies Ltd. and BMW will reduce the dependence on anchor clients Tata Motors and JLR and increase client connections with other global OEMs, according to JPMorgan.

JPMorgan remains 'underweight' on the company, citing excess valuation. The brokerage has a target price of Rs 800 apiece, implying a downside of 30% from the current market price on NSE.

Shares of Tata Tech rose as much as 4.35% to Rs 1,139.50 apiece on the NSE. It was trading 3.76% higher at Rs 1,133.10 apiece, compared to a 0.22% advance in the benchmark Nifty 50 as of 1:03 p.m.

The stock has declined 13.66% since November 2023. The total traded volume so far in the day stood at 5.8 times its 30-day average. The relative strength index was 63.63.

Out of the six analysts tracking the stock, two have a 'buy' rating and four suggest a 'sell', according to Bloomberg data. The average 12-month analyst price target implies a potential upside of 12.0%.

Vistara pilots' meeting with CEO and top management concludes.

Management addressed aircraft availability concerns, network planning issues etc.

Some pilots raised concerns on contract.

Management mentioned they would address the issues.

Indian Oil Corp is in talks with NPCIL to build small nuclear reactors, said director.

The company is seeking to use nuclear power in refineries.

Source: Indian Oil Corp Director To Bloomberg

Aster DM Healthcare Ltd. concluded the segregation of GCC business via sale of unit.

Source: Exchange Filing

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

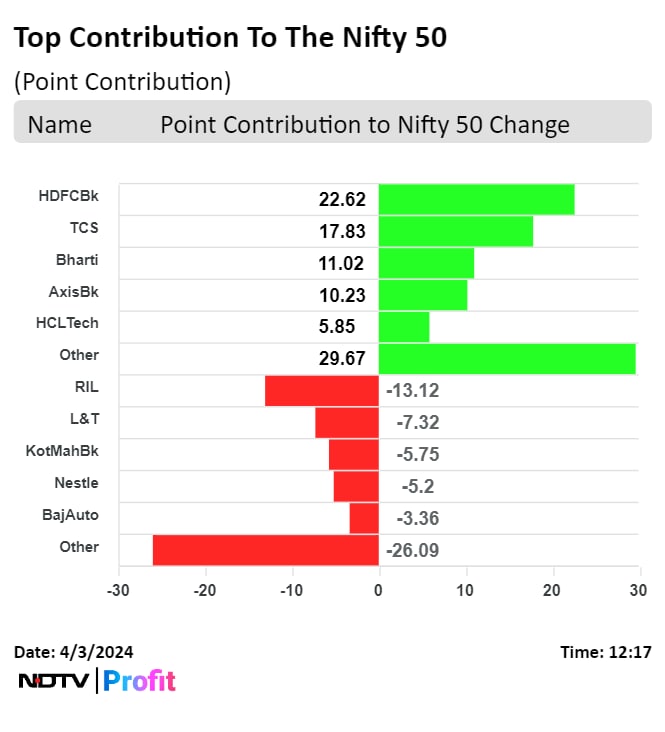

HDFC Bank Ltd., Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and HCL Technologies Ltd. were contributing to the Nifty.

Reliance Industries Ltd., Larsen & Toubro Ltd., Kotak Mahindra Bank Ltd., Nestle India Ltd., and Bajaj Auto Ltd. were weighing on the index.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

HDFC Bank Ltd., Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and HCL Technologies Ltd. were contributing to the Nifty.

Reliance Industries Ltd., Larsen & Toubro Ltd., Kotak Mahindra Bank Ltd., Nestle India Ltd., and Bajaj Auto Ltd. were weighing on the index.

On NSE, six sectors advanced, and six declined. The NSE Nifty Media rose over 1% to become the top performer, and the NSE Nifty Realty index was the top loser.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

HDFC Bank Ltd., Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and HCL Technologies Ltd. were contributing to the Nifty.

Reliance Industries Ltd., Larsen & Toubro Ltd., Kotak Mahindra Bank Ltd., Nestle India Ltd., and Bajaj Auto Ltd. were weighing on the index.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

India's benchmark stock indices rebounded by midday on Wednesday after opening lower, led by gains in HDFC Bank Ltd., Tata Consultancy Services Ltd., and Bharti Airtel Ltd.

As of 12:27 p.m., the NSE Nifty was trading 27.90 points, or 0.12%, higher at 22,481.20, and the S&P BSE Sensex gained 118.35 points, or 0.16%, to trade at 74,022.26.

The Nifty 50 fell to an intraday low of 22,346.50, and the Sensex touched a low of 73,540.27 so far in the day.

