SRF Ltd. share price touched the lowest level in over four months on Thursday as the UBS Global Research downgraded the stock to 'Sell' from 'Buy'. The Zurich–based brokerage firm has also reduced the target price to Rs 2,100 per share from Rs 2,700 apiece, which implied a downside of 8.77% from Wednesday's closing price.

UBS Global Research downgraded the stock noticing challenges in attaining growth in its agro–chemical and refrigerant gas segments. The brokerage firm estimates that these challenges will lead to 20–22% cut in earnings for SRF in fiscal year 2025.

SRF will release its earning report for July–September on Oct. 22. The share price has declined for two sessions in a row.

SRF is involved in business of specialty chemicals which are used in various sectors like tyre manufacturing, mines, cricket ground, automotive to household appliances, food packaging, and raw materials for pharmaceuticals.

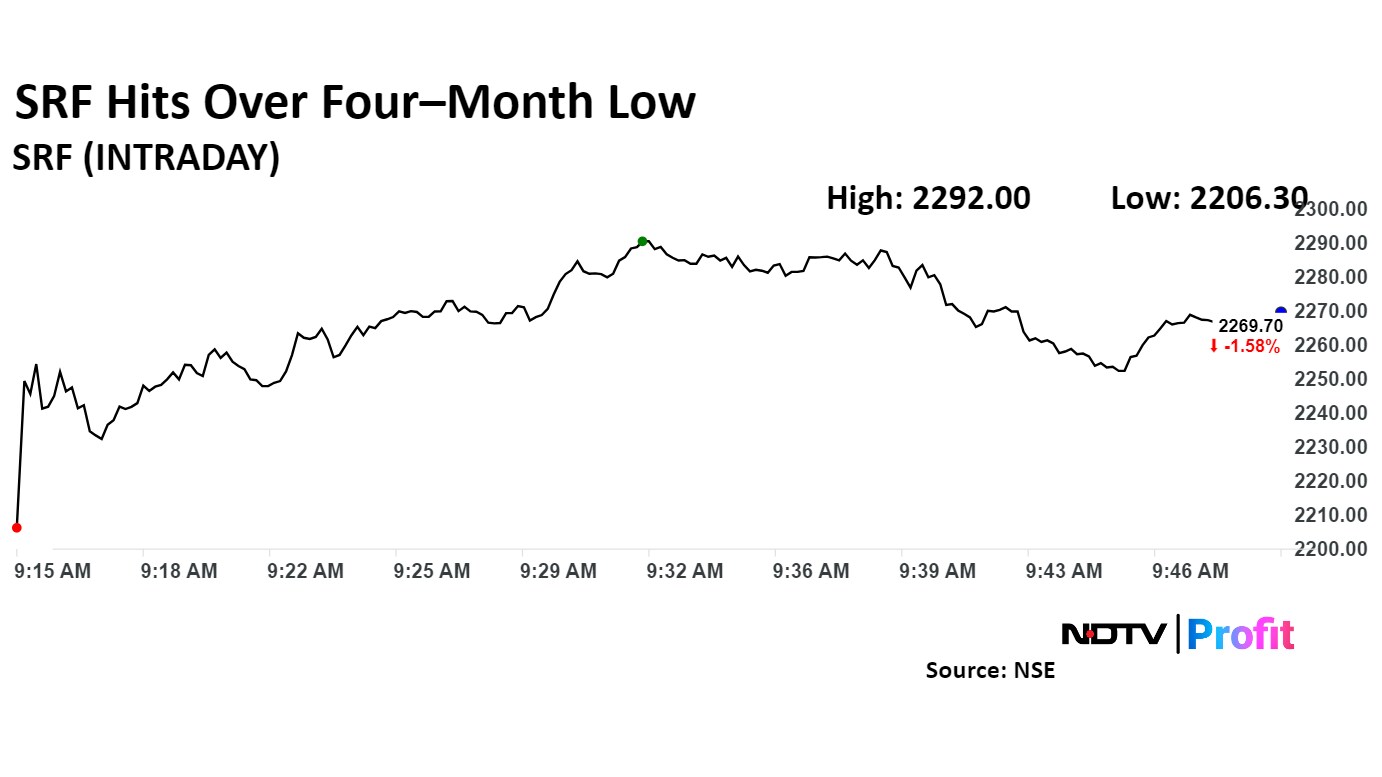

SRF share price fell 4.33% to Rs 2,206.30

SRF share price declined as much as 4.33% to Rs 2,206.30 apiece, the lowest level since June 5. It pared losses to trade 2.23% lower at Rs 2,254.75 as of 09:55 a.m., as compared to 0.59% decline in the NSE Nifty 50 index.

The stock declined 0.96% in 12 months, and 9.01% on a year-to-date basis. Total traded volume so far in the day stood at 8.7 times its 30-day average. The relative strength index was at 29.14, which implied the stock is oversold.

Out of 33 analysts tracking the company, 14 maintain a 'buy' rating, 10 recommend a 'hold,' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.