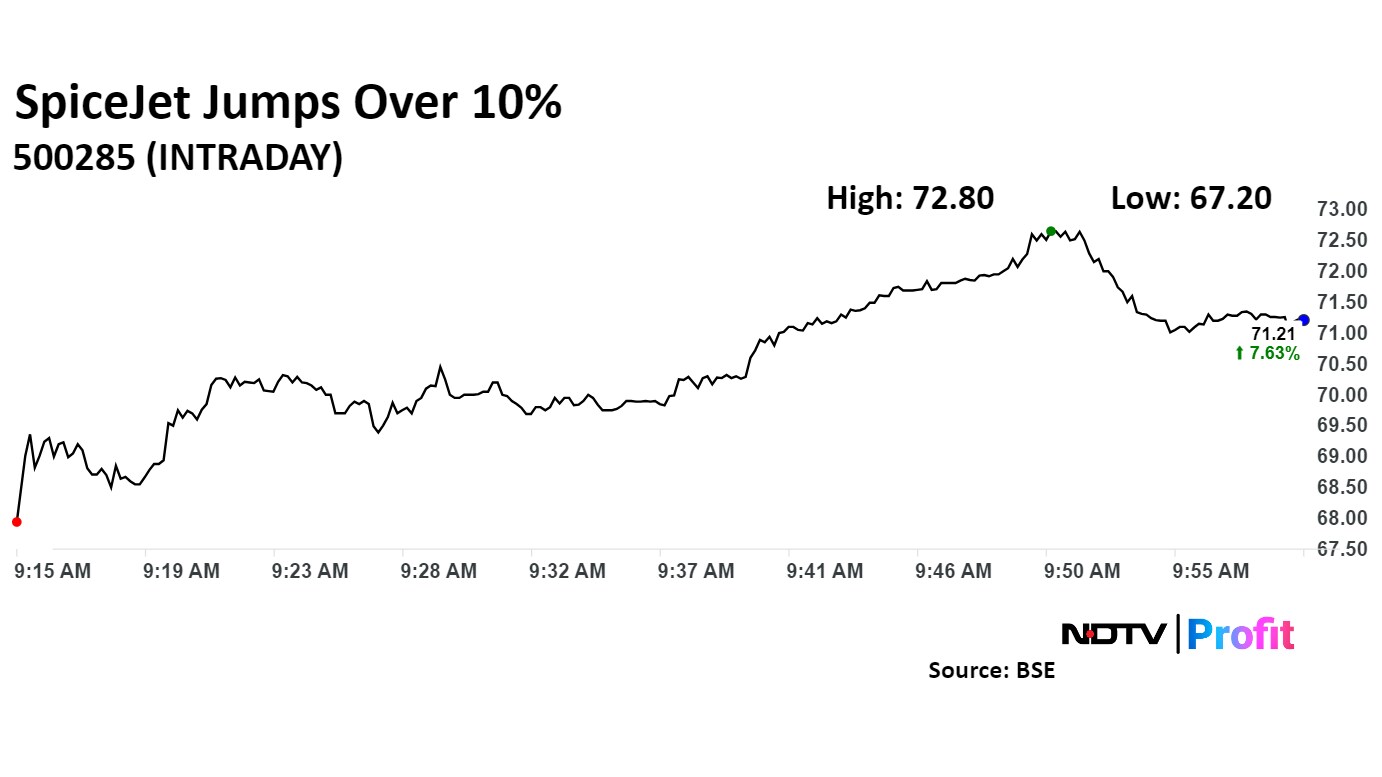

Shares of SpiceJet Ltd. surged by 10.04% to Rs 72.80 apiece, reaching their highest level since September 19, following the board's approval to issue 48.7 crore equity shares at an issue price of Rs 61.60 each.

This move aims to raise Rs 3,000 crore through a qualified institutional placement, which has seen strong interest from investors.

The QIP is part of the airline's strategy to bolster its balance sheet and tackle ongoing financial challenges.

The scrip rose as much as 10.04% to Rs 72.80 apiece. However, it later gave up gains to trade 7.21% higher at Rs 70.93 apiece, as of 10:44 a.m. This compares to a 0.19% rise in the benchmark BSE Sensex.

It has risen 18.22% year-to-date. Total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 58.03.

Out of four analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 37.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.