"For Nifty, support is foreseen around 22,325-22,375, with a robust buying zone around 22,175-22,250," said Shrey Jain, founder and chief executive at SAS Online.

"The broader market momentum is positive. The highest call OI has moved higher to a 22,700 strike, while on the downside, the highest put OI is at 22,300 for the weekly expiry," said Vikas Jain, senior research analyst at Reliance Securities.

HDFC Bank Ltd., Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., and HCL Technologies Ltd. were contributing to the Nifty.

Reliance Industries Ltd., Larsen & Toubro Ltd., Kotak Mahindra Bank Ltd., Nestle India Ltd., and Bajaj Auto Ltd. were weighing on the index.

On NSE, six sectors advanced, and six declined. The NSE Nifty Media rose over 1% to become the top performer, and the NSE Nifty Realty index was the top loser.

Broader markets outperformed benchmark indices, with the S&P BSE Midcap rising 0.40% and the S&P BSE Smallcap gaining 1.08% through midday on Wednesday.

The NSE Nifty Midcap 150 index scaled to record high, led by gains in Mazagon Dock Shipbuilders Ltd., Fertilisers and Chemicals Travancore Ltd.

On BSE, 14 sectors advanced, and six declined. The S&P BSE IT index rose the most among sectoral indices to become the top performer, and the S&P BSE Realty sector fell the most.

Market breadth was skewed in favour of the buyers. Around 2,645 stocks advanced, 1,015 stocks declined, and 125 stocks remained unchanged on BSE.

