Shares of Skipper Ltd. jumped 10% after it got a 'buy' rating as Nuvama initiated coverage. The brokerage views the company as a sector outperformer, on the back of substantial growth opportunities in the transmission and distribution ecosystem.

Nuvama projects that Skipper will benefit from the proposed National Electricity Plan, which outlines a massive Rs 9.1 lakh-crore investment in transmission infrastructure. This will likely lead to increased order intake both domestically and internationally, especially in the high-voltage segment, where demand is expected to rise.

Skipper reported order book/sales compound annual growth rate of 33%/24% from fiscal 2020 to fiscal 2024, with an order book of Rs 5,840—1.8 times its fiscal 2024 sales.

The company plans to double its tower manufacturing capacity to 6,00,000 metric tons per annum over the next four to five years, supported by an investment of approximately Rs 800 crore, Nuvama said.

The company is the only backward-integrated player in India, combining manufacturing and engineering, which enhances its competitive edge, the brokerage noted.

Potential risks include execution delays, fluctuations in raw material prices, and challenges in working capital management, Nuvama said.

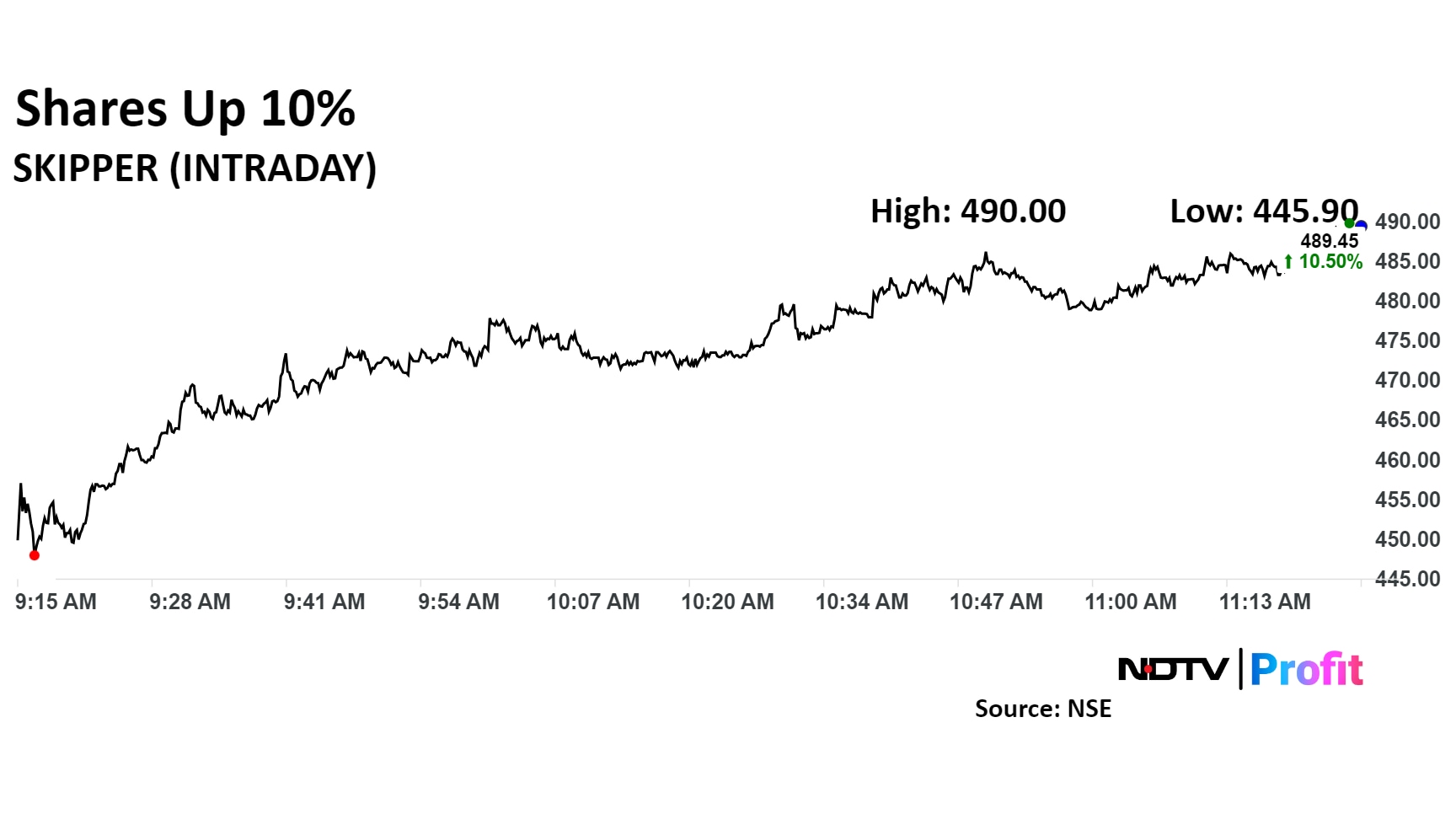

Skipper Share Price

Shares of Skipper Ltd. rose as much as 10.4% to Rs 489.10 apiece. They were trading at this level as of 11:29 a.m., compared to a 0.67% advance in the NSE Nifty 50.

The stock has risen 121.02% in the last 12 months. Total traded volume so far in the day stood at 4.0 times its 30-day average. The relative strength index was at 60.

All three analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 19.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.