The share price of Sona BLW Precision Forgings Ltd. recorded its best jump in nearly three years on Thursday after its consolidated net profit jumped 16% in the September quarter of the current financial year.

The company also announced its entry into the rail components sector by signing a pact to acquire Escorts Kubota Ltd.'s railways equipment division.

Sona BLW posted a profit of Rs 144 crore in the second quarter, according to an exchange filing, meeting the consensus estimate of Rs 142 crore by analysts tracked by Bloomberg.

JPMorgan has a 'neutral' rating for the stock and raised its target price by 6% to Rs 640 apiece, implying a potential downside of 0.6% from the previous close. The target price raise was driven by incorporating proforma numbers for the newly acquired business in its valuation and rolling forward to December 2025.

The brokerage cut its headline earnings-per-share forecasts by 7–10% for financial year 2025–27 to account for weaker growth.

Citi Research said it has reduced its target price for the stock to Rs 750 from Rs 850, while maintaining a 'buy' rating. The target now implies 16.4% upside.

It said that given the uncertainty on global demand, "we cut our estimates significantly for most sub-segments". "We do bake the RED (railway equipment business division) business into our numbers from 2HFY26 onwards, which partially offsets the impact of cuts in our core business estimates over FY26-27," it said.

In a press release, the company said that revenue grew 17% year-on-year, driven mainly by the scale-up of the EV programs.

In its pact with Escorts Kubota, it said that once completed, this acquisition will enhance its clean mobility product offerings by adding a market-leading railway components business. "The railway industry presents long-term growth opportunities, and with the Railway Equipment Division business, we see significant potential to broaden our product range by incorporating advanced technology and engineered products," it said.

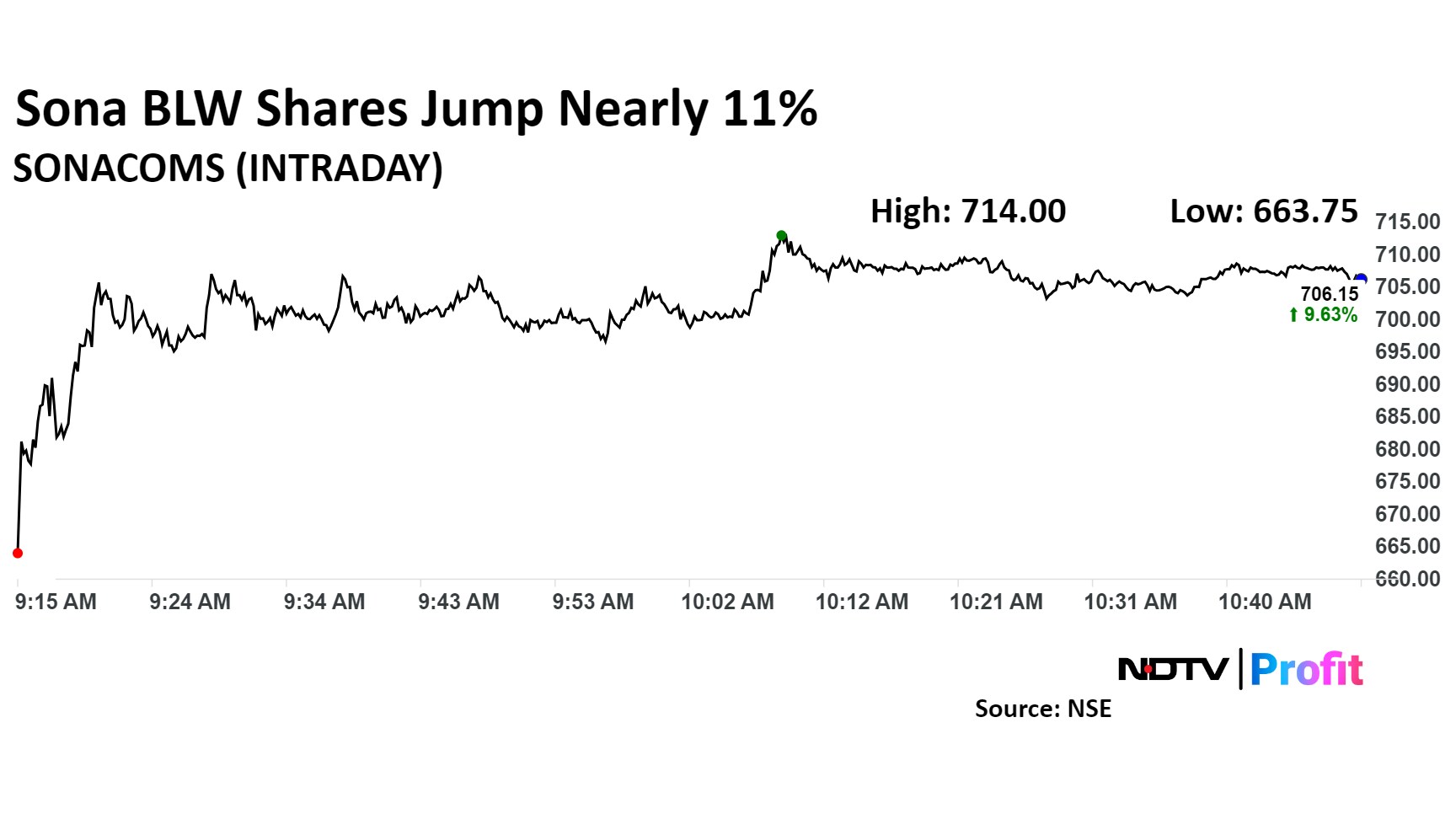

The scrip rose as much as 10.85% to Rs 714 apiece, the highest level since Oct. 3. It pared gains to trade 9.4% higher at Rs 705.45 apiece, as of 10:52 a.m. This compares to a 0.06% decline in the NSE Nifty 50 index.

It has risen 9.5% on a year-to-date basis and 30.2% in the last 12 months. Total traded volume so far in the day stood at 5.34 times its 30-day average. The relative strength index was at 57.8.

Out of the 19 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.