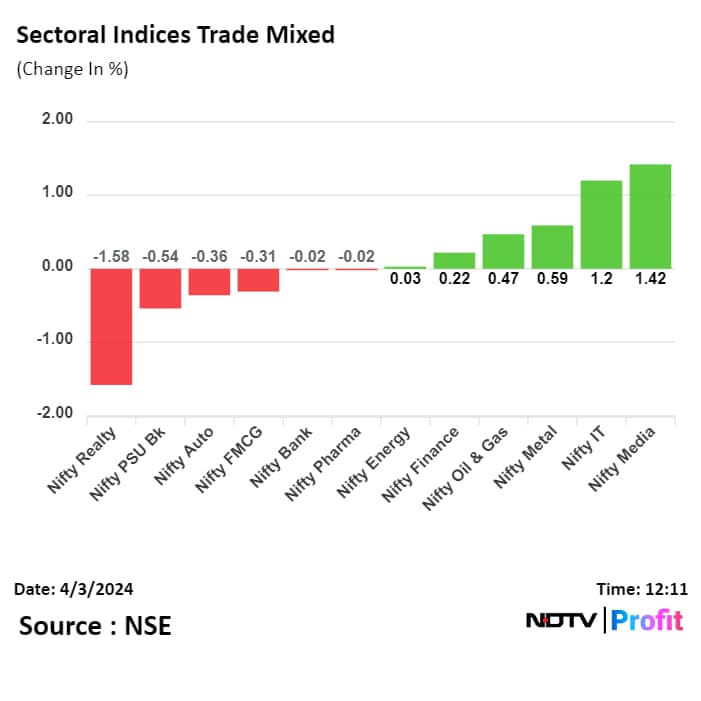

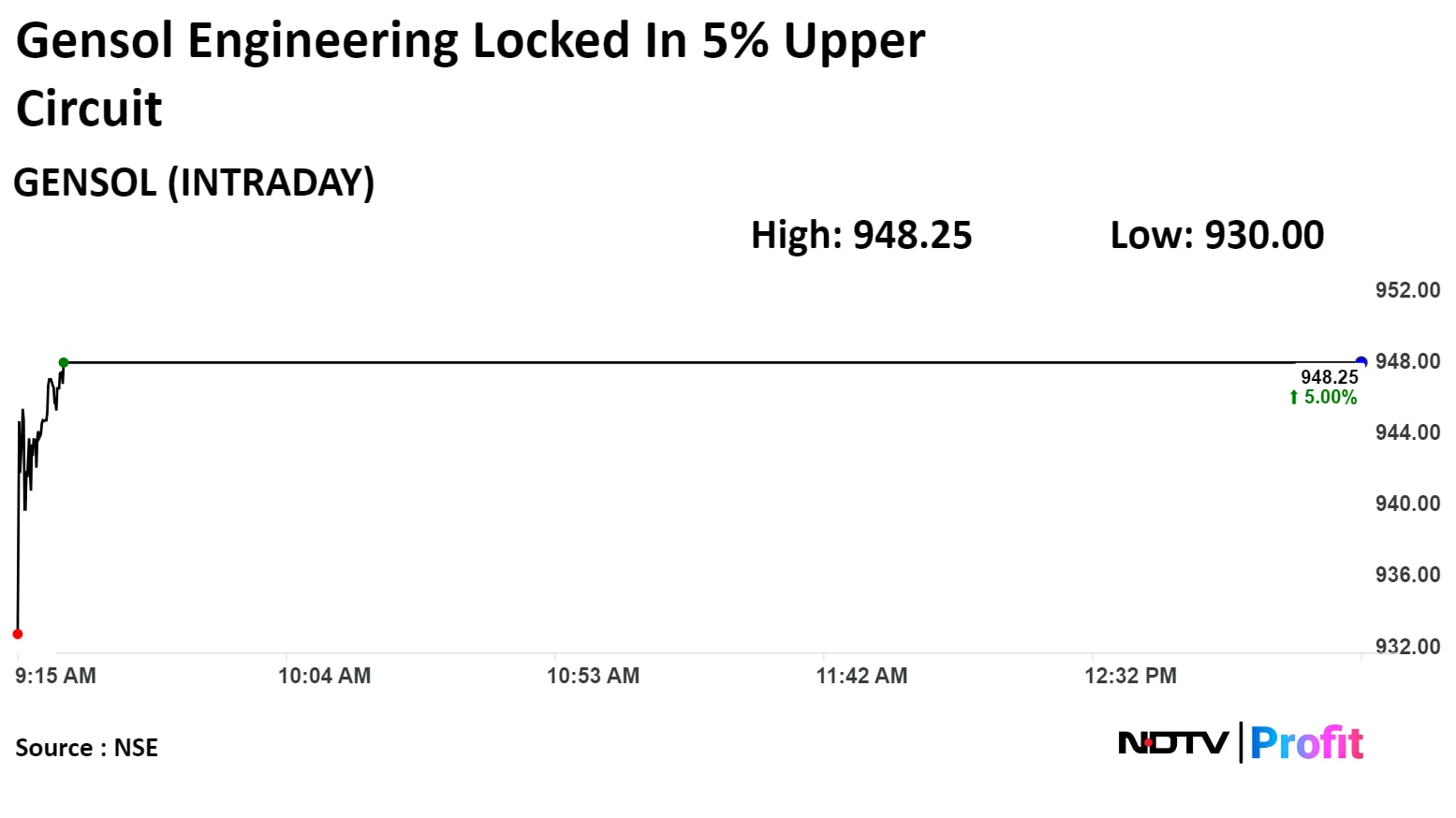

Gensol Engineering Ltd hit a 5% upper circuit after reporting highest-ever revenue of Rs 960 crore in FY24.

The company reported highest-ever revenue of Rs 960 crore in FY24 compared to Rs 398 crore in FY23, which implied 141% annual growth

It's revenue stand at Rs 396 crore in January-March period, compared to Rs 220 crore in the previous quarter, according to exchange filing.

Gensol Engineering Ltd. hit a 5% upper circuit and rose to Rs 948.25, the highest level March 27. It remained locked in the upper circuit as of 1:25 p.m., which compares to 0.16% advance in the NSE Nifty 50 index.

The scrip has risen 109.57% in 12 months. Total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 49.83.

Gensol Engineering Ltd hit a 5% upper circuit after reporting highest-ever revenue of Rs 960 crore in FY24.

The company reported highest-ever revenue of Rs 960 crore in FY24 compared to Rs 398 crore in FY23, which implied 141% annual growth

It's revenue stand at Rs 396 crore in January-March period, compared to Rs 220 crore in the previous quarter, according to exchange filing.

Gensol Engineering Ltd. hit a 5% upper circuit and rose to Rs 948.25, the highest level March 27. It remained locked in the upper circuit as of 1:25 p.m., which compares to 0.16% advance in the NSE Nifty 50 index.

The scrip has risen 109.57% in 12 months. Total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 49.83.

Crompton Greaves received a tax demand worth Rs 2.91 crore from Vasai-Virar Municipal Corp in Maharashtra.

The company is to file appeal against order.

Source: Exchange Filing

HCL Technologies Ltd. introduced strategic initiative with Google Cloud to scale Gemini to global enterprises.

The company is to enable 25,000 engineers on Gemini for Google Cloud.

Source: Exchange Filing

Launches TrustMF Flexi Cap Fund

NFO opens from April 5-19, 2024

Fund will be benchmarked to Nifty 500 TRI Index

Fund to be managed by CIO Mihir Vora along with fund manager Aakash Manghani

Vistara CEO to address pilots around 1:00 p.m. today.

The meeting will also have top management, HR and others.

The meeting is expected to be online.

