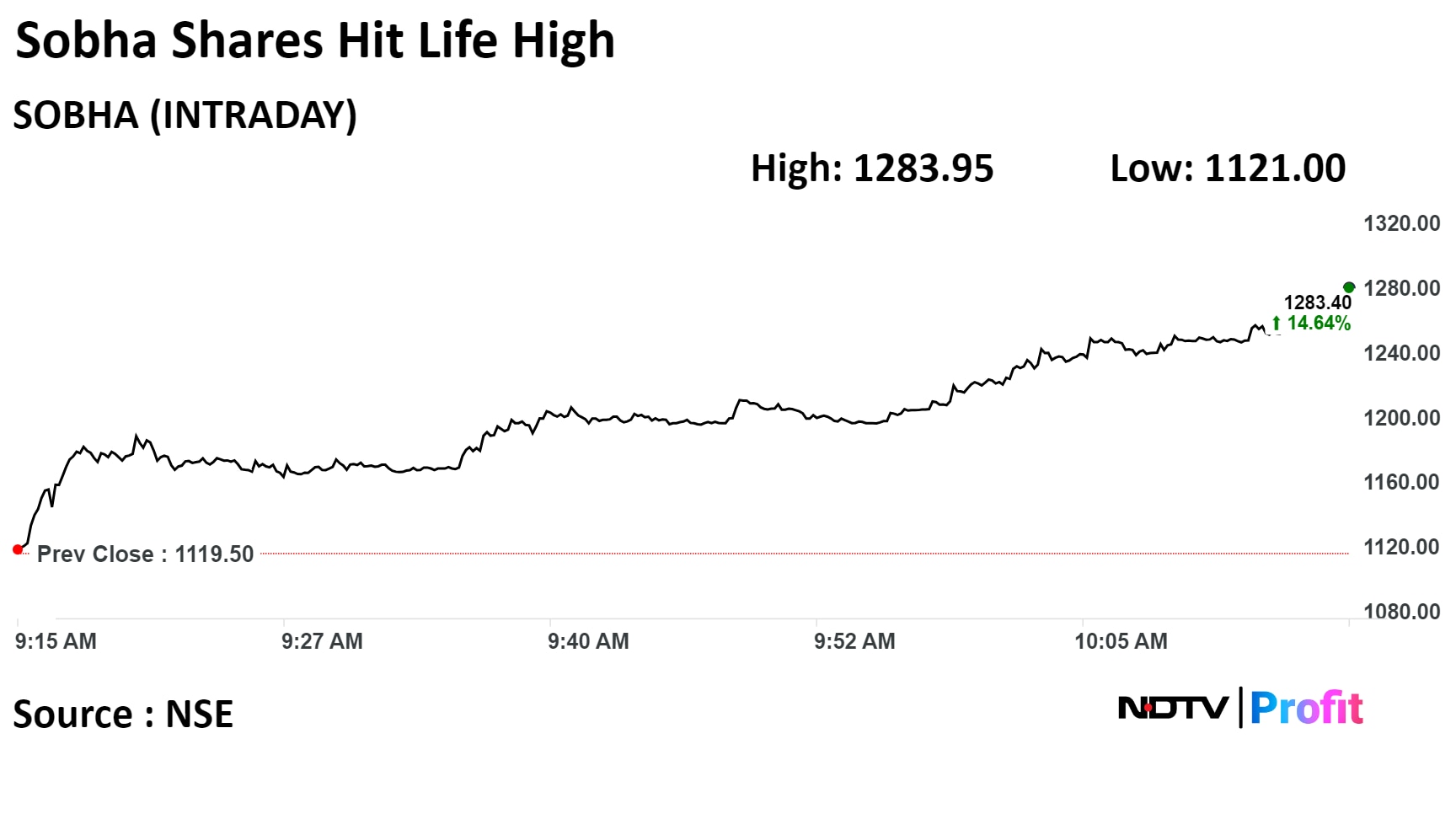

Shares of Sobha Ltd. hit a lifetime high on Thursday after Motilal Oswal Financial Services Ltd. raised its target price.

The brokerage raised the target price on the stock to Rs 1,400 from Rs 960 earlier, citing the company's sustainable growth outlook on the back of healthy cash flows and profitability.

"After underperforming its listed peers on pre-sales growth over FY21–23, we believe Sobha is set to outperform in terms of growth, given its focus on unlocking its vast land reserve and exploring external growth opportunities through its healthy balance sheet," the brokerage said in a report.

Motilal Oswal has revised its presales estimates by 4% and 12% for FY24 and FY25, respectively, to factor in higher launches over FY24–26.

"We believe that as the company unlocks its vast land reserves and explores growth opportunities beyond its existing land bank, it will provide further growth visibility. Project launches on its large land parcels in Bengaluru and Tamil Nadu will drive a re-rating for its existing land valuation," it said.

Downside risks include a slowdown in residential absorption, a delay in the monetisation of large land parcels, and the inability to sign BD deals.

Shares of Sobha rose as much as 15.10% before paring gains to trade 11.70% higher at 10:11 a.m., compared to a 0.49% advance in the NSE Nifty 50.

The stock has risen 114.68% year-to-date. Total traded volume so far in the day stood at 20 times its 30-day average. The relative strength index was at 78.23, indicating that the stock may be overbought.

All 17 analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 19.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)