The yield on the 10-year bond closed flat at 7.18% on Thursday.

Source: Bloomberg

The local currency strengthened by 2 paise to close at 83.11 against the U.S dollar.

It closed at 83.13 on Wednesday.

Source: Bloomberg

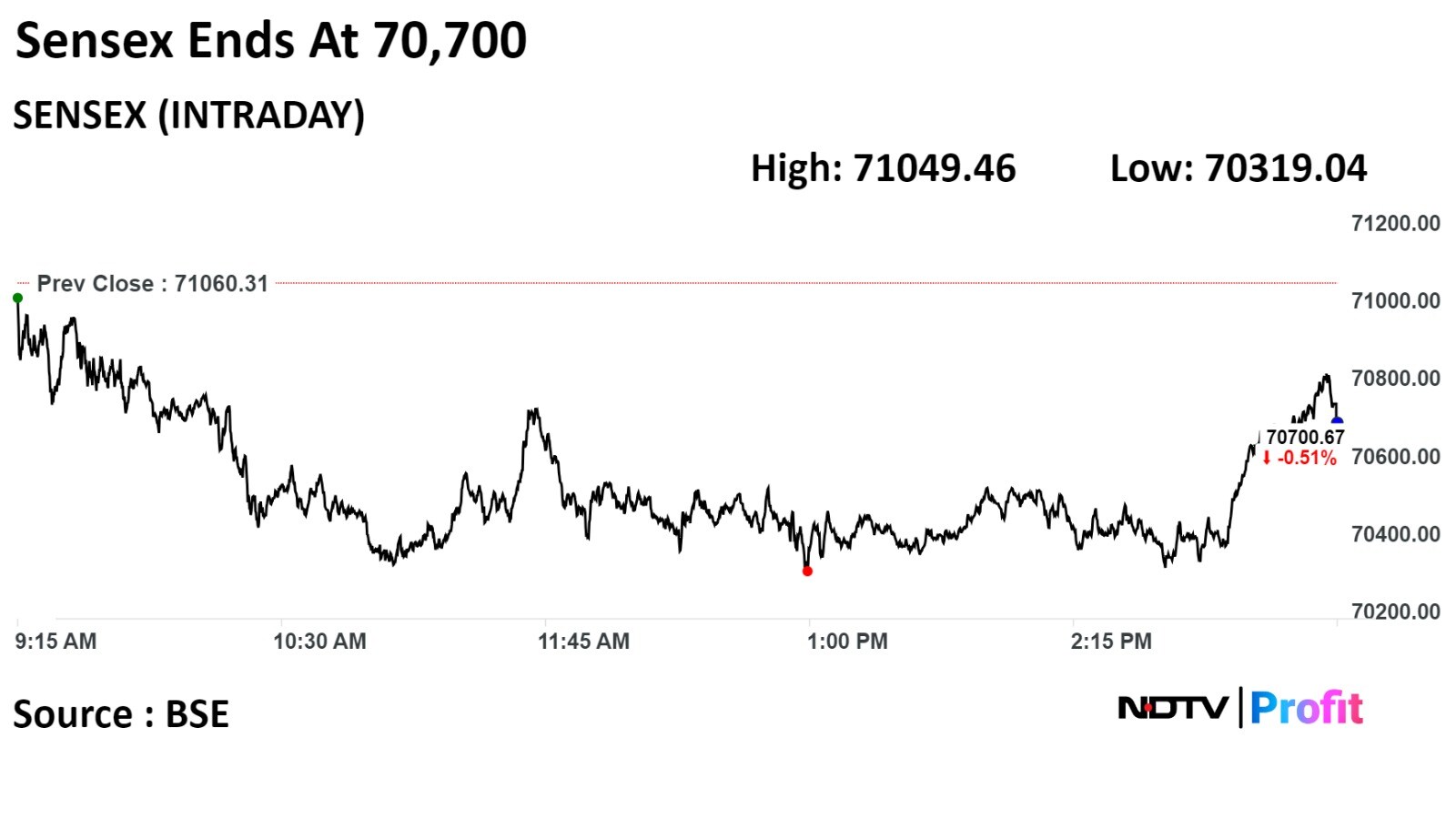

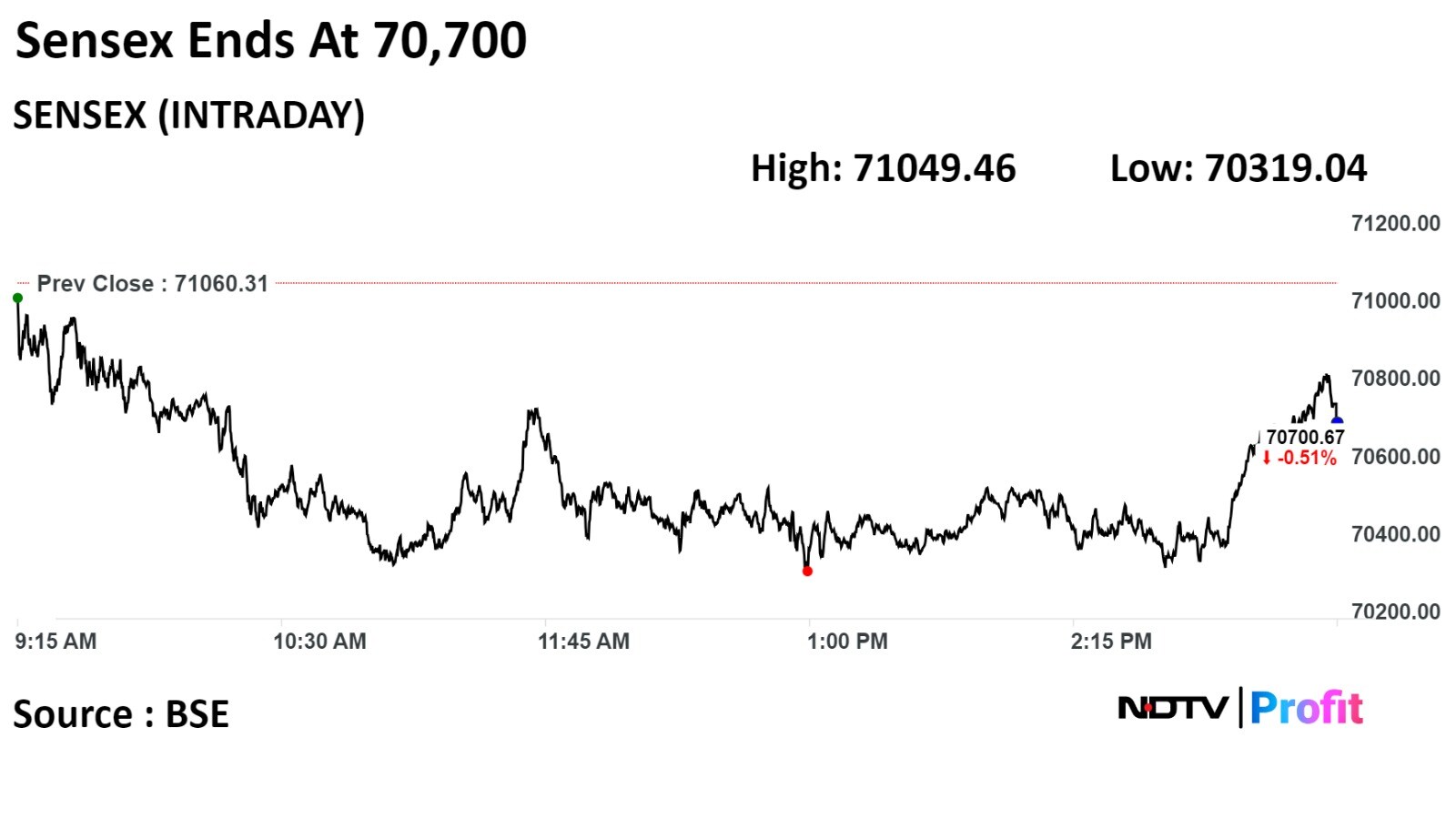

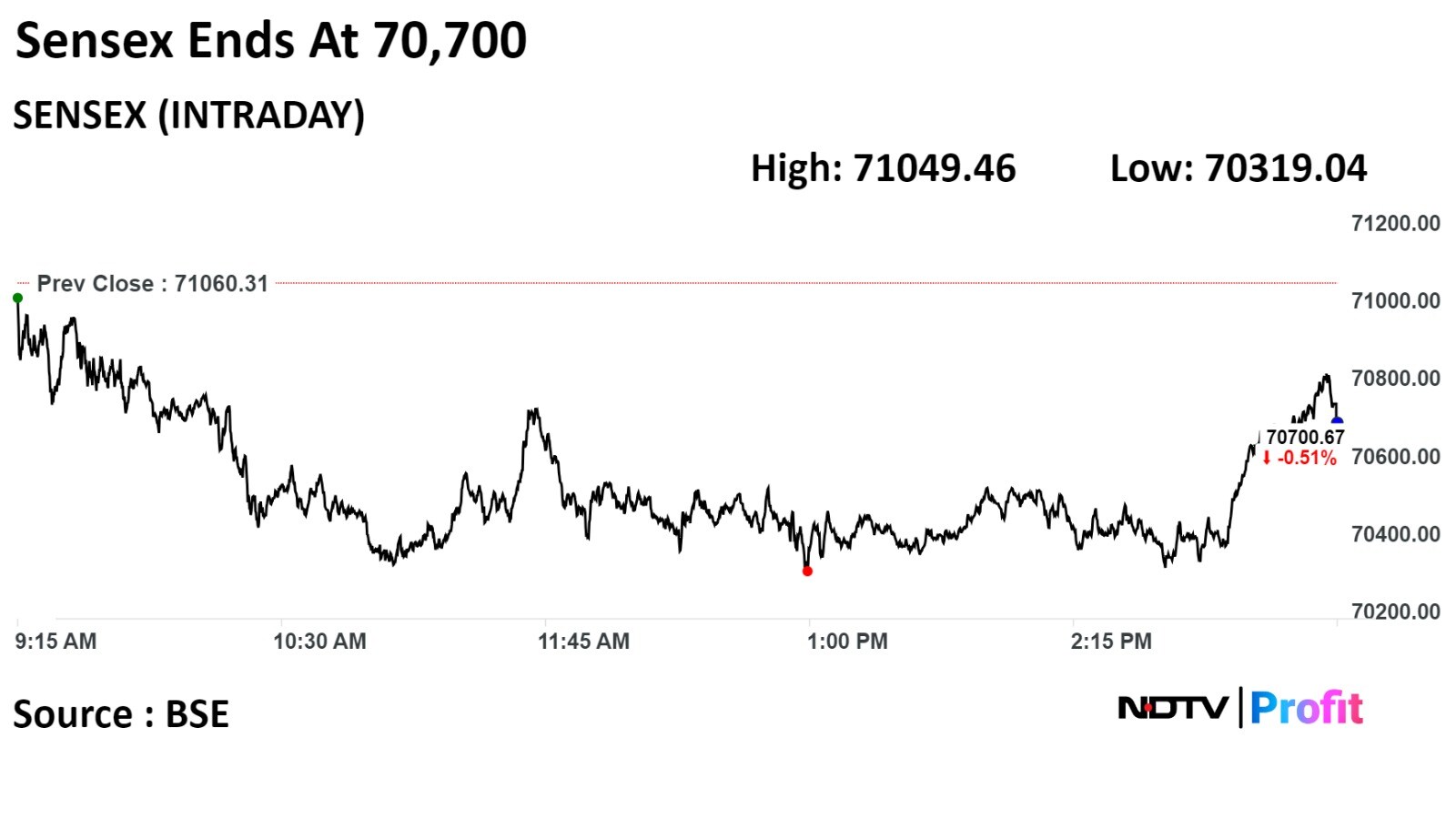

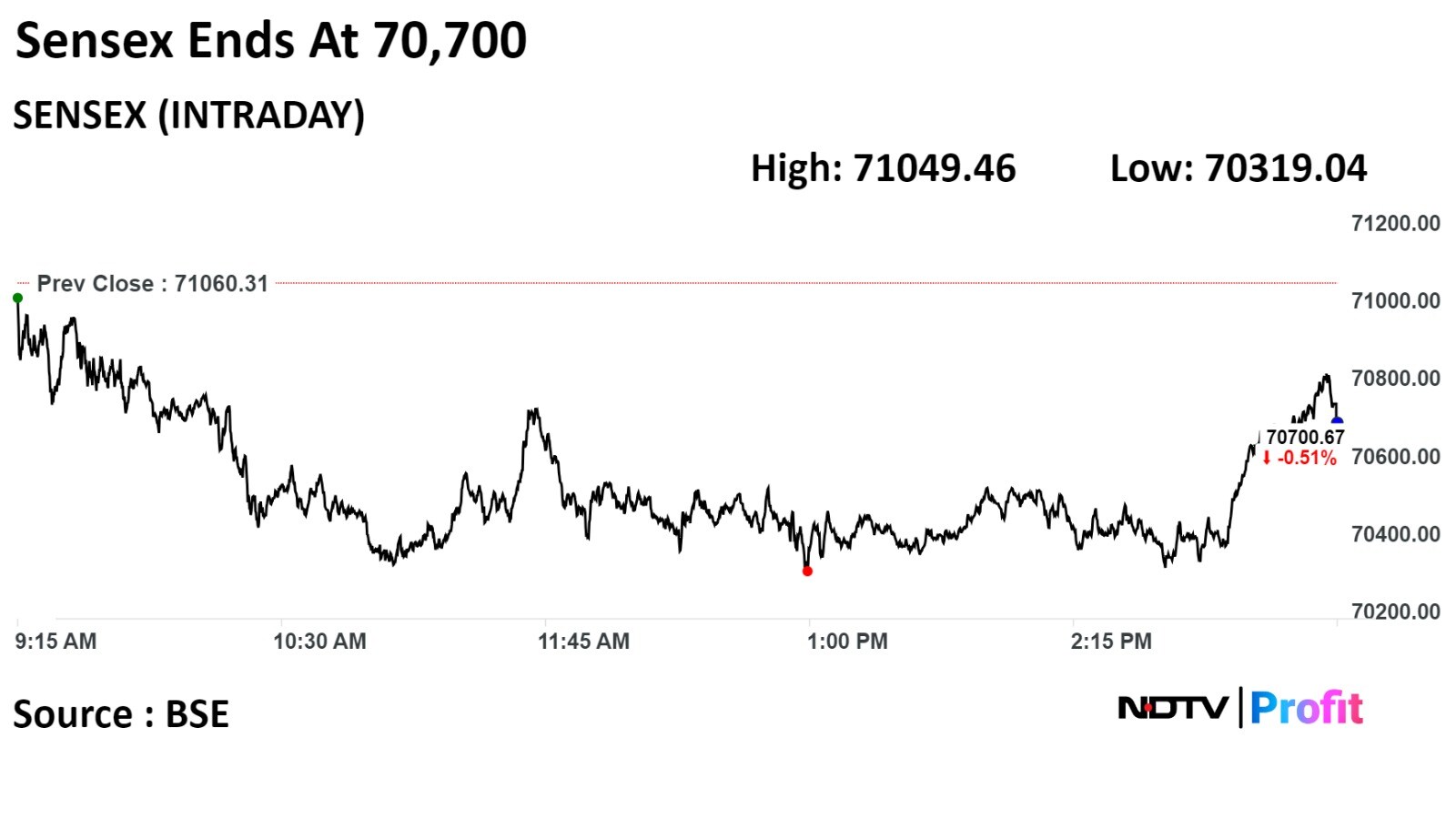

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

"The sentiment may continue to lean towards the bears as the Nifty struggled to surpass the 21500 mark, where call writers held substantial positions. Looking ahead, the trend is likely to remain sideways, fluctuating within the range of 21300 and 21500. Nevertheless, a decisive breakthrough above 21500 could propel the index towards 21700/22000 in the short term," said Senior Technical Analyst Rupak De from LKP Securities.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

India's benchmark stock indices extended losses for second week, and ended lower in a truncated week as shares of HDFC Bank Ltd, Axis Bank Ltd weighed.

The NSE Nifty 50 settled 101.35 points or 0.47% lower at 21,352.60, and the S&P BSE Sensex ended 359.64 points or 0.51% lower at 70,700.67.

Domestic equity markets witnessed correction in a shortened trading week. Nifty 50 and Sensex 30 corrected by 1% in this week," Shrikant Chouhan, head, Equity Research, Kotak Securities.