Source: people in the know

The U.S. Food and Drug Administration's inspection at Virginia plant of subsidiary ended with five observations with 'Voluntary Action Indicated' classification.

Source: Exchange filing

The U.S. Food and Drug Administration's inspection at Virginia plant of subsidiary ended with five observations with 'Voluntary Action Indicated' classification.

Source: Exchange filing

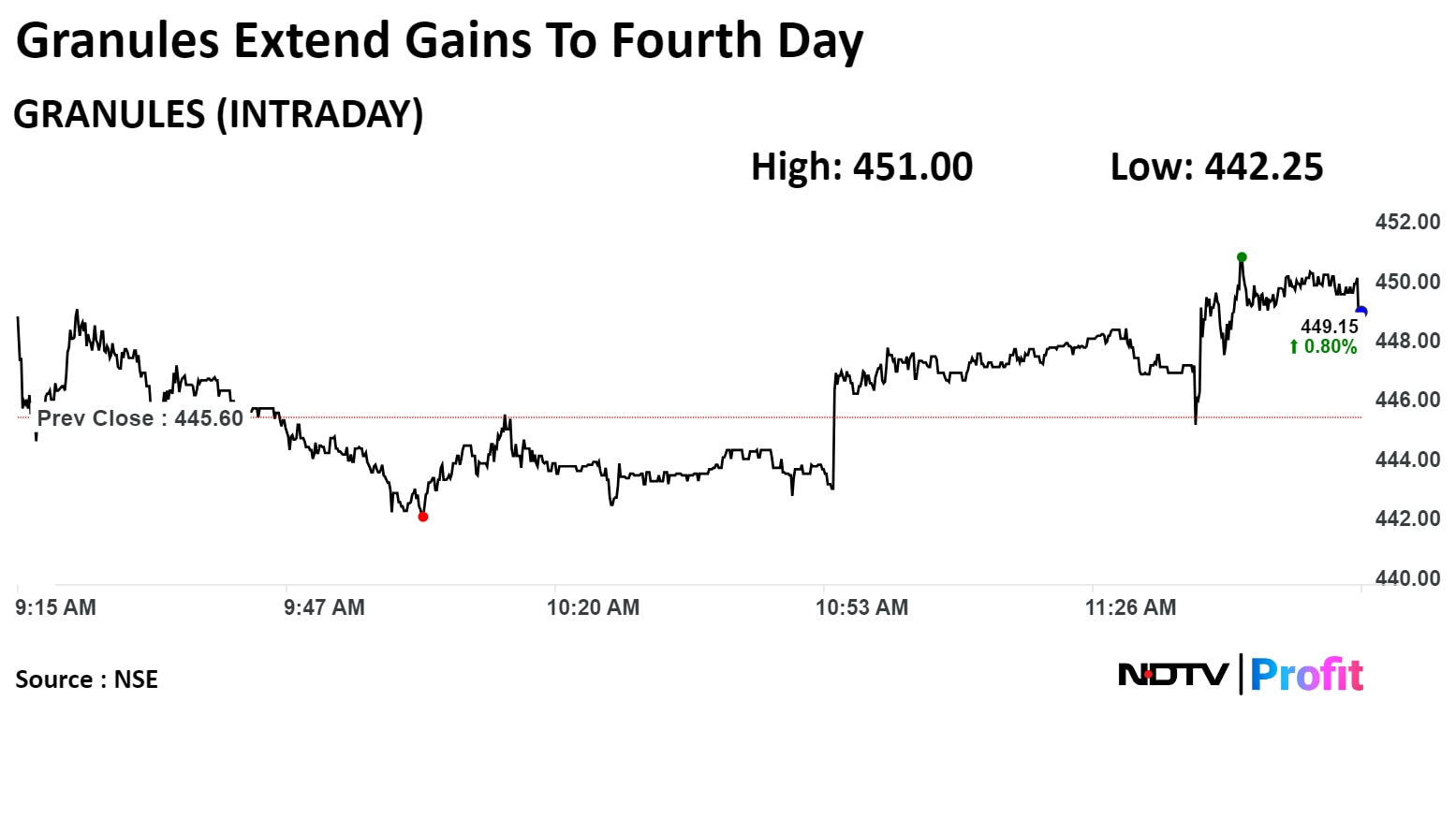

Rajahmundry plant's operation disrupted from April 2 due to workers union strike.

Management is in discussion with concerned unions to resolve issue.

