(Bloomberg) -- Sony Group Corp. plunged its most in two years after slashing projections for sales of the aging PlayStation 5 gaming console, underscoring a global electronics slump.

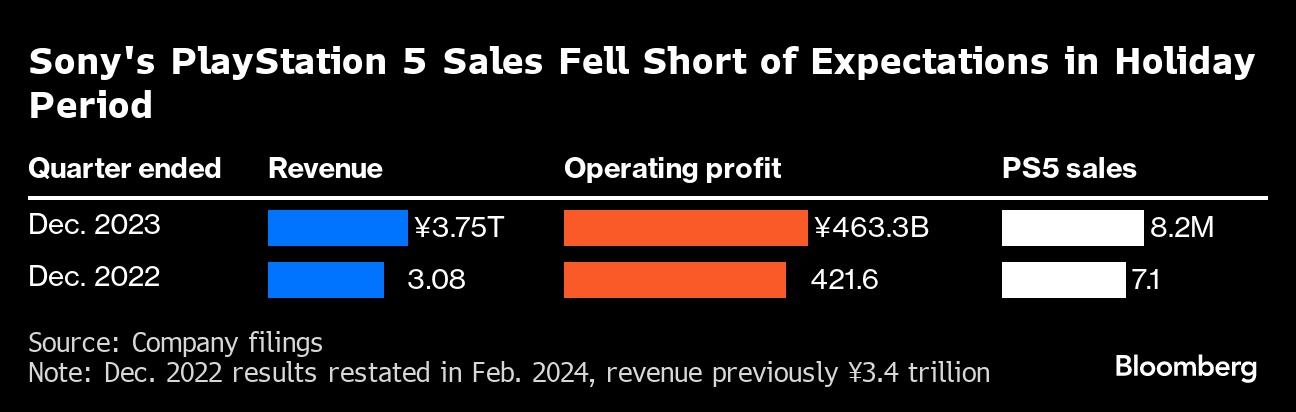

The shares fell as much as 8.4% in early Tokyo trading, the biggest intraday fall since February 2022. On Wednesday, Sony trimmed its revenue forecast after sales of its flagship PS5 in the December quarter came in roughly a million units lower than analysts' estimates, at 8.2 million consoles. The company now expects to sell 21 million units for the fiscal year, down from the previous forecast for 25 million units.

Sony now plans to partially spin off its financial services unit in October 2025 as part of a plan to focus on the growth of businesses such as entertainment and image sensors. The move will reverse a $3.7 billion take-private deal concluded in 2020. It plans to distribute just over 80% of its shares in the financial unit known as SFGI to Sony shareholders through dividends in kind, and to hold slightly less than 20% after the spinoff.

But on Thursday, investors zeroed in on the lackluster outlook. Rivals Nintendo Co. and Microsoft Corp. are expected to launch new hardware in time for the holiday season, raising the level of competition that Sony will face.

“If the platform has already peaked in growth then the outlook could be much grimmer than what even we had in mind for its games business,” Amir Anvarzadeh, a strategist with Asymmetric Advisors, wrote in a research note. “We have long feared that the deep pocketed Microsoft and its subscription service called Game Pass could prove highly disruptive to Sony.”

The Japanese firm now expects ¥12.3 trillion ($81.7 billion) in sales this fiscal year, down from ¥12.4 trillion previously. It reported revenue of ¥3.75 trillion and operating profit of ¥463.3 billion in the quarter ended December, in line with average analyst estimates.

“Looking ahead, PS5 will enter the latter stage of its life cycle,” said Naomi Matsuoka, senior vice president. “As such, we will put more emphasis on the balance between profitability and sales. For this reason, we expect the annual sales pace of PS5 hardware to start falling from the next fiscal year.”

The disappointing hardware sales came despite a strong quarter for software. Released in October as a PS5 exclusive, sold 2.5 million copies in its first 24 hours, making it the fastest-selling debut from Sony's in-house studios. It lifted expectations, along with Sony's record number of users on the PlayStation network in December, that the PS5 was gaining momentum after years of limited supply.

Key for the revenue-driving games division will be sustaining momentum for the $499 machine. On the market since late 2020, the PS5 has had a difficult time reaching Sony's audience as production issues and pandemic-related shipping snarls limited its availability. The company released an updated edition of the PS5 console in October, making it more compact and power-efficient.

“The result showed Sony spent a lot on promotions to sell the PS5, as the unit's profitability deteriorated, but the number of units it shipped during the quarter was much weaker than expected,” said Morningstar research director Kazunori Ito.

Outside of the games division, Sony has to reshape its strategy in India, after a planned merger between its local unit and media outfit Zee Entertainment Enterprises Ltd. reached an impasse due to disagreement over leadership. That deal was the centerpiece to the Japanese firm's increased push into a market of 1.4 billion people.

“Talks with Zee are not advancing, but we think India is a promising market with high growth potential over the long term,” Chief Operating Officer Hiroki Totoki said on a call after earnings. “If there's anything that can replace the Zee deal, we'd like to consider it actively.”

--With assistance from Mayumi Negishi and Edwin Chan.

(Updates with analyst's comment in the fourth paragraph. A previous story corrected the timeframe for biggest fall.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.