"Globally, the markets reacted to news with respect to potential China rescue package. China's central bank said it will cut banks' reserve ratio in early February. Investors will be keeping an eye on the monetary policy decision from the European Central Bank and the fourth-quarter US GDP data," he added.

"The sentiment may continue to lean towards the bears as the Nifty struggled to surpass the 21500 mark, where call writers held substantial positions. Looking ahead, the trend is likely to remain sideways, fluctuating within the range of 21300 and 21500. Nevertheless, a decisive breakthrough above 21500 could propel the index towards 21700/22000 in the short term," said Senior Technical Analyst Rupak De from LKP Securities.

The benchmark indices logged weekly losses for second consecutive week. the S&P BSE Sensex declined 1.01%, and the NSE Nifty 50 declined 1.02%.

HDFC Bank Ltd, Bharti Airtel Ltd, ITC Ltd, Tech Mahindra Ltd, and Axis Bank weighed on the indices.

ICICI Bank Ltd, Reliance Industries Ltd, Bajaj Auto Ltd, NTPC Ltd, and Adani Ports & Special Economic Zones Ltd capped losses in benchmark indices.

This week on NSE, 11 sectors fell with the Nifty Media slumping 10% to become the worst performer among its peers. Only Nifty Pharma gained 1.7% to become the best performer.

The broader markets were mixed with the BSE MidCap falling 0.36% and the BSE SmallCap was 0.54% higher. Eleven out of the 20 sectors compiled by the BSE advanced, while nine declined.

"BSE Midcap and BSE Smallcap index also ended lower for the week. On the sectoral front, majority of indices were lower. BSE Realty and BSE Bankex index declined by 3-5% in this week. On the other hand, BSE healthcare index posted positive gains," said Chouhan.

The market breadth was skewed in the favour of buyers. As many as 2,141 stocks advanced, 1,673 declined and 85 remained unchanged on the BSE.

ACC Ltd.'s profit rose more than fourfold in the quarter ended December 2023 as operating profit improved.

The Adani Group-owned cement manufacturer's third-quarter net profit rose 375.01% year-on-year to Rs 537.7 crore, according to an exchange filing. The average of analysts' estimates polled by Bloomberg had pegged the net income for the quarter at Rs 377 crore.

Revenue up 8.31% at Rs 4,914.4 crore (Bloomberg estimate: Rs 4,728 crore).

Ebitda up 138.62% at Rs 904.7 crore (Bloomberg estimate: Rs 660 crore).

Margin at 18.4% vs 8.35% (Bloomberg estimate: 14%).

Net profit up 375.01% at Rs 537.7 crore (Bloomberg estimate: Rs 377 crore)

The company held cash and cash equivalent to the tune of Rs 4,282 crore during the period under review, up from Rs 3,634 crore in the previous quarter.

"ACC's financial performance has seen a complete turnaround in the last 12 months. Recent capacity additions have taken the Adani Group’s cement capacity to 77.4 MPTA. This will enable volume and revenue growth on a sustainable basis," said Ajay Kapur, chief executive officer at ACC.

Opportunity buy of low cost petcoke will help the company to further optimise fuel costs in the coming quarters, ACC said in its outlook, aiding cost optimisation goals.

Shares of ACC surged as much as 7.3% after the results were declared, slightly cooling off to trade 6.75% higher at 2:42 p.m. The benchmark NSE Nifty 50 was trading 0.92% lower.

Revenue grew 7.2% to Rs 41,940 crore from Rs 39134 crore

Ebitda rose 57.9% to Rs 7,180 crore from Rs 4,547 crore

Margin rose 550 bps to 17.11% from 11.61%

Net profit surged 417% to Rs 2,450 crore vs Rs 474 crore

Lowers FY24 capex guidance to Rs 18,000 crore from Rs 20,000 crore earlier

Source: Exchange filing

Zomato Payments received RBI nod for carrying out business as an online payment aggregator.

Source: Exchange filing

Revenue rose 5.5% to Rs Rs 84.54 crore from Rs 80.17

Net profit rose to Rs 26.57 crore from Rs 7.61 crore

EBITDA rose to Rs 19.77 crore from Rs 7.64 crore

Margin at 23.38% vs 9.52% YoY

Vice Chairman and Managing Director Sanjay Murdeshwar resigns with effect from April 2.

Source: Exchanges

Cipla Ltd appointed Balram Bhargava as Non-Executive Independent Director for 5 years effective April 1.

Alert: Bhargava has previously served as director general of the Indian Council of Medical Research.

Source: Exchange Filing

Revenue rose 8.6% to Rs 853.5 crore from Rs 785.9 crore

Ebitda grew 0.21% to Rs 231.5 crore from Rs 231 crore

Margin fell 226 bps to 27.12% from 29.39%

Net profit rose 1.64 Rs 111.5 crore from Rs 109.7 crore

Zydus Lifesciences Ltd received U.S. Food and Drug Administration approval for Gabapentin tablets

Source: Exchange Filing

Samvardhana Motherson had 21.9 lakh shares changed hands in a large trade.

The company had 0.03% equity changed hands at Rs 113.55 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Net profit rose 62.9% to Rs 64.02 crore from Rs 39.31 crore

Total income grew 21.8% to Rs 236.9 crore from194.4 crore

Net profit rose to Rs 2,222.8 crore from Rs 628.88 crore YoY

NII rose to 12.1% to Rs 10,292.8 crore from Rs 9,179.4 crore YoY

Gross NPA at 6.24% vs 6.96% QoQ

Net NPA at 0.96% vs 1.47% QoQ

Revenue grew 8.31% to Rs 4914.36 crore from Rs 4536.97 crore

Ebitda rose 138.62% to Rs 904.72 crore from Rs 379.14 crore

Margin rose 1005 bps to 18.4% from 8.35%

Net profit rose 375.01 to Rs 537.67 crore from Rs 113.19 crore

Jio Financial Ltd had 14.4 lakh shares changed hands in a large trade

The company had 0.02% of its equity changed hands at Rs 239.4 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Markets in Europe declined as investors braced themselves for the outcome of the European Central Bank's policy meeting outcome, scheduled for release later today.

The central bank is expected to keep the interest rate steady. However, President Christine Lagarde's commentary will be crucial for insights into ECB's policy path going ahead.

Markets in Europe declined as investors braced themselves for the outcome of the European Central Bank's policy meeting outcome, scheduled for release later today.

The central bank is expected to keep the interest rate steady. However, President Christine Lagarde's commentary will be crucial for insights into ECB's policy path going ahead.

PNB Housing Finance Ltd had 2.57 crore shares changed hands in a large trade

The company had 9.9% equity changed hands at Rs 830 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Revenue grew 3.36% to Rs 1,043.6 crore from Rs 1,009.6 crore

Ebitda fell 13.27% to Rs 163.4 crore from Rs 188.4 crore

Margin fell 300 bps to 15.65% from 18.66%

Net profit fell 24.59% to Rs 62.6 crore from Rs 83.02 crore

Net profit rose to Rs 202 crore from Rs 170.1 crore

NII rose 21.3% to Rs 785.2 crore from Rs 647.5 crore

Gross NPA at 2.53% vs 2.27% QoQ

Net NPA at 1.13% vs 0.97 % QoQ

Net profit down 13.9% at Rs 475.5 crore vs Rs 552.7 crore

Revenue up 2.7% at Rs 3,556.2 crore vs Rs 3,458.5 crore

Ebitda down 14.39% at Rs 562.4 crore vs Rs 656.9 crore

Margin at 15.81% vs 18.99%.

Revenue at up 14.5% Rs 474.5 crore vs Rs 414.4 crore.

Ebitda at Rs 242.1 crore vs 197.5 crore.

Margin at 51.02% vs 47.65%

Net profit up 4.85% at Rs 157.7 crore vs 150.4 crore.

Net Profit down 87.8% at Rs 712.8 crore vs Rs 5,826.96 crore

Revenue up 15.4% at Rs 1.11 lakh crore vs Rs 95,752 crore

Ebitda down 73.8 at Rs 2160.4 crore vs Rs 8,240 crore

Margin at 1.94% vs 8.6%

Board approves interim dividend of Rs 15 per share

Revenue rose 21.79% to Rs 473.56 crore from Rs 388.82 crore

Ebitda grew 35.86% to Rs 120.36 crore from Rs 88.59 crore

Margin rose 263 bps to 25.41% from 22.78%

Net profit rose 44.06% to Rs 90.4 crore from Rs 62.75 crore

The shares of Balkrishna Industries Ltd. fell over 7% on Thursday as the company's third quarter results misses analysts' estimates.

The company reported a jump of 181.96% year-on-year jump in third quarter net profit however it missed the analysts' estimates. While Revenue was in line with the markets estimates, Ebitda also missed the margin.

Revenue up 5.02% at Rs 2,274.41 crore vs Rs 2,165.57 crore (Bloomberg estimate: Rs 2,357.1 crore).

Ebitda up 100.74% at Rs 540.59 crore vs Rs 269.29 crore (Bloomberg estimate: Rs 590.6 crore).

Margin expands 1,133 bps to 23.76% vs 12.43% (Bloomberg estimate: 25.10%).

Net profit up 181.96% at Rs 305.42 crore vs Rs 108.32 crore (Bloomberg estimate: Rs 332.9 crore).

The shares of Balkrishna Industries Ltd. fell over 7% on Thursday as the company's third quarter results misses analysts' estimates.

The company reported a jump of 181.96% year-on-year jump in third quarter net profit however it missed the analysts' estimates. While Revenue was in line with the markets estimates, Ebitda also missed the margin.

Revenue up 5.02% at Rs 2,274.41 crore vs Rs 2,165.57 crore (Bloomberg estimate: Rs 2,357.1 crore).

Ebitda up 100.74% at Rs 540.59 crore vs Rs 269.29 crore (Bloomberg estimate: Rs 590.6 crore).

Margin expands 1,133 bps to 23.76% vs 12.43% (Bloomberg estimate: 25.10%).

Net profit up 181.96% at Rs 305.42 crore vs Rs 108.32 crore (Bloomberg estimate: Rs 332.9 crore).

The scrip fell as much as 7.68% to 2,506 apiece, the lowest level since Jan. 4, 2024. It pared losses to trade 6.95% lower at Rs 2,525.85 apiece, as of 1:06 p.m. This compares to a 0.85% decline in the NSE Nifty 50 Index.

It has risen 12.24% in the last 12 months. Total traded volume so far in the day stood at 6 times its 30-day average. The relative strength index was at 45.

Out of 26 analysts tracking the company, 10 maintain a 'buy' rating, 5 recommend a 'hold,' and 11 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.4%.

NHPC had 14.5 lakh shares changed hands in a large trade.

The company had 0.01% equity changed hands at Rs 83.85 apiece.

Buyers and sellers not known immediately.

Source: Bloomberg

Jubilant Foodworks had 15 lakh shares changed hands in a large trade

The company had 0.2% equity changed hands at Rs 509.6 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Revenue fell 11.5% to Rs 1,322 crore from Rs 1,494 crore