Source: Exchange filing

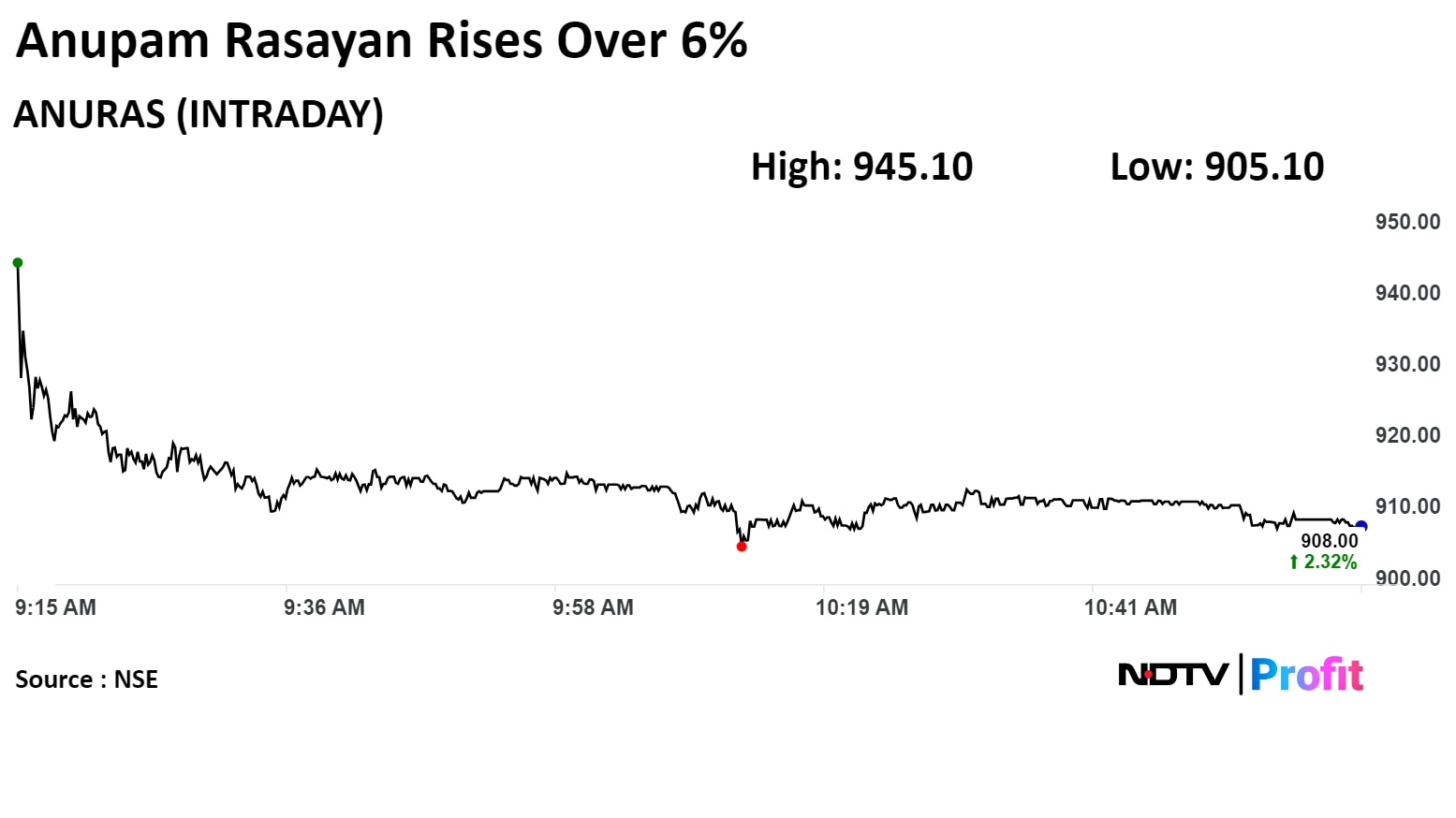

Shares of the company rose as much as 6.50% to its highest level since March 12. It pared gains to trade 2.67% higher at 10:36 a.m., compared to flat a NSE Nifty 50.

The stock has risen 7.85% in past 12 months. Total traded volume so far in the day stood at 43 times its 30-day average. The relative strength index was at 51.1.

Of the 11 analysts tracking the company, three maintain a 'buy' rating,two recommend a 'hold', and six suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies a downside of 11.0%.

Shares of the company rose as much as 6.50% to its highest level since March 12. It pared gains to trade 2.67% higher at 10:36 a.m., compared to flat a NSE Nifty 50.

The stock has risen 7.85% in past 12 months. Total traded volume so far in the day stood at 43 times its 30-day average. The relative strength index was at 51.1.

Of the 11 analysts tracking the company, three maintain a 'buy' rating,two recommend a 'hold', and six suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies a downside of 11.0%.

