India's benchmark stock indices recorded their worst fall since January, tracking declines in shares of heavyweights HDFC Bank Ltd., Larsen & Toubro Ltd., and Reliance Industries Ltd.

Market capitalisation of the Nifty Total Market, which tracks the performance of 750 stocks listed on the NSE, fell Rs 6.7 lakh crore in Thursday's crash, according to data on the NSE.

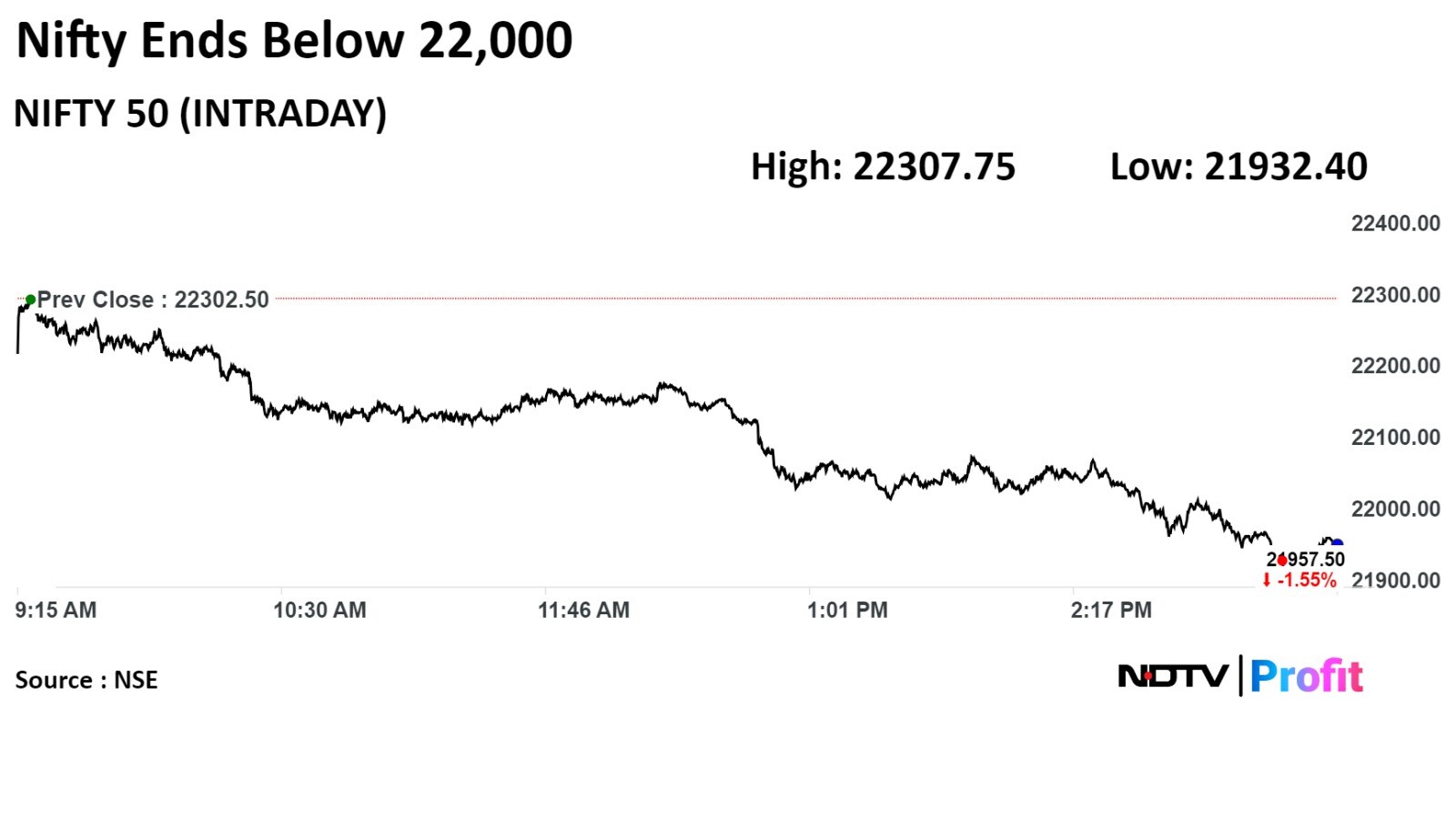

The NSE Nifty 50 ended 345 points, or 1.55%, lower at 21,957.50, and the S&P BSE Sensex settled 1,062.22 points, or 1.45%, lower at 72,404.17.