Ebitda declined 57.8% to Rs 109 crore vs Rs 216 crore

Margin fell 621 bps to 8.24% vs 14.45%

Net loss at Rs 59 crore vs profit of Rs 32 crore

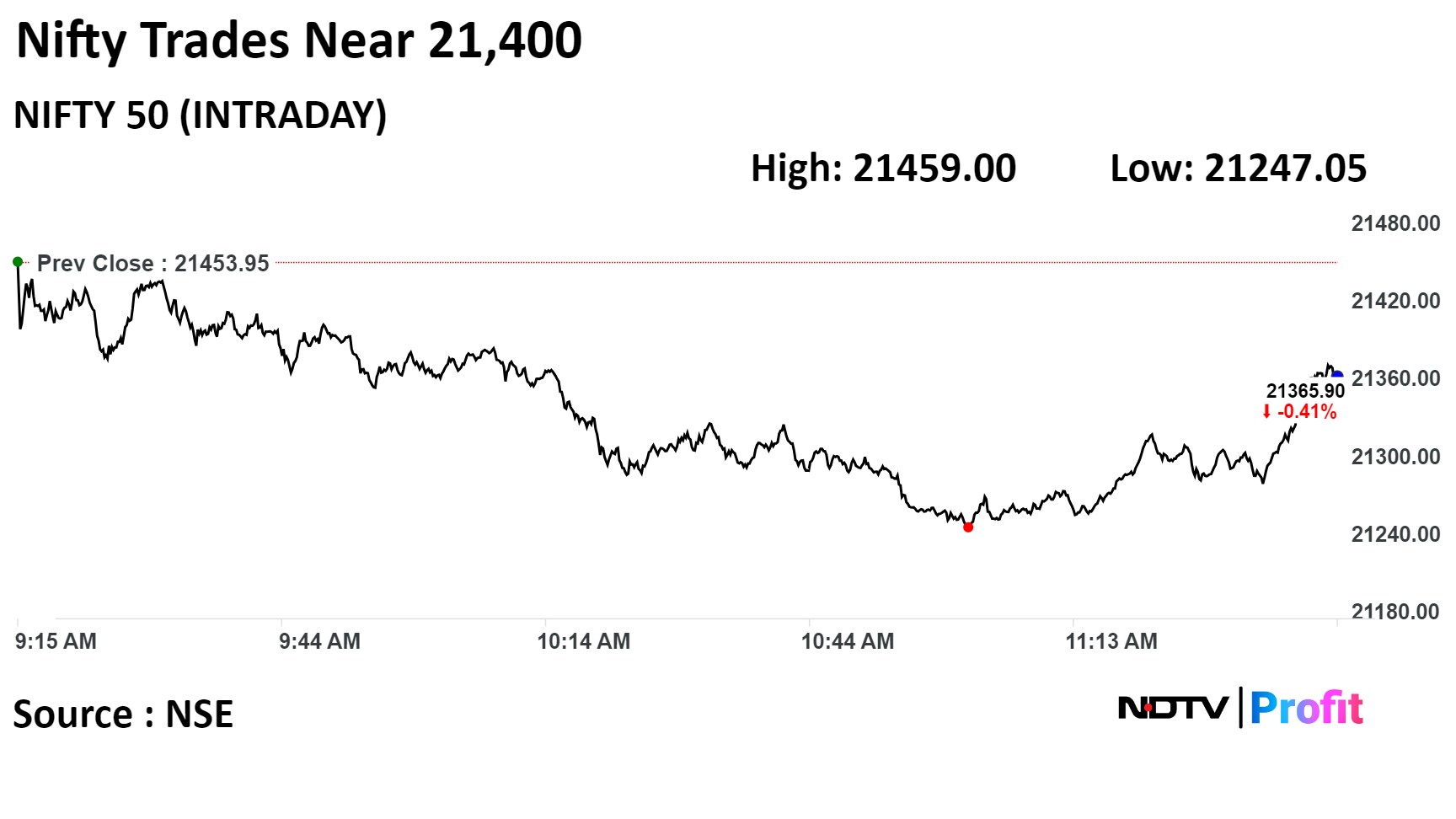

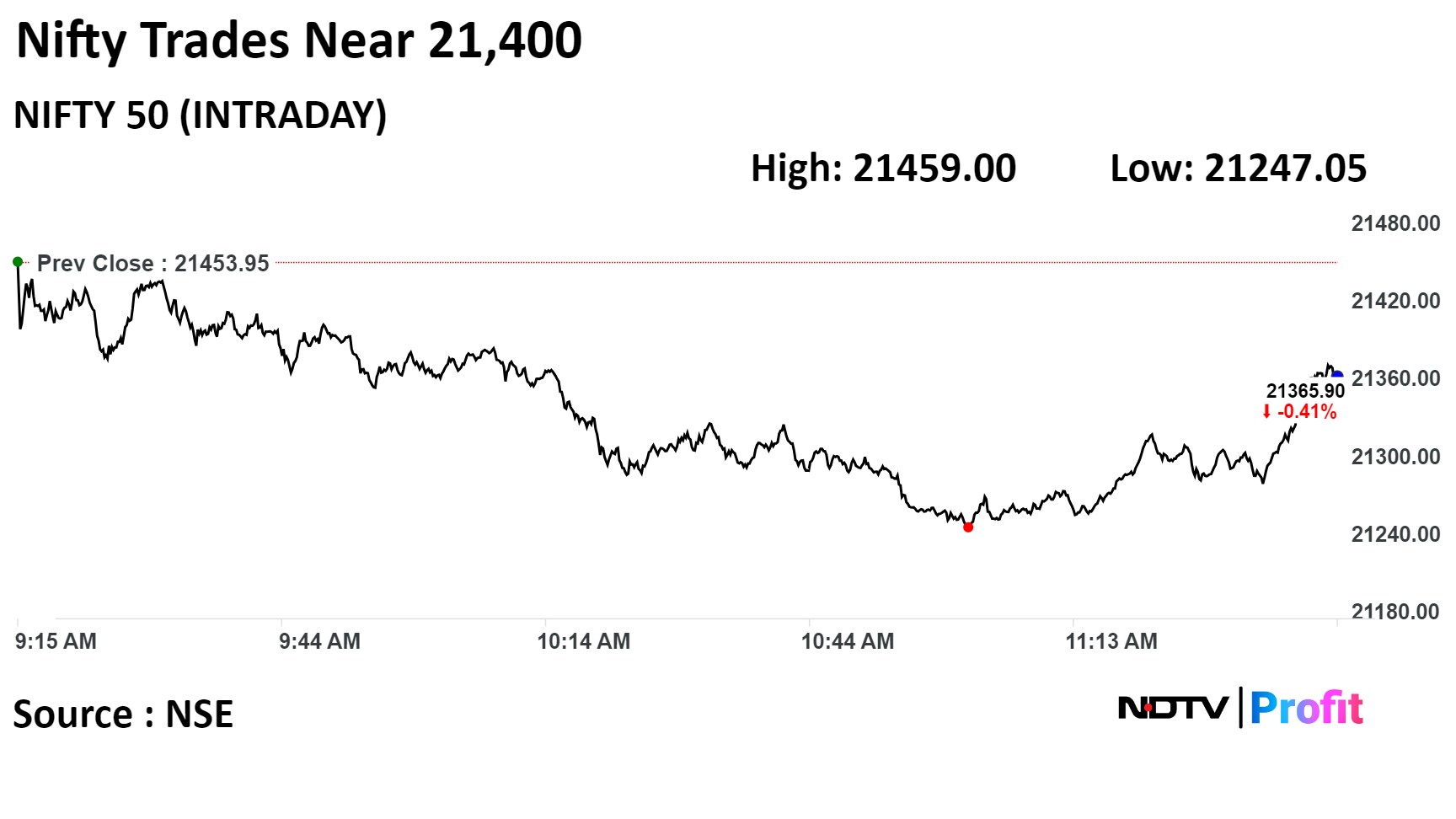

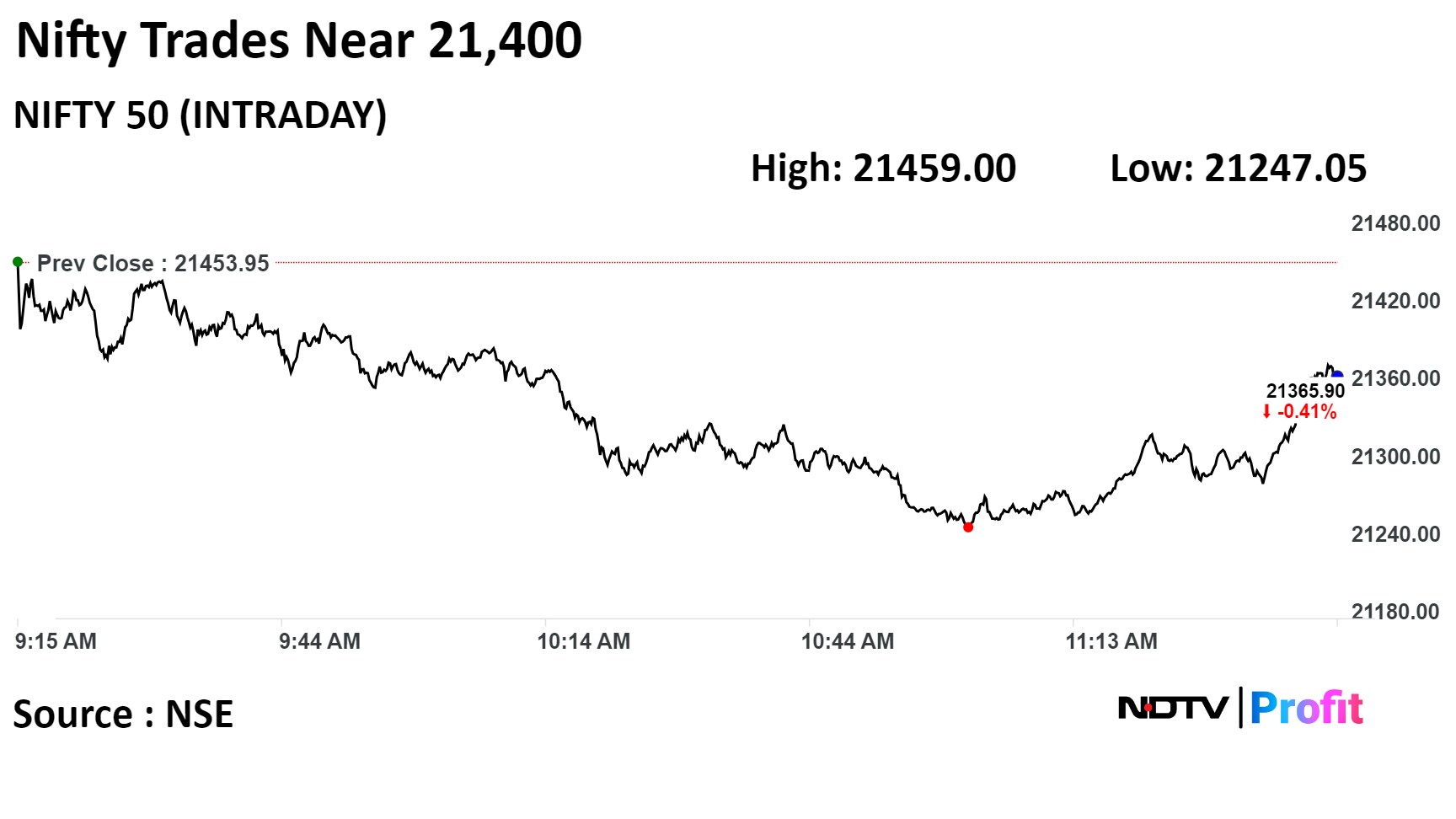

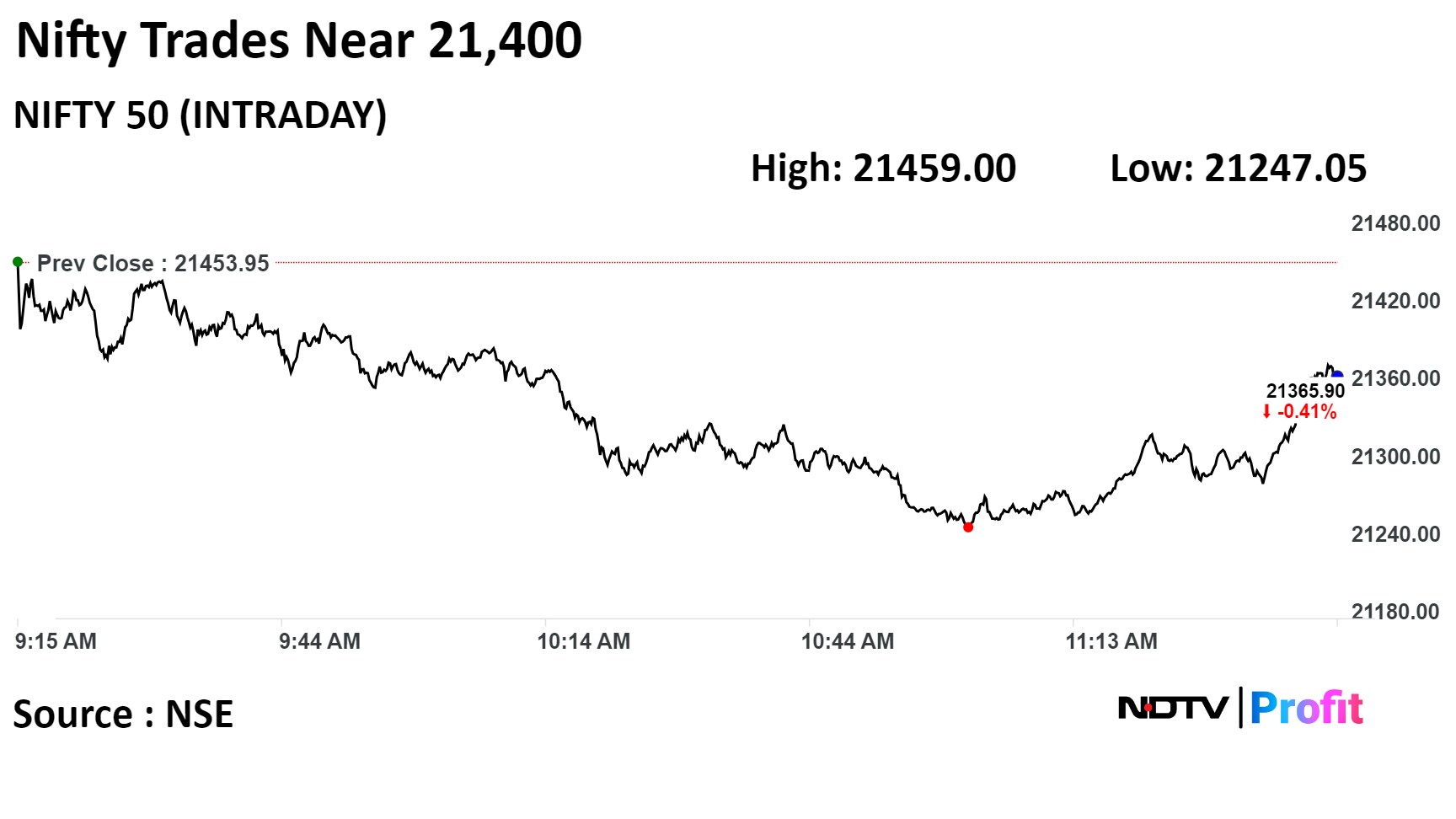

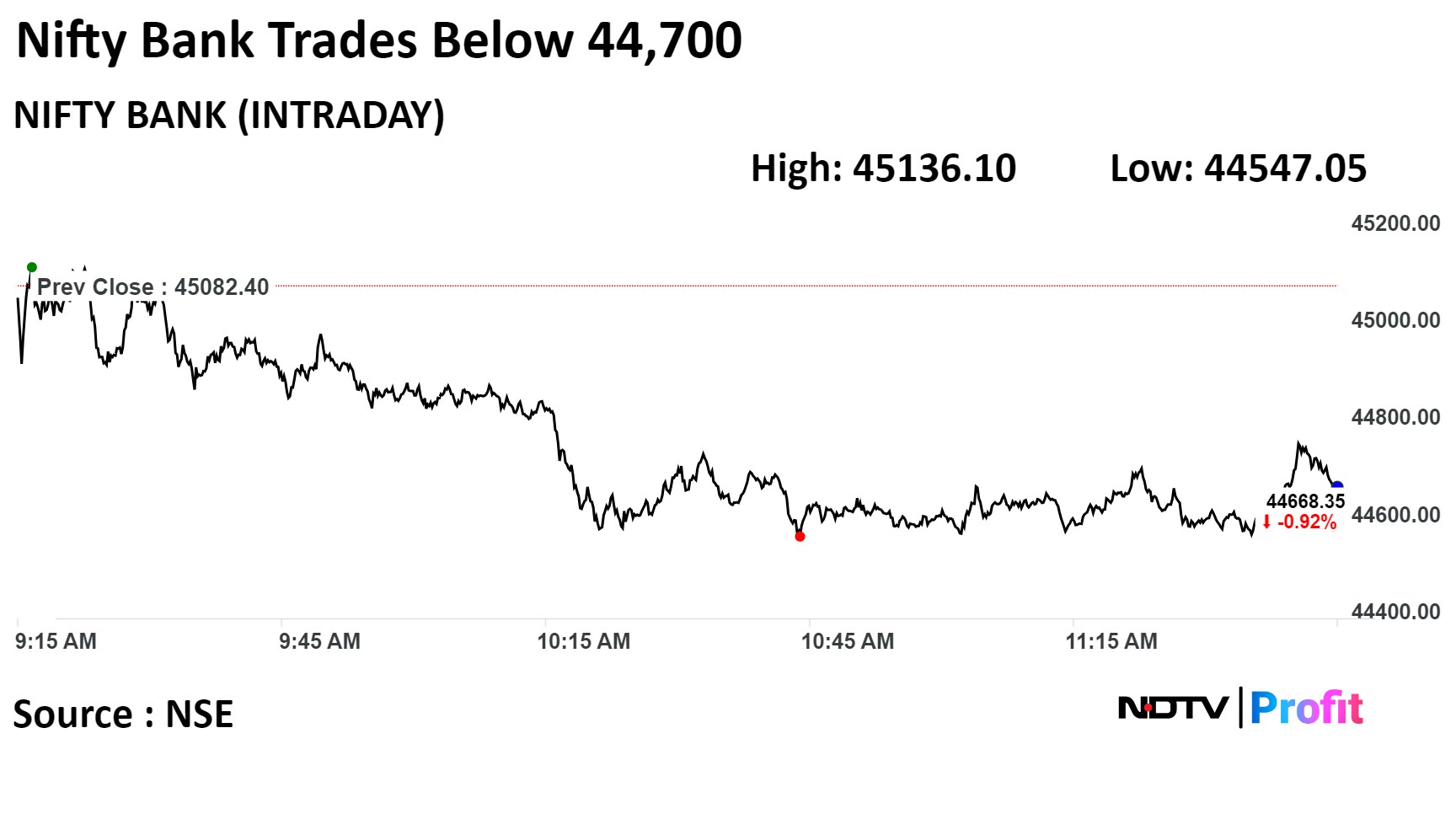

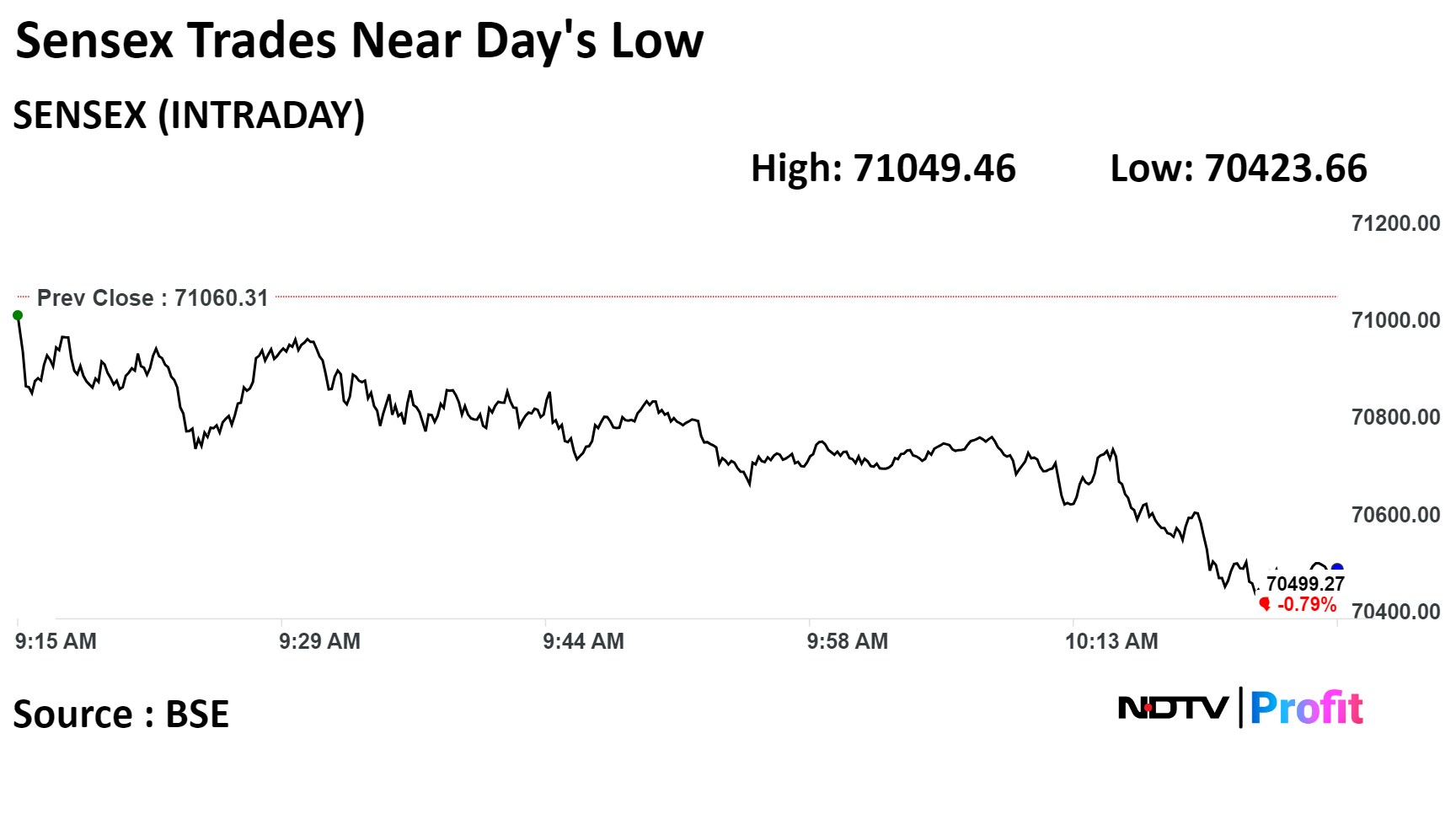

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Benchmark stock indices extended losses by midday on Thursday ahead of European Central Bank and FOMC meetings and release of key economic data in the US. Banks and information-technology stocks contributed the most to the losses.