The NSE Nifty Midcap 150 index rose as much as 0.44% to fresh high of 18,367.70 on Wednesday. Mazagon Dock Shipbuilders Ltd. and Fertilisers and Chemicals Travancore Ltd. added to the gains in the index.

The NSE Nifty Midcap 150 index rose as much as 0.44% to fresh high of 18,367.70 on Wednesday. Mazagon Dock Shipbuilders Ltd. and Fertilisers and Chemicals Travancore Ltd. added to the gains in the index.

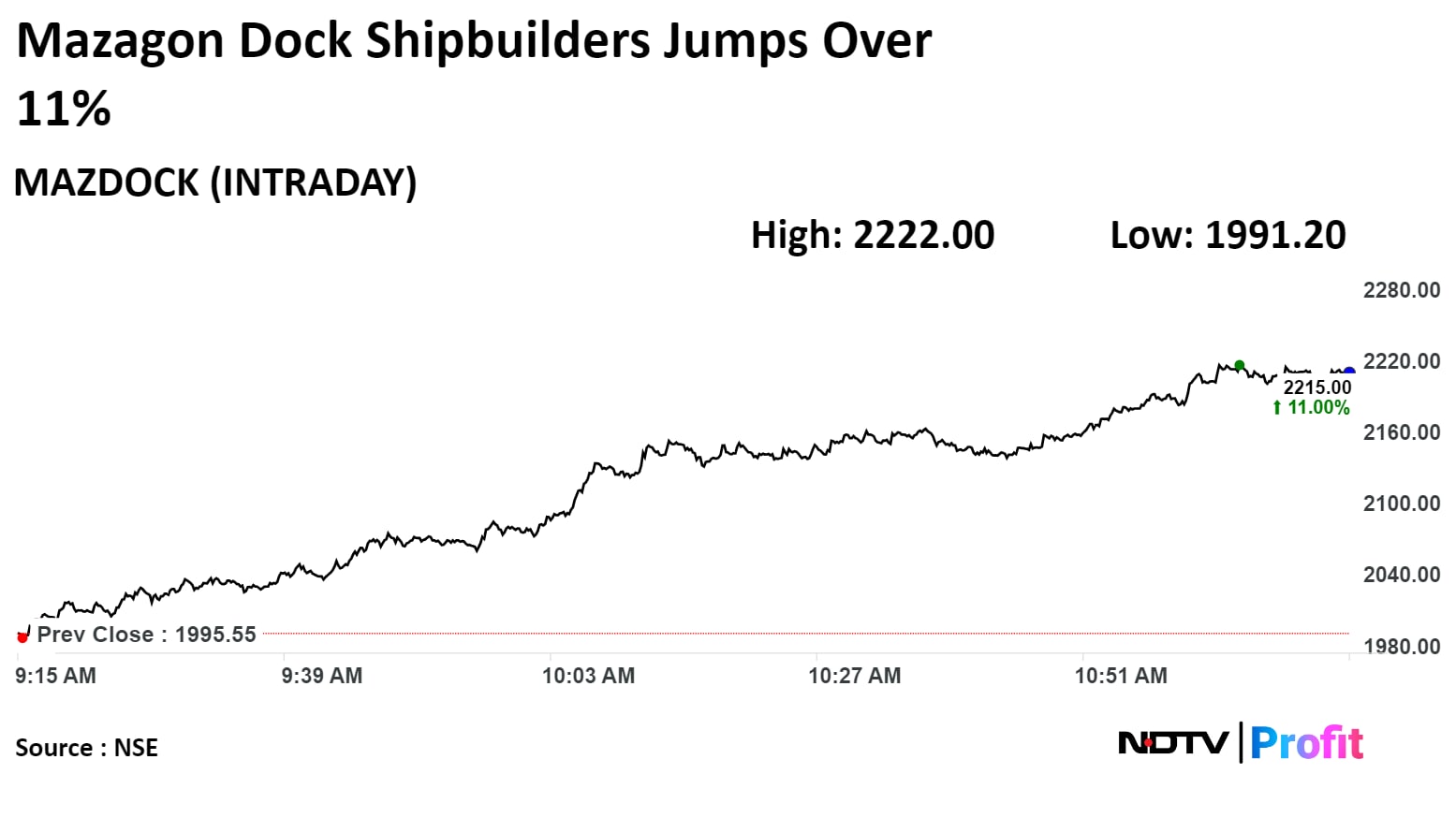

Mazagon Dock Shipbuilders Ltd.'s shares surged as much as 11.35% to Rs 2,222.00, the highest level since Feb 28. It was trading 10.40% up at Rs 2,203.05 as of 11:19 a.m., as compared to 0.02% advance in the NSE Nifty 50 index,

The scrip has gained 234.49% in 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 65.86.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.1%.