The Nifty fell 1.66% to 21,932.40, and the Sensex dropped 1.54% to 72,334.74 during the day.

The benchmark Nifty 50 also slipped below the 22,000 level for the first time in 14 sessions.

"On daily charts, the index has formed a long bearish candle, which supports further weakness from the current levels. We are of the view that the short-term market texture is weak, but due to temporary oversold conditions, we could see one technical pullback rally from the current levels," said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

For traders now, 22,000/72,550 would act as a key level to watch out for. Above 22,000/72,550, the market could bounce back to 22,100-22,150/72,300-72,500, according to him.

On the flip side, below 22,000/72,550, the weak sentiment is likely to continue. Below this, the market could slip to 21,850–21,800/72,100–72,000, Chouhan said.

"Pessimism persisted on the Indian bourses and bears tightened their grip in today's trading session by breaching all the key support levels to end the session at 21,957.50 with a loss of 345 points," said Aditya Gaggar, director, Progressive Share Brokers Pvt.

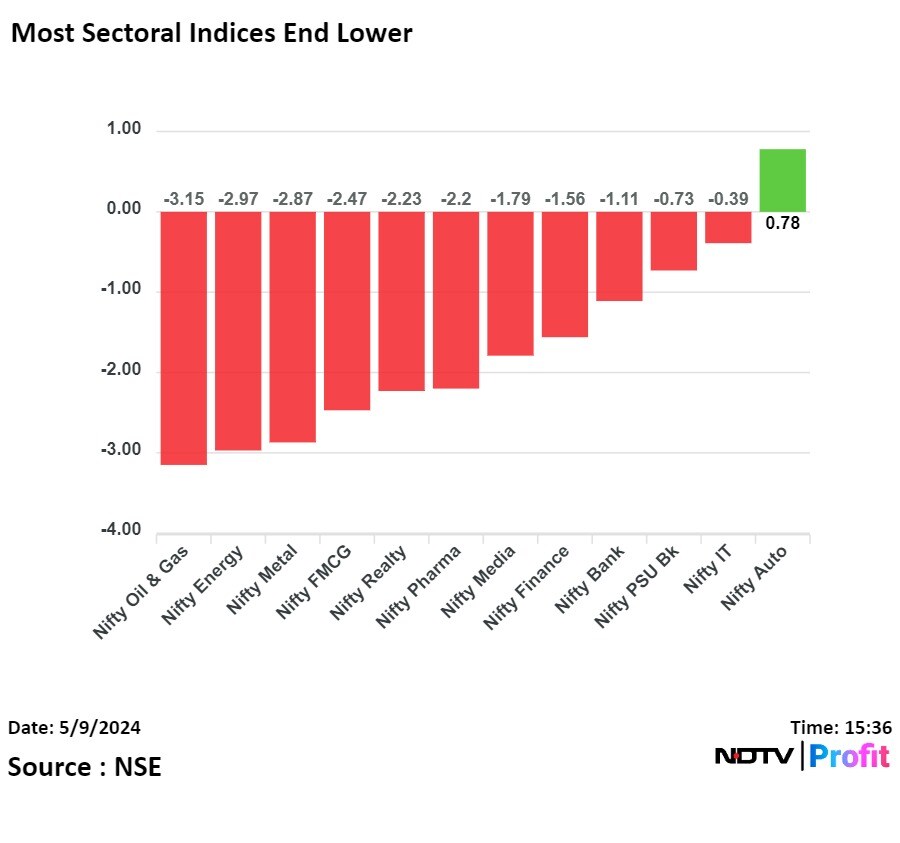

Barring auto, all other sectors ended the day in red, with energy and metal being the major laggards. Relentless selling continued in mid- and small-cap stocks, which resulted in the underperformance of the broader markets, he noted.