As of 12:25 p.m., the NSE Nifty 50 fell 168.55 points, or 0.79%, to 21,285.40, while the S&P BSE Sensex declined 588.71 points, or 0.83% to 70,471.60.

"If it (Nifty and Sensex) crosses 21,450/71,050, then the next levels to watch will be 21,600/71,500 and 21,750/72,100," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "However, if it falls below 21,300/70,600 levels, the indices may weaken further to 21,100/70,000–21,000/69,700 or 20,900/69,600."

Shares of HDFC Bank Ltd., Axis Bank Ltd., ITC Ltd., Tech Mahindra Ltd. and Tata Consultancy Services Ltd. dragged the Nifty 50.

NTPC Ltd., Bajaj Auto Ltd., Hindustan Unilever Ltd., Coal India Ltd. and IndusInd Bank Ltd. cushioned the fall.

Most sectoral indices traded lower, with the Nifty IT, Pharma and Bank falling over 1%.

The broader markets were mixed, with the S&P BSE MidCap falling 0.31%, and the S&P BSE SmallCap rising 0.46% through midday trade on Thursday.

Eleven out of the 20 sectors compiled by the BSE Ltd. declined.

The market breadth was skewed in favour of the buyers as 2,105 stocks advanced, 1,530 declined and 137 remained unchanged on the BSE.

Revenue at rose 19.2% to Rs 1,941.7 crore from Rs 1,778.5 crore

Ebitda rose 43.9% to Rs 238.6 crore from Rs 165.8 crore

Margin rose 296 bps to 12.28% from 9.32%

Net profit rose 52% to Rs 152.6 crore from Rs 100.4 crore

Revenue rose 13.94% to Rs 644.7 crore from Rs 565.8 crore

Ebitda rose 101.25% to Rs 183.02 crore from Rs 90.94 crore

Margin rose 1,231 bps to 28.38% from 16.07%

Net profit rose 156.77% to Rs 123.97 crore from Rs 48.28 crore

Revenue rose 0.22% to Rs 279.55 crore from Rs 278.93 crore

Ebitda fell 0.94% to Rs 32.76 crore from Rs 33.07 crore

Margin fell 13 bps to11.71% from 11.85%

Net profit rose 3.7% to Rs 24.1 crore from Rs 23.23 crore

Shares of Bajaj Auto Ltd. jumped to hit its lifetime high a day after the company detailed its results for the December quarter, which beat Bloomberg estimates.

Shares of Bajaj Auto Ltd. jumped to hit its lifetime high a day after the company detailed its results for the December quarter, which beat Bloomberg estimates.

The scrip rose as much as 3.97% to Rs 7,499 apiece, its lifetime high level. It pared gains to trade 3.04% higher at Rs 7,432.00 apiece, as of 11:08 a.m. This compares to a 0.9% decline in the NSE Nifty 50 Index.

It has risen 100% in the last twelve months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 72.75, indicating that the stock may be overbought.

Out of 46 analysts tracking the company, 24 maintain a 'buy' rating, 12 recommend a 'hold,' and 10 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.7%.

The scrip rose as much as 8.75% to 249.70 apiece, the highest level since Jan 20, 2023. It pared gains to trade 6.62% higher at Rs 244.80 apiece, as of 11:02 a.m. This compares to a 0.92% decline in the NSE Nifty 50 Index.

It has risen 212.64% in the last 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 60.

The one analysts tracking the company maintains a 'buy' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 228.9%.

Federal Bank had 11 lakh shares changed hands in a large trade at Rs

The private lender's 0.05% equity changed hands at Rs 141.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

CG Power and Industrial Solution had 15.4 lakh shares changed hands in a large trade

The company's 0.1% equity changed hands at Rs 445.7 apiece

Buyers and sellers not known immediately

Source: Bloomberg

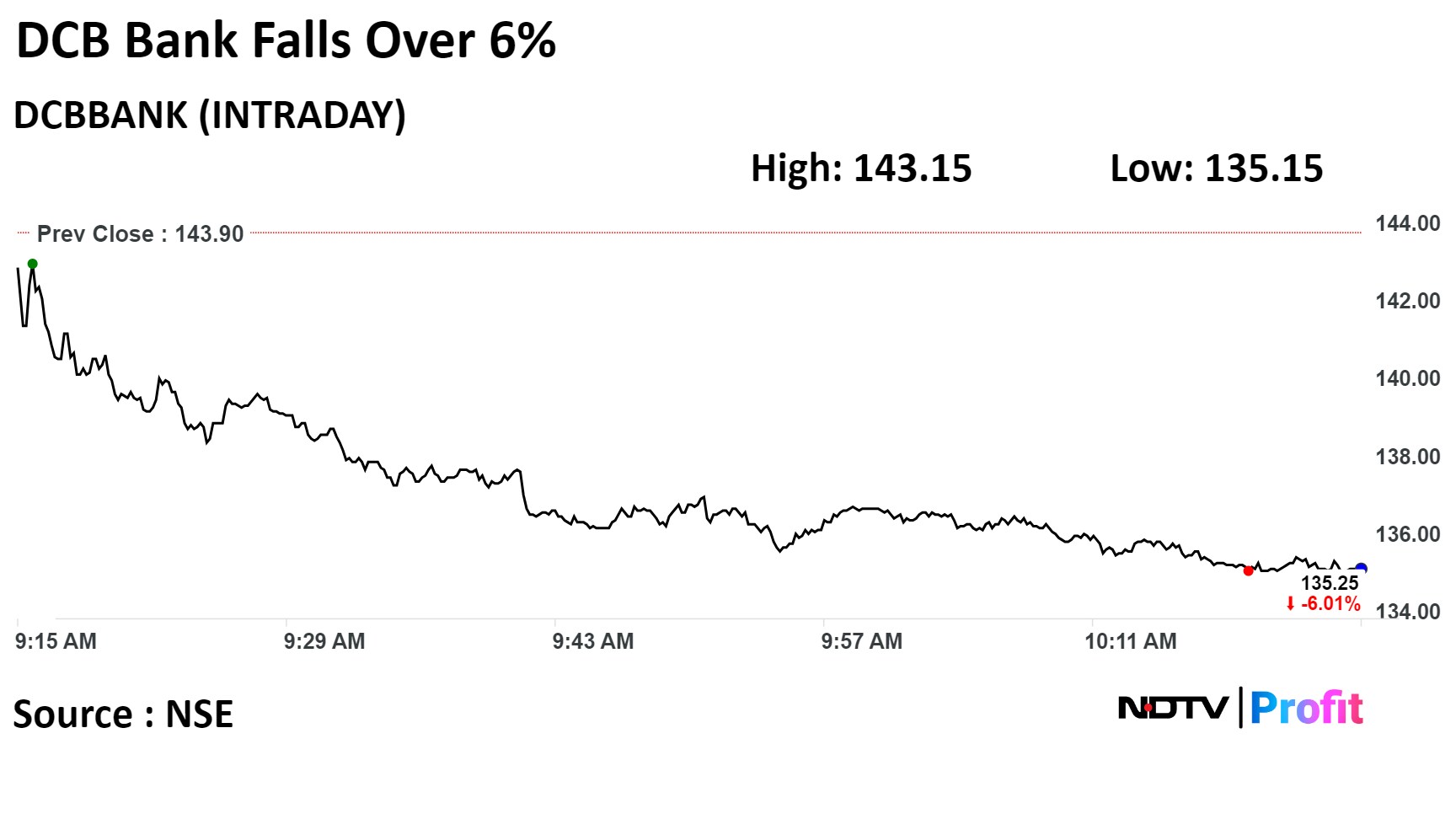

Shares of DCB Bank Ltd. declined 6% on Thursday after its standalone net profit remained flat in the third quarter on a sequential basis.

The private sector lender posted a profit of Rs 127 crore in the October–December period, same as the previous quarter. It reported a net interest income of Rs 474 crore in comparison to Rs 476 crore in the second quarter, according to an exchange filing on Wednesday.

NII up 6.3% at Rs 474 crore vs Rs 446 crore (YoY)

Gross non-performing asset widened to 3.43% vs 3.36% (QoQ).

Net NPA at 1.22% vs 1.28% (QoQ).

Net profit up 11% Rs 126.6 crore vs Rs 113.9 crore (YoY) (Bloomberg estimate: Rs 128.6 crore)

Shares of DCB Bank Ltd. declined 6% on Thursday after its standalone net profit remained flat in the third quarter on a sequential basis.

The private sector lender posted a profit of Rs 127 crore in the October–December period, same as the previous quarter. It reported a net interest income of Rs 474 crore in comparison to Rs 476 crore in the second quarter, according to an exchange filing on Wednesday.

NII up 6.3% at Rs 474 crore vs Rs 446 crore (YoY)

Gross non-performing asset widened to 3.43% vs 3.36% (QoQ).

Net NPA at 1.22% vs 1.28% (QoQ).

Net profit up 11% Rs 126.6 crore vs Rs 113.9 crore (YoY) (Bloomberg estimate: Rs 128.6 crore)

On the NSE, DCB's stock fell as much as 6.08% during the day to Rs 135.15 apiece, the lowest since Jan 1. It was trading 6.01% lower at Rs 135.25 per share compared to a 0.73% decline in the benchmark Nifty 50 at 10:24 a.m.

The share price has risen 13.65% in the last 12 months. The total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 40.72.

Nineteen out of 24 analysts tracking DCB have a 'buy' rating on the stock, four recommend 'hold' and one suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15.5%.

Bharti Airtel had 10 lakh shares changed hands in a large trade.

The company had 0.02% equity changed hands at Rs 1,199.8 piece.

Buyers and sellers not known immediately.

Source: Bloomberg

Azim Premji, founder of Wipro Ltd., gifts 51 lakh shares each to his sons Rishad and Tariq, equivalent to 0.2% stake.

Azim Premji’s shareholding now stands at 4.12% and those of Rishad and Tariq stand at 0.13% each.

Source: Exchange filing (Not just in)

Securities and Exchange Board of India received an informal Guidance request from Axis Bank Limited.

The requested guidance is in relation to the provisions of SEBI Master Circular dated July 11, 2023.

Source: SEBI

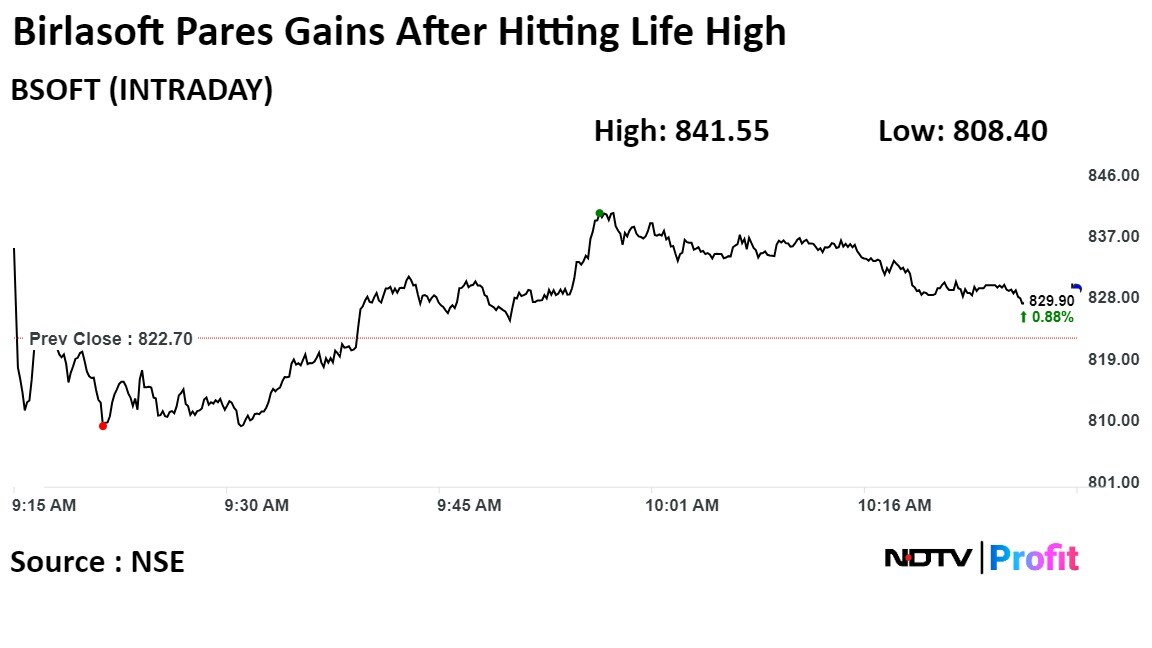

Birlasoft Ltd shares rose to its life high on Thursday as the company's third quarter net profit rises 11.03% quarter-on-quarter.

The company also repored a 2.52% QoQ jump in consolidated revenue on Wednesday meeting the analyts estimates.

Revenue up 2.52% at Rs 1,342.9 crore vs Rs 1,309.8 crore (Bloomberg estimate: Rs 1,333.3 crore).

Ebitda up 4.15% at Rs 193.2 crore vs Rs 185.5 crore (Bloomberg estimate: Rs 180.1 crore).

Margin expands 22 bps to 14.38% vs 14.16% (Bloomberg estimate: 13.50%).

Net profit up 11.03% at Rs 161 crore vs Rs 145 crore (Bloomberg estimate: Rs 142.4 crore).

Birlasoft Ltd shares rose to its life high on Thursday as the company's third quarter net profit rises 11.03% quarter-on-quarter.

The company also repored a 2.52% QoQ jump in consolidated revenue on Wednesday meeting the analyts estimates.

Revenue up 2.52% at Rs 1,342.9 crore vs Rs 1,309.8 crore (Bloomberg estimate: Rs 1,333.3 crore).

Ebitda up 4.15% at Rs 193.2 crore vs Rs 185.5 crore (Bloomberg estimate: Rs 180.1 crore).

Margin expands 22 bps to 14.38% vs 14.16% (Bloomberg estimate: 13.50%).

Net profit up 11.03% at Rs 161 crore vs Rs 145 crore (Bloomberg estimate: Rs 142.4 crore).

The scrip rose as much as 2.29% to 841.55 apiece to hit fresh life high. It recently hit life high on Jan 24. It pared gains to trade 0.85% higher at Rs 829.70 apiece, as of 10:26 a.m. This compares to a 0.67% decline in the NSE Nifty 50 Index.

It has risen 180.30% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 77 above indicating it was overbought.

Out of 14 analysts tracking the company, 9 maintain a 'buy' rating, 4 recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 185.6%.

The shares of Mazagon Dock Shipbuilders Ltd. rose on Thursday after the company bagged contract worth Rs 1,070.47 with the Ministry of Defence.

Mazagon Dock has signed a contract for the delivery of 14 Fast Patrol Vessels for the Indian Coast Guard, which will be created indigenously and manufactured under the 'Buy (Indian-IDDM)' category, said a Press Information Bureau release on Wednesday.

According to the release the FPVs are to be delivered to the Defence Ministry within 63 months.

The shares of Mazagon Dock Shipbuilders Ltd. rose on Thursday after the company bagged contract worth Rs 1,070.47 with the Ministry of Defence.