Mazagon Dock Shipbuilders Ltd.'s shares surged as much as 11.35% to Rs 2,222.00, the highest level since Feb 28. It was trading 10.40% up at Rs 2,203.05 as of 11:19 a.m., as compared to 0.02% advance in the NSE Nifty 50 index,

The scrip has gained 234.49% in 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 65.86.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.1%.

Star Health and Allied Insurance Co. signed a pact with PhonePe to offer insurance services.

Source: Exchange Filing

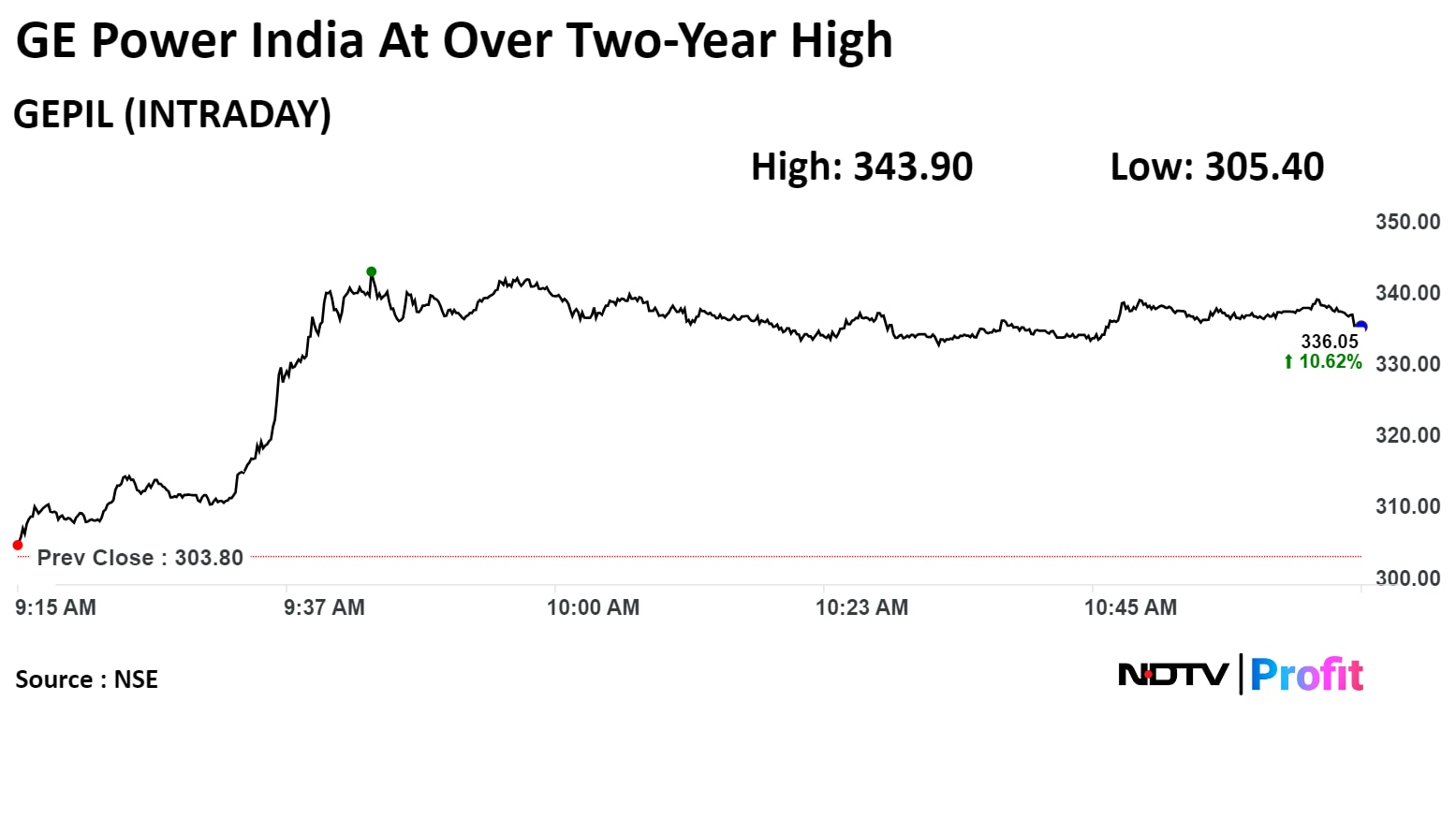

Shares of GE Power India Ltd. surged a13.22% to Rs 343.90, the highest level since Jul 27, 2021. It was trading 10.57% higher at Rs 335.90 as of 11:11 a.m. as compared to 0.01% decline in the NSE Nifty index.