"On a technical front, the index has formed a big bearish candle, which indicates the dominance of the bears. Now, the immediate support is placed at 21,830, which is the lower end of an ascending triangle formation, while on the higher side, 22,230 will be a crucial hurdle," Gaggar said.

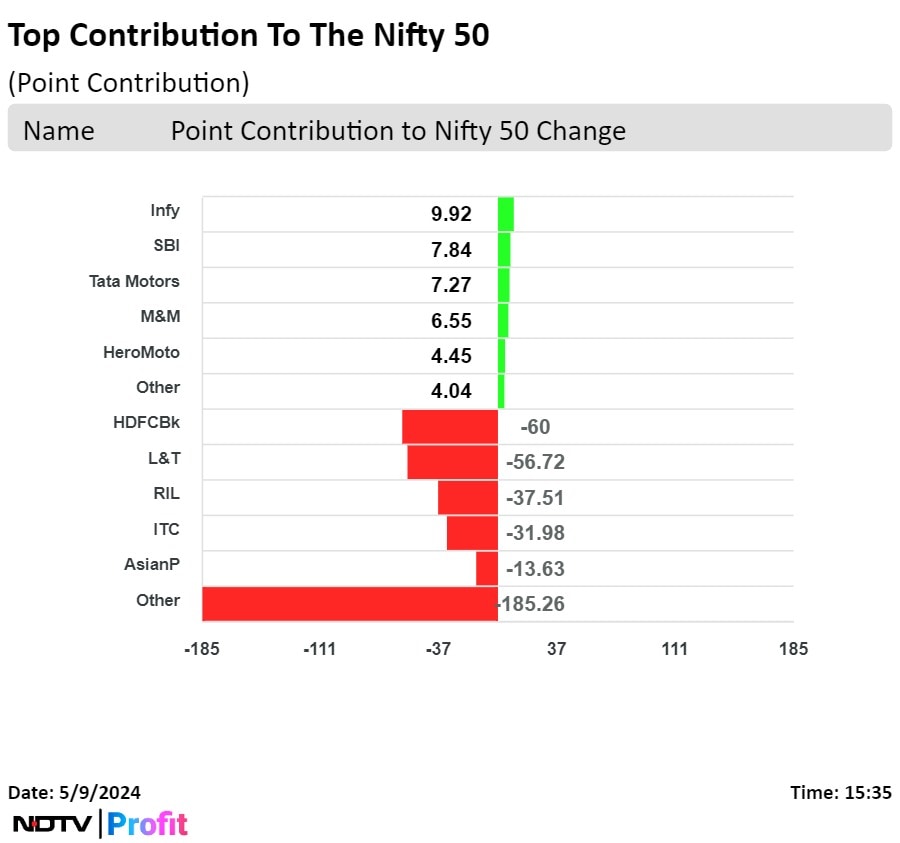

Shares of Infosys Ltd., State Bank of India, Tata Motors Ltd., Mahindra & Mahindra Ltd., and Hero MotoCorp Ltd. limited losses in the Nifty.

While those of HDFC Bank Ltd., Larsen & Toubro Ltd., Reliance Industries Ltd., ITC Ltd., and Asian Paints Ltd. dragged the index.

On NSE, 11 out of 12 sectors ended lower, and one sector ended higher. The NSE Nifty Oil & Gas was the worst performing sector, and the NSE Nifty Auto was the best performing sector.

The broader markets underperformed; the S&P BSE MidCap closed down 2.01%, whereas S&P BSE SmallCap was 2.41% lower.

Nineteen of the 20 sectors on BSE declined. Only S&P BSE Auto ended higher.

The market breadth was skewed in the favour of sellers. About 2,902 stocks fell, 929 rose, while 112 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.