Mazagon Dock has signed a contract for the delivery of 14 Fast Patrol Vessels for the Indian Coast Guard, which will be created indigenously and manufactured under the 'Buy (Indian-IDDM)' category, said a Press Information Bureau release on Wednesday.

According to the release the FPVs are to be delivered to the Defence Ministry within 63 months.

The scrip rose as much as 6.49% to 2,477.70 apiece, the highest level since Jan 16, 2024. It pared gains to trade 3.54% higher at Rs 2,408.95 apiece, as of 10:00 a.m. This compares to a 0.42% decline in the NSE Nifty 50 Index.

It has risen 226.39% in the last 12 months. Total traded volume so far in the day stood at 4.5 times its 30-day average. The relative strength index was at 62.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 228.6%.

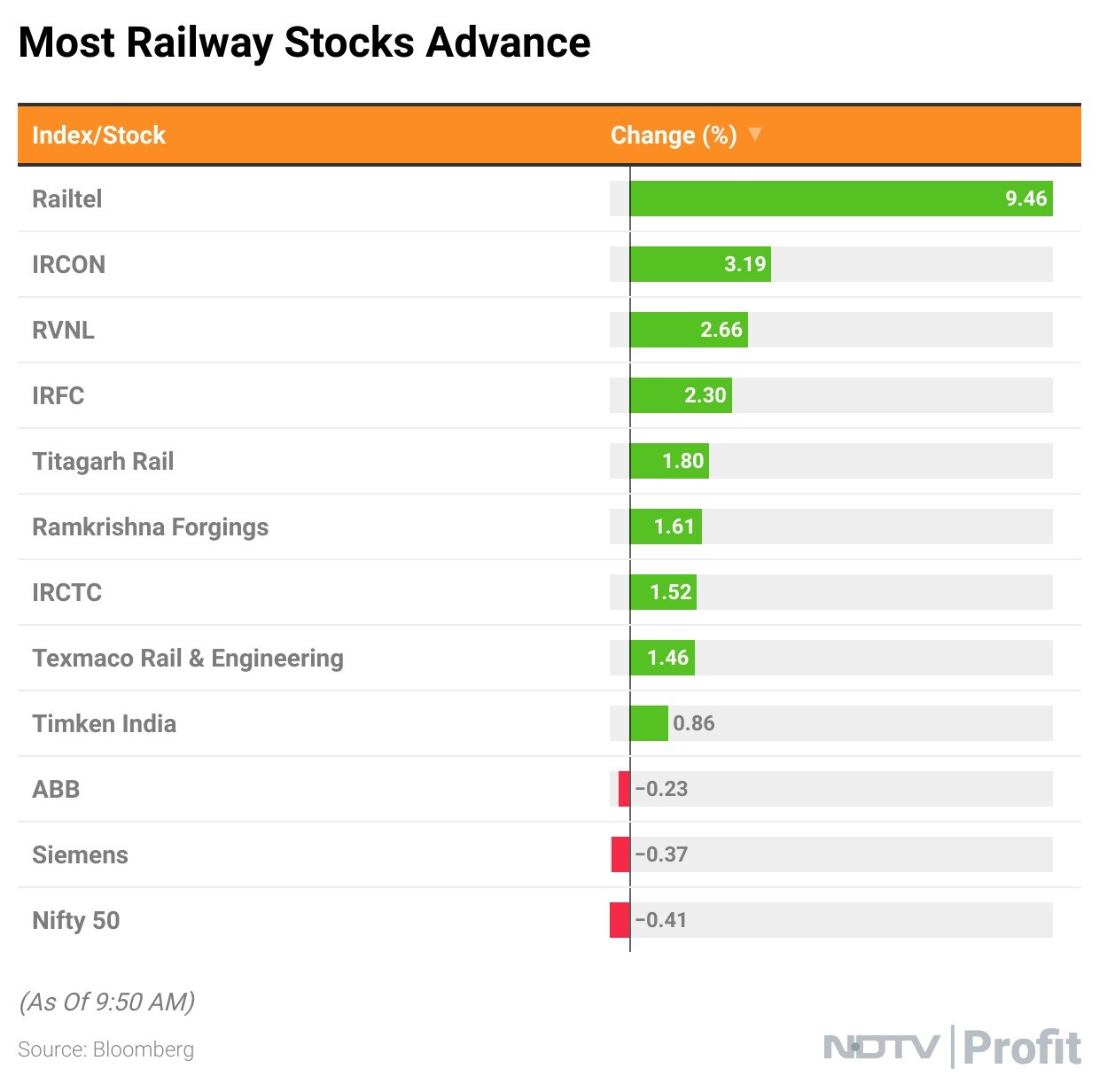

Tech Mahindra Ltd.'s shares fell over 6% after profit of the company rose but missed consensus estimate of analysts tracked by Bloomberg.

The net profit rose 3.34% at Rs 510.4 crore compares with the Rs 663.3-crore consensus estimate of analysts tracked by Bloomberg.

Tech Mahindra Ltd.'s shares fell over 6% after profit of the company rose but missed consensus estimate of analysts tracked by Bloomberg.

The net profit rose 3.34% at Rs 510.4 crore compares with the Rs 663.3-crore consensus estimate of analysts tracked by Bloomberg.

The scrip fell as much as 6.24% apiece, the lowest level since April 17, 2023. It was trading 4.58% lower at Rs 1,343.30 apiece, as of 9:46 a.m. This compares to a 0.39% decline in the NSE Nifty 50 Index.

It has risen 27.81% in the last 12 months. Total traded volume so far in the day stood at 6.8 times its 30-day average. The relative strength index was at 56.59 indicating it was underbought.

Out of 42 analysts tracking the company, 15 maintain a 'buy' rating, 11 recommend a 'hold,' and 16 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside 4.4%.

Laurus Labs had 12.1 lakh shares or 0.2% equity changed hands in a large trade.

Buyers and sellers not known immediately

Source: Bloomberg

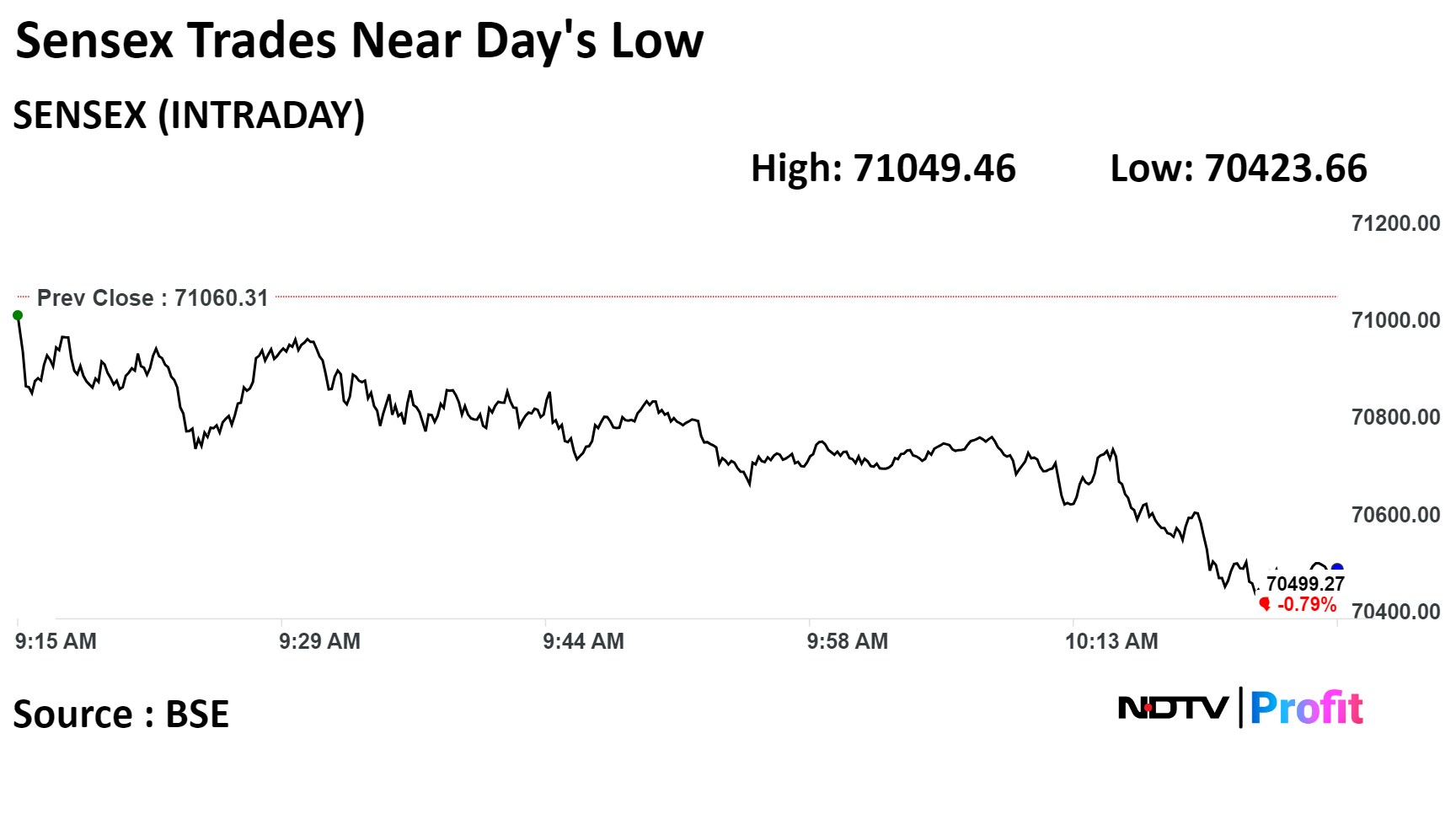

Railtel Corp of India Ltd received Rs 163 crore work order from Navodaya Vidyalaya.

Order for supply & implementation of integrated infrastructure & IT solutions.

Source: Exchange Filing

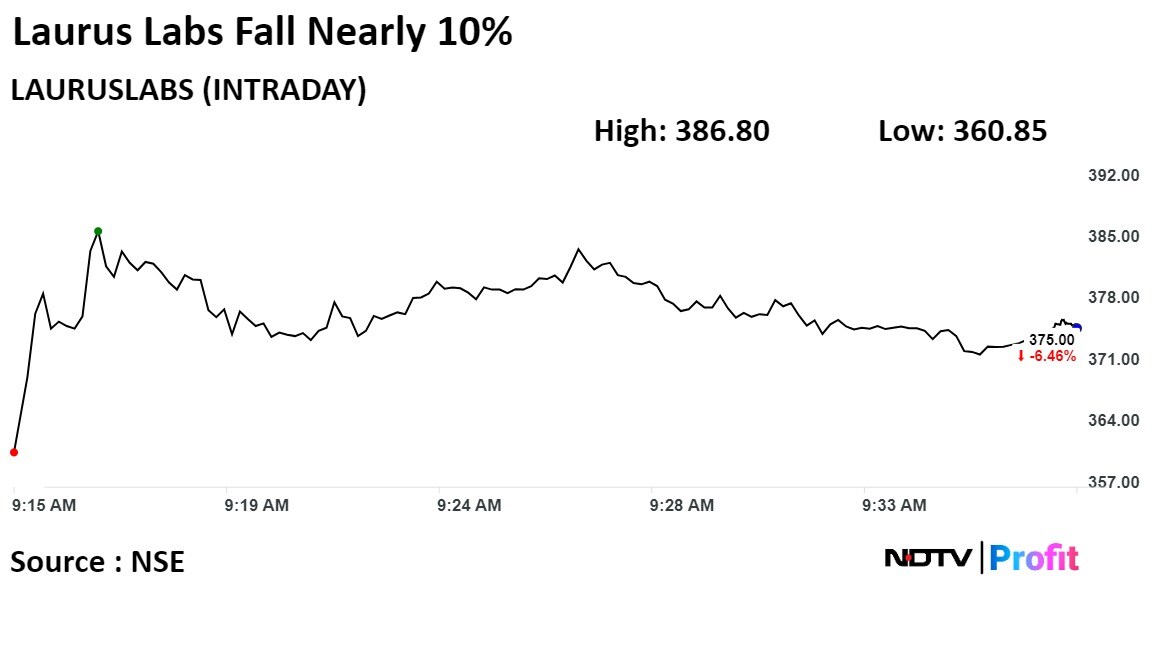

The shares of Laurus Labs Ltd. fell on Thursday to hit lower circuit and bounced back slightly after the company's third quarter profit slipped and missed analysts estimates.

The pharmaceutical firm reported its results on Wednesday with a 89% year-on-year dip in consolidated net profit in the quater that ended in December.

The shares of Laurus Labs Ltd. fell on Thursday to hit lower circuit and bounced back slightly after the company's third quarter profit slipped and missed analysts estimates.

The pharmaceutical firm reported its results on Wednesday with a 89% year-on-year dip in consolidated net profit in the quater that ended in December.

The scrip fell as much as 9.99% apiece, the lowest level since Oct. 31, 2023. It pared losses to trade 4.22% lower at Rs 384 apiece, as of 9:29 a.m. This compares to a 0.15% decline in the NSE Nifty 50 Index.

It has risen 12.22% in the last 12 months. Total traded volume so far in the day stood at 38 times its 30-day average. The relative strength index was at 27 indicating it was oversold.

Out of 15 analysts tracking the company, 8 maintain a 'buy' rating, 3 recommend a 'hold,' and 4 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.9%.

Glenmark Pharmaceutical Ltd signed a license agreement with Jiangsu Alphamab for KN035 (Envafolimab)

License is for India, Asia Pacific, other regions.

License from Jiangsu Alphamab, 3D Medicines for KN035 (Envafolimab)

Source: Exchange Filing

NTPC has 21.9 lakh shares or 0.02% equity change hands in two large trades.

Buyers and sellers not known immediately.

Source: Bloomberg

Crompton Greaves had 15.2 lakh shares or 0.2% equity changed hands in a large trade:

Buyers and sellers not known immediately.

Source: Bloomberg

Union Bank had 1.34 crore shares change hands in a pre-market large trade.

Buyers and sellers not known immediately.

Source: Bloomberg

One 97 Communication Ltd had 42.2 lakh shares or 1% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

