Analysts seem to be cautious about the information technology sector just as the markets prepare for the U.S. Federal Reserve's rate decision on Wednesday.

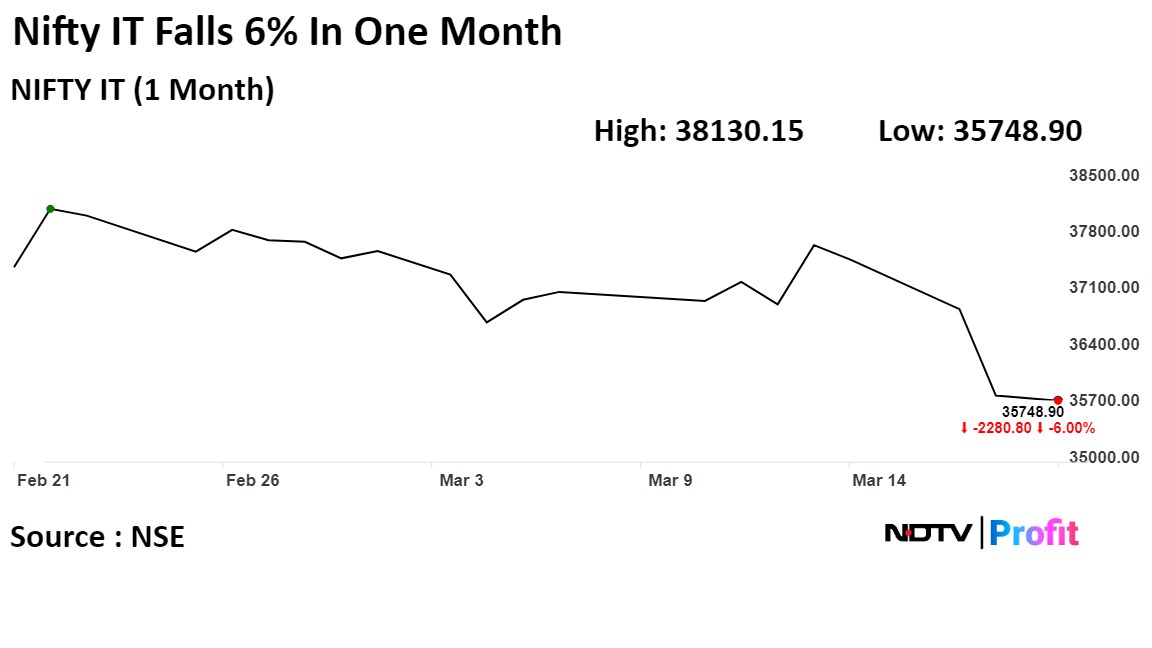

The Nifty IT closed 0.18% lower on Wednesday and has fallen close to 6% in the last month.

"IT services, the whole pack will face the same U.S. Fed again," Chakri Lokapriya, managing partner at RedStrawBerry LLP, told NDTV Profit. "Until that uncertainty goes away, which is probably the next two–three months, the sector is unlikely to really rerate going forward."

The valuations are OK, but it will only "trade water but not make much money from the current levels," he said.

Jai Bala, chief market technician at CashTheChaos, is "very cautious" about IT names. If the index goes below 34,200 levels, then there will be a trend change, he said.

Bala is hesitant to invest in frontline IT names as the entire sector is seeing an overlap of trending moves, with the fall overlapping with the previous year's high. However, he said, "I am bullish on Midcap IT names."

Fed Rates

The benchmark stock indices ended little changed with a positive bias amid volatility on Wednesday. The NSE Nifty 50 settled 21.65 points, or 0.10%, higher at 21,839.10, and the S&P BSE Sensex ended 89.64 points, or 0.12%, higher at 72,101.69.

"In terms of the Fed, I think now that markets are resigned that it will probably be June before any rates are going to be cut. Any language more or less indicating that would be neutral for the market," Lokapriya said. "There could be more surprises from the Fed."

He had previously predicted that the Fed would "backpedal" on the number of rate cuts, which goes in alignment with market expectations.

Maruti Suzuki

The auto segment closed with a 0.27% rise, led by Eicher Motors Ltd. and Maruti Suzuki India Ltd., which touched the 12,000 mark for the first time.

"I was expecting Maruti to be strong and I was a bit surprised that it took this much long for it to move higher," Bala said. "To me, the move looks unfinished; there is potential for Maruti to pull back first and then go towards 13,000."

Lokapriya said Maruti is the favourite in the passenger vehicle space. He said the company stood out from the competition in the past and would continue to do so in the future.

Competition helps to improve products and ultimately become more efficient, according to Shashank Srivastava, senior executive officer of marketing and sales at Maruti Suzuki.

The company welcomes newer competition in the auto and electric vehicle industry as it pushes them to be careful and further improve products, he told NDTV Profit.

Recommendations

While both Lokapriya and Bala are positive on Zomato Ltd. and Chalet Hotels Ltd., Bala is bearish on Polycab India Ltd., and Lokapriya said he will stay away from the oil marketing companies.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.