The stock has been rising for fourth sessions.

The scrip has gained 222.52% in 12 months. Total traded volume so far in the day stood at 7.1 times its 30-day average. The relative strength index was at 70.33, which implied the stock is overbought.

Shares of GE Power India Ltd. surged a13.22% to Rs 343.90, the highest level since Jul 27, 2021. It was trading 10.57% higher at Rs 335.90 as of 11:11 a.m. as compared to 0.01% decline in the NSE Nifty index.

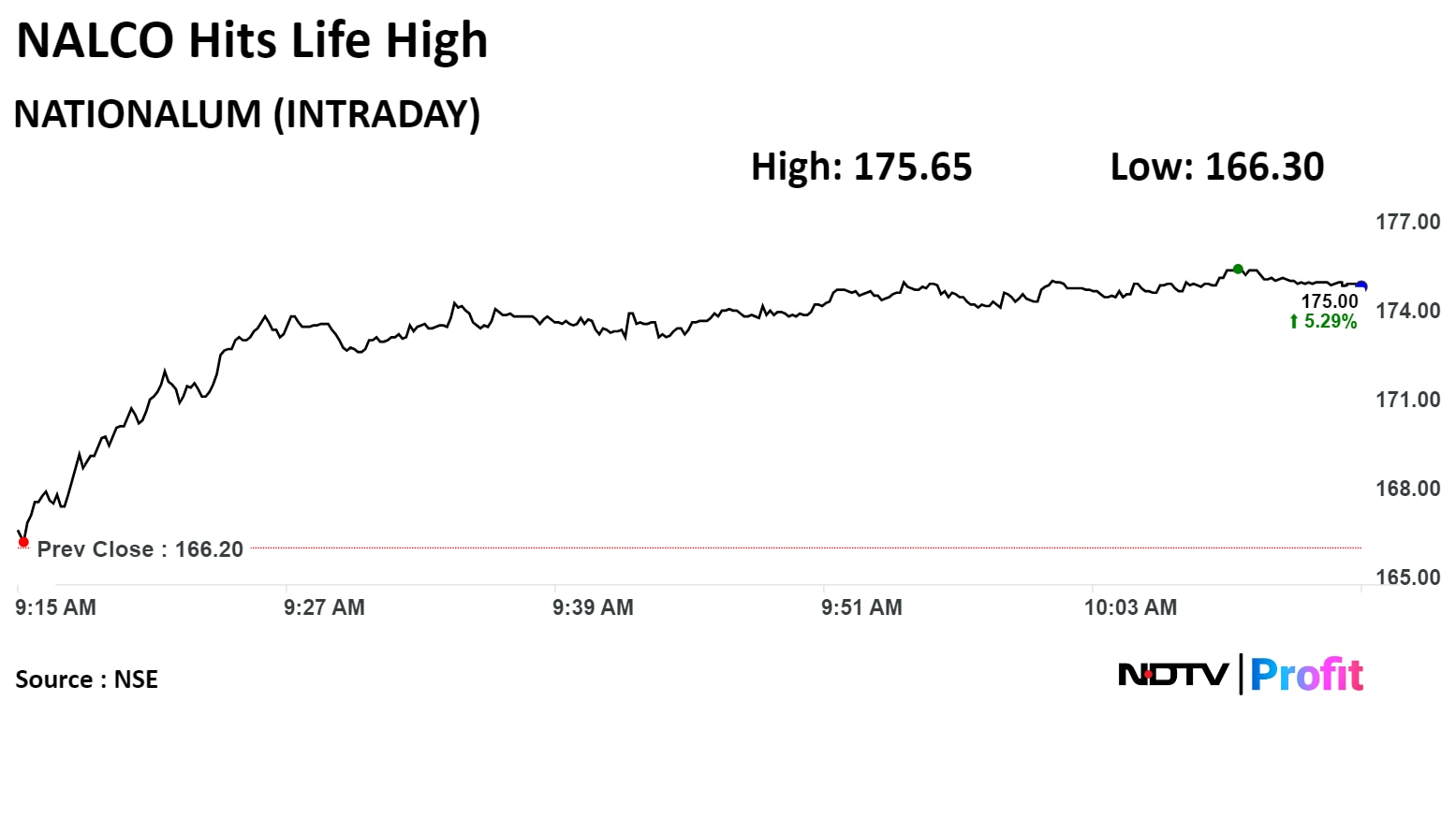

The stock has been rising for fourth sessions.