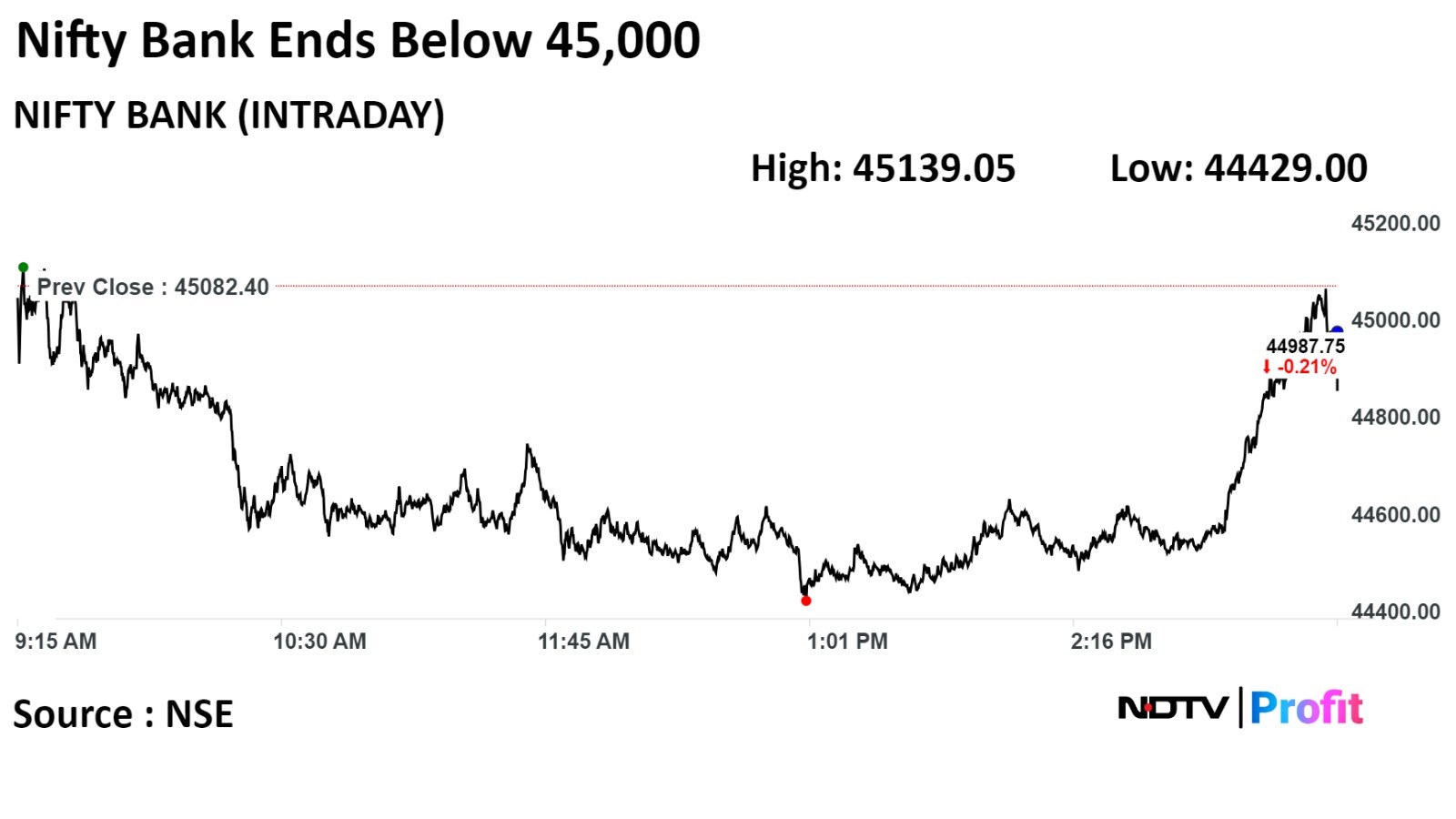

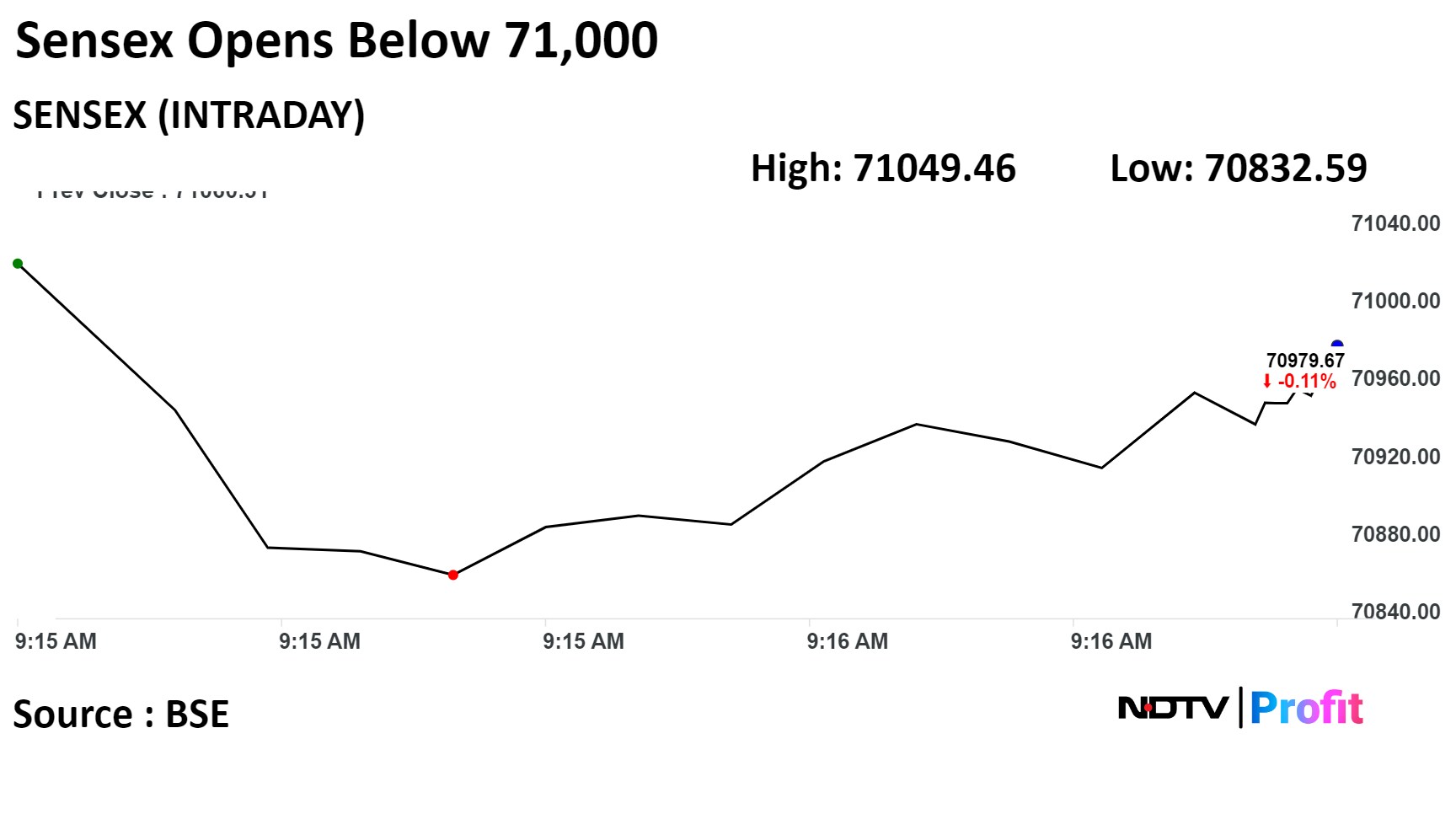

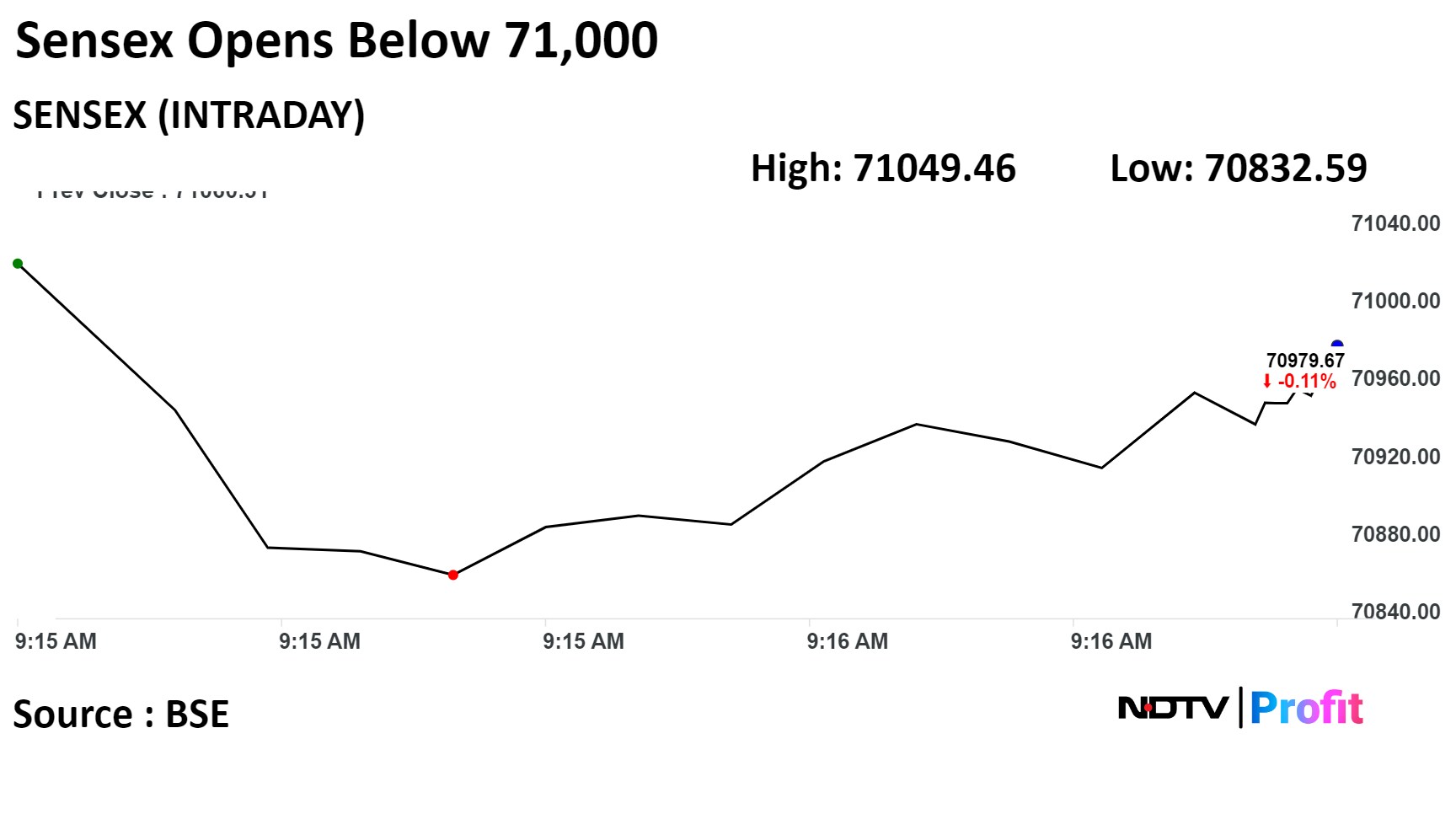

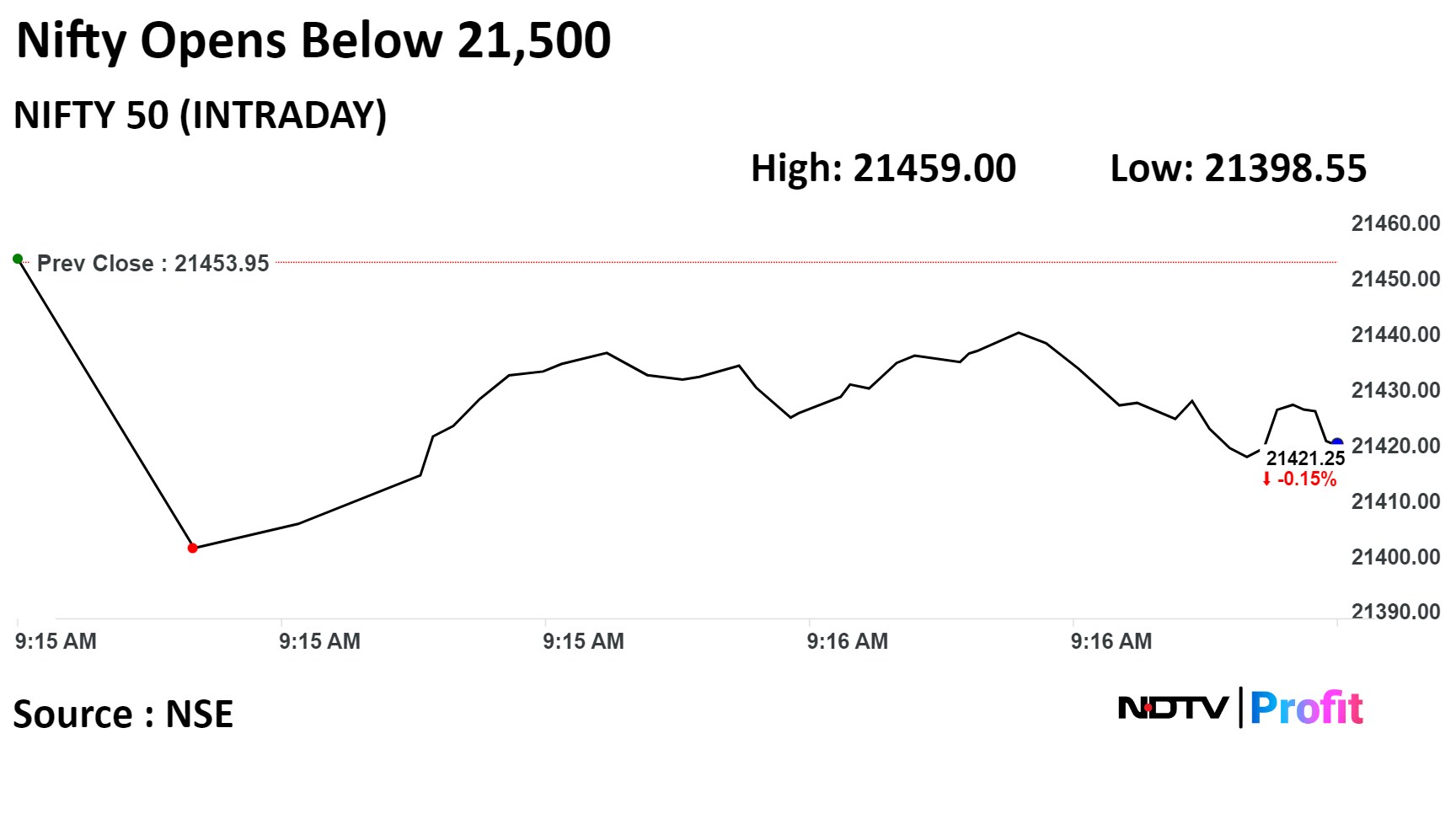

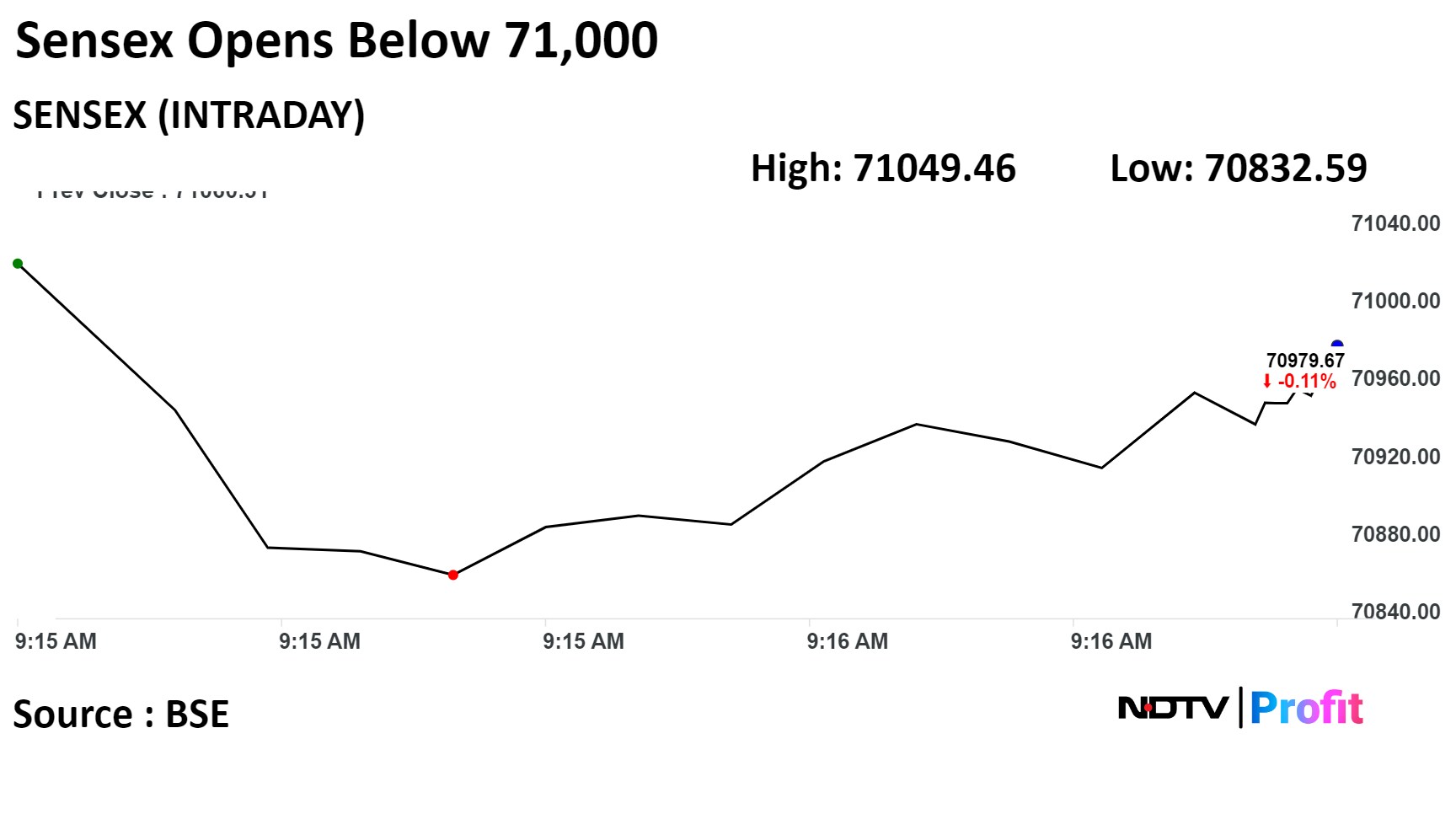

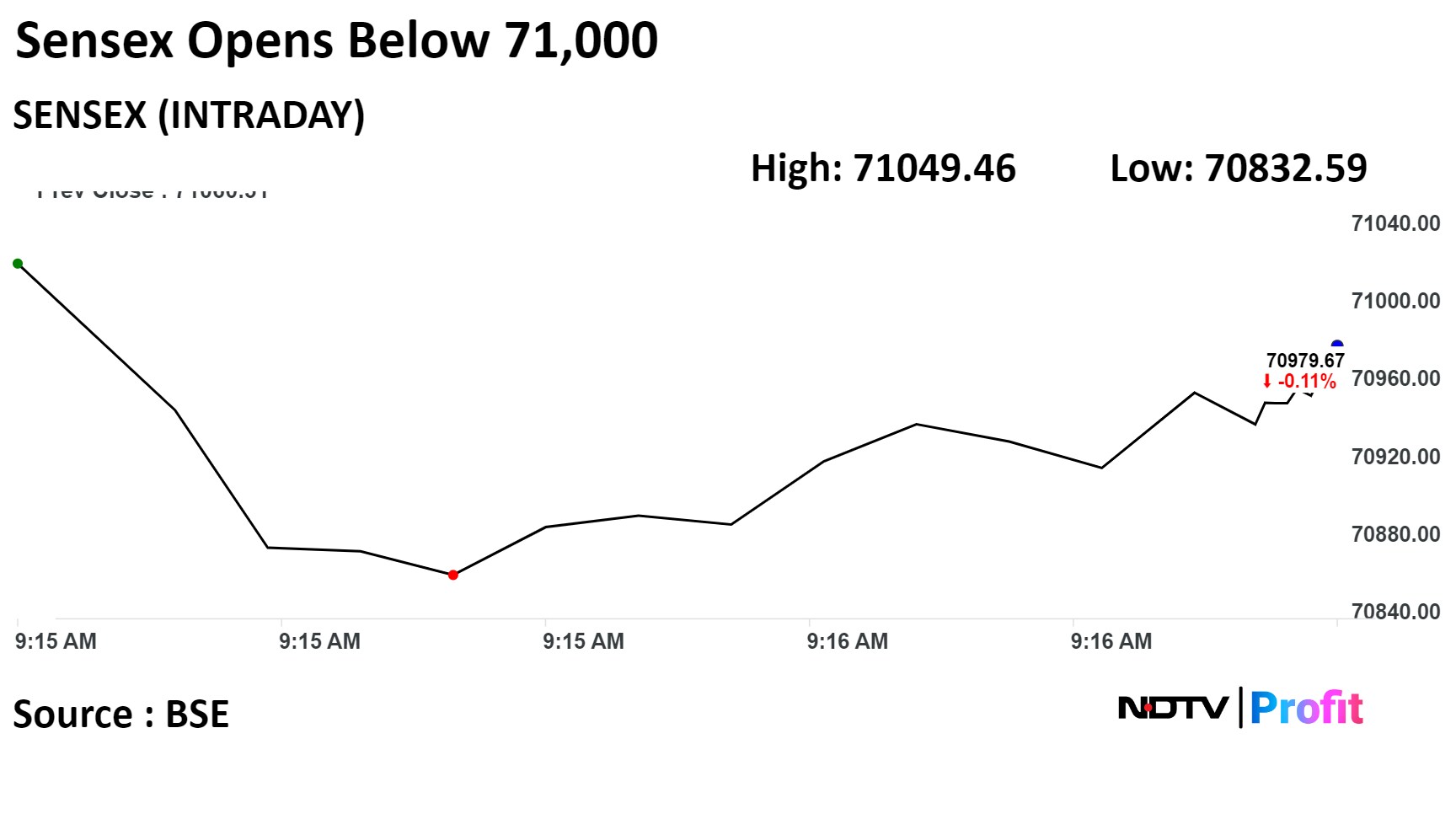

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

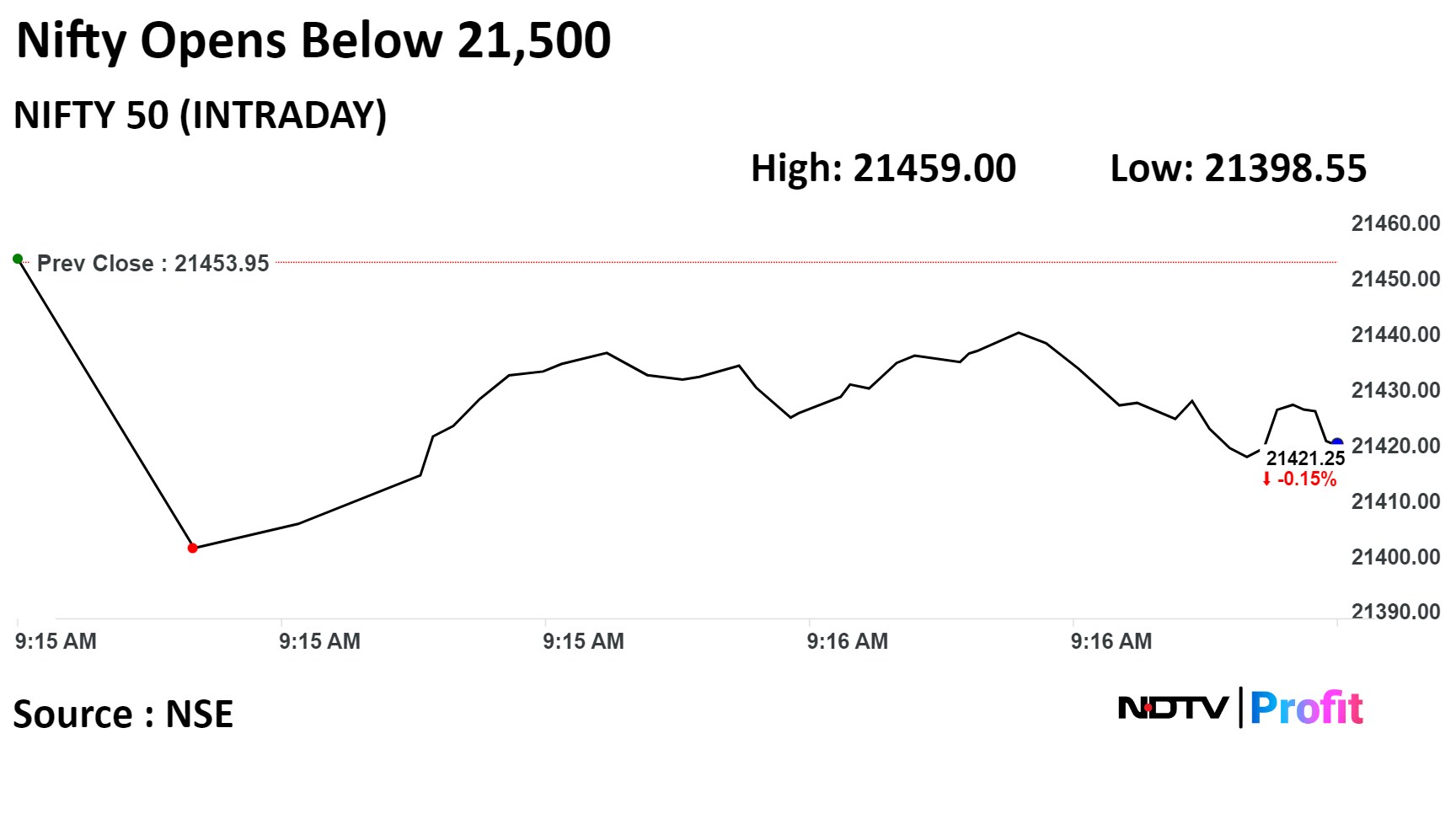

"Nifty Bank has virtually tested its long-term trendline support; however, to confirm trend reversal, needs to breach its immediate resistance of 45,500," Gaggar said.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices started the last trading session of the week on a muted note as gains in shares of Bajaj Auto Ltd, Coal India Ltd supported, while fall in Tech Mahindra Ltd, ICICI Bank Ltd weighed.

As of 09:19 a.m., the NSE Nifty 50 was 42.30 points or 0.20% lower at 21,411.65, while the BSE Sensex was 184.48 points 0.26% lower at 70,875.83.

"A bullish candlestick coupled with cypher pattern and hidden bullish divergence in RSI suggests a trend reversal. The immediate resistance is placed at 21,500 followed by 21,700 while the level of 21,200 will be considered as support," said Aditya Gaggar, director, Progressive Shares.

"Nifty Bank has virtually tested its long-term trendline support; however, to confirm trend reversal, needs to breach its immediate resistance of 45,500," Gaggar said.

State Bank of India, NTPC Ltd, Bajaj Finance Ltd, Coal India Ltd, and Larsen & Toubro Ltd added positively to the indices.

HDFC Bank Ltd, Tech Mahindra Ltd, Infosys Ltd, HCL Technologies Ltd, and Tata Consultancy Ltd weighed on the indices.

On NSE, eight out of 12 sectors rose, while four declined. The Nifty Realty gained 1.01% to become the best performer among sectoral indices, while the Nifty IT fell 0.81% to emerge as the worst performer.

Broader markets outperformed benchmark indices. The S&P BSE Midcap index rose 0.69% while the S&P BSE Smallcap gained 0.69%.

On BSE, 10 out of 20 sectors gained, with the S&P BSE Realty index rising the most to become the top performer. Around 10 sectors fell, with the S&P BSE IT index emerging as the worst performer.

Market breadth was skewed in favour of buyers. Around 2406 stocks rose, 1393 stocks declined, and 85 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was flat at 21,454.60, while the S&P BSE Sensex was 38.21points or 0.05% down at 71,022.10.

Titagarh Rail Systems Ltd signed a joint venture agreement with Amber Enterpises unit Sidwal Refrigeration for investing in SPV Shivaliks Mercantile

Joint venture SPV for carrying business of railway components and sub systems in India and overseas

Titagarh Rail and Sidwal will invest up to Rs 120 crore each in the JV-SPV

Alert: Promoter of Titagarh Rail holds stake in Shivaliks Mercantile

Source: Exchange filing

Motilal Oswal rated 'Neutral' to Tech Mahindra with A Target Price Rs 1,360

The brokerage said, margin pickup remains key for a rerating.

CME still a weak area, enterprise growth mixed, said Motilal Oswal

Trailing 12-month TCV lowest in the last three years

Trailing book-to-bill ratio lowest in five years

Restructuring initiatives under new CEO key positive

Nirmal Bang rated 'Accumulate' on Tech Mahindra with Target Price: Rs 1,535.

Management said, demand better than six months ago, but no “greenshoots”.

New CEO focused on delivering sustainable turnaround, not quick fixes.

Telecom vertical continues to face volatility, but worst may be behind.

Margins to improve going ahead, but focus on investments to deliver a sustainable turnaround.

If forced to make a choice between growth and margins, it would favour margins.

U.S. Dollar Index at 103.36

U.S. 10-year bond yield at 4.16%

Brent crude up 0.19% at $80.19 per barrel

Nymex crude up 0.27% at $75.29 per barrel

GIFT Nifty was up 20 points or 0.09% at 21,443.00 as of 8:14 a.m.

Bitcoin up 0.54% at 39,981.03

Maintain "equal-weight" with price target of Rs 120 apiece

Domestic Ebitda beat estimates on higher realisations, better costs

European business remained a drag, higher beat was led by "other" businesses

Upside risks: higher steel demand growth in India, recovery in steel prices

Downside risks: sharp correction in international steel prices, deeper losses in Europe

Morgan Stanley maintained 'overweight' on Bajaj Auto Ltd. and raised price target to Rs 8,082 from Rs 7,112 earlier.

The brokerage said improving motorcycle franchise drove earnings beat

All time high top- and bottom-line for three consecutive quarters

Portfolio of premium brands likely to outperform industry growth

Exports recovery will be next margin tailwind

Early read-across for Triumph, e-2W, e-3W is positive

Citi Research retained 'sell' but raised target price to Rs 5,000 apiece from Rs 4,300 apiece.

Due to minor miss in revenue earnings marginally below expected

Outlook for domestic business including EVs is positive

Competitive intensity is high in motorcycle space and export revival could be long drawn

Increases estimated given broader improvement in demand and better 3W sales trend

Increases target multiple to 18x from 17x earlier

Citi Research maintained 'sell' rating on TVS Motors, but raised price target to Rs 1,300 apiece from Rs 1,050 apiece earlier.

The company's Q3 Ebitda broadly in line, non-operating income buoys PAT.

Exports recovery likely to be gradual

Claims rich valuations and improved demand

Target P/E increased from 26x to 28x

Jefferies maintained 'buy' on TVS Motors with a target price Rs 2,525 apiece on TVS Motor.

TVS Motor's Q3 Ebitda rose to new highs but were below estimates.

Expect margins to rise to 11.9-12.5% in FY25

Norton (UK subsidiary) to take 6-8 quarters to start realising benefits

Indian 2W recovering, expect volumes to grow 11% in FY24E; exports bottoming

TVS has gained market share across scooters, motorcycles, export

Price band revised from 20% to 10%: Bajel Projects, IFCI.

Ex/record date dividend: Ksolves India, KDDL, IIFL Finance, Mastek.

Moved into short-term ASM framework: Vikas Lifecare, Zee Entertainment.

Moved out of short-term ASM framework: Accleya Solutions, Salasar Techno Engineering.

Nifty January futures up by 1.39% to 21,477.60 at a premium of 23.65 points.

Nifty January futures open interest down by 33%.

Nifty Bank January futures up by 0.49% to 45,131.30 at a premium of 48.9 points.

Nifty Bank January futures open interest down by 17.41%.

Nifty Options Jan 25 Expiry: Maximum Call open interest at 22,000 and Maximum Put open interest at 21,000.

Bank Nifty Options Jan 25 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 44,000.

Securities in the ban period: Zee Entertainment Enterprise.

Mangalore Chemicals and Fertilizers: Promoter Zuari Agro Chemicals revoked a pledge for 70 lakh shares on Jan 23.

Gensol Engineering: Promoter Gensol Ventures created a pledge of 15.50 lakh shares on Jan 17 and promoter Anmol created a pledge of 2.43 lakh shares on Jan 17.

Bank of Baroda: To meet analysts and investors on Jan. 31.

Poonawalla Fincorp: Magma Ventures sold 40.33 lakh shares (0.52%) and Rising Sun Holdings bought 40.33 lakh shares (0.52%) at Rs 495.85.

Computer Age Management Services: HDFC Bank sold 10 lakh shares (2.02%) at Rs 2,700.08 apiece. Fidelity Investment Trust Fidelity Emerging Markets Fund bought 2.82 lakh shares (0.57%) at Rs 2,700 apiece.

Manappuram Finance: BNP Paribas Arbitrage sold 46.46 lakh shares (0.54%) at Rs 172.06 apiece.

Sunteck Realty: Briarwood Capital Master Fund sold 47.15 lakh shares (3.21%), and CLSA Global Markets bought 46.52 lakh shares (3.17%) at Rs 445.5 apiece.

Epack Durable: The public issue was subscribed 16.37 times on day 3. The bids were led by non-institutional investors (28.10 times), retail investors (6.29 times) and institutional investors (25.50 times).

Nova Agritech: The public issue was subscribed 33.87 times on day 2. The bids were led by non-institutional investors (71.23 times), retail investors (36.28 times) and institutional investors (1.12 times).

Coal India, Reliance Industries, Adani Enterprises, BHEL, Gail, IOCL, NLC India: Cabinet approved the scheme for the promotion of coal gasification projects with an outlay of Rs 8,500 crore. Incentives for coal gasification projects are to be implemented in three categories.

Zee Entertainment Enterprises: The company has moved the National Company Law Tribunal seeking directions to implement the merger with Sony Group Corp.'s Indian subsidiary.

Tata Motors: The company has sought to deregister all its U.S.-listed securities from the country's capital markets regulator after meeting the set criteria for the action.

Mazagon Dock Shipbuilders: The company signed a contract worth Rs 1,070 crore with the acquisition wing of the Ministry of Defence for the construction and delivery of 14 fast patrol vessels for the Indian Coast Guard.

DLF: The board approved the sale of the asset 'DLF Centre' to unit DLF cyber city developers for consideration of Rs 825 crore.

CEAT: The company approved a capex expansion plan of Rs 572 crore at existing Plants. The proposed amount is to be spent over 3 years and is to be funded by debt and internal accruals.

Coal India: The company and Bharat Heavy Electricals will invest up to Rs 11,782 crore in a coal-to-ammonium nitrate joint venture project in Odisha. The company and GAIL invest up to Rs 13,053 crore in a coal-to-SNG JV project in West Bengal.

Piramal Enterprises: The company’s unit has agreed to buy a 10.39% stake in Annapurna Finance for Rs 300 crore through a mix of equity and debt.

Axis Bank: The private lender approved the investment of Rs 100 crore in a new wholly-owned unit. The new subsidiary will offer business correspondents and technological service providers to the bank.

Bajaj Auto: Madhur Bajaj resigned from the position of non-executive vice chairman.

Borosil: The company approved fundraising up to Rs 250 crore via qualified institutional placement.

Tasty Bite Eatables: Milin Bande resigned from the position of chief financial officer of the company.

Balkrishna Industries: The company approved the merger of the unit BKT Tyers with itself.

Cyient DLM: The company appointed Kausal Jadia as chief technology officer.

NHPC: The government will sell up to 50.5 lakh shares via an offer for sale to eligible employees at Rs 71 per share, which indicates a discount of 11.7% to the current market price.

Sona BLW Precision Forgings: The company signed a definitive agreement with CleanMax for setting up a captive power-generating facility in Haryana.

IRM Energy: Commercial operations at the company's LCNG station at Rasipuram, Namakkal district, commenced from Jan. 24.

JSW Steel, SBI Life, Cipla, Cholamandalam Investment, Shriram Finance, SBI Cards, AU Small Finance Bank, Tata Tech, ACC, Indraprastha Gas, Syngene International, Manyavar, Cyient, TVS Holdings, Asahi India Glass, Equitas SFB, IEX, Intellect Design Arena, Elecon Engineering, KFin Technologies, Maharashtra Scooters, ION Exchange, DB Corp, Sterlite Tech, Swaraj Engines.

Tata Steel Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 3.11% at Rs 55,311.9 crore vs Rs 57,083.6 crore (Bloomberg estimate: Rs 57,810 crore).

Ebitda up 54.73% at Rs 6,263.59 crore vs Rs 4047.88 crore (Bloomberg estimate: Rs 5,526.5 crore).

Margin expands 423 bps to 11.32% vs 7.09% (Bloomberg estimate: 9.6%).

Net profit at Rs 522.1 crore vs loss of Rs 2,502 crore (Bloomberg estimate: Profit of Rs 1,687.8 crore).

Tech Mahindra Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 1.84% at Rs 13,101.3 crore vs Rs 12,863.9 crore (Bloomberg estimate: Rs 12,801.10 crore).

EBIT up 53.79% at Rs 703.2 crore vs Rs 457.1 crore (Bloomberg estimate: Rs 780.4 crore).

Margin expands 181 bps at 5.36% vs 3.55% (Bloomberg estimate: 6.10%).

Net profit up 3.64% at Rs 523.7 crore vs Rs 505.3 crore (Bloomberg estimate: Rs 663.3 crore).

PNB Housing Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 2.4% at Rs 1,748.05 crore vs Rs 1,707.05 crore.

Ebitda up 18.79% at Rs 1,541.84 crore vs Rs 1,297.95 crore.

Margin expands 1,216 bps at 88.2% vs 76.03%.

Net profit up 27.28% at Rs 346.54 crore vs Rs 272.25 crore (Bloomberg estimate: Rs 360.1 crore).

Bajaj Auto Q3 Earnings FY24 (Standalone, YoY)

Revenue up 30.04% at Rs 1,2113.51 crore vs Rs 9,315.14 crore (Bloomberg estimate: Rs 11,766.7 crore).

Ebitda up 36.75% at Rs 2,429.87 crore vs Rs 1,776.81 crore (Bloomberg estimate: Rs 2,284.6 crore).

Margin expands 98 bps to 20.05% vs 19.07% (Bloomberg estimate: 19.40%).

Net profit up 36.9% at Rs 2,041.88 crore vs Rs 1,491.42 crore (Bloomberg estimate: Rs 1,930 crore).

DLF Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 1.76% at Rs 1,521.25 crore vs Rs 1494.8 crore (Bloomberg estimate: Rs 1,697 crore).

Ebitda up 7.12% at Rs 510.97 crore vs Rs 477 crore (Bloomberg estimate: Rs 597 crore).

Margin expands 167 bps to 33.58% vs 31.91% (Bloomberg estimate: 35.20%).

Net profit up 26.59% at Rs 655.71 crore vs Rs 517.94 crore (Bloomberg estimate: Rs 721 crore).

Birlasoft Q3 FY24 (Consolidated, QoQ)

Revenue up 2.52% at Rs 1,342.9 crore vs Rs 1,309.8 crore (Bloomberg estimate: Rs 1,333.3 crore).

Ebitda up 4.15% at Rs 193.2 crore vs Rs 185.5 crore (Bloomberg estimate: Rs 180.1 crore).

Margin expands 22 bps to 14.38% vs 14.16% (Bloomberg estimate: 13.50%).

Net profit up 11.03% at Rs 161 crore vs Rs 145 crore (Bloomberg estimate: Rs 142.4 crore).

Aarti Drugs Q3 FY24 (Consolidated, YoY)

Revenue down 8.74% at Rs 605.94 crore vs Rs 663.96 crore.

Ebitda down 0.71% at Rs 70.14 crore vs Rs 70.64 crore.

Margin expands 93 bps to 11.57% vs 10.63%.

Net profit up 0.1% at Rs 36.71 crore vs Rs 36.67 crore.

Board declared interim dividend of Re 1 per share.

Dalmia Bharat Q3 FY24 (Consolidated, YoY)

Revenue up 7.3% at Rs 3,600 crore vs Rs 3,355 crore (Bloomberg estimate: Rs 3,523.7 crore).

Ebitda up 20.34% at Rs 775 crore vs Rs 644 crore (Bloomberg estimate: Rs 750 crore).

Margin expands 233 bps to 21.52% vs 19.19% (Bloomberg estimate: 21.30%).

Net profit up 22.01% at Rs 266 crore vs Rs 218 crore (Bloomberg estimate: Rs 244.5 crore).

TVS Motor Q3 FY24 (Standalone, YoY)

Revenue up 25.96% at Rs 8,245.01 crore vs Rs 6,545.42 crore (Bloomberg estimate: Rs 8,335.9 crore).

Ebitda up 40.29% at Rs 924.43 crore vs Rs 658.93 crore (Bloomberg estimate: Rs 932.5 crore).

Margin up 114 bps at 11.21% vs 10.06% (Bloomberg estimate: 11.20%).

Net profit up 68.2% at Rs 593.35 crore vs Rs 352.75 crore (Bloomberg estimate: Rs 546.6 crore).

Balkrishna Industries Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 5.02% at Rs 2,274.41 crore vs Rs 2,165.57 crore (Bloomberg estimate: Rs 2,357.1 crore).

Ebitda up 100.74% at Rs 540.59 crore vs Rs 269.29 crore (Bloomberg estimate: Rs 590.6 crore).

Margin expands 1,133 bps to 23.76% vs 12.43% (Bloomberg estimate: 25.10%).

Net profit up 181.96% at Rs 305.42 crore vs Rs 108.32 crore (Bloomberg estimate: Rs 332.9 crore).

Sagar Cements Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 16.3% at Rs 669.4 crore vs Rs 575.7 crore (Bloomberg estimate: Rs 652.7 crore).

Ebitda up 83% at Rs 87.06 crore vs Rs 47.58 crore (Bloomberg estimate: Rs 95.3 crore).

Margin expands 474 bps to 13% vs 8.26% (Bloomberg estimate: Rs 14.6%).

Net loss at Rs 10.18 crore vs loss of Rs 23.68 crore (Bloomberg estimate: Loss of Rs 3.6 crore).

Blue Dart Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 3.42% at Rs 1,382.93 crore vs Rs 1,337.08 crore (Bloomberg estimate: Rs 1,449.1 crore).

Ebitda down 6.42% at Rs 213.43 crore vs Rs 228.05 crore (Bloomberg estimate: Rs 251.3 crore).

Margin contracts 162 bps to 15.43% vs 17.05% (Bloomberg estimate: 17.30%).

Net profit up 0.25% at Rs 88.89 crore vs Rs 88.66 crore (Bloomberg estimate: Rs 95.2 crore).

Chalet Hotels Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 28.96% at Rs 373.6 crore vs Rs 289.7 crore (Bloomberg estimate: Rs 354.9 crore).

Ebitda up 46.25% at Rs 166 crore vs Rs 113.5 crore (Bloomberg estimate: Rs 151.8 crore).

Margin expands 525 bps to 44.43% vs 39.17% (Bloomberg estimate: 42.8%).

Net profit down 30.98% at Rs 70.6 crore vs Rs 102.3 crore (Bloomberg estimate: Rs 54.7 crore).

Rainbow Children's Medicare Q3 FY24 (Consolidated, YoY)

Revenue up 9.6% at Rs 335.9 crore vs Rs 306.4 crore (Bloomberg estimate: Rs 340 crore).

Ebitda up 10.6% at Rs 118 crore vs Rs 106.7 crore (Bloomberg estimate: Rs 115.5 crore).

Margin up 30 bps at 35.12% vs 34.82% (Bloomberg estimate: 34%).

Net profit up 7.6% at Rs 62.6 crore vs Rs 58.2 crore (Bloomberg estimate: Rs 61.4 crore).

Ceat Q3 FY24 (Consolidated, YoY)

Revenue up 8.6% at Rs 2,963.1 crore vs Rs 2,727.2 crore (Bloomberg estimate: Rs 2,994.1 crore).

Ebitda up 75.7% at Rs 417.5 crore vs Rs 237.6 crore (Bloomberg estimate: Rs 414.5 crore).

Margin expands 537 bps to 14.08% vs 8.71% (Bloomberg estimate: 13.8%).

Net profit up 419.48% at Rs 181.3 crore vs Rs 34.9 crore (Bloomberg estimate: Rs 160.4 crore).

Container Corp Q3 FY24 (Consolidated, YoY)

Revenue up 10.3% at Rs 2,210.6 crore vs Rs 2,004.5 crore.

Ebitda up 19.7% at Rs 517.5 crore vs Rs 432.4 crore.

Margin expands 183 bps to 23.4% vs 21.57%.

Net profit up 13.1% at Rs 330.6 crore vs Rs 293.4 crore.

Railtel Corp Q3 FY24 (Consolidated, QoQ)

Revenue up 11.5% at Rs 668.4 crore vs Rs 599.2 crore.

Ebitda up 3% at Rs 118.8 crore vs Rs 115.3 crore.

Margin narrows 147 bps to 17.76% vs 19.24%.

Net profit down 8.9% at Rs 62.1 crore vs Rs 68.2 crore.

Laurus Labs Q3 Earnings FY24 (Consolidated, YoY)

Revenue down 22.65% at Rs 1,194.92 crore vs Rs 1,544.82 crore (Bloomberg estimate: Rs 1,385 crore).

Ebitda down 55.05% at Rs 181.42 crore vs Rs 403.57 crore (Bloomberg estimate: Rs 275.7 crore).

Margin contracts 1,094 bps at 15.18% vs 26.12% (Bloomberg estimate: 19.90%).

Net profit down 88.47% at Rs 23.34 crore vs Rs 202.54 crore (Bloomberg estimate: Rs 104.5 crore).

DCB Bank Q3 Earnings FY24 (Standalone, YoY)

NII up 6.3% Rs 474 corer vs Rs 446 crore.

Net profit up 11.2% Rs 126.6 crore vs Rs 113.9 crore (Bloomberg estimate: Rs 128.6 crore).

Gross NPA at 3.43% vs 3.36% (QoQ).

Net NPA at 1.22% vs 1.28% (QoQ).

Markets in the Asia-Pacific region were trading on a mixed note as investors evaluated China's central bank's new move to aid the economy and South Korea's GDP data.

The S&P ASX 200 was 4.80 points, or 0.06%, higher at 7,524.00, and the Nikkei 225 was 87.20 points, or 0.24%, lower at 36,139.28, as of 07:08 a.m.

South Korea's GDP grew 0.6% sequentially in the fourth quarter, in line with estimates from a Bloomberg Survey. The KOSPI Index was trading 7.61 points, or 0.31%, lower at 2,462.08 as of 7:08 a.m.

The People's Bank of China Governor said it would cut the reserve requirement ratio by 0.5% on Feb. 5 and hinted for more such cuts, Bloomberg reported.

Most of the countries in the Asia-Pacific region are dependent on China through international trade, thus making them vulnerable to the impact of any economic event in China.

Going forward in the day, the focus will be on the European Central Bank's policy meet outcome. The central bank is largely expected to hold rates steady, Bloomberg reported.

U.S. stocks held onto gains in Wednesday's trading, with traders positive about the economy after a fresh batch of data-topped estimates and technology companies reported robust earnings, according to Bloomberg.

The S&P 500 index and Nasdaq 100 rose by 0.08% and 0.55%, respectively, as of Wednesday. The Dow Jones Industrial Average fell by 0.26%.

Brent crude was trading 0.62% higher at $80.04 a barrel. Gold was higher by 0.07% at $2,015.20 an ounce.

The GIFT Nifty was trading 20 points, or 0.09%, higher at 21,443.00 as of 8:14 a.m.

India’s benchmark stock indices closed higher, snapping a two-day losing streak on Wednesday, as HDFC Bank Ltd. led the gains and nearly all sectors advanced. The NSE Nifty 50 ended 215.15 points, or 1.01%, higher at 21,453.95, and the S&P BSE Sensex gained 689.76 points, or 0.98%, to end at 71,060.31.

Overseas investors remained net sellers of Indian equities for the sixth consecutive session on Wednesday.

Foreign portfolio investors offloaded stocks worth Rs 6,934.9 crore, while domestic institutional investors remained net buyers and mopped up equities worth Rs 6,012.7 crore, the NSE data showed.

The Indian rupee strengthened by 4 paise to close at Rs 83.12 against the U.S. dollar.

Markets in the Asia-Pacific region were trading on a mixed note as investors evaluated China's central bank's new move to aid the economy and South Korea's GDP data.

The S&P ASX 200 was 4.80 points, or 0.06%, higher at 7,524.00, and the Nikkei 225 was 87.20 points, or 0.24%, lower at 36,139.28, as of 07:08 a.m.

South Korea's GDP grew 0.6% sequentially in the fourth quarter, in line with estimates from a Bloomberg Survey. The KOSPI Index was trading 7.61 points, or 0.31%, lower at 2,462.08 as of 7:08 a.m.

The People's Bank of China Governor said it would cut the reserve requirement ratio by 0.5% on Feb. 5 and hinted for more such cuts, Bloomberg reported.

Most of the countries in the Asia-Pacific region are dependent on China through international trade, thus making them vulnerable to the impact of any economic event in China.

Going forward in the day, the focus will be on the European Central Bank's policy meet outcome. The central bank is largely expected to hold rates steady, Bloomberg reported.

U.S. stocks held onto gains in Wednesday's trading, with traders positive about the economy after a fresh batch of data-topped estimates and technology companies reported robust earnings, according to Bloomberg.

The S&P 500 index and Nasdaq 100 rose by 0.08% and 0.55%, respectively, as of Wednesday. The Dow Jones Industrial Average fell by 0.26%.

Brent crude was trading 0.62% higher at $80.04 a barrel. Gold was higher by 0.07% at $2,015.20 an ounce.

The GIFT Nifty was trading 20 points, or 0.09%, higher at 21,443.00 as of 8:14 a.m.

India’s benchmark stock indices closed higher, snapping a two-day losing streak on Wednesday, as HDFC Bank Ltd. led the gains and nearly all sectors advanced. The NSE Nifty 50 ended 215.15 points, or 1.01%, higher at 21,453.95, and the S&P BSE Sensex gained 689.76 points, or 0.98%, to end at 71,060.31.

Overseas investors remained net sellers of Indian equities for the sixth consecutive session on Wednesday.

Foreign portfolio investors offloaded stocks worth Rs 6,934.9 crore, while domestic institutional investors remained net buyers and mopped up equities worth Rs 6,012.7 crore, the NSE data showed.

The Indian rupee strengthened by 4 paise to close at Rs 83.12 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.